UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box: |

| | | | |

| | |

| ¨ | | Preliminary Proxy Statement |

| | |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| x | | Definitive Proxy Statement |

| | |

| ¨ | | Definitive Additional Materials |

| | |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

| |

|

| (Name of Registrant as Specified In Its Charter) |

|

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

Payment of Filing Fee (Check the appropriate box): |

| | |

| x | | No fee required |

| | |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | (5) | | Total fee paid: |

| | | | | |

| | | | | |

| | |

| ¨ | | Fee paid previously with preliminary materials. |

| | |

¨

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | | | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | | (3) | | Filing Party: |

| | | | | |

| | | (4) | | Date Filed: |

2019 NOTICE OF ANNUAL MEETING &

PROXY STATEMENT

June 18, 2019

Dear Shareholder:

You are cordially invited to attend the 2019 Annual Meeting of Shareholders (the “Annual Meeting”) of Capri Holdings Limited, to be held at 10:00 a.m., local time, on August 1, 2019, at Baker & McKenzie LLP, 100 New Bridge Street, London, 6JA EC4V. Information concerning the matters to be considered and voted upon at the Annual Meeting is set out in the attached Notice of 2019 Annual Meeting of Shareholders and proxy statement.

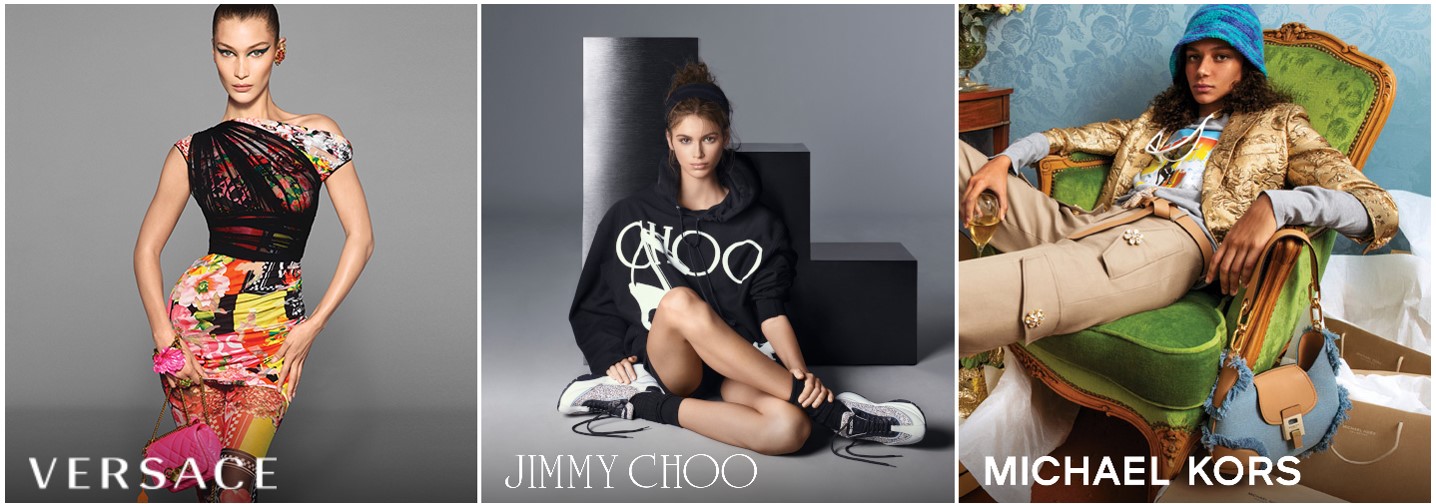

Fiscal 2019 was a transformational year for Capri Holdings. We expanded our fashion luxury group with the addition of Versace, one of the world’s most storied Italian luxury brands. Jimmy Choo delivered strong results and we continued to execute against Michael Kors’ three strategic growth pillars of product innovation, brand engagement and customer experience. For the year, we were pleased that our luxury group delivered both double digit revenue and adjusted earnings per share growth.

Looking ahead, Fiscal 2020 will be an investment year for our group, and we anticipate our initiatives will deliver strong revenue growth for Capri Holdings. Our three brands position Capri Holdings to accelerate revenue growth from $6 to $8 billion dollars. Our increased growth will be led by Versace and Jimmy Choo, with Michael Kors remaining a strong foundation for Capri Holdings. Long-term, we expect to grow Versace from $900 million to $2 billion dollars in revenue, expand Jimmy Choo from nearly $600 million to $1 billion in revenue, while building Michael Kors from $4.5 billion to $5 billion in revenue. Taken together, we believe our three iconic, founder-led fashion brands position Capri Holdings to deliver multiple years of earnings growth.

Thank you for your continued support. We look forward to seeing you at our 2019 Annual Meeting.

Sincerely,

John D. Idol

Chairman and Chief Executive Officer

NOTICE OF 2019 ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

Notice is hereby given that the 2019 Annual Meeting of Shareholders (the “Annual Meeting”) of Capri Holdings Limited, a British Virgin Islands corporation (the “Company”), will be held at Baker & McKenzie LLP, 100 New Bridge Street, London, United Kingdom 6JA EC4V, on August 1, 2019 at 10:00 a.m., local time, for the following purposes:

| |

| 1. | To elect two Class II directors for a three-year term and until the election and qualification of their respective successors in office; |

| |

| 2. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 28, 2020; |

| |

| 3. | To hold a non-binding advisory vote on executive compensation (“say on pay”); |

| |

| 4. | To hold a non-binding advisory vote on the frequency of the advisory vote on the Company’s executive compensation (“say on frequency”); and |

| |

| 5. | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The Board of Directors has fixed the close of business on May 31, 2019 as the record date for the Annual Meeting (the “Record Date”), and only holders of record of ordinary shares of the Company at such time will be entitled to notice of or to vote at the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the proxy statement for the Annual Meeting. On or about June 18, 2019, we intend to mail to our shareholders of record as of the Record Date a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access the proxy statement and a copy of our Annual Report on Form 10-K for the fiscal year ended March 30, 2019 (the “2019 Annual Report”). The Notice also provides instructions on how to vote online and on how to receive a paper copy of the proxy materials by mail.

Important Notice Regarding the Availability of Proxy Materials for the Shareholders’ Meeting to be Held on August 1, 2019

The Notice, proxy statement and the 2019 Annual Report are available at www.proxyvote.com.

YOUR VOTE IS IMPORANT

Based on current New York Stock Exchange rules your broker will NOT be able to vote your ordinary shares with respect to the election of directors (Proposal No. 1), the say on pay vote (Proposal No. 3) or the say on frequency vote (Proposal No. 4) if you have not provided instructions to your broker. We strongly encourage you to provide instructions to your broker to vote your ordinary shares and exercise your right as a shareholder.

If you are a shareholder of record as of the Record Date, you will be admitted to the meeting upon presenting a form of photo identification. If you own ordinary shares beneficially through a bank, broker or otherwise, you will be admitted to the meeting upon presenting a form of photo identification and proof of share ownership or a valid proxy signed by the record holder. A recent brokerage statement or a letter from a bank or broker are examples of proof of share ownership for this purpose.

Regardless of whether or not you plan to attend the Annual Meeting, please follow the instructions you received to authorize a proxy to vote your ordinary shares as soon as possible to ensure that your ordinary shares are represented at the Annual Meeting. Any shareholder that decides to attend the Annual Meeting in person may, if so desired, revoke their prior proxy by voting their ordinary shares at the Annual Meeting.

By order of the Board of Directors,

Hannah Merritt

Corporate Secretary

London, United Kingdom

June 18, 2019

TABLE OF CONTENTS

PROXY STATEMENT

2019 Annual Meeting of Shareholders

Thursday, August 1, 2019

GENERAL INFORMATION

This proxy statement is being provided to solicit proxies on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of Capri Holdings Limited (the “Company,” “Capri Holdings,” “we,” “our” or “us”) for use at the 2019 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Thursday, August 1, 2019, at 10:00 a.m., local time, at Baker & McKenzie LLP, 100 New Bridge Street, London, United Kingdom, 6JA EC4V, and any adjournment or postponement thereof. We expect to first make this proxy statement available, together with a copy of our Annual Report on Form 10-K for the fiscal year ended March 30, 2019 (the “2019 Annual Report”), to shareholders on or about June 18, 2019.

Internet Availability of Proxy Materials

We have elected to provide access to our proxy materials over the Internet in accordance with the rules adopted by the U.S. Securities and Exchange Commission (the “SEC”). Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders of record as of the close of business on May 31, 2019 (the “Record Date”). All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or to request to receive a printed copy of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. You will not receive a printed copy of the proxy materials unless you request one in the manner set forth in the Notice. This permits us to conserve natural resources and reduces our printing costs, while giving shareholders a convenient and efficient way to access our proxy materials and vote their ordinary shares.

We intend to mail the Notice on or about June 18, 2019 to all shareholders of record entitled to vote at the Annual Meeting as of the close of business on the Record Date. On that same date, we will also mail a printed copy of this proxy statement, our 2019 Annual Report and form of proxy to certain shareholders who had previously requested printed copies.

Who May Vote

Only holders of record of our ordinary shares at the close of business on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, 150,939,251 ordinary shares were issued and outstanding. Each ordinary share is entitled to one vote at the Annual Meeting.

What Constitutes a Quorum

Shareholders may not take action at the Annual Meeting unless there is a quorum present at the meeting. A meeting of shareholders is duly constituted, and a quorum is present, if, at the commencement of the meeting, there are present in person or by proxy not less than 50% of the votes of the shares entitled to vote on resolutions of shareholders to be considered at the meeting. Abstentions and broker non-votes (as described below) will be included in the calculation of the number of shares considered to be present at the meeting for quorum purposes.

Broker Non-Votes and Abstentions

Broker non-votes occur when brokers holding shares in street name for beneficial owners do not receive instructions from the beneficial owners about how to vote their shares. An abstention occurs when a shareholder withholds such shareholder’s vote by checking the “ABSTAIN” box on the proxy card, or similarly elects to abstain via Internet or telephone voting. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, including the ratification of the appointment of the independent registered public accounting firm (Proposal No. 2) and such broker non-votes are counted as shares entitled to vote on such proposal. Based on current New York Stock Exchange (“NYSE”) rules, your broker will NOT be able to vote your shares with respect to the election of directors (Proposal No. 1), the say on pay vote (Proposal No. 3) or the say on frequency vote (Proposal No. 4) if you have not provided instructions to your broker. In the absence of voting instructions, broker non-votes will not be counted as entitled to vote on Proposals No. 1, 3 or 4 and will not affect the outcome of these matters, assuming a quorum is obtained. We strongly encourage you to provide instructions to your broker to vote your ordinary shares and exercise your right as a shareholder. Abstentions are treated as shares that are entitled to vote and will have the same effect as a vote “AGAINST” a proposal.

Vote Required

Proposal No. 1 (Election of Directors): Under applicable British Virgin Islands law and our Amended and Restated Memorandum and Articles of Association (our “Memorandum”), directors are elected by the affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the Annual Meeting and voted, if a quorum is present. Our Memorandum does not provide for cumulative voting. Under our Corporate Governance Guidelines, a director nominee, running uncontested, who receives more “AGAINST” than “FOR” votes is required to tender his or her resignation for consideration by the Governance, Nominating and Corporate Social Responsibility Committee. See “Corporate Governance—Director Nomination Process and Elections; Board Diversity.”

Proposal No. 2 (Auditor Ratification): The ratification of the appointment of Ernst & Young LLP, our proposed independent registered public accounting firm for the fiscal year ending March 28, 2020 (“Fiscal 2020”), requires the affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the Annual Meeting and are voted, if a quorum is present.

Proposal No. 3 (Say on Pay): Our Board of Directors is seeking a non-binding advisory vote regarding the compensation of our named executive officers, as described in the Compensation Discussion and Analysis, executive compensation tables and accompanying narrative disclosures contained in this proxy statement. Under our Memorandum, the affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the Annual Meeting and are voted is required to approve this resolution, if a quorum is present. The vote is non-binding and advisory in nature, but our Compensation and Talent Committee and our Board will take into account the outcome of the vote when considering future executive compensation arrangements, to the extent they can determine the cause or causes of any significant negative voting results.

Proposal No. 4 (Say on Frequency): Our Board of Directors is seeking a non-binding advisory vote from shareholders as to how often they believe the advisory vote to approve executive compensation (say on pay) should be held in the future. The affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the Annual Meeting and are voted is required to approve this resolution, if a quorum is present, pursuant to our Memorandum. The vote on the frequency of future advisory votes on the compensation of the Company’s named executive officers is not binding on the Board or the Company. Even though this vote is non-binding and advisory in nature, the Board of Directors will take into account the outcome of this vote in making a determination on the frequency with which advisory votes on executive compensation will be held. If none of the frequency options — one year, two years or three years — receives the required majority vote, the option receiving the greatest number of votes will be considered the frequency approved by the shareholders.

Voting Process and Revocation of Proxies

If you are a shareholder of record, you may cast your vote in any of the following ways:

|

| | | | | | | | |

| | | | | | | | |

| Internet | | QR Code | | Telephone | | Mail | | In Person |

Go to www.proxyvote.com. You will need the 16-digit control number included in your proxy card or Notice. | | Scan the QR code included on your proxy card or Notice. You will need the 16-digit control number. | | Call (800) 690-6903 and provide your 16-digit control number. | | Mark, date, sign and return the proxy card to the address provided in the proxy materials. | | See “Attendance at Annual Meeting.” |

Internet and telephone voting facilities for shareholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on July 31, 2019. Submitting your proxy by any of these methods will not affect your ability to attend the Annual Meeting in-person and vote at the Annual Meeting.

If your ordinary shares are held in “street name,” meaning you are a beneficial owner with your shares held through a bank or brokerage firm, you will receive voting instructions from your bank or brokerage firm. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting will also be offered to shareholders owning shares through certain banks and brokers.

The Company will retain an independent tabulator to receive and tabulate the proxies.

If you submit proxy voting instructions and direct how your shares will be voted, the individuals named as proxies will vote your shares in the manner you indicate. If you submit proxy voting instructions but do not direct how your shares will be voted, the individuals named as proxies will vote your shares:

“FOR” the election of the two Class II nominees for director (Proposal No. 1);

“FOR” the ratification of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending March 28, 2020 (Proposal No. 2);

“FOR” the compensation of our named executive officers (Proposal No. 3); and

“FOR” one year as the frequency with which future advisory votes on executive compensation should be held by the Company (Proposal No. 4).

It is not expected that any other matters will be brought before the Annual Meeting. If, however, other matters are properly presented, the individuals named as proxies will vote in accordance with their discretion with respect to such matters.

A shareholder who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by:

| |

| • | attending the Annual Meeting and voting in person; |

| |

| • | voting by Internet or telephone (only the last vote cast by each shareholder of record will be counted), provided that the shareholder does so before 11:59 p.m. Eastern Time on July 31, 2019; |

| |

| • | delivering a written notice, at the address given below, bearing a date later than that indicated on the proxy card or the date you voted by Internet or telephone, but prior to the date of the Annual Meeting, stating that the proxy is revoked; or |

| |

| • | signing and delivering a subsequently dated proxy card prior to the vote at the Annual Meeting. |

You should send any written notice or new proxy card to Capri Holdings Limited, Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. If you are a shareholder of record you may request a new proxy card by calling the Company at its principal executive office in London at (44) 207 632 8600.

Any shareholder owning shares in street name may change or revoke previously given voting instructions by contacting the bank or brokerage firm holding the ordinary shares or by obtaining a legal proxy from such bank or brokerage firm and voting in person at the Annual Meeting. Your last vote, prior to or at the Annual Meeting, is the vote that will be counted.

Attendance at the Annual Meeting

Only shareholders or their legal proxy holders are invited to attend the Annual Meeting. To be admitted to the Annual Meeting, you will need a form of photo identification (such as a driver’s license or passport), and if you hold your ordinary shares in street name you must also bring valid proof of ownership of your ordinary shares or a valid legal proxy. If you are a shareholder of record, you will be admitted to the Annual Meeting only if we are able to verify your shareholder status by checking your name against the list of registered shareholders on the Record Date. If you hold your ordinary shares in street name through a bank or brokerage firm, a brokerage statement or a letter from a bank or broker reflecting your ownership as of the Record Date is sufficient proof of ownership to be admitted to the Annual Meeting.

No cameras, recording equipment, electronic devices or large bags, briefcases or packages will be permitted in the Annual Meeting. Attendees may be asked to pass through security prior to entering the Annual Meeting.

The Company encourages members of its Board of Directors to attend the Annual Meeting. Representatives of Ernst & Young LLP, the Company’s independent registered public accounting firm, may also attend the Annual Meeting along with certain members of management of the Company and outside counsel.

Electronic Delivery of Proxy Materials and Annual Report

The Notice, proxy statement and the 2019 Annual Report are available at www.proxyvote.com. In the future, instead of receiving copies of the Notice of Internet Availability of Proxy Materials, proxy statement and the annual report in the mail, shareholders may elect to view the proxy materials for the annual meeting on the Internet or to receive proxy materials for the annual meeting by e-mail. The Notice will provide you with instructions regarding how to view our proxy materials over the Internet and how to instruct us to send future proxy materials to you by e-mail. Receiving your proxy materials online permits the Company to conserve natural resources and saves the Company the cost of producing and mailing documents to your home or business, while giving you an automatic link to the proxy voting site.

If you are a shareholder of record with ordinary shares registered in your own name, you may enroll in electronic delivery service by contacting American Stock Transfer & Trust Company, our transfer agent, at (800) 937-5449, or by following the instructions on their website at www.astfinancial.com. If you hold your shares in street name through a bank or brokerage firm, check the information provided to you by your bank or broker or contact your bank or broker for information on electronic delivery service.

Householding

The SEC permits companies to send a single Notice, and for those shareholders that elect to receive a paper copy of proxy materials in the mail, one copy of this proxy statement, together with our 2019 Annual Report, to any household at which two or more shareholders reside, unless contrary instructions have been received, but only if we provide advance notice and follow certain procedures. This “householding” process reduces the volume of duplicate information and reduces printing and mailing expenses. If you are a shareholder of record with ordinary shares registered in your own name and you are interested in consenting to the delivery of a single notice or proxy statement and annual report to your household, you may do so by contacting American Stock Transfer & Trust Company, our transfer agent, at (800) 937-5449, or by following the instructions on their website at www.astfinancial.com. If your household has multiple accounts holding our ordinary shares in street name, you may have already received a householding notification from your broker. Please contact your broker directly if you hold your shares in street name and have any questions concerning the householding process or require additional copies of the Notice, the 2019 Annual Report or this proxy statement. The broker will arrange for delivery of a single set of materials (if requested) or a separate copy of the Notice, and, if so requested, a separate copy of these proxy materials promptly upon your written or verbal request. You may decide at any time to revoke your decision to receive a single copy of the proxy materials for your household, and thereby receive multiple copies of the proxy materials by contacting our transfer agent, if you are a record holder, or your broker, if you hold your ordinary shares in street name.

Solicitation of Proxies

We will pay the cost of soliciting proxies for the Annual Meeting. We will reimburse brokers, fiduciaries, custodians and other nominees for their costs in forwarding proxy materials to beneficial owners of our ordinary shares. Solicitation may be undertaken by written or electronic mail, telephone, personal contact, facsimile or other similar means by our directors, officers and employees without additional compensation.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Board Composition

Our Board of Directors consists of eight members. Our Memorandum provides that our Board of Directors must be composed of between one and twelve members. The number of directors is determined from time to time by a resolution of the directors. John D. Idol, our Chief Executive Officer, serves as the Chairman of our Board of Directors. He has primary responsibility for providing leadership and guidance to our Board and for managing the affairs of our Board.

Our Board of Directors is divided into three classes. Pursuant to our Memorandum, our directors are appointed at the annual meeting of shareholders for a period of three years, with each director serving until the third annual meeting of shareholders following his or her election. Upon the expiration of the term of a class of directors, directors in that class will be elected for three-year terms at the annual meeting of shareholders in the year of such expiration. Any additional directorships resulting from an increase in the number of directors or a vacancy will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors.

Judy Gibbons and Jane Thompson are Class II directors and their term will expire on the date of the upcoming Annual Meeting. Accordingly, we are nominating Ms. Gibbons and Ms. Thompson for re-election at the Annual Meeting. If elected, each of them will serve as a Class II director until our annual meeting of shareholders in 2022 and until the election and qualification of their respective successors in office.

The following table lists each of our directors, their respective ages and positions and the class in which they serve as of the date of this proxy statement: |

| | | | | | | | |

| Name | | Age | | Position | | Class | | Term Expiring |

| John D. Idol | | 60 | | Chairman and Chief Executive Officer | | III | | 2020

|

| M. William Benedetto | | 78 | | Lead Director | | I | | 2021 |

| Robin Freestone | | 60 | | Director | | III | | 2020 |

| Judy Gibbons | | 62 | | Director | | II | | 2019 Nominated for re-election |

| Ann Korologos | | 77 | | Director | | III | | 2020 |

| Stephen F. Reitman | | 71 | | Director | | I | | 2021 |

| Jane Thompson | | 47 | | Director | | II | | 2019 Nominated for re-election |

| Jean Tomlin | | 64 | | Director | | I | | 2021 |

Director Nominees

Class II Director Nominees for Election at the 2019 Annual Meeting

Set forth below is a brief biography of each of our Class II directors being nominated for election at the Annual Meeting:

Judy Gibbons

Director since: November 2012

Age: 62

Principal Occupation: Retired technology executive

Board Committees: Audit Committee and Governance, Nominating and Corporate Social Responsibility Committee

Qualifications: Over 25 years of experience as a business leader in technology sector with strong strategic and operational knowledge of digital media, e-commerce and technology

Ms. Gibbons was employed by Accel Partners in Europe as a venture partner and board member, focusing primarily on early stage equity investments across mobile applications, digital advertising, e-commerce and social media from 2005 until 2010. Prior to joining Accel Partners, Ms. Gibbons was Corporate Vice President at Microsoft where she spent ten years in international leadership roles in the company’s Internet division. Previously, she has held senior positions at Apple Inc. and Hewlett Packard. Ms. Gibbons currently serves as a non-executive director of Hammerson plc, and Chairman of Which? Limited. She previously served as a director of Guardian Media Group plc.

Jane Thompson

Director since: January 2015

Age: 47

Principal Occupation: Co-Founder and Director of The Fusion Labs

Board Committees: Audit Committee and Compensation and Talent Committee

Qualifications: Over 10 years of experience in e-commerce, digital marketing and technology with expertise in customer relationship management (CRM)

Ms. Thompson is currently Co-Founder and Director of The Fusion Labs, a UK-based digital marketing and e-commerce company, which operates a network of niche e-commerce sites. From 2007 to 2009, Ms. Thompson was Managing Director, International at IAC/InterActiveCorp, a leading interactive media and Internet company, and from 2003 to 2007, she held various senior roles at Match.com LLC, including as Senior Vice President and General Manager, North America. She also previously worked as a management consultant at Bain & Company in London. Ms. Thompson is an active investor in digital businesses as well as a director of Listcorp.com and Stitch.net. She holds a MBA from the Wharton School of the University of Pennsylvania.

Our Board of Directors has no reason to believe that any of the nominees listed above would be unable to serve as a director of the Company. If, however, any nominee were to become unable to serve as a director, the proxy holders will have discretionary authority to vote for a substitute nominee.

Vote Required and Board Recommendation

If a quorum is present, directors are elected by the affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the Annual Meeting and voted. Ordinary shares that constitute broker non-votes are not considered entitled to vote on Proposal No. 1 and will not affect the outcome of this matter, assuming a quorum is present. Abstentions will have the same effect as a vote “AGAINST” this proposal.

Our Board of Directors unanimously recommends a vote “FOR” the election of the two Class II director nominees named above. Unless contrary voting instructions are provided, the persons named as proxies will vote “FOR” the election of Judy Gibbons and Jane Thompson to hold office as directors until the 2022 annual meeting of shareholders and until the election and qualification of their respective successors in office.

Continuing Directors

Class III Directors for Election at the 2020 Annual Meeting

John D. Idol

Chairman

Director since: December 2003; Chairman since September 2011

Age: 60

Principal Occupation: Chief Executive Officer of Capri Holdings Limited

Board Committees: None

Qualifications: CEO for over 15 years with intimate knowledge of our business operations and strategy; more than 30 years of experience in the retail industry with extensive knowledge of sales and marketing, product development, operations, finance and strategy; and prior public company board and CEO experience

Mr. Idol has been our Chief Executive Officer since December 2003. Previously, from July 2001 until July 2003, Mr. Idol served as Chairman and Chief Executive Officer and a director of Kasper ASL, Ltd., whose lines included the Anne Klein brand. Prior to that, from July 1997 until July 2001, Mr. Idol served as Chief Executive Officer and a director of Donna Karan International Inc. Mr. Idol also served as Ralph Lauren’s Group President and Chief Operating Officer of Product Licensing, Home Collection and Men’s Collection from 1994 until 1997.

Robin Freestone

Director since: November 2016

Age: 60

Principal Occupation: Retired Chief Financial Officer

Board Committees: Audit Committee (Chair) and Compensation and Talent Committee

Qualifications: Esteemed FTSE 100 executive with significant experience across a broad array of international businesses, including as chief financial officer

Mr. Freestone was Chief Financial Officer of Pearson Plc, from 2006 through August 2015, having previously served as Deputy Chief Financial Officer since 2004. Prior to that, he held a number of senior financial positions at Amersham plc from 2000 to 2004, Henkel Chemicals UK Ltd from 1995 to 2000 and ICI/Zeneca Agrochemicals Ltd (now Syngenta) from 1985 to 1995. He began his financial and accounting career at Touche Ross (now Deloitte). Mr. Freestone also serves as a non-executive director of Smith and Nephew plc and as Chairman of the Board of moneysupermarket.com.

Ann Korologos

Director since: March 2013

Age: 77

Principal Occupation: Former U.S. Secretary of Labor; Chairman Emeritus of The Aspen Institute

Board Committees: Governance, Nominating and Corporate Social Responsibility Committee (Chair) and Compensation and Talent Committee

Qualifications: Significant knowledge and experience in the areas of international markets, marketing, regulatory and government affairs, policy making and corporate governance; and seasoned public company board member

Ms. Korologos is a former U.S. Secretary of Labor. She is Chairman Emeritus of The Aspen Institute, a nonprofit organization, and previously served as the Chairman of the Board of Trustees of the RAND Corporation from April 2004 to April 2009. Ms. Korologos has significant public company board experience and currently serves as a director of Host Hotels & Resorts, Inc. She previously served on the boards of AMR Corporation (and its subsidiary, American Airlines), Kellogg Company, Harman International Industries, Inc. and Vulcan Materials Company, among others.

Class I Directors for Election at the 2021 Annual Meeting

M. William Benedetto

Lead Director

Director since: December 2011

Age: 78

Principal Occupation: Co-founder and retired chairman emeritus of The Benedetto Gartland Group

Board Committees: Audit Committee and Compensation and Talent Committee

Qualifications: Strong financial background; significant experience as an executive in the financial services industry; and prior public company board experience (including as audit committee and compensation committee chairman)

Mr. Benedetto is a co-founder and retired chairman emeritus of The Benedetto Gartland Group, a boutique investment bank founded in 1988 that specializes in raising equity capital for private equity firms and providing other investment banking services. From 1983 to 1988, Mr. Benedetto served as executive vice president, director and manager of Dean Witter Reynolds, Inc.’s Investment Banking Division. From 1980 to 1983, Mr. Benedetto served as head of corporate finance for Warburg, Paribas Becker, and previously Mr. Benedetto served as an executive in the financial services industry since 1978. Mr. Benedetto was lead director of Donna Karan International from 1996 to 2001 and chaired its audit and compensation committees. Mr. Benedetto was a member of the board of directors of Georgetown University, as well as the chairman of its board of regents, until June 30, 2010, and was a director of FidelisCare, a non-for-profit healthcare insurance company, until 2018.

Stephen F. Reitman

Director since: December 2011

Age: 71

Principal Occupation: President of Reitmans (Canada) Limited

Board Committees: Audit Committee and Governance, Nominating and Corporate Social Responsibility Committee

Qualifications: Extensive experience as an executive in the retail industry with in-depth industry knowledge and strong retail operations background

Mr. Reitman has been President of Reitmans (Canada) Limited, a specialty ladies’ wear retailer based in Canada, since June 2010, having previously served as Executive Vice President and Chief Operating Officer since 1984. Mr. Reitman also serves as a director of Reitmans (Canada) Limited. In December 2018, Mr. Reitman joined the board of directors of Genfoot Inc., a manufacturer of outdoor footwear for men, women, and children.

Jean Tomlin

Director since: March 2013

Age: 64

Principal Occupation: Retired human resources executive

Board Committees: Compensation and Talent Committee (Chair) and Governance, Nominating and Corporate Social Responsibility Committee

Qualifications: Extensive management experience in human resources and unique insight into human resources matters

Ms. Tomlin served as Director of Human Resources of the London Organising Committee of the Olympic and Paralympic Games from 2006 through the end of March 2013. Previously, she was the Director of Human Resources of Marks & Spencer plc, a major British retailer. Ms. Tomlin also spent 15 years at Prudential plc and nine years at Ford Motor Company in the UK in various human resources management positions. Currently, Ms. Tomlin also serves as a director of J. Sainsbury plc, the UK’s third-largest food retailer and grocery store operator, and Holdingham Group Limited, a privately owned management consultancy business.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines, which are available on our website at www.capriholdings.com and in print to any shareholder who requests a copy from our Corporate Secretary. The Corporate Governance Guidelines set forth our corporate governance principles and reflect the governance rules of NYSE listed companies, and address, among other governance matters, Board composition and responsibilities, committees, director compensation, Board and committee self-appraisals, CEO compensation and executive succession planning.

|

| | |

10 | 2019 Proxy Statement | | |

Code of Business Conduct and Ethics

We have a Code of Business Conduct and Ethics, which is applicable to all of our directors, executive officers and employees, including our CEO and CFO. A copy of our Code of Business Conduct and Ethics is available on our website at www.capriholdings.com and in print to any shareholder who requests a copy from our Corporate Secretary. Our Code of Business Conduct and Ethics reflects our commitment to a culture of honesty, integrity and accountability and outlines the basic principles and policies with which all of our directors, executive officers and employees are expected to comply. We proactively promote ethical behavior and encourage our directors, executive officers and employees to report violations of the Code of Business Conduct and Ethics, unethical behavior or other concerns either directly to a supervisor, the Human Resources Department or the Legal Department or through an anonymous toll-free telephone hotline.

We also expect all of our employees (including our executive officers) and our directors to promptly report any potential relationships, actions or transactions, including those involving immediate family members, that reasonably could be expected to give rise to a conflict of interest to our General Counsel, Chief Human Resources Officer and Head of Internal Audit, in the case of potential conflicts involving an executive officer or director, or to the employee’s supervisor or a representative of our Human Resources Department, in the case of potential conflicts involving any other employee. If we amend or waive the Code of Business Conduct and Ethics with respect to any of our directors or our CEO or CFO, we will promptly disclose such amendment or waiver as required by applicable law and the NYSE and will post such amendment or waiver on the Investor Relations page of our website referenced above.

Independence of Board

A majority of our directors and each member of our Audit Committee, Compensation and Talent Committee and Governance, Nominating and Corporate Social Responsibility Committee are required to be “independent” within the meaning of the NYSE listing standards and the guidelines for director independence set forth in our Corporate Governance Guidelines. The Governance Committee reviews the independence of all members of the Board for purposes of determining which Board members are deemed independent and which are not. The Governance Committee and our Board of Directors affirmatively determined that M. William Benedetto, Robin Freestone, Judy Gibbons, Ann Korologos, Stephen F. Reitman, Jane Thompson and Jean Tomlin are each independent.

Committees of the Board

Our Board of Directors has three standing committees: an Audit Committee, a Compensation and Talent Committee and a Governance, Nominating and Corporate Social Committee. The following table sets forth the current members of each committee:

|

| | |

11 | 2019 Proxy Statement | | |

|

| | | | | | |

| | | Audit Committee | | Compensation and Talent Committee | | Governance, Nominating and Corporate Social Responsibility Committee |

M. William Benedetto  L L | | | | | | |

Robin Freestone  | | | | | | |

| Judy Gibbons | | | | | | |

| Ann Korologos | | | | | | |

| Stephen F. Reitman | | | | | | |

| Jane Thompson | | | | | | |

| Jean Tomlin | | | | | | |

_______________________________

Chairperson  Member

Member  Financial Expert

Financial Expert  Lead Director L

Lead Director L

Audit Committee

The primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities with respect to: (i) the accounting and financial reporting processes of the Company and the related internal controls, including the integrity of the financial statements and other financial information of the Company; (ii) the Company’s compliance with legal and regulatory requirements; (iii) the independent auditor’s qualifications and independence; (iv) the audit of the Company’s financial statements; (v) the performance of the Company’s internal audit function and the independent auditor; and (vi) such other matters mandated by applicable law or NYSE rules.

In carrying out these responsibilities, the Audit Committee, among other things:

| |

| • | Selects, determines compensation of, evaluates and, where appropriate, replaces the independent auditor; |

| |

| • | Approves all audit engagement fees and terms and all non-audit engagements with the independent auditor; |

| |

| • | Evaluates annually the performance of the independent auditor and the lead audit partner; |

| |

| • | Reviews annual audited and quarterly unaudited financial statements with management and the independent auditor; |

| |

| • | Reviews reports and recommendations of the independent auditor; |

| |

| • | Reviews the scope and plan of work to be done by the internal audit group and annually reviews the performance of the internal audit group and the appointment, replacement and compensation of the person responsible for the Company’s internal audit function; |

| |

| • | Reviews management’s assessment of the effectiveness of the Company’s internal control over financial reporting and the independent auditor’s related attestation; |

| |

| • | Oversees the Company’s risk assessment and risk management policies, procedures and practices; |

| |

| • | Establishes procedures for receiving and responding to complaints regarding accounting, internal accounting controls or auditing matters; |

| |

| • | Reviews and, if appropriate, approves related person transactions; and |

| |

| • | Evaluates its own performance annually and reports regularly to the Board. |

A complete copy of the Audit Committee Charter is available on our website at www.capriholdings.com.

|

| | |

12 | 2019 Proxy Statement | | |

The Board of Directors has determined that each member of the Audit Committee satisfies the independence requirements of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the NYSE rules, and that each member of the Audit Committee is financially literate. Furthermore, the Board of Directors has determined that each of Messrs. Benedetto and Freestone is an “audit committee financial expert” under the rules of the SEC implementing Section 407 of the Sarbanes-Oxley Act of 2002.

Compensation and Talent Committee

The Compensation and Talent Committee has direct responsibility for the compensation of the Company’s executive officers, including the CEO, and for the Company’s incentive compensation and equity-based plans.

In carrying out these responsibilities, the Compensation and Talent Committee, among other things:

| |

| • | Reviews the Company’s compensation strategy to ensure it is appropriate; |

| |

| • | Reviews and approves the corporate goals and objectives of the Company’s CEO, evaluates the CEO’s performance in light of those goals and objectives and, either as a committee or together with the other independent directors (as directed by the Board), determines and approves the CEO’s compensation level, perquisites and other benefits based on this evaluation; |

| |

| • | Recommends and sets appropriate compensation levels for the Company’s named executive officers; |

| |

| • | Evaluates the potential risks associated with the Company’s compensation policies and practices; |

| |

| • | Reviews, evaluates and makes recommendations to the Board with respect to incentive compensation plans, equity-based plans and director compensation, and is primarily responsible for setting performance targets under annual cash incentive and long-term equity incentive compensation plans, and certifying the achievement level of any such performance targets; |

| |

| • | Reviews our annual equity share usage rate and aggregate long-term equity incentive grant value on a regular basis to ensure that the dilutive and earnings impact of equity compensation remains appropriate, affordable and competitive; |

| |

| • | Reviews the Company’s programs relating to diversity and inclusion, leadership and talent development; |

| |

| • | Reviews the Company’s global HR strategy and strategic priorities; |

| |

| • | Retains (or terminates) consultants to assist in the evaluation of director and executive officer compensation; |

| |

| • | Reviews executive compensation-related regulatory developments and industry wide compensation practices and general market trends in order to ensure compliance with law and assess the adequacy and competitiveness of the Company’s compensation programs; and |

| |

| • | Evaluates its own performance annually and reports regularly to the Board. |

A complete copy of the Compensation and Talent Committee Charter is available on our website at www.capriholdings.com.

Compensation Committee Interlocks and Insider Participation

No person who served as a member of our Compensation and Talent Committee during Fiscal 2019 has served as one of our executive officers or employees or has any relationship requiring disclosure under Item 404 of Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”).

|

| | |

13 | 2019 Proxy Statement | | |

None of our executive officers serves as a member of the board of directors or as a member of the compensation committee of any other company that has an executive officer serving as a member of our Board or our Compensation and Talent Committee.

Governance, Nominating and Corporate Social Responsibility Committee

The purpose of the Governance, Nominating and Corporate Social Responsibility Committee (the “Governance Committe”) is to perform, or assist the Board in performing, the duties of the Board relating to: (i) identification and nomination of directors; (ii) areas of corporate governance; (iii) succession planning for the CEO and other members of senior management; (iv) annual performance evaluations of the Board and the committees of the Board; and (v) the other duties and responsibilities set forth in its charter. The Governance Committee Charter was recently amended to include oversight of the Company’s corporate social responsibility program in order to ensure appropriate supervision of our goal-setting and public reporting process relating to corporate social responsibility and sustainability.

In carrying out these responsibilities, the Governance Committee, among other things:

| |

| • | Reviews Board and committee composition and size; |

| |

| • | Identifies candidates qualified to serve as directors; |

| |

| • | Assists the Board in determining whether individual directors have material relationships with the Company that may interfere with their independence; |

| |

| • | Establishes procedures for the Governance Committee to exercise oversight of the evaluation of senior management; |

| |

| • | Reviews and discusses management succession and makes recommendations to the Board with respect to potential successors to the CEO and other key members of senior management; |

| |

| • | Reviews and assesses the adequacy of the Company’s Corporate Governance Guidelines; |

| |

| • | Reviews policies and practices of the Company and monitors compliance in the areas of corporate governance; |

| |

| • | Oversees the Company’s program relating to corporate social responsibility, including environmental, social and other matters of significance relating to sustainability; and |

| |

| • | Evaluates its own performance annually and reports regularly to the Board. |

A complete copy of the Governance Committee Charter is available on on our website at www.capriholdings.com.

Board and Committee Meeting Attendance

Our Board of Directors held four meetings and each of the Audit Committee, the Compensation and Talent Committee and the Governance Committee held four meetings in Fiscal 2019. During Fiscal 2019, each of our directors attended at least 75% of the total number of meetings of our Board of Directors, and each attended at least 75% of the total number of meetings of each committee of our Board of Directors on which such director served. All of our non-employee directors are invited to attend all committee meetings. The Board of Directors and its committees also act from time to time by written consent in lieu of meetings. Directors are encouraged (but not required) to attend our annual meeting of shareholders. John D. Idol, M. William Benedetto, Robin Freestone, Judy Gibbons, Jane Thompson and Jean Tomlin attended our annual meeting of shareholders held in 2018.

|

| | |

14 | 2019 Proxy Statement | | |

Executive Sessions

Pursuant to our Corporate Governance Guidelines, the Board is required to meet at least quarterly in executive session without management directors or any members of management, whether or not they are directors, present. Our Lead Director, M. William Benedetto, presides over executive sessions of the Board of Directors.

Director Nomination Process and Elections; Board Diversity

The Governance Committee is responsible for, among other things, identifying individuals qualified to become members of the Board in a manner consistent with the criteria approved by the Board. The Corporate Governance Guidelines set forth qualifications and criteria for our directors. The Board of Directors seeks members from diverse professional and personal backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. We do not have a formal policy on diversity, but the Governance Committee and the Board will assess an individual’s independence, diversity, age, skills and experience in the context of the needs of the Board.

The Governance Committee will consider candidates recommended by our executive officers and directors, including our Chairman and CEO, employees and others. In addition, the Governance Committee may engage third-party search firms to identify qualified director candidates. When identifying and evaluating candidates, the Governance Committee determines whether there are any evolving needs of the Board that require an expert in a particular field. The Chair of the Governance Committee and some or all of the members of the Board of Directors (including the Chairman and CEO) will interview potential candidates that the Governance Committee deems appropriate. The Governance Committee will listen to feedback received from those directors that had the opportunity to meet with the potential candidate. If the Governance Committee deems appropriate, it will recommend the nomination of the candidate to the full Board for approval.

The Governance Committee will also consider candidates proposed by shareholders of the Company and all candidates will be evaluated in the same manner regardless of the source of such nomination so long as shareholder nominations are properly submitted to us. Shareholders wishing to recommend persons for consideration by the Governance Committee as nominees for election to the Board must do so in accordance with the procedures set forth in “Proposals of Shareholders for the 2020 Annual Meeting” and in compliance with our Memorandum.

In accordance with the Memorandum, directors must be elected by the affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the meeting and voted. In the event an incumbent director fails to receive a simple majority of the votes in an uncontested election, such incumbent director is required to tender a resignation letter in accordance with the Company’s Corporate Governance Guidelines. The Governance Committee will then make a recommendation to the Board as to whether to accept or reject the resignation or whether such other action should be taken. The Board will act on the resignation, taking into account the Governance Committee’s recommendation, and publicly disclose its decision regarding the resignation within 90 days following certification of the election results.

|

| | |

15 | 2019 Proxy Statement | | |

The Governance Committee, in making its recommendation, may consider any factors and other information that it considers appropriate and relevant, including, without limitation, the stated reasons why shareholders voted “against” such director, the director’s length of service and qualifications, the director’s contributions to the Company, compliance with applicable NYSE rules and listing standards and the Corporate Governance Guidelines. The incumbent director will remain active and engage in Board activities while the Governance Committee and the Board decide whether to accept or reject such resignation or take other action, but the incumbent director will not participate in deliberations by the Governance Committee or the Board regarding whether to accept or reject the director’s resignation.

Board Leadership Structure; Lead Independent Director

John D. Idol, our CEO, has been the Chairman of our Board of Directors since shortly before our initial public offering in December 2011 (the “IPO”). The Board believes that the Company can most effectively execute its business plans and strategy and drive value for shareholders if Mr. Idol, who has intimate knowledge of our business operations and strategy and extensive experience in the retail industry, serves the combined role of Chairman and CEO. A combined Chairman and CEO serves as a bridge between the Board and management, and provides our Board and Company with unified leadership. The Board believes that Mr. Idol’s unified leadership enables us to better communicate our vision and strategy clearly and consistently across our organization and to customers and shareholders.

M. William Benedetto serves as Lead Director in order to provide for strong and independent leadership on the Board. As Lead Director, Mr. Benedetto: (i) presides at meetings of the Board in the absence of, or upon the request of, the Chairman, including executive sessions of the non-management directors; (ii) serves as principal liaison to facilitate communications between the other directors and the Chairman, without inhibiting direct communications between the Chairman and the other directors; (iii) consults with the Chairman in the preparation of the annual Board meeting schedule and in determining the need for special meetings of the Board; (iv) suggests to the Chairman agenda items for meetings of the Board and approves the agenda as well as the substance and timeliness of information sent to the Board; (v) calls meetings of the non-management directors when necessary and appropriate; (vi) leads the evaluation process and provides feedback to the CEO in consultation with the Chair of the Compensation and Talent Committee; (vii) serves as the liaison to shareholders who request direct communications with the Board; (viii) performs such other duties as the Board may from time to time delegate; and (ix) assists in optimizing the effectiveness of the Board and ensures that it operates independently of management.

In addition to the active and independent leadership that the Lead Director brings to the Board, the independent chairs of each of the Board’s standing committees provide leadership for matters under the jurisdiction of their respective committees.

Risk Oversight

Management is responsible for understanding and managing the risks that we face in our business, and the Board of Directors is responsible for overseeing management’s overall approach to risk management. The Board has an active role, as a whole and also at the committee level, in overseeing management of our risks to ensure our risk management policies are consistent with our corporate strategy. The Board regularly reviews the major strategic, operational, financial and legal risks relating to the Company as well as potential options for mitigating these risks. The Company’s independent and internal auditors and other relevant third parties work with senior management (and in connection with their oversight responsibility, the Board and its committees) to ensure that enterprise-wide risk management is incorporated into the Company’s business and strategy.

|

| | |

16 | 2019 Proxy Statement | | |

The Board has delegated to its committees responsibility for elements of the Company’s risk management program that relate specifically to matters within the scope of each such committee’s duties and responsibilities. The Audit Committee is responsible for the oversight of accounting, auditing and financial-related risks. The Compensation and Talent Committee periodically reviews the various design elements of our compensation program to determine whether any of its aspects encourage excessive or inappropriate risk-taking. See “Compensation and Talent Committee Risk Assessment.” The Compensation and Talent Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. The Governance Committee manages risks associated with the independence of the Board, compliance by the Company with corporate governance policies and rules, succession planning for the CEO and other key members of senior management and in the areas of corporate social responsibility and sustainability. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about those risks. The Company believes that the Board and its committees provide appropriate risk oversight of the Company’s business activities and strategic initiatives.

Communications with the Board and the Audit Committee

Shareholders and interested parties may contact any of the Company’s directors, including the Chairman, the non-management directors as a group, the Lead Director, the chair of any committee of the Board of Directors or any committee of the Board by writing them as follows:

Capri Holdings Limited

33 Kingsway

London, United Kingdom

WC2B 6UF

Attn: Corporate Secretary

Concerns relating to accounting, internal controls or auditing matters should be communicated to the Company through the Corporate Secretary and such matters will be handled in accordance with the procedures established by the Audit Committee. Any concerns may be reported anonymously.

Required Certifications

The Company has filed with the SEC, as an exhibit to its most recently filed Annual Report on Form 10-K, the certifications of its Chief Executive Officer and Chief Financial Officer required under the Sarbanes-Oxley Act of 2002. The Company has also timely submitted to the NYSE the Section 303A Annual CEO Certification for the fiscal year ended March 31, 2018 (“Fiscal 2018”), and such certification was submitted without any qualifications.

|

| | |

17 | 2019 Proxy Statement | | |

Executive Officers

The following table sets forth information regarding each of our executive officers as of the date of this proxy statement: |

| | | | |

| Name | | Age | | Position |

John D. Idol(1) | | 60 | | Chairman and CEO |

| Thomas J. Edwards, Jr. | | 54 | | Executive Vice President, CFO and COO |

| Krista A. McDonough | | 39 | | Senior Vice President, General Counsel |

| Pascale Meyran | | 59 | | Senior Vice President, Chief Human Resources Officer |

| Cathy Marie Robinson | | 51 | | Senior Vice President, Chief Operations and Transformation Officer |

| |

(1) | Biographical information regarding Mr. Idol is set forth under “Proposal No. 1 Election of Directors—Continuing Directors—Class III Directors for Election at the 2020 Annual Meeting.” |

Thomas J. Edwards, Jr. is the Executive Vice President, Chief Financial Officer and Chief Operating Officer of Capri Holdings and has been with the Company since April 2017. Previously, Mr. Edwards served as Executive Vice President and Chief Financial Officer of Brinker International, Inc. Prior to that, he held numerous positions within finance at Wyndham Worldwide from 2007 to 2015, including having served as Executive Vice President and Chief Financial Officer of the Wyndham Hotel Group from March 2013 to March 2015. Mr. Edwards has also held a number of financial and operational leadership positions in the consumer goods industry, including as Vice President, Consumer Innovation and Marketing Services at Kraft Foods and Vice President, Finance at Nabisco Food Service Company.

Krista A. McDonough is the Senior Vice President, General Counsel of Capri Holdings. She assumed this role in October 2016 and has been with the Company since August 2011 in various legal roles, including, previously, as Deputy General Counsel. Prior to joining Capri Holdings, Ms. McDonough was an attorney in the corporate department of Paul, Weiss, Rifkind, Wharton and Garrison LLP, where she specialized in capital markets and securities law, from 2005 to 2011.

Pascale Meyran is the Senior Vice President, Chief Human Resources Officer of Capri Holdings and has been with the Company since September 2014. Previously, Ms. Meyran was at S.C. Johnson & Son, where she held the position of Senior Vice President of Global Human Resources from 2010 until she joined the Company. Prior to her 20-year tenure at S.C. Johnson & Son, Ms. Meyran worked in a variety of human resources functions at General Electric.

Cathy Marie Robinson is the Senior Vice President, Chief Operations and Transformation Officer of Capri Holdings and has been with the Company since May 2014 (joining as Senior Vice President, Global Operations and then holding the title of Senior Vice President, Corporate Strategy and Chief Operations Officer). Previously from 2012 to 2014, Ms. Robinson was Senior Vice President, Chief Logistics Officer at ToysRUs, and from 2010 to 2012, Ms. Robinson was Senior Vice President, Supply, Logistics and Customer Experience at The Great Atlantic & Pacific Tea Company (A&P). Prior to that, from 2006 to 2010, she was Senior Vice President, Supply Chain at Smart & Final Stores LLC. Ms. Robinson began her career as a United States Army Logistics Officer and also held various logistics and operations positions at Wal-Mart Stores, Inc.

|

| | |

18 | 2019 Proxy Statement | | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our ordinary shares as of May 31, 2019 by:

| |

| • | each person known to us to beneficially own more than five percent of our outstanding ordinary shares based solely on our review of SEC filings; |

| |

| • | each of our named executive officers; |

| |

| • | each of our directors; and |

| |

| • | all directors and executive officers as a group. |

Beneficial ownership is based upon 150,939,251 ordinary shares outstanding as of May 31, 2019, unless otherwise indicated in the footnotes to the table. In addition, ordinary shares issuable upon exercise of share options or other derivative securities that are exercisable as of May 31, 2019 or will become exercisable within 60 days of May 31, 2019 are deemed outstanding for purposes of computing the percentage of the person holding such options or other derivative securities, but are not deemed outstanding for purposes of computing the percentage owned by any other person. All of the ordinary shares listed in the table below are entitled to one vote per share and each of the persons described below has sole voting power and sole investment power with respect to the shares set forth opposite his, her or its name, except as otherwise noted. Unless otherwise indicated, the address of each executive officer named in the table below is c/o Capri Holdings Limited, 11 West 42nd Street, New York, New York 10036, and the address of each director named in the table below is 33 Kingsway, London, United Kingdom WC2B 6UF.

|

| | | | |

| Beneficial Owner | | Ordinary Shares Beneficially Owned | | Percent of Ordinary Shares Beneficially Owned |

| 5% or More Shareholder | | | | |

The Vanguard Group(1) | | 15,175,700 | | 10.1% |

BlackRock, Inc.(2) | | 10,337,971 | | 6.9% |

Eminence Capital, LP(3) | | 9,796,242 | | 6.5% |

AQR Capital Management, LLC(4) | | 9,764,989 | | 6.5% |

| Named Executive Officers and Directors | | | | |

John D. Idol(5) | | 2,917,399 | | 1.9% |

Michael Kors(6) | | 4,858,511 | | 3.2% |

Thomas J. Edwards, Jr.(7) | | 30,389 | | * |

Pascale Meyran(8) | | 73,162 | | * |

Cathy Marie Robinson(9) | | 68,367 | | * |

M. William Benedetto(10) | | 17,789 | | * |

Robin Freestone(10) | | 3,509 | | * |

Judy Gibbons(10) | | 18,413 | | * |

Ann Korologos(10) | | 13,881 | | * |

Stephen F. Reitman(10) | | 12,095 | | * |

Jane Thompson(10) | | 8,540 | | * |

Jean Tomlin(10) | | 9,536 | | * |

| All Executive Officers and Directors as a Group (13 persons) | | 8,048,705 | | 5.3% |

_________________________________

* Represents beneficial ownership of less than one percent of the Company’s ordinary shares outstanding.

|

| | |

19 | 2019 Proxy Statement | | |

| |

(1) | Based on Amendment No. 6 to the Schedule 13G filed with the SEC by The Vanguard Group (“Vanguard”) on February 11, 2019. The mailing address for Vanguard is 100 Vanguard Blvd, Malvern, Pennsylvania 19355. Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of Vanguard, is the beneficial owner of 129,339 shares or .10% of the ordinary shares outstanding of the Company as a result of its serving as investment manager of collective trust accounts. Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of Vanguard, is the beneficial owner of 74,453 shares or .08% of the ordinary shares outstanding of the Company as a result of its serving as investment manager of Australian investment offerings. Vanguard may be deemed to have sole voting power with respect to 129,339 ordinary shares and shared voting power with respect to 31,653 ordinary shares. Vanguard may be deemed to have sole dispositive power with respect to 14,969,905 ordinary shares and shared dispositive power with respect to 205,795 ordinary shares. |

| |

(2) | Based on Amendment No. 5 to the Schedule 13G filed with the SEC by BlackRock, Inc. (“BlackRock”) on February 6, 2019. The mailing address for BlackRock is 55 East 52nd Street, New York, New York 10022. BlackRock may be deemed to have sole voting power with respect to 9,118,130 ordinary shares and sole dispositive power with respect to 10,337,971 ordinary shares. |

| |

(3) | Based on the Schedule 13G filed with the SEC by Eminence Capital, LP and related parties (“Eminence”) on February 19, 2019. The mailing address for Eminence is 399 Park Avenue, 25th Floor, New York, New York 10022. Eminence Capital may be deemed to have shared voting and dispositive power with respect to 9,796,242 ordinary shares, Eminence GP, LLC may be deemed to have shared voting and dispositive power with respect to 6,181,206 ordinary shares, and Ricky C. Sandler (Chief Executive Officer of Eminence Capital and the Managing Member of Eminence GP) may be deemed to have shared voting and dispositive power with respect to 9,796,242 ordinary shares. |

| |

(4) | Based on the Schedule 13G filed with the SEC by AQR Capital Management, LLC (“AQR Management”) and AQR Capital Management Holdings, LLC (“AQR Holdings” and, together with AQR Management, “AQR”) on February 14, 2019. The mailing address for AQR is Two Greenwich Plaza, Greenwich, Connecticut 06830. AQR Management is a wholly-owned subsidiary of AQR Holdings, and AQR Management and AQR Holdings may be deemed to have shared voting and dispositive power with respect to 9,764,989 ordinary shares. |

| |

(5) | This amount includes the following securities held by Mr. Idol: (i) 435,775 options to purchase ordinary shares that are vested and exercisable or will become vested and exercisable within 60 days of May 31, 2019 and (ii) 33,605 unvested restricted share units that will become vested within 60 days of May 31, 2019. This amount also includes 54,600 ordinary shares held by the Idol Family Foundation and 1,599,400 ordinary shares held by certain grantor retained annuity trusts (“GRATs”) established by Mr. Idol (as grantor) for the benefit of his children. Mr. Idol is not the trustee of the GRATs. Mr. Idol may be deemed to have shared voting and dispositive power over the ordinary shares held by the Idol Family Foundation and by the GRATs, and therefore, may be deemed to have beneficial ownership over such ordinary shares. |

| |

(6) | This amount includes the following securities held directly by Mr. Kors: (i) 307,329 options to purchase ordinary shares that are vested and exercisable or will become vested and exercisable within 60 days of May 31, 2019 and (ii) 33,605 unvested restricted share units that will become vested within 60 days of May 31, 2019. This amount also includes 95,000 ordinary shares held by the Kors LePere Foundation and the following securities held by Mr. Kors’ spouse: (x) 182,900 options to purchase ordinary shares that are vested and exercisable or will become vested and exercisable within 60 days of May 31, 2019 and (y) 11,146 unvested restricted share units that will become vested within 60 days of May 31, 2019. Mr. Kors may be deemed to have shared voting and dispositive power over the ordinary shares and other equity interests held by the Kors LePere Foundation and by his spouse, and therefore, may be deemed to have beneficial ownership over such ordinary shares and other equity interests. |

| |

(7) | This amount includes the following securities held by Mr. Edwards: (i) 3,063 options to purchase ordinary shares that are vested and exercisable or will become vested and exercisable within 60 days of May 31, 2019 and (ii) 4,073 unvested restricted restricted share units that will become vested within 60 days of May 31, 2019. |

| |

(8) | This amount includes the following securities held by Ms. Meyran: (i) 44,725 options to purchase ordinary shares that are vested and exercisable or will become vested and exercisable within 60 days of May 31, 2019 and (ii)12,432 unvested restricted share units that will become vested within 60 days of May 31, 2019. |

| |

(9) | This amount includes the following securities held by Ms. Robinson: (i) 28,998 options to purchase ordinary shares that are vested and exercisable or will become vested and exercisable within 60 days of May 31, 2019 and (ii) 12,220 unvested restricted share units that will become vested within 60 days of May 31, 2019. |

| |

(10) | This amount excludes 2,281 restricted share units that will vest at the annual meeting of shareholders to be held on August 1, 2019. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers and persons who beneficially own more than 10% of our ordinary shares to file initial reports of ownership and reports of changes in ownership of our ordinary shares with the SEC. To our knowledge, based solely on our review of the copies of the Section 16(a) reports furnished to us during and with respect to Fiscal 2019 and representations from certain reporting persons, we believe that all reportable transactions during such fiscal year were reported on a timely basis.

Securities Trading Policy and Hedging

Our executive officers, directors and certain other employees and related parties are prohibited from trading in Company shares during certain prescribed blackout periods that typically begin two weeks prior to the end of each fiscal quarter and end two days after the public release of our quarterly earnings announcement. We also prohibit all of our employees and directors from engaging in buying shares of the Company on margin, short sales, buying or selling puts, calls, options or other derivatives or engaging in hedging transactions in respect of securities of the Company.

|

| | |

20 | 2019 Proxy Statement | | |

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Shareholders Agreement

On July 11, 2011, we entered into a Shareholders Agreement (the “Shareholders Agreement”) with certain of our pre-IPO shareholders, including John D. Idol and Michael Kors. The Shareholders Agreement contains certain registration rights described below which have remained operative since our IPO.

If we propose to register any of our shares under the Securities Act either for our own account or for the account of others, we must give prompt notice to each of Messrs. Idol and Kors of our intent to do so and the number and class of shares to be registered, and each such shareholder will have piggyback registration rights and will be entitled to include any part of his registrable securities in such registration, subject to certain exceptions.

In addition, if we are eligible to use a shelf registration statement on Form S-3 or Form F-3 in connection with a secondary public offering of our ordinary shares, then, if Messrs. Idol and Kors, either individually or together as a group, hold at least 4% of the ordinary shares that were outstanding as of the date of the Shareholders Agreement, they will be entitled to unlimited demand registrations, subject to certain limitations including, among others, that such shareholders must propose to sell registrable securities at an aggregate price to the public (net of any underwriters’ discounts or commissions) of at least $20,000,000. Following the filing of a shelf registration statement on Form S-3 or F-3, the holders of a majority of the registrable securities included therein may initiate a shelf take-down offering, and we must use our reasonable best efforts to effect an amendment or supplement to such shelf registration statement for such offering.

The registration rights described above are subject to customary limitations and exceptions, including our right to withdraw or defer a registration in certain circumstances and certain cutbacks by the underwriters if marketing factors require a limitation on the number of shares to be underwritten in a proposed offering.

In connection with the potential registrations described above, we have agreed to indemnify Messrs. Idol and Kors against certain liabilities. In addition, we will bear all fees, costs and expenses associated with such registrations, excluding underwriting discounts and commissions and similar brokers’ fees, transfer taxes and certain costs of more than one counsel for all of the selling shareholders in an offering.

Other Relationships

Lance LePere is the Executive Vice President, Creative Director—Women’s Design of Michael Kors (USA), Inc. Mr. LePere is the spouse of Mr. Michael Kors. In Fiscal 2019, Mr. LePere’s total compensation (including long-term equity compensation) was approximately $1.308 million.

|

| | |

21 | 2019 Proxy Statement | | |

We entered into Aircraft Time Sharing Agreements with each of John D. Idol and Michael Kors on December 12, 2014 and November 24, 2014, respectively, relating to each such executive’s personal use of the Company-owned aircraft. Pursuant to these Aircraft Time Sharing Agreements, each of Messrs. Idol and Kors are permitted to use the Company aircraft with flight crew for personal purposes at no charge to the executive, except that the executive is required to reimburse the Company for the incremental costs associated with using the Company-owned aircraft for personal purposes. In Fiscal 2019, family members of John D. Idol used the Company aircraft for personal purposes; however, the incremental costs associated with the aircraft paid or payable to the Company by Mr. Idol and his family were de minimis. See “Executive Compensation—Summary Compensation Table—All Other Compensation.” During Fiscal 2019, Michael Kors did not use the Company aircraft for personal purposes, and as a result, no incremental costs associated with the aircraft were paid or payable to the Company by him.

Related Person Transactions Policies and Procedures