UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22649

iShares U.S. ETF Trust

(Exact name of registrant as specified in charter)

c/o: State Street Bank and Trust Company

100 Summer Street, 4th Floor, Boston, MA 02110

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: October 31, 2021

Date of reporting period: October 31, 2021

| Item 1. | Reports to Stockholders. |

(a) The Report to Shareholders is attached herewith.

| | |

| | OCTOBER 31, 2021 |

iShares U.S. ETF Trust

| · | | BlackRock Short Maturity Bond ETF | NEAR | Cboe BZX |

| · | | BlackRock Short Maturity Municipal Bond ETF | MEAR | Cboe BZX |

| · | | BlackRock Ultra Short-Term Bond ETF | ICSH | Cboe BZX |

The Markets in Review

Dear Shareholder,

The 12-month reporting period as of October 31, 2021 was a remarkable period of adaptation and recovery, as the global economy dealt with the implications of the coronavirus (or “COVID-19”) pandemic. The United States began the reporting period as the initial reopening-led economic rebound was beginning to slow. Nonetheless, the economy continued to grow at a solid pace for the reporting period, eventually regaining the output lost from the pandemic. However, a rapid rebound in consumer spending pushed up against supply constraints and led to elevated inflation.

Equity prices rose with the broader economy, as the implementation of mass vaccination campaigns and passage of two additional fiscal stimulus packages further boosted stocks, and many equity indices neared or surpassed all-time highs late in the reporting period. In the United States, returns of small-capitalization stocks, which benefited the most from the resumption of in-person activities, outpaced large-capitalization stocks. International equities also gained, as both developed and emerging markets continued to recover from the effects of the pandemic.

The 10-year U.S. Treasury yield (which is inversely related to bond prices) had fallen sharply prior to the beginning of the reporting period, which meant bonds were priced for extreme risk avoidance and economic disruption. Despite expectations of doom and gloom, the economy expanded rapidly, stoking inflation concerns in early 2021, which led to higher yields and a negative overall return for most U.S. Treasuries. In the corporate bond market, support from the U.S. Federal Reserve (the “Fed”) assuaged credit concerns and led to solid returns for high-yield corporate bonds, outpacing investment-grade corporate bonds.

The Fed remained committed to accommodative monetary policy by maintaining near-zero interest rates and by reiterating that inflation could exceed its 2% target for a sustained period without triggering a rate increase. In response to rising inflation late in the period, the Fed changed its market guidance, raising the possibility of higher rates in 2022 and reducing bond purchasing beginning in late 2021.

Looking ahead, we believe that the global expansion will continue to broaden as Europe and other developed market economies gain momentum, although the Delta variant of the coronavirus remains a threat, particularly in emerging markets. While we expect inflation to remain elevated in the medium-term as the expansion continues, we believe the recent uptick owes more to temporary supply disruptions than a lasting change in fundamentals. The change in Fed policy also means that moderate inflation is less likely to be followed by interest rate hikes that could threaten the economic expansion.

Overall, we favor a moderately positive stance toward risk, with an overweight in equities. Sectors that are better poised to manage the transition to a lower-carbon world, such as technology and health care, are particularly attractive in the long-term. U.S. small-capitalization stocks and European equities are likely to benefit from the continuing vaccine-led restart, while Chinese equities stand to gain from a more accommodative monetary and fiscal environment as the Chinese economy slows. We are underweight long-term credit, but inflation-protected U.S. Treasuries, Asian fixed income, and emerging market local-currency bonds offer potential opportunities. We believe that international diversification and a focus on sustainability can help provide portfolio resilience, and the disruption created by the coronavirus appears to be accelerating the shift toward sustainable investments.

In this environment, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit iShares.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock, Inc.

Rob Kapito

President, BlackRock, Inc.

| | | | |

| Total Returns as of October 31, 2021 |

| | | 6-Month | | 12-Month |

U.S. large cap equities

(S&P 500® Index) | | 10.91% | | 42.91% |

U.S. small cap equities

(Russell 2000® Index) | | 1.85 | | 50.80 |

International equities

(MSCI Europe, Australasia, Far East Index) | | 4.14 | | 34.18 |

Emerging market equities

(MSCI Emerging Markets Index) | | (4.87) | | 16.96 |

3-month Treasury bills

(ICE BofA 3-Month U.S. Treasury Bill Index) | | 0.01 | | 0.06 |

U.S. Treasury securities

(ICE BofA 10-Year U.S. Treasury Index) | | 1.59 | | (4.77) |

U.S. investment grade bonds

(Bloomberg U.S. Aggregate Bond Index) | | 1.06 | | (0.48) |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 0.33 | | 2.76 |

U.S. high yield bonds

(Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | 2.36 | | 10.53 |

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

Table of Contents

Market Overview

iShares U.S. ETF Trust

U.S. Bond Market Overview

The U.S. bond market declined slightly for the 12 months ended October 31, 2021 (“reporting period”). The Bloomberg U.S. Aggregate Bond Index, a broad measure of U.S. fixed-income performance, returned -0.48%.

The U.S. economy continued to recover from the effects of the coronavirus pandemic, growing at a brisk pace during the reporting period. Driven by strong consumer spending and significant fiscal and monetary stimulus, U.S. growth outpaced most other developed economies. An ongoing COVID-19 vaccination program helped accelerate the easing of pandemic-related restrictions, and consumers returned to activities that were previously curtailed, such as travel, restaurant dining, and in-person shopping. Spending on goods also remained elevated, leading imports to rise to an all-time high.

However, this robust consumer demand combined with continued pandemic-related disruptions to the global supply chain led to significantly higher inflation. Similarly, in the labor market, the reopening economy and pent-up demand meant that hiring accelerated, and the unemployment rate fell substantially. Nonetheless, total employment remained notably below pre-pandemic levels and job openings reached a record high despite rising wages. Elevated demand drove an increase in industrial production, although rising commodities prices and supply delays constrained growth, particularly late in the reporting period. The emergence of the highly contagious Delta variant, which was responsible for a significant rise in cases beginning late in summer 2021, also weighed on the economy.

The U.S. Federal Reserve Bank (“Fed”) continued to keep short-term interest rates at near-zero levels and maintained a significant bond-buying program for U.S. Treasuries and mortgage-backed securities, although it discontinued its corporate bond purchasing program. The Fed indicated that it would begin slowing its bond buying activities late in 2021 and signaled that an interest rate increase could be possible in 2022. However, the improving employment environment and a sharp rise in inflation led investors to anticipate a more accelerated tightening of monetary policy. Trading activity showed that investors view multiple interest rate increases as probable in 2022.

U.S. Treasuries declined, as inflation increased, and investors moved toward equities and lower-rated bonds. Rising domestic inflation expectations pressured U.S. Treasuries, which typically lose value in an inflationary environment. U.S. Treasury yields (which move inversely to prices) began the reporting period near historic lows, but generally rose as inflation increased and the economy continued to strengthen. Yields of U.S. Treasuries with intermediate- and long-term maturities, which are more sensitive to inflation, generally increased more than short-term U.S. Treasuries. However, long-term U.S. Treasury yields rose less than intermediate-term U.S. Treasury yields, with two-year, 10-year, and 30-year U.S. Treasury yields rising by 0.34%, 0.67%, and 0.28%, respectively.

Mortgage-backed securities (“MBS”) declined slightly, despite ongoing support from Fed bond purchasing. MBS performance was constrained by prepayments, as homeowners took advantage of low mortgage rates to refinance their mortgages at a lower interest rate.

On the upside, most corporate bonds advanced for the reporting period, particularly lower-rated corporate bonds. A narrowing yield spread (the difference between yields on corporate bonds and U.S. Treasuries) buoyed the performance of corporate bonds compared to U.S. Treasuries. Investors’ ongoing search for yield in a low interest rate environment drove the decline in the yield spread and supported corporate bond prices. High-yield bonds gained the most, as investors’ concerns about solvency abated alongside the growing economy, and the Fed’s support led to high investor confidence. Corporate bond issuance was elevated by historical standards as companies took advantage of low yields to refinance and lock in advantageous borrowing costs.

| | |

| 4 | | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

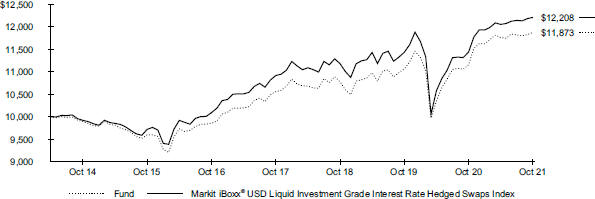

| Fund Summary as of October 31, 2021 | | BlackRock Short Maturity Bond ETF |

Investment Objective

The BlackRock Short Maturity Bond ETF (the “Fund”) (formerly the iShares Short Maturity Bond ETF) seeks to maximize current income by investing, under normal circumstances, at least 80% of its net assets in a portfolio of U.S. dollar-denominated investment-grade fixed income securities and maintain a weighted average maturity that is less than three years. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

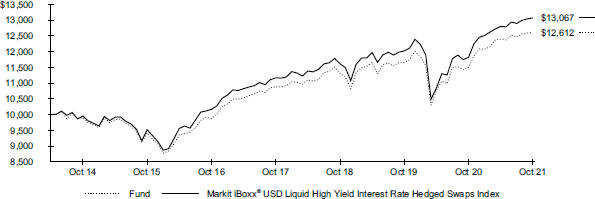

Performance

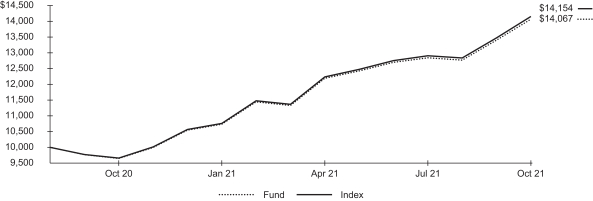

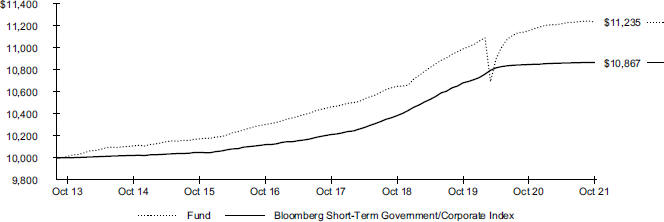

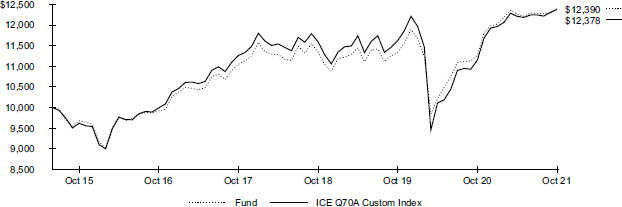

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

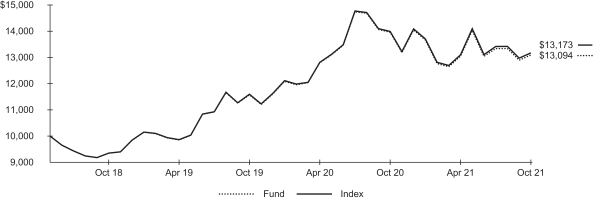

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | 5 Years | | | Since

Inception | | | | | | 1 Year | | | 5 Years | | | Since

Inception | |

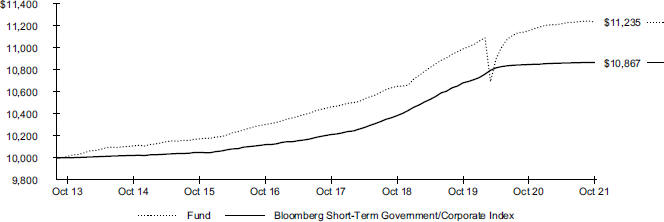

Fund NAV | | | 0.70 | % | | | 1.75 | % | | | 1.45 | % | | | | | | | 0.70 | % | | | 9.05 | % | | | 12.35 | % |

Fund Market | | | 0.70 | | | | 1.74 | | | | 1.45 | | | | | | | | 0.70 | | | | 9.00 | | | | 12.33 | |

Bloomberg Short-Term Government/Corporate Index | | | 0.17 | | | | 1.43 | | | | 1.03 | | | | | | | | 0.17 | | | | 7.37 | | | | 8.67 | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 9/25/13. The first day of secondary market trading was 9/26/13.

The Bloomberg Short-Term Government/Corporate Index (formerly the Bloomberg Barclays Short-Term Government/Corporate Index) is an unmanaged index that measures the performance of government and corporate securities with less than 1 year remaining to maturity.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 11 for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value

(05/01/21) |

| |

| Ending

Account Value

(10/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(05/01/21) |

| |

| Ending

Account Value

(10/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| $ | 1,000.00 | | | $ | 1,001.30 | | | $ | 1.26 | | | | | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 1.28 | | | | 0.25 | % |

| | (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 11 for more information. | |

| | |

| Fund Summary as of October 31, 2021 (continued) | | BlackRock Short Maturity Bond ETF |

Portfolio Management Commentary

Short-term investment-grade bonds posted a slightly positive return for the reporting period. Most short-term U.S. Treasury yields (which move inversely to prices) were relatively unchanged due to the Fed’s near-zero interest rate policy, which meant price gains for corporate and other higher-yielding bonds, as well as bond income, drove the Fund’s return. High consumer savings rates also supported demand for short-term bonds. Investment-grade corporate bonds, especially lower-quality securities, also benefited from narrowing spreads, or a decrease in the interest rate premium that corporate bonds carry relative to U.S. Treasuries, as fewer public health restrictions led to stronger economic growth and increased risk-taking by investors.

In terms of relative performance, the Fund outperformed the broader market, as represented by the Bloomberg Short-Term Government/Corporate Index. During the reporting period, the Fund increased its exposure to short-term investment-grade corporate bonds and reduced its exposure to U.S. Treasuries. Within corporate bonds, the Fund added to Baa-rated bonds to capitalize on their high yields. The Fund’s overweight position to investment-grade corporate bonds was a significant contributor to the Fund’s performance relative to the broader market. Positions in asset-backed securities also added to relative performance, as those bonds posted positive returns during the reporting period.

From a total return perspective, short-term investment-grade corporate bonds and asset-backed securities were the top contributors to the Fund’s performance. In particular, bonds issued by banks advanced strongly. Banks, which were flush with cash, issued record totals of debt in 2021, reflecting strong investor demand for yield. The automotive industry also contributed, as strong demand for cars and trucks drove bond prices higher, even as microchip shortages led to declining inventories and slower sales late in the reporting period. Energy sector bonds were another large contributor to the Fund’s return, as oil and gas prices more than doubled during the reporting period.

Portfolio Information

ALLOCATION BY INVESTMENT TYPE

| | | | |

| Investment Type | |

| Percent of

Total Investments |

(a) |

Corporate Bonds & Notes | | | 62.7 | % |

Asset-Backed Securities | | | 20.8 | |

Collaterized Mortgage Obligations | | | 7.2 | |

Commercial Paper | | | 5.5 | |

Repurchase Agreements | | | 2.7 | |

Certificates of Deposit | | | 1.1 | |

ALLOCATION BY CREDIT QUALITY

| | | | |

| Moody’s Credit Rating* | |

| Percent of

Total Investments |

(a) |

Aaa | | | 18.0 | % |

Aa | | | 2.3 | |

A | | | 26.5 | |

Baa | | | 31.7 | |

Ba | | | 2.3 | |

P-1 | | | 3.8 | |

P-2 | | | 4.3 | |

P-3 | | | 1.2 | |

Not Rated | | | 9.9 | |

| | * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

| | (a) | Excludes money market funds. | |

| | |

| 6 | | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

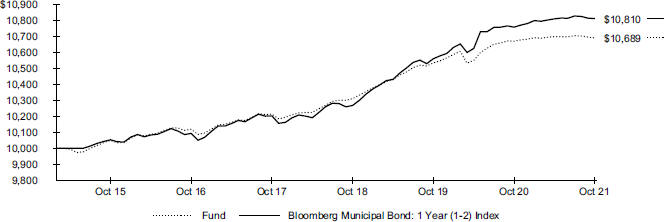

| Fund Summary as of October 31, 2021 | | BlackRock Short Maturity Municipal Bond ETF |

Investment Objective

The BlackRock Short Maturity Municipal Bond ETF (the “Fund”) (formerly the iShares Short Maturity Municipal Bond ETF) seeks to maximize tax-free current income by investing, under normal circumstances, at least 80% of its net assets in municipal securities such that the interest on each bond is exempt from U.S. federal income taxes and the federal alternative minimum tax. Under normal circumstances, the effective duration of the Fund’s portfolio is expected to be 1.2 years or less, as calculated by the management team, and is not expected to exceed 1.5 years. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

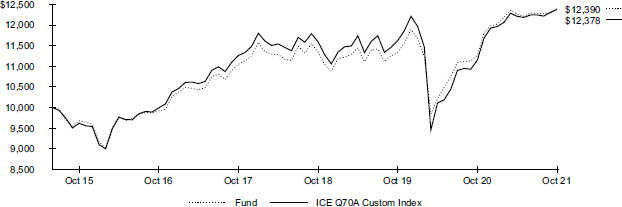

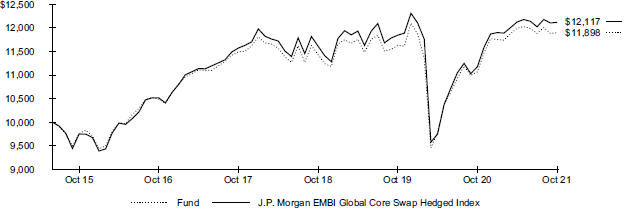

Performance

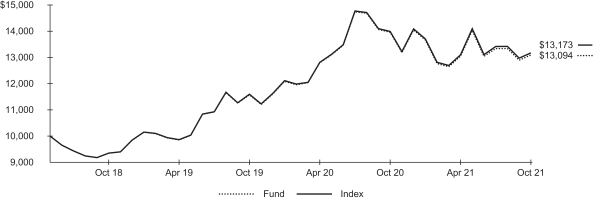

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

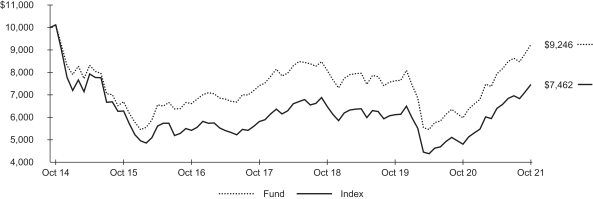

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | 5 Years | | | Since

Inception | | | | | | 1 Year | | | 5 Years | | | Since

Inception | |

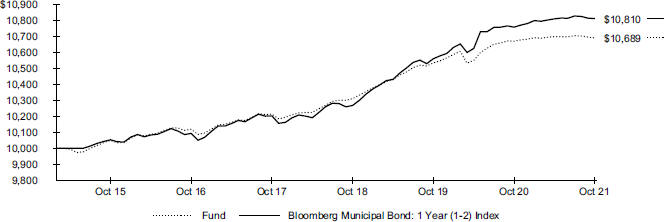

Fund NAV | | | 0.19 | % | | | 1.10 | % | | | 1.00 | % | | | | | | | 0.19 | % | | | 5.64 | % | | | 6.89 | % |

Fund Market | | | 0.15 | | | | 1.13 | | | | 1.00 | | | | | | | | 0.15 | | | | 5.79 | | | | 6.87 | |

Bloomberg Municipal Bond: 1 Year (1-2) Index | | | 0.50 | | | | 1.38 | | | | 1.18 | | | | | | | | 0.50 | | | | 7.11 | | | | 8.10 | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 3/3/15. The first day of secondary market trading was 3/5/15.

The Bloomberg Municipal Bond: 1 Year (1-2) Index (formerly the Bloomberg Barclays Municipal Bond: 1 Year (1-2) Index) is an unmanaged index comprised of national municipal bond issues having a maturity of at least one year and less than two years.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 11 for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value

(05/01/21) |

| |

| Ending Account Value

(10/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(05/01/21) |

| |

| Ending

Account Value

(10/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| $ | 1,000.00 | | | $ | 999.30 | | | $ | 1.26 | | | | | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 1.28 | | | | 0.25 | % |

| | (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 11 for more information. | |

| | |

| Fund Summary as of October 31, 2021 (continued) | | BlackRock Short Maturity Municipal Bond ETF |

Portfolio Management Commentary

Short-term municipal bonds posted a modest positive return for the reporting period. Continued uncertainty around the coronavirus pandemic led the Fed to maintain accommodative monetary policy, anchoring short-term interest rates near zero. As economies reopened from pandemic-related shutdowns, government tax revenues rose meaningfully, boosting municipal bonds. High consumer savings rates and investors’ concern over potentially rising tax rates supported demand for short-term municipal bonds.

In terms of relative performance, the Fund underperformed the broader market, as represented by the Bloomberg Municipal Bond: 1-2 Year Index. The short-term municipal bond market followed the same broad pattern as most fixed-income markets — bonds with higher risk and lower credit ratings generally outperformed comparable maturity, lower-risk, higher-rated bonds. Consequently, the Fund’s conservative positioning with a large overweight in floating-rate variable-rate demand notes (“VRDNs”) and other cash equivalents detracted from the Fund’s relative performance, as low short-term interest rates limited the yield available on VRDNs.

Additionally, the Fund carried an underweight allocation to bonds from the transportation sector given their sensitivity to pandemic-related closures. As economies reopened during the reporting period, these bonds rallied, resulting in underperformance relative to the broader market. To capitalize on the improving credit environment, the Fund carried an overweight allocation to Baa-rated bonds, which proved beneficial. From a state perspective, overweight positions in New Jersey and Georgia boosted relative return as those states outperformed, while security selection within New York and Illinois detracted from relative performance.

From a total return perspective, municipal bonds generally performed well during the reporting period, as the Fund’s investments in the corporate municipal sector, as well as bonds in the tobacco, housing, and healthcare industries, contributed to the Fund’s return. From a credit quality perspective, all ratings categories posted positive returns, with Baa-rated bonds contributing the most to the Fund’s performance.

Portfolio Information

ALLOCATION BY CREDIT QUALITY

| | | | |

| S&P Credit Rating* | |

| Percent of

Total Investments |

(a) |

| |

AAA | | | 3.3 | % |

AA+ | | | 5.1 | |

AA | | | 9.2 | |

AA- | | | 8.2 | |

A+ | | | 5.7 | |

A | | | 14.5 | |

A- | | | 8.2 | |

BBB+ | | | 3.4 | |

BBB | | | 11.2 | |

BB+ | | | 0.7 | |

Not Rated | | | 30.5 | |

TEN LARGEST STATES

| | | | |

State | |

| Percent of

Total Investments |

(a) |

| |

New Jersey | | | 16.0 | % |

New York | | | 10.4 | |

Georgia | | | 9.0 | |

Texas | | | 7.9 | |

Kentucky | | | 7.9 | |

Pennsylvania | | | 4.5 | |

Alabama | | | 3.6 | |

District of Columbia | | | 3.5 | |

North Carolina | | | 3.5 | |

Mississippi | | | 3.4 | |

| | * | Credit quality ratings shown reflect the ratings assigned by S&P Global Ratings, a widely used independent, nationally recognized statistical rating organization. S&P credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of BBB or higher. Below investment grade ratings are credit ratings of BB or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

| | (a) | Excludes money market funds. | |

| | |

| 8 | | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

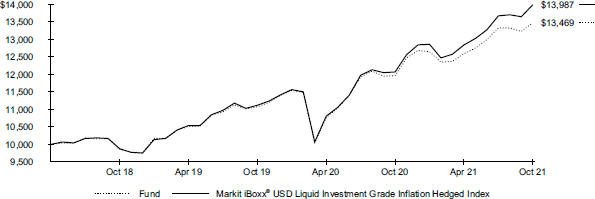

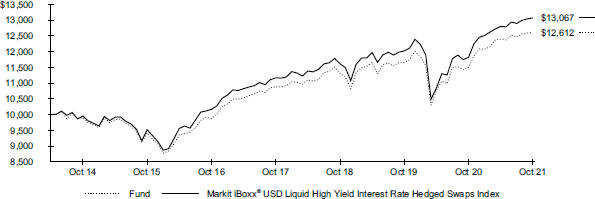

| Fund Summary as of October 31, 2021 | | BlackRock Ultra Short-Term Bond ETF |

Investment Objective

The BlackRock Ultra Short-Term Bond ETF (the “Fund”) (formerly the iShares Ultra Short-Term Bond ETF) seeks to provide current income consistent with preservation of capital by investing, under normal circumstances, at least 80% of its net assets in a portfolio of U.S. dollar-denominated investment-grade fixed- and floating-rate debt securities and maintain a dollar-weighted average maturity that is less than 180 days. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

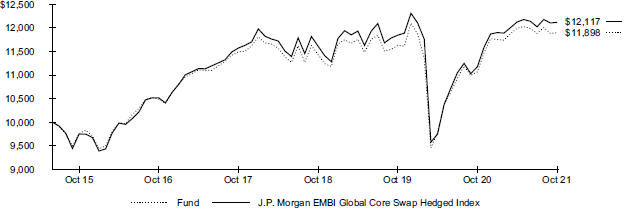

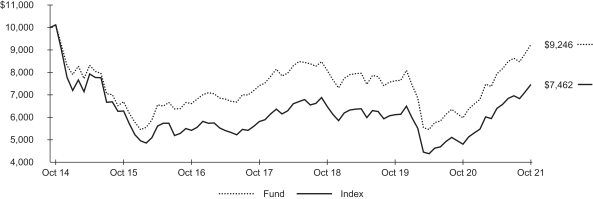

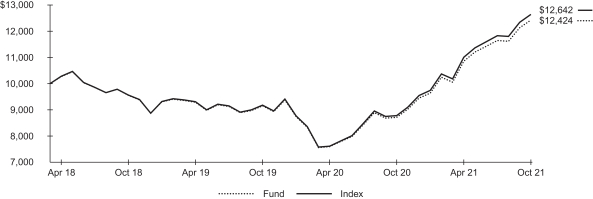

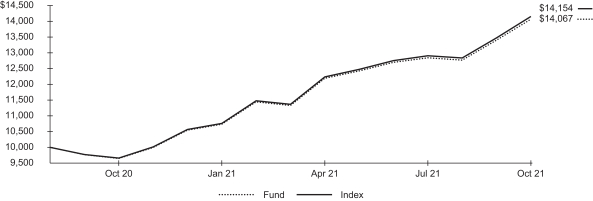

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | 5 Years | | | Since

Inception | | | | | | 1 Year | | | 5 Years | | | Since

Inception | |

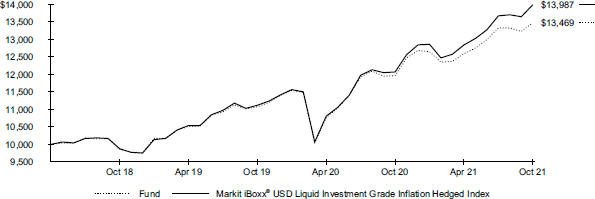

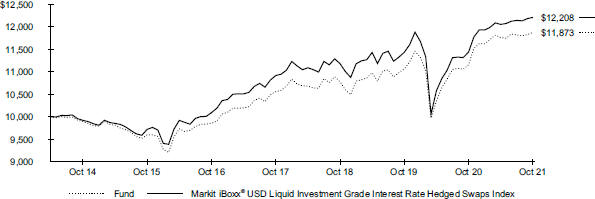

Fund NAV | | | 0.29 | % | | | 1.78 | % | | | 1.34 | % | | | | | | | 0.29 | % | | | 9.23 | % | | | 11.07 | % |

Fund Market | | | 0.31 | | | | 1.78 | | | | 1.34 | | | | | | | | 0.31 | | | | 9.21 | | | | 11.09 | |

ICE BofA US 6-Month Treasury Bill Index | | | 0.12 | | | | 1.32 | | | | 0.96 | | | | | | | | 0.12 | | | | 6.80 | | | | 7.83 | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 12/11/13. The first day of secondary market trading was 12/13/13.

On 3/1/2021 the Fund began referencing the 4pm pricing variant of the ICE BofA US 6-Month Treasury Bill Index. Historical index data prior to 3/1/2021 is for the 3pm pricing variant of the ICE BofA US 6-Month Treasury Bill Index. Index data on and after 3/1/2021 is for the 4pm pricing variant of the ICE BofA US 6-Month Treasury Bill Index.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 11 for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value

(05/01/21) |

| |

| Ending

Account Value

(10/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(05/01/21) |

| |

| Ending

Account Value

(10/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| $ | 1,000.00 | | | $ | 1,001.00 | | | $ | 0.40 | | | | | | | $ | 1,000.00 | | | $ | 1,024.80 | | | $ | 0.41 | | | | 0.08 | % |

| | (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 11 for more information. | |

| | |

| Fund Summary as of October 31, 2021 (continued) | | BlackRock Ultra Short-Term Bond ETF |

Portfolio Management Commentary

Ultra-short-term bonds posted a slightly positive return for the reporting period. Rising yields for longer-term maturities created demand for short-term bonds, as investors sought to reduce interest rate sensitivity by buying shorter maturities. High consumer savings rates also supported demand for short-term bonds. As the economy and coronavirus dynamics improved, credit spreads, or the difference in yields relative to U.S. Treasuries, on short-term investment-grade corporate bonds decreased, which helped the performance of short-term corporate bonds.

The Fund increased its exposure to short-term investment-grade corporate bonds and reduced its exposure to cash equivalents during the reporting period. Within corporate bonds, the Fund added to Baa-rated bonds during the reporting period to capitalize on their additional yield.

In terms of relative performance, the Fund outperformed the broader market, as represented by the Bloomberg Short-Term Government/Corporate Index. The Fund’s overweight positions to commercial paper and certificates of deposit contributed to relative performance. Short-term corporate bonds, particularly in the financial sector, were also additive to relative return. Furthermore, the Fund’s underweight position to U.S. Treasury bonds proved beneficial as those positions underperformed the broader market.

From a total return perspective, corporate bonds contributed the most to the Fund’s total return. Low yields among short-term fixed-income securities drove demand for corporate bonds, which offer additional income compared to cash equivalents and U.S. Treasuries. Within corporate bonds, bank bonds were the most significant contributors as some banks’ earnings benefited from borrowing at low short-term interest rates and lending at higher longer-term interest rates. The automotive industry also contributed, as strong demand for cars and trucks drove bond prices higher, even as microchip shortages led to declining inventories and slower sales late in the reporting period.

From a credit quality perspective, bonds from each rating category contributed to the Fund’s total return. Bonds rated Baa were the top performers, and A-rated bonds contributed the most to the Fund’s performance.

Portfolio Information

ALLOCATION BY INVESTMENT TYPE

| | | | |

| Investment Type | |

| Percent of

Total Investments |

(a) |

| |

Corporate Bonds & Notes | | | 42.1 | % |

Commercial Paper | | | 35.4 | |

Certificates of Deposit | | | 13.8 | |

Repurchase Agreements | | | 4.3 | |

Municipal Debt Obligations | | | 3.5 | |

Asset-Backed Securities | | | 0.7 | |

U.S. Government & Agency Obligations | | | 0.2 | |

ALLOCATION BY CREDIT QUALITY

| | | | |

| Moody’s Credit Rating* | |

| Percent of

Total Investments |

(a) |

| |

Aaa | | | 0.5 | % |

Aa | | | 8.8 | |

A | | | 26.7 | |

Baa | | | 9.4 | |

P-1 | | | 27.1 | |

P-2 | | | 23.3 | |

Not Rated | | | 4.2 | |

| | * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

| | (a) | Excludes money market funds. | |

| | |

| 10 | | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

About Fund Performance

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. Beginning August 10, 2020, the price used to calculate market return (“Market Price”) is the closing price. Prior to August 10, 2020, Market Price was determined by using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not trade in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary market trading in shares of the fund, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Shareholder Expenses

As a shareholder of your Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares and (2) ongoing costs, including management fees and other fund expenses. The expense example, which is based on an investment of $1,000 invested at the beginning of the period (or from the commencement of operations if less than 6 months) and held through the end of the period, is intended to help you understand your ongoing costs (in dollars and cents) of investing in your Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses – The table provides information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. To estimate the expenses that you paid on your account over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes – The table also provides information about hypothetical account values and hypothetical expenses based on your Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions and other fees paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

A B O U T F U N D P E R F O R M A N C E / S H A R E H O L D E R E X P E N S E S | | 11 |

| | |

Schedule of Investments October 31, 2021 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Asset-Backed Securities | | | | | | | | | | | | |

| | | |

AGL Core CLO 4 Ltd., 1.20%, 04/20/33 (Call 04/20/22),

(3 mo. LIBOR US + 1.070%)(a)(b) | | | USD | | | | 650 | | | $ | 650,324 | |

AIG CLO Ltd., 1.25%, 04/20/32 (Call 04/20/22),

(3 mo. LIBOR US + 1.120%)(a)(b) | | | USD | | | | 1,000 | | | | 1,001,600 | |

American Express Credit Account Master Trust, Series 2018-9, Class A, 0.47%, 04/15/26,

(1 mo. LIBOR US + 0.380%)(b) | | | USD | | | | 17,650 | | | | 17,763,197 | |

AmeriCredit Automobile Receivables Trust, Series 2021-1, Class A2, 0.28%, 06/18/24 (Call 02/18/24) | | | USD | | | | 9,238 | | | | 9,236,569 | |

AmeriCredit Automobile Receivables Trust 2020-2, Series 2020-2, Class A2B, 0.44%, 12/18/23 (Call 09/18/23), (1 mo. LIBOR US + 0.350%)(b) | | | USD | | | | 2,128 | | | | 2,129,001 | |

Anchorage Capital CLO 4-R Ltd., Series 2014-4RA, Class A, 1.19%, 01/28/31 (Call 01/28/22),

(3 mo. LIBOR US + 1.050%)(a)(b) | | | USD | | | | 4,500 | | | | 4,500,004 | |

Anchorage Capital CLO 7 Ltd., Series 2015-7A, Class AR2, 1.23%, 01/28/31 (Call 01/28/22),

(3 mo. LIBOR US + 1.090%)(a)(b) | | | USD | | | | 13,840 | | | | 13,836,995 | |

Anchorage Capital CLO 8 Ltd., Series 2016-8A, Class AR, 1.14%, 07/28/28 (Call 01/28/22),

(3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 3,962 | | | | 3,961,260 | |

Apidos CLO XII, 1.20%, 04/15/31 (Call 01/15/22),

(3 mo. LIBOR US + 1.08%)(a)(b) | | | USD | | | | 500 | | | | 500,326 | |

Apidos CLO XXI, 1.05%, 07/18/27 (Call 01/18/22),

(3 mo. LIBOR US + 0.93%)(a)(b) | | | USD | | | | 1,647 | | | | 1,646,359 | |

Arbor Realty Commercial Real Estate Notes Ltd., 1.16%, 08/15/34 (Call 03/15/24),

(1 mo. LIBOR US + 1.070%)(a)(b) | | | USD | | | | 14,450 | | | | 14,413,876 | |

ASSURANT CLO Ltd., Series 2018-2A, Class A, 1.17%, 04/20/31 (Call 01/20/22),

(3 mo. LIBOR US + 1.040%)(a)(b) | | | USD | | | | 250 | | | | 249,882 | |

Atlas Senior Loan Fund III Ltd., Series 2013-1A, Class AR, 0.95%, 11/17/27 (Call 11/17/21),

(3 mo. LIBOR US + 0.830%)(a)(b) | | | USD | | | | 8,410 | | | | 8,411,648 | |

Atrium XIII, Series 13A, Class A1, 1.30%, 11/21/30

(Call 01/23/22), (3 mo. LIBOR US + 1.180%)(a)(b) | | | USD | | | | 2,500 | | | | 2,501,250 | |

Autoflorence of Amyloids 0.14%, 12/24/44

(Call 12/24/26)(b)(c) | | | EUR | | | | 10,320 | | | | 12,057,807 | |

0.19%, 12/24/44 (Call 12/24/26)(b)(c) | | | EUR | | | | 898 | | | | 1,037,076 | |

Bain Capital Credit CLO Ltd., Series 2017-1A, Class A1R, 1.10%, 07/20/30 (Call 01/20/22),

(3 mo. LIBOR US + 0.97%)(a)(b) | | | USD | | | | 3,200 | | | | 3,199,309 | |

Barings Clo Ltd., 1.45%, 01/15/33 (Call 01/15/22),

(3 mo. LIBOR US + 1.330%)(a)(b) | | | USD | | | | 3,850 | | | | 3,852,848 | |

Barings CLO Ltd., 1.20%, 04/20/31 (Call 04/20/22),

(3 mo. LIBOR US + 1.070%)(a)(b) | | | USD | | | | 550 | | | | 550,384 | |

BDS 2021-FL9 Ltd., 1.17%, 11/16/38 (Call 10/16/23),

(1 mo. LIBOR US + 1.070%)(a)(b) | | | USD | | | | 8,750 | | | | 8,747,637 | |

Beechwood Park CLO Ltd., 1.45%, 01/17/33

(Call 01/17/22), (3 mo. LIBOR US + 1.330%)(a)(b) | | | USD | | | | 3,450 | | | | 3,450,003 | |

Benefit Street Partners CLO III Ltd., Series 2013-IIIA,

Class A1R2, 1.13%, 07/20/29 (Call 01/20/22),

(3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 456 | | | | 455,909 | |

Benefit Street Partners CLO VIII Ltd., Series 2015-8A,

Class A1AR, 1.23%, 01/20/31 (Call 01/20/22),

(3 mo. LIBOR US + 1.1%)(a)(b) | | | USD | | | | 750 | | | | 750,375 | |

Benefit Street Partners Clo XII Ltd., 1.07%, 10/15/30,

(3 mo. LIBOR US + 0.95%)(a)(b) | | | USD | | | | 1,678 | | | | 1,677,070 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

BlueMountain CLO Ltd., Series 2012-2A, Class AR2, 1.18%, 11/20/28 (Call 11/20/21),

(3 mo. LIBOR US + 1.050%)(a)(b) | | | USD | | | | 2,061 | | | $ | 2,061,292 | |

Canyon Capital CLO Ltd., Series 2019-1A, Class A1R, 1.22%, 04/15/32 (Call 01/15/22),

(3 mo. LIBOR US + 1.1%)(a)(b) | | | USD | | | | 5,800 | | | | 5,795,891 | |

Carlyle C17 CLO Ltd., Series C17A, Class A1AR, 1.16%, 04/30/31 (Call 10/30/21),

(3 mo. LIBOR US + 1.030%)(a)(b) | | | USD | | | | 1,000 | | | | 1,000,499 | |

Carlyle Global Market Strategies CLO Ltd. | | | | | | | | | | | | |

Series 2013-2A, Class AR, 1.01%, 01/18/29

(Call 01/18/22), (3 mo. LIBOR US + 0.890%)(a)(b) | | | USD | | | | 5,879 | | | | 5,878,834 | |

Series 2014-1A, Class A1R2, 1.09%, 04/17/31

(Call 01/17/22), (3 mo. LIBOR US + 0.970%)(a)(b) | | | USD | | | | 5,234 | | | | 5,234,848 | |

CarMax Auto Owner Trust, Series 2021-2, Class A2A, 0.27%, 06/17/24 (Call 03/15/24) | | | USD | | | | 14,340 | | | | 14,340,928 | |

Cbam Ltd., Series 2018-7A, Class A, 1.23%, 07/20/31

(Call 01/20/22), (3 mo. LIBOR US + 1.1%)(a)(b) | | | USD | | | | 750 | | | | 749,277 | |

Cedar Funding IX CLO Ltd., 1.11%, 04/20/31

(Call 01/20/22), (3 mo. LIBOR US +

0.98%)(a)(b) | | | USD | | | | 2,130 | | | | 2,131,182 | |

Chesapeake Funding II LLC, Series 2020-1A,

Class A2, 0.74%, 08/16/32,

(1 mo. LIBOR US + 0.650%)(a)(b) | | | USD | | | | 9,171 | | | | 9,210,905 | |

CIFC Funding Ltd. | | | | | | | | | | | | |

Series 2014-2RA, Class A1, 1.17%, 04/24/30

(Call 01/24/22), (3 mo. LIBOR US +

1.050%)(a)(b) | | | USD | | | | 250 | | | | 250,225 | |

Series 2015-2A, Class AR2, 1.13%, 04/15/30

(Call 01/15/22), (3 mo. LIBOR US +

1.010%)(a)(b) | | | USD | | | | 17,000 | | | | 16,993,534 | |

Series 2018-1A, Class A, 1.12%, 04/18/31

(Call 01/18/22), (3 mo. LIBOR US + 1.0%)(a)(b) | | | USD | | | | 16,610 | | | | 16,609,985 | |

Series 2018-2A, Class A1, 1.17%, 04/20/31

(Call 01/20/22), (3 mo. LIBOR US + 1.040%)(a)(b) | | | USD | | | | 1,250 | | | | 1,249,999 | |

Citibank Credit Card Issuance Trust, Series 2019-A5,

Class A5, 0.71%, 04/22/26,

(1 mo. LIBOR + 0.620%)(b) | | | USD | | | | 40,505 | | | | 40,966,275 | |

College Ave Student Loans LLC, Series 2021-A,

Class A1, 1.19%, 07/25/51 (Call 02/25/32),

(1 mo. LIBOR US + 1.100%)(a)(b) | | | USD | | | | 292 | | | | 295,043 | |

Credit Acceptance Auto Loan Trust | | | | | | | | | | | | |

Series 2019-1A, Class A, 3.33%, 02/15/28

(Call 08/15/22)(a) | | | USD | | | | 419 | | | | 419,185 | |

Series 2021-3A, Class A, 1.00%, 05/15/30

(Call 11/15/24)(a) | | | USD | | | | 4,130 | | | | 4,112,975 | |

Donlen Fleet Lease Funding 2 LLC, Series 2021-2,

Class A2, 0.56%, 12/11/34(a) | | | USD | | | | 14,030 | | | | 14,027,855 | |

Dowson PLC | | | | | | | | | | | | |

Series 2021-2, Class A, 0.73%, 10/20/28

(Call 11/20/24),

(Sterning Ovenight Index Average + 0.680%)(b)(c)

| | | GBP | | | | 10,900 | | | | 14,924,065 | |

Series 2021-2, Class B, 1.00%, 10/20/28

(Call 11/20/24),

(Sterning Ovenight Index Average + 1.200%)(b)(c) | | | GBP | | | | 1,600 | | | | 2,192,090 | |

Drive Auto Receivables Trust, Series 2021-1, Class A3, 0.44%, 11/15/24 (Call 05/15/24) | | | USD | | | | 9,070 | | | | 9,075,104 | |

Dryden 49 Senior Loan Fund, Series 2017-49A,

Class AR, 1.07%, 07/18/30 (Call 01/18/22),

(3 mo. LIBOR US + 0.95%)(a)(b) | | | USD | | | | 10,750 | | | | 10,762,670 | |

Dryden 77 CLO Ltd., Series 2020-77A, Class XR, 1.13%, 05/20/34 (Call 05/20/23),

(3 mo. LIBOR US + 1.0%)(a)(b) | | | USD | | | | 250 | | | | 250,069 | |

| | |

| 12 | | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) October 31, 2021 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Dryden XXVI Senior Loan Fund, Series 2013-26A,

Class AR, 1.02%, 04/15/29 (Call 01/15/22),

(3 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 15,854 | | | $ | 15,851,555 | |

Elevation CLO Ltd., Series 2014-2A, Class A1R,

1.35%, 10/15/29 (Call 01/15/22),

(3 mo. LIBOR US + 1.230%)(a)(b) | | | USD | | | | 500 | | | | 500,345 | |

Elmwood CLO X Ltd., Series 2021-3A, Class A, 1.13%, 10/20/34,

(3 mo. LIBOR US + 1.04%)(a)(b) | | | USD | | | | 23,000 | | | | 22,994,896 | |

Enterprise Fleet Funding LLC, Series 2021-1,

Class A2, 0.44%, 12/21/26

(Call 07/20/24)(a) | | | USD | | | | 12,780 | | | | 12,743,384 | |

Ford Credit Floorplan Master Owner Trust, Series 2019-1, Class A, 2.84%, 03/15/24 | | | USD | | | | 26,550 | | | | 26,809,168 | |

Ford Credit Floorplan Master Owner Trust A, Series 2019-3, Class A2, 0.69%, 09/15/24,

(1 mo. LIBOR US + 0.600%)(b) | | | USD | | | | 59,321 | | | | 59,598,634 | |

Galaxy XV CLO Ltd., Series 2013-15A, Class ARR, 1.09%, 10/15/30 (Call 01/15/22),

(3 mo. LIBOR US + 0.97%)(a)(b) | | | USD | | | | 670 | | | | 670,194 | |

Globaldrive Auto Receivables, Series 2019-UKA,

Class B, 1.55%, 09/20/26 (Call 03/20/22),

(SOFR + 1.5%)(b)(c) | | | GBP | | | | 875 | | | | 1,200,244 | |

GM Financial Consumer Automobile Receivables Trust,

Series 2021-2, Class A2, 0.27%, 06/17/24

(Call 02/16/25) | | | USD | | | | 14,753 | | | | 14,754,602 | |

GoldenTree Loan Opportunities IX Ltd., Series 2014-9A, Class AR2, 1.24%, 10/29/29

(Call 10/29/21), (3 mo. LIBOR US + 1.110%)(a)(b) | | | USD | | | | 16,680 | | | | 16,677,253 | |

Halcyon Loan Advisors Funding Ltd., Series 2015-2A,

Class AR, 1.20%, 07/25/27 (Call 01/25/22),

(3 mo. LIBOR US + 1.080%)(a)(b) | | | USD | | | | 435 | | | | 435,327 | |

HGI CRE CLO Ltd., 1.09%, 09/17/36 (Call 10/17/23),

(1 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 5,380 | | | | 5,359,862 | |

Highbridge Loan Management, Series 3A-2014,

Class A1R, 1.30%, 07/18/29 (Call 01/18/22),

(3 mo. LIBOR US + 1.18%)(a)(b) | | | USD | | | | 1,100 | | | | 1,099,745 | |

John Deere Owner Trust, Series 2020-B, Class A2, 0.41%, 03/15/23

(Call 01/15/24) | | | USD | | | | 4,129 | | | | 4,129,726 | |

KKR CLO 21 Ltd., 1.12%, 04/15/31 (Call 01/15/22),

(3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 5,590 | | | | 5,590,024 | |

LCM 29 Ltd., Series 29A, Class AR, 1.19%, 04/15/31

(Call 07/15/22), (3 mo. LIBOR US +

1.07%)(a)(b) | | | USD | | | | 2,600 | | | | 2,599,996 | |

LoanCore Issuer Ltd. | | | | | | | | | | | | |

1.39%, 11/15/38 (Call 11/15/23),

(1 mo. LIBOR US + 1.300%)(a)(b) | | | USD | | | | 2,640 | | | | 2,640,000 | |

Series 2018-CRE1, Class A, 1.22%, 05/15/28

(Call 11/15/21), (1 mo. LIBOR US + 1.130%)(a)(b) | | | USD | | | | 2,673 | | | | 2,672,919 | |

Madison Park Funding X Ltd., Series 2012-10A,

Class AR3, 1.14%, 01/20/29 (Call 01/20/22),

(3 mo. LIBOR US + 1.010%)(a)(b) | | | USD | | | | 6,121 | | | | 6,119,849 | |

Madison Park Funding XIII Ltd., Series 2014-13A,

Class AR2, 1.07%, 04/19/30 (Call 01/19/22),

(3 mo. LIBOR US + 0.950%)(a)(b) | | | USD | | | | 3,935 | | | | 3,934,528 | |

Madison Park Funding XVII Ltd., Series 2015-17A,

Class AR2, 1.13%, 07/21/30 (Call 01/21/22),

(3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 800 | | | | 799,813 | |

Madison Park Funding XXIII Ltd., Series 2017-23A,

Class AR, 1.10%, 07/27/31 (Call 01/27/22),

(3 mo. LIBOR US + 0.970%)(a)(b) | | | USD | | | | 13,200 | | | | 13,197,361 | |

Madison Park Funding XXVI Ltd., Series 2007-4A,

Class AR, 1.33%, 07/29/30,

(3 mo. LIBOR US + 1.2%)(a)(b) | | | USD | | | | 4,875 | | | | 4,881,285 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Madison Park Funding XXXVII Ltd., 1.19%, 07/15/33

(Call 07/15/22), (3 mo. LIBOR US +

1.070%)(a)(b) | | | USD | | | | 1,750 | | | $ | 1,749,309 | |

Marathon CRE Ltd., Series 2018-FL1, Class A, 1.24%, 06/15/28 (Call 11/11/21),

(1 mo. LIBOR US + 1.150%)(a)(b) | | | USD | | | | 1,563 | | | | 1,564,467 | |

Mariner CLO LLC, Series 2016-3A, Class AR2, 1.11%, 07/23/29 (Call 01/23/22),

(3 mo. LIBOR US + 0.99%)(a)(b) | | | USD | | | | 1,222 | | | | 1,222,628 | |

MF1 Multifamily Housing Mortgage Loan Trust, 1.19%, 07/16/36 (Call 07/16/23),

(1 mo. LIBOR US + 1.1%)(a)(b) | | | USD | | | | 4,520 | | | | 4,509,824 | |

Navient Private Education Loan Trust

| | | | | | | | | | | | |

Series 2017-A, Class A2B, 0.99%, 12/16/58

(Call 04/15/28), (1 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 721 | | | | 721,842 | |

Series 2020-IA, Class A1B, 1.09%, 04/15/69

(Call 09/15/30), (1 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 7,760 | | | | 7,796,573 | |

Navient Private Education Refi Loan Trust | | | | | | | | | | | | |

Series 2020-A, Class A1, 0.44%, 11/15/68

(Call 11/15/29), (1 mo. LIBOR US + 0.350%)(a)(b) | | | USD | | | | 487 | | | | 486,770 | |

Series 2021-BA, Class A, 0.94%, 07/15/69

(Call 07/15/28)(a) | | | USD | | | | 7,897 | | | | 7,837,374 | |

Series 2021-DA, Class A, 1.26%, 04/15/60,

(PRIME—1.99%)(a)(b) | | | USD | | | | 9,903 | | | | 9,903,993 | |

Nelnet Student Loan Trust

0.83%, 04/20/62 (Call 05/20/31),

(1 mo. LIBOR US + 0.740%)(a)(b) | | | USD | | | | 7,493 | | | | 7,496,992 | |

0.98%, 04/20/62, (1 mo. LIBOR US + 0.690%)(a)(b) | | | USD | | | | 3,797 | | | | 3,797,000 | |

Series 2021-A, Class A1, 0.89%, 04/20/62

(Call 02/20/29), (1 mo. LIBOR US + 0.8%)(a)(b) | | | USD | | | | 9,567 | | | | 9,607,399 | |

Series 2021-BA, Class AFL, 0.87%, 04/20/62

(Call 07/20/29), (1 mo. LIBOR US + 0.780%)(a)(b) | | | USD | | | | 16,351 | | | | 16,372,618 | |

Neuberger Berman CLO Ltd., Series 2013-14A,

Class AR2, 1.17%, 01/28/30 (Call 01/28/22),

(3 mo. LIBOR US + 0.99%)(a)(b) | | | USD | | | | 500 | | | | 499,910 | |

Neuberger Berman Loan Advisers CLO 33 Ltd., 1.20%, 10/16/33, (3 mo. LIBOR US + 1.080%)(a)(b)(d) | | | USD | | | | 2,050 | | | | 2,050,000 | |

Nissan Master Owner Trust Receivables | | | | | | | | | | | | |

Series 2019-A, Class A, 0.65%, 02/15/24,

(1 mo. LIBOR US + 0.560%)(b) | | | USD | | | | 23,950 | | | | 23,985,602 | |

Series 2019-B, Class A, 0.52%, 11/15/23,

(1 mo. LIBOR US + 0.430%)(b) | | | USD | | | | 24,000 | | | | 24,003,401 | |

NLY Commercial Mortgage Trust, Series 2019-FL2,

Class A, 1.39%, 02/15/36 (Call 11/15/21),

(1 mo. LIBOR US + 1.300%)(a)(b) | | | USD | | | | 4,774 | | | | 4,772,226 | |

OCP CLO Ltd. | | | | | | | | | | | | |

1.12%, 04/10/33 (Call 04/10/22),

(3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 4,000 | | | | 3,999,994 | |

Series 2016-12A, Class A1R, 1.24%, 10/18/28

(Call 01/18/22), (3 mo. LIBOR US + 1.120%)(a)(b) | | | USD | | | | 15,440 | | | | 15,440,639 | |

Series 2017-13A, 1.08%, 07/15/30 (Call 04/15/22),

(3 mo. LIBOR US + 0.96%)(a)(b) | | | USD | | | | 2,350 | | | | 2,349,998 | |

Octagon Investment Partners XVII Ltd., Series 2013-1A, Class A1R2, 1.12%, 01/25/31

(Call 01/25/22), (3 mo. LIBOR US +

1.0%)(a)(b) | | | USD | | | | 3,000 | | | | 3,001,500 | |

OneMain Financial Issuance Trust, Series 2016-3A,

Class A, 3.83%, 06/18/31 (Call 11/18/21)(a) | | | USD | | | | 850 | | | | 855,054 | |

Palmer Square CLO Ltd. | | | | | | | | | | | | |

1.12%, 10/17/31 (Call 07/19/22),

(3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 1,800 | | | | 1,801,256 | |

Series 2015-2, 1.23%, 07/20/30 (Call 01/20/22),

(3 mo. LIBOR US + 1.100%)(a)(b) | | | USD | | | | 3,650 | | | | 3,650,834 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 13 |

| | |

Schedule of Investments (continued) October 31, 2021 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Series 2021-3A, Class A1, 1.00%, 01/15/35(a) | | | USD | | | | 500 | | | $ | 500,000 | |

Palmer Square Loan Funding Ltd. | | | | | | | | | | | | |

Series 2018-4A, Class A1, 1.02%, 11/15/26

(Call 11/15/21), (3 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 3,241 | | | | 3,241,738 | |

Series 2018-5A, Class A1, 0.98%, 01/20/27

(Call 01/20/22), (3 mo. LIBOR US + 0.850%)(a)(b) | | | USD | | | | 4,519 | | | | 4,518,904 | |

PFS Financing Corp. | | | | | | | | | | | | |

Series 2019-A, Class A1, 0.64%, 04/15/24,

(1 mo. LIBOR US + 0.550%)(a)(b) | | | USD | | | | 40,000 | | | | 40,074,844 | |

Series 2020-F, Class A, 0.93%, 08/15/24(a) | | | USD | | | | 3,274 | | | | 3,288,192 | |

Pikes Peak CLO 1, Series 2018-1A, Class A, 1.30%, 07/24/31 (Call 01/24/22),

(3 mo. LIBOR US + 1.180%)(a)(b) | | | USD | | | | 1,500 | | | | 1,499,816 | |

Prodigy Finance CM2021-1 DAC, Series 2021-1A,

Class A, 1.34%, 07/25/51 (Call 02/25/27),

(1 mo. LIBOR US + 1.25%)(a)(b) | | | USD | | | | 2,423 | | | | 2,431,416 | |

Red & Black Auto Germany 8 UG, Class B, 0.18%, 09/15/30 (Call 10/15/25)(b)(c) | | | EUR | | | | 400 | | | | 463,556 | |

Red & Black Auto Italy S.r.l., Class A, 1.00%, 12/28/31

(Call 09/28/25)(b)(c) | | | EUR | | | | 19,902 | | | | 23,143,215 | |

Romark WM-R Ltd., Series 2018-1A, Class A1, 1.16%, 04/20/31 (Call 01/20/22),

(3 mo. LIBOR US + 1.03%)(a)(b) | | | USD | | | | 3,879 | | | | 3,880,867 | |

RR 3 Ltd., Series 2018-3A, Class A1R2, 1.21%, 01/15/30 (Call 01/15/22),

(3 mo. LIBOR US + 1.09%)(a)(b) | | | USD | | | | 2,000 | | | | 2,003,652 | |

Santander Drive Auto Receivables Trust | | | | | | | | | | | | |

Series 2020-4, Class A3, 0.48%, 07/15/24

(Call 08/15/23) | | | USD | | | | 6,225 | | | | 6,228,083 | |

Series 2021-1, Class A3, 0.32%, 09/16/24

(Call 10/15/23) | | | USD | | | | 19,870 | | | | 19,874,441 | |

Shackleton Clo Ltd., Series 2017-11A, 1.21%, 08/15/30

(Call 11/15/21), (3 mo. LIBOR US + 1.09%)(a)(b) | | | USD | | | | 2,750 | | | | 2,748,672 | |

Shackleton CLO Ltd., Series 2015-7R, 1.27%, 07/15/31 (Call 07/15/22),

(3 mo. LIBOR US + 1.150%)(a)(b) | | | USD | | | | 2,750 | | | | 2,748,742 | |

Signal Peak CLO 2 LLC, Series 2015-1A, Class AR2, 1.11%, 04/20/29 (Call 01/20/22), (3 mo. LIBOR US + 0.98%(a)(b) | | | USD | | | | 1,752 | | | | 1,753,500 | |

Silver Creek CLO Ltd., 1.37%, 07/20/30

(Call 01/20/22), (3 mo. LIBOR US + 1.240%)(a)(b) | | | USD | | | | 7,489 | | | | 7,488,955 | |

SLM Private Credit Student Loan Trust | | | | | | | | | | | | |

Series 2004-A, Class A3, 0.52%, 06/15/33

(Call 12/15/21), (3 mo. LIBOR US + 0.400%)(b) | | | USD | | | | 4,259 | | | | 4,227,704 | |

Series 2004-B, Class A3, 0.45%, 03/15/24

(Call 03/15/24), (3 mo. LIBOR US + 0.330%)(b) | | | USD | | | | 5,285 | | | | 5,278,003 | |

Series 2005-A, Class A4, 0.43%, 12/15/38

(Call 06/15/27), (3 mo. LIBOR US + 0.310%)(b) | | | USD | | | | 8,531 | | | | 8,426,874 | |

Series 2005-B, Class A4, 0.45%, 06/15/39

(Call 09/15/26), (3 mo. LIBOR US + 0.330%)(b) | | | USD | | | | 5,884 | | | | 5,796,373 | |

Series 2006-A, Class A5, 0.41%, 06/15/39

(Call 03/15/28), (3 mo. LIBOR US + 0.290%)(b) | | | USD | | | | 12,926 | | | | 12,672,301 | |

Series 2006-B, Class A5, 0.39%, 12/15/39

(Call 09/15/27), (3 mo. LIBOR US + 0.270%)(b) | | | USD | | | | 9,268 | | | | 9,099,810 | |

SLM Student Loan Trust, Series 2011-2, Class A1, 0.69%, 11/25/27 (Call 08/25/32),

(1 mo. LIBOR US + 0.600%)(b) | | | USD | | | | 9 | | | | 9,440 | |

SMB Private Education Loan Trust | | | | | | | | | | | | |

Series 2015-A, Class A2A, 2.49%, 06/15/27

(Call 02/15/28)(a) | | | USD | | | | 771 | | | | 774,025 | |

| | | | | | | | | | | | |

| Security | | | | | Par (000) | | | Value | |

| | | |

Series 2017-A, Class A2B, 0.99%, 09/15/34,

(1 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 14,646 | | | $ | 14,730,325 | |

Series 2021-C, Class A1, 0.49%, 01/15/53,

(1 mo. LIBOR US + 0.400%)(a)(b) | | | USD | | | | 5,226 | | | | 5,228,508 | |

SoFi Professional Loan Program LLC, Series 16-C,

Class A1, 1.19%, 10/27/36 (Call 04/25/23),

(1 mo. LIBOR US + 1.100%)(a)(b) | | | USD | | | | 736 | | | | 738,153 | |

Sound Point Clo XV Ltd., Series 2017-1A, Class ARR, 1.02%, 01/23/29 (Call 01/23/22),

(3 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 2,845 | | | | 2,842,787 | |

Sound Point CLO XXVIII Ltd., Series 2020 3A,

Class A1, 1.40%, 01/25/32 (Call 01/25/22),

(3 mo. LIBOR US + 1.28%)(a)(b) | | | USD | | | | 1,250 | | | | 1,250,306 | |

Southwick Park CLO LLC, Series 2019-4A, Class A1, 1.43%, 07/20/32 (Call 01/20/22),

(3 mo. LIBOR US + 1.300%)(a)(b) | | | USD | | | | 8,760 | | | | 8,760,361 | |

Symphony CLO XVI Ltd., Series 2015-16A, Class AR, 1.27%, 10/15/31 (Call 01/15/22),

(3 mo. LIBOR US + 1.15%)(a)(b) | | | USD | | | | 500 | | | | 500,186 | |

Tagus STC/Ulisses Finance No.2, 0.15%, 09/23/38

(Call 01/23/29)(b)(c) | | | EUR | | | | 12,100 | | | | 14,158,247 | |

TCI-Symphony CLO Ltd. | | | | | | | | | | | | |

1.14%, 10/13/32 (Call 01/13/22),

(3 mo. LIBOR US + 1.020%)(a)(b) | | | USD | | | | 5,235 | | | | 5,235,000 | |

Series 2016-1A, Class AR, 1.28%, 10/13/29

(Call 01/13/22),

(3 mo. LIBOR US + 1.160%)(a)(b) | | | USD | | | | 5,235 | | | | 5,232,847 | |

Tesla Auto Lease Trust, Series 2020-A, Class A, 0.55%, 05/22/23 (Call 04/20/23)(a) | | | USD | | | | 3,662 | | | | 3,664,501 | |

TICP CLO IX Ltd., Series 2017-9A, Class A, 1.27%, 01/20/31 (Call 01/20/22),

(3 mo. LIBOR US + 1.14%)(a)(b) | | | USD | | | | 500 | | | | 500,874 | |

Verizon Owner Trust, Series 2020-A, Class A1B, 0.36%, 07/22/24 (Call 04/20/23),

(1 mo. LIBOR US + 0.270%)(b) | | | USD | | | | 9,290 | | | | 9,302,231 | |

VOYA CLO, Series 2017-2A, Class A1R, 1.10%, 06/07/30 (Call 01/15/22),

(3 mo. LIBOR US + 0.980%)(a)(b) | | | USD | | | | 5,330 | | | | 5,328,764 | |

Voya CLO Ltd., Series 2015-2A, Class AR, 1.09%, 07/23/27 (Call 01/23/22),

(3 mo. LIBOR US + 0.970%)(a)(b) | | | USD | | | | 5,102 | | | | 5,107,566 | |

Voya Ltd., Series 2012-4, 1.12%, 10/15/30

(Call 07/15/22), (3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 16,523 | | | | 16,518,556 | |

Wellfleet CLO Ltd., Series 2016-1A, Class AR, 1.04%, 04/20/28 (Call 01/20/22),

(3 mo. LIBOR US + 0.91%)(a)(b) | | | USD | | | | 1,125 | | | | 1,125,127 | |

Westlake Automobile Receivables Trust, Series 2021-1A, Class A2A, 0.39%, 10/15/24

(Call 06/15/24)(a) | | | USD | | | | 13,770 | | | | 13,769,079 | |

| | | | | | | | | | | | |

| |

Total Asset-Backed Securities — 19.9%

(Cost: $962,541,858) | | | | 966,017,893 | |

| | | | | | | | | | | | |

| | | |

Certificates of Deposit | | | | | | | | | | | | |

| | | |

Barclays Bank PLC, 0.33%, 02/01/22 | | | | | | $ | 23,000 | | | | 23,011,993 | |

Sumitomo Mitsui Banking Corp./New York, 0.70%, 07/15/22 | | | | | | | 30,000 | | | | 30,089,051 | |

| | | | | | | | | | | | |

| | | |

Total Certificates of Deposit — 1.1%

(Cost: $53,000,000) | | | | | | | | | | | 53,101,044 | |

| | | | | | | | | | | | |

| | |

| 14 | | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) October 31, 2021 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

Collaterized Mortgage Obligations | |

| | | |

Mortgage-Backed Securities — 6.9% | | | | | | | | | | | | |

280 Park Avenue Mortgage Trust, Series 2017-280P, Class A, 0.97%, 09/15/34,

(1 mo. LIBOR US + 0.880%)(a)(b) | | | USD | | | | 12,100 | | | $ | 12,088,857 | |

AREIT Trust, Series 2019-CRE3, Class A, 1.18%, 09/14/36, (1 mo. LIBOR US + 1.020%)(a)(b) | | | USD | | | | 24,290 | | | | 24,242,552 | |

B.A.T. International Finance, Series 2018-TALL, Class A, 0.81%, 03/15/37,

(1 mo. LIBOR US + 0.722%)(a)(b) | | | USD | | | | 8,630 | | | | 8,581,152 | |

BAMLL Commercial Mortgage Securities Trust, Series 2018-DSNY, Class A, 0.94%, 09/15/34,

(1 mo. LIBOR US + 0.850%)(a)(b) | | | USD | | | | 19,220 | | | | 19,183,532 | |

BBCMS Mortgage Trust, Series 2019-BWAY, Class A, 1.05%, 11/15/34,

(1 mo. LIBOR US + 0.956%)(a)(b) | | | USD | | | | 11,305 | | | | 11,276,158 | |

BX Commercial Mortgage Trust 0.79%, 10/15/36,

(1 mo. LIBOR US + 0.69%)(a)(b) | | | USD | | | | 9,780 | | | | 9,731,242 | |

Series 2018-BIOA, Class A, 0.76%, 03/15/37,

(1 mo. LIBOR US + 0.671%)(a)(b) | | | USD | | | | 23,190 | | | | 23,190,021 | |

Series 2020-BXLP, Class A, 0.89%, 12/15/36,

(1 mo. LIBOR US + 0.800%)(a)(b) | | | USD | | | | 7,388 | | | | 7,383,423 | |

BX Trust 0.98%, 10/15/36,

(1 mo. LIBOR US + 0.89%)(a)(b) | | | USD | | | | 8,520 | | | | 8,501,322 | |

Series 2019-CALM, Class A, 0.97%, 11/15/32,

(1 mo. LIBOR US + 0.876%)(a)(b) | | | USD | | | | 6,798 | | | | 6,793,895 | |

Series 2021, Class A, 1.37%, 06/15/23,

(1 mo. LIBOR US + 1.280%)(a)(b) | | | USD | | | | 2,070 | | | | 2,069,999 | |

Chase Home Lending Mortgage Trust, Series 2019-ATR2, Class A11, 0.99%, 07/25/49

(Call 05/25/23), (1 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 1,769 | | | | 1,777,648 | |

Cold Storage Trust, Series 2020-ICE5, Class A, 0.99%, 11/15/37, (1 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 1,843 | | | | 1,842,551 | |

COMM Mortgage Trust, Series 2014-CR15, Class A2, 2.93%, 02/10/47 (Call 11/10/21) | | | USD | | | | 310 | | | | 310,170 | |

Commercial Mortgage Pass Through Certificates, | | | | | | | | | | | | |

Series 2021-LBA, Class A, 0.78%, 03/15/38

(Call 03/15/23), (1 mo. LIBOR US + 0.690%)(a)(b) | | | USD | | | | 2,800 | | | | 2,778,093 | |

Commission, Series 2013- GAM, Class A2, 3.37%, 02/10/28 (Call 02/10/22)(a) | | | USD | | | | 6,626 | | | | 6,574,983 | |

Commission Mortgage Trust, Series 2013-CR6, Class A3FL, 0.72%, 03/10/46 (Call 12/10/22),

(1 mo. LIBOR US + 0.630%)(a)(b) | | | USD | | | | 788 | | | | 787,940 | |

DBGS Mortgage Trust, Series 2018-5BP, Class A, 0.89%, 06/15/33 (Call 11/15/21),

(1 mo. LIBOR US + 0.645%)(a)(b) | | | USD | | | | 4,200 | | | | 4,194,929 | |

Dutch Property Finance, Series 2021-2, Class A, 0.16%, 04/28/59 (Call 04/28/26)(b)(c) | | | EUR | | | | 6,477 | | | | 7,518,110 | |

Elvet Mortgages PLC, Series 2021-1, Class A, 0.05%, 10/22/63 (Call 10/22/26)(b)(c) | | | GBP | | | | 11,586 | | | | 15,871,131 | |

Extended Stay America Trust, Series 2021-ESH, Class A, 1.17%, 07/15/38,

(1 mo. LIBOR US + 1.08%)(a)(b) | | | USD | | | | 6,198 | | | | 6,209,529 | |

GCT Commercial Mortgage Trust, Series 2021-GCT,

Class A, 0.89%, 02/15/38,

(1 mo. LIBOR US + 0.800%)(a)(b) | | | USD | | | | 8,600 | | | | 8,608,163 | |

Gosforth Funding PLC, Series 2018-1A, Class A1, 0.58%, 08/25/60 (Call 08/25/23),

(3 mo. LIBOR US + 0.450%)(a)(b) | | | USD | | | | 2,376 | | | | 2,377,600 | |

GS Mortgage Securities Corportation Trust, 1.05%, 10/15/36, (1 mo. LIBOR US + 0.95%)(a)(b) | | | USD | | | | 10,360 | | | | 10,363,136 | |

| | | | | | | | | | | | |

| Security | | | | | Par (000) | | | Value | |

| | | |

| Mortgage-Backed Securities (continued) | | | | | | | | | |

JP Morgan Chase Commercial Mortgage Securities Trust, Series 2019-BKWD, Class A, 1.09%, 09/15/29, (1 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 1,911 | | | $ | 1,909,779 | |

KNDL Mortgage Trust, Series 2019-KNSQ, Class A, 0.89%, 05/15/36, (1 mo. LIBOR US + 0.800%)(a)(b) | | | USD | | | | 8,533 | | | | 8,532,998 | |

MED Trust LLC, 1.00%, 11/15/26(a) | | | USD | | | | 4,260 | | | | 4,260,000 | |

Morgan Stanley Capital I Trust | | | | | | | | | | | | |

Series 2017-CLS, Class A, 0.79%, 11/15/34,

(1 mo. LIBOR US + 0.700%)(a)(b) | | | USD | | | | 14,512 | | | | 14,503,177 | |

Series 2018-BOP, Class A, 0.94%, 08/15/33,

(1 mo. LIBOR US + 0.850%)(a)(b) | | | USD | | | | 6,609 | | | | 6,605,229 | |

Series 2018-SUN, Class A, 0.99%, 07/15/35

(Call 07/15/22), (1 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 19,045 | | | | 19,038,955 | |

Natixis Commercial Mortgage Securities Trust, Series 2018-RIVA, Class A, 0.84%, 02/15/33,

(1 mo. LIBOR US + 0.750%)(a)(b) | | | USD | | | | 6,486 | | | | 6,482,658 | |

Taurus CMBS, 1.00%, 08/17/31 (Call 08/17/26),

(SOFR + 0.95%)(b)(c) | | | GBP | | | | 7,159 | | | | 9,809,865 | |

Together Asset Backed Securitisation, 0.75%, 07/12/63

(Call 10/12/25)(b)(c) | | | GBP | | | | 3,369 | | | | 4,611,154 | |

TPGI Trust, Series 2021 DGWD, Class A, 0.79%, 06/15/26, (1 mo. LIBOR US + 0.700%)(a)(b) | | | USD | | | | 6,320 | | | | 6,316,081 | |

Wells Fargo Commercial Mortgage Trust, Series 2017-SMP, Class A, 0.97%, 12/15/34,

(1 mo. LIBOR US + 0.750%)(a)(b) | | | USD | | | | 17,280 | | | | 17,259,383 | |

WFRBS Commercial Mortgage Trust | | | | | | | | | | | | |

Series 2012-C6, Class AS, 3.84%, 04/15/45

(Call 02/15/22) | | | USD | | | | 12,986 | | | | 13,044,002 | |

Series 2012-C8, Class AFL, 1.09%, 08/15/45

(Call 03/15/22), (1 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 18,999 | | | | 19,001,397 | |

| | | | | | | | | | | | |

| |

Total Collaterized Mortgage Obligations — 6.9%

(Cost: $334,138,511) | | | | 333,630,814 | |

| | | | | | | | | | | | |

| | | |

Commercial Paper | | | | | | | | | | | | |

| | | |

AT&T Inc., 0.41%, 12/14/21(e) | | | | | | $ | 23,000 | | | | 22,995,268 | |

CIGNA Corp., 0.16%, 12/01/21(e) | | | | | | | 25,000 | | | | 24,996,425 | |

Enel Finance America

0.23%, 02/22/22(e) | | | | | | | 20,000 | | | | 19,985,436 | |

0.33%, 06/27/22(e) | | | | | | | 13,800 | | | | 13,769,421 | |

0.36%, 07/08/22(e) | | | | | | | 20,000 | | | | 19,951,560 | |

0.38%, 08/09/22(e) | | | | | | | 16,000 | | | | 15,952,414 | |

0.41%, 04/22/22(e) | | | | | | | 25,000 | | | | 24,966,337 | |

ENI Finance USA Inc., 0.30%, 04/13/22(e) | | | | | | | 21,000 | | | | 20,971,144 | |

General Motors Financial Co. Inc., 0.34%, 12/14/21(e) | | | | | | | 20,000 | | | | 19,991,413 | |

Viatris Inc.

0.40%, 12/30/21(e) | | | | | | | 15,000 | | | | 14,989,615 | |

0.40%, 12/31/21(e) | | | | | | | 20,000 | | | | 19,985,895 | |

Volkswagen Group America Finance LLC, 0.31%, 11/12/21(e) | | | | | | | 22,000 | | | | 21,997,322 | |

VW CR Inc., 0.21%, 02/16/22(e) | | | | | | | 15,000 | | | | 14,990,513 | |

| | | | | | | | | | | | |

| | | |

Total Commercial Paper — 5.3%

(Cost: $255,474,713) | | | | | | | | | | | 255,542,763 | |

| | | | | | | | | | | | |

| | | |

Corporate Bonds & Notes | | | | | | | | | | | | |

| | | |

| Aerospace & Defense — 0.3% | | | | | | | | | |

Boeing Co. (The), 2.13%, 03/01/22 (Call 02/01/22)(f) | | | | | | | 9,550 | | | | 9,587,536 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 15 |

| | |

Schedule of Investments (continued) October 31, 2021 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

Aerospace & Defense (continued) | | | | | | | | |

L3Harris Technologies Inc., 3.85%, 06/15/23

(Call 05/15/23) | | $ | 5,000 | | | $ | 5,241,365 | |

| | | | | | | | |

| | |

| | | | | | | 14,828,901 | |

| | |

| Agriculture — 0.2% | | | | | | |

BAT Capital Corp., 1.00%, 08/15/22 (Call 07/15/22),

(3 mo. LIBOR US + 0.880%)(b) | | | 10,000 | | | | 10,049,646 | |

| | | | | | | | |

| | |

| Auto Manufacturers — 7.9% | | | | | | |

American Honda Finance Corp.

1.95%, 05/20/22(f) | | | 15,023 | | | | 15,155,617 | |

2.20%, 06/27/22(f) | | | 6,136 | | | | 6,213,680 | |

BMW Finance NV, 2.25%, 08/12/22(a)(f) | | | 16,350 | | | | 16,588,252 | |

BMW U.S. Capital LLC, 0.43%, 08/12/24,

(SOFR + 0.380%)(a)(b) | | | 22,230 | | | | 22,367,381 | |

Daimler Finance North America LLC

0.75%, 03/01/24(a)(f) | | | 9,005 | | | | 8,966,930 | |

1.01%, 02/22/22, (3 mo. LIBOR US + 0.880%)(a)(b) | | | 24,623 | | | | 24,681,516 | |

2.55%, 08/15/22(a)(f) | | | 19,691 | | | | 20,019,355 | |

Ford Motor Credit Co. LLC, 3.34%, 03/28/22

(Call 02/28/22) | | | 10,000 | | | | 10,057,000 | |

General Motors Financial Co. Inc.

0.67%, 10/15/24, (SOFR + 0.620%)(b) | | | 15,000 | | | | 15,008,895 | |

1.05%, 03/08/24(f) | | | 20,000 | | | | 19,957,056 | |

3.45%, 04/10/22 (Call 02/10/22) | | | 19,400 | | | | 19,563,234 | |

4.20%, 11/06/21(f) | | | 44,465 | | | | 44,482,823 | |

Hyundai Capital America

0.80%, 04/03/23(a)(f) | | | 17,710 | | | | 17,703,436 | |

1.00%, 09/17/24(a) | | | 8,105 | | | | 8,025,444 | |

Nissan Motor Acceptance Co. LLC, 1.13%, 09/16/24(a) | | | 10,520 | | | | 10,436,810 | |

Nissan Motor Acceptance Corp.

0.75%, 03/08/24, (3 mo. LIBOR US + 0.640%)(a)(b) | | | 4,375 | | | | 4,376,972 | |

1.05%, 03/08/24(a) | | | 12,515 | | | | 12,432,306 | |

Stellantis NV, 5.25%, 04/15/23 | | | 9,400 | | | | 9,989,944 | |

Volkswagen Group of America Finance LLC

0.75%, 11/23/22(a) | | | 44,345 | | | | 44,373,539 | |

2.70%, 09/26/22(a) | | | 2,145 | | | | 2,187,061 | |

2.90%, 05/13/22(a) | | | 35,500 | | | | 35,967,644 | |

4.25%, 11/13/23(a) | | | 13,000 | | | | 13,864,314 | |

| | | | | | | | |

| | |

| | | | | | | 382,419,209 | |

| | |

| Banks — 23.2% | | | | | | |

Banco Santander SA

0.70%, 06/30/24 (Call 06/30/23)(b) | | | 21,200 | | | | 21,135,188 | |

1.24%, 04/12/23, (3 mo. LIBOR US + 1.120%)(b) | | | 10,000 | | | | 10,127,851 | |

3.85%, 04/12/23 | | | 9,291 | | | | 9,705,858 | |

Bank of America Corp.

| | | | | | | | |

1.12%, 04/24/23 (Call 04/24/22),

(3 mo. LIBOR US + 1.000%)(b) | | | 12,500 | | | | 12,553,760 | |

1.29%, 01/20/23 (Call 01/20/22),

(3 mo. LIBOR US + 1.160%)(b) | | | 24,475 | | | | 24,533,099 | |

3.00%, 12/20/23 (Call 12/20/22),

(3 mo. LIBOR US + 0.790%)(b)(f) | | | 59,185 | | | | 60,734,365 | |

3.55%, 03/05/24 (Call 03/05/23)(b) | | | 30,000 | | | | 31,115,645 | |

Banque Federative du Credit Mutuel SA, 2.13%, 11/21/22(a) | | | 20,000 | | | | 20,357,670 | |

Barclays Bank PLC, 1.70%, 05/12/22 (Call 04/12/22)(f) | | | 15,000 | | | | 15,092,937 | |

Barclays PLC | | | | | | | | |

1.50%, 05/16/24 (Call 05/16/23),

(3 mo. LIBOR US + 1.380%)(b) | | | 41,000 | | | | 41,641,951 | |

1.55%, 02/15/23 (Call 02/15/22),

(3 mo. LIBOR US + 1.430%)(b) | | | 20,000 | | | | 20,067,357 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

Banks (continued) | | | | | | | | |

BPCE SA

1.35%, 09/12/23, (3 mo. LIBOR US + 1.240%)(a)(b) | | $ | 15,000 | | | $ | 15,264,393 | |

3.00%, 05/22/22(a) | | | 17,993 | | | | 18,249,102 | |

Canadian Imperial Bank of Commerce, 0.45%, 06/22/23 | | | 27,680 | | | | 27,578,644 | |

Citigroup Inc. | | | | | | | | |

0.82%, 10/27/22 (Call 09/27/22),

(3 mo. LIBOR US + 0.690%)(b) | | | 10,000 | | | | 10,053,784 | |

2.31%, 11/04/22 (Call 11/04/21),

(SOFR + 0.867%)(b) | | | 10,000 | | | | 10,000,898 | |

2.70%, 10/27/22 (Call 09/27/22) | | | 34,100 | | | | 34,788,171 | |

2.88%, 07/24/23 (Call 07/24/22),

(3 mo. LIBOR US + 0.950%)(b) | | | 10,000 | | | | 10,162,064 | |

2.90%, 12/08/21 (Call 11/08/21) | | | 18,350 | | | | 18,358,370 | |

Citizens Bank N.A./Providence RI, 0.84%, 02/14/22

(Call 01/14/22), (3 mo. LIBOR US +

0.720%)(b) | | | 30,000 | | | | 30,029,828 | |

Cooperatieve Rabobank UA, 0.99%, 09/26/23,

(3 mo. LIBOR US + 0.860%)(a)(b) | | | 10,000 | | | | 10,123,682 | |

Credit Suisse AG/New York NY, 0.52%, 08/09/23(f) | | | 25,000 | | | | 24,949,478 | |

Credit Suisse Group AG

3.57%, 01/09/23 (Call 01/09/22)(a) | | | 10,000 | | | | 10,054,821 | |

3.80%, 06/09/23 | | | 8,500 | | | | 8,898,501 | |

Credit Suisse Group Funding Guernsey Ltd., 3.80%, 09/15/22 | | | 15,000 | | | | 15,426,694 | |

Danske Bank A/S

2.70%, 03/02/22(a) | | | 15,000 | | | | 15,112,605 | |

5.00%, 01/12/22(a) | | | 23,888 | | | | 24,089,729 | |

Federation des Caisses Desjardins du Quebec, 0.48%, 05/21/24, (SOFR + 0.430%)(a)(b) | | | 20,000 | | | | 20,036,000 | |

Goldman Sachs Group Inc. (The)

0.52%, 03/08/23 (Call 03/08/22) | | | 25,000 | | | | 24,954,091 | |

1.12%, 07/24/23 (Call 07/24/22),

(3 mo. LIBOR US + 1.000%)(b) | | | 5,000 | | | | 5,024,535 | |

1.72%, 11/29/23, (3 mo. LIBOR US + 1.600%)(b) | | | 14,100 | | | | 14,469,136 | |

3.20%, 02/23/23 (Call 01/23/23) | | | 7,583 | | | | 7,812,000 | |

0.48%, 01/27/23 (Call 01/27/22) | | | 26,400 | | | | 26,328,062 | |

HSBC Holdings PLC

0.73%, 08/17/24 (Call 08/17/23)(b) | | | 11,120 | | | | 11,071,958 | |

1.34%, 03/11/25 (Call 03/11/24),

(3 mo. LIBOR US + 1.230%)(b) | | | 13,000 | | | | 13,241,228 | |

3.60%, 05/25/23(f) | | | 10,000 | | | | 10,452,348 | |

Huntington National Bank (The), 2.50%, 08/07/22

(Call 07/07/22)(f) | | | 15,430 | | | | 15,662,843 | |

ING Groep NV, 1.28%, 03/29/22,

(3 mo. LIBOR US + 1.150%)(b) | | | 3,500 | | | | 3,516,992 | |

JPMorgan Chase & Co. | | | | | | | | |

1.02%, 04/25/23 (Call 04/25/22),

(3 mo. LIBOR US + 0.900%)(b) | | | 9,175 | | | | 9,212,929 | |

2.78%, 04/25/23 (Call 04/25/22),

(3 mo. LIBOR US + 0.935%)(b)(f) | | | 16,000 | | | | 16,173,121 | |

3.25%, 09/23/22 | | | 5,000 | | | | 5,129,461 | |

3.56%, 04/23/24 (Call 04/23/23),

(3 mo. LIBOR US + 0.730%)(b) | | | 29,700 | | | | 30,911,034 | |

Lloyds Banking Group PLC, 2.86%, 03/17/23

(Call 03/17/22), (3 mo. LIBOR US +

1.2%)(b)(f) | | | 32,000 | | | | 32,274,462 | |

Mitsubishi UFJ Financial Group Inc. | | | | | | | | |

0.91%, 07/25/22, (3 mo. LIBOR US + 0.790%)(b) | | | 3,250 | | | | 3,265,250 | |

2.62%, 07/18/22(f) | | | 5,000 | | | | 5,077,648 | |

2.67%, 07/25/22(f) | | | 5,000 | | | | 5,081,350 | |

3.00%, 02/22/22(f) | | | 5,000 | | | | 5,040,859 | |

| | |

| 16 | | 2 0 2 1 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) October 31, 2021 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

Banks (continued) | | | | | | | | |

Mizuho Financial Group Inc. | | | | | | | | |

0.76%, 05/25/24 (Call 05/25/23),

(3 mo. LIBOR US + 0.630%)(b) | | $ | 10,000 | | | $ | 10,059,368 | |

0.91%, 03/05/23, (3 mo. LIBOR US + 0.790%)(b) | | | 3,000 | | | | 3,028,570 | |

0.96%, 09/13/23 (Call 09/13/22),

(3 mo. LIBOR US + 0.850%)(b) | | | 25,000 | | | | 25,157,799 | |

3.55%, 03/05/23(f) | | | 20,000 | | | | 20,773,526 | |

Morgan Stanley | | | | | | | | |

0.53%, 01/25/24 (Call 01/25/23),

(SOFR + 0.455%)(b) | | | 20,000 | | | | 19,957,916 | |

1.52%, 10/24/23 (Call 10/24/22),

(3 mo. LIBOR US + 1.400%)(b) | | | 24,025 | | | | 24,316,915 | |

3.75%, 02/25/23(f) | | | 25,000 | | | | 26,013,460 | |

MUFG Americas Holdings Corp., 3.50%, 06/18/22 | | | 2,885 | | | | 2,942,548 | |

National Bank of Canada, 0.54%, 08/06/24,

(SOFR + 0.490%)(b) | | | 8,695 | | | | 8,719,259 | |

Natwest Group PLC | | | | | | | | |

1.59%, 05/15/23 (Call 05/15/22),

(3 mo. LIBOR US + 1.470%)(b) | | | 9,895 | | | | 9,961,797 | |

1.68%, 06/25/24 (Call 06/25/23),

(3 mo. LIBOR US + 1.550%)(b) | | | 3,000 | | | | 3,060,520 | |

3.50%, 05/15/23 (Call 05/15/22), (3 mo. LIBOR US + 1.48%(b)(f) | | | 8,500 | | | | 8,625,061 | |

3.88%, 09/12/23 | | | 20,000 | | | | 21,079,178 | |

Santander Holdings USA Inc., 4.45%, 12/03/21

(Call 11/29/21) | | | 1,278 | | | | 1,281,658 | |

Skandinaviska Enskilda Banken AB, 0.76%, 12/12/22,

(3 mo. LIBOR US + 0.645%)(a)(b) | | | 15,000 | | | | 15,086,246 | |

Sumitomo Mitsui Financial Group Inc.

0.92%, 10/16/23, (3 mo. LIBOR US + 0.800%)(b) | | | 4,000 | | | | 4,049,282 | |

2.78%, 07/12/22(f) | | | 5,000 | | | | 5,084,534 | |

UBS AG/London

0.50%, 08/09/24, (SOFR + 0.450%)(a)(b) | | | 15,725 | | | | 15,808,500 | |

1.75%, 04/21/22 (Call 03/21/22)(a)(f) | | | 12,680 | | | | 12,744,832 | |

UBS Group AG | | | | | | | | |

1.35%, 05/23/23 (Call 05/23/22),

(3 mo. LIBOR US + 1.220%)(a)(b) | | | 20,000 | | | | 20,124,818 | |

3.49%, 05/23/23 (Call 05/23/22)(a)(f) | | | 20,000 | | | | 20,315,351 | |

UniCredit SpA, 3.75%, 04/12/22(a) | | | 17,595 | | | | 17,835,954 | |

Wells Fargo & Co., 1.36%, 10/31/23

(Call 10/31/22), (3 mo. LIBOR US +

1.230%)(b) | | | 14,250 | | | | 14,408,036 | |

| | | | | | | | |

| | |

| | | | | | | 1,125,376,880 | |

| | |

| Beverages — 0.2% | | | | | | |