Exhibit 10.3

Exhibit 10.3

PROPERTY OPTION AGREEMENT

THIS OPTION AGREEMENT is made effective as of the 23rd day of November, 2010 (the “Effective Date”).

BETWEEN:

SOLTORO LTD. (“Soltoro”), a corporation organized under the laws of Canada, having an office at 20 Adelaide east, suite 400, Toronto, Ontario, Suite 400, Toronto, Ontario, M5C 2T6 and SOLTORO S.A. de C.V. (“Soltoro Mexico”), a corporation organized under the laws of Mexico and a wholly owned subsidiary of Soltoro, having an office at Teotihuacan 1661, Pinar de la Calma, Zapopan, Jalisco, C.P. 45080, Mexico.

(collectively, the “Optionor”)

AND:

TIMMINS GOLD CORP., a corporation organized under the laws of British Columbia, Canada, having an office at 609 Granville Street, Suite 520, Vancouver, British Columbia, V7Y 1G5 and TIMMINS GOLDCORP MEXICO S.A. de C.V., Blvd. Navarrete 125-12, Col. “Valle Verde, Hermosillo, Sonora, Mexico, 83200.

(collectively, the “Optionee”)

WHEREAS:

A. The Optionor is the legal and beneficial owner of a 100% interest in the Property which forms part of the Quila Concession, as more particularly described in Schedule “A” attached to and made a part of this Agreement.

B. The Optionor has agreed to grant an exclusive option to the Optionee to acquire a 100% undivided interest in and to the Property upon the terms and conditions hereinafter set forth, subject only to the Royalty (as defined herein);

NOW THEREFORE THIS AGREEMENT WITNESSETH that in consideration of the sum of $10 having been, paid by the Optionee to the Optionor and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the Optionor, the parties hereto agree as follows:

1. DEFINITIONS

For the purposes of this Agreement the following words and phrases shall have the following meanings:

- 2 -

1.1 “Affiliate” shall have the meaning attributed to it by the Business Corporations Act

(Ontario).

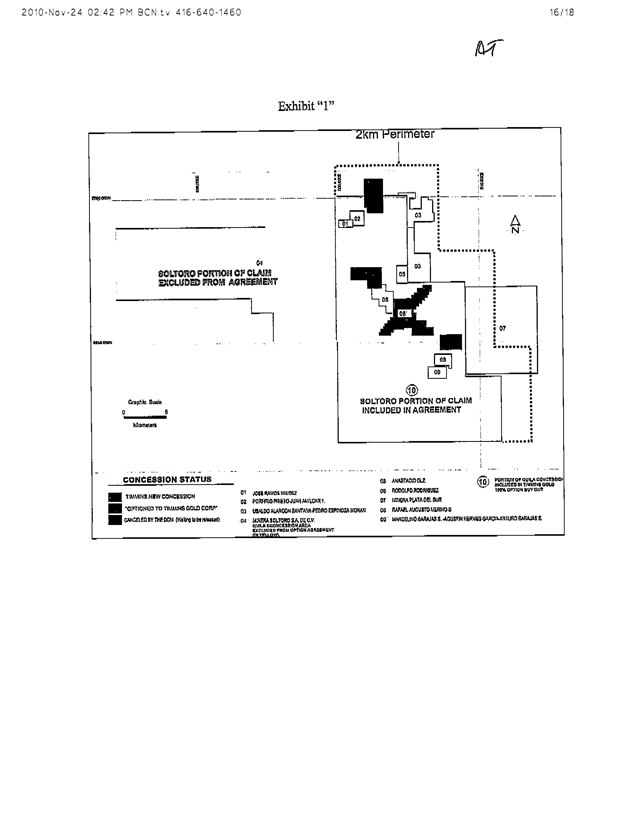

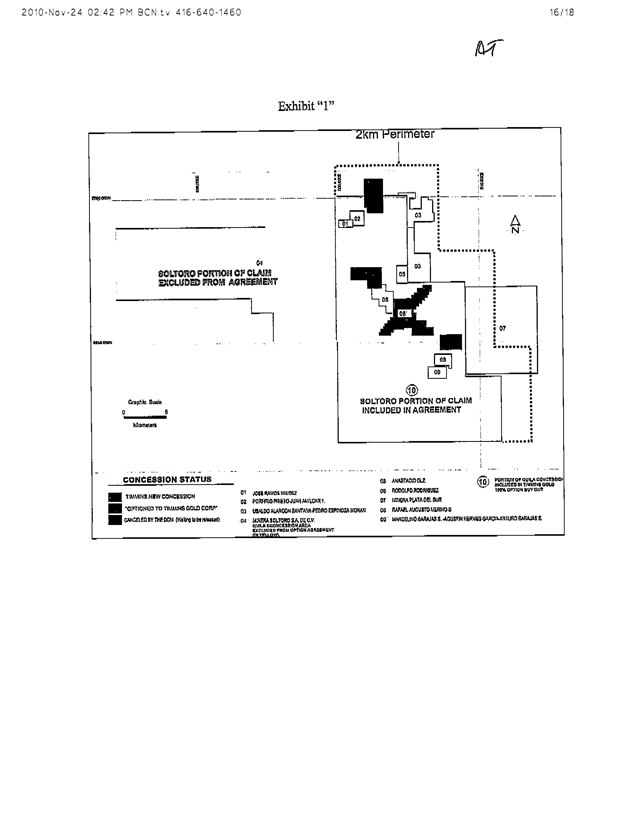

1.2 “After Acquired Properties” means any and all mineral interests not currently owned by Soltoro which are staked, located, granted or acquired by or on behalf of any party to this Agreement during the currency of this Agreement which are located, in whole or in part, east of the 60,000 easting line on the Quila Concession or within 2 kilometres of the northern and eastern perimeter of such part of the Quila Concession, as set forth in the map included in Exhibit 1 to Schedule & “A” attached hereto, which sets out in approximate manner the location and area of the After Acquired Properties, which are identified as the areas marked 1, 2, 3, 5, 6, 8.9 and part of 7 on the map.

1.3 “Agreement” means this Agreement, as the same may be amended, supplemented or modified from time to time.

1.4 “Buy-Back Right” means the right of the Optionee to purchase one-third of the Royalty (equal to 1% net smelter returns) from the Optionor by the payment of $1,000,000 and up to a maximum of two-thirds of the Royalty (equal to 2% net smelter returns) for $2,000,000.

1.5 “Cocula Property” means the mineral concessions and mining lots known as the Cocula claims located in the Municipality of San Martin Hidalgo, State of Jalisco, Mexico in which the Optionee has an option to acquire a 100% interest, pursuant to an agreement dated July 18, 2007, as amended June 1, 2009.

1.6 “Effective Date” means the date first written above.

1.7 “Exchange” means the TSX Venture Exchange.

1.8 “Exploration Expenditures” means all cash, expenses, obligations and liabilities, other than for personal injury or property damage, of whatever kind or nature spent or incurred directly or indirectly by the Optionee in connection with the maintenance, exploration or development of the Property or any portion thereof, including, monies expended in constructing, leasing or acquiring all facilities, buildings, machinery and equipment required in connection with. Exploration Work, in paying any taxes, fees, charges, payments or rentals (including payments in lieu, of assessment work) or otherwise to keep the Property in good standing (including any payment to or in respect of acquiring any agreement or confirmation from any holder of surface rights respecting the Property or any portion thereof), in carrying out any survey of the Property or any portion, thereof, in doing geophysical, geochemical and geological surveys, drilling, assaying and metallurgical testing, bulk sampling and pilot plant operations, in paying the fees, wages, salaries, travelling expenses and fringe benefits (whether or not required by law) of all persons engaged in work with respect to and for the benefit of the Property, or any portion thereof, in paying for the food, lodging and other reasonable needs of such persons, in preparing any reports and in supervising and managing any work done with respect to and for the benefit of the Property or any portion thereof, or in any other respects necessary for the due carrying out of the Exploration Work, provided, however, that the Operator’s overhead expenses shall not exceed 10% of the Exploration Expenses incurred directly on the Property and, provided further, that the Optionee shall be entitled to credit towards Exploration Expenditures its administrative or overhead expenses which shall not exceed 10% of the Exploration Expenses incurred directly on the Property. For greater certainty, Exploration Expenditures do not include any payments or expenditures made by the Optionee in respect of the acquisition of After Acquired Properties or any Exploration Work completed in respect of After Acquired Properties.

1.9 “Exploration Work” means every kind of work done on or in respect of the Property or

the products therefrom by or under the direction of or on behalf of the Optionee and, without

- 3 -

limiting the generality of the foregoing, includes assessment work, geophysical, geochemical and geological surveying, studies and mapping, investigating, drilling, designing, examining, equipping, improving, surveying, shaft sinking, raising, crosscutting and drifting, searching for, digging, trucking, sampling, working and procuring minerals, ores, metals and concentrates solely for test sample purposes, surveying and bringing any mineral claims or other interests to lease or patent, reporting and all other work usually considered to be prospecting, exploration, development and mining work.

1.10 “Operator” means that person or company acting as such pursuant to this Agreement.

1.11 “Option” means the option to acquire a 100% interest in and to the Property as provided for in Section 3.1 herein.

1.12 “Option Period” means the period during the term of this Agreement from the date hereof to and including the date of exercise of the Option.

1.13 “Property” means the mineral claims cast of the 60,000 easting line which form part of the Quila Concession owned toy the Optionor, described in Schedule “A” attached hereto, and the interest of the Optionor thereto, and any other permits or property interests of the Optionor incorporated into the Property by the terms of this Agreement.

1.14 “Quila Concession” means the mineral claims described in Schedule “A” attached hereto and the interest of the Optionor thereto.

1.15 “Royalty” means the net smelter returns royalty retained by the Optionor equal to 3% of net smelter returns on gold, base metals, precious metals and any other minerals derived from the Property, any After Acquired Properties and the Cocula Property (which are normally subject to net smelter returns) calculated and paid in accordance with the terms and conditions set out in Schedule “B” attached hereto.

1.16 In this Agreement, all dollar accounts are expressed in lawful currency of the United States of America.

1.17 The titles to the respective articles hereof shall not be deemed to be a part of this Agreement but shall be regarded as having been used for convenience only.

1.18 “Words used herein importing the singular number shall include the plural, and vice-versa, and words importing the masculine gender shall include the feminine and neuter genders, and vice-versa, and words importing persons shall include firms, partnerships and corporations.

2. REPRESENTATIONS AND WARRANTIES

2.1 The Optionee represents and warrants to the Optionor that:

(a) | | it is a company duly incorporated, validly subsisting and in good standing with |

respect to filing of annual reports under the laws of the jurisdiction of its incorporation and is or will be qualified to do business and to hold an interest in the Property in the jurisdiction in which the Property is located;

(b) | | it has full power and authority to carry on its business and to enter into this |

Agreement and any agreement or instrument referred to or contemplated by this Agreement and to carry out and perform all of its obligations and duties

hereunder;

- 4 -

(c) it has duly obtained, all authorizations for the execution, delivery and performance of this Agreement, and such execution, delivery and performance and consummation of the transactions herein contemplated will not conflict with, or accelerate the performance required by or result in any breach of any covenants or agreements contained in or constitute a default under, or result in the creation of any encumbrance, lien or charge under the provisions of its constating or initiating documents or any indenture, agreement or other instrument whatsoever to which it is a party or by which it is bound or to which it may be subject and will not contravene any applicable laws; and

(d) the option that the Optionee holds to acquire a 100% interest in the Cocula Property is in good standing and the Optionee is not in default of any of the provisions of the option.

2.2 The Optionor represents and warrants to the Optionee that:

(a) | | it is a company duly incorporated, validly subsisting and in good standing with |

respect to filing of annual reports under the laws of the jurisdiction of its incorporation and is or will be qualified to do business and to hold an interest in the Property in the jurisdiction in which the Property is located;

(b) | | it has full power and authority to carry on its business and to enter into this |

Agreement and any agreement or instrument referred to or contemplated by this Agreement and to carry out and perform all of its obligations and duties hereunder;

(c) | | it has duly obtained all authorizations for the execution, delivery and performance |

of this Agreement, and such execution, delivery and performance and consummation of the transactions herein contemplated will not conflict with, or accelerate the performance required, by or result in any breach of any covenants or agreements contained in or constitute a default under, or result in the creation of any encumbrance, lien or charge under the provisions of its constating or initiating documents or any indenture, agreement or other instrument whatsoever to which it is a party or by which it is bound or to which it may be subject and will not contravene any applicable laws;

(d) | | it is the sole legal and beneficial owner of a 100% undivided interest in and to the Property; |

(e) | | the Property is free and clear of all liens, charges and encumbrances and is not |

subject to any right, claim or interest of any other person;

(f) the Property is in good standing under the laws of the jurisdiction in which the Property is located up to and including December 11, 2056;

(g) the Optionor has complied with all laws in effect in the jurisdiction, in which the Property is located with respect to the Property and such Property has been duly and properly staked and recorded in accordance with, such laws, and the Optionee may enter in, under or upon the Property for all purposes of this Agreement without making further payment to the Optionor, and the Optionor is not aware of any requirement to obtain the permission of any other person or any payment required to be made to any other person for such purposes; and

- 5 -

(h) there is no adverse claim or challenge against or to the ownership of or title to the Property or any portion thereof nor is there any basis therefore and. there are no outstanding agreements or options to acquire or purchase the Property or any portion thereof or interest therein and no person, has any royalty or interest whatsoever in production or profits from the Property or any portion thereof, and the Property is not the whole or substantially the whole of Soltoro’s or Soltoro Mexico’s assets or undertaking.

2.3 The representations and warranties hereinbefore set out are conditions on which the parties have relied in entering into this Agreement, are to be construed as both conditions and warranties and shall, regardless of any investigation which may have been made by or on behalf of any party as to the accuracy of such representations and warranties, survive the closing of the transaction contemplated hereby and each of the parties will indemnify and save the other harmless from all loss, damage, costs, actions and suits arising out of or in connection with any breach of any representation of warranty contained in this Agreement, and each party shall be entitled, in addition to any other remedy to which it may be entitled, to set off any such loss, damage or costs suffered by it as a result of any such breach against any payment required to be made by it to any other party hereunder.

3. GRANT AND MAINTENANCE OF OPTION

3.1 The Optionor hereby grants to the Optionee the sole and exclusive right and option to acquire a 100% undivided interest in and to the Property in accordance with the terms of this Agreement (the “Option”), subject only to the Royalty.

3.2 In order to keep the right and Option granted, to the Optionee in respect of the Property in good standing and in force and effect the Optionee shall be obligated to:

Pay to the Optionor:

(i) | | the sum of $100,000 upon the Effective Date; |

(ii) the additional sum of $150,000 on the first anniversary of the Effective Date;

(iii) the additional sum of $250,000 on the second anniversary of the Effective Date; and

(iv) the final additional sum of $500,000 on the third anniversary of the Effective Date.

(b) | | Exploration Expenditures |

Incur cumulative minimum Exploration Expenditures on the Property of:

(i) | | $500,000 on or before the first anniversary of the Effective Date, provided |

that a minimum of $350,000 constitutes a firm commitment of the Optionee and must be incurred before this Option can be terminated;

- 6 -

(ii) an additional $750,000 on or before the second anniversary of the Effective Date; and

(iii) an additional $750,000 on or before the third anniversary of the Effective Date.

3.3 The Exploration Expenditures required to be made under Section 3.2(b) shall specifically exclude any acquisition or exploration expenditures made by the Optionee on the Cocula Property and any After Acquired Property. More specifically, the Exploration Expenditures required to be made pursuant to Section 3.2(b) may only be applied, to areas within the Property to which the Optionor holds title.

3.4 The Optionor recognizes that the acquisition by the Optionee of the Property may be subject to the approval of the Exchange. Where a variation in the terms of this Agreement is reasonably required by the Exchange, such changes will be deemed to be accepted by the parties hereto and form part of the terms of this Agreement.

3.5 If the Optionee fails to make the required payments or incur the required Exploration Expenditures in accordance with Section 3.2 herein within the time periods specified in Section 3.2 herein, then, this Agreement, the Option, and the Royalty shall immediately terminate.

During the term of this Option, the Operator shall be the Optionee.

3.6 During this time the Optionee shall in its capacity as Operator determine in its sole discretion, but after consultation with the Optionor, Exploration Work for the exploration and development of the Property. The Exploration Work shall take into consideration the minimum Exploration Expenditures to be incurred by the Optionee in each year pursuant to Section 3.2(b) of this Agreement, and the Optionee, as Operator, shall be allowed an amount for administration equal to 10% of the Exploration Expenditures to be incurred on the Property, which administrative charges shall constitute Exploration Expenditures for the purpose of Section. 3.2(b) of this Agreement.

3.7 Notwithstanding any other provision of this Agreement, if the optionee incurs

Exploration Expenditures exceeding the Exploration Expenditures required to be incurred during any of the periods described in subsection 3.2(b) as consideration, for and/or to maintain and exercise the Option, the Optionee may apply the excess Exploration Expenditures to reduce Exploration Expenditures otherwise required to be made by it to maintain or exercise the Option during the following or subsequent periods by a like amount. If the minimum Exploration Expenditures for a period are not made in accordance with Section 3.2(b), then in order to maintain the Option in good standing, the Optionee may pay to the Optionor a cash amount equal to the difference between the minimum Exploration Expenditures required for that period and the actual Exploration Expenditures incurred by the Optionee during the period.

4. EXERCISE OF OPTION

4.1 At such time as the Optionee has made all the required cash payments and Exploration

Expenditures in accordance with Section 3.2 herein within the time periods specified in Section 3.2 herein, then the Option, shall be deemed to have been, exercised by the Optionee, and the Optionee shall have thereby, without any further act, acquired a 100% undivided interest in and to the Property.

4.2. The parties have not created a partnership and nothing contained in this Agreement shall in any manner whatsoever constitute any party the partner, agent or legal representative of any other party, nor create any fiduciary relationship between them for any purpose whatsoever. No

- 7 -

party shall have any authority to act for, or to assume any obligations or responsibility on behalf of, any other party except as may be, from time to time, agreed upon in writing between the parties or as otherwise expressly provided.

5. RIGHT OF ENTRY

5.1 Throughout the Option Period the Optionee, and its employees, agents and independent

contractors, shall have the sole and exclusive right in respect of the Property to:

(a) | | enter in, under or upon the Property and conduct Exploration Work; |

(b) | | have exclusive and quiet possession, thereof; |

(c) | | bring upon and erect upon the Property buildings, plant, machinery and |

equipment as the Optionee may deem advisable; and.

(d) | | remove therefrom and dispose of reasonable quantities or ores, minerals and |

metals for the purpose of obtaining assays or making other tests.

6. VESTING OF INTEREST

6.1 Forthwith upon the Optionee exercising the Option, by performing the requirements of

Section 3.2, an undivided 100% interest in and to the Property shall vest, and shall be deemed for all purposes to have vested in the Optionee.

6.2. Forthwith upon the Optionee exercising the Option by performing the requirements of

Section 3.3, the Optionor shall deliver to the Optionee duly executed transfers of the mineral interests comprised in the Property in immediately recordable form in favour of the Optionee, free and clear of all liens, charges, encumbrances, security interests and adverse claims. The Optionee shall forthwith upon receipt record all transfers at its own cost with the appropriate

mining recorders office to effect legal transfer of the Property into the name of the Optionee. The Optionee acknowledges that the Property consists of only part of the Quila Concession held by the Optionor and agrees that upon exercise of the Option, by the Optionee, the Optionor will immediately take all required steps to divide the Quila Concession according to the description of the Property set forth in Schedule “A” and the transfer the Property to the Optionee.

6.3 The Parties acknowledge the right and privilege of the Optionor and Optionee to file,

register and to otherwise deposit a copy of this Agreement in the appropriate recording office for the jurisdiction in which the Property is located and with any other governmental agencies to give third parties notice of this Agreement, and hereby agree, each with the others, to do or cause to be done all acts or things reasonably necessary to effect such filing, registration or deposit.

7. OBLIGATIONS OF THE OPTIONEE DURING THE OPTION PERIOD

7.1 The Optionee shall have full right, power and authority to do everything necessary or

desirable to carry out the Exploration Work and to determine the manner of exploration and development of the Property and, without limiting the generality of the foregoing, the right, power and authority to:

- 8 -

(a) | | regulate access to the Property, subject only to the right of the Optionor and its |

representatives to have access to the Property at all reasonable times for the purpose of inspecting work being done thereon, but at their own risk and expense;

(b) | | employ and engage such, employees, agents and independent contractors as it may |

consider necessary or advisable to carry out its duties and obligations hereunder and in this connection to delegate any of its powers and rights to perform its duties and. obligations hereunder but the Optionee shall not enter into contractual relationship except on terms which are commercially competitive;

(c) | | execute all documents, deeds and instruments, do or cause to be done all such acts |

and things and give all such assurances as may be necessary to maintain good and valid title to the Property and each party hereby irrevocably appoints the Optionee its true and lawful attorney to give effect to the foregoing and hereby agrees to indemnify and save the Optionee harmless from any and all costs, loss or damage sustained or incurred without gross negligence or bad faith by the Optionee directly or indirectly as a result of its exercise of its powers pursuant to this Subsection 7.l(c); and

(d) | | conduct such title examinations and cure such title defects as may be advisable in |

the reasonable judgment of the Optionee.

7.2 During the Option Period the Optionee, as Operator, shall:

(a) | | maintain in good standing those material claims comprised in the Property that are |

in good standing on the date hereof by the doing and filing of assessment work or the making of payments in lieu thereof, by the payment of taxes and rentals and the performance of all other actions which may be necessary in that regard and in order to keep such mineral claims free and clear of all liens and other charges arising from the Optionee’s activities thereon except those at the time contested in good faith by the Optionee;

(b) | | permit the directors, officers, employees and designated, consultants of the |

Optionor, at their own risk, access to the Property at all reasonable times, subject always to the confidentiality provisions of Section 14 herein, provided that the Optionor agrees to indemnify the Optionee against and to save it harmless from all costs, claims, liabilities and expenses that the Optionee may incur or suffer as a result of any injury (including injury causing death) to any director, officer, employee or designated consultant of the Optionor while on the Property;

(c) | | deliver to the Optionor on or before March 30 in each year a report describing the |

results of the Exploration Work done in the last completed calendar year, together with reasonable details of Exploration Expenditures made;

(d) | | conduct all work on the Property in a good and workmanlike fashion and in |

accordance with all applicable laws, regulations, orders and ordinances of any governmental authority; and

(e) | | deliver to the Optionor forthwith after receipt by the Optionee assay results for |

samples taken. from the Property, together with reports showing the location from which the samples were taken and the type of samples.

- 9 -

S. ROYALTY

The Optionee shall pay the Optionor the Royalty, on the terms and conditions as set out in Schedule “B” hereto.

Par a. period of si?c months from the Date of Commencement of Commercial Production (as defined in Schedule “B” to this Agreement), the Optionee may exercise the Buy-Back Right t>y giving ^vrltten notice of its intention to exercise the Buy-Boclc Right, -with payment to be made within 3O days of delivery of such notice.

Any Royalty payment due pursuant to Schedule “B” up to the date of delivery of the notice referred to in Section 8.2 shall continue to be due and payable by the Optionee to the Optionor and delivery of such notice shall not effect the amount of trie exercise payment for the Buy-Back Right.

y. RESTRICTIONS ON ALIENATION

9.1 3>Jo party (the “Selling Party”) shall sell, transfer, convey, assign, mortgage or grant an

option in respect of or grant z\ right to purchase or in any manner transfer or alienate all or* any portion of its interest or rights under this Agreement “without trie prior consent in. Avriting, \vithin 3O days of receipt of notice thereof, of the other parties, such consent not to be unreasonably withheld and the failure to notify the Selling Party within the said 3O days that such consent has been withheld shall be deemed to constitute the consent of the other parties.

9.2. Before the completion of any sale or other disposition by any party of its interests or

rights or any portion thereof under this Agreement, the Selling Party shall require the proposed acquirer to enter into an agreement -with the party or parties not selling or otherwise disposing on the same terms and conditions as set out in this Agreement.

9.3 The provisions of Sections 9.1 arid 9.2 shall not prevent a party from entering into an

amalgamation or corporate reorganization which -will have the effect in law of the amalgamated or surviving company possessing all the property, rights and interests and being subject to all the debts, liabilities and obligations of each amalgamating or predecessor company, or prevent a party from assigning its interest to an Affiliate of” such party provided that the Affiliate first complies with Section 9.2 and agrees in -writing -with the other parties to re-transfer such interest to the originally assigning party immediately before ceasing to be an Affiliate of” such party.

1O. AFTER ACQUIRED PROPERTIES

1O.1 The parties covenant and agree, each with the others, that any and. all After Acquired

Properties shall be subject to the terms and conditions of this Agreement and shall be added to and deemed, fox- all purposes hereof, to tie included, in the Property.

IX. TERMINATION OF OPTION

In the event of default in the performance of the requirements of Section. 3.2, then subject to the provisions of Sections 1 1.3 and 1G. 1 of this Agreement, the Option and this Agreement shall terminate.

The Optionee shall have the right to terminate this Agreement by giving 3O days” written notice of such termination to the Optionor and upon effective date of such termination this

- 10-

Agreement shall tie of no iriirther force and effect except the Optionee shall toe requii-ed to fulfil arty obligations -which have accrued under the pro-visions of thi3 Agreement which have not been satisfied.

11.3 Notwithstanding any other provisions of this Agreement, in the event of termination of

this Agreement either toy default or by notice, the Optionee shall:

(a) | | ensure that the Property is in good, standing for a period of not less than 9O days |

from the date of termination;

(o) | | deliver to the Optionor any and all reports, samples, drill cores and engineering |

data of any kind whatsoever pertaining to the Property or related to Exploration Work which has not been previously delivered to the Optionor;

perform or secure the performance of all reclamation and environmental rehabilitation as may toe required by all applicable legislation.; and

upon notice from the Optionor, remove all materials, supplies and equipment from the Property, provided however, that the Optionor may at the cost of the Optionee, dispose of any such materials, supplies or equ.ipm.ent not removed from the Property -within one hundred and eighty (ISO) days of receipt of such notice toy the Optionee.

1 1 .A- In the event this Agreement is terminated toy the Optionee toy notice, in addition to the requirements of Section 11.3 of this Agreement, the Optionee shall forward to the Optionor an amount equivalent to the 12 month, tax payment required to toe paid in respect of the Property from the date of termination and pro-vide the Optionor with a. report summary of all the Exploration Expenditures and Exploration Work performed on the Property in the prior reporting period in order that the Optionor may file a -verification, report with, the TVTexioan government within the required preceding 12 month reporting period.

12. | | SURRENDER AND ACQUISITION OK PROPERTY INTERESTS E*RIOR TO) |

TERMINATION OF AG-REEIVIENT

12.1 The Optionee may at any time, either before or after tile exercise of the Option, elect to

abandon any one or more of the mineral claims comprised in the Property toy giving notice to the Optionor of such intention. For a period of30 days after the date of delivery of such notice the Optionor may elect to have any or all of the mineral claims in respect of which such notice has been given transferred to it toy delivery of a request therefor to the Optionee, -whereupon the Optionee shall deliver to the Optionor a t>ill of sale or other appropriate deed or assurance in registrable form transferring its entire interest in such mineral claims to the Optionor. Any claims so transferred, if in good standing at the date hereof or if the Optionee causes the same to be placed in good standing after the date hereof, shall be in good standing under the laws of the jurisdiction in which the claims are located for at least one year from the date of transfer. If the Optionor fails to make request for the transfer of any mineral claims as aforesaid within sucH 30-day period, the Optionee may then abandon such mineral claims without further notice to the Optionor. Upon any such transfer or abandonment the mineral claims so transferred or abandoned shall for all purposes of this Agreement cease to form part of the Property.

-11-

delayed, in complying -with any provisions of this Agreement by reason of strilces, -wallc-outs, labour shortages, power shortages, fires, wars, acts of God, govcmmeatal regulations restricting normal operations, shipping delays or any other reason or reasons beyond the control of the Optionee, excepting the want of funds, then, tile time limited for the performance by the Optionee of its obligations hereunder shall be extended by a. period of time equal in length to the period of

13.2 The Optionee shall withiix 1O days give notice to the Optionor of each event of force majeure under Section 13.1 herein, and upon cessation of such event shall furnish the Optionor with notice of that event together with particulars of the number of days by which the obligations of the Optionee hereunder have been, extended by -virtue of such event of force majeure and all preceding events of force majeure.

1.4. CONFIDENTIAL INFORMATION

14.1 All information and data concerning or derived from Exploration “Worle shall be

confidential and, except to the extent required by law or by regulation of any securities commission, stock exchange or other regulatory body, shall not be disclosed to any person, other than a party’s professional ad-visors or an Affiliate without the prior -written consent of the other party or parties, which consent shall not be unreasonably withheld. Each party shall provide copies of any proposed releases con.cern.ing the Property to the other party for comment before publishing.

The parties agrees that all questions or matters in dispute -with respect to this Agreement shall be submitted to arbitration pursuant to the terms hereof.

It shall be a condition precedent to the right of any party to submit any matter to arbitration pursuant to the provisions hereof, tliat any party intending to refer any matter to arbitration shall have given not less than. 1O days* prior written notice of its intention, to do so to the other party together with particulars of the matter in dispute. On the expiration of such 1O days, the party who gave such notice may proceed to refer the dispute to arbitration as provided in Section 15.3 herein.

The party desiring arbitration, shall appoint one arbitrator, and shall notify the other party of such appointment, and the other party shall, within. 15 days after receiving such notice, appoint an arbitrator, and the two arbitrators so named, before proceeding to act, shall, within 3O days of the appointment of the last appointed arbitrator, unanimously agree on the appointment of a third arbitrator, to act -with them and be chair of the arbitration provided for herein, provided that the parties may agree to appoint a single arbitrator in respect of such arbitration. If the other party shall fail to appoint an. arbitrator within 15 days after receiving notice of the appointment of the first arbitrator, or if the two arbitrators appointed by the parties shall be unable to agree on the appointment of the chair, the chair shall be appointed under the provisions of the Arbitration Act (Ontario)(the “Act”)- Except as specifically otherwise provided in this Section, the arbitration herein provided for shall be conducted in accordance with such Act. The chair, or in the case where only one arbitrator is appointed, the single arbitrator, shall fix. a time and place in Toronto, Ontario, for the purpose of hearing the evidence and representations of the parties, and the chair shall preside over the arbitration, and determine all questions ofprocedure not provided

- 12 -

for under such A.ct or this Section. After hearing any evidence and representations that the parties may submit, the single arbitrator, or the arbitrators, as the case may be, shall make an award and reduce the same to writing, and deliver one copy thereof to each of the parties. The expense of the arbitration shall be paid as specified in the award.

15.4 The parties agree that the award of a majority of the arbitrators, or in the case of a single arbitrator, of such arbitrator, shall be final and binding upon each of them.

16.1 The parties hereto agree that if the Optionee is in default with respect to any of the provisions of this Agreement, the Optionor shall give notice to the Optionee, designating such default, and within 3O days after its receipt of such, notice, the Optionee shall either:

Ca) cure such default, or commence proceedings to cure such default and prosecute

the same to completion without undue delay; or

(b~) give the Optionor notice that it denies that such default has occurred and that it is

16.2 If arbitration is sought, a party shall not be deemed in default until the matter shall have been determined finally by appropriate arbitration under the provisions of Section IS hereof.

16.3 If:

Ca) the default is not so cured or a commencement made on proceeding to cure it; or

QT^) ardltration is not so s^fu^^b-t^ oir*

<c) the Optionee is found in arbitration proceedings to be in default, and fails to cure

it or commence proceedings to cure it within 3O days after the rendering of the arbitration award;

then the Optionor shall, by -written, notice j^iven to the Optionee at any time while the default continues, terminate the interest of the Optionee in the Property and this Agreement, provided that the Optionee shall, upon such termination, provide the Optionor with copies of all maps, plans, reports and documents in the Optionee’s possession, with respect to the Property.

1”7. GENERAL PROVISIONS

IT. 1 Any notice, consent, waiver, approval, report, authorization or other communication

which any party is required to or may desire to give to or make upon any other party pursuant to this Agreement will be effective and valid only if in writing and actually delivered (including by telecopy) to the party at the folio-wing address of the party:

TllVIJVinvS C5OJL-I> CORP. sind

TIJVUVIXNS GOLDCORP MEXICO S.A. tie CV.

Suite 52O, 6O9 Granville Street “Vancouver Bi-itish Columbia V7Y 1G5

- 13 -

CfcO To the Optionor:

SOLTOR.O LTD. and SOLTORO S.A- de CV.

Suite 4OO, 2O Adelaide East, Toronto, Ontario IVlSti 2T6

or at such other address as such party may from time to time designate to tlie other party toy notice delivered in accordance with-this section. l-Jotico -will tie deemed given when receivsd or if deli-very is refused on the date delivery is so refused.

unenforceable in any respect in any jurisdiction, the validity, legality and enforce ability of such provision shall not in any way be affected or impaired thereby in any other jurisdiction and the validity, legality and enforce ability of the remaining provisions contained herein shall not in any way toe affected or impaired thereby.

17.4 This Agreement contains the whole agreement between the parties in respect of the

conditions or collateral agreements, express, implied or statutory, other than, as expressly set forth, in this Agreement and this Agreement supersedes all of the terms of any written or oral agreement or understanding between the parties.

17.5 This Agreement shall enure to the benefit of and be binding upon the Optionor and Optionee and each of them and, as applicable, their heirs, executors, administrators, successors

IV.G Each of the parties will, on demand by another party, execute and deliver or cause to be executed and delivered all such further documents and instruments and do all further acts and things as the other may either before or after the closing reasonably require to evidence, carry out and give full effect to the terms, conditions, intent and meaning of this Agreement and to assure the completion of the transactions contemplated hereby.

Agreement -will be effective unless in writing signed by the appropriate party and then only in the specific instance and for the specific purpose given.

1 | | *7_3 t Tnipss otlneir^vise sjpecifioall^^ jDr<^~vid.ed hereni, tlie parties ^vxll j?a^^ tr±ei.r respective le^ial, |

accounting and other professional fees and expenses, including goods and services taxes on such fees and. expensos, u^curre^i Is^’ sach ixx connection “^vith. trie negotiation and. settlement of tins Agreement, the completion of the transactions contemplated hereby and the other matters pertaining hereto.

17-p This Agreement may be executed in any number of counterparts or by facsimile, each of which shall together, for all purposes, constitute one and the same instrument, toinding on the parties, and each of” which shall together toe deemed to toe an original, notwithstanding that all parties are not signatory to the same counterpart or facsimile.

the Optionee without the consent of the Optionor provided that notice of such assignment is

- 14-

delivered to the Optionor at least three business days prior to closing- The Optionee may not otherwise assign the benefit of this Agreement except with the prior -written consent of the Optionor, which consent may be arbitrarily withheld. In the event of any permitted assignment, the Optionee shall nevertheless remain bound by the terms hereof including the obligation to pay the purchase price -when due.

17.1 1 This Agreement provides for an option, only, and except as specifically provided otherwise, nothing herein contained shall be construed as obligating the Optionee to do any acts or make any payments hereunder and ally act or acts or payment or payments as shall be made hereunder shall not be construed as obligating the Optionee to do any further act or make any further payment.

The obligations of the Optionee under this Agreement are first subject to the acceptance for filing of this Agreement on behalf of the Optionees by the Exchange.

This Agreement shall be governed hy and. interpreted in accordance with the laws of the province of Ontario.

IN WITNESS WHEREOF the parties hereto have executed this Agreement as of the day and year first above written.

TIMMINS GOLX> C^Srf?)

Per’ — -=5=T \ /

Autftiorized~Stgn*rt€M^

TirVUVTtNS GOLDCORP MEXICO S.A. de CV-

Per:

Aixtfi^prized Signatory

SOLTORO LTD.

Per:

Authorized Signatory

SOLTOR.O S.A. r>E C”V.

Per:

Authorized Signatory

SCHEDULE”A”

DESCRIPTION OF PROPERTY

The property consists of all claims east of” the 60,000 easting line which form part of trie Quila Concession owned oy Soltoro Ltd. (the “Property”).

For illustrative purposes, Exhibit “1” sets out in approximate manner the location and area of the Property, which is identified as the area marked as 1O on the attached map. The area marked in yellow and identified as area -4- on the attached map is specifically excluded from the definition of Property -which is subject to this Agreement. The map also sets out in approximate manner the location and area of the After Acquired Properties, which are identified as the areas marked 1 , 2, 3, 5, 6, S, 9 and part of V.

DESCRIPTION OF QUILA CONCESSION

Exploration Title Number: !FVlining concession name: Expedient number: Agency: IVTunioipality &. State Concession Size: 22859O Quila O45/16284 Guadalajara Jalisco Quila Jalisco 22427.7761 hectares

Exhibit “1”

SCHEDULE “B” NET SMELTER RETURNS ROYALTY

1. The following words and phrases shall have the following meanings, namely:

(a) “Date of Commencement of Commercial Production” shall be the date upon which Ore from the Property, After Acquired Properties or the Cocula Property is being consistently milled on a continuous basis at 75% of the rate projected in the final feasibility study, if any, prepared by or for the Optionee in respect of the Property, the After Acquired Properties or the Cocula Property or 180 days after the date on which Ore from the Property, After Acquired Properties or the Cocula Property is first mined, whichever shall first occur;

(b) “Net Smelter Returns” with respect to the Property, the After Acquired Properties and the Cocula Property shall mean the gross proceeds received by the Optionee in any year from the sale of Product from the mining operations on the Property, the After Acquired Properties and the Cocula Property less successively:

(i) the cost of transportation of such Product to a smelter or other place of treatment; and

(ii) smelter and treatment charges.;

(c) “Ore” shall mean any material containing a mineral or minerals of commercial

economic value mined from the Property, the After Acquired Properties and the Cocula Property; and

(d) “Product” means Ore mined from the Property, the After Acquired Properties and

the Cocula Property and any concentrates or other materials or products derived therefrom, provided, however, that if any such Ore, concentrates or other materials or products are further treated as part of the mining operation in respect of the Property, the After Acquired Properties and the Cocula Property, such Ore, concentrates or other materials or products shall not be considered to be “Product” until after they have been so treated.

2. The Optionee shall give notice to the Optionor of the date on which Ore is first mined. It

is agreed that pilot plant operations and the mining or milling of Ore in connection therewith shall not be considered commercial production.

3. The amount of Royalty payable to the Optionor, namely 3 % of Net Smelter Returns, shall be calculated by the Optionor each quarter and at the end of such quarter and shall be paid to the Optionor on or before the last day of the next following quarter. Any adjustments in the payment of Royalty hereunder arising out of an audit referred to in Section 7 hereof shall be made and paid at that time.

4. On or before the last day of each quarter of each year after the Date of Commencement of Commercial Production, the Optionee shall deliver to the Optionor a statement indicating in reasonable detail, as of the last day of the immediately preceding quarter, the calculation of Net Smelter Returns and the aggregate Royalty payable for such quarter.

5. The Optionee may remove reasonable quantities of Ore and rock from the Property, the After Acquired Properties and the Cocula Property for the purpose of bulk sampling and of

testing, and there shall be no Royalty payable to the Optionor with respect thereto unless revenues are derived therefrom.

6. The Optionee agrees to maintain for each mining operation on the Property, the After

Acquired Properties and the Cocula Property up to date and complete records relating to the production and sale of Product including accounts, records, statements and returns relating to treatment and smelting arrangements of the Product, and the Optionor or its agents shall have the right at all times, including for a period of twelve (12) months following the expiration or termination of this Agreement, to inspect such records, statements, and returns and make copies thereof at its own expense for the purpose of verifying the amount of Royalty payments to be made by the Optionee to the Optionor pursuant hereto. The Optionor shall have the right at its own expense to have such account audited by independent auditors once year.

7. The Optionee shall have an audited statement prepared by its auditors for each year with

respect to the Royalty payable to the Optionor hereunder, by the July 30 in the following year, and the Optionee shall forthwith deliver a copy of such statement to the Optionor.

8. All Royalty payments shall be consider final and in full satisfaction of all obligations of

the Optionee making same in respect thereof if such payments or the calculation in respect thereof are not disputed by the Optionor within 60 days after receipt by the Optionor of the audited statements referred to in Section 7 hereof. Any disputes under this section shall be decided by arbitration as provided in the Agreement.

9. The Optionee shall have the right to commingle with Ores from the Property, the After

Acquired Properties and the Cocula Property, ore produced from other properties provided that prior to such commingling, the Optionee shall adopt and employ reasonable practices and procedures for weighing, determination of moisture content, sampling and assaying, as well as utilize reasonable accurate recovery factors in order to determine the amount of products derived from, or attributable to Ore mined and produced from the Property, the After Acquired Properties and the Cocula Property. The Optionee shall maintain accurate records of the results of such sampling, weighing and analysis as pertaining to Ore mined and produced from the Property, the After Acquired Properties and the Cocula Property.