| | Olstein |

| | All Cap Value Fund |

| | |

| | Olstein |

| | Strategic Opportunities Fund |

| | |

| | |

| | |

| | |

| | |

| | ANNUAL REPORT |

| | |

| | JUNE 30, 2021 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |  |

| | |

| | The Olstein Funds |

CONTENTS

| | 3 | | Letters to Shareholders |

| | | | |

| | | | |

| | 17 | | Value of $10,000 Investment |

| | | | |

| | | | |

| | 23 | | Expense Examples |

| | | | |

| | | | |

| | 26 | | Schedules of Investments |

| | | | |

| | | | |

| | 36 | | Statements of Assets |

| | | | and Liabilities |

| | | | |

| | | | |

| | 38 | | Statements of Operations |

| | | | |

| | | | |

| | 40 | | Statements of Changes |

| | | | in Net Assets |

| | | | |

| | | | |

| | 44 | | Financial Highlights |

| | | | |

| | | | |

| | 50 | | Notes to Financial Statements |

| | | | |

| | | | |

| | 62 | | Report of Independent |

| | | | Registered Public Accounting Firm |

| | | | |

| | | | |

| | 63 | | Additional Information |

OLSTEIN FUNDS

Letter to Shareholders

DEAR FELLOW SHAREHOLDERS:

THE OLSTEIN ALL CAP VALUE FUND PERFORMANCE

For the twelve-month reporting period ended June 30, 2021, Advisor Class shares of the Olstein All Cap Value Fund appreciated 61.49%, Class C shares (load waived) appreciated 59.89% and Class A shares (load waived) appreciated 61.15%. During the same twelve-month period, the Russell 3000 Value Index appreciated 45.40% and the Russell 3000 Index appreciated 44.16%.1

THE MARKET

The Olstein Funds’ most recent fiscal year, which ended on June 30, 2021, was extraordinary by any measure. The fiscal year began with equity markets continuing their dramatic rebound from one of the steepest declines in history and an economy digging its way out of a recession caused by the onset of the global COVID-19 pandemic. The fiscal year ended with equity markets reaching all-time highs – both the S&P 500 and Dow Jones Industrial Average indices continued to set all-time closing highs during the final quarter of the Funds’ fiscal year – and a strengthening economic recovery fueled by the extraordinary scope of fiscal stimulus and the rapid development and rollout of highly effective vaccines to combat the spread of the COVID-19 virus.

1 | The performance data quoted represents past performance and does not guarantee future results. The Olstein All Cap Value Fund’s Class C average annual return for the one-year, five-year, and ten-year periods ended 6/30/21, assuming reinvestment of dividends and capital gain distributions and deduction of the Olstein All Cap Value Fund’s maximum CDSC of 1% during the one-year period, was 58.89%, 13.97%, and 11.32%, respectively. Per the Fund’s prospectus dated 10/28/20, the expense ratio for the Olstein All Cap Value Fund Class C was 2.15%. Performance and expense ratios for other share classes will vary due to differences in sales charge structure and class expenses. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. To obtain performance data current to the most recent month end, please go to our website at www.olsteinfunds.com. |

As a result of the sharp rebound in the market’s fortunes over the past twelve months, many investors are once again nervous about the prospect of slower economic growth restraining future equity returns. While the COVID-19 pandemic continues to pose global economic challenges, the market should continue to reward companies that practiced sound capital management throughout the crisis. Although discounts have narrowed during the past year, we are finding that the latest pessimism surrounding the Delta variant is again creating potential opportunities in companies which meet our criteria for investing.

OUR STRATEGIES

The portfolios of the Olstein All Cap Value Fund and Olstein Strategic Opportunities Fund consist of companies that we believe have sustainable competitive advantages, discernible balance sheet strength, management teams that emphasize decisions based on cost of capital calculations and deploy free cash flow to create value. We remain focused on individual companies, their operations, and prospects for maintaining or growing sustainable free cash flow. Our analysts and portfolio managers focus on looking behind the numbers of financial statements (10K’s, 10Q’s, shareholder letters, footnotes, etc.) looking for conservative or aggressive accounting assumptions or non-recurring items which we believe are causing the investing public to misread a company’s future ability to generate future free cash flow, and thus its value. Material undervaluation often occurs during periods of negative market psychology, or where there is over speculation and concentration in a limited group of rapidly growing companies where stock prices are advancing rapidly, which causes selling in more mature companies in order to raise funds to participate in the new bonanza. In addition, at times specific well-respected companies or industries can face temporary issues which cause over reactions by investors seeking instant gratification, creating additional potential under valuation opportunities. We are constantly screening our financial resources for new ideas. As long-term value investors, we recognize that companies generating sustainable free cash flow are generally well positioned to compete profitably during both favorable and challenging economic environments and can continue to build value during economic slowdowns.

In the recent strong pandemic rally, we were able to build a material cash position as we sold securities which had strong rallies and whose prices reached either full valuation or no longer offered the risk-reward ratio that we seek when investing in a stock. However, the recent fears of a market pullback have again created opportunities to invest in solid companies where we believe that our estimates of future free cash flows are not being properly valued by the market. Our cash position is slowly being re-employed. Our

timing is paying what we believe to be the right price, which creates favorable risk-reward ratios. We pay little attention to stock market forecasters, earnings beats and misses, or predictions of individual companies’ short-term stock movements based on short-term thinking. We continue to employ the same strategy now as we have since the Funds’ inception. We invite our shareholders to examine the Olstein All Cap Value Fund’s long-term performance table illustrated at the end of this letter.

PORTFOLIO REVIEW

At June 30, 2021, the Olstein All Cap Value Fund portfolio consisted of 86 holdings with an average weighted market capitalization of $165.49 billion. During the twelve-month reporting period, the Fund initiated positions in thirteen companies and eliminated its holdings in fifteen companies.

Positions initiated during the past fiscal year include: CBRE Group, Inc., Jones Lang LaSalle, Incorporated., Keurig Dr Pepper Inc, Kimberly-Clark Corporation, L3Harris Technologies, LKQ Corporation, Quest Diagnostics Incorporated, Reynolds Consumer Products, Southwest Airlines Co., SS&C Technologies, Inc., Stanley Black & Decker, Inc., The Timken Company and Winnebago Industries, Inc.

During the reporting period, the All Cap Value Fund sold its holdings in Aptiv plc, Caterpillar Inc., Danaher Corporation, DuPont de Nemours, Inc., Eaton Corporation plc, The Greenbrier Companies, Hologic, Inc., Ingersoll Rand, Inc., Littelfuse, Inc., Middleby Corp., Regal Beloit Corporation, SeaWorld Entertainment Inc., Snap-on Incorporated, Thermo Fisher Scientific, and Zebra Technologies Corporation as the stock price of each of these companies reached our valuation. We should note that many of the stocks in the portfolio rose significantly during the reporting period, which, given the Fund’s strict sell discipline triggered the liquidation of fourteen of the Fund’s holdings that reached or exceeded our value. In fact, seven of the above companies – Aptiv, DuPont, The Greenbrier Companies, Ingersoll Rand, Middleby, SeaWorld Entertainment, and Zebra Technologies increased approximately fifty percent or more in value during the reporting period. The Fund eliminated its position in Chevron Corporation as we lost confidence that the company’s free cash flow projections would support our valuation.

Our Leaders

The Olstein All Cap Value Fund’s leading performers for the twelve-month reporting period ended June 30, 2021, included: Generac Holdings Inc., Tapestry, Inc., Kulicke and Soffa Industries, Inc., WESCO International, Inc., and Invesco Ltd. We should note that, over the course of the fiscal year, the stock price of each of these companies increased more than 150%. At the close of the fiscal year the Fund continued to maintain positions in all five of these companies.

Our Laggards

Laggards during the twelve-month reporting period included: Chevron Corporation, Baxter International Inc., Intel Corporation, Kimberly-Clark and The Timken Company. Given the Fund’s strong investment performance for the fiscal year, it is important to note that the stock price of only three of these companies, Chevron, Baxter and Intel, decreased while the stock prices of Kimberly-Clark and Timken increased slightly over the past twelve months. At the close of the reporting period the All Cap Value Fund maintained positions in Baxter International Inc., Intel Corporation, Kimberly-Clark and The Timken Company. As previously discussed, the Fund eliminated its position in Chevron Corporation during the reporting period.

THE OLSTEIN STRATEGIC OPPORTUNITIES FUND

For the twelve-month reporting period ended June 30, 2021, Adviser Class shares of the Strategic Opportunities Fund appreciated 81.22%; Class A shares (load waived) appreciated 80.84% and Class C shares (load waived) appreciated 79.36%. The Fund’s primary benchmark, the Russell 2500® Value Index, appreciated 63.23% and the Fund’s secondary benchmark, Russell 2500® Index appreciated 57.79%, during the same period.2

PORTFOLIO REVIEW

As of June 30, 2021, the Olstein Strategic Opportunities Fund portfolio consisted of 43 holdings with an average weighted market capitalization of $6.91 billion. During the reporting period, the Fund initiated positions in twelve companies and eliminated nine holdings. The Fund initiated positions in Brady Corporation, Gates Industrial Corporation, Graham Corporation, Intelligent Systems Corporation, Johnson Outdoors Inc., Jones Lang LaSalle Incorporated, Kontoor Brands, Mohawk Industries, Inc., Reynolds Consumer Products, The Timken Company, UFP Technologies, Inc., and Winnebago Industries, Inc.

The Fund sold its holdings in AGCO Corporation, The Greenbrier Companies, Ingersoll Rand, Littelfuse, Inc., Middleby Corp., NOW Inc., Regal Beloit Corporation, SeaWorld Entertainment Inc., and Zebra Technologies Corporation as each company’s stock price reached or exceeded our valuation. Given the Fund’s strong investment returns over the fiscal year, many of the stocks in the portfolio rose significantly. In fact, six of the nine companies liquidated from the Fund’s portfolio — AGCO, The Greenbrier Companies, Ingersoll Rand, Middleby, SeaWorld Entertainment, and Zebra Technologies — appreciated approximately fifty percent or more during the reporting period.

2 | The performance data quoted represents past performance and does not guarantee future results. The Olstein Strategic Opportunities Fund Class C return as of 6/30/21 for the one-year, five-year, and ten-year periods, assuming deduction of the maximum Class C contingent deferred sales charge of 1% during the one-year period, was 78.36%, 14.42% and 10.92%, respectively. Per the Fund’s 10/28/20 prospectus, the gross expense ratio for the Class C share was 2.55% and the net expense ratio was 2.35%. The Adviser has contractually agreed to waive certain fees/expenses until October 28, 2021. Performance would have been lower without waivers in effect. Expense ratios for other share classes will vary. Performance for other share classes will vary due to differences in sales charge structure and class expenses. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. To obtain performance data current to the most recent month end, please visit our website at www.olsteinfunds.com. |

Our Leaders

Leading performers for the twelve-month reporting period include: Generac Holdings Inc., Tapestry, Inc., Kulicke and Soffa Industries, Inc., WESCO International, Inc., and Invesco Ltd. We should note that, over the course of the fiscal year, the stock price of each of these companies increased more than 150%. At the close of the fiscal year the Fund continued to maintain positions in all five of these companies.

Our Laggards

Laggards during the twelve-month reporting period include: Johnson Outdoors Inc., Intelligent Systems Corp., Regal Beloit Company, Gates Industrial Corp. and Littelfuse Inc. It is important to note that due the Fund’s strong investment performance for the fiscal year, only two of the Fund’s “laggards” depreciated in value during the reporting period – Johnson Outdoors and Intelligent Systems Corp. We should also note that both of these laggards are recent additions to the Fund’s portfolio. Johnson Outdoors was added to the portfolio in March 2021 and Intelligent Systems Corp was added to in July 2020. We took advantage of price volatility to build a meaningful initial position in each name and will continue to monitor each company’s progress relative to our investment thesis.

The other three “laggards,” Regal Beloit Company, Gates Industrial Corp. and Littelfuse Inc. all increased in value, with our holdings in Regal Beloit appreciating approximately 11%, Gates Industrial appreciating approximately 17% and Littelfuse appreciating approximately 21% during the reporting period. At the close of the fiscal year the Strategic Opportunities Fund maintained positions in Johnson Outdoors Inc., Intelligent Systems Corp., Gates Industrial Corp. and Littelfuse Inc. As previously discussed, the Fund liquidated its holding in Regal Beloit Corporation.

Positioning for the Future

For the past twelve months we initiated positions or increased holdings in companies that we believed were unfairly penalized by the market in reaction to short-term fundamental problems or were being ignored by the investing public seeking “lottery type” returns. However, in our opinion, those holdings had unique business models, strong balance sheets, and the ability to withstand a recession and were selling at material discounts to our determination of private market value.

Over the course of the fiscal year, we eliminated twenty-six holdings between our two Funds, with the overwhelming majority of those sold companies performing extremely well to reach our valuation levels. With the proceeds from the sales, we invested in new ideas, initiating positions in

twenty-five companies between our two Funds over the past year. The significant number of liquidations and addition of new ideas to the Funds was not only due to the extraordinary performance of both Funds but also necessary to, in our opinion, best position the portfolios for success during the next phase of the economic recovery.

FOCUSING ON QUALITY

As the economic recovery continues to unfold, however uneven that may be, we continue to focus on identifying high-quality companies. We define high-quality companies as those with unique business models, and strong balance sheets led by management teams with a proven track record of deploying cash to the benefit shareholders. For us, quality is found in thoughtful growth initiatives and sensible capital spending that emphasizes returns on invested capital, increased free cash flow and conservative balance sheets, all of which can act as a hedge against short-term problems if they occur.

Our persistent focus on free cash flow not only guides our search for such high-quality companies, but it also informs and directs our investment analysis and company valuation processes as well. By focusing on a company’s ability to generate free cash flow we understand its competitive advantages, the economic reality and profit drivers of its businesses, and the capabilities of its management. Most importantly, our emphasis on quality, specifically the quality of a company’s earnings, allows us to make more reliable estimates of a company’s future free cash flow and thus, a more reliable estimate of its intrinsic value. We define the “Quality of Earnings” as the economic realism of a company’s financial statements to reflect a true picture of a company’s current operations.

While determining a company’s ability to generate free cash flow is an extremely important part of gauging a company’s potential for capital appreciation, assessing how management has historically used free cash flow to benefit shareholders also becomes a critical part of identifying high-quality investment opportunities. We assess whether management has consistently used free cash flow to enhance the company’s financial strength by improving the balance sheet or reducing debt levels. We determine if management has a proven track record of reinvesting in the business at suitable rates of return on investment or returning free cash to investors through increased dividends or share buybacks. Our assessment of management actions provides an invaluable context for our valuation models. On the other hand, we do not visit or talk to management about future estimates but rather, rely on our own analyses after performing a forensic review of company financial statements.

As we have said many times before, free cash flow is the lifeblood of a business and companies that generate sustainable excess cash flow have the potential to enhance shareholder value by increasing dividend payments,

repurchasing company shares, reducing outstanding debt, and engaging in strategic acquisitions. In addition, sustainable free cash flow companies also attract other companies to propose takeovers, joint ventures or other strategic value raising proposals. Since inception in late 1995 our Funds have experienced over 40 companies acquired at value raising premiums. For us, superior investment opportunities are found in companies that generate sustainable excess cash flow; and are led by managements who use that excess cash in ways that will increase shareholder value and that we can buy at a significant discount to our determination of their intrinsic value.

FINAL THOUGHTS

(Investment Practices Over the Past 25 Years have Emphasized Trading Techniques Rather than Long Term Investing Techniques and Needs to be Modernized)

The Olstein All Cap Value Fund celebrated its 25th anniversary (9/21/20) during the current reporting period. We are extremely proud of the investment organization we have built (over 150 years of collective experience in our 7-person research and portfolio management team), and the disciplined application and necessary adjustments to our self-developed looking behind the numbers value investment process.

During the Olstein All Cap Value Fund’s over twenty-five year life, significant events have disrupted and adversely affected equity markets, including, but certainly not limited to: the Asian financial crisis in 1997; the Russian financial crisis in 1998; the bursting of the Internet bubble in March 2000; the terrorist attacks of September 11, 2001; the corporate accounting scandals of the early 2000s (most notably Enron in 2001 and Tyco International and WorldCom, both in 2002); the global financial crisis of 2007-08 culminating in the collapse of Lehman Brothers in September 2008; the ensuing Great Recession, the infamous Bernie Madoff Ponzi Scheme of 2008; the prolonged European sovereign debt crisis between 2008 and 2012; the May 2010 “Flash Crash;” the fiscal cliff/debt ceiling crisis in 2011; the Brexit vote of 2016 and, most recently, the COVID-19 pandemic.

Despite these and other market disrupting events since the Olstein All Cap Fund’s inception on September 21,1995, through June 30, 2021, a hypothetical $10,000 investment in the Olstein All Cap Value Fund (Class C, load waived) has appreciated to $132,404, after all fees. We manage the Fund to achieve absolute returns after considering risk. However, for comparison purposes, over the same period a $10,000 investment in the Russell 3000 Value Index (the All Cap Fund’s primary benchmark) accumulated to $103,465, while a $10,000 investment during the same time period in the S&P 500 Index (generally considered a broad market benchmark) appreciated to $120,057.

In our opinion, attempts to trade in and out of our Funds based on reactions to gloom and doom forecasts by analysts and the media, or reactions to the Funds’ periods of underperformance is a loser’s game and shows a lack of understanding how markets and crowd behavior operate, and why that lack of understanding by much of the investing public can increase the probability of the Funds achieving their investment objectives.

Our Funds are managed for long-term investors (3–5-year holders) who seek to make money over time rather than all of the time and realize the risks of treating investments as if they are overnight winning lottery tickets. We have yet to see an investment strategy that always works and doesn’t disappoint investors at times. Even “no lose” Bernie Madoff finally disappointed investors after 20 years of producing fake reports. It is hard to believe that so many sophisticated investors believed the scheme and believed that 15% returns were possible with no down months over a 20-year period. If something seems too good to be true, it usually is!

Our brand of value investing assumes there will be periods of disappointing performance at times. Periods of underperformance usually occur when there is a disconnect between intrinsic values based on our assessment of a company’s normalized ability to produce future free cash flow and stock prices. For example, disconnects can occur when only a small segment of so called “growth” stocks are working and producing returns for a small segment of funds. Many investors are like lemmings. They forget the fundamentals and sell good companies to raise funds to participate in the frenzy, and thus good companies can fall to attractive prices creating discounts having little to do with fundamentals. Extreme market negativity could be created by health issues like the recent pandemic, as well as political issues, extreme economic forecasts, or interest rate changes, and create overreactions to the prices of great companies. Extreme negativity can create massive feeding frenzies for value investors with patience who believe that large discounts have been created in companies whose future normalized free cash flow are on sale. However, turning a battleship takes time and patience is often required to realize these potential values. It is during these periods that we seize upon the opportunity to separate companies which, in our opinion, are being wrongfully punished from other companies which were overvalued and coming back to earth. Individual companies also experience problems at times which are real, but we believe are temporary, and we purchase these companies to take advantage of the undervaluation. To repeat, our timing is based on buying good companies at what we believe to be the right price and that usually occurs when there are clouds (negative market psychology, temporary fundamental issues affecting a company or an industry, or perhaps missing a quarterly estimate which has little to do with a company’s long-term ability to produce normalized free cash flow). The quarterly

estimate game has developed over many years and is an obsession having little to do with long-term valuations. As previously stated, our Funds are managed for success over the long-term rather than instantaneous gratification. In general market timers and stock timers who are successful can produce high returns, but the probability of being successful is low and the risk of failure (which destroys capital) is high. We have yet to find a professed market timer who has been able to time the market with enough consistency to profit therefrom. Our “timing” is paying the right price. We believe the right price on any investment is that price which provides a material discount to a company’s intrinsic value which we calculate by estimating future normalized free cash flow after an exhaustive analysis of a company’s financial statements, footnotes, shareholder releases, etc. We believe long-term above average performance is determined by the number and severity of one’s losses. A large gain does not have the same impact on performance as a large loss does. For example, an 80% gain in one year on a $100,000 investment followed by a 50% loss in year 2 leaves the investor with $90,000, or a 10% loss, and losses destroy capital. Our method of trying to protect against large losses is by paying attention to the prices we pay (look for material discounts from our calculation of intrinsic value) We also require sound balance sheets and realistic financial statements which accurately portray the economic reality of the underlining businesses (we make adjustments when necessary to aggressive assumptions). In addition, we require that companies in our portfolios demonstrate outstanding disclosure of the important facts and assumptions needed to make an informed estimate of future normalized free cash flow which we use to help determine a company’s value.

Another misconception about our Funds are that we do not buy so called “growth” stocks with high P/E ratios and therefore our long-term performance will be less than growth funds. Not only are we agnostic to ever-changing stock market predictions, but we also stick doggedly to valuing companies based on our assessment of normalized future free cash flow. We could care less whether we own a so-called growth stock, value stock, cyclical stock, asset stock or high P/E stock. Our only limitation when purchasing a stock for the portfolio is paying the right price, so that future risk-reward ratios are more in our favor based on our estimate of expected future free cash flow. Our past performance has received contributions from different categories of stocks such as growth, cyclical, high P/E low P/E etc. We can value any kind of company, but our measuring stick is buying a company at a price that results in a discount based on our estimate of future normalized free cash flow. In the past, and not necessarily indicative of future results, the Funds have earned large capital gains in high P/E growth stocks (Apple, Disney, Microsoft, Google, Cisco) because we paid the right price.

We also earned material gains on boring cyclical stocks such as (GM, Generac, Keysight, Citizen’s Financial. etc.) also because we paid the right price. Of course, P/E ratios are lower on cyclical stocks because future free cash flow can be harder to predict, but that doesn’t mean that the potential for gain is not greater for cyclical stocks. We believe growth is not a separate category but a component of valuing a company, and in our opinion, the traditional style box should be updated to deal with modern day realities.

We also believe all the wasted time spent on Wall Street research reports and the media to discuss whether or not a company beats or misses quarterly estimates is similar to the tail wagging the dog. If the analyst accepts management’s estimates, the estimate is now the analyst’s as well. Management should report the quarter and the person valuing the company should make future estimates. Media statements such as “value is in” or “value is out” are nonsense. Value is always important, and we believe that the only alternative to value is overvalued. Are non-value funds over valued funds? Are all growth funds overvalued? We define growth funds as funds that grow their shareholders net asset value over long periods of time. Media and or analyst statements such as “active management is in or out” or “growth stocks will or will not beat value stocks” are ridiculous and are idle random chatter that don’t add anything to investment prowess. In addition, the word “forever” should completely be eliminated from investment literature. Investors and the media take their most recent experiences and cannot see their current experience’s ever changing directions. In essence, whatever is happening now is “forever” and it matters little whether the trends are positive or negative. Selfishly we hope that the concept “forever” is never eliminated from investment thinking because that thought process helps produces the values we seek to execute our investment philosophy.

In conclusion, we believe that attempts to utilize trading strategies when investing in products with longer-term investment strategies has a high probability of producing lower returns. Our experience is that most of our gains occur in short periods of time right after periods of negativity and being out of the market during those periods can materially lower long term returns.

We value your trust and invest our own money alongside our shareholders. We look forward to the future!

Sincerely,

|  |

| Robert A. Olstein | Eric R. Heyman |

| Chairman and Chief Investment Officer | Co-Portfolio Manager |

The following chart illustrates the growth, on a quarterly basis, of a hypothetical $10,000 investment made in the Olstein All Cap Value Fund’s Class C share at the Olstein All Cap Value Fund’s inception date of September 21, 1995 (with dividends and capital gain distributions reinvested but no deduction of taxes on reinvested distributions—see important disclosures below):

(UNAUDITED)

| | | Value of Shares | |

| | | Owned, If Initial | |

| | | Investment | |

| | Date

| was $10,000 | |

| | 9/21/95 | |

| $10,000 | | |

| | 9/30/95 | | | 10,010 | | |

| | 12/31/95 | | | 10,261 | | |

| | 3/31/96 | | | 10,882 | | |

| | 6/30/96 | | | 11,462 | | |

| | 9/30/96 | | | 11,713 | | |

| | 12/31/96 | | | 12,760 | | |

| | 3/31/97 | | | 13,327 | | |

| | 6/30/97 | | | 14,602 | | |

| | 9/30/97 | | | 17,250 | | |

| | 12/31/97 | | | 17,205 | | |

| | 3/31/98 | | | 19,851 | | |

| | 6/30/98 | | | 18,468 | | |

| | 9/30/98 | | | 15,499 | | |

| | 12/31/98 | | | 19,788 | | |

| | 3/31/99 | | | 20,717 | | |

| | 6/30/99 | | | 25,365 | | |

| | 9/30/99 | | | 23,675 | | |

| | 12/31/99 | | | 26,692 | | |

| | 3/31/00 | | | 28,170 | | |

| | 6/30/00 | | | 28,899 | | |

| | 9/30/00 | | | 30,596 | | |

| | 12/31/00 | | | 30,142 | | |

| | 3/31/01 | | | 30,207 | | |

| | 6/30/01 | | | 36,192 | | |

| | 9/30/01 | | | 28,213 | | |

| | 12/31/01 | | | 35,340 | | |

| | 3/31/02 | | | 38,259 | | |

| | 6/30/02 | | | 33,797 | | |

| | 9/30/02 | | | 25,870 | | |

| | 12/31/02 | | | 28,528 | | |

| | 3/31/03 | | | 26,226 | | |

| | 6/30/03 | | | 31,448 | | |

| | 9/30/03 | | | 33,797 | | |

| | 12/31/03 | | | 38,853 | | |

| | 3/31/04 | |

| 40,870 | | |

| | 6/30/04 | | | 41,297 | | |

| | 9/30/04 | | | 39,043 | | |

| | 12/31/04 | | | 43,146 | | |

| | 3/31/05 | | | 42,640 | | |

| | 6/30/05 | | | 42,302 | | |

| | 9/30/05 | | | 43,749 | | |

| | 12/31/05 | | | 44,350 | | |

| | 3/31/06 | | | 46,566 | | |

| | 6/30/06 | | | 44,241 | | |

| | 9/30/06 | | | 46,836 | | |

| | 12/31/06 | | | 50,755 | | |

| | 3/31/07 | | | 51,863 | | |

| | 6/30/07 | | | 55,536 | | |

| | 9/30/07 | | | 53,029 | | |

| | 12/31/07 | | | 49,012 | | |

| | 3/31/08 | | | 42,447 | | |

| | 6/30/08 | | | 40,189 | | |

| | 9/30/08 | | | 38,452 | | |

| | 12/31/08 | | | 27,545 | | |

| | 3/31/09 | | | 24,767 | | |

| | 6/30/09 | | | 30,102 | | |

| | 9/30/09 | | | 35,648 | | |

| | 12/31/09 | | | 37,741 | | |

| | 3/31/10 | | | 40,392 | | |

| | 6/30/10 | | | 35,788 | | |

| | 9/30/10 | | | 39,695 | | |

| | 12/31/10 | | | 43,845 | | |

| | 3/31/11 | | | 45,276 | | |

| | 6/30/11 | | | 45,310 | | |

| | 9/30/11 | | | 37,497 | | |

| | 12/31/11 | | | 41,962 | | |

| | 3/31/12 | | | 48,519 | | |

| | 6/30/12 | | | 45,555 | | |

| | 9/30/12 | | | 47,159 | | |

| | 12/31/12 | |

| 48,380 | | |

| | 3/31/13 | | | 54,275 | | |

| | 6/30/13 | | | 56,786 | | |

| | 9/30/13 | | | 60,379 | | |

| | 12/31/13 | | | 65,995 | | |

| | 3/31/14 | | | 66,867 | | |

| | 6/30/14 | | | 69,134 | | |

| | 9/30/14 | | | 69,413 | | |

| | 12/31/14 | | | 75,913 | | |

| | 3/31/15 | | | 77,290 | | |

| | 6/30/15 | | | 75,525 | | |

| | 9/30/15 | | | 66,631 | | |

| | 12/31/15 | | | 68,694 | | |

| | 3/31/16 | | | 70,220 | | |

| | 6/30/16 | | | 68,859 | | |

| | 9/30/16 | | | 73,312 | | |

| | 12/31/16 | | | 76,612 | | |

| | 3/31/17 | | | 80,372 | | |

| | 6/30/17 | | | 82,232 | | |

| | 9/30/17 | | | 82,438 | | |

| | 12/31/17 | | | 87,561 | | |

| | 3/31/18 | | | 86,683 | | |

| | 6/30/18 | | | 86,815 | | |

| | 9/30/18 | | | 91,553 | | |

| | 12/31/18 | | | 77,934 | | |

| | 3/31/19 | | | 87,094 | | |

| | 6/30/19 | | | 91,214 | | |

| | 9/30/19 | | | 91,699 | | |

| | 12/31/19 | | | 99,092 | | |

| | 3/31/20 | | | 67,832 | | |

| | 6/30/20 | | | 82,811 | | |

| | 9/30/20 | | | 89,674 | | |

| | 12/31/20 | | | 109,015 | | |

| | 3/31/21 | | | 126,682 | | |

| | 6/30/21 | | | 132,404 | | |

Details:

The performance data quoted represents past performance and does not guarantee future results. The Olstein All Cap Value Fund’s Class C average annual return for the one-year, five-year, and ten-year periods ended 6/30/21, assuming reinvestment of dividends and capital gain distributions and deduction of the Olstein All Cap Value

Fund’s maximum CDSC of 1% during the one-year period, was 58.89%, 13.97%, and 11.32%, respectively. Per the Fund’s prospectus dated 10/28/20, the expense ratio for the Olstein All Cap Value Fund Class C was 2.15%. Performance and expense ratios for other share classes will vary due to differences in sales charge structure and class expenses. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. To obtain performance data current to the most recent month end, please go to our website at www.olsteinfunds.com.

The above represents the opinion of the Manager and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. The references to securities are not buy or sell recommendations but are intended to be descriptive examples of the Funds’ investment philosophy and are subject to change. Do not make investments based on the securities referenced. A full schedule of Fund holdings as of 6/30/21 is contained in this report and is subject to change. This information should be preceded or accompanied by a current prospectus, which contains more complete information, including investment objectives, risks, charges, and expenses of the Olstein Funds and should be read carefully before investing. A current prospectus may be obtained by calling (800) 799-2113 or visiting the Olstein Funds’ website at www.olsteinfunds.com.

The Olstein Funds follow a value-oriented investment approach. However, a particular value stock may not increase in price as the Investment Manager anticipates and may actually decline in price if other investors fail to recognize the stock’s value or if a catalyst that the Investment Manager believes will increase the price of the stock does not occur or does not affect the price of the stock in the manner or to the degree that the Investment Manager anticipated. Also, the Investment Manager’s calculation of a stock’s private market value involves estimates of future cash flow which may prove to be incorrect and, therefore, could result in sales of the stock at prices lower than the Fund’s original purchase price. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. There is no assurance that the Fund will achieve its investment objective.

Regarding the Olstein Strategic Opportunities Fund, an investment in a portfolio containing small- and mid-cap companies is subject to additional risks, as the share prices of small- and mid-cap companies are often more volatile than those of larger companies due to several factors, including limited trading volumes, products, financial resources, management inexperience and less publicly available information. The activist strategy invests in stocks of underperforming companies and any shareholder activism might not result in a change in performance or corporate governance. These stocks could also experience less liquidity and higher share price and trading volume volatility than stocks of other companies.

The Russell 3000® Index is an unmanaged index that seeks to represent the broad U.S. equity universe accounting for approximately 98% of the U.S. market capitalization. The Russell 3000® Value Index measures the performance of the broad value segment of U.S. equity value universe. It includes those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values. The Russell 3000® Value Index is constructed to provide a comprehensive and unbiased barometer of the broad value market. The S&P 500® Index is an unmanaged index created by Standard & Poor’s Corporation that includes a representative sample of 500 leading companies in leading industries of the U.S. economy and is considered to be a broad-based indicator representing the U.S. stock market performance in general. The Russell 2500® Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as “SMID” cap. The Russell 2500® Index is a subset of the Russell 3000® Index. It includes approximately 2,500 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2500® Value Index measures the performance of the small to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500® companies that are considered more value oriented relative to the overall market as defined by Russell’s leading style methodology. The Russell 2500® Value Index is constructed to provide a comprehensive and unbiased barometer of the small to mid-cap value market. Past performance does not guarantee future results. Index returns do not reflect payment of any expenses, fees or sales charges an investor would pay to purchase the securities the Index represents. Such costs would lower performance. One cannot invest directly in an index. Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business. At the most fundamental level, a company’s ability to create value for shareholders is determined by its ability to generate positive cash flows, or more specifically, maximize long-term free cash flow. Free cash flow represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital from the balance sheet. The price-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings. The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. It is widely followed indicator of the stock market in general.

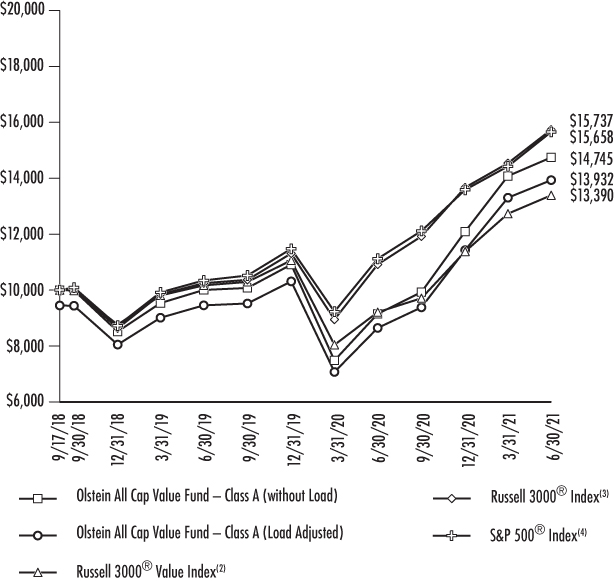

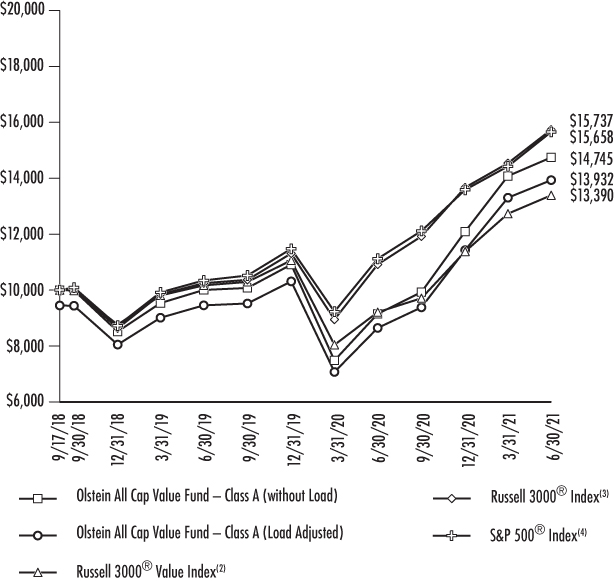

Value of $10,000 Investment (Unaudited)

Comparison of the Change in Value of a Hypothetical $10,000 Investment from the Fund’s Class A shares from Inception through the Fiscal Year End of June 30, 2021. The returns listed in the table do not reflect the deduction of taxes on reinvested dividends.

Average Annual Rate of Return For Periods Ended June 30, 2021 |

| | 1 Year | Inception(5) |

Olstein All Cap Value Fund – Class A (without Load)(1) | 61.15% | 14.97% |

Olstein All Cap Value Fund – Class A (Load Adjusted)(1) | 52.26% | 12.65% |

Russell 3000® Value Index(2) | 45.40% | 11.06% |

Russell 3000® Index(3) | 44.16% | 17.69% |

S&P 500® Index(4) | 40.79% | 17.48% |

| (1) | Assumes reinvestment of dividends and capital gains. Reflects the effect of the maximum sale load charge of 5.50% in load adjusted return. Past performance is not necessarily indicative of future results. Investment returns and principal values may fluctuate, so that, when redeemed, shares may be worth more or less than their original cost. |

| (2) | The Russell 3000® Value Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (3) | The Russell 3000® Index reflects the broad U.S. equity universe and represents approximately 98% of the U.S. market. The Russell 3000® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (4) | The S&P 500® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investment in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (5) | Commenced operations on September 17, 2018. |

| OLSTEIN ALL CAP VALUE FUND |

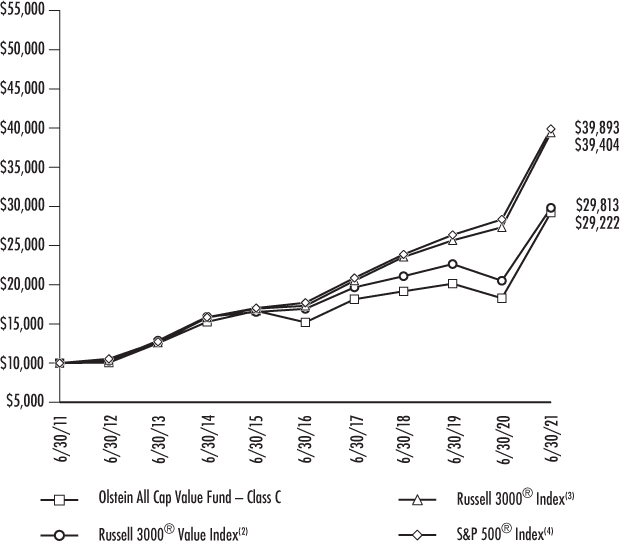

Value of $10,000 Investment (Unaudited)

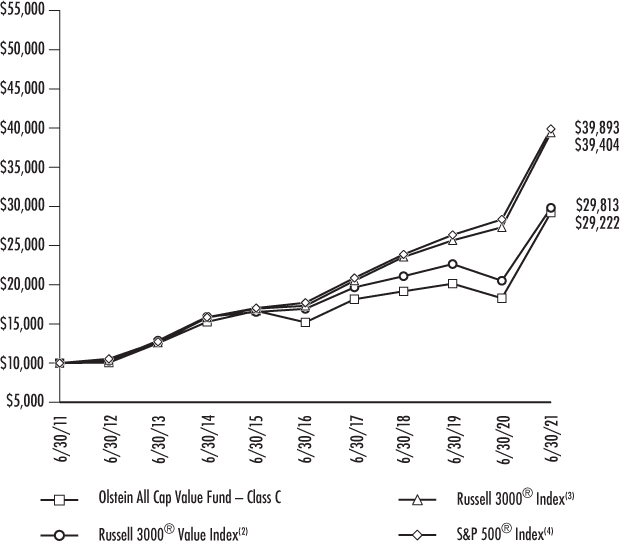

Comparison of the Change in Value of a Hypothetical $10,000 Investment in the Fund’s Class C shares for the past 10 years through the Fiscal Year End of June 30, 2021. The line chart does not reflect any applicable Contingent Deferred Sales Charge. The returns listed in the table do not reflect the deduction of taxes on reinvested dividends.

Average Annual Rate of Return For Periods Ended June 30, 2021 |

| | 1 Year | 5 Year | 10 Year | 15 Year | Inception(5) |

Olstein All Cap Value – Class C(1) | 58.89% | 13.97% | 11.32% | 7.58% | 10.54% |

Russell 3000® Value Index(2) | 45.40% | 11.99% | 11.54% | 7.99% | 9.47% |

Russell 3000® Index(3) | 44.16% | 17.89% | 14.70% | 10.78% | 10.19% |

S&P 500® Index(4) | 40.79% | 17.65% | 14.84% | 10.73% | 10.12% |

| (1) | Assumes reinvestment of dividends and capital gains. Also includes all expenses at the end of each period and assumes the deduction of the appropriate CDSC of 1% as if an investor had redeemed at the end of the one year period, and thus represents a “net return”. The CDSC is based on the lesser of the original purchase price and the value of such shares at the time of redemption. Past performance is not necessarily indicative of future results. Investment returns and principal values may fluctuate, so that, when redeemed, shares may be worth more or less than their original cost. |

| (2) | The Russell 3000® Value Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expense associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (3) | The Russell 3000® Index reflects the broad U.S. equity universe and represents approximately 98% of the U.S. market. The Russell 3000® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (4) | The S&P 500® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investment in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (5) | Commenced operations on September 21, 1995. |

| OLSTEIN ALL CAP VALUE FUND |

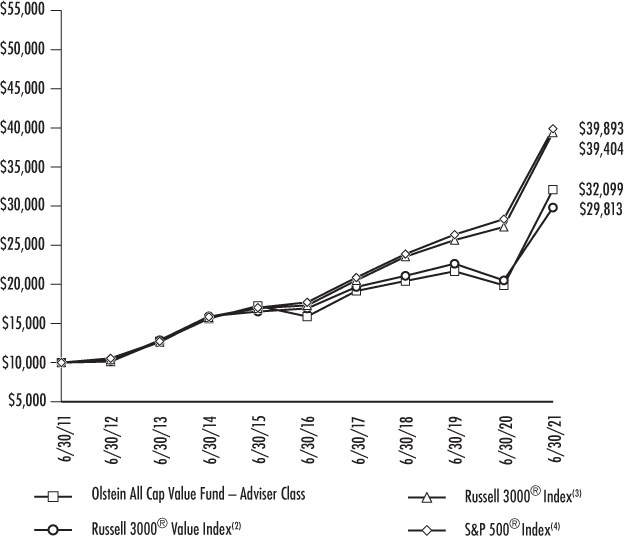

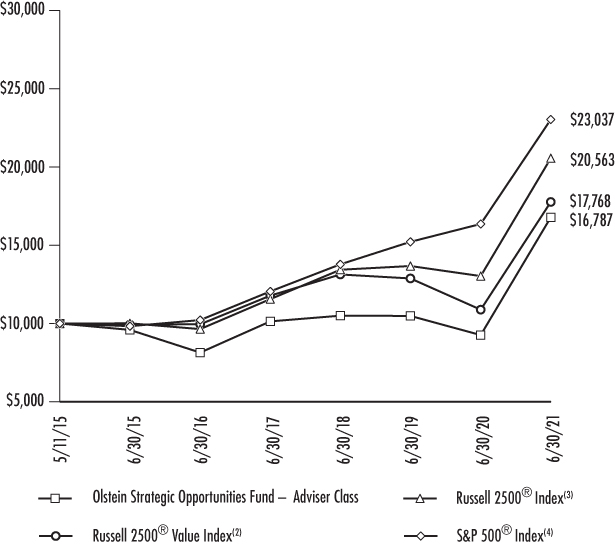

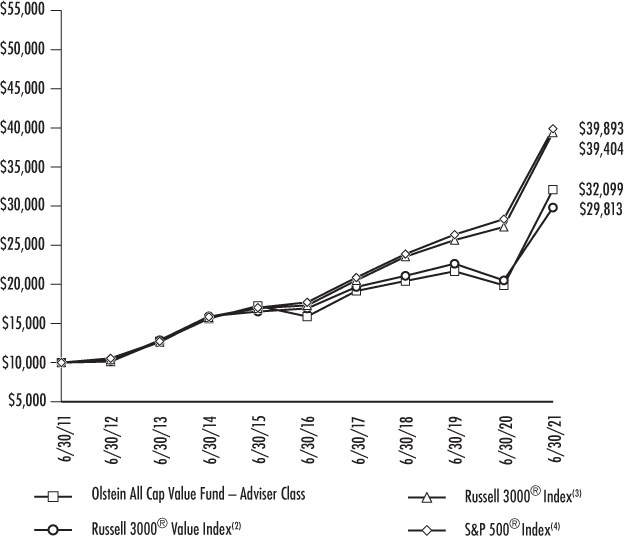

Value of $10,000 Investment (Unaudited)

Comparison of the Change in Value of a Hypothetical $10,000 Investment from the Fund’s Adviser Class shares for the past 10 years through the Fiscal Year End of June 30, 2021. The returns listed in the table do not reflect the deduction of taxes on reinvested dividends.

Average Annual Rate of Return For Periods Ended June 30, 2021 |

| | 1 Year | 5 Year | 10 Year | 15 Year | Inception(5) |

| Olstein All Cap Value Fund – | | | | | |

Adviser Class(1) | 61.49% | 15.10% | 12.37% | 8.53% | 8.94% |

Russell 3000® Value Index(2) | 45.40% | 11.99% | 11.54% | 7.99% | 7.74% |

Russell 3000® Index(3) | 44.16% | 17.89% | 14.70% | 10.78% | 8.13% |

S&P 500® Index(4) | 40.79% | 17.65% | 14.84% | 10.73% | 7.66% |

| (1) | Assumes reinvestment of dividends and capital gains. Also includes all expenses at the end of each period and thus represents a “net return”. Past performance is not necessarily indicative of future results. Investment returns and principal values may fluctuate, so that, when redeemed, shares may be worth more or less than their original cost. |

| (2) | The Russell 3000® Value Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expense associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (3) | The Russell 3000® Index reflects the broad U.S. equity universe and represents approximately 98% of the U.S. market. The Russell 3000® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (4) | The S&P 500® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investment in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (5) | Commenced operations on September 21, 1999. |

| OLSTEIN ALL CAP VALUE FUND |

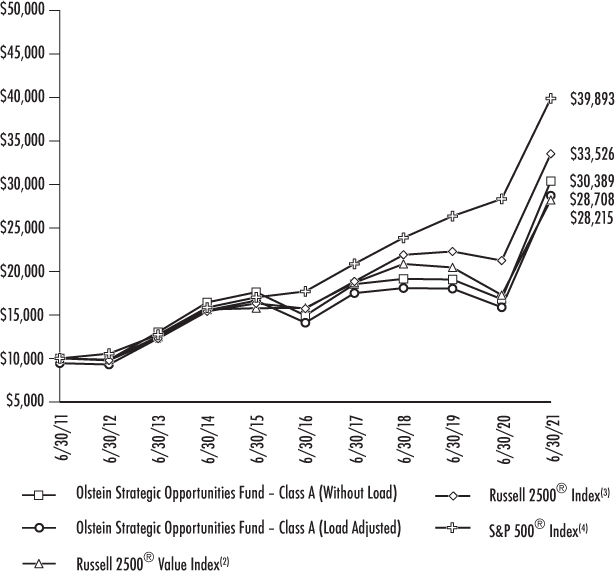

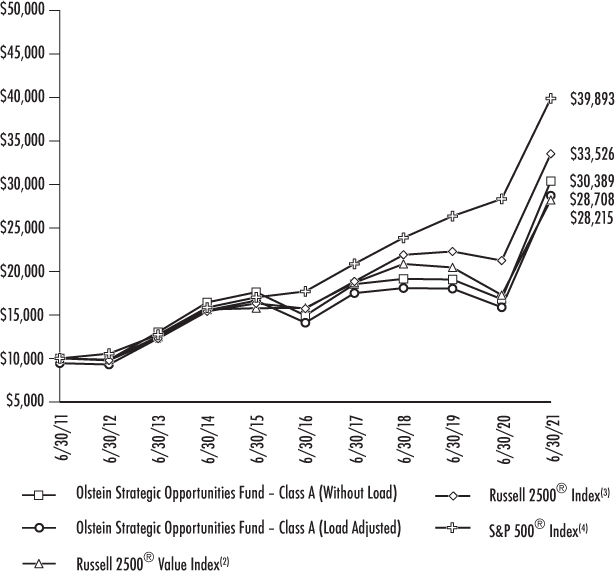

Value of $10,000 Investment (Unaudited)

Comparison of the Change in Value of a Hypothetical $10,000 Investment from the Fund’s Class A shares for the past 10 years through the Fiscal Year End of June 30, 2021. The returns listed in the table do not reflect the deduction of taxes on reinvested dividends.

Average Annual Rate of Return For Periods Ended June 30, 2021 |

| | 1 Year | 5 Year | 10 Year | Inception(5) |

| Olstein Strategic Opportunities Fund – | | | | |

Class A (without Load)(1) | 80.84% | 15.29% | 11.76% | 9.14% |

| Olstein Strategic Opportunities Fund – | | | | |

Class A (Load Adjusted)(1) | 70.94% | 13.99% | 11.12% | 8.72% |

Russell 2500® Value Index(2) | 63.23% | 12.29% | 10.93% | 8.20% |

Russell 2500® Index(3) | 57.79% | 16.35% | 12.86% | 10.21% |

S&P 500® Index(4) | 40.79% | 17.65% | 14.84% | 10.39% |

| (1) | Assumes reinvestment of dividends and capital gains. Reflects the effect of the maximum sale load charge of 5.50% in load adjusted return. Past performance is not necessarily indicative of future results. Investment returns and principal values may fluctuate, so that, when redeemed, shares may be worth more or less than their original cost. |

| (2) | The Russell 2500® Value Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (3) | The Russell 2500® Index measures the performance of the 2,500 smallest companies in the Russell 3000® Index. The Russell 2500® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (4) | S&P 500® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investment in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (5) | Commencement of operation was November 1, 2006. |

| OLSTEIN STRATEGIC OPPORTUNITIES FUND |

Value of $10,000 Investment (Unaudited)

Comparison of the Change in Value of a Hypothetical $10,000 Investment from the Fund’s Class C shares for the past 10 years through the Fiscal Year End of June 30, 2021. The line chart does not reflect any applicable Contingent Deferred Sales Charge. The returns listed in the table do not reflect the deduction of taxes on reinvested dividends.

Average Annual Rate of Return For Periods Ended June 30, 2021 |

| | 1 Year | 5 Year | 10 Year | Inception(5) |

| Olstein Strategic Opportunities Fund – | | | | |

Class C(1) | 78.36% | 14.42% | 10.92% | 8.34% |

Russell 2500® Value Index(2) | 63.23% | 12.29% | 10.93% | 8.20% |

Russell 2500® Index(3) | 57.79% | 16.35% | 12.86% | 10.21% |

S&P 500® Index(4) | 40.79% | 17.65% | 14.84% | 10.39% |

| (1) | Assumes reinvestment of dividends and capital gains. Also includes all expenses at the end of each period and assumes the deduction of the appropriate CDSC of 1% as if an investor had redeemed at the end of the one year period, and thus represents a “net return”. The CDSC is based on the lesser of the original purchase price and the value of such shares at the time of redemption. Past performance is not necessarily indicative of future results. Investment returns and principal values may fluctuate, so that, when redeemed, shares may be worth more or less than their original cost. |

| (2) | The Russell 2500® Value Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (3) | The Russell 2500® Index measures the performance of the 2,500 smallest companies in the Russell 3000® Index. The Russell 2500® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (4) | The S&P 500® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investment in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (5) | Commencement of operation was November 1, 2006. |

| OLSTEIN STRATEGIC OPPORTUNITIES FUND |

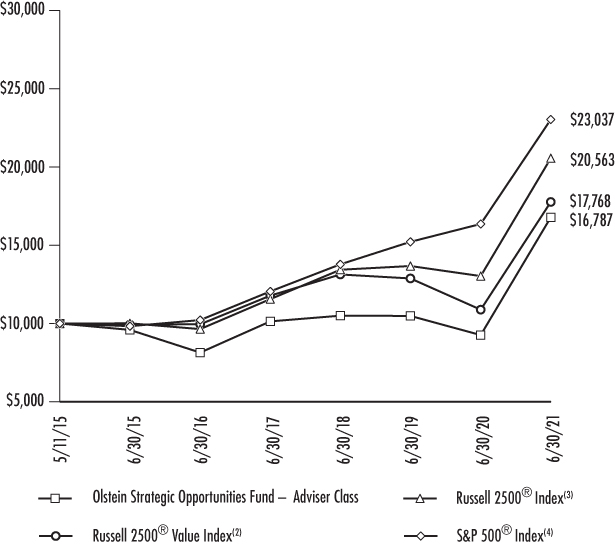

Value of $10,000 Investment (Unaudited)

Comparison of the Change in Value of a Hypothetical $10,000 Investment from the Fund’s Adviser Class shares from Inception through the Fiscal Year End of June 30, 2021. The returns listed in the table do not reflect the deduction of taxes on reinvested dividends.

Average Annual Rate of Return For Periods Ended June 30, 2021 |

| | 1 Year | 3 Year | 5 Year | Inception(5) |

| Olstein Strategic Opportunities Fund – | | | | |

Adviser Class(1) | 81.22% | 16.93% | 15.57% | 8.81% |

Russell 2500® Value Index(2) | 63.23% | 10.60% | 12.29% | 9.82% |

Russell 2500® Index(3) | 57.79% | 15.24% | 16.35% | 12.46% |

S&P 500® Index(4) | 40.79% | 18.67% | 17.65% | 14.57% |

| (1) | Assumes reinvestment of dividends and capital gains. Also include all expense at the end of the period and thus represents a “net return”. Past performance is not necessarily indicative of future results. Investment returns and principal values may fluctuate, so that, when redeemed, shares may be worth more or less than their original cost. |

| (2) | The Russell 2500® Value Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (3) | The Russell 2500® Index measures the performance of the 2,500 smallest companies in the Russell 3000® Index. The Russell 2500® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investments in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (4) | The S&P 500® Index return is adjusted upward to reflect reinvested dividends, but does not reflect the deduction of any fees or expenses associated with investment in the index, and thus represents a “gross return”. One cannot invest directly in an index. |

| (5) | Commencement of operation was May 11, 2015. |

| OLSTEIN STRATEGIC OPPORTUNITIES FUND |

The Olstein Funds

Expense Examples as of June 30, 2021 (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchase and sales of Fund shares, sales loads on purchase payments or contingent deferred sales charges on redemptions, if any, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, interest expense and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2021 – June 30, 2021.

Actual Expenses For each class, the first line of the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes For each class, the second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs may have been higher.

Olstein All Cap Value Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | 1/1/21 | 6/30/21 | 1/1/21 to 6/30/21 |

| Actual | | | |

Class A(2) | $1,000.00 | $1,219.20 | $7.59 |

Class C(2) | $1,000.00 | $1,214.50 | $11.70 |

Adviser Class(2) | $1,000.00 | $1,220.50 | $6.22 |

| Hypothetical (5% annual return | | | |

| before expenses) | | | |

| Class A | $1,000.00 | $1,017.95 | $6.90 |

| Class C | $1,000.00 | $1,014.23 | $10.64 |

| Adviser Class | $1,000.00 | $1,019.19 | $5.66 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.38%, 2.13% and 1.13% for Class A, Class C, and Adviser Class, respectively, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended June 30, 2021 of 21.92%, 21.45%, and 22.05% for the Class A, Class C and the Adviser Class, respectively. |

Olstein Strategic Opportunities Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(3) |

| | 1/1/21 | 6/30/21 | 1/1/21 to 6/30/21 |

| Actual | | | |

Class A(4) | $1,000.00 | $1,238.50 | $8.88 |

Class C(4) | $1,000.00 | $1,234.10 | $13.02 |

Adviser Class(4) | $1,000.00 | $1,240.10 | $7.50 |

| Hypothetical (5% annual return | | | |

| before expenses) | | | |

| Class A | $1,000.00 | $1,016.86 | $8.00 |

| Class C | $1,000.00 | $1,013.14 | $11.73 |

| Adviser Class | $1,000.00 | $1,018.10 | $6.76 |

| (3) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.60%, 2.35% and 1.35% for Class A, Class C, and Adviser Class, respectively, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| (4) | Based on the actual returns for the six-month period ended June 30, 2021 of 23.85%, 23.41%, and 24.01% for the Class��A, Class C and the Adviser Class, respectively. |

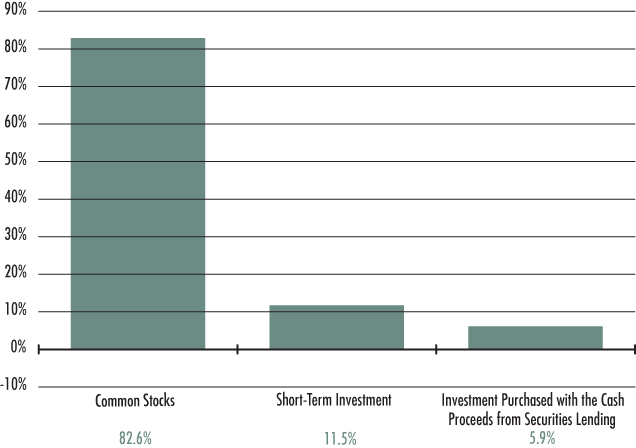

Olstein All Cap Value Fund

Allocation of Portfolio Assets as a percentage of investments

June 30, 2021 (Unaudited)

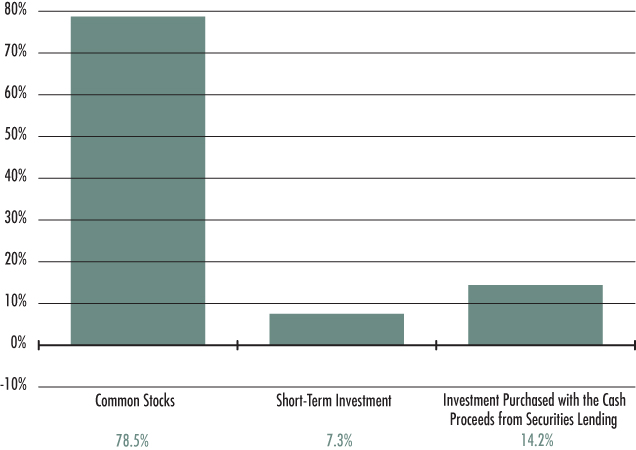

Olstein Strategic Opportunities Fund

Allocation of Portfolio Assets as a percentage of investments

June 30, 2021 (Unaudited)

Olstein All Cap Value Fund

Schedule of Investments as of June 30, 2021

| COMMON STOCKS – 88.2% | | | | | | |

| ADVERTISING AGENCIES – 1.5% | | Shares | | | Value | |

| Omnicom Group, Inc. (a) | | | 140,000 | | | $ | 11,198,600 | |

| | | | | | | | | |

| AEROSPACE & DEFENSE – 2.0% | | | | | | | | |

| L3Harris Technologies, Inc. | | | 39,000 | | | | 8,429,850 | |

| Raytheon Technologies Corporation | | | 77,000 | | | | 6,568,870 | |

| | | | | | | | 14,998,720 | |

| AIR DELIVERY & FREIGHT SERVICES – 2.4% | | | | | | | | |

| FedEx Corporation | | | 33,000 | | | | 9,844,890 | |

| United Parcel Service, Inc. – Class B | | | 39,000 | | | | 8,110,830 | |

| | | | | | | | 17,955,720 | |

| AIRLINES – 2.6% | | | | | | | | |

| Delta Air Lines, Inc. (b) | | | 193,000 | | | | 8,349,180 | |

| JetBlue Airways Corporation (b) | | | 447,000 | | | | 7,500,660 | |

| Southwest Airlines Company (b) | | | 72,000 | | | | 3,822,480 | |

| | | | | | | | 19,672,320 | |

| AUTO MANUFACTURERS – 1.0% | | | | | | | | |

| General Motors Company (b) | | | 129,000 | | | | 7,632,930 | |

| | | | | | | | | |

| AUTOMOBILES – 0.3% | | | | | | | | |

| Winnebago Industries, Inc. (a) | | | 37,550 | | | | 2,551,898 | |

| | | | | | | | | |

| BEVERAGES – 0.6% | | | | | | | | |

| Keurig Dr Pepper, Inc. | | | 124,000 | | | | 4,369,760 | |

| | | | | | | | | |

| BUILDING PRODUCTS – 1.3% | | | | | | | | |

| Carrier Global Corporation | | | 198,000 | | | | 9,622,800 | |

| | | | | | | | | |

| CAPITAL MARKETS – 1.2% | | | | | | | | |

| Goldman Sachs Group, Inc. | | | 24,500 | | | | 9,298,485 | |

| | | | | | | | | |

| CHEMICALS – 1.7% | | | | | | | | |

| Corteva, Inc. | | | 201,000 | | | | 8,914,350 | |

| Eastman Chemical Company | | | 31,000 | | | | 3,619,250 | |

| | | | | | | | 12,533,600 | |

The accompanying notes are an integral part of these financial statements.

| OLSTEIN ALL CAP VALUE FUND |

COMMON STOCKS – 88.2% – continued | | | | | | |

| COMMERCIAL BANKS – 5.6% | | Shares | | | Value | |

| Citizens Financial Group, Inc. | | | 180,750 | | | $ | 8,291,002 | |

| Fifth Third Bancorp (a) | | | 222,000 | | | | 8,487,060 | |

| Prosperity Bancshares, Inc. | | | 68,000 | | | | 4,882,400 | |

| U.S. Bancorp | | | 160,000 | | | | 9,115,200 | |

| Wells Fargo & Company | | | 247,000 | | | | 11,186,630 | |

| | | | | | | | 41,962,292 | |

| COMMERCIAL SERVICES – 1.5% | | | | | | | | |

| Moody’s Corporation | | | 15,500 | | | | 5,616,735 | |

| S&P Global, Inc. (a) | | | 13,500 | | | | 5,541,075 | |

| | | | | | | | 11,157,810 | |

| COMMUNICATIONS EQUIPMENT – 1.8% | | | | | | | | |

| Cisco Systems, Inc. | | | 251,000 | | | | 13,303,000 | |

| | | | | | | | | |

| COMPUTERS – 2.3% | | | | | | | | |

| Apple, Inc. | | | 75,000 | | | | 10,272,000 | |

| Western Digital Corporation (b) | | | 94,000 | | | | 6,689,980 | |

| | | | | | | | 16,961,980 | |

| CONSUMER FINANCE – 3.1% | | | | | | | | |

| American Express Company | | | 34,000 | | | | 5,617,820 | |

| Equifax, Inc. | | | 45,000 | | | | 10,777,950 | |

| Mastercard, Inc. – Class A | | | 7,500 | | | | 2,738,175 | |

| Visa, Inc. – Class A (a) | | | 19,000 | | | | 4,442,580 | |

| | | | | | | | 23,576,525 | |

| CONTAINERS & PACKAGING – 1.0% | | | | | | | | |

| WestRock Company | | | 139,750 | | | | 7,437,495 | |

| | | | | | | | | |

| DISTRIBUTORS – 0.9% | | | | | | | | |

| LKQ Corporation (a)(b) | | | 141,101 | | | | 6,944,991 | |

| | | | | | | | | |

| DIVERSIFIED FINANCIAL SERVICES – 2.6% | | | | | | | | |

| Berkshire Hathaway, Inc. – Class B (b) | | | 32,000 | | | | 8,893,440 | |

| Invesco Ltd. (c) | | | 409,600 | | | | 10,948,608 | |

| | | | | | | | 19,842,048 | |

| E-COMMERCE – 2.0% | | | | | | | | |

| eBay, Inc. | | | 214,000 | | | | 15,024,940 | |

The accompanying notes are an integral part of these financial statements.

| OLSTEIN ALL CAP VALUE FUND |

COMMON STOCKS – 88.2% – continued | | | | | | |

| ELECTRICAL EQUIPMENT – 1.0% | | Shares | | | Value | |

| Generac Holdings, Inc. (b) | | | 18,200 | | | $ | 7,555,730 | |

| | | | | | | | | |

| ELECTRONICS – 2.3% | | | | | | | | |

| Keysight Technologies, Inc. (b) | | | 49,650 | | | | 7,666,456 | |

| Sensata Technologies Holding PLC (b)(c) | | | 173,310 | | | | 10,046,781 | |

| | | | | | | | 17,713,237 | |

| ENERGY EQUIPMENT & SERVICES – 1.0% | | | | | | | | |

| Schlumberger Ltd. (c) | | | 239,000 | | | | 7,650,390 | |

| | | | | | | | | |

| FOOD & DRUG RETAILERS – 4.6% | | | | | | | | |

| CVS Health Corporation | | | 180,000 | | | | 15,019,200 | |

| Walgreens Boots Alliance, Inc. | | | 380,500 | | | | 20,018,105 | |

| | | | | | | | 35,037,305 | |

| HEALTH CARE EQUIPMENT & SUPPLIES – 5.5% | | | | | | | | |

| Baxter International, Inc. | | | 82,000 | | | | 6,601,000 | |

| Becton, Dickinson and Company | | | 47,000 | | | | 11,429,930 | |

| Hologic, Inc. (b) | | | 95,000 | | | | 6,338,400 | |

| Medtronic PLC (c) | | | 71,000 | | | | 8,813,230 | |

| Zimmer Biomet Holdings, Inc. | | | 52,000 | | | | 8,362,640 | |

| | | | | | | | 41,545,200 | |

| HEALTH CARE PROVIDERS & SERVICES – 2.8% | | | | | | | | |

| Quest Diagnostics, Inc. (a) | | | 62,000 | | | | 8,182,140 | |

| UnitedHealth Group, Inc. | | | 18,500 | | | | 7,408,140 | |

| Universal Health Services, Inc. – Class B | | | 37,000 | | | | 5,417,910 | |

| | | | | | | | 21,008,190 | |

| HOTELS, RESTAURANTS & LEISURE – 0.7% | | | | | | | | |

| Booking Holdings, Inc. (b) | | | 2,250 | | | | 4,923,203 | |

| | | | | | | | | |

| HOUSEHOLD DURABLES – 1.1% | | | | | | | | |

| Mohawk Industries, Inc. (b) | | | 44,250 | | | | 8,504,408 | |

| | | | | | | | | |

| HOUSEHOLD PRODUCTS – 1.4% | | | | | | | | |

| Kimberly-Clark Corporation | | | 47,000 | | | | 6,287,660 | |

| Reynolds Consumer Products, Inc. (a) | | | 132,000 | | | | 4,006,200 | |

| | | | | | | | 10,293,860 | |

The accompanying notes are an integral part of these financial statements.

| OLSTEIN ALL CAP VALUE FUND |

COMMON STOCKS – 88.2% – continued | | | | | | |

| INDUSTRIAL EQUIPMENT WHOLESALE – 1.3% | | Shares | | | Value | |

| WESCO International, Inc. (b) | | | 98,000 | | | $ | 10,076,360 | |

| | | | | | | | | |

| INSURANCE – 2.9% | | | | | | | | |

| Aon PLC – Class A (a)(c) | | | 9,000 | | | | 2,148,840 | |

| Marsh & McLennan Companies, Inc. (a) | | | 27,000 | | | | 3,798,360 | |

| Travelers Companies, Inc. | | | 51,000 | | | | 7,635,210 | |

| Willis Towers Watson PLC (c) | | | 36,000 | | | | 8,280,720 | |

| | | | | | | | 21,863,130 | |

| INTERACTIVE MEDIA & SERVICES – 1.4% | | | | | | | | |

| Facebook, Inc. – Class A (b) | | | 30,000 | | | | 10,431,300 | |

| | | | | | | | | |

| INTERNET SOFTWARE & SERVICES – 1.0% | | | | | | | | |

| Alphabet, Inc. – Class C (b) | | | 3,100 | | | | 7,769,592 | |

| | | | | | | | | |

| IT SERVICES – 1.3% | | | | | | | | |

| Accenture PLC – Class A (c) | | | 14,500 | | | | 4,274,455 | |

| Automatic Data Processing, Inc. | | | 29,000 | | | | 5,759,980 | |

| | | | | | | | 10,034,435 | |

| MACHINERY – 2.2% | | | | | | | | |

| Cummins, Inc. | | | 24,000 | | | | 5,851,440 | |

| Stanley Black & Decker, Inc. | | | 28,000 | | | | 5,739,720 | |

| Timken Company | | | 65,750 | | | | 5,298,793 | |

| | | | | | | | 16,889,953 | |

| MATERIALS – 0.7% | | | | | | | | |

| Axalta Coating Systems Ltd. (b)(c) | | | 172,700 | | | | 5,265,623 | |

| | | | | | | | | |

| MEDIA – 6.0% | | | | | | | | |

| Comcast Corporation – Class A | | | 168,000 | | | | 9,579,360 | |

| Discovery, Inc. – Class C (b) | | | 471,600 | | | | 13,666,968 | |

| ViacomCBS, Inc. – Class B | | | 275,000 | | | | 12,430,000 | |

| Walt Disney Company (b) | | | 55,000 | | | | 9,667,350 | |

| | | | | | | | 45,343,678 | |

| MULTILINE RETAIL – 1.0% | | | | | | | | |

| Dollar Tree, Inc. (b) | | | 76,000 | | | | 7,562,000 | |

The accompanying notes are an integral part of these financial statements.

| OLSTEIN ALL CAP VALUE FUND |

COMMON STOCKS – 88.2% – continued | | | | | | |

| PHARMACEUTICALS – 1.4% | | Shares | | | Value | |

| Johnson & Johnson | | | 64,000 | | | $ | 10,543,360 | |

| | | | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT – 1.5% | | | | | | | | |

| CBRE Group, Inc. – Class A (b) | | | 72,000 | | | | 6,172,560 | |

| Jones Lang LaSalle, Inc. (b) | | | 26,450 | | | | 5,169,917 | |

| | | | | | | | 11,342,477 | |

| RESTAURANTS – 3.4% | | | | | | | | |

| Cracker Barrel Old Country Store, Inc. | | | 39,000 | | | | 5,789,940 | |

| Denny’s Corporation (b) | | | 407,770 | | | | 6,724,127 | |

| Dine Brands Global, Inc. (b) | | | 85,850 | | | | 7,662,112 | |

| McDonald’s Corporation | | | 24,000 | | | | 5,543,760 | |

| | | | | | | | 25,719,939 | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT – 3.5% | | | | | | | | |

| Intel Corporation | | | 212,000 | | | | 11,901,680 | |

| Kulicke and Soffa Industries, Inc. (a) | | | 172,000 | | | | 10,526,400 | |

| Texas Instruments, Inc. | | | 20,000 | | | | 3,846,000 | |

| | | | | | | | 26,274,080 | |

| SOFTWARE – 2.5% | | | | | | | | |

| Microsoft Corporation | | | 21,000 | | | | 5,688,900 | |

| Oracle Corporation | | | 68,000 | | | | 5,293,120 | |

| SS&C Technologies Holdings, Inc. | | | 109,000 | | | | 7,854,540 | |

| | | | | | | | 18,836,560 | |

| SPECIALTY RETAIL – 0.7% | | | | | | | | |

| Lowe’s Companies, Inc. | | | 27,000 | | | | 5,237,190 | |

| | | | | | | | | |

| TELECOMMUNICATIONS – 1.3% | | | | | | | | |

| Corning, Inc. | | | 231,700 | | | | 9,476,530 | |

| | | | | | | | | |

| TEXTILES, APPAREL & LUXURY GOODS – 0.3% | | | | | | | | |

| Tapestry, Inc. (b) | | | 56,400 | | | | 2,452,272 | |

| TOTAL COMMON STOCKS (Cost $459,524,902) | | | | | | | 665,395,916 | |

The accompanying notes are an integral part of these financial statements.

| OLSTEIN ALL CAP VALUE FUND |

| SHORT-TERM INVESTMENT – 12.3% | | | | | | |

| MONEY MARKET DEPOSIT ACCOUNT – 12.3% | | Shares | | | Value | |

| U.S. Bank N.A., 0.01% (d) | | | | | | |

| Total Money Market Deposit Account | | | 92,854,217 | | | $ | 92,854,217 | |

| TOTAL SHORT-TERM INVESTMENT (Cost $92,854,217) | | | | | | | 92,854,217 | |

| | | | | | | | | |

| INVESTMENT PURCHASED WITH THE CASH | | | | | | | | |

| PROCEEDS FROM SECURITIES LENDING – 6.3% | | | | | | | | |

| INVESTMENT COMPANY – 6.3% | | | | | | | | |

| Mount Vernon Liquid Assets Portfolio, LLC, 0.10% (e) | | | | | | | | |

| Total Investment Company | | | 47,595,188 | | | | 47,595,188 | |

| TOTAL INVESTMENT PURCHASED WITH THE CASH | | | | | | | | |

| PROCEEDS FROM SECURITIES LENDING (Cost $47,595,188) | | | | | | | 47,595,188 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 106.8% | | | | | | | | |

| (Cost $599,974,307) | | | | | | | 805,845,321 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS – (6.8)% | | | | | | | (51,529,754 | ) |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 754,315,567 | |

| | PLC – Public Limited Company |

| (a) | All or a portion of this security was out on loan at June 30, 2021. Total loaned securities had a value of $46,704,768 at June 30, 2021. |

| (b) | Non-income producing security. |

| (c) | U.S. Dollar-denominated foreign security. |

| (d) | The Money Market Deposit Account (the “MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of June 30, 2021. |

| (e) | The rate quoted is the annualized seven-day yield for the Fund at year end. |

The accompanying notes are an integral part of these financial statements.

| OLSTEIN ALL CAP VALUE FUND |

Olstein Strategic Opportunities Fund

Schedule of Investments as of June 30, 2021

| COMMON STOCKS – 91.7% | | | | | | |

| AIRLINES – 2.5% | | Shares | | | Value | |

| JetBlue Airways Corporation (a) | | | 210,000 | | | $ | 3,523,800 | |

| | | | | | | | | |

| AUTO COMPONENTS – 1.2% | | | | | | | | |

| Miller Industries, Inc. | | | 43,000 | | | | 1,695,920 | |

| | | | | | | | | |

| AUTO MANUFACTURERS – 2.7% | | | | | | | | |

| Blue Bird Corporation (a) | | | 150,000 | | | | 3,729,000 | |

| | | | | | | | | |

| AUTOMOBILES – 1.6% | | | | | | | | |

| Winnebago Industries, Inc. (b) | | | 33,450 | | | | 2,273,262 | |

| | | | | | | | | |

| BANKS – 1.6% | | | | | | | | |

| First Hawaiian, Inc. (b) | | | 77,000 | | | | 2,182,180 | |

| | | | | | | | | |

| COMMERCIAL BANKS – 6.6% | | | | | | | | |

| Citizens Financial Group, Inc. | | | 86,250 | | | | 3,956,287 | |

| Home BancShares, Inc. | | | 129,000 | | | | 3,183,720 | |

| Prosperity Bancshares, Inc. | | | 30,211 | | | | 2,169,150 | |

| | | | | | | | 9,309,157 | |

| COMMERCIAL SERVICES & SUPPLIES – 1.1% | | | | | | | | |

| Brady Corporation – Class A | | | 27,000 | | | | 1,513,080 | |

| | | | | | | | | |

| CONTAINERS & PACKAGING – 3.0% | | | | | | | | |

| UFP Technologies, Inc. (a) | | | 12,300 | | | | 706,266 | |

| WestRock Company | | | 67,000 | | | | 3,565,740 | |

| | | | | | | | 4,272,006 | |

| DIVERSIFIED FINANCIAL SERVICES – 4.1% | | | | | | | | |

| Invesco Ltd. (c) | | | 217,484 | | | | 5,813,347 | |

| | | | | | | | | |

| ELECTRICAL EQUIPMENT – 3.4% | | | | | | | | |

| Generac Holdings, Inc. (a) | | | 4,300 | | | | 1,785,145 | |

| Vishay Intertechnology, Inc. (b) | | | 135,000 | | | | 3,044,250 | |

| | | | | | | | 4,829,395 | |

The accompanying notes are an integral part of these financial statements.

| OLSTEIN STRATEGIC OPPORTUNITIES FUND |

COMMON STOCKS – 91.7% – continued | | | | | | |

| ELECTRONICS – 4.0% | | Shares | | | Value | |

| Keysight Technologies, Inc. (a) | | | 6,850 | | | $ | 1,057,709 | |

| Sensata Technologies Holding PLC (a)(c) | | | 79,100 | | | | 4,585,427 | |

| | | | | | | | 5,643,136 | |

| HEALTH CARE EQUIPMENT & SUPPLIES – 1.7% | | | | | | | | |

| Zimmer Biomet Holdings, Inc. | | | 15,000 | | | | 2,412,300 | |

| | | | | | | | | |

| HEALTH CARE PRODUCTS – 2.2% | | | | | | | | |

| Integra LifeSciences Holdings Corporation (a)(b) | | | 46,000 | | | | 3,139,040 | |

| | | | | | | | | |

| HOUSEHOLD DURABLES – 7.4% | | | | | | | | |

| Central Garden & Pet Company – Class A (a) | | | 88,000 | | | | 4,250,400 | |

| Lifetime Brands, Inc. | | | 171,000 | | | | 2,559,870 | |

| Mohawk Industries, Inc. (a) | | | 18,750 | | | | 3,603,562 | |

| | | | | | | | 10,413,832 | |

| HOUSEHOLD PRODUCTS – 1.1% | | | | | | | | |

| Reynolds Consumer Products, Inc. (b) | | | 50,000 | | | | 1,517,500 | |

| | | | | | | | | |

| INDUSTRIAL EQUIPMENT WHOLESALE – 4.2% | | | | | | | | |

| WESCO International, Inc. (a) | | | 58,000 | | | | 5,963,560 | |

| | | | | | | | | |

| LEISURE PRODUCTS – 2.1% | | | | | | | | |

| Johnson Outdoors, Inc. – Class A | | | 24,000 | | | | 2,904,000 | |

| | | | | | | | | |

| MACHINERY – 9.6% | | | | | | | | |

| Federal Signal Corporation | | | 42,000 | | | | 1,689,660 | |

| Gates Industrial Corporation PLC (a)(c) | | | 200,000 | | | | 3,614,000 | |

| Graham Corporation | | | 113,910 | | | | 1,567,402 | |

| Shyft Group, Inc. (b) | | | 120,000 | | | | 4,489,200 | |

| Timken Company | | | 25,750 | | | | 2,075,192 | |

| | | | | | | | 13,435,454 | |

| MATERIALS – 1.9% | | | | | | | | |

| Axalta Coating Systems Ltd. (a)(c) | | | 86,000 | | | | 2,622,140 | |

| | | | | | | | | |

| MEDIA – 3.9% | | | | | | | | |

| Discovery, Inc. – Class C (a)(b) | | | 189,800 | | | | 5,500,404 | |

The accompanying notes are an integral part of these financial statements.

| OLSTEIN STRATEGIC OPPORTUNITIES FUND |

COMMON STOCKS – 91.7% – continued | | | | | | |

| PHARMACEUTICALS – 3.9% | | Shares | | | Value | |

| Prestige Consumer Healthcare, Inc. (a)(b) | | | 106,000 | | | $ | 5,522,600 | |

| | | | | | | | | |

| PROFESSIONAL SERVICES – 1.1% | | | | | | | | |

| Korn Ferry | | | 22,000 | | | | 1,596,100 | |

| | | | | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT – 1.8% | | | | | | | | |

| Jones Lang LaSalle, Inc. (a)(b) | | | 12,550 | | | | 2,453,023 | |

| | | | | | | | | |

| RESTAURANTS – 7.3% | | | | | | | | |

| Cracker Barrel Old Country Store, Inc. | | | 17,000 | | | | 2,523,820 | |

| Denny’s Corporation (a) | | | 207,100 | | | | 3,415,079 | |

| Dine Brands Global, Inc. (a)(b) | | | 47,650 | | | | 4,252,763 | |

| | | | | | | | 10,191,662 | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT – 3.0% | | | | | | | | |

| Kulicke and Soffa Industries, Inc. (b) | | | 69,000 | | | | 4,222,800 | |

| | | | | | | | | |

| SOFTWARE – 2.6% | | | | | | | | |

| Intelligent Systems Corporation (a)(b) | | | 114,000 | | | | 3,586,440 | |

| | | | | | | | | |

| SPECIALTY RETAIL – 1.7% | | | | | | | | |

| Big Lots, Inc. (b) | | | 37,000 | | | | 2,442,370 | |

| | | | | | | | | |

| TEXTILES, APPAREL & LUXURY GOODS – 1.9% | | | | | | | | |

| Kontoor Brands, Inc. | | | 30,000 | | | | 1,692,300 | |

| Tapestry, Inc. (a) | | | 23,600 | | | | 1,026,128 | |

| | | | | | | | 2,718,428 | |

| TRANSPORTATION EQUIPMENT – 2.5% | | | | | | | | |

| Wabash National Corporation (b) | | | 219,000 | | | | 3,504,000 | |

| TOTAL COMMON STOCKS (Cost $94,261,215) | | | | | | | 128,929,936 | |

The accompanying notes are an integral part of these financial statements.

| OLSTEIN STRATEGIC OPPORTUNITIES FUND |

| SHORT-TERM INVESTMENT – 8.5% | | | | | | |

| MONEY MARKET DEPOSIT ACCOUNT – 8.5% | | Shares | | | Value | |

| U.S. Bank N.A., 0.01% (d) | | | | | | |

| Total Money Market Deposit Account | | | 11,964,200 | | | $ | 11,964,200 | |

| TOTAL SHORT-TERM INVESTMENT (COST $11,964,200) | | | | | | | 11,964,200 | |

| | | | | | | | | |

| INVESTMENT PURCHASED WITH THE CASH | | | | | | | | |

| PROCEEDS FROM SECURITIES LENDING – 16.6% | | | | | | | | |

| INVESTMENT COMPANY – 16.6% | | | | | | | | |

| Mount Vernon Liquid Assets Portfolio, LLC, 0.10% (e) | | | | | | | | |

| Total Investment Company | | | 23,268,499 | | | | 23,268,499 | |

| TOTAL INVESTMENT PURCHASED WITH THE CASH | | | | | | | | |

| PROCEEDS FROM SECURITIES LENDING (Cost $23,268,499) | | | | | | | 23,268,499 | |

| | | | | | | | | |

| TOTAL INVESTMENTS – 116.8% | | | | | | | | |

| (Cost $129,493,914) | | | | | | | 164,162,635 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS – (16.8)% | | | | | | | (23,629,237 | ) |