UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | | | | | | | | |

| |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

|

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

¨

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

2021 NOTICE OF ANNUAL MEETING &

PROXY STATEMENT

June 15, 2021

Dear Shareholder:

You are cordially invited to attend the 2021 Annual Meeting of Shareholders (the “Annual Meeting”) of Capri Holdings Limited, to be held at 12:00 p.m., local time, on July 28, 2021, at the Company's headquarters, 33 Kingsway, London, United Kingdom WC2B 6UF. Information concerning the matters to be considered and voted upon at the Annual Meeting is set out in the attached Notice of 2021 Annual Meeting of Shareholders and proxy statement.

Looking back on fiscal 2021, the COVID-19 pandemic has had a profound effect on the entire world. The unprecedented challenges tested our lives, business and industry in ways we could never have imagined. As we managed through this evolving situation, our first priority was to help protect the health and safety of our employees, customers and communities. To support that goal, Capri Holdings contributed to local relief organizations in New York, London and Milan. In addition, our founders Michael Kors, Donatella Versace, and I each made personal contributions to these efforts. I am incredibly proud of our entire organization as they supported each other and their communities during this time.

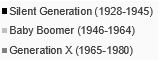

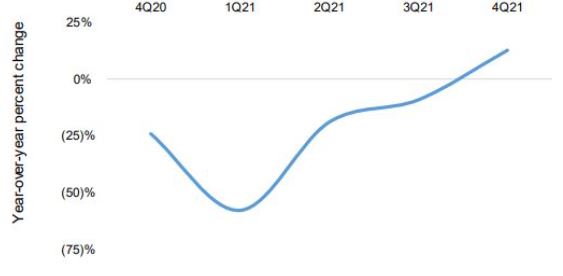

Despite these challenges, we were encouraged by the performance of the Company and all three of our luxury houses during the year. In the initial phase of the pandemic, we quickly implemented broad and decisive measures to maintain our financial strength to enable us to emerge from the pandemic strong and positioned for growth. These actions included significant expense reductions, including decreasing the size of our global workforce as well as compensation reductions for our Board of Directors, executive officers and employees, liquidity enhancements, and rigorous inventory management. As the world reopened, we continued to execute our brand strategies. This resulted in our revenue and earnings significantly exceeding our expectations. These results are a testament to the strength of our brands as well as the dedication, resilience and agility of our employees.

During fiscal 2021, we also continued to execute on our corporate social responsibility goals and objectives, building on the commitments previously announced in our April 2020 Corporate Social Responsibility Report. We also furthered our diversity and inclusion efforts by appointing a head of diversity and inclusion, establishing a global diversity and inclusion council as well as pledging $20 million to The Capri Holdings Foundation for the Advancement of Diversity in Fashion. We remain committed to improving the way we work in order to better the world in which we live.

During the year, we also reevaluated and refined Capri Holding’s strategic direction to ensure that the Company emerges from the pandemic stronger and more profitable. For Versace and Jimmy Choo, we reaffirmed our long-term plans and are even more enthusiastic about the prospects of these luxury houses. For Michael Kors, we recalibrated our plans to further elevate the brand positioning which will enable us to deliver higher profit margins. As the world continues to recover from the pandemic, we are confident in our growth opportunities for Versace, Jimmy Choo and Michael Kors. We believe our three luxury houses position Capri Holdings to deliver multiple years of revenue and earnings growth, as well as increase shareholder value.

Thank you for your continued support. We look forward to seeing you at our 2021 Annual Meeting.

Sincerely,

John D. Idol

Chairman and Chief Executive Officer

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

Notice is hereby given that the 2021 Annual Meeting of Shareholders (the “Annual Meeting”) of Capri Holdings Limited, a British Virgin Islands corporation (the “Company”), will be held at at the Company's headquarters, 33 Kingsway, London, United Kingdom WC2B 6UF, on July 28, 2021 at 12:00 p.m., local time, for the following purposes:

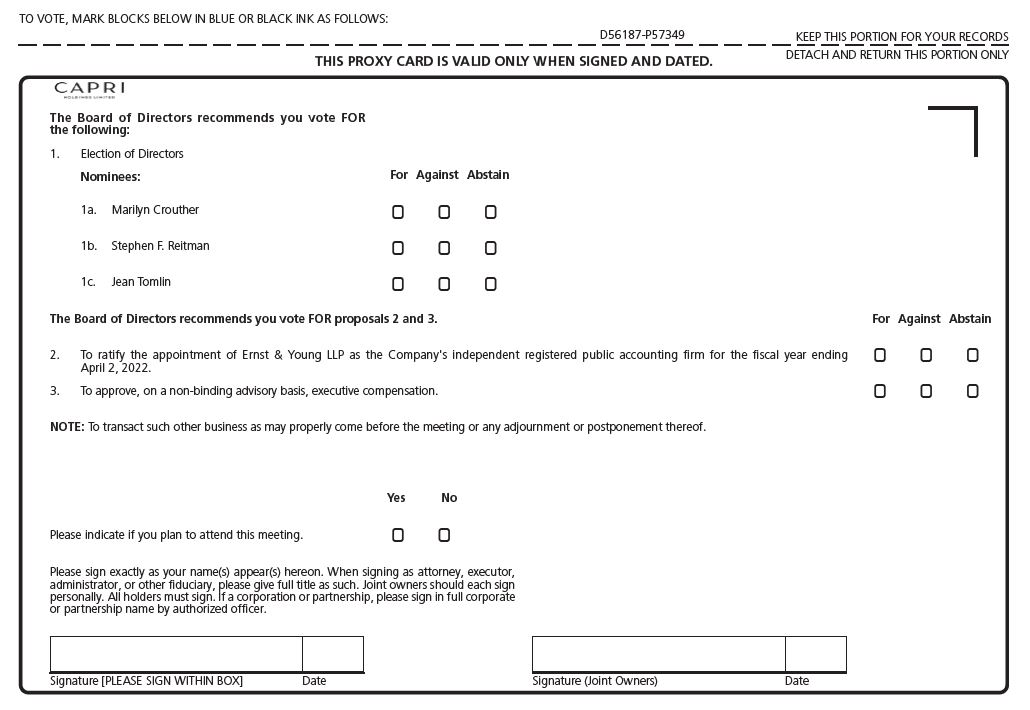

1.To elect three Class I directors for a three-year term and until the election and qualification of their respective successors in office;

2.To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 2, 2022;

3.To hold a non-binding advisory vote on executive compensation (“say on pay”); and

4.To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The Board of Directors has fixed the close of business on June 1, 2021 as the record date for the Annual Meeting (the “Record Date”), and only holders of record of ordinary shares of the Company at such time will be entitled to notice of or to vote at the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the proxy statement for the Annual Meeting. On or about June 15, 2021, we intend to mail to our shareholders of record as of the Record Date a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access the proxy statement and a copy of our Annual Report on Form 10-K for the fiscal year ended March 27, 2021 (the “2021 Annual Report”). The Notice also provides instructions on how to vote online and on how to receive a paper copy of the proxy materials by mail.

Important Notice Regarding the Availability of Proxy Materials for the Shareholders’ Meeting to be Held on July 28, 2021

The Notice, proxy statement and the 2021 Annual Report are available at www.proxyvote.com.

YOUR VOTE IS IMPORTANT

Based on current New York Stock Exchange rules your broker will NOT be able to vote your ordinary shares with respect to the election of directors (Proposal No. 1) or the say on pay vote (Proposal No. 3) if you have not provided instructions to your broker. We strongly encourage you to provide instructions to your broker to vote your ordinary shares and exercise your right as a shareholder.

We intend to hold our annual meeting in person. If you are a shareholder of record as of the Record Date, you will be admitted to the meeting upon presenting a form of photo identification. If you own ordinary shares beneficially through a bank, broker or otherwise, you will be admitted to the meeting upon presenting a form of photo identification and proof of share ownership or a valid proxy signed by the record holder. A recent brokerage statement or a letter from a bank or broker are examples of proof of share ownership for this purpose.

We are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials and federal, state and local governments may issue in light of COVID-19. As a result, we may impose additional procedures or limitations on meeting attendees (beyond those described above) or may decide to hold the meeting in a different location or solely by means of remote communication (i.e., a virtual-only meeting). If we take this step, we will announce the decision to do so in advance by issuing a press release and filing such press release as definitive additional soliciting material with the U.S. Securities and Exchange Commission.

Regardless of whether or not you plan to attend the Annual Meeting, please follow the instructions you received to authorize a proxy to vote your ordinary shares as soon as possible to ensure that your ordinary shares are represented at the Annual Meeting. Any shareholder that decides to attend the Annual Meeting may, if so desired, revoke their prior proxy by voting their ordinary shares at the Annual Meeting.

By order of the Board of Directors,

Hannah Merritt

Corporate Secretary

London, United Kingdom

June 15, 2021

TABLE OF CONTENTS

PROXY STATEMENT

2021 Annual Meeting of Shareholders

Wednesday, July 28, 2021

GENERAL INFORMATION

This proxy statement is being provided to solicit proxies on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of Capri Holdings Limited (the “Company,” “Capri Holdings,” “we,” “our” or “us”) for use at the 2021 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Wednesday, July 28, 2021, at 12:00 p.m., local time, at the Company's headquarters, 33 Kingsway, London, United Kingdom WC2B 6UF, and any adjournment or postponement thereof. We expect to first make this proxy statement available, together with a copy of our Annual Report on Form 10-K for the fiscal year ended March 27, 2021 (the “2021 Annual Report”), to shareholders on or about June 15, 2021.

Internet Availability of Proxy Materials

We have elected to provide access to our proxy materials over the Internet in accordance with the rules adopted by the U.S. Securities and Exchange Commission (the “SEC”). Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders of record as of the close of business on June 1, 2021 (the “Record Date”). All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or to request to receive a printed copy of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. You will not receive a printed copy of the proxy materials unless you request one in the manner set forth in the Notice. This permits us to conserve natural resources and reduces our printing costs, while giving shareholders a convenient and efficient way to access our proxy materials and vote their ordinary shares.

We intend to mail the Notice on or about June 15, 2021 to all shareholders of record entitled to vote at the Annual Meeting as of the close of business on the Record Date. On that same date, we will also mail a printed copy of this proxy statement, our 2021 Annual Report and form of proxy to certain shareholders who had previously requested printed copies.

Who May Vote

Only holders of record of our ordinary shares at the close of business on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, 151,329,069 ordinary shares were issued and outstanding. Each ordinary share is entitled to one vote at the Annual Meeting.

What Constitutes a Quorum

Shareholders may not take action at the Annual Meeting unless there is a quorum present at the meeting. A meeting of shareholders is duly constituted, and a quorum is present, if, at the commencement of the meeting, there are present in person or by proxy not less than 50% of the votes of the shares entitled to vote on resolutions of shareholders to be considered at the meeting. Abstentions and broker non-votes (as described below) will be included in the calculation of the number of shares considered to be present at the meeting for quorum purposes.

Broker Non-Votes and Abstentions

Broker non-votes occur when brokers holding shares in street name for beneficial owners do not receive instructions from the beneficial owners about how to vote their shares. An abstention occurs when a shareholder withholds such shareholder’s vote by checking the “ABSTAIN” box on the proxy card, or similarly elects to abstain via Internet or telephone voting. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, including the ratification of the appointment of the independent registered public accounting firm (Proposal No. 2) and such broker non-votes are counted as shares entitled to vote on such proposal. Based on current New York Stock Exchange (“NYSE”) rules, your broker will NOT be able to vote your shares with respect to the election of directors (Proposal No. 1) or the say on pay vote (Proposal No. 3) if you have not provided instructions to your broker. In the absence of voting instructions, broker non-votes will not be counted as entitled to vote on Proposals No. 1 or 3 and will not affect the outcome of these matters, assuming a quorum is obtained. We strongly encourage you to provide instructions to your broker to vote your ordinary shares and exercise your right as a shareholder. Abstentions are treated as shares that are entitled to vote and will have the same effect as a vote “AGAINST” a proposal.

Vote Required

Proposal No. 1 (Election of Directors): Under applicable British Virgin Islands law and our Amended and Restated Memorandum and Articles of Association (our “Memorandum”), directors are elected by the affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the Annual Meeting and are voted and not abstained, if a quorum is present. Our Memorandum does not provide for cumulative voting. Under our Corporate Governance Guidelines, a director nominee, running uncontested, who receives more “AGAINST” than “FOR” votes is required to tender his or her resignation for consideration by the Governance, Nominating and Corporate Social Responsibility Committee. See “Corporate Governance—Director Nomination Process and Elections; Board Diversity.”

Proposal No. 2 (Auditor Ratification): The ratification of the appointment of Ernst & Young LLP, our proposed independent registered public accounting firm for the fiscal year ending April 2, 2022 (“Fiscal 2022”), requires the affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the Annual Meeting and are voted and not abstained, if a quorum is present.

Proposal No. 3 (Say on Pay): Our Board of Directors is seeking a non-binding advisory vote regarding the compensation of our named executive officers, as described in the Compensation Discussion and Analysis, executive compensation tables and accompanying narrative disclosures contained in this proxy statement. Under our Memorandum, the affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the Annual Meeting and are voted and not abstained is required to approve this resolution, if a quorum is present. The vote is non-binding and advisory in nature, but our Compensation and Talent Committee and our Board will take into account the outcome of the vote when considering future executive compensation arrangements, to the extent they can determine the cause or causes of any significant negative voting results.

Voting Process and Revocation of Proxies

If you are a shareholder of record, you may cast your vote in any of the following ways:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Internet | | QR Code | | Telephone | | Mail | | In Person |

Go to www.proxyvote.com. You will need the 16-digit control number included in your proxy card or Notice. | | Scan the QR code included on your proxy card or Notice. You will need the 16-digit control number. | | Call (800) 690-6903 and provide your 16-digit control number. | | Mark, date, sign and return the proxy card to the address provided in the proxy materials. | | See “Attendance at the Annual Meeting.” |

Internet and telephone voting facilities for shareholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on July 27, 2021. Submitting your proxy by any of these methods will not affect your ability to attend the Annual Meeting and vote at the Annual Meeting.

If your ordinary shares are held in “street name,” meaning you are a beneficial owner with your shares held through a bank or brokerage firm, you will receive voting instructions from your bank or brokerage firm. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting will also be offered to shareholders owning shares through certain banks and brokers.

The Company will retain an independent tabulator to receive and tabulate the proxies.

If you submit proxy voting instructions and direct how your shares will be voted, the individuals named as proxies will vote your shares in the manner you indicate. If you submit proxy voting instructions but do not direct how your shares will be voted, the individuals named as proxies will vote your shares:

“FOR” the election of the three Class I nominees for director (Proposal No. 1);

“FOR” the ratification of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending April 2, 2022 (Proposal No. 2); and

“FOR” the compensation of our named executive officers (Proposal No. 3).

It is not expected that any other matters will be brought before the Annual Meeting. If, however, other matters are properly presented, the individuals named as proxies will vote in accordance with their discretion with respect to such matters.

A shareholder who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by:

•attending the Annual Meeting and voting at the Annual Meeting;

•voting by Internet or telephone (only the last vote cast by each shareholder of record will be counted), provided that the shareholder does so before 11:59 p.m. Eastern Time on July 27, 2021;

•delivering a written notice, at the address given below, bearing a date later than that indicated on the proxy card or the date you voted by Internet or telephone, but prior to the date of the Annual Meeting, stating that the proxy is revoked; or

•signing and delivering a subsequently dated proxy card prior to the vote at the Annual Meeting.

You should send any written notice or new proxy card to Capri Holdings Limited, Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. If you are a shareholder of record you may request a new proxy card by calling the Company at its principal executive office in London at (44) 207 632 8600.

Any shareholder owning shares in street name may change or revoke previously given voting instructions by contacting the bank or brokerage firm holding the ordinary shares or by obtaining a legal proxy from such bank or brokerage firm and voting at the Annual Meeting. Your last vote, prior to or at the Annual Meeting, is the vote that will be counted.

Attendance at the Annual Meeting

We intend to hold the Annual Meeting in person. Only shareholders or their legal proxy holders are invited to attend the Annual Meeting. To be admitted to the Annual Meeting, you will need a form of photo identification (such as a driver’s license or passport), and if you hold your ordinary shares in street name you must also bring valid proof of ownership of your ordinary shares or a valid legal proxy. If you are a shareholder of record, you will be admitted to the Annual Meeting only if we are able to verify your shareholder status by checking your name against the list of registered shareholders on the Record Date. If you hold your ordinary shares in street name through a bank or brokerage firm, a brokerage statement or a letter from a bank or broker reflecting your ownership as of the Record Date is sufficient proof of ownership to be admitted to the Annual Meeting.

No cameras, recording equipment, electronic devices or large bags, briefcases or packages will be permitted in the Annual Meeting. Attendees may be asked to pass through security prior to entering the Annual Meeting.

The Company encourages members of its Board of Directors to attend the Annual Meeting. Representatives of Ernst & Young LLP, the Company’s independent registered public accounting firm, may also attend the Annual Meeting along with certain members of management of the Company and outside counsel.

We are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials and federal, state and local governments may issue in light of COVID-19. As a result, we may impose additional procedures or limitations on meeting attendees (beyond those described above) or may decide to hold the meeting in a different location or solely by means of remote communication (i.e., a virtual-only meeting). If we take this step, we will announce the decision to do so in advance by issuing a press release and filing such press release as definitive additional soliciting material with the SEC.

Electronic Delivery of Proxy Materials and Annual Report

The Notice, proxy statement and the 2021 Annual Report are available at www.proxyvote.com. In the future, instead of receiving copies of the Notice of Internet Availability of Proxy Materials, proxy statement and the annual report in the mail, shareholders may elect to view the proxy materials for the annual meeting on the Internet or to receive proxy materials for the annual meeting by e-mail. The Notice will provide you with instructions regarding how to view our proxy materials over the Internet and how to instruct us to send future proxy materials to you by e-mail. Receiving your proxy materials online permits the Company to conserve natural resources and saves the Company the cost of producing and mailing documents to your home or business, while giving you an automatic link to the proxy voting site.

If you are a shareholder of record with ordinary shares registered in your own name, you may enroll in electronic delivery service by contacting American Stock Transfer & Trust Company, our transfer agent, at (800) 937-5449, or by following the instructions on their website at www.astfinancial.com. If you hold your shares in street name through a bank or brokerage firm, check the information provided to you by your bank or broker or contact your bank or broker for information on electronic delivery service.

Householding

The SEC permits companies to send a single Notice, and for those shareholders that elect to receive a paper copy of proxy materials in the mail, one copy of this proxy statement, together with our 2021 Annual Report, to any household at which two or more shareholders reside, unless contrary instructions have been received, but only if we provide advance notice and follow certain procedures. This “householding” process reduces the volume of duplicate information and reduces printing and mailing expenses. If you are a shareholder of record with ordinary shares registered in your own name and you are interested in consenting to the delivery of a single notice or proxy statement and annual report to your household, you may do so by contacting American Stock Transfer & Trust Company, our transfer agent, at (800) 937-5449, or by following the instructions on their website at www.astfinancial.com. If your household has multiple accounts holding our ordinary shares in street name, you may have already received a householding notification from your broker. Please contact your broker directly if you hold your shares in street name and have any questions concerning the householding process or require additional copies of the Notice, the 2021 Annual Report or this proxy statement. The broker will arrange for delivery of a single set of materials (if requested) or a separate copy of the Notice, and, if so requested, a separate copy of these proxy materials promptly upon your written or verbal request. You may decide at any time to revoke your decision to receive a single copy of the proxy materials for your household, and thereby receive multiple copies of the proxy materials by contacting our transfer agent, if you are a record holder, or your broker, if you hold your ordinary shares in street name.

Solicitation of Proxies

We will pay the cost of soliciting proxies for the Annual Meeting. We will reimburse brokers, fiduciaries, custodians and other nominees for their costs in forwarding proxy materials to beneficial owners of our ordinary shares. Solicitation may be undertaken by written or electronic mail, telephone, personal contact, facsimile or other similar means by our directors, officers and employees without additional compensation.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Board Composition

Our Board of Directors consists of nine members. Our Memorandum provides that our Board of Directors must be composed of between one and twelve members. The number of directors is determined from time to time by a resolution of the directors. In May 2021, Mr. M. William Benedetto expressed his intention to retire from the Board at the conclusion of his current term and, accordingly, his term will end at the conclusion of the Annual Meeting. The Board determined that, effective at the conclusion of the Annual Meeting, the size of the Board will be decreased from nine to eight directors.

John D. Idol, our Chief Executive Officer, serves as the Chairman of our Board of Directors. He has primary responsibility for providing leadership and guidance to our Board and for managing the affairs of our Board.

Our Board of Directors is divided into three classes. Pursuant to our Memorandum, our directors are appointed at the annual meeting of shareholders for a period of three years, with each director serving until the third annual meeting of shareholders following his or her election. Upon the expiration of the term of a class of directors, directors in that class will be elected for three-year terms at the annual meeting of shareholders in the year of such expiration. Any additional directorships resulting from an increase in the number of directors or a vacancy will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors.

Mr. Benedetto has expressed his intention to not stand for re-election to the Board at the Annual Meeting. Mr. Benedetto’s retirement comes after 9 and 1/2 years of distinguished service as a director, having previously served as the Chair of our Audit Committee and as our Lead Director for the last five years. We wish to express our sincere gratitude to Mr. Benedetto for his many years of outstanding service to the Company.

Marilyn Crouther, Stephen F. Reitman and Jean Tomlin are Class I directors and their term will expire on the date of the upcoming Annual Meeting. Accordingly, we are nominating Ms. Crouther, Mr. Reitman and Ms. Tomlin for re-election at the Annual Meeting. If elected, each of them will serve as a Class I director until our annual meeting of shareholders in 2024 and until the election and qualification of their respective successors in office.

The following table lists each of our directors as of the date of this proxy statement. All of our directors are independent except Mr. Idol.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Director Tenure (Years)* | | Principal Occupation | | Other Public Company Boards | | Class | | Term Expiring | | Committee Membership |

| John D. Idol | | 62 | | 9.5 | | Chairman and Chief Executive Officer of Capri Holdings Limited | | 0 | | III | | 2023 | | None |

| M. William Benedetto | | 80 | | 9.5 | | Co-founder and retired chairman emeritus of The Benedetto Gartland Group | | 0 | | I | | 2021 (retiring) | | Audit; Compensation and Talent |

| Marilyn Crouther | | 55 | | < 1 | | CEO & Principal of Crouther Consulting, LLC | | 1 | | I | | 2021 (nominated for re-election) | | Audit; Compensation and Talent |

| Robin Freestone | | 62 | | 4.5 | | Retired chief financial officer | | 3 | | III | | 2023 | | Audit (Chair); Compensation and Talent |

| Judy Gibbons | | 64 | | 8.5 | | Retired technology executive | | 0 | | II | | 2022 | | Audit; Governance, Nominating and Corporate Social Responsibility (Chair) |

| Ann Korologos | | 79 | | 8 | | Former U.S. Secretary of Labor; Chairman Emeritus of The Aspen Institute | | 0 | | III | | 2023 | | Compensation and Talent; Governance, Nominating and Corporate Social Responsibility |

| Stephen F. Reitman | | 73 | | 9.5 | | President and Chief Executive Officer of Reitmans (Canada) Limited | | 0 | | I | | 2021 (nominated for re-election) | | Audit; Governance, Nominating and Corporate Social Responsibility |

| Jane Thompson | | 49 | | 6.0 | | Co-founder and director of The Fusion Labs | | 0 | | II | | 2022 | | Audit; Compensation and Talent |

| Jean Tomlin | | 66 | | 8 | | Retired human resources executive | | 0 | | I | | 2021 (nominated for re-election) | | Compensation and Talent (Chair); Governance, Nominating and Corporate Social Responsibility |

_______________________________

*Commencing with our initial public offering (the “IPO”) in December 2011.

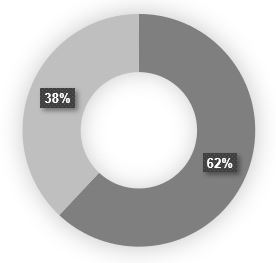

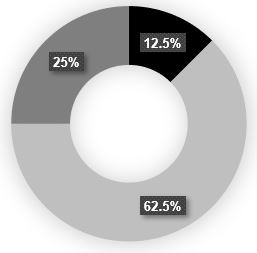

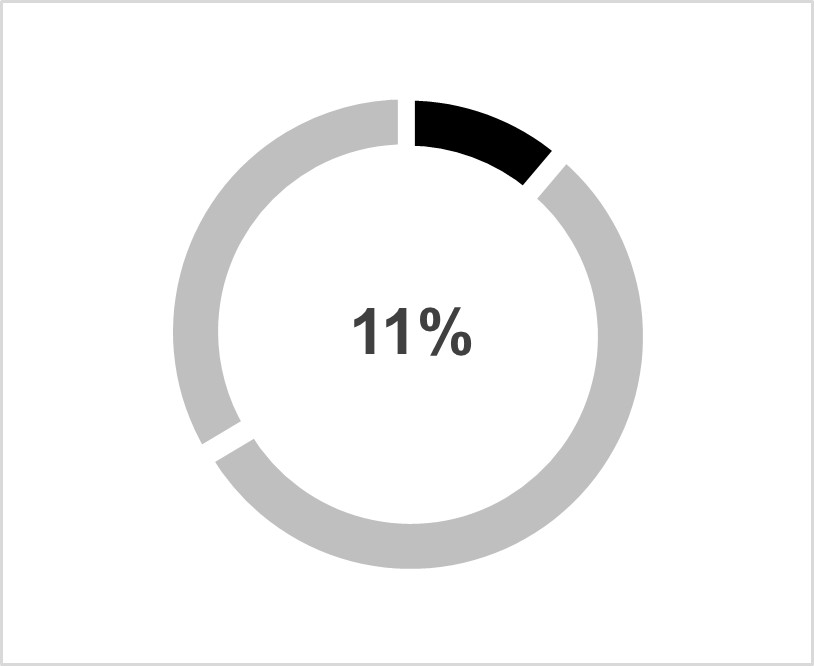

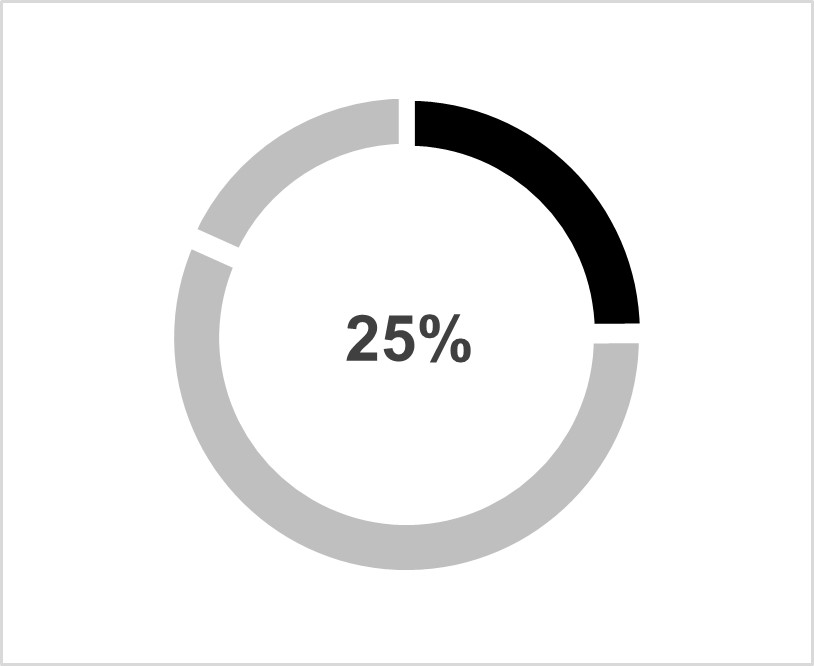

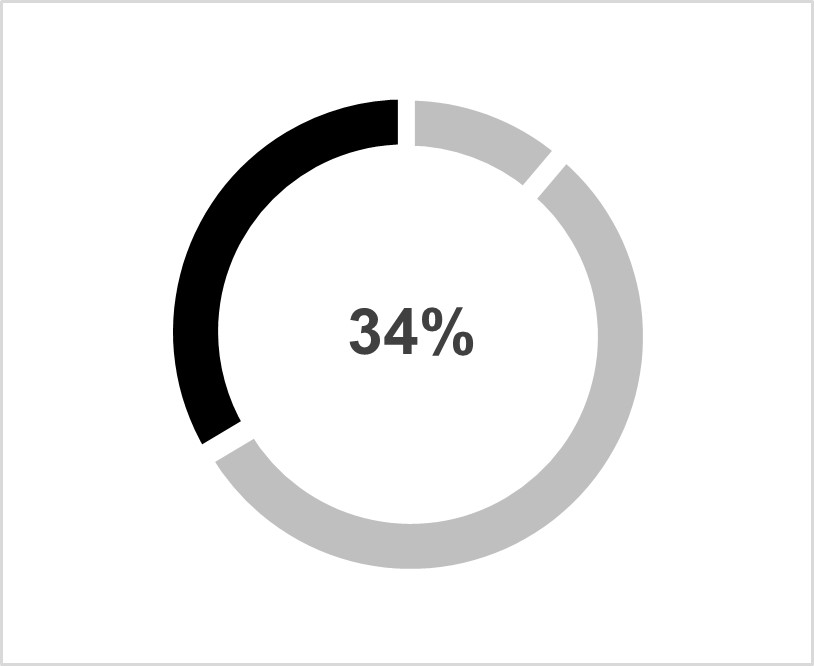

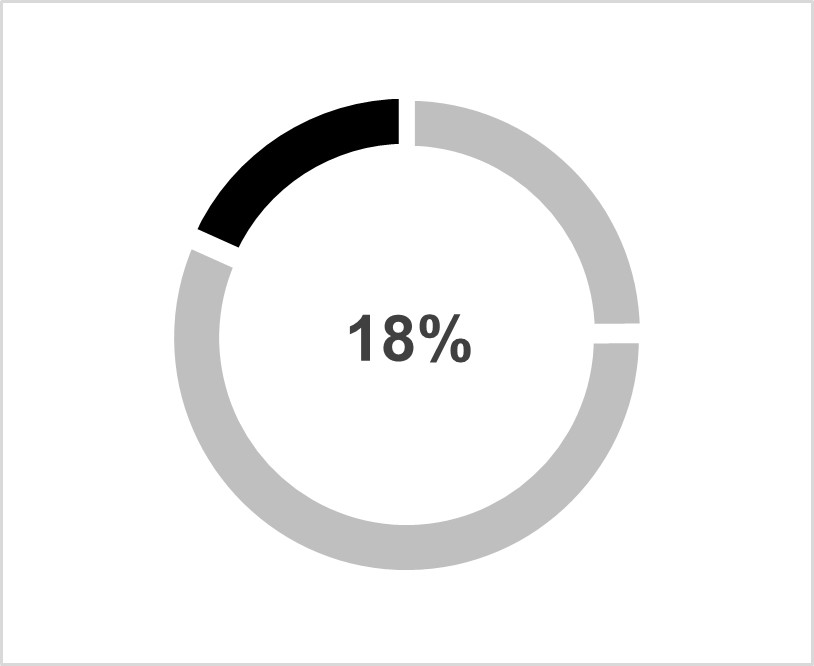

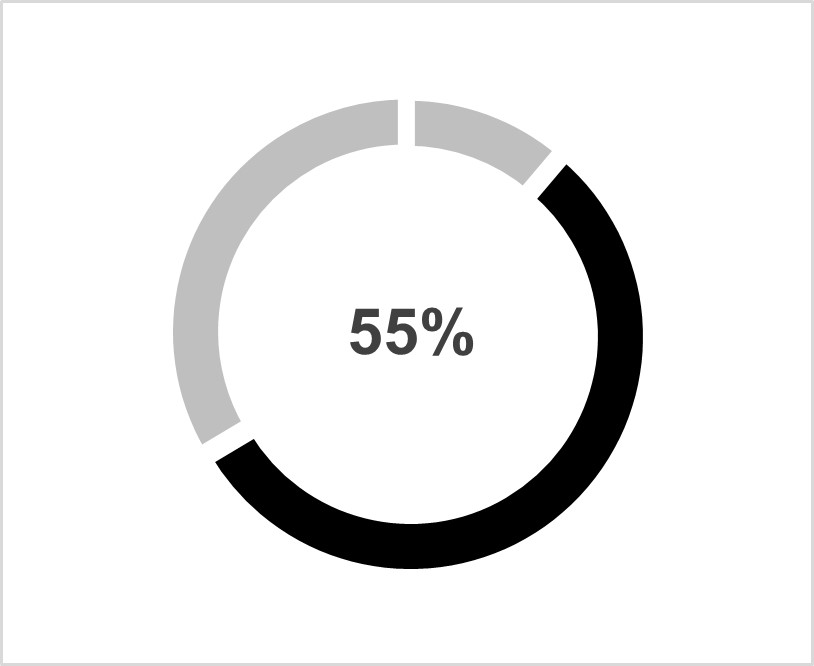

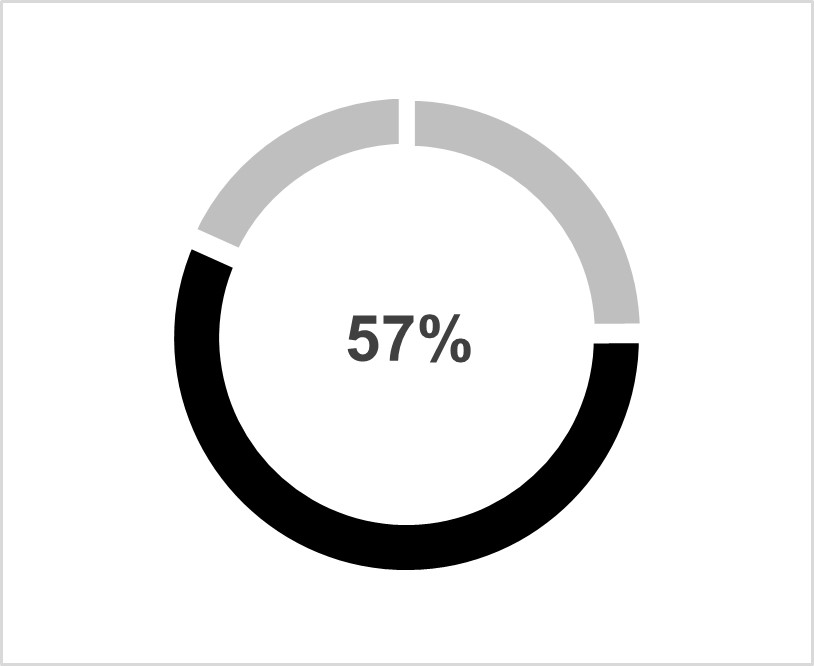

Director Diversity

We are proud of the diverse backgrounds that characterize our Board of Directors, including that more than half of our directors are women, and one-quarter of our directors are persons of color. We believe that our diversity provides significant benefits to us.

| | | | | | | | |

| GENDER | ETHNICITY | GENERATION |

| | |

| | |

_______________________________

NOTE: Data excludes M. William Benedetto who is retiring at the Annual Meeting.

Director Skills

Our Board represents a broad and diverse set of skills, qualifications and experiences that we believe are particularly valuable to the effective oversight of our Company and the execution of our strategy. The below matrix highlights the depth and breadth of skills on our Board (excluding Mr. Benedetto who is retiring).

Retiring Director

M. William Benedetto

Lead Director

Qualifications: Strong financial background; significant experience as an executive in the financial services industry; and prior public company board experience (including as audit committee and compensation committee chairman)

Experience: Mr. Benedetto joined our Board in December 2011. He is a co-founder and retired chairman emeritus of The Benedetto Gartland Group, a boutique investment bank founded in 1988 that specializes in raising equity capital for private equity firms and providing other investment banking services. From 1983 to 1988, Mr. Benedetto served as executive vice president, director and manager of Dean Witter Reynolds, Inc.’s Investment Banking Division. From 1980 to 1983, Mr. Benedetto served as head of corporate finance for Warburg Paribas Becker, and previously Mr. Benedetto served as an executive in the financial services industry since 1978. Mr. Benedetto was lead director of Donna Karan International from 1996 to 2001 and chaired its audit and compensation committees. Mr. Benedetto was a member of the board of directors of Georgetown University, as well as the chairman of its board of regents, until June 30, 2010, and was a director of FidelisCare, a non-for-profit healthcare insurance company, until 2018.

Class I Director Nominees for Election at the 2021 Annual Meeting

Marilyn Crouther

Qualifications: More than 30 years experience delivering transformational technology and IT modernization services and strong background in finance and accounting

Experience: Ms. Crouther joined our Board in June 2021. She is currently the CEO and Principal of Crouther Consulting, LLC, a firm that provides consulting services to IT companies. Most recently, Ms. Crouther was senior vice president, general manager at DXC Technology Company. Before that, she was senior vice president and general manager for Hewlett Packard Enterprise, having joined Hewlett Packard in 1989. While at Hewlett Packard, Marilyn served in various senior management positions, including vice president of finance for the U.S. public sector business and industry controller for its government industry group. Currently, Ms. Crouther also serves as a director of ICF, a NASDAQ-listed global consulting and digital services provider.

Stephen F. Reitman

Qualifications: Extensive experience as an executive in the retail industry with in-depth industry knowledge and strong retail operations background

Experience: Mr. Reitman joined our Board in December 2011. He has served on the board of directors and as an officer of Reitmans (Canada) Limited (“Reitmans”), a specialty ladies’ wear retailer based in Canada, since 1984. He is currently the President and Chief Executive Officer of Reitmans, having previously served as President and Chief Operating Officer.

Jean Tomlin

Qualifications: Extensive management experience in human resources and unique insight into human resources matters

Experience: Ms. Tomlin joined our Board in March 2013. She served as Director of Human Resources of the London Organising Committee of the Olympic and Paralympic Games from 2006 through the end of March 2013. Previously, she was the Director of Human Resources of Marks & Spencer plc, a major British retailer. Ms. Tomlin also spent 15 years at Prudential plc and nine years at Ford Motor Company in the UK in various human resources management positions. Currently, Ms. Tomlin also serves as a director of Holdingham Group Limited, a privately owned management consultancy business, and she previously served as a director of J. Sainsbury plc, the UK’s third-largest food retailer and grocery store operator.

Vote Required and Board Recommendation

If a quorum is present, directors are elected by the affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the Annual Meeting and are voted and not abstained. Ordinary shares that constitute broker non-votes are not considered entitled to vote on Proposal No. 1 and will not affect the outcome of this matter, assuming a quorum is present. Abstentions will have the same effect as a vote “AGAINST” this proposal.

Our Board of Directors has no reason to believe that any of the nominees listed above would be unable to serve as a director of the Company. If, however, any nominee were to become unable to serve as a director, the proxy holders will have discretionary authority to vote for a substitute nominee.

Our Board of Directors unanimously recommends a vote “FOR” the election of the three Class I director nominees named above. Unless contrary voting instructions are provided, the persons named as proxies will vote “FOR” the election of Marilyn Crouther, Stephen F. Reitman and Jean Tomlin to hold office as directors until the 2024 annual meeting of shareholders and until the election and qualification of their respective successors in office.

Continuing Directors

Class II Directors for Election at the 2022 Annual Meeting

Judy Gibbons

Qualifications: Over 25 years of experience as a business leader in technology sector with strong strategic and operational knowledge of digital media, e-commerce and technology

Experience: Ms. Gibbons joined our Board in November 2012. She was employed by Accel Partners in Europe as a venture partner and board member, focusing primarily on early stage equity investments across mobile applications, digital advertising, e-commerce and social media from 2005 until 2010. Prior to joining Accel Partners, Ms. Gibbons was Corporate Vice President at Microsoft where she spent ten years in international leadership roles in the company’s Internet division. Previously, she has held senior positions at Apple Inc. and Hewlett Packard. Ms. Gibbons currently serves as Chairman of Which? Limited. She previously served as a director of Guardian Media Group plc and Hammerson plc.

| | | | | | | | |

10 | 2021 Proxy Statement | | |

Jane Thompson

Qualifications: Over 10 years of experience in e-commerce, digital marketing and technology with expertise in customer relationship management (CRM)

Experience: Ms. Thompson joined our Board in January 2015. She is currently Co-Founder and Director of The Fusion Labs, a UK-based digital marketing and e-commerce company, which operates a network of niche e-commerce sites. From 2007 to 2009, Ms. Thompson was Managing Director, International at IAC/InterActiveCorp, a leading interactive media and Internet company, and from 2003 to 2007, she held various senior roles at Match.com LLC, including as Senior Vice President and General Manager, North America. She also previously worked as a management consultant at Bain & Company in London. Ms. Thompson is an active investor in digital businesses as well as a director of Listcorp.com, Stitch.net and Lightsense Technologies Ltd. She holds a MBA from the Wharton School of the University of Pennsylvania.

Class III Directors for Election at the 2023 Annual Meeting

John D. Idol

Chairman

Qualifications: CEO for over 15 years with intimate knowledge of our business operations and strategy; more than 30 years of experience in the retail industry with extensive knowledge of sales and marketing, product development, operations, finance and strategy; and prior public company board and CEO experience

Experience: Mr. Idol has been our Chief Executive Officer and a director since December 2003. In September 2011, he was appointed Chairman of the Board. Previously, from July 2001 until July 2003, Mr. Idol served as Chairman and Chief Executive Officer and a director of Kasper ASL, Ltd., whose lines included the Anne Klein brand. Prior to that, from July 1997 until July 2001, Mr. Idol served as Chief Executive Officer and a director of Donna Karan International Inc. Mr. Idol also served as Ralph Lauren’s Group President and Chief Operating Officer of Product Licensing, Home Collection and Men’s Collection from 1994 until 1997.

Robin Freestone

Qualifications: Esteemed FTSE 100 executive with significant experience across a broad array of international businesses, including as chief financial officer

Experience: Mr. Freestone joined our Board in November 2016. He was Chief Financial Officer of Pearson Plc, from 2006 through August 2015, having previously served as Deputy Chief Financial Officer since 2004. Prior to that, he held a number of senior financial positions at Amersham plc from 2000 to 2004, Henkel Chemicals UK Ltd from 1995 to 2000 and ICI/Zeneca Agrochemicals Ltd (now Syngenta) from 1985 to 1995. He began his financial and accounting career at Touche Ross (now Deloitte). Mr. Freestone also serves as a non-executive director of Smith and Nephew plc and Aston Martin Lagonda, and as Chairman of the Board of moneysupermarket.com.

| | | | | | | | |

11 | 2021 Proxy Statement | | |

Ann Korologos

Qualifications: Significant knowledge and experience in the areas of international markets, marketing, regulatory and government affairs, policy making and corporate governance; and seasoned public company board member

Experience: Ms. Korologos joined our Board in March 2013. She is a former U.S. Secretary of Labor. She is Chairman Emeritus of The Aspen Institute, a nonprofit organization, and previously served as the Chairman of the Board of Trustees of the RAND Corporation from April 2004 to April 2009. Ms. Korologos has significant public company board experience. She previously served on the boards of AMR Corporation (and its subsidiary, American Airlines), Kellogg Company, Harman International Industries, Inc. Vulcan Materials Company, and Host Hotels & Resorts, Inc. among others.

| | | | | | | | |

12 | 2021 Proxy Statement | | |

CORPORATE GOVERNANCE

Corporate Governance Highlights

We are committed to strong corporate governance practices as demonstrated by the following policies and practices:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Independence | | Accountability | | Alignment with Shareholders | | Board Practices | | Corporate Social Responsibility |

| All non-employee directors are independent | | Majority voting in uncontested elections | | Executive compensation program emphasizes pay for performance | | Strong lead independent director | | Global strategy to achieve significant, measurable goals across a range of important environmental and social sustainability issues |

| | | | | | | | |

| Independent directors meet regularly in executive session | | Advisory vote on compensation held annually | | Robust share ownership guidelines for executive officers and directors | | Comprehensive governance framework including Corporate Governance Guidelines and Code of Business Conduct and Ethics | | Commitment to fostering an inclusive environment where employees and customers of diverse backgrounds are respected, valued and celebrated |

| | | | | | | | |

| Fully independent Board committees | | Incentive compensation for executives subject to our Clawback Policy | | Shareholder engagement | | Board oversight of risk management | | Through our Code of Conduct for Business Partners and Factory Social Compliance Program, we partner with our suppliers on important human rights, health and safety, environmental and compliance issues |

| | | | | | | | |

| | | | No hedging our stock | | Annual board and committee evaluations | | |

| | | | | | | | |

| | | | | | Succession planning for Board, CEO and other members of senior management | | |

Corporate Social Responsibility

As a global fashion luxury group, we recognize the impact that our operations can have on the environment and the social well-being of others. We have developed a corporate social responsibility (CSR) strategy in order to drive positive change within our organization and our world. Our corporate social responsibility strategy builds upon the initiatives that each of our brands has already been working on. Our April 2020 CSR Report outlines our global strategy to achieve significant, measurable goals across a range of important environmental and social sustainability issues, including material sourcing, greenhouse gas emissions, water use, waste reduction, diversity and inclusion and philanthropic giving.

Our CSR strategy is divided into three areas:

•Our World – focused on actions across our operations and supply chain, meant to significantly reduce our environmental impact.

•Our Community – fostering a supportive, healthy, diverse and inclusive workplace for all of our employees.

•Our Philanthropy – connecting the talents, energy and success of each of our brands to those in need around the world.

A copy of our CSR Report is available on our website at www.capriholdings.com/csr.

| | | | | | | | |

13 | 2021 Proxy Statement | | |

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines, which are available on our website at www.capriholdings.com and in print to any shareholder who requests a copy from our Corporate Secretary. The Corporate Governance Guidelines set forth our corporate governance principles. These guidelines reflect the governance rules of NYSE listed companies, and address, among other governance matters, Board composition and responsibilities, committees, director compensation, Board and committee self-appraisals, CEO compensation and executive succession planning.

Code of Business Conduct and Ethics

We have a Code of Business Conduct and Ethics, which is applicable to all of our directors, executive officers and employees, including our CEO and CFO. A copy of our Code of Business Conduct and Ethics is available on our website at www.capriholdings.com and in print to any shareholder who requests a copy from our Corporate Secretary. Our Code of Business Conduct and Ethics reflects our commitment to a culture of honesty, integrity and accountability and outlines the basic principles and policies with which all of our directors, executive officers and employees are expected to comply. We proactively promote ethical behavior and encourage our directors, executive officers and employees to report violations of the Code of Business Conduct and Ethics, unethical behavior or other concerns either directly to a supervisor, the Human Resources Department or the Legal Department or through an anonymous toll-free telephone hotline.

We also expect all of our employees (including our executive officers) and our directors to promptly report any potential relationships, actions or transactions, including those involving immediate family members, that reasonably could be expected to give rise to a conflict of interest to our General Counsel, Chief People Officer and Head of Internal Audit, in the case of potential conflicts involving an executive officer or director, or to the employee’s supervisor or a representative of our Human Resources Department, in the case of potential conflicts involving any other employee. If we amend or waive the Code of Business Conduct and Ethics with respect to any of our directors or our CEO or CFO, we will promptly disclose such amendment or waiver as required by applicable law and the NYSE, and we will post such amendment or waiver on our website referenced above.

Independence of Board

A majority of our directors and each member of our Audit Committee, Compensation and Talent Committee and Governance, Nominating and Corporate Social Responsibility Committee are required to be “independent” within the meaning of the NYSE listing standards and the guidelines for director independence set forth in our Corporate Governance Guidelines. The Governance, Nominating and Corporate Social Responsibility Committee reviews the independence of all members of the Board for purposes of determining which Board members are deemed independent and which are not. The Governance, Nominating and Corporate Social Responsibility Committee and our Board of Directors affirmatively determined that M. William Benedetto, Marilyn Crouther, Robin Freestone, Judy Gibbons, Ann Korologos, Stephen F. Reitman, Jane Thompson and Jean Tomlin are each independent.

| | | | | | | | |

14 | 2021 Proxy Statement | | |

Committees of the Board and Meeting Attendance

Our Board of Directors has three standing committees: an Audit Committee, a Compensation and Talent Committee and a Governance, Nominating and Corporate Social Committee. Directors are expected to attend Board meetings and meetings of the committees on which they serve, and to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. Directors are also expected to review meeting materials prior to Board and committee meetings. Each director’s attendance at, and preparation for, Board and committee meetings is considered by the full Board (including the Chairman) when recommending director nominees. All of our non-employee directors are invited to attend all committee meetings.

The following table sets forth the current members of each committee and the number of meetings held by the Board and each standing committee:

| | | | | | | | | | | | | | | | | | | | |

| | Audit Committee | | Compensation and Talent Committee | | Governance, Nominating and Corporate Social Responsibility Committee |

M. William Benedetto  L(1)(2) L(1)(2) | | | | | | |

Marilyn Crouther  (3) (3) | | | | | | |

Robin Freestone  (2) (2) | | | | | | |

| Judy Gibbons | | | | | | |

| Ann Korologos | | | | | | |

| Stephen F. Reitman | | | | | | |

| Jane Thompson | | | | | | |

| Jean Tomlin | | | | | | |

| Number of Board Meetings in Fiscal 2021: 17 | | | | | | |

| Number of Committee Meetings in Fiscal 2021: | | 4 | | 4 | | 4 |

_______________________________

Chairperson  Member

Member  Financial Expert

Financial Expert  Lead Director L

Lead Director L (1) Retiring at the Annual Meeting.

(2) Effective immediately following the Annual Meeting, Robin Freestone will be appointed Lead Director.

(3) Appointed effective June 1, 2021.

During Fiscal 2021, the Board was extensively involved in COVID-19 pandemic risk management, which necessitated a number of special Board meetings focused on mitigating financial, operational, and human capital risk exposures associated with the global outbreak. Each of our directors who served on our Board during Fiscal 2021 attended at least 75% of the total number of meetings of our Board of Directors, and each attended at least 75% of the total number of meetings of each committee of our Board of Directors on which such director served in Fiscal 2021. The Board of Directors and its committees also act from time to time by written consent in lieu of meetings. Directors are encouraged (but not required) to attend our annual meeting of shareholders. John D. Idol, M. William Benedetto, Judy Gibbons, Ann Korologos, Stephen Reitman, Jane Thompson and Jean Tomlin attended our annual meeting of shareholders held in 2020.

| | | | | | | | |

15 | 2021 Proxy Statement | | |

Audit Committee

The primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities with respect to: (i) the accounting and financial reporting processes of the Company and the related internal controls, including the integrity of the financial statements and other financial information of the Company; (ii) the Company’s compliance with legal and regulatory requirements; (iii) the independent auditor’s qualifications and independence; (iv) the audit of the Company’s financial statements; (v) the performance of the Company’s internal audit function and the independent auditor; and (vi) such other matters mandated by applicable law or NYSE rules.

In carrying out these responsibilities, the Audit Committee, among other things:

•Selects, determines compensation of, evaluates and, where appropriate, replaces the independent auditor;

•Approves all audit engagement fees and terms and all non-audit engagements with the independent auditor;

•Evaluates annually the performance of the independent auditor and the lead audit partner;

•Reviews annual audited and quarterly unaudited financial statements with management and the independent auditor;

•Reviews reports and recommendations of the independent auditor;

•Reviews the scope and plan of work to be done by the internal audit group and annually reviews the performance of the internal audit group and the appointment, replacement and compensation of the person responsible for the Company’s internal audit function;

•Reviews management’s assessment of the effectiveness of the Company’s internal control over financial reporting and the independent auditor’s related attestation;

•Oversees the Company’s risk assessment and risk management policies, procedures and practices;

•Establishes procedures for receiving and responding to complaints regarding accounting, internal accounting controls or auditing matters;

•Reviews and, if appropriate, approves related person transactions; and

•Evaluates its own performance annually and reports regularly to the Board.

A complete copy of the Audit Committee Charter is available on our website at www.capriholdings.com.

The Board of Directors has determined that each member of the Audit Committee satisfies the independence requirements of Rule 10A-3 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the NYSE rules, and that each member of the Audit Committee is financially literate. Furthermore, the Board of Directors has determined that each of Mr. Benedetto, Ms. Crouther and Mr. Freestone is an “audit committee financial expert” under the rules of the SEC implementing Section 407 of the Sarbanes-Oxley Act of 2002.

Compensation and Talent Committee

The Compensation and Talent Committee has direct responsibility for the compensation of the Company’s executive officers, including the CEO, and for the Company’s incentive compensation and equity-based plans.

In carrying out these responsibilities, the Compensation and Talent Committee, among other things:

| | | | | | | | |

16 | 2021 Proxy Statement | | |

•Reviews the Company’s compensation strategy to ensure it is appropriate;

•Reviews and approves the corporate goals and objectives of the Company’s CEO, evaluates the CEO’s performance in light of those goals and objectives and, either as a committee or together with the other independent directors (as directed by the Board), determines and approves the CEO’s compensation level, perquisites and other benefits based on this evaluation;

•Recommends and sets appropriate compensation levels for the Company’s named executive officers;

•Evaluates the potential risks associated with the Company’s compensation policies and practices;

•Reviews, evaluates and makes recommendations to the Board with respect to incentive compensation plans, equity-based plans and director compensation, and is primarily responsible for setting performance targets under annual cash incentive and long-term equity incentive compensation plans, and certifying the achievement level of any such performance targets;

•Reviews our annual equity share usage rate and aggregate long-term equity incentive grant value on a regular basis to ensure that the dilutive and earnings impact of equity compensation remains appropriate, affordable and competitive;

•Reviews the Company’s programs relating to diversity and inclusion, leadership and talent development;

•Reviews the Company’s global HR strategy and strategic priorities;

•Retains (or terminates) consultants to assist in the evaluation of director and executive officer compensation;

•Reviews executive compensation-related regulatory developments and industry wide compensation practices and general market trends in order to ensure compliance with law and assess the adequacy and competitiveness of the Company’s compensation programs; and

•Evaluates its own performance annually and reports regularly to the Board.

A complete copy of the Compensation and Talent Committee Charter is available on our website at www.capriholdings.com.

Compensation Committee Interlocks and Insider Participation

No person who served as a member of our Compensation and Talent Committee during Fiscal 2021 has served as one of our executive officers or employees or has any relationship requiring disclosure under Item 404 of Regulation S-K of the U.S. Securities Act of 1933, as amended (the “Securities Act”).

None of our executive officers serves as a member of the board of directors or as a member of the compensation committee of any other company that has an executive officer serving as a member of our Board or our Compensation and Talent Committee.

| | | | | | | | |

17 | 2021 Proxy Statement | | |

Governance, Nominating and Corporate Social Responsibility Committee

The purpose of the Governance, Nominating and Corporate Social Responsibility Committee (the “Governance Committee”) is to perform, or assist the Board in performing, the duties of the Board relating to: (i) identification and nomination of directors; (ii) areas of corporate governance; (iii) succession planning for the CEO and other members of senior management; (iv) annual performance evaluations of the Board and the committees of the Board; (v) oversight of the Company’s corporate social responsibility program in order to ensure appropriate supervision of our goal-setting and public reporting process relating to corporate social responsibility and sustainability; and (v) the other duties and responsibilities set forth in its charter.

In carrying out these responsibilities, the Governance Committee, among other things:

•Reviews Board and committee composition and size;

•Identifies candidates qualified to serve as directors;

•Assists the Board in determining whether individual directors have material relationships with the Company that may interfere with their independence;

•Establishes procedures for the Governance Committee to exercise oversight of the evaluation of senior management;

•Reviews and discusses management succession and makes recommendations to the Board with respect to potential successors to the CEO and other key members of senior management;

•Reviews and assesses the adequacy of the Company’s Corporate Governance Guidelines;

•Reviews policies and practices of the Company and monitors compliance in the areas of corporate governance;

•Oversees the Company’s program relating to corporate social responsibility, including environmental, social and other matters of significance relating to sustainability; and

•Evaluates its own performance annually and reports regularly to the Board.

A complete copy of the Governance Committee Charter is available on our website at www.capriholdings.com.

Executive Sessions

Pursuant to our Corporate Governance Guidelines, the Board is required to meet at least quarterly in executive session without management directors or any members of management, whether or not they are directors, present. Our Lead Director presides over executive sessions of the Board of Directors.

Board Evaluations

The Board of Directors and each committee conducts annual evaluations of their performance to determine if the directors, the Board and the standing committees are performing effectively. The results of the Board and committee evaluations are reviewed and addressed by the Governance Committee and discussed with the full Board in an executive session without the presence of management. Relevant findings are communicated to management to improve the effectiveness of the Board and Board meetings.

| | | | | | | | |

18 | 2021 Proxy Statement | | |

Director Nomination Process and Elections; Board Diversity

The Governance Committee is responsible for, among other things, identifying individuals qualified to become members of the Board in a manner consistent with the criteria approved by the Board. The Corporate Governance Guidelines set forth qualifications and criteria for our directors. The Board of Directors seeks members from diverse professional and personal backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. We do not have a formal policy on diversity, but the Governance Committee and the Board will assess an individual’s independence, diversity, age, skills and experience in the context of the needs of the Board.

The Governance Committee will consider candidates recommended by our executive officers and directors, including our Chairman and CEO, employees and others. In addition, the Governance Committee may engage third-party search firms to identify qualified director candidates. When identifying and evaluating candidates, the Governance Committee determines whether there are any evolving needs of the Board that require an expert in a particular field. The Chair of the Governance Committee and some or all of the members of the Board of Directors (including the Chairman and CEO) will interview potential candidates that the Governance Committee deems appropriate. The Governance Committee will listen to feedback received from those directors that had the opportunity to meet with the potential candidate. If the Governance Committee deems appropriate, it will recommend the nomination of the candidate to the full Board for approval.

The Governance Committee will also consider candidates proposed by shareholders of the Company and all candidates will be evaluated in the same manner regardless of the source of such nomination so long as shareholder nominations are properly submitted to us. Shareholders wishing to recommend persons for consideration by the Governance Committee as nominees for election to the Board must do so in accordance with the procedures set forth under “Proposals of Shareholders for the 2022 Annual Meeting” and in compliance with our Memorandum.

In accordance with the Memorandum, directors must be elected by the affirmative vote of a simple majority of the votes of the ordinary shares entitled to vote that are present at the meeting and are voted and not abstained. In the event an incumbent director fails to receive a simple majority of the votes in an uncontested election, such incumbent director is required to tender a resignation letter in accordance with the Company’s Corporate Governance Guidelines. The Governance Committee will then make a recommendation to the Board as to whether to accept or reject the resignation or whether such other action should be taken. The Board will act on the resignation, taking into account the Governance Committee’s recommendation, and publicly disclose its decision regarding the resignation within 90 days following certification of the election results.

The Governance Committee, in making its recommendation, may consider any factors and other information that it considers appropriate and relevant, including, without limitation, the stated reasons why shareholders voted “against” such director, the director’s length of service and qualifications, the director’s contributions to the Company, compliance with applicable NYSE rules and listing standards and the Corporate Governance Guidelines. The incumbent director will remain active and engage in Board activities while the Governance Committee and the Board decide whether to accept or reject such resignation or take other action, but the incumbent director will not participate in deliberations by the Governance Committee or the Board regarding whether to accept or reject the director’s resignation.

| | | | | | | | |

19 | 2021 Proxy Statement | | |

Board Leadership Structure; Lead Independent Director

John D. Idol, our CEO, has been the Chairman of our Board of Directors since shortly before our IPO in December 2011. The Board believes that the Company can most effectively execute its business plans and strategy and drive value for shareholders if Mr. Idol, who has intimate knowledge of our business operations and strategy and extensive experience in the retail industry, serves the combined role of Chairman and CEO. A combined Chairman and CEO serves as a bridge between the Board and management, and provides our Board and Company with unified leadership. The Board believes that Mr. Idol’s unified leadership enables us to better communicate our vision and strategy clearly and consistently across our organization and to customers and shareholders.

We have a Lead Director in order to provide strong and independent leadership to the Board. Currently, M. William Benedetto serves as Lead Director. Upon Mr. Benedetto’s retirement, Robin Freestone will be appointed our Lead Director. The Lead Director:

•presides at meetings of the Board in the absence of, or upon the request of, the Chairman, including executive sessions of the non-management directors;

•serves as principal liaison to facilitate communications between the other directors and the Chairman, without inhibiting direct communications between the Chairman and the other directors;

•consults with the Chairman in the preparation of the annual Board meeting schedule and in determining the need for special meetings of the Board;

•suggests to the Chairman agenda items for meetings of the Board and approves the agenda as well as the substance and timeliness of information sent to the Board;

•calls meetings of the non-management directors when necessary and appropriate;

•leads the evaluation process and provides feedback to the CEO in consultation with the Chair of the Compensation and Talent Committee;

•serves as the liaison to shareholders who request direct communications with the Board;

•performs such other duties as the Board may from time to time delegate; and

•assists in optimizing the effectiveness of the Board and ensures that it operates independently of management.

In addition to the active and independent leadership that the Lead Director brings to the Board, the independent chairs of each of the Board’s standing committees provide leadership for matters under the jurisdiction of their respective committees.

| | | | | | | | |

20 | 2021 Proxy Statement | | |

Risk Oversight

Management is responsible for understanding and managing the risks that we face in our business, and the Board of Directors is responsible for overseeing management’s overall approach to risk management. The Board has an active role, as a whole and also at the committee level, in overseeing management of our risks to ensure our risk management policies are consistent with our corporate strategy. The Board regularly reviews the Company’s major strategic, operational, financial, legal and regulatory and reputational risks as well as risks relating to cybersecurity and global information systems and environmental, social and sustainability matters along with potential options for mitigating these risks. The Board is informed of these risks through regular reports from our Chief Executive Officer, Chief Financial Officer and Chief Operating Officer, General Counsel and Chief Sustainability Officer, and other key members of senior management. The Company’s independent and internal auditors and other relevant third parties work with senior management (and in connection with their oversight responsibility, the Board and its committees) to ensure that enterprise-wide risk management is incorporated into the Company’s business and strategy. In connection with the recent COVID-19 pandemic, the Board, together with management, has overseen our efforts to mitigate the financial, human capital management and other business and operational risks related to the outbreak.

The Board has delegated to its committees responsibility for elements of the Company’s risk management program that relate specifically to matters within the scope of each such committee’s duties and responsibilities.

The Audit Committee is primarily responsible for oversight of:

•accounting, auditing, internal control and financial-related risks;

•the operation of our enterprise risk management program;

•information systems infrastructure and cybersecurity risk; and

•risk management, compliance and legal and regulatory matters.

The Compensation and Talent Committee is primarily responsible for oversight of:

•the various design elements of our compensation program to determine whether any of its aspects encourage excessive or inappropriate risk-taking; and

•the management of risks relating to our executive compensation plans and arrangements.

See “Compensation and Talent Committee Risk Assessment.”

The Governance Committee is primarily responsible for oversight of:

•risks associated with the independence of the Board;

•compliance by the Company with corporate governance policies and rules;

•succession planning for the CEO and other key members of senior management; and

•environmental, social and sustainability related risks.

While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about those risks. The Company believes that the Board and its committees provide appropriate risk oversight of the Company’s business activities and strategic initiatives.

| | | | | | | | |

21 | 2021 Proxy Statement | | |

Shareholder Engagement

We regularly engage with shareholders to understand their perspectives on our company, our business and their concerns. We meet with and speak to shareholders during appearances by management at scheduled events, as well as in one-on-one meetings and through conference calls held throughout the year.

Communications with the Board and the Audit Committee

Shareholders and interested parties may contact any of the Company’s directors, including the Chairman, the non-management directors as a group, the Lead Director, the chair of any committee of the Board of Directors or any committee of the Board by writing them as follows:

Capri Holdings Limited

33 Kingsway

London, United Kingdom

WC2B 6UF

Attn: Corporate Secretary

Concerns relating to accounting, internal controls or auditing matters should be communicated to the Company through the Corporate Secretary and such matters will be handled in accordance with the procedures established by the Audit Committee. Any concerns may be reported anonymously.

Required Certifications

The Company has filed with the SEC, as an exhibit to its most recently filed Annual Report on Form 10-K, the certifications of its Chief Executive Officer and Chief Financial Officer required under the Sarbanes-Oxley Act of 2002. The Company has also timely submitted to the NYSE the Section 303A Annual CEO Certification for the fiscal year ended March 28, 2020 (“Fiscal 2020”), and such certification was submitted without any qualifications.

Executive Officers

The following table sets forth information regarding each of our executive officers as of the date of this proxy statement:

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

John D. Idol(1) | | 62 | | Chairman and CEO |

| Thomas J. Edwards, Jr. | | 56 | | Executive Vice President, CFO and COO |

| Jenna A. Hendricks | | 40 | | Senior Vice President, Chief People Officer |

| Krista A. McDonough | | 41 | | Senior Vice President, General Counsel and Chief Sustainability Officer |

| Daniel T. Purefoy | | 51 | | Senior Vice President, Global Operations and Head of Diversity and Inclusion |

__________________________________________

(1) Biographical information regarding Mr. Idol is set forth under “Proposal No. 1 Election of Directors—Continuing Directors—Class III Directors for Election at the 2023 Annual Meeting.”

| | | | | | | | |

22 | 2021 Proxy Statement | | |

Thomas J. Edwards, Jr. is the Executive Vice President, Chief Financial Officer and Chief Operating Officer of Capri Holdings and has been with the Company since April 2017. Previously, Mr. Edwards served as Executive Vice President and Chief Financial Officer of Brinker International, Inc. Prior to that, he held numerous positions within finance at Wyndham Worldwide from 2007 to 2015, including having served as Executive Vice President and Chief Financial Officer of the Wyndham Hotel Group from March 2013 to March 2015. Mr. Edwards has also held a number of financial and operational leadership positions in the consumer goods industry, including as Vice President, Consumer Innovation and Marketing Services at Kraft Foods and Vice President, Finance at Nabisco Food Service Company.

Jenna A. Hendricks is the Senior Vice President, Chief People Officer of Capri Holdings. She assumed this role in June 2021 having previously served as Senior Vice President, Global Human Resources for Michael Kors. She has been with the Company since 2004 in various human resources roles of increasing responsibility.

Krista A. McDonough is the Senior Vice President, General Counsel and Chief Sustainability Officer of Capri Holdings. She assumed the role of General Counsel in October 2016 and was subsequently appointed Chief Sustainability Officer. She has been with the Company since August 2011 in various legal roles, including, previously, as Deputy General Counsel. Prior to joining Capri Holdings, Ms. McDonough was an attorney in the corporate department of Paul, Weiss, Rifkind, Wharton and Garrison LLP, where she specialized in capital markets and securities law, from 2005 to 2011.

Daniel T. Purefoy has been the Senior Vice President, Global Operations since March 30, 2020 and is also the Head of Diversity and Inclusion. He has been with the Company since October 2014 in roles of increasing responsibility in the areas of operations, supply chain, strategy, engineering and procurement, most recently serving as Division Vice President, Global Operations Services. Previously, Mr. Purefoy held senior roles at The Home Depot from 2008 to 2014 and Dell from 2005 to 2008. He worked as a management consultant for Kurt Salmon Associates from 1996 to 2005. He was also a Captain in the United States Army.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our ordinary shares as of June 1, 2021 by:

•each person known to us to beneficially own more than five percent of our outstanding ordinary shares based solely on our review of SEC filings;

•each of our named executive officers;

•each of our directors; and

•all directors and executive officers as a group.

| | | | | | | | |

23 | 2021 Proxy Statement | | |

Beneficial ownership is based upon 151,329,069 ordinary shares outstanding as of June 1, 2021, unless otherwise indicated in the footnotes to the table. In addition, ordinary shares issuable upon exercise of share options or other derivative securities that are exercisable as of June 1, 2021 or will become exercisable within 60 days of June 1, 2021 are deemed outstanding for purposes of computing the percentage of the person holding such options or other derivative securities, but are not deemed outstanding for purposes of computing the percentage owned by any other person. All of the ordinary shares listed in the table below are entitled to one vote per share and each of the persons described below has sole voting power and sole investment power with respect to the shares set forth opposite his, her or its name, except as otherwise noted. Unless otherwise indicated, the address of each executive officer named in the table below is c/o Capri Holdings Limited, 11 West 42nd Street, New York, New York 10036, and the address of each director named in the table below is 33 Kingsway, London, United Kingdom WC2B 6UF.

| | | | | | | | | | | | | | |

| Beneficial Owner | | Ordinary Shares

Beneficially

Owned | | Percent of Ordinary

Shares Beneficially

Owned |

| 5% or More Shareholder | | | | |

FMR LLC(1) | | 22,595,741 | | 14.9% |

BlackRock, Inc.(2) | | 21,044,163 | | 13.9% |

The Vanguard Group(3) | | 15,077,583 | | 10.0% |

| Named Executive Officers and Directors | | | | |

John D. Idol(4) | | 3,677,998 | | 2.4% |

Thomas J. Edwards, Jr.(5) | | 126,918 | | * |

Krista A. McDonough(6) | | 60,107 | | * |

Daniel T. Purefoy(7) | | 22,497 | | * |

M. William Benedetto(8) | | 35,193 | | * |

| Marilyn Crouther | | — | | — |

Robin Freestone(8) | | 18,099 | | * |

Judy Gibbons(8) | | 33,003 | | * |

Ann Korologos(8) | | 31,285 | | * |

Stephen F. Reitman(8) | | 26,320 | | * |

Jane Thompson(8) | | 23,130 | | * |

Jean Tomlin(8) | | 24,126 | | * |

| All Executive Officers and Directors as a Group (13 persons) | | 4,105,248 | | 2.7% |

_________________________________

* Represents beneficial ownership of less than one percent of the Company’s ordinary shares outstanding.

(1) Based on Amendment No. 1 to the Schedule 13G filed with the SEC by FMR LLC (“FMR”) on February 8, 2021. The mailing address for FMR is 245 Summer Street, Boston, Massachusetts 02210. Abigail P. Johnson is a Director, the Chairman and the Chief Executive Officer of FMR. FMR may be deemed to have sole voting power with respect to 2,766,861 ordinary shares and sole dispositive power with respect to 22,595,741 ordinary shares, and Ms. Johnson has sole dispositive power with respect to 22,595,741 ordinary shares.

(2) Based on Amendment No. 2 to the Schedule 13G filed with the SEC by BlackRock, Inc. (“BlackRock”) on February 5, 2021. The mailing address for BlackRock is 55 East 52nd Street, New York, New York 10022. BlackRock may be deemed to have sole voting power with respect to 20,457,689 ordinary shares and sole dispositive power with respect to 21,044,163 ordinary shares.

(3) Based on Amendment No. 8 to the Schedule 13G filed with the SEC by The Vanguard Group (“Vanguard”) on February 10, 2021. The mailing address for Vanguard is 100 Vanguard Blvd, Malvern, Pennsylvania 19355. Vanguard may be deemed to have shared voting power with respect to 97,333 ordinary shares, sole dispositive power with respect to 14,859,330 ordinary shares and shared dispositive power with respect to 218,253 ordinary shares.