UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-22525

Managed Portfolio Series

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Brian R. Wiedmeyer, President

Managed Portfolio Series

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Ave, 5thFl

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 765-6844

Registrant's telephone number, including area code

Date of fiscal year end:November 30, 2019

Date of reporting period:November 30, 2019

Item 1. Reports to Stockholders.

|  | |

| | |

| Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (http://etp.tortoiseindexsolutions.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 844-TR-INDEX (844-874-6339) or by sending an e-mail request to info@tortoiseindexsolutions.com. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 844-TR-INDEX (844-874-6339) or send an email request to info@tortoiseindexsolutions.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with the Fund. | |

| |

| |

| |

| |

| Tortoise |

| 2019 Annual Report |

| |

Table of Contents

| Letter to Shareholders | | 2 |

| | | |

| TPYP: Fund Focus | | 5 |

| | | |

| TBLU: Fund Focus | | 7 |

| | | |

| TCLD: Fund Focus | | 9 |

| | | |

| TPAY: Fund Focus | | 11 |

| | | |

| Expense Example | | 15 |

| | | |

| Financial Statements | | 17 |

| | | |

| Notes to Financial Statements | | 31 |

| | | |

| Report of Independent Registered Public Accounting Firm | | 37 |

| | | |

| Trustees and Officers | | 38 |

| | | |

| Additional Information | | 40 |

| |

| |

| 2019 Annual Report| November 30, 2019 |

| |

| |

| |

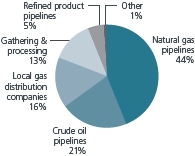

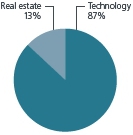

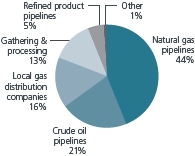

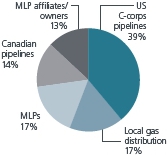

| Sector allocations |

| | | | | | | | |

| Name/Ticker | | Primary focus | | Total assets

($ 000’s)1 | | By asset type2 | | By ownership structure2 |

Tortoise North American

Pipeline Fund NYSE Arca: TPYP

Inception: 6/29/2015 | | North American

pipeline

companies | | $483,328.7 | |  | |  |

| Name/Ticker | | Primary focus | | Total assets

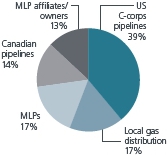

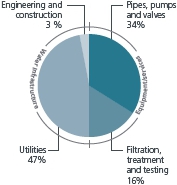

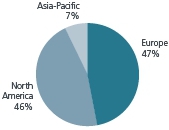

($ 000’s)1 | | By sector2 | | By geography2 |

Tortoise Global Water

ESG Fund CBOE Bzx: TBLU

Inception: 2/14/2017 | | Water

companies | | $15,278.1 | |  | |  |

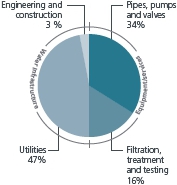

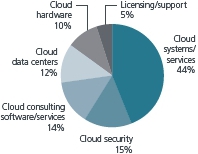

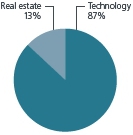

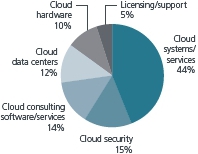

| Name/Ticker | | Primary focus | | Total assets

($ 000’s)1 | | By sector2 | | By revenue2 |

Tortoise Cloud

Infrastructure Fund CBOE Bzx: TCLD

Inception: 1/31/2019 | | Cloud

infrastructure

companies | | N/A | |  | |  |

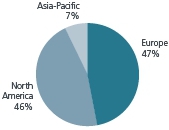

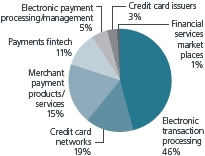

| Name/Ticker | | Primary focus | | Total assets

($ 000’s)1 | | By sector2 | | By revenue2 |

Tortoise Digital Payments

Infrastructure Fund CBOE Bzx: TPAY

Inception: 1/31/2019 | | Digital payment

companies | | $9,502.1 | |  | |  |

| 1 | As of 12/31/2019 |

| 2 | As of 11/30/2019 |

| 3 | Tortoise Cloud Infrastructure Fund liquidated on December 31, 2019. |

Dear shareholder,

Tortoise invests in essential assets and creates product solutions that allow investors to participate in the opportunities, innovations and development of these critical and essential assets including energy infrastructure, sustainable water and digital infrastructure.

Energy value chain

The broader energy sector, as represented by the S&P Energy Select Sector®Index, finished the fourth fiscal quarter ending November 30, 2019 in positive territory, returning 3.3%, bringing fiscal year 2019 performance to -7.7%. Oil markets experienced significant volatility during the period. Prices were caught in a tug-of-war between escalating tensions in the Middle East culminating in significant, but temporary supply outages, mixed signals from U.S.-China trade negotiations impacting demand growth.

Upstream

The Tortoise North American Oil and Gas Producers IndexSMreturned -1.3% in the fourth fiscal quarter, bringing fiscal year performance to -22.7%. Crude oil prices, represented by West Texas Intermediate (WTI), began the fiscal quarter at $53.94 per barrel and peaked at $62.90 on Sept. 16, 2019 following the attacks on Saudi oil infrastructure. Prices troughed quickly thereafter at $52.45 on Oct. 3, 2019 on Saudi claims of minimal disruption to production and the potential for a U.S.-Iran deal before ending the fiscal year at $58.11.

U.S. crude oil production growth is expected to broadly moderate in 2020 as compared to the rapid growth over the past two years. Specifically, U.S. crude oil production is projected to average 12.3 million barrels per day (MMbbl/d) in 2019 and 13.2 MMbbl/d in 2020. U.S. producers are facing increased pressure from investors to exhibit capital discipline and reign in production growth in favor of higher free cash flow generation and return of capital to shareholders. Nonetheless, with multiple years of tremendous production growth, propelled by the U.S. shale revolution, the U.S. transitioned into a net exporter of oil and petroleum products for the first time in recent history. The U.S. became a net exporter of oil and petroleum products in September 2019 with net exports projected to grow in 2020 and beyond1. Rising U.S. energy exports of liquids and natural gas are expected to positively affect the U.S. trade deficit and will ultimately help reduce global Co2emissions, along with renewables, as they take market share from coal.

Following the end of the fiscal year, the Organization of Petroleum Exporting Countries (OPEC) and their Non-OPEC partners (OPEC+) announced in December a clear goal of establishing a floor for crude prices through the seasonally weaker first quarter of 2020. OPEC+ members agreed to an incremental 0.5 MMbbl/d cut to the existing agreement taking the official cut to 1.7 MMbbl/d for 1Q20. In addition, Saudi Arabia agreed to continue its over-compliance of 0.4 MMbbl/d implying a new commitment level of cutting 2.1 MMbbl/d. Saudi Arabia is focused on stabilizing crude oil prices following the recent Saudi Aramco IPO. While the deal was not extended, OPEC+ did set a date for an extraordinary meeting to be held in early March 2020 to determine the need for additional cuts. Emphasis will likely be placed upon improved compliance from various OPEC members with poor historical compliance (Iraq, Nigeria, and UAE). With trade tensions easing and the global economy not showing any signs of a true slowdown, oil demand growth is currently expected to improve in 2020, which should bring worldwide supply and demand into better balance.

Natural gas demand has remained robust supported by record levels of domestic power burn, increased exports to Mexico and record liquefied natural gas (LNG) exports driven by the startup of three new liquefaction and export facilities (Elba Island, Cameron LNG, Freeport LNG). However, surging natural gas supply more than offset strong demand, resulting in an elevated pace of inventory builds and pricing pressure through much of the period. Natural gas prices, represented by Henry Hub, opened the fiscal quarter at $2.39 per million British thermal units, hit a low of $2.08 on Oct. 18, and then peaked at $2.87 in November, due to colder than average weather in the midwest, before ending the fiscal year back down to $2.46.

Persistently low natural gas prices have prompted natural gas producers to reign in capex budgets and drilling programs in 2020. While natural gas production is expected to continue growing, the pace of supply growth is set to slow measurably, with production expected to average 91.8 billion cubic feet per day (Bcf/d) in 2019 and 93.8 Bcf/d in 2020. The backdrop of slowing production growth and strong domestic and export demand paints a picture of improving natural gas fundamentals in the future. The second wave of LNG export facilities, led by final investment decisions (FIDs) made to Exxon’s Golden Pass and Venture Global’s Calcasieu Pass LNG export facilities in 2019 will provide another meaningful catalyst for natural gas export demand growth from 2022 to 2025.

Midstream

Midstream energy performance lagged broader energy in the fourth fiscal quarter with the Tortoise North American Pipeline IndexSMreturning -2.6% and the Tortoise MLP Index®returning -8.9%, bringing fiscal year performance to 5.9% and -7.0%, respectively. The sharp contrast in midstream index performance is due to midstream companies structured as C-Corps outperforming those structured as MLPs. C-Corps benefitted from several items versus MLPs, including: stronger corporate governance, broad market index inclusion for some companies, lack of K-1s, and a more certain corporate structure. Contributing to broad midstream underperformance for the fiscal quarter were concerns regarding a slowdown in U.S. production growth, political rhetoric regarding proposed fracking bans from Democratic Presidential candidates and tax loss selling. Gathering and processing companies in particular suffered following lower natural gas and natural gas liquids (NGL) pricing and the ‘going concern’ language introduced into Chesapeake Energy’s (CHK) quarterly filing. These items drove negative sentiment and raised questions related to producer financial health, counterparty risk and companies’ exposure to drilling slowdowns. However, the U.S. has seen tremendous production growth in recent years and we believe a more moderate pace of growth is healthy for the midstream sector through the reduction in growth capital expenditures and reduced risk of takeaway capacity overbuild.

| |

| |

| 2019 Annual Report| November 30, 2019 |

| |

| |

| |

| |

DCP Midstream LP (DCP) became the latest MLP to announce the elimination of its Incentive Distribution Rights (IDRs) in the fourth fiscal quarter. As the era of simplification comes to a close, the results have advanced the midstream sector in our view and accomplished widespread cost of capital and corporate governance improvements. Looking forward, the midstream sector continues to evolve. There has been an industry-wide shift to higher distribution coverage and self-funding the equity portion of capital expenditure programs. With the expected moderation in U.S. production growth, midstream companies are now shifting focus toward executing on delivering value through the return of capital to shareholders in the form of debt reduction, sustainable yields and distribution growth, and potential stock buybacks. A particular emphasis on the generation of free cash flow yields comparable to other S&P 500 sectors continues to emerge, achieved through the sale of non-core assets and the reduction of growth capital expenditures.

Interest in publicly traded midstream companies and assets, from both public and private entities, has remained elevated, highlighting their strategic value and attractive valuations. Recently announced or closed transactions include Energy Transfer’s (ET) acquisition of SemGroup Corporation (SEMG), DTE Energy’s (DTE) acquisition of a natural gas gathering system in the Haynesville Shale and Pembina Pipeline Corp’s (PPL CN) acquisition of Kinder Morgan Canada and the Cochin pipeline.

Capital markets activity increased during the fourth fiscal quarter with MLPs and other pipeline companies raising approximately $10.8 billion in total capital, with nearly all of the issuance in debt. This brings the total capital raised for the fiscal year to approximately $36.4 billion, slightly lower than the previous fiscal year. As expected, alternative options for capital and self-funding projects have continued to trend higher.

Merger and acquisition activity among MLPs and other pipeline companies in the last fiscal quarter of the year was largely driven by Energy Transfer’s acquisition of SemGroup Corporation, which at $5.1 billion made up nearly all of the merger and acquisition activity in the quarter. This brought the fiscal year’s announced transactions to $26.6 billion. This is significantly below the previous year when many large simplification transactions were announced. This fiscal year’s activity was driven by three large transactions. In addition to Energy Transfer’s acquisition of SemGroup Corporation, MPLX purchased Andeavor Logistics for approximately $13.5 billion and Pembina Pipeline Corporation purchased two businesses from Kinder Morgan for approximately $4.4 billion combined.

Downstream

Refinery utilization has remained challenged in 2019 due to heavy spring and fall turnarounds in preparation for the International Maritime Organization’s Jan. 1, 2020 implementation of sulfur reduction regulations on the shipping industry (IMO 2020), unplanned refinery outages, as well as the closure of Philadelphia Energy Solutions’ 350 Mbbl/d Philadelphia refinery, the largest refining complex on the east coast. IMO 2020 has positioned U.S. refiners to take advantage of higher distillate pricing and more heavily discounted medium-heavy sour crude oils as they have more flexibility than international refiners to use a wide range of crude oil feedstocks. We expected that U.S. refinery utilization and throughput will exhibit strong growth as refiners attempt to capture margin upside driven by IMO 2020.

Incremental NGL supply from completed Permian takeaway projects and overall liquids production growth surpassed current levels of domestic NGL demand, primarily from petrochemical facilities, resulting in price pressure. We expect that moderating northeast liquids production growth and increased demand from petrochemical projects coming online in late 2019 and early 2020 will begin to draw down inventories.

The solar industry is set to install 13 gigawatts (GWs) of capacity in the U.S. in 2019, the second highest annual installation on record. Much of the activity has been concentrated in the southwest and southeast, with Florida and Texas ranking behind California in year-to-date installations. Signed solar PPA prices range from $18-35 megawatts/ hour, putting solar on par with new gas generation and competitive with the operating costs of existing coal plants. Costs continue to decline, as evidenced by the 12% decline year-over-year in Q3 2019 to $0.95/watt for utility-scale projects. On the policy front, the investment tax credit (ITC) is set to phase down for projects beginning construction at the end of 2019. We continue to monitor efforts to extend the ITC as we enter 2020, but do not view an extension as necessary given anticipated continued cost declines.

Wind installations totaled 1,927 megawatts (MWs) in the third calendar quarter of 2019, reaching a total installed capacity of more than 100,000 MW across the U.S. with an additional 46,500 MW of capacity currently under construction or in advanced development. Nineteen states now have more than 1,000 MW under construction or advanced development. Texas hosts 19% of the total development pipeline, followed by Wyoming (11%), Oklahoma (7%), Iowa (6%), and Virginia (6%). It is also important to have offtake agreements in place. Currently, 44% of capacity in the pipeline has a Power Purchase Agreement (PPA) in place, while 28% is utility-owned and 6% has a hedge contract.4New developments are largely being driven by corporate customers who have signed 64% of capacity contracted in the third quarter. Turbine technology continues to improve with 22% of new turbines installed year to date rated between 3.4 MW and 3.6 MW in size.4

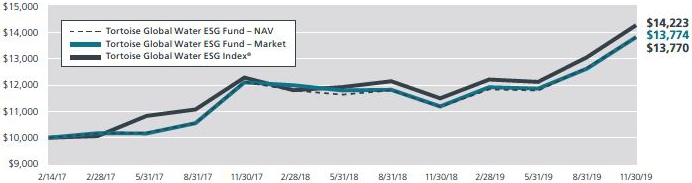

Water

The water sector, as measured by the Tortoise Global Water ESG Index, returned 23.9% for the fiscal year period ending November 30, 2019. The Tortoise Global Water ESG Fund seeks to track this index. The leading performance contributor during the period was the water infrastructure subsector, which is primarily comprised of water utilities. The water infrastructure subsector continues to benefit from a large backlog of growth projects as the group is focused on directing capital toward improving infrastructure across the globe. Organic projects are driving attractive earnings growth. In addition, governments are increasingly selling publically owned water systems to investor-owned utilities, providing further support for earnings growth. The water equipment/services providers also contributed to positive performance during the period. The subsector continues to profit from increased spending by water utilities and industrial users of water. We believe technology-oriented companies, including those with smart meters, filtration, treatment, and test offerings, are best positioned to capture future growth opportunities. The long-term earnings growth prospects are appealing as the subsector continues to innovate and adopt technologies to solve water shortfalls and improve demand efficiency.

Our long-term outlook remains positive for the water sector as we believe investment in infrastructure and technology is needed now to solve the water crisis. The investment opportunity is compelling, with visibility into a long runway of investment, driving strong earnings growth. While slower economic growth may present a headwind to the group, we believe the sector will benefit from executing on projects and adopting leading technologies to ensure a safe and reliable water supply across the world for years to come.

Digital Infrastructure

Cloud Infrastructure

For the fiscal period January 31, 2019 through November 30, 2019, the Tortoise Global Cloud Infrastructure IndexSMreturned 13.3%, compared to the S&P 500, which returned 18.2% over the same time period. We believe the long-term growth trajectory of the cloud computing industry is strong as enterprises increasingly rely on cloud providers for many services ranging from software delivery to full service computing infrastructure. Increased data consumption and storage, demand for real time data interactions, and a host of other factors continue to drive demand for computing space and power. Cloud systems and services companies contributed the most to the index return. The best performing sectors were data centers, and cloud security, which were driven by solid fundamentals as the need for computing, storage and interconnections grow.

Digital Payments Infrastructure

For the fiscal period January 31, 2019 through November 30, 2019, the Tortoise Global Digital Payments Infrastructure Index returned 30.2%, well outperforming the S&P 500. Merger and acquisition activity drove some actual returns. In March, Worldpay, Inc. announced the planned acquisition by Fidelity National Information Services and at the end of May, Total Systems Services announced the planned acquisition by Global Payments. Due to these transactions, the electronic transaction processing segment was the best performing sector for the fiscal year. Other credit value chain participants, such as the merchant payment products/services and the major credit card networks, also performed extremely well as the entire digital value chain grew. Companies in the financial services market place were the worst performing group as crackdowns on the industry, specifically in Asia, impacted company returns materially.

Concluding thoughts

We expect plenty of opportunities in essential assets in 2020. We are optimistic across the energy sector where we expect supply and demand will find better balance and companies will shine a brighter light on their cash flow as they return it to shareholders. We continue to believe in the sustainable water sector as the world strives to solve the global water crisis. Our outlook on digital infrastructure remains positive, particularly in the electronic payments segment. We maintain conviction in essential assets as they continue to highlight their critical nature across the globe.

| 1 | Energy Information Administration, Short-Term Energy Outlook, July 2019 |

| 2 | PIRA, May 2019 |

| 3 | Wood Mackenzie, Power and Renewables, December 2019 |

| 4 | AWEA, July – September 2019 |

The S&P Energy Select Sector®Index is a capitalization-weighted index of S&P 500®Index companies in the energy sector involved in the development or production of energy products. The Tortoise North American Oil and Gas Producers IndexSMis a float-adjusted, capitalization-weighted index of North American energy companies engaged primarily in the production of crude oil, condensate, natural gas or natural gas liquids (NGLs). The Tortoise North American Pipeline IndexSMis a float adjusted, capitalization-weighted index of energy pipeline companies domiciled in the United States and Canada. The Tortoise MLP Index®is a float-adjusted, capitalization-weighted index of energy master limited partnerships. The Tortoise Global Water ESG IndexSMis a proprietary, rules-based, modified capitalization-weighted, float-adjusted index comprised of companies that are materially engaged in the water infrastructure or water management industries. The Tortoise Global Cloud Infrastructure IndexSMis a proprietary, rules-based, modified market capitalization-weighted, float-adjusted index comprised of companies that are materially engaged in the cloud infrastructure industry, including cloud systems/services, cloud consulting software/services, cloud security, cloud hardware and cloud data centers. The Tortoise Global Digital Payments Infrastructure IndexSMis a proprietary, rules-based, modified market capitalization-weighted, float-adjusted index comprised of companies that are materially engaged in digital payments, including merchant processing and settlement, real time record keeping, settlement networks, and fintech products/services that facilitate the ease, efficiency and speed of electronic transactions. This includes companies whose primary business is comprised of one or a combination of the following categories: credit card networks, electronic transaction processing and associated products/services, credit card issuers, electronic transaction processing software (payments fintech) or online financial services market places.

Tortoise Index Solutions, LLC has contracted with S&P Opco, LLC(a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Tortoise MLP Index®, Tortoise North American Pipeline IndexSM, Tortoise North American Oil and Gas Producers IndexSMand Tortoise Global Water ESG IndexSM. These Indices are not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors (collectively, “S&P Dow Jones Indices LLC”). S&P Dow Jones Indices will not be liable for any errors or omission in calculating these Indices. “Calculated by S&P Dow Jones Indices” and its related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by Tortoise Index Solutions, LLC and its affiliates. S&P®is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”), and Dow Jones®is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”).

Tortoise Index Solutions, LLC has contracted with Solactive AG (“Solactive”) to calculate the Tortoise Global Cloud Infrastructure IndexSMand Tortoise Global Digital Payments Infrastructure IndexSM. The financial instruments that are based on these indices are not sponsored, endorsed, promoted or sold by Solactive in any way, and Solactive makes no express or implied representation, guarantee or assurance with regard to: (a) the advisability in investing in the financial instruments; (b) the quality, accuracy and/or completeness of these indices or the calculations thereof; and/or (c) the results obtained or to be obtained by any person or entity from the use of these indices.

Tortoise Indices are the exclusive property of Tortoise Index Solutions. LLC.

Free cash flow is the cash a company produces through its operations, less the cost of total capital expenditures (growth and maintenance).

It is not possible to invest directly in an index.

Performance data quoted represents past performance; past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost.

| |

| |

| 2019 Annual Report| November 30, 2019 |

| |

| Tortoise North American Pipeline Fund |

| |

| |

Top ten holdings(as of November 30, 2019)

| 1. | | Enbridge Inc. | | 8.5% |

| 2. | | TC Energy Corporation | | 8.0% |

| 3. | | ONEOK, Inc. | | 7.9% |

| 4. | | Kinder Morgan, Inc. | | 7.7% |

| 5. | | The Williams Companies, Inc. | | 7.6% |

| 6. | | Pembina Pipeline Corporation | | 6.5% |

| 7. | | Enterprise Products Partners L.P. | | 5.0% |

| 8. | | Cheniere Energy, Inc. | | 4.9% |

| 9. | | Atmos Energy Corporation | | 4.6% |

| 10. | | Energy Transfer LP | | 3.7% |

TPYP key benefits

| ● | Access to the sizable pipeline network of one of the world’s largest consumers of energy |

| ● | Attractive total return potential in a historically defensive sector |

| ● | Flow-through structure allows for tax-efficient access to the pipeline sector |

| ● | Exposure to Tortoise North American Pipeline IndexSM |

| – | Effectively represents the characteristics of the market |

| – | A leading benchmark for analysis of the pipeline sector |

| – | Proprietary, research-driven and rules-based methodology |

| – | Constituent caps to allow for broader representation of the market and investability |

Value of $10,000 vs. Tortoise North American Pipeline IndexSM

Since inception on June 29, 2015 through November 30, 2019 |

|

This chart illustrates the performance of a hypothetical $10,000 investment made on June 29, 2015 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the fund’s distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends for the fund and dividends for the index.

The performance data quoted above represents past performance since June 29, 2015 through November 30, 2019. Past performance is no guarantee of future results. The investment return and value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be obtained through the most recent month-end by calling 844-TR-INDEX (844-874-6339). Future performance may be lower or higher than the performance stated above.

The Tortoise North American Pipeline IndexSMis a float-adjusted, capitalization weighted index of pipeline companies headquartered in the United States and Canada. Returns include reinvested dividends. You cannot invest directly in an index.

| |

| |

| |

| |

| Tortoise North American Pipeline Fund(continued) |

| |

| |

Key asset performance drivers

| Top five contributors | | Company type | | Performance driver |

| TC Energy Corporation | | Midstream natural gas/natural gas liquids pipeline company | | Asset sales leading to reduced leverage high quality contracted cash flows with large back large back log of infrastructure projects across North America |

| Enbridge Inc. | | Midstream crude oil pipeline company | | Anticipated dividend growth of 5-7% in 2020+ |

| ONEOK, Inc. | | Midstream natural gas/natural gas liquids pipeline company | | Continued execution of backlog of infrastructure projects with high returns |

| Kinder Morgan, Inc. | | Midstream natural gas/natural gas liquids pipeline company | | Dividend increase of 25%, announced share buyback authorization and attractive multiple Canadian asset sale, exposure to liquefied natural gas (LNG) exports with significant insider buying |

| Atmos Energy Corporation | | Local gas distribution company | | Steady business model rewarded following lower interest rates |

| Bottom five contributors | | Company type | | Performance driver |

| Antero Midstream Corporation | | Midstream gathering and processing company | | Concerns around potential recontracting of gathering and process contracts and financial health of parent company Antero Resources (AR) as natural gas prices moved lower |

| Equitrans Midstream Corporation | | Midstream natural gas/natural gas liquids pipeline company | | Uncertainty around Mountain Valley Pipeline project |

| EnLink Midstream, LLC | | Midstream gathering and processing company | | Concern around producers slowing drilling activity in Oklahoma |

| Energy Transfer LP | | Midstream natural gas/natural gas liquids pipeline company | | Unexpected acquisition of SemGroup Corporation |

| Targa Resources Corp. | | Midstream gathering and processing company | | Leverage levels remain relatively high |

Total returns(as of November 30, 2019)

| Ticker | 1 year | | 3 year | | Since inception(1) | | Gross expense ratio |

| TPYP @ Market | 5.24% | | | 2.48% | | | | 1.28% | | | | 0.40% | |

| TPYP @ NAV | 5.22% | | | 2.50% | | | | 1.24% | | | | 0.40% | |

| S&P 500®Index(2) | 16.11% | | | 14.88% | | | | 12.32% | | | | — | |

| TNAPT(3) | 5.88% | | | 3.10% | | | | 1.85% | | | | — | |

| (1) | Reflects period from fund inception on June 29, 2015 through November 30, 2019. |

| (2) | The S&P 500®Index is an unmanaged market-value weighted index of stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance. Returns include reinvested dividends. You cannot invest directly in an index. |

| (3) | The Tortoise North American Pipeline IndexSMis a float-adjusted, capitalization weighted index of pipeline companies headquartered in the United States and Canada. You cannot invest directly in an index. |

Note: For periods over 1 year, performance reflected is for the average annual returns.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 844-TR-INDEX (844-874-6339).

| |

| |

| 2019 Annual Report| November 30, 2019 |

| |

| Tortoise Global Water ESG Fund |

| |

| |

Top ten holdings(as of November 30, 2019)

| 1. | | Ferguson PLC | | 8.0% |

| 2. | | Geberit AG | | 7.9% |

| 3. | | Veolia Environnement SA | | 7.7% |

| 4. | | American Water Works Co., Inc. | | 7.1% |

| 5. | | Xylem, Inc. | | 6.9% |

| 6. | | Aqua America Inc. | | 5.3% |

| 7. | | Pentair PLC | | 4.4% |

| 8. | | Severn Trent Plc | | 4.4% |

| 9. | | United Utilities Group PLC | | 4.3% |

| 10. | | Pennon Group Plc | | 3.8% |

TBLU key benefits

| ● | Provides access to the water infrastructure, management and treatment companies that we believe appear poised to benefit from the expected and much needed investment in rebuilding existing infrastructure, constructing new infrastructure and better managing this vital, but finite resource |

| ● | Flow-through ETF structure provides tax-efficient access to the water sector |

| ● | Purest exposure to the water industry by incorporating a fundamental weighting aspect |

| ● | Continuous liquidity |

| ● | Exposure to the Tortoise Global Water ESG Index® |

| – | Proprietary, rules-based, research-driven methodology |

| – | Fundamental weighting technique provides significant direct exposure to the water industry |

| – | A leading benchmark for analysis of the water sector |

| – | Backed by Tortoise’s proprietary fundamental research and index generation process |

Value of $10,000 vs. Tortoise Global Water ESG Index®

Since inception on February 14, 2017 through November 30, 2019 |

|

This chart illustrates the performance of a hypothetical $10,000 investment made on February 14, 2017 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the fund’s distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends for the fund and dividends for the index.

The performance data quoted above represents past performance since February 14, 2017 through November 30, 2019. Past performance is no guarantee of future results. The investment return and value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be obtained through the most recent month-end by calling 844-TR-INDEX (844-874-6339). Future performance may be lower or higher than the performance stated above.

The Tortoise Global Water ESG Index®is a proprietary, rules-based, modified capitalization-weighted, float-adjusted index comprised of companies that are materially engaged in the water infrastructure or water management industries. Water infrastructure companies’ principal business is providing public water distribution or supporting water distribution infrastructure via equipment or engineering and construction. Water management companies’ primary business is providing technologies or products that manage or facilitate water distribution and usage, including the fields of water efficiency, water treatment and irrigation. You cannot invest directly in an index.

| |

| |

| |

| |

| Tortoise Global Water ESG Fund(continued) |

| |

| |

Key asset performance drivers

| Top five contributors | | Company type | | Performance driver |

| Ferguson PLC | | Pipes, pumps, & valves | | Benefitted from exposure to rebound in U.S. residential housing market |

| Geberit AG | | Filtration, treatment, & test | | Better than expected margin expansion on lower input prices and price increases |

| Cia de Saneamento Basico do Estado de Sao Paulo – ADR | | Water utility | | Potential to benefit from privatization and sale by Brazilian government |

| American Water Works Company, Inc. | | Water utility | | Demand for less-volatile securities during period of mixed economic signals |

| Veolia Environnement SA | | Water utility | | Demand for less-volatile securities during period of mixed economic signals |

| Bottom five contributors | | Company type | | Performance driver |

| China Water Affairs Group Limited | | Water utility | | Geopolitical headwinds from U.S./China trade war as well as Hong Kong unrest |

| Beijing Enterprises Water Group Ltd. | | E&C | | Geopolitical headwinds from U.S./China trade war as well as Hong Kong unrest |

| Oyo Corp | | E&C | | Geopolitical headwinds from U.S./China trade war as well as Hong Kong unrest |

| NIHON TRIM Co., Ltd. | | Filtration, treatment, & test | | Headwinds from stagnant sales and declining profit margin during overhaul of business strategy |

| CT Environmental Group Limited | | Water utility | | Geopolitical headwinds from U.S./China trade war as well as Hong Kong unrest |

Total returns(as of November 30, 2019)

| Ticker | | 1 year | | Since inception(1) | | Gross expense ratio |

| TBLU @ Market | | 23.25% | | 12.15% | | | 0.40 | % | |

| TBLU @ NAV | | 23.42% | | 12.14% | | | 0.40 | % | |

| S&P 500®Index(2) | | 16.11% | | 13.39% | | | — | | |

| Tortoise Global Water ESG Index®(3) | | 23.91% | | 13.45% | | | — | | |

| (1) | Reflects period from fund inception on February 14, 2017 through November 30, 2019. |

| (2) | The S&P 500®Index is an unmanaged market-value weighted index of stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance. Returns include reinvested dividends. You cannot invest directly in an index. |

| (3) | The Tortoise Global Water ESG Index®is a proprietary, rules-based, modified capitalization-weighted, float-adjusted index comprised of companies that are materially engaged in the water infrastructure or water management industries. Water infrastructure companies’ principal business is providing public water distribution or supporting water distribution infrastructure via equipment or engineering and construction. Water management companies’ primary business is providing technologies or products that manage or facilitate water distribution and usage, including the fields of water efficiency, water treatment and irrigation. You cannot invest directly in an index. |

Note: For periods over 1 year, performance reflected is for the average annual returns.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 844-TR-INDEX (844-874-6339).

| |

| |

| 2019 Annual Report| November 30, 2019 |

| |

| Tortoise Cloud Infrastructure Fund |

| |

| |

Top ten holdings(as of November 30, 2019)

| 1. | | Splunk Inc. | | 5.6% |

| 2. | | Alibaba Group Holding Limited - ADR | | 4.9% |

| 3. | | Microsoft Corporation | | 4.8% |

| 4. | | Equinix, Inc. | | 4.6% |

| 5. | | Alphabet Inc. | | 4.5% |

| 6. | | Hewlett Packard Enterprise Company | | 4.4% |

| 7. | | Oracle Corporation | | 4.3% |

| 8. | | Fortinet, Inc. | | 4.2% |

| 9. | | Amazon.com, Inc. | | 4.2% |

| 10. | | Digital Realty Trust, Inc. | | 4.0% |

TCLD key benefits

| ● | The fund invests in companies that have the potential to benefit from the expected growing investments, rapid adoption and fast paced innovation of the cloud industry |

| – | Access to companies that provide and support cloud-based infrastructure |

| – | Exposure to companies that provide cloud services, cloud management software, data centers and cloud security |

| ● | Direct exposure to companies that we believe should benefit from the growth of the cloud |

| – | Users of the cloud are not included; their businesses and risks don’t align with the cloud industry |

| ● | Market cap and liquidity filters provide a comparatively high level of liquidity |

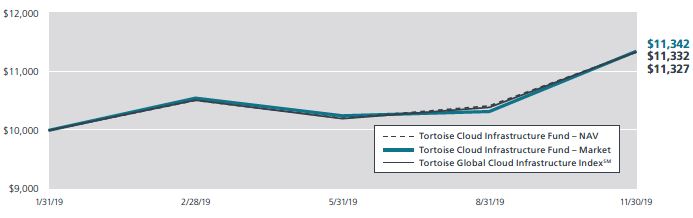

Value of $10,000 vs. Tortoise Global Cloud Infrastructure IndexSM

Since inception on January 31, 2019 through November 30, 2019 |

|

This chart illustrates the performance of a hypothetical $10,000 investment made on January 31, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the fund’s distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends for the fund and dividends for the index.

The performance data quoted above represents past performance since January 31, 2019 through November 30, 2019. Past performance is no guarantee of future results. The investment return and value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be obtained through the most recent month-end by calling 844-TR-INDEX (844-874-6339). Future performance may be lower or higher than the performance stated above.

The Tortoise Global Cloud Infrastructure IndexSMrepresents the existing global cloud infrastructure landscape. It is a proprietary, rules-based, modified market capitalization-weighted, float-adjusted index comprised of companies that are materially engaged in the cloud infrastructure industry, including cloud systems/services, cloud consulting software/services, cloud security, cloud hardware and cloud data centers.

| |

| |

| |

| |

| Tortoise Cloud Infrastructure Fund(continued) |

| |

| |

Key asset performance drivers

| Top five contributors | | Company type | | Performance driver |

| Atos SE | | Cloud systems/services | | Strong fundamental performance, continued announcement of partnerships |

| Equinix, Inc. | | Cloud data center | | Demand for co-location and hyperscale data centers, lower interest rates |

| Microsoft Corporation | | Licensing and support | | Continued growing cloud and cloud related revenue as a percentage of total revenue |

| Okta, Inc. | | Cloud security | | Strong fundamental and technical performance |

| Fortinet, Inc. | | Cloud security | | Strong fundamentals, big partnership announcements |

| Bottom five contributors | | Company type | | Performance driver |

| Worldline SA | | Software and services | | Underperformance relative to sector |

| Teradata Corporation | | Cloud systems/services | | Poor guidance, CEO transition |

| Nutanix, Inc. | | Cloud hardware | | Weak February earnings forecast |

| Dropbox, Inc. | | Cloud management software | | Disappointing fundamental growth and earnings |

| F5 Networks, Inc. | | Cloud systems/services | | Shifting business mix from hardware to software has disrupted financial performance |

Total returns(as of November 30, 2019)

| Ticker | | Since inception(1) | | Gross expense ratio |

| TCLD @ Market | | 13.42% | | | 0.40 | % | |

| TCLD @ NAV | | 13.27% | | | 0.40 | % | |

| S&P 500®Index(2) | | 18.16% | | | — | | |

| Tortoise Global Cloud Infrastructure IndexSM(3) | | 13.32% | | | — | | |

| (1) | Reflects period from fund inception on January 31, 2019 through November 30, 2019. |

| (2) | The S&P 500®Index is an unmanaged market-value weighted index of stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance. Returns include reinvested dividends. You cannot invest directly in an index. |

| (3) | The Tortoise Cloud Infrastructure IndexSMrepresents the existing global cloud infrastructure landscape. It is a proprietary, rules-based, modified market capitalization-weighted, float-adjusted index comprised of companies that are materially engaged in the cloud infrastructure industry, including cloud system/services, cloud consulting software/services, cloud security, cloud hardware and cloud data centers. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 844-TR-INDEX (844-874-6339).

| |

| |

| 2019 Annual Report| November 30, 2019 |

| |

| Tortoise Digital Payments Infrastructure Fund |

| |

| |

Top ten holdings(as of November 30, 2019)

| 1. | | Square, Inc. | | 5.4% |

| 2. | | Fiserv, Inc. | | 5.2% |

| 3. | | Global Payments Inc. | | 5.0% |

| 4. | | FleetCor Technologies Inc. | | 4.9% |

| 5. | | Fidelity National Information Services, Inc. | | 4.8% |

| 6. | | PayPal Holdings, Inc. | | 4.8% |

| 7. | | Jack Henry & Associates, Inc. | | 4.8% |

| 8. | | American Express Company | | 4.7% |

| 9. | | Western Union Company | | 4.6% |

| 10. | | Discover Financial Services | | 4.6% |

TPAY key benefits

| ● | The fund invests in companies that we believe have the potential to benefit as the world continues to evolve from traditional cash payments to the speed, accuracy and efficiency of digital payments |

| ● | Access to all participants in the fee-based credit card value chain, including merchant acquirers, processors, networks and issuers |

| ● | Exposure to new forms of digital payments, such as mobile, point-of-sale devices and P2P matching engines |

| ● | Market cap and liquidity filters that provide a comparatively high level of liquidity |

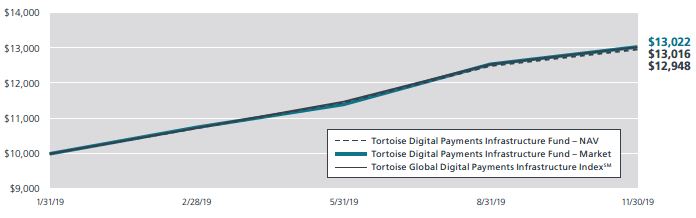

Value of $10,000 vs. Tortoise Global Digital Payments Infrastructure IndexSM

Since inception on January 31, 2019 through November 30, 2019 |

|

This chart illustrates the performance of a hypothetical $10,000 investment made on January 31, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the fund’s distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends for the fund and dividends for the index.

Performance data quoted above represents past performance since January 31, 2019 through November 30, 2019. Past performance is no guarantee of future results. The investment return and value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be obtained through the most recent month-end by calling 844-TR-INDEX (844-874-6339). Future performance may be lower or higher than the performance stated above.

The Tortoise Global Digital Payments Infrastructure IndexSMrepresents the existing global digital payments landscape. It is a proprietary, rules-based, modified market capitalization-weighted, float-adjusted index comprised of companies that are materially engaged in digital payments, including merchant processing and settlement, real time record keeping, settlement networks, and fintech products/services that facilitate the ease, efficiency and speed of electronic transactions.

| |

| |

| |

| |

| Tortoise Digital Payments Infrastructure Fund(continued) |

| |

| |

Key asset performance drivers

| Top five contributors | | Company type | | Performance driver |

| Worldpay Inc | | Electronic transaction processing | | Being acquired by Fidelity National Information Services |

| Total System Services | | Electronic transaction processing | | Being acquired by Global Payments |

| Global Payments Inc. | | Merchant payment products/services | | Growth through acquisition in robust payments industry |

| FleetCor Technologies Inc. | | Electronic transaction processing | | B2B and other internal growth opportunities |

| Fiserv, Inc. | | Electronic transaction processing | | Acquisition of First Data Corp, General growth in electronic payments |

| Bottom five contributors | | Company type | | Performance driver |

| Green Dot Corporation | | Electronic transaction processing | | Reduced earnings guidance |

| Wirecard AG | | Electronic transaction processing | | Inquiries into accounting practices |

| Yiren Digital Ltd. | | Financial services market place | | Increased Chinese regulation on on-line lenders |

| AEON Financial Service Co. Ltd. | | Credit card issuer | | Disappointing financial results |

| Provident Financial plc | | Credit card issuer | | Sub-prime business and Brexit |

Total returns(as of November 30, 2019)

| Ticker | | Since inception(1) | | Gross expense ratio |

| TPAY @ Market | | 30.22% | | | 0.40 | % | |

| TPAY @ NAV | | 29.48% | | | 0.40 | % | |

| S&P 500®Index(2) | | 18.16% | | | — | | |

| Tortoise Global Digital Payments IndexSM(3) | | 30.16% | | | — | | |

| (1) | Reflects period from fund inception on January 31, 2019 through November 30, 2019. |

| (2) | The S&P 500®Index is an unmanaged market-value weighted index of stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance. Returns include reinvested dividends. You cannot invest directly in an index. |

| (3) | The Tortoise Global Digital Payments Infrastructure IndexSMrepresents the existing global digital payments landscape. It is a proprietary, rules-based, modified market capitalization-weighted, float-adjusted index comprised of companies that are materially engaged in digital payments, including merchant processing and settlement, real time record keeping, settlement networks, and fintech products/services that facilitate the ease, efficiency and speed of electronic transactions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 844-TR-INDEX (844-874-6339).

| |

| |

| 2019 Annual Report| November 30, 2019 |

| |

| |

| |

| |

Tortoise North American Pipeline Fund

Investing involves risk. Principal loss is possible. The Fund has the same risks as the underlying securities traded on the exchange throughout the day. Redemptions are limited and often commissions are charged on each trade, and ETFs may trade at a premium or discount to their net asset value. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. The Fund may experience tracking error to a greater extent than a fund that seeks to replicate an index. The Fund is not actively managed and may be affected by a general decline in market segments related to the index. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Investing in specific sectors such as energy infrastructure may involve greater risk and volatility than less concentrated investments. Risks include, but are not limited to, risks associated with companies owning and/or operating pipelines and complementary assets, as well as Master Limited Partnerships (MLPs), MLP affiliates, capital markets, terrorism, natural disasters, climate change, operating, regulatory, environmental, supply and demand, and price volatility risks. The tax benefits received by an investor investing in the portfolio differs from that of a direct investment in an MLP by an investor. The value of the portfolio’s investment in an MLP will depend largely on the MLP’s treatment as a partnership for U.S. federal income tax purposes. If the MLP is deemed to be a corporation then its income would be subject to federal taxation, reducing the amount of cash available for distribution to the portfolio which could result in a reduction of the portfolio’s value. Investments in foreign issuers involve risk not ordinarily associated with investments in securities and instruments of U.S. issuers, including risks related to political, social and economic developments abroad, differences between U.S. and foreign regulatory and accounting requirements, tax risk and market practices, as well as fluctuations in foreign currencies. The portfolio invests in small and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility than larger companies. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The portfolio may also write call options which may limit the portfolio’s ability to profit from increases in the market value of a security, but cause it to retain the risk of loss should the price of the security decline.

Tortoise Global Water ESG Fund

Investment in the water infrastructure and management industry may significantly affect the value of the shares of the fund. Companies in the water industry are subject to environmental considerations, taxes, government regulation, price and supply fluctuations, competition and water conservation influences. Investments in non-U.S. companies (including Canadian issuers) involve risk not ordinarily associated with investments in securities and instruments of U.S. issuers, including risks related to political, social and economic developments abroad, differences between U.S. and foreign regulatory and accounting requirements, tax risk and market practices, as well as fluctuations in foreign currencies. The fund invests in small and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility than larger companies. The fund is not actively managed, and therefore the fund generally will not sell a security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the index or the selling of the security is otherwise required upon a rebalancing of the index. There is no guarantee that the fund will achieve a high degree of correlation to the index and therefore achieve its investment objective. The fund has elected to be, and intends to qualify each year for treatment as, a regulated investment company (RIC). To maintain the fund’s qualification for federal income tax treatment as a RIC, the fund must meet certain source of income, asset diversification and annual distribution requirements. If for any taxable year the fund fails to qualify for the special federal income tax treatment afforded to RICs, all of the fund’s taxable income will be subject to federal income tax at regular corporate rates (without any deduction for distributions to its shareholders) and its income available for distribution will be reduced. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. The fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the fund is more exposed to individual stock volatility than a diversified fund.

Tortoise Cloud Infrastructure Fund

Investing involves risk. Principal loss is possible. Investing in specific sectors such as digital infrastructure may involve greater risk and volatility than less concentrated investments. Risks include, but are not limited to, risks associated with investing in cloud infrastructure industry including disruption of service, security breaches, evolving internet regulation and technology risk. Investments in non-U.S. companies (including Canadian issuers) involve risk not ordinarily associated with investments in securities and instruments of U.S. issuers, including risks related to political, social and economic developments abroad, differences between U.S. and foreign regulatory and accounting requirements, tax risk and market practices, as well as fluctuations in foreign currencies. The fund invests in small and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility than larger companies. The fund is not actively managed and therefore the fund generally will not sell a security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the index or the selling of the security is otherwise required upon a rebalancing of the index. There is no guarantee that the fund will achieve a high degree of correlation to the index and therefore achieve its investment objective. Shares may trade at prices different than net asset value per share.

Tortoise Digital Payments Infrastructure Fund

Investing involves risk. Principal loss is possible. Investing in specific sectors such as digital payments may involve greater risk and volatility than less concentrated investments. Risks include, but are not limited to, risks associated with investing in digital payments industry including major changes in technology, security considerations, taxes, government regulations, economic conditions, competition, political influences, the cyclical nature of the industry, and consumer preferences. Investments in non-U.S. companies (including Canadian issuers) involve risk not ordinarily associated with investments in securities and instruments of U.S. issuers, including risks related to political, social and economic developments abroad, differences between U.S. and foreign regulatory and accounting requirements, tax risk and market practices, as well as fluctuations in foreign currencies. The fund invests in small and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility than larger companies. The fund is not actively managed and therefore the fund generally will not sell a security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the index or the selling of the security is otherwise required upon a rebalancing of the index. There is no guarantee that the fund will achieve a high degree of correlation to the index and therefore achieve its investment objective. Shares may trade at prices different than net asset value per share.

Cash flow is the total amount of money moving into and out of a business.

Nothing contained on this communication constitutes tax, legal, or investment advice. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation.

This report reflects our views and opinions as of the date herein, which are subject to change at any time based on market and other conditions. We disclaim any responsibility to update these views. The views should not be relied on as investment advice or an indication of trading intent on behalf of the fund.

Portfolio holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments in this report.

| |

| |

| 2019 Annual Report| November 30, 2019 |

| |

| |

| |

| |

Expense example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (June 1, 2019 – November 30, 2019).

Actual expenses

The first line of the table below provides information about actual account values based on actual returns and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Tortoise North American Pipeline Fund | | | | | | | | | |

| | | | | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period(1) |

| | Account Value | | Account Value | | (06/01/2019 – |

| | (06/01/2019) | | (11/30/2019) | | 11/30/2019) |

| Actual(2) | | $1,000.00 | | | $ | 974.90 | | | $1.98 |

| Hypothetical (5% annual return before expenses) | | $1,000.00 | | | $ | 1,023.06 | | | $2.03 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.40%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended November 30, 2019 of -2.51%. |

| Tortoise Global Water ESG Fund | | | | | | |

| | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period(1) |

| | Account Value | | Account Value | | (06/01/2019 – |

| | (06/01/2019) | | (11/30/2019) | | 11/30/2019) |

| Actual(2) | | $1,000.00 | | $1,170.00 | | $2.18 |

| Hypothetical (5% annual return before expenses) | | $1,000.00 | | $1,023.06 | | $2.03 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.40%, multiplied by the average account value over the period, multiplied by 183/365 to reflect to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended November 30, 2019 of 17.00%. |

| Tortoise Cloud Infrastructure Fund | | | | | | |

| | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period(1) |

| | Account Value | | Account Value | | (06/01/2019 – |

| | (06/01/2019) | | (11/30/2019) | | 11/30/2019) |

| Actual(2) | | $1,000.00 | | $1,109.80 | | $2.12 |

| Hypothetical (5% annual return before expenses) | | $1,000.00 | | $1,023.06 | | $2.03 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the period since inception of 0.40%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended November 30, 2019 of 10.98%. |

| Tortoise Digital Payments Infrastructure Fund | | | | | | |

| | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period(1) |

| | Account Value | | Account Value | | (06/01/2019 – |

| | (06/01/2019) | | (11/30/2019) | | 11/30/2019) |

| Actual(2) | | $1,000.00 | | $1,131.20 | | $2.14 |

| Hypothetical (5% annual return before expenses) | | $1,000.00 | | $1,023.06 | | $2.03 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the period since inception of 0.40%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended November 30, 2019 of 13.12%. |

| |

| |

| 2019 Annual Report| November 30, 2019 |

| |

| Tortoise North American Pipeline Fund |

| Schedule of Investments |

| November 30, 2019 |

| | Shares | | Fair Value |

| Common Stock — 81.5%(1) | | | | | |

| | | | | | |

| Canada Crude Oil Pipelines — 18.4%(1) | | | | | |

| Enbridge Inc. | | 916,938 | | $ | 34,843,644 |

| Gibson Energy Inc. | | 212,485 | | | 3,992,792 |

| Inter Pipeline Ltd. | | 611,635 | | | 10,130,219 |

| Kinder Morgan Canada Limited | | 49,706 | | | 530,627 |

| Pembina Pipeline Corporation | | 762,490 | | | 26,623,719 |

| | | | | 76,121,001 |

| | | | | | |

| Canada Natural Gas/Natural Gas Liquids Pipelines — 11.2%(1) |

| AltaGas Ltd. | | 411,122 | | | 6,097,345 |

| Keyera Corp. | | 317,524 | | | 7,747,462 |

| TC Energy Corporation | | 638,854 | | | 32,536,834 |

| | | | | 46,381,641 |

| | | | | | |

| United States Crude Oil Pipelines — 0.8%(1) | | | |

| Plains GP Holdings, L.P. | | 111,236 | | | 1,943,293 |

| SemGroup Corporation | | 93,861 | | | 1,442,643 |

| | | | | 3,385,936 |

| | | | | | |

| United States Local Distribution Companies — 16.3%(1) | |

| Atmos Energy Corporation | | 176,276 | | | 18,854,481 |

| Chesapeake Utilities Corporation | | 25,417 | | | 2,316,505 |

| New Jersey Resources Corporation | | 133,299 | | | 5,670,540 |

| NiSource Inc. | | 552,262 | | | 14,607,330 |

| Northwest Natural Holding Co. | | 44,162 | | | 3,037,021 |

| ONE Gas, Inc. | | 77,985 | | | 6,930,527 |

| South Jersey Industries, Inc. | | 135,150 | | | 4,222,086 |

| Southwest Gas Corporation | | 80,586 | | | 6,105,195 |

| Spire Inc. | | 75,382 | | | 5,836,074 |

| | | | | 67,579,759 |

| | | | | | |

| United States Natural Gas Gathering/Processing — 12.0%(1) |

| Antero Midstream Corp. | | 445,970 | | | 2,042,542 |

| Archrock, Inc. | | 182,619 | | | 1,535,826 |

| EnLink Midstream, LLC | | 377,907 | | | 1,795,058 |

| Rattler Midstream LP | | 20,970 | | | 333,633 |

| Targa Resources Corp. | | 347,011 | | | 12,676,312 |

| The Williams Companies, Inc. | | 1,365,961 | | | 31,034,634 |

| | | | | 49,418,005 |

| | | | | | |

| United States Natural Gas/Natural Gas Liquids Pipelines — 22.7%(1) |

| Altus Midstream Co.(2) | | 82,490 | | $ | 159,206 |

| Cheniere Energy, Inc.(2) | | 332,250 | | | 20,114,415 |

| Equitrans Midstream Corp. | | 298,290 | | | 2,973,951 |

| Kinder Morgan, Inc. | | 1,599,569 | | | 31,367,548 |

| National Fuel Gas Company | | 126,286 | | | 5,685,396 |

| ONEOK, Inc. | | 450,819 | | | 32,030,690 |

| Tallgrass Energy LP | | 81,016 | | | 1,450,996 |

| | | | | 93,782,202 |

| | | | | | |

| United States Other — 0.1%(1) | | | | | |

| New Fortress Energy LLC(2) | | 22,450 | | | 336,077 |

| Total Common Stock | | | | | |

| (Cost $324,237,609) | | | | | 337,004,621 |

| | | | | | |

| Master Limited Partnerships — 17.1%(1) | | | |

| | | | |

| United States Crude Oil Pipelines — 1.8%(1) | | | |

| BP Midstream Partners LP | | 22,229 | | | 324,543 |

| Delek Logistics Partners LP | | 3,849 | | | 123,630 |

| Genesis Energy, L.P. | | 59,506 | | | 1,131,209 |

| PBF Logistics LP | | 16,846 | | | 344,501 |

| Plains All American Pipeline, L.P. | | 247,776 | | | 4,311,302 |

| Shell Midstream Partners, L.P. | | 71,313 | | | 1,402,014 |

| USD Partners LP | | 5,309 | | | 50,223 |

| | | | | 7,687,422 |

| | | | | | |

| United States Natural Gas Gathering/Processing — 1.1%(1) |

| CNX Midstream Partners LP | | 22,656 | | | 328,512 |

| DCP Midstream, LP | | 49,803 | | | 1,051,341 |

| Enable Midstream Partners, LP | | 30,488 | | | 280,185 |

| Hess Midstream Partners LP | | 7,224 | | | 147,731 |

| Noble Midstream Partners LP | | 11,984 | | | 249,867 |

| Oasis Midstream Partners LP | | 5,227 | | | 83,632 |

| USA Compression Partners LP | | 26,591 | | | 437,156 |

| Western Midstream Partners LP | | 107,648 | | | 1,908,599 |

| | | | | 4,487,023 |

| See accompanying Notes to Financial Statements. | |

| | |

| Tortoise | 17 |

| |

| |

| |

| |

| Tortoise North American Pipeline Fund |

| Schedule of Investments(continued) |

| November 30, 2019 |

| | Shares | | Fair Value |

| United States Natural Gas/Natural Gas Liquids Pipelines — 9.5%(1) | | | | | |

| Cheniere Energy Partners, L.P. | | 23,022 | | $ | 894,865 |

| Crestwood Equity Partners LP | | 26,682 | | | 846,353 |

| Energy Transfer LP | | 1,278,732 | | | 15,101,825 |

| Enterprise Products Partners L.P. | | 772,089 | | | 20,321,382 |

| EQM Midstream Partners LP | | 44,406 | | | 1,028,887 |

| TC PipeLines, LP | | 29,129 | | | 1,135,740 |

| | | | | 39,329,052 |

| | | | | | |

| United States Refined Product Pipelines — 4.7%(1) | | | | | |

| CrossAmerica Partners LP | | 5,732 | | | 104,781 |

| Global Partners LP | | 12,741 | | | 255,075 |

| Holly Energy Partners, L.P. | | 25,019 | | | 559,425 |

| Magellan Midstream Partners, L.P. | | 129,469 | | | 7,570,052 |

| MPLX LP | | 215,443 | | | 5,095,227 |

| NuStar Energy L.P. | | 58,820 | | | 1,659,900 |

| Phillips 66 Partners LP | | 55,256 | | | 3,079,417 |

| Sprague Resources LP | | 4,579 | | | 73,264 |

| Sunoco LP | | 31,038 | | | 966,834 |

| | | | | 19,363,975 |

| Total Master Limited Partnerships | | | | | |

| (Cost $73,811,356) | | | | | 70,867,472 |

| | | | | | |

| Short-Term Investment — 1.2%(1) | | | | | |

| | | | | | |

| United States Investment Company — 1.2%(1) | | | | | |

| Invesco Government & Agency Portfolio — Institutional Class, 1.53%(3) | | | | | |

| (Cost $5,042,013) | | 5,042,013 | | | 5,042,013 |

| | | | | | |

| Total Investments — 99.8%(1) | | | | | |

| (Cost $403,090,978) | | | | | 412,914,106 |

Other Assets in Excess of Liabilities, Net — 0.2%(1) | | | | | 671,085 |

| Total Net Assets — 100.0%(1) | | | | $ | 413,585,191 |

| (1) | Calculated as a percentage of net assets. |

| (2) | Non-income producing security. |

| (3) | Rate indicated is the current yield as of November 30, 2019. |

| See accompanying Notes to Financial Statements. | |

| | |

| 18 | Tortoise |

| |

| |

| 2019 Annual Report| November 30, 2019 |

| |

| Tortoise Global Water ESG Fund |

| Schedule of Investments |

| November 30, 2019 |

| | Shares | | Fair Value |

| Common Stock — 99.0%(1) | | | | | |

| | | | | | |

| Brazil Water Utilities — 3.5%(1) | | | | | |

| Cia de Saneamento Basico do Estado de | | | | | |

| Sao Paulo — ADR | | 38,925 | | $ | 520,816 |

| | | | | | |

| Finland Water Equipment/Services — 0.6%(1) | | | | | |

| Uponor OYJ | | 6,411 | | | 82,291 |

| | | | | | |

| France Water Infrastructure — 11.3%(1) | | | | | |

| Suez | | 36,560 | | | 541,184 |

| Veolia Environnement SA | | 44,229 | | | 1,132,515 |

| | | | | | 1,673,699 |

| | | | | | |

| Hong Kong Water Equipment/Services — 0.8%(1) | | | | | |

| China Lesso Group Holdings Ltd. | | 113,089 | | | 118,460 |

| | | | | | |

| Hong Kong Water Infrastructure — 2.7%(1) | | | | | |

| Beijing Enterprises Water Group Ltd. | | 672,870 | | | 330,066 |

| China Water Affairs Group Limited | | 99,533 | | | 76,415 |

| CT Environmental Group Limited(2) | | 113,060 | | | — |

| | | | | | 406,481 |

| | | | | | |

| Japan Water Equipment/Services — 2.5%(1) | | | | | |

| Kurita Water Industries Ltd. | | 12,171 | | | 340,370 |

| NIHON TRIM Co., Ltd. | | 551 | | | 25,052 |

| | | | | 365,422 |

| | | | | | |

| Japan Water Infrastructure — 0.3%(1) | | | | | |

| METAWATER Co. Ltd. | | 1,269 | | | 46,274 |

| | | | | | |

| Netherlands Water Equipment/Services — 3.1%(1) | | | | | |

| Aalberts Industries N.V. | | 10,945 | | | 463,674 |

| | | | | | |

| Switzerland Water Equipment/Services — 12.0%(1) | | | | | |

| Ferguson PLC | | 13,511 | | | 1,174,581 |

| Georg Fischer AG | | 470 | | | 460,480 |

| Sulzer AG | | 1,433 | | | 153,656 |

| | | | | | 1,788,717 |

| | | | | | |

| Switzerland Water Management — 7.8%(1) | | | | | |

| Geberit AG | | 2,165 | | | 1,162,463 |

| | | | | | |

| United Kingdom Water Infrastructure — 16.7%(1) | | | | | |

| Pennon Group Plc | | 47,342 | | | 558,391 |

| Pentair PLC | | 14,592 | | | 647,155 |

| Severn Trent Plc | | 22,308 | | | 647,123 |

| United Utilities Group PLC | | 57,710 | | | 636,943 |

| | | | | 2,489,612 |

| | | | | | |

| United States Water Infrastructure — 16.6%(1) | | | | | |

| Advanced Drainage Systems, Inc. | | 4,710 | | | 179,734 |

| Aegion Corp.(3) | | 3,591 | | | 77,781 |

| Franklin Electric Co., Inc. | | 4,377 | | | 242,792 |

| Middlesex Water Company | | 1,855 | | | 116,513 |

| Mueller Water Products, Inc. | | 18,029 | | | 203,367 |

| Rexnord Corporation(3) | | 11,943 | | | 377,279 |

| SJW Group | | 2,657 | | | 188,169 |

| The York Water Company | | 1,469 | | | 65,121 |

| Xylem, Inc. | | 13,144 | | | 1,018,791 |

| | | | | 2,469,547 |

| | | | | | |

| United States Water Management — 3.8%(1) | | | | | |

| AquaVenture Holdings Limited(3) | | 2,218 | | | 49,373 |

| Badger Meter, Inc. | | 3,306 | | | 204,972 |

| Watts Water Technologies, Inc. | | 3,145 | | | 304,939 |

| | | | | 559,284 |

| | | | | |

| United States Water Treatment — 0.8%(1) | | | | | |

| Evoqua Water Technologies Corp.(3) | | 6,589 | | | 124,796 |

| | | | | |

| United States Water Utilities — 16.5%(1) | | | | | |

| American States Water Company | | 4,188 | | | 357,194 |

| American Water Works Co., Inc. | | 8,596 | | | 1,040,374 |

| Aqua America Inc. | | 17,669 | | | 782,207 |

| California Water Service Group | | 5,475 | | | 281,415 |

| | | | | 2,461,190 |

| Total Common Stock | | | | | |

| (Cost $13,650,982) | | | | | 14,732,726 |

| | | | | |

| Short-Term Investment — 0.7%(1) | | | | | |

| | | | | | |

| United States Investment Company — 0.7%(1) | | | | | |

| Invesco Government & Agency Portfolio — Institutional Class, 1.53%(4) | | | | | |

| (Cost $103,214) | | 103,214 | | | 103,214 |

| | | | | |

| Total Investments — 99.7%(1) | | | | | |

| (Cost $13,754,196) | | | | | 14,835,940 |

| Other Assets in Excess of Liabilities, Net — 0.3%(1) | | | | | 39,128 |

| Total Net Assets — 100.0%(1) | | | | $ | 14,875,068 |

| (1) | Calculated as a percentage of net assets. |

| (2) | Security considered illiquid and is categorized in Level 3 of the fair value hierarchy. |

| (3) | Non-income producing security. |

| (4) | Rate indicated is the current yield as of November 30, 2019. |

| ADR – American Depository Receipt |

| See accompanying Notes to Financial Statements. | |

| | |

| Tortoise | 19 |

| |

| |

| |

| |

| Tortoise Cloud Infrastructure Fund |

| Schedule of Investments |

| November 30, 2019 |

| | Shares | | Fair Value |

| Common Stock — 99.4%(1) | | | | | |

| | | | | | |

| France Cloud Systems — Services — 2.2%(1) | | | | | |

| Atos SE | | 1,127 | | $ | 95,712 |

| | | | | | |

| Hong Kong Online Retail — 4.8%(1) | | | | | |

| Alibaba Group Holding Limited — ADR(2) | | 1,030 | | | 206,000 |

| | | | | | |

| Israel Cloud Security — 4.2%(1) | | | | | |

| Check Point Software Technologies Ltd.(2) | | 1,411 | | | 166,329 |

| Radware Ltd.(2) | | 423 | | | 10,190 |

| | | | | | 176,519 |

| | | | | | |

| Netherlands Cloud Management Software — 1.8%(1) | | | | | |

| InterXion Holding N.V.(2) | | 880 | | | 74,835 |

| | | | | | |

| Netherlands Payments Fintech — 0.8%(1) | | | | | |

| Elastic N.V.(2) | | 417 | | | 33,114 |

| | | | | | |

| United States Cloud Hardware — 9.5%(1) | | | | | |

| Cisco Systems, Inc. | | 3,621 | | | 164,067 |

| j2 Global, Inc. | | 537 | | | 52,100 |

| Juniper Networks, Inc. | | 3,993 | | | 100,065 |

| NetScout Systems, Inc.(2) | | 850 | | | 21,420 |

| Nutanix, Inc.(2) | | 1,769 | | | 66,072 |

| | | | | | 403,724 |

| | | | | | |

| United States Cloud Management Software — 6.0%(1) | | | | | |

| Box, Inc.(2) | | 1,630 | | | 29,731 |

| Dropbox, Inc.(2) | | 2,471 | | | 45,689 |

| NetApp, Inc. | | 2,768 | | | 167,713 |

| Pivotal Software, Inc.(2) | | 928 | | | 13,939 |

| | | | | | 257,072 |

| | | | | | |

| United States Cloud Security — 10.5%(1) | | | | | |

| A10 Networks Inc.(2) | | 600 | | | 4,002 |

| Carbonite Inc.(2) | | 337 | | | 7,751 |

| CommVault Systems, Inc.(2) | | 481 | | | 24,348 |

| Fortinet, Inc.(2) | | 1,705 | | | 179,213 |

| MobileIron, Inc.(2) | | 1,099 | | | 5,308 |

| Okta, Inc.(2) | | 1,222 | | | 158,591 |

| Qualys, Inc.(2) | | 384 | | | 33,604 |

| Zscaler, Inc.(2) | | 637 | | | 33,207 |

| | | | | | 446,024 |

| | | | | | |

| United States Cloud Systems — Services — 27.5%(1) | | | | | |

| Akamai Technologies, Inc.(2) | | 1,874 | | | 163,263 |