Exhibit 99.1

STATE INVESTORS

BANCORP, INC.

SEND OVERNIGHT PACKAGES TO: State Investors Bancorp, Inc.

Stock Order Processing Center

10 S Wacker Drive, Suite 3400 Chicago, IL 60606

() -

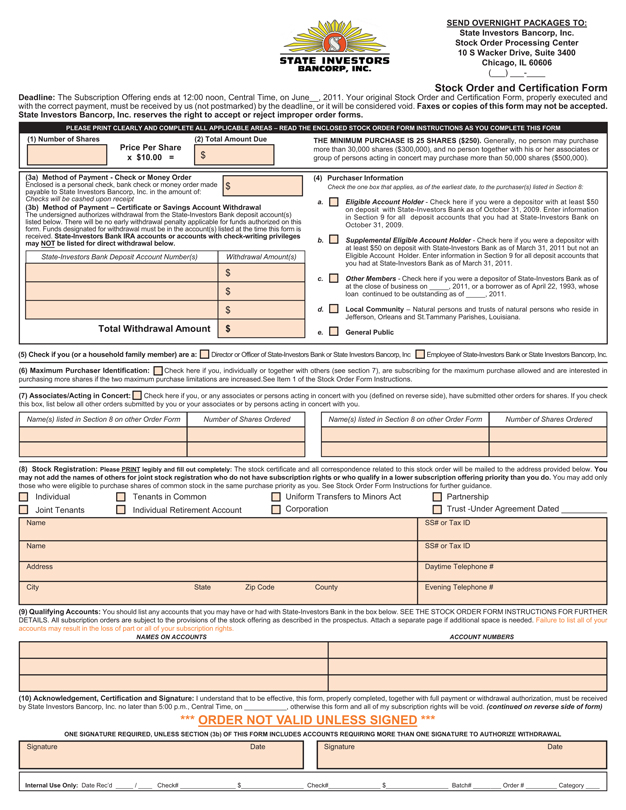

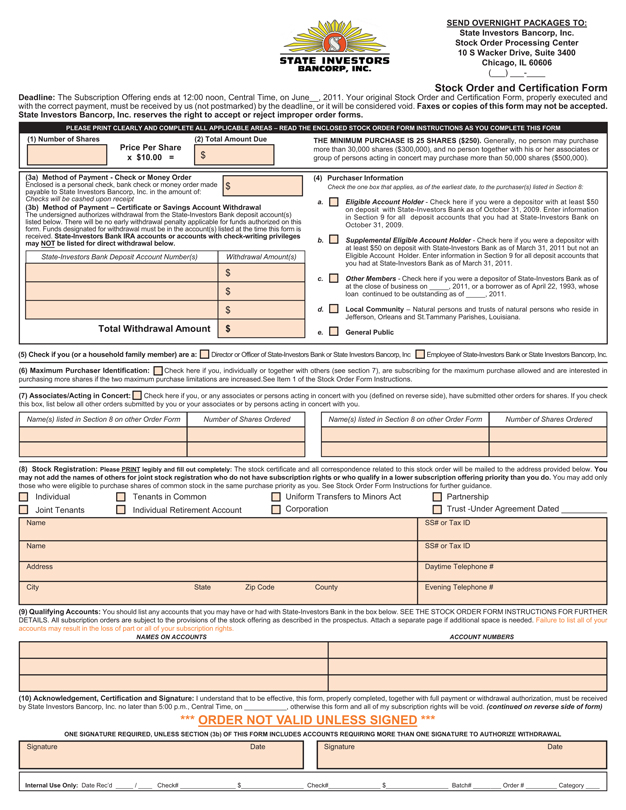

Stock Order and Certification Form

Deadline: The Subscription Offering ends at 12:00 noon, Central Time, on June , 2011. Your original Stock Order and Certification Form, properly executed and with the correct payment, must be received by us (not postmarked) by the deadline, or it will be considered void. Faxes or copies of this form may not be accepted. State Investors Bancorp, Inc. reserves the right to accept or reject improper order forms.

PLEASE PRINT CLEARLY AND COMPLETE ALL APPLICABLE AREAS – READ THE ENCLOSED STOCK ORDER FORM INSTRUCTIONS AS YOU COMPLETE THIS FORM

(1) Number of Shares (2) Total Amount Due

Price Per Share x $10.00 = $

THE MINIMUM PURCHASE IS 25 SHARES ($250). Generally, no person may purchase more than 30,000 shares ($300,000), and no person together with his or her associates or group of persons acting in concert may purchase more than 50,000 shares ($500,000).

(3a) Method of Payment - Check or Money Order Enclosed is a personal check, bank check or money order made payable to State Investors Bancorp, Inc. in the amount of: $

Checks will be cashed upon receipt

(3b) Method of Payment – Certificate or Savings Account Withdrawal The undersigned authorizes withdrawal from the State-Investors Bank deposit account(s) listed below. There will be no early withdrawal penalty applicable for funds authorized on this form. Funds designated for withdrawal must be in the account(s) listed at the time this form is received. State-Investors Bank IRA accounts or accounts with check-writing privileges

may NOT be listed for direct withdrawal below.

State-Investors Bank Deposit Account Number(s) Withdrawal Amount(s)

$

$

$

Total Withdrawal Amount $

(4) Purchaser Information

Check the one box that applies, as of the earliest date, to the purchaser(s) listed in Section 8:

a. Eligible Account Holder - Check here if you were a depositor with at least $50 on deposit with State-Investors Bank as of October 31, 2009. Enter information in Section 9 for all deposit accounts that you had at State-Investors Bank on October 31, 2009.

b. Supplemental Eligible Account Holder - Check here if you were a depositor with at least $50 on deposit with State-Investors Bank as of March 31, 2011 but not an Eligible Account Holder. Enter information in Section 9 for all deposit accounts that you had at State-Investors Bank as of March 31, 2011.

c. Other Members - Check here if you were a depositor of State-Investors Bank as of at the close of business on , 2011, or a borrower as of April 22, 1993, whose loan continued to be outstanding as of , 2011.

d. Local Community – Natural persons and trusts of natural persons who reside in Jefferson, Orleans and St.Tammany Parishes, Louisiana.

e. General Public

(5) Check if you (or a household family member) are a: Director or Officer of State-Investors Bank or State Investors Bancorp, Inc Employee of State-Investors Bank or State Investors Bancorp, Inc. (6) Maximum Purchaser Identification: Check here if you, individually or together with others (see section 7), are subscribing for the maximum purchase allowed and are interested in purchasing more shares if the two maximum purchase limitations are increased.See Item 1 of the Stock Order Form Instructions.

(7) Associates/Acting in Concert: Check here if you, or any associates or persons acting in concert with you (defined on reverse side), have submitted other orders for shares. If you check this box, list below all other orders submitted by you or your associates or by persons acting in concert with you.

Name(s) listed in Section 8 on other Order Form Number of Shares Ordered Name(s) listed in Section 8 on other Order Form Number of Shares Ordered

(8) Stock Registration: Please PRINT legibly and fill out completely: The stock certificate and all correspondence related to this stock order will be mailed to the address provided below. You may not add the names of others for joint stock registration who do not have subscription rights or who qualify in a lower subscription offering priority than you do. You may add only those who were eligible to purchase shares of common stock in the same purchase priority as you. See Stock Order Form Instructions for further guidance.

Individual Joint Tenants Tenants in Common Individual Retirement Account Uniform Transfers to Minors Act Corporation Partnership Trust -Under Agreement Dated

Name

Name

Address

City

State Zip Code County

SS# or Tax ID

SS# or Tax ID

Daytime Telephone #

Evening Telephone #

(9) Qualifying Accounts: You should list any accounts that you may have or had with State-Investors Bank in the box below. SEE THE STOCK ORDER FORM INSTRUCTIONS FOR FURTHER DETAILS. All subscription orders are subject to the provisions of the stock offering as described in the prospectus. Attach a separate page if additional space is needed. Failure to list all of your accounts may result in the loss of part or all of your subscription rights.

NAMES ON ACCOUNTS ACCOUNT NUMBERS

(10) Acknowledgement, Certification and Signature: I understand that to be effective, this form, properly completed, together with full payment or withdrawal authorization, must be received by State Investors Bancorp, Inc. no later than 5:00 p.m., Central Time, on , otherwise this form and all of my subscription rights will be void. (continued on reverse side of form)

*** ORDER NOT VALID UNLESS SIGNED ***

ONE SIGNATURE REQUIRED, UNLESS SECTION (3b) OF THIS FORM INCLUDES ACCOUNTS REQUIRING MORE THAN ONE SIGNATURE TO AUTHORIZE WITHDRAWAL

Signature Date Signature Date

Internal Use Only: Date Rec’d / Check# $ Check# $ Batch# Order # Category

(7) Associates/Acting In Concert (continued from front side of Stock Order Form)

Associate – The term “associate” of a particular person means:

| 1) | A corporation or organization, other than State-Investors Bank, State Investors Bancorp, Inc. or a majority-owned subsidiary of these entities, of which the person is a senior officer, partner or 10% beneficial stockholder; |

| 2) | Any trust or other estate in which the person has a substantial beneficial interest or serves as a trustee or in a fiduciary capacity, excluding any employee stock benefit plan in which the person has a substantial beneficial interest or serves as trustee or in a fiduciary capacity; and |

| 3) | Any blood or marriage relative of the person, who either lives in the same home as the person or who is a director or officer of State-Investors Bank or State Investors Bancorp, Inc. |

Acting in Concert – The term “acting in concert” means:

| 1) | Knowing participation in a joint activity or interdependent conscious parallel action towards a common goal whether or not pursuant to an express agreement; or |

| 2) | A combination or pooling of voting or other interests in the securities of an issuer for a common purpose pursuant to any contract, understanding, relationship, agreement or other arrangement, whether written or otherwise. |

A person or company that acts in concert with another person or company (“other party”) shall also be deemed to be acting in concert with any person or company who is also acting in concert with that other party, except that any tax-qualified employee stock benefit plan will not be deemed to be acting in concert with its trustee or a person who serves in a similar capacity solely for the purpose of determining whether common stock held by the trustee and common stock held by the employee stock benefit plan will be aggregated.

Please see the Prospectus section entitled “The Conversion and Offering – Limitations on Common Stock Purchases” for more information on purchase limitations and a more detailed description of “associates” and “acting in concert.”

(10) Acknowledgment, Certification and Signature (continued from front side of Stock Order Form)

I agree that after receipt by State Investors Bancorp, Inc., this Stock Order and Certification Form and may not be modified or cancelled without State Investors Bancorp, Inc.’s consent, and that if withdrawal from a deposit account has been authorized, the authorized amount will not otherwise be available for withdrawal. Under penalty of perjury, I certify that (1) the Social Security or Tax ID information and all other information provided hereon are true, correct and complete, (2)I am purchasing shares solely for my own account and that there is no agreement or understanding regarding the sale of such shares, or my right to subscribe for shares, and (3) I am not subject to backup withholding tax [cross out (3) if you have been notified by the IRS that you are subject to backup withholding.] I acknowledge that my order does not conflict with the maximum purchase limitation of $300,000 for any individual person, or $500,000 overall purchase limitation for any person or entity together with associates of, or persons acting in concert with, such person, or entity, in all categories of the offering, combined, as set forth in the The Conversion and Offering and the Prospectus dated .

Subscription rights pertain to those eligible to subscribe in the Subscription Offering. Federal regulations prohibit any person from transferring or entering into any agreement directly or indirectly to transfer the legal or beneficial ownership of subscription rights, or the underlying securities, to the account of another.

I ACKNOWLEDGE THAT THE SHARES OF COMMON STOCK ARE NOT A DEPOSIT OR ACCOUNT AND ARE NOT FEDERALLY INSURED, AND ARE NOT GUARANTEED BY STATE INVESTORS BANCORP, INC. OR STATE–INVESTORS BANK OR BY THE FEDERAL GOVERNMENT.

If anyone asserts that the shares of common stock are federally insured or guaranteed, or are as safe as an insured deposit, I should call the Office of Thrift Supervision Consumer Response Center at (800) 842-6929.

I further certify that, before purchasing the common stock of State Investors Bancorp, Inc., I received the Prospectus dated , and that I have read the terms and conditions described in the Prospectus, including disclosure concerning the nature of the security being offered and the risks involved in the investment described in the “Risk Factors” section beginning on page , which risks include but are not limited to the following:

| 1. | Our commercial real estate lending activities may expose us to increased lending risks. |

| 2. | A portion of our loan portfolio consists of loan participants secured by properties outside of our primary market area. Loan participations may have a higher risk of loss than loans we originate because we are not the lead lender and we have limited control over credit monitoring. |

| 3. | If our allowance for losses on loans is not adequate to cover losses, our earnings could decrease. |

| 4. | The recent economic recession could result in increases in our level of non-performing loans and/or reduce demand for our products and services, which could have an adverse effect on our results of operations. |

| 5. | We continue to feel the effects of Hurricane Katrina in 2005 which resulted in a significant reduction of population in metropolitan New Orleans and may continue to have long-term adverse effects on the banking business in southern Louisiana. |

| 6. | Our business is geographically concentrated in south central Louisiana, which makes us vulnerable to downturns in the local economy as well as the economic effects of hurricanes, tropical storms and oil spills. |

| 7. | Changes in interest rates could have a material adverse effect on our operations. |

| 8. | Increased and/or special Federal Deposit Insurance Corporation assessments will hurt our earnings. |

| 9. | We operate in a highly regulated environment and we may be adversely affected by changes in laws and regulations. |

| 10. | Recently enacted regulatory reform may have a material impact on our operations. |

| 11. | We face strong competition in our primary market area which may adversely affect our profitability. |

| 12. | We rely heavily on our management team and the loss of key officers may adversely affect operations. |

| 13. | We rely heavily on technology and computer systems. The negative effects of computer system failures and unethical individuals with the technological ability to cause disruption of service could significantly affect our reputation and our ability to generate deposits. |

| 14. | The implementation of stock-based benefit plans will increase our future compensation and may adversely affect our net income. |

| 15. | Our stock price may decline when trading commences. |

| 16. | A limited market for our common stock may depress our market price and make it difficult to buy or sell our stock. |

| 17. | We intend to remain independent, which may mean you will not receive a premium for your common stock. |

| 18. | We have broad discretion in investing the net proceeds of the offering. |

| 19. | Our stock-based benefit plans will be dilutive. |

| 20. | Our stock value may suffer from anti-takeover provisions in our articles of incorporation and bylaws that may impede potential takeovers that management opposes. |

| 21. | We will be required to implement additional finance and accounting systems, procedures and controls in order to satisfy our new public company reporting requirements, which will increase our operating expenses. |

EXECUTION OF THIS CERTIFICATION FORM WILL NOT CONSTITUTE A WAIVER OF ANY RIGHTS THAT A PURCHASER MAY HAVE UNDER THE SECURITIES ACT OF 1933 AND THE SECURITIES EXCHANGE ACT OF 1934, BOTH AS AMENDED.

| | | | |

| | | | | |

| | | STATE INVESTORS BANCORP, INC. Stock Order Form Instructions Stock Information Center: ( ) - | | |

| | | | | |

Stock Order Form Instructions –All orders are subject to the provisions of the stock offering as described in the prospectus.

Item 1 and 2- Fill in the number of shares that you wish to purchase and the total payment due. The amount due is determined by multiplying the number of shares ordered by the subscription price of $10.00 per share. The minimum purchase is 25 shares. The maximum purchase for any person is 30,000 shares (30,000 shares x $10.00 per share = $300,000). No person, together with “associates”, as defined in the prospectus, and persons “acting in concert”, as defined in the prospectus, may purchase more than 50,000 shares (50,000 shares x $10.00 per share = $500,000) of the common stock offered in the stock offering. For additional information, see “The Conversion and Offering – Limitations on Common Stock Purchases” in the prospectus.

Item 3a -Payment for shares may be made by check, bank draft or money order payable to State Investors Bancorp, Inc. DO NOT MAIL CASH. Your funds will earn interest at State-Investors Bank’s passbook savings rate until the stock offering is completed.

Item 3b- To pay by withdrawal from a deposit account or certificate of deposit at State-Investors Bank insert the account number(s) and the amount(s) you wish to withdraw from each account. If more than one signature is required for a withdrawal, all signatories must sign in the signature box on the front of the Stock Order form. To withdraw from an account with checking privileges, please write a check. State-Investors Bank will waive any applicable penalties for early withdrawal from certificate of deposit accounts (CDs) for the purposes of purchasing stock in the offering. A hold will be placed on the account(s) for the amount(s) you indicate to be withdrawn. Payments will remain in account(s) until the Stock Offering closes and earn their respective rate of interest, but will not be available for your use until the completion of the transaction.

Item 4- Please check the appropriate box to tell us the earliest of the three dates that apply to you, or the local community or general public boxes if you were not a customer of State-Investors Bank on any of the key dates.

Item 5- Please check one of these boxes if you are a director, officer or employee of State-Investors Bank or State Investors Bancorp, Inc., or a member of such person’s household.

Item 6- Please check the box, if applicable. If you check the box but have not subscribed for the maximum amount and did not complete Item 7, you may not be eligible to purchase more shares.

Item 7- Check the box, if applicable, and provide the requested information. Attach a separate page, if necessary. In the Prospectus dated , please see the section entitled “The Conversion and Offering – Limitations on Common Stock Purchases” for more information regarding the definition of “associate” and “acting in concert.”

Item 8- The stock transfer industry has developed a uniform system of shareholder registrations that we will use in the issuance of State Investors Bancorp, Inc. common stock. Please complete this section as fully and accurately as possible, and be certain to supply your social security or Tax I.D. number(s) and your daytime and evening phone numbers. We will need to call you if we cannot execute your order as given. If you have any questions regarding the registration of your stock, please consult your legal advisor or contact the Stock Information Center at ( ) - . Subscription rights are not transferable. If you are an eligible or supplemental eligible account holder or other member, to protect your priority over other purchasers as described in the prospectus, you must take ownership in at least one of the account holder’s names.

Item 9- You should list any qualifying accounts that you have or may have had with State-Investors Bank in the box located under the heading “Qualifying Accounts”. For example, if you are ordering stock in just your name, you should list all of your account numbers as of the earliest of the three dates that you were a depositor. Similarly, if you are ordering stock jointly with another depositor, you should list all account numbers under which either of you are owners, i.e. individual accounts, joint accounts, etc. If you are ordering stock in your minor child’s or grandchild’s name under the Uniform Transfers to Minors Act, the minor must have had an account number on one of the three dates and you should list only their account number(s). If you are ordering stock as a corporation, you need to list just that corporation’s account number, as your individual account number(s) do not qualify. Failure to list all of your qualifying deposit account numbers may result in the loss of part or all of your subscription rights.

Item 10- Sign and date the form where indicated. Before you sign please read carefully and review the information which you have provided and read the acknowledgement. Only one signature is required, unless any account listed in section 3b of this form requires more than one signature to authorize a withdrawal. Please review the Prospectus dated , carefully before making an investment decision.

If you have questions regarding the conversion and the stock offering, please call us toll free at ( ) - , Monday through Friday, from 9:00 a.m. to 5:00 p.m., Central Time, or stop by our Stock Information Center at our Metairie branch located at 1041 Veterans Blvd., Monday from 12:00 p.m. to 5:00 p.m., Tuesday through Thursday from 9:00 a.m. to 5:00 p.m. or Friday from 9:00 a.m. to 12:00 pm to speak with a stock center representative. The Stock Information Center will be closed weekends and bank holidays.

(See Reverse Side for Stock Ownership Guide)

| | | | |

| | | | | |

| | | STATE INVESTORS BANCORP, INC. Stock Ownership Guide Stock Information Center: ( ) - | | |

| | | | | |

Stock Ownership Guide

Individual- The stock is to be registered in an individual’s name only. You may not list beneficiaries for this ownership.

Joint Tenants - Joint tenants with rights of survivorship identifies two or more owners. When stock is held by joint tenants with rights of survivorship, ownership automatically passes to the surviving joint tenant(s) upon the death of any joint tenant. You may not list beneficiaries for this ownership.

Tenants in Common- Tenants in common may also identify two or more owners. When stock is to be held by tenants in common, upon the death of one co-tenant, ownership of the stock will be held by the surviving co-tenant(s) and by the heirs of the deceased co-tenant. All parties must agree to the transfer or sale of shares held by tenants in common. You may not list beneficiaries for this ownership.

Individual Retirement Account- Individual Retirement Account (“IRA”) holders may potentially make stock purchases from their existing IRA if it is aself-directed IRAor through aprearranged“trustee-to-trustee” transfer if their IRA is currently at State-Investors Bank.The stock cannot be held in your State-Investors Bank account. Please contact your broker or self-directed IRA account provider as quickly as possible to explore this option, as it may take a number of weeks to complete a trustee-to-trustee transfer and place a subscription in this manner.

Registration for IRA’s: | On Name Line 1 - list the name of the broker or trust department followed by CUST or TRUSTEE. |

On Name Line 2 - FBO (for benefit of) YOUR NAME [IRA a/c # ].

Address will be that of the broker / trust department to where the stock certificate will be sent.

The Social Security / Tax I.D. number(s) will be either yours or your trustee’s,as the trustee directs.

Please listyour phone numbers,not the phone numbers of your broker / trust department.

Uniform Transfers To Minors Act- For residents ofLouisianaand many states, stock may be held in the name of a custodian for the benefit of a minor under theUniform Transfers to Minors Act. In this form of ownership, the minor is the actual owner of the stock with the adult custodian being responsible for the investment until the child reaches legal age. Only one custodian and one minor may be designated.

Registration for UTMA: | On Name Line 1 – print the name of the custodian followed by the abbreviation “CUST” |

On Name Line 2 – FBO (for benefit of) followed by the name of the minor, followed by UTMA-LA

(or your state’s abbreviation)

List only the minor’s social security number on the form.

Corporation/Partnership– Corporations/Partnerships may purchase stock. Please provide the Corporation/Partnership’s legal name and Tax I.D. To have subscription rights, the Corporation/Partnership must have an account in its legal name and Tax I.D. Please contact the Stock Information Center to verify depositor rights and purchase limitations.

Fiduciary/Trust- Generally, fiduciary relationships (such as Trusts, Estates, Guardianships, etc.) are established under a form of trust agreement or pursuant to a court order. Without a legal document establishing a fiduciary relationship, your stock may not be registered in a fiduciary capacity.

Instructions: On the first name line, print the first name, middle initial and last name of the fiduciary if the fiduciary is an individual. If the fiduciary is a corporation, list the corporate title on the first name line. Following the name, print the fiduciary title, such as trustee, executor, personal representative, etc. On the second name line, print the name of the maker, donor or testator or the name of the beneficiary. Following the name, indicate the type of legal document establishing the fiduciary relationship (agreement, court order, etc.). In the blank after “Under Agreement Dated,” fill in the date of the document governing the relationship. The date of the document need not be provided for a trust created by a will.

If you have questions regarding the conversion and the stock offering, please call us toll free at ( ) - , Monday through Friday, from 9:00 a.m. to 5:00 p.m., Central Time, or stop by our Stock Information Center at our Metairie branch located at 1041 Veterans Blvd., Monday from 12:00 p.m. to 5:00 p.m., Tuesday through Thursday from 9:00 a.m. to 5:00 p.m. or Friday from 9:00 a.m. to 12:00 pm to speak with a stock center representative. The Stock Information Center will be closed weekends and bank holidays.

(See Reverse Side for Stock Order Form Instructions)