Exhibit 99.2

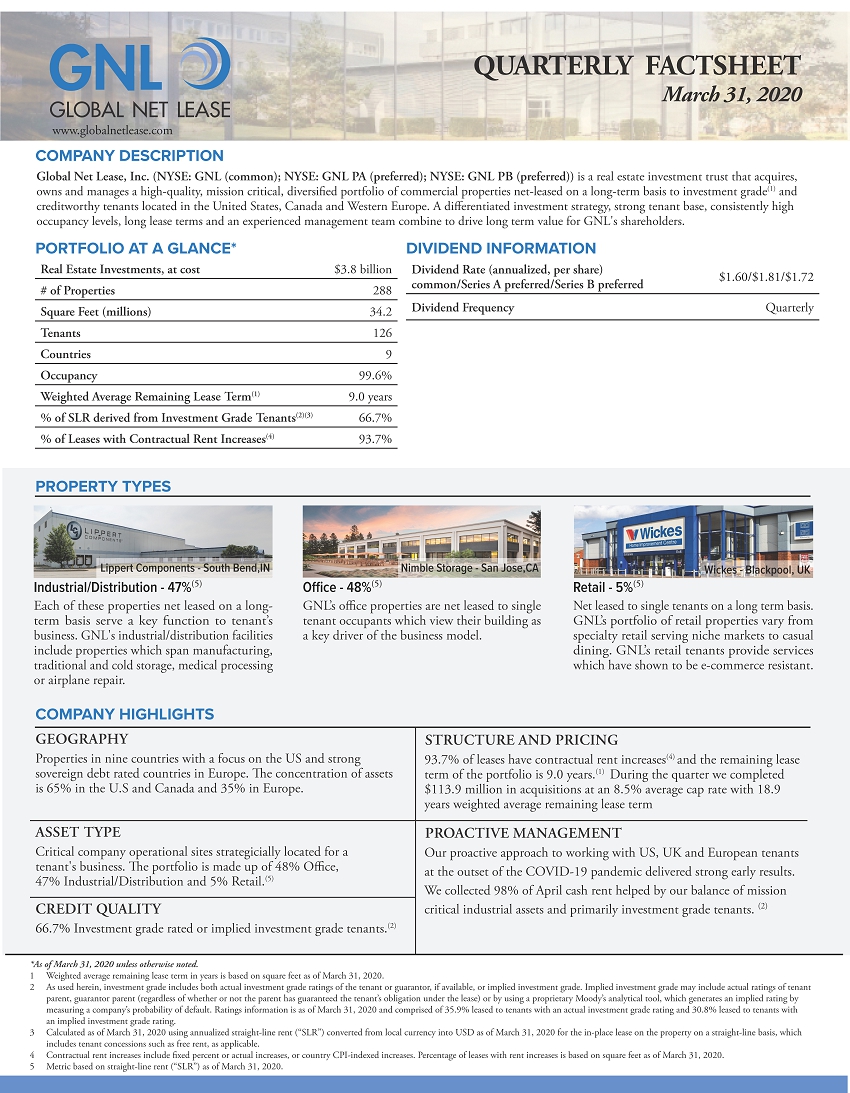

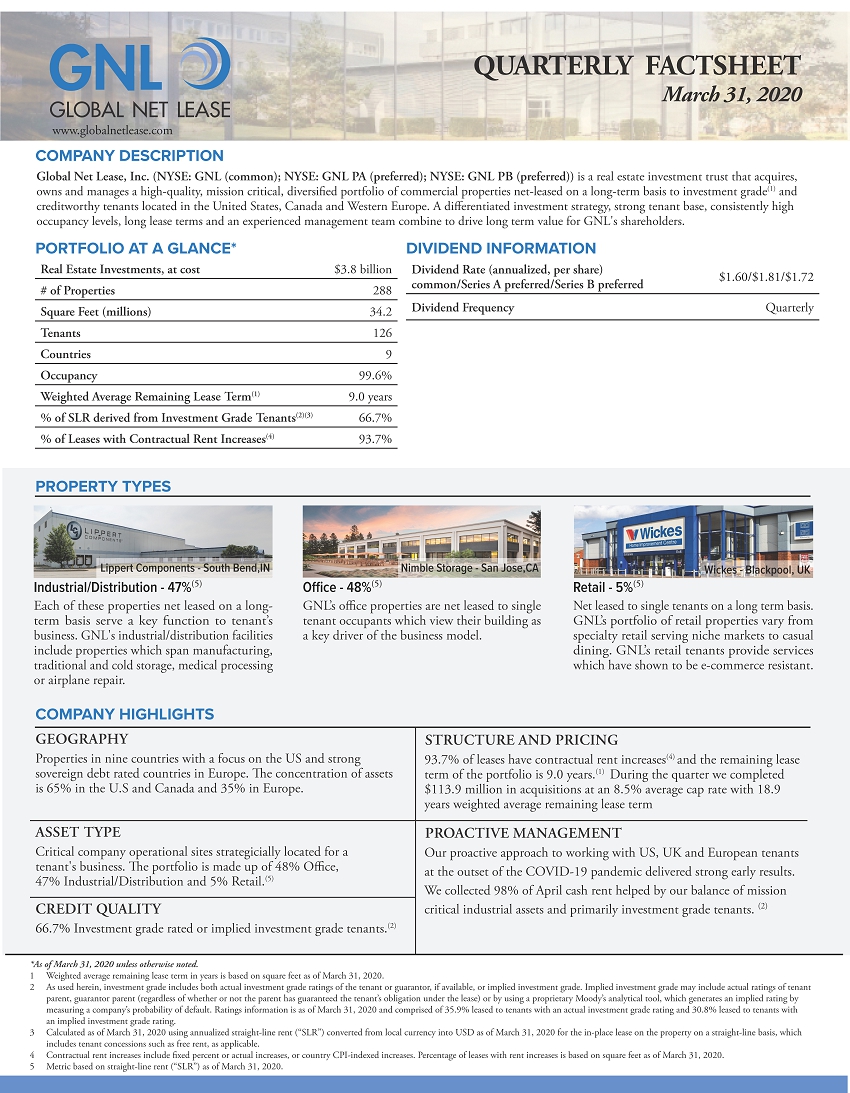

QUARTERLY FACTSHEET March 31, 2020 www.globalnetlease.com COMPANY DESCRIPTION Global Net Lease, Inc. (NYSE: GNL (common); NYSE: GNL PA (preferred); NYSE: GNL PB (preferred)) is a real estate investment trust that acquires, owns and manages a high-quality, mission critical, diversified portfolio of commercial properties net-leased on a long-term basis to investment grade (1) and creditworthy tenants located in the United States, Canada and Western Europe. A differentiated investment strategy, strong tenant base, consistently high occupancy levels, long lease terms and an experienced management team combine to drive long term value for GNL's shareholders. Real Estate Investments, at cost $3.8 billion# of Properties 288 Square Feet (millions) 34.2 Tenants 126 Countries 9 Occupancy 99.6% Weighted Average Remaining Lease Term (1) 9.0 years% of SLR derived from Investment Grade Tenants (2)(3) 66.7%% of Leases with Contractual Rent Increases (4) 93.7%PORTFOLIO AT A GLANCE*DIVIDEND INFORMATION Dividend Rate (annualized, per share) common/Series A preferred/Series B preferred $1.60/$1.81/$1.72 Dividend Frequency Quarterly PROPERTY TYPES Nimble Storage - San Jose,CA Wickes - Blackpool, UK Office - 48% (5) Retail - 5% (5) Industrial/Distribution - 47% (5) Each of these properties net leased on a long-term basis serve a key function to tenant’s business. GNL's industrial/distribution facilities include properties which span manufacturing, traditional and cold storage, medical processing or airplane repair. GNL’s office properties are net leased to single tenant occupants which view their building as a key driver of the business model. Net leased to single tenants on a long term basis. GNL’s portfolio of retail properties vary from specialty retail serving niche markets to casual dining. GNL’s retail tenants provide services which have shown to be e-commerce resistant. COMPANY HIGHLIGHTS GEOGRAPHY Properties in nine countries with a focus on the US and strong sovereign debt rated countries in Europe. The concentration of assets is 65% in the U.S and Canada and 35% in Europe. STRUCTURE AND PRICING 93.7% of leases have contractual rent increases(4) and the remaining lease term of the portfolio is 9.0 years.(1) During the quarter we completed $113.9 million in acquisitions at an 8.5% average cap rate with 18.9 years weighted average remaining lease term ASSET TYPE Critical company operational sites strategicially located for a tenant's business. The portfolio is made up of 48% Office, 47% Industrial/Distribution and 5% Retail. (5) PROACTIVE MANAGEMENT Our proactive approach to working with US, UK and European tenants at the outset of the COVID-19 pandemic delivered strong early results. We collected 98% of April cash rent helped by our balance of mission critical industrial assets and primarily investment grade tenants. (2) CREDIT QUALITY 66.7% Investment grade rated or implied investment grade tenants. (2)*As of March 31, 2020 unless otherwise noted. 1 Weighted average remaining lease term in years is based on square feet as of March 31, 2020. 2 As used herein, investment grade includes both actual investment grade ratings of the tenant or guarantor, if available, or implied investment grade. Implied investment grade may include actual ratings of tenant parent, guarantor parent (regardless of whether or not the parent has guaranteed the tenant’s obligation under the lease) or by using a proprietary Moody’s analytical tool, which generates an implied rating by measuring a company’s probability of default. Ratings information is as of March 31, 2020 and comprised of 35.9% leased to tenants with an actual investment grade rating and 30.8% leased to tenants with an implied investment grade rating. 3 Calculated as of March 31, 2020 using annualized straight-line rent (“SLR”) converted from local currency into USD as of March 31, 2020 for the in-place lease on the property on a straight-line basis, which includes tenant concessions such as free rent, as applicable. 4 Contractual rent increases include fixed percent or actual increases, or country CPI-indexed increases. Percentage of leases with rent increases is based on square feet as of March 31, 2020. 5 Metric based on straight-line rent (“SLR”) as of March 31, 2020.

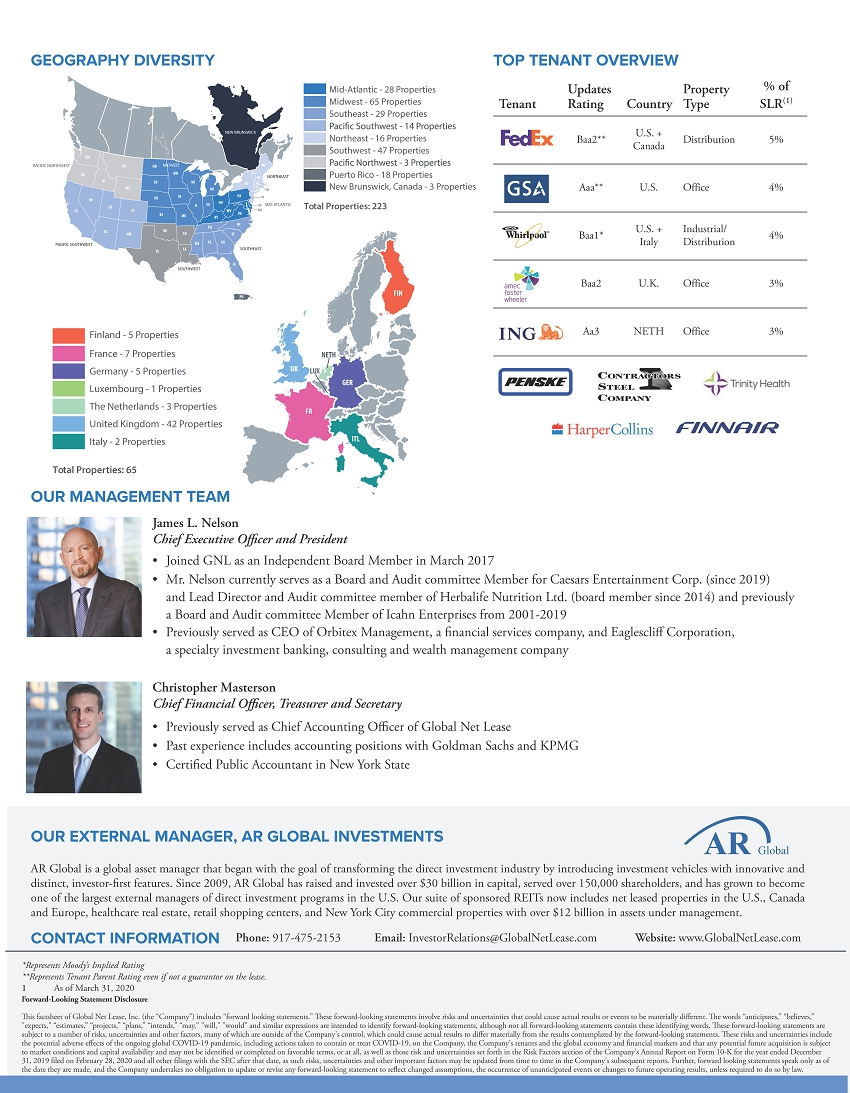

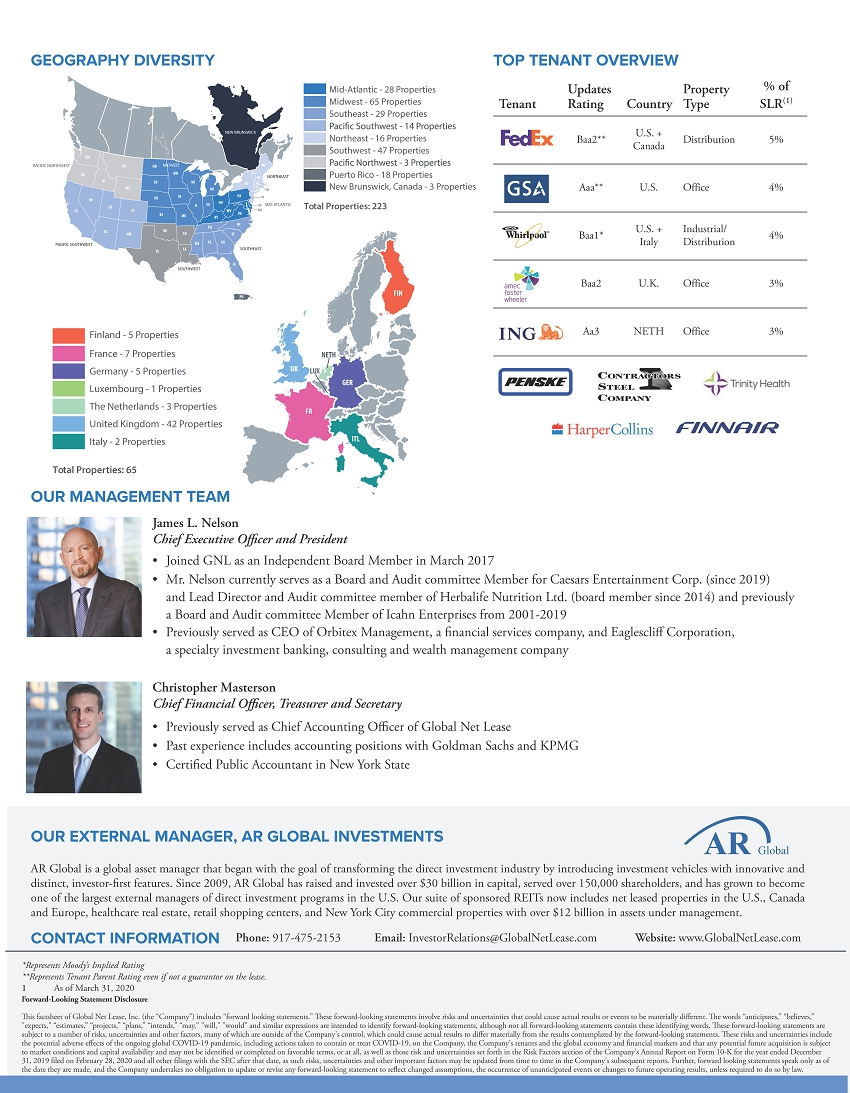

GEOGRAPHY DIVERSITY TOP TENANT OVERVIEW Tenant Updates Rating Country Property Type % of SLR (1) Baa2** U.S. + Canada Distribution 5% Aaa** U.S. Office 4% Baa1* U.S. + Italy Industrial/Distribution 4% Baa2 U.K. Office 3% Aa3 NETH Office 3% OUR MANAGEMENT TEAM James L. Nelson Chief Executive Officer and President• Joined GNL as an Independent Board Member in March 2017 • Mr. Nelson currently serves as a Board and Audit committee Member for Caesars Entertainment Corp. (since 2019) and Lead Director and Audit committee member of Herbalife Nutrition Ltd. (board member since 2014) and previously a Board and Audit committee Member of Icahn Enterprises from 2001-2019 • Previously served as CEO of Orbitex Management, a financial services company, and Eaglescliff Corporation,a specialty investment banking, consulting and wealth management company Christopher Masterson Chief Financial Officer, Treasurer and Secretary• Previously served as Chief Accounting Officer of Global Net Lease• Past experience includes accounting positions with Goldman Sachs and KPMG• Certified Public Accountant in New York State OUR EXTERNAL MANAGER, AR GLOBAL INVESTMENTS AR Global is a global asset manager that began with the goal of transforming the direct investment industry by introducing investment vehicles with innovative and distinct, investor-first features. Since 2009, AR Global has raised and invested over $30 billion in capital, served over 150,000 shareholders, and has grown to become one of the largest external managers of direct investment programs in the U.S. Our suite of sponsored REITs now includes net leased properties in the U.S., Canada and Europe, healthcare real estate, retail shopping centers, and New York City commercial properties with over $12 billion in assets under management. CONTACT INFORMATION Phone: 917-475-2153 Email: InvestorRelations@GlobalNetLease.com Website: www.GlobalNetLease.com* Represents Moody’s Implied Rating **Represents Tenant Parent Rating even if not a guarantor on the lease. 1 As of March 31, 2020 Forward-Looking Statement Disclosure This factsheet of Global Net Lease, Inc. (the “Company”) includes “forward looking statements.” These forward-looking statements involve risks and uncertainties that could cause actual results or events to be materially different. The words “anticipates,” “believes,” "expects," “estimates,” “projects,” “plans,” “intends,” “may," "will," "would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company's control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include the potential adverse effects of the ongoing global COVID-19 pandemic, including actions taken to contain or treat COVID-19, on the Company, the Company's tenants and the global economy and financial markets and that any potential future acquisition is subject to market conditions and capital availability and may not be identified or completed on favorable terms, or at all, as well as those risk and uncertainties set forth in the Risk Factors section of the Company's Annual Report on Form 10-K for the year ended December 31, 2019 filed on February 28, 2020 and all other filings with the SEC after that date, as such risks, uncertainties and other important factors may be updated from time to time in the Company's subsequent reports. Further, forward looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results, unless required to do so by law.