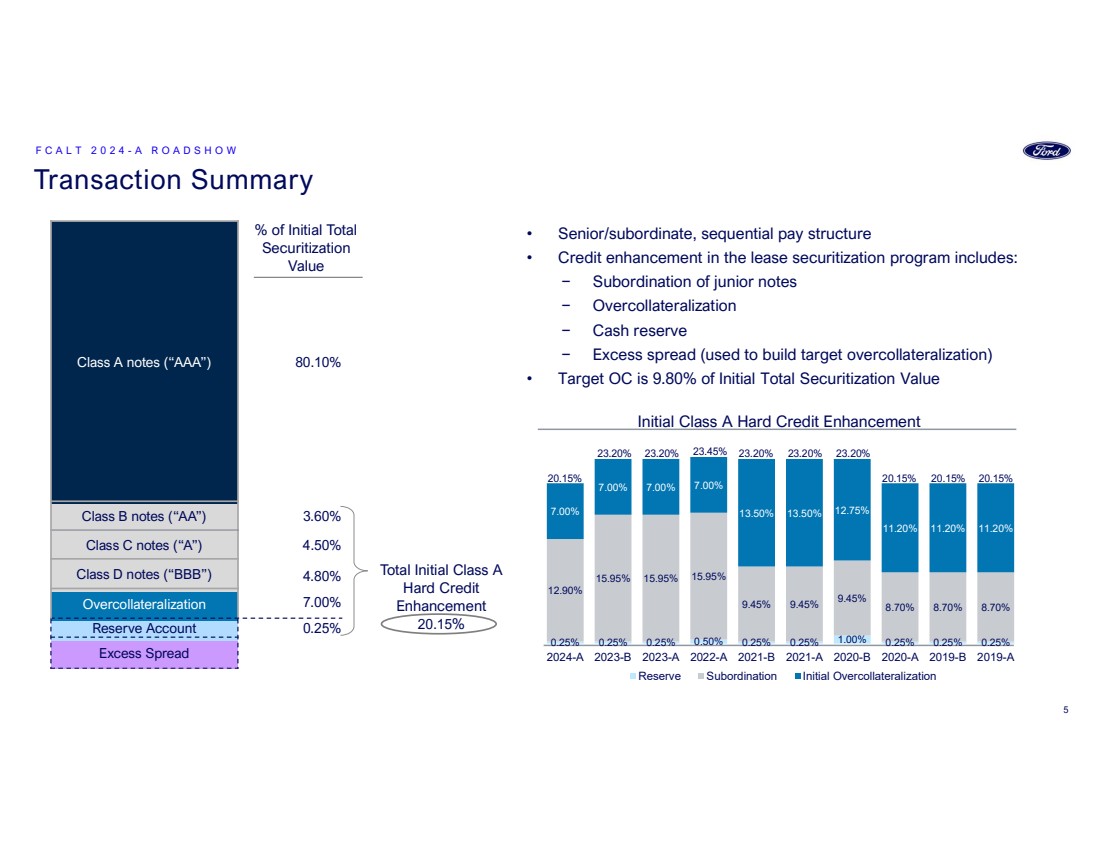

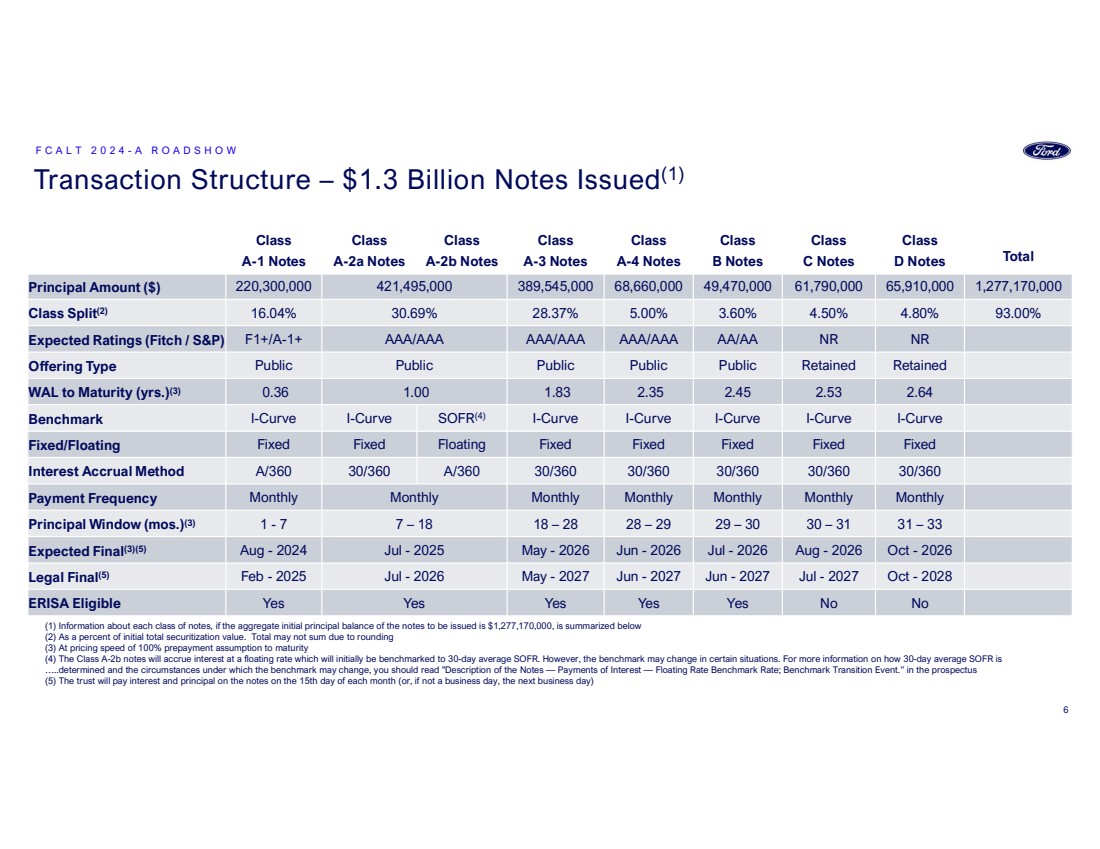

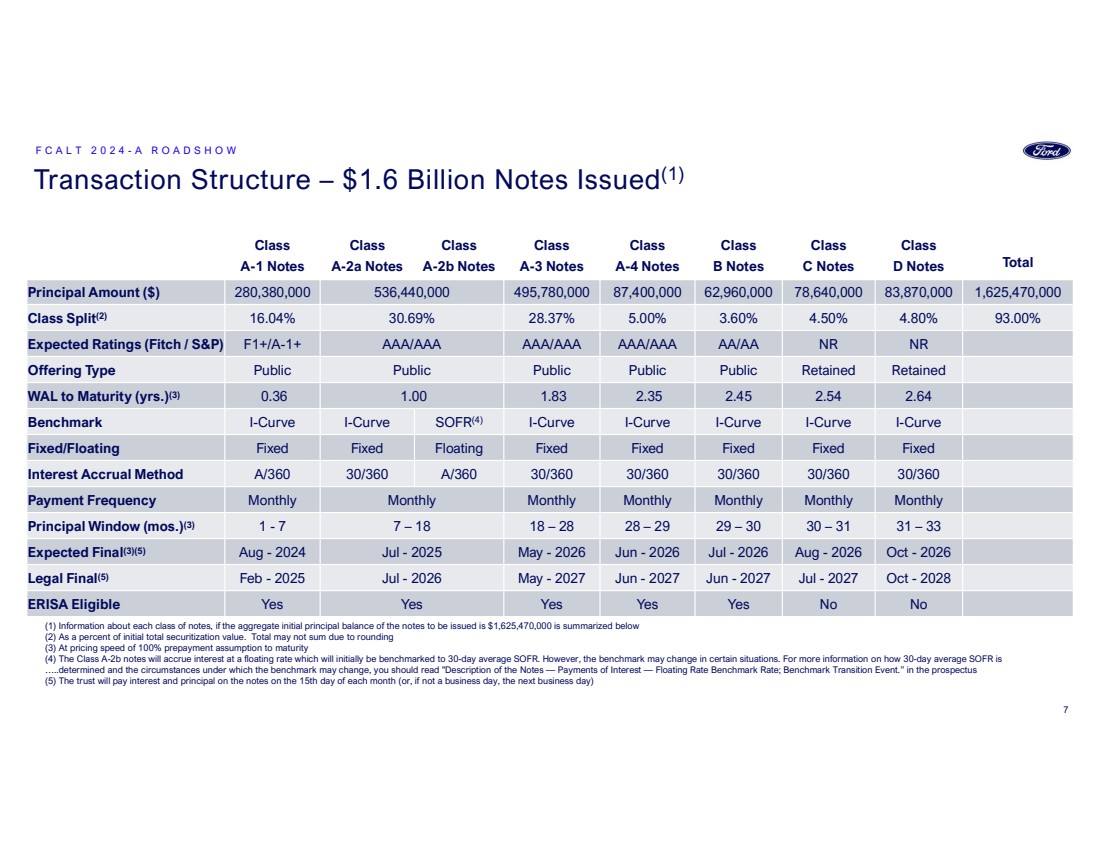

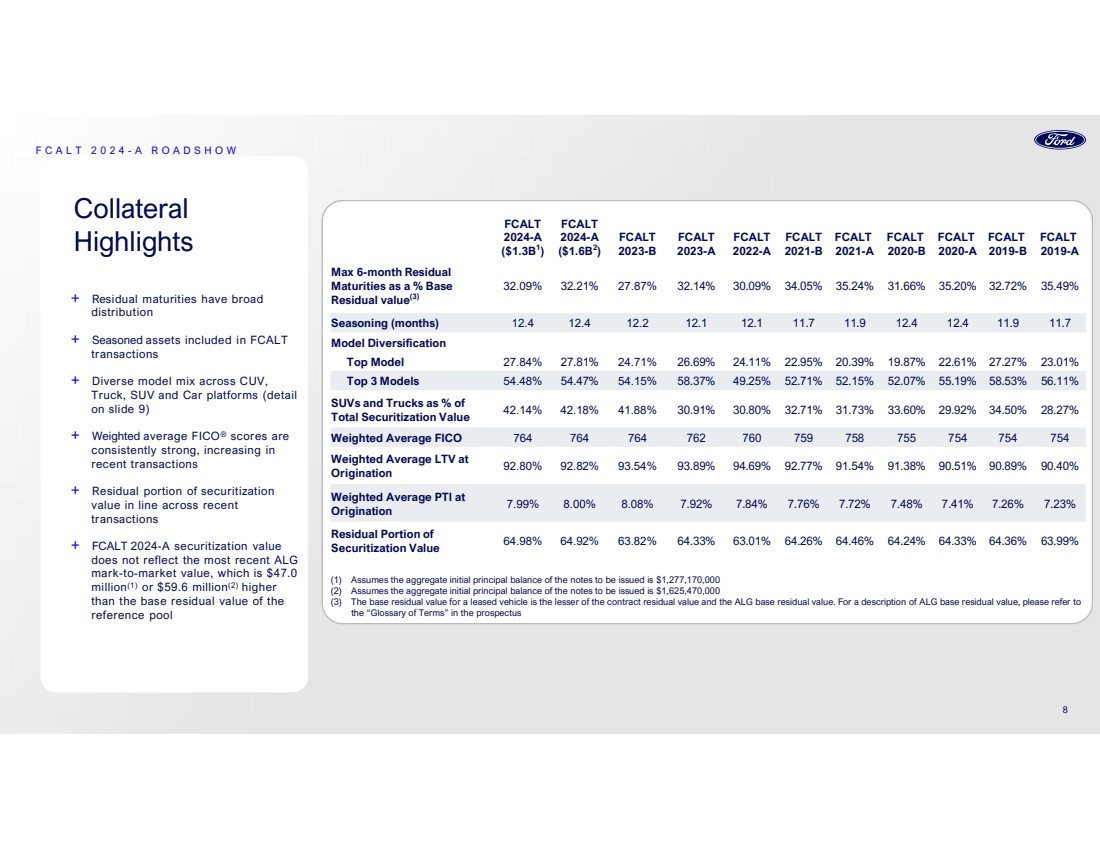

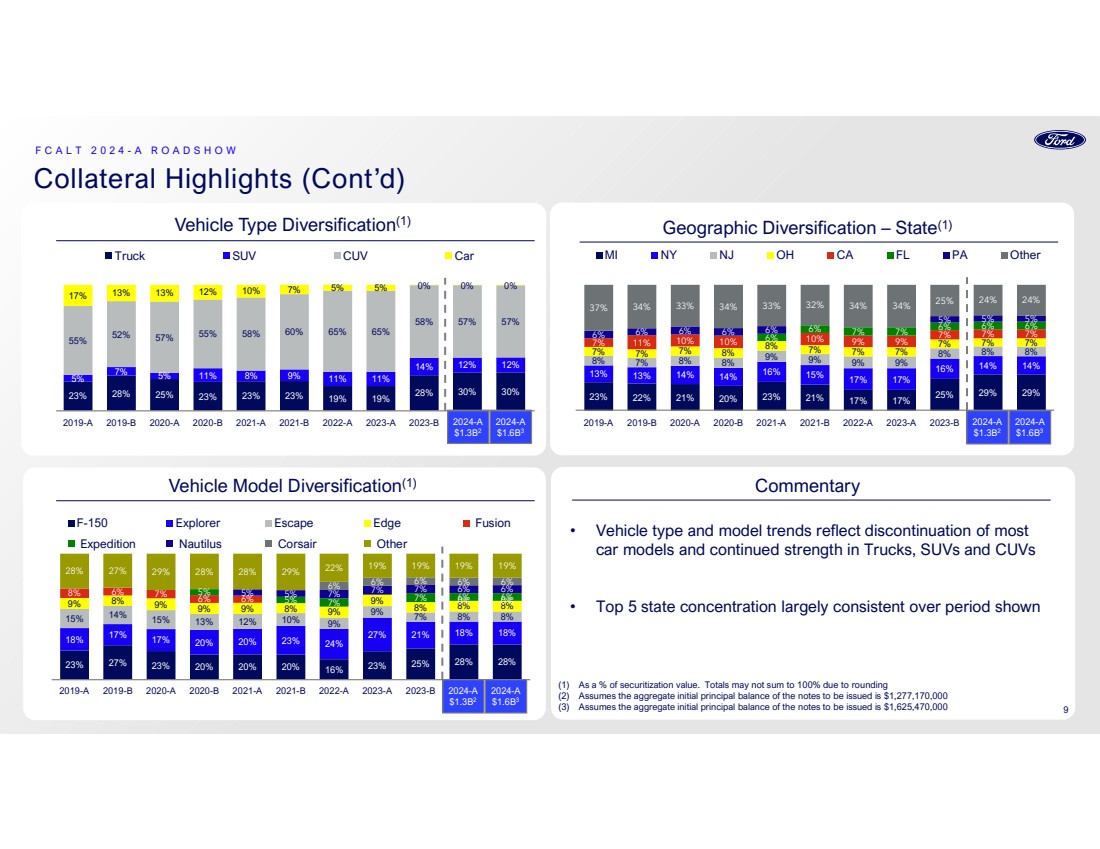

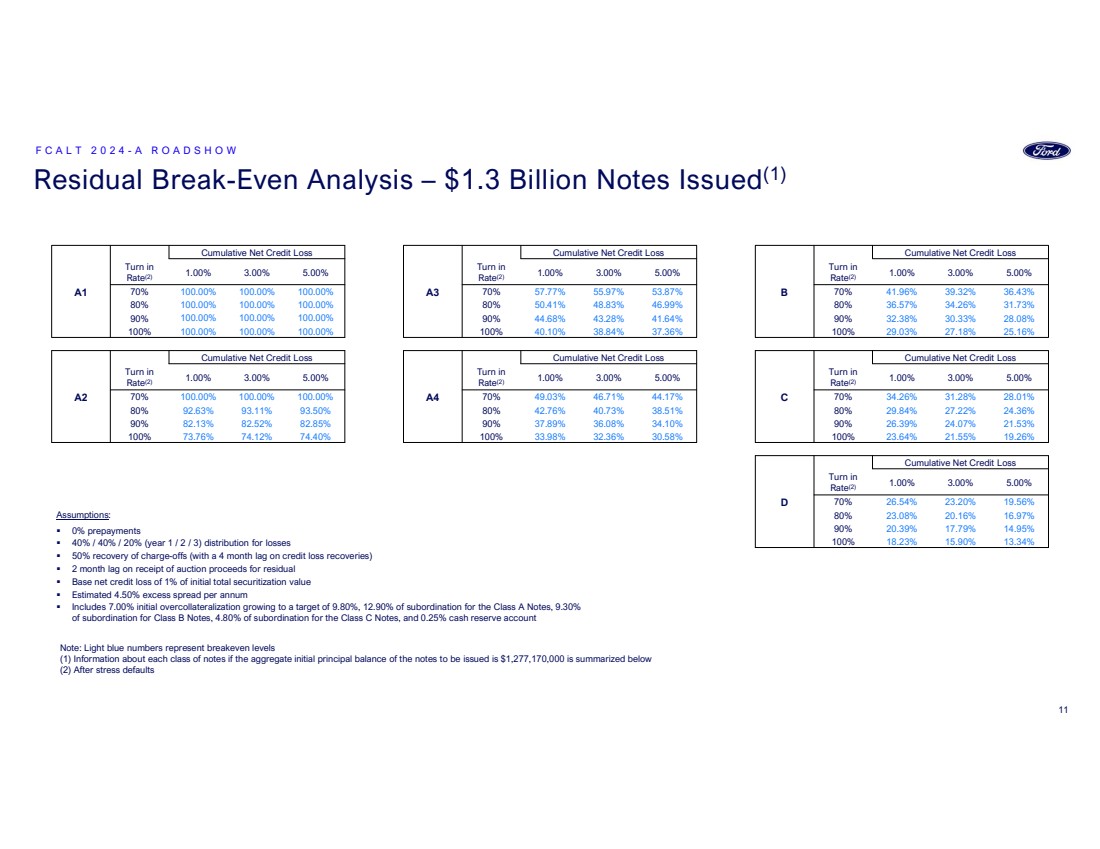

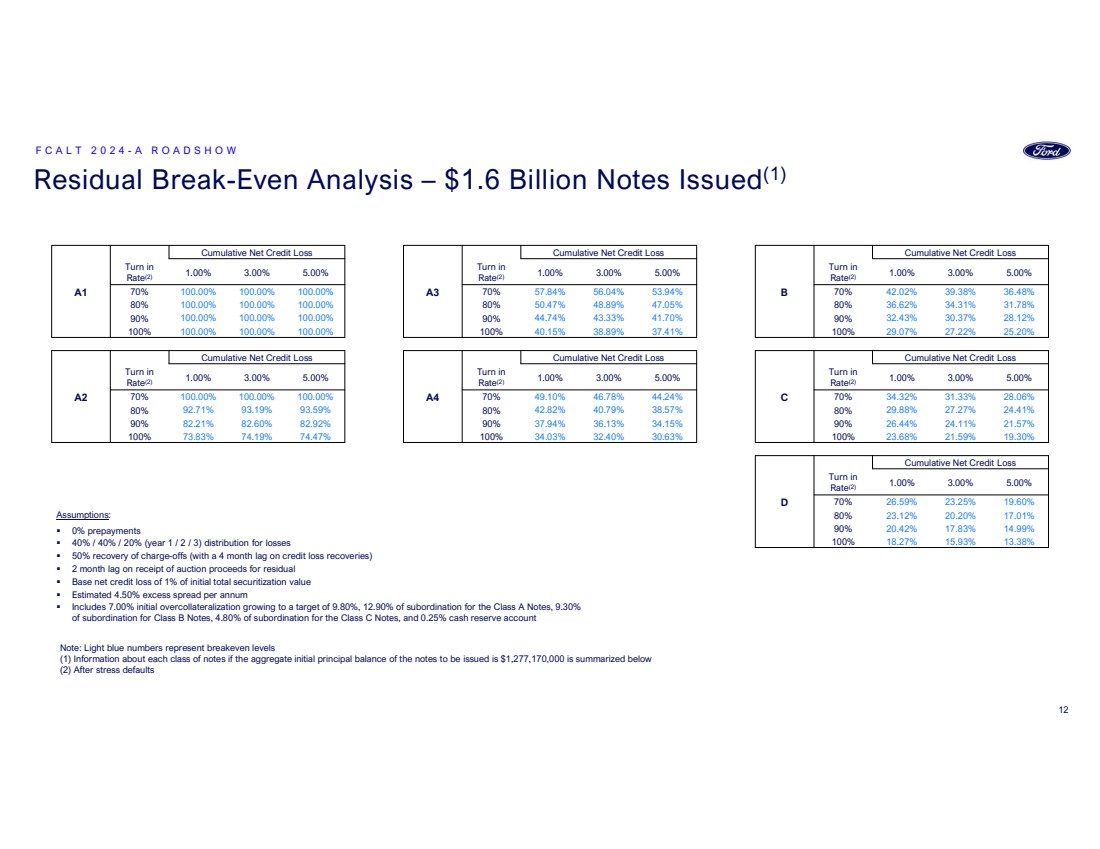

| Secret • Ford Credit Auto Lease Trust 2024-A (“FCALT 2024-A”) will issue notes with an aggregate initial principal amount of $1,277,170,000 or $1,625,470,000.(1) If the aggregate initial principal amount issued is: − $1,277,170,000, FCALT 2024-A will offer $1.10 billion of AAA/AAA-rated Class A notes(2) and $49.47 million of AA/AA rated Class B notes, or − $1,625,470,000, FCALT 2024-A will offer $1.40 billion of AAA/AAA-rated Class A notes(3) $62.96 million of AA/AA rated Class B − Offering will include fixed rate Class A-2a and floating rate Class A-2b notes which will be sized to demand; Class A-2b notes will not exceed 60% of the overall Class A-2 note amount. Floating rate notes will initially accrue interest based on 30-day average SOFR − Ford will only be offering the Class A through Class B notes, and will retain the Class C and Class D notes • FCALT 2024-A will be the 25th public term ABS issuance from Ford Credit’s lease securitization program • Similar to prior Ford Credit lease securitizations, FCALT 2024-A will use a senior / subordinate, sequential pay structure pre- and post-event of default, as well as an exchange note structure. The exchange note is secured by a reference pool of leases and leased vehicles • The principal amount of the notes will be based on the securitization value of the leases. The securitization value of a lease is the sum of the present values of (1) the remaining scheduled base monthly payments plus (2) the base residual value of the related leased vehicle ‒ The discount rate applied to each lease is the greater of (1) 11.35% and (2) its lease factor ‒ The base residual value for a leased vehicle is the lesser of (1) the contract residual value and (2) the ALG base residual value(2). As a result, the base residual value of 82.05%(3) of the leased vehicles in the reference pool by securitization value equals the ALG base residual value of the leased vehicle ‒ Securitization value does not reflect the most recent ALG mark-to-market value – $47.0 million(4) higher than the base residual value of the reference pool – driven by strong used vehicle demand and elevated auction values • The cutoff date for the reference pool is January 1, 2024. The first payment date will be February 15, 2024 • Credit enhancement for the notes will consist of (i) Overcollateralization, (ii) Subordination, (iii) a Non-Declining Cash Reserve Account, and (iv) Available Excess Spread • Ford Credit Auto Lease Trust 2024-A (“FCALT 2024-A”) will issue notes with an aggregate initial principal amount of $1,277,170,000 or $1,625,470,000.(1) If the aggregate initial principal amount issued is: − $1,277,170,000, FCALT 2024-A will offer $1.10 billion of AAA/AAA-rated Class A notes(2) and $49.47 million of AA/AA rated Class B notes, or − $1,625,470,000, FCALT 2024-A will offer $1.40 billion of AAA/AAA-rated Class A notes(3) $62.96 million of AA/AA rated Class B − Offering will include fixed rate Class A-2a and floating rate Class A-2b notes which will be sized to demand; Class A-2b notes will not exceed 60% of the overall Class A-2 note amount. Floating rate notes will initially accrue interest based on 30-day average SOFR − Ford will only be offering the Class A through Class B notes, and will retain the Class C and Class D notes • FCALT 2024-A will be the 25th public term ABS issuance from Ford Credit’s lease securitization program • Similar to prior Ford Credit lease securitizations, FCALT 2024-A will use a senior / subordinate, sequential pay structure pre- and post-event of default, as well as an exchange note structure. The exchange note is secured by a reference pool of leases and leased vehicles • The principal amount of the notes will be based on the securitization value of the leases. The securitization value of a lease is the sum of the present values of (1) the remaining scheduled base monthly payments plus (2) the base residual value of the related leased vehicle ‒ The discount rate applied to each lease is the greater of (1) 11.35% and (2) its lease factor ‒ The base residual value for a leased vehicle is the lesser of (1) the contract residual value and (2) the ALG base residual value(2). As a result, the base residual value of 82.05%(3) of the leased vehicles in the reference pool by securitization value equals the ALG base residual value of the leased vehicle ‒ Securitization value does not reflect the most recent ALG mark-to-market value – $47.0 million(4) higher than the base residual value of the reference pool – driven by strong used vehicle demand and elevated auction values • The cutoff date for the reference pool is January 1, 2024. The first payment date will be February 15, 2024 • Credit enhancement for the notes will consist of (i) Overcollateralization, (ii) Subordination, (iii) a Non-Declining Cash Reserve Account, and (iv) Available Excess Spread Key Highlights F C A L T 2 0 2 4 - A R O A D S H O W (1) The Sponsor will determine the aggregate initial principal amount of the notes to be issued on or before the day of pricing (2) For a description of ALG base residual value, please refer to the “Glossary of Terms” in the prospectus (3) Assumes the aggregate principal amount of notes issued is $1,277,170,000. If the aggregate principal amount of notes issued is $1,625,470,000, the base residual value of 81.88% of the leased vehicles in the reference pool by securitization value equals the ALG base residual value of the leased vehicle (4) Assumes the aggregate principal amount of notes issued is $1,277,170,000. If the aggregate principal amount of notes issued is $1,625,470,000, $59.6 million higher than the base residual value of the reference pool 4 |