Alta Mesa Resources, Inc. Goldman Sachs Global Energy Conference 2018 January 2018 Exhibit 99.1

Disclaimer Forward-Looking Statements The information in this presentation and the oral statements made in connection therewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this presentation, regarding Silver Run II’s (or Silver Run II) proposed business combination with Alta Mesa Holdings, LP (“Alta Mesa”) and Kingfisher Midstream, LLC (“KFM”), Silver Run II’s ability to consummate the business combination, the benefits of the business combination and Silver Run II’s future financial performance following the business combination, as well as Alta Mesa’s and KFM’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, including any oral statements made in connection therewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Silver Run II, Alta Mesa and KFM disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Silver Run II and Alta Mesa caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Silver Run II, Alta Mesa and KFM, incident to the development, production, gathering and sale of oil, natural gas and natural gas liquids. These risks include, but are not limited to, commodity price volatility, low prices for oil and/or natural gas, global economic conditions, inflation, increased operating costs, lack of availability of drilling and production equipment, supplies, services and qualified personnel, processing volumes and pipeline throughput, uncertainties related to new technologies, geographical concentration of Alta Mesa’s and KFM’s operations, environmental risks, weather risks, security risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating oil and natural gas reserves and in projecting future rates of production, reductions in cash flow, lack of access to capital, Alta Mesa’s and KFM’s ability to satisfy future cash obligations, restrictions in existing or future debt agreements of Alta Mesa or KFM, the timing of development expenditures, managing Alta Mesa’s and KFM’s growth and integration of acquisitions, failure to realize expected value creation from property acquisitions, title defects and limited control over non-operated properties and our ability to complete an initial public offering of the Kingfisher midstream business. Should one or more of the risks or uncertainties described in this presentation and the oral statements made in connection therewith occur, or should underlying assumptions prove incorrect, Silver Run II’s, Alta Mesa’s and KFM’s actual results and plans could differ materially from those expressed in any forward-looking statements. Reserve Information Reserve engineering is a process of estimating underground accumulations of hydrocarbons that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions could impact Alta Mesa’s strategy and change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil and natural gas that are ultimately recovered. Estimated Ultimate Recoveries, or “EURs,” refers to estimates of the sum of total gross remaining proved reserves per well as of a given date and cumulative production prior to such given date for developed wells. These quantities do not necessarily constitute or represent reserves as defined by the Securities and Exchange Commission (the “SEC”) and are not intended to be representative of anticipated future well results of all wells drilled on Alta Mesa’s STACK acreage. Use of Projections This presentation contains projections for Alta Mesa and KFM, including with respect to their EBITDA, net debt to EBITDA ratio and capital budget, as well as Alta Mesa’s production and KFM’s volumes, for the fiscal years 2017, 2018 and 2019. Neither Silver Run II’s nor Alta Mesa’s and KFM’s independent auditors or Alta Mesa’s independent petroleum engineering firm have audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, none of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. In this presentation, certain of the above-mentioned projected information has been repeated (in each case, with an indication that the information is subject to the qualifications presented herein), for purposes of providing comparisons with historical data. The assumptions and estimates underlying the projected information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projected information. Even if our assumptions and estimates are correct, projections are inherently uncertain due to a number of factors outside our control. Accordingly, there can be no assurance that the projected results are indicative of the future performance of Silver Run II, Alta Mesa or KFM or the combined company after completion of any business combination or that actual results will not differ materially from those presented in the projected information. Inclusion of the projected information in this presentation should not be regarded as a representation by any person that the results contained in the projected information will be achieved. Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including EBITDA and Adjusted EBITDAX of Alta Mesa. Please refer to the Appendix for a reconciliation of Adjusted EBITDAX to net (loss) income, the most comparable GAAP measure. Silver Run II, Alta Mesa and KFM believe EBITDA and Adjusted EBITDAX are useful because they allow Silver Run II, Alta Mesa and KFM to more effectively evaluate their operating performance and compare the results of their operations from period to period and against their peers without regard to financing methods or capital structure. The computations of EBITDA and Adjusted EBITDAX may not be comparable to other similarly titled measures of other companies. Alta Mesa excludes the items listed in the Appendix from net (loss) income in arriving at Adjusted EBITDAX because these amounts can vary substantially from company to company within its industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDAX should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP or as an indicator of Alta Mesa’s operating performance or liquidity. Certain items excluded from Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDAX. Alta Mesa’s presentation of Adjusted EBITDAX should not be construed as an inference that its results will be unaffected by unusual or non-recurring items. Industry and Market Data This presentation has been prepared by Alta Mesa and includes market data and other statistical information from sources believed by Silver Run II, Alta Mesa and KFM to be reliable, including independent industry publications, government publications or other published independent sources. Some data is also based on the good faith estimates of Alta Mesa and KFM, which are derived from their review of internal sources as well as the independent sources described above. Although Silver Run II, Alta Mesa and KFM believe these sources are reliable, they have not independently verified the information and cannot guarantee its accuracy and completeness. Trademarks and Trade Names Alta Mesa and KFM own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with Silver Run II, Alta Mesa or KFM, or an endorsement or sponsorship by or of Silver Run II, Alta Mesa or KFM. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Alta Mesa or KFM will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

Silver Run II has agreed to merge with Alta Mesa and Kingfisher Midstream (collectively renamed Alta Mesa Resources, Inc.), creating a world class energy company with a high-quality, integrated, and concentrated asset base in the core of the STACK oil play This transaction integrates premier upstream and midstream assets developed by a tenured executive team with unmatched complementary experience and track records Creation of a Pure-Play STACK Enterprise Pro Forma Organizational Structure Alta Mesa Resources, Inc.: AMR Jim Hackett, Executive Chairman Hal Chappelle, President & CEO Upstream Operations Kingfisher Midstream Corporate Development Finance & Accounting Mike Ellis Founder and COO Jim Hackett COO Tim Turner Vice President Mike McCabe Vice President and CFO Land David Murrell Vice President Top 10 managers average >25 years industry experience and >12 years at Alta Mesa

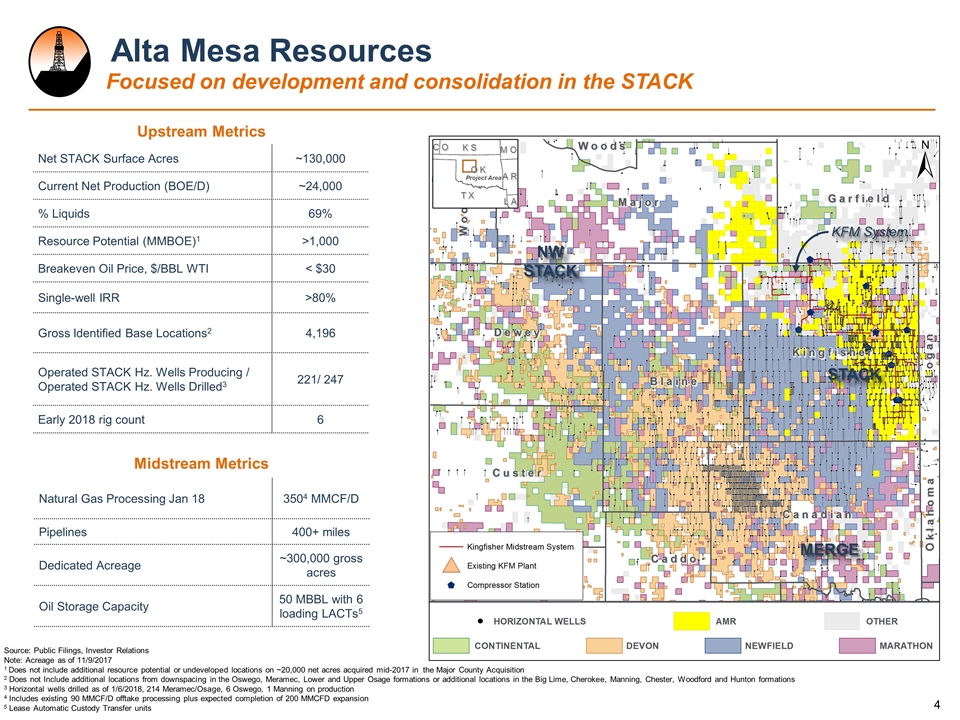

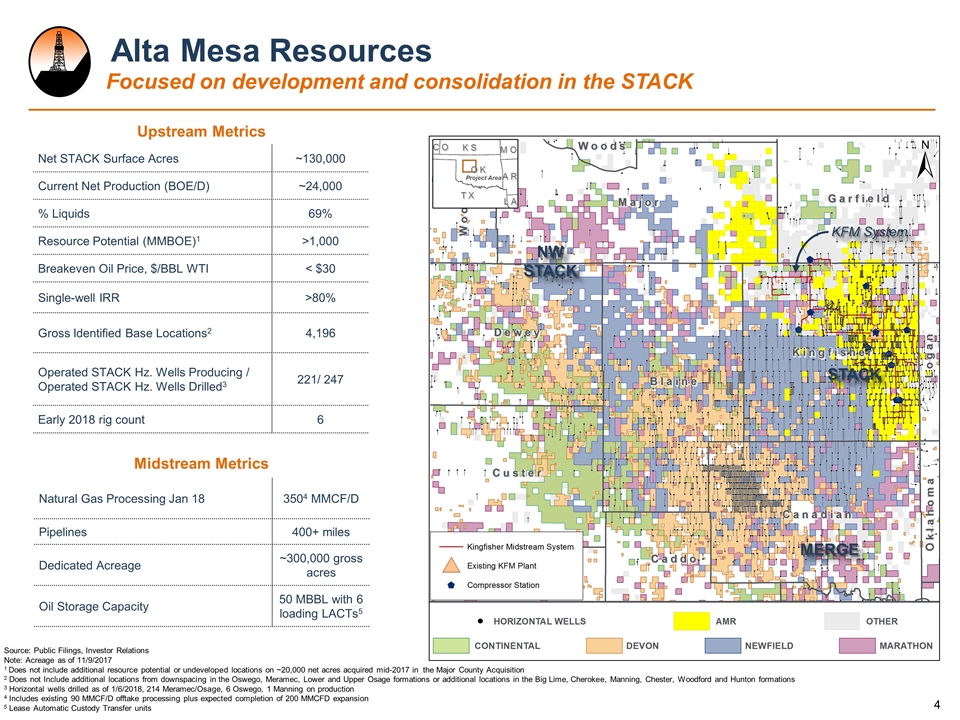

Upstream Metrics Alta Mesa Resources Focused on development and consolidation in the STACK Net STACK Surface Acres ~130,000 Current Net Production (BOE/D) ~24,000 % Liquids 69% Resource Potential (MMBOE)1 >1,000 Breakeven Oil Price, $/BBL WTI < $30 Single-well IRR >80% Gross Identified Base Locations2 4,196 Operated STACK Hz. Wells Producing / Operated STACK Hz. Wells Drilled3 221/ 247 Early 2018 rig count 6 Natural Gas Processing Jan 18 3504 MMCF/D Pipelines 400+ miles Dedicated Acreage ~300,000 gross acres Oil Storage Capacity 50 MBBL with 6 loading LACTs5 Midstream Metrics Source: Public Filings, Investor Relations Note: Acreage as of 11/9/2017 1 Does not include additional resource potential or undeveloped locations on ~20,000 net acres acquired mid-2017 in the Major County Acquisition 2 Does not Include additional locations from downspacing in the Oswego, Meramec, Lower and Upper Osage formations or additional locations in the Big Lime, Cherokee, Manning, Chester, Woodford and Hunton formations 3 Horizontal wells drilled as of 1/6/2018, 214 Meramec/Osage, 6 Oswego, 1 Manning on production 4 Includes existing 90 MMCF/D offtake processing plus expected completion of 200 MMCFD expansion 5 Lease Automatic Custody Transfer units STACK NW STACK MERGE KFM System

Disciplined Growth with 10+ year Horizon in STACK Oil Window, 10-12 rig cadence Highly contiguous ~130,000 net acres; infrastructure a key competitive advantage Kingfisher Midstream (KFM) purpose built and highly synergistic; flow assurance de-risks production growth Low cost operator, resilient well economics < $30/BBL breakeven; >80% single-well rate of return1 Low leverage development plan is fully-financed for 2 years, free cash flow positive in 2019 2012-2017 Execution and Results De-Risk Investment 240+ horizontal STACK wells drilled by Alta Mesa across entirety of Kingfisher acreage Development projects underway; pattern tests validate base development plan KFM initial 60 MMCFD plant full; 200 MMCFD expansion in commissioning on time, under budget Consistency and geographic breadth of well results affirms EUR repeatability Experienced Management Team Aligned with Shareholders Alta Mesa Resources management team will remain large shareholders, expected >35% post-transaction Demonstrated discipline to sustain and grow the enterprise through cyclical downturns Management compensation and team incentives based on capital efficiency and growth per debt-adjusted share Comprehensive Application of Best Practices and Technology Efficient, scalable drilling team managing 6 rig program delivering > 2 wells per month per rig Geoscience team applying full suite of tools including 3-D seismic and geosteering to optimize development Completions team providing top-tier design and execution of hydraulic fracture stimulations Production team enhances individual well performance by daily managing compression and artificial lift Sustainable STACK Development Combined midstream & upstream with fully funded growth and low leverage 1 Type curves assume 17% royalty burden and $3.5MM D&C well cost. Adjusted for transportation costs paid to KFM. Excludes $1.25 / bbl oil transportation costs. Broker Consensus price deck.

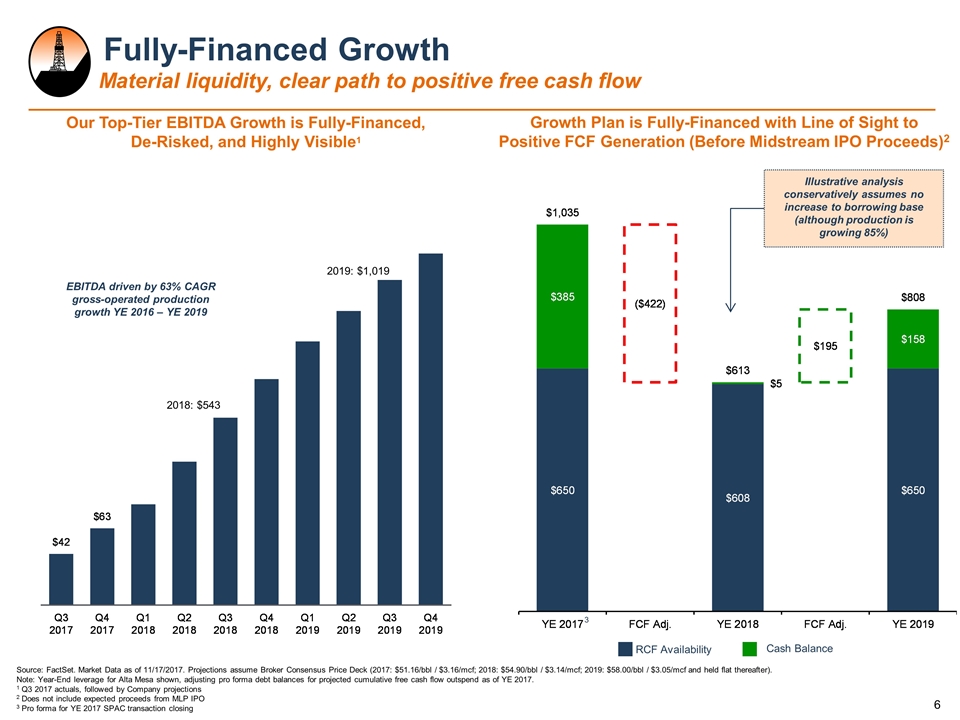

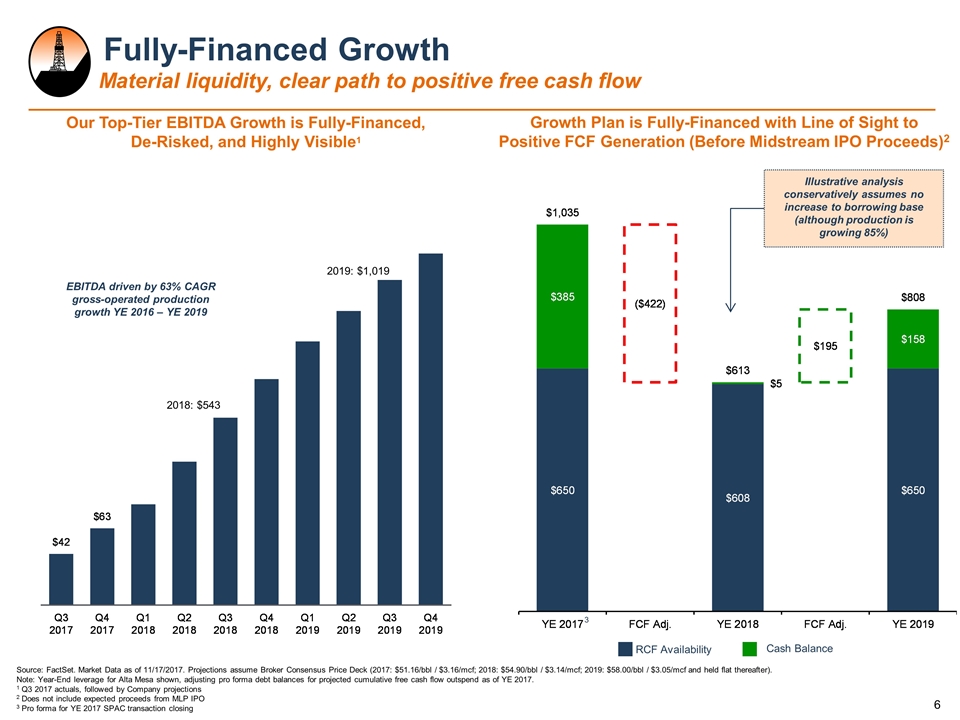

Fully-Financed Growth Material liquidity, clear path to positive free cash flow Our Top-Tier EBITDA Growth is Fully-Financed, De-Risked, and Highly Visible1 RCF Availability Cash Balance Growth Plan is Fully-Financed with Line of Sight to Positive FCF Generation (Before Midstream IPO Proceeds)2 Illustrative analysis conservatively assumes no increase to borrowing base (although production is growing 85%) Source: FactSet. Market Data as of 11/17/2017. Projections assume Broker Consensus Price Deck (2017: $51.16/bbl / $3.16/mcf; 2018: $54.90/bbl / $3.14/mcf; 2019: $58.00/bbl / $3.05/mcf and held flat thereafter). Note: Year-End leverage for Alta Mesa shown, adjusting pro forma debt balances for projected cumulative free cash flow outspend as of YE 2017. 1 Q3 2017 actuals, followed by Company projections 2 Does not include expected proceeds from MLP IPO 3 Pro forma for YE 2017 SPAC transaction closing 2018: $543 2019: $1,019 EBITDA driven by 63% CAGR gross-operated production growth YE 2016 – YE 2019 3

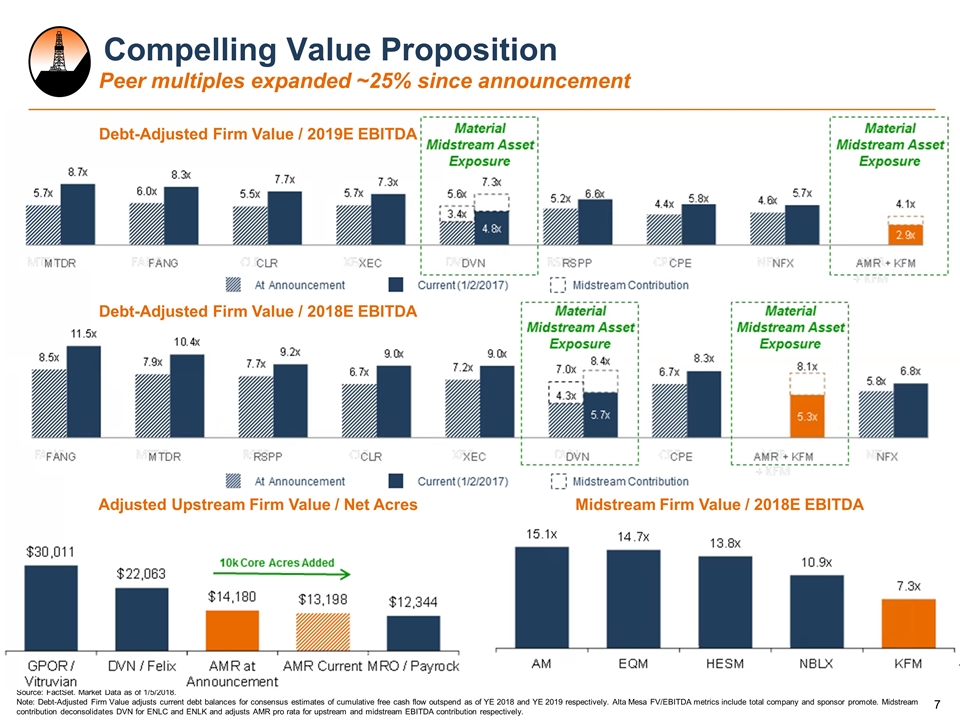

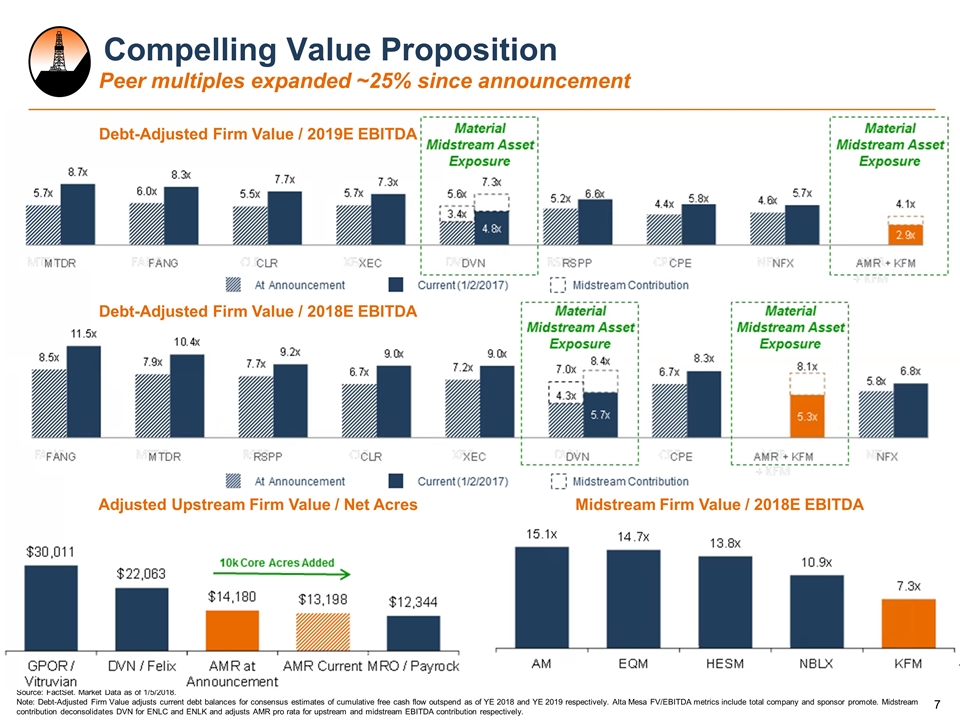

Source: FactSet. Market Data as of 1/5/2018. Note: Debt-Adjusted Firm Value adjusts current debt balances for consensus estimates of cumulative free cash flow outspend as of YE 2018 and YE 2019 respectively. Alta Mesa FV/EBITDA metrics include total company and sponsor promote. Midstream contribution deconsolidates DVN for ENLC and ENLK and adjusts AMR pro rata for upstream and midstream EBITDA contribution respectively. Compelling Value Proposition Peer multiples expanded ~25% since announcement Adjusted Upstream Firm Value / Net Acres Midstream Firm Value / 2018E EBITDA Debt-Adjusted Firm Value / 2018E EBITDA Debt-Adjusted Firm Value / 2019E EBITDA

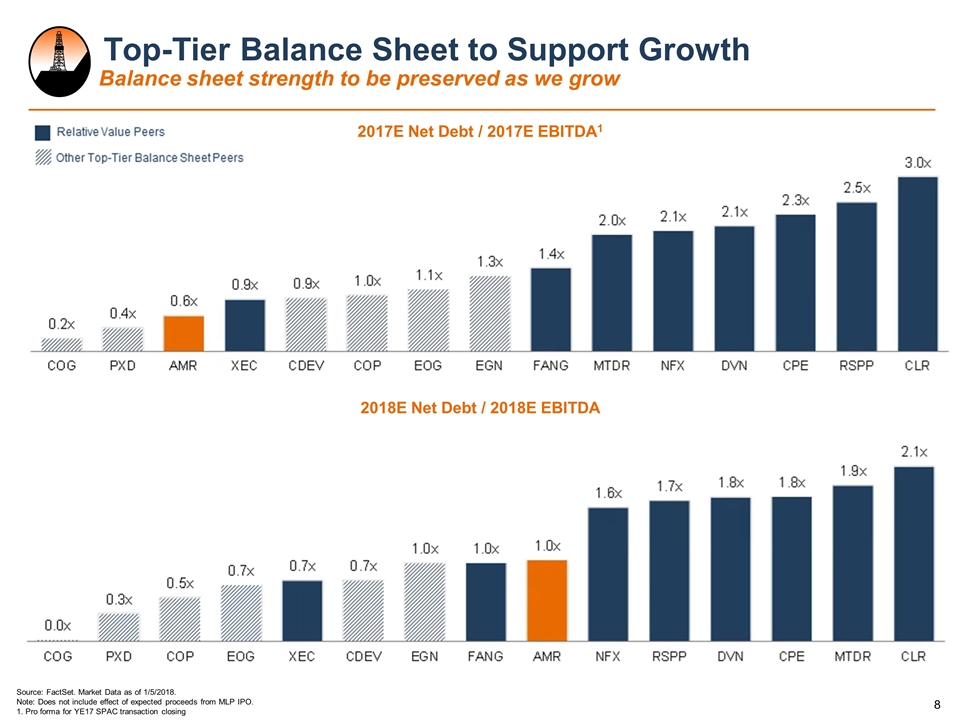

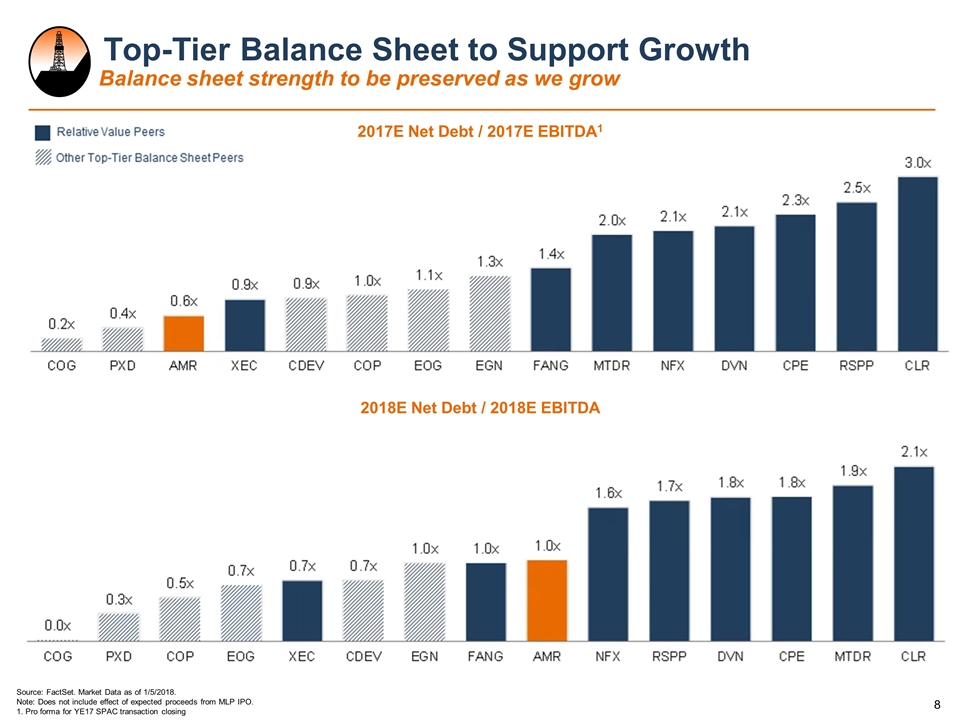

Top-Tier Balance Sheet to Support Growth Balance sheet strength to be preserved as we grow Source: FactSet. Market Data as of 1/5/2018. Note: Does not include effect of expected proceeds from MLP IPO. 1. Pro forma for YE17 SPAC transaction closing 2017E Net Debt / 2017E EBITDA1 2018E Net Debt / 2018E EBITDA

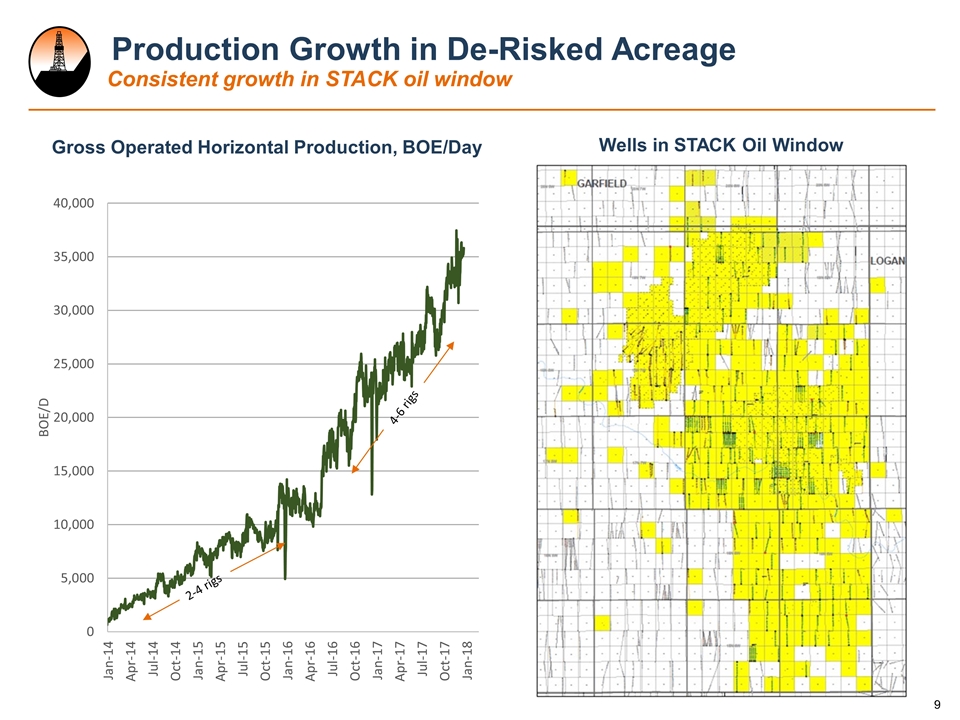

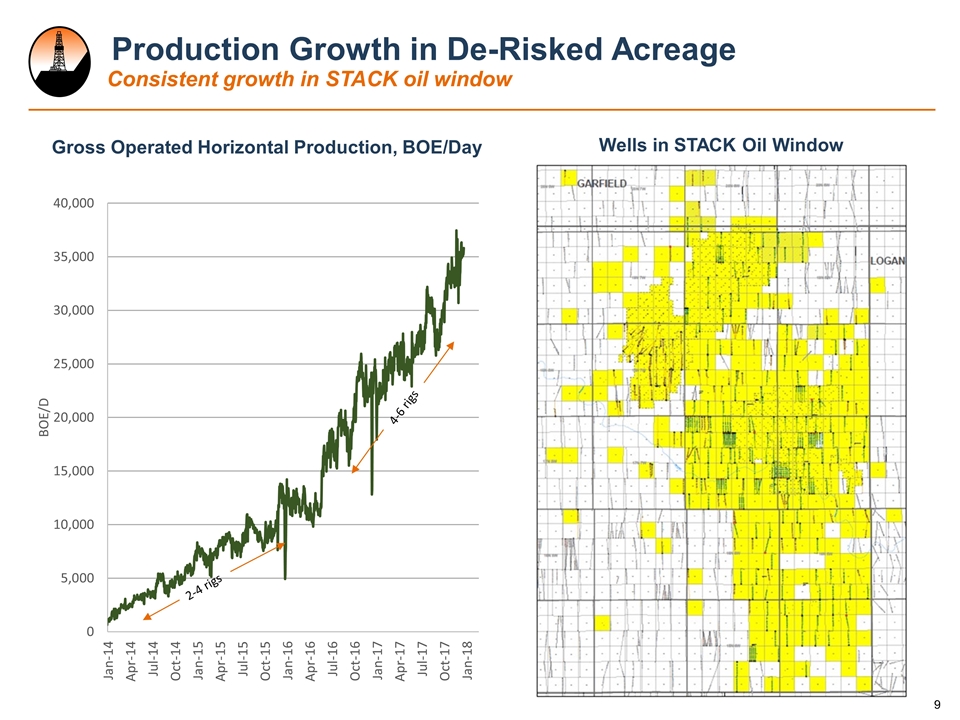

Production Growth in De-Risked Acreage Consistent growth in STACK oil window Gross Operated Horizontal Production, BOE/Day 9 2-4 rigs 4-6 rigs Wells in STACK Oil Window

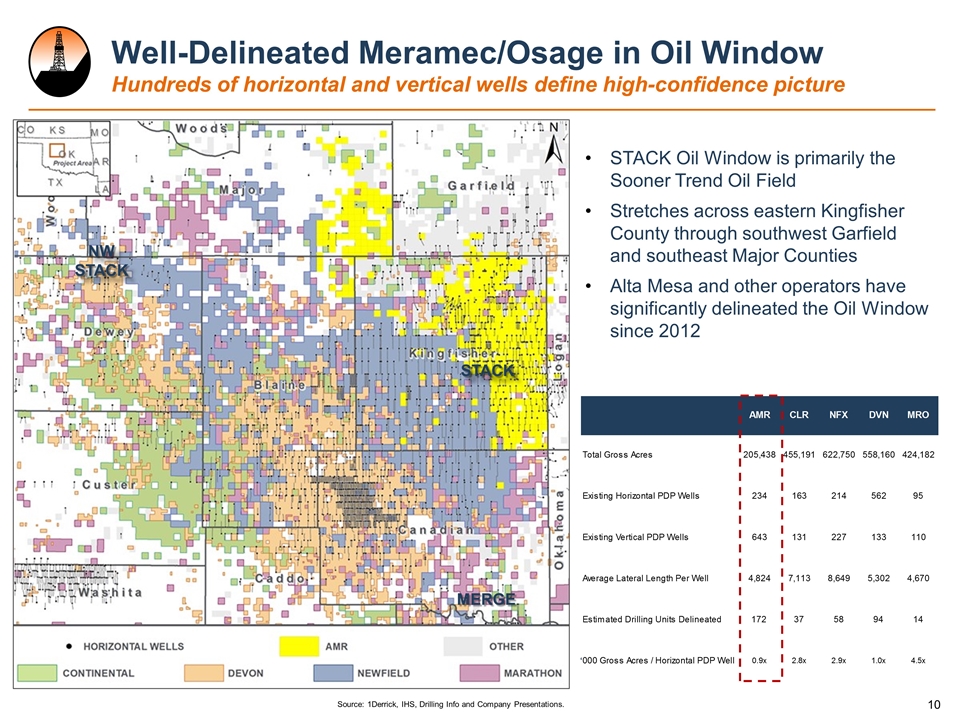

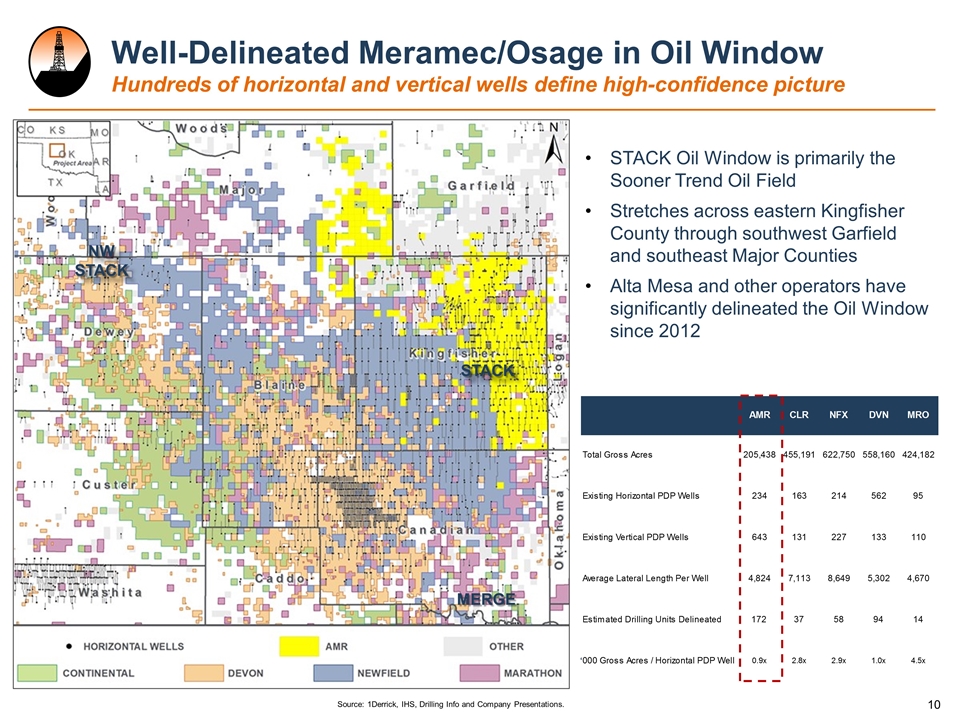

Source: 1Derrick, IHS, Drilling Info and Company Presentations. ‘ STACK Oil Window is primarily the Sooner Trend Oil Field Stretches across eastern Kingfisher County through southwest Garfield and southeast Major Counties Alta Mesa and other operators have significantly delineated the Oil Window since 2012 Well-Delineated Meramec/Osage in Oil Window Hundreds of horizontal and vertical wells define high-confidence picture STACK NW STACK MERGE

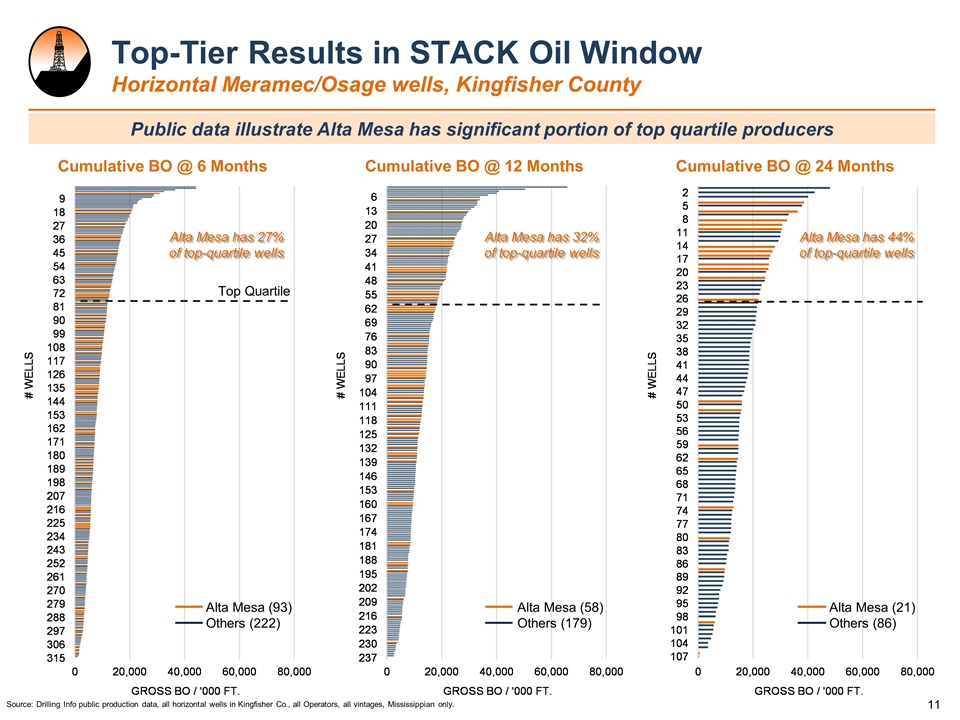

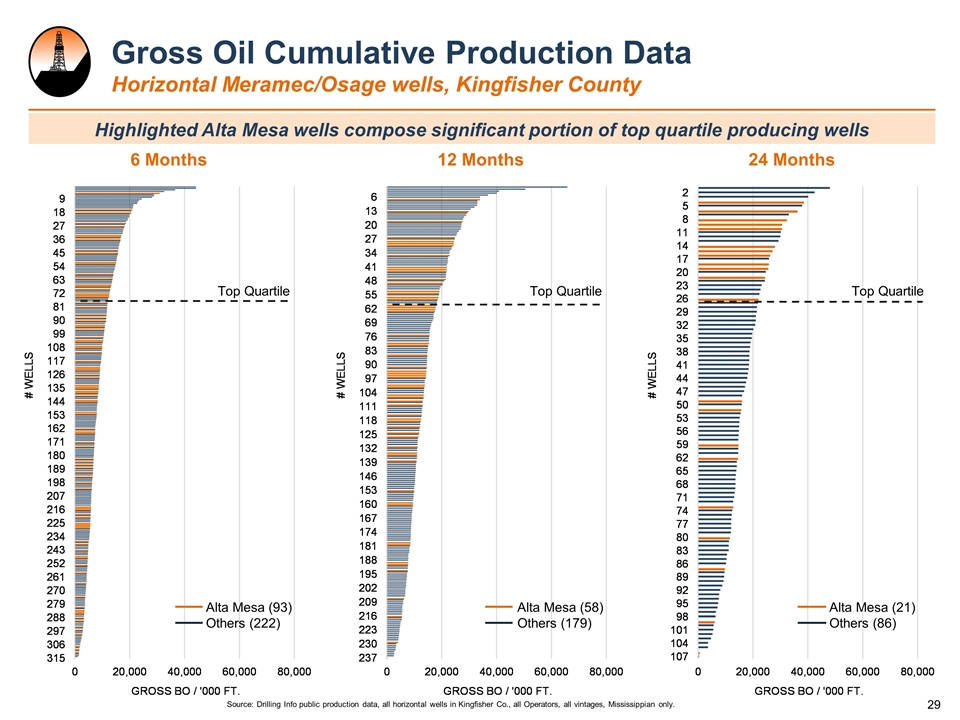

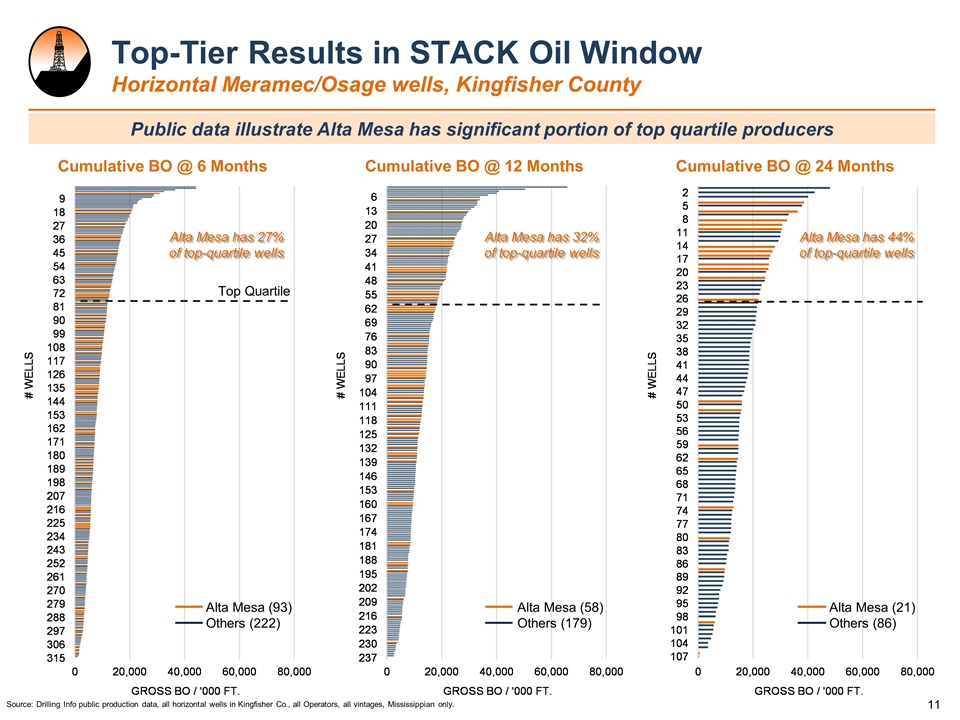

Source: Drilling Info public production data, all horizontal wells in Kingfisher Co., all Operators, all vintages, Mississippian only. Top Quartile Cumulative BO @ 6 Months Cumulative BO @ 12 Months Cumulative BO @ 24 Months Public data illustrate Alta Mesa has significant portion of top quartile producers Top-Tier Results in STACK Oil Window Horizontal Meramec/Osage wells, Kingfisher County Alta Mesa (93) Others (222) Alta Mesa has 27% of top-quartile wells Alta Mesa has 32% of top-quartile wells Alta Mesa has 44% of top-quartile wells Alta Mesa (58) Others (179) Alta Mesa (21) Others (86)

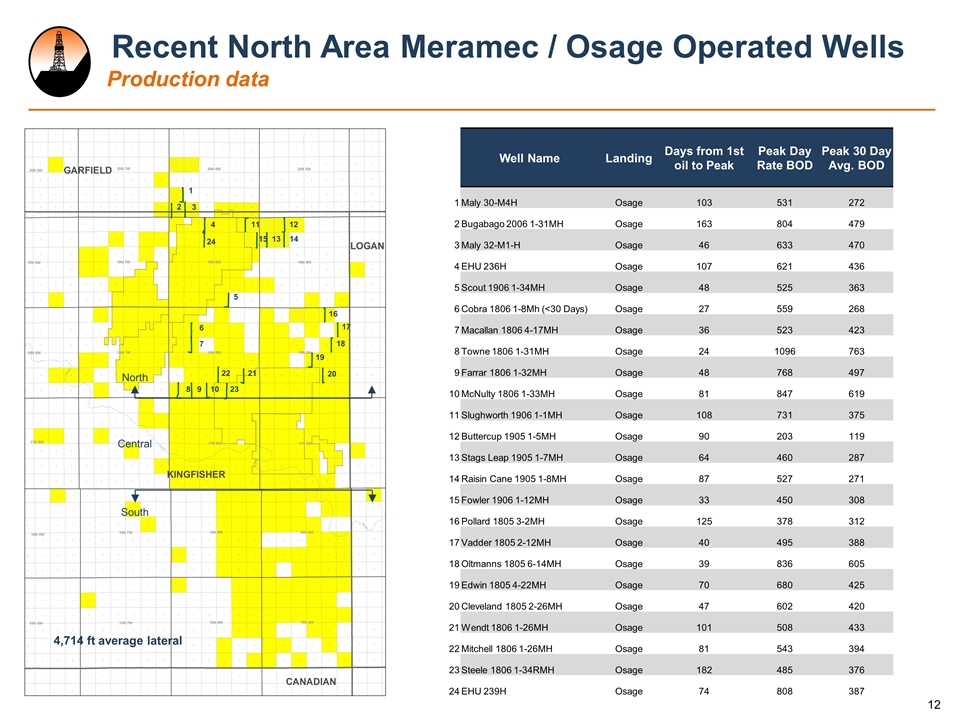

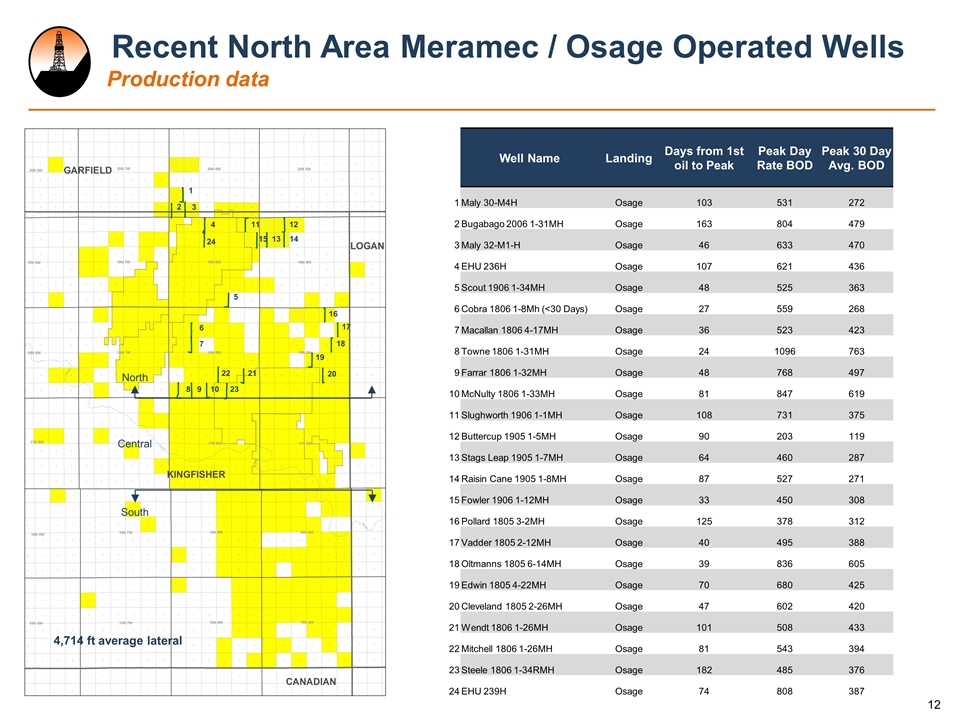

Recent North Area Meramec / Osage Operated Wells Production data Well Name Landing Days from 1st oil to Peak Peak Day Rate BOD Peak 30 Day Avg. BOD 1 Maly 30-M4H Osage 103 531 272 2 Bugabago 2006 1-31MH Osage 163 804 479 3 Maly 32-M1-H Osage 46 633 470 4 EHU 236H Osage 107 621 436 5 Scout 1906 1-34MH Osage 48 525 363 6 Cobra 1806 1-8Mh (<30 Days) Osage 27 559 268 7 Macallan 1806 4-17MH Osage 36 523 423 8 Towne 1806 1-31MH Osage 24 1096 763 9 Farrar 1806 1-32MH Osage 48 768 497 10 McNulty 1806 1-33MH Osage 81 847 619 11 Slughworth 1906 1-1MH Osage 108 731 375 12 Buttercup 1905 1-5MH Osage 90 203 119 13 Stags Leap 1905 1-7MH Osage 64 460 287 14 Raisin Cane 1905 1-8MH Osage 87 527 271 15 Fowler 1906 1-12MH Osage 33 450 308 16 Pollard 1805 3-2MH Osage 125 378 312 17 Vadder 1805 2-12MH Osage 40 495 388 18 Oltmanns 1805 6-14MH Osage 39 836 605 19 Edwin 1805 4-22MH Osage 70 680 425 20 Cleveland 1805 2-26MH Osage 47 602 420 21 Wendt 1806 1-26MH Osage 101 508 433 22 Mitchell 1806 1-26MH Osage 81 543 394 23 Steele 1806 1-34RMH Osage 182 485 376 24 EHU 239H Osage 74 808 387 1 2 3 4 11 12 24 15 13 14 8 9 10 23 5 6 7 22 21 16 17 18 19 20 North Central South 4,714 ft average lateral

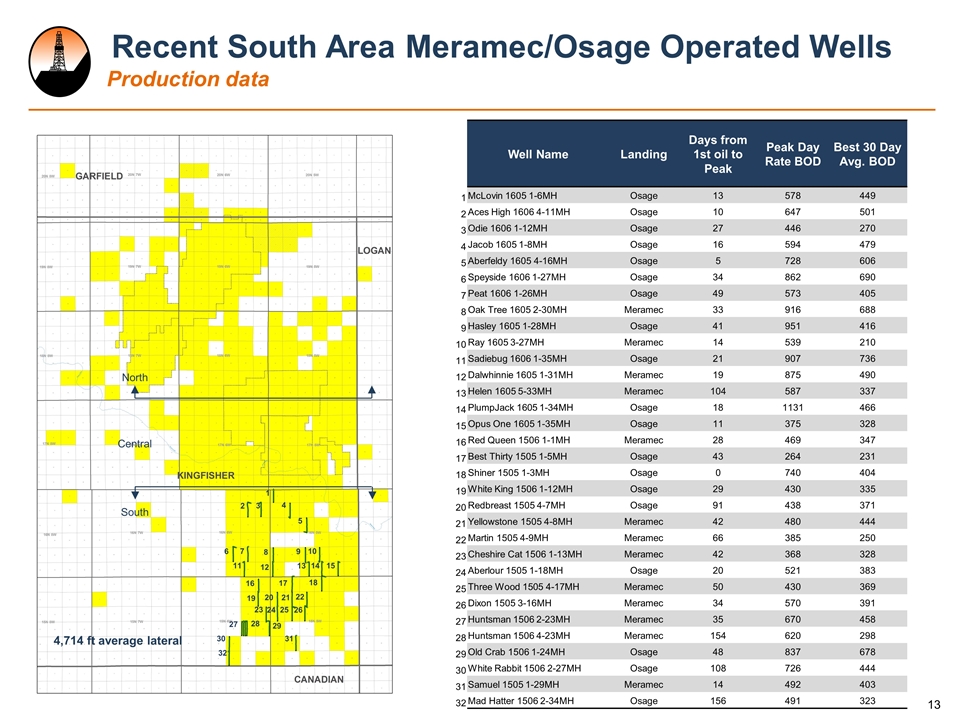

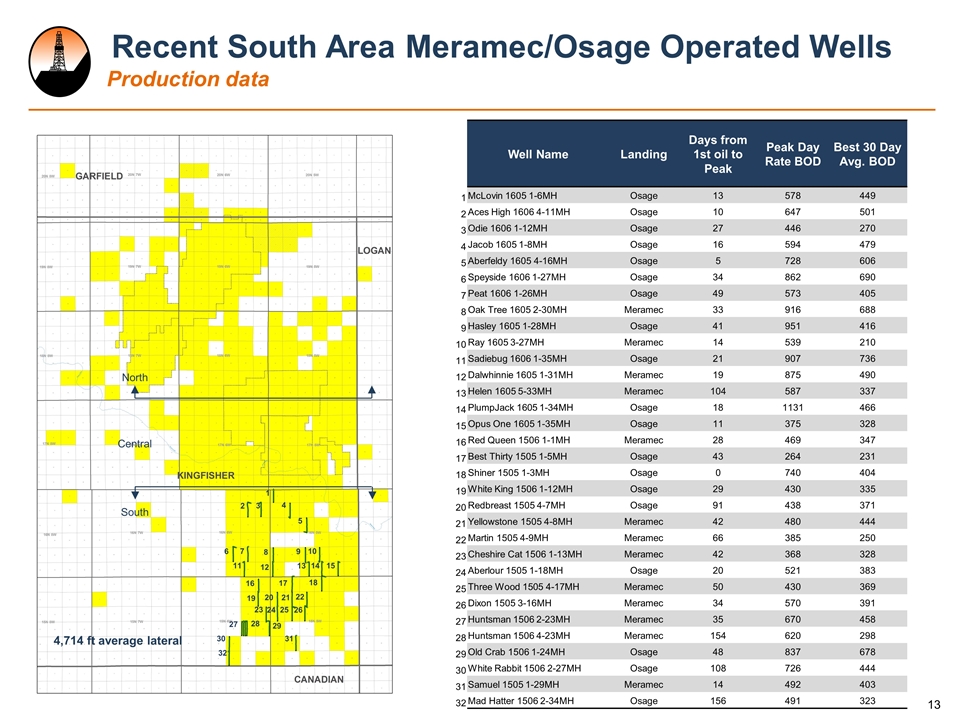

Recent South Area Meramec/Osage Operated Wells Production data 1 2 12 3 15 5 4 13 16 6 14 17 18 19 9 10 7 8 24 11 20 21 22 23 25 26 27 28 29 31 30 North Central South 4,714 ft average lateral Well Name Landing Days from 1st oil to Peak Peak Day Rate BOD Best 30 Day Avg. BOD 1 McLovin 1605 1-6MH Osage 13 578 449 2 Aces High 1606 4-11MH Osage 10 647 501 3 Odie 1606 1-12MH Osage 27 446 270 4 Jacob 1605 1-8MH Osage 16 594 479 5 Aberfeldy 1605 4-16MH Osage 5 728 606 6 Speyside 1606 1-27MH Osage 34 862 690 7 Peat 1606 1-26MH Osage 49 573 405 8 Oak Tree 1605 2-30MH Meramec 33 916 688 9 Hasley 1605 1-28MH Osage 41 951 416 10 Ray 1605 3-27MH Meramec 14 539 210 11 Sadiebug 1606 1-35MH Osage 21 907 736 12 Dalwhinnie 1605 1-31MH Meramec 19 875 490 13 Helen 1605 5-33MH Meramec 104 587 337 14 PlumpJack 1605 1-34MH Osage 18 1131 466 15 Opus One 1605 1-35MH Osage 11 375 328 16 Red Queen 1506 1-1MH Meramec 28 469 347 17 Best Thirty 1505 1-5MH Osage 43 264 231 18 Shiner 1505 1-3MH Osage 0 740 404 19 White King 1506 1-12MH Osage 29 430 335 20 Redbreast 1505 4-7MH Osage 91 438 371 21 Yellowstone 1505 4-8MH Meramec 42 480 444 22 Martin 1505 4-9MH Meramec 66 385 250 23 Cheshire Cat 1506 1-13MH Meramec 42 368 328 24 Aberlour 1505 1-18MH Osage 20 521 383 25 Three Wood 1505 4-17MH Meramec 50 430 369 26 Dixon 1505 3-16MH Meramec 34 570 391 27 Huntsman 1506 2-23MH Meramec 35 670 458 28 Huntsman 1506 4-23MH Meramec 154 620 298 29 Old Crab 1506 1-24MH Osage 48 837 678 30 White Rabbit 1506 2-27MH Osage 108 726 444 31 Samuel 1505 1-29MH Meramec 14 492 403 32 Mad Hatter 1506 2-34MH Osage 156 491 323 32

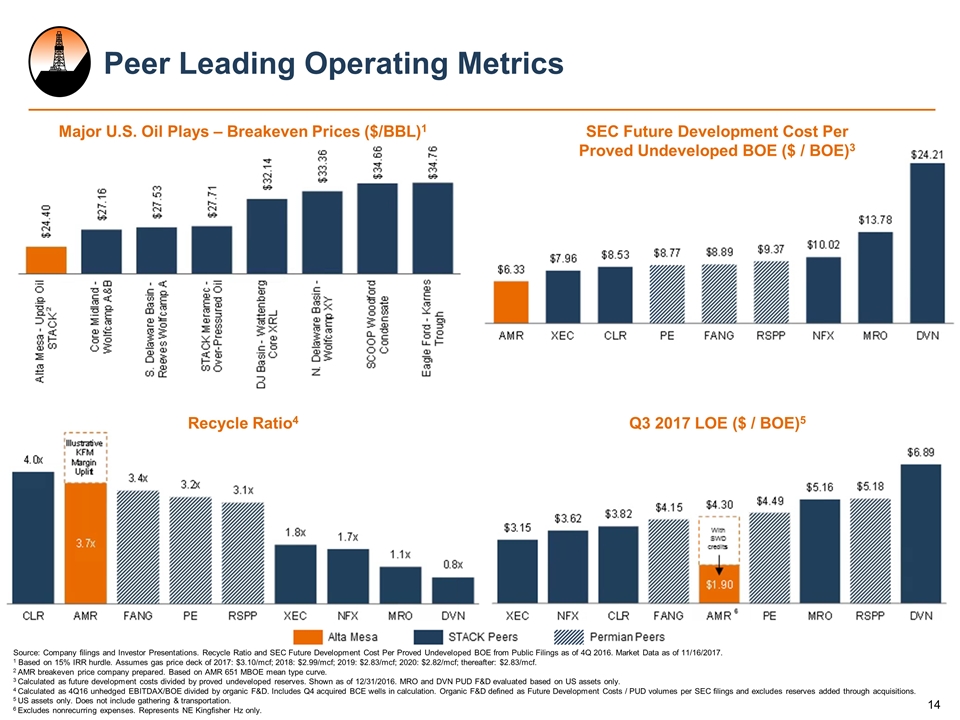

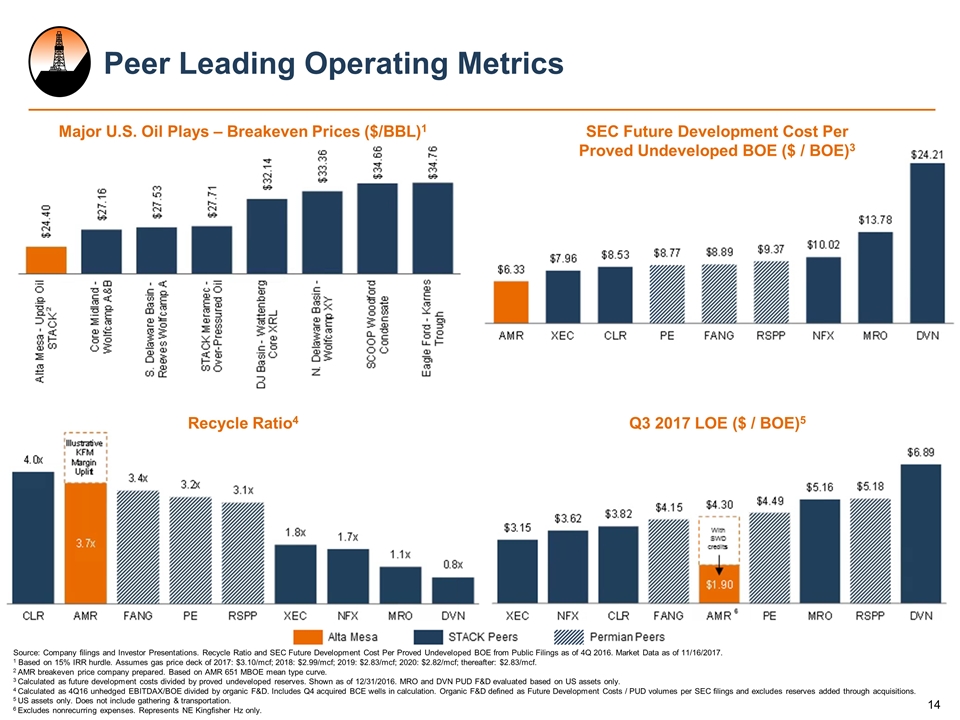

Source: Company filings and Investor Presentations. Recycle Ratio and SEC Future Development Cost Per Proved Undeveloped BOE from Public Filings as of 4Q 2016. Market Data as of 11/16/2017. 1 Based on 15% IRR hurdle. Assumes gas price deck of 2017: $3.10/mcf; 2018: $2.99/mcf; 2019: $2.83/mcf; 2020: $2.82/mcf; thereafter: $2.83/mcf. 2 AMR breakeven price company prepared. Based on AMR 651 MBOE mean type curve. 3 Calculated as future development costs divided by proved undeveloped reserves. Shown as of 12/31/2016. MRO and DVN PUD F&D evaluated based on US assets only. 4 Calculated as 4Q16 unhedged EBITDAX/BOE divided by organic F&D. Includes Q4 acquired BCE wells in calculation. Organic F&D defined as Future Development Costs / PUD volumes per SEC filings and excludes reserves added through acquisitions. 5 US assets only. Does not include gathering & transportation. 6 Excludes nonrecurring expenses. Represents NE Kingfisher Hz only. Peer Leading Operating Metrics Recycle Ratio4 Q3 2017 LOE ($ / BOE)5 Major U.S. Oil Plays – Breakeven Prices ($/BBL)1 SEC Future Development Cost Per Proved Undeveloped BOE ($ / BOE)3

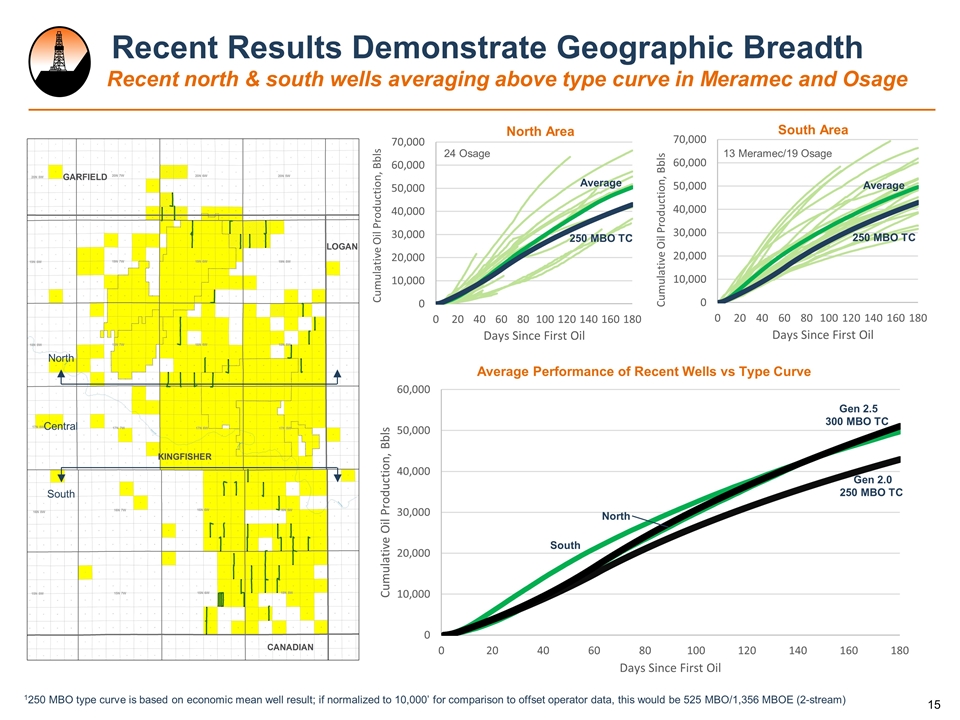

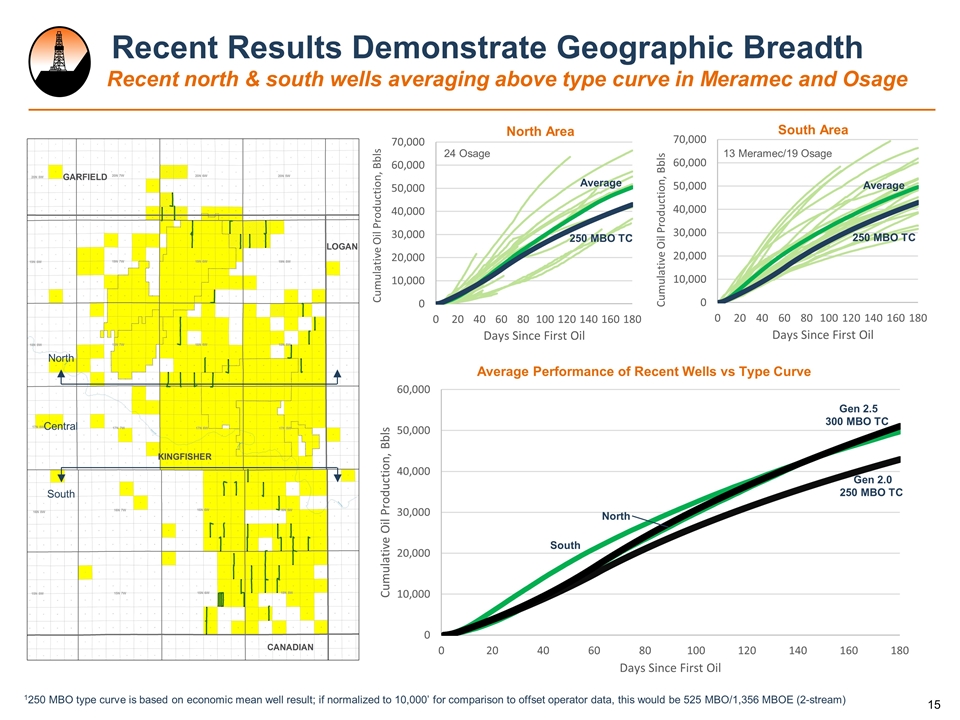

Recent Results Demonstrate Geographic Breadth Recent north & south wells averaging above type curve in Meramec and Osage 1250 MBO type curve is based on economic mean well result; if normalized to 10,000’ for comparison to offset operator data, this would be 525 MBO/1,356 MBOE (2-stream) South Area North Area 13 Meramec/19 Osage 24 Osage North Central South 250 MBO TC 250 MBO TC Gen 2.0 250 MBO TC North South Average Performance of Recent Wells vs Type Curve Average Average Gen 2.5 300 MBO TC

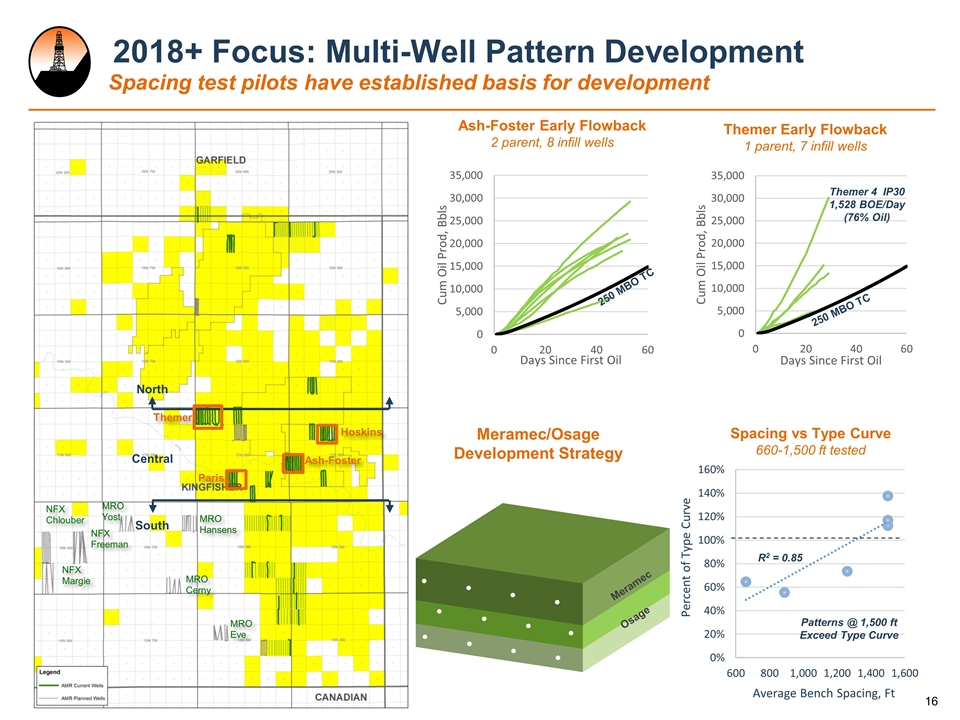

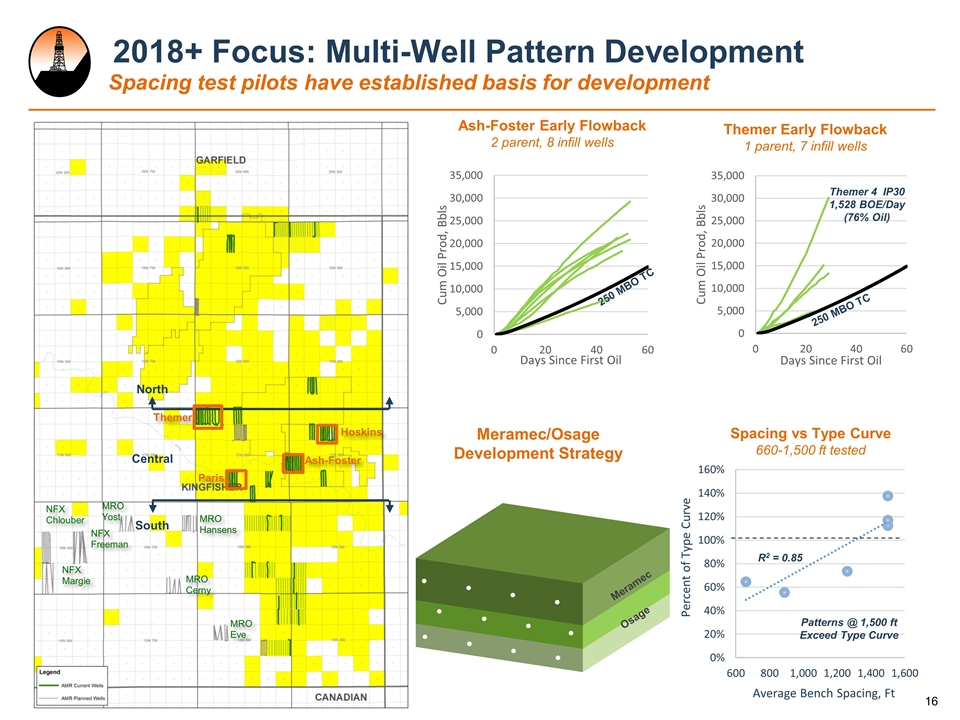

North Central South Themer MRO Hansens MRO Eve Ash-Foster Paris Hoskins MRO Cerny NFX Freeman NFX Chlouber NFX Margie MRO Yost 2018+ Focus: Multi-Well Pattern Development Spacing test pilots have established basis for development Ash-Foster Early Flowback 2 parent, 8 infill wells 250 MBO TC Patterns @ 1,500 ft Exceed Type Curve Spacing vs Type Curve 660-1,500 ft tested R2 = 0.85 Themer Early Flowback 1 parent, 7 infill wells 250 MBO TC Meramec Osage Themer 4 IP30 1,528 BOE/Day (76% Oil) Meramec/Osage Development Strategy

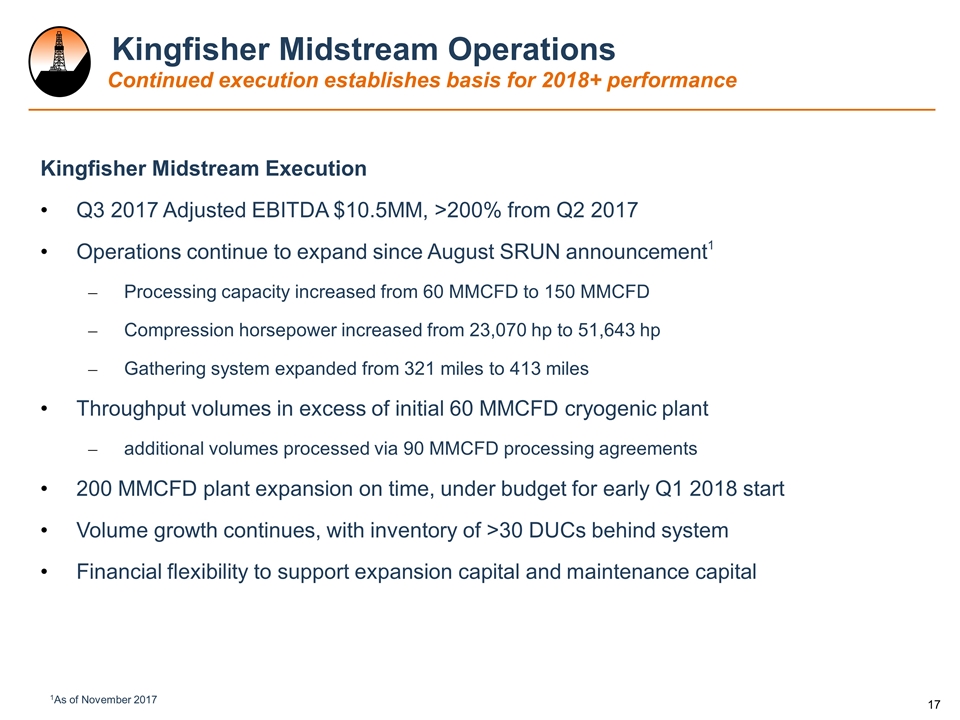

Kingfisher Midstream Operations Continued execution establishes basis for 2018+ performance Kingfisher Midstream Execution Q3 2017 Adjusted EBITDA $10.5MM, >200% from Q2 2017 Operations continue to expand since August SRUN announcement1 Processing capacity increased from 60 MMCFD to 150 MMCFD Compression horsepower increased from 23,070 hp to 51,643 hp Gathering system expanded from 321 miles to 413 miles Throughput volumes in excess of initial 60 MMCFD cryogenic plant additional volumes processed via 90 MMCFD processing agreements 200 MMCFD plant expansion on time, under budget for early Q1 2018 start Volume growth continues, with inventory of >30 DUCs behind system Financial flexibility to support expansion capital and maintenance capital 1As of November 2017

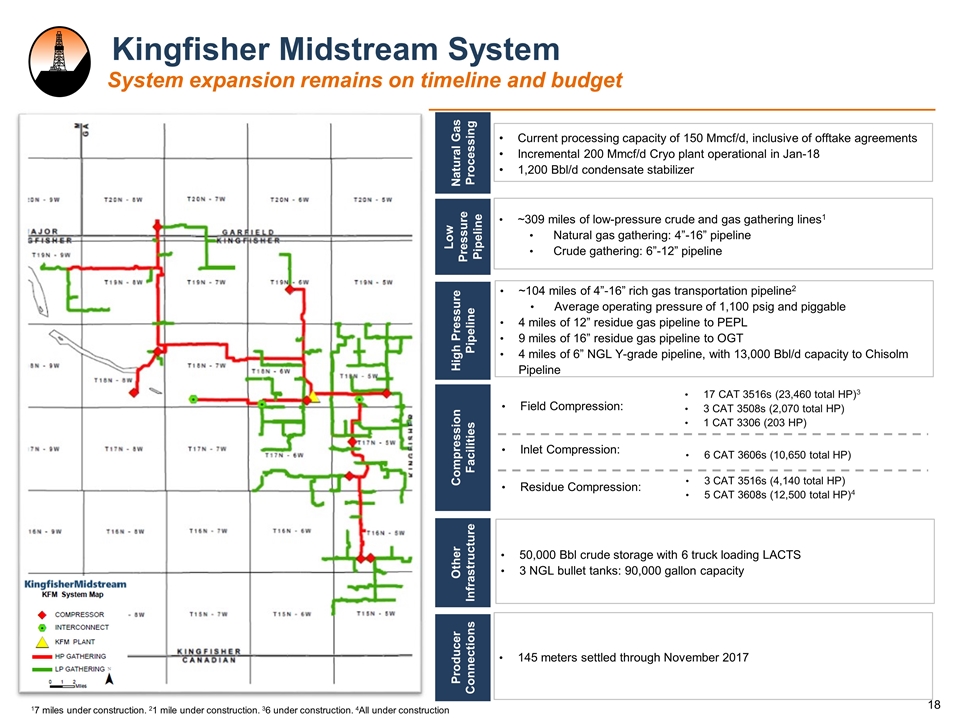

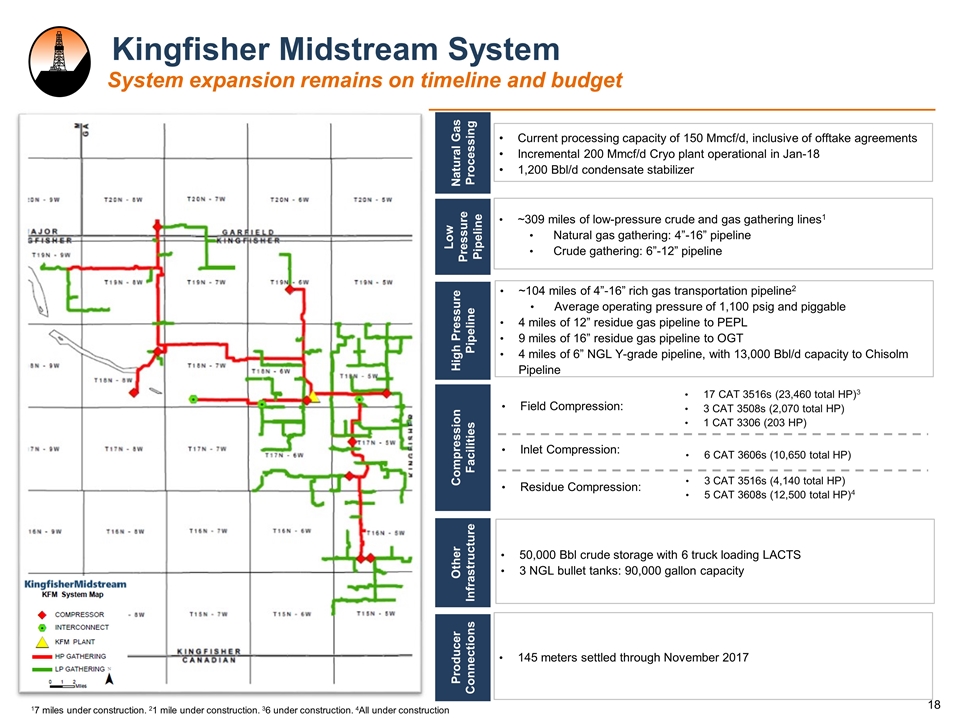

3 CAT 3516s (4,140 total HP) 5 CAT 3608s (12,500 total HP)4 6 CAT 3606s (10,650 total HP) 17 CAT 3516s (23,460 total HP)3 3 CAT 3508s (2,070 total HP) 1 CAT 3306 (203 HP) Kingfisher Midstream System System expansion remains on timeline and budget High Pressure Pipeline Producer Connections Natural Gas Processing Compression Facilities Low Pressure Pipeline Other Infrastructure Current processing capacity of 150 Mmcf/d, inclusive of offtake agreements Incremental 200 Mmcf/d Cryo plant operational in Jan-18 1,200 Bbl/d condensate stabilizer ~309 miles of low-pressure crude and gas gathering lines1 Natural gas gathering: 4”-16” pipeline Crude gathering: 6”-12” pipeline ~104 miles of 4”-16” rich gas transportation pipeline2 Average operating pressure of 1,100 psig and piggable 4 miles of 12” residue gas pipeline to PEPL 9 miles of 16” residue gas pipeline to OGT 4 miles of 6” NGL Y-grade pipeline, with 13,000 Bbl/d capacity to Chisolm Pipeline Field Compression: Inlet Compression: Residue Compression: 50,000 Bbl crude storage with 6 truck loading LACTS 3 NGL bullet tanks: 90,000 gallon capacity 145 meters settled through November 2017 17 miles under construction. 21 mile under construction. 36 under construction. 4All under construction

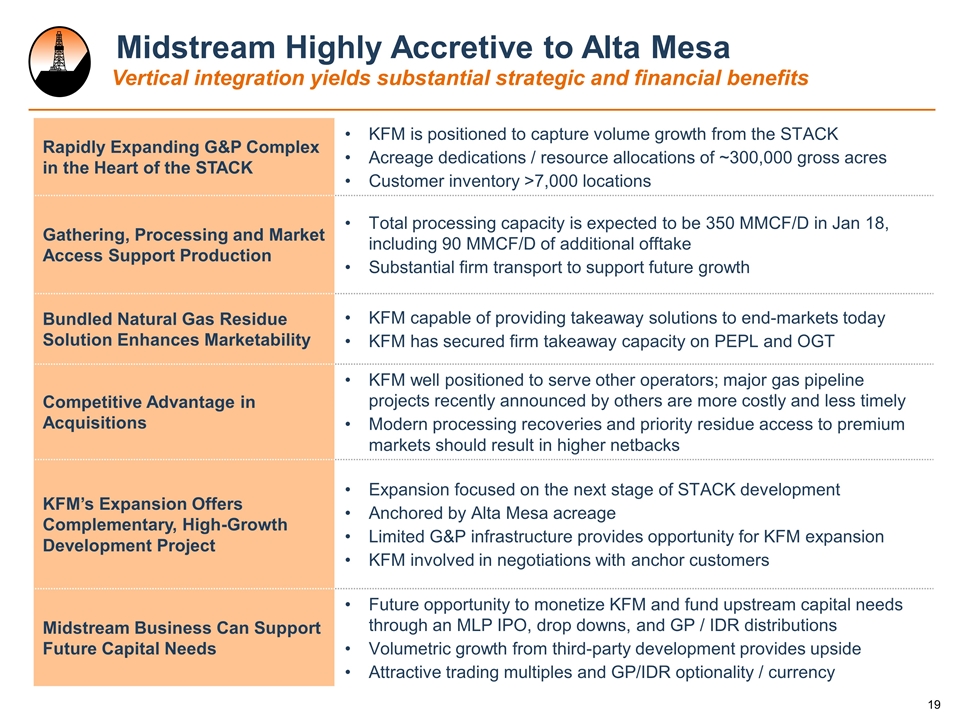

Rapidly Expanding G&P Complex in the Heart of the STACK KFM is positioned to capture volume growth from the STACK Acreage dedications / resource allocations of ~300,000 gross acres Customer inventory >7,000 locations Gathering, Processing and Market Access Support Production Total processing capacity is expected to be 350 MMCF/D in Jan 18, including 90 MMCF/D of additional offtake Substantial firm transport to support future growth Bundled Natural Gas Residue Solution Enhances Marketability KFM capable of providing takeaway solutions to end-markets today KFM has secured firm takeaway capacity on PEPL and OGT Competitive Advantage in Acquisitions KFM well positioned to serve other operators; major gas pipeline projects recently announced by others are more costly and less timely Modern processing recoveries and priority residue access to premium markets should result in higher netbacks KFM’s Expansion Offers Complementary, High-Growth Development Project Expansion focused on the next stage of STACK development Anchored by Alta Mesa acreage Limited G&P infrastructure provides opportunity for KFM expansion KFM involved in negotiations with anchor customers Midstream Business Can Support Future Capital Needs Future opportunity to monetize KFM and fund upstream capital needs through an MLP IPO, drop downs, and GP / IDR distributions Volumetric growth from third-party development provides upside Attractive trading multiples and GP/IDR optionality / currency Midstream Highly Accretive to Alta Mesa Vertical integration yields substantial strategic and financial benefits

Summary Continued execution facilitates disciplined growth SRUN/AMR/KFM combines leading upstream and midstream operations for sustained, disciplined growth over 10+ year horizon Fully-funded, low leverage growth in firmly-established resource Focus on capital efficiency, growth per debt-adjusted share Alta Mesa multi-well pattern development projects underway Alta Mesa has increased core acreage, overall footprint KFM 200 MMCFD expansion in commissioning, volumes growing 2018 projections an extension of successful 2017 performance Production, EBITDAX, EBITDA in line with pro forma forecasts

Appendix

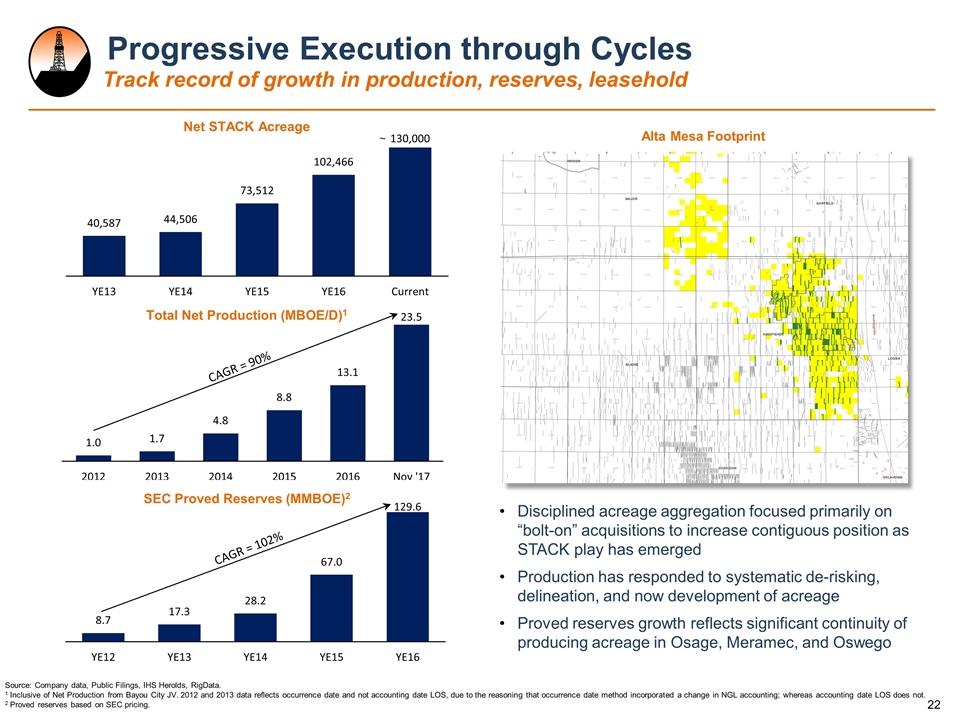

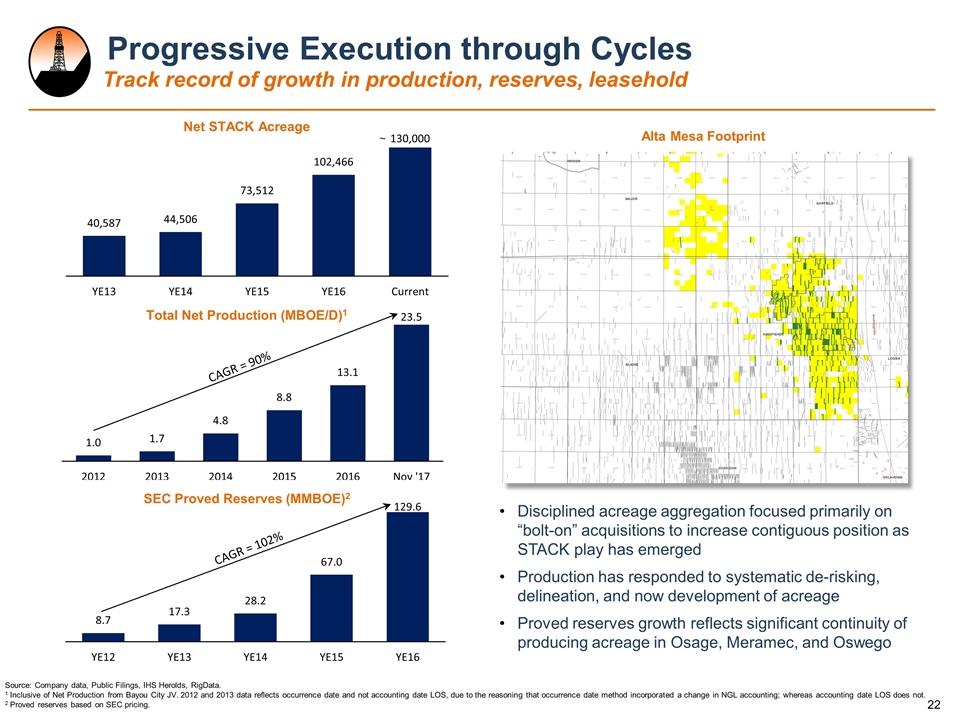

CAGR = 102% Progressive Execution through Cycles Track record of growth in production, reserves, leasehold Disciplined acreage aggregation focused primarily on “bolt-on” acquisitions to increase contiguous position as STACK play has emerged Production has responded to systematic de-risking, delineation, and now development of acreage Proved reserves growth reflects significant continuity of producing acreage in Osage, Meramec, and Oswego Alta Mesa Footprint Source: Company data, Public Filings, IHS Herolds, RigData. 1 Inclusive of Net Production from Bayou City JV. 2012 and 2013 data reflects occurrence date and not accounting date LOS, due to the reasoning that occurrence date method incorporated a change in NGL accounting; whereas accounting date LOS does not. 2 Proved reserves based on SEC pricing. Net STACK Acreage Total Net Production (MBOE/D)1 SEC Proved Reserves (MMBOE)2 ~ Slide 14 CAGR = 90%

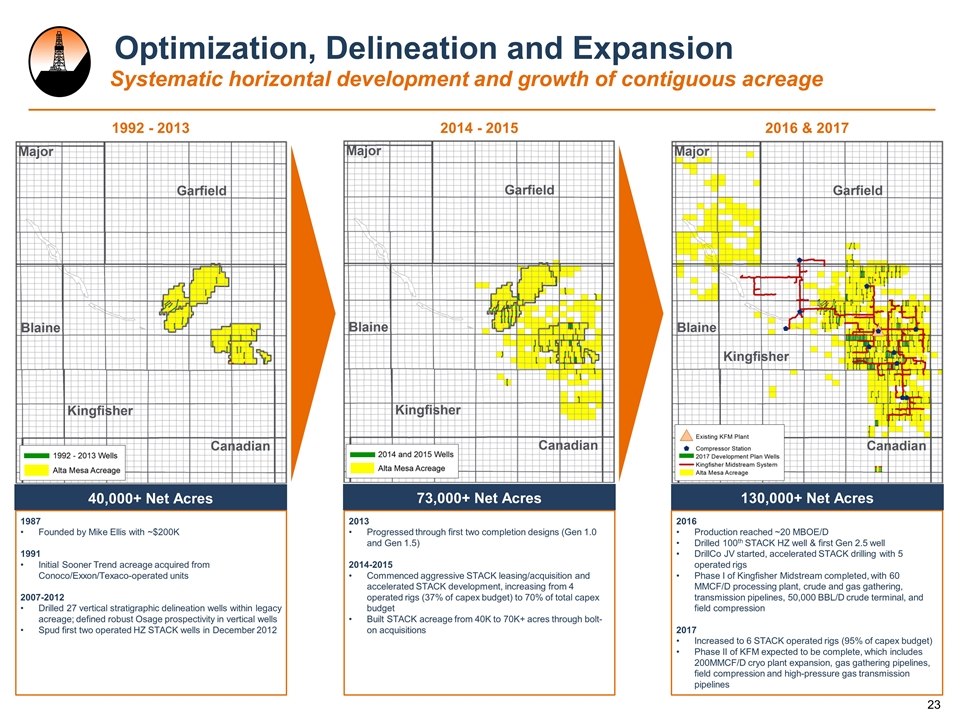

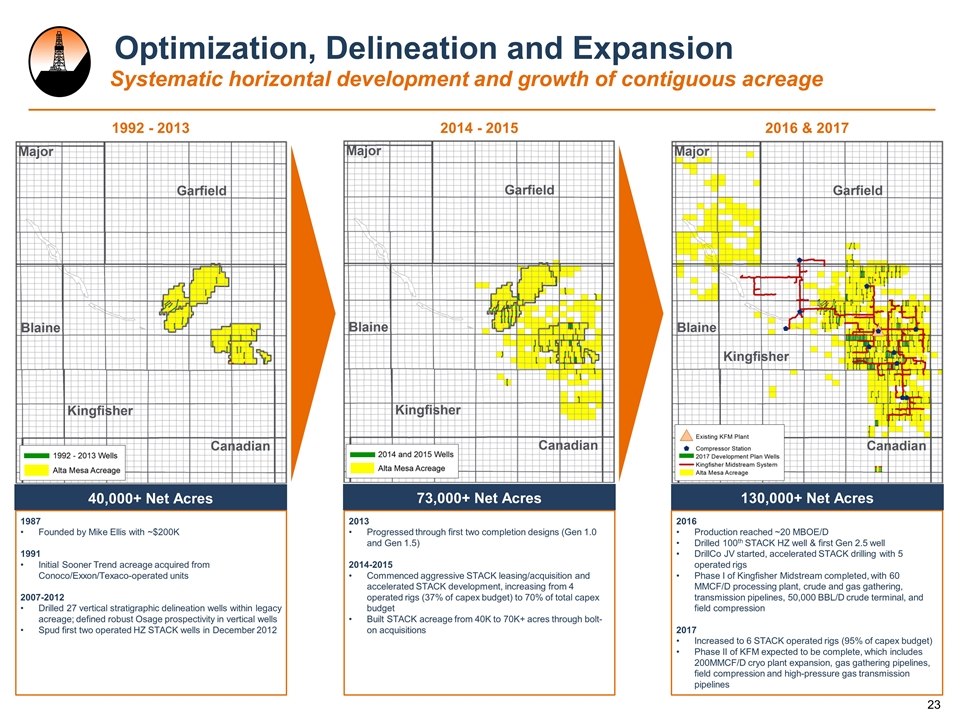

2014 - 2015 1992 - 2013 2016 & 2017 Optimization, Delineation and Expansion 40,000+ Net Acres 73,000+ Net Acres 130,000+ Net Acres Systematic horizontal development and growth of contiguous acreage 1987 Founded by Mike Ellis with ~$200K 1991 Initial Sooner Trend acreage acquired from Conoco/Exxon/Texaco-operated units 2007-2012 Drilled 27 vertical stratigraphic delineation wells within legacy acreage; defined robust Osage prospectivity in vertical wells Spud first two operated HZ STACK wells in December 2012 2013 Progressed through first two completion designs (Gen 1.0 and Gen 1.5) 2014-2015 Commenced aggressive STACK leasing/acquisition and accelerated STACK development, increasing from 4 operated rigs (37% of capex budget) to 70% of total capex budget Built STACK acreage from 40K to 70K+ acres through bolt-on acquisitions 2016 Production reached ~20 MBOE/D Drilled 100th STACK HZ well & first Gen 2.5 well DrillCo JV started, accelerated STACK drilling with 5 operated rigs Phase I of Kingfisher Midstream completed, with 60 MMCF/D processing plant, crude and gas gathering, transmission pipelines, 50,000 BBL/D crude terminal, and field compression 2017 Increased to 6 STACK operated rigs (95% of capex budget) Phase II of KFM expected to be complete, which includes 200MMCF/D cryo plant expansion, gas gathering pipelines, field compression and high-pressure gas transmission pipelines

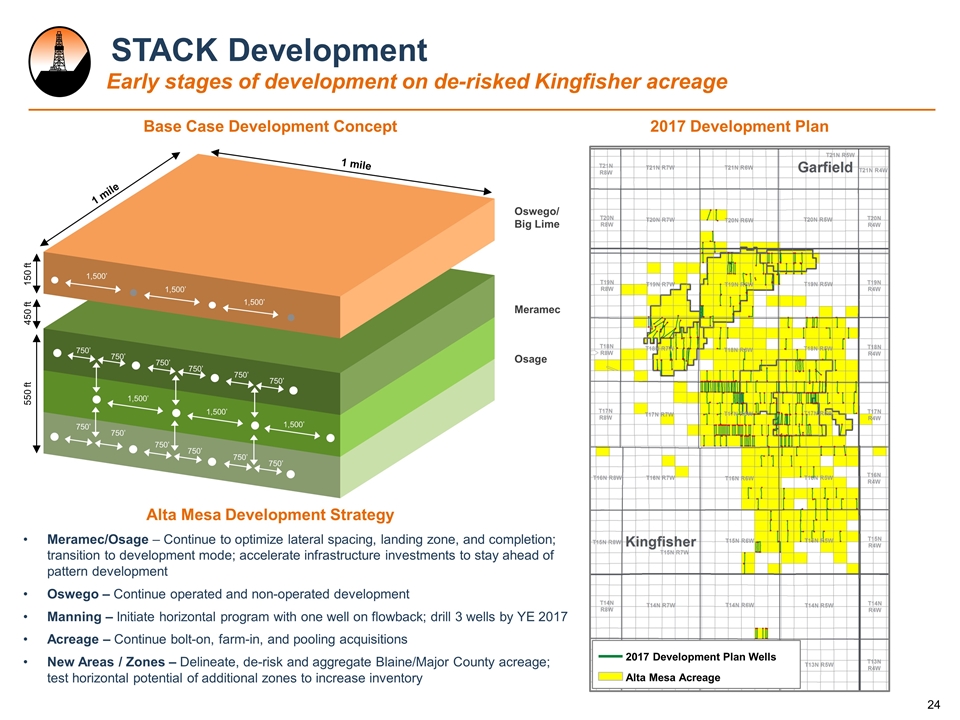

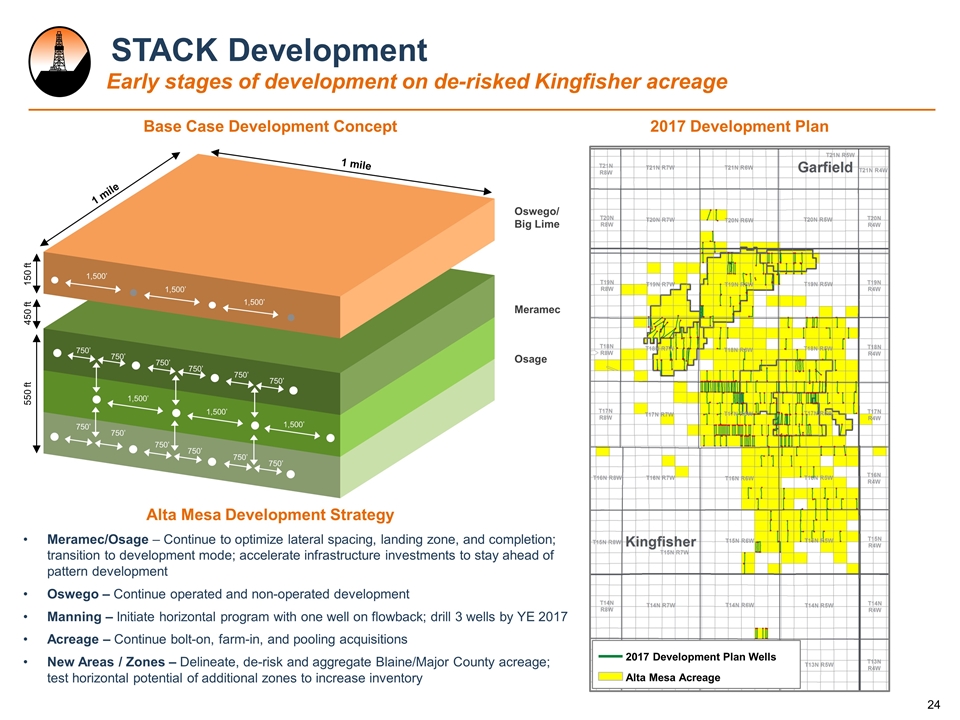

STACK Development Alta Mesa Development Strategy Base Case Development Concept Early stages of development on de-risked Kingfisher acreage 2017 Development Plan Oswego/ Big Lime Meramec Osage 1 mile 1 mile 1,500’ 1,500’ 1,500’ 1,500’ 1,500’ 1,500’ 750’ 750’ 750’ 750’ 750’ 750’ 750’ 750’ 750’ 750’ 750’ 750’ 150 ft 450 ft 550 ft 2017 Development Plan Wells Alta Mesa Acreage Meramec/Osage – Continue to optimize lateral spacing, landing zone, and completion; transition to development mode; accelerate infrastructure investments to stay ahead of pattern development Oswego – Continue operated and non-operated development Manning – Initiate horizontal program with one well on flowback; drill 3 wells by YE 2017 Acreage – Continue bolt-on, farm-in, and pooling acquisitions New Areas / Zones – Delineate, de-risk and aggregate Blaine/Major County acreage; test horizontal potential of additional zones to increase inventory

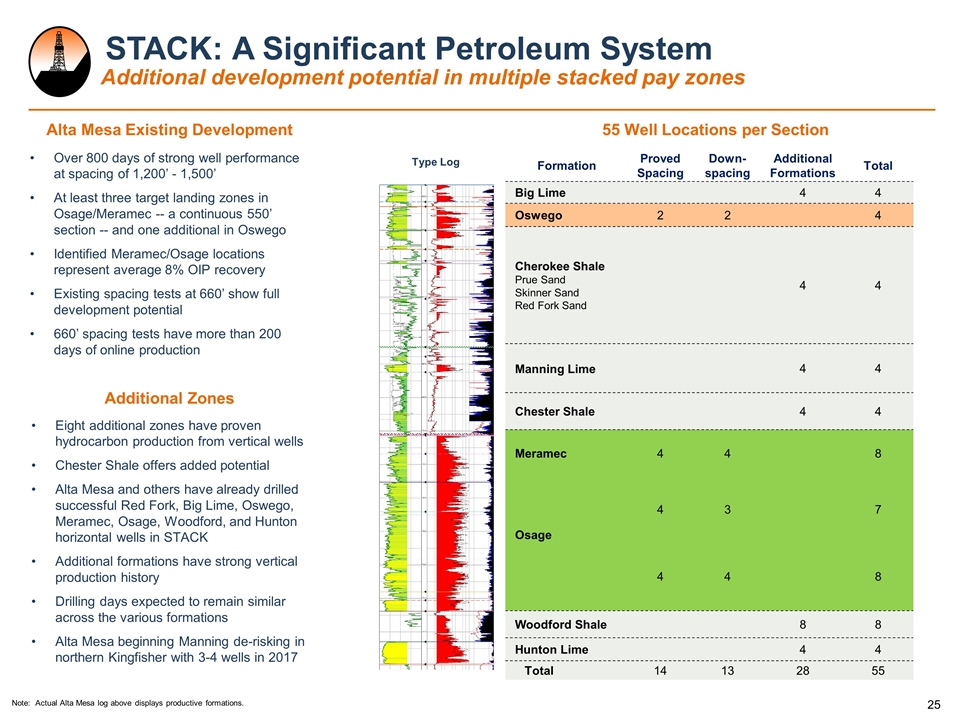

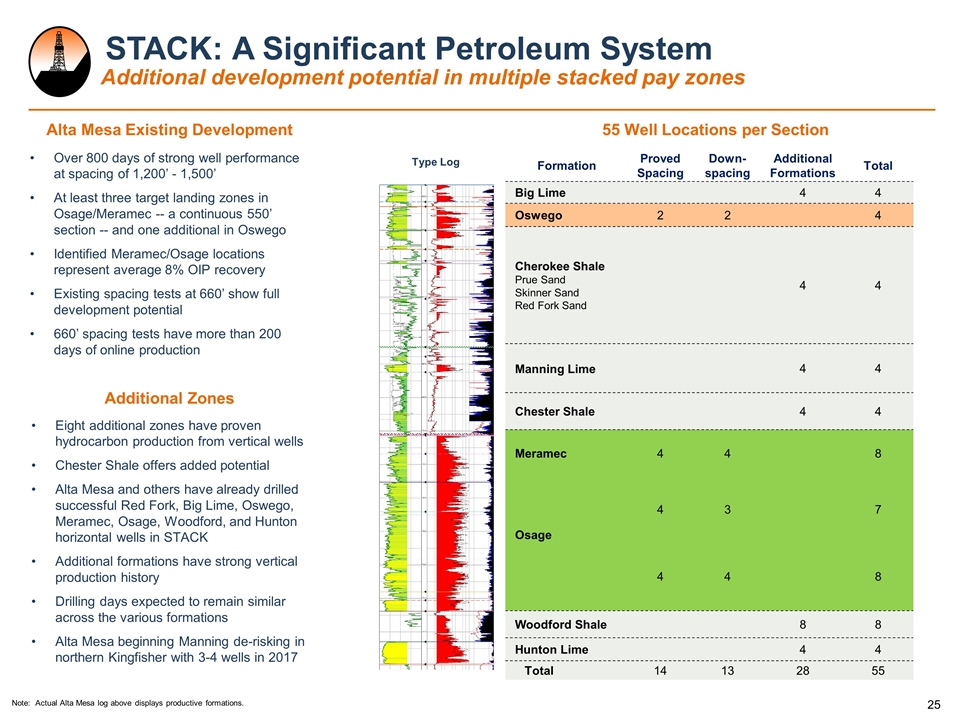

Alta Mesa Existing Development STACK: A Significant Petroleum System Additional development potential in multiple stacked pay zones Over 800 days of strong well performance at spacing of 1,200’ - 1,500’ At least three target landing zones in Osage/Meramec -- a continuous 550’ section -- and one additional in Oswego Identified Meramec/Osage locations represent average 8% OIP recovery Existing spacing tests at 660’ show full development potential 660’ spacing tests have more than 200 days of online production 55 Well Locations per Section Additional Zones Eight additional zones have proven hydrocarbon production from vertical wells Chester Shale offers added potential Alta Mesa and others have already drilled successful Red Fork, Big Lime, Oswego, Meramec, Osage, Woodford, and Hunton horizontal wells in STACK Additional formations have strong vertical production history Drilling days expected to remain similar across the various formations Alta Mesa beginning Manning de-risking in northern Kingfisher with 3-4 wells in 2017 Type Log Note: Actual Alta Mesa log above displays productive formations. Formation Proved Spacing Down-spacing Additional Formations Total Big Lime 4 4 Oswego 2 2 4 Cherokee Shale Prue Sand Skinner Sand Red Fork Sand 4 4 Manning Lime 4 4 Chester Shale 4 4 Meramec 4 4 8 Osage 4 3 7 4 4 8 Woodford Shale 8 8 Hunton Lime 4 4 Total 14 13 28 55

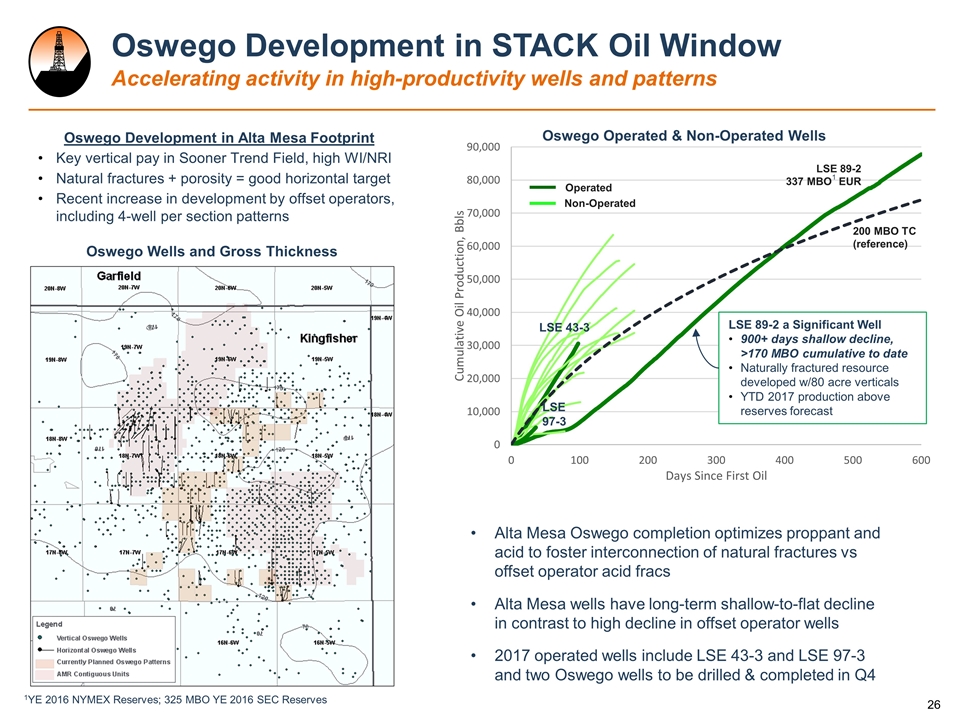

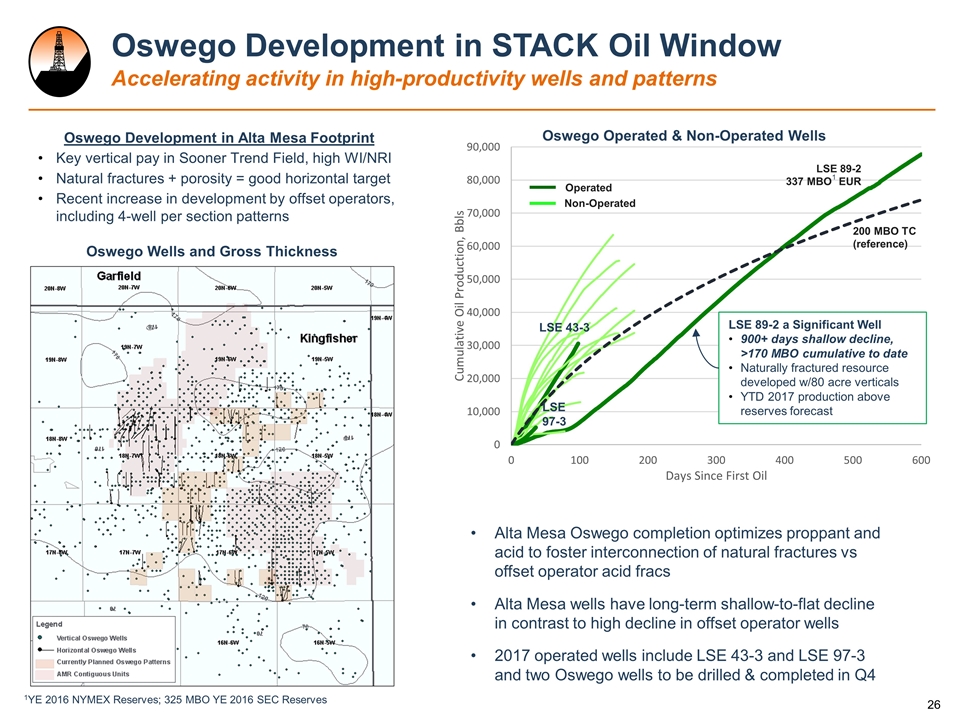

LSE 89-2 a Significant Well 900+ days shallow decline, >170 MBO cumulative to date Naturally fractured resource developed w/80 acre verticals YTD 2017 production above reserves forecast 200 MBO TC (reference) LSE 43-3 Oswego Development in STACK Oil Window Accelerating activity in high-productivity wells and patterns Alta Mesa Oswego completion optimizes proppant and acid to foster interconnection of natural fractures vs offset operator acid fracs Alta Mesa wells have long-term shallow-to-flat decline in contrast to high decline in offset operator wells 2017 operated wells include LSE 43-3 and LSE 97-3 and two Oswego wells to be drilled & completed in Q4 Oswego Development in Alta Mesa Footprint Key vertical pay in Sooner Trend Field, high WI/NRI Natural fractures + porosity = good horizontal target Recent increase in development by offset operators, including 4-well per section patterns LSE 97-3 Oswego Operated & Non-Operated Wells Oswego Wells and Gross Thickness 1YE 2016 NYMEX Reserves; 325 MBO YE 2016 SEC Reserves LSE 89-2 337 MBO1 EUR Operated Non-Operated

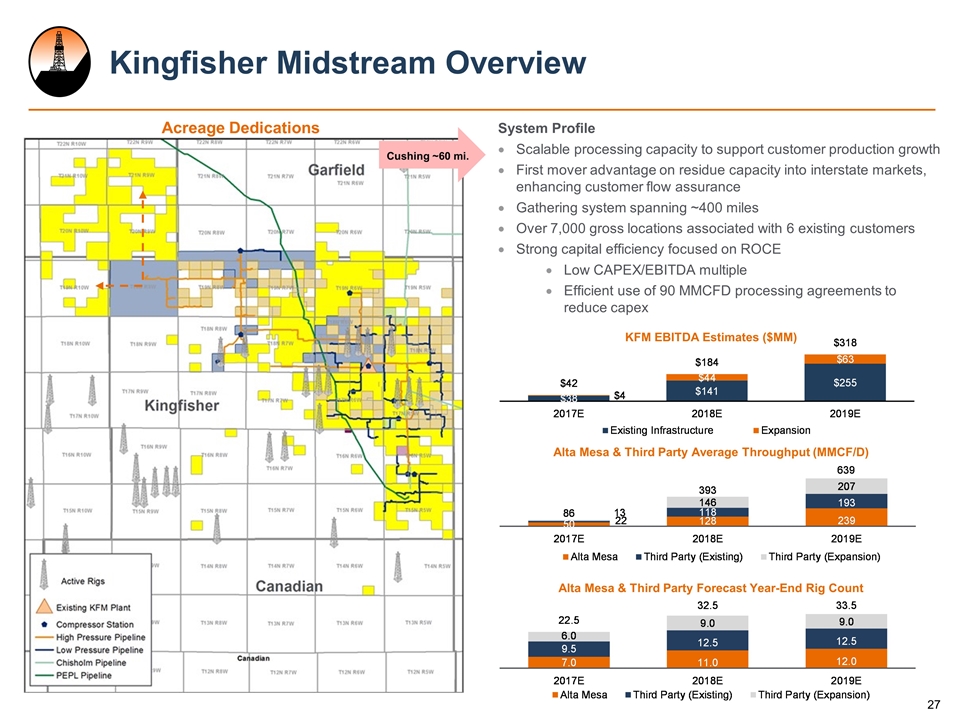

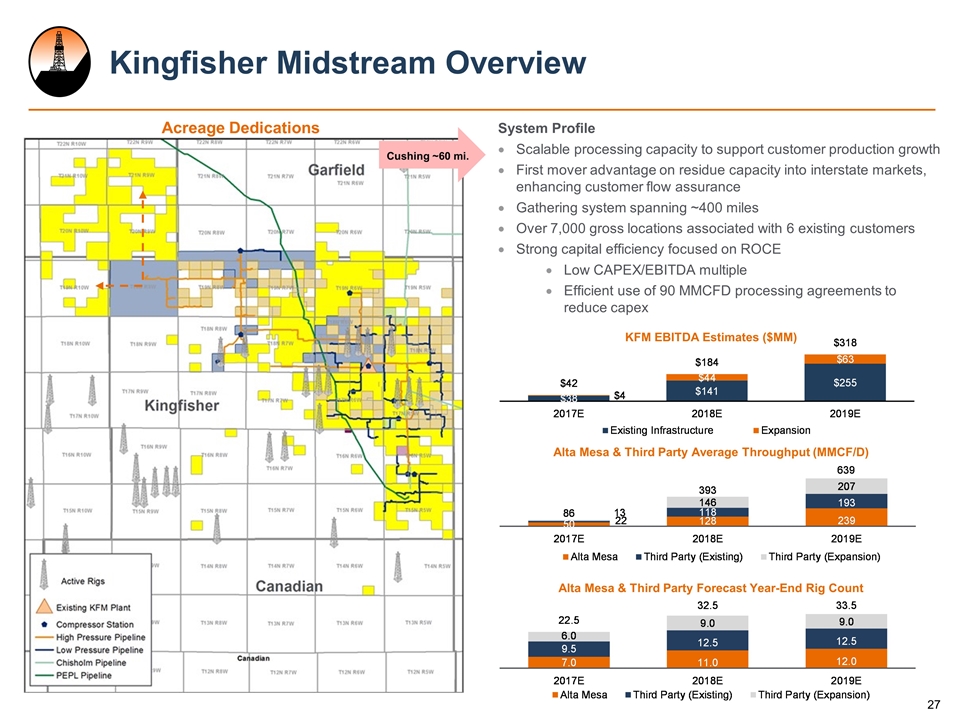

System Profile Scalable processing capacity to support customer production growth First mover advantage on residue capacity into interstate markets, enhancing customer flow assurance Gathering system spanning ~400 miles Over 7,000 gross locations associated with 6 existing customers Strong capital efficiency focused on ROCE Low CAPEX/EBITDA multiple Efficient use of 90 MMCFD processing agreements to reduce capex Kingfisher Midstream Overview Cushing ~60 mi. Alta Mesa & Third Party Forecast Year-End Rig Count KFM EBITDA Estimates ($MM) Acreage Dedications Alta Mesa & Third Party Average Throughput (MMCF/D)

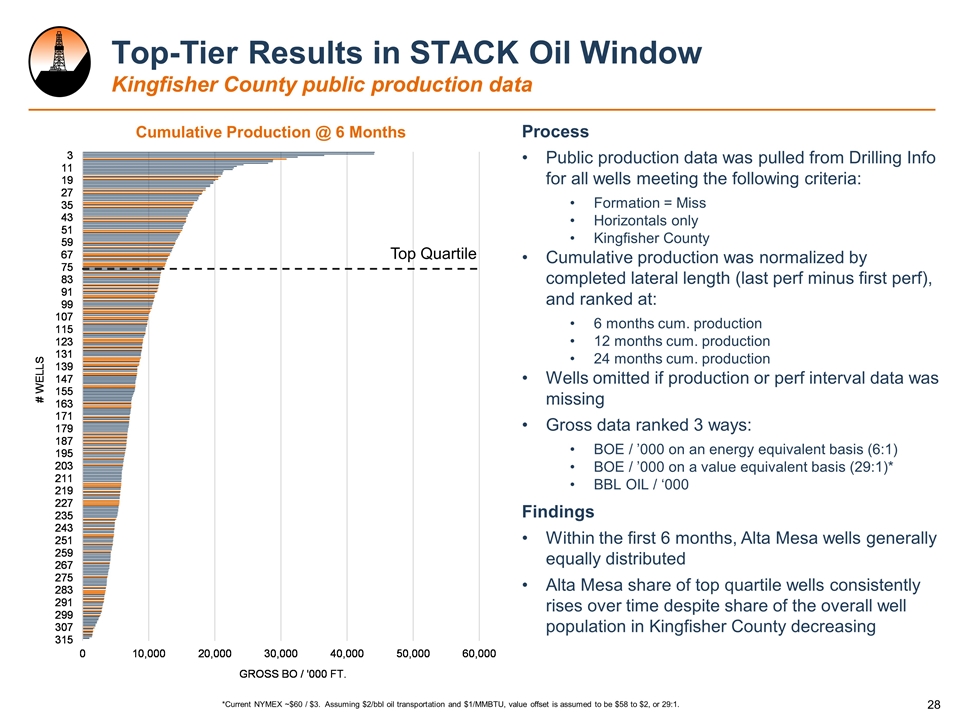

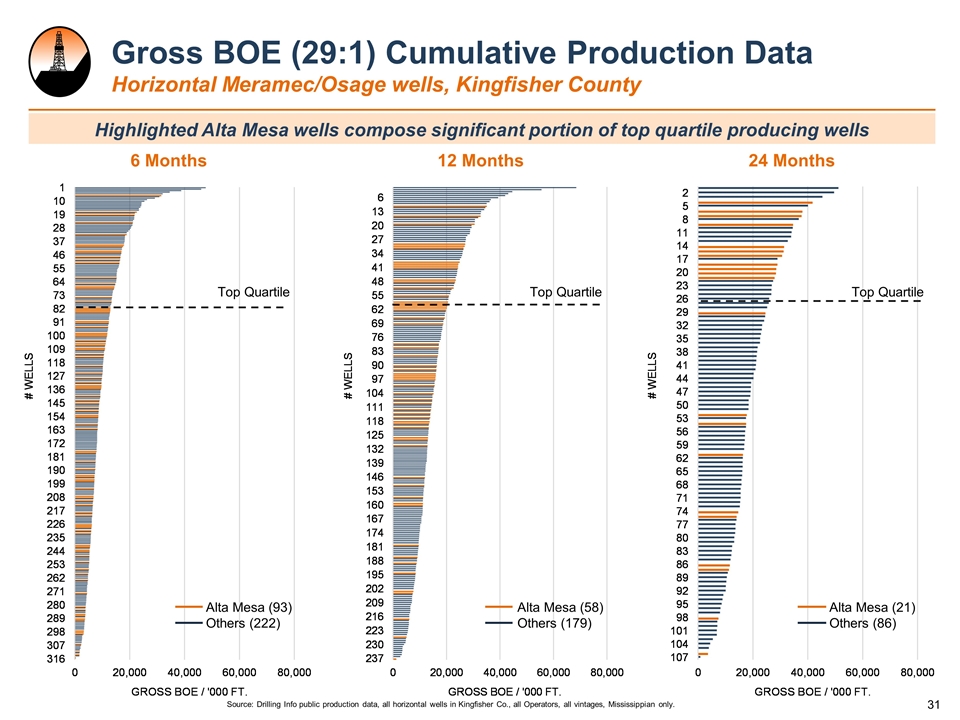

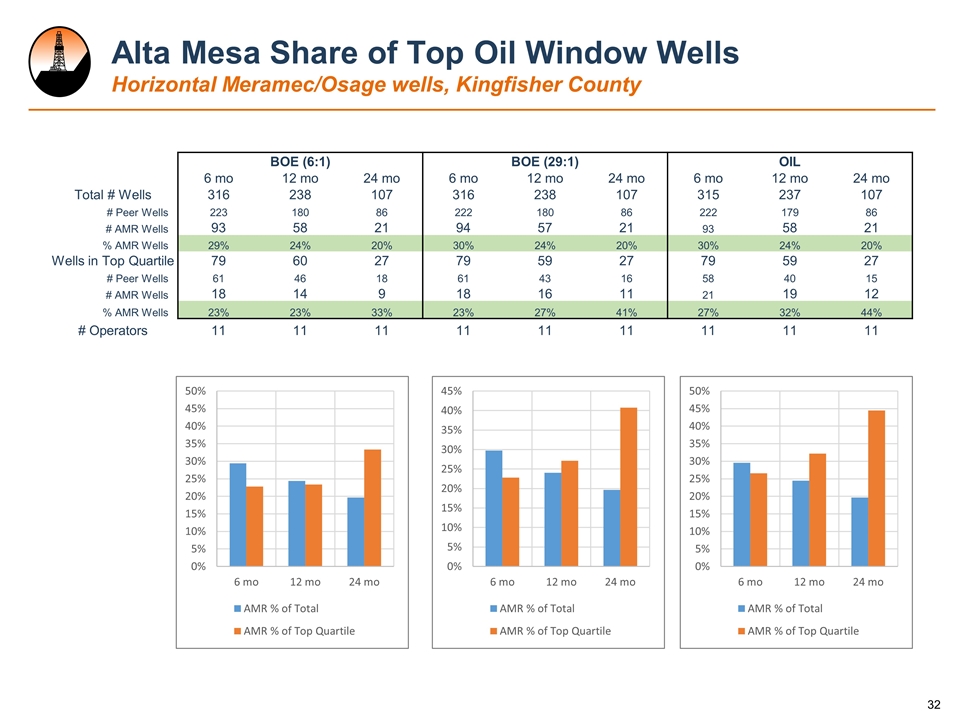

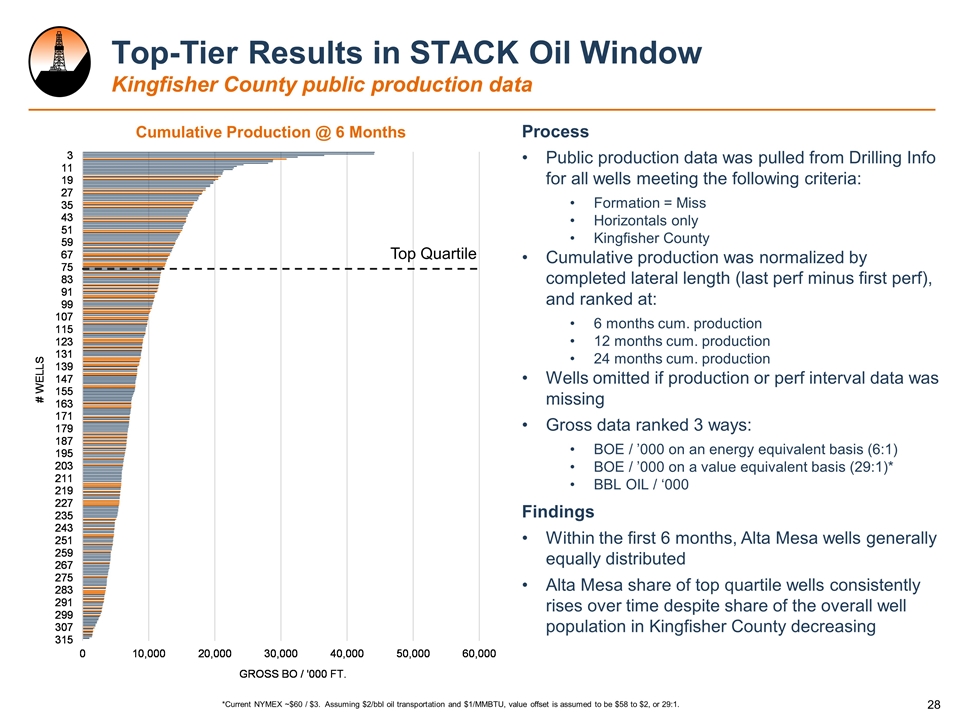

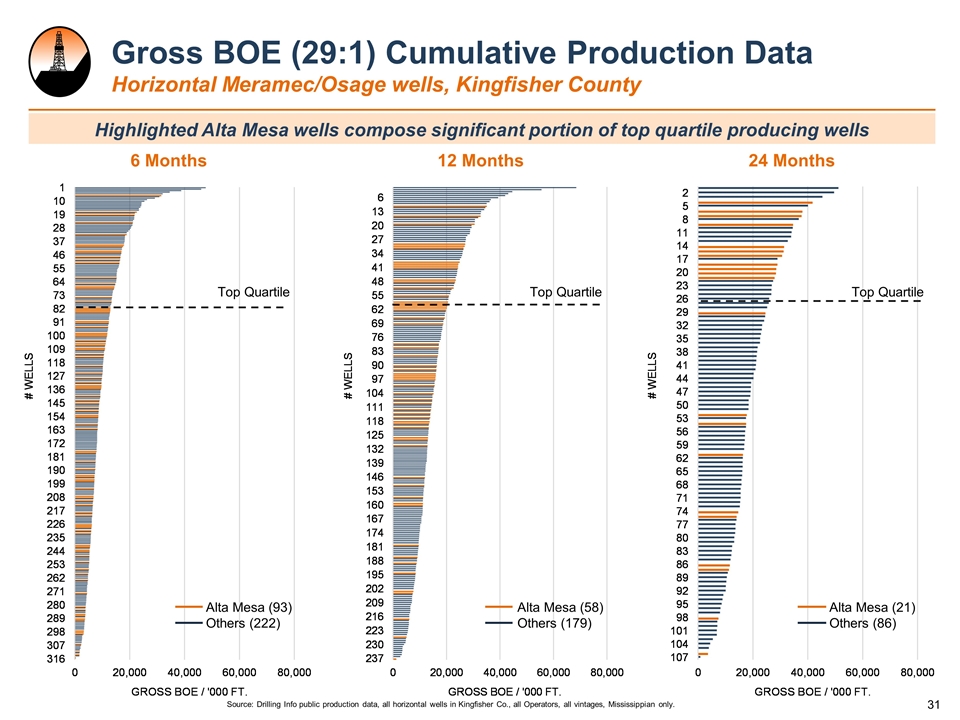

*Current NYMEX ~$60 / $3. Assuming $2/bbl oil transportation and $1/MMBTU, value offset is assumed to be $58 to $2, or 29:1. Top-Tier Results in STACK Oil Window Kingfisher County public production data Process Public production data was pulled from Drilling Info for all wells meeting the following criteria: Formation = Miss Horizontals only Kingfisher County Cumulative production was normalized by completed lateral length (last perf minus first perf), and ranked at: 6 months cum. production 12 months cum. production 24 months cum. production Wells omitted if production or perf interval data was missing Gross data ranked 3 ways: BOE / ’000 on an energy equivalent basis (6:1) BOE / ’000 on a value equivalent basis (29:1)* BBL OIL / ‘000 Findings Within the first 6 months, Alta Mesa wells generally equally distributed Alta Mesa share of top quartile wells consistently rises over time despite share of the overall well population in Kingfisher County decreasing Top Quartile Cumulative Production @ 6 Months

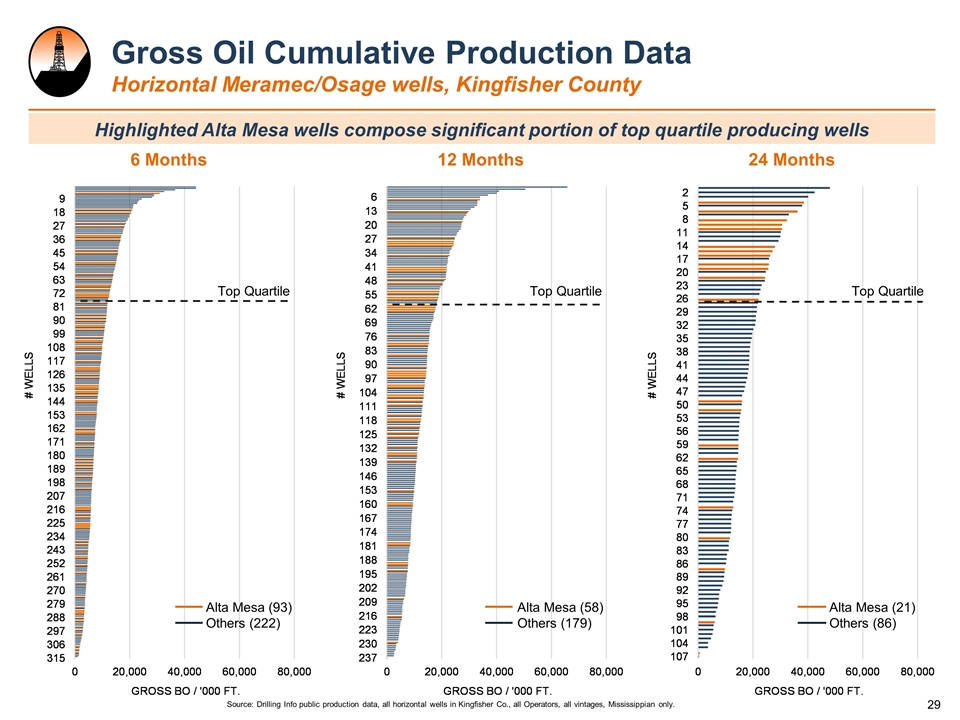

Source: Drilling Info public production data, all horizontal wells in Kingfisher Co., all Operators, all vintages, Mississippian only. Gross Oil Cumulative Production Data Horizontal Meramec/Osage wells, Kingfisher County Top Quartile Top Quartile Top Quartile 6 Months 12 Months 24 Months Highlighted Alta Mesa wells compose significant portion of top quartile producing wells Alta Mesa (93) Others (222) Alta Mesa (58) Others (179) Alta Mesa (21) Others (86)

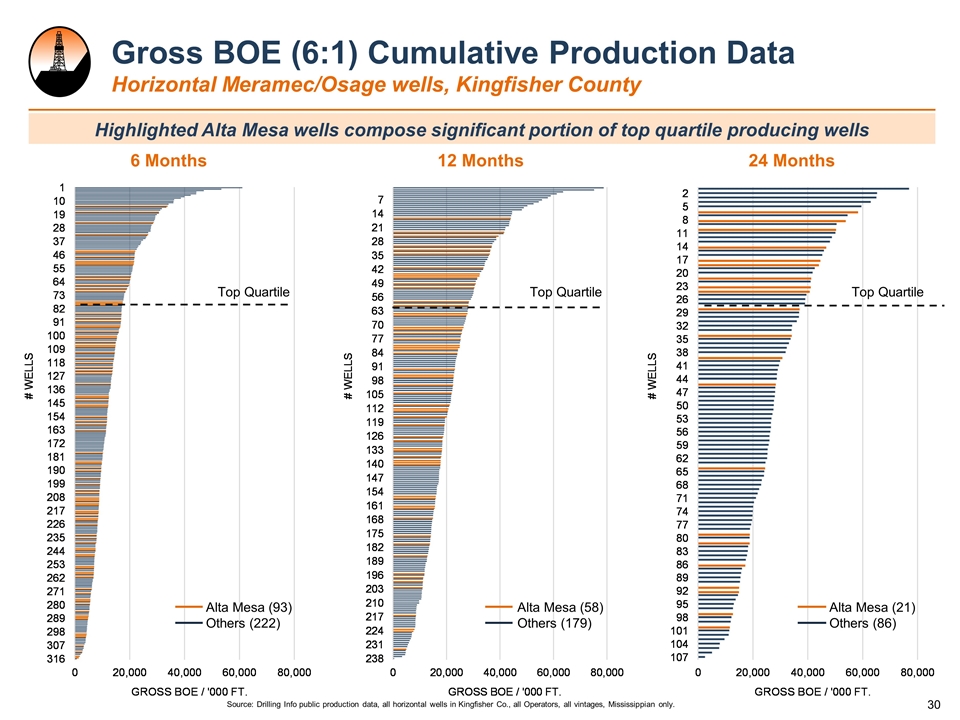

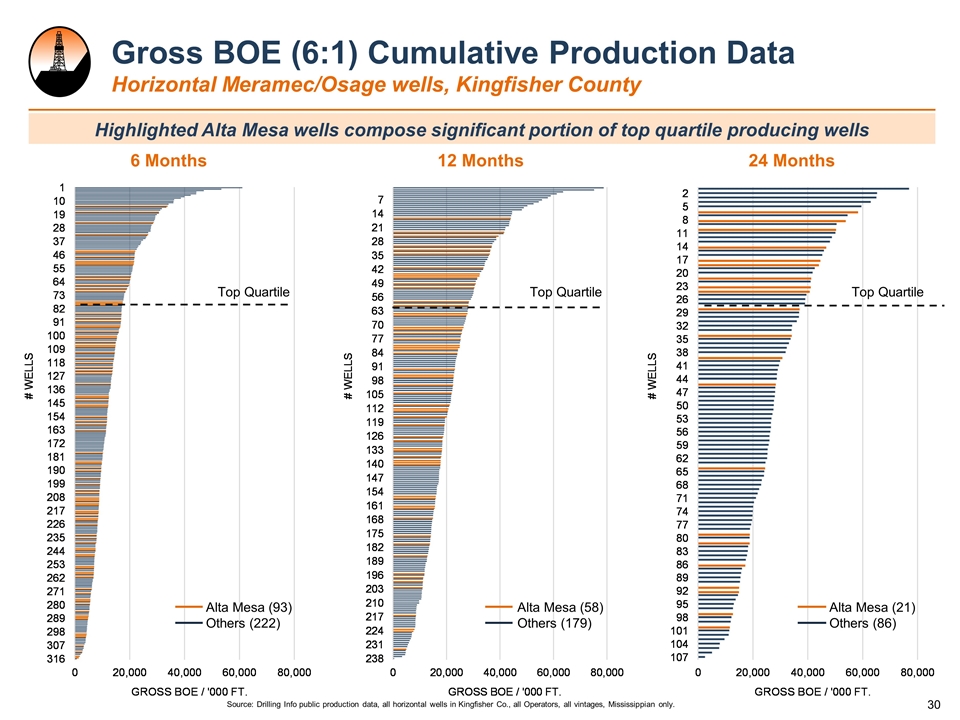

Source: Drilling Info public production data, all horizontal wells in Kingfisher Co., all Operators, all vintages, Mississippian only. Gross BOE (6:1) Cumulative Production Data Horizontal Meramec/Osage wells, Kingfisher County Top Quartile Top Quartile Top Quartile 6 Months 12 Months 24 Months Highlighted Alta Mesa wells compose significant portion of top quartile producing wells Alta Mesa (93) Others (222) Alta Mesa (58) Others (179) Alta Mesa (21) Others (86)

Source: Drilling Info public production data, all horizontal wells in Kingfisher Co., all Operators, all vintages, Mississippian only. Gross BOE (29:1) Cumulative Production Data Horizontal Meramec/Osage wells, Kingfisher County Top Quartile Top Quartile Top Quartile 6 Months 12 Months 24 Months Highlighted Alta Mesa wells compose significant portion of top quartile producing wells Alta Mesa (93) Others (222) Alta Mesa (58) Others (179) Alta Mesa (21) Others (86)

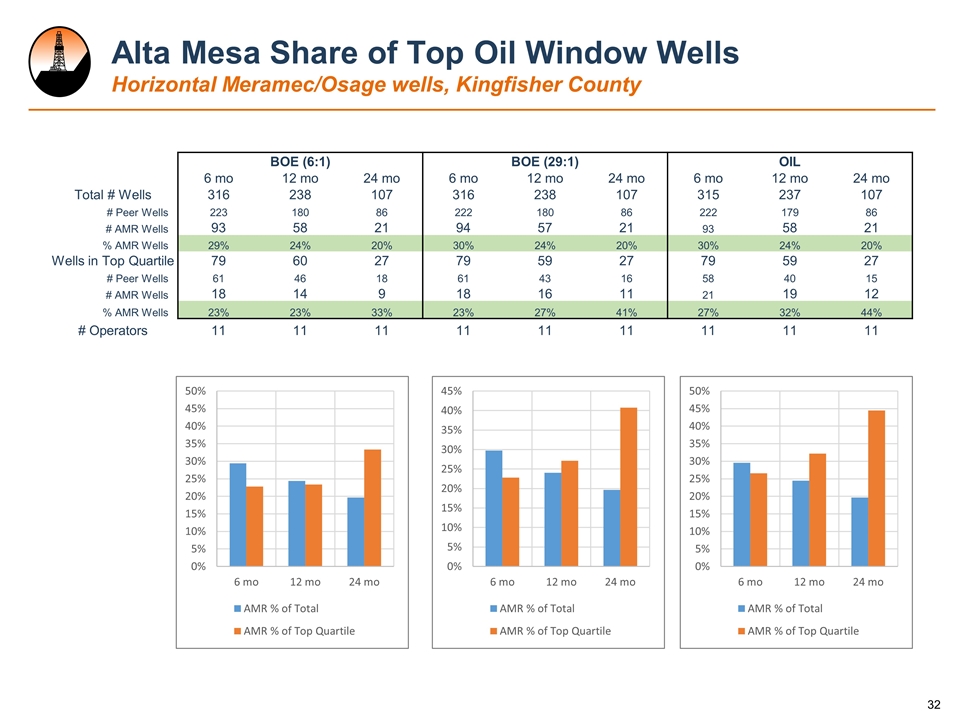

Alta Mesa Share of Top Oil Window Wells Horizontal Meramec/Osage wells, Kingfisher County BOE (6:1) BOE (29:1) OIL 6 mo 12 mo 24 mo 6 mo 12 mo 24 mo 6 mo 12 mo 24 mo Total # Wells 316 238 107 316 238 107 315 237 107 # Peer Wells 223 180 86 222 180 86 222 179 86 # AMR Wells 93 58 21 94 57 21 93 58 21 % AMR Wells 29% 24% 20% 30% 24% 20% 30% 24% 20% Wells in Top Quartile 79 60 27 79 59 27 79 59 27 # Peer Wells 61 46 18 61 43 16 58 40 15 # AMR Wells 18 14 9 18 16 11 21 19 12 % AMR Wells 23% 23% 33% 23% 27% 41% 27% 32% 44% # Operators 11 11 11 11 11 11 11 11 11

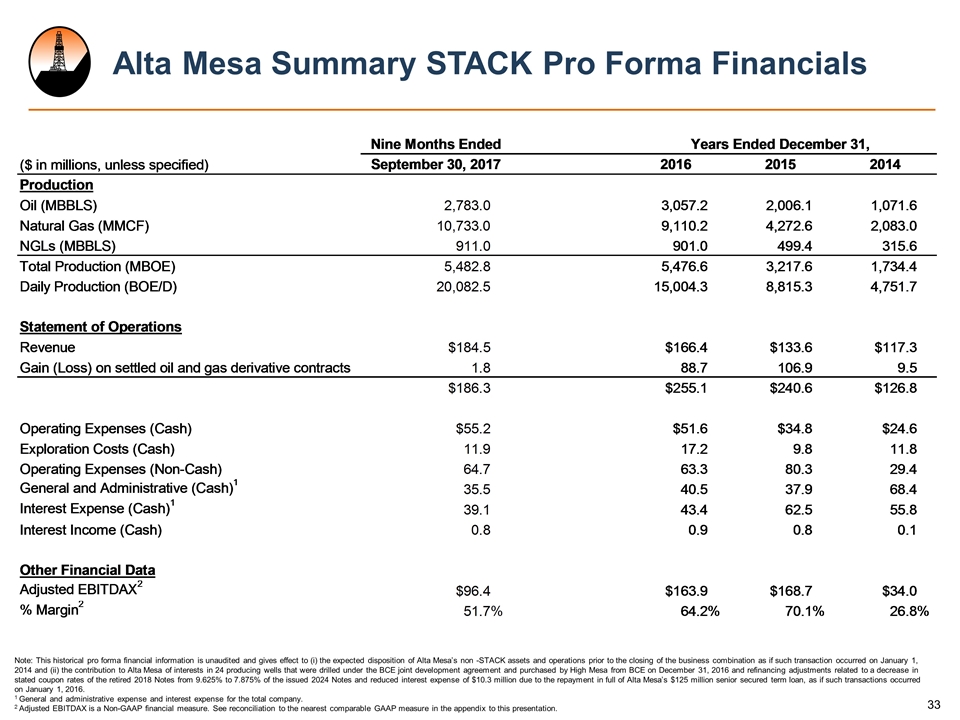

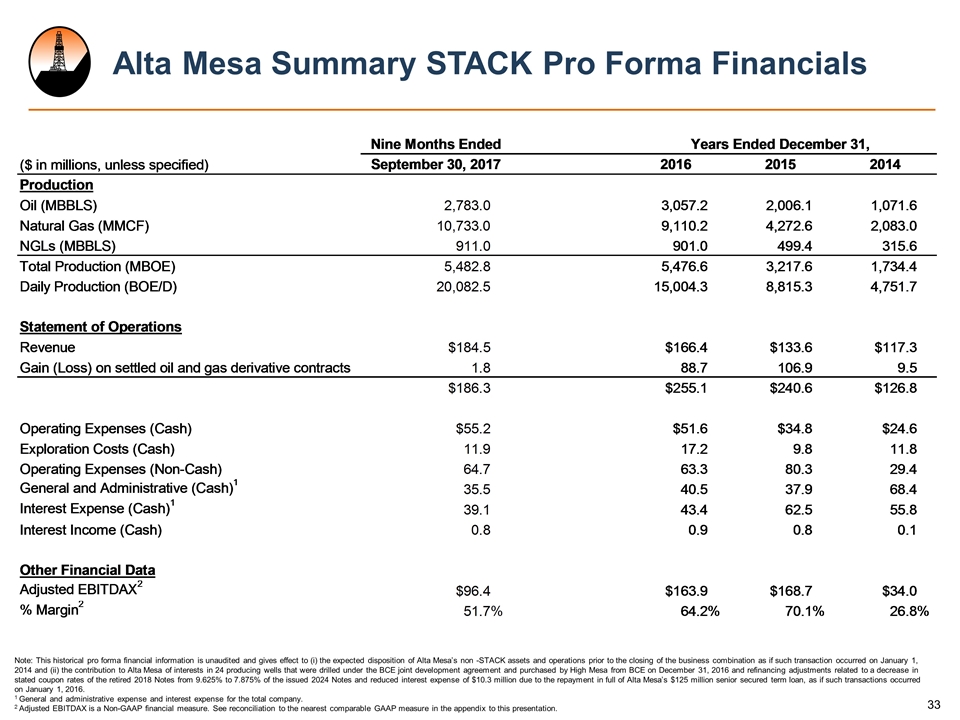

Alta Mesa Summary STACK Pro Forma Financials Note: This historical pro forma financial information is unaudited and gives effect to (i) the expected disposition of Alta Mesa’s non -STACK assets and operations prior to the closing of the business combination as if such transaction occurred on January 1, 2014 and (ii) the contribution to Alta Mesa of interests in 24 producing wells that were drilled under the BCE joint development agreement and purchased by High Mesa from BCE on December 31, 2016 and refinancing adjustments related to a decrease in stated coupon rates of the retired 2018 Notes from 9.625% to 7.875% of the issued 2024 Notes and reduced interest expense of $10.3 million due to the repayment in full of Alta Mesa’s $125 million senior secured term loan, as if such transactions occurred on January 1, 2016. 1 General and administrative expense and interest expense for the total company. 2 Adjusted EBITDAX is a Non-GAAP financial measure. See reconciliation to the nearest comparable GAAP measure in the appendix to this presentation.

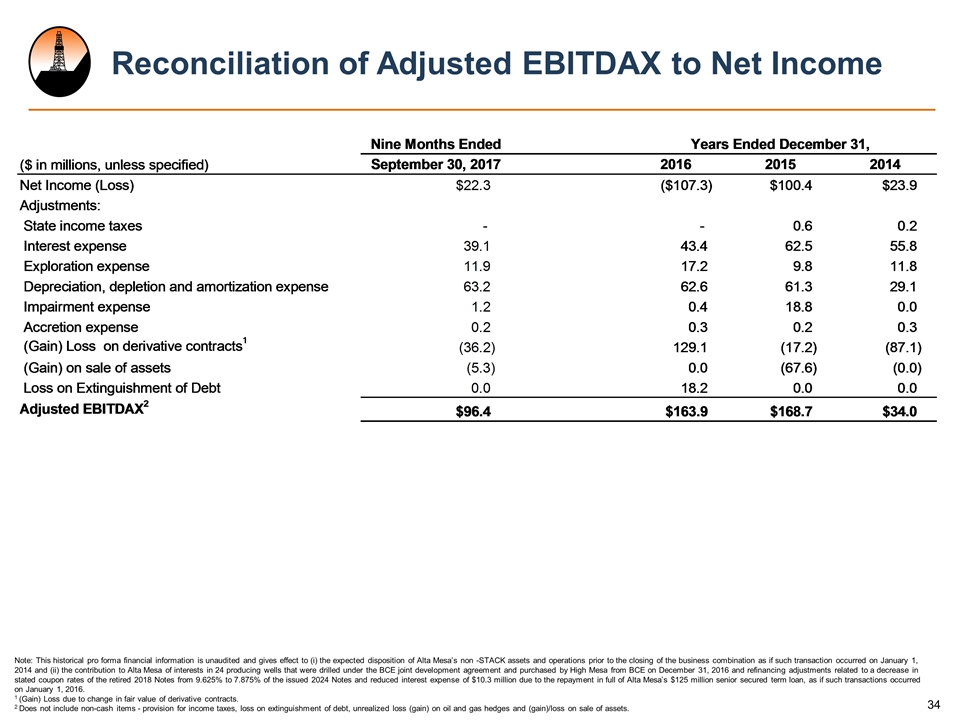

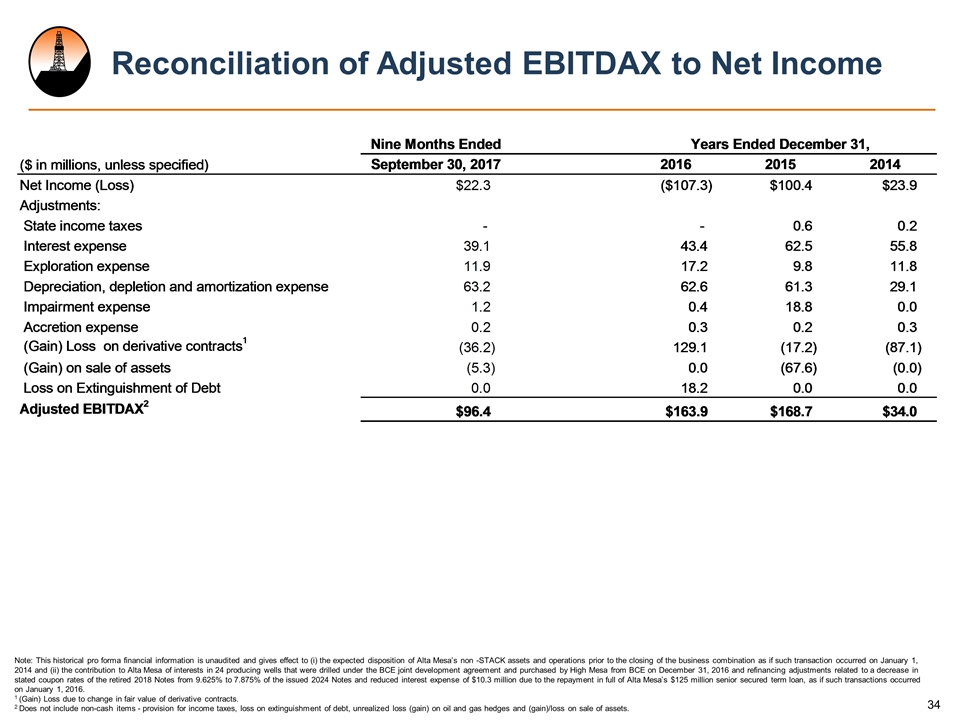

Reconciliation of Adjusted EBITDAX to Net Income Note: This historical pro forma financial information is unaudited and gives effect to (i) the expected disposition of Alta Mesa’s non -STACK assets and operations prior to the closing of the business combination as if such transaction occurred on January 1, 2014 and (ii) the contribution to Alta Mesa of interests in 24 producing wells that were drilled under the BCE joint development agreement and purchased by High Mesa from BCE on December 31, 2016 and refinancing adjustments related to a decrease in stated coupon rates of the retired 2018 Notes from 9.625% to 7.875% of the issued 2024 Notes and reduced interest expense of $10.3 million due to the repayment in full of Alta Mesa’s $125 million senior secured term loan, as if such transactions occurred on January 1, 2016. 1 (Gain) Loss due to change in fair value of derivative contracts. 2 Does not include non-cash items - provision for income taxes, loss on extinguishment of debt, unrealized loss (gain) on oil and gas hedges and (gain)/loss on sale of assets.