|

| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response. . . . . . .20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22551

MAINSTAY DEFINEDTERM

MUNICIPAL OPPORTUNITIES FUND

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: May 31

Date of reporting period: May 31, 2014

| Item 1. | Reports to Stockholders. |

MainStay DefinedTerm Municipal Opportunities Fund

Message from the President and Annual Report

May 31, 2014 | NYSE Symbol MMD

This page intentionally left blank

Message from the President

Municipal bonds generally provided positive returns for the 12 months ended May 31, 2014. Their performance, however, was affected by a variety of factors.

At the beginning of the reporting period, interest rates were rising in response to a suggestion by then-chairman of the Federal Reserve, Ben Bernanke, that the Federal Open Market Committee (“FOMC”) might begin tapering its extensive bond-purchase program, widely known as quantitative easing.

Interest rates later declined on assurances from the FOMC that economic progress did not yet warrant tapering. In December 2013, however, the FOMC announced that it would begin tapering its bond purchases in January 2014. The tapering program began on schedule, and the FOMC has continued to reduce its open-market bond purchases.

In the municipal market, yields rose in the latter half of 2013, fueled by reduced liquidity, the anticipated tapering of quantitative easing and persistent redemptions for tax-loss harvesting. These net redemptions stopped in January 2014, and the next four months were dominated by a scarcity of municipal supply. The lack of supply helped push municipal bond prices higher, spreads tighter and the yield curve flatter as U.S. Treasury rates declined and municipal credit fundamentals improved.

During the reporting period, the FOMC sought to maximize employment and maintain price stability by keeping the federal funds target rate in a near-zero range. Over the same period, the portfolio managers of MainStay DefinedTerm Municipal Opportunities Fund sought to make the most of shifting market opportunities while seeking to minimize exposure to unnecessary risks.

The report that follows provides additional information about the decisions, securities and market forces that affected the Fund during the 12 months ended May 31, 2014. We encourage you to read the report carefully, and we thank you for choosing MainStay DefinedTerm Municipal Opportunities Fund.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Annual Report

Table of Contents

Certain material in this report may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates and information about possible or future results or events related to the Fund, market or regulatory developments. The views expressed herein are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed herein are subject to change at any time based upon economic, market, or other conditions and the Fund undertakes no obligation to update the views expressed herein.

Fund Performance and Statistics (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Index performance is shown for illustration purposes only. You cannot invest directly into an index. Investment return and principal value will fluctuate, and as a result, when shares are sold, they may be worth more or less than their original cost. For performance information current to the most recent month-end, please visit mainstayinvestments.com/mmd.

| | | | | | | | |

| Total Returns | | One Year | | | Since Inception

6/26/12 | |

| | |

| Net Asset Value (“NAV”)1 | | | 2.36 | % | | | 6.60 | % |

| | |

| Market Price1 | | | 3.81 | | | | 1.77 | |

| | |

| Barclays Municipal Bond Index2 | | | 3.05 | | | | 3.24 | |

| | |

| Average Lipper general & insured municipal debt fund (leveraged)3 | | | 4.04 | | | | 6.62 | |

| | | | | | | | | | |

| Fund Statistics (as of May 31, 2014) | | | | | | | | |

| | | |

| NYSE Symbol | | | MMD | | | Premium/Discount4 | | | –4.42 | % |

| | | |

| CUSIP | | | 56064K100 | | | Total Net Assets (millions) | | $ | 517.0 | |

| | | |

| Inception Date | | | 6/26/12 | | | Total Managed Assets (millions)5 | | $ | 801.4 | |

| | | |

| Market Price | | | $17.93 | | | Leverage6 | | | 35.4 | % |

| | | |

| NAV | | | $18.76 | | | Percent of AMT Bonds7 | | | 3.78 | % |

| 1. | Total returns assume dividends and capital gains distributions are reinvested. |

| 2. | The Barclays Municipal Bond Index is considered representative of the broad market for investment-grade, tax-exempt bonds with a maturity of at least one year. Bonds subject to the alternative minimum tax or with floating or zero coupons are excluded. An investment cannot be made directly in an index. |

| 3. | The average Lipper general & insured municipal debt fund (leveraged) is representative of funds that either invest primarily in municipal debt issues rated in the top four credit ratings or invest primarily in municipal debt issues insured as to timely payment. These funds can be leveraged via use of debt, preferred equity, and/or reverse repurchase agreements. This benchmark is a product of Lipper Inc. Lipper Inc. is an independent monitor of fund performance. Results are based on average total returns of similar funds with all dividend and capital gain distributions reinvested. |

| 4. | Premium/Discount is the percentage (%) difference between the market price and the NAV price. When the market price exceeds the NAV, the Fund is trading at a Premium. When the market price is less than the NAV, the Fund is trading at a Discount. |

| 5. | “Managed Assets” is defined as the Fund’s total assets, minus the sum of its accrued liabilities (other than Fund liabilities incurred for the purpose of creating effective leverage (i.e. tender option bonds) or Fund liabilities related to liquidation preference of any preferred shares issued). |

| 6. | Leverage is based on the use of proceeds received from tender option bond transactions, issuing Preferred Shares, funds borrowed from banks or other institutions or derivative transactions, expressed as a percentage of Managed Assets. |

| 7. | Alternative Minimum Tax (“AMT”) is a separate tax computation under the Internal Revenue Code that, in effect, eliminates many deductions and credits and creates a tax liability for an individual who would otherwise pay little or no tax. |

Portfolio Composition as of May 31, 2014† (Unaudited)

| | | | |

| California | | | 19.3 | % |

| Illinois | | | 12.3 | |

| Michigan | | | 6.5 | |

| Texas | | | 6.3 | |

| Pennsylvania | | | 5.5 | |

| Virginia | | | 4.6 | |

| Florida | | | 4.4 | |

| Ohio | | | 3.4 | |

| New Jersey | | | 3.4 | |

| Guam | | | 3.2 | |

| Puerto Rico | | | 3.0 | |

| Maryland | | | 2.9 | |

| Kansas | | | 2.7 | |

| Nebraska | | | 2.7 | |

| Washington | | | 2.6 | |

| Rhode Island | | | 2.1 | |

| Tennessee | | | 2.0 | |

| Nevada | | | 1.6 | |

| Louisiana | | | 1.4 | |

| | | | |

| Arizona | | | 1.3 | % |

| New York | | | 1.2 | |

| U.S. Virgin Islands | | | 1.0 | |

| Colorado | | | 0.7 | |

| Iowa | | | 0.7 | |

| Alabama | | | 0.6 | |

| Alaska | | | 0.5 | |

| District of Columbia | | | 0.5 | |

| Missouri | | | 0.4 | |

| New Hampshire | | | 0.3 | |

| Vermont | | | 0.2 | |

| Georgia | | | 0.1 | |

| Indiana | | | 0.1 | |

| Massachusetts | | | 0.1 | |

| West Virginia | | | 0.1 | |

| Other Assets, Less Liabilities | | | 2.3 | |

| | | | |

| | | 100.0 | % |

| | | | |

See Portfolio of Investments beginning on page 9 for specific holdings within these categories.

Top Ten Holdings or Issuers Held as of May 31, 2014# (Unaudited)

| 1. | Texas Municipal Gas Acquisition & Supply Corp. III, Revenue Bonds, 5.00%, due 12/15/29–12/15/32 |

| 2. | Chicago Board of Education, Unlimited General Obligation, 5.50%, due 12/1/39 |

| 3. | University of California, Regents Medical Center, Revenue Bonds, 5.00%, due 5/15/43 |

| 4. | Virginia Commonwealth Transportation Board, Capital Projects, Revenue Bonds, 5.00%, due 5/15/31 |

| 5. | Golden State Tobacco Securitization Corp., Asset Backed, Revenue Bonds, 4.50%–5.30%,

due 6/1/27–6/1/37 |

| 6. | Maryland Health & Higher Educational Facilities Authority, Johns Hopkins Health System Obligated Group, Revenue Bonds, 5.00%, due 5/15/43 |

| 7. | Riverside County Transportation Commission, Limited Tax, Revenue Bonds, 5.25%, due 6/1/39 |

| 8. | State of Illinois, Unlimited General Obligation, 5.25%, due 7/1/31 |

| 9. | City of Sacramento, California, Water, Revenue Bonds, 5.00%, due 9/1/42 |

| 10. | Metropolitan Pier & Exposition Authority, McCormick Place Expansion, Revenue Bonds, 5.50%, due 6/15/50 |

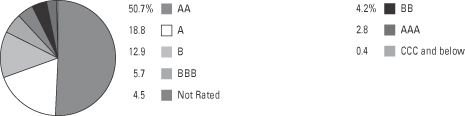

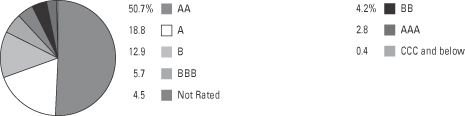

Credit Quality as of May 31, 2014† (Unaudited)

Ratings apply to the underlying portfolio of bonds held by the Fund and are rated by an independent rating agency, such as Standard & Poor’s (“S&P”), Moody’s Investors Service, Inc. and/or Fitch Ratings, Inc. If ratings are provided by the ratings agencies, but differ, the higher rating will be utilized. If only one rating is provided, the available rating will be utilized. Securities that are unrated by the rating agencies are reflected as such in the breakdown. Unrated securities do not necessarily indicate low quality. S&P rates borrowers on a scale from AAA to D. AAA through BBB represent investment grade, while BB through D represent non-investment grade.

| † | As a percentage of Managed Assets. |

| # | Some of these holdings have been transferred to a Tender Option Bond (‘TOB”) Issuer in exchange for the TOB residuals and cash. |

| | |

| 6 | | MainStay DefinedTerm Municipal Opportunities Fund |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio managers Robert DiMella, CFA, John Loffredo, CFA, Michael Petty, Scott Sprauer and David Dowden of MacKay Shields LLC, the Fund’s Subadvisor.

How did MainStay DefinedTerm Municipal Opportunities Fund perform relative to its benchmark and peers for the 12 months ended May 31, 2014?

For the 12 months ended May 31, 2014, MainStay DefinedTerm Municipal Opportunities Fund returned 2.36% at net asset value applicable to Common shares and 3.81% at market price. At net asset value, the Fund underperformed—and at market price, the Fund outperformed—the 3.05% return of the Barclays Municipal Bond Index1 over the same period. At net asset value and at market price, the Fund underperformed the 4.04% return of the average Lipper2 general & insured municipal debt fund (leveraged) for the 12 months ended May 31, 2014.

What factors affected the Fund’s relative performance during the reporting period?

The Fund was positioned with a longer-maturity, lower investment-grade rating profile than the Barclays Municipal Bond Index. This strategy performed well as the municipal yield curve3 flattened and credit spreads4 narrowed. Additionally, while the Fund’s benchmark contains only investment-grade bonds, the Fund can invest a portion of its assets in bonds rated below investment grade. During the latter half of the reporting period, these lower-rated securities produced higher returns as credit spreads tightened. The Fund was also able to invest in some attractive new issues. These securities have shown strong performance in the first four months of 2014.

How was the Fund’s leverage strategy implemented during the reporting period?

Overall, the Fund’s leverage percentage stayed within a specified range during the reporting period. The decline in municipal prices during last summer’s sell-off, however, resulted in correspondingly higher yields. While yields on most municipal bonds increased during the reporting period, the Fund’s cost of borrowing on its leverage remained stable.

What was the Fund’s duration5 strategy during the reporting period?

The Fund’s duration during most of the reporting period was longer than that of the Barclays Municipal Bond Index. This positioning resulted from what we viewed to be a significant buying opportunity during the technical dislocation that occurred in the second half of 2013. We have since brought the Fund’s duration closer to neutral in relation to the Barclays Municipal Bond Index after the strong returns realized year-to-date. We continue to use a position in U.S. Treasury futures to hedge some of the Fund’s higher exposure in longer-maturity issues. At the end of the reporting period, the Fund’s unlevered duration to worst was 6.65 years and the Fund’s leveraged duration to worst was 10.27 years.6

What specific factors, risks or market forces prompted significant decisions for the Fund during the reporting period?

A combination of factors affected the municipal market during the reporting period. Among these were stronger economic data, which prompted speculation about a rotation from bonds to equities, and the Federal Reserve’s tapering of its bond purchases. Financial difficulties in Detroit and Puerto Rico also affected the municipal market. Together, these forces drew money away from municipal mutual funds in 2013. As a closed-end fund, the Fund was not directly subject to the industry-wide outflows. Nevertheless, these redemptions caused municipal yields to move materially higher and drove bond prices lower. This rapid change in market sentiment created opportunities for the Fund to reposition itself in several ways. We focused on selling securities that had fallen in value, as we sought to realize losses that could offset current and future gains for the Fund. During periods of institutional market illiquidity, we targeted the strong appetite for individual bonds among retail investors to execute sales at prices we viewed as favorable relative to the market. We used the proceeds to buy bonds from funds that were forced to sell because of severe outflows.

| 1. | See footnote on page 5 for more information on Barclays Municipal Bond Index. |

| 2. | See footnote on page 5 for more information on Lipper Inc. |

| 3. | The yield curve is a line that plots the yield of various securities of similar quality—typically U.S. Treasury issues—across a wide range of maturities. The U.S. Treasury yield curve serves as a benchmark for other debt and is used in economic forecasting. |

| 4. | The terms “spread” and “yield spread” may refer to the difference in yield between a security or type of security and comparable U.S. Treasury issues. The terms may also refer to the difference in yield between two specific securities or types of securities at a given time. The term “credit spread” typically refers to the difference in yield between corporate or municipal bonds (or a specific category of these bonds) and comparable U.S. Treasury issues. |

| 5. | Duration is a measure of the price sensitivity of a fixed-income investment to changes in interest rates. Duration is expressed as a number of years and is considered a more accurate sensitivity gauge than average maturity. |

| 6. | Duration to worst is the duration of a bond computed using the bond’s nearest call date or maturity, whichever comes first. This measure ignores future cash flow fluctuations due to embedded optionality. Leverage-adjusted duration is a measure of the price sensitivity of a bond or a bond fund to changes in market interest rates. Generally, the longer a bond’s or fund’s duration, the more the price of the bond of fund will change as interest rates change. Leverage-adjusted duration takes into account the leveraging process for a fund and therefore results in a duration that is longer than the duration of the fund’s portfolio of bonds. |

Puerto Rico bonds significantly underperformed the general municipal market during the reporting period, and the Fund’s decision to have minimal exposure to these securities proved beneficial for the Fund. Yield-curve positioning, credit quality and longer-maturity municipals all helped the Fund’s performance during the reporting period.

During the reporting period, which market segments were the strongest positive contributors to the Fund’s performance and which market segments were particularly weak?

The strongest positive contributors to the Fund’s performance were overweight positions among bonds with longer maturities and bonds that tend to be more credit-sensitive. (Contributions take weightings and total returns into account.) An overweight position in bonds wrapped by insurers also added to the Fund’s performance, as these securities outperformed. Hospitals, charter schools and local general obligation bonds also contributed to the Fund’s performance. Currently callable securities detracted from the Fund’s performance. While these securities continued to provide a superior yield, their short duration structure kept prices more muted than the general market.

How did the Fund’s sector and state weightings change during the reporting period?

Because the Fund’s strategy did not materially change during the reporting period, there were no major changes to the Fund’s sector and state weightings. Sectors that we continued to favor were marginally increased, including transportation and water/sewer bonds. During the reporting period, we took the opportunity to lower the Fund’s exposure to the special tax and health care sectors.

From a state perspective, we opportunistically increased the Fund’s exposure to Illinois bonds after a sell-off during the summer pushed prices lower. We also reduced exposure to Ohio, Texas and Virginia bonds.

How was the Fund positioned at the end of the reporting period?

As of May 31, 2014, the Fund was overweight relative to the Barclays Municipal Bond Index in the special tax and health care sectors. As of the same date, the Fund still favored credits rated A and BBB,7 but we increased the overall credit quality of the Fund during the reporting period by increasing exposure to AA-rated8 credits.

| 7. | An obligation rated ‘A’ by Standard & Poor’s (“S&P”) is deemed by S&P to be somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher-rated categories. In the opinion of S&P, however, the obligor’s capacity to meet its financial commitment on the obligation is still strong. An obligation rated ‘BBB’ by S&P is deemed by S&P to exhibit adequate protection parameters. It is the opinion of S&P, however, that adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation. When applied to Fund holdings, ratings are based solely on the creditworthiness of the bonds in the portfolio and are not meant to represent the security or safety of the Fund. |

| 8. | An obligation rated ‘AA’ by S&P is deemed by S&P to differ from the highest-rated obligations only to a small degree. In the opinion of S&P, the obligor’s capacity to meet its financial commitment on the obligation is very strong. When applied to Fund holdings, ratings are based solely on the creditworthiness of the bonds in the portfolio and are not meant to represent the security or safety of the Fund. |

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

| | |

| 8 | | MainStay DefinedTerm Municipal Opportunities Fund |

Portfolio of Investments May 31, 2014

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds 151.2% † | |

Alabama 0.9% (0.6% of Managed Assets) | |

Birmingham Jefferson Civic Center Authority, Special Tax | | | | | | | | |

Series A, Insured: AMBAC

4.125%, due 7/1/14 | | $ | 250,000 | | | $ | 250,190 | |

Jefferson County, Limited Obligation School, Revenue Bonds | | | | | | | | |

Series A, Insured: AMBAC

4.75%, due 1/1/25 | | | 250,000 | | | | 243,317 | |

Jefferson County, Public Building Authority, Revenue Bonds | | | | | | | | |

Insured: AMBAC

5.00%, due 4/1/26 | | | 4,500,000 | | | | 3,989,115 | |

| | | | | | | | |

| | | | | | | 4,482,622 | |

| | | | | | | | |

Alaska 0.8% (0.5% of Managed Assets) | |

Northern Tobacco Securitization Corp., Tobacco Settlement, Asset-Backed, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 6/1/46 | | | 5,295,000 | | | | 4,003,285 | |

| | | | | | | | |

|

Arizona 2.0% (1.3% of Managed Assets) | |

Arizona Department of Transportation State Highway Fund, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 7/1/38 | | | 5,750,000 | | | | 6,419,185 | |

Phoenix Industrial Development Authority, Downtown Phoenix Student LLC, Revenue Bonds | | | | | | | | |

Series A, Insured: AMBAC

4.50%, due 7/1/32 | | | 1,000,000 | | | | 907,620 | |

Series A, Insured: AMBAC

4.50%, due 7/1/42 | | | 150,000 | | | | 126,590 | |

Phoenix Industrial Development Authority, Espiritu Community Development Corp., Revenue Bonds | | | | | | | | |

Series A

6.25%, due 7/1/36 | | | 2,000,000 | | | | 2,006,520 | |

Pima County Industrial Development Authority, PLC Charter Schools Project, Revenue Bonds

6.75%, due 4/1/36 | | | 1,075,000 | | | | 1,082,213 | |

| | | | | | | | |

| | | | | | | 10,542,128 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

California 30.0% (19.3% of Managed Assets) | |

California County Tobacco Securitization Agency, Asset Backed, Revenue Bonds | | | | | | | | |

Series A

5.125%, due 6/1/38 | | $ | 3,860,000 | | | $ | 3,194,961 | |

5.60%, due 6/1/36 | | | 2,575,000 | | | | 2,240,765 | |

California Municipal Finance Authority, Southwestern Law School, Revenue Bonds

6.50%, due 11/1/41 | | | 2,165,000 | | | | 2,577,541 | |

California Statewide Communities Development Authority, Sutter Health, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 11/15/42 | | | 1,900,000 | | | | 1,999,313 | |

Carson Redevelopment Agency, Redevelopment Project Area 1, Tax Allocation | | | | | | | | |

Series B, Insured: NATL-RE

(zero coupon), due 10/1/25 | | | 75,000 | | | | 44,135 | |

Ceres Unified School District, Cabs-Election, Unlimited General Obligation | | | | | | | | |

Series A

(zero coupon), due 8/1/43 | | | 6,375,000 | | | | 924,757 | |

¨City of Sacramento, California, Water, Revenue Bonds

5.00%, due 9/1/42 (a)(b) | | | 19,500,000 | | | | 21,622,965 | |

Fontana Unified School District, Cabs Unlimited General Obligation | | | | | | | | |

Series C

(zero coupon), due 8/1/34 | | | 14,000,000 | | | | 4,986,940 | |

Series C

(zero coupon), due 8/1/40 | | | 10,000,000 | | | | 2,392,500 | |

Series C

(zero coupon), due 8/1/41 | | | 19,700,000 | | | | 4,430,924 | |

Series C

(zero coupon), due 8/1/42 | | | 18,600,000 | | | | 3,935,202 | |

Foothill-Eastern Transportation Corridor Agency, Revenue Bonds | | | | | | | | |

Series A

6.00%, due 1/15/49 | | | 5,000,000 | | | | 5,727,600 | |

¨Golden State Tobacco Securitization Corp., Asset Backed, Revenue Bonds | | | | | | | | |

Series A-1

4.50%, due 6/1/27 | | | 2,500,000 | | | | 2,282,975 | |

Series A, Insured: AGC, FGIC

5.00%, due 6/1/35 (a)(b) | | | 16,110,000 | | | | 16,699,465 | |

Series A-2

5.30%, due 6/1/37 (c) | | | 5,000,000 | | | | 4,118,900 | |

| † | Percentages indicated are based on Fund net assets applicable to Common Shares, unless otherwise noted. |

| ¨ | | Among the Fund’s 10 largest holdings or issuers held, as of May 31, 2014. May be subject to change daily. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 9 | |

Portfolio of Investments May 31, 2014 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

California 30.0% (19.3% of Managed Assets) (continued) | |

Inglewood Public Financing Authority, Cabs-Lease, Revenue Bonds | | | | | | | | |

(zero coupon), due 8/1/30 | | $ | 2,530,000 | | | $ | 835,153 | |

(zero coupon), due 8/1/31 | | | 2,530,000 | | | | 767,577 | |

Lancaster Financing Authority, Subordinated Project No. 5 & 6, Redevelopment Projects, Tax Allocation | | | | | | | | |

Series B, Insured: NATL-RE

4.625%, due 2/1/24 | | | 215,000 | | | | 215,155 | |

Marysville Joint Unified School District, Capital Project, Certificates of Participation | | | | | | | | |

Insured: AGM

(zero coupon), due 6/1/25 | | | 1,850,000 | | | | 1,076,015 | |

Insured: AGM

(zero coupon), due 6/1/27 | | | 2,445,000 | | | | 1,248,588 | |

Insured: AGM

(zero coupon), due 6/1/33 | | | 2,800,000 | | | | 943,740 | |

Insured: AGM

(zero coupon), due 6/1/34 | | | 2,820,000 | | | | 892,051 | |

Insured: AGM

(zero coupon), due 6/1/38 | | | 2,820,000 | | | | 678,154 | |

Insured: AGM

(zero coupon), due 6/1/39 | | | 2,820,000 | | | | 635,995 | |

Insured: AGM

(zero coupon), due 6/1/40 | | | 2,820,000 | | | | 596,825 | |

Merced Union High School District, Cabs-Election, Unlimited General Obligation | | | | | | | | |

Series C

(zero coupon), due 8/1/41 | | | 16,780,000 | | | | 3,156,654 | |

Oceanside, California Unified School District, Unlimited General Obligation | | | | | | | | |

Series C

(zero coupon), due 8/1/50 | | | 20,190,000 | | | | 2,281,268 | |

¨Riverside County Transportation Commission, Limited Tax, Revenue Bonds | | | | | | | | |

Series A

5.25%, due 6/1/39 (a)(b) | | | 19,100,000 | | | | 21,988,476 | |

San Bernardino City Unified School District, Unlimited General Obligation | | | | | | | | |

Series C, Insured: NATL-RE

(zero coupon), due 8/1/31 | | | 5,000,000 | | | | 2,191,800 | |

San Joaquin Hills Transportation Corridor Agency, Revenue Bonds | | | | | | | | |

Series A, Insured: NATL-RE

(zero coupon), due 1/15/31 | | | 150,000 | | | | 59,547 | |

Series A, Insured: NATL-RE

5.25%, due 1/15/30 | | | 900,000 | | | | 900,153 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

California 30.0% (19.3% of Managed Assets) (continued) | |

Stockton Public Financing Authority, Parking & Capital Projects, Revenue Bonds | | | | | | | | |

Insured: NATL-RE

4.25%, due 9/1/14 | | $ | 50,000 | | | $ | 49,918 | |

Insured: NATL-RE

4.50%, due 9/1/17 | | | 100,000 | | | | 97,937 | |

Insured: NATL-RE

4.80%, due 9/1/20 | | | 105,000 | | | | 101,200 | |

Stockton Public Financing Authority, Redevelopment Projects, Revenue Bonds | | | | | | | | |

Series A, Insured: RADIAN

5.25%, due 9/1/31 | | | 630,000 | | | | 532,199 | |

Series A, Insured: RADIAN

5.25%, due 9/1/34 | | | 2,925,000 | | | | 2,418,887 | |

Stockton Public Financing Authority, Water System, Capital Improvement Projects, Revenue Bonds | | | | | | | | |

Series A, Insured: NATL-RE

5.00%, due 10/1/31 | | | 175,000 | | | | 176,598 | |

Stockton, California Unified School District, Unlimited General Obligation | | | | | | | | |

Series D, Insured: AGM

(zero coupon), due 8/1/35 | | | 4,165,000 | | | | 1,397,399 | |

Series D, Insured: AGM

(zero coupon), due 8/1/40 | | | 13,930,000 | | | | 3,525,544 | |

Tobacco Securitization Authority of Southern California, Asset-Backed, Revenue Bonds | | | | | | | | |

Series A-1

5.00%, due 6/1/37 | | | 3,000,000 | | | | 2,479,050 | |

¨University of California, Regents Medical Center, Revenue Bonds | | | | | | | | |

Series J

5.00%, due 5/15/43 (a)(b) | | | 23,260,000 | | | | 25,426,824 | |

Westminster School District, Cabs-Election 2008, Unlimited General Obligation | | | | | | | | |

Series B, Insured: BAM

(zero coupon), due 8/1/48 | | | 27,045,000 | | | | 3,140,195 | |

| | | | | | | | |

| | | | | | | 154,991,845 | |

| | | | | | | | |

Colorado 1.1% (0.7% of Managed Assets) | |

Colorado Health Facilities Authority, Revenue Bonds

5.625%, due 6/1/43 | | | 5,000,000 | | | | 5,525,600 | |

E-470 Public Highway Authority, Revenue Bonds | | | | | | | | |

Series B, Insured: NATL-RE

(zero coupon), due 9/1/29 | | | 660,000 | | | | 296,380 | |

| | | | | | | | |

| | | | | | | 5,821,980 | |

| | | | | | | | |

| | | | |

| 10 | | MainStay DefinedTerm Municipal Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

District of Columbia 0.8% (0.5% of Managed Assets) | |

Metropolitan Washington Airports Authority, Revenue Bonds | | | | | | | | |

Series C, Insured: GTY

0.00%, due 10/1/41 (c) | | $ | 3,900,000 | | | $ | 4,224,870 | |

| | | | | | | | |

|

Florida 6.8% (4.4% of Managed Assets) | |

City of Orlando, Tourist Development Tax Revenue, 3rd Lien, 6th Cent Contract, Revenue Bonds | | | | | | | | |

Insured: GTY

5.50%, due 11/1/38 | | | 20,000,000 | | | | 20,706,600 | |

JEA Electric System, Revenue Bonds | | | | | | | | |

Series C

5.00%, due 10/1/37 (a)(b) | | | 12,980,000 | | | | 14,381,542 | |

| | | | | | | | |

| | | | | | | 35,088,142 | |

| | | | | | | | |

Georgia 0.1% (0.1% of Managed Assets) | |

Marietta Development Authority, University Facilities-Life University, Inc. Project, Revenue Bonds

6.25%, due 6/15/20 | | | 440,000 | | | | 452,496 | |

| | | | | | | | |

|

Guam 4.9% (3.2% of Managed Assets) | |

Guam Economic Development & Commerce Authority, Tobacco Settlement Asset Backed, Revenue Bonds

5.625%, due 6/1/47 | | | 350,000 | | | | 278,163 | |

Guam Government, Waterworks Authority, Revenue Bonds

5.50%, due 7/1/43 | | | 10,025,000 | | | | 10,739,181 | |

Guam International Airport Authority, Revenue Bonds | | | | | | | | |

Series C

5.00%, due 10/1/21 (d) | | | 5,500,000 | | | | 6,188,435 | |

Series C, Insured: AGM

6.00%, due 10/1/34 (d) | | | 3,425,000 | | | | 3,874,942 | |

Territory of Guam, Unlimited General Obligation | | | | | | | | |

Series A

7.00%, due 11/15/39 | | | 4,000,000 | | | | 4,358,040 | |

| | | | | | | | |

| | | | | | | 25,438,761 | |

| | | | | | | | |

Illinois 19.1% (12.3% of Managed Assets) | |

¨Chicago Board of Education, Unlimited General Obligation | | | | | | | | |

Series A

5.50%, due 12/1/39 | | | 5,000,000 | | | | 5,284,450 | |

Series A, Insured: AGM

5.50%, due 12/1/39 (a)(b) | | | 20,000,000 | | | | 21,531,800 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Illinois 19.1% (12.3% of Managed Assets) (continued) | |

Chicago, Illinois O’ Hare International Airport, Revenue Bonds | | | | | | | | |

Series A, Insured: AGM

5.00%, due 1/1/38 | | $ | 3,000,000 | | | $ | 3,104,760 | |

Insured: AGM

5.75%, due 1/1/38 | | | 5,000,000 | | | | 5,632,300 | |

Chicago, Unlimited General Obligation | | | | | | | | |

Series C

5.00%, due 1/1/40 (a)(b) | | | 19,570,000 | | | | 19,837,130 | |

¨Metropolitan Pier & Exposition Authority, McCormick Place Expansion, Revenue Bonds | | | | | | | | |

Series A

5.50%, due 6/15/50 (a)(b) | | | 20,000,000 | | | | 21,490,148 | |

¨State of Illinois, Unlimited General Obligation

5.25%, due 7/1/31 (a)(b) | | | 20,000,000 | | | | 21,784,758 | |

| | | | | | | | |

| | | | | | | 98,665,346 | |

| | | | | | | | |

Indiana 0.2% (0.1% of Managed Assets) | |

Anderson Economic Development Revenue, Anderson University Project, Revenue Bonds

5.00%, due 10/1/32 | | | 1,105,000 | | | | 1,058,844 | |

| | | | | | | | |

|

Iowa 1.1% (0.7% of Managed Assets) | |

Coralville Urban Renewal Revenue, Tax Increment, Tax Allocation | | | | | | | | |

Series C

5.00%, due 6/1/47 | | | 4,220,000 | | | | 3,388,069 | |

Iowa Higher Education Loan Authority, Private College Facility, Wartburg College, Revenue Bonds | | | | | | | | |

Series B

5.50%, due 10/1/31 | | | 2,075,000 | | | | 2,047,465 | |

| | | | | | | | |

| | | | | | | 5,435,534 | |

| | | | | | | | |

Kansas 4.2% (2.7% of Managed Assets) | |

Kansas Development Finance Authority, Adventist Health Sunbelt Obligated Group, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 11/15/32 (a)(b) | | | 19,290,000 | | | | 21,477,458 | |

| | | | | | | | |

|

Louisiana 2.2% (1.4% of Managed Assets) | |

Louisiana Public Facilities Authority, Archdiocese of New Orleans Project, Revenue Bonds | | | | | | | | |

Insured: CIFG

4.50%, due 7/1/37 | | | 6,685,000 | | | | 6,330,762 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 11 | |

Portfolio of Investments May 31, 2014 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

Louisiana 2.2% (1.4% of Managed Assets) (continued) | |

Louisiana Public Facilities Authority, Black & Gold Facilities Project, Revenue Bonds | | | | | | | | |

Series A, Insured: CIFG

4.50%, due 7/1/38 | | $ | 405,000 | | | $ | 323,303 | |

Series A, Insured: CIFG

5.00%, due 7/1/22 | | | 1,105,000 | | | | 1,089,077 | |

Series A, Insured: CIFG

5.00%, due 7/1/24 | | | 1,200,000 | | | | 1,157,568 | |

Series A, Insured: CIFG

5.00%, due 7/1/30 | | | 2,870,000 | | | | 2,603,865 | |

| | | | | | | | |

| | | | | | | 11,504,575 | |

| | | | | | | | |

Maryland 4.5% (2.9% of Managed Assets) | |

¨Maryland Health & Higher Educational Facilities Authority, Johns Hopkins Health System Obligated Group, Revenue Bonds | | | | | | | | |

Series C

5.00%, due 5/15/43 (a)(b) | | | 20,870,000 | | | | 23,098,521 | |

| | | | | | | | |

|

Massachusetts 0.1% (0.1% of Managed Assets) | |

Massachusetts Development Finance Agency, Seven Hills Foundation & Affiliates, Revenue Bonds | | | | | | | | |

Insured: RADIAN

5.00%, due 9/1/35 | | | 435,000 | | | | 436,040 | |

| | | | | | | | |

|

Michigan 10.1% (6.5% of Managed Assets) | |

Detroit, Michigan Water and Sewerage Department, Senior Lien, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 7/1/32 | | | 1,500,000 | | | | 1,486,725 | |

Series A

5.25%, due 7/1/39 | | | 10,730,000 | | | | 10,692,445 | |

Series C-1, Insured: AGM

7.00%, due 7/1/27 | | | 3,450,000 | | | | 3,763,571 | |

Detroit, Michigan Water Supply System, Revenue Bonds | | | | | | | | |

Series A, Insured: NATL-RE

4.50%, due 7/1/31 | | | 760,000 | | | | 724,637 | |

Series B, Insured: NATL-RE

5.00%, due 7/1/34 | | | 3,840,000 | | | | 3,839,731 | |

Series C

5.00%, due 7/1/41 | | | 1,005,000 | | | | 981,342 | |

Series A

5.25%, due 7/1/41 | | | 2,385,000 | | | | 2,372,932 | |

Series A

5.75%, due 7/1/37 | | | 5,000,000 | | | | 4,990,200 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Michigan 10.1% (6.5% of Managed Assets) (continued) | |

Michigan Finance Authority, Limited Obligation, Public School Academy, University Learning, Revenue Bonds

7.375%, due 11/1/30 | | $ | 2,920,000 | | | $ | 3,180,873 | |

Michigan Finance Authority, Public School Academy, Revenue Bonds

7.50%, due 11/1/40 | | | 2,745,000 | | | | 2,991,117 | |

Michigan Public Educational Facilities Authority, Dr. Joseph F. Pollack, Revenue Bonds | | | | | | | | |

8.00%, due 4/1/30 | | | 1,195,000 | | | | 1,294,137 | |

8.00%, due 4/1/40 | | | 500,000 | | | | 539,960 | |

Michigan Tobacco Settlement Finance Authority, Revenue Bonds | | | | | | | | |

Series A

6.00%, due 6/1/34 | | | 5,000,000 | | | | 4,224,750 | |

Series A

6.00%, due 6/1/48 | | | 13,435,000 | | | | 11,136,406 | |

| | | | | | | | |

| | | | | | | 52,218,826 | |

| | | | | | | | |

Missouri 0.6% (0.4% of Managed Assets) | |

St. Louis County Industrial Development Authority, Nazareth Living Center, Revenue Bonds | | | | | | | | |

5.875%, due 8/15/32 | | | 750,000 | | | | 758,070 | |

6.125%, due 8/15/42 | | | 2,120,000 | | | | 2,177,494 | |

| | | | | | | | |

| | | | | | | 2,935,564 | |

| | | | | | | | |

Nebraska 4.1% (2.7% of Managed Assets) | |

Central Plains Energy, Project No. 3, Revenue Bonds

5.25%, due 9/1/37 (a)(b) | | | 20,000,000 | | | | 21,335,600 | |

| | | | | | | | |

|

Nevada 2.5% (1.6% of Managed Assets) | |

City of Sparks, Tourism Improvement District No. 1, Senior Sales Tax Anticipation, Revenue Bonds | | | | | | | | |

Series A

6.75%, due 6/15/28 (a) | | | 12,500,000 | | | | 13,057,750 | |

| | | | | | | | |

|

New Hampshire 0.4% (0.3% of Managed Assets) | |

Manchester Housing & Redevelopment Authority Inc., Revenue Bonds | | | | | | | | |

Series B, Insured: ACA

(zero coupon), due 1/1/24 | | | 4,740,000 | | | | 2,238,797 | |

| | | | | | | | |

|

New Jersey 5.2% (3.4% of Managed Assets) | |

New Jersey Economic Development Authority, Continental Airlines, Inc. Project, Revenue Bonds | | | | | | | | |

5.25%, due 9/15/29 (d) | | | 9,120,000 | | | | 9,447,773 | |

| | | | |

| 12 | | MainStay DefinedTerm Municipal Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

New Jersey 5.2% (3.4% of Managed Assets) (continued) | |

New Jersey Economic Development Authority, Continental Airlines, Inc. Project, Revenue Bonds (continued) | | | | | | | | |

Series B

5.625%, due 11/15/30 (d) | | $ | 2,500,000 | | | $ | 2,671,600 | |

New Jersey Economic Development Authority, UMM Energy Partners, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 6/15/37 (d) | | | 1,000,000 | | | | 1,018,330 | |

New Jersey Health Care Facilities Financing Authority, Hospital Asset Transformation Program, Revenue Bonds | | | | | | | | |

Series A

5.75%, due 10/1/31 | | | 2,480,000 | | | | 2,880,545 | |

New Jersey Tobacco Settlement Financing Corp., Revenue Bonds | | | | | | | | |

Series 1A

5.00%, due 6/1/41 | | | 14,000,000 | | | | 11,061,540 | |

| | | | | | | | |

| | | | | | | 27,079,788 | |

| | | | | | | | |

New York 1.8% (1.2% of Managed Assets) | |

Onondaga Civic Development Corp., St. Joseph’s Hospital Health Center, Revenue Bonds

5.00%, due 7/1/42 | | | 2,000,000 | | | | 1,958,540 | |

Riverhead Industrial Development Agency, Revenue Bonds | | | | | | | | |

7.00%, due 8/1/43 | | | 5,595,000 | | | | 6,339,023 | |

7.00%, due 8/1/48 | | | 1,000,000 | | | | 1,122,650 | |

| | | | | | | | |

| | | | | | | 9,420,213 | |

| | | | | | | | |

Ohio 5.3% (3.4% of Managed Assets) | |

Buckeye Tobacco Settlement Financing Authority, Asset-Backed, Senior Turbo, Revenue Bonds | | | | | | | | |

Series A-2

5.75%, due 6/1/34 | | | 2,425,000 | | | | 2,008,482 | |

Series A-2

5.875%, due 6/1/30 | | | 10,600,000 | | | | 8,923,292 | |

Series A-2

6.00%, due 6/1/42 | | | 5,915,000 | | | | 4,948,252 | |

Southeastern Ohio Port Authority, Hospital Facilities Revenue, Memorial Health Systems, Revenue Bonds | | | | | | | | |

5.75%, due 12/1/32 | | | 6,700,000 | | | | 6,737,989 | |

6.00%, due 12/1/42 | | | 4,900,000 | | | | 4,948,657 | |

| | | | | | | | |

| | | | | | | 27,566,672 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Pennsylvania 8.5% (5.5% of Managed Assets) | |

Bristol Township School District, Limited General Obligation

5.25%, due 6/1/43 | | $ | 2,000,000 | | | $ | 2,223,400 | |

Harrisburg, Capital Appreciation, Unlimited General Obligation | | | | | | | | |

Series F, Insured: AMBAC

(zero coupon), due 9/15/21 | | | 95,000 | | | | 56,005 | |

Pennsylvania Economic Development Financing Authority, Capitol Region Parking System, Revenue Bonds

6.00%, due 7/1/53 (a)(b) | | | 14,260,000 | | | | 16,603,740 | |

Pennsylvania Turnpike Commission, Revenue Bonds | | | | | | | | |

Series C

5.00%, due 12/1/43 | | | 12,570,000 | | | | 13,758,494 | |

Philadelphia Authority for Industrial Development, Nueva Esperanza Inc., Revenue Bonds

8.20%, due 12/1/43 | | | 2,000,000 | | | | 2,109,780 | |

Philadelphia Authority for Industrial Development, Please Touch Museum Project, Revenue Bonds

5.25%, due 9/1/31 | | | 2,500,000 | | | | 874,975 | |

Philadelphia Water and Wastewater Revenue, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 1/1/36 | | | 2,830,000 | | | | 3,061,239 | |

Philadelphia, Unlimited General Obligation

6.00%, due 8/1/36 | | | 4,625,000 | | | | 5,284,756 | |

| | | | | | | | |

| | | | | | | 43,972,389 | |

| | | | | | | | |

Puerto Rico 4.7% (3.0% of Managed Assets) | |

Puerto Rico Commonwealth, Public Improvement, Unlimited General Obligation | | | | | | | | |

Series A-4, Insured: AGM

5.25%, due 7/1/30 | | | 7,000,000 | | | | 7,026,740 | |

Series A, Insured: NATL-RE

5.50%, due 7/1/20 | | | 575,000 | | | | 626,641 | |

Puerto Rico Highways & Transportation Authority, Revenue Bonds | | | | | | | | |

Series K, Insured: CIFG

5.00%, due 7/1/18 | | | 530,000 | | | | 538,633 | |

Series N, Insured: NATL-RE

5.25%, due 7/1/32 | | | 5,000,000 | | | | 4,913,850 | |

Series N, Insured: AGM, GTY

5.50%, due 7/1/29 | | | 6,000,000 | | | | 6,211,740 | |

Series C, Insured: AGM

5.50%, due 7/1/30 | | | 4,705,000 | | | | 4,790,443 | |

| | | | | | | | |

| | | | | | | 24,108,047 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 13 | |

Portfolio of Investments May 31, 2014 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

Rhode Island 3.2% (2.1% of Managed Assets) | |

Narragansett Bay Commission Wastewater System, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 9/1/38 (a)(b) | | $ | 15,000,000 | | | $ | 16,515,150 | |

| | | | | | | | |

|

Tennessee 3.2% (2.0% of Managed Assets) | |

Chattanooga, TN, Industrial Development Board, Lease Rental, Revenue Bonds | | | | | | | | |

Insured: AGM

5.00%, due 10/1/30 (a)(b) | | | 15,000,000 | | | | 16,368,750 | |

| | | | | | | | |

|

Texas 9.8% (6.3% of Managed Assets) | |

Harris County-Houston Sports Authority, Revenue Bonds | | | | | | | | |

Series H, Insured: NATL-RE

(zero coupon), due 11/15/28 | | | 50,000 | | | | 23,669 | |

Series H, Insured: NATL-RE

(zero coupon), due 11/15/30 | | | 8,775,000 | | | | 3,763,685 | |

Series H, Insured: NATL-RE

(zero coupon), due 11/15/33 | | | 1,320,000 | | | | 449,645 | |

Series A, Insured: NATL-RE

(zero coupon), due 11/15/34 | | | 2,520,000 | | | | 833,868 | |

Series H, Insured: NATL-RE

(zero coupon), due 11/15/35 | | | 2,080,000 | | | | 586,186 | |

Series H, Insured: NATL-RE

(zero coupon), due 11/15/37 | | | 6,705,000 | | | | 1,695,627 | |

Series A, Insured: NATL-RE

(zero coupon), due 11/15/38 | | | 175,000 | | | | 44,179 | |

Series H, Insured: NATL-RE

(zero coupon), due 11/15/38 | | | 260,000 | | | | 61,256 | |

Series A, Insured: NATL-RE

(zero coupon), due 11/15/40 | | | 1,000,000 | | | | 214,630 | |

Series B, Insured: NATL-RE

5.25%, due 11/15/40 | | | 755,000 | | | | 755,325 | |

New Hope Cultural Education Facilities Corp., Student Housing, CHF-Stephenville Tarleton State University Project, Revenue Bonds | | | | | | | | |

Series A

5.375%, due 4/1/28 | | | 1,845,000 | | | | 1,950,958 | |

Newark Cultural Education Facilities Finance Corp., A. W. Brown-Fellowship Leadership Academy, Revenue Bonds | | | | | | | | |

Series A

6.00%, due 8/15/42 | | | 5,640,000 | | | | 5,854,940 | |

¨Texas Municipal Gas Acquisition & Supply Corp. III, Revenue Bonds | | | | | | | | |

5.00%, due 12/15/29 | | | 880,000 | | | | 942,471 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Texas 9.8% (6.3% of Managed Assets) (continued) | |

Texas Municipal Gas Acquisition & Supply Corp. III, Revenue Bonds (continued) | | | | | | | | |

5.00%, due 12/15/30 | | $ | 5,500,000 | | | $ | 5,857,665 | |

5.00%, due 12/15/32 (a)(b) | | | 20,000,000 | | | | 20,860,763 | |

Texas State Turnpike Authority, Central Texas System, Revenue Bonds | | | | | | | | |

Insured: AMBAC

(zero coupon), due 8/15/35 | | | 23,750,000 | | | | 6,664,488 | |

| | | | | | | | |

| | | | | | | 50,559,355 | |

| | | | | | | | |

U.S. Virgin Islands 1.5% (1.0% of Managed Assets) | |

Virgin Islands Public Finance Authority, Gross Receipts Taxes Loan, Revenue Bonds | | | | | | | | |

Insured: AGM

5.00%, due 10/1/32 | | | 2,475,000 | | | | 2,717,822 | |

Virgin Islands Public Finance Authority, Revenue Bonds | | | | | | | | |

Series A, Insured: AGM

5.00%, due 10/1/32 | | | 4,650,000 | | | | 5,106,212 | |

| | | | | | | | |

| | | | | | | 7,824,034 | |

| | | | | | | | |

Vermont 0.3% (0.2% of Managed Assets) | |

Vermont State Student Assistance Corp., Revenue Bonds | | | | | | | | |

Series A

5.10%, due 6/15/32 (d) | | | 1,545,000 | | | | 1,580,257 | |

| | | | | | | | |

|

Virginia 7.0% (4.6% of Managed Assets) | |

Tobacco Settlement Financing Corp., Revenue Bonds | | | | | | | | |

Series B1

5.00%, due 6/1/47 | | | 10,760,000 | | | | 7,698,134 | |

¨Virginia Commonwealth Transportation Board, Capital Projects, Revenue Bonds

5.00%, due 5/15/31 (a)(b) | | | 20,315,000 | | | | 23,195,432 | |

Virginia Small Business Financing Authority, Senior Lien, Elizabeth River Crossing, Revenue Bonds

6.00%, due 1/1/37 (d) | | | 5,000,000 | | | | 5,539,150 | |

| | | | | | | | |

| | | | | | | 36,432,716 | |

| | | | | | | | |

Washington 4.0% (2.6% of Managed Assets) | |

Washington Health Care Facilities Authority, Multicare Health System, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 8/15/44 (a)(b) | | | 19,665,000 | | | | 20,936,146 | |

| | | | | | | | |

| | | | |

| 14 | | MainStay DefinedTerm Municipal Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

West Virginia 0.2% (0.1% of Managed Assets) | |

Ohio County, Wheeling Jesuit, Revenue Bonds | | | | | | | | |

Series A

5.50%, due 6/1/36 | | $ | 845,000 | | | $ | 835,435 | |

| | | | | | | | |

Total Investments

(Cost $743,632,197) (h) | | | 151.2 | % | | | 781,707,936 | |

Floating Rate Note Obligations (e) | | | (41.3 | ) | | | (213,380,000 | ) |

Fixed Rate Municipal Term Preferred Shares, at Liquidation Value | | | (13.5 | ) | | | (70,000,000 | ) |

Other Assets, Less Liabilities | | | 3.6 | | | | 18,632,055 | |

Net Assets Applicable to Common Shares | | | 100.0 | % | | $ | 516,959,991 | |

| | |

| | | | | | | | |

| | | | | | | | |

| | | Contracts

Short | | | Unrealized

Appreciation

(Depreciation) (f) | |

| Futures Contracts 0.0%‡ | | | | | | | | |

United States Treasury Note September 2014 (10 Year) (g) | | | (625 | ) | | $ | 48,512 | |

| | | | | | | | |

Total Futures Contracts Short

(Notional Amount $78,447,266) | | | | | | $ | 48,512 | |

| | | | | | | | |

| ‡ | Less than one-tenth of a percent. |

| (a) | May be sold to institutional investors only under Rule 144A or securities offered pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. |

| (b) | All or portion of principal amount transferred to a Tender Option Bond (“TOB”) Issuer in exchange for TOB Residuals and cash. |

| (c) | Step coupon – Rate shown was the rate in effect as of May 31, 2014. |

| (d) | Interest on these securities was subject to alternative minimum tax. |

| (e) | Face value of Floating Rate Notes received from TOB transactions. |

| (f) | Represents the difference between the value of the contracts at the time they were opened and the value as of May 31, 2014. |

| (g) | As of May 31, 2014, cash in the amount of $812,500 was on deposit with a broker for futures transactions. |

| (h) | As of May 31, 2014, cost was $532,952,394 for federal income tax purposes and net unrealized appreciation was as follows: |

| | | | |

Gross unrealized appreciation | | $ | 42,276,621 | |

Gross unrealized depreciation | | | (6,088,579 | ) |

| | | | |

Net unrealized appreciation | | $ | 36,188,042 | |

| | | | |

“Managed Assets” is defined as the Fund’s total assets, minus the sum of its accrued liabilities (other than Fund liabilities incurred for the purpose of creating effective leverage (i.e. tender option bonds) or Fund liabilities related to liquidation preference of any preferred shares issued).

The following abbreviations are used in the above portfolio:

ACA—ACA Financial Guaranty Corp.

AGC—Assured Guaranty Corp.

AGM—Assured Guaranty Municipal Corp.

AMBAC—Ambac Assurance Corp.

BAM—Build America Mutual Assurance Co.

CIFG—CIFG Group

FGIC—Financial Guaranty Insurance Co.

GTY—Assured Guaranty Corp.

NATL-RE—National Public Finance Guarantee Corp.

RADIAN—Radian Asset Assurance, Inc.

The following is a summary of the fair valuations according to the inputs used as of May 31, 2014, for valuing the Fund’s assets.

Asset Valuation Inputs

| | | | | | | | | | | | | | | | |

Description | | Quoted

Prices in

Active

Markets for

Identical

Assets (Level 1) | | | Significant

Other

Observable

Inputs (Level 2) | | | Significant

Unobservable

Inputs (Level 3) | | | Total | |

| Investments in Securities (a) | | | | | | | | | | | | | | | | |

| Municipal Bonds | | $ | — | | | $ | 781,707,936 | | | $ | — | | | $ | 781,707,936 | |

| | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

Futures Contracts Short (b) | | | 48,512 | | | | — | | | | — | | | | 48,512 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities and Other Financial Instruments | | $ | 48,512 | | | $ | 781,707,936 | | | $ | — | | | $ | 781,756,448 | |

| | | | | | | | | | | | | | | | |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

| (b) | The value listed for these securities reflects unrealized appreciation (depreciation) as shown on the Portfolio of Investments. |

The Fund recognizes transfers between the levels as of the beginning of the period.

For the year ended May 31, 2014, the Fund did not have any transfers between Level 1 and Level 2 fair value measurements. (See Note 2)

As of May 31, 2014, the Fund did not hold any investments with significant unobservable inputs (Level 3). (See Note 2)

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 15 | |

Statement of Assets and Liabilities as of May 31, 2014

| | | | |

| Assets | |

Investment in securities, at value (identified cost $743,632,197) | | $ | 781,707,936 | |

Cash collateral on deposit at broker | | | 812,500 | |

Cash | | | 256,572 | |

Receivables: | | | | |

Interest | | | 12,660,484 | |

Investment securities sold | | | 6,299,275 | |

Variation margin on futures contracts | | | 47,168 | |

Deferred offering costs (See Note 2 (M)) | | | 225,868 | |

Other assets | | | 48,120 | |

| | | | |

Total assets | | | 802,057,923 | |

| | | | |

| |

| Liabilities | | | | |

Payable for Floating Rate Note Obligations | | | 213,380,000 | |

Fixed Rate Municipal Term Preferred Shares, at liquidation value, Series A (a) | | | 35,000,000 | |

Fixed Rate Municipal Term Preferred Shares, at liquidation value, Series B (a) | | | 35,000,000 | |

Payables: | | | | |

Manager (See Note 3) | | | 404,281 | |

Professional fees | | | 81,999 | |

Shareholder communication | | | 25,107 | |

Transfer agent | | | 3,061 | |

Custodian | | | 953 | |

Trustees | | | 503 | |

Accrued expenses | | | 1,810 | |

Interest expense and fees payable | | | 1,010,312 | |

Common share dividend payable | | | 189,906 | |

| | | | |

Total liabilities | | | 285,097,932 | |

| | | | |

Net assets applicable to Common shares | | $ | 516,959,991 | |

| | | | |

Common shares outstanding | | | 27,554,564 | |

| | | | |

Net asset value per Common share (Net assets applicable to Common shares divided by Common shares outstanding) | | $ | 18.76 | |

| | | | |

|

Net assets applicable to Common Shares

consist of | |

Common shares, $0.001 par value per share, unlimited number of shares authorized | | $ | 27,555 | |

Additional paid-in capital | | | 524,930,310 | |

| | | | |

| | | 524,957,865 | |

Undistributed net investment income | | | 2,708,187 | |

Accumulated net realized gain (loss) on investments and futures transactions | | | (48,830,312 | ) |

Net unrealized appreciation (depreciation) on investments and futures contracts | | | 38,124,251 | |

| | | | |

Net assets applicable to Common shares | | $ | 516,959,991 | |

| | | | |

| (a) | Unlimited authorized shares, $0.01 par value, liquidation preference of $100,000 per share (See Note 2 (J)). |

| | | | |

| 16 | | MainStay DefinedTerm Municipal Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statement of Operations for the year ended May 31, 2014

| | | | |

| Investment Income (Loss) | |

Income | | | | |

Interest | | $ | 40,000,500 | |

| | | | |

Expenses | | | | |

Manager (See Note 3) | | | 4,511,721 | |

Interest expense and fees | | | 3,100,895 | |

Professional fees | | | 137,617 | |

Shareholder communication | | | 49,381 | |

Transfer agent | | | 37,701 | |

Trustees | | | 31,104 | |

Custodian | | | 11,878 | |

Miscellaneous | | | 134,964 | |

| | | | |

Total expenses | | | 8,015,261 | |

| | | | |

Net investment income (loss) | | | 31,985,239 | |

| | | | |

|

Realized and Unrealized Gain (Loss) on Investments

and Futures Contracts | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | (44,126,423 | ) |

Futures transactions | | | (1,464,031 | ) |

| | | | |

Net realized gain (loss) on investments and futures transactions | | | (45,590,454 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 22,011,802 | |

Futures contracts | | | (910,551 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on investments and futures contracts | | | 21,101,251 | |

| | | | |

Net realized and unrealized gain (loss) on investments and futures transactions | | | (24,489,203 | ) |

| | | | |

Net increase (decrease) in net assets to Common shares resulting from operations | | $ | 7,496,036 | |

| | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year ended May 31, 2014 | | | June 26, 2012* through May 31, 2013 | |

Net Increase (Decrease) in Net Assets Applicable

to Common Shares | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | 31,985,239 | | | $ | 25,313,226 | |

Net realized gain (loss) on investments and futures transactions | | | (45,590,454 | ) | | | 12,431,388 | |

Net change in unrealized appreciation (depreciation) on investments and futures contracts | | | 21,101,251 | | | | 17,023,000 | |

| | | | |

Net increase (decrease) in net assets applicable to Common shares resulting from operations | | | 7,496,036 | | | | 54,767,614 | |

| | | | |

Dividends and distributions to Common shareholders: | | | | | | | | |

From net investment income | | | (31,720,814 | ) | | | (23,745,652 | ) |

From net realized gain on investments | | | (9,582,651 | ) | | | (5,481,764 | ) |

| | | | |

Total dividends and distributions to Common shareholders | | | (41,303,465 | ) | | | (29,227,416 | ) |

| | | | |

Capital share transactions (Common shares): | | | | | | | | |

Net proceeds issued to shareholders resulting from initial public offering | | | — | | | | 524,508,195 | |

Net proceeds issued to shareholders from reinvestment of dividends and distributions | | | — | | | | 619,027 | |

| | | | |

Increase (decrease) in net assets applicable to Common shares from capital share transactions | | | — | | | | 525,127,222 | |

| | | | |

Net increase (decrease) in net assets applicable to Common shares | | | (33,807,429 | ) | | | 550,667,420 | |

|

| Net Assets Applicable to Common Shares | |

Beginning of period | | | 550,767,420 | | | | 100,000 | |

| | | | |

End of period | | $ | 516,959,991 | | | $ | 550,767,420 | |

| | | | |

Undistributed net investment income at end of period | | $ | 2,708,187 | | | $ | 1,974,196 | |

| | | | |

| | | | |

| 18 | | MainStay DefinedTerm Municipal Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statement of Cash Flows for the year ended May 31, 2014

| | | | |

| Cash flows used in operating activities: | |

Net increase in net assets resulting from operations | | $ | 7,496,036 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: | | | | |

Investments purchased | | | (999,892,881 | ) |

Investments sold | | | 993,835,406 | |

Amortization (accretion) of discount and premium, net | | | (3,216,962 | ) |

Increase in interest receivable | | | (1,481,094 | ) |

Decrease in cash collateral on deposit at broker | | | 12,500 | |

Decrease in variation margin on futures contracts | | | 128,613 | |

Increase in other assets | | | (3,863 | ) |

Increase in professional fees payable | | | 18,098 | |

Decrease in custodian payable | | | (652 | ) |

Decrease in shareholder communication payable | | | (9,176 | ) |

Increase in interest expense and fees payable | | | 120,114 | |

Decrease in due to Trustees | | | (122 | ) |

Decrease in due to manager | | | (15,088 | ) |

Decrease in due to transfer agent | | | (6,109 | ) |

Increase in accrued expenses | | | 1,810 | |

Net change in unrealized (appreciation) depreciation on investments | | | (22,011,802 | ) |

Net realized (gain) loss from investments | | | 44,126,423 | |

| | | | |

Net cash provided by operating activities | | | 19,101,251 | |

| | | | |

| |

| Cash flows from financing activities: | | | | |

Issuance of floating rate note obligations | | | 186,185,000 | |

Redemption of floating rate note obligations | | | (164,185,000 | ) |

Cash distributions paid | | | (41,227,755 | ) |

| | | | |

Net cash from financing activities | | | (19,227,755 | ) |

| | | | |

Net decrease in cash: | | | (126,504 | ) |

Cash at beginning of year | | | 383,076 | |

| | | | |

Cash at end of year | | $ | 256,572 | |

| | | | |

Cash payments recognized as interest expense on the Fund’s Fixed Rate Municipal Term Preferred Shares for the year ended May 31, 2014, was $1,257,203. Net increase in net assets result from operations for the year ended May 31, 2014, includes $1,696,959 of non-cash interest income and non-cash interest expense on floating rate note obligations related to the Fund’s tender option bonds.

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 19 | |

Financial Highlights selected per share data and ratios

| | | | | | | | |

| | | Year ended

May 31,

2014 | | | June 26, 2012* through May 31,

2013 | |

Net asset value at beginning of period applicable to Common shares | | $ | 19.99 | | | $ | 19.06 | (a) |

| | | | | | | | |

Net investment income (loss) | | | 1.16 | | | | 0.92 | |

Net realized and unrealized gain (loss) on investments | | | (0.89 | ) | | | 1.11 | |

| | | | | | | | |

Total from investment operations | | | 0.27 | | | | 2.03 | |

| | | | | | | | |

| Less dividends and distributions to Common shareholders: | | | | | | | | |

From net investment income | | | (1.15 | ) | | | (0.86 | ) |

From net realized gain on investments | | | (0.35 | ) | | | (0.20 | ) |

| | | | | | | | |

Total dividends and distributions to Common shareholders | | | (1.50 | ) | | | (1.06 | ) |

| | | | | | | | |

Dilution effect on net asset value from overallotment issuance | | | — | | | | (0.04 | ) |

| | | | | | | | |

Net asset value at end of period applicable to Common shares | | $ | 18.76 | | | $ | 19.99 | |

| | | | | | | | |

Market price at end of period applicable to Common shares | | $ | 17.93 | | | $ | 18.91 | |

| | | | | | | | |

Total investment return on net asset value | | | 2.36 | % | | | 10.52 | % (b) |

Total investment return on market price | | | 3.81 | % | | | (0.36 | %)(b) |

| Ratios (to average net assets of Common shareholders)/Supplemental Data: | | | | | | | | |

Net investment income (loss) | | | 6.67 | % | | | 5.01 | % †† |

Net expenses (excluding interest expense and fees) | | | 1.02 | % | | | 0.89 | % ††(c) |

Expenses (including interest expense and fees) | | | 1.67 | % | | | 1.32 | % ††(c) |

Interest expense and fees (d) | | | 0.65 | % | | | 0.43 | % †† |

Portfolio turnover rate | | | 83 | % | | | 64 | % |

Net assets applicable to Common shareholders end of period (in 000’s) | | $ | 516,960 | | | $ | 550,767 | |

Preferred shares outstanding at $100,000 liquidation preference, end of period (in 000’s) | | $ | 70,000 | | | $ | 70,000 | |

Assets coverage per Preferred share, end of period (e) | | $ | 838,514 | | | $ | 886,811 | |

Average market value per Preferred share: | | | | | | | | |

Series A | | $ | 100,006 | | | $ | 100,008 | |

Series B | | $ | 100,006 | | | $ | 100,007 | |

| (a) | Net asset value at beginning of period reflects the deduction of the sales load of $0.90 per share and offering costs of $0.04 per share from the $20.00 offering price. |

| (b) | Total investment return is not annualized. |

| (c) | The Manager has agreed to reimburse all organizational expenses. |

| (d) | Interest expense and fees relate to the costs of tender option bond transactions (See Note 2 (I)) and the issuance of fixed rate municipal term preferred shares (See Note 2 (J)). |

| (e) | Calculated by subtracting the Fund’s total liabilities (not including the Preferred shares) from the Fund’s total assets, and dividing the result by the number of Preferred shares outstanding. |

| | | | |

| 20 | | MainStay DefinedTerm Municipal Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Notes to Financial Statements

Note 1–Organization and Business

MainStay DefinedTerm Municipal Opportunities Fund (the “Fund”) was organized as a Delaware statutory trust on April 20, 2011, pursuant to an agreement and declaration of trust, which was amended and restated on May 16, 2012 (“Declaration of Trust’’). The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified, closed-end management investment company. The Fund first offered Common shares through an initial public offering on June 26, 2012.

Pursuant to the terms of the Declaration of Trust, the Fund will commence the process of liquidation and dissolution at the close of business on December 31, 2024 (the “Termination Date”) unless otherwise extended by a majority of the Board of Trustees (the “Board”) (as discussed in further detail below). During the six-month period preceding the Termination Date or Extended Termination Date (as defined below), the Board may, without shareholder approval unless such approval is required by the 1940 Act, determine to (i) merge or consolidate the Fund so long as the surviving or resulting entity is an open-end registered investment company that is managed by the same investment adviser which serves as the investment adviser to the Fund at that time or is an affiliate of such investment adviser; or (ii) convert the Fund from a closed-end fund into an open-end registered investment company. Upon liquidation and termination of the Fund, shareholders will receive an amount equal to the Fund’s net asset value (“NAV”) at that time, which may be greater or less than the price at which Common shares were issued. The Fund’s investment objectives and policies are not designed to return to investors who purchased Common shares in the initial offering of such shares their initial investment on the Termination Date and such initial investors may receive more or less than their original investment upon termination.

Prior to the commencement of the six-month period preceding the Termination Date, a majority of the Board may extend the Termination Date for a period of not more than two years or such shorter time as may be determined (the “Extended Termination Date”), upon a determination that taking such actions as described in (i) or (ii) above would not, given prevailing market conditions, be in the best interests of the Fund’s shareholders. The Termination Date may be extended an unlimited number of times by the Board prior to the first business day of the sixth month before the next occurring Extended Termination Date.

The Fund’s primary investment objective is to seek current income exempt from regular U.S. Federal income taxes (but which may be includable in taxable income for purpose of the Federal alternative minimum tax). Total return is a secondary objective.

Note 2–Significant Accounting Policies

The Fund prepares its financial statements in accordance with generally accepted accounting principles (“GAAP”) in the United States of America and follows the significant accounting policies described below.

(A) Securities Valuation. Investments are valued as of the close of regular trading on the New York Stock Exchange (“Exchange”) (generally 4:00 p.m. Eastern time) on each day the Fund is open for business (“valuation date”).

The Board adopted procedures for the valuation of the Fund’s securities and delegated the responsibility for valuation determinations under

those procedures to the Valuation Committee of the Fund (the “Valuation Committee”). The Board authorized the Valuation Committee to appoint a Valuation Sub-Committee (the “Sub-Committee”) to deal in the first instance with questions that arise or cannot be resolved under these procedures. The Sub-Committee meets (in person, via electronic mail or via teleconference) on an as-needed basis. The Valuation Committee meets at a later time, as necessary, to ensure that actions taken by the Sub-Committee were appropriate. The procedures recognize that, subject to the oversight of the Board and unless otherwise noted, the responsibility for day-to-day valuation of portfolio assets (including securities for which market prices are not readily available) rests with New York Life Investment Management LLC (“New York Life Investments” or the “Manager”), aided to whatever extent necessary by the Subadvisor (as defined in Note 3(A)) to the Fund.

To assess the appropriateness of security valuations, the Manager or the Fund’s third party service provider, who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities, and the sale prices to the prior and current day prices and challenges prices exceeding certain tolerance levels with third party pricing services or broker sources. For those securities valued through either a standardized fair valuation methodology or a fair valuation measurement, the Sub-Committee deals in the first instance with such valuation and the Valuation Committee reviews and affirms the reasonableness of the valuation based on such methodologies and measurements on a regular basis after considering all relevant information that is reasonably available. Any action taken by the Sub-Committee with respect to the valuation of a portfolio security is submitted by the Valuation Committee to the Board for its review at its next regularly scheduled meeting immediately after such action.

“Fair value” is defined as the price that the Fund would receive upon selling an asset or liability in an orderly transaction to an independent buyer in the principal or most advantageous market for the asset or liability. Fair value measurements are determined within a framework that established a three-tier hierarchy which maximizes the use of observable market data and minimizes the use of unobservable inputs to establish a classification of fair value measurements for disclosure purposes. “Inputs” refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, such as the risk inherent in a particular valuation technique used to measure fair value using a pricing model and/or the risk inherent in the inputs for the valuation technique. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the information available. The inputs or methodology used for valuing securities may not be an indication of the risks associated with investing in those securities. The three-tier hierarchy of inputs is summarized below.

| • | | Level 1—quoted prices in active markets for an identical asset or liability |

| • | | Level 2—other significant observable inputs (including quoted prices for a similar asset or liability in active markets, interest rates and yield curves, prepayment speeds, credit risk, etc.) |

Notes to Financial Statements (continued)

| • | | Level 3—significant unobservable inputs (including the Fund’s own assumptions about the assumptions that market participants would use in measuring fair value of an asset or liability) |

The aggregate value by input level, as of May 31, 2014, for the Fund’s assets or liabilities is included at the end of the Fund’s Portfolio of Investments.

The Fund may use third party vendor evaluations, whose prices may be derived from one or more of the following standard inputs among others:

| | |

• Benchmark Yields | | • Reported Trades |

• Broker Dealer Quotes | | • Issuer Spreads |

• Two-sided markets | | • Benchmark securities |

• Bids/Offers | | • Reference Data (corporate actions or material event notices) |

• Industry and economic events | | • Comparable bonds |

• Monthly payment information | | |

An asset or liability for which market values cannot be measured using the methodologies described above are valued by methods deemed reasonable and in good faith by the Valuation Committee, following the procedures established by the Board, to represent fair value. Under these procedures, the Fund generally uses a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the asset or liability are discounted to calculate fair value. Discounts may also be applied due to the nature and/or duration of any restrictions on the disposition of the asset or liability. Due to the inherent valuation uncertainty of such assets or liabilities, fair values may differ significantly from values that would have been used had an active market existed. For the year ended May 31, 2014, there have been no material changes to the fair value methodologies.

Securities which may be valued in this manner include, but are not limited to: (i) a security for which trading has been halted or suspended; (ii) a debt security that has recently gone into default and for which there is not a current market quotation; (iii) a security of an issuer that has entered into a restructuring; (iv) a security that has been de-listed from a national exchange; (v) a security for which the market price is not readily available from a third party pricing source or, if so provided, does not, in the opinion of the Manager or Subadvisor reflect the security’s market value; (vi) a security subject to trading collars for which no or limited trading takes place; and (vii) a security whose principal market has been temporarily closed at a time when, under normal conditions, it would be open. Securities for which market quotations or observable inputs are not readily available are generally categorized as Level 3 in the hierarchy. As of May 31, 2014, the Fund did not hold any securities that were fair valued in such a manner.

Futures contracts are valued at the last posted settlement price on the market where such futures are primarily traded and are generally categorized as Level 1 in the hierarchy.

Municipal debt securities are valued at the evaluated mean prices supplied by a pricing agent or broker selected by the Manager, in con-

sultation with the Subadvisor. Those prices reflect broker/dealer supplied valuations and electronic data processing techniques, if such prices are deemed by the Manager, in consultation with the Subadvisor, to be representative of market values, at the regular close of trading of the Exchange on each valuation date. Debt securities purchased on a delayed delivery basis are marked to market daily until settlement at the forward settlement date. Municipal debt securities are generally categorized as Level 2 in the hierarchy.