united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22549

Northern Lights Fund Trust II

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246

(Address of principal executive offices) (Zip code)

Kevin Wolf, Ultimus Fund Solutions, LLC

4221 North 203rd Street, Suite 100, Elkhorn, NE 68022

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 12/31

Date of reporting period: 12/31/23

Item 1. Reports to Stockholders.

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| Acclivity Mid Cap Multi-Style Fund |

| |

| Acclivity Small Cap Value Fund |

| |

| |

| |

| |

| |

| Annual Report |

| |

| December 31, 2023 |

| |

| |

| |

| |

| |

| www.acclivityfunds.com |

| 1 (855) 873-3837 |

| |

| |

| |

| |

| |

| Distributed by Northern Lights Distributors, LLC |

| Member FINRA |

Acclivity Funds Annual Shareholder Letter (Unaudited)

Dear Shareholder,

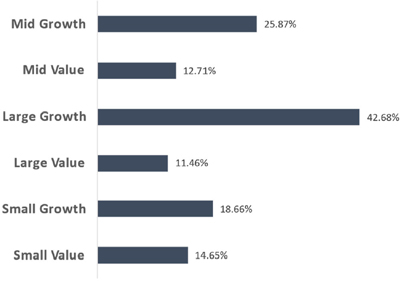

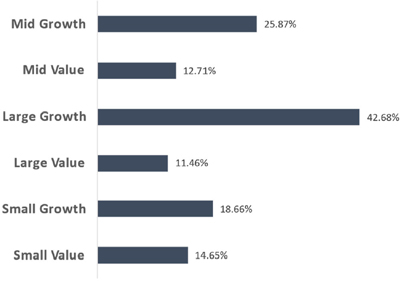

After a turbulent first half weighed down by aggressive Fed interest rate hikes to fight inflation and recession fears, both the equity and fixed-income markets staged an impressive rebound in the last quarter of 2023. The U.S. equities, represented by the S&P 500 Index, gained ~26% for the year, fueled by resilient economic performance, strong corporate earnings, and a late-year dovish pivot by the Fed. The bond market also benefited from easing inflation and hopes of early rate cuts. The broader fixed- income markets, represented by the Bloomberg U.S. Aggregate Bond Index, gained ~5% for the year. Within U.S. sectors, Information Technology and Communication Services outperformed while Utilities lagged. Regarding investment styles, growth securities outperformed value securities across all size segments, as measured by Russell indices in 2023 (see Exhibit 1).

Exhibit 1. Russell Index Performance Source: Bloomberg Finance, L.P., as of December 31, 2023. Large Growth refers to the Russell 1000 Growth TR Index. Large Value refers to the Russell 1000 Value TR Index. Mid Growth refers to the Russell Mid Cap Growth TR Index. Mid Value refers to the Russell Mid Cap Value TR Index. Small Growth refers to the Russell 2000 Growth TR Index. Small Value refers to the Russell 2000 Value TR Index. Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |  |

Grounded in decades of academic research, Acclivity’s strategies are designed to target equity securities that have specific characteristics associated with higher expected returns. Our organization remains stable, and our research team continues to pursue agile implementation that allows us to identify, validate, and incorporate new relevant research into strategies. Every day, we manage our strategies in an efficient way to reduce costs and enhance services for our clients.

Thank you for entrusting us with your investments.

Fund Performance

Acclivity Mid Cap Multi-Style Fund

In 2023, Acclivity Mid Cap Multi-Style Fund I Share class (“AXMIX”) was up 16.41%.

Exhibit 3. Quarterly Performance of AXMIX v.s. Russell Mid-Cap Index as of December 31st, 2023

| 2023 Performance | Q1 | Q2 | Q3 | Q4 | YTD |

| | | | | | |

| AXMIX | 2.31% | 4.52% | -2.32% | 11.45% | 16.41% |

| | | | | | |

| Russell Mid Cap | 4.06% | 4.76% | -4.68% | 12.82% | 17.23% |

| | | | | | |

To decompose fund performance, most of the underperformance was attributed to security selections. Regarding sector allocation effects, the underweight allocations to utilities, real estate, and healthcare securities were the main contributors. In contrast, the overweight allocation to consumer staples and energy securities were the main detractors. Regarding security selection effects, consumer staples, healthcare, utilities, and communication services securities were the main contributors, while information technology, consumer discretionary, financials, and energy securities were the main detractors.

Acclivity Small Cap Value Fund

In 2023, Acclivity Small Cap Value Fund I Share class (“AXVIX”) was up 22.62%.

Exhibit 4. Quarterly Performance of AXVIX v.s. Russell 2000 Value as of December 31st, 2023

| 2023 Performance | Q1 | Q2 | Q3 | Q4 | YTD |

| | | | | | |

| AXVIX | 0.91% | 5.87% | -0.61% | 15.48% | 22.62% |

| | | | | | |

| Russell 2000 Value | -0.66% | 3.18% | -2.96% | 15.26% | 14.65% |

| | | | | | |

To decompose fund performance, 55% of the outperformance was attributed to sector allocations, while the remaining portion was attributed to security selections. Regarding sector allocation effects, the overweight allocations to consumer discretionary and information technology and the underweight allocation to utilities and healthcare were the main contributors. In contrast, the underweight allocation to financials and overweight allocation to consumer staples were the main detractors. Regarding security selection effects, consumer discretionary, information technology, materials, and financials were the main contributors, while energy, industrials, and consumer staples were the main detractors.

Disclosures and Important Information

S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. Bloomberg Barclays U.S. Aggregate Bond Index is representative of the entire universe of taxable fixed-income investments. It includes issues of the U.S. Government and any agency thereof, corporate issues of investment grade quality (Baa/BBB or better), and mortgage-backed securities. Russell Mid-Cap Index is a stock market index that tracks the 800 smallest companies in the Russell 1000 Index, which represents approximately 25% of the total market capitalization of the Russell 1000 Index. Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Russell Midcap Value Index measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. Russell 2000 Value Index measures the performance of Russell 2000 companies with lower price-to-book ratios and forecasted growth values. Russell 2000 Growth Index measures the performance of Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

Total return indexes reinvest dividends. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Indices do not reflect any fees, expenses, or sales charges and are not available for direct investment. Investments cannot be made in an index. Unmanaged index returns do not reflect any fees, expenses, or sales charges. Past performance is no guarantee of future results.

3464-INN-02/02/2024

3131-NLD-02/02/2024

ACCLIVITY MID CAP MULTI-STYLE FUND

PORTFOLIO REVIEW (Unaudited)

December 31, 2023

The Fund’s performance figures* for the periods ended December 31, 2023, compared to its benchmark:

| | | Annualized |

| | | | Since Inception |

| | One Year | Three Year | (12/31/19) |

| Acclivity Mid Cap Multi-Style Fund - Class I | 16.41% | 8.82% | 9.21% |

| Acclivity Mid Cap Multi-Style Fund - Class N | 16.41% | 8.82% | 9.21% |

| Russell Mid-Cap Total Return Index** | 17.23% | 5.92% | 8.61% |

| S&P 500 Total Return Index*** | 26.29% | 10.00% | 12.04% |

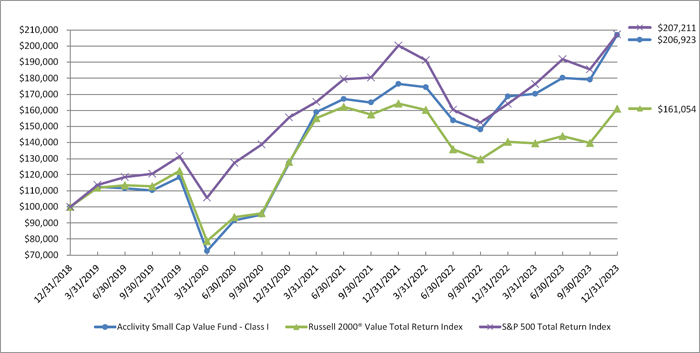

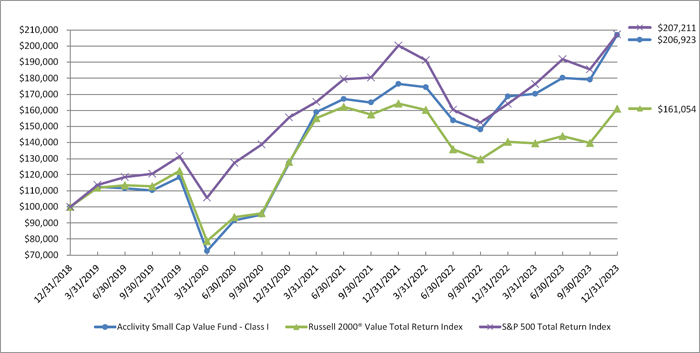

Comparison of the Change in Value of a $100,000 Investment

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gain distributions, if any. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expenses are 35.66% for Class I shares and 35.91% for Class N shares per the May 1, 2023, prospectus. After fee waivers, the Fund’s total annual operating expenses are 0.45% for Class I shares and 0.70% for Class N shares. For performance information current to the most recent month-end, please call toll-free 1-855-873-3837 (1-855-USE-ETFS). |

| ** | The Russell Mid-Cap Total Return Index measures the performance of the smallest 800 companies in the Russell 1000 index. Investors cannot invest directly in an index. |

| *** | The S&P 500 Total Return Index is a widely accepted, unmanaged index of U.S. stock market performance which does not take into account charges, fees and other expenses. Investors cannot invest directly in an index. |

| Holdings By Asset Class as of December 31, 2023 | | % of Net Assets | |

| Insurance | | | 8.5 | % |

| Software | | | 6.7 | % |

| Technology Hardware | | | 4.4 | % |

| Oil & Gas Producers | | | 4.2 | % |

| Machinery | | | 3.9 | % |

| Medical Equipment & Devices | | | 3.9 | % |

| Biotechnology & Pharmaceuticals | | | 3.8 | % |

| Chemicals | | | 3.7 | % |

| Retail - Discretionary | | | 3.7 | % |

| Technology Services | | | 3.6 | % |

| Other Investments & Assets in Excess of Liabilities | | | 53.6 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments in this annual report for a detailed analysis of the Fund’s holdings.

ACCLIVITY SMALL CAP VALUE FUND

PORTFOLIO REVIEW (Unaudited)

December 31, 2023

The Fund’s performance figures* for the periods ended December 31, 2023, compared to its benchmark:

| | | Annualized |

| | | | Since Inception |

| | One Year | Three Year | (12/31/18) |

| Acclivity Small Cap Value Fund - Class I | 22.62% | 17.57% | 15.65% |

| Acclivity Small Cap Value Fund - Class N | 22.37% | 17.44% | 15.54% |

| Russell 2000® Value Total Return Index** | 14.65% | 7.94% | 10.00% |

| S&P 500 Total Return Index*** | 26.29% | 10.00% | 15.69% |

Comparison of the Change in Value of a $100,000 Investment

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gain distributions, if any. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s total annual operating expenses are 1.99% for Class I shares and 1.54% for Class N shares per the May 1, 2023 prospectus. After fee waivers, the Fund’s total annual operating expenses are 0.48% for Class I shares and 0.73% for Class N shares. For performance information current to the most recent month-end, please call toll-free 1-855-873-3837 (1-855-USE-ETFS). |

| ** | The Russell 2000® Value Total Return Index measures the performance of the largest 2,000 U.S. companies determined by total market capitalization. Investors cannot invest directly in an index. |

| *** | The S&P 500 Total Return Index is a widely accepted, unmanaged index of U.S. stock market performance which does not take into account charges, fees and other expenses. Investors cannot invest directly in an index. |

| Holdings By Asset Class as of December 31, 2023 | | % of Net Assets | |

| Banking | | | 12.4 | % |

| Home Construction | | | 6.9 | % |

| Retail - Discretionary | | | 6.9 | % |

| Oil & Gas Producers | | | 6.4 | % |

| Specialty Finance | | | 4.8 | % |

| Technology Hardware | | | 4.6 | % |

| Insurance | | | 4.3 | % |

| Transportation & Logistics | | | 3.9 | % |

| Semiconductors | | | 3.2 | % |

| Commercial Support Services | | | 3.1 | % |

| Other Investments & Liabilities in Excess of Assets | | | 43.5 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments in this annual report for a detailed analysis of the Fund’s holdings.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% | | | | |

| | | | | ADVERTISING & MARKETING - 1.5% | | | | |

| | 317 | | | Interpublic Group of Companies, Inc. (The) | | $ | 10,347 | |

| | 148 | | | Omnicom Group, Inc. | | | 12,803 | |

| | 5 | | | Trade Desk, Inc. (The), Class A(a) | | | 360 | |

| | | | | | | | 23,510 | |

| | | | | AEROSPACE & DEFENSE - 1.3% | | | | |

| | 9 | | | Hexcel Corporation | | | 664 | |

| | 12 | | | Howmet Aerospace, Inc. | | | 649 | |

| | 19 | | | Huntington Ingalls Industries, Inc. | | | 4,933 | |

| | 1 | | | Teledyne Technologies, Inc.(a) | | | 446 | |

| | 114 | | | Textron, Inc. | | | 9,168 | |

| | 36 | | | Woodward, Inc. | | | 4,901 | |

| | | | | | | | 20,761 | |

| | | | | APPAREL & TEXTILE PRODUCTS - 1.6% | | | | |

| | 1 | | | Columbia Sportswear Company | | | 80 | |

| | 2 | | | Crocs, Inc.(a) | | | 187 | |

| | 12 | | | Deckers Outdoor Corporation(a) | | | 8,021 | |

| | 1 | | | Hanesbrands, Inc. | | | 5 | |

| | 2 | | | PVH Corporation | | | 244 | |

| | 7 | | | Ralph Lauren Corporation | | | 1,009 | |

| | 100 | | | Skechers USA, Inc., Class A(a) | | | 6,234 | |

| | 266 | | | Tapestry, Inc. | | | 9,791 | |

| | 3 | | | VF Corporation | | | 56 | |

| | | | | | | | 25,627 | |

| | | | | ASSET MANAGEMENT - 1.0% | | | | |

| | 1 | | | Ares Management Corporation, Class A | | | 119 | |

| | 81 | | | Carlyle Group, Inc. (The) | | | 3,296 | |

| | 365 | | | Franklin Resources, Inc. | | | 10,874 | |

| | 2 | | | LPL Financial Holdings, Inc. | | | 455 | |

| | 2 | | | Raymond James Financial, Inc. | | | 223 | |

| | 9 | | | Stifel Financial Corporation | | | 622 | |

| | | | | | | | 15,589 | |

| | | | | AUTOMOTIVE - 0.8% | | | | |

| | 30 | | | Autoliv, Inc. | | | 3,306 | |

| | 166 | | | BorgWarner, Inc. | | | 5,951 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | AUTOMOTIVE - 0.8% (Continued) | | | | |

| | 59 | | | Gentex Corporation | | $ | 1,927 | |

| | 11 | | | Lear Corporation | | | 1,553 | |

| | | | | | | | 12,737 | |

| | | | | BANKING - 2.5% | | | | |

| | 93 | | | East West Bancorp, Inc. | | | 6,691 | |

| | 17 | | | First Horizon Corporation | | | 241 | |

| | 709 | | | Huntington Bancshares, Inc. | | | 9,019 | |

| | 5 | | | KeyCorporation | | | 72 | |

| | 2 | | | M&T Bank Corporation | | | 274 | |

| | 2 | | | Pinnacle Financial Partners, Inc. | | | 174 | |

| | 2 | | | Prosperity Bancshares, Inc. | | | 135 | |

| | 783 | | | Regions Financial Corporation | | | 15,175 | |

| | 2 | | | SouthState Corporation | | | 169 | |

| | 1 | | | SVB Financial Group(a) | | | 0 | |

| | 2 | | | Synovus Financial Corporation | | | 75 | |

| | 5 | | | Valley National Bancorp | | | 54 | |

| | 122 | | | Webster Financial Corporation | | | 6,193 | |

| | 3 | | | Zions Bancorp | | | 132 | |

| | | | | | | | 38,404 | |

| | | | | BEVERAGES - 0.6% | | | | |

| | 157 | | | Molson Coors Beverage Company, Class B | | | 9,610 | |

| | | | | | | | | |

| | | | | BIOTECHNOLOGY & PHARMACEUTICALS - 3.8% | | | | |

| | 1 | | | ACADIA Pharmaceuticals, Inc.(a) | | | 31 | |

| | 74 | | | BioMarin Pharmaceutical, Inc.(a) | | | 7,135 | |

| | 1 | | | Blueprint Medicines Corporation(a) | | | 92 | |

| | 2 | | | Denali Therapeutics, Inc.(a) | | | 43 | |

| | 305 | | | Elanco Animal Health, Inc.(a) | | | 4,545 | |

| | 60 | | | Exelixis, Inc.(a) | | | 1,440 | |

| | 4 | | | Halozyme Therapeutics, Inc.(a) | | | 148 | |

| | 255 | | | ImmunoGen, Inc.(a) | | | 7,561 | |

| | 194 | | | Incyte Corporation(a) | | | 12,181 | |

| | 95 | | | Ionis Pharmaceuticals, Inc.(a) | | | 4,806 | |

| | 1 | | | Iovance Biotherapeutics, Inc.(a) | | | 8 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | BIOTECHNOLOGY & PHARMACEUTICALS - 3.8% (Continued) | | | | |

| | 1 | | | Mirati Therapeutics, Inc.(a) | | $ | 59 | |

| | 67 | | | Neurocrine Biosciences, Inc.(a) | | | 8,828 | |

| | 59 | | | Sarepta Therapeutics, Inc.(a) | | | 5,689 | |

| | 1 | | | TG Therapeutics, Inc.(a) | | | 17 | |

| | 34 | | | United Therapeutics Corporation(a) | | | 7,476 | |

| | | | | | | | 60,059 | |

| | | | | CABLE & SATELLITE - 0.4% | | | | |

| | 79 | | | Liberty Broadband Corporation - Series C(a) | | | 6,367 | |

| | | | | | | | | |

| | | | | CHEMICALS - 3.7% | | | | |

| | 60 | | | Albemarle Corporation(b) | | | 8,669 | |

| | 2 | | | Ashland, Inc. | | | 169 | |

| | 48 | | | Avery Dennison Corporation | | | 9,704 | |

| | 16 | | | Celanese Corporation | | | 2,486 | |

| | 44 | | | CF Industries Holdings, Inc. | | | 3,498 | |

| | 2 | | | Chemours Company (The) | | | 63 | |

| | 83 | | | Eastman Chemical Company | | | 7,455 | |

| | 129 | | | FMC Corporation | | | 8,133 | |

| | 3 | | | Huntsman Corporation | | | 75 | |

| | 2 | | | International Flavors & Fragrances, Inc. | | | 162 | |

| | 257 | | | Mosaic Company (The) | | | 9,182 | |

| | 2 | | | Olin Corporation | | | 108 | |

| | 74 | | | RPM International, Inc. | | | 8,261 | |

| | 17 | | | Valvoline, Inc. | | | 639 | |

| | | | | | | | 58,604 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 0.9% | | | | |

| | 9 | | | Aramark | | | 253 | |

| | 2 | | | ASGN, Inc.(a) | | | 192 | |

| | 20 | | | Clean Harbors, Inc.(a) | | | 3,490 | |

| | 19 | | | FTI Consulting, Inc.(a) | | | 3,784 | |

| | 1 | | | ManpowerGroup, Inc. | | | 79 | |

| | 64 | | | Robert Half, Inc. | | | 5,627 | |

| | 1 | | | Stericycle, Inc.(a) | | | 50 | |

| | | | | | | | 13,475 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | CONSTRUCTION MATERIALS - 2.3% | | | | |

| | 52 | | | Advanced Drainage Systems, Inc. | | $ | 7,313 | |

| | 28 | | | Carlisle Companies, Inc. | | | 8,748 | |

| | 26 | | | Eagle Materials, Inc. | | | 5,274 | |

| | 1 | | | Martin Marietta Materials, Inc. | | | 499 | |

| | 5 | | | MDU Resources Group, Inc. | | | 99 | |

| | 64 | | | Owens Corning | | | 9,487 | |

| | 25 | | | Simpson Manufacturing Company, Inc. | | | 4,949 | |

| | | | | | | | 36,369 | |

| | | | | CONSUMER SERVICES - 0.3% | | | | |

| | 74 | | | Service Corporation International | | | 5,065 | |

| | | | | | | | | |

| | | | | CONTAINERS & PACKAGING - 2.9% | | | | |

| | 36 | | | AptarGroup, Inc. | | | 4,450 | |

| | 93 | | | Crown Holdings, Inc. | | | 8,564 | |

| | 259 | | | Graphic Packaging Holding Company | | | 6,384 | |

| | 269 | | | International Paper Company | | | 9,724 | |

| | 45 | | | Packaging Corporation of America | | | 7,331 | |

| | 5 | | | Sealed Air Corporation | | | 183 | |

| | 8 | | | Sonoco Products Company | | | 447 | |

| | 199 | | | Westrock Company | | | 8,263 | |

| | | | | | | | 45,346 | |

| | | | | DIVERSIFIED INDUSTRIALS - 0.4% | | | | |

| | 56 | | | ITT, Inc. | | | 6,682 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 1.3% | | | | |

| | 1 | | | Alliant Energy Corporation | | | 51 | |

| | 3 | | | Evergy, Inc. | | | 157 | |

| | 1 | | | IDACORP, Inc. | | | 98 | |

| | 196 | | | OGE Energy Corporation | | | 6,846 | |

| | 2 | | | Pinnacle West Capital Corporation | | | 144 | |

| | 1 | | | Portland General Electric Company | | | 43 | |

| | 348 | | | Vistra Corporation | | | 13,405 | |

| | | | | | | | 20,744 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | ELECTRICAL EQUIPMENT - 3.5% | | | | |

| | 80 | | | A O Smith Corporation | | $ | 6,595 | |

| | 128 | | | API Group Corporation(a) | | | 4,429 | |

| | 34 | | | BWX Technologies, Inc. | | | 2,609 | |

| | 5 | | | Cognex Corporation | | | 209 | |

| | 31 | | | Generac Holdings, Inc.(a) | | | 4,006 | |

| | 25 | | | Hubbell, Inc. | | | 8,223 | |

| | 24 | | | Lennox International, Inc. | | | 10,740 | |

| | 4 | | | Littelfuse, Inc. | | | 1,070 | |

| | 143 | | | Trimble, Inc.(a) | | | 7,608 | |

| | 193 | | | Vertiv Holdings Company | | | 9,270 | |

| | | | | | | | 54,759 | |

| | | | | ENGINEERING & CONSTRUCTION - 2.7% | | | | |

| | 20 | | | AECOM | | | 1,849 | |

| | 20 | | | Comfort Systems USA, Inc. | | | 4,113 | |

| | 30 | | | EMCOR Group, Inc. | | | 6,463 | |

| | 74 | | | Jacobs Solutions, Inc. | | | 9,605 | |

| | 55 | | | KBR, Inc. | | | 3,048 | |

| | 2 | | | MasTec, Inc.(a) | | | 151 | |

| | 2 | | | Quanta Services, Inc. | | | 432 | |

| | 23 | | | Tetra Tech, Inc. | | | 3,839 | |

| | 20 | | | TopBuild Corporation(a) | | | 7,485 | |

| | 110 | | | WillScot Mobile Mini Holdings Corporation(a) | | | 4,895 | |

| | | | | | | | 41,880 | |

| | | | | ENTERTAINMENT CONTENT - 0.0%(c) | | | | |

| | 4 | | | Take-Two Interactive Software, Inc.(a) | | | 644 | |

| | | | | | | | | |

| | | | | FOOD - 2.4% | | | | |

| | 203 | | | Campbell Soup Company | | | 8,776 | |

| | 309 | | | Conagra Brands, Inc. | | | 8,856 | |

| | 26 | | | Darling Ingredients, Inc.(a) | | | 1,296 | |

| | 5 | | | Flowers Foods, Inc. | | | 112 | |

| | 3 | | | Ingredion, Inc. | | | 326 | |

| | 68 | | | J M Smucker Company (The) | | | 8,594 | |

| | 85 | | | Lamb Weston Holdings, Inc. | | | 9,188 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | FOOD - 2.4% (Continued) | | | | |

| | 1 | | | Lancaster Colony Corporation | | $ | 166 | |

| | | | | | | | 37,314 | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - 0.9% | | | | |

| | 3 | | | Louisiana-Pacific Corporation | | | 212 | |

| | 63 | | | Trex Company, Inc.(a) | | | 5,216 | |

| | 69 | | | UFP Industries, Inc. | | | 8,663 | |

| | | | | | | | 14,091 | |

| | | | | GAS & WATER UTILITIES - 0.5% | | | | |

| | 5 | | | Atmos Energy Corporation | | | 579 | |

| | 179 | | | Essential Utilities, Inc. | | | 6,686 | |

| | | | | | | | 7,265 | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 3.2% | | | | |

| | 36 | | | Acadia Healthcare Company, Inc.(a) | | | 2,799 | |

| | 2 | | | Cardinal Health, Inc. | | | 202 | |

| | 81 | | | Catalent, Inc.(a) | | | 3,639 | |

| | 24 | | | Charles River Laboratories International, Inc.(a) | | | 5,674 | |

| | 8 | | | Chemed Corporation | | | 4,678 | |

| | 2 | | | Encompass Health Corporation(b) | | | 133 | |

| | 98 | | | Henry Schein, Inc.(a) | | | 7,420 | |

| | 19 | | | Medpace Holdings, Inc.(a) | | | 5,824 | |

| | 66 | | | Quest Diagnostics, Inc. | | | 9,100 | |

| | 2 | | | Teladoc Health, Inc.(a) | | | 43 | |

| | 67 | | | Universal Health Services, Inc., Class B | | | 10,214 | |

| | | | | | | | 49,726 | |

| | | | | HOME & OFFICE PRODUCTS - 0.4% | | | | |

| | 2 | | | Leggett & Platt, Inc. | | | 52 | |

| | 107 | | | Tempur Sealy International, Inc. | | | 5,454 | |

| | | | | | | | 5,506 | |

| | | | | HOME CONSTRUCTION - 1.7% | | | | |

| | 72 | | | Fortune Brands Innovations, Inc. | | | 5,482 | |

| | 157 | | | Masco Corporation | | | 10,516 | |

| | 22 | | | PulteGroup, Inc. | | | 2,271 | |

| | 86 | | | Toll Brothers, Inc. | | | 8,840 | |

| | | | | | | | 27,109 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | HOUSEHOLD PRODUCTS - 0.1% | | | | |

| | 90 | | | Coty, Inc., Class A(a) | | $ | 1,118 | |

| | | | | | | | | |

| | | | | INDUSTRIAL INTERMEDIATE PRODUCTS - 0.2% | | | | |

| | 12 | | | RBC Bearings, Inc.(a) | | | 3,419 | |

| | 2 | | | Timken Company (The) | | | 160 | |

| | | | | | | | 3,579 | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 1.0% | | | | |

| | 2 | | | SiteOne Landscape Supply, Inc.(a) | | | 325 | |

| | 24 | | | U-Haul Holding Company | | | 1,691 | |

| | 1 | | | United Rentals, Inc. | | | 573 | |

| | 17 | | | Watsco, Inc. | | | 7,284 | |

| | 37 | | | WESCO International, Inc. | | | 6,434 | |

| | | | | | | | 16,307 | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 1.6% | | | | |

| | 124 | | | Jefferies Financial Group, Inc. | | | 5,011 | |

| | 96 | | | Northern Trust Corporation | | | 8,101 | |

| | 86 | | | SEI Investments Company | | | 5,465 | |

| | 64 | | | Tradeweb Markets, Inc., Class A | | | 5,816 | |

| | | | | | | | 24,393 | |

| | | | | INSURANCE - 8.5% | | | | |

| | 86 | | | American Financial Group, Inc. | | | 10,224 | |

| | 59 | | | Assurant, Inc. | | | 9,941 | |

| | 140 | | | Cincinnati Financial Corporation | | | 14,484 | |

| | 179 | | | Equitable Holdings, Inc. | | | 5,961 | |

| | 107 | | | Globe Life, Inc. | | | 13,024 | |

| | 15 | | | Kinsale Capital Group, Inc. | | | 5,024 | |

| | 3 | | | Lincoln National Corporation | | | 81 | |

| | 235 | | | Loews Corporation | | | 16,354 | |

| | 1 | | | Markel Group, Inc.(a) | | | 1,420 | |

| | 244 | | | Old Republic International Corporation | | | 7,174 | |

| | 37 | | | Primerica, Inc. | | | 7,613 | |

| | 1 | | | Radian Group, Inc. | | | 28 | |

| | 47 | | | Reinsurance Group of America, Inc. | | | 7,604 | |

| | 275 | | | Unum Group | | | 12,435 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | INSURANCE - 8.5% (Continued) | | | | |

| | 136 | | | Voya Financial, Inc. | | $ | 9,923 | |

| | 154 | | | W R Berkley Corporation | | | 10,891 | |

| | | | | | | | 132,181 | |

| | | | | INTERNET MEDIA & SERVICES - 1.0% | | | | |

| | 67 | | | Expedia Group, Inc.(a) | | | 10,170 | |

| | 42 | | | Pinterest, Inc., Class A(a) | | | 1,556 | |

| | 47 | | | Roku, Inc.(a) | | | 4,308 | |

| | 1 | | | TripAdvisor, Inc.(a) | | | 21 | |

| | 5 | | | Zillow Group, Inc., Class C(a) | | | 289 | |

| | | | | | | | 16,344 | |

| | | | | LEISURE FACILITIES & SERVICES - 0.9% | | | | |

| | 2 | | | Darden Restaurants, Inc. | | | 329 | |

| | 5 | | | Hilton Grand Vacations, Inc.(a) | | | 201 | |

| | 49 | | | Light & Wonder, Inc.(a) | | | 4,023 | |

| | 54 | | | Texas Roadhouse, Inc. | | | 6,600 | |

| | 26 | | | Wyndham Hotels & Resorts, Inc. | | | 2,091 | |

| | | | | | | | 13,244 | |

| | | | | LEISURE PRODUCTS - 0.4% | | | | |

| | 18 | | | Axon Enterprise, Inc.(a) | | | 4,650 | |

| | 2 | | | Brunswick Corporation | | | 194 | |

| | 2 | | | Fox Factory Holding Corporation(a) | | | 135 | |

| | 5 | | | Hasbro, Inc. | | | 255 | |

| | 37 | | | Mattel, Inc.(a) | | | 699 | |

| | 3 | | | Polaris, Inc. | | | 284 | |

| | 1 | | | Thor Industries, Inc. | | | 118 | |

| | | | | | | | 6,335 | |

| | | | | MACHINERY - 3.9% | | | | |

| | 81 | | | AGCO Corporation | | | 9,834 | |

| | 20 | | | Curtiss-Wright Corporation | | | 4,456 | |

| | 70 | | | Donaldson Company, Inc. | | | 4,575 | |

| | 1 | | | Enovis Corporation(a) | | | 56 | |

| | 1 | | | Flowserve Corporation | | | 41 | |

| | 3 | | | Graco, Inc. | | | 260 | |

| | 37 | | | Lincoln Electric Holdings, Inc. | | | 8,046 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | MACHINERY - 3.9% (Continued) | | | | |

| | 2 | | | Middleby Corporation (The)(a) | | $ | 294 | |

| | 23 | | | MSA Safety, Inc. | | | 3,883 | |

| | 6 | | | Oshkosh Corporation | | | 650 | |

| | 48 | | | Regal Rexnord Corporation | | | 7,105 | |

| | 47 | | | Snap-on, Inc. | | | 13,576 | |

| | 89 | | | Stanley Black & Decker, Inc. | | | 8,731 | |

| | 1 | | | Toro Company (The) | | | 96 | |

| | | | | | | | 61,603 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 3.9% | | | | |

| | 366 | | | Avantor, Inc.(a) | | | 8,356 | |

| | 17 | | | Bio-Rad Laboratories, Inc., Class A(a) | | | 5,489 | |

| | 2 | | | Bio-Techne Corporation | | | 154 | |

| | 96 | | | Bruker Corporation | | | 7,054 | |

| | 6 | | | Dentsply Sirona, Inc. | | | 214 | |

| | 2 | | | Exact Sciences Corporation(a) | | | 148 | |

| | 66 | | | Globus Medical, Inc., Class A(a) | | | 3,517 | |

| | 1 | | | Haemonetics Corporation(a) | | | 86 | |

| | 38 | | | Insulet Corporation(a) | | | 8,245 | |

| | 2 | | | Integra LifeSciences Holdings Corporation(a) | | | 87 | |

| | 1 | | | iRhythm Technologies, Inc.(a) | | | 107 | |

| | 2 | | | Masimo Corporation(a) | | | 234 | |

| | 1 | | | Nevro Corporation(a) | | | 22 | |

| | 14 | | | Repligen Corporation(a),(b) | | | 2,517 | |

| | 81 | | | Revvity, Inc. | | | 8,854 | |

| | 3 | | | Shockwave Medical, Inc.(a) | | | 572 | |

| | 25 | | | Teleflex, Inc. | | | 6,233 | |

| | 29 | | | Waters Corporation(a) | | | 9,548 | |

| | | | | | | | 61,437 | |

| | | | | METALS & MINING - 0.6% | | | | |

| | 4 | | | Alcoa Corporation | | | 136 | |

| | 389 | | | Cleveland-Cliffs, Inc.(a) | | | 7,943 | |

| | 4 | | | Royal Gold, Inc. | | | 484 | |

| | | | | | | | 8,563 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | OIL & GAS PRODUCERS - 4.2% | | | | |

| | 167 | | | Antero Resources Corporation(a) | | $ | 3,788 | |

| | 223 | | | APA Corporation | | | 8,001 | |

| | 25 | | | Coterra Energy, Inc. | | | 638 | |

| | 2 | | | Diamondback Energy, Inc. | | | 310 | |

| | 34 | | | EQT Corporation | | | 1,315 | |

| | 270 | | | HF Sinclair Corporation | | | 15,004 | |

| | 7 | | | Magnolia Oil & Gas Corporation, Class A | | | 149 | |

| | 482 | | | Marathon Oil Corporation | | | 11,645 | |

| | 84 | | | Matador Resources Company | | | 4,776 | |

| | 36 | | | Murphy Oil Corporation | | | 1,536 | |

| | 9 | | | Murphy USA, Inc. | | | 3,209 | |

| | 18 | | | ONEOK, Inc.(b) | | | 1,264 | |

| | 62 | | | Ovintiv, Inc. | | | 2,723 | |

| | 1 | | | PBF Energy, Inc., Class A | | | 44 | |

| | 135 | | | Range Resources Corporation | | | 4,109 | |

| | 2 | | | SM Energy Company | | | 77 | |

| | 1,005 | | | Southwestern Energy Company(a) | | | 6,583 | |

| | 6 | | | Targa Resources Corporation(b) | | | 521 | |

| | | | | | | | 65,692 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 0.1% | | | | |

| | 7 | | | Halliburton Company | | | 253 | |

| | 50 | | | NOV, Inc. | | | 1,014 | |

| | | | | | | | 1,267 | |

| | | | | PUBLISHING & BROADCASTING - 1.5% | | | | |

| | 101 | | | New York Times Company (The), Class A | | | 4,948 | |

| | 729 | | | News Corporation, Class A | | | 17,897 | |

| | | | | | | | 22,845 | |

| | | | | REAL ESTATE SERVICES - 0.7% | | | | |

| | 57 | | | Jones Lang LaSalle, Inc.(a) | | | 10,766 | |

| | | | | | | | | |

| | | | | RENEWABLE ENERGY - 0.2% | | | | |

| | 2 | | | Enphase Energy, Inc.(a) | | | 264 | |

| | 12 | | | First Solar, Inc.(a) | | | 2,068 | |

| | | | | | | | 2,332 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 1.0% | | | | |

| | 95 | | | BJ’s Wholesale Club Holdings, Inc.(a) | | $ | 6,333 | |

| | 36 | | | Casey’s General Stores, Inc. | | | 9,890 | |

| | 1 | | | Ollie’s Bargain Outlet Holdings, Inc.(a) | | | 76 | |

| | | | | | | | 16,299 | |

| | | | | RETAIL - DISCRETIONARY - 3.7% | | | | |

| | 154 | | | Best Buy Company, Inc. | | | 12,055 | |

| | 86 | | | Builders FirstSource, Inc.(a) | | | 14,357 | |

| | 40 | | | Burlington Stores, Inc.(a) | | | 7,779 | |

| | 58 | | | Dick’s Sporting Goods, Inc. | | | 8,523 | |

| | 42 | | | Floor & Decor Holdings, Inc., Class A(a),(b) | | | 4,686 | |

| | 2 | | | Genuine Parts Company | | | 277 | |

| | 1 | | | Tractor Supply Company | | | 215 | |

| | 1 | | | Ulta Beauty, Inc.(a) | | | 490 | |

| | 46 | | | Williams-Sonoma, Inc. | | | 9,282 | |

| | | | | | | | 57,664 | |

| | | | | SEMICONDUCTORS - 3.5% | | | | |

| | 1 | | | Azenta, Inc.(a) | | | 65 | |

| | 80 | | | Entegris, Inc.(b) | | | 9,586 | |

| | 88 | | | Lattice Semiconductor Corporation(a) | | | 6,071 | |

| | 4 | | | MKS Instruments, Inc. | | | 412 | |

| | 1 | | | Monolithic Power Systems, Inc. | | | 631 | |

| | 5 | | | ON Semiconductor Corporation(a) | | | 418 | |

| | 22 | | | Onto Innovation, Inc.(a) | | | 3,364 | |

| | 66 | | | Qorvo, Inc.(a) | | | 7,432 | |

| | 48 | | | Rambus, Inc.(a) | | | 3,276 | |

| | 91 | | | Skyworks Solutions, Inc. | | | 10,230 | |

| | 2 | | | Synaptics, Inc.(a) | | | 228 | |

| | 83 | | | Teradyne, Inc. | | | 9,007 | |

| | 24 | | | Universal Display Corporation | | | 4,590 | |

| | 2 | | | Wolfspeed, Inc.(a),(b) | | | 87 | |

| | | | | | | | 55,397 | |

| | | | | SOFTWARE - 6.7% | | | | |

| | 1 | | | ACI Worldwide, Inc.(a) | | | 31 | |

| | 72 | | | Akamai Technologies, Inc.(a) | | | 8,521 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | SOFTWARE - 6.7% (Continued) | | | | |

| | 1 | | | Alteryx, Inc., Class A(a) | | $ | 47 | |

| | 2 | | | Aspen Technology, Inc.(a) | | | 440 | |

| | 52 | | | BILL Holdings, Inc.(a) | | | 4,243 | |

| | 54 | | | Ceridian HCM Holding, Inc.(a) | | | 3,625 | |

| | 1 | | | Concentrix Corporation | | | 98 | |

| | 130 | | | DocuSign, Inc.(a) | | | 7,729 | |

| | 118 | | | Dynatrace, Inc.(a) | | | 6,453 | |

| | 1 | | | Five9, Inc.(a) | | | 79 | |

| | 328 | | | Gen Digital, Inc. | | | 7,485 | |

| | 30 | | | Guidewire Software, Inc.(a) | | | 3,271 | |

| | 42 | | | Manhattan Associates, Inc.(a) | | | 9,043 | |

| | 72 | | | Okta, Inc.(a) | | | 6,518 | |

| | 1 | | | Omnicell, Inc.(a) | | | 38 | |

| | 34 | | | Paycom Software, Inc. | | | 7,029 | |

| | 29 | | | Paylocity Holding Corporation(a) | | | 4,781 | |

| | 1 | | | Pegasystems, Inc. | | | 49 | |

| | 5 | | | PTC, Inc.(a) | | | 875 | |

| | 40 | | | Qualys, Inc.(a) | | | 7,851 | |

| | 157 | | | SS&C Technologies Holdings, Inc. | | | 9,594 | |

| | 1 | | | Tenable Holdings, Inc.(a) | | | 46 | |

| | 2 | | | Teradata Corporation(a) | | | 87 | |

| | 113 | | | Twilio, Inc., Class A(a) | | | 8,573 | |

| | 189 | | | Unity Software, Inc.(a) | | | 7,728 | |

| | 1 | | | Ziff Davis, Inc.(a) | | | 67 | |

| | 29 | | | ZoomInfo Technologies, Inc., Class A(a) | | | 536 | |

| | | | | | | | 104,837 | |

| | | | | SPECIALTY FINANCE - 2.0% | | | | |

| | 341 | | | Fidelity National Financial, Inc. | | | 17,398 | |

| | 2 | | | First American Financial Corporation | | | 129 | |

| | 1 | | | MGIC Investment Corporation | | | 19 | |

| | 349 | | | Synchrony Financial | | | 13,328 | |

| | | | | | | | 30,874 | |

| | | | | STEEL - 1.3% | | | | |

| | 4 | | | Commercial Metals Company | | | 200 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | STEEL - 1.3% (Continued) | | | | |

| | 38 | | | Reliance Steel & Aluminum Company | | $ | 10,628 | |

| | 5 | | | Steel Dynamics, Inc. | | | 590 | |

| | 183 | | | United States Steel Corporation | | | 8,903 | |

| | | | | | | | 20,321 | |

| | | | | TECHNOLOGY HARDWARE - 4.4% | | | | |

| | 102 | | | Ciena Corporation(a) | | | 4,591 | |

| | 42 | | | Dolby Laboratories, Inc., Class A | | | 3,620 | |

| | 37 | | | F5, Inc.(a) | | | 6,622 | |

| | 13 | | | Jabil, Inc. | | | 1,656 | |

| | 251 | | | Juniper Networks, Inc. | | | 7,399 | |

| | 1 | | | Lumentum Holdings, Inc.(a) | | | 52 | |

| | 97 | | | NetApp, Inc. | | | 8,552 | |

| | 221 | | | Pure Storage, Inc., Class A(a) | | | 7,881 | |

| | 37 | | | Super Micro Computer, Inc.(a) | | | 10,518 | |

| | 2 | | | TD SYNNEX Corporation | | | 215 | |

| | 170 | | | Western Digital Corporation(a) | | | 8,903 | |

| | 33 | | | Zebra Technologies Corporation, Class A(a) | | | 9,020 | |

| | | | | | | | 69,029 | |

| | | | | TECHNOLOGY SERVICES - 3.6% | | | | |

| | 34 | | | Booz Allen Hamilton Holding Corporation | | | 4,349 | |

| | 13 | | | CACI International, Inc., Class A(a) | | | 4,210 | |

| | 5 | | | DXC Technology Company(a),(b) | | | 114 | |

| | 26 | | | EPAM Systems, Inc.(a) | | | 7,731 | |

| | 1 | | | Euronet Worldwide, Inc.(a) | | | 101 | |

| | 36 | | | Jack Henry & Associates, Inc. | | | 5,883 | |

| | 80 | | | Leidos Holdings, Inc. | | | 8,659 | |

| | 2 | | | MarketAxess Holdings, Inc. | | | 586 | |

| | 18 | | | Morningstar, Inc. | | | 5,152 | |

| | 46 | | | Science Applications International Corporation | | | 5,719 | |

| | 113 | | | TransUnion | | | 7,764 | |

| | 15 | | | Western Union Company (The) | | | 179 | |

| | 30 | | | WEX, Inc.(a) | | | 5,837 | |

| | | | | | | | 56,284 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 100.0% (Continued) | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 2.1% | | | | |

| | 14 | | | CH Robinson Worldwide, Inc. | | $ | 1,209 | |

| | 1 | | | JB Hunt Transport Services, Inc. | | | 200 | |

| | 128 | | | Knight-Swift Transportation Holdings, Inc. | | | 7,379 | |

| | 3 | | | Landstar System, Inc. | | | 581 | |

| | 1 | | | Saia, Inc.(a) | | | 438 | |

| | 614 | | | Southwest Airlines Company | | | 17,732 | |

| | 67 | | | XPO Logistics, Inc.(a) | | | 5,869 | |

| | | | | | | | 33,408 | |

| | | | | TRANSPORTATION EQUIPMENT - 0.0%(c) | | | | |

| | 2 | | | Westinghouse Air Brake Technologies Corporation | | | 254 | |

| | | | | | | | | |

| | | | | WHOLESALE - CONSUMER STAPLES - 1.1% | | | | |

| | 143 | | | Performance Food Group Company(a) | | | 9,889 | |

| | 147 | | | US Foods Holding Corporation(a) | | | 6,675 | |

| | | | | | | | 16,564 | |

| | | | | WHOLESALE - DISCRETIONARY - 1.2% | | | | |

| | 173 | | | LKQ Corporation | | | 8,267 | |

| | 25 | | | Pool Corporation | | | 9,968 | |

| | | | | | | | 18,235 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $1,370,314) | | | 1,564,415 | |

| | | | | | | | | |

| | | | | RIGHT — 0.0%(d) | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 0.0%(d) | | | | |

| | 7 | | | ABIOMED, Inc. - CVR (Cost $7)(a)(e) | | | 7 | |

See accompanying notes to financial statements.

| ACCLIVITY MID CAP MULTI-STYLE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | SHORT-TERM INVESTMENT — 1.8% | | | | |

| | | | | COLLATERAL FOR SECURITIES LOANED - 1.8% | | | | |

| | 27,907 | | | Mount Vernon Liquid Assets Portfolio, 5.55% (Cost $27,907)(f),(g) | | $ | 27,907 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 101.8% (Cost $1,398,228) | | $ | 1,592,329 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (1.8)% | | | (27,928 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 1,564,401 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is on loan. The total fair value of the securities on loan as of December 31, 2023 was $26,731. |

| (c) | Amount represents less than 0.05%. |

| (d) | Amount represents less than 0.05%. |

| (e) | Fair value was determined using significant unobservable inputs. See Note 2. |

| (f) | Rate disclosed is the seven day effective yield as of December 31, 2023. |

| (g) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of December 31, 2023 is $27,907. |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% | | | | |

| | | | | AEROSPACE & DEFENSE - 0.6% | | | | |

| | 5 | | | Barnes Group, Inc. | | $ | 163 | |

| | 41 | | | Ducommun, Inc.(a) | | | 2,135 | |

| | 800 | | | Kaman Corporation | | | 19,160 | |

| | 1,106 | | | Kratos Defense & Security Solutions, Inc.(a) | | | 22,441 | |

| | 1,055 | | | Mercury Systems, Inc.(a) | | | 38,581 | |

| | 514 | | | Moog, Inc., Class A | | | 74,417 | |

| | 71 | | | National Presto Industries, Inc. | | | 5,700 | |

| | 2 | | | SIFCO Industries, Inc.(a) | | | 9 | |

| | | | | | | | 162,606 | |

| | | | | APPAREL & TEXTILE PRODUCTS - 1.2% | | | | |

| | 443 | | | Culp, Inc.(a) | | | 2,565 | |

| | 340 | | | Jerash Holdings US, Inc. | | | 1,044 | |

| | 477 | | | Lakeland Industries, Inc. | | | 8,844 | |

| | 1,005 | | | Movado Group, Inc. | | | 30,301 | |

| | 1,243 | | | PVH Corporation | | | 151,795 | |

| | 647 | | | Rocky Brands, Inc. | | | 19,526 | |

| | 843 | | | Superior Group of Companies, Inc. | | | 11,381 | |

| | 149 | | | Tandy Leather Factory, Inc.(a) | | | 639 | |

| | 11,339 | | | Under Armour, Inc., Class A(a) | | | 99,670 | |

| | 387 | | | Unifi, Inc.(a) | | | 2,577 | |

| | 22 | | | Weyco Group, Inc. | | | 690 | |

| | | | | | | | 329,032 | |

| | | | | ASSET MANAGEMENT - 1.2% | | | | |

| | 15 | | | Associated Capital Group, Inc., Class A | | | 536 | |

| | 12,266 | | | Blue Owl Capital Corporation | | | 181,046 | |

| | 3 | | | First Western Financial, Inc.(a) | | | 59 | |

| | 39 | | | Hennessy Advisors, Inc. | | | 262 | |

| | 1,654 | | | ODP Corporation (The)(a) | | | 93,120 | |

| | 1,107 | | | Oppenheimer Holdings, Inc., Class A | | | 45,741 | |

| | | | | | | | 320,764 | |

| | | | | AUTOMOTIVE - 1.7% | | | | |

| | 3,076 | | | American Axle & Manufacturing Holdings, Inc.(a) | | | 27,099 | |

| | 1,444 | | | China Automotive Systems, Inc.(a) | | | 4,664 | |

| | 2,769 | | | Dana, Inc. | | | 40,455 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | AUTOMOTIVE - 1.7% (Continued) | | | | |

| | 13,206 | | | Goodyear Tire & Rubber Company (The)(a) | | $ | 189,110 | |

| | 3,138 | | | Harley-Davidson, Inc. | | | 115,604 | |

| | 594 | | | Kandi Technologies Group, Inc.(a) | | | 1,663 | |

| | 716 | | | Methode Electronics, Inc. | | | 16,275 | |

| | 712 | | | Miller Industries, Inc. | | | 30,110 | |

| | 1,247 | | | Motorcar Parts of America, Inc.(a) | | | 11,647 | |

| | 876 | | | Standard Motor Products, Inc. | | | 34,874 | |

| | | | | | | | 471,501 | |

| | | | | BANKING - 12.4% | | | | |

| | 17 | | | ACNB Corporation | | | 761 | |

| | 134 | | | Amalgamated Financial Corporation | | | 3,610 | |

| | 127 | | | American National Bankshares, Inc. | | | 6,191 | |

| | 1,160 | | | Ameris Bancorp | | | 61,538 | |

| | 1,455 | | | Atlantic Union Bankshares Corporation | | | 53,166 | |

| | 3,341 | | | Banc of California, Inc. | | | 44,870 | |

| | 501 | | | Bank of Marin Bancorp | | | 11,032 | |

| | 2,073 | | | Bank OZK(b) | | | 103,298 | |

| | 845 | | | BankFinancial Corporation | | | 8,670 | |

| | 377 | | | BankUnited, Inc. | | | 12,226 | |

| | 1,017 | | | Banner Corporation | | | 54,471 | |

| | 398 | | | Bar Harbor Bankshares | | | 11,685 | |

| | 512 | | | BayCom Corporation | | | 12,078 | |

| | 1,035 | | | Berkshire Hills Bancorp, Inc. | | | 25,699 | |

| | 605 | | | Business First Bancshares, Inc. | | | 14,913 | |

| | 882 | | | Byline Bancorp, Inc. | | | 20,780 | |

| | 2,169 | | | Cadence Bank | | | 64,181 | |

| | 197 | | | Camden National Corporation | | | 7,413 | |

| | 223 | | | Capital City Bank Group, Inc. | | | 6,563 | |

| | 403 | | | Capstar Financial Holdings, Inc. | | | 7,552 | |

| | 1,014 | | | Carter Bankshares, Inc.(a) | | | 15,180 | |

| | 1,162 | | | Cathay General Bancorp | | | 51,790 | |

| | 49 | | | CB Financial Services, Inc. | | | 1,167 | |

| | 965 | | | Central Pacific Financial Corporation | | | 18,991 | |

| | 258 | | | Central Valley Community Bancorp | | | 5,766 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | BANKING - 12.4% (Continued) | | | | |

| | 81 | | | Citizens & Northern Corporation | | $ | 1,817 | |

| | 514 | | | Citizens Community Bancorp, Inc. | | | 6,019 | |

| | 656 | | | Civista Bancshares, Inc. | | | 12,097 | |

| | 649 | | | CNB Financial Corporation | | | 14,661 | |

| | 378 | | | Colony Bankcorp, Inc. | | | 5,027 | |

| | 208 | | | Community Trust Bancorp, Inc.(b) | | | 9,123 | |

| | 564 | | | Customers Bancorp, Inc.(a) | | | 32,498 | |

| | 2,214 | | | CVB Financial Corporation | | | 44,701 | |

| | 567 | | | Dime Community Bancshares, Inc. | | | 15,269 | |

| | 166 | | | Eagle Bancorp Montana, Inc. | | | 2,621 | |

| | 3,551 | | | Eastern Bankshares, Inc. | | | 50,424 | |

| | 769 | | | Enterprise Financial Services Corporation | | | 34,336 | |

| | 250 | | | Equity Bancshares, Inc., Class A | | | 8,475 | |

| | 85 | | | ESSA Bancorp, Inc. | | | 1,702 | |

| | 1,168 | | | First Bancshares, Inc. (The) | | | 34,257 | |

| | 1,371 | | | First Busey Corporation | | | 34,028 | |

| | 1 | | | First Commonwealth Financial Corporation | | | 15 | |

| | 265 | | | First Community Bankshares, Inc. | | | 9,831 | |

| | 2,448 | | | First Financial Bancorp | | | 58,140 | |

| | 563 | | | First Financial Corporation | | | 24,226 | |

| | 301 | | | First Financial Northwest, Inc. | | | 4,057 | |

| | 5,535 | | | First Horizon Corporation | | | 78,376 | |

| | 39 | | | First Internet Bancorp | | | 943 | |

| | 2,307 | | | First Interstate BancSystem, Inc., Class A | | | 70,940 | |

| | 1,225 | | | First Merchants Corporation | | | 45,423 | |

| | 325 | | | First Mid Bancshares, Inc. | | | 11,265 | |

| | 371 | | | First Northwest Bancorp | | | 5,914 | |

| | 632 | | | First of Long Island Corporation (The) | | | 8,368 | |

| | 103 | | | Flushing Financial Corporation | | | 1,697 | |

| | 4,019 | | | FNB Corporation | | | 55,342 | |

| | 196 | | | FS Bancorp, Inc. | | | 7,244 | |

| | 3,459 | | | Fulton Financial Corporation | | | 56,935 | |

| | 121 | | | Great Southern Bancorp, Inc. | | | 7,181 | |

| | 1,983 | | | Hancock Whitney Corporation | | | 96,354 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | BANKING - 12.4% (Continued) | | | | |

| | 1,078 | | | Hanmi Financial Corporation | | $ | 20,913 | |

| | 1,214 | | | Heartland Financial USA, Inc. | | | 45,659 | |

| | 2,595 | | | Heritage Commerce Corporation | | | 25,742 | |

| | 1,426 | | | Heritage Financial Corporation | | | 30,502 | |

| | 1,586 | | | Hilltop Holdings, Inc. | | | 55,843 | |

| | 290 | | | Home Bancorp, Inc. | | | 12,183 | |

| | 739 | | | HomeTrust Bancshares, Inc. | | | 19,894 | |

| | 2,375 | | | Hope Bancorp, Inc. | | | 28,690 | |

| | 1,208 | | | Horizon Bancorp, Inc. | | | 17,286 | |

| | 1,394 | | | Independent Bank Corporation (Massachusetts) | | | 91,739 | |

| | 739 | | | Independent Bank Corporation (Michigan) | | | 19,229 | |

| | 591 | | | Investar Holding Corporation | | | 8,812 | |

| | 1,391 | | | Lakeland Bancorp, Inc. | | | 20,573 | |

| | 381 | | | LCNB Corporation | | | 6,008 | |

| | 672 | | | Macatawa Bank Corporation | | | 7,580 | |

| | 570 | | | Mercantile Bank Corporation | | | 23,017 | |

| | 183 | | | Metropolitan Bank Holding Corporation(a),(b) | | | 10,135 | |

| | 828 | | | Midland States Bancorp, Inc. | | | 22,820 | |

| | 904 | | | MidWestOne Financial Group, Inc. | | | 24,327 | |

| | 1,339 | | | Northfield Bancorp, Inc. | | | 16,845 | |

| | 224 | | | Northrim BanCorp, Inc. | | | 12,815 | |

| | 4,385 | | | Northwest Bancshares, Inc. | | | 54,725 | |

| | 1,487 | | | OceanFirst Financial Corporation | | | 25,814 | |

| | 45 | | | Ohio Valley Banc Corporation | | | 1,035 | |

| | 6,499 | | | Old National Bancorp | | | 109,768 | |

| | 6 | | | Old Point Financial Corporation | | | 106 | |

| | 700 | | | OP Bancorp | | | 7,665 | |

| | 470 | | | Orrstown Financial Services, Inc. | | | 13,865 | |

| | 2,468 | | | Pacific Premier Bancorp, Inc. | | | 71,843 | |

| | 388 | | | Parke Bancorp, Inc. | | | 7,857 | |

| | 12 | | | Pathfinder Bancorp, Inc. | | | 166 | |

| | 506 | | | Peapack-Gladstone Financial Corporation | | | 15,089 | |

| | 1,441 | | | Peoples Bancorp, Inc.(b) | | | 48,648 | |

| | 1,736 | | | Premier Financial Corporation | | | 41,838 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | BANKING - 12.4% (Continued) | | | | |

| | 537 | | | Primis Financial Corporation | | $ | 6,798 | |

| | 281 | | | Princeton Bancorp, Inc. | | | 10,088 | |

| | 2,060 | | | Prosperity Bancshares, Inc. | | | 139,524 | |

| | 212 | | | Provident Financial Holdings, Inc. | | | 2,673 | |

| | 2,301 | | | Provident Financial Services, Inc. | | | 41,487 | |

| | 705 | | | RBB Bancorp | | | 13,423 | |

| | 1,529 | | | Renasant Corporation | | | 51,497 | |

| | 583 | | | Republic Bancorp, Inc., Class A | | | 32,158 | |

| | 3,100 | | | Republic First Bancorp, Inc.(a) | | | 93 | |

| | 972 | | | Riverview Bancorp, Inc. | | | 6,221 | |

| | 1,205 | | | S&T Bancorp, Inc. | | | 40,271 | |

| | 394 | | | SB Financial Group, Inc. | | | 6,005 | |

| | 207 | | | Seacoast Banking Corporation of Florida | | | 5,891 | |

| | 590 | | | Sierra Bancorp | | | 13,305 | |

| | 303 | | | SmartFinancial, Inc. | | | 7,420 | |

| | 85 | | | South Plains Financial, Inc. | | | 2,462 | |

| | 61 | | | SouthState Corporation | | | 5,151 | |

| | 139 | | | Stellar Bancorp, Inc. | | | 3,870 | |

| | 1,375 | | | Sterling Bancorp, Inc.(a) | | | 7,934 | |

| | 411 | | | Summit Financial Group, Inc. | | | 12,614 | |

| | 1,818 | | | Synovus Financial Corporation | | | 68,448 | |

| | 54 | | | Territorial Bancorp, Inc. | | | 602 | |

| | 679 | | | Texas Capital Bancshares, Inc.(a) | | | 43,884 | |

| | 1,870 | | | Towne Bank | | | 55,651 | |

| | 783 | | | TrustCompany Bank Corporation | | | 24,312 | |

| | 1,233 | | | Trustmark Corporation | | | 34,376 | |

| | 172 | | | United Bancshares, Inc. | | | 3,311 | |

| | 2,658 | | | United Bankshares, Inc. | | | 99,808 | |

| | 420 | | | United Security Bancshares | | | 3,532 | |

| | 5,465 | | | Valley National Bancorp | | | 59,350 | |

| | 1,145 | | | Washington Federal, Inc. | | | 37,739 | |

| | 1,873 | | | WesBanco, Inc. | | | 58,756 | |

| | 924 | | | Western New England Bancorp, Inc. | | | 8,316 | |

| | 523 | | | Wintrust Financial Corporation | | | 48,508 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | BANKING - 12.4% (Continued) | | | | |

| | 2,462 | | | Zions Bancorp | | $ | 108,008 | |

| | | | | | | | 3,455,414 | |

| | | | | BIOTECHNOLOGY & PHARMACEUTICALS - 1.6% | | | | |

| | 808 | | | Amneal Pharmaceuticals, Inc.(a) | | | 4,904 | |

| | 944 | | | Cumberland Pharmaceuticals, Inc.(a) | | | 1,643 | |

| | 13,685 | | | Elanco Animal Health, Inc.(a) | | | 203,906 | |

| | 2,069 | | | Innoviva, Inc.(a) | | | 33,187 | |

| | 346 | | | Ligand Pharmaceuticals, Inc.(a) | | | 24,711 | |

| | 1,450 | | | Pacira BioSciences, Inc.(a) | | | 48,923 | |

| | 1,062 | | | Prestige Consumer Healthcare, Inc.(a) | | | 65,016 | |

| | 1,822 | | | Supernus Pharmaceuticals, Inc.(a) | | | 52,729 | |

| | | | | | | | 435,019 | |

| | | | | CABLE & SATELLITE - 0.1% | | | | |

| | 5,770 | | | DISH Network Corporation, Class A(a),(b) | | | 33,293 | |

| | 966 | | | WideOpenWest, Inc.(a) | | | 3,912 | |

| | | | | | | | 37,205 | |

| | | | | CHEMICALS - 1.4% | | | | |

| | 396 | | | AdvanSix, Inc. | | | 11,864 | |

| | 734 | | | American Vanguard Corporation | | | 8,052 | |

| | 713 | | | Ashland, Inc. | | | 60,113 | |

| | 1,217 | | | Avient Corporation | | | 50,591 | |

| | 2,143 | | | Ecovyst, Inc.(a) | | | 20,937 | |

| | 352 | | | Haynes International, Inc. | | | 20,082 | |

| | 195 | | | HB Fuller Company | | | 15,875 | |

| | 2,768 | | | Huntsman Corporation | | | 69,560 | |

| | 414 | | | LSB Industries, Inc.(a) | | | 3,854 | |

| | 42 | | | Materion Corporation | | | 5,466 | |

| | 884 | | | Minerals Technologies, Inc. | | | 63,038 | |

| | 375 | | | Stepan Company | | | 35,456 | |

| | 760 | | | Valhi, Inc. | | | 11,544 | |

| | | | | | | | 376,432 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 3.1% | | | | |

| | 1,428 | | | ABM Industries, Inc. | | | 64,017 | |

| | 12,270 | | | ADT, Inc. | | | 83,681 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - 3.1% (Continued) | | | | |

| | 2,208 | | | ARC Document Solutions, Inc. | | $ | 7,242 | |

| | 698 | | | ASGN, Inc.(a) | | | 67,127 | |

| | 252 | | | BGSF, Inc. | | | 2,369 | |

| | 7,511 | | | BrightView Holdings, Inc.(a) | | | 63,243 | |

| | 4,954 | | | CoreCivic, Inc.(a) | | | 71,982 | |

| | 864 | | | Cross Country Healthcare, Inc.(a) | | | 19,561 | |

| | 1,303 | | | Deluxe Corporation | | | 27,949 | |

| | 531 | | | Ennis, Inc. | | | 11,634 | |

| | 9,359 | | | GEO Group, Inc. (The)(a) | | | 101,358 | |

| | 897 | | | Heidrick & Struggles International, Inc. | | | 26,488 | |

| | 1,030 | | | Information Services Group, Inc. | | | 4,851 | |

| | 1,773 | | | Kelly Services, Inc., Class A | | | 38,332 | |

| | 1,102 | | | Korn Ferry | | | 65,404 | |

| | 684 | | | ManpowerGroup, Inc. | | | 54,358 | |

| | 1,061 | | | Resources Connection, Inc. | | | 15,034 | |

| | 251 | | | Schnitzer Steel Industries, Inc., Class A | | | 7,570 | |

| | 1,060 | | | Stericycle, Inc.(a) | | | 52,534 | |

| | 983 | | | TrueBlue, Inc.(a) | | | 15,079 | |

| | 359 | | | UniFirst Corporation | | | 65,665 | |

| | 83 | | | V2X, Inc.(a) | | | 3,855 | |

| | | | | | | | 869,333 | |

| | | | | CONSTRUCTION MATERIALS - 0.4% | | | | |

| | 5,716 | | | MDU Resources Group, Inc. | | | 113,177 | |

| | | | | | | | | |

| | | | | CONSUMER SERVICES - 1.2% | | | | |

| | 390 | | | Adtalem Global Education, Inc.(a) | | | 22,991 | |

| | 1,934 | | | American Public Education, Inc.(a) | | | 18,663 | |

| | 1,697 | | | Chegg, Inc.(a) | | | 19,278 | |

| | 131 | | | Graham Holdings Company, Class B | | | 91,244 | |

| | 199 | | | Grand Canyon Education, Inc.(a) | | | 26,276 | |

| | 321 | | | Lincoln Educational Services Corporation(a) | | | 3,223 | |

| | 713 | | | Matthews International Corporation, Class A | | | 26,131 | |

| | 3,400 | | | Perdoceo Education Corporation | | | 59,704 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | CONSUMER SERVICES - 1.2% (Continued) | | | | |

| | 616 | | | Strategic Education, Inc. | | $ | 56,900 | |

| | | | | | | | 324,410 | |

| | | | | CONTAINERS & PACKAGING - 0.8% | | | | |

| | 173 | | | Greif, Inc., Class A | | | 11,347 | |

| | 5,705 | | | O-I Glass, Inc.(a) | | | 93,448 | |

| | 6,272 | | | Pactiv Evergreen, Inc. | | | 85,989 | |

| | 1,029 | | | TriMas Corporation | | | 26,065 | |

| | | | | | | | 216,849 | |

| | | | | E-COMMERCE DISCRETIONARY - 0.1% | | | | |

| | 1,593 | | | Lands’ End, Inc.(a) | | | 15,229 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 1.1% | | | | |

| | 47 | | | Argan, Inc. | | | 2,199 | |

| | 376 | | | Bel Fuse, Inc., Class B | | | 25,105 | |

| | 990 | | | Belden, Inc. | | | 76,477 | |

| | 939 | | | Kimball Electronics, Inc.(a) | | | 25,306 | |

| | 343 | | | Littelfuse, Inc. | | | 91,773 | |

| | 1,133 | | | LSI Industries, Inc. | | | 15,953 | |

| | 415 | | | OSI Systems, Inc.(a) | | | 53,556 | |

| | 195 | | | Preformed Line Products Company | | | 26,103 | |

| | | | | | | | 316,472 | |

| | | | | ENGINEERING & CONSTRUCTION - 1.2% | | | | |

| | 711 | | | Arcosa, Inc. | | | 58,757 | |

| | 1,075 | | | Granite Construction, Inc. | | | 54,674 | |

| | 1,344 | | | MasTec, Inc.(a) | | | 101,768 | |

| | 1,648 | | | Mistras Group, Inc.(a) | | | 12,063 | |

| | 2,158 | | | Primoris Services Corporation | | | 71,667 | |

| | 342 | | | Tutor Perini Corporation(a) | | | 3,112 | |

| | 473 | | | VSE Corporation | | | 30,561 | |

| | | | | | | | 332,602 | |

| | | | | ENTERTAINMENT CONTENT - 0.1% | | | | |

| | 1,285 | | | AMC Networks, Inc., Class A(a) | | | 24,145 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | FOOD - 1.2% | | | | |

| | 256 | | | Alico, Inc. | | $ | 7,445 | |

| | 2,066 | | | B&G Foods, Inc. | | | 21,693 | |

| | 711 | | | Hain Celestial Group, Inc. (The)(a) | | | 7,785 | |

| | 1,588 | | | Ingredion, Inc. | | | 172,346 | |

| | 56 | | | J M Smucker Company (The) | | | 7,077 | |

| | 12 | | | Natural Health Trends Corporation | | | 70 | |

| | 322 | | | Nature’s Sunshine Products, Inc.(a) | | | 5,567 | |

| | 3 | | | Seaboard Corporation | | | 10,710 | |

| | 640 | | | Seneca Foods Corporation, Class A(a) | | | 33,562 | |

| | 906 | | | Simply Good Foods Company (The)(a) | | | 35,878 | |

| | 893 | | | TreeHouse Foods, Inc.(a) | | | 37,015 | |

| | | | | | | | 339,148 | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - 0.8% | | | | |

| | 863 | | | Boise Cascade Company | | | 111,638 | |

| | 540 | | | Mercer International, Inc. | | | 5,119 | |

| | 856 | | | UFP Industries, Inc. | | | 107,471 | |

| | | | | | | | 224,228 | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 1.5% | | | | |

| | 126 | | | Addus HomeCare Corporation(a) | | | 11,699 | |

| | 398 | | | Amedisys, Inc.(a) | | | 37,834 | |

| | 2,825 | | | Brookdale Senior Living, Inc.(a) | | | 16,442 | |

| | 14 | | | Encompass Health Corporation(b) | | | 934 | |

| | 863 | | | National HealthCare Corporation | | | 79,758 | |

| | 4,533 | | | OPKO Health, Inc.(a) | | | 6,845 | |

| | 1,536 | | | Owens & Minor, Inc.(a) | | | 29,599 | |

| | 903 | | | Patterson Companies, Inc. | | | 25,690 | |

| | 4,302 | | | Pediatrix Medical Group, Inc.(a) | | | 40,009 | |

| | 712 | | | Premier, Inc., Class A | | | 15,920 | |

| | 2,723 | | | Select Medical Holdings Corporation | | | 63,991 | |

| | 3,088 | | | Teladoc Health, Inc.(a) | | | 66,546 | |

| | 308 | | | US Physical Therapy, Inc. | | | 28,687 | |

| | | | | | | | 423,954 | |

| | | | | HOME & OFFICE PRODUCTS - 1.2% | | | | |

| | 6,166 | | | ACCO Brands Corporation | | | 37,489 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | HOME & OFFICE PRODUCTS - 1.2% (Continued) | | | | |

| | 434 | | | HNI Corporation | | $ | 18,154 | |

| | 328 | | | Hooker Furnishings Corporation | | | 8,554 | |

| | 200 | | | Kewaunee Scientific Corporation(a) | | | 5,814 | |

| | 2,696 | | | Leggett & Platt, Inc. | | | 70,554 | |

| | 1,783 | | | Lifetime Brands, Inc. | | | 11,964 | |

| | 2,429 | | | MillerKnoll, Inc. | | | 64,806 | |

| | 5,054 | | | Newell Brands, Inc. | | | 43,869 | |

| | 5,309 | | | Steelcase, Inc., Class A | | | 71,778 | |

| | 789 | | | Virco Manufacturing Corporation(a) | | | 9,492 | |

| | | | | | | | 342,474 | |

| | | | | HOME CONSTRUCTION - 6.9% | | | | |

| | 503 | | | American Woodmark Corporation(a) | | | 46,703 | |

| | 3,076 | | | Beazer Homes USA, Inc.(a) | | | 103,938 | |

| | 1,104 | | | Century Communities, Inc. | | | 100,619 | |

| | 2,411 | | | Forestar Group, Inc.(a) | | | 79,732 | |

| | 1,493 | | | Green Brick Partners, Inc.(a) | | | 77,546 | |

| | 771 | | | Griffon Corporation | | | 46,992 | |

| | 2,179 | | | Interface, Inc. | | | 27,499 | |

| | 2,255 | | | JELD-WEN Holding, Inc.(a) | | | 42,574 | |

| | 2,967 | | | KB Home | | | 185,319 | |

| | 631 | | | LGI Homes, Inc.(a) | | | 84,024 | |

| | 1,034 | | | M/I Homes, Inc.(a) | | | 142,423 | |

| | 1,801 | | | MDC Holdings, Inc. | | | 99,505 | |

| | 1,325 | | | Meritage Homes Corporation | | | 230,815 | |

| | 1,542 | | | Mohawk Industries, Inc.(a) | | | 159,597 | |

| | 623 | | | Patrick Industries, Inc. | | | 62,518 | |

| | 3,633 | | | Taylor Morrison Home Corporation(a) | | | 193,821 | |

| | 1,410 | | | Toll Brothers, Inc. | | | 144,934 | |

| | 2,744 | | | Tri Pointe Homes, Inc.(a) | | | 97,138 | |

| | | | | | | | 1,925,697 | |

| | | | | HOUSEHOLD PRODUCTS - 0.9% | | | | |

| | 1,185 | | | Central Garden & Pet Company, Class A(a) | | | 52,187 | |

| | 1,037 | | | Clearwater Paper Corporation(a) | | | 37,456 | |

| | 313 | | | Crown Crafts, Inc. ARS | | | 1,553 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | HOUSEHOLD PRODUCTS - 0.9% (Continued) | | | | |

| | 1,460 | | | Edgewell Personal Care Company | | $ | 53,480 | |

| | 159 | | | Nu Skin Enterprises, Inc., Class A | | | 3,088 | |

| | 1,636 | | | Quanex Building Products Corporation | | | 50,013 | |

| | 685 | | | Spectrum Brands Holdings, Inc. | | | 54,642 | |

| | | | | | | | 252,419 | |

| | | | | INDUSTRIAL INTERMEDIATE PRODUCTS - 1.4% | | | | |

| | 1,488 | | | Ampco-Pittsburgh Corporation(a) | | | 4,062 | |

| | 485 | | | AZZ, Inc. | | | 28,174 | |

| | 347 | | | Core Molding Technologies, Inc.(a) | | | 6,430 | |

| | 189 | | | Eastern Company (The) | | | 4,158 | |

| | 330 | | | Enpro, Inc. | | | 51,724 | |

| | 564 | | | Gibraltar Industries, Inc.(a) | | | 44,545 | |

| | 466 | | | Insteel Industries, Inc. | | | 17,843 | |

| | 345 | | | L B Foster Company, Class A(a) | | | 7,587 | |

| | 1,973 | | | Mueller Industries, Inc. | | | 93,027 | |

| | 788 | | | Park-Ohio Holdings Corporation | | | 21,244 | |

| | 450 | | | Strattec Security Corporation(a) | | | 11,300 | |

| | 1,342 | | | Timken Company (The) | | | 107,561 | |

| | 603 | | | Tredegar Corporation | | | 3,262 | |

| | | | | | | | 400,917 | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 0.5% | | | | |

| | 638 | | | DXP Enterprises, Inc.(a) | | | 21,501 | |

| | 5,938 | | | Resideo Technologies, Inc.(a) | | | 111,753 | |

| | 524 | | | Titan Machinery, Inc.(a) | | | 15,133 | |

| | | | | | | | 148,387 | |

| | | | | INSURANCE - 4.3% | | | | |

| | 312 | | | Ambac Financial Group, Inc.(a) | | | 5,142 | |

| | 338 | | | American Coastal Insurance Corporation(a) | | | 3,197 | |

| | 1,797 | | | Brighthouse Financial, Inc.(a) | | | 95,097 | |

| | 5,810 | | | Citizens, Inc.(a) | | | 15,629 | |

| | 1,996 | | | Donegal Group, Inc., Class A | | | 27,924 | |

| | 2,193 | | | eHealth, Inc.(a) | | | 19,123 | |

| | 1,030 | | | Employers Holdings, Inc. | | | 40,582 | |

| | 37,604 | | | Genworth Financial, Inc., Class A(a) | | | 251,195 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | INSURANCE - 4.3% (Continued) | | | | |

| | 1,026 | | | Global Indemnity Group, LLC | | $ | 33,078 | |

| | 49 | | | Kemper Corporation | | | 2,385 | |

| | 551 | | | Kingstone Companies, Inc.(a) | | | 1,174 | |

| | 4,833 | | | Lincoln National Corporation | | | 130,346 | |

| | 276 | | | National Western Life Group, Inc., Class A | | | 133,313 | |

| | 2,654 | | | NMI Holdings, Inc., Class A(a) | | | 78,771 | |

| | 5,370 | | | ProAssurance Corporation | | | 74,052 | |

| | 8,180 | | | Radian Group, Inc. | | | 233,539 | |

| | 2,585 | | | Security National Financial Corporation, Class A(a) | | | 23,265 | |

| | 337 | | | Tiptree, Inc. | | | 6,389 | |

| | 246 | | | Unico American Corporation(a) | | | 1 | |

| | 1,489 | | | United Fire Group, Inc. | | | 29,959 | |

| | 51 | | | Universal Insurance Holdings, Inc. | | | 815 | |

| | | | | | | | 1,204,976 | |

| | | | | INTERNET MEDIA & SERVICES - 0.8% | | | | |

| | 172 | | | Cars.com, Inc.(a) | | | 3,263 | |

| | 744 | | | DHI Group, Inc.(a) | | | 1,927 | |

| | 13,555 | | | GoodRx Holdings, Inc.(a) | | | 90,818 | |

| | 2,458 | | | IAC, Inc.(a) | | | 128,750 | |

| | 1,449 | | | TrueCar, Inc.(a) | | | 5,014 | |

| | | | | | | | 229,772 | |

| | | | | LEISURE FACILITIES & SERVICES - 1.1% | | | | |

| | 10 | | | Ark Restaurants Corporation | | | 142 | |

| | 1,662 | | | Bally’s Corporation(a) | | | 23,168 | |

| | 128 | | | Biglari Holdings, Inc.(a) | | | 21,111 | |

| | 793 | | | Cannae Holdings, Inc.(a) | | | 15,472 | |

| | 3,422 | | | Carrols Restaurant Group, Inc. | | | 26,965 | |

| | 154 | | | Chuy’s Holdings, Inc.(a) | | | 5,887 | |

| | 1,994 | | | El Pollo Loco Holdings, Inc.(a) | | | 17,587 | |

| | 834 | | | Good Times Restaurants, Inc.(a) | | | 2,118 | |

| | 2,641 | | | Marcus Corporation (The) | | | 38,506 | |

| | 955 | | | Marriott Vacations Worldwide Corporation | | | 81,070 | |

| | 2,743 | | | Penn Entertainment, Inc.(a) | | | 71,373 | |

| | | | | | | | 303,399 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | LEISURE PRODUCTS - 1.7% | | | | |

| | 481 | | | Escalade, Inc. | | $ | 9,663 | |

| | 124 | | | LCI Industries | | | 15,588 | |

| | 409 | | | MasterCraft Boat Holdings, Inc.(a) | | | 9,260 | |

| | 693 | | | Smith & Wesson Brands, Inc. | | | 9,397 | |

| | 1,213 | | | Thor Industries, Inc. | | | 143,437 | |

| | 12,284 | | | Topgolf Callaway Brands Corporation(a) | | | 176,153 | |

| | 1,973 | | | Vista Outdoor, Inc.(a) | | | 58,342 | |

| | 824 | | | Winnebago Industries, Inc.(b) | | | 60,053 | |

| | | | | | | | 481,893 | |

| | | | | MACHINERY - 2.6% | | | | |

| | 55 | | | Alamo Group, Inc. | | | 11,560 | |

| | 73 | | | Astec Industries, Inc. | | | 2,716 | |

| | 1,165 | | | Columbus McKinnon Corporation | | | 45,458 | |

| | 1,377 | | | Enovis Corporation(a) | | | 77,140 | |

| | 676 | | | Gencor Industries, Inc.(a) | | | 10,911 | |

| | 1,732 | | | Hillenbrand, Inc. | | | 82,876 | |

| | 225 | | | Hurco Companies, Inc. | | | 4,844 | |

| | 2,693 | | | Kennametal, Inc. | | | 69,452 | |

| | 495 | | | LS Starrett Company (The), Class A(a) | | | 5,990 | |

| | 2,227 | | | Manitowoc Company, Inc. (The)(a) | | | 37,169 | |

| | 878 | | | Middleby Corporation (The)(a) | | | 129,215 | |

| | 941 | | | NN, Inc.(a) | | | 3,764 | |

| | 1,945 | | | Oshkosh Corporation | | | 210,857 | |

| | 2,057 | | | Titan International, Inc.(a) | | | 30,608 | |

| | | | | | | | 722,560 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 1.9% | | | | |

| | 1,236 | | | AngioDynamics, Inc.(a) | | | 9,690 | |

| | 148 | | | Artivion, Inc.(a) | | | 2,646 | |

| | 1,461 | | | Avanos Medical, Inc.(a) | | | 32,770 | |

| | 2,947 | | | Dentsply Sirona, Inc. | | | 104,884 | |

| | 2,545 | | | Envista Holdings Corporation(a) | | | 61,233 | |

| | 811 | | | FONAR Corporation(a) | | | 15,863 | |

| | 1,650 | | | Harvard Bioscience, Inc.(a) | | | 8,828 | |

| | 256 | | | ICU Medical, Inc.(a) | | | 25,533 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 1.9% (Continued) | | | | |

| | 37 | | | Inogen, Inc.(a) | | $ | 203 | |

| | 510 | | | Integer Holdings Corporation(a) | | | 50,531 | |

| | 1,044 | | | Integra LifeSciences Holdings Corporation(a) | | | 45,466 | |

| | 4,326 | | | OraSure Technologies, Inc.(a) | | | 35,473 | |

| | 1,431 | | | QuidelOrtho Corporation(a) | | | 105,465 | |

| | 60 | | | Utah Medical Products, Inc. | | | 5,053 | |

| | 1,722 | | | Varex Imaging Corporation(a) | | | 35,301 | |

| | | | | | | | 538,939 | |

| | | | | METALS & MINING - 2.6% | | | | |

| | 2,211 | | | Alcoa Corporation | | | 75,174 | |

| | 168 | | | Alpha Metallurgical Resources, Inc. | | | 56,939 | |

| | 6,371 | | | Coeur Mining, Inc.(a) | | | 20,769 | |

| | 520 | | | Encore Wire Corporation | | | 111,072 | |

| | 9,015 | | | Hecla Mining Company | | | 43,362 | |

| | 2,507 | | | Livent Corporation(a) | | | 45,076 | |

| | 7,427 | | | Peabody Energy Corporation | | | 180,625 | |

| | 2,172 | | | Ramaco Resources, Inc. | | | 37,315 | |

| | 5,099 | | | SunCoke Energy, Inc. | | | 54,763 | |

| | 1,729 | | | Warrior Met Coal, Inc. | | | 105,417 | |

| | | | | | | | 730,512 | |

| | | | | OIL & GAS PRODUCERS - 6.4% | | | | |

| | 3,775 | | | Amplify Energy Corporation(a) | | | 22,386 | |

| | 7,401 | | | Berry Corporation | | | 52,029 | |

| | 4,992 | | | Callon Petroleum Company(a) | | | 161,741 | |

| | 3,370 | | | Civitas Resources, Inc. | | | 230,441 | |

| | 5,182 | | | CNX Resources Corporation(a),(b) | | | 103,640 | |

| | 550 | | | Comstock Resources, Inc. | | | 4,867 | |

| | 324 | | | Delek US Holdings, Inc. | | | 8,359 | |

| | 6,877 | | | Murphy Oil Corporation | | | 293,373 | |

| | 6,814 | | | PBF Energy, Inc., Class A | | | 299,543 | |

| | 1,106 | | | Permian Resources Corporation | | | 15,042 | |

| | 5,604 | | | Ring Energy, Inc.(a) | | | 8,182 | |

| | 2,674 | | | SilverBow Resources, Inc.(a) | | | 77,760 | |

| | 2,734 | | | SM Energy Company | | | 105,860 | |

See accompanying notes to financial statements.

| ACCLIVITY SMALL CAP VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2023 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS — 99.6% (Continued) | | | | |

| | | | | OIL & GAS PRODUCERS - 6.4% (Continued) | | | | |

| | 36,855 | | | Southwestern Energy Company(a) | | $ | 241,400 | |

| | 67 | | | Talos Energy, Inc.(a) | | | 953 | |

| | 9,273 | | | VAALCO Energy, Inc. | | | 41,636 | |

| | 2,344 | | | Vital Energy, Inc.(a) | | | 106,629 | |

| | 1,003 | | | World Kinect Corporation | | | 22,848 | |

| | | | | | | | 1,796,689 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 1.5% | | | | |

| | 490 | | | Archrock, Inc. | | | 7,546 | |

| | 1,078 | | | Dril-Quip, Inc.(a) | | | 25,085 | |

| | 805 | | | Geospace Technologies Corporation(a) | | | 10,433 | |

| | 7,528 | | | Helix Energy Solutions Group, Inc.(a),(b) | | | 77,388 | |

| | 1,213 | | | Helmerich & Payne, Inc. | | | 43,935 | |

| | 2,280 | | | MRC Global, Inc.(a) | | | 25,103 | |

| | 126 | | | Natural Gas Services Group, Inc.(a) | | | 2,026 | |

| | 2,237 | | | NOW, Inc.(a) | | | 25,323 | |

| | 6,430 | | | Patterson-UTI Energy, Inc. | | | 69,444 | |

| | 8,404 | | | ProPetro Holding Corporation(a) | | | 70,425 | |