Filed by Lantheus Holdings, Inc.

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule14a-12

of the Securities Exchange Act of 1934

Subject Company: Progenics Pharmaceuticals, Inc.

Commission File No.: 000 – 23143

The following is a slide deck relating to the proposed transaction involving Lantheus Holdings, Inc. and Progenics Pharmaceuticals, Inc. available atwww.lantheusprogenics.transactionannouncement.com.

Safe Harbor Statements Important Information For Investors And Stockholders This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. In connection with the proposed transaction, Lantheus Holdings intends to file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a joint proxy statement of Lantheus Holdings and Progenics that also constitutes a prospectus of Lantheus Holdings. Each of Lantheus Holdings and Progenics also plan to file other relevant documents with the SEC regarding the proposed transaction. Any definitive joint proxy statement/prospectus (if and when available) will be mailed to stockholders of Lantheus Holdings and Progenics. INVESTORS AND SECURITY HOLDERS OF LANTHEUS HOLDINGS AND PROGENICS ARE STRONGLY ENCOURAGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (if and when available) and other documents filed with the SEC by Lantheus Holdings or Progenics through the website maintained by the SEC at https://www.sec.gov. Copies of the documents filed with the SEC by Lantheus Holdings will also be available free of charge on Lantheus Holdings’ website at https://www.lantheus.com/ or by contacting Lantheus Holdings’ Investor Relations Department by email at ir@lantheus.com or by phone at (978) 671-8001. Copies of the documents filed with the SEC by Progenics will also be available free of charge on Progenics’ internet website at https://www.progenics.com/ or by contacting Progenics’ Investor Relations Department by email at mdowns@progenics.com or by phone at (646) 975-2533. Certain Information Regarding Participants Lantheus Holdings, Progenics, and their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Lantheus Holdings is set forth in its Annual Report on Form 10-K for the year ended December 31, 2018, which was filed with the SEC on February 20, 2019, its definitive proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on March 15, 2019, and its Current Report on Form 8-K, which was filed with the SEC on March 25, 2019. Other information regarding the participants of Lantheus Holdings in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Information about the directors and executive officers of Progenics is set forth in its Annual Report on Form 10-K for the year ended December 31, 2018, which was filed with the SEC on March 15, 2019 and amended on April 30, 2019, and its definitive proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on May 30, 2019. Other information regarding the participants of Progenics in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at https://www.sec.gov and from Investor Relations at Lantheus Holdings or Progenics as described above.

Safe Harbor Statements Cautionary Statement Regarding Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are based upon current plans, estimates and expectations that are subject to various risks and uncertainties. The inclusion of forward-looking statements should not be regarded as a representation that such plans, estimates and expectations will be achieved. Words such as “anticipate,” “expect,” “project,” “intend,” “believe,” “may,” “will,” “should,” “plan,” “could,” “target,” “contemplate,” “estimate,” “predict,” “potential,” “opportunity,” “creates” and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. All statements, other than historical facts, including the expected timing of the closing of the merger; the ability of the parties to complete the merger considering the various closing conditions; the expected benefits of the merger, such as efficiencies, cost savings, synergies, revenue growth, creating shareholder value, growth potential, market profile, enhanced competitive position, and financial strength and flexibility; the competitive ability and position of the combined company; and any assumptions underlying any of the foregoing, are forward-looking statements. Important factors that could cause actual results to differ materially from Lantheus Holdings’ and Progenics’ plans, estimates or expectations could include, but are not limited to: (i) Lantheus Holdings or Progenics may be unable to obtain stockholder approval as required for the merger; (ii) conditions to the closing of the merger may not be satisfied; (iii) the merger may involve unexpected costs, liabilities or delays; (iv) the effect of the announcement of the merger on the ability of Lantheus Holdings or Progenics to retain and hire key personnel and maintain relationships with customers, suppliers and others with whom Lantheus Holdings or Progenics does business, or on Lantheus Holdings’ or Progenics’ operating results and business generally; (v) Lantheus Holdings’ or Progenics’ respective businesses may suffer as a result of uncertainty surrounding the merger and disruption of management’s attention due to the merger; (vi) the outcome of any legal proceedings related to the merger; (vii) Lantheus Holdings or Progenics may be adversely affected by other economic, business, and/or competitive factors; (viii) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (ix) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (x) the risk that Lantheus Holdings or Progenics may be unable to obtain governmental and regulatory approvals required for the transaction, or that required governmental and regulatory approvals may delay the transaction or result in the imposition of conditions that could reduce the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (xi) risks that the anticipated benefits of the merger or other commercial opportunities may otherwise not be fully realized or may take longer to realize than expected; (xii) the impact of legislative, regulatory, competitive and technological changes; (xiii) expectations for future clinical trials, the timing and potential outcomes of clinical studies and interactions with regulatory authorities; and (xiv) other risks to the consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all. Additional factors that may affect the future results of Lantheus Holdings and Progenics are set forth in their respective filings with the SEC, including each of Lantheus Holdings’ and Progenics’ most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the SEC, which are available on the SEC’s website at www.sec.gov. Readers are urged to consider these factors carefully in evaluating these forward-looking statements, and not to place undue reliance on any forward-looking statements. Readers should also carefully review the risk factors described in other documents that Lantheus Holdings and Progenics file from time to time with the SEC. The forward-looking statements in this document speak only as of the date of these materials. Except as required by law, Lantheus Holdings and Progenics assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

The Lantheus Story 1 Market Leader Where We Are Today 4 Strong Capital Position To Fund Our Future 2 Targeting Growing Markets 3 Enhancing Growth from a Position of Strength

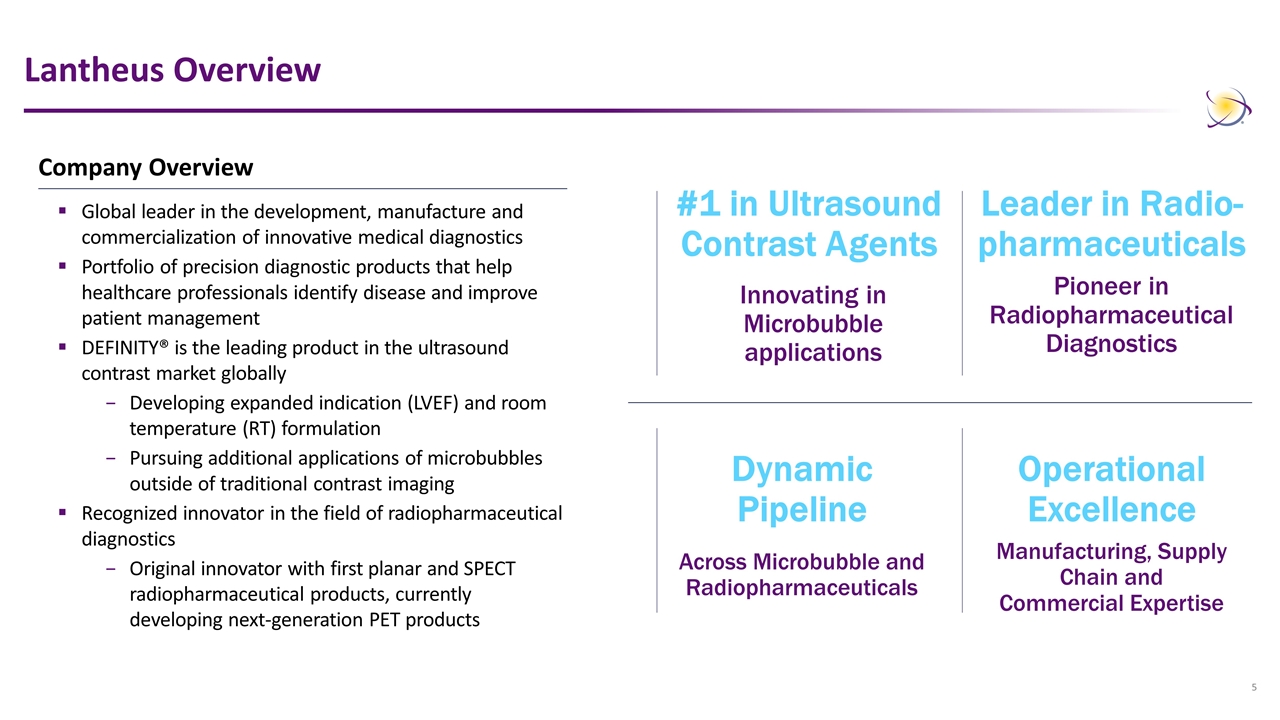

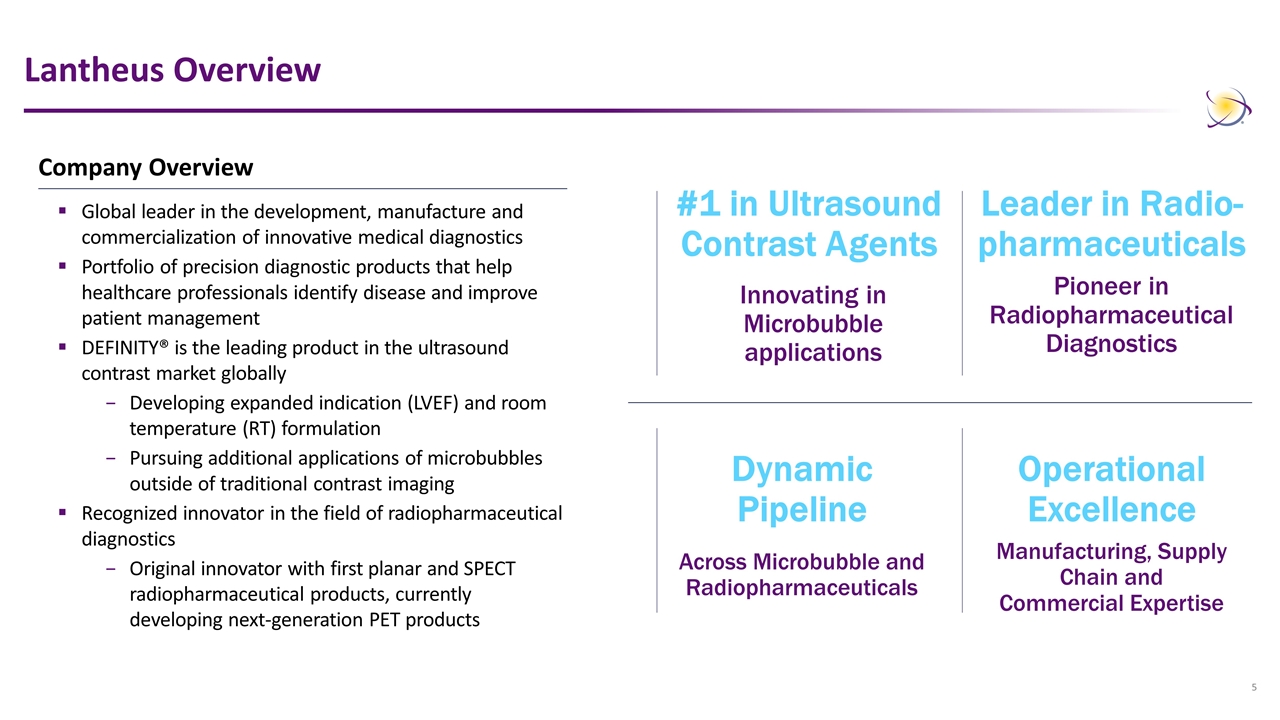

Lantheus Overview #1 in Ultrasound Contrast Agents Innovating in Microbubble applications Across Microbubble and Radiopharmaceuticals Dynamic Pipeline Manufacturing, Supply Chain and Commercial Expertise Operational Excellence Leader in Radio- pharmaceuticals Pioneer in Radiopharmaceutical Diagnostics Company Overview Global leader in the development, manufacture and commercialization of innovative medical diagnostics Portfolio of precision diagnostic products that help healthcare professionals identify disease and improve patient management DEFINITY® is the leading product in the ultrasound contrast market globally Developing expanded indication (LVEF) and room temperature (RT) formulation Pursuing additional applications of microbubbles outside of traditional contrast imaging Recognized innovator in the field of radiopharmaceutical diagnostics Original innovator with first planar and SPECT radiopharmaceutical products, currently developing next-generation PET products

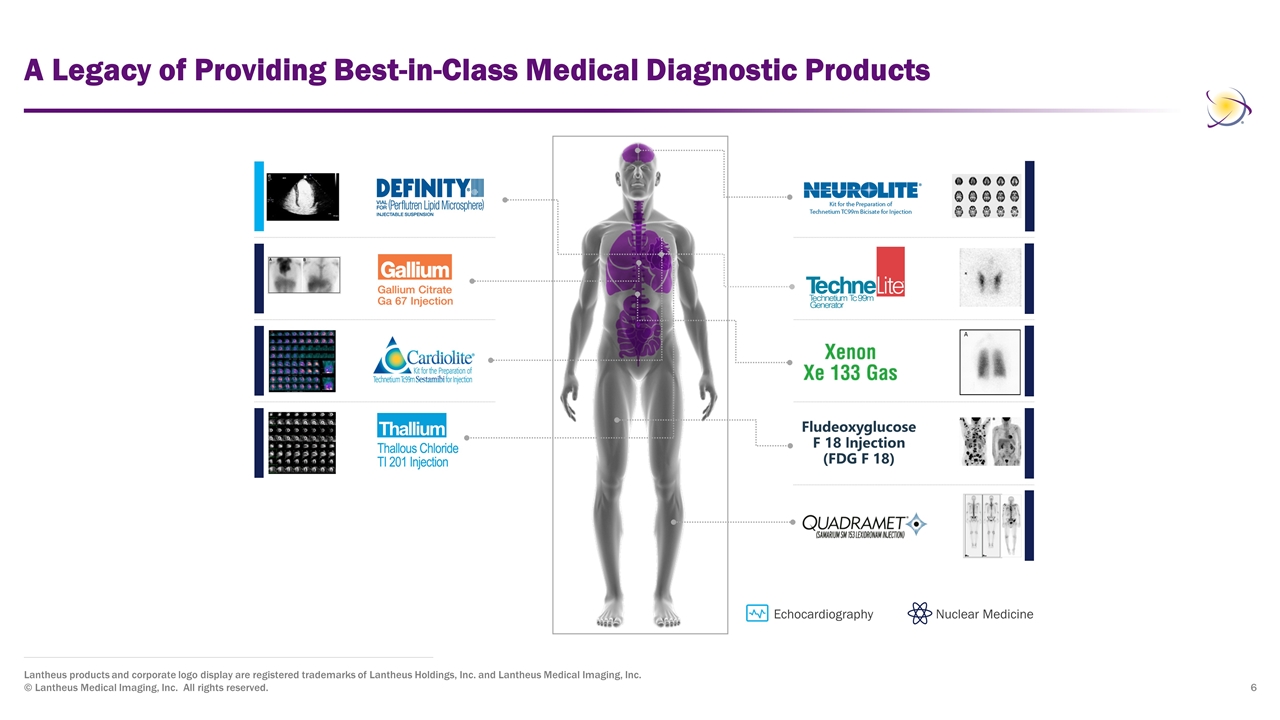

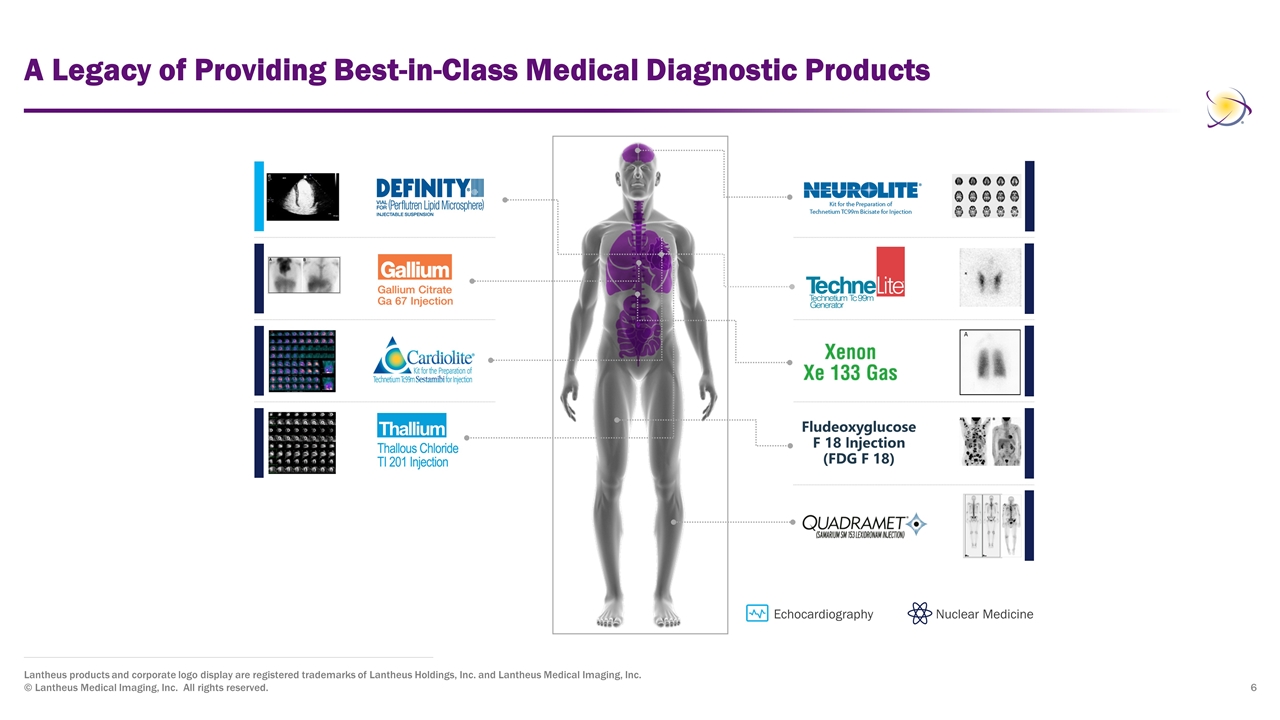

A Legacy of Providing Best-in-Class Medical Diagnostic Products Lantheus products and corporate logo display are registered trademarks of Lantheus Holdings, Inc. and Lantheus Medical Imaging, Inc. © Lantheus Medical Imaging, Inc. All rights reserved. Echocardiography Nuclear Medicine

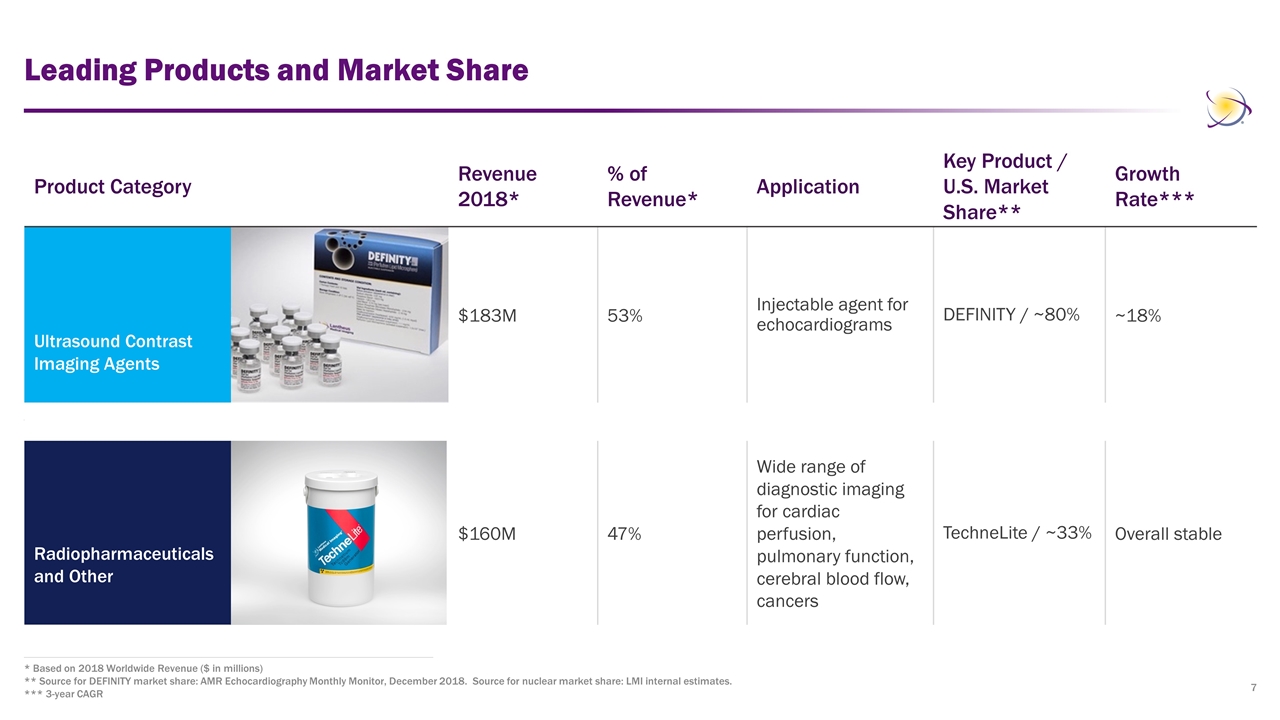

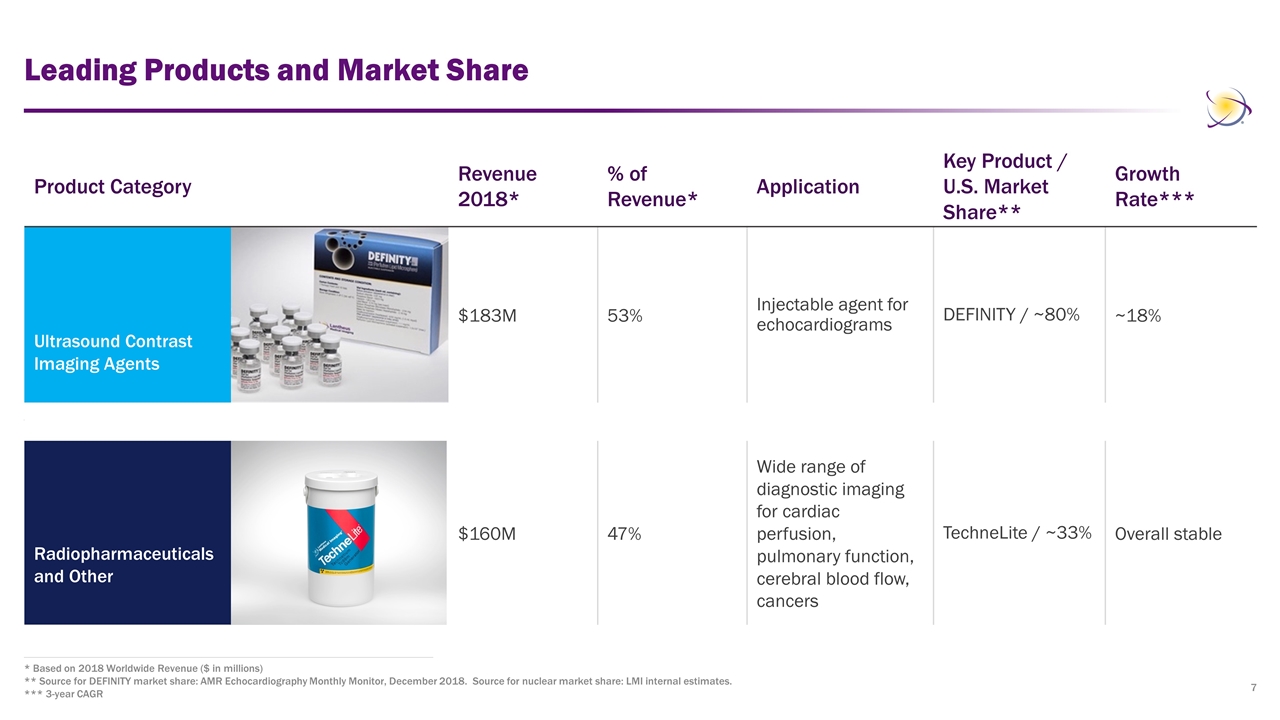

Leading Products and Market Share * Based on 2018 Worldwide Revenue ($ in millions) ** Source for DEFINITY market share: AMR Echocardiography Monthly Monitor, December 2018. Source for nuclear market share: LMI internal estimates. *** 3-year CAGR Product Category Revenue 2018* % of Revenue* Application Key Product / U.S. Market Share** Growth Rate*** Ultrasound Contrast Imaging Agents $183M 53% Injectable agent for echocardiograms DEFINITY / ~80% ~18% Radiopharmaceuticals and Other $160M 47% Wide range of diagnostic imaging for cardiac perfusion, pulmonary function, cerebral blood flow, cancers TechneLite / ~33% Overall stable

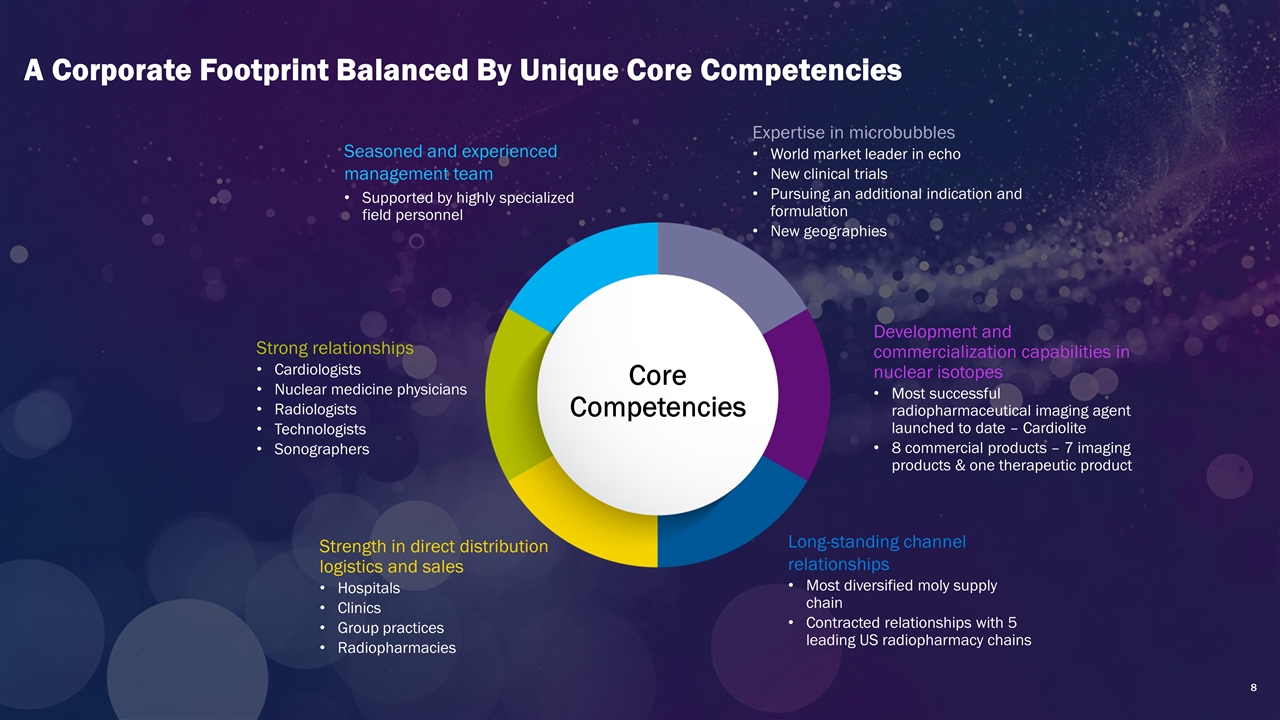

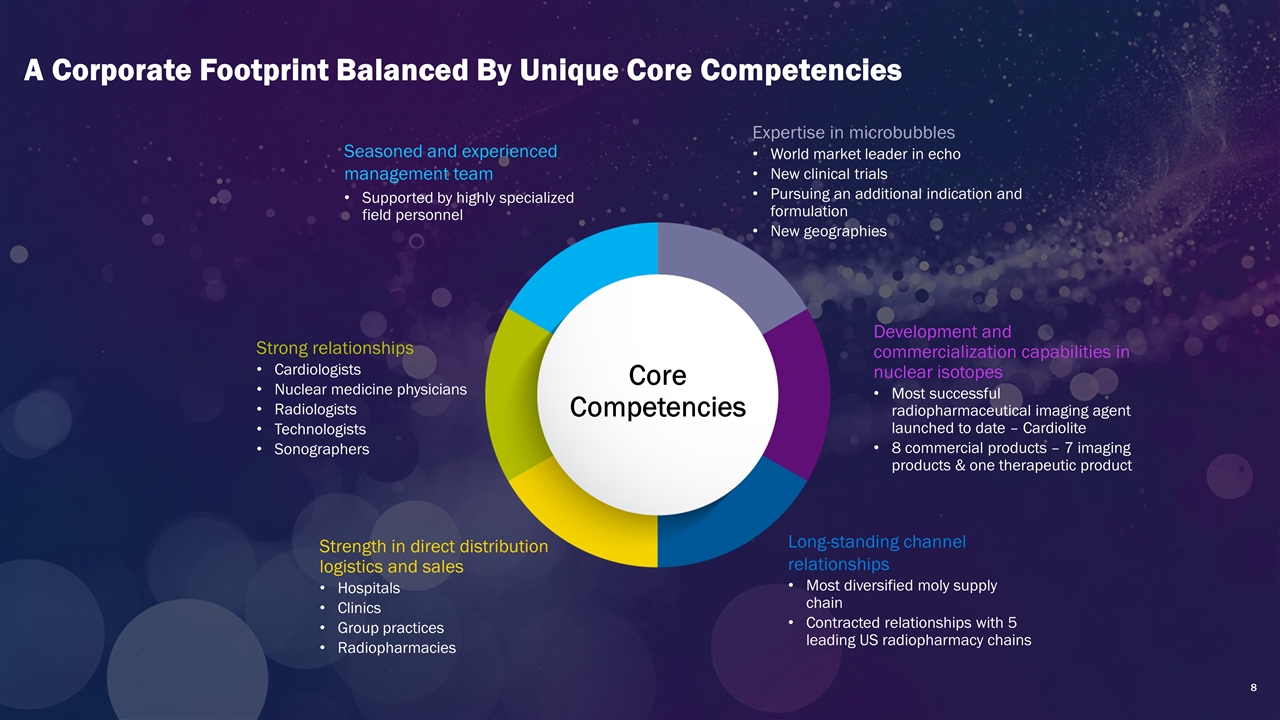

A Corporate Footprint Balanced By Unique Core Competencies Expertise in microbubbles World market leader in echo New clinical trials Pursuing an additional indication and formulation New geographies Strength in direct distribution logistics and sales Hospitals Clinics Group practices Radiopharmacies Development and commercialization capabilities in nuclear isotopes Most successful radiopharmaceutical imaging agent launched to date – Cardiolite 8 commercial products – 7 imaging products & one therapeutic product Strong relationships Cardiologists Nuclear medicine physicians Radiologists Technologists Sonographers Seasoned and experienced management team Supported by highly specialized field personnel Core Competencies Long-standing channel relationships Most diversified moly supply chain Contracted relationships with 5 leading US radiopharmacy chains

The Lantheus Story 1 Market Leader Where We Are Today 4 Strong Capital Position To Fund Our Future 2 Targeting Growing Markets 3 Enhancing Growth from a Position of Strength

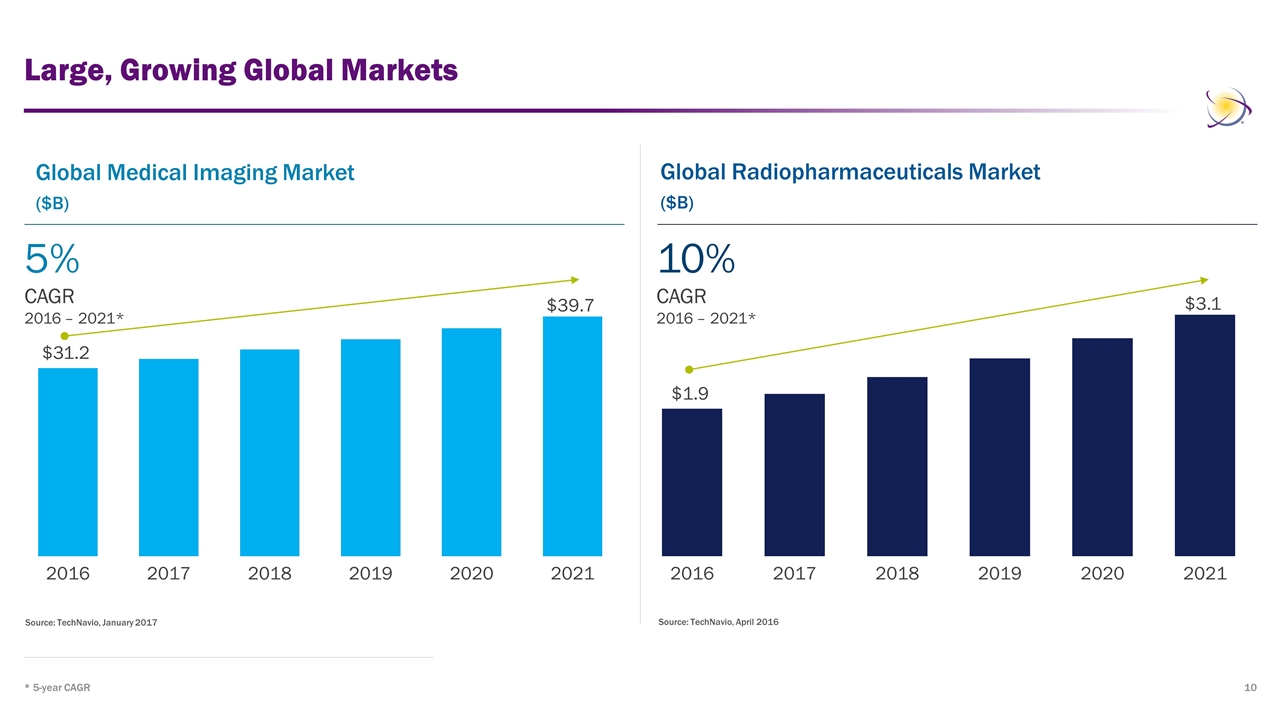

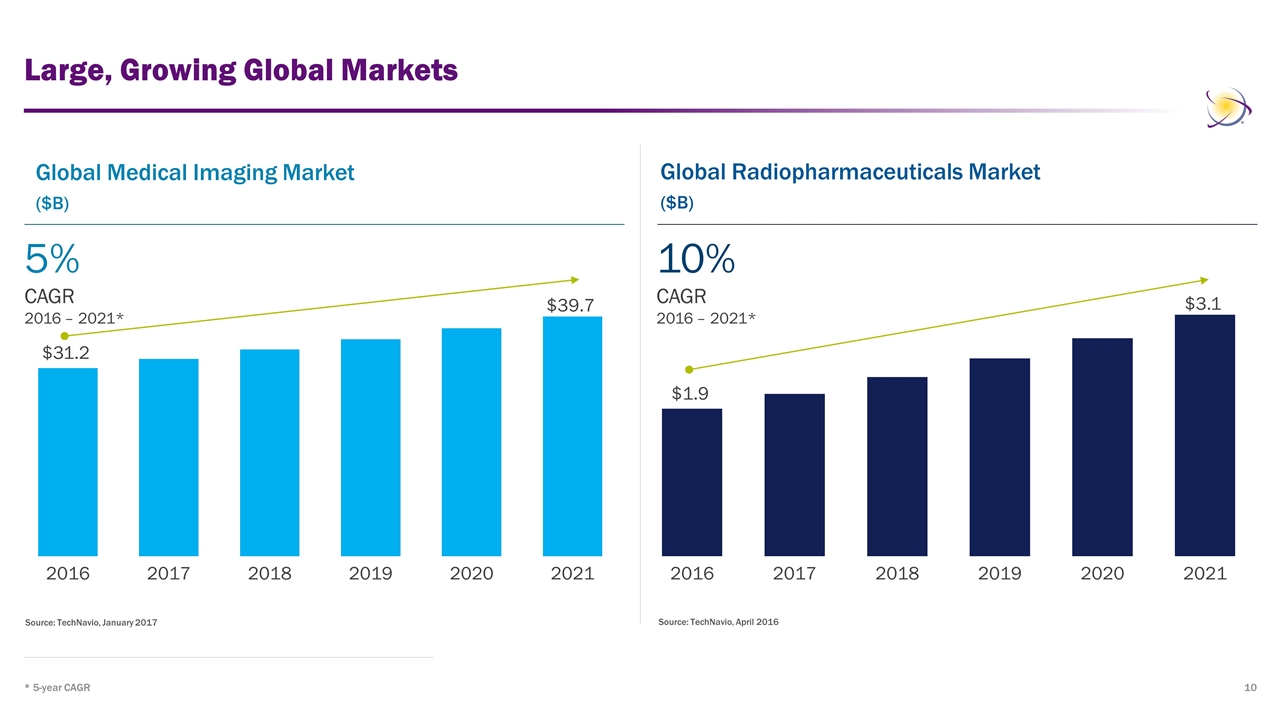

Large, Growing Global Markets * 5-year CAGR Source: TechNavio, January 2017 Source: TechNavio, April 2016 Global Medical Imaging Market ($B) Global Radiopharmaceuticals Market ($B) 5% CAGR 2016 – 2021* 10% CAGR 2016 – 2021*

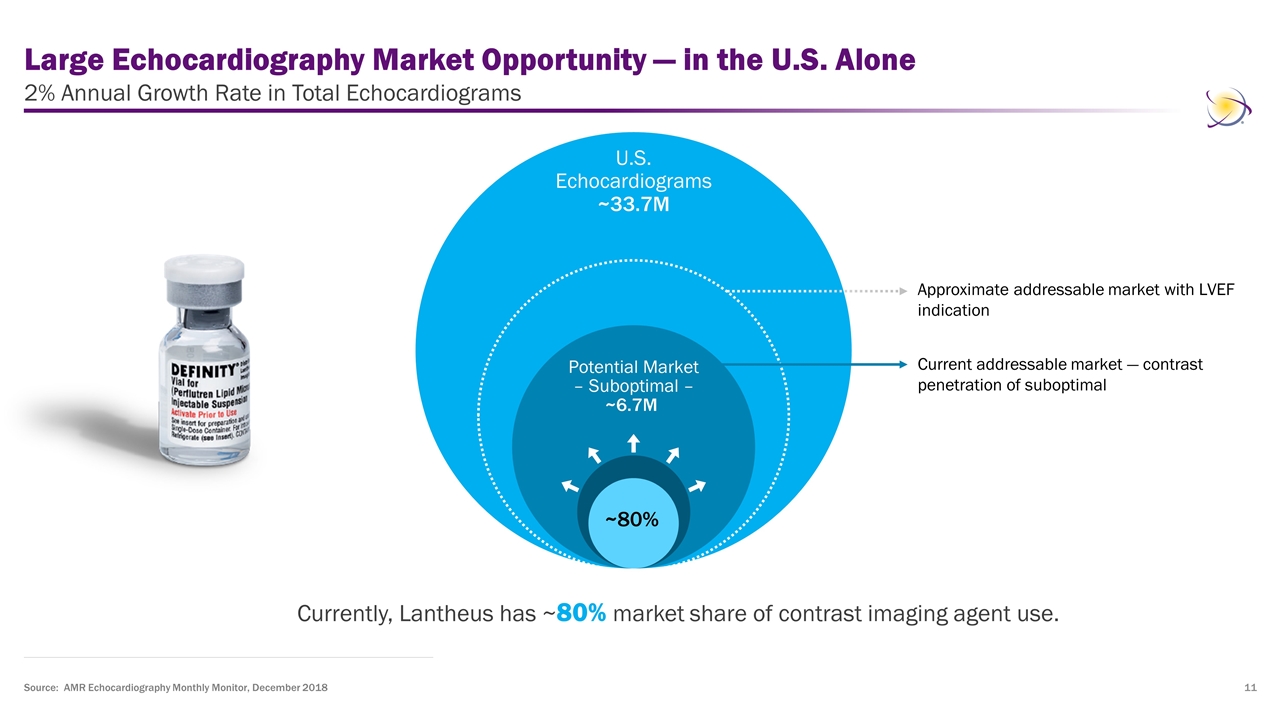

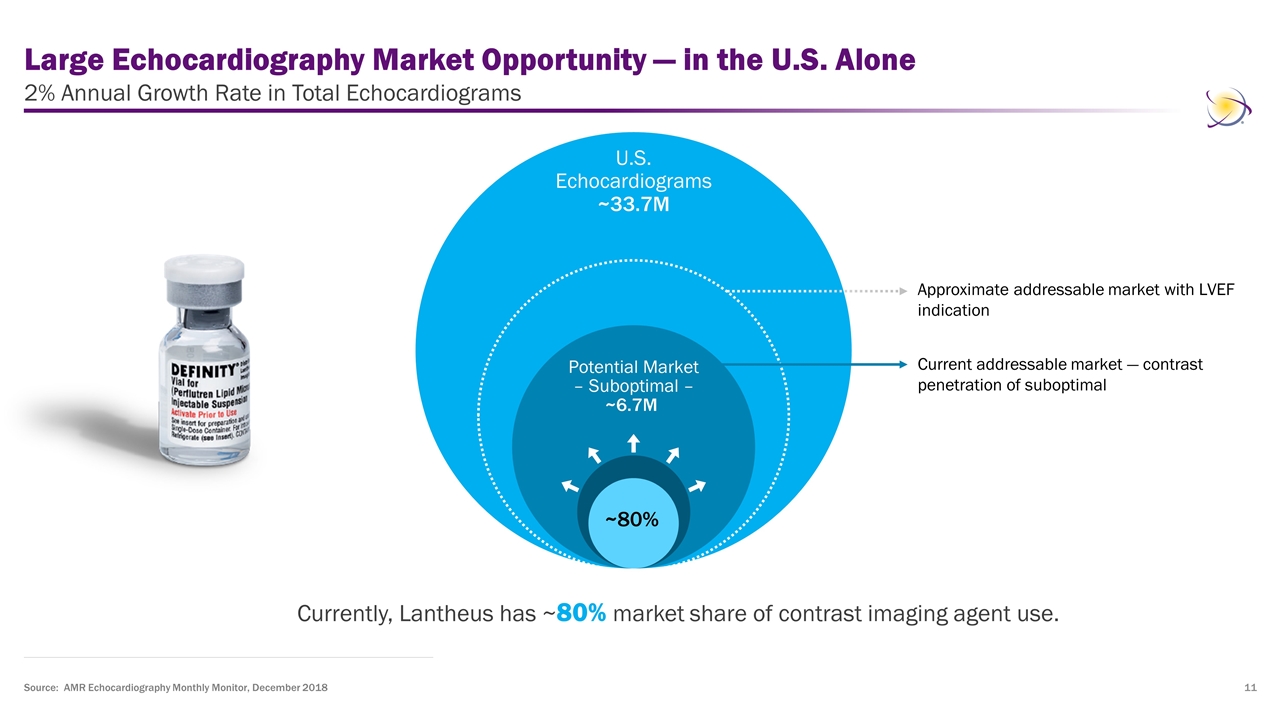

Large Echocardiography Market Opportunity — in the U.S. Alone 2% Annual Growth Rate in Total Echocardiograms Currently, Lantheus has ~80% market share of contrast imaging agent use. Source: AMR Echocardiography Monthly Monitor, December 2018 Current addressable market — contrast penetration of suboptimal U.S. Echocardiograms ~33.7M Potential Market – Suboptimal – ~6.7M ~80% Approximate addressable market with LVEF indication

The Lantheus Story 1 Market Leader Where We Are Today 4 Strong Capital Position To Fund Our Future 2 Targeting Growth Markets 3 Enhancing Growth from a Position of Strength

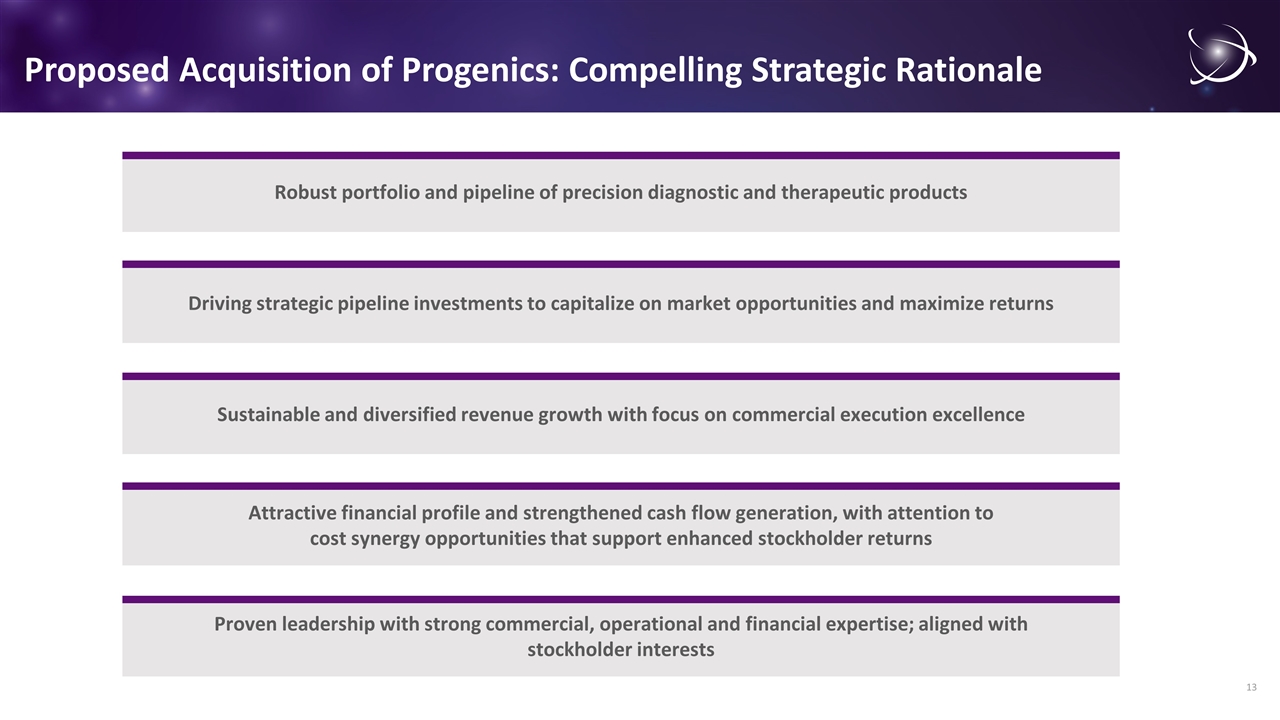

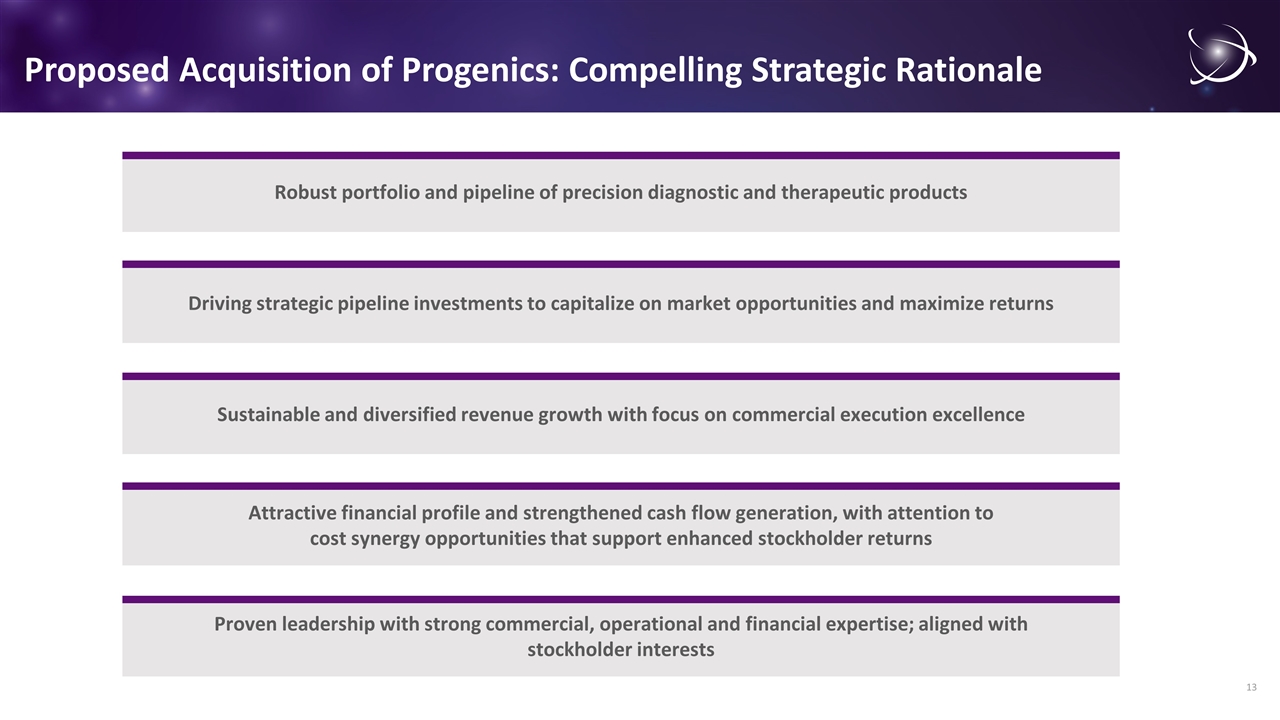

Proposed Acquisition of Progenics: Compelling Strategic Rationale Robust portfolio and pipeline of precision diagnostic and therapeutic products Proven leadership with strong commercial, operational and financial expertise; aligned with stockholder interests Sustainable and diversified revenue growth with focus on commercial execution excellence Attractive financial profile and strengthened cash flow generation, with attention to cost synergy opportunities that support enhanced stockholder returns Driving strategic pipeline investments to capitalize on market opportunities and maximize returns

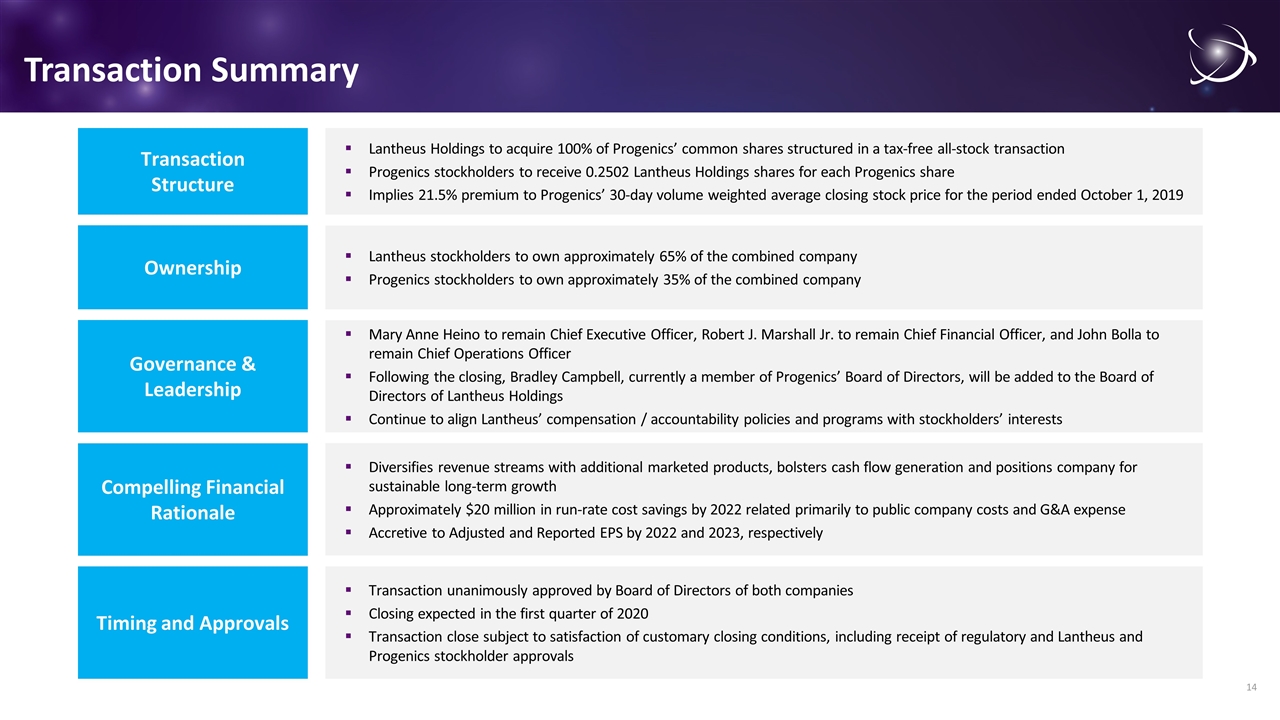

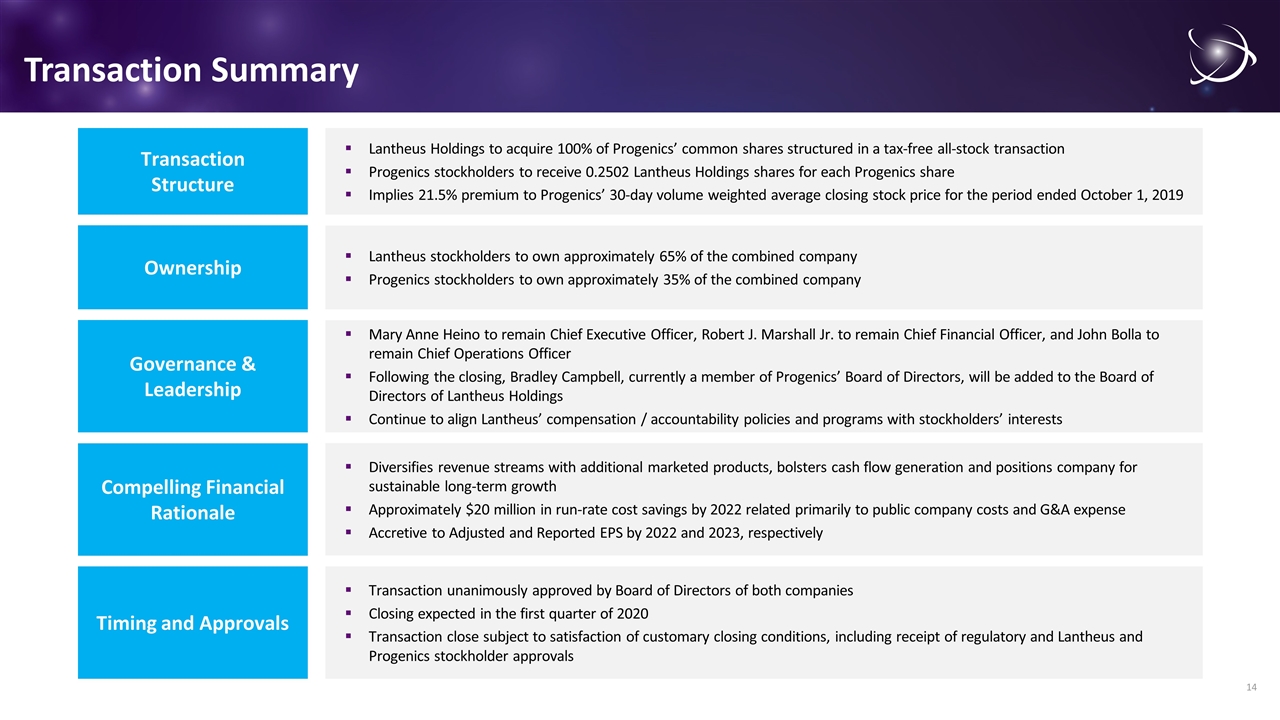

Transaction Summary Lantheus Holdings to acquire 100% of Progenics’ common shares structured in a tax-free all-stock transaction Progenics stockholders to receive 0.2502 Lantheus Holdings shares for each Progenics share Implies 21.5% premium to Progenics’ 30-day volume weighted average closing stock price for the period ended October 1, 2019 Transaction Structure Lantheus stockholders to own approximately 65% of the combined company Progenics stockholders to own approximately 35% of the combined company Ownership Mary Anne Heino to remain Chief Executive Officer, Robert J. Marshall Jr. to remain Chief Financial Officer, and John Bolla to remain Chief Operations Officer Following the closing, Bradley Campbell, currently a member of Progenics’ Board of Directors, will be added to the Board of Directors of Lantheus Holdings Continue to align Lantheus’ compensation / accountability policies and programs with stockholders’ interests Governance & Leadership Transaction unanimously approved by Board of Directors of both companies Closing expected in the first quarter of 2020 Transaction close subject to satisfaction of customary closing conditions, including receipt of regulatory and Lantheus and Progenics stockholder approvals Timing and Approvals Diversifies revenue streams with additional marketed products, bolsters cash flow generation and positions company for sustainable long-term growth Approximately $20 million in run-rate cost savings by 2022 related primarily to public company costs and G&A expense Accretive to Adjusted and Reported EPS by 2022 and 2023, respectively Compelling Financial Rationale

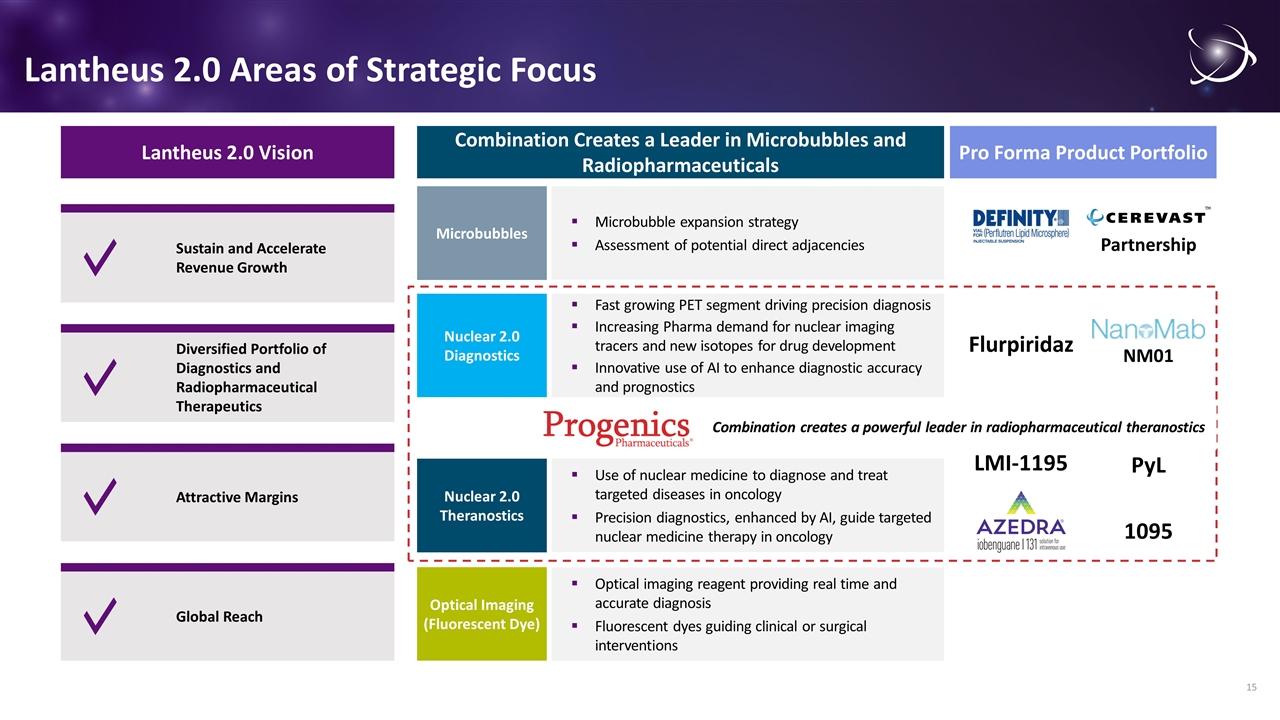

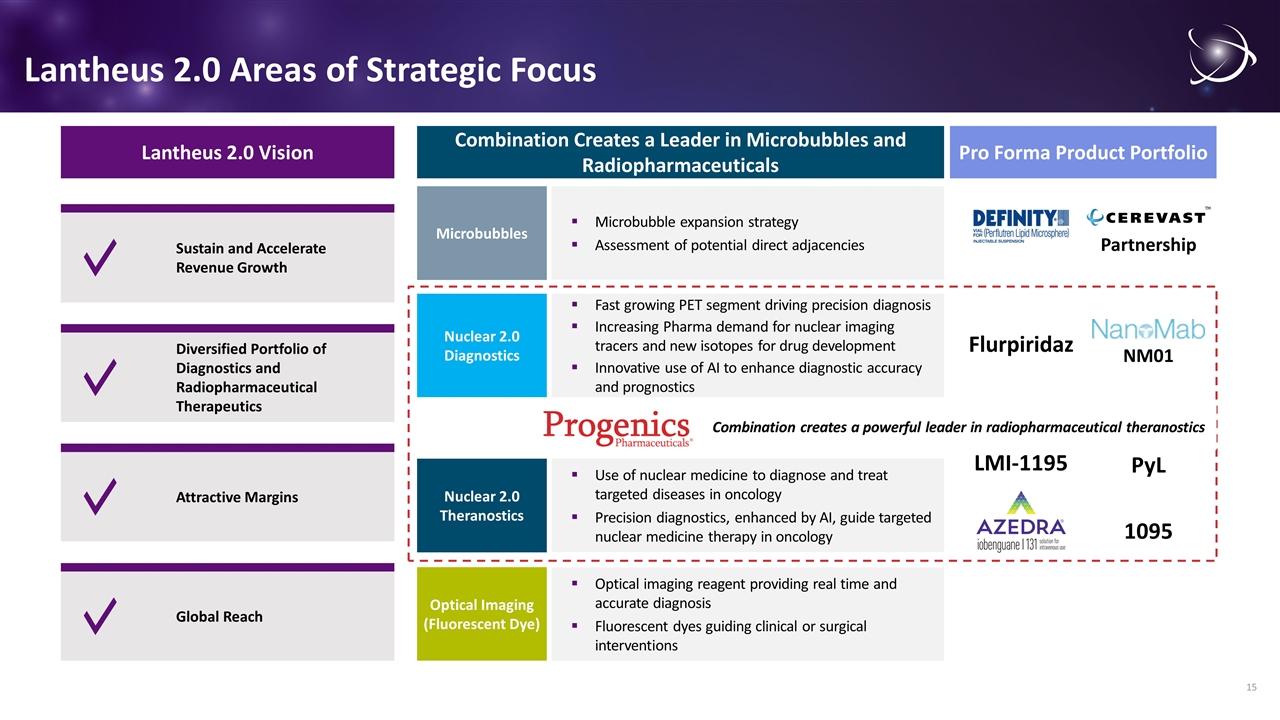

Lantheus 2.0 Areas of Strategic Focus Lantheus 2.0 Vision Sustain and Accelerate Revenue Growth Diversified Portfolio of Diagnostics and Radiopharmaceutical Therapeutics Global Reach Attractive Margins Microbubble expansion strategy Assessment of potential direct adjacencies Microbubbles Fast growing PET segment driving precision diagnosis Increasing Pharma demand for nuclear imaging tracers and new isotopes for drug development Innovative use of AI to enhance diagnostic accuracy and prognostics Nuclear 2.0 Diagnostics Use of nuclear medicine to diagnose and treat targeted diseases in oncology Precision diagnostics, enhanced by AI, guide targeted nuclear medicine therapy in oncology Nuclear 2.0 Theranostics Optical imaging reagent providing real time and accurate diagnosis Fluorescent dyes guiding clinical or surgical interventions Optical Imaging (Fluorescent Dye) Combination Creates a Leader in Microbubbles and Radiopharmaceuticals Pro Forma Product Portfolio 1095 PyL LMI-1195 Flurpiridaz NM01 Partnership Combination creates a powerful leader in radiopharmaceutical theranostics

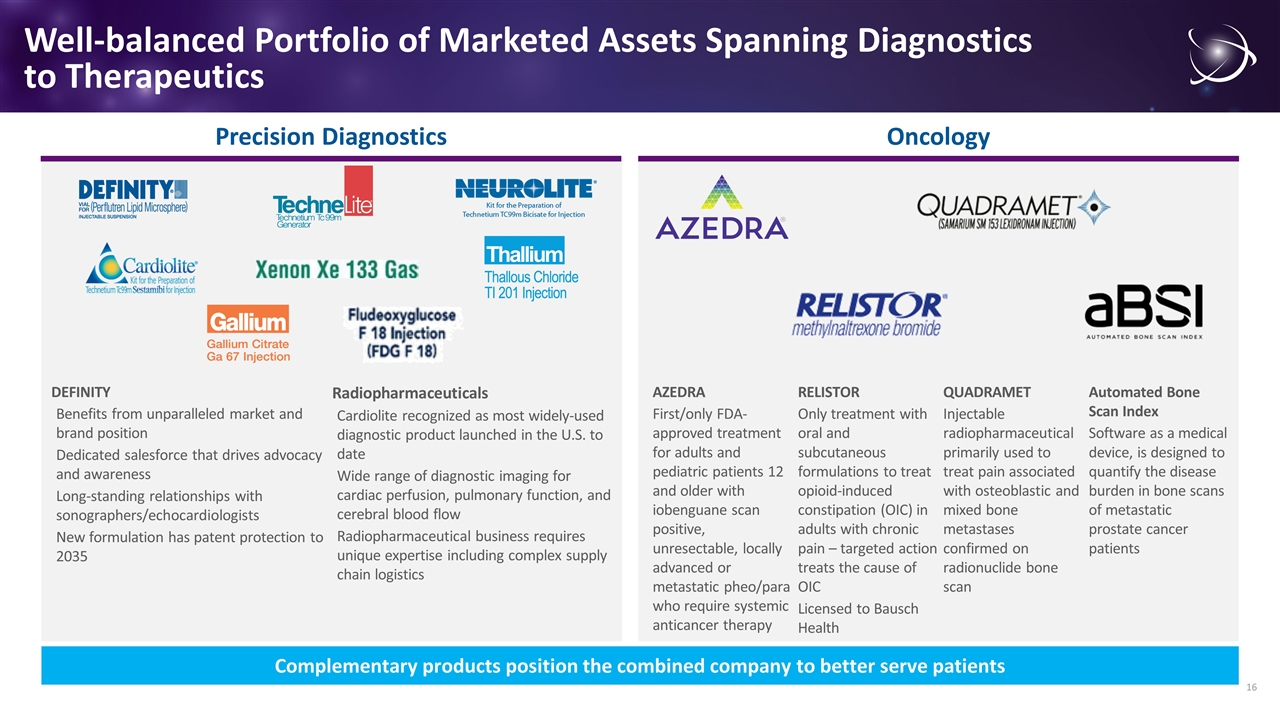

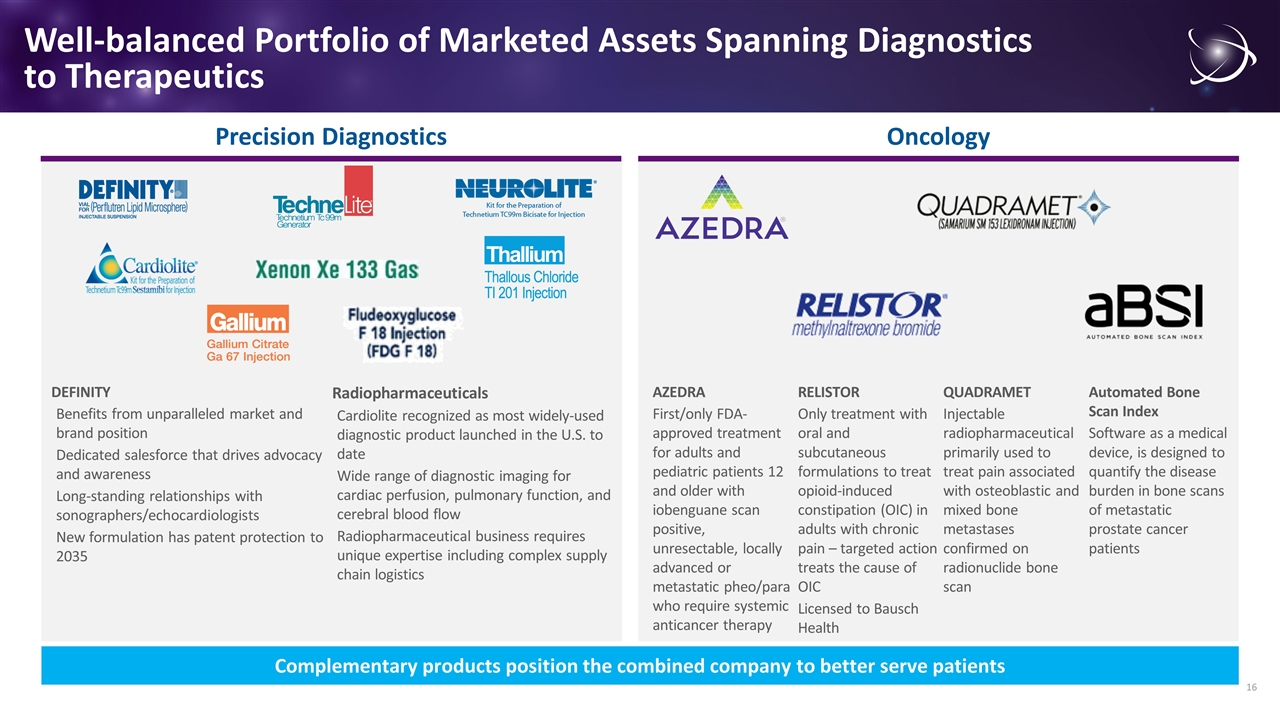

DEFINITY Benefits from unparalleled market and brand position Dedicated salesforce that drives advocacy and awareness Long-standing relationships with sonographers/echocardiologists New formulation has patent protection to 2035 Radiopharmaceuticals Cardiolite recognized as most widely-used diagnostic product launched in the U.S. to date Wide range of diagnostic imaging for cardiac perfusion, pulmonary function, and cerebral blood flow Radiopharmaceutical business requires unique expertise including complex supply chain logistics Well-balanced Portfolio of Marketed Assets Spanning Diagnostics to Therapeutics AZEDRA First/only FDA-approved treatment for adults and pediatric patients 12 and older with iobenguane scan positive, unresectable, locally advanced or metastatic pheo/para who require systemic anticancer therapy RELISTOR Only treatment with oral and subcutaneous formulations to treat opioid-induced constipation (OIC) in adults with chronic pain – targeted action treats the cause of OIC Licensed to Bausch Health QUADRAMET Injectable radiopharmaceutical primarily used to treat pain associated with osteoblastic and mixed bone metastases confirmed on radionuclide bone scan Automated Bone Scan Index Software as a medical device, is designed to quantify the disease burden in bone scans of metastatic prostate cancer patients Precision Diagnostics Oncology Complementary products position the combined company to better serve patients

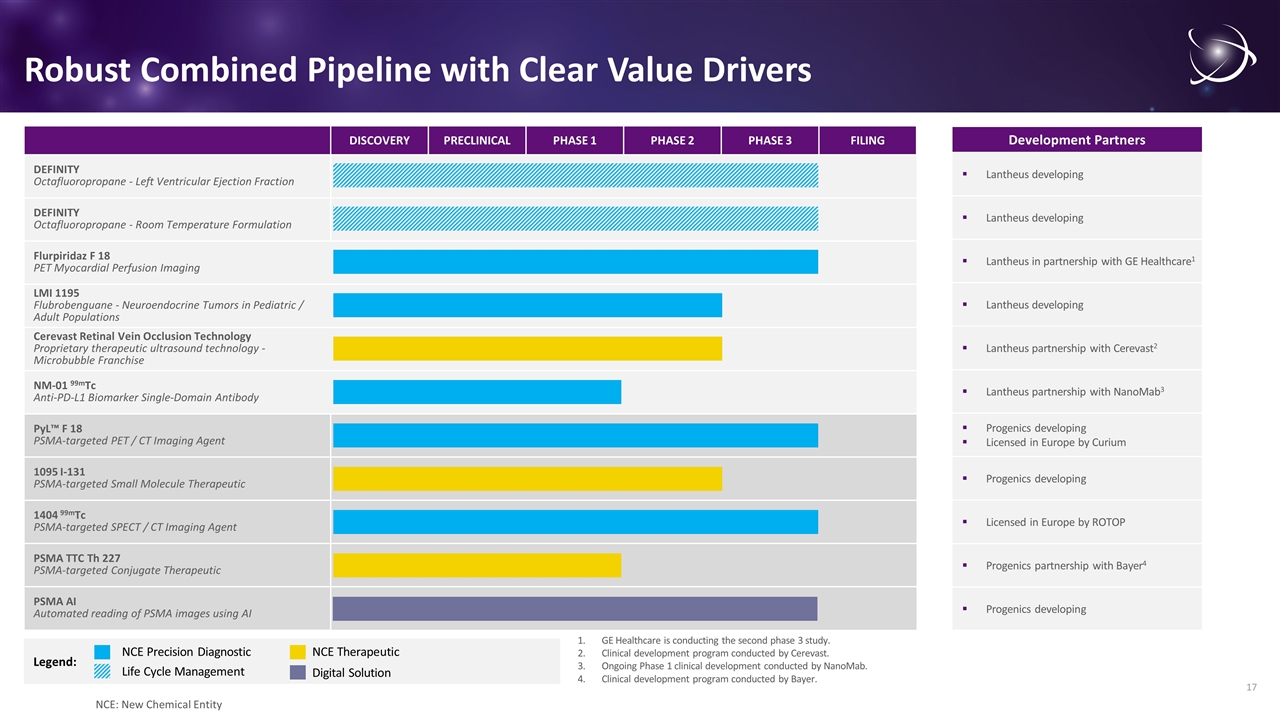

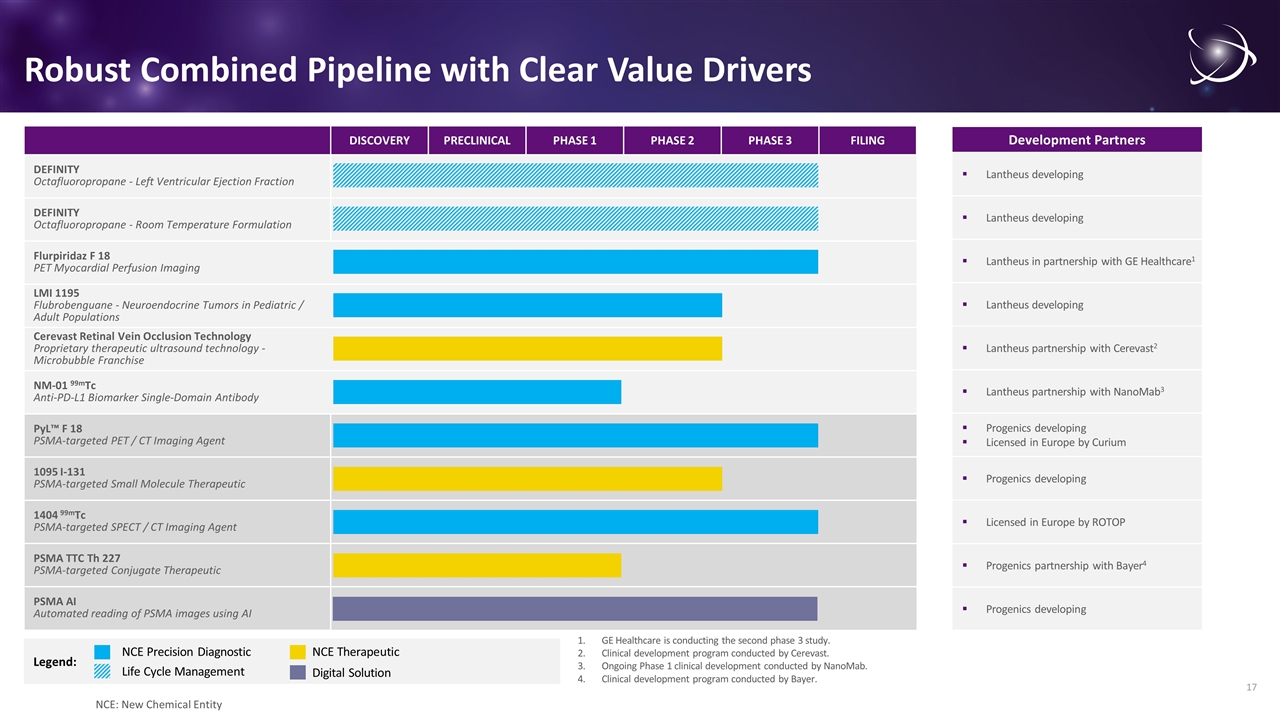

Legend: DISCOVERY PRECLINICAL PHASE 1 PHASE 2 PHASE 3 FILING DEFINITY Octafluoropropane - Left Ventricular Ejection Fraction DEFINITY Octafluoropropane - Room Temperature Formulation Flurpiridaz F 18 PET Myocardial Perfusion Imaging LMI 1195 Flubrobenguane - Neuroendocrine Tumors in Pediatric / Adult Populations Cerevast Retinal Vein Occlusion Technology Proprietary therapeutic ultrasound technology - Microbubble Franchise NM-01 99mTc Anti-PD-L1 Biomarker Single-Domain Antibody PyL™ F 18 PSMA-targeted PET / CT Imaging Agent 1095 I-131 PSMA-targeted Small Molecule Therapeutic 1404 99mTc PSMA-targeted SPECT / CT Imaging Agent PSMA TTC Th 227 PSMA-targeted Conjugate Therapeutic PSMA AI Automated reading of PSMA images using AI NCE Precision Diagnostic Robust Combined Pipeline with Clear Value Drivers Development Partners NCE Therapeutic Progenics developing Licensed in Europe by Curium Progenics developing Licensed in Europe by ROTOP Progenics developing Progenics partnership with Bayer4 Lantheus in partnership with GE Healthcare1 Lantheus developing Lantheus developing Lantheus partnership with Cerevast2 Lantheus partnership with NanoMab3 Lantheus developing GE Healthcare is conducting the second phase 3 study. Clinical development program conducted by Cerevast. Ongoing Phase 1 clinical development conducted by NanoMab. Clinical development program conducted by Bayer. Life Cycle Management Digital Solution NCE: New Chemical Entity

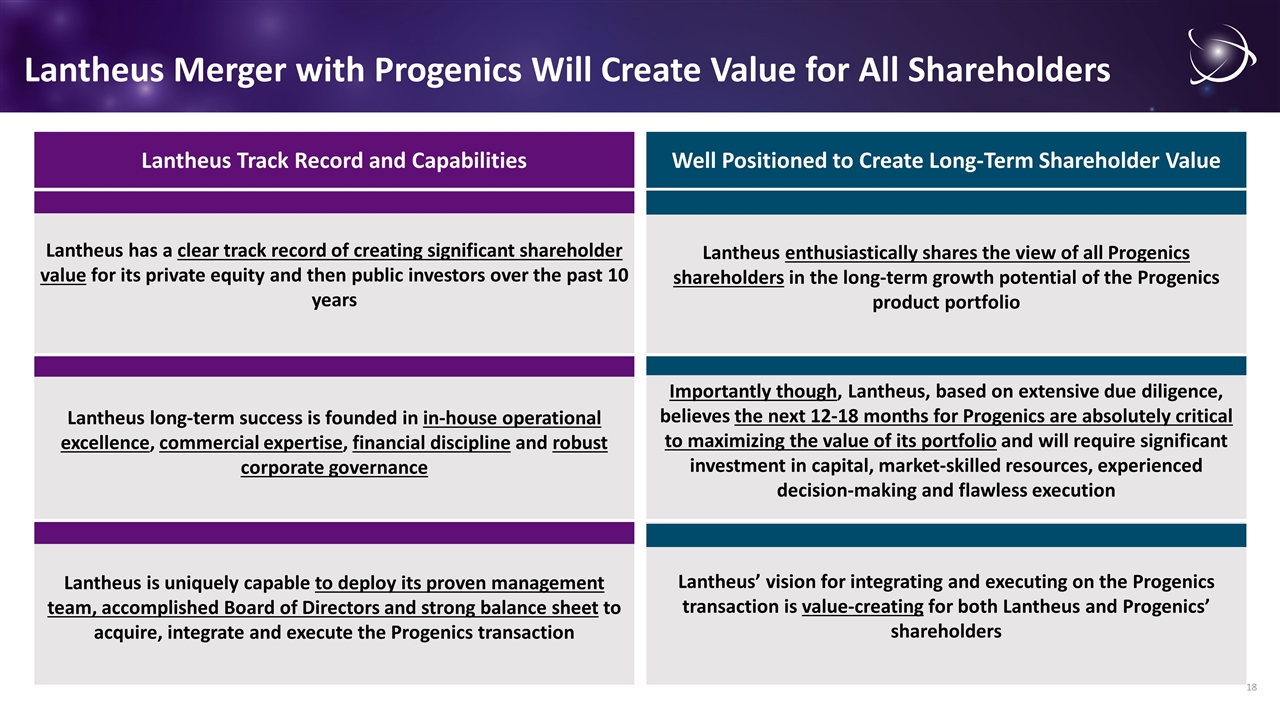

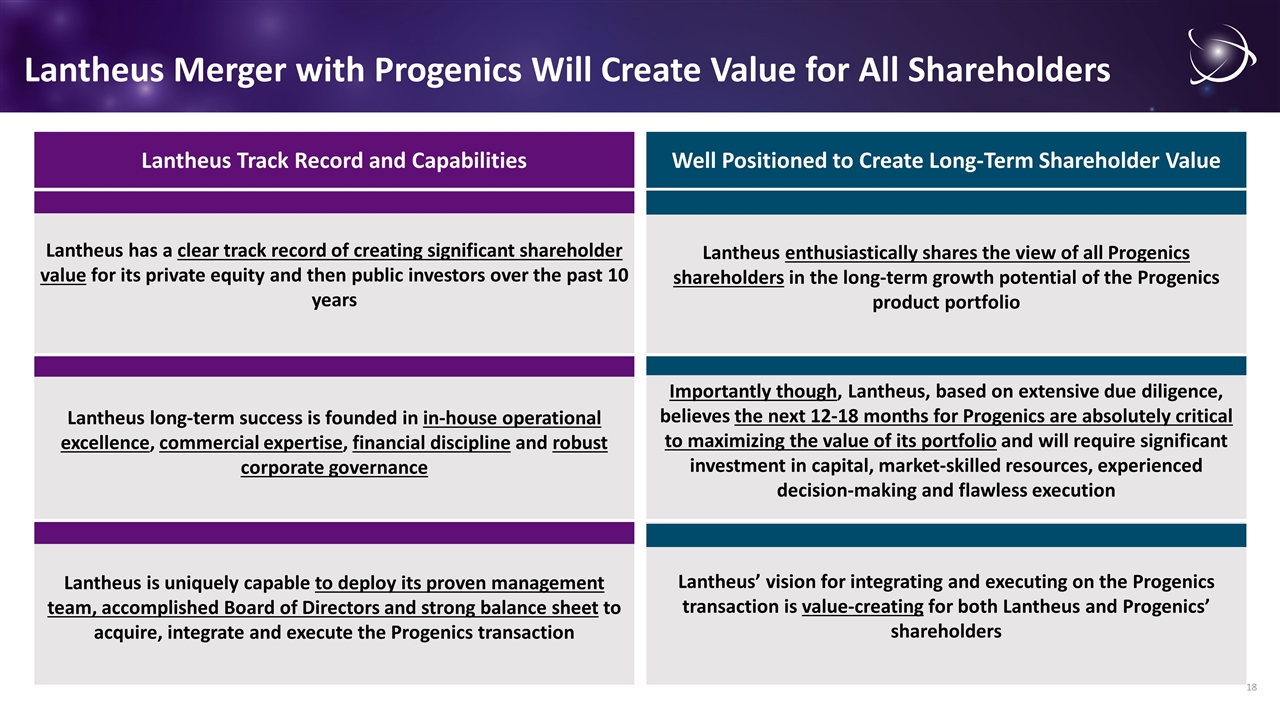

Lantheus Merger with Progenics Will Create Value for All Shareholders Lantheus has a clear track record of creating significant shareholder value for its private equity and then public investors over the past 10 years Lantheus long-term success is founded in in-house operational excellence, commercial expertise, financial discipline and robust corporate governance Importantly though, Lantheus, based on extensive due diligence, believes the next 12-18 months for Progenics are absolutely critical to maximizing the value of its portfolio and will require significant investment in capital, market-skilled resources, experienced decision-making and flawless execution Lantheus is uniquely capable to deploy its proven management team, accomplished Board of Directors and strong balance sheet to acquire, integrate and execute the Progenics transaction Lantheus enthusiastically shares the view of all Progenics shareholders in the long-term growth potential of the Progenics product portfolio Lantheus’ vision for integrating and executing on the Progenics transaction is value-creating for both Lantheus and Progenics’ shareholders Lantheus Track Record and Capabilities Well Positioned to Create Long-Term Shareholder Value

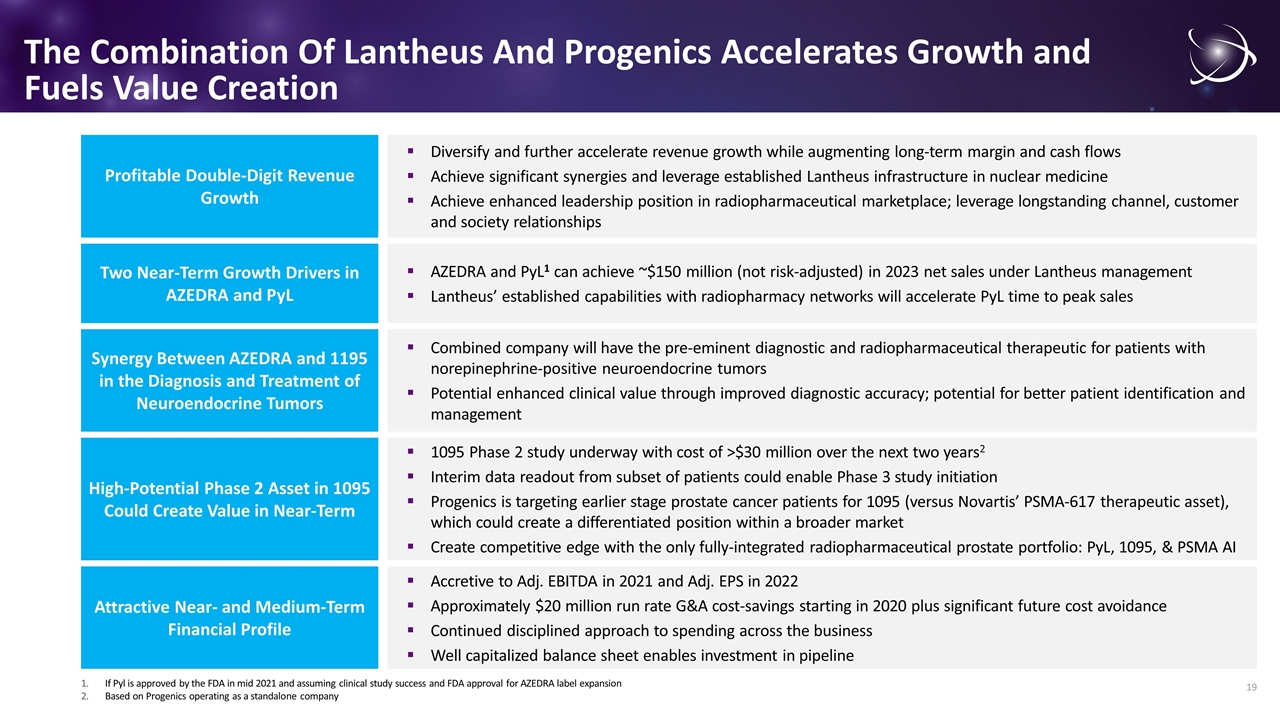

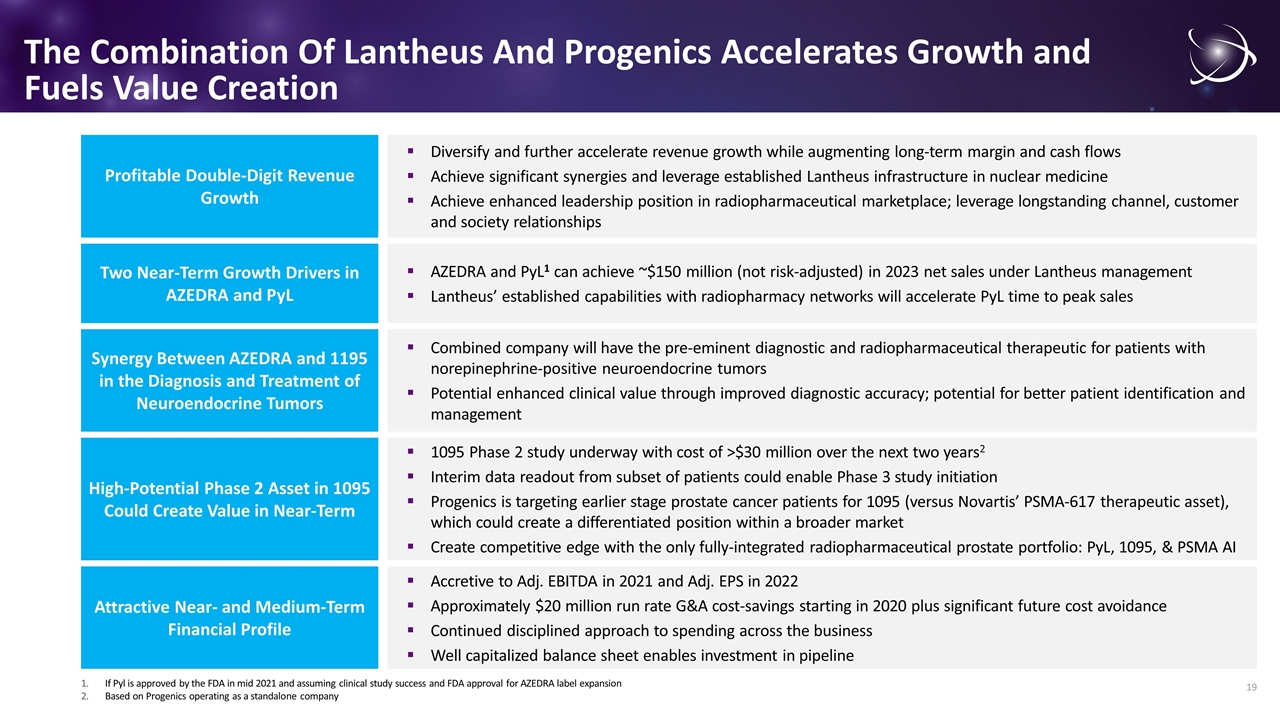

The Combination Of Lantheus And Progenics Accelerates Growth and Fuels Value Creation Diversify and further accelerate revenue growth while augmenting long-term margin and cash flows Achieve significant synergies and leverage established Lantheus infrastructure in nuclear medicine Achieve enhanced leadership position in radiopharmaceutical marketplace; leverage longstanding channel, customer and society relationships Profitable Double-Digit Revenue Growth Combined company will have the pre-eminent diagnostic and radiopharmaceutical therapeutic for patients with norepinephrine-positive neuroendocrine tumors Potential enhanced clinical value through improved diagnostic accuracy; potential for better patient identification and management Synergy Between AZEDRA and 1195 in the Diagnosis and Treatment of Neuroendocrine Tumors 1095 Phase 2 study underway with cost of >$30 million over the next two years2 Interim data readout from subset of patients could enable Phase 3 study initiation Progenics is targeting earlier stage prostate cancer patients for 1095 (versus Novartis’ PSMA-617 therapeutic asset), which could create a differentiated position within a broader market Create competitive edge with the only fully-integrated radiopharmaceutical prostate portfolio: PyL, 1095, & PSMA AI AZEDRA and PyL1 can achieve ~$150 million (not risk-adjusted) in 2023 net sales under Lantheus management Lantheus’ established capabilities with radiopharmacy networks will accelerate PyL time to peak sales Two Near-Term Growth Drivers in AZEDRA and PyL Accretive to Adj. EBITDA in 2021 and Adj. EPS in 2022 Approximately $20 million run rate G&A cost-savings starting in 2020 plus significant future cost avoidance Continued disciplined approach to spending across the business Well capitalized balance sheet enables investment in pipeline Attractive Near- and Medium-Term Financial Profile If Pyl is approved by the FDA in mid 2021 and assuming clinical study success and FDA approval for AZEDRA label expansion Based on Progenics operating as a standalone company High-Potential Phase 2 Asset in 1095 Could Create Value in Near-Term

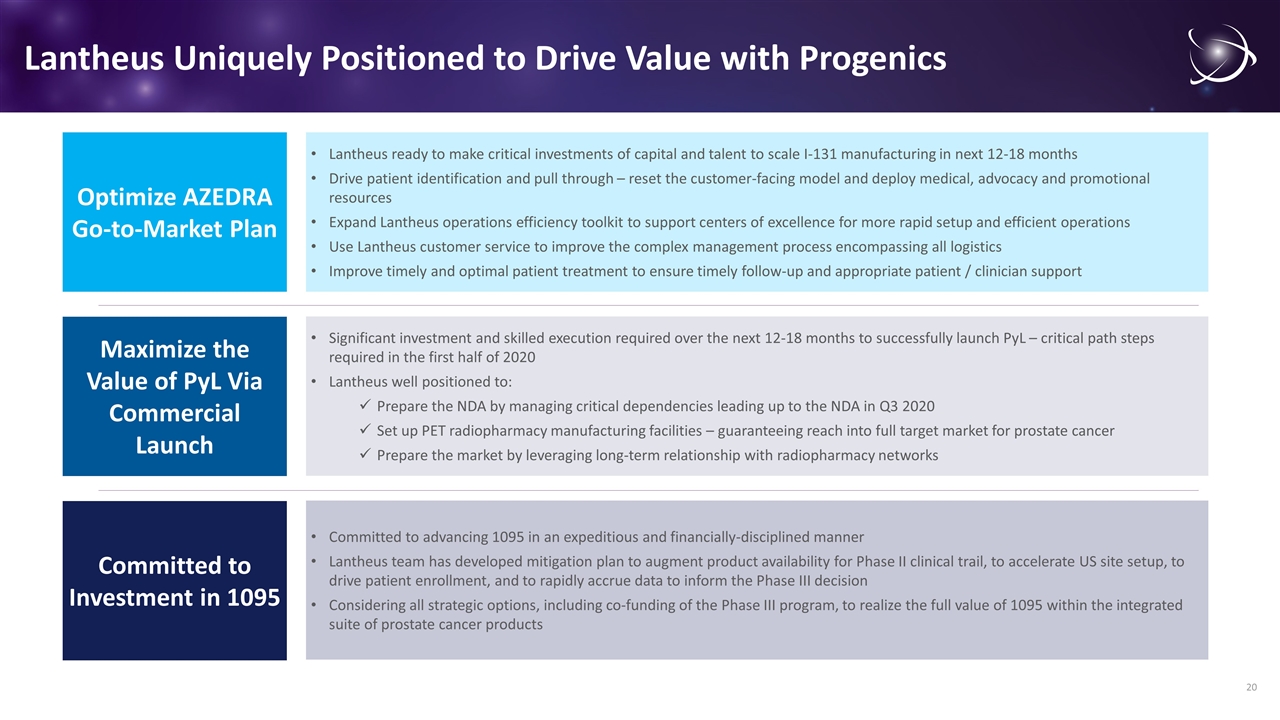

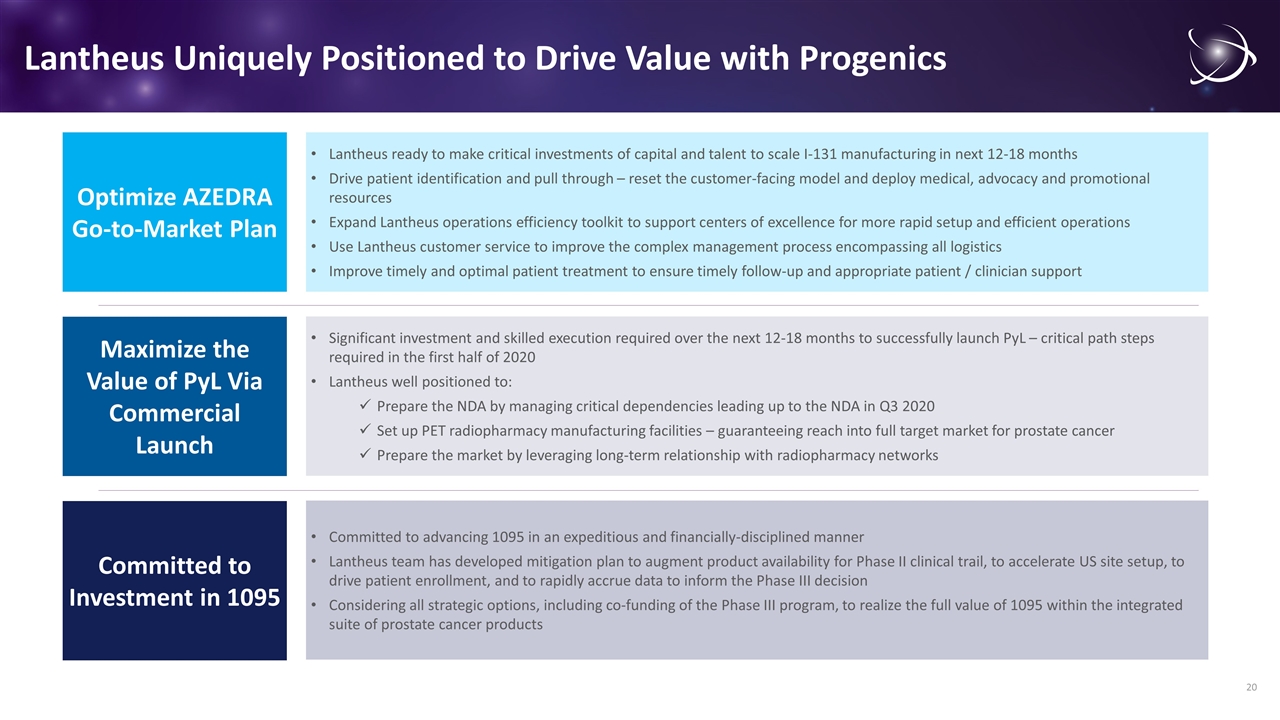

Lantheus Uniquely Positioned to Drive Value with Progenics Use Lantheus customer service to improve the complex multi-stakeholder management process encompassing all logistics from scheduling of patients, facility, and staffing; just-in-time manufacturing and delivery of the dosimetry dose to the radiopharmacy Provide Lantheus services to support efficient dosimetry dose preparation; dosimetry imaging and therapeutic dose calculation, including cost-efficient access to qualified software systems Reset the customer-facing model, deploying medical, advocacy and promotional resources to ensure timely patient referral to nuclear medicine within the stakeholder network of centers of excellence Foster patient-centric and multi-disciplinary connections within identified centers of excellence to bridge silos, drive streamlined processes, and ensure timely and optimal clinical outcomes for patients Implement site-finder system and tools for patients, advocacy groups, and providers to find AZEDRA-ready centers for treatment and improve connections across the treatment network Tune hub-services model to ensure patients are expeditiously qualified and referred for treatment Fund a patient registry in partnership with centers of excellence to track patient outcomes and recurrence; leverage data to demonstrate value and drive pull-through Expand LASH group capabilities to ensure timely follow-up and appropriate patient and clinician support for therapeutic doses and to enhance the patient experience Use Lantheus customer service and best-in-class operations to provide logistics support for just-in-time delivery of therapeutic doses Invest in expanded Lantheus operations efficiency toolkit to support centers of excellence for more rapid setup and efficient operations. Operations efficiency toolkit comprises a comprehensive training program for staffing, dosimetry calculations tools, nuclear licensing, patient scheduling, room and mobile shielding and process management Leverage Lantheus’ long-term operations within nuclear medicine to support hospital investment decisions for required lead-lined room, shielding and systems Execute an educational program to establish the superiority of AZEDRA to the standard of care through peer-to-peer interaction, working closely with ASCO, NCCN, SNMMI and NANETs Ensure appropriate coverage policies are in place with commercial payers surrounding each center of excellence and provide best practices on case rate negotiation from centers actively treating patients Integrate guidance on optimal reimbursement via the new technology add-on payment and other applicable CMS mechanisms (e.g. outlier payments) into reimbursement toolkit Reset the customer-facing model, deploying medical, advocacy and promotional resources to ensure timely patient referral to nuclear medicine within the stakeholder network of centers of excellence Foster patient-centric and multi-disciplinary connections within identified centers of excellence to bridge silos, drive streamlined processes, and ensure timely and optimal clinical outcomes for patients Implement site-finder system and tools for patients, advocacy groups, and providers to find AZEDRA-ready centers for treatment and improve connections across the treatment network Tune hub-services model to ensure patients are expeditiously qualified and referred for treatment Fund a patient registry in partnership with centers of excellence to track patient outcomes and recurrence; leverage data to demonstrate value and drive pull-through Optimize AZEDRA Go-to-Market Plan Significant investment and skilled execution required over the next 12-18 months to successfully launch PyL – critical path steps required in the first half of 2020 Lantheus well positioned to: Prepare the NDA by managing critical dependencies leading up to the NDA in Q3 2020 Set up PET radiopharmacy manufacturing facilities – guaranteeing reach into full target market for prostate cancer Prepare the market by leveraging long-term relationship with radiopharmacy networks Maximize the Value of PyL Via Commercial Launch Lantheus ready to make critical investments of capital and talent to scale I-131 manufacturing in next 12-18 months Drive patient identification and pull through – reset the customer-facing model and deploy medical, advocacy and promotional resources Expand Lantheus operations efficiency toolkit to support centers of excellence for more rapid setup and efficient operations Use Lantheus customer service to improve the complex management process encompassing all logistics Improve timely and optimal patient treatment to ensure timely follow-up and appropriate patient / clinician support Committed to Investment in 1095 Committed to advancing 1095 in an expeditious and financially-disciplined manner Lantheus team has developed mitigation plan to augment product availability for Phase II clinical trail, to accelerate US site setup, to drive patient enrollment, and to rapidly accrue data to inform the Phase III decision Considering all strategic options, including co-funding of the Phase III program, to realize the full value of 1095 within the integrated suite of prostate cancer products

The Lantheus Story 1 Market Leader Where We Are Today 4 Strong Capital Position To Fund Our Future 2 Targeting Growth Markets 3 Enhancing Growth from a Position of Strength

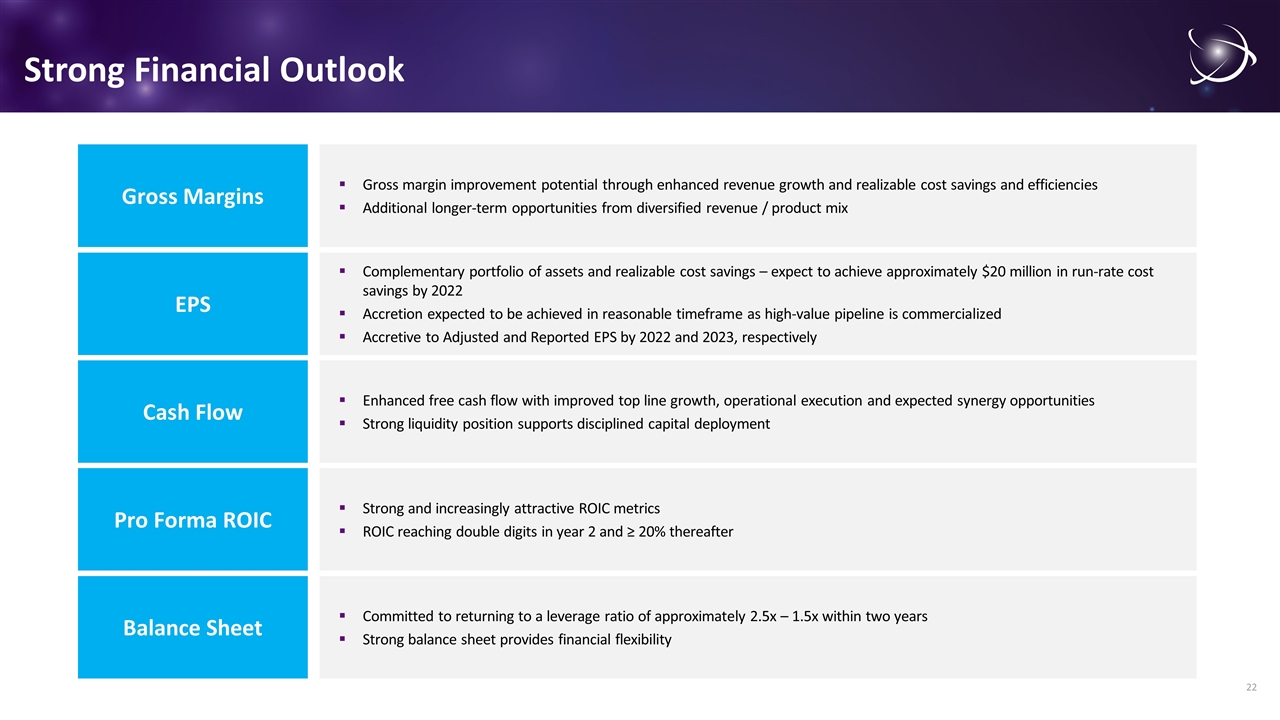

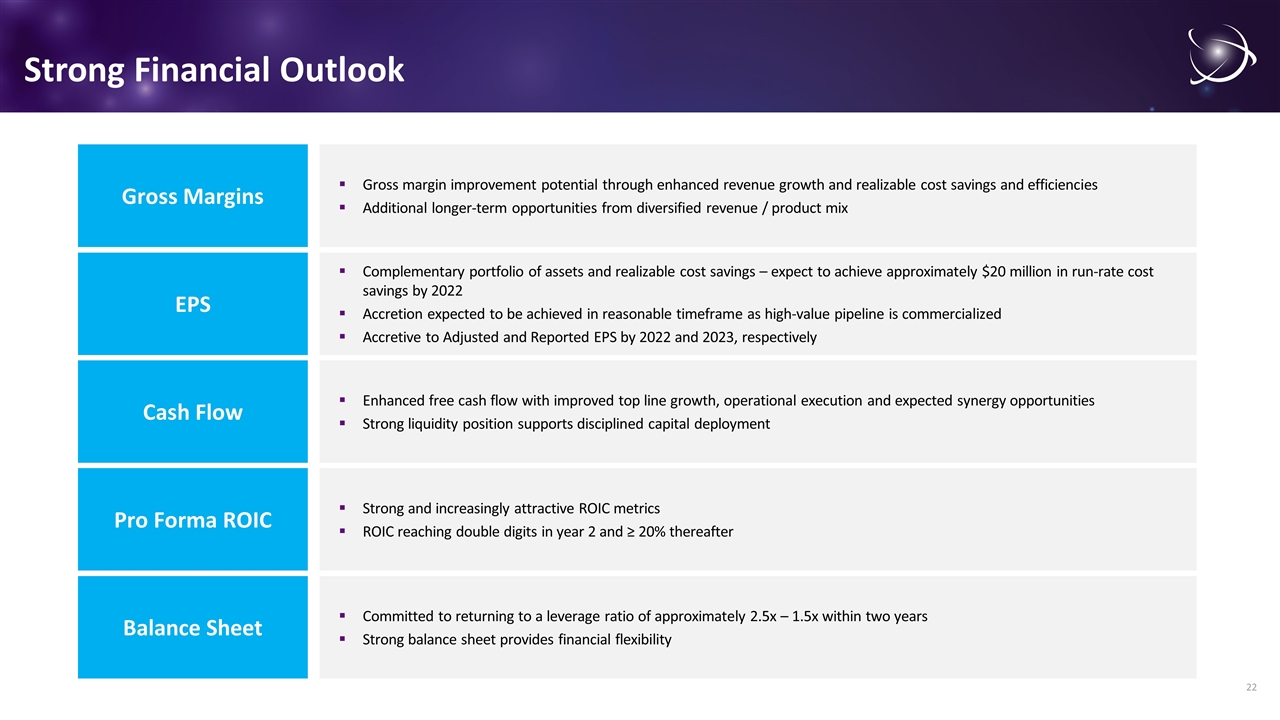

Strong Financial Outlook Gross margin improvement potential through enhanced revenue growth and realizable cost savings and efficiencies Additional longer-term opportunities from diversified revenue / product mix Gross Margins Enhanced free cash flow with improved top line growth, operational execution and expected synergy opportunities Strong liquidity position supports disciplined capital deployment Cash Flow Strong and increasingly attractive ROIC metrics ROIC reaching double digits in year 2 and ≥ 20% thereafter Pro Forma ROIC Complementary portfolio of assets and realizable cost savings – expect to achieve approximately $20 million in run-rate cost savings by 2022 Accretion expected to be achieved in reasonable timeframe as high-value pipeline is commercialized Accretive to Adjusted and Reported EPS by 2022 and 2023, respectively EPS Committed to returning to a leverage ratio of approximately 2.5x – 1.5x within two years Strong balance sheet provides financial flexibility Balance Sheet

Lantheus’ Management Team Has the Experience to Integrate and Execute on the Acquisition of Progenics Joined Lantheus in April 2013 as Chief Commercial Officer and was promoted to Chief Operating Officer in March 2015, before becoming President and Chief Executive Officer in August 2015 Fmr. President and SVP of World Wide Sales and Marketing at Angelini Labopharm LLC and Labopharm USA Fmr. VP of Strategic Planning and Competitive Intelligence and VP of Sales at Centocor, Inc., a Johnson & Johnson Company Mary Anne Heino President, CEO and Director Lantheus Holdings Strong Leadership Joined Lantheus in September 2018 as Chief Financial Officer and Treasurer Fmr. VP of Americas Finance and Corporate Treasurer of Zimmer Biomet Holdings Fmr. VP of Investor Relations and Treasurer of Zimmer Biomet Holdings Robert Marshall Chief Financial Officer and Treasurer Joined Lantheus in May 2018 as SVP of Technical Operations and was promoted to Chief Operating Officer in March 2019 Fmr. VP of Supply Chain, North America at GlaxoSmithKline Fmr. VP and Global Head of External Supply and Global Contract Manufacturing at GlaxoSmithKline John Bolla Chief Operations Officer

Lantheus’ Board Offers Diverse and Impressive Experience Base and Leadership Credentials in Commercial, Operations, R&D, M&A and Finance Diverse and Experienced Board of Directors BOARD MEMBERS (EXCL. MANAGEMENT) MOST RECENT ROLE COMMERCIAL OPERATIONAL M&A FINANCE R&D HCP Brian Markison (Chairman)4 Chief Executive Officer, Osmotica Holdings, S.C.Sp ✓ ✓ ✓ ✓ ✓ James C. Clemmer1,2 President and Chief Executive Officer, AngioDynamics Inc. ✓ ✓ ✓ ✓ ✓ Samuel Leno1,4 Fmr. Executive Vice President and Chief Operations Officer, Boston Scientific ✓ ✓ ✓ Julie McHugh2 Fmr. Chief Operating Officer, Endo Health Solutions, Inc. ✓ ✓ ✓ ✓ ✓ Gary J. Pruden1,4 Fmr. Executive Vice President, Worldwide Chairman, Medical Devices, Johnson & Johnson ✓ ✓ ✓ ✓ ✓ Kenneth J. Pucel2 Executive Vice President of Global Operations, Engineering & Lean, Polaris Industries Inc. ✓ ✓ Dr. Frederick Robertson1,3 Venture Partner, Baird Capital ✓ ✓ ✓ ✓ ✓ ✓ Dr. Derace Schaffer2,3 Founder and Chief Executive Officer, The Lan Group ✓ ✓ ✓ ✓ Dr. James H. Thrall3 Distinguished Juan M. Taveras Professorship of Radiology, Harvard Medical School ✓ ✓ 1.Audit Committee member 2.Compensation Committee member 3.Nominating and Corporate Governance Committee member 4.Financing and Strategy Committee member