UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22619

Name of Registrant: Vanguard Charlotte Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Anne E. Robinson, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2016 – April 30, 2017

Item 1: Reports to Shareholders

Semiannual Report | April 30, 2017

Vanguard Total International Bond

Index Fund

A new format, unwavering commitment

As you begin reading this report, you’ll notice that we’ve made some improvements to the opening sections—based on feedback from you, our clients.

Page 1 starts with a new ”Your Fund’s Performance at a Glance,” a concise, handy summary of how your fund performed during the period.

In the renamed ”Chairman’s Perspective,” Bill McNabb will focus on enduring principles and investment insights.

We’ve modified some tables, and eliminated some redundancy, but we haven’t removed any information.

At Vanguard, we’re always looking for better ways to communicate and to help you make sound investment decisions. Thank you for entrusting your assets to us.

| |

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| Chairman’s Perspective. | 3 |

| Fund Profile. | 7 |

| Performance Summary. | 9 |

| Financial Statements. | 10 |

| About Your Fund’s Expenses. | 122 |

| Trustees Approve Advisory Arrangement. | 124 |

| Glossary. | 126 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: No matter what language you speak, Vanguard has one consistent message and set of principles. Our primary focus is on you, our clients. We conduct our business with integrity as a faithful steward of your assets. This message is shown translated into seven languages, reflecting our expanding global presence.

Your Fund’s Performance at a Glance

• The return of Vanguard Total International Bond Index Fund was slightly negative for the six months ended April 30, 2017. That performance was in line with that of its benchmark (–0.12%) after taking expenses into account but behind the average return of its peers (+0.45%).

• Demand for bonds was buoyed by the prospect of a more protectionist trade stance by the new U.S. administration, political uncertainties in Europe, and the United Kingdom’s upcoming exit from the European Union. On the other hand, monetary policy generally remained accommodative and economic data from Europe, China, and Japan was solid.

• Among the largest constituents of the index, the United Kingdom and Germany produced positive returns, but those of France, Italy, and Spain were negative. Japan, which makes up almost one-quarter of the index, was also in the red.

• By sector, corporate bonds held up much better than their non-corporate and government counterparts.

| | | | |

| Total Returns: Six Months Ended April 30, 2017 | | | | |

| | 30-Day SEC | Income | Capital | Total |

| | Yield | Returns | Returns | Returns |

| Vanguard Total International Bond Index Fund | | | | |

| Investor Shares | 0.69% | 1.18% | -1.45% | -0.27% |

| ETF Shares | 0.74 | | | |

| Market Price | | | | -0.44 |

| Net Asset Value | | | | -0.27 |

| Admiral™ Shares | 0.74 | 1.20 | -1.45 | -0.25 |

| Institutional Shares | 0.77 | 1.22 | -1.45 | -0.23 |

| Bloomberg Barclays Global Aggregate ex-USD Float | | | | |

| Adjusted RIC Capped Index (USD Hedged) | | | | -0.12 |

| International Income Funds Average | | | | 0.45 |

International Income Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements. Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria. The Vanguard ETF® Shares shown are traded on the NYSE Arca exchange and are available only through brokers. The table provides ETF returns based on both the NYSE Arca market price and the net asset value for a share. U.S. Pat. Nos. 6,879,964; 7,337,138; 7,720,749; 7,925,573; 8,090,646; and 8,417,623. The Vanguard ETF® Shares shown are traded on the Nasdaq exchange and are available only through brokers. The table provides ETF returns based on both the Nasdaq market price and the net asset value for a share. U.S. Pat. Nos. 6,879,964; 7,337,138; 7,720,749; 7,925,573; 8,090,646; and 8,417,623.

For the ETF Shares, the market price is determined by the midpoint of the bid-offer spread as of the closing time of the New York Stock Exchange (generally 4 p.m., Eastern time). The net asset value is also determined as of the NYSE closing time. For more information about how the ETF Shares' market prices have compared with their net asset value, visit vanguard.com, select your ETF, and then select the Price and Performance tab. The ETF premium/discount analysis there shows the percentages of days on which the ETF Shares' market price was above or below the NAV.

1

| | | | | |

| Expense Ratios | | | | | |

| Your Fund Compared With Its Peer Group | | | | | |

| | Investor | ETF | Admiral | Institutional | Peer Group |

| | Shares | Shares | Shares | Shares | Average |

| Total International Bond Index Fund | 0.15% | 0.12% | 0.12% | 0.07% | 1.01% |

The fund expense ratios shown are from the prospectus dated February 23, 2017, and represent estimated costs for the current fiscal year. For the six months ended April 30, 2017, the fund’s annualized expense ratios were 0.15% for Investor Shares, 0.12% for ETF Shares, 0.12% for Admiral Shares, and 0.07% for Institutional Shares. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through year-end 2016.

Peer group: International Income Funds.

2

Chairman’s Perspective

Bill McNabb

Chairman and Chief Executive Officer

Dear Shareholder,

“Buy what you know.”

It’s one of the adages of investing, and it has plenty of intuitive appeal. After all, the familiar seems inherently less risky. It’s no wonder that many investors heavily tilt their portfolios toward the stocks and bonds of their home country. This is known in investing parlance as “home bias.”

U.S. investors sometimes think they can get all the global diversification they need by owning shares of U.S.-based multinational companies. And that may seem like the best of both worlds: international diversification without ever leaving the friendly confines of home.

The potential pitfall is that, as Vanguard research has suggested, the performance of a company’s shares tends to be highly correlated to its domestic market, regardless of where that company conducts most of its business.

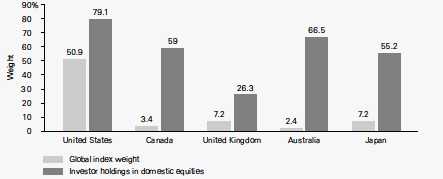

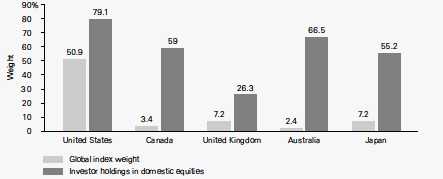

Americans aren’t alone in being portfolio homebodies. Vanguard has found that in a range of developed countries—Australia, Canada, Japan, and the United Kingdom, as well as the United States—investors held a greater percentage of domestic stocks than would be indicated if they had taken their cues from a globally diversified, market-weighted benchmark. (You can see this tendency in the chart later in this letter.)

3

Why home bias exists

Vanguard’s Investment Strategy Group identified a range of reasons why investors might not embrace global diversification, including concerns about currency risk and an expectation that their home country will deliver outsized returns.

One factor we identified—preference for the familiar—seems particularly relevant. With so much global uncertainty about geopolitics, monetary policy, and the economic outlook, it’s understandable why investors may not want to stray too far from home.

But in their aversion to the unknown, investors can end up increasing, rather than lessening, their risks. That’s

because they’re sacrificing broad global diversification—one of the best ways I know of to help control risk.

In many cases, individual country markets are much less diversified than the global market in total. Global investing, then, can be an answer for investors who want to reduce concentration risk. That can include overconcentration in a particular country, region, or industry.

And the good news is that global investing is easier than ever, thanks to the wide availability of low-cost, internationally diversified stock and bond funds. It’s possible, in a sense, to own the whole world with just a couple of funds.

| | | |

| Market Barometer | | | |

| | | | Total Returns |

| | | Periods Ended April 30, 2017 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 13.46% | 18.03% | 13.63% |

| Russell 2000 Index (Small-caps) | 18.37 | 25.63 | 12.95 |

| Russell 3000 Index (Broad U.S. market) | 13.83 | 18.58 | 13.57 |

| FTSE All-World ex US Index (International) | 10.55 | 12.98 | 5.60 |

| |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | -0.67% | 0.83% | 2.27% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | -0.34 | 0.14 | 3.16 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.23 | 0.37 | 0.11 |

| |

| CPI | | | |

| Consumer Price Index | 1.16% | 2.20% | 1.22% |

4

Expanding our opportunities

A key to overcoming home bias is reframing the way we look at investing outside our home countries. Take, for example, automakers or pharmaceutical companies. There are well-regarded firms in both industries located throughout the world. Over the next five years, nobody can know for sure whether a Japanese or U.S. or European company will produce a popular new sedan that outsells the competition or come up with new treatments to combat illness. So why not own them all? And that includes their bonds along with their stocks.

Full global diversification also allows you to capitalize on opportunities in both developed and emerging economies. Betting on which individual country—let alone company—will be the next market darling can be a fool’s errand.

A better choice can be to harness the potential of all markets. In my personal investment account, I have an emerging markets position that complements my developed-market holdings. Not only can global diversification help control risk, but it can also expand our set of opportunities among stocks and bonds.

Home bias shows investors across the world are fixated on the familiar

Investors often own a greater share of their home country’s stocks than would be indicated by the allocations of a globally diversified, market-capitalization-weighted index fund.

Notes: Data as of December 31, 2014 (the latest available from the International Monetary Fund, or IMF), in U.S. dollars. Domestic investment is calculated by subtracting total foreign investment (as reported by the IMF) in a given country from its market capitalization in the MSCI All Country World Index. Given that the IMF data are voluntary, there may be some discrepancies between the market values in the survey and the MSCI ACWI.

Sources: Vanguard, based on data from the IMF’s Coordinated Portfolio Investment Survey (2014), Bloomberg, Thomson Reuters Datastream, and FactSet.

5

Ultimately, I believe we have the best chance for investment success by giving ourselves more opportunities, not fewer. Own the whole haystack and you never have to worry about finding the needle.

Thank you for entrusting your assets to Vanguard.

F. William McNabb III

Chairman and Chief Executive Officer

May 12, 2017

6

Total International Bond Index Fund

Fund Profile

As of April 30, 2017

| | | | |

| Share-Class Characteristics | | | | |

| | Investor | | Admiral | Institutional |

| | Shares | ETF Shares | Shares | Shares |

| Ticker Symbol | VTIBX | BNDX | VTABX | VTIFX |

| Expense Ratio1 | 0.15% | 0.12% | 0.12% | 0.07% |

| 30-Day SEC Yield | 0.69% | 0.74% | 0.74% | 0.77% |

| | |

| Financial Attributes | | |

| |

| |

| | | Bloomberg |

| | | Barclays GA |

| | | ex-USD |

| | | Float Adj |

| | | RIC Capped Idx |

| | Fund | (USD Hedged) |

| |

| Number of Bonds | 4,462 | 8,665 |

| |

| Yield to Maturity | | |

| (before expenses) | 0.8% | 0.8% |

| |

| Average Coupon | 2.2% | 2.6% |

| |

| Average Duration | 7.8 years | 7.7 years |

| |

| Average Effective | | |

| Maturity | 9.3 years | 9.2 years |

| |

| Short-Term | | |

| Reserves | 1.8% | — |

| |

| Volatility Measures | |

| | Bloomberg |

| | Barclays GA |

| | ex-USD |

| | Float Adj |

| | RIC Capped Idx |

| | (USD Hedged) |

| R-Squared | 0.99 |

| Beta | 0.99 |

These measures show the degree and timing of the fund’s fluctuations compared with the index over 36 months.

Distribution by Credit Quality (% of portfolio)

| |

| Aaa | 22.3% |

| Aa | 27.5 |

| A | 30.7 |

| Baa | 19.5 |

| |

| Sector Diversification (% of portfolio) | |

| Asset-Backed | 0.1% |

| Finance | 5.3 |

| Foreign Government | 81.9 |

| Industrial | 6.0 |

| Utilities | 1.1 |

| Other | 5.6 |

The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are generally not backed by the full faith and credit of the U.S. government.

Credit-quality ratings are obtained from Barclays and are from Moody's, Fitch, and S&P. When ratings from all three agencies are used, the median rating is shown. When ratings from two of the agencies are used, the lower rating for each issue is shown. "Not Rated" is used to classify securities for which a rating is not available. For more information about these ratings, see the Glossary entry for Credit Quality.

| |

| Distribution by Effective Maturity | |

| (% of portfolio) | |

| Under 1 Year | 1.1% |

| 1 - 3 Years | 19.5 |

| 3 - 5 Years | 20.5 |

| 5 - 10 Years | 30.6 |

| 10 - 20 Years | 17.3 |

| 20 - 30 Years | 8.6 |

| Over 30 Years | 2.4 |

1 The expense ratios shown are from the prospectus dated February 23, 2017, and represent estimated costs for the current fiscal year. For the six months ended April 30, 2017, the annualized expense ratios were 0.15% for Investor Shares, 0.12% for ETF Shares, 0.12% for Admiral Shares, and 0.07% for Institutional Shares.

7

Total International Bond Index Fund

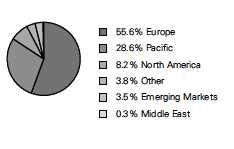

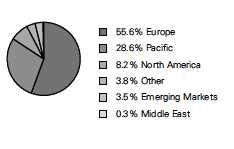

Market Diversification (% of equity exposure)

| |

| Europe | |

| France | 11.7% |

| Germany | 10.0 |

| United Kingdom | 8.1 |

| Italy | 8.0 |

| Spain | 5.4 |

| Netherlands | 2.9 |

| Belgium | 2.3 |

| Switzerland | 1.5 |

| Sweden | 1.3 |

| Austria | 1.3 |

| Other | 3.1 |

| Subtotal | 55.6% |

| Pacific | |

| Japan | 22.3% |

| Australia | 2.8 |

| South Korea | 2.7 |

| Other | 0.8 |

| Subtotal | 28.6% |

| Emerging Markets | 3.5% |

| North America | |

| Canada | 5.6% |

| United States | 2.6 |

| Subtotal | 8.2% |

| Middle East | 0.3% |

| Other | 3.8% |

Allocation by Region (% of portfolio)

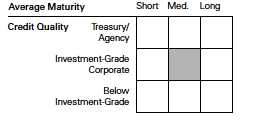

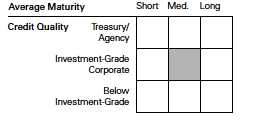

Investment Focus

8

Total International Bond Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

| | | | |

| Fiscal-Year Total Returns (%): May 31, 2013, Through April 30, 2017 | | |

| | | | | Bloomberg |

| | | | | Barclays GA |

| | | | | ex-USD |

| | | | | Float Adj |

| | | | | RIC Capped Idx |

| | | | Investor Shares | (USD Hedged) |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2013 | 0.60% | -0.10% | 0.50% | 0.62% |

| 2014 | 1.52 | 4.60 | 6.12 | 6.46 |

| 2015 | 1.51 | 1.53 | 3.04 | 3.38 |

| 2016 | 1.52 | 3.86 | 5.38 | 5.70 |

| 2017 | 1.18 | -1.45 | -0.27 | -0.12 |

| Note: For 2017, performance data reflect the six months ended April 30, 2017. | | |

Average Annual Total Returns: Periods Ended March 31, 2017

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | |

| | | | | | Since Inception |

| | Inception Date | One Year | Income | Capital | Total |

| Investor Shares | 5/31/2013 | 1.15% | 1.63% | 2.05% | 3.68% |

| ETF Shares | 5/31/2013 | | | | |

| Market Price | | 1.13 | | | 3.77 |

| Net Asset Value | | 1.13 | | | 3.70 |

| Admiral Shares | 5/31/2013 | 1.14 | 1.67 | 2.04 | 3.71 |

| Institutional Shares | 5/31/2013 | 1.18 | 1.73 | 2.05 | 3.78 |

See Financial Highlights for dividend and capital gains information.

9

Total International Bond Index Fund

Financial Statements (unaudited)

Statement of Net Assets

As of April 30, 2017

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| Australia (2.7%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.1%) | | | | |

| Australia & New Zealand Banking Group Ltd. | 0.450% | 11/22/23 | EUR | 1,000 | 1,092 |

| Australia & New Zealand Banking Group Ltd. | 1.125% | 5/13/20 | EUR | 7,000 | 7,903 |

| Australia & New Zealand Banking Group Ltd. | 1.375% | 9/4/18 | EUR | 2,000 | 2,227 |

| Australia & New Zealand Banking Group Ltd. | 2.500% | 1/16/24 | EUR | 5,000 | 6,191 |

| Australia & New Zealand Banking Group Ltd. | 5.000% | 8/16/23 | AUD | 2,000 | 1,648 |

| Commonwealth Bank of Australia | 0.750% | 11/4/21 | EUR | 4,000 | 4,483 |

| Commonwealth Bank of Australia | 1.375% | 1/22/19 | EUR | 5,000 | 5,601 |

| Commonwealth Bank of Australia | 3.000% | 5/3/22 | EUR | 11,000 | 13,650 |

| Commonwealth Bank of Australia | 3.000% | 9/4/26 | GBP | 1,700 | 2,459 |

| National Australia Bank Ltd. | 0.875% | 11/16/22 | EUR | 5,000 | 5,625 |

| National Australia Bank Ltd. | 0.875% | 2/19/27 | EUR | 10,000 | 10,891 |

| National Australia Bank Ltd. | 1.375% | 5/28/21 | EUR | 700 | 803 |

| National Australia Bank Ltd. | 1.875% | 1/13/23 | EUR | 5,000 | 5,929 |

| National Australia Bank Ltd. | 2.250% | 6/6/25 | EUR | 1,800 | 2,207 |

| National Australia Bank Ltd. | 3.000% | 9/4/26 | GBP | 500 | 724 |

| National Australia Bank Ltd. | 5.000% | 3/11/24 | AUD | 4,000 | 3,301 |

| Westpac Banking Corp. | 0.625% | 1/14/22 | EUR | 10,000 | 11,133 |

| Westpac Banking Corp. | 1.375% | 4/17/20 | EUR | 2,000 | 2,273 |

| Westpac Banking Corp. | 1.500% | 3/24/21 | EUR | 7,000 | 8,063 |

| Westpac Banking Corp. | 2.125% | 7/9/19 | EUR | 2,500 | 2,862 |

| Westpac Banking Corp. | 5.250% | 11/21/23 | AUD | 2,000 | 1,673 |

| | | | | | 100,738 |

| Corporate Bonds (0.4%) | | | | | |

| AGL Energy Ltd. | 5.000% | 11/5/21 | AUD | 1,500 | 1,178 |

| APT Pipelines Ltd. | 1.375% | 3/22/22 | EUR | 300 | 336 |

| APT Pipelines Ltd. | 2.000% | 3/22/27 | EUR | 8,400 | 9,313 |

| APT Pipelines Ltd. | 4.250% | 11/26/24 | GBP | 1,000 | 1,458 |

| Asciano Finance Ltd. | 5.000% | 9/19/23 | GBP | 500 | 724 |

| Asciano Finance Ltd. | 5.250% | 5/19/25 | AUD | 5,000 | 3,834 |

| Aurizon Network Pty Ltd. | 2.000% | 9/18/24 | EUR | 3,000 | 3,396 |

| AusNet Services Holdings Pty Ltd. | 1.500% | 2/26/27 | EUR | 2,600 | 2,873 |

| AusNet Services Holdings Pty Ltd. | 3.000% | 2/13/24 | EUR | 4,000 | 4,950 |

| Australia & New Zealand Banking Group Ltd. | 3.750% | 7/25/19 | AUD | 4,000 | 3,074 |

| Australia Pacific Airports Melbourne Pty Ltd. | 1.750% | 10/15/24 | EUR | 14,000 | 16,087 |

| BHP Billiton Finance Ltd. | 2.125% | 11/29/18 | EUR | 8,800 | 9,916 |

| BHP Billiton Finance Ltd. | 2.250% | 9/25/20 | EUR | 1,000 | 1,165 |

| BHP Billiton Finance Ltd. | 3.000% | 3/30/20 | AUD | 5,140 | 3,882 |

10

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| BHP Billiton Finance Ltd. | 3.125% | 4/29/33 | EUR | 500 | 643 |

| BHP Billiton Finance Ltd. | 3.250% | 9/25/24 | GBP | 5,000 | 7,164 |

| BHP Billiton Finance Ltd. | 3.250% | 9/24/27 | EUR | 12,700 | 16,558 |

| BHP Billiton Finance Ltd. | 3.750% | 10/18/17 | AUD | 1,000 | 754 |

| BHP Billiton Finance Ltd. | 4.300% | 9/25/42 | GBP | 3,100 | 5,046 |

| 1 BHP Billiton Finance Ltd. | 6.500% | 10/22/77 | GBP | 1,200 | 1,775 |

| Commonwealth Bank of Australia | 0.407% | 5/2/19 | JPY | 500,000 | 4,497 |

| Commonwealth Bank of Australia | 1.625% | 2/4/19 | EUR | 2,000 | 2,243 |

| 1 Commonwealth Bank of Australia | 2.000% | 4/22/27 | EUR | 10,000 | 11,261 |

| Commonwealth Bank of Australia | 2.250% | 12/7/18 | GBP | 2,360 | 3,136 |

| Commonwealth Bank of Australia | 3.750% | 10/18/19 | AUD | 10,000 | 7,662 |

| Commonwealth Bank of Australia | 4.250% | 1/25/18 | AUD | 1,000 | 759 |

| Commonwealth Bank of Australia | 4.375% | 2/25/20 | EUR | 3,500 | 4,279 |

| Commonwealth Bank of Australia | 5.150% | 4/9/20 | CAD | 6,989 | 5,596 |

| Macquarie Bank Ltd. | 1.125% | 1/20/22 | EUR | 500 | 559 |

| Macquarie Bank Ltd. | 2.500% | 9/18/18 | EUR | 400 | 451 |

| Macquarie Bank Ltd. | 3.250% | 3/3/20 | AUD | 1,000 | 756 |

| Macquarie Bank Ltd. | 3.500% | 12/18/20 | GBP | 1,000 | 1,404 |

| Macquarie Bank Ltd. | 6.000% | 9/21/20 | EUR | 1,500 | 1,902 |

| National Australia Bank Ltd. | 0.350% | 9/7/22 | EUR | 10,000 | 10,809 |

| National Australia Bank Ltd. | 0.875% | 1/20/22 | EUR | 18,000 | 20,022 |

| National Australia Bank Ltd. | 1.000% | 4/17/20 | CHF | 1,000 | 1,041 |

| National Australia Bank Ltd. | 1.125% | 11/10/21 | GBP | 600 | 785 |

| National Australia Bank Ltd. | 1.875% | 2/20/20 | GBP | 3,500 | 4,663 |

| National Australia Bank Ltd. | 2.000% | 11/12/20 | EUR | 6,000 | 6,948 |

| 1 National Australia Bank Ltd. | 2.000% | 11/12/24 | EUR | 2,000 | 2,239 |

| National Australia Bank Ltd. | 4.000% | 5/23/18 | AUD | 5,000 | 3,813 |

| National Australia Bank Ltd. | 4.000% | 7/13/20 | EUR | 5,850 | 7,164 |

| National Australia Bank Ltd. | 4.625% | 2/10/20 | EUR | 1,000 | 1,224 |

| National Australia Bank Ltd. | 5.125% | 12/9/21 | GBP | 4,000 | 6,118 |

| 1 National Australia Bank Ltd. | 7.125% | 6/12/23 | GBP | 200 | 275 |

| National Capital Trust I | 5.620% | 9/29/49 | GBP | 1,801 | 2,452 |

| Origin Energy Finance Ltd. | 2.500% | 10/23/20 | EUR | 310 | 359 |

| Origin Energy Finance Ltd. | 2.875% | 10/11/19 | EUR | 2,200 | 2,546 |

| Perth Airport Pty Ltd. | 5.500% | 3/25/21 | AUD | 6,500 | 5,197 |

| Qantas Airways Ltd. | 7.500% | 6/11/21 | AUD | 8,500 | 7,238 |

| Qantas Airways Ltd. | 7.750% | 5/19/22 | AUD | 1,230 | 1,078 |

| 1 QBE Capital Funding IV Ltd. | 7.500% | 5/24/41 | GBP | 1,000 | 1,458 |

| QPH Finance Co. Pty Ltd. | 5.750% | 7/29/20 | AUD | 780 | 629 |

| Rio Tinto Finance plc | 2.875% | 12/11/24 | EUR | 300 | 377 |

| Rio Tinto Finance plc | 4.000% | 12/11/29 | GBP | 5,200 | 7,941 |

| Scentre Group Trust 1 | 2.250% | 7/16/24 | EUR | 3,598 | 4,242 |

| Scentre Group Trust 1 | 4.500% | 9/8/21 | AUD | 1,600 | 1,250 |

| Scentre Group Trust 1 / Scentre Group Trust 2 | 2.375% | 4/8/22 | GBP | 3,000 | 4,071 |

| Scentre Group Trust 2 | 3.250% | 9/11/23 | EUR | 6,273 | 7,827 |

| Scentre Management Ltd. | 1.500% | 7/16/20 | EUR | 5,000 | 5,648 |

| Telstra Corp. Ltd. | 1.125% | 4/14/26 | EUR | 10,600 | 11,597 |

| Telstra Corp. Ltd. | 2.500% | 9/15/23 | EUR | 10,000 | 12,101 |

| Telstra Corp. Ltd. | 3.750% | 5/16/22 | EUR | 100 | 127 |

| Telstra Corp. Ltd. | 4.000% | 9/16/22 | AUD | 1,000 | 781 |

| Telstra Corp. Ltd. | 4.500% | 11/13/18 | AUD | 6,000 | 4,622 |

| Transurban Finance Co. Pty Ltd. | 1.875% | 9/16/24 | EUR | 3,000 | 3,435 |

| Vicinity Centres | 3.375% | 4/7/26 | GBP | 1,259 | 1,797 |

| Wesfarmers Ltd. | 1.250% | 10/7/21 | EUR | 500 | 567 |

| Wesfarmers Ltd. | 2.750% | 8/2/22 | EUR | 3,000 | 3,606 |

11

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| Wesfarmers Ltd. | 3.660% | 11/18/20 | AUD | 1,400 | 1,072 |

| Wesfarmers Ltd. | 4.750% | 3/12/20 | AUD | 10,000 | 7,885 |

| Westpac Banking Corp. | 0.875% | 2/16/21 | EUR | 15,000 | 16,809 |

| Westpac Banking Corp. | 3.250% | 1/22/20 | AUD | 10,000 | 7,612 |

| Westpac Banking Corp. | 4.125% | 5/25/18 | EUR | 8,000 | 9,133 |

| Westpac Banking Corp. | 5.000% | 10/21/19 | GBP | 500 | 715 |

| Woolworths Ltd. | 6.000% | 3/21/19 | AUD | 2,900 | 2,306 |

| | | | | | 340,210 |

| Sovereign Bonds (2.2%) | | | | | |

| Australian Capital Territory | 4.000% | 5/22/24 | AUD | 5,000 | 4,042 |

| Commonwealth Bank of Australia | 1.125% | 12/22/21 | GBP | 1,800 | 2,350 |

| Commonwealth of Australia | 1.750% | 11/21/20 | AUD | 75,000 | 55,847 |

| Commonwealth of Australia | 2.000% | 12/21/21 | AUD | 45,000 | 33,595 |

| Commonwealth of Australia | 2.250% | 5/21/28 | AUD | 32,000 | 22,970 |

| Commonwealth of Australia | 2.750% | 10/21/19 | AUD | 122,000 | 93,592 |

| Commonwealth of Australia | 2.750% | 4/21/24 | AUD | 98,800 | 75,842 |

| Commonwealth of Australia | 2.750% | 11/21/27 | AUD | 10,000 | 7,559 |

| Commonwealth of Australia | 2.750% | 6/21/35 | AUD | 28,365 | 20,108 |

| Commonwealth of Australia | 3.000% | 3/21/47 | AUD | 35,000 | 23,626 |

| Commonwealth of Australia | 3.250% | 10/21/18 | AUD | 27,800 | 21,309 |

| Commonwealth of Australia | 3.250% | 4/21/25 | AUD | 182,790 | 144,588 |

| Commonwealth of Australia | 3.250% | 4/21/29 | AUD | 110,000 | 86,526 |

| Commonwealth of Australia | 3.250% | 6/21/39 | AUD | 20,000 | 14,825 |

| Commonwealth of Australia | 3.750% | 4/21/37 | AUD | 41,000 | 33,038 |

| Commonwealth of Australia | 4.250% | 4/21/26 | AUD | 220,500 | 187,857 |

| Commonwealth of Australia | 4.500% | 4/15/20 | AUD | 119,350 | 96,257 |

| Commonwealth of Australia | 4.500% | 4/21/33 | AUD | 42,000 | 37,507 |

| Commonwealth of Australia | 4.750% | 4/21/27 | AUD | 74,351 | 66,225 |

| Commonwealth of Australia | 5.250% | 3/15/19 | AUD | 48,940 | 39,050 |

| Commonwealth of Australia | 5.500% | 4/21/23 | AUD | 50,600 | 44,802 |

| Commonwealth of Australia | 5.750% | 5/15/21 | AUD | 62,540 | 53,667 |

| Commonwealth of Australia | 5.750% | 7/15/22 | AUD | 102,322 | 90,264 |

| New South Wales Treasury Corp. | 3.000% | 3/20/28 | AUD | 40,000 | 29,817 |

| New South Wales Treasury Corp. | 3.500% | 3/20/19 | AUD | 20,000 | 15,427 |

| New South Wales Treasury Corp. | 4.000% | 4/8/21 | AUD | 10,000 | 8,010 |

| New South Wales Treasury Corp. | 4.000% | 4/20/23 | AUD | 8,000 | 6,498 |

| New South Wales Treasury Corp. | 4.000% | 5/20/26 | AUD | 5,000 | 4,092 |

| New South Wales Treasury Corp. | 5.000% | 8/20/24 | AUD | 17,000 | 14,748 |

| New South Wales Treasury Corp. | 6.000% | 5/1/20 | AUD | 5,000 | 4,176 |

| New South Wales Treasury Corp. | 6.000% | 3/1/22 | AUD | 34,000 | 29,758 |

| New South Wales Treasury Corp. | 6.000% | 5/1/30 | AUD | 3,000 | 2,901 |

| 2 Queensland Treasury Corp. | 2.750% | 8/20/27 | AUD | 18,000 | 12,952 |

| 2 Queensland Treasury Corp. | 3.250% | 7/21/26 | AUD | 18,500 | 14,073 |

| 2 Queensland Treasury Corp. | 3.250% | 7/21/28 | AUD | 23,000 | 17,229 |

| 2 Queensland Treasury Corp. | 4.250% | 7/21/23 | AUD | 43,000 | 35,119 |

| 2 Queensland Treasury Corp. | 4.750% | 7/21/25 | AUD | 42,000 | 35,670 |

| Queensland Treasury Corp. | 5.500% | 6/21/21 | AUD | 22,000 | 18,544 |

| Queensland Treasury Corp. | 5.750% | 7/22/24 | AUD | 10,000 | 8,932 |

| Queensland Treasury Corp. | 6.000% | 7/21/22 | AUD | 25,000 | 21,938 |

| Queensland Treasury Corp. | 6.250% | 2/21/20 | AUD | 45,000 | 37,553 |

| SGSP Australia Assets Pty Ltd. | 2.000% | 6/30/22 | EUR | 3,700 | 4,280 |

| SGSP Australia Assets Pty Ltd. | 5.125% | 2/11/21 | GBP | 1,000 | 1,472 |

| SGSP Australia Assets Pty Ltd. | 5.500% | 3/12/21 | AUD | 4,000 | 3,228 |

| South Australian Government Financing Authority | 1.500% | 9/22/22 | AUD | 20,000 | 14,196 |

| South Australian Government Financing Authority | 2.750% | 4/16/25 | AUD | 11,000 | 8,123 |

12

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| South Australian Government Financing Authority | 4.250% | 11/20/23 | AUD | 5,000 | 4,081 |

| South Australian Government Financing Authority | 4.750% | 8/6/19 | AUD | 7,500 | 5,968 |

| South Australian Government Financing Authority | 5.000% | 5/20/21 | AUD | 10,000 | 8,291 |

| Tasmanian Public Finance Corp. | 3.250% | 2/19/26 | AUD | 9,000 | 6,812 |

| Treasury Corp. of Victoria | 3.000% | 10/20/28 | AUD | 8,000 | 5,931 |

| Treasury Corp. of Victoria | 5.500% | 11/15/18 | AUD | 25,000 | 19,750 |

| Treasury Corp. of Victoria | 5.500% | 12/17/24 | AUD | 10,000 | 8,964 |

| Treasury Corp. of Victoria | 5.500% | 11/17/26 | AUD | 15,000 | 13,721 |

| Treasury Corp. of Victoria | 6.000% | 6/15/20 | AUD | 10,000 | 8,379 |

| Treasury Corp. of Victoria | 6.000% | 10/17/22 | AUD | 22,000 | 19,543 |

| Western Australian Treasury Corp. | 2.500% | 7/22/20 | AUD | 59,000 | 44,559 |

| Western Australian Treasury Corp. | 2.500% | 7/23/24 | AUD | 10,000 | 7,210 |

| Western Australian Treasury Corp. | 2.750% | 10/20/22 | AUD | 25,000 | 18,812 |

| Western Australian Treasury Corp. | 5.000% | 7/23/25 | AUD | 12,000 | 10,235 |

| Western Australian Treasury Corp. | 7.000% | 10/15/19 | AUD | 15,000 | 12,564 |

| Westpac Banking Corp. | 0.750% | 7/22/21 | EUR | 10,000 | 11,205 |

| | | | | | 1,810,207 |

| Total Australia (Cost $2,325,873) | | | | | 2,251,155 |

| Austria (1.3%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.0%) | | | | |

| BAWAG PSK Bank fuer Arbeit und Wirtschaft | | | | | |

| und Oesterreichische Postsparkasse AG | 1.875% | 9/18/19 | EUR | 500 | 571 |

| Erste Group Bank AG | 0.750% | 2/5/25 | EUR | 2,500 | 2,779 |

| Erste Group Bank AG | 3.500% | 2/8/22 | EUR | 600 | 760 |

| Erste Group Bank AG | 4.000% | 1/20/21 | EUR | 2,000 | 2,506 |

| HYPO NOE Gruppe Bank AG | 3.000% | 5/9/22 | EUR | 2,000 | 2,477 |

| KA Finanz AG | 1.625% | 9/25/18 | EUR | 2,000 | 2,234 |

| Raiffeisen-Landesbank Steiermark AG | 2.375% | 6/14/28 | EUR | 300 | 375 |

| Raiffeisenlandesbank Niederoesterreich-Wien AG | 1.750% | 10/2/20 | EUR | 1,700 | 1,965 |

| UniCredit Bank Austria AG | 0.750% | 2/25/25 | EUR | 500 | 553 |

| UniCredit Bank Austria AG | 1.250% | 7/30/18 | EUR | 500 | 555 |

| UniCredit Bank Austria AG | 1.375% | 5/26/21 | EUR | 5,000 | 5,740 |

| UniCredit Bank Austria AG | 2.375% | 1/22/24 | EUR | 5,100 | 6,277 |

| UniCredit Bank Austria AG | 4.125% | 2/24/21 | EUR | 2,000 | 2,518 |

| | | | | | 29,310 |

| Corporate Bonds (0.0%) | | | | | |

| Erste Group Bank AG | 0.625% | 1/19/23 | EUR | 4,000 | 4,461 |

| JAB Holdings BV | 1.750% | 5/25/23 | EUR | 700 | 790 |

| OMV AG | 3.500% | 9/27/27 | EUR | 2,400 | 3,177 |

| OMV AG | 4.250% | 10/12/21 | EUR | 1,000 | 1,279 |

| 1 OMV AG | 5.250% | 12/29/49 | EUR | 1,450 | 1,755 |

| 1 OMV AG | 6.250% | 12/29/49 | EUR | 3,050 | 3,858 |

| Telekom Finanzmanagement GmbH | 3.125% | 12/3/21 | EUR | 5,000 | 6,112 |

| Telekom Finanzmanagement GmbH | 4.000% | 4/4/22 | EUR | 500 | 637 |

| 1 UNIQA Insurance Group AG | 6.000% | 7/27/46 | EUR | 3,000 | 3,790 |

| 1 Vienna Insurance Group AG Wiener | | | | | |

| Versicherung Gruppe | 5.500% | 10/9/43 | EUR | 1,200 | 1,523 |

| | | | | | 27,382 |

| Sovereign Bonds (1.3%) | | | | | |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs-AG | 1.375% | 4/9/21 | EUR | 7,000 | 8,067 |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs-AG | 2.750% | 6/11/32 | EUR | 500 | 653 |

13

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs-AG | 2.750% | 6/20/33 | EUR | 1,200 | 1,575 |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs-AG | 3.375% | 9/22/25 | EUR | 2,000 | 2,686 |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs-AG | 4.375% | 7/8/19 | EUR | 11,000 | 13,229 |

| Erdoel-Lagergesellschaft mbH | 2.750% | 3/20/28 | EUR | 2,000 | 2,541 |

| 3 Hypo Alpe-Adria-Bank International AG | 2.375% | 12/13/22 | EUR | 3,000 | 3,585 |

| HYPO NOE Gruppe Bank AG | 0.500% | 9/11/20 | EUR | 10,000 | 11,039 |

| 3 KA Finanz AG | 0.375% | 8/11/20 | EUR | 10,900 | 12,078 |

| 3 Kaerntner Ausgleichszahlungs-Fonds | 0.000% | 1/14/32 | EUR | 20,000 | 18,634 |

| 3 OeBB Infrastruktur AG | 1.000% | 11/18/24 | EUR | 7,000 | 7,950 |

| 3 OeBB Infrastruktur AG | 2.250% | 7/4/23 | EUR | 10,000 | 12,224 |

| 3 OeBB Infrastruktur AG | 2.250% | 5/28/29 | EUR | 3,000 | 3,717 |

| 3 OeBB Infrastruktur AG | 3.375% | 5/18/32 | EUR | 7,000 | 9,798 |

| 3 OeBB Infrastruktur AG | 3.500% | 10/19/20 | EUR | 6,000 | 7,374 |

| 3 OeBB Infrastruktur AG | 3.500% | 10/19/26 | EUR | 1,800 | 2,465 |

| 3 OeBB Infrastruktur AG | 3.625% | 7/13/21 | EUR | 1,000 | 1,257 |

| 3 Oesterreichische Kontrollbank AG | 2.000% | 12/17/18 | GBP | 2,000 | 2,655 |

| 3 Oesterreichische Kontrollbank AG | 2.125% | 7/23/19 | CHF | 3,500 | 3,728 |

| 3 Oesterreichische Kontrollbank AG | 2.625% | 11/22/24 | CHF | 10,610 | 12,890 |

| 3 Oesterreichische Kontrollbank AG | 2.875% | 2/25/30 | CHF | 4,500 | 6,058 |

| 2 Republic of Austria | 0.000% | 7/15/23 | EUR | 75,000 | 81,630 |

| 2 Republic of Austria | 0.250% | 10/18/19 | EUR | 19,400 | 21,541 |

| 2 Republic of Austria | 0.500% | 4/20/27 | EUR | 40,000 | 43,128 |

| 2 Republic of Austria | 0.750% | 10/20/26 | EUR | 120,000 | 133,682 |

| 2 Republic of Austria | 1.150% | 10/19/18 | EUR | 14,250 | 15,924 |

| 2 Republic of Austria | 1.200% | 10/20/25 | EUR | 30,000 | 34,948 |

| 2 Republic of Austria | 1.500% | 2/20/47 | EUR | 9,000 | 9,840 |

| 2 Republic of Austria | 1.500% | 11/2/86 | EUR | 24,071 | 23,098 |

| 2 Republic of Austria | 1.650% | 10/21/24 | EUR | 36,500 | 44,001 |

| 2 Republic of Austria | 1.950% | 6/18/19 | EUR | 60,000 | 68,877 |

| 2 Republic of Austria | 2.400% | 5/23/34 | EUR | 24,600 | 32,509 |

| 2 Republic of Austria | 3.150% | 6/20/44 | EUR | 23,180 | 35,163 |

| 2 Republic of Austria | 3.400% | 11/22/22 | EUR | 30,000 | 39,084 |

| 2 Republic of Austria | 3.500% | 9/15/21 | EUR | 40,000 | 50,862 |

| 2 Republic of Austria | 3.650% | 4/20/22 | EUR | 53,000 | 68,869 |

| 2 Republic of Austria | 3.900% | 7/15/20 | EUR | 20,450 | 25,409 |

| 2 Republic of Austria | 4.150% | 3/15/37 | EUR | 40,000 | 66,733 |

| 2 Republic of Austria | 4.350% | 3/15/19 | EUR | 25,000 | 29,758 |

| 2 Republic of Austria | 4.850% | 3/15/26 | EUR | 20,000 | 30,164 |

| Republic of Austria | 6.250% | 7/15/27 | EUR | 14,750 | 25,321 |

| | | | | | 1,024,744 |

| Total Austria (Cost $1,111,977) | | | | | 1,081,436 |

| Belgium (2.3%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.1%) | | | | |

| Belfius Bank SA/NV | 0.625% | 10/14/21 | EUR | 11,000 | 12,279 |

| Belfius Bank SA/NV | 1.250% | 1/28/19 | EUR | 2,000 | 2,236 |

| Belfius Bank SA/NV | 1.375% | 6/5/20 | EUR | 11,500 | 13,100 |

| Belfius Bank SA/NV | 2.125% | 1/30/23 | EUR | 3,000 | 3,617 |

| KBC Bank NV | 0.450% | 1/22/22 | EUR | 5,000 | 5,540 |

| KBC Bank NV | 1.000% | 2/25/19 | EUR | 1,000 | 1,115 |

| KBC Bank NV | 1.250% | 5/28/20 | EUR | 3,000 | 3,403 |

| | | | | | 41,290 |

14

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| Corporate Bonds (0.2%) | | | | | |

| Anheuser-Busch InBev SA/NV | 0.625% | 3/17/20 | EUR | 15,000 | 16,631 |

| Anheuser-Busch InBev SA/NV | 0.875% | 3/17/22 | EUR | 11,900 | 13,322 |

| Anheuser-Busch InBev SA/NV | 1.500% | 3/17/25 | EUR | 15,620 | 17,802 |

| Anheuser-Busch InBev SA/NV | 1.875% | 1/20/20 | EUR | 3,000 | 3,433 |

| Anheuser-Busch InBev SA/NV | 2.000% | 12/16/19 | EUR | 750 | 860 |

| Anheuser-Busch InBev SA/NV | 2.000% | 3/17/28 | EUR | 16,000 | 18,480 |

| Anheuser-Busch InBev SA/NV | 2.750% | 3/17/36 | EUR | 15,500 | 18,497 |

| Anheuser-Busch InBev SA/NV | 2.875% | 9/25/24 | EUR | 4,000 | 5,026 |

| Anheuser-Busch InBev SA/NV | 4.000% | 6/2/21 | EUR | 5,000 | 6,289 |

| Anheuser-Busch InBev SA/NV | 4.000% | 9/24/25 | GBP | 6,000 | 9,066 |

| Anheuser-Busch InBev SA/NV | 9.750% | 7/30/24 | GBP | 800 | 1,594 |

| 1 Argenta Spaarbank NV | 3.875% | 5/24/26 | EUR | 15,200 | 17,660 |

| Belfius Bank SA/NV | 2.250% | 9/26/18 | EUR | 5,000 | 5,621 |

| Belfius Bank SA/NV | 3.125% | 5/11/26 | EUR | 1,700 | 1,934 |

| Delhaize Le Lion / De Leeuw BV | 3.125% | 2/27/20 | EUR | 300 | 355 |

| KBC Bank NV | 0.375% | 9/1/22 | EUR | 32,000 | 35,273 |

| KBC Group NV | 0.750% | 10/18/23 | EUR | 13,200 | 14,182 |

| KBC IFIMA SA | 2.125% | 9/10/18 | EUR | 5,500 | 6,172 |

| Solvay SA | 1.625% | 12/2/22 | EUR | 300 | 343 |

| Solvay SA | 2.750% | 12/2/27 | EUR | 300 | 366 |

| | | | | | 192,906 |

| Sovereign Bonds (2.0%) | | | | | |

| 4 Dexia Credit Local SA | 0.200% | 7/31/18 | EUR | 4,000 | 4,381 |

| 4 Dexia Credit Local SA | 0.250% | 3/19/20 | EUR | 10,000 | 10,983 |

| 4 Dexia Credit Local SA | 0.625% | 1/21/22 | EUR | 7,000 | 7,754 |

| 4 Dexia Credit Local SA | 0.750% | 1/25/23 | EUR | 8,000 | 8,842 |

| 4 Dexia Credit Local SA | 0.875% | 9/7/21 | GBP | 3,000 | 3,859 |

| 4 Dexia Credit Local SA | 1.250% | 11/26/24 | EUR | 17,200 | 19,344 |

| 4 Dexia Credit Local SA | 1.375% | 9/18/19 | EUR | 5,000 | 5,640 |

| 4 Dexia Credit Local SA | 1.625% | 10/29/18 | EUR | 3,000 | 3,358 |

| 4 Dexia Credit Local SA | 2.000% | 6/17/20 | GBP | 5,000 | 6,702 |

| 4 Dexia Credit Local SA | 2.125% | 2/12/25 | GBP | 3,000 | 4,027 |

| Eandis CVBA | 1.750% | 12/4/26 | EUR | 6,000 | 7,003 |

| Eandis CVBA | 4.500% | 11/8/21 | EUR | 1,500 | 1,940 |

| Eandis System Operator SCRL | 2.875% | 10/9/23 | EUR | 1,000 | 1,247 |

| 2 Kingdom of Belgium | 0.200% | 10/22/23 | EUR | 30,000 | 32,929 |

| 2 Kingdom of Belgium | 0.800% | 6/22/25 | EUR | 62,000 | 69,374 |

| 2 Kingdom of Belgium | 0.800% | 6/22/27 | EUR | 74,200 | 80,959 |

| 2 Kingdom of Belgium | 1.000% | 6/22/26 | EUR | 96,364 | 108,623 |

| 2 Kingdom of Belgium | 1.000% | 6/22/31 | EUR | 63,000 | 67,419 |

| Kingdom of Belgium | 1.125% | 12/21/18 | GBP | 4,000 | 5,234 |

| Kingdom of Belgium | 1.250% | 6/22/18 | EUR | 33,000 | 36,707 |

| 2 Kingdom of Belgium | 1.600% | 6/22/47 | EUR | 15,000 | 15,690 |

| 2 Kingdom of Belgium | 1.900% | 6/22/38 | EUR | 40,000 | 47,018 |

| 2 Kingdom of Belgium | 2.150% | 6/22/66 | EUR | 45,000 | 49,813 |

| Kingdom of Belgium | 2.250% | 6/22/23 | EUR | 69,500 | 86,343 |

| 2 Kingdom of Belgium | 2.250% | 6/22/57 | EUR | 10,000 | 11,643 |

| 2 Kingdom of Belgium | 2.600% | 6/22/24 | EUR | 80,000 | 101,689 |

| Kingdom of Belgium | 3.000% | 9/28/19 | EUR | 24,000 | 28,403 |

| 2 Kingdom of Belgium | 3.000% | 6/22/34 | EUR | 41,970 | 58,125 |

| 2 Kingdom of Belgium | 3.750% | 9/28/20 | EUR | 102,342 | 127,715 |

| Kingdom of Belgium | 3.750% | 6/22/45 | EUR | 19,000 | 30,302 |

| Kingdom of Belgium | 4.000% | 3/28/19 | EUR | 80,000 | 94,831 |

| Kingdom of Belgium | 4.000% | 3/28/22 | EUR | 28,950 | 38,210 |

15

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| Kingdom of Belgium | 4.000% | 3/28/32 | EUR | 33,000 | 50,201 |

| 2 Kingdom of Belgium | 4.250% | 9/28/21 | EUR | 61,000 | 80,033 |

| Kingdom of Belgium | 4.250% | 9/28/22 | EUR | 80,000 | 108,078 |

| 2 Kingdom of Belgium | 4.250% | 3/28/41 | EUR | 47,250 | 79,584 |

| 2 Kingdom of Belgium | 4.500% | 3/28/26 | EUR | 7,000 | 10,299 |

| 2 Kingdom of Belgium | 5.000% | 3/28/35 | EUR | 41,000 | 71,806 |

| Kingdom of Belgium | 5.500% | 3/28/28 | EUR | 23,000 | 37,571 |

| Proximus SADP | 2.375% | 4/4/24 | EUR | 3,100 | 3,735 |

| | | | | | 1,617,414 |

| Total Belgium (Cost $1,890,978) | | | | | 1,851,610 |

| Bermuda (0.0%) | | | | | |

| Corporate Bond (0.0%) | | | | | |

| Bacardi Ltd. | 2.750% | 7/3/23 | EUR | 2,000 | 2,418 |

| Total Bermuda (Cost $2,665) | | | | | 2,418 |

| Brazil (0.0%) | | | | | |

| Corporate Bonds (0.0%) | | | | | |

| BRF SA | 2.750% | 6/3/22 | EUR | 2,440 | 2,658 |

| Vale SA | 3.750% | 1/10/23 | EUR | 5,000 | 5,892 |

| Total Brazil (Cost $8,441) | | | | | 8,550 |

| Bulgaria (0.1%) | | | | | |

| Sovereign Bonds (0.1%) | | | | | |

| Republic of Bulgaria | 1.875% | 3/21/23 | EUR | 6,000 | 6,871 |

| Republic of Bulgaria | 2.000% | 3/26/22 | EUR | 3,000 | 3,485 |

| Republic of Bulgaria | 2.625% | 3/26/27 | EUR | 3,000 | 3,455 |

| Republic of Bulgaria | 2.950% | 9/3/24 | EUR | 800 | 959 |

| Republic of Bulgaria | 3.000% | 3/21/28 | EUR | 25,000 | 29,530 |

| Republic of Bulgaria | 3.125% | 3/26/35 | EUR | 3,000 | 3,330 |

| Total Bulgaria (Cost $45,695) | | | | | 47,630 |

| Canada (5.5%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.3%) | | | | |

| Bank of Montreal | 0.100% | 10/20/23 | EUR | 10,000 | 10,700 |

| Bank of Montreal | 0.250% | 1/22/20 | EUR | 10,000 | 11,023 |

| Bank of Montreal | 1.000% | 5/7/19 | EUR | 25,000 | 27,920 |

| Bank of Nova Scotia | 0.100% | 1/21/19 | EUR | 10,000 | 10,966 |

| Bank of Nova Scotia | 0.500% | 7/23/20 | EUR | 23,000 | 25,526 |

| Bank of Nova Scotia | 0.750% | 9/17/21 | EUR | 10,000 | 11,222 |

| Bank of Nova Scotia | 1.000% | 4/2/19 | EUR | 5,000 | 5,578 |

| Caisse Centrale Desjardins | 1.125% | 3/11/19 | EUR | 3,000 | 3,351 |

| Canadian Imperial Bank of Commerce | 1.250% | 8/7/18 | EUR | 3,000 | 3,334 |

| National Bank of Canada | 0.000% | 9/29/23 | EUR | 3,500 | 3,723 |

| National Bank of Canada | 0.500% | 1/26/22 | EUR | 14,000 | 15,525 |

| National Bank of Canada | 1.250% | 12/17/18 | EUR | 2,000 | 2,233 |

| National Bank of Canada | 1.500% | 3/25/21 | EUR | 5,000 | 5,766 |

| Royal Bank of Canada | 0.875% | 6/17/22 | EUR | 2,000 | 2,257 |

| Royal Bank of Canada | 1.250% | 10/29/18 | EUR | 10,000 | 11,140 |

| Royal Bank of Canada | 1.625% | 8/4/20 | EUR | 11,500 | 13,222 |

| Toronto-Dominion Bank | 0.250% | 4/27/22 | EUR | 5,000 | 5,472 |

| Toronto-Dominion Bank | 0.375% | 1/12/21 | EUR | 10,000 | 11,058 |

| Toronto-Dominion Bank | 0.375% | 4/27/23 | EUR | 1,000 | 1,094 |

16

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| Toronto-Dominion Bank | 0.625% | 7/29/19 | EUR | 15,000 | 16,656 |

| Toronto-Dominion Bank | 0.750% | 10/29/21 | EUR | 6,000 | 6,734 |

| Toronto-Dominion Bank | 1.680% | 6/8/21 | CAD | 10,000 | 7,370 |

| | | | | | 211,870 |

| Corporate Bonds (0.9%) | | | | | |

| 407 International Inc. | 3.600% | 5/21/47 | CAD | 4,900 | 3,709 |

| 407 International Inc. | 4.190% | 4/25/42 | CAD | 5,500 | 4,544 |

| 407 International Inc. | 4.300% | 5/26/21 | CAD | 1,500 | 1,218 |

| 407 International Inc. | 5.750% | 2/14/36 | CAD | 995 | 954 |

| Aeroports de Montreal | 5.170% | 9/17/35 | CAD | 325 | 301 |

| Aeroports de Montreal | 5.670% | 10/16/37 | CAD | 2,000 | 1,993 |

| 2 Algonquin Power Co. | 4.090% | 2/17/27 | CAD | 800 | 626 |

| Alimentation Couche-Tard Inc. | 3.600% | 6/2/25 | CAD | 7,900 | 6,107 |

| AltaGas Ltd. | 4.500% | 8/15/44 | CAD | 1,757 | 1,306 |

| AltaLink LP | 3.668% | 11/6/23 | CAD | 2,000 | 1,620 |

| AltaLink LP | 3.717% | 12/3/46 | CAD | 4,000 | 3,081 |

| AltaLink LP | 3.990% | 6/30/42 | CAD | 2,925 | 2,345 |

| AltaLink LP | 4.922% | 9/17/43 | CAD | 3,000 | 2,759 |

| Bank of Montreal | 1.610% | 10/28/21 | CAD | 10,000 | 7,309 |

| Bank of Montreal | 2.100% | 10/6/20 | CAD | 5,100 | 3,814 |

| Bank of Montreal | 2.120% | 3/16/22 | CAD | 15,300 | 11,393 |

| 1 Bank of Montreal | 3.320% | 6/1/26 | CAD | 10,500 | 8,034 |

| 1 Bank of Montreal | 3.340% | 12/8/25 | CAD | 10,750 | 8,217 |

| Bank of Montreal | 3.400% | 4/23/21 | CAD | 3,000 | 2,350 |

| Bank of Montreal | 4.609% | 9/10/25 | CAD | 5,000 | 4,339 |

| Bank of Montreal | 6.020% | 5/2/18 | CAD | 4,000 | 3,072 |

| Bank of Nova Scotia | 1.900% | 12/2/21 | CAD | 2,000 | 1,478 |

| Bank of Nova Scotia | 2.090% | 9/9/20 | CAD | 8,400 | 6,276 |

| Bank of Nova Scotia | 2.130% | 6/15/20 | CAD | 20,000 | 14,961 |

| Bank of Nova Scotia | 2.400% | 10/28/19 | CAD | 9,700 | 7,290 |

| 1 Bank of Nova Scotia | 2.580% | 3/30/27 | CAD | 4,550 | 3,369 |

| 1 Bank of Nova Scotia | 3.036% | 10/18/24 | CAD | 5,000 | 3,794 |

| Bank of Nova Scotia | 3.270% | 1/11/21 | CAD | 5,000 | 3,889 |

| 1 Bank of Nova Scotia | 3.367% | 12/8/25 | CAD | 7,000 | 5,357 |

| Bell Canada Inc. | 3.000% | 10/3/22 | CAD | 5,200 | 3,978 |

| Bell Canada Inc. | 3.250% | 6/17/20 | CAD | 5,350 | 4,109 |

| Bell Canada Inc. | 3.350% | 6/18/19 | CAD | 5,000 | 3,807 |

| Bell Canada Inc. | 3.350% | 3/22/23 | CAD | 5,000 | 3,888 |

| Bell Canada Inc. | 3.550% | 3/2/26 | CAD | 3,000 | 2,335 |

| Bell Canada Inc. | 4.350% | 12/18/45 | CAD | 3,150 | 2,378 |

| Bell Canada Inc. | 4.450% | 2/27/47 | CAD | 5,000 | 3,829 |

| Bell Canada Inc. | 4.750% | 9/29/44 | CAD | 3,500 | 2,806 |

| Bell Canada Inc. | 5.520% | 2/26/19 | CAD | 2,000 | 1,572 |

| Bell Canada Inc. | 7.850% | 4/2/31 | CAD | 5,000 | 5,204 |

| 1 BMO Capital Trust II | 10.221% | 12/31/07 | CAD | 700 | 583 |

| BP LP | 3.244% | 1/9/20 | CAD | 1,035 | 778 |

| Brookfield Asset Management Inc. | 3.800% | 3/16/27 | CAD | 4,235 | 3,258 |

| Brookfield Asset Management Inc. | 4.540% | 3/31/23 | CAD | 6,875 | 5,584 |

| Brookfield Asset Management Inc. | 4.820% | 1/28/26 | CAD | 6,000 | 4,990 |

| Brookfield Asset Management Inc. | 5.040% | 3/8/24 | CAD | 1,500 | 1,256 |

| Brookfield Infrastructure Finance ULC | 3.315% | 2/22/24 | CAD | 5,000 | 3,747 |

| Brookfield Infrastructure Finance ULC | 3.538% | 10/30/20 | CAD | 850 | 652 |

| Brookfield Renewable Partners ULC | 3.752% | 6/2/25 | CAD | 5,301 | 4,134 |

| Bruce Power LP | 3.969% | 6/23/26 | CAD | 5,000 | 3,972 |

| Caisse Centrale Desjardins | 1.748% | 3/2/20 | CAD | 10,150 | 7,506 |

17

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| Caisse Centrale Desjardins | 2.091% | 1/17/22 | CAD | 2,590 | 1,923 |

| Caisse Centrale Desjardins | 2.795% | 11/19/18 | CAD | 4,000 | 3,002 |

| Cameco Corp. | 4.190% | 6/24/24 | CAD | 3,500 | 2,675 |

| Canadian Imperial Bank of Commerce | 0.375% | 10/15/19 | EUR | 10,000 | 11,052 |

| Canadian Imperial Bank of Commerce | 1.640% | 7/12/21 | CAD | 250 | 183 |

| Canadian Imperial Bank of Commerce | 1.700% | 10/9/18 | CAD | 10,000 | 7,381 |

| Canadian Imperial Bank of Commerce | 1.850% | 7/14/20 | CAD | 250 | 186 |

| Canadian Imperial Bank of Commerce | 1.900% | 4/26/21 | CAD | 4,000 | 2,966 |

| Canadian Imperial Bank of Commerce | 2.040% | 3/21/22 | CAD | 10,000 | 7,424 |

| 1 Canadian Imperial Bank of Commerce | 3.000% | 10/28/24 | CAD | 12,000 | 9,032 |

| 1 Canadian Imperial Bank of Commerce | 3.420% | 1/26/26 | CAD | 10,000 | 7,650 |

| Canadian National Railway Co. | 2.800% | 9/22/25 | CAD | 5,000 | 3,859 |

| Canadian Natural Resources Ltd. | 2.890% | 8/14/20 | CAD | 400 | 301 |

| Canadian Natural Resources Ltd. | 3.310% | 2/11/22 | CAD | 10,000 | 7,631 |

| Canadian Pacific Railway Co. | 6.250% | 6/1/18 | CAD | 5,000 | 3,858 |

| Canadian Pacific Railway Co. | 6.450% | 11/17/39 | CAD | 1,750 | 1,759 |

| 1 Capital Desjardins Inc. | 4.954% | 12/15/26 | CAD | 3,000 | 2,491 |

| Capital Desjardins Inc. | 5.187% | 5/5/20 | CAD | 5,355 | 4,327 |

| Capital Power Corp. | 5.276% | 11/16/20 | CAD | 4,650 | 3,716 |

| CI Financial Corp. | 2.645% | 12/7/20 | CAD | 5,200 | 3,897 |

| 1 CIBC Capital Trust | 10.250% | 6/30/08 | CAD | 225 | 224 |

| Cogeco Communications Inc. | 4.175% | 5/26/23 | CAD | 250 | 198 |

| CU Inc. | 3.805% | 9/10/42 | CAD | 450 | 349 |

| CU Inc. | 3.964% | 7/27/45 | CAD | 3,000 | 2,395 |

| CU Inc. | 4.085% | 9/2/44 | CAD | 5,400 | 4,404 |

| CU Inc. | 4.543% | 10/24/41 | CAD | 1,000 | 862 |

| CU Inc. | 4.722% | 9/9/43 | CAD | 3,000 | 2,673 |

| CU Inc. | 6.800% | 8/13/19 | CAD | 900 | 740 |

| Emera Inc. | 2.900% | 6/16/23 | CAD | 8,000 | 6,054 |

| Enbridge Gas Distribution Inc. | 2.500% | 8/5/26 | CAD | 2,000 | 1,479 |

| Enbridge Gas Distribution Inc. | 3.310% | 9/11/25 | CAD | 240 | 190 |

| Enbridge Gas Distribution Inc. | 4.000% | 8/22/44 | CAD | 2,000 | 1,596 |

| Enbridge Gas Distribution Inc. | 4.040% | 11/23/20 | CAD | 350 | 279 |

| Enbridge Gas Distribution Inc. | 4.950% | 11/22/50 | CAD | 1,000 | 922 |

| Enbridge Inc. | 3.190% | 12/5/22 | CAD | 5,000 | 3,833 |

| Enbridge Inc. | 4.240% | 8/27/42 | CAD | 2,375 | 1,721 |

| Enbridge Inc. | 4.530% | 3/9/20 | CAD | 9,700 | 7,659 |

| Enbridge Inc. | 4.570% | 3/11/44 | CAD | 1,400 | 1,068 |

| Enbridge Income Fund | 3.950% | 11/19/24 | CAD | 3,000 | 2,390 |

| Enbridge Pipelines Inc. | 3.450% | 9/29/25 | CAD | 5,240 | 4,127 |

| Enbridge Pipelines Inc. | 4.550% | 8/17/43 | CAD | 1,000 | 812 |

| Enbridge Pipelines Inc. | 4.550% | 9/29/45 | CAD | 5,600 | 4,574 |

| EPCOR Utilities Inc. | 4.550% | 2/28/42 | CAD | 2,900 | 2,510 |

| Fairfax Financial Holdings Ltd. | 4.500% | 3/22/23 | CAD | 2,500 | 1,952 |

| Fairfax Financial Holdings Ltd. | 4.700% | 12/16/26 | CAD | 5,000 | 3,888 |

| Fairfax Financial Holdings Ltd. | 4.950% | 3/3/25 | CAD | 575 | 458 |

| Fairfax Financial Holdings Ltd. | 5.840% | 10/14/22 | CAD | 2,800 | 2,329 |

| First Capital Realty Inc. | 4.790% | 8/30/24 | CAD | 5,000 | 4,126 |

| Great-West Lifeco Inc. | 1.750% | 12/7/26 | EUR | 500 | 562 |

| Great-West Lifeco Inc. | 5.998% | 11/16/39 | CAD | 1,000 | 980 |

| Great-West Lifeco Inc. | 6.670% | 3/21/33 | CAD | 2,000 | 1,989 |

| Greater Toronto Airports Authority | 5.300% | 2/25/41 | CAD | 3,100 | 3,036 |

| Home Trust Co. | 3.400% | 12/10/18 | CAD | 350 | 232 |

| HSBC Bank Canada | 2.078% | 11/26/18 | CAD | 10,000 | 7,417 |

| HSBC Bank Canada | 2.449% | 1/29/21 | CAD | 150 | 113 |

18

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| HSBC Bank Canada | 2.491% | 5/13/19 | CAD | 5,000 | 3,744 |

| HSBC Bank Canada | 2.908% | 9/29/21 | CAD | 3,000 | 2,306 |

| HSBC Bank Canada | 2.938% | 1/14/20 | CAD | 1,950 | 1,484 |

| 1 Industrial Alliance Insurance & Financial | | | | | |

| Services Inc. | 3.300% | 9/15/28 | CAD | 5,000 | 3,840 |

| Inter Pipeline Ltd. | 3.173% | 3/24/25 | CAD | 4,950 | 3,748 |

| Inter Pipeline Ltd. | 3.776% | 5/30/22 | CAD | 2,300 | 1,812 |

| Inter Pipeline Ltd. | 4.637% | 5/30/44 | CAD | 3,000 | 2,375 |

| John Deere Canada Funding Inc. | 2.050% | 9/17/20 | CAD | 700 | 521 |

| John Deere Canada Funding Inc. | 2.350% | 6/24/19 | CAD | 3,675 | 2,746 |

| Kraft Canada Inc. | 2.700% | 7/6/20 | CAD | 1,865 | 1,402 |

| Laurentian Bank of Canada | 2.500% | 1/23/20 | CAD | 300 | 224 |

| Laurentian Bank of Canada | 2.810% | 6/13/19 | CAD | 1,107 | 830 |

| Loblaw Cos. Ltd. | 3.748% | 3/12/19 | CAD | 2,800 | 2,139 |

| 1 Manufacturers Life Insurance Co. | 2.100% | 6/1/25 | CAD | 9,000 | 6,670 |

| 1 Manufacturers Life Insurance Co. | 2.640% | 1/15/25 | CAD | 200 | 150 |

| 1 Manufacturers Life Insurance Co. | 3.181% | 11/22/27 | CAD | 5,000 | 3,864 |

| 1 Manulife Finance Delaware LP | 5.059% | 12/15/41 | CAD | 900 | 737 |

| 1 Manulife Financial Capital Trust II | 7.405% | 12/31/08 | CAD | 4,000 | 3,332 |

| Manulife Financial Corp. | 7.768% | 4/8/19 | CAD | 300 | 245 |

| Metro Inc. | 5.970% | 10/15/35 | CAD | 5,048 | 4,595 |

| National Bank of Canada | 1.742% | 3/3/20 | CAD | 500 | 370 |

| National Bank of Canada | 1.809% | 7/26/21 | CAD | 5,000 | 3,684 |

| National Bank of Canada | 2.404% | 10/28/19 | CAD | 15,400 | 11,577 |

| National Bank of Canada | 2.794% | 8/9/18 | CAD | 850 | 635 |

| NBC Asset Trust | 7.235% | 12/29/49 | CAD | 150 | 117 |

| North West Redwater Partnership / | | | | | |

| NWR Financing Co. Ltd. | 3.700% | 2/23/43 | CAD | 4,000 | 2,918 |

| North West Redwater Partnership / | | | | | |

| NWR Financing Co. Ltd. | 4.050% | 7/22/44 | CAD | 3,350 | 2,590 |

| North West Redwater Partnership / | | | | | |

| NWR Financing Co. Ltd. | 4.250% | 6/1/29 | CAD | 250 | 203 |

| North West Redwater Partnership / | | | | | |

| NWR Financing Co. Ltd. | 4.750% | 6/1/37 | CAD | 5,000 | 4,255 |

| Nova Scotia Power Inc. | 5.610% | 6/15/40 | CAD | 4,300 | 4,165 |

| Ottawa MacDonald-Cartier International | | | | | |

| Airport Authority | 3.933% | 6/9/45 | CAD | 775 | 600 |

| Pembina Pipeline Corp. | 3.710% | 8/11/26 | CAD | 4,850 | 3,747 |

| Pembina Pipeline Corp. | 4.240% | 6/15/27 | CAD | 3,000 | 2,396 |

| Pembina Pipeline Corp. | 4.750% | 4/30/43 | CAD | 3,000 | 2,282 |

| Pembina Pipeline Corp. | 4.810% | 3/25/44 | CAD | 2,000 | 1,536 |

| Plenary Properties LTAP LP | 6.288% | 1/31/44 | CAD | 4,505 | 4,441 |

| RioCan REIT | 3.850% | 6/28/19 | CAD | 1,025 | 787 |

| Rogers Communications Inc. | 2.800% | 3/13/19 | CAD | 300 | 225 |

| Rogers Communications Inc. | 4.000% | 3/13/24 | CAD | 4,000 | 3,230 |

| Rogers Communications Inc. | 4.700% | 9/29/20 | CAD | 400 | 322 |

| Rogers Communications Inc. | 5.340% | 3/22/21 | CAD | 6,000 | 4,970 |

| Rogers Communications Inc. | 6.110% | 8/25/40 | CAD | 5,000 | 4,710 |

| Rogers Communications Inc. | 6.680% | 11/4/39 | CAD | 3,044 | 3,033 |

| Royal Bank of Canada | 0.500% | 12/16/20 | EUR | 5,000 | 5,549 |

| Royal Bank of Canada | 0.750% | 10/23/18 | CHF | 2,000 | 2,037 |

| Royal Bank of Canada | 1.583% | 9/13/21 | CAD | 4,700 | 3,428 |

| Royal Bank of Canada | 1.968% | 3/2/22 | CAD | 25,100 | 18,517 |

| Royal Bank of Canada | 2.000% | 3/21/22 | CAD | 4,500 | 3,331 |

| Royal Bank of Canada | 2.333% | 12/5/23 | CAD | 8,500 | 6,351 |

19

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| Royal Bank of Canada | 2.350% | 12/9/19 | CAD | 6,750 | 5,069 |

| Royal Bank of Canada | 2.770% | 12/11/18 | CAD | 28,000 | 21,027 |

| Royal Bank of Canada | 2.980% | 5/7/19 | CAD | 7,000 | 5,302 |

| 1 Royal Bank of Canada | 2.990% | 12/6/24 | CAD | 14,225 | 10,797 |

| 1 Royal Bank of Canada | 3.040% | 7/17/24 | CAD | 400 | 301 |

| 1 Royal Bank of Canada | 3.310% | 1/20/26 | CAD | 5,900 | 4,508 |

| 1 Royal Bank of Canada | 3.450% | 9/29/26 | CAD | 10,000 | 7,707 |

| Royal Office Finance LP | 5.209% | 11/12/32 | CAD | 7,049 | 6,377 |

| Saputo Inc. | 2.654% | 11/26/19 | CAD | 250 | 188 |

| 1 Scotiabank Capital Trust | 5.650% | 12/31/56 | CAD | 200 | 182 |

| Shaw Communications Inc. | 4.350% | 1/31/24 | CAD | 10,000 | 8,029 |

| Shaw Communications Inc. | 5.500% | 12/7/20 | CAD | 100 | 82 |

| Shaw Communications Inc. | 6.750% | 11/9/39 | CAD | 3,850 | 3,556 |

| 1 Sun Life Financial Inc. | 2.600% | 9/25/25 | CAD | 350 | 263 |

| 1 Sun Life Financial Inc. | 3.050% | 9/19/28 | CAD | 10,000 | 7,605 |

| Sun Life Financial Inc. | 4.570% | 8/23/21 | CAD | 3,000 | 2,458 |

| 1 Sun Life Financial Inc. | 5.400% | 5/29/42 | CAD | 850 | 753 |

| Suncor Energy Inc. | 3.000% | 9/14/26 | CAD | 3,000 | 2,245 |

| Suncor Energy Inc. | 4.340% | 9/13/46 | CAD | 5,154 | 3,984 |

| Suncor Energy Inc. | 5.800% | 5/22/18 | CAD | 5,000 | 3,838 |

| TELUS Corp. | 2.350% | 3/28/22 | CAD | 9,800 | 7,287 |

| TELUS Corp. | 3.200% | 4/5/21 | CAD | 750 | 577 |

| TELUS Corp. | 3.350% | 4/1/24 | CAD | 10,700 | 8,282 |

| TELUS Corp. | 3.750% | 1/17/25 | CAD | 2,460 | 1,943 |

| TELUS Corp. | 3.750% | 3/10/26 | CAD | 900 | 709 |

| TELUS Corp. | 4.400% | 4/1/43 | CAD | 3,000 | 2,222 |

| TELUS Corp. | 4.400% | 1/29/46 | CAD | 250 | 185 |

| TELUS Corp. | 4.750% | 1/17/45 | CAD | 1,430 | 1,116 |

| TELUS Corp. | 4.850% | 4/5/44 | CAD | 9,250 | 7,331 |

| TELUS Corp. | 5.050% | 12/4/19 | CAD | 150 | 120 |

| TELUS Corp. | 5.050% | 7/23/20 | CAD | 300 | 243 |

| Teranet Holdings LP | 4.807% | 12/16/20 | CAD | 8,875 | 7,083 |

| Teranet Holdings LP | 5.754% | 12/17/40 | CAD | 1,200 | 970 |

| Thomson Reuters Corp. | 4.350% | 9/30/20 | CAD | 4,439 | 3,527 |

| Toronto-Dominion Bank | 1.693% | 4/2/20 | CAD | 15,000 | 11,088 |

| Toronto-Dominion Bank | 2.045% | 3/8/21 | CAD | 5,000 | 3,729 |

| Toronto-Dominion Bank | 2.447% | 4/2/19 | CAD | 5,000 | 3,745 |

| Toronto-Dominion Bank | 2.621% | 12/22/21 | CAD | 12,450 | 9,505 |

| 1 Toronto-Dominion Bank | 2.982% | 9/30/25 | CAD | 7,400 | 5,590 |

| Toronto-Dominion Bank | 3.226% | 7/24/24 | CAD | 5,450 | 4,299 |

| 1 Toronto-Dominion Bank | 4.859% | 3/4/31 | CAD | 5,150 | 4,323 |

| 1 Toronto-Dominion Bank | 5.828% | 7/9/23 | CAD | 450 | 347 |

| TransAlta Corp. | 5.000% | 11/25/20 | CAD | 350 | 269 |

| TransCanada PipeLines Ltd. | 3.650% | 11/15/21 | CAD | 5,000 | 3,974 |

| TransCanada PipeLines Ltd. | 3.690% | 7/19/23 | CAD | 5,240 | 4,201 |

| TransCanada PipeLines Ltd. | 4.350% | 6/6/46 | CAD | 4,000 | 3,212 |

| TransCanada PipeLines Ltd. | 4.550% | 11/15/41 | CAD | 2,000 | 1,636 |

| Union Gas Ltd. | 4.200% | 6/2/44 | CAD | 2,400 | 1,990 |

| Union Gas Ltd. | 4.880% | 6/21/41 | CAD | 3,450 | 3,111 |

| Veresen Inc. | 3.430% | 11/10/21 | CAD | 3,000 | 2,257 |

| VW Credit Canada Inc. | 2.500% | 10/1/19 | CAD | 10,000 | 7,475 |

| Wells Fargo Canada Corp. | 2.944% | 7/25/19 | CAD | 2,000 | 1,516 |

| Wells Fargo Canada Corp. | 3.040% | 1/29/21 | CAD | 10,000 | 7,698 |

| Westcoast Energy Inc. | 5.600% | 1/16/19 | CAD | 275 | 215 |

| | | | | | 724,141 |

20

Total International Bond Index Fund

| | | | | | |

| | | | | | Face | Market |

| | | | Maturity | | Amount | Value• |

| | | Coupon | Date | Currency | (000) | ($000) |

| Sovereign Bonds (4.3%) | | | | | |

| | Canada | 0.250% | 5/1/18 | CAD | 90,010 | 65,686 |

| | Canada | 0.500% | 8/1/18 | CAD | 51,600 | 37,722 |

| | Canada | 0.500% | 11/1/18 | CAD | 78,300 | 57,210 |

| | Canada | 0.500% | 2/1/19 | CAD | 85,000 | 62,059 |

| | Canada | 0.500% | 3/1/22 | CAD | 5,530 | 3,955 |

| | Canada | 0.750% | 5/1/19 | CAD | 50,000 | 36,641 |

| | Canada | 0.750% | 9/1/20 | CAD | 41,720 | 30,463 |

| | Canada | 0.750% | 3/1/21 | CAD | 45,240 | 32,950 |

| | Canada | 0.750% | 9/1/21 | CAD | 20,365 | 14,789 |

| | Canada | 1.000% | 6/1/27 | CAD | 17,818 | 12,397 |

| | Canada | 1.250% | 9/1/18 | CAD | 30,000 | 22,146 |

| | Canada | 1.500% | 3/1/20 | CAD | 69,175 | 51,677 |

| | Canada | 1.500% | 6/1/23 | CAD | 71,371 | 53,319 |

| | Canada | 1.500% | 6/1/26 | CAD | 41,750 | 30,748 |

| | Canada | 1.750% | 3/1/19 | CAD | 35,860 | 26,772 |

| | Canada | 1.750% | 9/1/19 | CAD | 47,970 | 35,962 |

| | Canada | 2.250% | 6/1/25 | CAD | 41,240 | 32,314 |

| | Canada | 2.500% | 6/1/24 | CAD | 45,609 | 36,242 |

| | Canada | 2.750% | 6/1/22 | CAD | 70,100 | 55,663 |

| | Canada | 2.750% | 12/1/48 | CAD | 23,978 | 19,922 |

| | Canada | 2.750% | 12/1/64 | CAD | 14,414 | 12,513 |

| | Canada | 3.250% | 6/1/21 | CAD | 32,455 | 25,985 |

| | Canada | 3.500% | 1/13/20 | EUR | 2,000 | 2,410 |

| | Canada | 3.500% | 6/1/20 | CAD | 45,000 | 35,652 |

| | Canada | 3.500% | 12/1/45 | CAD | 89,194 | 83,345 |

| | Canada | 3.750% | 6/1/19 | CAD | 64,510 | 50,204 |

| | Canada | 4.000% | 6/1/41 | CAD | 55,660 | 54,676 |

| | Canada | 4.250% | 6/1/18 | CAD | 86,105 | 65,522 |

| | Canada | 5.000% | 6/1/37 | CAD | 61,390 | 66,249 |

| | Canada | 5.750% | 6/1/29 | CAD | 37,584 | 39,568 |

| | Canada | 5.750% | 6/1/33 | CAD | 99,523 | 110,886 |

| | Canada | 8.000% | 6/1/23 | CAD | 6,000 | 6,157 |

| | Canada | 8.000% | 6/1/27 | CAD | 7,000 | 8,219 |

| | Canada | 10.500% | 3/15/21 | CAD | 15,000 | 14,993 |

| 2 | Canada Housing Trust No 1 | 1.150% | 12/15/21 | CAD | 75,854 | 55,208 |

| 2 | Canada Housing Trust No 1 | 1.200% | 6/15/20 | CAD | 9,050 | 6,657 |

| 2 | Canada Housing Trust No 1 | 1.250% | 12/15/20 | CAD | 30,000 | 22,036 |

| 2,5 | Canada Housing Trust No 1 | 1.250% | 6/15/21 | CAD | 30,000 | 22,035 |

| 2 | Canada Housing Trust No 1 | 1.450% | 6/15/20 | CAD | 15,000 | 11,118 |

| 2 | Canada Housing Trust No 1 | 1.500% | 12/15/21 | CAD | 600 | 444 |

| 2,5 | Canada Housing Trust No 1 | 1.750% | 6/15/18 | CAD | 20,175 | 14,941 |

| 2 | Canada Housing Trust No 1 | 1.750% | 6/15/22 | CAD | 30,000 | 22,291 |

| 2 | Canada Housing Trust No 1 | 1.900% | 9/15/26 | CAD | 31,950 | 23,342 |

| 2 | Canada Housing Trust No 1 | 1.950% | 6/15/19 | CAD | 78,000 | 58,419 |

| 2 | Canada Housing Trust No 1 | 1.950% | 12/15/25 | CAD | 20,000 | 14,661 |

| 2 | Canada Housing Trust No 1 | 2.000% | 12/15/19 | CAD | 43,800 | 32,941 |

| 2 | Canada Housing Trust No 1 | 2.050% | 6/15/18 | CAD | 10,000 | 7,430 |

| 2 | Canada Housing Trust No 1 | 2.250% | 12/15/25 | CAD | 5,225 | 3,921 |

| 2 | Canada Housing Trust No 1 | 2.350% | 12/15/18 | CAD | 45,000 | 33,794 |

| 2 | Canada Housing Trust No 1 | 2.350% | 9/15/23 | CAD | 210 | 161 |

| 2 | Canada Housing Trust No 1 | 2.350% | 6/15/27 | CAD | 10,000 | 7,536 |

| 2 | Canada Housing Trust No 1 | 2.400% | 12/15/22 | CAD | 10,000 | 7,696 |

| 2 | Canada Housing Trust No 1 | 2.550% | 3/15/25 | CAD | 13,000 | 10,008 |

| 2 | Canada Housing Trust No 1 | 2.650% | 3/15/22 | CAD | 16,500 | 12,785 |

21

Total International Bond Index Fund

| | | | | | |

| | | | | | Face | Market |

| | | | Maturity | | Amount | Value• |

| | | Coupon | Date | Currency | (000) | ($000) |

| 2 | Canada Housing Trust No 1 | 2.900% | 6/15/24 | CAD | 14,000 | 11,102 |

| 2 | Canada Housing Trust No 1 | 3.150% | 9/15/23 | CAD | 30,000 | 24,056 |

| 2 | Canada Housing Trust No 1 | 3.350% | 12/15/20 | CAD | 12,000 | 9,467 |

| 2,5 | Canada Housing Trust No 1 | 3.750% | 3/15/20 | CAD | 10,000 | 7,891 |

| 2 | Canada Housing Trust No 1 | 3.800% | 6/15/21 | CAD | 25,000 | 20,416 |

| 2,5 | Canada Housing Trust No 1 | 4.100% | 12/15/18 | CAD | 9,800 | 7,562 |

| 5 | Canada Post Corp. | 4.360% | 7/16/40 | CAD | 3,650 | 3,312 |

| | CDP Financial Inc. | 4.600% | 7/15/20 | CAD | 350 | 282 |

| | City of Montreal | 3.000% | 9/1/25 | CAD | 7,000 | 5,386 |

| | City of Montreal | 3.500% | 9/1/23 | CAD | 7,450 | 5,931 |

| | City of Montreal | 4.100% | 12/1/34 | CAD | 3,175 | 2,605 |

| | City of Montreal | 5.000% | 12/1/18 | CAD | 400 | 311 |

| | City of Toronto | 2.950% | 4/28/35 | CAD | 6,250 | 4,419 |

| | City of Toronto | 3.900% | 9/29/23 | CAD | 4,742 | 3,867 |

| | City of Toronto | 4.150% | 3/10/44 | CAD | 4,950 | 4,109 |

| | City of Toronto | 4.500% | 12/2/19 | CAD | 5,000 | 3,964 |

| | City of Toronto | 4.700% | 6/10/41 | CAD | 2,000 | 1,783 |

| | City of Toronto | 5.200% | 6/1/40 | CAD | 1,220 | 1,156 |

| | CPPIB Capital Inc. | 1.400% | 6/4/20 | CAD | 700 | 515 |

| | Export Development Canada | 1.375% | 12/16/19 | GBP | 3,500 | 4,644 |

| | Export Development Canada | 1.875% | 12/17/18 | GBP | 3,000 | 3,979 |

| | Export Development Canada | 2.400% | 6/7/21 | AUD | 20,564 | 15,352 |

| | Export Development Canada | 3.500% | 6/5/19 | AUD | 10,000 | 7,702 |

| | Financement-Quebec | 2.450% | 12/1/19 | CAD | 9,240 | 6,995 |

| | Financement-Quebec | 5.250% | 6/1/34 | CAD | 3,000 | 2,867 |

| | Hydro One Inc. | 1.840% | 2/24/21 | CAD | 400 | 297 |

| | Hydro One Inc. | 2.770% | 2/24/26 | CAD | 4,800 | 3,659 |

| | Hydro One Inc. | 2.780% | 10/9/18 | CAD | 2,000 | 1,500 |

| | Hydro One Inc. | 3.200% | 1/13/22 | CAD | 350 | 275 |

| | Hydro One Inc. | 3.720% | 11/18/47 | CAD | 1,441 | 1,110 |

| | Hydro One Inc. | 3.790% | 7/31/62 | CAD | 2,000 | 1,535 |

| | Hydro One Inc. | 4.390% | 9/26/41 | CAD | 5,115 | 4,312 |

| | Hydro One Inc. | 4.400% | 6/1/20 | CAD | 3,000 | 2,396 |

| | Hydro One Inc. | 4.590% | 10/9/43 | CAD | 5,500 | 4,822 |

| | Hydro One Inc. | 5.360% | 5/20/36 | CAD | 1,000 | 930 |

| | Hydro One Inc. | 5.490% | 7/16/40 | CAD | 3,525 | 3,415 |

| | Hydro One Inc. | 6.930% | 6/1/32 | CAD | 1,000 | 1,045 |

| | Hydro-Quebec | 1.000% | 5/25/19 | CAD | 9,840 | 7,203 |

| | Hydro-Quebec | 4.000% | 2/15/55 | CAD | 1,270 | 1,131 |

| | Hydro-Quebec | 5.000% | 2/15/45 | CAD | 18,950 | 18,858 |

| | Hydro-Quebec | 5.000% | 2/15/50 | CAD | 24,900 | 25,525 |

| | Hydro-Quebec | 6.000% | 8/15/31 | CAD | 4,270 | 4,330 |

| | Hydro-Quebec | 6.000% | 2/15/40 | CAD | 15,915 | 17,271 |

| | Hydro-Quebec | 6.500% | 1/16/35 | CAD | 155 | 170 |

| | Hydro-Quebec | 6.500% | 2/15/35 | CAD | 14,000 | 15,293 |

| | Hydro-Quebec | 9.625% | 7/15/22 | CAD | 12,000 | 12,267 |

| | Hydro-Quebec | 10.500% | 10/15/21 | CAD | 2,000 | 2,030 |

| | Hydro-Quebec | 11.000% | 8/15/20 | CAD | 450 | 432 |

| 2,5 | Labrador-Island Link Funding Trust | 3.760% | 6/1/33 | CAD | 3,000 | 2,488 |

| 2,5 | Labrador-Island Link Funding Trust | 3.850% | 12/1/53 | CAD | 2,070 | 1,818 |

| 2,5 | Labrador-Island Link Funding Trust | 3.860% | 12/1/45 | CAD | 3,790 | 3,261 |

| 5 | Maritime Link Financing Trust | 3.500% | 12/1/52 | CAD | 7,372 | 5,781 |

| | Municipal Finance Authority of British Columbia | 1.650% | 4/19/21 | CAD | 4,500 | 3,318 |

| | Municipal Finance Authority of British Columbia | 2.050% | 6/2/19 | CAD | 7,150 | 5,339 |

| | Municipal Finance Authority of British Columbia | 2.500% | 4/19/26 | CAD | 1,850 | 1,389 |

22

Total International Bond Index Fund

| | | | | | |

| | | | | | Face | Market |

| | | | Maturity | | Amount | Value• |

| | | Coupon | Date | Currency | (000) | ($000) |

| | Municipal Finance Authority of British Columbia | 2.950% | 10/14/24 | CAD | 6,000 | 4,657 |

| | Municipal Finance Authority of British Columbia | 4.150% | 6/1/21 | CAD | 4,050 | 3,275 |

| | Municipal Finance Authority of British Columbia | 4.450% | 6/1/20 | CAD | 400 | 320 |

| 2,5 | Muskrat Falls / Labrador Transmission Assets | | | | | |

| | Funding Trust | 3.630% | 6/1/29 | CAD | 5,300 | 4,361 |

| 2,5 | Muskrat Falls / Labrador Transmission Assets | | | | | |

| | Funding Trust | 3.830% | 6/1/37 | CAD | 1,000 | 837 |

| 2,5 | Muskrat Falls / Labrador Transmission Assets | | | | | |

| | Funding Trust | 3.860% | 12/1/48 | CAD | 3,500 | 3,037 |

| | Newfoundland & Labrador Hydro | 3.600% | 12/1/45 | CAD | 1,500 | 1,124 |

| | Newfoundland & Labrador Hydro | 6.650% | 8/27/31 | CAD | 2,000 | 2,021 |

| | Ontario Electricity Financial Corp. | 8.250% | 6/22/26 | CAD | 7,000 | 7,599 |

| | Ontario Electricity Financial Corp. | 8.900% | 8/18/22 | CAD | 10,250 | 10,202 |

| | Ontario Electricity Financial Corp. | 10.125% | 10/15/21 | CAD | 2,500 | 2,494 |

| | OPB Finance Trust | 2.980% | 1/25/27 | CAD | 5,000 | 3,820 |

| | Province of Alberta | 1.000% | 11/15/21 | GBP | 2,500 | 3,263 |

| | Province of Alberta | 1.250% | 6/1/20 | CAD | 15,900 | 11,656 |

| | Province of Alberta | 1.350% | 9/1/21 | CAD | 12,000 | 8,744 |

| | Province of Alberta | 2.200% | 6/1/26 | CAD | 20,000 | 14,617 |

| | Province of Alberta | 2.350% | 6/1/25 | CAD | 9,300 | 6,930 |

| | Province of Alberta | 2.550% | 6/1/27 | CAD | 8,000 | 5,964 |

| | Province of Alberta | 2.900% | 9/20/29 | CAD | 6,000 | 4,530 |

| | Province of Alberta | 3.300% | 12/1/46 | CAD | 19,165 | 14,377 |

| | Province of Alberta | 3.450% | 12/1/43 | CAD | 14,075 | 10,835 |

| | Province of Alberta | 3.900% | 12/1/33 | CAD | 2,000 | 1,649 |

| | Province of Alberta | 4.500% | 12/1/40 | CAD | 5,000 | 4,501 |

| | Province of British Columbia | 2.300% | 6/18/26 | CAD | 15,000 | 11,166 |

| | Province of British Columbia | 2.550% | 6/18/27 | CAD | 3,500 | 2,642 |

| | Province of British Columbia | 2.700% | 12/18/22 | CAD | 4,902 | 3,799 |

| | Province of British Columbia | 2.800% | 6/18/48 | CAD | 13,908 | 9,815 |

| | Province of British Columbia | 2.850% | 6/18/25 | CAD | 5,185 | 4,049 |

| | Province of British Columbia | 3.200% | 6/18/44 | CAD | 12,800 | 9,718 |

| | Province of British Columbia | 3.250% | 12/18/21 | CAD | 2,270 | 1,799 |

| | Province of British Columbia | 3.300% | 12/18/23 | CAD | 11,000 | 8,818 |

| | Province of British Columbia | 4.100% | 12/18/19 | CAD | 25,000 | 19,755 |

| | Province of British Columbia | 4.300% | 6/18/42 | CAD | 10,725 | 9,668 |

| | Province of British Columbia | 4.650% | 12/18/18 | CAD | 2,270 | 1,766 |

| | Province of British Columbia | 4.700% | 6/18/37 | CAD | 3,200 | 2,974 |

| | Province of British Columbia | 4.900% | 6/18/48 | CAD | 3,000 | 3,045 |

| | Province of British Columbia | 4.950% | 6/18/40 | CAD | 7,000 | 6,815 |

| | Province of British Columbia | 5.700% | 6/18/29 | CAD | 13,500 | 13,217 |

| | Province of British Columbia | 6.350% | 6/18/31 | CAD | 15,000 | 15,811 |

| | Province of Manitoba | 1.600% | 9/5/20 | CAD | 3,000 | 2,221 |

| | Province of Manitoba | 2.450% | 6/2/25 | CAD | 7,000 | 5,257 |

| | Province of Manitoba | 2.550% | 6/2/26 | CAD | 19,000 | 14,391 |

| | Province of Manitoba | 2.850% | 9/5/46 | CAD | 8,000 | 5,472 |

| | Province of Manitoba | 3.150% | 9/5/52 | CAD | 2,750 | 1,991 |

| | Province of Manitoba | 3.250% | 9/5/29 | CAD | 2,270 | 1,774 |

| | Province of Manitoba | 3.300% | 6/2/24 | CAD | 3,000 | 2,392 |

| | Province of Manitoba | 3.350% | 3/5/43 | CAD | 2,000 | 1,501 |

| | Province of Manitoba | 3.400% | 9/5/48 | CAD | 4,000 | 3,068 |

| | Province of Manitoba | 4.050% | 9/5/45 | CAD | 5,000 | 4,237 |

| | Province of Manitoba | 4.100% | 3/5/41 | CAD | 5,000 | 4,221 |

| | Province of Manitoba | 4.150% | 6/3/20 | CAD | 6,000 | 4,783 |

| | Province of Manitoba | 4.400% | 9/5/25 | CAD | 3,500 | 2,996 |

23

Total International Bond Index Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| Province of Manitoba | 4.600% | 3/5/38 | CAD | 3,000 | 2,691 |

| Province of Manitoba | 4.650% | 3/5/40 | CAD | 4,000 | 3,634 |

| Province of Manitoba | 4.700% | 3/5/50 | CAD | 235 | 224 |

| Province of Manitoba | 4.750% | 2/11/20 | CAD | 5,250 | 4,222 |

| Province of Manitoba | 5.700% | 3/5/37 | CAD | 3,000 | 3,024 |

| Province of New Brunswick | 2.600% | 8/14/26 | CAD | 10,000 | 7,492 |

| Province of New Brunswick | 2.850% | 6/2/23 | CAD | 5,000 | 3,873 |

| Province of New Brunswick | 3.550% | 6/3/43 | CAD | 3,000 | 2,282 |

| Province of New Brunswick | 3.650% | 6/3/24 | CAD | 11,000 | 8,935 |

| Province of New Brunswick | 3.800% | 8/14/45 | CAD | 7,965 | 6,325 |

| Province of New Brunswick | 4.550% | 3/26/37 | CAD | 7,000 | 6,104 |

| Province of New Brunswick | 4.800% | 9/26/39 | CAD | 2,420 | 2,197 |

| Province of New Brunswick | 4.800% | 6/3/41 | CAD | 2,990 | 2,730 |

| Province of Newfoundland and Labrador | 2.300% | 6/2/25 | CAD | 5,000 | 3,663 |

| Province of Newfoundland and Labrador | 3.000% | 6/2/26 | CAD | 6,000 | 4,581 |

| Province of Newfoundland and Labrador | 3.300% | 10/17/46 | CAD | 8,950 | 6,371 |

| Province of Newfoundland and Labrador | 3.700% | 10/17/48 | CAD | 2,925 | 2,258 |

| Province of Newfoundland and Labrador | 4.650% | 10/17/40 | CAD | 2,270 | 1,991 |

| Province of Newfoundland and Labrador | 6.150% | 4/17/28 | CAD | 1,000 | 965 |

| Province of Nova Scotia | 2.100% | 6/1/27 | CAD | 16,000 | 11,439 |

| Province of Nova Scotia | 3.450% | 6/1/45 | CAD | 3,000 | 2,294 |

| Province of Nova Scotia | 3.500% | 6/2/62 | CAD | 5,270 | 4,121 |

| Province of Nova Scotia | 4.100% | 6/1/21 | CAD | 8,000 | 6,481 |

| Province of Nova Scotia | 4.150% | 11/25/19 | CAD | 250 | 197 |

| Province of Nova Scotia | 4.400% | 6/1/42 | CAD | 2,000 | 1,766 |

| Province of Nova Scotia | 4.700% | 6/1/41 | CAD | 2,000 | 1,836 |

| Province of Nova Scotia | 5.800% | 6/1/33 | CAD | 2,000 | 1,986 |

| Province of Ontario | 0.875% | 1/21/25 | EUR | 5,000 | 5,569 |

| Province of Ontario | 1.350% | 3/8/22 | CAD | 35,000 | 25,504 |

| Province of Ontario | 1.750% | 10/9/18 | CAD | 20,000 | 14,833 |

| Province of Ontario | 1.875% | 5/21/24 | EUR | 5,000 | 5,969 |

| Province of Ontario | 2.100% | 9/8/18 | CAD | 10,000 | 7,452 |

| Province of Ontario | 2.100% | 9/8/19 | CAD | 11,500 | 8,630 |

| Province of Ontario | 2.375% | 5/7/20 | CHF | 1,100 | 1,201 |

| Province of Ontario | 2.400% | 6/2/26 | CAD | 28,280 | 21,087 |

| Province of Ontario | 2.600% | 6/2/25 | CAD | 53,465 | 40,730 |

| Province of Ontario | 2.600% | 6/2/27 | CAD | 5,000 | 3,761 |

| Province of Ontario | 2.800% | 6/2/48 | CAD | 42,550 | 29,714 |

| Province of Ontario | 2.850% | 6/2/23 | CAD | 35,090 | 27,307 |

| Province of Ontario | 2.900% | 12/2/46 | CAD | 55,467 | 39,393 |

| Province of Ontario | 3.000% | 9/28/20 | EUR | 7,750 | 9,351 |

| Province of Ontario | 3.150% | 6/2/22 | CAD | 73,000 | 57,497 |

| Province of Ontario | 3.450% | 6/2/45 | CAD | 61,735 | 48,574 |

| Province of Ontario | 3.500% | 6/2/24 | CAD | 46,250 | 37,411 |

| Province of Ontario | 3.500% | 6/2/43 | CAD | 44,000 | 34,791 |