Exhibit 99.4

TEMBEC

FINANCIAL REPORT 2012

| 01 | Message to Shareholders |

| | |

| 04 | Management’s Discussion and Analysis |

| | |

| 52 | Management Responsibility |

| | |

| 53 | Independent Auditors’ Report |

| | |

| 54 | Consolidated Financial Statements |

| | |

| 111 | Directors and Officers |

| | |

| 112 | Shareholder Information |

The covers are printed on 10pt. FSC-certified Kallima® Coated Cover C1S Plus,

manufactured by Tembec’s Temiscaming, Quebec, coated bleached board mill.

TEMBEC INC.

©2012 All rights reserved Printed in Canada

MESSAGE

TO SHAREHOLDERS

The financial results for 2012 were below expectations, primarily due to poor market conditions for paper pulp. External economic factors continue to hamper the Company’s ability to achieve its full economic potential. The Company did continue with strategic investments in certain energy projects, the most significant being the $190 million energy investment at the Temiscaming specialty cellulose site. The focus remains to increase profit margins and reduce volatility of earnings.

The Company continued to make significant strides in its health and safety performance, achieving a 32% reduction in recordable incidents in 2012 versus the previous year. This follows a 25% reduction in 2011 and marks seven consecutive years of improvement in the Company’s health and safety performance. The focus will remain on transforming the health and safety culture to achieve world class levels.

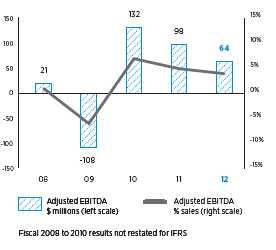

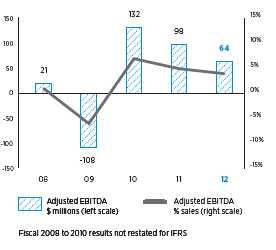

Adjusted EBITDA for 2012 was $64 million versus $98 million in the previous year. Market conditions were generally favorable for the Specialty Cellulose business throughout the year, providing the primary driver for the earnings. The Paper business was stable with very little volatility in price, allowing this business to be a steady contributor of cash flow. The Forest Products business, which has had a negative impact on profitability for the last several years, finally turned profitable in the final quarter of the year. The Company’s Paper Pulp business, the largest of all the Company’s businesses, suffered from poor product pricing and generated negative adjusted EBITDA.

The Company has embarked on the implementation of a Business Improvement Plan focusing on capital expenditures on key projects to increase overall adjusted EBITDA margins and to reduce the volatility of earnings. Several of these projects were completed last year and a new $190 million project was launched in 2012. These projects have placed demands on the Company’s cash flow as expected. The Company’s defined benefit pension plans are being greatly impacted by declining interest rates, increasing funding requirements and making extra demands on cash flow. Given the challenging conditions in some of the Company’s major markets, and the cash requirements to fund the strategic projects and excess pension funding obligations, the Company will continue with judicious cash flow management to maintain adequate levels of liquidity.

INVESTMENTS

In 2012, the Company began construction of the $190 million energy investment at its Temiscaming specialty cellulose mill. This will replace three old low pressure recovery boilers with a new high pressure boiler. A new 50-megawatt (MW) steam turbine will also be installed to produce electricity from the steam generated by the new boiler. The project will result in an adjusted EBITDA improvement of approximately $42 million per year through a combination of electricity revenue, cost reduction and productivity improvements.

A critical element of the Temiscaming energy investment is a power purchase agreement with Hydro-Quebec that was signed in 2012. The agreement provides for a guaranteed purchase of electricity produced by the new turbine at a fixed price of $106 per MW/hour (based on 2012), which is adjusted for inflation annually, for a 25 year-term.

The Company began construction of the Temiscaming energy project in 2012. Procurement of the major equipment and most of the civil construction work is complete. The Company targeted an aggressive construction schedule with the boiler starting up in December 2013 and the turbine starting April 2014. It has now been determined that the construction will be delayed and the start-up of the boiler will be postponed until the Spring of 2014 due to the high demand for contractors and construction workers in the Province of Quebec. It will be impossible to achieve the December 2013 boiler completion cost effectively in the over-heated construction market in Quebec.

After the completion of the $190 million investment, a second phase is being planned, which will involve a capacity expansion of this operation through the installation of new digesters. The new recovery boiler, turbine and power purchase agreement with Hydro-Quebec have been upsized to accommodate this second phase of investment.

Tembec Financial Report 20121

Message to Shareholders

Several other green energy projects were brought to completion in 2012 and will contribute to improved profitability in 2013. The new turbine installed at the Tartas specialty cellulose mill is now in full operation. The biomass boiler installed at the Béarn sawmill has been successfully commissioned and is operating at the expected level. The anaerobic treatment plant at the Matane high-yield pulp mill was commissioned in September and is in ramp-up mode. Once the Matane project is fully optimized, it is expected that these three green energy projects will generate an additional $21 million of adjusted EBITDA per year.

Defined Benefit Pension Plans

The Company administers several defined benefit pension plans in Canada on behalf of current and past employees. The progressive declines in interest rates over the last several years have led to increases in the estimated present value of future pension obligations. This in turn led to the creation of “solvency” or “wind up” deficits, which required that the Company fund amounts well in excess of normal annual costs. In fiscal 2012, the Company made $34 million of excess payments into its defined benefit pension plans. When combined with investment returns that exceeded the plan assumptions, the Company’s defined benefit pension plans are now approaching fully funded status on a going-concern basis. The Company is now in a better position to reduce defined benefit pension plan risk should future investment returns permit or discount rates increase.

As well, the Company has taken steps to reduce defined benefit pension risk by making a number of changes to its plans. All salaried employees are now on a defined contribution pension plan. As collective agreements have been renewed with unionized employees at several of the Company’s facilities, the pension plans have been changed to require all new employees to participate in defined contribution plans.

Forest Products

The Company’s lumber business has experienced several years of very poor results due to the low levels of new home construction in the United States. As expected, this market is taking several years to recover and has yet to hit normalized levels. Despite near record levels in housing affordability in the U.S., tight credit conditions, high unemployment and economic uncertainty have all created headwinds in the new home construction market.

As highlighted in last year’s report, the emergence of China as a new and significant market for North American lumber has helped keep the North American market somewhat balanced and has effectively set a floor on prices. While this market did not grow in 2012, shipments at levels comparable to 2011 continued, providing an important outlet for product and helping to maintain a balanced market in North America.

The second half of 2012 began to show signs of improvement in the U.S. housing market. Levels of existing home and new home inventories declined in the U.S. and housing starts in this market increased substantially over the same period of the previous year, but still remained below normalized levels. During this period, demand at the box stores, which typically service the repair and renovation market, also increased. These factors, combined with the steady demand from China, created a favorable environment for lumber sales in North America and pushed up prices materially. This allowed the Company’s lumber segment to generate positive adjusted EBITDA in the fiscal fourth quarter, which was the first positive quarter in several years.

The U.S. demographic and household formation projections, combined with continued high levels of affordability and increased consumer confidence, point toward an improving housing market in the U.S. While some lumber capacity will likely be restarted in North America in 2013, it is anticipated that the positive conditions seen in the latter half of 2012 will continue in the coming year.

Specialty Cellulose

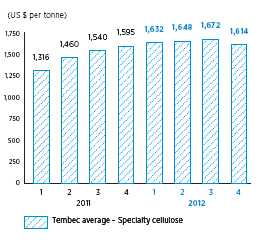

Fiscal 2012 was another good year for the Company’s specialty cellulose business. Demand throughout most of the year was strong, but did experience a slowdown in some sectors in the latter part of the year. The Company successfully implemented price increases across all of its specialty grades.

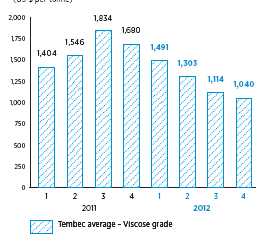

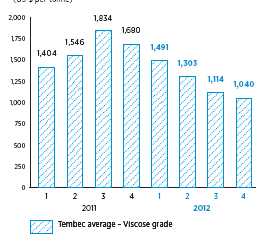

The Company continues to sell viscose grade pulp from the Temiscaming operation. This market declined from the very strong conditions the year prior. While the viscose demand is stable and is still expected to grow over the next five years, capacity additions of viscose grade pulp have created excess supply, which has driven down prices in the second half of 2012.

The long-term outlook for specialty cellulose remains strong. A number of the Company’s strategic customers have indicated aggressive growth plans and that additional supply will be required from Tembec in order for them to achieve their objectives. These needs will be accommodated in the short-term by phasing out the viscose commodity grade, which began last year. The viscose grade represented 15-20% of the total output of the Company’s specialty pulp mills in fiscal 2012. Additional specialty cellulose capacity will be added with phase two of the Temiscaming investment plan, which will accommodate additional customer requirements in the long-term.

2Tembec Financial Report 2012

Message to Shareholders

In the short-term, growth in specialty cellulose markets will be slowed by the current economic conditions impacting certain sectors, particularly the construction business. The European situation is the biggest concern and the effect that it is having on business prospects in China. It is unclear how long it will take to resolve the situation.

The Company remains focused on the specialty cellulose business due to the higher margins and reduced volatility that this sector offers. The long-term prospects for overall growth in demand will benefit those companies with the assets and technology to compete in this sector. As one of the largest and most specialized companies servicing this business, Tembec feels confident that its future prospects are excellent.

Paper Pulp

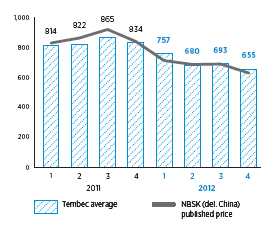

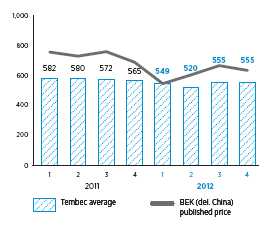

Fiscal 2012 was a disappointing year for both softwood and hardwood paper pulps. The dramatic slowdown in the European economy and declining consumer confidence had a significant negative impact on the demand for pulp. Europe is still the largest consumer of market pulp in the world. Demand from China, while still increasing, was unable to pick up the slack in the market. The result was a drop in both hardwood and softwood prices. The price level in the September quarter reached the cash breakeven point for many pulp mills, including the Company’s high-yield pulp mills.

In the short-term, it is expected that supply and demand will be in relative balance and prices should begin to recover for both softwood and hardwood pulp. Softwood is likely to benefit from a stable supply and consistent demand, potentially leading to a more favorable price environment. While the situation will likely improve for hardwood producers in the short-term, the new hardwood pulp capacity scheduled to start-up in 2013 and 2014 poses a threat to the overall hardwood market balance.

It is expected that 4 million to 5 million tonnes of new bleached eucalyptus pulp capacity will start up in Brazil in 2013-2014, bringing substantial hardwood pulp capacity onto the market in a short period of time. While mid-term projections indicate that this new supply can be absorbed into the global pulp markets based on growing demand, it is unclear if it can be absorbed as quickly as the new production enters the market. This potential oversupply situation could keep downward pressure on prices. The Company’s high-yield pulp competes in a number of applications with eucalyptus pulp and will be affected by low prices in this market. To prepare for a potential weak pulp market, the Company has taken a number of steps to mitigate the downside impact on its high-yield pulp business. This includes the indefinite idling of the Chetwynd, BC, pulp mill.

Paper

The Company sells into both the newsprint and coated paper board markets. The North American newsprint market has been stable for a prolonged period of time. While demand by daily newspapers has continued to decline over the past year, the rate of decline has decelerated. The loss in volume in the U.S. daily newspaper market has been compensated by capacity reductions, increased off-shore shipments and substitution for other grades. The result has been price stability, allowing the Company to generate stable earnings in this business.

The coated bleached board business suffers from declining demand in North America. The Company has been successful in offsetting this through product and customer diversification. This has resulted in stable sales volumes and relatively stable product pricing. This business should continue to be a consistent contributor of adjusted EBITDA for the Company.

SUMMARY

The Company’s Management and Board of Directors remain focused on the implementation of the strategic plan. This includes certain strategic initiatives to improve liquidity and maximize shareholder value. Cash flow will be managed prudently in the short-term during this period of economic uncertainty and relatively high capital investment. Significant progress has been made on the journey to becoming a world-class health and safety organization, but there is more to be done.

|  |

| JAMES M. LOPEZ | JAMES V. CONTINENZA |

| President and Chief Executive Officer | Chairman of the Board |

Tembec Financial Report 20123

MANAGEMENT’S

DISCUSSION AND ANALYSIS

as at November 30, 2012

The Management’s Discussion and Analysis (MD&A) section provides a review of the significant developments and issues that influenced Tembec Inc.’s financial performance during the fiscal year ended September 29, 2012, as compared to the fiscal year ended September 24, 2011. The MD&A should be read in conjunction with the audited consolidated financial statements for the fiscal year ended September 29, 2012. Financial data has been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). Effective September 25, 2011, Tembec adopted IFRS as the Company’s basis for financial reporting commencing with the interim financial statements for the three-month period ended December 24, 2011, and using September 26, 2010, as the transition date. Except where otherwise noted, all prior period comparative figures have been restated for IFRS. All financial references are stated in Canadian dollars, unless otherwise noted. All references to quarterly information relate to Tembec’s fiscal quarters. Adjusted EBITDA, net debt, total capitalization, free cash flow and certain other financial measures utilized in the MD&A are non-IFRS financial measures. As they have no standardized meaning prescribed by IFRS, they may not be comparable to similar measures presented by other companies.

The MD&A includes “forward-looking statements” within the meaning of securities laws. Such statements relate, without limitation, to the Company’s or management’s objectives, projections, estimates, expectations or predictions of the future and can be identified by words such as “may”, “will”, “could”, “anticipate”, “estimate”, “expect”, and “project”, the negative or variations thereof, and expressions of similar nature. Forward-looking statements are based on certain assumptions and analyses made by the Company in light of its experience, information available to it and its perception of future developments. Such statements are subject to a number of risks and uncertainties, including, but not limited to, changes in foreign exchange rates, product selling prices, raw material and operating costs and other factors identified in the Company’s periodic filings with securities regulatory authorities. Many of these risks are beyond the control of the Company and, therefore, may cause actual actions or results to materially differ from those expressed or implied herein. The forward-looking statements contained herein reflect the Company’s expectations as of the date hereof and are subject to change after such date. The Company disclaims any intention to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by applicable securities legislation. The information in this MD&A is as at November 30, 2012. Disclosure contained in this document is current to that date, unless otherwise stated.

Throughout the MD&A, “Tembec” or “Company” means Tembec Inc. and its consolidated subsidiaries. Tembec’s operations consist of five reportable business segments: Forest Products, Specialty Cellulose and Chemical Pulp, High-Yield Pulp, Paper and Corporate. On September 29, 2012, the Company had approximately 3,700 employees, as compared to 4,250 at the end of the prior fiscal year. The Company operates manufacturing facilities in Quebec, Ontario, British Columbia, the state of Ohio as well as in Southern France. Principal facilities are described in the subsequent sections of the MD&A.

4Tembec Financial Report 2012

Management’s Discussion and Analysis

2012 VS. 2011

| FINANCIAL SUMMARY | |

| (in millions of dollars, unless otherwise noted) | |

| | | 2011 | | | 2012 | |

Sales | | 1,743 | | | 1,666 | |

Freight and other deductions | | 237 | | | 232 | |

Lumber export taxes | | 13 | | | 7 | |

Cost of sales (excluding depreciation and amortization) | | 1,321 | | | 1,290 | |

SG&A | | 72 | | | 74 | |

Share-based compensation | | 2 | | | (1 | ) |

Adjusted EBITDA | | 98 | | | 64 | |

Depreciation and amortization | | 48 | | | 46 | |

Other items | | 3 | | | 50 | |

Operating earnings (loss) | | 47 | | | (32 | ) |

Interest, foreign exchange and other | | 31 | | | 41 | |

Exchange loss (gain) on long-term debt | | 1 | | | (13 | ) |

Earnings (loss) before income taxes | | 15 | | | (60 | ) |

Income tax expense | | 20 | | | 22 | |

Net loss | | (5 | ) | | (82 | ) |

Basic and diluted net loss in dollars per share | | (0.05 | ) | | (0.82 | ) |

Net comprehensive loss | | (67 | ) | | (131 | ) |

| | | | | | |

Total assets (at year-end) | | 1,093 | | | 1,059 | |

Total long-term debt (at year-end)(1) | | 289 | | | 339 | |

Total long-term financial liabilities (at year-end) | | 574 | | | 627 | |

(1)Includes current portion

| CONSOLIDATED SALES | CONSOLIDATED SALES BY SEGMENT |

| (in millions of dollars) | (in millions of dollars) |

|  |

Tembec Financial Report 20125

Management’s Discussion and Analysis

| ADJUSTED EBITDA BY SEGMENT | FINANCIAL PERFORMANCE |

| (in millions of dollars) | |

|  |

| | | | | | | | | | | | | | | | |

| SALES | | | | | | | | | | | | | | | |

| (in millions of dollars) | | | | | | | | | | | | | | | |

| | | | | | | | | Total | | | Price | | | Volume and | |

| | | 2011 | | | 2012 | | | variance | | | variance | | | mix variance | |

Forest Products | | 471 | | | 432 | | | (39 | ) | | 26 | | | (65 | ) |

Specialty Cellulose and Chemical Pulp | | 693 | | | 662 | | | (31 | ) | | (6 | ) | | (25 | ) |

High-Yield Pulp | | 378 | | | 352 | | | (26 | ) | | (12 | ) | | (14 | ) |

Paper | | 339 | | | 346 | | | 7 | | | 6 | | | 1 | |

Corporate | | 7 | | | 13 | | | 6 | | | – | | | 6 | |

| | 1,888 | | | 1,805 | | | (83 | ) | | 14 | | | (97 | ) |

Less: intersegment sales | | (145 | ) | | (139 | ) | | 6 | | | | | | | |

Sales | | 1,743 | | | 1,666 | | | (77 | ) | | | | | | |

Sales decreased by $77 million as compared to fiscal 2011. Currency was favourable as the Canadian dollar averaged US $0.992, a 2.1% decrease from US $1.013 in the prior year. Forest Products segment sales decreased by $39 million as a result of lower shipments, partially offset by higher prices. Specialty Cellulose and Chemical Pulp segment sales decreased by $31 million due to lower shipments and prices. High-Yield Pulp segment sales decreased by $26 million due to lower shipments and prices. Paper segment sales increased by $7 million due primarily to higher prices.

In terms of geographical distribution, the U.S. remained the Company’s principal market with 37% of consolidated sales in fiscal 2012, as compared to 34% in the prior year. Canadian sales represented 18% of sales, unchanged from the prior year. Sales outside of the U.S. and Canada represented the remaining 45% in fiscal 2012, as compared to 48% a year ago.

6Tembec Financial Report 2012

Management’s Discussion and Analysis

| ADJUSTED EBITDA | | | | | | | | | | | | | | | |

| (in millions of dollars) | | | | | | | | | | | | | | | |

| | | | | | | | | Total | | | Price | | | Cost and | |

| | | 2011 | | | 2012 | | | variance | | | variance | | | volume variance | |

Forest Products | | (47 | ) | | (16 | ) | | 31 | | | 26 | | | 5 | |

Specialty Cellulose and Chemical Pulp | | 140 | | | 92 | | | (48 | ) | | (6 | ) | | (42 | ) |

High-Yield Pulp | | (3 | ) | | (29 | ) | | (26 | ) | | (12 | ) | | (14 | ) |

Paper | | 29 | | | 37 | | | 8 | | | 6 | | | 2 | |

Corporate | | (21 | ) | | (20 | ) | | 1 | | | – | | | 1 | |

| | 98 | | | 64 | | | (34 | ) | | 14 | | | (48 | ) |

Adjusted EBITDA of $64 million was $34 million lower than the prior year. Forest Products segment adjusted EBITDA was up $31 million from the prior year primarily as a result of higher prices. Specialty Cellulose and Chemical Pulp segment adjusted EBITDA declined by $48 million due to higher costs and lower prices. High-Yield Pulp segment adjusted EBITDA declined by $26 million due to higher costs and lower prices. Paper segment adjusted EBITDA improved by $8 million due to higher prices and lower costs.

| OPERATING EARNINGS (LOSS) | |

| (in millions of dollars) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Adjusted | | | | | | Other | |

| | | | | | | | | Total | | | EBITDA | | | Depreciation | | | items | |

| | | 2011 | | | 2012 | | | variance | | | variance | | | variance | | | variance | |

Forest Products | | (64 | ) | | (4 | ) | | 60 | | | 31 | | | 4 | | | 25 | |

Specialty Cellulose and Chemical Pulp | | 121 | | | 71 | | | (50 | ) | | (48 | ) | | (2 | ) | | – | |

High-Yield Pulp | | (14 | ) | | (92 | ) | | (78 | ) | | (26 | ) | | (2 | ) | | (50 | ) |

Paper | | 26 | | | 35 | | | 9 | | | 8 | | | 1 | | | – | |

Corporate | | (22 | ) | | (42 | ) | | (20 | ) | | 1 | | | 1 | | | (22 | ) |

| | | 47 | | | (32 | ) | | (79 | ) | | (34 | ) | | 2 | | | (47 | ) |

The Company generated an operating loss of $32 million compared to operating earnings of $47 million in fiscal 2011.

The Forest Products segment generated an operating loss of $4 million, as compared to an operating loss of $64 million in fiscal 2011. In addition to the previously noted improvement in adjusted EBITDA, the sale of the British Columbia (BC) sawmills and the hardwood flooring operations led to lower depreciation expense. During the most recent fiscal year, the Company recorded a gain of $24 million related to the sale of the BC sawmills. The Company also sold its Toronto, Ontario, hardwood flooring plant and concurrently closed its Huntsville, Ontario, hardwood flooring plant. The combined effect was a charge of $2 million.

Tembec Financial Report 20127

Management’s Discussion and Analysis

In the prior year period, the segment recorded a charge of $2 million relating to the permanent closure of the Taschereau, Quebec, sawmill. The charge was for severance and other closure costs. The Company also absorbed a charge of $1 million related to severance payments at an idled planer mill in Cranbrook, BC.

The Specialty Cellulose and Chemical Pulp segment generated operating earnings of $71 million compared to operating earnings of $121 million in the prior year. The previously noted decline in adjusted EBITDA led to the lower operating earnings.

The High-Yield Pulp segment generated an operating loss of $92 million compared to an operating loss of $14 million in the prior year. In addition to the previously noted decline in adjusted EBITDA, the segment absorbed an impairment charge of $50 million relating to the property, plant and equipment, including supplies and materials, of the Chetwynd, BC, pulp mill.

The Paper segment generated operating earnings of $35 million compared to operating earnings of $26 million in the prior year. The previously noted improvement in adjusted EBITDA led to the higher operating earnings.

Corporate expenses increased by $20 million primarily due to other items. The current year includes a $16 million charge relating to the write-down of the loan receivable from Temlam Inc. The latter is currently under creditor protection and owns an idled laminated veneer lumber (LVL) facility located in Amos, Quebec. The Company has a 50% secured interest in the facility. The cutting rights that were previously attached to the LVL facility were granted to another company. In the absence of a guaranteed fibre supply, the Company concluded that the re-start of the facility is unlikely and has adjusted its carrying value to the amount anticipated to be realized upon liquidation or sale. The current year also includes a gain of $4 million relating to the sale of a minority equity interest in two dissolving pulp mills. The prior year includes a gain of $4 million related to the filing of Tembec USA LLC under Chapter 7 of the Bankruptcy Code of the United States. The gain was generated by a reduction in the Company’s accrued benefit obligation. The period also included a gain of $3 million related to the sale of hydro-electric generating assets located in Smooth Rock Falls, Ontario.

8Tembec Financial Report 2012

Management’s Discussion and Analysis

SEGMENT REVIEW – 2012 VS. 2011

| FOREST PRODUCTS | | | | | | |

| (in millions of dollars) | | | | | | |

| | | 2011 | | | 2012 | |

Sales(1) | | 471 | | | 432 | |

Freight and other deductions | | 47 | | | 41 | |

Lumber export taxes | | 13 | | | 7 | |

Cost of sales(1) | | 441 | | | 385 | |

SG&A | | 17 | | | 15 | |

Adjusted EBITDA | | (47 | ) | | (16 | ) |

Adjusted EBITDA margin on sales | | (10.0 | )% | | (3.7 | )% |

Depreciation and amortization | | 14 | | | 10 | |

Other items: | | | | | | |

Gain on sale of BC sawmills | | – | | | (24 | ) |

Loss on sale/closure of flooring assets | | – | | | 2 | |

Taschereau sawmill closure charge | | 2 | | | – | |

Cranbrook planer mill closure charge | | 1 | | | – | |

Operating loss | | (64 | ) | | (4 | ) |

| | | | | | |

Identifiable assets (excluding cash) | | 267 | | | 216 | |

(1)Includes intersegment sales eliminated on consolidation

The Forest Products segment is divided into two main areas of activity: forest resource management and manufacturing operations.

The Forest Resource Management group is responsible for managing all of the Company’s Canadian forestry operations. This includes the harvesting of timber, either directly or by contractual agreements, and all silviculture and regeneration work required to ensure a sustainable supply for the manufacturing units. The group is also responsible for third party timber purchases, which are needed to supplement total requirements. The group’s main objective is the optimization of the flow of timber into various manufacturing units. As the Company’s forest activity in Canada is conducted primarily on Crown lands, the Forest Resource Management group works closely with provincial governments to ensure harvesting plans and operations comply with established regulations and that stumpage charged by the provinces is reasonable and reflects the fair value of the timber being harvested. During fiscal 2012, the Company’s operations harvested and delivered 3.9 million cubic metres of timber, unchanged from the prior year. Additional supply of approximately 0.8 million cubic metres was secured mainly through purchases and exchanges with third parties, compared to 0.9 million cubic metres in the prior year.

The Forest Products segment includes operations located in Quebec and Ontario. At the end of the March 2012 quarter, the Company sold its two BC sawmills. The sawmills had a capacity of 450 million board feet of lumber, which represented approximately 29% of the Company’s total SPF lumber capacity at that time. The SPF lumber operations can produce approximately 930 million board feet of lumber. The specialty wood operations can annually produce 30 million board feet of hardwood lumber. During the December 2011 quarter, the Company sold its Toronto, Ontario, hardwood flooring plant and announced the closure of its Huntsville, Ontario, hardwood flooring plant. The two operations had a combined capacity of 20 million square feet of hardwood flooring. The Company’s engineered wood operations consist of two finger joint lumber operations, which were idle for all of fiscal 2011 and fiscal 2012.

Tembec Financial Report 20129

Management’s Discussion and Analysis

The following summarizes the current annual capacity of each facility by product group:

SPF LUMBER | | mbf | |

Stud lumber - La Sarre, QC | | 135,000 | |

Stud lumber - Senneterre, QC | | 150,000 | |

Stud lumber - Cochrane, ON | | 110,000 | |

Stud lumber - Kapuskasing, ON | | 105,000 | |

Random lumber - Béarn, QC | | 110,000 | |

Random lumber - Chapleau, ON | | 135,000 | |

Random lumber - Hearst, ON | | 160,000 | |

Finger joint lumber - Cranbrook, BC | | 25,000 | |

| | 930,000 | |

SPECIALTY WOOD | | mbf | |

Hardwood lumber - Huntsville, ON | | 30,000 | |

ENGINEERED WOOD | | mbf | |

Engineered finger joint lumber - La Sarre, QC | | 60,000 | |

Engineered finger joint lumber - Kirkland Lake, ON | | 30,000 | |

| | | 90,000 | |

The segment is dominated by SPF lumber, which represented 94% of building material sales in fiscal 2012, compared to 85% in the prior year. The volume of SPF lumber sold in fiscal 2012 decreased by 72 million board feet or 8%. The sale of the Company’s two BC sawmills at the end of the March 2012 quarter had a significant impact on shipments and volumes. Shipments of lumber from the two sawmills during the first two quarters of fiscal 2012 totalled 172 million board feet as compared to 343 million board feet in the full 12-month period of fiscal 2011, a decrease of 171 million board feet. Shipments from the Company’s Eastern sawmills increased by 99 million board feet, partially offsetting the previously noted decrease. Shipments were equal to 62% of capacity, up from 57% in fiscal 2011. In response to relatively low lumber demand, the Company continued to reduce production by curtailing operations at several facilities for either indefinite or temporary periods. The split between Eastern/Western shipments was 79/21 as compared to 62/38 a year ago. US $ reference prices for random lumber were up by US $16 per mbf on average while stud lumber increased by US $39 per mbf. Currency was favourable as the Canadian dollar averaged US $0.992, a 2.1% decrease from US $1.013 in the prior year. The combined result was a $35 per mbf price increase from a year ago.

10Tembec Financial Report 2012

Management’s Discussion and Analysis

Specialty wood represented 6% of building material sales in fiscal 2012, down from 15% in the prior year. The decline was due to the sale of the Toronto, Ontario, hardwood flooring plant and the closure of the Huntsville, Ontario, hardwood flooring plant.

There were no engineered wood sales in fiscal 2011 and 2012. The two finger joint facilities were idle for all of fiscal 2011 and fiscal 2012.

The Forest Products segment produced and shipped approximately 1.0 million tonnes of wood chips in fiscal 2012, 80% of which were directed to the Company’s pulp and paper operations. In 2011, the segment produced 1.1 million tonnes and shipped 85% of this volume to the pulp and paper mills. The internal transfer price of wood chips is based on current and expected market transaction prices.

Total sales for this segment reached $432 million, a decrease of $39 million over the prior year. After eliminating internal sales, the Forest Products segment generated 21% of Company consolidated sales, down from 22% in the prior year. The segment’s main market is North America, which represented 97% of consolidated sales in fiscal 2012, compared to 94% in the prior year.

| | | | | | Sales | | | | | | Shipments | | | | | | Selling prices | |

| | | | | | ($ millions) | | | | | | (000 units | ) | | | | | ($ / unit) | |

| | | 2011 | | | 2012 | | | 2011 | | | 2012 | | | 2011 | | | 2012 | |

SPF lumber (mbf) | | 283 | | | 282 | | | 907.9 | | | 835.7 | | | 312 | | | 337 | |

Specialty wood | | | | | | | | | | | | | | | | | | |

Hardwood (mbf) | | 6 | | | 8 | | | 9.5 | | | 12.7 | | | 632 | | | 629 | |

Hardwood flooring (000 square ft) | | 45 | | | 10 | | | 9.1 | | | 2.2 | | | 4,945 | | | 4,545 | |

| | 51 | | | 18 | | | | | | | | | | | | | |

Engineered wood | | | | | | | | | | | | | | | | | | |

Engineered finger joint lumber (mbf) | | – | | | – | | | – | | | – | | | – | | | – | |

Total building materials | | 334 | | | 300 | | | | | | | | | | | | | |

Wood chips, logs and by-products | | 137 | | | 132 | | | | | | | | | | | | | |

Total sales | | 471 | | | 432 | | | | | | | | | | | | | |

Internal wood chips and other sales | | (96 | ) | | (84 | ) | | | | | | | | | | | | |

Consolidated sales | | 375 | | | 348 | | | | | | | | | | | | | |

Tembec Financial Report 201211

Management’s Discussion and Analysis

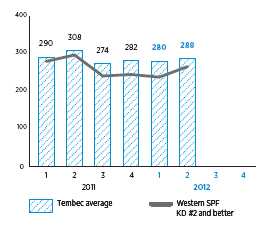

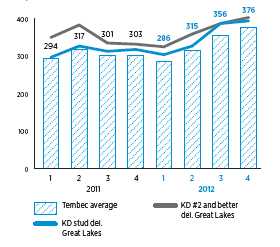

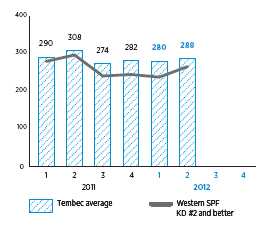

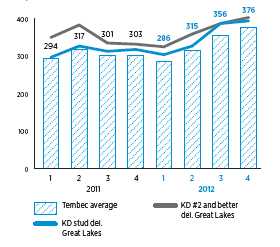

| QUARTERLY PRICES – WESTERN SPF MILL NET | QUARTERLY PRICES – EASTERN SPF DELIVERED |

| (US $ per mbf) | (US $ per mbf) |

|  |

MARKETS

The Company markets its lumber with its own internal sales force.

The benchmark random length Western SPF (#2 and better) lumber net price averaged US $275 per mbf in 2012, an increase from US $263 per mbf in 2011. In the East, the random length Eastern SPF average lumber price (delivered Great Lakes) increased from US $350 per mbf to US $370 per mbf in 2012. The Company considers these to be relatively low levels, approximately US $30 to US $40 below normal trend line prices for random lumber. The reference price for stud lumber increased with the Eastern average lumber price (delivered Great Lakes) up from US $314 per mbf to US $353 per mbf, a level approximately US $30 to US $40 per mbf below trend line prices. The prices were driven by a relatively weak U.S. housing market. Housing starts in the U.S. on a seasonally adjusted basis averaged 729,000 units in fiscal 2012, an increase over the 578,000 units in fiscal 2011. However, these remain well below the 2 million unit mark experienced in the 2004-2006 period and the +1.2 million average that would be indicative of normal market conditions. While the Company recognized several years ago that U.S. housing starts could not maintain the 2 million unit per year run rate, and that a degree of market correction would likely occur at some point, the severity and extent of the correction had not been anticipated. The negative effects of the sub-prime mortgage difficulties, the latter having fuelled the strong demand in 2004-2006, have been much greater in terms of impact and duration than originally foreseen.

12Tembec Financial Report 2012

Management’s Discussion and Analysis

In addition to difficult market conditions, the Company’s financial performance continued to be impacted by export taxes on lumber shipped to the U.S. Effective October 12, 2006, the governments of Canada and the United States implemented an agreement for the settlement of the softwood lumber dispute. The Softwood Lumber Agreement (SLA) requires that an export tax be collected by the Government of Canada, which is based on the price and volume of lumber shipped. Since that date, the Company’s Eastern Canadian sawmills, located in Quebec and Ontario, have been subject to export quota limitations and 5% export tax on lumber shipped to the U.S. In April 2009, the effective tax on Eastern lumber shipments increased from 5% to 15% as a result of an arbitration decision relating to alleged over-shipments of lumber between January 2007 and June 2007. The SLA provides that during periods of relatively high prices, as was the case during the early summer months, the export tax rate declines. During fiscal 2011, a second arbitration penalty of approximately 1% was imposed on Eastern lumber shipments beginning in March 2011. However, the first arbitration penalty of 10% expired in June 2011. Overall, the average rate on all Eastern lumber shipments to the U.S. was 11.7% and the total cost was $6 million in the prior year. In fiscal 2012, the average tax rate on Eastern lumber shipments to the U.S. was 4.8% and the total cost was $4 million. The decrease in rate was caused by the previously noted expiration of the 10% arbitration penalty. The decrease in rate was partially offset by an increase in the volume and price of lumber shipped to the U.S.

During fiscal 2012, the Company sold its two British Columbia sawmills in March 2012. As such, the MD&A data reflects the mills financial results for six months in fiscal 2012 as compared to 12 months in fiscal 2011. The BC sawmills were subject to a 15% export tax, but shipments were not quota limited. Under certain circumstances, the tax could be increased to 22.5%, which was not the case in either fiscal 2011 or the first six months of fiscal 2012. During fiscal 2011, the average rate on shipments to the U.S was 15% and the total cost was $7 million. In fiscal 2012, the average rate on shipments was also 15% and the total cost was $3 million. The reduction in cost relates to the shorter period of ownership.

Tembec Financial Report 201213

Management’s Discussion and Analysis

OPERATING RESULTS

The following summarizes adjusted EBITDA variances by major element:

| | | Variance - favourable (unfavourable) | |

| | | | | | Export | | | Mill | | | Inventory NRV | | | | | | | |

| (in millions of dollars) | | Price | | | taxes | | | costs | | | adjustments | | | Other | | | TOTAL | |

| SPF lumber | | 27 | | | 6 | | | 2 | | | 1 | | | (5 | ) | | 31 | |

| Specialty wood | | (1 | ) | | – | | | – | | | – | | | 1 | | | – | |

| Engineered wood | | – | | | – | | | – | | | – | | | – | | | – | |

| Other segment items | | – | | | – | | | – | | | – | | | – | | | – | |

| | | 26 | | | 6 | | | 2 | | | 1 | | | (4 | ) | | 31 | |

In fiscal 2012, adjusted EBITDA was negative $16 million compared to negative adjusted EBITDA of $47 million in the prior year. SPF lumber adjusted EBITDA improved by $31 million. The previously noted higher selling prices for lumber increased adjusted EBITDA by $27 million. The higher prices were assisted by currency as the Canadian dollar averaged US $0.992, a 2.1% decrease from US $1.013 in the prior year. The previously noted decline in export taxes on lumber shipped to the U.S. increased adjusted EBITDA by a further $6 million. Sawmill manufacturing costs declined by $2 million, primarily in the Eastern sawmills, which produced 16% more lumber versus 2011. In the prior year, the segment had benefited from a $1 million favourable adjustment to the carrying values of logs and lumber inventories compared to a favourable adjustment of $2 million in the current year. The $5 million negative variance in “Other” includes a $4 million negative volume variance due to selling a higher volume of lumber at negative margins as well as a negative variance of $1 million related to freight costs. Specialty wood adjusted EBITDA was unchanged year-over-year. Engineered wood results were also unchanged as both plants remained idle for both years. The adjusted EBITDA margin to total sales was negative 3.7% compared to negative 10.0% in the prior year.

The following summarizes operating results variances by major element:

| | | | | | | | | Variance | |

| | | | | | | | | favourable | |

| (in millions of dollars) | | 2011 | | | 2012 | | | (unfavourable) | |

| Adjusted EBITDA | | (47 | ) | | (16 | ) | | 31 | |

| Depreciation and amortization | | 14 | | | 10 | | | 4 | |

| Other items (gain) | | 3 | | | (22 | ) | | 25 | |

| Operating loss | | (64 | ) | | (4 | ) | | 60 | |

The Forest Products segment generated an operating loss of $4 million, as compared to an operating loss of $64 million in fiscal 2011. In addition to the previously noted improvement in adjusted EBITDA, the sale of the BC sawmills and the hardwood flooring operations led to lower depreciation expense. During the most recent fiscal year, the Company recorded a gain of $24 million related to the sale of the BC sawmills. The Company sold its Toronto, Ontario, hardwood flooring plant and concurrently closed its Huntsville, Ontario, hardwood flooring plant. The combined effect was a charge of $2 million. In the prior year period, the segment recorded a charge of $2 million relating to the permanent closure of the Taschereau, Quebec, sawmill. The charge was for severance and other closure costs. The Company also absorbed a charge of $1 million related to severance payments at an idled planer mill in Cranbrook, BC.

14Tembec Financial Report 2012

Management’s Discussion and Analysis

| SPECIALTY CELLULOSE AND CHEMICAL PULP | | | | | | |

| (in millions of dollars) | | | | | | |

| | | 2011 | | | 2012 | |

| Sales - Pulp(1) | | 600 | | | 562 | |

| Sales - Chemicals | | 93 | | | 100 | |

| | | 693 | | | 662 | |

| Freight and other deductions | | 66 | | | 68 | |

| Cost of sales(1) | | 464 | | | 481 | |

| SG&A | | 23 | | | 21 | |

| Adjusted EBITDA | | 140 | | | 92 | |

| Adjusted EBITDA margin on sales | | 20.2 | % | | 13.9 | % |

| Depreciation and amortization | | 19 | | | 21 | |

| Operating earnings | | 121 | | | 71 | |

| | | | | | | |

| Identifiable assets (excluding cash) | | 491 | | | 544 | |

(1) Includes intersegment sales eliminated on consolidation

The Specialty Cellulose and Chemical Pulp segment consists of three market pulp manufacturing facilities. The facilities are divided into two main types. Two pulp mills produce specialty cellulose pulps. The remaining facility produces chemical softwood kraft paper pulp (NBSK).

The two specialty cellulose pulp mills have an annual capacity of 310,000 tonnes per year. The softwood kraft mill has an annual capacity of 270,000 tonnes. The specialty cellulose pulp produced at the two pulp mills is a high purity cellulose utilized in a wide variety of specialized products such as pharmaceuticals, food additives, and industrial chemicals. The Temiscaming mill also produces “viscose” grade pulp, which is utilized in the production of viscose staple fibre, which in turn is used to produce rayon for the textile industry. The Tartas mill also produced specialized fluff pulp, which is utilized in the production of sanitary products. The production of specialized fluff pulp was discontinued in September 2011 as the mill transitioned to 100% specialty cellulose grades.

The two specialty cellulose mills generate lignin as a by-product of the sulphite process, which is sold to third parties. The Temiscaming mill also includes a facility that produces ethanol as a by-product that is also sold to third parties.

The segment also includes a stand-alone resin business, which produces powder and liquid phenolic resins at three operating sites in Quebec: Temiscaming, Longueuil, and Trois-Pistoles. The Company also operates a fourth facility located in Toledo, Ohio, which manufactures powder and liquid amino-resins. The chemical business periodically purchases and re-sells third party pulp mill by-product chemicals.

The following summarizes the annual operating capacity of each facility:

SPECIALTY CELLULOSE | | tonnes | |

Specialty cellulose and commodity dissolving pulp - Temiscaming, QC | | 160,000 | |

Specialty cellulose - Tartas, France | | 150,000 | |

| | 310,000 | |

CHEMICAL PULP | | | |

NBSK - Skookumchuck, BC | | 270,000 | |

CHEMICALS | | | |

Resin and related products - Temiscaming and Longueuil, QC; Toledo, Ohio | | 170,000 | |

Lignin - Temiscaming, QC; Tartas, France | | 190,000 | |

Ethanol - Temiscaming, QC (million litres) | | 12.1 | |

Tembec Financial Report 201215

Management’s Discussion and Analysis

Specialty cellulose shipments represented 54% of segment shipments in fiscal 2012, compared to 53% in the prior year. Specialty cellulose sales as a percentage of total segment pulp sales increased from 68% to 72% due to lower prices for NBSK pulp.

Chemical pulp NBSK represented 46% of segment pulp shipments in fiscal 2012, compared to 47% in the prior year. Based on sales dollars, NBSK pulp sales as a percentage of total segment pulp sales decreased from 32% to 28% due to a decline in selling prices.

Total 2012 pulp shipments of 479,900 tonnes include 17,300 tonnes of NBSK pulp consumed by the Company’s paperboard operations as compared to 15,300 tonnes in the prior year.

Total sales for the Specialty Cellulose and Chemical Pulp segment were $662 million, a decrease of $31 million from the prior year. After eliminating internal sales, the Specialty Cellulose and Chemical Pulp segment generated 39% of Company consolidated sales, unchanged from the prior year. The Specialty Cellulose and Chemical Pulp segment is a global business. In 2012, 61% of consolidated pulp sales were generated outside of Canada and the U.S., as compared to 64% in the prior year.

| | | | | | Sales | | | | | | Shipments | | | | | | Selling prices | |

| | | | | | ($ millions) | | | | | | (000 units | ) | | | | | ($ / unit) | |

| | | 2011 | | | 2012 | | | 2011 | | | 2012 | | | 2011 | | | 2012 | |

Specialty pulp | | | | | | | | | | | | | | | | | | |

Specialty cellulose (tonnes) | | 311 | | | 353 | | | 209.5 | | | 215.1 | | | 1,484 | | | 1,641 | |

Viscose grade (tonnes) | | 85 | | | 54 | | | 52.4 | | | 42.3 | | | 1,622 | | | 1,253 | |

Specialty fluff (tonnes) | | 9 | | | – | | | 8.1 | | | – | | | 1,111 | | | – | |

| | 405 | | | 407 | | | 270.0 | | | 257.4 | | | | | | | |

Chemical paper pulps (tonnes) | | 195 | | | 155 | | | 237.3 | | | 222.5 | | | 822 | | | 697 | |

Total specialty celluloseand chemical pulp sales | | 600 | | | 562 | | | 507.3 | | | 479.9 | | | | | | | |

Chemicals | | | | | | | | | | | | | | | | | | |

Resin and related products (tonnes) | | 55 | | | 55 | | | 55.2 | | | 55.7 | | | 996 | | | 987 | |

Lignin (tonnes) | | 29 | | | 29 | | | 131.5 | | | 132.4 | | | 221 | | | 219 | |

Ethanol (000 litres) | | 7 | | | 9 | | | 8.9 | | | 10.0 | | | 787 | | | 900 | |

| | 91 | | | 93 | | | | | | | | | | | | | |

Other sales | | 2 | | | 7 | | | | | | | | | | | | | |

Total sales | | 693 | | | 662 | | | | | | | | | | | | | |

Internal pulp sales | | (12 | ) | | (12 | ) | | (15.3 | ) | | (17.3 | ) | | | | | | |

Consolidated sales | | 681 | | | 650 | | | | | | | | | | | | | |

16Tembec Financial Report 2012

Management’s Discussion and Analysis

MARKETS

The Company markets its pulp on a world-wide basis, primarily through its own sales force. Permanent sales offices are maintained in Toronto, Canada; Dax, France; and Beijing, China. Contractual arrangements with third party representatives are also utilized.

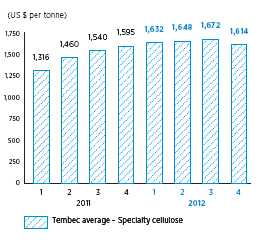

The shipments to capacity ratio for specialty pulp was 83% in fiscal 2012 versus 87% in the prior year. The decrease in shipment ratio was due to a decrease of 10,100 tonnes in viscose grade pulp shipments and 8,100 tonnes in specialty fluff shipments, which the Company no longer manufactures. This was due to the Company’s objective of focusing on “specialty” or higher purity grades and reducing its exposure to viscose and fluff grades. Specialty cellulose pulps have a lesser yield, which in turn reduces the productivity of the two mills. During fiscal 2011 and 2012, both mills operated at full rates and no downtime was taken for market conditions. The strong market conditions for specialty grades led to higher US dollar and euro prices. Pricing for specialty cellulose increased by $157 per tonne. The increase in Canadian dollar selling prices would have been higher if not for the weaker euro, which averaged 5.1% lower and reduced average prices by $37 per tonne. Market conditions in the viscose grade weakened from the record levels reached in 2011 and prices declined by $369 per tonne. The favourable specialty cellulose market conditions also led to low inventory levels of finished pulp, ending fiscal 2012 at 27 days of supply compared to 22 days at the end of 2011.

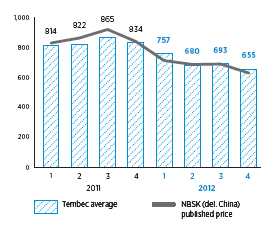

The shipments to capacity ratio for chemical paper pulp or NBSK was 82% in fiscal 2012 versus 88% in the prior year. The decline in shipment ratio was due to a combination of lower productivity and inventory movement. Market conditions for NBSK pulp were significantly weaker during the most recent year. The benchmark price (delivered China) declined by US $183 per tonne. With a weaker Canadian dollar and a higher sales mix factor providing a partial offset, the net effect was a reduction of $125 per tonne. Fiscal 2012 inventory of NBSK ended the year at only nine days, as year-end coincided with the annual maintenance shutdown. This level does not allow for effective customer service and will be increased in the first quarter of fiscal 2013.

QUARTERLY PRICES – SPECIALTY CELLULOSE

QUARTERLY PRICES – VISCOSE GRADE

(US $ per tonne)

QUARTERLY PRICES – NBSK

(US $ per tonne)

Tembec Financial Report 201217

Management’s Discussion and Analysis

OPERATING RESULTS

The following summarizes adjusted EBITDA variances by major element:

| | | Variance - favourable (unfavourable) | |

| | | | | | | | | | | | Foreign | | | | | | | |

| | | | | | | | | Inventory | | | exchange | | | | | | | |

| | | | | | Mill | | | NRV | | | impact | | | | | | | |

(in millions of dollars) | | Price | | | costs | | | adjustments | | | on costs | | | Other | | | TOTAL | |

Specialty cellulose | | 18 | | | (28 | ) | | – | | | 7 | | | (5 | ) | | (8 | ) |

Chemical paper pulp (NBSK) | | (28 | ) | | (6 | ) | | (1 | ) | | – | | | – | | | (35 | ) |

Chemicals | | 4 | | | (7 | ) | | – | | | – | | | – | | | (3 | ) |

Other segment items | | – | | | – | | | – | | | – | | | (2 | ) | | (2 | ) |

| | | (6 | ) | | (41 | ) | | (1 | ) | | 7 | | | (7 | ) | | (48 | ) |

Fiscal 2012 adjusted EBITDA was $92 million compared to $140 million in the prior year. Specialty grades of cellulose pulp increased in price and more than offset declines in viscose grades, increasing adjusted EBITDA by $18 million. Manufacturing costs at the two specialty pulp mills increased by $28 million, primarily for chemicals, supplies and fiber. The mills produced more specialty grades of cellulose pulp, which have lower yields and are more costly to produce than viscose grades. The weaker euro versus the Canadian dollar, which reduced the Tartas’ mill selling prices by $10 million, also reduced their Canadian dollar equivalent costs by $7 million leaving a net adjusted EBITDA impact of $3 million. The remaining $5 million negative variance is primarily related to volume as shipments declined by 4.7% year-over-year.

As noted previously, market conditions for NBSK were significantly weaker during 2012. The decline in prices reduced adjusted EBITDA by $28 million. Mill manufacturing costs increased by $6 million, primarily for fiber and chemicals.

The $4 million favourable chemicals price variance was due to higher resin prices. However, raw material costs increased by a similar amount and resin profitability was relatively unchanged. The decline of $3 million in chemicals adjusted EBITDA was due to the Canadian lignin business, which experienced lower prices and higher costs.

The two North American mills purchased approximately 852,000 bone dry tonnes of wood chips in fiscal 2012, up from 845,000 in the prior year. Of this amount, approximately 49% was supplied by the Forest Products segment, compared to 67% in the prior year. The decline in internal fiber percentage was due to the sale of the two BC sawmills in March 2012. While the Skookumchuck NBSK mill continues to utilize the wood chip output of the two sawmills from the new owner, they are now classified as external supply. The remaining requirements were purchased from third parties under contracts and agreements of various durations. The pulp mill located in Southern France purchased 287,000 bone dry tonnes of wood in fiscal 2012 as compared to 308,000 bone dry tonnes in the prior year. The fibre is sourced from many private landowners.

Overall, lower NBSK prices and higher manufacturing costs reduced adjusted EBITDA margins from 20.2% in 2011 to 13.9% in 2012.

The following summarizes operating results variances by major element:

| | | | | | | | | Variance | |

| | | | | | | | | favourable | |

(in millions of dollars) | | 2011 | | | 2012 | | | (unfavourable) | |

Adjusted EBITDA | | 140 | | | 92 | | | (48 | ) |

Depreciation and amortization | | 19 | | | 21 | | | (2 | ) |

Operating earnings | | 121 | | | 71 | | | (50 | ) |

The Specialty Cellulose and Chemical Pulp segment generated operating earnings of $71 million during the most recently completed fiscal year, compared to operating earnings of $121 million in the prior year. The previously noted decline in adjusted EBITDA led to the lower operating earnings.

18Tembec Financial Report 2012

Management’s Discussion and Analysis

| HIGH-YIELD PULP | | | | | | |

| (in millions of dollars) | | | | | | |

| | | 2011 | | | 2012 | |

Sales(1) | | 378 | | | 352 | |

Freight and other deductions | | 79 | | | 77 | |

Cost of sales(1) | | 299 | | | 298 | |

SG&A | | 3 | | | 6 | |

Adjusted EBITDA | | (3 | ) | | (29 | ) |

Adjusted EBITDA margin on sales | | (0.8 | )% | | (8.2 | )% |

Depreciation and amortization | | 11 | | | 13 | |

Other item: | | | | | | |

Chetwynd impairment charge | | - | | | 50 | |

Operating loss | | (14 | ) | | (92 | ) |

| | | | | | |

Identifiable assets (excluding cash) | | 173 | | | 156 | |

(1) Includes intersegment sales eliminated on consolidation

The High-Yield Pulp segment consists of three market pulp manufacturing facilities. High-yield pulps are produced with a combination of mechanical and chemical processes. The Company produces hardwood grades made from maple, aspen and birch. High-yield pulps have a lower tensile and tear strength than kraft pulps but they offer advantages on bulk and opacity. They compete against other hardwood or “short fibre” grades, with Bleached Eucalyptus Kraft (BEK) being the most prominent.

The following summarizes the annual capacity of each facility:

| HIGH-YIELD PULP | | tonnes | |

Hardwood high-yield - Temiscaming, QC | | 315,000 | |

Hardwood high-yield - Matane, QC | | 250,000 | |

Hardwood high-yield - Chetwynd, BC | | 240,000 | |

| | | 805,000 | |

Total 2012 shipments of 640,700 tonnes include 60,000 tonnes of high-yield pulp consumed by the Company’s paperboard operations as compared to 57,500 tonnes in the prior year.

Total sales for the High-Yield Pulp segment were $352 million, a decrease of $26 million from the prior year. After eliminating internal sales, the High-Yield Pulp segment generated 19% of Company consolidated sales, as compared to 20% in the prior year. The High-Yield Pulp segment is more export oriented than the other business segments within the Company. In 2012, 99% of consolidated pulp sales were generated outside of Canada and the U.S., unchanged from the prior year. China alone accounted for 36% of sales compared to 49% in the prior year.

Tembec Financial Report 201219

Management’s Discussion and Analysis

| | | | | | Sales | | | | | | Shipments | | | | | | Selling prices | |

| | | | | | ($ millions) | | | | | | (000 tonnes | ) | | | | | ($/tonne) | |

| | | 2011 | | | 2012 | | | 2011 | | | 2012 | | | 2011 | | | 2012 | |

Hardwood high-yield | | 378 | | | 352 | | | 664.3 | | | 640.7 | | | 569 | | | 549 | |

Internal sales | | (30 | ) | | (30 | ) | | (57.5 | ) | | (60.0 | ) | | 522 | | | 500 | |

Consolidated sales | | 348 | | | 322 | | | 606.8 | | | 580.7 | | | 573 | | | 555 | |

MARKETS

The Company markets its pulp on a world-wide basis, primarily through its own sales force. Sales offices are maintained in Toronto, Canada; Dax, France; and Beijing, China. Contractual arrangements with third party representatives are also utilized.

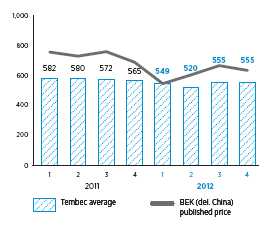

The shipments to capacity ratio for high-yield pulp was at 80% versus 83% in the prior year. These are relatively low percentages, which are not indicative of a strong market. The US $ reference price for BEK decreased by US $120 per tonne compared to the prior year period. However, the drop in US $ pricing for high-yield pulp was less pronounced. Currency was slightly favourable as the Canadian dollar averaged US $0.992, a 2.1% decrease from US $1.013 in the prior year. The net effect reduced prices by approximately $20 per tonne during the fiscal year. The average selling price for third party sales was $555 per tonne, a decrease of $18 per tonne from the prior year average. In response to the weak market conditions, the Company indefinitely curtailed production at the Chetwynd pulp mill in September 2012. Inventory levels ended the year at 35 days of supply as compared to 15 days at the end of 2011. The abnormally low level of inventory at the end of the prior year was related to a labour strike that occurred at the Matane mill.

QUARTERLY PRICES – HIGH-YIELD

(US $ per tonne)

20Tembec Financial Report 2012

Management’s Discussion and Analysis

OPERATING RESULTS

The following summarizes adjusted EBITDA variances by major element:

| | | Variance - favourable (unfavourable) | |

| | | | | | | | | | | | Inventory | | | | | | | |

| | | | | | Mill | | | Freight | | | NRV | | | | | | | |

| (in millions of dollars) | | Price | | | costs | | | and SG&A | | | adjustments | | | Other | | | TOTAL | |

| High-yield pulps | | (12 | ) | | (6 | ) | | (3 | ) | | (2 | ) | | (3 | ) | | (26 | ) |

Fiscal 2012 adjusted EBITDA was negative $29 million compared to negative $3 million in the prior year. The previously noted decrease in pulp selling prices decreased adjusted EBITDA by $12 million. Mill costs increased by $6 million, primarily for fiber and chemicals. This was partially offset by improved fixed cost absorption as the mills produced 6.9% more tonnes in 2012. Freight and SG&A costs increased by $3 million. The current year costs include a charge of $3 million relating to the decrease in the carrying values of finished goods raw material inventory as compared to a charge of $1 million in the prior year.

The three pulp mills purchased approximately 707,600 bone dry tonnes of wood chips in fiscal 2012, up from 682,800 in the prior year. Of this amount, approximately 24% was supplied by the Forest Products segment, compared to 19% in the prior year. The remaining requirements were purchased from third parties under contracts and agreements of various durations.

Overall, lower prices and higher costs reduced profitability with a negative adjusted EBITDA margin of 8.2% compared to negative 0.8% in the prior year.

The following summarizes operating results variances by major element:

| | | | | | | | | Variance | |

| | | | | | | | | favourable | |

| (in millions of dollars) | | 2011 | | | 2012 | | | (unfavourable) | |

| Adjusted EBITDA | | (3 | ) | | (29 | ) | | (26 | ) |

| Depreciation and amortization | | 11 | | | 13 | | | (2 | ) |

| Other items | | – | | | 50 | | | (50 | ) |

| Operating loss | | (14 | ) | | (92 | ) | | (78 | ) |

The High-Yield Pulp segment generated an operating loss of $92 million during the most recently completed fiscal year, compared to an operating loss of $14 million in the prior year. In addition to the previously noted decline in adjusted EBITDA, the segment absorbed an impairment charge of $50 million relating to the property, plant and equipment, including supplies and materials, of the Chetwynd, BC, pulp mill.

Tembec Financial Report 201221

Management’s Discussion and Analysis

| PAPER | | | | | | |

| (in millions of dollars) | | | | | | |

| | | 2011 | | | 2012 | |

Sales | | 339 | | | 346 | |

Freight and other deductions | | 45 | | | 46 | |

Cost of sales | | 255 | | | 252 | |

SG&A | | 10 | | | 11 | |

Adjusted EBITDA | | 29 | | | 37 | |

Adjusted EBITDA margin on sales | | 8.6 | % | | 10.7 | % |

Depreciation and amortization | | 3 | | | 2 | |

Operating earnings | | 26 | | | 35 | |

| | | | | | |

Identifiable assets (excluding cash) | | 122 | | | 120 | |

The Paper segment currently includes two paper manufacturing facilities with a total of three paper machines. The mill located in Kapuskasing, Ontario, produces newsprint on two machines. The facility located in Temiscaming, Quebec, produces multiply coated bleached board on one machine. The board mill is partially integrated with a high-yield pulp mill and also consumes pulp manufactured by the Company at its British Columbia NBSK pulp mill. The total capacity of the Paper segment is 420,000 tonnes. Prior to April 2011, the Paper segment also included the financial results of a hydro-electric dam located in Smooth Rock Falls, Ontario. The dam was sold on March 29, 2011.

The following summarizes the products and capacity of each facility:

| COATED BLEACHED BOARD | | tonnes | |

| Temiscaming, QC | | 180,000 | |

| NEWSPRINT | | | |

| Kapuskasing, ON | | 240,000 | |

| | | | |

| | | 420,000 | |

Coated bleached board shipments represented 44% of Paper segment shipments in fiscal 2012, as compared to 42% in the prior year. As a percentage of total segment sales, coated bleached board represented 59% of sales compared to 57% in the prior year.

Newsprint shipments represented 56% of Paper segment shipments in fiscal 2012, as compared to 58% in the prior year. In terms of total segment sales, newsprint represented 41% of sales compared to 42% in the prior year.

Sales for the Paper segment totalled $346 million, as compared to $339 million in the prior year. The segment generated 21% of Company consolidated sales, as compared to 19% in fiscal 2011. The focus of the paper business is North America, which accounted for 94% of consolidated sales in 2012, compared to 92% in the prior year. The U.S. alone accounted for 77% of sales in fiscal 2012, up from 74% the prior year.

22Tembec Financial Report 2012

Management’s Discussion and Analysis

| | | | | | Sales | | | | | | Shipments | | | | | | Selling prices | |

| | | | | | ($ millions) | | | | | | (000 tonnes | ) | | | | | ($/tonne) | |

| | | 2011 | | | 2012 | | | 2011 | | | 2012 | | | 2011 | | | 2012 | |

Coated bleached board (rolls and sheets) | | 194 | | | 204 | | | 165.2 | | | 171.2 | | | 1,174 | | | 1,192 | |

Newsprint | | 143 | | | 142 | | | 228.5 | | | 221.8 | | | 626 | | | 640 | |

Electricity sales | | 2 | | | – | | | | | | | | | | | | | |

Consolidated sales | | 339 | | | 346 | | | 393.7 | | | 393.0 | | | | | | | |

MARKETS

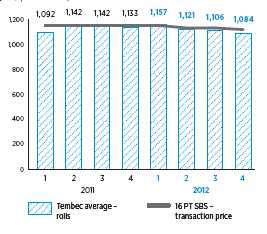

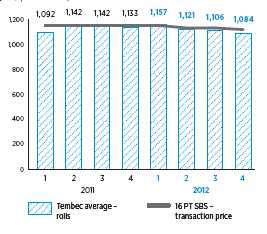

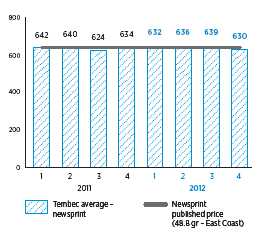

The benchmark price for coated bleached board (16 point) averaged US $1,132 per short ton in fiscal 2012, an US $18 per short ton decrease over the prior year. Relatively stable pricing was supported by good market demand. The shipments to capacity ratio for coated bleached board was 95% in fiscal 2012 compared to 92% in the prior year. These percentages reflect the good market fundamentals of the North American coated bleached board market over the last two years. The board mill operated at “full” capacity in both fiscal 2011 and fiscal 2012, with no market downtime taken in either year. The small decline in US $ prices was offset by favourable currency as the Canadian dollar averaged $0.992, a 2.1% decrease from US $1.013 in the prior year. The inventory level at year-end was at 50 days, compared to 52 days at the end of the prior year. These are normal levels given the product sales mix, which includes both rolls and sheets.

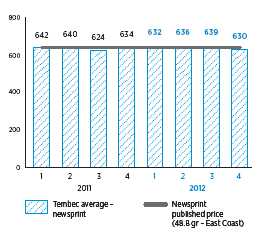

The benchmark newsprint price (48.8 gram – East Coast) averaged US $640 per tonne in fiscal 2012, unchanged from the prior year. The shipments to capacity ratio for newsprint was 92% as compared to 95% in the prior year, while these ratios would normally be indicative of a stable market, that was not the case for North American newsprint, as demand continued to decline. Despite flat US $ prices, the Company’s average selling price increased by $14 due to the previously noted weaker Canadian dollar. Inventory levels at year-end were at 14 days, unchanged from the prior year, which is a normal level for the newsprint mill.

| QUARTERLY PRICES – COATED BLEACHED BOARD | QUARTERLY PRICES – NEWSPRINT |

| (US $ per short ton) | (US $ per tonne) |

|  |

Tembec Financial Report 201223

Management’s Discussion and Analysis

OPERATING RESULTS

The following summarizes adjusted EBITDA variances by major element:

| | | Variance - favourable (unfavourable) | |

| | | | | | | | | | | | | | | | |

| | | | | | Mill | | | Freight | | | | | | | |

| (in millions of dollars) | | Price | | | costs | | | SGA | | | Other | | | TOTAL | |

Coated bleached board | | 3 | | | 2 | | | (1 | ) | | – | | | 4 | |

Newsprint | | 3 | | | 5 | | | (2 | ) | | (1 | ) | | 5 | |

Other segment items | | – | | | – | | | – | | | (1 | ) | | (1 | ) |

| | | 6 | | | 7 | | | (3 | ) | | (2 | ) | | 8 | |

Fiscal 2012 adjusted EBITDA was $37 million compared to $29 million in the prior year. Higher coated bleached board prices added $3 million to adjusted EBITDA. Costs at the mill declined by $2 million with lower fiber costs offsetting increases in other areas. Higher newsprint prices increased adjusted EBITDA by $3 million. Manufacturing costs at the newsprint mill also declined by $5 million, primarily as a result of lower energy costs.

The coated bleached board mill utilizes a combination of chemical kraft and high-yield pulps to produce a three-ply sheet. During fiscal 2012, the mill utilized 17,300 tonnes of NBSK supplied by the Company’s Skookumchuck NBSK pulp mill as compared to 15,300 tonnes in the prior year. The mill also consumed 60,000 tonnes of high-yield pulp supplied by the Temiscaming mill versus 57,500 tonnes in fiscal 2011. The balance of pulp requirements is purchased from third parties.

The newsprint mill utilizes virgin fibre, primarily in the form of wood chips. During fiscal 2012, the operations purchased 238,500 bone dry tonnes of virgin fibre, of which approximately 80% was internally sourced. In the prior year, 257,400 bone dry tonnes of virgin fibre were purchased, with 81% being sourced internally.

Overall, the higher prices and the lower costs increased adjusted EBITDA margins from 8.6% to 10.7% .

The following summarizes operating results variances by major element:

| | | | | | | | | Variance | |

| | | | | | | | | favourable | |

| (in millions of dollars) | | 2011 | | | 2012 | | | (unfavourable) | |

Adjusted EBITDA | | 29 | | | 37 | | | 8 | |

Depreciation and amortization | | 3 | | | 2 | | | 1 | |

Operating earnings | | 26 | | | 35 | | | 9 | |

The Paper segment generated operating earnings of $35 million compared to operating earnings of $26 million in the prior year. The previously noted improvement in adjusted EBITDA led to the higher operating earnings.

24Tembec Financial Report 2012

Management’s Discussion and Analysis

| CORPORATE | | | | | | |

| (in millions of dollars) | | | | | | |

| | | 2011 | | | 2012 | |

General and administrative expenses | | 19 | | | 21 | |

Share-based compensation | | 2 | | | (1 | ) |

Depreciation | | 1 | | | – | |

Other items: | | | | | | |

Custodial - idled facilities | | 7 | | | 10 | |

Write-down of Temlam loan receivable | | – | | | 16 | |

Gain on sale of minority equity interest | | – | | | (4 | ) |

Gain on Tembec USA LLC filing | | (4 | ) | | – | |

Gain on sale of Smooth Rock Falls hydro dam | | (3 | ) | | – | |

Operating expenses | | 22 | | | 42 | |

The Company recorded a $1 million credit for share-based compensation in the current year, compared to a $2 million charge last year. Senior executives currently participate in a long-term incentive plan which entitles participants to potentially receive units that are equal in value to one common share. The units have a defined vesting period and are subject to performance conditions that ultimately determine the amount of units that vest and are earned by plan participants. Non-executive members of the Board of Directors receive a portion of their fees in the form of “Deferred Share Units” (DSU). The DSUs vest at specified dates. The period credit/expense consists of normal periodic variation in the number of units based on anticipated or normal vesting and the changes in the value of the Company’s share price.

The Corporate segment’s “other items” include expenses relating to several permanently idled facilities. The costs relate to custodial, site security, legal and remediation activities. These “legacy” costs totalled $10 million in the most recent year, as compared to $7 million in the prior year.

The current year includes a $16 million charge relating to the write-down of the loan receivable from Temlam Inc. The latter is currently under creditor protection and owns an idled laminated veneer lumber (LVL) facility located in Amos, Quebec. The Company has a 50% secured interest in the facility. The cutting rights that were previously attached to the LVL facility were granted to another company. In the absence of a guaranteed fibre supply, the Company concluded that the re-start of the facility is unlikely and has adjusted its carrying value to the amount anticipated to be realized upon liquidation or sale. The current year also includes a gain of $4 million relating to the sale of a minority equity interest in two dissolving pulp mills.

The prior year includes a gain of $4 million related to the filing of Tembec USA LLC under Chapter 7 of the Bankruptcy Code of the United States. The gain was generated by a reduction in the Company’s accrued benefit obligation. The period also included a gain of $3 million related to the sale of hydro-electric generating assets located in Smooth Rock Falls, Ontario.

Tembec Financial Report 201225

Management’s Discussion and Analysis

NON-OPERATING ITEMS

| INTEREST, FOREIGN EXCHANGE AND OTHER | | | | | | |

| (in millions of dollars) | | | | | | |

| | | 2011 | | | 2012 | |

Interest on debt | | 32 | | | 38 | |

Interest income | | (1 | ) | | (1 | ) |

Capitalized interest | | – | | | (2 | ) |

Fees - new working capital facility | | 2 | | | – | |

Foreign exchange items | | – | | | 4 | |

Change in fair value of warrants (gain) | | (5 | ) | | – | |

Bank charges and other | | 3 | | | 2 | |

| | | 31 | | | 41 | |

The increase in the interest expense relates primarily to the issue of a US $50 million additional tranche of 11.25% senior secured notes in February 2012. This brought the total amount outstanding of 11.25% senior secured notes to US $305 million, which constitutes the bulk of the Company’s annual interest expense. Foreign exchange items relate primarily to gains or losses on the translation of US $ net monetary assets. When the Canadian dollar strengthens versus the US dollar, losses are generated. This was the case in the current year. Prior to February 29, 2012, there were 11,093,943 outstanding warrants convertible into common shares of the Company. They expired on that date and were not converted into common shares of the Company.

| TRANSLATION OF FOREIGN DEBT |

During fiscal 2012, the Company recorded a gain of $13 million on the translation of its US $ denominated debt as the relative value of the Canadian dollar increased from US $0.971 to US $1.017.

During fiscal 2011, the Company recorded a loss of $1 million on the translation of its US $ denominated debt as the relative value of the Canadian dollar decreased from US $0.975 to US $0.971.

During fiscal 2012, the Company recorded an income tax expense of $22 million on a loss before income taxes of $60 million. The income tax expense reflected a $38 million unfavourable variance versus an anticipated income tax recovery of $16 million based on the Company’s effective tax rate of 26.3% . The current year absorbed $32 million unfavourable variance related to period losses for which no deferred tax asset was recognized. Based on past financial performance, deferred income tax assets of the Company’s Canadian operations have not been recognized as it has not been determined that future realization of these assets is probable. The expense was also increased by $6 million due to higher statutory income tax rates in France.

During fiscal 2011, the Company recorded an income tax expense of $20 million on earnings before income taxes of $15 million. The income tax expense reflected a $16 million unfavourable variance versus an anticipated tax expense of $4 million based on the Company’s effective tax rate of 27.8% . The prior year absorbed a $10 million unfavourable variance related to period losses for which no deferred tax asset was recognized. The expense was also increased by $6 million due to higher statutory income tax rates in France.

26Tembec Financial Report 2012

Management’s Discussion and Analysis

NET LOSS

The Company generated a net loss of $82 million or $0.82 per share for the year ended September 29, 2012, compared to a net loss of $5 million or $0.05 per share for the year ended September 24, 2011. As noted previously, the Company’s financial results were impacted by certain specific items. The following table summarizes the impact of these items on the reported financial results. The Company believes it is useful supplemental information as it provides an indication of results excluding the specific items. This supplemental information is not intended as an alternative measure for net earnings as determined by IFRS. The table below contains the gain or loss on translation of foreign debt, which is a recurring item. Because the Company has a substantial amount of US $ denominated debt, relatively minor changes in the value of the Canadian dollar versus the US dollar can lead to large unrealized periodic gains or losses. As well, this item receives capital gain/loss tax treatment and is not tax-affected at regular business income rates.

| | | Year ended | | | Year ended | |

| | | September 24, 2011 | | | September 29, 2012 | |

| | | $ millions | | | $ per share | | | $ millions | | | $ per share | |

Net loss as reported | | | | | | | | | | | | |

- in accordance with IFRS | | (5 | ) | | (0.05 | ) | | (82 | ) | | (0.82 | ) |

Specific items (after-tax): | | | | | | | | | | | | |

Loss (gain) on translation of foreign debt | | 1 | | | 0.01 | | | (11 | ) | | (0.11 | ) |

Gain on derivative financial instruments | | (1 | ) | | (0.01 | ) | | – | | | – | |

Gain on sale of BC sawmills | | – | | | – | | | (18 | ) | | (0.18 | ) |

Loss on sale/closure of flooring assets | | – | | | – | | | 2 | | | 0.02 | |

Write-down of Temlam loan receivable | | – | | | – | | | 14 | | | 0.14 | |

Gain on sale of minority interest | | – | | | – | | | (4 | ) | | (0.04 | ) |

Asset impairment - Chetwynd pulp mill | | – | | | – | | | 37 | | | 0.37 | |

Taschereau sawmill closure charge | | 2 | | | 0.02 | | | – | | | – | |

Cranbrook planer mill severance charge | | 1 | | | 0.01 | | | – | | | – | |

Gain on Tembec USA LLC filing | | (4 | ) | | (0.04 | ) | | – | | | – | |

Gain on sale of Smooth Rock Falls hydro dam | | (2 | ) | | (0.02 | ) | | – | | | – | |

Costs for permanently idled facilities | | 5 | | | 0.05 | | | 8 | | | 0.08 | |

Unrecognized deferred tax assets on above items | | 1 | | | 0.01 | | | 10 | | | 0.10 | |

Net loss excluding specific items | | | | | | | | | | | | |

- not in accordance with IFRS | | (2 | ) | | (0.02 | ) | | (44 | ) | | (0.44 | ) |

Tembec Financial Report 201227

Management’s Discussion and Analysis

COMPREHENSIVE LOSS

The following table summarizes the impact of items affecting the reported total comprehensive loss during the last two fiscal years:

| | | September | | | September | |

| (in millions of dollars) | | 2011 | | | 2012 | |

Net loss | | (5 | ) | | (82 | ) |

Defined benefit pension plans loss | | (64 | ) | | (42 | ) |

Other benefit plans gain | | – | | | 4 | |

Foreign currency translation gain (loss) on foreign operations | | 2 | | | (11 | ) |

Total comprehensive loss | | (67 | ) | | (131 | ) |