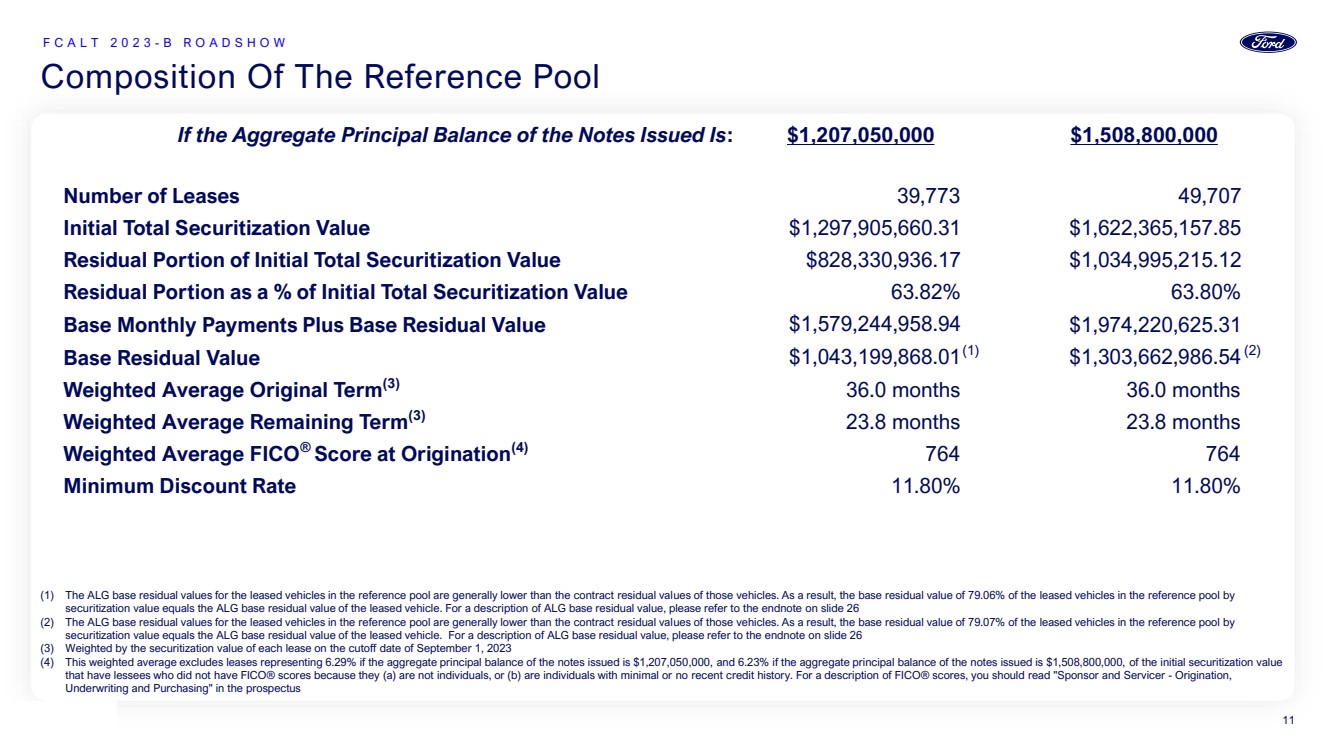

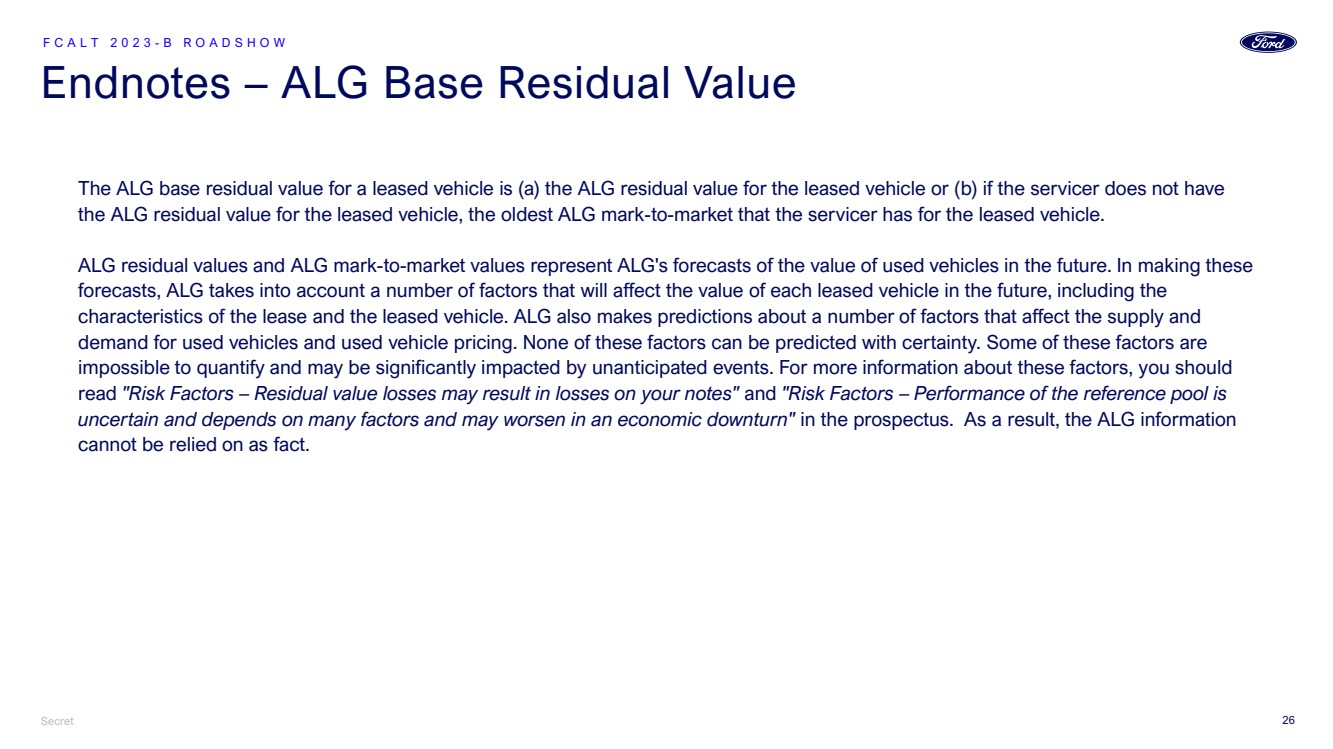

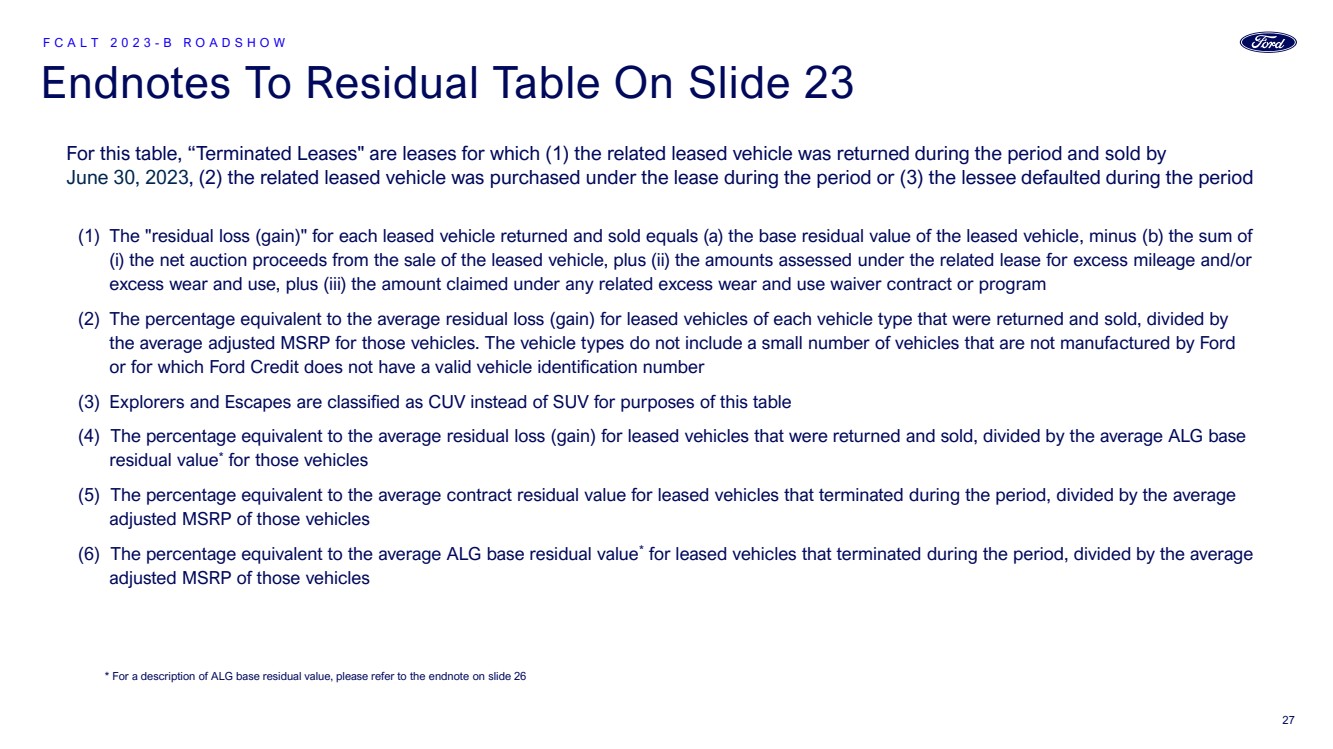

| Secret Composition Of The Reference Pool F C A L T 2 0 2 3 - B R O A D S H O W (1) The ALG base residual values for the leased vehicles in the reference pool are generally lower than the contract residual values of those vehicles. As a result, the base residual value of 79.06% of the leased vehicles in the reference pool by securitization value equals the ALG base residual value of the leased vehicle. For a description of ALG base residual value, please refer to the endnote on slide 26 (2) The ALG base residual values for the leased vehicles in the reference pool are generally lower than the contract residual values of those vehicles. As a result, the base residual value of 79.07% of the leased vehicles in the reference pool by securitization value equals the ALG base residual value of the leased vehicle. For a description of ALG base residual value, please refer to the endnote on slide 26 (3) Weighted by the securitization value of each lease on the cutoff date of September 1, 2023 (4) This weighted average excludes leases representing 6.29% if the aggregate principal balance of the notes issued is $1,207,050,000, and 6.23% if the aggregate principal balance of the notes issued is $1,508,800,000, of the initial securitization value that have lessees who did not have FICO® scores because they (a) are not individuals, or (b) are individuals with minimal or no recent credit history. For a description of FICO® scores, you should read "Sponsor and Servicer - Origination, Underwriting and Purchasing" in the prospectus If the Aggregate Principal Balance of the Notes Issued Is: $1,207,050,000 $1,508,800,000 Number of Leases 39,773 49,707 Initial Total Securitization Value $1,297,905,660.31 $1,622,365,157.85 Residual Portion of Initial Total Securitization Value $828,330,936.17 $1,034,995,215.12 Residual Portion as a % of Initial Total Securitization Value 63.82% 63.80% Base Monthly Payments Plus Base Residual Value $1,579,244,958.94 $1,974,220,625.31 Base Residual Value $1,043,199,868.01 (1) $1,303,662,986.54(2) Weighted Average Original Term(3) 36.0 months 36.0 months Weighted Average Remaining Term(3) 23.8 months 23.8 months Weighted Average FICO® Score at Origination(4) 764 764 Minimum Discount Rate 11.80% 11.80% 11 |