SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 333-175137

|

| Pinafore Holdings B.V. |

| (Exact name of Registrant as specified in its charter) |

The Netherlands |

| (Jurisdiction of incorporation or organization) |

Prins Bernhardplein 200, 1097 JB, Amsterdam, The Netherlands |

| (Address of principal executive offices) |

Contact details of Company Contact Person:

| | | | | | |

| | Name | | Johan Broekhuis | | |

| | Email | | Joost.broekhuis@atcgroup.com | | |

| | Telephone | | +31 20577 1177 | | |

| | Address | | Prins Bernhardplein 200 1097 JB Amsterdam The Netherlands | | |

| | With a copy to: | | | | |

| | Name | | Thomas C. Reeve | | |

| | E-mail | | treeve@tomkins.co.uk | | |

| | Telephone | | +1 303 744 5059 | | |

| | Address | | Gates Corporation 1551 Wewatta Street Denver, Colorado 80202 United States | | |

Securities registered or to be registered to Section 12(b) of the Act:

| | | | |

| Title of each class | | | | Name of each exchange on which registered |

| | |

| None. | | | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act

None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

9% Senior Secured Second Lien Notes

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| | | | |

Ordinary ‘B’ shares, nominal value $0.01 per share | | | 1,091,117 | |

| |

Preferred ‘A’ shares, nominal value $3,600 per share | | | 2 | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Nox

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yesx No¨

Pinafore Holdings B.V. has filed all Exchange Act reports for the preceding 12 months.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes¨ No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that registrant was required to submit and post such files): Yes¨ No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by a check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

US GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow: Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Nox

Pinafore Holdings B.V.

TABLE OF CONTENTS

Pinafore Holdings B.V.

Financial and Other Information

On July 27, 2010, the independent directors of Tomkins plc and the board of directors of Gates Acquisitions Limited (formerly Tomkins Acquisitions Limited, which was formerly Pinafore Acquisitions Limited) announced that they had reached an agreement on the terms of a recommended cash acquisition (the ‘Acquisition’) for the entire share capital of Tomkins plc, including the Tomkins plc shares underlying the Tomkins American Depository Receipts (‘ADRs’) and certain employee equity awards, implemented by way of a scheme of arrangement under Part 26 of the UK’s Companies Act 2006 (the ‘Scheme’). On the Acquisition date, Tomkins plc was re-registered as a private company and its name was changed to Tomkins Limited (now known as Gates Worldwide Limited).

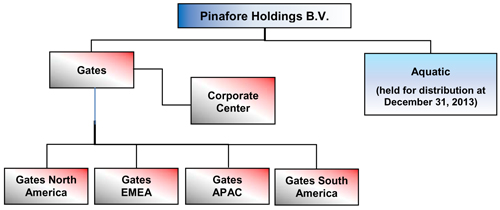

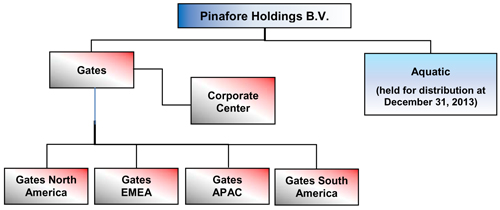

The direct parent of Gates Acquisitions Limited is Pinafore Holdings B.V. (the ‘Company’ or the ‘Registrant’), whose immediate and ultimate parent entity is Pinafore Coöperatief U.A. (the ‘Co-operative’). The Co-operative is owned by a consortium representing the interests of Onex Corporation (‘Onex’), a Canadian private equity investor, Onex Partners III and various syndication participants, and the Canada Pension Plan Investment Board (‘CPPIB’), collectively the ‘Sponsors’.

Results of Tomkins plc and its subsidiaries (‘Tomkins’) for periods prior to the Acquisition on September 24, 2010 (‘Predecessor’) have been presented separately from those of the Company and its subsidiaries for the periods subsequent to the Acquisition (‘Successor’).

The Company draws up its annual financial statements to December 31. This annual report on Form 20-F (the ‘Report’) contains consolidated financial statements that present the results of operations for the year from January 1, 2013 to December 31, 2013 (‘Fiscal 2013’), the year from January 1, 2012 to December 31, 2012 (‘Fiscal 2012’) and the year from January 1, 2011 to December 31, 2011 (‘Fiscal 2011’).

The consolidated financial statements of the Company and its subsidiaries (the ‘Group’) appearing in this Report are presented in US dollars and are prepared in accordance with IFRS as issued by the International Accounting Standards Board (‘IASB’), which differs in certain respects from US GAAP.

Effective January 1, 2013, the Group adopted a number of IFRS accounting pronouncements. The only one of these that had any significant impact on the results or financial position of the Group during the periods presented in this Report was IAS 19 ‘Employee Benefits (2011)’ (‘IAS 19R’). The retrospective adoption of this pronouncement had no impact on the consolidated balance sheet as of December 31, 2012 or December 31, 2011, but did impact the results from operations for all periods presented.

In addition to the restatements described above, the Group has re-presented its comparative information for the following:

| • | | reclassification of the Aquatic operating segment as a discontinued operation (see note 15 to the Group’s consolidated financial statements); |

| • | | revisions to the cost allocations in the segmental reporting as described in note 5 to the Group’s consolidated financial statements; and |

| • | | the reclassification of certain costs in the consolidated income statement to present more appropriately the Group’s expenses based on their function. These amounts were previously included primarily in cost of sales, however, based on a re-assessment of their nature and their presentation, it has been determined that they are more aligned with administrative expenses and with distribution costs. To reflect this change in presentation, cost of sales in each of the periods has been reduced and adjustments have been made to distribution expenses and to administrative expenses. These reclassifications have had no impact on operating profit for any of the periods presented. |

The impacts of the above restatements and re-presentations are summarized in note 3A to the consolidated financial statements. Comparative information for all periods is presented throughout this Report on a comparable basis.

We assess the performance of our businesses using a variety of measures. Certain of these measures are not explicitly defined under IFRS and are therefore termed ‘non-GAAP measures’. Under the heading ‘Non-GAAP measures’ inItem 5 ‘Operating and financial review and prospects’ we identify and explain the relevance of each of the non-GAAP measures referenced herein, show how they are calculated and present a reconciliation to the most directly comparable measure defined under IFRS. We do not regard these non-GAAP measures as a substitute for, or superior to, the equivalent measures defined under IFRS. The non-GAAP measures that we use may not be directly comparable with similarly-titled measures used by other companies.

In this Report, all references to the ‘Group’, ‘we’, ‘us’, ‘our’ refer, except as otherwise indicated or as the context otherwise indicates the Company and its subsidiaries. References to ‘US dollars’, ‘$’ ‘cents’ and ‘c’ are to United States currency, references to ‘pounds sterling’, ‘£’, ‘pence’ and ‘p’ are to British currency, references to ‘Canadian dollars’ are to Canadian currency, and ‘Euros’ or ‘€’ are to the currency of certain member states of the European Union. These and certain other terms and acronyms used in this document are defined in the glossary to this document.

Special note regarding forward-looking statements

This Report and oral statements made in connection with this document contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the ‘Exchange Act’), including assumptions, anticipations, expectations and forecasts concerning the Company’s future business strategy, products, services, financial results, performance, future events and information relevant to our business, industries and operating environments. When used in this document, the words “may”, “will”, “intend”, “plan”, “foresee”, “anticipate”, “believe”, “expect”, “estimate”, “assume”, “could”, “should”, “continue” and similar expressions, as they relate to the Company, its end markets or its management, are intended to identify forward-looking statements.

i

Pinafore Holdings B.V.

Such statements reflect the current views of management with respect to future events and are subject to certain risks, uncertainties and assumptions. The forward-looking statements contained herein represent a good-faith assessment of our future performance for which we believe there is a reasonable basis. Important factors that could cause actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements are disclosed underItem 3D ‘Risk factors’. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include:

| • | | global and general economic conditions, including those specific to our end markets; |

| • | | significant global operations and global expansion; |

| • | | the cost and availability of raw materials; |

| • | | our ability to compete successfully with other companies in our industry; |

| • | | equipment failures, explosions and adverse weather; |

| • | | the impact of natural disasters and terrorist attacks; |

| • | | the demand for our products by industrial manufacturers and automakers; |

| • | | currency fluctuations from our international sales; |

| • | | product liability claims against us; |

| • | | regulations applicable to our global operations; |

| • | | environmental, health and safety laws and regulations; |

| • | | the sufficiency of our insurance policies to cover losses, including liabilities arising from litigation; |

| • | | failure to develop and maintain intellectual property rights; |

| • | | our ability to integrate acquired companies into our business and the success of our acquisition strategy; |

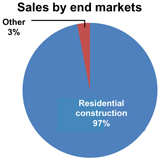

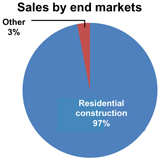

| • | | the downturn in the US residential construction industry; |

| • | | the potential loss of key personnel; |

| • | | labor shortages, labor costs and collective bargaining agreements; |

| • | | our ability to comply with new regulations related to conflict minerals; |

| • | | potential inability to obtain necessary capital; |

| • | | the dependence on our subsidiaries for cash to meet our debt obligations; |

| • | | substantial indebtedness and maintaining compliance with debt covenants; |

| • | | our ability to incur additional indebtedness; |

| • | | cash requirements to service indebtedness; |

| • | | ability and willingness of our lenders to fund borrowings under their credit commitments; |

| • | | changes in capital availability or costs, such as changes in interest rates, security ratings and market perceptions of the businesses in which we operate, or the ability to obtain capital on commercially reasonable terms or at all; |

| • | | continued global economic weakness and uncertainties and disruption in the capital, credit and commodities markets; |

| • | | the amount of the costs, fees, expenses and charges related to this initial public offering and the related costs of being a public company; |

| • | | any statements of belief and any statements of assumptions underlying any of the foregoing; |

| • | | other risks and uncertainties, including those listed underItem 3D ‘Risk factors’; and |

| • | | other factors beyond our control. |

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. Other unpredictable factors could also cause actual results to differ materially from those in the forward-looking statements. Therefore investors should not place undue reliance on such statements as a prediction of actual results.

These forward-looking statements represent our view only as of the date they are made, and we disclaim any obligation to update forward-looking statements contained herein, except as may be otherwise required by law.

ii

Pinafore Holdings B.V.

Non-GAAP metrics

We assess the performance of our businesses using a variety of measures, some which are not explicitly defined under IFRS and are therefore termed ‘non-GAAP measures’. Under the heading ‘Non-GAAP measures’ at the end ofItem 5B‘Liquidity and capital resources’, we identify and explain the relevance of each of the non-GAAP measures presented in this Report, show how they are calculated and present a reconciliation to the most directly comparable measure defined under IFRS. We do not regard these non-GAAP measures as a substitute for, or superior to, the equivalent measures defined under IFRS. The non-GAAP measures that we use may not be directly comparable with similarly-titled measures used by other companies.

Market and industry data

The market data and other statistical information used throughout this Report are based on independent industry publications, reports by market research firms or other published independent sources. Some market data and statistical information are also based on our good faith estimates, which are derived from management’s knowledge of our industry and such independent sources referred to above. Certain market, ranking and industry data included elsewhere in this Report, including the size of certain markets and our size or position and the positions of our competitors within these markets, including our services relative to our competitors, are based on estimates of our management. These estimates have been derived from our management’s knowledge and experience in the markets in which we operate, as well as information obtained from surveys, reports by market research firms, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate. Unless otherwise noted, all of our market share and market position information presented in this prospectus is an approximation. Our market share and market position in each of our businesses and divisions, unless otherwise noted, is based on our sales relative to the estimated sales in the markets we served. References herein to our being a leader in a market or product category refer to our belief that we have a leading market share position in each specified market, unless the context otherwise requires. As there are no publicly available sources supporting this belief, it is based solely on our internal analysis of our sales as compared to our estimates of sales of our competitors. In addition, the discussion herein regarding our various end markets is based on how we define the end markets for our products, which products may be either part of larger overall end markets or end markets that include other types of products and services.

Certain monetary amounts, percentages and other figures included elsewhere in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

In this Report we have cited information compiled by certain industry sources and third parties including:

| • | | European Automobile Manufacturers Association (‘ACEA’) |

| • | | National Bureau of Statistics of China |

| • | | US Federal Highway Administration |

iii

Pinafore Holdings B.V.

Item 1

PART I

| Item 1. | Identity of Directors, Senior Management and Advisors |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

1

Pinafore Holdings B.V.

Item 3D

A. Selected financial data

The selected financial data set out below as at December 31, 2013, December 31, 2012 and December 31, 2011 and for Fiscal 2013, Fiscal 2012 and Fiscal 2011 has been derived from the Group’s consolidated financial statements prepared in accordance with IFRS and included in this Report.

The historical financial information as at December 31, 2010 and January 2, 2010 and for the 14-week period ended December 31, 2010 (‘Q4 2010’), the 38-week period ended September 24, 2010 (‘9M 2010’) and the fiscal year ended January 2, 2010 (‘Fiscal 2009’) has also been prepared in accordance with IFRS and has been derived from consolidated financial statements not separately presented herein and after restatement for the retrospective application of IAS 19R and after re-presentation for the classification of the Aquatic, Sensors & Valves, Dexter and Air Distribution operating segments as discontinued operations (see note 3A and note 15, respectively to the Group’s consolidated financial statements).

The selected financial data set forth below should be read in conjunction with, and is qualified in its entirety by reference to, such consolidated financial statements and notes thereto andItem 5 ‘Operating and financial review and prospects’.

Consolidated income statement data

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ million, unless otherwise stated | | SUCCESSOR | | | | | PREDECESSOR | |

| | | Fiscal 2013 | | | Fiscal 2012* | | | Fiscal 2011* | | | Q4 2010* | | | | | 9M 2010* | | | Fiscal 2009* | |

Sales from continuing operations | | | 2,947.3 | | | | 2,922.8 | | | | 3,320.1 | | | | 873.1 | | | | | | 2,351.7 | | | | 2,655.5 | |

| | | | | | | |

Operating profit/(loss) | | | 300.3 | | | | 188.8 | | | | 245.1 | | | | (196.6 | ) | | | | | 236.7 | | | | 31.6 | |

| | | | | | | |

Profit/(loss) for the period from continuing operations | | | 135.8 | | | | (15.9 | ) | | | (30.5 | ) | | | (278.0 | ) | | | | | 143.9 | | | | (21.3 | ) |

| | | | | | | |

Profit for the period from discontinued operations | | | 0.3 | | | | 764.5 | | | | 74.6 | | | | 5.1 | | | | | | 91.6 | | | | 17.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Profit/(loss) for the period | | | 136.1 | | | | 748.6 | | | | 44.1 | | | | (272.9 | ) | | | | | 235.5 | | | | (4.3 | ) |

| | | | | | | |

Profit/(loss) for the period attributable to equity shareholders | | | 107.6 | | | | 725.5 | | | | 14.8 | | | | (273.8 | ) | | | | | 209.3 | | | | (25.9 | ) |

| | | | | | | |

Dividend per share paid or proposed during the period: | | | | | | | | | | | | | | | | | | | | | | | | | | |

– Interim (cents per share) | | | — | | | | — | | | | — | | | | — | | | | | | — | | | | 3.50 | c |

– Final (cents per share) | | | — | | | | — | | | | — | | | | — | | | | | | — | | | | 6.50 | c |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | — | | | | — | | | | — | | | | — | | | | | | — | | | | 10.00 | c |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Restated (see note 3A) and re-presented for discontinued operations (see note 15) |

Consolidated balance sheet data

| | | | | | | | | | | | | | | | | | | | | | |

$ million | | SUCCESSOR | | | | | PREDECESSOR | |

| | | As at

December 31,

2013 | | | As at

December 31,

2012 | | | As at

December 31,

2011 | | | As at

December 31,

2010 | | | | | As at

January 2,

2010 | |

| | | | | | |

Total assets | | | 4,945.6 | | | | 5,083.6 | | | | 6,705.2 | | | | 7,552.3 | | | | | | 3,673.6 | |

Net assets | | | 2,031.6 | | | | 1,943.9 | | | | 2,343.6 | | | | 2,339.8 | | | | | | 1,678.0 | |

Share capital | | | — | | | | — | | | | — | | | | — | | | | | | 79.6 | |

Share premium account | | | 984.0 | | | | 984.0 | | | | 2,143.3 | | | | 2,124.7 | | | | | | 799.2 | |

Shareholders’ equity | | | 1,796.5 | | | | 1,694.6 | | | | 2,074.9 | | | | 2,028.3 | | | | | | 1,536.6 | |

Acquisitions and disposals

Acquisitions and disposals during the three most recent fiscal years are detailed in ‘Principal acquisitions and disposals’ underItem 4A ‘History and development of the Company’.

B. Capitalization and indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

2

Pinafore Holdings B.V.

Item 3D

D. Risk factors

We operate globally in a variety of markets and are affected by a number of risks inherent in our activities. Business risk can be considered either as downside risk (the risk that something can go wrong and result in a financial loss or exposure) or volatility risk (the risk associated with uncertainty, meaning there may be an opportunity for financial gain as well as the potential for loss).

We outline below the risks and uncertainties that the Company’s board of directors (the ‘Board’) believes have the potential to affect the Group’s results or financial position. Details of the Group’s risk management procedures are set out under the heading ‘Internal control’ underItem 15 ‘Controls and procedures’.

Additional risks that we currently do not regard as significant, could also have a material adverse effect on our results or financial position. Our analysis of our principal risks and uncertainties should, therefore, be read in conjunction with the cautionary statement regarding forward-looking statements set out on page i.

When applying the Group’s accounting policies, management must make assumptions and estimates about the future that may differ from actual outcomes. We discuss the key sources of estimation uncertainty that have a significant risk of causing a material adjustment to the carrying amount of the Group’s assets and liabilities in note 4 to the Group’s consolidated financial statements.

Risks associated with our business

Conditions in the global and regional economy and the major end markets we serve may materially and adversely affect the business and results of operations of our businesses should they deteriorate.

Our business and operating results have been, and will continue to be, affected by worldwide and regional economic conditions, including conditions in the general industrial, automotive and residential construction end markets we serve. As a result of continuing effects from the slowdown in global economic growth, the credit market crisis, weak consumer and business confidence, high levels of unemployment, reduced levels of capital expenditures, fluctuating commodity prices, bankruptcies and other challenges affecting the global economy, some of our customers may experience the deterioration of their businesses, cash flow shortages or difficulty obtaining financing. As a result, existing or potential customers may delay or cancel plans to purchase our products and services and may not be able to fulfill their obligations to us in a timely fashion.

Further, our suppliers, distributors and vendors may be experiencing similar conditions, which may impact their ability to fulfill their obligations to us. If the global economic slowdown continues for a significant period or there is significant further deterioration in the global economy, our results of operations, financial position and cash flows could be materially adversely affected.

We are subject to economic, political and other risks associated with international operations, and this could adversely affect our business and our strategy to continue to expand our geographic reach.

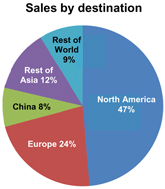

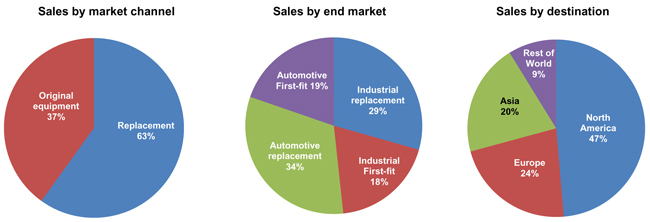

One of our key strategies is to continue to expand our geographic reach, and as a result, a substantial portion of our operations are now conducted and located outside the US. In Fiscal 2013, approximately 63% of sales from continuing operations originated from outside of North America. We have manufacturing, sales and service facilities spanning five continents and sell to customers in over 120 countries. Moreover, a significant amount of our manufacturing functions and sources of our raw materials and components are from emerging markets such as China, India and Eastern Europe. Accordingly, our business and results of operations, as well as the business and results of operations of our vendors, suppliers and customers, are subject to risks associated with doing business internationally, including:

| • | | changes in foreign currency exchange rates; |

| • | | trade protection measures, such as tariff increases, and import and export licensing and control requirements; |

| • | | the complexities of operating within multiple tax jurisdictions, including potentially negative consequences from changes in tax laws or from tax examinations, which may, in addition, require an extended period of time to resolve; |

| • | | instability in a specific country’s or region’s political, economic or social conditions; |

| • | | difficulty in staffing and managing widespread operations; |

| • | | difficulty of enforcing agreements and collecting receivables through some foreign legal systems; |

| • | | differing and, in some cases, more stringent labor regulations; |

| • | | partial or total expropriation; |

| • | | differing protection of intellectual property; |

| • | | unexpected changes in regulatory requirements and required compliance with a variety of foreign laws, including environmental regulations and laws; |

| • | | the burden of complying with multiple and possibly conflicting laws; |

| • | | differing local product preferences and product requirements; |

| • | | strong competition from companies that are already established in the markets we seek to enter; |

| • | | inability to repatriate income or capital; and |

| • | | difficulty in administering and enforcing corporate policies, which may be different than the normal business practices of local cultures, and implementing restructuring actions on a timely basis. |

The likelihood of such occurrences and their potential effect on us vary from country to country and are unpredictable. Certain regions, including Latin America, Asia, the Middle East and Africa, are inherently more economically and politically volatile and as a result, our business units that operate in these regions could be subject to significant fluctuations in sales and operating income from quarter to quarter. Because a significant percentage of our operating income in recent years has come from these regions, adverse fluctuations in the operating results in these regions could have a disproportionate impact on our results of operations in future periods.

3

Pinafore Holdings B.V.

Item 3D

Additionally, concerns persist regarding the debt burden of certain European countries and the ability of these countries to meet future financial obligations, as well as concerns regarding the overall stability of the euro and the suitability of the Euro as a single currency given the diverse economic and political circumstances of individual euro area countries. If a country within the Euro area were to default on its debt or withdraw from the Euro currency, or if the Euro were to be dissolved entirely, the impact on markets around the world, and on our global business, could be immediate and material. Such a development could cause financial and capital markets within and outside Europe to constrict, thereby negatively impacting our ability to finance our business, and also could cause a substantial dip in consumer confidence and spending that could negatively impact sales. Any one of these impacts could have a material adverse effect on our financial condition and results of operations.

If we are unable to obtain raw materials at favorable prices in sufficient quantities, or at the time we require them, our operating margins and results of operations may be materially adversely affected.

We purchase our energy, steel, aluminum, rubber and rubber-based materials, and other key manufacturing inputs from outside sources. We do not traditionally have long-term pricing contracts with raw material suppliers. The costs of these raw materials have been volatile historically and are influenced by factors that are outside our control. In recent years, the prices for energy, metal alloys, polymers and certain other of our raw materials have fluctuated significantly. While we strive to avoid this risk through the use of price escalation mechanisms with respect to our raw materials in our customer contracts and we seek to offset our increased costs with gains achieved through operational efficiencies, if we are unable to pass increases in the costs of our raw materials on to our customers and operational efficiencies are not achieved, our operating margins and results of operations may be materially adversely.

Additionally, our businesses compete globally for key production inputs. The availability of qualified suppliers and of key inputs may be disrupted by market disturbances or any number of geopolitical factors, including political unrest and significant weather events. Such disruptions may require additional capital or operating expenditure by us or force reductions in our production volumes. In the event of an industry-wide general shortage of certain raw materials or key inputs, or a shortage or discontinuation of certain raw materials or key inputs from one or more of our suppliers, we may not be able to arrange for alternative sources of certain raw materials or key inputs. Any such shortage may materially adversely affect our competitive position versus companies that are able to better or more cheaply source such raw materials or key inputs.

We face competition in all areas of our business and may not be able to successfully compete with our competitors, which could lead to lower levels of profits and reduce the amount of cash we generate.

We are subject to competition from other producers of products that are similar to ours. We compete on a number of factors, including product performance, quality, value, product availability, customer service and innovation and technology. Our customers often demand delivery of our products on a tight time schedule and in a number of geographic markets. If our quality of service declines or we cannot meet the demands of our customers, they may utilize the services or products of our competitors. Our competitors include manufacturers that may be better capitalized, may have a more extensive low-cost sourcing strategy and presence in low-cost regions or may receive significant governmental support and as a result, may be able to offer more aggressive pricing. If we are unable to continue to provide technologically superior or better quality products or to price our products competitively, our ability to compete could be harmed and we could lose customers or market share.

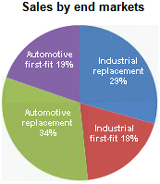

Pricing pressures from our customers may materially adversely affect our business.

We generate strong margins by selling premium products at premium prices. Accordingly, our margins could suffer if our customers are no longer willing to pay a premium for our product and service offering. We face the greatest pricing pressure from our customers in the automotive first-fit end market. Virtually all vehicle manufacturers seek price reductions in both the initial bidding process and during the term of the award. We are also, from time to time, subject to pricing pressures from customers in our other end markets. If we are not able to offset price reductions through improved operating efficiencies and reduced expenditures or new product introduction, those price reductions may have a material adverse effect on our results of operations.

We are dependent on the continued operation of our manufacturing facilities.

While we are not heavily dependent on any single manufacturing facility, major disruptions at a number of our manufacturing facilities, due to labor unrest, adverse weather, natural disasters, terrorist attacks, significant mechanical failure of our facilities, or other catastrophic event, could result in significant interruption of our business and a potential loss of customers and sales or could significantly increase our operating costs.

We may not be able to accurately forecast demand or meet significant increases in demand for our products.

Certain of our businesses operate with short lead times and we order raw materials and supplies and plan production based on discussions with our customers and internal forecasts of demand. If we are unable to accurately forecast demand for our products, in terms of both volume and specific products, or react appropriately to abrupt changes in demand, we may experience delayed product shipments and customer dissatisfaction. Additionally, if demand increases significantly from current levels, both we and our suppliers may have difficulty meeting such demand, particularly if such demand increases occur rapidly. Failure to accurately forecast demand or meet significant increases in demand could have a material adverse impact on our business, financial condition and operating results.

We are exposed to exchange rate fluctuations in the international markets in which we operate.

We conduct operations in many areas of the world involving transactions denominated in a variety of functional currencies. We are subject to currency exchange rate risk to the extent that our costs may be denominated in currencies other than those in which we earn and report revenues and vice versa. In addition, a decrease in the value of any of these currencies relative to the US dollar could reduce our profits from non-US operations and the translated value of the net assets of our non-US operations when reported in US dollars in our consolidated financial statements. For example, in Fiscal 2013, movements in average currency translation rates adversely affected our sales by $26.2 million, but favorably impacted our operating profit by $1.4 million. Ongoing movements in average currency translation rates in the future could continue to have a negative impact on our business, financial condition or results of operations as reported in US dollars. Fluctuations in currencies may also make it more difficult to perform period-to-period comparisons of our reported results of operations.

4

Pinafore Holdings B.V.

Item 3D

We anticipate that there will be instances in which costs and revenues will not be exactly matched with respect to currency denomination. As a result, to the extent we expand geographically, we expect that increasing portions of our revenues, costs, assets and liabilities will be subject to fluctuations in foreign currency valuations. We may experience economic loss and a negative impact on earnings or net assets solely as a result of foreign currency exchange rate fluctuations. Further, the markets in which we operate could restrict the removal or conversion of the local or foreign currency, resulting in our inability to hedge against these risks.

We also face risks arising from the imposition of exchange controls and currency devaluations. Exchange controls may limit our ability to convert foreign currencies into US dollars or to remit dividends and other payments by our foreign subsidiaries or businesses located in or conducted within a country imposing controls. Currency devaluations result in a diminished value of funds denominated in the currency of the country instituting the devaluation. Actions of this nature, if they occur or continue for significant periods of time, could have an adverse effect on our results of operations and financial condition in any given period.

We may be subject to increased income taxes, and other restrictions and limitations, if we were to decide to repatriate any of our non-US income, capital or cash to the United States.

Government regulations and restrictions in some countries may limit the amount of non-US income, capital or cash that may be repatriated. The repatriation of non-US income, capital or cash is often subject to restrictions such as the need for certain governmental consents. Even where there is no outright restriction, the mechanics of repatriation or, in certain countries, the inadequacy of the availability of foreign currency (such as US dollars) to non-governmental entities, may affect certain aspects of our operations. In the event we need to repatriate our non-US income, capital or cash from a particular country to fund operations in another part of the world, we may need to repatriate some of our non-US cash balances out of the country where they are located to another jurisdiction and we may be subject to additional income taxes in the jurisdiction receiving the cash. Any of these scenarios may subject us to costs, restrictions and/or limitations that result in us being unable to use our cash in the manner we desire, which may have a material adverse effect on our results of operations and financial condition.

We are dependent on market acceptance of new product introductions and product innovations for continued revenue growth.

The markets in which we operate are subject to technological change. Our long-term operating results depend substantially upon our ability to continually develop, introduce, and market new and innovative products, to modify existing products, to respond to technological change, and to customize certain products to meet customer requirements and evolving industry standards. There are numerous risks inherent in this process, including the risks that we will be unable to anticipate the direction of technological change or that we will be unable to develop and market new products and applications in a timely fashion to satisfy customer demands.

We have taken, and continue to take, cost-reduction actions, which may expose us to additional production risk and we may not be able to maintain the level of cost reductions that we have achieved.

We have been reducing costs in all of our businesses and have discontinued product lines, exited businesses, consolidated manufacturing operations and reduced our employee population. The impact of these cost-reduction actions on our sales and profitability may be influenced by many factors and we may not be able to maintain the level of cost savings that we have achieved depending on our ability to successfully complete these efforts. In connection with the implementation and maintenance of our cost reduction measures, we may face delays in implementation of anticipated workforce reductions, a decline in employee morale and a potential inability to meet operational targets due to an inability to retain or recruit key employees.

We are subject to risks from litigation, legal and regulatory proceedings and obligations that may materially impact our operations.

We face an inherent business risk of exposure to various types of claims, lawsuits and proceedings. We are involved in various tax, intellectual property, product liability, product warranty, environmental claims and lawsuits, and other legal and regulatory proceedings arising in the ordinary course of our business. Although it is not possible to predict with certainty the outcome of every claim, lawsuit or proceeding and the range of probable loss, we believe these claims, lawsuits and proceedings will not individually or in the aggregate have a material impact on our results. However, we could, in the future, be subject to various claims, lawsuits and proceedings, including, amongst others, tax, intellectual property, product liability, product warranty, environmental claims and antitrust claims, and we may incur judgments or enter into settlements of claims, lawsuits and proceedings that could have a material adverse effect on our results of operations in any particular period.

We may be subject to recalls, product liability claims or may incur costs related to product warranties that may materially and adversely affect our business.

Meeting or exceeding many government-mandated safety standards is costly and requires manufacturers to remedy defects related to product safety through recall campaigns if the products do not comply with safety, health or environmental standards. If we, customers or government regulators determine that a product is defective or does not comply with safety standards prior to the start of production, the launch of a product could be delayed until such defect is remedied. The costs associated with any protracted delay of a product launch or a recall campaign to remedy defects in products that have been sold could be substantial.

We face an inherent risk of product liability claims if product failure results in any claim for injury or loss. Litigation is inherently unpredictable and these claims, regardless of their outcome, may be costly, divert management attention and adversely affect our reputation. Supplier consolidation and the increase in low-cost country sourcing may increase the likelihood of receiving defective materials, thereby increasing the risk of product failure and resulting liability claims. In addition, even if we are successful in defending against a claim relating to our products, claims of this nature could cause our customers to lose confidence in our products and us.

From time to time, we receive product warranty claims from our customers, pursuant to which we may be required to bear costs of repair or replacement of certain of our products. Vehicle manufacturers are increasingly requiring their outside suppliers to participate in the warranty of their products and to be responsible for the operation of these component products in new vehicles sold to consumers. Warranty claims may range from individual customer claims to full recalls of all products in the field. It cannot be assured that costs associated with providing product warranties will not be material.

5

Pinafore Holdings B.V.

Item 3D

We are subject to anti-corruption laws in various jurisdictions, as well as other laws governing our international operations. If we fail to comply with these laws we could be subject to civil or criminal penalties, other remedial measures, and legal expenses, which could materially adversely affect our business, financial condition and results of operations.

Our international operations are subject to one or more anti-corruption laws in various jurisdictions, such as the US Foreign Corrupt Practices Act of 1977, as amended (‘FCPA’), the UK Bribery Act of 2010 and other anticorruption laws. The FCPA and these other laws generally prohibit employees and intermediaries from bribing or making other prohibited payments to foreign officials or other persons to obtain or retain business or gain some other business advantage. We operate in a number of jurisdictions that pose a high risk of potential FCPA or other anti-corruption violations, (and we participate in joint ventures and relationships with third parties whose actions could potentially subject us to liability under the FCPA. In addition, we cannot predict the nature, scope or effect of future regulatory requirements to which our international operations might be subject or the manner in which existing laws might be administered or interpreted.

We are also subject to other laws and regulations governing our international operations, including regulations administered by the US Department of Commerce’s Bureau of Industry and Security, the US Department of Treasury’s Office of Foreign Asset Control and various non-US government entities, including applicable export control regulations, economic sanctions on countries and persons, customs requirements, currency exchange regulations, and transfer pricing regulations (collectively, ‘Trade Control laws’).

We have instituted policies, procedures and ongoing training of certain employees with regard to business ethics, designed to ensure that we and our employees comply with the FCPA, other anticorruption laws and Trade Control laws. However, there is no assurance that our efforts have been and will be completely effective in ensuring our compliance with all applicable anti-corruption laws, including the FCPA, or other legal requirements. If we are not in compliance with the FCPA, other anti-corruption laws or Trade Control laws, we may be subject to criminal and civil penalties, disgorgement and other sanctions and remedial measures, and legal expenses, which could have a material adverse impact on our business, financial condition, results of operations and liquidity. Likewise, any investigation of any potential violations of the FCPA or other anti-corruption laws by US or foreign authorities could also have a material adverse impact on our reputation, business, financial condition and results of operations.

Our information technology systems are decentralized, which may lead to certain security risks and make access to our applications cumbersome.

In general our information technology systems are decentralized. This decentralization may lead to security risks and makes access to common applications cumbersome. We are in the midst of several large-scale information technology projects, including with respect to Enterprise Resource Planning (‘ERP’) systems and consolidation of applications and servers. The costs of such projects may exceed the amounts we have budgeted for them, and any material failures in the execution of such projects may hinder our day-to-day operations.

Our business could be materially adversely affected by interruptions to our computer and IT systems.

Most of our business activities rely on the efficient and uninterrupted operation of our computer and information technology (‘IT’) systems and those of third parties with which we have contracted. Our computer and IT systems are vulnerable to damage or interruption from a variety of sources, as well as potential cyber security incidents. Any failure of these systems or cybersecurity incidents could have a material adverse effect on our business, financial condition and results of operations.

Environmental compliance costs and liabilities and responses to concerns regarding climate change could affect our financial condition, results of operations and cash flows adversely.

Our operations, products and properties are subject to stringent US and foreign, federal, state, local and provincial laws and regulations relating to environmental protection, including laws and regulations governing the investigation and clean up of contaminated properties as well as air emissions, water discharges, waste management and disposal, product safety and workplace health and safety. Such laws and regulations affect all of our operations, are continually changing, generally vary by jurisdiction and can impose substantial fines and sanctions for violations. Further, they may require substantial clean-up costs for our properties (many of which are sites of long-standing manufacturing operations) or other sites where we have operated or disposed waste and the installation of costly pollution control equipment or operational changes to limit pollution emissions and/or decrease the likelihood of accidental releases of regulated materials. Under some of these laws, such as the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA” or “Superfund”) and analogous state statutes, liability for the entire cost of the cleanup of contaminated sites can be imposed jointly and severally upon current or former owners or operators, or upon parties who have sent or arranged to send waste for disposal, without regard to fault or the legality of the activities giving rise to the contamination. We must conform our operations, products and properties to these laws and adapt to regulatory requirements in all jurisdictions as these requirements change.

We have experienced, and expect to continue to experience costs and liabilities relating to environmental laws and regulations, including costs and liabilities associated with the clean-up and investigation of some of our current and former properties and offsite disposal locations as well as personal injury and/or property damage lawsuits alleging damages arising from exposure to hazardous materials associated with our current or former operations, facilities or products. In addition, environmental, health and safety laws and regulations applicable to our business and the business of our customers, and the interpretation or enforcement of these laws and regulations, are constantly evolving and it is impossible to predict accurately the effect that changes in these laws and regulations, or their interpretation or enforcement, may have upon our business, financial condition or results of operations. Such developments, as well as the discovery of previously unknown contamination, the imposition of new clean-up requirements, or new claims for property damage, personal injury or damage to natural resources arising from environmental matters, or claims arising from exposure to hazardous materials used, or alleged to be used, by us in the past, including in our operations, facilities or products, could require us to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on our business, financial condition and results of operations.

6

Pinafore Holdings B.V.

Item 3D

In addition, our products may be subject to chemical regulations in the markets in which we operate. Such regulations may restrict or prohibit the types of substances that are used or present in our products, or impose other requirements, and are becoming increasingly stringent. For example, our products manufactured or sold in the European Union are potentially subject to REACH (“Registration, Evaluation, Authorisation, and Restriction of Chemical substances”). Under REACH, we may be required to register or provide notifications to the European Chemicals Agency regarding the use of certain chemicals in our products. This process could result in significant costs or market delays. In certain circumstances, we may be required to make significant expenditures to reformulate or develop alternatives to the chemicals that we use in our products. In other cases, we may incur costs for registration or extensive laboratory analysis on such chemicals to gain and/or regain authorization for its continued use, leading to a potential loss of revenue and customer base. Other chemical substance regulations include RoHS (“Restriction of Hazardous Substances”), SEC Conflict Minerals, Globally Harmonized System of Classification and Labeling of Chemicals (“GHS”), and California Proposition 65. To the extent that other nations in which we operate have similar chemical regulations, potential delays comparable to those in Europe may limit our access into these markets. Additionally, we could be subject to significant fines or other civil and criminal penalties should we fail to comply with these product regulations. Any failure to obtain or delay in obtaining regulatory approvals for chemical products we manufacture, sell or use could have a material adverse effect on our business, financial condition and results of operations.

In addition, increasing global efforts to control emissions of carbon dioxide, methane and other greenhouse gases (‘GHG’) have the potential to impact our facilities, products or customers. Certain countries, states, provinces, regulatory agencies and multinational and international authorities with jurisdiction over our operations have implemented measures, or are in the process of evaluating options, including so-called “cap and trade” systems, to regulate GHG emissions. The stringency of these measures varies among jurisdictions where we have operations. GHG regulation could increase the price of the energy and raw materials we purchase, require us to purchase allowances to offset our own emissions, or negatively impact the market for the products we distribute. GHG regulation could also negatively affect our customers, in particular those in the oil and gas industry, which is a key demand driver of our industrial end markets and has been a focus of GHG regulation by the US EPA. These effects of GHG regulation could significantly increase our costs, reduce our competitiveness in a global economy or otherwise negatively affect our business, operations or financial results. See “—We may be subject to recalls, product liability claims or may incur costs related to product warranties that may materially and adversely affect our business” for additional risks relating to environmental, health and safety regulations applicable to our products.

Our insurance may not fully cover all future losses we may incur.

Manufacturers of products such as ours are subject to inherent risks. We maintain an amount of insurance protection that we consider adequate, but we cannot provide any assurance that our insurance will be sufficient or provide effective coverage under all circumstances and against all hazards or liabilities to which we may be subject. Specifically, our insurance may not be sufficient to replace facilities or equipment that are damaged in part or in full. Damages or third party claims for which we are not fully insured could hurt our financial results and materially harm our financial condition. Further, due to rising insurance costs and changes in the insurance markets, insurance coverage may not continue to be available at all or at rates or on terms similar to those presently available. Additionally, our insurance may subject us to significant deductibles, self-insured retentions, retrospectively rated premiums or similar costs. Any losses not covered by insurance could have a material adverse effect on us. We typically purchase business interruption insurance for our facilities. However, if we have a stoppage, our insurance policies may not cover every contingency and may not be sufficient to cover all of our lost revenues. In the future, we may be unable to purchase sufficient business interruption insurance at desirable costs.

We supply products to industries that are subject to inherent risks, including equipment defects, malfunctions and failures and natural disasters, which could result in unforeseen and damaging events. These risks may expose us, as an equipment operator and supplier, to liability for personal injury, wrongful death, property damage, and pollution and other environmental damage. The insurance we carry against many of these risks may not be adequate to cover our claims or losses. Further, insurance covering the risks we expect to face or in the amounts we desire may not be available in the future or, if available, the premiums may not be commercially justifiable. If we were to incur substantial liability and such damages were not covered by insurance or were in excess of policy limits, or if we were to incur liability at a time when we were not able to obtain liability insurance, our business, results of operations, cash flows and financial condition could be negatively impacted. If our clients suffer damages as a result of the occurrence of such events, they may reduce their business with us.

Longer product lives of automotive parts are adversely affecting demand for some of our replacement products.

The average useful life of automotive parts has steadily increased in recent years due to innovations in products, technologies and manufacturing processes. The longer product lives allow vehicle owners to replace parts of their vehicles less often. As a result, a portion of sales in the replacement market has been displaced. This has adversely impacted, and could continue to adversely impact, our replacement market sales. Also, any additional increases in the average useful lives of automotive parts would further adversely affect the demand for our replacement market products.

The replacement market in emerging markets may develop in a manner that could limit our ability to grow in those markets.

In emerging markets such as China, India, Eastern Europe and Russia the replacement markets are still nascent as compared to those in developed nations. In these markets, we have focused on building a first-fit presence in order to establish brand visibility in the end markets we serve. However, as the replacement markets in these regions grow, our products may not be selected as the replacement product, although we are the first-fit provider. If we are not able to convert our first-fit presence in these emerging markets into sales in the replacement end market, there may be a material adverse effect on our replacement end market growth potential in those emerging markets.

Relatively stagnant or declines in miles driven in emerging markets, as well as declines in automotive sales in Europe from 2008 to the present could limit our ability to grow in these markets.

In the near-term, growth in sales in the emerging markets we serve may not occur at the rate that we currently expect due to relatively stagnant or declines in miles driven in these markets. Miles driven is one of the drivers of vehicle repair, which is correlated with demand for replacement products. If miles driven in emerging markets do not increase at the rate that we currently expect due to an increase in gasoline prices, a deterioration in general economic conditions or other factors, we may not realize our forecasted growth in these markets and this could negatively impact our business. Additionally, due to sustained economic weakness in several European countries, automotive sales in Europe have generally declined since 2008. This, coupled with the overall weakness in the European economy may limit our growth opportunities in Europe.

7

Pinafore Holdings B.V.

Item 3D

Failure to develop, obtain and protect intellectual property rights could adversely affect our competitive position.

Our success depends on our ability to develop technologies and inventions used in our products and to brand such products, to obtain intellectual property rights in such technologies, inventions, and brands, and to protect and enforce such intellectual property rights. In this regard, we rely on US and foreign trademark, patent, copyright, and trade secret laws, as well as license agreements, nondisclosure agreements, and confidentiality and other contractual provisions. Nevertheless, the technologies and inventions developed by our engineers in the future may not prove to be as valuable as those of competitors, or competitors may develop similar or identical technologies and inventions independently of us and before we do.

We may not be able to obtain patents or other intellectual property rights in our new technologies and inventions or, if we do, the scope of such rights may not be sufficiently broad to afford us any significant commercial advantage over our competitors. Owners of intellectual property rights that we need to conduct our business as it evolves may be unwilling to license such intellectual property rights to us on terms we consider reasonable. Competitors and others may successfully challenge the ownership, validity, and/or enforceability of our intellectual property rights. In the past, pirates have counterfeited certain of our products and sold them under our trademarks, which has led to loss of sales. It is difficult to police such counterfeiting, particularly on a worldwide basis, and the efforts we take to stop such counterfeiting may not be effective.

Our other efforts to enforce our intellectual property rights against infringers may not prove successful and will likely be time consuming and expensive and may divert management’s attention from the day-to-day operation of our business. Adequate remedies may not be available in the event of an unauthorized use or disclosure of our trade secrets and manufacturing expertise. If we fail to successfully enforce our intellectual property rights, our competitive position could suffer, which could harm our business, financial condition, results of operations and cash flows. We operate in industries with respect to which there are many patents, and it is not possible for us to ascertain that none of our products infringes any patents. If we were found to infringe any patent rights or other intellectual property rights of others, we could be required to pay substantial damages or we could be enjoined from offering certain products and services.

We may in the future acquire related businesses or assets, which we may not be able to successfully integrate, and we may be unable to recoup our investment in these businesses and assets.

We consider strategic acquisitions of complementary businesses or assets to expand our product portfolio and geographic presence on an ongoing basis, and regularly have discussions concerning potential acquisitions, certain of which may be material and which may be consummated following the completion of this offering. Acquisitions, particularly investments in emerging markets, involve legal, economic and political risks. We also encounter risks in the selection of appropriate investment and disposal targets, execution of the transactions and integration of acquired businesses or assets.

While we believe we have successfully integrated the operations we have acquired, we may not be able to effectively integrate future acquisitions or successfully implement appropriate operational, financial and management systems and controls to achieve the benefits expected to result from these acquisitions. As a result, we may not be able to recoup our investment in those acquisitions or achieve the economic benefits that we anticipate from these acquisitions. Our efforts to integrate these businesses or assets could be affected by a number of factors beyond our control, such as general economic conditions and increased competition. In addition, the process of integrating these businesses or assets could cause the interruption of, or loss of momentum in, the activities of our existing business and the diversion of management’s attention. These impacts and any delays or difficulties encountered in connection with the integration of these businesses or assets could negatively impact our business and results of operations.

A portion of our business relies on home improvement and new home construction activity levels, both of which are inherently cyclical.

A portion of our business relies on the US residential new construction and repair and refurbishment end markets. The US residential new construction market is cyclical in nature. Economic turmoil has in the past, and may in the future, cause certain shifts in consumer preferences and purchasing practices and has resulted in changes in the business models and strategies of our customers. If we do not timely and effectively respond to these changing consumer preferences, our relationships with our customers could be adversely affected, the demand for our products could be reduced and our market share could be negatively affected.

If we lose our senior management or key personnel, our business may be materially and adversely affected.

The success of our business is largely dependent on our senior management team, as well as on our ability to attract and retain other qualified key personnel. In addition, there is significant demand in our industry for skilled workers. It cannot be assured that we will be able to retain all of our current senior management personnel and to attract and retain other necessary personnel, including skilled workers, necessary for the development of our business. The loss of the services of senior management and other key personnel or the failure to attract additional personnel as required could have a material adverse effect on our business, financial condition and results of operations.

We may be materially adversely impacted by work stoppages and other labor matters.

As of December 31, 2013, we had approximately 15,000 employees worldwide. Certain of our employees are represented by various unions under collective bargaining agreements. While we have no reason to believe that we will be impacted by work stoppages and other labor matters, we cannot assure that future issues with our labor unions will be resolved favorably or that we will not encounter future strikes, work stoppages, or other types of conflicts with labor unions or our employees. Any of these factors may have a materially adverse effect on us or may limit our flexibility in dealing with our workforce. In addition, many of our customers have unionized work forces. If one or more of our customers experience a material work stoppage, it could similarly have a material adverse effect on our business, results of operations and financial condition.

8

Pinafore Holdings B.V.

Item 3D

We are subject to liabilities with respect to businesses that we have divested in the past.

In recent years, we have divested a number of businesses. With respect to some of these former businesses, we have contractually agreed to indemnify the buyer against liabilities arising prior to the divestiture, including lawsuits, tax liabilities, product liability claims or environmental matters. Under these types of arrangements, conditions outside our control could affect our future financial results.

Terrorist acts, conflicts and wars may materially adversely affect our business, financial condition and results of operations.

As a Group with a large international footprint, we are subject to increased risk of damage or disruption to us, our employees, facilities, partners, suppliers, distributors, resellers or customers due to terrorist acts, conflicts and wars, wherever located around the world. The potential for future attacks, the national and international responses to attacks or perceived threats to national security, and other actual or potential conflicts or wars have created many economic and political uncertainties. Although it is impossible to predict the occurrences or consequences of any such events, they could result in a decrease in demand for our products, make it difficult or impossible to deliver products to our customers or to receive components from our suppliers, create delays and inefficiencies in our supply chain and result in the need to impose employee travel restrictions, and thereby materially adversely affect our business, financial condition, results of operations and cash flows.

New regulations related to conflict minerals could adversely impact our business.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (or the ‘Dodd-Frank Act’), contains provisions to improve transparency and accountability concerning the supply of certain minerals, known as conflict minerals, deemed to be financing conflict in the Democratic Republic of Congo (the ‘DRC’) and adjoining countries. As a result, in August 2012 the SEC adopted annual disclosure and reporting requirements for those companies who use conflict minerals mined from the DRC and adjoining countries in their products. These new requirements will require due diligence efforts in Fiscal 2014, with initial disclosure requirements beginning in May 2014. We have incurred costs associated with diligence efforts to confirm the applicability of this legislation, and have concluded that we will not face further disclosure obligations. We continue to incur costs associated with responding to customer requests regarding conflict minerals, and to ensure that our supply chain remains free from conflict minerals.

Risks relating to our capital structure

We are dependent upon lenders for financing to execute our business strategy and meet our liquidity needs and the lack of adequate financing could negatively impact our business.

We may require capital to expand our business, implement our strategic initiatives and remain competitive. In the current credit market, there is risk that any lenders, even those with strong balance sheets and sound lending practices, could fail or refuse to honor their legal commitments and obligations under existing credit commitments, including but not limited to: extending credit up to the maximum permitted by a credit facility, allowing access to additional credit features and otherwise accessing capital and/or honoring loan commitments. If our lenders failed to honor their legal commitments under our senior secured revolving credit facility, it could be difficult in this environment to replace our senior secured revolving credit facility on similar terms.

Failure to obtain sufficient funding to meet our liquidity requirements may result in our losing business opportunities or in the curtailment of capital spending, research and development and other important strategic programs.

Restrictions on the availability of credit may cause some of our customers to be slower in settling the amounts that they owe to us, thereby reducing our own liquidity or, indeed, may cause them to be unable to pay the amounts that they owe to us. Restrictions on the availability of credit also increase the risk that some of our suppliers may fail, which could cause disruption in the supply of critical inputs to our manufacturing processes. If there were any interruption in the supply of our products to any of our customers, we may lose sales to those customers and there would be the risk that some of them would migrate to other suppliers.

If management’s plans or assumptions regarding the funding requirements change, the Group may need to seek other sources of financing, such as additional lines of credit with commercial banks or vendors or public financing, or to renegotiate existing bank facilities. It is possible that additional funding may not be available on commercially acceptable terms or at all.

We have substantial indebtedness, the size and terms of which could affect our ability to meet our debt obligations and may otherwise restrict our activities

As of December 31, 2013, we had total principal debt outstanding of $1,776.5 million. We are permitted by the terms of our debt instruments to incur substantial additional indebtedness, subject to the restrictions therein. Our inability to generate sufficient cash flow to satisfy our debt obligations, or to refinance our obligations on commercially reasonable terms, could have a material adverse effect on our business, financial condition and results of operations.

Our substantial indebtedness could have important consequences, for example, it could:

| • | | make it more difficult for us to satisfy our obligations under our indebtedness; |

| • | | limit our ability to borrow money for our working capital, capital expenditures, debt service requirements or other corporate purposes; |

| • | | require us to dedicate a substantial portion of our cash flow to payments on our indebtedness, which would reduce the amount of cash flow available to fund working capital, capital expenditures and other corporate requirements; |

| • | | increase our vulnerability to general adverse economic and industry conditions; |

| • | | limit our ability to respond to business opportunities; and |

| • | | subject us to financial and other restrictive covenants, which, if we fail to comply with these covenants and our failure is not waived or cured, could result in an event of default under our debt. |

In addition, our existing debt obligations contain, and any future indebtedness of ours would likely contain, a number of restrictive covenants that will impose significant operating and financial restrictions on us, including, amongst others, restrictions on our ability to incur or guarantee additional debt, make certain investments and engage in sales of assets and subsidiary stock.

A failure to comply with the covenants contained in our debt agreements could result in an event of default, which, if not cured or waived, could have a material adverse effect on our business, financial condition and results of operations. In the event of any default, the lenders:

| • | | will not be required to lend any additional amounts to us; |

| • | | could elect to declare all borrowings outstanding, together with accrued and unpaid interest and fees, to be due and payable; |

| • | | may have the ability to foreclose on collateral and apply the proceeds to repay these borrowings; or |

| • | | may prevent us from making debt service payments under our other agreements. |

Such actions by lenders could cause cross defaults under our other indebtedness.

We have pledged substantially all of our assets as collateral under our senior secured credit facilities and the indenture governing the senior secured second lien notes due in 2018 (‘Second Lien Notes’) subject to certain exceptions. If any of the holders of our indebtedness accelerate the repayment of such indebtedness, there can be no assurance that we will have sufficient assets to repay our indebtedness. If we were unable to repay those amounts, the holders of our secured indebtedness could proceed against the collateral granted to them to secure that indebtedness.

We may not be able to generate sufficient cash to service all of our indebtedness, and may be forced to take other actions to satisfy our obligations under our indebtedness that may not be successful.

Our ability to satisfy our debt obligations will depend upon, among other things:

| • | | our future financial and operating performance, which will be affected by prevailing economic conditions and financial, business, regulatory and other factors, many of which are beyond our control; and |

| • | | the future availability of borrowings under our senior secured credit facilities, which depends on, among other things, our complying with the covenants in those facilities. |

It cannot be assured that our business will generate sufficient cash flow from operations, or that future borrowings will be available to us under our senior secured credit facilities or otherwise, in an amount sufficient to fund our liquidity needs.

If our cash flows and capital resources are insufficient to service our indebtedness, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance our indebtedness, including the Second Lien Notes. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. Our ability to restructure or refinance our debt will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. In addition, the terms of existing or future debt agreements, may restrict us from adopting some of these alternatives. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions for fair market value or at all, and any proceeds that we could realize from any such dispositions may not be adequate to meet our debt service obligations then due.

If we are required to make unexpected payments to any post-employment benefit plans applicable to our employees, our financial condition may be adversely affected.