Exhibit 99.1

Tembec Inc.

Annual Information Form

December 14, 2012

For the fiscal year ended September 29, 2012

Annual Information Form Annual Information Form |

TABLE OFCONTENTS

| ITEM 1 - | DATE OF ANNUAL INFORMATION FORM | 5 |

| ITEM 2 - | CORPORATE STRUCTURE | 5 |

| ITEM 3 - | GENERAL DEVELOPMENT OF THE BUSINESS | 7 |

| | 3.1 | BUSINESS OVERVIEW | 7 |

| | 3.2 | THREE-YEAR HISTORY | 7 |

| | 3.3 | TRENDS | | 11 |

| ITEM 4 - | NARRATIVE DESCRIPTION OF THE BUSINESS | 11 |

| | 4.1 | PRINCIPAL OPERATIONS | 11 |

| | | 4.1.1 | FOREST PRODUCTS SEGMENT | 11 |

| | | 4.1.2 | SPECIALTY CELLULOSE AND CHEMICAL PULP SEGMENT | 16 |

| | | 4.1.3 | HIGH YIELD PULP SEGMENT | 17 |

| | | 4.1.4 | PAPER SEGMENT | 18 |

| | 4.2 | ENVIRONMENTAL AND SOCIAL POLICIES | 19 |

| | 4.3 | ENERGY | | 21 |

| | 4.4 | RESEARCH AND DEVELOPMENT | 22 |

| | 4.5 | COMPETITION | 22 |

| | 4.6 | RISK FACTORS | 23 |

| ITEM 5 - | DIVIDENDS | | 31 |

| ITEM 6 - | GENERAL DESCRIPTION OF CAPITAL STRUCTURE | 31 |

| | 6.1 | GENERAL DESCRIPTION OF CAPITAL STRUCTURE | 31 |

| | 6.2 | RATINGS | 31 |

| ITEM 7 - | MARKET FOR SECURITIES OF THE CORPORATION | 32 |

| ITEM 8 - | DIRECTORS AND OFFICERS | 33 |

| | 8.1 | INFORMATION CONCERNING DIRECTORS | 33 |

| | | 8.1.1 | INDEPENDENCE | 36 |

| | 8.2 | AUDIT COMMITTEE | 36 |

| | | 8.2.1 | GENERAL | 36 |

| | | 8.2.2 | CHARTER OF THE AUDIT COMMITTEE | 36 |

| | | 8.2.3 | RELEVANT EDUCATION AND EXPERIENCE OF THE AUDIT COMMITTEE MEMBERS | 36 |

| | | 8.2.4 | EXTERNAL AUDITOR SERVICE FEES | 37 |

| | | 8.2.5 | POLICIES AND PROCEDURES FOR THE ENGAGEMENT OF NON-AUDIT SERVICES | 38 |

| | 8.3 | INFORMATION CONCERNING NON-DIRECTOR OFFICERS | 39 |

| | 8.4 | CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES AND SANCTIONS | 39 |

| ITEM 9 - | LEGAL PROCEEDINGS | 41 |

| ITEM 10 - | TRANSFER AGENT AND REGISTRAR | 41 |

| ITEM 11 - | MATERIAL CONTRACTS | 41 |

| ITEM 12 - | INTERESTS OF EXPERTS | 42 |

| ITEM 13 - | ADDITIONAL INFORMATION | 43 |

| DEFINITIONS | 44 |

| SCHEDULE “A” AUDIT COMMITTEE CHARTER | 45 |

Annual Information Form Annual Information Form |

DOCUMENTS INCORPORATED BY REFERENCE

CERTAIN SPECIFICALLY IDENTIFIED PAGES OF THE AUDITED CONSOLIDATED FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED SEPTEMBER 29, 2012 (THE “2012 FINANCIAL STATEMENTS”) AND THE MANAGEMENT’S DISCUSSION AND ANALYSIS DATED NOVEMBER30, 2012 (THE “2012 MD&A”), FILED WITH THE SECURITIES COMMISSION OR SIMILAR AUTHORITY IN EACH OF THE PROVINCES OF CANADA, ARE INCORPORATED BY REFERENCE INTO AND FORMAN INTEGRAL PART OF THIS ANNUAL INFORMATION FORM (THE “AIF”).

GLOSSARY

Unless otherwise noted or the context otherwise indicates, references to the “Corporation” in this AIF are to Tembec Inc. References to “Tembec” are to, as the context may require, either the Corporation or Former Tembec, as defined below, or the Corporation or Former Tembec together with one or more of their respective subsidiaries (the “Subsidiaries”), affiliates and its interests in joint ventures and other entities. Reference to “Tembec Industries” is to Tembec Industries Inc., a wholly-owned subsidiary of the Corporation. In addition, unless otherwise defined herein, certain terms are defined in the Definitions section of this AIF. All dollar figures are in Canadian dollars unless stated otherwise.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this AIF include “forward-looking statements” within the meaning of securities laws. Such statements relate, without limitation, to the Corporation’s or management’s objectives, projections, estimates, expectations or predictions of the future and can be identified by words such as “may”, “will”, “could”, “anticipate”, “estimate”, “expect” and “project”, the negative or variation thereof, and expressions of similar nature. Forward-looking statements are based on certain assumptions and analyses made by the Corporation in light of its experience, information available to it and its perception of future developments. The forward-looking statements contained in this AIF reflect the Corporation’s expectations as of the date hereof and are subject to change after such date. The Corporation disclaims any intention to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by applicable securities legislation.

Such statements are subject to a number of risks and uncertainties, including, but not limited to

- The demand and prices for the products that Tembec sells;

- Fluctuations in the exchange rate of the Canadian dollar to the U.S. dollar and to the euro;

- Raw material availability and prices;

- Energy availability and costs;

- Labour availability and labour disruptions;

- The effect and enforcement of environmental and other governmental regulations;

- Levels of capital expenditures required to maintain and upgrade processes;

- Fluctuations in export taxes and/or volume restrictions imposed on lumber exported to the United States;

- Debt service requirements;

- Performance of pension fund assets;

- Scope of insurance coverage; and

- First Nations' land claims.

Many of these risks are beyond the control of the Corporation and, therefore, may cause actual actions or results to materially differ from those expressed or implied herein. In addition, other risks could adversely affect Tembec and it is not possible to predict or assess all risks. Tembec’s actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will occur, or if any of them do so, what benefits, including the amount of proceeds, Tembec will derive from them. Except as otherwise indicated, forward-looking statements do not take into account the effect that transactions or non-recurring or other special items announced or occurring after the statements are made may have on Tembec’s business. Such statements do not, unless otherwise specified by Tembec, reflect the impact of dispositions, sales of assets, monetizations, mergers, acquisitions, combinations or transactions, asset write-downs or other charges announced or occurring after forward-looking statements are made. The financial impact of these transactions and non-recurring and other special items can be complex and depends on the facts particular to each of them, and cannot be expressed in a meaningful way or in the same way Tembec presents known risks affecting its business.

Annual Information Form Annual Information Form |

IFRS REPORTING

Effective September 26, 2010, the Corporation fully adopted International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) as the basis for preparation of financial information and accounting.

An explanation of how the transition to IFRS has affected the reported financial position, financial performance and cash flows of the Corporation is provided in note 22 of the 2012 Financial Statements.

NON-IFRS FINANCIAL MEASURES

The following summarizes non-IFRS financial measures utilized in the 2012 MD&A. As there is no generally accepted method of calculating these financial measures, they may not be comparable to similar measures reported by other companies. Adjusted EBITDA refers to earnings before interest, income taxes, depreciation, amortization and other items. Since the Corporation excludes “other items” such as gains and losses on significant asset disposals, restructuring charges and custodial costs for permanently idled facilities, it differs from EBITDA. Adjusted EBITDA does not have any standardized meaning according to IFRS. The Corporation defines adjusted EBITDA as sales less cost of sales and selling, general and administrative expenses, meaning it represents operating earnings before depreciation, amortization and other items. The Corporation considers adjusted EBITDA to be a useful indicator of the financial performance of the Corporation, the business segments and the individual business units. The most comparable financial measure is operating earnings or loss. A reconciliation of operating earnings to the Corporation's definition of adjusted EBITDA is provided in the 2012 MD&A.

Annual Information Form Annual Information Form |

TEMBEC INC.

ANNUAL INFORMATION FORM

| ITEM 1 - | DATE OF ANNUAL INFORMATION FORM |

This AIF is dated as of December 14, 2012. Except as otherwise indicated, the information contained in this AIF is stated as at September 29, 2012.

| ITEM 2 - | CORPORATE STRUCTURE |

On February 29, 2008, the former Tembec Inc. (“Former Tembec”), completed a recapitalization transaction (the “Recapitalization”).

On January 16, 2008, a new entity, Tembec Arrangement Inc., was incorporated under the Canada Business Corporations Act to carry on business as of February 29, 2008 under the name of Tembec Inc. As part of the Recapitalization, Former Tembec Inc. became Tembec Holdings Inc. and Tembec Arrangement Inc. changed its name to Tembec Inc. Former Tembec was dissolved effective December 8, 2010. Additional information relating to the Recapitalization may be found on SEDAR atwww.sedar.com. In this AIF, all references made to Tembec Inc. or to the Corporation refer to this new Tembec Inc. incorporated on January 16, 2008, unless specified otherwise. References to “Tembec” refer to the Corporation or Former Tembec together with one or more of their respective subsidiaries.

The Corporation’s head office is located at Suite 1050, 800 René-Lévesque Blvd. West, Montreal, Québec, H3B 1X9, telephone: 514-871-0137. Its website address iswww.tembec.com.

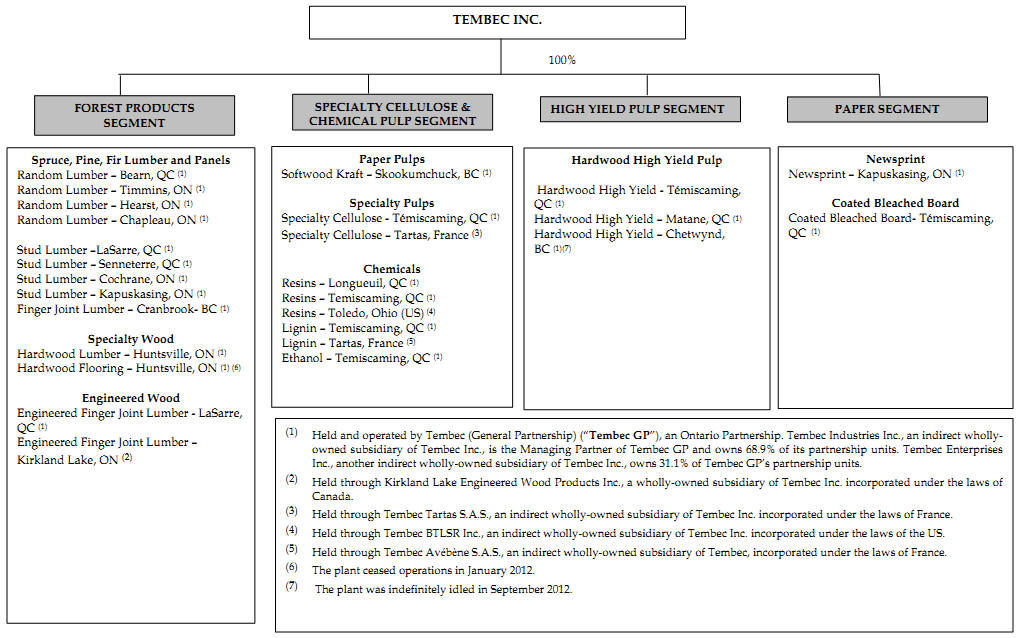

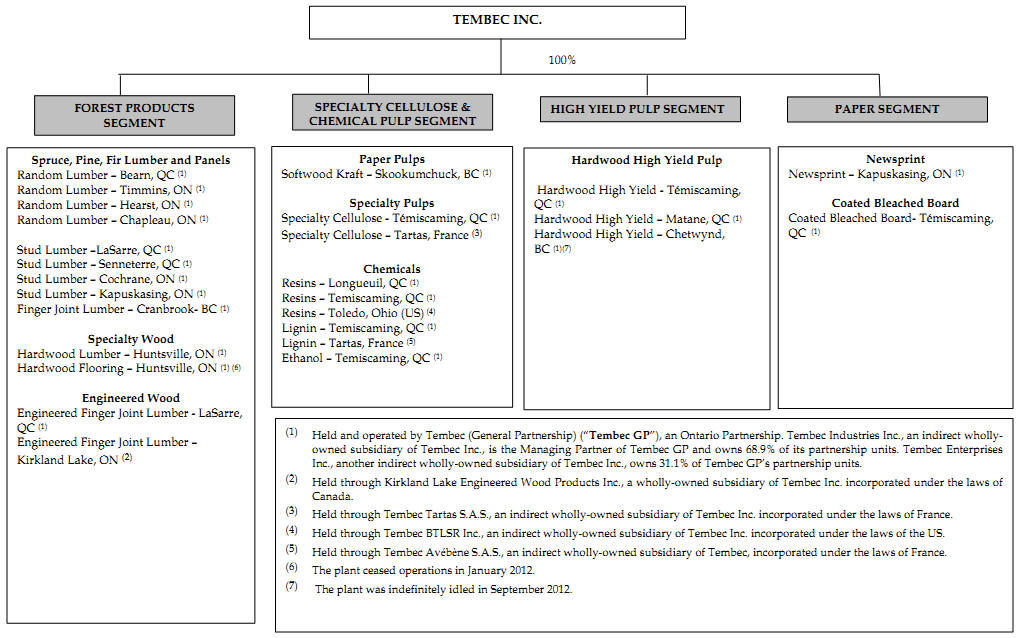

The chart below depicts Tembec’s principal facilities by industry segment as at the date of this AIF and, where appropriate, the Subsidiaries or affiliates that own substantially all of the assets of such operating facilities.

Annual Information Form Annual Information Form |

CORPORATEORGANIZATIONCHART

Annual Information Form Annual Information Form |

| ITEM 3 - | GENERAL DEVELOPMENT OF THE BUSINESS |

Tembec is a diversified and integrated forest products Company with operations principally located in Canada and France. Its business segments are forest products, specialty cellulose and chemical pulp, high-yield pulp and paper.

Tembec can currently produce approximately 930 million board feet of lumber, 580,000 tonnes of specialty cellulose and chemical pulp, 805,000 tonnes of High Yield pulp and 420,000 tonnes of paper. A breakdown of production capacities by operating facility is included in the Segment Review section of the 2012 MD&A. For the fiscal year ended September 29, 2012, Tembec had sales of $1.7 billion, adjusted EBITDA of $64 million, an operating loss of $32 million and a net loss of $82 million. Tembec’s total assets at that date were $1.1 billion and it employed approximately 3,700 people. The segmented results and the breakdown of sales of the Corporation’s products by geographic areas are included in the Corporation’s 2012 Financial Statements.

Tembec’s strategy is to maintain low cost, efficient operations and utilize its technical and operating expertise to develop niche products and markets within its business segments.

The following summarizes major events that have occurred over the past three years:

Forest Products Segment

In Fiscal 2010, 2011 and 2012,Tembec incurred a series of production curtailments and shutdowns, ranging from a few weeks to indefinite periods of time, at various sawmill and engineered wood facilities. These production curtailments and shutdowns were due to several factors, including low product pricing resulting from declining demand, the high relative value of the Canadian dollar versus the U.S. dollar, the internal requirement for by-product chips and the related need to manage inventory levels and working capital.

In Fiscal 2011, Tembec permanently closed its sawmill in Taschereau, Québec. The facility had been idle since October 2009. The majority of the log supply was reallocated to Tembec’s La Sarre and Bearn sawmills.

In Fiscal 2012, Tembec sold its Toronto (Ontario) flooring plant assets, as well as its Muskoka and Vintage brands, for proceeds of $13 million.

In Fiscal 2012, Tembec sold its Elko and Canal Flats sawmills located in British Columbia and the associated Crown tenures, which consisted of approximately 1.1 million cubic meters of combined Crown, private land and contract annual allowable cut, for proceeds of $66 million.

Annual Information Form Annual Information Form |

Specialty Cellulose and Chemical Pulp Segment

In Fiscal 2010 and 2011, demand for specialty cellulose pulp improved and remained favorable throughout fiscal 2012 and the mills had “full” operations with no market related downtime.

While markets were favorable in 2010 and 2011 for chemical pulp (NBSK), market conditions were significantly weaker during the most recent year.

In Fiscal 2010, Tembec completed the sale of the two Kraft pulp mills and related operations located in Southern France to Paper Excellence B.V. for a total consideration including assumption of debt of approximately $127 million dollars which remains subject to closing working capital adjustments.

High Yield Pulp Segment

In the first quarter of Fiscal 2010, Tembec incurred market related downtime at its Chetwynd, BC mill totaling 67,200 tonnes due to low pricing and the continuing strength of the Canadian dollar versus the US dollar. A fire occurred at this facility in the fourth quarter of Fiscal 2010 which temporarily halted production and removed a further 17,400 tonnes.

In Fiscal 2011, the unionized employees at Tembec’s High Yield pulp mill in Matane, Québec, went on strike following a breakdown in labour discussions. Consequently, production activities at the pulp mill were interrupted and resulted in 127 days of downtime before the mill resumed operations in mid September 2011. Total lost annual production was approximately 81,400 tonnes.

In Fiscal 2012, Tembec inaugurated a new anaerobic treatment facility which will produce methane biogas and greatly reduce the use of fossil fuels at its high-yield pulp mill in Matane, Québec. Funding for the investment was provided mainly by the Government of Canada with $19.7 million and the Government of Québec with $6.3 million. The overall project represents a total gross investment of $29 million - $26 million for the anaerobic facility and $3 million for the installation of the new electric boiler.

In Fiscal 2012, due to continuing low product prices and the operation’s relative cost, the Chetwynd high yield pulp mill was indefinitely idled. This mill has a rated annual capacity of 240,000 tonnes. Additionally, during the first half of the year, market-related production curtailments totaling 27,000 tonnes were taken at the Matane and Temiscaming mills.

Paper Segment

In Fiscal 2010, Tembec announced temporary production curtailments and shutdown, which reduced newsprint output by 273,000 tonnes. At the end of Fiscal 2011, the previously idled paper machine #3 at Kapuskasing, Ontario newsprint mill was deemed to be permanently shutdown and consequently 90,000 tonnes were removed from newsprint production capacity figures provided in this AIF. These production curtailments and shutdowns were necessary due to low product pricing and declining demand for newsprint.

In Fiscal 2010, West Feliciana Acquisition LLC (“WFA”), the entity that purchased the St. Francisville paper mill from Tembec USA LLC, filed for creditor protection. Given the prior ranking of another creditor, the Corporation has taken a special charge of $12 million to write off all amounts receivable from WFA.

In Fiscal 2010, Tembec announced the permanent closure of its newsprint mill located in Pine Falls, Manitoba.

In Fiscal 2012, Tembec sold its newsprint mill and related assets located in Pine Falls, Manitoba, for nominal net proceeds.

Annual Information Form Annual Information Form |

In Fiscal 2011, Tembec USA LLC filed a petition seeking relief under Chapter 7 of the Bankruptcy Code of the United States. As a result of the filing, Tembec reduced its consolidated accrued benefit obligations by US$4 million.

In Fiscal 2012, the Kapuskasing newsprint mill operated fully with stable pricing available in the eastern North American markets. The board mill operated at “full” capacity in both 2011 and fiscal 2012, with no market downtime taken in either year.

Corporate

In Fiscal 2010, Tembec Industries completed a private offering of US$255 million in aggregate principal amount of 11.25% senior secured notes due in December 2018 (“Notes”). The Notes were sold in a private offering to “qualified institutional buyers” as defined in Rule 144A under the U.S. Securities Act of 1933, as amended (the “Securities Act”), and outside the United States in reliance on Regulation S under the Securities Act. In March 2011, Tembec Industries completed its exchange offer to exchange up to US $255 million in aggregate principal amount of 11.25% senior secured notes due 2018 registered under the Securities Act (“2018 Senior Secured Notes”), for any and all of its outstanding US $255 million Notes, which were issued in August 2010, in transactions exempt from registration under the Securities Act. This exchange offer followed an undertaking by Tembec Industries to file an exchange offer registration statement with the U.S. Securities and Exchange Commission (the “SEC”) with respect to the Notes issued in August 2010 to allow for the Notes to be sold without restrictions on transfer. The proceeds from the offering, together with cash on hand, were used to permanently repay all outstanding indebtedness under Tembec’s existing US$300 million term loan facility, to pay prepayment premium in connection therewith and to pay fees and expenses related to the offering.

In Fiscal 2012, Tembec Industries issued an additional US$50 million in aggregate principal amount of 11.25% senior secured notes due in December 2018 (“Additional Notes”), bringing the aggregate principal amount of 2018 Senior Secured Notes issued by Tembec Industries to US$305 million. The Additional Notes were sold in a private offering to “qualified institutional buyers” as defined in Rule 144A under the Securities Act, and outside the United States in reliance on Regulation S under the Securities Act. In September 2012, Tembec Industries completed its exchange offer to exchange up to US $50 million in aggregate principal amount of 11.25% Senior Secured Notes due 2018 registered under the Securities Act, for any and all of its outstanding US $50 million Additional Notes, which were issued in transactions exempt from registration under the Securities Act. This exchange offer followed an undertaking by Tembec Industries to file an exchange offer registration statement with the SEC with respect to the Additional Notes issued in February 2012 to allow for the notes to be sold without restrictions on transfer. The proceeds from the offering, together with cash on hand, were used for general corporate purposes, as additional liquidity to support Tembec’s capital expenditure initiatives and to pay fees and expenses related to the offering.

The 2018 Senior Secured Notes are senior secured obligations of Tembec Industries, secured by a first priority lien on certain of the property and assets of Tembec Industries and certain subsidiaries of the Corporation, other than receivables, inventory and certain intangibles upon which the note holders have a second priority lien. The 2018 Senior Secured Notes are guaranteed by the Corporation and certain of the other Corporation’s subsidiaries.

In Fiscal 2011, the Corporation (as “Guarantor”), and Tembec Industries, Tembec Enterprises Inc., A.R.C. Resins Corporation and Tembec General Partnership (as “Borrowers”), entered into a financing agreement with GE Canada Finance Holding Company and a syndicate of lenders (“ABL lenders”) for a revolving credit facility of $200 million (“ABL Facility”) maturing on March 4, 2016 secured by a first priority charge over receivables and inventory of the Borrowers. Interest is based on the prime rate or the banker’s acceptance rate, as the case may be. As at September 29, 2012, the amount available under this facility was $144 million, amount of which $65 million was drawn and $48 million was reserved for letters of credit. In April 2011, the Ontario Court of Appeal rendered a decision in the restructuring proceedings involving Indalex Limited under theCompanies’ Creditors Arrangement Act(“CCAA”).The Court of Appeal held that defined benefit pension plan deficiency claims had priority over security held by debtor-in-possession (DIP) lenders in the context of a sale made under a CCAA proceeding. This decision is currently being appealed to the Supreme Court of Canada. The agent for the ABL lenders’ syndicate recently expressed concern regarding the solvency deficits of the Company’s Ontario defined benefit pension plans. In light of the uncertainty surrounding the decision of the Ontario Court of Appeal, the ABL agent requested that the Corporation refrain from making any further draws or utilization of the ABL Facility until such priority issue is dealt with by the Supreme Court of Canada. The Corporation is currently under discussions with the ABL agent regarding this request as it considers the risk to be minimal and the position of the agent to be unwarranted.

Annual Information Form Annual Information Form |

The Corporation’s French operations are supported by “receivable factoring” agreements. As such, the borrowing base fluctuates periodically, depending on shipments and cash receipts. As at September 29, 2012, the amount available under such agreements was $20 million, of which $3 million was drawn.

In Fiscal 2012 Tembec, Tembec Industries Inc. and Tembec Energy L.P. entered into a $75-million loan with Investissement Québec, a governmental agency, which will be used to finance a portion of the total cost of the project to upgrade Tembec’s specialty cellulose manufacturing facility in Temiscaming, Québec which is currently estimated at $190 million (the “Project”). The loan is secured by a second ranking charge over the Project’s assets. Tembec has also granted to Investissement Québec a five-year option starting on the first loan disbursement date to acquire 3 million common shares of Tembec at a price of $7 per share.

In Fiscal 2012, Tembec Energy L.P. entered into a $30 million loan(“IPD Loan”) with Integrated Private Debt Fund III LP(“IPD”), which will be used to finance the acquisition of the boiler and the turbine required in connection with the Project. Tembec intervened to the IPD Loan to guarantee all obligations of Tembec Energy L.P. thereunder. The IPD Loan is secured by a first ranking charge over the Project’s assets.

Other Developments

In Fiscal 2011, Tembec completed the sale of its hydro-electric generating assets which have a capacity of approximately 7.4 megawatts, located in Smooth Rock Falls, Ontario to Gemini-SRF Power Corporation for a total consideration of $16.5 million.

The Corporation is proceeding with a capital expenditure program of approximately $300 million to be spent over the next five years to modernize the Temiscaming specialty cellulose mill. As part of the first phase, the Corporation is undertaking an energy investment of $190 million for the installation of a high pressure liquor recovery boiler and an electrical turbine, which will result in the production of an additional 40 megawatts of electricity on average. The Corporation entered into a Power Purchase Agreement with Hydro Québec as part of the investment. Part of the Project will be financed with $105 million of the new debt, which consists of a $75 million loan from Investissement Québec and a $30 million loan from IPD. The Corporation recently indicated that due to various circumstances, including the fact that recent quotes provided by potential vendors for construction labor have significantly exceeded the budgeted amounts, it has decided to reduce construction activity over the winter months. As a result, the boiler start-up, initially scheduled for December 2013, will likely be delayed by approximately three months. The impact on the start-up of the turbine, scheduled for May 2014, is still under review.

In Fiscal 2012, Tembec Energy L.P. has entered into a long term power purchase contract with Hydro Québec, acting through its Hydro Québec Distribution Division. The agreement will allow Tembec to sell to Hydro Québec, for a 25 year term, up to 50 megawatts of the electricity generated by a new turbine to be installed at the Temiscaming site as part of the Project.

Annual Information Form Annual Information Form |

Reference is made to the Segment Review section of the 2012 MD&A.

| ITEM 4 - | NARRATIVE DESCRIPTION OF THE BUSINESS |

Tembec’s business is centered on the production and sale of forest, pulp and paper products. The manufacturing assets of Tembec are located primarily in Canada, with a fairly large presence in the eastern part of the country, namely, Northeastern Ontario and Northwestern Québec.

Tembec has approximately 3,700 employees of which approximately 2,500 are covered by collective bargaining agreements. At the end of Fiscal 2012, there were seven agreements covering 431 employees that had expired. During Fiscal 2013, no collective agreements will expire. The lumber and paper businesses are North American in nature and Tembec’s assets in these segments are located in this market. The pulp businesses are more global in nature, with Europe and China being the largest consumers. One specialty dissolving pulp mill is located in France. The other five pulp mills are located in Canada.

The following sections provide specifics in relation to each of Tembec’s principal business segments.

| 4.1.1 | Forest Products Segment |

The Forest Products Segment produces an extensive range of forest products focusing on two main product groups: SPF and Specialty Wood products. For the fiscal year ended September 29, 2012, the Forest Products Segment generated consolidated sales of $348 million as compared to $375 million in Fiscal 2011, negative adjusted EBITDA of $16 million as compared to a negative adjusted EBITDA of $47 million in Fiscal 2011 and an operating loss of $4 million as compared to an operating loss of $64 million in Fiscal 2011. The Forest Products Segment’s annual sales accounted for approximately 21% of Tembec’s total consolidated sales in Fiscal 2012 as compared to 22% in Fiscal 2011.

Annual Information Form Annual Information Form |

The following table summarizes the annual operating levels of each operating facility by product group:

| SPRUCE, PINE, FIR LUMBER | | | |

| | | | |

| Location and Product | | MBF | |

| | | | |

| Stud Lumber | | | |

| La Sarre, QC | | 135,000 | |

| Senneterre, QC | | 150,000 | |

| Cochrane, ON | | 110,000 | |

| Kapuskasing, ON | | 105,000 | |

| | | | |

| Random Lumber | | | |

| Hearst, ON | | 160,000 | |

| Chapleau, ON | | 135,000 | |

| Bearn, QC | | 110,000 | |

| | | | |

| Finger Joint Lumber | | | |

| Cranbrook, BC | | 25,000 | |

| | | 930,000 | |

| | | | |

| SPECIALTY WOOD | | | |

| | | | |

| Location and Product | | MBF | |

| | | | |

| Hardwood Lumber - Huntsville, ON | | 30,000 | |

| | | 30,000 | |

| ENGINEERED WOOD | | | |

| | | | |

| Location and Product | | | |

| | | | |

| Engineered Finger Joint Lumber | | | |

| | | MBF | |

| | | | |

| La Sarre, QC - | | 60,000 | |

| Kirkland Lake, ON | | 30,000 | |

| | | 90,000 | |

Products and Markets

The Softwood (SPF) lumber sawmills produce various types, species and grades of lumber which are used primarily for residential and commercial construction. Higher value SPF lumber products include J-Grade, TemPlusTM and TemSelectTM and machine stress rated (MSR) grades. Hardwood lumber is used in a wide variety of applications, including furniture, flooring and specialty residential and commercial applications. In addition, the Forest Products Segment produced and shipped approximately 1.0 million tonnes of wood chips in Fiscal 2012, approximately 80% of which were directed to Tembec’s pulp and paper facilities.

The SPF lumber industry is subject to both cyclical and seasonal fluctuations in demand, which can lead to volatility in prices. North American solid wood products demand is influenced by the general level of economic activity, consumer confidence and interest rates. All of the above impact on housing construction starts, which is generally regarded as the best indicator of lumber demand. Total North American lumber demand in 2012 was estimated at 45 billion board feet, with U.S. demand of approximately 37 billion board feet and the balance being consumed in Canada. U.S. producers currently supply 26 billion board feet, leaving a U.S. domestic shortfall of approximately 11 billion board feet. Canadian producers sold a total of 24 billion board feet, shipping 9 billion board feet to the U.S. and exporting 7 billion board feet outside North America. The remaining 8 billion board feet was consumed domestically in Canada. Tembec’s production capacity represents approximately 1.3% of North American SPF lumber capacity of 70 billion board feet.

Annual Information Form Annual Information Form |

The Forest Products Segment business fosters a highly diversified customer base. Products are sold by Tembec’s own internal sales force directly to large retailers, industrial end-users and distributors. Tembec markets most of its solid wood products in North America. In Fiscal 2012, 56% of Tembec’s consolidated sales occurred in Canada, 42% in the United States and 2% offshore.

As a result of the significant dependence on the U.S. market, Tembec’s forest products’ competitiveness is heavily influenced by the relative strength of the Canadian dollar versus the U.S. dollar. Tembec competes directly with other Canadian and U.S. producers of SPF lumber. While selling prices, product quality and customer service are important factors affecting competition, other factors such as fibre costs, foreign exchange rates and the 2006 Softwood Lumber Agreement (“SLA”) also have an impact on Tembec’s competitive position. The SLA, which came into force on October 12, 2006, required Canadian exporters to the U.S to pay an export tax which varied inversely with the price of lumber. Effective October 12, 2006, Tembec’s Québec and Ontario sawmills became subject to a combination of export taxes and volume restraints or quotas that vary depending on the option selected by individual Canadian provinces. Tembec’s Eastern Canadian sawmills located in Ontario were subject to an average export tax of 4.4% in fiscal 2012. Tembec’s Québec sawmills were subject to an average export tax of 6.9% . The difference in tax rate is on account for an adverse arbitration award that came into effect in March 2011. For the six months ended March 2012, Tembec’s British Columbia sawmills were subject to a 15% export tax but shipments were not restricted by any quota. On January 18, 2011, the United States filed a request for arbitration under the SLA alleging that Canada had been underpricing timber in British Columbia and that such measures constituted a breach of the SLA. The United States was seeking compensatory adjustments to the export measures in the vicinity of $304 million. On July 18 2012, a tribunal of the London court of International arbitration dismissed all claims by the United States. The SLA which was set to expire on October 12, 2013 was extended for an additional two years, to October 2015.

Timber Supply

Tembec’s Canadian forestry operations are managed by the Forest Products Group. This includes the harvesting of timber, either directly or through contractors, and all silviculture and regeneration work required to ensure a sustainable supply of wood fibre to the manufacturing units. The Forest Products Group is also responsible for third-party timber purchases and wood chip production from whole log chippers which are required to supplement total requirements. Its main objective is the optimization of the flow of timber to the various manufacturing units.

Tembec seeks to maximize the utilization of timberlands for which it is responsible through efficient management and by following sustainable forest management practices so that the timberlands provide a continuous supply of wood for future needs. Site preparation, planting and harvesting techniques are continually improved through a variety of methods, such as research to improve the timber yield of the forests.

As Tembec’s forestry activity in Canada is conducted primarily on Crown land, the Forest Products Group works closely with provincial governments to ensure harvesting plans and operations comply with established laws & regulations.

Annual Information Form Annual Information Form |

Québec

Tembec has timber supply and forest management agreements (commonly known as Contrats d’aménagement et d’approvisionnement forestier “CAAFs”) with the Ministry of Natural Resources (Québec) for the supply of its Québec sawmills. Each CAAF has a term of 25 years and is subject to review and renewal every five years. Renewal at the end of each five-year period remains at the discretion of the Ministry of Natural Resources (Québec) and is subject to its determination that Tembec has satisfied the obligations specified under the relevant CAAF. The Province of Québec has renewed CAAFs for the five year period starting April 1, 2008.

The Province of Québec announced reforms to its forest tenure regime. Once the reforms become effective in 2013, available harvest volumes will be reduced by 30%, and an undetermined portion of the current contractual volumes will be reallocated to a timber marketing board for sale on the open market and social economic development projects, leaving the remaining 70% available to current license holders. In furtherance to these reforms, Tembec is working with the Ministry of Natural Resources (Québec) to ensure the best transition to the new Québec Forest Act in 2013. In September 2011, the Chief Forester of the Province of Québec rendered public an update of the forestry allowable harvest volumes for the various forest management units in the Province of Québec. This data update is temporary for the 2013-2014 period and does not constitute the final data for the 2013-2018 five-year period. This temporary calculation was necessary to allow the Ministry of Natural Resources (Québec) to plan the attribution of timber supply and determine the guaranteed annual supply for the period 2013-2014. This update confirmed a global decrease of the forestry allowable harvest volume in the Province of Québec in the order of 10%.

Ontario

Tembec’s cutting rights in Ontario are provided principally through several Sustainable Forest Licenses on Crown land issued by the Ministry of Natural Resources (Ontario). These licenses expire at different dates and have 20-year terms and are renewable every five years. Their renewal is based on satisfactory performance determined by independent audits and approval of the Ministry of Natural Resources (Ontario). The Province of Ontario has approved legislation for reforms of its forest tenure regime and where the Ministry of Natural Resources (Ontario) will facilitate the trial of new tenure systems over the next 5 years. Tembec will continue to monitor developments and work with the Ministry of Natural Resources (Ontario) in connection therewith.

Annual Information Form Annual Information Form |

Manitoba

In Fiscal 2012, Tembec sold its newsprint mill and related assets for nominal net proceeds. Tembec is working with the Province of Manitoba to ensure obligations are fulfilled related to the Forest Management License currently held by Tembec. Tembec expects to complete all outstanding obligations in Fiscal 2013.

British Columbia

Approximately 95% of all timberlands in the Province of British Columbia are Crown lands. Rights to harvest Crown timber may be granted on behalf of the Crown in the form of forest tenures regulated under theBritish Columbia Forest Act, theForest Practices Code of British Columbia Act and theForest and Range Practices Act and associated regulations.

The forms of forest tenures held by Tembec are two Non-Replaceable Forest Licenses (20-year term) and a Pulp Wood Agreement (25-year term). Such licenses typically confer to their holder the right to harvest a specific volume of timber on Crown lands. In harvesting these tenures, Tembec is required to satisfy specific government objectives which include forest management, protection of non-timber resources, harvesting, reforestation and protection of archaeology and cultural heritage sites. Tembec also manages two Managed Forests which are comprised of 103,690 ha of privately held lands.

Timber Resources Availability

Tembec harvests timber under forest tenures held by it in British Columbia, Ontario and Québec and has a total allowable annual cut (“AAC “) of approximately 4.8 million cubic meters. Tembec’s Canadian wood fibre requirements are also met with deliveries from our Free holds, open market purchases and exchanges on either a spot or contract basis (Business to Business).

The following table sets out Tembec’s timber resources available as at September 29, 2012:

| | CUBIC METERS | |

Chetwynd (High Yield Pulp) | | | |

Forest Licenses (non-replaceable) | | 335,500 | |

Pulpwood Agreement 13 | | 200,000 | |

��Sub-total – Crown (HYP) | | 535,500 | |

Managed Forests (Free Hold) | | 123,700 | |

| | | |

Total British Columbia | | 659,200 | |

| | | |

Ontario | | | |

Sawmills | | | |

Sustainable Forest Licenses | | 2,471,800 | |

Sub-total – Crown | | 2,471,800 | |

| | | |

Free Hold | | 50,000 | |

Business to Business | | 130,000 | |

Total Ontario | | 2,651,800 | |

| | | |

Québec | | | |

Sawmills | | | |

CAAF | | 1,446,500 | |

Sub-total – Crown (sawmills) | | 1,446,500 | |

| | | |

Matane & Témiscaming (HYP) | | | |

CAAF | | 394,500 | |

Sub-total – Crown (HYP) | | 394,500 | |

Total Québec | | 1,841,000 | |

Annual Information Form Annual Information Form |

Stumpage and Other Charges

Provincial authorities impose stumpage fees on volumes of wood cut on Crown land. These fees are determined under specific mechanisms in each province. Part of the mandate of the Corporation’s Forest Resources Management Group is to ensure that stumpage charged by the provincial governments reflects the fair value of the timber being harvested.

| 4.1.2 | Specialty Cellulose and Chemical Pulp Segment |

The Specialty Cellulose and Chemical Pulp segment consists of three market pulp manufacturing facilities. The facilities are divided into two main types. Two dissolving pulp mills produce specialty cellulose pulps. The remaining facility produces chemical softwood kraft paper pulp (NBSK). The two specialty cellulose pulp mills generate lignin as a by-product of the sulphite process, which is sold to third parties. The Temiscaming mill also includes a facility that produces ethanol as a by-product that is also sold to third parties. The segment also includes a stand-alone resin business, which produces powder and liquid phenolic resins at two operating sites in Québec: Temiscaming and Longueuil. The Corporation also operates a third facility located in Toledo, Ohio, United States which manufactures powder and liquid amino-resins. The chemical business also purchases and re-sells pulp mill by-product chemicals from third parties.

NBSK is produced by chemical processes. Kraft paper pulps are used to produce a variety of high-quality paper products with specific brightness and strength characteristics. Softwood kraft normally sells for a premium over hardwood kraft as its longer fibres provide required strength properties for paper producers and it costs more to produce.

In Fiscal 2012, the Specialty Cellulose and Chemical Pulp Segment generated consolidated sales of $650 million as compared to $681 million in Fiscal 2011, adjusted EBITDA of $92 million as compared to $140 million in Fiscal 2011 and operating earnings of $71 million as compared to operating earnings of $121 million in Fiscal 2011.

The following table summarizes the products and current capacity levels of each facility by main type:

| Location and Product | | | |

| | | Tonnes | |

| Specialty cellulose Pulps | | | |

| Temiscaming, QC – Specialty cellulose and | | 160,000 | |

| Commodity Dissolving Pulp | | | |

| Tartas, France – Specialty cellulose Pulp | | 150,000 | |

| | | 310,000 | |

| Chemical Pulps | | | |

| Skookumchuck, BC - NBSK | | 270,000 | |

Products and Markets

The specialty cellulose pulp produced at the two pulp mills is high purity cellulose utilized in a wide variety of specialized products such as pharmaceuticals, food additives, and industrial chemicals. The Temiscaming specialty cellulose pulp mill also produces ″viscose” grade pulp, which is utilized in the production of viscose staple fibre, which in turn is used to produce rayon for the textile industry.

The chemical pulp market is international in nature, with large volumes of pulp moving duty-free between net-producing regions and net-consuming regions. Global market demand for this pulp in 2012 was approximately 53 million tonnes. North America and Latin America are the largest producing regions with respective capacity of 16 million tonnes and 17 million tonnes. Western Europe, including Nordic countries can produce 12 million tonnes. Western Europe is the largest consuming region at 16million tonnes per year, followed by China at 14 million tonnes per year and North America at 7million tonnes per year.

Annual Information Form Annual Information Form |

Tembec markets its specialty and chemical pulp on a world-wide basis, primarily through its own sales force, with a network of offices in Toronto, Canada, Dax, France, and Beijing, China. This is consistent with Tembec’s strategy of selling directly to customers and establishing long-term strategic relationships. Sales from the Specialty Cellulose and Chemical Pulp Segment represented approximately 39% of Tembec’s total consolidated sales in Fiscal 2012.

Fibre Supply

The two North American pulp mills purchased approximately 852,000 bone dry tonnes of wood chips in fiscal 2012, up from 845,000 in the prior year. Of this amount, approximately 49% was supplied by the Forest Products segment, compared to 67% in the prior year. This volume is significantly lower for 2012 as the BC sawmills were sold and were only considered internal suppliers for the first 6 months. The remaining requirements were purchased from third parties under contracts and agreements of various durations. The pulp mill located in Southern France purchased approximately 287,000 bone dry tonnes of wood in Fiscal 2012 as compared to 308,000 bone dry tonnes in the prior year. The fibre is sourced from many private landowners.

| 4.1.3 | High Yield Pulp Segment |

The High Yield Pulp Segment consists of three facilities manufacturing hardwood high yield paper pulp.

In Fiscal 2012, the High Yield Pulp Segment generated consolidated sales of $322 million as compared to $348 million in Fiscal 2011, negative adjusted EBITDA of $29 million as compared to negative adjusted EBITDA of $3 million in Fiscal 2011 and an operating loss of $92 million as compared to an operating loss of $14 million in Fiscal 2011.

The following table summarizes the products and current capacity levels of each facility

| Location and Product | | | |

| | | Tonnes | |

| Hardwood High Yield | | | |

| Temiscaming, QC | | 315,000 | |

| Matane, QC | | 250,000 | |

| Chetwynd, BC1 | | 240,000 | |

| Total | | 805,000 | |

Products and Markets

High-yield market pulps have been produced in North America since the mid 1980’s. Initially, most high-yield pulps were manufactured with softwood and utilized in tissue and towel applications, where their superior bulk and absorbency are desired characteristics. However, Tembec has always maintained a strategy of targeting the use of high-yield pulps in paper and board production. The strategy led to the development of hardwood high-yield grades made from birch, aspen and maple. Although high-yield pulps are lower than kraft pulps in tensile and tear strength, they offer advantages in bulk and opacity.

The high-yield pulp market is relatively small compared to the chemical pulp market. At approximately 5 million tonnes, it is less than one tenth the size. Canada is the principal producer at 2 million tonnes per year of capacity, followed by Western Europe at 1 million tonnes. The principal market is China which consumes 2 million tonnes, followed by other Asian countries and Western Europe which consume 1 million tonnes each.

_________________________________________

1 On September 16, 2012, Tembec indefinitely idled its high-yield pulp mill in Chetwynd, British Columbia due to market related conditions.

Annual Information Form Annual Information Form |

Tembec markets its high-yield pulp mainly to Asian and European destinations, primarily through its own sales force, with a network of offices in Toronto, Canada, Dax, France, and Beijing, China. This is consistent with Tembec’s strategy of selling directly to customers and establishing long-term strategic relationships. Sales from the High-Yield Pulp Segment represented approximately 19% of Tembec’s total consolidated sales in Fiscal 2012.

Fibre Supply

Tembec’s High Yield Pulp mills procured 707,600 bone dry tonnes of wood chips in Fiscal 2012. Of this amount, approximately 24% was supplied by the Forest Products Segment.Theremainder was purchased from third parties under contracts and agreements of various durations.

The Paper Segment currently consists of two facilities with a total of three paper machines. The mill located in Kapuskasing, Ontario, produces newsprint on two machines. The facility located in Temiscaming, Quebec, produces multi-ply coated bleached board on one machine. In Fiscal 2012, Tembec sold its Pine Falls Manitoba Newsprint Mill and related assets. For Fiscal 2012, the Paper Segment generated consolidated sales of $346 million as compared to $339 million in Fiscal 2011, adjusted EBITDA $37 million as compared to EBITDA of $29 million in Fiscal 2011 and operating earnings of $35 million as compared to operating earnings of $26 million in Fiscal 2011.

The following table summarizes the products and current capacity levels of each facility:

| Location and Product | | | |

| | | Tonnes | |

| Coated Bleached Board | | | |

| Temiscaming, QC | | 180,000 | |

| | | | |

| Newsprint | | | |

| Kapuskasing, ON | | 240,000 | |

| Total | | 420,000 | |

Products and Markets

Tembec’s coated bleached board sales’ focus is on lightweight, fully bleached coated board used in commercial printing. Target markets include book cover, directory cover, lightweight premium packaging and coated linerboard. The board is sold primarily in North America through its own sales force located in the U.S. and Canada. Board is also sold to merchants and large commercial printers.

Newsprint is used primarily for the publication of daily newspapers. It is generally considered to be a commodity product, having a uniform definition and few distinct differences. Newsprint demand is driven primarily by the requirements of daily newspapers. Canadian manufacturers of newsprint are very dependent on export markets, particularly the U.S. market. In calendar year 2012, total North American newsprint demand is expected to be approximately 4.9 million tonnes with the U.S. market consuming approximately 4.2 million tonnes. Another 1.9 million tonnes will be shipped to export markets outside North America. U.S. capacity is 3.0 million tonnes while Canadian newsprint capacity is 4.0 million tonnes of the approximate total 7.0 million tonnes of capacity in North America. Tembec’s newsprint capacity represents approximately 3.4% of total North American production capacity.

Annual Information Form Annual Information Form |

The focus of the Paper Segment is the North American market which accounted for 94% of consolidated sales in Fiscal 2012, with the U.S. representing 77% of consolidated sales. For Fiscal 2012, the Paper Segment represented 21% of the Corporation’s consolidated sales.

Fibre Supply

The Paper Segment’s newsprint mill purchased 238,500 bone dry tonnes of virgin fibre in the last fiscal year, of which approximately 80% was internally sourced.

The coated bleached board mill utilizes a combination of chemical kraft high yield pulps to produce a three-ply sheet. During Fiscal 2012, the mill utilized 17,300 tonnes of NBSK supplied by the Corporation’s Skookumchuck pulp mill. The mill also consumed 60,000 tonnes of high-yield pulp supplied by the Temiscaming mill.

| 4.2 | ENVIRONMENTAL ANDSOCIALPOLICIES |

Tembec is committed to demonstrating responsible stewardship of resources and continuous improvement of its environmental performance. Tembec’s objectives are to:

- Maintain compliance with its corporate principles and environmental policy;

- Comply with all applicable environmental legislation and continually improve its environmental performance;

- Integrate sustainable development into its business and operating plans;

- Respond effectively to environmental issues; and

- Maintain recognized environmental certifications.

Tembec’s environmental policy is available on the Corporation’s website atwww.tembec.com

Environmental Management Programs:

These objectives have been incorporated into the Environmental Management Programs , which minimize the impact of manufacturing activities and forest operations on the environment. These EMPs are administered under an Environmental Management System (“EMS”) in accordance with ISO 14001 standard.

In 2012, a certifiable EMS is in place in our manufacturing and forest operations. Each year, Tembec fully reviews all progress accomplished through its EMS to ensure continuous improvement in its environmental performance.

Environmental Management System (ISO 14001)

Every business unit must implement an appropriate EMS, in accordance with the ISO 14001 standard. Teams of internal auditors audit all EMS procedures to ensure compliance with ISO 14001 and Tembec’s environmental requirements. Tembec’s operating pulp manufacturing are certified to the ISO 14001 standard. Also, audits are conducted at each site to ensure compliance with all applicable laws and regulations.

Integration of the OHSAS-18001 Health and Safety through the EMS (ISO 14001) Environmental System

The implementation of the OHSAS 18001 Health and Safety Management System continues across Tembec. The majority of our mills continue to maintain the system in place and perform internal audits regularly. Tembec will continue to monitor the implementation for those who are not at 100%.

Annual Information Form Annual Information Form |

Environmental Performance

Tembec has developed environmental performance indicators to continually monitor the progress of each of its business units towards the achievement of EMS as well as regulatory standards.

On the whole, Tembec’s environmental performance is in compliance with statutory and regulatory requirements governing atmospheric emissions, effluent and solid waste. In fact, through its EMS, Tembec exceeds in many cases statutory and regulatory requirements.

Over the years, Tembec has implemented voluntary measures to protect the environment. Since 1990, Tembec has been taking action to significantly reduce its greenhouse gas emissions, and has actively supported and promoted the Kyoto Protocol. Tembec has established specific objectives and targets to reduce energy consumption and greenhouse gas emissions at its mills, and has set goals to improve biomass recovery as a source of energy.

Tembec’s initiatives, including those described above, have already led to significant improvements in its overall environmental performance. Moreover, the implementation of Tembec’s EMS at all sites will ensure continuous improvement of Tembec’s environmental performance in accordance with its strong commitment to environmental protection and sustainable development.

In Fiscal 2012, Tembec spent approximately $4,212,000 on capital projects as part of its commitment to continuously improve its environmental performance as per its policy and to comply with applicable environmental requirements.

Forest Certification

The portfolio of Forest Stewardship Council (“FSC”) forest management certificates held by Tembec and partners in Canada consists of seven certified forests across more than 8.5 million hectares forming a substantial base of certified wood supply for company facilities. As a leader in the achievement of FSC forest certification in Canada, Tembec is active in renewing forest certificates consistent with the five year anniversary date. In 2013, the Ministry of Natural Resources in Québec will assume accountability for FSC certification. Tembec is working closely with the Ministry of Natural Resources (Québec) personnel in support of that objective.

Assessment of external fibre supply sources is guided by Tembec’s Fibre Procurement Policy (2006). Tembec provides evidence of Chain of Custody certification to customers to enable them to produce and label their own products as certified. All of Tembec facilities are linked to a corporate multi-site FSC chain of custody and FSC Controlled Wood system. All of Tembec pulp mills additionally have Program for Endorsement of Forest Certification (“PEFC”) Chain of Custody (“COC”) certification. These independent third party audited systems ensure Tembec fibre procurement personnel source fibre from known sources with certainty and assurance.

Forest conservation, as an integral component of well managed forests, is a key theme for the Tembec Forest Resources Management (“FRM”) Group. The identification and conservation of habitat of rare, threatened and endangered species is a strong priority across Tembec’s Canadian Boreal and British Columbia interior operations. Detailed engagement with government and environmental organizations regarding the conservation of woodland caribou in Ontario was undertaken in 2012. Tembec and other signatories to the Canadian Boreal Forest Agreement (BCFA) presented a woodland caribou conservation plan to the Ontario government in June 2012. Work to implement this plan will continue through 2013.

Tembec is a signatory to the Canadian Boreal Initiative and the Canadian Boreal Forest Agreement. Both initiatives bring non-government interests together to identify strategies to advance forest conservation initiatives and support world leading forest management practices in the Canadian Boreal forest region.

Annual Information Form Annual Information Form |

Tembec’s boreal forest tenures are included in the scope of these agreements and Tembec FRM personnel lead Tembec’s participation.

Advocating for a strengthened integration of Ecosystem-Based Management (“EBM”) principles in forest management is a strong focus for Tembec’s forest management group in Québec. Tembec continued its ongoing involvement in EBM projects in the Abitibi Region of the Boreal Forest and in the Mixed Forest of the Temiscaming Region.

First Nations Policy

As part of sustainable forest management and corporate social responsibility, Tembec recognizes its operations in Canada take place on territories on which Aboriginal People assert rights and interests. Tembec has adopted a First Nations Policy, the purpose of which is to build and maintain relationships with Aboriginal communities located in the vicinity of Tembec operations. Tembec’s policy addresses such priorities as capacity building, employment, information-sharing, business relations and measures to harmonize traditional land use and forestry operations.

To strengthen relations with specific nations and communities, Tembec has entered into agreements with First Nations communities or Tribal Councils across Canada. Tembec has agreements in place with Ktunaxa Nation Tribal Council, representing four communities in southeastern British Columbia and with three Treaty 8 communities in the vicinity of Chetwynd in northeastern British Columbia. Tembec has entered into these agreements to promote a positive long-term working relationship between the parties, and to identify approaches to accommodation of community interests. These agreements are under review and will be modified or terminated given Tembec has sold its sawmills in southern BC and the Chetwynd facility is indefinitely closed.

In Québec, Tembec has agreements in place with Long Point First Nation, Eagle Village First Nation, Wolf Lake First Nation, Pikogan First Nation, Lac Simon First Nation and Timiskaming First Nation. These agreements are in place to accommodate the traditional activities of the communities during forestry planning and operations through the identification of areas of concern and development of measures to harmonize. Financial support to assist the community in engaging resource management expertise is also provided. These agreements terminate in March 2013 and are under review pending the implementation of the new forestry regime in Québec.

In Ontario, Tembec has partnership agreements in place with communities or businesses associated with Missanabie Cree First Nation, Wahgoshig First Nation, Brunswick House First Nation and Taykwa Tagamou Nation to recognize the interests of the respective communities in participating in forest management activities, the creation of economic opportunities and consultation initiatives. In north central Ontario, Tembec and a unique collaboration involving five First Nation communities called the Northeast Superior Chiefs Forum signed a Memorandum of Understanding. The goal of the agreement is to work collaboratively on forestry activities taking place in the Chapleau, Ontario region. On-going, regular dialogue occurs between other First Nation communities in northeastern Ontario and Tembec depending on the unique interests of specific communities.

Tembec is committed to operating energy efficient plants and to making full use of its forest resources. To this end, Tembec converts waste pulping liquors, mill effluent and biomass wastes into energy through various processes. Tembec also plans to further improve its capacity to convert these wastes. In Fiscal 2012, Tembec generated approximately 490,000 MWhrs of electricity which represents approximately 16% of Tembec’s total electricity consumption.

Annual Information Form Annual Information Form |

Skookumchuck

This Kraft pulp mill is a net exporter of electricity generated through the combustion of mill process black liquor and biomass wastes.

Temiscaming and Kapuskasing

Both the Temiscaming and Kapuskasing mill complexes utilize biomass boilers fired on bark, sawdust and shavings to generate approximately 4% of their total electricity consumption.

Chapleau

The Chapleau cogeneration facility exports the bulk of its power under a non-utility generator contract with the Ontario Power Authority. Steam is then fed to the sawmill kilns to dry lumber. The Chapleau cogeneration facility consumes residual biomass from the sawmill and the surrounding region.

Tartas

The Tartas mill burns both waste sulphite liquor and biomass at its cogeneration facility. Since the commissioning of its new turbine, the Tartas mill generates approximately 67% of its electricity needs.

Other Green Energy

Tembec also converts effluent to energy through two operating anaerobic effluent treatment plants. Current methane consumption of approx. 156,000 GJ/year (Tembec I & II) will be increased with the completion of a third installation at the Matane mill. Methane is used to offset fossil fuel purchases in pulp dryers. Recovered biomass is also sold to third parties for cogeneration purposes.

| 4.4 | RESEARCH ANDDEVELOPMENT |

Tembec considers research and development (“R&D”) essential to its growth and to its long-term ability to compete successfully on world markets. Tembec’s mission of minimizing costs and encouraging innovation while protecting the environment is backed by its history of continued research investment. R&D activities are carried out with specialized research centers, Canadian and foreign universities, strategic equipment and technology developers, in conjunction with in-house development and trials. The R&D thrust is a crucial aspect of Tembec’s activities, enabling Tembec to continue meeting its customers and other key stakeholders’ ever-growing expectations. Recent research efforts are focused on further enhancing Tembec’s already sound environmental practices, improving delivered fiber costs, developing value-added products and exploiting waste to energy opportunities.

The lumber, pulp and paper industries are essentially commodity markets in which producers compete primarily on the basis of price. In addition, since the majority of Tembec’s lumber, pulp and paper production is directed to export markets, it competes on a worldwide basis against many producers with approximately the same or larger capacity. In export markets, Tembec generally competes with U.S., Latin American, Asian and Scandinavian producers. Some of Tembec’s competitors have lower energy and labor costs and fewer environmental and governmental regulations to comply with than Tembec does. Others are larger in size, allowing them to achieve greater economies of scale. Also, some of Tembec’s foreign competitors may benefit fromincentives given by foreign governments, which may ultimately adversely affect Tembec’s competitive position.

Annual Information Form Annual Information Form |

The following information is a summary of certain risk factors relating to the business of Tembec and is qualified in its entirety by reference to, and must be read in conjunction with, information appearing elsewhere in this AIF and the 2012 MD&A.

Demand and prices for Tembec’s products are cyclical, which could have a material adverse effect on its business, financial condition and results of operations.

Demand and prices for most lumber, pulp and paper products are cyclical and are influenced by a variety of factors. These factors include periods of excess product supply due to industry capacity increases, periods of decreased demand due to generally reduced economic activity or product-specific activity, inventory de-stocking by customers and fluctuations in currency exchange rates. Tembec has in the past, and may in the future, decide to schedule production curtailments and shutdowns as a result of weak economic conditions, reduced demand for its products, lack of economically viable fibre, declining demand for newsprint, reduced market prices and other factors. If global economic conditions were to deteriorate in the future, prolonged curtailments of production or extended shutdowns could have a material adverse effect on its business, financial condition and results of operations. In addition, the relatively high fixed cost component of certain manufacturing processes, specifically in pulp and paper, requires producers to operate facilities with target efficiency in the 80-85% range even when demand is not sufficient to absorb all of the output. This excess production may saturate the market and have a negative impact on product prices, further increasing the inherent cyclicality of the industry.

Tembec does not currently engage in hedging transactions to mitigate the impact of price volatility. However, even if Tembec were to engage in hedging transactions, there can be no assurance that such transactions would eliminate the risks of demand and price cyclicality and their impact on Tembec’s business, financial condition and results of operations.

Tembec is exposed to the risk of exchange rate fluctuations.

Revenues for most of Tembec’s products are affected by fluctuations in the relative exchange rates of the Canadian dollar, the U.S. dollar and the euro. The prices for many of Tembec’s products, including those that Tembec sells in Canada and Europe, are generally driven by prices referenced in U.S. dollars. Tembec generates approximately 1.1 billion of U.S. dollar denominated sales annually from its Canadian operations. As a result, any decrease in the value of the U.S. dollar and the euro relative to the Canadian dollar reduces the amount of revenues Tembec realizes on its sales in local currency. In addition, because Tembec’s business units purchase the majority of their production materials in local currency, fluctuations in foreign exchange rates can significantly affect a unit’s relative profitability when compared to competing manufacturing sites in other currency jurisdictions.

Direct U.S. dollar purchases of raw materials, supplies and services provide a partial offset to the impact of exchange rate fluctuations on sales. To further reduce the risks associated with exchange rate fluctuations, Tembec has a policy which permits hedging up to 50% of its anticipated U.S. dollar receipts for up to 36 months in duration. Notwithstanding such policy, Tembec does not currently engage in hedging transactions to mitigate the impact of exchange rate fluctuations. However, if Tembec were to engage in such transactions, there can be no assurance that it will be able to do so on commercially reasonable terms or at all, or that such transactions will reduce the risks associated with such fluctuations.

The availability of, and prices for, wood fibre significantly impact Tembec’s business.

Fibre is the most important raw material for the production of wood products, pulp and paper. Regulatory developments and environmental litigation have caused, and may cause in the future, significant reductions in the amount of timber available for commercial harvest in Canada, thereby increasing prices for alternative sources of wood fibre. The availability of harvested timber may further be limited by natural and man-made events. In addition, future domestic or foreign legislation, litigation advanced by Aboriginal groups and litigation concerning the use of timberlands, the protection of endangered species, the promotion of forest diversity and the response to and prevention of wildfires could also affect timber supplies.

Annual Information Form Annual Information Form |

In Canada, virgin fibre or timber is sourced primarily from Crown lands through agreements with provincial authorities. In fiscal 2012, approximately 83% of Tembec’s virgin fibre and timber requirements were sourced from Crown lands. Tembec’s current agreements with provincial authorities grant timber tenure for terms varying from 5 to 25 years and may be subject to renewals every five years. These agreements contain commitments with respect to sustainable forest management, silvicultural work, forest and soil renewal, as well as cooperation with other forest users. The price and availability of Tembec’s fibre depends, in large part, on Tembec’s ability to replace or renew these agreements on acceptable terms or enter into acceptable alternative fibre supply arrangements with provincial authorities. The terms of any replacement, renewal or alternative arrangement are based on legislative and regulatory provisions as well as governmental policy. Therefore, changes in legislation, regulatory regimes or policy in the provinces in which Tembec operates, may reduce the availability of fibre and increase costs through the imposition of additional and more stringent harvesting, rehabilitation and silvicultural standards or the alteration of fee structures. There can be no assurance that Tembec’s agreements with provincial authorities for the supply of fibre will be renewed, extended or replaced in the future on acceptable terms, or at all, or that the amount of timber that Tembec is allowed to harvest will not decrease.

Additionally, evolving tenure legislation and regulation may have an impact on Tembec’s access to fibre. The province of British Columbia reformed its forest tenure regime in 2006 and, in July 2010 implemented a timber pricing mechanism by which stumpage fees increasingly resemble a market pricing system. This system may exert upward pressure on timber pricing in the mid-term, thereby reducing profitability. Similarly, the Province of Québec recently reformed its tenure regime. In Québec, once the reform becomes effective in 2013, it is possible that available harvest volumes will be reduced, as an undetermined portion of the current contractual volumes will be reallocated to a timber marketing board for sale on the open market and socio-economic development projects. Also, Québec’s new regime removes from commercial parties, such as Tembec, authority over forest planning and harvesting. Accordingly, Tembec may be unable to ensure that the fibre processed at its Québec mills benefits from its current certifications, such as those provided by the Canadian Forest Stewardship Council, or FSC.

The Province of Ontario also recently reformed its tenure system with amendments that came into force in June 2011, but that will only be implemented over the next five to seven years. Similar to the Québec regime, in Ontario, new local Crown corporations (Local Forest Management Corporations) will manage forest planning and market harvesting rights and enhanced sustainability. Forest Licenses to manage Crown forests may be issued to corporations formed by groups of mills and/or harvester companies. Ontario is also moving towards a timber pricing system driven by competitive markets. Availability of fibre and prices could be materially affected by forest tenure reform in the provinces of British Columbia, Québec and Ontario. It is too early to assess these and other possible effects of the reforms in British Columbia, Québec and Ontario. To the extent the availability of fibre from Crown lands is insufficient, Tembec will be required to increase its purchases of fibre on the open market. Further, even if sufficient fibre is available from these Crown lands, there can be no assurance that fibre will be available at prices that will allow Tembec to operate its mills at desired and/or profitable levels of production.

In addition to sourcing its fibre requirements from Crown lands, Tembec also sources a significant amount of fibre by purchasing from third parties pursuant to contracts and agreements of various durations and on the open market. Tembec’s dependence on external sources of fibre could increase materially in the future as a result of, among other things, the factors discussed above, which may limit the availability of timber Tembec harvests from Crown lands. Fibre is a commodity and prices historically have been cyclical. Fibre pricing is also subject to regional market influences, and Tembec’s cost of fibre may increase in particular regions in which it operates due to market shifts in those regions. Tembec’s more geographically diversified competitors may not be affected to the same degree by such regional price volatility. Any sustained increase in fibre prices, whether sourced from Crown lands or from third parties, could materially increase Tembec’s operating costs and thereby materially reduce Tembec’s operating margins to the extent that Tembec cannot pass through equivalent increases in the prices for its products to its customers. Additionally, if one or more of Tembec’s major suppliers of fibre stops selling to Tembec, Tembec’s financial condition and operating results may suffer.

Annual Information Form Annual Information Form |

Tembec is dependent on the supply of certain raw materials.

As noted above, Tembec depends on the supply of fibre. Tembec also depends on the supply of other raw materials used in its production facilities, including certain chemicals. Any disruption in the supply of any of these raw materials could affect Tembec’s ability to manufacture its products and meet customer demand in a timely manner, which could thereby harm Tembec’s reputation and its results of operations. In addition, any material increase in the cost of these raw materials could have a negative impact on Tembec’s profitability.

In addition, natural and man-made events, including forest fires, adverse weather conditions, insect infestation, tree disease, ice storms, prolonged drought, flooding, periodically affect the industry in which Tembec operates. The occurrence of any of these events could have a material adverse effect on the availability of, and could significantly increase prices for, raw materials. One example is the mountain pine beetle, which currently poses a significant threat to the lodge pole pine forest in the interior regions of British Columbia. The beetle can infest lodge pole pine forests, and once infested, pine trees typically die within one year. Lodge pole pine currently accounts for a majority of the total timber volume harvested in British Columbia and approximately 70% of the total timber volume harvested by Tembec in the province over the last five years. If the outbreak continues to spread, the potential implications include reduced fibre supply, a change in lumber product mix, increased costs and a decrease in the quality of lumber produced.

Tembec relies heavily on third parties, typically railroads or trucks, to transport its manufactured products and to deliver the necessary raw materials for its production processes. If any of Tembec’s transportation providers were to fail to deliver these raw materials or manufactured products in a timely manner and Tembec were unable to find a comparable transportation provider in a timely manner, its reputation and customer relationships could be adversely affected, and it may be unable to sell such products at full value, or at all. In addition, if any of Tembec’s transportation providers were to cease operations or cease doing business with Tembec, it may be unable to replace them at a reasonable cost.

Reductions in the availability of energy supplies or an increase in energy costs may increase Tembec’s operating costs.

Tembec is affected by the cost of natural gas and electricity. Natural gas and electricity are important components of mill costs, especially for high-yield pulp mills, newsprint and paper mills. For fiscal 2012, purchased energy costs totaled approximately $125 million, 63% of which was electricity, which accounted for 10% of the total cost of sales. The price and availability of natural gas and electricity are influenced by a number of factors that are often beyond Tembec’s control, including mechanical failures, weather, political factors and unanticipated or sudden increases in demand. While Tembec purchases electricity primarily from large public utilities at rates set by regulatory bodies, in certain other jurisdictions, electricity is deregulated, which can lead to greater price volatility.

Tembec purchases its electricity, natural gas and other fossil fuel requirements at market rates. To mitigate the effect of price fluctuations on its financial performance, Tembec employs several tactics, including securing longer term supply agreements and operational curtailments in periods of high prices. Tembec does not currently hold any electricity or natural gas derivative commodity contracts. If Tembec is unable to continue to purchase its natural gas and electricity requirements for its operations on commercially reasonable terms, Tembec’s operations could be disrupted and its business, financial condition and results of operations could be materially adversely affected.

Tembec may not be able to successfully renegotiate its collective agreements with its unionized employees, which could affect its labor costs and operations.

Annual Information Form Annual Information Form |

As of September 29, 2012, Tembec had approximately 2,500 hourly paid employees covered by collective agreements. Collective agreements governing approximately 430 unionized employees will be under negotiation in the next fiscal year. There is a risk, however, that Tembec may not be able to negotiate collective agreements on acceptable terms. If Tembec is not able to renegotiate its collective agreements, it could face a strike or work stoppage or be obligated to pay higher wages and more benefits to union members. Any disruption in the operations of Tembec or higher ongoing labor costs could have a material adverse effect on its business, financial condition and results of operations.

Furthermore, at many of Tembec’s facilities, as well as those of the North American industry as a whole, reductions in employment levels due to technological and process improvements have resulted in a workforce with longer average years of service. This increases the cost of pensions and benefits.

Tembec is subject to the risk of substantial environmental liability and limitations on its operations brought about by the requirements of environmental laws and regulations.

Tembec is subject to various federal, state, provincial and local environmental, health and safety laws and regulations concerning such issues as air emissions, wastewater discharges, solid and hazardous materials and waste handling and disposal, forestry operations, endangered species, landfill operation and closure, and the investigation and remediation of contamination. These laws and regulations are increasingly stringent. While Tembec believes that its facilities are and will continue to be in material compliance with all applicable environmental laws and regulations, the risks of substantial additional costs and liabilities related to compliance with such laws and regulations are an inherent part of its business.