UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22558

BROOKFIELD INVESTMENT FUNDS

(Exact name of registrant as specified in charter)

BROOKFIELD PLACE

250 VESEY STREET, 15th Floor

NEW YORK, NEW YORK 10281-1023

(Address of principal executive offices) (Zip code)

BRIAN F. HURLEY, PRESIDENT

BROOKFIELD INVESTMENT FUNDS

BROOKFIELD PLACE

250 VESEY STREET 15th Floor NEW

YORK, NEW YORK 10281-1023

(Name and address of agent for service)

Registrant’s telephone number, including area code: (855) 777-8001

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

Item 1. Reports to Shareholders.

2021

ANNUAL REPORT

SEPTEMBER 30, 2021

Center Coast Brookfield

Midstream Focus Fund

* Please see inside front cover of the report for important information regarding delivery of shareholder reports.

IN PROFILE

Brookfield Public Securities Group LLC (the "Firm") is an SEC-registered investment adviser and represents the Public Securities platform of Brookfield Asset Management. The Firm provides global listed real assets strategies including real estate equities, infrastructure and energy infrastructure equities, multi-real-asset-class strategies and real asset debt. With over $20 billion of assets under management as of September 30, 2021, the Firm manages separate accounts, registered funds and opportunistic strategies for institutional and individual clients, including financial institutions, public and private pension plans, insurance companies, endowments and foundations, sovereign wealth funds and high net worth investors. The Firm is a wholly owned subsidiary of Brookfield Asset Management, a leading global alternative asset manager with approximately $650 billion of assets under management as of September 30, 2021. For more information, go to https://publicsecurities.brookfield.com/en.

Center Coast Brookfield Midstream Focus Fund (the "Fund") is managed by Brookfield Public Securities Group LLC. The Fund uses its website as a channel of distribution of material company information. Financial and other material information regarding the Fund is routinely posted on and accessible at https://publicsecurities.brookfield.com/en.

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund's website (https://publicsecurities.brookfield.com/en), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker, investment adviser, bank or trust company) or, if you are a direct investor, by calling the Fund (toll-free) at 1-855-244-4859 or by sending an e-mail request to the Fund at publicsecurities.enquiries@brookfield.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may call 1-855-244-4859 or send an email request to publicsecurities.enquiries@brookfield.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the fund complex if you invest directly with the Fund.

TABLE OF CONTENTS

Letter to Shareholders | 1 | ||||||

About Your Fund's Expenses | 3 | ||||||

Management Discussion of Fund Performance | 4 | ||||||

| Portfolio Characteristics | 11 | ||||||

| Schedule of Investments | 12 | ||||||

| Statement of Assets and Liabilities | 14 | ||||||

| Statement of Operations | 15 | ||||||

| Statements of Changes in Net Assets | 16 | ||||||

| Financial Highlights | 17 | ||||||

| Notes to Financial Statements | 20 | ||||||

| Report of Independent Registered Public Accounting Firm | 30 | ||||||

| Liquidity Risk Management Program | 31 | ||||||

| Board Considerations Relating to the Investment Advisory Agreement | 32 | ||||||

| Information Concerning Trustees and Officers | 36 | ||||||

| Joint Notice of Privacy Policy | 39 | ||||||

This report is for shareholder information. This is not a prospectus intended for use in the purchase or sale of Fund shares.

NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | |||||||||

[THIS PAGE IS INTENTIONALLY LEFT BLANK]

LETTER TO SHAREHOLDERS

Dear Shareholders,

We are pleased to provide the Annual Report for Center Coast Brookfield Midstream Focus Fund (the "Fund") for the fiscal year ended September 30, 2021 (the "period").

The Fund's fiscal year was marked by optimism, as the COVID-19 vaccine rollout marked the hopeful beginning of a return to normalcy. A number of vaccines were approved for use in December, with the very first COVID-19 vaccinations administered during the month, starting in the U.K. on December 8 and in the U.S. six days later.1,2

Stock markets rallied throughout the period on global fiscal stimulus measures and the vaccine rollout, overcoming concerns related to new COVID-19 variants and rising case numbers. The MSCI World Index and the S&P 500 Index returned 29.39% and 30.00%, respectively, over the period. While optimism was the general theme of the period, rising interest rates, inflationary pressures, and global supply chain disruptions became increasing concerns as the period came to a close. In addition, the U.S. Federal Reserve signaled in September that it could begin tapering monthly bond purchases in short order, which spooked markets.

Energy infrastructure enjoyed a banner period, driven by the risk-on trade in the markets and improving industry fundamentals. The price of West Texas Intermediate crude oil nearly doubled throughout the period, rising to $75.03 from $48.52. On the demand side, the U.S. ended the period fairly close to a full recovery for key refined products,3 while some analysts estimate that the rest of the world could return to pre-pandemic levels sometime in 2022. From a supply side, OPEC+ appears to still be in the driver's seat, as its tapering plan is in place and scheduled to start this November. U.S. producers so far have remained fairly restrained despite the high price environment, adhering to capital discipline requests from public shareholders. In addition, investors closely watched the new Biden Administration on any decision on potential policies that would adversely impact the U.S. oil & gas industry.

In addition to performance information and additional discussion on factors impacting the Fund, this report provides the Fund's audited financial statements and schedule of investments as of September 30, 2021.

We welcome your questions and comments, and encourage you to contact our Investor Relations team at 1-855-777-8001 or to visit us at https://publicsecurities.brookfield.com/en for more information. Thank you for your support.

Sincerely,

Brian F. Hurley

President

Center Coast Brookfield Midstream Focus Fund

David W. Levi, CFA

Chief Executive Officer

Brookfield Public Securities Group LLP

1 https://www.bbc.com/news/uk-55227325

2 https://www.wsj.com/articles/covid-19-vaccinations-in-the-u-s-slated-to-begin-monday-11607941806

3 EIA as of 9/30/21. (https://www.eia.gov/petroleum/supply/weekly/)

2021 Annual Report

1

LETTER TO SHAREHOLDERS (continued)

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

The S&P 500 Index is an equity index of 500 widely held, large-capitalization U.S. companies.

Indexes are not managed and an investor cannot invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible.

These views represent the opinions of Brookfield Public Securities Group LLC and are not intended to predict or depict the performance of any investment. These views are primarily as of the close of business on September 30, 2021 and subject to change based on subsequent developments.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC is the distributor of Brookfield Investment Funds.

Brookfield Public Securities Group LLC

2

ABOUT YOUR FUND'S EXPENSES (Unaudited)

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges and redemption fees on redemptions; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Fund Return

The table below provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with hypothetical examples that appear in shareholders' reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the hypothetical account values and expenses in the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs overall would have been higher.

| Annualized Expense Ratio | Beginning Account Value (04/01/21) | Ending Account Value (09/30/21) | Expenses Paid During Period (04/01/21– 09/30/21)(1) | ||||||||||||||||

Actual | |||||||||||||||||||

Class A Shares | 1.46 | % | $ | 1,000.00 | $ | 1,192.00 | $ | 8.02 | |||||||||||

Class C Shares | 2.21 | % | 1,000.00 | 1,184.70 | 12.10 | ||||||||||||||

Class I Shares | 1.21 | % | 1,000.00 | 1,190.60 | 6.64 | ||||||||||||||

Hypothetical (assuming a 5% return before expenses) | |||||||||||||||||||

Class A Shares | 1.46 | % | 1,000.00 | 1,017.75 | 7.38 | ||||||||||||||

Class C Shares | 2.21 | % | 1,000.00 | 1,013.99 | 11.16 | ||||||||||||||

Class I Shares | 1.21 | % | 1,000.00 | 1,019.00 | 6.12 | ||||||||||||||

(1) Expenses are equal to the Fund's annualized expense ratio by class multiplied by the average account value over the period, multiplied by 183/365 (to reflect a six-month period).

2021 Annual Report

3

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

For the fiscal year ended September 30, 2021, the Fund's Class I shares had a total return of 77.63%, which assumes the reinvestment of distributions and is exclusive of brokerage commissions, outperforming the Alerian Midstream Energy Index (AMNA) and S&P 500 Index and underperforming the Alerian MLP Index (AMZ), which returned 66.90%, 30.00% and 84.63%, respectively.

MARKET OVERVIEW

Fiscal First Quarter (October – December 2020)

The fourth quarter of 2020 (the Fund's fiscal first quarter) was a great end to a tough 2020 for energy infrastructure equities. Almost all of this quarter's impressive return came after the initial Pfizer vaccine announcement in early November. The vaccine announcement allowed us to see (or at least conceptualize) the light at the end of the COVID-19 pandemic. Life, and all its associated energy demand, may indeed go back to "normal" at some point. Energy infrastructure showed its resiliency against an extraordinary backdrop. From pre-pandemic 2019 through most of 2020, the EBITDA1 of the AMNA constituents was essentially flat, as asset diversification, contractual protections, and aggressive cost rationalization protected against volumetric declines.

Moreover, earnings season was replete with guidance revisions upwards and stock buyback announcements made possible by excess free cash flow.2 Although EBITDA was effectively flat year-over-year, reduced producer activity drove midstream3 capital expenditures down by over 25% (for AMNA constituents), meaning "free cash flow" improved in the COVID environment. In our view, energy infrastructure companies are leaner, meaner, and cleaner than ever before. Armed with free cash flow and even more defensible dividend policies, we believe the asset class is not only positioned to benefit as the COVID era fades, but that it may also be positioned much better should it linger.

Contributors

• The Fund's relative underweight positioning in a group of refined products transportation companies was the largest positive group contributor vs. the AMZ during the quarter.

• The Fund's positioning in a group of crude-oriented gathering and processing companies was the second largest positive group contributor.

o In particular, the Fund's relative overweight to Targa Resources Corp. (NYSE: TRGP) was the largest positive individual contributor to the Fund's performance vs. the AMZ during the quarter.

Detractors

• The Fund's relative overweight positioning in a group of natural gas-focused companies was the largest group detractor vs. the AMZ during the quarter.

• The Fund's ownership of large Canadian companies, TC Energy Corp. (NYSE: TRP) and Enbridge, Inc. (NYSE: ENB), which are not in the AMZ, also contributed to the Fund's underperformance during the quarter.

Fiscal Second Quarter (January – March 2021)

Midstream energy equities turned the page on a tumultuous 2020 and opened 2021 with a solid first-quarter of performance despite pandemic-related shutdown complications still rippling through the global economy. The macro backdrop included a swift move higher in U.S. interest rates, accommodating moves from OPEC+4 (with a cautious outlook from Saudi Arabia), increased chatter about a medium-term crude oil super-cycle,5 the outperformance of value stocks vs. growth stocks,6 headlines related to oil & gas policies from the new Biden administration, and increasing vaccinations domestically, all while the coldest cold snap in Texas in nearly 30 years roiled local gas and power markets.

Brookfield Public Securities Group LLC

4

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Midstream oil & gas businesses continued to react swiftly in responding to the changing environment. With the most recent earnings cycle behind us, we can finally put a bow on 2020 operational performance. We think the results provide a compelling blueprint for the near-term path forward for companies in the Brookfield Energy Infrastructure (BEI) midstream universe,7 which generated cash flow just 4% shy of pre-COVID EBITDA guidance, on average, despite what we hope was a once-in-a-generation swat to crude oil demand and some meaningful changes to consumption habits for at least a short period of time. Growth capital expenditures for the group were cut by more than 30% vs. pre-COVID guidance, which resulted in approximately $5 billion higher free cash flow before dividends vs. pre-COVID expectations. Management teams are choosing to allocate this excess cash to de-lever further or institute share buyback programs, in some cases.8

Contributors

• The Fund's positioning in Independent Canadian companies which are not in the AMZ was the largest contributor to performance.

• The Fund's positioning in a family of liquefied natural gas companies was the second largest contributor to performance.

Detractors

• The Fund's positioning in a group of crude-oriented gathering and processing companies was the largest group detractor.

o In particular, the Fund's relative overweight to Targa Resources Corp. (NYSE: TRGP) was the second largest individual detractor to the Fund's performance vs. the AMZ during the quarter.

• The Fund's relative overweight positioning in a group of natural gas-focused companies was the second largest group detractor vs. the AMZ during the quarter.

Fiscal Third Quarter (April – June 2021)

The second quarter of 2021 (the Fund's fiscal third quarter) was the third positive quarter in a row for the midstream sector, with U.S. midstream securities again performing well alongside crude. The U.S. crude oil benchmark West Texas Intermediate (WTI) reached a 32-month high, amid strengthening supply-demand fundamentals and expectations that OPEC+ will continue to keep supply off the market.

During the quarter, OPEC+ still controlled an estimated 8 million barrels per day (MMBPD) in excess production capacity, generally enabling global crude oil and refined products inventories to decrease to levels near five-year high-low ranges as demand picked up amid global economic re-openings.9 U.S. oil & gas producers appeared to be adhering to capital discipline plans more focused on corporate returns and returning cash to shareholders than on absolute production growth, which had often been the target in prior years.

Resilient global demand for natural gas and natural gas liquids (NGLs) helped offset impacts from lower demand for refined products, as liquefied natural gas (LNG) and NGL exports again set quarterly records.10 Finally, the first-quarter earnings reporting season proved to be a monumental one for the sector—windfall earnings related to Winter Storm Uri for a handful of companies completely offset negative impacts to 2020 earnings from COVID.11

Contributors

• The Fund's positioning in a group of gathering & processing ("G&P") companies was the largest positive group contributor vs. the AMZ during the quarter.

o In particular, the Fund's relative overweight to Targa Resources Corp. (NYSE: TRGP) was the largest positive individual contributor to the Fund's performance vs. the AMZ during the quarter.

• The Fund's relative underweight to a group of companies focused on refined products was the second-largest group contributor relative performance vs. the AMZ.

2021 Annual Report

5

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Detractors

• The Fund's positioning in natural gas-focused companies contributed to approximately 90% of the relative underperformance during the quarter vs. the AMZ.

o Stock selection within this group, particularly the Fund's relative exposure to Equitrans Midstream Corp. (NYSE: ETRN) explains the bulk of the natural gas group's underperformance vs. the AMZ.

o ETRN's marquee project, the Mountain Valley Pipeline ("MVP"), continues to experience regulatory delays. We remain confident the project will be completed in 2022 based on current regulatory analysis.

• The Fund's ownership of large Canadian companies, TC Energy Corp. (NYSE: TRP) and Enbridge, Inc. (NYSE: ENB), which are not in the AMZ, also contributed to the Fund's underperformance during the quarter.

Fiscal Fourth Quarter (July – September 2021)

The third quarter of 2021 (the Fund's fiscal fourth quarter) was the first negative quarter for the midstream sector since the same period last year. The most notable story in the energy sector over the last three months was the steep rise in natural gas prices. In the U.S., natural gas prices increased approximately 50% during the quarter to more than $5.00 per one million British thermal unit (MMBtu)—a price level not seen outside of winter since 2009.12 Resilient global demand for natural gas and a lack of sufficient available supplies have created a short-term energy crunch. Gas inventory levels in regions like the U.S. and Europe are below five-year norms, potentially threatening energy reliability and relatively cheap access to heating fuels. The precarious global storage situation pushed the Asian liquid natural gas (LNG) benchmark price north of $30 per MMBtu—a level not seen before, according to Bloomberg.13

The tight supply-demand environment for natural gas at the end of quarter was not an anomaly in energy markets: prices for natural gas liquids (NGLs) increased by more than 25% during the third quarter due to similarly tight market fundamentals. Prices for heating supplies like propane, for example, increased by 33% during the quarter.14 Meanwhile, demand for key refined products in the U.S. stood just 1% below 2019 levels, according to weekly EIA data at the end of Q3,15 suggesting there has been no structural demand destruction related to COVID.

The second-quarter earnings season was another good one for midstream companies. Strong volumes out of areas like the Permian, the Northeast, and Haynesville continue to help explain the stability and diversity of cash flows generated by the midstream sector in the face of lower overall domestic crude production.

Contributors

• The Fund's positioning in a group of natural gas-focused companies was the largest positive group contributor vs. the AMZ during the quarter.

o The Fund's relative overweight to Equitrans Midstream Corp. (NYSE: ETRN) was the largest positive individual contributor to the Fund's performance vs. the AMZ during Q3, a reversal of ETRN's negative attribution during the previous quarter.

• The Fund's relative overweight to a group of large Canadian companies was the second-largest positive group contributor to third quarter relative performance vs. the AMZ.

• The Fund's ownership of Cheniere Energy, Inc. (NYSE: LNG) was the third-largest positive individual attributor for the Fund during Q3, and the Fund's positioning in LNG companies (entirely in LNG) was the third-largest group contributor to performance vs. the AMZ.

Brookfield Public Securities Group LLC

6

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Detractors

• The Fund did not have any major detractors by group vs. the AMZ during the quarter.

• The largest negative individual attributors vs. the AMZ during the third quarter included the Fund's relative under-ownership of three gatherers & processors: EnLink Midstream LLC (NYSE: ENLC), Western Midstream Partners LP (NYSE: WES), and Hess Midstream LP (NYSE: HESM)

1 EBITDA represents earnings before interest, taxes, depreciation and amortization.

2 Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.

3 Midstream energy securities refer to companies that perform a variety of activities, including processing, storing and transporting oil, natural gas and natural gas liquids (NGLs).

4 The Organization of Petroleum Exporting Countries (OPEC) Plus (OPEC+), an entity that includes the 13 members of OPEC and their allies.

5 An extended period of prices rising above the long-term trend.

6 Based on a Bloomberg Factors to Watch Movers analysis for the S&P 500 over the year-to-date period ending in 03/31/2021.

7 Sources: Brookfield Energy Infrastructure. Consists of a group of 40 predominantly midstream MLPs and C corporations.

8 Sources: Brookfield Energy Infrastructure, Bloomberg, company filings. Compares 2020 actual results to initial 2020 annual guidance provided by February 29, 2020. If guidance not provided by management, actual results were compared to Bloomberg consensus EBITDA and capital expenditure estimates as of 02/28/2021.

9 "IEA sees OPEC+ spare capacity gaining slightly in 2022," Reuters, June 11, 2021.

10 According to Bloomberg and Bloomberg New Energy Finance, as of 7/6/21.

11 According to management, consensus, and Brookfield Energy Infrastructure estimates.

12 Natural gas price represented by NYMEX priced at Henry Hub. Bloomberg as of 9/30/21.

13 Based on JK1 Comdty in Bloomberg as of 9/30/21 taking back to maximum weekly price history on 1/1/2011.

14 Source: Bloomberg as of 9/30/21.

15 Source: EIA as of 9/30/21 (https://www.eia.gov/petroleum/supply/weekly/). Key refined products include motor gasoline, distillate, and jet fuel.

AVERAGE ANNUAL TOTAL RETURNS

As of September 30, 20211 | 1 Year | 5 Years | 10 Years | Since Inception* | |||||||||||||||

Class A (Excluding Sales Charges) | 77.31 | % | -4.29 | % | -0.13 | % | -0.03 | % | |||||||||||

Class A (Including Sales Charges) | 69.13 | % | -5.42 | % | -0.72 | % | -0.58 | % | |||||||||||

Class C (Excluding Sales Charges) | 75.46 | % | -5.04 | % | -0.89 | % | -0.82 | % | |||||||||||

Class C (Including Sales Charges) | 74.46 | % | -5.04 | % | -0.89 | % | -0.82 | % | |||||||||||

Class I Shares | 77.63 | % | -4.09 | % | 0.10 | % | 0.17 | % | |||||||||||

Alerian Midstream Energy Index | 66.90 | % | N/A2 | N/A2 | N/A2 | ||||||||||||||

Alerian MLP Index | 84.63 | % | -2.42 | % | 1.21 | % | 0.92 | % | |||||||||||

S&P 500 Index | 30.00 | % | 16.90 | % | 16.63 | % | 14.42 | % | |||||||||||

* Class A, Class C and Class I Shares were incepted on December 31, 2010. Returns for Class I Shares prior to February 5, 2018 reflect the performance of the Predecessor Fund's Institutional Class Shares (defined below). As of the close of business on February 2, 2018, the Fund acquired all of the assets, subject to liabilities, of the Center Coast MLP Focus Fund (the "Predecessor Fund") through a tax-free reorganization (the "Reorganization"). As a result of the Reorganization, shareholders of the Predecessor Fund's Class A and Class C Shares received Class A and Class C Shares of the Fund, respectively, and shareholders of the Predecessor Fund's Institutional Class Shares received Class Y Shares of the Fund. In addition, as a result of the Reorganization, the Fund's Class A and Class C Shares adopted the Predecessor Fund's Class A and Class C Shares' performance and accounting history, and the Fund's Class Y Shares adopted the Predecessor Fund's Institutional Class Shares' performance and accounting history. Performance information for the Fund's Class I Shares reflects the performance history of the Predecessor Fund's Institutional Share Class. On March 25, 2021, the Board of Trustees of Brookfield Investment Funds, on behalf of Center Coast Brookfield Midstream Focus Fund, approved a proposal to close the Fund's Class I Shares (the "Legacy Class I Shares"). On March 25, 2021, the Board of Trustees of Brookfield Investment Funds, on behalf of the Fund, approved a proposal to close the Fund's Class I Shares (the "Legacy Class I Shares"). On April 6, 2021, shareholders in the Legacy Class I Shares redeemed all shares. Following the close of business on April 30, 2021, the Fund's Class Y Shares (the "Legacy Class Y Shares") were renamed "Class I Shares" (the "Class I Shares"). The Fund's new Class I Shares adopted the Legacy Class Y Share's performance and accounting history.

1 All returns shown in USD.

2 Data for the Alerian Midstream Energy Index is unavailable prior to its inception date of June 25, 2018.

2021 Annual Report

7

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

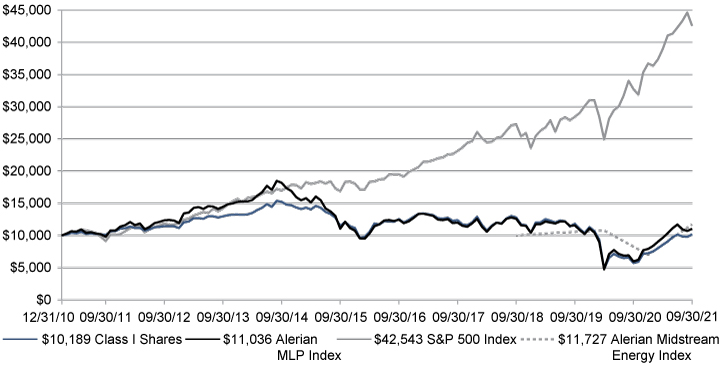

The graph below illustrates a hypothetical investment of $10,000 in the Fund—Class I Shares from the commencement of investment operations on December 31, 2010 to September 30, 2021 compared to the Alerian MLP Index and S&P 500 Index and from June 25, 2018 (inception of index) to September 30, 2021 compared to the Alerian Midstream Energy Index.

The table and graphs do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-244-4859. Investment performance reflects fee waivers, expenses and reimbursements in effect. In the absence of such waivers, total return and NAV would be reduced. For periods prior to the Reorganization (defined below), performance shown including sales charge reflects the Class A maximum sales charge of 5.75% of the Predecessor Fund (defined below). For periods following the Reorganization, performance shown including sales charge reflects the Class A maximum sales charge of 4.75%. Performance data excluding sales charge does not reflect the deduction of the sales charge and if reflected, the sales charge or fee would reduce the performance quoted. On purchases of Class A Shares, no sales charge is payable at the time of purchase on investments of $1 million or more, although for such investments the Fund will impose a CDSC of 1.00% on redemptions made within 18 months of the purchase. If imposed, the CDSC is based on the original cost of the shares redeemed. Class C Shares are subject to a CDSC of 1.00% when redeemed within 12 months of the purchase.

Mutual fund investing involves risk. Principal loss is possible. Investing in Master Limited Partnerships ("MLPs") involves additional risks as compared to the risks of investing in common stock, including risks related to cash flow, dilution and voting rights. The Fund's investments are concentrated in the energy infrastructure industry with an emphasis on securities issued by MLPs, which may increase volatility. Energy infrastructure companies are subject to risks specific to the industry such as fluctuations in commodity prices, reduced volumes of natural gas or other energy commodities, environmental hazards, changes in the macroeconomic or the regulatory environment or extreme weather. MLPs may trade less frequently than larger companies due to their smaller capitalizations which may result in erratic price movement or difficulty

Brookfield Public Securities Group LLC

8

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

in buying or selling. The Fund invests in small and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility. Additional management fees and other expenses are associated with investing in MLPs. Additionally, investing in MLPs involves material income tax risks and certain other risks. Actual results, performance or events may be affected by, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) changes in laws and regulations and (5) changes in the policies of governments and/or regulatory authorities.

Unlike most other open-end mutual funds, the Fund will be taxable as a regular corporation, or "C" corporation. Consequently, the Fund will accrue and pay federal, state and local income taxes on its taxable income, if any, at the Fund level, which will ultimately reduce the returns that the shareholder would have otherwise received. Additionally, on a daily basis the Fund's net asset value per share ("NAV") will include a deferred tax expense (which reduces the Fund's NAV) or asset (which increases the Fund's NAV, unless offset by a valuation allowance). To the extent the Fund has a deferred tax asset, consideration is given as to whether or not a valuation allowance is required. The Fund's deferred tax expense or asset is based on estimates that could vary dramatically from the Fund's actual tax liability/benefit and, therefore, could have a material impact on the Fund's NAV. This material is provided for general and educational purposes only, and is not intended to provide legal, tax or investment advice or to avoid legal penalties that may be imposed under U.S. federal tax laws. Investors should contact their own legal or tax advisors to learn more about the rules that may affect individual situations.

Past performance is no guarantee of future results. The Center Coast Brookfield Midstream Focus Fund is managed by Brookfield Public Securities Group LLC.

The Fund is not required to make distributions and in the future could decide not to make such distributions or not to make distributions at a rate that over time is similar to the distribution rate it receives from the MLPs in which it invests. It is expected that a portion of the distributions will be considered tax deferred return of capital (ROC). ROC is tax deferred and reduces the shareholder's cost basis (until the cost basis reaches zero); and when the Fund shares are sold, if the result is a gain, it would then be taxable to the shareholder at the capital gains rate. Any portion of distributions that are not considered ROC are expected to be characterized as qualified dividends for tax purposes. Qualified dividends are taxable in the year received and do not serve to reduce the shareholder's cost basis. The portion of the Fund's distributions that are considered ROC may vary materially from year to year. Accordingly, there is no guarantee that future distributions will maintain the same classification for tax purposes as past distributions. An investment in the Fund may not receive the same tax advantages as a direct investment in the MLP. Because deferred tax liability is reflected in the daily NAV, the Fund's after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked.

The outbreak of an infectious respiratory illness caused by a novel coronavirus known as "COVID-19" is causing materially reduced consumer demand and economic output, disrupting supply chains, resulting in market closures, travel restrictions and quarantines, and adversely impacting local and global economies. As with other serious economic disruptions, governmental authorities and regulators are responding to this crisis with significant fiscal and monetary policy changes, including by providing direct capital infusions into companies, introducing new monetary programs and considerably lowering interest rates, which in some cases resulted in negative interest rates. These actions, including their possible unexpected or sudden reversal or potential ineffectiveness, could further increase volatility in securities and other financial markets, reduce market liquidity, heighten investor uncertainty and adversely affect the value of the Fund's investments and the performance of the Fund. Markets generally and the energy sector specifically, including MLPs and energy infrastructure companies in which the Fund invests, have also been adversely impacted by reduced demand for oil and other energy commodities as a result of the slowdown in economic activity resulting from the spread of COVID-19 and by price competition among key oil-producing countries. These developments have and may continue to adversely impact the Fund's NAV.

2021 Annual Report

9

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

As of the close of business on February 2, 2018, the Fund acquired all of the assets, subject to liabilities, of the Center Coast Midstream Focus Fund (the "Predecessor Fund") through a tax-free reorganization (the "Reorganization"). The Fund is a newly created series of Brookfield Investment Funds, which has the same investment objective and substantially similar investment strategies and policies as the Predecessor Fund. As a result of the Reorganization, shareholders of the Predecessor Fund's Class A and Class C Shares received Class A and Class C Shares of the Fund, respectively, and shareholders of the Predecessor Fund's Institutional Class Shares received Class I Shares of the Fund. In addition, as a result of the Reorganization, the Fund's Class A and Class C Shares adopted the Predecessor Fund's Class A and Class C Shares' performance and accounting history, and the Fund's Class I Shares adopted the Predecessor Fund's Institutional Class Shares' performance and accounting history.

On March 25, 2021, the Board of Trustees of Brookfield Investment Funds, on behalf of the Fund, approved a proposal to close the Fund's Class I Shares (the "Legacy Class I Shares"). On April 6, 2021, shareholders in the Legacy Class I Shares redeemed all shares. Following the close of business on April 30, 2021, the Fund's Class Y Shares (the "Legacy Class Y Shares") were renamed "Class I Shares" (the "Class I Shares"). The Fund's new Class I Shares adopted the Legacy Class Y Share's performance and accounting history.

The gross expense ratio in the prospectus dated January 28, 2021 is 1.50% for Class A Shares, 2.25% for Class C Shares and 1.25% for Class I Shares, as applicable to investors respectively.

The Fund's gross and net expense ratios excluding the current tax expense in the financial highlights of this report are as follows: Class A is 1.50% and 1.46%, Class C is 2.25% and 2.21% and Class I is 1.25% and 1.21%, respectively for the fiscal year ended September 30, 2021.

The Adviser has contractually agreed to waive and/or reimburse the Fund's expenses through February 2, 2022. There is no guarantee that such reimbursement will be continued after that date.

The Alerian Midstream Energy Index is a broad-based composite of North American energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMNA) and on a total-return basis (AMNAX).

The Alerian MLP Index is the leading gauge of energy infrastructure Master Limited Partnerships (MLPs). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a total return basis (AMZX).

The S&P 500 Index is an equity index of 500 widely held, large-capitalization U.S. companies.

These indices do not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

The Fund's portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Center Coast Brookfield Midstream Focus Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings as of September 30, 2021.

Total return figures include the reinvestment of dividends and capital gains, and as the Fund is taxable as a "C" corporation performance is net of federal, state and local taxes paid by the Fund.

These views represent the opinions of Brookfield Public Securities Group LLC and are not intended to predict or depict the performance of any investment. These views are as of the close of business on September 30, 2021 and subject to change based on subsequent developments.

Brookfield Public Securities Group LLC

10

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Portfolio Characteristics (Unaudited)

September 30, 2021

| Asset Allocation by Sector | Percent of Total Investments | ||||||

Master Limited Partnerships | |||||||

Pipeline Transportation | Petroleum | 25.9 | % | |||||

Pipeline Transportation | Natural Gas | 14.5 | % | |||||

Gathering & Processing | 5.2 | % | |||||

Renewables | 1.0 | % | |||||

Total Master Limited Partnerships | 46.6 | % | |||||

Common Stocks | |||||||

Gathering & Processing | 27.7 | % | |||||

Pipeline Transportation | Petroleum | 10.4 | % | |||||

Pipeline Transportation | Natural Gas | 10.4 | % | |||||

Liquefaction | 4.0 | % | |||||

Total Common Stocks | 52.5 | % | |||||

Money Market Fund | 0.9 | % | |||||

Total | 100.0 | % | |||||

| TOP TEN HOLDINGS | Percent of Total Investments | ||||||

Plains All American Pipeline LP | 8.2 | % | |||||

The Williams Companies, Inc. | 8.1 | % | |||||

Energy Transfer LP | 8.1 | % | |||||

| MPLX LP | 8.0 | % | |||||

Enbridge, Inc. | 7.8 | % | |||||

Targa Resources Corp. | 6.9 | % | |||||

Kinder Morgan, Inc. | 6.5 | % | |||||

Enterprise Products Partners LP | 6.4 | % | |||||

Equitrans Midstream Corp. | 5.7 | % | |||||

Western Midstream Partners LP | 4.2 | % | |||||

2021 Annual Report

11

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Schedule of Investments

September 30, 2021

Shares | Value | ||||||||||

MASTER LIMITED PARTNERSHIPS – 46.8% | |||||||||||

Gathering & Processing – 5.2% | |||||||||||

DCP Midstream LP | 396,855 | $ | 11,203,217 | ||||||||

Western Midstream Partners LP | 2,233,506 | 46,814,286 | |||||||||

Total Gathering & Processing | 58,017,503 | ||||||||||

Pipeline Transportation | Natural Gas – 14.5% | |||||||||||

Energy Transfer LP | 9,433,371 | 90,371,694 | |||||||||

Enterprise Products Partners LP | 3,318,450 | 71,811,258 | |||||||||

Total Pipeline Transportation | Natural Gas | 162,182,952 | ||||||||||

Pipeline Transportation | Petroleum – 26.1% | |||||||||||

Holly Energy Partners LP | 555,511 | 10,182,517 | |||||||||

Magellan Midstream Partners LP | 922,725 | 42,057,805 | |||||||||

| MPLX LP | 3,138,605 | 89,356,084 | |||||||||

NuStar Energy LP | 688,098 | 10,830,662 | |||||||||

Phillips 66 Partners LP | 1,184,103 | 42,450,093 | |||||||||

Plains All American Pipeline LP | 8,992,828 | 91,457,061 | |||||||||

Shell Midstream Partners LP | 372,012 | 4,378,581 | |||||||||

Total Pipeline Transportation | Petroleum | 290,712,803 | ||||||||||

Renewables – 1.0% | |||||||||||

Enviva Partners LP | 206,363 | 11,162,175 | |||||||||

| Total MASTER LIMITED PARTNERSHIPS (Cost $607,263,084) | 522,075,433 | ||||||||||

COMMON STOCKS – 52.7% | |||||||||||

Gathering & Processing – 27.8% | |||||||||||

DT Midstream, Inc. | 634,634 | 29,345,476 | |||||||||

Equitrans Midstream Corp. | 6,260,744 | 63,483,944 | |||||||||

Hess Midstream LP | 332,281 | 9,373,647 | |||||||||

Keyera Corp. (u) | 1,109,567 | 27,918,759 | |||||||||

Rattler Midstream LP | 982,777 | 11,537,802 | |||||||||

Targa Resources Corp. | 1,572,438 | 77,379,674 | |||||||||

The Williams Companies, Inc. | 3,514,509 | 91,166,363 | |||||||||

Total Gathering & Processing | 310,205,665 | ||||||||||

Liquefaction – 4.1% | |||||||||||

Cheniere Energy, Inc. (n) | 466,407 | 45,553,972 | |||||||||

Pipeline Transportation | Natural Gas – 10.4% | |||||||||||

Kinder Morgan, Inc. | 4,339,167 | 72,594,264 | |||||||||

TC Energy Corp. (u) | 907,571 | 43,645,089 | |||||||||

Total Pipeline Transportation | Natural Gas | 116,239,353 | ||||||||||

Pipeline Transportation | Petroleum – 10.4% | |||||||||||

Enbridge, Inc. (u) | 2,190,417 | 87,178,597 | |||||||||

Pembina Pipeline Corp. (u) | 920,691 | 29,176,698 | |||||||||

Total Pipeline Transportation | Petroleum | 116,355,295 | ||||||||||

| Total COMMON STOCKS (Cost $480,568,145) | 588,354,285 | ||||||||||

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

12

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Schedule of Investments (continued)

September 30, 2021

Shares | Value | ||||||||||

MONEY MARKET FUND – 0.9% | |||||||||||

First American Treasury Obligations Fund, X Class, 0.01% (y) | 10,221,449 | $ | 10,221,449 | ||||||||

| Total MONEY MARKET FUND (Cost $10,221,449) | 10,221,449 | ||||||||||

| Total Investments – 100.4% (Cost $1,098,052,678) | 1,120,651,167 | ||||||||||

Liabilities in Excess of Other Assets – (0.4%) | (4,414,441 | ) | |||||||||

TOTAL NET ASSETS – 100.0% | $ | 1,116,236,726 | |||||||||

LP — Limited Partnership

(n) — Non-income producing security.

(u) — Foreign security or a U.S. security of a foreign company.

(y) — The rate quoted is the annualized seven-day yield as of September 30, 2021.

See Notes to Financial Statements.

2021 Annual Report

13

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Statement of Assets and Liabilities

September 30, 2021

Assets: | |||||||

Investments in securities, at value (cost $1,098,052,678) | $ | 1,120,651,167 | |||||

Receivable for investments sold | 1,652,245 | ||||||

Receivable for fund shares sold | 640,813 | ||||||

Dividends and interest receivable | 1,368,577 | ||||||

Prepaid expenses | 106,645 | ||||||

Total assets | 1,124,419,447 | ||||||

Liabilities: | |||||||

Payable for investments purchased | 3,232,883 | ||||||

Payable for fund shares purchased | 1,174,294 | ||||||

Payable for current income taxes (Note 3) | 636,594 | ||||||

Distribution fees payable | 1,475,583 | ||||||

Investment advisory fees payable, net (Note 4) | 1,054,856 | ||||||

Trustees' fees payable | 16,912 | ||||||

Accrued expenses | 591,599 | ||||||

Total liabilities | 8,182,721 | ||||||

Commitments and contingencies (Note 9) | |||||||

Net Assets | $ | 1,116,236,726 | |||||

Composition of Net Assets: | |||||||

| Paid-in capital | 2,157,816,782 | ||||||

| Accumulated losses | (1,041,580,056 | ) | |||||

Net assets applicable to capital shares outstanding | $ | 1,116,236,726 | |||||

Net Assets | |||||||

Class A Shares — Net Assets | $ | 238,520,444 | |||||

Shares outstanding | 59,978,357 | ||||||

Net asset value and redemption price per share | $ | 3.98 | |||||

Offering price per share based on a maximum sales charge of 4.75% | $ | 4.18 | |||||

Class C Shares — Net Assets | $ | 160,637,679 | |||||

Shares outstanding | 47,087,082 | ||||||

Net asset value and redemption price per share | $ | 3.41 | |||||

Class I Shares — Net Assets | $ | 717,078,603 | |||||

Shares outstanding | 173,475,944 | ||||||

Net asset value and redemption price per share | $ | 4.13 | |||||

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

14

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Statement of Operations

For the Fiscal Year Ended September 30, 2021

Investment Income: | |||||||

| Dividends and distributions from unaffiliated issuers (net of foreign withholding tax of $1,614,982) | $ | 78,176,193 | |||||

Interest | 2,514 | ||||||

| Less return of capital on distributions from unaffiliated issuers | (59,942,851 | ) | |||||

| Total investment income | 18,235,856 | ||||||

Expenses: | |||||||

Investment advisory fees (Note 4) | 10,409,913 | ||||||

Administration fees (Note 4) | 851,303 | ||||||

Distribution fees — Class A | 540,970 | ||||||

Distribution fees — Class C | 1,640,672 | ||||||

Transfer agent fees | 623,589 | ||||||

Fund accounting and sub-administration fees | 265,664 | ||||||

Trustees' fees | 206,794 | ||||||

Audit and tax services | 137,834 | ||||||

Registration fees | 130,415 | ||||||

Insurance | 123,836 | ||||||

Legal fees | 107,820 | ||||||

Miscellaneous | 83,390 | ||||||

Reports to shareholders | 70,354 | ||||||

Custodian fees | 47,202 | ||||||

Total operating expenses | 15,239,756 | ||||||

Less expenses waived by the investment adviser (Note 4) | (462,120 | ) | |||||

Net expenses | 14,777,636 | ||||||

| Net investment income before taxes | 3,458,220 | ||||||

Current income tax refund (Note 3) | 17,208,361 | ||||||

| Net investment income | 20,666,581 | ||||||

Net realized gain (loss) on: | |||||||

Investments in unaffiliated issuers | 83,501,495 | ||||||

Investments in affiliated issuers | (222,900 | ) | |||||

Foreign currency transactions | 38,297 | ||||||

Net realized gain | 83,316,892 | ||||||

Net change in unrealized appreciation on: | |||||||

| Investments in unaffiliated issuers | 457,779,686 | ||||||

Investments in affiliated issuers | 1,141,953 | ||||||

Foreign currency translations | 9,400 | ||||||

| Net change in unrealized appreciation | 458,931,039 | ||||||

| Net realized and unrealized gain | 542,247,931 | ||||||

Net increase in net assets resulting from operations | $ | 562,914,512 | |||||

See Notes to Financial Statements.

2021 Annual Report

15

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Statements of Changes in Net Assets

| For the Fiscal Year Ended September 30, 2021 | For the Fiscal Year Ended September 30, 2020 | ||||||||||

Increase (Decrease) in Net Assets Resulting from Operations: | |||||||||||

| Net investment income (loss) | $ | 20,666,581 | $ | (19,521,303 | ) | ||||||

Net realized gain (loss) | 83,316,892 | (598,159,043 | ) | ||||||||

| Net unrealized appreciation (depreciation) | 458,931,039 | (484,144,444 | ) | ||||||||

Net increase (decrease) in net assets resulting from operations | 562,914,512 | (1,101,824,790 | ) | ||||||||

Distributions to Shareholders: | |||||||||||

From distributable earnings: | |||||||||||

Class A shares | (20,873,279 | ) | — | ||||||||

Class C shares | (18,638,358 | ) | — | ||||||||

Class I shares | (61,951,618 | ) | — | ||||||||

Legacy Class I shares (Note 1) | (10 | ) | — | ||||||||

From return of capital: | |||||||||||

| Class A shares | — | (32,358,499 | ) | ||||||||

| Class C shares | — | (42,818,712 | ) | ||||||||

| Class I shares | — | (126,909,097 | ) | ||||||||

| Legacy Class I shares (Note 1) | — | (23 | ) | ||||||||

Total distributions | (101,463,265 | ) | (202,086,331 | ) | |||||||

Capital Share Transactions (Note 6): | |||||||||||

Subscriptions | 258,847,563 | 915,013,074 | |||||||||

Reinvestment of distributions | 96,662,673 | 195,261,938 | |||||||||

Redemptions | (501,655,655 | ) | (1,307,609,038 | ) | |||||||

Net decrease in net assets from capital share transactions | (146,145,419 | ) | (197,334,026 | ) | |||||||

Total increase (decrease) in net assets | 315,305,828 | (1,501,245,147 | ) | ||||||||

Net Assets: | |||||||||||

Beginning of year | 800,930,898 | 2,302,176,045 | |||||||||

End of year | $ | 1,116,236,726 | $ | 800,930,898 | |||||||

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

16

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Financial Highlights

| For the Fiscal Year Ended September 30, | For the Ten Month Period Ended September 30, | For the Fiscal Year Ended November 30, | |||||||||||||||||||||||||

Class A | 2021 | 2020 | 2019 | 20182 | 2017 | 2016 | |||||||||||||||||||||

Per Share Operating Performance: | |||||||||||||||||||||||||||

Net asset value, beginning of period | $ | 2.48 | $ | 5.96 | $ | 7.21 | $ | 7.03 | $ | 8.23 | $ | 8.30 | |||||||||||||||

Income from Investment Operations: | |||||||||||||||||||||||||||

Net investment income (loss)1 | 0.06 | (0.06 | ) | (0.04 | ) | (0.07 | ) | (0.11 | ) | (0.05 | ) | ||||||||||||||||

Return of capital1 | 0.15 | 0.24 | 0.46 | 0.33 | 0.38 | 0.37 | |||||||||||||||||||||

Net realized and unrealized gain (loss)1,3 | 1.63 | (3.11 | ) | (0.99 | ) | 0.43 | (0.79 | ) | 0.29 | ||||||||||||||||||

Total from investment operations | 1.84 | (2.93 | ) | (0.57 | ) | 0.69 | (0.52 | ) | 0.61 | ||||||||||||||||||

Distributions to Shareholders: | |||||||||||||||||||||||||||

| From distributable earnings | (0.34 | ) | — | (0.14 | ) | (0.16 | ) | — | — | ||||||||||||||||||

| From return of capital | — | (0.55 | ) | (0.54 | ) | (0.35 | ) | (0.68 | ) | (0.68 | ) | ||||||||||||||||

Total distributions to shareholders* | (0.34 | ) | (0.55 | ) | (0.68 | ) | (0.51 | ) | (0.68 | ) | (0.68 | ) | |||||||||||||||

Net asset value, end of period | $ | 3.98 | $ | 2.48 | $ | 5.96 | $ | 7.21 | $ | 7.03 | $ | 8.23 | |||||||||||||||

Total Return† | 77.31 | % | -51.51 | % | -8.02 | % | 10.26 | %7 | -6.88 | % | 8.17 | % | |||||||||||||||

Ratios and Supplemental Data: | |||||||||||||||||||||||||||

Net assets, end of period (in thousands) | $ | 238,520 | $ | 153,189 | $ | 362,375 | $ | 388,010 | $ | 369,684 | $ | 451,900 | |||||||||||||||

Ratio of Expenses to Average Net Assets: | |||||||||||||||||||||||||||

| Before expense reimbursement/waivers and after current tax expense | (0.15 | )% | 2.96 | % | 1.47 | % | 1.47 | %8 | 1.44 | % | 1.46 | % | |||||||||||||||

| Before expense reimbursement/waivers, current and deferred tax expense | 1.50 | % | 1.50 | % | 1.47 | % | 1.47 | %8 | 1.44 | % | 1.46 | % | |||||||||||||||

Expense reimbursement/waivers | (0.04 | )% | (0.04 | )% | (0.01 | )% | (0.01 | )%8 | — | % | — | % | |||||||||||||||

| Net of expense reimbursement/waivers and before current and deferred tax expense | 1.46 | % | 1.46 | % | 1.46 | % | 1.46 | %8 | 1.44 | % | 1.46 | % | |||||||||||||||

Deferred tax expense (benefit)4,5 | — | % | — | % | — | % | — | %8 | — | % | 5.61 | % | |||||||||||||||

Total expense (benefit) before current tax expense | 1.46 | % | 1.46 | % | 1.46 | % | 1.46 | %8 | 1.44 | % | 7.07 | % | |||||||||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets: | |||||||||||||||||||||||||||

| Before expense reimbursement/waivers, current and deferred tax benefit | 0.16 | % | (0.12 | )% | (0.62 | )% | (1.13 | )%8 | (1.39 | )% | (1.10 | )% | |||||||||||||||

Expense reimbursement/waivers | 0.04 | % | 0.04 | % | 0.01 | % | 0.01 | %8 | — | % | — | % | |||||||||||||||

| Net of expense reimbursement/waivers and before current and deferred tax benefit | 0.20 | % | (0.08 | )% | (0.61 | )% | (1.12 | )%8 | (1.39 | )% | (1.10 | )% | |||||||||||||||

Deferred tax benefit5,6 | — | % | — | % | — | % | — | %8 | 0.09 | % | 0.41 | % | |||||||||||||||

| Net income (loss) before current tax expense | 0.20 | % | (0.08 | )% | (0.61 | )% | (1.12 | )%8 | (1.30 | )% | (0.69 | )% | |||||||||||||||

Portfolio turnover rate | 48 | % | 80 | % | 57 | % | 35 | %7 | 32 | % | 60 | % | |||||||||||||||

† Total investment return is computed based upon the net asset value of the Fund's shares and excludes the effects of sales charges or contingent deferred sales charges, if applicable. Distributions are assumed to be reinvested at the net asset value of the Class on the ex-date of the distribution.

* Distributions for annual periods determined in accordance with federal income tax regulations.

1 Per share amounts presented are based on average shares outstanding throughout the period indicated.

2 Amounts shown are for the period ended September 30, 2018 and are not necessarily indicative of a full year of operations. The Fund changed its fiscal year end from November 30 to September 30.

3 Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share in the period. It may not agree to the aggregate gains and losses in the Statement of Operations due to the fluctuation in share transactions this period.

4 Deferred tax expense (benefit) estimate for the ratio calculation is derived from net investment income (loss), and realized and unrealized gains (losses).

5 The deferred tax expense and deferred tax benefit are allocated based on average net assets.

6 Deferred tax benefit (expense) estimate for the ratio calculation is derived from net investment income (loss) only.

7 Not annualized.

8 Annualized.

See Notes to Financial Statements.

2021 Annual Report

17

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Financial Highlights

| For the Fiscal Year Ended September 30, | For the Ten Month Period Ended September 30, | For the Fiscal Year Ended November 30, | |||||||||||||||||||||||||

Class C | 2021 | 2020 | 2019 | 20182 | 2017 | 2016 | |||||||||||||||||||||

Per Share Operating Performance: | |||||||||||||||||||||||||||

Net asset value, beginning of period | $ | 2.17 | $ | 5.37 | $ | 6.61 | $ | 6.54 | $ | 7.75 | $ | 7.91 | |||||||||||||||

Income from Investment Operations: | |||||||||||||||||||||||||||

Net investment income (loss)1 | 0.04 | (0.07 | ) | (0.08 | ) | (0.10 | ) | (0.16 | ) | (0.11 | ) | ||||||||||||||||

Return of capital1 | 0.13 | 0.22 | 0.42 | 0.30 | 0.36 | 0.35 | |||||||||||||||||||||

Net realized and unrealized gain (loss)1,3 | 1.41 | (2.80 | ) | (0.90 | ) | 0.38 | (0.73 | ) | 0.28 | ||||||||||||||||||

Total from investment operations | 1.58 | (2.65 | ) | (0.56 | ) | 0.58 | (0.53 | ) | 0.52 | ||||||||||||||||||

Distributions to Shareholders: | |||||||||||||||||||||||||||

| From distributable earnings | (0.34 | ) | — | (0.14 | ) | (0.16 | ) | — | — | ||||||||||||||||||

| From return of capital | — | (0.55 | ) | (0.54 | ) | (0.35 | ) | (0.68 | ) | (0.68 | ) | ||||||||||||||||

Total distributions to shareholders* | (0.34 | ) | (0.55 | ) | (0.68 | ) | (0.51 | ) | (0.68 | ) | (0.68 | ) | |||||||||||||||

Net asset value, end of period | $ | 3.41 | $ | 2.17 | $ | 5.37 | $ | 6.61 | $ | 6.54 | $ | 7.75 | |||||||||||||||

Total Return† | 75.46 | % | -51.78 | % | -8.63 | % | 9.31 | %7 | -7.44 | % | 7.40 | % | |||||||||||||||

Ratios and Supplemental Data: | |||||||||||||||||||||||||||

Net assets, end of period (in thousands) | $ | 160,638 | $ | 142,354 | $ | 470,088 | $ | 637,182 | $ | 660,663 | $ | 796,542 | |||||||||||||||

Ratio of Expenses to Average Net Assets: | |||||||||||||||||||||||||||

| Before expense reimbursement/waivers and after current tax expense | 0.68 | % | 3.50 | % | 2.22 | % | 2.22 | %8 | 2.19 | % | 2.21 | % | |||||||||||||||

| Before expense reimbursement/waivers, current and deferred tax expense | 2.25 | % | 2.25 | % | 2.22 | % | 2.22 | %8 | 2.19 | % | 2.21 | % | |||||||||||||||

Expense reimbursement/waivers | (0.04 | )% | (0.04 | )% | (0.01 | )% | (0.01 | )%8 | — | % | — | % | |||||||||||||||

| Net of expense reimbursement/waivers and before current and deferred tax expense | 2.21 | % | 2.21 | % | 2.21 | % | 2.21 | %8 | 2.19 | % | 2.21 | % | |||||||||||||||

Deferred tax expense (benefit)4,5 | — | % | — | % | — | % | — | %8 | — | % | 5.61 | % | |||||||||||||||

Total expense (benefit) before current tax expense | 2.21 | % | 2.21 | % | 2.21 | % | 2.21 | %8 | 2.19 | % | 7.82 | % | |||||||||||||||

Ratio of Net Investment Income (Loss) to Average Net Assets: | |||||||||||||||||||||||||||

| Before expense reimbursement/waivers, current and deferred tax benefit | (0.45 | )% | (0.87 | )% | (1.37 | )% | (1.88 | )%8 | (2.14 | )% | (1.85 | )% | |||||||||||||||

Expense reimbursement/waivers | 0.04 | % | 0.04 | % | 0.01 | % | 0.01 | %8 | — | % | — | % | |||||||||||||||

| Net of expense reimbursement/waivers and before current and deferred tax benefit | (0.41 | )% | (0.83 | )% | (1.36 | )% | (1.87 | )%8 | (2.14 | )% | (1.85 | )% | |||||||||||||||

Deferred tax benefit5,6 | — | % | — | % | — | % | — | %8 | 0.09 | % | 0.41 | % | |||||||||||||||

| Net income (loss) before current tax expense | (0.41 | )% | (0.83 | )% | (1.36 | )% | (1.87 | )%8 | (2.05 | )% | (1.44 | )% | |||||||||||||||

Portfolio turnover rate | 48 | % | 80 | % | 57 | % | 35 | %7 | 32 | % | 60 | % | |||||||||||||||

† Total investment return is computed based upon the net asset value of the Fund's shares and excludes the effects of sales charges or contingent deferred sales charges, if applicable. Distributions are assumed to be reinvested at the net asset value of the Class on the ex-date of the distribution.

* Distributions for annual periods determined in accordance with federal income tax regulations.

1 Per share amounts presented are based on average shares outstanding throughout the period indicated.

2 Amounts shown are for the period ended September 30, 2018 and are not necessarily indicative of a full year of operations. The Fund changed its fiscal year end from November 30 to September 30.

3 Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share in the period. It may not agree to the aggregate gains and losses in the Statement of Operations due to the fluctuation in share transactions this period.

4 Deferred tax expense (benefit) estimate for the ratio calculation is derived from net investment income (loss), and realized and unrealized gains (losses).

5 The deferred tax expense and deferred tax benefit are allocated based on average net assets.

6 Deferred tax benefit (expense) estimate for the ratio calculation is derived from net investment income (loss) only.

7 Not annualized.

8 Annualized.

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

18

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Financial Highlights

| For the Fiscal Year Ended September 30, | For the Ten Month Period Ended September 30, | For the Fiscal Year Ended November 30, | |||||||||||||||||||||||||

Class I (Note 1) | 2021 | 2020 | 2019 | 20182 | 2017 | 2016 | |||||||||||||||||||||

Per Share Operating Performance: | |||||||||||||||||||||||||||

Net asset value, beginning of period | $ | 2.56 | $ | 6.12 | $ | 7.36 | $ | 7.16 | $ | 8.34 | $ | 8.38 | |||||||||||||||

Income from Investment Operations: | |||||||||||||||||||||||||||

Net investment income (loss)1 | 0.08 | (0.04 | ) | (0.02 | ) | (0.05 | ) | (0.09 | ) | (0.03 | ) | ||||||||||||||||

Return of capital1 | 0.16 | 0.25 | 0.47 | 0.33 | 0.39 | 0.38 | |||||||||||||||||||||

Net realized and unrealized gain (loss)1,3 | 1.67 | (3.22 | ) | (1.01 | ) | 0.43 | (0.80 | ) | 0.29 | ||||||||||||||||||

Total from investment operations | 1.91 | (3.22 | ) | (0.56 | ) | 0.71 | (0.50 | ) | 0.64 | ||||||||||||||||||

Distributions to Shareholders: | |||||||||||||||||||||||||||

| From distributable earnings | (0.34 | ) | — | (0.14 | ) | (0.16 | ) | — | — | ||||||||||||||||||

| From return of capital | — | (0.55 | ) | (0.54 | ) | (0.35 | ) | (0.68 | ) | (0.68 | ) | ||||||||||||||||

Total distributions to shareholders* | (0.34 | ) | (0.55 | ) | (0.68 | ) | (0.51 | ) | (0.68 | ) | (0.68 | ) | |||||||||||||||

Net asset value, end of period | $ | 4.13 | $ | 2.56 | $ | 6.12 | $ | 7.36 | $ | 7.16 | $ | 8.34 | |||||||||||||||

Total Return† | 77.63 | % | -51.47 | % | -7.70 | % | 10.35 | %7 | -6.53 | % | 8.46 | % | |||||||||||||||

Ratios and Supplemental Data: | |||||||||||||||||||||||||||

Net assets, end of period (in thousands) | $ | 717,079 | $ | 505,389 | $ | 1,469,712 | $ | 1,568,976 | $ | 1,490,129 | $ | 1,353,904 | |||||||||||||||

Ratio of Expenses to Average Net Assets: | |||||||||||||||||||||||||||

| Before expense reimbursement/waivers and after current tax expense | (0.42 | )% | 2.51 | % | 1.22 | % | 1.22 | %8 | 1.19 | % | 1.21 | % | |||||||||||||||

| Before expense reimbursement/waivers, current and deferred tax expense | 1.25 | % | 1.25 | % | 1.22 | % | 1.22 | %8 | 1.19 | % | 1.21 | % | |||||||||||||||

Expense reimbursement/waivers | (0.04 | )% | (0.04 | )% | (0.01 | )% | (0.01 | )%8 | — | % | — | % | |||||||||||||||

| Net of expense reimbursement/waivers and before current and deferred tax expense | 1.21 | % | 1.21 | % | 1.21 | % | 1.21 | %8 | 1.19 | % | 1.21 | % | |||||||||||||||

Deferred tax expense (benefit)4,5 | — | % | — | % | — | % | — | %8 | — | % | 5.61 | % | |||||||||||||||

Total expense (benefit) before current tax expense | 1.21 | % | 1.21 | % | 1.21 | % | 1.21 | %8 | 1.19 | % | 6.82 | % | |||||||||||||||

| Ratio of Net Investment Income (Loss) to Average Net Assets: | |||||||||||||||||||||||||||

| Before expense reimbursement/waivers, current and deferred tax benefit | 0.52 | % | 0.13 | % | (0.37 | )% | (0.88 | )%8 | (1.14 | )% | (0.85 | )% | |||||||||||||||

Expense reimbursement/waivers | 0.04 | % | 0.04 | % | 0.01 | % | 0.01 | %8 | — | % | — | % | |||||||||||||||

| Net of expense reimbursement/waivers and before current and deferred tax benefit | 0.56 | % | 0.17 | % | (0.36 | )% | (0.87 | )%8 | (1.14 | )% | (0.85 | )% | |||||||||||||||

Deferred tax benefit5,6 | — | % | — | % | — | % | — | %8 | 0.09 | % | 0.41 | % | |||||||||||||||

| Net income (loss) before current tax expense | 0.56 | % | 0.17 | % | (0.36 | )% | (0.87 | )%8 | (1.05 | )% | (0.44 | )% | |||||||||||||||

Portfolio turnover rate | 48 | % | 80 | % | 57 | % | 35 | %7 | 32 | % | 60 | % | |||||||||||||||

† Total investment return is computed based upon the net asset value of the Fund's shares and excludes the effects of sales charges or contingent deferred sales charges, if applicable. Distributions are assumed to be reinvested at the net asset value of the Class on the ex-date of the distribution.

* Distributions for annual periods determined in accordance with federal income tax regulations.

1 Per share amounts presented are based on average shares outstanding throughout the period indicated.

2 Amounts shown are for the period ended September 30, 2018 and are not necessarily indicative of a full year of operations. The Fund changed its fiscal year end from November 30 to September 30.

3 Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share in the period. It may not agree to the aggregate gains and losses in the Statement of Operations due to the fluctuation in share transactions this period.

4 Deferred tax expense (benefit) estimate for the ratio calculation is derived from net investment income (loss), and realized and unrealized gains (losses).

5 The deferred tax expense and deferred tax benefit are allocated based on average net assets.

6 Deferred tax benefit (expense) estimate for the ratio calculation is derived from net investment income (loss) only.

7 Not annualized.

8 Annualized.

See Notes to Financial Statements.

2021 Annual Report

19

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Notes to Financial Statements

September 30, 2021

1. Organization

Brookfield Investment Funds (the "Trust") was organized as a statutory trust under the laws of the State of Delaware on May 12, 2011. The Trust is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company. The Trust currently consists of seven separate investment series as of September 30, 2021. Center Coast Brookfield Midstream Focus Fund (the "Fund''), a series of the Trust, is a non-diversified open-end management investment company.

The Fund currently has three classes of shares: Class A, Class C and Class I shares. Each class represents an interest in the same portfolio of assets and has identical voting, dividend, liquidation and other rights except that: (i) Class A Shares have a maximum front end sales charge of 4.75% and Class C shares have a maximum deferred sales charge of 1.00%; (ii) Class A shares have a 12b-1 fee of 0.25% and Class C shares have a 12b-1 fee of 1.00%; and (iii) each class has exclusive voting rights with respect to matters relating to its own distribution arrangements.

On March 25, 2021, the Board of Trustees of Brookfield Investment Funds, on behalf of the Fund, approved a proposal to close the Fund's Class I Shares (the "Legacy Class I Shares"). On April 6, 2021, shareholders in the Legacy Class I Shares redeemed all shares. Following the close of business on April 30, 2021, the Fund's Class Y Shares (the "Legacy Class Y Shares") were renamed "Class I Shares" (the "Class I Shares"). The Fund's new Class I Shares adopted the Legacy Class Y Share's performance and accounting history.

Brookfield Public Securities Group LLC (the "Adviser"), a wholly-owned subsidiary of Brookfield Asset Management Inc., is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, and serves as investment adviser to the Fund.

The Fund's primary investment objective is to seek maximum total return with an emphasis on providing cash distributions to shareholders. The Fund's investment objective is not fundamental and may be changed by the Trust's Board of Trustees (the "Board") without shareholder approval, upon not less than 60 days prior written notice to shareholders. No assurance can be given that the Fund's investment objective will be achieved.

2. Significant Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company within the scope of Financial Accounting Standards Board ("FASB") Accounting Standards Update ("ASU") 2013-08 and follows accounting and reporting guidance under FASB Accounting Standards Codification ("ASC") Topic 946 Financial Services-Investment Companies.

Valuation of Investments: The Board has adopted procedures for the valuation of the Fund's securities. The Adviser oversees the day to day responsibilities for valuation determinations under these procedures. The Board regularly reviews the application of these procedures to the securities in the Fund's portfolio. The Adviser's Valuation Committee is comprised of senior members of the Adviser's management team.

Investments in equity securities listed or traded on any securities exchange or traded in the over-the-counter market are valued at the last trade price as of the close of business on the valuation date. If the NYSE closes early, then the equity security will be valued at the last traded price before the NYSE close. Prices of foreign equities that are principally traded on certain foreign markets will generally be adjusted daily pursuant to a fair value pricing service approved by the Board in order to reflect an adjustment for the factors occurring after the close of certain foreign markets but before the NYSE close. When fair value pricing is employed, the value of the portfolio securities used to calculate the Fund's net asset value ("NAV") may differ from quoted or official closing prices. Investments in open-end registered investment companies, if any, are valued at the NAV as reported by those investment companies.

Brookfield Public Securities Group LLC

20

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Notes to Financial Statements (continued)

September 30, 2021

Securities for which market prices are not readily available, cannot be determined using the sources described above, or the Adviser's Valuation Committee determines that the quotation or price for a portfolio security provided by a broker-dealer or an independent pricing service is inaccurate will be valued at a fair value determined by the Adviser's Valuation Committee following the procedures adopted by the Adviser under the supervision of the Board. The Adviser's valuation policy establishes parameters for the sources, methodologies, and inputs the Adviser's Valuation Committee uses in determining fair value.

The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve, and credit quality. The fair value may be difficult to determine and thus judgment plays a greater role in the valuation process. Imprecision in estimating fair value can also impact the amount of unrealized appreciation or depreciation recorded for a particular portfolio security and differences in the assumptions used could result in a different determination of fair value, and those differences could be material. For those securities valued by fair valuations, the Adviser's Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available. There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund's NAV.

A three-tier hierarchy has been established to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The three-tier hierarchy of inputs is summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets or liabilities

Level 2 — quoted prices in markets that are not active or other significant observable inputs (including, but not limited to: quoted prices for similar assets or liabilities, quoted prices based on recently executed transactions, interest rates, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of assets or liabilities)

The following table summarizes the Fund's investments valuation inputs categorized in the disclosure hierarchy as of September 30, 2021:

Level 1 | Level 2 | Level 3 | Total | ||||||||||||||||

Master Limited Partnerships | $ | 522,075,433 | $ | — | $ | — | $ | 522,075,433 | |||||||||||

Common Stocks | 588,354,285 | — | — | 588,354,285 | |||||||||||||||

Money Market Fund | 10,221,449 | — | — | 10,221,449 | |||||||||||||||

Total Investments | $ | 1,120,651,167 | $ | — | $ | — | $ | 1,120,651,167 | |||||||||||

For further information regarding security characteristics, see the Schedule of Investments.

Investment Transactions and Investment Income: Securities transactions are recorded on the trade date. Realized gains and losses from securities transactions are calculated on the identified cost basis. Interest income is recorded

2021 Annual Report

21

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND

Notes to Financial Statements (continued)

September 30, 2021

on the accrual basis. Discounts and premiums on securities are accreted and amortized, respectively, on a daily basis, using the effective yield to maturity method adjusted based on management's assessment of the collectability of such interest. Dividend income is recorded on the ex-dividend date. A distribution received from the Fund's investments in master limited partnerships ("MLP") generally are comprised of return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded.

Master Limited Partnerships: A MLP is an entity receiving partnership taxation treatment under the U.S. Internal Revenue Code of 1986 (the "Code"), the partnership interests or "units" of which are traded on securities exchanges like shares of corporate stock. Holders of MLP units generally have limited control and voting rights on matters affecting the partnership.