UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22525

Managed Portfolio Series

(Exact name of Registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Brian R. Wiedmeyer, President

Managed Portfolio Series

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Ave, 5th Fl

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 765-6844

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2019

Date of reporting period: October 31, 2019

Item 1. Reports to Stockholders.

| | | Ticker Symbols | |

| | Investor Class | Institutional Class | IS Class |

| | | | |

| Jackson Square | [Not available | [Not available | |

| All-Cap Growth Fund | for purchase] | for purchase] | JSSSX |

| | | | |

| Jackson Square | [Not available | | |

| Global Growth Fund | for purchase] | JSPTX | JSPUX |

| | | | |

| Jackson Square | | | |

| Large-Cap Growth Fund | JSPJX | JSPIX | DPLGX |

| | | | |

| Jackson Square | [Not available | [Not available | |

| Select 20 Growth Fund | for purchase] | for purchase] | DPCEX |

| | | | |

| Jackson Square | | | |

| SMID-Cap Growth Fund | JSMVX | JSMTX | DCGTX |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.jspfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-844-577-3863 or by sending an e-mail request to info@jspfunds.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-844-577-3863 or send an email request to info@jspfunds.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with a Fund.

| | Annual Report |

| www.jspfunds.com | October 31, 2019 |

Jackson Square Funds

October 31, 2019

Dear Shareholders:

Jackson Square Partners, LLC (“Jackson Square”), a U.S. registered investment adviser, is the adviser to the Jackson Square All-Cap Growth Fund, Jackson Square Global Growth Fund, Jackson Square Large-Cap Growth Fund, Jackson Square Select 20 Growth Fund, and Jackson Square SMID-Cap Growth Fund.

After significant positive absolute returns in the equity market over the past several years, we saw volatility return in late 2018 and sporadically in 2019. The volatility appears to be both technical and fundamental, leaving investors continuing to struggle with accurately predicting the pace of global economic recovery and assessing external factors that threaten economic fundamentals, such as central bank actions and fiscal policy debates across the globe. In any given period, including the fiscal year, the markets oscillate quickly from sector rotations to stock differentiation and then back again. The result can sometimes be investor focus on equities as an asset class as opposed to a focus on company-specific fundamentals. Within this backdrop, investors have generally leaned toward equities as a preferred asset allocation choice resulting in a strong U.S. equity market with only minor pullbacks.

Adding to investor consideration is not only President Trump’s unconventional style as a head of state, but now an impeachment inquiry process that may hamper the administration’s goals of significant policy changes. We are also mindful of the potential macroeconomic implications of President Trump’s exiting policy positions, including his comments and public positioning on global trade negotiations with China that could have deleterious impacts on global economic conditions. We believe it is too early to determine the long-term magnitude of such outcomes but we will closely monitor President Trump’s tenure with a keen eye on ongoing controversies and challenges as well as the effectiveness of potential policy shifts. Nonetheless, regardless of policy outcomes, we remain consistent in our long-term investment philosophy:

We want to own what we view as strong secular-growth companies with solid business models and competitive positions that we believe can grow market share and have the potential to deliver shareholder value in a variety of market environments.

Jackson Square All-Cap Growth Fund

Jackson Square All-Cap Growth Fund (the “All-Cap Growth Fund”)

Within the Fund

For the fiscal year ended Oct. 31, 2019, All-Cap Growth Fund IS Class shares gained 11.85%. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 3000® Growth Index, rose 16.34%. For complete, annualized performance of All-Cap Growth Fund, please see the table on page 4.

Strong relative performance in information technology was unable to overcome weak relative performance in communication services. On a stock-specific level, the following were the most significant contributors and detractors during the period.

Chewy Inc., an online retailer of pet food and other pet-related products, was purchased during the fiscal year and contributed to the Fund’s performance. The stock went public to significant investor interest due to its strong brand recognition, subscription-heavy model, and brand and industry barriers to new entrants. We like the high reoccurring revenue from pet-product sales and what we view as Chewy’s competitive position in the pet-supply area. While profit margins are low today as Chewy invests in fulfillment and brand recognition, we see the upside potential over time to financial metrics and to the stock as customer lifetime value grows with each new cohort of customers.

Applied Materials Inc., the global leader in providing equipment for advanced semiconductors and flat-panel displays, added to the Fund’s performance. The sector drifted higher on stronger foundry investment from Taiwanese semiconductor manufacturer TSMC, signs of a bottom in the NAND flash memory (a type of nonvolatile storage technology that does not require power to retain data) market, along with positive commentary from management on market-share gains in 2020. We remain confident that Applied Materials is undervalued by the market and is attractively positioned in a consolidating sector with high barriers to entry.

Charter Communications Inc., a cable telecommunications company, also contributed. The company continues to report strong earnings driven by well-above consensus broadband-subscriber additions. Charter Communications generated margin expansion of earnings before interest, taxes, depreciation, and amortization (EBITDA), driven by the economically accretive mix shift towards broadband and declines in capital intensity. We believe these trends support our thesis and should continue to do so for the foreseeable future. The stock remains undervalued versus our intrinsic business value estimate even with strong year-to-date stock performance. Overall, we like the company’s cable business given the structurally high barriers to entry, limited competition in broadband, inherent long-term pricing power, and that it directly benefits from the durable and inexorable secular trends underlying consumer high-speed data consumption.

Liberty TripAdvisor Holdings Inc., a travel website providing travel advice and planning features, detracted from the Fund’s performance during the fiscal year. The company’s hotel segment has struggled against competitive headwinds, including increased challenges from Google’s search business. That said, we believe Liberty TripAdvisor Holdings’ commitment to increased focus on its experiences and dining products – a growing business line that enhances the company’s overall profitability – is the right strategic move. We continue to monitor the fundamentals closely.

Farfetch Ltd., a UK-based online retail business selling multi-brand digital luxury goods in 122 countries, detracted from the Fund’s performance. The company announced an unexpected acquisition of New Guards Group, owner of Off-White, which caught investors by surprise. This acquisition gives Farfetch exclusive rights to sell Off-White goods that attract a younger demographic and adds exposure to this demographic for its other customers. Additionally, Farfetch announced it faced greater headwinds from increased promotions by both offline and online retailers. This pressure is expected to be temporary, lasting two-to-four quarters, as brands withdraw inventory from

Jackson Square All-Cap Growth Fund

the wholesale channel and continue to accelerate supply growth at Farfetch. Lastly, the company announced the departure of its chief operating officer. While each of these events can be reasonably explained, we believe the clustering of these negative data points in a single quarter has damaged management’s credibility in its first year as a public company. We remain constructive on Farfetch’s long-term opportunity to be the primary destination for online, multi-brand shopping in the luxury segment, but are carefully evaluating recent events.

LiveRamp Holdings Inc., a global technology and enablement-services company, also weighed on the Fund’s performance during the fiscal year. Despite slightly disappointing earnings, we believe recent stock weakness can be partly attributed to concerns about upcoming changes to Google Chrome’s security policy. That said, the absence of third-party cookie data as a result of changes in security policy should increase the relative value of first-party data for marketers. Further, the company announced that it had agreed to acquire Data Plus Math Corp., raising questions among investors regarding execution risk. Although we remain untroubled on its merits, we will monitor the acquisition. We continue to believe that LiveRamp Holdings is well-positioned to drive value over the long term given the combination of new management, an attractive software-as-a-service (SaaS) data platform, and a strong balance sheet with excess cash.

Jackson Square All-Cap Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of October 31, 2019

| | 1 year | 3 years | Since Inception(1) |

| IS Class | 11.85% | 13.14% | 11.72% |

Russell 3000® Growth Index(2) | 16.34% | 18.50% | 17.24% |

| (1) | The IS Class commenced operations on September 19, 2016. |

| (2) | The Russell 3000® Growth Index measures the growth segment of the U.S. equity universe. It includes those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an Index. |

Jackson Square All-Cap Growth Fund

Sector Allocation(1) (Unaudited)

As of October 31, 2019

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2019

(% of Net Assets)

| | Microsoft | | | 8.4 | % |

| | New York Times – Class A | | | 7.6 | % |

| | LiveRamp Holdings | | | 5.1 | % |

| | KKR & Co. – Class A | | | 3.6 | % |

| | Ball | | | 3.6 | % |

| | Charter Communications – Class A | | | 3.3 | % |

| | Dollar Tree | | | 3.2 | % |

| | IQVIA Holdings | | | 3.0 | % |

| | Varonis Systems | | | 2.8 | % |

| | Autodesk | | | 2.7 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Jackson Square Global Growth Fund

Jackson Square Global Growth Fund (the “Global Growth Fund”)

Within the Fund

For the fiscal year ended Oct. 31, 2019, the Global Growth Fund IS Class and Institutional Class shares gained 13.47% and 13.53%, respectively. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the MSCI All Country World Index, rose 12.59%. For complete, annualized performance of Jackson Square Global Growth Fund, please see the table on page 8.

Strong relative performance in Industrials outperformance weak relative performance in communication services. On a stock-specific level, the following were the most significant contributors and detractors during the period.

MercadoLibre, Inc., a top online retailer in Latin America, was a contributor to performance during the fiscal year. The company has continued to solidify its position in e-commerce and digital payments throughout Latin America as demonstrated by its robust growth and improved monetization of marketplaces as well as continued execution in its off-platform revenue streams. During the year, it raised capital to continue to expand its e-commerce platform; investing in the logistics infrastructure and digital payment solutions. As the digital marketplace leader in Latin America, we believe that MercadoLibre is well positioned to benefit from the secular growth of e-commerce within the region.

Arco Platform Ltd., a provider of educational content, was a contributor to performance during the fiscal year. The company continues to track ahead of its guidance for top line growth as well as margin improvement. The company made two small acquisitions during the year that we believe will help broaden its product functionality as well as open additional cross selling opportunities for its base of 4,800 partner schools and 1 million students. Arco continues to execute on its plan to digitize content and curriculum for the Brazilian private education market with a business model similar to many U.S. SaaS businesses: an asset-light platform with high visibility; strong recurring revenues; high returns on capital; and strong free cash flow. Further, we believe Arco is unique among many education companies that are typically dependent on government funding or policies, as its end user is 100% private pay.

Mastercard Incorporated, a financial service corporation that facilitates electronic funds transfer, was a contributor to performance during the fiscal year. The company reported a string of positive earnings. Additionally, the company committed to an additional three years of high-teens EPS growth. We continue to believe the global payment trend away from paper currency and checks toward electronic payments (credit and debit) is inexorable. We believe Mastercard is well positioned to take advantage of this trend; the company’s revenues are based on transactions executed over an existing network with minimal incremental capital investment required, resulting in high incremental margins.

Farfetch Ltd., a UK-based online retail business selling multi-brand digital luxury goods in 122 countries, detracted from the Fund’s performance. The company announced an unexpected acquisition of New Guards Group, owner of Off-White, which caught investors by surprise. This acquisition gives Farfetch exclusive rights to sell Off-White goods that attract a younger demographic and adds exposure to this demographic for its other customers. Additionally, Farfetch announced it faced greater headwinds from increased promotions by both offline and online retailers. This pressure is expected to be temporary, lasting two-to-four quarters, as brands withdraw inventory from the wholesale channel and continue to accelerate supply growth at Farfetch. Lastly, the company announced the departure of its chief operating officer. While each of these events can be reasonably explained, we believe the clustering of these negative data points in a single quarter has damaged management’s credibility in its first year as a public company. We remain constructive on Farfetch’s long-term opportunity to be the primary destination for online, multi-brand shopping in the luxury segment, but are carefully evaluating recent events.

Jackson Square Global Growth Fund

Ubisoft Entertainment, a global console video game publisher, was a detractor from performance during the fiscal year. The stock was impacted by the underperformance of its latest game, “Ghost Recon: Breakpoint”, and the company made the difficult decision to delay its remaining three games (originally scheduled for this fiscal year) in order to optimize the net present value and lifetime engagement of those games. While the fundamental news has been disappointing, we believe the issues are transitory in nature and caused an overreaction to the stock price from short-term investors. We believe Ubisoft is doing the right thing for the health of its franchises and monetization potential and that our long-term growth thesis remains intact.

HealthEquity, Inc., a platform for Health Savings Accounts (HAS) and consumer driven health and retirement solutions, was a detractor for the fiscal year. During the year, HealthEquity announced a definitive agreement to acquire WageWorks--a leading independent provider of consumer directed benefits--for $2B. In August, WageWorks reported 2Q19 numbers that were below analyst expectations and showed year-over-year declines in revenue and EBITDA. While not unexpected given the challenges at the business, the declines were larger than expected and highlighted that the integration with HealthEquity will take time for the benefits to be fully realized. Nonetheless, we believe in the reasonable synergy assumptions of the WageWorks deal and that management will be able to adequately reset the combined company.

Jackson Square Global Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of October 31, 2019

| | 1 year | 3 years | Since Inception(1) |

| IS Class | 13.47% | 15.11% | 13.83% |

| Institutional Class | 13.53% | 15.10% | 13.81% |

MSCI All Country World Index(2) | 12.59% | 11.33% | 10.76% |

| (1) | Both the IS Class and Institutional Class commenced operations on September 19, 2016. |

| (2) | The MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets worldwide. One cannot invest directly in an Index. |

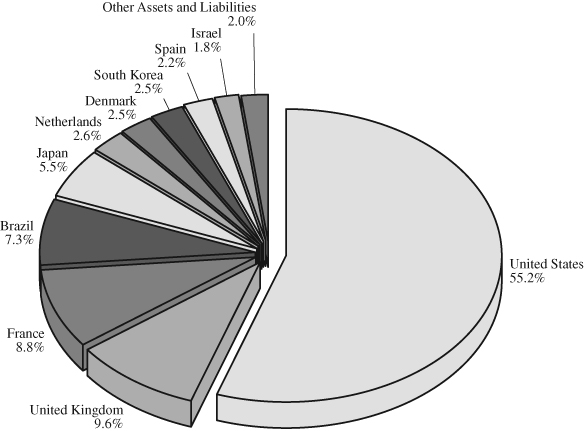

Jackson Square Global Growth Fund

Country Allocation(1) (Unaudited)

As of October 31, 2019

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2019

(% of Net Assets)

| | Microsoft | | | 4.8 | % |

| | Airbus | | | 4.5 | % |

| | Mastercard – Class A | | | 4.3 | % |

| | Visa – Class A | | | 4.1 | % |

| | New York Times – Class A | | | 4.0 | % |

| | IQVIA Holdings | | | 3.9 | % |

| | Experian | | | 3.3 | % |

| | KKR & Co. – Class A | | | 3.1 | % |

| | CME Group | | | 3.1 | % |

| | Haemonetics | | | 3.1 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Jackson Square Large-Cap Growth Fund

Jackson Square Large-Cap Growth Fund (the “Large-Cap Growth Fund”)

Within the Fund

For the fiscal year ended Oct. 31, 2019, the Large-Cap Growth Fund IS, Institutional and Investor Classes shares gained 14.40%, 14.44% and 14.18%, respectively. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 1000® Growth Index, gained 17.10%. For complete, annualized performance of Large-Cap Growth Fund, please see the table on page 12.

Strong relative performance in information technology was unable to overcome weak relative performance in communication services. On a stock-specific level, the following were the most significant contributors and detractors during the period.

Applied Materials Inc., the global leader in providing equipment for advanced semiconductors and flat-panel displays, contributed to the Fund’s performance during the fiscal year. The sector drifted higher on stronger foundry investment from Taiwanese semiconductor manufacturer TSMC, signs of a bottom in the NAND flash memory (a type of nonvolatile storage technology that does not require power to retain data) market, along with positive commentary from management on market share-gains in 2020. We remain confident that Applied Materials is undervalued by the market and is attractively positioned in a consolidating sector with high barriers to entry.

Charter Communications Inc., a cable telecommunications company, added to the Fund’s performance during the fiscal year. The company continues to report strong earnings driven by well-above consensus broadband-subscriber additions. Charter Communications generated margin expansion of earnings before interest, taxes, depreciation, and amortization (EBITDA), driven by the economically accretive mix shift towards broadband and declines in capital intensity. We believe these trends support our thesis and should continue to do so for the foreseeable future. The stock remains undervalued versus our intrinsic business value estimate even with strong year-to-date stock performance. Overall, we like the company’s cable business given the structurally high barriers to entry, limited competition in broadband, inherent long-term pricing power, and that it directly benefits from the durable and inexorable secular trends underlying consumer high-speed data consumption.

Microsoft Corp., a multinational technology company, was also a contributor to performance during the fiscal period. Microsoft has continued to report double-digit growth in Azure, its enterprise cloud computing offering. We believe the conversion of clients to Office 365 subscriptions from packaged software and increased integration of LinkedIn to corporate customers have helped to strengthen its competitive position in the enterprise business. Our thesis of Microsoft’s becoming one of just a few key competitors in the cloud computing space and consequently transitioning to more consistent, stable revenue streams is intact, and the stock remains a significant holding in the Fund’s portfolio.

TripAdvisor Inc., a travel website providing travel advice and planning features, detracted from the Fund’s performance during the fiscal year. The company’s hotel segment has struggled against competitive headwinds, including increased challenges from Google’s search business. That said, we believe TripAdvisor’s commitment to increased focus on its experiences and dining products – a growing business line that enhances the company’s overall profitability – is the right strategic move. We continue to monitor the fundamentals closely.

Take-Two Interactive Software Inc., a publisher and distributor of video games, detracted from the Fund’s performance. The stock had a drawdown earlier in 2019 caused primarily by its correlation to poor results from peers. A related issue is skeptics’ lingering perception that Fortnite and the “free-to-play” gaming concept are impairing industry fundamentals via deflation and reduced barriers to entry, a view we continue to dispute. Long term, we continue to believe Take-Two is in the early stages of its journey towards increased scale, profitability,

Jackson Square Large-Cap Growth Fund

and diversification, all of which has been underappreciated by the market. Additionally, the company’s balance sheet remains strong, in our view, with significant cash, short-term investments, and no debt.

Liberty Global Plc, an international telecommunications and diversified cable company, also weighed on the Fund’s performance during the fiscal period. Increased concern about the potential for a hard Brexit has investors worried about the company’s UK business, which represents 60% of operating profits. As such, the stock has underperformed. We continue to believe that Liberty Global’s UK business has held up better operationally than sentiment suggests, and that it should ultimately benefit from its advantaged network with sustainable pricing power in a consolidating industry.

Jackson Square Large-Cap Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of October 31, 2019

| | 1 year | 5 years | 10 years | Since Inception(1) |

| IS Class | 14.40% | 9.41% | 13.96% | 8.77% |

| Institutional Class | 14.44% | 9.37% | 13.88% | 8.69% |

| Investor Class | 14.18% | 9.10% | 13.60% | 8.42% |

Russell 1000® Growth Index(2) | 17.10% | 13.43% | 15.41% | 10.65% |

| (1) | The IS Class commenced operations on November 1, 2005, and the Institutional Class and Investor Class shares commenced operations on September 19, 2016. Performance for the Institutional Class and Investor Class prior to the inception of each class is based on the performance of the IS Class shares, adjusted for higher expenses applicable to each class’ shares. |

| (2) | The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an Index. |

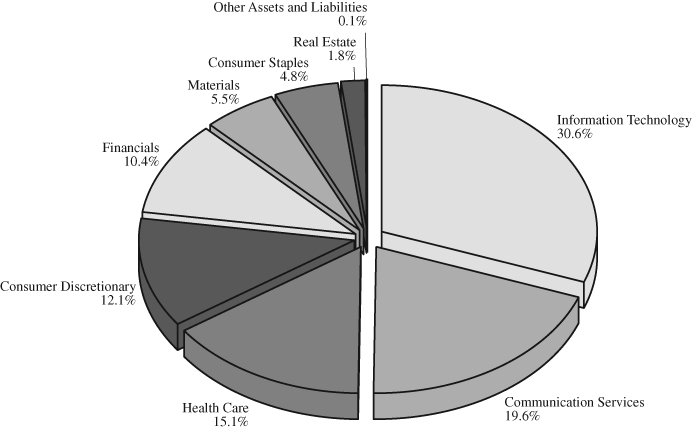

Jackson Square Large-Cap Growth Fund

Sector Allocation(1) (Unaudited)

As of October 31, 2019

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2019

(% of Net Assets)

| | Microsoft | | | 10.2 | % |

| | Ball | | | 5.4 | % |

| | IQVIA Holdings | | | 5.4 | % |

| | Charter Communications – Class A | | | 4.9 | % |

| | Dollar Tree | | | 4.8 | % |

| | Constellation Brands – Class A | | | 4.8 | % |

| | KKR & Co. – Class A | | | 4.8 | % |

| | Hasbro | | | 4.2 | % |

| | UnitedHealth Group | | | 4.0 | % |

| | Mastercard – Class A | | | 3.9 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Jackson Square Select 20 Growth Fund

Jackson Square Select 20 Growth Fund (the “Select 20 Growth Fund”)

Within the Fund

For the fiscal year ended Oct. 31, 2019, Jackson Square Select 20 Fund IS Class shares gained 10.47%. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 3000® Growth Index, rose 16.34%. For complete, annualized performance of Jackson Square Select 20 Fund, please see the table on page 16.

Strong relative performance in Healthcare could not overcome the relative weak performance in communication services. On a stock-specific level, the following were the most significant contributors and detractors during the period.

Applied Materials Inc., the global leader in providing equipment for advanced semiconductors and flat-panel displays, added to the Fund’s performance. The sector drifted higher on stronger foundry investment from Taiwanese semiconductor manufacturer TSMC, signs of a bottom in the NAND flash memory (a type of nonvolatile storage technology that does not require power to retain data) market, along with positive commentary from management on market-share gains in 2020. We remain confident that Applied Materials is undervalued by the market and is attractively positioned in a consolidating sector with high barriers to entry.

Chewy Inc., an online retailer of pet food and other pet-related products, was purchased during the fiscal year and contributed to the Fund’s performance. The stock went public to significant investor interest due to its strong brand recognition, subscription-heavy model, and brand and industry barriers to new entrants. We like the high reoccurring revenue from pet-product sales and what we view as Chewy’s competitive position in the pet-supply area. While profit margins are low today as Chewy invests in fulfillment and brand recognition, we see the upside potential over time to financial metrics and to the stock as customer lifetime value grows with each new cohort of customers.

Nevro Corp., a global medical device company that is providing innovative, evidence-based solutions for the treatment of chronic pain conditions, was a contributor to performance during the fiscal year end. The company’s results in 2019 have confirmed the business is turning around rapidly under new CEO Keith Grossman, with the company reporting better revenue than expected and showing an inflection in leading indicators such as implant trials. The company is on track to launch its new Omnia product by the end of the year which we believe will further accelerate both overall market growth and Nevro’s market share gains.

Farfetch Ltd., a UK-based online retail business selling multi-brand digital luxury goods in 122 countries, detracted from the Fund’s performance. The company announced an unexpected acquisition of New Guards Group, owner of Off-White, which caught investors by surprise. This acquisition gives Farfetch exclusive rights to sell Off-White goods that attract a younger demographic and adds exposure to this demographic for its other customers. Additionally, Farfetch announced it faced greater headwinds from increased promotions by both offline and online retailers. This pressure is expected to be temporary, lasting two-to-four quarters, as brands withdraw inventory from the wholesale channel and continue to accelerate supply growth at Farfetch. Lastly, the company announced the departure of its chief operating officer. While each of these events can be reasonably explained, we believe the clustering of these negative data points in a single quarter has damaged management’s credibility in its first year as a public company. We remain constructive on Farfetch’s long-term opportunity to be the primary destination for online, multi-brand shopping in the luxury segment, but are carefully evaluating recent events.

Jackson Square Select 20 Growth Fund

Liberty TripAdvisor Holdings Inc., a travel website providing travel advice and planning features, detracted from the Fund’s performance during the fiscal year. The company’s hotel segment has struggled against competitive headwinds, including increased challenges from Google’s search business. That said, we believe Liberty TripAdvisor Holdings’ commitment to increased focus on its experiences and dining products – a growing business line that enhances the company’s overall profitability – is the right strategic move. We continue to monitor the fundamentals closely.

LiveRamp Holdings Inc., a global technology and enablement-services company, also weighed on the Fund’s performance during the fiscal year. Despite slightly disappointing earnings, we believe recent stock weakness can be partly attributed to concerns about upcoming changes to Google Chrome’s security policy. That said, the absence of third-party cookie data as a result of changes in security policy should increase the relative value of first-party data for marketers. Further, the company announced that it had agreed to acquire Data Plus Math Corp., raising questions among investors regarding execution risk. Although we remain untroubled on its merits, we will monitor the acquisition. We continue to believe that LiveRamp Holdings is well-positioned to drive value over the long term given the combination of new management, an attractive software-as-a-service (SaaS) data platform, and a strong balance sheet with excess cash.

Jackson Square Select 20 Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of October 31, 2019

| | 1 year | 5 years | 10 years | Since Inception(1) |

| IS Class | 10.47% | 7.29% | 12.55% | 3.37% |

Russell 3000® Growth Index(2) | 16.34% | 13.05% | 15.26% | 4.55% |

| (1) | The IS Class commenced operations on March 31, 2000. |

| (2) | The Russell 3000® Growth Index measures the growth segment of the U.S. equity universe. It includes those Russell 3000® Index composites with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an Index. |

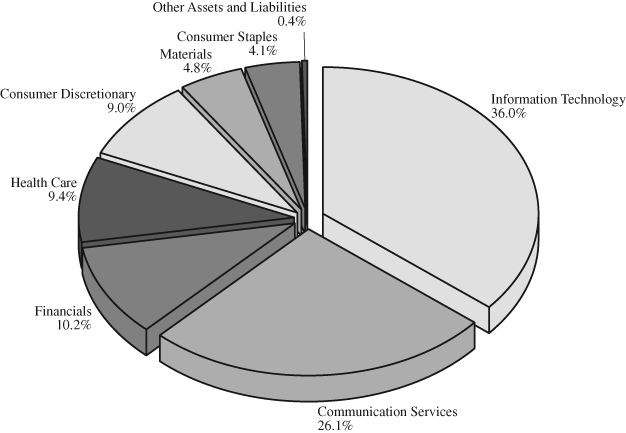

Jackson Square Select 20 Growth Fund

Sector Allocation(1) (Unaudited)

As of October 31, 2019

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2019

(% of Net Assets)

| | Microsoft | | | 11.9 | % |

| | Visa – Class A | | | 6.7 | % |

| | New York Times – Class A | | | 6.0 | % |

| | GCI Liberty – Class A | | | 6.0 | % |

| | KKR & Co. – Class A | | | 5.8 | % |

| | LiveRamp Holdings | | | 4.9 | % |

| | Hasbro | | | 4.8 | % |

| | Autodesk | | | 4.8 | % |

| | Ball | | | 4.7 | % |

| | TripAdvisor | | | 4.7 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Jackson Square SMID-Cap Growth Fund

Jackson Square SMID-Cap Growth Fund (the “SMID-Cap Growth Fund”)

Within the Fund

For the fiscal year ended Oct. 31, 2019, SMID-Cap Growth Fund IS, Institutional and Investor Class shares gained 14.02%, 14.08% and 13.69%, respectively. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 2500® Growth Index, rose 11.77%. For complete, annualized performance of Jackson Square SMID-Cap Growth Fund, please see the table on page 20.

Strong relative performance in Financials outperformed weak relative performance in communication services. On a stock-specific level, the following were the most significant contributors and detractors during the period.

Coupa Software, Inc., a cloud platform for business spend management, was a contributor to performance during the fiscal year. The company continued to reported strong earnings, demonstrating 50% billings growth, beating consensus expectations by 22%. The company also signed USPS as its first federal customer. We believe that Coupa Software is moving rapidly from an early stage disruptor start-up to a gold-standard choice for procurement teams in large enterprises.

LendingTree, Inc., an online loan marketplace, was a contributor to performance during the fiscal year. With the Federal Reserve lowering interest rates during 2019, mortgage activity has increased and has allowed individuals to refinance or purchase a home more quickly and to lock-in costs. We believe this positive mortgage data has encouraged investors to question the pervading bear thesis in 2018 around the lending industry. We continue to believe that LendingTree will not only continue to be a leader in online loan referrals, but will also strengthen its business model by successfully diversifying its product offerings.

Paycom Software, Inc., an online payroll and human resource technology company, was a contributor to performance during the fiscal year. The company raised earnings expectations guidance and is performing well operationally through the year. We continue to believe Paycom is a unique human resources software business with strong profitability that is taking share from legacy incumbents due to its SaaS platform and unique sales culture led by the company’s founder.

Farfetch Ltd., a UK-based online retail business selling multi-brand digital luxury goods in 122 countries, detracted from the Fund’s performance. The company announced an unexpected acquisition of New Guards Group, owner of Off-White, which caught investors by surprise. This acquisition gives Farfetch exclusive rights to sell Off-White goods that attract a younger demographic and adds exposure to this demographic for its other customers. Additionally, Farfetch announced it faced greater headwinds from increased promotions by both offline and online retailers. This pressure is expected to be temporary, lasting two-to-four quarters, as brands withdraw inventory from the wholesale channel and continue to accelerate supply growth at Farfetch. Lastly, the company announced the departure of its chief operating officer. While each of these events can be reasonably explained, we believe the clustering of these negative data points in a single quarter has damaged management’s credibility in its first year as a public company. We remain constructive on Farfetch’s long-term opportunity to be the primary destination for online, multi-brand shopping in the luxury segment, but are carefully evaluating recent events.

Cars.com, Inc., an automotive classified site, was a detractor from performance during the fiscal year. While desktop and mobile traffic continue to improve, revenue growth has remained challenged and the fundamentals have deteriorated in the most recent quarter. We had hoped activist activity and a strategic review to catalyze new management or the potential sale of the company could happen, but it has not materialized. Therefore, we have moved on from the position.

Jackson Square SMID-Cap Growth Fund

LiveRamp Holdings Inc., a global technology and enablement-services company, also weighed on the Fund’s performance during the fiscal year. Despite slightly disappointing earnings, we believe recent stock weakness can be partly attributed to concerns about upcoming changes to Google Chrome’s security policy. That said, the absence of third-party cookie data as a result of changes in security policy should increase the relative value of first-party data for marketers. Further, the company announced that it had agreed to acquire Data Plus Math Corp., raising questions among investors regarding execution risk. Although we remain untroubled on its merits, we will monitor the acquisition. We continue to believe that LiveRamp Holdings is well-positioned to drive value over the long term given the combination of new management, an attractive software-as-a-service (SaaS) data platform, and a strong balance sheet with excess cash.

Jackson Square SMID-Cap Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Returns as of October 31, 2019

| | 1 year | 5 years | 10 years | Since Inception(1) |

| IS Class | 14.02% | 12.67% | 16.64% | 11.26% |

| Institutional Class | 14.08% | 12.62% | 16.56% | 11.16% |

| Investor Class | 13.69% | 12.30% | 16.25% | 10.88% |

Russell 2500® Growth Index(2) | 11.77% | 9.83% | 14.42% | 9.59% |

| (1) | The IS Class commenced operations on December 1, 2003, the Institutional Class commenced operations on September 16, 2016 and the Investor Class commenced operations on September 19, 2016. Performance of the Institutional Class and Investor Class prior to inception of each class is based on the performance of the IS Class, adjusted for the higher expenses applicable to each class’ shares. |

| (2) | The Russell 2500® Growth Index measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500® companies with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an Index. |

Jackson Square SMID-Cap Growth Fund

Sector Allocation(1) (Unaudited)

As of October 31, 2019

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2019

(% of Net Assets)

| | New York Times – Class A | | | 6.6 | % |

| | Equity Commonwealth – REIT | | | 5.4 | % |

| | Bio-Techne | | | 5.0 | % |

| | GCI Liberty – Class A | | | 4.9 | % |

| | j2 Global | | | 4.8 | % |

| | Guidewire Software | | | 4.6 | % |

| | Wyndham Hotels & Resorts | | | 4.4 | % |

| | Dunkin’ Brands Group | | | 4.3 | % |

| | LiveRamp Holdings | | | 4.3 | % |

| | Papa John’s International | | | 3.6 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Jackson Square Funds

Expense Examples (Unaudited)

October 31, 2019

As a shareholder of a Fund, you incur two types of costs: (1) transactions costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees, shareholder servicing fees; interest expense, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2019 – October 31, 2019).

ACTUAL EXPENSES

For each class, the first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only. Therefore, the second line of the tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds, In addition, if transactional costs were included, your costs may have been higher.

All-Cap Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (5/1/2019) | (10/31/2019) | (5/1/2019 to 10/31/2019) |

IS Class Actual(2) | $1,000.00 | $ 986.00 | $4.51 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.67 | $4.58 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.90% for the IS Class, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended October 31, 2019 of -1.40% for the IS Class. |

Jackson Square Funds

Expense Examples (Unaudited) – Continued

October 31, 2019

Global Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (5/1/2019) | (10/31/2019) | (5/1/2019 to 10/31/2019) |

IS Class Actual(2) | $1,000.00 | $1,020.20 | $5.35 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,019.91 | $5.35 |

Institutional Class Actual(2) | $1,000.00 | $1,020.30 | $5.35 |

| Institutional Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,019.91 | $5.35 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.05% and 1.05% for the IS Class and Institutional Class, respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended October 31, 2019 of 2.02% and 2.03% for the IS Class and Institutional Class, respectively. |

Large-Cap Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(3) |

| | (5/1/2019) | (10/31/2019) | (5/1/2019 to 10/31/2019) |

IS Class Actual(4) | $1,000.00 | $1,027.40 | $3.27 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,021.98 | $3.26 |

Institutional Class Actual(4) | $1,000.00 | $1,028.30 | $3.27 |

| Institutional Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,021.98 | $3.26 |

Investor Class Actual(4) | $1,000.00 | $1,026.60 | $4.55 |

| Investor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.72 | $4.53 |

| (3) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.64%, 0.64% and 0.89% for the IS Class, Institutional Class and Investor Class, respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (4) | Based on the actual returns for the six-month period ended October 31, 2019 of 2.74%, 2.83% and 2.66% for the IS Class, Institutional Class and Investor Class, respectively. |

Jackson Square Funds

Expense Examples (Unaudited) – Continued

October 31, 2019

Select 20 Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (5/1/2019) | (10/31/2019) | (5/1/2019 to 10/31/2019) |

IS Class Actual(2) | $1,000.00 | $ 985.50 | $4.35 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.82 | $4.43 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.87% for the IS Class, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended October 31, 2019 of -1.45% for the IS Class. |

SMID-Cap Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(3) |

| | (5/1/2019) | (10/31/2019) | (5/1/2019 to 10/31/2019) |

IS Class Actual(4) | $1,000.00 | $ 957.90 | $4.29 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.82 | $4.43 |

Institutional Class Actual(4) | $1,000.00 | $ 957.50 | $4.69 |

| Institutional Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.42 | $4.84 |

Investor Class Actual(4) | $1,000.00 | $ 956.00 | $6.01 |

| Investor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,019.06 | $6.21 |

| (3) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.87%, 0.95% and 1.22% for the IS Class, Institutional Class and Investor Class, respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (4) | Based on the actual returns for the six-month period ended October 31, 2019 of -4.21%, -4.25% and -4.40% for the IS Class, Institutional Class and Investor Class, respectively. |

Jackson Square All-Cap Growth Fund

Schedule of Investments

October 31, 2019

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.1% | | | | | | |

| | | | | | | |

| Communication Services – 18.8% | | | | | | |

Alphabet – Class A* | | | 18 | | | $ | 22,658 | |

Alphabet – Class C* | | | 18 | | | | 22,682 | |

Charter Communications – Class A* | | | 424 | | | | 198,373 | |

GCI Liberty – Class A* | | | 468 | | | | 32,751 | |

Liberty Global – Series C* (a) | | | 3,299 | | | | 78,747 | |

Liberty TripAdvisor Holdings – Series A* | | | 7,150 | | | | 68,998 | |

Netflix* | | | 235 | | | | 67,541 | |

New York Times – Class A | | | 14,708 | | | | 454,477 | |

Take-Two Interactive Software* | | | 1,139 | | | | 137,079 | |

TripAdvisor* | | | 1,118 | | | | 45,167 | |

| | | | | | | | 1,128,473 | |

| | | | | | | | | |

| Consumer Discretionary – 14.1% | | | | | | | | |

Afya – Class A* | | | 164 | | | | 4,428 | |

Alibaba Group Holding – ADR* | | | 124 | | | | 21,907 | |

Arco Platform – Class A* | | | 398 | | | | 16,517 | |

Chewy – Class A* | | | 1,894 | | | | 46,725 | |

Dollar Tree* | | | 1,727 | | | | 190,661 | |

Domino’s Pizza | | | 47 | | | | 12,766 | |

Dunkin’ Brands Group | | | 536 | | | | 42,140 | |

Farfetch – Class A* | | | 3,130 | | | | 27,951 | |

Hasbro | | | 1,522 | | | | 148,106 | |

Papa John’s International | | | 2,003 | | | | 117,276 | |

Stitch Fix – Class A* | | | 4,883 | | | | 111,625 | |

Wyndham Hotels & Resorts | | | 1,980 | | | | 106,860 | |

| | | | | | | | 846,962 | |

| | | | | | | | | |

| Consumer Staples – 2.5% | | | | | | | | |

Constellation Brands – Class A | | | 776 | | | | 147,696 | |

| | | | | | | | | |

| Energy – 0.3% | | | | | | | | |

Kinder Morgan | | | 856 | | | | 17,103 | |

| | | | | | | | | |

| Financials – 8.4% | | | | | | | | |

Charles Schwab | | | 3,601 | | | | 146,597 | |

CME Group | | | 626 | | | | 128,799 | |

KKR & Co. – Class A | | | 7,482 | | | | 215,706 | |

LendingTree* | | | 28 | | | | 10,076 | |

| | | | | | | | 501,178 | |

See Notes to the Financial Statements

Jackson Square All-Cap Growth Fund

Schedule of Investments – Continued

October 31, 2019

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.1% (Continued) | | | | | | |

| | | | | | | |

| Health Care – 11.9% | | | | | | |

ABIOMED* | | | 140 | | | $ | 29,061 | |

Biogen* | | | 233 | | | | 69,599 | |

Haemonetics* | | | 356 | | | | 42,980 | |

HealthEquity* | | | 1,411 | | | | 80,131 | |

Illumina* | | | 385 | | | | 113,775 | |

IQVIA Holdings* | | | 1,237 | | | | 178,648 | |

Nevro* | | | 100 | | | | 8,620 | |

Portola Pharmaceuticals* | | | 1,602 | | | | 46,314 | |

UnitedHealth Group | | | 572 | | | | 144,544 | |

| | | | | | | | 713,672 | |

| | | | | | | | | |

| Industrials – 4.4% | | | | | | | | |

Airbus (a)(b) | | | 298 | | | | 42,750 | |

Expeditors International of Washington | | | 567 | | | | 41,357 | |

Experian (a)(b) | | | 739 | | | | 23,294 | |

IHS Markit* | | | 555 | | | | 38,861 | |

Safran (a)(b) | | | 417 | | | | 66,049 | |

Waste Management | | | 484 | | | | 54,310 | |

| | | | | | | | 266,621 | |

| | | | | | | | | |

Information Technology – 32.6%# | | | | | | | | |

Amadeus IT Group (a)(b) | | | 63 | | | | 4,661 | |

Applied Materials | | | 851 | | | | 46,175 | |

Arista Networks* | | | 347 | | | | 84,866 | |

ASML Holding (a)(b) | | | 53 | | | | 13,892 | |

Autodesk* | | | 1,104 | | | | 162,685 | |

Coupa Software* | | | 97 | | | | 13,337 | |

Guidewire Software* | | | 202 | | | | 22,773 | |

IPG Photonics* | | | 67 | | | | 8,997 | |

j2 Global | | | 698 | | | | 66,282 | |

LiveRamp Holdings* | | | 7,763 | | | | 303,456 | |

Logitech International (a)(b) | | | 1,016 | | | | 41,704 | |

Mastercard – Class A | | | 490 | | | | 135,637 | |

Microsoft | | | 3,494 | | | | 500,935 | |

Paycom Software* | | | 37 | | | | 7,827 | |

PayPal Holdings* | | | 944 | | | | 98,270 | |

SailPoint Technologies Holding* | | | 451 | | | | 8,731 | |

Samsung Electronics (a)(b) | | | 364 | | | | 15,732 | |

ServiceNow* | | | 127 | | | | 31,402 | |

Ubisoft Entertainment* (a)(b) | | | 85 | | | | 5,023 | |

See Notes to the Financial Statements

Jackson Square All-Cap Growth Fund

Schedule of Investments – Continued

October 31, 2019

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.1% (Continued) | | | | | | |

| | | | | | | |

Information Technology – 32.6%# (Continued) | | | | | | |

Varonis Systems* | | | 2,350 | | | $ | 168,143 | |

Visa – Class A | | | 906 | | | | 162,047 | |

Wix.com* | | | 417 | | | | 50,903 | |

| | | | | | | | 1,953,478 | |

| | | | | | | | | |

| Materials – 3.6% | | | | | | | | |

Ball | | | 3,068 | | | | 214,668 | |

| | | | | | | | | |

| Real Estate – 1.5% | | | | | | | | |

Crown Castle International – REIT | | | 152 | | | | 21,096 | |

Equity Commonwealth – REIT | | | 469 | | | | 15,093 | |

Redfin* | | | 3,016 | | | | 52,448 | |

| | | | | | | | 88,637 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $4,957,380) | | | | | | | 5,878,488 | |

| Total Investments – 98.1% | | | | | | | | |

| (Cost $4,957,380) | | | | | | | 5,878,488 | |

| Other Assets and Liabilities, Net – 1.9% | | | | | | | 111,465 | |

| Total Net Assets – 100.0% | | | | | | $ | 5,989,953 | |

| * | | Non-income producing security. |

| (a) | | Foreign Security. |

| (b) | | Level 2 Security. |

| # | | As of October 31, 2019, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 10 in Notes to the Financial Statements. |

ADR – American Depositary Receipt

REIT – Real Estate Investment Trust

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square Global Growth Fund

Schedule of Investments

October 31, 2019

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.0% | | | | | | |

| | | | | | | |

| Brazil – 7.3% | | | | | | |

Afya – Class A* | | | 4,714 | | | $ | 127,278 | |

Arco Platform – Class A* | | | 5,921 | | | | 245,721 | |

Localiza Rent a Car | | | 26,276 | | | | 281,727 | |

MercadoLibre* | | | 384 | | | | 200,264 | |

| | | | | | | | 854,990 | |

| | | | | | | | | |

| Denmark – 2.5% | | | | | | | | |

DSV (a) | | | 3,029 | | | | 294,386 | |

| | | | | | | | | |

| France – 8.8% | | | | | | | | |

Airbus (a) | | | 3,679 | | | | 527,783 | |

Safran (a) | | | 1,909 | | | | 302,367 | |

Ubisoft Entertainment* (a) | | | 3,356 | | | | 198,337 | |

| | | | | | | | 1,028,487 | |

| | | | | | | | | |

| Israel – 1.8% | | | | | | | | |

Wix.com* | | | 1,696 | | | | 207,031 | |

| | | | | | | | | |

| Japan – 5.5% | | | | | | | | |

MonotaRO (a) | | | 9,637 | | | | 291,140 | |

Otsuka Holdings (a) | | | 8,506 | | | | 354,617 | |

| | | | | | | | 645,757 | |

| | | | | | | | | |

| Netherlands – 2.6% | | | | | | | | |

ASML Holding (a) | | | 1,170 | | | | 306,674 | |

| | | | | | | | | |

| South Korea – 2.5% | | | | | | | | |

Samsung Electronics (a) | | | 6,590 | | | | 284,819 | |

| | | | | | | | | |

| Spain – 2.2% | | | | | | | | |

Amadeus IT Group (a) | | | 3,384 | | | | 250,342 | |

| | | | | | | | | |

| United Kingdom – 9.6% | | | | | | | | |

Experian (a) | | | 12,276 | | | | 386,957 | |

InterContinental Hotels Group (a) | | | 4,027 | | | | 243,694 | |

Intertek Group (a) | | | 3,925 | | | | 272,144 | |

Liberty Global – Series C* | | | 9,289 | | | | 221,728 | |

| | | | | | | | 1,124,523 | |

| | | | | | | | | |

| United States – 55.2% | | | | | | | | |

Ball | | | 4,473 | | | | 312,976 | |

CME Group | | | 1,756 | | | | 361,297 | |

Guidewire Software* | | | 2,642 | | | | 297,859 | |

Haemonetics* | | | 2,958 | | | | 357,119 | |

See Notes to the Financial Statements

Jackson Square Global Growth Fund

Schedule of Investments – Continued

October 31, 2019

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.0% (Continued) | | | | | | |

| | | | | | | |

| United States – 55.2% (Continued) | | | | | | |

HealthEquity* | | | 4,288 | | | $ | 243,516 | |

IHS Markit* | | | 4,414 | | | | 309,068 | |

Illumina* | | | 904 | | | | 267,150 | |

IPG Photonics* | | | 1,816 | | | | 243,852 | |

IQVIA Holdings* | | | 3,149 | | | | 454,779 | |

KKR & Co. – Class A | | | 12,646 | | | | 364,584 | |

LiveRamp Holdings* | | | 5,022 | | | | 196,310 | |

Mastercard – Class A | | | 1,833 | | | | 507,393 | |

Microsoft | | | 3,944 | | | | 565,451 | |

Netflix* | | | 934 | | | | 268,441 | |

New York Times – Class A | | | 15,162 | | | | 468,506 | |

PayPal Holdings* | | | 2,555 | | | | 265,976 | |

TripAdvisor* | | | 4,669 | | | | 188,628 | |

UnitedHealth Group | | | 1,179 | | | | 297,933 | |

Visa – Class A | | | 2,644 | | | | 472,906 | |

| | | | | | | | 6,443,744 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $8,704,669) | | | | | | | 11,440,753 | |

| Total Investments – 98.0% | | | | | | | | |

| (Cost $8,704,669) | | | | | | | 11,440,753 | |

| Other Assets and Liabilities, Net – 2.0% | | | | | | | 228,372 | |

| Total Net Assets – 100.0% | | | | | | $ | 11,669,125 | |

| * | | Non-income producing security. |

| (a) | | Level 2 Security. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square Global Growth Fund

Schedule of Investments – Continued

October 31, 2019

At October 31, 2019, the sector diversification for the Fund was as follows:

| | | % of | |

| Sector | | Net Assets | |

Information Technology# | | | 32.5 | % |

Industrials | | | 22.9 | % |

Health Care | | | 16.9 | % |

Communication Services | | | 9.8 | % |

Consumer Discretionary | | | 7.0 | % |

Financials | | | 6.2 | % |

Materials | | | 2.7 | % |

Other Assets and Liabilities, Net | | | 2.0 | % |

Total | | | 100.0 | % |

| # | As of October 31, 2019, the Fund has a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 10 in Notes to the Financial Statements. |

See Notes to the Financial Statements

Jackson Square Large-Cap Growth Fund

Schedule of Investments

October 31, 2019

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 99.9% | | | | | | |

| | | | | | | |

| Communication Services – 19.6% | | | | | | |

Alphabet – Class A* | | | 2,337 | | | $ | 2,941,816 | |

Charter Communications – Class A* | | | 7,891 | | | | 3,691,883 | |

Liberty Global – Series C* (a) | | | 109,166 | | | | 2,605,793 | |

Netflix* | | | 7,066 | | | | 2,030,839 | |

Take-Two Interactive Software* | | | 18,504 | | | | 2,226,956 | |

TripAdvisor* | | | 28,315 | | | | 1,143,926 | |

| | | | | | | | 14,641,213 | |

| | | | | | | | | |

| Consumer Discretionary – 12.1% | | | | | | | | |

Dollar Tree* | | | 32,495 | | | | 3,587,448 | |

Domino’s Pizza | | | 8,670 | | | | 2,354,946 | |

Hasbro | | | 32,272 | | | | 3,140,388 | |

| | | | | | | | 9,082,782 | |

| | | | | | | | | |

| Consumer Staples – 4.8% | | | | | | | | |

Constellation Brands – Class A | | | 18,809 | | | | 3,579,917 | |

| | | | | | | | | |

| Financials – 10.4% | | | | | | | | |

Charles Schwab | | | 55,672 | | | | 2,266,407 | |

CME Group | | | 9,407 | | | | 1,935,490 | |

KKR & Co. – Class A | | | 123,732 | | | | 3,567,194 | |

| | | | | | | | 7,769,091 | |

| | | | | | | | | |

| Health Care – 15.1% | | | | | | | | |

Biogen* | | | 5,388 | | | | 1,609,449 | |

Illumina* | | | 8,978 | | | | 2,653,179 | |

IQVIA Holdings* | | | 28,137 | | | | 4,063,546 | |

UnitedHealth Group | | | 11,872 | | | | 3,000,054 | |

| | | | | | | | 11,326,228 | |

| | | | | | | | | |

Information Technology – 30.6%# | | | | | | | | |

Applied Materials | | | 36,239 | | | | 1,966,328 | |

Arista Networks* | | | 7,845 | | | | 1,918,652 | |

Autodesk* | | | 14,075 | | | | 2,074,092 | |

Mastercard – Class A | | | 10,657 | | | | 2,949,964 | |

Microsoft | | | 53,412 | | | | 7,657,678 | |

PayPal Holdings* | | | 22,886 | | | | 2,382,433 | |

ServiceNow* | | | 4,782 | | | | 1,182,397 | |

Visa – Class A | | | 15,641 | | | | 2,797,549 | |

| | | | | | | | 22,929,093 | |

See Notes to the Financial Statements

Jackson Square Large-Cap Growth Fund

Schedule of Investments – Continued

October 31, 2019

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 99.9% (Continued) | | | | | | |

| | | | | | | |

| Materials – 5.5% | | | | | | |

Ball | | | 58,267 | | | $ | 4,076,942 | |

| | | | | | | | | |

| Real Estate – 1.8% | | | | | | | | |

Crown Castle International – REIT | | | 9,833 | | | | 1,364,722 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $64,147,526) | | | | | | | 74,769,988 | |

| Total Investments – 99.9% | | | | | | | | |

| (Cost $64,147,526) | | | | | | | 74,769,988 | |

| Other Assets and Liabilities, Net – 0.1% | | | | | | | 76,008 | |

| Total Net Assets – 100.0% | | | | | | $ | 74,845,996 | |

| * | | Non-income producing security. |

| (a) | | Foreign Security. |

| # | | As of October 31, 2019, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 10 in Notes to the Financial Statements. |

REIT – Real Estate Investment Trust

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square Select 20 Growth Fund

Schedule of Investments

October 31, 2019

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 99.6% | | | | | | |

| | | | | | | |

Communication Services – 26.1%# | | | | | | |

GCI Liberty – Class A* | | | 4,694 | | | $ | 328,486 | |

Liberty Global – Series C* (a) | | | 10,946 | | | | 261,281 | |

New York Times – Class A | | | 10,689 | | | | 330,290 | |

Take-Two Interactive Software* | | | 2,166 | | | | 260,678 | |

TripAdvisor* | | | 6,475 | | | | 261,590 | |

| | | | | | | | 1,442,325 | |

| | | | | | | | | |

| Consumer Discretionary – 9.0% | | | | | | | | |

Dollar Tree* | | | 2,106 | | | | 232,502 | |

Hasbro | | | 2,738 | | | | 266,435 | |

| | | | | | | | 498,937 | |

| | | | | | | | | |

| Consumer Staples – 4.1% | | | | | | | | |

Constellation Brands – Class A | | | 1,192 | | | | 226,873 | |

| | | | | | | | | |

| Financials – 10.2% | | | | | | | | |

CME Group | | | 1,181 | | | | 242,991 | |

KKR & Co. – Class A | | | 11,102 | | | | 320,071 | |

| | | | | | | | 563,062 | |

| | | | | | | | | |

| Health Care – 9.4% | | | | | | | | |

IQVIA Holdings* | | | 1,780 | | | | 257,067 | |

Nevro* | | | 3,013 | | | | 259,721 | |

| | | | | | | | 516,788 | |

| | | | | | | | | |

Information Technology – 36.0%# | | | | | | | | |

Applied Materials | | | 3,889 | | | | 211,017 | |

Autodesk* | | | 1,803 | | | | 265,690 | |

LiveRamp Holdings* | | | 6,970 | | | | 272,457 | |

Microsoft | | | 4,566 | | | | 654,628 | |

Varonis Systems* | | | 3,042 | | | | 217,655 | |

Visa – Class A | | | 2,056 | | | | 367,736 | |

| | | | | | | | 1,989,183 | |

See Notes to the Financial Statements

Jackson Square Select 20 Growth Fund

Schedule of Investments – Continued

October 31, 2019

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 99.6% (Continued) | | | | | | |

| | | | | | | |

| Materials – 4.8% | | | | | | |

Ball | | | 3,747 | | | $ | 262,178 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $4,317,227) | | | | | | | 5,499,346 | |

| Total Investments – 99.6% | | | | | | | | |

| (Cost $4,317,227) | | | | | | | 5,499,346 | |

| Other Assets and Liabilities, Net – 0.4% | | | | | | | 20,343 | |

| Total Net Assets – 100.0% | | | | | | $ | 5,519,689 | |

| * | | Non-income producing security. |

| (a) | | Foreign Security. |

| # | | As of October 31, 2019, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 10 in Notes to the Financial Statements. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square SMID-Cap Growth Fund

Schedule of Investments

October 31, 2019

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 95.0% | | | | | | |

| | | | | | | |

| Communication Services – 15.0% | | | | | | |

GCI Liberty – Class A* | | | 723,949 | | | $ | 50,661,951 | |

Liberty TripAdvisor Holdings – Series A* | | | 1,860,755 | | | | 17,956,286 | |

New York Times – Class A | | | 2,193,605 | | | | 67,782,394 | |

TripAdvisor* | | | 444,384 | | | | 17,953,114 | |

| | | | | | | | 154,353,745 | |

| | | | | | | | | |

| Consumer Discretionary – 16.7% | | | | | | | | |

Dunkin’ Brands Group | | | 566,403 | | | | 44,530,604 | |

Farfetch – Class A* | | | 1,887,280 | | | | 16,853,410 | |

Papa John’s International | | | 626,621 | | | | 36,688,660 | |

Stitch Fix – Class A* | | | 1,256,073 | | | | 28,713,829 | |

Wyndham Hotels & Resorts | | | 834,965 | | | | 45,063,061 | |

| | | | | | | | 171,849,564 | |

| | | | | | | | | |

| Financials – 2.7% | | | | | | | | |

LendingTree* | | | 77,252 | | | | 27,799,132 | |

| | | | | | | | | |

| Health Care – 17.7% | | | | | | | | |

ABIOMED* | | | 58,410 | | | | 12,124,748 | |

Bio-Techne | | | 246,816 | | | | 51,379,686 | |

Haemonetics* | | | 236,801 | | | | 28,588,985 | |

HealthEquity* | | | 572,429 | | | | 32,508,243 | |

Nevro* | | | 390,475 | | | | 33,658,945 | |

Portola Pharmaceuticals* | | | 852,431 | | | | 24,643,780 | |

| | | | | | | | 182,904,387 | |

| | | | | | | | | |

| Industrials – 5.1% | | | | | | | | |

Expeditors International of Washington | | | 349,857 | | | | 25,518,570 | |

Graco | | | 593,834 | | | | 26,841,297 | |

| | | | | | | | 52,359,867 | |

| | | | | | | | | |

Information Technology – 29.3%# | | | | | | | | |

Coupa Software* | | | 179,107 | | | | 24,625,421 | |

Guidewire Software* | | | 422,780 | | | | 47,664,217 | |

j2 Global | | | 516,513 | | | | 49,048,074 | |

LiveRamp Holdings* | | | 1,126,940 | | | | 44,052,085 | |

Logitech International (a)(b) | | | 697,323 | | | | 28,623,083 | |

Paycom Software* | | | 69,356 | | | | 14,670,875 | |

PTC* | | | 158,248 | | | | 10,588,374 | |

SailPoint Technologies Holding* | | | 903,102 | | | | 17,484,055 | |

Varonis Systems* | | | 459,390 | | | | 32,869,354 | |

Wix.com* | | | 265,490 | | | | 32,408,364 | |

| | | | | | | | 302,033,902 | |

See Notes to the Financial Statements

Jackson Square SMID-Cap Growth Fund

Schedule of Investments – Continued

October 31, 2019

Description | | Shares/Par | | | Value | |

| | | | | | | |

| COMMON STOCKS – 95.0% (Continued) | | | | | | |

| | | | | | | |

| Real Estate – 8.5% | | | | | | |

| Equity Commonwealth – REIT | | | 1,724,890 | | | $ | 55,506,960 | |

| Redfin* | | | 1,836,710 | | | | 31,940,387 | |

| | | | | | | | 87,447,347 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $909,477,415) | | | | | | | 978,747,944 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 2.3% | | | | | | | | |

| United States Treasury Bill | | | | | | | | |

| 1.445%, 12/19/2019 (b)^ | | $ | 16,500,000 | | | | 16,468,210 | |

| 1.528%, 03/05/2020 (b)^ | | | 7,880,000 | | | | 7,838,206 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $24,285,736) | | | | | | | 24,306,416 | |

| Total Investments – 97.3% | | | | | | | | |

| (Cost $933,763,151) | | | | | | | 1,003,054,360 | |

| Other Assets and Liabilities, Net – 2.7% | | | | | | | 27,459,240 | |

| Total Net Assets – 100.0% | | | | | | $ | 1,030,513,600 | |

| * | | Non-income producing security. |

| (a) | | Foreign Security. |

| (b) | | Level 2 Security. |

| # | | As of October 31, 2019, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 10 in Notes to the Financial Statements. |

| ^ | | The rate shown is the effective yield as of October 31, 2019. |

REIT – Real Estate Investment Trust

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square Funds

Statements of Assets and Liabilities

October 31, 2019

| | | All-Cap | | | Global | | | Large-Cap | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| ASSETS: | | | | | | | | | |

| Investment securities: | | | | | | | | | |

| At cost | | $ | 4,957,380 | | | $ | 8,704,669 | | | $ | 64,147,526 | |

| At value | | $ | 5,878,488 | | | $ | 11,440,753 | | | $ | 74,769,988 | |

| Cash | | | 165,896 | | | | 254,478 | | | | 523,846 | |

| Receivable for investment securities sold | | | 2,536 | | | | — | | | | — | |

| Dividends receivable | | | 1,980 | | | | 5,461 | | | | 24,746 | |

| Receivable from investment adviser | | | 5,934 | | | | 2,747 | | | | — | |

| Prepaid expenses | | | 2,536 | | | | 3,033 | | | | 26,358 | |

| Total Assets | | | 6,057,370 | | | | 11,706,472 | | | | 75,344,938 | |

| LIABILITIES: | | | | | | | | | | | | |

| Payable for investment securities purchased | | | 34,913 | | | | — | | | | 430,971 | |

| Payable to investment adviser | | | — | | | | — | | | | 14,742 | |

| Payable for fund administration & accounting fees | | | 2,235 | | | | 3,651 | | | | 10,536 | |

| Payable for compliance fees | | | 44 | | | | 85 | | | | 872 | |

| Payable for transfer agent fees & expenses | | | 3,554 | | | | 6,197 | | | | 10,543 | |

| Payable for custody fees | | | 2,403 | | | | 2,503 | | | | 2,697 | |

| Payable for trustee fees | | | 119 | | | | 139 | | | | 221 | |

| Accrued distribution and/or shareholder service fees | | | — | | | | 42 | | | | 143 | |

| Payable for audit fees | | | 16,501 | | | | 16,998 | | | | 18,002 | |

| Payable for legal fees | | | 5,877 | | | | 5,875 | | | | 6,375 | |

| Accrued expenses | | | 1,771 | | | | 1,857 | | | | 3,840 | |

| Total Liabilities | | | 67,417 | | | | 37,347 | | | | 498,942 | |

| NET ASSETS | | $ | 5,989,953 | | | $ | 11,669,125 | | | $ | 74,845,996 | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | | |

| Paid-in capital | | $ | 4,839,754 | | | $ | 8,708,239 | | | $ | 50,801,688 | |

| Total distributable earnings | | | 1,150,199 | | | | 2,960,886 | | | | 24,044,308 | |

| Total net assets | | $ | 5,989,953 | | | $ | 11,669,125 | | | $ | 74,845,996 | |

| | | | | | | | | | | | | |

IS Class Shares: | | | | | | | | | | | | |

| Net Assets | | $ | 5,989,953 | | | $ | 11,599,466 | | | $ | 72,149,469 | |

Shares issued and outstanding(1) | | | 265,070 | | | | 469,522 | | | | 6,016,705 | |

| Net asset value, offering price, and redemption price per share | | $ | 22.60 | | | $ | 24.70 | | | $ | 11.99 | |

| | | | | | | | | | | | | |

Institutional Class Shares: | | | | | | | | | | | | |

| Net Assets | | $ | — | | | $ | 69,659 | | | $ | 2,654,224 | |

Shares issued and outstanding(1) | | | — | | | | 2,822 | | | | 220,999 | |

| Net asset value, offering price, and redemption price per share | | $ | — | | | $ | 24.68 | | | $ | 12.01 | |

| | | | | | | | | | | | | |

Investor Class Shares: | | | | | | | | | | | | |

| Net Assets | | $ | — | | | $ | — | | | $ | 42,303 | |

Shares issued and outstanding(1) | | | — | | | | — | | | | 3,541 | |

| Net asset value, offering price, and redemption price per share | | $ | — | | | $ | — | | | $ | 11.95 | |

(1) | Unlimited shares authorized without par value |

See Notes to the Financial Statements

Jackson Square Funds

Statements of Assets and Liabilities – Continued

October 31, 2019

| | | Select 20 | | | SMID-Cap | |

| | | Growth Fund | | | Growth Fund | |

| ASSETS: | | | | | | |

| Investment securities: | | | | | | |

| At cost | | $ | 4,317,227 | | | $ | 933,763,151 | |

| At value | | $ | 5,499,346 | | | $ | 1,003,054,360 | |

| Cash | | | 54,782 | | | | 23,898,732 | |

| Dividends receivable | | | 4,179 | | | | 357,052 | |

| Receivable from investment adviser | | | 7,731 | | | | — | |

| Receivable for capital shares sold | | | — | | | | 4,252,124 | |

| Prepaid expenses | | | 11,035 | | | | 27,112 | |

| Total Assets | | | 5,577,073 | | | | 1,031,589,380 | |

| LIABILITIES: | | | | | | | | |

| Payable for investment securities purchased | | | 27,124 | | | | — | |

| Payable for capital shares redeemed | | | — | | | | 166,593 | |

| Payable to investment adviser | | | — | | | | 623,350 | |

| Payable for fund administration & accounting fees | | | 1,497 | | | | 102,989 | |

| Payable for compliance fees | | | 38 | | | | 7,015 | |

| Payable for transfer agent fees & expenses | | | 3,533 | | | | 19,603 | |