C S C A X

September 30, 2019

Cove Street Capital

Small Cap Value Fund

Ticker : CSCAX | Cusip : 56166Y875

Annual Report

2 0 1 9

NOTE

Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (defined herein) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website (www.covestreetfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-866-497-0097 or by sending an e-mail request to mtynan@covestreetcapital.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-866-497-0097 or send an e-mail request to mtynan@covestreetcapital.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary.

www.CoveStreetFunds.com | 866-497-0097

C S C A X

2 0 1 9

Annual Report 2019

Cove Street Capital Small Cap Value Fund

C S C A X

Table of

Contents

| Letter to Shareholders | 4 |

| | |

| Performance | 9 |

| | |

| Expense Example | 10 |

| | |

| Holdings Presentation | 11 |

| | |

| Annual Schedule of Investments | 12 |

| | |

| Financial Statements | 14 |

| | |

| Financial Highlights | 17 |

| | |

| Notes to Financials | 18 |

| | |

| Appendix | 25 |

www.CoveStreetFunds.com

866-497-0097

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Letter to Shareholders (unaudited) |

Dear Fellow

Shareholders

This writing constitutes our “Annual Letter” in the world of mutual fund reporting, and since we write extensive quarterly letters to our partners, we try to step back a bit in this piece to review our purpose and reinforce our value proposition as we see it.

Regular readers and longer-term clients might notice a familiar refrain—also known as repetitiveness—but that is exactly the point with which we would like to leave you. The world remains ever bizarrely uncertain, and we are unlikely to be more of a guide to it than your favorite talking head (OK, we can probably do a little better than that!). What we can do is stick to a flexibly disciplined and time-tested approach of value investing and not go zigging and zagging with the latest headline or trend du jour. It does not work in every time period, but it most certainly has worked over time.

As far as our recent performance, the past quarter saw a modest relative and absolute retracement from otherwise solid performance over the fiscal year ending September 30, 2019, as some of our largest positions “rested”. Details on specific holdings will be noted below. Overall, no huge changes in our demeanor (cheerfully bearish), our strategy and process (“unch”), or our management firm.

What also remains is a near zero interest rate world supporting historically expensive valuations in almost all asset classes. What also remains is some truly stupefying global socio-political developments of which you are surely aware. One on top of the other remains a concern.

But, there was an interesting development at the end of our fiscal year, as from September 9th through the 11th, some apparently fat finger hit the “sell large cap growth and buy value” button and there was an unusually rapid, and presently short-term, change in the direction of the investment business’s favorite characterization of a stock: growth or value.

As Ernest Hemingway once noted, inevitable changes often happened very slowly…and then ALL AT ONCE for reasons which lie well outside of a quantitative view of financial history.

Now, one might presume that we would be cheering for this moment, and we are clearly vigorously clapping for a tailwind of funds flowing into value strategies versus the bone-numbing relative debacle witnessed over the last…10 years? Depending on your index and exact time frame, value indices (represented by the Russell 2000® Value) underperformed growth (represented by the Russell 2000® Growth) by 400-ish basis points (bps) annualized since the 2009 market bottom, an outcome that led growth to compound to almost twice the dollar amount.

But, as one might intuit from a 30 stock portfolio, we are not fund flow people. We don’t try to trade the trend du jour and to be frank, 2000 boats in the water carries a rising tide much better than does 30. If trading value and growth is your thing, then you may want to skip our world and go right to the ETF and potentially save money. Our performance is always about the success of our curated choices and our ten largest positions, which generally average 40 to 50% of the portfolio. So, yes, money flowing into value beats a sharp stick in the eye—but it is not the critical variable in our performance.

Moving to what actually happened in the portfolio over the trailing 12 months—as is our tradition, we start with our detractors and the first one was also a sale in the most recent quarter. We exited GTT Communications (Ticker: GTT, -85.8%) in what was a belated and sad misread of a situation. After our success in Level 3 Communications (Ticker: LVLT), we identified GTT as a beneficiary of any fall-out from their merger with CenturyLink (Ticker: CTL). GTT was an asset-light business that delivered connectivity to the Forbes Global 2000, and the management troika—who still owns about 18% of the company—did a terrific job of managing a customer roll-up over a decade. We originally bought the stock at $25 and were sellers up to $60, as their operational success continued. We did not manage to sell all of it, and

| |  | C S C A X |

Letter to Shareholders (continued) (unaudited) | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

repurchased the stock back in the low $20’s. We just sold out in the high single digits. What we misjudged was two-fold. We assumed there was organic growth inherent in the business and there isn’t—pricing declines faster than new broadband volume is generated. Secondly, leverage has gotten completely out of hand and creates material permanent risk to shareholder value. The only good news is that we “risk-weighted” the position on the second go-around.

Millicom International Cellular (Ticker: TIGO, -22.6%) became our largest position after a recent decline. This was prompted by the last act of a truly dysfunctional Swedish investment group—Kinnevik—that owns 37% of the stock. After milking it for cash flow to fund new investment schemes, then trying to put it up for sale to Liberty Latin America without the backing of the rest of the Board or management, Kinnevik is now distributing the stock to its shareholders. We are buyers. This is simply a collection of Latin American cable and mobile assets run with relatively modest leverage by an ex-Liberty CEO in whom we have great confidence. He has personally invested millions through open market purchase, something we would really like to see a lot more of from other CEOs. The stock is statistically and thematically dirt-cheap. Our risk is the risk in investing in any emerging market countries.

We were long suffering shareholders of Tupperware Brands (Ticker: TUP, -52.3%) and during the most recent quarter, we decided to close out our position. The company is in the middle of a difficult turnaround and strategic pivot that we are not sure will be successful in helping the company re-accelerate its revenue growth. As mentioned in previous letters, the stock is “cheap” on just about every possible metric but we have come around to the opinion that it is cheap for a reason. As such, we decided to put the capital to work in stocks for which we have much more conviction.

Our largest contributor to performance was Hallmark Financial Services (Ticker: HALL, 74.0%), a small insurance company out of Texas that we purchased cheaply about six years ago. This process almost defines our oft-used phrase: “We attempt to look for equities where our downside is boredom and our upside is material if certain critical variables are realized.” Despite our wonderful spreadsheets, a detailed and wide-ranging process, and keen and non-consensus analytic insight, we are consistently reminded that life in the real world is a lot messier and more difficult than is the scenario work that we can conjure at our desks. In this case, the “Founder-in-Chief” Mark Schwarz simply struggled to execute the right “paper” strategy, to attract the right people to the small insurance company, and then to build the systems and distribution to allow for and monitor good execution. Finally, it all appears to be working. The company is harvesting efforts to write specialty business at good underwriting ratios, there are proper management and systems in place, and the investment strategy has been conservative and value-based. We truly watched paint dry for years, but as our confidence in our 33% partner did not wane and the direction remained intelligent and doable, we stuck it out and are looking at a stock that has almost doubled in the last year. Value investing defined.

Avid Technology (Ticker: AVID, 5.9%) remains one of the more volatile stocks in our portfolio as far as stock price. The stock can move violently based on management’s tone on a conference call, but the underlying fundamentals remain sluggishly positive. We have made a substantial amount of money in Avid over the past five years taking advantage of this volatility, as our research suggests a value closer to$10 per share on a base case. We once again sold aggressively and more than halved our position in Avid as it doubled to $10 per share last quarter. We have a deep knowledge base of the company and industry fundamentals, and while we would prefer more material upward fundamental evidence of the company’s convergence into a software-oriented, consistent performer, we think this is a field in which we can regularly reap dollars for clients by sticking to a disciplined fundamental valuation process.

So let’s go back to the beginning. We are classic value investors in the tradition of Ben Graham and Warren Buffett, seeking superior long-term performance through the purchase of securities selling at prices

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Letter to Shareholders (continued) (unaudited) |

materially below our estimate of intrinsic value. This process of “winning by not losing” helps to protect capital from permanent loss (as distinguished from “quotational risk”) and can put us on the correct side of the mathematics of compounding.

The Fund mirrors Cove Street Capital’s Classic Value Small Cap strategy, which in proper verbiage is a “concentrated strategy that applies a fundamental, bottom-up stock selection process to a universe of approximately 3,600 U.S. companies with a market capitalization below $5 billion, as well as a relevant universe of non-U.S. companies.” The portfolio generally holds 30 to 39 stocks. I am the Portfolio Manager and am responsible for the final portfolio decision. I am 57 years old, have been in the investment business since graduating college, and remain utterly absorbed in the endeavor much to the chagrin of my social life and 29-year marriage. Sector weightings are a result of the bottom-up approach, and no attempts are made in any way to replicate an easily available index. Employees at the firm, my partners, myself, and our extended families are multi-seven figure investors in the Fund—we are on the same ship together.

And no one on the ship enjoys paying more fees than are, in any way, necessary. Our management fee is 0.85% on assets, and everything else is administrative—fees which can be substantial on smaller funds. For much of our past, we capped fees to investors and absorbed the overage from our management fee. Our current expense ratio is 1.23%for the year ended September 30, 2019.* More assets have helped lower fees, but over the past few years we have proactively eliminated all the bells and whistles that frankly always seemed unnecessary but were deemed “conventional” at our origin. We have gotten older, wiser, and more discriminating. We are less interested in being universally popular and available, and more interested in working with long-term partners that travel with us on our quest to deliver value. This is a small cap value fund and to paraphrase Ted Williams, our job is to try to generate the best returns, not to be the biggest, most widely-distributed fund.

And speaking of which, let’s return to the aforementioned “index funds and ETFs” about which you might have noticed consistent financial press. From the enlightened height of our own self-interest, and also in yours, we would like to note the following. The more liquid, efficient, and broadly disseminated an asset class, the more it should be indexed. The larger your assets, the more you should consider indexing. The less you pay attention, the more you should index. Small cap value as an asset class is simply full of thousands of companies, many of which receive little attention.

Our ability to find something special is more probable if we turn over a lot of rocks which are infrequently turned. Your Fund remains small-ish—therefore we can take advantage of big firms’ fears of liquidity. Often we find ourselves trying to talk management teams out of doing something stupid in regard to “creating liquidity so big firms can trade.” Wall Street research was always bad—but at least it was a marketing tool for companies to let possible investors know of their existence. Sell-side firms continue to fold like wet toilet paper, and one existing firm recently banned the purchase of “stocks selling for under $5 or less than a $300mm market cap.” We continue to see a very reasonable environment for our efforts, although if present trends continue, we may be the last fund standing!

We would also venture to opine that the process of picking your significant other or your favorite ice cream is slightly more discriminating than “any one will do”. You love Jaime and Caramel Crunch—not just people and ice cream. We similarly think conscious discrimination in favor of better and/or cheaper is entirely doable as the weighing machine always beats the voting machine. The more that people just blindly buy a pool of assets without discriminating, the more value there is to be added by discriminating.

Our ability to differentiate also enables us to potentially add value with every dollar that comes through our door. We buy what we view as our best

| |  | C S C A X |

Letter to Shareholders (continued) (unaudited) | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

values with new money—an index fund inherently buys everything in the index every day, with an emphasis on the relative size of a company in the index, a process that suggests buying what HAS done well, rather than what can do well. So, if you are reading this, our guess is that you tend to agree—but a little reminder never hurts.

We recognize that the mix of our shareholders contains a fair number of taxable accounts, and we do everything intelligently possible to minimize our realized gains. As of 10/1/19, our best estimate of capital gains per share is $0.00.**

Our view of the upcoming year remains remarkably similar to that of most years, and thus you won’t mind if we repeat it. We come in the office looking for inefficiencies within public stock markets that we can attempt to take advantage of. Inefficiencies come from fairly obvious and consistent places that have remained remarkably unchanged over decades:

| → | Fears of the short-term; |

| | |

| → | The inability of large funds to practically take positions in smaller companies; |

| | |

| → | The difficulty of structuring an organization in a way that compensates its people to do actual research into smaller companies...and be willing to hold these companies in the face of short-term issues and in sufficient size in order to make a difference. |

Our “edge” is simple:

| • | We do not employ group decision-making—investment people contribute—PM makes final call. |

| | |

| • | We do not attempt to mimic indices or the portfolios or holdings of other well regarded money managers. |

| | |

| • | We do not adhere to an over-diversification policy that inevitably inhibits performance. |

| | |

| • | We will limit assets under management. |

| | |

| • | We record our decision process and build an honest intellectual history of our decision-making. |

| | |

| • | We have a culture dedicated to meritocracy and continuous improvement. |

We are sure that the upcoming year will have more surprises in store. In closing, we remain “cheerfully” bearish as it relates to the current environment, but continue to see interesting and curated value opportunities that for a multitude of different reasons, are not perceived to be the flavor du jour. Taking advantage of the “time arbitrage” between the daily nonsense of the investment business and how a thoughtful private investor operates is a time tested way to create and add value.

Thank you again on behalf of your fellow shareholders at CSC.

Best Regards,

Jeffrey Bronchick, CFA

Principal, Portfolio Manager

Shareholder, Cove Street Capital Small Cap Value Fund

The information provided herein represents the opinions of Cove Street Capital, LLC and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions expressed are subject to change at any time.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk. Please refer to the Schedule of Investments for a complete list of holdings.

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Letter to Shareholders (continued) (unaudited) |

Mutual fund investing involves risk. Principal loss is possible. There is no assurance that the investment process will consistently lead to successful results. Value investing involves risks and uncertainties and does not guarantee better performance or lower costs than other investment methodologies. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. Concentration of assets in a single or small number of issuers, may reduce diversification and result in increased volatility.

Quotational risk is the potential for gains or losses based upon volatility in the trading price of a security, which in the near-term do not reflect fluctuations in the intrinsic value of the security’s interest in the underlying assets but are the manifestation of other dynamics in the market.

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe, representing approximately 10% of the total market capitalization of the Russell 3000® Index, and the Russell 2000® Value Index includes those Russell 2000® Index companies with lower price to book ratios and lower forecasted growth values. The Russell 2000® Growth Index includes Russell 2000® Index companies with higher price to book ratios and higher forecasted growth values. One cannot invest directly in an index. Basis points (BPS) are a common unit of measurement in finance with one basis point equal to 1/100 of 1%. Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

*The current expense ratio is the actual, fiscal year-to-date net expense ratio, as of September 30, 2019, as displayed in the Financial Highlights on page 17 of this report. Gross expense ratio is also applicable to investors. As of the fund prospectus dated January 28, 2019, the Fund’s gross expense ratio was 1.17%. The Fund imposes a 2.00% redemption fee on shares sold within 60 days of purchase.

**Any tax or legal information provided is merely a summary of our understanding and interpretation of some of the current income tax regulations and it is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Fund nor any of its representatives may give legal or tax advice.

The Cove Street Small Cap Value Fund is distributed by Quasar Distributors, LLC. Quasar Distributors, LLC is affiliated with U.S. Bancorp Fund Services LLC.

| |  | C S C A X |

Institutional Class Performance (unaudited) | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

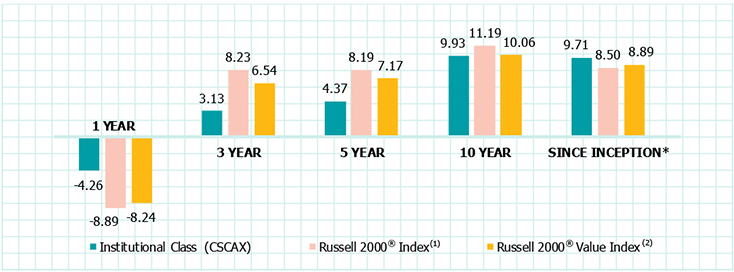

Rates of Return (%) as of September 30, 2019

Value of $10,000 Investment as of September 30, 2019

| (1) | The Russell 2000® Index is a market capitalization-weighted index comprised of the 2,000 smallest companies listed on the Russell 3000® Index, which contains the 3,000 largest companies in the U.S. based on market capitalization. One cannot invest directly in an Index. |

| | |

| (2) | The Russell 2000® Value Index measures the performance of the small cap value segment of U.S. equity securities. It includes those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values. One cannot invest directly in an Index. |

| | |

| * | The Institutional Class commenced operations on October 3, 2001. The performance results for the Institutional Class reflect the performance of the Investor Class shares from September 30, 1998 through October 2, 2001. The Investor Class subsequentl9y closed, effective November 25, 2015. |

| | |

| | Returns for periods greater than one year are annualized. |

| | |

| | Past performance does not guarantee future results. Graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Expense Example September 30, 2019 (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include but are not limited to, redemption fees, broker commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2019 – September 30, 2019).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by$1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5%hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or brokerage commissions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs may have been higher.

| | BEGINNING | ENDING | EXPENSES PAID |

| | ACCOUNT VALUE | ACCOUNT VALUE | DURING PERIOD(1) |

| | 4/1/2019 | 9/30/2019 | 4/1/2019 - 9/30/2019 |

| | | | |

Institutional Class Actual(2) | $1,000.00 | $983.60 | $6.22 |

| | | | |

| Institutional Class Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,018.80 | $6.33 |

| (1) | Expenses are equal to the Fund's annualized expense ratio for the most recent six -month period of 1.25%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| | |

| (2) | Based on the actual return for the six-month period ended September 30, 2019 of -1.64%. |

| |  | C S C A X |

Holdings Presentation September 30, 2019 (unaudited) | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

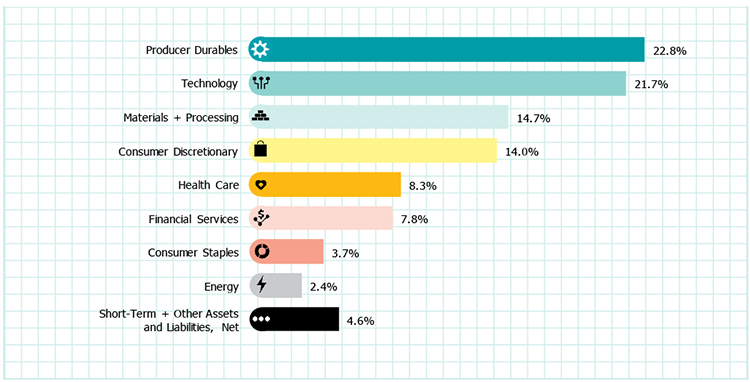

Sector Allocation(1) (% of net assets) as of September 30, 2019

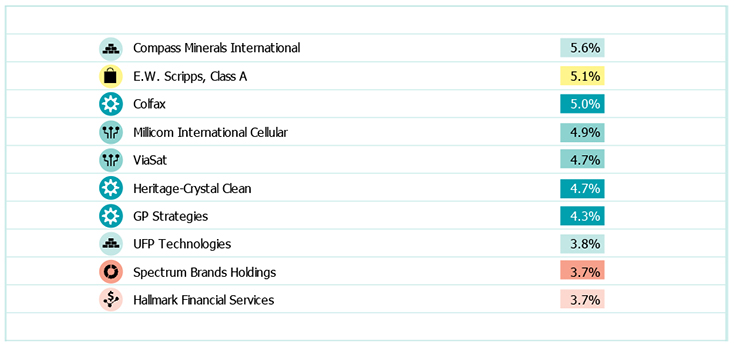

Top 10 Equity Holdings(1) (% of net assets) as of September 30, 2019

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Schedule of Investments September 30, 2019 |

| COMMON STOCKS - 91.2% | | Shares | | | Value | |

| | | | | | | |

| Consumer Discretionary - 9.8% | | | | | | |

Apex Global Brands * (a) | | | 78,989 | | | $ | 96,375 | |

| Apex Global Brands * | | | 237,143 | | | | 348,600 | |

| Carrols Restaurant Group * | | | 233,166 | | | | 1,932,946 | |

| E.W. Scripps, Class A | | | 470,000 | | | | 6,241,600 | |

| TEGNA | | | 208,100 | | | | 3,231,793 | |

| | | | | | | | 11,851,314 | |

| Consumer Staples - 3.7% | | | | | | | | |

| Spectrum Brands Holdings | | | 85,000 | | | | 4,481,200 | |

| | | | | | | | | |

| Energy - 2.4% | | | | | | | | |

| NOW * | | | 250,100 | | | | 2,868,647 | |

| | | | | | | | | |

| Financial Services - 7.8% | | | | | | | | |

| Equity Commonwealth - REIT | | | 40,000 | | | | 1,370,000 | |

| Hallmark Financial Services * | | | 233,699 | | | | 4,470,662 | |

| INTL FCStone * | | | 87,400 | | | | 3,588,644 | |

| | | | | | | | 9,429,306 | |

| Health Care - 8.3% | | | | | | | | |

| Avanos Medical * | | | 8,498 | | | | 318,335 | |

| Capital Senior Living * | | | 663,209 | | | | 2,904,855 | |

| Patterson Companies | | | 231,239 | | | | 4,120,679 | |

| Phibro Animal Health | | | 129,700 | | | | 2,766,501 | |

| | | | | | | | 10,110,370 | |

| Materials & Processing - 14.7% | | | | | | | | |

| American Vanguard | | | 190,200 | | | | 2,986,140 | |

| Compass Minerals International | | | 120,300 | | | | 6,795,747 | |

| GCP Applied Technologies * | | | 100,000 | | | | 1,925,000 | |

| Mueller Water Products | | | 136,800 | | | | 1,537,632 | |

| UFP Technologies * | | | 120,000 | | | | 4,632,000 | |

| | | | | | | | 17,876,519 | |

| Producer Durables - 22.8% | | | | | | | | |

| Actuant, Class A | | | 137,200 | | | | 3,010,168 | |

| Colfax * | | | 209,300 | | | | 6,082,258 | |

| CSW Industrials | | | 31,814 | | | | 2,196,120 | |

| GP Strategies * | | | 410,907 | | | | 5,276,046 | |

| Heritage-Crystal Clean * | | | 214,085 | | | | 5,673,253 | |

| Macquarie Infrastructure | | | 78,400 | | | | 3,094,448 | |

| Standex International | | | 33,330 | | | | 2,431,090 | |

| | | | | | | | 27,763,383 | |

See Notes to Financial Statements.

| |  | C S C A X |

Schedule of Investments (continued) September 30, 2019 | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

| COMMON STOCKS (continued) - 91.2% | | Shares | | | Value | |

| | | | | | | |

| Technology - 21.7% | | | | | | |

| Avid Technology * | | | 390,046 | | | $ | 2,414,385 | |

| CommVault Systems * | | | 60,000 | | | | 2,682,600 | |

| Great Elm Capital Group * | | | 900,000 | | | | 3,330,000 | |

| LogMeIn | | | 42,300 | | | | 3,001,608 | |

| Millicom International Cellular | | | 122,200 | | | | 5,947,474 | |

| ViaSat * | | | 75,551 | | | | 5,690,501 | |

| Yelp, Inc. * | | | 94,300 | | | | 3,276,925 | |

| | | | | | | | 26,343,493 | |

| Total Common Stocks (Cost $98,589,824) | | | | | | | 110,724,232 | |

| | | | | | | | | |

| SUBORDINATED NOTES - 4.2% | | Par | | | | | |

| Consumer Discretionary - 4.2% | | | | | | | | |

| Apex Global Brands | | | | | | | | |

10.88%, (3 month LIBOR + 8.75%), 11/02/2021 (b) (c) | | | | | | | | |

| Total Subordinated Notes (Cost $4,919,185) | | $ | 5,142,857 | | | | 5,078,572 | |

| | | | | | | | | |

| WARRANTS - 0.0% | | Shares | | | | | |

| Consumer Discretionary - 0.0% | | | | | | | | |

Apex Global Brands (Expires 08/11/24, Exercise Price $12.66) * (b) | | | 19,747 | | | | — | |

Apex Global Brands (Expires 12/07/24, Exercise Price $6.75) * (b) | | | 59,259 | | | | — | |

| Total Warrants (Cost $446,041) | | | | | | | — | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT - 4.5% | | | | | | | | |

| The Government TaxAdvantage Portfolio, Institutional Class, 1.86% ^ | | | | | | | | |

| Total Short-Term Investment (Cost $5,503,188) | | | 5,503,188 | | | | 5,503,188 | |

| | | | | | | | | |

| Total Investments - 99.9% (Cost $109,458,238) | | | | | | | 121,305,992 | |

| Other Assets and Liabilities, Net - 0.1% | | | | | | | 138,394 | |

| Total Net Assets - 100.0% | | | | | | $

| 121,444,386

| |

| * | Non-income producing security | | |

| | |

| (a) | Security is restricted from resale and considered illiquid. Restricted securities have ben fair valued in accordance with procedures approved by the Board of Trustees and have a total fair value $96,375, which represents 0.1% of net assets. See Notes 2 and 3 in Notes to Financial Statements. |

| | |

| (b) | Security is considered illiquid and is categorized in Level 2 of the fair value hierarchy. These Level 2 illiquid securities have a total fair value of $5,078,572, which represents 4.2% of net assets. See Notes 2 and 3 in Notes to Financials Statements. |

| | |

| (c) | Variable rate security. The rate shown is the rate in effect as of September 30, 2019. |

| | |

| ^ | The rate of shown is the annualized seven day effective yield as of September 30, 2019. |

See Notes to Financial Statements.

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Statement of Assets and Liabilities September 30, 2019 |

| ASSETS: | | | |

| Investments, at value (Cost: $109,458,238) | | $ | 121,305,992 | |

| Cash | | | 19,558 | |

| Receivable for capital shares sold | | | 354,122 | |

| Dividends and interest receivable | | | 72,740 | |

| Prepaid expenses | | | 13,126 | |

| Total assets | | | 121,765,538 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for capital shares redeemed | | | 91,068 | |

| Payable to investment adviser | | | 94,999 | |

| Payable for fund administration & accounting fees | | | 20,342 | |

| Payable for compliance fees | | | 3,381 | |

| Payable for custody fees | | | 2,602 | |

| Payable for transfer agent fees & expenses | | | 41,512 | |

| Payable for trustee fees | | | 3,223 | |

| Accrued expenses | | | 64,025 | |

| Total liabilities | | | 321,152 | |

| | | | | |

| NET ASSETS | | $ | 121,444,386 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | | 109,531,433 | |

| Total distributable earnings | | | 11,912,953 | |

| Net Assets | | $ | 121,444,386 | |

| | | | | |

Shares issued and outstanding (1) | | | 3,481,274 | |

Net asset value, redemption price and offering price per share (2) | | $ | 34.89 | |

| (1) Unlimited shares authorized without par value. |

| |

| (2) A redemption fee of 2.00% is assessed against shares redeemed within 60 days of purchase. |

See Notes to Financial Statements.

| |  | C S C A X |

Statement of Operations for the Year Ended September 30, 2019 | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

| INVESTMENT INCOME: | | | |

| Dividend income | | $ | 1,576,170 | |

| Less: Foreign taxes withheld | | | (43,560 | ) |

| Interest income | | | 907,918 | |

| Total investment income | | | 2,440,528 | |

| | | | | |

| EXPENSES: | | | | |

| Investment adviser fees (See Note 4) | | | 1,099,990 | |

| Transfer agent fees & expenses (See Note 4) | | | 165,006 | |

| Fund administration & accounting fees (See Note 4) | | | 114,757 | |

| Postage & printing fees | | | 33,429 | |

| Legal fees | | | 26,796 | |

| Federal & state registration fees | | | 26,493 | |

| Audit fees | | | 23,250 | |

| Custody fees (See Note 4) | | | 17,305 | |

| Trustee fees | | | 13,491 | |

| Compliance fees (See Note 4) | | | 13,130 | |

| Other | | | 50,424 | |

| Total expenses before waiver | | | 1,584,071 | |

| Adviser waiver recoupment (See Note 4) | | | 15,138 | |

| Less: waiver from investment adviser (See Note 4) | | | (3,322 | ) |

| Net Expenses | | | 1,595,887 | |

| | | | | |

| NET INVESTMENT INCOME | | | 844,641 | |

| | | | | |

| REALIZED AND UNREALIZED LOSS ON INVESTMENTS: | | | | |

| Net realized loss on investments | | | (765,277 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | (6,982,211 | ) |

| Net realized and unrealized loss on investments | | | (7,747,488 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (6,902,847 | ) |

See Notes to Financial Statements.

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Statements of Changes in Net Assets September 30, 2019 |

| | | Year Ended September 30, 2019 | | | Year Ended September 30, 2018 | |

| | | | | | | |

| OPERATIONS: | | | | | | |

| Net investment income (loss) | | $ | 844,641 | | | $ | (164,372 | ) |

| Net realized gain (loss) on investments | | | (765,277 | ) | | | 5,780,853 | |

| Net change in unrealized appreciation/depreciation on investments | | | (6,982,211 | ) | | | 2,989,030 | |

| Net increase (decrease) in net assets from operations | | | (6,902,847 | ) | | | 8,605,511 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 16,061,993 | | | | 23,269,663 | |

| Proceeds from reinvestments of distributions | | | 3,432,948 | | | | 3,568,831 | |

| Payments for shares redeemed | | | (35,570,654 | ) | | | (3,264,001 | ) |

| Redemption fees | | | 1,656 | | | | 6,139 | |

| Decrease in net assets resulting from capital share transactions | | | (16,074,057 | ) | | | (3,419,368 | ) |

| | | | | | | | | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | (3,973,004 | ) | | | (4,186,440 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (26,949,908 | ) | | | 999,703 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 148,394,294 | | | | 147,394,591 | |

| End of year | | $ | 121,444,386 | | | $ | 148,394,294 | |

See Notes to Financial Statements.

| |  | C S C A X |

Financial Highlights (for a Fund Share Outstanding Throughout the Years) | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

| | | Year Ended September 30, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 37.51 | | | $ | 36.49 | | | $ | 34.21 | | | $ | 31.66 | | | $ | 35.53 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.24 | | | | (0.04 | ) | | | (0.18 | ) | | | (0.15 | )(1) | | | (0.21 | ) |

| Net realized and unrealized gain (loss) on investments | | | (1.84 | ) | | | 2.10 | | | | 2.92 | | | | 4.33 | | | | 0.20 | |

| Total from investment operations | | | (1.60 | ) | | | 2.06 | | | | 2.74 | | | | 4.18 | | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net realized gains | | | (1.02 | ) | | | (1.04 | ) | | | (0.46 | ) | | | (1.63 | ) | | | (3.86 | ) |

| Total distributions | | | (1.02 | ) | | | (1.04 | ) | | | (0.46 | ) | | | (1.63 | ) | | | (3.86 | ) |

| Paid-in capital from redemption fees | | | – | (2) | | | – | (2) | | | – | (2) | | | – | (2) | | | – | (2) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 34.89 | | | $ | 37.51 | | | $ | 36.49 | | | $ | 34.21 | | | $ | 31.66 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | -4.26 | % | | | 5.92 | % | | | 8.17 | % | | | 13.63 | % | | | -0.57 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA and RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in millions) | | $ | 121.4 | | | $ | 148.4 | | | $ | 147.4 | | | $ | 119.7 | | | $ | 18.4 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver/recoupment | | | 1.22 | % | | | 1.16 | % | | | 1.20 | % | | | 1.38 | % | | | 1.41 | % |

| After expense waiver/recoupment | | | 1.23 | % | | | 1.16 | % | | | 1.20 | % | | | 1.22 | % | | | 1.40 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | |

| After expense waiver/recoupment | | | 0.65 | % | | | (0.11 | )% | | | (0.59 | )% | | | (0.45 | )% | | | (0.63 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 53 | % | | | 59 | % | | | 48 | % | | | 85 | % | | | 107 | % |

| (1) | Per share amounts are calculated using the average shares outstanding method. |

| | |

| (2) | Amount per share is less than $0.01. |

| | |

| | See Notes to Financial Statements. |

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Notes to Financial Statements September 30, 2019 |

1. Organization

Managed Portfolio Series (the “Trust”) was organized as a Delaware statutory trust on January 27, 2011. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Cove Street Capital Small Cap Value Fund (the “Fund”) is a diversified series with its own investment objectives and policies within the Trust. The investment objective of the Fund is capital appreciation. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies. The Fund commenced operations on September 30, 1998 and currently offers Institutional Class shares. The Fund may issue an unlimited number of shares of beneficial interest, with no par value.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Security Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3.

Federal Income Taxes – The Fund complies with the requirements of subchapter M of the Internal Revenue Code of 1986, as amended, as necessary to qualify as a regulated investment company and distributes substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income tax or excise tax provision is required. As of and during the year ended September 30, 2019, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. As of and during the year ended September 30, 2019, the Fund did not have liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. As of and during the year ended September 30, 2019, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. tax authorities for tax years prior to the year ended September 30, 2016.

Security Transactions, Income, and Distributions – The Fund follows industry practice and records security transactions on the trade date. Realized gains and losses on sales of securities are calculated on the basis of identified cost. Dividend income is recorded on the ex-dividend date and interest income and expense is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities using the constant yield method.

The Fund may utilize earnings and profits distributed to shareholders on redemptions of shares as part of the dividend paid deduction. The Fund distributes substantially all net investment income and net realized capital gains, if any, at least annually. Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. There were no reclassifications needed for the year ended September 30, 2019.

| |  | C S C A X |

Notes to Financial Statements (continued) September 30, 2019 | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Allocation of Expenses – Expenses associated with a specific fund in the Trust are charged to that fund. Common Trust expenses are typically allocated evenly between the funds of the Trust, or by other equitable means.

Illiquid or Restricted Securities – A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the price at which the security is valued by the Fund. Illiquid securities may be valued under methods approved by the Board of Trustees (the “Board”) as reflecting fair value. The Fund will not hold more than 15% of the value of its net assets in illiquid securities. Certain restricted securities may be considered illiquid. Restricted securities are often purchased in private placement transactions, are not registered under the Securities Act of 1933, may have contractual restrictions on resale, and may be valued under methods approved by the Board as reflecting fair value. At September 30, 2019, the Fund had investments in illiquid securities with a total value of $5,174,947 or 4.3% of total net assets.

Information concerning illiquid securities, including restricted securities considered to be illiquid, is as follows:

Security | | Shares/Par | | Date Acquired | | Cost Basis | |

| Apex Global Brands Notes | | $ | 5,142,857 | | Aug-18 | | $ | 4,919,185 | |

| Apex Global Brands | | | 78,989 | | Aug-17 | | $ | 828,794 | |

| Apex Global Brands Warrant (08/11/24) | | | 19,747 | | Aug-17 | | $ | 171,206 | |

| Apex Global Brands Warrant (12/07/24) | | | 59,259 | | Dec-17 | | $ | 274,835 | |

3. Securities Valuation

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the period and expanded disclosure of valuation Levels for major security types. These inputs are summarized in the three broad Levels listed below:

Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | |

Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | |

Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Notes to Financial Statements (continued) September 30, 2019 |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Equity Securities – Equity securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and ask prices, or last trade. Securities traded primarily in the Nasdaq Global Market System for which market quotations are readily available are valued using the Nasdaq Official Closing Price (“NOCP”). If the NOCP is not available, such securities are valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and ask prices, or last trade. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. If the market for a particular security is not active, and the mean between bid and ask prices, or last trade is used, these securities are categorized in Level 2 of the fair value hierarchy.

Short-Term Investments – Investments in other mutual funds, including money market funds, are valued at their net asset value per share. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Debt Securities – Convertible bonds and subordinated notes held by the Fund are valued at fair value on the basis of valuations furnished by an independent pricing service which utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. These bonds and notes are categorized in Level 2 of the fair value hierarchy. Due to market data not being readily available, the subordinated notes may be valued using an income approach, as approved by the Board.

Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued following procedures approved by the Board. These procedures consider many factors, including the type of security, size of holding, trading volume, liquidity, and news events. There can be no assurance that the Fund could obtain the fair value assigned to a security if they were to sell the security at approximately the time at which the Fund determines its net asset value per share. The Board has established a Valuation Committee to administer, implement, and oversee the fair valuation process, and to make fair value decisions when necessary. The Board regularly reviews reports that describe any fair value determinations and methods.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s securities as of September 30, 2019:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 110,627,857 | | | $ | - | | | $ | 96,375 | | | $ | 110,724,232 | |

| Subordinated Notes | | | - | | | | 5,078,572 | | | | - | | | | 5,078,572 | |

| Warrants | | | - | | | | - | | | | - | | | | - | |

| Short-Term Investment | | | 5,503,188 | | | | - | | | | - | | | | 5,503,188 | |

| Total Investments in Securities | | $ | 116,131,045 | | | $ | 5,078,572 | | | $ | 96,375 | | | $ | 121,305,992 | |

Continued on next page.

| |  | C S C A X |

Notes to Financial Statements (continued) September 30, 2019 | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| | Investments in Securities |

| Balance as of September 30, 2018 | | $ | 145,545 | |

| Accrued discounts/premiums | | | - | |

| Realized losses | | | - | |

| Change in net unrealized appreciation/depreciation | | | (49,170 | )

|

| Net sales | | | - | |

| Transfers into and/or out of Level 3 | | | - | |

| Balance as of September 30, 2019 | | $ | 96,375 | |

| Change in unrealized appreciation/depreciation during the year for Level 3 | | | | |

| investments held at September 30, 2019 | | $ | (49,170 | ) |

The Level 3 investments as of September 30, 2019, represented 0.1% of the Fund’s net assets. Refer to the Schedule of Investments for further information on the classification of investments.

The following provides information regarding the valuation technique, unobservable input used, and other information related to the fair value of the Level 3 investment as of September 30, 2019:

| Security | Fair Value as of | Valuation | Unobservable | Range/Weighted |

Type | 9/30/2019 | Technique | Input | Average |

| Common Stocks | $96,375 | Consensus Pricing | Discount for lack of marketability | 17% |

4. Investment Advisory Fee and Other Transactions With Affiliates

The Trust has an agreement with Cove Street Capital, LLC (the “Adviser”) to furnish investment advisory services to the Fund. Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is entitled to receive, on a monthly basis, an annual advisory fee equal to 0.85% of the Fund's average daily net assets.

The Fund’s Adviser has contractually agreed to waive a portion or all of its management fees and/or reimburse the Fund for its expenses to ensure that total annual operating expenses (excluding acquired fund fees and expenses, interest, taxes, brokerage commissions and extraordinary expenses) do not exceed 1.25% of the average daily net assets. Fees waived and expenses reimbursed by the Adviser may be recouped by the Adviser for a period of thirty-six months following the month during which such waiver or reimbursement was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the expense reimbursement occurred and at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite in term, but cannot be terminated within a year after the effective date of the Fund’s prospectus. After that date, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board or the Adviser, with the consent of the Board. As of September 30, 2019, the Fund’s previously waived fees have been recouped or the recoupment period has expired, therefore the Fund has no waived fees or reimbursed expenses subject to potential recovery. Total fee recoupment in the fiscal year ended September 30, 2019 was $15,138, with $11,816 representing fee waivers from prior fiscal years and $3,322 representing current year fee waivers.

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Notes to Financial Statements (continued) September 30, 2019 |

U.S. Bancorp Fund Services, LLC (the “Administrator”), doing business as U.S. Bank Global Fund Services, acts as the Fund’s Administrator, Transfer Agent, and Fund Accountant. U.S. Bank N.A. (the “Custodian”) serves as the custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Custodian; coordinates the payment of the Fund’s expenses and reviews the Fund’s expense accruals. The officers of the Trust, including the Chief Compliance Officer, are employees of the Administrator. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums. Fees paid by the Fund for administration and accounting, transfer agency, custody and compliance services for the year ended September 30, 2019, are disclosed in the Statement of Operations.

Quasar Distributors, LLC (the “Distributor”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of the Administrator.

5. Capital Share Transactions

Transactions in shares of the Fund were as follows:

| | | For the Year Ended | | | For the Year Ended | |

| Transactions in Shares: | | September 30, 2019 | | | September 30, 2018 | |

| Institutional Class: | | | | | | |

| Shares sold | | | 470,738 | | | | 654,908 | |

| Shares issued to holders in reinvestment of distributions | | | 99,189 | | | | 104,078 | |

| Shares redeemed | | | (1,044,331 | ) | | | (842,667 | ) |

| Net decrease in shares outstanding | | | (474,404 | ) | | | (83,681 | ) |

6. Investment Transactions

The aggregate purchases and sales, excluding Short-Term investments, by the Fund for the year ended September 30, 2019, were as follows:

| | | Purchases | | | Sales | |

| U.S. Government Securities | | $ | - | | | $ | - | |

| Other Securities | | $ | 65,670,219 | | | $ | 88,489,238 | |

Continued on next page.

| |  | C S C A X |

Notes to Financial Statements (continued) September 30, 2019 | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

7. Income Tax Information

The aggregate gross unrealized appreciation and depreciation of securities held by the Fund and the total cost of securities for federal income tax purposes at September 30, 2019, were as follows:

| Aggregate Gross | Aggregate Gross | Net | Federal Income |

Appreciation | Depreciation | Appreciation | Tax Cost |

| $17,325,180 | $(5,477,426) | $11,847,754 | $109,458,238 |

Any difference between book-basis and tax-basis unrealized appreciation would be attributable primarily to the tax deferral of losses on wash sales in the Fund.

At September 30, 2019, the Fund’s components of distributable earnings on a tax-basis were as follows:

| Undistributed | Undistributed Long- | Other Accumulated | Unrealized | Total Distributable |

Ordinary Income | Term Capital Gain | Losses | Appreciation | Earnings |

| $844,613 | $- | $(779,414) | $11,847,754 | $11,912,953 |

A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital, and ordinary losses which occur during the portion of a Fund’s taxable year subsequent to October 31 and December 31, respectively. For the taxable year ended September 30, 2019, the Fund did not defer any qualified late year losses. As of September 30, 2019, the Fund had a short-term capital loss carryforward of $779,414, which will be permitted to be carried over for an unlimited period.

The tax character of distributions paid for the year ended September 30, 2019, were as follows:

| | Ordinary Income* | Long Term Capital Gains | Total |

| Amount in Dollars | $159,360 | $3,813,644 | $3,973,004 |

| Amount per Share | $0.04073 | $0.97476 | $1.01549 |

The tax character of distributions paid for the year ended September 30, 2018 were as follows:

| | Ordinary Income* | Long Term Capital Gains | Total |

| Amount in Dollars | $3,329,612 | $856,828 | $4,186,440 |

| Amount per Share | $0.82884 | $0.21329 | $1.04213 |

*For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income distributions.

Continued on next page.

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Notes to Financial Statements (continued) September 30, 2019 |

8. Control Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of September 30, 2019, Charles Schwab & Co., for the benefit of its customers, owned 35.90% of the outstanding shares of the Fund.

End of Notes to Financial Statements.

| |  | C S C A X |

Appendix

Appendix Contents

Report of Independent Registered Public Accounting Firm

Additional Information

Privacy Notice

Report of Independent Registered Public Accounting Firm | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

To the Shareholders of Cove Street Capital Small Cap Value Fund

and Board of Trustees of Managed Portfolio Series

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Cove Street Capital Small Cap Value Fund (the “Fund”), a series of Managed Portfolio Series, as of September 30, 2019, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2019, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2011.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

November 22, 2019

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Additional Information (unaudited) |

| | | | NUMBER of | | OTHER |

| | | TERM OF | PORTFOLIOS | PRINCIPAL | DIRECTORSHIPS |

| NAME, | POSITION(S) | OFFICE & | IN TRUST | OCCUPATION(S) | HELD by TRUSTEE |

| ADDRESS, | HELD WITH | LENGTH of | OVERSEEN | DURING THE | DURING THE |

| YEAR of BIRTH | THE TRUST | TIME SERVED | by TRUSTEE | PAST FIVE YEARS | PAST FIVE YEARS |

| | | | | | |

| Independent Trustees |

| | | | | | |

| | | | | | |

| Leonard M. Rush, CPA | Lead Independent | Indefinite Term; | 37 | Retired, Chief Financial | Independent Trustee, |

| 615 E. Michigan St | Trustee and | Since April 2011 | | Officer, Robert W. Baird | ETF Series Solutions |

| Milwaukee, WI 53202 | Audit Committee | | | & Co. Incorporated | (49 Portfolios) |

| | Chairman | | | (2000-2011). | (2012-Present); |

| Year of Birth: 1946 | | | | | Director, Anchor |

| | | | | | Bancorp Wisconsin, Inc. |

| | | | | | (2011-2013) |

| | | | | | |

| | | | | | |

| David A. Massart | Trustee and | Indefinite Term; | 37 | Co-Founder and Chief | Independent Trustee, |

| 615 E. Michigan St. | Valuation | Since April 2011 | | Investment Strategist, | ETF Series Solutions |

| Milwaukee, WI 53202 | Committee | | | Next Generation Wealth | (49 Portfolios) |

| | Chairman | | | Management, Inc. | (2012-Present) |

| Year of Birth: 1967 | | | | (2005-present). | |

| | | | | | |

| | | | | | |

| David M. Swanson | Trustee | Indefinite Term; | 37 | Founder and Managing | Independent Trustee, |

| 615 E. Michigan St. | | Since April 2011 | | Principal, SwanDog | ALPS Variable Investment |

| Milwaukee, WI 53202 | | | | Strategic Marketing, | Trust (10 Portfolios) |

| | | | | LLC (2006-present). | (2006-Present); |

| Year of Birth: 1957 | | | | | Independent Trustee, |

| | | | | | RiverNorth Opportunities |

| | | | | | Closed-End Fund |

| | | | | | (2015-Present) |

| | | | | | |

| | | | | | |

| Interested Trustee |

| | | | | | |

| | | | | | |

| Robert J. Kern* | Chairman, | Indefinite Term; | 37 | Retired, Executive Vice | None |

| 615 E. Michigan St. | and Trustee | Since January 2011 | | President, U.S. | |

| Milwaukee, WI 53202 | | | | Bancorp Fund | |

| | | | | Services, LLC (1994- | |

| Year of Birth: 1958 | | | | 2018). | |

| * | Mr. Kern is an interested person of the Trust as defined by the 1940 Act by virtue of the fact that he was a board member of the Fund’s principal underwriter, Quasar Distributors, LLC, an affiliate of the Administrator. |

| |  | C S C A X |

Additional Information (continued) (unaudited) | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

| | | | NUMBER of | | OTHER |

| | | TERM OF | PORTFOLIOS | PRINCIPAL | DIRECTORSHIPS |

| NAME, | POSITION(S) | OFFICE & | IN TRUST | OCCUPATION(S) | HELD by TRUSTEE |

| ADDRESS, | HELD WITH | LENGTH of | OVERSEEN | DURING THE | DURING THE |

| YEAR of BIRTH | THE TRUST | TIME SERVED | by TRUSTEE | PAST FIVE YEARS | PAST FIVE YEARS |

| | | | | | |

| |

| Officers |

| | | | | | |

| | | | | | |

| Brian R. Wiedmeyer | President and | Indefinite Term, | N/A | Vice President, | N/A |

| 615 E. Michigan St. | Principal Executive | Since November | | U.S. Bancorp Fund | |

| Milwaukee, WI 53202 | Officer | 2018 | | Services, LLC | |

| | | | | (2005-present). | |

| Year of Birth: 1973 | | | | | |

| | | | | | |

| | | | | | |

| Deborah Ward | Vice President, Chief | Indefinite Term; | N/A | Senior Vice President, | N/A |

| 615 E. Michigan St. | Compliance Officer | Since April 2013 | | U.S. Bancorp Fund | |

| Milwaukee, WI 53202 | and Anti-Money | | | Services, LLC | |

| | Laundering Officer | | | (2004-present). | |

| Year of Birth: 1966 | | | | | |

| | | | | | |

| | | | | | |

| Benjamin Eirich | Vice President, | Indefinite Term; | N/A | Assistant Vice | N/A |

| 615 E. Michigan St. | Treasurer and | Since August 2019 | | President, U.S. | |

| Milwaukee, WI 53202 | Principal Financial | (Treasurer); Since | | Bancorp Fund | |

| | Officer | November 2018 | | Services, LLC | |

| Year of Birth: 1981 | | (Vice President) | | (2008-present). | |

| | | | | | |

| | | | | | |

| Thomas A. Bausch, Esq. | Secretary | Indefinite Term; | N/A | Assistant Vice | N/A |

| 615 E. Michigan St. | | Since November | | President, U.S. | |

| Milwaukee, WI 53202 | | 2017 | | Bancorp Fund | |

| | | | | Services, LLC | |

| Year of Birth: 1979 | | | | (2016-Present); | |

| | | | | Associate, Godfrey & | |

| | | | | Kahn S.C. (2012-2016). | |

| | | | | | |

| | | | | | |

| Douglas Schafer | Vice President | Indefinite Term; | N/A | Assistant Vice | N/A |

| 615 E. Michigan St. | and Assistant | Since May 2016 | | President, U.S. | |

| Milwaukee, WI 53202 | Treasurer | (Assistant | | Bancorp Fund | |

| | | Treasurer); Since | | Services, LLC (2002- | |

| Year of Birth: 1970 | | November 2018 | | present). | |

| | | (Vice President) | | | |

| | | | | | |

| | | | | | |

| Michael Cyr II | Vice President | Indefinite Term; | N/A | Officer, U.S. | N/A |

| 615 E. Michigan St. | and Assistant | Since August 2019 | | Bancorp Fund | |

| Milwaukee, WI 53202 | Treasurer | | | Services, LLC | |

| | | | | (2013-present). | |

| Year of Birth: 1992 | | | | | |

| C S C A X |  | |

Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund | Additional Information (continued) (unaudited) |

Availability of Fund Portfolio Information

The Fund files complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q, which is available on the SEC’s website at www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. For information on the Public Reference Room call 1-800-SEC-0330. In addition, the Fund’s Form N-Q is available without charge upon request by calling 1-866-497-0097.

Availability of Fund Proxy Voting Information

A description of the Fund’s Proxy Voting Policies and Procedures is available without charge, upon request, by calling 1-866-497-0097. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, is available (1) without charge, upon request, by calling 1-888-621-9258, or (2) on the SEC’s website at www.sec.gov.

Fund Distribution Information

For the fiscal year ended September 30, 2019, certain dividends paid by the Fund may be reported as qualified dividend income and may be eligible for taxation at capital gain rates. The percentage of dividends declared from ordinary income as qualified dividend income was 100.00% for the Fund.

For corporate shareholders, the percent of ordinary income distributions qualified for the corporate dividends received deduction for the fiscal year ended September 30, 2019 was 100.00% for the Fund.

The percentage of taxable ordinary income distributions that are designated as short-term capital gains distributions under Internal Revenue Section 871(k)(2)(c) was 100.00%.

| |  | C S C A X |

Privacy Notice (unaudited) | Annual Report 2019 — CSCAX Cove Street Capital Small Cap Value Fund |

The Fund collects only relevant information about you that the law allows or requires it to have in order to conduct its business and properly service you. The Fund collects financial and personal information about you (“Personal Information”) directly (e.g., information on account applications and other forms, such as your name, address, and social security number, and information provided to access account information or conduct account transactions online, such as password, account number, e-mail address, and alternate telephone number), and indirectly (e.g., information about your transactions with us, such as transaction amounts, account balance and account holdings).

The Fund does not disclose any non-public personal information about its shareholders or former shareholders other than for everyday business purposes such as to process a transaction, service an account, respond to court orders and legal investigations or as otherwise permitted by law. Third parties that may receive this information include companies that provide transfer agency, technology and administrative services to the Fund, as well as the Fund’s investment adviser who is an affiliate of the Fund. If you maintain a retirement/educational custodial account directly with the Fund, we may also disclose your Personal Information to the custodian for that account for shareholder servicing purposes. The Fund limits access to your Personal Information provided to unaffiliated third parties to information necessary to carry out their assigned responsibilities to the Fund. All shareholder records will be disposed of in accordance with applicable law. The Fund maintains physical, electronic and procedural safeguards to protect your Personal Information and requires its third party service providers with access to such information to treat your Personal Information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, credit union, bank or trust company, the privacy policy of your financial intermediary governs how your non-public personal information is shared with unaffiliated third parties.

| C S C A X |  | |

ANNUAL REPORT 2019

Cove Street Capital

Small Cap Value Fund

C S C A X

This report must be accompanied or preceded by a prospectus.

The Fund’s Statement of Additional Information contains additional information about the Fund’s

trustees and is available without charge upon request by calling 1-866-497-0097.

Investment Adviser

Cove Street Capital, LLC

2101 East El Segundo Boulevard, Suite 302

El Segundo, CA 90245

Custodian

U.S. Bank N.A.

1555 N. Rivercenter Drive, Suite 302

Milwaukee, WI 53212

Independent Registered

Public Accounting Firm

Cohen & Company, Ltd.

342 N. Water Street, Suite 830

Milwaukee, WI 53202

Distributor

Quasar Distributors, LLC

777 E. Wisconsin Avenue

Milwaukee, WI 53202

Administrator, Fund Accountant

and Transfer Agent

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

Legal Counsel

Stradley Ronon Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103

www.CoveStreetFunds.com

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer and principal financial officer. The Registrant has not made any substantive amendments to its code of ethics during the period covered by this period.

The Registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the Registrant’s code of ethics that applies to the Registrant’s principal executive officer and principal financial officer is filed herewith.

Item 3. Audit Committee Financial Expert.

The Registrant’s Board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Leonard M. Rush is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The Registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning, including reviewing the Fund’s tax returns and distribution calculations. There were no “other services” provided by the principal accountant. For the fiscal years ended September 30, 2019 and September 30, 2018, the Fund’s principal accountant was Cohen & Company, Ltd. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 9/30/2019 | FYE 9/30/2018 |

Audit Fees | $17,000 | $13,500 |

Audit-Related Fees | $0 | $3,250 |

Tax Fees | $3,000 | $3,000 |

All Other Fees | $0 | $0 |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre‑approve all audit and non‑audit services of the Registrant, including services provided to any entity affiliated with the Registrant.

The percentage of fees billed by Cohen & Company, Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement was as follows:

| | FYE 9/30/2019 | FYE 9/30/2018 |

Audit-Related Fees | 0% | 0% |

Tax Fees | 0% | 0% |

All Other Fees | 0% | 0% |

All of the principal accountant’s hours spent on auditing the Registrant’s financial statements were attributed to work performed by full‑time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the Registrant’s accountant for services to the Registrant and to the Registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years. The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the Registrant’s investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

Non-Audit Related Fees | FYE 9/30/2019 | FYE 9/30/2018 |