UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT

PURSUANT TO SECTION 13

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2019

Commission file number 001-37777

GRUPO SUPERVIELLE S.A.

(Exact name of Registrant as specified in its charter)

SUPERVIELLE GROUP S.A.

(Translation of Registrant’s name into English)

REPUBLIC OF ARGENTINA

(Jurisdiction of incorporation or organization)

Bartolomé Mitre 434, 5th Floor

C1036AAH Buenos Aires

Republic of Argentina

(Address of principal executive offices)

Alejandra Naughton

Bartolomé Mitre 434, 5th Floor

C1036AAH Buenos Aires

Republic of Argentina

Tel: 54-11-4340-3053

Email: Alejandra.Naughton@supervielle.com.ar

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class | Trading

Symbol(s) | Name of each exchange

on which registered |

| American Depositary Shares, each representing 5 Class B shares of Grupo Supervielle S.A. | SUPV | New York Stock Exchange |

| Class B shares of Grupo Supervielle S.A. | SUPV | New York Stock Exchange* |

*Not for trading, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the New York Stock Exchange.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2019 was:

Title of class | Number of shares outstanding |

| Class B ordinary shares, nominal value Ps.1.00 per share | 394,984,134 |

| Class A ordinary shares, nominal value Ps.1.00 per share | 61,738,188 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated Filer | ☐ | Accelerated Filer | ☒ |

| Non-accelerated Filer | ☐ | Emerging Growth Company | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

TABLE OF CONTENTS

Page

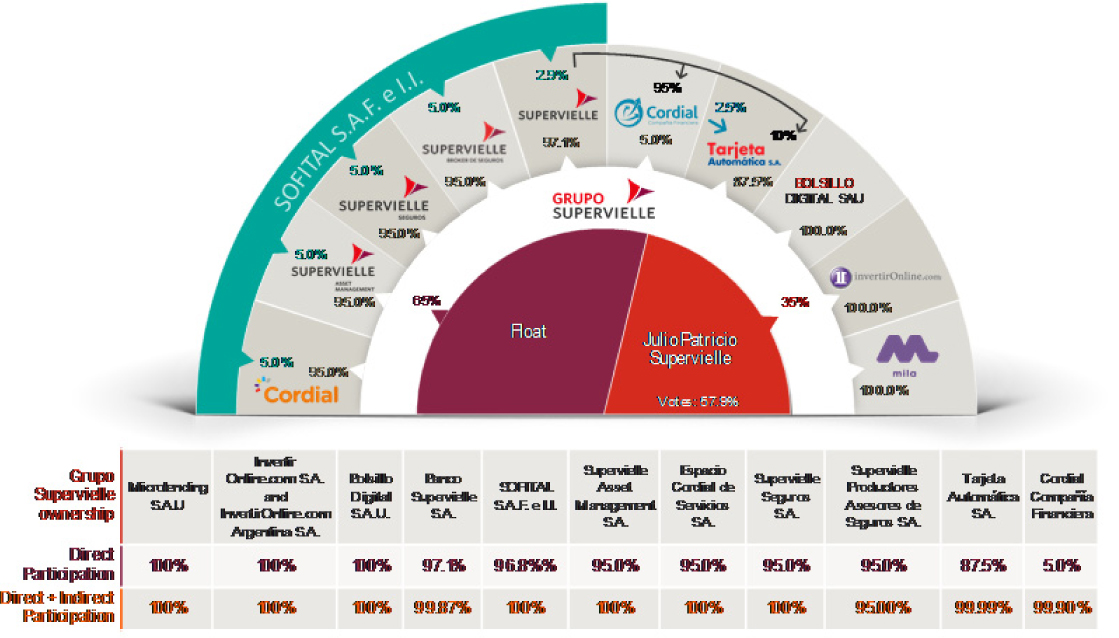

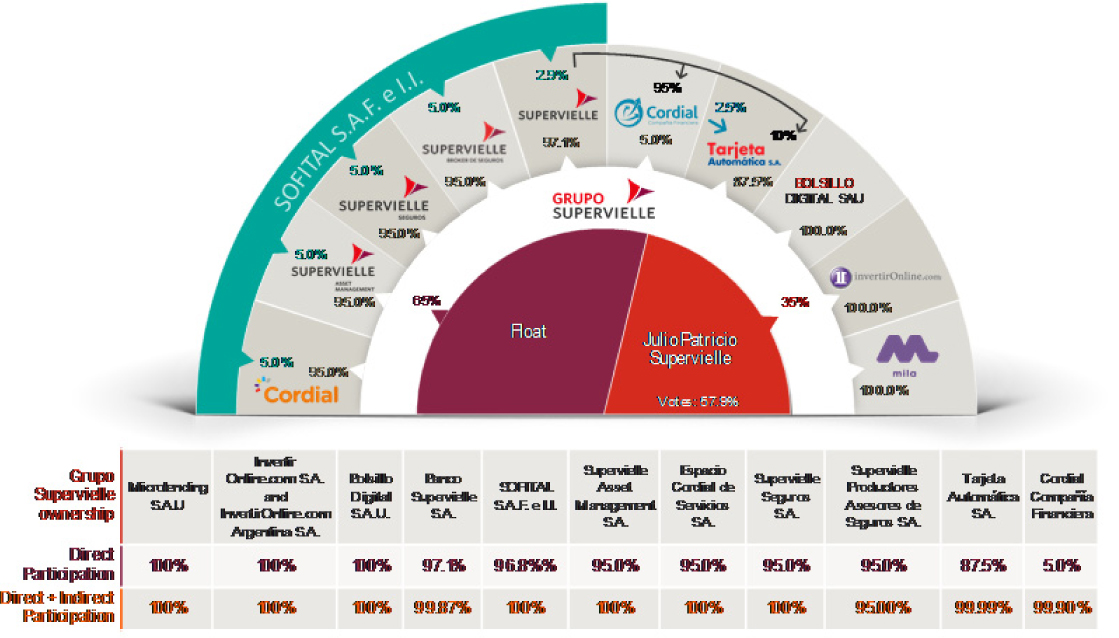

INTRODUCTION

Certain Defined Terms and Conventions

In this annual report, we use the terms “we,” “us,” “our” and the “Group” to refer to Grupo Supervielle S.A. and its consolidated subsidiaries, including Banco Supervielle S.A., unless otherwise indicated. References to “Grupo Supervielle” mean Grupo Supervielle S.A. References to the “Bank” mean Banco Supervielle S.A. and its consolidated subsidiaries. References to “Tarjeta” mean Tarjeta Automática S.A. References to “SAM” mean Supervielle Asset Management S.A. References to “Sofital” mean Sofital S.A.F.e I.I. References to “CCF” mean Cordial Compañía Financiera S.A. References to “Supervielle Seguros” mean Supervielle Seguros S.A. References to “Espacio Cordial” or “Cordial Servicios” mean Espacio Cordial Servicios S.A. References to “InvertirOnline” mean InvertirOnline S.A.U. and InvertirOnline.com Argentina S.A.U. References to “MILA” mean Micro Lending S.A.U. References to “Supervielle Productores Asesores de Seguros” mean Supervielle Productores Asesores de Seguros S.A. References to “Supervielle Agente de Negociacion” mean Supervielle Agente de Negociación S.A.

References to “Class A shares” refer to shares of our Class A common stock, with a par value of Ps.1.00 per share, references to “Class B shares” refer to shares of our Class B common stock, with a par value of Ps.1.00 per share, and references to “ADSs” are to American depositary shares, each representing five Class B shares.

The term “Argentina” refers to the Republic of Argentina. The terms “Argentine government” or the “government” refers to the federal government of Argentina, the term “Central Bank” refers to theBanco Central de la República Argentina, or the Argentine Central Bank, and the term “CNV” refers to the ArgentineComisión Nacional de Valores, or the Argentine securities and capital markets regulator. The term “ByMA” refers to the exchange Bolsas y Mercados Argentinos S.A. The term “MAE” refers to the exchange Mercado Abierto Electrónico S.A. The term “Argentine Capital Markets Law” refers to Law No. 26,831, as amended and supplemented. The term “Argentine Negotiable Obligations Law” refers to Law No. 23,576, as amended and supplemented. The term “AGCL” refers to Argentine General Corporations Law No. 19,550, as amended and supplemented. The term “Argentine Productive Financing Law” refers to Law No. 27,440.

“Argentine GAAP” refers to generally accepted accounting principles in Argentina and “Argentine Banking GAAP” refers to the accounting rules of the Central Bank. “IFRS” refers to the International Financial Reporting Standards, as issued by the International Accounting Standards Board (“IASB”).

The term “GDP” refers to gross domestic product and all references in this annual report to GDP growth are to real GDP growth, the term “CPI” refers to the consumer price index and the term “WPI” refers to the wholesale price index.

The term “customers” refers to individuals or entities that have at least one of our products without any requirement of customer activity during any time period. The term “active customer” refers to customers that had activity in the previous 90 days.

Unless the context otherwise requires, the term “financial institutions” refers to institutions regulated by the Central Bank. The term “Argentine banks” refers to banks that operate in Argentina. The term “Argentine private banks” refers to banks that are not controlled or owned by the Argentine federal government or any Argentine provincial, municipality or city government.

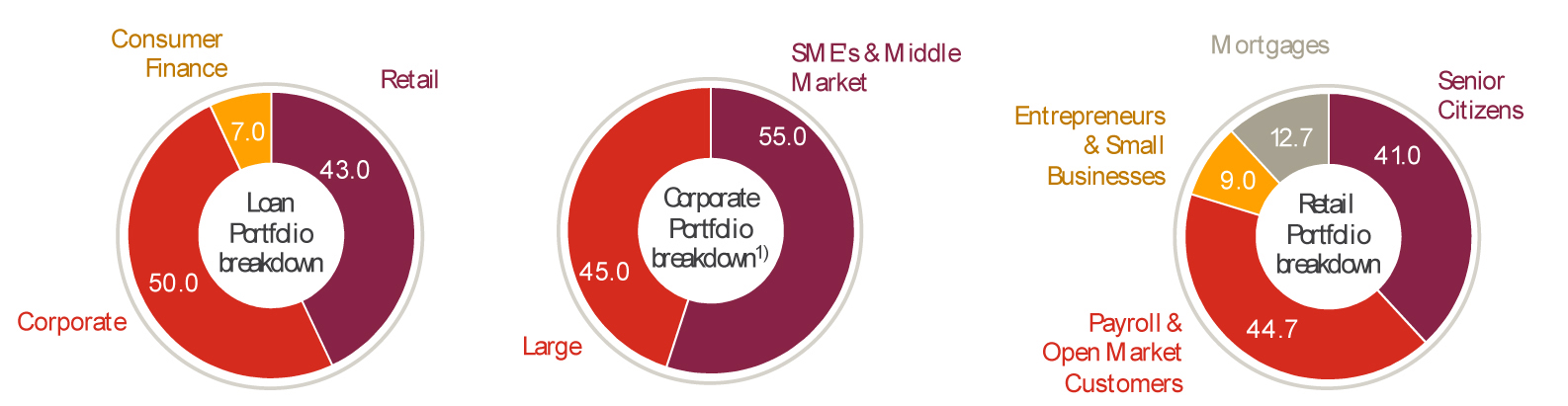

For information up to December 31, 2017, the term “small businesses” refers to individuals and businesses with annual sales of up to Ps.40.0 million, the term “SMEs” refers to individuals and businesses with annual sales over Ps.40.0 million and below Ps.200.0 million, the term “middle-market companies” refers to companies with annual sales over Ps.200.0 million and below Ps.1.0 billion and the term “large corporates” refers to companies with annual sales over Ps.1.0 billion. For information since January 1, 2018, the term “small businesses” refers to individuals and businesses with annual sales up to Ps.70.0 million, the term “SMEs” refers to individuals and businesses with annual sales over Ps.70.0 million and below Ps.550.0 million, the term “middle-market companies” refers to companies with annual sales over Ps.550.0 million and below Ps.2.0 billion and the term “large corporates” refers to companies with annual sales over Ps.2.0 billion. For information since January 1, 2019, the term “small businesses” refers to individuals and businesses with annual sales up to Ps.100 million, the term “SMEs” refers to individuals and businesses with annual sales over Ps.100 million and below Ps.700 million, the term “middle-market companies” refers to companies with annual sales over Ps.700 million and below Ps.2.5 billion and the term “large corporates” refers to companies with annual sales over Ps.2.5 billion.

PRESENTATION of FINANCIAL and Other Information

Financial Statements

This annual report contains our audited consolidated financial statements as of December, 2019 and 2018, and for the years ended December 31, 2019, 2018 and 2017 (our “audited consolidated financial statements”), which have been audited by Price Waterhouse & Co. S.R.L., Buenos Aires, Argentina, a member firm of PricewaterhouseCoopers, an independent registered public accounting firm (“Price Waterhouse & Co.”), whose report is included herein.

We have prepared our audited consolidated financial statements under IFRS for the first time for our financial year ended December 31, 2018, with a transition date of January 1, 2017.

“Financial Reporting in Hyperinflationary Economies” (IAS 29) requires that the financial statements of an entity whose functional currency is one of a hyperinflationary economy be measured in terms of the current unit of measurement at the closing date of the reporting period, regardless of whether they are based on the historical cost method or the current cost method. This requirement also includes the comparative information in financial statements. Our audited consolidated financial statements are stated in the measurement unit current as of December 31, 2019.

In order to conclude on whether an economy is categorized as highly inflationary, IAS 29 outlines a series of factors to be considered, including the existence of an accumulated inflation rate in three years that is approximate or exceed 100%. As of July 1, 2018, Argentina reported a cumulative three-year inflation rate higher than 100% and therefore financial information published as from that date should be adjusted for inflation in accordance with IAS 29. Therefore, we have applied IAS 29 to our audited consolidated financial statements.

Effective January 1, 2019, we adopted IFRS 16 “Leases” using the simplified retrospective approach, so that the cumulative impact of the adoption was recognized in retained earnings at the beginning of the year starting on January 1, 2019, and the comparative figures were consequently not modified. Accordingly, certain comparisons between periods may be affected. See Note 10 to our audited consolidated financial statements and “Operating and Financial Review and Prospects—New Accounting Standards” for a more comprehensive discussion of the effects of the adoption by the Group of this and other new standards.

We are subject to the provisions of Article 2 – Section I – Chapter I of Title IV: Periodical Reporting Requirements of the rules issued by the CNV according to General Resolution No. 622/2013, as amended and supplemented (the “CNV Rules”) and we are required to present our financial statements in accordance with the valuation and disclosure criteria set forth by the Argentine Central Bank. The Argentine Central Bank, through Communications “A” 5541, as amended, set forth a convergence plan towards the application of IFRS as issued by the IASB and the interpretations issued by the IFRIC, for entities under its supervision, effective for fiscal years beginning on or after January 1, 2018. The convergence plan had two exceptions to the application of IFRS: (i) item 5.5 (Impairment) of IFRS 9 “Financial Instruments”, and (ii) IAS 29 “Financial Reporting in Hyperinflationary Economies”, both of which were waived until January 1, 2020, at which time entities will be required to apply the provisions of IFRS in full. We presented our local financial statements under these rules on February 21, 2020.

Our consolidated financial statements contained in this annual report differ in certain material respects from our financial statements as of December 31, 2019 and 2018 and for the years ended December 31, 2019, 2018 and 2017 prepared in accordance with Argentine Banking GAAP and filed with theCNV.

Unless otherwise indicated, all financial information of our company included in this annual report is stated on a consolidated basis under IFRS and in Argentine Pesos subject to inflation accounting adjustment, except for certainregulatory capital information, statistical information for years 2015 and 2016, information about the Argentine financial sector, and national statistical data, which is expressed following Argentine Banking GAAP in nominal historic Peso amounts (i.e., not adjusted for inflation).

Overview of IAS 29

Pursuant to IAS 29, the financial statements of an entity whose functional currency is that of a highly inflationary economy, as mentioned above, should be reported measured in terms of the measuring unit current as of the date of the financial statements. All the amounts included in the statement of financial position which are not stated in terms of the measuring unit current as of the date of the financial statements should be restated adjusted applying the general price index. All items in the statement of income should be stated in terms of the measuring unit current as of the date of the financial statements, applying the changes in the general price index occurred from the date on which the revenues and expenses were originally recognized in the financial statements.

Adjustment for inflation in the initial balances has been calculated considering the indexes based on the price indexes published by the National Institute of Statistics and Census (Instituto Nacional de Estadística y Censos or “INDEC”, per its initials in Spanish).

The principal inflation adjustment procedures are the following:

| · | Monetary assets and liabilities that are recorded in the current currency as of the financial position’s closing date are not restated because they are already stated in terms of the currency unit current as of the date of the financial statements. |

| · | Non-monetary assets and liabilities are recorded at cost as of the financial position date, and equity components are restated applying the relevant adjustment ratios. |

| · | All items in the consolidated income statement are restated applying the relevant conversion factors, as described in Note 1.1(b) to our consolidated financial statements contained in this annual report. |

| · | The effect of inflation in the Group’s net monetary position is included in the consolidated income statement, in the item “Results from exposure to changes in the purchasing power of money.” |

| · | Comparative figures have been adjusted for inflation following the procedure explained in the previous bullets. |

| · | Upon initially applying inflation adjustment, the equity accounts were restated as follows: |

| o | Capital stock was restated as from the date of subscription or the date of the most recent inflation adjustment for accounting purposes, whichever is later. |

| o | The resulting amount was included in the “Results from exposure to changes in the purchasing power of money” account. |

| o | Consolidated Statement of Comprehensive Income were restated as from each accounting allocation. |

| o | The legal reserve and other reserves in the statement of income were not restated as of the initial application date. |

Certain Financial Data

The term “ROAE” refers to return on average shareholders’ equity, calculated based on daily averages. The term “ROAA” refers to return on average assets, calculated based on daily averages. ROAE and ROAA are frequently used by financial institutions as benchmarks to measure profitability compared to peers but not as benchmarks to determine returns for investors, which is affected by multiple factors that ROAE and ROAA do not consider.

Currencies and Rounding

The terms “U.S. dollar” and “U.S. dollars” and the symbol “U.S.$” refer to the legal currency of the United States. The terms “Peso” and “Pesos” and the symbol “Ps.” refer to the legal currency of Argentina.

We have translated certain of the Peso amounts contained in this annual report into U.S. dollars for convenience purposes only. Unless otherwise indicated, the rate used to translate such amounts as of December 31, 2019 was Ps.59.895 to U.S.$1.00, which was the reference exchange rate reported by the Central Bank for U.S. dollars as of December 30, 2019. The Federal Reserve Bank of New York does not report a noon buying rate for Pesos. The U.S. dollar equivalent information presented in this annual report is provided solely for the convenience of investors and should not be construed as implying that the Peso amounts represent, or could have been or could be converted into, U.S. dollars at such rates or at any other rate. The reference exchange rate reported by the Central Bank was Ps.66.635 per U.S.$1.00 as of April 28, 2020.

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

Market Share and Other Information

We make statements in this annual report about our competitive position and market share in, and the market size of, the Argentine banking industry. We have made these statements on the basis of statistics and other information derived from the Central Bank’s publications and other third-party sources that we believe are reliable. Although we have no reason to believe any of this information or these reports are inaccurate in any material respect, we have not independently verified the competitive position, market share and market size or market growth data provided by third parties or by industry or general publications.

In January 2007, the INDEC, which is the only institution in Argentina with the statutory authority to produce official nationwide statistics, modified the methodology used to calculate certain of its indices. On January 8, 2016, the Macri administration issued Decree No. 55/2016 declaring a state of administrative emergency with respect to the national statistical system and the INDEC until December 31, 2016. During this state of emergency, the INDEC suspended the publication of certain statistical data until it completed a reorganization of its technical and administrative structure capable of producing sufficient and reliable statistical information. Following the implementation of certain methodological reforms and the adjustment of macroeconomic statistics on the basis of these reforms, on June 15, 2016, the INDEC published the INDEC Report including revised GDP data for the years 2004 through 2015. As of the date of this annual report, the INDEC has resumed publishing certain revised data, including GDP, foreign trade, poverty and balance of payment statistics.

Forward-Looking Statements

This annual report contains estimates and forward-looking statements, principally in “Item 3.D Risk Factors”, “Item 5.A Operating Results”, and “Item 4.B Business Overview.” We have based these forward-looking statements largely on our current beliefs, expectations and projections about future courses of action, events and financial trends affecting our business. Many important factors, in addition to those discussed elsewhere in this annual report, could cause our actual results to differ substantially from those anticipated in our forward-looking statements, including, among others:

| (i) | the ongoing COVID-19 pandemic and government measures to contain the virus, which are disrupting economic activity globally and in Argentina; |

| (ii) | changes in general economic, financial, business, political, legal, social or other conditions in Argentina, including the performance of the newFernández administration, or elsewhere in Latin America or changes in either developed or emerging markets; |

| (iii) | the effects of the Argentine government’s ongoing restructuring of the country’s sovereign debt; |

| (iv) | fluctuations in the exchange rate of the Peso and inflation; |

| (v) | changes in interest rates and the cost of deposits, which may, among other things, affect margins; |

| (vi) | unanticipated increases in financing or other costs or the inability to obtain additional debt or equity financing on attractive terms, which may limit our ability to fund existing operations and to finance new activities; |

| (vii) | changes in capital markets in general that may affect policies or attitudes toward lending to or investing in Argentina or Argentine companies, including expected or unexpected volatility in domestic and international financial markets; |

| (viii) | changes in government regulation, including tax and banking regulations; |

| (ix) | adverse legal or regulatory disputes or proceedings; |

| (x) | credit and other risks of lending, such as increases in defaults by borrowers; |

| (xi) | exposure to Argentine government liabilities and fluctuations and declines in the value of Argentine public debt; |

| (xii) | increased competition in the banking, financial services, credit card services, asset management and related industries; |

| (xiii) | a loss of market share by any of our main businesses; |

| (xiv) | increase in the allowances for loan losses; |

| (xv) | technological changes or an inability to implement new technologies, changes in consumer spending and saving habits; |

| (xvi) | ability to implement our business strategy; and |

| (xvii) | other factors discussed under “Item 3.D Risk Factors” in this annual report. |

The words “believe,” “may,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “forecast” and similar words are intended to identify forward-looking statements. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, the effects of future regulation and the effects of competition. Forward-looking statements speak only as of the date they were made, and we do not undertake any obligation to update publicly or to revise any forward-looking statements after we distribute this annual report because of new information, future events or other factors, except as required by applicable law. In light of the risks and uncertainties described above, the forward-looking events and circumstances discussed in this annual report might not occur and do not constitute guarantees of future performance. Because of these uncertainties, you should not make any investment decisions based on these estimates and forward-looking statements.

Part I

| Item 1 | Identity of Directors, Senior Management and Advisors |

Not applicable.

| Item 2 | Offer Statistics and Expected Timetable |

Not applicable.

| Item 3.A | Selected Financial Data |

The following selected consolidated financial data should be read in conjunction with our audited consolidated financial statements and related notes beginning on page F-1, the “Presentation of Financial and Other Information” section and the discussion in Item 5 “Item 5.A Operating Results” included elsewhere in this annual report. The selected consolidated statement of income data for the years ended December 31, 2019, 2018 and 2017 and the selected consolidated statement of financial position data as of December 31, 2019 and 2018 have been derived from our audited consolidated financial statements included in this annual report which have been audited by Price Waterhouse & Co., member firm of PricewaterhouseCoopers an independent registered public accounting firm. The selected consolidated statement of financial position data as of December 31, 2017 have been derived from our audited consolidated financial statements that arenot included in this annual report.

Our consolidated financial statements were prepared and presented in accordance with IFRS. We applied IFRS for the first time for the year ended December 31, 2018, with a transition date of January 1, 2017.

Our consolidated financial statements are presented in Argentine Pesos which is our functional currency.

IAS 29 establishes the conditions under which an entity shall restate its financial statements if it is located in an economic environment considered hyperinflationary. This standard requires that the financial statements of an entity that reports in the currency of a highly inflationary economy shall be stated in terms of the measuring unit current at the closing date of the latest reporting period, regardless of whether they are based on a historical cost approach or a current cost approach. To this end, in general terms, the inflation rate must be computed in the non-monetary items as from the acquisition date or the revaluation date, as applicable. These requirements also comprise the comparative information of the financial statements. Accordingly, the following selected consolidated financial data is stated in the measuring unit current as at December 31, 2019.

Solely for convenience of the reader, we have translated certain Peso amounts as of and for the year ended December 31, 2019 into U.S. dollars at the reference exchange rate reported by the Central Bank as of December 31, 2019 which was Ps.59.895 to U.S.$1.00. U.S. dollar equivalent information should not be construed to imply that the Peso amounts represent, or could have been or could be converted into, U.S. dollars at such rates or any other rate.

Our consolidated financial statements contained in this annual report differ in certain material respects from our financial statements as of December 31, 2019 and 2018 and for the years ended December 31, 2019, 2018 and 2017 prepared in accordance with Argentine Banking GAAP and filed with theCNV.

| | | Grupo Supervielle S.A. |

| | | For the year endedDecember 31, |

| | | 2019 | | 2018 | | 2017 |

| | | U.S.$. | | Ps. | | Ps. | | Ps. |

| | | (in thousands of Pesos or U.S. dollars, as indicated) |

| Consolidated Income Statement Data IFRS: | | | | | | | | |

| Interest income | | 747,885 | | | 44,794,595 | | | 46,790,036 | | | 34,250,524 | |

| Interest expenses | | (582,911 | ) | | (34,913,451 | ) | | (26,787,390 | ) | | (12,782,957 | ) |

| Net interest income | | 164,974 | | | 9,881,144 | | | 20,002,646 | | | 21,467,567 | |

| Net income from financial instruments (NIFFI) at fair value through profit or loss | | 349,962 | | | 20,960,966 | | | 9,707,395 | | | 5,454,354 | |

Exchange rate difference on gold and foreign

currency | | (5,411 | ) | | (324,070 | ) | | 1,733,237 | | | 604,734 | |

| NIFFI and Exchange Rate Differences | | 344,551 | | | 20,636,896 | | | 11,440,632 | | | 6,059,088 | |

| Net Financial Income | | 509,525 | | | 30,518,040 | | | 31,443,278 | | | 27,526,655 | |

| Service fee income | | 143,578 | | | 8,599,607 | | | 9,118,706 | | | 9,327,965 | |

| Service fee expenses | | (37,465 | ) | | (2,243,970 | ) | | (2,181,620 | ) | | (1,877,412 | ) |

| Income from insurance activities | | 23,263 | | | 1,393,356 | | | 1,305,522 | | | 1,383,709 | |

| Net Service Fee Income | | 129,376 | | | 7,748,993 | | | 8,242,608 | | | 8,834,262 | |

| Subtotal | | 638,901 | | | 38,267,033 | | | 39,685,886 | | | 36,360,917 | |

| Result from exposure to changes in the purchasing power of money | | (89,483 | ) | | (5,359,565 | ) | | (9,253,021 | ) | | (3,986,190 | ) |

| Other operating income | | 46,002 | | | 2,755,267 | | | 3,805,134 | | | 2,827,476 | |

| Loan loss provisions | | (129,174 | ) | | (7,736,868 | ) | | (7,967,031 | ) | | (6,204,348 | ) |

| Net Operating Income | | 466,246 | | | 27,925,867 | | | 26,270,968 | | | 28,997,855 | |

| Personnel expenses | | 236,485 | | | 14,164,289 | | | 13,504,300 | | | 13,439,165 | |

| Administration expenses | | 126,447 | | | 7,573,543 | | | 8,615,396 | | | 7,566,294 | |

| Depreciations and impairment of non-financial assets | | 30,298 | | | 1,814,671 | | | 665,154 | | | 956,819 | |

| Other operating expenses | | 106,157 | | | 6,358,291 | | | 6,633,161 | | | 6,394,542 | |

| Income / (loss) before taxes | | (33,141 | ) | | (1,984,927 | ) | | (3,147,043 | ) | | 641,035 | |

| Income tax | | (2,817 | ) | | (168,695 | ) | | (1,555,074 | ) | | (1,802,869 | ) |

| Net loss for the year | | (35,958 | ) | | (2,153,622 | ) | | (4,702,117 | ) | | (1,161,834 | ) |

| Net loss for the year attributable to owners of the parent company | | (35,924 | ) | | (2,151,600 | ) | | (4,658,050 | ) | | (1,160,465 | ) |

| Net loss for the year attributable to non-controlling interest | | (34 | ) | | (2,022 | ) | | (44,067 | ) | | (1,369 | ) |

| Other Comprehensive Income | | (798 | ) | | (47,833 | ) | | 371,617 | | | 72,120 | |

| Other comprehensive income attributable to parent company | | (796 | ) | | (47,701 | ) | | 371,231 | | | 72,100 | |

| Other comprehensive income attributable to non-controlling interest | | (2 | ) | | (132 | ) | | 386 | | | 20 | |

| Comprehensive Loss | | (36,756 | ) | | (2,201,455 | ) | | (4,330,500 | ) | | (1,089,714 | ) |

| Comprehensive loss for the year attributable to owners of the parent company | | (36,720 | ) | | (2,199,301 | ) | | (4,286,819 | ) | | (1,088,365 | ) |

| Comprehensive loss for the year attributable to non-controlling interest | | (36 | ) | | (2,154 | ) | | (43,681 | ) | | (1,349 | ) |

| | | Grupo Supervielle S.A. |

| | | As of December 31, |

| | | 2019 | | 2018 | | 2017 |

| | | U.S.$. | | Ps. | | Ps. | | Ps. |

| | | (in thousands of Pesos or U.S. dollars, as indicated) |

| ASSETS | | | | | | | | | | | | |

| Cash and due from banks | | 440,823 | | | 26,403,099 | | | 51,822,372 | | | 25,205,322 | |

| Cash | | 146,107 | | | 8,751,111 | | | 7,368,112 | | | 6,902,384 | |

| Financial institutions and correspondents | | 294,716 | | | 17,651,988 | | | 44,454,260 | | | 18,302,938 | |

| Argentine Central Bank | | 265,922 | | | 15,927,336 | | | 42,132,824 | | | 16,011,978 | |

| Other local financial institutions | | 28,295 | | | 1,694,742 | | | 2,305,439 | | | 2,177,115 | |

| Others | | 499 | | | 29,910 | | | 15,997 | | | 113,845 | |

| Debt Securities at fair value through profit or loss | | 9,492 | | | 568,501 | | | 23,247,329 | | | 25,902,184 | |

| Derivatives | | 4,301 | | | 257,587 | | | 24,496 | | | 61,133 | |

| Repo transactions | | — | | | — | | | — | | | 7,608,341 | |

| Other financial assets | | 35,009 | | | 2,096,866 | | | 2,612,157 | | | 3,674,743 | |

| Loans and other financing | | 1,469,405 | | | 88,010,011 | | | 118,771,635 | | | 134,001,359 | |

| To the non-financial public sector | | 482 | | | 28,872 | | | 50,460 | | | 74,060 | |

| To the financial sector | | 1,077 | | | 64,522 | | | 613,101 | | | 902,009 | |

| To the non-financial private sector and foreign residents | | 1,467,846 | | | 87,916,617 | | | 118,108,074 | | | 133,025,290 | |

| Other debt securities | | 174,615 | | | 10,458,556 | | | 6,631,861 | | | 815,144 | |

| Financial assets in guarantee | | 89,051 | | | 5,333,704 | | | 3,087,750 | | | 2,955,457 | |

| Current income tax assets | | 1,711 | | | 102,458 | | | 910,777 | | | 277,603 | |

| Inventories | | 742 | | | 44,455 | | | 107,557 | | | 240,449 | |

| Investments in equity instruments | | 243 | | | 14,579 | | | 16,005 | | | 105,961 | |

| Property, plant and equipment | | 66,818 | | | 4,002,078 | | | 3,359,290 | | | 3,169,795 | |

| Investment property | | 67,697 | | | 4,054,737 | | | 635,877 | | | 441,610 | |

| Intangible assets | | 73,003 | | | 4,372,514 | | | 4,170,146 | | | 706,737 | |

| Deferred income tax assets | | 27,902 | | | 1,671,195 | | | 1,264,222 | | | 1,779,810 | |

| Non-current assets held for sale | | — | | | — | | | 4,307 | | | — | |

| Other non-financial assets | | 21,610 | | | 1,294,351 | | | 1,367,029 | | | 1,082,140 | |

| TOTAL ASSETS | | 2,482,422 | | | 148,684,691 | | | 218,032,810 | | | 208,027,788 | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Deposits | | 1,486,070 | | | 89,008,177 | | | 145,996,201 | | | 128,119,290 | |

| Non-financial public sector | | 91,329 | | | 5,470,177 | | | 17,083,822 | | | 14,017,493 | |

| Financial sector | | 469 | | | 28,098 | | | 38,821 | | | 35,663 | |

| Non-financial private sector and foreign residents | | 1,394,272 | | | 83,509,902 | | | 128,873,558 | | | 114,066,134 | |

| Liabilities at fair value through profit or loss | | 3,165 | | | 189,554 | | | 412,403 | | | — | |

| Derivatives | | — | | | — | | | 144,944 | | | — | |

| Repo transactions | | 5,340 | | | 319,817 | | | — | | | — | |

| Other financial liabilities | | 152,192 | | | 9,115,565 | | | 6,564,396 | | | 8,883,137 | |

| Financing received from the Argentine Central Bank and other financial institutions | | 150,557 | | | 9,017,597 | | | 12,357,106 | | | 8,008,155 | |

| Unsubordinated negotiable Obligations | | 101,619 | | | 6,086,475 | | | 14,317,445 | | | 19,507,851 | |

| Current income tax liabilities | | — | | | — | | | 1,217,233 | | | 1,873,619 | |

| Subordinated negotiable obligations | | 35,393 | | | 2,119,888 | | | 2,128,759 | | | 1,557,801 | |

| Provisions | | 11,303 | | | 677,018 | | | 133,703 | | | 182,071 | |

| Deferred income tax liabilities | | 8,453 | | | 506,291 | | | 343,586 | | | 45,854 | |

| Other non-financial liabilities | | 137,055 | | | 8,208,914 | | | 8,314,639 | | | 8,634,696 | |

| TOTAL LIABILITIES | | 2,091,147 | | | 125,249,296 | | | 191,930,415 | | | 176,812,474 | |

| SHAREHOLDERS’ EQUITY | | 391,275 | | | 23,435,395 | | | 26,102,395 | | | 31,215,314 | |

| Shareholders’ equity attributable to owners of the parent company | | 390,947 | | | 23,415,797 | | | 26,080,725 | | | 30,873,343 | |

| Shareholders’ equity attributable to non-controlling interests | | 328 | | | 19,598 | | | 21,670 | | | 341,971 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | 2,482,422 | | | 148,684,691 | | | 218,032,810 | | | 208,027,788 | |

| | | Grupo Supervielle S.A. |

| | | As of and for the year ended December 31, |

| | | 2019 | | 2018 | | 2017 |

| SELECTED RATIOS | | | | | | | | | |

| Return on average equity(1) | | (9.2% | ) | | (16.2% | ) | | (4.7% | ) |

| Return on average assets(2) | | (1.1% | ) | | (1.9% | ) | | (0.6% | ) |

| Net Interest Margin(3) | | 21.0% | | | 17.0% | | | 18.4% | |

| Net Fee Income Ratio(4) | | 28.6% | | | 28.6% | | | 31.4% | |

| Efficiency Ratio(5) | | 62.7% | | | 61.8% | | | 66.3% | |

| Cost/assets(6) | | 10.9% | | | 9.5% | | | 11.2% | |

| Basic earnings per share (in Pesos)(7) | | (4.7 | ) | | (10.2 | ) | | (2.5 | ) |

| Diluted earnings per share (in Pesos) | | n/a | | | n/a | | | n/a | |

| Basic earnings per share (in U.S.$.)(8) | | (0.1 | ) | | (4.7 | ) | | (0.0 | ) |

| Diluted earnings per share (in U.S.$.)(8) | | n/a | | | n/a | | | n/a | |

| Liquidity and Capital | | | | | | | | | |

| Loans to Total Deposits(9) | | 106.5% | | | 86.6% | | | 110.1% | |

| Total Equity / Total Assets | | 15.7% | | | 12.0% | | | 14.8% | |

| Pro forma Consolidated Capital / Risk weighted assets(10) | | 12.1% | | | 14.0% | | | 19.6% | |

| Pro forma Consolidated Tier1 Capital / Risk weighted assets(10) | | 11.3% | | | 12.9% | | | 17.2% | |

| LCR Pro forma(10) | | 150.3% | | | 173.4% | | | 113.9% | |

| Risk Weighted Assets/Assets(10) | | 87.2% | | | 73.0% | | | 81.7% | |

| Asset Quality | | | | | | | | | |

| Non-performing loans as a percentage of Total Loans | | 7.4% | | | 4.1% | | | 3.1% | |

| Allowances as apercentageof Total Loans | | 7.1% | | | 6.0% | | | 5.0% | |

| Cost of risk(11) | | 7.5% | | | 5.4% | | | 5.0% | |

| Cost of risk, net(12) | | 7.1% | | | 5.1% | | | 4.7% | |

| Coverage Ratio(13) | | 96.0% | | | 147.2% | | | 162.3% | |

| Other Data | | | | | | | | | |

| Dividends paid to ordinary shares (Ps.million) | | 426.0 | | | 466.1 | | | 505.1 | |

| Dividends per ordinary share (Ps.) | | 0.9 | | | 0.7 | | | 1.1 | |

| Employees | | 5,019 | | | 5,253 | | | 5,236 | |

| Branch and sales points | | 316 | | | 317 | | | 326 | |

| ATMs, self service terminals and cash dispensers with biometric identification | | 955 | | | 920 | | | 704 | |

| (1) | Attributable comprehensive income divided by average shareholders’ equity, calculated on a daily basis and measured in local currency. |

| (2) | Attributable Comprehensive Income divided by average assets, calculated on a daily basis and measured in local currency. |

| (3) | Net interest income + Net income from financial instruments at fair value through profit or loss + Exchange rate differences on gold and foreign currency, divided by average interest-earning assets. Since 2019, the Net Interest Margin ratio (“NIM”) also includes the exchange rate differences and net gains or losses from currency derivatives representing more accurately our financial margin and spreads. This ratio coincides with the net financial margin ratio published in previous years (now renamed as NIM). |

| (4) | Net services fee income + Income from insurance activities divided by the sum of Net interest income + Net income from financial instruments at fair value through profit or loss + Exchange rate differences on gold and foreign currency, net Services fee income, Income from insurance activities, etc. |

| (5) | Personnel, Administrative expenses and Depreciation & Amortization divided by the sum of Net interest income + Net income from financial instruments at fair value through profit or loss + Exchange rate differences on gold and foreign currency, net Services fee income, Income from insurance activities and Other net operating income. |

| (6) | Administration expenses divided by average assets, calculated on a daily basis. |

| (7) | Basic earnings per share (in Pesos) are based upon the weighted average of Grupo Supervielle’s outstanding shares, which were Ps.456.7 million for the year ended December 31, 2019 and 2018 and 392.8 million for the year ended December 31, 2017. |

| (8) | Peso amounts have been translated into U.S. dollars at the reference exchange rate reported by the Central Bank as of December 31, 2019 which was Ps.59.895 to U.S.$1.00. |

| (9) | Loans and Leasing before allowances divided by total deposits. |

| (10) | For the calculation of these line items, see “Item 4.B – Business Overview – Banking Regulation and Supervision.”Proforma ratios include the liquidity retained at the holding company (Grupo Supervielle) level, which are available for future capital injections to our subsidiaries in order to fund our growth strategy. |

| (11) | Loan loss provisions divided by average loans, calculated on a daily basis. |

| (12) | Loan loss provisions including recovered loan loss provisions divided by average loans, calculated on a daily basis. |

| (13) | Allowances for loan losses divided by non-performing loans. |

| Item 3.B | Capitalization and indebtedness |

Not applicable.

| Item 3.C | Reasons for the offer and use of proceeds |

Not applicable.

You should carefully consider the risks described below, as well as the other information in this annual report. Our business, results of operations, financial condition or prospects could be materially and adversely affected if any of these risks occurs. In general, investors take more risk when they invest in the securities of issuers in emerging markets such as Argentina than when they invest in the securities of issuers in the United States and other more developed markets. The risks described below are those known to us and that as of the date of this annual report believe may materially affect us.

Risks Relating to Argentina

Substantially all of our operations, property and customers are located in Argentina. As a result, the quality of our assets, our financial condition and the results of our operations are dependent upon the macroeconomic, regulatory, social and political conditions prevailing in Argentina from time to time. These conditions include growth rates, inflation rates, exchange rates, taxes, foreign exchange controls, changes to interest rates, changes to government policies, social instability, and other political, economic or international developments either taking place in, or otherwise affecting, Argentina.

The ongoing COVID-19 pandemic and government measures to contain the virus are adversely affecting our business and results of operations, and, as conditions are evolving rapidly, we cannot accurately predict the ultimate impact on the Group.

In December 2019, a novel strain of coronavirus (SARS-COV-2) causing a severe acute respiratory syndrome (“COVID-19”) was reported to have surfaced in Wuhan, China. COVID-19 has since spread across the world, including Argentina, and on March 11, 2020, the World Health Organization declared COVID-19 a pandemic. By late April, around 4,000 cases had been confirmed in Argentina. In response, countries have adopted extraordinary measures to contain the spread of the virus, including imposing travel restrictions and closing borders, requiring closures of non-essential businesses, instructing residents to practice social distancing, issuing stay at home orders, implementing quarantines and similar actions. The ongoing pandemic and these extraordinary government measures are disrupting global economic activity and resulting in significant volatility in global financial markets. According to the IMF, the global economy has recently entered into a recession.

The Argentine government has adopted multiple measures in response to the COVID-19 pandemic, including a nationwide mandatory lockdown that began on March 19, 2020 and has been extended several times, most recently through May 10, 2020. The government has also required the mandatory shutdown of businesses not considered essential, including initially the closure of bank branches.

At the same time, in order to mitigate the economic impact of the COVID-19 pandemic and mandatory lockdown and shutdown of non-essential businesses, the Argentine government has adopted social aid, monetary and fiscal measures. We cannot assure you whether these measures will be sufficient to prevent a severe economic downturn in Argentina, particularly if current conditions are prolonged and if Argentina’s main trading partners are concurrently facing an economic recession. However, the Argentine government may have more limited resources at this time to support the country’s economy; the pandemic has struck at a time when Argentina is struggling to pull out of a two year recession and the government is seeking to restructure the country’s large sovereign debt.

Some of the measures adopted by the Argentine government may adversely affect financial institutions, such as our Group. These temporary measures include (i) postponement of loan payments without punitive interests, (ii) prohibiting banks to charge fees for ATM transactions, (iii) freezing mortgage payments and suspending foreclosures, (iv) the automatic refinancing of credit card payments and reduction of the maximum interest rates that can be charged on credit cards, (v) imposing a minimum interest rate to be paid on time deposits under Ps.1 million made by individuals, and (vi) forbidding bank account closures. Additionally, some of the government measures are aimed at encouraging bank lending, such as (i) limitations on banks’ holdings of notes from the Central Bank (LELIQ), in order to make liquidity available and encourage the provision of credit lines to SMEs, (ii) lowering of reserve requirements on loans to households and SMEs, and (iii) the easing of bank loan classification rules (providing an additional 60 days of non-payment before a loan is required to be classified as non-performing). Moreover, banks may not distribute dividends until at least June 30, 2020 or carry out employees’ layoffs until at least May 30, 2020. For more information on regulations in connection with the COVID-19 pandemic and their impact on our Group, see “Item 4.B.—Business Overview—Argentine Banking Regulations – Government Measures in Response to the Ongoing COVID-19 Pandemic” and “Item 5.A Operating Results – The Ongoing COVID-19 Pandemic.” Although these measures may help attenuate the economic impact on the Argentine economy overall, they may have a negative impact on our business and results of operations.

The ongoing COVID-19 pandemic and government measures taken to contain the spread of the virus are adversely affecting our business and results of operations. Our branches were required to remain closed during the second half of March 2020, and were subsequently only gradually allowed to open with limited operations. As of the date of this annual report, banks are permitted to open to provide limited services to clients, in each case with prior appointment, provided that certain health and safety requirements set forth by the Central Bank are complied with. Additionally, we have transitioned a significant part of our workforce to work remotely, which may exacerbate certain risks to our business, including an increased reliance on information technology resources, increased risk of phishing and other cybersecurity attacks, and increased risk of unauthorized dissemination of sensitive personal information. Moreover, we face various risks arising from the economic impact of the pandemic and government measures which are difficult to predict accurately at this time, such as (i) a higher risk of impairment of our assets, (ii) lower revenues as a consequence of the temporary restrictions on charging certain fees to customers, and as a result of lower interest rates on loans promoted by the Central Bank, (iii) a possible significant increase in loan defaults and credit losses, with a consequent increase in loan loss provisions, and (iv) a decrease in credit demand and in our business activity in general, particularly new retail lending.

We are continuing to monitor the impact of the ongoing COVID-19 pandemic on the Group. The ultimate impact of the pandemic on our business, results of operations and financial condition remains highly uncertain and will depend on future developments outside of our control, including the intensity and duration of the pandemic and the government measures taken in order to contain the virus or mitigate the economic impact. To the extent the COVID-19 pandemic adversely affects our business, it may also have the effect of heightening many of the other risks described in this “Risk Factors” section.

Economic and political instability in Argentina may adversely and materially affect our business, results of operations and financial condition.

The Argentine economy has experienced significant volatility in recent decades, characterized by periods of low or negative growth, high levels of inflation and currency devaluation. As a consequence, our business and operations have been, and could in the future be, affected from time to time to varying degrees by economic and political developments and other material events affecting the Argentine economy, such as: inflation; price controls; foreign exchange controls; fluctuations in foreign currency exchange rates and interest rates; governmental policies regarding spending and investment, national, provincial or municipal tax increases and other initiatives increasing government involvement with economic activity; civil unrest and local security concerns. You should make your own investigation into Argentina’s economy and its prevailing conditions before making an investment in us.

During 2001 and 2002, Argentina went through a period of severe political, economic and social crisis. Among other consequences, the crisis resulted in Argentina defaulting on its foreign debt obligations, introducing emergency measures and numerous changes in economic policies that affected utilities, financial institutions, and many other sectors of the economy. Argentina also suffered a significant real devaluation of the Peso, which in turn caused numerous Argentine private sector debtors with foreign currency exposure to default on their outstanding debt. In the past three years, GDP grew 2.7% in 2017, but it contracted 2.5% in 2018 and 2.2% in 2019.

A decline in international demand for Argentine products, a lack of stability and competitiveness of the Peso against other currencies, a decline in confidence among consumers and foreign and domestic investors, a high rate of inflation and future political uncertainties, among other factors, may affect the development of the Argentine economy, which could lead to reduced demand for our services and adversely affect our business, financial condition and results of operations.

The primary elections (Elecciones Primarias, Abiertas y Simultáneas y Obligatorias - “PASO”, per its acronym in Spanish), which define which political parties and which candidates of the different political parties may run in the general elections, took place in August 11, 2019. In these elections, theFrente de Todos coalition (a political coalition composed of, among others, the Justicialist Party and the Renovating Front, which was at the time part of the opposition and included former president Fernandez de Kirchner as a candidate to the vice-presidency) obtained 47.78% of the votes, whileJuntos por el Cambio coalition (then president Mr. Mauricio Marcri’s coalition), obtained 31.79% of the votes.

After the results of the primary elections, the Peso devalued almost 30% and the share price of Argentine listed companies dropped approximately 38% on average. In turn, the emerging market bond index (EMBI) peaked to one of the highest levels in Argentine history, above 2000 points on August 28, 2019. As of April 28, 2020 the EMBI was 3,995 points. As a consequence of the aforementioned effects, in order to control the currency outflow and restrict exchange rate fluctuations, the Central Bank re-implemented exchange controls, in hopes of strengthening the normal functioning of the economy, fostering a prudent administration of the exchange market, reducing the volatility of financial variables and containing the impact of the variations of financial flows on the real economy.

Presidential and Congressional elections in Argentina took place on October 27, 2019, which resulted in Mr. Alberto Fernández being elected President of Argentina, having earned 48.1% of the votes. The Fernández administration assumed office on December 10, 2019. As of such date, the Argentine Congress was composed as follows:Frente de Todoscommanded a majority in the Senate with 41 seats, with the first minority beingJuntos por el Cambio with 28 seats; while in the House of RepresentativesJuntos por el Cambio commanded the first minority with 119 seats and the second minority belongs to the Frente de Todos with 116 seats.

The political uncertainty in Argentina about the measures that the new Fernández administration could take with respect to the economy, including with respect to the crisis resulting from the ongoing COVID-19 pandemic, could generate volatility in the price of the Argentine companies’ securities or even a decrease in their prices, in particular companies in the financial sector like us.

We can offer no assurances as to the policies that may be implemented by the new Fernández Argentine administration, or that political developments in Argentina will not adversely affect the Argentine economy and our financial condition and results of operations. In addition, we cannot assure you that future economic, regulatory, social and political developments in Argentina will not impair our business, financial condition or results of operations, or cause the market value of our shares to decline.

If the current levels of inflation continue or increase, the Argentine economy and our financial position and business could be adversely affected.

In the past, inflation has materially undermined the Argentine economy and Argentina’s ability to create conditions that would permit growth. High inflation may also undermine Argentina’s competitiveness abroad and lead to a decline in private consumption which, in turn, could also affect employment levels, salaries and interest rates. Moreover, a high inflation rate could undermine confidence in the Argentine financial system, reducing the Peso deposit base and negatively affecting long-term credit markets.

The INDEC reported a cumulative variation of the CPI of 24.8% for 2017, 47.6% for 2018 and 53.8% for 2019.

There can be no assurances that inflation rates will not continue to escalate in the future or that the measures adopted or that may be adopted by the new Fernández administration to control inflation will be effective or successful. Inflation remains a challenge for Argentina. Significant inflation could have a material adverse effect on Argentina’s economy and in turn could increase our costs of operation, in particular labor costs, and may negatively affect our business, financial condition and results of operations.

A high level of uncertainty with regard to these economic variables, and a general lack of stability in terms of inflation, could have a negative impact on economic activity and adversely affect our financial condition.

The Argentine government’s ability to obtain financing from international markets is limited, which may impair its ability to implement reforms and foster economic growth, which may negatively impact our financial condition or cash flows.

In 2005 and 2010, Argentina conducted exchange offers to restructure part of its sovereign debt that had been in default since the end of 2001. As a result of these exchange offers, Argentina restructured over 92% of its eligible defaulted debt. However,litigation initiated by bondholders thatdid not accept Argentina’s settlement offers continued in several jurisdictions and limited the country’s access to international capital markets. In April 2016, the Argentine government settled U.S.$4.2 billion outstanding principal amount of untendered debt.

In 2018, due to Argentina’s limitation of access to international markets, the Argentine government and the IMF entered into a “stand-by” credit facility agreement for an amount of U.S.$57.1 billion with a 36-month maturity. As of the date of this annual report, Argentina has received disbursements under the agreement for U.S.$46.1 billion. Notwithstanding the foregoing, thenew Fernández administration has publicly announced that they will refrain from requesting additional disbursements under the agreement, and instead vowed to renegotiate its terms and conditions in good faith.

Thenew Fernández administration has initiated negotiations with creditors in order to restructurethe country’s current Peso and U.S. dollar-denominated public debt. In this context, on February 5, 2020, the Argentine Congress passed Law N° 27,544, by virtue of which the sustainability ofthe sovereign debt is declared a national priority, authorizing the Ministry of Economy to renegotiate new terms and conditions with Argentina’s creditors within certain parameters.

Additionally, in the midst of debt restructuring negotiations, on April 5, 2020 the Argentine government issued Decree No. 346/2020, through which the repayment of Argentine law-governed dollar-denominated notes was postponed.

On April 21, 2020, the Argentine government launched an exchange offer with the aim of refinancing its external indebtedness in a manner which does not compromise the development and potential growth of Argentina in the next years. For more information on this offer, see “Item 5.A—Operating Results—The Argentine Economy and Financial System—Argentina’s Sovereign Debt Restructuring”. As of the date of this annual report,the exchange offer is still open and there is uncertainty as to whether the Argentine government will be able to successfully carry out theexchangeofferand restructure its foreign financial indebtedness, under the proposed terms or at all.

If the Argentine government is not able to successfully renegotiate the terms ofthe sovereign debt, or if the negotiations with creditors are prolonged beyond May 22, 2020, or if significant litigation with holdout bondholders results from such negotiations,the country’s ability to access international credit markets may be adversely affected.Additionally, the pressure from creditors may result in restructured terms that are not sustainable for Argentina, or the IMF may impose strict austerity measures as a condition to restructuring its debt. As a result, the Argentine government may not have theability or the financial resources necessary to foster economic growth, which, in turn, could have a material adverse effect on the country’s economy and, consequently, our business and results of operations. Furthermore, Argentina’s inability to obtain credit in international markets could have a direct impact on our own ability to access international credit markets to finance our operations and growth, which could adversely affect our results of operations and financial condition.

Fluctuations in the value of the Peso could adversely affect the Argentine economy, and consequently our results of operations or financial condition.

Fluctuations in the value of the Peso may also adversely affect the Argentine economy, our financial condition and results of operations. In 2017, 2018 and 2019, the Peso lost approximately 18.4%, 101% and 58% of its value against the U.S. dollar, respectively.The devaluation of the Peso in real terms can have a negative impact on the ability of certain Argentine businesses to honor their foreign currency denominated debt, and also lead to very high inflation and significant reduced real wages. The devaluation can also negatively impact businesses whose success is dependent on domestic market demand, and adversely affect the Argentine government’s ability to honor its foreign debt obligations. A substantial increase in the value of the Peso against the U.S. dollar also represents risks for the Argentine economy since it may lead to a deterioration of the country’s current account balance and the balance of payments which may have a negative effect on GDP growth and employment, and reduce the revenues of the Argentine public sector by reducing tax revenues in real terms, due to its current heavy dependence on export taxes.

As of April 28, 2020, the exchange rate was Ps.66.635 per dollar.

As a result of the greater volatility of the Peso, the former administration announced several measures to restore market’s confidence and stabilize the value of the Argentine Peso. Among them, during 2018, the Argentine government negotiated two agreements with the IMF, increased the interest rates and the Central Bank decided to intervene in the exchange market in order to stabilize the value of the Peso. During 2019, based on a new agreement with the IMF, the government established a new regime for a stricter control of the local monetary base, which would remain in place until December 2019, in an attempt to reduce the amount of Pesos available in the market and reduce the demand for foreign currency. Complementing these measures,in September 2019, foreign currency controls were reinstated in Argentina. As a consequence of the reimposition of exchange controls, the spread between the official exchange rate and other exchange rates resulting implicitly from certain common capital market operations (“dolar MEP” or “contado con liquidación”) has broadened significantly, reaching a value of approximately 50% above the official exchange rate. The success of any measures taken by the Argentine government to restore market’s confidence and stabilize the value of the Argentine Peso is uncertain and the continued depreciation of the Peso could have a significant adverse effect on our financial condition and results of operations.

The maintenance or implementation in the future of new exchange controls, restrictions on transfers abroad and capital inflow restrictions could limit the availability of international credit and could threaten the financial system, which may adversely affect the Argentine economy and, as a result, our business.

In 2001 and 2002, following a run on the financial system triggered by the public’s lack of confidence in the continuity of the convertibility regime that resulted in massive capital outflows, the Argentine government imposed exchange controls and transfer restrictions, substantially limiting the ability of companies to retain foreign currency or make payments abroad. Although several of such exchange controls and transfer restrictions were subsequently suspended or terminated, in June 2005 the federal government issued a decree that established new controls on capital inflows, which resulted in a decrease in the availability of international credit for Argentine companies. From 2011 until 2015, the Argentine government increased controls on the sale of foreign currency and the acquisition of foreign assets by local residents, limiting the possibility of transferring funds abroad.

After former Macri’s administration eliminated a significant portion of the foreign exchange restrictions, on September 1, 2019 it temporarily reinstated exchange restrictions, followed by new exchange restrictions imposed by the new Fernandez’s administration. The new controls apply with respect to access to the foreign exchange market by residents for savings and investment purposes abroad, the payment of external financial debt abroad, the payment of dividends in foreign currency abroad, payments of imports of goods and services, and the obligation to repatriate and settle for Pesos the proceeds from exports of goods and services, among others. For more information on foreign exchange restrictions, see “Item 10.D—Exchange Controls.”

Exchange control measures may negatively affect Argentina’s international competitiveness, discouraging foreign investments and lending by foreign investors or increasing foreign capital outflow which could have an adverse effect on economic activity in Argentina, and which in turn could adversely affect our business and results of operations.

The Argentine economy may be adversely affected by economic developments in other markets and by more general “contagion” effects, which could have a material adverse effect on Argentina’s economic growth, and consequently, could adversely affect our business, financial condition and results of operations.

Argentina’s economy is vulnerable to external shocks that could be caused by adverse developments affecting its principal trading partners. A significant decline in the economic growth of any of Argentina’s major trading partners (including Brazil, the European Union, China and the United States), including as a result of the ongoing COVID-19 pandemic, could have a material adverse impact on Argentina’s balance of trade and adversely affect Argentina’s economic growth. In addition, Argentina may be affected by economic and market conditions in other markets worldwide, as was the case in 2008/2009, when the globalfinancial crisis led to asignificant economiccontraction in Argentina in 2009.

Since 2015, the Brazilian economy, Argentina’s largest export market and the principal source of imports, has experienced heightened negative pressure due to the uncertainties stemming from the ongoing political crisis, including the impeachment of Brazil’s president, which resulted in the Senate of Brazil removing Ms. Dilma Rousseff from office for the rest of her term on August 31, 2016. Mr. Michel Temer, who previously held office as vice president of Brazil, subsequently took office until the end of the presidential period and in October 2018, Mr. Jair Bolsonaro was elected president. Mr. Bolsonaro has liberal, conservative and nationalist tendencies and assumed office on January 1, 2019. Given that Brazil is the largest economy in Latin America, the measures taken to clean up its economy can have a great impact in the region. A further deterioration in economic conditions in Brazil may reduce the demand for Argentine exports to the neighboring country and, if this occurs, it could have a negative effect on the Argentine economy and potentially on our operations.

In addition, financial and securities markets in Argentina have been influenced by economic and market conditions in other markets worldwide. Although economic conditions vary from country to country, investors’ perceptions of events occurring in other countries have in the past substantially affected, and may continue to substantially affect, capital flows into, and investments in securities from issuers in, other countries, including Argentina. International investors’ reactions to events occurring in one market sometimes demonstrate a “contagion” effect in which an entire region or class of investment is disfavored by international investors.

The Argentine financial system and securities markets could be also adversely affected by events in developed countries’ economies, such as the United States and Europe. On June 23, 2016, the United Kingdom voted in favor of the United Kingdom exiting the European Union (“Brexit”). The United Kingdom formally left the European Union on January 31, 2020. Even when the United Kingdom agreed its departure from the European Union, negotiations on the terms and conditions are expected to continue during the transition period, which is dueto expire on December 31, 2020. The effects of the Brexit vote and the perceptions as to the impact of the withdrawal of the United Kingdom from the European Union may adversely affect business activity and economic and market conditions in the United Kingdom, the Eurozone and globally, and could contribute to instability in global financial and foreign exchange markets. In addition, Brexit could lead to additional political, legal and economic instability in the European Union and have a negative impact on the commercial exchange of Argentina with that region.

On November 8, 2016, Mr. Donald Trump was elected president of the United States. His presidency has created significant uncertainty about the future relationships between the United States and other countries, including with respect to the trade policies, treaties, government regulations and tariffs that could apply to trade between the United States and other nations. We cannot predict how Mr. Trump’s protectionist measures will evolve or how they may affect Argentina, nor will the effect that the same or any other measure taken by the Trump administration could cause on global economic conditions and the stability of global financial markets. Moreover, the next presidential elections in the United States are expected to take place in November 2020, and we cannot predict the outcome of such elections.

In July 2019, the Common Market of the South (“MERCOSUR”) signed a strategic partnership agreement with the European Union (the “EU”), which is expected to enter into force in 2021, once approved by the relevant legislatures of each member country. The objective of this agreement is to promote investments, regional integration, increase the competitiveness of the economy and achieve an increase in GDP. However, the effect that this agreement could have on the Argentine economy and the policies implemented by the Argentine government is uncertain.

Changes in social, political, regulatory and economic conditions in other countries or regions, or in the laws and policies governing foreign trade, could create uncertainty in the international markets and could have a negative impact on emerging market economies, including the Argentine economy. Also, if these countries fall into a recession, the Argentine economy would be impacted by a decline in its exports, particularly of its main agricultural commodities. All of these factors could have a negative impact on Argentina’s economy and, in turn, our business, financial condition and results of operations.

Furthermore, the financial markets have also been affected by the oil production crisis in March 2020 arising from the OPEC’s failure to reduce production. For more information, see in this section “Sustained declines in the international prices for oil could have an adverse material effect on the Argentine and the global economy.” Any of these factors could depress economic activity and restrict our access to suppliers and could have a material adverse effect on our business, financial condition and results of operations.

Government measures, as well as pressure from labor unions, could require salary increases or added benefits, all of which could increase the company’s operating costs.

In the past, the Argentine government has passed laws and regulations forcing privately owned companies to maintain certain wage levels and provide added benefits for their employees. Additionally, both public and private employers have been subject to strong pressure from the workforce and trade unions to grant salary increases and certain worker benefits.

Labor relations in Argentina are governed by specific legislation, such as labor Law No. 20,744 and Collective Bargaining Law No. 14,250, which, among other things, dictate how salary and other labor negotiations are to be conducted. Every industrial or commercial activity is regulated by a specific collective bargaining agreement that groups companies together according to industry sectors and by trade unions. While the process of negotiation is standardized, each chamber of industrial or commercial activity separately negotiates the increases of salaries and labor benefits with the relevant trade union of such commercial or industrial activity. In the banking activity, salaries are established on an annual basis through negotiations between the chambers that represent the banks and the banking employees’ trade union. The National Labor Ministry mediates between the parties and ultimately approves the annual salary increase to be applied in the banking activity. Parties are bound by the final decision once it is approved by the labor authority and must observe the established salary increases for all employees that are represented by the banking union and to whom the collective bargaining agreement applies.

In addition, each company is entitled, regardless of union-negotiated mandatory salary increases, to give its employees additional merit increase or variable compensation scheme.

Argentine employers, both in the public and private sectors, have experienced significant pressure from their employees and labor organizations to increase wages and to provide additional employee benefits. Due to the high levels of inflation, employees and labor organizations are demanding significant wage increases. In August 2018, the National Labor Ministry resolved to increase the minimum salary to Ps.12,500 in four stages: an increase (i) to Ps.10,700 in September 2018, (ii) to Ps.11,300 in December 2018, (iii) to Ps.11,900 in March 2019, and to 12,500 in June 2019.

Due to high levels of inflation, employers in both the public and private sectors are experiencing significant pressure from unions and their employees to further increase salaries. Through Decree No. 610/2019, a staggered increase of the minimum salary was approved as follows: (i) Ps.14,125 as of August 1, 2019; (ii) Ps.15,625 as of September 1, 2019; and (iii) Ps.16,875 as of October 1, 2019. In addition, the Argentine government has arranged various measures to mitigate the impact of inflation and exchange rate fluctuation in wages. Moreover due to high levels of inflation, both public and private sector employers continue to experience significant pressure to further increase salaries. In December 2019, the Argentine government issued Decree No. 34/2019, which established that in case of dismissals without cause during six (6) months after the publication in the official gazette of such Decree, employees have the right to collect double indemnification. This Decree was enacted due to the economical emergency and the increase of the unemployment, and its aim was to dissuade employers to dismiss personnel. This measure was further reinforced through Decree No. 329/2020, issued amid the COVID-19 pandemic crisis, by virtue of which dismissals without cause or with cause under the argument of force majeure or lack of/reduction of work not imputable to the employer for 60 business days (this last cause also applies for temporary suspensions). Also, in January 2020, the Argentine government issued Decree No. 14/2020 which established a general increase for all employees of Ps.3,000 in January 2020, and an additional amount of Ps.1,000 in February 2020 (total Ps.4,000 as from February 2020).

In the future, the Argentine government could take new measures requiring salary increases or additional benefits for workers, and the labor force and labor unions may apply pressure for such measures. Any such increase in wage or worker benefit could result in added costs and reduced results of operations for Argentine companies, including us. Such added costs could adversely affect our business, financial condition, results of operations and our ability to make payments under the notes.

Government intervention in the Argentine economy could adversely affect our results of operations or financial condition.

The Argentine government exercises substantial control over the economy and may increase its level of intervention in certain areas of the economy, including through the regulation of market conditions and prices.

By way of example, in 2008, the Fernández de Kirchner administration absorbed and replaced the former private pension system for a public “pay as you go” pension system. As a result, all resources administered by the private pension funds, including significant equity interests in a wide range of listed companies, were transferred to a separate fund (Fondo de Garantía de Sustentabilidad, or “FGS”) to be administered by the National Social Security Administration (Administración Nacional de la Seguridad Social, or “ANSES”, per its acronym in Spanish). The dissolution of the private pension funds and the transfer of their financial assets to the FGS have had important repercussions on the financing of private sector companies. Debt and equity instruments which previously could be placed with pension fund administrators are now entirely subject to the discretion of the ANSES. Since it acquired equity interests in privately owned companies through the process of replacing the pension system, the ANSES is entitled to designate government representatives to the boards of directors of those entities. Pursuant to Decree No. 1,278/12, issued by the Executive Branch on July 25, 2012, the ANSES’s representatives must report directly to the Ministry of Public Finance are subject to a mandatory information-sharing regime, under which, among other obligations, they must immediately inform the Ministry of Public Finance of the agenda for each Board of Directors’ meetings and provide related documentation.

Also, in April 2012, the Fernández de Kirchner administration decreed the removal of directors and senior officers of YPF S.A. (“YPF”), the country’s largest oil and gas company, which was controlled by the Spanish group Repsol, and submitted a bill to the Argentine Congress to expropriate shares held by Repsol representing 51% of the shares of YPF. The Argentine Congress approved the bill in May 2012 through the passage of Law No. 26,741, which declared the production, industrialization, transportation and marketing of hydrocarbons to be activities of public interest and fundamental policies of Argentina, and empowered the Argentine government to adopt any measures necessary to achieve self-sufficiency in hydrocarbon supply. In February 2014, the Argentine government and Repsol announced that they had reached an agreement on the terms of the compensation payable to Repsol for the expropriation of the YPF shares. Such compensation totaled U.S.$5 billion payable by delivery of Argentine sovereign bonds with various maturities. The agreement, which was ratified by Law No. 26,932, settled the claim filed by Repsol before the International Centre for Settlement of Investment Disputes (“ICSID”).

Historically, actions carried out by the Argentine government concerning the economy, including decisions regarding interest rates, taxes, price controls, wage increases, increased benefits for workers, exchange controls and potential changes in the market of foreign currency, have had a substantial adverse effect on Argentina’s economic growth.

It is widely reported by private economists that expropriations, price controls, exchange controls and other direct involvement by the Argentine government in the economy have had an adverse impact on the level of investment in Argentina, the access of Argentine companies to international capital markets and Argentina’s commercial and diplomatic relations with other countries. If the level of government intervention in the economy continues or increases, the Argentine economy and, in turn, our business, results of operations and financial condition could be adversely affected.

We cannot assurethatmeasures implementedin connection with the Law of Solidarity and Productive Reactivation No. 27,541 willnot adversely impact our operations, financial condition and results of operations.