- APTV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Aptiv (APTV) DEF 14ADefinitive proxy

Filed: 11 Mar 13, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

DELPHI AUTOMOTIVE PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

To our Shareholders:

I am pleased to invite you to the second Annual General Meeting of Shareholders of Delphi Automotive PLC to be held on Thursday, April 25, 2013, at 9:30 a.m., local time, at the Four Seasons Hotel London at Park Lane, Hamilton Place, Park Lane London, England W1J 7DR. The attached Notice of Annual General Meeting of Shareholders and Proxy Statement will serve as your guide to the business to be conducted at the meeting.

On or about March 11, 2013, we will begin mailing to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and Annual Report and how to vote. The Notice will also include details of the Annual Meeting and instructions on how to request a paper copy of the proxy materials.

This year’s proxy statement includes several enhancements in how we present information, especially about our executive compensation policies. We have enhanced the Compensation Discussion and Analysis in order to show how our executives’ pay is linked to performance and to clearly explain our executive compensation philosophy and practices.

Your vote is very important to us and to our business. Prior to the meeting, I encourage you to sign and return your proxy card or use telephone or Internet voting so that your shares will be represented and voted at the meeting.

Thank you for your continued support. We look forward to seeing you on April 25, 2013.

Sincerely,

Rodney O’Neal

Chief Executive Officer and President

Notice of Annual General Meeting of Shareholders

To Be Held Thursday, April 25, 2013

DATE: Thursday, April 25, 2013

TIME: 9:30 a.m., local time

PLACE: Four Seasons Hotel London at Park Lane, Hamilton Place, Park Lane London, England W1J 7DR

PURPOSE OF MEETING: Presenting the Company’s accounts for the fiscal year ended December 31, 2012, together with the auditors’ reports on those accounts, to the shareholders at the Annual Meeting and passing the following resolutions, and to transact such other business as may properly come before the Annual Meeting. Resolutions 1 to 12 will be proposed as ordinary resolutions, and Resolution 13 will be proposed as an advisory non-binding resolution:

ORDINARY RESOLUTIONS

Re-election of Directors

1) THAT Gary L. Cowger be re-elected as a director of the Company.

2) THAT Nicholas M. Donofrio be re-elected as a director of the Company.

3) THAT Mark P. Frissora be re-elected as a director of the Company.

4) THAT Rajiv L. Gupta be re-elected as a director of the Company.

5) THAT John A. Krol be re-elected as a director of the Company.

6) THAT J. Randall MacDonald be re-elected as a director of the Company.

7) THAT Sean O. Mahoney be re-elected as a director of the Company.

8) THAT Rodney O’Neal be re-elected as a director of the Company.

9) THAT Thomas W. Sidlik be re-elected as a director of the Company.

10) THAT Bernd Wiedemann be re-elected as a director of the Company.

11) THAT Lawrence A. Zimmerman be re-elected as a director of the Company.

Auditors

12) THAT Ernst & Young LLP be re-appointed as the auditors of the Company to hold office from the conclusion of this meeting until the conclusion of the Annual Meeting of the Company to be held in 2014, that the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for purposes of United States securities law reporting for the year ending December 31, 2013 be ratified and that the directors be authorized to determine the fees to be paid to the auditors.

ADVISORY NON-BINDING RESOLUTION

Executive Compensation

13) THAT the Company’s shareholders approve, on an advisory, non-binding basis, the compensation paid to the Company’s named executive officers as disclosed in the Proxy Statement pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the “Compensation Discussion and Analysis,” the compensation tables and narrative discussion.

Record Date

You are entitled to vote only if you were a shareholder of Delphi Automotive PLC at the close of business on February 26, 2013. Holders of ordinary shares of Delphi are entitled to one vote for each share held of record on the record date.

Attendance at the Annual Meeting

We hope you will be able to attend the Annual Meeting in person. If you expect to attend, please check the appropriate box on the proxy card when you return your proxy or follow the instructions on your proxy card to vote and confirm your attendance by telephone or Internet.

Where to Find More Information about the Resolutions and Proxies

Further information regarding the business to be conducted and the resolutions is set out in the proxy statement (the “Proxy Statement”) and other proxy materials, which can be accessed by following the instructions on the Notice of Internet Availability that accompanies this Notice.

You are entitled to appoint one or more proxies to attend the Annual Meeting and vote on your behalf. Your proxy does not need to be a shareholder of the Company. Instructions on how to appoint a proxy are set out in the Proxy Statement and on the proxy card.

PLEASE NOTE THAT YOU WILL NEED PROOF

THAT YOU OWN DELPHI SHARES AS OF THE RECORD DATE

TO BE ADMITTED TO THE ANNUAL MEETING

Record shareholder: If your shares are registered directly in your name,

please bring proof of such ownership.

Shares held in street name by a broker or a bank: If your shares are held for your account

in the name of a broker, bank or other nominee, please bring a current brokerage

statement, letter from your stockbroker or other proof of ownership to the meeting together with a proxy issued in your name if you intend to vote in person at the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

David M. Sherbin

Senior Vice President, General Counsel, Secretary

and Chief Compliance Officer

This Notice of Annual Meeting and the Proxy Statement are being distributed

or made available on or about March 11, 2013.

| Page | ||||

| 1 | ||||

| 4 | ||||

Meetings of the Board of Directors and Committees of the Board | 4 | |||

| 5 | ||||

| 8 | ||||

| 9 | ||||

| 12 | ||||

| 14 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

Advisory Vote to Approve Executive Compensation (Resolution 13) | 40 | |||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| A-1 | ||||

DELPHI AUTOMOTIVE PLC

PROXY STATEMENT

FOR

ANNUAL GENERAL MEETING OF SHAREHOLDERS

The Board of Directors of DELPHI AUTOMOTIVE PLC (“Delphi,” the “Company,” or “we”) is soliciting proxies for use at the 2013 Annual General Meeting of Shareholders to be held on Thursday, April 25, 2013 (the “Annual Meeting”), and at any adjournment or postponement of the Annual Meeting. This Proxy Statement and the accompanying form of proxy will first be made available to shareholders who hold ordinary shares of Delphi as of February 26, 2013, the record date for the Annual Meeting, on or about March 11, 2013.

What am I voting on?

You will be voting on the following proposals at our Annual Meeting:

| • | to re-elect 11 directors; |

| • | to re-appoint Ernst & Young LLP as the Company’s auditors, ratify their appointment as independent registered public accounting firm and to authorize the directors to determine the fees to be paid to the auditors; |

| • | to approve the Company’s executive compensation on an advisory, non-binding basis; and |

| • | to transact such other business as may properly come before the Annual Meeting. |

Presentation of accounts

Under Jersey law, the directors are required to present the accounts of the Company and the reports of the directors and auditors before shareholders at a general meeting. Therefore, the accounts of the Company for the fiscal year ended December 31, 2012 will be presented to the shareholders at the Annual Meeting.

What are the recommendations of the Board?

All shares represented by a properly executed proxy will be voted unless the proxy is revoked and, if a choice is specified, your shares will be voted in accordance with that choice. If no choice is specified but the proxy card is signed, the proxy holders will vote your shares according to the recommendations of the Board, which are included in the discussion of each matter later in this Proxy Statement. The Board recommends that you vote:

FOR the re-election of each of the nominees as directors;

FOR the re-appointment of Ernst & Young LLP as our auditors, ratification as our independent registered public accounting firm and the authorization of the directors to determine the fees to be paid to the auditors; and

FOR the approval of the Company’s executive compensation on an advisory, non-binding basis.

In addition, the proxy holders may vote in their discretion with respect to any other matter that properly comes before the Annual Meeting.

Who is entitled to vote?

For each proposal to be voted on, each shareholder is entitled to one vote for each Ordinary Share owned at that time. At the close of business on February 26, 2013, the record date for the Annual Meeting, 315,437,509 ordinary shares, $0.01 par value (“Ordinary Shares”) were outstanding.

1

How do I vote by proxy in lieu of attending the Annual Meeting?

If you are a shareholder of record, you may vote by proxy in any of the following ways:

| • | By Internet or Telephone — If you have Internet or telephone access, you may authorize the submission of a proxy on your behalf by following the voting instructions in the materials you receive. If you vote by Internet or telephone, you should not return your proxy card. |

| • | By Mail — You may vote by mail by completing, dating and signing your proxy card and mailing it in the envelope provided. You must sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as officer of a corporation, guardian, executor, trustee or custodian), you must indicate your name and title or capacity. |

If you vote over the Internet or by telephone, your vote must be received by 1:00 a.m., Central Time, on April 24, 2013.

You may also vote in person at the Annual Meeting or you may be represented by another person at the Annual Meeting by executing a proxy designating that person.

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the beneficial owner of shares held in “street name.” The street name holder will provide you with instructions that you must follow in order to have your shares voted.

If you hold your shares in street name and you wish to vote in person at the Annual Meeting, you must obtain a proxy issued in your name from the street name holder.

May I change my mind after submitting a proxy?

If you are a shareholder of record, you may revoke your proxy before it is exercised by:

| • | Written notice to the Corporate Secretary of the Company, care of Delphi Automotive Systems, LLC, 5725 Delphi Drive, Troy, Michigan, 48098; |

| • | Timely delivery of a valid, later-dated proxy or later-dated vote by Internet or telephone; or |

| • | Voting in person at the Annual Meeting. |

If you are a beneficial owner of shares held in street name, you may submit new voting instructions by contacting your brokerage firm, bank or other holder of record.

What are broker non-votes?

A broker non-vote occurs when the broker that holds your shares in street name is not entitled to vote on a matter without instruction from you and you do not give any instruction. Unless instructed otherwise by you, brokers will not have discretionary authority to vote on any matter other than Resolution 12, which is considered to be “routine” for these purposes. It is important that you cast your vote for your shares to be represented on all matters.

What is the required vote?

To be approved, Resolutions 1 to 12 require a simple majority of the votes cast at the Annual Meeting in favor of each Resolution. If a director does not receive a majority of the votes cast for his re-election, then that director will not be re-elected to the Board, and the Board may fill the vacancy with a different person, or the Board may reduce the number of directors to eliminate the vacancy. A simple majority of the votes cast is also required for Resolution 13 to be considered approved; however, the vote is advisory and is not binding on our Board or the Company. Votes that are withheld with respect to the election of directors and abstentions on the other matters are not counted as votes cast.

2

What will constitute the quorum for the Annual Meeting?

A quorum will consist of one or more shareholders present in person or by proxy who hold or represent shares of not less than a majority of the total voting rights of all of the shareholders entitled to vote at the Annual Meeting.

How can I attend the Annual Meeting?

If you plan to attend the Annual Meeting, you must present proof that you own Delphi shares to be admitted.

| • | Record Shareholders. If you are a record shareholder (a person who owns shares registered directly in his or her name with Computershare, Delphi’s transfer agent) and plan to attend the Annual Meeting, please indicate this when voting, either by marking the attendance box on the proxy card or responding affirmatively when prompted during telephone or Internet voting. |

| • | Owners of Shares Held in Street Name. Beneficial owners of Delphi ordinary shares held in street name by a broker, bank or other nominee will need proof of ownership to be admitted to the Annual Meeting. A recent brokerage statement or letters from the broker, bank or other nominee are examples of proof of ownership. If your shares are held in street name and you want to vote in person at the Annual Meeting, you must obtain a written proxy from the broker, bank or other nominee holding your shares. |

Can I access these proxy materials on the Internet?

This Proxy Statement and our 2012 Annual Report on Form 10-K are available at www.delphi.com.

Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of printed proxy materials?

The SEC permits companies to furnish proxy materials to shareholders by providing access to these documents over the Internet instead of mailing a printed copy. Accordingly, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to shareholders. Shareholders have the ability to access, view and print the proxy materials on a website referred to in the Notice and request a printed set of proxy materials.

Can I get electronic access to the proxy materials if I received printed materials?

If you received a printed copy of our proxy materials, you may choose to receive future proxy materials by email. Choosing to receive your future proxy materials by email will lower our costs of delivery and is beneficial for the environment. If you choose to receive our future proxy materials by email, you will receive an email next year with instructions containing a link to view those proxy materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it or for so long as the email address provided by you is valid.

Who pays for this proxy solicitation and how much did it cost?

We will pay the cost for soliciting proxies for the Annual Meeting. Delphi will distribute proxy materials and follow-up reminders by mail and electronic means. We have engaged Morrow & Co., LLC (“Morrow”) at 470 West Avenue, Stamford, CT 06902 to assist with the solicitation of proxies. We will pay Morrow an aggregate fee, including reasonable out-of-pocket expenses, of up to $10,000, depending on the level of services actually provided. Certain Delphi employees, officers, and directors may also solicit proxies by mail, telephone, or personal visits. They will not receive any additional compensation for their services.

We will reimburse brokers, banks, and other nominees for their expenses in forwarding proxy materials to beneficial owners.

3

How can I obtain the Company’s corporate governance information?

The following documents are posted on Delphi’s website at www.delphi.com/investors, under “Corporate Governance.”

| • | Memorandum and Articles of Association |

| • | Corporate Governance Guidelines |

| • | Board Committee Charters |

| • | Code of Ethical Business Conduct |

Where can I find voting results for this Annual Meeting?

The voting results will be published in a current report on Form 8-K, which will be filed with the SEC no later than four business days after the Annual Meeting. The voting results will also be published on our website at www.delphi.com at the same time.

HISTORY OF DELPHI AND SECOND ANNUAL GENERAL MEETING

Our History and Structure

This will be our second annual general meeting of shareholders as a publicly held company following our November 2011 initial public offering. Prior to November 2011, we were organized as Delphi Automotive LLP, a limited liability partnership under the laws of England and Wales, which was formed in August 2009 for the purpose of acquiring certain assets and subsidiaries of Delphi Corporation (the “Predecessor”), which had filed for bankruptcy protection.

In May 2011, Delphi Automotive PLC, a Jersey public limited company, was formed. At the time of its initial public offering in November 2011, it acquired all of the outstanding membership interests of Delphi Automotive LLP from its existing equity holders in exchange for ordinary shares of Delphi Automotive PLC and, as a result, Delphi Automotive LLP became a wholly-owned subsidiary of Delphi Automotive PLC. The Board of Managers then became the Board of Directors of the Company. For purposes of this Proxy Statement, references to the Board of Directors will also include actions taken by the Board of Managers, as the context may require.

MEETINGS OF THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

During 2012, the Board held seven in person or telephonic regular meetings. Attendance at all Board and Committee meetings exceeded 95% and all of our directors attended at least 75% of the Board and Committee meetings on which the member sits.

Our Board currently has five committees, as described below. Each committee has a separate written charter that is available on Delphi’s website at www.delphi.com. Click on the tab “About Delphi” and then the caption “Corporate Governance” under the heading “Investor Relations.”

The Board believes that a substantial majority of its members should be independent, non-employee directors. Only one member of the Board, Rodney O’Neal, who serves as our Chief Executive Officer and President, is an employee of Delphi. The non-employee directors of the Company are John A. Krol, Gary L. Cowger, Nicholas M. Donofrio, Mark P. Frissora, Rajiv L. Gupta, J. Randall MacDonald, Sean O. Mahoney, Michael McNamara, Thomas W. Sidlik, Bernd Wiedemann and Lawrence A. Zimmerman. The Board has determined that all of its non-employee directors and all director nominees, other than Mr. O’Neal, meet the requirements for independence under the New York Stock Exchange (“NYSE”) listing standards and the rules required for Audit Committee members by the SEC. Furthermore, the Board limits membership on the Audit, Compensation and Human Resources, and Nominating and Governance Committees to independent directors.

4

Audit Committee

The Audit Committee currently consists of Messrs. Zimmerman (Chair), Cowger, Mahoney, Sidlik and Wiedemann, each of whom is independent. Each of these directors is financially literate, and the Board has determined that Mr. Zimmerman meets the qualifications of the audit committee financial expert as defined under the Securities Exchange Act of 1934, as amended. Mr. Zimmerman serves as the Chair of the audit committees of three additional public companies, and the Board has determined that such simultaneous service will not impair Mr. Zimmerman’s ability to effectively serve on Delphi’s Audit Committee. The Audit Committee is responsible for oversight of the adequacy of our internal accounting and financial controls and the accounting principles and auditing practices and procedures to be employed in preparation and review of our financial statements. The Audit Committee is also responsible for the engagement of the registered independent public accounting firm and the review of the scope of the audit to be undertaken by the registered independent public accounting firm. The Audit Committee met ten times during the year ended December 31, 2012.

Compensation and Human Resources Committee

The Compensation and Human Resources Committee (the “Compensation Committee”) currently consists of Messrs. Gupta (Chair), Krol, MacDonald and McNamara, each of whom is independent. The Compensation Committee reviews and recommends to the Board policies, practices and procedures relating to the compensation of the Chief Executive Officer (“CEO”) and other officers. The Compensation Committee met seven times during the year ended December 31, 2012.

Finance Committee

The Finance Committee currently consists of Messrs. Zimmerman (Chair), Donofrio, Frissora and Mahoney. The Finance Committee is responsible for oversight of corporate finance matters, including capital structure, financing transactions, acquisitions and divestitures, share repurchase and dividend programs, employee retirement plans, interest rate policies, commodity and currency hedging, annual business plan development and such other topics as the Board may deem appropriate. The Finance Committee met six times during the year ended December 31, 2012.

Innovation and Technology Committee

The Innovation and Technology Committee currently consists of Messrs. Donofrio (Chair), Cowger, Sidlik and Wiedemann. The Innovation and Technology Committee is responsible for assisting the Board in its oversight responsibilities relating to research and development, technological innovation and strategy. The Innovation and Technology Committee met four times during the year ended December 31, 2012.

Nominating and Governance Committee

The Nominating and Governance Committee (the “Governance Committee”) currently consists of Messrs. Krol (Chair), Frissora, MacDonald and McNamara, each of whom is independent. The Governance Committee reviews and, as it deems appropriate, recommends to the Board policies and procedures relating to director and board committee nominations, corporate governance policies and has responsibility for the oversight of the Company’s environmental, health and safety management programs. The Governance Committee met seven times during the year ended December 31, 2012.

In order to help our shareholders better understand our Board practices, we are including the following description of current practices. The Governance Committee periodically reviews these practices.

Size of the Board

The Board currently consists of the 12 directors named above. Mr. McNamara will be departing the Board of Directors after the Annual General Meeting. Following the Annual General Meeting, assuming all nominated

5

directors are re-elected, the Board will consist of 11 directors. Our Memorandum and Articles of Association provides that our Board must consist of a minimum of two directors. The exact number of members on our Board will be determined from time to time by our full Board.

Leadership Structure

The Board believes it is important to retain flexibility to allocate the responsibilities of the offices of the Chairman and CEO in a manner that is in the best interests of the Company. Currently, the Board believes it is in the best interests of the Company to separate the positions of CEO and Chairman and to have a Non-Executive Chairman. John A. Krol has served in this role since 2009. It is expected that Mr. Krol will continue to serve as the Non-Executive Chairman, contingent upon re-election to the Board. The Board believes this leadership structure affords the Company an effective combination of internal and external experience, continuity and independence, which will serve the Board and the Company well.

Evaluation of Board Performance

The Governance Committee coordinates an annual evaluation process by which the directors evaluate the Board’s and its Committees’ performance and procedures. This self-evaluation leads to a full Board discussion of the results. Each Committee of the Board also conducts an annual evaluation of its performance and procedures.

Director Retirement

Our Corporate Governance Guidelines provide that the retirement age for directors is 75, unless waived by the Board. No Director who is or would be over 75 at the expiration of his current term may be nominated to a new term, unless the Board waives the retirement age for a specific Director. Once granted, such waiver must be renewed annually. The Board carefully considered the application of this policy with respect to Mr. Krol, who is 76. Based upon the leadership he provides as Chairman of the Board, the Board authorized a waiver of the retirement age to allow Mr. Krol to serve one additional year.

Our Corporate Governance Guidelines also provide that non-employee directors who significantly change their primary employment during their tenure as Board members must offer to tender their resignation to the Governance Committee. The Governance Committee will evaluate the continued appropriateness of Board membership under the new circumstances and make a recommendation to the Board as to any action to be taken with respect to such offer.

Nomination of Directors

The Governance Committee recommends individuals for membership on the Board. In making its recommendations, the Governance Committee considers an individual’s independence based on NYSE independence requirements and the criteria determined by the Board.

The Governance Committee considers not only a candidate’s qualities, performance and professional responsibilities, but also the composition of the Board and the challenges and needs of the Board at that time. The Board as a whole is constituted to be strong in its collective knowledge and diversity of accounting and finance, management and leadership, vision and strategy, business operations, business judgment, crisis management, risk assessment, industry knowledge, corporate governance and global markets.

The culture of the Board enables the Board to operate quickly and effectively in making key decisions. Board meetings are conducted in an environment of trust, confidentiality, open dialogue, mutual respect and constructive commentary.

The Governance Committee views diversity in its broadest sense, which includes education, ethnicity, experience, gender and leadership qualities. The Governance Committee will use the same process and criteria for evaluating all nominees, regardless of who submits the nominee for consideration.

6

Directors are encouraged to submit the name of any candidate whom they believe to be qualified to serve on the Board, together with background information on the candidate, to the Chair of the Governance Committee. In accordance with procedures set forth in our Memorandum and Articles of Association, shareholders holding at least one-tenth of the ordinary shares outstanding and who have the right to vote at general meetings of the Company may propose, and the Governance Committee will consider, nominees for election to the Board at the next annual general meeting by giving timely written notice to the Corporate Secretary, which must be received at our principal executive offices no later than the close of business on March 5, 2014 and no earlier than November 25, 2013. The notice periods may change in accordance with the procedures set out in our Memorandum and Articles of Association. Any such notice must include the name of the nominee, a biographical sketch and resume, contact information and such other background materials as the Governance Committee may request.

Executive Sessions

Independent directors meet together as a group during each Board meeting, without the CEO or any other employees in attendance. The Non-Executive Chairman presides over each executive session of the Board. Each Committee also has an executive session at which Committee members meet without the CEO or any other employees in attendance.

Board’s Role in Risk Oversight

The Board takes an active role in risk oversight related to the Company both as a full Board and through its Committees. While the Company’s management is responsible for day-to-day management of the various risks facing the Company, the Board is responsible for monitoring management’s actions and decisions. The Board, as apprised by the Audit Committee, determines that appropriate risk management and mitigation procedures are in place and that senior management takes the appropriate steps to manage all major risks.

Attendance at Shareholder Meetings

The Board does not have a formal policy regarding director attendance at shareholder meetings. However, all directors are expected to attend. All directors attended the Annual General Meeting in 2012.

Stock Ownership Guidelines

The Board believes that directors should hold meaningful equity ownership positions in the Company and sets appropriate equity holding requirements. In order to align the interests of the directors with the interests of shareholders, the Board established equity holding requirements for our non-employee directors. The holding requirement for each non-employee director is five times the value of his designated annual cash retainer (at least $500,000, based upon the current cash retainer). Each new director will have up to five full years from his or her date of appointment to fulfill this holding requirement. Current directors are required to hold a minimum of $750,000 in equity until December 31, 2013 and a minimum of $500,000 in equity thereafter. All non-employee directors hold in excess of this minimum shareholding requirement.

Governance Principles

The Board maintains a formal statement of Corporate Governance Guidelines, which sets forth the corporate governance practices for Delphi. The Corporate Governance Guidelines are available on our website at www.delphi.com. Click on the tab “About Delphi” and then the caption “Corporate Governance” under the heading “Investor Relations.”

Code of Ethical Business Conduct

Delphi has adopted a Code of Ethical Business Conduct, which applies to all employees and directors, including the principal executive officer, principal financial officer, principal accounting officer and controller,

7

or persons performing similar functions. The Code of Ethical Business Conduct is available on Delphi’s website at www.delphi.com. Click on the tab “About Delphi” and then the caption “Code of Ethical Business Conduct” under the heading “Social Responsibility.” Copies of our Code of Ethical Business Conduct are also available to any shareholder who submits a request to the Corporate Secretary at the mailing address above. We intend to satisfy any disclosure requirement under Item 5.05 of Form 8-K by posting on our website any amendments to, or waivers from, a provision of our Code of Ethical Business Conduct that applies to our directors or officers.

Communications with the Board of Directors

Any interested parties who desire to communicate with the Board or any individual member of the Board may do so by sending a letter addressed to the director or directors in care of the Corporate Secretary at Delphi Automotive PLC, c/o Delphi Automotive Systems, LLC, 5725 Delphi Drive, Troy, Michigan 48098. All correspondence, other than items such as junk mail that are unrelated to a director’s duties and responsibilities as a Board member, will be forwarded to the appropriate director or directors.

RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

We, or one of our subsidiaries, may occasionally enter into transactions with a “related party.” Related parties include our executive officers, directors, nominees for director, 5% or more beneficial owners of our ordinary shares, and immediate family members of these persons. We refer to transactions involving amounts in excess of $120,000 and in which the related party has a direct or indirect material interest as a “related party transaction.” Each related party transaction must be promptly disclosed to our general counsel, who will then assess and communicate the information to the Governance Committee for its approval in accordance with our written Related Party Transaction Policy. The Governance Committee will generally not approve or ratify a related party transaction unless it has determined that, upon consideration of all relevant information, the related party transaction is in, or not inconsistent with, the best interests of the Company and its shareholders. If we become aware of an existing related person transaction that has not been pre-approved under our Related Party Transaction Policy, the transaction will be referred to the Governance Committee, which will evaluate all options available, including ratification, revision or termination of such transaction. On at least an annual basis, the Governance Committee will review previously approved related person transactions to determine whether such transactions should continue.

Our Related Party Transaction Policy provides that the following types of transactions are deemed not to create or involve a material interest on the part of the related party and will not be reviewed, or require approval or ratification:

| • | Transactions including the purchase or sale of products or services in the ordinary course of business, not exceeding $120,000. |

| • | Transactions in which the related party’s interest derives solely from his or her service as a director of another corporation or organization that is a party to the transaction. |

| • | Transactions in which the related party’s interest derives solely from his or her ownership of less than 10% of the equity interest in another person (other than a general partnership interest) which is a party to the transaction. |

| • | Transactions in which the related party’s interest derives solely from his or her ownership of a class of equity securities of the Company and all holders of that class of equity securities received the same benefit on a pro rata basis. |

| • | Transactions in which the related party’s interest derives solely from his or her service as a director, trustee or officer (or similar position) of a not-for-profit organization or charity that receives donations from the Company, which donations are made in accordance with the Company’s matching program that is available on the same terms to all employees of the Company. |

8

| • | Compensation arrangements of any officer, other than an individual who is an immediate family member of a related party, if such arrangements have been approved by the Compensation Committee. |

| • | Director compensation arrangements, if such arrangements have been approved by the Board or the Governance and/or Compensation Committee. |

Registration Rights Agreement

During 2012, we were party to a registration rights agreement (the “Registration Rights Agreement”), dated November 22, 2011, with our shareholders that received ordinary shares of the Company in exchange for their interests in Delphi Automotive LLP in connection with our initial public offering. The ordinary shares were issued to such holders in a private placement and thereafter became subject to restrictions on resale under the Securities Act of 1933. The Registration Rights Agreement provided for certain demand registration rights, shelf registration rights and piggyback registration rights, in each case upon expiration of the applicable lock-up periods, that were applicable until the shares ceased to be subject to transfer restrictions under Rule 144. In connection with the Registration Rights Agreement, in 2012 Delphi filed shelf registration statements on Form S-1 relating to the resale by selling shareholders of up to an aggregate of 301,567,586 ordinary shares at prevailing market prices or at privately negotiated prices. As of December 31, 2012, there were no remaining registrable securities under the Registration Rights Agreement.

ELECTION OF DIRECTORS (RESOLUTIONS 1 TO 11)

All of our current directors, other than Mr. McNamara, are nominated for one-year terms expiring in 2014. The Board has been informed that each nominee is willing to serve as a director. If a director does not receive a majority of the vote for his re-election, then that director will not be re-elected to the Board, and the Board may fill the vacancy with a different person, or the Board may reduce the number of directors to eliminate the vacancy. Each member of our Board was a member of Delphi Automotive LLP’s Board of Managers immediately prior to the Company’s initial public offering, and information below as to each member’s tenure on our Board also reflects their tenure on Delphi Automotive LLP’s Board.

The Board believes that the combination of the various qualifications, skills and experiences of the director nominees would contribute to an effective and well-functioning Board. The Board and the Governance Committee believe that, individually and as a whole, the directors possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company’s management.

Included in each Director nominee’s biography below is an assessment of his specific qualifications, attributes, skills and experience.

Gary L. Cowger, age 65, has been a Director since November 2009. He retired as Group Vice President of Global Manufacturing and Labor Relations for General Motors in December 2009, a position which he held since April 2005. Mr. Cowger began his career with GM in 1965 and held a range of senior leadership positions in business and operations in several countries, including President of GM North America, Chairman and Managing Director, Opel, AG, and President of GM de Mexico. In 2006, he was elected to the National Academy of Engineering and currently serves as Co-Chair of the Martin Luther King Memorial Foundation’s executive Leadership Cabinet. He is Chairman of the Board of Trustees of Kettering University and on the Board of Trustees of the Center for Creative Studies. Through his extensive experience in the automotive industry across global markets, Mr. Cowger provides industry and operational expertise and strengthens the Board’s global perspective.

Nicholas M. Donofrio, age 67, has been a Director since December 2009. He retired as Executive Vice President, Innovation & Technology at IBM in October 2008. Mr. Donofrio began his career at IBM in 1964, and worked there for more than 40 years in various positions of increasing responsibility, including Division

9

Director; Divisional Vice President for Advanced Workstations; General Manager, Large Scale Computing Division; and Senior Vice President, Technology & Manufacturing. Mr. Donofrio earned a B.S. from Rensselaer Polytechnic Institute and holds a Master’s degree from Syracuse University. Mr. Donofrio brings to the Board executive management skills, a global perspective and significant technological expertise.

Other Directorships:Advanced Micro Devices, Inc. and Bank of New York Mellon Corporation

Mark P. Frissora, age 57, has been a Director since December 2009. He is Chairman and CEO of Hertz Global Holdings, Inc. Prior to joining Hertz in 2006, Mr. Frissora served as Chairman and CEO of Tenneco, Inc. from 2000. Mr. Frissora previously served for five years as a Vice President at Aeroquip-Vickers Corporation. From 1987 to 1991, he held various management positions at Philips N.V., including Director of Marketing and Director of Sales. Prior to Philips, he worked for ten years at General Electric Co. in brand management, marketing and sales. Mr. Frissora holds a B.A. degree from The Ohio State University and has completed advanced studies at both the University of Pennsylvania’s Wharton School and the Thunderbird International School of Management. Mr. Frissora contributes expertise in automotive operations, product development, marketing and sales. As the Chairman and CEO of a global public company, Mr. Frissora also contributes leadership and strategic and financial management skills.

Other Directorships: Walgreen Co., Hertz Global Holdings and NCR Corporation (2002-2009)

Rajiv L. Gupta, age 67, has been a Director since November 2009. He is former Chairman and CEO of Rohm and Haas Company, a position he held from October 1999 to March 2009. Mr. Gupta began his career at Rohm and Haas in 1971 and served in a broad range of global operations and financial leadership roles. Mr. Gupta received a B.S. in Mechanical Engineering from the Indian Institute of Technology, a M.S. in Operations Research from Cornell University and an MBA in Finance from Drexel University. Mr. Gupta’s educational and professional experience, including as Chairman and CEO of a global public company and other board assignments, enable him to contribute his expertise in corporate leadership, strategic analysis, operations, finance and executive compensation matters.

Other Directorships:Hewlett Packard, Tyco International Ltd. and The Vanguard Group, Inc.

John A. Krol, age 76, has been a Director and Chairman of the Board since October 2009. He is the former Chairman and Chief Executive Officer of E.I. du Pont de Nemours & Company. Following four years of service in the U.S. Navy, he joined Du Pont as a chemist and, following sales, marketing, manufacturing, and senior business management positions, was appointed Vice Chairman in 1992, CEO in 1995, then Chairman and CEO, retiring in December 1998. Subsequently, he has served on numerous corporate boards, including J.P. Morgan, MeadWestvaco, Milliken Company, and advisory boards of Bechtel Corporation and Teijin Ltd. Mr. Krol received B.S. and M.S. degrees in chemistry from Tufts University. Mr. Krol’s wide-ranging leadership experience, including as Chairman and CEO of a global public company and numerous board and chairman assignments, brings to the Board extensive expertise in corporate governance, as well as significant operational and strategic expertise, financial management and strategic development.

Other Directorships:Tyco International Ltd. and ACE, Ltd.

J. Randall MacDonald, age 64, has been a Director since November 2009. He is Senior Vice President, Human Resources at IBM. From 1983 to 2000, prior to joining IBM, Mr. MacDonald held a variety of senior positions at GTE, including Executive Vice President, Human Resources and Administration. He also has held senior leadership assignments at Ingersoll-Rand Company, Inc. and Sterling Drug. He earned both undergraduate and graduate degrees from St. Francis University. Through Mr. MacDonald’s many years of senior leadership in the field, he is able to provide expertise in global human resources management, compensation practices and leadership assessment and development.

Other Directorships:Covance, Inc. (1997-2008)

Sean O. Mahoney, age 50, has been a Director since November 2009. He is a private investor with over two decades of experience in investment banking and finance. Mr. Mahoney spent 17 years in investment

10

banking at Goldman, Sachs & Co., where he was a partner and head of the Financial Sponsors Group, followed by four years at Deutsche Bank Securities, where he served as Vice Chairman, Global Banking. During his banking career, Mr. Mahoney acted as an advisor to companies across a broad range of industries and product areas. He earned his undergraduate degree from the University of Chicago and his graduate degree from Oxford University, where he was a Rhodes Scholar. Through his experience in investment banking and finance, Mr. Mahoney provides the Board with expertise in financial and business strategy, capital markets, financing and mergers and acquisitions.

Other Directorships:Post-bankruptcy Board of Lehman Brothers Holdings Inc.

Rodney O’Neal, age 59, has been a Director since May 2011. He is president and CEO of Delphi. He was named president and CEO in October 2009. Mr. O’Neal was president and CEO of the former Delphi Corporation from January 2007. He was president and chief operating officer (COO) of Old Delphi from January 1, 2005. Prior to the president and COO position, Mr. O’Neal served as president of Old Delphi’s former Dynamics, Propulsion and Thermal sector from January 2003 and as executive vice president and president of Old Delphi’s former Safety, Thermal and Electrical Architecture sector from January 2000. Previously, he served as vice president and president of Delphi Interior Systems since November 1998 and general manager of the former Delphi Interior & Lighting Systems since May 1997. Mr. O’Neal earned a B.S. from Kettering University and a Master’s Degree from Stanford University. Through his 40 years of experience at Delphi and its predecessor companies, Mr. O’Neal brings extensive strategic, financial, management and industry expertise and a comprehensive understanding of Delphi’s business and operations.

Other Directorships: Sprint Nextel Corporation and Goodyear Tire & Rubber Company (2004-2012)

Thomas W. Sidlik, age 63, has been a Director since December 2009. In 2007, he retired from the DaimlerChrysler AG Board of Management in Germany after a 34 year career in the automotive industry. He previously served as Chairman and CEO of Chrysler Financial Corporation, Chairman of the Michigan Minority Business Development Council, and Vice-Chairman of the National Minority Supplier Development Council. He serves on the Board of Eastern Michigan University, where he has been Vice-Chairman and Chairman of the Board. He received a B.S. from New York University and an MBA from the University of Chicago. Mr. Sidlik’s experience on the board of a global automaker provides the Board with significant industry, management and strategic expertise, as well as his comprehensive understanding of the issues of diversity in the corporate environment.

Bernd Wiedemann, age 70, has been a Director since April 2010. He is Senior Advisor at IAV GmbH, a leading provider of engineering services to the automotive industry based in Germany. Mr. Wiedemann joined IAV after retiring from Volkswagen AG and is former Chief Executive Officer, Volkswagen Commercial Vehicles and Truck Division in Wolfsburg, Germany. A 37-year employee of Volkswagen, Mr. Wiedemann held senior executive positions including Executive Vice President, Volkswagen, South America (1994-1995); Executive Vice President, Autolatina (1992-1994) and Director, Passenger Car and Commercial Vehicle Development (1989-1992). Mr. Wiedemann received a Master’s degree from the Hannover Technical University, a doctorate from Brandenburg Technical University and is a professor at the Berlin Institute of Technology. Mr. Wiedemann’s extensive engineering expertise and his global OEM management experience enable him to provide engineering, product development, industry and leadership expertise to the Board.

11

Lawrence A. Zimmerman, age 70, has been a Director since November 2009. He is the former Vice Chairman and Chief Financial Officer of Xerox Corporation, a position he held from June 2002 until April 2011. He joined Xerox as CFO in 2002 after retiring from IBM. A 31-year employee of IBM, Mr. Zimmerman held senior executive positions, including Vice President of Finance for IBM’s Europe, Middle East and Africa operations, and Corporate Controller. Mr. Zimmerman received a B.S. in finance from New York University in 1965 and an MBA from Adelphi University in 1967. Mr. Zimmerman brings to the Board significant experience leading the finance organization of a large global company, and contributes financial, risk management and strategy expertise.

Other Directorships:Brunswick Corporation, Computer Sciences Corporation, Flextronics Inc. and Stanley Black & Decker, Inc. (2005-2011)

The Board of Directors recommends a vote “FOR” each of the 11 director nominees named above. If you complete the enclosed proxy card, unless you direct to the contrary on that card, the shares represented by that proxy will be voted FOR the election of all 11 nominees.

NON-EMPLOYEE DIRECTOR COMPENSATION

Board Compensation

Our directors (other than Mr. O’Neal, who is compensated as an officer of the Company and does not receive additional compensation for his services as member of the Board) receive the following annual compensation, 40% of which is paid in cash and 60% of which is delivered in the form of time-based restricted stock units. Each director may elect, on an annual basis, to receive 50% or 100% of his cash retainer in restricted stock units. The Chairman of the Board receives $500,000 annually, and all other directors receive $250,000 annually. Additionally, chairs of our board committees receive the following additional annual compensation:

Committee | Additional | |||

Audit Committee/Finance Committee (1) | $ | 25,000 | ||

Compensation Committee | 20,000 | |||

Innovation and Technology Committee | 10,000 | |||

Governance Committee (2) | 10,000 | |||

| (1) | The compensation is for the aggregate responsibilities of Mr. Zimmerman, who serves as the chair of both the Audit Committee and the Finance Committee. |

| (2) | Mr. Krol is currently the chair of the Governance Committee. As he receives compensation for his position as Chairman of the Board, he does not receive an additional fee for his service as the committee chair. |

An annual grant of restricted stock units is made on the day of the Annual Meeting and vests on the day before the next Annual Meeting. Cash compensation is paid at the end of each fiscal quarter. Any director who joins the Board, other than in connection with the Annual Meeting, will receive prorated cash compensation and a prorated grant of restricted stock units based on the date the director joins the Board and the date prior to the next annual meeting. The restricted stock units will vest on the day before the next Annual Meeting.

12

The table below shows 2012 cash and equity compensation for each member of the Board.

2012 Director Compensation

Name | Fees Earned or Paid in Cash | Stock Awards (1) | Total | |||||||||||||||

Gary L. Cowger | $ | 100,000 | $ | 150,021 | $ | 250,021 | ||||||||||||

Nicholas M. Donofrio | 104,000 | 156,022 | 260,022 | |||||||||||||||

Mark P. Frissora | 100,000 | 150,021 | 250,021 | |||||||||||||||

Rajiv L. Gupta | 108,000 | 162,023 | 270,023 | |||||||||||||||

John A. Krol | 200,000 | 300,014 | 500,014 | |||||||||||||||

J. Randall MacDonald | 100,000 | 150,021 | 250,021 | |||||||||||||||

Sean O. Mahoney | 58,333 | 150,021 | 208,354 | |||||||||||||||

Michael McNamara | 100,000 | 150,021 | 250,021 | |||||||||||||||

Thomas W. Sidlik | 100,000 | 150,021 | 250,021 | |||||||||||||||

Bernd Wiedemann | 100,000 | 150,021 | 250,021 | |||||||||||||||

Lawrence A. Zimmerman | 110,000 | 165,009 | 275,009 | |||||||||||||||

| (1) | Reflects the grant date fair value of the equity awards granted to directors on June 14, 2012. As of December 31, 2012, these awards are unvested; they will vest in full on April 24, 2013. The values as set forth in the table were determined in accordance with FASB ASC Topic 718. The grant date for accounting purposes is June 14, 2012. For assumptions used in determining the fair value of the awards, see Note 19. Share-Based Compensation to the Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012. The year-end restricted stock unit balances for our directors are: |

Name | Unvested Restricted Stock Units 12/31/2012 | |||||

Gary L. Cowger | 5,275 | |||||

Nicholas M. Donofrio | 5,486 | |||||

Mark P. Frissora | 5,275 | |||||

Rajiv L. Gupta | 5,697 | |||||

John A. Krol | 10,549 | |||||

J. Randall MacDonald | 5,275 | |||||

Sean O. Mahoney | 5,275 | |||||

Michael McNamara | 5,275 | |||||

Thomas W. Sidlik | 5,275 | |||||

Bernd Wiedemann | 5,275 | |||||

Lawrence A. Zimmerman | 5,802 | |||||

13

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

The Compensation Committee, composed entirely of independent directors, is responsible to the Board for executive compensation at Delphi. The Compensation Committee, in consultation with management and its independent outside advisor, sets the principles guiding the Company’s compensation philosophy, reviews and approves executive compensation for executive officers (including cash compensation, equity incentives, benefits and perquisites) and reports its actions to the Board for review and, as necessary, approval.

In this section, we describe the material components of our executive compensation programs for the “named executive officers” or “NEOs”, the compensation decisions the Compensation Committee has made under those programs and the factors considered in making those decisions, including 2012 Company performance. For fiscal year 2012, the NEOs were:

| • | Rodney O’Neal, our Chief Executive Officer and President; |

| • | Kevin P. Clark, our Executive Vice President and Chief Financial Officer; |

| • | James A. Spencer, our Executive Vice President of Operations; |

| • | Jeffrey J. Owens, our Executive Vice President and Chief Technology Officer; and |

| • | James A. Bertrand, our Senior Vice President and President, Thermal Systems. |

Our executive compensation program is designed to attract, retain and, most importantly, motivate execution of our business plan, which seeks to balance achievement of stretch near-term results with building shareholder value through long-term investments and sustained execution. Our focus on pay-for-performance and corporate governance ensures alignment with the interests of shareholders, as highlighted below:

ALIGNMENT OF STAKEHOLDERS

| Pay for Performance | Corporate Governance | |||

| We target executive compensation at peer groupmedian and deliver compensation above or below this level when warranted by performance. | Wedevote significant time to leadership development efforts. | |||

| Over 85% of total compensation for the CEO isperformance-based and 67% is granted inequity. | We meet at least annually with many of our major shareholders. | |||

| Over 75% of total compensation for NEOs other than the CEO isperformance-basedand 51% is granted inequity. | We utilize anindependent compensation consultant. | |||

| We use arigorous goal setting processwith multiple levels of review. | Wediscloseour performance metrics. | |||

| 100% of the NEOannual incentive compensation istied solely toDelphi’s consolidatedfinancial performance. | We maintainshare ownership guidelines for our NEOs and directors. | |||

| 75% of the NEOs’ long-term incentive compensation is performance-contingent andonly delivers value if financial and relative total shareholder value targets are met, thus contributing to long-term corporate financial health and company value. The value of theremaining 25% of NEOs’ long-term incentive compensation is in the form of time-based RSUs andfluctuates with stock price. | Wedo not have compensation programs thatencourage imprudent risk. | |||

14

| Pay for Performance | Corporate Governance | |||

| Wereview and validateourpay-for-performancerelationship on an annual basis. | We maintainclawback and anti-hedging policies. | |||

| We provide no perquisites orspecial or supplemental health benefits to our NEOs. | Annual dilution associated with equity awards was well below our typical peer industries in 2012. | |||

| Our non-qualified, supplemental pension plan is a modified and reduced version of a predecessor plan which was frozen in 2008 (no new benefits and no new participants). | There are no tax gross-ups or tax assistance on perquisites and no re-pricing of underwater stock options without shareholder approval We maintain amarket-aligned severance program with reasonable post-employment provisions. | |||

| We do not have individual change in control agreements | ||||

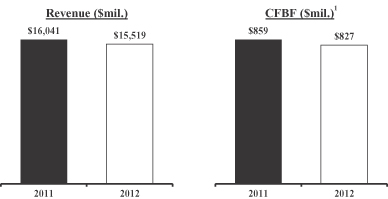

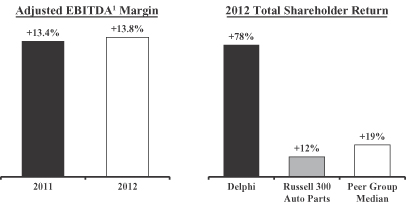

2012 Company Performance Highlights

During 2012, Delphi continued execution of its long-term plan of driving operating efficiency in a dynamic global market. Despite macro-economic headwinds (e.g. customer volume, foreign exchange and commodity pricing), which impacted annual revenue, we were able to deliver significant shareholder value, as shown below:

| (1) | “EBITDA” is defined as net income (loss) before depreciation and amortization (including long-lived asset and goodwill impairment), interest expense, other income (expense), income tax expense and equity income (loss) net of tax. “Adjusted EBITDA” is defined as net income (loss) before depreciation and amortization (including long-lived asset and goodwill impairment), interest expense, other income (expense), income tax expense, equity income (loss) net of tax, restructuring and acquisition-related costs. |

15

| “CFBF” is cash flow before financing, which is defined as cash provided by (used in) operating activities plus cash provided by (used in) investing activities (adjusted for maturities of time deposits, costs associated with the initial public offering and costs of the MVL acquisition). EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin and CFBF are used throughout this CD&A and are non-GAAP financial measures. Please see Appendix A to this proxy statement for a reconciliation of these numbers to U.S. GAAP financial measures. |

In addition to the financial performance shown above, we accomplished the following in 2012:

| • | Completed the acquisition of MVL to strengthen our market position and global presence in the connector business |

| • | Were selected to become a member company of the S&P 500 index |

2012 Compensation: What’s New in 2012?

Delphi filed its first proxy statement in 2012. At our 2012 Annual General Meeting of Shareholders, approximately 98% of votes cast supported our executive compensation program. Management and the Compensation Committee reviewed our shareholders’ affirmative 2012 Say-on-Pay vote and believe it to be a strong show of support for Delphi’s executive compensation program. Moreover, during 2012, we met with nearly half of our top institutional investors, who hold more than 60% of our outstanding shares. During these meetings, no executive compensation-related issues or concerns were raised. During 2012 we:

| • | Granted our first incentive equity award under the Long Term Incentive Plan. The officer awards (including the NEOs), granted in February 2012, consisted of 75% restricted stock units (“RSUs”) contingent on three-year Company performance (based on performance metrics described below) and 25% time-based RSUs that vest over a period of three years. |

| • | Ensured leadership stability and company performance momentum by implementing continuity awards for key NEOs: |

| • | Mr. O’Neal received a cash continuity award of $500,000 per year for three years (2013 – 15). |

| • | Mr. Spencer and Mr. Owens received $1,000,000 continuity awards denominated in time-based RSUs. Such awards are contingent upon their continued service through 2014. |

| • | Mr. Clark was awarded continuity payments of $600,000 in 2012 and $500,000 in 2013, 2014 and 2015. |

| • | Re-mixed the weighting of Annual Incentive Plan metrics to 50% EBITDA, 40% CFBF and 10% Revenue Growth (Bookings) from 70% EBITDA, 20% CFBF and 10% Revenue Growth (Bookings) to highlight the importance of cash generation to better balance the focus between profit and cash flow. |

| • | Shifted target CEO pay mix to provide increased focus on long-term company performance. Mr. O’Neal’s target annual incentive was reduced from 181% to 150% of base salary and his long-term incentive target was approved at $6,000,000. |

| • | Adopted an annual non-binding Say-on-Pay advisory shareholder vote. |

2012 Compensation Decisions

We believe that in order to increase shareholder value, our compensation plans and structure must: have a majority of direct pay be “performance-based” (i.e., pay where the value is not guaranteed); link performance-based pay to financial goals that are directly aligned with business strategy; link performance-based pay to stock price performance through use of a total shareholder return metric; and align with compensation-related governance best practice. As such, the Compensation Committee made the following decisions in 2012:

| • | Adjusted the base pay of new presidents who were appointed in late 2011 and early 2012. |

| • | Approved a payout of the 2012 Annual Incentive Plan at an enterprise consolidated basis of 83% of target, as results were below the stretch targets established under the plan. The Compensation Committee sets financial performance metrics for our annual incentive plans at stretch levels to drive superior financial and stock price performance. |

16

| • | Approved payout of the Value Creation Plan (“VCP”) at approximately 231% of target. Prior to our initial public offering, the Compensation Committee designed the VCP, a one-time, 39-month cliff vested award, to make a significant portion of executive compensation contingent upon company value creation (plus certain distributions). Payout of the VCP was market-based and tied directly to value creation for Delphi’s shareholders. |

Compensation Philosophy and Strategy – How Do We Pay Executives?

General Philosophy in Establishing and Making Pay Decisions.It is important that we ensure that our compensation programs encourage executives to make sound decisions that drive long-term value creation. The Compensation Committee utilizes a combination of fixed and variable pay elements in our compensation structure in order to achieve the following objectives:

| • | Support Delphi’s overall business strategy and results as they relate to long-term value creation; |

| • | Pay for performance by linking incentive compensation to defined short- and long-term performance goals; |

| • | Attract and retain key executives by providing competitive total compensation opportunities; and |

| • | Align executive and investor interests by establishing market and investor-relevant metrics which drive and enable shareholder value. |

Peer Group Analysis. Benchmarking is an integral aspect of our compensation system. To attract and retain our key executives, our goal is to provide compensation opportunities at competitive market rates. Our intent is to create a compensation structure that targets the median of our selected peer companies, but also allows total compensation to exceed the median when our performance and individual experience, responsibilities and performance warrant.

A key element of this process is selecting a relevant peer group against which we compare our elements of pay. The Compensation Committee reviews and determines the composition of our peer group on an annual basis, taking into consideration input from its independent compensation consultant. Delphi’s 2012 peer group was made up of the following 18 companies, whose aggregate profile was comparable to Delphi in terms of size, industry, competition for executive talent and financial performance.

AutoLiv Inc. | Emerson Electric Co. | Lear Corporation | ||

BorgWarner Inc. | Genuine Parts Company | Navistar International Corporation | ||

Cummins Inc. | The Goodyear Tire & Rubber Co. | PACCAR Inc. | ||

Danaher Corporation | Illinois Tool Works, Inc. | Parker-Hannifin Corporation | ||

Dover Corporation | Ingersoll-Rand plc | Textron Inc. | ||

Eaton Corporation | Johnson Controls, Inc. | TRW Automotive Holdings Corp |

Total target direct compensation for all officers, including the NEOs, in 2012 was approximated at median (50th percentile) of the peer group. In addition to considering each executive’s roles and responsibilities and experience in position within Delphi, we monitor our compensation structure in relation to our peer group annually to ensure that target total direct compensation for our NEOs is appropriate, considering our peer companies in terms of both size and overall company performance.

Role of the Compensation Committee and Use of Outside Consultants. The scope of the work done by consultants for the Compensation Committee includes analyses and recommendations that inform the Compensation Committee’s decisions, preparing and evaluating market data and competitive position benchmarking, assisting in the design and development of Delphi’s executive compensation programs, providing updates on market trends and the regulatory environment as they relate to executive compensation, reviewing various management proposals presented to the Compensation Committee related to executive compensation, and working with the Compensation Committee to validate and strengthen the pay for performance relationship and alignment with shareholders.

17

Radford, an Aon Hewitt Consulting Company, was retained by the Compensation Committee from November 2009 through late 2012 to provide advice on executive compensation matters. Radford did not perform any other work for Delphi. In 2012, we paid Radford $55,731 for its services. Aon Hewitt Consulting provides risk management and insurance and other consulting services for Delphi. The amount paid for these services in 2012 was approximately $893,530.

In August 2012, the Compensation Committee decided to review the executive compensation consultant services arrangement. After a competitive assessment and selection process, the Compensation Committee retained Compensation Advisory Partners LLC (“CAP”) as its independent compensation consultant going forward. CAP fees in 2012 totaled $142,570. The Compensation Committee has assessed the independence of CAP pursuant to SEC rules and concluded that no conflict of interest exists that would prevent CAP from independently representing the Compensation Committee. CAP does not perform other services for Delphi, and will not do so without the prior consent of the Chair of the Compensation Committee. CAP meets with the Compensation Committee Chair and the Compensation Committee outside the presence of management. In addition, CAP participates in all of the Committee’s meetings and, when requested by the Compensation Committee Chairman, in the preparatory meetings and the executive sessions.

Overview of Executive Compensation – What Are the Elements of Pay?

Consistent with the objectives outlined in “Compensation Philosophy and Strategy—General Philosophy”, we regularly undertake a comprehensive review of our overall long-term business plan to identify key strategic initiatives that should be linked to compensation. Further, we derive the annual short-term and long-term compensation performance metrics that will reward executives based on Delphi’s performance. We also assess and review the level of risk in our compensation programs to ensure that they do not encourage imprudent risk-taking.

Elements of Executive Compensation. In line with the philosophy described above, we include the following elements in the compensation of our executives, including the NEOs, as displayed in the Summary Compensation Table below:

| • | Base salary; |

| • | An annual incentive award; |

| • | Long-term incentive awards; and |

| • | Other compensation, which consists primarily of qualified and non-qualified defined contribution plans. |

18

The following chart outlines these elements of compensation and indicates how they relate to the key objectives of our compensation programs for executives:

Element | Key Features | Relationship to Objectives | ||

Direct Compensation | ||||

Base Salary | • Commensurate with responsibilities, experience and performance • Reviewed on a periodic basis for competitiveness and individual performance • Targeted at market median | • Attract and retain key executives | ||

Annual Incentive Plan | • Compensation Committee approves a target incentive pool for each performance period based on selected financial and/or operational metrics • Each executive is granted a target award opportunity varying by level of responsibility • Payouts are determined by performance to metrics (at both the corporate and, where applicable, division level), then adjusted (only on a downward basis for NEOs) to reflect individual performance based on pre-established individual objectives | • Pay for performance • Align executive and shareholder interests • Attract and retain key executives | ||

Long Term Incentive Plan | • Target award granted commensurate with responsibilities, experience and performance • Issue full share unit awards (no options), 75% with payout contingent on company performance vs. select metrics including Total Shareholder Return (TSR) | • Pay for performance • Align executive and shareholder interests • Attract and retain key executives • Focus on long-term value creation | ||

Other Compensation | ||||

Salaried Retirement Savings Program, Salaried Retirement Equalization Savings Program and Supplemental Executive Retirement Program | • Qualified defined contribution plan available to all U.S. salaried employees, including executives • Non-qualified defined contribution plan available to eligible employees, including executives, who exceed statutory limits under our qualified defined contribution plan • Defined benefit plan that was frozen as of September 2008 and provides reduced benefits to certain eligible executives who participated in the defined benefit plan that predates the formation of Delphi Automotive LLP and Delphi Automotive PLC | • Attract and retain key executives | ||

19

Total Direct Compensation Mix. Base salary and annual and long-term incentive awards make up our executives’ total direct compensation. Delphi strives to ensure that a majority of each executive’s total direct compensation is comprised of “performance-based” pay. Our annual incentive and long-term incentive awards are considered “performance-based” pay because the recipients of these awards must achieve specified performance goals at corporate, division and individual levels to receive any payment.

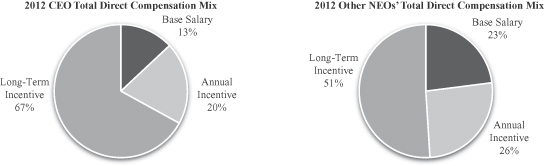

Mr. O’Neal’s 2012 annualized target performance-based pay makes up 87% of his 2012 total target compensation, which includes the 67% of his total target compensation that is derived from long-term incentives. His base salary makes up 13% of his total direct compensation. As a result of the introduction of annual grants under our Long Term Incentive Plan, Mr. O’Neal’s performance-based pay was re-apportioned. His annual incentive target was reduced from 181% of base pay to 150% of base pay, resulting in an annual target of $1,800,000. Mr. O’Neal’s annual long-term incentive target was approved at $6,000,000. Our remaining NEOs’ total direct compensation, on average, is comprised of 77% performance-based pay and 23% base salary, with long-term incentives constituting 51% of total direct compensation. The large proportion of performance-based pay, combined with a focus on long-term incentive awards, aligns the NEOs’ interests with the interests of Delphi’s shareholders.

The mix of compensation for our CEO and other NEOs is shown below:

2012 Target Compensation Structure. The following table depicts the total target direct compensation for each of the NEOs.

Name | Base | Annual Incentive | Long Term | Total | ||||||||||||

Rodney O’Neal | $ | 1,211,100 | $ | 1,800,000 | $ | 6,000,000 | $ | 9,011,100 | ||||||||

Chief Executive Officer and President | ||||||||||||||||

Kevin P. Clark | 800,000 | 800,000 | 2,000,000 | 3,600,000 | ||||||||||||

Executive Vice President and Chief Financial Officer | ||||||||||||||||

James A. Spencer | 590,000 | 659,000 | 1,475,000 | 2,724,000 | ||||||||||||

Executive Vice President Operations and President, Delphi Latin America | ||||||||||||||||

Jeffrey J. Owens | 528,600 | 627,500 | 1,083,000 | 2,239,100 | ||||||||||||

Executive Vice President and Chief Technology Officer | ||||||||||||||||

James A. Bertrand | 573,600 | 660,500 | 1,125,000 | 2,359,100 | ||||||||||||

Senior Vice President, President Thermal Systems | ||||||||||||||||

| (1) | At the time of his assignment as Senior Vice President and President, Electrical and Electronics Sector and President, Delphi Latin America in February 2012, Mr. Spencer received an approximate 5% base pay adjustment. His new salary is $590,000. In addition, his annual incentive award is based on 100% corporate performance results. |

20

| (2) | All annual incentive awards have been granted under our Annual Incentive Plan. |

| (3) | The long-term incentive award targets were established at the time of our initial grant under the 2011 Long Term Incentive Plan that occurred in February 2012. |

Officer Annual Compensation Determination. Individual base salaries and annual incentive targets for the officers are established based on the scope and size of each officer’s responsibilities. At the beginning of each year, we also define the key strategic objectives each officer is expected to achieve during that year, which are evaluated and approved by the Compensation Committee.

Base Salary. Base salary is generally targeted at the median of our peer group for new officers and executives and is intended to be commensurate with each executive’s responsibilities, experience and performance. For newly hired officers, the Compensation Committee conducts a market review of the position in terms of its size and scope of responsibility and also takes into account the individual’s compensation for his or her prior role or at his or her previous employer. In February 2012, Mr. Spencer became Senior Vice President and Sector President, Electrical and Electronics Sector in addition to continuing his role as President, Delphi Latin America. As such, his annual base pay increased to $590,000.

Annual Incentive Plan. Our Annual Incentive Plan is designed to motivate executives to drive company earnings, cash flow before financing and growth by measuring the executives’ performance against the current year business plan at the corporate and relevant division levels. The Compensation Committee, working with management and its independent advisor, sets the annual incentive performance objectives and payout levels based on Delphi’s annual company business objectives, which are then reviewed and approved by the Board. For 2012, each NEO’s award payout was determined as follows:

| • | Corporate performance metrics, weighted 100% for Messrs. O’Neal, Clark, Owens and Spencer and 25% for Mr. Bertrand. Given the significant financial impact of the divisions Mr. Spencer was given responsibility for in February 2012, his annual performance was weighted at the 100% corporate performance level. |

| • | Division performance metrics are weighted 75% for Mr. Bertrand. |

| • | Attainment of individual performance metrics that allow for reduction of the incentive payment if individual metrics are not met. |

For 2012, both corporate and division performance objectives were based on three metrics: EBITDA, CFBF and Revenue Growth (Bookings). The Compensation Committee selected the following weightings in 2012 for both corporate and division performance metrics: