UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22562

Babson Capital Global Short Duration High Yield Fund

(Exact name of registrant as specified in charter)

550 South Tryon Street

Charlotte, NC 28202

(Address of principal executive offices) (Zip code)

Janice M. Bishop

Secretary and Chief Legal Officer

c/o Babson Capital Management LLC

Independence Wharf

470 Atlantic Avenue

Boston, MA 02210

(Name and address of agent for service)

(704) 805-7200

Registrant’s telephone number, including area code

Date of fiscal year end: December 31, 2016

Date of reporting period: June 30, 2016

Item 1. Reports to Stockholders.

BABSON CAPITAL GLOBAL SHORT DURATION HIGH YIELD FUND

Semi-Annual Report

June 30, 2016

Babson Capital Global Short Duration High Yield Fund

c / o Babson Capital Management LLC

550 South Tryon St.

Charlotte, NC 28202

704.805.7200

http://www.BabsonCapital.com/bgh

ADVISER

Babson Capital Management LLC

550 South Tryon St.

Suite 3300

Charlotte, NC 28202

SUB-ADVISOR

Babson Capital Global Advisors Limited

61 Aldwych

London, UK

WC2B 4AE

COUNSEL TO THE FUND

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, Massachusetts 02110

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

KPMG LLP

Two Financial Center

60 South Street

Boston, Massachusetts 02111

CUSTODIAN

US Bank

MK-WI-S302

1555 N. River Center Drive

Milwaukee, WI 53212

TRANSFER AGENT & REGISTRAR

U.S. Bancorp Fund Services, LLC

615 E. Michigan St.

Milwaukee, WI 53202

FUND ADMINISTRATION/ACCOUNTING

U.S. Bancorp Fund Services, LLC

615 E. Michigan St.

Milwaukee, WI 53202

PROXY VOTING POLICIES & PROCEDURES

The Trustees of Babson Capital Global Short Duration High Yield Fund (the “Fund”) have delegated proxy voting responsibilities relating to the voting of securities held by the Fund to Babson Capital Management LLC (“Babson Capital”). A description of Babson Capital’s proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 1-866-399-1516; (2) on the Fund’s website at http://www.BabsonCapital.com/bgh; and (3) on the U.S. Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

FORM N-Q

The Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This information is available (1) on the SEC’s website at http://www.sec.gov; and (2) at the SEC’s Public Reference Room in Washington, DC (which information on their operation may be obtained by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available on the Fund’s website at http://www.BabsonCapital.com/bgh or upon request by calling, toll-free, 1-866-399-1516.

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

OFFICERS OF THE FUND

Russell Morrison

President

Carlene Pollock

Chief Financial Officer

Andrew Lennon

Treasurer

Michael Freno

Vice President

Sean Feeley

Vice President

Scott Roth

Vice President

Melissa LaGrant

Chief Compliance Officer

Janice Bishop

Secretary/Chief Legal Officer

Michele Manha

Assistant Secretary

Babson Capital Global Short Duration High Yield Fund is a closed-end investment company, first offered to the public in 2012, whose shares are traded on the New York Stock Exchange.

INVESTMENT OBJECTIVE & POLICY

Babson Capital Global Short Duration High Yield Fund (the “Fund”) was organized as a business trust under the laws of the Commonwealth of Massachusetts. The Fund is registered under the Investment Company Act of 1940, as amended, as a non-diversified, closed-end management investment company with its own investment objective. The Fund’s common shares are listed on the New York Stock Exchange under the symbol “BGH”.

The Fund’s primary investment objective is to seek as high a level of current income as the Adviser (as defined herein) determines is consistent with capital preservation. The Fund seeks capital appreciation as a secondary investment objective when consistent with its primary investment objective. There can be no assurance that the Fund will achieve its investment objectives.

The Fund will seek to take advantage of inefficiencies between geographies, primarily the North American and Western European high yield bond and loan markets and within capital structures between bonds and loans. For example, the Fund will seek to take advantage of differences in pricing between bonds and loans of an issuer denominated in U.S. dollars and substantially similar bonds and loans of the same issuer denominated in Euros, potentially allowing the Fund to achieve a higher relative return for the same credit risk exposure.

1

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

Dear Fellow Shareholders,

It is our pleasure to provide you with the 2016 Semi-Annual Report for the Babson Capital Global Short Duration High Yield Fund (the “Fund”) to recap portfolio performance and positioning during an interesting market environment over the past six months. We would like to remind shareholders that we continue to believe our Global High Yield Investments Group is one of the largest teams primarily focused on North American and Western European credits and that the Fund offers investors a compelling portfolio of global high yield assets. Utilizing the Group’s expertise, deep resources, and time-tested process, we continue to believe we can provide investors an attractive level of current income even during periods of uncertainty and market volatility.

The global nature of the portfolio, primarily focusing on North American and Western European credits, may provide investors with additional benefits compared to a U.S.-only portfolio, such as additional diversification, higher credit quality, increased yield, and lower duration. More importantly, the global strategy provides flexibility to dynamically shift the geographical weighting in order to capture our best risk-adjusted investment opportunities. This strategy also pays close attention to limiting the duration of the Fund while maintaining what we consider a reasonable amount of leverage.

Market Review

The first quarter of 2016 was marked with high levels of volatility that troughed in the middle of February and ended with a sharp recovery in lower rated credits and commodity prices, fueling price appreciation across all ratings categories and industry sectors. For the quarter, the Bank of America Merrill Lynch Non-Financial Developed Markets High Yield Constrained Index returned 3.32%. Of the first quarter’s tailwinds, the rally in commodity prices was by far the most significant. After an elongated decline throughout 2015, stability in the space brought a much needed catalyst for commodity exposed issuers to retrace some of the heavy losses suffered during the downturn with energy, chemicals, and metals & mining outperforming the broader Index towards the end of the quarter.

Following the strength of the first quarter, the global high yield market finished in positive territory during the second quarter, concluding the strongest quarterly performance for the global high yield market since 2012. The Index returned 5.93% for the second quarter, bringing year-to-date performance to 8.89%. On the economic front, the most significant headline of the second quarter was the United Kingdom’s historic decision to leave the European Union, bringing renewed uncertainty and heightened volatility to global markets at the conclusion of an otherwise strong quarter. While the surprise vote on June 23rd caused volatility in risk assets in the trading days immediately following the decision to leave, markets remained orderly and recovered well after dipping slightly through the first half of the week following the vote.

Although fears of an immediate market panic quickly subsided, almost all details remain unknown regarding the terms and process of the United Kingdom’s departure from the European Union, which is expected to take years to complete. Assumptions are that global central banks will remain accommodative in the near term with the likelihood of a rate hike in the United States being pushed even further into the future. In the U.S., economic backlash from the Brexit vote is less likely than in the rest of Europe and attention has now turned to the upcoming jobs report, which follows a disappointing report in May. Barring the events in Britain, U.S. economic data released over the quarter points to a fairly healthy, albeit tepid, domestic economy with home sales and consumer spending robust.

Year-to-date, U.S. dollar denominated high yield new issue supply totaled $155.3 billion, down 19% from the same period last year on the back of lower acquisition activity. Year-to-date volume in non-U.S. dollar denominated bonds totals the dollar equivalent of $31.6 billion, compared with $50.3 billion over the same period last year. Default activity decreased towards the end of the first half of the year, but remains elevated relative to historical averages primarily due to continued strain in the Energy and Metals & Mining sectors. The par-weighted U.S. high yield default rate is 3.56% at the end of June, which is up from 1.88% one year ago. Notably, excluding the Energy and Metals & Mining sectors, the default rate is a mere 0.53%.

Babson Capital Global Short Duration High Yield Fund Overview and Performance

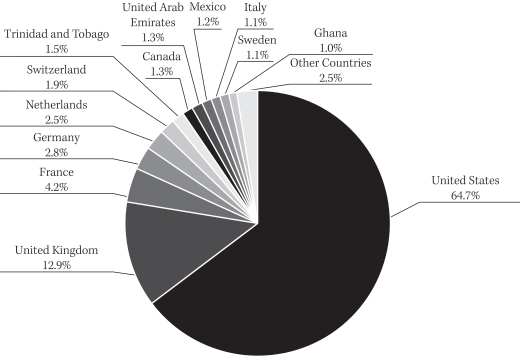

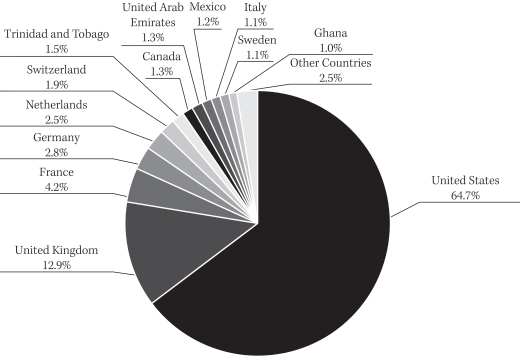

The Fund ended June with a portfolio of 137 issuers, which is a minor increase from the beginning of the year of 126 issuers. A majority of the issuers continue to be domiciled in the U.S. (64.7%) with the U.K. (12.9%) and France (4.2%) representing the next largest country exposures – see Country Composition chart on page 5. From a geographic standpoint, exposure to U.S. domiciled companies increased since the beginning of the year. High yield bond spreads in

2

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

the Western European market remain compressed compared to the U.S. market as the commodity related sectors in the U.S. experienced headwinds causing significant spread widening to occur. The Western European market, with less exposure to commodity sensitive assets, however, did not experience spread widening to the same degree. Therefore, we selectively allocated across the U.S. market to take advantage of attractive opportunities that offered an appropriate amount of yield to the portfolio without significantly altering the risk profile. The Western European market continues to offer global diversification, reduced duration, and potentially attractive yield opportunities while also providing a buffer against market volatility with limited exposure to commodity related sectors.

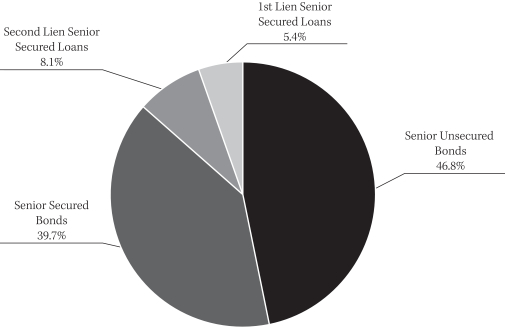

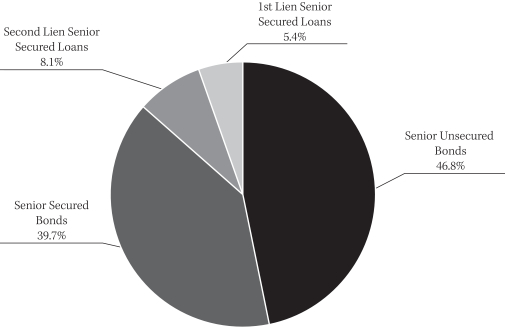

As of June 30, 2016, the Fund remained well positioned across the credit quality spectrum: 8.4% BB-rated and above, 72.6% B-rated, and 13.6% CCC-rated and below, with over 50% of the portfolio consisting of senior secured obligations. A small portion of the assets are not rated at 1.3% and cash and accrued income standing at 4.1% of the portfolio.1 Within the CCC-rated and below category, the majority of these assets are senior secured loans or short duration, yield-to-call high yield bond paper. Based on our experience in the current market environment, we believe these senior secured loan assets offer the potential for compelling risk-adjusted returns and may provide the portfolio with added protection against principal loss in the event of an issuer’s bankruptcy.

The Fund paid monthly dividend payments totaling $0.9285 per share over the first of half of 2016 comprised of net investment income. The Fund’s share price and net asset value (“NAV”) ended the reporting period at $17.86 and $19.39, respectively, or at a 7.89% discount to NAV. Based on the Fund’s share price and NAV on June 30, 2016, the Fund’s market price and NAV distribution rates, on an annualized basis were 10.31% and 9.49%, respectively. Assets acquired through leverage, which represented 24.82% of the Fund’s total assets as of June 30, 2016, were accretive to net investment income and benefited shareholders.

On a year-to-date basis, the NAV total return was +10.95%, outperforming the global high yield bond market as measured by the Bank of America / Merrill Lynch Non-Financial Developed Markets High Yield Constrained Index (HNDC), which returned +8.89%. From a market value perspective, the total return through the year-to-date period was +14.47%.2 As a reminder, following the January 28th, 2016 Board of Trustee’s meeting, the Fund changed the Index from the Bank of America / Merrill Lynch Global Non-Financial High Yield Constrained Index to the Bank of America / Merrill Lynch Non-Financial Developed Markets High Yield Constrained Index. The previous index returned +9.35% over the same year-to-date time period.

In Conclusion

The global high yield markets held up relatively well following the Brexit referendum. While we expect to see some headline-driven weakness in high yield markets in the near term – particularly in sterling denominated credits – it will take time for the economic implications of the vote to become clear. That said, outside of commodity related sectors, credit fundamentals for high yield borrowers across geographies remain largely intact. Further, we believe the European high yield markets will benefit from the expansion of the European Central Bank’s purchasing program to include corporate credit. Negative pressure in the near-term will most likely stem from broader market sentiment rather than the fundamentals of individual credits. Additionally, the macro-driven volatility tied to Brexit may result in some spread widening, which could present opportunities in quality credits that have been trading at tighter levels following the recent strong performance.

At Babson, we take a long-term view of investing through market and economic cycles and adhere to a disciplined, repeatable investment process that is deeply rooted in fundamental bottom-up analysis. In times of market volatility, we

| 1 | Ratings are based on Moody’s and S&P. If securities are rated differently by the rating agencies, the higher rating is applied and all ratings are converted to the equivalent Moody’s major rating category for purposes of the category shown. Credit ratings are based largely on the rating agency’s investment analysis at the time of rating and the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The rating assigned to a security by a rating agency does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Ratings of Baa3 or higher by Moody’s and BBB- or higher by S&P are considered to be investment grade quality. |

| 2 | Past performance is not necessarily indicative of future results. Current performance may be lower or higher. All performance is net of fees, which is inclusive of advisory fees, administrator fees and interest expenses. |

3

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

focus on our disciplined approached and emphasize our fundamental bottom-up research with the goal of preserving investor capital while seeking to capture such attractive capital appreciation opportunities as may exist. We continue to believe in and manage to this philosophy and believe the Fund will continue to offer an attractive dividend yield through the remainder of 2016.

We value your continued partnership and support, and look forward to helping you achieve your investment objectives.

Sincerely,

Russ Morrison

President

Babson Capital Global Short Duration High Yield Fund

4

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

PORTFOLIO COMPOSITION (% OF ASSETS*)

COUNTRY COMPOSITION (% OF ASSETS*)

| * | Percentage of assets are expressed by market value excluding cash and accrued income, and may vary over time. The percentages shown above represent a percentage of the assets as of June 30, 2016. |

5

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

FINANCIAL REPORT

6

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

STATEMENT OF ASSETS AND LIABILITIES

(Unaudited)

| | | | |

| | | JUNE 30, 2016 | |

| |

| Assets | | | | |

| Investments, at fair value (cost $560,642,688) | | $ | 501,912,997 | |

| Cash | | | 8,051,704 | |

| Foreign currency, at fair value (cost $603,093) | | | 601,500 | |

| Interest receivable | | | 10,142,202 | |

| Unrealized appreciation on forward foreign exchange contracts | | | 8,197,555 | |

| Prepaid expenses and other assets | | | 11,244 | |

| | | | |

Total assets | | | 528,917,202 | |

| | | | |

| |

| Liabilities | | | | |

| Note payable | | | 130,800,000 | |

| Dividend payable | | | 3,076,874 | |

| Payable for investments purchased | | | 5,206,436 | |

| Payable to adviser | | | 340,324 | |

| Unrealized depreciation on forward foreign exchange contracts | | | 180,500 | |

| Accrued expenses and other liabilities | | | 429,948 | |

| | | | |

Total liabilities | | | 140,034,082 | |

| | | | |

Total net assets | | $ | 388,883,120 | |

| | | | |

| |

| Net Assets: | | | | |

| Common stock, $0.00001 par value | | $ | 201 | |

| Additional paid-in capital | | | 477,884,220 | |

| Dividends in excess of net investment income | | | (1,878,903 | ) |

| Accumulated net realized loss | | | (36,295,348 | ) |

| Net unrealized depreciation | | | (50,827,050 | ) |

| | | | |

Total net assets | | $ | 388,883,120 | |

| | | | |

| |

| Common shares issued and outstanding (unlimited shares authorized) | | | 20,057,849 | |

| | | | |

| |

Net asset value per share | | $ | 19.39 | |

| | | | |

See accompanying Notes to Financial Statements.

7

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

STATEMENT OF OPERATIONS

(Unaudited)

| | | | |

| | | PERIOD FROM

JANUARY 1, 2016

THROUGH

JUNE 30, 2016 | |

| |

| Investment Income | | | | |

Interest income | | $ | 23,301,929 | |

Other income | | | 77,560 | |

| | | | |

Total investment income | | | 23,379,489 | |

| | | | |

| |

| Operating Expenses | | | | |

Advisory fees | | | 2,466,531 | |

Interest expense | | | 897,887 | |

Administrator fees | | | 242,244 | |

Professional fees | | | 82,931 | |

Directors’ fees | | | 70,790 | |

Printing and mailing expense | | | 45,692 | |

Other operating expenses | | | 39,859 | |

| | | | |

Total operating expenses | | | 3,845,934 | |

| | | | |

Less fees waived by Adviser | | | (489,118 | ) |

| | | | |

Net Expenses | | | 3,356,816 | |

| | | | |

Net investment income | | | 20,022,673 | |

| | | | |

| |

| Realized and Unrealized Gains (Losses) on Investments | | | | |

Net realized loss on investments | | | (26,736,258 | ) |

Net realized gain on forward foreign exchange contracts | | | 633,846 | |

Net realized loss on foreign currency and translation | | | (144,242 | ) |

| | | | |

Net realized loss on investments | | | (26,246,654 | ) |

| | | | |

Net unrealized appreciation of investments | | | 36,895,694 | |

Net unrealized appreciation of forward foreign exchange contracts | | | 6,452,157 | |

Net unrealized depreciation of foreign currency and translation | | | (35,338 | ) |

| | | | |

Net unrealized appreciation on investments | | | 43,312,513 | |

| | | | |

Net realized and unrealized gains on investments | | | 17,065,859 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 37,088,532 | |

| | | | |

See accompanying Notes to Financial Statements.

8

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

STATEMENT OF CASH FLOWS

(Unaudited)

| | | | |

| | | PERIOD FROM

JANUARY 1, 2016

THROUGH

JUNE 30, 2016 | |

| |

Reconciliation of net increase in net assets resulting from

operations to net cash provided by operating activities | | | | |

| Net increase in net assets applicable to common shareholders resulting from operations | | $ | 37,088,532 | |

Adjustments to reconcile net decrease in net assets applicable to common shareholders

resulting from operations to net cash provided by operating activities: | | | | |

Purchases of long-term investments | | | (113,448,411 | ) |

Proceeds from sales of long-term investments | | | 97,331,861 | |

Purchases of foreign currency, net | | | 1,287,738 | |

Forward currency exchange contracts, net | | | (6,452,157 | ) |

Net unrealized appreciation | | | (36,909,298 | ) |

Net realized loss | | | 26,736,258 | |

Amortization and accretion | | | (499,772 | ) |

Changes in operating assets and liabilities: | | | | |

Increase in interest receivable | | | (17,779 | ) |

Increase in prepaid expenses and other assets | | | (2,260 | ) |

Decrease in payable for investments purchased | | | (2,002,136 | ) |

Decrease in payable to Adviser | | | (58,096 | ) |

Increase in accrued expenses and other liabilities | | | 90,813 | |

| | | | |

Net cash provided by operating activities | | | 3,145,293 | |

| | | | |

| Cash Flows From Financing Activities | | | | |

Advances from credit facility | | | 12,300,000 | |

Repayments on credit facility | | | (15,000,000 | ) |

Distributions paid to common shareholders | | | (23,190,885 | ) |

| | | | |

Net cash used in financing activities | | | (25,890,885 | ) |

| | | | |

Net change in cash | | | (22,745,592 | ) |

Cash beginning of period | | | 30,797,296 | |

| | | | |

Cash end of period | | $ | 8,051,704 | |

| | | | |

Supplemental disclosure of cashflow information | | | | |

Income taxes paid | | $ | – | |

Interest paid | | | 815,825 | |

See accompanying Notes to Financial Statements.

9

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

STATEMENT OF CHANGES IN NET ASSETS

(Unaudited)

| | | | | | | | |

| | | PERIOD FROM

JANUARY 1, 2016

THROUGH

JUNE 30, 2016 | | | YEAR ENDED

DECEMBER 31, 2015 | |

| | |

| Operations | | | | | | | | |

Net investment income | | $ | 20,022,673 | | | $ | 39,220,735 | |

Net realized loss on investments | | | (26,246,654 | ) | | | (5,072,108 | ) |

Net unrealized appreciation (depreciation) on investments | | | 43,312,513 | | | | (60,941,488 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 37,088,532 | | | | (26,792,861 | ) |

| | | | | | | | |

| | |

| Dividends to Common Stockholders | | | | | | | | |

Net investment income | | | (18,623,713 | ) | | | (44,022,967 | ) |

| | | | | | | | |

Total dividends to common stockholders | | | (18,623,713 | ) | | | (44,022,967 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | 18,464,819 | | | | (70,815,828 | ) |

| | | | | | | | |

| | |

| Net Assets | | | | | | | | |

Beginning of period | | | 370,418,301 | | | | 441,234,129 | |

| | | | | | | | |

End of period (including dividends in excess of net investment income of $1,878,903 and $2,125,852, respectively) | | $ | 388,883,120 | | | $ | 370,418,301 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

10

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

FINANCIAL HIGHLIGHTS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | PERIOD FROM

JANUARY 1, 2015

THROUGH

JUNE 30, 2016 | | | YEAR ENDED

DECEMBER 31,

2015 | | | YEAR ENDED

DECEMBER 31,

2014 | | | YEAR ENDED

DECEMBER 31,

2013 | | | PERIOD FROM

OCTOBER 26, 2012 (1)

THROUGH

DECEMBER 31, 2012 | |

| | | | | |

| Per Common Share Data (2) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 18.47 | | | $ | 22.00 | | | $ | 25.24 | | | $ | 24.30 | | | | 23.82 | (3) |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.94 | | | | 1.90 | | | | 2.12 | | | | 2.05 | | | | 0.18 | |

Net realized and unrealized gains (losses) on investments | | | 0.91 | | | | (3.23 | ) | | | (2.76 | ) | | | 1.21 | | | | 0.47 | |

| | | | | | | | | | | | | | | | | | | | |

Total increase (decrease) from investment operations | | | 1.85 | | | | (1.33 | ) | | | (0.64 | ) | | | 3.26 | | | | 0.65 | |

| | | | | | | | | | | | | | | | | | | | |

Less dividends to common stockholders: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.93 | ) | | | (2.20 | ) | | | (2.56 | ) | | | (2.01 | ) | | | (0.17 | ) |

Net realized gain | | | – | | | | – | | | | (0.04 | ) | | | (0.31 | ) | | | – | |

| | | | | | | | | | | | | | | | | | | | |

Total dividends to common stockholders | | | (0.93 | ) | | | (2.20 | ) | | | (2.60 | ) | | | (2.32 | ) | | | (0.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 19.39 | | | $ | 18.47 | | | $ | 22.00 | | | $ | 25.24 | | | $ | 24.30 | |

| | | | | | | | | | | | | | | | | | | | |

Per common share market value, end of period | | $ | 17.86 | | | $ | 16.49 | | | $ | 20.19 | | | $ | 23.12 | | | $ | 23.77 | |

| | | | | | | | | | | | | | | | | | | | |

Total investment return based on net asset value (2)(4) | | | 10.95 | % | | | (5.57 | )% | | | (2.25 | )% | | | 14.48 | % | | | 2.69 | % |

| | | | | | | | | | | | | | | | | | | | |

Total investment return based on market value (2)(4) | | | 14.47 | % | | | (8.13 | )% | | | (2.06 | )% | | | 7.20 | % | | | (4.27 | )% |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 388,883 | | | $ | 370,418 | | | $ | 441,234 | | | $ | 506,197 | | | $ | 487,005 | |

Ratio of expenses (before reductions and reimbursements) to average net assets (5) | | | 2.10 | %(6) | | | 2.27 | % | | | 2.20 | % | | | 2.06 | % | | | 1.85 | %(6) |

Ratio of expenses to average net assets | | | 2.37 | %(6) | | | – | % | | | – | % | | | – | % | | | – | %(6) |

Ratio of net investment income (before reductions and reimbursements) to average net assets (5) | | | 11.19 | %(6) | | | 9.18 | % | | | 8.47 | % | | | 8.20 | % | | | 4.70 | %(6) |

Ratio of net investment income to average net assets | | | 10.93 | %(6) | | | – | % | | | – | % | | | – | % | | | – | %(6) |

Portfolio turnover rate (2) | | | 20.34 | % | | | 38.13 | % | | | 63.66 | % | | | 60.87 | % | | | 4.74 | % |

| (1) | | Commencement of operations. |

| (3) | | Net asset value at the beginning of the period reflects the deduction of the sales load and offering costs of $1.18 per share paid by the shareholder from the $25.00 offering price. |

| (4) | | Total investment return calculation assumes reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. |

| (5) | | The Adviser has contractually waived a portion of its management and other fees equal to an annual rate of 0.275% of the Fund’s managed assets for a period of one year commencing on January 1, 2016. |

| (6) | | Annualized for periods less than one full year. |

See accompanying Notes to Financial Statements.

11

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

SCHEDULE OF INVESTMENTS

June 30, 2016 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Fixed Income — 129.07%*: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Bank Loans§ — 17.28%*: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Aerospace and Defense — 0.39%*: | | | | | | | | | | | | | | | | | | | | |

Swissport Investments+ | | | 6.25 | % | | | 2/9/2022 | | | | 1,400,000 | | | | $1,489,222 | | | | $1,530,072 | |

| | | | | | | | | | | | | | | | | | | | |

Total Aerospace and Defense | | | | | | | | | | | 1,400,000 | | | | 1,489,222 | | | | 1,530,072 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Chemicals, Plastics and Rubber — 0.82%*: | | | | | | | | | | | | | |

Flint Group Holdings+ | | | 8.25 | | | | 9/30/2022 | | | | 3,451,145 | | | | 3,435,940 | | | | 3,175,054 | |

| | | | | | | | | | | | | | | | | | | | |

Total Chemicals, Plastics and Rubber | | | | | | | | | | | 3,451,145 | | | | 3,435,940 | | | | 3,175,054 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Diversified/Conglomerate Manufacturing — 0.31%*: | | | | | | | | | | | | | |

TenCate+ | | | 5.25 | | | | 1/27/2023 | | | | 1,100,000 | | | | 1,176,692 | | | | 1,200,893 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified/Conglomerate Manufacturing | | | | | | | | | | | 1,100,000 | | | | 1,176,692 | | | | 1,200,893 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Diversified Natural Resources, Precious Metals and Minerals — 1.33%*: | | | | | | | | | | | | | |

Caraustar Industries Inc. | | | 8.00 | | | | 5/1/2019 | | | | 5,215,261 | | | | 5,226,102 | | | | 5,191,375 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified Natural Resources, Precious Metals and Minerals | | | | | | | | | | | 5,215,261 | | | | 5,226,102 | | | | 5,191,375 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Electronics — 1.93%*: | | | | | | | | | | | | | | | | | | | | |

Kronos, Inc. | | | 9.75 | | | | 4/30/2020 | | | | 7,483,740 | | | | 7,408,915 | | | | 7,514,947 | |

| | | | | | | | | | | | | | | | | | | | |

Total Electronics | | | | | | | | | | | 7,483,740 | | | | 7,408,915 | | | | 7,514,947 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Farming and Agriculture — 1.58%*: | | | | | | | | | | | | | | | | | | | | |

Allflex Holdings, Inc. | | | 8.00 | | | | 7/19/2021 | | | | 6,232,322 | | | | 6,226,859 | | | | 6,149,245 | |

| | | | | | | | | | | | | | | | | | | | |

Total Farming and Agriculture | | | | | | | | | | | 6,232,322 | | | | 6,226,859 | | | | 6,149,245 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Finance — 0.52%*: | | | | | | | | | | | | | |

Cunningham Lindsey Group, Inc. | | | 9.25 | | | | 6/10/2020 | | | | 5,504,015 | | | | 5,510,065 | | | | 2,036,486 | |

| | | | | | | | | | | | | | | | | | | | |

Total Finance | | | | | | | | | | | 5,504,015 | | | | 5,510,065 | | | | 2,036,486 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Healthcare, Education and Childcare — 0.38%*: | | | | | | | | | | | | | |

Tecomet | | | 5.75 | | | | 12/5/2021 | | | | 1,574,287 | | | | 1,441,411 | | | | 1,479,830 | |

| | | | | | | | | | | | | | | | | | | | |

Total Healthcare, Education and Childcare | | | | | | | | | | | 1,574,287 | | | | 1,441,411 | | | | 1,479,830 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Leisure, Amusement, Motion Pictures and Entertainment — 0.96%*: | | | | | | | | | | | | | |

Endemol+ | | | 6.75 | | | | 8/11/2021 | | | | 3,607,592 | | | | 3,458,665 | | | | 2,947,692 | |

Exterion Media+ | | | 7.00 | | | | 3/30/2018 | | | | 700,000 | | | | 771,348 | | | | 772,944 | |

| | | | | | | | | | | | | | | | | | | | |

Total Leisure, Amusement, Motion Pictures and Entertainment | | | | | | | | | | | 4,307,592 | | | | 4,230,013 | | | | 3,720,636 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Mining, Steel, Iron and Non-Precious Metals — 1.23%*: | | | | | | | | | | | | | |

Boomerang Tube, LLC | | | 15.00 | | | | 8/1/2017 | | | | 670,565 | | | | 672,116 | | | | 670,565 | |

Boomerang Tube, LLC | | | 20.00 | | | | 2/1/2019 | | | | 609,111 | | | | 553,805 | | | | 548,200 | |

Boomerang Tube, LLC | | | 17.50 | | | | 2/1/2021 | | | | 1,458,654 | | | | 1,458,654 | | | | 1,458,654 | |

See accompanying Notes to Financial Statements.

12

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2016 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Bank Loans (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | |

Mining, Steel, Iron and Non-Precious Metals (Continued) | | | | | | | | | | | | | |

Boomerang Tube, LLC | | | 15.65 | % | | | 2/1/2019 | | | | 1,774,652 | | | | $1,774,652 | | | | $1,774,652 | |

Murray Energy Corp. | | | 7.50 | | | | 4/16/2020 | | | | 445,609 | | | | 434,553 | | | | 323,066 | |

| | | | | | | | | | | | | | | | | | | | |

Total Mining, Steel, Iron and Non-Precious Metals | | | | | | | | | | | 4,958,591 | | | | 4,893,780 | | | | 4,775,137 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Oil and Gas — 6.31%*: | | | | | | | | | | | | | |

Caelus Energy Alaska | | | 8.75 | | | | 4/15/2020 | | | | 17,863,828 | | | | 17,372,841 | | | | 10,539,659 | |

Fieldwood Energy LLC | | | 8.38 | | | | 9/30/2020 | | | | 8,925,706 | | | | 6,931,820 | | | | 2,454,569 | |

Fieldwood Energy LLC | | | 8.13 | | | | 9/30/2020 | | | | 7,481,592 | | | | 5,811,501 | | | | 3,946,540 | |

Fieldwood Energy LLC | | | 7.65 | | | | 9/30/2020 | | | | 5,651,171 | | | | 4,994,845 | | | | 4,652,778 | |

Jonah Energy LLC | | | 7.50 | | | | 5/12/2021 | | | | 1,301,497 | | | | 1,310,050 | | | | 1,135,557 | |

MD America Energy, LLC | | | 9.50 | | | | 7/2/2019 | | | | 152,319 | | | | 146,872 | | | | 141,657 | |

NFR Energy LLC> | | | 10.00 | | | | 12/31/2018 | | | | 7,684,465 | | | | 7,774,974 | | | | 259,351 | |

Templar Energy> | | | 8.50 | | | | 11/25/2020 | | | | 5,580,408 | | | | 5,447,238 | | | | 1,395,102 | |

| | | | | | | | | | | | | | | | | | | | |

Total Oil and Gas | | | | | | | | | | | 54,640,986 | | | | 49,790,141 | | | | 24,525,213 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Printing and Publishing — 0.83%*: | | | | | | | | | | | | | |

Springer+ | | | 9.00 | | | | 8/14/2021 | | | | 2,850,000 | | | | 3,262,480 | | | | 3,226,057 | |

| | | | | | | | | | | | | | | | | | | | |

Total Printing and Publishing | | | | | | | | | | | 2,850,000 | | | | 3,262,480 | | | | 3,226,057 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Retail Store — 0.69%*: | | | | | | | | | | | | | | | | | | | | |

FleetPride | | | 5.25 | | | | 11/19/2019 | | | | 827,088 | | | | 717,036 | | | | 696,136 | |

FleetPride | | | 9.25 | | | | 5/19/2020 | | | | 3,000,000 | | | | 2,957,421 | | | | 1,980,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total Retail Store | | | | | | | | | | | 3,827,088 | | | | 3,674,457 | | | | 2,676,136 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total Bank Loans | | | | | | | | | | | 102,545,027 | | | | 97,766,077 | | | | 67,201,081 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Corporate Bonds — 111.79%*: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Aerospace and Defense — 1.69%*: | | | | | | | | | | | | | | | | | | | | |

CPI International Inc.# | | | 8.75 | | | | 2/15/2018 | | | | 5,550,000 | | | | 5,634,416 | | | | 5,508,375 | |

Swissport Investments+^ | | | 6.75 | | | | 12/15/2021 | | | | 950,000 | | | | 1,040,150 | | | | 1,080,624 | |

| | | | | | | | | | | | | | | | | | | | |

Total Aerospace and Defense | | | | | | | | | | | 6,500,000 | | | | 6,674,566 | | | | 6,588,999 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Automobile — 9.79%*: | | | | | | | | | | | | | | | | | | | | |

Accuride Corp# | | | 9.50 | | | | 8/1/2018 | | | | 11,210,000 | | | | 11,261,989 | | | | 10,382,702 | |

Allied Specialty Vehicles#^ | | | 8.50 | | | | 11/1/2019 | | | | 6,000,000 | | | | 5,965,020 | | | | 6,075,000 | |

Gates Global LLC^ | | | 6.00 | | | | 7/15/2022 | | | | 4,740,000 | | | | 4,182,787 | | | | 4,147,500 | |

International Automotive Components Group, S.A.#^ | | | 9.13 | | | | 6/1/2018 | | | | 8,125,000 | | | | 8,194,681 | | | | 8,125,000 | |

J.B. Poindexter & Co. Inc.#^ | | | 9.00 | | | | 4/1/2022 | | | | 8,989,000 | | | | 9,341,548 | | | | 9,348,560 | |

| | | | | | | | | | | | | | | | | | | | |

Total Automobile | | | | | | | | | | | 39,064,000 | | | | 38,946,025 | | | | 38,078,762 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Banking — 0.89%*: | | | | | | | | | | | | | | | | | | | | |

Lock AS+^ | | | 7.00 | | | | 8/15/2021 | | | | 3,050,000 | | | | 3,783,602 | | | | 3,443,985 | |

| | | | | | | | | | | | | | | | | | | | |

Total Banking | | | | | | | | | | | 3,050,000 | | | | 3,783,602 | | | | 3,443,985 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

13

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2016 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Corporate Bonds (Continued) | | | | | | | | | | | | | |

| | | |

Beverage, Food and Tobacco — 0.91%*: | | | | | | | | | | | | | |

Boparan Finance PLC+^ | | | 5.50 | % | | | 7/15/2021 | | | | 1,350,000 | | | | $1,946,326 | | | | $1,568,054 | |

Carrols Corp.# | | | 8.00 | | | | 5/1/2022 | | | | 709,000 | | | | 731,627 | | | | 763,947 | |

Manitowoc Foodservice#^ | | | 9.50 | | | | 2/15/2024 | | | | 1,074,000 | | | | 1,074,000 | | | | 1,200,195 | |

| | | | | | | | | | | | | | | | | | | | |

Total Beverage, Food and Tobacco | | | | | | | | | | | 3,133,000 | | | | 3,751,953 | | | | 3,532,196 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Broadcasting and Entertainment — 3.92%*: | | | | | | | | | | | | | |

Arqiva Finance#+^ | | | 9.50 | | | | 3/31/2020 | | | | 5,000,000 | | | | 7,851,739 | | | | 7,095,331 | |

Dish DBS Corp.#^ | | | 7.75 | | | | 7/1/2026 | | | | 3,094,000 | | | | 3,131,459 | | | | 3,186,820 | |

Entertainment One Ltd.+^ | | | 6.88 | | | | 12/15/2022 | | | | 850,000 | | | | 1,282,422 | | | | 1,136,547 | |

RCN Cable#^ | | | 8.50 | | | | 8/15/2020 | | | | 3,733,000 | | | | 3,831,578 | | | | 3,826,325 | |

| | | | | | | | | | | | | | | | | | | | |

Total Broadcasting and Entertainment | | | | | | | | | | | 12,677,000 | | | | 16,097,198 | | | | 15,245,023 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Buildings and Real Estate — 4.54%*: | | | | | | | | | | | | | |

Cemex S.A.B. de C.V.#+^ | | | 9.38 | | | | 10/12/2022 | | | | 5,000,000 | | | | 5,176,331 | | | | 5,500,000 | |

Cemex S.A.B. de C.V.#+^ | | | 7.75 | | | | 4/16/2026 | | | | 602,000 | | | | 601,916 | | | | 631,558 | |

Keystone Financing+^ | | | 9.50 | | | | 10/15/2019 | | | | 3,900,000 | | | | 6,201,571 | | | | 5,232,917 | |

Lyon Williams Homes, Inc.# | | | 8.50 | | | | 11/15/2020 | | | | 5,000,000 | | | | 5,037,507 | | | | 5,137,500 | |

Paroc Group+^ | | | 6.25 | | | | 5/15/2020 | | | | 1,050,000 | | | | 1,444,431 | | | | 1,155,921 | |

| | | | | | | | | | | | | | | | | | | | |

Total Buildings and Real Estate | | | | | | | | | | | 15,552,000 | | | | 18,461,756 | | | | 17,657,896 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Cargo Transport — 5.76%*: | | | | | | | | | | | | | |

Direct ChassisLink Inc.^ | | | 10.00 | | | | 6/15/2023 | | | | 3,010,000 | | | | 3,010,000 | | | | 3,115,350 | |

Kenan Advantage Group, Inc.#^ | | | 7.88 | | | | 7/31/2023 | | | | 10,000,000 | | | | 10,078,140 | | | | 9,850,000 | |

Moto Hospitality Limited+^ | | | 6.38 | | | | 9/1/2020 | | | | 2,400,000 | | | | 3,584,497 | | | | 3,258,916 | |

World Flight Services, Inc.+^ | | | 9.50 | | | | 7/15/2022 | | | | 1,350,000 | | | | 1,530,563 | | | | 1,400,788 | |

XPO Logistics, Inc.#^ | | | 6.50 | | | | 6/15/2022 | | | | 5,000,000 | | | | 4,850,037 | | | | 4,768,750 | |

| | | | | | | | | | | | | | | | | | | | |

Total Cargo Transport | | | | | | | | | | | 21,760,000 | | | | 23,053,237 | | | | 22,393,804 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Chemicals, Plastics and Rubber — 13.72%*: | | | | | | | | | | | | | |

Associated Asphalt Partners LLC#^ | | | 8.50 | | | | 2/15/2018 | | | | 2,327,000 | | | | 2,332,139 | | | | 2,327,000 | |

Chemours Co.# | | | 7.00 | | | | 5/15/2025 | | | | 5,962,000 | | | | 5,512,862 | | | | 5,000,627 | |

Consolidated Energy Finance S.A.#+^ | | | 6.75 | | | | 10/15/2019 | | | | 8,120,000 | | | | 7,923,406 | | | | 7,632,800 | |

Cornerstone Chemical Co.#^ | | | 9.38 | | | | 3/15/2018 | | | | 4,725,000 | | | | 4,794,536 | | | | 4,630,500 | |

CVR Partners LP#^ | | | 9.25 | | | | 6/15/2023 | | | | 5,913,000 | | | | 5,818,085 | | | | 6,016,477 | |

Ineos+^ | | | 6.50 | | | | 8/15/2018 | | | | 2,200,000 | | | | 2,514,622 | | | | 2,471,979 | |

LSB Industries, Inc.# | | | 7.75 | | | | 8/1/2019 | | | | 5,669,000 | | | | 5,440,904 | | | | 5,647,741 | |

Monitchem Holdco+^ | | | 5.25 | | | | 6/15/2021 | | | | 100,000 | | | | 111,414 | | | | 109,311 | |

Omnova Solutions, Inc.# | | | 7.88 | | | | 11/1/2018 | | | | 4,244,000 | | | | 4,296,311 | | | | 4,244,000 | |

Pinnacle Operating Corp.#^ | | | 9.00 | | | | 11/15/2020 | | | | 2,635,000 | | | | 2,640,702 | | | | 2,213,400 | |

Platform Specialty Products Corporation#^ | | | 10.38 | | | | 5/1/2021 | | | | 5,539,000 | | | | 5,632,088 | | | | 5,580,542 | |

TPC Group, Inc.#^ | | | 8.75 | | | | 12/15/2020 | | | | 8,398,000 | | | | 8,411,762 | | | | 6,571,435 | |

Trinseo^ | | | 6.38 | | | | 5/1/2022 | | | | 800,000 | | | | 936,354 | | | | 892,909 | |

| | | | | | | | | | | | | | | | | | | | |

Total Chemicals, Plastics and Rubber | | | | | | | | | | | 56,632,000 | | | | 56,365,185 | | | | 53,338,721 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

14

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2016 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Containers, Packaging and Glass — 6.20%*: | | | | | | | | | | | | | | | | | | | | |

Bormioli+^ | | | 10.00 | % | | | 8/1/2018 | | | | 350,000 | | | | $393,737 | | | | $394,435 | |

Coveris Holdings S.A.#^ | | | 7.88 | | | | 11/1/2019 | | | | 7,600,000 | | | | 7,645,145 | | | | 7,381,500 | |

Horizon Holdings+^ | | | 7.25 | | | | 8/1/2023 | | | | 3,750,000 | | | | 4,116,582 | | | | 4,308,276 | |

Multi Packaging Solutions, Inc.#^ | | | 8.50 | | | | 8/15/2021 | | | | 6,105,000 | | | | 6,126,079 | | | | 6,379,725 | |

Onex Wizard Acquisition Co+^ | | | 7.75 | | | | 2/15/2023 | | | | 3,600,000 | | | | 4,134,082 | | | | 4,206,459 | |

Signode Industrial#^ | | | 6.38 | | | | 5/1/2022 | | | | 1,500,000 | | | | 1,444,528 | | | | 1,434,375 | |

| | | | | | | | | | | | | | | | | | | | |

Total Containers, Packaging and Glass | | | | | | | | | | | 22,905,000 | | | | 23,860,153 | | | | 24,104,770 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

Diversified/Conglomerate Manufacturing — 3.58%*: | | | | | | | | | | | | | | | | | |

Appvion Inc.#^ | | | 9.00 | | | | 6/1/2020 | | | | 13,200,000 | | | | 13,383,213 | | | | 7,458,000 | |

Carlisle Transportation Products#^ | | | 8.25 | | | | 12/15/2019 | | | | 3,950,000 | | | | 4,027,583 | | | | 3,476,000 | |

StoneMor Partners L.P.# | | | 7.88 | | | | 6/1/2021 | | | | 3,000,000 | | | | 2,944,275 | | | | 2,970,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified/Conglomerate Manufacturing | | | | | | | | | | | 20,150,000 | | | | 20,355,071 | | | | 13,904,000 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Diversified/Conglomerate Service — 1.39%*: | | | | | | | | | | | | | | | | | | | | |

Carlson Travel Holdings Inc.#^ | | | 7.50 | | | | 8/15/2019 | | | | 2,690,000 | | | | 2,719,579 | | | | 2,568,950 | |

Zachry Holdings Inc.#^ | | | 7.50 | | | | 2/1/2020 | | | | 2,875,000 | | | | 2,817,957 | | | | 2,846,250 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified/Conglomerate Service | | | | | | | | | | | 5,565,000 | | | | 5,537,536 | | | | 5,415,200 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Diversified Natural Resources, Precious Metals and Minerals — 0.19%*: | | | | | | | | | | | | | |

Lecta S.A.#+^ | | | 8.88 | | | | 5/15/2019 | | | | 630,000 | | | | 821,226 | | | | 720,190 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified Natural Resources, Precious Metals and Minerals | | | | | | | | | | | 630,000 | | | | 821,226 | | | | 720,190 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Electronics — 4.41%*: | | | | | | | | | | | | | | | | | | | | |

ADT Corp/Protection One#^ | | | 9.25 | | | | 5/15/2023 | | | | 2,455,000 | | | | 2,455,000 | | | | 2,602,300 | |

Dell Inc.^ | | | 7.13 | | | | 6/15/2024 | | | | 533,000 | | | | 533,000 | | | | 556,676 | |

International Wire Group, Inc.#^ | | | 8.50 | | | | 10/15/2017 | | | | 8,086,000 | | | | 8,142,749 | | | | 8,005,140 | |

Microsemi Corporation#^ | | | 9.13 | | | | 4/15/2023 | | | | 1,326,000 | | | | 1,326,000 | | | | 1,458,600 | |

Western Digital Corporation#^ | | | 10.50 | | | | 4/1/2024 | | | | 4,224,000 | | | | 4,354,901 | | | | 4,519,680 | |

| | | | | | | | | | | | | | | | | | | | |

Total Electronics | | | | | | | | | | | 16,624,000 | | | | 16,811,650 | | | | 17,142,396 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Finance — 7.20%*: | | | | | | | | | | | | | | | | | | | | |

Arrow Global Finance PLC+^ | | | 4.75 | | | | 5/1/2023 | | | | 350,000 | | | | 389,086 | | | | 382,588 | |

Cabot Financial#+^ | | | 10.38 | | | | 10/1/2019 | | | | 4,364,000 | | | | 7,227,102 | | | | 6,129,132 | |

Galaxy Finco Ltd.+^ | | | 7.88 | | | | 11/15/2021 | | | | 3,900,000 | | | | 6,351,736 | | | | 5,088,063 | |

GFKL Financial Services+^ | | | 8.50 | | | | 11/1/2022 | | | | 4,900,000 | | | | 7,407,352 | | | | 6,170,254 | |

Marlin Financial+^ | | | 10.50 | | | | 8/1/2020 | | | | 1,850,000 | | | | 2,929,086 | | | | 2,659,851 | |

National Financial Partners Corp.#^ | | | 9.00 | | | | 7/15/2021 | | | | 1,720,000 | | | | 1,711,400 | | | | 1,657,650 | |

TMF Group Holding+^ | | | 9.88 | | | | 12/1/2019 | | | | 5,000,000 | | | | 6,210,887 | | | | 5,920,542 | |

| | | | | | | | | | | | | | | | | | | | |

Total Finance | | | | | | | | | | | 22,084,000 | | | | 32,226,649 | | | | 28,008,080 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

15

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2016 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Grocery — 0.66%*: | | | | | | | | | | | | | | | | | | | | |

Post Holdings#^ | | | 8.00 | % | | | 7/15/2025 | | | | 1,232,000 | | | | $1,232,000 | | | | $1,365,980 | |

Premier Foods Finance+^ | | | 6.50 | | | | 3/15/2021 | | | | 950,000 | | | | 1,528,720 | | | | 1,201,459 | |

| | | | | | | | | | | | | | | | | | | | |

Total Grocery | | | | | | | | | | | 2,182,000 | | | | 2,760,720 | | | | 2,567,439 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Healthcare, Education and Childcare — 8.45%*: | | | | | | | | | | | | | |

Capsugel Holdings#^ | | | 7.00 | | | | 5/15/2019 | | | | 1,159,000 | | | | 1,166,458 | | | | 1,161,897 | |

Cerba+^ | | | 8.25 | | | | 2/1/2020 | | | | 3,450,000 | | | | 3,869,998 | | | | 3,901,398 | |

Cognita Financing+^ | | | 7.75 | | | | 8/15/2021 | | | | 2,200,000 | | | | 3,435,055 | | | | 2,969,826 | |

ConvaTec Healthcare#^ | | | 10.50 | | | | 12/15/2018 | | | | 850,000 | | | | 860,701 | | | | 869,125 | |

Kindred Healthcare, Inc.# | | | 8.75 | | | | 1/15/2023 | | | | 5,699,000 | | | | 5,757,772 | | | | 5,624,229 | |

Labco+^ | | | 6.25 | | | | 7/1/2022 | | | | 250,000 | | | | 290,134 | | | | 292,698 | |

Regionalcare Hospital Partners, Inc.#^ | | | 8.25 | | | | 5/1/2023 | | | | 1,496,000 | | | | 1,535,941 | | | | 1,533,400 | |

Tenet Healthcare Corporation# | | | 8.13 | | | | 4/1/2022 | | | | 4,700,000 | | | | 4,671,494 | | | | 4,816,560 | |

Unilabs+^ | | | 7.25 | | | | 7/15/2018 | | | | 2,600,000 | | | | 3,575,471 | | | | 2,836,311 | |

Unilabs+^ | | | 8.50 | | | | 7/15/2018 | | | | 2,450,000 | | | | 3,203,818 | | | | 2,774,365 | |

Valeant#^ | | | 6.13 | | | | 4/15/2025 | | | | 4,006,000 | | | | 3,677,601 | | | | 3,214,815 | |

Valeant#+^ | | | 7.50 | | | | 7/15/2021 | | | | 3,260,000 | | | | 3,260,000 | | | | 2,874,912 | |

| | | | | | | | | | | | | | | | | | | | |

Total Healthcare, Education and Childcare | | | | | | | | | | | 32,120,000 | | | | 35,304,443 | | | | 32,869,536 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Hotels, Motels, Inns and Gaming — 0.61%*: | | | | | | | | | | | | | |

Gala Group Finance#+^ | | | 8.88 | | | | 9/1/2018 | | | | 565,714 | | | | 907,881 | | | | 771,186 | |

Travelodge+^ | | | 8.50 | | | | 5/15/2023 | | | | 1,250,000 | | | | 1,830,318 | | | | 1,604,580 | |

| | | | | | | | | | | | | | | | | | | | |

Total Hotels, Motels, Inns and Gaming | | | | | | | | | | | 1,815,714 | | | | 2,738,199 | | | | 2,375,766 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Insurance — 0.67%*: | | | | | | | | | | | | | |

Onex York Acquisition Corp.#^ | | | 8.50 | | | | 10/1/2022 | | | | 3,524,000 | | | | 3,524,000 | | | | 2,598,950 | |

| | | | | | | | | | | | | | | | | | | | |

Total Insurance | | | | | | | | | | | 3,524,000 | | | | 3,524,000 | | | | 2,598,950 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Leisure, Amusement, Motion Pictures and Entertainment — 4.51%*: | | | | | | | | | | | | | |

CPUK Finance Ltd+^ | | | 7.00 | | | | 2/28/2042 | | | | 4,100,000 | | | | 6,142,756 | | | | 5,594,606 | |

Odeon & UCI Finco+^ | | | 9.00 | | | | 8/1/2018 | | | | 2,150,000 | | | | 3,173,124 | | | | 2,885,099 | |

Perform Group+^ | | | 8.50 | | | | 11/15/2020 | | | | 900,000 | | | | 1,344,830 | | | | 1,084,308 | |

Vue Cinimas+^ | | | 7.88 | | | | 7/15/2020 | | | | 3,650,000 | | | | 5,854,374 | | | | 4,968,416 | |

Warner Music#^ | | | 6.75 | | | | 4/15/2022 | | | | 3,000,000 | | | | 2,739,076 | | | | 3,022,500 | |

| | | | | | | | | | | | | | | | | | | | |

Total Leisure, Amusement, Motion Pictures and Entertainment | | | | | | | | | | | 13,800,000 | | | | 19,254,160 | | | | 17,554,929 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Machinery (Non-Agriculture, Non-Construct, Non-Electronic) — 2.02%*: | | | | | | | | | | | | | |

Apex Tool Group LLC^ | | | 7.00 | | | | 2/1/2021 | | | | 1,896,000 | | | | 1,666,610 | | | | 1,635,300 | |

Xerium Technologies# | | | 8.88 | | | | 6/15/2018 | | | | 6,324,000 | | | | 6,346,213 | | | | 6,229,140 | |

| | | | | | | | | | | | | | | | | | | | |

Total Machinery (Non-Agriculture, Non-Construct, Non-Electronic) | | | | | | | | | | | 8,220,000 | | | | 8,012,823 | | | | 7,864,440 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

16

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2016 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | |

Mining, Steel, Iron and Non-Precious Metals — 4.53%*: | | | | | | | | | | | | | |

Constellium Holdco B.V.#+^ | | | 7.88 | % | | | 4/1/2021 | | | | 2,474,000 | | | | $2,471,500 | | | | $2,551,312 | |

Constellium Holdco B.V.#+^ | | | 7.00 | | | | 1/15/2023 | | | | 3,350,000 | | | | 3,924,528 | | | | 2,994,590 | |

Freeport-McMoRan Inc. | | | 3.55 | | | | 3/1/2022 | | | | 3,000,000 | | | | 2,338,045 | | | | 2,640,000 | |

Hecla Mining Company# | | | 6.88 | | | | 5/1/2021 | | | | 5,888,000 | | | | 5,659,885 | | | | 5,637,760 | |

Kissner Milling Company Limited#^ | | | 7.25 | | | | 6/1/2019 | | | | 3,300,000 | | | | 2,969,320 | | | | 3,300,000 | |

Zekelman Industries Inc.^ | | | 9.88 | | | | 6/15/2023 | | | | 489,000 | | | | 489,000 | | | | 493,890 | |

| | | | | | | | | | | | | | | | | | | | |

Total Mining, Steel, Iron and Non-Precious Metals | | | | | | | | | | | 18,501,000 | | | | 17,852,278 | | | | 17,617,552 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

Oil and Gas — 14.09%*: | | | | | | | | | | | | | |

Calumet Specialty Products# | | | 7.63 | | | | 1/15/2022 | | | | 1,135,000 | | | | 1,117,907 | | | | 803,012 | |

Calumet Specialty Products# | | | 6.50 | | | | 4/15/2021 | | | | 6,000,000 | | | | 5,937,852 | | | | 4,290,000 | |

CITGO Holding Inc.#^ | | | 10.75 | | | | 2/15/2020 | | | | 7,584,000 | | | | 7,428,767 | | | | 7,621,920 | |

EP Energy | | | 9.38 | | | | 5/1/2020 | | | | 9,000,000 | | | | 4,999,395 | | | | 6,367,500 | |

Ferrellgas Partners LP# | | | 8.63 | | | | 6/15/2020 | | | | 7,635,000 | | | | 7,546,460 | | | | 7,635,000 | |

Jupiter Resources Inc.#+^ | | | 8.50 | | | | 10/1/2022 | | | | 5,025,000 | | | | 4,791,883 | | | | 3,605,437 | |

Kosmos Energy Ltd.#+^ | | | 7.88 | | | | 8/1/2021 | | | | 5,070,000 | | | | 4,663,416 | | | | 4,892,550 | |

Kosmos Energy Ltd.#^ | | | 7.88 | | | | 8/1/2021 | | | | 1,085,000 | | | | 1,011,698 | | | | 1,047,025 | |

Pbf Holding Company LLC# | | | 8.25 | | | | 2/15/2020 | | | | 6,000,000 | | | | 6,170,440 | | | | 6,225,000 | |

Pbf Logistics LP# | | | 6.88 | | | | 5/15/2023 | | | | 1,117,000 | | | | 1,117,000 | | | | 1,094,660 | |

SM Energy Company | | | 5.63 | | | | 6/1/2025 | | | | 4,000,000 | | | | 2,713,098 | | | | 3,440,000 | |

Topaz Marine SA#+^ | | | 8.63 | | | | 11/1/2018 | | | | 6,877,000 | | | | 6,902,976 | | | | 6,478,547 | |

Welltec#+^ | | | 8.00 | | | | 2/1/2019 | | | | 1,387,000 | | | | 1,348,593 | | | | 1,288,176 | |

| | | | | | | | | | | | | | | | | | | | |

Total Oil and Gas | | | | | | | | | | | 61,915,000 | | | | 55,749,485 | | | | 54,788,827 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Printing and Publishing — 2.16%*: | | | | | | | | | | | | | | | | | | | | |

Cimpress N.V.#^ | | | 7.00 | | | | 4/1/2022 | | | | 1,560,000 | | | | 1,560,000 | | | | 1,544,400 | |

McGraw-Hill Education#^ | | | 8.50 | | | | 8/1/2019 | | | | 6,794,000 | | | | 6,807,180 | | | | 6,861,940 | |

| | | | | | | | | | | | | | | | | | | | |

Total Printing and Publishing | | | | | | | | | | | 8,354,000 | | | | 8,367,180 | | | | 8,406,340 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Retail Store — 3.02%*: | | | | | | | | | | | | | | | | | | | | |

Boing Group Finance+^ | | | 6.63 | | | | 7/15/2019 | | | | 3,050,000 | | | | 4,163,755 | | | | 3,103,818 | |

Brighthouse Group PLC#+^ | | | 7.88 | | | | 5/15/2018 | | | | 2,000,000 | | | | 3,111,098 | | | | 2,393,999 | |

HSS Financing PLC+^ | | | 6.75 | | | | 8/1/2019 | | | | 816,000 | | | | 1,240,099 | | | | 1,058,061 | |

Takko Fashion+^ | | | 9.88 | | | | 4/15/2019 | | | | 2,300,000 | | | | 3,045,451 | | | | 1,448,507 | |

Travelex+^ | | | 8.00 | | | | 8/1/2018 | | | | 2,800,000 | | | | 4,343,244 | | | | 3,753,611 | |

| | | | | | | | | | | | | | | | | | | | |

Total Retail Store | | | | | | | | | | | 10,966,000 | | | | 15,903,647 | | | | 11,757,996 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Telecommunications — 6.28%*: | | | | | | | | | | | | | | | | | | | | |

Altice S.A.#+^ | | | 7.75 | | | | 5/15/2022 | | | | 3,240,000 | | | | 3,240,000 | | | | 3,272,400 | |

Altice S.A.#+^ | | | 7.50 | | | | 5/15/2026 | | | | 1,622,000 | | | | 1,622,000 | | | | 1,589,560 | |

BiSoho S.A.S.+^ | | | 5.88 | | | | 5/1/2023 | | | | 350,000 | | | | 399,804 | | | | 398,114 | |

Digicel Limited+^ | | | 6.00 | | | | 4/15/2021 | | | | 4,000,000 | | | | 3,457,500 | | | | 3,428,800 | |

Eircom+^ | | | 4.50 | | | | 5/31/2022 | | | | 600,000 | | | | 681,447 | | | | 657,398 | |

Entercom Communications Corporation# | | | 10.50 | | | | 12/1/2019 | | | | 3,500,000 | | | | 3,618,377 | | | | 3,692,500 | |

See accompanying Notes to Financial Statements.

17

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2016 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Telecommunications (Continued) | | | | | | | | | | | | | | | | | | | | |

Frontier Communications# | | | 10.50 | % | | | 9/15/2022 | | | | 1,406,000 | | | | $1,406,000 | | | | $1,487,724 | |

Numericable-SFR#+^ | | | 7.38 | | | | 5/1/2026 | | | | 1,933,000 | | | | 1,933,000 | | | | 1,911,254 | |

UPC Broadband+^ | | | 6.75 | | | | 3/15/2023 | | | | 150,000 | | | | 159,028 | | | | 164,516 | |

Wind Acquisition+^ | | | 7.00 | | | | 4/23/2021 | | | | 550,000 | | | | 758,861 | | | | 595,106 | |

Wind Acquisition#+^ | | | 7.38 | | | | 4/23/2021 | | | | 4,995,000 | | | | 4,612,445 | | | | 4,757,738 | |

Ziggo+^ | | | 7.13 | | | | 5/15/2024 | | | | 2,000,000 | | | | 2,392,870 | | | | 2,447,009 | |

| | | | | | | | | | | | | | | | | | | | |

Total Telecommunications | | | | | | | | | | | 24,346,000 | | | | 24,281,332 | | | | 24,402,119 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Textiles & Leather — 0.60%*: | | | | | | | | | | | | | | | | | | | | |

Perry Ellis International Inc# | | | 7.88 | | | | 4/1/2019 | | | | 2,334,000 | | | | 2,382,537 | | | | 2,334,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total Textiles & Leather | | | | | | | | | | | 2,334,000 | | | | 2,382,537 | | | | 2,334,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total Corporate Bonds | | | | | | | | | | | 434,403,714 | | | | 462,876,611 | | | | 434,711,916 | |

| | | | | | | | | | | | | | | | | | | | |

Total Fixed Income | | | | | | | | | | | 536,948,741 | | | | 560,642,688 | | | | 501,912,997 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Other assets and liabilities — (29.07)% | | | | | | | | | | | | | | | | | | | (113,029,877 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net Assets — 100% | | | | | | | | | | | | | | | | | | | $388,883,120 | |

| | | | | | | | | | | | | | | | | | | | |

| ‡ | The effective interest rates are based on settled commitment amount. |

| * | Calculated as a percentage of net assets applicable to common shareholders. |

| § | Bank loans are exempt from registration under the Securities Act of 1933, as amended, but contain certain restrictions on resale and cannot be sold publicly. These loans pay interest at rates which adjust periodically. The interest rates shown for bank loans are the current interest rates at June 30, 2016. Bank loans are also subject to mandatory and/or optional prepayment which cannot be predicted. As a result, the remaining maturity may be substantially less than the stated maturity shown. |

| # | All or a portion of the security is segregated as collateral for the credit facility. See Note 8 to the financial statements for further disclosure. |

| ^ | Security exempt from registration under Rule 144a of the Securities Act of 1933. These securities may only be resold in transactions exempt from registration, normally to qualified institutional buyers. |

See accompanying Notes to Financial Statements.

18

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2016 (Unaudited)

Distributions of investments by country of risk. Percentage of assets are expressed by market value excluding cash and accrued income as of June 30, 2016.

| | | | | | |

| | United States | | | 64.7% | |

| | United Kingdom | | | 12.9% | |

| | France | | | 4.2% | |

| | Germany | | | 2.8% | |

| | Netherlands | | | 2.5% | |

| | Switzerland | | | 1.9% | |

| | Trinidad and Tobago | | | 1.5% | |

| | Canada | | | 1.3% | |

| | United Arab Emirates | | | 1.3% | |

| | Mexico | | | 1.2% | |

| | Italy | | | 1.1% | |

| | Sweden | | | 1.1% | |

| | Ghana | | | 1.0% | |

| | (Individually less than 1%) | | | 2.5% | |

| | | | | | |

| | | | | 100.0% | |

| | | | | | |

Forward Foreign Exchange Contracts at June 30, 2016 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | |

| COUNTERPARTY | | CURRENCY | | CONTRACT TYPE | | | DELIVERY DATE | | | VALUE | | | AGGREGATE FACE

VALUE | | | UNREALIZED

APPRECIATION/

(DEPRECIATION) | |

J.P. Morgan | | | | | | | | | | | | | | | | | | | | | | |

| | British pounds | | | Buy | | | | 7/15/2016 | | | $ | 1,843,810 | | | $ | 1,833,122 | | | $ | (10,688 | ) |

| | British pounds | | | Sell | | | | 7/15/2016 | | | | (78,794,121 | ) | | | (72,256,730 | ) | | | 6,537,391 | |

| | Euros | | | Buy | | | | 7/15/2016 | | | | 1,449,988 | | | | 1,413,056 | | | | (36,932 | ) |

| | Euros | | | Sell | | | | 7/15/2016 | | | | (58,304,989 | ) | | | (56,712,135 | ) | | | 1,592,854 | |

| | U.S. Dollars | | | Buy | | | | 7/15/2016 | | | | 137,099,110 | | | | 137,099,110 | | | | – | |

| | U.S. Dollars | | | Sell | | | | 7/15/2016 | | | | (3,293,798 | ) | | | (3,293,798 | ) | | | – | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | – | | | | 8,082,625 | | | | 8,082,625 | |

| | | | | | |

Morgan Stanley | | | | | | | | | | | | | | | | | | | | | | |

| | British pounds | | | Buy | | | | 7/1/2016 | | | $ | 1,421,649 | | | $ | 1,402,816 | | | $ | (18,833 | ) |

| | British pounds | | | Buy | | | | 7/15/2016 | | | | 3,432,113 | | | | 3,318,328 | | | | (113,785 | ) |

| | British pounds | | | Sell | | | | 7/15/2016 | | | | (1,421,737 | ) | | | (1,402,966 | ) | | | 18,771 | |

| | Euros | | | Buy | | | | 7/15/2016 | | | | 55,362 | | | | 55,100 | | | | (262 | ) |

| | Euros | | | Sell | | | | 7/15/2016 | | | | (2,588,554 | ) | | | (2,543,345 | ) | | | 45,209 | |

| | Swiss francs | | | Sell | | | | 7/15/2016 | | | | (179,093 | ) | | | (175,763 | ) | | | 3,330 | |

| | U.S. Dollars | | | Buy | | | | 7/15/2016 | | | | 4,189,384 | | | | 4,189,384 | | | | – | |

| | U.S. Dollars | | | Sell | | | | 7/1/2016 | | | | (1,421,649 | ) | | | (1,421,649 | ) | | | – | |

| | U.S. Dollars | | | Sell | | | | 7/15/2016 | | | | (3,487,475 | ) | | | (3,487,475 | ) | | | – | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | – | | | | (65,570 | ) | | | (65,570 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | – | | | | 8,017,055 | | | | 8,017,055 | |

| | | | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

19

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2016 (Unaudited)

Babson Capital Global Short Duration High Yield Fund (the “Fund”) was organized as a business trust under the laws of the Commonwealth of Massachusetts on May 20, 2011, and commenced operations on October 26, 2012. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company.

Babson Capital Management LLC (the “Adviser”), a wholly-owned indirect subsidiary of Massachusetts Mutual Life Insurance Company, is a registered investment adviser under the Investment Advisers Act of 1940, as amended, and serves as investment adviser to the Fund.

Babson Capital Global Advisors Limited (“Sub-Adviser”), an indirect wholly-owned subsidiary of the Adviser will serve as a sub-adviser with respect to the Fund’s European investments.

The Fund’s primary investment objective is to seek as high a level of current income as the Adviser determines is consistent with capital preservation. The Fund seeks capital appreciation as a secondary investment objective when consistent with its primary investment objective. There can be no assurance that the Fund will achieve its investment objectives. The Fund seeks to take advantage of inefficiencies between geographies, primarily the North American and Western European high yield bond and loan markets and within capital structures between bonds and loans. Under normal market conditions, the Fund will invest at least 80% of its Managed Assets in bonds, loans and other income-producing instruments that are, at the time of purchase, rated below investment grade (below Baa3 by Moody’s Investors Service, Inc. (“Moody’s”) or below BBB- by either Standard & Poor’s Rating Services, a division of the McGraw-Hill Company, Inc. (“S&P”) or Fitch, Inc. (“Fitch”) or unrated but judged by the Adviser or Sub-Adviser to be of comparable quality.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed consistently by the Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

| | A. | Valuation of Investments |

The Fund’s investments in fixed income securities are generally valued using the prices provided directly by

independent third party services or provided directly from one or more broker dealers or market makers, each in accordance with the valuation policies and procedures approved by the Fund’s Board of Trustees (the “Board”).

The pricing services may use valuation models or matrix pricing, which consider yield or prices with respect to comparable bond quotations from bond dealers or by reference to other securities that are considered comparable in such characteristics as credit rating, interest rates and maturity date, to determine the current value. The closing prices of domestic or foreign securities may not reflect their market values at the time the Fund calculates its NAV if an event that materially affects the value of those securities has occurred since the closing prices were established on the domestic or foreign exchange market, but before the Fund’s NAV calculation. Under certain conditions, the Board has approved an independent pricing service to fair value foreign securities. This is generally accomplished by adjusting the closing price for movements in correlated indices, securities or derivatives. Fair value pricing may cause the value of the security on the books of the Fund to be different from the closing value on the non-U.S. exchange and may affect the calculation of the Fund’s NAV. The Fund may fair value securities in other situations, for example, when a particular foreign market is closed but the Fund is pricing their shares.

The Fund’s investments in bank loans are normally valued at the bid quotation obtained from dealers in loans by an independent pricing service in accordance with the Fund’s valuation policies and procedures approved by the Board.

A Valuation Committee, made up of officers of the Fund and employees of the Adviser, is responsible for determining, in accordance with the Funds’ valuation policies and procedures approved by the Board: (1) whether market quotations are readily available for investments held by the Fund; and (2) the fair value of investments held by the Fund for which market quotations are not readily available or are deemed not reliable by the Adviser. In certain cases, authorized pricing service vendors may not provide prices for a security held by the Fund, or the price provided by such pricing service vendor is deemed unreliable by the Adviser. In such cases, the Fund may use market maker quotations provided by an established market maker for that security (i.e. broker quotes) to value the security if the Adviser has experience obtaining quotations from the

20

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

June 30, 2016 (Unaudited)

market maker and the Adviser determines that quotations obtained from the market maker in the past have generally been reliable (or, if the Adviser has no such experience with respect to a market maker, it determines based on other information available to it that quotations obtained by it from the market maker are reasonably likely to be reliable). In any such case, the Adviser will review any market quotations so obtained in light of other information in its possession for their general reliability.

Bank loans in which the Fund may invest have similar risks to lower-rated fixed income securities. Changes in the financial condition of the borrower or economic conditions or other circumstances may reduce the capacity of the borrower to make principal and interest payments on such instruments and may lead to defaults. Senior secured bank loans are supported by collateral; however the value of the collateral may be insufficient to cover the amount owed to the Fund. By relying on a third party to administer a loan, the Fund is subject to the risk that the third party will fail to perform it obligations. The loans in which the Fund will invest are largely floating rate instruments; therefore, the interest rate risk generally is lower than for fixed-rate debt obligations. However, from the perspective of the borrower, an increase in interest rates may adversely affect the borrower’s financial condition. Due to the unique and customized nature of loan agreements evidencing loans and the private syndication thereof, loans are not as easily purchased or sold as publicly traded securities. Although the range of investors in loans has broadened in recent years, there can be no assurance that future levels of supply and demand in loan trading will provide the degree of liquidity which currently exists in the market. In addition, the terms of the loans may restrict their transferability without borrower consent. These factors may have an adverse effect on the market price and the Fund’s ability to dispose of particular portfolio investments. A less liquid secondary market also may make it more difficult for the Fund to obtain precise valuations of the high yield loans in its portfolio.

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A three-tier hierarchy is utilized to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that

market participants would use in pricing the asset or liability, including assumptions about risk. For example, market participants would consider the risk inherent in a particular valuation technique used to measure fair value, such as a pricing model, and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability and are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability and are developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised is determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

21

Babson Capital Global Short Duration High Yield Fund 2016 Semi-Annual Report

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

June 30, 2016 (Unaudited)

The following is a summary of the inputs used as of June 30, 2016 in valuing the Fund’s investments:

| | | | | | | | | | | | | | | | |

| DESCRIPTION | | LEVEL 1 | | | LEVEL 2 | | | LEVEL 3 | | | TOTAL INVESTMENTS | |

| | | | |

Assets: | | | | | | | | | | | | | | | | |

| Fixed Income: | | | | | | | | | | | | | | | | |

Bank Loans | | $ | – | | | $ | 55,864,980 | | | $ | 11,336,101 | | | $ | 67,201,081 | |

Bonds | | | – | | | | 434,711,916 | | | | – | | | | 434,711,916 | |

| | | | | | | | �� | | | | | | | | |

| Total Fixed Income | | $ | – | | | $ | 490,576,896 | | | $ | 11,336,101 | | | $ | 501,912,997 | |

| | | | | | | | | | | | | | | | |

| Derivative Securities: | | | | | | | | | | | | | | | | |

Foreign Exchange Contracts: | | $ | – | | | $ | 8,197,555 | | | $ | – | | | $ | 8,197,555 | |

| | | | | | | | | | | | | | | | |

| Total Derivative Securities | | | – | | | | 8,197,555 | | | | – | | | | 8,197,555 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Assets | | $ | – | | | $ | 498,774,451 | | | $ | 11,336,101 | | | $ | 510,110,552 | |

| | | | | | | | | | | | | | | | |

| | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Foreign Exchange Contracts | | $ | – | | | $ | 180,500 | | | $ | – | | | $ | 180,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Liabilities: | | $ | – | | | $ | 180,500 | | | $ | – | | | $ | 180,500 | |

| | | | | | | | | | | | | | | | |

As of the period ended June 30, 2016, certain securities were transferred from one Level (as of December 31, 2015) to another. Based on beginning of period market values as of December 31, 2015, approximately $7,735,917 was transferred to Level 3 from Level 2 as a result of infrequent trading and limited reliable market prices. Valuation has been based on management and market assumptions or expectations.

The following table is a summary of quantitative information about significant unobservable valuation inputs for Level 3 fair value measurement for investments held as of June 30, 2016.

| | | | | | | | |

| TYPE OF ASSETS | | FAIR VALUE AS OF

JUNE 30, 2016 | | | VALUATION

TECHNIQUE(S) | | UNOBSERVABLE INPUT |

| | | |

Second Lien Term Loans | | | | | | | | |

| | | |

Boomerang Tube, LLC | | $ | 670,565 | | | Model Price | | Average Enterprise Valuation Multiple: 5.5x; EBITDA: $36 million. |

| | | |

Boomerang Tube, LLC | | $ | 548,200 | | | Model Price | | Average Enterprise Valuation Multiple: 5.5x; EBITDA: $36 million. |

| | | |