Filed by Lantheus Holdings, Inc.

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Progenics Pharmaceuticals, Inc.

Commission File No.: 000 – 23143

On January 8, 2020, Lantheus Holdings, Inc. made available the following slides to its investors.

Safe Harbor Statements Important Information For Investors And Stockholders This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. In connection with the proposed transaction, Lantheus Holdings filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 on November 12, 2019 that includes a joint proxy statement of Lantheus Holdings and Progenics that also constitutes a preliminary prospectus of Lantheus Holdings. The registration statement has not yet become effective. After the registration statement is declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to stockholders of Lantheus Holdings and Progenics. INVESTORS AND SECURITY HOLDERS OF LANTHEUS HOLDINGS AND PROGENICS ARE STRONGLY ENCOURAGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders are able to obtain free copies of the registration statement and the joint proxy statement/prospectus and other documents filed with the SEC by Lantheus Holdings or Progenics through the website maintained by the SEC at https://www.sec.gov. Copies of the documents filed with the SEC by Lantheus Holdings are or will also be available free of charge on Lantheus Holdings’ website at https://www.lantheus.com/ or by contacting Lantheus Holdings’ Investor Relations Department by email at ir@lantheus.com or by phone at (978) 671-8001. Copies of the documents filed with the SEC by Progenics are or will also be available free of charge on Progenics’ internet website at https://www.progenics.com/ or by contacting Progenics’ Investor Relations Department by email at mdowns@progenics.com or by phone at (646) 975-2533. Certain Information Regarding Participants Lantheus Holdings, Progenics, and their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Lantheus Holdings is set forth in its Annual Report on Form 10-K for the year ended December 31, 2018, which was filed with the SEC on February 20, 2019, its definitive proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on March 15, 2019, and its Current Report on Form 8-K, which was filed with the SEC on March 25, 2019. Other information regarding the participants of Lantheus Holdings in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Information about the directors and executive officers of Progenics is set forth in its Annual Report on Form 10-K for the year ended December 31, 2018, which was filed with the SEC on March 15, 2019 and amended on April 30, 2019, and its definitive proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on May 30, 2019. Other information regarding the participants of Progenics in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at https://www.sec.gov and from Investor Relations at Lantheus Holdings or Progenics as described above.

Safe Harbor Statements Cautionary Statement Regarding Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are based upon current plans, estimates and expectations that are subject to various risks and uncertainties. The inclusion of forward-looking statements should not be regarded as a representation that such plans, estimates and expectations will be achieved. Words such as “anticipate,” “expect,” “project,” “intend,” “believe,” “may,” “will,” “should,” “plan,” “could,” “target,” “contemplate,” “estimate,” “predict,” “potential,” “opportunity,” “creates” and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. All statements, other than historical facts, including the expected timing of the closing of the merger; the ability of the parties to complete the merger considering the various closing conditions; the expected benefits of the merger, such as efficiencies, cost savings, synergies, revenue growth, creating shareholder value, growth potential, market profile, enhanced competitive position, and financial strength and flexibility; the competitive ability and position of the combined company; and any assumptions underlying any of the foregoing, are forward-looking statements. Important factors that could cause actual results to differ materially from Lantheus Holdings’ and Progenics’ plans, estimates or expectations could include, but are not limited to: (i) Lantheus Holdings or Progenics may be unable to obtain stockholder approval as required for the merger; (ii) conditions to the closing of the merger may not be satisfied; (iii) the merger may involve unexpected costs, liabilities or delays; (iv) the effect of the announcement of the merger on the ability of Lantheus Holdings or Progenics to retain and hire key personnel and maintain relationships with customers, suppliers and others with whom Lantheus Holdings or Progenics does business, or on Lantheus Holdings’ or Progenics’ operating results and business generally; (v) Lantheus Holdings’ or Progenics’ respective businesses may suffer as a result of uncertainty surrounding the merger and disruption of management’s attention due to the merger; (vi) the outcome of any legal proceedings related to the merger; (vii) Lantheus Holdings or Progenics may be adversely affected by other economic, business, and/or competitive factors; (viii) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (ix) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (x) the risk that Lantheus Holdings or Progenics may be unable to obtain governmental and regulatory approvals required for the transaction, or that required governmental and regulatory approvals may delay the transaction or result in the imposition of conditions that could reduce the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (xi) risks that the anticipated benefits of the merger or other commercial opportunities may otherwise not be fully realized or may take longer to realize than expected; (xii) the impact of legislative, regulatory, competitive and technological changes; (xiii) expectations for future clinical trials, the timing and potential outcomes of clinical studies and interactions with regulatory authorities; and (xiv) other risks to the consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all. Additional factors that may affect the future results of Lantheus Holdings and Progenics are set forth in their respective filings with the SEC, including each of Lantheus Holdings’ and Progenics’ most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the SEC, which are available on the SEC’s website at www.sec.gov. Readers are urged to consider these factors carefully in evaluating these forward-looking statements, and not to place undue reliance on any forward-looking statements. Readers should also carefully review the risk factors described in other documents that Lantheus Holdings and Progenics file from time to time with the SEC. The forward-looking statements in this document speak only as of the date of these materials. Except as required by law, Lantheus Holdings and Progenics assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

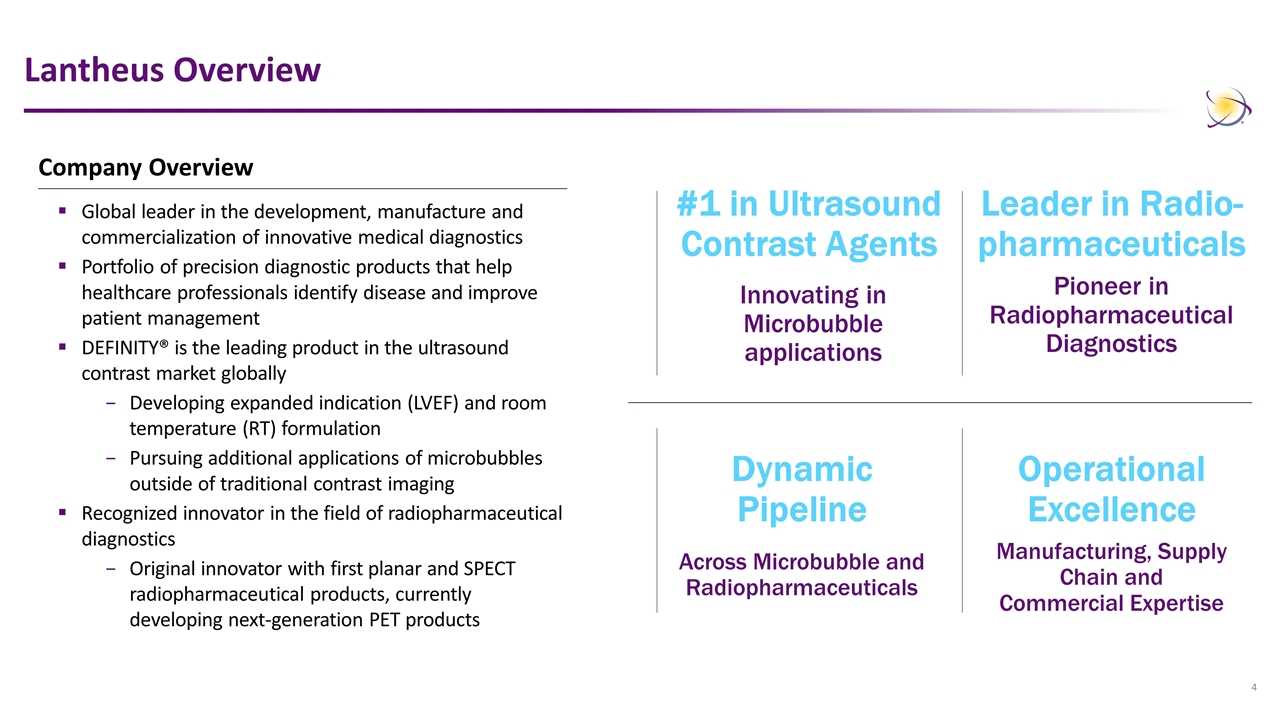

Lantheus Overview #1 in Ultrasound Contrast Agents Innovating in Microbubble applications Across Microbubble and Radiopharmaceuticals Dynamic Pipeline Manufacturing, Supply Chain and Commercial Expertise Operational Excellence Leader in Radio- pharmaceuticals Pioneer in Radiopharmaceutical Diagnostics Company Overview Global leader in the development, manufacture and commercialization of innovative medical diagnostics Portfolio of precision diagnostic products that help healthcare professionals identify disease and improve patient management DEFINITY® is the leading product in the ultrasound contrast market globally Developing expanded indication (LVEF) and room temperature (RT) formulation Pursuing additional applications of microbubbles outside of traditional contrast imaging Recognized innovator in the field of radiopharmaceutical diagnostics Original innovator with first planar and SPECT radiopharmaceutical products, currently developing next-generation PET products

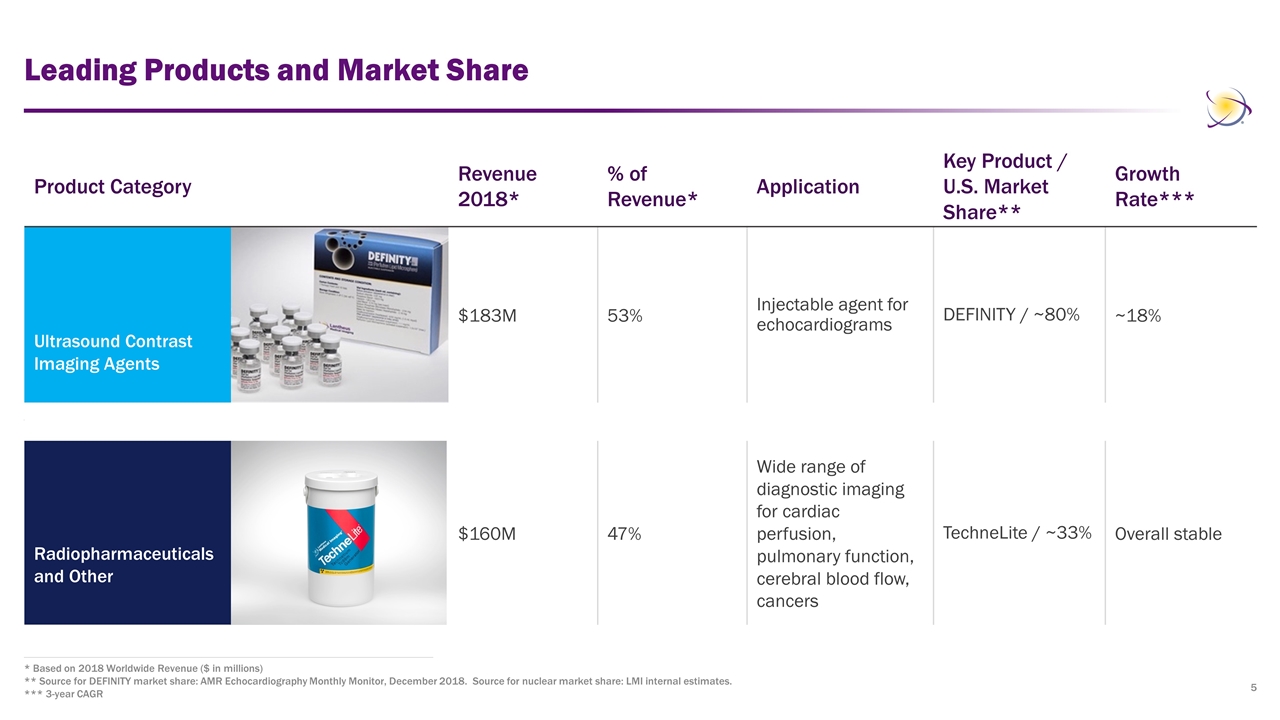

Leading Products and Market Share * Based on 2018 Worldwide Revenue ($ in millions) ** Source for DEFINITY market share: AMR Echocardiography Monthly Monitor, December 2018. Source for nuclear market share: LMI internal estimates. *** 3-year CAGR Product Category Revenue 2018* % of Revenue* Application Key Product / U.S. Market Share** Growth Rate*** Ultrasound Contrast Imaging Agents $183M 53% Injectable agent for echocardiograms DEFINITY / ~80% ~18% Radiopharmaceuticals and Other $160M 47% Wide range of diagnostic imaging for cardiac perfusion, pulmonary function, cerebral blood flow, cancers TechneLite / ~33% Overall stable

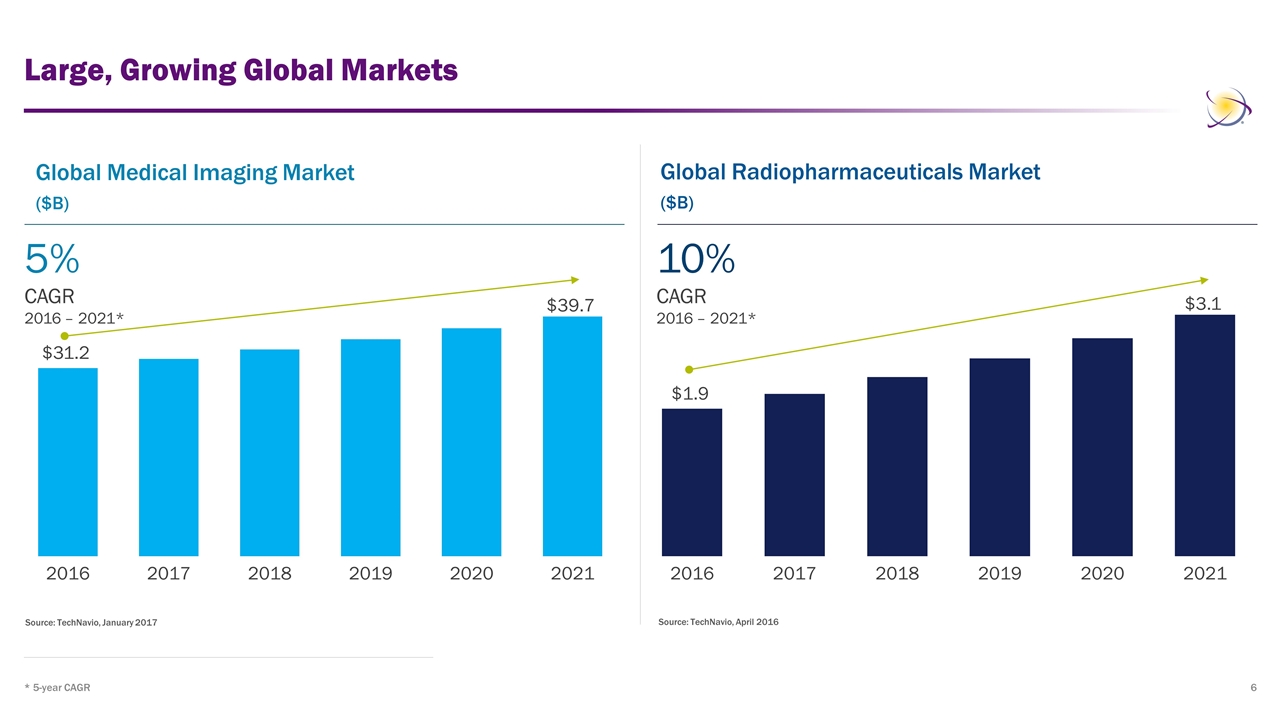

Large, Growing Global Markets * 5-year CAGR Source: TechNavio, January 2017 Source: TechNavio, April 2016 Global Medical Imaging Market ($B) Global Radiopharmaceuticals Market ($B) 5% CAGR 2016 – 2021* 10% CAGR 2016 – 2021*

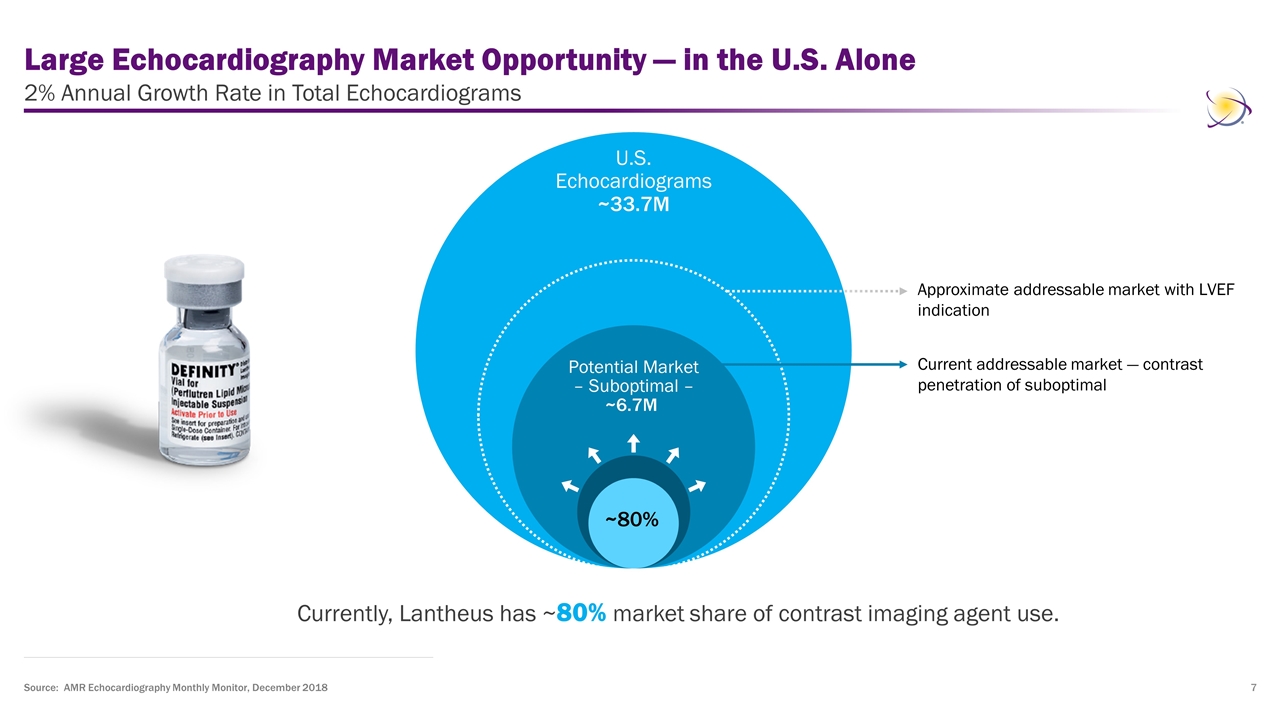

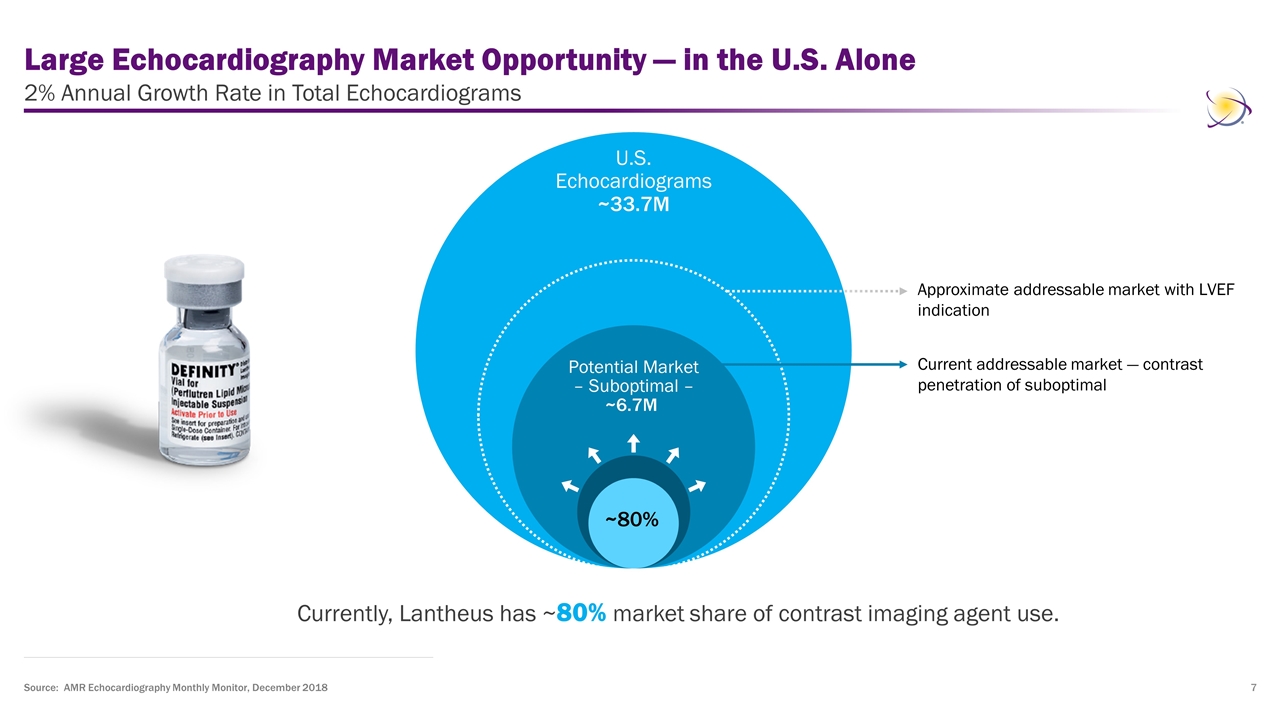

Large Echocardiography Market Opportunity — in the U.S. Alone 2% Annual Growth Rate in Total Echocardiograms Currently, Lantheus has ~80% market share of contrast imaging agent use. Source: AMR Echocardiography Monthly Monitor, December 2018 Current addressable market — contrast penetration of suboptimal U.S. Echocardiograms ~33.7M Potential Market – Suboptimal – ~6.7M ~80% Approximate addressable market with LVEF indication

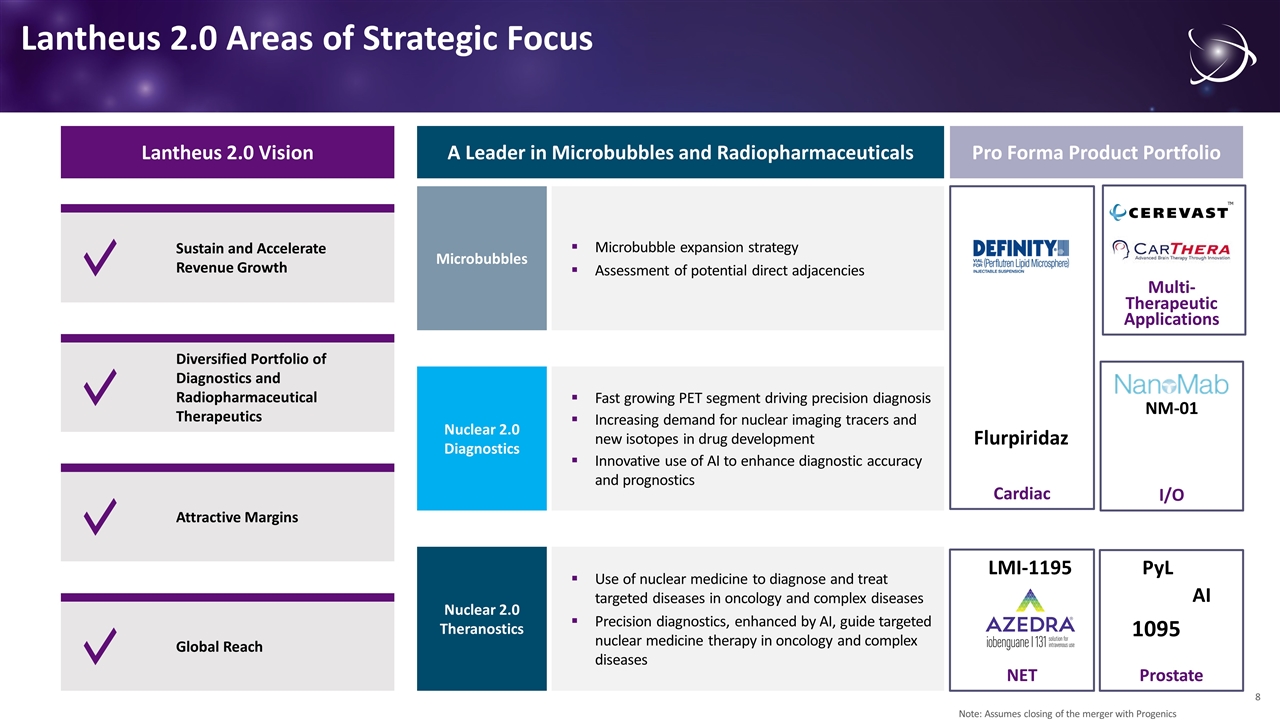

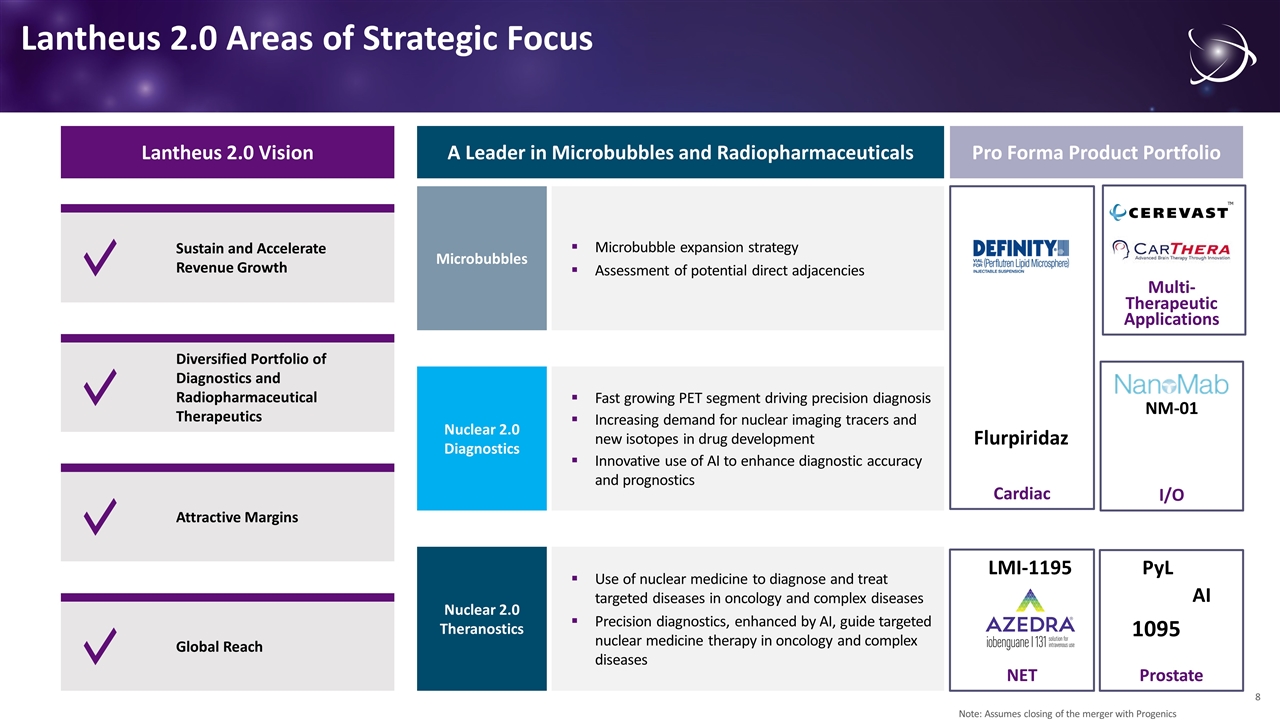

NET Lantheus 2.0 Areas of Strategic Focus Lantheus 2.0 Vision Sustain and Accelerate Revenue Growth Diversified Portfolio of Diagnostics and Radiopharmaceutical Therapeutics Global Reach Attractive Margins Microbubble expansion strategy Assessment of potential direct adjacencies Microbubbles Fast growing PET segment driving precision diagnosis Increasing demand for nuclear imaging tracers and new isotopes in drug development Innovative use of AI to enhance diagnostic accuracy and prognostics Nuclear 2.0 Diagnostics Use of nuclear medicine to diagnose and treat targeted diseases in oncology and complex diseases Precision diagnostics, enhanced by AI, guide targeted nuclear medicine therapy in oncology and complex diseases Nuclear 2.0 Theranostics A Leader in Microbubbles and Radiopharmaceuticals Pro Forma Product Portfolio 1095 PyL LMI-1195 Flurpiridaz NM-01 Multi-Therapeutic Applications Prostate I/O Cardiac Note: Assumes closing of the merger with Progenics AI 8

Proposed Acquisition of Progenics: Compelling Strategic Rationale Robust portfolio and pipeline of precision diagnostic and therapeutic products Proven leadership with strong commercial, operational and financial expertise; aligned with stockholder interests Sustainable and diversified revenue growth with focus on commercial execution excellence Attractive financial profile and strengthened cash flow generation, with attention to cost synergy opportunities that support enhanced stockholder returns Driving strategic pipeline investments to capitalize on market opportunities and maximize returns

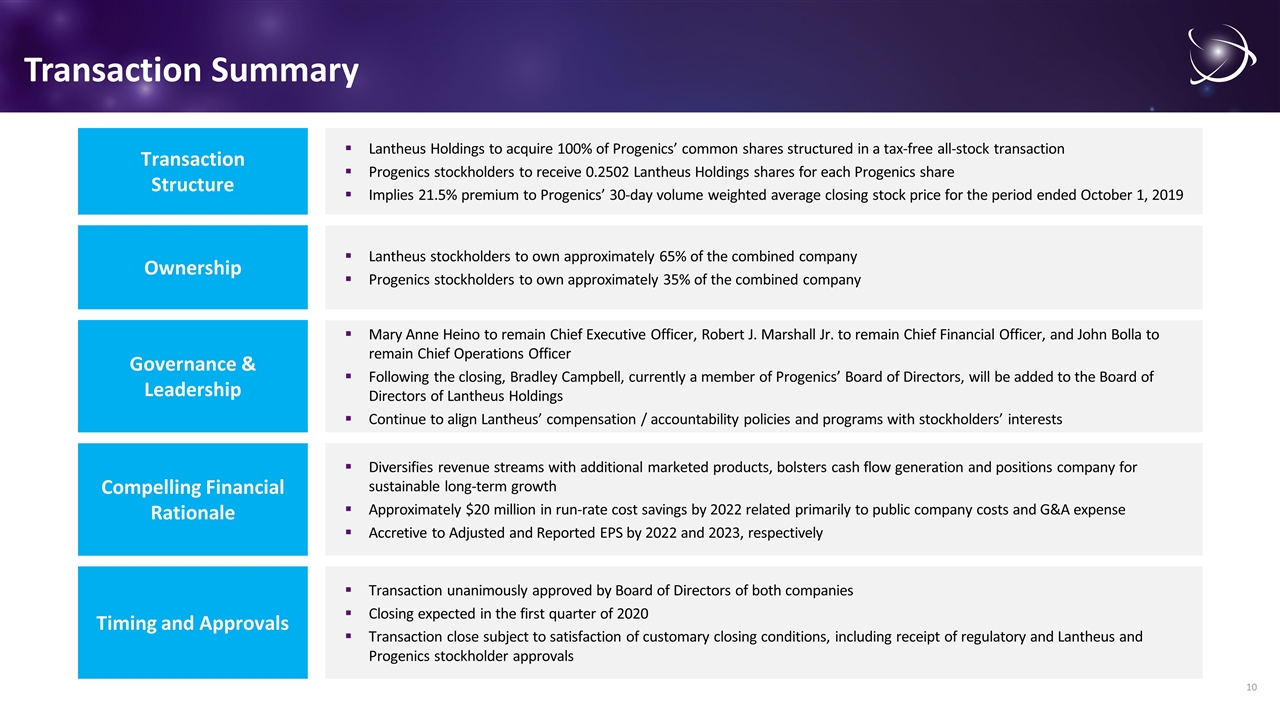

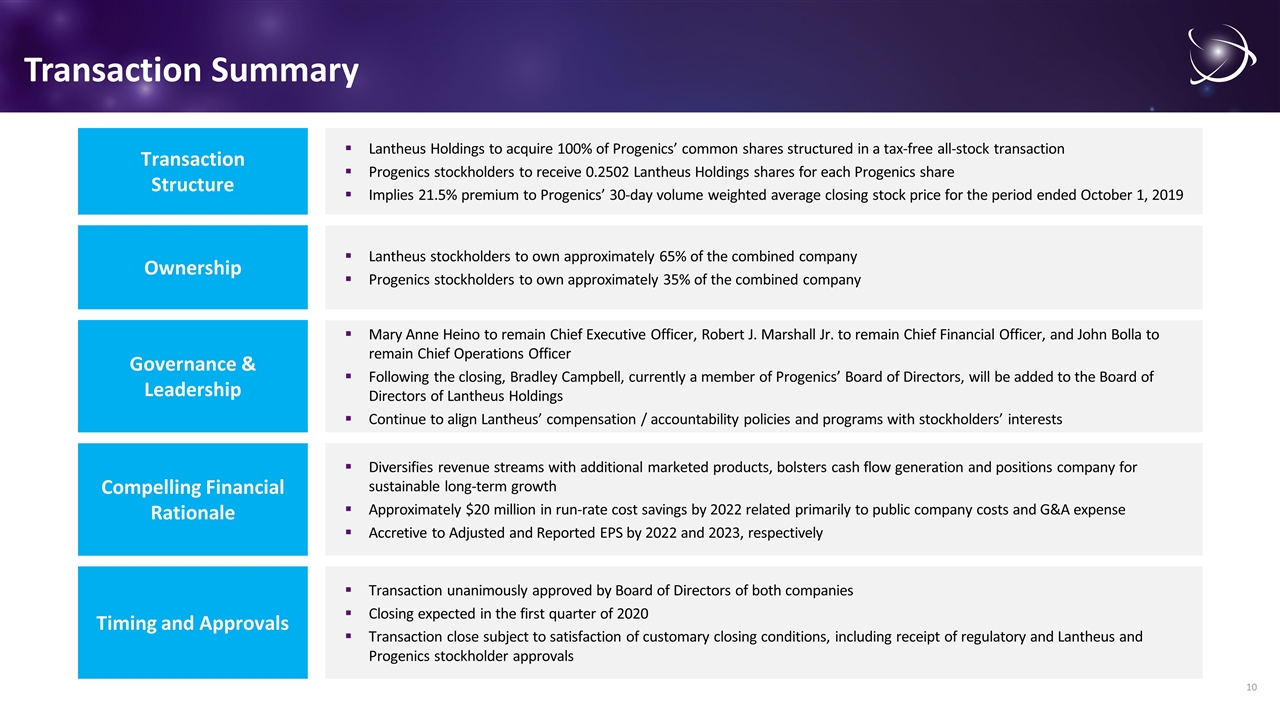

Transaction Summary Lantheus Holdings to acquire 100% of Progenics’ common shares structured in a tax-free all-stock transaction Progenics stockholders to receive 0.2502 Lantheus Holdings shares for each Progenics share Implies 21.5% premium to Progenics’ 30-day volume weighted average closing stock price for the period ended October 1, 2019 Transaction Structure Lantheus stockholders to own approximately 65% of the combined company Progenics stockholders to own approximately 35% of the combined company Ownership Mary Anne Heino to remain Chief Executive Officer, Robert J. Marshall Jr. to remain Chief Financial Officer, and John Bolla to remain Chief Operations Officer Following the closing, Bradley Campbell, currently a member of Progenics’ Board of Directors, will be added to the Board of Directors of Lantheus Holdings Continue to align Lantheus’ compensation / accountability policies and programs with stockholders’ interests Governance & Leadership Transaction unanimously approved by Board of Directors of both companies Closing expected in the first quarter of 2020 Transaction close subject to satisfaction of customary closing conditions, including receipt of regulatory and Lantheus and Progenics stockholder approvals Timing and Approvals Diversifies revenue streams with additional marketed products, bolsters cash flow generation and positions company for sustainable long-term growth Approximately $20 million in run-rate cost savings by 2022 related primarily to public company costs and G&A expense Accretive to Adjusted and Reported EPS by 2022 and 2023, respectively Compelling Financial Rationale

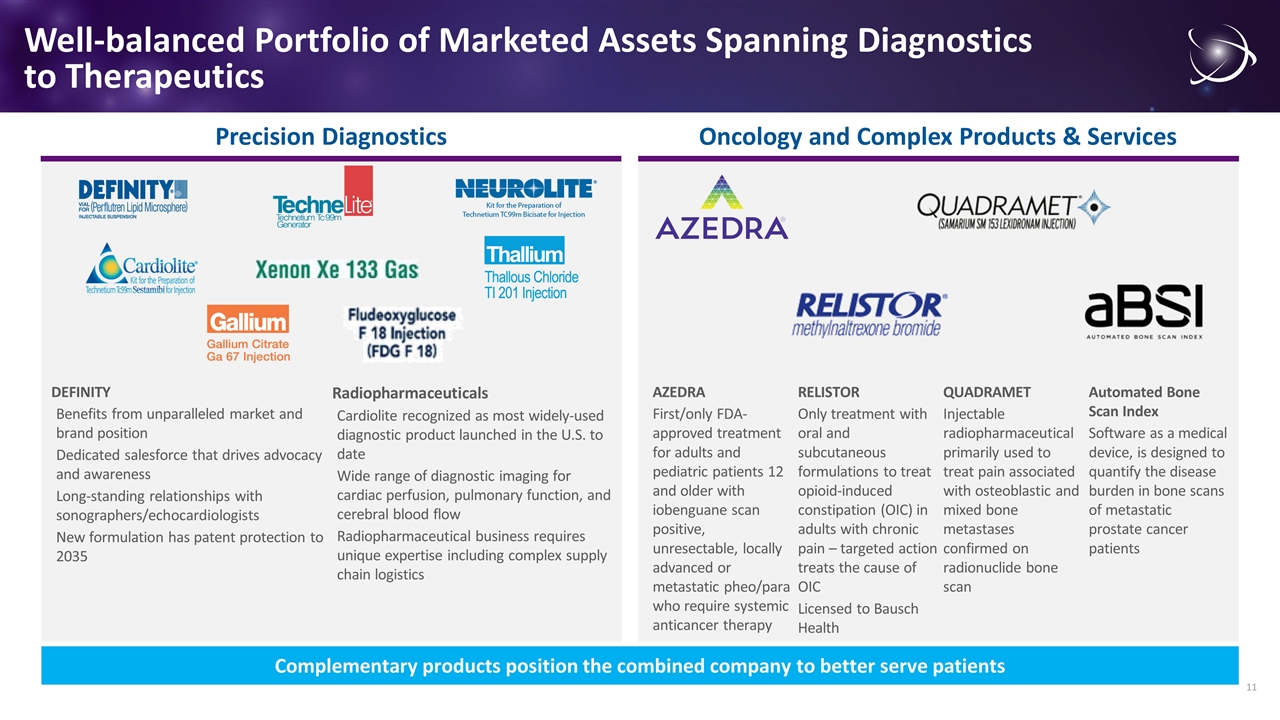

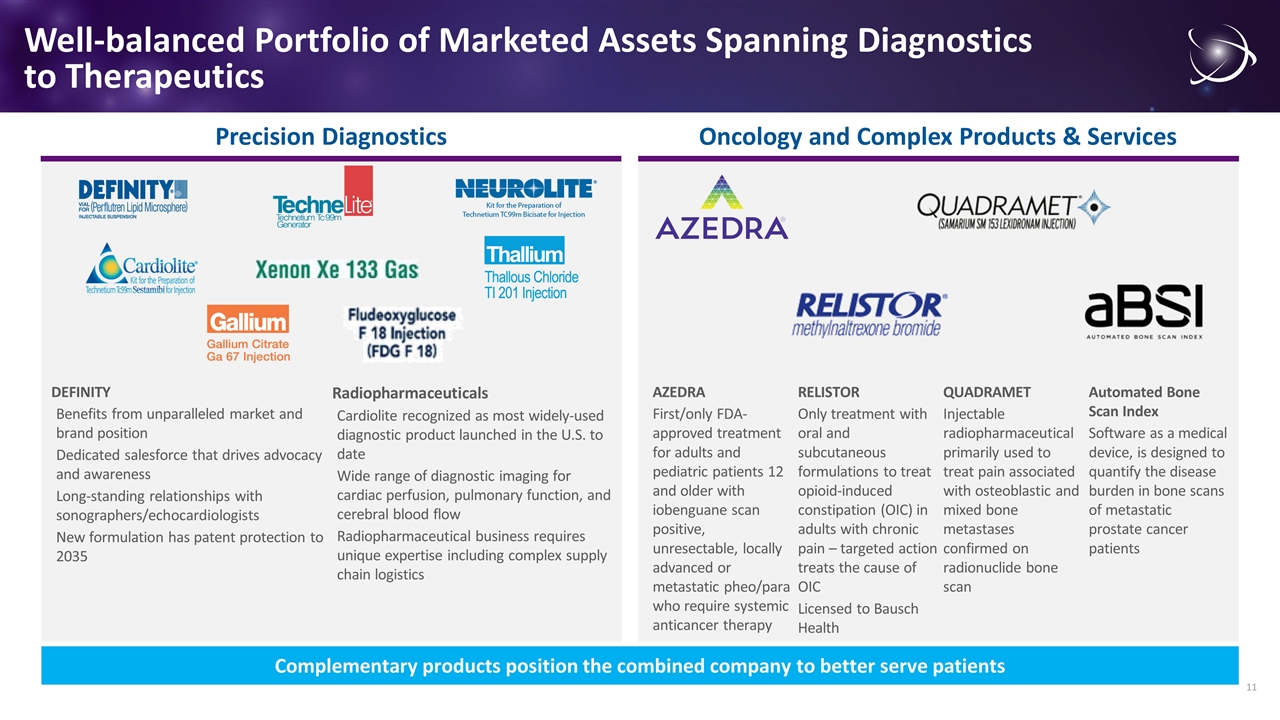

DEFINITY Benefits from unparalleled market and brand position Dedicated salesforce that drives advocacy and awareness Long-standing relationships with sonographers/echocardiologists New formulation has patent protection to 2035 Radiopharmaceuticals Cardiolite recognized as most widely-used diagnostic product launched in the U.S. to date Wide range of diagnostic imaging for cardiac perfusion, pulmonary function, and cerebral blood flow Radiopharmaceutical business requires unique expertise including complex supply chain logistics Well-balanced Portfolio of Marketed Assets Spanning Diagnostics to Therapeutics AZEDRA First/only FDA-approved treatment for adults and pediatric patients 12 and older with iobenguane scan positive, unresectable, locally advanced or metastatic pheo/para who require systemic anticancer therapy RELISTOR Only treatment with oral and subcutaneous formulations to treat opioid-induced constipation (OIC) in adults with chronic pain – targeted action treats the cause of OIC Licensed to Bausch Health QUADRAMET Injectable radiopharmaceutical primarily used to treat pain associated with osteoblastic and mixed bone metastases confirmed on radionuclide bone scan Automated Bone Scan Index Software as a medical device, is designed to quantify the disease burden in bone scans of metastatic prostate cancer patients Precision Diagnostics Oncology and Complex Products & Services Complementary products position the combined company to better serve patients

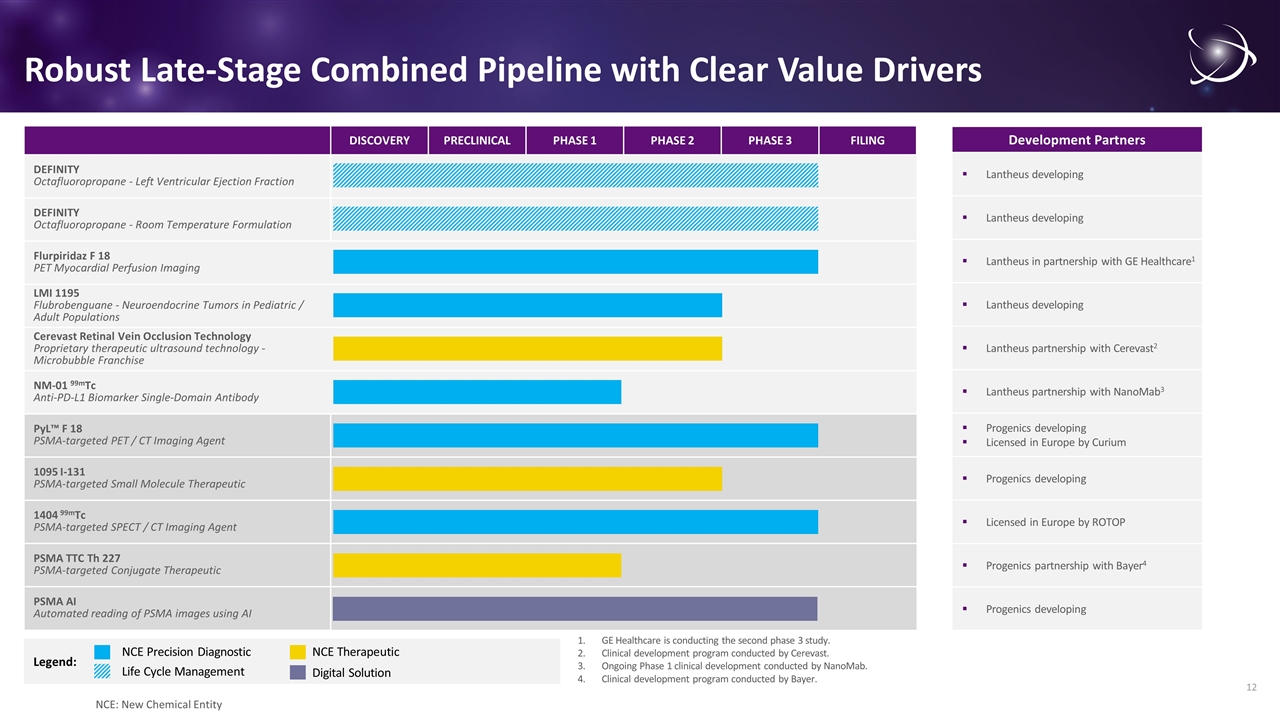

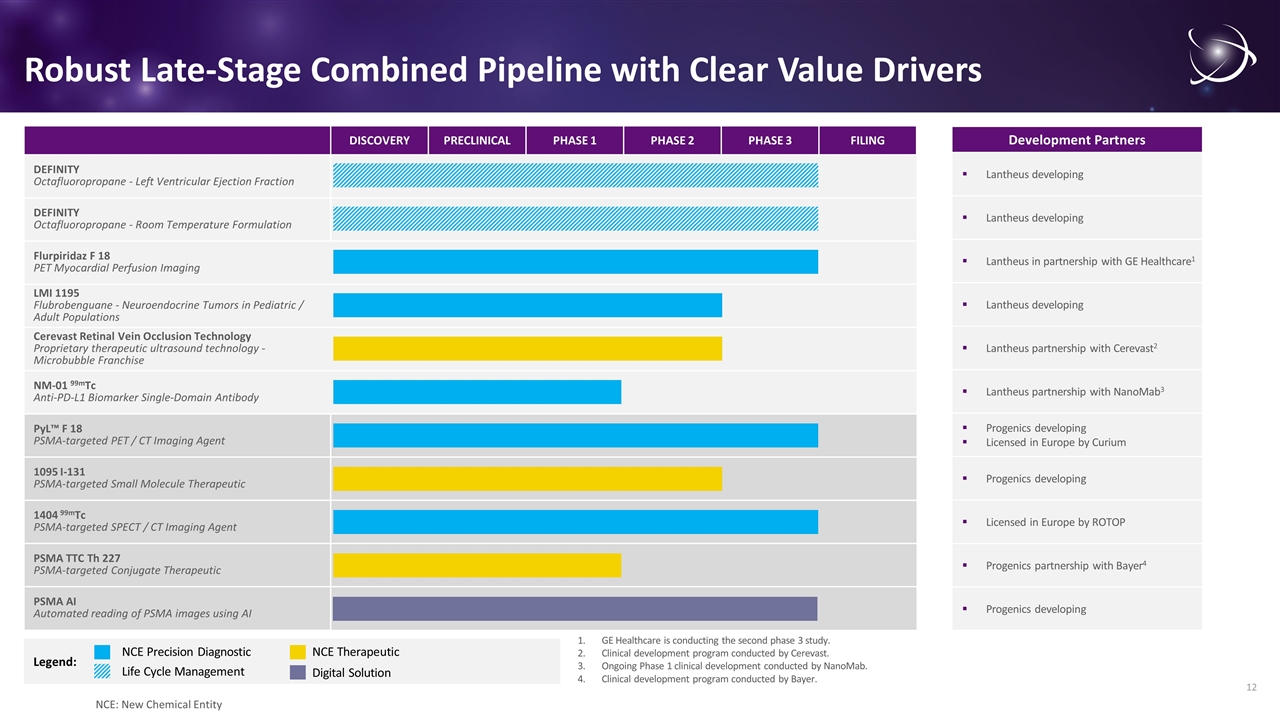

Legend: DISCOVERY PRECLINICAL PHASE 1 PHASE 2 PHASE 3 FILING DEFINITY Octafluoropropane - Left Ventricular Ejection Fraction DEFINITY Octafluoropropane - Room Temperature Formulation Flurpiridaz F 18 PET Myocardial Perfusion Imaging LMI 1195 Flubrobenguane - Neuroendocrine Tumors in Pediatric / Adult Populations Cerevast Retinal Vein Occlusion Technology Proprietary therapeutic ultrasound technology - Microbubble Franchise NM-01 99mTc Anti-PD-L1 Biomarker Single-Domain Antibody PyL™ F 18 PSMA-targeted PET / CT Imaging Agent 1095 I-131 PSMA-targeted Small Molecule Therapeutic 1404 99mTc PSMA-targeted SPECT / CT Imaging Agent PSMA TTC Th 227 PSMA-targeted Conjugate Therapeutic PSMA AI Automated reading of PSMA images using AI NCE Precision Diagnostic Robust Late-Stage Combined Pipeline with Clear Value Drivers Development Partners NCE Therapeutic Progenics developing Licensed in Europe by Curium Progenics developing Licensed in Europe by ROTOP Progenics developing Progenics partnership with Bayer4 Lantheus in partnership with GE Healthcare1 Lantheus developing Lantheus developing Lantheus partnership with Cerevast2 Lantheus partnership with NanoMab3 Lantheus developing GE Healthcare is conducting the second phase 3 study. Clinical development program conducted by Cerevast. Ongoing Phase 1 clinical development conducted by NanoMab. Clinical development program conducted by Bayer. Life Cycle Management Digital Solution NCE: New Chemical Entity

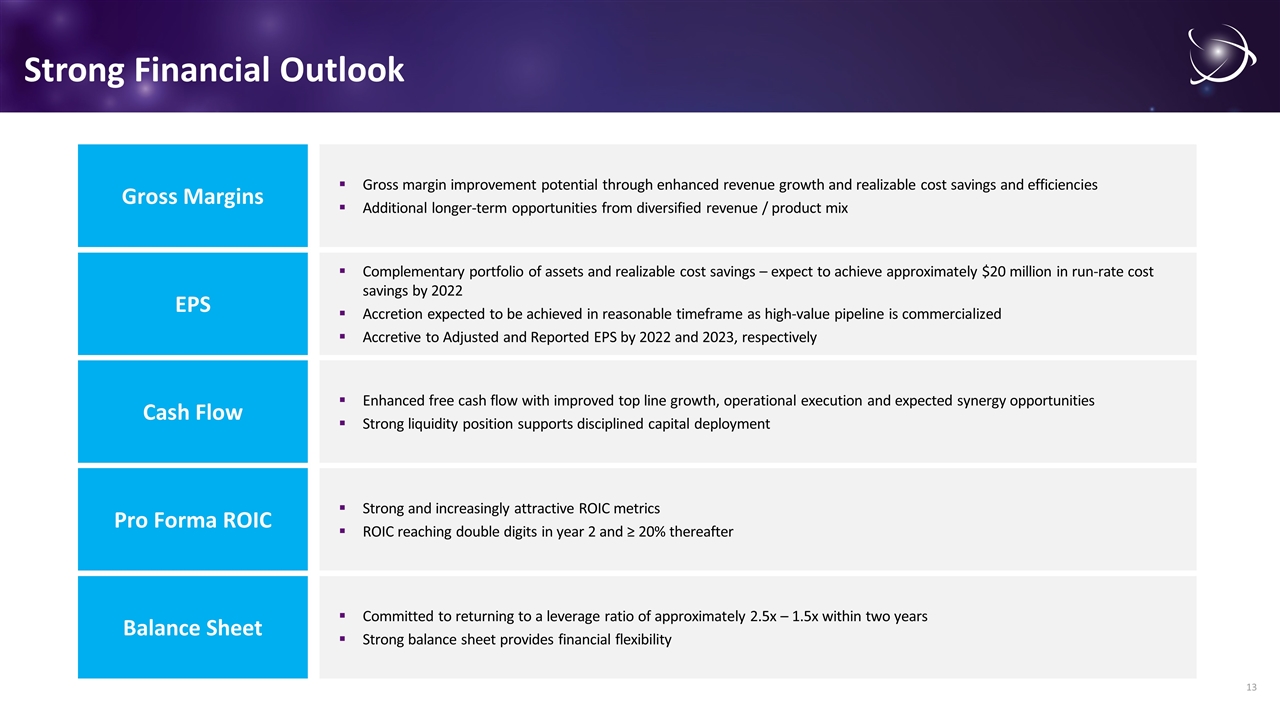

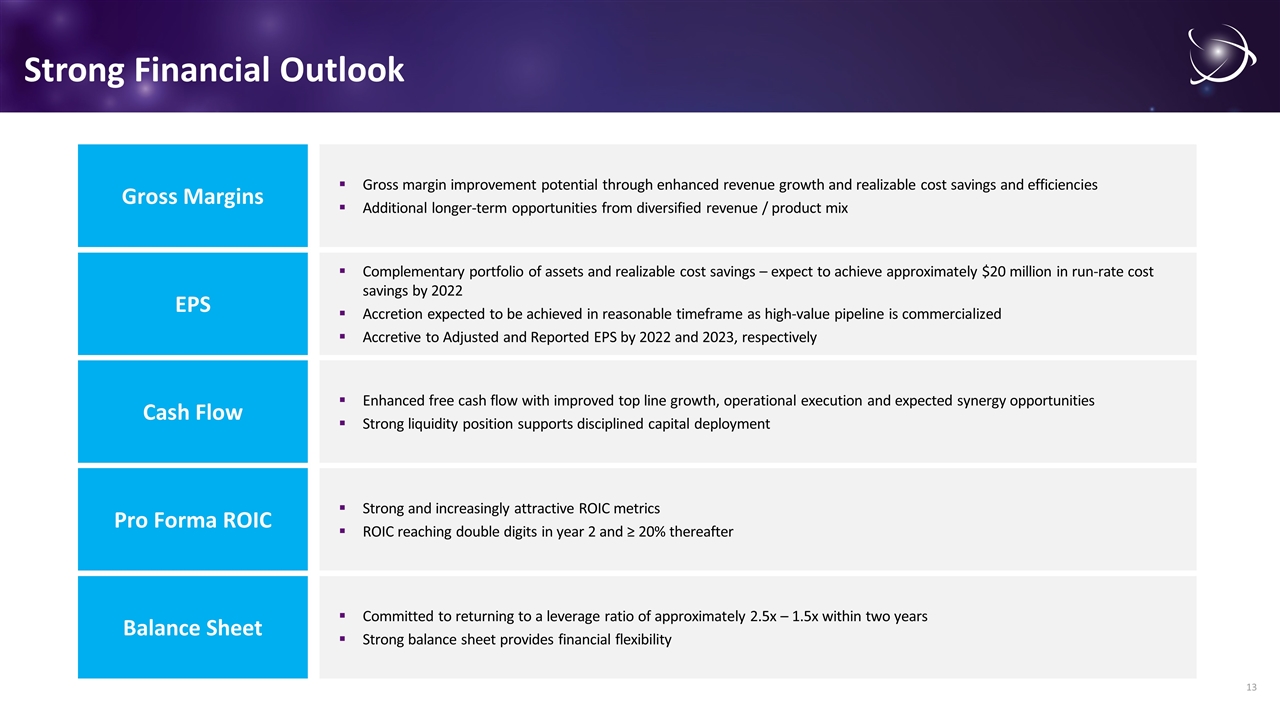

Strong Financial Outlook Gross margin improvement potential through enhanced revenue growth and realizable cost savings and efficiencies Additional longer-term opportunities from diversified revenue / product mix Gross Margins Enhanced free cash flow with improved top line growth, operational execution and expected synergy opportunities Strong liquidity position supports disciplined capital deployment Cash Flow Strong and increasingly attractive ROIC metrics ROIC reaching double digits in year 2 and ≥ 20% thereafter Pro Forma ROIC Complementary portfolio of assets and realizable cost savings – expect to achieve approximately $20 million in run-rate cost savings by 2022 Accretion expected to be achieved in reasonable timeframe as high-value pipeline is commercialized Accretive to Adjusted and Reported EPS by 2022 and 2023, respectively EPS Committed to returning to a leverage ratio of approximately 2.5x – 1.5x within two years Strong balance sheet provides financial flexibility Balance Sheet