united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered

management investment companies

| Investment Company Act file number | 811-22549 | |

Northern Lights Fund Trust II

(Exact name of registrant as specified in charter)

| 225 Pictoria Drive, Suite 450 Cincinnati, OH | | 45246 |

| (Address of principal executive offices) | | (Zip code) |

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | (631) 490-4300 | |

| Date of fiscal year end: | 11/30 | |

| | | |

| Date of reporting period: | 11/30/2024 | |

Item 1. Reports to Stockholders.

Annual Shareholder Report - November 30, 2024

This annual shareholder report contains important information about North Star Bond Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.nsinvestfunds.com. You can also request this information by contacting us at 1-855-580-0900.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $164 | 1.59% |

|---|

How did the Fund perform during the reporting period?

The Fund performed consistent with expectations and inline with its benchmark for the twelve-month period ending 11-30-2024, with a 6.58% positive return. There was little movement in the prevailing interest rates for our very short duration portfolio, which has a duration of less than 3-years. Meanwhile, the yield on the 10-year Treasury declined steeply and then recovered to finish the period down 32 basis points. Short term rates remained static, leading to a positive slope on the 10-2 spread and ending the lengthy period of an inverted yield curve. We had no credit issues and no material declines in any of our individual holdings

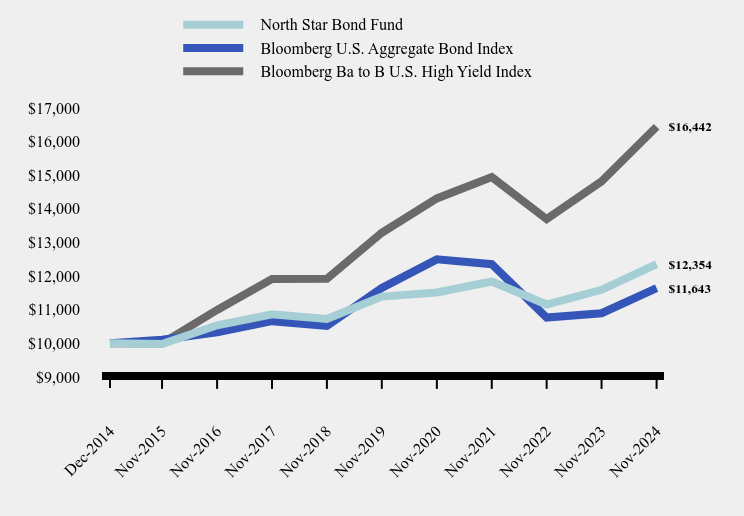

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| North Star Bond Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg Ba to B U.S. High Yield Index |

|---|

| Dec-2014 | $10,000 | $10,000 | $10,000 |

|---|

| Nov-2015 | $9,980 | $10,106 | $9,995 |

|---|

| Nov-2016 | $10,535 | $10,325 | $10,992 |

|---|

| Nov-2017 | $10,860 | $10,657 | $11,909 |

|---|

| Nov-2018 | $10,726 | $10,514 | $11,918 |

|---|

| Nov-2019 | $11,388 | $11,649 | $13,288 |

|---|

| Nov-2020 | $11,510 | $12,497 | $14,309 |

|---|

| Nov-2021 | $11,838 | $12,353 | $14,943 |

|---|

| Nov-2022 | $11,152 | $10,767 | $13,694 |

|---|

| Nov-2023 | $11,591 | $10,894 | $14,817 |

|---|

| Nov-2024 | $12,354 | $11,643 | $16,442 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (December 19, 2014) |

|---|

| North Star Bond Fund | 6.58% | 1.64% | 2.15% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 6.88% | -0.01% | 1.54% |

|---|

| Bloomberg Ba to B U.S. High Yield Index | 10.96% | 4.35% | 5.13% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $32,609,397 |

|---|

| Number of Portfolio Holdings | 30 |

|---|

| Advisory Fee | $264,863 |

|---|

| Portfolio Turnover | 43% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Corporate Bonds | 85.5% |

| Money Market Funds | 2.9% |

| Preferred Stocks | 7.0% |

| U.S. Government & Agencies | 4.6% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.2% |

| Money Market Funds | 2.9% |

| Materials | 3.7% |

| Health Care | 4.4% |

| U.S. Treasury Obligations | 4.6% |

| Industrials | 6.1% |

| Real Estate | 6.3% |

| Energy | 7.5% |

| Consumer Staples | 8.0% |

| Financials | 19.8% |

| Consumer Discretionary | 35.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Wendy's International, LLC | 4.6% |

| Elanco Animal Health, Inc. | 4.4% |

| Wintrust Financial Corporation | 4.4% |

| Under Armour, Inc. | 4.4% |

| Hercules Capital, Inc. | 4.4% |

| Gulfport Energy Corporation | 4.3% |

| Cedar Fair, L.P./Canada's Wonderland Company/Magnum Management Corporation | 4.3% |

| J M Smucker Company (The) | 4.3% |

| EPR Properties | 4.2% |

| Ford Motor Company | 4.2% |

No material changes occurred during the year ended November 30, 2024.

North Star Bond Fund - Class I (NSBDX )

Annual Shareholder Report - November 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.nsinvestfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - November 30, 2024

This annual shareholder report contains important information about North Star Dividend Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.nsinvestfunds.com. You can also request this information by contacting us at 1-855-580-0900.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $154 | 1.39% |

|---|

How did the Fund perform during the reporting period?

The Fund delivered a 21.91% positive return for the twelve-month period that modestly trailed its benchmark. Dividend paying securities are particularly sensitive to interest rates, as those rates provide an alternative for income-oriented investors. At the beginning of 2024 the consensus expectation was for short-term interest rates to decrease consistently in 2024, with six 25 basis points cuts in the Fed Funds rate as the base case scenario. Whereas the rate cutting cycle finally started in the final three months, investors tempered their expectations for the pace and size of future rate cuts. Nevertheless, many of the Fund’s holdings fared well, led by Flexsteel Industries, Bar Harbor Bankshares, and LSI Industries Inc. Flexsteel Industries Inc is a United States-based company that manufactures, imports, and markets residential upholstered wooden furniture products. Bar Harbor Bankshares Inc is a New England-based bank holding company that offers a full range of financial services products. LSI Industries Inc provides corporate visual image solutions to the petroleum and convenience store industry. The company's operating segments include Lighting and Display Solutions. It generates maximum revenue from the Lighting segment. Our consumer discretionary companies, such as Rocky Brands, were a drag on performance.

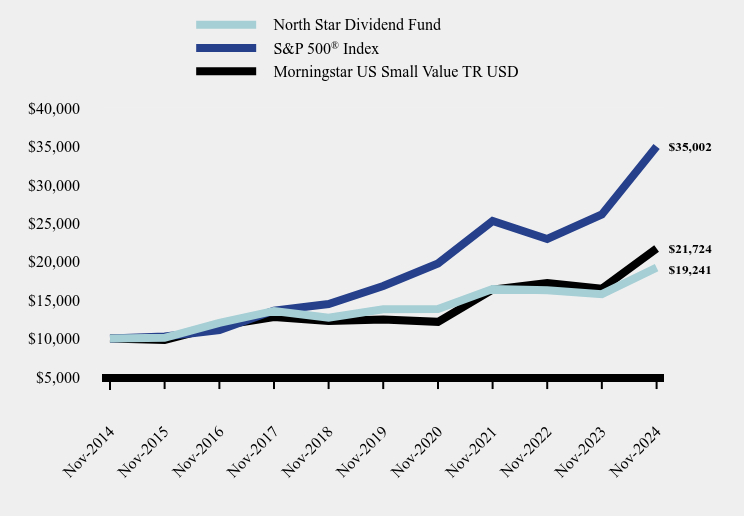

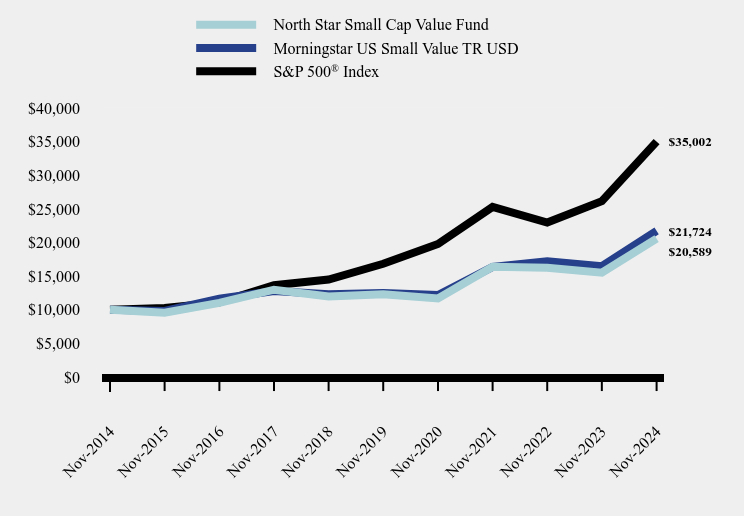

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Star Dividend Fund | S&P 500® Index | Morningstar US Small Value TR USD |

|---|

| Nov-2014 | $10,000 | $10,000 | $10,000 |

|---|

| Nov-2015 | $10,109 | $10,275 | $9,827 |

|---|

| Nov-2016 | $12,060 | $11,103 | $11,650 |

|---|

| Nov-2017 | $13,597 | $13,642 | $12,799 |

|---|

| Nov-2018 | $12,733 | $14,498 | $12,296 |

|---|

| Nov-2019 | $13,810 | $16,834 | $12,483 |

|---|

| Nov-2020 | $13,860 | $19,773 | $12,181 |

|---|

| Nov-2021 | $16,451 | $25,294 | $16,366 |

|---|

| Nov-2022 | $16,294 | $22,964 | $17,223 |

|---|

| Nov-2023 | $15,783 | $26,142 | $16,489 |

|---|

| Nov-2024 | $19,241 | $35,002 | $21,724 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Star Dividend Fund | 21.91% | 6.86% | 6.76% |

|---|

S&P 500® Index | 33.89% | 15.77% | 13.35% |

|---|

| Morningstar US Small Value TR USD | 31.75% | 11.72% | 8.07% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $96,061,516 |

|---|

| Number of Portfolio Holdings | 50 |

|---|

| Advisory Fee | $903,054 |

|---|

| Portfolio Turnover | 34% |

|---|

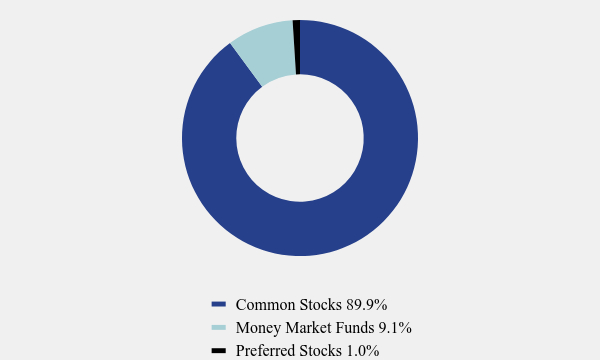

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 89.9% |

| Money Market Funds | 9.1% |

| Preferred Stocks | 1.0% |

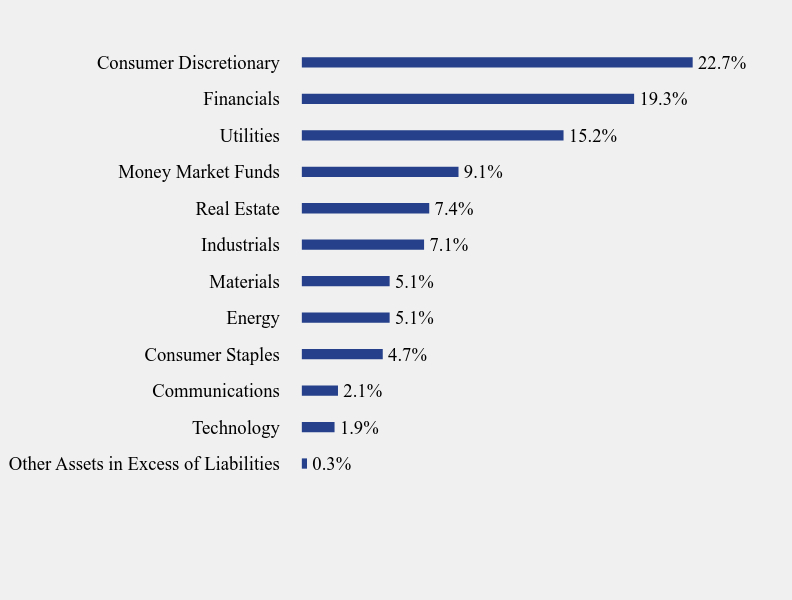

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.3% |

| Technology | 1.9% |

| Communications | 2.1% |

| Consumer Staples | 4.7% |

| Energy | 5.1% |

| Materials | 5.1% |

| Industrials | 7.1% |

| Real Estate | 7.4% |

| Money Market Funds | 9.1% |

| Utilities | 15.2% |

| Financials | 19.3% |

| Consumer Discretionary | 22.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 9.1% |

| Flexsteel Industries, Inc. | 3.9% |

| LSI Industries, Inc. | 3.8% |

| Sprott, Inc. | 3.8% |

| Oil-Dri Corp of America | 3.5% |

| Ethan Allen Interiors, Inc. | 3.1% |

| Compass Diversified Holdings | 3.0% |

| Escalade, Inc. | 3.0% |

| Postal Realty Trust, Inc. | 2.9% |

| Bar Harbor Bankshares | 2.9% |

No material changes occurred during the year ended November 30, 2024.

North Star Dividend Fund - Class I (NSDVX )

Annual Shareholder Report - November 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.nsinvestfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Star Micro Cap Fund

Annual Shareholder Report - November 30, 2024

This annual shareholder report contains important information about North Star Micro Cap Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.nsinvestfunds.com. You can also request this information by contacting us at 1-855-580-0900.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $153 | 1.33% |

|---|

How did the Fund perform during the reporting period?

The Fund outperformed its benchmarks during the twelve-month period ending 11-30-2024, while producing a 30.50% gain. United States Lime & Minerals surged throughout the year as demand remained strong for construction materials. The Fund also enjoyed sizeable gains in Green Brick Partners, Hackett Group, and Interface. Green Brick Partners Inc is a homebuilding and land development company. Interface Inc is engaged in the design, production, and sale of carpet tiles for the institutional markets. Two of our holdings, Mitek Systems and Rocky Shoes & Boots, suffered substantial declines. Mitek Systems Inc is engaged in the development, sale, and service of proprietary software solutions related to mobile imaging. Rocky Brands Inc is a designer, manufacturer, and marketer of premium-quality footwear and apparel.

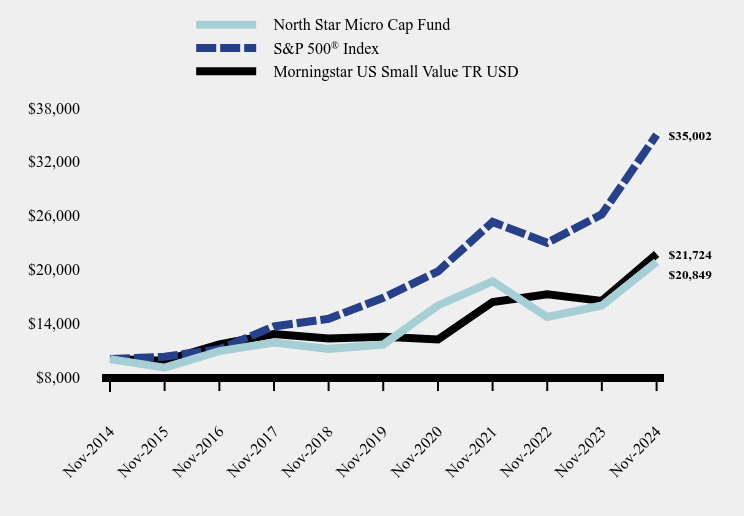

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Star Micro Cap Fund | S&P 500® Index | Morningstar US Small Value TR USD |

|---|

| Nov-2014 | $10,000 | $10,000 | $10,000 |

|---|

| Nov-2015 | $9,051 | $10,275 | $9,827 |

|---|

| Nov-2016 | $10,889 | $11,103 | $11,650 |

|---|

| Nov-2017 | $11,838 | $13,642 | $12,799 |

|---|

| Nov-2018 | $11,143 | $14,498 | $12,296 |

|---|

| Nov-2019 | $11,617 | $16,834 | $12,483 |

|---|

| Nov-2020 | $15,981 | $19,773 | $12,181 |

|---|

| Nov-2021 | $18,679 | $25,294 | $16,366 |

|---|

| Nov-2022 | $14,693 | $22,964 | $17,223 |

|---|

| Nov-2023 | $15,976 | $26,142 | $16,489 |

|---|

| Nov-2024 | $20,849 | $35,002 | $21,724 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Star Micro Cap Fund | 30.50% | 12.41% | 7.62% |

|---|

S&P 500® Index | 33.89% | 15.77% | 13.35% |

|---|

| Morningstar US Small Value TR USD | 31.75% | 11.72% | 8.07% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$126,324,274

- Number of Portfolio Holdings52

- Advisory Fee $1,124,152

- Portfolio Turnover26%

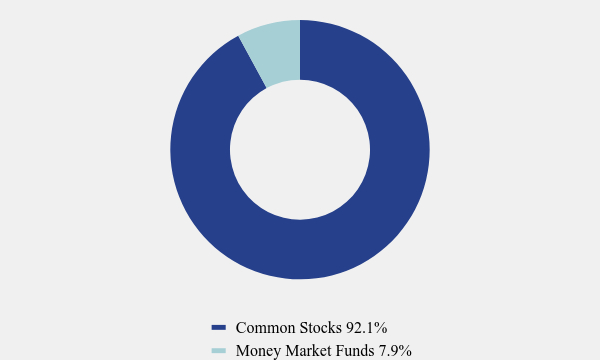

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 92.1% |

| Money Market Funds | 7.9% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Health Care | 0.9% |

| Real Estate | 1.8% |

| Technology | 2.7% |

| Consumer Staples | 3.4% |

| Energy | 4.2% |

| Financials | 4.8% |

| Money Market Funds | 7.9% |

| Materials | 9.2% |

| Industrials | 22.7% |

| Consumer Discretionary | 42.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 7.9% |

| United States Lime & Minerals, Inc. | 7.9% |

| Build-A-Bear Workshop, Inc. | 4.9% |

| Green Brick Partners, Inc. | 4.3% |

| Barrett Business Services, Inc. | 3.8% |

| Blue Bird Corporation | 3.3% |

| Acme United Corporation | 3.2% |

| QEP Company, Inc. | 3.2% |

| Interface, Inc. | 3.0% |

| Miller Industries, Inc. | 2.9% |

No material changes occurred during the year ended November 30, 2024.

North Star Micro Cap Fund - Class I (NSMVX )

Annual Shareholder Report - November 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.nsinvestfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Star Opportunity Fund

Annual Shareholder Report - November 30, 2024

This annual shareholder report contains important information about North Star Opportunity Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.nsinvestfunds.com. You can also request this information by contacting us at 1-855-580-0900.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $171 | 1.55% |

|---|

How did the fund perform last year?

The Fund performed in line with its benchmark for the twelve-month period ending 11-30-24, while posting a 21.07% and 21.42% positive return for Class A shares and Class I shares, respectively. The technology holdings provided mixed results, with nice returns from Apple, but sizeable losses from Advanced Micro Devices and Qualcomm. Big banks JPMorgan Chase and Bank of America performed well, and the biggest winners were private equity firms Blackstone Group and KKR & Co. As a group small caps produce returns consistent with the large cap equities in the portfolio, with no significant winners or losers. The fixed income sleeve of 15% of the Fund was positioned primarily in short-term Treasuries that performed as expected. Consumer Discretionary represents a significant sector allocation for the Fund, and produced mixed results, as lower-end consumers continued to be pressured by high prices and dialed back their spending.

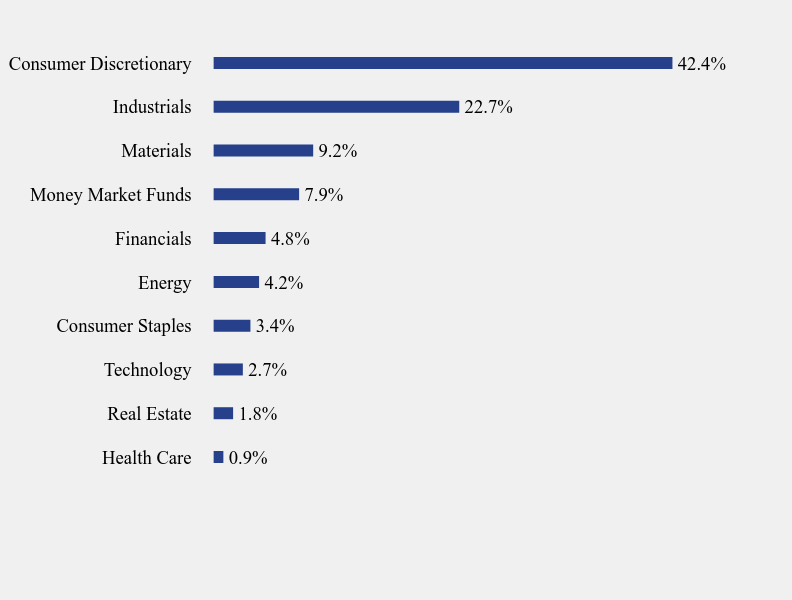

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Star Opportunity Fund | S&P 500® Index | S&P Target Risk Aggressive Index |

|---|

| Nov-2014 | $9,426 | $10,000 | $10,000 |

|---|

| Nov-2015 | $8,642 | $10,275 | $10,011 |

|---|

| Nov-2016 | $9,549 | $11,103 | $10,410 |

|---|

| Nov-2017 | $10,641 | $13,642 | $12,555 |

|---|

| Nov-2018 | $10,952 | $14,498 | $12,428 |

|---|

| Nov-2019 | $11,973 | $16,834 | $14,031 |

|---|

| Nov-2020 | $14,366 | $19,773 | $15,695 |

|---|

| Nov-2021 | $17,201 | $25,294 | $18,254 |

|---|

| Nov-2022 | $14,156 | $22,964 | $16,419 |

|---|

| Nov-2023 | $14,318 | $26,142 | $17,864 |

|---|

| Nov-2024 | $17,335 | $35,002 | $21,801 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Star Opportunity Fund | | | |

|---|

| Without Load | 21.07% | 7.68% | 6.28% |

|---|

| With Load | 14.13% | 6.41% | 5.66% |

|---|

S&P 500® Index | 33.89% | 15.77% | 13.35% |

|---|

| S&P Target Risk Aggressive Index | 22.04% | 9.21% | 8.11% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $138,507,500 |

|---|

| Number of Portfolio Holdings | 44 |

|---|

| Advisory Fee (net of waivers) | $1,259,055 |

|---|

| Portfolio Turnover | 21% |

|---|

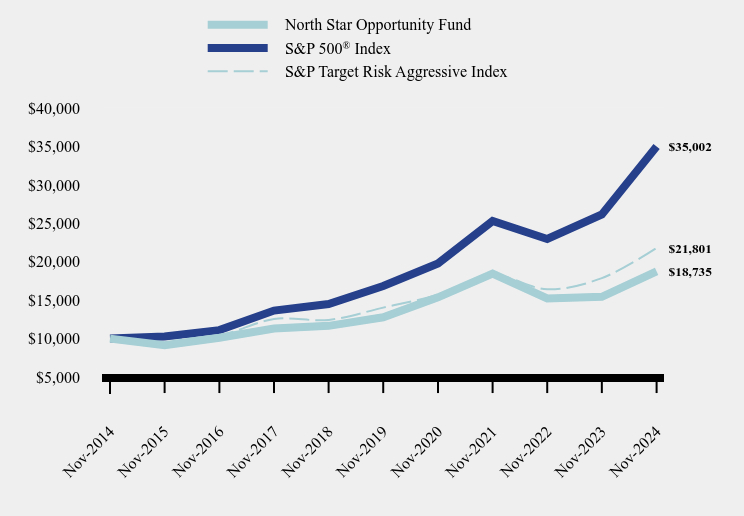

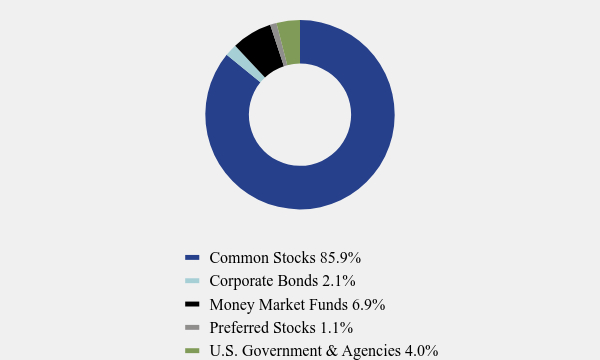

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 85.9% |

| Corporate Bonds | 2.1% |

| Money Market Funds | 6.9% |

| Preferred Stocks | 1.1% |

| U.S. Government & Agencies | 4.0% |

What did the Fund invest in?

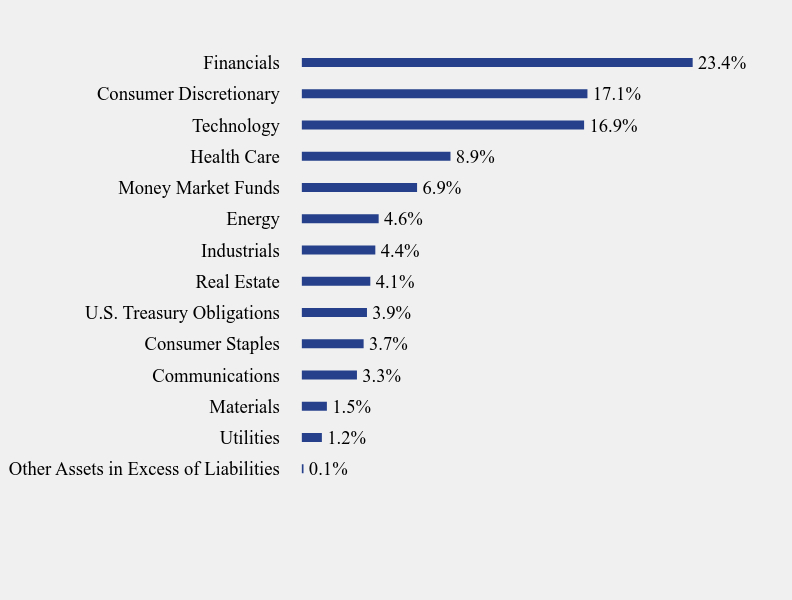

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Utilities | 1.2% |

| Materials | 1.5% |

| Communications | 3.3% |

| Consumer Staples | 3.7% |

| U.S. Treasury Obligations | 3.9% |

| Real Estate | 4.1% |

| Industrials | 4.4% |

| Energy | 4.6% |

| Money Market Funds | 6.9% |

| Health Care | 8.9% |

| Technology | 16.9% |

| Consumer Discretionary | 17.1% |

| Financials | 23.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 6.9% |

| Blackstone, Inc. | 5.4% |

| KKR & Company, Inc. | 5.4% |

| Apple, Inc. | 4.8% |

| JPMorgan Chase & Company | 4.3% |

| Bank of America Corporation | 3.7% |

| Advanced Micro Devices, Inc. | 3.5% |

| Amazon.com, Inc. | 3.3% |

| AbbVie, Inc. | 3.3% |

| Alphabet, Inc., Class A | 3.3% |

No material changes occurred during the year ended November 30, 2024.

North Star Opportunity Fund - Class A (NSOPX )

Annual Shareholder Report - November 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.nsinvestfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Star Opportunity Fund

Annual Shareholder Report - November 30, 2024

This annual shareholder report contains important information about North Star Opportunity Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.nsinvestfunds.com. You can also request this information by contacting us at 1-855-580-0900.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $144 | 1.30% |

|---|

How did the fund perform last year?

The Fund performed in line with its benchmark for the twelve-month period ending 11-30-24, while posting a 21.07% and 21.42% positive return for Class A shares and Class I shares, respectively. The technology holdings provided mixed results, with nice returns from Apple, but sizeable losses from Advanced Micro Devices and Qualcomm. Big banks JPMorgan Chase and Bank of America performed well, and the biggest winners were private equity firms Blackstone Group and KKR & Co. As a group small caps produce returns consistent with the large cap equities in the portfolio, with no significant winners or losers. The fixed income sleeve of 15% of the Fund was positioned primarily in short-term Treasuries that performed as expected. Consumer Discretionary represents a significant sector allocation for the Fund, and produced mixed results, as lower-end consumers continued to be pressured by high prices and dialed back their spending.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Star Opportunity Fund | S&P 500® Index | S&P Target Risk Aggressive Index |

|---|

| Nov-2014 | $10,000 | $10,000 | $10,000 |

|---|

| Nov-2015 | $9,153 | $10,275 | $10,011 |

|---|

| Nov-2016 | $10,115 | $11,103 | $10,410 |

|---|

| Nov-2017 | $11,305 | $13,642 | $12,555 |

|---|

| Nov-2018 | $11,659 | $14,498 | $12,428 |

|---|

| Nov-2019 | $12,779 | $16,834 | $14,031 |

|---|

| Nov-2020 | $15,371 | $19,773 | $15,695 |

|---|

| Nov-2021 | $18,446 | $25,294 | $18,254 |

|---|

| Nov-2022 | $15,222 | $22,964 | $16,419 |

|---|

| Nov-2023 | $15,430 | $26,142 | $17,864 |

|---|

| Nov-2024 | $18,735 | $35,002 | $21,801 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Star Opportunity Fund | 21.42% | 7.95% | 6.48% |

|---|

S&P 500® Index | 33.89% | 15.77% | 13.35% |

|---|

| S&P Target Risk Aggressive Index | 22.04% | 9.21% | 8.11% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $138,507,500 |

|---|

| Number of Portfolio Holdings | 44 |

|---|

| Advisory Fee (net of waivers) | $1,259,055 |

|---|

| Portfolio Turnover | 21% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 85.9% |

| Corporate Bonds | 2.1% |

| Money Market Funds | 6.9% |

| Preferred Stocks | 1.1% |

| U.S. Government & Agencies | 4.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Utilities | 1.2% |

| Materials | 1.5% |

| Communications | 3.3% |

| Consumer Staples | 3.7% |

| U.S. Treasury Obligations | 3.9% |

| Real Estate | 4.1% |

| Industrials | 4.4% |

| Energy | 4.6% |

| Money Market Funds | 6.9% |

| Health Care | 8.9% |

| Technology | 16.9% |

| Consumer Discretionary | 17.1% |

| Financials | 23.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 6.9% |

| Blackstone, Inc. | 5.4% |

| KKR & Company, Inc. | 5.4% |

| Apple, Inc. | 4.8% |

| JPMorgan Chase & Company | 4.3% |

| Bank of America Corporation | 3.7% |

| Advanced Micro Devices, Inc. | 3.5% |

| Amazon.com, Inc. | 3.3% |

| AbbVie, Inc. | 3.3% |

| Alphabet, Inc., Class A | 3.3% |

No material changes occurred during the year ended November 30, 2024.

North Star Opportunity Fund - Class I (NSOIX )

Annual Shareholder Report - November 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.nsinvestfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Star Small Cap Value Fund

Institutional Class (WFICX)

Annual Shareholder Report - November 30, 2024

This annual shareholder report contains important information about North Star Small Cap Value Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.nsinvestfunds.com. You can also request this information by contacting us at 1-855-580-0900.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $114 | 0.98% |

|---|

How did the Fund perform during the reporting period?

The Fund posted a 32.98% and 32.75% positive returns for Institutional Class shares and Investor Class shares, respectively, which was modestly above its benchmarks during the twelve -month period ending 11-30-2024. The top performer from the first half of the year, school bus manufacturer Blue Bird, reversed course and was a drag on performance during the back half. A top performer for the year was heating and cooling company Comfort Systems, with no significant detractors, although there were a handful of companies that experienced low double-digit declines. The other top performers were Champion Homes, Hackett Group, OSI Systems, QCR Holdings, and VSE Corp. Champion Homes Inc is a factory-built housing company. The Hackett Group Inc is an IP-based executive advisory, strategic consulting, and digital transformation firm. OSI Systems Inc is a designer and manufacturer of electronic systems and components for businesses in the homeland security, healthcare, defense, and aerospace markets. QCR Holdings Inc is a Midwest-based multi-bank holding company. VSE Corp is a diversified aftermarket products and services company.

How has the Fund performed since inception?

Total Return Based on $100,000 Investment

| North Star Small Cap Value Fund | Morningstar US Small Value TR USD | S&P 500® Index |

|---|

| 12/31/18 | $100,000 | $100,000 | $100,000 |

|---|

| 11/30/19 | $118,073 | $116,049 | $127,634 |

|---|

| 11/30/20 | $112,533 | $113,246 | $149,914 |

|---|

| 11/30/21 | $158,322 | $152,152 | $191,772 |

|---|

| 11/30/22 | $157,185 | $160,122 | $174,110 |

|---|

| 11/30/23 | $150,305 | $153,298 | $198,206 |

|---|

| 11/30/24 | $199,872 | $201,965 | $265,380 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (December 31, 2018) |

|---|

| North Star Small Cap Value Fund | 32.98% | 11.10% | 12.42% |

|---|

S&P 500® Index | 33.89% | 15.77% | 17.94% |

|---|

| Morningstar US Small Value TR USD | 31.75% | 11.72% | 12.62% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $36,670,274 |

|---|

| Number of Portfolio Holdings | 38 |

|---|

| Advisory Fee (net of waivers) | $146,457 |

|---|

| Portfolio Turnover | 29% |

|---|

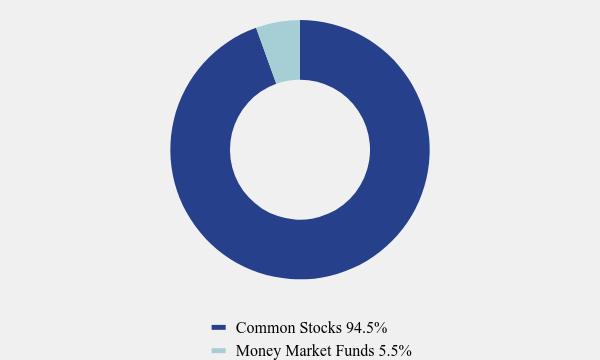

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 94.5% |

| Money Market Funds | 5.5% |

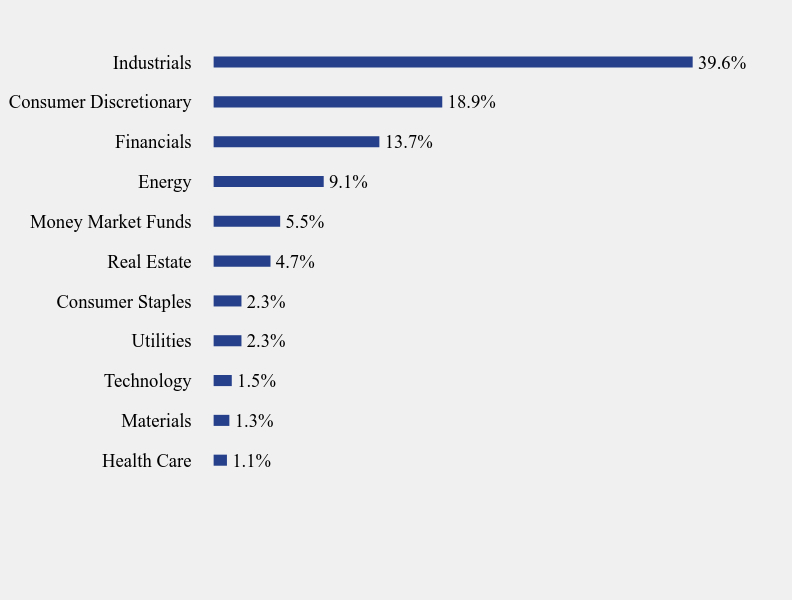

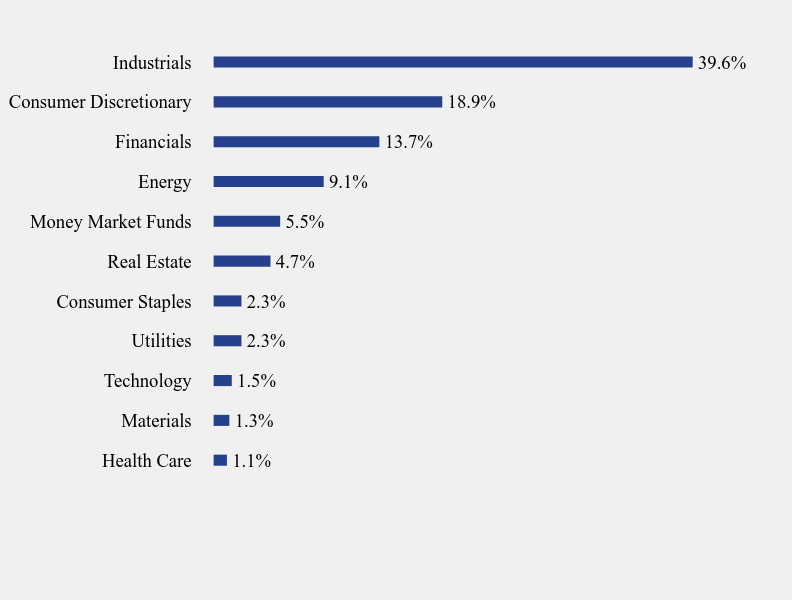

What did the Fund invest in?

| Value | Value |

|---|

| Health Care | 1.1% |

| Materials | 1.3% |

| Technology | 1.5% |

| Utilities | 2.3% |

| Consumer Staples | 2.3% |

| Real Estate | 4.7% |

| Money Market Funds | 5.5% |

| Energy | 9.1% |

| Financials | 13.7% |

| Consumer Discretionary | 18.9% |

| Industrials | 39.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Comfort Systems USA, Inc. | 5.9% |

| VSE Corporation | 5.6% |

| First American Treasury Obligations Fund, Class X | 5.5% |

| OSI Systems, Inc. | 4.9% |

| AZZ, Inc. | 4.7% |

| Champion Homes, Inc. | 4.5% |

| Hackett Group, Inc. (The) | 4.0% |

| Alamo Group, Inc. | 3.3% |

| Blue Bird Corporation | 3.3% |

| Liquidity Services, Inc. | 3.2% |

No material changes occurred during the year ended November 30, 2024.

North Star Small Cap Value Fund

Annual Shareholder Report - November 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.nsinvestfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Star Small Cap Value Fund

Annual Shareholder Report - November 30, 2024

This annual shareholder report contains important information about North Star Small Cap Value Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.nsinvestfunds.com. You can also request this information by contacting us at 1-855-580-0900.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor | $141 | 1.21% |

|---|

How did the Fund perform during the reporting period?

The Fund posted a 32.98% and 32.75% positive returns for Institutional Class shares and Investor Class shares, respectively, which was modestly above its benchmarks during the twelve -month period ending 11-30-2024. The top performer from the first half of the year, school bus manufacturer Blue Bird, reversed course and was a drag on performance during the back half. A top performer for the year was heating and cooling company Comfort Systems, with no significant detractors, although there were a handful of companies that experienced low double-digit declines. The other top performers were Champion Homes, Hackett Group, OSI Systems, QCR Holdings, and VSE Corp. Champion Homes Inc is a factory-built housing company. The Hackett Group Inc is an IP-based executive advisory, strategic consulting, and digital transformation firm. OSI Systems Inc is a designer and manufacturer of electronic systems and components for businesses in the homeland security, healthcare, defense, and aerospace markets. QCR Holdings Inc is a Midwest-based multi-bank holding company. VSE Corp is a diversified aftermarket products and services company.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Star Small Cap Value Fund | Morningstar US Small Value TR USD | S&P 500® Index |

|---|

| Nov-2014 | $10,000 | $10,000 | $10,000 |

|---|

| Nov-2015 | $9,567 | $9,827 | $10,275 |

|---|

| Nov-2016 | $11,030 | $11,650 | $11,103 |

|---|

| Nov-2017 | $12,984 | $12,799 | $13,642 |

|---|

| Nov-2018 | $11,987 | $12,296 | $14,498 |

|---|

| Nov-2019 | $12,300 | $12,483 | $16,834 |

|---|

| Nov-2020 | $11,688 | $12,181 | $19,773 |

|---|

| Nov-2021 | $16,406 | $16,366 | $25,294 |

|---|

| Nov-2022 | $16,259 | $17,223 | $22,964 |

|---|

| Nov-2023 | $15,510 | $16,489 | $26,142 |

|---|

| Nov-2024 | $20,589 | $21,724 | $35,002 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Star Small Cap Value Fund | 32.75% | 10.85% | 7.49% |

|---|

S&P 500® Index | 33.89% | 15.77% | 13.35% |

|---|

| Morningstar US Small Value TR USD | 31.75% | 11.72% | 8.07% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $36,670,274 |

|---|

| Number of Portfolio Holdings | 38 |

|---|

| Advisory Fee (net of waivers) | $146,457 |

|---|

| Portfolio Turnover | 29% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 94.5% |

| Money Market Funds | 5.5% |

What did the Fund invest in?

| Value | Value |

|---|

| Health Care | 1.1% |

| Materials | 1.3% |

| Technology | 1.5% |

| Utilities | 2.3% |

| Consumer Staples | 2.3% |

| Real Estate | 4.7% |

| Money Market Funds | 5.5% |

| Energy | 9.1% |

| Financials | 13.7% |

| Consumer Discretionary | 18.9% |

| Industrials | 39.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Comfort Systems USA, Inc. | 5.9% |

| VSE Corporation | 5.6% |

| First American Treasury Obligations Fund, Class X | 5.5% |

| OSI Systems, Inc. | 4.9% |

| AZZ, Inc. | 4.7% |

| Champion Homes, Inc. | 4.5% |

| Hackett Group, Inc. (The) | 4.0% |

| Alamo Group, Inc. | 3.3% |

| Blue Bird Corporation | 3.3% |

| Liquidity Services, Inc. | 3.2% |

No material changes occurred during the year ended November 30, 2024.

North Star Small Cap Value Fund

Annual Shareholder Report - November 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.nsinvestfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| | |

| (b) | N/A |

| | |

| (c) | During the period covered by this report, there were no amendments to any provision of the code of ethics. |

| | |

| (d) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| | |

| (e) | N/A |

| | |

| (f) | See Item 19(a)(1) |

Item 3. Audit Committee Financial Expert.

| (a)(1) | The Registrant’s Board of Trustees has determined that Mr. Keith Rhoades are audit committee financial experts, as defined in Item 3 of Form N-CSR. Mr. Rhoades is independent for purposes of this Item. |

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant’s principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows: |

| | 2024 | | | $ | 82,500 | |

| | 2023 | | | $ | 84,600 | |

| (b) | Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| (c) | Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows: |

| | 2024 | | | $ | 16,250 | |

| | 2023 | | | $ | 15,125 | |

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

| (d) | All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 and $0 for the fiscal years ended November 30, 2024 and 2023, respectively. |

| | |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| | |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| | |

| (f) | Not applicable. |

| | |

| (g) | All non-audit fees billed by the registrant’s principal accountant for services rendered to the registrant for the fiscal years ended November 30, 2024 and 2023 respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser. |

| | |

| (h) | Not applicable. |

| | |

| (i) | Not applicable. |

| | |

| (j) | Not applicable. |

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| | | |

| | | |

| | | |

| |  | |

| | | |

| | | |

| | | |

| | North Star Opportunity Fund | |

| | Class I Shares (Symbol: NSOIX)

Class A Shares (Symbol: NSOPX) | |

| | | |

| | | |

| | North Star Micro Cap Fund | |

| | Class I Shares (Symbol: NSMVX) | |

| | | |

| | | |

| | North Star Dividend Fund | |

| | Class I Shares (Symbol: NSDVX) | |

| | | |

| | | |

| | North Star Bond Fund | |

| | Class I Shares (Symbol: NSBDX) | |

| | | |

| | | |

| | North Star Small Cap Value Fund | |

| | Investor Class Shares (Symbol: WSCVX)

Institutional Class Shares (Symbol: WFICX) | |

| | | |

| | Annual Financial Statements and Additional Information | |

| | November 30, 2024 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

North Star Opportunity Fund

SCHEDULE OF INVESTMENTS

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 85.8% | | | | |

| | | | | ASSET MANAGEMENT - 8.1% | | | | |

| | 39,000 | | | Blackstone, Inc. | | $ | 7,452,510 | |

| | 165,000 | | | Compass Diversified Holdings | | | 3,910,500 | |

| | | | | | | | 11,363,010 | |

| | | | | BANKING - 8.0% | | | | |

| | 108,000 | | | Bank of America Corporation | | | 5,131,080 | |

| | 24,000 | | | JPMorgan Chase & Company | | | 5,993,280 | |

| | | | | | | | 11,124,360 | |

| | | | | BEVERAGES - 1.7% | | | | |

| | 14,000 | | | PepsiCo, Inc. | | | 2,288,300 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 7.6% | | | | |

| | 25,000 | | | AbbVie, Inc. | | | 4,573,250 | |

| | 100,000 | | | Pfizer, Inc. | | | 2,621,000 | |

| | 19,000 | | | Zoetis, Inc. | | | 3,329,750 | |

| | | | | | | | 10,524,000 | |

| | | | | CAPITAL MARKETS - 5.4% | | | | |

| | 45,500 | | | KKR & Company, Inc. | | | 7,410,585 | |

| | | | | | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 3.3% | | | | |

| | 22,000 | | | Amazon.com, Inc.(a) | | | 4,573,580 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 1.2% | | | | |

| | 125,000 | | | AES Corporation (The) | | | 1,630,000 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 2.9% | | | | |

| | 31,000 | | | Carrier Global Corporation | | | 2,398,470 | |

| | 1,980,000 | | | Orion Energy Systems, Inc.(a),(b) | | | 1,659,240 | |

| | | | | | | | 4,057,710 | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 1.3% | | | | |

| | 3,000 | | | UnitedHealth Group, Inc. | | | 1,830,600 | |

| | | | | | | | | |

| | | | | INTERNET MEDIA & SERVICES - 3.3% | | | | |

| | 27,000 | | | Alphabet, Inc., Class A | | | 4,561,650 | |

The accompanying notes are an integral part of theses financial statements.

North Star Opportunity Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 85.8% (Continued) | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 7.4% | | | | |

| | 83,000 | | | Madison Square Garden Entertainment Corporation(a) | | $ | 3,070,170 | |

| | 75,000 | | | Sphere Entertainment Company(a) | | | 3,086,250 | |

| | 8,500 | | | Vail Resorts, Inc. | | | 1,523,540 | |

| | 140,000 | | | Wendy’s Company (The), Class A | | | 2,570,400 | |

| | | | | | | | 10,250,360 | |

| | | | | METALS & MINING - 1.5% | | | | |

| | 48,000 | | | Freeport-McMoRan, Inc. | | | 2,121,600 | |

| | | | | | | | | |

| | | | | MULTI ASSET CLASS REITS - 1.2% | | | | |

| | 185,000 | | | LXP Industrial Trust | | | 1,729,750 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 4.6% | | | | |

| | 24,000 | | | Exxon Mobil Corporation | | | 2,831,040 | |

| | 125,000 | | | Kinder Morgan, Inc. | | | 3,533,750 | |

| | | | | | | | 6,364,790 | |

| | | | | RETAIL - CONSUMER STAPLES - 2.0% | | | | |

| | 21,000 | | | Target Corporation | | | 2,778,510 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 2.4% | | | | |

| | 24,000 | | | Boot Barn Holdings, Inc.(a) | | | 3,291,360 | |

| | | | | | | | | |

| | | | | RETAIL REIT - 1.6% | | | | |

| | 38,000 | | | Realty Income Corporation | | | 2,199,820 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS - 7.6% | | | | |

| | 35,500 | | | Advanced Micro Devices, Inc.(a) | | | 4,869,713 | |

| | 11,000 | | | NVIDIA Corporation | | | 1,520,750 | |

| | 26,000 | | | QUALCOMM, Inc. | | | 4,121,780 | |

| | | | | | | | 10,512,243 | |

| | | | | SPECIALTY REIT - 1.3% | | | | |

| | 40,000 | | | EPR Properties | | | 1,814,800 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 6.7% | | | | |

| | 28,000 | | | Apple, Inc. | | | 6,645,240 | |

The accompanying notes are an integral part of theses financial statements.

North Star Opportunity Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 85.8% (Continued) | | | | |

| | | | | TECHNOLOGY HARDWARE - 6.7% (Continued) | | | | |

| | 44,000 | | | Cisco Systems, Inc. | | $ | 2,605,240 | |

| | | | | | | | 9,250,480 | |

| | | | | TECHNOLOGY SERVICES - 2.6% | | | | |

| | 25,000 | | | Paychex, Inc. | | | 3,656,750 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 1.5% | | | | |

| | 15,000 | | | United Parcel Service, Inc., B | | | 2,035,800 | |

| | | | | | | | | |

| | | | | WHOLESALE - DISCRETIONARY - 2.6% | | | | |

| | 81,300 | | | Acme United Corporation | | | 3,618,663 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $55,365,687) | | | 118,988,721 | |

| Shares | | | | | Fair Value | |

| | | | | PREFERRED STOCKS — 1.1% | | | | |

| | | | | ASSET MANAGEMENT — 1.1% | | | | |

| | 64,000 | | | Compass Diversified Holdings, 7.875% | | | 1,512,320 | |

| | | | | | | | | |

| | | | | TOTAL PREFERRED STOCKS (Cost $1,441,399) | | | 1,512,320 | |

| Principal | | | | | Coupon Rate | | | | | | | |

| Amount ($) | | | | | (%) | | | Maturity | | | Fair Value | |

| | | | | CORPORATE BONDS — 2.1% | | | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES — 0.7% | | | | | | | | | | |

| | 1,000,000 | | | Lazard Group, LLC | | 3.7500 | | | 02/13/25 | | | | 999,448 | |

| | | | | | | | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES — 1.4% | | | | | | | | | | |

| | 1,850,000 | | | Wendy’s International, LLC | | 7.0000 | | | 12/15/25 | | | | 1,880,771 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL CORPORATE BONDS (Cost $2,880,338) | | | | | | | | | 2,880,219 | |

The accompanying notes are an integral part of theses financial statements.

North Star Opportunity Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Principal | | | | | Coupon Rate | | | | | | | |

| Amount ($) | | | | | (%) | | | Maturity | | | Fair Value | |

| | | | | U.S. GOVERNMENT & AGENCIES — 4.0% | | | | | | | | | | |

| | | | | U.S. TREASURY BILLS — 1.8% | | | | | | | | | | |

| | 1,000,000 | | | United States Treasury Bill(c) | | 4.2600 | | | 12/26/24 | | | $ | 996,973 | |

| | 1,500,000 | | | United States Treasury Bill(c) | | 4.3400 | | | 01/23/25 | | | | 1,490,423 | |

| | | | | | | | | | | | | | 2,487,396 | |

| | | | | U.S. TREASURY NOTES — 2.2% | | | | | | | | | | |

| | 1,000,000 | | | United States Treasury Note | | 3.8750 | | | 03/31/25 | | | | 998,118 | |

| | 1,000,000 | | | United States Treasury Note | | 3.8750 | | | 04/30/25 | | | | 997,828 | |

| | 1,000,000 | | | United States Treasury Note | | 4.2500 | | | 05/31/25 | | | | 999,052 | |

| | | | | | | | | | | | | | 2,994,998 | |

| | | | | TOTAL U.S. GOVERNMENT & AGENCIES (Cost $5,471,342) | | | | | | | | | 5,482,394 | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 6.9% | | | | |

| | | | | MONEY MARKET FUNDS - 6.9% | | | | |

| | 9,545,705 | | | First American Treasury Obligations Fund, Class X, 4.55% (Cost $9,545,705)(d) | | | 9,545,705 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.9% (Cost $74,704,471) | | $ | 138,409,359 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.1% | | | 98,141 | |

| | | | | NET ASSETS - 100.0% | | $ | 138,507,500 | |

| LLC | - Limited Liability Company |

| REIT | - Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Affiliated Company – North Star Opportunity Fund holds in excess of 5% of outstanding voting securities of this security. |

| (c) | Zero coupon bond. Rate disclosed is the current yield as of November 30, 2024. |

| (d) | Rate disclosed is the seven day effective yield as of November 30, 2024. |

The accompanying notes are an integral part of theses financial statements.

North Star Micro Cap Fund

SCHEDULE OF INVESTMENTS

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 92.1% | | | | |

| | | | | AEROSPACE & DEFENSE - 1.1% | | | | |

| | 20,300 | | | Ducommun, Inc.(a) | | $ | 1,360,100 | |

| | | | | | | | | |

| | | | | APPAREL & TEXTILE PRODUCTS - 7.7% | | | | |

| | 149,000 | | | Lakeland Industries, Inc. | | | 3,373,360 | |

| | 47,000 | | | Movado Group, Inc. | | | 956,450 | |

| | 112,500 | | | Rocky Brands, Inc. | | | 2,441,250 | |

| | 175,000 | | | Superior Group of Companies, Inc. | | | 2,962,750 | |

| | | | | | | | 9,733,810 | |

| | | | | ASSET MANAGEMENT - 1.2% | | | | |

| | 92,000 | | | Westwood Holdings Group, Inc. | | | 1,453,600 | |

| | | | | | | | | |

| | | | | AUTOMOTIVE - 2.9% | | | | |

| | 49,500 | | | Miller Industries, Inc. | | | 3,644,190 | |

| | | | | | | | | |

| | | | | BANKING - 2.4% | | | | |

| | 50,500 | | | Bar Harbor Bankshares | | | 1,817,495 | |

| | 50,000 | | | First Busey Corporation | | | 1,334,500 | |

| | | | | | | | 3,151,995 | |

| | | | | BEVERAGES - 0.0% | | | | |

| | 278,942 | | | Truett-Hurst, Inc.(a),(b),(c) | | | – | |

| | | | | | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - 8.3% | | | | |

| | 112,000 | | | Barrett Business Services, Inc. | | | 4,805,920 | |

| | 107,000 | | | Hackett Group, Inc. (The) | | | 3,353,380 | |

| | 100,000 | | | Healthcare Services Group, Inc.(a) | | | 1,234,000 | |

| | 150,000 | | | Quest Resource Holding Corporation(a) | | | 1,096,500 | |

| | | | | | | | 10,489,800 | |

| | | | | CONSTRUCTION MATERIALS - 9.1% | | | | |

| | 19,000 | | | Apogee Enterprises, Inc. | | | 1,599,990 | |

| | 65,000 | | | United States Lime & Minerals, Inc. | | | 9,945,000 | |

| | | | | | | | 11,544,990 | |

| | | | | CONSUMER SERVICES - 1.1% | | | | |

| | 85,000 | | | Lincoln Educational Services Corporation(a) | | | 1,396,550 | |

The accompanying notes are an integral part of these financial statements.

North Star Micro Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 92.1% (Continued) | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 2.6% | | | | |

| | 126,000 | | | Liquidity Services, Inc.(a) | | $ | 3,221,820 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 0.9% | | | | |

| | 43,000 | | | Allient, Inc. | | | 1,116,710 | |

| | | | | | | | | |

| | | | | FOOD - 2.1% | | | | |

| | 16,000 | | | Nathan’s Famous, Inc. | | | 1,400,000 | |

| | 72,000 | | | Nature’s Sunshine Products, Inc.(a) | | | 1,169,280 | |

| | | | | | | | 2,569,280 | |

| | | | | HOME & OFFICE PRODUCTS - 3.4% | | | | |

| | 203,000 | | | ACCO Brands Corporation | | | 1,181,460 | |

| | 88,051 | | | Hamilton Beach Brands Holding Company, Class A | | | 1,705,548 | |

| | 82,000 | | | Virco Mfg. Corporation | | | 1,346,440 | |

| | | | | | | | 4,233,448 | |

| | | | | HOME CONSTRUCTION - 7.3% | | | | |

| | 76,000 | | | Green Brick Partners, Inc.(a) | | | 5,430,960 | |

| | 143,000 | | | Interface, Inc. | | | 3,796,650 | |

| | | | | | | | 9,227,610 | |

| | | | | HOUSEHOLD PRODUCTS - 1.3% | | | | |

| | 19,800 | | | Central Garden & Pet Company(a) | | | 787,050 | |

| | 4,950 | | | Central Garden & Pet Company, Class A(a) | | | 167,261 | |

| | 157,000 | | | Crown Crafts, Inc. | | | 722,200 | |

| | | | | | | | 1,676,511 | |

| | | | | INDUSTRIAL INTERMEDIATE PROD - 2.7% | | | | |

| | 120,000 | | | Eastern Company (The) | | | 3,446,400 | |

| | | | | | | | | |

| | | | | INSURANCE - 1.2% | | | | |

| | 65,000 | | | Tiptree, Inc. | | | 1,481,350 | |

| | | | | | | | | |

| | | | | LEISURE PRODUCTS - 3.7% | | | | |

| | 238,000 | | | Escalade, Inc. | | | 3,570,000 | |

| | 32,101 | | | Johnson Outdoors, Inc., Class A | | | 1,080,520 | |

| | | | | | | | 4,650,520 | |

The accompanying notes are an integral part of these financial statements.

North Star Micro Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 92.1% (Continued) | | | | |

| | | | | MACHINERY - 6.4% | | | | |

| | 16,100 | | | Alamo Group, Inc. | | $ | 3,219,195 | |

| | 116,499 | | | QEP Company, Inc. | | | 3,991,839 | |

| | 10,500 | | | Tennant Company | | | 927,885 | |

| | | | | | | | 8,138,919 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 0.9% | | | | |

| | 483,000 | | | Accuray, Inc.(a) | | | 1,077,090 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 3.2% | | | | |

| | 435,000 | | | Evolution Petroleum Corporation | | | 2,549,100 | |

| | 50,000 | | | World Kinect Corporation | | | 1,447,500 | |

| | | | | | | | 3,996,600 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 1.0% | | | | |

| | 157,000 | | | ProPetro Holding Corporation(a) | | | 1,318,800 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 9.9% | | | | |

| | 21,000 | | | Boot Barn Holdings, Inc.(a) | | | 2,879,940 | |

| | 162,000 | | | Build-A-Bear Workshop, Inc. | | | 6,154,379 | |

| | 79,000 | | | Ethan Allen Interiors, Inc. | | | 2,427,670 | |

| | 33,000 | | | Shoe Carnival, Inc. | | | 1,114,080 | |

| | | | | | | | 12,576,069 | |

| | | | | SEMICONDUCTORS - 0.5% | | | | |

| | 35,000 | | | Penguin Solutions, Inc.(a) | | | 634,900 | |

| | | | | | | | | |

| | | | | SOFTWARE - 1.2% | | | | |

| | 170,000 | | | Cantaloupe, Inc.(a) | | | 1,543,600 | |

| | | | | | | | | |

| | | | | SPECIALTY REIT - 1.8% | | | | |

| | 163,000 | | | Postal Realty Trust, Inc. | | | 2,309,710 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 1.0% | | | | |

| | 83,000 | | | AstroNova, Inc.(a) | | | 1,275,710 | |

The accompanying notes are an integral part of these financial statements.

North Star Micro Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 92.1% (Continued) | | | | |

| | | | | TRANSPORTATION EQUIPMENT - 3.3% | | | | |

| | 102,000 | | | Blue Bird Corporation(a) | | $ | 4,146,300 | |

| | | | | | | | | |

| | | | | WHOLESALE - DISCRETIONARY - 3.9% | | | | |

| | 91,000 | | | Acme United Corporation | | | 4,050,410 | |

| | 144,000 | | | Hudson Technologies, Inc.(a) | | | 855,360 | |

| | | | | | | | 4,905,770 | |

| | | | | TOTAL COMMON STOCKS (Cost $62,285,955) | | | 116,322,152 | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 7.9% | | | | |

| | | | | MONEY MARKET FUNDS - 7.9% | | | | |

| | 10,021,203 | | | First American Treasury Obligations Fund, Class X, 4.55% (Cost $10,021,203)(d) | | | 10,021,203 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.0% (Cost $72,307,158) | | $ | 126,343,355 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - 0.0% | | | (19,081 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 126,324,274 | |

| REIT | - Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Affiliated Company – North Star Micro Cap Fund holds in excess of 5% of outstanding voting securities of this security. |

| (c) | Illiquid security. The total fair value of the securities at November 30, 2024 was $0 representing 0.0% of net assets. |

| (d) | Rate disclosed is the seven day effective yield as of November 30, 2024. |

The accompanying notes are an integral part of these financial statements.

North Star Dividend Fund

SCHEDULE OF INVESTMENTS

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 89.6% | | | | |

| | | | | APPAREL & TEXTILE PRODUCTS - 7.6% | | | | |

| | 45,000 | | | Movado Group, Inc. | | $ | 915,750 | |

| | 87,000 | | | Rocky Brands, Inc. | | | 1,887,900 | |

| | 148,000 | | | Superior Group of Companies, Inc. | | | 2,505,640 | |

| | 59,000 | | | Weyco Group, Inc. | | | 2,106,890 | |

| | | | | | | | 7,416,180 | |

| | | | | ASSET MANAGEMENT - 10.3% | | | | |

| | 122,300 | | | Compass Diversified Holdings | | | 2,898,510 | |

| | 81,000 | | | Sprott, Inc. | | | 3,592,350 | |

| | 35,000 | | | Vitesse Energy, Inc. | | | 982,800 | |

| | 153,700 | | | Westwood Holdings Group, Inc. | | | 2,428,460 | |

| | | | | | | | 9,902,120 | |

| | | | | BANKING - 5.6% | | | | |

| | 15,850 | | | Bank of Hawaii Corporation | | | 1,251,833 | |

| | 76,500 | | | Bar Harbor Bankshares | | | 2,753,235 | |

| | 10,000 | | | Wintrust Financial Corporation | | | 1,380,100 | |

| | | | | | | | 5,385,168 | |

| | | | | CHEMICALS - 3.5% | | | | |

| | 49,000 | | | Oil-Dri Corp of America | | | 3,386,880 | |

| | | | | | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - 3.3% | | | | |

| | 23,200 | | | ABM Industries, Inc. | | | 1,326,344 | |

| | 45,000 | | | Ennis, Inc. | | | 959,850 | |

| | 106,000 | | | Resources Connection, Inc. | | | 894,640 | |

| | | | | | | | 3,180,834 | |

| | | | | CONSTRUCTION MATERIALS - 1.6% | | | | |

| | 18,100 | | | Apogee Enterprises, Inc. | | | 1,524,201 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 7.0% | | | | |

| | 46,000 | | | Avista Corporation | | | 1,779,740 | |

| | 38,000 | | | Northwestern Energy Group, Inc. | | | 2,099,120 | |

| | 10,500 | | | Otter Tail Corporation | | | 846,720 | |

| | 33,500 | | | Unitil Corporation | | | 2,010,670 | |

| | | | | | | | 6,736,250 | |

The accompanying notes are an integral part of these financial statements.

North Star Dividend Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 89.6% (Continued) | | | | |

| | | | | ELECTRICAL EQUIPMENT - 3.8% | | | | |

| | 178,000 | | | LSI Industries, Inc. | | $ | 3,638,320 | |

| | | | | | | | | |

| | | | | GAS & WATER UTILITIES - 8.3% | | | | |

| | 51,000 | | | Artesian Resources Corporation, Class A | | | 1,771,740 | |

| | 162,000 | | | Global Water Resources, Inc. | | | 2,170,800 | |

| | 48,000 | | | Northwest Natural Holding Company | | | 2,103,360 | |

| | 90,000 | | | RGC Resources, Inc. | | | 1,872,000 | |

| | | | | | | | 7,917,900 | |

| | | | | HOME & OFFICE PRODUCTS - 6.2% | | | | |

| | 157,000 | | | ACCO Brands Corporation | | | 913,740 | |

| | 64,000 | | | Flexsteel Industries, Inc. | | | 3,777,920 | |

| | 64,000 | | | Hamilton Beach Brands Holding Company, Class A | | | 1,239,680 | |

| | | | | | | | 5,931,340 | |

| | | | | HOUSEHOLD PRODUCTS - 3.4% | | | | |

| | 169,000 | | | Crown Crafts, Inc. | | | 777,400 | |

| | 66,000 | | | Energizer Holdings, Inc. | | | 2,515,260 | |

| | | | | | | | 3,292,660 | |

| | | | | INSURANCE - 1.0% | | | | |

| | 79,000 | | | Crawford & Company | | | 936,150 | |

| | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 0.1% | | | | |

| | 6,000 | | | Wendy’s Company (The), Class A | | | 110,160 | |

| | | | | | | | | |

| | | | | LEISURE PRODUCTS - 3.0% | | | | |

| | 190,000 | | | Escalade, Inc. | | | 2,850,000 | |

| | | | | | | | | |

| | | | | MULTI ASSET CLASS REITS - 2.0% | | | | |

| | 48,000 | | | Alexander & Baldwin, Inc. | | | 944,640 | |

| | 107,000 | | | LXP Industrial Trust | | | 1,000,450 | |

| | | | | | | | 1,945,090 | |

| | | | | OIL & GAS PRODUCERS - 3.2% | | | | |

| | 367,000 | | | Evolution Petroleum Corporation | | | 2,150,620 | |

| | 149,000 | | | Granite Ridge Resources, Inc. | | | 961,050 | |

| | | | | | | | 3,111,670 | |

The accompanying notes are an integral part of these financial statements.

North Star Dividend Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 89.6% (Continued) | | | | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 1.9% | | | | |

| | 121,000 | | | Select Water Solutions, Inc., Class A | | $ | 1,787,170 | |

| | | | | | | | | |

| | | | | RESIDENTIAL REIT - 2.5% | | | | |

| | 125,000 | | | UMH Properties, Inc. | | | 2,400,000 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 1.3% | | | | |

| | 38,000 | | | Village Super Market, Inc., Class A | | | 1,230,060 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 4.7% | | | | |

| | 22,000 | | | Buckle, Inc. (The) | | | 1,145,980 | |

| | 96,300 | | | Ethan Allen Interiors, Inc. | | | 2,959,299 | |

| | 14,000 | | | Monro, Inc. | | | 393,680 | |

| | | | | | | | 4,498,959 | |

| | | | | SOFTWARE - 1.0% | | | | |

| | 96,000 | | | Logility Supply Chain Solutions, Inc., Class A | | | 1,010,880 | |

| | | | | | | | | |

| | | | | SPECIALTY FINANCE - 2.4% | | | | |

| | 14,000 | | | GATX Corporation | | | 2,298,240 | |

| | | | | | | | | |

| | | | | SPECIALTY REIT - 2.9% | | | | |

| | 196,000 | | | Postal Realty Trust, Inc. | | | 2,777,320 | |

| | | | | | | | | |

| | | | | TECHNOLOGY SERVICES - 0.9% | | | | |

| | 16,100 | | | Value Line, Inc. | | | 838,166 | |

| | | | | | | | | |

| | | | | TELECOMMUNICATIONS - 2.1% | | | | |

| | 122,000 | | | Spok Holdings, Inc. | | | 2,002,020 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $60,995,358) | | | 86,107,738 | |

The accompanying notes are an integral part of these financial statements.

North Star Dividend Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | PREFERRED STOCKS — 1.0% | | | | |

| | | | | HOME CONSTRUCTION — 1.0% | | | | |

| | 40,000 | | | Green Brick Partners, Inc., 5.750% | | $ | 950,052 | |

| | | | | | | | | |

| | | | | TOTAL PREFERRED STOCKS (Cost $846,709) | | | 950,052 | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 9.1% | | | | |

| | | | | MONEY MARKET FUNDS - 9.1% | | | | |

| | 8,724,386 | | | First American Treasury Obligations Fund, Class X, 4.55% (Cost $8,724,386)(a) | | | 8,724,386 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.7% (Cost $70,566,453) | | $ | 95,782,176 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.3% | | | 279,340 | |

| | | | | NET ASSETS - 100.0% | | $ | 96,061,516 | |

| REIT | - Real Estate Investment Trust |

| (a) | Rate disclosed is the seven day effective yield as of November 30, 2024. |

The accompanying notes are an integral part of these financial statements.

North Star Bond Fund

SCHEDULE OF INVESTMENTS

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | PREFERRED STOCKS — 6.9% | | | | |

| | | | | ASSET MANAGEMENT — 2.1% | | | | |

| | 29,000 | | | Compass Diversified Holdings, 7.875% | | $ | 685,270 | |

| | | | | | | | | |

| | | | | BANKING — 2.0% | | | | |

| | 27,000 | | | Bank of America Corporation, 4.000% | | | 663,660 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES — 0.7% | | | | |

| | 250,000 | | | Mellon Capital IV - Series 1, 5.6400% | | | 220,101 | |

| | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 2.1% | | | | |

| | 31,000 | | | EPR Properties - Series C, 5.7500% | | | 665,260 | |

| | | | | | | | | |

| | | | | TOTAL PREFERRED STOCKS (Cost $2,176,741) | | | 2,234,291 | |

Principal

Amount ($) | | | | | Coupon Rate

(%) | | | Maturity | | | Fair Value | |

| | | | | CORPORATE BONDS — 84.4% | | | | | | | | | | |

| | | | | AEROSPACE & DEFENSE — 3.0% | | | | | | | | | | |

| | 1,000,000 | | | TransDigm, Inc. | | 5.5000 | | | 11/15/27 | | | | 992,354 | |

| | | | | | | | | | | | | | | |

| | | | | APPAREL & TEXTILE PRODUCTS — 4.4% | | | | | | | | | | |

| | 1,475,000 | | | Under Armour, Inc. | | 3.2500 | | | 06/15/26 | | | | 1,428,947 | |

| | | | | | | | | | | | | | | |

| | | | | ASSET MANAGEMENT — 6.9% | | | | | | | | | | |

| | 850,000 | | | Blackstone Private Credit Fund | | 2.6250 | | | 12/15/26 | | | | 805,304 | |

| | 1,500,000 | | | Hercules Capital, Inc. | | 2.6250 | | | 09/16/26 | | | | 1,426,666 | |

| | | | | | | | | | | | | | 2,231,970 | |

| | | | | AUTOMOTIVE — 4.2% | | | | | | | | | | |

| | 1,350,000 | | | Ford Motor Company | | 7.1250 | | | 11/15/25 | | | | 1,371,254 | |

| | | | | | | | | | | | | | | |

| | | | | BANKING — 4.4% | | | | | | | | | | |

| | 1,500,000 | | | Wintrust Financial Corporation | | 4.8500 | | | 06/06/29 | | | | 1,436,380 | |

| | | | | | | | | | | | | | | |

| | | | | BIOTECH & PHARMA — 4.4% | | | | | | | | | | |

| | 1,400,000 | | | Elanco Animal Health, Inc. | | 6.6500 | | | 08/28/28 | | | | 1,448,539 | |

The accompanying notes are an integral part of these financial statements.

North Star Bond Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

Principal

Amount ($) | | | | | Coupon Rate

(%) | | | Maturity | | | Fair Value | |

| | | | | CORPORATE BONDS — 84.4% (Continued) | | | | | | | | | | |

| | | | | CONTAINERS & PACKAGING — 3.7% | | | | | | | | | | |

| | 1,200,000 | | | Ball Corporation | | 5.2500 | | | 07/01/25 | | | $ | 1,200,857 | |

| | | | | | | | | | | | | | | |

| | | | | FOOD — 4.3% | | | | | | | | | | |

| | 1,400,000 | | | J M Smucker Company (The) | | 3.5000 | | | 03/15/25 | | | | 1,393,033 | |

| | | | | | | | | | | | | | | |

| | | | | HOME & OFFICE PRODUCTS — 11.2% | | | | | | | | | | |

| | 1,000,000 | | | ACCO Brands Corporation(a) | | 4.2500 | | | 03/15/29 | | | | 929,515 | |

| | 1,360,000 | | | Scotts Miracle-Gro Company (The) | | 5.2500 | | | 12/15/26 | | | | 1,351,885 | |

| | 1,400,000 | | | Steelcase, Inc. | | 5.1250 | | | 01/18/29 | | | | 1,362,931 | |

| | | | | | | | | | | | | | 3,644,331 | |

| | | | | HOME CONSTRUCTION — 6.8% | | | | | | | | | | |

| | 1,250,000 | | | Beazer Homes USA, Inc. | | 5.8750 | | | 10/15/27 | | | | 1,247,228 | |

| | 1,000,000 | | | Interface, Inc.(a) | | 5.5000 | | | 12/01/28 | | | | 981,375 | |

| | | | | | | | | | | | | | 2,228,603 | |

| | | | | HOUSEHOLD PRODUCTS — 3.7% | | | | | | | | | | |

| | 1,200,000 | | | Energizer Holdings, Inc.(a) | | 6.5000 | | | 12/31/27 | | | | 1,217,194 | |

| | | | | | | | | | | | | | | |

| | | | | INDUSTRIAL SUPPORT SERVICES — 3.1% | | | | | | | | | | |

| | 1,000,000 | | | United Rentals North America, Inc. | | 5.5000 | | | 05/15/27 | | | | 1,000,457 | |

| | | | | | | | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES — 3.7% | | | | | | | | | | |

| | 1,250,000 | | | Lazard Group, LLC | | 3.6250 | | | 03/01/27 | | | | 1,218,537 | |

| | | | | | | | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES — 8.9% | | | | | | | | | | |

| | 1,400,000 | | | Cedar Fair, L.P./Canada’s Wonderland Company/Magnum Management Corporation | | 5.3750 | | | 04/15/27 | | | | 1,393,396 | |

| | 1,471,000 | | | Wendy’s International, LLC | | 7.0000 | | | 12/15/25 | | | | 1,495,467 | |

| | | | | | | | | | | | | | 2,888,863 | |

| | | | | OIL & GAS PRODUCERS — 4.3% | | | | | | | | | | |

| | 1,390,000 | | | Gulfport Energy Corporation | | 8.0000 | | | 05/17/26 | | | | 1,407,878 | |

| | | | | | | | | | | | | | | |

| | | | | OIL & GAS SERVICES & EQUIPMENT — 3.2% | | | | | | | | | | |

| | 1,050,000 | | | Oceaneering International, Inc. | | 6.0000 | | | 02/01/28 | | | | 1,042,832 | |

The accompanying notes are an integral part of these financial statements.

North Star Bond Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

Principal

Amount ($) | | | | | Coupon Rate

(%) | | | Maturity | | | Fair Value | |

| | | | | CORPORATE BONDS — 84.4% (Continued) | | | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 4.2% | | | | | | | | | | |

| | 1,400,000 | | | EPR Properties | | 4.9500 | | | 04/15/28 | | | $ | 1,381,832 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL CORPORATE BONDS (Cost $27,170,679) | | | | | | | | | 27,533,861 | |

Principal

Amount ($) | | | | | Coupon Rate

(%) | | | Maturity | | | Fair Value | |

| | | | | U.S. GOVERNMENT & AGENCIES — 4.6% | | | | | | | | | | |

| | | | | U.S. TREASURY BILLS — 1.5% | | | | | | | | | | |

| | 500,000 | | | United States Treasury Bill(b) | | 4.3800 | | | 02/13/25 | | | | 495,539 | |

| | | | | | | | | | | | | | | |

| | | | | U.S. TREASURY NOTES — 3.1% | | | | | | | | | | |

| | 500,000 | | | United States Treasury Note | | 3.8750 | | | 03/31/25 | | | | 499,059 | |

| | 500,000 | | | United States Treasury Note | | 3.8750 | | | 04/30/25 | | | | 498,914 | |

| | | | | | | | | | | | | | 997,973 | |

| | | | | TOTAL U.S. GOVERNMENT & AGENCIES (Cost $1,490,261) | | | | | | | | | 1,493,512 | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 2.9% | | | | |

| | | | | MONEY MARKET FUNDS - 2.9% | | | | |

| | 945,459 | | | First American Treasury Obligations Fund, Class X, 4.55% (Cost $945,459)(c) | | | 945,459 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 98.8% (Cost $31,783,140) | | $ | 32,207,123 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 1.2% | | | 402,274 | |

| | | | | NET ASSETS - 100.0% | | $ | 32,609,397 | |

| LLC | - Limited Liability Company |

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of November 30, 2024 the total market value of 144A securities is $3,128,084 or 9.6% of net assets. |

| (b) | Zero coupon bond. Rate disclosed is the current yield as of November 30, 2024. |

| (c) | Rate disclosed is the seven day effective yield as of November 30, 2024. |

The accompanying notes are an integral part of these financial statements.

North Star Small Cap Value Fund

SCHEDULE OF INVESTMENTS

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 94.5% | | | | |

| | | | | ASSET MANAGEMENT - 6.1% | | | | |

| | 18,000 | | | Compass Diversified Holdings | | $ | 426,600 | |

| | 22,000 | | | Sprott, Inc. | | | 975,700 | |

| | 69,000 | | | WisdomTree, Inc. | | | 824,550 | |

| | | | | | | | 2,226,850 | |

| | | | | BANKING - 7.6% | | | | |

| | 15,500 | | | Bar Harbor Bankshares | | | 557,845 | |

| | 3,710 | | | City Holding Company | | | 487,197 | |

| | 12,000 | | | NBT Bancorp, Inc. | | | 601,440 | |

| | 12,460 | | | QCR Holdings, Inc. | | | 1,147,691 | |

| | | | | | | | 2,794,173 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 7.0% | | | | |

| | 46,861 | | | Hackett Group, Inc. (The) | | | 1,468,624 | |

| | 18,225 | | | V2X, Inc.(a) | | | 1,098,056 | |

| | | | | | | | 2,566,680 | |

| | | | | E-COMMERCE DISCRETIONARY - 3.2% | | | | |

| | 45,200 | | | Liquidity Services, Inc.(a) | | | 1,155,764 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 9.8% | | | | |

| | 27,000 | | | Allient, Inc. | | | 701,190 | |

| | 53,000 | | | LSI Industries, Inc. | | | 1,083,320 | |

| | 10,152 | | | OSI Systems, Inc.(a) | | | 1,800,965 | |

| | | | | | | | 3,585,475 | |

| | | | | ENGINEERING & CONSTRUCTION - 11.5% | | | | |

| | 4,400 | | | Comfort Systems USA, Inc. | | | 2,170,389 | |

| | 17,500 | | | VSE Corporation | | | 2,052,050 | |

| | | | | | | | 4,222,439 | |

| | | | | GAS & WATER UTILITIES - 2.3% | | | | |

| | 63,000 | | | Global Water Resources, Inc. | | | 844,200 | |

| | | | | | | | | |

| | | | | HOME CONSTRUCTION - 4.5% | | | | |

| | 15,980 | | | Champion Homes, Inc.(a) | | | 1,657,605 | |

The accompanying notes are an integral part of theses financial statements.

North Star Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 94.5% (Continued) | | | | |

| | | | | HOUSEHOLD PRODUCTS - 2.3% | | | | |

| | 11,000 | | | Central Garden & Pet Company(a) | | $ | 437,250 | |

| | 11,000 | | | Energizer Holdings, Inc. | | | 419,210 | |

| | | | | | | | 856,460 | |

| | | | | INDUSTRIAL INTERMEDIATE PROD - 4.7% | | | | |

| | 18,574 | | | AZZ, Inc. | | | 1,729,982 | |

| | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 4.5% | | | | |

| | 60,000 | | | Lucky Strike Entertainment Corporation | | | 738,600 | |

| | 22,400 | | | Sphere Entertainment Company(a) | | | 921,760 | |

| | | | | | | | 1,660,360 | |

| | | | | MACHINERY - 3.3% | | | | |

| | 6,063 | | | Alamo Group, Inc. | | | 1,212,297 | |

| | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 1.1% | | | | |

| | 4,675 | | | Haemonetics Corporation(a) | | | 408,922 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 2.8% | | | | |

| | 5,900 | | | Gulfport Energy Corporation(a) | | | 1,037,220 | |

| | | | | | | | | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 6.3% | | | | |

| | 65,000 | | | Helix Energy Solutions Group, Inc.(a) | | | 694,850 | |

| | 100,000 | | | ProPetro Holding Corporation(a) | | | 840,000 | |

| | 24,200 | | | Thermon Group Holdings, Inc.(a) | | | 763,752 | |

| | | | | | | | 2,298,602 | |

| | | | | RESIDENTIAL REIT - 2.6% | | | | |

| | 49,561 | | | UMH Properties, Inc. | | | 951,571 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 6.0% | | | | |

| | 6,800 | | | Boot Barn Holdings, Inc.(a) | | | 932,552 | |

| | 21,817 | | | Shoe Carnival, Inc. | | | 736,542 | |

| | 5,300 | | | Signet Jewelers Ltd. | | | 531,060 | |

| | | | | | | | 2,200,154 | |

The accompanying notes are an integral part of theses financial statements.

North Star Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 94.5% (Continued) | | | | |

| | | | | SEMICONDUCTORS - 1.5% | | | | |

| | 7,392 | | | Axcelis Technologies, Inc.(a) | | $ | 548,782 | |

| | | | | | | | | |

| | | | | SPECIALTY REIT - 2.1% | | | | |

| | 55,500 | | | Postal Realty Trust, Inc. | | | 786,435 | |

| | | | | | | | | |

| | | | | STEEL - 1.3% | | | | |

| | 7,800 | | | Commercial Metals Company | | | 481,182 | |

| | | | | | | | | |

| | | | | TRANSPORTATION EQUIPMENT - 3.3% | | | | |

| | 29,400 | | | Blue Bird Corporation(a) | | | 1,195,110 | |

| | | | | | | | | |

| | | | | WHOLESALE - DISCRETIONARY - 0.7% | | | | |

| | 44,000 | | | Hudson Technologies, Inc.(a) | | | 261,360 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $18,361,760) | | | 34,681,623 | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 5.5% | | | | |

| | | | | MONEY MARKET FUNDS - 5.5% | | | | |

| | 2,005,942 | | | First American Treasury Obligations Fund, Class X, 4.55% (Cost $2,005,942)(b) | | | 2,005,942 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.0% (Cost $20,367,702) | | $ | 36,687,565 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - 0.0% | | | (17,291 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 36,670,274 | |

| REIT | - Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of November 30, 2024. |

The accompanying notes are an integral part of theses financial statements.

North Star Funds

STATEMENTS OF ASSETS AND LIABILITIES

November 30, 2024

| | | North Star

Opportunity

Fund | | | North Star

Micro Cap

Fund | | | North Star

Dividend

Fund | | | North Star

Bond

Fund | | | North Star

Small Cap Value

Fund | |

| Assets: | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Securities at Cost | | $ | 72,477,723 | | | $ | 72,307,158 | | | $ | 70,566,453 | | | $ | 31,783,140 | | | $ | 20,367,702 | |

| Investments in Non-controlled Affiliated Securities at Cost | | | 2,226,748 | | | | - | | | | - | | | | - | | | | - | |

| Total Securities at Cost | | | 74,704,471 | | | | 72,307,158 | | | | 70,566,453 | | | | 31,783,140 | | | | 20,367,702 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Securities at Value | | $ | 136,750,119 | | | $ | 126,343,355 | | | $ | 95,782,176 | | | $ | 32,207,123 | | | $ | 36,687,565 | |

| Investments in Non-controlled Affiliated Securities at Value | | | 1,659,240 | | | | - | | | | - | | | | - | | | | - | |

| Total Securities at Value | | | 138,409,359 | | | | 126,343,355 | | | | 95,782,176 | | | | 32,207,123 | | | | 36,687,565 | |

| | | | | | | | | | | | | | | | | | | | | |

| Cash | | | 21,250 | | | | - | | | | - | | | | - | | | | | |

| Dividends and Interest Receivable | | | 245,898 | | | | 140,763 | | | | 393,564 | | | | 465,918 | | | | 36,995 | |

| Receivable for Fund Shares Sold | | | 594 | | | | 25 | | | | 700 | | | | - | | | | 97 | |

| Prepaid Expenses and Other Assets | | | 9,977 | | | | 10,619 | | | | 16,565 | | | | 4,255 | | | | 6,662 | |