As filed with the Securities and Exchange Commission on April 18, 2011

Registration No. 333-172659

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 1 to the

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

STATE INVESTORS BANCORP, INC.

AND STATE-INVESTORS BANK 401(k) PLAN

(Exact name of registrant as specified in its articles of incorporation)

| | | | |

| Louisiana | | 6035 | | 27-5301129 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

1041 Veterans Boulevard

Metairie, Louisiana 70005

(504) 834-9400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Anthony S. Sciortino

Chairman, President and Chief Executive Officer

State Investors Bancorp, Inc.

1041 Veterans Boulevard

Metairie, Louisiana 70005

(504) 834-9400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Raymond A. Tiernan, Esq. Eric M. Marion, Esq. Elias, Matz, Tiernan & Herrick L.L.P. 734 15th Street, N.W., 11th Floor Washington, D.C. 20005 202-347-0300 | | James C. Stewart, Esq. Malizia Spidi & Fisch, PC Suite 200 West 1227 25th Street, N.W. Washington, D.C. 20037 202-434-4660 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | x |

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| |

Title of Each Class of Securities to be Registered | | Amount to be Registered | | Proposed Maximum

Offering Price Per Unit | | Proposed Maximum

Aggregate Offering Price | | Amount of

Registration Fee |

Common Stock, $.01 par value per share | | 2,909,500 shares | | $10.00 | | $29,095,000 (1) | | $3,377.93 (3) |

Participation interests | | 380,361 interests(2) | | — | | — | | — |

| |

| |

| | (1) | Estimated solely for the purpose of calculating the registration fee. |

| | (2) | Represents shares which may be purchased by participants in the State-Investors Bank 401(k) Plan. Pursuant to Rule 457(h) of the Securities Act, as amended, no separate fee is required for the participation interests, and the number of participation interests registered has been calculated on the basis of the maximum number of shares which could be purchased utilizing the assets of such plan. |

The Registrant hereby amends this Registration Statement on such date as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that the Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

PROSPECTUS

(Proposed Holding Company for State-Investors Bank)

Up to 2,530,000 shares of Common Stock

(Anticipated Maximum)

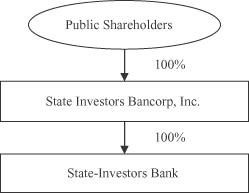

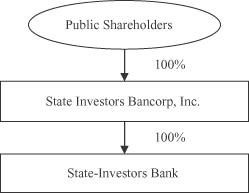

This prospectus describes the initial public offering of shares of State Investors Bancorp, Inc., a company being formed in connection with the conversion of State-Investors Bank from the mutual to the stock form of organization. Upon completion of the conversion and offering, all of the common stock of State-Investors Bank will be owned by State Investors Bancorp, and all of the common stock of State Investors Bancorp will be owned by public shareholders.

We are offering up to 2,530,000 shares of common stock for sale, at a price of $10.00 per share, on a priority basis to State-Investors Bank’s depositors in a subscription offering. Shares of common stock not purchased in the subscription offering may be offered to the general public in a community offering which may begin during or immediately following the subscription offering. We expect that the common stock of State Investors Bancorp will be listed on the Nasdaq Capital Market under the symbol SIBC.

Certain depositors of State-Investors Bank have priority rights to purchase shares of common stock in the subscription offering:

| | • | | Depositors with at least $50 on deposit at State-Investors Bank at the close of business on October 31, 2009; |

| | • | | Depositors with at least $50 on deposit at State-Investors Bank at the close of business on March 31, 2011; and |

| | • | | Depositors of State-Investors Bank at the close of business on [DATE1], 2011, and borrowers as of April 22, 1993, whose loans continued to be outstanding as of [DATE1], 2011. |

If you fit none of the categories above, but are interested in purchasing shares of our common stock:

| | • | | You may have an opportunity to purchase shares of common stock after priority orders are filled. |

We must sell a minimum of 1,870,000 shares to complete the offering. We may increase the maximum shares that we sell in the offering up to 2,909,500 shares without further notice to persons who have subscribed for shares, due to regulatory considerations, demand for the shares or changes in financial market conditions. The offering is expected to terminate at 12:00 noon, Central time, on [DATE2], 2011. We may extend this expiration date without notice to you until [DATE3], 2011. No single extension may exceed 90 days and the offering must be completed by [DATE4], 2013.

The minimum number of shares you may purchase is 25 shares. The maximum number of shares that can be ordered through a single qualifying account in the offering is 30,000 shares. Orders are irrevocable after submission unless the offering is terminated or is extended beyond [DATE3], 2011 or the number of shares of common stock to be sold increases to more than 2,909,500 shares or decreases to less than 1,870,000 shares. If the offering is extended beyond [DATE3], 2011, subscribers will be notified and will have the right to confirm, modify or rescind their purchase orders, and funds will be returned promptly to subscribers who do not respond to this notice. Funds received prior to completion of the offering will be held in a segregated account at State-Investors Bank and will earn interest at our passbook savings rate. If we terminate the offering, or if we extend the offering beyond [DATE3], 2011 and you reduce or rescind your order, we will promptly return your funds without penalty, with interest at our passbook savings rate, and deposit withdrawal authorizations will be cancelled or reduced.

Keefe, Bruyette & Woods will assist us in selling our shares of common stock on a best efforts basis, but is not required to purchase any of the common stock that is being offered. Our directors and executive officers, together with their associates, intend to purchase 230,000 shares of common stock in the offering, or 9.1% based on the maximum of the offering. These purchases will count towards the minimum purchases needed to complete the offering.

This investment involves a degree of risk, including the possible loss of principal.

Please read “Risk Factors” beginning on page 10.

OFFERING SUMMARY

Price per share: $10.00

| | | | | | | | | | | | |

| | | Minimum | | | Maximum | | | Maximum, as Adjusted | |

Number of shares | | | 1,870,000 | | | | 2,530,000 | | | | 2,909,500 | |

Gross offering proceeds | | $ | 18,700,000 | | | $ | 25,300,000 | | | $ | 29,095,000 | |

Estimated offering expenses (excluding selling agent fees)(1) | | $ | 825,000 | | | $ | 825,000 | | | $ | 825,000 | |

Selling agent fees and expenses(2) | | $ | 187,550 | | | $ | 263,450 | | | $ | 307,093 | |

Estimated net proceeds | | $ | 17,687,450 | | | $ | 24,211,550 | | | $ | 27,962,907 | |

Estimated net proceeds per share | | $ | 9.46 | | | $ | 9.57 | | | $ | 9.61 | |

| (1) | Includes reimbursable out-of-pocket expenses of our selling agent and conversion agent fees of $90,000 and $10,000, respectively. |

| (2) | Assumes all shares are sold in the subscription and community offering and no shares are sold in the syndicated community offering based on a success fee equal to 1.25% of shares sold, excluding shares purchased by our tax-qualified employee benefit plans and by our directors, officers and employees and their immediate families. If all shares are sold in a syndicated community offering, excluding shares purchased by our tax qualified stock benefit plans and by our insiders, the maximum selling agent fee would be $940,000 at the minimum, $1.1 million at the midpoint, $1.3 million at the maximum and $1.5 million at the maximum, as adjusted. For a description of the compensation to be paid to Keefe, Bruyette & Woods and other FINRA members in the event that shares are sold in a syndicated community offering, see “The Conversion and Offering – Plan of Distribution and Marketing Arrangements.” |

These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Neither the Securities and Exchange Commission, the Office of Thrift Supervision nor any state securities regulator has approved or disapproved of these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

For assistance, please contact the stock information center at ( ) - .

KEEFE, BRUYETTE & WOODS

The date of this prospectus is , 2011

Table of Contents

SUMMARY

This summary highlights material information from this document and may not contain all the information that is important to you. You should read this entire document carefully, including the sections entitled “Risk Factors” and “The Conversion and Offering,” before making a decision to invest in our common stock.

In this prospectus, unless we specify otherwise, “State Investors,” “we,” “us,” and “our” refer to State Investors Bancorp, Inc., a Louisiana corporation. “State-Investors Bank” refers to State-Investors Bank, a federally chartered savings bank in its mutual form or in its stock form as the context requires.

The Companies

State Investors Bancorp, Inc.State Investors Bancorp is a Louisiana corporation recently formed for the purpose of implementing the conversion and offering described in this prospectus. Our principal activity after the conversion will be the ownership of all of the outstanding common stock of State-Investors Bank. This offering is being made by State Investors Bancorp. Our corporate office is located at 1041 Veterans Boulevard, Metairie, Louisiana 70005.

State-Investors Bank.State-Investors Bank is a federally chartered mutual savings bank. State-Investors Bank was formed in 1894 as a Louisiana chartered mutual savings association, named “Sixth District Building & Loan Association.” Following a series of name changes, State Savings and Loan Association merged with Investors Homestead Association on December 31, 1980, and was renamed “State-Investors Savings and Loan Association.” State-Investors Savings and Loan Association converted to a federally chartered savings bank effective April 22, 1993, and changed its name to “State-Investors Bank” in 1997. State-Investors Bank is subject to regulation, supervision and examination by the Office of Thrift Supervision, as its chartering authority. The Office of the Comptroller of the Currency, which currently regulates national banks, will become State-Investors Bank’s primary federal regulator after July 21, 2011, pursuant to recently-enacted legislation. State-Investors Bank’s corporate office is located at 1041 Veterans Boulevard, Metairie, Louisiana 70005. Its telephone number at this address is (504) 832-9400. State-Investors Bank’s website iswww.stateinvestors.com. The information on our website is not a part of this prospectus.

Our Business

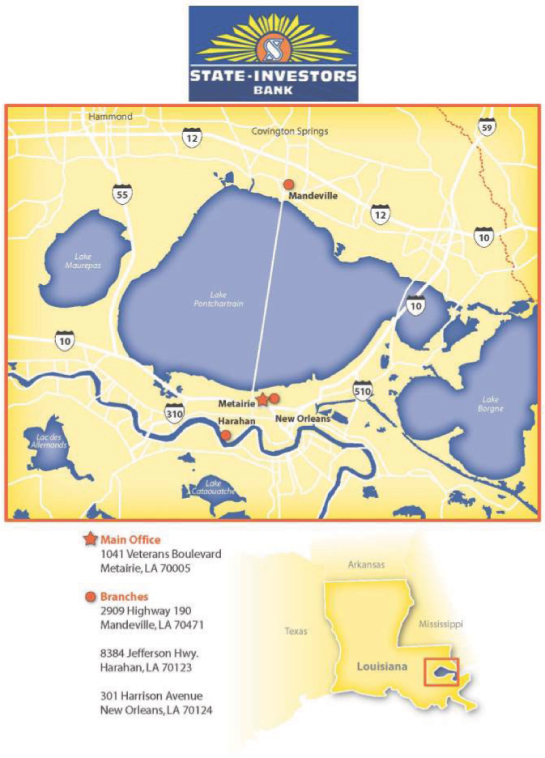

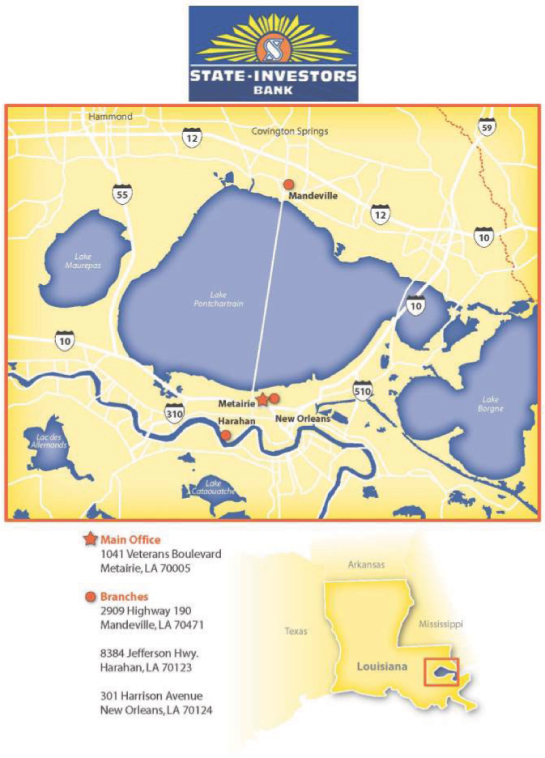

State-Investors Bank conducts its operations through its main office in Metairie, Louisiana, located in Jefferson Parish, and three branch offices located in Jefferson, St. Tammany and Orleans Parishes, Louisiana. Jefferson and St. Tammany Parishes are suburbs of New Orleans and Orleans Parish consists solely of the city of New Orleans. State-Investors Bank’s principal business has been accepting deposits from the general public and using those deposits to make residential and commercial loans to individuals and businesses located primarily in the parishes in which we have branch offices which are a part of the seven parish New Orleans-Metairie-Kenner Metropolitan Statistical Area. State-Investors Bank operates as a traditional savings and loan association with a focus on one- to four-family residential loans in its primary market area. In February 2011, we opened our new home office which replaced our former main office at the same location in Metairie, Louisiana.

At December 31, 2010, State-Investors Bank had total assets of $208.7 million, deposits of $159.1 million and total equity of $21.3 million, equal to 10.2% of total assets. Total loans, net, at December 31, 2010, amounted to $180.6 million, or 86.6% of total assets. In recent periods, we have originated primarily fixed-rate owner occupied one-to four-family residential loans of 15 to 20 year amortizations. State-Investors Bank’s investment in securities consisted exclusively of government-guaranteed adjustable-rate mortgage-backed securities totaling $9.4 million at December 31, 2010.

Following the conversion and offering, State-Investors Bank will be wholly-owned by State Investors Bancorp. State Investors Bancorp intends to contribute 50% of the net proceeds as equity capital to State-Investors Bank in exchange for the purchase of all of State-Investors Bank’s capital stock and the remaining 50% of the net proceeds will be retained by State Investors Bancorp. Initially, State Investors Bancorp intends to use the net proceeds it retains to loan funds to the employee stock ownership plan to purchase 8.0% of the shares sold in the offering and will invest the remaining amount in a deposit account at State-Investors Bank. Under applicable regulations, State Investors Bancorp

1

may, during the first year following the conversion, assuming shareholder approval, use a portion of the net proceeds it retains to fund the proposed recognition and retention plan. See “How We Intend to Use the Proceeds from the Offering.” In the future, the proceeds from the offering are expected to provide us with additional capital which we will use to expand our business activities, enhance our existing products and services and upgrade our technology infrastructure and marketing. We also may use a portion of the net proceeds received to purchase loans and loan participation interests outside of our local market area. We expect this will facilitate our loan growth and returns and, again, help to reduce the geographic concentration risk in our portfolio. See “—Reasons for the Conversion and Offering.”

Our Business Strategy

Our business strategy is designed to operate and grow State-Investors Bank as a profitable community-oriented financial institution serving primarily individual customers and small- to medium-sized businesses in our market area. To implement this business strategy, we will strive to:

| | • | | maintain high levels of asset quality, primarily through our disciplined and conservative lending practices; |

| | • | | grow our retail deposit accounts by focusing on the establishment of long-term customer relationships; |

| | • | | target loan growth on residential and owner occupied commercial real estate loans while funding growth with core deposits; and |

| | • | | capitalize on our senior management’s knowledge of the local real estate market and meet the needs of local residents through a community-oriented approach to banking, which focuses on local decision-making and delivering a consistent and high quality level of professional service. |

Our business strategy is focused on prudent growth through our existing four branch offices. We recently completed constructing a new home office which replaced our former main office in February 2011. The approximately $3.7 million expense related to the new office is being recognized over 40 years. We have no current plans for additional growth through new branches or acquisitions but will consider opportunities if they present themselves.

Reasons for the Conversion and Offering

The conversion and offering are intended to provide an additional source of capital not currently available to State-Investors Bank. The stock savings bank form of organization is also a more common structure which may alleviate some of the uncertainties of the recently enacted financial regulatory legislation. The net proceeds raised in the offering will allow us to better serve the needs of our community by:

| | • | | increasing capital and capital ratios of State-Investors Bank to ensure its ability to meet regulatory capital requirements, which are likely to increase in the next several years, and prudently grow; |

| | • | | enabling State-Investors Bank to increase lending limits and support the development of new products and services, although we do not anticipate significant changes in our lending practices; and |

| | • | | establishing stock-based benefit plans to attract and retain qualified personnel. |

After considering the advantages and risks of the conversion and offering, the board of directors of State-Investors Bank approved the conversion and offering as being in the best interests of State-Investors Bank, its customers and members and the communities that it serves.

2

The Conversion and Offering

The mutual-to-stock conversion that State-Investors Bank is undertaking involves a series of transactions by which it will convert from the mutual form of organization to the public stock holding company form of organization. In connection with the conversion, State-Investors Bank will adopt a federal stock savings bank charter to authorize the issuance of shares of capital stock. After the conversion and offering are completed, all of State-Investors Bank’s stock will be owned by State Investors Bancorp, and all of State Investors Bancorp’s outstanding common stock will be owned by the public. The management and business operations of State-Investors Bank will continue after the conversion and offering. The following diagram shows our new ownership structure after completion of the conversion and offering.

Terms of the Offering

We are offering between 1,870,000 and 2,530,000 shares of common stock of State Investors Bancorp for sale at an offering price of $10.00 per share. The subscription offering is made to State-Investors Bank’s eligible account holders, our employee stock ownership plan, supplemental eligible account holders and State-Investors Bank’s voting members. Shares not purchased in the subscription offering may be made available to the public in a community offering, giving a preference to natural persons and trusts of natural persons who reside in Jefferson, Orleans and St. Tammany Parishes, Louisiana. Shares not purchased in the subscription offering or the community offering may be offered for sale through a syndicated community offering. The maximum number of shares that we sell in the offering may increase by up to 15%, to 2,909,500 shares, due to regulatory considerations, demand for the shares in the offering or changes in financial market conditions in general and with respect to financial institution stocks in particular. After submission, orders are irrevocable unless the offering is terminated or is extended beyond [DATE3], 2011 or the number of shares of common stock to be sold increases to more than 2,909,500 shares or decreases to less than 1,870,000 shares. If the offering is extended beyond [DATE3], 2011, subscribers will have the right to confirm, modify or rescind their purchase orders.

All investors will pay $10.00 per share in the offering. No commission will be charged to purchase shares of common stock. Keefe, Bruyette & Woods, our selling agent in the offering, will use its best efforts to assist us in selling shares of our common stock, but is not obligated to purchase any shares of common stock in the offering.

Purchases By Directors and Officers

We expect our directors and executive officers, together with their associates, to subscribe for a total of 230,000 shares, which represents 12.3% and 9.1% of the total shares to be outstanding at the minimum and maximum, respectively, of the offering range. The purchase price paid by them will be the same $10.00 per share price paid by all other persons who purchase shares of common stock in the offering. See “Proposed Purchases of Common Stock by Management.”

How We Determined the Offering Range and the $10.00 Price Per Share

The amount of common stock we are offering in connection with the conversion is based on an independent appraisal of the estimated market value of State Investors Bancorp, assuming that the offering is completed. An

3

appraisal firm experienced in appraisals of banks and financial institutions, RP Financial, LC., has estimated that in its opinion, as of February 25, 2011, this market value was $22.0 million at the midpoint. Pursuant to Office of Thrift Supervision regulations, this indicates an offering range from $18.7 million to $25.3 million. Based on this valuation and the $10.00 per share price, the number of shares of common stock being offered for sale by State Investors Bancorp will range from 1,870,000 shares to 2,530,000 shares.

The $10.00 per share price was selected primarily because it is the price most commonly used in mutual-to-stock conversions of financial institutions. RP Financial, LC.’s appraisal is based in part on our financial condition and results of operations, the effect of the additional capital raised by the sale of shares of common stock in the offering and an analysis of a peer group of ten publicly traded savings bank and thrift holding companies that RP Financial, LC. considered comparable to us.

The independent appraisal will be updated prior to the completion of the conversion and offering. If the appraised value decreases below $18.7 million or increases above $29.1 million, subscribers may be resolicited with the approval of the Office of Thrift Supervision and be given the opportunity to change or cancel their orders. If you do not respond, we will cancel your stock order and return your subscription funds, with interest, and cancel any authorization to withdraw funds from your deposit accounts for the purchase of shares of common stock. For a more complete discussion of the amount of stock we are offering for sale and the independent appraisal, see “The Conversion and Offering—How We Determined the Price Per Share and the Offering Range.”

RP Financial relied primarily on a comparative market value methodology in determining the pro forma market value of our common stock. The following table presents a summary of selected pricing ratios for State Investors Bancorp, for the peer group and for all fully converted publicly traded savings banks. The figures for State Investors Bancorp are from RP Financial’s appraisal report and they thus do not correspond exactly to the ratios presented in the Pro Forma Data section of this prospectus. Compared to the average pricing ratios of the peer group, State Investors Bancorp’s pro forma pricing ratios at the maximum of the offering range indicate a premium of 114.8% on a price-to-earnings basis, discount of 19.9% on a price-to-book value basis and discount of 21.7% on a price-to-tangible book basis.

| | | | | | | | | | | | |

| | | Price-to-Earnings

Multiple(1) | | | Price-to-Book

Value Ratio(2) | | | Price-to-Tangible

Book Value Ratio(2) | |

State Investors Bancorp (pro forma): | | | | | | | | | | | | |

Midpoint | | | 32.66 | x | | | 55.56 | % | | | 55.56 | % |

Maximum | | | 38.84 | | | | 59.56 | | | | 59.56 | |

Maximum, as adjusted | | | 46.41 | | | | 63.57 | | | | 63.57 | |

| | | |

Peer Group: | | | | | | | | | | | | |

Average | | | 16.20 | x | | | 74.37 | % | | | 76.03 | % |

Median | | | 12.63 | | | | 77.33 | | | | 77.66 | |

| | | |

All fully-converted, publicly-traded savings banks: | | | | | | | | | | | | |

Average | | | 18.08 | x | | | 82.02 | % | | | 90.28 | % |

Median | | | 17.80 | | | | 82.66 | | | | 86.05 | |

| (1) | Ratios are based on earnings for twelve months ended December 31, 2010, and share prices as of February 25, 2011. |

| (2) | Ratios are based on book value as of December 31, 2010, and share prices as of February 25, 2011. |

RP Financial, LC. advised the board of directors that the appraisal was prepared in conformance with the regulatory appraisal methodology. That methodology requires a valuation based on an analysis of the trading prices of ten comparable public companies whose stocks have traded for at least one year prior to the valuation date, and as a result of this analysis, RP Financial, LC. determined that our pro forma price-to-earnings ratios were generally higher than the peer group companies and our pro forma price-to-book ratios were generally lower than the peer group companies. See “The Conversion and Offering—How We Determined the Price Per Share and the Offering Range.” RP Financial, LC. also advised the board of directors that the aftermarket trading experience of thrift conversion offerings completed during the three-month period ended February 25, 2011 was considered in the appraisal as a

4

general indicator of current market conditions, but was not relied upon as a primary valuation methodology. See “The Conversion and Offering—After-Market Performance Information.” There were two standard mutual-to-stock conversion offerings completed during the three-month period ended February 25, 2011.

After-Market Performance Information

The following table provides information regarding the after-market stock price performance for all standard mutual-to-stock conversion transactions completed between January 1, 2010 and February 25, 2011. As part of its appraisal of our estimated pro forma market value, RP Financial, LC. considered the after market performance of mutual-to-stock conversions completed in the three months prior to February 25, 2011, which is the date of its appraisal report. RP Financial, LC. considered information regarding the new issue market for converting thrifts as part of its consideration of the market for thrift stocks.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Price Performance from Initial Trading Date | |

Company Name | | Ticker

Symbol | | | Conversion

Date | | | 1 Day | | | 1 Week | | | 1 Month | | | Through

2/25/11 | |

Nasdaq listed companies: | | | | | | | | | | | | | | | | | | | | | | | | |

Anchor Bancorp | | | ANCB | | | | 01/26/11 | | | | — | % | | | 0.3 | % | | | 4.5 | % | | | 4.5 | % |

Wolverine Bancorp, Inc. | | | WBKC | | | | 01/20/11 | | | | 24.5 | | | | 22.4 | | | | 35.0 | | | | 35.6 | |

SP Bancorp, Inc. | | | SPBC | | | | 11/01/10 | | | | (6.0 | ) | | | (6.6 | ) | | | (8.0 | ) | | | 3.0 | |

Standard Financial Corp. | | | STND | | | | 10/07/10 | | | | 19.0 | | | | 18.9 | | | | 29.5 | | | | 46.7 | |

Peoples Federal Bancshares, Inc. | | | PEOP | | | | 07/07/10 | | | | 4.0 | | | | 6.9 | | | | 4.2 | | | | 39.2 | |

OBA Financial Services, Inc. | | | OBAF | | | | 01/22/10 | | | | 3.9 | | | | 1.1 | | | | 3.0 | | | | 39.5 | |

OmniAmerican Bancorp, Inc. | | | OABC | | | | 01/21/10 | | | | 18.5 | | | | 13.2 | | | | 9.9 | | | | 56.4 | |

Athens Bancshares, Inc. | | | AFCB | | | | 01/07/10 | | | | 16.0 | | | | 13.9 | | | | 10.6 | | | | 35.1 | |

| | | | | | |

OTC Bulletin Board quoted companies: | | | | | | | | | | | | | | | | | | | | | | | | |

Madison Bancorp, Inc. | | | MDSN | | | | 10/07/10 | | | | 25.0 | | | | 25.0 | | | | 25.0 | | | | 10.0 | |

Century Next Financial Corporation | | | CTUY | | | | 10/01/10 | | | | 25.0 | | | | 15.0 | | | | 10.0 | | | | 23.0 | |

United-American Savings Bank | | | UASB | | | | 08/06/10 | | | | — | | | | (5.0 | ) | | | 5.0 | | | | 30.0 | |

Fairmount Bancorp, Inc. | | | FMTB | | | | 06/03/10 | | | | 10.0 | | | | 20.0 | | | | 10.0 | | | | 60.0 | |

Harvard Illinois Bancorp, Inc. | | | HARI | | | | 04/09/10 | | | | — | | | | — | | | | (1.0 | ) | | | (5.0 | ) |

Versailles Financial Corp. | | | VERF | | | | 01/13/10 | | | | — | | | | — | | | | — | | | | 75.0 | |

| | | | | | |

1/1/10 – 2/25/11 Average for all companies | | | | | | | | | | | 10.0 | | | | 8.9 | | | | 9.8 | | | | 32.4 | |

1/1/10 – 2/25/11 Median for all companies | | | | | | | | | | | 7.0 | | | | 10.1 | | | | 7.5 | | | | 35.4 | |

There can be no assurance that our stock price will not trade below $10.00 per share, as has been the case for some mutual-to-stock conversions. Before you make an investment decision, we urge you to carefully read this prospectus, including, but not limited to, the section entitled “Risk Factors” beginning on page 10.

Conditions to Completing the Conversion

The conversion will be conducted in accordance with the terms of our plan of conversion. We cannot complete the conversion and offering unless:

| | • | | the plan of conversion is approved by the affirmative vote of at least a majority of the votes eligible to be cast by State-Investors Bank’s voting members; |

| | • | | we receive all regulatory approvals necessary to complete the mutual-to-stock conversion and the offering; and |

| | • | | we sell at least the minimum number of shares of common stock offered. |

Regulatory approval for the conversion is contingent upon us obtaining the approval of State-Investors Bank’s voting members for the plan of conversion and the successful completion of the offering.

Benefits to Management and Potential Dilution to Shareholders Resulting From the Offering

We intend to adopt an employee stock ownership plan, which will allocate shares of our common stock to eligible employees primarily based on their compensation. Our employee stock ownership plan will purchase a number of shares equal to 8.0% of the shares sold in the offering using funds borrowed from State Investors Bancorp. The loan from State Investors Bancorp to the employee stock ownership plan trust for the purchase of shares will have a term of 20 years. We will incur additional compensation expense as a result of the employee stock ownership plan’s release of shares over the term of the loan.

5

In addition, no earlier than six months after the conversion as required by applicable regulations, we intend to consider the implementation of a stock option plan and a recognition and retention plan. If the stock option plan and the recognition and retention plan are approved by shareholders and implemented within one year of the completion of the conversion and offering, the number of options granted or shares awarded may not exceed 10.0% and 4.0%, respectively, of the shares outstanding after the offering.

The following table summarizes the stock benefits that our officers, directors and employees may receive following the offering, assuming that we initially implement a stock option plan, granting options to purchase 10.0% of the shares outstanding after the offering, and a recognition and retention plan, awarding shares of common stock equal to 4.0% of the shares outstanding after the offering, as permitted under applicable regulations. In the table below, it is assumed that, at the minimum and maximum of the offering range, a total of 1,870,000 and 2,530,000 shares, respectively, will be sold and outstanding after the offering.

| | | | | | | | | | | | | | | | | | |

Plan | | Individuals Eligible to Receive

Awards | | Number of Shares to be

Granted or Purchased | | | Dilution

Resulting from

Issuance of

Shares | | | Estimated

Value

of Grants(1) | |

| | | At Maximum of

Offering Range | | | As Percent of

Shares Sold | | | |

Employee Stock Ownership Plan | | Officers and employees | | | 202,400 | | | | 8.0 | % | | | — | % | | $ | 2,024,000 | |

Recognition and Retention Plan | | Directors, officers and employees | | | 101,200 | | | | 4.0 | % | | | 3.8 | %(2) | | | 1,012,000 | |

Stock Option Plan | | Directors, officers and employees | | | 253,000 | | | | 10.0 | % | | | 9.1 | % | | | 880,440 | |

| (1) | The actual value of the stock awards will be determined based on their fair value as of the date the grants are made. For purposes of this table, fair value is assumed to be the offering price of $10.00 per share. The fair value of stock options has been estimated at $3.48 per option using the Black-Scholes option pricing model with the following assumptions: a grant date share price and option exercise price of $10.00; dividend yield of zero; expected option life of 10 years; risk free interest rate of 3.30% (based on the 10-year U.S. Treasury rate); and a volatility rate of 16.16% based on an index of publicly-traded thrift institutions. The actual expense of the stock options will be determined by the grant date fair value of the options, which will depend on a number of factors, including the valuation assumptions used in the option pricing model ultimately adopted. |

| (2) | Assumes shares of common stock to be awarded under the recognition and retention plan are issued from authorized but unissued stock. It is our intention, however, to purchase shares of our common stock on the open market to fund the recognition and retention plan. |

Shareholders will experience a reduction or dilution in their ownership interest of approximately 12.3% if we use authorized but unissued shares to fund stock awards and stock option grants made under the recognition and retention plan and the stock option plan (or taken individually, 3.8% for the recognition and retention plan and 9.1% for the stock option plan). Such dilution will not occur if we determine to fund these stock benefit plans through open market purchases, as opposed to the issuance of authorized but unissued shares.

Persons Who May Order Stock in the Offering

We are offering shares of our common stock in what is called a “subscription offering” in the following order of priority:

| | (1) | Depositors with a minimum of $50 on deposit at State-Investors Bank at the close of business on October 31, 2009; |

| | (2) | Our tax-qualified employee stock ownership plan; |

| | (3) | Depositors with a minimum of $50 on deposit at State-Investors Bank at the close of business on March 31, 2011; and |

| | (4) | Depositors of State-Investors Bank at the close of business on [DATE1], 2011, and borrowers as of April 22, 1993, whose loans continued to be outstanding as of [DATE1], 2011. |

If all shares are not subscribed for in the subscription offering, we may offer shares in a community offering. The community offering, if any, may commence during the subscription offering or just after the subscription offering concludes. If a community offering is conducted, shares will be offered with a preference given first to natural persons and trusts of natural persons who reside in Jefferson, Orleans and St. Tammany Parishes, Louisiana and then to members of the general public. We may also offer shares of common stock not purchased in the subscription offering or the community offering to the public through a syndicate of broker-dealers managed by Keefe, Bruyette & Woods, referred to as a syndicated community offering. We have the right to accept or reject orders received in the community offering and the syndicated community offering, at our sole discretion.

6

If we receive subscriptions for more shares than are to be sold in this offering, we may be unable to fill or partially fill your order. In such an event, shares will be allocated under a formula outlined in the plan of conversion and as described in the section entitled “The Conversion and Offering—Subscription Offering and Subscription Rights.”

Limits on Your Purchase of Shares of Common Stock

The minimum number of shares of common stock that you may purchase is 25 ($250). No individual or persons exercising subscription rights through a single qualifying deposit account held jointly may purchase more than 30,000 shares of common stock ($300,000). If any of the following persons purchase shares of common stock, their purchases when combined with your purchases cannot exceed 50,000 shares ($500,000):

| | • | | your spouse, or relatives of you or your spouse either living in your household or serving as a director or officer of State-Investors Bank; |

| | • | | companies, trusts or other entities in which you are a trustee, have a substantial financial interest or hold a senior management position; or |

| | • | | other persons who may be acting in concert with you. |

Unless we determine otherwise, persons having the same address and persons exercising subscription rights through bank accounts registered to the same address will be aggregated and subject to this overall purchase limitation. We have the right to determine, in our sole discretion, whether prospective purchasers are associates or acting in concert.

Subject to the approval of the Office of Thrift Supervision, we may increase or decrease the purchase and ownership limitations at any time. For a detailed description of purchase limitations see “The Conversion and Offering—Limitations on Common Stock Purchases.”

How You May Purchase Shares of Common Stock

If you want to place an order for shares of common stock in the subscription or community offering, you must complete and sign an original stock order form and submit it to us, together with full payment. We are not required to accept copies or facsimiles of stock order forms. The stock order form also includes an acknowledgement from you that, before purchasing shares of our common stock, you have received a copy of this prospectus and that you are aware of the risks involved in the investment, including those described under “Risk Factors” beginning at page 10. We must receive your stock order form before the end of the subscription offering or the end of the community offering. Once we receive your order, you cannot cancel or change it. You may pay for shares in the subscription offering or the community offering in the following ways:

| | • | | by personal check, bank check or money order made payable to “State Investors Bancorp.” Funds submitted by personal check must be available in your account when the stock order is received; or |

| | • | | by authorizing us to withdraw funds from your deposit account(s) maintained at State-Investors Bank. On the stock order form, you may authorize withdrawal from all types of our savings accounts and certificate of deposit accounts, excluding individual retirement accounts. |

Checks and money orders received by State Investors Bancorp will be cashed immediately and placed in a segregated account at State-Investors Bank. We will pay interest on your funds submitted by check or money order at the rate we pay on our passbook savings accounts, from the date we receive your funds until the date the offering is completed or terminated. All funds authorized for withdrawal from deposit accounts must be available in the account when the stock order form is received. Funds will remain in the account and continue to earn interest at the applicable contract rate, and subscription funds will be withdrawn upon completion of the offering. A hold will be placed on those funds when your stock order is received, making the designated funds otherwise unavailable to you during the offering period. If, upon a withdrawal from a certificate account, the balance falls below the minimum balance requirement, the remaining funds will earn interest at our passbook savings rate. There will be no early withdrawal penalty for withdrawals from certificate of deposit accounts used to pay for stock.

Federal law prohibits us from knowingly loaning funds to anyone for the purpose of purchasing shares in the offering, including funds drawn on a State-Investors Bank line of credit. Cash, wire transfers and third party checks may not be remitted.

7

For a further discussion regarding the stock ordering procedures, see “The Conversion and Offering—Procedure for Purchasing Shares in the Subscription and Community Offerings.”

Using Individual Retirement Account Funds

If you intend to use your individual retirement account funds to purchase shares in the offering, please contact the stock information center promptly at ( ) - , preferably at least two weeks before [DATE2], 2011. On your stock order form, you are not permitted to authorize direct withdrawal of funds from an individual retirement account. Please be aware that federal law requires that such funds first be transferred to a self-directed retirement account with an independent trustee such as a brokerage account. The transfer of such funds to a new trustee takes time. Because we do not control the policies and procedures of other trustees, we cannot guarantee that you will be able to use your individual retirement account funds to purchase shares of common stock in the offering. Your ability to use your individual retirement account funds will depend on timing constraints and, possibly, limitations imposed by the individual retirement account trustee.

You May Not Sell or Transfer Your Subscription Rights

Under federal law, you are not permitted to sell or transfer your subscription rights, and we will act to ensure that you do not do so. We will not accept any stock orders that we believe involve the transfer of subscription rights.We intend to pursue any and all legal and equitable remedies if we learn of the transfer of any subscription rights.For a further discussion of subscription rights, see “The Conversion and Offering—Subscription Offering and Subscription Rights.”

Deadline for Placing Orders of Common Stock

If you wish to purchase shares of our common stock, a properly completed and signed original stock order form, together with payment for the shares, must be received (not postmarked) by State Investors Bancorp no later than 12:00 noon, Central time, on [DATE2], 2011. You may submit your order form in one of three ways: by mail using the order reply return envelope provided, by overnight courier to the address indicated on the stock order form or by bringing the stock order form and payment to our stock information center located at State-Investors Bank’s main office, 1041 Veterans Boulevard, Metairie, Louisiana. Once submitted, your order is irrevocable unless the offering is terminated or extended or the number of shares to be issued increases to more than 2,909,500 shares or decreases to less than 1,870,000 shares. We may extend the [DATE2], 2011, expiration date, without notice to you, until [DATE3], 2011. If the offering is extended beyond [DATE3], 2011, or if the offering range is increased or decreased, we will be required to resolicit subscriptions before proceeding with the offering. In either of these cases, subscribers will have the right to confirm, modify or rescind their purchase orders. If we do not receive a response from you to any resolicitation, your order will be rescinded and all funds received will be returned promptly with interest, or withdrawal authorizations will be cancelled. All extensions, in the aggregate, may not last beyond [DATE4], 2013.

Steps We May Take If We Do Not Receive Orders for the Minimum Number of Shares

If we do not receive orders for at least 1,870,000 shares of common stock, we may take several steps in order to sell the minimum number of shares. Specifically, we may:

| | • | | increase the purchase limitations; and/or |

| | • | | extend the community offering; and/or |

| | • | | hold a syndicated community offering; and/or |

| | • | | seek regulatory approval to extend the offering beyond [DATE3], 2011, provided that any such extension will require us to resolicit subscriptions as described above. |

If we fail to sell the minimum number of shares, we will return your funds to you with interest, or cancel your deposit account withdrawal authorization.

Delivery of Stock Certificates

Certificates representing shares of common stock sold in the offering will be mailed to the certificate registration address noted on the stock order form as soon as practicable following completion of the conversion and offering and

8

receipt of all regulatory approvals. It is possible that, until certificates for the common stock are delivered to purchasers, purchasers might not be able to sell the shares of common stock which they ordered, even though the common stock will have begun trading.

Market for Common Stock

We expect that our common stock will be listed on the Nasdaq Capital Market under the symbol SIBC. Keefe, Bruyette & Woods currently intends to become a market maker in our common stock, but is under no obligation to continue to do so. After shares of the common stock begin trading, you may contact a firm that offers investment services in order to buy or sell shares.

Our Dividend Policy

We have not made a decision at this time whether to pay dividends, or if we do decide to pay dividends, at what rate. After the offering, we may consider a policy of paying cash dividends on the common stock of State Investors Bancorp. The payment of dividends is dependent on numerous factors, including but not limited to, our future operating results and financial performance, growth prospects, ongoing capital requirements, regulatory limitations and overall economic conditions. In addition, during the first three years after the conversion, no dividend will be declared or paid if it would be classified as a return of capital for federal income tax purposes.

Tax Aspects

As a general matter, the conversion and offering will not be a taxable transaction for purposes of federal or state income taxes to State Investors Bancorp, State-Investors Bank, or persons eligible to subscribe in the subscription offering. Elias, Matz, Tiernan & Herrick L.L.P., our special counsel, has issued an opinion to us to the effect that consummation of transactions contemplated by the conversion and offering qualifies as a tax-free transaction for federal income tax purposes and will not result in any adverse federal tax consequences to State Investors Bancorp, State-Investors Bank, or persons eligible to subscribe in the subscription offering. Sagona, Bourg, Lee, Matthew & Co., L.L.C., a certified public accounting firm, has issued an opinion to us to the effect that consummation of transactions contemplated by the conversion and offering will qualify as a tax-free transaction for Louisiana state income tax purposes and will not result in any adverse Louisiana state tax consequences to State Investors Bancorp, State-Investors Bank, or persons eligible to subscribe in the subscription offering. See “The Conversion and Offering—Material Federal and Louisiana Income Tax Consequences of the Conversion.”

Stock Information Center

If you have any questions regarding the offering or the conversion, please visit our stock information center, located at our main office, 1041 Veterans Boulevard, Metairie, Louisiana. This location will accept stock order forms and proxy cards, and will have supplies of offering materials. The stock information center is open weekdays during the offering, except for bank holidays, on Mondays from 12:00 p.m. to 5:00 p.m., on Tuesdays through Thursdays from 9:00 a.m. to 5:00 p.m. and on Fridays from 9:00 a.m. to 12:00 p.m. Central time. You can reach the stock information center at ( ) - from 9:00 a.m. to 5:00 p.m. Central time, Monday through Friday, except bank holidays.

To ensure that you receive a prospectus at least 48 hours before the offering deadline, we may not mail prospectuses any later than five days prior to the offering deadline or hand-deliver any prospectus later than two days prior to the offering deadline. Stock order forms may only be distributed with or preceded by a prospectus. We will make reasonable attempts to provide a prospectus and offering materials to holders of subscription rights. The subscription offering and all subscription rights are expected to expire at 12:00 noon, Central time, on [DATE2], 2011, regardless of whether we have been able to locate each person entitled to subscription rights.

By signing the stock order form, you are acknowledging your receipt of a prospectus and your understanding that the shares are not a deposit or account and are not federally insured and are not guaranteed by State Investors Bancorp, State-Investors Bank, the Federal Deposit Insurance Corporation, or any other federal or state governmental agency.

9

RISK FACTORS

You should consider carefully the following risk factors before deciding whether to invest in State Investors Bancorp’s common stock. Our business could be harmed by any of these risks. In assessing these risks you should also refer to the other information contained in this prospectus, including our financial statements and the related notes thereto.

Risks Related to Our Business

Our commercial real estate lending activities may expose us to increased lending risks.We intend to continue to originate commercial real estate loans for portfolio, as well as participate in larger commercial real estate loans, which include loans secured by owner occupied commercial real estate and investment real estate with guarantor support. Such lending activities generally are considered to involve a higher degree of risk than single-family residential lending due to a variety of factors, including generally larger loan balances, shorter terms to maturity and loan terms which often do not require full amortization of the loan over its term and, instead, provide for a balloon payment at stated maturity. As a result, we may need to increase our provision for loan losses in future periods to address possible loan losses in our commercial real estate loan portfolio.

A portion of our loan portfolio consists of loan participations secured by properties outside of our primary market area. Loan participations may have a higher risk of loss than loans we originate because we are not the lead lender and we have limited control over credit monitoring.A portion of our loan portfolio consists of loan participations purchased from other banks secured by properties outside of our primary market area. Historically, our loan participations have been secured by commercial properties and one- to four-family residential properties both within and outside our market area. Although we underwrite these loan participations consistent with our general underwriting criteria, loan participations may have a higher risk of loss than loans we originate because we rely on the lead lender to monitor the performance of the loan. Moreover, our decision regarding the classification of a loan participation and loan loss provisions associated with a loan participation is made in part based upon information provided by the lead lender. A lead lender also may not monitor a participation loan in the same manner as we would for loans that we originate. At December 31, 2010, our loan participations totaled $41.9 million, or 23.0% of our loan portfolio, $12.0 million, or 6.6% of our loan portfolio, of which were outside our primary market area. The loan participations at December 31, 2010, included $34.9 million in commercial real estate and $7.0 million in residential real estate. We intend to continue to purchase loan participations following completion of the stock offering as a way to geographically diversify our portfolio and invest our net proceeds. If the underwriting of these participation loans is not adequate, our non-performing loans may increase and our earnings may decrease.

If our allowance for losses on loans is not adequate to cover losses, our earnings could decrease.We have established an allowance for loan losses which we believe is adequate to offset probable losses on our existing loans. We anticipate continuing to originate commercial real estate loans and participate in larger commercial real estate loans for which we may require additional provisions for loan losses. Material additions to our allowance would materially decrease our net income. We make various assumptions and judgments about the collectability of our loan portfolio, including the creditworthiness of our borrowers and the value of the real estate and other assets serving as collateral for the repayment of many of our loans. We rely on our loan quality reviews, our experience and our evaluation of economic conditions, among other factors, in determining the amount of the allowance for loan losses. While we are not aware of any specific factors indicating a deficiency in the amount of our allowance for loan losses, in light of the current economic slowdown, the increased number of foreclosures and lower real estate values, one of the most pressing current issues faced by financial institutions is the adequacy of their allowance for loan losses. Federal bank regulators have increased their scrutiny of the level of the allowance for losses maintained by regulated institutions. Many banks and other lenders are reporting significantly higher provisions to their allowance for loan losses, which are materially impacting their earnings. In the event that we have to increase our allowance for loan losses, it would have an adverse effect on our results in future periods. At December 31, 2010, our allowance for loan losses amounted to $1.5 million while our total loan portfolio was $182.2 million at such date, $37.1 million, or 20.3%, of which were commercial real estate loans.

The recent economic recession could result in increases in our level of non-performing loans and/or reduce demand for our products and services, which could have an adverse effect on our results of operations. In recent periods, there has been a decline in the housing and real estate markets and the national economy has recently experienced a recession. While rebuilding investments in the New Orleans area helped to insulate the local economy from the recession, according to the New Orleans Metropolitan Association of Realtors (NOMAR), total single-family home sales declined in Jefferson, St. Tammany and Orleans Parish by approximately 10% in 2010 compared to 2009. No assurance can be given that these

10

conditions will improve or will not worsen in the near term. Concerns over inflation, energy costs, geopolitical issues, the availability and cost of credit, the mortgage market and a declining real estate market have contributed to increased volatility and diminished expectations for the economy and markets going forward. This turbulence in the markets also has been largely attributable to the fallout associated with a deteriorating market for subprime mortgage loans and securities backed by such loans.

Dramatic declines in the housing market, with falling home prices and increasing foreclosures and unemployment, resulted in significant asset write-downs by financial institutions, which have caused many financial institutions to seek additional capital, to merge with other institutions and, in some cases, to fail. These developments also have contributed to a substantial decrease in both lending activities by banks and other financial institutions and activity in the secondary residential mortgage loan market. If these conditions do not improve or worsen, they could adversely affect our results of operations.

We continue to feel the effects of Hurricane Katrina in 2005 which resulted in a significant reduction of population in metropolitan New Orleans and may continue to have long-term adverse effects on the banking business in southern Louisiana. Hurricane Katrina impacted the greater New Orleans area in August 2005. The hurricane caused widespread property damage, required the relocation of an unprecedented number of residents and business operations, and severely disrupted normal economic activity in the impacted areas. Many businesses that relocated after the hurricane have not returned to the area. Prior to Hurricane Katrina, in 2000, the Census Bureau counted approximately 1.3 million residents in the seven parishes of the New Orleans metropolitan area. The 2010 census counted 1.2 million residents, a decline of approximately 150,000 residents. Population losses were concentrated in those parishes hardest hit by Katrina and the multiple levee failures—specifically Orleans, St. Bernard, Plaquemines, and Jefferson parishes. Orleans lost 29% of its population, St. Bernard lost 47%, Plaquemines lost 14% and Jefferson lost 5%. Meanwhile, the more northern and western parishes of St. Tammany, St. Charles, and St. John experienced population gains of 22%, 10% and 1%, respectively. If the population of metropolitan New Orleans does not rebound, economic activity in the area may stagnate, which could limit our future business opportunities such as new loan originations. The lower population levels also may adversely affect our ability to attract and retain deposits in a cost efficient manner. There is considerable uncertainty whether the area will fully recover. Businesses, including banking, have been adversely affected by the population decline, the continuing problems with basic services in the area, fundamental differences on how the rebuilding should proceed and the exodus of many firms. If the area does not recover, it could have a long-term adverse effect on us as well as the banking business in southern Louisiana as a whole.

Our business is geographically concentrated in south central Louisiana, which makes us vulnerable to downturns in the local economy as well as the economic effects of hurricanes, tropical storms and oil spills. Most of our loans are to individuals located generally in south central Louisiana. Regional economic conditions affect the demand for our products and services as well as the ability of our customers to repay loans. The concentration of our business operations makes us particularly vulnerable to downturns in the local economy. Declines in local real estate values could adversely affect the value of property used as collateral for the loans we make. Historically, the tourism industry has constituted a significant component of the local economy in south central Louisiana. The tourism industry remains an important factor in the local economy in the markets that State-Investors Bank operates in and downturns in the local tourism industry could adversely affect State-Investors Bank. Tourism, the largest single employment sector in metropolitan New Orleans, which declined dramatically after August 2005, has improved in the past several years. The New Orleans tourism industry was further impacted by the nationwide recession and Gulf oil spill. According to the New Orleans Convention and Visitors Bureau, in 2009, the total number of visitors to the New Orleans area was 7.5 million compared to 10.1 million visitors in 2004. In addition, the region is susceptible to hurricanes, tropical storms and oil spills. Basic services, such as water, gas, electricity, health care and the transportation network, as well as the flood prevention system, may be severely affected in the event of a hurricane. Any new storm could adversely affect our loan portfolio by damaging properties pledged as collateral and impair the ability of certain borrowers to repay their loans.

Changes in interest rates could have a material adverse effect on our operations.Our profitability is dependent to a large extent on net interest income, which is the difference between the interest income earned on interest-earning assets such as loans and investment securities and the interest expense paid on interest-bearing liabilities such as deposits and borrowings. Changes in the general level of interest rates and differences between long-term and short-term rates can affect our net interest income by affecting the difference between the weighted average yield earned on our interest-earning assets and the weighted average rate paid on our interest-bearing liabilities, or interest rate spread, and the average life of our interest-earning assets and interest-bearing liabilities. We continue to monitor our interest rate sensitivity and expect to grow our higher yielding types of lending and lower cost transaction deposit accounts, but may not be able to effectively do so.

11

Increased and/or special Federal Deposit Insurance Corporation assessments will hurt our earnings.The recent economic recession has caused a high level of bank failures, which has dramatically increased Federal Deposit Insurance Corporation resolution costs and led to a significant reduction in the balance of the Deposit Insurance Fund. As a result, the Federal Deposit Insurance Corporation has significantly increased the initial base assessment rates paid by financial institutions for deposit insurance. Increases in the base assessment rate have increased our deposit insurance costs and negatively impacted our earnings. On February 7, 2011, the Federal Deposit Insurance Corporation approved a final rule that changed the assessment base from domestic deposits to average assets minus average tangible equity, adopted a new large-bank pricing assessment scheme, and set a target size for the Deposit Insurance Fund as mandated by the recently enacted regulatory reform legislation. Additional changes in the base assessment rate or special assessments would negatively impact our earnings.

We operate in a highly regulated environment and we may be adversely affected by changes in laws and regulations.We are subject to extensive regulation, supervision and examination by the Office of Thrift Supervision, our primary federal regulator, and by the Federal Deposit Insurance Corporation, as insurer of our deposits. Such regulation and supervision governs the activities in which an institution and its holding company may engage and are intended primarily for the protection of the insurance fund and the depositors and borrowers of State-Investors Bank rather than for holders of our common stock. Regulatory authorities have extensive discretion in their supervisory and enforcement activities, including the imposition of restrictions on our operations, the classification of our assets and determination of the level of our allowance for loan losses. Any change in such regulation and oversight, whether in the form of regulatory policy, regulations, legislation or supervisory action, may have a material impact on our operations. Our primary federal regulator will change from the Office of Thrift Supervision to the Office of the Comptroller of the Currency after July 21, 2011, pursuant to recently enacted legislation.

Recently enacted regulatory reform may have a material impact on our operations.On July 21, 2010, the President signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act that, among other things, imposes new restrictions and an expanded framework of regulatory oversight for financial institutions and their holding companies, including State-Investors Bank and State Investors Bancorp. Under the new law, State-Investors Bank’s primary regulator, the Office of Thrift Supervision, will be eliminated and existing federal thrifts will be subject to regulation and supervision by the Office of Comptroller of the Currency, which currently supervises and regulates all national banks. Savings and loan holding companies will be regulated by the Federal Reserve Board, which will have the authority to promulgate new regulations governing State Investors Bancorp that will impose additional capital requirements and may result in additional restrictions on investments and other holding company activities. The law also creates a new consumer financial protection bureau that will have the authority to promulgate rules intended to protect consumers in the financial products and services market. The creation of this independent bureau could result in new regulatory requirements and raise the cost of regulatory compliance. The federal preemption of state laws currently accorded federally chartered financial institutions will be reduced. In addition, regulation mandated by the new law could require changes in regulatory capital requirements, loan loss provisioning practices, and compensation practices which may have a material impact on our operations. Because many of the regulations under the new law have not been promulgated, we cannot determine the full impact on our business and operations at this time. See “Regulation—Recently Enacted Regulatory Reform.”

We face strong competition in our primary market area which may adversely affect our profitability.We are subject to vigorous competition in all aspects and areas of our business from commercial banks, mortgage banking companies, credit unions and other providers of financial services, such as money market mutual funds, brokerage firms, consumer finance companies and insurance companies. Based on data from the Federal Deposit Insurance Corporation, as of June 30, 2010, the most recent date for which data is available, we had 0.56% of the total deposits in the New Orleans-Metairie-Kenner Metropolitan Statistical Area. The financial resources of our larger competitors may permit them to pay higher interest rates on their deposits and to be more aggressive in new loan originations. We also compete with non-financial institutions, including retail stores that maintain their own credit programs and governmental agencies that make available low cost or guaranteed loans to certain borrowers. Competition from both bank and non-bank organizations will continue.

We rely heavily on our management team and the loss of key officers may adversely affect operations.Our success has been and will continue to be greatly influenced by the ability to retain existing senior management and to attract and retain qualified senior management. Anthony S. Sciortino, President and Chief Executive Officer, and other executive officers have been instrumental in developing and managing our business. A formal management succession plan has not been established. The loss of the services of existing senior management, or future unexpected loss of services of Mr. Sciortino could have an adverse effect on State Investors Bancorp.

12

We rely heavily on technology and computer systems. The negative effects of computer system failures and unethical individuals with the technological ability to cause disruption of service could significantly affect our reputation and our ability to generate deposits.Our ability to compete depends on our ability to continue to adapt and deliver technology on a timely and cost-effective basis to meet customers’ demands for financial services. We currently provide our customers the ability to bank online. The secure transmission of confidential information over the Internet is a critical element of these services. Our network could be vulnerable to unauthorized access, computer viruses, phishing schemes and other security problems. We may be required to spend significant capital and other resources to protect against the threat of security breaches and computer viruses, or to alleviate problems caused by security breaches or viruses. To the extent that our activities or the activities of our customers involve the storage and transmission of confidential information, security breaches and viruses could expose us to claims, litigation and other possible liabilities. Any inability to prevent security breaches or computer viruses could also cause existing customers to lose confidence in our systems and could adversely affect our reputation and our ability to generate deposits.

Risks Related to this Offering

Our stock-based benefit plans will be dilutive.If the offering is completed and shareholders subsequently approve a recognition and retention plan and a stock option plan, we will allocate stock to our officers, employees and directors through these plans. If the shares for the recognition and retention plan are issued from our authorized but unissued stock, the ownership percentage of outstanding shares of State Investors Bancorp would be diluted by approximately 3.8%. However, it is our intention to purchase shares of our common stock in the open market to fund the recognition and retention plan. Assuming the shares of our common stock to be awarded under the recognition and retention plan are purchased at a price equal to the offering price in the offering, the reduction to stockholders’ equity from the recognition and retention plan would be between $748,000 and $1.2 million at the minimum and the maximum, as adjusted, of the offering range. The ownership percentage of State Investors Bancorp shareholders would also decrease by approximately 9.1% if all potential stock options under our proposed stock option plan are exercised and are filled using shares issued from authorized but unissued common stock. See “Unaudited Pro Forma Data” for data on the dilutive effect of the recognition and retention plan and the stock option plan and “Management—New Stock Benefit Plans” for a description of the plans.

The implementation of stock-based benefit plans will increase our future compensation and may adversely affect our net income.Following the offering, we will recognize additional employee compensation and benefit expenses stemming from options and shares granted to employees, directors and executives under our proposed new stock benefit plans. These additional expenses will adversely affect our net income. We cannot determine the actual amount of these new stock-related compensation and benefit expenses at this time because applicable accounting practices generally require that they be based on the fair market value of the options or shares of common stock at the date of the grant; however, we expect them to be significant. We will recognize expenses for our employee stock ownership plan when shares are committed to be released to participants’ accounts and will recognize expenses for restricted stock awards and stock options generally over the vesting period of awards made to recipients. These benefit expenses, after taxes, in the first year following the offering have been estimated to be approximately $362,000, in the aggregate, at the maximum of the offering range as set forth in the pro forma financial information under “Unaudited Pro Forma Data” assuming the $10.00 per share purchase price as fair market value. Actual expenses, however, may be higher or lower, depending on the price of our common stock at that time. For further discussion of these plans, see “Management—New Stock Benefit Plans.”

Our stock price may decline when trading commences.We are offering shares of our common stock at a uniform price of $10.00 per share. After the offering is completed, the trading price of the common stock will be determined by the marketplace, and will be influenced by many factors outside of our control, including prevailing interest rates, investor perceptions, securities analyst research reports and general industry, geopolitical and economic conditions. Publicly traded stock, including stocks of financial institutions, often experience substantial market price volatility. Market fluctuations in the price of our common stock may not be related to the operating performance of State Investors Bancorp.

A limited market for our common stock may depress our market price and make it difficult to buy or sell our stock.We expect our stock to be listed on the Nasdaq Capital Market. If an active and liquid trading market for our stock does not develop, you may not be able to buy or sell our common stock immediately following the close of the offering or at or above the $10.00 per share offering price. There may be a wide spread between the bid and asked price for our common stock after the conversion. You should consider the potentially long-term nature of an investment in our common stock.

We intend to remain independent, which may mean you will not receive a premium for your common stock.We intend to remain independent for the foreseeable future. Because we do not plan on seeking possible acquirors, it is unlikely

13

that we will be acquired in the foreseeable future. Accordingly, you should not purchase our common stock with any expectation that a takeover premium will be paid to you in the near term.

We have broad discretion in investing the net proceeds of the offering.State Investors Bancorp intends to contribute 50% of the net proceeds as equity capital to State-Investors Bank for the purchase of all of State-Investors Bank’s capital stock and the remaining 50% of the net proceeds will be retained by State Investors Bancorp. Initially, State Investors Bancorp intends to use the proceeds that it retains to loan funds to the employee stock ownership plan to purchase 8.0% of the shares sold in the offering and will invest the remaining amount in a deposit account at State-Investors Bank. Under applicable regulations, State Investors Bancorp may during the first year following the conversion, assuming shareholder approval, use a portion of the net proceeds it retains to fund the recognition and retention plan. After one year following the conversion, we may repurchase shares of common stock, subject to regulatory restriction. State-Investors Bank initially intends to use the net proceeds it receives as a contribution of capital from State Investors Bancorp to fund loans and to invest in securities.We have not allocated specific amounts of proceeds for any of these purposes, and we will have significant flexibility in determining how much of the net proceeds we apply to different uses and the timing of such applications. There is a risk that we may fail to effectively use the net proceeds which could have a negative effect on our future profitability ratios.

Our stock value may suffer from anti-takeover provisions in our articles of incorporation and bylaws that may impede potential takeovers that management opposes.Provisions in our corporate documents, as well as certain federal regulations, may make it difficult and expensive to pursue a tender offer, change in control or takeover attempt that our board of directors opposes. As a result, our shareholders may not have an opportunity to participate in such a transaction, and the trading price of our stock may not rise to the level of other institutions that are more vulnerable to hostile takeovers. Anti-takeover provisions contained in our corporate documents include:

| | • | | restrictions on acquiring more than 10% of our common stock by any person and limitations on voting rights; |

| | • | | the election of members of the board of directors to staggered three-year terms; |

| | • | | the absence of cumulative voting by shareholders in the election of directors; |

| | • | | advance notice requirements for shareholder nominations and new business; |

| | • | | provisions restricting the calling of special meetings of shareholders; and |

| | • | | our ability to issue preferred stock and additional shares of common stock without shareholder approval. |

See “Restrictions on Acquisition of State Investors Bancorp and State-Investors Bank and Related Anti-Takeover Provisions” for a description of anti-takeover provisions in our corporate documents and federal regulations.

We will be required to implement additional finance and accounting systems, procedures and controls in order to satisfy our new public company reporting requirements, which will increase our operating expenses. After the completion of this offering, we will become a public reporting company. The federal securities laws and the regulations of the Securities and Exchange Commission will require that we file annual, quarterly and current reports and that we maintain effective disclosure controls and procedures and internal controls over financial reporting. We expect that the obligations of being a public company, including substantial public reporting obligations, will require significant expenditures and place additional demands on our management team. These obligations will increase our operating expense and could divert our management’s attention from our operations.

14

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements, which can be identified by the use of such words as “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect” and similar expressions. These forward-looking statements include, but are not limited to:

| | • | | statements of goals, intentions and expectations; |

| | • | | statements regarding prospects and business strategy; |

| | • | | statements regarding asset quality and market risk; and |

| | • | | estimates of future costs, benefits and results. |