Securian AM Dynamic Managed Volatility Fund

Institutional Class Shares – VVMIX

Securian AM Managed Volatility Equity Fund

Institutional Class Shares – VMEIX

Securian AM Real Asset Income Fund

Institutional Class Shares – VSDIX

Annual Report

| www.securianamfunds.com | August 31, 2019 |

SECURIAN AM FUNDS

October 9, 2019

Securian AM Dynamic Managed Volatility Fund

Managers:

Craig Stapleton, CFA; Jeremy Gogos, CFA; Merlin Erickson

Securian Asset Management

FUND PERFORMANCE UPDATE

For the period beginning September 1, 2018 and ending August 31, 2019, the Dynamic Managed Volatility Fund (the “DMV Fund”) Institutional Class returned 4.54%, underperforming the DMV Benchmark return of 6.22%.

The Fund had a realized volatility, as measured by its standard deviation of daily returns, of 9.08%, compared to the Fund’s custom benchmark realized volatility of 9.56%.

The DMV Benchmark is a custom benchmark for the DMV Fund developed by Securian Asset Management.

For comparison, the S&P 500 Index (dividend adjusted) was up 2.92% with a volatility of 16.61% over the same period.

STRATEGY UPDATE

This period began with low volatility prevailing in the market. S&P 500 realized one-month volatility was 7.30% on August 31, 2018, and that metric drifted marginally lower over the course of September. As such, the Fund entered the period with an equity exposure of 81.33%. On October 10, 2018, the S&P 500 saw a 3.29% selloff, and the beginning of a period of elevated volatility that would last through January 2019. At its minimum, on Christmas Eve, the S&P had sold off 19.36% from its previous high, just shy of a bear market. In response to the escalating volatility, the Fund equity exposure was reduced to a period minimum of 27.00% on November 30, 2018 and was positioned at 32.81% at the trough of the S&P selloff (December 24, 2018). As volatility decreased through Q1 of 2019, the Fund equity exposure was increased, and closed out Q1 at 79.92%. May 2019 saw another bout of modestly elevated volatility, and a drawdown on the S&P of 6.62% (May 3, 2019 to June 3, 2019). Again, the Fund equity exposure was decreased to 53.65% in response. As volatility subsided in early June, we took a more defensive approach to re-risking the Fund and introduced S&P 500 call spreads, as opposed to direct linear exposure (e.g. futures). This approach proved appropriate, as the Fund was able to participate in some of the positive equity returns through July and avoid some of the volatility and losses that occurred in August. The Fund ended the period at 31.26% equity exposure.

MARKET SECTOR UPDATE

This period saw the current U.S. economic expansion set the record for longest ever: 123 months and counting, as of August 2019. While this fact could be taken as a positive indication for both the economy and financial assets going forward, we are firmly of the belief that the spectrum of possible equity returns over the near term is substantially skewed to the downside. Consider the following asset class returns.

SECURIAN AM FUNDS

Returns September 30, 2018 to August 30, 2019 | Gold (in U.S. Dollars) | Long Treasuries | Low Volatility Equity | S&P 500 | Russell 2000 | |

| Nasdaq |

| |

| 27.67% | 27.98% | 13.79% | 2.33% | -10.78% | 1.89% |

Source: Bloomberg.

September 30, 2018 was the approximate date the S&P made a local high before the volatility flare in Q4. And since that high, its price return has been essentially flat. More risky equity has fared worse. On the other hand, perceived “safe-haven” assets have performed incredibly well.

This period also saw global negative yielding debt top $16 trillion, S&P 500 earnings decline year over year for the first two quarters of 2019, and the U.S.-China trade dispute start to materially impact gross domestic product (GDP), with estimates ranging from 0.3 to 0.6% of GDP lost due to tariffs. Finally, the U.S. 3M-10Y yield curve was inverted for essentially all of the final three months, and as we have previously alluded to, the yield curve inversion has preceded every recession since 1980.

We view this mosaic as the manifestation of misguided monetary policy—more on that shortly—and poor execution on trade negotiations coming home to roost.

Regarding monetary policy, all three major central banks had been on a path toward tighter monetary policy in early 2019. Unfortunately, no bank made it very far toward normalization. The European Central Bank (ECB) merely stopped quantitative easing at the end of 2018; their policy rate is still 0%. The Bank of Japan (BOJ) is still targeting essentially 0% yield on its policy rate and 10Y bond. The Federal Reserve managed to hike its policy rate to 2.5%, but began cutting rates again on July 30, 2019! On the one hand, short-term yields in the United States are quite out of line with most of the rest of the developed world, so one can argue that rate cuts are warranted. On the other hand, the Fed’s policy rate was 5.25%, and its balance sheet was less than $1 trillion, going into the Great Financial Crisis. Starting from a policy rate of 2.25%, and a balance sheet of over $3.5 trillion, means that there is significantly less ammunition with which to combat the next recession.

This period also saw markets venture into uncharted territory. No prior time in history has seen the confluence of monetary, fiscal, and foreign policy unfolding on social media, and algorithmic trading reacting to this “news” in real time. At first blush, this certainly seems a destabilizing influence on equity markets.

SECURIAN AM FUNDS

OUTLOOK

Because of the state of the yield curve at the time of our last commentary, we had dismissed the possibility of further Fed hikes. We had also pointed to the Fed being forced to cut rates because of weakening macroeconomic conditions as our most likely outcome, and that seems to have come to pass. This reporting period began as one in which all three major central banks were simultaneously moving toward tighter monetary policy. By the end of the period, both the ECB and the Fed had announced, or actually enacted, easing measures. While the U.S. consumer is one area of economic strength, economic data across the globe has largely been deteriorating through 2019. Inflation has been muted, and below central bank targets. And global bond markets are screaming that there is no growth or inflation on the horizon; maybe the most extreme example of this is the Swiss 50Y sovereign bond, which was yielding -0.46% on August 30. Other long-duration sovereign yields may be a bit higher—the U.S. 30Y yield hit 1.95% on August 27 (an all-time low)—but they are telling the same story.

One could argue that the equity markets are also harmonizing with fixed income; over this period, we have seen selloffs and retracements to lost highs, but precious little appreciation past those previous high water marks. On a trailing one-year basis, most developed world indexes are either only modestly up:

| | • | S&P 500 = 2.92% |

| | • | Nasdaq = 1.60% |

| | • | FTSE 100 = 1.40% |

or outright in the red:

| | • | Russell 2000 = -12.92% |

| | • | MSCI EAFE (USD) = -2.65% |

| | • | MSCI Emerging Markets (USD) = -4.01% |

Maybe the most ominous signal from the global equity markets is the following. The Fed announced its first rate cut in this cycle on July 30, and that rate cut, along with several more over the next year were already priced into the market at that point. Even against that backdrop of anticipated monetary policy easing, every equity index mentioned above was down at least -1.58% for August. This reaction suggests that the world may have finally reached the limits of supporting financial asset valuations through monetary policy.

It is possible that the Federal Reserve’s new easing campaign could continue to support equity valuations for a time. Internationally, our view is that the ECB and BOJ are essentially helpless to foment further growth; they are already at the zero rate boundary, and any attempt to normalize monetary policy would almost certainly send their respective economies into recession. If one assumes cuts of 25 basis points, and four cuts per year, this implies the Fed can keep markets moving, and GDP from contracting, for about two years. We feel it would be optimistic to expect the current expansion to last that long, or to expect equities to produce returns in these next two years on par with the prior ten. We also expect volatility to be elevated going forward. Regardless, we will continue to use our volatility metrics to inform the equity allocation of the DMV Fund. We will aim to de-risk when we believe volatility will be high, and aim to re-risk when we believe volatility will be low.

SECURIAN AM FUNDS

October 9, 2019

Securian AM Managed Volatility Equity Fund

Managers:

Craig Stapleton, CFA; Jeremy Gogos, CFA; Merlin Erickson

Securian Asset Management

FUND PERFORMANCE UPDATE

For the period September 1, 2018 and ending August 31, 2019, the Managed Volatility Equity Fund (the “MVE Fund”) Institutional Class returned 3.32%, underperforming the MVE Benchmark return of 11.97%.

The MVE Benchmark is a custom benchmark for the MVE Fund developed by Securian Asset Management.

The Fund had a realized volatility, as measured by its standard deviation of daily returns, of 9.01%, as compared to the MVE Benchmark realized volatility of 7.94%.

For comparison, the S&P 500 Index (dividend adjusted) was up 2.92% with a volatility of 16.61% over the same period.

STRATEGY UPDATE

This period began with low volatility prevailing in the market. S&P 500 realized one-month volatility was 7.30% on August 31, 2018, and that metric drifted marginally lower over the course of September. As such, the Fund entered the period with an equity exposure of 93.97%. On October 10, 2018, the S&P 500 saw a 3.29% selloff, and the beginning of a period of elevated volatility that would last through January, 2019. At its minimum, on Christmas Eve, the S&P had sold off 19.36% from its previous high, just shy of a bear market. In response to the escalating volatility, the Fund equity exposure was gradually reduced over the course of December and was positioned at 62.08% at the trough of the S&P selloff (December 24, 2018). As volatility decreased through Q1 of 2019, the Fund equity exposure was increased, and closed out Q1 at 97.96%. While May and August saw periods of modestly elevated volatility, the Managed Volatility Equity allocation target did not materially change, and so the Fund equity exposure was maintained between 94.32% and 98.05%. We did, however, carry S&P put spread or VIX call options through June, July, and August, to hedge against a significant equity market selloff. The Fund ended the period at 97.51% equity exposure.

Another obvious strategy point to address is the large underperformance of the Fund relative to the benchmark for this period. Managed Volatility Equity is a global equity strategy that targets a 10% realized volatility over a full market cycle and seeks to mitigate severe equity drawdowns. We select what we believe are best-of-breed low volatility equity vehicles as a starting point for the portfolio, and we then incorporate a derivatives-based risk management overlay. The domestic and international low volatility vehicles we employ track indexes from MSCI; the benchmark’s constituents are from S&P and were chosen simply because they were thematically similar to our actual investments, but distinct in their approach. MSCI begins from a universe (domestic or international) of mid and large cap stocks similar to other developed market indexes and employs a constrained optimization approach that attempts to constructs a minimum variance portfolio that maintains roughly the same market cap distribution and sector representation as the starting universe. S&P, on the other hand, simply weights each universe member by the reciprocal of its realized volatility, and then takes a fixed number of members to create a low volatility index (100 members, in the case of the S&P 500 Low Volatility Index). This approach tends to skew heavily toward utilities, financials, real estate, consumer staples, and other “defensive” sectors. To give a sense for what this heavy sector skew in the benchmark produced during the period, consider the following returns for the period:

SECURIAN AM FUNDS

| | • | S&P 500 = 2.92% |

| | • | S&P 500 Utilities = 21.18% |

| | • | S&P 500 Financials = -2.91% |

| | • | S&P 500 Real Estate = 20.29% |

| | • | S&P 500 Consumer Staples = 16.09% |

Financials did poorly, which is understandable given the current interest rate environment. On the other hand, It is extremely unusual to see the utilities, real estate, and consumer staples sectors so massively outperform the full S&P 500 Index. And, in the S&P 500, utilities currently have a weight around 3.5%; in the S&P 500 Low Volatility Index, they comprise around 28%. These happenstance sector overweights are the predominant reason for the recent exceptional benchmark performance.

Clearly, the benchmark would have been a better managed volatility choice for this one-year period. But longer term, we still firmly believe in diversification, and still believe that the MSCI approach is the superior method for constructing a minimum variance equity portfolio. Further, something feels fundamentally amiss when the Fund outperformed the S&P 500 for the period, and yet the performance is deeply unsatisfactory. We actually interpret this as a market inflection point and delve into why in the remainder of this Letter.

MARKET SECTOR UPDATE

This period saw the current U.S. economic expansion set the record for longest ever: 123 months and counting, as of August 2019. While this fact could be taken as a positive indication for both the economy and financial assets going forward, we are firmly of the belief that the spectrum of possible equity returns over the near term is substantially skewed to the downside. Consider the following asset class returns.

Returns September 30, 2018 to August 30, 2019 | Gold (in U.S. Dollars) | Long Treasuries | Low Volatility Equity | S&P 500 | Russell 2000 | |

| Nasdaq |

| |

| 27.67% | 27.98% | 13.79% | 2.33% | -10.78% | 1.89% |

Source: Bloomberg.

September 30, 2018 was the approximate date the S&P made a local high before the volatility flare in Q4. And since that high, its price return has been essentially flat. More risky equity has fared worse. On the other hand, perceived “safe-haven” assets have performed incredibly well.

This period also saw global negative yielding debt top $16T, S&P 500 earnings decline year over year for the first two quarters of 2019, and the US-China trade dispute start to materially impact gross domestic product (GDP), with estimates ranging from 0.3 to 0.6% of GDP lost due to tariffs. Finally, the US 3M-10Y yield curve was inverted for essentially all of the final three months, and as we have previously alluded to, the yield curve inversion has preceded every recession since 1980.

SECURIAN AM FUNDS

We view this mosaic as the manifestation of misguided monetary policy—more on that shortly—and poor execution on trade negotiations coming home to roost.

Regarding monetary policy, all three major central banks had been on a path toward tighter monetary policy in early 2019. Unfortunately, no bank made it very far toward normalization. The European Central Bank (ECB) merely stopped quantitative easing at the end of 2018; their policy rate is still 0%. The Bank of Japan (BOJ) is still targeting essentially 0% yield on its policy rate and 10Y bond. The Federal Reserve managed to hike its policy rate to 2.5%, but began cutting rates again on July 30, 2019! On the one hand, short-term yields in the United States are quite out of line with most of the rest of the developed world, so one can argue that rate cuts are warranted. On the other hand, the Fed’s policy rate was 5.25%, and its balance sheet was less than $1T, going into the Great Financial Crisis. Starting from a policy rate of 2.25%, and a balance sheet of over $3.5T, means that there is significantly less ammunition with which to combat the next recession.

This period also saw markets venture into uncharted territory. No prior time in history has seen the confluence of monetary, fiscal, and foreign policy unfolding on social media, and algorithmic trading reacting to this “news” in real time. At first blush, this certainly seems a destabilizing influence on equity markets.

OUTLOOK

Because of the state of the yield curve at the time of our last commentary, we had dismissed the possibility of further Fed hikes. We had also pointed to the Fed being forced to cut rates because of weakening macroeconomic conditions as our most likely outcome, and that seems to have come to pass. This reporting period began as one in which all three major central banks were simultaneously moving toward tighter monetary policy. By the end of the period, both the ECB and the Fed had announced, or actually enacted, easing measures. While the US consumer is one area of economic strength, economic data across the globe has largely been deteriorating through 2019. Inflation has been muted, and below central bank targets. And global bond markets are screaming that there is no growth or inflation on the horizon; maybe the most extreme example of this is the Swiss 50Y sovereign bond, which was yielding -0.46% on August 30. Other long-duration sovereign yields may be a bit higher—the US 30Y yield hit 1.95% on August 27 (an all-time low)—but they are telling the same story.

SECURIAN AM FUNDS

One could argue that the equity markets are also harmonizing with fixed income; over this period, we have seen selloffs and retracements to lost highs, but precious little appreciation past those previous high water marks. On a trailing one-year basis, most developed world indexes are either only modestly up:

| | • | S&P 500 = 2.92% |

| | • | Nasdaq = 1.60% |

| | • | FTSE 100 = 1.40% |

or outright in the red:

| | • | Russell 2000 = -12.92% |

| | • | MSCI EAFE (USD) = -2.65% |

| | • | MSCI Emerging Markets (USD) = -4.01% |

Maybe the most ominous signal from the global equity markets is the following. The Fed announced its first rate cut in this cycle on July 30, and that rate cut, along with several more over the next year were already priced into the market at that point. Even against that backdrop of anticipated monetary policy easing, every equity index mentioned above was down at least -1.58% for August. This reaction suggests that the world may have finally reached the limits of supporting financial asset valuations through monetary policy.

It is possible that the Federal Reserve’s new easing campaign could continue to support equity valuations for a time. Internationally, our view is that the ECB and BOJ are essentially helpless to foment further growth; they are already at the zero rate boundary, and any attempt to normalize monetary policy would almost certainly send their respective economies into recession. If one assumes cuts of 25 bps, and four cuts per year, this implies the Fed can keep markets moving, and GDP from contracting, for about two years. We feel it would be optimistic to expect the current expansion to last that long, or to expect equities to produce returns in these next two years on par with the prior ten. We also expect volatility to be elevated going forward. Regardless, we will continue to use our volatility metrics to inform the equity allocation of the MVE Fund. We will aim to de-risk when we believe volatility will be high, and aim to re-risk when we believe volatility will be low.

SECURIAN AM FUNDS

October 9, 2019

Securian AM Real Asset Income Fund

Managers:

Joseph Betlej, CFA; Lowell Bolken, CFA; Craig Stapleton, CFA

Securian Asset Management

For the period beginning September 1, 2018 and ending August 31, 2019, the return for the Securian AM Real Asset Income Fund’s (the “RAI Fund”) Institutional Class was 6.32%, outperforming the Morningstar US Real Asset Total Return Index at 1.65%, but trailing the RAI custom benchmark return of 9.41%. For additional comparison, the S&P 500 Index (dividend adjusted) was up 2.92% during the same period. The RAI Fund’s dividend yield and volatility relative to the S&P 500 volatility throughout the year was consistent with expectations.

Indeed, spikes of market volatility returned to investment markets during the year. A lack of clarity regarding long- and short-term interest rates, energy commodity price drops, Federal Reserve (the “Fed”) actions, trade tensions, slowing economic growth, and corporate earnings provided many short-term swings in market performance. Growing uncertainty let risk sentiment to rise throughout the period. U.S. growth, however, remained relatively strong versus other parts of the globe. The Fed has attempted to support economic growth and targeted inflation through more dovish positioning through the year. Investment markets moved to a defensive stance, providing support for many of the Fund’s target sectors.

Real Estate Investment Trusts (“REITs”) saw a decline in the beginning of the period after a significant rally at the end of the previous timeframe. With concerns on a weakening economy and continued slowing of earnings growth, REITs had weak performance during the first four months of the reporting period. Later, with the return of defensive sentiment, REITs rebounded, on the backs of higher yielding, more visible earnings property types, such as healthcare, self-storage, multifamily, and warehouse. Economically sensitive REIT sectors (hotels and retail) provided lesser performance. For the year, REITs were up 12.1 percent.

Utilities generated very strong performance in the period, with positive returns of 21.0 percent. Among the uncertain economic backdrop, utility companies also provided a defensive, perceived “safe haven” in the market. Best opportunities were in well-capitalized regulated utilities with very visible earnings.

Midstream energy infrastructure stocks, as measured by the Alerian MLP Index, plummeted down 11.2 percent for the year, reflecting concerns on product flow based on weak energy commodity prices. Trade issues and Middle Eastern tensions added significant volatility to this group for the year.

Bonds and preferred stock performed well during the year. Tightening credit spreads and declining yields on long-term Treasury bonds were factors supporting performance in these asset classes.

STRATEGY

A weaker outlook for the economy and corporate earnings led us to increase weightings in more defensive names in our targeted sectors. Significant momentum, however, carried into utility and REIT stocks, particularly into names with high multiples and low dividend yields. On valuations at the high end of historic ranges, our discipline led us to sell. This move, however, was to the detriment of portfolio return as we missed out on the extended valuation move found in these sectors in the year. We added to midstream energy infrastructure names as commodity prices dragged down the stock prices for these companies. Additionally, we feel that many of these companies are better investments today, having restructured their business models, improved balance sheets, and are moving away from the need to tap the capital markets to enhance their growth.

SECURIAN AM FUNDS

OUTLOOK

In these times of uncertainty, it appears that investors are taking refuge in fast growing and income producing sectors. Though the broader equity markets hit record highs during the summer, much of the gain came from the large-cap tech companies. Still, some defensive sectors, such as utilities and some REITs were outperformers. With U.S. gross domestic product expectations to be below 2 percent versus earlier thoughts of 3 percent growth, corporate earnings may also be weaker. Tariff wars with China, flare-ups in the Mideast, and global economic weakness (some influence from Brexit issues) are ingredients leading to heightened volatility. The question is whether domestic earnings, boosted by the Fed’s recent dovish stance, can sustain amidst turmoil abroad.

Commercial real estate markets are showing near-term improvement as modest demand continues, and new supply additions appear to be slowing. While the next few quarter’s earnings might have some challenges, continued economic and job growth should allow for sound fundamentals for REITs. The direction of interest rates will continue to be a major factor influencing returns for REITs. Focus will be on companies with a competitive advantage in their markets, and a visible earnings growth path.

Regulated rate base growth should continue to drive performance for utility stocks, while valuation multiples are not likely to expand from this point. Companies investing in renewable generation, system reliability, and some merger and acquisition activity could provide opportunities for outperformance in utilities.

If Oil and Natural Gas prices continue their rebound from recent lows, energy commodity volumes should pick up, benefiting midstream companies. Best opportunities may be in energy basins that could see upside due to better pricing metrics in their markets. Constrained access to midstream assets, particularly export facilities, should drive better margins and improved cashflow for these companies.

SECURIAN AM FUNDS

Past performance is not a guarantee of future results.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments in this report.

Diversification does not assure a profit nor protect against loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. Investors should be aware of the risks involved with investing in a fund concentrating in a specific industry such as REITs or real estate securities. These include risks such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Investing in small and medium-sized companies involves greater risks than those associated with investing in large company stocks, such as business risk, significant stock price fluctuations and illiquidity. The Funds may invest in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. Investments in ETFs and ETNs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. MLPs are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, the limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates. The funds may also use options and future contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates and currency exchange rates. Covered calls may limit the upside potential of the underlying security. Interest payments on TIPS are unpredictable and will fluctuate as the principal and corresponding interest payments are adjusted for inflation. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in asset backed and mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Municipal securities are subject to adverse political or economic factors, including changes in the tax law. Derivatives involve special risks including leverage, correlation, counterparty, liquidity, operational, accounting and tax risks. These risks, in certain cases, may be greater than the risks presented by more traditional investments. The Funds may invest in illiquid securities which involve the risk that the securities will not be able to be sold at the time or prices desired by the fund, particularly during times of market turmoil.

The DMV Benchmark is a custom benchmark created by Securian Asset Management, it is comprised of 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index. The S&P 500 Index is an unmanaged, market-value weighted index of stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance. The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged, market-value weighted index of bonds, which is widely regarded as the standard for measuring investment grade bond performance.

The MVE Benchmark is a custom benchmark created by Securian Asset Management, it is comprised of 60% S&P 500 Low Volatility Index; 20% S&P BMI International Developed Low Volatility Index; and 20% Bloomberg Barclays U.S. 3 Month Treasury Bellwether Index. The S&P 500 Low Volatility Index measures the performance of the 100 least volatile stocks in the S&P 500 Index based on their historical volatility. The S&P BMI International Developed Low Volatility Index measures the performance of the 200 least volatile stocks in the S&P Developed Market large/midcap universe. Constituents are weighted relative to the inverse of their corresponding volatility, with the least volatile stocks receiving the highest weights. The Bloomberg Barclays U.S. 3 Month Treasury Bellwether Index measures the performance of U.S. Treasury Bills with a maturity of less than three months.

The RAI Benchmark is a custom benchmark created by Securian Asset Management, it is comprised of 54% FTSE NAREIT Equity REITs Index; 12% S&P 500 Utilities Index; 12% Alerian MLP Total Return Index; 12% Bloomberg Barclays Capital US Government Inflation Linked Bond Index; and 10% Wells Fargo Hybrid & Preferred REIT. Alerian MLP Total Return Index – a composite of the 50 most prominent energy Master Limited Partnerships (MLPs). Bloomberg Barclays Capital US Government Inflation Linked Bond Index – an index that includes publicly issued, U.S. Treasury inflation protected securities that have at least 1 year remaining to maturity of index rebalancing date, with an issue size equal to or in excess of $500 million. The S&P 500 Utilities Index – an index of those companies included in the S&P 500 that are classified as members of the GICS® utilities sector. Wells Fargo Hybrid & Preferred REIT Index – an index composed exclusively of preferred shares and depository shares designed to track the performance of preferred securities issued in the U.S. markets by Real Estate Investment Trusts (REITs). FTSE NAREIT Equity REITs Index – an index of publicly traded U.S. real estate equity securities.

The Alerian MLP Index is a market-cap weighted, float-adjusted index created to provide a comprehensive benchmark for investors to track the performance of the energy MLP sector.

SECURIAN AM FUNDS

The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices.

The FTSE (Financial Times Stock Exchange) 100 Index is a market-capitalization weighted index of UK-listed blue chip companies. The index is part of the FTSE UK Series and is designed to measure the performance of the 100 largest companies traded on the London Stock Exchange that pass screening for size and liquidity. FTSE 100 constituents are all traded on the London Stock Exchange’s SETS trading system.

The Morningstar US Real Asset Index is a diversified portfolio of four different asset classes that have historically displayed high sensitivity to inflation. These four asset classes are U.S. Treasury inflation-protected securities (“TIPS”), commodity futures-based strategies, real estate investment trusts (“REITs”), and inflation-sensitive equities such as upstream commodity stocks and master limited partnerships.

The MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. and Canada. The EAFE acronym stands for Europe, Australasia and Far East.

The MSCI Emerging Markets Index captures large and mid cap representation across 26 emerging markets countries. With 1,202 constituents, the index covers approximately 85% of the free-float adjusted market capitalization in each country.

The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite is calculated under a market capitalization weighted methodology index.

The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

S&P 500 Financials Index – an index of those companies included in the S&P 500 that are classified as members of the GICS® financial sector.

S&P 500 Real Estate Index – an index of those companies included in the S&P 500 that are classified as members of the GICS® real estate sector.

S&P 500 Consumer Staples Index – an index of those companies included in the S&P 500 that are classified as members of the GICS® consumer staples sector.

It is not possible to invest directly in an index.

Standard deviation measures the dispersion of a set of data from its mean.

Dividend yield is calculated by annualizing the last quarterly dividend paid and dividing it by the current share price. The dividend yield is that of the securities held in the portfolio; it is not reflective of the yield distributed to shareholders.

Drawdown reflects the peak-to-trough decline during a specific period of time.

Spread is the difference between a bid and ask price. It also refers to the difference in a trading position – the gap between a short position in one futures contract and a long position in another.

Basis points is a common unit of measure in finance and is used to denote the percentage change in a financial instrument. One basis point is equal to 0.01 percent.

A stock may trade with more or less liquidity than a bond depending on the number of shares and bonds outstanding, the size of the company, and the demand for the securities. Gold is considered a commodity and liquidity is based on buying or selling an asset easily without disrupting price in a market.

Treasury notes are guaranteed by the U.S. government and thus they are considered to be safer than other asset classes.

All investments involve risk. Principal loss is possible.

Must be preceded or accompanied by a current prospectus.

Quasar Distributors, LLC, distributor.

Earnings growth is not a measure of the Fund’s future performance.

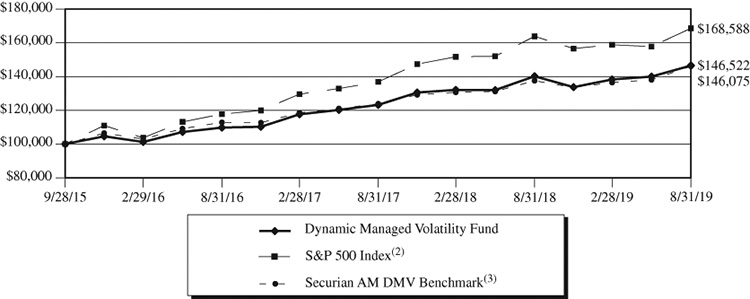

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Value of $100,000 Investment (Unaudited)

The chart assumes an initial investment of $100,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return (%) – As of August 31, 2019 (Unaudited)

| | One Year | Three Years | Since Inception(1) |

| Dynamic Managed Volatility Fund | 4.54% | 10.11% | 10.22% |

S&P 500 Index(2) | 2.92% | 12.70% | 14.23% |

Securian AM DMV Benchmark(3) | 6.22% | 8.98% | 10.13% |

| (1) | September 28, 2015. |

| (2) | The Standard & Poor’s 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

| (3) | The Securian AM DMV Benchmark is comprised of 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index. This Index cannot be invested in directly. |

SECURIAN AM MANAGED VOLATILITY EQUITY FUND

Value of $100,000 Investment (Unaudited)

The chart assumes an initial investment of $100,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return (%) – As of August 31, 2019 (Unaudited)

| | One Year | Three Years | Since Inception(1) |

| Managed Volatility Equity Fund | 3.32% | 6.76% | 7.73% |

S&P 500 Index(2) | 2.92% | 12.70% | 14.23% |

Securian AM MVE Benchmark(3) | 11.97% | 9.85% | 11.37% |

| (1) | September 28, 2015. |

| (2) | The Standard & Poor’s 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

| (3) | The Securian AM MVE Benchmark is comprised of 60% S&P 500 Low Volatility Index, 20% S&P BMI International Developed Low Volatility Index, and 20% Bloomberg Barclays U.S. 3 Month Treasury Bellwether Index. This Index cannot be invested in directly. |

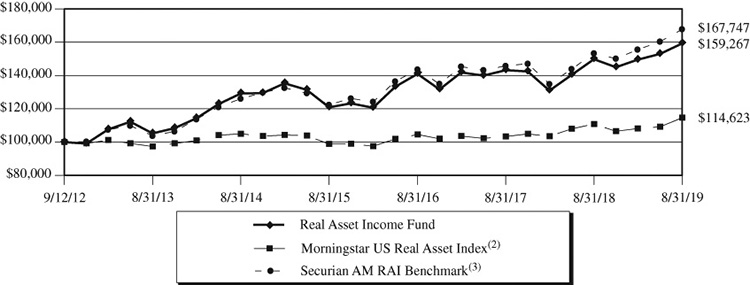

SECURIAN AM REAL ASSET INCOME FUND

Value of $100,000 Investment (Unaudited)

The chart assumes an initial investment of $100,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return (%) – As of August 31, 2019 (Unaudited)

| | One Year | Three Years | Five Years | Since Inception(1) |

| Real Asset Income Fund | 6.32% | 4.15% | 4.27% | 6.91% |

Morningstar US Real Asset Index(2) | 3.41% | 3.11% | 1.77% | 1.98% |

Securian AM RAI Benchmark(3) | 9.41% | 5.32% | 5.88% | 7.71% |

| (1) | September 12, 2012. |

| (2) | The Morningstar US Real Asset Index is a diversified portfolio of four different asset classes that have historically displayed high sensitivity to inflation. These four asset classes are U.S. Treasury inflation-protected securities (“TIPS”), commodity futures-based strategies, real estate investment trusts (“REITs”), and inflation-sensitive equities such as upstream commodity stocks and master limited partnerships. This Index cannot be invested in directly. |

| (3) | The Securian AM RAI Benchmark is comprised of 54% FTSE NAREIT Equity REITs Index; 12% S&P 500 Utilities Index; 12% Alerian MLP Total Return Index; 12% Bloomberg Barclays Capital US Government Inflation Linked Bond Index; and 10% Wells Fargo Hybrid & Preferred REIT Index. This Index cannot be invested in directly. |

SECURIAN AM FUNDS

Expense Example (Unaudited)

August 31, 2019

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (March 1, 2019 – August 31, 2019).

ACTUAL EXPENSES

For each Fund, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

For each Fund, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs may have been higher.

Securian AM Dynamic Managed Volatility Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (3/1/2019) | (8/31/2019) | (3/1/2019 to 8/31/2019) |

Dynamic Managed Volatility Fund Actual(2) | $1,000.00 | $1,059.70 | $2.86 |

| Dynamic Managed Volatility Fund Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,022.43 | $2.80 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.55% for the Fund multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended August 31, 2019 of 5.97% for the Fund. |

SECURIAN AM FUNDS

Expense Example (Unaudited) – Continued

August 31, 2019

Securian AM Managed Volatility Equity Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(3) |

| | (3/1/2019) | (8/31/2019) | (3/1/2019 to 8/31/2019) |

Managed Volatility Equity Fund Actual(4) | $1,000.00 | $1,047.80 | $2.84 |

| Managed Volatility Equity Fund Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,022.43 | $2.80 |

| (3) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.55% for the Fund multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (4) | Based on the actual returns for the six-month period ended August 31, 2019 of 4.78% for the Fund. |

Securian AM Real Asset Income Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(5) |

| | (3/1/2019) | (8/31/2019) | (3/1/2019 to 8/31/2019) |

Real Asset Income Fund Actual(6) | $1,000.00 | $1,065.30 | $3.90 |

| Real Asset Income Fund Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,021.42 | $3.82 |

| (5) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.75% for the Fund multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (6) | Based on the actual returns for the six-month period ended August 31, 2019 of 6.53% for the Fund. |

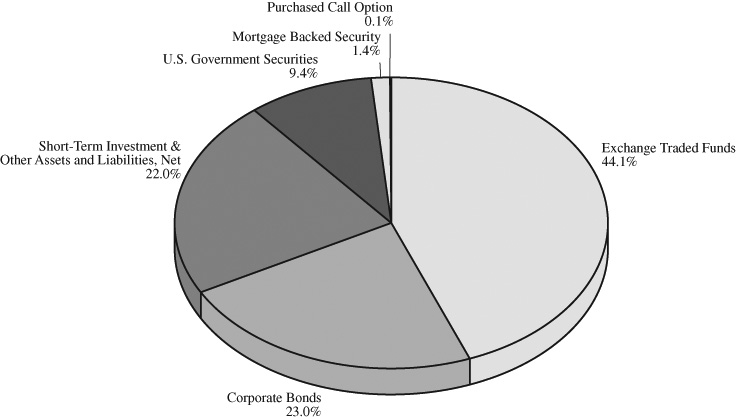

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Asset Allocation (Unaudited)

As of August 31, 2019(1)

(% of net assets)

Top Ten Holdings (Unaudited)

As of August 31, 2019(1)(2)

(% of net assets)

| iShares Core S&P 500 Fund | 39.8% |

| U.S. Treasury Bond, 2.625%, 12/15/2021 | 8.6% |

| iShares iBoxx $ Investment Grade Corporate Bond Fund | 4.4% |

| Credit Suisse Mortgage Trust, Series 2015-GLPA, 4.276%, 11/15/2037 | 1.4% |

| Takeda Pharmaceutical Company, 5.000%, 11/26/2028 | 1.0% |

| E*TRADE Financial, 2.950%, 08/24/2022 | 0.9% |

| Abbott Laboratories, 4.750%, 04/15/2043 | 0.6% |

| AT&T, 4.500%, 05/15/2035 | 0.6% |

| Florida Gas Transmission, 4.350%, 07/15/2025 | 0.5% |

| Sherwin-Williams, 3.950%, 01/15/2026 | 0.5% |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments are not included. |

SECURIAN AM MANAGED VOLATILITY EQUITY FUND

Asset Allocation (Unaudited)

As of August 31, 2019(1)

(% of net assets)

Fund Holdings (Unaudited)

As of August 31, 2019(1)(2)

(% of net assets)

| iShares MSCI USA Minimum Volatility Fund | 33.3% |

| iShares MSCI EAFE Minimum Volatility Fund | 24.9% |

| iShares Core High Dividend Fund | 17.8% |

| iShares MSCI Emerging Markets Minimum Volatility Fund | 6.0% |

| iShares Short Maturity Bond Fund | 5.0% |

| iShares MSCI Germany Fund | 3.8% |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments are not included. |

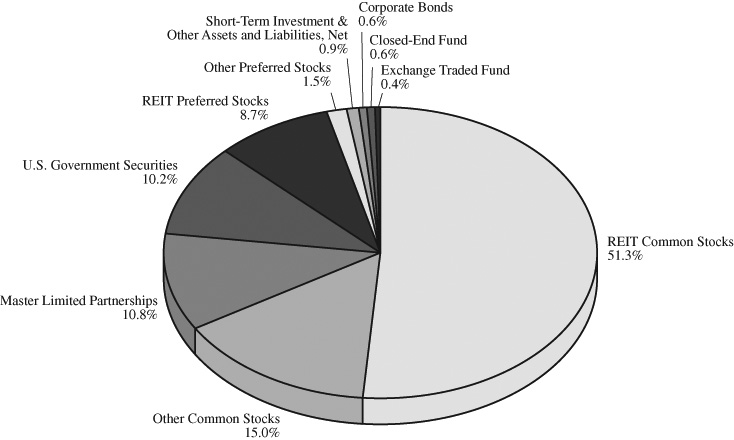

SECURIAN AM REAL ASSET INCOME FUND

Asset Allocation (Unaudited)

As of August 31, 2019(1)

(% of net assets)

Top Ten Holdings (Unaudited)

As of August 31, 2019(1)(2)

(% of net assets)

| Simon Property Group | 2.6% |

| Digital Realty Trust | 2.1% |

| Crown Castle International | 1.9% |

| U.S. Treasury Bond, 2.375%, 01/15/2025 | 1.8% |

| Enterprise Products Partners | 1.8% |

| Prologis | 1.8% |

| Ventas | 1.7% |

| Welltower | 1.7% |

| Energy Transfer | 1.6% |

| STAG Industrial | 1.5% |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments are not included. |

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Investments

August 31, 2019

| | | | | | Fair | |

| | | Shares | | | Value | |

| EXCHANGE TRADED FUNDS – 44.1% | | | | | | |

| iShares Core S&P 500 Fund (a)(b) | | | 80,666 | | | $ | 23,737,584 | |

| iShares iBoxx $ Investment Grade Corporate Bond Fund | | | 20,300 | | | | 2,614,640 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $19,621,243) | | | | | | | 26,352,224 | |

| | | | | | | | | |

| | | Par | | | | | |

| CORPORATE BONDS – 23.0% | | | | | | | | |

| | | | | | | | | |

| Airlines – 0.3% | | | | | | | | |

| British Airways | | | | | | | | |

| Series 2013-1 | | | | | | | | |

| 4.625%, 12/20/2025 (c) | | $ | 187,504 | | | | 199,776 | |

| | | | | | | | | |

| Banks – 2.1% | | | | | | | | |

| Astoria Financial | | | | | | | | |

| 3.500%, 06/08/2020 | | | 250,000 | | | | 250,773 | |

| Barclays | | | | | | | | |

| 4.375%, 01/12/2026 (d) | | | 200,000 | | | | 211,643 | |

| JPMorgan Chase | | | | | | | | |

| 4.500%, 01/24/2022 | | | 250,000 | | | | 264,673 | |

| PNC Bank | | | | | | | | |

| 2.450%, 07/28/2022 | | | 250,000 | | | | 253,371 | |

| Synchrony Bank | | | | | | | | |

| 3.000%, 06/15/2022 | | | 250,000 | | | | 254,627 | |

| | | | | | | | 1,235,087 | |

| Chemicals – 1.0% | | | | | | | | |

| Sherwin-Williams | | | | | | | | |

| 3.950%, 01/15/2026 | | | 300,000 | | | | 321,821 | |

| Yara International | | | | | | | | |

| 4.750%, 06/01/2028 (c)(d)(e) | | | 250,000 | | | | 275,200 | |

| | | | | | | | 597,021 | |

| Consumer Discretionary – 1.0% | | | | | | | | |

| CBS | | | | | | | | |

| 3.500%, 01/15/2025 | | | 300,000 | | | | 312,935 | |

| Harley-Davidson Financial Services | | | | | | | | |

| 3.550%, 05/21/2021 (c)(e) | | | 250,000 | | | | 254,545 | |

| | | | | | | | 567,480 | |

See Notes to the Financial Statements

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Investments – Continued

August 31, 2019

| | | | | | Fair | |

| | | Par | | | Value | |

| CORPORATE BONDS – 23.0% (Continued) | | | | | | |

| | | | | | | |

| Consumer Staples – 0.4% | | | | | | |

| CVS Health | | | | | | |

| 6.943%, 01/10/2030 | | $ | 197,104 | | | $ | 234,514 | |

| | | | | | | | | |

| Diversified Financial Services – 3.0% | | | | | | | | |

| American Express | | | | | | | | |

| 2.500%, 08/01/2022 | | | 250,000 | | | | 253,604 | |

| Capital One Financial | | | | | | | | |

| 4.250%, 04/30/2025 | | | 250,000 | | | | 271,920 | |

| E*TRADE Financial | | | | | | | | |

| 2.950%, 08/24/2022 | | | 500,000 | | | | 510,491 | |

| First American Financial | | | | | | | | |

| 4.600%, 11/15/2024 | | | 200,000 | | | | 215,815 | |

| Invesco Financial | | | | | | | | |

| 3.750%, 01/15/2026 (d) | | | 250,000 | | | | 269,140 | |

| Total System Services | | | | | | | | |

| 4.800%, 04/01/2026 | | | 250,000 | | | | 281,667 | |

| | | | | | | | 1,802,637 | |

| Energy – 2.8% | | | | | | | | |

| Florida Gas Transmission | | | | | | | | |

| 4.350%, 07/15/2025 (c) | | | 300,000 | | | | 325,436 | |

| ONEOK | | | | | | | | |

| 4.000%, 07/13/2027 | | | 250,000 | | | | 263,148 | |

| Phillips 66 | | | | | | | | |

| 4.650%, 11/15/2034 | | | 200,000 | | | | 232,312 | |

| Valero Energy | | | | | | | | |

| 3.650%, 03/15/2025 | | | 300,000 | | | | 316,692 | |

| 4.350%, 06/01/2028 | | | 250,000 | | | | 272,318 | |

| Williams Partners | | | | | | | | |

| 3.750%, 06/15/2027 | | | 250,000 | | | | 260,910 | |

| | | | | | | | 1,670,816 | |

| Health Care – 0.6% | | | | | | | | |

| Abbott Laboratories | | | | | | | | |

| 4.750%, 04/15/2043 | | | 300,000 | | | | 375,482 | |

| | | | | | | | | |

| Industrial – 1.3% | | | | | | | | |

| General Dynamics | | | | | | | | |

| 3.500%, 05/15/2025 | | | 250,000 | | | | 269,266 | |

| Textron | | | | | | | | |

| 4.000%, 03/15/2026 | | | 250,000 | | | | 268,746 | |

See Notes to the Financial Statements

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Investments – Continued

August 31, 2019

| | | | | | Fair | |

| | | Par | | | Value | |

| CORPORATE BONDS – 23.0% (Continued) | | | | | | |

| | | | | | | |

| Industrial – 1.3% (Continued) | | | | | | |

| Tyco Electronics Group | | | | | | |

| 3.700%, 02/15/2026 (d) | | $ | 250,000 | | | $ | 266,703 | |

| | | | | | | | 804,715 | |

| Insurance – 3.0% | | | | | | | | |

| Allied World Assurance Company Holdings | | | | | | | | |

| 4.350%, 10/29/2025 (d) | | | 250,000 | | | | 260,117 | |

| Assured Guaranty US Holdings | | | | | | | | |

| 5.000%, 07/01/2024 | | | 200,000 | | | | 221,845 | |

| Hanover Insurance Group | | | | | | | | |

| 4.500%, 04/15/2026 | | | 250,000 | | | | 271,614 | |

| Horace Mann Educators | | | | | | | | |

| 4.500%, 12/01/2025 | | | 250,000 | | | | 266,569 | |

| Liberty Mutual Group | | | | | | | | |

| 4.250%, 06/15/2023 (c) | | | 250,000 | | | | 266,497 | |

| Manulife Financial | | | | | | | | |

| 4.150%, 03/04/2026 (d) | | | 250,000 | | | | 277,398 | |

| Old Republic International | | | | | | | | |

| 4.875%, 10/01/2024 | | | 200,000 | | | | 221,147 | |

| | | | | | | | 1,785,187 | |

| Pharmaceuticals – 1.0% | | | | | | | | |

| Takeda Pharmaceutical Company | | | | | | | | |

| 5.000%, 11/26/2028 (c)(d)(e) | | | 500,000 | | | | 592,160 | |

| | | | | | | | | |

| Real Estate Investment Trusts – 2.2% | | | | | | | | |

| Alexandria Real Estate Equities | | | | | | | | |

| 4.300%, 01/15/2026 | | | 200,000 | | | | 220,779 | |

| Essex Portfolio | | | | | | | | |

| 3.500%, 04/01/2025 | | | 300,000 | | | | 315,867 | |

| Healthcare Trust of America Holdings | | | | | | | | |

| 3.750%, 07/01/2027 | | | 250,000 | | | | 263,656 | |

| Host Hotels & Resorts | | | | | | | | |

| Series F | | | | | | | | |

| 4.500%, 02/01/2026 | | | 250,000 | | | | 273,936 | |

| Kimco Realty | | | | | | | | |

| 3.400%, 11/01/2022 | | | 250,000 | | | | 259,017 | |

| | | | | | | | 1,333,255 | |

See Notes to the Financial Statements

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Investments – Continued

August 31, 2019

| | | | | | Fair | |

| | | Par | | | Value | |

| CORPORATE BONDS – 23.0% (Continued) | | | | | | |

| | | | | | | |

| Technology – 0.5% | | | | | | |

| Hewlett Packard Enterprise | | | | | | |

| 4.900%, 10/15/2025 | | $ | 100,000 | | | $ | 110,810 | |

| Juniper Networks | | | | | | | | |

| 4.500%, 03/15/2024 | | | 200,000 | | | | 217,677 | |

| | | | | | | | 328,487 | |

| Telecommunications – 2.1% | | | | | | | | |

| AT&T | | | | | | | | |

| 4.500%, 05/15/2035 | | | 300,000 | | | | 334,276 | |

| Comcast | | | | | | | | |

| 4.650%, 07/15/2042 | | | 250,000 | | | | 305,497 | |

| Verizon Communications | | | | | | | | |

| 5.250%, 03/16/2037 | | | 250,000 | | | | 316,629 | |

| Vodafone Group | | | | | | | | |

| 4.125%, 05/30/2025 (d) | | | 250,000 | | | | 271,538 | |

| | | | | | | | 1,227,940 | |

| Transportation – 1.3% | | | | | | | | |

| Kansas City Southern | | | | | | | | |

| 4.300%, 05/15/2043 | | | 250,000 | | | | 280,284 | |

| Penske Truck Leasing / PTL Finance | | | | | | | | |

| 3.300%, 04/01/2021 (c) | | | 200,000 | | | | 203,192 | |

| 3.900%, 02/01/2024 (c) | | | 250,000 | | | | 264,537 | |

| | | | | | | | 748,013 | |

| Utilities – 0.4% | | | | | | | | |

| Oglethorpe Power | | | | | | | | |

| 4.250%, 04/01/2046 | | | 200,000 | | | | 214,201 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $12,633,003) | | | | | | | 13,716,771 | |

| | | | | | | | | |

| U.S. GOVERNMENT SECURITIES – 9.4% | | | | | | | | |

| | | | | | | | | |

| U.S. Treasury Bonds – 9.4% | | | | | | | | |

| 2.000%, 01/31/2020 | | | 500,000 | | | | 500,117 | |

| 2.625%, 12/15/2021 | | | 5,000,000 | | | | 5,129,200 | |

| Total U.S. Government Securities | | | | | | | | |

| (Cost $5,479,265) | | | | | | | 5,629,317 | |

See Notes to the Financial Statements

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Investments – Continued

August 31, 2019

| | | | | | Fair | |

| | | Par | | | Value | |

| MORTGAGE BACKED SECURITY – 1.4% | | | | | | |

| | | | | | | |

| Commercial – 1.4% | | | | | | |

| Credit Suisse Mortgage Trust | | | | | | |

| Series 2015-GLPA, Class C | | | | | | |

| 4.276%, 11/15/2037 (c)(f) | | | | | | |

| (Cost $754,411) | | $ | 750,000 | | | $ | 824,246 | |

| | | | Contracts | | | Notional | | | |

| PURCHASED CALL OPTION – 0.1% | | | | | | | | | |

| CBOE S&P 500 Index (g) | | | | | | | | | |

| Expiration: September 2019, Exercise Price: $3,005 | | | | | | | | | |

| (Cost $74,360) | | | | 55 | | | $ | 16,095,530 | | 44,275 | |

| | | Shares | | | | |

| SHORT-TERM INVESTMENT – 19.9% | | | | | | |

| First American Government Obligations Fund, Class X, 2.03% (h) | | | | | | |

| (Cost $11,862,961) | | | 11,862,961 | | | | 11,862,961 | |

| Total Investments – 97.9% | | | | | | | | |

| (Cost $50,425,243) | | | | | | | 58,429,794 | |

| Other Assets and Liabilities, Net – 2.1% | | | | | | | 1,235,149 | |

| Total Net Assets – 100.0% | | | | | | $ | 59,664,943 | |

| (a) | All or a portion of this security is designated as collateral for futures contracts. As of August 31, 2019, the fair value of collateral was $23,737,584. |

| (b) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (c) | Security purchased within the terms of a private placement memorandum, exempt from registration under Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” As of August 31, 2019, the fair value of these investments were $3,205,589, or 5.4% of total net assets. |

| (d) | Foreign Security. The Fund had $2,423,899 or 4.1% of net assets in foreign securities at August 31, 2019. |

| (e) | Security considered illiquid and is categorized in Level 2 of the fair value hierarchy. See Notes 2 & 3 in Notes to the Financial Statements. |

| (f) | Variable rate security – The coupon is based on an underlying pool of loans. |

| (g) | Held in connection with written option contracts. See Schedule of Written Options for further information. |

| (h) | The rate shown is the annualized seven day effective yield as of August 31, 2019. |

See Notes to the Financial Statements

SECURIAN AM DYNAMIC MANAGED VOLATILITY FUND

Schedule of Open Futures Contracts

August 31, 2019

| | Number of | | | | |

| | Contracts | Expiration | Notional | Fair | Unrealized |

Description | Sold | Date | Amount | Value | Depreciation |

| E-mini S&P 500 Index | 36 | September 2019 | $5,264,640 | $3,420 | $(14,625)

|

Schedule of Written Options

August 31, 2019

| | | Contracts | Expiration | Notional | Exercise | Fair |

Description | Call/Put | Written | Date | Amount | Price | Value |

| CBOE S&P 500 Index* | Call | 55 | September 2019 | $16,095,530 | $3,110 | $1,925

|

| * | Held in connection with purchased option contracts. See Schedule of Investments for further information. |

See Notes to the Financial Statements

SECURIAN AM MANAGED VOLATILITY EQUITY FUND

Schedule of Investments

August 31, 2019

| | | | | | Fair | |

| | | Shares | | | Value | |

| EXCHANGE TRADED FUNDS – 90.8% | | | | | | |

| iShares Core High Dividend Fund | | | 76,717 | | | $ | 7,108,597 | |

| iShares MSCI EAFE Minimum Volatility Fund (a) | | | 137,716 | | | | 9,903,846 | |

| iShares MSCI Emerging Markets Minimum Volatility Fund | | | 41,866 | | | | 2,377,570 | |

| iShares MSCI Germany Fund | | | 57,796 | | | | 1,517,145 | |

| iShares MSCI USA Minimum Volatility Fund (a)(b) | | | 207,929 | | | | 13,256,514 | |

| iShares Short Maturity Bond Fund | | | 39,455 | | | | 1,986,362 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $28,383,900) | | | | | | | 36,150,034 | |

| | | | | | | | | |

| | | Par | | | | | |

| U.S. GOVERNMENT SECURITY – 1.2% | | | | | | | | |

| | | | | | | | | |

| U.S. Treasury Bond – 1.2% | | | | | | | | |

| 2.000%, 01/31/2020 | | | | | | | | |

| (Cost $498,975) | | $ | 500,000 | | | | 500,117 | |

| | | Contracts | | | Notional | | |

| |

| PURCHASED PUT OPTIONS – 0.1% | | | | | | | | | |

| CBOE S&P 500 Index (c) | | | | | | | | | |

| Expiration: September 2019, Exercise Price: $2,750 | | | 14 | | | $ | 3,850,000 | | | | 15,750 | |

| Expiration: September 2019, Exercise Price: $2,810 | | | 14 | | | | 3,934,000 | | | | 26,040 | |

| Total Purchased Put Options | | | | | | | | | | | | |

| (Cost $68,726) | | | | | | | | | | | 41,790 | |

| | | Shares | | | | |

| SHORT-TERM INVESTMENT – 7.6% | | | | | | |

| First American Government Obligations Fund, Class X, 2.03% (d) | | | | | | |

| (Cost $3,018,657) | | | 3,018,657 | | | | 3,018,657 | |

| Total Investments – 99.7% | | | | | | | | |

| (Cost $31,970,258) | | | | | | | 39,710,598 | |

| Other Assets and Liabilities, Net – 0.3% | | | | | | | 115,270 | |

| Total Net Assets – 100.0% | | | | | | $ | 39,825,868 | |

| (a) | All or a portion of this security is designated as collateral for futures contracts. As of August 31, 2019, the fair value of the collateral was $12,135,096. |

| (b) | Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (c) | Held in connection with written option contracts. See Schedule of Written Options for further information. |

| (d) | The rate shown is the annualized seven day effective yield as of August 31, 2019. |

See Notes to the Financial Statements

SECURIAN AM MANAGED VOLATILITY EQUITY FUND

Schedule of Open Futures Contracts

August 31, 2019

| | Number of | | | | |

| | Contracts | Expiration | Notional | Fair | Unrealized |

Description | Purchased | Date | Amount | Value | Appreciation |

| E-mini S&P 500 Index | 32 | September 2019 | $4,679,680 | $(3,040) | $50,266

|

Schedule of Written Options

August 31, 2019

| | | | Contracts | | Expiration | | Notional | | | Exercise | | | Fair | |

Description | Call/Put | | Written | | Date | | Amount | | | Price | | | Value | |

| CBOE S&P 500 Index* | Put | | 14 | | September 2019 | | $ | 3,612,000 | | | $ | 2,580 | | | $ | 3,745 | |

| CBOE S&P 500 Index* | Put | | 14 | | September 2019 | | | 3,668,000 | | | | 2,620 | | | | 5,180 | |

| | | | | | | | | | | | | | | | $ | 8,925 | |

| * | Held in connection with purchased option contracts. See Schedule of Investments for further information. |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments

August 31, 2019

| | | | | | Fair | |

| | | Shares | | | Value | |

| REIT COMMON STOCKS – 51.3% | | | | | | |

| | | | | | | |

| Health Care – 8.5% | | | | | | |

| CareTrust REIT | | | 24,812 | | | $ | 590,277 | |

| HCP | | | 34,238 | | | | 1,188,401 | |

| Healthcare Trust of America, Class A | | | 8,214 | | | | 232,949 | |

| LTC Properties | | | 4,400 | | | | 214,720 | |

| National Health Investors | | | 8,581 | | | | 711,880 | |

| OMEGA Healthcare Investors | | | 13,078 | | | | 532,013 | |

| Physicians Realty Trust | | | 30,400 | | | | 526,528 | |

| Sabra Health Care REIT | | | 10,659 | | | | 230,448 | |

| Ventas | | | 19,500 | | | | 1,431,105 | |

| Welltower | | | 15,764 | | | | 1,411,824 | |

| | | | | | | | 7,070,145 | |

| Hotels – 2.9% | | | | | | | | |

| Hersha Hospitality Trust | | | 20,590 | | | | 286,201 | |

| Hospitality Properties Trust | | | 30,100 | | | | 726,614 | |

| Host Hotels & Resorts | | | 21,100 | | | | 338,444 | |

| Pebblebrook Hotel Trust | | | 24,500 | | | | 660,765 | |

| Ryman Hospitality Properties | | | 5,600 | | | | 446,096 | |

| | | | | | | | 2,458,120 | |

| Industrial – 3.9% | | | | | | | | |

| Industrial Logistics Properties Trust | | | 23,648 | | | | 505,831 | |

| Prologis | | | 17,601 | | | | 1,471,795 | |

| STAG Industrial | | | 44,026 | | | | 1,280,276 | |

| | | | | | | | 3,257,902 | |

| Mortgage – 2.3% | | | | | | | | |

| Blackstone Mortgage Trust, Class A | | | 22,447 | | | | 781,156 | |

| Ladder Capital | | | 13,500 | | | | 226,530 | |

| Starwood Property Trust | | | 39,600 | | | | 927,828 | |

| | | | | | | | 1,935,514 | |

| Multi-Family – 7.2% | | | | | | | | |

| American Campus Communities | | | 24,500 | | | | 1,138,760 | |

| Apartment Investment & Management Company, Class A | | | 19,303 | | | | 984,453 | |

| AvalonBay Communities | | | 5,600 | | | | 1,190,336 | |

| Camden Property Trust | | | 10,778 | | | | 1,166,719 | |

| Equity Residential | | | 1,500 | | | | 127,140 | |

| Mid-America Apartment Communities | | | 4,000 | | | | 506,720 | |

| UDR | | | 18,000 | | | | 867,240 | |

| | | | | | | | 5,981,368 | |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments – Continued

August 31, 2019

| | | | | | Fair | |

| | | Shares | | | Value | |

| REIT COMMON STOCKS – 51.3% (Continued) | | | | | | |

| | | | | | | |

| Net Lease – 3.5% | | | | | | |

| Agree Realty | | | 10,212 | | | $ | 762,734 | |

| Easterly Government Properties | | | 27,400 | | | | 563,070 | |

| EPR Properties | | | 4,000 | | | | 313,000 | |

| Spirit Realty Capital | | | 4,155 | | | | 199,191 | |

| STORE Capital | | | 28,298 | | | | 1,068,532 | |

| | | | | | | | 2,906,527 | |

| Office – 4.4% | | | | | | | | |

| Boston Properties | | | 7,300 | | | | 937,466 | |

| Brandywine Realty Trust | | | 6,700 | | | | 96,145 | |

| City Office REIT | | | 7,500 | | | | 101,550 | |

| Corporate Office Properties Trust | | | 11,110 | | | | 320,968 | |

| Highwoods Properties | | | 27,500 | | | | 1,188,275 | |

| SL Green Realty | | | 7,222 | | | | 579,349 | |

| Vornado Realty Trust | | | 8,000 | | | | 483,760 | |

| | | | | | | | 3,707,513 | |

| Retail – 7.7% | | | | | | | | |

| Acadia Realty Trust | | | 7,000 | | | | 191,450 | |

| Essential Properties Realty Trust | | | 16,500 | | | | 374,715 | |

| Federal Realty Investment Trust | | | 1,500 | | | | 193,815 | |

| Four Corners Property Trust | | | 10,400 | | | | 296,296 | |

| Getty Realty | | | 11,500 | | | | 365,240 | |

| Macerich | | | 7,700 | | | | 219,681 | |

| National Retail Properties | | | 12,500 | | | | 701,875 | |

| Regency Centers | | | 15,700 | | | | 1,012,807 | |

| Retail Opportunity Investments | | | 26,836 | | | | 469,898 | |

| Simon Property Group | �� | | 14,400 | | | | 2,144,736 | |

| Weingarten Realty Investors | | | 18,600 | | | | 492,714 | |

| | | | | | | | 6,463,227 | |

| Specialty – 10.9% | | | | | | | | |

| CatchMark Timber Trust, Class A | | | 31,500 | | | | 312,165 | |

| CoreSite Realty | | | 3,900 | | | | 453,102 | |

| Crown Castle International | | | 11,200 | | | | 1,625,904 | |

| CubeSmart | | | 7,800 | | | | 279,942 | |

| CyrusOne | | | 5,049 | | | | 370,899 | |

| Digital Realty Trust | | | 14,312 | | | | 1,769,393 | |

| Extra Space Storage | | | 3,743 | | | | 456,347 | |

| Hannon Armstrong Sustainable Infrastructure Capital | | | 8,500 | | | | 234,855 | |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments – Continued

August 31, 2019

| | | | | | Fair | |

| | | Shares | | | Value | |

| REIT COMMON STOCKS – 51.3% (Continued) | | | | | | |

| | | | | | | |

| Specialty – 10.9% (Continued) | | | | | | |

| Jernigan Capital | | | 17,800 | | | $ | 343,718 | |

| Life Storage | | | 3,600 | | | | 381,456 | |

| Public Storage | | | 3,200 | | | | 847,168 | |

| QTS Realty Trust, Class A | | | 8,300 | | | | 407,198 | |

| VICI Properties | | | 36,300 | | | | 804,408 | |

| Weyerhaeuser Company | | | 33,100 | | | | 870,861 | |

| | | | | | | | 9,157,416 | |

| Total REIT Common Stocks | | | | | | | | |

| (Cost $36,593,293) | | | | | | | 42,937,732 | |

| | | | | | | | | |

| OTHER COMMON STOCKS – 15.0% | | | | | | | | |

| | | | | | | | | |

| Energy – 2.7% | | | | | | | | |

| Kinder Morgan | | | 36,473 | | | | 739,308 | |

| ONEOK | | | 13,000 | | | | 926,640 | |

| Targa Resources | | | 6,000 | | | | 216,720 | |

| Williams Companies | | | 16,160 | | | | 381,376 | |

| | | | | | | | 2,264,044 | |

| Infrastructure – 1.1% | | | | | | | | |

| Brookfield Infrastructure Partners (a) | | | 19,300 | | | | 907,100 | |

| | | | | | | | | |

| Real Estate Operating Company – 0.5% | | | | | | | | |

| Brookfield Property Partners (a) | | | 18,823 | | | | 354,437 | |

| | | | | | | | | |

| Telecommunications – 0.6% | | | | | | | | |

| Verizon Communications | | | 8,900 | | | | 517,624 | |

| | | | | | | | | |

| Utilities – 10.1% | | | | | | | | |

| AES | | | 53,300 | | | | 817,089 | |

| American Electric Power | | | 13,110 | | | | 1,194,976 | |

| Brookfield Renewable Partners (a) | | | 13,100 | | | | 490,726 | |

| CenterPoint Energy | | | 29,500 | | | | 816,855 | |

| Clearway Energy, Class A | | | 5,900 | | | | 98,884 | |

| Covanta Holding | | | 10,593 | | | | 182,200 | |

| Dominion Energy | | | 9,170 | | | | 711,867 | |

| DTE Energy | | | 3,847 | | | | 498,802 | |

| Duke Energy | | | 5,800 | | | | 537,892 | |

| Entergy | | | 1,800 | | | | 203,112 | |

| Evergy | | | 9,356 | | | | 608,140 | |

| Exelon | | | 25,200 | | | | 1,190,952 | |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments – Continued

August 31, 2019

| | | | | | Fair | |

| | | Shares | | | Value | |

| OTHER COMMON STOCKS – 15.0% (Continued) | | | | | | |

| | | | | | | |

| Utilities – 10.1% (Continued) | | | | | | |

| FirstEnergy | | | 10,100 | | | $ | 464,600 | |

| South Jersey Industries | | | 20,241 | | | | 654,594 | |

| | | | | | | | 8,470,689 | |

| Total Other Common Stocks | | | | | | | | |

| (Cost $10,219,058) | | | | | | | 12,513,894 | |

| | | | | | | | | |

| MASTER LIMITED PARTNERSHIPS – 10.8% | | | | | | | | |

| | | | | | | | | |

| Energy – 10.8% | | | | | | | | |

| Cheniere Energy Partners | | | 5,100 | | | | 223,533 | |

| DCP Midstream | | | 15,000 | | | | 365,400 | |

| Enable Midstream Partners | | | 27,631 | | | | 348,151 | |

| Energy Transfer | | | 97,252 | | | | 1,323,600 | |

| Enterprise Products Partners | | | 53,084 | | | | 1,513,425 | |

| Magellan Midstream Partners | | | 16,601 | | | | 1,106,955 | |

| MPLX | | | 40,472 | | | | 1,129,573 | |

| NextEra Energy Partners | | | 13,300 | | | | 681,625 | |

| PBF Logistics | | | 8,394 | | | | 174,595 | |

| Plains All American Pipeline | | | 54,500 | | | | 1,167,935 | |

| Sprague Resources | | | 16,875 | | | | 271,856 | |

| USA Compression Partners | | | 21,100 | | | | 357,645 | |

| Western Midstream Partners | | | 16,473 | | | | 379,526 | |

| Total Master Limited Partnerships | | | | | | | | |

| (Cost $7,700,775) | | | | | | | 9,043,819 | |

| | | | | | | | | |

| | | Par | | | | | |

| U.S. GOVERNMENT SECURITIES – 10.2% | | | | | | | | |

| | | | | | | | | |

| U.S. Treasury Bonds – 10.2% | | | | | | | | |

| 1.250%, 07/15/2020 (b) | | $ | 587,255 | | | | 590,111 | |

| 1.125%, 01/15/2021 (b) | | | 585,465 | | | | 588,297 | |

| 0.625%, 07/15/2021 (b) | | | 568,235 | | | | 571,789 | |

| 0.125%, 07/15/2022 (b) | | | 556,920 | | | | 556,510 | |

| 0.125%, 01/15/2023 (b) | | | 443,880 | | | | 443,115 | |

| 0.375%, 07/15/2023 (b) | | | 550,330 | | | | 557,651 | |

| 0.125%, 07/15/2024 (b) | | | 1,159,646 | | | | 1,169,533 | |

| 2.375%, 01/15/2025 (b) | | | 1,358,870 | | | | 1,528,585 | |

| 0.375%, 07/15/2025 (b) | | | 432,048 | | | | 443,002 | |

| 0.625%, 01/15/2026 (b) | | | 592,895 | | | | 616,143 | |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments – Continued

August 31, 2019

| | | | | | Fair | |

| | | Par | | | Value | |

| U.S. GOVERNMENT SECURITIES – 10.2% (Continued) | | | | | | |

| | | | | | | |

| U.S. Treasury Bonds – 10.2% (Continued) | | | | | | |

| 3.875%, 04/15/2029 (b) | | $ | 779,055 | | | $ | 1,066,458 | |

| 2.125%, 02/15/2040 (b) | | | 296,270 | | | | 407,892 | |

| Total U.S. Government Securities | | | | | | | | |

| (Cost $8,441,323) | | | | | | | 8,539,086 | |

| | | | | | | | | |

| | | Shares | | | | | |

| REIT PREFERRED STOCKS – 8.7% | | | | | | | | |

| | | | | | | | | |

| Hotels – 2.8% | | | | | | | | |

| Hersha Hospitality Trust, Series E, 6.500% | | | 16,270 | | | | 407,726 | |

| Pebblebrook Hotel Trust, Series D, 6.375% | | | 15,500 | | | | 417,570 | |

| Pebblebrook Hotel Trust, Series E, 6.375% | | | 19,702 | | | | 502,598 | |

| Summit Hotel Properties, Series D, 6.450% | | | 16,071 | | | | 418,650 | |

| Summit Hotel Properties, Series E, 6.250% | | | 11,200 | | | | 294,000 | |

| Sunstone Hotel Investors, Series E, 6.950% | | | 11,963 | | | | 319,532 | |

| | | | | | | | 2,360,076 | |

| Industrial – 0.2% | | | | | | | | |

| STAG Industrial, Series C, 6.875% | | | 5,427 | | | | 149,785 | |

| | | | | | | | | |

| Net Lease – 0.6% | | | | | | | | |

| EPR Properties, Series G, 5.750% | | | 20,380 | | | | 531,307 | |

| | | | | | | | | |

| Office – 1.5% | | | | | | | | |

| Armada Hoffler Properties, Series A, 6.750% | | | 12,700 | | | | 340,487 | |

| PS Business Parks, Series U, 5.750% | | | 13,848 | | | | 357,555 | |

| PS Business Parks, Series W, 5.200% | | | 21,100 | | | | 542,270 | |

| | | | | | | | 1,240,312 | |

| Other – 0.3% | | | | | | | | |

| Colony Capital, Class H, 7.125% | | | 6,900 | | | | 147,936 | |

| Digital Realty Trust, Series I, 6.350% | | | 4,063 | | | | 107,263 | |

| | | | | | | | 255,199 | |

| Retail – 2.0% | | | | | | | | |

| Investors Real Estate Trust, Series C, 6.625% | | | 12,332 | | | | 321,671 | |

| Kimco Realty, Series K, 5.625% | | | 13,033 | | | | 328,432 | |

| National Retail Properties, Series E, 5.700% | | | 11,507 | | | | 289,056 | |

| Pennsylvania Real Estate Investment Trust, Series D, 6.875% | | | 17,586 | | | | 351,720 | |

| Saul Centers, Series D, 6.125% | | | 14,300 | | | | 364,650 | |

| | | | | | | | 1,655,529 | |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments – Continued

August 31, 2019

| | | | | | Fair | |

| | | Shares | | | Value | |

| REIT PREFERRED STOCKS – 8.7% (Continued) | | | | | | |

| | | | | | | |

| Single-Family – 0.8% | | | | | | |

| American Homes 4 Rent, Series F, 5.875% | | | 23,798 | | | $ | 622,080 | |

| | | | | | | | | |

| Specialty – 0.5% | | | | | | | | |

| Public Storage, Series H, 5.600% | | | 15,700 | | | | 439,443 | |

| Total REIT Preferred Stocks | | | | | | | | |

| (Cost $6,950,754) | | | | | | | 7,253,731 | |

| | | | | | | | | |

| OTHER PREFERRED STOCKS – 1.5% | | | | | | | | |

| | | | | | | | | |

| Energy – 0.8% | | | | | | | | |

| Energy Transfer Partners, Series D, 7.625% | | | 14,600 | | | | 357,700 | |

| Sempra Energy, 5.750% | | | 11,600 | | | | 310,880 | |

| | | | | | | | 668,580 | |

| Utilities – 0.7% | | | | | | | | |

| CMS Energy, 5.875% | | | 10,500 | | | | 295,680 | |

| Duke Energy, 5.625% | | | 10,400 | | | | 291,720 | |

| | | | | | | | 587,400 | |

| Total Other Preferred Stocks | | | | | | | | |

| (Cost $1,168,101) | | | | | | | 1,255,980 | |

| | | | | | | | | |

| | | Par | | | | | |

| CORPORATE BONDS – 0.6% | | | | | | | | |

| | | | | | | | | |

| Real Estate – 0.4% | | | | | | | | |

| CyrusOne LP / CyrusOne Finance | | | | | | | | |

| 5.000%, 03/15/2024 | | $ | 300,000 | | | | 310,500 | |

| | | | | | | | | |

| Utilities – 0.2% | | | | | | | | |

| CenterPoint Energy | | | | | | | | |

| 6.125%, 03/01/2024 | | | 200,000 | | | | 209,643 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $500,000) | | | | | | | 520,143 | |

| | | | | | | | | |

| | | Shares | | | | | |

| CLOSED-END FUND – 0.6% | | | | | | | | |

| BlackRock Floating Rate Income Strategies Fund | | | | | | | | |

| (Cost $541,357) | | | 40,922 | | | | 509,888 | |

See Notes to the Financial Statements

SECURIAN AM REAL ASSET INCOME FUND

Schedule of Investments – Continued

August 31, 2019

| | | | | | Fair | |

| | | Shares | | | Value | |

| EXCHANGE TRADED FUND – 0.4% | | | | | | |

| Invesco DB Commodity Index Tracking Fund | | | | | | |

| (Cost $274,382) | | | 19,400 | | | $ | 287,702 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT – 0.7% | | | | | | | | |

| First American Government Obligations Fund, Class X, 2.03% (c) | | | | | | | | |

| (Cost $626,446) | | | 626,446 | | | | 626,446 | |

| Total Investments – 99.8% | | | | | | | | |

| (Cost $73,015,489) | | | | | | | 83,488,421 | |

| Other Assets and Liabilities, Net – 0.2% | | | | | | | 208,492 | |

| Total Net Assets – 100.0% | | | | | | $ | 83,696,913 | |