UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22550

Name of Fund: BlackRock Preferred Partners LLC

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Preferred

Partners LLC, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 03/31/2012

Date of reporting period: 03/31/2012

Item 1 – Report to Stockholders

| | |

| | March 31, 2012 |

BlackRock Preferred Partners LLC

| | | | |

| | Not FDIC Insured § No Bank Guarantee § May Lose Value | | |

Table of Contents

| | | | | | |

| | | | | | | |

| | | | | | |

| 2 | | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | |

| | | | | | | | | | |

Dear Member Twelve months ago, risk assets were charging forward, only to be met with a sharp reversal in May 2011 when escalating political strife in Greece rekindled fears about sovereign debt problems spreading across Europe. Concurrently, global economic indicators signaled that the recovery had slowed. Confidence was further shaken by the prolonged debt ceiling debate in Washington, DC. On August 5, 2011, Standard & Poor’s made history by downgrading the US government’s credit rating, and turmoil erupted in financial markets around the world. Extraordinary levels of volatility persisted in the months that followed as the European debt crisis intensified. Macro news flow became a greater influence on trading decisions than the fundamentals of the securities traded, resulting in high correlations between asset prices. By the end of the third quarter, equity markets had fallen nearly 20% from their April peak while safe-haven assets such as US Treasuries and gold had rallied to historic highs. October brought enough positive economic data to assuage fears of a global double-dip recession. Additionally, European leaders began to show progress toward stemming the region’s debt crisis. Investors began to reenter the markets, putting risk assets on the road to recovery. Improving investor sentiment carried over into the first several months of 2012. Debt problems in Europe stabilized as policymakers secured a bailout plan for Greece and completed the nation’s debt restructuring without significant market disruptions. While concerns about slowing growth in China and a European recession weighed on the outlook for the global economy, an acceleration of the US recovery lifted sentiment. Several consecutive months of stronger jobs data signaled solid improvement in the US labor market, a pivotal factor for economic growth. Meanwhile, the European Central Bank revived financial markets with additional liquidity through its long-term refinancing operations. The improving market conditions and generally better-than-expected economic news lured investors still holding cash on the sidelines back to risk assets. Stocks, commodities and high yield bonds rallied through the first two months of the year while rising Treasury yields pressured higher-quality fixed income assets. The rally softened in late March, however, as concerns about slowing growth in China were refueled by negative signals from the world’s second-largest economy. Additionally, concerns over the European debt crisis resurfaced given uncertainty around policies for sovereign debt financing in peripheral countries and rising yields in Portugal and Spain. Thanks in large part to an exceptionally strong first quarter of 2012, risk assets, including equities and high yield bonds, posted solid returns for the 6-month period ended March 31, 2012. On a 12-month basis, US large-cap stocks and high yield bonds delivered positive results, while small-cap stocks finished in slightly negative territory. International and emerging markets, which experienced significant downturns in 2011, lagged the broader rebound. Fixed income securities experienced mixed results, given recent volatility in yields. US Treasury bonds performed particularly well for the 12-month period; however, an early-2012 sell-off resulted in a negative return for the 6-month period. Municipal bonds staged a solid advance over the past year. Continued low short-term interest rates kept yields on money market securities near their all-time lows. While markets have improved in recent months, considerable headwinds remain. Europe faces a prolonged recession and the financial situations in Italy, Portugal and Spain remain worrisome. Higher oil and gasoline prices along with slowing growth in China and other emerging-market countries weigh heavily on the future of the global economy. But, we believe that with these challenges come opportunities. We remain committed to working with you and your financial professional to identify actionable ideas for your portfolio. We encourage you to visit www.blackrock.com/newworld for more information. | | | |

“While markets have improved in recent months, considerable headwinds remain.” Rob Kapito President, BlackRock Advisors, LLC |

| | | | Total Returns as of March 31, 2012 |

| | | | | | | | 6-month | | 12-month |

| | | | | | US large cap equities (S&P 500® Index) | | 25.89% | | 8.54% |

| | | | | | US small cap equities (Russell 2000® Index) | | 29.83 | | (0.18) |

| | | | | | International equities (MSCI Europe, Australasia, Far East Index) | | 14.56 | | (5.77) |

| | | | | | Emerging market equities (MSCI Emerging Markets Index) | | 19.12 | | (8.81) |

| | | | | | 3-month Treasury bill (BofA Merrill Lynch 3-Month Treasury Bill Index) | | 0.01 | | 0.06 |

| | | | | | US Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index) | | (1.05) | | 14.92 |

| | | | | | US investment grade bonds (Barclays US Aggregate Bond Index) | | 1.43 | | 7.71 |

| | | | | | Tax-exempt municipal bonds (S&P Municipal Bond Index) | | 4.16 | | 12.56 |

| | | | | | US high yield bonds (Barclays US Corporate High Yield 2% Issuer Capped Index) | | 12.17 | | 6.43 |

| | | | | | HFRI Fund of Funds Composite Index | | 2.88 | | (3.40) |

| | | | Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Sincerely, | | | | |

| | | | |

Rob Kapito President, BlackRock Advisors, LLC | | | | |

| | | | | | |

| | | | | | | |

| | | | | | |

| | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

Fund Summary as of March 31, 2012

BlackRock Preferred Partners LLC’s (the “Fund”) investment objective is to seek total return. Over an investment cycle, the Fund expects to achieve net returns commensurate with the long-term return on equities with less volatility and a relatively low degree of correlation to the equity markets. The Fund seeks to achieve its investment objective by investing directly or indirectly in private funds or other pooled investment vehicles or accounts organized outside the United States (“Portfolio Funds”) generally believed not to be highly correlated with the Standard & Poor’s 500 Index over a long-term horizon. The Fund may also invest directly in securities (other than those of Portfolio Funds) or other financial instruments.

No assurance can be given that the Fund’s investment objective will be achieved.

| | |

Portfolio Management Commentary | | |

How did the Fund perform?

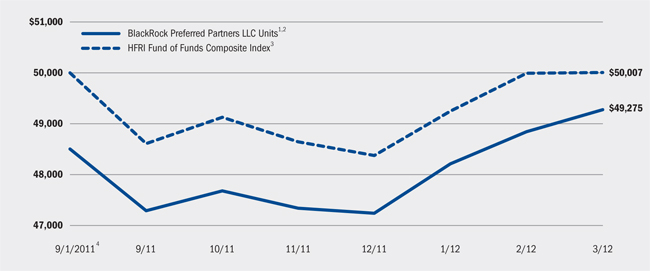

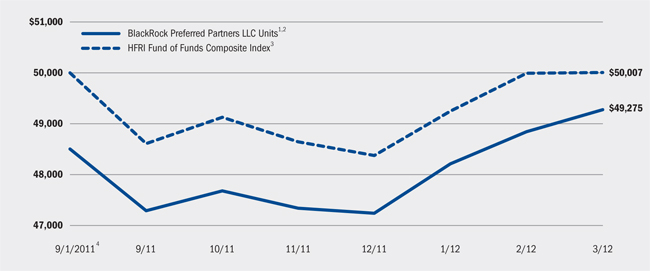

| — | | For the period beginning with the Fund’s commencement of operations on September 1, 2011 through March 31, 2012, the Fund returned 1.60% based on net asset value. For the same period, the return on the Fund’s benchmark, the HFRI Fund of Funds Composite Index, was 0.01%. |

Underlying Fund strategies

| — | | The Fund invests in a portfolio of hedge funds as a means to gain exposure to various types of investment strategies in four major categories including directional trading, event-driven, fundamental long/short and relative value strategies. |

| — | | Directional trading strategies seek to profit in changes from macro-level exposures, such as broad securities markets, interest rates, exchange rates and commodities. |

| — | | Event-driven strategies concentrate on companies that are subject to corporate events such as mergers, acquisitions, restructurings, spin-offs, shareholder activism or other special situations that alter a company’s financial structure or operating strategy. The intended goal of these strategies is to profit when the price of a security changes to reflect more accurately the likelihood and potential impact of the occurrence, or non-occurrence, of the corporate event. |

| — | | Fundamental long/short strategies involve buying or selling predominantly corporate securities believed to be over- or under-priced relative to their potential value. Investment strategies in this category include long and short equity- or credit-based strategies, which emphasize a fundamental valuation framework, and equity active value strategies, where an active role is taken to enhance corporate value. |

| — | | Relative value strategies seek to profit from the mispricing of financial instruments relative to each other or historical norms. These strategies utilize quantitative and qualitative analyses to identify securities or spreads between securities that deviate from their theoretical fair value and/or historical norms. |

What factors influenced performance?

| — | | During the period, event-driven strategies within the portfolio’s underlying funds were the largest contributor to the Fund’s positive performance as a result of increased corporate activity, such as reorganizations, post-reorganizational activity, mergers and bankruptcies. Also having a positive impact on the Fund’s performance was exposure to a number of relative value strategies, including rates strategies, convergence programs and volatility strategies. |

| — | | Detracting from performance was the Fund’s exposure to fundamental long/short strategies, particularly equity selection and credit strategies, as global macroeconomic concerns continued to drive widespread risk-on/risk-off market behavior, creating a difficult environment for trading on fundamentals. |

Describe recent portfolio activity.

| — | | Since the Fund’s commencement of operations on September 1, 2011 through March 31, 2012, the Fund’s selection of hedge fund investments remained largely unchanged with the exception of one transaction at the end of the period. The Fund redeemed its shares of Fortress Macro Fund, Ltd. in order to pursue an opportunity in the Asian macro space. Elsewhere in the portfolio, changes in position sizes resulted from the allocation of new cash inflows from Fund subscriptions. |

Describe portfolio positioning at period end.

| — | | At period end, the Fund held broad exposure across a spectrum of different hedge fund strategies. From a high-level strategy allocation perspective, the Fund held 55% of its investments in hedge funds that are classified (based on their largest underlying strategy exposure) as fundamental long/short strategy funds, 21% in hedge funds classified as event-driven strategy funds, 12% in hedge funds classified as relative value strategy funds and 12% in hedge funds classified as directional trading funds. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| | | | | | | |

| | | | | | |

| 4 | | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | |

Fund Summary as of March 31, 2012

| | |

Total Return Based on a $50,000 Investment | | |

|

|

1 Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. 2 Under normal market conditions, the Fund will invest, in varying proportions, across a number of portfolio strategies, including but not limited to hedge fund strategies and cash strategies. The Fund may also invest directly in securities (other than those of Portfolio Funds) or other financial instruments selected by the Advisors. 3 This index represents funds of hedge funds that invest with multiple hedge fund managers focused on absolute return strategies. This equal-weighted index includes funds of hedge funds tracked by Hedge Fund Research Inc. and is revised several times each month to reflect updated hedge fund return information. For performance presented as of any given month, estimated values of underlying funds are used to build the index until valuations are finalized (generally on a 5-month lag although the time period may vary). This index is a proxy for the performance of the universe of funds of hedge funds focused on absolute return strategies. Returns are net of fees. 4 Commencement of operations. |

| | |

Performance Summary for the Period Ended March 31, 2012 | | |

| | | | | | |

| | | | | Total Returns5 |

| | | | | Since Inception6 |

| | | 6-Month Total Returns | | w/o sales charge | | w/ sales charge |

BlackRock Preferred Partners LLC Units | | 4.21% | | 1.60% | | (1.45)% |

HFRI Fund of Funds Composite Index | | 2.88 | | 0.01 | | N/A |

| | 5 | Assuming maximum sales charges, if any. Aggregate total returns with and without sales charges reflect reductions for distribution fees. |

| | 6 | The Fund commenced operations on September 1, 2011. |

| | | N/A - Not applicable as share class and index do not have a sales charge. |

| | | Past performance is not indicative of future results. |

BlackRock Preferred Partners LLC Units incur a maximum initial sales charge of 3.00%, an annual distribution fee of 0.75% and an annual management fee of 0.75%.

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Performance results do not reflect the deduction of taxes that a Member would pay on Fund distributions or the repurchase of Fund Units. The Fund charges a 2% early repurchase fee for Members who tender their Units in connection with a tender offer with a valuation date that is prior to the business day immediately preceding the one-year anniversary of the Member’s purchase of respective Units. Performance data does not reflect this potential fee. Figures shown in

the performance table assume reinvestment of all dividends and distributions, if any, at net asset value on the payable date. Investment return and the principal value of Units will fluctuate so that Units, when and if repurchased pursuant to a tender offer, if any, may be worth more or less than their original cost.

The Fund’s investment advisor waived and/or reimbursed a portion of the Fund’s expenses. Without such waiver and/or reimbursement, the Fund’s performance would have been lower.

| | | | | | |

| | | | | | | |

| | | | | | |

| | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | 5 |

Fund Summary as of March 31, 2012

The following charts show the ten largest holdings and investment strategies as a percentage of the Fund’s long-term investments:

| | |

| Portfolio Holdings | | 3/31/12 |

Magnetar Capital Fund II, Ltd. | | 8% |

One William Street Capital Offshore Fund, Ltd. | | 8 |

Claren Road Credit Fund, Ltd. | | 8 |

D.E. Shaw Oculus International Fund | | 8 |

Pentwater Event Fund, Ltd. | | 7 |

HBK Offshore Fund II LP | | 5 |

BG Fund | | 5 |

Scout Capital Fund, Ltd. | | 5 |

Brigade Leveraged Capital Structures Offshore, Ltd. | | 5 |

Davidson Kempner International (BVI), Ltd. | | 5 |

| | |

| Investment Strategies | | 3/31/12 |

Fundamental Long/Short | | 55% |

Event Driven | | 21 |

Relative Value | | 12 |

Directional Trading | | 12 |

|

The table below summarizes the changes in the Fund’s monthly Net Asset Value per unit:

| | | | | | | | | | | | |

| | | 3/31/12 | | 9/01/111 | | Change | | High | | Low | |

Net Asset Value | | $10.16 | | $10.00 | | 1.60% | | $10.16 | | | $9.74 | |

| | 1 | Commencement of Operations. The Fund is a continuously offered closed-end fund that does not trade on an exchange. |

| | |

Disclosure of Expenses for Continuously Offered Closed-End Funds | | |

Members of the Fund may incur the following charges: (a) expenses related to transactions, including sales charges and early withdrawal fees; and (b) operating expenses, including advisory fees, distribution fees, and other Fund expenses. The expense example shown below (which is based on a hypothetical investment of $1,000 invested on October 1, 2011 and held through March 31, 2012) is intended to assist members both in calculating operating expenses based on an investment in the Fund and in comparing these operating expenses with similar costs of investing in other mutual funds.

The table provides information about actual account values and actual expenses. In order to estimate the expenses a member paid during the period covered by this report, members can divide their account value by $1,000 and then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

The table also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. In order to assist members in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ member reports.

The expenses shown in the table are intended to highlight members’ ongoing costs only and do not reflect any transactional expenses, such as sales charges or early withdrawal fees. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help members determine the relative total expenses of owning different funds. If these transactional expenses were included, member expenses would have been higher.

| | | | | | | | | | | | | | |

| | | Actual | | Hypothetical2 | | |

| | | Beginning Account Value October 1, 2011 | | Ending

Account Value March 31, 2012 | | Expenses Paid

During the Period1 | | Beginning

Account Value October 1, 2011 | | Ending

Account Value March 31, 2012 | | Expenses Paid During the Period1 | | Annualized

Expense

Ratio |

|

| BlackRock Preferred Partners LLC | | $1,000.00 | | $1,042.10 | | $10.21 | | $1,000.00 | | $1,015.00 | | $10.08 | | 2.00% |

|

| | 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Annualized expense ratio does not include expenses incurred indirectly as a result of investments in Portfolio Funds. |

| | 2 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 366. |

| | | | | | |

| | | | | | | |

| | | | | | |

| 6 | | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | |

| | |

| Schedule of Investments March 31, 2012 | | (Percentages shown are based on Members’ Capital) |

| | | | |

| Portfolio Funds | | Value | |

| |

Directional Trading – 11.0% | | | | |

AlphaMosaic SPC Platform, Class A: | | | | |

Series 09-2011 | | $ | 457,569 | |

Series 02-2012 | | | 48,149 | |

D.E. Shaw Oculus International Fund, Liquidity Class | | | 2,179,127 | |

Fortress Commodities Fund LP, Class S1, Series 09-2011 NI | | | 725,890 | |

| | | | |

| | | 3,410,735 | |

| |

| |

Event Driven – 19.4% | | | | |

Davidson Kempner International (BVI), Ltd., Class C, Tranche 3, Series 01-2012 | | | 1,347,411 | |

HBK Offshore Fund II LP, Class A, Sub-Class A1 | | | 1,457,504 | |

Pentwater Event Fund, Ltd., Class F-NV-U: | | | | |

Initial Series | | | 1,516,800 | |

Series 02-2012 | | | 107,601 | |

Series 03-2012 | | | 512,338 | |

York Investment, Ltd., Class D, Series 09-2011 | | | 1,108,658 | |

| | | | |

| | | 6,050,312 | |

| |

| |

Fundamental Long/Short – 51.6% | | | | |

BG Fund, Class B | | | 1,442,495 | |

Brigade Leveraged Capital Structures Offshore, Ltd.: | | | | |

Series 09-2011 NV | | | 1,069,583 | |

Series 02-2012 NV | | | 100,933 | |

Series 03-2012 NV | | | 251,338 | |

Claren Road Credit Fund, Ltd., Class A: | | | | |

Series 32 | | | 1,035,349 | |

Series 69 | | | 170,782 | |

Series 70 | | | 642,720 | |

Series 71 | | | 473,566 | |

Conatus Capital Overseas Ltd., Class A, Sub-Class 1, Series 09-2011 | | | 1,115,640 | |

Glenview Capital Partners (Cayman), Ltd., Series G/84 | | | 975,213 | |

King Street Capital, Ltd., Class A, Series 3 | | | 1,022,754 | |

Oak Hill Credit Alpha Fund (Offshore), Ltd., Class A, Series 09-2011 | | | 1,037,925 | |

One William Street Capital Offshore Fund, Ltd., Class CC: | | | | |

Series 09-2011-AA | | | 1,727,591 | |

Series 02-2012 | | | 102,997 | |

Series 03-2012 | | | 557,425 | |

Scout Capital Fund, Ltd., Class B, Series NV | | | 1,434,773 | |

Standard Pacific Capital Offshore, Ltd., Class B, Series C | | | 985,666 | |

Standard Pacific Pan-Asia Fund, Ltd., Series A, Sub-Series 02-2011 | | | 841,636 | |

Taconic Opportunity Offshore Fund, Ltd., Class A-NR, Series 50 | | | 1,040,765 | |

| | | | |

| | | 16,029,151 | |

| |

| |

Relative Value – 11.5% | | | | |

Aristeia International, Ltd., Class A, Series A-NV | | | 1,161,717 | |

Magnetar Capital Fund II, Ltd., Class A: | | | | |

Series 25 | | | 1,782,641 | |

Series 47 | | | 315,692 | |

Series 50 | | | 102,790 | |

Series 52 | | | 201,980 | |

| | | | |

| | | 3,564,820 | |

| |

Total Investments (Cost $28,240,000) – 93.5% | | | 29,055,018 | |

Other Assets Less Liabilities – 6.5% | | | 2,014,701 | |

| | | | |

Members’ Capital – 100.0% | | $ | 31,069,719 | |

| | | | |

| — | | Fair Value Measurements - Various inputs are used in determining the fair value of investments. These inputs are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| | — | | Level 1 - unadjusted price quotations in active markets/exchanges for identical assets and liabilities; |

| | — | | Level 2 - other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs). If the reporting entity has the ability to redeem its investment with the Portfolio Funds at the net asset value per share (or its equivalent) at the measurement date or within the near term and there are no other liquidity restrictions. |

| | — | | Level 3 - unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments). Investments in Portfolio Funds that are currently subject to liquidity restrictions that will not be lifted in the near term. |

The Fund’s investments in Portfolio Funds not otherwise traded on a securities exchange are classified within Level 2 or Level 3 of the fair value hierarchy as the value of these interests are primarily based on the respective net asset value reported by management of each Portfolio Fund rather than actual market transactions and other observable market data. The determination of whether such investment will be classified in Level 2 or Level 3 will be based upon the ability to redeem such investment within a reasonable period of time (within 90 days of the period end and any other month-end). If an investment in a Portfolio Fund may be redeemed within 90 days of the period end and any other month-end, and the fair value of the investment is based on information provided by management of the Portfolio Funds, it is classified as Level 2; in all other cases it is classified as Level 3. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investment and derivative financial instrument and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and other significant accounting policies, please refer to Note 1 of the Notes to Financial Statements.

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | | | | | |

| | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | 7 |

| | |

| Schedule of Investments (concluded) | | |

The following tables summarize the inputs used as of March 31, 2012 in determining the fair valuation of the Fund’s investments:

| | | | | | | | | | | | | | | | |

| |

| Valuation Inputs | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Portfolio Funds:1 | | | | | | | | | | | | | | | | |

Directional Trading | | | – | | | $ | 1,231,608 | | | $ | 2,179,127 | | | $ | 3,410,735 | |

Event Driven | | | – | | | | 2,456,069 | | | | 3,594,243 | | | | 6,050,312 | |

Fundamental Long/Short | | | – | | | | 1,442,495 | | | | 14,586,656 | | | | 16,029,151 | |

Relative Value | | | – | | | | 1,161,717 | | | | 2,403,103 | | | | 3,564,820 | |

| |

Total | | | – | | | $ | 6,291,889 | | | $ | 22,763,129 | | | $ | 29,055,018 | |

| | | | |

| | 1 | In determining the classification of investments in Portfolio Funds included in the table above, no consideration was given to the classification of securities held by each underlying Portfolio Fund. |

The following table is a reconciliation of Level 3 investments:

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Directional

Trading | | | Event

Driven | | | Fundamental

Long/Short | | | Relative

Value | | | Total | |

| |

Assets: | | | | | | | | | | | | | | | | | | | | |

Balance, as of September 1, 20111 | | | – | | | | – | | | | – | | | | – | | | | – | |

Net realized gain (loss) | | | – | | | | – | | | | – | | | | – | | | | – | |

Net change in unrealized appreciation/depreciation2 | | $ | 179,127 | | | $ | 274,243 | | | $ | 211,656 | | | $ | 113,103 | | | $ | 778,129 | |

Purchases | | | 2,000,000 | | | | 3,320,000 | | | | 14,375,000 | | | | 2,290,000 | | | | 21,985,000 | |

Sales | | | – | | | | – | | | | – | | | | – | | | | – | |

Transfers in3 | | | – | | | | – | | | | – | | | | – | | | | – | |

Transfers out3 | | | – | | | | – | | | | – | | | | – | | | | – | |

| |

Balance, as of March 31, 2012 | | $ | 2,179,127 | | | $ | 3,594,243 | | | $ | 14,586,656 | | | $ | 2,403,103 | | | $ | 22,763,129 | |

| | | | |

| | 1 | Commencement of operations. |

| | 2 | Included in the related net change in unrealized appreciation/depreciation in the Statement of Operations. The change in unrealized appreciation/depreciation on investments still held at March 31, 2012 was $778,129. |

| | 3 | The Fund’s policy is to recognize transfers in and transfers out as of the beginning of the period of the event or the change in circumstances that caused the transfer. |

A reconciliation of Level 3 investments is presented when the Fund had a significant amount of Level 3 investments at the beginning and/or end of the period in relation to members’ capital.

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | | | | | |

| 8 | | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | |

Statement of Assets, Liabilities and Members’ Capital

March 31, 2012

| | | | |

Assets | | | | |

Investments in Portfolio Funds at value (cost – $28,240,000) | | $ | 29,055,018 | |

Cash | | | 952,389 | |

Investments in Portfolio Funds paid in advance | | | 3,600,000 | |

Redemptions receivable | | | 1,098,371 | |

Receivable for reimbursement from advisor | | | 231,590 | |

Deferred offering costs | | | 193,625 | |

Prepaid expenses | | | 531 | |

Total assets | | | 35,131,524 | |

| | | | |

| | |

Liabilities | | | | |

| | |

Capital contributions received in advance | | | 3,835,000 | |

Offering costs payable | | | 37,340 | |

Advisory fees payable | | | 19,443 | |

Distribution fees payable | | | 19,443 | |

Officer’s and Directors’ fees payable | | | 1,377 | |

Other accrued expenses payable | | | 149,202 | |

Total liabilities | | | 4,061,805 | |

Members’ Capital | | $ | 31,069,719 | |

| | | | |

| | |

Members’ Capital Consist of | | | | |

| | |

Paid-in capital | | $ | 30,416,700 | |

Accumulated net investment loss | | | (161,999 | ) |

Net unrealized appreciation/depreciation | | | 815,018 | |

Members’ Capital | | $ | 31,069,719 | |

| | | | |

| | |

Net Asset Value | | | | |

| | |

Based on members’ capital of $31,069,719 and 3,057,023 units outstanding | | $ | 10.16 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | | | | | |

| | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | 9 |

Statement of Operations

Period September 1, 20111 to March 31, 2012

| | | | |

Expenses | | | | |

Investment advisory | | $ | 115,398 | |

Organization | | | 293,000 | |

Offering | | | 271,076 | |

Professional | | | 133,705 | |

Distribution | | | 115,398 | |

Administration | | | 40,680 | |

Printing | | | 20,000 | |

Officer and Directors | | | 2,917 | |

Miscellaneous | | | 25,676 | |

Total expenses | | | 1,017,850 | |

Less expenses reimbursed by advisor | | | (714,180 | ) |

Total expenses after fees waived and reimbursed | | | 303,670 | |

Net investment loss | | | (303,670 | ) |

| | | | |

Realized and Unrealized Gain | | | | |

Net realized gain from investments | | | 38,371 | |

Net change in unrealized appreciation/depreciation on investments | | | 815,018 | |

Total realized and unrealized gain | | | 853,389 | |

Net Increase in Members’ Capital Resulting from Operations | | $ | 549,719 | |

| | 1 | Commencement of operations. Reflects activity prior to September 1, 2011, related to the initial seeding of the Fund. |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | | | | | |

| 10 | | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | |

Statement of Changes in Members’ Capital

| | | | |

Increase (Decrease) in Members’ Capital: | | Period

September 1, 20111

to March 31, 2012 | |

Operations | | | | |

Net investment loss | | $ | (303,670 | ) |

Net realized gain | | | 38,371 | |

Net change in unrealized appreciation/depreciation | | | 815,018 | |

Net increase in members’ capital resulting from operations | | | 549,719 | |

| | | | |

Capital Transactions | | | | |

Proceeds from the issuance of units (excluding capital contributions received in advance) | | | 30,520,000 | |

| | | | |

Members’ Capital | | | | |

Total increase in members’ capital | | | 31,069,719 | |

Beginning of period | | | – | |

End of period | | $ | 31,069,719 | |

Accumulated net investment loss | | $ | (161,999 | ) |

| | 1 | Commencement of operations. Reflects activity prior to September 1, 2011, related to the initial seeding of the Fund. |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | | | | | |

| | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | 11 |

Statement of Cash Flows

Period September 1, 20111 to March 31, 2012

| | | | |

Cash Used in Operating Activities | | | | |

Cash flows from operating activities: | | | | |

Net increase in members’ capital resulting from operations | | $ | 549,719 | |

Increase in investments in Portfolio Funds paid in advance | | | (3,600,000 | ) |

Increase in redemptions receivable | | | (1,098,371 | ) |

Increase in receivable from advisor | | | (212,147 | ) |

Increase in prepaid expenses | | | (531 | ) |

Increase in offering costs payable | | | 37,340 | |

Increase in distribution fees payable | | | 19,443 | |

Increase in officer’s and directors’ fees payable | | | 1,377 | |

Increase in other accrued expenses payable | | | 149,202 | |

Net realized and unrealized gain on investments | | | (853,389 | ) |

Purchases of long-term investments | | | (29,300,000 | ) |

Amortization of deferred offering costs | | | 271,076 | |

Proceeds from sales of long-term investments | | | 1,098,371 | |

Cash used in operating activities | | | (32,937,910 | ) |

| | | | |

Cash Provided by Financing Activities | | | | |

Cash receipts from issuance of units (excluding capital contributions received in advance) | | | 30,520,000 | |

Capital contributions received in advance | | | 3,835,000 | |

Cash payments for offering costs | | | (464,701 | ) |

Cash provided by financing activities | | | 33,890,299 | |

| | | | |

Cash | | | | |

Net increase in cash | | | 952,389 | |

Cash at beginning of period | | | – | |

Cash at end of period | | $ | 952,389 | |

| | 1 | Commencement of operations. Reflects activity prior to September 1, 2011, related to the initial seeding of the Fund. |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | | | | | |

| 12 | | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | |

Financial Highlights

| | |

| | | Period September 1, 20111 to March 31, 2012 |

Per Unit Operating Performance | | |

Net asset value, beginning of period | | $ 10.002 |

| | |

Net investment loss3 | | (0.11) |

Net realized and unrealized gain | | 0.27 |

| | |

Net increase from investment operations | | 0.16 |

| | |

Net asset value, end of period | | $ 10.16 |

| | |

| | |

Total Investment Return4 | | |

Based on net asset value | | 1.60%5 |

| | |

| | |

Ratios to Average Members’ Capital | | |

Total expenses6 | | 5.84%7,8 |

| | |

Total expenses after fees waived and reimbursed | | 2.00%7,8 |

| | |

Net investment loss | | (2.00)%7,8 |

| | |

| | |

Supplemental Data | | |

Members’ capital, end of period (000) | | $ 31,070 |

| | |

Portfolio turnover | | 4% |

| | |

| | |

| | 1 | Commencement of operations. Reflects activity prior to September 1, 2011, related to the initial seeding of the Fund. This information includes the initial investment by BlackRock HoldCo 2, Inc., a wholly owned subsidiary of BlackRock, Inc. |

| | 2 | Net asset value, beginning of period, reflects a deduction of $0.30 per unit sales charges from initial offering price of $10.30 per unit. |

| | 3 | Based on average units outstanding. |

| | 4 | Where applicable, total investment returns exclude the effects of any sales charges and include the reinvestment of dividends and distributions. The Fund is a continuously offered closed-end fund, the units of which are offered at net asset value. No secondary market for the Fund’s units exists. |

| | 5 | Aggregate total investment return. |

| | 6 | Organization expenses were not annualized in the calculation of expense ratios. If these ratios were annualized, the total expenses would have been 6.63%. |

| | 7 | Ratios do not include expenses incurred indirectly as a result of investments in Portfolio Funds. |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | | | | | |

| | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | 13 |

Notes to Financial Statements

1. Organization and Significant Accounting Policies:

BlackRock Preferred Partners LLC (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a continuously offered, non diversified, closed-end management investment company. The Fund is organized as a Delaware limited liability company. The Fund’s financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“US GAAP”), which may require management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results may differ from those estimates. The Fund continuously offers one class of limited liability company interests (“Units”), which may be sold to certain eligible investors with a front-end sales charge of up to 3.00%.

Prior to commencement of operations on September 1, 2011, the Fund had no operations other than those relating to organizational matters and the sale of 10,000 Units on August 15, 2011 to BlackRock HoldCo 2, Inc., a wholly owned subsidiary of BlackRock, Inc. (“BlackRock”) for $100,000.

The following is a summary of significant accounting policies followed by the Fund:

Valuation of Portfolio Funds: US GAAP defines fair value as the price the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Fund will invest in Portfolio Funds selected by and unaffiliated with BlackRock Advisors, LLC (the “Advisor”), an indirect wholly owned subsidiary of BlackRock. Managers of Portfolio Funds or their respective administrators typically provide unaudited Portfolio Fund valuations monthly. It is anticipated that these unaudited values will be prepared in accordance with US GAAP and will, in effect, be the fair value of each Portfolio Fund’s assets less such Portfolio Fund’s liabilities (the net asset value). In some cases, estimated unaudited values are provided before final unaudited values. The Advisor will rely primarily on such estimated unaudited values or final unaudited values, to the extent they are the most reliable and relevant indication of value of interests in the Portfolio Funds. The Advisor will give weight to such valuations and other factors and considerations set forth below and in the written policies and procedures (“Valuation Procedures”) that the Fund’s Board of Directors (the “Board”) has approved for purposes of determining the fair value of securities held by the Fund, as deemed appropriate in each case.

In instances where unaudited estimated or final values may not be available, or where such unaudited estimated or final values are determined not to be the most reliable and relevant indication of value of an interest in a Portfolio Fund (as further discussed below), additional factors that may be relevant in determining the value of an interest in a Portfolio Fund include (1) changes in the valuation of hedge fund indices, (2) publicly available information regarding a Portfolio Fund’s underlying portfolio companies or investments, (3) the price at which recent subscriptions and redemptions of such Portfolio Fund interests were offered, (4) relevant news and other sources, (5) significant market events and

(6) information provided to the Advisor or the Fund by a Portfolio Fund, or the failure to provide such information as agreed to in the Portfolio Fund’s offering materials or other agreements with the Fund. In circumstances where, taking into account the factors and considerations set forth above and in the Valuation Procedures, the Advisor has reason to believe that a value provided by a Portfolio Fund is not the most reliable and relevant indication of the value of an interest in the Portfolio Fund, the Advisor may adjust such reported value to reflect the fair value of the interest in the Portfolio Fund. Likewise, in circumstances where a Portfolio Fund does not provide a valuation as contemplated above, the factors and considerations set forth above and in the Valuation Procedures may be the only indicators of the value of an interest in a Portfolio Fund and the Advisor will use such factors, together with other valuation methodologies set forth in the Valuation Procedures that may be relevant, to estimate the fair value of its interest in such a Portfolio Fund. In circumstances where the Advisor determines to adjust the values reported by Portfolio Funds, or in circumstances where Portfolio Funds do not provide valuations as contemplated above (collectively, “Adjusted Fair Values”), such valuations will be subject to review and approval by the internal valuation committee of the Advisor and its registered investment advisory affiliates (“Valuation Committee”).

Investment Transactions and Investment Income: For financial reporting purposes, investment transactions are recorded on the dates the transactions are entered into (the trade dates). Realized gains and losses on investment transactions are determined on the identified cost basis.

Dividends and Distributions: Dividends from net investment income and distributions of capital gains are declared and paid annually. If the total dividends and distributions made in any tax year exceeds net investment income and accumulated realized capital gains, a portion of the total distribution may be treated as a return of capital for U.S. federal income tax purposes. The amount and timing of dividends and distributions are determined in accordance with federal income tax regulations, which may differ from US GAAP.

Income Taxes: It is the Fund’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute substantially all of its taxable income to its members. Therefore, no federal income tax provision is required.

The Fund files US federal and various state and local tax returns. Management does not believe there are any uncertain tax positions that require recognition of a tax liability.

Recent Accounting Standards: In May 2011, the Financial Accounting Standards Board (the “FASB”) issued amended guidance to improve disclosure about fair value measurements which will require the following disclosures for fair value measurements categorized as Level 3: quantitative information about the unobservable inputs and assumptions used in the fair value measurement, a description of the valuation policies and procedures and a narrative description of the sensitivity of the fair

| | | | | | |

| | | | | | | |

| | | | | | |

| 14 | | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | |

Notes to Financial Statements (continued)

value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, the amounts and reasons for all transfers in and out of Level 1 and Level 2 will be required to be disclosed as well as disclosure of the level in the fair value hierarchy of assets and liabilities not recorded at fair value but where fair value is disclosed. The amended guidance is effective for financial statements for fiscal years beginning after December 15, 2011, and interim periods within those fiscal years. Management is evaluating the impact of this guidance on the Fund’s financial statements and disclosures.

In December 2011, the FASB issued guidance that will expand current disclosure requirements on the offsetting of certain assets and liabilities. The new disclosures will be required for investments and derivative financial instruments subject to master netting or similar agreements which are eligible for offset in the Statements of Assets, Liabilities and Members’ Capital and will require an entity to disclose both gross and net information about such investments and transactions in the financial statements. The guidance is effective for financial statements with fiscal years beginning on or after January 1, 2013, and interim periods within those fiscal years. Management is evaluating the impact of this guidance on the Fund’s financial statement disclosures.

Organization and Offering Costs: Upon commencement of operations, organization costs associated with the establishment of the Fund were expensed by the Fund and reimbursed by the Advisor. Offering costs are amortized over a 12-month period beginning with the commencement of operations. The Advisor reimbursed the Fund $293,000 which is included in expenses reimbursed by advisor in the Statement of Operations.

Other: Expenses directly related to the Fund are charged to the Fund. Other operating expenses shared by several funds are pro rated among those funds on the basis of relative members’ capital or other appropriate methods.

The Fund has an arrangement with the custodian whereby fees may be reduced by credits earned on uninvested cash balances, which, if applicable, are shown as fees paid indirectly in the Statement of Operations. The custodian imposes fees on overdrawn cash balances, which can be offset by accumulated credits earned or may result in additional custody charges.

2. Investment Advisory Agreements and Other Transactions with Affiliates:

The PNC Financial Services Group, Inc. (“PNC”) and Barclays Bank PLC (“Barclays”) are the largest stockholders of BlackRock. Due to the ownership structure, PNC is an affiliate for 1940 Act purposes, but Barclays is not.

The Fund entered into an Investment Advisory Agreement with the Advisor to provide investment advisory services. The Fund pays the Advisor an annual fee accrued monthly and payable quarterly in arrears, in an amount equal to 0.75% of the Fund’s month-end members’ capital.

The Advisor has entered into a separate sub-advisory agreement with BlackRock Financial Management, Inc. (“BFM”), an affiliate of the Advisor. The Advisor pays BFM for services it provides, a monthly fee that is a percentage of the investment advisory fees paid by the Fund to the Advisor.

The Fund has entered into an expense limitation agreement in which the Advisor has agreed to reimburse certain operating and other expenses of the Fund in order to maintain certain expenses below 0.50% per annum of the Fund’s average members’ capital (the “Expense Cap”). Expenses covered by the Expense Cap include all of the Fund’s expenses other than those expressly excluded by the Expense Cap Agreement as follows: (1) the investment management fee, (2) interest expense, if any, (3) expenses incurred directly or indirectly by the Fund as a result of expenses related to investing in, or incurred by, a Portfolio Fund or other permitted investment, (4) any trading-related expenses, including, but not limited to, clearing costs and commissions, (5) dividends on short sales, if any, (6) any extraordinary expenses not incurred in the ordinary course of the Fund’s business (including, without limitation, litigation expenses) and (7) if applicable, the distribution fees paid to BlackRock Investments, LLC (“BRIL”) or financial intermediaries.

If the Fund has received a waiver or reimbursement from the Adviser within the preceding two fiscal years and the Fund’s operating expenses are less than the expense limit for the Fund, the Advisor is entitled to be reimbursed by the Fund up to the lesser of (a) the amount of fees waived or expenses reimbursed during those prior two fiscal years under the agreement and (b) the amount by which the expense limit for the Fund exceeds the operating expenses of the Fund for the current fiscal year, provided that: (1) the Fund has more than $50 million in assets for the fiscal year and (2) the Advisor or an affiliate continues to serve as the Fund’s investment advisor or administrator. In the event the expense limit for the Fund is changed subsequent to a fiscal year in which the Advisor becomes entitled to reimbursement for fees waived or reimbursed, the amount available to reimburse the Advisor shall be calculated by reference to the expense limit for the Fund in effect at the time the Advisor became entitled to receive such reimbursement, rather than the subsequently changed expense limit for the Fund.

On March 31, 2012, the amount subject to possible future recoupment under the expense limitation agreement for the period September 1, 2011 to March 31, 2012 is $714,180. This amount will expire on March 31, 2014.

The Fund entered into a Distribution Agreement with BRIL, an affiliate of the Advisor. Pursuant to a Distribution Plan approved by the Fund’s Board, the Fund pays BRIL ongoing distribution fees. The fees are accrued monthly and paid quarterly in arrears at an annual rate equal to 0.75% of the Fund’s month-end members’ capital.

Certain officers and/or directors of the Fund are officers and/or directors of BlackRock or its affiliates. The Fund reimburses the Advisor for compensation paid to the Fund’s Chief Compliance Officer.

| | | | | | |

| | | | | | | |

| | | | | | |

| | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | 15 |

Notes to Financial Statements (continued)

3. Investments:

Purchases and sales of investments, excluding short-term securities, for the period September 1, 2011 to March 31, 2012 were $29,300,000 and $1,098,371, respectively.

4. Investments in Portfolio Funds:

Information reflecting the Fund’s investments in Portfolio Funds as of March 31, 2012 is summarized below. The Fund is not able to obtain complete investment holding details of each of the Portfolio Funds held within the Fund’s portfolio in order to determine whether the Fund’s proportionate share of any investments held by a Portfolio Fund exceeds 5% of the members’ capital of the Fund as of March 31, 2012.

| | | | | | | | | | | | |

| Investment | | Value | | | % of Fund’s Members’ Capital | | Primary Geographical Locations* | | Redemptions Permitted** | |

Directional Trading | | | | | | | | | | | | |

AlphaMosaic SPC Platform, Class A: | | | | | | | | | | | | |

Series 09-2011 | | $ | 457,569 | | | 1.5% | | Africa/Mid East, Central/South Asia, North America, PacRim Developed, | | | Semi-Monthly | |

Series 02-2012 | | | 48,149 | | | 0.2 | | PacRim Emerging, Western Europe | | | | |

D.E. Shaw Oculus International Fund, Liquidity Class | | | 2,179,127 | | | 7.0 | | Latin America, North America, PacRim Developed, Western Europe | | | Quarterly | |

Fortress Commodities Fund LP, Class S1, Series 09-2011 NI | | | 725,890 | | | 2.3 | | Africa/Mid East, Central/South Asia, North America, PacRim Developed, PacRim Emerging, Western Europe | | | Monthly | |

Event Driven | | | | | | | | | | | | |

Davidson Kempner International (BVI), Ltd., Class C, Tranche 3, Series 01-2012 | | | 1,347,411 | | | 4.3 | | Africa/Mid East, Central/South Asia, North America, PacRim Developed, PacRim Emerging, Western Europe | | | Quarterly | |

HBK Offshore Fund II LP, Class A, Sub-Class A1 | | | 1,457,504 | | | 4.7 | | Eastern Europe, Latin America, North America, PacRim Developed, PacRim Emerging, Western Europe | | | Quarterly | |

Pentwater Event Fund, Ltd., Class F-NV-U: | | | | | | | | North America, PacRim Developed, Western Europe | | | Monthly | |

Initial Series | | | 1,516,800 | | | 4.9 | | | | | | |

Series 02-2012 | | | 107,601 | | | 0.3 | | | | | | |

Series 03-2012 | | | 512,338 | | | 1.6 | | | | | | |

York Investment, Ltd., Class D, Series 09-2011 | | | 1,108,658 | | | 3.6 | | North America, Western Europe | | | Quarterly | |

Fundamental Long/Short | | | | | | | | | | | | |

BG Fund, Class B | | | 1,442,495 | | | 4.7 | | North America, PacRim Developed, Western Europe | | | Monthly | |

Brigade Leveraged Capital Structures Offshore, Ltd.: | | | | | | | | North America, PacRim Developed, Western Europe | | | Quarterly | |

Series 09-2011 NV | | | 1,069,583 | | | 3.5 | | | | | | |

Series 02-2012 NV | | | 100,933 | | | 0.3 | | | | | | |

Series 03-2012 NV | | | 251,338 | | | 0.8 | | | | | | |

Claren Road Credit Fund, Ltd., Class A: | | | | | | | | North America, Western Europe | | | Quarterly | |

Series 32 | | | 1,035,349 | | | 3.3 | | | | | | |

Series 69 | | | 170,782 | | | 0.6 | | | | | | |

Series 70 | | | 642,720 | | | 2.1 | | | | | | |

Series 71 | | | 473,566 | | | 1.5 | | | | | | |

Conatus Capital Overseas Ltd., Class A, Sub-Class 1, Series 09-2011 | | | 1,115,640 | | | 3.6 | | North America, Western Europe | | | Quarterly | |

Glenview Capital Partners (Cayman), Ltd., Series G/84 | | | 975,213 | | | 3.1 | | North America, Western Europe | | | Quarterly | |

King Street Capital, Ltd., Class A, Series 3 | | | 1,022,754 | | | 3.3 | | PacRim Developed, Western Europe | | | Quarterly | |

Oak Hill Credit Alpha Fund (Offshore), Ltd., Class A, Series 09-2011 | | | 1,037,925 | | | 3.3 | | Latin America, North America, PacRim Developed, Western Europe | | | Quarterly | |

One William Street Capital Offshore Fund, Ltd., Class CC: | | | | | | | | North America | | | Quarterly | |

Series 09-2011-AA | | | 1,727,591 | | | 5.6 | | | | | | |

Series 02-2012 | | | 102,997 | | | 0.3 | | | | | | |

Series 03-2012 | | | 557,425 | | | 1.8 | | | | | | |

Scout Capital Fund, Ltd., Class B, Series NV | | | 1,434,773 | | | 4.6 | | Latin America, North America, Western Europe | | | Quarterly | |

Standard Pacific Capital Offshore, Ltd., Class B, Series C | | | 985,666 | | | 3.2 | | Central/South Asia, Eastern Europe, Latin America, North America, PacRim Developed, Western Europe | | | Quarterly | |

| | | | | | |

| | | | | | | |

| | | | | | |

| 16 | | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | |

Notes to Financial Statements (continued)

4. Investments in Portfolio Funds (continued):

| | | | | | | | | | | | | | |

| Investment | | Value | | | % of Fund’s Members’ Capital | | | Primary Geographical Locations* | | Redemptions

Permitted** | |

Fundamental Long/Short (continued) | | | | | | | | | | | | | | |

Standard Pacific Pan-Asia Fund, Ltd., Series A, Sub-Series 02-2011 | | $ | 841,636 | | | | 2.7% | | | Central/South Asia, PacRim Developed, PacRim Emerging | | | Quarterly | |

Taconic Opportunity Offshore Fund, Ltd., Class A-NR, Series 50 | | | 1,040,765 | | | | 3.3 | | | LatinAmerica, North America, PacRim Developed, Western Europe | | | Annually | |

Relative Value | | | | | | | | | | | | | | |

Aristeia International, Ltd., Class A, Series A-NV | | | 1,161,717 | | | | 3.8 | | | North America, Western Europe | | | Quarterly | |

Magnetar Capital Fund II, Ltd., Class A: | | | | | | | | | | North America, Western Europe | | | Quarterly | |

Series 25 | | | 1,782,641 | | | | 5.7 | | | | | | | |

Series 47 | | | 315,692 | | | | 1.0 | | | | | | | |

Series 50 | | | 102,790 | | | | 0.3 | | | | | | | |

Series 52 | | | 201,980 | | | | 0.7 | | | | | | | |

Total | | $ | 29,055,018 | | | | 93.5% | | | | | | | |

| | | | | | | | | | |

* Primary Geographic Locations refer to information of which the Fund is aware regarding the geographical allocation of the investments held by the Portfolio Funds in which the Fund invests. The Fund does not have or obtain sufficient portfolio holdings information with respect to the Portfolio Funds to monitor such positions on a look through basis. The information regarding the geographical allocation of investments held by the Portfolio Funds is derived from periodic information provided to the Fund by the managers of such Portfolio Funds. The information in this table represents only information that has been made available to the Fund with respect to investments held by the Portfolio Funds as of March 31, 2012. This information has not been independently verified by the Fund and may not be representative of the current geographical allocation of investments held by the Portfolio Funds since such Portfolio Funds are actively managed and this information is generally provided by the Portfolio Funds on a delayed basis after the date of such information.

** Redemptions Permitted reflects general redemption terms for each Portfolio Fund and excludes any temporary liquidity restrictions.

The agreements related to investments in Portfolio Funds provide for compensation to the investment managers/general partners in the form of management fees generally ranging from 1% to 3% (per annum) of members’ capital and incentive fees/allocations generally ranging from 15% to 30% of the net profits earned. The Portfolio Funds’ management fees and incentive fees/allocations are included in the net increase in members’ capital resulting from operations in the Statement of Operations.

The table below summarizes the fair value and other pertinent liquidity information of the underlying Portfolio Funds by class:

| | | | | | | | | | | | | | | | | | | | |

| Major Category | | Fair Value | | | Illiquid Investments (1) | | Gates (2) | | | Lock-ups (3) | | | Redemption Frequency (4) | | Redemption Notice Period (4) | |

Directional Trading (a) | | $ | 3,410,735 | | | – | | $ | 1,815,866 | | | | – | | | Semi-Monthly/Monthly/Quarterly | | | 2-75 Days | |

Event Driven (b) | | | 6,050,312 | | | – | | | 2,695,682 | | | | – | | | Monthly/Quarterly | | | 30-90 Days | |

Fundamental Long/Short (c) | | | 16,029,151 | | | – | | | 767,065 | | | | $14,586,656 | | | Monthly/Quarterly/Annually | | | 45-90 Days | |

Relative Value (d) | | | 3,564,820 | | | – | | | 2,102,716 | | | | – | | | Quarterly | | | 60-90 Days | |

Total | | $ | 29,055,018 | | | – | | $ | 7,381,329 | | | | $14,586,656 | | | | | | | |

| | | | | | | | | | |

(1) Represents private investment funds that cannot be voluntarily redeemed by the fund at any time. This includes: (i) private investment funds that are liquidating and making distribution payments as their underlying assets are sold, (ii) suspended redemptions/withdrawals, and (iii) side pocket holdings. These types of investments may be realized within 1 to 3 years or longer from March 31, 2012, depending on the specific investment and market conditions. This does not include private investment funds with gates and lockups, which are noted above.

(2) Represents investor level and enacted Portfolio level gates, which are limitations of the amount of a Portfolio Fund’s net assets that may be redeemed in any one redemption cycle.

(3) Represents investments that cannot be redeemed without a fee due to a lock-up provision. The lock-up period for these investments ranged from 5 to 12 months at March 31, 2012.

(4) Redemption frequency and redemption notice period reflect general redemption terms, and exclude liquidity restrictions noted above. Private investment funds that have an investor level gate and are still in the lock-up period are represented in both (2) and (3) in the above table.

| | | | | | |

| | | | | | | |

| | | | | | |

| | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | 17 |

Notes to Financial Statements (continued)

(a) Investment strategies within this category seek to profit from buying and/or selling securities or financial instruments with a primary focus on seeking to profit primarily from changes in macro-level exposures, such as broad securities markets, interest rates, currency exchange rates, or commodity prices. The application of the Valuation Procedures to investments in this category did not result in any Adjusted Fair Values as of March 31, 2012. Thus, the fair values of the investments in this category are based on the net asset values provided by management of the Portfolio Funds.

(b) Investment strategies within this category concentrate on companies that are, or may be, subject to extraordinary corporate events such as restructurings, takeovers, mergers, liquidations, bankruptcies or other corporate events. The application of the Valuation Procedures to investments in this category did not result in any Adjusted Fair Values as of March 31, 2012. Thus, the fair values of the investments in this category are based on the net asset values provided by management of the Portfolio Funds.

(c) Investment strategies within this category involve buying and/or selling a security or financial instrument believed to be significantly under- or over-priced by the market in relation to its potential value. The application of the Valuation Procedures to investments in this category did not result in any Adjusted Fair Values as of March 31, 2012. Thus, the fair values of the investments in this category are based on the net asset values provided by management of the Portfolio Funds.

(d) Investment strategies within this category seek to profit from the mispricing of related financial instruments. This discipline utilizes quantitative and qualitative analysis to identify securities or spreads between securities that deviate from their theoretical fair value and/or historical returns. The application of the Valuation Procedures to investments in this category did not result in any Adjusted Fair Values as of March 31, 2012. Thus, the fair values of the investments in this category are based on the net asset values provided by management of the Portfolio Funds.

The Fund had no unfunded capital commitments as of March 31, 2012.

5. Income Tax Information:

US GAAP requires that certain components of members’ capital be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on members’ capital or net asset values per unit. The following permanent differences as of March 31, 2012 attributable to the sale of stock of passive foreign investment companies and non-deductible expenses were reclassified to the following accounts:

| | | | |

| |

Paid-in capital | | $ | (103,300 | ) |

Accumulated net investment loss | | $ | 141,671 | |

Accumulated net realized gain. | | $ | (38,371 | ) |

| |

As of March 31, 2012, the tax components of accumulated net earnings were as follows:

| | | | |

| |

Undistributed ordinary income | | $ | 967,161 | |

Net unrealized losses* | | | (314,142 | ) |

| | | | |

Total | | $ | 653,019 | |

| | | | |

| * | The difference between book-basis and tax-basis net unrealized losses was attributable primarily to the realization for tax purposes of unrealized gains on investments in passive foreign investment companies. |

As of March 31, 2012, gross unrealized appreciation and gross unrealized depreciation based on cost for federal income tax purposes were as follows:

| | | | |

| |

Tax cost | | $ | 29,369,160 | |

| | | | |

Gross unrealized appreciation | | | – | |

Gross unrealized depreciation | | $ | (314,142 | ) |

| | | | |

Net unrealized depreciation. | | $ | (314,142 | ) |

| | | | |

6. Market and Credit Risk:

The Fund’s investments in Portfolio Funds involve varying degrees of interest rate risk, credit and counterparty risk, and market, industry or geographic concentration risks for the Fund. While BlackRock monitors these risks, the varying degrees of transparency into and potential illiquidity of the securities in the Portfolio Funds may hinder BlackRock’s ability to effectively manage and mitigate these risks.

The Portfolio Funds in which the Fund is invested utilize a wide variety of financial instruments in their trading strategies including over-the-counter (“OTC”) options, financial futures contracts, forward contracts and swap agreements, and securities sold but not yet purchased. Several of these financial instruments contain varying degrees of off-balance sheet risk where the maximum potential loss on a particular financial instrument may be in excess of the amounts recorded on each Portfolio Fund’s balance sheet. The Portfolio Funds are required to account for all investments on a fair value basis, and recognize changes in unrealized gains and losses in their statements of operations. In determining the fair values for these financial instruments, the Portfolio Funds will make estimates about future interest rates, default probabilities, volatilities and other pricing factors. These estimates of fair value could differ from actual results.

| | | | | | |

| | | | | | | |

| | | | | | |

| 18 | | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | |

Notes to Financial Statements (concluded)

The Fund’s maximum exposure to market risks of the Portfolio Funds is limited to amounts included in the Fund’s investments in Portfolio Funds recorded as assets on the Statement of Assets, Liabilities and Members’ Capital.

The Fund is designed primarily for long term investors and an investment in the Fund’s Units should be considered to be illiquid. The Fund’s Units will not be listed for trading on a securities exchange. Members may not be able to sell their Units as it is unlikely that a secondary market for the Units will develop or, if a secondary market does develop, members may be able to sell their Units only at substantial discounts from net asset value. Additionally, transfers of Units generally may not be effected without the express written consent of the Board. The Fund may, but is not obligated to, conduct tender offers to repurchase outstanding Units. If the Fund does conduct tender offers, it may be required to sell its more liquid, higher quality portfolio securities to purchase Units that are tendered, which may increase risks for remaining members and increase Fund expenses.

7. Liquidity Risk:

The Portfolio Funds invest in securities and investments with various degrees of liquidity and as such the Fund is subject to certain redemption/withdrawal provisions, in accordance with the Portfolio Funds’ offering agreements.

Certain of the Fund’s Portfolio Funds have the ability to suspend redemptions/withdrawals, and restrict redemptions/withdrawals through the creation of side pockets. At March 31, 2012, none of the Fund’s members’ capital were subject to Portfolio Funds that had suspended redemptions/withdrawals (including those Portfolio Funds undergoing liquidation); and none of the Fund’s members’ capital were invested directly in side pockets maintained by Portfolio Funds. The Fund’s ability to liquidate its investment in Portfolio Funds that had imposed such provisions may be adversely impacted. In such cases, until the Fund is permitted to liquidate its interest in the Portfolio Fund, the Fund’s residual interest remains subject to continued exposure to changes in valuations.

The Fund may also invest in closed-end investments that may not permit redemptions/withdrawals or in Portfolio Funds that impose an initial “lockup” period before a redemption/withdrawal can be made. In addition, certain of the Fund’s Portfolio Funds have the ability to impose redemption gates, and in so doing, may reduce the Fund’s requested redemption/withdrawal below the requested amount.

8. Capital Shares Transactions:

Units issued and outstanding during the period September 1, 2011 to March 31, 2012 increased 2,490,000 as a result of Units sold to BlackRock Holdco 2, Inc. and 557,023 as a result of Units sold to other eligible investors. At March 31, 2012, 2,500,000 Units were owned by BlackRock Holdco 2, Inc., an affiliate of the Fund.

Units are offered at closings, for purchase as of the first business day of each month or at such other times as determined in the discretion of the Board.

The Fund may choose to conduct quarterly tender offers for up to 15% of its net asset value at the time in the sole discretion of its Board. The valuation date for the first such tender offer, if any, will not be earlier than the last business day of September in 2012. In a tender offer, the Fund repurchases outstanding Units at the Fund’s net asset value on the valuation date for the tender offer, which would generally be expected to be the last business day of March, June, September or December. In any given year, the Advisor may or may not recommend to the Board that the Fund conduct tender offers. Accordingly, there may be years in which no tender offer is made. Units will not be redeemable at an investor’s option nor will they be exchangeable for shares of any other fund.

A 2.00% early repurchase fee payable to the Fund will be charged to any member that tenders its Units to the Fund in connection with a tender offer with a valuation date that is prior to the business day immediately preceding the one-year anniversary of the member’s purchase of the respective Units. This early repurchase fee would apply separately to each purchase of Units made by a member. The purpose of the 2.00% early repurchase fee is to reimburse the Fund for the costs incurred in liquidating investments in the Fund’s portfolio in order to honor the member’s repurchase request and to discourage short-term investments which are generally disruptive to the Fund’s investment program.

9. Subsequent Events:

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued and has determined that there were no subsequent events requiring adjustment or additional disclosure in the financial statements.

| | | | | | |

| | | | | | | |

| | | | | | |

| | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | 19 |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Members of

BlackRock Preferred Partners LLC:

We have audited the accompanying statement of assets, liabilities and members’ capital of BlackRock Preferred Partners, LLC (the “Fund”), including the schedule of investments, as of March 31, 2012, and the related statements of operations, changes in members’ capital, cash flows and the financial highlights for the period September 1, 2011 (commencement of operations) to March 31, 2012. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial

reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of March 31, 2012, by correspondence with the portfolio funds’ investment advisor or administrator. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of BlackRock Preferred Partners, LLC as of March 31, 2012, the results of its operations, the changes in its members’ capital, its cash flows and the financial highlights for the period September 1, 2011 (commencement of operations) to March 31, 2012, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

Philadelphia, Pennsylvania

May 25, 2012

| | | | | | |

| | | | | | | |

| | | | | | |

| 20 | | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | |

Officers and Directors

| | | | | | | | | | |

Name, Address, and Year of Birth | | Position(s)

Held with

Fund | | Length of Time

Served as

a Director2 | | Principal Occupation(s) During Past Five Years | | Number of BlackRock-

Advised Registered

Investment Companies

(“RICs”) Consisting of

Investment Portfolios

(“Portfolios”) Overseen | | Public Directorships |

| | | | | | | | | | |

Non-Interested Directors1 |

| | | | | |

Richard E. Cavanagh 55 East 52nd Street New York, NY 10055 1946 | | Chairman of the Board and Director | | Since 2011 | | Trustee, Aircraft Finance Trust from 1999 to 2009; Director, The Guardian Life Insurance Company of America since 1998; Director, Arch Chemical (chemical and allied products) from 1999 to 2011; Trustee, Educational Testing Service from 1997 to 2009 and Chairman thereof from 2005 to 2009; Senior Advisor, The Fremont Group since 2008 and Director thereof since 1996; Adjunct Lecturer, Harvard University since 2007; President and Chief Executive Officer, The Conference Board, Inc. (global business research organization) from 1995 to 2007. | | 95 RICs consisting of 95 Portfolios | | None |

| | | | | |

Karen P. Robards 55 East 52nd Street New York, NY 10055 1950 | | Vice Chairperson of the Board, Chairperson of the Audit Committee and Director | | Since 2011 | | Partner of Robards & Company, LLC, (financial advisory firm) since 1987; Co-founder and Director of the Cooke Center for Learning and Development, (a not-for-profit organization) since 1987; Director of Care Investment Trust, Inc. (health care real estate investment trust) from 2007 to 2010; Director of Enable Medical Corp. from 1996 to 2005; Investment Banker at Morgan Stanley from 1976 to 1987. | | 95 RICs consisting of 95 Portfolios | | AtriCure, Inc. (medical devices) |

| | | | | |

Michael J. Castellano 55 East 52nd Street New York, NY 10055 1946 | | Director and Member of the Audit Committee | | Since 2011 | | Managing Director and Chief Financial Officer of Lazard Group LLC from 2001 to 2011; Chief Financial Officer of Lazard Ltd from 2004 to 2011; Director, Support Our Aging Religions (non-profit) since 2009; Director, National Advisory Board of Church Management at Villanova University since 2010. | | 95 RICs consisting of 95 Portfolios | | None |

| | | | | |

Frank J. Fabozzi 55 East 52nd Street New York, NY 10055 1948 | | Director and Member of the Audit Committee | | Since 2011 | | Editor of and Consultant for The Journal of Portfolio Management since 1986; Professor of Finance, EDHEC Business School since 2011; Professor in the Practice of Finance and Becton Fellow, Yale University School of Management from 2006 to 2011; Adjunct Professor of Finance and Becton Fellow, Yale University from 1994 to 2006. | | 95 RICs consisting of 95 Portfolios | | None |

| | | | | |

Kathleen F. Feldstein 55 East 52nd Street New York, NY 10055 1941 | | Director | | Since 2011 | | President of Economics Studies, Inc. (private economic consulting firm) since 1987; Chair, Board of Trustees, McLean Hospital from 2000 to 2008 and Trustee Emeritus thereof since 2008; Member of the Board of Partners Community Healthcare, Inc. from 2005 to 2009; Member of the Corporation of Partners HealthCare since 1995; Trustee, Museum of Fine Arts, Boston since 1992; Member of the Visiting Committee to the Harvard University Art Museum since 2003; Director, Catholic Charities of Boston since 2009. | | 95 RICs consisting of 95 Portfolios | | The McClatchy Company (publishing); BellSouth (telecommunications); Knight Ridder (publishing) |

| | | | | |

James T. Flynn 55 East 52nd Street New York, NY 10055 1939 | | Director and Member of the Audit Committee | | Since 2011 | | Chief Financial Officer of JPMorgan & Co., Inc. from 1990 to 1995. | | 95 RICs consisting of 95 Portfolios | | None |

| | | | | |

Jerrold B. Harris 55 East 52nd Street New York, NY 10055 1942 | | Director | | Since 2011 | | Trustee, Ursinus College since 2000; Director, Troemner LLC (scientific equipment) since 2000; Director of Delta Waterfowl Foundation since 2001; President and Chief Executive Officer VWR Scientific Products Corporation from 1990 to 1999. | | 95 RICs consisting of 95 Portfolios | | BlackRock Kelso Capital Corp. (business development company) |

| | | | | | | | | | |

| | | | | | |

| | | | | | | |

| | | | | | |

| | BLACKROCK PREFERRED PARTNERS LLC | | MARCH 31, 2012 | | 21 |

Officers and Directors (continued)

| | | | | | | | | | |

Name, Address, and Year of Birth | | Position(s)

Held with

Fund | | Length of Time

Served as

a Director2 | | Principal Occupation(s) During Past Five Years | | Number of BlackRock-

Advised Registered

Investment Companies

(“RICs”) Consisting of

Investment Portfolios

(“Portfolios”) Overseen | | Public Directorships |