UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22525

Managed Portfolio Series

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Brian Wiedmeyer, President

Managed Portfolio Series

c/o U.S. Bank Global Fund Services

777 East Wisconsin Ave., 6th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1712

Registrant’s telephone number, including area code

Date of fiscal year end: 3/31/2025

Date of reporting period: 9/30/2024

Item 1. Reports to Stockholders.

| | |

| CornerCap Small-Cap Value Fund | |

| Institutional Class | CSCJX |

| Semi-Annual Shareholder Report | September 30, 2024 |

This semi-annual shareholder report contains important information about the CornerCap Small-Cap Value Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at https://www.cornercapfunl-etf.com/valuedocuments. You can also request this information by contacting us at 888-813-8637.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $46 | 0.89% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $138,018,678 |

Number of Holdings | 380 |

Portfolio Turnover | 42% |

Visit https://www.cornercapfunl-etf.com/valuedocuments for more recent performance information.

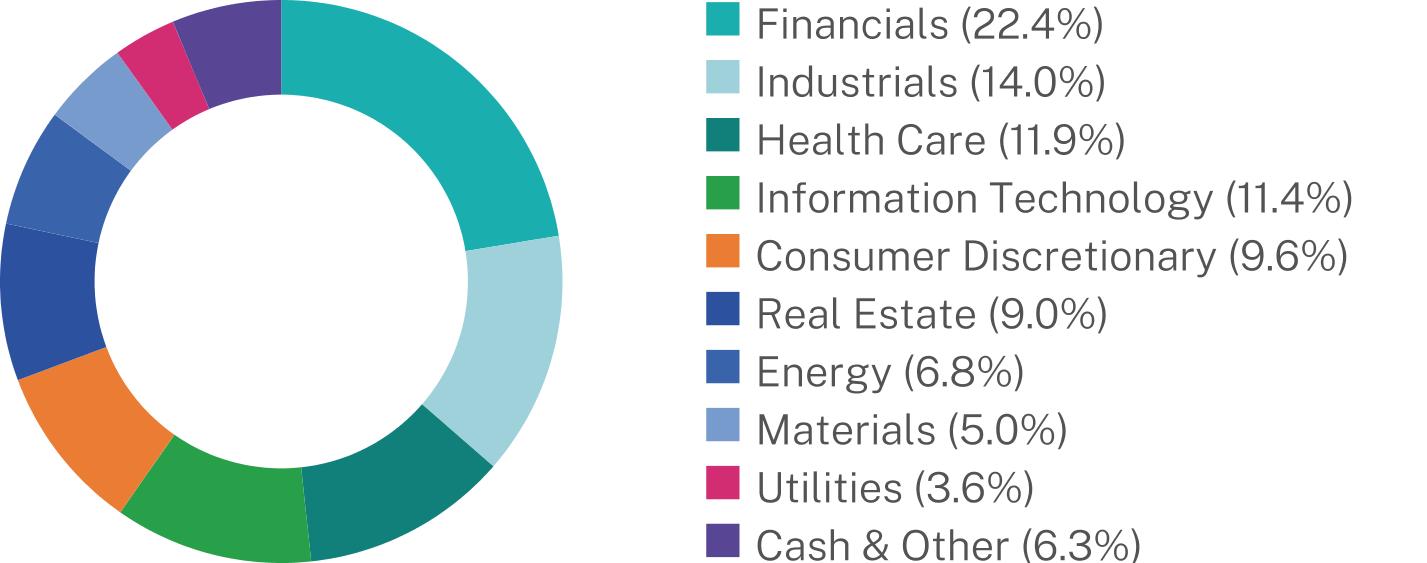

WHAT DID THE FUND INVEST IN? (% of net assets as of September 30, 2024)

| |

Top 10 Issuers | (%) |

Western Alliance Bancorp | 0.7% |

PetIQ, Inc. | 0.6% |

Chord Energy Corp. | 0.6% |

Cirrus Logic, Inc. | 0.6% |

CrossFirst Bankshares, Inc. | 0.6% |

Virtu Financial, Inc. | 0.6% |

Smartsheet, Inc. | 0.5% |

Gates Industrial Corp. PLC | 0.5% |

Ameris Bancorp | 0.5% |

Addus HomeCare Corp. | 0.5% |

Sector Breakdown (% of net assets)

Based upon a recommendation by the Adviser, the Board of Trustees of the Trust approved a plan of liquidation for the Fund. The liquidation is expected to occur on January 31, 2025. In an Asset Purchase Agreement (the “Agreement”) dated July 28, 2024, the Adviser sold its advisory accounts for cash consideration in a transaction that closed September 13, 2024. Under the terms of the Agreement, the Adviser agreed to manage the Fund until January 31, 2025. The Adviser also agreed, effective September 13, 2024, to change the Fund’s advisory fee from 0.88% to 0.00% and the Fund’s operating expense limit from 0.95% to 0.25% (exclusive of 12b-1 and shareholder service fees) of the Fund’s average daily net assets.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.cornercapfunl-etf.com/valuedocuments.

| CornerCap Small-Cap Value Fund | PAGE 1 | TSR-SAR-56167N258 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your CornerCap Investment Counsel Inc documents not be householded, please contact CornerCap Investment Counsel Inc at 888-813-8637, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by CornerCap Investment Counsel Inc or your financial intermediary.

| CornerCap Small-Cap Value Fund | PAGE 2 | TSR-SAR-56167N258 |

22.414.011.911.49.69.06.85.03.66.3

| | |

| CornerCap Small-Cap Value Fund | |

| Advisor Class | CSCVX |

| Semi-Annual Shareholder Report | September 30, 2024 |

This semi-annual shareholder report contains important information about the CornerCap Small-Cap Value Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at https://www.cornercapfunl-etf.com/valuedocuments. You can also request this information by contacting us at 888-813-8637.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Advisor Class | $61 | 1.19% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $138,018,678 |

Number of Holdings | 380 |

Portfolio Turnover | 42% |

Visit https://www.cornercapfunl-etf.com/valuedocuments for more recent performance information.

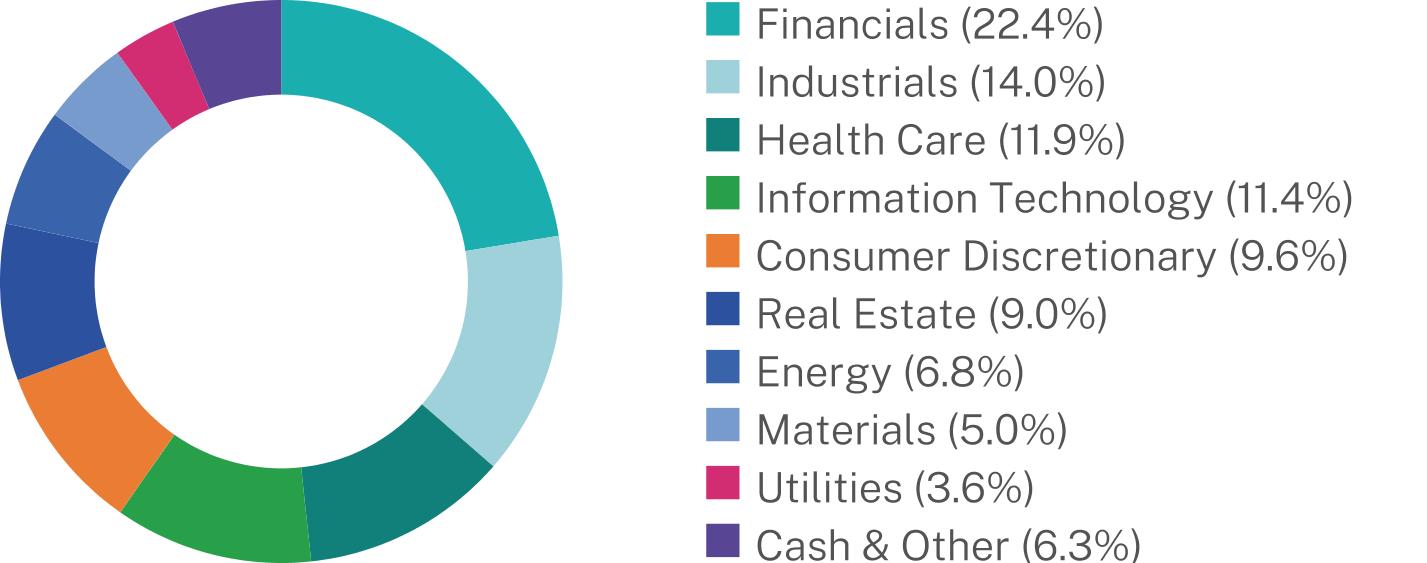

WHAT DID THE FUND INVEST IN? (% of net assets as of September 30, 2024)

| |

Top 10 Issuers | (%) |

Western Alliance Bancorp | 0.7% |

PetIQ, Inc. | 0.6% |

Chord Energy Corp. | 0.6% |

Cirrus Logic, Inc. | 0.6% |

CrossFirst Bankshares, Inc. | 0.6% |

Virtu Financial, Inc. | 0.6% |

Smartsheet, Inc. | 0.5% |

Gates Industrial Corp. PLC | 0.5% |

Ameris Bancorp | 0.5% |

Addus HomeCare Corp. | 0.5% |

Sector Breakdown (% of net assets)

Based upon a recommendation by the Adviser, the Board of Trustees of the Trust approved a plan of liquidation for the Fund. The liquidation is expected to occur on January 31, 2025. In an Asset Purchase Agreement (the “Agreement”) dated July 28, 2024, the Adviser sold its advisory accounts for cash consideration in a transaction that closed September 13, 2024. Under the terms of the Agreement, the Adviser agreed to manage the Fund until January 31, 2025. The Adviser also agreed, effective September 13, 2024, to change the Fund’s advisory fee from 0.88% to 0.00% and the Fund’s operating expense limit from 0.95% to 0.25% (exclusive of 12b-1 and shareholder service fees) of the Fund’s average daily net assets.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.cornercapfunl-etf.com/valuedocuments.

| CornerCap Small-Cap Value Fund | PAGE 1 | TSR-SAR-56167N241 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your CornerCap Investment Counsel Inc documents not be householded, please contact CornerCap Investment Counsel Inc at 888-813-8637, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by CornerCap Investment Counsel Inc or your financial intermediary.

| CornerCap Small-Cap Value Fund | PAGE 2 | TSR-SAR-56167N241 |

22.414.011.911.49.69.06.85.03.66.3

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

CornerCap Small-Cap Value Fund

Core Financial Statements

September 30, 2024

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 98.9%

| | | | | | |

Agriculture - 0.9%

| | | | | | |

Andersons, Inc. | | | 10,105 | | | $ 506,665 |

Dole PLC | | | 20,431 | | | 332,821 |

Vector Group Ltd. | | | 23,245 | | | 346,815 |

| | | | | | 1,186,301 |

Airlines - 0.4%

| | | | | | |

SkyWest, Inc.(a) | | | 6,484 | | | 551,270 |

Auto Parts & Equipment - 1.5%

| | | | | | |

Allison Transmission Holdings, Inc. | | | 6,898 | | | 662,691 |

Dorman Products, Inc.(a)(b) | | | 2,798 | | | 316,509 |

Gentex Corp.(b) | | | 16,623 | | | 493,537 |

Standard Motor Products, Inc. | | | 17,154 | | | 569,513 |

| | | | | | 2,042,250 |

Banks - 12.7%

| | | | | | |

Amalgamated Financial Corp. | | | 10,708 | | | 335,910 |

Ameris Bancorp | | | 11,807 | | | 736,639 |

Bank OZK(b) | | | 12,324 | | | 529,809 |

Bridgewater Bancshares, Inc.(a) | | | 21,252 | | | 301,141 |

Business First Bancshares, Inc. | | | 10,639 | | | 273,103 |

Byline Bancorp, Inc. | | | 10,971 | | | 293,694 |

Camden National Corp.(b) | | | 8,220 | | | 339,650 |

Central Pacific Financial Corp. | | | 13,550 | | | 399,860 |

Columbia Banking System, Inc. | | | 26,844 | | | 700,897 |

Community Trust Bancorp, Inc. | | | 5,829 | | | 289,468 |

ConnectOne Bancorp, Inc. | | | 28,327 | | | 709,591 |

CrossFirst Bankshares, Inc.(a) | | | 47,336 | | | 790,038 |

Customers Bancorp, Inc.(a) | | | 10,261 | | | 476,623 |

Eastern Bankshares, Inc. | | | 33,643 | | | 551,409 |

Equity Bancshares, Inc. - Class A | | | 7,117 | | | 290,943 |

Esquire Financial Holdings, Inc. | | | 5,611 | | | 365,893 |

Financial Institutions, Inc. | | | 12,607 | | | 321,100 |

First Internet Bancorp | | | 8,187 | | | 280,487 |

FNB Corp. | | | 18,606 | | | 262,531 |

Fulton Financial Corp. | | | 13,669 | | | 247,819 |

Hancock Whitney Corp. | | | 9,921 | | | 507,658 |

Horizon Bancorp Inc. | | | 19,829 | | | 308,341 |

Independent Bank Corp. | | | 5,122 | | | 302,864 |

Investar Holding Corp. | | | 14,031 | | | 272,201 |

Mercantile Bank Corp. | | | 14,206 | | | 621,086 |

Metropolitan Bank Holding Corp.(a) | | | 4,679 | | | 246,022 |

Mid Penn Bancorp, Inc. | | | 8,824 | | | 263,220 |

Northeast Bank | | | 4,473 | | | 345,002 |

Peoples Bancorp, Inc. | | | 7,971 | | | 239,847 |

Premier Financial Corp. | | | 10,782 | | | 253,161 |

Primis Financial Corp. | | | 18,725 | | | 228,071 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Banks - (Continued)

|

Provident Financial Services, Inc. | | | 33,427 | | | $ 620,405 |

QCR Holdings, Inc. | | | 4,490 | | | 332,395 |

Shore Bancshares, Inc. | | | 22,523 | | | 315,097 |

Southern First Bancshares, Inc.(a) | | | 8,168 | | | 278,365 |

Southside Bancshares, Inc. | | | 7,632 | | | 255,138 |

Synovus Financial Corp. | | | 11,433 | | | 508,426 |

Trustmark Corp. | | | 7,800 | | | 248,196 |

UMB Financial Corp. | | | 3,091 | | | 324,895 |

Veritex Holdings, Inc. | | | 21,713 | | | 571,486 |

Webster Financial Corp. | | | 12,018 | | | 560,159 |

Western Alliance Bancorp | | | 10,506 | | | 908,664 |

Zions Bancorp NA | | | 10,799 | | | 509,929 |

| | | | | | 17,517,233 |

Biotechnology - 3.1%

| | | | | | |

Adicet Bio, Inc.(a) | | | 18,074 | | | 26,027 |

Allogene Therapeutics, Inc.(a)(b) | | | 28,533 | | | 79,892 |

Annexon, Inc.(a) | | | 22,604 | | | 133,816 |

Arcus Biosciences, Inc.(a) | | | 6,192 | | | 94,676 |

Beam Therapeutics, Inc.(a) | | | 3,276 | | | 80,262 |

BioAtla, Inc.(a) | | | 29,805 | | | 52,457 |

Black Diamond Therapeutics, Inc.(a) | | | 22,583 | | | 98,236 |

C4 Therapeutics, Inc.(a) | | | 11,791 | | | 67,209 |

Caribou Biosciences, Inc.(a) | | | 16,522 | | | 32,383 |

Century Therapeutics, Inc.(a) | | | 25,978 | | | 44,422 |

Cogent Biosciences, Inc.(a) | | | 16,165 | | | 174,582 |

Cullinan Oncology, Inc.(a) | | | 5,560 | | | 93,074 |

CytomX Therapeutics, Inc.(a) | | | 41,458 | | | 48,920 |

Editas Medicine, Inc.(a) | | | 9,513 | | | 32,439 |

Entrada Therapeutics, Inc.(a) | | | 5,752 | | | 91,917 |

Exelixis, Inc.(a) | | | 24,903 | | | 646,233 |

Fate Therapeutics, Inc.(a) | | | 20,683 | | | 72,391 |

Generation Bio Co.(a) | | | 28,995 | | | 71,618 |

Halozyme Therapeutics, Inc.(a) | | | 8,007 | | | 458,321 |

Intellia Therapeutics, Inc.(a) | | | 3,072 | | | 63,130 |

Ionis Pharmaceuticals, Inc.(a) | | | 1,751 | | | 70,145 |

iTeos Therapeutics, Inc.(a) | | | 6,219 | | | 63,496 |

MacroGenics, Inc.(a) | | | 6,314 | | | 20,773 |

MeiraGTx Holdings PLC(a) | | | 13,290 | | | 55,419 |

Monte Rosa Therapeutics, Inc.(a) | | | 19,236 | | | 101,951 |

Nurix Therapeutics, Inc.(a) | | | 2,941 | | | 66,084 |

Nuvation Bio, Inc.(a) | | | 25,811 | | | 59,107 |

Poseida Therapeutics, Inc.(a) | | | 43,177 | | | 123,486 |

REGENXBIO, Inc.(a) | | | 5,601 | | | 58,755 |

Relay Therapeutics, Inc.(a) | | | 10,811 | | | 76,542 |

Replimune Group, Inc.(a) | | | 12,167 | | | 133,350 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Biotechnology - (Continued)

|

Sage Therapeutics, Inc.(a) | | | 5,294 | | | $ 38,223 |

Sutro Biopharma, Inc.(a) | | | 18,563 | | | 64,228 |

Tenaya Therapeutics, Inc.(a) | | | 30,222 | | | 58,328 |

United Therapeutics Corp.(a) | | | 2,027 | | | 726,375 |

Verastem, Inc.(a) | | | 11,810 | | | 35,312 |

Verve Therapeutics, Inc.(a) | | | 7,310 | | | 35,380 |

Vir Biotechnology, Inc.(a) | | | 10,587 | | | 79,297 |

Zentalis Pharmaceuticals, Inc.(a) | | | 6,108 | | | 22,477 |

| | | | | | 4,350,733 |

Building Materials - 1.5%

| | | | | | |

American Woodmark Corp.(a) | | | 6,080 | | | 568,176 |

Gibraltar Industries, Inc.(a) | | | 7,530 | | | 526,573 |

Masterbrand, Inc.(a) | | | 31,464 | | | 583,342 |

Mohawk Industries, Inc.(a) | | | 2,751 | | | 442,031 |

| | | | | | 2,120,122 |

Chemicals - 1.5%

| | | | | | |

Ecovyst, Inc.(a) | | | 77,036 | | | 527,697 |

LSB Industries, Inc.(a) | | | 30,236 | | | 243,097 |

Minerals Technologies, Inc. | | | 8,168 | | | 630,815 |

Quaker Chemical Corp. | | | 2,870 | | | 483,566 |

Valhi, Inc. | | | 4,506 | | | 150,365 |

| | | | | | 2,035,540 |

Coal - 0.3%

| | | | | | |

Ramaco Resources, Inc.(a) | | | 33,158 | | | 387,949 |

Commercial Services - 4.4%

| | | | | | |

ABM Industries, Inc. | | | 4,821 | | | 254,356 |

ADT, Inc.(b) | | | 80,481 | | | 581,878 |

Alarm.com Holdings, Inc.(a) | | | 7,603 | | | 415,656 |

Brink’s Co. | | | 2,889 | | | 334,084 |

Ennis, Inc. | | | 10,496 | | | 255,263 |

Euronet Worldwide, Inc.(a) | | | 5,581 | | | 553,803 |

Franklin Covey Co.(a) | | | 6,265 | | | 257,679 |

Herc Holdings, Inc. | | | 1,938 | | | 308,975 |

John Wiley & Sons, Inc. - Class A | | | 11,000 | | | 530,750 |

LiveRamp Holdings, Inc.(a) | | | 16,441 | | | 407,408 |

Progyny, Inc.(a) | | | 36,148 | | | 605,840 |

Upbound Group, Inc. | | | 15,210 | | | 486,568 |

V2X, Inc.(a) | | | 12,058 | | | 673,560 |

WEX, Inc.(a)(b) | | | 2,105 | | | 441,482 |

| | | | | | 6,107,302 |

Computers - 2.3%

| | | | | | |

Crane NXT Co. | | | 4,207 | | | 236,013 |

Genpact Ltd. | | | 15,773 | | | 618,459 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Computers - (Continued)

|

Maximus, Inc. | | | 6,173 | | | $ 575,077 |

NetScout Systems, Inc.(a) | | | 22,626 | | | 492,115 |

OneSpan, Inc.(a) | | | 23,189 | | | 386,561 |

Rapid7, Inc.(a) | | | 5,207 | | | 207,707 |

TaskUS, Inc. - Class A(a) | | | 17,793 | | | 229,886 |

Tenable Holdings, Inc.(a) | | | 11,658 | | | 472,382 |

| | | | | | 3,218,200 |

Consumer Discretionary Products - 2.4%

| | | | | | |

BorgWarner, Inc. | | | 15,252 | | | 553,495 |

Dream Finders Homes, Inc. - Class A(a)(b) | | | 9,851 | | | 356,705 |

Interface, Inc. | | | 17,152 | | | 325,373 |

LCI Industries(b) | | | 2,464 | | | 297,011 |

Levi Strauss & Co. - Class A(b) | | | 14,373 | | | 313,331 |

LGI Homes, Inc.(a)(b) | | | 5,292 | | | 627,208 |

Phinia, Inc. | | | 5,902 | | | 271,669 |

Rocky Brands, Inc. | | | 8,597 | | | 273,900 |

Superior Group of Cos., Inc. | | | 16,126 | | | 249,792 |

| | | | | | 3,268,484 |

Consumer Discretionary Services - 0.1%

| | | | | | |

American Public Education, Inc.(a) | | | 14,464 | | | 213,344 |

Consumer Staple Products - 1.2%

| | | | | | |

Edgewell Personal Care Co.(b) | | | 12,405 | | | 450,798 |

Hain Celestial Group, Inc.(a) | | | 32,682 | | | 282,045 |

Simply Good Foods Co.(a)(b) | | | 16,326 | | | 567,655 |

SunOpta, Inc.(a) | | | 48,571 | | | 309,883 |

| | | | | | 1,610,381 |

Distribution/Wholesale - 0.9%

| | | | | | |

MRC Global, Inc.(a) | | | 41,994 | | | 535,004 |

Resideo Technologies, Inc.(a) | | | 24,522 | | | 493,873 |

ScanSource, Inc.(a) | | | 5,668 | | | 272,234 |

| | | | | | 1,301,111 |

Diversified Financial Services - 3.5%

| | | | | | |

Affiliated Managers Group, Inc. | | | 3,229 | | | 574,116 |

BGC Group, Inc. - Class A | | | 60,032 | | | 551,094 |

Bridge Investment Group Holdings, Inc. - Class A | | | 39,514 | | | 390,003 |

Federated Hermes, Inc. - Class B | | | 16,008 | | | 588,614 |

International Money Express, Inc.(a) | | | 11,530 | | | 213,190 |

Invesco Ltd. | | | 16,755 | | | 294,218 |

NewtekOne, Inc. | | | 18,911 | | | 235,631 |

StoneX Group, Inc.(a) | | | 3,889 | | | 318,431 |

Victory Capital Holdings, Inc. - Class A | | | 8,519 | | | 471,953 |

Virtu Financial, Inc. - Class A | | | 24,972 | | | 760,647 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Diversified Financial Services - (Continued)

|

Virtus Investment Partners, Inc. | | | 1,104 | | | $ 231,233 |

Western Union Co. | | | 19,054 | | | 227,314 |

| | | | | | 4,856,444 |

Electric - 1.4%

| | | | | | |

Avista Corp. | | | 14,196 | | | 550,095 |

Black Hills Corp. | | | 9,462 | | | 578,317 |

NorthWestern Energy Group, Inc. | | | 8,876 | | | 507,885 |

Portland General Electric Co. | | | 5,834 | | | 279,449 |

| | | | | | 1,915,746 |

Electrical Components & Equipment - 0.5%

| | | | | | |

Energizer Holdings, Inc. | | | 6,930 | | | 220,097 |

EnerSys | | | 5,274 | | | 538,212 |

| | | | | | 758,309 |

Electronics - 1.4%

| | | | | | |

Allient, Inc. | | | 12,058 | | | 228,981 |

Itron, Inc.(a) | | | 2,879 | | | 307,506 |

Sanmina Corp.(a) | | | 7,578 | | | 518,714 |

Sensata Technologies Holding PLC | | | 14,124 | | | 506,487 |

TTM Technologies, Inc.(a) | | | 18,024 | | | 328,938 |

| | | | | | 1,890,626 |

Energy - Alternate Sources - 0.1%

| | | | | | |

REX American Resources Corp.(a) | | | 4,549 | | | 210,573 |

Engineering & Construction - 1.7%

| | | | | | |

Great Lakes Dredge & Dock Corp.(a) | | | 30,697 | | | 323,239 |

Latham Group, Inc.(a) | | | 105,699 | | | 718,753 |

Primoris Services Corp. | | | 11,311 | | | 656,943 |

Tutor Perini Corp.(a) | | | 25,385 | | | 689,457 |

| | | | | | 2,388,392 |

Entertainment - 1.1%

| | | | | | |

Accel Entertainment, Inc.(a) | | | 44,083 | | | 512,244 |

Everi Holdings, Inc.(a) | | | 42,268 | | | 555,402 |

International Game Technology PLC | | | 24,461 | | | 521,019 |

| | | | | | 1,588,665 |

Financial Services - 0.4%

| | | | | | |

Voya Financial, Inc. | | | 7,029 | | | 556,837 |

Food - 0.2%

| | | | | | |

Post Holdings, Inc.(a) | | | 2,591 | | | 299,908 |

Gas - 1.5%

| | | | | | |

National Fuel Gas Co.(b) | | | 8,888 | | | 538,702 |

Northwest Natural Holding Co. | | | 12,592 | | | 514,005 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Gas - (Continued)

|

Spire, Inc. | | | 7,514 | | | $ 505,617 |

UGI Corp.(b) | | | 20,753 | | | 519,240 |

| | | | | | 2,077,564 |

Health Care - 1.4%

| | | | | | |

4D Molecular Therapeutics, Inc.(a) | | | 5,229 | | | 56,526 |

Anika Therapeutics, Inc.(a) | | | 9,653 | | | 238,429 |

Bioventus, Inc. - Class A(a) | | | 32,191 | | | 384,682 |

LivaNova PLC(a) | | | 9,432 | | | 495,557 |

Prothena Corp. PLC(a) | | | 3,793 | | | 63,457 |

Sana Biotechnology, Inc.(a)(b) | | | 16,218 | | | 67,467 |

SIGA Technologies, Inc. | | | 34,894 | | | 235,535 |

TScan Therapeutics, Inc.(a) | | | 10,788 | | | 53,724 |

Veracyte, Inc.(a) | | | 8,516 | | | 289,885 |

| | | | | | 1,885,262 |

Healthcare-Products - 1.3%

| | | | | | |

Avanos Medical, Inc.(a)(b) | | | 25,769 | | | 619,229 |

CONMED Corp. | | | 3,078 | | | 221,370 |

Haemonetics Corp.(a)(b) | | | 2,679 | | | 215,338 |

LeMaitre Vascular, Inc.(b) | | | 4,454 | | | 413,732 |

Tactile Systems Technology, Inc.(a) | | | 20,929 | | | 305,773 |

| | | | | | 1,775,442 |

Healthcare-Services - 2.0%

| | | | | | |

Addus HomeCare Corp.(a) | | | 5,537 | | | 736,587 |

Encompass Health Corp. | | | 3,295 | | | 318,429 |

HealthEquity, Inc.(a)(b) | | | 7,405 | | | 606,099 |

Pennant Group, Inc.(a) | | | 15,522 | | | 554,135 |

Select Medical Holdings Corp. | | | 17,134 | | | 597,463 |

| | | | | | 2,812,713 |

Household Products/Wares - 0.4%

| | | | | | |

ACCO Brands Corp. | | | 49,236 | | | 269,321 |

Reynolds Consumer Products, Inc. | | | 8,978 | | | 279,216 |

| | | | | | 548,537 |

Housewares - 0.6%

| | | | | | |

Newell Brands, Inc. | | | 69,102 | | | 530,703 |

Scotts Miracle-Gro Co.(b) | | | 3,754 | | | 325,472 |

| | | | | | 856,175 |

Industrial Products - 2.5%

| | | | | | |

Atkore, Inc. | | | 5,090 | | | 431,327 |

Gorman-Rupp Co. | | | 12,870 | | | 501,286 |

Insteel Industries, Inc. | | | 8,286 | | | 257,612 |

Luxfer Holdings PLC | | | 22,449 | | | 290,715 |

Mesa Laboratories, Inc. | | | 3,797 | | | 493,078 |

Middleby Corp.(a) | | | 1,964 | | | 273,251 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Industrial Products - (Continued)

|

Mueller Industries, Inc. | | | 4,474 | | | $ 331,523 |

Tennant Co. | | | 5,098 | | | 489,612 |

Vontier Corp. | | | 11,809 | | | 398,436 |

| | | | | | 3,466,840 |

Industrial Services - 0.2%

| | | | | | |

Kelly Services, Inc. - Class A | | | 11,346 | | | 242,918 |

Insurance - 3.4%

| | | | | | |

CNO Financial Group, Inc. | | | 19,389 | | | 680,554 |

Essent Group Ltd. | | | 4,765 | | | 306,342 |

Hamilton Insurance Group Ltd. - Class B(a) | | | 12,993 | | | 251,284 |

Hanover Insurance Group, Inc. | | | 1,997 | | | 295,776 |

Heritage Insurance Holdings, Inc.(a) | | | 16,803 | | | 205,669 |

Horace Mann Educators Corp. | | | 13,722 | | | 479,584 |

Jackson Financial, Inc. - Class A(b) | | | 3,789 | | | 345,670 |

Kemper Corp. | | | 3,880 | | | 237,650 |

Lincoln National Corp. | | | 18,582 | | | 585,519 |

Mercury General Corp. | | | 5,118 | | | 322,332 |

NMI Holdings, Inc. - Class A(a) | | | 8,715 | | | 358,971 |

Universal Insurance Holdings, Inc. | | | 26,610 | | | 589,677 |

| | | | | | 4,659,028 |

Internet - 1.2%

| | | | | | |

HealthStream, Inc. | | | 10,110 | | | 291,573 |

Magnite, Inc.(a) | | | 28,830 | | | 399,296 |

TechTarget, Inc.(a) | | | 10,003 | | | 244,573 |

Upwork, Inc.(a) | | | 16,334 | | | 170,690 |

Yelp, Inc.(a) | | | 14,203 | | | 498,241 |

| | | | | | 1,604,373 |

Iron/Steel - 0.8%

| | | | | | |

Carpenter Technology Corp. | | | 2,230 | | | 355,863 |

Universal Stainless & Alloy Products, Inc.(a) | | | 12,465 | | | 481,523 |

Worthington Steel, Inc. | | | 7,672 | | | 260,925 |

| | | | | | 1,098,311 |

Leisure Time - 0.2%

| | | | | | |

Harley-Davidson, Inc.(b) | | | 7,420 | | | 285,893 |

Lodging - 0.6%

| | | | | | |

Boyd Gaming Corp. | | | 9,126 | | | 589,996 |

Travel + Leisure Co. | | | 5,844 | | | 269,291 |

| | | | | | 859,287 |

Machinery - Construction & Mining - 0.3%

| | | | | | |

Oshkosh Corp. | | | 2,252 | | | 225,673 |

Terex Corp. | | | 4,274 | | | 226,137 |

| | | | | | 451,810 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Machinery-Diversified - 1.1%

| | | | | | |

Columbus McKinnon Corp. | | | 13,464 | | | $ 484,704 |

Gates Industrial Corp. PLC(a) | | | 42,015 | | | 737,363 |

Mayville Engineering Co., Inc.(a) | | | 13,170 | | | 277,624 |

| | | | | | 1,499,691 |

Materials - 1.5%

| | | | | | |

Alcoa Corp. | | | 8,183 | | | 315,700 |

Ardagh Metal Packaging SA(b) | | | 72,290 | | | 272,533 |

Century Aluminum Co.(a)(b) | | | 18,482 | | | 299,963 |

Kronos Worldwide, Inc. | | | 21,203 | | | 263,977 |

Mativ Holdings, Inc. | | | 13,423 | | | 228,057 |

Olin Corp. | | | 9,377 | | | 449,909 |

SunCoke Energy, Inc. | | | 26,257 | | | 227,911 |

| | | | | | 2,058,050 |

Media - 1.1%

| | | | | | |

Gray Television, Inc. | | | 35,769 | | | 191,722 |

Grindr, Inc.(a) | | | 26,782 | | | 319,509 |

Nexstar Media Group, Inc.(b) | | | 1,551 | | | 256,458 |

TEGNA, Inc.(b) | | | 36,169 | | | 570,747 |

Ziff Davis, Inc.(a)(b) | | | 4,201 | | | 204,420 |

| | | | | | 1,542,856 |

Metal Fabricate & Hardware - 0.9%

| | | | | | |

Hillman Solutions Corp.(a) | | | 63,664 | | | 672,292 |

Park-Ohio Holdings Corp. | | | 9,970 | | | 306,079 |

Proto Labs, Inc.(a) | | | 7,842 | | | 230,319 |

| | | | | | 1,208,690 |

Oil & Gas - 4.2%

| | | | | | |

Amplify Energy Corp.(a) | | | 34,975 | | | 228,387 |

Antero Midstream Corp. | | | 18,201 | | | 273,925 |

APA Corp.(b) | | | 17,119 | | | 418,731 |

Berry Corp. | | | 71,774 | | | 368,918 |

Chord Energy Corp. | | | 6,218 | | | 809,770 |

Civitas Resources, Inc. | | | 10,961 | | | 555,394 |

Diversified Energy Co. PLC | | | 20,607 | | | 234,508 |

Murphy Oil Corp. | | | 11,731 | | | 395,804 |

Noble Corp. PLC(b) | | | 5,372 | | | 194,144 |

Ovintiv, Inc. | | | 11,169 | | | 427,885 |

Riley Exploration Permian, Inc. | | | 17,780 | | | 470,992 |

SandRidge Energy, Inc. | | | 20,287 | | | 248,110 |

Sitio Royalties Corp. - Class A | | | 10,695 | | | 222,884 |

SM Energy Co.(b) | | | 11,461 | | | 458,096 |

VAALCO Energy, Inc. | | | 84,768 | | | 486,568 |

| | | | | | 5,794,116 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Oil & Gas Services - 1.0%

| | | | | | |

Archrock, Inc. | | | 18,917 | | | $ 382,880 |

ChampionX Corp. | | | 8,049 | | | 242,678 |

Helix Energy Solutions Group, Inc.(a) | | | 41,959 | | | 465,745 |

Newpark Resources, Inc.(a) | | | 37,325 | | | 258,662 |

| | | | | | 1,349,965 |

Packaging & Containers - 0.7%

| | | | | | |

Berry Global Group, Inc. | | | 8,781 | | | 596,933 |

Pactiv Evergreen, Inc. | | | 33,159 | | | 381,660 |

| | | | | | 978,593 |

Pharmaceuticals - 2.9%

| | | | | | |

AdaptHealth Corp.(a) | | | 23,292 | | | 261,569 |

Alector, Inc.(a) | | | 11,767 | | | 54,834 |

Amphastar Pharmaceuticals, Inc.(a)(b) | | | 5,421 | | | 263,081 |

Collegium Pharmaceutical, Inc.(a) | | | 10,395 | | | 401,663 |

Corcept Therapeutics, Inc.(a)(b) | | | 9,212 | | | 426,331 |

Enanta Pharmaceuticals, Inc.(a) | | | 6,712 | | | 69,536 |

Foghorn Therapeutics, Inc.(a) | | | 13,147 | | | 122,399 |

GoodRx Holdings, Inc. - Class A(a)(b) | | | 36,489 | | | 253,234 |

Harmony Biosciences Holdings, Inc.(a)(b) | | | 8,790 | | | 351,600 |

Lyell Immunopharma, Inc.(a)(b) | | | 47,763 | | | 65,913 |

Option Care Health, Inc.(a) | | | 15,835 | | | 495,635 |

ORIC Pharmaceuticals, Inc.(a) | | | 10,063 | | | 103,146 |

PetIQ, Inc.(a) | | | 26,441 | | | 813,590 |

USANA Health Sciences, Inc.(a) | | | 4,901 | | | 185,846 |

Vanda Pharmaceuticals, Inc.(a) | | | 16,101 | | | 75,514 |

Voyager Therapeutics, Inc.(a) | | | 10,937 | | | 63,981 |

| | | | | | 4,007,872 |

Pipelines - 0.2%

| | | | | | |

EnLink Midstream LLC | | | 19,612 | | | 284,570 |

Real Estate - 9.0%

| | | | | | |

Alexander & Baldwin, Inc. | | | 23,008 | | | 441,754 |

American Assets Trust, Inc. | | | 21,225 | | | 567,132 |

Apple Hospitality REIT, Inc. | | | 12,400 | | | 184,140 |

Brixmor Property Group, Inc. | | | 20,455 | | | 569,876 |

Broadstone Net Lease, Inc.(b) | | | 26,835 | | | 508,523 |

CareTrust REIT, Inc. | | | 18,600 | | | 573,996 |

Centerspace | | | 5,606 | | | 395,055 |

COPT Defense Properties | | | 15,916 | | | 482,732 |

Cushman & Wakefield PLC(a) | | | 24,811 | | | 338,174 |

EastGroup Properties, Inc. | | | 2,203 | | | 411,564 |

Empire State Realty Trust, Inc. - Class A | | | 20,823 | | | 230,719 |

EPR Properties | | | 4,522 | | | 221,759 |

Essential Properties Realty Trust, Inc.(b) | | | 19,479 | | | 665,208 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Real Estate - (Continued)

|

Getty Realty Corp.(b) | | | 12,276 | | | $ 390,500 |

Gladstone Land Corp. | | | 12,921 | | | 179,602 |

Innovative Industrial Properties, Inc.(b) | | | 5,445 | | | 732,897 |

Kite Realty Group Trust | | | 13,755 | | | 365,333 |

National Health Investors, Inc.(b) | | | 7,200 | | | 605,232 |

NETSTREIT Corp. | | | 22,126 | | | 365,743 |

Park Hotels & Resorts, Inc.(b) | | | 35,218 | | | 496,574 |

Phillips Edison & Co, Inc.(b) | | | 12,017 | | | 453,161 |

Plymouth Industrial REIT, Inc. | | | 16,735 | | | 378,211 |

Rayonier, Inc. | | | 12,107 | | | 389,603 |

Retail Opportunity Investments Corp. | | | 32,639 | | | 513,411 |

Sabra Health Care REIT, Inc.(b) | | | 28,584 | | | 531,948 |

Terreno Realty Corp. | | | 7,893 | | | 527,489 |

UMH Properties, Inc. | | | 24,328 | | | 478,532 |

Whitestone REIT | | | 26,637 | | | 360,399 |

| | | | | | 12,359,267 |

Retail - 1.0%

| | | | | | |

American Eagle Outfitters, Inc. | | | 21,936 | | | 491,147 |

Caleres, Inc.(b) | | | 15,891 | | | 525,198 |

Sally Beauty Holdings, Inc.(a) | | | 24,332 | | | 330,185 |

| | | | | | 1,346,530 |

Retail & Wholesale - Discretionary - 0.6%

| | | | | | |

BlueLinx Holdings, Inc.(a) | | | 2,606 | | | 274,725 |

Lands’ End, Inc.(a) | | | 19,119 | | | 330,185 |

Urban Outfitters, Inc.(a) | | | 6,508 | | | 249,321 |

| | | | | | 854,231 |

Savings & Loans - 1.7%

| | | | | | |

Axos Financial, Inc.(a) | | | 3,897 | | | 245,043 |

Brookline Bancorp, Inc. | | | 26,005 | | | 262,391 |

Capitol Federal Financial, Inc. | | | 44,548 | | | 260,160 |

FS Bancorp, Inc. | | | 6,045 | | | 268,942 |

OceanFirst Financial Corp. | | | 34,669 | | | 644,497 |

WaFd, Inc.(b) | | | 17,666 | | | 615,660 |

| | | | | | 2,296,693 |

Semiconductors - 1.7%

| | | | | | |

Cirrus Logic, Inc.(a) | | | 6,405 | | | 795,565 |

MKS Instruments, Inc.(b) | | | 4,398 | | | 478,107 |

SMART Global Holdings, Inc.(a)(b) | | | 23,632 | | | 495,090 |

Ultra Clean Holdings, Inc.(a) | | | 13,194 | | | 526,836 |

| | | | | | 2,295,598 |

Software - 5.1%

| | | | | | |

Appfolio, Inc. - Class A(a) | | | 1,223 | | | 287,894 |

Blackbaud, Inc.(a)(b) | | | 7,509 | | | 635,862 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Software - (Continued)

|

Box, Inc. - Class A(a) | | | 9,521 | | | $ 311,622 |

Clear Secure, Inc. - Class A(b) | | | 12,359 | | | 409,577 |

CSG Systems International, Inc. | | | 10,538 | | | 512,674 |

Doximity, Inc. - Class A(a)(b) | | | 8,608 | | | 375,051 |

Envestnet, Inc.(a)(b) | | | 4,690 | | | 293,688 |

IBEX Holdings Ltd.(a) | | | 16,599 | | | 331,648 |

JFrog Ltd.(a) | | | 12,076 | | | 350,687 |

nCino, Inc.(a) | | | 7,538 | | | 238,125 |

Olo, Inc. - Class A(a) | | | 114,748 | | | 569,150 |

Progress Software Corp. | | | 9,593 | | | 646,280 |

RingCentral, Inc. - Class A(a) | | | 8,854 | | | 280,052 |

Smartsheet, Inc. - Class A(a) | | | 13,513 | | | 748,080 |

SolarWinds Corp.(a) | | | 22,565 | | | 294,473 |

Verint Systems, Inc.(a) | | | 8,135 | | | 206,060 |

Zuora, Inc. - Class A(a) | | | 57,322 | | | 494,116 |

| | | | | | 6,985,039 |

Software & Tech Services - 1.6%

| | | | | | |

Clearwater Analytics Holdings, Inc. - Class A(a) | | | 13,595 | | | 343,274 |

DoubleVerify Holdings, Inc.(a) | | | 13,190 | | | 222,119 |

Dropbox, Inc. - Class A(a) | | | 11,804 | | | 300,176 |

Freshworks, Inc. - Class A(a) | | | 21,812 | | | 250,402 |

Gitlab, Inc. - Class A(a) | | | 5,784 | | | 298,107 |

Jamf Holding Corp.(a) | | | 27,721 | | | 480,959 |

Workiva, Inc.(a) | | | 3,382 | | | 267,584 |

| | | | | | 2,162,621 |

Tech Hardware & Semiconductors - 1.2%

| | | | | | |

Arrow Electronics, Inc.(a) | | | 2,072 | | | 275,224 |

CEVA, Inc.(a) | | | 12,906 | | | 311,680 |

Diebold Nixdorf, Inc.(a)(b) | | | 6,131 | | | 273,810 |

PlayAGS, Inc.(a) | | | 21,512 | | | 245,022 |

Sonos, Inc.(a) | | | 43,836 | | | 538,744 |

| | | | | | 1,644,480 |

Telecommunications - 0.4%

| | | | | | |

Iridium Communications, Inc. | | | 8,476 | | | 258,094 |

Lantronix, Inc.(a) | | | 60,945 | | | 251,094 |

| | | | | | 509,188 |

Toys/Games/Hobbies - 0.4%

| | | | | | |

Mattel, Inc.(a)(b) | | | 27,466 | | | 523,227 |

Transportation - 2.0%

| | | | | | |

ArcBest Corp.(b) | | | 2,222 | | | 240,976 |

DHT Holdings, Inc. | | | 46,582 | | | 513,800 |

Genco Shipping & Trading Ltd. | | | 13,104 | | | 255,528 |

Pangaea Logistics Solutions Ltd. | | | 38,027 | | | 274,935 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Schedule of Investments

September 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Transportation - (Continued)

|

Radiant Logistics, Inc.(a) | | | 47,428 | | | $304,962 |

Teekay Tankers Ltd. - Class A | | | 8,637 | | | 503,105 |

World Kinect Corp.(b) | | | 23,067 | | | 713,001 |

| | | | | | 2,806,307 |

Utilities - 0.7%

| | | | | | |

Artesian Resources Corp. - Class A | | | 7,215 | | | 268,254 |

California Water Service Group | | | 8,609 | | | 466,780 |

Consolidated Water Co. Ltd. | | | 9,664 | | | 243,629 |

| | | | | | 978,663 |

TOTAL COMMON STOCKS

(Cost $117,825,599) | | | | | | 136,486,120 |

CONTINGENT VALUE RIGHTS - 0.0%(c)

| | | | | | |

Ligand Pharmaceuticals, Inc. Earn-Out Shares(a)(d) | | | 491 | | | 0 |

Ligand Pharmaceuticals, Inc. Earn-Out Shares(a)(d) | | | 491 | | | 0 |

TOTAL CONTINGENT VALUE RIGHTS

(Cost $0) | | | | | | 0 |

SHORT-TERM INVESTMENTS - 15.5%

| | | | | | |

Investments Purchased with Proceeds from Securities Lending - 14.4%

| | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 4.95%(e) | | | 19,907,407 | | | 19,907,407 |

Money Market Funds - 1.1%

| | | | | | |

First American Government Obligations Fund - Class X, 4.83%(e) | | | 1,515,594 | | | 1,515,594 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $21,423,001) | | | | | | 21,423,001 |

TOTAL INVESTMENTS - 114.4%

(Cost $139,248,600) | | | | | | $157,909,121 |

Liabilities in Excess of Other Assets - (14.4)% | | | | | | (19,890,443) |

TOTAL NET ASSETS - 100.0% | | | | | | $138,018,678 |

| | | | | | | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

SA - Sociedad Anónima

(a)

| Non-income producing security.

|

(b)

| All or a portion of this security is on loan as of September 30, 2024. The total market value of these securities was $19,453,324 which represented 14.1% of net assets.

|

(c)

| Represents less than 0.05% of net assets.

|

(d)

| Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $0 or 0.0% of net assets as of September 30, 2024.

|

(e)

| The rate shown represents the 7-day annualized effective yield as of September 30, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2024 (Unaudited)

| | | | |

ASSETS:

| | | |

Investment securities:

| | | |

At cost | | | $ 139,248,600 |

At value(1) | | | $157,909,121 |

Dividends & interest receivable | | | 149,494 |

Receivable for capital shares sold | | | 1,897 |

Income receivable from securities lending | | | 1,477 |

Prepaid expenses | | | 53,535 |

Total assets | | | 158,115,524 |

LIABILITIES:

| | | |

Payable upon return of securities loaned (See Note 9) | | | 19,907,407 |

Payable for capital shares redeemed | | | 86,275 |

Payable to investment adviser | | | 34,187 |

Payable for fund administration & accounting fees | | | 46,189 |

Payable for transfer agent fees & expenses | | | 13,724 |

Payable for custody fees | | | 2,324 |

Accrued other fees | | | 4,492 |

Accrued distribution & shareholder service fees | | | 2,248 |

Total liabilities | | | 20,096,846 |

NET ASSETS | | | $ 138,018,678 |

Composition of Net Assets

| | | |

Paid-in capital | | | $114,303,539 |

Total distributable earnings | | | 23,715,139 |

Total net assets | | | $ 138,018,678 |

(1)Includes loaned securities of: | | | $19,453,324 |

Advisor Class Shares:

| | | |

Net Assets | | | $571,244 |

Shares issued and outstanding(2) | | | 37,068 |

Net asset value, offering price, and redemption price per share | | | $15.41 |

Institutional Class Shares:

| | | |

Net Assets | | | $137,447,434 |

Shares issued and outstanding(2) | | | 8,843,549 |

Net asset value, offering price, and redemption price per share | | | $15.54 |

| | | | |

(2)

| Unlimited shares authorized without par value. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

STATEMENT OF OPERATIONS

For the Six Months Ended September 30, 2024 (Unaudited)

| | | | |

INVESTMENT INCOME:

| | | |

Interest income | | | $30,124 |

Dividend income | | | 1,325,857 |

Less: Foreign taxes withheld | | | (1,386) |

Securities lending income | | | 11,510 |

Total investment income | | | 1,366,105 |

EXPENSES:

| | | |

Investment advisory fees (See Note 4) | | | 538,170 |

Fund administration & accounting fees (See Note 4) | | | 69,673 |

Federal & state registration fees | | | 36,511 |

Transfer agent fees & expenses (See Note 4) | | | 23,201 |

Trustee fees | | | 11,737 |

Legal fees | | | 10,945 |

Audit and tax fees | | | 8,288 |

Other fees | | | 7,425 |

Custody fees (See Note 4) | | | 5,852 |

Postage & printing fees | | | 5,447 |

Distribution & shareholder sevice fees - Advisor Class (See Note 5) | | | 829 |

Total expenses before waiver | | | 718,078 |

Less: Fee waiver from investment adviser (See Note 4) | | | (123,082) |

Total net expenses | | | 594,996 |

Net investment income | | | 771,109 |

REALIZED AND UNREALIZED GAIN ON INVESTMENTS

| | | |

Net realized gain on investments | | | 2,085,761 |

Net change in unrealized appreciation/depreciation of investments | | | 3,491,782 |

Net realized and unrealized gain on investments | | | 5,577,543 |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | | $ 6,348,652 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | |

OPERATIONS:

| | | | | | |

Net investment income | | | $771,109 | | | $1,209,973 |

Net realized gain on investments | | | 2,085,761 | | | 2,494,064 |

Net change in unrealized appreciation/depreciation of investments | | | 3,491,782 | | | 19,714,448 |

Net increase resulting from operations | | | 6,348,652 | | | 23,418,485 |

CAPITAL SHARE TRANSACTIONS:

| | | | | | |

Advisor Class:

| | | | | | |

Proceeds from shares sold | | | 12,980 | | | 656,251 |

Proceeds from reinvestment of distributions | | | — | | | 7,612 |

Payments for shares redeemed | | | (27,916) | | | (201,634) |

Redemption Fees | | | — | | | 1 |

Increase (Decrease) in net assets from Advisor Class transactions | | | (14,936) | | | 462,230 |

Institutional Class:

| | | | | | |

Proceeds from shares sold | | | 700,704 | | | 8,415,586 |

Proceeds from reinvestment of distributions | | | — | | | 1,666,019 |

Payments for shares redeemed | | | (5,294,706) | | | (21,230,135) |

Redemption Fees | | | 10 | | | 1 |

Decrease in net assets from Institutional Class transactions | | | (4,593,992) | | | (11,148,529) |

Net decrease in net assets from capital share transactions | | | (4,608,928) | | | (10,686,299) |

DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | |

Net Distributions to Shareholders - Advisor Class | | | — | | | (7,612) |

Net Distributions to Shareholders - Institutional Class | | | — | | | (1,666,123) |

Total distributions to shareholders | | | — | | | (1,673,735) |

Total increase in net assets | | | 1,739,724 | | | 11,058,451 |

NET ASSETS:

| | | | | | |

Beginning of Period | | | 136,278,954 | | | 125,220,503 |

End of Period | | | $ 138,018,678 | | | $136,278,954 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

FINANCIAL HIGHLIGHTS

Advisor Class

For a Fund share outstanding throughout each period.

| | | | | | | | | | |

Per Common Share Data

| | | | | | | | | |

Net asset value, beginning of period | | | $14.73 | | | $12.40 | | | $14.21 |

Investment operations:

| | | | | | | | | |

Net investment income(2) | | | 0.06 | | | 0.09 | | | 0.05 |

Net realized and unrealized gain (loss) on investments | | | 0.62 | | | 2.40 | | | (0.60) |

Total from investment operations | | | 0.68 | | | 2.49 | | | (0.55) |

Less distributions from:

| | | | | | | | | |

Net investment income | | | — | | | (0.14) | | | (0.07) |

Net realized gains | | | — | | | (0.02) | | | (1.19) |

Total distributions | | | — | | | (0.16) | | | (1.26) |

Paid-in capital from redemption fees(2) | | | — | | | —(3) | | | — |

Net asset value, end of period | | | $15.41 | | | $14.73 | | | $12.40 |

Total return | | | 4.62%(4) | | | 20.14% | | | −4.00%(4) |

Supplemental Data and Ratios

| | | | | | | | | |

Net assets, at end of period (000’s) | | | $571 | | | $560 | | | $9 |

Ratio of expenses to average net assets:

| | | | | | | | | |

Before expense waiver | | | 1.38%(5) | | | 1.42% | | | 1.45%(5) |

After expense waiver | | | 1.19%(5)(6) | | | 1.25% | | | 1.25%(5) |

Ratio of net investment income to average net assets:

| | | | | | | | | |

After expense waiver | | | 0.86%(5) | | | 0.67% | | | 1.15%(5) |

Portfolio Turnover Rate | | | 42% | | | 111% | | | 131% |

| | | | | | | | | | |

(1)

| Commencement of operations of the Advisor Class was November 18, 2022. |

(2)

| Per share amounts calculated using the average shares method. |

(3)

| Less than $0.005 per share. |

(6)

| Effective September 13, 2024, the Fund’s expense cap was changed to 0.25%. See Note 11 for additional details. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

FINANCIAL HIGHLIGHTS

Institutional Class

For a Fund share outstanding throughout each period.

| | | | | | | |

Per Common Share Data:

|

Net asset value, beginning of period | | $14.83 | | | $12.47 | | | $14.93 | | | $18.16 | | | $9.69 | | | $13.15 |

Investment operations:

| | | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.09 | | | 0.13 | | | 0.12 | | | 0.17 | | | 0.18 | | | 0.14 |

Net realized and unrealized gain (loss) on investments | | | 0.62 | | | 2.41 | | | (1.31) | | | 1.63 | | | 8.43 | | | (3.48) |

Total from investment operations | | | 0.71 | | | 2.54 | | | (1.19) | | | 1.80 | | | 8.61 | | | (3.34) |

Less distributions from:

| | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | (0.16) | | | (0.08) | | | (0.17) | | | (0.14) | | | (0.12) |

Net realized gains | | | — | | | (0.02) | | | (1.19) | | | (4.86) | | | — | | | — |

Total distributions | | | — | | | (0.18) | | | (1.27) | | | (5.03) | | | (0.14) | | | (0.12) |

Paid-in capital from redemption fees(1) | | | —(2) | | | —(2) | | | —(2) | | | —(2) | | | —(2) | | | —(2) |

Net asset value, end of period | | | $15.54 | | | $14.83 | | | $12.47 | | | $14.93 | | | $18.16 | | | $9.69 |

Total return | | | 4.79%(3) | | | 20.43% | | | −8.12% | | | 9.45% | | | 89.19% | | | −25.72% |

Supplemental Data and Ratios

|

Net assets, at end of period (000’s) | | | $137,447 | | | $135,719 | | | $125,211 | | | $69,206 | | | $63,407 | | | $27,890 |

Ratio of expenses to average net assets:

| | | | | | | | | | | | | | | | | | |

Before expense waiver | | | 1.08%(4) | | | 1.11% | | | 1.08% | | | 1.00% | | | 1.00% | | | 1.00% |

After expense waiver | | | 0.89%(4)(5) | | | 0.95% | | | 0.98%(5) | | | 1.00% | | | 1.00% | | | 1.00% |

Ratio of net investment income to average

net assets:

| | | | | | | | | | | | | | | |

After expense waiver | | | 1.16%(4) | | | 0.97% | | | 0.96% | | | 0.96% | | | 1.31% | | | 1.05% |

Portfolio Turnover Rate | | | 42%(3) | | | 111% | | | 131% | | | 116% | | | 121% | | | 127% |

| | | | | | | | | | | | | | | | | | | |

(1)

| Per share amounts calculated using the average shares method. |

(2)

| Less than $0.005 per share. |

(5)

| Effective September 13, 2024, the Fund’s expense cap (exclusive of 12b-1 and shareholder service fees) was changed to 0.25%. See Note 11 for additional details. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Notes to Financial Statements

September 30, 2024 (Unaudited)

1. ORGANIZATION

Managed Portfolio Series (the “Trust”) was organized as a Delaware statutory trust on January 27, 2011. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The CornerCap Small-Cap Value Fund (the “Fund”) is a diversified series with its own investment objectives and policies within the Trust. The investment objective of the Fund is long-term capital appreciation with a secondary objective of generating income from dividends or interest on securities. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946 Financial Services – Investment Companies. The Fund commenced operations on September 30, 1992. On November 18, 2022, the CornerCap Small-Cap Value Fund, a series of The CornerCap Group of Funds (the “Acquired Fund”), reorganized into the Fund, a series of the Trust. The Fund currently offers two classes, the Advisor Class and the Institutional Class. The Adviser Class commenced operations on November 18, 2022. Advisor Class shares are subject to a 0.25% of average daily net assets distribution and servicing fee and a shareholder servicing fee of up to 0.05% of average daily net assets. Each class of shares has identical rights and privileges with respect to voting on matters affecting a single share class. The Fund may issue an unlimited number of shares of beneficial interest, with no par value.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Security Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3.

Federal Income Taxes – The Fund complies with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, necessary to qualify as a regulated investment company and distributes substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income or excise tax provision is required. As of and during the year period September 30, 2024, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. During the period ended September 30, 2024, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. taxing authorities for the tax years ended March 31, 2021 through 2024.

Security Transactions, Income and Distributions – The Fund follows industry practice and records security transactions on the trade date. Realized gains and losses on sales of securities are calculated on the basis of identified cost. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities using the constant yield method of calculation.

The Fund will make distributions, if any, of net investment income annually. The Fund will also distribute net realized capital gains, if any, annually. Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Notes to Financial Statements

September 30, 2024 (Unaudited)(Continued)

Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. 12b-1 fees are expensed at 0.25% of average daily net assets of Advisor Class shares. Shareholder service fees are expensed at up to 0.05% of average daily net assets Advisor Class shares. Expenses associated with a specific fund in the Trust are charged to that fund. Common Trust expenses are typically allocated evenly between the funds of the Trust, or by other equitable means.

Illiquid Securities – A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the price at which the security is valued by the Funds. Illiquid securities may be valued under methods approved by the Board as reflecting fair value. The Fund will not hold more than 15% of the value of its net assets in illiquid securities. At September 30, 2024, the Fund had investments in illiquid securities with a total of $0 or 0.0% of total assets.

| | | | | | | | | | |

Ligand Pharmaceuticals, Inc. Earn-Out Shares | | | 11/7/2022 | | | 491 | | | $0 |

Ligand Pharmaceuticals, Inc. Earn-Out Shares | | | 11/7/2022 | | | 491 | | | $0 |

| | | | | | | | | | |

Security Loans – When the Fund loans securities held in its portfolio, the Fund receives compensation in the form of fees, or retains a portion of the interest on the investment of any cash received as collateral. The Fund also continues to receive dividends on the securities loaned. The loans are secured by collateral at least equal to 105% of the value of the loaned securities that are foreign securities or 102% of the value of any other loaned securities marked-to market daily. Loans shall be marked to market daily and the margin restored in the event collateralization is below 100% of the value of securities loaned. Gain or loss in the value of securities loaned that may occur during the term of the loan will be for the account of the Fund. The Fund has the right under the lending agreement to recover the securities from the borrower on demand. See Note 9.

3. SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

Level 1 –

| Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

Level 2 –

| Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

Level 3 –

| Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Equity Securities – Securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and ask prices. Securities traded primarily in the Nasdaq Global Market System for which market quotations are readily available are valued using the Nasdaq Official Closing Price (“NOCP”). If the NOCP is not available, such securities are valued at the last sale price on the day of valuation, or if there has been no sale

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Notes to Financial Statements

September 30, 2024 (Unaudited)(Continued)

on such day, at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Short-Term Investments – Investments in other mutual funds, including money market funds are valued at their net asset value per share and are categorized in Level 1 of the fair value hierarchy. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

The Board of Trustees (the “Board”) has adopted a pricing and valuation policy for use by the Funds and their Valuation Designee (as defined below) in calculating the Funds’ NAV. Pursuant to Rule 2a-5 under the 1940 Act, the Funds have designated CornerCap Investment Counsel, Inc. (the “Adviser”) as its “Valuation Designee” to perform all of the fair value determinations as well as to perform all of the responsibilities that may be performed by the Valuation Designee in accordance with Rule 2a-5. The Valuation Designee is authorized to make all necessary determinations of the fair values of portfolio securities and other assets for which market quotations are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are unreliable.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s securities as of September 30, 2024:

| | | | | | | | | | | | | | | | |

Common Stock | | | $— | | | $136,486,120 | | | $— | | | $— | | | $136,486,120 |

Investments Purchased with Proceeds from Securities Lending(*) | | | 19,907,407 | | | — | | | — | | | — | | | 19,907,407 |

Contingent Value Rights | | | — | | | — | | | — | | | — | | | — |

Money Market Fund | | | — | | | 1,515,594 | | | — | | | — | | | 1,515,594 |

Total Investments | | | $19,907,407 | | | $138,001,714 | | | $— | | | $— | | | $157,909,121 |

| | | | | | | | | | | | | | | | |

*

| Certain investments that are measured at fair value using the NAV per share (or its equivalent) as a practical expedient have not been characterized in the fair value hierarchy. The fair value amounts presented in the table are intended to permit reconciliation of the fair value hierarchy to the amount presented in the Statements of Assets and Liabilities. See Note 9 for additional information regarding securities lending activity. |

**

| Additional Level 3 disclosures deemed immaterial to the financial statements. |

Refer to the Schedule of Investments for further information on the classification of investments.

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | | | |

Balance as of 3/31/2024 | | | $ — |

Accrued discounts/ premiums | | | — |

Realized gain (loss) | | | — |

Change in net unrealized appreciation (depreciation) | | | — |

Net purchases (sales) | | | — |

Transfers in and/or out of Level 3 | | | — |

Balance as of 9/30/2024 | | | $— |

Net change in unrealized appreciation/depreciation of Level 3 assets as of September 30, 2024 | | | $— |

| | | | |

Additional Level 3 disclosures were deemed immaterial to the financial statements by Management.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Notes to Financial Statements

September 30, 2024 (Unaudited)(Continued)

4. INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Trust has an agreement with the Adviser to furnish investment advisory services to the Fund. Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is entitled to receive, on a monthly basis, an annual advisory fee equal to 0.88% of the Fund’s average daily net assets. Effective September 13, 2024, the advisory fee rate was changed to 0.00% of the Fund’s average daily net assets as a condition of the Fund’s pending liquidation (See Note 11).

The Fund’s Adviser has contractually agreed to waive a portion or all of its management fees and reimburse the Fund for its expenses to ensure that total annual operating expenses (excluding Rule 12b-1 fees, Shareholder Servicing Plan fees, leverage/borrowing interest, interest expense, dividend paid on short sales, brokerage and other transactional expenses, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, or extraordinary expenses) for the Fund do not exceed 0.95% of average daily net assets of the Fund. Effective September 13, 2024, the rate was changed to 0.25% of the Fund’s average daily net assets as a condition of the Fund’s pending liquidation (See Note 11). Fees waived and expenses reimbursed by the Adviser may be recouped by the Adviser for a period of thirty-six months following the month during which such waiver or reimbursement was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the waiver and reimbursement occurred. The Operating Expenses Limitation Agreement cannot be terminated through at least November 18, 2025. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser, with the consent of the Board. For the period ended September 30, 2024, the Adviser did not recoup any previously waived expenses. Waived fees and reimbursed expenses subject to potential recovery by year of expiration are as follows:

| | | | |

November 2025 – March 2026 | | | $90,816 |

April 2026 – March 2027 | | | 200,442 |

April 2027 – September 2028 | | | 123,082 |

| | | | |

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, (“Fund Services” or the “Administrator”), acts as the Fund’s Administrator, Transfer Agent, and Fund Accountant. U.S. Bank N.A. (the “Custodian”) serves as the custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian; coordinates the payment of the Fund’s expenses and reviews the Fund’s expense accruals. The officers of the Trust, including the Chief Compliance Officer are employees of the Administrator. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums. Fees paid by the Fund for administration and accounting, transfer agency, custody and compliance services for the period ended September 30, 2024, are disclosed in the Statement of Operations.

5. DISTRIBUTION & SHAREHOLDER SERVICING FEES

The Fund has adopted a Distribution Plan pursuant to Rule 12b-1 (the “Plan”) in the Advisor Class only. The Plan permits the Fund to pay for distribution and related expenses at an annual rate of 0.25% of the Advisor Class average daily net assets. The expenses covered by the Plan may include the cost of preparing and distributing prospectuses and other sales material, advertising and public relations expenses, payments to financial intermediaries and compensation of personnel involved in selling shares of the Fund. Payments made pursuant to the Plan will represent compensation for distribution and service activities, not reimbursements for specific expenses incurred. For the period ended September 30, 2024, the Advisor Class incurred expenses of $691 pursuant to the Plan.

The Fund has entered into a shareholder servicing agreement (the “Agreement”) where the Adviser acts as the shareholder agent, under which the Fund may pay servicing fees at an annual rate of up to 0.05% of the average daily net assets of the Advisor Class. Payments, if any, to the Adviser under the Agreement may reimburse the Adviser for payments it makes to selected brokers, dealers and administrators which have entered into service agreements with the Adviser for services provided to shareholders of the Fund. Payments may also be made directly to the intermediaries

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Notes to Financial Statements

September 30, 2024 (Unaudited)(Continued)

providing shareholder services. Services provided by such intermediaries also include the provision of support services to the Fund and includes establishing and maintaining shareholders’ accounts and record processing, purchase and redemption transactions, answering routine client inquiries regarding the Fund, and providing such other personal services to shareholders as the Fund may reasonably request. For the period ended September 30, 2024, the Advisor Class incurred $138 of shareholder servicing fees under the Agreement.

6. CAPITAL SHARE TRANSACTIONS

Transactions in shares of the Fund were as follows:

| | | | | | | |

Adviser Class

| | | | | | |

Shares sold | | | 895 | | | 51,076 |

Shares issue in reinvestment of distributions | | | — | | | 540 |

Shares redeemed | | | (1,824) | | | (14,375) |

Net increase (decrease) | | | (929) | | | 37,421 |

Institutional Class

| | | | | | |

Shares sold | | | 49,100 | | | 649,031 |

Shares issue in reinvestment of distributions | | | — | | | 117,339 |

Shares redeemed | | | (356,686) | | | (1,657,673) |

Net decrease | | | (307,586) | | | (891,303) |

Net decrease in capital shares | | | (308,515) | | | (854,062) |

| | | | | | | |

7. INVESTMENT TRANSACTIONS

The aggregate purchases and sales, excluding short-term investments, by the Fund for the period ended September 30, 2024, were as follows:

| | | | | | | |

U.S. Government | | | $— | | | $— |

Other | | | $55,537,780 | | | $59,655,890 |

| | | | | | | |

8. FEDERAL TAX INFORMATION

The aggregate gross unrealized appreciation and depreciation of securities held by the Fund and the total cost of securities for federal income tax purposes at March 31, 2024, the Funds’ most recent fiscal year end, were as follows:

| | | | | | | | | | |

$21,736,701 | | | $(6,580,171) | | | $15,156,530 | | | $141,177,094 |

| | | | | | | | | | |

At March 31, 2024, components of distributable earnings on a tax-basis were as follows:

| | | | | | | | | | | | | |

$429,264 | | | $1,780,693 | | | $ — | | | $15,156,530 | | | $17,366,487 |

| | | | | | | | | | | | | |

As of March 31, 2024, the Fund’s most recent fiscal year end, the Fund did not have any capital loss carryovers. A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital, and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31. For the taxable year ended March 31, 2024, the Fund does not plan to defer any qualified later year losses.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Notes to Financial Statements

September 30, 2024 (Unaudited)(Continued)

There were no distributions paid by the Fund for the period ended September 30, 2024

The tax character of distributions paid during the year ended March 31, 2024, were as follows:

| | | | | | | |

$1,474,599 | | | $199,136 | | | $1,673,735 |

| | | | | | | |

*

| For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income distributions. |

The Fund designated as long-term capital gain dividend, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits of the Fund related to net capital gain to zero for the tax year ended March 31, 2024.

9. SECURITIES LENDING

Following the terms of a securities lending agreement with the Fund’s Custodian, the Fund may lend securities from its portfolio to brokers, dealers and financial institutions in order to increase the return on its portfolio, primarily through the receipt of borrowing fees and earnings on invested collateral. Any such loan must be continuously secured by collateral in cash or cash equivalents maintained on a current basis in an amount at least equal to 105% of the value of the loaned securities that are foreign securities or 102% of the value of any other loaned securities marked-to-market daily. Loans shall be marked to market daily and the margin restored in the event the collateralization is below 100% of the value of the securities loaned. During the time securities are on loan, the borrower will pay the applicable Fund any accrued income on those securities, and the Fund may invest the cash collateral and earn income or receive an agreed-upon fee from a borrower that has delivered cash-equivalent collateral. In determining whether or not to lend a security to a particular broker, dealer or financial institution, the Adviser considers all relevant facts and circumstances, including the size, creditworthiness and reputation of the broker, relevant facts dealer or financial institution. Securities lending involves the risk of a default or insolvency of the borrower. In either of these cases, a Fund could experience delays in recovering securities or collateral or could lose all or part of the value of the loaned securities. A Fund also could lose money in the event of a decline in the value of the collateral provided for loaned securities. Additionally, the loaned portfolio securities may not be available to a Fund on a timely basis and that Fund may therefore lose the opportunity to sell the securities at a desirable price. Any decline in the value of a security that occurs while the security is out on loan would continue to be borne by the applicable Fund. As of September 30, 2024, the Fund had securities on loan with a value of $19,453,324 and collateral value of $19,907,407.

The Fund receives cash as collateral in return for securities lent as part of the securities lending program. The collateral is invested in the Mount Vernon Liquid Assets Portfolio, LLC of which the investment objective is to seek to maximize current income to the extent with the preservation of capital and liquidity and maintain a stable NAV of $1.00 per unit. The remaining contractual maturity of all securities lending transactions is overnight and continuous. The Fund manages credit exposure arising from these lending transactions by, in appropriate circumstances, entering into master netting agreements and collateral agreements with third party borrowers that provide the Fund, in the event of default (such as bankruptcy or a borrower’s failure to pay or perform), the right to net a third party borrower’s rights and obligations under such agreement and liquidate and set off collateral against the net amount owed by the counterparty. The net income earned by the Fund on investments of cash collateral received from borrowers for the securities loaned to them are reflected in the Fund’s Statements of Operations. Securities lending income, as disclosed in the Fund’s Statements of Operations, represents the income earned from the investment of cash collateral, net of fee rebates paid to the borrower and net of fees paid to the Custodian as lending agent.

10. CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of March 31, 2024, Charles Schwab & Co., Inc, for the benefit of its customers, owned 90.26% of the Fund.

TABLE OF CONTENTS

CornerCap Small-Cap Value Fund

Notes to Financial Statements

September 30, 2024 (Unaudited)(Continued)

11. LIQUIDATION OF FUND

Based upon a recommendation by the Adviser, the Board of Trustees of the Trust approved a plan of liquidation for the Fund. The liquidation is expected to occur on January 31, 2025. In an Asset Purchase Agreement (the “Agreement”) dated July 28, 2024, the Adviser sold its advisory accounts for cash consideration in a transaction that closed September 13, 2024. Under the terms of the Agreement, the Adviser agreed to manage the Fund until January 31, 2025. The Adviser also agreed, effective September 13, 2024, to change the Fund’s advisory fee from 0.88% to 0.00% and the Fund’s operating expense limit from 0.95% to 0.25% (exclusive of 12b-1 and shareholder service fees) of the Fund’s average daily net assets.

12. SUBSEQUENT EVENTS

Management has performed an evaluation of subsequent events through the date the financial statements were issued and has determined that no additional items require recognition or disclosure.

TABLE OF CONTENTS

CORNERCAP SMALL-CAP VALUE FUND

Additional Information (Unaudited)

AVAILABILITY OF FUND PORTFOLIO INFORMATION

The Fund files complete schedules of portfolio holdings with the U.S. Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Part F of Form N-PORT. The Fund’s Part F of Form N-PORT is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-732-0330. The Fund’s Part F of Form N-PORT may also be obtained by calling 1-888-813-8637.

AVAILABILITY OF PROXY VOTING INFORMATION