UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22619

Name of Registrant: Vanguard Charlotte Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2013 – April 30, 2014

Item 1: Reports to Shareholders

Semiannual Report | April 30, 2014

Vanguard Total International Bond Index Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Fund Profile. | 7 |

| Performance Summary. | 9 |

| Financial Statements. | 10 |

| About Your Fund’s Expenses. | 80 |

| Trustees Approve Advisory Arrangement. | 82 |

| Glossary. | 83 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: The ship’s wheel represents leadership and guidance, essential qualities in navigating difficult seas.

This one is a replica based on an 18th-century British vessel. The HMSVanguard, another ship of that era, served as the flagship for British Admiral Horatio Nelson when he defeated a French fleet at the Battle of the Nile.

| | | | |

| Your Fund’s Total Returns | | | | |

| |

| |

| |

| |

| Six Months Ended April 30, 2014 | | | | |

| | 30-Day SEC | Income | Capital | Total |

| | Yield | Returns | Returns | Returns |

| Vanguard Total International Bond Index Fund | | | | |

| Investor Shares | 1.44% | 0.74% | 1.40% | 2.14% |

| Admiral™ Shares | 1.47 | 0.76 | 1.45 | 2.21 |

| Institutional Shares | 1.55 | 0.80 | 1.47 | 2.27 |

| ETF Shares | 1.47 | | | |

| Market Price | | | | 2.33 |

| Net Asset Value | | | | 2.20 |

| Barclays Global Aggregate ex-USD Float Adjusted RIC Capped | | | | |

| Index (USD Hedged) | | | | 2.45 |

| International Income Funds Average | | | | 2.28 |

| International Income Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | | |

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements. Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria. The Vanguard ETF® Shares shown are traded on the NYSE Arca exchange and are available only through brokers. The table provides ETF returns based on both the NYSE Arca market price and the net asset value for a share. U.S. Pat. Nos. 6,879,964; 7,337,138; 7,720,749; 7,925,573; 8,090,646; and 8,417,623. The Vanguard ETF® Shares shown are traded on the Nasdaq exchange and are available only through brokers. The table provides ETF returns based on both the Nasdaq market price and the net asset value for a share. U.S. Pat. Nos. 6,879,964; 7,337,138; 7,720,749; 7,925,573; 8,090,646; and 8,417,623.

For the ETF Shares, the market price is determined by the midpoint of the bid-offer spread as of the closing time of the New York Stock Exchange (generally 4 p.m., Eastern time). The net asset value is also determined as of the NYSE closing time. For more information about how the ETF Shares' market prices have compared with their net asset value, visit vanguard.com, select your ETF, and then select the Price and Performance tab. The ETF premium/discount analysis there shows the percentages of days on which the ETF Shares' market price was above or below the NAV.

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| October 31, 2013, Through April 30, 2014 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Total International Bond Index Fund | | | | |

| Investor Shares | $9.99 | $10.13 | $0.073 | $0.000 |

| Admiral Shares | 19.98 | 20.27 | 0.150 | 0.000 |

| Institutional Shares | 29.97 | 30.41 | 0.237 | 0.000 |

| ETF Shares | 49.95 | 50.67 | 0.371 | 0.000 |

1

Chairman’s Letter

Dear Shareholder,

As global bond markets found their footing during the six months ended April 30, 2014, Vanguard Total International Bond Index Fund returned 2.14% for Investor Shares and a bit more for other share classes. In addition to earning interest income, the fund’s holdings increased in price.

The fund accomplished its investment objective of closely tracking its benchmark index: The Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged), which of course incurs no expenses, returned 2.45%. This close tracking, for a fund that is shy of its one-year anniversary, is a tribute to the skill and experience of Vanguard Fixed Income Group, the fund’s advisor.

As I noted in my first shareholder report last year, Barclays constructs and manages your fund’s custom index with caps, or limits, on certain holdings. The intent is to comply with Internal Revenue Service diversification standards for regulated investment companies, or RICs, a category that includes mutual funds. In seeking to track the index, the advisor uses a sampling strategy, holding a range of securities that in total approximates the index’s key risk factors and characteristics—such as average duration and credit quality. Sampling is a common industry practice for bond index funds because it can be very difficult and potentially costly to own all the bonds in an index—currently more than 7,600 bonds in the case of your fund’s benchmark.

2

At April 30, the fund’s 30-day SEC yield for Investor Shares was 1.44%, down from 1.64% last October and lower than the 2.10% yield of the broad U.S. bond market (as measured by Vanguard Total Bond Market Index Fund).

Despite low yields, the bond market experienced a surprising rally

Overall, bonds continued to emerge from the struggles that marked much of 2013, when many markets were roiled by the prospect that the Federal Reserve would reduce its stimulative bond-buying. Such concerns hit emerging economies especially hard, because their capital markets have been bolstered by significant cash inflows under the Fed’s easy-money policy. In January, however, when the Fed actually started to trim purchases, investors seemed to take the news in stride.

Outside the United States, bond markets overall (as measured by the Barclays Global Aggregate Index ex USD, unhedged for currency exposure) returned 2.33% for the six months ended April 30. Some of the best performers were emerging economies—whose bonds make up a very small slice of the total international bond market—and a few European markets; the European Central Bank reiterated its commitment to fight deflation and continue to stimulate economic growth. However, Russia’s conflict with Ukraine, and concerns about the impact of more Western sanctions against Russia, led to negative returns for Russian bonds.

| | | |

| Market Barometer | | | |

| | | | Total Returns |

| | | Periods Ended April 30, 2014 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable | | | |

| market) | 1.74% | -0.26% | 4.88% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 4.08 | 0.50 | 5.54 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.00 | 0.04 | 0.08 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 8.25% | 20.81% | 19.52% |

| Russell 2000 Index (Small-caps) | 3.08 | 20.50 | 19.84 |

| Russell 3000 Index (Broad U.S. market) | 7.83 | 20.78 | 19.54 |

| FTSE All-World ex US Index (International) | 2.84 | 9.77 | 13.22 |

| |

| CPI | | | |

| Consumer Price Index | 1.51% | 1.95% | 2.14% |

3

The broad U.S. taxable bond market lagged international bonds, returning 1.74%. The yield of the 10-year Treasury note ended at 2.69% in April, up from 2.54% on October 31 but down from nearly 3% on December 31. (Bond prices and yields move in opposite directions.) Municipal bonds returned 4.08%. Money market funds and savings accounts posted paltry returns as the Fed’s target for short-term interest rates remained at 0%–0.25%.

Global stocks continued to climb, despite some recent choppiness

International stocks, in aggregate, returned nearly 3% for the half year, with the developed markets of Europe faring the best. The developed markets of the Pacific region and emerging markets declined.

Investors were unsettled by the conflict in Ukraine and weak economic data from China—whose efforts to reposition its economy have significant implications for trade with countries around the globe.

U.S. stocks returned almost 8%, notwithstanding the patches of turbulence the market has encountered in 2014. Technology stocks, for example, turned in a rocky performance amid concerns about pricey valuations.

Global economic and political shifts are, of course, as inevitable as they are unpredictable. Broad diversification across stock and bond markets remains the best way of managing the risks they pose to your portfolio. As Joe Davis, our chief economist, noted recently, “Having a

| | | | | |

| Expense Ratios | | | | | |

| Your Fund Compared With Its Peer Group | | | | | |

| |

| | Investor | Admiral | Institutional | ETF | Peer Group |

| | Shares | Shares | Shares | Shares | Average |

| Total International Bond Index Fund | 0.23% | 0.20% | 0.12% | 0.20% | 1.01% |

The fund expense ratios shown are from the prospectus dated February 27, 2014, and represent estimated costs for the current fiscal year. For the six months ended April 30, 2014, the fund’s annualized expense ratios were 0.23% for Investor Shares, 0.20% for Admiral Shares, 0.12% for Institutional Shares, and 0.20% for ETF Shares. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through year-end 2013.

Peer group: International Income Funds.

4

broader portfolio tends to moderate those individual issues, and that’s always, I think, a valuable starting point for investors.”

Most bond markets gained, led by Southern Europe

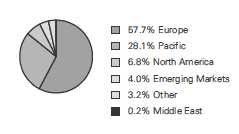

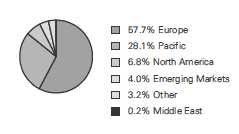

Because of their sheer size, European bond markets tend to be the main drivers of your fund’s performance. During the half year, they represented the largest regional slice of the fund and its index—nearly 60%. But Europe’s stock markets don’t always move in lockstep, and neither do their bond markets—which underscores the benefits of diversification.

A case in point: France and Germany, the two largest European markets in the index, posted returns of about 2% to 3%. Both countries have relatively strong economies compared with some other Eurozone markets such as Italy and Spain. But Italy and Spain both posted some of the highest returns in the index, about 7%, as investors gained more confidence in those nations’ creditworthiness (which helped push down bond yields and pull up their prices).

Offering perhaps the best sign of increasing confidence is Greece, which required bailouts during the financial crisis. Most Greek bonds still don’t meet the credit standards for inclusion in the Barclays Global Aggregate Index. The government’s successful sale of more than $4 billion of bonds in April was a welcome sign that things seem to be returning to normal—for Greece and the Eurozone as a whole.

The performance of Japanese bonds—the largest country holding in the fund and its index—helps illustrate the importance of your fund’s currency-hedging strategy. As the yen weakened against the U.S. dollar during the six months, Japanese bond returns were lower for U.S. investors than for yen-based investors. For example, the unhedged Barclays Japanese Aggregate Bond Index returned about –3% when translated into dollars. However, the currency-hedged index had a positive return of about half a percentage point, similar to its return in yen. Admittedly, the reverse can happen: If a foreign currency strengthens, hedging would reduce a U.S. investor’s return. Either way, hedging allows international bonds to perform like bonds.

Global bonds can help diversify interest rate risk

As the Fed further trims its bond-buying program, we’re likely to see more headlines about the prospect of higher interest rates and lower bond prices. But the latest media speculation is never a sound basis for changing your portfolio’s long-term allocation to bonds, which serve to moderate the much higher volatility of stocks.

You can nevertheless take a step to limit your exposure to U.S. interest rate risk while maintaining your portfolio’s bond allocation, by shifting some of your holdings into international bonds that are hedged for foreign currency risk.

5

Using nearly three decades of data from periods when interest rates rose, Vanguard’s research has shown that adding international bonds can effectively diversify an investor’s portfolio of local bonds—regardless of the investor’s home country. Much of this benefit arises because the interest rate movements of various markets can cancel one another out to some extent, leading to more stable returns.

Of course, there’s no guarantee that such trends will continue, and diversification doesn’t prevent losses. But it’s unlikely that all interest rates across the globe would increase at the same time or by the same magnitude. (You can read more in Fearful of Rising Interest Rates? Consider a More Global Bond Portfolio, available at vanguard.com/research.)

This strategy of global diversification is simple and straightforward and can make sense in any rate environment. As an investor in Vanguard Total International Bond Index Fund, with its low costs, you’ve already taken a step in this direction. And unlike changes in interest rates, such a strategy is under your control.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

May 19, 2014

6

Total International Bond Index Fund

Fund Profile

As of April 30, 2014

| | | | |

| Share-Class Characteristics | | | | |

| | Investor | Admiral | Institutional | |

| | Shares | Shares | Shares | ETF Shares |

| Ticker Symbol | VTIBX | VTABX | VTIFX | BNDX |

| Expense Ratio1 | 0.23% | 0.20% | 0.12% | 0.20% |

| 30-Day SEC Yield | 1.44% | 1.47% | 1.55% | 1.47% |

| | |

| Financial Attributes | | |

| |

| | | Barclays GA |

| | | ex-USD |

| | | Float Adj |

| | | RIC Capped Idx |

| | Fund | (USD Hedged) |

| Number of Bonds | 2,549 | 7,661 |

| Yield to Maturity | | |

| (before expenses) | 1.7% | 1.7% |

| Average Coupon | 3.1% | 3.2% |

| Average Duration | 6.8 years | 6.7 years |

| Average Effective | | |

| Maturity | 8.4 years | 8.4 years |

| Short-Term | | |

| Reserves | 0.9% | — |

| |

| |

| Sector Diversification (% of portfolio) |

| Asset-Backed | | 0.3% |

| Finance | | 6.5 |

| Foreign Government | | 80.6 |

| Industrial | | 5.0 |

| Utilities | | 1.4 |

| Other | | 6.2 |

| The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are generally not backed by the full faith and credit of the U.S. government. |

|

|

| | |

| |

| Distribution by Credit Quality (% of portfolio) |

| Aaa | 24.6% |

| Aa | 45.8 |

| A | 10.3 |

| Baa | 19.3 |

| For information about these ratings, see the Glossary entry for Credit Quality. |

| |

| |

| |

| Distribution by Effective Maturity | |

| (% of portfolio) | |

| Under 1 Year | 0.2% |

| 1 - 3 Years | 23.8 |

| 3 - 5 Years | 20.7 |

| 5 - 10 Years | 31.5 |

| 10 - 20 Years | 14.0 |

| 20 - 30 Years | 7.7 |

| Over 30 Years | 2.1 |

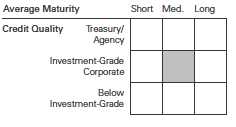

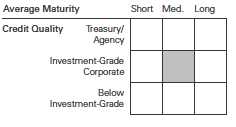

Investment Focus

1 The expense ratios shown are from the prospectus dated February 27, 2014, and represent estimated costs for the current fiscal year. For the six months ended April 30, 2014, the annualized expense ratios were 0.23% for Investor Shares, 0.20% for Admiral Shares, 0.12% for Institutional Shares, and 0.20% for ETF Shares.

7

| |

| Total International Bond Index Fund | |

| |

| |

| Market Diversification (% of portfolio ) | |

| | Fund |

| Europe | |

| France | 11.6% |

| Germany | 10.8 |

| Italy | 8.3 |

| United Kingdom | 8.1 |

| Spain | 5.6 |

| Netherlands | 3.5 |

| Belgium | 2.1 |

| Sweden | 1.7 |

| Austria | 1.5 |

| Switzerland | 1.5 |

| Other | 3.0 |

| Subtotal | 57.7% |

| Pacific | |

| Japan | 22.6% |

| Australia | 2.6 |

| South Korea | 2.1 |

| Other | 0.8 |

| Subtotal | 28.1% |

| Emerging Markets | 4.0% |

| North America | |

| Canada | 5.1% |

| United States | 1.7 |

| Subtotal | 6.8% |

| Middle East | 0.2% |

| Other | 3.2% |

Allocation by Region(% of portfolio)

8

Total International Bond Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

| | | | |

| Fiscal-Year Total Returns (%): May 31, 2013, Through April 30, 2014 | | |

| | | | | Barclays GA |

| | | | | ex-USD |

| | | | | Float Adj |

| | | | | RIC Capped Idx |

| | | | Investor Shares | (USD Hedged) |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2013 | 0.60% | -0.10% | 0.50% | 0.62% |

| 2014 | 0.74 | 1.40 | 2.14 | 2.45 |

| Note: For 2014, performance data reflect the six months ended April 30, 2014. | | |

Total Returns: Periods Ended March 31, 2014

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | | | | Since Inception |

| | Inception Date | Income | Capital | Total |

| Investor Shares | 5/31/2013 | 1.20% | 0.90% | 2.10% |

| Admiral Shares | 5/31/2013 | 1.25 | 0.85 | 2.10 |

| Institutional Shares | 5/31/2013 | 1.30 | 0.87 | 2.17 |

| ETF Shares | 5/31/2013 | | | |

| Market Price | | | | 2.41 |

| Net Asset Value | | | | 2.08 |

See Financial Highlights for dividend and capital gains information.

9

Total International Bond Index Fund

Financial Statements (unaudited)

Statement of Net Assets

As of April 30, 2014

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Australia (2.6%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.1%) | | | | |

| Australia & New Zealand Banking Group Ltd. | 1.125% | 5/13/20 | EUR | 2,000 | 2,742 |

| Australia & New Zealand Banking Group Ltd. | 1.375% | 9/4/18 | EUR | 2,000 | 2,825 |

| Commonwealth Bank of Australia | 2.625% | 1/12/17 | EUR | 1,000 | 1,463 |

| Commonwealth Bank of Australia | 3.000% | 5/3/22 | EUR | 3,000 | 4,559 |

| Commonwealth Bank of Australia | 3.000% | 9/4/26 | GBP | 700 | 1,109 |

| National Australia Bank Ltd. | 2.250% | 6/6/25 | EUR | 1,800 | 2,530 |

| National Australia Bank Ltd. | 3.000% | 9/4/26 | GBP | 500 | 792 |

| Westpac Banking Corp. | 1.375% | 4/17/20 | EUR | 2,000 | 2,786 |

| | | | | | 18,806 |

| Corporate Bonds (0.5%) | | | | | |

| Asciano Finance Ltd. | 5.000% | 9/19/23 | GBP | 500 | 875 |

| Australia & New Zealand Banking Group Ltd. | 3.750% | 3/10/17 | EUR | 5,000 | 7,501 |

| BHP Billiton Finance Ltd. | 2.125% | 11/29/18 | EUR | 3,800 | 5,513 |

| BHP Billiton Finance Ltd. | 2.250% | 9/25/20 | EUR | 1,000 | 1,448 |

| BHP Billiton Finance Ltd. | 3.125% | 4/29/33 | EUR | 500 | 710 |

| BHP Billiton Finance Ltd. | 3.250% | 9/25/24 | GBP | 3,000 | 4,852 |

| BHP Billiton Finance Ltd. | 6.375% | 4/4/16 | EUR | 2,000 | 3,076 |

| Commonwealth Bank of Australia | 1.625% | 2/4/19 | EUR | 2,000 | 2,829 |

| Commonwealth Bank of Australia | 3.875% | 12/14/15 | GBP | 180 | 318 |

| Commonwealth Bank of Australia | 4.250% | 11/10/16 | EUR | 4,000 | 6,032 |

| Commonwealth Bank of Australia | 4.375% | 2/25/20 | EUR | 3,500 | 5,654 |

| Macquarie Bank Ltd. | 3.000% | 8/9/17 | CHF | 3,000 | 3,640 |

| Macquarie Bank Ltd. | 6.000% | 9/21/20 | EUR | 1,500 | 2,397 |

| National Australia Bank Ltd. | 3.625% | 11/8/17 | GBP | 400 | 713 |

| National Australia Bank Ltd. | 4.000% | 7/13/20 | EUR | 5,100 | 8,075 |

| National Australia Bank Ltd. | 4.250% | 6/24/15 | CHF | 1,000 | 1,187 |

| National Australia Bank Ltd. | 4.750% | 7/15/16 | EUR | 4,000 | 6,036 |

| National Australia Bank Ltd. | 5.125% | 12/9/21 | GBP | 1,000 | 1,907 |

| National Australia Bank Ltd. | 6.000% | 2/15/17 | AUD | 7,500 | 7,420 |

| Origin Energy Finance Ltd. | 2.875% | 10/11/19 | EUR | 2,000 | 2,896 |

| 1 Origin Energy Finance Ltd. | 3.500% | 10/4/21 | EUR | 1,500 | 2,206 |

| 2 QBE Capital Funding IV Ltd. | 7.500% | 5/24/41 | GBP | 1,000 | 1,876 |

| QBE Insurance Group Ltd. | 6.125% | 9/28/15 | GBP | 130 | 232 |

| 2 Santos Finance Ltd. | 8.250% | 9/22/70 | EUR | 750 | 1,180 |

| Telstra Corp. Ltd. | 2.500% | 9/15/23 | EUR | 3,000 | 4,243 |

| Wesfarmers Ltd. | 2.750% | 8/2/22 | EUR | 3,000 | 4,330 |

| Wesfarmers Ltd. | 4.750% | 3/12/20 | AUD | 5,000 | 4,671 |

| Westfield Retail Trust 1 | 3.250% | 9/11/23 | EUR | 3,273 | 4,850 |

10

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Westfield UK & Europe Finance plc | 4.250% | 7/11/22 | GBP | 2,300 | 4,225 |

| Westpac Banking Corp. | 1.375% | 12/23/15 | GBP | 300 | 509 |

| Westpac Banking Corp. | 4.250% | 9/22/16 | EUR | 6,000 | 9,017 |

| Westpac Banking Corp. | 6.000% | 2/20/17 | AUD | 3,700 | 3,661 |

| Westpac Banking Corp. | 7.250% | 11/18/16 | AUD | 11,500 | 11,663 |

| | | | | | 125,742 |

| Sovereign Bonds (2.0%) | | | | | |

| Australia Government Bond | 5.750% | 7/15/22 | AUD | 10,000 | 10,574 |

| Commonwealth of Australia | 2.750% | 4/21/24 | AUD | 21,000 | 17,581 |

| Commonwealth of Australia | 3.250% | 4/21/29 | AUD | 13,000 | 10,639 |

| Commonwealth of Australia | 4.250% | 7/21/17 | AUD | 10,000 | 9,640 |

| Commonwealth of Australia | 4.500% | 4/15/20 | AUD | 22,000 | 21,551 |

| Commonwealth of Australia | 4.500% | 4/21/33 | AUD | 7,000 | 6,511 |

| Commonwealth of Australia | 4.750% | 10/21/15 | AUD | 25,000 | 23,915 |

| Commonwealth of Australia | 4.750% | 6/15/16 | AUD | 40,000 | 38,669 |

| Commonwealth of Australia | 4.750% | 4/21/27 | AUD | 10,000 | 9,818 |

| Commonwealth of Australia | 5.250% | 3/15/19 | AUD | 11,000 | 11,098 |

| Commonwealth of Australia | 5.500% | 1/21/18 | AUD | 16,000 | 16,098 |

| Commonwealth of Australia | 5.500% | 4/21/23 | AUD | 50,600 | 52,871 |

| Commonwealth of Australia | 5.750% | 5/15/21 | AUD | 15,000 | 15,759 |

| Commonwealth of Australia | 6.000% | 2/15/17 | AUD | 35,000 | 35,184 |

| New South Wales Treasury Corp. | 3.500% | 3/20/19 | AUD | 10,000 | 9,289 |

| New South Wales Treasury Corp. | 4.000% | 2/20/17 | AUD | 11,000 | 10,483 |

| New South Wales Treasury Corp. | 6.000% | 5/1/20 | AUD | 5,000 | 5,208 |

| New South Wales Treasury Corp. | 6.000% | 3/1/22 | AUD | 14,000 | 14,732 |

| New South Wales Treasury Corp. | 6.000% | 5/1/30 | AUD | 3,000 | 3,178 |

| Queensland Treasury Corp. | 3.500% | 9/21/17 | AUD | 15,000 | 14,052 |

| Queensland Treasury Corp. | 4.250% | 7/21/23 | AUD | 10,000 | 9,241 |

| Queensland Treasury Corp. | 5.500% | 6/21/21 | AUD | 3,000 | 3,043 |

| Queensland Treasury Corp. | 6.000% | 4/21/16 | AUD | 9,000 | 8,857 |

| Queensland Treasury Corp. | 6.000% | 2/21/18 | AUD | 10,000 | 10,166 |

| Queensland Treasury Corp. | 6.000% | 7/21/22 | AUD | 15,000 | 15,707 |

| Queensland Treasury Corp. | 6.250% | 2/21/20 | AUD | 10,000 | 10,485 |

| South Australian Government | | | | | |

| Financing Authority | 4.750% | 8/6/19 | AUD | 7,500 | 7,313 |

| Treasury Corp. of Victoria | 5.500% | 11/15/18 | AUD | 10,000 | 10,096 |

| Treasury Corp. of Victoria | 5.500% | 12/17/24 | AUD | 10,000 | 10,200 |

| Treasury Corp. of Victoria | 6.000% | 6/15/20 | AUD | 10,000 | 10,434 |

| Treasury Corp. of Victoria | 6.000% | 10/17/22 | AUD | 7,000 | 7,390 |

| Western Australian Treasury Corp. | 3.000% | 6/8/16 | AUD | 14,000 | 13,029 |

| | | | | | 452,811 |

| Total Australia (Cost $600,677) | | | | | 597,359 |

| Austria (1.5%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.1%) | | | | |

| BAWAG PSK Bank fuer Arbeit und Wirtschaft | | | | | |

| und Oesterreichische Postsparkasse AG | 1.875% | 9/18/19 | EUR | 500 | 718 |

| Erste Group Bank AG | 4.000% | 1/20/21 | EUR | 2,000 | 3,242 |

| HYPO NOE Gruppe Bank AG | 3.000% | 5/9/22 | EUR | 2,000 | 3,055 |

| Raiffeisen-Landesbank Steiermark AG | 2.375% | 6/14/28 | EUR | 300 | 419 |

| Raiffeisenlandesbank | | | | | |

| Niederoesterreich-Wien AG | 1.750% | 10/2/20 | EUR | 1,700 | 2,421 |

| UniCredit Bank Austria AG | 2.875% | 11/4/16 | EUR | 2,000 | 2,940 |

| UniCredit Bank Austria AG | 4.125% | 2/24/21 | EUR | 2,000 | 3,240 |

| | | | | | 16,035 |

11

Total International Bond Index Fund

| | | | | | |

| | | | | | Face | Market |

| | | | Maturity | | Amount | Value |

| | | Coupon | Date | Currency | (000) | ($000) |

| Corporate Bonds (0.1%) | | | | | |

| | Erste Group Bank AG | 3.375% | 3/28/17 | EUR | 1,500 | 2,226 |

| | OMV AG | 3.500% | 9/27/27 | EUR | 1,000 | 1,526 |

| | OMV AG | 4.250% | 10/12/21 | EUR | 1,000 | 1,612 |

| 2 | OMV AG | 6.750% | 6/29/49 | EUR | 1,000 | 1,563 |

| | Raiffeisen Bank International AG | 2.750% | 7/10/17 | EUR | 1,500 | 2,178 |

| 2 | Raiffeisen Bank International AG | 4.500% | 2/21/25 | EUR | 1,000 | 1,369 |

| | Telekom Finanzmanagement GmbH | 3.125% | 12/3/21 | EUR | 5,000 | 7,392 |

| | Telekom Finanzmanagement GmbH | 4.250% | 1/27/17 | EUR | 634 | 958 |

| | UniCredit Bank Austria AG | 2.625% | 1/30/18 | EUR | 1,000 | 1,434 |

| 2 | Vienna Insurance Group AG Wiener | | | | | |

| | Versicherung Gruppe | 5.500% | 10/9/43 | EUR | 1,000 | 1,535 |

| | | | | | | 21,793 |

| Sovereign Bonds (1.3%) | | | | | |

| 3 | Autobahnen- Und | | | | | |

| | Schnellstrassen-Finanzierungs-AG | 2.750% | 6/11/32 | EUR | 500 | 720 |

| 3 | Autobahnen- Und | | | | | |

| | Schnellstrassen-Finanzierungs-AG | 2.750% | 6/20/33 | EUR | 700 | 997 |

| 3 | Autobahnen- Und | | | | | |

| | Schnellstrassen-Finanzierungs-AG | 3.375% | 9/22/25 | EUR | 2,000 | 3,141 |

| 3 | Autobahnen- Und | | | | | |

| | Schnellstrassen-Finanzierungs-AG | 4.375% | 7/8/19 | EUR | 4,000 | 6,489 |

| | Autobahnen- Und | | | | | |

| | Schnellstrassen-Finanzierungs-AG | 4.500% | 10/16/17 | EUR | 1,000 | 1,572 |

| | Erdoel-Lagergesellschaft mbH | 2.750% | 3/20/28 | EUR | 2,000 | 2,860 |

| 3 | Hypo Alpe-Adria-Bank International AG | 2.375% | 12/13/22 | EUR | 3,000 | 4,212 |

| 3 | OeBB Infrastruktur AG | 2.250% | 7/4/23 | EUR | 1,000 | 1,443 |

| 3 | OeBB Infrastruktur AG | 3.375% | 5/18/32 | EUR | 2,000 | 3,116 |

| 3 | OeBB Infrastruktur AG | 3.500% | 10/19/20 | EUR | 6,000 | 9,479 |

| 3 | OeBB Infrastruktur AG | 3.500% | 10/19/26 | EUR | 1,000 | 1,586 |

| 3 | Oesterreichische Kontrollbank AG | 2.000% | 12/17/18 | GBP | 2,000 | 3,377 |

| 3 | Oesterreichische Kontrollbank AG | 2.125% | 7/23/19 | CHF | 3,500 | 4,313 |

| | Oesterreichische Kontrollbank AG | 3.875% | 9/15/16 | EUR | 2,000 | 3,005 |

| 1,4 | Republic of Austria | 1.150% | 10/19/18 | EUR | 9,000 | 12,735 |

| 1 | Republic of Austria | 1.750% | 10/20/23 | EUR | 10,000 | 13,927 |

| 1 | Republic of Austria | 1.950% | 6/18/19 | EUR | 12,000 | 17,564 |

| 1 | Republic of Austria | 2.400% | 5/23/34 | EUR | 4,000 | 5,536 |

| 1 | Republic of Austria | 3.150% | 6/20/44 | EUR | 5,000 | 7,799 |

| 1 | Republic of Austria | 3.200% | 2/20/17 | EUR | 20,000 | 29,956 |

| 1 | Republic of Austria | 3.400% | 11/22/22 | EUR | 10,000 | 15,931 |

| 1 | Republic of Austria | 3.500% | 7/15/15 | EUR | 10,000 | 14,420 |

| 1 | Republic of Austria | 3.500% | 9/15/21 | EUR | 12,000 | 19,195 |

| 1 | Republic of Austria | 3.800% | 1/26/62 | EUR | 3,000 | 5,500 |

| 1,4 | Republic of Austria | 3.900% | 7/15/20 | EUR | 15,000 | 24,306 |

| 1 | Republic of Austria | 4.000% | 9/15/16 | EUR | 10,000 | 15,095 |

| 1 | Republic of Austria | 4.150% | 3/15/37 | EUR | 9,800 | 17,509 |

| 1 | Republic of Austria | 4.350% | 3/15/19 | EUR | 5,000 | 8,115 |

| 1 | Republic of Austria | 4.650% | 1/15/18 | EUR | 7,000 | 11,180 |

| 1 | Republic of Austria | 4.850% | 3/15/26 | EUR | 15,000 | 27,099 |

| | Republic of Austria | 6.250% | 7/15/27 | EUR | 6,000 | 12,297 |

| | | | | | | 304,474 |

| Total Austria (Cost $322,252) | | | | | 342,302 |

12

| | | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | | Face | Market |

| | | | Maturity | | Amount | Value |

| | | Coupon | Date | Currency | (000) | ($000) |

| Belgium (2.1%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.0%) | | | | |

| | Belfius Bank SA | 1.375% | 6/5/20 | EUR | 1,500 | 2,100 |

| | KBC Bank NV | 1.250% | 5/28/20 | EUR | 3,000 | 4,161 |

| | | | | | | 6,261 |

| Corporate Bonds (0.2%) | | | | | |

| | Anheuser-Busch InBev NV | 2.000% | 12/16/19 | EUR | 750 | 1,078 |

| | Anheuser-Busch InBev NV | 2.875% | 9/25/24 | EUR | 4,000 | 5,829 |

| | Anheuser-Busch InBev NV | 4.000% | 4/26/18 | EUR | 1,173 | 1,816 |

| | Anheuser-Busch InBev NV | 6.500% | 6/23/17 | GBP | 2,480 | 4,775 |

| | Anheuser-Busch InBev NV | 8.625% | 1/30/17 | EUR | 3,000 | 5,043 |

| | Anheuser-Busch InBev NV | 9.750% | 7/30/24 | GBP | 800 | 2,033 |

| | BNP Paribas Fortis SA | 5.757% | 10/4/17 | EUR | 2,500 | 3,957 |

| | Elia System Operator SA | 5.625% | 4/22/16 | EUR | 900 | 1,366 |

| | KBC Internationale | | | | | |

| | Financieringsmaatschappij NV | 5.000% | 3/16/16 | EUR | 3,450 | 5,158 |

| | | | | | | 31,055 |

| Sovereign Bonds (1.9%) | | | | | |

| | Belgacom SA | 3.875% | 2/7/18 | EUR | 1,000 | 1,530 |

| 5,6,7 Dexia Credit Local SA | 1.000% | 7/11/16 | EUR | 5,000 | 7,004 |

| 5,6,7 Dexia Credit Local SA | 1.625% | 10/29/18 | EUR | 3,000 | 4,264 |

| | Eandis CVBA | 4.500% | 11/8/21 | EUR | 1,500 | 2,437 |

| | Flemish Community | 3.000% | 1/31/18 | EUR | 2,000 | 2,996 |

| | Flemish Community | 3.875% | 7/20/16 | EUR | 2,000 | 2,982 |

| | Kingdom of Belgium | 1.250% | 6/22/18 | EUR | 9,000 | 12,760 |

| | Kingdom of Belgium | 2.250% | 6/22/23 | EUR | 28,500 | 40,783 |

| 1 | Kingdom of Belgium | 2.750% | 3/28/16 | EUR | 10,000 | 14,527 |

| 4 | Kingdom of Belgium | 3.000% | 9/28/19 | EUR | 16,000 | 24,514 |

| 1 | Kingdom of Belgium | 3.000% | 6/22/34 | EUR | 5,000 | 7,112 |

| 1 | Kingdom of Belgium | 3.250% | 9/28/16 | EUR | 30,000 | 44,560 |

| 1 | Kingdom of Belgium | 3.500% | 6/28/17 | EUR | 15,000 | 22,780 |

| 1 | Kingdom of Belgium | 3.750% | 9/28/15 | EUR | 5,000 | 7,280 |

| 1 | Kingdom of Belgium | 3.750% | 9/28/20 | EUR | 13,000 | 20,838 |

| | Kingdom of Belgium | 3.750% | 6/22/45 | EUR | 5,000 | 7,930 |

| 1 | Kingdom of Belgium | 4.000% | 3/28/17 | EUR | 6,000 | 9,186 |

| 1 | Kingdom of Belgium | 4.000% | 3/28/18 | EUR | 10,000 | 15,672 |

| | Kingdom of Belgium | 4.000% | 3/28/19 | EUR | 15,000 | 23,940 |

| | Kingdom of Belgium | 4.000% | 3/28/22 | EUR | 12,000 | 19,643 |

| | Kingdom of Belgium | 4.000% | 3/28/32 | EUR | 14,000 | 22,960 |

| 1 | Kingdom of Belgium | 4.250% | 9/28/21 | EUR | 12,000 | 19,905 |

| | Kingdom of Belgium | 4.250% | 9/28/22 | EUR | 10,000 | 16,642 |

| 1 | Kingdom of Belgium | 4.250% | 3/28/41 | EUR | 14,500 | 25,012 |

| 1 | Kingdom of Belgium | 4.500% | 3/28/26 | EUR | 7,000 | 11,955 |

| 1 | Kingdom of Belgium | 5.000% | 3/28/35 | EUR | 15,000 | 27,889 |

| | Kingdom of Belgium | 5.500% | 3/28/28 | EUR | 13,000 | 24,512 |

| | | | | | | 441,613 |

| Total Belgium (Cost $446,892) | | | | | 478,929 |

| Bermuda (0.0%) | | | | | |

| Corporate Bond (0.0%) | | | | | |

| | Bacardi Ltd. | 2.750% | 7/3/23 | EUR | 2,000 | 2,830 |

| Total Bermuda (Cost $2,655) | | | | | 2,830 |

13

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Brazil (0.1%) | | | | | |

| Corporate Bonds (0.0%) | | | | | |

| Telemar Norte Leste SA | 5.125% | 12/15/17 | EUR | 500 | 752 |

| Vale SA | 3.750% | 1/10/23 | EUR | 1,500 | 2,222 |

| | | | | | 2,974 |

| Sovereign Bonds (0.1%) | | | | | |

| 1 Banco do Brasil SA | 3.750% | 7/25/18 | EUR | 3,000 | 4,304 |

| 1 Banco Nacional de Desenvolvimento | | | | | |

| Economico e Social | 3.625% | 1/21/19 | EUR | 1,000 | 1,437 |

| Federative Republic of Brazil | 2.875% | 4/1/21 | EUR | 1,900 | 2,652 |

| Petrobras Global Finance BV | 2.750% | 1/15/18 | EUR | 500 | 702 |

| Petrobras Global Finance BV | 3.250% | 4/1/19 | EUR | 5,000 | 7,103 |

| Petrobras Global Finance BV | 3.750% | 1/14/21 | EUR | 500 | 712 |

| Petrobras Global Finance BV | 4.750% | 1/14/25 | EUR | 500 | 717 |

| Petrobras International Finance Co. | 6.250% | 12/14/26 | GBP | 2,000 | 3,391 |

| | | | | | 21,018 |

| Total Brazil (Cost $23,182) | | | | | 23,992 |

| Canada (5.0%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.1%) | | | | |

| National Bank of Canada | 1.250% | 12/17/18 | EUR | 2,000 | 2,817 |

| Royal Bank of Canada | 1.625% | 8/4/20 | EUR | 1,500 | 2,121 |

| Royal Bank of Canada | 3.770% | 3/30/18 | CAD | 5,000 | 4,892 |

| Royal Bank of Canada | 4.625% | 1/22/18 | EUR | 3,000 | 4,755 |

| | | | | | 14,585 |

| Corporate Bonds (0.9%) | | | | | |

| 407 International Inc. | 3.870% | 11/24/17 | CAD | 2,000 | 1,937 |

| 407 International Inc. | 4.190% | 4/25/42 | CAD | 1,500 | 1,339 |

| 407 International Inc. | 4.300% | 5/26/21 | CAD | 1,500 | 1,490 |

| AltaLink LP | 3.668% | 11/6/23 | CAD | 2,000 | 1,868 |

| Bank of Montreal | 1.890% | 10/5/15 | CAD | 5,000 | 4,588 |

| Bank of Montreal | 2.240% | 12/11/17 | CAD | 7,500 | 6,886 |

| Bank of Montreal | 2.390% | 7/12/17 | CAD | 5,000 | 4,625 |

| Bank of Montreal | 6.020% | 5/2/18 | CAD | 4,000 | 4,225 |

| Bank of Nova Scotia | 2.242% | 3/22/18 | CAD | 7,500 | 6,869 |

| Bank of Nova Scotia | 2.250% | 5/8/15 | CAD | 2,000 | 1,840 |

| Bank of Nova Scotia | 2.598% | 2/27/17 | CAD | 2,000 | 1,865 |

| 2 Bank of Nova Scotia | 3.036% | 10/18/24 | CAD | 5,000 | 4,633 |

| Bank of Nova Scotia | 3.270% | 1/11/21 | CAD | 5,000 | 4,677 |

| Bank of Nova Scotia | 3.610% | 2/22/16 | CAD | 2,000 | 1,889 |

| Bell Aliant Regional Communications LP | 5.520% | 2/26/19 | CAD | 2,000 | 2,054 |

| Bell Canada | 3.350% | 6/18/19 | CAD | 5,000 | 4,693 |

| Bell Canada | 3.350% | 3/22/23 | CAD | 5,000 | 4,493 |

| Brookfield Asset Management Inc. | 4.540% | 3/31/23 | CAD | 2,000 | 1,890 |

| Brookfield Asset Management Inc. | 5.040% | 3/8/24 | CAD | 1,500 | 1,452 |

| Caisse Centrale Desjardins | 2.795% | 11/19/18 | CAD | 4,000 | 3,712 |

| Canadian Imperial Bank of Commerce | 2.220% | 3/7/18 | CAD | 3,000 | 2,759 |

| Canadian Imperial Bank of Commerce | 2.350% | 10/18/17 | CAD | 1,500 | 1,389 |

| Canadian Imperial Bank of Commerce | 2.650% | 11/8/16 | CAD | 10,000 | 9,328 |

| 2 Canadian Imperial Bank of Commerce | 3.150% | 11/2/20 | CAD | 2,000 | 1,866 |

| Canadian Pacific Railway Co. | 6.450% | 11/17/39 | CAD | 1,000 | 1,154 |

| 2 Capital Desjardins Inc. | 4.954% | 12/15/26 | CAD | 3,000 | 3,062 |

| Capital Power LP | 5.276% | 11/16/20 | CAD | 4,000 | 3,971 |

| CU Inc. | 4.543% | 10/24/41 | CAD | 1,000 | 949 |

| Enbridge Gas Distribution Inc. | 4.950% | 11/22/50 | CAD | 1,000 | 1,025 |

14

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Enbridge Inc. | 4.240% | 8/27/42 | CAD | 2,000 | 1,745 |

| Enbridge Inc. | 4.530% | 3/9/20 | CAD | 3,000 | 3,010 |

| Enbridge Pipelines Inc. | 4.550% | 8/17/43 | CAD | 1,000 | 948 |

| Fairfax Financial Holdings Ltd. | 5.840% | 10/14/22 | CAD | 2,000 | 1,989 |

| 2 Great-West Lifeco Finance Delaware LP | 5.691% | 6/21/67 | CAD | 4,000 | 4,023 |

| Greater Toronto Airports Authority | 5.300% | 2/25/41 | CAD | 2,000 | 2,125 |

| HSBC Bank Canada | 2.938% | 1/14/20 | CAD | 2,000 | 1,852 |

| HSBC Bank Canada | 3.558% | 10/4/17 | CAD | 5,000 | 4,796 |

| Loblaw Cos. Ltd. | 3.748% | 3/12/19 | CAD | 2,500 | 2,382 |

| 2 Manulife Financial Capital Trust II | 7.405% | 12/31/08 | CAD | 4,000 | 4,480 |

| 2 National Bank of Canada | 3.261% | 4/11/22 | CAD | 7,000 | 6,592 |

| NAV Canada | 1.949% | 4/19/18 | CAD | 2,000 | 1,819 |

| NAV Canada | 5.304% | 4/17/19 | CAD | 1,000 | 1,048 |

| Plenary Properties LTAP LP | 6.288% | 1/31/44 | CAD | 1,500 | 1,833 |

| Rogers Communications Inc. | 4.000% | 3/13/24 | CAD | 4,000 | 3,645 |

| Rogers Communications Inc. | 5.340% | 3/22/21 | CAD | 6,000 | 6,195 |

| Royal Bank of Canada | 2.260% | 3/12/18 | CAD | 7,500 | 6,874 |

| Royal Bank of Canada | 2.770% | 12/11/18 | CAD | 3,000 | 2,783 |

| 2 Royal Bank of Canada | 2.990% | 12/6/24 | CAD | 4,000 | 3,699 |

| 2 Royal Bank of Canada | 3.180% | 11/2/20 | CAD | 2,000 | 1,863 |

| Royal Bank of Canada | 3.360% | 1/11/16 | CAD | 7,500 | 7,045 |

| 2 Royal Bank of Canada | 4.350% | 6/15/20 | CAD | 2,000 | 1,878 |

| Shaw Communications Inc. | 6.750% | 11/9/39 | CAD | 2,500 | 2,689 |

| Sobeys Inc. | 3.520% | 8/8/18 | CAD | 2,000 | 1,884 |

| Sun Life Financial Inc. | 4.570% | 8/23/21 | CAD | 3,000 | 2,990 |

| Talisman Energy Inc. | 6.625% | 12/5/17 | GBP | 1,350 | 2,564 |

| TELUS Corp. | 3.200% | 4/5/21 | CAD | 750 | 684 |

| TELUS Corp. | 3.350% | 4/1/24 | CAD | 7,500 | 6,626 |

| Teranet Holdings LP | 4.807% | 12/16/20 | CAD | 4,000 | 3,968 |

| Thomson Reuters Corp. | 6.000% | 3/31/16 | CAD | 3,000 | 2,942 |

| Toronto-Dominion Bank | 2.171% | 4/2/18 | CAD | 7,500 | 6,859 |

| Toronto-Dominion Bank | 2.447% | 4/2/19 | CAD | 5,000 | 4,562 |

| Toronto-Dominion Bank | 2.948% | 8/2/16 | CAD | 2,000 | 1,876 |

| TransCanada PipeLines Ltd. | 4.550% | 11/15/41 | CAD | 2,000 | 1,885 |

| Wells Fargo Canada Corp. | 2.944% | 7/25/19 | CAD | 2,000 | 1,868 |

| Wells Fargo Canada Corp. | 3.700% | 3/30/16 | CAD | 3,000 | 2,843 |

| Westcoast Energy Inc. | 5.600% | 1/16/19 | CAD | 275 | 281 |

| | | | | | 209,673 |

| Sovereign Bonds (4.0%) | | | | | |

| Alberta Capital Finance Authority | 3.050% | 6/15/15 | CAD | 2,000 | 1,864 |

| Canada | 1.000% | 5/1/15 | CAD | 5,000 | 4,562 |

| Canada | 1.250% | 2/1/16 | CAD | 30,000 | 27,459 |

| Canada | 1.250% | 3/1/18 | CAD | 37,000 | 33,531 |

| Canada | 1.250% | 9/1/18 | CAD | 21,840 | 19,656 |

| Canada | 1.500% | 8/1/15 | CAD | 15,000 | 13,770 |

| Canada | 1.500% | 3/1/17 | CAD | 20,000 | 18,417 |

| Canada | 1.500% | 6/1/23 | CAD | 9,000 | 7,678 |

| Canada | 1.750% | 3/1/19 | CAD | 13,000 | 11,899 |

| Canada | 2.500% | 6/1/15 | CAD | 35,000 | 32,445 |

| Canada | 2.500% | 6/1/24 | CAD | 5,000 | 4,600 |

| Canada | 2.750% | 9/1/16 | CAD | 25,000 | 23,673 |

| Canada | 2.750% | 6/1/22 | CAD | 12,000 | 11,425 |

| Canada | 3.000% | 12/1/15 | CAD | 10,000 | 9,405 |

| Canada | 3.250% | 6/1/21 | CAD | 7,000 | 6,915 |

| Canada | 3.500% | 1/13/20 | EUR | 2,000 | 3,187 |

15

| | | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | | Face | Market |

| | | | Maturity | | Amount | Value |

| | | Coupon | Date | Currency | (000) | ($000) |

| | Canada | 3.500% | 6/1/20 | CAD | 12,250 | 12,242 |

| | Canada | 3.500% | 12/1/45 | CAD | 11,600 | 11,821 |

| | Canada | 4.000% | 6/1/41 | CAD | 14,000 | 15,281 |

| | Canada | 4.250% | 6/1/18 | CAD | 10,000 | 10,130 |

| | Canada | 5.000% | 6/1/37 | CAD | 16,000 | 19,736 |

| | Canada | 5.750% | 6/1/29 | CAD | 11,000 | 13,832 |

| | Canada | 5.750% | 6/1/33 | CAD | 23,500 | 30,649 |

| | Canada | 8.000% | 6/1/23 | CAD | 6,000 | 8,064 |

| | Canada | 8.000% | 6/1/27 | CAD | 7,000 | 10,246 |

| 1 | Canada Housing Trust No 1 | 1.700% | 12/15/17 | CAD | 7,000 | 6,411 |

| 1 | Canada Housing Trust No 1 | 1.850% | 12/15/16 | CAD | 10,000 | 9,244 |

| 1 | Canada Housing Trust No 1 | 2.050% | 6/15/17 | CAD | 10,000 | 9,286 |

| 1 | Canada Housing Trust No 1 | 2.050% | 6/15/18 | CAD | 10,000 | 9,242 |

| 1 | Canada Housing Trust No 1 | 2.350% | 12/15/18 | CAD | 10,000 | 9,319 |

| 1 | Canada Housing Trust No 1 | 2.400% | 12/15/22 | CAD | 10,000 | 8,958 |

| 1 | Canada Housing Trust No 1 | 2.450% | 12/15/15 | CAD | 20,000 | 18,630 |

| 1 | Canada Housing Trust No 1 | 2.650% | 3/15/22 | CAD | 7,500 | 6,904 |

| 1 | Canada Housing Trust No 1 | 2.750% | 6/15/16 | CAD | 20,000 | 18,831 |

| | Canada Housing Trust No 1 | 2.900% | 6/15/24 | CAD | 5,000 | 4,590 |

| 1 | Canada Housing Trust No 1 | 3.150% | 9/15/23 | CAD | 5,000 | 4,720 |

| 1 | Canada Housing Trust No 1 | 3.800% | 6/15/21 | CAD | 5,000 | 4,972 |

| 1,8 | Canada Housing Trust No 1 | 4.100% | 12/15/18 | CAD | 10,000 | 10,026 |

| 8 | Canada Post Corp. | 4.360% | 7/16/40 | CAD | 1,000 | 1,043 |

| | CDP Financial Inc. | 4.600% | 7/15/20 | CAD | 350 | 356 |

| | City of Montreal Canada | 3.500% | 9/1/23 | CAD | 2,500 | 2,306 |

| | City of Toronto | 4.700% | 6/10/41 | CAD | 2,000 | 2,007 |

| | City of Toronto | 5.200% | 6/1/40 | CAD | 1,000 | 1,074 |

| | Export Development Canada | 0.875% | 12/7/16 | GBP | 1,000 | 1,675 |

| | Export Development Canada | 1.875% | 12/17/18 | GBP | 3,000 | 5,053 |

| | Financement-Quebec | 2.450% | 12/1/19 | CAD | 9,000 | 8,232 |

| | Hydro One Inc. | 2.780% | 10/9/18 | CAD | 2,000 | 1,865 |

| | Hydro One Inc. | 3.200% | 1/13/22 | CAD | 5,000 | 4,633 |

| | Hydro One Inc. | 3.790% | 7/31/62 | CAD | 2,000 | 1,630 |

| | Hydro One Inc. | 4.400% | 6/1/20 | CAD | 3,000 | 3,008 |

| | Hydro-Quebec | 5.000% | 2/15/45 | CAD | 8,500 | 9,116 |

| | Hydro-Quebec | 5.000% | 2/15/50 | CAD | 6,500 | 7,075 |

| | Hydro-Quebec | 6.000% | 8/15/31 | CAD | 4,000 | 4,634 |

| | Hydro-Quebec | 6.000% | 2/15/40 | CAD | 1,000 | 1,202 |

| | Hydro-Quebec | 6.500% | 1/16/35 | CAD | 280 | 349 |

| | Hydro-Quebec | 6.500% | 2/15/35 | CAD | 3,000 | 3,737 |

| | Hydro-Quebec | 10.500% | 10/15/21 | CAD | 2,000 | 2,749 |

| 1,8 | Labrador-Island Link Funding Trust | 3.760% | 6/1/33 | CAD | 3,000 | 2,894 |

| 1,8 | Labrador-Island Link Funding Trust | 3.850% | 12/1/53 | CAD | 1,000 | 980 |

| | Municipal Finance Authority | | | | | |

| | of British Columbia | 3.000% | 6/1/16 | CAD | 5,000 | 4,730 |

| 1,8 | Muskrat Falls / Labrador Transmission | | | | | |

| | Assets Funding Trust | 3.830% | 6/1/37 | CAD | 1,000 | 972 |

| 1,8 | Muskrat Falls / Labrador Transmission | | | | | |

| | Assets Funding Trust | 3.860% | 12/1/48 | CAD | 1,500 | 1,474 |

| | Ontario Electricity Financial Corp. | 8.250% | 6/22/26 | CAD | 2,000 | 2,701 |

| | Ontario Electricity Financial Corp. | 10.125% | 10/15/21 | CAD | 2,500 | 3,353 |

| | Province of Alberta | 1.700% | 12/15/17 | CAD | 7,500 | 6,855 |

| | Province of Alberta | 2.900% | 9/20/29 | CAD | 2,800 | 2,381 |

| | Province of Alberta | 3.450% | 12/1/43 | CAD | 4,000 | 3,478 |

| | Province of Alberta | 3.900% | 12/1/33 | CAD | 2,000 | 1,889 |

16

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Province of British Columbia | 2.700% | 12/18/22 | CAD | 5,000 | 4,506 |

| Province of British Columbia | 3.200% | 6/18/44 | CAD | 5,000 | 4,134 |

| Province of British Columbia | 3.250% | 12/18/21 | CAD | 5,000 | 4,745 |

| Province of British Columbia | 4.100% | 12/18/19 | CAD | 5,000 | 5,025 |

| Province of British Columbia | 4.300% | 6/18/42 | CAD | 2,500 | 2,506 |

| Province of British Columbia | 4.650% | 12/18/18 | CAD | 2,000 | 2,036 |

| Province of British Columbia | 4.700% | 6/18/37 | CAD | 3,300 | 3,464 |

| Province of British Columbia | 4.900% | 6/18/48 | CAD | 3,000 | 3,357 |

| Province of Manitoba | 4.100% | 3/5/41 | CAD | 5,000 | 4,784 |

| Province of Manitoba | 4.150% | 6/3/20 | CAD | 6,000 | 6,015 |

| Province of Manitoba | 4.600% | 3/5/38 | CAD | 3,000 | 3,078 |

| Province of Manitoba | 5.200% | 12/3/15 | CAD | 3,000 | 2,908 |

| Province of New Brunswick | 2.850% | 6/2/23 | CAD | 5,000 | 4,451 |

| Province of New Brunswick | 3.550% | 6/3/43 | CAD | 1,000 | 849 |

| Province of New Brunswick | 3.650% | 6/3/24 | CAD | 3,000 | 2,822 |

| Province of New Brunswick | 4.450% | 3/26/18 | CAD | 2,000 | 2,009 |

| Province of New Brunswick | 4.800% | 6/3/41 | CAD | 2,750 | 2,855 |

| Province of Newfoundland and Labrador | 4.650% | 10/17/40 | CAD | 2,000 | 2,050 |

| Province of Newfoundland and Labrador | 6.150% | 4/17/28 | CAD | 1,000 | 1,163 |

| Province of Nova Scotia | 3.500% | 6/2/62 | CAD | 2,500 | 2,120 |

| Province of Nova Scotia | 4.100% | 6/1/21 | CAD | 6,000 | 5,966 |

| Province of Nova Scotia | 4.400% | 6/1/42 | CAD | 2,000 | 1,990 |

| Province of Ontario | 1.900% | 9/8/17 | CAD | 15,000 | 13,874 |

| Province of Ontario | 2.100% | 9/8/18 | CAD | 15,000 | 13,828 |

| Province of Ontario | 2.850% | 6/2/23 | CAD | 10,000 | 8,953 |

| Province of Ontario | 3.000% | 9/28/20 | EUR | 3,750 | 5,733 |

| Province of Ontario | 3.150% | 6/2/22 | CAD | 15,000 | 13,915 |

| Province of Ontario | 3.450% | 6/2/45 | CAD | 7,000 | 5,908 |

| Province of Ontario | 3.500% | 6/2/43 | CAD | 10,000 | 8,542 |

| Province of Ontario | 4.000% | 6/2/21 | CAD | 6,000 | 5,926 |

| Province of Ontario | 4.200% | 6/2/20 | CAD | 15,000 | 15,025 |

| Province of Ontario | 4.300% | 3/8/17 | CAD | 5,000 | 4,937 |

| Province of Ontario | 4.600% | 6/2/39 | CAD | 15,000 | 15,262 |

| Province of Ontario | 4.650% | 6/2/41 | CAD | 12,500 | 12,885 |

| Province of Ontario | 4.700% | 6/2/37 | CAD | 9,000 | 9,268 |

| Province of Ontario | 4.850% | 6/2/20 | CAD | 10,000 | 10,350 |

| Province of Ontario | 5.600% | 6/2/35 | CAD | 8,000 | 9,159 |

| Province of Ontario | 5.850% | 3/8/33 | CAD | 6,500 | 7,555 |

| Province of Ontario | 6.500% | 3/8/29 | CAD | 4,000 | 4,861 |

| Province of Ontario | 7.600% | 6/2/27 | CAD | 3,000 | 3,923 |

| Province of Saskatchewan | 3.400% | 2/3/42 | CAD | 3,500 | 3,018 |

| Province of Saskatchewan | 4.750% | 6/1/40 | CAD | 2,000 | 2,133 |

| Quebec | 3.000% | 9/1/23 | CAD | 10,000 | 9,001 |

| Quebec | 3.500% | 12/1/22 | CAD | 7,000 | 6,616 |

| Quebec | 4.250% | 12/1/21 | CAD | 15,000 | 14,981 |

| Quebec | 4.250% | 12/1/43 | CAD | 10,000 | 9,546 |

| Quebec | 4.500% | 12/1/17 | CAD | 5,000 | 5,013 |

| Quebec | 4.500% | 12/1/18 | CAD | 5,000 | 5,048 |

| Quebec | 4.500% | 12/1/20 | CAD | 8,000 | 8,125 |

| Quebec | 4.750% | 4/29/18 | EUR | 1,000 | 1,600 |

| Quebec | 5.000% | 4/29/19 | EUR | 5,500 | 9,092 |

| Quebec | 5.000% | 12/1/38 | CAD | 2,000 | 2,114 |

| Quebec | 5.000% | 12/1/41 | CAD | 10,000 | 10,667 |

| Quebec | 5.350% | 6/1/25 | CAD | 5,000 | 5,346 |

| Quebec | 5.750% | 12/1/36 | CAD | 2,000 | 2,312 |

17

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Quebec | 6.000% | 10/1/29 | CAD | 5,000 | 5,778 |

| Quebec | 6.250% | 6/1/32 | CAD | 7,000 | 8,389 |

| Regional Municipality of Peel Ontario | 5.100% | 6/29/40 | CAD | 1,000 | 1,040 |

| | | | | | 929,627 |

| Total Canada (Cost $1,218,711) | | | | | 1,153,885 |

| Chile (0.0%) | | | | | |

| Corporate Bond (0.0%) | | | | | |

| Banco Santander Chile | 1.000% | 7/31/17 | CHF | 1,000 | 1,140 |

| Total Chile (Cost $1,138) | | | | | 1,140 |

| China (0.0%) | | | | | |

| Sovereign Bond (0.0%) | | | | | |

| 1 Sinopec Group Overseas | | | | | |

| Development 2013 Ltd. | 2.625% | 10/17/20 | EUR | 500 | 706 |

| Total China (Cost $672) | | | | | 706 |

| Czech Republic (0.3%) | | | | | |

| Sovereign Bonds (0.3%) | | | | | |

| CEZ AS | 3.000% | 6/5/28 | EUR | 500 | 684 |

| CEZ AS | 4.875% | 4/16/25 | EUR | 500 | 829 |

| CEZ AS | 5.000% | 10/19/21 | EUR | 2,000 | 3,317 |

| Czech Republic | 0.500% | 7/28/16 | CZK | 50,000 | 2,538 |

| Czech Republic | 2.500% | 8/25/28 | CZK | 70,000 | 3,497 |

| Czech Republic | 3.625% | 4/14/21 | EUR | 3,000 | 4,701 |

| Czech Republic | 3.750% | 9/12/20 | CZK | 100,000 | 5,775 |

| Czech Republic | 3.850% | 9/29/21 | CZK | 80,000 | 4,693 |

| Czech Republic | 3.875% | 5/24/22 | EUR | 2,000 | 3,178 |

| Czech Republic | 4.000% | 4/11/17 | CZK | 328,000 | 18,265 |

| Czech Republic | 4.600% | 8/18/18 | CZK | 100,000 | 5,875 |

| Czech Republic | 4.850% | 11/26/57 | CZK | 50,000 | 2,979 |

| Czech Republic | 5.000% | 6/11/18 | EUR | 2,000 | 3,240 |

| Czech Republic | 5.700% | 5/25/24 | CZK | 100,000 | 6,810 |

| Total Czech Republic (Cost $65,424) | | | | | 66,381 |

| Denmark (0.8%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.1%) | | | | |

| Danske Bank A/S | 1.625% | 2/28/20 | EUR | 4,000 | 5,681 |

| Danske Bank A/S | 3.250% | 3/9/16 | EUR | 1,000 | 1,459 |

| Danske Bank A/S | 4.125% | 11/26/19 | EUR | 1,000 | 1,610 |

| Nordea Kredit Realkreditaktieselskab | 2.000% | 1/1/16 | DKK | 20,000 | 3,827 |

| Nordea Kredit Realkreditaktieselskab | 3.500% | 10/1/44 | DKK | 9,788 | 1,855 |

| Nykredit Realkredit A/S | 2.000% | 4/1/18 | DKK | 30,000 | 5,835 |

| Nykredit Realkredit A/S | 2.000% | 10/1/18 | DKK | 20,000 | 3,905 |

| Nykredit Realkredit A/S | 3.250% | 6/1/17 | EUR | 2,000 | 2,945 |

| Realkredit Danmark A/S | 2.000% | 4/1/16 | DKK | 5,000 | 957 |

| Realkredit Danmark A/S | 4.000% | 10/1/41 | DKK | 4,392 | 860 |

| | | | | | 28,934 |

| Corporate Bonds (0.1%) | | | | | |

| AP Moeller - Maersk A/S | 3.375% | 8/28/19 | EUR | 2,000 | 3,012 |

| AP Moeller - Maersk A/S | 4.000% | 4/4/25 | GBP | 700 | 1,168 |

| AP Moeller - Maersk A/S | 6.250% | 12/16/16 | NOK | 5,000 | 913 |

| Carlsberg Breweries A/S | 2.625% | 7/3/19 | EUR | 3,000 | 4,351 |

| Carlsberg Breweries A/S | 7.250% | 11/28/16 | GBP | 1,600 | 3,056 |

18

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Danske Bank A/S | 3.875% | 5/18/16 | EUR | 3,000 | 4,422 |

| Danske Bank A/S | 4.000% | 12/9/15 | GBP | 200 | 351 |

| 2 Danske Bank A/S | 4.878% | 5/29/49 | EUR | 3,000 | 4,370 |

| TDC A/S | 4.375% | 2/23/18 | EUR | 2,000 | 3,099 |

| | | | | | 24,742 |

| Sovereign Bonds (0.6%) | | | | | |

| DONG Energy A/S | 2.625% | 9/19/22 | EUR | 1,000 | 1,433 |

| DONG Energy A/S | 4.875% | 1/12/32 | GBP | 1,000 | 1,742 |

| DONG Energy A/S | 4.875% | 7/8/49 | EUR | 1,500 | 2,207 |

| DONG Energy A/S | 5.750% | 4/9/40 | GBP | 1,000 | 1,945 |

| 2 DONG Energy A/S | 6.250% | 6/26/13 | EUR | 1,045 | 1,622 |

| DONG Energy A/S | 6.500% | 5/7/19 | EUR | 1,000 | 1,721 |

| Kingdom of Denmark | 1.500% | 11/15/23 | DKK | 60,100 | 11,148 |

| Kingdom of Denmark | 1.750% | 10/5/15 | EUR | 5,000 | 7,088 |

| Kingdom of Denmark | 3.000% | 11/15/21 | DKK | 145,000 | 30,546 |

| Kingdom of Denmark | 4.000% | 11/15/17 | DKK | 109,800 | 23,022 |

| Kingdom of Denmark | 4.000% | 11/15/19 | DKK | 80,000 | 17,486 |

| 4 Kingdom of Denmark | 4.500% | 11/15/39 | DKK | 100,900 | 26,511 |

| Kingdom of Denmark | 7.000% | 11/10/24 | DKK | 22,600 | 6,462 |

| | | | | | 132,933 |

| Total Denmark (Cost $176,457) | | | | | 186,609 |

| Finland (0.7%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.1%) | | | | |

| Aktia Bank plc | 1.125% | 6/25/18 | EUR | 1,200 | 1,686 |

| Danske Bank Oyj | 3.875% | 6/21/21 | EUR | 2,000 | 3,230 |

| Nordea Bank Finland Abp | 1.375% | 1/15/20 | EUR | 6,000 | 8,448 |

| Nordea Bank Finland Abp | 2.250% | 5/3/19 | EUR | 2,000 | 2,948 |

| Nordea Bank Finland Abp | 2.375% | 7/17/17 | EUR | 5,000 | 7,327 |

| OP Mortgage Bank | 1.625% | 5/23/17 | EUR | 5,000 | 7,157 |

| OP Mortgage Bank | 3.500% | 7/11/18 | EUR | 500 | 771 |

| | | | | | 31,567 |

| Corporate Bonds (0.1%) | | | | | |

| Citycon Oyj | 3.750% | 6/24/20 | EUR | 500 | 733 |

| Pohjola Bank plc | 1.250% | 5/14/18 | EUR | 825 | 1,148 |

| Pohjola Bank plc | 3.125% | 1/12/16 | EUR | 1,500 | 2,169 |

| Sampo Oyj | 4.250% | 2/22/16 | EUR | 2,000 | 2,935 |

| Sampo Oyj | 4.250% | 2/27/17 | EUR | 500 | 752 |

| Teollisuuden Voima Oyj | 4.625% | 2/4/19 | EUR | 1,000 | 1,566 |

| | | | | | 9,303 |

| Sovereign Bonds (0.5%) | | | | | |

| Fortum Oyj | 2.250% | 9/6/22 | EUR | 1,500 | 2,081 |

| Fortum Oyj | 6.000% | 3/20/19 | EUR | 1,000 | 1,676 |

| Municipality Finance plc | 1.125% | 12/7/17 | GBP | 1,800 | 2,985 |

| Republic of Finland | 1.125% | 12/7/17 | GBP | 200 | 333 |

| 1 Republic of Finland | 1.125% | 9/15/18 | EUR | 3,000 | 4,248 |

| 1 Republic of Finland | 1.500% | 4/15/23 | EUR | 10,000 | 13,780 |

| 1 Republic of Finland | 1.625% | 9/15/22 | EUR | 4,000 | 5,610 |

| 1 Republic of Finland | 1.750% | 4/15/16 | EUR | 10,000 | 14,292 |

| 1 Republic of Finland | 2.625% | 7/4/42 | EUR | 2,000 | 2,887 |

| 1 Republic of Finland | 2.750% | 7/4/28 | EUR | 3,000 | 4,456 |

| 1 Republic of Finland | 3.375% | 4/15/20 | EUR | 10,000 | 15,777 |

| 1 Republic of Finland | 3.500% | 4/15/21 | EUR | 3,000 | 4,795 |

19

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| 1 Republic of Finland | 3.875% | 9/15/17 | EUR | 10,000 | 15,465 |

| 1 Republic of Finland | 4.000% | 7/4/25 | EUR | 10,000 | 16,798 |

| 1 Republic of Finland | 4.375% | 7/4/19 | EUR | 4,000 | 6,546 |

| | | | | | 111,729 |

| Total Finland (Cost $142,953) | | | | | 152,599 |

| France (11.3%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (1.3%) | | | | |

| AXA Bank Europe SCF | 1.875% | 9/20/19 | EUR | 3,000 | 4,325 |

| AXA Bank Europe SCF | 2.250% | 4/19/17 | EUR | 2,000 | 2,904 |

| BNP Paribas Home Loan SFH | 1.375% | 6/17/20 | EUR | 7,500 | 10,523 |

| BNP Paribas Home Loan SFH | 3.125% | 3/22/22 | EUR | 2,000 | 3,090 |

| BNP Paribas Home Loan SFH | 3.375% | 1/12/17 | EUR | 2,000 | 2,987 |

| BNP Paribas Public Sector SCF SA | 2.250% | 10/22/15 | EUR | 1,000 | 1,425 |

| BPCE SFH SA | 2.125% | 9/17/20 | EUR | 3,000 | 4,364 |

| BPCE SFH SA | 3.625% | 5/12/16 | EUR | 8,000 | 11,862 |

| BPCE SFH SA | 4.000% | 3/23/22 | EUR | 3,000 | 4,897 |

| Caisse de Refinancement de l’Habitat SA | 1.375% | 10/25/19 | EUR | 1,500 | 2,116 |

| Caisse de Refinancement de l’Habitat SA | 2.400% | 1/17/25 | EUR | 1,000 | 1,438 |

| Caisse de Refinancement de l’Habitat SA | 2.500% | 3/29/21 | CHF | 1,000 | 1,252 |

| Caisse de Refinancement de l’Habitat SA | 2.600% | 4/26/16 | EUR | 3,841 | 5,564 |

| Caisse de Refinancement de l’Habitat SA | 3.300% | 9/23/22 | EUR | 6,500 | 10,140 |

| Caisse de Refinancement de l’Habitat SA | 3.500% | 4/25/17 | EUR | 2,500 | 3,770 |

| Caisse de Refinancement de l’Habitat SA | 3.600% | 9/13/21 | EUR | 2,000 | 3,177 |

| Caisse de Refinancement de l’Habitat SA | 3.600% | 3/8/24 | EUR | 5,000 | 7,977 |

| Caisse de Refinancement de l’Habitat SA | 4.000% | 4/25/18 | EUR | 4,525 | 7,076 |

| Caisse de Refinancement de l’Habitat SA | 4.000% | 6/17/22 | EUR | 4,870 | 7,951 |

| Caisse de Refinancement de l’Habitat SA | 4.100% | 10/25/15 | EUR | 8,140 | 11,921 |

| Caisse Francaise de Financement Local | 2.375% | 2/9/16 | CHF | 2,000 | 2,356 |

| Caisse Francaise de Financement Local | 2.750% | 1/25/16 | EUR | 11,000 | 15,871 |

| Caisse Francaise de Financement Local | 3.000% | 10/2/28 | EUR | 2,000 | 2,947 |

| Caisse Francaise de Financement Local | 3.125% | 9/15/15 | EUR | 1,500 | 2,158 |

| Caisse Francaise de Financement Local | 3.500% | 9/16/16 | EUR | 2,000 | 2,970 |

| Caisse Francaise de Financement Local | 3.500% | 9/24/20 | EUR | 3,051 | 4,795 |

| Caisse Francaise de Financement Local | 3.625% | 2/26/18 | EUR | 3,000 | 4,607 |

| Caisse Francaise de Financement Local | 4.250% | 1/26/22 | EUR | 3,000 | 4,948 |

| Caisse Francaise de Financement Local | 5.250% | 2/6/17 | EUR | 3,037 | 4,751 |

| Caisse Francaise de Financement Local | 5.375% | 7/8/24 | EUR | 4,000 | 7,243 |

| CIF Euromortgage SA | 3.750% | 10/23/19 | EUR | 7,000 | 11,027 |

| Compagnie De Financement Foncier SA | 5.500% | 1/26/27 | GBP | 350 | 681 |

| Compagnie De Financement Foncier SA | 2.250% | 8/21/15 | EUR | 5,000 | 7,100 |

| Compagnie De Financement Foncier SA | 2.375% | 8/24/18 | CHF | 4,000 | 4,893 |

| Compagnie De Financement Foncier SA | 2.375% | 11/21/22 | EUR | 5,000 | 7,287 |

| Compagnie De Financement Foncier SA | 4.125% | 10/25/17 | EUR | 1,500 | 2,323 |

| Compagnie De Financement Foncier SA | 4.250% | 1/19/22 | EUR | 1,000 | 1,650 |

| Compagnie De Financement Foncier SA | 4.625% | 9/23/17 | EUR | 13,000 | 20,392 |

| Compagnie De Financement Foncier SA | 4.875% | 5/25/21 | EUR | 11,544 | 19,569 |

| Compagnie De Financement Foncier SA | 5.750% | 10/4/21 | EUR | 500 | 895 |

| Credit Agricole Home Loan SFH | 1.625% | 3/11/20 | EUR | 2,200 | 3,135 |

| Credit Agricole Home Loan SFH | 1.750% | 7/27/17 | CHF | 2,000 | 2,399 |

| Credit Agricole Home Loan SFH | 3.250% | 3/23/17 | EUR | 3,000 | 4,479 |

| Credit Agricole Home Loan SFH | 3.875% | 1/12/21 | EUR | 2,500 | 4,016 |

| Credit Agricole Home Loan SFH | 4.000% | 7/16/25 | EUR | 2,000 | 3,290 |

| Credit Agricole Home Loan SFH | 4.500% | 1/29/16 | EUR | 5,800 | 8,616 |

| Credit Agricole Public Sector SCF | 1.875% | 9/20/19 | EUR | 1,500 | 2,165 |

| Credit Agricole Public Sector SCF | 1.875% | 6/7/23 | EUR | 1,200 | 1,673 |

20

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Credit Mutuel - CIC Home Loan SFH | 1.375% | 4/22/20 | EUR | 6,500 | 9,115 |

| Credit Mutuel - CIC Home Loan SFH | 2.500% | 9/11/23 | EUR | 3,000 | 4,390 |

| Credit Mutuel - CIC Home Loan SFH | 3.375% | 7/18/16 | EUR | 4,000 | 5,902 |

| Credit Mutuel Arkea Home Loans SFH | 2.375% | 7/11/23 | EUR | 2,000 | 2,900 |

| HSBC SFH France SA | 1.875% | 10/28/20 | EUR | 2,000 | 2,874 |

| HSBC SFH France SA | 2.000% | 10/16/23 | EUR | 2,500 | 3,519 |

| Societe Generale SCF SA | 4.250% | 2/3/23 | EUR | 4,000 | 6,671 |

| Societe Generale SFH | 3.250% | 6/6/16 | EUR | 5,000 | 7,343 |

| Societe Generale SFH | 4.000% | 1/18/22 | EUR | 2,000 | 3,265 |

| | | | | | 312,974 |

| Corporate Bonds (1.8%) | | | | | |

| Air Liquide SA | 2.908% | 10/12/18 | EUR | 2,800 | 4,197 |

| 2 Allianz France SA | 4.625% | 6/29/49 | EUR | 1,000 | 1,421 |

| Alstom SA | 2.250% | 10/11/17 | EUR | 2,000 | 2,862 |

| Alstom SA | 2.875% | 10/5/15 | EUR | 2,000 | 2,854 |

| Alstom SA | 4.125% | 2/1/17 | EUR | 2,000 | 2,995 |

| Arkema SA | 3.850% | 4/30/20 | EUR | 600 | 924 |

| Arkema SA | 4.000% | 10/25/17 | EUR | 1,000 | 1,518 |

| Autoroutes du Sud de la France SA | 2.875% | 1/18/23 | EUR | 3,000 | 4,358 |

| Autoroutes du Sud de la France SA | 4.125% | 4/13/20 | EUR | 2,000 | 3,153 |

| 2 AXA SA | 5.125% | 7/4/43 | EUR | 3,000 | 4,698 |

| AXA SA | 5.250% | 4/16/40 | EUR | 1,350 | 2,113 |

| 2 AXA SA | 5.777% | 7/29/49 | EUR | 2,000 | 2,963 |

| 2 AXA SA | 6.667% | 7/29/49 | GBP | 450 | 813 |

| 2 AXA SA | 6.772% | 10/29/49 | GBP | 2,000 | 3,703 |

| AXA SA | 7.125% | 12/15/20 | GBP | 500 | 1,006 |

| Banque Federative du Credit Mutuel SA | 1.625% | 1/11/18 | EUR | 1,000 | 1,411 |

| Banque Federative du Credit Mutuel SA | 2.875% | 6/21/17 | EUR | 5,000 | 7,332 |

| Banque Federative du Credit Mutuel SA | 4.000% | 10/22/20 | EUR | 4,000 | 6,126 |

| Banque Federative du Credit Mutuel SA | 4.375% | 5/31/16 | EUR | 4,000 | 5,957 |

| 7 Banque PSA Finance SA | 0.625% | 4/8/16 | EUR | 4,000 | 5,576 |

| BNP Paribas SA | 1.375% | 11/21/18 | EUR | 4,000 | 5,583 |

| BNP Paribas SA | 2.250% | 1/13/21 | EUR | 2,000 | 2,853 |

| BNP Paribas SA | 2.375% | 11/20/19 | GBP | 3,350 | 5,586 |

| BNP Paribas SA | 2.875% | 11/27/17 | EUR | 4,000 | 5,896 |

| BNP Paribas SA | 2.875% | 9/26/23 | EUR | 5,000 | 7,291 |

| BNP Paribas SA | 3.000% | 2/24/17 | EUR | 2,000 | 2,934 |

| BNP Paribas SA | 3.500% | 3/7/16 | EUR | 3,000 | 4,372 |

| 2 BNP Paribas SA | 5.019% | 4/29/49 | EUR | 2,500 | 3,714 |

| 2 BNP Paribas SA | 5.945% | 4/29/49 | GBP | 650 | 1,150 |

| Bouygues SA | 3.641% | 10/29/19 | EUR | 2,500 | 3,824 |

| Bouygues SA | 6.125% | 7/3/15 | EUR | 3,000 | 4,420 |

| BPCE SA | 1.750% | 3/14/16 | EUR | 5,000 | 7,067 |

| BPCE SA | 2.875% | 1/16/24 | EUR | 3,500 | 5,066 |

| BPCE SA | 4.625% | 7/18/23 | EUR | 1,500 | 2,294 |

| 2 BPCE SA | 4.625% | 7/29/49 | EUR | 600 | 852 |

| 2 BPCE SA | 6.117% | 10/29/49 | EUR | 1,250 | 1,912 |

| Carrefour SA | 1.750% | 5/22/19 | EUR | 5,420 | 7,626 |

| Carrefour SA | 1.875% | 12/19/17 | EUR | 1,000 | 1,426 |

| Casino Guichard Perrachon SA | 3.311% | 1/25/23 | EUR | 3,000 | 4,385 |

| Casino Guichard Perrachon SA | 4.726% | 5/26/21 | EUR | 1,900 | 3,065 |

| 2 CNP Assurances | 6.000% | 9/14/40 | EUR | 1,000 | 1,570 |

| 2 CNP Assurances | 7.375% | 9/30/41 | GBP | 1,000 | 1,927 |

| Compagnie De St. Gobain SA | 3.500% | 9/30/15 | EUR | 2,500 | 3,601 |

| Compagnie De St. Gobain SA | 3.625% | 3/28/22 | EUR | 5,000 | 7,662 |

| Compagnie De St. Gobain SA | 5.625% | 12/15/16 | GBP | 300 | 554 |

21

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Cie Financiere et Industrielle | | | | | |

| des Autoroutes SA | 5.000% | 5/24/21 | EUR | 1,500 | 2,494 |

| Credit Agricole SA | 2.375% | 11/27/20 | EUR | 5,000 | 7,190 |

| Credit Agricole SA | 3.625% | 3/8/16 | EUR | 4,900 | 7,157 |

| Credit Agricole SA | 3.875% | 2/13/19 | EUR | 4,000 | 6,196 |

| Credit Agricole SA | 5.875% | 6/11/19 | EUR | 4,000 | 6,613 |

| 2 Credit Agricole SA | 7.875% | 10/29/49 | EUR | 2,000 | 3,288 |

| Danone SA | 1.375% | 6/10/19 | EUR | 2,600 | 3,635 |

| Danone SA | 2.250% | 11/15/21 | EUR | 2,000 | 2,858 |

| Edenred | 3.625% | 10/6/17 | EUR | 1,500 | 2,239 |

| Eutelsat SA | 4.125% | 3/27/17 | EUR | 2,000 | 3,010 |

| GDF Suez | 1.500% | 7/20/17 | EUR | 2,000 | 2,831 |

| GDF Suez | 2.250% | 6/1/18 | EUR | 3,500 | 5,086 |

| GDF Suez | 2.750% | 10/18/17 | EUR | 2,000 | 2,946 |

| 2 GDF Suez | 4.750% | 7/29/49 | EUR | 1,000 | 1,500 |

| GDF Suez | 5.000% | 10/1/60 | GBP | 1,650 | 2,983 |

| GDF Suez | 5.625% | 1/18/16 | EUR | 2,000 | 3,011 |

| GDF Suez | 6.375% | 1/18/21 | EUR | 4,500 | 8,097 |

| GDF Suez | 6.875% | 1/24/19 | EUR | 250 | 435 |

| GDF Suez | 7.000% | 10/30/28 | GBP | 550 | 1,216 |

| Gecina SA | 2.875% | 5/30/23 | EUR | 2,500 | 3,526 |

| Groupe Auchan SA | 2.250% | 4/6/23 | EUR | 2,000 | 2,789 |

| Groupe Auchan SA | 2.375% | 12/12/22 | EUR | 2,000 | 2,835 |

| Klepierre | 4.000% | 4/13/17 | EUR | 2,100 | 3,153 |

| La Banque Postale Home Loan SFH | 2.375% | 1/15/24 | EUR | 1,800 | 2,603 |

| Legrand SA | 4.375% | 3/21/18 | EUR | 1,000 | 1,550 |

| 2 Natixis | 6.307% | 10/29/49 | EUR | 200 | 306 |

| Orange SA | 1.875% | 10/2/19 | EUR | 5,000 | 7,068 |

| Orange SA | 2.500% | 3/1/23 | EUR | 100 | 141 |

| Orange SA | 3.125% | 1/9/24 | EUR | 3,000 | 4,413 |

| Orange SA | 3.375% | 9/16/22 | EUR | 3,000 | 4,540 |

| 2 Orange SA | 4.250% | 2/28/49 | EUR | 1,500 | 2,129 |

| Orange SA | 4.750% | 2/21/17 | EUR | 4,000 | 6,138 |

| Orange SA | 5.375% | 11/22/50 | GBP | 1,000 | 1,792 |

| Orange SA | 5.625% | 5/22/18 | EUR | 2,000 | 3,257 |

| 2 Orange SA | 5.875% | 2/28/49 | GBP | 700 | 1,215 |

| Orange SA | 7.250% | 11/10/20 | GBP | 400 | 825 |

| Orange SA | 8.000% | 12/20/17 | GBP | 800 | 1,608 |

| Orange SA | 8.125% | 11/20/28 | GBP | 1,000 | 2,313 |

| Pernod Ricard SA | 2.000% | 6/22/20 | EUR | 2,000 | 2,801 |

| Pernod Ricard SA | 5.000% | 3/15/17 | EUR | 2,500 | 3,842 |

| RCI Banque SA | 1.750% | 7/6/16 | EUR | 1,500 | 2,110 |

| RCI Banque SA | 2.875% | 1/22/18 | EUR | 2,500 | 3,645 |

| RCI Banque SA | 3.250% | 4/25/18 | GBP | 500 | 863 |

| RCI Banque SA | 4.000% | 3/16/16 | EUR | 690 | 1,008 |

| Sanofi | 1.000% | 11/14/17 | EUR | 2,000 | 2,803 |

| Sanofi | 1.875% | 9/4/20 | EUR | 3,000 | 4,241 |

| Sanofi | 4.125% | 10/11/19 | EUR | 1,000 | 1,597 |

| Sanofi | 4.500% | 5/18/16 | EUR | 2,000 | 2,991 |

| Schneider Electric SA | 4.000% | 8/11/17 | EUR | 4,137 | 6,293 |

| 2 SCOR SE | 5.375% | 12/29/49 | CHF | 2,000 | 2,394 |

| Societe Des Autoroutes Paris-Rhin-Rhone | 4.875% | 1/21/19 | EUR | 1,000 | 1,603 |

| Societe Des Autoroutes Paris-Rhin-Rhone | 5.000% | 1/12/17 | EUR | 2,500 | 3,828 |

| Societe Des Autoroutes Paris-Rhin-Rhone | 5.125% | 1/18/18 | EUR | 1,500 | 2,371 |

| Societe Generale SA | 2.250% | 1/23/20 | EUR | 4,000 | 5,738 |

| Societe Generale SA | 3.875% | 12/17/15 | GBP | 50 | 88 |

22

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Societe Generale SA | 4.000% | 4/20/16 | EUR | 1,500 | 2,213 |

| Societe Generale SA | 4.000% | 6/7/23 | EUR | 3,700 | 5,395 |

| Societe Generale SA | 4.750% | 3/2/21 | EUR | 1,000 | 1,643 |

| Societe Generale SA | 5.000% | 12/20/18 | GBP | 2,790 | 5,209 |

| Societe Generale SA | 5.400% | 1/30/18 | GBP | 700 | 1,279 |

| 2 Suez Environnement Co. | 4.820% | 9/29/49 | EUR | 500 | 715 |

| Suez Environnement Co. | 5.500% | 7/22/24 | EUR | 2,400 | 4,223 |

| Thales SA | 1.625% | 3/20/18 | EUR | 2,500 | 3,528 |

| Total Capital International SA | 2.125% | 3/15/23 | EUR | 3,000 | 4,223 |

| Total Capital International SA | 2.500% | 3/25/26 | EUR | 2,000 | 2,799 |

| Total Capital SA | 4.250% | 12/8/17 | GBP | 550 | 1,009 |

| Total Capital SA | 4.700% | 6/6/17 | EUR | 3,000 | 4,657 |

| Transport et Infrastructures Gaz France SA | 4.339% | 7/7/21 | EUR | 2,000 | 3,171 |

| Unibail-Rodamco SE | 1.625% | 6/26/17 | EUR | 1,400 | 1,981 |

| Unibail-Rodamco SE | 2.375% | 2/25/21 | EUR | 2,000 | 2,870 |

| Unibail-Rodamco SE | 2.500% | 6/12/23 | EUR | 800 | 1,139 |

| Unibail-Rodamco SE | 4.625% | 9/23/16 | EUR | 3,000 | 4,530 |

| Veolia Environnement SA | 4.247% | 1/6/21 | EUR | 3,000 | 4,759 |

| Veolia Environnement SA | 4.625% | 3/30/27 | EUR | 500 | 801 |

| Veolia Environnement SA | 6.125% | 11/25/33 | EUR | 1,000 | 1,825 |

| Veolia Environnement SA | 6.125% | 10/29/37 | GBP | 1,000 | 1,947 |

| Vinci SA | 3.375% | 3/30/20 | EUR | 1,500 | 2,276 |

| Vinci SA | 4.125% | 2/20/17 | EUR | 2,000 | 3,015 |

| 2 Vinci SA | 6.250% | 11/29/49 | EUR | 1,000 | 1,481 |

| Vivendi SA | 4.125% | 7/18/17 | EUR | 900 | 1,373 |

| Vivendi SA | 4.250% | 12/1/16 | EUR | 2,150 | 3,250 |

| Vivendi SA | 4.750% | 7/13/21 | EUR | 2,000 | 3,267 |

| | | | | | 410,390 |

| Sovereign Bonds (8.2%) | | | | | |

| Aeroports de Paris | 2.750% | 6/5/28 | EUR | 1,000 | 1,399 |

| Aeroports de Paris | 3.125% | 6/11/24 | EUR | 2,000 | 2,992 |

| Agence Francaise de Developpement | 2.250% | 5/27/25 | EUR | 10,000 | 13,898 |

| 2 Agence Francaise de Developpement | 4.615% | 7/29/49 | EUR | 500 | 735 |

| Areva SA | 3.500% | 3/22/21 | EUR | 3,500 | 5,125 |

| Bpifrance Financement | 2.750% | 10/25/25 | EUR | 3,000 | 4,361 |

| Bpifrance Financement SA | 2.000% | 7/25/17 | EUR | 3,000 | 4,347 |

| Caisse d’Amortissement de la Dette Sociale | 1.000% | 5/25/18 | EUR | 10,000 | 14,028 |

| Caisse d’Amortissement de la Dette Sociale | 2.250% | 12/7/15 | GBP | 1,000 | 1,724 |

| Caisse d’Amortissement de la Dette Sociale | 2.375% | 1/25/24 | EUR | 3,500 | 5,028 |

| Caisse d’Amortissement de la Dette Sociale | 2.500% | 10/25/22 | EUR | 3,000 | 4,420 |

| Caisse d’Amortissement de la Dette Sociale | 3.000% | 2/25/16 | EUR | 13,000 | 18,902 |

| Caisse d’Amortissement de la Dette Sociale | 3.375% | 4/25/21 | EUR | 3,000 | 4,714 |

| Caisse d’Amortissement de la Dette Sociale | 3.625% | 4/25/16 | EUR | 7,000 | 10,337 |

| Caisse d’Amortissement de la Dette Sociale | 3.750% | 10/25/20 | EUR | 2,000 | 3,201 |

| Caisse d’Amortissement de la Dette Sociale | 4.000% | 12/15/25 | EUR | 8,000 | 13,129 |

| Caisse d’Amortissement de la Dette Sociale | 4.125% | 4/25/17 | EUR | 6,500 | 9,992 |

| Caisse d’Amortissement de la Dette Sociale | 4.125% | 4/25/23 | EUR | 5,000 | 8,244 |

| Caisse d’Amortissement de la Dette Sociale | 4.250% | 4/25/20 | EUR | 3,000 | 4,900 |

| Caisse d’Amortissement de la Dette Sociale | 4.375% | 10/25/21 | EUR | 8,000 | 13,359 |

| Caisse des Depots et Consignations | 4.375% | 4/9/18 | EUR | 3,000 | 4,739 |

| Caisse Nationale des Autoroutes | 4.500% | 3/28/18 | EUR | 3,870 | 6,136 |

| Caisse Nationale des Autoroutes | 6.000% | 10/26/15 | EUR | 943 | 1,418 |

| 2 Electricite de France SA | 4.250% | 12/29/49 | EUR | 4,000 | 5,834 |

| Electricite de France SA | 2.250% | 9/29/17 | CHF | 1,000 | 1,203 |

| Electricite de France SA | 3.875% | 1/18/22 | EUR | 3,000 | 4,716 |

| Electricite de France SA | 4.500% | 11/12/40 | EUR | 3,900 | 6,428 |

23

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value |

| | Coupon | Date | Currency | (000) | ($000) |

| Electricite de France SA | 4.625% | 9/11/24 | EUR | 2,000 | 3,320 |

| Electricite de France SA | 5.125% | 9/22/50 | GBP | 2,000 | 3,570 |

| Electricite de France SA | 5.375% | 5/29/20 | EUR | 2,000 | 3,372 |

| 2 Electricite de France SA | 5.375% | 1/29/49 | EUR | 3,400 | 5,144 |

| Electricite de France SA | 5.500% | 10/17/41 | GBP | 1,000 | 1,872 |

| 2 Electricite de France SA | 6.000% | 12/29/49 | GBP | 3,800 | 6,707 |

| Electricite de France SA | 6.250% | 1/25/21 | EUR | 5,000 | 8,901 |

| Electricite de France SA | 6.250% | 5/30/28 | GBP | 3,000 | 6,057 |

| French Republic | 0.250% | 11/25/15 | EUR | 25,000 | 34,705 |

| French Republic | 1.000% | 7/25/17 | EUR | 30,000 | 42,385 |

| French Republic | 1.000% | 5/25/18 | EUR | 39,000 | 54,934 |

| French Republic | 1.000% | 11/25/18 | EUR | 20,000 | 28,080 |

| French Republic | 1.000% | 5/25/19 | EUR | 10,000 | 13,979 |

| French Republic | 1.750% | 2/25/17 | EUR | 45,000 | 64,899 |

| French Republic | 1.750% | 5/25/23 | EUR | 36,000 | 49,935 |

| French Republic | 2.000% | 7/12/15 | EUR | 20,000 | 28,340 |

| French Republic | 2.250% | 2/25/16 | EUR | 30,000 | 43,141 |

| French Republic | 2.250% | 10/25/22 | EUR | 35,000 | 50,954 |

| French Republic | 2.250% | 5/25/24 | EUR | 20,000 | 28,482 |

| French Republic | 2.500% | 7/25/16 | EUR | 42,000 | 61,147 |

| French Republic | 2.500% | 10/25/20 | EUR | 39,000 | 58,597 |

| French Republic | 2.750% | 10/25/27 | EUR | 16,000 | 23,235 |

| French Republic | 3.000% | 10/25/15 | EUR | 40,000 | 57,782 |

| French Republic | 3.000% | 4/25/22 | EUR | 31,000 | 47,839 |

| French Republic | 3.250% | 4/25/16 | EUR | 20,000 | 29,385 |

| French Republic | 3.250% | 10/25/21 | EUR | 37,000 | 58,075 |

| French Republic | 3.250% | 5/25/45 | EUR | 12,000 | 17,651 |

| French Republic | 3.500% | 4/25/20 | EUR | 50,000 | 79,173 |

| French Republic | 3.500% | 4/25/26 | EUR | 40,000 | 63,070 |

| French Republic | 3.750% | 4/25/17 | EUR | 20,000 | 30,524 |

| French Republic | 3.750% | 10/25/19 | EUR | 40,000 | 63,845 |

| French Republic | 3.750% | 4/25/21 | EUR | 28,000 | 45,214 |

| French Republic | 4.000% | 4/25/18 | EUR | 15,000 | 23,597 |

| French Republic | 4.000% | 10/25/38 | EUR | 25,000 | 41,908 |

| French Republic | 4.000% | 4/25/55 | EUR | 14,000 | 23,936 |

| French Republic | 4.000% | 4/25/60 | EUR | 10,000 | 17,166 |

| French Republic | 4.250% | 10/25/17 | EUR | 25,000 | 39,198 |

| French Republic | 4.250% | 10/25/18 | EUR | 25,000 | 40,117 |

| French Republic | 4.250% | 4/25/19 | EUR | 25,000 | 40,500 |

| French Republic | 4.250% | 10/25/23 | EUR | 25,000 | 42,040 |

| French Republic | 4.500% | 4/25/41 | EUR | 21,500 | 39,022 |

| French Republic | 4.750% | 4/25/35 | EUR | 19,300 | 35,421 |

| French Republic | 5.000% | 10/25/16 | EUR | 20,000 | 30,964 |

| French Republic | 5.500% | 4/25/29 | EUR | 26,000 | 49,903 |

| French Republic | 5.750% | 10/25/32 | EUR | 31,500 | 63,789 |

| French Republic | 6.000% | 10/25/25 | EUR | 15,000 | 29,065 |