united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22549

Northern Lights Fund Trust II

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246

(Address of principal executive offices) (Zip code)

Kevin Wolf, Gemini Fund Services, LLC

80 Arkay Drive, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 12/31

Date of reporting period: 12/31/20

Item 1. Reports to Stockholders.

Acclivity Mid Cap Multi-Style Fund

Acclivity Small Cap Value Fund

Annual Report

December 31, 2020

www.acclivityfunds.com

1 (855) 873-3837

Distributed by Northern Lights Distributors, LLC

Member FINRA

US Market Review (unaudited)

A Brief Recap

The U.S. equity market had a historic and unprecedented year in 2020 because of the global healthcare pandemic. Across different market capitalization segments, the U.S. large-cap, as represented by the Russell 1000 Index, finished with 20.96%, the U.S. mid-cap, as represented by the Russell Mid-Cap Index, went up with 17.10%, while the U.S. small-cap, as represented by the Russell 2000 Index, underperformed the large peers by 1%. Among all the GICS sectors, Information Technology and Consumer Discretionary securities outperformed while Energy securities lagged behind most. Value securities underperformed growth securities across different market capitalization segments measured by Russell indices in 2020.

Acclivity Mid-Cap Multi-Style Fund (AXMIX)

Within the Mid Caps for this period, the Russell Mid-Cap Value Total Return Index went up 4.96%, while the Russell Mid-Cap Growth Total Return Index surged 35.59%. Acclivity Mid-Cap Multi-Style Fund I Share class was up 10.40%. Exhibit 1 compares the quarterly performance of AXMIX and its benchmark Russell Mid-Cap Total Return Index.

Exhibit 1. Performance of AXMIX v.s. Russell Mid-Cap Index as of December 31th, 2020

| | | | | | |

| 2020 Performance | Q1 | Q2 | Q3 | Q4 | YTD |

| | | | | | |

| AXMIX | -31.00% | 22.46% | 6.86% | 22.26% | 10.40% |

| Russell Mid-Cap | -27.07% | 24.61% | 7.46% | 19.91% | 17.10% |

To decompose fund performance, the underweight of real estate and utility securities have made up most of the positive sector allocation, and the overweight in financial securities dragged the performance. In the meanwhile, the security selections in the information technology and real estate sectors struggled.

Exhibit 2 compares the characteristics of the fund against the benchmark. Our fund investment style is consistent and is in line with the investment prospectus, while the investment style of the benchmark deviates over time due to the infrequent rebalance.

Exhibit 2. Characteristics of AXMIX v.s. Russell Mid-Cap Index as of December 31th, 2020.

| | | | | Market |

| | | | EBITDA/Total | Capitalization |

| Fund/Index | Price-to-Book | Price-to-Earnings | Market Value | ($B) |

| AXMIX | 2.63 | 20.11 | 2.67% | 12.78 |

| Russell Mid-Cap Index | 3.20 | 23.31 | 2.97% | 20.48 |

Our research team pursues an active research agenda in which we are looking for better ways to define and measure factors systematically. We work with leading financial economists to follow, digest, and analyze the latest academic research. And as always, we are focused on delivering long-term results that our clients expect from Innealta Capital.

Acclivity Small Cap Value Fund (AXVIX)

Within the Small Caps for this period, the Russell 2000 Value Total Return Index (“The Benchmark”) gained 4.63%, while the Russell 2000 Growth Total Return Index surged 34.63%. Acclivity Small Cap Value Fund I Share class was up 7.51%. Exhibit 1 compares the quarterly performance of AXVIX and its benchmark Russell 2000 Value Index.

Exhibit 1. Quarterly Performance of AXVIX v.s. Russell 2000 Value in 2020

| | | | | | |

| 2020 Performance | Q1 | Q2 | Q3 | Q4 | YTD |

| | | | | | |

| AXVIX | -38.78% | 26.39% | 3.96% | 33.65% | 7.51% |

| Russell 2000 Value | -35.66% | 18.91% | 2.56% | 33.36% | 4.63% |

To decompose fund performance, the overweight in consumer discretionary and information technology securities and the underweight of real estate securities have made up most of the positive sector allocation. Meanwhile, the security selections in the financial and real estate sectors have made up most of the positive security selection. The security selections in information technology and materials securities struggled.

Exhibit 2 compares the characteristics of the fund against the benchmark. Our fund investment style is consistent and is in line with the investment prospectus, while the investment style of the benchmark deviates over time due to the infrequent rebalance.

Exhibit 2. Characteristics of AXVIX v.s. Russell 2000 Value Index as of December 31st, 2020.

| | | | | Market |

| | | | EBITDA/Total | Capitalization |

| Fund/Index | Price-to-Book | Price-to-Earnings | Market Value | ($B) |

| AXVIX | 1.09 | 11.84 | 6.41% | 2.87 |

| Russell 2000 Value Index | 1.51 | 15.88 | 2.76% | 2.50 |

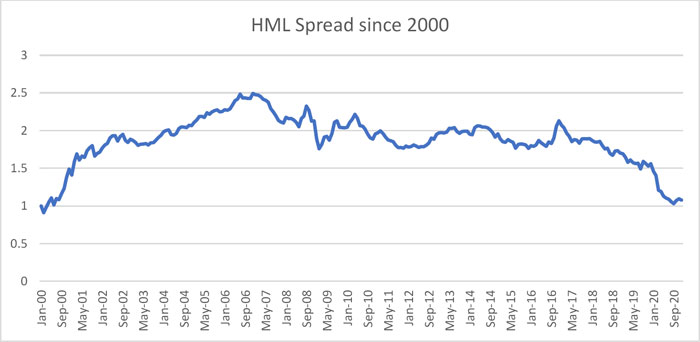

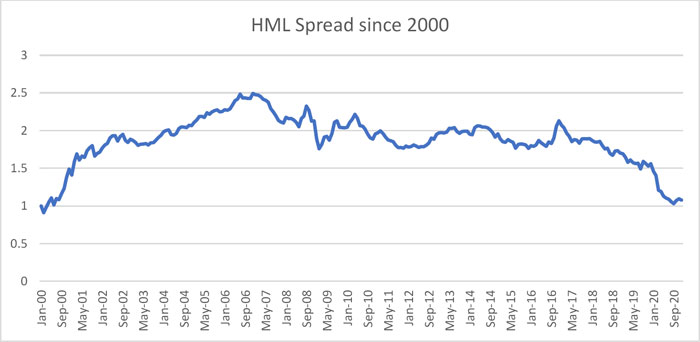

The underperformance of value securities relative to the growth securities has been a headwind for our more profound value tilt throughout 2020. The spread between Value and Growth is the widest in almost the last 20 years. See Exhibit 3 for Value v.s. Growth spread from January 2000 to December 2020. In the long run, value still outperforms growth. However, the spread has been narrowed sharply in the last five years.

Exhibit 3. High minus Low (Value v.s. Growth) spread from January 2000 to December 2020.

Source: Kenneth R. French data library. Fama/French 3 Factors from 01/01/2000 to 12/31/2020. Frequency monthly. HML (High Minus Low) is the average return on the two value portfolios minus the average return on the two growth portfolios.

If we look into the historical performance of value and growth, the value factor’s current underperformance is not surprising. Although value has a long-term outperformance track record, value underperforms growth when the economy is slowing down. We believe that the monetary and fiscal policy easing has played a significant role in this outperformance of growth investing.

Disclosures and Important Information

Russell 1000 Index is a stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index. Russell 2000 Index is a small-cap stock market index of the bottom 2,000 stocks in the Russell 3000 Index. Total return indexes reinvest dividends. Russell Mid-Cap Index is a stock market index that tracks the 800 smallest companies in the Russell 1000 Index, which represents approximately 25% of the total market capitalization of the Russell 1000 Index. Russell 2000 Value Index measures the performance of Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Russell 2000 Growth Index measures the performance of Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Indices do not reflect any fees, expenses, or sales charges and are not available for direct investment.

Price-to-book ratio is calculated using Index Methodology. Price-to-earnings ratio is calculated using Weighted Harmonic Average. EBITDA/Total Market Value is a proxy for current cash flow to total market value, commonly known in factor investing as “profitability”.

Investments cannot be made in an index. Unmanaged index returns do not reflect any fees, expenses, or sales charges. Past performance is no guarantee of future results.

706-INN-02/02/2021

2136-NLD-2/2/2021

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| PORTFOLIO REVIEW (Unaudited) |

| December 31, 2020 |

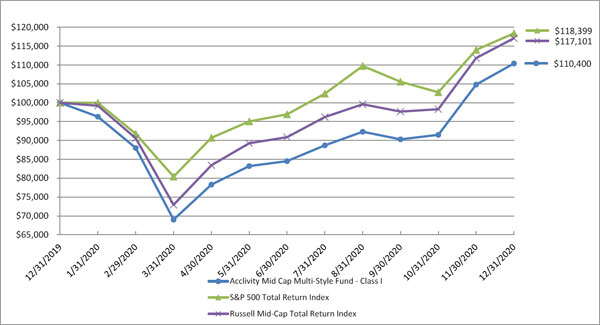

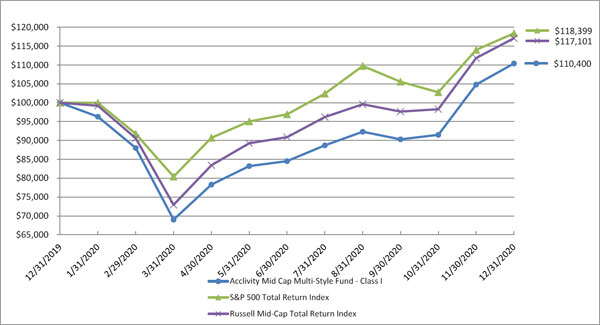

The Fund’s performance figures* for the period ended December 31, 2020, compared to its benchmark:

| | | Since Inception |

| | One Year | (12/31/19) |

| Acclivity Mid Cap Multi-Style Fund - Class I | 10.40% | 10.40% |

| Acclivity Mid Cap Multi-Style Fund - Class N | 10.40% | 10.40% |

| Russell Mid-Cap Total Return Index** | 17.10% | 17.10% |

| S&P 500 Total Return Index*** | 18.40% | 18.40% |

Comparison of the Change in Value of a $100,000 Investment

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gain distributions, if any. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expenses are 0.89% for Class I shares and 1.14% for Class N shares per the May 1, 2020, prospectus. After fee waivers, the Fund’s total annual operating expenses are 0.45% for Class I shares and 0.70% for Class N shares. For performance information current to the most recent month-end, please call toll-free 1-855-873-3837 (1-855-USE-ETFS). |

| ** | The Russell Mid-Cap Total Return Index measures the performance of the smallest 800 companies in the Russell 1000 index. Investors cannot invest directly in an index. |

| *** | The S&P 500 Total Return Index is a widely accepted, unmanaged index of U.S. stock market performance which does not take into account charges, fees and other expenses. Investors cannot invest directly in an index. |

| | Holdings By Asset Class as of December 31, 2020 | | % of Net Assets | |

| | Money Market Fund | | | 19.1 | % |

| | Insurance | | | 8.9 | % |

| | Health Care Facilities & Services | | | 5.3 | % |

| | Medical Equipment & Devices | | | 5.0 | % |

| | Semiconductors | | | 4.8 | % |

| | Technology Hardware | | | 4.6 | % |

| | Chemicals | | | 4.3 | % |

| | Banking | | | 4.2 | % |

| | Machinery | | | 4.1 | % |

| | Other | | | 54.9 | % |

| | Liabilities in Excess of Other Assets | | | (15.2 | )% |

| | | | | 100.0 | % |

| | | | | | |

| | Please refer to the Schedule of Investments in this annual report for a detailed analysis of the Fund’s holdings. |

| ACCLIVITY SMALL CAP VALUE FUND |

| PORTFOLIO REVIEW (Unaudited) |

| December 31, 2020 |

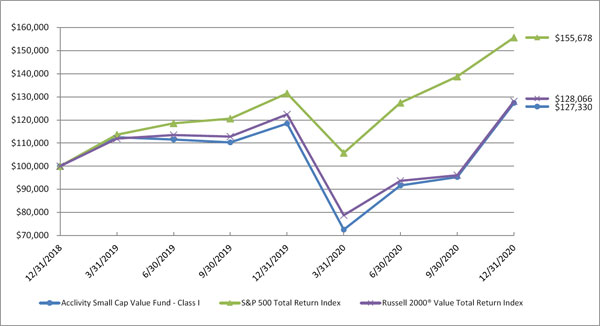

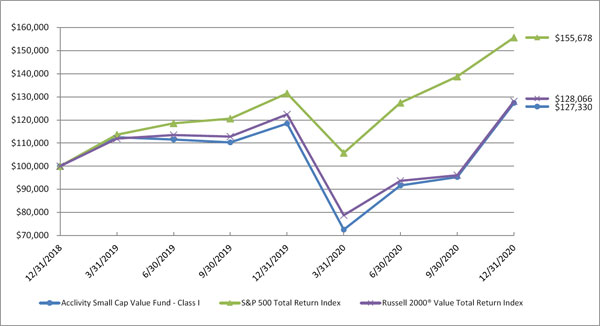

The Fund’s performance figures* for the periods ended December 31, 2020, compared to its benchmark:

| | | Since Inception |

| | One Year | (12/31/18) |

| Acclivity Small Cap Value Fund - Class I | 7.51% | 12.84% |

| Acclivity Small Cap Value Fund - Class N | 7.43% | 12.75% |

| Russell 2000® Value Total Return Index** | 4.63% | 13.17% |

| S&P 500 Total Return Index*** | 18.40% | 24.77% |

Comparison of the Change in Value of a $100,000 Investment

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gain distributions, if any. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expenses are 14.44% for Class I shares and 81.47% for Class N shares per the May 1, 2020, prospectus. After fee waivers, the Fund’s total annual operating expenses are 0.49% for Class I shares and 0.74% for Class N shares. For performance information current to the most recent month-end, please call toll-free 1-855-873-3837 (1-855-USE-ETFS). |

| ** | The Russell 2000® Value Total Return Index measures the performance of the largest 2,000 U.S. companies determined by total market capitalization. Investors cannot invest directly in an index. |

| *** | The S&P 500 Total Return Index is a widely accepted, unmanaged index of U.S. stock market performance which does not take into account charges, fees and other expenses. Investors cannot invest directly in an index. |

| | Holdings By Asset Class as of December 31, 2020 | | % of Net Assets | |

| | Banking | | | 21.0 | % |

| | Retail - Discretionary | | | 8.9 | % |

| | Insurance | | | 6.5 | % |

| | Technology Hardware | | | 5.9 | % |

| | Specialty Finance | | | 4.2 | % |

| | Machinery | | | 4.2 | % |

| | Oil & Gas Producers | | | 3.1 | % |

| | Biotech & Pharma | | | 2.6 | % |

| | Engineering & Construction | | | 2.3 | % |

| | Other | | | 41.9 | % |

| | Liabilities in Excess of Other Assets | | | (0.6 | )% |

| | | | | 100.0 | % |

| | | | | | |

| | Please refer to the Schedule of Investments in this annual report for a detailed analysis of the Fund’s holdings. |

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.1% | | | | |

| | | | | ADVERTISING & MARKETING - 2.9% | | | | |

| | 44 | | | Interpublic Group of Companies, Inc. (The) | | $ | 1,035 | |

| | 10 | | | Omnicom Group, Inc. | | | 624 | |

| | 3 | | | Trade Desk, Inc. (The), Class A(a) | | | 2,403 | |

| | | | | | | | 4,062 | |

| | | | | AEROSPACE & DEFENSE - 0.2% | | | | |

| | 1 | | | Hexcel Corporation | | | 48 | |

| | 6 | | | Textron, Inc. | | | 290 | |

| | | | | | | | 338 | |

| | | | | APPAREL & TEXTILE PRODUCTS - 1.0% | | | | |

| | 1 | | | Carter’s, Inc. | | | 94 | |

| | 2 | | | Deckers Outdoor Corporation(a) | | | 574 | |

| | 4 | | | Ralph Lauren Corporation | | | 415 | |

| | 6 | | | Skechers USA, Inc., Class A(a) | | | 216 | |

| | 6 | | | Tapestry, Inc. | | | 186 | |

| | | | | | | | 1,485 | |

| | | | | ASSET MANAGEMENT - 2.5% | | | | |

| | 20 | | | Apollo Global Management, Inc. | | | 979 | |

| | 3 | | | Eaton Vance Corporation | | | 204 | |

| | 25 | | | Franklin Resources, Inc. | | | 625 | |

| | 5 | | | LPL Financial Holdings, Inc. | | | 521 | |

| | 13 | | | Raymond James Financial, Inc. | | | 1,244 | |

| | | | | | | | 3,573 | |

| | | | | AUTOMOTIVE - 1.1% | | | | |

| | 6 | | | Autoliv, Inc. | | | 553 | |

| | 11 | | | BorgWarner, Inc. | | | 425 | |

| | 4 | | | Lear Corporation | | | 636 | |

| | | | | | | | 1,614 | |

| | | | | BANKING - 4.2% | | | | |

| | 1 | | | CIT Group, Inc. | | | 36 | |

| | 24 | | | Citizens Financial Group, Inc. | | | 858 | |

| | 61 | | | Huntington Bancshares, Inc. | | | 770 | |

| | 59 | | | KeyCorp | | | 968 | |

| | 7 | | | M&T Bank Corporation | | | 891 | |

| | 57 | | | Regions Financial Corporation | | | 919 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.1% (Continued) | | | | |

| | | | | BANKING - 4.2% (Continued) | | | | |

| | 3 | | | SVB Financial Group(a) | | $ | 1,164 | |

| | 8 | | | Zions Bancorp NA | | | 348 | |

| | | | | | | | 5,954 | |

| | | | | BEVERAGES - 0.8% | | | | |

| | 1 | | | Boston Beer Company, Inc. (The), Class A(a) | | | 994 | |

| | 2 | | | Molson Coors Beverage Company, Class B | | | 91 | |

| | | | | | | | 1,085 | |

| | | | | BIOTECH & PHARMA - 1.4% | | | | |

| | 1 | | | Arrowhead Pharmaceuticals, Inc.(a) | | | 77 | |

| | 6 | | | BioMarin Pharmaceutical, Inc.(a) | | | 526 | |

| | 16 | | | Exelixis, Inc.(a) | | | 321 | |

| | 3 | | | Ionis Pharmaceuticals, Inc.(a) | | | 170 | |

| | 5 | | | Neurocrine Biosciences, Inc.(a) | | | 479 | |

| | 3 | | | United Therapeutics Corporation(a) | | | 455 | |

| | | | | | | | 2,028 | |

| | | | | CABLE & SATELLITE - 0.4% | | | | |

| | 4 | | | Liberty Broadband Corporation - Series A(a) | | | 630 | |

| | | | | | | | | |

| | | | | CHEMICALS - 4.3% | | | | |

| | 5 | | | Albemarle Corporation | | | 738 | |

| | 2 | | | Ashland Global Holdings, Inc. | | | 158 | |

| | 4 | | | Avery Dennison Corporation | | | 620 | |

| | 6 | | | Celanese Corporation | | | 780 | |

| | 13 | | �� | CF Industries Holdings, Inc. | | | 503 | |

| | 8 | | | Eastman Chemical Company | | | 802 | |

| | 11 | | | FMC Corporation | | | 1,264 | |

| | 4 | | | Huntsman Corporation | | | 101 | |

| | 5 | | | International Flavors & Fragrances, Inc. | | | 544 | |

| | 6 | | | RPM International, Inc. | | | 545 | |

| | 2 | | | W R Grace & Company | | | 110 | |

| | | | | | | | 6,165 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 0.4% | | | | |

| | 1 | | | Aramark | | | 39 | |

| | 2 | | | ManpowerGroup, Inc. | | | 180 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.1% (Continued) | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - 0.4% (Continued) | | | | |

| | 2 | | | Robert Half International, Inc. | | $ | 125 | |

| | 4 | | | Stericycle, Inc.(a) | | | 277 | |

| | | | | | | | 621 | |

| | | | | CONSTRUCTION MATERIALS - 1.7% | | | | |

| | 3 | | | Carlisle Companies, Inc. | | | 468 | |

| | 4 | | | Martin Marietta Materials, Inc. | | | 1,136 | |

| | 2 | | | MDU Resources Group, Inc. | | | 53 | |

| | 10 | | | Owens Corning | | | 758 | |

| | | | | | | | 2,415 | |

| | | | | CONSUMER SERVICES - 0.6% | | | | |

| | 9 | | | Chegg, Inc.(a) | | | 813 | |

| | | | | | | | | |

| | | | | CONTAINERS & PACKAGING - 1.7% | | | | |

| | 4 | | | AptarGroup, Inc. | | | 547 | |

| | 8 | | | Crown Holdings, Inc.(a) | | | 802 | |

| | 2 | | | Graphic Packaging Holding Company | | | 34 | |

| | 8 | | | Packaging Corp of America | | | 1,103 | |

| | | | | | | | 2,486 | |

| | | | | DIVERSIFIED INDUSTRIALS - 0.2% | | | | |

| | 4 | | | ITT, Inc. | | | 308 | |

| | | | | | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 0.9% | | | | |

| | 7 | | | Etsy, Inc.(a) | | | 1,245 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 1.5% | | | | |

| | 2 | | | Hawaiian Electric Industries, Inc. | | | 71 | |

| | 2 | | | IDACORP, Inc. | | | 192 | |

| | 25 | | | NRG Energy, Inc. | | | 939 | |

| | 13 | | | OGE Energy Corporation | | | 414 | |

| | 6 | | | Pinnacle West Capital Corporation | | | 480 | |

| | 2 | | | Portland General Electric Company | | | 85 | |

| | | | | | | | 2,181 | |

| | | | | ELECTRICAL EQUIPMENT - 3.0% | | | | |

| | 10 | | | A O Smith Corporation | | | 548 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.1% (Continued) | | | | |

| | | | | ELECTRICAL EQUIPMENT - 3.0% (Continued) | | | | |

| | 1 | | | Acuity Brands, Inc. | | $ | 121 | |

| | 6 | | | BWX Technologies, Inc. | | | 362 | |

| | 6 | | | Cognex Corporation | | | 482 | |

| | 4 | | | Generac Holdings, Inc.(a) | | | 910 | |

| | 4 | | | Hubbell, Inc. | | | 627 | |

| | 4 | | | National Instruments Corporation | | | 176 | |

| | 15 | | | Trimble, Inc.(a) | | | 1,001 | |

| | | | | | | | 4,227 | |

| | | | | ENGINEERING & CONSTRUCTION - 1.5% | | | | |

| | 8 | | | AECOM(a) | | | 398 | |

| | 2 | | | EMCOR Group, Inc. | | | 183 | |

| | 6 | | | Jacobs Engineering Group, Inc. | | | 654 | |

| | 13 | | | Quanta Services, Inc. | | | 936 | |

| | | | | | | | 2,171 | |

| | | | | ENTERTAINMENT CONTENT - 0.3% | | | | |

| | 37 | | | Zynga, Inc., Class A(a) | | | 365 | |

| | | | | | | | | |

| | | | | FOOD - 1.3% | | | | |

| | 9 | | | Darling Ingredients, Inc.(a) | | | 519 | |

| | 4 | | | Ingredion, Inc. | | | 315 | |

| | 6 | | | J M Smucker Company (The) | | | 694 | |

| | 2 | | | Lancaster Colony Corporation | | | 367 | |

| | | | | | | | 1,895 | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - 0.5% | | | | |

| | 8 | | | Trex Company, Inc.(a) | | | 670 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 5.3% | | | | |

| | 16 | | | Cardinal Health, Inc. | | | 857 | |

| | 3 | | | Charles River Laboratories International, Inc.(a) | | | 749 | |

| | 1 | | | Chemed Corporation | | | 533 | |

| | 7 | | | DaVita, Inc.(a) | | | 822 | |

| | 7 | | | Encompass Health Corporation | | | 579 | |

| | 2 | | | LHC Group, Inc.(a) | | | 427 | |

| | 5 | | | Molina Healthcare, Inc.(a) | | | 1,063 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.1% (Continued) | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 5.3% (Continued) | | | | |

| | 3 | | | PRA Health Sciences, Inc.(a) | | $ | 376 | |

| | 7 | | | Syneos Health, Inc.(a) | | | 477 | |

| | 3 | | | Teladoc Health, Inc.(a) | | | 600 | |

| | 8 | | | Universal Health Services, Inc., Class B | | | 1,100 | |

| | | | | | | | 7,583 | |

| | | | | HOME & OFFICE PRODUCTS - 1.3% | | | | |

| | 2 | | | Leggett & Platt, Inc. | | | 89 | |

| | 18 | | | Newell Brands, Inc. | | | 382 | |

| | 3 | | | Scotts Miracle-Gro Company (The) | | | 597 | |

| | 8 | | | Tempur Sealy International, Inc.(a) | | | 216 | |

| | 3 | | | Whirlpool Corporation | | | 542 | |

| | | | | | | | 1,826 | |

| | | | | HOME CONSTRUCTION - 0.9% | | | | |

| | 7 | | | Fortune Brands Home & Security, Inc. | | | 600 | |

| | 15 | | | PulteGroup, Inc. | | | 647 | |

| | | | | | | | 1,247 | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 1.6% | | | | |

| | 2 | | | AMERCO | | | 908 | |

| | 4 | | | United Rentals, Inc.(a) | | | 928 | |

| | 2 | | | Watsco, Inc. | | | 453 | |

| | | | | | | | 2,289 | |

| | | | | INSURANCE - 8.9% | | | | |

| | 10 | | | American Financial Group, Inc. | | | 876 | |

| | 6 | | | Assurant, Inc. | | | 817 | |

| | 13 | | | Globe Life, Inc. | | | 1,235 | |

| | 33 | | | Hartford Financial Services Group, Inc. (The) | | | 1,616 | |

| | 9 | | | Kemper Corporation | | | 691 | |

| | 26 | | | Lincoln National Corporation | | | 1,308 | |

| | 29 | | | Loews Corporation | | | 1,306 | |

| | 25 | | | Old Republic International Corporation | | | 493 | |

| | 19 | | | Principal Financial Group, Inc. | | | 943 | |

| | 8 | | | Radian Group, Inc. | | | 162 | |

| | 8 | | | Reinsurance Group of America, Inc. | | | 927 | |

| | 9 | | | Unum Group | | | 206 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.1% (Continued) | | | | |

| | | | | INSURANCE - 8.9% (Continued) | | | | |

| | 12 | | | Voya Financial, Inc. | | $ | 706 | |

| | 20 | | | W R Berkley Corporation | | | 1,328 | |

| | | | | | | | 12,614 | |

| | | | | INTERNET MEDIA & SERVICES - 2.8% | | | | |

| | 16 | | | Expedia Group, Inc. | | | 2,119 | |

| | 16 | | | GoDaddy, Inc., Class A(a) | | | 1,327 | |

| | 5 | | | Grubhub, Inc.(a) | | | 371 | |

| | 4 | | | TripAdvisor, Inc. (a) | | | 115 | |

| | | | | | | | 3,932 | |

| | | | | LEISURE FACILITIES & SERVICES - 1.2% | | | | |

| | 1 | | | Choice Hotels International, Inc. | | | 107 | |

| | 6 | | | Darden Restaurants, Inc. | | | 714 | |

| | 3 | | | Vail Resorts, Inc. | | | 837 | |

| | | | | | | | 1,658 | |

| | | | | LEISURE PRODUCTS - 0.8% | | | | |

| | 5 | | | Brunswick Corporation | | | 381 | |

| | 5 | | | Hasbro, Inc. | | | 468 | |

| | 3 | | | Polaris, Inc. | | | 286 | |

| | | | | | | | 1,135 | |

| | | | | MACHINERY - 4.1% | | | | |

| | 5 | | | AGCO Corporation | | | 515 | |

| | 2 | | | Crane Company | | | 155 | |

| | 2 | | | Curtiss-Wright Corporation | | | 233 | |

| | 10 | | | Donaldson Company, Inc. | | | 559 | |

| | 2 | | | Flowserve Corporation | | | 74 | |

| | 11 | | | Graco, Inc. | | | 796 | |

| | 3 | | | IDEX Corporation | | | 597 | |

| | 2 | | | Middleby Corporation (The)(a) | | | 258 | |

| | 2 | | | MSA Safety, Inc. | | | 299 | |

| | 3 | | | Nordson Corporation | | | 603 | |

| | 3 | | | Oshkosh Corporation | | | 258 | |

| | 5 | | | Snap-on, Inc. | | | 856 | |

| | 6 | | | Toro Company (The) | | | 569 | |

| | | | | | | | 5,772 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.1% (Continued) | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 5.0% | | | | |

| | 3 | | | ABIOMED, Inc.(a) | | $ | 973 | |

| | 6 | | | Bruker Corporation | | | 325 | |

| | 12 | | | DENTSPLY SIRONA, Inc. | | | 628 | |

| | 3 | | | Globus Medical, Inc., Class A(a) | | | 196 | |

| | 2 | | | Haemonetics Corporation(a) | | | 238 | |

| | 4 | | | Hill-Rom Holdings, Inc. | | | 392 | |

| | 5 | | | Insulet Corporation(a) | | | 1,278 | |

| | 1 | | | Integra LifeSciences Holdings Corporation(a) | | | 65 | |

| | 3 | | | Masimo Corporation(a) | | | 805 | |

| | 7 | | | PerkinElmer, Inc. | | | 1,004 | |

| | 2 | | | Quidel Corporation(a) | | | 359 | |

| | 5 | | | Varian Medical Systems, Inc.(a) | | | 875 | |

| | | | | | | | 7,138 | |

| | | | | OIL & GAS PRODUCERS - 0.5% | | | | |

| | 28 | | | Cabot Oil & Gas Corporation | | | 456 | |

| | 1 | | | Diamondback Energy, Inc. | | | 48 | |

| | 6 | | | HollyFrontier Corporation | | | 155 | |

| | 5 | | | Parsley Energy, Inc., Class A | | | 71 | |

| | | | | | | | 730 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 0.7% | | | | |

| | 44 | | | Halliburton Company | | | 832 | |

| | 10 | | | NOV, Inc. | | | 137 | |

| | | | | | | | 969 | |

| | | | | PUBLISHING & BROADCASTING - 1.6% | | | | |

| | 12 | | | Liberty Media Corp-Liberty Formula One - Series C(a) | | | 512 | |

| | 18 | | | Liberty Media Corp-Liberty SiriusXM, Class C(a) | | | 783 | |

| | 8 | | | New York Times Company (The), Class A | | | 414 | |

| | 30 | | | News Corporation, Class A | | | 539 | |

| | | | | | | | 2,248 | |

| | | | | RENEWABLE ENERGY - 2.1% | | | | |

| | 5 | | | Enphase Energy, Inc.(a) | | | 877 | |

| | 8 | | | First Solar, Inc.(a) | | | 791 | |

| | 4 | | | SolarEdge Technologies, Inc.(a) | | | 1,277 | |

| | | | | | | | 2,945 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.1% (Continued) | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 0.5% | | | | |

| | 4 | | | Casey’s General Stores, Inc. | | $ | 714 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 3.8% | | | | |

| | 4 | | | Advance Auto Parts, Inc. | | | 630 | |

| | 3 | | | Burlington Stores, Inc.(a) | | | 785 | |

| | 25 | | | Gap, Inc. (The) (a) | | | 505 | |

| | 7 | | | Genuine Parts Company | | | 703 | |

| | 1 | | | Lithia Motors, Inc., Class A | | | 293 | |

| | 9 | | | Tractor Supply Company | | | 1,265 | |

| | 2 | | | Ulta Beauty, Inc.(a) | | | 574 | |

| | 6 | | | Williams-Sonoma, Inc. | | | 611 | |

| | | | | | | | 5,366 | |

| | | | | SEMICONDUCTORS - 4.8% | | | | |

| | 2 | | | Cirrus Logic, Inc.(a) | | | 164 | |

| | 6 | | | Cree, Inc.(a) | | | 635 | |

| | 7 | | | Entegris, Inc. | | | 673 | |

| | 4 | | | MKS Instruments, Inc. | | | 602 | |

| | 2 | | | Monolithic Power Systems, Inc. | | | 733 | |

| | 23 | | | ON Semiconductor Corporation(a) | | | 753 | |

| | 8 | | | Qorvo, Inc.(a) | | | 1,330 | |

| | 2 | | | Silicon Laboratories, Inc.(a) | | | 255 | |

| | 14 | | | Teradyne, Inc. | | | 1,678 | |

| | | | | | | | 6,823 | |

| | | | | SOFTWARE - 3.8% | | | | |

| | 2 | | | ACI Worldwide, Inc.(a) | | | 77 | |

| | 5 | | | Aspen Technology, Inc.(a) | | | 651 | |

| | 7 | | | Black Knight, Inc.(a) | | | 619 | |

| | 3 | | | Concentrix Corporation(a) | | | 296 | |

| | 3 | | | Guidewire Software, Inc.(a) | | | 386 | |

| | 2 | | | J2 Global, Inc. (a) | | | 195 | |

| | 8 | | | NortonLifeLock, Inc. | | | 166 | |

| | 21 | | | Nuance Communications, Inc.(a) | | | 926 | |

| | 3 | | | Paylocity Holding Corporation(a) | | | 618 | |

| | 7 | | | PTC, Inc.(a) | | | 837 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.1% (Continued) | | | | |

| | | | | SOFTWARE - 3.8% (Continued) | | | | |

| | 4 | | | Zendesk, Inc.(a) | | $ | 573 | |

| | | | | | | | 5,344 | |

| | | | | SPECIALTY FINANCE - 2.7% | | | | |

| | 17 | | | Fidelity National Financial, Inc. | | | 664 | |

| | 12 | | | First American Financial Corporation | | | 620 | |

| | 9 | | | MGIC Investment Corporation | | | 113 | |

| | 69 | | | Synchrony Financial | | | 2,395 | |

| | | | | | | | 3,792 | |

| | | | | STEEL - 1.0% | | | | |

| | 6 | | | Reliance Steel & Aluminum Company | | | 718 | |

| | 18 | | | Steel Dynamics, Inc. | | | 664 | |

| | | | | | | | 1,382 | |

| | | | | TECHNOLOGY HARDWARE - 4.6% | | | | |

| | 4 | | | Arrow Electronics, Inc.(a) | | | 389 | |

| | 15 | | | Ciena Corporation(a) | | | 793 | |

| | 7 | | | Dolby Laboratories, Inc., Class A | | | 680 | |

| | 5 | | | F5 Networks, Inc.(a) | | | 880 | |

| | 3 | | | FLIR Systems, Inc. | | | 131 | |

| | 9 | | | Jabil, Inc. | | | 383 | |

| | 31 | | | Juniper Networks, Inc. | | | 698 | |

| | 12 | | | NetApp, Inc. | | | 795 | |

| | 8 | | | Pure Storage, Inc., Class A(a) | | | 181 | |

| | 3 | | | SYNNEX Corporation | | | 244 | |

| | 2 | | | ViaSat, Inc.(a) | | | 65 | |

| | 21 | | | Western Digital Corporation | | | 1,163 | |

| | 4 | | | Xerox Holdings Corporation | | | 93 | |

| | | | | | | | 6,495 | |

| | | | | TECHNOLOGY SERVICES - 2.6% | | | | |

| | 8 | | | Booz Allen Hamilton Holding Corporation | | | 697 | |

| | 2 | | | Euronet Worldwide, Inc.(a) | | | 290 | |

| | 2 | | | FactSet Research Systems, Inc. | | | 665 | |

| | 5 | | | Gartner, Inc.(a) | | | 801 | |

| | 6 | | | Leidos Holdings, Inc. | | | 631 | |

| | 2 | | | MAXIMUS, Inc. | | | 146 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.1% (Continued) | | | | |

| | | | | TECHNOLOGY SERVICES - 2.6% (Continued) | | | | |

| | 2 | | | WEX, Inc.(a) | | $ | 407 | |

| | | | | | | | 3,637 | |

| | | | | TRANSPORTATION & LOGISTICS - 1.6% | | | | |

| | 8 | | | CH Robinson Worldwide, Inc. | | | 751 | |

| | 5 | | | JB Hunt Transport Services, Inc. | | | 683 | |

| | 9 | | | Knight-Swift Transportation Holdings, Inc. | | | 376 | |

| | 3 | | | Landstar System, Inc. | | | 404 | |

| | | | | | | | 2,214 | |

| | | | | TRANSPORTATION EQUIPMENT - 0.5% | | | | |

| | 1 | | | Allison Transmission Holdings, Inc. | | | 43 | |

| | 10 | | | Westinghouse Air Brake Technologies Corporation | | | 732 | |

| | | | | | | | 775 | |

| | | | | WHOLESALE - DISCRETIONARY – 1.0% | | | | |

| | 17 | | | LKQ Corporation(a) | | | 599 | |

| | 2 | | | Pool Corporation | | | 745 | |

| | | | | | | | 1,344 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $105,528) | | | 136,303 | |

| | | | | | | | | |

| | | | | MONEY MARKET FUND – 19.1% | | | | |

| | 27,038 | | | BlackRock Liquidity Funds T-Fund, Institutional Class, 0.01%(b) | | | 27,038 | |

| | | | | | | | | |

| | | | | TOTAL MONEY MARKET FUND (Cost $27,038) | | | 27,038 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS – 115.2% (Cost $132,566) | | $ | 163,341 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (15.2)% | | | (21,528 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 141,813 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of December 31, 2020. |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% | | | | |

| | | | | AEROSPACE & DEFENSE - 0.4% | | | | |

| | 79 | | | Barnes Group, Inc. | | $ | 4,005 | |

| | 35 | | | Ducommun, Inc.(a) | | | 1,879 | |

| | 47 | | | Moog, Inc., Class A | | | 3,727 | |

| | 21 | | | National Presto Industries, Inc. | | | 1,857 | |

| | | | | | | | 11,468 | |

| | | | | APPAREL & TEXTILE PRODUCTS - 0.6% | | | | |

| | 18 | | | Culp, Inc. | | | 286 | |

| | 124 | | | Fossil Group, Inc.(a) | | | 1,075 | |

| | 31 | | | Movado Group, Inc. | | | 515 | |

| | 110 | | | PVH Corporation | | | 10,328 | |

| | 76 | | | Rocky Brands, Inc. | | | 2,133 | |

| | 149 | | | Tandy Leather Factory, Inc.(a) | | | 477 | |

| | 26 | | | Unifi, Inc.(a) | | | 461 | |

| | 22 | | | Weyco Group, Inc. | | | 349 | |

| | | | | | | | 15,624 | |

| | | | | ASSET MANAGEMENT - 0.9% | | | | |

| | 34 | | | Associated Capital Group, Inc., Class A | | | 1,194 | |

| | 22 | | | BM Technologies, Inc.(a) | | | 306 | |

| | 275 | | | Boston Private Financial Holdings, Inc. | | | 2,324 | |

| | 112 | | | Community Bankers Trust Corporation | | | 756 | |

| | 138 | | | Entasis Therapeutics Holdings, Inc.(a) | | | 341 | |

| | 14 | | | First Western Financial, Inc.(a) | | | 274 | |

| | 45 | | | Hennessy Advisors, Inc. | | | 384 | |

| | 13 | | | Medallion Financial Corporation(a) | | | 64 | |

| | 7 | | | Mediaco Holding, Inc.(a) | | | 18 | |

| | 419 | | | ODP Corporation (The) | | | 12,276 | |

| | 132 | | | Oppenheimer Holdings, Inc., Class A | | | 4,149 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | ASSET MANAGEMENT - 0.9% (Continued) | | | | |

| | 37 | | | PennantPark Investment Corporation | | $ | 171 | |

| | 171 | | | SuRo Capital Corporation | | | 2,238 | |

| | 105 | | | TCG BDC, Inc. | | | 1,077 | |

| | | | | | | | 25,572 | |

| | | | | AUTOMOTIVE - 1.9% | | | | |

| | 238 | | | American Axle & Manufacturing Holdings, Inc.(a) | | | 1,985 | |

| | 665 | | | China Automotive Systems, Inc.(a) | | | 4,150 | |

| | 104 | | | Cooper Tire & Rubber Company | | | 4,212 | |

| | 260 | | | Dana, Inc. | | | 5,075 | |

| | 549 | | | Goodyear Tire & Rubber Company (The) | | | 5,989 | |

| | 458 | | | Harley-Davidson, Inc. | | | 16,809 | |

| | 276 | | | Methode Electronics, Inc. | | | 10,565 | |

| | 34 | | | Miller Industries, Inc. | | | 1,293 | |

| | 225 | | | Modine Manufacturing Company(a) | | | 2,826 | |

| | | | | | | | 52,904 | |

| | | | | BANKING - 21.0% | | | | |

| | 61 | | | American National Bankshares, Inc. | | | 1,599 | |

| | 82 | | | American River Bankshares | | | 1,078 | |

| | 627 | | | Associated Banc-Corporation | | | 10,690 | |

| | 274 | | | Atlantic Union Bankshares Corporation | | | 9,026 | |

| | 12 | | | Bank of Princeton (The) | | | 281 | |

| | 378 | | | Bank OZK | | | 11,820 | |

| | 97 | | | BankFinancial Corporation | | | 852 | |

| | 219 | | | BankUnited, Inc. | | | 7,617 | |

| | 75 | | | Bar Harbor Bankshares | | | 1,694 | |

| | 183 | | | Berkshire Hills Bancorp, Inc. | | | 3,133 | |

| | 339 | | | BOK Financial Corporation | | | 23,215 | |

| | 108 | | | Bridge Bancorp, Inc. | | | 2,611 | |

| | 904 | | | Cadence BanCorporation | | | 14,844 | |

| | 86 | | | Capstar Financial Holdings, Inc. | | | 1,268 | |

| | 52 | | | CBM Bancorp, Inc. | | | 691 | |

| | 147 | | | Central Pacific Financial Corporation | | | 2,794 | |

| | 348 | | | CIT Group, Inc. | | | 12,493 | |

| | 83 | | | Citizens Community Bancorp, Inc. | | | 904 | |

| | 114 | | | Civista Bancshares, Inc. | | | 1,998 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | BANKING - 21.0% (Continued) | | | | |

| | 18 | | | Codorus Valley Bancorp, Inc. | | $ | 305 | |

| | 10 | | | Community Financial Corporation (The) | | | 265 | |

| | 56 | | | County Bancorp, Inc. | | | 1,236 | |

| | 198 | | | Customers Bancorp, Inc.(a) | | | 3,600 | |

| | 135 | | | Dime Community Bancshares, Inc. | | | 2,129 | |

| | 138 | | | Eagle Bancorp, Inc. | | | 5,699 | |

| | 84 | | | ESSA Bancorp, Inc. | | | 1,260 | |

| | 31 | | | Financial Institutions, Inc. | | | 697 | |

| | 277 | | | First Bancorp | | | 9,371 | |

| | 379 | | | First Busey Corporation | | | 8,167 | |

| | 48 | | | First Business Financial Services, Inc. | | | 884 | |

| | 248 | | | First Commonwealth Financial Corporation | | | 2,713 | |

| | 378 | | | First Financial Bancorp | | | 6,626 | |

| | 114 | | | First Financial Corporation | | | 4,429 | |

| | 99 | | | First Financial Northwest, Inc. | | | 1,129 | |

| | 234 | | | First Hawaiian, Inc. | | | 5,518 | |

| | 2,026 | | | First Horizon Corporation | | | 25,852 | |

| | 459 | | | First Midwest Bancorp, Inc. | | | 7,307 | |

| | 90 | | | First Northwest Bancorp | | | 1,404 | |

| | 1,548 | | | FNB Corporation | | | 14,706 | |

| | 395 | | | Fulton Financial Corporation | | | 5,024 | |

| | 526 | | | Great Western Bancorp, Inc. | | | 10,993 | |

| | 428 | | | Hancock Whitney Corporation | | | 14,561 | |

| | 200 | | | Hanmi Financial Corporation | | | 2,268 | |

| | 218 | | | Heartland Financial USA, Inc. | | | 8,801 | |

| | 1,030 | | | Hilltop Holdings, Inc. | | | 28,335 | |

| | 20 | | | HomeStreet, Inc. | | | 675 | |

| | 102 | | | HomeTrust Bancshares, Inc. | | | 1,970 | |

| | 891 | | | Hope Bancorp, Inc. | | | 9,721 | |

| | 109 | | | Horizon Bancorp, Inc. | | | 1,729 | |

| | 147 | | | Howard Bancorp, Inc.(a) | | | 1,736 | |

| | 678 | | | Investors Bancorp, Inc. | | | 7,160 | |

| | 207 | | | Lakeland Bancorp, Inc. | | | 2,629 | |

| | 115 | | | LCNB Corporation | | | 1,689 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | BANKING - 21.0% (Continued) | | | | |

| | 79 | | | Mackinac Financial Corporation | | $ | 1,008 | |

| | 164 | | | Meridian Bancorp, Inc. | | | 2,445 | |

| | 100 | | | MidWestOne Financial Group, Inc. | | | 2,450 | |

| | 1,083 | | | New York Community Bancorp, Inc. | | | 11,426 | |

| | 232 | | | OceanFirst Financial Corporation | | | 4,322 | |

| | 1,096 | | | Old National Bancorp | | | 18,150 | |

| | 10 | | | Old Point Financial Corporation | | | 190 | |

| | 45 | | | OP Bancorp | | | 346 | |

| | 686 | | | PacWest Bancorp | | | 17,424 | |

| | 21 | | | Pathfinder Bancorp, Inc. | | | 241 | |

| | 135 | | | PCB Bancorp | | | 1,365 | |

| | 165 | | | Peoples Bancorp, Inc. | | | 4,470 | |

| | 245 | | | Pinnacle Financial Partners, Inc. | | | 15,778 | |

| | 45 | | | Premier Financial Bancorp, Inc. | | | 598 | |

| | 245 | | | Provident Financial Services, Inc. | | | 4,400 | |

| | 230 | | | Renasant Corporation | | | 7,746 | |

| | 137 | | | Riverview Financial Corporation | | | 1,254 | |

| | 12 | | | SB Financial Group, Inc. | | | 219 | |

| | 112 | | | Select Bancorp, Inc.(a) | | | 1,061 | |

| | 406 | | | Simmons First National Corporation, Class A | | | 8,766 | |

| | 120 | | | SmartFinancial, Inc. | | | 2,177 | |

| | 36 | | | South State Corporation | | | 2,603 | |

| | 237 | | | Southern National Bancorp of Virginia, Inc. | | | 2,870 | |

| | 456 | | | Sterling Bancorp | | | 8,199 | |

| | 1,302 | | | Synovus Financial Corporation | | | 42,146 | |

| | 530 | | | TCF Financial Corporation | | | 19,621 | |

| | 313 | | | Towne Bank | | | 7,349 | |

| | 1,294 | | | Umpqua Holdings Corporation | | | 19,591 | |

| | 53 | | | United Bancshares, Inc. | | | 1,296 | |

| | 362 | | | United Bankshares, Inc. | | | 11,729 | |

| | 134 | | | Univest Financial Corporation | | | 2,758 | |

| | 843 | | | Valley National Bancorp | | | 8,219 | |

| | 773 | | | Webster Financial Corporation | | | 32,582 | |

| | 142 | | | WesBanco, Inc. | | | 4,254 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | BANKING - 21.0% (Continued) | | | | |

| | 276 | | | Wintrust Financial Corporation | | $ | 16,861 | |

| | | | | | | | 595,110 | |

| | | | | BEVERAGES - 0.0%(b) | | | | |

| | 8 | | | Coffee Holding Company, Inc.(a) | | | 31 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 2.6% | | | | |

| | 193 | | | Akebia Therapeutics, Inc.(a) | | | 540 | |

| | 21 | | | ANI Pharmaceuticals, Inc.(a) | | | 610 | |

| | 83 | | | Cumberland Pharmaceuticals, Inc.(a) | | | 244 | |

| | 41 | | | Eagle Pharmaceuticals, Inc.(a) | | | 1,909 | |

| | 169 | | | Emergent BioSolutions, Inc.(a) | | | 15,142 | |

| | 841 | | | Innoviva, Inc.(a) | | | 10,420 | |

| | 78 | | | Lannett Company, Inc.(a) | | | 509 | |

| | 81 | | | MacroGenics, Inc.(a) | | | 1,852 | |

| | 141 | | | Minerva Neurosciences, Inc.(a) | | | 330 | |

| | 180 | | | Prestige Consumer Healthcare, Inc.(a) | | | 6,277 | |

| | 376 | | | Sangamo Therapeutics, Inc.(a) | | | 5,867 | |

| | 112 | | | Travere Therapeutics, Inc.(a) | | | 3,053 | |

| | 174 | | | United Therapeutics Corporation(a) | | | 26,411 | |

| | 467 | | | Verastem, Inc.(a) | | | 995 | |

| | | | | | | | 74,159 | |

| | | | | CHEMICALS - 2.0% | | | | |

| | 126 | | | AdvanSix, Inc.(a) | | | 2,519 | |

| | 207 | | | American Vanguard Corporation | | | 3,213 | |

| | 385 | | | Element Solutions, Inc. | | | 6,826 | |

| | 34 | | | Hawkins, Inc. | | | 1,778 | |

| | 56 | | | Haynes International, Inc. | | | 1,335 | |

| | 700 | | | Huntsman Corporation | | | 17,598 | |

| | 164 | | | Kraton Corporation(a) | | | 4,557 | |

| | 141 | | | Minerals Technologies, Inc. | | | 8,759 | |

| | 28 | | | Oil-Dri Corp of America | | | 954 | |

| | 70 | | | PQ Group Holdings, Inc. | | | 998 | |

| | 102 | | | Trecora Resources(a) | | | 713 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | CHEMICALS - 2.0% (Continued) | | | | |

| | 457 | | | Univar Solutions, Inc.(a) | | $ | 8,688 | |

| | | | | | | | 57,938 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 1.4% | | | | |

| | 56 | | | ABM Industries, Inc. | | | 2,119 | |

| | 28 | | | BrightView Holdings, Inc.(a) | | | 423 | |

| | 137 | | | Deluxe Corporation | | | 4,000 | |

| | 163 | | | Emerald Holding, Inc. | | | 884 | |

| | 156 | | | Ennis, Inc. | | | 2,785 | |

| | 90 | | | GP Strategies Corporation(a) | | | 1,067 | |

| | 77 | | | Heidrick & Struggles International, Inc. | | | 2,262 | |

| | 106 | | | Kelly Services, Inc., Class A | | | 2,180 | |

| | 18 | | | Korn Ferry | | | 783 | |

| | 131 | | | ManpowerGroup, Inc. | | | 11,814 | |

| | 110 | | | Quest Resource Holding Corporation(a) | | | 252 | |

| | 79 | | | Resources Connection, Inc. | | | 993 | |

| | 204 | | | Schnitzer Steel Industries, Inc., Class A | | | 6,510 | |

| | 72 | | | TrueBlue, Inc.(a) | | | 1,346 | |

| | 28 | | | Vectrus, Inc.(a) | | | 1,392 | |

| | | | | | | | 38,810 | |

| | | | | CONSTRUCTION MATERIALS - 0.2% | | | | |

| | 199 | | | Apogee Enterprises, Inc. | | | 6,304 | |

| | | | | | | | | |

| | | | | CONSUMER SERVICES - 0.7% | | | | |

| | 134 | | | Adtalem Global Education, Inc.(a) | | | 4,549 | |

| | 81 | | | American Public Education, Inc.(a) | | | 2,469 | |

| | 12 | | | Graham Holdings Company, Class B | | | 6,401 | |

| | 130 | | | Matthews International Corporation, Class A | | | 3,822 | |

| | 183 | | | Perdoceo Education Corporation(a) | | | 2,311 | |

| | | | | | | | 19,552 | |

| | | | | CONTAINERS & PACKAGING - 0.1% | | | | |

| | 121 | | | TriMas Corporation(a) | | | 3,832 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 0.1% | | | | |

| | 137 | | | Lands’ End, Inc.(a) | | $ | 2,955 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 0.6% | | | | |

| | 61 | | | Bel Fuse, Inc., Class B | | | 917 | |

| | 97 | | | Belden, Inc. | | | 4,064 | |

| | 174 | | | Houston Wire & Cable Company (a) | | | 485 | |

| | 228 | | | Kimball Electronics, Inc.(a) | | | 3,646 | |

| | 243 | | | LSI Industries, Inc. | | | 2,080 | |

| | 48 | | | Powell Industries, Inc. | | | 1,416 | |

| | 48 | | | Preformed Line Products Company | | | 3,285 | |

| | | | | | | | 15,893 | |

| | | | | ENGINEERING & CONSTRUCTION - 2.3% | | | | |

| | 190 | | | Aegion Corporation(a) | | | 3,608 | |

| | 106 | | | Dycom Industries, Inc.(a) | | | 8,005 | |

| | 137 | | | EMCOR Group, Inc. | | | 12,530 | |

| | 371 | | | Fluor Corporation | | | 5,925 | |

| | 162 | | | Granite Construction, Inc. | | | 4,327 | |

| | 70 | | | Limbach Holdings, Inc.(a) | | | 863 | |

| | 183 | | | MasTec, Inc.(a) | | | 12,477 | |

| | 192 | | | Mistras Group, Inc.(a) | | | 1,490 | |

| | 160 | | | MYR Group, Inc.(a) | | | 9,616 | |

| | 185 | | | Orion Group Holdings, Inc.(a) | | | 918 | |

| | 50 | | | Primoris Services Corporation | | | 1,380 | |

| | 248 | | | Sterling Construction Company, Inc.(a) | | | 4,615 | |

| | 20 | | | VSE Corporation | | | 770 | |

| | | | | | | | 66,524 | |

| | | | | ENTERTAINMENT CONTENT - 0.1% | | | | |

| | 100 | | | AMC Networks, Inc., Class A(a) | | | 3,577 | |

| | | | | | | | | |

| | | | | FOOD - 1.0% | | | | |

| | 75 | | | Alico, Inc. | | | 2,327 | |

| | 512 | | | B&G Foods, Inc. | | | 14,198 | |

| | 276 | | | Hostess Brands, Inc.(a) | | | 4,041 | |

| | 111 | | | Nature’s Sunshine Products, Inc.(a) | | | 1,659 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | FOOD - 1.0% (Continued) | | | | |

| | 380 | | | S&W Seed Company(a) | | $ | 1,113 | |

| | 24 | | | Sanderson Farms, Inc. | | | 3,173 | |

| | 45 | | | Tootsie Roll Industries, Inc. | | | 1,336 | |

| | 19 | | | TreeHouse Foods, Inc.(a) | | | 807 | |

| | | | | | | | 28,654 | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - 0.5% | | | | |

| | 165 | | | Domtar Corporation | | | 5,222 | |

| | 119 | | | Glatfelter Corporation | | | 1,949 | |

| | 70 | | | Mercer International, Inc. | | | 718 | |

| | 29 | | | Neenah, Inc. | | | 1,604 | |

| | 90 | | | Schweitzer-Mauduit International, Inc. | | | 3,619 | |

| | 114 | | | Verso Corporation, Class A | | | 1,370 | |

| | | | | | | | 14,482 | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 1.8% | | | | |

| | 741 | | | MEDNAX, Inc.(a) | | | 18,184 | |

| | 1,630 | | | OPKO Health, Inc.(a) | | | 6,438 | |

| | 16 | | | Owens & Minor, Inc. | | | 433 | |

| | 513 | | | Patterson Companies, Inc. | | | 15,200 | |

| | 18 | | | Psychemedics Corporation | | | 92 | |

| | 380 | | | Select Medical Holdings Corporation(a) | | | 10,511 | |

| | | | | | | | 50,858 | |

| | | | | HOME & OFFICE PRODUCTS - 0.5% | | | | |

| | 240 | | | ACCO Brands Corporation | | | 2,028 | |

| | 90 | | | Hooker Furniture Corporation | | | 2,902 | |

| | 4 | | | Kewaunee Scientific Corporation(a) | | | 50 | |

| | 364 | | | Knoll, Inc. | | | 5,344 | |

| | 276 | | | Steelcase, Inc., Class A | | | 3,740 | |

| | | | | | | | 14,064 | |

| | | | | HOME CONSTRUCTION - 2.1% | | | | |

| | 41 | | | American Woodmark Corporation(a) | | | 3,848 | |

| | 256 | | | Beazer Homes USA, Inc.(a) | | | 3,878 | |

| | 80 | | | Century Communities, Inc.(a) | | | 3,502 | |

| | 198 | | | Green Brick Partners, Inc.(a) | | | 4,546 | |

| | 9 | | | Griffon Corporation | | | 184 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | HOME CONSTRUCTION - 2.1% (Continued) | | | | |

| | 160 | | | Interface, Inc. | | $ | 1,680 | |

| | 143 | | | KB Home | | | 4,793 | |

| | 91 | | | LGI Homes, Inc.(a) | | | 9,632 | |

| | 88 | | | M/I Homes, Inc.(a) | | | 3,898 | |

| | 89 | | | MDC Holdings, Inc. | | | 4,325 | |

| | 96 | | | Meritage Homes Corporation(a) | | | 7,951 | |

| | 142 | | | Toll Brothers, Inc. | | | 6,173 | |

| | 351 | | | TRI Pointe Group, Inc.(a) | | | 6,055 | |

| | | | | | | | 60,465 | |

| | | | | HOUSEHOLD PRODUCTS - 1.5% | | | | |

| | 304 | | | Central Garden & Pet Company, Class A(a) | | | 11,044 | |

| | 84 | | | Clearwater Paper Corporation(a) | | | 3,171 | |

| | 195 | | | Crown Crafts, Inc. | | | 1,394 | |

| | 337 | | | Edgewell Personal Care Company | | | 11,654 | |

| | 138 | | | Quanex Building Products Corporation | | | 3,060 | |

| | 144 | | | Spectrum Brands Holdings, Inc. | | | 11,373 | |

| | | | | | | | 41,696 | |

| | | | | INDUSTRIAL INTERMEDIATE PRODUCTS - 1.4% | | | | |

| | 124 | | | Ampco-Pittsburgh Corporation(a) | | | 679 | |

| | 136 | | | AZZ, Inc. | | | 6,452 | |

| | 26 | | | Eastern Company (The) | | | 627 | |

| | 102 | | | L B Foster Company, Class A(a) | | | 1,535 | |

| | 122 | | | Park-Ohio Holdings Corporation | | | 3,770 | |

| | 322 | | | Timken Company (The) | | | 24,910 | |

| | 70 | | | Tredegar Corporation | | | 1,169 | |

| | | | | | | | 39,142 | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 1.1% | | | | |

| | 151 | | | CAI International, Inc. | | | 4,717 | |

| | 95 | | | DXP Enterprises, Inc.(a) | | | 2,112 | |

| | 299 | | | Herc Holdings, Inc.(a) | | | 19,857 | |

| | 54 | | | WESCO International, Inc.(a) | | | 4,239 | |

| | | | | | | | 30,925 | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 1.5% | | | | |

| | 322 | | | Cowen, Inc., Class A | | | 8,369 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 1.5% (Continued) | | | | |

| | 1,363 | | | Jefferies Financial Group, Inc. | | $ | 33,530 | |

| | | | | | | | 41,899 | |

| | | | | INSURANCE - 6.5% | | | | |

| | 187 | | | Ambac Financial Group, Inc.(a) | | | 2,876 | |

| | 360 | | | American Equity Investment Life Holding Company | | | 9,958 | |

| | 159 | | | American National Group, Inc. | | | 15,283 | |

| | 513 | | | Brighthouse Financial, Inc.(a) | | | 18,573 | |

| | 844 | | | CNO Financial Group, Inc. | | | 18,762 | |

| | 40 | | | Employers Holdings, Inc. | | | 1,288 | |

| | 90 | | | FBL Financial Group, Inc., Class A | | | 4,726 | |

| | 179 | | | FedNat Holding Company | | | 1,060 | |

| | 3,604 | | | Genworth Financial, Inc., Class A(a) | | | 13,623 | |

| | 490 | | | Heritage Insurance Holdings, Inc. | | | 4,964 | |

| | 13 | | | Horace Mann Educators Corporation | | | 546 | |

| | 36 | | | National General Holdings Corporation | | | 1,230 | |

| | 40 | | | National Western Life Group, Inc., Class A | | | 8,258 | |

| | 385 | | | ProAssurance Corporation | | | 6,849 | |

| | 135 | | | Protective Insurance Corporation, Class B | | | 1,851 | |

| | 1,621 | | | Radian Group, Inc. | | | 32,825 | |

| | 103 | | | Security National Financial Corporation, Class A(a) | | | 860 | |

| | 150 | | | United Fire Group, Inc. | | | 3,765 | |

| | 418 | | | United Insurance Holdings Corporation | | | 2,391 | |

| | 1,307 | | | Unum Group | | | 29,982 | |

| | 4 | | | White Mountains Insurance Group Ltd. | | | 4,003 | |

| | | | | | | | 183,673 | |

| | | | | INTERNET MEDIA & SERVICES - 0.2% | | | | |

| | 241 | | | Cars.com, Inc.(a) | | | 2,723 | |

| | 1,146 | | | DHI Group, Inc.(a) | | | 2,544 | |

| | 328 | | | TrueCar, Inc.(a) | | | 1,378 | |

| | | | | | | | 6,645 | |

| | | | | LEISURE FACILITIES & SERVICES - 1.3% | | | | |

| | 15 | | | Ark Restaurants Corporation | | | 291 | |

| | 37 | | | Biglari Holdings, Inc.(a) | | | 4,114 | |

| | 397 | | | Carrols Restaurant Group, Inc.(a) | | | 2,493 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 1.3% (Continued) | | | | |

| | 124 | | | Chuy’s Holdings, Inc.(a) | | $ | 3,285 | |

| | 441 | | | El Pollo Loco Holdings, Inc.(a) | | | 7,982 | |

| | 172 | | | Fiesta Restaurant Group, Inc.(a) | | | 1,961 | |

| | 108 | | | Full House Resorts, Inc.(a) | | | 424 | |

| | 39 | | | Golden Entertainment, Inc.(a) | | | 776 | |

| | 108 | | | J Alexander’s Holdings, Inc.(a) | | | 787 | |

| | 331 | | | Marcus Corporation (The) | | | 4,462 | |

| | 42 | | | Potbelly Corporation(a) | | | 185 | |

| | 104 | | | RCI Hospitality Holdings, Inc. | | | 4,102 | |

| | 266 | | | Red Robin Gourmet Burgers, Inc.(a) | | | 5,115 | |

| | | | | | | | 35,977 | |

| | | | | LEISURE PRODUCTS - 0.9% | | | | |

| | 63 | | | American Outdoor Brands, Inc.(a) | | | 1,073 | |

| | 118 | | | Escalade, Inc. | | | 2,498 | |

| | 252 | | | Smith & Wesson Brands, Inc. | | | 4,473 | |

| | 157 | | | Thor Industries, Inc. | | | 14,599 | |

| | 130 | | | Vista Outdoor, Inc.(a) | | | 3,089 | |

| | | | | | | | 25,732 | |

| | | | | MACHINERY - 4.2% | | | | |

| | 201 | | | AGCO Corporation | | | 20,721 | |

| | 639 | | | Altra Industrial Motion Corporation | | | 35,420 | |

| | 303 | | | CECO Environmental Corporation(a) | | | 2,109 | |

| | 1 | | | CIRCOR International, Inc. (a) | | | 38 | |

| | 233 | | | Colfax Corporation(a) | | | 8,910 | |

| | 91 | | | Columbus McKinnon Corporation | | | 3,498 | |

| | 117 | | | Gencor Industries, Inc.(a) | | | 1,439 | |

| | 314 | | | Hillenbrand, Inc. | | | 12,497 | |

| | 46 | | | Hurco Companies, Inc. | | | 1,380 | |

| | 36 | | | Hyster-Yale Materials Handling, Inc., Class A | | | 2,144 | |

| | 126 | | | Intevac, Inc.(a) | | | 909 | |

| | 177 | | | Kennametal, Inc. | | | 6,415 | |

| | 67 | | | LS Starrett Company (The), Class A(a) | | | 283 | |

| | 170 | | | Manitowoc Company, Inc. (The)(a) | | | 2,263 | |

| | 1,072 | | | NN, Inc. (a) | | | 7,043 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | MACHINERY - 4.2% (Continued) | | | | |

| | 73 | | | Regal Beloit Corporation | | $ | 8,965 | |

| | 14 | | | SPX FLOW, Inc.(a) | | | 811 | |

| | 119 | | | Terex Corporation | | | 4,152 | |

| | | | | | | | 118,997 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 0.6% | | | | |

| | 720 | | | Accuray, Inc.(a) | | | 3,002 | |

| | 155 | | | AngioDynamics, Inc.(a) | | | 2,376 | |

| | 96 | | | Avanos Medical, Inc.(a) | | | 4,405 | |

| | 20 | | | CryoLife, Inc. (a) | | | 472 | |

| | 300 | | | Harvard Bioscience, Inc.(a) | | | 1,287 | |

| | 17 | | | Luminex Corporation | | | 393 | |

| | 41 | | | Natus Medical, Inc.(a) | | | 822 | |

| | 146 | | | OraSure Technologies, Inc.(a) | | | 1,545 | |

| | 9 | | | Utah Medical Products, Inc. | | | 759 | |

| | 45 | | | Varex Imaging Corporation(a) | | | 751 | |

| | | | | | | | 15,812 | |

| | | | | METALS & MINING - 0.9% | | | | |

| | 445 | | | Alcoa Corporation(a) | | | 10,257 | |

| | 52 | | | Encore Wire Corporation | | | 3,150 | |

| | 812 | | | Hecla Mining Company | | | 5,262 | |

| | 657 | | | SunCoke Energy, Inc. | | | 2,858 | |

| | 235 | | | Warrior Met Coal, Inc. | | | 5,010 | |

| | | | | | | | 26,537 | |

| | | | | OIL & GAS PRODUCERS - 2.6% | | | | |

| | 144 | | | Bonanza Creek Energy, Inc.(a) | | | 2,784 | |

| | 815 | | | Earthstone Energy, Inc., Class A(a) | | | 4,344 | |

| | 1,284 | | | EQT Corporation | | | 16,320 | |

| | 958 | | | Equitrans Midstream Corporation | | | 7,702 | |

| | 556 | | | HollyFrontier Corporation | | | 14,373 | |

| | 120 | | | Matador Resources Company(a) | | | 1,447 | |

| | 442 | | | PBF Energy, Inc., Class A | | | 3,138 | |

| | 233 | | | PDC Energy, Inc.(a) | | | 4,783 | |

| | 22 | | | Plains GP Holdings, L.P., Class A | | | 186 | |

| | 4,666 | | | Southwestern Energy Company(a) | | | 13,905 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | OIL & GAS PRODUCERS - 2.6% (Continued) | | | | |

| | 173 | | | World Fuel Services Corporation | | $ | 5,391 | |

| | | | | | | | 74,373 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 0.2% | | | | |

| | 215 | | | Helmerich & Payne, Inc. | | | 4,979 | |

| | 175 | | | Natural Gas Services Group, Inc.(a) | | | 1,659 | |

| | | | | | | | 6,638 | |

| | | | | PUBLISHING & BROADCASTING - 2.1% | | | | |

| | 199 | | | Beasley Broadcast Group, Inc., Class A | | | 297 | |

| | 60 | | | Cumulus Media, Inc., Class A(a) | | | 523 | |

| | 130 | | | Emmis Communications Corporation(a) | | | 237 | |

| | 1,606 | | | Entravision Communications Corporation, Class A | | | 4,416 | |

| | 853 | | | EW Scripps Company (The), Class A | | | 13,042 | |

| | 476 | | | Gray Television, Inc.(a) | | | 8,516 | |

| | 81 | | | Houghton Mifflin Harcourt Company(a) | | | 270 | |

| | 476 | | | Meredith Corporation | | | 9,139 | |

| | 70 | | | Saga Communications, Inc., Class A | | | 1,681 | |

| | 212 | | | Scholastic Corporation | | | 5,300 | |

| | 624 | | | TEGNA, Inc. | | | 8,705 | |

| | 445 | | | Townsquare Media, Inc., Class A | | | 2,964 | |

| | 193 | | | Tribune Publishing Company | | | 2,644 | |

| | 360 | | | Urban One, Inc.(a) | | | 421 | |

| | | | | | | | 58,155 | |

| | | | | REAL ESTATE OWNERS & DEVELOPERS - 0.1% | | | | |

| | 24 | | | FRP Holdings, Inc.(a) | | | 1,093 | |

| | 14 | | | Stratus Properties, Inc.(a) | | | 357 | |

| | | | | | | | 1,450 | |

| | | | | REAL ESTATE SERVICES - 0.4% | | | | |

| | 59 | | | RE/MAX Holdings, Inc., Class A | | | 2,143 | |

| | 738 | | | Realogy Holdings Corporation(a) | | | 9,683 | |

| | | | | | | | 11,826 | |

| | | | | RENEWABLE ENERGY - 1.0% | | | | |

| | 266 | | | FutureFuel Corporation | | | 3,378 | |

| | 141 | | | Green Plains, Inc. (a) | | | 1,857 | |

| | 314 | | | Renewable Energy Group, Inc.(a) | | | 22,238 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | RENEWABLE ENERGY - 1.0% (Continued) | | | | |

| | 100 | | | Ultralife Corporation(a) | | $ | 647 | |

| | | | | | | | 28,120 | |

| | | | | RETAIL - CONSUMER STAPLES - 1.0% | | | | |

| | 221 | | | Big Lots, Inc. | | | 9,488 | |

| | 135 | | | Ingles Markets, Inc., Class A | | | 5,759 | |

| | 147 | | | Rite Aid Corporation(a) | | | 2,327 | |

| | 179 | | | SpartanNash Company | | | 3,116 | |

| | 60 | | | Village Super Market, Inc., Class A | | | 1,324 | |

| | 140 | | | Weis Markets, Inc. | | | 6,693 | |

| | | | | | | | 28,707 | |

| | | | | RETAIL - DISCRETIONARY - 8.9% | | | | |

| | 18 | | | Aaron’s Company, Inc. (The)(a) | | | 341 | |

| | 226 | | | Abercrombie & Fitch Company, Class A | | | 4,601 | |

| | 50 | | | American Eagle Outfitters, Inc. | | | 1,004 | |

| | 20 | | | America’s Car-Mart, Inc.(a) | | | 2,197 | |

| | 292 | | | AutoNation, Inc.(a) | | | 20,379 | |

| | 256 | | | Beacon Roofing Supply, Inc.(a) | | | 10,289 | |

| | 476 | | | Bed Bath & Beyond, Inc. | | | 8,454 | |

| | 199 | | | Big 5 Sporting Goods Corporation | | | 2,032 | |

| | 88 | | | Children’s Place, Inc. (The) | | | 4,409 | |

| | 333 | | | Conn’s, Inc.(a) | | | 3,893 | |

| | 312 | | | Container Store Group, Inc. (The)(a) | | | 2,976 | |

| | 20 | | | Designer Brands, Inc., Class A | | | 153 | |

| | 386 | | | Dick’s Sporting Goods, Inc. | | | 21,697 | |

| | 102 | | | Ethan Allen Interiors, Inc. | | | 2,061 | |

| | 224 | | | Foot Locker, Inc. | | | 9,059 | |

| | 259 | | | Foundation Building Materials, Inc.(a) | | | 4,975 | |

| | 151 | | | GMS, Inc.(a) | | | 4,602 | |

| | 271 | | | Group 1 Automotive, Inc. | | | 35,539 | |

| | 173 | | | Guess?, Inc. | | | 3,913 | |

| | 57 | | | Haverty Furniture Companies, Inc. | | | 1,577 | |

| | 19 | | | Hertz Global Holdings, Inc.(a) | | | 24 | |

| | 38 | | | Hibbett Sports, Inc.(a) | | | 1,755 | |

| | 750 | | | Kohl’s Corporation | | | 30,518 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | RETAIL - DISCRETIONARY - 8.9% (Continued) | | | | |

| | 103 | | | La-Z-Boy, Inc. | | $ | 4,104 | |

| | 170 | | | Penske Automotive Group, Inc. | | | 10,096 | |

| | 2,853 | | | Qurate Retail, Inc. - Series A | | | 31,297 | |

| | 432 | | | Rush Enterprises, Inc., Class A | | | 17,893 | |

| | 63 | | | Sonic Automotive, Inc., Class A | | | 2,430 | |

| | 111 | | | Tilly’s, Inc., Class A | | | 906 | |

| | 276 | | | Urban Outfitters, Inc.(a) | | | 7,066 | |

| | 265 | | | Vera Bradley, Inc.(a) | | | 2,109 | |

| | 5 | | | Zumiez, Inc.(a) | | | 184 | |

| | | | | | | | 252,533 | |

| | | | | SEMICONDUCTORS - 1.5% | | | | |

| | 1,075 | | | Amkor Technology, Inc. | | | 16,211 | |

| | 127 | | | Amtech Systems, Inc.(a) | | | 810 | |

| | 16 | | | Data I/O Corporation(a) | | | 66 | |

| | 488 | | | Photronics, Inc.(a) | | | 5,446 | |

| | 12 | | | Rambus, Inc.(a) | | | 210 | |

| | 183 | | | Ultra Clean Holdings, Inc.(a) | | | 5,700 | |

| | 547 | | | Veeco Instruments, Inc.(a) | | | 9,496 | |

| | 260 | | | Vishay Intertechnology, Inc. | | | 5,385 | |

| | | | | | | | 43,324 | |

| | | | | SOFTWARE - 2.0% | | | | |

| | 944 | | | Allscripts Healthcare Solutions, Inc.(a) | | | 13,631 | |

| | 214 | | | Avaya Holdings Corporation(a) | | | 4,098 | |

| | 205 | | | ChannelAdvisor Corporation(a) | | | 3,276 | |

| | 110 | | | Computer Programs and Systems, Inc. | | | 2,952 | |

| | 273 | | | Donnelley Financial Solutions, Inc.(a) | | | 4,633 | |

| | 90 | | | Ebix, Inc. | | | 3,417 | |

| | 149 | | | NextGen Healthcare, Inc.(a) | | | 2,718 | |

| | 181 | | | SeaChange International, Inc.(a) | | | 253 | |

| | 288 | | | Support.com, Inc. (a) | | | 634 | |

| | 71 | | | Verint Systems, Inc.(a) | | | 4,770 | |

| | 771 | | | Xperi Holding Corporation | | | 16,114 | |

| | | | | | | | 56,496 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | SPECIALTY FINANCE - 4.2% | | | | |

| | 178 | | | Alliance Data Systems Corporation | | $ | 13,190 | |

| | 20 | | | Consumer Portfolio Services, Inc.(a) | | | 85 | |

| | 221 | | | Encore Capital Group, Inc.(a) | | | 8,608 | |

| | 561 | | | EZCORP, Inc., Class A(a) | | | 2,687 | |

| | 110 | | | GATX Corporation | | | 9,150 | |

| | 190 | | | General Finance Corporation(a) | | | 1,617 | |

| | 4 | | | Investors Title Company | | | 612 | |

| | 27 | | | Marlin Business Services Corporation | | | 330 | |

| | 1,351 | | | MGIC Investment Corporation | | | 16,955 | |

| | 98 | | | Nelnet, Inc., Class A | | | 6,981 | |

| | 57 | | | Nicholas Financial, Inc.(a) | | | 478 | |

| | 1,081 | | | OneMain Holdings, Inc. | | | 52,061 | |

| | 37 | | | PROG Holdings, Inc. | | | 1,993 | |

| | 81 | | | Regional Management Corporation | | | 2,419 | |

| | 49 | | | Willis Lease Finance Corporation(a) | | | 1,493 | |

| | | | | | | | 118,659 | |

| | | | | STEEL - 1.7% | | | | |

| | 168 | | | Carpenter Technology Corporation | | | 4,892 | |

| | 960 | | | Commercial Metals Company | | | 19,718 | |

| | 86 | | | Friedman Industries, Inc. | | | 590 | |

| | 158 | | | Northwest Pipe Company(a) | | | 4,472 | |

| | 258 | | | Olympic Steel, Inc. | | | 3,439 | |

| | 922 | | | United States Steel Corporation | | | 15,462 | |

| | | | | | | | 48,573 | |

| | | | | TECHNOLOGY HARDWARE - 5.9% | | | | |

| | 239 | | | ADTRAN, Inc. | | | 3,530 | |

| | 100 | | | Applied Optoelectronics, Inc.(a) | | | 851 | |

| | 2 | | | AstroNova, Inc. | | | 21 | |

| | 82 | | | Aviat Networks, Inc.(a) | | | 2,800 | |

| | 242 | | | Avnet, Inc. | | | 8,497 | |

| | 200 | | | Aware, Inc.(a) | | | 700 | |

| | 88 | | | Benchmark Electronics, Inc. | | | 2,377 | |

| | 940 | | | CommScope Holding Company, Inc.(a) | | | 12,596 | |

| | 196 | | | Communications Systems, Inc. | | | 896 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | TECHNOLOGY HARDWARE - 5.9% (Continued) | | | | |

| | 896 | | | Daktronics, Inc. | | $ | 4,193 | |

| | 104 | | | InterDigital, Inc. | | | 6,311 | |

| | 492 | | | Jabil, Inc. | | | 20,925 | |

| | 56 | | | Key Tronic Corporation(a) | | | 386 | |

| | 207 | | | Knowles Corporation(a) | | | 3,815 | |

| | 265 | | | Maxar Technologies, Inc. | | | 10,226 | |

| | 677 | | | NCR Corporation(a) | | | 25,435 | |

| | 314 | | | NETGEAR, Inc.(a) | | | 12,758 | |

| | 762 | | | NetScout Systems, Inc.(a) | | | 20,894 | |

| | 63 | | | PCTEL, Inc. | | | 414 | |

| | 477 | | | Pitney Bowes, Inc. | | | 2,938 | |

| | 252 | | | Sanmina Corporation(a) | | | 8,036 | |

| | 229 | | | TTM Technologies, Inc.(a) | | | 3,159 | |

| | 5 | | | Vishay Precision Group, Inc.(a) | | | 158 | |

| | 574 | | | Xerox Holdings Corporation | | | 13,311 | |

| | 443 | | | ZAGG, Inc.(a) | | | 1,847 | |

| | | | | | | | 167,074 | |

| | | | | TECHNOLOGY SERVICES - 1.4% | | | | |

| | 793 | | | DXC Technology Company | | | 20,420 | |

| | 101 | | | Insight Enterprises, Inc.(a) | | | 7,685 | |

| | 54 | | | ManTech International Corporation, Class A | | | 4,803 | |

| | 91 | | | NetSol Technologies, Inc.(a) | | | 346 | |

| | 132 | | | Sykes Enterprises, Inc.(a) | | | 4,972 | |

| | | | | | | | 38,226 | |

| | | | | TELECOMMUNICATIONS - 1.1% | | | | |

| | 1,499 | | | Alaska Communications Systems Group, Inc. | | | 5,531 | |

| | 353 | | | EchoStar Corporation, Class A(a) | | | 7,480 | |

| | 563 | | | ORBCOMM, Inc.(a) | | | 4,178 | |

| | 109 | | | Spok Holdings, Inc. | | | 1,213 | |

| | 683 | | | Telephone and Data Systems, Inc. | | | 12,683 | |

| | | | | | | | 31,085 | |

| | | | | TOBACCO & CANNABIS - 0.3% | | | | |

| | 155 | | | Universal Corporation | | | 7,535 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 1.8% | | | | |

| | 144 | | | Alaska Air Group, Inc. | | $ | 7,488 | |

| | 308 | | | Atlas Air Worldwide Holdings, Inc.(a) | | | 16,798 | |

| | 9 | | | Echo Global Logistics, Inc.(a) | | | 241 | |

| | 152 | | | Hawaiian Holdings, Inc. | | | 2,690 | |

| | 32 | | | Hub Group, Inc., Class A(a) | | | 1,824 | |

| | 128 | | | Kirby Corporation(a) | | | 6,634 | |

| | 20 | | | Macquarie Infrastructure Corporation | | | 751 | |

| | 29 | | | Patriot Transportation Holding, Inc. | | | 255 | |

| | 113 | | | Ryder System, Inc. | | | 6,979 | |

| | 59 | | | Schneider National, Inc., Class B | | | 1,221 | |

| | 66 | | | SEACOR Holdings, Inc.(a) | | | 2,736 | |

| | 111 | | | SkyWest, Inc. | | | 4,475 | |

| | | | | | | | 52,092 | |

| | | | | TRANSPORTATION EQUIPMENT - 0.5% | | | | |

| | 216 | | | Greenbrier Companies, Inc. (The) | | | 7,858 | |

| | 181 | | | REV Group, Inc. | | | 1,595 | |

| | 195 | | | Trinity Industries, Inc. | | | 5,146 | |

| | 45 | | | Wabash National Corporation | | | 775 | |

| | | | | | | | 15,374 | |

| | | | | WHOLESALE - CONSUMER STAPLES - 0.5% | | | | |

| | 234 | | | Core-Mark Holding Company, Inc. | | | 6,873 | |

| | 520 | | | United Natural Foods, Inc.(a) | | | 8,304 | |

| | | | | | | | 15,177 | |

| | | | | WHOLESALE - DISCRETIONARY - 1.0% | | | | |

| | 36 | | | Educational Development Corporation | | | 553 | |

| | 39 | | | ePlus, Inc.(a) | | | 3,430 | |

| | 431 | | | G-III Apparel Group Ltd.(a) | | | 10,232 | |

| | 199 | | | KAR Auction Services, Inc. | | | 3,703 | |

| | 106 | | | PC Connection, Inc. | | | 5,013 | |

| | 232 | | | ScanSource, Inc.(a) | | | 6,120 | |

| | 7 | | | Wayside Technology Group, Inc. | | | 134 | |

| | | | | | | | 29,185 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.1% (Continued) | | | | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $2,165,800) | | $ | 2,810,413 | |

| | | | | | | | | |

| | | | | PARTNERSHIP SHARES — 0.7% | | | | |

| | | | | METALS & MINING - 0.1% | | | | |

| | 774 | | | Alliance Resource Partners, L.P. | | | 3,466 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 0.5% | | | | |

| | 188 | | | NGL Energy Partners, L.P. | | | 451 | |

| | 1,426 | | | Plains All American Pipeline, L.P. | | | 11,751 | |

| | | | | | | | 12,202 | |

| | | | | REIT - 0.1% | | | | |

| | 190 | | | Landmark Infrastructure Partners, L.P. | | | 2,037 | |

| | | | | | | | | |

| | | | | SPECIALTY FINANCE - 0.0% (b) | | | | |

| | 224 | | | America First Multifamily Investors, L.P. | | | 952 | |

| | | | | | | | | |

| | | | | TOTAL PARTNERSHIP SHARES (Cost $17,324) | | | 18,657 | |

| | | | | | | | | |

| | | | | REIT — 0.1% | | | | |

| | | | | MORTGAGE FINANCE - 0.1% | | | | |

| | 214 | | | Ellington Financial, Inc. | | | 3,176 | |

| | | | | | | | | |

| | | | | TOTAL REIT (Cost $3,260) | | | 3,176 | |

| | | | | | | | | |

| | | | | MONEY MARKET FUND - 0.7% | | | | |

| | 19,076 | | | BlackRock Liquidity Funds T-Fund, Institutional Class, 0.01%(c) | | | 19,076 | |

| | | | | | | | | |

| | | | | TOTAL MONEY MARKET FUND (Cost $19,076) | | | 19,076 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2020 |

| Shares | | | | | Value | |

| | | | | TOTAL INVESTMENTS - 100.6% (Cost $2,205,460) | | $ | 2,851,322 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (0.6)% | | | (16,066 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 2,835,256 | |

| (a) | Non-income producing security. |

| (b) | Percentage rounds to less than 0.1%. |

| (c) | Rate disclosed is the seven day effective yield as of December 31, 2020. |

LP - Limited Partnership

REIT - Real Estate Investment Trust.

See accompanying notes to financial statements.

| Acclivity Funds |

| STATEMENTS OF ASSETS AND LIABILITIES |

| December 31, 2020 |

| | | Acclivity Mid Cap | | | Acclivity Small Cap | |

| | | Multi-Style Fund | | | Value Fund | |

| ASSETS | | | | | | | | |

| Investment securities: | | | | | | | | |

| At cost | | $ | 132,566 | | | $ | 2,205,460 | |

| At value | | $ | 163,341 | | | $ | 2,851,322 | |

| Dividends and interest receivable | | | 106 | | | | 2,394 | |

| Receivable due from Advisor | | | 2,473 | | | | 9,857 | |

| Prepaid expenses and other assets | | | 1,152 | | | | 1,864 | |

| TOTAL ASSETS | | | 167,072 | | | | 2,865,437 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Payable for Fund shares redeemed | | | — | | | | 15 | |

| Audit fees payable | | | 12,200 | | | | 12,205 | |

| Distribution (12b-1) fees payable | | | — | | | | 6 | |

| Payable to related parties | | | 9,135 | | | | 10,953 | |

| Accrued expenses and other liabilities | | | 3,924 | | | | 7,002 | |

| TOTAL LIABILITIES | | | 25,259 | | | | 30,181 | |

| NET ASSETS | | $ | 141,813 | | | $ | 2,835,256 | |

| | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | |

| Paid in capital | | $ | 125,020 | | | $ | 2,551,759 | |

| Accumulated earnings | | | 16,793 | | | | 283,497 | |

| NET ASSETS | | $ | 141,813 | | | $ | 2,835,256 | |

| | | | | | | | | |

| Net Asset Value Per Share: | | | | | | | | |

| Class I Shares: | | | | | | | | |