UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22562

Barings Global Short Duration High Yield Fund

(Exact name of registrant as specified in charter)

300 South Tryon Street, Suite 2500, Charlotte, NC 28202

(Address of principal executive offices) (Zip code)

Jill Dinerman

Secretary and Chief Legal Officer

c/o Barings LLC

300 South Tryon Street

Suite 2200

Charlotte, NC 28202

(Name and address of agent for service)

704-805-7200

Registrant’s telephone number, including area code

Date of fiscal year end: December 31, 2020

Date of reporting period: June 30, 2020

Item 1. Reports to Stockholders.

1

Item 1. Reports to Stockholders.

BARINGS GLOBAL SHORT DURATION HIGH YIELD FUND

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website http://www.barings.com/MCI, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank).

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account.

Semi-Annual Report

June 30, 2020

Barings Global Short Duration High Yield Fund

c/o Barings LLC

300 S Tryon St.

Suite 2500

Charlotte, NC 28202

704.805.7200

http://www.Barings.com/bgh

ADVISER

Barings LLC

300 S Tryon St.

Suite 2500

Charlotte, NC 28202

SUB-ADVISOR

Baring International Investment Limited

20 Old Bailey

London EC4M 78F UK

COUNSEL TO THE FUND

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, Massachusetts 02110

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte & Touche LLP

30 Rockefeller Plaza

New York, NY 10112

CUSTODIAN

US Bank

MK-WI-S302

1555 N. River Center Drive

Milwaukee, WI 53212

TRANSFER AGENT & REGISTRAR

U.S. Bancorp Fund Services, LLC, d/b/a

U.S. Bank Global Fund Services

615 E. Michigan St.

Milwaukee, WI 53202

FUND ADMINISTRATION/ACCOUNTING

U.S. Bancorp Fund Services, LLC, d/b/a

U.S. Bank Global Fund Services

615 E. Michigan St.

Milwaukee, WI 53202

PROXY VOTING POLICIES & PROCEDURES

The Trustees of Barings Global Short Duration High Yield Fund (the “Fund”) have delegated proxy voting responsibilities relating to the voting of securities held by the Fund to Barings LLC (“Barings”). A description of Barings’ proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 1-866-399-1516; (2) on the Fund’s website at http://www.barings.com/bgh; and (3) on the U.S. Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

FORM N-Q

The Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q or Part F of Form N-PORT (beginning with filings after March 31, 2019). This information is available (1) on the SEC’s website at http://www.sec.gov; and (2) at the SEC’s Public Reference Room in Washington, DC (which information on their operation may be obtained by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available on the Fund’s website at http://www.barings.com/bgh or upon request by calling, toll-free, 1-866-399-1516.

CERTIFICATIONS

The Fund’s President has submitted to the NYSE the annual CEO Certification as required by Section 303A.12(a) of the NYSE Listed Company Manual.

LEGAL MATTERS

The Fund has entered into contractual arrangements with an investment adviser, transfer agent and custodian (collectively “service providers”) who each provide services to the Fund. Shareholders are not parties to, or intended beneficiaries of, these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the Fund.

Under the Fund’s Bylaws, any claims asserted against or on behalf of the Fund, including claims against Trustees and officers must be brought in courts located within the Commonwealth of Massachusetts.

The Fund’s registration statement and this shareholder report are not contracts between the Fund and its shareholders and do not give rise to any contractual rights or obligations or any shareholder rights other than any rights conferred explicitly by federal or state securities laws that may not be waived.

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

OFFICERS OF THE FUND

Sean Feeley

President

Carlene Pollock

Chief Financial Officer

Lesley Mastandrea

Treasurer

Michael Freno

Vice President

Scott Roth

Vice President

Michael Cowart

Chief Compliance Officer

Janice Bishop

Secretary/Chief Legal Officer

Jill Dinerman

Assistant Secretary

Barings Global Short Duration High Yield Fund is a closed-end investment company, first offered to the public in 2012, whose shares are traded on the New York Stock Exchange.

INVESTMENT OBJECTIVE & POLICY

Barings Global Short Duration High Yield Fund (the “Fund”) was organized as a business trust under the laws of the Commonwealth of Massachusetts. The Fund is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end management investment company with its own investment objective. The Fund’s common shares are listed on the New York Stock Exchange under the symbol “BGH”.

The Fund’s primary investment objective is to seek as high a level of current income as the Adviser (as defined herein) determines is consistent with capital preservation. The Fund seeks capital appreciation as a secondary investment objective when consistent with its primary investment objective. There can be no assurance that the Fund will achieve its investment objectives.

The Fund seeks to take advantage of inefficiencies between geographies, primarily the North American and Western European high yield bond and loan markets and within capital structures between bonds and loans. For example, the Fund seeks to take advantage of differences in pricing between bonds and loans of an issuer denominated in U.S. dollars and substantially similar bonds and loans of the same issuer denominated in Euros, potentially allowing the Fund to achieve a higher relative return for the same credit risk exposure.

1

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report (Unaudited)

Dear Fellow Shareholders,

We present the 2020 Annual Report for the Barings Global Short Duration High Yield Fund (the “Fund”) to recap portfolio performance and positioning. We believe our Global High Yield Investments Group is one of the largest teams in the market primarily focused on North American and Western European credit. Utilizing the Group’s unparalleled expertise, deep resources and time-tested process, we believe we can provide investors with an attractive level of current income while navigating the challenging times that may still lie ahead, and continuing to uncover compelling opportunities across the global high yield market.

The Fund’s strategy focuses primarily on North American and Western European high yield companies, with the flexibility to dynamically shift the geographic weighting in order to capture, in our opinion, the best risk-adjusted investment opportunities. In the coming months and quarters, as the economic road to recovery may vary across different countries and regions, Barings’ global capabilities on the ground in major markets allows for us to be nimble in these times, and take advantage of the unique opportunities as they arise. In addition, the strategy focuses closely on limiting the duration of the Fund, while maintaining what we consider to be a reasonable amount of leverage.

Market Review

In the first quarter, global markets experienced a historic sell-off, as a result of the Covid-19 pandemic and a freefall in crude oil prices. With a global economic shutdown in place, sectors related to travel, leisure, and services found themselves being most heavily impacted by the lockdown In the second quarter, global markets began to recover some of the losses from the first three months of the year. The U.S. Federal Reserve (Fed) announced a sweeping backstop of the market via its support of fallen angels and high yield ETF purchases, which played an integral role in stabilizing market conditions alongside unprecedented central bank action in Europe. Crude oil prices made a sharp recovery on optimism around economies reopening, demand improvement and OPEC supply cuts, leading WTI spot prices to rebound from historic lows.

The U.S. high yield bond market finished the first six months of the year with a negative return. As global markets saw significant declines in tandem with extraordinary volatility in the first quarter, investors were in risk-off mode for much of the six-month period. During a period of such indiscriminate selling across the market, in the U.S., CCCs naturally saw more significant pressure on trading levels and, as such, underperformed relative to higher quality BB issuers. Eventually, the search for yield returned, and lower quality began to outperform, but still lagged higher quality bonds by June month-end. The energy sector also experienced historic volatility during the period, alongside the price of crude oil. While making a recovery through the second quarter, U.S. energy credits – alongside sectors most heavily impacted by the Covid-19 lockdown, such as leisure and travel – would be the largest detractors to market returns. The technology, electronics and the consumer goods sectors outperformed, and managed to generate positive returns. Similarly, the European high yield bond market generated a negative return over the first half of 2020, as the wider economic impact of the coronavirus pandemic led to wide-scale sell-offs and a collapse in prices. All industries in the European high yield bond market saw negative performance and, as in the U.S., the leisure, services and automotive sectors were heavily impacted. The U.S. high yield bond option-adjusted spread (OAS) ended June at 647 basis points (bps), tightening in substantially from year-to-date (YTD) wide of 1,102 bps on March 23. The yield-to-worst (YTW) ended at 6.89%, in from a wide of 11.51% on March 23.

The European high yield bond OAS widened significantly from 323 bps, to finish the period at 550 bps, having peaked at 907 bps toward the end of March. This brought the spread differential between single-Bs and BBs to 278 bps (672 bps versus 394 bps) at the end of June. The European high yield index decreased from 102.65 to 94.85, and the YTW ended at 4.97%. U.S. high yield bond gross new issuance soared in the second quarter, setting a record quarter of $145.5 billion, bringing YTD gross new issuance to $218.4 billion. This represented a 55% increase from the first six months in the prior year. Flows into U.S. high yield bond retail mutual funds were also up year-over-year, totaling $31.9 billion, compared to $18.8 billion during the first half of 2019. Despite net inflows over the second quarter, the European high yield market still saw a net outflow YTD of -€2.8 billion. Total gross new issuance YTD was €37.2 billion, compared to €29.7 billion over the same period last year. Despite some of the strong technical tailwinds, some companies started to experience difficulties making interest payments in this extreme market environment, and the U.S. high yield bond 12-month, par-weighted default rate ended the period at 6.19% – which represents a 10-year high, and was heavily impacted by issuers in the energy sector. The European high yield default rate ended higher, at 2.7%

2

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report (Unaudited)

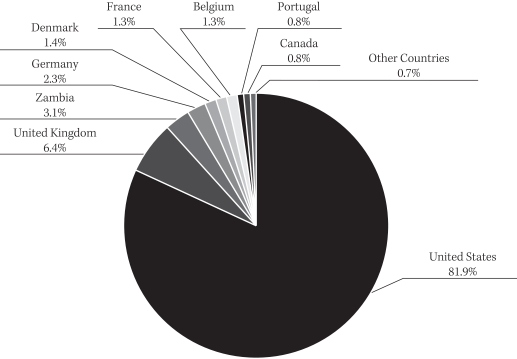

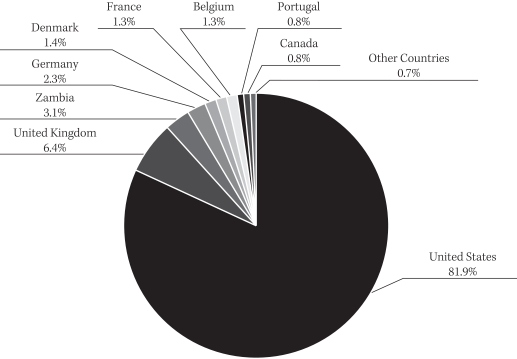

Fund Overview and Performance

The Fund ended June 2020 with a portfolio of 129 issuers, up slightly from 127 issuers at the beginning of the year. A majority of the issuers are domiciled in the U.S. at 81.9%, followed by the U.K. at 6.4% (see the Country Composition chart below). From a geographic standpoint, exposure to North American issuers was up from year-end 2019, along with rest-of-world issuers domiciled outside of the U.S. and Europe but fits within the Fund’s developed market focus. The Fund’s exposure to Europe was down from the prior year-end. The Fund’s primary exposure continues to be in the U.S. market, where the fundamental and technical picture created a better backdrop for high yield issuers during the first six months of the year.

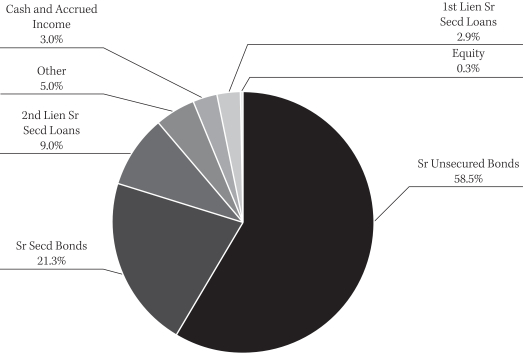

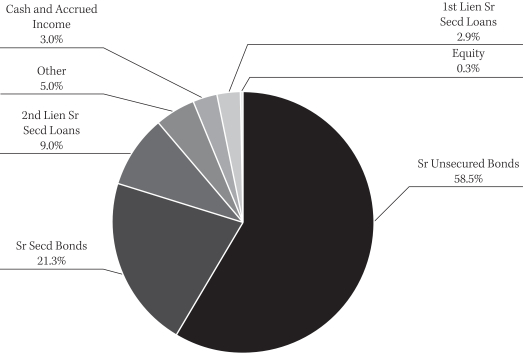

As of June 30, 2020, the Fund’s positioning across the credit quality spectrum is as follows: 15.3% BB rated and above, 37.5% single-B rated, and 45.7% CCC rated and below, with approximately 29% of the portfolio consisting of secured obligations. The credit quality of the Fund’s underlying holdings changed since the beginning of the year, following the removal of certain investment restrictions by the Board of Directors in August of 2019. The Fund decreased single-B rated credits, while CCC and below rated credits increased during the period, to take advantage of yield opportunities within the category, but also through ratings downgrades. Non-publicly rated securities, and cash and accrued interest represented 1.6% and 3.0%, respectively.

The Fund paid three consecutive monthly dividend payments of $0.1408 from January to March, and subsequent payments of $0.1056 per share from April to June following a downward revision. These latter payments represent a 25% reduction from previous estimates, and are based on the assessment of market conditions by Barings. The Fund’s share price and net asset value (NAV) ended the reporting period at $12.57 and $14.06, respectively, or at a 10.60% discount to NAV. Based on the Fund’s share price and NAV on June 30, 2020, the Fund’s market price and NAV distribution rates – using the most recent monthly dividend, on an annualized basis – were 10.08% and 9.01%, respectively. Assets acquired through leverage, which represented 23.8% of the Fund’s total assets at the end of June, were accretive to net investment income.

On a YTD basis through June 30, 2020, the NAV total return was -18.81%, underperforming the global high yield bond market, as measured by the Bank of America/Merrill Lynch Non-Financial Developed Markets High Yield Constrained Index (HNDC), which returned -4.77% on a USD hedged basis. From a market value perspective, the total return YTD through June 30, 2020 was -24.15%. In particular, some notable detracting factors to performance during the period include idiosyncratic credit events in positions with a more substantial weight, such as Dominion Diamonds and Fieldwood Energy, as well as industry sectors where the Fund maintained a higher allocation on average, most notably the metals/minerals and energy sectors. Issuers in the U.S. weighed most heavily on total returns; however, as mentioned above, the geography also constituted the bulk of Fund holdings.

Market Outlook

Global credit markets staged a strong rebound throughout the second quarter of 2020, and were further supported by swift action by governments, central banks and private investors, to support global economies as the world comes to terms with life during a pandemic. While default activity has increased across the global high yield bond market, certainly some of these elements have softened expectations on near-term defaults from what they were at the peak of volatility in March. Despite the recovery thus far, the high yield bond market has not yet fully recovered to pre-pandemic levels, and the outlook for many companies will have an element of uncertainty until there is a clear path past Covid-19. The demand for high yield bonds has increased in recent months, particularly in the U.S., as a result of central bank actions, which will likely continue in the near term. Even after a meaningful recovery, we continue to believe there are many opportunities for below investment grade bonds to be additive to total return performance as the recovery continues. That said, the potential for further volatility and defaults remains, which is why we continue to believe that prudent asset selection and active portfolio management will remain critical moving forward.

At Barings, we remain committed to focusing on corporate fundamentals, as market sentiment can change quickly and unexpectedly. Our focused and disciplined approach emphasizes our fundamental, bottom-up research – with the goal of preserving investor capital, while seeking to capture attractive capital appreciation opportunities that may exist through market and economic cycles. On behalf of the Barings team, we continue to take a long-term view of investing despite the recent economic challenges, and look forward to helping you achieve your investment goals.

Sincerely,

Sean Feeley

3

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report (Unaudited)

PORTFOLIO COMPOSITION (% OF ASSETS*)

COUNTRY COMPOSITION (% OF ASSETS*)

| * | The percentages shown above represent a percentage of the assets. As of June 30, 2020. |

4

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report (Unaudited)

| 1. | Ratings are based on Moody’s, S&P and Fitch. If securities are rated differently by the rating agencies, the higher rating is applied and all ratings are converted to the equivalent Moody’s major rating category for purposes of the category shown. Credit ratings are based largely on the rating agency’s investment analysis at the time of rating and the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The rating assigned to a security by a rating agency does not necessarily reflect its assessment of the volatility of the security’s market value or of the liquidity of an investment in the security. Ratings of Baa3 or higher by Moody’s and BBB- or higher by S&P and Fitch are considered to be investment grade quality. |

| 2. | Past performance is not necessarily indicative of future results. Current performance may be lower or higher. All performance is net of fees, which is inclusive of advisory fees, administrator fees and interest expenses. |

5

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

FINANCIAL REPORT

6

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

STATEMENT OF ASSETS AND LIABILITIES

(Unaudited)

| | | | |

| | | JUNE 30, 2020 | |

| |

| Assets | | | | |

| Investments, at fair value (cost $471,722,074) | | $ | 369,893,080 | |

| Cash | | | 4,726,720 | |

| Foreign currency, at fair value (cost $1,162,306) | | | 1,154,386 | |

| Receivable for investments sold | | | 20,000 | |

| Interest receivable | | | 8,800,243 | |

| Unrealized appreciation on forward foreign exchange contracts | | | 359,606 | |

| Prepaid expenses and other assets | | | 19,468 | |

| | | | |

Total assets | | | 384,973,503 | |

| | | | |

| |

| Liabilities | | | | |

| Note payable | | | 91,450,000 | |

| Dividend payable | | | 2,118,791 | |

| Payable for investments purchased | | | 8,595,534 | |

| Payable to adviser | | | 307,053 | |

| Accrued expenses and other liabilities | | | 420,313 | |

| | | | |

Total liabilities | | | 102,891,691 | |

| | | | |

Total net assets | | $ | 282,081,812 | |

| | | | |

| |

| Net Assets: | | | | |

| Common shares, $0.00001 par value | | $ | 201 | |

| Additional paid-in capital | | | 468,871,409 | |

| Accumulated losses | | | (186,789,798 | ) |

| | | | |

Total net assets | | $ | 282,081,812 | |

| | | | |

| |

| Common shares issued and outstanding (unlimited shares authorized) | | | 20,064,313 | |

| | | | |

| |

Net asset value per share | | $ | 14.06 | |

| | | | |

See accompanying Notes to the Financial Statements.

7

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

STATEMENT OF OPERATIONS

(Unaudited)

| | | | |

| | | PERIOD FROM

JANUARY 1, 2020

THROUGH

JUNE 30, 2020 | |

| |

| Investment Income | | | | |

Interest income | | $ | 19,483,288 | |

Other income | | | 42,771 | |

| | | | |

Total investment income | | | 19,526,059 | |

| | | | |

| |

| Operating Expenses | | | | |

Advisory fees | | | 2,094,006 | |

Interest expense | | | 1,104,410 | |

Administrator fees | | | 218,231 | |

Taxes paid on undistributed income | | | 123,794 | |

Professional fees | | | 80,843 | |

Directors’ fees | | | 53,043 | |

Printing and mailing expense | | | 41,001 | |

Pricing expense | | | 8,698 | |

Other operating expenses | | | 14,784 | |

| | | | |

Total operating expenses | | | 3,738,810 | |

| | | | |

Net investment income | | | 15,787,249 | |

| | | | |

| |

| Realized and Unrealized Gains (Losses) on Investments | | | | |

Net realized loss on investments | | | (13,571,600 | ) |

Net realized gain on forward foreign exchange contracts | | | 2,478,703 | |

Net realized loss on foreign currency and translation | | | (1,895,537 | ) |

| | | | |

Net realized loss on investments | | | (12,988,434 | ) |

| | | | |

Net change in unrealized depreciation of investments | | | (74,259,732 | ) |

Net change in unrealized appreciation of forward foreign exchange contracts | | | 730,745 | |

Net change in unrealized depreciation of foreign currency and translation | | | (5,278 | ) |

| | | | |

Net change in unrealized depreciation on investments | | | (73,534,265 | ) |

| | | | |

Net realized and unrealized losses | | | (86,522,699 | ) |

| | | | |

Net decrease in net assets resulting from operations | | $ | (70,735,450 | ) |

| | | | |

See accompanying Notes to the Financial Statements.

8

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

STATEMENT OF CASH FLOWS

(Unaudited)

| | | | |

| | | PERIOD FROM

JANUARY 1, 2020

THROUGH

JUNE 30, 2020 | |

| |

Reconciliation of net decrease in net assets resulting from

operations to net cash provided by operating activities | | | | |

| Net decrease in net assets applicable to common shareholders resulting from operations | | $ | (70,735,450 | ) |

Adjustments to reconcile net decrease in net assets applicable to common shareholders

resulting from operations to net cash provided by operating activities: | | | | |

Purchases of long-term investments | | | (54,578,981 | ) |

Proceeds from sales of long-term investments | | | 101,941,977 | |

Proceeds from sales of foreign currency, net | | | (1,127,790 | ) |

Forward currency exchange contracts, net | | | (730,745 | ) |

Net unrealized depreciation | | | 74,267,746 | |

Net realized loss | | | 13,571,600 | |

Amortization and accretion | | | (642,329 | ) |

Changes in operating assets and liabilities: | | | | |

Decrease in interest receivable | | | 1,969,369 | |

Increase in prepaid expenses and other assets | | | (19,468 | ) |

Increase in receivable for investments sold | | | (20,000 | ) |

Increase in payable for investments purchased | | | 8,233,396 | |

Decrease in payable to Adviser | | | (125,473 | ) |

Decrease in accrued expenses and other liabilities | | | (396,807 | ) |

| | | | |

Net cash provided by operating activities | | | 71,607,045 | |

| | | | |

| Cash flows from financing activities | | | | |

Advances from credit facility | | | 20,000,000 | |

Repayments on credit facility | | | (75,750,000 | ) |

Distributions paid to common shareholders | | | (15,686,280 | ) |

| | | | |

Net cash used in financing activities | | | (71,436,280 | ) |

| | | | |

Net change in cash | | | 170,765 | |

Cash beginning of period | | | 4,555,955 | |

| | | | |

Cash end of period | | $ | 4,726,720 | |

| | | | |

Supplemental disclosure of cash flow information | | | | |

Income taxes paid | | $ | – | |

Interest paid | | | 1,075,910 | |

See accompanying Notes to the Financial Statements.

9

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | PERIOD FROM

JANUARY 1, 2020

THROUGH

JUNE 30, 2020 | | | YEAR ENDED

DECEMBER 31, 2019 | |

| | | (Unaudited) | | | | |

| | |

| Operations | | | | | | | | |

Net investment income | | $ | 15,787,249 | | | $ | 37,994,028 | |

Net realized loss | | | (12,988,434 | ) | | | (15,486,954 | ) |

Net change in unrealized appreciation (depreciation) | | | (73,534,265 | ) | | | 14,010,346 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (70,735,450 | ) | | | 36,517,420 | |

| | | | | | | | |

| | |

| Dividends to Common Shareholders | | | | | | | | |

From distributable earnings | | | (14,831,540 | ) | | | (35,672,794 | ) |

Return of capital | | | – | | | | – | |

| | | | | | | | |

Total dividends to common shareholders | | | (14,831,540 | ) | | | (35,672,794 | ) |

| | | | | | | | |

| | |

| Capital Stock Transactions | | | | | | | | |

Issuance from common shares issued on reinvestment | | | – | | | | 112,799 | |

| | | | | | | | |

Net increase in net assets from capital stock transactions | | | – | | | | 112,799 | |

| | | | | | | | |

Total increase (decrease) in net assets | | | (85,566,990 | ) | | | 957,425 | |

| | | | | | | | |

| | |

| Net Assets | | | | | | | | |

Beginning of period | | | 367,648,802 | | | | 366,691,377 | |

| | | | | | | | |

End of period | | $ | 282,081,812 | | | $ | 367,648,802 | |

| | | | | | | | |

See accompanying Notes to the Financial Statements.

10

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | PERIOD FROM

JANUARY 1,

2020

THROUGH

JUNE 30,

2020

(Unaudited) | | | YEAR ENDED

DECEMBER 31,

2019 | | | YEAR ENDED

DECEMBER 31,

2018 | | | YEAR ENDED

DECEMBER 31,

2017 | | | YEAR ENDED

DECEMBER 31,

2016 | | | YEAR ENDED

DECEMBER 31,

2015 | | | YEAR ENDED

DECEMBER 31,

2014 | |

| | | | | | | |

| Per Common Share Data (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 18.32 | | | $ | 18.28 | | | $ | 20.84 | | | $ | 20.87 | | | $ | 18.47 | | | $ | 22.00 | | | $ | 25.24 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.79 | | | | 1.87 | | | | 1.89 | | | | 1.77 | | | | 1.57 | | | | 1.90 | | | | 2.12 | |

Net realized and unrealized gains (losses) on investments | | | (4.31 | ) | | | (0.05 | ) | | | (2.67 | ) | | | 0.04 | | | | 2.68 | | | | (3.23 | ) | | | (2.76 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total increase (decrease) from investment operations | | | (3.52 | ) | | | 1.82 | | | | (0.78 | ) | | | 1.81 | | | | 4.25 | | | | (1.33 | ) | | | (0.64 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Less dividends to common stockholders: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.74 | ) | | | (1.78 | ) | | | (1.78 | ) | | | (1.63 | ) | | | (1.60 | ) | | | (2.20 | ) | | | (2.56 | ) |

Net realized gain | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | (0.04 | ) |

Return of capital | | | – | | | | – | | | | – | | | | (0.21 | ) | | | (0.25 | ) | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total dividends to common stockholders | | | (0.74 | ) | | | (1.78 | ) | | | (1.78 | ) | | | (1.84 | ) | | | (1.85 | ) | | | (2.20 | ) | | | (2.60 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 14.06 | | | $ | 18.32 | | | $ | 18.28 | | | $ | 20.84 | | | $ | 20.87 | | | $ | 18.47 | | | $ | 22.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per common share market value, end of period | | $ | 17.68 | | | $ | 17.53 | | | $ | 15.95 | | | $ | 19.38 | | | $ | 19.23 | | | $ | 16.49 | | | $ | 20.19 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total investment return based on net asset value (2)(4) | | | (18.81 | )% | | | 10.77 | | | | (3.42 | )% | | | 9.40 | % | | | 25.42 | % | | | (5.57 | )% | | | (2.25 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total investment return based on market value (2)(4) | | | (24.15 | )% | | | 21.45 | | | | (9.38 | )% | | | 10.41 | % | | | 29.44 | % | | | (8.13 | )% | | | (2.06 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 282,082 | | | $ | 367,649 | | | $ | 366,691 | | | $ | 417,924 | | | $ | 418,613 | | | $ | 370,418 | | | $ | 441,234 | |

Ratio of expenses (before reductions and reimbursements) to average net assets | | | 1.24 | %(4) | | | 3.00 | % | | | 2.93 | % | | | 2.33 | % | | | 2.05 | %(3) | | | 2.27 | % | | | 2.20 | % |

Ratio of expenses (after reductions and reimbursements) to average net assets | | | 1.24 | %(4) | | | 3.00 | % | | | 2.93 | % | | | 2.33 | % | | | 1.78 | % | | | 2.27 | % | | | 2.20 | % |

Ratio of net investment income (before reductions and reimbursements) to average net assets | | | 5.23 | %(4) | | | 10.22 | % | | | 9.34 | % | | | 9.20 | % | | | 10.68 | %(3) | | | 9.18 | % | | | 8.47 | % |

Ratio of net investment income (after reductions and reimbursements) to average net assets | | | 5.23 | %(4) | | | 10.22 | % | | | 9.34 | % | | | 9.20 | % | | | 10.41 | % | | | 9.18 | % | | | 8.47 | % |

Portfolio turnover rate | | | 31.69 | % | | | 52.25 | % | | | 48.92 | % | | | 36.59 | % | | | 44.81 | % | | | 38.13 | % | | | 63.66 | % |

| (2) | | Total investment return calculation assumes reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. |

| (3) | | The Adviser contractually waived a portion of its management and other fees equal to an annual rate of 0.275% of the Fund’s managed assets for a period of one year ended December 31, 2016. |

| (4) | | Annualized for periods less than one full year. |

See accompanying Notes to the Financial Statements.

11

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

SCHEDULE OF INVESTMENTS

June 30, 2020 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | SHARES | | | COST | | | FAIR

VALUE | |

Equities — 0.33%*: | |

|

Common Stocks — 0.02%*: | |

Boomerang Tube Holdings, Inc.¤ | | | | | | | | | | | 36,149 | | | | $3,510,832 | | | | $0 | |

Fieldwood Energy LLC¤ | | | | | | | | | | | 167,574 | | | | 4,057,567 | | | | 8,379 | |

Jupiter Resources Inc.¤+ | | | | | | | | | | | 1,171,624 | | | | 5,662,542 | | | | 878,718 | |

Sabine Oil & Gas LLC¤ | | | | | | | | | | | 4,342 | | | | 248,858 | | | | 56,446 | |

Templar Energy LLC¤ | | | | | | | | | | | 135,392 | | | | 734,072 | | | | 0 | |

Templar Energy LLC¤ | | | | | | | | | | | 101,589 | | | | 1,015,894 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | |

Total Common Stocks | | | | | | | | | | | 1,616,670 | | | | 15,229,765 | | | | 943,543 | |

| | | | | | | | | | | | | | | | | | | | |

|

Preferred Stocks — 0.00%*: | |

Pinnacle Operating Corp.¤ | | | | | | | | | | | 213,016 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | |

Total Preferred Stocks | | | | | | | | | | | 213,016 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | |

|

Warrants — 0.31%*: | |

Appvion Holdings Corp.¤ | | | | | | | | | | | 12,892 | | | | 137,280 | | | | 0 | |

Appvion Inc.¤ | | | | | | | | | | | 12,892 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | |

Total Warrants | | | | | | | | | | | 25,784 | | | | 137,280 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total Equities | | | | | | | | | | | 1,855,470 | | | | 15,367,045 | | | | 943,543 | |

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Fixed Income — 130.79%*: | |

|

Asset-Backed Securities — 12.13%*: | |

|

CDO/CLO — 12.13%*: | |

Anchorage Capital CLO LTD 2015-6A, 3M LIBOR + 6.350%^~ | | | 7.57 | % | | | 7/15/2030 | | | | 600,000 | | | | $609,366 | | | | $541,958 | |

Anchorage Capital CLO LTD 2016-9A ER, 3M LIBOR + 6.410%^~ | | | 7.63 | | | | 7/15/2032 | | | | 1,500,000 | | | | 1,455,000 | | | | 1,323,192 | |

Anchorage Capital CLO LTD 2013-1R, 3M LIBOR + 6.800%^~ | | | 8.11 | | | | 10/15/2030 | | | | 1,000,000 | | | | 977,213 | | | | 930,961 | |

Bain Capital Credit CLO 2020-2 E, 3M

LIBOR + 6.830%^~ | | | 7.15 | | | | 7/29/2031 | | | | 1,000,000 | | | | 920,703 | | | | 956,995 | |

Ballyrock CLO LTD 2019-2A, 3M

LIBOR + 7.740%^~ | | | 8.12 | | | | 11/20/2030 | | | | 2,000,000 | | | | 1,960,000 | | | | 1,893,114 | |

BlueMountain CLO LTD 2018-23A, 3M

LIBOR + 5.650%^~ | | | 6.79 | | | | 10/20/2031 | | | | 1,000,000 | | | | 1,000,000 | | | | 841,158 | |

Canyon CLO LTD 2019-2A, 3M

LIBOR + 7.150%^~ | | | 8.37 | | | | 10/15/2032 | | | | 1,000,000 | | | | 1,000,000 | | | | 935,360 | |

Carbone CLO, LTD 2017-1A, 3M

LIBOR + 5.900%^~ | | | 7.04 | | | | 1/21/2031 | | | | 750,000 | | | | 750,000 | | | | 641,759 | |

Carlyle Global Market Strategies 2013-3A, 3M LIBOR + 7.750%^~ | | | 8.97 | | | | 10/15/2030 | | | | 1,000,000 | | | | 1,000,000 | | | | 542,080 | |

Carlyle Global Market Strategies 2017-5A, 3M LIBOR + 5.300%^~ | | | 6.44 | | | | 1/22/2030 | | | | 700,000 | | | | 700,000 | | | | 532,925 | |

See accompanying Notes to the Financial Statements.

12

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2020 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Fixed Income (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Asset-Backed Securities (Continued) | | | | | | | | | | | | | | | | | | | | |

|

CDO/CLO (Continued) | |

Carlyle Global Market Strategies 2019-3 LTD, 3M LIBOR + 7.030%^~ | | | 8.17 | % | | | 10/20/2032 | | | | 1,000,000 | | | | $975,000 | | | | $923,776 | |

Cedar Funding LTD 2016-6A, 3M

LIBOR + 5.900%^~ | | | 7.04 | | | | 10/20/2028 | | | | 2,500,000 | | | | 2,500,000 | | | | 2,086,680 | |

CIFC Funding 2020-1 LTD^~ | | | 7.08 | | | | 7/15/2032 | | | | 1,900,000 | | | | 1,881,000 | | | | 1,881,000 | |

Galaxy CLO LTD 2017-24A, 3M

LIBOR + 5.500%^~ | | | 6.72 | | | | 1/15/2031 | | | | 1,000,000 | | | | 1,000,000 | | | | 824,469 | |

GoldenTree Loan Management 2018-3A, 3M LIBOR + 6.500%^~ | | | 7.64 | | | | 4/22/2030 | | | | 1,500,000 | | | | 1,432,493 | | | | 1,001,289 | |

GoldenTree Loan Opportunities XI LTD 2015-11A, 3M LIBOR + 5.400%^~ | | | 6.54 | | | | 1/18/2031 | | | | 500,000 | | | | 500,000 | | | | 424,526 | |

KKR Financial CLO LTD 2017-20, 3M

LIBOR + 5.500%^~ | | | 6.68 | | | | 10/16/2030 | | | | 1,500,000 | | | | 1,500,000 | | | | 1,215,032 | |

LCM LTD 2019-30, 3M LIBOR + 6.950%^~ | | | 8.09 | | | | 4/21/2031 | | | | 1,100,000 | | | | 1,100,000 | | | | 1,032,527 | |

Madison Park Funding LTD 2015-19A, 3M LIBOR + 4.350%^~ | | | 5.45 | | | | 1/24/2028 | | | | 1,000,000 | | | | 1,000,000 | | | | 839,566 | |

Madison Park Funding LTD 2018-29A, 3M LIBOR + 7.570%#^~ | | | 8.71 | | | | 10/18/2030 | | | | 2,000,000 | | | | 1,960,000 | | | | 1,500,968 | |

Madison Park Funding LTD 2019-32E, 3M LIBOR + 7.100%^~ | | | 8.20 | | | | 1/22/2031 | | | | 1,000,000 | | | | 997,800 | | | | 951,710 | |

Magnetite CLO LTD 2016-18A, 3M

LIBOR + 7.600%^~ | | | 7.99 | | | | 11/15/2028 | | | | 1,400,000 | | | | 1,386,000 | | | | 1,014,504 | |

Neuberger Berman Loan Advisers CLO LTD, 3M LIBOR + 7.050% ¤^~ | | | 7.35 | | | | 7/21/2031 | | | | 800,000 | | | | 792,000 | | | | 792,000 | |

OCP CLO LTD 2020-19, 3M

LIBOR + 6.110% ¤^~ | | | 6.41 | | | | 7/21/2031 | | | | 800,000 | | | | 708,186 | | | | 700,074 | |

OHA Credit Partners LTD 2015-11A, 3M LIBOR + 7.900%^~ | | | 9.04 | | | | 1/20/2032 | | | | 2,000,000 | | | | 1,970,323 | | | | 1,312,770 | |

OHA Loan Funding LTD 2013-1A, 3M

LIBOR + 7.900%^~ | | | 8.94 | | | | 7/23/2031 | | | | 1,500,000 | | | | 1,477,500 | | | | 991,043 | |

Sound Point CLO XVIII 2018-18D, 3M

LIBOR + 5.500%^~ | | | 6.64 | | | | 1/21/2031 | | | | 2,000,000 | | | | 2,000,000 | | | | 1,363,784 | |

Sound Point CLO Ltd Series 2020-1A Class E, 3M LIBOR + 7.080%^~ | | | 7.39 | | | | 7/22/2030 | | | | 1,600,000 | | | | 1,464,080 | | | | 1,464,000 | |

Steele Creek CLO LTD 2017-1A, 3M

LIBOR + 6.200%^~ | | | 7.42 | | | | 10/15/2030 | | | | 800,000 | | | | 800,000 | | | | 570,740 | |

TICP CLO LTD 2018-10A, 3M

LIBOR + 5.500%^~ | | | 6.64 | | | | 4/20/2031 | | | | 1,000,000 | | | | 925,461 | | | | 860,880 | |

Voya CLO LTD 2019-4A, 3M

LIBOR + 7.480%^~ | | | 8.70 | | | | 1/18/2033 | | | | 1,400,000 | | | | 1,358,585 | | | | 1,325,779 | |

Wellfleet CLO LTD 2017-3A, 3M

LIBOR + 5.550%^~ | | | 6.68 | | | | 1/17/2031 | | | | 1,500,000 | | | | 1,500,000 | | | | 1,169,501 | |

Wind River CLO LTD 2017-4A, 3M

LIBOR + 5.800%^~ | | | 6.18 | | | | 11/20/2030 | | | | 1,000,000 | | | | 1,000,000 | | | | 844,261 | |

| | | | | | | | | | | | | | | | | | | | |

Total CDO/CLO | | | | | | | | | | | 41,350,000 | | | | 40,600,710 | | | | 34,230,381 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total Asset-Backed Securities | | | | | | | | | | | 41,350,000 | | | | 40,600,710 | | | | 34,230,381 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to the Financial Statements.

13

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2020 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Fixed Income (Continued) | | | | | | | | | | | | | | | | | | | | |

|

Bank Loans§ — 10.73%*: | |

|

Automotive — 0.63%*: | |

Dexko Global Inc, 3M LIBOR + 8.250%~ | | | 9.25 | % | | | 7/24/2025 | | | | 2,000,000 | | | | $2,000,000 | | | | $1,780,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total Automotive | | | | | | | | | | | 2,000,000 | | | | 2,000,000 | | | | 1,780,000 | |

| | | | | | | | | | | | | | | | | | | | |

|

Cargo Transport — 0.95%*: | |

PS Logistics, 1M LIBOR + 4.750%~ | | | 5.75 | | | | 3/6/2025 | | | | 2,947,500 | | | | 2,966,436 | | | | 2,682,225 | |

| | | | | | | | | | | | | | | | | | | | |

Total Cargo Transport | | | | | | | | | | | 2,947,500 | | | | 2,966,436 | | | | 2,682,225 | |

| | | | | | | | | | | | | | | | | | | | |

|

Chemicals, Plastics and Rubber — 0.50%*: | |

Colouroz Investment 2 LLC, 3M

LIBOR + 7.250%+~ | | | 8.27 | | | | 9/7/2022 | | | | 2,033,201 | | | | 2,025,452 | | | | 1,402,908 | |

| | | | | | | | | | | | | | | | | | | | |

Total Chemicals, Plastics and Rubber | | | | | | | | | | | 2,033,201 | | | | 2,025,452 | | | | 1,402,908 | |

| | | | | | | | | | | | | | | | | | | | |

|

Diversified/Conglomerate Manufacturing — 1.02%*: | |

Averys, 3M LIBOR + 8.250%+~ | | | 8.25 | | | | 8/7/2026 | | | | 500,000 | | | | 571,943 | | | | 511,190 | |

Commercial Vehicle Group Inc., 1M

LIBOR + 6.000%~ | | | 11.50 | | | | 4/12/2023 | | | | 573,262 | | | | 566,104 | | | | 504,471 | |

SunSource, Inc., 1M LIBOR + 8.000%~ | | | 9.00 | | | | 4/30/2026 | | | | 2,500,000 | | | | 2,516,293 | | | | 1,862,500 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified/Conglomerate Manufacturing | | | | | | | | | | | 3,573,262 | | | | 3,654,340 | | | | 2,878,161 | |

| | | | | | | | | | | | | | | | | | | | |

|

Diversified/Conglomerate Service — 4.77%*: | |

Misys (Finastra), 3M LIBOR + 7.250%~ | | | 8.25 | | | | 6/16/2025 | | | | 15,630,136 | | | | 15,502,516 | | | | 13,459,272 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified/Conglomerate Service | | | | | | | | | | | 15,630,136 | | | | 15,502,516 | | | | 13,459,272 | |

| | | | | | | | | | | | | | | | | | | | |

|

Healthcare, Education and Childcare — 1.26%*: | |

Advanz Pharma Corp., 1M LIBOR + 5.500%+~ | | | 6.57 | | | | 9/6/2024 | | | | 3,860,000 | | | | 3,800,635 | | | | 3,566,640 | |

| | | | | | | | | | | | | | | | | | | | |

Total Healthcare, Education and Childcare | | | | | | | | | | | 3,860,000 | | | | 3,800,635 | | | | 3,566,640 | |

| | | | | | | | | | | | | | | | | | | | |

|

Home and Office Furnishings, Housewares, and Durable Consumer Products — 1.10%*: | |

Serta Simmons Bedding New Monthly First Out T/L 1M LIBOR +7.500%~ | | | 8.50 | | | | 8/10/2023 | | | | 525,151 | | | | 509,408 | | | | 514,648 | |

Serta Simmons T/L Super Priority Second Out 1M LIBOR +7.500%~ | | | 8.50 | | | | 8/10/2023 | | | | 3,094,000 | | | | 3,094,000 | | | | 2,578,323 | |

| | | | | | | | | | | | | | | | | | | | |

Total Home and Office Furnishings, Housewares, and Durable Consumer Products | | | | | | | | | | | 3,619,151 | | | | 3,603,408 | | | | 3,092,971 | |

| | | | | | | | | | | | | | | | | | | | |

|

Mining, Steel, Iron and Non-Precious Metals — 0.11%*: | |

Boomerang Tube, LLC, 3M LIBOR + 6.500%¤~ | | | 5.17 | | | | 6/30/2022 | | | | 2,540,684 | | | | 2,540,684 | | | | 304,882 | |

| | | | | | | | | | | | | | | | | | | | |

Total Mining, Steel, Iron and Non-Precious Metals | | | | | | | | | | | 2,540,684 | | | | 2,540,684 | | | | 304,882 | |

| | | | | | | | | | | | | | | | | | | | |

|

Oil and Gas — 0.39%*: | |

Fieldwood Energy LLC, 1M LIBOR + 5.250%~ | | | 0.00 | | | | 4/11/2022 | | | | 5,751,171 | | | | 5,252,407 | | | | 1,044,815 | |

Fieldwood Energy LLC, 1M LIBOR + 7.250%~ | | | 0.00 | | | | 4/11/2023 | | | | 7,481,592 | | | | 2,720,500 | | | | 44,890 | |

| | | | | | | | | | | | | | | | | | | | |

Total Oil and Gas | | | | | | | | | | | 13,232,763 | | | | 7,972,907 | | | | 1,089,705 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total Bank Loans | | | | | | | | | | | 49,436,697 | | | | 44,066,378 | | | | 30,256,764 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to the Financial Statements.

14

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2020 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Fixed Income (Continued) | | | | | | | | | | | | | | | | | | | | |

|

Corporate Bonds — 107.93%*: | |

|

Aerospace and Defense — 4.08%*: | |

Avolon Holdings#^ | | | 6.50 | % | | | 9/15/2024 | | | | 2,741,000 | | | | $2,759,630 | | | | $1,836,470 | |

Mileage Plus Holdings^ | | | 6.50 | | | | 6/20/2027 | | | | 556,000 | | | | 549,050 | | | | 557,390 | |

TransDigm Group, Inc.# | | | 7.50 | | | | 3/15/2027 | | | | 3,000,000 | | | | 2,977,500 | | | | 2,878,500 | |

Triumph Group, Inc.# | | | 7.75 | | | | 8/15/2025 | | | | 8,289,000 | | | | 8,293,449 | | | | 6,227,111 | |

| | | | | | | | | | | | | | | | | | | | |

Total Aerospace and Defense | | | | | | | | | | | 14,586,000 | | | | 14,579,629 | | | | 11,499,471 | |

| | | | | | | | | | | | | | | | | | | | |

|

Automotive — 3.19%*: | |

Power Solutions#^ | | | 8.50 | | | | 5/15/2027 | | | | 8,965,000 | | | | 9,065,179 | | | | 9,009,377 | |

| | | | | | | | | | | | | | | | | | | | |

Total Automotive | | | | | | | | | | | 8,965,000 | | | | 9,065,179 | | | | 9,009,377 | |

| | | | | | | | | | | | | | | | | | | | |

|

Beverage, Food and Tobacco — 2.47%*: | |

Boparan Finance plc#+^ | | | 5.50 | | | | 7/15/2021 | | | | 800,000 | | | | 1,039,185 | | | | 896,939 | |

Kehe Distributors, LLC#^ | | | 8.63 | | | | 10/15/2026 | | | | 1,287,000 | | | | 1,287,000 | | | | 1,370,655 | |

Manitowoc Foodservice# | | | 9.50 | | | | 2/15/2024 | | | | 3,074,000 | | | | 3,212,151 | | | | 2,935,670 | |

Refresco Group N.V.#+^ | | | 6.50 | | | | 5/15/2026 | | | | 1,600,000 | | | | 1,931,912 | | | | 1,775,121 | |

| | | | | | | | | | | | | | | | | | | | |

Total Beverage, Food and Tobacco | | | | | | | | | | | 6,761,000 | | | | 7,470,248 | | | | 6,978,385 | |

| | | | | | | | | | | | | | | | | | | | |

|

Broadcasting and Entertainment — 4.68%*: | |

Arqiva Broadcast#+^ | | | 6.75 | | | | 9/30/2023 | | | | 2,400,000 | | | | 3,040,377 | | | | 3,078,033 | |

Banijay#+^ | | | 6.50 | | | | 3/1/2026 | | | | 2,500,000 | | | | 2,761,119 | | | | 2,503,427 | |

Clear Channel Worldwide Holdings Inc. | | | 9.25 | | | | 2/15/2024 | | | | 5,546,000 | | | | 5,888,338 | | | | 5,144,470 | |

Cox Media Group#^ | | | 8.88 | | | | 12/15/2027 | | | | 1,837,000 | | | | 1,854,637 | | | | 1,761,224 | |

Dish DBS Corp. | | | 7.75 | | | | 7/1/2026 | | | | 673,000 | | | | 607,787 | | | | 713,380 | |

| | | | | | | | | | | | | | | | | | | | |

Total Broadcasting and Entertainment | | | | | | | | | | | 12,956,000 | | | | 14,152,258 | | | | 13,200,534 | |

| | | | | | | | | | | | | | | | | | | | |

|

Buildings and Real Estate — 2.93%*: | |

Cemex S.A.B. de C.V.^ | | | 7.38 | | | | 6/5/2027 | | | | 698,000 | | | | 698,000 | | | | 709,168 | |

Realogy Group#^ | | | 9.38 | | | | 4/1/2027 | | | | 7,763,000 | | | | 7,673,252 | | | | 7,239,774 | |

Realogy Group^ | | | 7.63 | | | | 6/15/2025 | | | | 329,000 | | | | 329,000 | | | | 329,066 | |

| | | | | | | | | | | | | | | | | | | | |

Total Buildings and Real Estate | | | | | | | | | | | 8,790,000 | | | | 8,700,252 | | | | 8,278,008 | |

| | | | | | | | | | | | | | | | | | | | |

|

Cargo Transport — 3.12%*: | |

Kenan Advantage#^ | | | 7.88 | | | | 7/31/2023 | | | | 10,000,000 | | | | 10,038,967 | | | | 8,800,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total Cargo Transport | | | | | | | | | | | 10,000,000 | | | | 10,038,967 | | | | 8,800,000 | |

| | | | | | | | | | | | | | | | | | | | |

|

Chemicals, Plastics and Rubber — 5.05%*: | |

Carlyle Group#^ | | | 8.75 | | | | 6/1/2023 | | | | 3,000,000 | | | | 2,970,300 | | | | 2,992,500 | |

Consolidated Energy Finance S.A.#^ | | | 6.88 | | | | 6/15/2025 | | | | 1,779,000 | | | | 1,770,105 | | | | 1,512,150 | |

Consolidated Energy Finance S.A.^ | | | 6.50 | | | | 5/15/2026 | | | | 2,470,000 | | | | 1,698,322 | | | | 2,059,363 | |

CVR Partners LP#^ | | | 9.25 | | | | 6/15/2023 | | | | 6,213,000 | | | | 6,158,006 | | | | 6,088,740 | |

Diversey#^ | | | 5.63 | | | | 8/15/2025 | | | | 1,500,000 | | | | 1,620,695 | | | | 1,587,498 | |

| | | | | | | | | | | | | | | | | | | | |

Total Chemicals, Plastics and Rubber | | | | | | | | | | | 14,962,000 | | | | 14,217,428 | | | | 14,240,251 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to the Financial Statements.

15

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2020 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Fixed Income (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | | | | | |

|

Containers, Packaging, and Glass — 3.73%*: | |

Mauser Packaging Solutions#^ | | | 7.25 | % | | | 4/15/2025 | | | | 2,575,000 | | | | $2,445,483 | | | | $2,334,933 | |

Tekni-Plex#^ | | | 9.25 | | | | 8/1/2024 | | | | 8,000,000 | | | | 7,900,474 | | | | 8,200,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total Containers, Packaging, and Glass | | | | | | | | | | | 10,575,000 | | | | 10,345,957 | | | | 10,534,933 | |

| | | | | | | | | | | | | | | | | | | | |

|

Diversified/Conglomerate Manufacturing — 3.22%*: | |

Appvion Inc.¤ | | | 9.00 | | | | 6/1/2021 | | | | 13,200,000 | | | | 0 | | | | 0 | |

Heat Exchangers+^ | | | 7.78 | | | | 10/9/2025 | | | | 625,000 | | | | 654,854 | | | | 629,879 | |

Manitowoc Cranes#^ | | | 9.00 | | | | 4/1/2026 | | | | 8,538,000 | | | | 8,563,864 | | | | 8,452,620 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified/Conglomerate Manufacturing | | | | | | | | | | | 22,363,000 | | | | 9,218,718 | | | | 9,082,499 | |

| | | | | | | | | | | | | | | | | | | | |

|

Diversified/Conglomerate Service — 4.23%*: | |

Algeco Scotsman#+^ | | | 6.50 | | | | 2/15/2023 | | | | 1,750,000 | | | | 2,137,797 | | | | 1,885,269 | |

Carlson Travel Holdings Inc.#^ | | | 9.50 | | | | 12/15/2024 | | | | 6,040,000 | | | | 6,050,468 | | | | 2,657,600 | |

Endurance International Group LLC# | | | 10.88 | | | | 2/1/2024 | | | | 1,324,000 | | | | 1,379,614 | | | | 1,284,280 | |

Truck Hero Inc.#^ | | | 8.50 | | | | 4/21/2024 | | | | 6,118,000 | | | | 6,143,025 | | | | 6,118,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified/Conglomerate Service | | | | | | | | | | | 15,232,000 | | | | 15,710,904 | | | | 11,945,149 | |

| | | | | | | | | | | | | | | | | | | | |

|

Electronics — 7.85%*: | |

International Wire Group Inc.#^ | | | 10.75 | | | | 8/1/2021 | | | | 7,389,000 | | | | 7,227,295 | | | | 5,541,750 | |

Wesco Distribution Inc. | | | 7.13 | | | | 6/15/2025 | | | | 460,000 | | | | 460,000 | | | | 484,440 | |

Wesco Distribution Inc. | | | 7.25 | | | | 6/15/2028 | | | | 475,000 | | | | 471,409 | | | | 502,313 | |

Veritas Bermuda Ltd.#^ | | | 10.50 | | | | 2/1/2024 | | | | 16,957,000 | | | | 14,950,478 | | | | 15,176,514 | |

Presidio Inc.#^ | | | 8.25 | | | | 2/1/2028 | | | | 430,000 | | | | 430,000 | | | | 429,999 | |

| | | | | | | | | | | | | | | | | | | | |

Total Electronics | | | | | | | | | | | 25,711,000 | | | | 23,539,182 | | | | 22,135,016 | |

| | | | | | | | | | | | | | | | | | | | |

|

Finance — 2.14%*: | |

Galaxy Bidco Ltd.#+^ | | | 6.50 | | | | 7/31/2026 | | | | 1,500,000 | | | | 1,865,092 | | | | 1,872,584 | |

Lowell#+^ | | | 8.50 | | | | 11/1/2022 | | | | 2,540,000 | | | | 3,133,965 | | | | 2,958,466 | |

Travelex#+^ | | | 8.00 | | | | 5/15/2022 | | | | 4,600,000 | | | | 5,097,344 | | | | 1,217,164 | |

| | | | | | | | | | | | | | | | | | | | |

Total Finance | | | | | | | | | | | 8,640,000 | | | | 10,096,401 | | | | 6,048,214 | |

| | | | | | | | | | | | | | | | | | | | |

|

Healthcare, Education and Childcare — 13.08%*: | |

Advanz Pharma Corp.+ | | | 8.00 | | | | 9/6/2024 | | | | 3,743,000 | | | | 3,674,030 | | | | 3,443,560 | |

Avantor Performance Materials Holdings, Inc.#^ | | | 9.00 | | | | 10/1/2025 | | | | 5,180,000 | | | | 5,262,474 | | | | 5,568,500 | |

Bausch Health Companies Inc.#^ | | | 9.00 | | | | 12/15/2025 | | | | 11,045,000 | | | | 11,279,013 | | | | 11,897,784 | |

Endo International#^ | | | 7.50 | | | | 4/1/2027 | | | | 1,890,000 | | | | 1,890,000 | | | | 1,939,518 | |

Envision Healthcare Corp.#^ | | | 8.75 | | | | 10/15/2026 | | | | 12,551,000 | | | | 11,667,643 | | | | 5,961,725 | |

Ortho-Clinical Diagnostics Inc.#^ | | | 7.25 | | | | 2/1/2028 | | | | 2,063,000 | | | | 2,063,000 | | | | 2,096,998 | |

Radiology Partners Inc.#^ | | | 9.25 | | | | 2/1/2028 | | | | 586,000 | | | | 586,000 | | | | 552,305 | |

Synlab#+^ | | | 8.25 | | | | 7/1/2023 | | | | 2,000,000 | | | | 2,498,159 | | | | 2,291,929 | |

Verscend Technologies, Inc.#^ | | | 9.75 | | | | 8/15/2026 | | | | 2,915,000 | | | | 3,082,228 | | | | 3,131,730 | |

| | | | | | | | | | | | | | | | | | | | |

Total Healthcare, Education and Childcare | | | | | | | | | | | 41,973,000 | | | | 42,002,547 | | | | 36,884,049 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to the Financial Statements.

16

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2020 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Fixed Income (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | | | | | |

|

Home and Office Furnishings, Housewares, and Durable Consumer Products — 1.06%*: | |

Balta#+^ | | | 7.75 | % | | | 9/15/2022 | | | | 4,171,500 | | | | $4,844,431 | | | | $2,977,715 | |

| | | | | | | | | | | | | | | | | | | | |

Total Home and Office Furnishings, Housewares, and Durable Consumer Products | | | | | | | | | | | 4,171,500 | | | | 4,844,431 | | | | 2,977,715 | |

| | | | | | | | | | | | | | | | | | | | |

|

Hotels, Motels, Inns and Gaming — 2.43%*: | |

Boyne USA, Inc.#^ | | | 7.25 | | | | 5/1/2025 | | | | 950,000 | | | | 950,000 | | | | 995,125 | |

Golden Nugget Inc.#^ | | | 8.75 | | | | 10/1/2025 | | | | 6,500,000 | | | | 6,646,857 | | | | 3,672,500 | |

Scientific Games International Inc.^ | | | 8.63 | | | | 7/1/2025 | | | | 2,325,000 | | | | 2,321,484 | | | | 2,173,178 | |

| | | | | | | | | | | | | | | | | | | | |

Total Hotels, Motels, Inns and Gaming | | | | | | | | | | | 9,775,000 | | | | 9,918,341 | | | | 6,840,803 | |

| | | | | | | | | | | | | | | | | | | | |

|

Insurance — 5.78%*: | |

Acrisure LLC#^ | | | 7.00 | | | | 11/15/2025 | | | | 1,311,000 | | | | 1,259,407 | | | | 1,253,644 | |

Acrisure LLC#^ | | | 10.13 | | | | 8/1/2026 | | | | 9,575,000 | | | | 9,763,455 | | | | 10,293,125 | |

Acrisure LLC#^ | | | 8.13 | | | | 2/15/2024 | | | | 4,564,000 | | | | 4,680,684 | | | | 4,745,191 | |

| | | | | | | | | | | | | | | | | | | | |

Total Insurance | | | | | | | | | | | 15,450,000 | | | | 15,703,546 | | | | 16,291,960 | |

| | | | | | | | | | | | | | | | | | | | |

|

Leisure, Amusement, Entertainment — 1.40%*: | |

Eldorado Resorts | | | 8.13 | | | | 7/1/2027 | | | | 2,000,000 | | | | 1,975,000 | | | | 1,932,500 | |

Motion Finco+ | | | 7.00 | | | | 5/15/2025 | | | | 1,750,000 | | | | 1,934,115 | | | | 2,022,641 | |

| | | | | | | | | | | | | | | | | | | | |

Total Machinery (Non-Agriculture, Non-Construct, Non-Electronic) | | | | | | | | | | | 3,750,000 | | | | 3,909,115 | | | | 3,955,141 | |

| | | | | | | | | | | | | | | | | | | | |

|

Machinery (Non-Agriculture, Non-Construct, Non-Electronic) — 3.31%*: | |

Apex Tool Group LLC#^ | | | 9.00 | | | | 2/15/2023 | | | | 10,627,000 | | | | 10,437,999 | | | | 7,678,008 | |

Sarens#+^ | | | 5.75 | | | | 2/21/2027 | | | | 1,900,000 | | | | 2,085,826 | | | | 1,665,019 | |

| | | | | | | | | | | | | | | | | | | | |

Total Machinery (Non-Agriculture, Non-Construct, Non-Electronic) | | | | | | | | | | | 12,527,000 | | | | 12,523,825 | | | | 9,343,027 | |

| | | | | | | | | | | | | | | | | | | | |

|

Mining, Steel, Iron and Non-Precious Metals — 7.70%*: | |

Alliance Resources Partners, L.P.#^ | | | 7.50 | | | | 5/1/2025 | | | | 556,000 | | | | 556,000 | | | | 373,910 | |

Consol Energy Inc.#^ | | | 11.00 | | | | 11/15/2025 | | | | 10,316,000 | | | | 10,713,910 | | | | 4,360,676 | |

First Quantum Minerals#+^ | | | 7.25 | | | | 4/1/2023 | | | | 2,000,000 | | | | 1,934,426 | | | | 1,910,000 | |

First Quantum Minerals#+^ | | | 7.50 | | | | 4/1/2025 | | | | 9,775,000 | | | | 9,396,136 | | | | 9,359,563 | |

Northwest Acquisitions ULC+^ | | | 7.13 | | | | 11/1/2022 | | | | 16,122,000 | | | | 12,400,112 | | | | 165,251 | |

SunCoke Energy Inc.#^ | | | 7.50 | | | | 6/15/2025 | | | | 5,743,000 | | | | 5,723,025 | | | | 4,853,984 | |

Warrior Met Coal Inc.#^ | | | 8.00 | | | | 11/1/2024 | | | | 914,000 | | | | 914,000 | | | | 891,150 | |

| | | | | | | | | | | | | | | | | | | | |

Total Mining, Steel, Iron and Non-Precious Metals | | | | | | | | | | | 45,426,000 | | | | 41,637,609 | | | | 21,914,534 | |

| | | | | | | | | | | | | | | | | | | | |

|

Oil and Gas — 12.58%*: | |

Calumet Specialty Products# | | | 7.63 | | | | 1/15/2022 | | | | 4,398,000 | | | | 4,214,755 | | | | 4,200,090 | |

Calumet Specialty Products#^ | | | 11.00 | | | | 4/15/2025 | | | | 1,030,000 | | | | 1,065,162 | | | | 993,950 | |

Calumet Specialty Products# | | | 7.75 | | | | 4/15/2023 | | | | 2,550,000 | | | | 2,408,264 | | | | 2,371,500 | |

See accompanying Notes to the Financial Statements.

17

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2020 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Fixed Income (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Oil and Gas (Continued) | | | | | | | | | | | | | | | | | | | | |

Genesis Energy LP | | | 7.75 | % | | | 2/1/2028 | | | | 2,000,000 | | | | $1,865,677 | | | | $1,780,000 | |

Globe Luxembourg SA#+^ | | | 9.63 | | | | 4/1/2023 | | | | 4,238,000 | | | | 4,282,057 | | | | 2,027,735 | |

Globe Luxembourg SA#+^ | | | 9.88 | | | | 4/1/2022 | | | | 203,000 | | | | 206,465 | | | | 96,425 | |

Jonah Energy LLC#^ | | | 7.25 | | | | 10/15/2025 | | | | 5,714,000 | | | | 5,009,911 | | | | 699,965 | |

Jupiter Resources Inc.+¤ | | | 10.00 | | | | 1/31/2024 | | | | 1,424,667 | | | | 1,424,667 | | | | 1,282,200 | |

Laredo Petroleum Inc. | | | 9.50 | | | | 1/15/2025 | | | | 622,000 | | | | 622,000 | | | | 429,958 | |

Laredo Petroleum Inc. | | | 10.13 | | | | 1/15/2028 | | | | 3,765,000 | | | | 3,663,969 | | | | 2,597,850 | |

MEG Energy Corp.#+^ | | | 7.13 | | | | 2/1/2027 | | | | 898,000 | | | | 898,000 | | | | 746,463 | |

Neptune Energy Bondco PLC | | | 6.63 | | | | 5/15/2025 | | | | 2,806,000 | | | | 2,569,677 | | | | 2,441,220 | |

Vine Oil & Gas#^ | | | 9.75 | | | | 4/15/2023 | | | | 17,662,000 | | | | 15,748,752 | | | | 10,685,509 | |

Welltec A/S#+^ | | | 9.50 | | | | 12/1/2022 | | | | 5,713,000 | | | | 5,684,775 | | | | 5,141,700 | |

| | | | | | | | | | | | | | | | | | | | |

Total Oil and Gas | | | | | | | | | | | 53,023,667 | | | | 49,664,131 | | | | 35,494,565 | |

| | | | | | | | | | | | | | | | | | | | |

|

Other — 0.16%*: | |

Vertical Holdco GMBH | | | 7.63 | | | | 7/15/2028 | | | | 438,000 | | | | 438,000 | | | | 438,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total Other | | | | | | | | | | | 438,000 | | | | 438,000 | | | | 438,000 | |

| | | | | | | | | | | | | | | | | | | | |

|

Personal and Non Durable Consumer Products — 0.02%*: | |

High Ridge Brands Co.^ | | | 8.88 | | | | 3/15/2025 | | | | 2,982,000 | | | | 2,982,000 | | | | 59,640 | |

| | | | | | | | | | | | | | | | | | | | |

Total Personal and Non Durable Consumer Products | | | | | | | | | | | 2,982,000 | | | | 2,982,000 | | | | 59,640 | |

| | | | | | | | | | | | | | | | | | | | |

|

Personal Transportation — 1.15%*: | |

American Airlines^ | | | 11.75 | | | | 7/15/2025 | | | | 3,000,000 | | | | 2,970,000 | | | | 2,841,570 | |

Naviera Armas, 3M EURIBOR + 4.250%+^~ | | | 4.25 | | | | 11/15/2024 | | | | 150,000 | | | | 126,574 | | | | 88,812 | |

Naviera Armas, 3M EURIBOR + 6.500%+^~ | | | 6.50 | | | | 7/31/2023 | | | | 525,000 | | | | 608,461 | | | | 324,409 | |

| | | | | | | | | | | | | | | | | | | | |

Total Personal Transportation | | | | | | | | | | | 3,675,000 | | | | 3,705,035 | | | | 3,254,791 | |

| | | | | | | | | | | | | | | | | | | | |

|

Printing and Publishing — 1.70%*: | |

Cimpress N.V.#^ | | | 7.00 | | | | 6/15/2026 | | | | 2,069,000 | | | | 2,069,000 | | | | 1,908,653 | |

Houghton Mifflin Harcourt Publishers Inc.#^ | | | 9.00 | | | | 2/15/2025 | | | | 3,000,000 | | | | 2,944,893 | | | | 2,895,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total Printing and Publishing | | | | | | | | | | | 5,069,000 | | | | 5,013,893 | | | | 4,803,653 | |

| | | | | | | | | | | | | | | | | | | | |

|

Retail Store — 0.37%*: | |

Ken Garff Automotive#^ | | | 7.50 | | | | 8/15/2023 | | | | 1,034,000 | | | | 1,034,000 | | | | 1,032,708 | |

| | | | | | | | | | | | | | | | | | | | |

Total Retail Store | | | | | | | | | | | 1,034,000 | | | | 1,034,000 | | | | 1,032,708 | |

| | | | | | | | | | | | | | | | | | | | |

|

Telecommunications — 9.01%*: | |

Altice International S.A.^ | | | 7.63 | | | | 2/15/2025 | | | | 3,000,000 | | | | 3,036,995 | | | | 3,120,030 | |

BMC Software#^ | | | 9.75 | | | | 9/1/2026 | | | | 8,000,000 | | | | 7,742,987 | | | | 8,050,000 | |

Commscope Inc.#^ | | | 8.25 | | | | 3/1/2027 | | | | 11,673,000 | | | | 11,691,519 | | | | 11,996,342 | |

Commscope Inc.^ | | | 7.13 | | | | 7/1/2028 | | | | 1,431,000 | | | | 1,431,000 | | | | 1,427,566 | |

Digicel Limited#+^ | | | 8.25 | | | | 9/30/2020 | | | | 2,500,000 | | | | 2,491,364 | | | | 25,000 | |

See accompanying Notes to the Financial Statements.

18

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2020 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL | | | COST | | | FAIR

VALUE | |

Fixed Income (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Telecommunications (Continued) | | | | | | | | | | | | | | | | | | | | |

Viasat^ | | | 6.50 | % | | | 7/15/2028 | | | | 790,000 | | | | $790,000 | | | | $790,166 | |

| | | | | | | | | | | | | | | | | | | | |

Total Telecommunications | | | | | | | | | | | 27,394,000 | | | | 27,183,865 | | | | 25,409,104 | |

| | | | | | | | | | | | | | | | | | | | |

|

Utilities — 1.42%*: | |

Techem#+^ | | | 6.00 | | | | 7/30/2026 | | | | 3,500,000 | | | | 3,992,486 | | | | 4,010,875 | |

| | | | | | | | | | | | | | | | | | | | |

Total Utilities | | | | | | | | | | | 3,500,000 | | | | 3,992,486 | | | | 4,010,875 | |

| | | | | | | | | | | | | | | | | | | | |

Total Corporate Bonds | | | | | | | | | | | 380,472,167 | | | | 362,326,939 | | | | 304,462,402 | |

| | | | | | | | | | | | | | | | | | | | |

Total Fixed Income | | | | | | | | | | | 471,258,864 | | | | 446,994,027 | | | | 368,949,547 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investments | | | | | | | | | | | 473,114,334 | | | | 462,361,072 | | | | 369,893,090 | |

| | | | | | | | | | | | | | | | | | | | |

| |

Other assets and liabilities — (31.12)% | | | | (87,811,278 | ) |

| | | | | | | | | | | | | | | | | | | | |

| |

Net Assets — 100% | | | | $282,081,812 | |

| | | | | | | | | | | | | | | | | | | | |

| ‡ | The effective interest rates are based on settled commitment amount. |

| * | Calculated as a percentage of net assets applicable to common shareholders. |

| ¤ | Value determined using significant unobservable inputs, security is categorized as Level 3. |

| ^ | Security exempt from registration under Rule 144a of the Securities Act of 1933. These securities may only be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| ~ | Variable rate security. The interest rate shown is the rate in effect at June 30, 2020. |

| # | All or a portion of the security is segregated as collateral for the credit facility. |

| § | Bank loans are exempt from registration under the Securities Act of 1933, as amended, but contain certain restrictions on resale and cannot be sold publicly. These loans pay interest at rates which adjust periodically. The interest rates shown for bank loans are the current interest rates at June 30, 2020. Bank loans are also subject to mandatory and/or optional prepayment which cannot be predicted. As a result, the remaining maturity may be substantially less than the stated maturity shown. |

Distributions of investments by country of risk. Percentage of assets are expressed by market value excluding cash and accrued income as of June 30, 2020.

| | | | | | |

| | United States | | | 84.8% | |

| | United Kingdom | | | 4.9% | |

| | Zambia | | | 3.0% | |

| | Germany | | | 2.1% | |

| | Denmark | | | 1.4% | |

| | France | | | 1.3% | |

| | Belgium | | | 1.3% | |

| | (Individually less than 1%) | | | 1.2% | |

| | | | | | |

| | | | | 100.0% | |

| | | | | | |

See accompanying Notes to the Financial Statements.

19

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2020 (Unaudited)

A summary of outstanding derivatives at June 30, 2020 is as follows:

Schedule of Open Forward Currency Contracts

June 30, 2020

| | | | | | | | | | | | | | | | | | | | | | |

CURRENCY TO BE

RECEIVED | | | | | CURRENCY TO BE

DELIVERED(1) | | | | | | COUNTERPARTY OF

CONTRACT | | FORWARD

SETTLEMENT

DATE | | | UNREALIZED

APPRECIATION/

(DEPRECIATION) | |

| | 22,234,510 | | | EUR | | | (25,143,615 | ) | | | USD | | | Morgan Stanley | | | 7/15/2020 | | | $ | 154,922 | |

| | 7,255,936 | | | GBP | | | (9,196,417 | ) | | | USD | | | JP Morgan Chase | | | 7/15/2020 | | | | 204,684 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | $ | 359,606 | |

| | | | | | | | | | | | | | | | | | | | | | |

| (1) | Values are listed in U.S. dollars. |

See accompanying Notes to the Financial Statements.

20

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2020 (Unaudited)

Barings Global Short Duration High Yield Fund (the “Fund”) was organized as a business trust under the laws of the Commonwealth of Massachusetts on May 20, 2011, and commenced operations on October 26, 2012. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified, closed-end management investment company.

Barings LLC (the “Adviser”), a wholly-owned indirect subsidiary of Massachusetts Mutual Life Insurance Company, is a registered investment adviser under the Investment Advisers Act of 1940, as amended, and serves as investment adviser to the Fund.

Baring International Investment Limited (the “Sub-Adviser”), an indirect wholly-owned subsidiary of the Adviser, serves as sub-adviser with respect to the Fund’s European investments.

The Fund’s primary investment objective is to seek as high a level of current income as the Adviser determines is consistent with capital preservation. The Fund seeks capital appreciation as a secondary investment objective when consistent with its primary investment objective. There can be no assurance that the Fund will achieve its investment objectives. The Fund seeks to take advantage of inefficiencies between geographies, primarily the North American and Western European high yield bond and loan markets and within capital structures between bonds and loans. Under normal market conditions, the Fund will invest at least 80% of its Managed Assets in bonds, loans and other income-producing instruments that are, at the time of purchase, rated below investment grade (below Baa3 by Moody’s Investors Service, Inc. (“Moody’s”) or below BBB- by either Standard & Poor’s Rating Services, a division of the McGraw-Hill Company, Inc. (“S&P”) or Fitch, Inc. (“Fitch”), or unrated but judged by the Adviser or Sub-Adviser to be of comparable quality).

| 2. | Significant Accounting Policies |

The Fund is an investment company and follows accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946. The following is a summary of significant accounting policies followed consistently by the Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

| | A. | Valuation of Investments |

The Fund’s investments in fixed income securities are generally valued using the prices provided directly by independent third party services or provided directly from one or more broker dealers or market makers, each in accordance with the valuation policies and procedures approved by the Fund’s Board of Trustees (the “Board”).

The pricing services may use valuation models or matrix pricing, which consider yield or prices with respect to comparable bond quotations from bond dealers or by reference to other securities that are considered comparable in such characteristics as credit rating, interest rates and maturity date, to determine the current value. The closing prices of domestic or foreign securities may not reflect their market values at the time the Fund calculates its NAV if an event that materially affects the value of those securities has occurred since the closing prices were established on the domestic or foreign exchange market, but before the Fund’s NAV calculation. Under certain conditions, the Board has approved an independent pricing service to fair value foreign securities. This is generally accomplished by adjusting the closing price for movements in correlated indices, securities or derivatives. Fair value pricing may cause the value of the security on the books of the Fund to be different from the closing value on the non-U.S. exchange and may affect the calculation of the Fund’s NAV. The Fund may fair value securities in other situations, for example, when a particular foreign market is closed but the Fund is pricing their shares.

The Fund’s investments in bank loans are normally valued at the bid quotation obtained from dealers in loans by an independent pricing service in accordance with the Fund’s valuation policies and procedures approved by the Board.

Forward foreign exchange contracts are normally valued on the basis of independent pricing service providers.

A Valuation Committee, made up of officers of the Fund and employees of the Adviser, is responsible for determining, in accordance with the Fund’s valuation policies and procedures approved by the Board: (1) whether market quotations are readily available for investments held by the Fund; and (2) the fair value of investments held by the Fund for which market quotations are not readily available or are deemed not reliable by the Adviser. In certain cases, authorized pricing service vendors may not provide prices for a security held by the Fund, or the price provided by such

21

Barings Global Short Duration High Yield Fund 2020 Semi-Annual Report

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

June 30, 2020 (Unaudited)

pricing service vendor is deemed unreliable by the Adviser. In such cases, the Fund may use market maker quotations provided by an established market maker for that security (i.e. broker quotes) to value the security if the Adviser has experience obtaining quotations from the market maker and the Adviser determines that quotations obtained from the market maker in the past have generally been reliable (or, if the Adviser has no such experience with respect to a market maker, it determines based on other information available to it that quotations obtained by it from the market maker are reasonably likely to be reliable). In any such case, the Adviser will review any market quotations so obtained in light of other information in its possession for their general reliability.

Bank loans in which the Fund may invest have similar risks to lower-rated fixed income securities. Changes in the financial condition of the borrower or economic conditions or other circumstances may reduce the capacity of the borrower to make principal and interest payments on such instruments and may lead to defaults. Senior secured bank loans are supported by collateral; however, the value of the collateral may be insufficient to cover the amount owed to the Fund. By relying on a third party to administer a loan, the Fund is subject to the risk that the third party will fail to perform it obligations. The loans in which the Fund will invest are largely floating rate instruments; therefore, the interest rate risk generally is lower than for fixed-rate debt obligations. However, from the perspective of the borrower, an increase in interest rates may adversely affect the borrower’s financial condition. Due to the unique and customized nature of loan agreements evidencing loans and the private syndication thereof, loans are not as easily purchased or sold as publicly traded securities. Although the range of investors in loans has broadened in recent years, there can be no assurance that future levels of supply and demand in loan trading will provide the degree of liquidity which currently exists in the market. In addition, the terms of the loans may restrict their transferability without borrower consent. These factors may have an adverse effect on the market price and the Fund’s ability to dispose of particular portfolio investments. A less liquid secondary market also may make it more difficult for the Fund to obtain precise valuations of the high yield loans in its portfolio.

The Fund may invest in collateralized debt obligations (“CDOs”), which include collateralized bond obligations (“CBOs”) and collateralized loan obligations (“CLOs”).

CBOs and CLOs are types of asset-backed securities. A CDO is an entity that is backed by a diversified pool of debt securities (CBOs) or syndicated bank loans (CLOs). The cash flows of the CDO can be split into multiple segments, called “tranches,” which will vary in risk profile and yield. The riskiest segment is the subordinated or “equity” tranche. This tranche bears the greatest risk of defaults from the underlying assets in the CDO and serves to protect the other, more senior, tranches from default in all but the most severe circumstances. Since it is shielded from defaults by the more junior tranches, a “senior” tranche will typically have higher credit ratings and lower yields than their underlying securities, and often receive investment grade ratings from one or more of the nationally recognized rating agencies. Despite the protection from the more junior tranches, senior tranches can experience substantial losses due to actual defaults, increased sensitivity to future defaults and the disappearance of one or more protecting tranches as a result of changes in the credit profile of the underlying pool of assets.