- APTV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Aptiv (APTV) DEF 14ADefinitive proxy

Filed: 9 Mar 16, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

DELPHI AUTOMOTIVE PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid:

| |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

To our Shareholders:

I am pleased to invite you to Delphi Automotive PLC’s Annual General Meeting of Shareholders to be held on Thursday, April 28, 2016, at 9:00 a.m. local time, at the Four Seasons Hotel London at Park Lane. Our entire management team focuses every day on delivering value to our shareholders, and our company continues to be well positioned for profitable growth. I could not be more optimistic about our future.

The following Notice of Annual General Meeting of Shareholders and Proxy Statement describes the business to be conducted at the annual meeting. You can find financial and other information about Delphi in the accompanying Form 10-K for the fiscal year ended December 31, 2015. These materials are also available on Delphi’s website, delphi.com.

Your vote is very important to Delphi. Prior to the meeting, I encourage you to sign and return your proxy card or use telephone or Internet voting so that your shares will be represented and voted at the meeting.

Thank you for your continued support. We look forward to seeing you on April 28, 2016.

Sincerely,

Kevin P. Clark

President and Chief Executive Officer

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Notice of Annual General Meeting of Shareholders

Thursday, April 28, 2016 9:00 a.m. local time | Four Seasons Hotel London at Park Lane Hamilton Place Park Lane London England W1J 7DR | Record Date The close of business February 26, 2016 |

Purpose of Meeting

Presenting the Company’s accounts for the fiscal year ended December 31, 2015, together with the auditors’ reports on those accounts, to the shareholders at the Annual Meeting and passing the following resolutions, and to transact such other business as may properly come before the Annual Meeting. Resolutions 1 to 14 will be proposed as ordinary resolutions, and Resolution 15 will be proposed as an advisory, non-binding resolution:

| • | Ordinary Resolutions |

Election of Directors

| 1) | THAT Joseph S. Cantie be re-elected as a director of the Company. |

| 2) | THAT Kevin P. Clark be re-elected as a director of the Company. |

| 3) | THAT Gary L. Cowger be re-elected as a director of the Company. |

| 4) | THAT Nicholas M. Donofrio be re-elected as a director of the Company. |

| 5) | THAT Mark P. Frissora be re-elected as a director of the Company. |

| 6) | THAT Rajiv L. Gupta be re-elected as a director of the Company. |

| 7) | THAT J. Randall MacDonald be re-elected as a director of the Company. |

| 8) | THAT Sean O. Mahoney be re-elected as a director of the Company. |

| 9) | THAT Timothy M. Manganello be re-elected as a director of the Company. |

| 10) | THAT Bethany J. Mayer be re-elected as a director of the Company. |

| 11) | THAT Thomas W. Sidlik be re-elected as a director of the Company. |

| 12) | THAT Bernd Wiedemann be re-elected as a director of the Company. |

| 13) | THAT Lawrence A. Zimmerman be re-elected as a director of the Company. |

Auditors

| �� | 14) | THAT Ernst & Young LLP be re-appointed as the auditors of the Company from the conclusion of this meeting until the conclusion of the Annual Meeting of the Company to be held in 2017, that the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for purposes of United States securities law reporting for the year ending December 31, 2016 be ratified and that the directors be authorized to determine the fees to be paid to the auditors. |

| • | Advisory, Non-Binding Resolution |

Executive Compensation

| 15) | THAT the Company’s shareholders approve, on an advisory, non-binding basis, the compensation paid to the Company’s named executive officers as disclosed in the Proxy Statement pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the “Compensation Discussion and Analysis,” the compensation tables and narrative discussion. |

| • | Record Date |

You are entitled to vote only if you were a shareholder of Delphi Automotive PLC at the close of business on February 26, 2016. Holders of ordinary shares of Delphi are entitled to one vote for each share held of record on the record date.

DELPHI AUTOMOTIVE PLC 1

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Notice of Annual General Meeting of Shareholders(continued)

| • | Attendance at the Annual Meeting |

We hope you will be able to attend the Annual Meeting in person. If you expect to attend, please check the appropriate box on the proxy card when you return your proxy or follow the instructions on your proxy card to vote and confirm your attendance by telephone or Internet.

| • | Where to Find More Information about the Resolutions and Proxies |

Further information regarding the business to be conducted and the resolutions is set out in the proxy statement (the “Proxy Statement”) and other proxy materials, which can be accessed by following the instructions on the Notice of Internet Availability that accompanies this Notice.

You are entitled to appoint one or more proxies to attend the Annual Meeting and vote on your behalf. Your proxy does not need to be a shareholder of the Company. Instructions on how to appoint a proxy are set out in the Proxy Statement and on the proxy card.

BY ORDER OF THE BOARD OF DIRECTORS

David M. Sherbin

Senior Vice President, General Counsel,

Secretary and Chief Compliance Officer

PLEASE NOTE THAT YOU WILL NEED PROOF THAT YOU OWN DELPHI SHARES AS OF THE RECORD DATE TO BE ADMITTED TO THE ANNUAL MEETING

Record shareholder: If your shares are registered directly in your name, please bring proof of such ownership.

Shares held in street name by a broker or a bank: If your shares are held for your account in the name of a broker, bank or other nominee, please bring a current brokerage statement, letter from your stockbroker or other proof of ownership to the meeting together with a proxy issued in your name if you intend to vote in person at the Annual Meeting.

This Notice of Annual Meeting and the Proxy Statement are being distributed or made available on or about March 9, 2016.

2 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Table of Contents

DELPHI AUTOMOTIVE PLC 3

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Table of Contents(continued)

4 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

DELPHI AUTOMOTIVE PLC

2016 Proxy Statement — Summary

This summary highlights information contained elsewhere in the Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

ANNUAL MEETING OF SHAREHOLDERS

Date: April 28, 2016

Time: 9:00 a.m. local time

Location: Four Seasons Hotel London at Park Lane, Hamilton Place, Park Lane London, England W1J 7DR

Record Date: February 26, 2016

GENERAL INFORMATION

Stock Symbol: DLPH

Exchange: NYSE

Ordinary Shares Outstanding (as of the record date):276 million shares

Registrar & Transfer Agent: Computershare Investor Services

Principal Executive Offices: Courteney Road, Hoath Way, Gillingham, Kent ME8 0RU United Kingdom

Corporate Website:delphi.com

Investor Relations Website:investor.delphi.com

CORPORATE GOVERNANCE

Director Nominees: 13

Joseph S. Cantie (Independent)

Kevin P. Clark (Management)

Gary L. Cowger (Independent)

Nicholas M. Donofrio (Independent)

Mark P. Frissora (Independent)

Rajiv L. Gupta (Independent)

J. Randall MacDonald (Independent)

Sean O. Mahoney (Independent)

Timothy M. Manganello (Independent)

Bethany J. Mayer (Independent)

Thomas W. Sidlik (Independent)

Bernd Wiedemann (Independent)

Lawrence A. Zimmerman (Independent)

Director Term: One year

Board Meetings in 2015: 12

Standing Board Committees’ Meetings in 2015:

Audit (5), Compensation and Human Resources (6), Finance (7), Innovation and Technology (3), Nominating and Governance (7)

NAMED EXECUTIVE OFFICERS

| • | Kevin P. Clark |

| • | Mark J. Murphy (stepped down from his position effective February 29, 2016) |

| • | Majdi B. Abulaban |

| • | Liam Butterworth |

| • | Jugal K. Vijayvargiya |

| • | Rodney O’Neal (retired from the Company on March 1, 2015) |

Stock Ownership Guidelines: Yes (p. 27)

Clawback Policy: Yes (p. 27)

Restrictive Covenants for Executives: Yes (p. 28)

No Tax Gross-Ups: Yes (p. 28)

No Hedging/No Pledging: Yes (p. 28)

OTHER ITEMS TO BE VOTED ON

Appointment of and Payment to Auditors

(Ernst & Young LLP) (p. 43)

Advisory Vote to Approve Executive Compensation (p. 43)

DELPHI AUTOMOTIVE PLC 5

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

(Resolutions 1 to 13)

All of our current directors are nominated for one-year terms expiring in 2017.

The Board has nominated Mr. Cantie and Ms. Mayer for election as directors. Mr. Cantie joined the Board on June 1, 2015 and Ms. Mayer joined the Board on October 1, 2015. In recruiting Mr. Cantie and Ms. Mayer, the Nominating and Governance Committee retained a search firm to help identify director prospects, perform candidate outreach, assist in reference and background checks, and provide other related services. The recruiting process typically involves either the search firm or a member of the Nominating and Governance Committee contacting a prospect to gauge his or her interest and availability. A candidate will then meet with several members of the Board. At the same time, the Nominating and Governance Committee and the search firm will contact references for the candidate. A background check is completed before a final recommendation is made to the Board to appoint a candidate to the Board.

The Board has been informed that each nominee is willing to continue to serve as a director. If a director does not receive a majority of the vote for his or her election, then that director will not be elected to the Board, and the Board may fill the vacancy with a different person, or the Board may reduce the number of directors to eliminate the vacancy. Each member of our Board, other than Messrs. Cantie, Clark, Manganello and Ms. Mayer, was a member of Delphi Automotive LLP’s Board of Managers immediately prior to the Company’s initial public offering in 2011, and information below as to each member’s tenure on our Board also reflects their tenure on Delphi Automotive LLP’s Board.

The Board believes that the combination of the various qualifications, skills, and breadth and depth of experiences of the director nominees contributes to an effective and well-functioning Board. The Board and the Nominating and Governance Committee believe that, individually and as a whole, the directors possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company’s management.

Included in each director nominee’s biography below is an assessment of each member’s specific qualifications, attributes, skills and experience.

Joseph S. Cantie He is the former Executive Vice President and Chief Financial Officer of ZF TRW, a division of ZF Friedrichshafen AG (“ZF”), a global automotive supplier, a position he held from May 2015 until January 2016. He served in these same roles for TRW Automotive Holdings Corp., which was acquired by ZF in May 2015, since 2003. Prior to that time, he held other executive positions at TRW Inc., which he joined in 1999. From 1996-1999, Mr. Cantie served in several executive positions with LucasVarity Plc, including serving as Vice President and Controller. Prior to joining LucasVarity, Mr. Cantie spent 10 years with KPMG. Mr. Cantie is a certified public accountant and holds a bachelor of science degree from the State University of New York at Buffalo. | Director since: June 2015

Qualifications: As a seasoned financial executive, with extensive automotive supply and global public company experience, Mr. Cantie provides the Board significant enterprise risk management, financial and industry expertise.

Other Directorships: TopBuild Corp. Age: 52 | |

6 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Election of Directors(continued)

Kevin P. Clark In March 2015, Mr. Clark became Delphi’s President and Chief Executive Officer. In 2014, Mr. Clark was appointed Chief Operating Officer responsible for Delphi’s business divisions, as well as the Global Supply Management function. Mr. Clark joined Delphi in 2010 as Chief Financial Officer, responsible for all financial activities including strategic planning, corporate development, financial planning and analysis, treasury, accounting, and tax. Before coming to Delphi, he was a founding partner of Liberty Lane Partners, LLC, a private equity investment firm focused on investing in and building and improving middle-market companies. Prior to that, Mr. Clark served as Chief Financial Officer of Fisher-Scientific International Inc., a manufacturer, distributor and service provider to the global healthcare market, from the company’s initial public offering in 2001 through the completion of its merger with Thermo Electron Corporation in 2006. He also held a number of senior management positions at Fisher-Scientific. Mr. Clark began his career in the financial organization of Chrysler Corporation. He has both a bachelor’s degree in financial administration and a master’s degree in finance from Michigan State University. | Director since: March 2015

Qualifications: Mr. Clark is a strong leader with extensive experience across multiple industries, significant financial expertise and demonstrated success in creating and implementing Delphi’s business strategy.

Other Directorships: None Age: 53 | |

Gary L. Cowger He retired as Group Vice President of Global Manufacturing and Labor Relations for General Motors in 2009, a position he held since 2005. He is currently the Chairman and CEO of GLC Ventures, LLC, a consulting firm. Mr. Cowger began his career with GM in 1965 and held a range of senior leadership positions in business and operations in several countries, including President of GM North America, Chairman and Managing Director, Opel, AG and President of GM de Mexico. Mr. Cowger earned a bachelor of science degree from Kettering University and a master of science degree from the Massachusetts Institute of Technology. | Director since: November 2009

Qualifications: Through his extensive experience in the automotive industry across global markets, Mr. Cowger provides industry and operational expertise and strengthens the Board’s global perspective.

Other Directorships: Titan International, Inc. and Tecumseh Products Company (2013-2015) Age: 68 | |

Nicholas M. Donofrio He retired as Executive Vice President, Innovation & Technology at IBM in 2008. Mr. Donofrio began his career at IBM in 1964, and worked there for more than 40 years in various positions of increasing responsibility, including Division Director; Divisional Vice President for Advanced Workstations; General Manager, Large Scale Computing Division; and Senior Vice President, Technology & Manufacturing. Mr. Donofrio earned a bachelor of science degree from Rensselaer Polytechnic Institute and holds a master’s degree from Syracuse University. | Director since: December 2009

Qualifications: Mr. Donofrio brings to the Board executive management skills and significant technological expertise, providing us with valuable insight regarding technology and innovation strategies.

Other Directorships: Advanced Micro Devices, Inc. and Bank of New York Mellon Corporation Age: 70 | |

DELPHI AUTOMOTIVE PLC 7

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Election of Directors(continued)

Mark P. Frissora In July 2015, he became the President and Chief Executive Officer of Caesars Entertainment Corporation, a casino entertainment company. He joined Caesars in February 2015 as CEO Designate and a member of their Board of Directors. He previously served as the Chairman and CEO of Hertz Global Holdings, Inc. from 2006 to 2014. Prior to joining Hertz, Mr. Frissora served as Chairman and CEO of Tenneco, Inc. from 2000 to 2006. Mr. Frissora previously served for five years as a Vice President at Aeroquip-Vickers Corporation. From 1987 to 1991, he held various management positions at Philips N.V., including Director of Marketing and Director of Sales. Prior to Philips, he worked for ten years at General Electric Co. in brand management, marketing and sales. Mr. Frissora holds a bachelor’s degree from The Ohio State University and has completed advanced studies at both Babson College and the Thunderbird International School of Management. | Director since: December 2009

Qualifications: Mr. Frissora contributes expertise in automotive operations, product development, marketing and sales. As the CEO of a global public company, Mr. Frissora also contributes talent development and strategic and financial management skills.

Other Directorships: Caesars Entertainment Corporation, Walgreens Boots Alliance, Inc.(2009-2015) and Hertz Global Holdings, Inc. (2006-2014) Age: 60 | |

Rajiv L. Gupta He is former Chairman and CEO of Rohm and Haas Company, a worldwide producer of specialty materials, a position he held from 1999 to 2009. Mr. Gupta began his career at Rohm and Haas in 1971 and served in a broad range of global operations and financial leadership roles. Mr. Gupta received a bachelor of science degree in Mechanical Engineering from the Indian Institute of Technology, a master of science degree in Operations Research from Cornell University and an MBA in Finance from Drexel University. | Director since: November 2009

Qualifications: Mr. Gupta’s professional experience, including as Chairman and CEO of a global public company and other board assignments, enable him to contribute his expertise in corporate leadership, strategic analysis, operations and executive compensation matters.

Other Directorships: HP Inc. (formerly Hewlett Packard), Tyco International Ltd. and The Vanguard Group, Inc. Age: 70 | |

J. Randall MacDonald He retired from IBM, where he served as the Senior Vice President, Human Resources from 2000 to 2013. From 1983 to 2000, prior to joining IBM, Mr. MacDonald held a variety of senior positions at GTE, including Executive Vice President, Human Resources and Administration. He also has held senior human resources leadership assignments at Ingersoll-Rand Company, Inc. and Sterling Drug. He earned both undergraduate and graduate degrees from St. Francis University. | Director since: November 2009

Qualifications: Through Mr. MacDonald’s many years of senior leadership in the field, he is able to provide expertise in global human resources management, compensation practices, leadership assessment and talent development and general management.

Other Directorships: Time Inc. Age: 67 | |

8 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Election of Directors(continued)

Sean O. Mahoney He is a private investor with over two decades of experience in investment banking and finance. Mr. Mahoney spent 17 years in investment banking at Goldman, Sachs & Co., where he was a partner and head of the Financial Sponsors Group, followed by four years at Deutsche Bank Securities, where he served as Vice Chairman, Global Banking. During his banking career, Mr. Mahoney acted as an advisor to companies across a broad range of industries and product areas. He earned his undergraduate degree from the University of Chicago and his graduate degree from Oxford University, where he was a Rhodes Scholar. | Director since: November 2009

Qualifications: Through his experience in investment banking and finance and proven investment acumen, Mr. Mahoney provides the Board with expertise in financial and business strategy, capital markets, financing, and mergers and acquisitions.

Other Directorships: Alcoa Inc., Cooper-Standard Holdings, Inc., Formula One Holdings and Post-bankruptcy Board of Lehman Brothers Holdings Inc. Age: 53 | |

Timothy M. Manganello He retired as Chief Executive Officer of BorgWarner Inc., a global automotive supplier, in 2012, and retired as Executive Chairman of the Board of BorgWarner in 2013. He served in these roles since 2003 and had also served as President and Chief Operating Officer, among other executive roles. He joined the company in 1989. Mr. Manganello also served as the Chairman of the Chicago Federal Reserve Bank, Detroit branch, from 2007 to 2011. He earned both undergraduate and graduate engineering degrees from the University of Michigan. | Director since: March 2015

Qualifications: As the retired Chairman and CEO of an automotive supply company and global public company, Mr. Manganello offers the Board valuable experience in automotive operations, international sales, operations and engineering, as well as strategic and financial management skills.

Other Directorships: Bemis Company, Inc., BorgWarner Inc. (2002-2013) and Zep Inc.(2011-2015) Age: 66 | |

Bethany J. Mayer She is currently the President and Chief Executive Officer and a director of Ixia, a position she has held since September 2014. Ixia provides application performance and security resilience solutions to validate, secure and optimize businesses’ physical and virtual networks. From 2014 until 2014, she served as Senior Vice President and General Manager of the Network Functions Virtualization business of Hewlett-Packard Company. From 2011 until 2014, Ms. Mayer served as Senior Vice President and General Manager of HP’s Networking Business unit. From 2010 until 2011, Ms. Mayer was Vice President, Marketing and Alliances for HP’s Enterprise Servers, Storage and Networking Group. Prior to joining HP, Ms. Mayer served from 2007 until 2010 as Senior Vice President of Worldwide Marketing and Corporate Development at Bluecoat Systems, Inc. Ms. Mayer has a bachelor of science degree in political science from Santa Clara University and an MBA from California State University, Monterey Bay. | Director since: October 2015

Qualifications: In addition to her extensive operational experience, Ms. Mayer offers significant technical expertise to the Board as Delphi continues to focus on vehicle connectivity and automotive software.

Other Directorships: Ixia Age: 54 | |

DELPHI AUTOMOTIVE PLC 9

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Election of Directors(continued)

Thomas W. Sidlik He retired from the DaimlerChrysler AG Board of Management in Germany in 2007 after a 34 year career in the automotive industry. He previously served as Chairman and CEO of Chrysler Financial Corporation, Chairman of the Michigan Minority Business Development Council and Vice-Chairman of the National Minority Supplier Development Council. He received a bachelor of science degree from New York University and an MBA from the University of Chicago. | Director since: December 2009

Qualifications: Mr. Sidlik’s experience on the board of a global automaker provides the Board with significant industry, management, purchasing and strategic expertise, as well as his comprehensive understanding of the issues of diversity in the corporate environment.

Other Directorships: Cooper-Standard Holdings Inc. Age: 66 | |

Bernd Wiedemann He is Senior Advisor at IAV GmbH, a leading provider of engineering services to the automotive industry based in Germany. Mr. Wiedemann joined IAV after retiring from Volkswagen AG and is former Chief Executive Officer, Volkswagen Commercial Vehicles and Truck Division in Wolfsburg, Germany. A 37-year employee of Volkswagen, Mr. Wiedemann held senior executive positions including Executive Vice President, Volkswagen, South America (1994-1995); Executive Vice President, Autolatina (1992-1994) and Director, Passenger Car and Commercial Vehicle Development (1989-1992). Mr. Wiedemann received a master’s degree from the Hannover Technical University, a doctorate from Brandenburg Technical University and is a professor at the Berlin Institute of Technology. | Director since: April 2010

Qualifications: Mr. Wiedemann’s extensive engineering expertise and his global OEM management experience enable him to provide engineering, product development, industry and leadership expertise to the Board.

Other Directorships: None Age: 73 | |

Lawrence A. Zimmerman He is the former Vice Chairman and Chief Financial Officer of Xerox Corporation, a position he held from 2002 until 2011. He joined Xerox as CFO in 2002 after retiring from IBM. A 31-year employee of IBM, Mr. Zimmerman held senior executive positions, including Vice President of Finance for IBM’s Europe, Middle East and Africa operations, and Corporate Controller. Mr. Zimmerman received a bachelor of science degree in finance from New York University and an MBA from Adelphi University. | Director since: November 2009

Qualifications: Mr. Zimmerman brings to the Board significant experience leading the finance organization of a large global company, and contributes financial, risk management and strategy expertise.

Other Directorships: Flextronics International Ltd., Brunswick Corporation (2006-2015), Computer Sciences Corporation (2012-2014), and Stanley Black & Decker, Inc. (2005-2011) Age: 73 | |

The Board of Directors recommends a vote “FOR” each of the 13 director nominees named above. If you complete the enclosed proxy card, unless you direct to the contrary on that card, the shares represented by that proxy will be voted FOR the election of all 13 nominees.

10 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

In order to help our shareholders better understand our Board practices, we are including the following description of current practices. The Nominating and Governance Committee periodically reviews these practices.

The Board currently consists of the 13 directors named above. Our Memorandum and Articles of Association provides that our Board must consist of a minimum of 2 directors. The exact number of directors will be determined from time to time by our full Board.

The Board believes it is important to retain flexibility to allocate the responsibilities of the offices of the Chairman and CEO in a manner that is in the best interests of the Company. Currently, the Board believes it is in the best interests of the Company to separate the positions of CEO and Chairman and to have an independent Non-Executive Chairman. Rajiv L. Gupta was elected to this role on March 1, 2015. The Board believes this leadership structure affords the Company an effective combination of internal and external experience, continuity and independence, which will serve the Board and the Company well.

The Board believes that a substantial majority of its members should be independent, non-employee directors. Mr. Clark, our President and Chief Executive Officer, is the only non-independent director. The current non-employee directors of the Company are Joseph S. Cantie, Gary L. Cowger, Nicholas M. Donofrio, Mark P. Frissora, Rajiv L. Gupta, J. Randall MacDonald, Sean O. Mahoney, Timothy M. Manganello, Bethany J. Mayer, Thomas W. Sidlik, Bernd Wiedemann and Lawrence A. Zimmerman. The Board has determined that all of its non-employee directors meet the requirements for independence under the New York Stock Exchange (“NYSE”) listing standards. Furthermore, the Board limits membership on the Audit, Compensation and Human Resources, and Nominating and Governance Committees to independent directors.

Audit Committee Financial Expert

The Board has determined that all of the members of the Audit Committee are financially literate and meet the independence rules required for Audit Committee members

by the Securities and Exchange Commission (“SEC”). Messrs. Zimmerman, Cantie and Mahoney meet the qualifications of audit committee financial experts, as defined under the Securities Exchange Act of 1934, as amended.

Evaluation of Board Performance

The Nominating and Governance Committee coordinates an annual evaluation process by which the directors evaluate the Board’s and its Committees’ performance and procedures. This self-evaluation leads to a full Board discussion of the results. Each Committee of the Board also conducts an annual evaluation of its performance and procedures.

Our Corporate Governance Guidelines provide that the retirement age for directors is 75, unless waived by the Board. No director who is or would be over 75 at the expiration of his or her current term may be nominated to a new term, unless the Board waives the retirement age for a specific director. Once granted, such waiver must be renewed annually.

Our Corporate Governance Guidelines also provide that non-employee directors who significantly change their primary employment during their tenure as Board members must offer to tender their resignation to the Nominating and Governance Committee. The Nominating and Governance Committee will evaluate the continued appropriateness of Board membership under the new circumstances and make a recommendation to the Board as to any action to be taken with respect to such offer.

The Nominating and Governance Committee recommends individuals for membership on the Board. The Nominating and Governance Committee considers a candidate’s qualities and expertise, performance, personal characteristics, diversity (inclusive of age, gender, race and ethnicity) and professional responsibilities, and also reviews the composition of the Board relative to the long-term business strategy and the challenges and needs of the Board at that time. The Board as a whole is constituted to be strong in its collective knowledge and diversity of accounting and finance, management and leadership, vision and strategy, business operations, business judgment, crisis management, risk assessment, industry knowledge, corporate governance and global markets.

DELPHI AUTOMOTIVE PLC 11

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Board Practices(continued)

The culture of the Board enables the Board to operate quickly and effectively in making key decisions. Board meetings are conducted in an environment of trust, confidentiality, open dialogue, mutual respect and constructive commentary.

The Nominating and Governance Committee views diversity in its broadest sense, which includes age, education, ethnicity, experience, gender, leadership qualities and race. The Nominating and Governance Committee will use the same selection process and criteria for evaluating all nominees, regardless of who submits the nominee for consideration.

In accordance with procedures set forth in our Memorandum and Articles of Association, shareholders holding at least ten percent of the ordinary shares outstanding and who have the right to vote at general meetings of the Company may propose, and the Nominating and Governance Committee will consider, nominees for election to the Board at the next annual meeting by giving timely written notice to the Corporate Secretary, which must be received at our principal executive offices no later than the close of business on March 8, 2017, and no earlier than November 28, 2016. The notice periods may change in accordance with the procedures set out in our Memorandum and Articles of Association. Any such notice must include the name of the nominee, a biographical sketch and resume, contact information and such other background materials as the Nominating and Governance Committee may request.

Independent directors meet in executive session each Board meeting, without the CEO or any other employees in attendance. The Chairman presides over each executive session of the Board. Each Committee also convenes an executive session at which Committee members meet without the CEO or any other employees in attendance.

Board’s Role in Risk Oversight

The Board takes an active role in risk oversight related to the Company both as a full Board and through its Committees, each of which has primary risk oversight responsibility with respect to all matters within the scope of its duties as contemplated by its charter. While the Company’s management is responsible for day-to-day management of the various risks facing the Company, the Board is responsible for monitoring management’s actions and decisions. The Board, as apprised by the Audit Committee, determines that appropriate risk management and mitigation procedures are in place and that senior management takes the appropriate steps to manage all major risks.

The Board believes that each director should hold a meaningful equity position in the Company and has established equity holding requirements for our non-employee directors. The holding requirement for each non-employee director is five times the value of his or her designated annual cash retainer (at least $500,000, based upon the current cash retainer). Each new director will have up to five full years from his or her date of appointment to fulfill this holding requirement. All current non-employee directors, other than Mr. Cantie and Ms. Mayer, both of whom joined the Board in 2015, hold in excess of this minimum shareholding requirement.

The Board adopted a formal statement of Corporate Governance Guidelines, which sets forth the corporate governance practices for Delphi. The Corporate Governance Guidelines are available on our website at delphi.com by clicking on the tab “Investors” and then the caption “Governance Documents” under the heading “Corporate Governance.”

Code of Ethical Business Conduct

Delphi adopted a Code of Ethical Business Conduct, which applies to all employees and directors, including the principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions. The Code of Ethical Business Conduct is available on Delphi’s website at delphi.com by clicking on the tab “Responsibility” and then the heading “Code of Ethics.” Copies of our Code of Ethical Business Conduct are also available to any shareholder who submits a request to the Corporate Secretary at Delphi Automotive PLC, c/o Delphi Automotive Systems, LLC, 5725 Delphi Drive, Troy, Michigan 48098. We intend to satisfy any disclosure requirement under Item 5.05 of Form 8-K by posting on our website any amendments to, or waivers from, a provision of our Code of Ethical Business Conduct that applies to our directors or officers.

Communications with the Board of Directors

Anyone who wishes to communicate with the Board or any individual member of the Board (or independent directors as a group) may do so by sending a letter addressed to the director or directors in care of the Corporate Secretary at Delphi Automotive PLC, c/o Delphi Automotive Systems, LLC, 5725 Delphi Drive, Troy, Michigan 48098. All correspondence, other than items such as junk mail that are unrelated to a director’s duties and responsibilities, will be forwarded to the appropriate director or directors.

12 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Board Practices(continued)

During 2015, the Board held 12 in-person or telephonic regular meetings. All of our directors attended at least 75% of the Board and Committee meetings on which the director sits. In addition, all directors are expected to attend annual meetings of shareholders. In 2015, all directors were in attendance at the Annual Meeting.

DELPHI AUTOMOTIVE PLC 13

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Our Board has five committees, as described below: Audit; Compensation and Human Resources; Finance; Innovation and Technology; and Nominating and Governance. Committee charters are available on Delphi’s website at delphi.com by clicking on the tab “Investors” and then the caption “Governance Documents” under the heading “Corporate Governance.” Committee membership for 2015 is set forth below:

| Committee | Members | Primary Responsibilities | Number of 2015 Meetings | |||

| Audit | ||||||

Lawrence A. Zimmerman (Chairman) Joseph S. Cantie Gary L. Cowger Sean O. Mahoney Thomas W. Sidlik Bernd Wiedemann | Responsible for the engagement of the registered independent public accounting firm and the review of the scope of the audit to be undertaken by the registered independent public accounting firm. Responsible for oversight of the adequacy of our internal accounting and financial controls and the accounting principles and auditing practices and procedures to be employed in preparation and review of our financial statements. Responsible for oversight of the Company’s compliance programs and enterprise risk management program. | 5 | ||||

| Compensation and Human Resources | ||||||

J. Randall MacDonald (Chairman) Rajiv L. Gupta Timothy M. Manganello | Responsible for the oversight of the Company’s compensation philosophy and reviews and approves executive compensation for executive officers (including cash compensation, equity incentives and benefits). | 6 | ||||

| Finance | ||||||

Lawrence A. Zimmerman (Chairman) Joseph S. Cantie Nicholas M. Donofrio Mark P. Frissora Sean O. Mahoney | Responsible for oversight of corporate finance matters, including capital structure, financing transactions, acquisitions and divestitures, share repurchase and dividend programs, employee retirement plans, interest rate policies, commodity and currency hedging and the annual business plan, including review of capital expenditures and restructurings. | 7 | ||||

| Innovation and Technology | ||||||

Nicholas M. Donofrio (Chairman) Gary L. Cowger Bethany J. Mayer Thomas W. Sidlik Bernd Wiedemann | Responsible for assisting the Board in its oversight responsibilities relating to research and development, assessing engineering competency, technological innovation and strategy. | 3 | ||||

| Nominating and Governance | ||||||

Rajiv L. Gupta (Chairman) Mark P. Frissora J. Randall MacDonald Timothy M. Manganello | Responsible for reviewing and recommending to the Board policies and procedures relating to director and board committee nominations and corporate governance policies, conducting director searches and has responsibility for the oversight of the Company’s environmental, health and safety management programs. | 7 | ||||

For 2016, Mr. Manganello has joined the Innovation and Technology Committee and Ms. Mayer has joined the Compensation and Human Resources Committee.

14 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Our directors (other than Mr. Clark and Mr. O’Neal, prior to his retirement from the Company, who are compensated as officers of the Company and do not receive additional compensation for services as members of the Board) received the following annual compensation, which is paid in cash and time-based restricted stock units (“RSUs”). Each director may elect, on an annual basis, to receive 60%, 80% or 100% of his or her compensation in RSUs, with the remainder paid in cash. The Chairman of the Board receives $500,000 annually, and all other directors receive $250,000 annually. In 2015, chairs of our board committees received the following additional annual compensation:

| Committee | Additional Annual Compensation | |||

| Audit Committee | $ | 25,000 | ||

| Compensation and Human Resources Committee | 20,000 | |||

| Finance Committee | 15,000 | |||

| Innovation and Technology Committee | 10,000 | |||

| Nominating and Governance Committee(1) | 10,000 | |||

| (1) | The Chairman of the Nominating and Governance Committee is also the Chairman of the Board. As he receives compensation for his position as Chairman of the Board, he does not receive an additional fee for his service as the committee Chairman. |

An annual grant of RSUs is made on the day of the Annual Meeting and vests on the day before the next Annual Meeting. Cash compensation is paid at the end of each fiscal quarter. Any director who joins the Board, other than in connection with the Annual Meeting, will receive prorated cash compensation and a prorated grant of RSUs, based on the date the director joins the Board. These RSUs vest on the day before the next Annual Meeting.

The table below shows 2015 cash and equity compensation for each member of the Board:

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Total | |||||||||

| Joseph S. Cantie | $ | — | $ | 249,241 | $ | 249,241 | ||||||

| Gary L. Cowger | 100,000 | 150,075 | 250,075 | |||||||||

| Nicholas M. Donofrio | 104,000 | 156,064 | 260,064 | |||||||||

| Mark P. Frissora | 100,000 | 150,075 | 250,075 | |||||||||

| Rajiv L. Gupta | 200,000 | 300,066 | 500,066 | |||||||||

| J. Randall MacDonald | 108,000 | 162,054 | 270,054 | |||||||||

| Sean O. Mahoney | 100,000 | 150,075 | 250,075 | |||||||||

| Timothy M. Manganello | 100,000 | 150,075 | 250,075 | |||||||||

| Bethany J. Mayer | 50,000 | 88,276 | 138,276 | |||||||||

| Thomas W. Sidlik | 100,000 | 150,075 | 250,075 | |||||||||

| Bernd Wiedemann | 100,000 | 150,075 | 250,075 | |||||||||

| Lawrence A. Zimmerman | 116,000 | 174,033 | 290,033 | |||||||||

| (1) | Reflects the grant date fair value of the equity awards granted to directors as of the date of grant, which was April 23, 2015 for all directors except Mr. Cantie and Ms. Mayer. Grant dates for Mr. Cantie and Ms. Mayer were June 23, 2015 and October 20, 2015, respectively. As of December 31, 2015, these awards were unvested; they vest in full on April 27, 2016. The values set forth in the table were determined in accordance with FASB ASC Topic 718. The grant date for accounting purposes is April 23, 2015 for all directors except Mr. Cantie and Ms. Mayer. Grant dates for Mr. Cantie and Ms. Mayer are June 23, 2015 and October 20, 2015, respectively. For assumptions used in determining the fair value of the awards, see Note 21. Share-Based Compensation to the Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015. The year-end RSU balances for our directors are: |

| Name | Unvested RSUs 12/31/2015 | |||

| Joseph S. Cantie | 2,815 | |||

| Gary L. Cowger | 1,804 | |||

| Nicholas M. Donofrio | 1,876 | |||

| Mark P. Frissora | 1,804 | |||

| Rajiv L. Gupta | 3,607 | |||

| J. Randall MacDonald | 1,948 | |||

| Sean O. Mahoney | 1,804 | |||

| Timothy M. Manganello | 1,804 | |||

| Bethany J. Mayer | 1,073 | |||

| Thomas W. Sidlik | 1,804 | |||

| Bernd Wiedemann | 1,804 | |||

| Lawrence A. Zimmerman | 2,092 | |||

DELPHI AUTOMOTIVE PLC 15

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

COMPENSATION DISCUSSION AND ANALYSIS

Overview

The Compensation and Human Resources Committee (the “Compensation Committee”), composed entirely of independent directors, is responsible to the Board for executive compensation at Delphi. The Compensation Committee, in consultation with management and its independent compensation consultant, oversees the Company’s compensation philosophy and reviews and approves compensation for executive officers (including cash compensation, equity incentives and benefits).

In this section, we describe and analyze: (1) the material components of our executive compensation programs for the “named executive officers”, or “NEOs”; (2) the compensation decisions the Compensation Committee has made under those programs; and (3) the key factors considered in making those decisions, including 2015 Company performance. For fiscal year 2015, the NEOs were:

| • | Kevin P. Clark, our President and Chief Executive Officer (“CEO”) effective March 1, 2015, who also served as our Chief Operating Officer (“COO”) until March 1, 2015; |

| • | Mark J. Murphy, our Chief Financial Officer (“CFO”) and Executive Vice President, who stepped down from his position effective February 29, 2016; |

| • | Majdi B. Abulaban, our Senior Vice President and President, Electrical/Electronic Architecture and President, Asia Pacific; |

| • | Liam Butterworth, our Senior Vice President and President, Powertrain Systems; and |

| • | Jugal K. Vijayvargiya, our Senior Vice President and President, Electronics & Safety. |

Rodney O’Neal, our former CEO, retired March 1, 2015 and served as an advisor to the Company through December 31, 2015; as such, he is also considered a NEO for fiscal year 2015. Within the Compensation Discussion and Analysis and related tables in this Proxy Statement, specific references are made to Mr. O’Neal with respect to his fiscal year 2015 compensation; otherwise, references to the CEO, the NEOs or the other NEOs exclude Mr. O’Neal.

Delphi’s executive compensation program is designed to attract, retain and motivate the leaders who drive the successful execution of our business strategies, which seek to balance achievement of targeted near-term results with building long-term shareholder value through sustained execution. Our focus on pay-for-performance and corporate governance aims to help ensure alignment with the interests of our shareholders, as highlighted below:

ALIGNMENT WITH SHAREHOLDERS

| Pay-for-Performance | Status | |

| We target executive compensation at our peer groupmedian and deliver compensation above or below this level as determined by performance. | ü | |

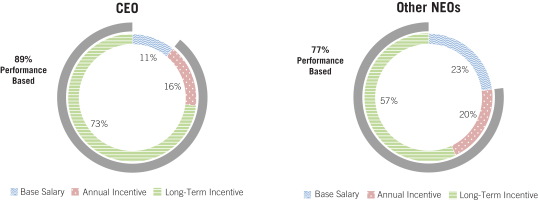

| 89% of 2015 total target annual compensation for the CEO isperformance-based and 73% is granted inequity, while 77% of 2015 total target annual compensation for the other NEOs isperformance-based and 57% is granted inequity. | ü | |

| We use astructured goal-setting process for performance incentives, with multiple levels of review. | ü | |

| NEOs’annual incentives arebased on achievement of Corporate, Divisional and individualperformance goals. | ü | |

| 75% of the NEOs’ long-term incentive compensation consists of performance-based restricted stock units (“RSUs”) whichonly deliver value if financial and relative total shareholder return goals are met. The value of theremaining 25% of the NEOs’ long-term incentive compensation is awarded in the form of time-based RSUs andfluctuates with Delphi’s share price. | ü | |

| Performance-based RSUs granted in 2013 achieved performance at 176% of target for the 2013 through 2015 performance period. We believe these awards and this result demonstrate our commitment topay-for-performance. | ü | |

| Wereview and analyze ourpay-for-performance alignment on an annual basis. | ü |

16 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis(continued)

| Corporate Governance | Status | |||

| Wedevote focused time to leadership development and succession efforts. | ü | |||

| Weactively engage with our shareholders by conducting regular meetings with our major shareholders to discuss governance and executive compensation matters. | ü | |||

| Our Compensation Committee utilizes anindependent compensation consultant. | ü | |||

| Wedisclose our performance metrics. | ü | |||

| We maintainshare ownership guidelines for our NEOs and directors. | ü | |||

| The Compensation Committee is providedtally sheets to assess total compensation of our NEOs. | ü | |||

| Wedo not have compensation programs thatencourage imprudent risk. | ü | |||

| We maintainclawback, anti-hedging and anti-pledging policies. | ü | |||

| Ourequity grant practices, including burn rate and dilution,are prudent. | ü | |||

We offerno gross-ups or tax assistance unique to our NEOs. | ü | |||

| We maintain acompetitive severance practice with marketappropriate post-employment provisions, as recommended by management and approved by the Compensation Committee. | ü | |||

| Wedo not have any individualchange in control agreements and maintain “double-trigger” vesting provisions for equity awards upon a change in control. | ü | |||

Leadership Transition Completed

As a part of a planned succession transition related to Mr. O’Neal’s retirement, Mr. Clark became CEO effective March 1, 2015, after previously having served as CFO, then COO. Mr. Murphy succeeded Mr. Clark as CFO and Executive Vice President in October 2014 when Mr. Clark became COO. Following his retirement, Mr. O’Neal served the Company as an advisor through December 31, 2015.

2015 Company Performance Highlights

Our achievements in 2015 included the following:

| • | Achieved world-class employee health and safety performance through improvements in our Lost Work Day Case rate as we continue our pursuit to achieve zero safety incidents; |

| • | Generated gross business bookings of $26.2 billion, based upon expected volumes and pricing; |

| • | Generated $1.5 billion of net income and $1.7 billion of cash from continuing operations; |

| • | Executed $1.2 billion of share repurchases and $286 million in dividend payments; |

| • | Achieved top quartile performance as compared to our peer group in Total Shareholder Return and Return on Net Assets; |

| • | Strategically positioned the Company’s product portfolio in high-growth spaces to meet consumer preferences for products that address the industry mega-trends of Safe, Green and Connected; |

| • | Acquired HellermannTyton Group PLC (“HellermannTyton”), a leading global manufacturer of high-performance and innovative cable management solutions, which expanded our product offerings within the connected vehicle solutions market and further strengthened our leading position in the electrical architecture market, while also providing a platform to grow HellermannTyton’s adjacent industrial end markets, including aerospace, defense, alternative energy and mass transit; |

| • | Enhanced our leading active safety and automated driving capabilities through the acquisition of Ottomatika, Inc. and strategic investment in Quanergy Systems, Inc.; |

| • | Further increased our software and services capabilities through the acquisition of Control-Tec LLC and strategic investment in Tula Technology, Inc.; |

| • | Completed the divestitures of our wholly owned Thermal Systems business and our interest in a Korean joint venture; |

| • | Continued to maximize the flexibility and profitability of our global operational footprint; and |

| • | Enhanced talent and leadership development, succession planning and recruiting practices globally. |

DELPHI AUTOMOTIVE PLC 17

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis(continued)

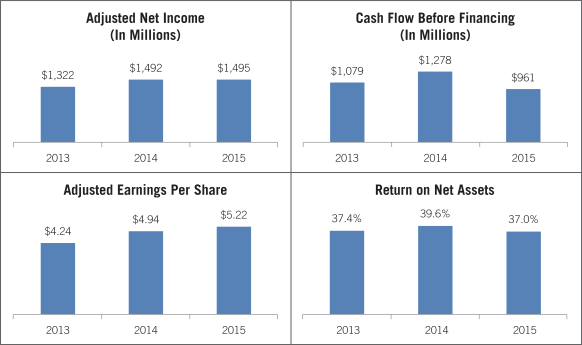

Our strategic, operational and financial performance over time is reflected in our results and returns to shareholders. This performance is shown in the following financial metrics and total shareholder return charts. We have aligned our performance-based annual and long-term incentive plans for executives with these metrics:

Metric definitions:

Adjusted Net Income is defined as net income (loss) attributable to Delphi before income (loss) from discontinued operations, net of tax, restructuring, transaction and related costs associated with acquisitions, other acquisition and portfolio project costs (which includes costs incurred to integrate acquired businesses and to plan and execute product portfolio transformation actions, including business and product acquisitions and divestitures), asset impairments, gains (losses) on business divestitures, debt extinguishment costs, contingent consideration liability fair value adjustments and the net impact of significant deferred tax asset valuation allowance estimate changes.

Cash Flow Before Financing represents cash provided by (used in) operating activities from continuing operations plus cash provided by (used in) investing activities from continuing operations, adjusted for the purchase price of business acquisitions and net proceeds from the divestiture of discontinued operations.

Adjusted Earnings Per Share (“EPS”) is defined as adjusted net income divided by the weighted number of diluted shares outstanding.

Return on Net Assets is defined as tax-affected adjusted operating income [net income before interest expense, other income (expense), net, equity income (loss), income (loss) from discontinued operations, restructuring, other acquisition and portfolio project costs (which includes costs incurred to integrate acquired businesses and to plan and execute product portfolio transformation actions, including business and product acquisitions and divestitures), asset impairments and gains (losses) on business divestitures], divided by average continuing operations net working capital plus average continuing operations net property, plant and equipment, measured each calendar year.

Please seeAppendix A for a reconciliation of these numbers to U.S. GAAP financial measures.

18 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis(continued)

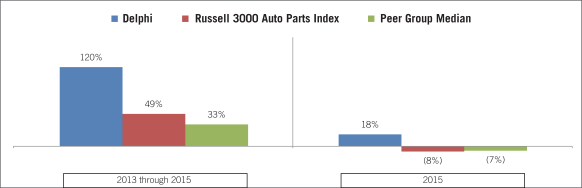

Total shareholder return (share price change inclusive of reinvestment of dividends) history:

Compensation Philosophy and Strategy

General Philosophy in Establishing and Making Pay Decisions. Our compensation programs reflect our pay-for-performance philosophy and encourage executives to make sound decisions that drive short- and long-term shareholder value creation. The Compensation Committee utilizes a combination of fixed and variable pay elements in order to achieve the following objectives:

| • | Support Delphi’s overall business strategy and results as they relate to long-term shareholder value creation; |

| • | Reinforce a pay-for-performance culture by linking incentive compensation to defined short- and long-term performance goals; |

| • | Attract, retain and motivate key executives by providing competitive total compensation opportunities; and |

| • | Align executive and investor interests by establishing market- and investor-relevant metrics that drive shareholder value creation. |

Our pay positioning goal for target total direct compensation (base salary, annual and long-term incentives) for our officers, including the NEOs, is to approximate the market median (50th percentile). Compensation for individual roles may be positioned higher or lower than the market median where we believe it is appropriate, considering multiple factors, such as each executive’s roles and responsibilities, the individual’s performance, labor market dynamics, the desired mix of cash and equity compensation, and the potential over time and experience the individual may have in his or her role with Delphi.

Peer Group Analysis. To attract, retain and motivate key executives, our goal is to provide total compensation opportunities at competitive market pay rates. We have created a compensation structure based on our compensation philoso-

phy, which approximates the median of our peer companies, but allows total compensation to vary above or below this level based on considerations such as job responsibilities, experience, and quantitative and qualitative company or individual performance factors.

We use a group of peer companies to compare NEO compensation to market. The Compensation Committee reviews and determines the composition of our peer group on an annual basis, considering input from its independent compensation consultant and management.

Delphi’s 2015 peer group included the following 15 companies, whose aggregate profile was comparable to Delphi in terms of size, industry, operating characteristics and competition for executive talent.

Autoliv, Inc. | Ingersoll-Rand plc | |

BorgWarner Inc. | Johnson Controls, Inc. | |

Cummins Inc. | Lear Corporation | |

Danaher Corporation | Parker-Hannifin Corporation | |

Eaton Corporation | TE Connectivity Ltd. | |

Emerson Electric Co. | Textron Inc. | |

Honeywell International Inc. | The Goodyear Tire & Rubber Company | |

Illinois Tool Works, Inc. |

In 2015, an evaluation of the peer group was conducted and the Compensation Committee approved changes to the group, reducing the number of peer companies from 17 to 15. In addition to the comparability factors listed above, the additional criteria for considering peer group changes were: companies with a global presence and the businesses involved in the evolution of in-vehicle technology. This peer group will also be used for compensation decisions

DELPHI AUTOMOTIVE PLC 19

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis(continued)

beginning in 2016. The following table summarizes the changes, and reasons for each:

| Company Name | Change | Reason for Change | ||

1) Honeywell International Inc. 2) TE Connectivity Ltd. | added | Company meets additional peer group criteria: similar business with respect to global presence and/or in-vehicle technology evolution | ||

3) Dover Corp. | removed | No longer comparable due to size | ||

4) Genuine Parts Company 5) PACCAR Inc. | removed | Not reflective of additional peer group criteria | ||

6) TRW Automotive Holdings Corporation | removed | Acquired in 2015 — no longer publicly traded |

In 2015, target total direct compensation among our NEOs, on average, was positioned within a competitive range of the peer group median. Pay adjustments are typically made when we believe that there is a market or individual performance issue that should be addressed to preserve the best interests of the shareholders.

Shareholder Engagement. During 2015, we continued to engage shareholders with respect to our governance and executive compensation practices. These outreach meetings, conducted by members of management, give us an opportunity to solicit feedback from our major institutional shareholders on a variety of topics related to corporate governance and executive compensation and provide us with valuable insight, which management shares with the Board, with respect to the shareholders’ voting policies and priorities. We expect to continue to engage with shareholders on a regular basis to better understand and consider their views on our executive compensation programs and corporate governance practices.

Say-on-Pay. At our 2015 Annual Meeting of Shareholders, we received 97.4% of votes cast in support of our executive compensation program. Management and the Compensation Committee reviewed our shareholders’ affirmative 2015 Say-on-Pay vote and believe it to be a strong indication of support

for Delphi’s executive compensation program, and pay-for-performance philosophy. Therefore, the Compensation Committee continued the philosophy, compensation objectives and governing principles it has used in recent years when making decisions or adopting policies regarding executive compensation for 2015 and subsequent years.

Overview of Executive Compensation

We regularly undertake a comprehensive review of our business plan to identify strategic initiatives that should be linked to executive compensation. We also assess and review the level of risk in our company-wide compensation programs to ensure that they do not encourage imprudent risk-taking.

Elements of Executive Compensation. In line with our executive compensation philosophy, we annually provide the following primary elements of compensation to our officers, including the NEOs:

| • | Base salary; |

| • | Annual incentive award; |

| • | Long-term incentive award; and |

| • | Other compensation, such as defined contribution retirement plans and benefits that are the same as those provided to similarly situated non-officer employees. |

Additional, non-primary elements of executive compensation, such as payments related to expatriate assignments or relocation, may be provided to a NEO. These elements are reflected in the “All Other Compensation” column of the “2015 Summary Compensation Table”.

As a result of his retirement in March 2015, Mr. O’Neal did not receive the annual long-term incentive award granted to other NEOs in February 2015, but instead received a one-time transition equity award as further described below as compensation for his advisory services to Delphi through December 31, 2015.

20 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis(continued)

The following table outlines the primary elements of executive compensation for the NEOs and indicates how these elements relate to our key strategic objectives:

| Element | Key Features | Relationship to Objectives | ||

| Total Direct Compensation | ||||

Base Salary | • Commensurate with job responsibilities, experience, and qualitative and quantitative company or individual performance factors • Reviewed on a periodic basis for competitiveness and individual performance • Targeted at market median | • Attract, retain and motivate key executives | ||

| Annual Incentive Plan | • Compensation Committee approves a target incentive pool for each performance period based on selected financial and/or operational metrics • Each executive is granted a target award opportunity varying by level of responsibility • Payouts are determined by achievement of financial goals based on pre-established objectives (at both the Corporate and, where applicable, Division level), then adjusted to reflect individual performance achievement • Strategic Results Modifier (“SRM”) provides for an adjustment to individual payout levels based on an assessment of performance against qualitative factors reviewed and approved by the Compensation Committee at the beginning of the performance period | • Pay-for-performance • Align executive and shareholder interests • Attract, retain and motivate key executives | ||

Long-Term Incentive Plan | • Target award granted commensurate with job responsibilities, experience, and qualitative and quantitative company or individual performance factors • Issue full share unit awards, 75% weighted on company performance metrics, including use of relative total shareholder return (“TSR”), and 25% time-based, which means that the value is determined by Delphi’s share price | • Pay-for-performance • Align executive and shareholder interests • Attract, retain and motivate key executives • Focus on long-term shareholder value creation | ||

| Other Compensation | ||||

Retirement Programs (Plan names and descriptions provided under “Other Compensation” section) | • Qualified defined contribution plan available to all U.S. salaried employees, including executives • Non-qualified defined contribution plan available to eligible employees, including executives, who exceed statutory limits under our qualified defined contribution plan • Defined benefit plan that was frozen in 2008 | • Attract, retain and motivate key executives | ||

DELPHI AUTOMOTIVE PLC 21

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis(continued)

Target Annual Total Direct Compensation Mix. Base salary and annual and long-term incentive awards are our NEOs’ primary total direct compensation elements. A majority of each NEO’s total direct compensation opportunity is comprised of performance-based pay. Our annual incentive awards and the performance-based RSUs component of our long-term incentive awards are considered performance-based pay because the recipients of these awards must achieve specified performance goals at Corporate, Division and/or individual levels to receive any payment. The time-based portion of our RSU awards align with Company

performance as the final value received is based on share price change.

The significant proportion of performance-based pay, combined with a focus on long-term incentive awards, helps to align the NEOs’ interests with the interests of Delphi’s shareholders. The total direct compensation mix illustrated below and in the Target Compensation Structure that follows does not include the value of the 2015 continuity awards for three NEOs (described below under the “2015 Grants” section).

The mix of compensation for our CEO and other NEOs is shown below:

Target Compensation Structure. The following table depicts 2015 target annual total direct compensation opportunities for the NEOs serving as executive officers as of December 31, 2015:

| Name | Base Salary ($) | Annual Incentive Target Award ($) | Long-Term Incentive Plan Target Annual | Total ($) | ||||||||||||

| Kevin P. Clark | $ | 1,100,000 | $ | 1,650,000 | $ | 7,600,000 | $ | 10,350,000 | ||||||||

| President and Chief Executive Officer | ||||||||||||||||

| Mark J. Murphy | 685,000 | 685,000 | 2,000,000 | 3,370,000 | ||||||||||||

| Chief Financial Officer and Executive Vice President | ||||||||||||||||

| Majdi B. Abulaban | 630,000 | 535,500 | 1,400,000 | 2,565,500 | ||||||||||||

| Senior Vice President and President, Electrical/Electronic Architecture and President, Asia Pacific | ||||||||||||||||

| Liam Butterworth(1) | 557,753 | 462,935 | 1,200,000 | 2,220,688 | ||||||||||||

| Senior Vice President and President, Powertrain Systems | ||||||||||||||||

| Jugal K. Vijayvargiya | 500,000 | 357,000 | 1,200,000 | 2,057,000 | ||||||||||||

| Senior Vice President and President, Electronics & Safety | ||||||||||||||||

| (1) | Mr. Butterworth is a Luxembourg employee and his salary and bonus are paid in Euros. U.S. Dollar amounts in this Proxy Statement with respect to Mr. Butterworth have been converted from Euros at a rate of 1.11 Dollars to one Euro. The exchange rate used was calculated by averaging exchange rates for each calendar month in 2015. |

Annual Compensation Determination. Individual base salaries and annual incentive targets for the NEOs are established based on the scope of each NEO’s responsibilities, individual performance, experience and market pay data. At

the beginning of each year, we also define key strategic objectives each NEO is expected to achieve during that year.

Base Salaries. Base salary is targeted at approximately the median of our peer group and is intended to reward and be

22 DELPHI AUTOMOTIVE PLC

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis(continued)

commensurate with each NEO’s responsibilities, individual performance and experience. Our practice is to periodically make base salary adjustments, although we review compensation competitiveness annually. During 2015, three of our NEOs received base salary adjustments. These adjustments were intended to specifically recognize: Mr. Clark’s expanded responsibilities as CEO, Mr. Butterworth’s and Mr. Vijayvargiya’s 2014 contributions and performance, as well as increase the competitiveness of salary in comparison to market median. The following table summarizes the adjustments:

| Name | Base Salary Adjustment Effective Date | Adjusted Base Salary ($) | Increase (Decrease) (%) | |||||||||

| Kevin P. Clark | March 1, 2015 | $ | 1,100,000 | 22 | % | |||||||

| Liam Butterworth | February 1, 2015 | 557,753 | 10 | |||||||||

| Jugal K. Vijayvargiya | February 1, 2015 | 500,000 | 11 | |||||||||

For the first two months of 2015, Mr. O’Neal received base salary at an annual rate of $1.3 million which remained unchanged from 2014 due to his pending retirement. The “2015 Summary Compensation Table” displays the actual, prorated where applicable, base salary amounts paid for 2015. Mr. O’Neal’s base salary for the two months of service prior to his retirement is included.

Annual Incentive Plan. Our Annual Incentive Plan, structured under the Delphi Leadership Incentive Plan (“DLIP”), is designed to motivate our NEOs to drive company earnings, cash flow and profitable growth by measuring the NEOs’ performance against our plans at the Corporate and relevant Division levels. The DLIP was approved by our shareholders in 2015 and is designed to give us the flexibility to potentially maximize the tax deductibility of certain incentives as performance-based awards under Section 162(m) of the Internal Revenue Code of 1986, as amended (“Section 162(m)”), as further described below under the “Tax and Accounting Considerations” section. For use in guiding final payout decisions for the NEOs, the Compensation Committee sets the financial performance metrics underlying the DLIP at levels that help drive superior Company performance, potentially resulting in superior shareholder returns.

The Compensation Committee establishes the annual incentive target for each NEO in a manner similar to the process for determining base salary. The approved target is initially set near the median of our peer group, but can be adjusted based on the NEO’s position, individual performance, and the size and scope of his or her responsibilities. Final payouts can range from 0% to 200% of each NEO’s annual incentive target. Mr. O’Neal participated in the Annual Incentive Plan for the

first two months of 2015 at his 2014 incentive target. For 2015, the annual incentive targets were adjusted for two of our NEOs in consideration of their expanded responsibilities and the market median annual incentive targets for such roles.

| Name | Adjusted Annual Incentive Target ($)(1) | Percentage of Salary (%) | ||||||

| Kevin P. Clark | $ | 1,650,000 | 150 | % | ||||

| Liam Butterworth | 462,935 | 83 | ||||||

| (1) | Adjustment effective date for Mr. Clark was March 1, 2015, upon his promotion to CEO, and February 1, 2015 for Mr. Butterworth. |

The Compensation Committee, working with management and its independent compensation consultant, sets the underlying performance metrics and objectives for the DLIP and preliminary annual incentive plan payout levels based on Delphi’s annual business objectives. For 2015, each NEO’s award payout was determined as follows:

| • | Corporate performance metrics were weighted 100% for Messrs. Clark and Murphy. For Messrs. Abulaban, Butterworth and Vijayvargiya, who are Division Presidents, Corporate and Division performance metrics were weighted 40% and 60%, respectively, because of their Division President roles. |

| • | Individual performance was considered for adjustments to the final annual incentive payouts based on individual performance and achievements. |

For 2015, both Corporate and Division underlying performance objectives were based on the following metrics which are aligned with our business strategy:

| • | Corporate performance: Net Income (“NI”), Cash Flow Before Financing (“CFBF”) and Revenue Growth (Bookings). |

| • | Division performance: Operating Income (“OI”), Simplified Operating Cash Flow (“SOCF”) and Revenue Growth (Bookings). |

The Compensation Committee selected the following weightings in 2015 for both Corporate and Division performance metrics:

Clark and Murphy 100% Corporate | Other NEOs | |||||||||||

Weighting (%) Performance Metrics | 60% Division | 40% Corporate | ||||||||||

| NI (Corporate) or OI (Division)(1) | 50 | % | 50 | % | 50 | % | ||||||

| CFBF (Corporate) and SOCF (Division)(2) | 40 | 40 | 40 | |||||||||

| Revenue Growth (Bookings)(3) | 10 | 10 | 10 | |||||||||

| In addition, discretionary adjustments can be applied based on qualitative factors and considerations(4) | ||||||||||||

DELPHI AUTOMOTIVE PLC 23

| 2016 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis(continued)

| (1) | NI and OI are appropriate measurements of our underlying earnings for 2015 and a good indication of our overall financial performance. |

| (2) | CFBF and SOCF are different metrics for measuring cash. CFBF is cash flow before financing, which is defined as cash provided by (used in) operating activities from continuing operations plus cash provided by (used in) investing activities from continuing operations, adjusted for the purchase price of business acquisitions and net proceeds from the divestiture of discontinued operations. SOCF is defined, on a Divisional basis, as earnings before interest, tax, depreciation and amortization (“EBITDA”), plus or minus changes in accounts receivable, inventory and accounts payable, less capital expenditures net of proceeds from asset dispositions, plus restructuring expense, less cash expenditures for restructuring. |

| (3) | Revenue Growth (Bookings) is based on our future business booked in the current fiscal year. In general, in order to achieve the target performance level, a specified percentage of our planned future sales for the next two calendar years must be booked by the end of the measurement period, in this case the end of fiscal year 2015. |

| (4) | May be applied, in all cases subject to the maximum funding level for awards under the DLIP, based on any of the Strategic Results Modifier factors, CEO discretion with Compensation Committee approval (approved by the full Board of Directors for the CEO), and/or consideration of individual performance goals/criteria established at the beginning of the year. |

The NI / OI and CFBF / SOCF metrics and the award payout levels related to those metrics were measured on a performance scale, with threshold, target and maximum financial performance requirements and the payout levels for different levels of achievement set by the Compensation Committee. Performance below the minimum threshold results in no payout, and performance above the maximum level is capped at a maximum total payout, which is 200% of the target award. For the NI /OI and CFBF / SOCF metrics the threshold, target and maximum payout levels were 50%, 100% and 200%, respectively. Revenue Growth (Bookings) is treated differently than the NI /OI and CFBF / SOCF metrics. If the Revenue Growth (Bookings) targets are achieved, the target payout for that metric is paid. If the Revenue Growth (Bookings) targets are not achieved, no portion of the Revenue Growth (Bookings) award is paid.

The 2015 performance targets by metric were:

| Category | NI / OI ($ in millions) | CFBF / SOCF(1) ($ in millions) | Revenue Growth (Bookings) | |||

| Corporate Metrics: | $1,612 | $1,200 | 99%/91% | |||

| Division Metrics: | ||||||

| Electrical/Electronic Architecture | 1,101 | 970 | 98/91 | |||

| Powertrain Systems | 519 | 413 | 100/91 | |||

| Electronics & Safety | 388 | 312 | 98/90 |

| (1) | CFBF and SOCF are different metrics for measuring cash. CFBF is cash flow before financing, which is defined as cash provided by (used in) operating activities from continuing operations plus cash provided by (used in) investing activities from continuing operations, adjusted for the purchase price of business acquisitions and net proceeds from the divestiture of discontinued operations. SOCF is defined, on a Divisional basis, as EBITDA, plus or minus changes in accounts receivable, inventory and accounts payable, less capital expenditures net of proceeds from asset dispositions, plus restructuring expense, less cash expenditures for restructuring. |

Our Annual Incentive Plan target goals are established to reflect our focus on growth over prior year actual outcomes,

and above market growth in the performance period. The Compensation Committee approved target goals for the 2015 Annual Incentive Plan which, if achieved, would represent growth in NI / OI, CFBF / SOCF, and Revenue Growth in 2016 / 2017 (Bookings). Given the performance levels required for target payment, 2015 performance at both the Corporate and Division levels was below target.