UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-2474 |

|---|

| |

Midas Dollar Reserves, Inc.

(Exact name of registrant as specified in charter)

11 Hanover Square, New York, NY 10005

(Address of principal executive offices) (Zipcode)

Thomas B. Winmill, President

11 Hanover Square

New York, NY 10005

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-212-480-6432

Date of fiscal year end: 12/31

Date of reporting period: 1/1/07 - 12/31/07

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a current valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under clearance requirements of 44 U.S.C. sec. 3507.

Item 1. Report to Stockholders.

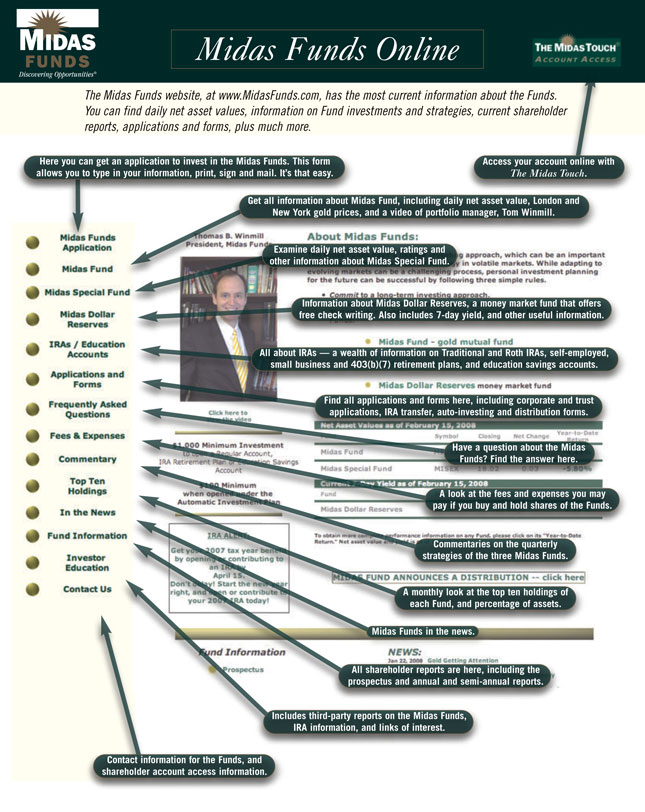

To Our Shareholders

Times like these reward quality investing! In our last letter to shareholders, we warned that there may be some “clouds” on the horizon – and the financial storm certainly did come. As central banks in many nations increased interest rates to head off inflation, the growth momentum of their economies seemed to stall. In the United States, higher interest rates burst the residential real estate bubble and its negative effect spilled over to the sub-prime mortgage market. Financial markets around the world fell.

I invite you to read the following letters to shareholders of each of the Funds to see for yourself the gratifying results of the Midas quality approach to investing.

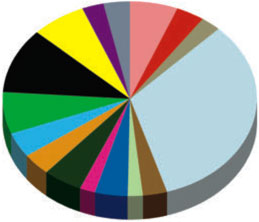

The Benefits of Diversification

We think sunny days for investors will return and the wait can be made easier by holding quality investments that can weather a temporary market or economic downturn. Moreover, predictably volatile financial markets mean that most investors should consider diversifying their portfolios. We would suggest that you consider some or all of the Midas Funds, which combined can balance the returns offered by precious metals, general equities, and U.S. Government money market investments. Midas also offers an excellent free service to make regular investing safe and convenient. For regular automatic investing, the free Midas Bank Transfer Plan will transfer, at the same time each month for as long as you like, a fixed amount of money from your bank account to your Midas Funds account for investment in whichever Fund you designate. You should then periodically review your overall portfolio.

| | | | |

| Fund | | Midas Dollar Reserves | | |

As with most Midas services, there is no charge or penalty to change or discontinue the Midas Bank Transfer Plan. Investing the same amount regularly, known as “dollar cost averaging,” can reduce the anxiety of investing in a rising or falling market or buying all your shares at market highs. Although this strategy cannot assure a profit or protect against loss in a declining market, it can result in a lower average cost for your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels when undertaking such a strategy.

Predicting the Future?

We cannot predict the future of the markets, and we are skeptical of those who try to do so. Reacting to every news item and rapidly shifting money between stocks, bonds, industries, and sectors seldom seems to work. Instead, we recommend a long term approach with a diversified portfolio of Midas Funds. Although it does not eliminate the risk of potential loss, as noted above, it can help lessen the anxiety of getting started.

Markets do evolve meaningfully over the long term, however, and so the Midas Funds have a flexible investing approach, an important advantage in formulating successful portfolio strategies. Further, the Midas Funds remain focused on quality companies with unique combinations of strength in operations, finances, and products. With our disciplined and flexible analytical process, we continue to seek attractive investments that offer the potential for rewarding returns across varied economic cycles.

Personal Investment Success

Means Planning for the Future

Although we can’t predict the future, our experience over the last three decades has convinced us that personal investment planning for the future can be successful by following three simple steps.

First, commit to a long term investing approach.

Second, follow a regular investment plan as described above.

Third, manage your investment risk by diversifying among the three Midas Funds: Midas Special Fund for longer term, stock market oriented objectives, Midas Dollar Reserves for income, short term liquidity, and check writing, and Midas Fund for precious metals capital appreciation and as a hedge against inflation. As you invest in the Midas Funds for your future, we will remain committed over the years ahead to discovering opportunities to achieve the investment objectives of the Funds.

If you have any questions, we will be happy to assist you without any obligation on your part. Please call us at 1-800-400-MIDAS (6432), or visit www.MidasFunds.com.

|

| Sincerely, |

|

|

| Thomas B. Winmill |

| President |

1

Midas Fund

COMMENTARY

We are very pleased to welcome new shareholders attracted to Midas Fund’s track record of past performance, its policy of investing primarily in securities of companies principally involved in mining, processing, fabricating, distributing or otherwise dealing in gold, silver, platinum, or other natural resources, and its no-charge shareholder services, including free switching among Midas Fund, Midas Dollar Reserves, and Midas Special Fund.

Midas Fund achieved a solid return of 31.70% for 2007, a satisfying result after being up 44.02% in 2006 and up 39.72% in 2005. We are also pleased to note the Fund’s performance relative to the Philadelphia Gold and Silver Sector Index of stocks, which rose only about 22% in 2007, 11% in 2006, and 29% in 2005. But since Midas Fund was down 2.72% in 2004, we wish to remind our shareholders that, while long term investing can be rewarding, it also inevitably includes frustrating periods as well.

Strategy Review and Outlook

After dropping in January 2007, gold rose to trade in a range generally between $650/oz to $700/oz for the next eight months of the year. Then in September, as worldwide credit markets weakened, gold prices increased to a new range in the last quarter of the year, mostly between $725 and $825/oz. Gold’s 2007 average price was $695/oz, a 15% increase over the 2006 average ($604/oz), representing the highest annual average ever and the 6th consecutive average price increase. After finishing the year at $834/oz, gold started 2008 by breaking through the prior all time high of $850/oz, set in 1980, recently trading above $910/oz.

TOP 10 HOLDINGS

AS OF DECEMBER 31, 2007

| 1 | Golden Cycle Gold Corporation |

| 2 | Freeport McMoRan Copper & Gold Inc. |

| 3 | Pan American Silver Corp. |

| 7 | First Quantum Minerals Ltd. |

| 10 | Impala Platinum Holdings Ltd. |

2007 saw gold emerge as an “alternative currency” to the U.S. dollar. We believe that explains why gold rose 32% in U.S. dollar terms, but in terms of foreign currencies, gold’s 2007 rise was somewhat less dramatic – for example 18% in euro terms and 13% in Canadian dollar terms. To the extent U.S. government and consumer debt levels remain high and inflation increases, we believe the positive role of gold investing for Americans will continue.

Among other precious metals, platinum performed best in 2007 – up 34% – silver increased 15%, while palladium increased only 10%. Prices for many base metals, energy, and other commodities performed well in the first half of the year as global economic growth and demand for commodities continued, but dropped in the second half as new supply became available and concern grew that a possible U.S. recession would cut demand.

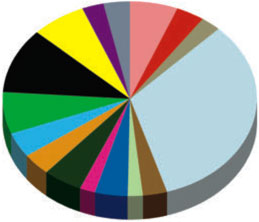

Seeking quality companies with growth potential, Midas Fund’s strategy in the current environment of economic gains – despite turmoil in credit markets – was to construct its portfolio with companies of financial strength, strong management, and robust project development plans. Midas broadened its metals focus to include more silver and platinum companies, as market demand appeared to enhance their business prospects. The Fund sought to limit its holdings of smaller companies to those judged attractive enough to receive a high bid in an acquisition by a larger company. Large mining companies producing gold, silver, platinum, or energy, as well as takeover targets, contributed most to returns in the year, while smaller operations and uranium companies underperformed.

By carefully assessing company reports and management statements, the Fund seeks to position its portfolio in those companies most likely to achieve revenue and production growth objectives and future profitability, notwithstanding industry-wide cost inflation. At this time, the Fund is positioned to capitalize on rising gold, platinum, and silver prices, and may also benefit from increases in certain commodities prices, including coal and copper.

2

Midas Special Fund

COMMENTARY

It is a pleasure to submit this 2007 Annual Report for Midas Special Fund, and to welcome new shareholders who find the Fund’s aggressive and flexible investment approach attractive. The Fund’s total return in 2007 was 14.28%, a gratifying performance, particularly when compared to the S&P 500 Index, which returned only 5.49% in the year.

Midas Special Fund invests aggressively for capital appreciation, using a flexible strategy in the selection of securities, and is not limited by the issuer’s location, size, or industry sector. The Fund may invest in equity and fixed income securities of both new and seasoned U.S. and foreign issuers with no minimum rating, including securities convertible into common stock, debt securities, futures, options, derivatives, and other instruments. The Fund also may employ aggressive and speculative investment techniques, such as selling securities short and borrowing money for investment purposes, a practice known as “leveraging,” and may invest defensively.

Markets and the Fund’s Capital Appreciation Strategies

In the first half of 2007 some markets reached medium term highs, despite a weaker economic outlook and indications that global growth may have peaked. Share buy backs and merger activity bolstered returns. In the second half of 2007 concerns rose over tightening credit and the housing slump, however, and stock and bond markets fell, negatively affecting ongoing market sentiment. In these market conditions, the Fund’s strategy was to de-emphasize health care, reduce leverage slightly, and broaden its holdings to include quality companies with attractive valuations in finance, insurance, wholesaling, and data processing. By year end, Midas Special Fund’s holdings included the stocks of some of the largest and best known U.S. companies in insurance, technology, banking, and finance.

Seasonal Investing Strategy

To achieve its objective, Midas Special Fund may use a seasonal investing strategy to invest the Fund’s assets to gain exposure to the securities markets during periods anticipated to be favorable based on patterns of investor behavior related to accounting periods, tax events, holidays, and other factors. During periods anticipated to be less favorable, and from time to time, the Fund may take a defensive position in high grade, short term, liquid securities and/or by selling securities short.

Looking ahead, whether the current pause in the economy will become a full fledged recession is unclear. Recent reports indicated that U.S. wholesalers’ inventories rose higher in November than expected, while sales surged by the most in two years. These data suggest that the retail economy is strengthening. At the same time, the U.S. unemployment rate recently rose to 5%, a level which is often associated with the advent of recessions. Some economists are forecasting the unemployment rate to rise in 2008 to 5.1% by June and 5.2% by December. Meanwhile, U.S. inflation rose to a two year high of 4.1% in November, and 2008 inflation expectations appear to be increasing, although modestly, as shown by a recent Dow Jones survey. In any event, our current view of markets suggests that the Fund may benefit during 2008 from a flexible and quality portfolio selection strategy.

Tax Advantaged Retirement Accounts

Midas Special Fund will pursue its capital appreciation objective aggressively as financial market conditions evolve, seeking to discover long term opportunities for attractive investment - whether due to a changing outlook for the prospects of a particular company or an industry sector generally. Since these strategies may reflect longer term wealth building goals, we believe the Fund can be especially appropriate for tax advantaged retirement accounts. Of course, we also would be very pleased to discuss with you any questions you may have. Call us at 1-800-400-MIDAS (6432) and a Shareholder Services Representative will be glad to assist you, as always, without obligation on your part.

TOP 10 HOLDINGS

AS OF DECEMBER 31 , 2007

| 1 | Berkshire Hathaway Inc. Class B |

| 8 | The Goldman Sachs Group Inc. |

| 10 | Canadian Natural Resources Ltd. |

3

Midas Dollar Reserves

COMMENTARY

We are pleased to submit this Annual Report for the year ended December 31, 2007 and to welcome new shareholders who have made their initial investment since our last Report. The Fund’s all-weather income and safety conscious approach, plus free check writing and transfers among the Midas Funds, make it an ideal vehicle for a program of steady monthly investing, or as an easily accessible haven for proceeds from sales of other assets. The Fund invests exclusively in obligations of the U.S. Government, its agencies and instrumentalities (U.S. Government Securities). The U.S. Government Securities in which the Fund may invest include U.S. Treasury bills and notes and certain agency securities that are backed by the full faith and credit of the U.S. Government. The Fund also may invest without limit in securities issued by U.S. Government agencies and instrumentalities that may have different degrees of U.S. backing as to principal or interest but which are not backed by the full faith and credit of the U.S. Government.

Investment Strategy and Market Report

The second half of 2007 has seen the financial markets in the United States and in a number of other developed countries under pressure. According to Federal Reserve Chairman Ben S. Bernanke, economic turmoil in the housing and other industry sectors has negatively affected investor sentiment. As investors attempt to grapple with new economic data and market commentary on future earnings, asset values, and consumer demand, financial markets have seen sharp monthly, weekly, and even daily swings.

TOP 10 HOLDINGS

AS OF DECEMBER 31 , 2007

| 1 | Freddie Mac, due 2/04/08 |

| 2 | Federal Home Loan Bank, due 1/09/08 |

| 3 | Federal Home Loan Bank, due 2/06/08 |

| 4 | Federal National Mortgage Association, due 2/08/08 |

| 5 | Federal Home Loan Bank, due 2/01/08 |

| 6 | Federal National Mortgage Association, due 2/29/08 |

| 7 | Federal Home Loan Bank, due 1/02/08 |

| 8 | Federal National Mortgage Association, due 2/26/08 |

| 9 | Federal Home Loan Bank, due 1/30/08 |

| 10 | Federal National Mortgage Association, due 1/03/08 |

To help address the significant strains in short term money markets, the Federal Reserve has taken a range of steps. Notably, on August 17, the Federal Reserve Board cut the discount rate – the rate at which it lends directly to banks by one half a percent. Also, the Federal Reserve’s Open Market Committee cut its target for the federal funds rate by one half a percent at its September meeting and by one quarter of a percent each at the October and December meetings. Mr. Bernanke has stated that the “Fed” took these actions to help offset tightening credit and the housing slump.

Considering these economic conditions and market trends, Midas Dollar Reserves’ investment strategy was to focus on money market obligations of the U.S. Government, its agencies and instrumentalities offering relative safety while maintaining a conservative average maturity over the course of the year of approximately 38 days. Looking ahead, we are concerned that the U.S. trade deficit in November rose to the highest level in 14 months. The Commerce Department reported that the trade deficit, the gap between imports and exports, jumped by 9.3% to $63.1 billion.

Steady Investment and Long Term Goals

The Fund’s average seven day income yield, net of expenses for the year 2007, was an attractive 3.92%. Given current economic trends, Midas Dollar Reserves’ steady investment approach may have added appeal in the year ahead.

To help investors get started with a regular plan of setting amounts aside to meet long term financial goals, the Fund offers automatic investing through the Midas Bank Transfer Plan. A simple form for this free service is available for printing at www.MidasFunds.com. For further information and assistance with this and Midas’ other free shareholder services, please give us a call at 1-800-MIDAS (6432) and we will help you get started.

4

Report of Independent Registered Public Accounting Firm

To the Shareholders and Boards of Directors of

Midas Fund, Inc.

Midas Special Fund, Inc.

Midas Dollar Reserves, Inc.

We have audited the accompanying statements of assets and liabilities, including the schedule of portfolio investments, of Midas Fund, Inc., Midas Special Fund, Inc., and Midas Dollar Reserves, Inc. as of December 31, 2007, the related statements of operations and of cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Funds are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. Our audits included considerations of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2007, by correspondence with the custodian and broker. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Midas Fund, Inc., Midas Special Fund, Inc., and Midas Dollar Reserves, Inc. as of December 31, 2007, the results of their operations and cash flows for the year then ended, the changes in their net assets for each of the two years in the period then ended and the financial highlights for the five years presented in conformity with accounting principles generally accepted in the United States of America.

Philadelphia, Pennsylvania

February 26, 2008

5

Midas Fund, Inc.

Schedule of Portfolio Investments - December 31, 2007

| | | | | |

| COMMON STOCKS AND WARRANTS (99.02%) | | | |

| |

| Common Stocks (98.52%) | | | |

| | |

Shares | | | | Value |

| Major Precious Metals Producers (19.78%) | | | |

| 65,000 | | Anglo Platinum Ltd. | | $ | 9,606,293 |

| 350,000 | | Goldcorp Inc. | | | 11,875,500 |

| 250,000 | | Impala Platinum Holdings Ltd. | | | 8,678,523 |

| 500,000 | | Kinross Gold Corp. (a) | | | 9,200,000 |

| 800,000 | | Yamana Gold, Inc. | | | 10,352,000 |

| | | | | |

| | | | | 49,712,316 |

| Intermediate Precious Metals Producers (19.34%) | | | |

| 100,000 | | Agnico-Eagle Mines Ltd. | | | 5,463,000 |

| 1,000,000 | | Golden Star Resources Ltd. (a) | | | 3,160,000 |

| 550,000 | | Hochschild Mining PLC | | | 4,740,247 |

| 350,700 | | IAMGold Corp. | | | 2,840,670 |

| 2,723,333 | | Lihir Gold Limited (a) | | | 8,494,076 |

| 350,000 | | Pan American Silver Corp. (a) | | | 12,225,500 |

| 200,000 | | Randgold Resources Limited (b) | | | 7,426,000 |

| 450,000 | | Silvercorp Metals, Inc. | | | 4,276,812 |

| | | | | |

| | | | | 48,626,305 |

| Junior Precious Metals Producers (13.16%) | | | |

| 1,964,500 | | Golden Cycle Gold Corp. (a)(d) | | | 20,037,900 |

| 407,675 | | Jaguar Mining, Inc. (a) | | | 4,871,716 |

| 1,500,000 | | Metallica Resources, Inc. (a) | | | 8,175,000 |

| | | | | |

| | | | | 33,084,616 |

| Exploration and Project Development Companies (20.37%) | | | |

| 1,400,000 | | Andean Resources Ltd. (a) | | | 2,609,929 |

| 1,000,000 | | Aurelian Resources, Inc. (a) | | | 7,781,155 |

| 500,000 | | Comaplex Minerals Corp. (a) | | | 2,978,723 |

| 1,300,000 | | Equinox Minerals Ltd. (a) | | | 7,217,832 |

| 1,125,000 | | Etruscan Resources Inc. (a) | | | 2,507,599 |

| 7,000,000 | | Farallon Resources Ltd. (a) | | | 4,929,078 |

| 1,000,000 | | Great Basin Gold Ltd. (a) | | | 2,660,000 |

| 180,000 | | Guyana Goldfields (a) | | | 1,319,453 |

| 37,699 | | Ivanhoe Nickel & Platinum Ltd. (e) | | | — |

| 400,000 | | Minefinders Corporation Ltd. (a) | | | 4,520,000 |

| 600,000 | | Northern Dynasty Minerals Ltd. (a) | | | 7,878,000 |

| 199,500 | | Pelangio Mines Inc. (a) | | | 544,635 |

| 550,000 | | Olympus Pacific Minerals, Inc. (a) | | | 246,581 |

| 2,700,000 | | Ridge Mining PLC (a) | | | 6,019,108 |

| | | | | |

| | | | | 51,212,093 |

| Other Natural Resources Companies (25.87%) | | | |

| 154,700 | | Anglo American PLC (b) | | | 4,698,239 |

| 400,000 | | Anvil Mining Ltd. (a) | | | 6,186,424 |

| 847 | | Areva | | | 972,069 |

| 100,000 | | BHP Billiton Ltd. (b) | | | 7,004,000 |

| 894,000 | | Brilliant Mining Corp. (a) | | | 1,209,210 |

| 115,000 | | Chevron Corp. | | | 10,732,950 |

| 300,000 | | Endeavour Mining Capital Corp. | | | 2,677,812 |

| 115,000 | | First Quantum Minerals | | | 9,909,574 |

| 120,000 | | Freeport McMoRan Copper & Gold, Inc. | | | 12,292,800 |

| 28,100 | | Harry Winston Diamond Corp. | | | 917,746 |

| 725,000 | | Mercator Minerals Ltd. (a) | | | 6,655,015 |

| 50,000 | | Teck Cominco Ltd. | | | 1,785,500 |

| | | | | |

| | | | | 65,041,339 |

| | | | | |

| | Total common stocks (cost: $196,004,915) | | | 247,676,669 |

| Warrants (0.50%) (a) | | | |

| 562,500 | | Etruscan Resources Inc., expiring 11/02/10 | | | 287,804 |

| 300,000 | | Great Basin Gold Ltd., expiring 4/19/09 | | | 165,000 |

| 100,000 | | IAMGOLD Corp., expiring 8/12/08 | | | 71,935 |

| 100,000 | | Kinross Gold Corp., expiring 9/7/11 | | | 281,155 |

| 50,000 | | New Gold, Inc., expiring 2/23/08 | | | 1,140 |

| 275,000 | | Siver Eagle Mines, Inc., expiring 10/31/08 (e) | | | — |

| 84,375 | | Yamana Gold Inc., expiring 11/20/08 | | | 451,368 |

| | | | | |

| | Total warrants (cost: $129,310) | | | 1,258,402 |

| | | | | |

| Money Market Fund (0.83%) | | | |

| 2,088,515 | | Midas Dollar Reserves, Inc., 3.05%

(cost $2,088,515) (c)(d) | | | 2,088,515 |

| | | | | |

Total investments (cost: $198,222,740)

(99.85%) | | | 251,023,586 |

Other assets in excess of liabilities

(0.15%) | | | 370,499 |

| | | | | |

| Net assets (100.00%) | | $ | 251,394,085 |

| | | | | |

| (b) | American Depositary Receipt. |

| (c) | Rate shown is the 7-day yield as of December 31, 2007. |

| (d) | Affiliated company (Note 5). |

| (e) | Security is valued at fair value using methods determined by the Board of Directors. |

See notes to financial statements.

6

Midas Special Fund, Inc.

Schedule of Portfolio Investments - December 31, 2007

| | | | | | |

| COMMON STOCKS (115.82%) | | | | |

| | |

Shares | | | | Value | |

| Cigarettes (6.93%) | | | | |

| 18,200 | | Reynolds American Inc.* | | $ | 1,200,472 | |

| Crude Petroluem & Natural Gas (4.22%) | | | | |

| 10,000 | | Canadian Natural Resources Ltd. | | | 731,400 | |

| Data Processing and Preparation (3.08%) | | | | |

| 12,000 | | Automatic Data Processing, Inc. | | | 534,360 | |

| Fire, Marine & Casualty Insurance (38.19%) | | | | |

| 1,050 | | Berkshire Hathaway, Inc. (a) * | | | 4,972,800 | |

| 20,000 | | Leucadia National Corporation* | | | 942,000 | |

| 14,000 | | Loews Corp. | | | 704,760 | |

| | | | | | |

| | | | | 6,619,560 | |

| Holding Companies (3.70%) | | | | |

| 18,000 | | Brookfield Asset Management Inc. | | | 642,060 | |

| Metal Ores (2.21%) | | | | |

| 25,000 | | Franco-Nevada Corp. (a) | | | 383,739 | |

| National Commercial Banks (4.89%) | | | | |

| 19,400 | | JP Morgan Chase & Co.* | | | 846,810 | |

| Operative Builders (2.25%) | | | | |

| 25,000 | | Hovnanian Enterprises, Inc. (a) | | | 179,250 | |

| 20,000 | | Pulte Homes, Inc. | | | 210,800 | |

| | | | | | |

| | | | | 390,050 | |

| Petroleum Refining (5.50%) | | | | |

| 10,800 | | ConocoPhillips* | | | 953,640 | |

| Pharmaceutical Preparations (4.23%) | | | | |

| 11,000 | | Johnson & Johnson* | | | 733,700 | |

| Retail - Lumber & Other Building Materials Dealers (4.81%) | | | | |

| 15,000 | | The Home Depot, Inc. | | | 404,100 | |

| 19,000 | | Lowe’s Companies, Inc. | | | 429,780 | |

| | | | | | |

| | | | | 833,880 | |

| Security Brokers, Dealers & Flotation Companies (8.21%) | | | | |

| 8,000 | | Legg Mason, Inc. | | | 585,200 | |

| 3,900 | | The Goldman Sachs Group, Inc. | | | 838,695 | |

| | | | | | |

| | | | | 1,423,895 | |

| Services - Business Services (12.42%) | | | | |

| 10,000 | | MasterCard, Inc.* | | | 2,152,000 | |

| Services - Computer Programming, Data Processing, Etc. (7.98%) | | | | |

| 2,000 | | Google, Inc. - Class A (a) * | | | 1,382,960 | |

| Soap, Detergents, Cleaning Preparations, Perfumes, Cosmetics (3.18%) | | | | |

| 7,500 | | Procter & Gamble Company | | | 550,650 | |

| Variety Stores (4.02%) | | | | |

| 10,000 | | Costco Wholesale Corp. | | | 697,600 | |

| | | | | | |

| Total common stocks (cost: $14,188,101) (115.82%) | | | 20,076,776 | |

| Liabilities in excess of cash and other assets (-15.82%) | | | (2,742,950 | ) |

| | | | | | |

| Net assets (100.00%) | | $ | 17,333,826 | |

| | | | | | |

| * | Fully or partially pledged as collateral on bank credit facility. |

See notes to financial statements.

7

Midas Dollar Reserves, Inc.

Schedule of Portfolio Investments - December 31, 2007

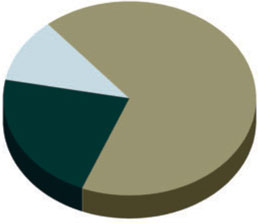

U.S. GOVERNMENT AGENCIES (97.47%)

| | | | | | | | | |

Principal

Amount | | | | Yield* | | | Value** |

| | Federal Home Loan Bank (61.28%) | | | | | | |

| $ | 960,000 | | Federal Home Loan Bank, due 1/02/08 | | 4.566 | % | | $ | 959,878 |

| | 700,000 | | Federal Home Loan Bank, due 1/03/08 | | 4.640 | % | | | 699,819 |

| | 175,000 | | Federal Home Loan Bank, due 1/04/08 | | 4.170 | % | | | 174,939 |

| | 1,335,000 | | Federal Home Loan Bank, due 1/09/08 | | 4.310 | % | | | 1,333,721 |

| | 340,000 | | Federal Home Loan Bank, due 1/11/08 | | 4.260 | % | | | 339,598 |

| | 610,000 | | Federal Home Loan Bank, due 1/15/08 | | 4.260 | % | | | 608,989 |

| | 625,000 | | Federal Home Loan Bank, due 1/16/08 | | 4.340 | % | | | 623,870 |

| | 600,000 | | Federal Home Loan Bank, due 1/25/08 | | 4.300 | % | | | 598,280 |

| | 500,000 | | Federal Home Loan Bank, due 1/25/08 | | 4.320 | % | | | 498,604 |

| | 770,000 | | Federal Home Loan Bank, due 1/30/08 | | 4.315 | % | | | 767,323 |

| | 1,000,000 | | Federal Home Loan Bank, due 2/01/08 | | 4.280 | % | | | 996,315 |

| | 1,300,000 | | Federal Home Loan Bank, due 2/06/08 | | 4.080 | % | | | 1,294,696 |

| | | | | | | | | |

| | | | | | | | | 8,896,032 |

| | Federal National Mortgage Association (23.67%) | | | | | | |

| | 1,100,000 | | Federal National Mortgage Association, due 2/08/08 | | 4.200 | % | | | 1,095,123 |

| | 530,000 | | Federal National Mortgage Association, due 2/11/08 | | 4.280 | % | | | 527,417 |

| | 825,000 | | Federal National Mortgage Association, due 2/26/08 | | 4.210 | % | | | 819,597 |

| | 1,000,000 | | Federal National Mortgage Association, due 2/29/08 | | 4.210 | % | | | 993,099 |

| | | | | | | | | |

| | | | | | | | | 3,435,236 |

| | Freddie Mac Discount Notes (12.52%) | | | | | | |

| $ | 1,400,000 | | Freddie Mac Discount Note, due 2/04/08 | | 4.230 | % | | | 1,394,407 |

| | 425,000 | | Freddie Mac Discount Note, due 2/07/08 | | 4.180 | % | | | 423,157 |

| | | | | | | | | |

| | | | | | | | | 1,817,564 |

| | | | | | | | | |

| | Total investments (cost: $14,148,832) (97.47%) | | | | | | 14,148,832 |

| | Other assets in excess of liabilities (2.53%) | | | | | | 367,401 |

| | | | | | | | | |

| | Net assets (100.00%) | | | | | $ | 14,516,233 |

| | | | | | | | | |

| * | Represents discount rate at date of purchase for discount securities, or coupon for coupon-bearing securities. |

| ** | Cost of investments for financial reporting and for Federal income tax purposes is the same as value. |

See notes to financial statements.

8

Statements of Assets and Liabilities

| | | | | | | | | | | | |

December 31, 2007 | | Midas Fund | | | Midas Special

Fund | | | Midas Dollar

Reserves | |

Assets | | | | | | | | | | | | |

Investments at cost | | | | | | | | | | | | |

Non-affiliated | | $ | 193,074,192 | | | $ | 14,188,101 | | | $ | 14,148,832 | |

Affiliated | | | 5,148,548 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total investments at cost | | $ | 198,222,740 | | | $ | 14,188,101 | | | $ | 14,148,832 | |

| | | | | | | | | | | | |

Investments at value | | | | | | | | | | | | |

Non-affiliated | | $ | 228,897,171 | | | $ | 20,076,776 | | | $ | 14,148,832 | |

Affiliated | | | 22,126,415 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total investments at value | | | 251,023,586 | | | | 20,076,776 | | | | 14,148,832 | |

| | | | | | | | | | | | |

Cash | | | 316 | | | | — | | | | 403,353 | |

Receivables: | | | | | | | | | | | | |

Fund shares sold | | | 1,197,642 | | | | 50 | | | | — | |

Dividends and interest | | | 51,147 | | | | 20,412 | | | | — | |

Investments sold | | | 22,112 | | | | — | | | | — | |

Other assets | | | 53,240 | | | | 9,381 | | | | 8,726 | |

| | | | | | | | | | | | |

Total assets | | | 252,348,043 | | | | 20,106,619 | | | | 14,560,911 | |

| | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | |

Fund shares redeemed | | | 409,851 | | | | 707 | | | | — | |

Accrued expenses | | | 263,392 | | | | 83,060 | | | | 41,940 | |

Management and distribution fees payable | | | 252,416 | | | | 24,478 | | | | — | |

Administrative services payable | | | 28,299 | | | | 2,944 | | | | 2,738 | |

Bank credit facility | | | — | | | | 1,601,183 | | | | — | |

Payable for investments purchased | | | — | | | | 1,060,421 | | | | — | |

| | | | | | | | | | | | |

| | | 953,958 | | | | 2,772,793 | | | | 44,678 | |

| | | | | | | | | | | | |

Net assets | | $ | 251,394,085 | | | $ | 17,333,826 | | | $ | 14,516,233 | |

| | | | | | | | | | | | |

Shares outstanding, $0.01 par value | | | 44,571,406 | | | | 906,190 | | | | 14,515,756 | |

Net asset value, offering, and redemption price per share | | $ | 5.64 | | | $ | 19.13 | | | $ | 1.00 | |

At December 31, 2007, net assets consisted of: | | | | | | | | | | | | |

Paid in capital | | $ | 280,741,651 | | | $ | 17,325,920 | | | $ | 14,516,199 | |

Accumulated undistributed net investment income (loss) | | | (2,626,520 | ) | | | (266 | ) | | | 252 | |

Accumulated net realized loss on investments | | | (79,521,900 | ) | | | (5,880,502 | ) | | | (218 | ) |

Net unrealized appreciation on investments and foreign currencies | | | 52,800,854 | | | | 5,888,674 | | | | — | |

| | | | | | | | | | | | |

| | $ | 251,394,085 | | | $ | 17,333,826 | | | $ | 14,516,233 | |

| | | | | | | | | | | | |

See notes to financial statements.

9

Statements of Operations

| | | | | | | | | | | | |

For the Year Ended December 31, 2007 | | Midas Fund | | | Midas Special Fund | | | Midas Dollar

Reserves | |

Investment income | | | | | | | | | | | | |

Dividends - non-affiliates | | $ | 1,670,514 | | | $ | 200,483 | | | $ | — | |

Dividends - affiliates | | | 1,299 | | | | 883 | | | | — | |

Foreign tax withholding | | | (45,139 | ) | | | (972 | ) | | | — | |

Interest | | | 8,412 | | | | — | | | | 693,049 | |

| | | | | | | | | | | | |

Total investment income | | | 1,635,086 | | | | 200,394 | | | | 693,049 | |

| | | | | | | | | | | | |

Expenses | | | | | | | | | | | | |

Investment management | | | 1,918,084 | | | | 157,597 | | | | 68,436 | |

Interest and fees on bank credit facility | | | 1,076,715 | | | | 140,391 | | | | 644 | |

Distribution | | | 481,196 | | | | 165,825 | | | | 34,218 | |

Transfer agent | | | 481,047 | | | | 82,794 | | | | 42,376 | |

Administrative services | | | 154,805 | | | | 13,090 | | | | 12,070 | |

Legal | | | 125,600 | | | | 17,910 | | | | 16,520 | |

Bookkeeping and pricing | | | 85,940 | | | | 22,710 | | | | 25,975 | |

Printing and postage | | | 81,535 | | | | 9,705 | | | | 3,150 | |

Registration | | | 81,331 | | | | 22,595 | | | | 21,950 | |

Custodian | | | 72,920 | | | | 3,524 | | | | 4,436 | |

Insurance | | | 52,790 | | | | 5,119 | | | | 4,537 | |

Auditing | | | 29,090 | | | | 21,900 | | | | 20,277 | |

Directors | | | 25,885 | | | | 7,670 | | | | 3,650 | |

Other | | | 25,377 | | | | 3,214 | | | | 2,892 | |

| | | | | | | | | | | | |

Total expenses | | | 4,692,315 | | | | 674,044 | | | | 261,131 | |

Expense reductions | | | (8,927 | ) | | | (292 | ) | | | (1,507 | ) |

Waived investment management and distribution fees | | | — | | | | — | | | | (102,654 | ) |

| | | | | | | | | | | | |

Net expenses | | | 4,683,388 | | | | 673,752 | | | | 156,970 | |

| | | | | | | | | | | | |

Net investment income (loss) | | | (3,048,302 | ) | | | (473,358 | ) | | | 536,079 | |

| | | | | | | | | | | | |

Realized and Unrealized Gain (Loss) on Investments and Foreign Currencies | | | | | | | | | | | | |

Net realized gain (loss) | | | | | | | | | | | | |

Sale of investments | | | 35,034,803 | | | | 2,749,580 | | | | 327 | |

Foreign currencies | | | 4,051,980 | | | | (266 | ) | | | — | |

Short sales | | | 1,201,163 | | | | — | | | | — | |

Net unrealized appreciation (depreciation) of investments | | | 8,271,826 | | | | (131,364 | ) | | | — | |

| | | | | | | | | | | | |

Net realized and unrealized gain on investments and foreign currencies | | | 48,559,772 | | | | 2,617,950 | | | | 327 | |

| | | | | | | | | | | | |

Net increase in net assets resulting from operations | | $ | 45,511,470 | | | $ | 2,144,592 | | | $ | 536,406 | |

| | | | | | | | | | | | |

See notes to financial statements.

10

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Midas Fund | | | Midas Special Fund | | | Midas Dollar Reserves | |

For the Years Ended December 31, | | 2007 | | | 2006 | | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | (3,048,302 | ) | | $ | (2,390,407 | ) | | $ | (473,358 | ) | | $ | (367,194 | ) | | $ | 536,079 | | | $ | 523,379 | |

Net realized gain (loss) from sale of investments and foreign currencies | | | 40,287,946 | | | | 18,014,411 | | | | 2,749,314 | | | | (385,489 | ) | | | 327 | | | | (78 | ) |

Net unrealized appreciation (depreciation) of investments and foreign currencies | | | 8,271,826 | | | | 18,497,540 | | | | (131,364 | ) | | | 2,740,070 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | 45,511,470 | | | | 34,121,544 | | | | 2,144,592 | | | | 1,987,387 | | | | 536,406 | | | | 523,301 | |

Distributions to shareholders | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from ordinary income | | | (428,183 | ) | | | (515,627 | ) | | | — | | | | — | | | | (536,129 | ) | | | (523,637 | ) |

Capital share transactions | | | | | | | | | | | | | | | | | | | | | | | | |

Change in net assets resulting from capital share transactions (a) | | | 67,447,306 | | | | 30,235,952 | | | | (1,961,394 | ) | | | (1,270,866 | ) | | | (11,927 | ) | | | 1,639,379 | |

Redemption fees | | | 137,633 | | | | 152,274 | | | | 1,767 | | | | 884 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Increase (decrease) in net assets resulting from capital share transactions | | | 67,584,939 | | | | 30,388,226 | | | | (1,959,627 | ) | | | (1,269,982 | ) | | | (11,927 | ) | | | 1,639,379 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total change in net assets | | | 112,668,226 | | | | 63,994,143 | | | | 184,965 | | | | 717,405 | | | | (11,650 | ) | | | 1,639,043 | |

Net assets | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of year | | | 138,725,859 | | | | 74,731,716 | | | | 17,148,861 | | | | 16,431,456 | | | | 14,527,883 | | | | 12,888,840 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

End of year (b) | | $ | 251,394,085 | | | $ | 138,725,859 | | | $ | 17,333,826 | | | $ | 17,148,861 | | | $ | 14,516,233 | | | $ | 14,527,883 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(a) Capital share transactions were as follows: | | | | | | | | | | | | | | | | | | | | | | | | |

Value | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | $ | 184,044,970 | | | $ | 116,084,072 | | | $ | 821,189 | | | $ | 2,150,044 | | | $ | 23,573,730 | | | $ | 10,012,537 | |

Shares issued and reinvestment of distributions | | | 385,333 | | | | 465,044 | | | | — | | | | — | | | | 527,201 | | | | 497,139 | |

Shares redeemed | | | (116,982,997 | ) | | | (86,313,164 | ) | | | (2,782,583 | ) | | | (3,420,910 | ) | | | (24,112,858 | ) | | | (8,870,297 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) | | $ | 67,447,306 | | | $ | 30,235,952 | | | $ | (1,961,394 | ) | | $ | (1,270,866 | ) | | $ | (11,927 | ) | | $ | 1,639,379 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Number | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 36,048,415 | | | | 29,202,982 | | | | 48,234 | | | | 140,860 | | | | 23,573,730 | | | | 10,012,537 | |

Shares issued and reinvestment of distributions | | | 67,359 | | | | 108,910 | | | | — | | | | — | | | | 527,201 | | | | 497,139 | |

Shares redeemed | | | (23,895,005 | ) | | | (21,961,196 | ) | | | (166,363 | ) | | | (226,244 | ) | | | (24,112,858 | ) | | | (8,870,297 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) | | | 12,220,769 | | | | 7,350,696 | | | | (118,129 | ) | | | (85,384 | ) | | | (11,927 | ) | | | 1,639,379 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(b) End of year net assets include undistributed net investment income (loss) | | $ | (2,626,520 | ) | | $ | (1,504,530 | ) | | $ | (266 | ) | | $ | — | | | $ | 252 | | | $ | 302 | |

See notes to financial statements.

11

Statements of Cash Flows

| | | | | | | | | | | | |

For the Year Ended December 31, 2007 | | Midas Fund | | | Midas Special

Fund | | | Midas Dollar

Reserves | |

Cash flows from operating activities | | | | | | | | | | | | |

Net increase in net assets resulting from operations | | $ | 45,511,470 | | | $ | 2,144,592 | | | $ | 536,406 | |

Adjustments to reconcile change in net assets resulting from operations to net cash provided by (used in) operating activities: | | | | | | | | | | | | |

Purchase of long term investments | | | (317,586,795 | ) | | | (6,808,624 | ) | | | — | |

Proceeds from sales of long term investments | | | 264,645,289 | | | | 9,725,773 | | | | — | |

Net realized gain on sales of investments and foreign currencies | | | (40,287,946 | ) | | | (2,749,314 | ) | | | (327 | ) |

Proceeds from short sale of investments | | | 20,052,422 | | | | — | | | | — | |

Buy to cover investments held short | | | (18,851,259 | ) | | | — | | | | — | |

Unrealized (appreciation) depreciation of investments and foreign currencies | | | (8,271,826 | ) | | | 131,364 | | | | — | |

Net (purchases) sales of short term investments | | | (1,730,037 | ) | | | (266 | ) | | | 11,764 | |

Decrease in receivable for investments sold | | | 998,467 | | | | — | | | | — | |

Increase (decrease) in other assets and liabilities | | | 162,569 | | | | (15,560 | ) | | | 4,254 | |

Increase in payable for investments purchased | | | — | | | | 1,060,421 | | | | — | |

| | | | | | | | | | | | |

Net cash (used in) provided by operating activities | | | (55,357,646 | ) | | | 3,488,386 | | | | 552,097 | |

| | | | | | | | | | | | |

Cash flows from financing activities | | | | | | | | | | | | |

Repayment of bank credit facility | | | (11,265,258 | ) | | | (1,260,360 | ) | | | — | |

Net shares sold (redeemed) | | | 66,665,982 | | | | (2,228,026 | ) | | | (539,128 | ) |

Cash distributions paid | | | (42,850 | ) | | | — | | | | (9,752 | ) |

| | | | | | | | | | | | |

Net cash provided by (used in) financing activities | | | 55,357,874 | | | | (3,488,386 | ) | | | (548,880 | ) |

| | | | | | | | | | | | |

Net increase in cash | | | 228 | | | | — | | | | 3,217 | |

Cash | | | | | | | | | | | | |

Beginning of year | | | 88 | | | | — | | | | 400,136 | |

| | | | | | | | | | | | |

End of year | | $ | 316 | | | $ | — | | | $ | 403,353 | |

| | | | | | | | | | | | |

Supplemental disclosure of cash flow information: | | | | | | | | | | | | |

Cash paid for interest | | $ | 1,021,833 | | | $ | 146,351 | | | $ | 708 | |

Non-cash financing activities not included herein consisted of reinvestment of distributions | | $ | 385,333 | | | $ | — | | | $ | 527,201 | |

See notes to financial statements.

12

Notes to Financial Statements

December 31, 2007

1 Organization, Investment Objectives, and Summary of Significant Accounting Policies

The Midas Funds are all Maryland corporations registered under the Investment Company Act of 1940, as amended (the “Act”), as open end management investment companies. Midas Fund’s investment objectives are primarily capital appreciation and protection against inflation and, secondarily, current income. The Fund seeks to achieve these objectives by investing at least 65% of its total assets primarily in (1) securities of companies primarily involved, directly or indirectly, in the business of mining, processing, fabricating, distributing or otherwise dealing in gold, silver, platinum, or other natural resources and (2) gold, silver, and platinum bullion. Midas Special Fund’s investment objective is capital appreciation. The Fund seeks capital appreciation by investing aggressively in all types of securities, futures, and options. Midas Dollar Reserves seeks to provide its shareholders maximum current income consistent with preservation of capital and maintenance of liquidity. The Fund invests exclusively in obligations of the U.S. Government, its agencies and instrumentalities.

The following is a summary of significant accounting policies consistently followed by each Fund in the preparation of its financial statements.

Security Valuation - With respect to security valuation, except for Midas Dollar Reserves, securities traded on a national securities exchange, unless over-the-counter quotations for such securities are believed to more closely reflect their fair value, are valued at the last reported sales price on the day the valuations are made. Securities traded primarily on the NASDAQ Stock Market (“NASDAQ”) are normally valued by the Funds at the NASDAQ Official Closing Price (“NOCP”) provided by NASDAQ each business day. The NOCP is the most recently reported price as of 4:00:02 p.m., Eastern time, unless that price is outside the range of the “inside” bid and asked prices (i.e., the bid and asked prices that dealers quote to each other when trading for their own accounts); in that case, NASDAQ will adjust the price to equal the inside bid or asked price, whichever is closer. Because of delays in reporting trades, the NOCP may not be based on the price of the last trade to occur before the market closes. Such securities that are not traded on a particular day, securities traded in the over-the-counter market that are not on NASDAQ, and foreign securities are valued at the mean between the current bid and asked prices. Debt obligations with remaining maturities of 60 days or less are valued at cost adjusted for amortization of premiums and accretion of discounts. Open end investment companies that are not traded on an exchange are valued at their net asset value. Securities for which market quotations are not readily available or reliable and other assets may be valued as determined in good faith under the direction of and pursuant to procedures established by the Fund’s Board of Directors.

Midas Dollar Reserves values its portfolio securities using the amortized cost method of valuation, under which the market value is approximated by amortizing the difference between acquisition cost and value at maturity of an instrument on a straight-line basis over its remaining life.

Foreign Currency Translation - Securities denominated in foreign currencies are translated into U.S. dollars at prevailing exchange rates. Realized gain or loss on the sale of investments denominated in foreign currencies is reported separately from gain or loss attributable to the change in foreign exchange rates for those investments.

Foreign Currency Contracts - Forward contracts are marked to market and the change in market value is recorded by the Fund as an unrealized gain or loss. When a contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The Fund could be exposed to risk if the counterparties are unable to meet the terms of the contracts or if the value of the currency changes unfavorably.

Futures Contracts - Midas Fund and Midas Special Fund may engage in transactions in futures contracts. Upon entering into a futures contract, the Fund provides the broker an amount of cash or securities at least equal to a certain percentage of the contract amount. This is known as “initial margin.” Subsequent payments (“variation margin”) are credited to or debited from the Fund each day, depending on the daily fluctuation of the value of the contract. The daily change in the contract is included in unrealized appreciation or depreciation on investments and futures contracts. The Fund recognizes a realized gain or loss when the contract is closed. Futures transactions sometimes may reduce returns or increase volatility. In addition, futures can be illiquid and highly sensitive to changes in their underlying security, interest rate or index, and as a result can be highly volatile. A small investment in futures could have a large impact on a Fund’s performance.

13

Notes to Financial Statements

CONTINUED

Short Sales - Midas Fund and Midas Special Fund may sell a security it does not own in anticipation of a decline in the market value of the security. When a Fund sells a security short, it must borrow the security sold short and deliver it to the broker/dealer through which it made the short sale. The Fund is liable for any dividends or interest paid on securities sold short. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of a short sale.

Investment in Affiliated Money Market Fund - Midas Fund and Midas Special Fund invest daily available cash balances in Midas Dollar Reserves. As a shareholder, each investing Fund is subject to its proportional share of Midas Dollar Reserves expenses, including its management and distribution fees. Midas Management Corporation (the “Investment Manager”) and Investor Service Center, Inc. (the “Distributor”) voluntarily reimburse management and distribution fees, respectively, due from Midas Dollar Reserves. These voluntary reimbursements may be terminated at any time. Should the Distributor no longer voluntarily waive its Midas Dollar Reserves distribution fee, the Investment Manager will waive a sufficient amount of its investing Fund management fee to offset the cost of such distribution fee.

Security Transactions - Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income - Interest income is recorded on the accrual basis. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Expenses - Estimated expenses are accrued daily. Expenses directly attributable to a Fund are charged to that Fund. Expenses borne by the complex of related investment companies, which includes open end and closed end investment companies for which the Investment Manager and its affiliates serve as investment manager, that are not directly attributed to the Fund are allocated among the Fund and the other investment companies in the complex on the basis of relative net assets, except where a more appropriate allocation of expenses to each investment company in the complex can otherwise be made fairly.

Expense Reduction Arrangement - Through arrangements with the Funds’ custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce custody and transfer agency expenses, by $6,939 and $3,787, respectively, during the year ended December 31, 2007.

Distributions - Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Income Taxes - No provision has been made for U.S. income taxes because each Fund intends to qualify as a regulated investment company under the Internal Revenue Code and to distribute to shareholders substantially all taxable income and net realized gains. Foreign securities held by the Fund may be subject to foreign taxation. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests.

Redemption Fees - Midas Fund and Midas Special Fund impose a short term trading redemption fee on any Fund shares that are redeemed or exchanged within 30 days following their purchase date. The redemption fee is 1% of the amount redeemed. Such fees are retained by the Funds for the benefit of the remaining shareholders and are accounted for as an addition to paid in capital.

Use of Estimates - In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of

14

Notes to Financial Statements

CONTINUED

assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications - The Funds indemnify officers and directors for certain liabilities that might arise from their performance of their duties for the Funds. Additionally, in the normal course of business the Funds enter into contracts that contain a variety of representations and warranties and which may provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as it involves future claims that may be made against the Funds under circumstances that have not occurred.

2 Fees and Transactions with Related Parties

Under the investment management agreement of Midas Fund, the Investment Manager receives a management fee, payable monthly, based on the average daily net assets of the Fund at the annual rate of 1% on the first $200 million, .95% from $200 million to $400 million, .90% from $400 million to $600 million, .85% from $600 million to $800 million, .80% from $800 million to $1 billion, and .75% over $1 billion. Under the investment management agreement of Midas Special Fund, the Investment Manager receives a management fee, payable monthly, based on the average daily net assets of the Fund at the annual rate of 1% on the first $10 million, 7/8 of 1% from $10 million to $30 million, 3/4 of 1% from $30 million to $150 million, 5/8 of 1% from $150 million to $500 million, and 1/2 of 1% over $500 million. Under the investment management agreement of Midas Dollar Reserves, the Investment Manager receives a management fee, payable monthly, based on the average daily net assets of the Fund, at the annual rate of .50 of 1% of the first $250 million, .45 of 1% from $250 million to $500 million, and .40 of 1% over $500 million. For Midas Dollar Reserves, the Investment Manager voluntarily waived its management fee of $68,436 for the year ended December 31, 2007.

Each Fund has adopted a plan of distribution pursuant to Rule 12b-1 under the Act. Under each plan, each Fund pays the Distributor, an affiliate of the Investment Manager, a fee of .25% (Midas Fund and Midas Dollar Reserves) or 1.00% (Midas Special Fund) for distribution and shareholder services. The shareholder service fee is intended to cover personal services provided to the shareholders of the Funds and the maintenance of shareholder accounts. The distribution fee is to cover all other activities and expenses primarily intended to result in the sale of the Funds’ shares. For Midas Dollar Reserves, the Distributor voluntarily waived $34,218 of its distribution fee for the year ended December 31, 2007.

Certain officers and directors of the Funds are officers and directors of the Investment Manager and the Distributor. Pursuant to the investment management agreements, the Funds reimburse the Investment Manager for providing certain administrative services at cost comprised of compliance and accounting services. For the year ended December 31, 2007, the Funds incurred total administrative costs of $179,965 comprised of $92,825 and $87,140 for compliance and accounting services, respectively. In addition, Midas Fund, Midas Special Fund, and Midas Dollar Reserves each reimbursed the Distributor $145,215, $1,857, and $5, respectively, for payments made to certain brokers for record keeping services for the year ended December 31, 2007.

3 Distributions to Shareholders and Distributable Earnings

The tax character of distributions paid by the Funds for the years ended December 31, 2007 and 2006 are summarized as follows:

| | | | | | | | | | | | |

| | | Midas Fund | | Midas Dollar Reserves |

| | | 2007 | | 2006 | | 2007 | | 2006 |

Distributions paid from ordinary income | | $ | 428,183 | | $ | 515,627 | | $ | 536,129 | | $ | 523,637 |

There were no distributions paid by Midas Special Fund during the years ended December 31, 2007 and 2006.

15

Notes to Financial Statements

CONTINUED

At December 31, 2007, the components of distributable earnings on a tax basis were as follows:

| | | | | | | | | | | | |

| | | Midas Fund | | | Midas Special

Fund | | | Midas Dollar

Reserves | |

Accumulated undistributed net investment income | | $ | 714,438 | | | $ | — | | | $ | 252 | |

Accumulated net realized loss on investments | | | (79,364,655 | ) | | | (5,480,327 | ) | | | (218 | ) |

Capital loss carryover limitation | | | (157,245 | ) | | | (131,565 | ) | | | — | |

Post-October losses | | | — | | | | (268,876 | ) | | | — | |

Unrealized appreciation | | | 49,459,896 | | | | 5,888,674 | | | | — | |

| | | | | | | | | | | | |

| | $ | (29,347,566 | ) | | $ | 7,906 | | | $ | 34 | |

| | | | | | | | | | | | |

Federal income tax regulations permit post October net capital losses to be deferred and recognized on the tax return of the next succeeding taxable year. The differences between book-basis and tax-basis unrealized appreciation is attributable primarily to the Passive Foreign Investment Company (“PFIC”) mark to market adjustments and deficiency dividends. Accounting principles generally accepted in the United States of America require certain components of net assets to be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended December 31, 2007, permanent differences between book and tax accounting have been reclassified to paid-in capital as follows:

| | | | | | | | |

| | | Midas Fund | | | Midas Special

Fund | |

Increase (decrease) in: | | | | | | | | |

Accumulated undistributed net investment loss | | $ | 2,354,496 | | | $ | 473,092 | |

Accumulated net realized loss on investments | | | 38,451,233 | | | | 266 | |

Paid-in capital | | | (40,805,729 | ) | | | (473,358 | ) |

At December 31, 2007, Midas Fund had net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes of $79,364,655, of which $72,484,629, $6,800,444, and $79,582 expire in 2008, 2009, and 2010, respectively. A capital loss carryover of $157,245 related to the acquisition of the Midas Gold Investors Fund in November 2001 is remaining to be recognized over 2008.

At December 31, 2007, Midas Special Fund had net capital loss carryovers that may be used to offset future realized gains for federal income tax purposes of $5,480,327, of which $3,316,069, $1,823,745, and $340,513 expire in 2009, 2011, and 2014, respectively. A capital loss carryover of $131,565 related to the acquisition of the Midas U.S. and Overseas Fund in November 2001 is remaining to be recognized over 2008.

At December 31, 2007, Midas Dollar Reserves had net capital loss carryovers that may be used to offset future realized gains for federal income tax purposes of $218 which expire in 2014.

4 Securities Transactions

At December 31, 2007, aggregate cost and unrealized appreciation of securities for federal income tax purposes were as follows:

| | | | | | | | | | | | | |

| | | Federal Income

Tax Cost | | Gross

Unrealized

Appreciation | | Gross

Unrealized

Depreciation | | | Net

Unrealized

Appreciation |

Midas Fund | | $ | 203,500,261 | | $ | 53,868,864 | | $ | (6,345,539 | ) | | $ | 47,523,325 |

Midas Special Fund | | $ | 14,188,101 | | $ | 6,770,668 | | $ | (881,993 | ) | | $ | 5,888,675 |

The cost of investments is the same for financial reporting and federal income tax purposes for Midas Dollar Reserves.

16

Notes to Financial Statements

CONTINUED

Purchases and sales of securities, excluding short sale transactions and short term investments, for the year ended December 31, 2007 were as follows:

| | | | | | |

| | | Midas Fund | | Midas Special Fund |

Purchase of investment securities | | $ | 317,586,795 | | $ | 6,808,624 |

Proceeds from the sale of investment securities | | $ | 264,672,150 | | $ | 9,708,935 |

5 Affiliated Issuers

The term affiliate, as defined under the Act, includes companies in which there is a direct or indirect (a) ownership of, control of, or voting power over 5% or more of the outstanding voting shares or (b) control of or common control under, another company or persons. Transactions with affiliates for the year ended December 31, 2007 were as follows:

Midas Fund

| | | | | | | | | | | | | | | | | |

| | | Number of Shares Held | | Value

December 31,

2007 | | Dividend

Income | | Realized

Gains/

(Losses) |

Name of Issuer | | December 31,

2006 | | Gross

Additions | | Gross

Reductions | | December 31,

2007 | | | |

Golden Cycle Gold Corp. | | 1,964,500 | | — | | — | | 1,964,500 | | $ | 20,037,900 | | $ | — | | $ | — |

Midas Dollar Reserves, Inc. | | — | | 2,095,591 | | 7,076 | | 2,088,515 | | $ | 2,088,515 | | $ | 1,299 | | $ | — |

| | | | | | | |

| Midas Special Fund | | | | | | | | | | | | | | | | | |

| | | | |

| | | Number of Shares Held | | Value

December 31,

2007 | | Dividend

Income | | Realized

Gains/

(Losses) |

Name of Issuer | | December 31,

2006 | | Gross

Additions | | Gross

Reductions | | December 31,

2007 | | | |

Midas Dollar Reserves, Inc. | | — | | 1,398,843 | | 1,398,843 | | — | | $ | — | | $ | 883 | | $ | — |

6 Bank Credit Facilities

The Funds (except Midas Dollar Reserves), Global Income Fund, Inc., and Foxby Corp. (the “Borrowers”) have entered into a committed secured line of credit facility with State Street Bank and Trust Company (“Bank”) the Funds’ custodian. Global Income Fund, Inc. and Foxby Corp. are closed end investment companies advised by CEF Advisers, Inc., an affiliate of the Investment Manager. The aggregate amount of the credit facility is $25,000,000. The borrowing of each Borrower is collateralized by the underlying investments of such Borrower. The Bank will make revolving loans to a Borrower not to exceed in the aggregate outstanding at any time with respect to any one Borrower the least of $25,000,000, the maximum amount permitted pursuant to each Borrower’s prospectus, or as permitted under the Act. The commitment fee on this facility is 0.10% per annum on the unused portion of the commitment, based on a 360 day year. All loans under this facility will be available at the Borrower’s option of (i) overnight Federal funds or (ii) LIBOR (30, 60, 90 days), each as in effect from time to time, plus 0.75% per annum, calculated on the basis of actual days elapsed for a 360-day year.

The Funds have also entered into an uncommitted secured redemption facility with the Bank with an aggregate amount available of $25,000,000 which was increased from $10,000,000 effective April 27, 2007. The borrowing of each Borrower is collateralized by the underlying investments of such Borrower. This facility carries no legal obligation on the part of the Bank to lend any amount of money to the Funds at any time and the Funds do not pay a commitment fee under this facility. The Bank may make revolving loans to a Fund not to exceed in the aggregate outstanding at any time with respect to any one Fund the least of $25,000,000, the maximum amount permitted pursuant to the Borrower’s prospectus, or as permitted under the Act. All loans under this facility will be available at the overnight Federal Funds rate in effect from time to time plus a spread to be determined at the time of borrowing, calculated on the basis of actual days elapsed for a 360 day year.

17

Notes to Financial Statements

CONTINUED

The outstanding loan balance and the market value of eligible collateral investments at December 31, 2007, and the weighted average interest rate and average daily amount outstanding under the committed and uncommitted facilities for the year ended December 31, 2007 were as follows:

| | | | | | | | | | | | |

| | | Midas Fund | | | Midas Special

Fund | | | Midas Dollar

Reserves | |

Outstanding balance | | $ | — | | | $ | 1,601,183 | | | $ | — | |

Value of eligible collateral | | $ | — | | | $ | 10,510,434 | | | $ | — | |

Average daily amount outstanding | | $ | 17,951,349 | | | $ | 2,345,319 | | | $ | 10,591 | |

Weighted average interest rate | | | 5.92 | % | | | 5.99 | % | | | 5.96 | % |

7 Off-Balance Sheet Risks

Option contracts written and securities sold short result in off-balance sheet risk as the Funds ultimate obligation to satisfy the terms of the contract or the sale of securities sold short may exceed the amount recognized in the Statement of Assets and Liabilities.

8 Recently Issued Accounting Standards

The Funds adopted Financial Accounting Standards Board (“FASB”) Interpretation No. 48, “Accounting for Uncertainty in Income Taxes - an Interpretation of FASB Statement No. 109, Accounting for Income Taxes” (“FIN 48”) on June 29, 2007. FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented, and disclosed in the financial statements. FIN 48 requires an evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax position not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken on federal, state, and local income tax returns for all open tax years (tax years ended December 31, 2004-2007) and has concluded that no provision from income tax is required in the Fund’s financial statements.

The FASB issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”), in September 2006, which is effective for fiscal years beginning after November 15, 2007. FAS 157defines fair value, establishes a framework for measuring fair value, and expands the required financial statement disclosures about fair value measurements. Management is currently evaluating the impact of adopting FAS 157.

18

Financial Highlights- Midas Fund

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Per Share Data (for a share outstanding throughout each period) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 4.29 | | | $ | 2.99 | | | $ | 2.14 | | | $ | 2.20 | | | $ | 1.53 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.08 | ) | | | (0.08 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.02 | ) |

Net realized and unrealized gain (loss) on investments | | | 1.44 | | | | 1.39 | | | | 0.90 | | | | (0.01 | ) | | | 0.69 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.36 | | | | 1.31 | | | | 0.85 | | | | (0.06 | ) | | | 0.67 | |

| | | | | | | | | | | | | | | | | | | | |

Paid-in capital from redemption fees | | | — | * | | | 0.01 | | | | — | * | | | — | * | | | — | * |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.01 | ) | | | (0.02 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.01 | ) | | | (0.02 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 5.64 | | | $ | 4.29 | | | $ | 2.99 | | | $ | 2.14 | | | $ | 2.20 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return | | | 31.70 | % | | | 44.02 | % | | | 39.72 | % | | | (2.72 | )% | | | 43.79 | % |

| | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets at end of period (000s omitted) | | $ | 251,394 | | | $ | 138,726 | | | $ | 74,732 | | | $ | 56,770 | | | $ | 67,123 | |

Ratio of total expenses to average net assets | | | 2.43 | % | | | 2.39 | % | | | 2.79 | % | | | 2.58 | % | | | 2.44 | % |

Ratio of net expenses to average net assets | | | 2.43 | % | | | 2.38 | % | | | 2.78 | % | | | 2.58 | % | | | 2.44 | % |

Ratio of net expenses excluding loan interest and fees to average net assets | | | 1.87 | % | | | 1.96 | % | | | 2.44 | % | | | 2.39 | % | | | 2.27 | % |

Ratio of net investment loss to average net assets | | | (1.58 | )% | | | (1.96 | )% | | | (2.39 | )% | | | (2.40 | )% | | | (1.28 | )% |

Portfolio turnover rate | | | 126 | % | | | 118 | % | | | 63 | % | | | 34 | % | | | 54 | % |

| * | Less than $.01 per share. |

| | Average shares outstanding during the period are used to calculate per share data. |

Financial Highlights- Midas Special Fund

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Per Share Data (for a share outstanding throughout each period) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 16.74 | | | $ | 14.80 | | | $ | 14.98 | | | $ | 13.54 | | | $ | 12.91 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.50 | ) | | | (0.35 | ) | | | (0.32 | ) | | | (0.26 | ) | | | (0.12 | ) |

Net realized and unrealized gain (loss) on investments | | | 2.89 | | | | 2.29 | | | | 0.14 | | | | 1.70 | | | | 0.75 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.39 | | | | 1.94 | | | | (0.18 | ) | | | 1.44 | | | | 0.63 | |

| | | | | | | | | | | | | | | | | | | | |

Paid-in capital from redemption fees* | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 19.13 | | | $ | 16.74 | | | $ | 14.80 | | | $ | 14.98 | | | $ | 13.54 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return | | | 14.28 | % | | | 13.11 | % | | | (1.20 | )% | | | 10.63 | % | | | 4.88 | % |

| | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets at end of period (000s omitted) | | $ | 17,334 | | | $ | 17,149 | | | $ | 16,431 | | | $ | 18,110 | | | $ | 18,044 | |

Ratio of total expenses to average net assets | | | 4.06 | % | | | 3.89 | % | | | 4.03 | % | | | 3.49 | % | | | 3.67 | % |

Ratio of net expenses to average net assets | | | 4.06 | % | | | 3.88 | % | | | 4.03 | % | | | 3.49 | % | | | 3.67 | % |

Ratio of net expenses excluding loan interest and fees to average net assets | | | 3.22 | % | | | 3.39 | % | | | 3.83 | % | | | 3.39 | % | | | 3.47 | % |

Ratio of net investment loss to average net assets | | | (2.85 | )% | | | (2.32 | )% | | | (2.15 | )% | | | (1.82 | )% | | | (0.99 | )% |

Portfolio turnover rate | | | 36 | % | | | 73 | % | | | 118 | % | | | 9 | % | | | 29 | % |

| * | Less than $.01 per share. |

| | Average shares outstanding during the period are used to calculate per share data. |

19

Financial Highlights- Midas Dollar Reserves

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Per Share Data (for a share outstanding throughout each period) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | .039 | | | | .039 | | | | .016 | | | | .003 | | | | .002 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (.039 | ) | | | (.039 | ) | | | (.016 | ) | | | (.003 | ) | | | (.002 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return | | | 4.00 | % | | | 3.88 | % | | | 1.61 | % | | | 0.29 | % | | | 0.15 | % |

| | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets at end of period (000s omitted) | | $ | 14,516 | | | $ | 14,528 | | | $ | 12,889 | | | $ | 15,543 | | | $ | 18,638 | |

Ratio of total expenses to average net assets | | | 1.91 | % | | | 1.83 | % | | | 2.34 | % | | | 1.97 | % | | | 1.75 | % |

Ratio of net expenses to average net assets | | | 1.15 | % | | | 1.08 | % | | | 1.59 | % | | | 1.12 | % | | | 0.99 | % |

Ratio of net investment income to average net assets | | | 3.92 | % | | | 3.87 | % | | | 1.58 | % | | | 0.24 | % | | | 0.16 | % |

Performance Graphs/Total Returns

(Unaudited)

Results of $10,000 Investment

January 1, 1998 through December 31, 2007

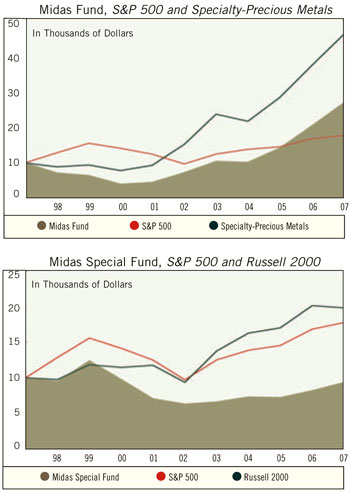

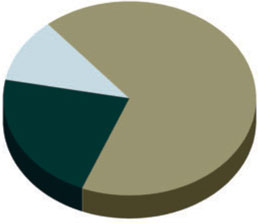

The performance graphs show returns of an initial investment of $10,000 in Midas Fund and Midas Special Fund from 1/1/98 to 12/31/07. Midas Special Fund is compared to the Russell 2000 and the S&P 500. Midas Fund is compared to the S&P 500 and the Morningstar Specialty Fund-Precious Metals Average (“PMA”) of 67 funds, 29 of which have been in existence since 1998. Results in each case reflect reinvestment of dividends and distributions. The Russell 2000, a small company index, and the S&P 500, a broad equity index, are unmanaged and fully invested in common stocks. Midas Special Fund invests in common stocks and may also leverage and own fixed income securities, options, and futures. Midas Fund invests primarily in securities of companies involved in mining, processing or dealing in precious metals or other resources, may use leverage and futures, and may invest in fixed income securities for temporary defensive purposes and other securities. Past performance is not predictive of future performance.

| | | | | | | | | |

Fund Name | | $ Final

Value | | % Aggregate

Total Return* | | | % Avg. Annual

Return* | |

Midas Fund | | $ | 26,877 | | 168.77 | % | | 10.39 | % |

Midas Special Fund | | $ | 9,343 | | (6.57 | )% | | (0.68 | )% |

PMA | | $ | 46,227 | | 362.27 | % | | 16.54 | % |

Russell 2000 | | $ | 19,824 | | 98.24 | % | | 7.08 | % |

S&P 500 | | $ | 17,756 | | 77.56 | % | | 5.91 | % |

| | | | | | | | | |

| | | Average Annual Total Return

for the Periods Ended December 31, 2007 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Midas Fund | | 31.70 | % | | 29.96 | % | | 10.39 | % |

Midas Special Fund | | 14.28 | % | | 8.18 | % | | (0.68 | )% |

| * | The returns shown do not reflect the deduction of taxes if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

20

About Your Fund’s Expenses

(Unaudited)