LK Balanced Fund

Institutional Class Shares – LKBLX

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.lkfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-855-698-1378, or by enrolling at www.lkfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-855-698-1378 or contact the Fund at www.lkfunds.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary.

Annual Report

| www.lkfunds.com | June 30, 2021 |

(This Page Intentionally Left Blank.)

July 26, 2021

Fellow Shareholders,

The past year was one for the record books. A global pandemic causing an almost complete economic shutdown followed by an unbelievably strong re-opening and unprecedented economic growth led to strong equity markets worldwide. Easy money policies promulgated by the world’s central banks kept interest rates low throughout the year which fueled a “risk on” mentality and expanded valuations. U.S. stock indices marched to new heights with the Standard & Poor’s 500® Index posting a 40.79% gain for the June 30, 2020 to June 30, 2021 period*.

In this environment, the Fund returned 39.33%—outpacing the Lipper Balanced Fund Index which returned 26.44%—for the twelve months ending June 30, 2021*. In a period of strong economic recovery, our smaller and more economically sensitive stocks provided solid returns. Leading individual contributors to the Fund’s performance were Texas Pacific Land, Kansas City Southern and Walt Disney which collectively added about 11.2%. The largest detractors were Hexcel, Gilead Sciences and Viatris which subtracted about 0.7% from Fund performance.

In the middle of the global pandemic, the U.S. struggled through one of the most contentious elections in recent history, and yet through all the daily ups and downs, the markets continued to march forward. Books will be written to cover this unique period in our history, so we won’t try and recount all the events other than to say it has been an interesting and challenging environment in which to invest. While much of the news and market focus is on the macro environment, our focus remains on individual company performance. Overall, corporate earnings have recovered at a healthy rate, and companies have been generating excess cash flow. There are a multitude of risk factors that seem to be ever present. Current concerns about a lack of labor market growth, a lack of wage growth or higher inflation do not seem to have impacted consumer spending. Consumers appear confident about their personal financial situations keeping spending levels brisk which may drive market results in the short run, but—in the longer term—it will be corporate performance that matters.

Although current valuations are not cheap, we hesitate to categorize them as overly expensive. When considered against the backdrop of low interest rates, we find ourselves in the position of continuing to favor stocks over bonds for long-term performance. When or whether corporate performance is reflected in a company’s stock price is less predictable than underlying fundamentals. Our long-term positive outlook is predicated on the belief that good companies that grow and adapt to an ever-changing environment have an ability to provide attractive risk adjusted returns in a portfolio.

Thank you for your continued trust and confidence.

Sincerely,

|  |

| | |

Thomas J. Sudyka, Jr., CFA® | Bruce H. Van Kooten, CFA® |

| * | The performance quoted may be attributable to unusually favorable conditions that are likely not sustainable; that the conditions might not continue to exist; and, that this performance probably will not be repeated in the future. |

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Fund holdings and allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the schedule of investments for a complete list of fund holdings.

Earnings growth is not representative of the Fund’s future performance.

Mutual fund investing involves risk. Principal loss is possible. Securities of mid-cap and small-cap companies may be more volatile and less liquid than the securities of large-cap companies. Foreign companies involve risks not generally associated with investment in the securities of U.S. companies, including risks relating to political, social and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices, including fluctuations in foreign currencies. The Fund’s investments in debt securities will be subject to credit risk, interest rate risk, prepayment risk and duration risk. Credit risk is the risk that an issuer will not make timely payments of principal and interest. Interest rate risk is the risk that the value of debt securities fluctuates with changes in interest rates (e.g. increases in interest rates result in a decrease in value of debt securities). Pre-payment risk is the risk that the principal on debt securities will be paid off prior to maturity causing the Fund to invest in debt securities with lower interest rates. Investments in below investment grade debt securities and unrated securities of similar credit quality as determined by the Adviser (commonly known as “junk bonds”) involve a greater risk of default and are subject to greater levels of credit and liquidity risk. The Fund may be exposed to liquidity risk when trading volume, lack of a market maker, or legal restrictions impair the Fund’s ability to sell particular securities at an advantageous price or in a timely manner.

The S&P 500® Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. One may not directly invest in an index.

The Lipper Balanced Funds Index is an equally weighted index of the 30 largest U.S. Balanced Funds. One may not directly invest in an index.

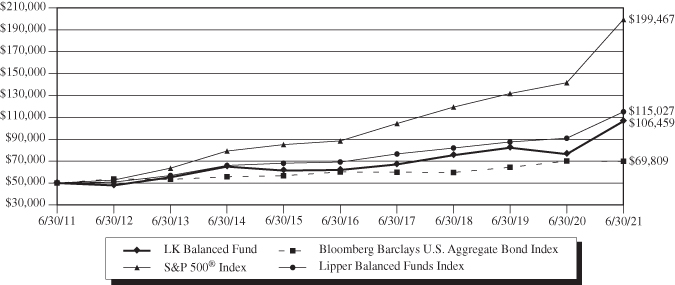

Value of $50,000 Investment (Unaudited)

The chart assumes an initial investment of $50,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-855-698-1378. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of June 30, 2021

| | One Year | Five Year | Ten Year | Since Inception |

LK Balanced Fund(1)(2) | 39.33% | 11.43% | 7.85% | 8.47% |

S&P 500® Index(3) | 40.79% | 17.65% | 14.84% | 11.13% |

| Bloomberg Barclays U.S. | | | | |

Aggregate Bond Index(4) | -0.33% | 3.03% | 3.39% | 6.02% |

Lipper Balanced Funds Index(5) | 26.44% | 10.71% | 8.69% | 8.30% |

| (1) | Fund commenced operations on July 1, 2012. |

| (2) | The performance data quoted for periods prior to July 1, 2012 is that of the L/K Limited Partnership #1 (the “Partnership”). The Partnership commenced operations on December 31, 1986. The Partnership was not a registered mutual fund and was not subject to the same investment and tax restrictions as the Fund. If it had been, the Partnership’s performance might have been lower. |

| (3) | The S&P 500® Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. One may not invest directly in an index. |

| (4) | The Bloomberg Barclays U.S. Aggregate Bond Index is an intermediate term index and a market capitalization-weighted index, where securities in the index are weighted according to market size of each bond type. One may not invest directly in an index. |

| (5) | The Lipper Balanced Funds Index is an equally weighted index of the 30 largest U.S. Balanced Funds. One may not invest directly in an index. |

Expense Example (Unaudited)

June 30, 2021

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2021 – June 30, 2021).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs may have been higher.

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period(1) |

| | Value (1/1/2021) | Value (6/30/2021) | (1/1/2021 to 6/30/2021) |

LK Balanced Fund Actual(2) | $1,000.00 | $1,173.70 | $5.39 |

LK Balanced Fund Hypothetical | | | |

(5% return before expenses) | $1,000.00 | $1,019.84 | $5.01 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.00%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| (2) | Based on the actual return for the six-month period ended June 30, 2021 of 17.37%. |

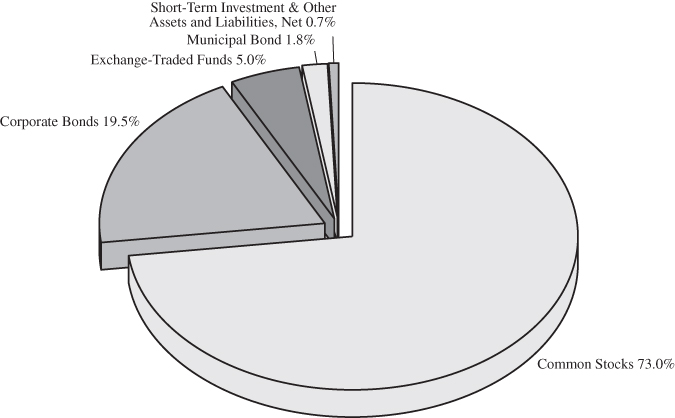

Sector Allocation(1) (Unaudited)

June 30, 2021

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

June 30, 2021

(% of Net Assets)

| | Berkshire Hathaway, Class A & B | 5.4% | |

| | Texas Pacific Land Trust | 5.3% | |

| | Brookfield Asset Management, Class A | 4.3% | |

| | Kansas City Southern | 3.7% | |

| | Thermo Fisher Scientific | 3.3% | |

| | Arthur J. Gallagher & Co. | 3.2% | |

| | Microsoft | 3.1% | |

| | Lincoln Electric Holdings | 3.0% | |

| | Johnson & Johnson | 3.0% | |

| | Walt Disney | 2.9% | |

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Schedule of Investments

June 30, 2021

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 73.0% | | | | | | |

| | | | | | | |

| Communication Services – 5.2% | | | | | | |

Discovery, Class C* | | | 12,000 | | | $ | 347,760 | |

Lumen Technologies | | | 25,000 | | | | 339,750 | |

Walt Disney | | | 5,000 | | | | 878,850 | |

| | | | | | | | 1,566,360 | |

| Consumer Discretionary – 4.3% | | | | | | | | |

Gildan Activewear | | | 19,000 | | | | 701,480 | |

LKQ* | | | 12,200 | | | | 600,484 | |

| | | | | | | | 1,301,964 | |

| Consumer Staples – 5.3% | | | | | | | | |

Anheuser-Busch InBev – ADR | | | 9,000 | | | | 648,090 | |

Crimson Wine Group* | | | 30,000 | | | | 274,200 | |

Hershey | | | 4,000 | | | | 696,720 | |

| | | | | | | | 1,619,010 | |

| Energy – 9.0% | | | | | | | | |

Chevron | | | 4,418 | | | | 462,741 | |

Phillips 66 | | | 7,700 | | | | 660,814 | |

Texas Pacific Land | | | 1,000 | | | | 1,599,740 | |

| | | | | | | | 2,723,295 | |

| Financials – 12.5% | | | | | | | | |

Aflac | | | 10,000 | | | | 536,600 | |

Arthur J. Gallagher | | | 7,000 | | | | 980,560 | |

Berkshire Hathaway, Class A* | | | 2 | | | | 837,202 | |

Berkshire Hathaway, Class B* | | | 2,900 | | | | 805,968 | |

Brookfield Asset Management | | | 176 | | | | 9,149 | |

Cullen/Frost Bankers | | | 5,500 | | | | 616,000 | |

| | | | | | | | 3,785,479 | |

| Health Care – 11.9% | | | | | | | | |

Gilead Sciences | | | 5,000 | | | | 344,300 | |

Johnson & Johnson | | | 5,500 | | | | 906,070 | |

Pfizer | | | 20,000 | | | | 783,200 | |

Thermo Fisher Scientific | | | 2,000 | | | | 1,008,940 | |

Viatris, Inc. | | | 40,000 | | | | 571,600 | |

| | | | | | | | 3,614,110 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

June 30, 2021

Description | | Shares/Par | | | Value | |

| | | | | | | |

| COMMON STOCKS – 73.0% (CONTINUED) | | | | | | |

| | | | | | | |

| Industrials – 10.3% | | | | | | |

Aerojet Rocketdyne Holdings | | | 12,000 | | | $ | 579,480 | |

Boeing* | | | 2,050 | | | | 491,098 | |

Kansas City Southern | | | 4,000 | | | | 1,133,480 | |

Lincoln Electric Holdings | | | 7,000 | | | | 921,970 | |

| | | | | | | | 3,126,028 | |

| Information Technology – 4.0% | | | | | | | | |

Keysight Technologies* | | | 1,700 | | | | 262,497 | |

Microsoft | | | 3,500 | | | | 948,150 | |

| | | | | | | | 1,210,647 | |

| Materials – 4.8% | | | | | | | | |

Constellium, Class A* | | | 20,000 | | | | 379,000 | |

Orion Engineered Carbons* | | | 24,000 | | | | 455,760 | |

Vulcan Materials | | | 3,500 | | | | 609,245 | |

| | | | | | | | 1,444,005 | |

| Real Estate – 5.7% | | | | | | | | |

Brookfield Asset Management, Class A | | | 25,500 | | | | 1,299,990 | |

Weyerhaeuser – REIT | | | 12,800 | | | | 440,576 | |

| | | | | | | | 1,740,566 | |

| Total Common Stocks | | | | | | | | |

| (Cost $9,773,067) | | | | | | | 22,131,464 | |

| | | | | | | | | |

| CORPORATE BONDS – 19.5% | | | | | | | | |

| | | | | | | | | |

| Communication Services – 1.1% | | | | | | | | |

TWDC Enterprises 18 | | | | | | | | |

3.000%, 02/13/2026 | | $ | 325,000 | | | | 353,277 | |

| | | | | | | | | |

| Consumer Discretionary – 3.5% | | | | | | | | |

Advance Auto Parts | | | | | | | | |

4.500%, 12/01/2023 | | | 250,000 | | | | 268,800 | |

Bed Bath & Beyond | | | | | | | | |

3.749%, 08/01/2024 | | | 500,000 | | | | 518,465 | |

Newell Rubbermaid | | | | | | | | |

3.900%, 11/01/2025 | | | 250,000 | | | | 263,918 | |

| | | | | | | | 1,051,183 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

June 30, 2021

Description | | Par | | | Value | |

| | | | | | | |

| CORPORATE BONDS – 19.5% (CONTINUED) | | | | | | |

| | | | | | | |

| Consumer Staples – 2.7% | | | | | | |

Campbell Soup | | | | | | |

2.500%, 08/02/2022 | | $ | 300,000 | | | $ | 306,689 | |

Campbell Soup | | | | | | | | |

2.375%, 04/24/2030 | | | 500,000 | | | | 504,334 | |

| | | | | | | | 811,023 | |

| Financials – 4.9% | | | | | | | | |

Deutsche Bank | | | | | | | | |

5.000%, 02/14/2022 | | | 500,000 | | | | 513,716 | |

Old Republic International | | | | | | | | |

3.875%, 08/26/2026 | | | 500,000 | | | | 559,749 | |

Opus Bank | | | | | | | | |

5.500%, 07/01/2026 | | | 400,000 | | | | 400,000 | |

| | | | | | | | 1,473,465 | |

| Industrials – 5.1% | | | | | | | | |

Boeing | | | | | | | | |

2.196%, 02/04/2026 | | | 500,000 | | | | 505,304 | |

General Electric | | | | | | | | |

3.449%, (Quarterly LIBOR + 3.33%), Perpetual (b) | | | 500,000 | | | | 492,375 | |

Hexcel | | | | | | | | |

4.700%, 08/15/2025 | | | 250,000 | | | | 275,696 | |

Keysight Technologies | | | | | | | | |

4.550%, 10/30/2024 | | | 250,000 | | | | 277,970 | |

| | | | | | | | 1,551,345 | |

| Information Technology – 2.2% | | | | | | | | |

Corning | | | | | | | | |

7.530%, 03/01/2023 | | | 110,000 | | | | 121,023 | |

Intel | | | | | | | | |

2.700%, 12/15/2022 | | | 250,000 | | | | 258,791 | |

KLA Tencor | | | | | | | | |

4.650%, 11/01/2024 | | | 250,000 | | | | 279,264 | |

| | | | | | | | 659,078 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $5,687,341) | | | | | | | 5,899,371 | |

See Notes to the Financial Statements

Schedule of Investments – Continued

June 30, 2021

Description | | Shares/Par | | | Value | |

| | | | | | | |

| EXCHANGE TRADED FUNDS – 5.0% | | | | | | |

iShares Core 1-5 Year USD Bond | | | 15,000 | | | $ | 769,350 | |

Vanguard Short-Term Bond | | | 9,000 | | | | 739,440 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $1,516,900) | | | | | | | 1,508,790 | |

| | | | | | | | | |

| MUNICIPAL BOND – 1.8% | | | | | | | | |

| | | | | | | | | |

| Iowa – 1.8% | | | | | | | | |

City of Coralville | | | | | | | | |

7.500%, 06/01/2028 | | | | | | | | |

| Total Municipal Bond | | | | | | | | |

| (Cost $556,958) | | $ | 500,000 | | | | 551,611 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT – 0.7% | | | | | | | | |

First American Government Obligations, Class Z, 0.02% (a) | | | | | | | | |

| Total Short-Term Investment | | | | | | | | |

| (Cost $224,763) | | | 224,763 | | | | 224,763 | |

| Total Investments – 100.0% | | | | | | | | |

| (Cost $17,759,029) | | | | | | | 30,315,999 | |

| Other Assets and Liabilities, Net – 0.0% | | | | | | | 6,278 | |

| Total Net Assets – 100.0% | | | | | | $ | 30,322,277 | |

| | | | | | | | | |

ADR – American Depositary Receipt.

REIT – Real Estate Investment Trust.

| * | | Non-income producing security. |

| (a) | | The rate shown is the annualized seven-day effective yield as of June 30, 2021. |

| (b) | | Variable rate security. The rate shown represents the rate in effect as of June 30, 2021. |

The Global Industry Classification Standard (“GICS®”) was developed by and is the exclusive Property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Statement of Assets and Liabilities

June 30, 2021

| ASSETS: | | | |

Investments, at value | | | |

(Cost: $17,759,029) | | $ | 30,315,999 | |

Dividends & interest receivable | | | 74,077 | |

Prepaid expenses | | | 4,951 | |

Cash | | | 2,486 | |

Total Assets | | | 30,397,513 | |

| | | | | |

| LIABILITIES: | | | | |

Payable for fund administration & accounting fees | | | 20,804 | |

Payable for audit fees | | | 19,503 | |

Payable to investment adviser | | | 7,890 | |

Payable for transfer agent fees & expenses | | | 6,898 | |

Payable for trustee fees | | | 4,049 | |

Payable for compliance fees | | | 3,750 | |

Payable for custody fees | | | 921 | |

Accrued expenses | | | 11,421 | |

Total Liabilities | | | 75,236 | |

| | | | | |

| NET ASSETS | | $ | 30,322,277 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 15,376,690 | |

Total distributable earnings | | | 14,945,587 | |

Net Assets | | $ | 30,322,277 | |

| | | | | |

Shares issued and outstanding(1) | | | 511,023 | |

| | | | | |

Net asset value, redemption price and offering price per share | | $ | 59.34 | |

(1) Unlimited shares authorized, without par value.

See Notes to the Financial Statements

Statement of Operations

For the Year Ended June 30, 2021

| INVESTMENT INCOME: | | | |

Dividend income | | $ | 370,646 | |

Less: Foreign taxes withheld | | | (3,163 | ) |

Interest income | | | 183,325 | |

Total investment income | | | 550,808 | |

| | | | | |

| EXPENSES: | | | | |

Investment adviser fees (See Note 4) | | | 205,032 | |

Fund administration & accounting fees (See Note 4) | | | 82,659 | |

Transfer agent fees & expenses (See Note 4) | | | 26,460 | |

Audit fees | | | 19,506 | |

Trustee fees | | | 16,260 | |

Legal fees | | | 15,195 | |

Compliance fees (See Note 4) | | | 15,001 | |

Federal & state registration fees | | | 8,726 | |

Postage & printing fees | | | 7,027 | |

Custody fees (See Note 4) | | | 5,445 | |

Other expenses | | | 4,272 | |

Insurance | | | 1,714 | |

Total expenses before waiver | | | 407,297 | |

Less: waiver from investment adviser (See Note 4) | | | (133,920 | ) |

Net expenses | | | 273,377 | |

| | | | | |

| NET INVESTMENT INCOME | | | 277,431 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | | |

Net realized gain on investments | | | 2,245,128 | |

Net change in unrealized appreciation/depreciation on investments | | | 6,546,759 | |

Net realized and unrealized gain on investments | | | 8,791,887 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 9,069,318 | |

See Notes to the Financial Statements

Statements of Changes in Net Assets

| | | Year Ended | | | Year Ended | |

| | | June 30, 2021 | | | June 30, 2020 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 277,431 | | | $ | 316,722 | |

| Net realized gain on investments | | | 2,245,128 | | | | 1,858,837 | |

| Net change in unrealized appreciation/depreciation on investments | | | 6,546,759 | | | | (4,241,555 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 9,069,318 | | | | (2,065,996 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 544,397 | | | | 4,006,117 | |

| Proceeds from reinvestment of distributions | | | 1,528,448 | | | | 883,812 | |

| Payments for shares redeemed | | | (2,989,880 | ) | | | (7,805,129 | ) |

| Net decrease in net assets resulting | | | | | | | | |

| from capital share transactions | | | (917,035 | ) | | | (2,915,200 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | (1,528,448 | ) | | | (883,812 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 6,623,835 | | | | (5,865,008 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 23,698,442 | | | | 29,563,450 | |

| End of year | | $ | 30,322,277 | | | $ | 23,698,442 | |

See Notes to the Financial Statements

Financial Highlights

For a Fund share outstanding throughout the years.

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 45.19 | | | $ | 50.19 | | | $ | 49.41 | | | $ | 44.84 | | | $ | 42.10 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.56 | | | | 0.61 | | | | 0.65 | | | | 0.65 | | | | 0.65 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 16.63 | | | | (4.01 | ) | | | 3.26 | | | | 4.95 | | | | 2.78 | |

| Total from investment operations | | | 17.19 | | | | (3.40 | ) | | | 3.91 | | | | 5.60 | | | | 3.43 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.52 | ) | | | (0.64 | ) | | | (0.82 | ) | | | (0.81 | ) | | | (0.32 | ) |

| Net realized gains | | | (2.52 | ) | | | (0.96 | ) | | | (2.31 | ) | | | (0.22 | ) | | | (0.37 | ) |

| Total distributions | | | (3.04 | ) | | | (1.60 | ) | | | (3.13 | ) | | | (1.03 | ) | | | (0.69 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 59.34 | | | $ | 45.19 | | | $ | 50.19 | | | $ | 49.41 | | | $ | 44.84 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 39.33 | % | | | -7.12 | % | | | 9.06 | % | | | 12.55 | % | | | 8.18 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in millions) | | $ | 30.3 | | | $ | 23.7 | | | $ | 29.6 | | | $ | 27.1 | | | $ | 26.1 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.49 | % | | | 1.45 | % | | | 1.36 | % | | | 1.36 | % | | | 1.41 | % |

| After expense waiver | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense waiver | | | 1.02 | % | | | 1.18 | % | | | 1.32 | % | | | 1.29 | % | | | 1.44 | % |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 21 | % | | | 4 | % | | | 8 | % | | | 10 | % | | | 11 | % |

See Notes to the Financial Statements

Notes to the Financial Statements

June 30, 2021

1. ORGANIZATION

Managed Portfolio Series (the “Trust”) was organized as a Delaware statutory trust on January 27, 2011. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The LK Balanced Fund (the “Fund”) is a diversified series with its own investment objectives and policies within the Trust. The investment objective of the Fund is long-term capital appreciation and current income. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies. Prior to July 1, 2012, the Fund’s investment adviser managed a limited partnership with an investment objective and investment policies that were, in all material respects, equivalent to those of the Fund. The limited partnership, which incepted on December 31, 1986, converted into, and the Fund commenced operations in the Trust on, July 1, 2012. The Fund currently offers one class, the Institutional Class. The Fund may issue an unlimited number of shares of beneficial interest, with no par value.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Security Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3.

Federal Income Taxes – The Fund complies with the requirements of subchapter M of the Internal Revenue Code of 1986, as amended, necessary to qualify as a regulated investment company and distributes substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income tax provision is required. As of and during the year ended June 30, 2021, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. As of and during the year ended June 30, 2021, the Fund did not have liabilities for any unrecognized tax benefits. The Fund is not subject to examination by U.S. tax authorities for tax years prior to the year ended June 30, 2018.

Security Transactions, Income, and Distributions – The Fund follows industry practice and records security transactions on the trade date. Realized gains and losses on sales of securities are calculated on the basis of identified cost. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities using the constant yield method.

The Fund distributes substantially all net investment income, if any, and net realized capital gains, if any, annually. Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. For the year ended June 30, 2021, no such reclassifications were needed.

Notes to the Financial Statements – Continued

June 30, 2021

Allocation of Expenses – Expenses associated with a specific fund in the Trust are charged to that fund. Common Trust expenses are typically allocated evenly between funds of the Trust, or by other equitable means.

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

3. SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the period and expanded disclosure of valuation Levels for major security types. These inputs are summarized in the three broad Levels listed below:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Short-Term Investments – Investments in other mutual funds, including money market funds, are valued at their net asset value per share. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Equity Securities – Equity securities, including common stocks, preferred stocks, exchange traded funds (“ETF”s) and real estate investment trusts (“REIT”s), that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and ask prices. Securities traded primarily in the Nasdaq Global Market System for which market quotations are readily available are valued using the Nasdaq Official Closing Price (“NOCP”). If the NOCP is not available, such securities are valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Fixed Income Securities – Fixed income securities, including asset-backed, corporate, mortgage-backed, municipal bonds, and U.S. government & agency securities, are valued at fair value on the basis of valuations furnished by an independent pricing service which utilizes both dealer-supplied valuations and formula-based

Notes to the Financial Statements – Continued

June 30, 2021

techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. Fixed income securities are categorized in Level 2 of the fair value hierarchy.

Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued following procedures approved by the Board of Trustees (the “Board”). These procedures consider many factors, including the type of security, size of holding, trading volume and news events. There can be no assurance that the Fund could obtain the fair value assigned to a security if it were to sell the security at approximately the time at which the Fund determines its net asset values per share. The Board has established a Valuation Committee to administer, implement, and oversee the fair valuation process, and to make fair value decisions when necessary. The Board regularly reviews reports of the Valuation Committee that describe any fair value determinations and methods.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s securities as of June 30, 2021:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 22,131,464 | | | $ | — | | | $ | — | | | $ | 22,131,464 | |

| Corporate Bonds | | | — | | | | 5,899,371 | | | | — | | | | 5,899,371 | |

| Exchange Traded Funds | | | 1,508,790 | | | | — | | | | — | | | | 1,508,790 | |

| Municipal Bond | | | — | | | | 551,611 | | | | — | | | | 551,611 | |

| Short-Term Investment | | | 224,763 | | | | — | | | | — | | | | 224,763 | |

| Total Investments in Securities | | $ | 23,865,017 | | | $ | 6,450,982 | | | $ | — | | | $ | 30,315,999 | |

Refer to the Schedule of Investments for further information on the classification of investments.

4. INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Trust has an agreement with Lawson Kroeker Investment Management, Inc. (the “Adviser”) to furnish investment advisory services to the Fund. Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is entitled to receive an annual advisory fee equal to 0.75% of the Fund’s average daily net assets on a monthly basis.

The Fund’s Adviser has contractually agreed to waive its management fees and pay Fund expenses, in order to ensure that Total Annual Operating Expenses (excluding acquired fund fees and expenses, leverage/borrowing interest, interest expense, taxes, brokerage commissions and extraordinary expenses) do not exceed 1.00% of the Fund’s average daily net assets. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of thirty-six months following the date on which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and the expense limit in effect at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite in term and cannot be terminated within a year after the effective date of the Fund’s Prospectus. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board or the Adviser, with the consent of the Board. Waived fees and reimbursed expenses subject to potential recovery by month of expiration are as follows:

Expiration | Amount | |

| July 2021 – June 2022 | $101,524 | |

| July 2022 – June 2023 | $120,701 | |

| July 2023 – June 2024 | $133,920 | |

Notes to the Financial Statements – Continued

June 30, 2021

U.S. Bancorp Fund Services, LLC (the “Administrator”), doing business as U.S. Bank Global Fund Services, acts as the Fund’s Administrator, Transfer Agent, and Fund Accountant. U.S. Bank N.A. (the “Custodian”) serves as the Custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s Custodian; coordinates the payment of the Fund’s expenses and reviews the Fund’s expense accruals. The officers of the Trust, including the Chief Compliance Officer, are employees of the Administrator. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums. Fees incurred by the Fund for administration and accounting, transfer agency, custody and chief compliance officer services for the year ended June 30, 2021, are disclosed in the Statement of Operations.

5. CAPITAL SHARE TRANSACTIONS

Transactions in shares of the Fund were as follows:

| | | Year Ended | | | Year Ended | |

| | | June 30, 2021 | | | June 30, 2020 | |

Shares sold | | | 11,068 | | | | 84,854 | |

Shares issued to holders in reinvestment of dividends | | | 30,691 | | | | 17,426 | |

Shares redeemed | | | (55,183 | ) | | | (166,911 | ) |

Net decrease in shares outstanding | | | (13,424 | ) | | | (64,631 | ) |

6. INVESTMENT TRANSACTIONS

The aggregate purchases and sales, excluding short-term investments, by the Fund for the year ended June 30, 2021, were as follows:

| U.S. Government Securities | | Other Securities | |

Purchases | Sales | | Purchases | Sales | |

| $ — | $ — | | $5,798,502 | $5,205,951 | |

7. FEDERAL TAX INFORMATION

The aggregate gross unrealized appreciation and depreciation of securities held by the Fund and the total cost of securities for federal income tax purposes at June 30, 2021, were as follows:

| Aggregate Gross | Aggregate Gross | | Federal Income | |

| Appreciation | Depreciation | Net Appreciation | Tax Cost | |

| $12,977,766 | $(421,020) | $12,556,746 | $17,759,253 | |

At June 30, 2021, components of distributable earnings on a tax-basis were as follows:

| Undistributed | Undistributed | | Total | |

| Ordinary | Long-Term | Net | Distributable | |

| Income | Capital Gains | Appreciation | Earnings | |

| $192,880 | $2,195,961 | $12,556,746 | $14,945,587 | |

Notes to the Financial Statements – Continued

June 30, 2021

As of June 30, 2021, the Fund did not have any capital loss carryovers. A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital, and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31 and December 31, respectively. For the taxable year ended June 30, 2021, the Fund did not defer, on a tax basis, any qualified late year losses.

The tax character of distributions paid during the year ended June 30, 2021, were as follows:

| Ordinary Income* | Long-Term Capital Gains | Total | |

| $259,600 | $1,268,848 | $1,528,448 | |

The tax character of distributions paid during the year ended June 30, 2020, were as follows:

| Ordinary Income* | Long-Term Capital Gains** | Total | |

| $355,927 | $527,885 | $883,812 | |

* For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income.

8. RECENT ACCOUNTING PRONOUNCEMENT

In December 2020, the SEC adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes requirements for determining fair value in good faith for purposes of the 1940 Act. Rule 2a-5 will permit fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other conditions. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the 1940 Act and the threshold for determining whether a fund must fair value a security. In connection with Rule 2a-5, the SEC also adopted related recordkeeping requirements and is rescinding previously issued guidance, including with respect to the role of a board in determining fair value and the accounting and auditing of fund investments. The Fund’s will be required to comply with the rules by September 8, 2022. Management is currently assessing the potential impact of the new rules on the Fund’s financial statements.

9. COVID-19

The global outbreak of COVID-19 (commonly referred to as “coronavirus”) has disrupted economic markets and the prolonged economic impact is uncertain. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn adversely affect the value and liquidity of the Fund’s investments, impair the Fund’s ability to satisfy redemption requests, and negatively impact the Fund’s performance.

10. SUBSEQUENT EVENT

The Fund’s distributor is Quasar, a wholly-owned broker-dealer subsidiary of Foreside Financial Group, LLC (“Foreside”). On July 7, 2021, Foreside announced that it had entered into a definitive purchase and sale agreement with Genstar Capital (“Genstar”) such that Genstar would acquire a majority stake in Foreside. The transaction is expected to close at the end of the third quarter of 2021. Quasar will remain the Fund’s distributor at the close of the transaction, subject to Board approval.

Report of Independent Registered Public Accounting Firm

To the Shareholders of LK Balanced Fund and

Board of Trustees of Managed Portfolio Series

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of LK Balanced Fund (the “Fund”), a series of Managed Portfolio Series, as of June 30, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of June 30, 2021, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2021, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2012.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

August 27, 2021

Additional Information (Unaudited)

June 30, 2021

APPROVAL OF INVESTMENT ADVISORY AGREEMENT – Lawson Kroeker Investment Management, Inc.

At the regular meeting of the Board of Trustees of Managed Portfolio Series (“Trust”) on February 23-24, 2021, the Trust’s Board of Trustees (“Board”), each of whom were present virtually via video conference, including all of the Trustees who are not “interested persons” of the Trust, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended, (“Independent Trustees”) considered and approved the continuation of the Investment Advisory Agreement between the Trust and Lawson Kroeker Investment Management, Inc. (“LK” or the “Adviser”) regarding the LK Balanced Fund (the “Fund”) (the “Investment Advisory Agreement”) for another annual term.

Prior to the meeting and at a meeting held on January 6, 2021, the Trustees received and considered information from LK and the Trust’s administrator designed to provide the Trustees with the information necessary to evaluate the continuance of the Investment Advisory Agreement (“Support Materials”). Before voting to approve the continuance of the Investment Advisory Agreement, the Trustees reviewed the Support Materials with Trust management and with counsel to the Independent Trustees, and received a memorandum from such counsel discussing the legal standards for the Trustees’ consideration of the renewal of the Investment Advisory Agreement. This information, together with the information provided to the Board throughout the course of the year, formed the primary (but not exclusive) basis for the Board’s determinations.

In determining whether to continue the Investment Advisory Agreement, the Trustees considered all factors they believed relevant, including the following with respect to the Fund: (1) the nature, extent, and quality of the services provided by LK with respect to the Fund; (2) the Fund’s historical performance and the performance of other investment accounts managed by LK; (3) the costs of the services provided by LK and the profits realized by LK from services rendered to the Fund; (4) comparative fee and expense data for the Fund and other investment companies with similar investment objectives; (5) the extent to which economies of scale may be realized as the Fund grows, and whether the advisory fee for the Fund reflects such economies of scale for the Fund’s benefit; and (6) other benefits to LK resulting from its relationship with the Fund. In their deliberations, the Trustees weighed to varying degrees the importance of the information provided to them, and did not identify any particular information that was all-important or controlling.

Based upon the information provided to the Board throughout the course of the year, including at a telephonic presentation by a representative of LK, and the Support Materials, the Board concluded that the overall arrangements between the Trust and LK set forth in the Investment Advisory Agreement continue to be fair and reasonable in light of the services that LK performs, the investment advisory fees that the Fund pays and such other matters as the Trustees considered relevant in the exercise of their reasonable business judgment. The material factors and conclusions that formed the basis of the Trustees’ determination to approve the continuation of the Investment Advisory Agreement are summarized below.

Nature, Extent and Quality of Services Provided. The Trustees considered the scope of services that LK provides under the Investment Advisory Agreement, noting that such services include, but are not limited to, the following: (1) investing the Fund’s assets consistent with the Fund’s investment objective and investment policies; (2) determining the portfolio securities to be purchased, sold or otherwise disposed of and the timing of such transactions; (3) voting all proxies, if any, with respect to the Fund’s portfolio securities; (4) maintaining the required books and records for transactions that LK effects on behalf of the Fund; (5) selecting broker-dealers to execute orders on behalf of the Fund; and (6) monitoring and maintaining the Fund’s compliance with policies and procedures of the Trust and with applicable securities laws. The Trustees noted the investment philosophy of the

Additional Information (Unaudited) – Continued

June 30, 2021

portfolio managers and their significant investment and portfolio management experience. The Trustees also considered LK’s capitalization and its assets under management. In that regard, the Trustees determined that LK had sufficient resources to support the management of the Fund. The Trustees concluded that they were satisfied with the nature, extent and quality of services provided by LK to the Fund pursuant to the Investment Advisory Agreement.

Fund Historical Performance and the Overall Performance of LK. In assessing the quality of the portfolio management delivered by LK, the Trustees reviewed the short-term and long-term performance of the Fund on both an absolute basis and in comparison to appropriate benchmark indices, the Fund’s peer funds according to Morningstar classifications, and the composite of separate accounts that LK manages utilizing a similar investment strategy as that of the Fund. When reviewing the Fund’s performance against its Morningstar peer group, the Trustees took into account that the investment objective and strategies of the Fund, as well as its level of risk tolerance, may differ significantly from funds in the peer group. The Trustees noted that the Fund underperformed its peer group median and average over the year-to-date, one-year, three-year, five-year and ten-year periods ended October 31, 2020. The Trustees also noted that the Fund underperformed its benchmark S&P 500 Index across all periods but outperformed its secondary benchmark over the five-year and ten-year periods ended October 31, 2020. The Trustees also considered that the Fund has provided shareholders with positive absolute returns over the three-year, five-year and ten-year periods ended October 31, 2020. The Trustees then observed that the Fund’s performance was generally consistent with the performance of a composite of similar accounts managed by LK over all relevant time periods, but that in certain periods the Fund’s performance diverged from the composite due to variations in asset holdings or tax status of the composite accounts.

Cost of Advisory Services and Profitability. The Trustees considered the annual advisory fee that the Fund pays to LK under the Investment Advisory Agreement, as well as LK’s profitability from services that LK rendered to the Fund during the 12-month period ended September 30, 2020. The Trustees also considered the effect of an expense limitation agreement on LK’s compensation and that LK has contractually agreed to reduce its advisory fees and, if necessary, reimburse the Fund for operating expenses, as specified in the Fund’s prospectus. In that regard, the Trustees observed that LK had waived a portion of its management fee during the one-year period ended September 30, 2020. The Trustees also noted that while the management fees LK charges to separately managed accounts with similar investment strategies and asset levels as those of the Fund may be above or below the advisory fee for the Fund, LK has additional responsibilities with respect to the Fund which include more frequent trading and cash management stemming from the Fund’s daily subscriptions and redemptions, additional compliance and shareholder servicing obligations, and the preparation of Board and shareholder materials, that justify a higher fee. The Trustees concluded that LK’s service relationship with the Fund has not been profitable.

Comparative Fee and Expense Data. The Trustees considered a comparative analysis of contractual expenses borne by the Fund and those of funds within the same Morningstar peer group. The Trustees noted the Fund’s management fee was higher than the peer group median and average. They also considered that the total expenses of the Fund (after waivers and expense reimbursements) were higher than the peer group median and average, but that the average net assets of funds comprising the peer group were significantly higher than the assets of the Fund. The Trustees also took into account that the advisory fees and total expenses (after waivers and expense reimbursements) borne by the Fund were well within the range of that borne by funds in the peer group and that when the peer group was limited to similarly-sized Funds, the Fund’s management fee and total expenses were equal to the peer group median and above the average. While recognizing that it is difficult to compare advisory fees because the scope of advisory services provided may vary from one investment adviser to another, the Trustees concluded that LK’s advisory fee continues to be reasonable.

Additional Information (Unaudited) – Continued

June 30, 2021

Economies of Scale. The Trustees considered whether the Fund may benefit from any economies of scale, noting that the investment advisory fee for the Fund does not contain breakpoints. The Trustees noted that given current asset levels, it was not necessary to consider the implementation of fee breakpoints at the present time, but agreed to revisit the issue in the future as circumstances change and asset levels increase. The Trustees also considered that LK had agreed to consider breakpoints in the future in response to asset growth.

Other Benefits. The Trustees considered the direct and indirect benefits that could be realized by the Adviser from its relationship with the Fund. The Trustees considered the extent to which LK utilizes soft dollar arrangements with respect to portfolio transactions. The Trustees also took into account that LK does not use affiliated brokers to execute the Fund’s portfolio transactions. The Trustees considered that LK may receive some form of reputational benefit from services rendered to the Fund, but that any such benefits are difficult to accurately quantify. The Trustees concluded that LK does not receive additional material benefits from its relationship with the Fund.

Additional Information (Unaudited) – Continued

June 30, 2021

STATEMENT REGARDING THE FUND’S LIQUIDITY RISK MANAGEMENT PROGRAM

Pursuant to Rule 22e-4 under the Investment Company Act of 1940, the Trust, on behalf of the LK Balanced Fund (the “Fund”), has adopted and implemented a written liquidity risk management program (the “Program”) that includes policies and procedures reasonably designed to comply with the requirements of Rule 22e-4, including: (i) assessment, management and periodic review of liquidity risk; (ii) classification of portfolio holdings; (iii) establishment of a highly liquid investment minimum (“HLIM”), as applicable; (iv) limitation on illiquid investments; and (v) redemptions in-kind. The Trust’s Board of Trustees (the “Board”) has approved the designation of Lawson Kroeker Investment Management Inc. (“LK”) as the administrator of the Program (the “Program Administrator”). Personnel of LK or its affiliates conduct the day-to-day operation of the Program pursuant to policies and procedures administered by the Program Administrator.

In accordance with Rule 22e-4, the Board reviewed a report prepared by the Program Administrator (the “Report”) regarding the operation of the Program and its adequacy and effectiveness of implementation for the period January 1, 2020, through December 31, 2020 (the “Reporting Period”). No significant liquidity events impacting the Fund during the Reporting Period or material changes to the Program were noted in the Report.

Under the Program, LK manages and periodically reviews the Fund’s liquidity risk, including consideration of applicable factors specified in Rule 22e-4 and the Program. Liquidity risk is defined as the risk that the Fund could not meet shareholder redemption requests without significant dilution of remaining shareholders’ interests in the Fund. In general, this risk was managed during the Reporting Period by monitoring the degree of liquidity of the Fund’s investments, limiting the amount of the Fund’s illiquid investments, and utilizing various risk management tools and facilities available to the Fund for meeting shareholder redemptions, among other means. In the Report, LK provided its assessment that, based on the information considered in its review, the Program remains reasonably designed to manage the Fund’s liquidity risk and the Fund’ s investment strategy remains appropriate for an open-end fund.

Pursuant to the Program, the Program Administrator oversaw the classification of each of the Fund’s portfolio investments as highly liquid, moderately liquid, less liquid or illiquid during the Reporting Period, including in connection with recording investment classifications on Form N-PORT. LK’s process of determining the degree of liquidity of the Fund’s investments is supported by one or more third-party liquidity assessment vendors.

The Fund qualified as a “primarily highly liquid fund” as defined in the Program during the Reporting Period. Accordingly, the Fund was not required to establish a HLIM or comply with the related Program provisions during the Reporting Period.

During the Reporting Period, the Fund’s investments were monitored for compliance with the 15% limitation on illiquid investments pursuant to the Program and in accordance with Rule 22e-4.

The Report noted that the Fund did not effect redemptions in-kind during the Reporting Period pursuant to the Program. The Report concluded: (i) the Program was implemented and operated effectively to achieve the goal of assessing and managing the Fund’s liquidity risk during the Reporting Period; and (ii) the Fund was able to meet requests for redemption without significant dilution of remaining investors’ interests in the Fund during the Reporting Period.

Additional Information (Unaudited) – Continued

June 30, 2021

TRUSTEES AND OFFICERS

| | | | Number of | | Other |

| | | Term of | Portfolios | | Directorships |

| Name, | Position(s) | Office and | in Trust | | Held by Trustee |

| Address and | Held with | Length of | Overseen | Principal Occupation(s) | During the |

Year of Birth | the Trust | Time Served | by Trustee | During the Past Five Years | Past Five Years |

| | | | | | |

| Independent Trustees | | | | | |

| | | | | | |

Leonard M. Rush, CPA | Chairman | Indefinite | 33 | Retired, Chief Financial Officer, | Independent |

615 E. Michigan St. | and Audit | Term; Since | | Robert W. Baird & Co. Incorporated | Trustee, ETF |

Milwaukee, WI 53202 | Committee | April 2011 | | (2000-2011). | Series Solutions |

Year of Birth: 1946 | Chairman | | | | (47 Portfolios) |

| | | | | | (2012-present) |

| | | | | | |

David A. Massart | Trustee | Indefinite | 33 | Co-Founder and Chief Investment | Independent |

615 E. Michigan St. | | Term; Since | | Strategist, Next Generation Wealth | Trustee, ETF |

Milwaukee, WI 53202 | | April 2011 | | Management, Inc. (2005-present). | Series Solutions |

Year of Birth: 1967 | | | | | (47 Portfolios) |

| | | | | | (2012-present) |

Additional Information (Unaudited) – Continued

June 30, 2021

| | | | Number of | | Other |

| | | Term of | Portfolios | | Directorships |

| Name, | Position(s) | Office and | in Trust | | Held by Trustee |

| Address and | Held with | Length of | Overseen | Principal Occupation(s) | During the |

Year of Birth | the Trust | Time Served | by Trustee | During the Past Five Years | Past Five Years |

| | | | | | |

David M. Swanson | Trustee | Indefinite | 33 | Founder and Managing Principal, | Independent |

615 E. Michigan St. | and | Term; Since | | SwanDog Strategic Marketing, LLC | Trustee, ALPS |

Milwaukee, WI 53202 | Nominating | April 2011 | | (2006-present). Executive Vice | Variable |

Year of Birth: 1957 | & Governance | | | President, Calamos Investments | Investment Trust |

| | Committee | | | (2004-2006). | (7 Portfolios) |

| | Chairman | | | | (2006-present); |

| | | | | | RiverNorth Funds |

| | | | | | (3 Portfolios) |

| | | | | | (2018-present); |

| | | | | | RiverNorth |

| | | | | | Managed |

| | | | | | Duration |

| | | | | | Municipal Income |

| | | | | | Fund Inc. |

| | | | | | (1 Portfolio) |

| | | | | | (2019-present); |

| | | | | | RiverNorth |

| | | | | | Specialty Finance |

| | | | | | Corporation |

| | | | | | (1 Portfolio) |

| | | | | | (2018-present); |

| | | | | | RiverNorth/ |

| | | | | | DoubleLine |

| | | | | | Strategic |

| | | | | | Opportunity Fund, |

| | | | | | Inc. (1 Portfolio) |

| | | | | | (2018-present); |

| | | | | | RiverNorth |

| | | | | | Opportunities |

| | | | | | Fund, Inc. |

| | | | | | (1 Portfolio) |

| | | | | | (2015-present); |

| | | | | | RiverNorth |

| | | | | | Opportunistic |

| | | | | | Municipal Income |

| | | | | | Fund, Inc. |

| | | | | | (1 Portfolio) |

| | | | | | (2018-present); |

| | | | | | RiverNorth |

| | | | | | Flexible Municipal |

| | | | | | Income Fund |

| | | | | | (2020-present) |

Additional Information (Unaudited) – Continued

June 30, 2021

| | | | Number of | | Other |

| | | Term of | Portfolios | | Directorships |

| Name, | Position(s) | Office and | in Trust | | Held by Trustee |

| Address and | Held with | Length of | Overseen | Principal Occupation(s) | During the |

Year of Birth | the Trust | Time Served | by Trustee | During the Past Five Years | Past Five Years |

| | | | | | |

Robert J. Kern* | Trustee | Indefinite | 33 | Retired (2018-present); | None |

615 E. Michigan St. | | Term; Since | | Executive Vice President, | |

Milwaukee, WI 53202 | | January 2011 | | U.S. Bancorp Fund Services, | |

Year of Birth: 1958 | | | | LLC (1994-2018). | |

| | | | | | |

| Officers | | | | | |

Brian R. Wiedmeyer | President | Indefinite | N/A | Vice President, U.S. Bancorp Fund | N/A |

615 E. Michigan St. | and | Term, Since | | Services, LLC (2005-present). | |

Milwaukee, WI 53202 | Principal | November | | | |

Year of Birth: 1973 | Executive | 2018 | | | |

| | Officer | | | | |

| | | | | | |

Deborah Ward | Vice | Indefinite | N/A | Senior Vice President, U.S. | N/A |

615 E. Michigan St. | President, | Term; Since | | Bancorp Fund Services, LLC | |

Milwaukee, WI 53202 | Chief | April 2013 | | (2004-present). | |

Year of Birth: 1966 | Compliance | | | | |

| | Officer and | | | | |

| | Anti-Money | | | | |

| | Laundering | | | | |

| | Officer | | | | |

| | | | | | |

Benjamin Eirich | Treasurer, | Indefinite | N/A | Assistant Vice President, U.S. | N/A |

615 E. Michigan St. | Principal | Term; Since | | Bancorp Fund Services, LLC | |

Milwaukee, WI 53202 | Financial | August 2019 | | (2008-present). | |

Year of Birth: 1981 | Officer and | (Treasurer); | | | |

| | Vice | Since | | | |

| | President | November | | | |

| | | 2018 | | | |

| | | (Vice | | | |

| | | President) | | | |

| | | | | | |

Joseph Destache | Secretary | Indefinite | N/A | Assistant Vice President, U.S. | N/A |

615 E. Michigan St. | | Term; Since | | Bancorp Fund Services, LLC | |

Milwaukee, WI 53202 | | March 2021 | | (2019-present); Regulatory | |

Year of Birth: 1991 | | | | Administration Intern, U.S. | |

| | | | | Bancorp Fund Services, LLC | |

| | | | | (2018-2019); Law Student | |

| | | | | (2016-2019). | |

* Mr. Kern became an Independent Trustee on July 6, 2020. Previously, he was an Interested Trustee.

Additional Information (Unaudited) – Continued

June 30, 2021

| | | | Number of | | Other |

| | | Term of | Portfolios | | Directorships |

| Name, | Position(s) | Office and | in Trust | | Held by Trustee |

| Address and | Held with | Length of | Overseen | Principal Occupation(s) | During the |

Year of Birth | the Trust | Time Served | by Trustee | During the Past Five Years | Past Five Years |

| | | | | | |

Douglas Schafer | Vice | Indefinite | N/A | Assistant Vice President, U.S. | N/A |

615 E. Michigan St. | President | Term; Since | | Bancorp Fund Services, LLC | |

Milwaukee, WI 53202 | and | May 2016 | | (2002-present). | |

Year of Birth: 1970 | Assistant | (Assistant | | | |

| | Treasurer | Treasurer); | | | |

| | | Since | | | |

| | | November | | | |

| | | 2018 | | | |

| | | (Vice | | | |

| | | President) | | | |

| | | | | | |

Michael J. Cyr II, CPA | Assistant | Indefinite | N/A | Assistant Vice President, U.S. | N/A |

615 E. Michigan St. | Treasurer | Term; Since | | Bancorp Fund Services, LLC | |

Milwaukee, WI 53202 | and Vice | August 2019 | | (2013-present). | |

Year of Birth: 1992 | President | | | | |

Additional Information (Unaudited) – Continued

June 30, 2021

AVAILABILITY OF FUND PORTFOLIO INFORMATION

The Fund files complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Part F of Form N-PORT. The Fund’s Part F of Form N-PORT is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. For information on the Public Reference Room call 1-800-SEC-0330. In addition, the Fund’s Part F of Form N-PORT is available without charge upon request by calling 1-855-698-1378.

AVAILABILITY OF PROXY VOTING INFORMATION

A description of the Fund’s Proxy Voting Policies and Procedures is available without charge, upon request, by calling 1-855-698-1378. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (1) without charge, upon request, by calling 1-888-621-9258, or (2) on the SEC’s website at www.sec.gov.

QUALIFIED DIVIDEND INCOME/DIVIDENDS RECEIVED DEDUCTION

For the fiscal year ended June 30, 2021, certain dividends paid by the Fund may be reported as qualified dividend income and may be eligible for taxation at capital gain rates. The percentage of dividends declared from ordinary income designated as qualified dividend income was 97.99% for the Fund. For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal year ended June 30, 2021 was 89.45% for the Fund. The percentage of taxable ordinary income distributions designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(c) was 0.00%.

Privacy Notice (Unaudited)

The Fund collects only relevant information about you that the law allows or requires it to have in order to conduct its business and properly service you. The Fund collects financial and personal information about you (“Personal Information”) directly (e.g., information on account applications and other forms, such as your name, address, and social security number, and information provided to access account information or conduct account transactions online, such as password, account number, e-mail address, and alternate telephone number), and indirectly (e.g., information about your transactions with us, such as transaction amounts, account balance and account holdings).

The Fund does not disclose any non-public personal information about its shareholders or former shareholders other than for everyday business purposes such as to process a transaction, service an account, respond to court orders and legal investigations or as otherwise permitted by law. Third parties that may receive this information include companies that provide transfer agency, technology and administrative services to the Fund, as well as the Fund’s investment adviser who is an affiliate of the Fund. If you maintain a retirement/educational custodial account directly with the Fund, we may also disclose your Personal Information to the custodian for that account for shareholder servicing purposes. The Fund limits access to your Personal Information provided to unaffiliated third parties to information necessary to carry out their assigned responsibilities to the Fund. All shareholder records will be disposed of in accordance with applicable law. The Fund maintains physical, electronic and procedural safeguards to protect your Personal Information and requires its third-party service providers with access to such information to treat your Personal Information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, credit union, bank or trust company, the privacy policy of your financial intermediary governs how your non-public personal information is shared with unaffiliated third parties.

INVESTMENT ADVISER

Lawson Kroeker Investment Management, Inc.

1926 South 67th Street, Suite 201

Omaha, NE 68106

DISTRIBUTOR

Quasar Distributors, LLC

111 East Kilbourn Avenue, Suite 2200

Milwaukee, WI 53202

CUSTODIAN

U.S. Bank N.A.

1555 North Rivercenter Drive, Suite 202

Milwaukee, WI 53212

ADMINISTRATOR, FUND ACCOUNTANT

AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

342 North Water Street, Suite 830

Milwaukee, WI 53202

LEGAL COUNSEL

Stradley Ronon Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103

This report should be accompanied or preceded by a prospectus.

The Fund’s Statement of Additional Information contains additional information about the

Fund’s trustees and is available without charge upon request by calling 1-855-698-1378.

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer and principal financial officer. The Registrant has not made any substantive amendments to its code of ethics during the period covered by this report.

The Registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the Registrant’s code of ethics that applies to the Registrant’s principal executive officer and principal financial officer is filed herewith.

Item 3. Audit Committee Financial Expert.

The Registrant’s Board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Leonard M. Rush is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The Registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the Registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning; including reviewing the Funds’ tax returns and distribution calculations. There were no “other services” provided by the principal accountant. For the fiscal years ended June 30, 2021, and June 30, 2020, the Funds’ principal accountant was Cohen & Company, Ltd. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 6/30/2021 | FYE 6/30/2020 |

Audit Fees | $16,000 | $15,500 |

Audit-Related Fees | $0 | $0 |

Tax Fees | $3,500 | $3,000 |

All Other Fees | $0 | $0 |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre‑approve all audit and non‑audit services of the Registrant, including services provided to any entity affiliated with the Registrant.

The percentage of fees billed by Cohen & Company, Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement was as follows:

| | FYE 6/30/2021 | FYE 6/30/2020 |

Audit-Related Fees | 0% | 0% |

Tax Fees | 0% | 0% |

All Other Fees | 0% | 0% |

All of the principal accountant’s hours spent on auditing the Registrant’s financial statements were attributed to work performed by full‑time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the Registrant’s accountant for services to the Registrant and to the Registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

Non-Audit Related Fees | FYE 6/30/2021 | FYE 6/30/2020 |

Registrant | $0 | $0 |

Registrant’s Investment Adviser | $0 | $0 |