UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22584

Guggenheim Equal Weight Enhanced Equity Income Fund

(Exact name of registrant as specified in charter)

227 West Monroe Street, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Amy J. Lee

227 West Monroe Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 827-0100

Date of fiscal year end: December 31

Date of reporting period: January 1, 2014 – June 30, 2014

Item 1. Reports to Stockholders.

The registrant's semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: [Provide full text of annual report.]

Guggenheim Equal Weight Enhanced Equity Income Fund’s (the “Fund”) reported amounts and sources of distributions are estimates and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon the Fund’s investment experience during the year and may be subject to changes based on the tax regulations. The Fund will provide a Form 1099-DIV each calendar year that will explain the character of these dividends and distributions for federal income tax purposes.

June 30, 2014 | |||||||||

| Total Cumulative Distribution For the Fiscal Year | % Breakdown of the Total Cumulative Distributions for the Fiscal Year | ||||||||

Net | Net | Net | Net | ||||||

Realized | Realized | Realized | Realized | ||||||

Net | Short-Term | Long-Term | Total per | Net | Short-Term | Long-Term | Total Per | ||

Investment | Capital | Capital | Return of | Common | Investment | Capital | Capital | Return of | Common |

Income | Gains | Gains | Capital | Share | Income | Gains | Gains | Capital | Share |

$0.0375 | $0.0000 | $0.8375 | $0.0000 | $0.8750 | 4.3% | 0.0% | 95.7% | 0.0% | 100.0% |

If the Fund estimates it has distributed more than its income and net realized capital gains, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of a shareholder’s investment in a Fund is returned to the shareholder. A return of capital distribution does not necessarily reflect a Fund’s investment performance and should not be confused with “yield” or “income.”

Section 19(a) notices for the Fund are available on the Fund’s website at guggenheiminvestments.com/geq.

The Fund, acting pursuant to a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of the Fund’s Board of Trustees (the “Board”), has adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plan, the Fund currently distributes a fixed amount per share, $0.437500, on a quarterly basis.

The fixed amounts distributed per share are subject to change at the discretion of the Fund’s Board. Under its Plan, the Fund will distribute all available investment income to its shareholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a quarterly basis, the Fund will distribute capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each quarterly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Fund to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Plan. The Fund’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate the Fund’s Plan without prior notice if it deems such actions to be in the best interests of the Fund or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above net asset value) or widening an existing trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to the Fund’s prospectus and its website, guggenheiminvestments.com/geq for a more complete description of its risks.

This Page Intentionally Left Blank.

GUGGENHEIMINVESTMENTS.COM/GEQ

. . .YOUR LINK TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT GUGGENHEIM EQUAL

WEIGHT ENHANCED EQUITY INCOME FUND

The shareholder report you are reading right now is just the beginning of the story. Online at guggenheiminvestments.com/geq, you will find:

• Daily, weekly and monthly data on share prices, net asset values, distributions and more

• Portfolio overviews and performance analyses

• Announcements, press releases and special notices

• Fund and adviser contact information

Guggenheim Partners Investment Management, LLC, Security Investors, LLC and Guggenheim Funds Investment Advisors, LLC are continually updating and expanding shareholder information services on the Fund’s website in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

June 30, 2014

DEAR SHAREHOLDER

We thank you for your investment in the Guggenheim Equal Weight Enhanced Equity Income Fund (the “Fund”). This report covers the Fund’s performance for the six-month period ended June 30, 2014.

The Fund’s investment objective is to provide a high level of risk-adjusted total return with an emphasis on current income.

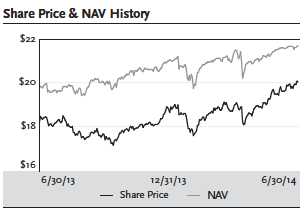

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six months ended June 30, 2014, the Fund provided a total return based on market price of 11.17% and a total return net of fees based on NAV of 7.56%. The closing price of the Fund’s shares as of June 30, 2014, was $20.03, which represented a discount of 7.61% to the NAV of $21.68.

Past performance does not guarantee future results. The market price of the Fund’s shares fluctuates from time to time, and it may be higher or lower than the Fund’s NAV. NAV performance data reflects fees and expenses of the Fund.

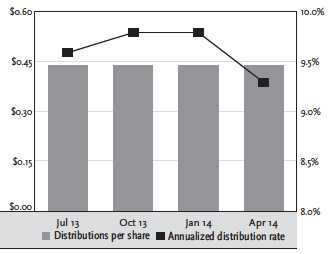

The Fund paid distributions of $0.4375 in January and April 2014. The most recent distribution represents an annualized distribution rate of 8.74% based on the Fund’s closing market price of $20.03 on June 30, 2014. Distributions may include ordinary income, realized gains and/or return of capital. The final determination of the tax character of distributions paid by the Fund in 2014 will be reported to shareholders in January 2015.

Guggenheim Funds Investment Advisors, LLC (“GFIA” or the “Adviser”) serves as the investment adviser to the Fund. Guggenheim Partners Investment Management, LLC serves as the Fund’s Options Strategy Sub-Adviser, responsible for the management of the Fund’s options strategy. Security Investors, LLC serves as the Equity Strategy Sub-Adviser, responsible for managing the underlying equity portfolio. Each of the Adviser and the two Sub-Advisers is an affiliate of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

The Fund seeks to achieve its investment objective primarily through a two-part strategy. Under normal circumstances, the Fund invests substantially all of its managed assets in a portfolio of common stocks included in the S&P 500 Equal Weight™ Index in equal weight. In addition, the Fund utilizes a call option writing strategy to seek to generate current income and potentially mitigate overall portfolio volatility.

In connection with the implementation of its strategy, the Fund currently uses leverage through a credit facility provided by a large multi-national financial institution. Although the use of financial leverage by the Fund may create an opportunity for increased return for the common shares, it also results in additional risks and can magnify the effect of any losses. There can be no assurance that a leveraging strategy will be successful during any period during which it is employed.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 30 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the quarterly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost effective means to accumulate additional shares and enjoy the potential benefits of compounding returns over time.

To learn more about the Fund’s performance and investment strategy for the six-month period ended June 30, 2014, we encourage you to read the Questions & Answers section of the report, which begins on page 6.

We appreciate your investment and look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at guggenheiminvestments.com/geq.

Sincerely,

Donald C. Cacciapaglia

Chief Executive Officer

Guggenheim Equal Weight Enhanced Equity Income Fund

July 31, 2014

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 5

QUESTIONS & ANSWERS | June 30, 2014 |

Guggenheim Equal Weight Enhanced Equity Income Fund (the “Fund”) is managed by a team of seasoned investment professionals. Guggenheim Funds Investment Advisors, LLC (the “Adviser”) is responsible for overall management of the Fund. Guggenheim Partners Investment Management, LLC (“GPIM” or the) is the Fund’s investment sub-adviser responsible for the management of the Fund’s options strategy “Options Strategy Sub-Adviser”. The options strategy is managed by a team that includes Farhan Sharaff, Assistant Chief Investment Officer, Equitius Jayson Flowers, Senior Managing Director; and Jamal Pesaran, CFA, Portfolio Manager. Security Investors, LLC (“Security Investors” or the) is the sub-adviser responsible for managing the underlying equity portfolio “Equity Strategy Sub-Adviser”. The team at Security Investors includes Ryan Harder, CFA, Portfolio Manager, and James R. King, CFA, Portfolio Manager. The Adviser, the Options Strategy Sub-Adviser and the Equity Strategy Sub-Adviser are all affiliates of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm. In the following interview, the investment team discusses the market environment and the Fund’s performance for the six-month period ended June 30, 2014.

Please describe the Fund’s investment objective and strategy.

The Fund’s investment objective is to provide a high level of risk-adjusted total return with an emphasis on current income. The Fund seeks to achieve its investment objective primarily through a two-part strategy. Under normal circumstances, the Fund invests substantially all of its managed assets in a portfolio of common stocks included in the S&P 500 Equal Weight™ Index (the “Index”) in equal weight. In addition, the Fund utilizes a call option writing strategy to seek to generate current income and potentially mitigate overall portfolio volatility.

The Index has the same constituents as the S&P 500® Index (“S&P 500”), a capitalization-weighted index comprised of 500 common stocks, chosen by Standard & Poor’s Financial Services LLC on a statistical basis, but each company in the Index is assigned an equal weight rather than a weight based on its relative market capitalization. The Fund’s equity portfolio is rebalanced quarterly so that each stock in the Fund’s portfolio has the same target weighting. While the Fund generally expects to invest in substantially all of the stocks included in the Index, the Fund may also seek to obtain exposure through investments in other investment funds, other securities and/or financial instruments that are intended to correlate with or replicate the characteristics of exposure to stocks included in the Index or the Index generally.

The Fund utilizes a call option writing strategy to seek to generate current income and potentially mitigate overall portfolio volatility. The Fund’s options strategy follows the Options Strategy Sub-Adviser’s proprietary dynamic rules-based methodology, GPIM’s “Portable Volatility Monetization Strategy”SM. The Options Strategy Sub-Adviser expects to implement the Fund’s options strategy by selling (i.e., writing) call options on securities indices, exchange-traded funds (“ETFs”) that track securities indices, baskets of securities and other instruments, which will include securities that are not held by the Fund. As this strategy involves uncovered option writing, it may result in less volatility mitigation than, and may be subject to more risks compared to, option strategies involving writing options on securities held by the Fund. There can be no assurance that the Fund’s use of call options will be successful.

The Fund currently employs leverage through a credit facility provided by a large multi-national financial institution. As of June 30, 2014, the amount of leverage was approximately 18% of the Fund’s total assets.

Although financial leverage may create an opportunity for increased return for shareholders, it also results in additional risks and can magnify the effect of any losses. There is no assurance that the strategy will be successful. If income and gains earned on securities purchased with the financial leverage proceeds are greater than the cost of the financial leverage, common shareholders’ return will be greater than if financial leverage had not been used. Conversely, if the income or gains from the securities purchased with the proceeds of financial leverage are less than the cost of the financial leverage, common shareholders’ return will be less than if financial leverage had not been used.

Please provide an overview of the economic and market environment during the six months ended June 30, 2014.

Economic growth hit a winter soft patch in the first quarter of 2014, but strong underlying fundamentals helped the economy strengthen in the second quarter. The economy is adding an average of 214,000 jobs per month in 2014, while the housing market is being helped by an improving labor market, subdued mortgage rates and tight inventory. State and local government spending is positive for growth for the first time in five years. After the period end, minutes released from the U.S. Federal Reserve Board (the “Fed”) and Federal Open Market Committee June meeting indicated a clear end-date for its quantitative easing program—October 2014—following reductions that began in January of the Fed’s monthly purchases of U.S. Treasury securities and mortgage-backed securities.

Overseas political concerns, European monetary policy and devaluation of the Chinese currency combined in the period to help push global investors into U.S. Treasuries, driving rates lower. As growth accelerates in the U.S., rates are expected to climb, but the upward pressure on rates from economic growth could be offset by increasing overseas demand and falling debt issuance by the U.S. government, putting a cap on how far rates can rise before the Fed begins tightening.

Recent economic data suggest that growth is improving slowly in the euro zone core and even more so in the peripheral countries. The European Central Bank has enacted further monetary easing, which is expected to

QUESTIONS & ANSWERS continued | June 30, 2014 |

push both yields and the euro lower, supporting the recovery. Asia is seeking an export-led rebound, although more monetary accommodation may be needed to sustain Japan’s economic expansion. Recent reforms in China are having a positive effect, but policymakers continue to depreciate the currency to help maintain export competitiveness.

Global central banks continue to flood markets with abundant liquidity. A synchronous global expansion is beginning to take hold, creating a positive environment for risk assets. We are approaching the speculative phase of the bull market in both equity and credit. Equities continue to benefit from an improving economy and continued capital flows into the U.S. Credit spreads continue to remain tight in the near term. Historically, spreads don’t begin to widen until defaults rise, which typically takes place one to two years after the Fed begins a tightening cycle.

How did the Fund perform for the six months ended June 30, 2014?

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six months ended June 30, 2014, the Fund provided a total return based on market price of 11.17% and a total return net of fees based on NAV of 7.56%. The closing price of the Fund’s shares as of June 30, 2014, was $20.03, which represented a discount of 7.61% to the NAV of $21.68. The discount narrowed over the first six months of 2014, as the closing price of the Fund’s shares as of December 31, 2013, was $18.89, which represented a discount of 10.13% to the NAV of $21.02.

Past performance does not guarantee future results. The market price of the Fund’s shares fluctuates from time to time, and it may be higher or lower than the Fund’s NAV. NAV performance data reflects fees and expenses of the Fund.

The Fund paid distributions of $0.4375 in January and April 2014. The most recent distribution represents an annualized distribution rate of 8.74% based on the Fund’s last closing market price of $20.03 on June 30, 2014. Distributions may include ordinary income, realized gains and/or return of capital. The final determination of the tax character of distributions paid by the Fund in 2014 will be reported to shareholders in January 2015. The distribution rate of the Fund exceeded the dividend rate of the S&P 500, which is approximately 2%.

The Fund delivered attractive returns with less-than-market risk. The Fund’s risk, as measured by the standard deviation of returns, was 9.9% during the period, compared with 10.8% for the S&P 500.

Compared with the Fund’s six-month market price return of 11.17%, the S&P 500 Index returned 7.14% and the S&P 500 Equal Weight Index returned 8.66%, with the benchmark for covered call strategies, the CBOE S&P 500 Buy Write Index, delivering 5.66%.

What role did the option strategy play in performance for the period?

The option strategy reduced the risk of the equity holdings over the period, delivering positive performance during market declines, but detracting from performance during moves higher.

The Fund had to contend with the combination of a steadily rising market with very low realized volatility. This led the level of equity implied volatility to drift dramatically lower over the period, with the VIX hitting a low of 10.34 in June 2014—its lowest level in seven years. Selling call options in such an environment is challenging for the strategy because low levels of implied volatility lead to low option premiums.

The low volatility environment came about despite the Fed starting to taper its program of asset purchases. Yields on Treasury securities remained low, with the U.S. Government 10-year rate falling from near 3% at the start of 2014 to near 2.5% by the end of the second quarter. It would appear that the attractiveness of U.S. yields relative to Europe and Asia outweighed the taper impact. A reduction in rates with a corresponding decline in rate volatility caused by excess liquidity led to a decrease in equity volatility.

What were the major contributors to performance?

The main driver of performance for the period was the return 8.66% of the underlying index, the S&P 500 Equal Weight Index, which outperformed the capitalization-weighted S&P 500 Index by 152 basis points. Such outperformance reflects broader strength across a variety of names rather than focused strength in the largest companies. Rebalancing the Index twice in the period also contributed to performance, as the “buy low, sell high” scenario occurred—profits were taken in stocks that had performed well and investments made in stocks that had performed poorly.

It is interesting to note that this underlying strength from the broader equal weight index, and outperformance over the S&P 500 Index, came despite notable weakness in small cap equities. The S&P 500 outperformed the Russell 2000 (small cap benchmark) by 388 basis points during the first half of 2014.

Derivative use detracted slightly from performance. This typically occurs whenever the market is moving steadily upward and some of the calls sold subsequently rise in value.

Leverage was also a positive contributor to performance for the period, as it typically is when the market is rising steadily. Our approach to leverage is dynamic, and we tend to increase leverage where implied volatility levels are attractive and decrease leverage when implied volatility is less attractive. Leverage at the end of the period was about 18% of the Fund’s total assets compared with about 11% six months earlier. The dynamic management of leverage helped lower the risk of the strategy over the period.

QUESTIONS & ANSWERS continued | June 30, 2014 |

Index Definitions

Indices are unmanaged and reflect no expenses. It is not possible to invest directly in an index.

The Chicago Board Options Exchange (CBOE) Volatility Index, often referred to as the VIX (its ticker symbol), the fear index or the fear gauge, is a measure of the implied volatility of S&P 500 Index options. It represents a measure of the market’s expectation of stock market volatility over the next 30 day period. Quoted in percentage points, the VIX represents the expected daily movement in the S&P 500 Index over the next 30-day period, which is then annualized.

The CBOE S&P 500 BuyWrite Index (BXM) is a benchmark index designed to show the hypothetical performance of a portfolio that purchases all the constituents of the S&P 500 Index and then sells at-the-money (meaning same as purchase price) calls of one-month duration against those positions.

The Russell 2000® Index measures the performance of the small-cap value segment of the U.S. equity universe.

The Standard & Poor’s (S&P) 500 Index is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The S&P 500 Equal Weight Index has the same constituents as the S&P 500, but each company is assigned a fixed equal weight.

Risks and Other Considerations

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass.

There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. Risk is inherent in all investing, including the loss of your entire principal. Therefore, before investing you should consider the risks carefully.

Please see guggenheiminvestments.com/geq for a detailed discussion about Fund risks and considerations.

FUND SUMMARY (Unaudited) | June 30, 2014 |

Fund Statistics | ||

Share Price | $20.03 | |

Common Share Net Asset Value | $21.68 | |

Premium/(Discount) to NAV | (7.61%) | |

Net Assets ($000) | $190,098 | |

Total Returns | ||

(Inception 10/27/11) | Market | NAV |

Six Month | 11.17% | 7.56% |

One Year | 21.12% | 19.54% |

Since Inception - average annual | 9.18% | 13.77% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. For the most recent month-end performance figures, please visit guggenheiminvestments.com/geq. The investment return and principal value of an investment will fluctuate with changes in the market conditions and other factors so that an investor’s shares, when sold, may be worth more or less than their original cost.

% of | |

Portfolio Composition | Net Assets |

Common Stocks | 122.5% |

Short-Term Investments | 0.2% |

Total Investments | 122.7% |

Total Value of Options Written | -0.5% |

Liabilities in excess of Other Assets | -0.1% |

Borrowings | -22.1% |

Net Assets | 100.0% |

Sector Breakdown* | % of Common Stocks |

Consumer, Non-cyclical | 20.0% |

Financial | 16.3% |

Consumer, Cyclical | 13.7% |

Industrial | 12.8% |

Energy | 9.1% |

Technology | 8.9% |

Communications | 8.0% |

Utilities | 6.2% |

Basic Materials | 4.8% |

Diversified | 0.2% |

*Securities are classified by sectors that represent broad groupings of industries.

Distributions to Shareholders & Annualized Distribution Rate

Portfolio composition and sector breakdown are subject to change daily. For more information, please visit guggenheiminvestments.com/geq. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results. All or a portion of the above distributions may be characterized as a return of capital. For the year ended December 31, 2013 approximately 61% of the distributions were characterized as return of capital. As of June 30, 2014, 0% of the distributions were estimated to be characterized as return of capital. The final determination of the tax character of the distributions paid by the Fund in 2014 will be reported to shareholders in January 2015.

PORTFOLIO OF INVESTMENTS (Unaudited) | June 30, 2014 |

Number | |||

of Shares | Description | Value | |

Total Investments – 122.7% | |||

Common Stocks – 122.5% | |||

Basic Materials – 5.9% | |||

3,773 | Air Products & Chemicals, Inc.(a) | $ 485,284 | |

4,306 | Airgas, Inc.(a) | 468,966 | |

31,473 | Alcoa, Inc.(a) | 468,633 | |

10,989 | Allegheny Technologies, Inc.(a) | 495,604 | |

1,941 | CF Industries Holdings, Inc.(a) | 466,869 | |

8,720 | Dow Chemical Co.(a) | 448,731 | |

5,144 | Eastman Chemical Co.(a) | 449,328 | |

4,226 | Ecolab, Inc.(a) | 470,523 | |

6,690 | EI du Pont de Nemours & Co.(a) | 437,794 | |

5,916 | FMC Corp.(a) | 421,160 | |

13,453 | Freeport-McMoRan Copper & Gold, Inc.(a) | 491,035 | |

4,533 | International Flavors & Fragrances, Inc.(a) | 472,701 | |

9,503 | International Paper Co.(a) | 479,616 | |

4,618 | LyondellBasell Industries NV, Class A (Netherlands)(a) | 450,948 | |

10,552 | MeadWestvaco Corp.(a) | 467,032 | |

3,819 | Monsanto Co.(a) | 476,382 | |

9,407 | Mosaic Co.(a) | 465,176 | |

19,529 | Newmont Mining Corp.(a) | 496,817 | |

8,988 | Nucor Corp.(a) | 442,659 | |

2,237 | PPG Industries, Inc.(a) | 470,106 | |

3,475 | Praxair, Inc.(a) | 461,619 | |

2,255 | Sherwin-Williams Co.(a) | 466,582 | |

4,567 | Sigma-Aldrich Corp.(a) | 463,459 | |

19,080 | United States Steel Corp.(a) | 496,843 | |

11,213,867 | |||

Communications – 9.8% | |||

1,401 | Amazon.com, Inc.(a) (b) | 455,017 | |

13,045 | AT&T, Inc.(a) | 461,271 | |

26,848 | Cablevision Systems Corp., Class A(a) | 473,867 | |

7,560 | CBS Corp., Class B(a) | 469,778 | |

12,367 | CenturyLink, Inc.(a) | 447,685 | |

18,501 | Cisco Systems, Inc.(a) | 459,750 | |

8,709 | Comcast Corp., Class A(a) | 467,499 | |

21,555 | Corning, Inc.(a) | 473,132 | |

5,501 | DIRECTV(a) (b) | 467,640 | |

5,879 | Discovery Communications, Inc., Class A(a) (b) | 436,692 | |

9,318 | eBay, Inc.(a) (b) | 466,459 | |

6,154 | Expedia, Inc.(a) | 484,689 | |

4,068 | F5 Networks, Inc.(a) (b) | 453,338 | |

7,086 | Facebook, Inc., Class A(a) (b) | 476,817 | |

81,022 | Frontier Communications Corp.(a) | 473,168 |

Number | |||

of Shares | Description | Value | |

15,905 | Gannett Co., Inc.(a) | $ 497,985 | |

815 | Google, Inc., Class A(a) (b) | 476,506 | |

829 | Google, Inc., Class C(a) (b) | 476,907 | |

655 | Graham Holdings Co., Class B(a) | 470,362 | |

6,014 | Harris Corp.(a) | 455,561 | |

23,363 | Interpublic Group of Cos., Inc.(a) | 455,812 | |

18,583 | Juniper Networks, Inc.(a) | 456,027 | |

6,843 | Motorola Solutions, Inc.(a) | 455,539 | |

1,069 | NetFlix, Inc.(a) (b) | 471,001 | |

26,521 | News Corp. Class A(a) (b) | 475,787 | |

9,851 | Nielsen NV (Netherlands)(a) | 476,887 | |

6,507 | Omnicom Group, Inc.(a) | 463,429 | |

385 | Priceline Group, Inc.(a) (b) | 463,155 | |

5,904 | Scripps Networks Interactive, Inc., Class A(a) | 479,051 | |

21,058 | Symantec Corp.(a) | 482,228 | |

3,212 | Time Warner Cable, Inc.(a) | 473,128 | |

6,735 | Time Warner, Inc.(a) | 473,134 | |

| 1 | Time, Inc.(a) (b) | 24 | |

4,480 | TripAdvisor, Inc.(a) (b) | 486,798 | |

12,864 | Twenty-First Century Fox, Inc., Class A(a) | 452,170 | |

8,993 | VeriSign, Inc.(a) (b) | 438,948 | |

9,293 | Verizon Communications, Inc.(a) | 454,706 | |

5,318 | Viacom, Inc., Class B(a) | 461,230 | |

5,520 | Walt Disney Co.(a) | 473,285 | |

46,628 | Windstream Holdings, Inc.(a) | 464,415 | |

12,370 | Yahoo!, Inc.(a) (b) | 434,558 | |

18,635,435 | |||

Consumer, Cyclical – 16.8% | |||

8,260 | AutoNation, Inc.(a) (b) | 492,957 | |

875 | Autozone, Inc.(a) (b) | 469,210 | |

7,587 | Bed Bath & Beyond, Inc.(a) (b) | 435,342 | |

15,955 | Best Buy Co., Inc.(a) | 494,765 | |

7,017 | BorgWarner, Inc.(a) | 457,438 | |

10,341 | CarMax, Inc.(a) (b) | 537,835 | |

11,740 | Carnival Corp. (Panama)(a) | 442,011 | |

776 | Chipotle Mexican Grill, Inc.(a) (b) | 459,788 | |

11,607 | Coach, Inc.(a) | 396,843 | |

3,963 | Costco Wholesale Corp.(a) | 456,379 | |

6,023 | CVS Caremark Corp.(a) | 453,954 | |

9,199 | Darden Restaurants, Inc.(a) | 425,638 | |

6,722 | Delphi Automotive PLC (Jersey)(a) | 462,070 | |

11,646 | Delta Air Lines, Inc.(a) | 450,933 | |

7,530 | Dollar General Corp.(a) (b) | 431,921 | |

8,475 | Dollar Tree, Inc.(a) (b) | 461,549 |

See notes to financial statements.

10 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) continued | June 30, 2014 |

Number | |||

of Shares | Description | Value | |

Consumer, Cyclical (continued) | |||

19,494 | DR Horton, Inc.(a) | $ 479,162 | |

6,855 | Family Dollar Stores, Inc.(a) | 453,390 | |

9,219 | Fastenal Co.(a) | 456,248 | |

27,594 | Ford Motor Co.(a) | 475,720 | |

4,293 | Fossil Group, Inc.(a) (b) | 448,704 | |

12,354 | GameStop Corp., Class A(a) | 499,966 | |

11,117 | Gap, Inc.(a) | 462,134 | |

12,825 | General Motors Co.(a) | 465,548 | |

5,369 | Genuine Parts Co.(a) | 471,399 | |

17,416 | Goodyear Tire & Rubber Co.(a) | 483,816 | |

6,614 | Harley-Davidson, Inc.(a) | 461,988 | |

4,437 | Harman International Industries, Inc.(a) | 476,667 | |

8,723 | Hasbro, Inc.(a) | 462,755 | |

5,854 | Home Depot, Inc.(a) | 473,940 | |

9,206 | Johnson Controls, Inc.(a) | 459,656 | |

8,768 | Kohl’s Corp.(a) | 461,898 | |

11,374 | Lennar Corp., Class A(a) | 477,481 | |

7,967 | Limited Brands, Inc.(a) | 467,344 | |

10,055 | Lowe’s Cos., Inc.(a) | 482,539 | |

7,960 | Macy’s, Inc.(a) | 461,839 | |

7,445 | Marriott International, Inc., Class A(a) | 477,225 | |

11,877 | Mattel, Inc.(a) | 462,847 | |

4,547 | McDonald’s Corp.(a) | 458,065 | |

4,867 | Michael Kors Holdings Ltd. (British Virgin Islands)(a) (b) | 431,460 | |

3,457 | Mohawk Industries, Inc.(a) (b) | 478,241 | |

14,938 | Newell Rubbermaid, Inc.(a) | 462,929 | |

6,124 | NIKE, Inc., Class B(a) | 474,916 | |

6,731 | Nordstrom, Inc.(a) | 457,237 | |

3,056 | O’Reilly Automotive, Inc.(a) (b) | 460,234 | |

7,221 | PACCAR, Inc.(a) | 453,695 | |

7,848 | PetSmart, Inc.(a) | 469,310 | |

23,531 | Pulte Group, Inc.(a) | 474,385 | |

3,922 | PVH Corp. | 457,305 | |

2,976 | Ralph Lauren Corp.(a) | 478,214 | |

6,809 | Ross Stores, Inc.(a) | 450,279 | |

17,374 | Southwest Airlines Co.(a) | 466,666 | |

41,580 | Staples, Inc.(a) | 450,727 | |

6,117 | Starbucks Corp.(a) | 473,333 | |

5,781 | Starwood Hotels & Resorts Worldwide, Inc.(a) | 467,220 | |

7,985 | Target Corp.(a) | 462,731 | |

4,615 | Tiffany & Co.(a) | 462,654 | |

8,340 | TJX Cos., Inc.(a) | 443,271 | |

7,031 | Tractor Supply Co.(a) | 424,672 |

Number | |||

of Shares | Description | Value | |

7,947 | Under Armour, Inc., Class A(a) (b) | $ 472,767 | |

13,633 | Urban Outfitters, Inc.(a) (b) | 461,613 | |

7,413 | VF Corp.(a) | 467,019 | |

6,255 | Walgreen Co.(a) | 463,683 | |

6,069 | Wal-Mart Stores, Inc.(a) | 455,600 | |

3,306 | Whirlpool Corp.(a) | 460,261 | |

1,758 | WW Grainger, Inc.(a) | 447,007 | |

6,305 | Wyndham Worldwide Corp.(a) | 477,414 | |

2,273 | Wynn Resorts Ltd.(a) | 471,784 | |

5,767 | Yum! Brands, Inc.(a) | 468,280 | |

31,953,871 | |||

Consumer, Non-cyclical – 24.6% | |||

11,484 | Abbott Laboratories(a) | 469,696 | |

8,436 | AbbVie, Inc.(a) | 476,128 | |

2,186 | Actavis PLC (Ireland)(a) (b) | 487,588 | |

13,457 | ADT Corp.(a) | 470,188 | |

5,647 | Aetna, Inc.(a) | 457,859 | |

2,791 | Alexion Pharmaceuticals, Inc.(a) (b) | 436,094 | |

2,825 | Allergan, Inc.(a) | 478,046 | |

1,694 | Alliance Data Systems Corp.(a) (b) | 476,438 | |

11,024 | Altria Group, Inc. | 462,346 | |

6,367 | AmerisourceBergen Corp.(a) | 462,626 | |

3,938 | Amgen, Inc.(a) | 466,141 | |

10,424 | Archer Daniels Midland Co.(a) | 459,803 | |

5,799 | Automatic Data Processing, Inc.(a) | 459,745 | |

9,187 | Avery-Dennison Corp.(a) | 470,834 | |

31,109 | Avon Products, Inc.(a) | 454,502 | |

6,250 | Baxter International, Inc. | 451,875 | |

3,885 | Becton, Dickinson & Co.(a) | 459,596 | |

1,474 | Biogen Idec, Inc.(a) (b) | 464,767 | |

35,701 | Boston Scientific Corp.(a) (b) | 455,902 | |

9,705 | Bristol-Myers Squibb Co.(a) | 470,790 | |

4,881 | Brown-Forman Corp., Class B(a) | 459,644 | |

3,324 | C.R. Bard, Inc. | 475,365 | |

10,083 | Campbell Soup Co.(a) | 461,902 | |

6,745 | Cardinal Health, Inc.(a) | 462,437 | |

10,696 | CareFusion Corp.(a) (b) | 474,368 | |

5,714 | Celgene Corp.(a) (b) | 490,718 | |

5,021 | Cigna Corp.(a) | 461,781 | |

7,241 | Cintas Corp.(a) | 460,093 | |

5,073 | Clorox Co.(a) | 463,672 | |

11,319 | Coca-Cola Co.(a) | 479,473 | |

10,250 | Coca-Cola Enterprises, Inc.(a) | 489,744 | |

6,733 | Colgate-Palmolive Co.(a) | 459,055 |

See notes to financial statements.

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 11

PORTFOLIO OF INVESTMENTS (Unaudited) continued | June 30, 2014 |

Number | |||

of Shares | Description | Value | |

Consumer, Non-cyclical (continued) | |||

14,062 | ConAgra Foods, Inc.(a) | $ 417,360 | |

5,534 | Constellation Brands, Inc., Class A(a) (b) | 487,711 | |

6,344 | Covidien PLC (Ireland)(a) | 572,102 | |

6,456 | DaVita HealthCare Partners, Inc.(a) (b) | 466,898 | |

9,561 | DENTSPLY International, Inc.(a) | 452,713 | |

7,908 | Dr Pepper Snapple Group, Inc.(a) | 463,251 | |

5,831 | Edwards Lifesciences Corp.(a) (b) | 500,532 | |

7,759 | Eli Lilly & Co.(a) | 482,377 | |

6,376 | Equifax, Inc.(a) | 462,515 | |

5,975 | Estee Lauder Cos., Inc., Class A(a) | 443,704 | |

6,383 | Express Scripts Holding Co.(a) (b) | 442,533 | |

8,414 | General Mills, Inc.(a) | 442,072 | |

5,662 | Gilead Sciences, Inc.(a) (b) | 469,436 | |

14,064 | H&R Block, Inc.(a) | 471,425 | |

4,680 | Hershey Co.(a) | 455,692 | |

9,492 | Hormel Foods Corp.(a) | 468,430 | |

8,995 | Hospira, Inc.(a) (b) | 462,073 | |

3,665 | Humana, Inc.(a) | 468,094 | |

1,152 | Intuitive Surgical, Inc.(a) (b) | 474,394 | |

14,742 | Iron Mountain, Inc.(a) | 522,604 | |

4,343 | JM Smucker Co.(a) | 462,834 | |

4,457 | Johnson & Johnson(a) | 466,291 | |

6,800 | Kellogg Co.(a) | 446,760 | |

3,814 | Keurig Green Mountain, Inc.(a) | 475,263 | |

4,130 | Kimberly-Clark Corp.(a) | 459,339 | |

7,743 | Kraft Foods Group, Inc.(a) | 464,193 | |

9,691 | Kroger Co.(a) | 479,026 | |

4,490 | Laboratory Corp. of America Holdings(a) (b) | 459,776 | |

7,477 | Lorillard, Inc.(a) | 455,873 | |

6,017 | MasterCard, Inc., Class A(a) | 442,069 | |

6,371 | McCormick & Co., Inc.(a) | 456,100 | |

5,481 | McGraw-Hill Cos., Inc.(a) | 455,087 | |

2,502 | McKesson Corp.(a) | 465,897 | |

5,224 | Mead Johnson Nutrition Co.(a) | 486,720 | |

7,528 | Medtronic, Inc.(a) | 479,985 | |

7,846 | Merck & Co., Inc.(a) | 453,891 | |

6,415 | Molson Coors Brewing Co., Class B(a) | 475,736 | |

12,203 | Mondelez International, Inc., Class A(a) | 458,955 | |

6,635 | Monster Beverage Corp.(a) (b) | 471,284 | |

5,327 | Moody’s Corp.(a) | 466,965 | |

9,103 | Mylan, Inc.(a) (b) | 469,351 | |

11,804 | Patterson Cos., Inc.(a) | 466,376 | |

11,117 | Paychex, Inc.(a) | 462,023 |

Number | |||

of Shares | Description | Value | |

5,240 | PepsiCo, Inc.(a) | $ 468,142 | |

3,256 | Perrigo Co. PLC (Ireland)(a) | 474,595 | |

15,474 | Pfizer, Inc.(a) | 459,268 | |

5,167 | Philip Morris International, Inc.(a) | 435,630 | |

5,737 | Procter & Gamble Co.(a) | 450,871 | |

13,475 | Quanta Services, Inc.(a) (b) | 465,966 | |

7,718 | Quest Diagnostics, Inc.(a) | 452,969 | |

1,493 | Regeneron Pharmaceuticals, Inc.(a) (b) | 421,728 | |

7,649 | Reynolds American, Inc.(a) | 461,617 | |

9,645 | Robert Half International, Inc.(a) | 460,452 | |

13,405 | Safeway, Inc.(a) | 460,328 | |

7,022 | St. Jude Medical, Inc.(a) | 486,274 | |

5,476 | Stryker Corp.(a) | 461,736 | |

12,374 | Sysco Corp.(a) | 463,406 | |

9,730 | Tenet Healthcare Corp.(a) (b) | 456,726 | |

14,986 | Total System Services, Inc.(a) | 470,710 | |

12,899 | Tyson Foods, Inc., Class A(a) | 484,227 | |

5,772 | UnitedHealth Group, Inc.(a) | 471,861 | |

5,584 | Varian Medical Systems, Inc.(a) (b) | 464,254 | |

6,218 | Vertex Pharmaceuticals, Inc.(a) (b) | 588,720 | |

4,277 | WellPoint, Inc.(a) | 460,248 | |

28,400 | Western Union Co.(a) | 492,456 | |

10,850 | Whole Foods Market, Inc.(a) | 419,136 | |

4,329 | Zimmer Holdings, Inc.(a) | 449,610 | |

14,226 | Zoetis, Inc.(a) | 459,073 | |

46,674,929 | |||

Diversified – 0.2% | |||

17,732 | Leucadia National Corp.(a) | 464,933 | |

Energy – 11.1% | |||

4,178 | Anadarko Petroleum Corp.(a) | 457,366 | |

4,680 | Apache Corp.(a) | 470,902 | |

6,422 | Baker Hughes, Inc.(a) | 478,117 | |

13,180 | Cabot Oil & Gas Corp., Class A(a) | 449,965 | |

7,022 | Cameron International Corp.(a) (b) | 475,460 | |

881 | Chesapeake Energy Corp.(b) | 26,104 | |

14,998 | Chesapeake Energy Corp.(a) | 466,138 | |

3,590 | Chevron Corp.(a) | 468,675 | |

3,290 | Cimarex Energy Co.(a) | 471,983 | |

5,501 | ConocoPhillips(a) | 471,601 | |

9,915 | Consol Energy, Inc.(a) | 456,784 | |

25,847 | Denbury Resources, Inc.(a) | 477,136 | |

5,856 | Devon Energy Corp.(a) | 464,966 | |

9,215 | Diamond Offshore Drilling, Inc.(a) | 457,340 | |

8,576 | Ensco PLC, Class A (United Kingdom)(a) | 476,568 |

See notes to financial statements.

12 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) continued | June 30, 2014 |

Number | |||

of Shares | Description | Value | |

Energy (continued) | |||

4,009 | EOG Resources, Inc.(a) | $ 468,492 | |

4,318 | EQT Corp.(a) | 461,594 | |

4,451 | Exxon Mobil Corp.(a) | 448,127 | |

7,766 | FMC Technologies, Inc.(a) (b) | 474,270 | |

6,763 | Halliburton Co.(a) | 480,241 | |

4,041 | Helmerich & Payne, Inc.(a) | 469,201 | |

4,762 | Hess Corp.(a) | 470,914 | |

12,986 | Kinder Morgan, Inc.(a) | 470,872 | |

11,692 | Marathon Oil Corp.(a) | 466,745 | |

5,289 | Marathon Petroleum Corp.(a) | 412,912 | |

7,001 | Murphy Oil Corp.(a) | 465,426 | |

16,617 | Nabors Industries Ltd. (Bermuda)(a) | 488,041 | |

5,893 | National Oilwell Varco, Inc.(a) | 485,288 | |

11,298 | Newfield Exploration Co.(a) (b) | 499,372 | |

13,778 | Noble Corp. PLC (United Kingdom)(a) | 462,390 | |

5,998 | Noble Energy, Inc.(a) | 464,605 | |

4,428 | Occidental Petroleum Corp.(a) | 454,446 | |

7,015 | Oneok, Inc.(a) | 477,581 | |

27,217 | Peabody Energy Corp.(a) | 444,998 | |

5,474 | Phillips 66(a) | 440,274 | |

2,012 | Pioneer Natural Resources Co.(a) | 462,378 | |

14,135 | QEP Resources, Inc.(a) | 487,658 | |

5,181 | Range Resources Corp.(a) | 450,488 | |

14,105 | Rowan Companies PLC, Class A (United Kingdom)(a) | 450,373 | |

4,222 | Schlumberger Ltd. (Curacao)(a) | 497,984 | |

9,975 | Southwestern Energy Co.(a) (b) | 453,763 | |

11,099 | Spectra Energy Corp.(a) | 471,486 | |

7,908 | Tesoro Corp.(a) | 463,962 | |

10,309 | Transocean Ltd. (Switzerland)(a) | 464,214 | |

8,503 | Valero Energy Corp.(a) | 426,000 | |

9,687 | Williams Cos., Inc.(a) | 563,880 | |

21,067,080 | |||

Financial – 20.0% | |||

4,398 | ACE Ltd. (Switzerland)(a) | 456,073 | |

2,361 | Affiliated Managers Group, Inc. (b) | 484,948 | |

7,374 | Aflac, Inc.(a) | 459,032 | |

7,743 | Allstate Corp.(a) | 454,669 | |

4,817 | American Express Co.(a) | 456,989 | |

8,354 | American International Group, Inc.(a) | 455,961 | |

5,167 | American Tower Corp., REIT(a) | 464,927 | |

3,938 | Ameriprise Financial, Inc.(a) | 472,560 | |

5,082 | Aon PLC (United Kingdom)(a) | 457,837 | |

14,249 | Apartment Investment & Management Co., Class A, REIT(a) | 459,815 |

Number | |||

of Shares | Description | Value | |

6,768 | Assurant, Inc.(a) | $ 443,642 | |

3,265 | AvalonBay Communities, Inc., REIT(a) | 464,250 | |

29,598 | Bank of America Corp. | 454,921 | |

12,924 | Bank of New York Mellon Corp.(a) | 484,392 | |

11,903 | BB&T Corp.(a) | 469,335 | |

3,610 | Berkshire Hathaway, Inc., Class B(a) (b) | 456,882 | |

1,477 | BlackRock, Inc.(a) | 472,049 | |

3,913 | Boston Properties, Inc., REIT(a) | 462,438 | |

5,678 | Capital One Financial Corp.(a) | 469,003 | |

14,964 | CBRE Group, Inc., Class A(a) (b) | 479,447 | |

17,569 | Charles Schwab Corp.(a) | 473,133 | |

4,888 | Chubb Corp.(a) | 450,527 | |

9,348 | Cincinnati Financial Corp.(a) | 449,078 | |

9,602 | Citigroup, Inc.(a) | 452,254 | |

6,397 | CME Group, Inc.(a) | 453,867 | |

9,121 | Comerica, Inc.(a) | 457,509 | |

6,193 | Crown Castle International Corp., REIT(a) | 459,892 | |

7,489 | Discover Financial Services(a) | 464,168 | |

22,656 | E*TRADE Financial Corp.(a) (b) | 481,667 | |

7,399 | Equity Residential, REIT(a) | 466,137 | |

2,548 | Essex Property Trust, Inc., REIT(a) | 471,151 | |

21,383 | Fifth Third Bancorp(a) | 456,527 | |

8,217 | Franklin Resources, Inc.(a) | 475,271 | |

19,437 | General Growth Properties, Inc., REIT | 457,936 | |

26,218 | Genworth Financial, Inc., Class A(a) (b) | 456,193 | |

2,754 | Goldman Sachs Group, Inc.(a) | 461,130 | |

12,789 | Hartford Financial Services Group, Inc.(a) | 457,974 | |

11,014 | HCP, Inc., REIT(a) | 455,759 | |

7,235 | Health Care REIT, Inc., REIT(a) | 453,417 | |

20,593 | Host Hotels & Resorts, Inc., REIT(a) | 453,252 | |

46,393 | Hudson City Bancorp, Inc.(a) | 456,043 | |

48,407 | Huntington Bancshares, Inc.(a) | 461,803 | |

2,364 | Intercontinental Exchange, Inc.(a) | 446,560 | |

12,271 | Invesco Ltd. (Bermuda)(a) | 463,230 | |

8,011 | JPMorgan Chase & Co.(a) | 461,594 | |

32,114 | KeyCorp(a) | 460,194 | |

20,140 | Kimco Realty Corp., REIT(a) | 462,817 | |

9,203 | Legg Mason, Inc.(a) | 472,206 | |

9,041 | Lincoln National Corp.(a) | 465,069 | |

10,499 | Loews Corp.(a) | 462,061 | |

3,725 | M&T Bank Corp.(a) | 462,086 | |

6,992 | Macerich Co., REIT(a) | 466,716 | |

8,993 | Marsh & McLennan Cos., Inc.(a) | 466,018 | |

8,388 | MetLife, Inc.(a) | 466,038 |

See notes to financial statements.

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 13

PORTFOLIO OF INVESTMENTS (Unaudited) continued | June 30, 2014 |

Number | |||

of Shares | Description | Value | |

Financial (continued) | |||

14,465 | Morgan Stanley(a) | $ 467,653 | |

12,441 | NASDAQ OMX Group, Inc.(a) | 480,471 | |

27,413 | Navient Corp.(a) | 485,485 | |

7,347 | Northern Trust Corp.(a) | 471,751 | |

30,834 | People’s United Financial, Inc.(a) | 467,752 | |

10,355 | Plum Creek Timber Co., Inc., REIT(a) | 467,011 | |

5,204 | PNC Financial Services Group, Inc.(a) | 463,416 | |

9,373 | Principal Financial Group, Inc.(a) | 473,150 | |

18,068 | Progressive Corp.(a) | 458,204 | |

11,170 | Prologis, Inc., REIT(a) | 458,975 | |

5,186 | Prudential Financial, Inc.(a) | 460,361 | |

2,695 | Public Storage, REIT(a) | 461,788 | |

42,668 | Regions Financial Corp.(a) | 453,134 | |

2,784 | Simon Property Group, Inc., REIT(a) | 462,924 | |

6,896 | State Street Corp.(a) | 463,825 | |

11,351 | SunTrust Banks, Inc.(a) | 454,721 | |

5,584 | T Rowe Price Group, Inc.(a) | 471,345 | |

5,609 | Torchmark Corp.(a) | 459,489 | |

4,789 | Travelers Cos., Inc.(a) | 450,501 | |

13,100 | Unum Group(a) | 455,356 | |

10,611 | US Bancorp(a) | 459,669 | |

7,180 | Ventas, Inc., REIT(a) | 460,238 | |

2,163 | Visa, Inc., Class A(a) | 455,766 | |

4,373 | Vornado Realty Trust, REIT(a) | 466,730 | |

8,805 | Wells Fargo & Co.(a) | 462,791 | |

14,817 | Weyerhaeuser Co., REIT(a) | 490,295 | |

13,929 | XL Group PLC (Ireland)(a) | 455,896 | |

15,428 | Zions Bancorporation(a) | 454,663 | |

37,951,807 | |||

Industrial – 15.6% | |||

3,187 | 3M Co.(a) | 456,506 | |

7,811 | Agilent Technologies, Inc.(a) | 448,664 | |

8,147 | Allegion PLC (Ireland)(a) | 461,772 | |

8,578 | AMETEK, Inc.(a) | 448,458 | |

4,721 | Amphenol Corp., Class A(a) | 454,821 | |

7,507 | Ball Corp.(a) | 470,539 | |

11,168 | Bemis Co., Inc.(a) | 454,091 | |

3,455 | Boeing Co.(a) | 439,580 | |

4,279 | Caterpillar, Inc.(a) | 464,999 | |

7,370 | CH Robinson Worldwide, Inc.(a) | 470,132 | |

15,057 | CSX Corp.(a) | 463,906 | |

2,928 | Cummins, Inc.(a) | 451,761 | |

5,694 | Danaher Corp.(a) | 448,289 | |

5,050 | Deere & Co.(a) | 457,278 |

Number | |||

of Shares | Description | Value | |

5,126 | Dover Corp.(a) | $ 466,210 | |

6,081 | Eaton Corp. PLC (Ireland)(a) | 469,331 | |

6,875 | Emerson Electric Co.(a) | 456,225 | |

10,229 | Expeditors International of Washington, Inc.(a) | 451,713 | |

3,258 | FedEx Corp.(a) | 493,195 | |

12,780 | FLIR Systems, Inc.(a) | 443,849 | |

5,914 | Flowserve Corp.(a) | 439,706 | |

5,886 | Fluor Corp.(a) | 452,634 | |

7,711 | Garmin Ltd. (Switzerland)(a) | 469,600 | |

3,835 | General Dynamics Corp.(a) | 446,969 | |

16,900 | General Electric Co.(a) | 444,132 | |

4,874 | Honeywell International, Inc.(a) | 453,038 | |

5,183 | Illinois Tool Works, Inc.(a) | 453,823 | |

7,335 | Ingersoll-Rand PLC (Ireland)(a) | 458,511 | |

23,091 | Jabil Circuit, Inc.(a) | 482,603 | |

8,347 | Jacobs Engineering Group, Inc.(a) (b) | 444,728 | |

7,480 | Joy Global, Inc.(a) | 460,618 | |

4,368 | Kansas City Southern(a) | 469,604 | |

3,640 | L-3 Communications Holdings, Inc.(a) | 439,530 | |

13,654 | Leggett & Platt, Inc.(a) | 468,058 | |

2,786 | Lockheed Martin Corp.(a) | 447,794 | |

20,914 | Masco Corp.(a) | 464,291 | |

4,517 | Norfolk Southern Corp.(a) | 465,387 | |

3,782 | Northrop Grumman Corp.(a) | 452,440 | |

13,732 | Owens-Illinois, Inc.(a) (b) | 475,675 | |

5,440 | Pall Corp.(a) | 464,522 | |

3,594 | Parker Hannifin Corp.(a) | 451,874 | |

6,078 | Pentair PLC (Ireland)(a) | 438,345 | |

9,847 | PerkinElmer, Inc.(a) | 461,233 | |

1,719 | Precision Castparts Corp.(a) | 433,876 | |

4,730 | Raytheon Co.(a) | 436,343 | |

12,448 | Republic Services, Inc.(a) | 472,651 | |

3,638 | Rockwell Automation, Inc.(a) | 455,332 | |

5,758 | Rockwell Collins, Inc.(a) | 449,930 | |

3,127 | Roper Industries, Inc.(a) | 456,573 | |

5,275 | Ryder System, Inc.(a) | 464,675 | |

13,727 | Sealed Air Corp.(a) | 469,052 | |

3,913 | Snap-On, Inc.(a) | 463,769 | |

5,243 | Stanley Black & Decker, Inc.(a) | 460,440 | |

3,858 | Stericycle, Inc.(a) (b) | 456,864 | |

7,436 | TE Connectivity Ltd. (Switzerland)(a) | 459,842 | |

11,598 | Textron, Inc.(a) | 444,087 | |

3,835 | Thermo Fisher Scientific, Inc.(a) | 452,530 | |

10,211 | Tyco International Ltd. (Switzerland)(a) | 465,622 | |

4,528 | Union Pacific Corp.(a) | 451,668 |

See notes to financial statements.

14 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) continued | June 30, 2014 |

Number | |||

of Shares | Description | Value | |

Industrial (continued) | |||

4,524 | United Parcel Service, Inc., Class B(a) | $ 464,434 | |

3,913 | United Technologies Corp.(a) | 451,756 | |

7,058 | Vulcan Materials Co.(a) | 449,948 | |

10,385 | Waste Management, Inc.(a) | 464,521 | |

4,357 | Waters Corp.(a) (b) | 455,045 | |

11,839 | Xylem, Inc.(a) | 462,668 | |

29,718,060 | |||

Technology – 10.9% | |||

5,524 | Accenture PLC, Class A (Ireland)(a) | 446,560 | |

6,838 | Adobe Systems, Inc.(a) (b) | 494,799 | |

7,766 | Akamai Technologies, Inc.(a) (b) | 474,192 | |

13,441 | Altera Corp.(a) | 467,209 | |

8,217 | Analog Devices, Inc.(a) | 444,293 | |

5,007 | Apple, Inc.(a) | 465,301 | |

20,428 | Applied Materials, Inc.(a) | 460,651 | |

8,423 | Autodesk, Inc.(a) (b) | 474,889 | |

6,399 | Avago Technologies Ltd. (Singapore)(a) | 461,176 | |

11,916 | Broadcom Corp., Class A(a) | 442,322 | |

15,790 | CA, Inc.(a) | 453,805 | |

8,631 | Cerner Corp.(a) (b) | 445,187 | |

7,177 | Citrix Systems, Inc.(a) (b) | 448,921 | |

9,638 | Cognizant Technology Solutions Corp., Class A(a) (b) | 471,395 | |

7,221 | Computer Sciences Corp.(a) | 456,367 | |

4,396 | Dun & Bradstreet Corp.(a) | 484,439 | |

12,807 | Electronic Arts, Inc.(a) (b) | 459,387 | |

17,166 | EMC Corp.(a) | 452,152 | |

8,487 | Fidelity National Information Services, Inc.(a) | 464,578 | |

7,088 | First Solar, Inc.(a) (b) | 503,674 | |

7,628 | Fiserv, Inc.(a) (b) | 460,121 | |

12,997 | Hewlett-Packard Co.(a) | 437,739 | |

15,305 | Intel Corp.(a) | 472,925 | |

2,502 | International Business Machines Corp.(a) | 453,538 | |

5,785 | Intuit, Inc.(a) | 465,866 | |

6,664 | KLA-Tencor Corp.(a) | 484,073 | |

6,955 | Lam Research Corp.(a) | 470,019 | |

9,691 | Linear Technology Corp.(a) | 456,155 | |

9,300 | Microchip Technology, Inc.(a) | 453,933 | |

14,661 | Micron Technology, Inc.(a) | 483,080 | |

11,083 | Microsoft Corp.(a) | 462,161 | |

12,814 | NetApp, Inc.(a) | 467,967 | |

23,386 | NVIDIA Corp.(a) | 433,576 | |

10,845 | Oracle Corp.(a) | 439,548 | |

16,635 | Pitney Bowes, Inc.(a) | 459,459 | |

5,776 | QUALCOMM, Inc.(a) | 457,459 |

Number | |||

of Shares | Description | Value | |

8,801 | Red Hat, Inc.(a) (b) | $ 486,431 | |

8,414 | salesforce.com, Inc.(a) (b) | 488,685 | |

4,641 | SanDisk Corp.(a) | 484,659 | |

8,256 | Seagate Technology PLC (Ireland)(a) | 469,106 | |

10,524 | Teradata Corp.(a) (b) | 423,065 | |

9,455 | Texas Instruments, Inc.(a) | 451,854 | |

4,961 | Western Digital Corp.(a) | 457,900 | |

36,239 | Xerox Corp.(a) | 450,813 | |

9,774 | Xilinx, Inc.(a) | 462,408 | |

20,803,837 | |||

Utilities – 7.6% | |||

32,180 | AES Corp.(a) | 500,399 | |

8,633 | AGL Resources, Inc.(a) | 475,074 | |

11,900 | Ameren Corp.(a) | 486,472 | |

8,659 | American Electric Power Co., Inc.(a) | 482,912 | |

19,032 | CenterPoint Energy, Inc.(a) | 486,077 | |

15,458 | CMS Energy Corp.(a) | 481,517 | |

8,276 | Consolidated Edison, Inc.(a) | 477,856 | |

6,676 | Dominion Resources, Inc.(a) | 477,468 | |

6,136 | DTE Energy Co.(a) | 477,810 | |

6,452 | Duke Energy Corp.(a) | 478,674 | |

8,324 | Edison International(a) | 483,708 | |

5,843 | Entergy Corp.(a) | 479,652 | |

12,793 | Exelon Corp.(a) | 466,689 | |

13,370 | FirstEnergy Corp.(a) | 464,206 | |

7,919 | Integrys Energy Group, Inc.(a) | 563,278 | |

4,721 | NextEra Energy, Inc.(a) | 483,808 | |

12,287 | NiSource, Inc.(a) | 483,371 | |

10,073 | Northeast Utilities(a) | 476,151 | |

12,448 | NRG Energy, Inc.(a) | 463,066 | |

16,701 | Pepco Holdings, Inc.(a) | 458,943 | |

9,817 | PG&E Corp.(a) | 471,412 | |

8,427 | Pinnacle West Capital Corp.(a) | 487,418 | |

13,427 | PPL Corp.(a) | 477,061 | |

12,077 | Public Service Enterprise Group, Inc.(a) | 492,621 | |

9,016 | SCANA Corp.(a) | 485,151 | |

4,519 | Sempra Energy(a) | 473,184 | |

10,497 | Southern Co.(a) | 476,354 | |

26,278 | TECO Energy, Inc.(a) | 485,617 | |

10,140 | Wisconsin Energy Corp.(a) | 475,769 | |

14,890 | Xcel Energy, Inc.(a) | 479,905 | |

14,451,623 | |||

Total Common Stocks – 122.5% | |||

(Cost $191,897,708) | 232,935,442 |

See notes to financial statements.

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 15

PORTFOLIO OF INVESTMENTS (Unaudited) continued | June 30, 2014 |

Number | |||

of Shares | Description | Value | |

Short Term Investments – 0.2% | |||

Money Market Fund – 0.2% | |||

319,099 | Dreyfus Treasury Prime Cash Management | ||

Institutional Shares(a) | $ 319,099 | ||

(Cost $319,099) | |||

Total Investments – 122.7% | |||

(Cost $192,216,807) | 233,254,541 | ||

Liabilities in excess of Other Assets – (0.1%) | (116,585) | ||

Total Value of Options Written – (0.5%) (Premiums | |||

received $1,192,693) | (1,040,423) | ||

Borrowings – (22.1% of Net Assets or 18.0% of Total | |||

Investments) | (42,000,000) | ||

Net Assets – 100.0% | $190,097,533 | ||

Contracts | |||||

(100 shares | Expiration | Exercise | |||

per contract) | Options Written – (0.5%) (b) | Month | Price | Value | |

Call Options Written – (0.5%) | |||||

| 1,188 | Basic Industries Select | ||||

Sector SPDR Fund | July 2014 | $50.00 | $ (33,858) | ||

| 1,179 | Energy Select Sector SPDR Fund | July 2014 | 100.00 | (146,196) | |

| 2,582 | Financial Select Sector SPDR Fund | July 2014 | 23.00 | (30,984) | |

| 2,537 | Powershares QQQ Trust, Series 1 | July 2014 | 94.00 | (216,913) | |

| 1,021 | ProShares Ultra S&P 500 | July 2014 | 116.00 | (165,402) | |

722 | S&P 500 Index | July 2014 | 1,990.00 | (187,720) | |

910 | SPDR S&P MidCap 400 ETF | July 2014 | 260.00 | (259,350) | |

Total Value of Call Options Written – ( 0.5%) | |||||

Premiums received $1,192,693 | $ (1,040,423) | ||||

Country Breakdown* | |

United States | 94.4% |

Ireland | 2.0% |

Switzerland | 1.0% |

United Kingdom | 0.8% |

Bermuda | 0.4% |

Netherlands | 0.4% |

Curacao | 0.2% |

Jersey | 0.2% |

Singapore | 0.2% |

Panama | 0.2% |

British Virgin Islands | 0.2% |

| * | Subject to change daily. Based on common stock. |

NV – Publicly Traded Company

PLC – Public Limited Company

REIT – Real Estate Investment Trust

| (a) | All or a portion of these securities have been physically segregated in connection with borrowings. As of June 30, 2014, the total amount segregated was $233,214,932. |

| (b) | Non-income producing security. |

Securities are classified by sectors that represent broad groupings of industries.

See notes to financial statements.

16 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) | June 30, 2014 |

Assets | |||

Investments, at value (cost $192,216,807) | $ | 233,254,541 | |

Cash | 441,072 | ||

Receivable for securities sold | 503,489 | ||

Dividends receivable | 95,350 | ||

Other assets | 16,126 | ||

Total assets | 234,310,578 | ||

Liabilities | |||

Borrowings | 42,000,000 | ||

Options written, at value (premiums received of $1,192,693) | 1,040,423 | ||

Payable for securities purchased | 536,238 | ||

Advisory fee payable | 184,528 | ||

Interest due on borrowings | 37,105 | ||

Fund accounting fee payable | 5,195 | ||

Administration fee payable | 4,923 | ||

Accrued expenses and other liabilities | 404,633 | ||

Total liabilities | 44,213,045 | ||

Net Assets | $ | 190,097,533 | |

Composition of Net Assets | |||

Common stock, $.01 par value per share; unlimited number of shares authorized, | |||

8,770,121 shares issued and outstanding | $ | 87,701 | |

Additional paid-in capital | 147,080,685 | ||

Accumulated net realized gain on investments and options | 9,083,264 | ||

Net unrealized appreciation on investments and options | 41,190,004 | ||

Distributions in excess of net investment income | (7,344,121 | ) | |

Net Assets | $ | 190,097,533 | |

Net Asset Value (based on 8,770,121 common shares outstanding) | $ | 21.68 | |

See notes to financial statements.

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 17

STATEMENT OF OPERATIONS For the six months ended June 30, 2014 (Unaudited) | June 30, 2014 |

Investment Income | ||||||

Dividends (net of foreign withholding taxes of $160) | $ | 2,002,073 | ||||

Total income | $ | 2,002,073 | ||||

Expenses | ||||||

Advisory fee | 1,081,721 | |||||

Interest expense | 168,928 | |||||

Custodian fee | 129,042 | |||||

Professional fees | 67,332 | |||||

Fund accounting | 43,773 | |||||

Printing expense | 41,811 | |||||

Trustees’ fees and expenses | 36,404 | |||||

Administrative fee | 29,073 | |||||

Licensing fee | 24,862 | |||||

Transfer agent fee | 17,919 | |||||

NYSE listing fee | 11,765 | |||||

Insurance | 9,184 | |||||

Miscellaneous | 11,494 | |||||

Total expenses | 1,673,308 | |||||

Net investment income | 328,765 | |||||

Realized and Unrealized Gain (Loss) on Investments and Options | ||||||

Net realized gain (loss) on: | ||||||

Investments | 16,210,408 | |||||

Written options | (5,632,986 | ) | ||||

Net change in unrealized appreciation (depreciation) on: | ||||||

Investments | (58,717 | ) | ||||

Written options | 2,586,920 | |||||

Net realized and unrealized gain on investments and options | 13,105,625 | |||||

Net Increase in Net Assets Resulting from Operations | $ | 13,434,390 | ||||

See notes to financial statements.

18 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

STATEMENTS OF CHANGES IN NET ASSETS | June 30, 2014 |

For the Six Months Ended June 30, 2014 (Unaudited) | For the Year Ended December 31, 2013 | |||||

Increase in Net Assets Resulting from Operations | ||||||

Net investment income | $ | 328,765 | $ | 579,541 | ||

Net realized gain on investments and options | 10,577,422 | 10,898,171 | ||||

Net change in unrealized appreciation on investments and options | 2,528,203 | 20,989,394 | ||||

Net increase in net assets resulting from operations | 13,434,390 | 32,467,106 | ||||

Distributions to Shareholders | ||||||

From and in excess of net investment income | (7,672,886 | ) | (415,054 | ) | ||

Return of capital | – | (9,308,314 | ) | |||

Capital gains | – | (5,624,344 | ) | |||

Total distributions | (7,672,886 | ) | (15,347,712 | ) | ||

Total increase in net assets | 5,761,504 | 17,119,394 | ||||

Net Assets: | ||||||

Beginning of period | 184,336,029 | 167,216,635 | ||||

End of period (including distributions in excess of net investment income of $7,344,121 and $0, respectively) | $ | 190,097,533 | $ | 184,336,029 | ||

See notes to financial statements.

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 19

STATEMENT OF CASH FLOWS For the six months ended June 30, 2014 (Unaudited) | June 30, 2014 |

Cash Flows from Operating Activities: | |||

Net increase in net assets resulting from operations | $ | 13,434,390 | |

Adjustments to Reconcile Net Increase in Net Assets Resulting from Operations to | |||

Net Cash Used in Operating and Investing Activities: | |||

Net change in unrealized depreciation on investments | 58,717 | ||

Net change in unrealized appreciation on options | (2,586,920 | ) | |

Net realized gain on investments | (16,210,408 | ) | |

Net realized loss on options | 5,632,986 | ||

Purchase of long-term investments | (158,127,455 | ) | |

Cost of written options closed | (24,560,705 | ) | |

Premiums received on call options written | 18,769,425 | ||

Proceeds from sale of long-term investments | 152,327,027 | ||

Net proceeds from sale of short-term investments | 23,611 | ||

Decrease in dividends receivable | 173,885 | ||

Increase in receivable for securities sold | (503,489 | ) | |

Increase in other assets | (14,875 | ) | |

Increase in investments purchased payable | 536,238 | ||

Increase in advisory fee payable | 17,501 | ||

Increase in administration fee payable | 341 | ||

Increase in interest due on borrowings | 16,238 | ||

Increase in fund accounting fee payable | 5,195 | ||

Increase in accrued expenses and other liabilities | 116,778 | ||

Net Cash Used in Operating and Investing Activities | (10,891,520 | ) | |

Cash Flows From Financing Activities: | |||

Proceeds from borrowings | 49,500,000 | ||

Payments made on borrowings | (30,500,000 | ) | |

Distributions to shareholders | (7,672,886 | ) | |

Net Cash Provided By Financing Activities | 11,327,114 | ||

Net change in cash | 435,594 | ||

Cash at Beginning of Period | 5,478 | ||

Cash at End of Period | $ | 441,072 | |

Supplemental Disclosure of Cash Flow Information: Cash paid during the period for interest | $ | 152,690 | |

Supplemental Disclosure of Non Cash Operating Activity: Options exercised during the period | $ | 915,950 | |

See notes to financial statements.

20 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

FINANCIAL HIGHLIGHTS | June 30, 2014 |

Per share operating performance for a common share outstanding throughout the period | For the Six Months Ended | For the Year Ended December 31, 2013 | For the Period Ended December 31, 2012* | For the Period October 27, 2011** | |||||||||||

Net asset value, beginning of period | $ | 21.02 | $ | 19.07 | $ | 19.24 | $ | 19.10 | (a) | ||||||

Investment operations | |||||||||||||||

Net investment income (b) | 0.04 | 0.07 | 0.12 | 0.09 | |||||||||||

Net realized and unrealized gain on | |||||||||||||||

investments and options | 1.50 | 3.63 | 0.59 | 0.97 | |||||||||||

Total from investment operations | 1.54 | 3.70 | 0.71 | 1.06 | |||||||||||

Common shares’ offering expenses charged to paid-in-capital | – | – | – | (0.04 | ) | ||||||||||

Distributions to Shareholders | |||||||||||||||

From and in excess of net investment income | (0.88 | ) | (0.05 | ) | (0.11 | ) | (0.42 | ) | |||||||

Return of capital | – | (1.06 | ) | (0.77 | ) | (0.46 | ) | ||||||||

Capital gains | – | (0.64 | ) | – | – | ||||||||||

Total distributions to shareholders | (0.88 | ) | (1.75 | ) | (0.88 | ) | (0.88 | ) | |||||||

Net asset value, end of period | $ | 21.68 | $ | 21.02 | $ | 19.07 | $ | 19.24 | |||||||

Market value, end of period | $ | 20.03 | $ | 18.89 | $ | 17.73 | $ | 18.61 | |||||||

Total investment return (c) | |||||||||||||||

Net asset value | 7.56 | % | 20.28 | % | 3.69 | % | 5.30 | % | |||||||

Market value | 11.17 | % | 17.12 | % | -0.35 | % | -2.57 | % | |||||||

Ratios and supplemental data | |||||||||||||||

Net assets end of period (thousands) | $ | 190,098 | $ | 184,336 | $ | 167,217 | $ | 168,444 | |||||||

Ratios to Average Net Assets: | |||||||||||||||

Total expenses, including interest expense(g) | 1.72 | %(d) | 1.68 | % | 1.78 | %(d) | 1.80 | %(d) | |||||||

Net investment income, including interest expense | 0.47 | %(d) | 0.33 | % | 1.25 | %(d) | 0.71 | %(d) | |||||||

Portfolio Turnover(e) | 69 | % | 154 | % | 54 | % | 31 | % | |||||||

Senior Indebtedness: | |||||||||||||||

Total Borrowings outstanding (in thousands) | $ | 42,000 | $ | 23,000 | $ | 32,000 | $ | 34,000 | |||||||

Asset Coverage per $1,000 of indebtedness(f) | $ | 5,526 | $ | 9,015 | $ | 6,226 | $ | 5,954 | |||||||

| * | Fiscal year end changed from June 30 to December 31. |

| ** | Commencement of investment operations. |

| (a) | Before deduction of offering expenses charged to capital. |

| (b) | Based on average shares outstanding. |

| (c) | Total investment return is calculated assuming a purchase of a share at the beginning of the period and a sale on the last day of the period reported either at net asset value (NAV) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Fund’s Dividend Reinvestment Plan market value returns. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

| (d) | Annualized. |

| (e) | Portfolio turnover is not annualized for periods of less than one year. |

| (f) | Calculated by subtracting the Fund's total liabilities (not including borrowings) from the Fund’s total assets and dividing by the total borrowings. |

| (g) | Excluding interest expense, the operating expense ratio would be |

| For the | For the Period | |||||||

| Six Months Ended | October 27, 2011** | |||||||

| June 30, 2014 | For the Year Ended | For the Period Ended | through | |||||

| (Unaudited) | December 31, 2013 | December 31, 2012* | June 30, 2012 | |||||

| 1.53 | %(d) | 1.51 | % | 1.54 | %(d) | 1.59 | %(d) | |

See notes to financial statements.

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 21

NOTES TO FINANCIAL STATEMENTS (Unaudited) | June 30, 2014 |

Note 1 – Organization:

Guggenheim Equal Weight Enhanced Equity Income Fund (the “Fund”) was organized as a Delaware statutory trust on July 11, 2011. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund’s investment objective is to provide a high level of risk-adjusted total return with an emphasis on current income. There can be no assurance that the Fund will achieve its investment objective. The Fund’s investment objective is considered fundamental and may not be changed without shareholder approval.

Note 2 – Accounting Policies:

The preparation of the financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

The following is a summary of significant accounting policies consistently followed by the Fund.

(a) Valuation of Investments

The Board of Trustees of the Fund (the “Board”) has adopted policies and procedures for the valuation of the Fund’s investments (the “Valuation Procedures”). Pursuant to the Valuation Procedures, the Board has delegated to a valuation committee, consisting of representatives from Guggenheim’s investment management, fund administration, legal and compliance departments (the “Valuation Committee”), the day-to-day responsibility for implementing the Valuation Procedures, including, under most circumstances, the responsibility for determining the fair value of the Fund’s securities or other assets.

Valuations of the Fund’s securities are supplied primarily by pricing services appointed pursuant to the processes set forth in the Valuation Procedures. The Valuation Committee convenes monthly, or more frequently as needed and will review the valuation of all assets which have been fair valued for reasonableness. The Fund’s officers, through the Valuation Committee and consistent with the monitoring and review responsibilities set forth in the Valuation Procedures, regularly review procedures used by, and valuations provided by, the pricing services.

Equity securities listed on an exchange (New York Stock Exchange (“NYSE”) or American Stock Exchange) are valued at the last quoted sales price as of the close of business on the NYSE, usually 4:00 p.m. on the valuation date. Equity securities listed on the NASDAQ market system are valued at the NASDAQ Official Closing Price on the valuation date, which may not necessarily represent the last sale price. If there has been no sale on such exchange or NASDAQ on such day, the security is valued at the mean of the most recent bid and asked prices on such day.

Open-end investment companies (“Mutual Funds”) are valued at their NAV as of the close of business on the valuation date. Exchange Traded Funds (“ETFs”) and closed-end investment companies are valued at the last quoted sales price.

Exchange traded options are valued between the bid and ask prices on the principal exchange on which they are traded.

Debt securities with a maturity of greater than 60 days at acquisition are valued at prices that reflect broker/dealer supplied valuations or are obtained from independent pricing services, which may consider the trade activity, treasury spreads, yields or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Short-term debt securities with a maturity of 60 days or less at acquisition and repurchase agreements are valued at amortized cost, which approximates market value.

Generally, trading in foreign securities markets is substantially completed each day at various times prior to the close of the NYSE. The values of foreign securities are determined as of the close of such foreign markets or the close of the NYSE, if earlier. All investments quoted in foreign currency are valued in U.S. dollars on the basis of the foreign currency exchange rates prevailing at the close of U.S. business at 4:00 p.m. Investments in foreign securities may involve risks not present in domestic investments.

The Valuation Committee will determine the current value of such foreign securities by taking into consideration certain factors which may include those discussed above, as well as the following factors, among others: the value of the securities traded on other foreign markets, ADR trading, closed-end fund trading, foreign currency exchange activity, and the trading prices of financial products that are tied to foreign securities such as World Equity Benchmark Securities. In addition, under the Valuation Procedures, the Valuation Committee and the Adviser are authorized to use prices and other information supplied by a third party pricing vendor in valuing foreign securities.

Investments for which market quotations are not readily available are fair valued as determined in good faith by Guggenheim Funds Investment Advisors, LLC (“GFIA” or the “Adviser”), subject to review by the Valuation Committee, pursuant to methods established or ratified by the Board. Valuations in accordance with these methods are intended to reflect each security’s (or asset’s) “fair value.” Each such determination is based on a consideration of all relevant factors, which are likely to vary from one pricing context to another. Examples of such factors may include, but are not limited to: (i) the type of security, (ii) the initial cost of the security, (iii) the existence of any contractual restrictions on the security’s disposition, (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies, (v) quotations or evaluated prices from broker-dealers and/or pricing services, (vi) information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange traded securities), (vii) an analysis of the company’s financial statements, and (viii) an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold (e.g. the existence of pending merger activity, public offerings or tender offers that might affect the value of the security).

22 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | June 30, 2014 |

(b) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded net of applicable withholding taxes on the ex-dividend date. Interest income, including the amortization of premiums and accretion of discount, is accrued daily.

(c) Options

The Fund will utilize a call option writing strategy to seek to generate current income and potentially mitigate overall portfolio volatility. The option strategy will include writing (i.e. selling) call options on securities indices, exchange-traded funds that track securities indices, baskets of securities and other instruments, which will include securities that are not held by the Fund.

An option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from (in the case of a call) or sell to (in the case of a put) the writer of the option the security underlying the option at a specific exercise or “strike” price. The writer of an option on a security has an obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price (in the case of a call) or to pay the exercise price upon delivery of the underlying security (in the case of a put). When an option is written, the premium received is recorded as an asset with an equal liability and is subsequently marked to market to reflect the current market value of the option written. These liabilities are reflected as options written in the Statement of Assets and Liabilities. Premiums received from writing options which expire unexercised are recorded on the expiration date as a realized gain. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transactions, as a realized loss. If an option is exercised, the premium is added to the cost of the purchase (in the case of a put) or proceeds from the sale of the underlying security (in case of a call) in determining whether there has been a realized gain or loss.