UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22649

Name of Fund: iShares U.S. ETF Trust

Fund Address: c/o BlackRock Fund Advisors, 400 Howard Street, San Francisco, CA 94105

Name and address of agent for service: The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: 10/31/2024

Date of reporting period: 10/31/2024

Item 1 – Reports to Stockholders

(a) The Reports to Shareholders are attached herewith.

iShares Short Maturity Municipal Bond Active ETF

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about iShares Short Maturity Municipal Bond Active ETF (the “Fund”) (Formerly known as BlackRock Short Maturity Municipal Bond ETF) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at 1-800-iShares (1-800-474-2737).

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| iShares Short Maturity Municipal Bond Active ETF | $26 | 0.25% |

How did the Fund perform last year?

For the reporting period ended October 31, 2024, the Fund returned 4.30%.

For the same period, the Bloomberg Municipal Bond Index returned 9.70% and the Bloomberg Municipal Bond: 1 Year (1-2) Index returned 4.42%.

What contributed to performance?

During the reporting period, a combination of moderating inflation levels and a softening labor market contributed to the U.S. Federal Reserve’s decision to loosen monetary policy with a 50-basis point target policy rate cut in September. Amid a volatile overall rate market, the investment adviser’s selective approach to the timing of duration extension trades was a positive contributor to the Fund’s performance. Variable rate demand note (“VRDN”) securities provided price protection from adverse market pricing changes because the securities traded at par while capturing increases in yields with daily or weekly rate adjustments and contributed to performance. A selective overweight to the 2-5year part of the yield curve also contributed to performance. From a credit perspective, A and BBB rated municipal bonds were additive.

What detracted from performance?

Detracting from the Fund’s performance during the reporting period were underweights to the tax-backed states, utilities and transportation sectors, and an underweight allocation to the one-two-year part of the yield curve.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

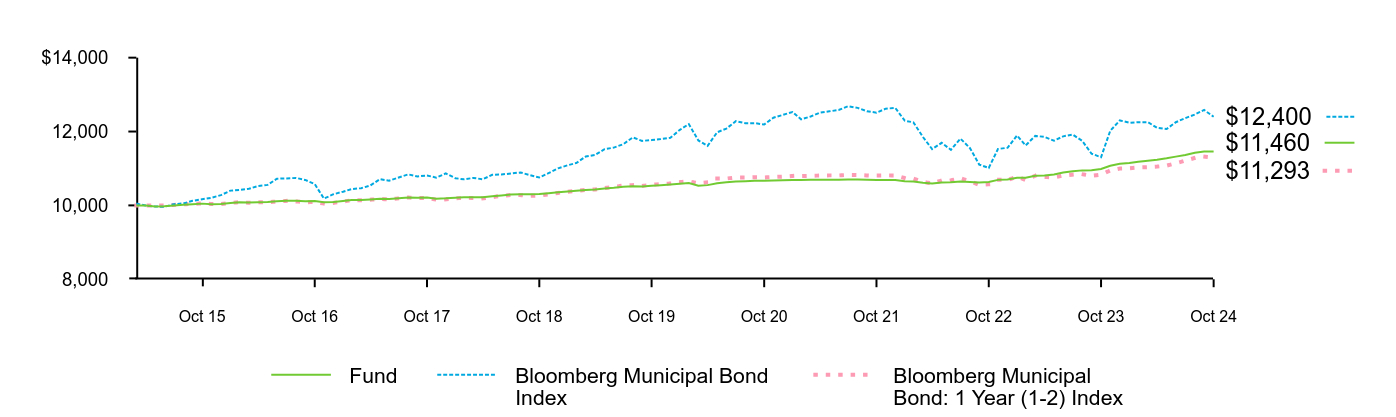

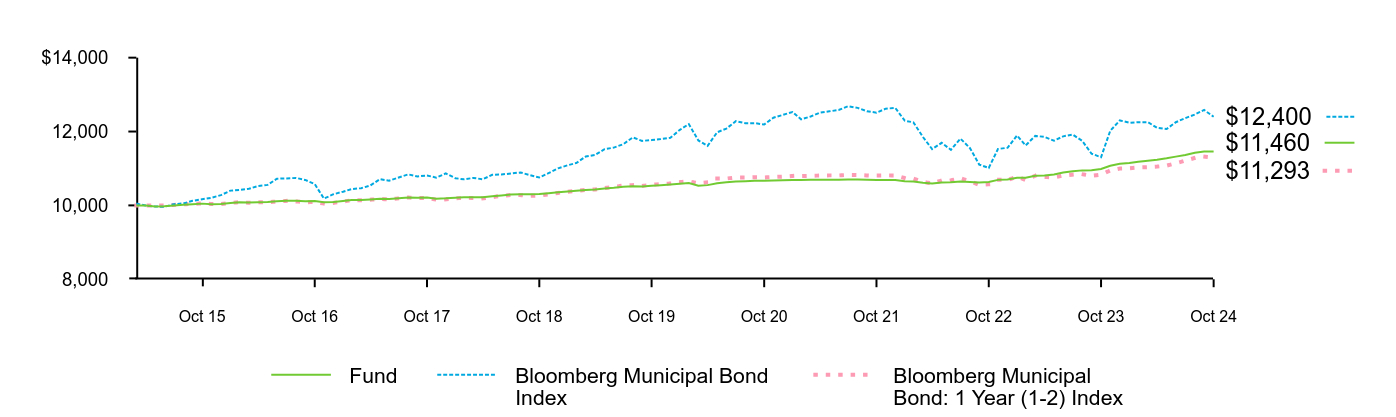

Cumulative performance: March 3, 2015 through October 31, 2024

Initial Investment of $10,000

| Fund | Bloomberg Municipal Bond Index | Bloomberg Municipal Bond: 1 Year (1-2) Index |

|---|

| Mar 15 | $9,998 | $10,050 | $10,000 |

| Apr 15 | $9,994 | $9,998 | $10,000 |

| May 15 | $9,972 | $9,970 | $10,000 |

| Jun 15 | $9,978 | $9,961 | $10,000 |

| Jul 15 | $9,999 | $10,033 | $10,013 |

| Aug 15 | $10,017 | $10,053 | $10,030 |

| Sep 15 | $10,034 | $10,125 | $10,042 |

| Oct 15 | $10,048 | $10,166 | $10,052 |

| Nov 15 | $10,034 | $10,206 | $10,040 |

| Dec 15 | $10,036 | $10,278 | $10,038 |

| Jan 16 | $10,062 | $10,400 | $10,069 |

| Feb 16 | $10,084 | $10,417 | $10,085 |

| Mar 16 | $10,076 | $10,450 | $10,071 |

| Apr 16 | $10,087 | $10,527 | $10,082 |

| May 16 | $10,092 | $10,555 | $10,087 |

| Jun 16 | $10,111 | $10,723 | $10,104 |

| Jul 16 | $10,125 | $10,730 | $10,122 |

| Aug 16 | $10,126 | $10,744 | $10,107 |

| Sep 16 | $10,111 | $10,690 | $10,085 |

| Oct 16 | $10,118 | $10,578 | $10,092 |

| Nov 16 | $10,086 | $10,184 | $10,049 |

| Dec 16 | $10,095 | $10,303 | $10,068 |

| Jan 17 | $10,119 | $10,371 | $10,105 |

| Feb 17 | $10,145 | $10,443 | $10,138 |

| Mar 17 | $10,149 | $10,466 | $10,138 |

| Apr 17 | $10,161 | $10,542 | $10,154 |

| May 17 | $10,177 | $10,709 | $10,173 |

| Jun 17 | $10,173 | $10,671 | $10,165 |

| Jul 17 | $10,192 | $10,757 | $10,189 |

| Aug 17 | $10,215 | $10,839 | $10,212 |

| Sep 17 | $10,210 | $10,784 | $10,200 |

| Oct 17 | $10,213 | $10,810 | $10,201 |

| Nov 17 | $10,183 | $10,752 | $10,155 |

| Dec 17 | $10,193 | $10,865 | $10,161 |

| Jan 18 | $10,209 | $10,737 | $10,190 |

| Feb 18 | $10,220 | $10,705 | $10,207 |

| Mar 18 | $10,223 | $10,744 | $10,200 |

| Apr 18 | $10,223 | $10,706 | $10,190 |

| May 18 | $10,247 | $10,828 | $10,224 |

| Jun 18 | $10,269 | $10,838 | $10,260 |

| Jul 18 | $10,293 | $10,864 | $10,281 |

| Aug 18 | $10,300 | $10,892 | $10,278 |

| Sep 18 | $10,299 | $10,821 | $10,258 |

| Oct 18 | $10,310 | $10,755 | $10,267 |

| Nov 18 | $10,331 | $10,874 | $10,299 |

| Dec 18 | $10,354 | $11,004 | $10,338 |

| Jan 19 | $10,377 | $11,087 | $10,370 |

| Feb 19 | $10,396 | $11,146 | $10,394 |

| Mar 19 | $10,416 | $11,323 | $10,422 |

| Apr 19 | $10,428 | $11,365 | $10,430 |

| May 19 | $10,456 | $11,522 | $10,469 |

| Jun 19 | $10,476 | $11,564 | $10,501 |

| Jul 19 | $10,504 | $11,658 | $10,536 |

| Aug 19 | $10,519 | $11,842 | $10,550 |

| Sep 19 | $10,513 | $11,747 | $10,528 |

| Oct 19 | $10,533 | $11,768 | $10,559 |

| Nov 19 | $10,546 | $11,797 | $10,577 |

| Dec 19 | $10,564 | $11,833 | $10,592 |

| Jan 20 | $10,585 | $12,046 | $10,630 |

| Feb 20 | $10,605 | $12,201 | $10,651 |

| Mar 20 | $10,531 | $11,759 | $10,598 |

| Apr 20 | $10,549 | $11,611 | $10,623 |

| May 20 | $10,598 | $11,980 | $10,728 |

| Jun 20 | $10,625 | $12,079 | $10,728 |

| Jul 20 | $10,649 | $12,282 | $10,755 |

| Aug 20 | $10,657 | $12,225 | $10,756 |

| Sep 20 | $10,670 | $12,227 | $10,764 |

| Oct 20 | $10,668 | $12,191 | $10,756 |

| Nov 20 | $10,677 | $12,375 | $10,769 |

| Dec 20 | $10,681 | $12,450 | $10,779 |

| Jan 21 | $10,690 | $12,529 | $10,797 |

| Feb 21 | $10,687 | $12,330 | $10,793 |

| Mar 21 | $10,693 | $12,406 | $10,801 |

| Apr 21 | $10,697 | $12,510 | $10,808 |

| May 21 | $10,696 | $12,548 | $10,813 |

| Jun 21 | $10,695 | $12,582 | $10,812 |

| Jul 21 | $10,703 | $12,686 | $10,826 |

| Aug 21 | $10,701 | $12,640 | $10,823 |

| Sep 21 | $10,694 | $12,549 | $10,812 |

| Oct 21 | $10,689 | $12,512 | $10,810 |

| Nov 21 | $10,689 | $12,618 | $10,813 |

| Dec 21 | $10,688 | $12,639 | $10,812 |

| Jan 22 | $10,651 | $12,293 | $10,740 |

| Feb 22 | $10,646 | $12,249 | $10,726 |

| Mar 22 | $10,616 | $11,852 | $10,637 |

| Apr 22 | $10,594 | $11,524 | $10,594 |

| May 22 | $10,621 | $11,695 | $10,675 |

| Jun 22 | $10,627 | $11,504 | $10,678 |

| Jul 22 | $10,650 | $11,808 | $10,736 |

| Aug 22 | $10,636 | $11,549 | $10,650 |

| Sep 22 | $10,622 | $11,105 | $10,558 |

| Oct 22 | $10,634 | $11,013 | $10,572 |

| Nov 22 | $10,691 | $11,528 | $10,694 |

| Dec 22 | $10,704 | $11,561 | $10,688 |

| Jan 23 | $10,751 | $11,893 | $10,778 |

| Feb 23 | $10,749 | $11,624 | $10,687 |

| Mar 23 | $10,802 | $11,882 | $10,802 |

| Apr 23 | $10,812 | $11,855 | $10,770 |

| May 23 | $10,834 | $11,752 | $10,758 |

| Jun 23 | $10,889 | $11,870 | $10,810 |

| Jul 23 | $10,923 | $11,917 | $10,833 |

| Aug 23 | $10,948 | $11,746 | $10,844 |

| Sep 23 | $10,953 | $11,401 | $10,800 |

| Oct 23 | $10,988 | $11,304 | $10,831 |

| Nov 23 | $11,075 | $12,022 | $10,947 |

| Dec 23 | $11,128 | $12,301 | $10,998 |

| Jan 24 | $11,151 | $12,239 | $11,005 |

| Feb 24 | $11,181 | $12,254 | $11,026 |

| Mar 24 | $11,209 | $12,254 | $11,035 |

| Apr 24 | $11,235 | $12,102 | $11,050 |

| May 24 | $11,275 | $12,067 | $11,076 |

| Jun 24 | $11,321 | $12,252 | $11,139 |

| Jul 24 | $11,365 | $12,363 | $11,212 |

| Aug 24 | $11,423 | $12,461 | $11,286 |

| Sep 24 | $11,461 | $12,584 | $11,321 |

| Oct 24 | $11,460 | $12,400 | $11,293 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | 5 Years | Since Fund Inception |

|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.30% | 1.70% | 1.42% |

Bloomberg Municipal Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.70 | 1.05 | 2.25 |

Bloomberg Municipal Bond: 1 Year (1-2) Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.42 | 1.38 | 1.28 |

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $682,282,883 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 220 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $1,630,132 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 91% |

The Fund has added the Bloomberg Municipal Bond Index in response to new regulatory requirements.

The inception date of the Fund was March 3, 2015.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit iShares.com for more recent performance information.

What did the Fund invest in?

Credit quality allocation

S&P Credit RatingFootnote Reference* | Percent of Total InvestmentsFootnote Reference(a) |

|---|

AAA........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.3% |

AA+........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 26.5 |

AA........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.2 |

AA-........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.1 |

A+........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.3 |

A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.6 |

A-........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 13.6 |

BBB+........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.4 |

BBB........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.5 |

Not Rated........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 31.5 |

| State | Percent of TotaI InvestmentsFootnote Reference(a) |

|---|

Texas ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.5% |

Iowa ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.9 |

New York ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.7 |

Tennessee ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.2 |

New Jersey ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.8 |

Alabama ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.7 |

Louisiana ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.3 |

Illinois ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

Wisconsin ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

Kentucky ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.7 |

|

| Footnote | Description |

Footnote* | Credit quality ratings shown reflect the ratings assigned by S&P Global Ratings, a widely used independent, nationally recognized statistical rating organization. S&P credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of BBB or higher. Below investment grade ratings are credit ratings of BB or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Footnote(a) | Excludes money market funds. |

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available approximately 120 days after October 31, 2024 at blackrock.com/fundreports or upon request by contacting us at 1-800-iShares (1-800-474-2737).

Effective October 10, 2024, the name of the Fund was changed from BlackRock Short Maturity Municipal Bond ETF to iShares Short Maturity Municipal Bond Active ETF.

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding is an option available to certain fund investors. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status.

The Fund is not sponsored, endorsed, issued, sold or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc or its affiliates. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iShares Short Maturity Municipal Bond Active ETF

Annual Shareholder Report — October 31, 2024

(b) Not Applicable

Item 2 – Code of Ethics – The registrant has adopted a code of ethics, as of the end of the period covered by this report, applicable to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. During the period covered by this report, the registrant has not amended the code of ethics and there have been no waivers granted under the code of ethics. The registrant undertakes to provide a copy of the code of ethics to any person upon request, without charge, by calling 1-800-474-2737.

Item 3 – Audit Committee Financial Expert – The registrant’s board of trustees (the “board of trustees”), has determined that (i) the registrant has the following audit committee financial experts serving on its audit committee and (ii) each audit committee financial expert is independent:

Richard L. Fagnani

Madhav V. Rajan

Under applicable securities laws, a person determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and board of trustees in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the audit committee or board of trustees.

Item 4 – Principal Accountant Fees and Services

The principal accountant fees disclosed in items 4(a), 4(b), 4(c), 4(d) and 4(g) are for the one series of the registrant for which the fiscal year-end is October 31, 2024 (the “Fund”), and whose annual financial statements are reported in Item 1.

(a) Audit Fees – The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the Fund’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were $13,850 for the fiscal year ended October 31, 2023 and $13,850 for the fiscal year ended October 31, 2024.

(b) Audit-Related Fees – There were no fees billed for the fiscal years ended October 31, 2023 and October 31, 2024 for assurance and related services by the principal accountant that were reasonably related to the performance of the audit of the Fund’s financial statements and are not reported under (a) of this Item.

(c) Tax Fees – The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning for the Fund were $9,700 for the fiscal year ended October 31, 2023 and $9,700 for the fiscal year ended October 31, 2024. These services related to the review of the Fund’s tax returns and excise tax calculations.

(d) All Other Fees – There were no other fees billed in each of the fiscal years ended October 31, 2023 and October 31, 2024 for products and services provided by the principal accountant, other than the services reported in (a) through (c) of this Item.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The registrant’s audit committee charter, as amended, provides that the audit committee is responsible for the approval, prior to appointment, of the engagement of the principal accountant to annually audit and provide their opinion on the registrant’s financial statements. The audit committee must also approve, prior to appointment, the engagement of the principal accountant to provide non-audit services to the registrant or to any entity controlling, controlled by or under common control with the registrant’s investment adviser (“Adviser Affiliate”) that provides ongoing services to the registrant, if the engagement relates directly to the operations and financial reporting of the registrant.

(e)(2) None of the services described in each of Items 4(b) through (d) were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not Applicable

(g) The aggregate non-audit fees billed by the registrant’s principal accountant for services rendered to the Fund, and rendered to the registrant’s investment adviser, and any Adviser Affiliate that provides ongoing services to the registrant for the last two fiscal years were $9,700 for the fiscal year ended October 31, 2023 and $9,700 for the fiscal year ended October 31, 2024.

(h) The registrant’s audit committee has considered whether the provision of non-audit services rendered to the registrant’s investment adviser and any Adviser Affiliate that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, if any, is compatible with maintaining the principal accountant’s independence, and has determined that the provision of these services, if any, does not compromise the principal accountant’s independence.

(i) – Not Applicable

(j) – Not Applicable

Item 5 – Audit Committee of Listed Registrant

(a) The following individuals are members of the registrant’s separately designated standing Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (15 U.S.C. 78c(a)(58)(A)):

Richard L. Fagnani

Laura F. Fergerson

Cecilia H. Herbert

Madhav V. Rajan

(b) Not Applicable

Item 6 – Investments

(a) The registrant’s Schedule of Investments is included as part of the Financial Statements and Financial Highlights for Open-End Management Investment Companies filed under Item 7 of this Form.

(b) Not Applicable due to no such divestments during the semi-annual period covered since the previous Form N-CSR filing.

Item 7 – Financial Statements and Financial Highlights for Open-End Management Investment Companies

(a) The registrant’s Financial Statements are attached herewith.

(b) The registrant’s Financial Highlights are attached herewith.

2024

Annual

Financial

Statements

and

Additional

Information

iShares

U.S.

ETF

Trust

iShares

Short

Maturity

Municipal

Bond

Active

ETF

|

MEAR

|

Cboe

BZX

Exchange

Schedules

of

Investments

.................................................................................................

3

Statement

of

Assets

and

Liabilities

............................................................................................

8

Statement

of

Operations

..................................................................................................

9

Statements

of

Changes

in

Net

Assets

..........................................................................................

10

Financial

Highlights

.....................................................................................................

11

Notes

to

Financial

Statements

...............................................................................................

12

Report

of

Independent

Registered

Public

Accounting

Firm

..............................................................................

17

Important

Tax

Information

.................................................................................................

18

Additional

Information

....................................................................................................

19

Board

Review

and

Approval

of

Investment

Advisory

Contract

............................................................................

20

Glossary

of

Terms

Used

in

this

Report

..........................................................................................

22

Schedule

of

Investments

October

31,

2024

iShares

®

Short

Maturity

Municipal

Bond

Active

ETF

(Formerly,

BlackRock

Short

Maturity

Bond

ETF)

(Percentages

shown

are

based

on

Net

Assets)

Security

Par

(000)

Par

(000)

Value

Municipal

Bonds

Alabama

—

5.8%

Black

Belt

Energy

Gas

District

Series

2021B

,

RB

,

4.00

%

,

12/01/24

.....

USD

1,250

$

1,249,611

Series

2022C-1

,

RB

,

5.25

%

,

12/01/24

....

630

630,546

Series

2022F

,

RB

,

5.25

%

,

12/01/24

.....

2,745

2,746,944

Series

2022C-1

,

RB

,

5.25

%

,

06/01/25

....

615

619,598

Series

2023C

,

RB

,

5.50

%

,

06/01/26

.....

1,000

1,025,308

Series

2024C

,

RB

,

5.00

%

,

07/01/27

.....

935

964,794

Series

2024C

,

RB

,

5.00

%

,

07/01/28

.....

1,480

1,542,185

Series

2022E

,

RB

,

VRDN

5.00

%

,

06/01/28

(a)

5,000

5,201,561

Energy

Southeast

A

Cooperative

District

Series

2023B-1

,

RB

,

5.50

%

,

11/01/26

....

800

830,398

Series

2024B

,

RB

,

5.00

%

,

12/01/26

.....

100

102,950

Series

2023B-1

,

RB

,

5.50

%

,

05/01/27

....

1,570

1,643,549

Series

2024B

,

RB

,

5.00

%

,

06/01/27

.....

115

119,143

Series

2024B

,

RB

,

5.00

%

,

12/01/27

.....

100

104,208

Series

2024B

,

RB

,

5.00

%

,

06/01/28

.....

240

251,148

Series

2024B

,

RB

,

5.00

%

,

12/01/28

.....

250

262,585

Southeast

Alabama

Gas

Supply

District

(The)

Series

2024B

,

RB

,

5.00

%

,

11/01/24

.....

815

815,000

Series

2024A

,

RB

,

5.00

%

,

04/01/25

.....

3,500

3,511,975

Series

2024B

,

RB

,

5.00

%

,

05/01/25

.....

965

969,710

Series

2024B

,

RB

,

5.00

%

,

05/01/26

.....

800

814,823

Southeast

Energy

Authority

A

Cooperative

District

Series

2023B

,

RB

,

(

Royal

Bank

of

Canada

LIQ

),

5.00

%

,

06/01/25

............

170

170,801

Series

2023A

,

RB

,

5.00

%

,

07/01/25

.....

650

654,239

Series

2023B

,

RB

,

(

Royal

Bank

of

Canada

LIQ

),

5.00

%

,

06/01/26

............

185

188,384

Series

2024C

,

RB

,

5.00

%

,

11/01/26

.....

1,000

1,026,345

Series

2023B

,

RB

,

(

Royal

Bank

of

Canada

LIQ

),

5.00

%

,

06/01/27

............

1,000

1,034,302

Series

2024C

,

RB

,

5.00

%

,

11/01/27

.....

1,000

1,040,160

Series

2024C

,

RB

,

5.00

%

,

11/01/28

.....

1,000

1,050,197

Series

2022B-1

,

RB

,

VRDN

5.00

%

,

08/01/28

(a)

...............

10,500

10,951,381

39,521,845

Arizona

—

0.8%

Arizona

Health

Facilities

Authority

Series

2015B

,

RB

,

VRDN

3.49

%

,

11/07/24

,

(SIFMA

Municipal

Swap

Index)

(a)

(b)

....

3,600

3,592,296

City

of

Phoenix

Civic

Improvement

Corp.,

Series

2017A,

RB,

AMT,

5.00%, 07/01/29

......

1,700

1,757,432

5,349,728

California

—

1.7%

City

of

Los

Angeles,

Series

2024,

RB,

5.00%, 06/26/25

.................

10,000

10,124,306

State

of

California,

Series

2021,

GO,

5.00%, 12/01/24

.................

1,190

1,191,667

11,315,973

Colorado

—

0.7%

Colorado

School

of

Mines,

Series

2022D,

RB,

VRDN,

4.11%, 11/07/24,

(SIFMA

Municipal

Swap

Index)

(a)

(b)

.................

4,860

4,896,374

Connecticut

—

1.7%

Connecticut

State

Health

&

Educational

Facilities

Authority

Series

2024A

,

RB

,

5.00

%

,

07/01/25

.....

550

555,272

Series

2024A

,

RB

,

5.00

%

,

07/01/26

.....

2,050

2,115,128

Security

Par

(000)

Par

(000)

Value

Connecticut

(continued)

State

of

Connecticut

Series

2013A

,

GO

,

VRDN

4.23

%

,

11/07/24

,

(SIFMA

Municipal

Swap

Index)

(a)

(b)

....

USD

4,600

$

4,601,388

Series

2023B

,

GO

,

5.00

%

,

08/01/25

.....

4,575

4,636,653

11,908,441

District

of

Columbia

—

0.0%

Metropolitan

Washington

Airports

Authority,

Tender

Option

Bond

Trust

Receipts/

Certificates,

Series

2019-XG0267,

RB,

VRDN

(Bank

of

America

NA

LOC),

3.29%, 11/07/24

(a)

(

c)

(d)

.........................

220

220,000

Florida

—

3.1%

County

of

Miami-Dade,

Series

2024A,

RB,

AMT,

5.00%, 10/01/28

.................

1,760

1,857,500

County

of

Miami-Dade

Water

&

Sewer

System,

Series

2015,

RB,

5.00%, 10/01/26

......

1,515

1,538,773

Hillsborough

County

Aviation

Authority

Series

2024B

,

RB,

AMT

,

5.00

%

,

10/01/27

.

330

344,026

Series

2024B

,

RB,

AMT

,

5.00

%

,

10/01/28

.

3,200

3,374,581

Monroe

County

School

District,

RB,

4.00%, 05/29/25

.................

7,000

7,035,812

School

Board

of

Miami-Dade

County

(The),

RB,

4.50%, 01/07/25

.................

5,000

5,009,270

Tender

Option

Bond

Trust

Receipts,

Series

2024-XG0577,

RB,

VRDN

(Barclays

Bank

plc

LOC),

3.29%, 11/07/24

(AGM)

(a)

(c)

(d)

.....

2,215

2,215,000

21,374,962

Georgia

—

2.8%

Development

Authority

of

Burke

County

(The),

Series

2013-1,

RB,

VRDN,

3.38%, 03/12/27

(a)

3,750

3,762,605

Main

Street

Natural

Gas,

Inc.

Series

2023D

,

RB

,

5.00

%

,

12/01/24

.....

300

300,213

Series

2024A

,

RB

,

5.00

%

,

03/01/25

.....

555

556,536

Series

2023B

,

RB

,

5.00

%

,

03/01/25

.....

290

290,803

Series

2023A

,

RB

,

5.00

%

,

06/01/25

.....

750

754,776

Series

2023B

,

RB

,

5.00

%

,

09/01/25

.....

260

262,373

Series

2024B

,

RB

,

5.00

%

,

09/01/25

.....

245

247,237

Series

2024A

,

RB

,

5.00

%

,

09/01/25

.....

500

504,564

Series

2023D

,

RB

,

5.00

%

,

12/01/25

.....

550

557,545

Series

2024B

,

RB

,

5.00

%

,

03/01/26

.....

350

355,900

Series

2024A

,

RB

,

5.00

%

,

03/01/26

.....

680

691,462

Series

2019A

,

RB

,

5.00

%

,

05/15/26

.....

5,695

5,805,738

Series

2024B

,

RB

,

5.00

%

,

09/01/26

.....

200

205,170

Series

2023D

,

RB

,

5.00

%

,

12/01/26

.....

1,000

1,029,277

Series

2024B

,

RB

,

5.00

%

,

03/01/27

.....

490

506,976

Series

2022B

,

RB

,

5.00

%

,

06/01/27

.....

1,750

1,812,318

Series

2024C

,

RB

,

5.00

%

,

12/01/27

.....

750

781,080

Series

2024C

,

RB

,

5.00

%

,

12/01/28

.....

925

970,487

19,395,060

Hawaii

—

0.5%

State

of

Hawaii,

Series

EY,

GO,

5.00%, 10/01/27

3,405

3,460,062

Illinois

—

4.0%

Chicago

Midway

International

Airport

Series

2024A

,

RB,

AMT

,

5.00

%

,

01/01/25

.

450

450,692

Series

2024A

,

RB,

AMT

,

5.00

%

,

01/01/26

.

1,350

1,371,059

Series

2024A

,

RB,

AMT

,

5.00

%

,

01/01/27

.

1,000

1,029,802

Chicago

O'Hare

International

Airport

Series

2022C

,

RB,

AMT

,

5.00

%

,

01/01/26

.

1,400

1,422,005

Series

2024C

,

RB,

AMT

,

5.00

%

,

01/01/26

.

6,000

6,093,835

Series

2024C

,

RB,

AMT

,

5.00

%

,

01/01/29

.

10,000

10,540,774

2024

iShares

Annual

Financial

Statements

and

Additional

Information

Schedule

of

Investments

(continued)

October

31,

2024

iShares

®

Short

Maturity

Municipal

Bond

Active

ETF

(Formerly,

BlackRock

Short

Maturity

Bond

ETF)

(Percentages

shown

are

based

on

Net

Assets)

Security

Par

(000)

Par

(000)

Value

Illinois

(continued)

Illinois

Finance

Authority

Series

2024

,

RB

,

5.00

%

,

08/01/25

......

USD

325

$

327,777

Series

2024

,

RB

,

5.00

%

,

08/01/26

......

400

409,217

Series

2024

,

RB

,

5.00

%

,

08/01/27

......

425

440,561

State

of

Illinois

Series

2024B

,

GO

,

5.00

%

,

05/01/25

.....

1,000

1,006,632

Series

2024B

,

GO

,

5.00

%

,

05/01/26

.....

2,300

2,355,632

Series

2024B

,

GO

,

5.00

%

,

05/01/28

.....

1,600

1,693,592

27,141,578

Indiana

—

2.7%

Indiana

Finance

Authority

Series

2024

,

RB

,

5.00

%

,

03/01/27

......

275

286,124

Series

2024

,

RB

,

5.00

%

,

03/01/28

......

900

950,569

Series

2024

,

RB

,

5.00

%

,

03/01/29

......

765

817,512

Series

2010A

,

RB,

AMT

,

VRDN

3.95

%

,

12/02/24

(a)

...............

9,500

9,468,864

Series

2021B

,

RB

,

VRDN

3.54

%

,

11/07/24

,

(SIFMA

Municipal

Swap

Index)

(a)

(b)

....

880

874,856

Tender

Option

Bond

Trust

Receipts,

Series

2016-XL0019,

RB,

VRDN

(Barclays

Bank

plc

LIQ),

3.39%, 11/07/24

(a)

(c)

(d)

...........

6,000

6,000,000

18,397,925

Iowa

—

9.0%

(a)

Iowa

Finance

Authority

Series

2021

,

RB

,

VRDN

(

Korea

Development

Bank

LOC

),

3.40

%

,

11/07/24

(d)

.......

29,600

29,600,000

Series

2021

,

RB,

AMT

,

VRDN

(

Citibank

NA

LOC

),

3.88

%

,

04/01/26

............

7,000

6,988,383

PEFA,

Inc.,

Series

2019,

RB,

VRDN,

5.00%, 09/01/26

.................

24,140

24,593,052

61,181,435

Kansas

—

1.9%

City

of

Burlington

(a)

Series

2007A

,

RB

,

VRDN

3.45

%

,

11/06/24

4,000

4,000,000

Series

2007B

,

RB

,

VRDN

3.45

%

,

11/06/24

9,000

9,000,000

13,000,000

Kentucky

—

3.7%

County

of

Meade

(a)

Series

2021B-1

,

RB

,

VRDN

4.50

%

,

11/01/24

6,105

6,105,000

Series

2021A-1

,

RB,

AMT

,

VRDN

4.60

%

,

11/01/24

................

5,000

5,000,000

Kentucky

Economic

Development

Financing

Authority,

Tender

Option

Bond

Trust

Receipts/

Certificates,

Series

2018-XG0161,

RB,

VRDN

(Bank

of

America

NA

LOC),

3.27%, 11/08/24

(AGM)

(a)

(c)

(d)

....................

500

500,000

Kentucky

Public

Energy

Authority

Series

2024A

,

RB

,

5.00

%

,

07/01/25

.....

315

316,723

Series

2024B

,

RB

,

5.00

%

,

08/01/25

.....

375

377,794

Series

2024A

,

RB

,

5.00

%

,

07/01/26

.....

375

381,664

Series

2024A

,

RB

,

5.00

%

,

07/01/27

.....

425

437,687

Series

2024B

,

RB

,

5.00

%

,

08/01/27

.....

865

894,041

Series

2023A-1

,

RB

,

5.00

%

,

08/01/28

....

490

510,330

Series

2024B

,

RB

,

5.00

%

,

08/01/28

.....

920

958,170

Series

2018C-1

,

RB

,

VRDN

4.00

%

,

06/01/25

(a)

...............

4,000

3,998,413

Kentucky

State

Property

&

Building

Commission

Series

A

,

RB

,

5.00

%

,

11/01/24

.........

300

300,000

Series

2024B

,

RB

,

5.00

%

,

11/01/25

.....

5,250

5,353,813

Security

Par

(000)

Par

(000)

Value

Kentucky

(continued)

Series

A

,

RB

,

5.00

%

,

11/01/25

.........

USD

375

$

382,192

25,515,827

Louisiana

—

5.4%

(a)

Lake

Charles

Harbor

&

Terminal

District,

Series

2021,

RB,

AMT,

VRDN,

1.00%, 12/01/24

..

4,325

4,313,418

Louisiana

Local

Government

Environmental

Facilities

&

Community

Development

Auth,

Series

2002,

RB,

VRDN,

3.70%, 11/07/24

.

6,000

6,000,000

Parish

of

St

James,

Series

2010B-1,

RB,

VRDN,

3.47%, 11/06/24

.................

26,500

26,500,000

36,813,418

Maine

—

1.5%

Maine

State

Housing

Authority,

Series

2024E,

RB,

VRDN,

3.25%, 11/15/25

(a)

.........

10,000

9,981,325

Maryland

—

0.7%

County

of

Montgomery

TECP

,

3.30

%

,

11/05/24

.............

1,000

999,984

TECP

,

3.28

%

,

11/06/24

.............

4,000

3,999,989

4,999,973

Massachusetts

—

1.3%

Massachusetts

Bay

Transportation

Authority,

TECP,

3.20%, 11/05/24

.............

5,200

5,199,885

Massachusetts

Bay

Transportation

Authority

Sales

Tax

Revenue,

TECP,

3.20%, 11/01/24

3,000

2,999,983

Town

of

Sharon,

GO,

4.50%, 02/27/25

.....

1,000

1,004,514

9,204,382

Michigan

—

0.7%

Michigan

Strategic

Fund,

Series

2001,

RB,

0.58%, 08/01/27

.................

2,700

2,740,065

Okemos

Public

Schools,

Series

2024II,

GO,

5.00%, 05/01/26

(Q-SBLF)

..........

1,200

1,237,023

Walled

Lake

Consolidated

School

District

Series

2024

,

GO

,

5.00

%

,

05/01/25

(

Q-SBLF

)

405

408,596

Series

2024

,

GO

,

5.00

%

,

05/01/26

(

Q-SBLF

)

475

489,655

4,875,339

Minnesota

—

0.4%

Minneapolis-St

Paul

Metropolitan

Airports

Commission,

Series

2024B,

RB,

AMT,

5.00%, 01/01/28

.................

2,850

2,989,421

Missouri

—

0.3%

Missouri

State

Health

&

Education

Facilities

Authority,

Tender

Option

Bond

Trust

Receipts/Certificates,

Series

2018C-16,

RB,

VRDN

(Royal

Bank

of

Canada

LOC),

3.29%, 11/07/24

(a)

(c)

(d)

..............

2,000

2,000,000

Nebraska

—

2.5%

County

of

Douglas,

Series

2021B,

RB,

VRDN,

3.77%, 11/07/24,

(SIFMA

Municipal

Swap

Index)

(a)

(b)

.....................

3,400

3,372,166

Lincoln

Nebraska

Electric,

TECP,

3.28%, 11/13/24

.................

13,350

13,349,712

16,721,878

Nevada

—

0.1%

Reno-Tahoe

Airport

Authority,

Series

2024A,

RB,

AMT,

5.00%, 07/01/29

.............

580

613,311

Schedule

of

Investments

(continued)

October

31,

2024

iShares

®

Short

Maturity

Municipal

Bond

Active

ETF

(Formerly,

BlackRock

Short

Maturity

Bond

ETF)

(Percentages

shown

are

based

on

Net

Assets)

Security

Par

(000)

Par

(000)

Value

New

Hampshire

—

3.1%

(a)

New

Hampshire

Business

Finance

Authority,

Series

2018A,

RB,

AMT,

VRDN,

4.50%, 07/01/25

.................

USD

15,000

$

15,016,326

New

Hampshire

Housing

Finance

Authority,

Series

2024D,

RB,

VRDN,

3.58%, 07/01/25

(GNMA/FNMA/FHLMC)

............

5,950

5,944,873

20,961,199

New

Jersey

—

5.8%

Borough

of

Haledon,

GO,

4.00%, 09/25/25

..

3,338

3,350,972

Borough

of

Manasquan,

GO,

4.00%, 10/01/25

2,711

2,725,050

Borough

of

Pompton

Lakes,

GO,

4.50%, 06/06/25

.................

700

705,675

Essex

County

Improvement

Authority,

Series

2024,

RB,

5.00%, 06/18/25

(GTD)

......

8,295

8,380,330

Jersey

City

Municipal

Utilities

Authority,

Series

2024B,

RB,

5.00%, 05/01/25

(GTD)

.....

3,550

3,570,837

New

Jersey

Economic

Development

Authority,

Series

B,

RB,

5.00%, 11/01/24

........

1,010

1,010,000

New

Jersey

Higher

Education

Student

Assistance

Authority

Series

2022A

,

RB

,

5.00

%

,

12/01/24

.....

500

500,332

Series

2024B

,

RB,

AMT

,

5.00

%

,

12/01/27

.

1,600

1,656,515

New

Jersey

Transportation

Trust

Fund

Authority,

Series

2018A,

RB,

5.00%, 12/15/24

.....

1,000

1,001,699

Township

of

Bordentown,

GO,

4.50%, 04/01/25

1,000

1,005,388

Township

of

Egg

Harbor,

GO,

4.00%, 08/07/25

900

904,309

Township

of

Little

Falls,

GO,

5.00%, 12/13/24

.

1,530

1,531,775

Township

of

Maplewood,

GO,

4.00%, 10/07/25

5,100

5,126,081

Township

of

Montville,

GO,

5.00%, 11/06/24

.

1,300

1,300,262

Township

of

Mount

Holly,

GO,

4.00%, 09/24/25

3,417

3,430,404

Township

of

Pemberton,

GO,

4.50%, 05/27/25

3,477

3,506,305

39,705,934

New

Mexico

—

0.1%

New

Mexico

Mortgage

Finance

Authority,

Series

2023,

RB,

VRDN,

5.00%, 09/01/25

(a)

.....

970

975,889

New

York

—

7.8%

Babylon

Union

Free

School

District,

GO,

4.00%, 06/24/25

(SAW)

............

3,100

3,113,510

Battery

Park

City

Authority,

Series

2019D-1,

RB,

VRDN

(TD

Bank

NA

SBPA),

3.90%, 11/01/24

(a)

4,600

4,600,000

Hempstead

Town

Local

Development

Corp.,

Series

2021A,

RB,

5.00%, 07/01/25

.....

520

525,569

Lafayette

Central

School

District,

Series

2024,

GO,

4.50%, 06/20/25

(SAW)

.........

1,000

1,006,750

Monroe

County

Industrial

Development

Corp.,

Series

2023B-1,

RB,

VRDN,

5.00%, 07/01/27

(a)

................

4,000

4,159,654

New

York

City

Transitional

Finance

Authority

Series

2025D

,

RB

,

5.00

%

,

05/01/26

.....

4,450

4,584,747

Series

2025D

,

RB

,

5.00

%

,

05/01/29

.....

2,500

2,726,440

Onondaga

County

Resource

Recovery

Agency,

Series

2015A,

RB,

AMT,

5.00%, 05/01/27

(AGM)

.......................

2,830

2,850,815

Palmyra

Macedon

Central

School

District,

GO,

4.50%, 06/17/25

(SAW)

............

4,320

4,344,272

Schodack

Central

School

District,

GO,

4.00%, 07/15/25

(SAW)

............

1,200

1,205,990

Town

of

Ossining,

GO,

4.50%, 08/01/25

....

3,536

3,576,583

Triborough

Bridge

&

Tunnel

Authority,

Series

2022E-2A,

RB,

VRDN,

4.28%, 11/01/24

,(1-

day

SOFR

+

1.05%)

(a)

(b)

............

11,000

11,001,835

Union

Endicott

Central

School

District,

GO,

4.50%, 06/27/25

(SAW)

............

4,800

4,834,563

Security

Par

(000)

Par

(000)

Value

New

York

(continued)

Webutuck

Central

School

District,

GO,

4.50%, 06/20/25

(SAW)

............

USD

4,700

$

4,726,981

53,257,709

North

Carolina

—

0.9%

Durham

Capital

Financing

Corp.,

Series

2016,

RB,

5.00%, 12/01/28

..............

1,000

1,037,874

North

Carolina

Capital

Facilities

Finance

Agency,

Series

2010-A,

RB,

VRDN,

3.50%, 12/02/24

(a)

4,500

4,498,413

North

Carolina

Housing

Finance

Agency,

Series

56,

RB,

VRDN,

3.38%, 07/15/25

(GNMA/

FNMA/FHLMC)

(a)

................

655

653,157

6,189,444

Ohio

—

1.4%

Ohio

Air

Quality

Development

Authority,

Series

2005C,

RB,

AMT,

3.70%, 04/01/28

......

3,250

3,225,882

Ohio

Higher

Educational

Facility

Commission,

Series

2021B,

RB,

VRDN,

3.47%, 11/07/24,

(SIFMA

Municipal

Swap

Index)

(a)

(b)

......

6,500

6,405,950

9,631,832

Oklahoma

—

0.9%

Garfield

County

Industrial

Authority,

Series

2024A,

RB,

VRDN,

3.40%, 11/06/24

(a)

....

5,400

5,400,000

Oklahoma

Industries

Authority,

Series

2024,

RB,

5.00%, 04/01/26

.................

400