UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22525

Managed Portfolio Series

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Brian Wiedmeyer, President

Managed Portfolio Series

c/o U.S. Bank Global Fund Services

777 East Wisconsin Ave., 6th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1712

Registrant’s telephone number, including area code

Date of fiscal year end: 04/30/2025

Date of reporting period: 10/31/2024

Item 1. Reports to Stockholders.

| | |

| Nuance Mid Cap Value Fund | |

| Institutional Class | NMVLX | |

| Semi-Annual Shareholder Report | October 31, 2024 | |

This semi-annual shareholder report contains important information about the Nuance Mid Cap Value Fund for the period of May 1, 2024, to October 31, 2024. You can find additional information about the Fund at https://nuanceinvestments.com/mid-cap-value-fund/. You can also request this information by contacting us at 1-855-682-6233.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $48 | 0.92% |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $1,531,811,362 |

Number of Holdings | 55 |

Portfolio Turnover | 33% |

Visit https://nuanceinvestments.com/mid-cap-value-fund/ for more recent performance information.

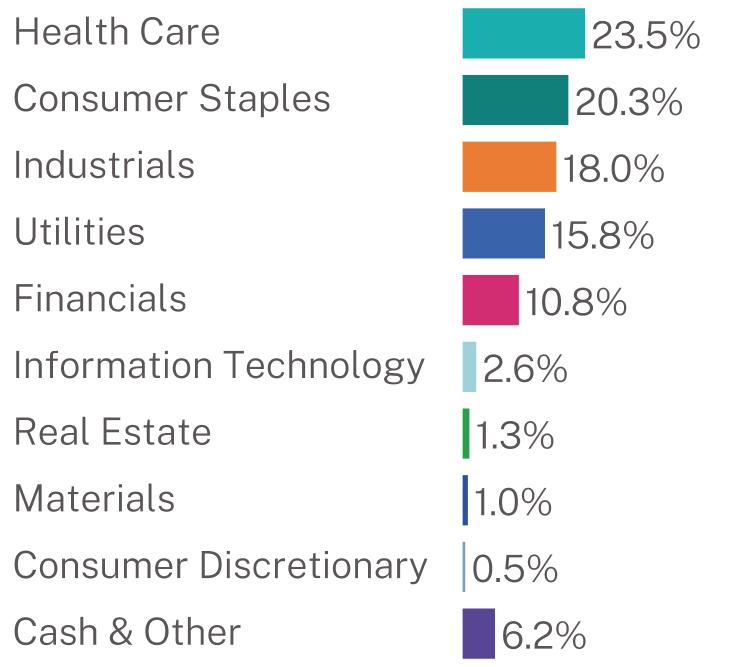

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Top Holdings | (%) |

Dentsply Sirona, Inc. | 7.0% |

Estee Lauder Companies, Inc. - Class A | 5.9% |

Henkel AG & Co KGaA | 5.8% |

Qiagen NV | 5.1% |

Northern Trust Corp. | 4.1% |

Henry Schein, Inc. | 4.0% |

Werner Enterprises, Inc. | 4.0% |

United Utilities Group PLC | 3.8% |

Envista Holdings Corp. | 3.5% |

Globe Life Inc. | 3.3% |

Sector Breakdown (% of net assets)

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://nuanceinvestments.com/mid-cap-value-fund/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Nuance Investments, LLC documents not be householded, please contact Nuance Investments, LLC at 1-855-682-6233, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Nuance Investments, LLC or your financial intermediary.

| Nuance Mid Cap Value Fund | PAGE 1 | TSR-SAR-56166Y511 |

23.520.318.015.810.82.61.31.00.56.2

| | |

| Nuance Mid Cap Value Fund | |

| Investor Class | NMAVX | |

| Semi-Annual Shareholder Report | October 31, 2024 | |

This semi-annual shareholder report contains important information about the Nuance Mid Cap Value Fund for the period of May 1, 2024, to October 31, 2024. You can find additional information about the Fund at https://nuanceinvestments.com/mid-cap-value-fund/. You can also request this information by contacting us at 1-855-682-6233.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $60 | 1.18% |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $1,531,811,362 |

Number of Holdings | 55 |

Portfolio Turnover | 33% |

Visit https://nuanceinvestments.com/mid-cap-value-fund/ for more recent performance information.

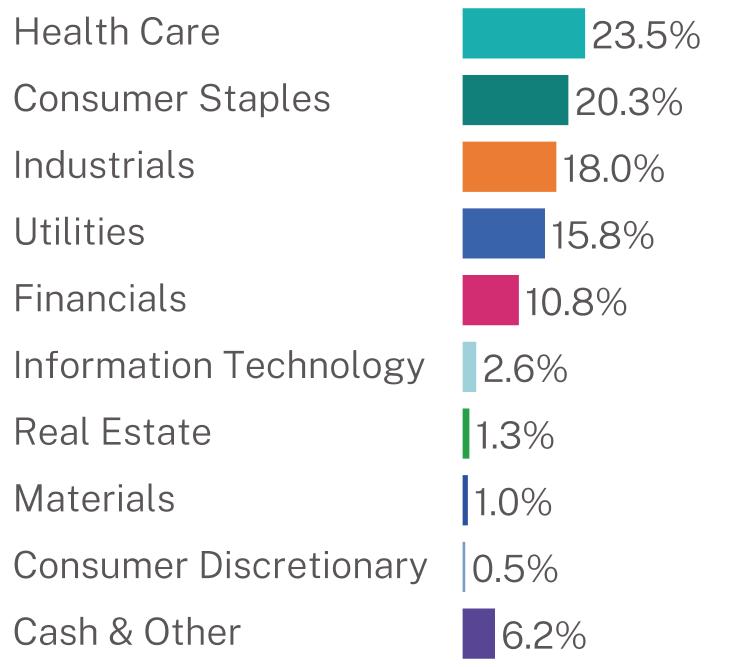

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Top Holdings | (%) |

Dentsply Sirona, Inc. | 7.0% |

Estee Lauder Companies, Inc. - Class A | 5.9% |

Henkel AG & Co KGaA | 5.8% |

Qiagen NV | 5.1% |

Northern Trust Corp. | 4.1% |

Henry Schein, Inc. | 4.0% |

Werner Enterprises, Inc. | 4.0% |

United Utilities Group PLC | 3.8% |

Envista Holdings Corp. | 3.5% |

Globe Life Inc. | 3.3% |

Sector Breakdown (% of net assets)

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://nuanceinvestments.com/mid-cap-value-fund/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Nuance Investments, LLC documents not be householded, please contact Nuance Investments, LLC at 1-855-682-6233, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Nuance Investments, LLC or your financial intermediary.

| Nuance Mid Cap Value Fund | PAGE 1 | TSR-SAR-56166Y495 |

23.520.318.015.810.82.61.31.00.56.2

| | |

| Nuance Mid Cap Value Fund | |

| Z Class | NMVZX | |

| Semi-Annual Shareholder Report | October 31, 2024 | |

This semi-annual shareholder report contains important information about the Nuance Mid Cap Value Fund for the period of May 1, 2024, to October 31, 2024. You can find additional information about the Fund at https://nuanceinvestments.com/mid-cap-value-fund/. You can also request this information by contacting us at 1-855-682-6233.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Z Class | $41 | 0.78% |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $1,531,811,362 |

Number of Holdings | 55 |

Portfolio Turnover | 33% |

Visit https://nuanceinvestments.com/mid-cap-value-fund/ for more recent performance information.

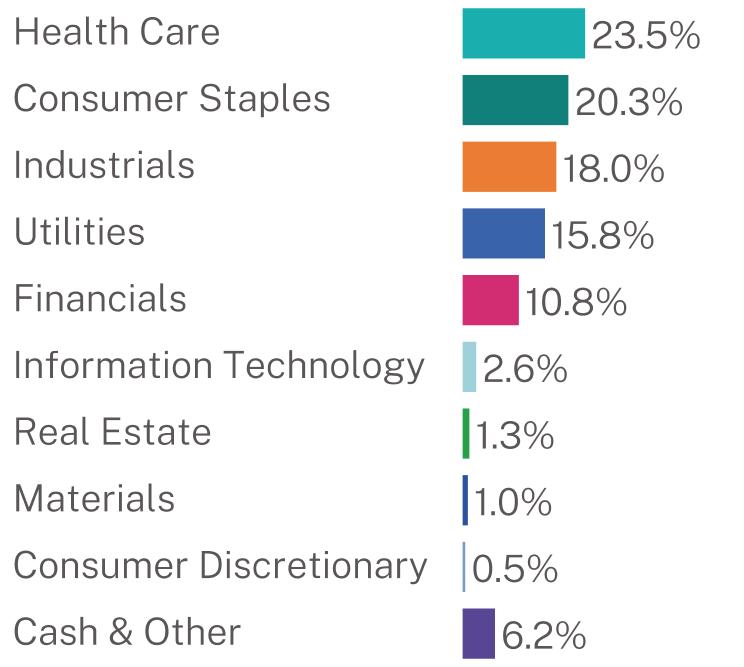

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Top Holdings | (%) |

Dentsply Sirona, Inc. | 7.0% |

Estee Lauder Companies, Inc. - Class A | 5.9% |

Henkel AG & Co KGaA | 5.8% |

Qiagen NV | 5.1% |

Northern Trust Corp. | 4.1% |

Henry Schein, Inc. | 4.0% |

Werner Enterprises, Inc. | 4.0% |

United Utilities Group PLC | 3.8% |

Envista Holdings Corp. | 3.5% |

Globe Life Inc. | 3.3% |

Sector Breakdown (% of net assets)

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://nuanceinvestments.com/mid-cap-value-fund/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Nuance Investments, LLC documents not be householded, please contact Nuance Investments, LLC at 1-855-682-6233, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Nuance Investments, LLC or your financial intermediary.

| Nuance Mid Cap Value Fund | PAGE 1 | TSR-SAR-56167N712 |

23.520.318.015.810.82.61.31.00.56.2

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

Nuance Mid Cap Value Fund

Core Financial Statements

October 31, 2024

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

Schedule of Investments

October 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 91.9%

| | | | | | |

Consumer Discretionary - 0.5%

| | | | | | |

Gentherm, Inc.(a) | | | 183,309 | | | $7,689,813 |

Consumer Staples - 20.3%

| | | | | | |

Calavo Growers, Inc. | | | 708,460 | | | 18,830,867 |

Clorox Co. | | | 293,286 | | | 46,500,495 |

Estee Lauder Companies, Inc. - Class A | | | 1,313,354 | | | 90,542,625 |

Henkel AG & Co. KGaA - ADR | | | 4,573,431 | | | 88,724,561 |

Kenvue, Inc. | | | 184,435 | | | 4,229,094 |

Kimberly-Clark Corp. | | | 230,043 | | | 30,867,170 |

McCormick & Co., Inc. | | | 197,838 | | | 15,478,845 |

Mission Produce, Inc.(a) | | | 1,281,242 | | | 15,118,656 |

| | | | | | 310,292,313 |

Financials - 9.1%

| | | | | | |

Globe Life, Inc. | | | 475,157 | | | 50,176,579 |

Independent Bank Corp. | | | 54,467 | | | 3,425,975 |

Northern Trust Corp. | | | 617,564 | | | 62,077,533 |

Reinsurance Group of America, Inc. | | | 89,585 | | | 18,909,602 |

TowneBank | | | 151,387 | | | 4,923,105 |

| | | | | | 139,512,794 |

Health Care - 23.5%

| | | | | | |

Dentsply Sirona, Inc. | | | 4,646,998 | | | 107,670,944 |

Envista Holdings Corp.(a) | | | 2,582,284 | | | 54,150,495 |

Henry Schein, Inc.(a) | | | 875,578 | | | 61,491,843 |

Hologic, Inc.(a) | | | 50,126 | | | 4,053,690 |

Qiagen NV | | | 1,867,447 | | | 78,619,519 |

Solventum Corp.(a) | | | 641,244 | | | 46,541,489 |

Waters Corp.(a) | | | 22,918 | | | 7,405,035 |

| | | | | | 359,933,015 |

Industrials - 18.0%

| | | | | | |

3M Co. | | | 318,341 | | | 40,897,268 |

Graco Inc. | | | 183,899 | | | 14,978,574 |

IDEX Corp. | | | 63,472 | | | 13,623,630 |

J.B. Hunt Transport Services, Inc. | | | 23,205 | | | 4,191,287 |

Knight-Swift Transportation Holdings, Inc. | | | 529,327 | | | 27,567,350 |

Legrand SA - ADR | | | 182,906 | | | 4,115,385 |

Lindsay Corp. | | | 102,497 | | | 12,268,891 |

Marten Transport Ltd. | | | 1,246,818 | | | 19,300,743 |

Mueller Water Products, Inc. - Class A | | | 355,436 | | | 7,673,863 |

Northrop Grumman Corp. | | | 36,952 | | | 18,809,307 |

Rockwell Automation, Inc. | | | 15,839 | | | 4,224,420 |

Southwest Airlines Co. | | | 403,287 | | | 12,332,516 |

Spirax Group PLC - ADR | | | 90,452 | | | 3,850,542 |

Stericycle, Inc.(a) | | | 324,435 | | | 19,943,019 |

Toro Co. | | | 142,411 | | | 11,461,237 |

Werner Enterprises, Inc. | | | 1,645,956 | | | 60,719,317 |

| | | | | | 275,957,349 |

Information Technology - 2.6%

| | | | | | |

Rogers Corp.(a) | | | 310,331 | | | 31,119,993 |

TE Connectivity PLC | | | 55,489 | | | 8,180,188 |

| | | | | | 39,300,181 |

| | | | | | | |

| | | | | | | |

Materials - 0.8%

| | | | | | |

AptarGroup, Inc. | | | 71,106 | | | $11,939,408 |

Real Estate - 1.3%

| | | | | | |

Equity Commonwealth(a) | | | 546,303 | | | 10,811,336 |

Healthpeak Properties, Inc. | | | 371,808 | | | 8,347,090 |

| | | | | | 19,158,426 |

Utilities - 15.8% | | | | | | |

American Water Works Co., Inc. | | | 55,027 | | | 7,599,779 |

Avista Corp. | | | 418,529 | | | 15,686,467 |

California Water Service Group | | | 670,373 | | | 34,832,581 |

IDACORP, Inc. | | | 303,339 | | | 31,389,520 |

Pennon Group PLC - ADR | | | 3,287,031 | | | 46,018,434 |

Portland General Electric Co. | | | 341,942 | | | 16,208,051 |

Severn Trent PLC - ADR | | | 115,452 | | | 3,857,251 |

SJW Group | | | 514,153 | | | 28,617,756 |

United Utilities Group PLC - ADR | | | 2,189,573 | | | 57,826,623 |

| | | | | | 242,036,462 |

TOTAL COMMON STOCKS

(Cost $1,355,972,102) | | | | | | 1,405,819,761 |

PREFERRED STOCKS - 1.7%

| | | | | | |

Financials - 1.7%

| | | | | | |

Charles Schwab Corp. Series D, 5.95%, Perpetual | | | 890,285 | | | 22,604,336 |

MetLife, Inc., (Call 03/15/2025

@ $25.00) Series F, 4.75%, Perpetual | | | 186,909 | | | 4,097,045 |

TOTAL PREFERRED STOCKS

(Cost $25,035,881) | | | | | | 26,701,381 |

CONVERTIBLE PREFERRED STOCKS - 0.2%

|

Materials - 0.2%

| | | | | | |

Albemarle Corp. 7.25%, 03/01/2027 | | | 82,375 | | | 3,686,281 |

TOTAL CONVERTIBLE PREFERRED STOCKS

(Cost $3,661,019) | | | | | | 3,686,281 |

SHORT-TERM INVESTMENTS - 6.9%

| | | |

Money Market Funds - 6.9%

| | | | | | |

First American Government Obligations Fund - Class X, 4.78%(b) | | | 106,078,037 | | | 106,078,037 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $106,078,037) | | | | | | 106,078,037 |

TOTAL INVESTMENTS - 100.7%

(Cost $1,490,747,039) | | | | | | $1,542,285,460 |

Liabilities in Excess of Other

Assets - (0.7)% | | | | | | (10,474,098) |

TOTAL NET ASSETS - 100.0% | | | | | | $1,531,811,362 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

Schedule of Investments

October 31, 2024 (Unaudited)(Continued)

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

KGaA - Kommanditgesellschaft auf Aktien

NV - Naamloze Vennootschap

PLC - Public Limited Company

SA - Sociedad Anónima

(a)

| Non-income producing security. |

(b)

| The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

NUANCE MID CAP VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2024 (Unaudited)

| | | | |

ASSETS:

| | | |

Investments, at value

| | | |

Unaffiliated Investments (cost $1,490,747,039) | | | $1,542,285,460 |

Receivable for investment securities sold | | | 36,361,439 |

Receivable for capital shares sold | | | 566,589 |

Dividends and interest receivable | | | 3,166,973 |

Prepaid expenses | | | 56,309 |

Total assets | | | 1,582,436,770 |

LIABILITIES:

| | | |

Payable for investment securities purchased | | | 45,685,960 |

Payable for capital shares redeemed | | | 3,844,176 |

Payable to investment adviser | | | 904,716 |

Payable for fund services fees | | | 16,131 |

Payable for trustee fees | | | 5,266 |

Accrued distribution & shareholder service fees | | | 119,381 |

Accrued expenses | | | 49,778 |

Total liabilities | | | 50,625,408 |

NET ASSETS | | | $1,531,811,362 |

Net Assets Consist of:

| | | |

Paid-in capital | | | $1,453,346,541 |

Total distributable earnings | | | 78,464,821 |

Net Assets | | | $1,531,811,362 |

| | | | |

| | | | | | | | | | |

Net assets | | | $30,507,275 | | | $214,584,760 | | | $1,286,719,327 |

Shares issued and outstanding(1) | | | 2,324,455 | | | 16,279,627 | | | 98,250,658 |

Net asset value, redemption price and minimum offering price per share | | | $13.12 | | | $13.18 | | | $13.10 |

Maximum offering price per share ($13.12/0.95)(2) | | | $13.81 | | | N/A | | | N/A |

| | | | | | | | | | |

(1)

| Unlimited shares authorized with no par value. |

(2)

| Reflects a maximum sales charge of 5.00%. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

NUANCE MID CAP VALUE FUND

STATEMENT OF OPERATIONS

For the Six Months Ended October 31, 2024 (Unaudited)

| | | | |

INVESTMENT INCOME:

| | | |

Dividend income from unaffiliated common stock | | | $23,004,802 |

Less: Foreign taxes withheld | | | (232,657) |

Interest income | | | 3,153,760 |

Total investment income | | | 25,925,905 |

EXPENSES:

| | | |

Investment adviser fees (See Note 4) | | | 7,370,445 |

Fund services fees (See Note 4) | | | 764,747 |

Postage & printing fees | | | 64,040 |

Federal & state registration fees | | | 53,470 |

Trustee fees | | | 12,492 |

Audit fees | | | 9,845 |

Other | | | 8,832 |

Insurance fees | | | 7,848 |

Legal fees | | | 7,097 |

Distribution & shareholder service fees (See Note 5):

| | | |

Investor Class | | | 69,414 |

Institutional Class | | | 598,283 |

Total expenses before waiver | | | 8,966,513 |

Less: waiver from investment adviser (See Note 4) | | | (169,030) |

Net expenses | | | 8,797,483 |

NET INVESTMENT INCOME | | | 17,128,422 |

REALIZED AND UNREALIZED GAIN ON INVESTMENTS:

| | | |

Net realized gain on unaffiliated investments | | | 99,499,353 |

Net change in unrealized appreciation/depreciation on unaffiliated investments | | | 30,487,008 |

Net realized and unrealized gain on investments | | | 129,986,361 |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $147,114,783 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

NUANCE MID CAP VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | |

OPERATIONS:

| | | | | | |

Net investment income | | | $17,128,422 | | | $50,880,099 |

Net realized gain on investments | | | 99,499,353 | | | 36,223,518 |

Net realized loss on affiliated investments | | | — | | | (4,191,933) |

Net change in unrealized appreciation/depreciation on unaffiliated investments | | | 30,487,008 | | | (134,973,319) |

Net change in unrealized appreciation/depreciation on affiliated investments | | | — | | | 110,051 |

Net increase (decrease) in net assets resulting from operations | | | 147,114,783 | | | (51,951,584) |

CAPITAL SHARE TRANSACTIONS:

| | | | | | |

Investor Class:

| | | | | | |

Proceeds from shares sold | | | 4,317,044 | | | 11,837,951 |

Proceeds from reinvestment of distributions | | | 470,213 | | | 852,276 |

Payments for shares redeemed | | | (13,641,332) | | | (41,235,639) |

Decrease in net assets resulting from Investor Class transactions | | | (8,854,075) | | | (28,545,412) |

Z Class:

| | | | | | |

Proceeds from shares sold | | | 6,006,697 | | | 68,492,144 |

Proceeds from reinvestment of distributions | | | 2,820,592 | | | 3,519,081 |

Payments for shares redeemed | | | (94,235,463) | | | (136,979,241) |

Decrease in net assets resulting from Z Class transactions | | | (85,408,174) | | | (64,968,016) |

Institutional Class:

| | | | | | |

Proceeds from shares sold | | | 117,611,888 | | | 589,789,652 |

Proceeds from reinvestment of distributions | | | 25,059,924 | | | 37,734,477 |

Payments for shares redeemed | | | (1,021,547,237) | | | (1,175,104,511) |

Decrease in net assets resulting from Institutional Class transactions | | | (878,875,425) | | | (547,580,382) |

Net decrease in net assets resulting from capital share transactions | | | (973,137,674) | | | (641,093,810) |

DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | |

Investor Class | | | (476,951) | | | (857,535) |

Z Class | | | (3,607,830) | | | (6,019,847) |

Institutional Class | | | (27,559,053) | | | (43,717,129) |

Total distributions to shareholders | | | (31,643,834) | | | (50,594,511) |

Total DECREASE IN NET ASSETS | | | (857,666,725) | | | (743,639,905) |

NET ASSETS:

| | | | | | |

Beginning of period | | | 2,389,478,087 | | | 3,133,117,992 |

End of period | | | $1,531,811,362 | | | $2,389,478,087 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

FINANCIAL HIGHLIGHTS

Investor Class

For a Fund share outstanding throughout the period.

| | | | | | | |

PER SHARE DATA:

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $12.36 | | | $12.73 | | | $13.40 | | | $15.36 | | | $11.81 | | | $12.80 |

INVESTMENT OPERATIONS:

| | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.13 | | | 0.25 | | | 0.19 | | | 0.13 | | | 0.07 | | | 0.12 |

Net realized and unrealized gain (loss) on investments | | | 0.80 | | | (0.44) | | | 0.35 | | | (0.42) | | | 3.55 | | | (0.30) |

Total from investment operations | | | 0.93 | | | (0.19) | | | 0.54 | | | (0.29) | | | 3.62 | | | (0.18) |

LESS DISTRIBUTIONS:

| | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.17) | | | (0.18) | | | (0.15) | | | (0.08) | | | (0.07) | | | (0.14) |

Distributions from net realized gains | | | — | | | — | | | (1.06) | | | (1.59) | | | — | | | (0.67) |

Total distributions | | | (0.17) | | | (0.18) | | | (1.21) | | | (1.67) | | | (0.07) | | | (0.81) |

Net asset value, end of period | | | $13.12 | | | $12.36 | | | $12.73 | | | $13.40 | | | $15.36 | | | $11.81 |

Total return(1)(2) | | | 7.63% | | | (1.41)% | | | 4.51% | | | (2.07)% | | | 30.77% | | | (2.12)% |

SUPPLEMENTAL DATA AND RATIOS:

| | | | | | | | | | | | | | | |

Net assets, end of period (in millions) | | | $30.5 | | | $37.3 | | | $68.3 | | | $78.1 | | | $117.1 | | | $94.3 |

Ratio of expenses to average net assets(3):

| | | | | | | | | | | | | | | | | | |

Before expense waiver/recoupment | | | 1.25% | | | 1.23% | | | 1.22% | | | 1.22% | | | 1.23% | | | 1.24% |

After expense waiver/recoupment | | | 1.18% | | | 1.18% | | | 1.18% | | | 1.18% | | | 1.18% | | | 1.18% |

Ratio of net investment income to average net assets(3):

| | | | | | | | | | | | | | | | | | |

Before expense waiver/recoupment | | | 1.39% | | | 1.51% | | | 1.39% | | | 0.74% | | | 0.48% | | | 0.96% |

After expense waiver/recoupment | | | 1.46% | | | 1.56% | | | 1.43% | | | 0.78% | | | 0.53% | | | 1.02% |

Portfolio turnover rate(2) | | | 33% | | | 78% | | | 62% | | | 61% | | | 76% | | | 124% |

| | | | | | | | | | | | | | | | | | | |

(1)

| Total return does not reflect sales charges. |

(2)

| Not annualized for periods less than one year. |

(3)

| Annualized for periods less than one year. |

See Notes to Financial Statements

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

FINANCIAL HIGHLIGHTS

Z Class

For a Fund share outstanding throughout the period.

| | | | | | | |

PER SHARE DATA:

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $12.41 | | | $12.77 | | | $13.45 | | | $15.42 | | | $11.84 | | | $12.83 |

INVESTMENT OPERATIONS:

| | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.16 | | | 0.25 | | | 0.24 | | | 0.17 | | | 0.12 | | | 0.18 |

Net realized and unrealized gain (loss) on investments | | | 0.81 | | | (0.39) | | | 0.34 | | | (0.40) | | | 3.57 | | | (0.32) |

Total from investment operations | | | 0.97 | | | (0.14) | | | 0.58 | | | (0.23) | | | 3.69 | | | (0.14) |

LESS DISTRIBUTIONS:

| | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.20) | | | (0.22) | | | (0.20) | | | (0.15) | | | (0.11) | | | (0.18) |

Distributions from net realized gains | | | — | | | — | | | (1.06) | | | (1.59) | | | — | | | (0.67) |

Total distributions | | | (0.20) | | | (0.22) | | | (1.26) | | | (1.74) | | | (0.11) | | | (0.85) |

Net asset value, end of period | | | $13.18 | | | $12.41 | | | $12.77 | | | $13.45 | | | $15.42 | | | $11.84 |

Total return(1) | | | 7.91% | | | (1.01)% | | | 4.87% | | | (1.62)% | | | 31.34% | | | (1.78)% |

SUPPLEMENTAL DATA AND RATIOS:

| | | | | | | | | | | | | | | |

Net assets, end of period (in millions) | | | $214.6 | | | $285.7 | | | $362.4 | | | $395.3 | | | $409.5 | | | $254.2 |

Ratio of expenses to average net assets(2):

| | | | | | | | | | | | | | | | | | |

Before expense waiver/recoupment | | | 0.85% | | | 0.83% | | | 0.82% | | | 0.82% | | | 0.83% | | | 0.84% |

After expense waiver/recoupment | | | 0.78% | | | 0.78% | | | 0.78% | | | 0.78% | | | 0.78% | | | 0.78% |

Ratio of net investment income to average net assets(2):

| | | | | | | | | | | | | | | | | | |

Before expense waiver/recoupment | | | 1.79% | | | 1.91% | | | 1.79% | | | 1.15% | | | 0.88% | | | 1.36% |

After expense waiver/recoupment | | | 1.86% | | | 1.96% | | | 1.83% | | | 1.19% | | | 0.93% | | | 1.42% |

Portfolio turnover rate(1) | | | 33% | | | 78% | | | 62% | | | 61% | | | 76% | | | 124% |

| | | | | | | | | | | | | | | | | | | |

(1)

| Not annualized for periods less than one year. |

(2)

| Annualized for periods less than one year. |

See Notes to Financial Statements

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

FINANCIAL HIGHLIGHTS

Institutional Class

For a Fund share outstanding throughout the period.

| | | | | | | |

PER SHARE DATA:

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $12.34 | | | $12.71 | | | $13.39 | | | $15.36 | | | $11.81 | | | $12.80 |

INVESTMENT OPERATIONS:

| | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.12 | | | 0.23 | | | 0.22 | | | 0.16 | | | 0.10 | | | 0.17 |

Net realized and unrealized gain (loss) on investments | | | 0.84 | | | (0.39) | | | 0.35 | | | (0.40) | | | 3.55 | | | (0.31) |

Total from investment operations | | | 0.96 | | | (0.16) | | | 0.57 | | | (0.24) | | | 3.65 | | | (0.14) |

LESS DISTRIBUTIONS:

| | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.20) | | | (0.21) | | | (0.19) | | | (0.14) | | | (0.10) | | | (0.18) |

Distributions from net realized gains | | | — | | | — | | | (1.06) | | | (1.59) | | | — | | | (0.67) |

Total distributions | | | (0.20) | | | (0.21) | | | (1.25) | | | (1.73) | | | (0.10) | | | (0.85) |

Net asset value, end of period | | | $13.10 | | | $12.34 | | | $12.71 | | | $13.39 | | | $15.36 | | | $11.81 |

Total return(1) | | | 7.83% | | | (1.15)% | | | 4.82% | | | (1.71)% | | | 31.09% | | | (1.85)% |

SUPPLEMENTAL DATA AND RATIOS:

| | | | | | | | | | | | | | | |

Net assets, end of period (in millions) | | | $1,286.7 | | | $2,066.5 | | | $2,702.4 | | | $3,033.8 | | | $3,284.4 | | | $1,474.8 |

Ratio of expenses to average net assets(2):

| | | | | | | | | | | | | | | | | | |

Before expense waiver/recoupment | | | 0.92% | | | 0.90% | | | 0.89% | | | 0.88% | | | 0.91% | | | 0.92% |

After expense waiver/recoupment | | | 0.91% | | | 0.90% | | | 0.89% | | | 0.88% | | | 0.92% | | | 0.93% |

Ratio of net investment income to average net assets(2):

| | | | | | | | | | | | | | | | | | |

Before expense waiver/recoupment | | | 1.72% | | | 1.84% | | | 1.72% | | | 1.08% | | | 0.80% | | | 1.29% |

After expense waiver/recoupment | | | 1.73% | | | 1.84% | | | 1.72% | | | 1.08% | | | 0.79% | | | 1.28% |

Portfolio turnover rate(1) | | | 33% | | | 78% | | | 62% | | | 61% | | | 76% | | | 124% |

| | | | | | | | | | | | | | | | | | | |

(1)

| Not annualized for periods less than one year. |

(2)

| Annualized for periods less than one year. |

See Notes to Financial Statements

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

Notes to Financial Statements

October 31, 2024 (Unaudited)

1. ORGANIZATION

Managed Portfolio Series (the “Trust”) was organized as a Delaware statutory trust on January 27, 2011. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Nuance Mid Cap Value Fund (the “Fund”) is a diversified series with its own investment objectives and policies within the Trust. The investment objective of the Fund is long-term capital appreciation. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies. The Fund commenced operations on May 31, 2011. The Fund currently offers three classes, the Investor Class, the Institutional Class and the Z Class. Investor Class shares may be subject to a front-end sales charge of up to 5.00%. Investor Class shares are subject to a 0.25% of average daily net assets of distribution and servicing fee and Investor Class and Institutional Class shares are subject to a shareholder servicing fee of up to 0.15% of average daily net assets. Each class of shares has identical rights and privileges with respect to voting on matters affecting a single share class. The Fund may issue an unlimited number of shares of beneficial interest, with no par value.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Security Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3.

Federal Income Taxes – The Fund complies with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, necessary to qualify as a regulated investment company and distributes substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income or excise tax provision is required. As of and during the period ended October 31, 2024, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. During the six months ended October 31, 2024, the Fund did not incur any interest or penalties.

Security Transactions, Income and Distributions – The Fund follows industry practice and records security transactions on the trade date. Realized gains and losses on sales of securities are calculated on the basis of identified cost. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities using the constant yield method of calculation.

The Fund will make distributions, if any, of net investment income quarterly. The Fund will also distribute net realized capital gains, if any, annually. Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

Notes to Financial Statements

October 31, 2024 (Unaudited)(Continued)

Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. 12b-1 fees are expensed at 0.25% of average daily net assets of Investor Class shares. Shareholder service fees are expensed at up to 0.15% of average daily net assets for Investor and Institutional shares. Expenses associated with a specific fund in the Trust are charged to that fund. Common Trust expenses are typically allocated evenly between the funds of the Trust, or by other equitable means.

3. SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

Level 1 –

| Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

Level 2 –

| Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

Level 3 –

| Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Equity Securities – Securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and ask prices. Securities traded primarily in the Nasdaq Global Market System for which market quotations are readily available are valued using the Nasdaq Official Closing Price (“NOCP”). If the NOCP is not available, such securities are valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Short-Term Investments – Investments in other mutual funds, including money market funds are valued at their net asset value per share and are categorized in Level 1 of the fair value hierarchy. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

The Board of Trustees (the “Board”) has adopted a pricing and valuation policy for use by the Fund and its Valuation Designee (as defined below) in calculating the Fund’s NAV. Pursuant to Rule 2a-5 under the 1940 Act, the Fund has designated Nuance Investments, LLC (the “Adviser”) as its “Valuation Designee” to perform all of the fair value determinations as well as to perform all of the responsibilities that may be performed by the Valuation Designee in accordance with Rule 2a-5. The Valuation Designee is authorized to make all necessary determinations of the fair values of portfolio securities and other assets for which market quotations are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are unreliable.

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

Notes to Financial Statements

October 31, 2024 (Unaudited)(Continued)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s securities as of October 31, 2024:

| | | | | | | | | | | | | |

Common Stocks | | | $1,405,819,761 | | | $ — | | | $ — | | | $1,405,819,761 |

Preferred Stocks | | | 26,701,381 | | | — | | | — | | | 26,701,381 |

Convertible Preferred Stocks | | | 3,686,281 | | | — | | | — | | | 3,686,281 |

Short-Term Investment | | | 106,078,037 | | | — | | | — | | | 106,078,037 |

Total Investments in Securities | | | $1,542,285,460 | | | $— | | | $— | | | $1,542,285,460 |

| | | | | | | | | | | | | |

Refer to the Schedule of Investments for further information on the classification of investments.

4. INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Trust has an agreement with Nuance Investments, LLC (the “Adviser”) to furnish investment advisory services to the Fund. Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is entitled to receive, on a monthly basis, an annual advisory fee equal to 0.75% of the Fund’s average daily net assets.

The Fund’s Adviser has contractually agreed to waive a portion or all of its management fees and reimburse the Fund for its expenses to ensure that total annual operating expenses (excluding acquired fund fees and expenses, leverage, interest, dividend and interest expense on short sales, taxes, brokerage commissions and extraordinary expenses) for the Fund do not exceed 1.18%, 0.78% and 0.93% of average daily net assets of the Fund’s Investor Class, Z Class and Institutional Class, respectively. Fees waived and expenses reimbursed by the Adviser may be recouped by the Adviser for a period of thirty-six months following the month during which such waiver or reimbursement was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the waiver and reimbursement occurred. The Operating Expense Limitation Agreement is intended to be continual in nature and cannot be terminated within a year after the effective date of the Fund’s prospectus. After that date, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board or the Adviser, with the consent of the Board. For the period ended October 31, 2024, the Adviser did not recoup any previously waived expenses. Waived fees and reimbursed expenses subject to potential recovery by year of expiration are as follows:

| | | | |

November 2024 – April 2025 | | | $103,855 |

May 2025 – April 2026 | | | $173,502 |

May 2026 – April 2027 | | | $171,439 |

May 2027 – October 2027 | | | $169,030 |

| | | | |

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, (“Fund Services” or the “Administrator”), acts as the Fund’s Administrator, Transfer Agent, and Fund Accountant. U.S. Bank N.A. (the “Custodian”) serves as the custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian; coordinates the payment of the Fund’s expenses and reviews the Fund’s expense accruals. The officers of the Trust, including the Chief Compliance Officer are employees of the Administrator. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums. Fees paid by the Fund for administration and accounting, transfer agency, custody and compliance services for the period ended October 31, 2024, are disclosed in the Statement of Operations as fund services fees.

5. DISTRIBUTION & SHAREHOLDER SERVICING FEES

The Fund has adopted a Distribution Plan pursuant to Rule 12b-1 (the “Plan”) in the Investor Class only. The Plan permits the Fund to pay for distribution and related expenses at an annual rate of 0.25% of the Investor Class average daily net assets. The expenses covered by the Plan may include the cost of preparing and distributing prospectuses and other sales material, advertising and public relations expenses, payments to financial intermediaries and compensation

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

Notes to Financial Statements

October 31, 2024 (Unaudited)(Continued)

of personnel involved in selling shares of the Fund. Payments made pursuant to the Plan will represent compensation for distribution and service activities, not reimbursements for specific expenses incurred. For the period ended October 31, 2024, the Investor Class incurred expenses of $43,384 pursuant to the Plan.

The Fund has entered into a shareholder servicing agreement (the “Agreement”) where the Adviser acts as the shareholder agent, under which the Fund may pay servicing fees at an annual rate of up to 0.15% of the average daily net assets of each class. Payments, if any, to the Adviser under the Agreement may reimburse the Adviser for payments it makes to selected brokers, dealers and administrators which have entered into service agreements with the Adviser for services provided to shareholders of the Fund. Payments may also be made directly to the intermediaries providing shareholder services. The services provided by such intermediaries are primarily designed to assist shareholders of the Fund and include the furnishing of office space and equipment, telephone facilities, personnel and assistance to the Fund in servicing such shareholders. Services provided by such intermediaries also include the provision of support services to the Fund and includes establishing and maintaining shareholders’ accounts and record processing, purchase and redemption transactions, answering routine client inquiries regarding the Fund, and providing such other personal services to shareholders as the Fund may reasonably request. For the period ended October 31, 2024, the Investor and Institutional Class incurred $26,030 and $598,283, respectively, of shareholder servicing fees under the Agreement.

6. CAPITAL SHARE TRANSACTIONS

Transactions in shares of the Fund were as follows:

| | | | | | | |

Investor Class:

| | | | | | |

Shares sold | | | 333,941 | | | 976,751 |

Shares issued to holders in reinvestment of distributions | | | 37,836 | | | 70,542 |

Shares redeemed | | | (1,066,453) | | | (3,395,982) |

Net decrease in Investor Class shares | | | (694,676) | | | (2,348,689) |

Z Class:

| | | | | | |

Shares sold | | | 470,290 | | | 5,631,059 |

Shares issued to holders in reinvestment of distributions | | | 224,667 | | | 290,551 |

Shares redeemed | | | (7,428,295) | | | (11,277,591) |

Net decrease in Z Class shares | | | (6,733,338) | | | (5,355,987) |

Institutional Class:

| | | | | | |

Shares sold | | | 9,248,037 | | | 49,540,910 |

Shares issued to holders in reinvestment of distributions | | | 2,026,235 | | | 3,134,255 |

Shares redeemed | | | (80,515,037) | | | (97,875,184) |

Net decrease in Institutional Class shares | | | (69,240,765) | | | (45,200,019) |

Net decrease in shares outstanding | | | (76,668,779) | | | (52,904,695) |

| | | | | | | |

7. INVESTMENT TRANSACTIONS

The aggregate purchases and sales, excluding short-term investments, by the Fund for the year ended April 30, 2024, were as follows:

| | | | | | | |

U.S. Government | | | $— | | | $— |

Other | | | $601,334,695 | | | $1,502,883,856 |

| | | | | | | |

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

Notes to Financial Statements

October 31, 2024 (Unaudited)(Continued)

8. FEDERAL TAX INFORMATION

The aggregate gross unrealized appreciation and depreciation of securities held by the Fund and the total cost of securities for federal income tax purposes at April 30, 2024, the Fund’s most recent fiscal year end, were as follows:

| | | | | | | | | | |

$148,968,505 | | | $(162,363,020) | | | $(13,394,515) | | | $2,386,412,896 |

| | | | | | | | | | |

The difference between book-basis and tax-basis unrealized appreciation is attributable primarily to the deferral of wash sale losses. At April 30, 2024, components of distributed earnings on a tax-basis were as follows:

| | | | | | | | | | | | | |

$15,651,239 | | | $ — | | | $(39,262,852) | | | $(13,394,515) | | | $(37,006,128) |

| | | | | | | | | | | | | |

As of April 30, 2024, the Fund’s most recent fiscal year end, the Fund had $28,805,699 in short term capital loss carryovers and $7,914,299 in long term capital loss carryovers. For the year ended April 30, 2024 the Fund utilized $42,558,684 in capital loss carryforwards. A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital, and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31. For the taxable year ended April 30, 2024, the Fund does not plan to defer any qualified later year losses.

The tax character of distributions paid during the period ended October 31, 2024, were as follows:

| | | | | | | |

$31,643,834 | | | $ — | | | $31,643,834 |

| | | | | | | |

The tax character of distributions paid during the year ended April 30, 2024, were as follows:

| | | | | | | |

$50,594,511 | | | $ — | | | $50,594,511 |

| | | | | | | |

*

| For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income distributions. |

The Fund designated as long-term capital gain dividend, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings of the Fund related to net capital gain to zero for the tax year ended April 30, 2024.

9. CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of October 31, 2024, Morgan Stanley Smith Barney, LLC, and National Financial Services, LLC, for the benefit of their customers, owned 33.20% and 13.66% of the Fund, respectively.

TABLE OF CONTENTS

Nuance Mid Cap Value Fund

Additional Information (Unaudited)

AVAILABILITY OF FUND PORTFOLIO INFORMATION

The Fund files complete schedules of portfolio holdings with the U.S. Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Part F of Form N-PORT. The Fund’s Part F of Form N-PORT is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-732-0330. The Fund’s Part F of Form N-PORT may also be obtained by calling 1-855-682-6233.

AVAILABILITY OF PROXY VOTING INFORMATION

Each Fund’s actual voting record relating to portfolio securities during the most recent 12-month period ended June 30, may be obtained upon request and without charge by calling toll-free, (800) SEC-0330, on the Fund’s website at https://nuanceinvestments.com/funds/, and on the SEC’s website at http://www.sec.gov.

TABLE OF CONTENTS

INVESTMENT ADVISER

Nuance Investments, LLC

4900 Main Street, Suite 220

Kansas City, MO 64112

DISTRIBUTOR

Quasar Distributors, LLC

3 Canal Plaza, Suite 100

Portland, ME 04101

CUSTODIAN

U.S. Bank, N.A.

1555 North Rivercenter Drive

Milwaukee, WI 53212

ADMINISTRATOR, FUND ACCOUNTANT

AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

342 North Water Street, Suite 830

Milwaukee, WI 53202

LEGAL COUNSEL

Stradley Ronon Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103

| (b) | Financial Highlights are included within the financial statements filed under Item 7 of this Form. |

Item 8. Changes in and Disagreements with Accountants for Open-End Investment Companies.

There were no changes in or disagreements with accountants during the period covered by this report.

Item 9. Proxy Disclosure for Open-End Investment Companies.

There were no matters submitted to a vote of shareholders during the period covered by this report.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Investment Companies.

See Item 7(a).

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Not applicable

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 15. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 16. Controls and Procedures.

| (a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable

Item 19. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not applicable for semi-annual reports |

(2) Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant’s securities are listed. Not applicable for semi-annual reports.

(3) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)). Filed herewith.

(4) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (5) | Change in the registrant’s independent public accountant. Provide the information called for by Item 4 of Form 8-K under the Exchange Act (17 CFR 249.308). Unless otherwise specified by Item 4, or related to and necessary for a complete understanding of information not previously disclosed, the information should relate to events occurring during the reporting period. Not applicable to open-end investment companies and ETFs. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | (Registrant) | Managed Portfolio Series | |

| | By (Signature and Title) * | /s/ Brian R. Wiedmeyer | |

| | | Brian R. Wiedmeyer, President | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By (Signature and Title) * | /s/ Brian R. Wiedmeyer | |

| | | Brian R. Wiedmeyer, President | |

| | By (Signature and Title) * | /s/ Benjamin J. Eirich | |

| | | Benjamin J. Eirich, Treasurer | |

* Print the name and title of each signing officer under his or her signature.