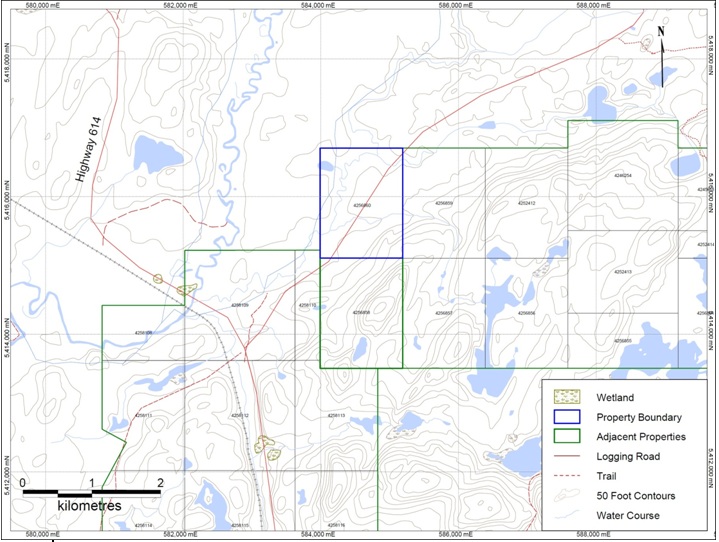

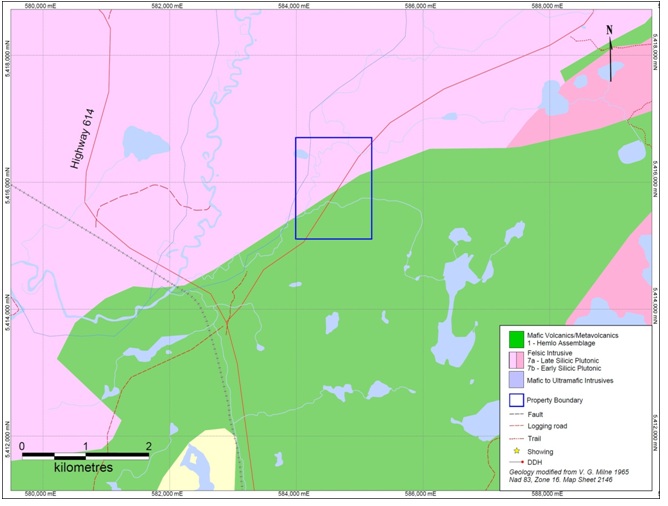

Figure 4: Property Geology

PRESENT PROPERTY CONDITION AND PERMITTING REQUIREMENTS

The Mobert Property has no plant and equipment, infrastructure or other facilities, and there is currently no exploration of the Mobert Property. We have incurred $38,808 in operating costs, and an additional $5,888 in property acquisition, as at June 30, 2011 We expect to incur $94,000 of exploration costs to complete Phases 1, 2 and 3 of our Plan of Operation, with Phase 3 being Positive areas of the Mobert Property being diamond drill tested. There is no source of power or water on the Mobert Property that can be utilized.

Not less than $4,800 must be expended on the Mobert Property prior to September 23, 2012 to keep the claim in good standing for an additional year. No other permits are required for us to perform the exploration activities on the Mobert Property.

CONDITIONS TO RETAIN TITLE TO THE CLAIM

Provincial and Federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with Federal regulations, the Mobert property is in good standing to September 23, 2012. Not less than $4,800 must be expended on the Mobert property prior to September 23, 2012 to keep the claim in good standing for an additional year.

COMPETITIVE CONDITIONS

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are a very early stage mineral exploration company and a very small participant in the mineral exploration business. Being a junior mineral exploration company, we compete with other companies like ours for financing and joint venture partners. Additionally, we compete for resources such as professional geologists, camp staff, helicopters and mineral exploration supplies.

GOVERNMENT APPROVALS AND RECOMMENDATIONS

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in Canada generally, and in Ontario specifically.

COSTS AND EFFECTS OF COMPLIANCE WITH ENVIRONMENTAL LAWS

We currently have no costs to comply with environmental laws concerning our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills. Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended three phases described above. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

EMPLOYEES

We currently have no employees other than our directors. We intend to retain the services of geologists, prospectors and consultants on a contract basis to conduct the exploration programs on our mineral claims and to assist with regulatory compliance and preparation of financial statements.

OUR EXECUTIVE OFFICES

Our executive offices are located at #358 - 315 Place d’Youville, Montreal, Quebec, Canada H2Y 0A4.

LEGAL PROCEEDINGS

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s mineral claim is not the subject of any pending legal proceedings.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

MARKET INFORMATION

ADMISSION TO QUOTATION ON THE OTC BULLETIN BOARD

We intend to have our common stock be quoted on the OTC Bulletin Board. If our securities are not quoted on the OTC Bulletin Board, a security holder may find it more difficult to dispose of, or to obtain accurate quotations as to the market value of our securities. The OTC Bulletin Board differs from national and regional stock exchanges in that it:

(1) is not situated in a single location but operates through communication of bids, offers and confirmations between broker-dealers, and

(2) securities admitted to quotation are offered by one or more Broker-dealers rather than the “specialist” common to stock exchanges.

To qualify for quotation on the OTC Bulletin Board, an equity security must have one registered broker-dealer, known as the market maker, willing to list bid or sale quotations and to sponsor the company listing. We do not yet have an agreement with a registered broker-dealer, as the market maker, willing to list bid or sale quotations and to sponsor the Company listing. If the Company meets the qualifications for quotation securities on the OTC Bulletin Board our securities will be quoted on the OTC Bulletin Board until a future time, if at all, that we apply and qualify for admission to quotation on the NASDAQ Capital Market. We may not now and it may never qualify for quotation on the OTC Bulletin Board or be accepted for listing of our securities on the NASDAQ Capital Market.

We have not retained a transfer agent to serve as transfer agent for shares of our common stock. Until we engage such a transfer agent, we will be responsible for all record-keeping and administrative functions in connection with the shares of our common stock.

HOLDERS

As of October 25 , 2011, the Company had 6,750,000 shares of our common stock issued and outstanding held by 39 holders of record.

The selling stockholders are offering hereby up to 1,750,000 shares of common stock at a price of $0.10 per share.

DIVIDEND POLICY

We have not declared or paid dividends on our common stock since our formation, and we do not anticipate paying dividends in the foreseeable future. Declaration or payment of dividends, if any, in the future, will be at the discretion of our Board of Directors and will depend on our then current financial condition, results of operations, capital requirements and other factors deemed relevant by the Board of Directors. There are no contractual restrictions on our ability to declare or pay dividends. See the Risk Factor entitled “ BECAUSE WE DO NOT INTEND TO PAY ANY CASH DIVIDENDS ON OUR COMMON STOCK, OUR STOCKHOLDERS WILL NOT BE ABLE TO RECEIVE A RETURN ON THEIR SHARES UNLESS THEY SELL THEM.” on page 11.

SECURITIES AUTHORIZED UNDER EQUITY COMPENSATION PLANS

We have no equity compensation or stock option plans. We may in the future adopt a stock option plan as our mineral exploration activities progress.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATION

Certain statements contained in this prospectus, including statements regarding the anticipated development and expansion of our business, our intent, belief or current expectations, primarily with respect to the future operating performance of the Company and the products we expect to offer and other statements contained herein regarding matters that are not historical facts, are “forward-looking” statements. Future filings with the Securities and Exchange Commission, future press releases and future oral or written statements made by us or with our approval, which are not statements of historical fact, may contain forward-looking statements, because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements.

All forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made.

PLAN OF OPERATION

Our plan of operation for the twelve months following the date of this prospectus is to complete the first and second phases of the three phased exploration program on our claim. In addition to the $19,000 we anticipate spending for the first two phases of the exploration program as outlined below, we anticipate spending an additional $16,000 on general and administration expenses including fees payable in connection with the filing of our registration statement and complying with reporting obligations, and general administrative costs. Total expenditures over the next 12 months are therefore expected to be approximately $35,000. If we experience a shortage of funds prior to funding we may utilize funds from our directors, however they have no formal commitment, arrangement or legal obligation to advance or loan funds to the company.

Phase 1: Localized soil surveys, trenching and sampling over known and indicated mineralized zones.

Phase 2: VLF-EM and magnetometer surveys.

Phase 3: Positive areas will need to be diamond drill tested. The amount of drilling will depend on the success of phase 1 and 2.

BUDGET

| | | $ | |

| Phase 1 | | | 7,000 | |

| Phase 2 | | | 12,000 | |

| Phase 3 | | | 75,000 | |

| Total | | | 94,000 | |

We plan to commence Phase 1 of the exploration program on the claim in spring 2012. We expect this phase to take two weeks to complete and an additional one to two months for the geologist to prepare his report.

The above program costs are management's estimates based upon the recommendations of the professional geologist's report and the actual project costs may exceed our estimates. To date, we have not commenced exploration.

Following phase one of the exploration program, if it proves successful in identifying mineral deposits, we intend to proceed with phase two of our exploration program. Subject to the results of phase 1, we anticipate commencing with phase 2 in summer 2012. We will require additional funding to proceed with phase 3 work on the claim; we have no current plans on how to raise the additional funding. We cannot provide any assurance that we will be able to raise sufficient funds to proceed with any work after the first two phases of the exploration program.

ACCOUNTING AND AUDIT PLAN

We intend to continue to have our Chief Financial Officer prepare our quarterly and annual financial statements and have these financial statements reviewed or audited by our independent auditor. Our independent auditor is expected to charge us approximately $1,500 to review our quarterly financial statements and approximately $5,000 to audit our annual financial statements. In the next twelve months, we anticipate spending approximately $11,000 pay for our accounting and audit requirements.

SEC FILING PLAN

We will be required to file annual and periodic reports subsequent to the effectiveness of this Form S-1. This means that we will file documents with the United States Securities and Exchange Commission.

We expect to incur filing costs of approximately $1,000 per quarter to support our quarterly and annual filings. In the next twelve months, we anticipate spending approximately $ 5 ,000 for legal costs in connection with our three quarterly filings, annual filing, and costs associated with filing the registration statement to register our common stock.

RESULTS OF OPERATIONS

We have had no operating revenues since our inception on September 14, 2009, through June 30, 2011. Our activities have been financed from the proceeds of share subscriptions. From our inception to June 30, 2011 we have raised a total of $47,500 from private offerings of our common stock. All such private offerings were made in reliance on the exemption from registration afforded by Rule 903(b)(3) of Regulation S, promulgated pursuant to the Securities Act of 1933, as amended. The Company made all offers and sales offshore of the US, to non-US persons, with no directed selling efforts in the US, and offering restrictions were implemented.

For the period from September 14, 2009 (inception) to June 30, 2011, we incurred expenses of $38,808, consisting of general and administrative expenses and management fees and rent. For the year ended June 30, 2011 and the period from June 14, 2009 (inception) to June 30, 2010 we incurred expenses of $25,288 and $13,520, respectively. This increase was the result of professional fees, management fees and rent.

LIQUIDITY AND CAPITAL RESOURCES

At June 30, 2011, we had a cash balance of $39,379. We believe that we have enough cash on hand to complete Phases 1 and 2 of our exploration program. If the results of the Phases 1 and 2 are particularly encouraging, we may wish to raise additional funds for a more in depth Phase 3. Additional funds will need to be raised to support work that may be undertaken subsequent to Phase 3.

If additional funds become required, the additional funding will likely come from equity financing from the sale of our common stock or sale of part of our interest in our mineral claims. If we are successful in completing an equity financing, existing shareholders will experience dilution of their interest in our Company. We do not have any financing arranged and we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our exploration activities. In the absence of such financing, our business will fail.

There are no assurances that we will be able to achieve further sales of our common stock or any other form of additional financing. If we are unable to achieve the financing necessary to continue our plan of operations, then we will not be able to continue our exploration of the Claims and our business will fail.

At June 30, 2011, we had a cash balance of $39,379. For the year ended June 30, 2011, $2,233 in cash was used in operating activities.

GOING CONCERN CONSIDERATION

We have not generated any revenues since inception. As of June 30, 2011, the Company had accumulated losses of $38,808. Our independent auditors included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors. Our financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

OFF BALANCE SHEET ARRANGEMENTS.

We have no off-balance sheet arrangements including arrangements that would affect our liquidity, capital resources, market risk support and credit risk support or other benefits.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The Company’s financial statements are prepared using the accrual method of accounting and are presented in United States Dollars.

Basic Earnings (loss) per Share

The Company computes net income (loss) per share in accordance with ASC 260, Earnings per Share. ASC 260 specifies the computation, presentation and disclosure requirements for earnings (loss) per share for entities with publicly held common stock.

Basic net earnings (loss) per share amounts are computed by dividing the net earnings (loss) by the weighted average number of common shares outstanding. Diluted earnings (loss) per share are the same as basic earnings (loss) per share due to the lack of dilutive items in the Company.

Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents.

Mineral Property Costs

The Company has been in the exploration stage since its formation on September 14, 2009 and has not yet realized any revenues from its planned operations. All exploration expenditures are expensed as incurred. Costs of acquisition and option costs of mineral rights are capitalized upon acquisition. Mine development costs incurred to develop new ore deposits, to expand the capacity of mines, or to develop mine areas substantially in advance of current production are also capitalized once proven and probable reserves exist and the property is a commercially mineable property. Costs incurred to maintain current production or to maintain assets on a standby basis are charged to operations. If the Company does not continue with exploration after the completion of the feasibility study, the mineral rights will be expensed at that time. Costs of abandoned projects are charged to mining costs including related property and equipment costs. To determine if these costs are in excess of their recoverable amount periodic evaluation of carrying value of capitalized costs and any related property and equipment costs are based upon expected future cash flows and/or estimated salvage value in accordance with Accounting Standards Codification (ASC) 360, Property, Plant and Equipment.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Due to the limited level of operations, the Company has not had to make material assumptions or estimates other than the assumption that the Company is a going concern.

Income Taxes

Income taxes are provided in accordance with ASC 740, Income Taxes. A deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and net operating loss carry forwards. Deferred tax expense (benefit) results from the net change during the year of deferred tax assets and liabilities.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Foreign Currency Translation

The Company’s functional and reporting currency is the United States dollar. Occasional transactions may occur in Canadian dollars. Monetary assets and liabilities denominated in foreign currencies are translated using the exchange rate prevailing at the balance sheet date. Non-monetary assets and liabilities enominated in foreign currencies are translated at rates of exchange in effect at the date of the transaction. Average monthly rates are used to translate expenses. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of net income (loss).

Fair Value of Financial Instruments

The carrying amount of cash and current liabilities approximates fair value due to the short maturity of these instruments. These fair value estimates are subjective in nature and involve uncertainties and matters of significant judgement and therefore cannot be determined with precision. Unless otherwise noted, it is management’s opinion the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments.

Environmental Costs

Environmental expenditures that relate to current operations are expensed or capitalized as appropriate. Expenditures that relate to an existing condition caused by past operations and which do not contribute to current or future revenue generation are expensed. Liabilities are recorded when environmental assessments and/or remedial efforts are probable and the cost can be reasonably estimated. Generally, the timing of these accruals coincides with the earlier of completion of a feasibility study of the Company’s commitments to plan of action based on the then known facts.

Stock Based Compensation

The Company records stock-based compensation using the fair value method of valuing stock options and other equity-based compensation issued. The Company has not granted any stock options since its inception. Accordingly, no stock-based compensation has been recorded.

Start-Up expenses

As a start-up company, the costs associated with start-up activities are expensed as incurred. Accordingly, start-up costs associated with the Company’s formation have been included in the Company’s general and administrative expenses for the period from September 14, 2009 (inception) through June 30, 2011.

Recent Accounting Pronouncements

In February 2010, the FASB issued ASU No. 2010-09 which is included in the Codification under

ASC 855, Subsequent Events (“ASC 855”). This update removes the requirement for an SEC filer to disclose the date through which subsequent events have been evaluated and became effective for interim and annual reporting periods beginning January 1, 2010. The adoption of this guidance did not have a material impact on the Company’s financial statements.

In January 2010, the FASB issued ASU No. 2010-06, which is included in the Codification under ASC 820, Fair Value Measurements and Disclosures (“ASC 820”). This update requires the disclosure of transfers between the observable input categories and activity in the unobservable input category for fair value measurements. The guidance also requires disclosures about the inputs and valuation techniques used to measure fair value and became effective for interim and annual reporting periods beginning January 1, 2010. The adoption of this guidance did not have a material impact on the Company’s financial statements.

FASB Accounting Standards Codification — Effective for interim and annual periods ending after September 15, 2009, the FASB has defined a new hierarchy for U.S. GAAP and established the FASB Accounting Standards Codification (ASC) as the sole source for authoritative guidance to be applied by nongovernmental entities. The adoption of the ASC changes the manner in which U.S. GAAP guidance is referenced, but it does not have any impact on our financial position or results of operations

In August 2009, the FASB issued ASU No. 2009-05, “Measuring Liabilities at Fair Value,” or ASU 2009-05, which amends ASC 820 to provide clarification of a circumstances in which a quoted price in an active market for an identical liability is not available. A reporting entity is required to measure fair value using one or more of the following methods: 1) a valuation technique that uses a) the quoted price of the identical liability when traded as an asset or b) quoted prices for similar liabilities (or similar liabilities when traded as assets) and/or 2) a valuation technique that is consistent with the principles of ASC 820. ASU 2009-05 also clarifies that when estimating the fair value of a liability, a reporting entity is not required to adjust to include inputs relating to the existence of transfer restrictions on that liability. The adoption of this ASU did not have an impact on the Company’s consolidated financial statements.

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

The Directors and Officers currently serving our Company is as follows:

| Name | | Age | | Positions and Offices |

| | | | | |

| Mr. Edward Hayes (1) | | 62 | | President, Chief Executive Officer, Treasurer and Director |

| | | | | |

| Ms. Linda Lamb (1) | | 60 | | Secretary, Treasurer & Director |

(1) c/o Cassidy Ventures Inc., #358 - 315 Place d’Youville, Montreal, Quebec, Canada H2Y 0A4.

The directors named above will serve until the next annual meeting of the stockholders or until their respective resignation or removal from office. Thereafter, directors are anticipated to be elected for one-year terms at the annual stockholders’ meeting. Officers will hold their positions at the pleasure of the Board of Directors, absent any employment agreement, of which none currently exists or is contemplated.

EDWARD HAYES, AGE 62

Mr. Hayes has served as our President and a Director since July 30, 2010. Since 1971, Mr. Hayes has been self-employed as a prospector. Additionally, from 1989 until 1997, Mr. Hayes was a consulting partner at CME Consulting Inc., a company which provides mining project management and mineral exportation services. During his time at CME Consulting, he consulted primarily on mining projects in Africa. Mr. Hayes’s 40 years of experience in the mining industry led to our conclusion that he should be serving as a member of our Board of Directors.

LINDA LAMB, AGE 60

Ms. Lamb has served as our Secretary, Treasurer and a Director since our inception on September 14, 2009. She also served as our President from our inception on September 14, 2009 until July 30, 2010. In 2006, Ms. Lamb retired from a career as a controller in the Personnel Department at Bell Canada, where she worked from 1998 until 2006. In 1985, Ms. Lamb received her Bachelor of Science degree from the University of Toronto. Ms. Lamb’s background as a controller and her desire to work in the mining industry and work with Mr. Hayes led to our conclusion that she should be serving as a member of our Board of Directors.

DIRECTOR INDEPENDENCE

Our board of directors is currently composed of two members, neither of whom qualifies as an independent director in accordance with the published listing requirements of the NASDAQ Global Market. The NASDAQ independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director, nor any of his family members has engaged in various types of business dealings with us. In addition, our board of directors has not made a subjective determination as to each director that no relationships exist which, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, though such subjective determination is required by the NASDAQ rules. Had our board of directors made these determinations, our board of directors would have reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management.

SIGNIFICANT EMPLOYEES AND CONSULTANTS

Other than our officers and directors, we currently have no other significant employees.

CONFLICTS OF INTEREST

Since we do not have an audit or compensation committee comprised of independent directors, the functions that would have been performed by such committees are performed by our directors. The Board of Directors has not established an audit committee and does not have an audit committee financial expert, nor has the Board established a nominating committee. The Board is of the opinion that such committees are not necessary since the Company is an early exploration stage company and has only two directors, and to date, such directors have been performing the functions of such committees. Thus, there is a potential conflict of interest in that our directors and officers have the authority to determine issues concerning management compensation, nominations, and audit issues that may affect management decisions.

There are no family relationships among our directors or officers. Other than as described above, we are not aware of any other conflicts of interest with any of our executive officers or directors.

INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS

No director, person nominated to become a director, executive officer, promoter or control person of our company has, during the last ten years: (i) been convicted in or is currently subject to a pending a criminal proceeding (excluding traffic violations and other minor offenses); (ii) been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to any federal or state securities or banking or commodities laws including, without limitation, in any way limiting involvement in any business activity, or finding any violation with respect to such law, nor (iii) any bankruptcy petition been filed by or against the business of which such person was an executive officer or a general partner, whether at the time of the bankruptcy or for the two years prior thereto.

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

The table below summarizes all compensation awarded to, earned by, or paid to our Officers for all services rendered in all capacities to us for the fiscal periods indicated.

| | | | | | | | | | | | | | | | | Non-Equity | | | | | | | | | | |

| Name and | | | | | | | | | | | | | | | | Incentive | | | Nonqualified | | | | | | | |

| Principal | | | | | | | | | | Stock | | | Option | | | Plan | | | Deferred | | | All Other | | | | |

| Position | | Year | | Salary($) | | | Bonus($) | | | Awards($) | | | Awards($) | | | Compensation($) | | | Compensation($) | | | Compensation($) | | | Total($) | |

| Edward Hayes (1) | | 2011 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | | 2010 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Linda Lamb (2) | | 2011 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | | 2010 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

______________

(1) President and a Director.

(2) Secretary, Treasurer and a Director.

None of our directors have received monetary compensation since our inception to the date of this prospectus. We currently do not pay any compensation to our directors serving on our board of directors.

STOCK OPTION GRANTS

We have not granted any stock options to the executive officers since our inception. Upon the further development of our business, we will likely grant options to directors and officers consistent with industry standards for junior mineral exploration companies.

EMPLOYMENT AGREEMENTS

The Company is not a party to any employment agreement and has no compensation agreement with any of its officers and directors.

DIRECTOR COMPENSATION

The following table sets forth director compensation as of June 30, 2011:

| | | Fees | | | | | | | | | Non-Equity | | | Nonqualified | | | | | | | |

| | | Earned | | | | | | | | | Incentive | | | Deferred | | | | | | | |

| | | Paid in | | | Stock | | | Option | | | Plan | | | Compensation | | | All Other | | | | |

| Name | | Cash($) | | | Awards($) | | | Awards($) | | | Compensation($) | | | Earnings($) | | | Compensation($) | | | Total($) | |

| Edward Hayes | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Linda Lamb | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table lists, as of October 25 , 2011, the number of shares of common stock of our Company that are beneficially owned by (i) each person or entity known to our Company to be the beneficial owner of more than 5% of the outstanding common stock; (ii) each officer and director of our Company; and (iii) all officers and directors as a group. Information relating to beneficial ownership of common stock by our principal shareholders and management is based upon information furnished by each person using “beneficial ownership” concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

The percentages below are calculated based on 6,750,000 shares of our common stock issued and outstanding as of October 25 , 2011. We do not have any outstanding warrant, options or other securities exercisable for or convertible into shares of our common stock.

| | | Name and Address | | Number of Shares | | | | |

| Title of Class | | of Beneficial Owner | | Owned Beneficially | | | Percent of Class Owned | |

| | | | | | | | | |

| Common Stock: | | Mr. Edward Hayes, President and Director | | | 2,500,000 | | | | 37 | % |

| | | Director (1) | | | | | | | | |

| | | | | | | | | | | |

| Common Stock: | | Ms. Linda Lamb, Secretary, Treasurer and | | | 2,500,000 | | | | 37 | % |

| | | Director (1) | | | | | | | | |

| | | | | | | | | | | |

| All executive officers and directors as a group | | | | | 5,000,000 | | | | 74 | % |

___________

| (1) | c/o Cassidy Ventures Inc., #358 - 315 Place d’Youville, Montreal, Quebec, Canada H2Y 0A4. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In October 2009, we offered and sold 2,500,000 shares of common stock to each of Edward Hayes and Linda Lamb, both officers and directors of the Company, at a purchase price of $0.001 per share, for aggregate proceeds of $5,000. The offering was made to non-U.S. persons, offshore of the U.S., with no directed selling efforts in the U.S., where offering restrictions were implemented in a transaction pursuant to the exclusion from registration provided by Rule 903(b)(3) of Regulation S of the Securities Act of 1933, as amended (the “Securities Act”).

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITIES

Our By-laws provide to the fullest extent permitted by law that our directors or officers, former directors and officers, and persons who act at our request as a director or officer of a body corporate of which we are a shareholder or creditor shall be indemnified by us. We believe that the indemnification provisions in our By-laws are necessary to attract and retain qualified persons as directors and officers.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers or persons controlling the Company pursuant to provisions of the State of Nevada, the Company has been informed that, in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Commission a Registration Statement on Form S-1, under the Securities Act of 1933, as amended, with respect to the securities offered by this prospectus. This prospectus, which forms a part of the registration statement, does not contain all the information set forth in the registration statement, as permitted by the rules and regulations of the Commission. For further information with respect to us and the securities offered by this prospectus, reference is made to the registration statement. We do not file reports with the Securities and Exchange Commission, and we will not otherwise be subject to the proxy rules. The registration statement and other information may be read and copied at the Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains a web site at http://www.sec.gov that contains reports and other information regarding issuers that file electronically with the Commission.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

LBB & Associates Ltd., LLP, Certified Public Accountants is our registered independent auditor. There have not been any changes in or disagreements with accountants on accounting and financial disclosure or any other matter.

CASSIDY VENTURES INC.

INDEX TO FINANCIAL STATEMENTS

| Report of Independent Registered Public Accounting Firm | | | F-2 | |

| | | | | |

| | | F-3 | |

| | | | | |

| Balance Sheets | | | F-3 | |

| | | | | |

| Statements of Operations | | | F-4 | |

| | | | | |

| Statements of Stockholders’ Equity | | | F-5 | |

| | | | | |

| Statements of Cash Flows | | | F-6 | |

| | | | | |

| Notes to Financial Statements | | | F-7 | |

LBB & ASSOCIATES LTD., LLP

10260 Westheimer Road, Suite 310

Houston, TX 77042

Phone: (713) 800-4343 Fax: (713) 456-2408

Report of Independent Registered Public Accounting Firm

To the Board of Directors of

Cassidy Ventures, Inc.

(An Exploration Stage Company)

Carson City, Nevada

We have audited the accompanying balance sheets of Cassidy Ventures, Inc. (the “Company”) as of June 30, 2011 and 2010, and the related statements of operations, stockholders' equity, and cash flows for the year ended June 30, 2011 and the periods from September 14, 2009 (Inception) through June 30, 2011 and 2010. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Cassidy Ventures, Inc. as of June 30, 2011 and 2010, and the results of its operations and its cash flows for the year ended June 30, 2011 and the periods from September 13, 2009 (Inception) through June 30, 2011 and 2010 in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 3 to the financial statements, the Company's absence of significant revenues, recurring losses from operations, and its need for additional financing in order to fund its projected loss in 2012 raise substantial doubt about its ability to continue as a going concern. The 2011 financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ LBB & Associates Ltd., LLP

LBB & Associates Ltd., LLP

Houston, Texas

September 19, 2011

| CASSIDY VENTURES INC. |

| (An Exploration Stage Company) |

| Balance Sheets |

| |

| | | | | | | |

| | | June 30, 2011 | | | June 30, 2010 | |

| | | | | | | |

| | | | | | | |

| ASSETS |

| | | | | | | |

| Current Assets | | | | | | |

| Cash and cash equivalents | | $ | 39,379 | | | $ | 47,480 | |

| Total current assets | | | 39,379 | | | | 47,480 | |

| Other Assets | | | | | | | | |

| Mining Claim | | | 5,888 | | | | - | |

| Total other assets | | | 5,888 | | | | - | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 45,267 | | | $ | 47,480 | |

| | | | | | | | | |

| | | | | | | | | |

| LIABILITIES & STOCKHOLDERS' EQUITY |

| | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Accounts payable | | $ | 5,055 | | | $ | - | |

| Loan from shareholder | | | 20 | | | | - | |

| Total current liabilities | | | 5,075 | | | | - | |

| | | | | | | | | |

| TOTAL LIABILITIES | | $ | 5,075 | | | $ | - | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Common stock, ($0.001 par value, 75,000,000 shares | | | | | | | | |

| authorized; 6,750,000 shares issued and outstanding at | | | | | | | | |

| June 30, 2011 and June 30, 2010 respectively | | | 6,750 | | | | 6,750 | |

| Additional paid-in capital | | | 72,250 | | | | 54,250 | |

| Deficit accumulated during exploration stage | | | (38,808 | ) | | | (13,520 | ) |

| TOTAL STOCKHOLDERS' EQUITY | | | 40,192 | | | | 47,480 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL LIABILITITES & STOCKHOLDERS' EQUITY | | $ | 45,267 | | | $ | 47,480 | |

See notes to financial statements

| CASSIDY VENTURES INC. | |

| (An Exploration Stage Company) | |

| Statements of Operations | |

| | | | | | | | | | |

| | | | | | Inception | | | Inception | |

| | | | | | September 14, 2009 | | | September 14, 2009 | |

| | | Year Ended | | | Through | | | Through | |

| | | June 30, 2011 | | | June 30, 2010 | | | June 30, 2011 | |

| | | | | | | | | | |

| Operating Costs | | | | | | | | | |

| | | | | | | | | | |

| Management Fees and Rent | | $ | 18,000 | | | $ | 13,500 | | | $ | 31,500 | |

| General and Administative | | | 7,288 | | | | 20 | | | | 7,308 | |

| | | | | | | | | | | | | |

| Total Operating Costs | | | 25,288 | | | | 13,520 | | | | 38,808 | |

| | | | | | | | | | | | | |

| Net Loss | | $ | (25,288 | ) | | $ | (13,520 | ) | | $ | (38,808 | ) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Basic and diluted earnings per share | | $ | (0.00 | ) | | $ | (0.00 | ) | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Weighted average number of | | | | | | | | | | | | |

| common shares outstanding, basic and diluted | | | 6,750,000 | | | | 4,223,836 | | | | | |

See notes to financial statements

CASSIDY VENTURES INC.

(An Exploration Stage Company)

| | | | | | | | | | | | Deficit | | | | |

| | | | | | Common | | | | | | Accumulated | | | | |

| | | Common | | | Stock | | | Additional | | | During | | | | |

| | | Stock | | | Amount | | | Paid-in Capital | | | Exploration Stage | | | Total | |

| | | | | | | | | | | | | | | | |

| Stock issued to founders for cash | | | 5,000,000 | | | $ | 5,000 | | | $ | - | | | $ | - | | | $ | 5,000 | |

| Stock issued for cash | | | 1,750,000 | | | | 1,750 | | | | 40,750 | | | | - | | | | 42,500 | |

| Donated services | | | - | | | | - | | | | 13,500 | | | | - | | | | 13,500 | |

| Net loss | | | - | | | | - | | | | - | | | | (13,520 | ) | | | (13,520 | ) |

| Balance, June 30, 2010 | | | 6,750,000 | | | | 6,750 | | | | 54,250 | | | | (13,520 | ) | | | 47,480 | |

| Donated services | | | - | | | | - | | | | 18,000 | | | | - | | | | 18,000 | |

| Net loss | | | - | | | | - | | | | - | | | | (25,288 | ) | | | (25,288 | ) |

| Balance, June 30, 2011 | | | 6,750,000 | | | $ | 6,750 | | | $ | 72,250 | | | $ | (38,808 | ) | | $ | 40,192 | |

See notes to financial statements

| |

| (An Exploration Stage Company) | |

| Statements of Cash Flows | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | Inception | | | Inception | |

| | | | | | September 14, 2009 | | | September 14, 2009 | |

| | | Year Ended | | | Through | | | Through | |

| | | June 30, 2011 | | | June 30, 2010 | | | June 30, 2011 | |

| | | | | | | | | | |

| | | | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | |

| Net loss | | $ | (25,288 | ) | | $ | (13,520 | ) | | $ | (38,808 | ) |

| Adjustments to reconcile net loss to net cash | | | | | | | | | | | | |

| provided by (used in) operating activities: | | | | | | | | | | | | |

| Donated services | | | 18,000 | | | | 13,500 | | | | 31,500 | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | |

| Accounts payable | | | 5,055 | | | | - | | | | 5,055 | |

| Net cash used in operating activities | | | (2,233 | ) | | | (20 | ) | | | (2,253 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Acquisition of mining claim | | | (5,888 | ) | | | - | | | | (5,888 | ) |

| Net cash used in investing activities | | | (5,888 | ) | | | - | | | | (5,888 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | | | | |

| Proceeds from shareholder loans | | | 20 | | | | - | | | | 20 | |

| Issuance of common stock for cash | | | - | | | | 47,500 | | | | 47,500 | |

| | | | | | | | | | | | | |

| Net cash provided by financing activities | | | 20 | | | | 47,500 | | | | 47,520 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net change in cash | | | (8,101 | ) | | | 47,480 | | | | 39,379 | |

| | | | | | | | | | | | | |

| Cash and cash equivalents at beginning of period | | | 47,480 | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Cash and cash equivalents at end of period | | $ | 39,379 | | | $ | 47,480 | | | $ | 39,379 | |

| | | | | | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | | | | | | | | | |

| | | | | | | | | | | | | |

| Cash paid for : | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Interest | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | |

| Income Taxes | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | |

See notes to financial statements

Cassidy Ventures, Inc.

(An Exploration Stage Company)

Notes to Financial Statements

June 30, 2011 and 2010

NOTE 1 ORGANIZATION AND DESCRIPTION OF BUSINESS

Cassidy Ventures, Inc. (the “Company”) was incorporated in the State of Nevada on September 14,, 2009, and its year-end is June 30. The Company is “An Exploration Stage Company” as defined by Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 918, Development Stage Entities. The Company has acquired mineral properties located in the Thunder Bay mining district, Province of Ontario, Canada but has not yet determined whether these properties contain reserves that are economically recoverable. The recoverability of costs incurred for acquisition and exploration of the properties will be dependent upon the discovery of economically recoverable reserves, confirmation of the Company’s interest in the underlying properties, the ability of the Company to obtain necessary financing to satisfy the expenditure requirements and to complete the development of the properties and upon future profitable production or proceeds from the sale thereof.

NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The Company’s financial statements are prepared using the accrual method of accounting and are presented in United States Dollars.

Basic Earnings (loss) per Share

The Company computes net income (loss) per share in accordance with ASC 260, Earnings per Share. ASC 260 specifies the computation, presentation and disclosure requirements for earnings (loss) per share for entities with publicly held common stock.

Basic net earnings (loss) per share amounts are computed by dividing the net earnings (loss) by the weighted average number of common shares outstanding. Diluted earnings (loss) per share are the same as basic earnings (loss) per share due to the lack of dilutive items in the Company.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents.

Cassidy Ventures, Inc.

(An Exploration Stage Company)

Notes to Financial Statements

June 30, 2011 and 2010

NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Mineral Property Costs

The Company has been in the exploration stage since its formation on September 14, 2009 and has not yet realized any revenues from its planned operations. All exploration expenditures are expensed as incurred. Costs of acquisition and option costs of mineral rights are capitalized upon acquisition. Mine development costs incurred to develop new ore deposits, to expand the capacity of mines, or to develop mine areas substantially in advance of current production are also capitalized once proven and probable reserves exist and the property is a commercially mineable property. Costs incurred to maintain current production or to maintain assets on a standby basis are charged to operations. If the Company does not continue with exploration after the completion of the feasibility study, the mineral rights will be expensed at that time. Costs of abandoned projects are charged to mining costs including related property and equipment costs. To determine if these costs are in excess of their recoverable amount periodic evaluation of carrying value of capitalized costs and any related property and equipment costs are based upon expected future cash flows and/or estimated salvage value in accordance with Accounting Standards Codification (ASC) 360 Property, Plant and Equipment.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Due to the limited level of operations, the Company has not had to make material assumptions or estimates other than the assumption that the Company is a going concern.

Income Taxes

Income taxes are provided in accordance with ASC 740, Income Taxes. A deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and net operating loss carry forwards. Deferred tax expense (benefit) results from the net change during the year of deferred tax assets and liabilities.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Cassidy Ventures, Inc.

(An Exploration Stage Company)

Notes to Financial Statements

June 30, 2011 and 2010

NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Foreign Currency Translation

The Company’s functional and reporting currency is the United States dollar. Occasional

transactions may occur in Canadian dollars. Monetary assets and liabilities denominated in foreign currencies are translated using the exchange rate prevailing at the balance sheet date. Non-monetary assets and liabilities denominated in foreign currencies are translated at rates of exchange in effect at the date of the transaction. Average monthly rates are used to translate expenses. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of net income (loss).

Fair Value of Financial Instruments

The carrying amount of cash and current liabilities approximates fair value due to the short maturity of these instruments. These fair value estimates are subjective in nature and involve uncertainties and matters of significant judgement and therefore cannot be determined with precision. Unless otherwise noted, it is management’s opinion the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments.

Environmental Costs

Environmental expenditures that relate to current operations are expensed or capitalized as appropriate. Expenditures that relate to an existing condition caused by past operations and which do not contribute to current or future revenue generation are expensed. Liabilities are recorded when environmental assessments and/or remedial efforts are probable and the cost can be reasonably estimated. Generally, the timing of these accruals coincides with the earlier of completion of a feasibility study of the Company’s commitments to plan of action based on the then known facts.

Stock Based Compensation

The Company records stock-based compensation using the fair value method of valuing stock options and other equity-based compensation issued. The Company has not granted any stock options since its inception. Accordingly, no stock-based compensation has been recorded.

Start-Up expenses

As a start-up company, the costs associated with start-up activities are expensed as incurred. Accordingly, start-up costs associated with the Company’s formation have been included in the Company’s general and administrative expenses for the period from September 14, 2009 (inception) through June 30, 2011.

Cassidy Ventures, Inc.

(An Exploration Stage Company)

Notes to Financial Statements

June 30, 2011 and 2010

NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Recent Accounting Pronouncements

In February 2010, the FASB issued ASU No. 2010-09 which is included in the Codification under

ASC 855, Subsequent Events (“ASC 855”). This update removes the requirement for an SEC filer to disclose the date through which subsequent events have been evaluated and became effective for interim and annual reporting periods beginning January 1, 2010. The adoption of this guidance did not have a material impact on the Company’s financial statements.

In January 2010, the FASB issued ASU No. 2010-06, which is included in the Codification under ASC 820, Fair Value Measurements and Disclosures (“ASC 820”). This update requires the disclosure of transfers between the observable input categories and activity in the unobservable input category for fair value measurements. The guidance also requires disclosures about the inputs and valuation techniques used to measure fair value and became effective for interim and annual reporting periods beginning January 1, 2010. The adoption of this guidance did not have a material impact on the Company’s financial statements.

FASB Accounting Standards Codification — Effective for interim and annual periods ending after September 15, 2009, the FASB has defined a new hierarchy for U.S. GAAP and established the FASB Accounting Standards Codification (ASC) as the sole source for authoritative guidance to be applied by nongovernmental entities. The adoption of the ASC changes the manner in which U.S. GAAP guidance is referenced, but it does not have any impact on our financial position or results of operations

In August 2009, the FASB issued ASU No. 2009-05, “Measuring Liabilities at Fair Value,” or ASU 2009-05, which amends ASC 820 to provide clarification of a circumstances in which a quoted price in an active market for an identical liability is not available. A reporting entity is required to measure fair value using one or more of the following methods: 1) a valuation technique that uses a) the quoted price of the identical liability when traded as an asset or b) quoted prices for similar liabilities (or similar liabilities when traded as assets) and/or 2) a valuation technique that is consistent with the principles of ASC 820. ASU 2009-05 also clarifies that when estimating the fair value of a liability, a reporting entity is not required to adjust to include inputs relating to the existence of transfer restrictions on that liability. The adoption of this ASU did not have an impact on the Company’s consolidated financial statements.

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Cassidy Ventures, Inc.

(An Exploration Stage Company)

Notes to Financial Statements

June 30, 2011 and 2010

NOTE 3 GOING CONCERN

These financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The Company has incurred a loss since inception resulting in an accumulated deficit of $38,808 as at June 30, 2011 and further losses are anticipated in the development of its business raising substantial doubt about the Company’s ability to continue as a going concern. The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or obtaining the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management intends to finance operating costs over the next twelve months with existing cash

on hand, loans from directors and/or private placement of common stock.

There is no guarantee that the Company will be able to raise any capital through any type of offering.

NOTE 4 RELATED PARTY TRANSACTIONS

The officer of the Company could become involved in other business activities as they become available. This could create a conflict between the Company and the other business interests. The Company has not formulated a policy for the resolution of such a conflict should one arise.

Loan from shareholder represents a loan from a related party. As of June 30, 2011 the loan balance is $20.

NOTE 5 INCOME TAXES

The Company follows ASC 740. Deferred income taxes reflect the net effect of (a) temporary difference between carrying amounts of assets and liabilities for financial purposes and the amounts used for income tax reporting purposes and (b) net operating costs carry-forwards. No net provision for refundable Federal income tax has been made in the accompanying statement of loss because no recoverably taxes were paid previously. Similarly, no deferred tax asset attributable to the net operating loss carry-forward has been recognized as it is not determined likely to be realized.

The provision for refundable Federal income tax consists of the following for the periods ending:

| | | June 30, 2011 | | | June 30, 2010 | |

| Federal income tax benefit attributable to: | | | | | | |

| Net operating loss | | $ | 8,600 | | | $ | 4,600 | |

| Less, change in valuation allowance | | $ | (8,600 | ) | | $ | (4,600 | ) |

| Net benefit | | | - | | | | - | |

| | | | | | | | | |

| | | June 30, 2011 | | | June 30, 2010 | |

| The cumulative tax effect at the expected rate of 34% of significant items comprising our net deferred tax amount as follows | | | | | |

| Deferred tax attributed: | | | | | | | | |

| Net operating loss carryover | | $ | 13,200 | | | $ | 4,600 | |

| Less valuation allowance | | | (13,200 | ) | | | (4,600 | ) |

| Net Deferred Tax Asset | | $ | - | | | $ | - | |

On June 30, 2011 the Company had an unused net operating loss carry-forward of approximately $38,800 that is available to offset future taxable income; the loss carry-forward will start to expire in 2030. Realization of deferred tax assets is dependent upon sufficient future taxable income during the period that deductible temporary differences and carryforwards are expected to be available to reduce taxable income. As the achievement of required future taxable income is uncertain, the Company recorded a valuation allowance.

Cassidy Ventures, Inc.

(An Exploration Stage Company)

Notes to Financial Statements

June 30, 2011 and 2010

NOTE 6 MINERAL PROPERTY

On June 17, 2011, the Company paid $5,888 for the property acquisition of claim # 4256860 in the Thunder Bay mining district, Ontario, Canada.

NOTE 7 EQUITY TRANSACTIONS

On October 1 6, 2009 the Company issued 5,000,000 shares of common stock at $0.001 per share, par value, to the founders of the Company for net cash proceeds of $5,000.

Between September 30 and November 12, 2009 the Company issued 750,000 shares of common stock at $0.01 per share to various investors, for net cash proceeds of $7,500.

Between February 23 and March 26, 2010, the Company issued 500,000 shares of common stock at $0.01 per share to various investors, for net cash proceeds of $5,000.

Between April 22 and May 28, 2010 the Company issued 400,000 shares of common stock at $0.05 per share, to various investors for net cash proceeds of $20,000.

On June 25, 2010 the Company issued 100,000 shares of common stock at $0.10 per share to two investors for net cash proceeds of $10,000.

As of June 30, 2011 and 2010 the Company had 6,750,000 shares of common stock issued and outstanding.

NOTE 8 SUBSEQUENT EVENTS

The Company evaluated all events or transactions that occurred after June 30, 2011 up through the date these financial statements were available for issuance, September 19, 2011. During this period, the Company did not have any material recognizable subsequent events.

PROSPECTUS

CASSIDY VENTURES INC.

1,750,000 SHARES OF

COMMON STOCK

TO BE SOLD BY CURRENT SHAREHOLDERS

We have not authorized any dealer, salesperson or other person to give you written information other than this prospectus or to make representations as to matters not stated in this prospectus. You must not rely on unauthorized information. This prospectus is not an offer to sell these securities or a solicitation of your offer to buy the securities in any jurisdiction where that would not be permitted or legal. Neither the delivery of this prospectus nor any sales made hereunder after the date of this prospectus shall create an implication that the information contained herein nor the affairs of the Issuer have not changed since the date hereof.

Until __________, 2011 (90 days after the date of this prospectus), all dealers that effect transactions in these shares of common stock may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

THE DATE OF THIS PROSPECTUS IS OCTOBER 25 , 2011

PART II - INFORMATION NOT REQUIRED IN PROSPECTUS

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

The following table sets forth the estimated expenses in connection with the issuance and distribution of the securities being registered hereby. All such expenses will be borne by the Company; none shall be borne by any selling security holders. | | | Amount | |

| Item | | (US$) | |

| SEC Registration Fee | | $ | 20.31 | |

| Transfer Agent Fees | | | 1,000.00 | |

| Legal Fees | | | 5,000.00 | |

| Accounting Fees | | | 5,000.00 | |

| Printing Costs | | | 500.00 | |

| Miscellaneous | | | 1,000.00 | |

| TOTAL | | $ | 12,520.31 | |

INDEMNIFICATION OF DIRECTORS AND OFFICERS

The Company’s Bylaws and Articles of Incorporation provide that we shall, to the full extent permitted by the Nevada General Business Corporation Law, as amended from time to time (the “Nevada Corporate Law”), indemnify all of our directors and officers. Section 78.7502 of the Nevada Corporate Law provides in part that a corporation shall have the power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding (other than an action by or in the right of the corporation) by reason of the fact that such person is or was a director, officer, employee or agent of another corporation or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

Similar indemnity is authorized for such persons against expenses (including attorneys’ fees) actually and reasonably incurred in defense or settlement of any threatened, pending or completed action or suit by or in the right of the corporation, if such person acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and provided further that (unless a court of competent jurisdiction otherwise provides) such person shall not have been adjudged liable to the corporation. Any such indemnification may be made only as authorized in each specific case upon a determination by the stockholders or disinterested directors that indemnification is proper because the indemnitee has met the applicable standard of conduct. Under our Bylaws and Articles of Incorporation, the indemnitee is presumed to be entitled to indemnification and we have the burden of proof to overcome that presumption. Where an officer or a director is successful on the merits or otherwise in the defense of any action referred to above, we must indemnify him against the expenses which such offer or director actually or reasonably incurred. Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

RECENT SALES OF UNREGISTERED SECURITIES

Within the past two years we have issued and sold the following securities without registration.

On October 16, 2009, we offered and sold 2,500,000 shares of common stock to each of Edward Hayes and Linda Lamb, both officers and directors of the Company, at a purchase price of $0.001 per share, for aggregate proceeds of $5,000. The offering was made to non-U.S. persons, offshore of the U.S., with no directed selling efforts in the U.S., where offering restrictions were implemented in a transaction pursuant to the exclusion from registration provided by Rule 903(b)(3) of Regulation S of the Securities Act of 1933, as amended (the “Securities Act”).

Between September 30 and November 12, 2009, we offered and sold 750,000 shares of our common stock to 15 persons, at a purchase price of $0.01 per share, for aggregate proceeds of $7,500. The offering was made to non-U.S. persons, offshore of the U.S., with no directed selling efforts in the U.S., where offering restrictions were implemented in transactions pursuant to the exclusion from registration provided by Rule 903(b)(3) of Regulation S of the Securities Act.

Between February 23 and March 26, 2010, we offered and sold 500,000 shares of our common stock to 10 persons, at a purchase price of $0.01 per share, for aggregate proceeds of $7,500. The offering was made to non-U.S. persons, offshore of the U.S., with no directed selling efforts in the U.S., where offering restrictions were implemented in transactions pursuant to the exclusion from registration provided by Rule 903(b)(3) of Regulation S of the Securities Act.

Between March 28 and April 22, 2010, we offered and sold 400,000 shares of our common stock to 10 persons, at a purchase price of $0.05 per share, for aggregate proceeds of $20,000. The offering was made to non-U.S. persons, offshore of the U.S., with no directed selling efforts in the U.S., where offering restrictions were implemented in transactions pursuant to the exclusion from registration provided by Rule 903(b)(3) of Regulation S of the Securities Act.

On June 25, 2010, we offered and sold 100,000 shares of our common stock to 2 persons, at a purchase price of $0.10 per share, for aggregate proceeds of $10,000. The offering was made to non-U.S. persons, offshore of the U.S., with no directed selling efforts in the U.S., where offering restrictions were implemented in transactions pursuant to the exclusion from registration provided by Rule 903(b)(3) of Regulation S of the Securities Act.

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

The following exhibits are filed as part of this registration statement:

| Exhibit | | Description |

| | | |

| 3.1 | | Articles of Incorporation of Registrant (1) |

| 3.2 | | Bylaws of the Registrant (1) |

| 5.1 | | Opinion of Law Offices of Thomas E. Puzzo, PLLC, regarding the legality of the securities being registered (1) |

| 23.1 | | Consent of Law Offices of Thomas E. Puzzo, PLLC (included in Exhibit 5.1) |

| 23.2 | | Consent of LBB & Associates Ltd., LLP, Certified Public Accountants (1) |

| 23.3 | | Consent of Fladgate Exploration Consulting (1) |

| (1) | Incorporated by reference to the Registrant’s Form S-1 (File No. 333-176939), filed with the Commission on September 21, 2011. |

UNDERTAKINGS

The undersigned Registrant hereby undertakes:

(a)(1) To file, during any period in which offers or sales of securities are being made, a post-effective amendment to this registration statement to:

| | (i) | Include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| | (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) (Sec.230.424(b) of this chapter) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement. |

| | (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

| | (i) | If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use. |

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or our securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 (the “Act”) may be permitted to our directors, officers and controlling persons pursuant to the provisions above, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act, and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities, other than the payment by us of expenses incurred or paid by one of our directors, officers, or controlling persons in the successful defense of any action, suit or proceeding, is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification is against public policy as expressed in the Securities Act, and we will be governed by the final adjudication of such issue.

SIGNATURES