UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22538

Advisers Investment Trust

(Exact name of registrant as specified in charter)

50 S. LaSalle Street

Chicago, Illinois 60603

(Address of principal executive offices) (Zip code)

The Northern Trust Company

50 S. LaSalle Street

Chicago, Illinois 60603

(Name and address of agent for service)

Registrant’s telephone number, including area code: 866-638-5859

Date of fiscal year end: September 30

Date of reporting period: March 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The following are copies of reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

INDEPENDENT FRANCHISE PARTENRS

US EQUITY FUND

SEMI-ANNUAL REPORT

March 31, 2023

This report is submitted for the general information of the shareholders of the Independent Franchise Partners US Equity Fund (the “Fund”). It is not authorized for the distribution to prospective investors unless preceded or accompanied by an effective prospectus.

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

TABLE OF CONTENTS

March 31, 2023 (Unaudited)

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| | | | | | | | | | |

| | | Percentage of Net Assets | | Shares | | | Value | |

COMMON STOCKS | | 97.3% | | | | | | | | |

Biotechnology | | 3.1% | | | | | | | | |

Corteva Inc. | | | | | 900,214 | | | $ | 54,291,906 | |

| | | | | | | | | | |

Commercial Services | | 8.2% | | | | | | | | |

Ritchie Bros. Auctioneers Inc. | | | | | 1,684,877 | | | | 94,841,741 | |

TransUnion | | | | | 754,183 | | | | 46,864,931 | |

| | | | | | | | | | |

| | | | | | | | | 141,706,672 | |

| | | | | | | | | | |

Diversified Financials | | 6.2% | | | | | | | | |

Intercontinental Exchange Inc. | | | | | 586,236 | | | | 61,138,553 | |

S&P Global Inc. | | | | | 133,446 | | | | 46,008,177 | |

| | | | | | | | | | |

| | | | | | | | | 107,146,730 | |

| | | | | | | | | | |

Insurance | | 4.2% | | | | | | | | |

Aon PLC - Class A | | | | | 229,896 | | | | 72,483,910 | |

| | | | | | | | | | |

Internet Software & Services | | 15.2% | | | | | | | | |

Alphabet Inc. - Class A(a) | | | | | 267,744 | | | | 27,773,085 | |

Booking Holdings Inc.(a) | | | | | 35,378 | | | | 93,836,961 | |

eBay Inc. | | | | | 1,188,567 | | | | 52,736,718 | |

Zillow Group Inc. - Class A(a) | | | | | 246,208 | | | | 10,759,290 | |

Zillow Group Inc. - Class C(a) | | | | | 1,757,569 | | | | 78,159,093 | |

| | | | | | | | | | |

| | | | | | | | | 263,265,147 | |

| | | | | | | | | | |

Media | | 14.1% | | | | | | | | |

Fox Corp. - Class A | | | | | 2,078,740 | | | | 70,781,097 | |

New York Times Co. - Class A | | | | | 539,727 | | | | 20,984,586 | |

News Corp. - Class A | | | | | 3,398,606 | | | | 58,693,925 | |

News Corp. - Class B | | | | | 1,440,437 | | | | 25,106,817 | |

World Wrestling Entertainment Inc. - Class A | | | | | 760,901 | | | | 69,439,825 | |

| | | | | | | | | | |

| | | | | | | | | 245,006,250 | |

| | | | | | | | | | |

Pharmaceuticals | | 12.3% | | | | | | | | |

Bristol-Myers Squibb Co. | | | | | 1,350,657 | | | | 93,614,037 | |

Johnson & Johnson | | | | | 265,412 | | | | 41,138,860 | |

Novartis AG - REG | | | | | 857,687 | | | | 78,517,802 | |

| | | | | | | | | | |

| | | | | | | | | 213,270,699 | |

| | | | | | | | | | |

Software | | 16.8% | | | | | | | | |

Electronic Arts Inc. | | | | | 544,670 | | | | 65,605,501 | |

Microsoft Corp. | | | | | 177,532 | | | | 51,182,476 | |

Oracle Corp. | | | | | 1,008,461 | | | | 93,706,196 | |

Salesforce Inc.(a) | | | | | 404,115 | | | | 80,734,095 | |

| | | | | | | | | | |

| | | | | | | | | 291,228,268 | |

| | | | | | | | | | |

Textiles, Apparel & Luxury Goods | | 4.9% | | | | | | | | |

Cie Financiere Richemont S.A. - Class A - REG | | | | | 532,591 | | | | 84,928,168 | |

| | | | | | | | | | |

Tobacco | | 8.4% | | | | | | | | |

British American Tobacco PLC | | | | | 1,540,783 | | | | 53,989,668 | |

Philip Morris International Inc. | | | | | 947,206 | | | | 92,115,783 | |

| | | | | | | | | | |

| | | | | | | | | 146,105,451 | |

| | | | | | | | | | |

See Notes to Financial Statements.

1

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| | | | | | | | | | |

| | | Percentage of Net Assets | | Shares | | | Value | |

Toys/Games/Hobbies | | 3.9% | | | | | | | | |

Nintendo Co. Ltd. | | | | | 1,757,570 | | | $ | 67,920,103 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS (Cost $1,323,459,575) | | | | | | | | | 1,687,353,304 | |

| | | | | | | | | | |

TOTAL INVESTMENTS

(Cost $1,323,459,575) | | 97.3% | | | | | | | 1,687,353,304 | |

NET OTHER ASSETS (LIABILITIES) | | 2.7% | | | | | | | 47,073,497 | |

| | | | | | | | | | |

NET ASSETS | | 100.0% | | | | | | $ | 1,734,426,801 | |

| | | | | | | | | | |

(a)Non-income producing security.

Abbreviations:

REG – Registered

At March 31, 2023, the Fund’s investments were concentrated in the following countries:

| | | | |

| Country Allocation | | Percentage of Net Assets | |

United States | | | 75.4 | % |

Switzerland | | | 9.4 | |

Canada(b) | | | 5.5 | |

Japan | | | 3.9 | |

United Kingdom | | | 3.1 | |

Total | | | 97.3 | % |

| | | | | |

(b)Ritchie Bros. Auctioneers is incorporated in Canada; however, its primary listing is on the New York Stock Exchange (NYSE) in the United States. Independent Franchise Partners, LLP therefore defines Ritchie Bros. Auctioneers as a United States equity, consistent with the terms set out in the prospectus.

See Notes to Financial Statements.

2

ADVISERS INVESTMENT TRUST

STATEMENT OF ASSETS & LIABILITIES

March 31, 2023 (Unaudited)

| | | | |

| | | Independent Franchise Partners US Equity Fund | |

Assets: | | | | |

Investments, at value (Cost: $1,323,459,575) | | $ | 1,687,353,304 | |

Cash | | | 38,570,640 | |

Receivable for dividends | | | 3,837,999 | |

Reclaims receivable | | | 2,578,271 | |

Receivable for capital shares sold | | | 3,710,000 | |

Prepaid expenses | | | 47,937 | |

| | | | |

Total Assets | | | 1,736,098,151 | |

| | | | |

Liabilities: | | | | |

Securities purchased payable | | | 86,474 | |

Investment advisory fees payable | | | 846,176 | |

Accounting and Administration fees payable | | | 675,984 | |

Regulatory and Compliance fees payable | | | 20,662 | |

Risk Officer fees payable | | | 1,613 | |

Accrued expenses and other payables | | | 40,441 | |

| | | | |

Total Liabilities | | | 1,671,350 | |

| | | | |

Net Assets | | $ | 1,734,426,801 | |

| | | | |

Net Assets | | $ | 1,734,426,801 | |

Shares of common stock outstanding | | | 96,638,533 | |

| | | | |

Net asset value per share | | $ | 17.95 | |

| | | | |

Net Assets: | | | | |

Paid in capital | | $ | 1,382,266,096 | |

Distributable earnings (loss) | | | 352,160,705 | |

| | | | |

Net Assets | | $ | 1,734,426,801 | |

| | | | |

|

| |

See Notes to Financial Statements.

3

ADVISERS INVESTMENT TRUST

STATEMENT OF OPERATIONS

For the six months ended March 31, 2023 (Unaudited)

| | | | |

| | | Independent Franchise Partners US Equity Fund | |

Investment Income: | | | | |

Dividend income (Net of foreign withholding tax of $772,873) | | $ | 16,278,884 | |

Operating expenses: | | | | |

Investment advisory | | | 4,955,002 | |

Accounting and Administration | | | 352,542 | |

Regulatory and Compliance | | | 82,977 | |

Trustees | | | 35,034 | |

Legal | | | 27,956 | |

Risk Officer | | | 14,959 | |

Other | | | 53,599 | |

| | | | |

Total expenses | | | 5,522,069 | |

| | | | |

Net investment income | | | 10,756,815 | |

| | | | |

Realized and Unrealized Gains (Losses) from Investment Activities: | | | | |

Net realized losses from investment transactions | | | (1,601,283 | ) |

Net realized gains from foreign currency transactions | | | 42,770 | |

Change in unrealized appreciation (depreciation) on investments | | | 276,768,229 | |

Change in unrealized appreciation (depreciation) on foreign currency | | | 125,246 | |

| | | | |

Net realized and unrealized gains from investment activities | | | 275,334,962 | |

| | | | |

Change in Net Assets Resulting from Operations | | $ | 286,091,777 | |

| | | | |

|

| |

See Notes to Financial Statements.

4

ADVISERS INVESTMENT TRUST

STATEMENTS OF CHANGES IN NET ASSETS

For the six months ended March 31, 2023 (Unaudited) and the year ended September 30, 2022

| | | | | | | | |

| | | Independent Franchise Partners

US Equity Fund | |

| | | 2023 | | | 2022 | |

| |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 10,756,815 | | | $ | 19,641,833 | |

Net realized gains (losses) from investment and foreign currency transactions | | | (1,558,513 | ) | | | 212,430,625 | |

Change in unrealized appreciation (depreciation) on investments and foreign currency | | | 276,893,475 | | | | (512,018,179 | ) |

| | | | | | | | |

Change in net assets resulting from operations | | | 286,091,777 | | | | (279,945,721 | ) |

| | | | | | | | |

Dividends paid to shareholders: | | | | | | | | |

From distributable earnings | | | (235,042,088 | ) | | | (137,522,026 | ) |

| | | | | | | | |

Total dividends paid to shareholders | | | (235,042,088 | ) | | | (137,522,026 | ) |

| | | | | | | | |

Capital Transactions: | | | | | | | | |

Proceeds from sale of shares | | | 46,469,374 | | | | 63,964,242 | |

Value of shares issued to shareholders in reinvestment of dividends | | | 203,432,724 | | | | 131,436,175 | |

Value of shares redeemed | | | (56,743,745 | ) | | | (315,038,992 | ) |

| | | | | | | | |

Change in net assets from capital transactions | | | 193,158,353 | | | | (119,638,575 | ) |

| | | | | | | | |

Change in net assets | | | 244,208,042 | | | | (537,106,322 | ) |

Net assets: | | | | | | | | |

Beginning of period | | | 1,490,218,759 | | | | 2,027,325,081 | |

| | | | | | | | |

End of period | | $ | 1,734,426,801 | | | $ | 1,490,218,759 | |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Sold | | | 2,621,201 | | | | 3,008,252 | |

Reinvested | | | 11,882,753 | | | | 6,238,072 | |

Redeemed | | | (3,183,553 | ) | | | (15,006,072 | ) |

| | | | | | | | |

Change | | | 11,320,401 | | | | (5,759,748 | ) |

| | | | | | | | |

|

| |

See Notes to Financial Statements.

5

ADVISERS INVESTMENT TRUST

FINANCIAL HIGHLIGHTS

For the periods indicated

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Independent Franchise Partners

US Equity Fund | |

| | | | | | |

| | | Six Months Ended March 31, 2023 (Unaudited) | | | Year Ended September 30, 2022 | | | Year Ended September 30, 2021 | | | Year Ended September 30, 2020 | | | Year Ended September 30, 2019 | | | Year Ended September 30, 2018 | |

| |

Net asset value, beginning of period | | $ | 17.47 | | | $ | 22.26 | | | $ | 19.72 | | | $ | 18.67 | | | $ | 18.55 | | | $ | 17.66 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.11 | | | | 0.23 | | | | 0.31 | | | | 0.37 | | | | 0.30 | | | | 0.28 | |

Net realized and unrealized gains (losses) from investments | | | 3.14 | | | | (3.52 | ) | | | 4.70 | | | | 2.72 | | | | 1.06 | | | | 1.51 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 3.25 | | | | (3.29 | ) | | | 5.01 | | | | 3.09 | | | | 1.36 | | | | 1.79 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions paid: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.20 | ) | | | (0.26 | ) | | | (0.30 | ) | | | (0.37 | ) | | | (0.31 | ) | | | (0.24 | ) |

From net realized gains on investments | | | (2.57 | ) | | | (1.24 | ) | | | (2.17 | ) | | | (1.68 | ) | | | (0.93 | ) | | | (0.66 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions paid | | | (2.77 | ) | | | (1.50 | ) | | | (2.47 | ) | | | (2.05 | ) | | | (1.24 | ) | | | (0.90 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Increase from redemption fees | | | — | (a) | | | — | (a) | | | — | (a) | | | 0.01 | | | | — | (a) | | | — | (a) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value | | | 0.48 | | | | (4.79 | ) | | | 2.54 | | | | 1.05 | | | | 0.12 | | | | 0.89 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 17.95 | | | $ | 17.47 | | | $ | 22.26 | | | $ | 19.72 | | | $ | 18.67 | | | $ | 18.55 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return(b), (c) | | | 19.38 | % | | | (15.93 | %) | | | 27.34 | % | | | 17.50 | %(d) | | | 8.67 | % | | | 10.34 | % |

| | | | | | |

Ratios/Supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 1,734,427 | | | $ | 1,490,219 | | | $ | 2,027,325 | | | $ | 1,677,925 | | | $ | 2,128,522 | | | $ | 2,125,045 | |

Ratio of net expenses to average net assets | | | 0.67 | %(e) | | | 0.68 | % | | | 0.72 | % | | | 0.76 | % | | | 0.76 | % | | | 0.76 | % |

Ratio of net investment income to average net assets | | | 1.30 | %(e) | | | 1.06 | % | | | 1.42 | % | | | 1.49 | % | | | 1.62 | % | | | 1.54 | % |

Ratio of gross expenses to average net assets | | | 0.67 | %(e) | | | 0.68 | % | | | 0.72 | % | | | 0.76 | % | | | 0.76 | %(f) | | | 0.76 | %(f) |

Portfolio turnover rate(b), (g) | | | 5.75 | % | | | 25.80 | % | | | 23.67 | % | | | 43.46 | % | | | 37.99 | % | | | 38.63 | % |

| |

| (a) | Redemption fees were less than $0.005 per share. |

| (b) | Not annualized for periods less than one year. |

| (c) | Total return excludes redemption fees. |

| (d) | During the period, the Adviser reimbursed the Fund for a loss realized in connection with a trade error. Such payment represented 0.02% to the Fund’s total return. |

| (e) | Annualized for periods less than one year. |

| (f) | During the periods shown, certain fees were reduced. If such fee reductions had not occurred, the ratio would have been as indicated. |

| (g) | Portfolio turnover rate includes applicable corporate action activity and securities trading as a result of investor subscription and redemption activity. |

See Notes to Financial Statements.

6

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

Advisers Investment Trust (the “Trust”) is a Delaware statutory trust operating under a Fifth Amended and Restated Agreement and Declaration of Trust (the “Trust Agreement”) dated March 9, 2023. The Trust was formerly an Ohio business trust, which commenced operations on December 20, 2011. On March 31, 2017, the Trust was converted to a Delaware statutory trust. As an open-end registered investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2013-08, the Trust follows accounting and reporting guidance under FASB Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The Trust Agreement permits the Board of Trustees (the “Trustees” or “Board”) to authorize and issue an unlimited number of shares of beneficial interest, at no par value, in separate series of the Trust. The Fund is a series of the Trust. These financial statements and notes only relate to the IFP US Equity Fund.

The Fund is a non-diversified fund, meaning it may invest in a smaller number of companies than a diversified fund, and seeks to achieve an attractive long-term rate of return.

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust and Fund. In addition, in the normal course of business, the Trust enters into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund.

| A. | Significant accounting policies are as follows: |

INVESTMENT VALUATION

Investments are recorded at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques employed by the Fund, as described below, maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. These inputs are summarized in the following three broad levels:

Level 1 —quoted prices in active markets for identical assets

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, certain short-term debt securities may be valued using amortized cost. Generally, amortized cost approximates the current value of a security, but since this valuation is not obtained from a quoted price in an active market, such securities would be reflected as Level 2 in the fair value hierarchy.

Security prices are generally provided by an approved independent third party pricing service as of the close of the New York Stock Exchange, normally at 4:00 p.m. Eastern Time, each business day on which the share price of the Fund is calculated. Equity securities listed or traded on a primary exchange are valued at the closing price, if available, or the last sales price on the primary exchange. If no sale occurred on the valuation date, the securities will be valued at the latest quotations as of the close of the primary exchange. Investments in other open-end registered investment companies are valued at their respective net asset value as reported by such companies. In these types of situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

Debt and other fixed income securities, if any, are generally valued at an evaluated price provided by an approved independent pricing source. To value debt securities, pricing services may use various pricing techniques, which take into account appropriate factors such as market activity, yield, quality, coupon rate, maturity, type of issue, trading characteristics, call features, credit ratings and other data, as well as broker quotes. Short-term debt securities of sufficient credit quality that mature within sixty days may be valued at amortized cost, which approximates fair value. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

7

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

The Trustees have designated Independent Franchise Partners, LLP, as investment adviser to the Fund, as the Fund’s Valuation Designee with responsibility for establishing fair value when the price of a security is not readily available or deemed unreliable (e.g., an approved pricing service does not provide a price, a furnished price is in error, certain stale prices, or an event occurs that materially affects the furnished price) according to policies approved by the Board. In addition, fair value pricing may be used if events materially affecting the value of foreign securities occur between the time when the exchange on which they are traded closes and the time when the Fund’s net asset value is calculated. The Fund identifies possible fluctuations in international securities by monitoring the increase or decrease in the value of a designated benchmark index. In the event of an increase or decrease greater than predetermined levels, the Fund may use a systematic valuation model provided by an approved independent third party pricing service to fair value its international equity securities.

In the fair value situations noted above, while the Trust’s valuation policy is intended to result in a calculation of the Fund’s net asset value that fairly reflects security values as of the time of pricing, the Trust cannot ensure that fair values determined pursuant to these guidelines would accurately reflect the price that the Fund could obtain for a security if it were to dispose of that security as of the time of pricing (for instance, in a forced or distressed sale). The prices used by the Fund may differ from the value that would be realized if the securities were sold, and these differences could be material to the financial statements. Depending on the source and relative significance of the valuation inputs in these instances, the instruments may be classified as Level 2 or Level 3 in the fair value hierarchy.

The following is a summary of the valuation inputs used as of March 31, 2023 in valuing the Fund’s investments based upon the three fair value levels defined above:

| | | | | | | | | | | | | | | | |

| Fund | | Level 1 - Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| |

Independent Franchise Partners US Equity Fund | | | | | | | | | | | | | | | | |

Common Stocks(1) | | $ | 1,687,353,304 | | | $ | — | | | $ | — | | | $ | 1,687,353,304 | |

| | | | |

Total Investments | | $ | 1,687,353,304 | | | $ | — | | | $ | — | | | $ | 1,687,353,304 | |

| | | | |

| (1) | See investment industries in the Schedule of Investments. |

As of March 31, 2023, there were no Level 3 securities held by the Fund. There were no transfers to or from Level 3 during the six months ended March 31, 2023.

CURRENCY TRANSACTIONS

The Fund may engage in spot currency transactions for the purpose of foreign security settlement and operational processes. Changes in foreign currency exchange rates will affect the value of the Fund’s securities and the price of the Fund’s shares. Generally, when the value of the U.S. dollar rises in value relative to a foreign currency, an investment in that country loses value because that currency is worth fewer U.S. dollars. Devaluation of a currency by a country’s government or banking authority also may have a significant impact on the value of any investments denominated in that currency. Currency markets generally are not as regulated as securities markets.

INVESTMENT TRANSACTIONS AND INCOME

Investment transactions are accounted for no later than one business day after trade date. At financial reporting period ends, investments are reported as of the trade date. The Fund determines the gain or loss realized from investment transactions by using an identified cost basis method. Dividend income is recognized on the ex-dividend date. Dividends from foreign securities are recorded on the ex-dividend date, or as soon as the information is available.

EXPENSE ALLOCATIONS

Expenses directly attributable to a fund in the Trust are charged to that fund, while expenses that are attributable to more than one fund in the Trust are allocated among the applicable funds on a pro-rata basis to each adviser’s series of funds based on relative net assets or another reasonable basis.

8

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

DIVIDENDS AND DISTRIBUTIONS

The Fund intends to distribute substantially all of its net investment income as dividends to shareholders on an annual basis. The Fund intends to distribute its net realized long-term capital gains and its net realized short-term capital gains at least once a year.

Distributions from net investment income and from net realized capital gain are determined in accordance with Federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America (“GAAP”). These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g. treatment of certain dividend distributions, gains/losses, return of capital, redemption in-kind, etc.), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Distributions to shareholders that exceed net investment income and net realized capital gains for tax purposes are reported as return of capital.

REDEMPTION FEES

The Fund will charge a redemption fee of up to 0.25% of the total redemption amount if you sell your shares, regardless of the length of time you have held your shares and subject to certain exceptions and limitations described in the prospectus. The redemption fee is paid directly to the Fund and is intended to encourage long-term investment in the Fund, to facilitate portfolio management and to avoid (or compensate the Fund for the impact of) transaction and other Fund expenses incurred as a result of shareholder redemptions. Redemption fees charged for the six months ended March 31, 2023 and year ended September 30, 2022 were $64,643 and $450,889, respectively, and are reflected within the value of shares redeemed on the Statements of Changes in Net Assets.

FEDERAL INCOME TAX INFORMATION

No provision is made for Federal income taxes as the Fund intends to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and distribute substantially all of its net investment income and net realized capital gain in accordance with the Code.

As of March 31, 2023, the Fund did not have material uncertain tax positions that would require financial statement recognition or disclosure based on an evaluation of all open tax years for all major tax jurisdictions. The Fund’s Federal tax returns for the tax years ended September 30, 2019, 2020, 2021 and 2022 remain subject to examination by the Internal Revenue Service. Interest or penalties incurred, if any, on future unknown, uncertain tax positions taken by the Fund will be recorded as interest expense on the Statement of Operations.

Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

USE OF ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

9

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

| B. | Fees and Transactions with Affiliates and Other Parties |

The Trust, on behalf of the Fund, has entered into an Investment Advisory Agreement (the “Agreement”) with Independent Franchise Partners, LLP (the “Adviser”) to provide investment management services to the Fund. Total fees incurred pursuant to the Agreement are reflected as “Investment advisory” fees on the Statement of Operations. Under the terms of the Agreement, and for the six months ended March 31, 2023, the Fund paid the Adviser a monthly fee based on the Fund’s daily net assets at the following annualized rates:

| | | | | | |

Adviser’s Assets Under Management(1) | | Scale Discount for Assets in each Range(1) | | Annualized Rate(1) | | Effective Overall Annual Fee(1) |

First $1 billion | | — | | 0.80% | | 0.80% |

$1 - 2 billion | | 0.10% | | 0.70% | | at $2 billion 0.75% |

$2 - 3 billion | | 0.20% | | 0.60% | | at $3 billion 0.70% |

$3 - 4 billion | | 0.30% | | 0.50% | | at $4 billion 0.65% |

$4 - 5 billion | | 0.40% | | 0.40% | | at $5 billion 0.60% |

Above $5 billion | | — | | — | | 0.60% |

| (1) | The Adviser’s total assets under management at the end of each calendar quarter are used to calculate the effective annual fee to be applied during the next calendar quarter. During the six months ended March 31, 2023, the effective annualized rate was 0.60% given the Adviser’s total assets under management were in excess of $5 billion during the period. |

Foreside Financial Services, LLC (the “Distributor”) provides distribution services to the Fund pursuant to a distribution agreement with the Trust, on behalf of the Fund. Under its agreement with the Trust, the Distributor acts as an agent of the Trust in connection with the offering of the shares of the Fund on a continuous basis. The Adviser, at its own expense, pays the Distributor an annual $5,000 fee for these services and reimbursement for certain expenses incurred on behalf of the Fund.

The Northern Trust Company (“Northern Trust”) serves as the administrator, transfer agent, custodian and fund accounting agent for the Fund pursuant to written agreements between the Trust, on behalf of the Fund, and Northern Trust. The Fund has agreed to pay Northern Trust certain annual and transaction-based fees, a tiered basis-point fee based on the Fund’s daily net assets, subject to a minimum annual fee of $175,000 relating to these services, and reimburse for certain expenses incurred on behalf of the Fund as well as other charges for additional service activities. Total fees paid to Northern Trust pursuant to these agreements are reflected as “Accounting and Administration” fees on the Statement of Operations.

Foreside Fund Officer Services, LLC (“Foreside”) provides compliance and financial control services for the Fund pursuant to a written agreement with the Trust, on behalf of the Fund, including providing certain officers to the Fund. The Fund pays Foreside an annual base fee, a basis-point fee based on the Fund’s daily net assets and reimburses for certain expenses incurred on behalf of the Fund. Total fees paid to Foreside pursuant to these agreements are reflected as “Regulatory and Compliance” fees on the Statement of Operations.

Carne Global Financial Services (US) LLC (“Carne”) provides risk management and oversight services for the Fund pursuant to a written agreement between the Trust, on behalf of the Fund, and Carne, including providing the Risk Officer to the Fund to administer the Fund’s risk program and oversee the analysis of investment performance and performance of service providers. The Fund has agreed to pay Carne an annual fee of $30,000 for these services, and reimburse for certain expenses incurred on behalf of the Fund. Total fees paid to Carne pursuant to this agreement are reflected as “Risk Officer” fees on the Statement of Operations.

The officers of the Trust are affiliated with Foreside, Northern Trust, Carne or the Distributor and receive no compensation directly from the Fund for serving in their respective roles. Through March 31, 2023, the Trust paid each Trustee who is not an “interested person,” as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (each, an “Independent Trustee” and, collectively, the “Independent Trustees”) compensation for their services based on an annual retainer of $125,000 and reimbursement for certain expenses. Effective April 1, 2023, the Trust pays an annual retainer of $132,000 and reimbursement for certain expenses. If there are more than six meetings in a year, additional meeting fees may apply. For the six months ended March 31, 2023, the aggregate Trustee compensation paid by the Trust was $218,750. The amount of total Trustee compensation and reimbursement of out-of-pocket expenses allocated from the Trust to the Fund is reflected as “Trustees” fees on the Statement of Operations.

10

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

The Adviser has contractually agreed to waive fees and/or reimburse expenses to the extent necessary to limit the Fund’s total annual fund operating expenses (exclusive of brokerage costs, interest, taxes, dividends on short positions, litigation and indemnification expenses, fees and expenses associated with investments in underlying investment companies and extraordinary expenses) to 0.85% of the average daily net assets of the Fund until January 28, 2024. For the six months ended March 31, 2023, there were no expenses reduced by the Adviser. Any fees waived or expenses reimbursed during a fiscal year are not subject to repayment from the Fund to the Adviser in subsequent fiscal years.

| C. | Investment Transactions |

For the six months ended March 31, 2023, the aggregate costs of purchases and proceeds from sales of securities (excluding short-term investments) for the Fund were as follows:

| | | | | | | | |

| Fund | | Cost of Purchases | | | Proceeds from sales | |

Independent Franchise Partners US Equity Fund | | $ | 93,565,020 | | | $ | 159,947,824 | |

As of March 31, 2023, the cost, gross unrealized appreciation and gross unrealized depreciation on investments, for Federal income tax purposes, were as follows:

| | | | | | | | | | | | | | | | |

| Fund | | Cost | | | Gross Unrealized Appreciation | | | Gross Unrealized (Depreciation) | | | Net Unrealized Appreciation (Depreciation) | |

Independent Franchise Partners US Equity Fund | | $ | 1,341,235,374 | | | $ | 405,394,896 | | | $ | (59,276,966 | ) | | $ | 346,117,930 | |

The tax character of distributions paid to shareholders during the latest tax years ended September 30, 2022 and September 30, 2021 for the Fund was as follows:

| | | | | | | | | | | | | | | | | | | | |

Independent Franchise Partners US Equity Fund | | Ordinary Income | | | Net Long Term Gains | | | Total Taxable Distributions | | | Tax Return of Capital | | | Total Distributions Paid | |

2022 | | $ | 38,179,775 | | | $ | 99,342,251 | | | $ | 137,522,026 | | | $ | — | | | $ | 137,522,026 | |

2021 | | | 43,931,463 | | | | 169,039,186 | | | | 212,970,649 | | | | — | | | | 212,970,649 | |

As of the latest tax year ended September 30, 2022, the components of accumulated earnings on a tax basis were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fund | | Undistributed Ordinary Income | | | Undistributed Long Term Capital Gains | | | Accumulated Earnings | | | Distributions Payable | | | Accumulated Capital and Other Losses | | | Unrealized Appreciation | | | Total Accumulated Earnings | |

Independent Franchise Partners US Equity Fund | | | $23,670,068 | | | | $204,471,984 | | | | $228,142,052 | | | | $ — | | | | $ — | | | | $72,968,964 | | | | $301,111,016 | |

At September 30, 2022, the latest tax year end, the Fund had no capital loss carry-forwards available to offset future net capital gains.

| E. | Concentration of Ownership Risk |

A significant portion of the Fund’s shares may be held in a limited number of shareholder accounts. To the extent that a shareholder or group of shareholders redeem a significant portion of the shares issued by the Fund, this could have a disruptive impact on the efficient implementation of the Fund’s investment strategy.

11

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

The Fund is subject to market risk, which is the risk related to investments in securities in general and the daily fluctuations in the securities markets. The Fund’s investment return per share will change daily based on many factors, including fluctuation in interest rates, the quality of the instruments in the Fund’s investment portfolio, national and international economic conditions, disruptions to business operations and supply chains, staffing shortages, and general market conditions. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Political events, including armed conflict, tariffs and economic sanctions also contribute to market volatility. Securities in the Fund’s portfolio may be impacted by inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics (including COVID-19), climate change and climate-related events, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. These events can have a significant impact on the Fund’s operations and performance.

12

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

ADDITIONAL INFORMATION

March 31, 2023 (Unaudited)

| A. | Summary of Fund Holdings as of March 31, 2023 |

| | | | |

| Market Exposure | | | |

Equity Securities | | % of Net Assets | |

| |

Software | | | 16.8 | % |

Internet Software & Services | | | 15.2 | |

Media | | | 14.1 | |

Pharmaceuticals | | | 12.3 | |

Tobacco | | | 8.4 | |

Commercial Services | | | 8.2 | |

Diversified Financials | | | 6.2 | |

Textiles, Apparel & Luxury Goods | | | 4.9 | |

Insurance | | | 4.2 | |

Toys/Games/Hobbies | | | 3.9 | |

Biotechnology | | | 3.1 | |

Total | | | 97.3 | % |

| | | | | |

| |

| 5 Largest Security Positions | | | |

Issuer | | % of Net Assets | |

| |

Ritchie Bros. Auctioneers Inc. | | | 5.5 | % |

Booking Holdings Inc. | | | 5.4 | |

Oracle Corp. | | | 5.4 | |

Bristol-Myers Squibb Co. | | | 5.4 | |

Philip Morris International Inc. | | | 5.3 | |

Total | | | 27.0 | % |

| | | | | |

As a Fund shareholder, you may incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the examples are useful in comparing ongoing costs only and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples below are based on an investment of $1,000 invested at October 1, 2022 and held for the entire period through March 31, 2023.

The Actual Expense Example below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid” to estimate the expenses you paid on your account during this period.

The Hypothetical Expense Example below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

13

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

ADDITIONAL INFORMATION

March 31, 2023 (Unaudited)

| | | | | | | | | | | | | | |

| | | Expense Ratio | | Beginning Account Value 10/1/2022 | | | Ending Account Value 3/31/2023 | | | Expenses Paid 10/1/22-3/31/23* | |

Actual | | 0.67% | | $ | 1,000.00 | | | $ | 1,193.80 | | | $ | 3.66 | |

Hypothetical | | 0.67% | | $ | 1,000.00 | | | $ | 1,021.59 | | | $ | 3.38 | |

| * | Expenses are calculated using the annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the most recent half fiscal year (182), and divided by the number of days in the current year (365). |

| C. | Liquidity Risk Management Program |

To promote effective liquidity risk management throughout the fund industry and to enhance disclosure regarding fund liquidity and redemption practices, the Securities and Exchange Commission (the “SEC”) adopted Rule 22e-4 under the Investment Company Act of 1940, as amended. This Rule requires every registered open-end management company to establish a liquidity risk management program (the “LRMP”) that, among other things, provides for the assessment, management and review of liquidity risk, the classification of a fund’s portfolio investments into one of four liquidity buckets based upon the number of days that such investments may reasonably be expected to be converted into cash or otherwise disposed of without significantly impacting their price, the establishment of a highly liquid investment minimum where required, and the establishment of a 15% limitation on illiquid investments. Additionally, the Commission adopted Rule 30b1-10 and Form N-LIQUID, which generally requires a fund to notify the SEC when certain liquidity-related events occur.

The Board approved the appointment of the Adviser’s Programme Administrator Team as the administrator of the LRMP for the Fund on November 15, 2018. The Board approved the Fund’s LRMP at its regular board meeting on March 6, 2019. At the Board’s regular meeting on March 8-9, 2023, the Trust’s Chief Compliance Officer and the Adviser each provided a report to the Board on the operation and effectiveness of the LRMP. The Adviser manages liquidity risks associated with the Fund’s investments by monitoring cash and cash equivalents, the use of derivatives, the concentration of investments and the appropriateness of portfolio strategies for open-end funds, and by classifying every fund investment as either highly liquid, moderately liquid, less liquid or illiquid on at least a monthly basis. To assist with the classification of Fund investments, the Adviser has contracted with a third party provider of liquidity monitoring services. The Adviser supplies portfolio-level data and certain assumptions to this provider, which the provider uses to determine preliminary classifications. Once these preliminary classifications are received by the Adviser, the Adviser’s personnel review the information.

The LRMP effectively managed the Fund’s liquidity risks for the twelve-month period ended December 31, 2022. During this period, the Fund held no less than 50% of its total net assets in highly liquid investments. Because the Fund consisted primarily of highly liquid investments, no highly liquid investment minimum was required to be established for the Fund, and the Fund was well under its illiquid investment limitations. Additionally, no events that would require the filing of Form N-LIQUID occurred.

| D. | Shareholder Meeting Results |

A Meeting of Shareholders of the Fund was held on January 5, 2023 at 333 S. Wabash Street, Chicago, Illinois 60604. At the meeting, the following matter was voted upon and approved by the Shareholders: to approve a new investment advisory agreement between the Trust, on behalf of the Fund, and the Adviser.

| | | | | | | | |

| Fund: | | Record Date Outstanding Shares | | Total Voted Shares | | % of Outstanding Shares Voted | | % of Voted Shares “FOR” Proposal |

Independent Franchise Partners US Equity Fund | | 85,441,314 | | 57,309,995 | | 67.075% | | 99.306% |

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by writing to the Fund at Independent Franchise Partners US Equity Fund c/o The Northern Trust Company, P.O. Box 4766, Chicago, Illinois 60680-4766 or by calling the Fund at 855-233-0437 (toll free); and (ii) on the U.S. Securities

14

ADVISERS INVESTMENT TRUST

INDEPENDENT FRANCHISE PARTNERS US EQUITY FUND

ADDITIONAL INFORMATION

March 31, 2023 (Unaudited)

and Exchange Commission’s (the “SEC”) website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (i) without charge, by calling the Fund at 855-233-0437 (toll free); and (ii) on the SEC’s website at www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov. The information on Form N-PORT is also available to shareholders upon written request or by calling the Fund at 855-233-0437 (toll free).

15

Investment Adviser

Independent Franchise Partners, LLP

Level 1, 10 Portman Square

London, W1H 6AZ

United Kingdom

Custodian

The Northern Trust Company

50 South LaSalle Street

Chicago, Illinois 60603

Independent Registered Public

Accounting Firm

PricewaterhouseCoopers LLP

One North Wacker Drive

Chicago, Illinois 60606

Legal Counsel

Thompson Hine LLP

41 South High Street, Suite 1700

Columbus, Ohio 43215-6101

Distributor

Foreside Financial Services, LLC

3 Canal Plaza, Suite 100

Portland, Maine 04101

For Additional Information, call

855-233-0437 or 312-557-7902

IFP 03/23

VONTOBEL U.S. EQUITY INSTITUTIONAL FUND

SEMI-ANNUAL REPORT

March 31, 2023

This report is submitted for the general information of the shareholders of the Vontobel U.S. Equity Institutional Fund (the “Fund”). It is not authorized for the distribution to prospective investors unless preceded or accompanied by an effective prospectus.

ADVISERS INVESTMENT TRUST

VONTOBEL U.S. EQUITY INSTITUTIONAL FUND

TABLE OF CONTENTS

March 31, 2023 (Unaudited)

ADVISERS INVESTMENT TRUST

VONTOBEL U.S. EQUITY INSTITUTIONAL FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| | | | | | | | | | | | |

| | | Percentage of Net Assets | | Shares | | | Value | |

| |

COMMON STOCKS | | | 100.8 | % | | | | | | | | |

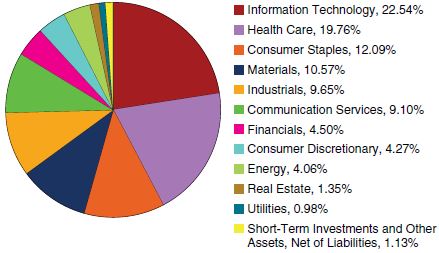

Communication Services | | | 9.1 | % | | | | | | | | |

Alphabet, Inc. - Class A(a) | | | | | | | 2,525 | | | $ | 261,918 | |

Alphabet, Inc. - Class C(a) | | | | | | | 7,654 | | | | 796,016 | |

Comcast Corp. - Class A | | | | | | | 23,272 | | | | 882,242 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,940,176 | |

| | | | | | | | | | | | |

Consumer Discretionary | | | 7.5 | % | | | | | | | | |

Amazon.com, Inc.(a) | | | | | | | 7,255 | | | | 749,369 | |

Booking Holdings, Inc.(a) | | | | | | | 92 | | | | 244,022 | |

Floor & Decor Holdings, Inc. - Class A(a) | | | | | | | 653 | | | | 64,138 | |

Home Depot (The), Inc. | | | | | | | 1,037 | | | | 306,039 | |

NIKE, Inc. - Class B | | | | | | | 1,877 | | | | 230,195 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,593,763 | |

| | | | | | | | | | | | |

Consumer Staples | | | 17.6 | % | | | | | | | | |

Casey’s General Stores, Inc. | | | | | | | 2,996 | | | | 648,514 | |

Coca-Cola (The) Co. | | | | | | | 13,212 | | | | 819,540 | |

Mondelez International, Inc. - Class A | | | | | | | 15,714 | | | | 1,095,580 | |

PepsiCo, Inc. | | | | | | | 3,872 | | | | 705,866 | |

Walmart, Inc. | | | | | | | 3,324 | | | | 490,124 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,759,624 | |

| | | | | | | | | | | | |

Financials | | | 21.3 | % | | | | | | | | |

Berkshire Hathaway, Inc. - Class B(a) | | | | | | | 2,779 | | | | 858,072 | |

CME Group, Inc. | | | | | | | 5,287 | | | | 1,012,566 | |

Intercontinental Exchange, Inc. | | | | | | | 9,096 | | | | 948,622 | |

Mastercard, Inc. - Class A | | | | | | | 2,390 | | | | 868,550 | |

Progressive (The) Corp. | | | | | | | 1,639 | | | | 234,475 | |

Visa, Inc. - Class A | | | | | | | 2,789 | | | | 628,808 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,551,093 | |

| | | | | | | | | | | | |

Health Care | | | 17.3 | % | | | | | | | | |

Abbott Laboratories | | | | | | | 6,532 | | | | 661,430 | |

Becton Dickinson and Co. | | | | | | | 2,155 | | | | 533,449 | |

Boston Scientific Corp.(a) | | | | | | | 15,925 | | | | 796,728 | |

Humana, Inc. | | | | | | | 1,049 | | | | 509,248 | |

Intuitive Surgical, Inc.(a) | | | | | | | 200 | | | | 51,094 | |

Thermo Fisher Scientific, Inc. | | | | | | | 758 | | | | 436,888 | |

UnitedHealth Group, Inc. | | | | | | | 1,499 | | | | 708,412 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,697,249 | |

| | | | | | | | | | | | |

Industrials | | | 5.0 | % | | | | | | | | |

Copart, Inc.(a) | | | | | | | 820 | | | | 61,672 | |

Graco, Inc. | | | | | | | 2,892 | | | | 211,145 | |

Otis Worldwide Corp. | | | | | | | 2,561 | | | | 216,148 | |

Ritchie Bros. Auctioneers, Inc. | | | | | | | 10,237 | | | | 576,241 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,065,206 | |

| | | | | | | | | | | | |

Information Technology | | | 19.8 | % | | | | | | | | |

Adobe, Inc.(a) | | | | | | | 2,511 | | | | 967,664 | |

See Notes to Financial Statements.

1

ADVISERS INVESTMENT TRUST

VONTOBEL U.S. EQUITY INSTITUTIONAL FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| | | | | | | | | | | | |

| | | Percentage of Net Assets | | Shares | | | Value | |

| |

Amphenol Corp. - Class A | | | | | | | 3,363 | | | $ | 274,824 | |

Intuit, Inc. | | | | | | | 1,307 | | | | 582,700 | |

Keysight Technologies, Inc.(a) | | | | | | | 1,625 | | | | 262,405 | |

KLA Corp. | | | | | | | 434 | | | | 173,240 | |

Microsoft Corp. | | | | | | | 4,330 | | | | 1,248,339 | |

ServiceNow, Inc.(a) | | | | | | | 922 | | | | 428,472 | |

Synopsys, Inc.(a) | | | | | | | 716 | | | | 276,555 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,214,199 | |

| | | | | | | | | | | | |

Materials | | | 3.2 | % | | | | | | | | |

Sherwin-Williams (The) Co. | | | | | | | 1,416 | | | | 318,274 | |

Vulcan Materials Co. | | | | | | | 2,051 | | | | 351,870 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 670,144 | |

| | | | | | | | | | | | |

TOTAL COMMON STOCKS (Cost $16,917,800) | | | | | | | | | | | 21,491,454 | |

| | | | | | | | | | | | |

SHORT-TERM INVESTMENTS | | | 0.3 | % | | | | | | | | |

Northern Institutional U.S. Government Select Portfolio – Shares Class, 4.70%(b) | | | | | | | 60,329 | | | | 60,329 | |

| | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $60,329) | | | | | | | | | | | 60,329 | |

| | | | | | | | | | | | |

TOTAL INVESTMENTS

(Cost $16,978,129) | | | 101.1 | % | | | | | | | 21,551,783 | |

NET OTHER ASSETS (LIABILITIES) | | | (1.1 | %) | | | | | | | (225,332 | ) |

| | | | | | | | | | | | |

NET ASSETS | | | 100.0 | % | | | | | | $ | 21,326,451 | |

| | | | | | | | | | | | |

| | | |

(a)Non-income producing security. | | | | | | | | | | | | |

(b)7-day current yield as of March 31, 2023 is disclosed. | | | | | | | | | | | | |

|

At March 31, 2023, the Fund’s investments (excluding short-term investments) were domiciled in the following countries: | |

| | |

| CONCENTRATION BY COUNTRY | | % OF NET ASSETS |

|

United States | | 98.1% |

Canada | | 2.7 |

|

Total | | 100.8% |

|

See Notes to Financial Statements.

2

ADVISERS INVESTMENT TRUST

STATEMENT OF ASSETS & LIABILITIES

March 31, 2023 (Unaudited)

| | | | |

| | | Vontobel U.S. Equity Institutional Fund | |

| |

Assets: | | | | |

Investments, at value (Cost: $16,978,129) | | $ | 21,551,783 | |

Receivable for dividends | | | 17,196 | |

Reclaims receivable | | | 3,130 | |

Receivable for investments sold | | | 54,027 | |

Receivable from investment adviser | | | 32,073 | |

Prepaid expenses | | | 31,020 | |

| | | | |

Total Assets | | | 21,689,229 | |

| | | | |

Liabilities: | | | | |

Securities purchased payable | | | 53,442 | |

Accounting and Administration fees payable | | | 257,711 | |

Regulatory and Compliance fees payable | | | 24,247 | |

Accrued expenses and other payables | | | 27,378 | |

| | | | |

Total Liabilities | | | 362,778 | |

| | | | |

Net Assets | | $ | 21,326,451 | |

| | | | |

| |

Class I Shares: | | | | |

Net Assets | | $ | 21,326,451 | |

Shares of common stock outstanding | | | 1,552,413 | |

| | | | |

Net asset value per share | | $ | 13.74 | |

| | | | |

Net Assets: | | | | |

Paid in capital | | $ | 16,865,126 | |

Distributable earnings (loss) | | | 4,461,325 | |

| | | | |

Net Assets | | $ | 21,326,451 | |

| | | | |

| | | | |

| |

See Notes to Financial Statements.

3

ADVISERS INVESTMENT TRUST

STATEMENT OF OPERATIONS

For the six months ended March 31, 2023 (Unaudited)

| | | | |

| | | Vontobel U.S. Equity Institutional Fund | |

| |

Investment Income: | | | | |

Dividend income (Net of foreign withholding tax of $3,189) | | $ | 155,352 | |

Operating expenses: | | | | |

Investment advisory | | | 51,873 | |

Accounting and Administration | | | 80,280 | |

Regulatory and Compliance | | | 74,795 | |

Trustees | | | 35,034 | |

Legal | | | 22,755 | |

Other | | | 39,393 | |

| | | | |

Total expenses before reductions | | | 304,130 | |

Expenses reduced by Adviser | | | (236,695 | ) |

| | | | |

Net expenses | | | 67,435 | |

| | | | |

Net investment income | | | 87,917 | |

| | | | |

Realized and Unrealized Gains (Losses) from Investment Activities: | | | | |

Net realized gains from investment transactions | | | 35,565 | |

Net realized losses from foreign currency transactions | | | (2 | ) |

Change in unrealized appreciation (depreciation) on investments | | | 2,979,001 | |

Change in unrealized appreciation (depreciation) on foreign currency | | | 10 | |

| | | | |

Net realized and unrealized gains from investment activities | | | 3,014,574 | |

| | | | |

Change in Net Assets Resulting from Operations | | $ | 3,102,491 | |

| | | | |

| | | | |

| |

See Notes to Financial Statements.

4

ADVISERS INVESTMENT TRUST

STATEMENTS OF CHANGES IN NET ASSETS

For the six months ended March 31, 2023 (Unaudited) and the year ended September 30, 2022

| | | | | | | | |

| | | Vontobel U.S. Equity Institutional Fund | |

| | | | |

| | |

| | | 2023 | | | 2022 | |

| |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 87,917 | | | $ | 117,348 | |

Net realized gains (losses) from investment and foreign currency transactions | | | 35,563 | | | | 1,045,059 | |

Change in unrealized appreciation (depreciation) on investments and foreign currency | | | 2,979,011 | | | | (4,711,952 | ) |

| | | | | | | | |

Change in net assets resulting from operations | | | 3,102,491 | | | | (3,549,545 | ) |

| | | | | | | | |

Dividends paid to shareholders: | | | | | | | | |

From distributable earnings | | | (982,720 | ) | | | (2,462,623 | ) |

| | | | | | | | |

Total dividends paid to shareholders | | | (982,720 | ) | | | (2,462,623 | ) |

| | | | | | | | |

Capital Transactions (Class I Shares): | | | | | | | | |

Proceeds from sale of shares | | | 844,327 | | | | 1,562,920 | |

Value of shares issued to shareholders in reinvestment of dividends | | | 292,582 | | | | 643,635 | |

Value of shares redeemed | | | (1,276,987 | ) | | | (850,379 | ) |

| | | | | | | | |

Change in net assets from capital transactions | | | (140,078 | ) | | | 1,356,176 | |

| | | | | | | | |

Change in net assets | | | 1,979,693 | | | | (4,655,992 | ) |

Net assets: | | | | | | | | |

Beginning of period | | | 19,346,758 | | | | 24,002,750 | |

| | | | | | | | |

End of period | | $ | 21,326,451 | | | $ | 19,346,758 | |

| | | | | | | | |

Share Transactions (Class I Shares): | | | | | | | | |

Sold | | | 63,190 | | | | 100,684 | |

Reinvested | | | 22,805 | | | | 41,022 | |

Redeemed | | | (95,440 | ) | | | (57,551 | ) |

| | | | | | | | |

Change | | | (9,445 | ) | | | 84,155 | |

| | | | | | | | |

| | | | | | | | |

| |

See Notes to Financial Statements.

5

ADVISERS INVESTMENT TRUST

FINANCIAL HIGHLIGHTS

For the periods indicated

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | I shares | |

| | | | |

| | | | | | |

Vontobel U.S. Equity Institutional Fund | | Six Months Ended March 31, 2023 (Unaudited) | | | Year Ended September 30, 2022 | | | Year Ended September 30, 2021 | | | Year Ended September 30, 2020 | | | Year Ended September 30, 2019 | | | Period Ended September 30, 2018(a) | |

| |

Net asset value, beginning of period | | $ | 12.39 | | | $ | 16.24 | | | $ | 13.77 | | | $ | 12.35 | | | $ | 11.16 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income(b) | | | 0.06 | | | | 0.08 | | | | 0.05 | | | | 0.07 | | | | 0.09 | | | | 0.05 | |

Net realized and unrealized gains (losses) from investments and foreign currency | | | 1.91 | | | | (2.29 | ) | | | 2.81 | | | | 1.58 | | | | 1.17 | | | | 1.11 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.97 | | | | (2.21 | ) | | | 2.86 | | | | 1.65 | | | | 1.26 | | | | 1.16 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions paid: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.05 | ) | | | (0.06 | ) | | | (0.04 | ) | | | (0.09 | ) | | | (0.07 | ) | | | — | |

From net realized gains | | | (0.57 | ) | | | (1.58 | ) | | | (0.35 | ) | | | (0.14 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions paid | | | (0.62 | ) | | | (1.64 | ) | | | (0.39 | ) | | | (0.23 | ) | | | (0.07 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value | | | 1.35 | | | | (3.85 | ) | | | 2.47 | | | | 1.42 | | | | 1.19 | | | | 1.16 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 13.74 | | | $ | 12.39 | | | $ | 16.24 | | | $ | 13.77 | | | $ | 12.35 | | | $ | 11.16 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return(c) | | | 16.25 | % | | | (15.76 | %) | | | 21.18 | % | | | 13.47 | % | | | 11.46 | % | | | 11.60 | % |

Ratios/Supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 21,326 | | | $ | 19,347 | | | $ | 24,003 | | | $ | 19,816 | | | $ | 15,921 | | | $ | 11,427 | |

Ratio of net expenses to average net assets(d) | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % |

Ratio of net investment income to average net assets(d) | | | 0.85 | % | | | 0.51 | % | | | 0.34 | % | | | 0.54 | % | | | 0.82 | % | | | 0.84 | % |

Ratio of gross expenses to average net assets(d) | | | 2.93 | % | | | 2.74 | % | | | 2.61 | % | | | 3.33 | % | | | 3.15 | % | | | 2.93 | % |

Portfolio turnover rate(c) | | | 17.71 | % | | | 50.11 | % | | | 43.97 | % | | | 57.97 | % | | | 27.31 | % | | | 20.78 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| (a) | For the period from March 27, 2018, commencement of operations, to September 30, 2018. |

| (b) | Net investment income (loss) for the period ended was calculated using the average shares outstanding method. |

| (c) | Not annualized for periods less than one year. |

| (d) | Annualized for periods less than one year. |

See Notes to Financial Statements.

6

ADVISERS INVESTMENT TRUST

VONTOBEL U.S. EQUITY INSTITUTIONAL FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

Advisers Investment Trust (the “Trust”) is a Delaware statutory trust operating under a Fifth Amended and Restated Agreement and Declaration of Trust (the “Trust Agreement”) dated March 9, 2023. The Trust was formerly an Ohio business trust, which commenced operations on December 20, 2011. On March 31, 2017, the Trust was converted to a Delaware statutory trust. As an open-end registered investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2013-08, the Trust follows accounting and reporting guidance under FASB Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies”. The Trust Agreement permits the Board of Trustees (the “Trustees” or “Board”) to authorize and issue an unlimited number of shares of beneficial interest, at no par value, in separate series of the Trust. The Fund is a series of the Trust and commenced operations on March 27, 2018. These financial statements and notes only relate to the Fund.

The Fund is a diversified fund. The investment objective of the Fund is to provide long-term capital appreciation.

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust and Fund. In addition, in the normal course of business, the Trust enters into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund.

A. Significant accounting policies are as follows:

INVESTMENT VALUATION

Investments are recorded at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques employed by the Fund, as described below, maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. These inputs are summarized in the following three broad levels:

Level 1 —quoted prices in active markets for identical assets

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, certain short-term debt securities may be valued using amortized cost. Generally, amortized cost approximates the current value of a security, but since this valuation is not obtained from a quoted price in an active market, such securities would be reflected as Level 2 in the fair value hierarchy.

Security prices are generally provided by an approved independent third party pricing service as of the close of the New York Stock Exchange, normally at 4:00 p.m. Eastern Time, each business day on which the share price of the Fund is calculated. Equity securities listed or traded on a primary exchange are valued at the closing price, if available, or the last sales price on the primary exchange. If no sale occurred on the valuation date, the securities will be valued at the latest quotations as of the close of the primary exchange. Investments in other open-end registered investment companies are valued at their respective net asset value as reported by such companies. In these types of situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

Debt and other fixed income securities, if any, are generally valued at an evaluated price provided by an approved independent pricing source. To value debt securities, pricing services may use various pricing techniques, which take into account appropriate factors such as market activity, yield, quality, coupon rate, maturity, type of issue, trading characteristics, call features, credit ratings and other data, as well as broker quotes. Short-term debt securities of sufficient credit quality that mature within sixty days may be valued at amortized cost, which approximates fair value. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

7

ADVISERS INVESTMENT TRUST

VONTOBEL U.S. EQUITY INSTITUTIONAL FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

The Trustees have designated Vontobel Asset Management, Inc., as investment adviser to the Fund, as the Fund’s Valuation Designee with responsibility for establishing fair value when the price of a security is not readily available or deemed unreliable (e.g., an approved pricing service does not provide a price, a furnished price is in error, certain stale prices, or an event occurs that materially affects the furnished price) according to policies approved by the Board. In addition, fair value pricing may be used if events materially affecting the value of foreign securities occur between the time when the exchange on which they are traded closes and the time when the Fund’s net asset value is calculated. The Fund identifies possible fluctuations in international securities by monitoring the increase or decrease in the value of a designated benchmark index. In the event of an increase or decrease greater than predetermined levels, the Fund may use a systematic valuation model provided by an approved independent third party pricing service to fair value its international equity securities.

In the fair value situations noted above, while the Trust’s valuation policy is intended to result in a calculation of the Fund’s net asset value that fairly reflects security values as of the time of pricing, the Trust cannot ensure that fair values determined pursuant to these guidelines would accurately reflect the price that the Fund could obtain for a security if it were to dispose of that security as of the time of pricing (for instance, in a forced or distressed sale). The prices used by the Fund may differ from the value that would be realized if the securities were sold, and these differences could be material to the financial statements. Depending on the source and relative significance of the valuation inputs in these instances, the instruments may be classified as Level 2 or Level 3 in the fair value hierarchy.

The following is a summary of the valuation inputs used as of March 31, 2023 in valuing the Fund’s investments based upon the three fair value levels defined above:

| | | | | | | | | | | | | | | | |

| Fund | | Level 1 - Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| |

Vontobel U.S. Equity Institutional Fund | | | | | | | | | | | | | | | | |

Common Stocks* | | $ | 21,491,454 | | | $ | — | | | $ | — | | | $ | 21,491,454 | |

Short-Term Investments | | | 60,329 | | | | — | | | | — | | | | 60,329 | |

| | | | |

Total Investments | | $ | 21,551,783 | | | $ | — | | | $ | — | | | $ | 21,551,783 | |

| | | | |

*See additional categories in the Schedule of Investments.

As of March 31, 2023 there were no Level 2 or Level 3 securities held by the Fund. There were no transfers to or from Level 3 during the six months ended March 31, 2023.

CURRENCY TRANSACTIONS

The functional and reporting currency for the Fund is the U.S. dollar. The market values of foreign securities, currency holdings and other assets and liabilities are translated into U.S. dollars based on the current exchange rates each business day. Purchases and sales of securities and income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. The Fund does not separately report the effects of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in Net realized and unrealized gains (and losses) from investment activities on the Statements of Operations. The Fund may invest in foreign currency-denominated securities and may engage in foreign currency transactions either on a spot (cash) basis at the rate prevailing in the currency exchange market at the time or through a forward foreign currency contract. Realized foreign exchange gains or losses arising from sales of spot foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid are included in Net realized gains (losses) from foreign currency transactions on the Statements of Operations. Net unrealized foreign exchange gains (losses) arising from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period are included in Change in unrealized appreciation (depreciation) on foreign currency on the Statement of Operations.

8

ADVISERS INVESTMENT TRUST

VONTOBEL U.S. EQUITY INSTITUTIONAL FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

The Fund may engage in spot currency transactions for the purpose of foreign security settlement and operational processes. Changes in foreign currency exchange rates will affect the value of the Fund’s securities and the price of the Fund’s shares. Generally, when the value of the U.S. dollar rises in value relative to a foreign currency, an investment in that country loses value because that currency is worth fewer U.S. dollars. Devaluation of a currency by a country’s government or banking authority also may have a significant impact on the value of any investments denominated in that currency. Currency markets generally are not as regulated as securities markets.

INVESTMENT TRANSACTIONS AND INCOME

Investment transactions are accounted for no later than one business day after trade date. For financial reporting purposes, investments are reported as of the trade date. The Fund determines the gain or loss realized from investment transactions by using an identified cost basis method. Interest income is recognized on an accrual basis and includes, where applicable, the amortization of premium or accretion of discount. Dividend income is recognized on the ex-dividend date. Dividends from foreign securities are recorded on the ex-dividend date, or as soon as the information is available.

EXPENSE ALLOCATIONS

Expenses directly attributable to a fund in the Trust are charged to that fund, while expenses that are attributable to more than one fund in the Trust are allocated among the applicable funds on a pro-rata basis to each adviser’s series of funds based on relative net assets or another reasonable basis.

DIVIDENDS AND DISTRIBUTIONS

The Fund intends to distribute substantially all of its net investment income as dividends to shareholders on an annual basis. The Fund intends to distribute its net realized long-term capital gains and its net realized short-term capital gains at least once a year.

Distributions from net investment income and from net realized capital gain are determined in accordance with Federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America (“GAAP”). These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g. treatment of certain dividend distributions, gains/losses, return of capital, redemption in-kind, etc.), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Distributions to shareholders that exceed net investment income and net realized capital gains for tax purposes are reported as return of capital.

FEDERAL INCOME TAX INFORMATION

No provision is made for Federal income taxes as the Fund intends to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and distribute substantially all of its net investment income and net realized capital gain in accordance with the Code.

As of March 31, 2023, the Fund did not have uncertain tax positions that would require financial statement recognition or disclosure based on an evaluation of all open tax years for all major tax jurisdictions. The Fund’s tax return for the tax years ended September 30, 2022, 2021, 2020 and 2019 remain subject to examination by the Internal Revenue Service. Interest or penalties incurred, if any, on future unknown, uncertain tax positions taken by the Fund will be recorded as interest expense on the Statement of Operations.

Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

USE OF ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

9

ADVISERS INVESTMENT TRUST

VONTOBEL U.S. EQUITY INSTITUTIONAL FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2023 (Unaudited)

OTHER RISKS