UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22548

Wall Street EWM Funds Trust

(Exact name of registrant as specified in charter)

55 E. 52nd Street

New York, NY 10055

(Address of principal executive offices) (Zip code)

Frederick Taylor, President

Wall Street EWM Funds Trust

55 E. 52nd Street

New York, NY 10055

(Name and address of agent for service)

(800) 443-4693

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2015

Date of reporting period: June 30, 2015

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

June 30, 2015

THE WALL STREET FUND

SHAREHOLDER LETTER

Dear Shareholders,

For the year to date through June 30, 2015, The Wall Street Fund returned 2.57%. The benchmark S&P 500 Index returned 1.23% for the same period. For the trailing one, three, five and ten years through June 30, 2015, The Wall Street Fund has returned average annual returns of 9.76%, 19.29%, 18.16% and 8.26%, respectively. The S&P 500 Index has returned 7.42%, 17.31%, 17.34% and 7.89% for the same respective time periods.

For the year to date the three most significant contributors to performance were NXPI, Blackstone and United Health. The three holdings that detracted from performance the most were Western Digital, Ralph Lauren and Union Pacific. At quarter–end the Fund held 44 positions and had $109 million of assets.

After several years of high returns, the US equity markets have mostly tread water for the first half of 2015. Valuations for the broad market are above historical averages and we view further gains from rising valuation as unlikely in the near term. Despite the broader market valuations, we continue to find interesting opportunities for the Fund and are hopeful that our companies will continue to execute in a demanding environment.

Sincerely,

| Timothy Evnin | Charles Ryan |

| Portfolio Manager | Portfolio Manager |

| | |

| Michael Seppelt | |

| Portfolio Analyst | |

Performance data shown above represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-443-4693.

The Fund’s gross expense ratio as of the most recent prospectus is 1.29%. Please see the Financial Highlights on page 8 for a more recent ratio.

This report must be preceded or accompanied by a prospectus.

Definitions: The S&P 500 Index is a market-capitalization weighted index that includes the 500 most widely held common stocks. It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. The Fund may invest in small and medium capitalization companies, which involves additional risks such as limited liquidity and greater volatility than large capitalization companies. The Fund may invest in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. Opinions expressed are subject to change, are not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. Please see the schedule of investments section in this report for a full listing of the Fund’s holdings.

The Wall Street Fund is distributed by Quasar Distributors, LLC.

THE WALL STREET FUND

SCHEDULE OF INVESTMENTS

June 30, 2015 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.1% | | | | | | |

| | | | | | | |

| Aerospace – 2.3% | | | | | | |

| United Technologies Corp. | | | 23,200 | | | $ | 2,573,576 | |

| | | | | | | | | |

| Biotechnology – 2.3% | | | | | | | | |

| Gilead Sciences, Inc. | | | 21,200 | | | | 2,482,096 | |

| | | | | | | | | |

| Chemicals – 3.0% | | | | | | | | |

| Celanese Corp. | | | 46,700 | | | | 3,356,796 | |

| | | | | | | | | |

| Containers & Packaging – 2.4% | | | | | | | | |

| Rock-Tenn Co. | | | 44,600 | | | | 2,684,920 | |

| | | | | | | | | |

| Diversified – 2.2% | | | | | | | | |

| 3M Co. | | | 15,800 | | | | 2,437,940 | |

| | | | | | | | | |

| Drugs – 2.5% | | | | | | | | |

| Allergan PLC (a)(b) | | | 8,900 | | | | 2,700,794 | |

| | | | | | | | | |

| Electrical Equipment – 2.5% | | | | | | | | |

| Roper Industries, Inc. | | | 15,800 | | | | 2,724,868 | |

| | | | | | | | | |

| Energy – 2.1% | | | | | | | | |

| Marathon Oil Corp. | | | 85,800 | | | | 2,277,132 | |

| | | | | | | | | |

| Energy Equipment & Services – 5.0% | | | | | | | | |

| Core Laboratories NV (b) | | | 13,800 | | | | 1,573,752 | |

| Noble Corp. (b) | | | 87,900 | | | | 1,352,781 | |

| Schlumberger Ltd. (b) | | | 30,100 | | | | 2,594,319 | |

| | | | | | | | 5,520,852 | |

| | | | | | | | | |

| Financial Services – 12.0% | | | | | | | | |

| American Express Co. | | | 29,100 | | | | 2,261,652 | |

| Apollo Global Management, | | | | | | | | |

| LLC – Class A | | | 84,800 | | | | 1,878,320 | |

| East West Bancorp, Inc. | | | 52,000 | | | | 2,330,640 | |

| Mastercard, Inc. | | | 34,300 | | | | 3,206,364 | |

| The Blackstone Group LP | | | 84,800 | | | | 3,465,776 | |

| | | | | | | | 13,142,752 | |

| | | | | | | | | |

| Forest Products – 2.5% | | | | | | | | |

| Weyerhaeuser Co. – REIT | | | 85,800 | | | | 2,702,700 | |

| | | | | | | | | |

| Health Care Services – 3.3% | | | | | | | | |

| UnitedHealth Group, Inc. | | | 29,600 | | | | 3,611,200 | |

| | | | | | | | | |

| Industrial Equipment – 2.1% | | | | | | | | |

| Fastenal Co. | | | 54,100 | | | | 2,281,938 | |

| | | | | | | | | |

| Insurance – 2.1% | | | | | | | | |

| ACE Ltd. (b) | | | 22,700 | | | | 2,308,136 | |

| | | | | | | | | |

| Leisure – 4.6% | | | | | | | | |

| Las Vegas Sands Corp. | | | 42,400 | | | | 2,228,968 | |

| Polaris Industries, Inc. | | | 19,000 | | | | 2,814,090 | |

| | | | | | | | 5,043,058 | |

| | | | | | | | | |

| Media – 4.0% | | | | | | | | |

| AMC Networks, Inc. – | | | | | | | | |

| Class A (a) | | | 17,300 | | | | 1,416,005 | |

| Walt Disney Co. | | | 25,750 | | | | 2,939,105 | |

| | | | | | | | 4,355,110 | |

| | | | | | | | | |

| Office Equipment – 5.2% | | | | | | | | |

| Apple, Inc. | | | 24,500 | | | | 3,072,912 | |

| Western Digital Corp. | | | 34,000 | | | | 2,666,280 | |

| | | | | | | | 5,739,192 | |

| | | | | | | | | |

| Property Management – 3.0% | | | | | | | | |

| CBRE Group, Inc. – Class A (a) | | | 90,100 | | | | 3,333,700 | |

| | | | | | | | | |

| Retail – 2.7% | | | | | | | | |

| TJX Companies, Inc. | | | 45,600 | | | | 3,017,352 | |

| | | | | | | | | |

| Semiconductors – 4.3% | | | | | | | | |

| NXP Semiconductors NV (a)(b) | | | 31,700 | | | | 3,112,940 | |

| Texas Instruments, Inc. | | | 30,300 | | | | 1,560,753 | |

| | | | | | | | 4,673,693 | |

| | | | | | | | | |

| Services – 3.8% | | | | | | | | |

| Accenture PLC – Class A (b) | | | 11,600 | | | | 1,122,648 | |

| Google, Inc. – Class A (a) | | | 2,700 | | | | 1,458,108 | |

| Google, Inc. – Class C (a) | | | 3,007 | | | | 1,565,174 | |

| | | | | | | | 4,145,930 | |

| | | | | | | | | |

| Software – 4.8% | | | | | | | | |

| Ansys, Inc. (a) | | | 29,600 | | | | 2,700,704 | |

| Microsoft Corp. | | | 57,300 | | | | 2,529,795 | |

| | | | | | | | 5,230,499 | |

| | | | | | | | | |

| Specialty Retail – 15.3% | | | | | | | | |

| AutoNation, Inc. (a) | | | 43,500 | | | | 2,739,630 | |

| AutoZone, Inc. (a) | | | 5,400 | | | | 3,601,260 | |

| Dorman Products, Inc. (a) | | | 26,400 | | | | 1,258,224 | |

| Five Below, Inc. (a) | | | 39,200 | | | | 1,549,576 | |

| Home Depot, Inc. | | | 28,000 | | | | 3,111,640 | |

| Nike, Inc. – Class B | | | 22,700 | | | | 2,452,054 | |

| Ralph Lauren Corp. | | | 15,800 | | | | 2,091,288 | |

| | | | | | | | 16,803,672 | |

The accompanying notes are an integral part of these financial statements.

THE WALL STREET FUND

SCHEDULE OF INVESTMENTS (continued)

June 30, 2015 (Unaudited)

| | | Shares | | | Value | |

COMMON STOCKS – 98.1% (continued) | | | | | | |

| | | | | | | |

| Telecommunications – 2.0% | | | | | | |

| American Tower Corp. – REIT | | | 23,200 | | | $ | 2,164,328 | |

| | | | | | | | | |

| Transportation – 2.1% | | | | | | | | |

| Union Pacific Corp. | | | 24,300 | | | | 2,317,491 | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $76,283,471) | | | | | | | 107,629,725 | |

| | | | | | | | | |

| SHORT TERM INVESTMENT – 4.6% | | | | | | | | |

| | | | | | | | | |

| Money Market Fund – 4.6% | | | | | | | | |

| First American Prime Obligations | | | | | | | | |

| Fund, Class Z, 0.026% (c) | | | 5,104,272 | | | | 5,104,272 | |

| | | | | | | | | |

| TOTAL SHORT TERM | | | | | | | | |

| INVESTMENT | | | | | | | | |

| (Cost $5,104,272) | | | | | | | 5,104,272 | |

| TOTAL INVESTMENTS | | | | | | | | |

| (Cost $81,387,743) – 102.7% | | | | | | | 112,733,997 | |

| Liabilities in Excess | | | | | | | | |

| of Other Assets – (2.7)% | | | | | | | (3,002,018 | ) |

| TOTAL NET | | | | | | | | |

| ASSETS – 100.0% | | | | | | $ | 109,731,979 | |

| | | | | | | | | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security |

| (c) | Variable rate security – the rate shown is the annualized seven-day effective yield as of June 30, 2015. |

REIT – Real Estate Investment Trust

The accompanying notes are an integral part of these financial statements.

THE WALL STREET FUND

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2015 (Unaudited)

| ASSETS: | | | |

| Investments, at value (cost $81,387,743) | | $ | 112,733,997 | |

| Receivable for fund shares sold | | | 135,244 | |

| Receivable for investment securities sold | | | 181,885 | |

| Dividends receivable | | | 77,745 | |

| Expense reimbursement due | | | | |

| from Adviser (Note 4) | | | 10,004 | |

| Prepaid expenses | | | 22,706 | |

| Total Assets | | | 113,161,581 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for investments purchased | | | 3,293,701 | |

| Investment advisory fee payable (Note 4) | | | 65,021 | |

| Accrued expenses and other payables | | | 70,880 | |

| Total Liabilities | | | 3,429,602 | |

| NET ASSETS | | $ | 109,731,979 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital stock | | $ | 72,863,392 | |

| Net unrealized appreciation | | | | |

| on investments | | | 31,346,254 | |

| Undistributed net investment income | | | 204,635 | |

| Accumulated undistributed net realized | | | | |

| gain on investments | | | 5,317,698 | |

| TOTAL NET ASSETS | | $ | 109,731,979 | |

| | | | | |

| Shares outstanding (unlimited shares | | | | |

| authorized, no par value) | | | 7,436,699 | |

| NET ASSET VALUE, OFFERING AND | | | | |

| REDEMPTION PRICE PER SHARE | | $ | 14.76 | |

THE WALL STREET FUND

STATEMENT OF OPERATIONS

For the six months ended June 30, 2015 (Unaudited)

| INVESTMENT INCOME: | | | |

| Dividend income | | $ | 711,047 | |

| Total investment income | | | 711,047 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees (Note 4) | | | 380,795 | |

| Administration and fund accounting fees | | | 64,103 | |

| Professional fees | | | 45,060 | |

| Transfer agent fees and expenses | | | 20,649 | |

| Trustees' fees and expenses | | | 18,934 | |

| Federal and state registration fees | | | 16,556 | |

| Insurance expense | | | 11,196 | |

| Reports to shareholders | | | 4,837 | |

| Custody fees | | | 4,757 | |

| Total expenses before | | | | |

| expense reimbursement | | | 566,887 | |

| Expenses reimbursed by Adviser (Note 4) | | | (59,161 | ) |

| Net expenses | | | 507,726 | |

| NET INVESTMENT INCOME | | | 203,321 | |

| | | | | |

| REALIZED AND UNREALIZED | | | | |

| GAIN (LOSS) ON INVESTMENTS: | | | | |

| Net realized gain on | | | | |

| investment transactions | | | 3,046,618 | |

| Change in unrealized appreciation | | | | |

| on investments | | | (809,669 | ) |

| Net realized and unrealized gain | | | | |

| on investments | | | 2,236,949 | |

| NET INCREASE IN NET ASSETS | | | | |

| RESULTING FROM OPERATIONS | | $ | 2,440,270 | |

The accompanying notes are an integral part of these financial statements.

THE WALL STREET FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the | | | For the | |

| | | Six Months | | | Year | |

| | | Ended | | | Ended | |

| | | June 30, | | | December 31, | |

| | | 2015 | | | 2014 | |

| | | (Unaudited) | | | | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 203,321 | | | $ | 132,301 | |

| Net realized gain on | | | | | | | | |

| investment transactions | | | 3,046,618 | | | | 7,169,212 | |

| Change in | | | | | | | | |

| unrealized appreciation | | | | | | | | |

| on investments | | | (809,669 | ) | | | 6,262,290 | |

| Net increase in net assets | | | | | | | | |

| resulting from operations | | | 2,440,270 | | | | 13,563,803 | |

| | | | | | | | | |

| CAPITAL SHARE | | | | | | | | |

| TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 16,857,786 | | | | 18,346,195 | |

| Cost of shares redeemed | | | (6,749,792 | ) | | | (7,583,594 | ) |

| Reinvested distributions | | | — | | | | 1,017,854 | |

| Net increase in net assets | | | | | | | | |

| resulting from capital | | | | | | | | |

| share transactions | | | 10,107,994 | | | | 11,780,455 | |

| | | | | | | | | |

| DISTRIBUTIONS TO | | | | | | | | |

| SHAREHOLDERS FROM: | | | | | | | | |

| Net investment income | | | — | | | | (164,449 | ) |

| Net realized gain | | | — | | | | (6,043,706 | ) |

| Total distributions | | | | | | | | |

| to shareholders | | | — | | | | (6,208,155 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN | | | | | | | | |

| NET ASSETS | | | 12,548,264 | | | | 19,136,103 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 97,183,715 | | | | 78,047,612 | |

| End of period | | $ | 109,731,979 | | | $ | 97,183,715 | |

| | | | | | | | | |

| UNDISTRIBUTED NET | | | | | | | | |

| INVESTMENT | | | | | | | | |

| INCOME | | $ | 204,635 | | | $ | 1,314 | |

THE WALL STREET FUND

NOTES TO FINANCIAL STATEMENTS

June 30, 2015 (Unaudited)

1. Organization

The Wall Street Fund (the "Fund") is the sole series of Wall Street EWM Funds Trust (the "Trust"). The Trust was organized as a Delaware statutory trust on April 12, 2011. The Trust is registered under the Investment Company Act of 1940 (the "1940 Act"), as amended, as an open-end management investment company. The Fund is a diversified series with its own investment objectives and policies within the Trust. The Fund seeks to produce growth of capital by investing principally in a diversified portfolio of growth-oriented common stocks. As a secondary objective, the Fund seeks realization of current income through the receipt of interest or dividends from investments by investing in dividend paying securities. The Fund is the successor in interest to The Wall Street Fund, Inc. (the "Predecessor Fund"). On September 15, 2014, the shareholders of the Predecessor Fund approved the reorganization of the Predecessor Fund into the Fund, and effective as of the close of business on October 1, 2014, the assets and liabilities of the Predecessor Fund were transferred to the Fund in exchange for shares of the Fund. Prior, to the reorganization, the Fund had no assets or operations. Since the Fund's investment objectives and policies are the same in all material respects as the Predecessor Fund's, and since the Fund has engaged Evercore Wealth Management, LLC, the investment adviser that previously provided services to the Predecessor Fund, the Fund has adopted the prior performance and financial history of the Predecessor Fund.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America, which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported results of operations during the reporting period. Actual results could differ from those estimates and assumptions.

(a) Investment Valuation – Securities which are traded on a national stock exchange are valued at the last sale price on the securities exchange on which such securities are primarily traded. Securities traded on the over-the-counter market and listed securities for which there were no transactions are valued at the mean between the closing bid and asked prices. Debt securities are valued at the mean price furnished by a national pricing service, subject to review by

The accompanying notes are an integral part of these financial statements.

THE WALL STREET FUND

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2015 (Unaudited)

the Fund’s investment adviser and determination of the appropriate price whenever a furnished price is significantly different from the previous day’s furnished price. Investments in open-end mutual funds (other than exchange-traded funds) are valued at their respective net asset values on the valuation date. Securities for which market quotations are not readily available and other assets are valued at fair value as determined in good faith by the Fund’s investment adviser pursuant to procedures approved by and under supervision of the Fund’s Board of Trustees.

Generally accepted accounting principles require disclosures regarding the valuation inputs and techniques used to measure fair value and any changes in such valuation inputs and techniques. The various inputs used in determining the value of each of the Fund’s investments are summarized in the following three broad categories:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The valuation levels are not necessarily an indication of the risk associated with investing in these investments. As of June 30, 2015, the Fund’s investments were classified as follows:

| | | | | | | | | | | | Total | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Fair Value | |

| Common | | | | | | | | | | | | |

| Stocks* | | $ | 107,629,725 | | | $ | — | | | $ | — | | | $ | 107,629,725 | |

| Short-Term | | | | | | | | | | | | | | | | |

| Investment | | | 5,104,272 | | | | — | | | | — | | | | 5,104,272 | |

| Total | | | | | | | | | | | | | | | | |

| Investments | | $ | 112,733,997 | | | $ | — | | | $ | — | | | $ | 112,733,997 | |

| * | Please refer to the Schedule of Investments for further industry breakout. |

Transfers between levels are recognized at the end of the reporting period. During the six months ended June 30, 2015, the Fund did not have any transfers between valuation levels or invest in any Level 3 securities.

(b) Federal Income and Excise Taxes – The Fund intends to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all net investment company taxable income and net capital gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income or excise tax provision is recorded.

The Fund has adopted financial reporting rules regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. Management has reviewed all open tax years and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. The Fund is not subject to examination by U.S. federal tax authorities for any tax years before 2011.

(c) Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gain, if any, will be declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date. The Fund may periodically make reclassifications among certain of its capital accounts as a result of the recognition and characterization of certain income and capital gain distributions determined annually in accordance with federal tax regulations which may differ from generally accepted accounting principles.

(d) Securities Transactions and Investment Income – Investment transactions are recorded on the trade date for financial statement purposes. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sale proceeds. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Acquisition and market discounts and premiums are amortized over the life of the security. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations.

3. Investment Transactions

The aggregate purchases and sales of securities for the six months ended June 30, 2015, excluding short-term investments, were $20,844,905 and $12,103,864, respectively. There were no purchases or sales of long-term U.S. government securities.

THE WALL STREET FUND

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2015 (Unaudited)

4. Investment Adviser

The Fund has entered into an Investment Advisory Agreement with Evercore Wealth Management, LLC (the “Adviser”), with whom certain trustees and officers of the Fund are also officers and partners/advisors of the investment adviser. Pursuant to this Agreement, the Adviser is entitled to receive a management fee, calculated daily and payable monthly, at an annual rate of 0.75% of the Fund’s average daily net assets.

The Adviser has contractually agreed to waive its management fee and reimburse the Fund’s other expenses to the extent necessary to ensure that total annual operating expenses (excluding all federal, state and local taxes, interest, dividends and interest on short positions, acquired fund fees and expenses, brokerage commissions and other costs incurred in connection with the purchase and sale of securities and extraordinary items) do not exceed 1.00% of the Fund’s average daily net assets. Any such reduction made by the Adviser in its fees or payment of expenses which is the Fund’s obligation are subject to possible reimbursement by the Fund to the Adviser within three years after the fees have been waived and/or reimbursed. Fees waived and expenses reimbursed by the Adviser may be recouped by the Adviser if such recoupment can be achieved without exceeding the expense limit in effect at the time the waiver and reimbursement occurred. As of June 30, 2015, the Adviser did not recoup any previously waived expenses. This expense limitation agreement will continue in effect until September 30, 2016. Waived fees and reimbursed expenses subject to potential recovery by year of expiration are as follows:

| | Expiration | Amount | |

| | 2015 | $135,338 | |

| | 2016 | $172,135 | |

| | 2017 | $261,698 | |

| | 2018 | $5 9,161 | |

5. Shares of Common Stock

Transactions in shares of common stock were as follows:

| | | Six Months Ended | | | Year Ended | |

| | | June 30, | | | December 31, | |

| | | 2015 | | | 2014 | |

| Shares Sold | | | 1,141,120 | | | | 1,324,090 | |

| Shares Redeemed | | | (456,995 | ) | | | (540,677 | ) |

| Shares Reinvested | | | — | | | | 70,100 | |

| Net Increase | | | 684,125 | | | | 853,513 | |

| Shares Outstanding: | | | | | | | | |

| Beginning of Period | | | 6,752,574 | | | | 5,899,061 | |

| End of Period | | | 7,436,699 | | | | 6,752,574 | |

6. Tax Information

As of December 31, 2014, the Fund's most recently completed fiscal year end, the components of accumulated earnings on a tax basis were as follows:

| Cost of Investments | | $ | 64,960,781 | |

| Gross unrealized appreciation | | $ | 32,711,175 | |

| Gross unrealized depreciation | | | (755,310 | ) |

| Net unrealized appreciation | | | 31,955,865 | |

| Undistributed ordinary income | | | 181,467 | |

| Undistributed long-term capital gain | | | 2,290,985 | |

| Total distributable earnings | | | 2,472,452 | |

| Total accumulated earnings | | $ | 34,428,317 | |

The basis of investments for tax and financial reporting purposes differs principally due to the deferral of losses on wash sales.

The tax character of distributions paid during the years ended December 31, 2014 and 2013 were as follows:

| | | 2014 | | | 2013 | |

| Ordinary Income | | $ | 397,879 | | | $ | 368,295 | |

| Long Term Capital Gain | | $ | 5,810,276 | | | $ | 1,465,788 | |

The Fund intends to utilize provisions of the federal income tax laws which allow it to carry a realized capital loss forward and offset such losses against any future realized capital gains. At December 31, 2014, the Fund did not have a capital loss carryover. Any future capital losses will be permitted to be carried over for an unlimited period.

7. Guarantees and Indemnifications

In the normal course of business, the Fund enters into contracts with its service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

THE WALL STREET FUND

FINANCIAL HIGHLIGHTS

Selected per share data is based on a share of common stock outstanding throughout each period.

| | | Six Months | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | June 30, | | | Year Ended December 31, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| beginning of period | | $ | 14.39 | | | $ | 13.23 | | | $ | 9.84 | | | $ | 8.99 | | | $ | 8.93 | | | $ | 7.76 | | | $ | 5.79 | | | $ | 9.88 | | | $ | 8.78 | | | $ | 8.42 | | | $ | 7.83 | |

| | |

| Income from investment operations: | |

Net investment income (loss)(1) | | | 0.03 | | | | 0.02 | | | | 0.02 | | | | 0.01 | | | | 0.04 | | | | (0.01 | ) | | | (0.02 | ) | | | (0.02 | ) | | | (0.03 | ) | | | (0.05 | ) | | | (0.05 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| gains (losses) on investments | | | 0.34 | | | | 2.07 | | | | 3.68 | | | | 0.87 | | | | 0.02 | | | | 1.18 | | | | 1.99 | | | | (4.01 | ) | | | 1.51 | | | | 0.51 | | | | 0.64 | |

| Total from investment operations | | | 0.37 | | | | 2.09 | | | | 3.70 | | | | 0.88 | | | | 0.06 | | | | 1.17 | | | | 1.97 | | | | (4.03 | ) | | | 1.48 | | | | 0.46 | | | | 0.59 | |

| | | | | | |

| Less distributions: | | | | | |

| Distributions from net | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| investment income | | | — | | | | (0.02 | ) | | | (0.03 | ) | | | (0.03 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| gains from security transactions | | | — | | | | (0.91 | ) | | | (0.28 | ) | | | — | | | | — | | | | — | | | | — | | | | (0.06 | ) | | | (0.38 | ) | | | (0.10 | ) | | | — | |

| Total distributions | | | — | | | | (0.93 | ) | | | (0.31 | ) | | | (0.03 | ) | | | — | | | | — | | | | — | | | | (0.06 | ) | | | (0.38 | ) | | | (0.10 | ) | | | — | |

| Net asset value, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| end of period | | $ | 14.76 | | | $ | 14.39 | | | $ | 13.23 | | | $ | 9.84 | | | $ | 8.99 | | | $ | 8.93 | | | $ | 7.76 | | | $ | 5.79 | | | $ | 9.88 | | | $ | 8.78 | | | $ | 8.42 | |

| Total return | | | 2.57 | %(2) | | | 15.74 | % | | | 37.65 | % | | | 9.77 | % | | | 0.67 | % | | | 15.08 | % | | | 34.02 | % | | | (41.02 | %) | | | 16.92 | % | | | 5.42 | % | | | 7.54 | % |

| | |

| Supplemental data and ratios: | |

Net assets, end of period (in 000's) | | $ | 109,732 | | | $ | 97,184 | | | $ | 78,048 | | | $ | 54,216 | | | $ | 28,051 | | | $ | 20,394 | | | $ | 12,209 | | | $ | 10,594 | | | $ | 19,310 | | | $ | 17,351 | | | $ | 17,470 | |

| Ratio of operating expenses to | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| before reimbursements | | | 1.12 | %(3) | | | 1.29 | % | | | 1.25 | % | | | 1.32 | % | | | 1.47 | % | | | 2.08 | % | | | 1.98 | % | | | 1.76 | % | | | 1.60 | % | | | 1.71 | % | | | 1.71 | % |

| Ratio of operating expenses to | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| net of reimbursements | | | 1.00 | %(3) | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.63 | % | | | 1.95 | % | | | 1.76 | % | | | 1.60 | % | | | 1.71 | % | | | 1.71 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (loss) to average net assets, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| before reimbursements | | | 0.28 | %(3) | | | (0.14 | %) | | | (0.10 | %) | | | 0.05 | % | | | (0.04 | %) | | | (0.64 | %) | | | (0.34 | %) | | | (0.22 | %) | | | (0.34 | %) | | | (0.56 | %) | | | (0.69 | %) |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (loss) to average net assets, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| net of reimbursement | | | 0.40 | %(3) | | | 0.15 | % | | | 0.15 | % | | | 0.37 | % | | | 0.43 | % | | | (0.19 | %) | | | (0.31 | %) | | | (0.22 | %) | | | (0.34 | %) | | | (0.56 | %) | | | (0.69 | %) |

| Portfolio turnover rate | | | 12.06 | %(2) | | | 21.53 | % | | | 36.65 | % | | | 84.10 | % | | | 88.29 | % | | | 42.58 | % | | | 49.44 | % | | | 58.78 | % | | | 65.26 | % | | | 94.41 | % | | | 115.90 | % |

__________

| (1) | Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

The accompanying notes are an integral part of these financial statements.

THE WALL STREET FUND

EXPENSE EXAMPLE

For the Six Months Ended June 30, 2015 (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. If you invest through a financial intermediary, you may also incur additional costs such as a transaction fee charged on the purchase or sale of the Fund or an asset-based management fee. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2015 to June 30, 2015.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any costs that may be associated with investing in the Fund through a financial intermediary. Therefore, the second line of the table is useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any costs associated with investing through a financial intermediary were included, your costs would have been higher.

| | | | Expenses |

| | | | Paid |

| | Beginning | Ending | During |

| | Account | Account | Period(1) |

| | Value | Value | 1/1/15 – |

| | 1/1/15 | 6/30/15 | 6/30/15 |

Actual(2) | $1,000.00 | $1,025.70 | $5.02 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,019.84 | 5.01 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio of 1.00% for the six-months ended June 30, 2015, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| (2) | Based on the actual returns of 2.57% for the six-month period ended June 30, 2015. |

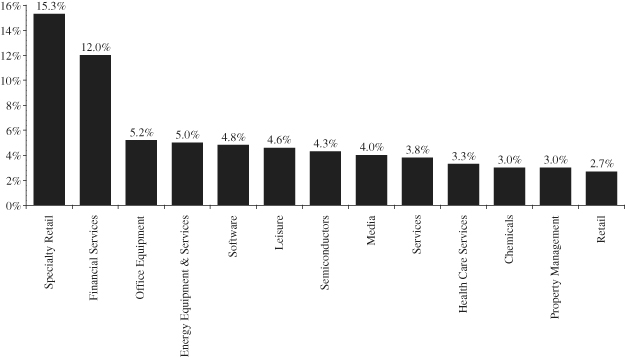

ALLOCATION OF PORTFOLIO ASSETS

(Calculated as a percentage of net assets)

June 30, 2015 (Unaudited)

ADDITIONAL INFORMATION

June 30, 2015 (Unaudited)

Availability of Proxy Voting Information

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge upon request by calling toll-free at (800) 443-4693 or by accessing the Fund’s website at www.evercorewealthfunds.com and the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month period ended June 30 is available on the SEC’s website at www.sec.gov or by calling the toll-free number listed above.

Availability of Fund Portfolio Information

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q, which is available on the SEC’s website at www.sec.gov, or by calling the Fund at (800) 443-4693. The Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. For information on the Public Reference Room call 1-800-SEC-0330. In addition, the Fund will make its portfolio holdings information publicly available by posting the information at www.evercorewealthfunds.com on a monthly basis.

TRUSTEES

Frederick Taylor, Chairman

Laird I. Grant

Katharine Plourde

OFFICERS

Frederick Taylor, President

Ruth Calaman, Executive Vice President,

Secretary & Chief Compliance Officer

John Rendinaro,

Executive Vice President & Treasurer

INVESTMENT ADVISOR

Evercore Wealth Management, LLC.

55 E. 52nd Street

23rd Floor

New York, New York 10055

CUSTODIAN

U.S. Bank, N.A.

1555 North Rivercenter Drive, Suite 302

Milwaukee, Wisconsin 53212

ADMINISTRATOR, TRANSFER AGENT,

DIVIDEND PAYING AGENT &

SHAREHOLDER SERVICING AGENT

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

P.O. Box 701

Milwaukee, Wisconsin 53201

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, Ohio 44115

DISTRIBUTOR

Quasar Distributors, LLC

615 E. Michigan Street

Milwaukee, Wisconsin 53202

THE WALL STREET FUND

55 E. 52nd Street

23rd Floor

New York, New York 10055

(800) 443-4693

http://www.evercorewealthfunds.com

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Filed herewith. |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Wall Street EWM Funds Trust

By (Signature and Title)* /s/Frederick Taylor

Frederick Taylor, President

Date September 8, 2015

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/Frederick Taylor

Frederick Taylor, President

Date September 8, 2015

By (Signature and Title)* /s/John J. Rendinaro

John J. Rendinaro, Treasurer

Date September 8, 2015

* Print the name and title of each signing officer under his or her signature.