UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | 811-22619 |

Name of Registrant: | Vanguard Charlotte Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: October 31 |

Date of reporting period: November 1, 2015 – October 31, 2016 |

Item 1: Reports to Shareholders |

Annual Report | October 31, 2016

Vanguard Tax-Exempt Bond Index Fund

A new format, unwavering commitment

As you begin reading this report, you’ll notice that we’ve made some improvements to the opening sections—based on feedback from you, our clients.

Page 1 starts with a new ”Your Fund’s Performance at a Glance,” a concise, handy summary of how your fund performed during the period.

In the renamed ”Chairman’s Perspective,” Bill McNabb will focus on enduring principles and investment insights.

We’ve modified some tables, and eliminated some redundancy, but we haven’t removed any information.

At Vanguard, we’re always looking for better ways to communicate and to help you make sound investment decisions. Thank you for entrusting your assets to us.

| |

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| Chairman’s Perspective. | 3 |

| Fund Profile. | 7 |

| Performance Summary. | 8 |

| Financial Statements. | 10 |

| About Your Fund’s Expenses. | 81 |

| Glossary. | 83 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: No matter what language you speak, Vanguard has one consistent message and set of principles. Our primary

focus is on you, our clients. We conduct our business with integrity as a faithful steward of your assets. This message is shown

translated into seven languages, reflecting our expanding global presence.

Your Fund’s Performance at a Glance

• For the 12 months ended October 31, 2016, Vanguard Tax-Exempt Bond Index Fund returned 4.28% for Investor Shares, 4.29% for ETF Shares, and 4.36% for Admiral Shares. Its benchmark index returned 4.32%, and the average return of peer funds was 4.34%.

• Municipal bond issuance picked up in the second half of the fiscal year. At the same time, demand was solid, helped by concerns about global growth and Britain’s vote to leave the European Union.

• Toward the end of the period, the fund posted negative monthly returns. Demand cooled while supply accelerated as the prospect of a Federal Reserve rate hike seemed increasingly likely.

• By maturity, lower-quality investment-grade bonds generally returned more than their higher-quality counterparts. And with the muni bond yield curve flattening, longer-dated bonds outstripped shorter-dated ones, although returns were positive across the maturity spectrum.

| | | | | |

| Total Returns: Fiscal Year Ended October 31, 2016 | | | | |

| | | Taxable- | | | |

| | 30-Day SEC | Equivalent | Income | Capital | Total |

| | Yield | Yield | Returns | Returns | Returns |

| Vanguard Tax-Exempt Bond Index Fund | | | | | |

| Investor Shares | 1.61% | 2.84% | 1.49% | 2.79% | 4.28% |

| ETF Shares | 1.70 | 3.00 | | | |

| Market Price | | | | | 4.19 |

| Net Asset Value | | | | | 4.29 |

| Admiral™ Shares | 1.70 | 3.00 | 1.62 | 2.74 | 4.36 |

| S&P National AMT-Free Municipal Bond Index | | | | | 4.32 |

| General Municipal Funds Average | | | | | 4.34 |

The calculation of taxable-equivalent yield assumes a typical itemized tax return and is based on the maximum federal tax rate of 43.4%.

State and local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

General Municipal Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements. The Vanguard ETF®

Shares shown are traded on the NYSE Arca exchange and are available only through brokers. The table provides ETF returns based on both

the NYSE Arca market price and the net asset value for a share. U.S. Pat. Nos. 6,879,964; 7,337,138; 7,720,749; 7,925,573; 8,090,646; and

8,417,623.

For the ETF Shares, the market price is determined by the midpoint of the bid-offer spread as of the closing time of the New York Stock

Exchange (generally 4 p.m., Eastern time). The net asset value is also determined as of the NYSE closing time. For more information about

how the ETF Shares' market prices have compared with their net asset value, visit vanguard.com, select your ETF, and then select the Price

and Performance tab. The ETF premium/discount analysis there shows the percentages of days on which the ETF Shares' market price was

above or below the NAV.

1

| | | | |

| Expense Ratios | | | | |

| Your Fund Compared With Its Peer Group | | | | |

| | Investor | ETF | Admiral | Peer Group |

| | Shares | Shares | Shares | Average |

| Tax-Exempt Bond Index Fund | 0.20% | 0.12% | 0.12% | 0.94% |

The fund expense ratios shown are from the prospectus dated February 26, 2016, and represent estimated costs for the current fiscal year.

For the fiscal year ended October 31, 2016, the fund’s expense ratios were 0.19% for Investor Shares, 0.09% for ETF Shares, and 0.09% for

Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information

through year-end 2015.

Peer group: General Municipal Funds Average.

2

Chairman’s Perspective

Bill McNabb

Chairman and Chief Executive Officer

Dear Shareholder,

Over the three years ended August 31, 2016, investors poured more than $1 trillion into index funds. Indexing now accounts for nearly a third of all mutual fund assets—more than double what it did a decade ago and eight times its share two decades ago.1

By contrast, active management’s commercial struggles have reflected its disappointing investment performance. Over the decade ended December 31, 2015, 82% of actively managed stock funds and 81% of active bond funds have either underperformed their benchmarks or shut down.

This subpar performance has fueled the explosion of asset growth in indexing among individual, retirement, and nonprofit investors. So what might the trend mean for the future of actively managed funds?

Our research and experience indicate that active management can survive—and even succeed—but only if it’s offered at much lower expense.

High costs, which limit a manager’s ability to deliver benchmark-beating returns to clients, are the biggest reason why active has lagged. Industrywide as of December 31, 2015, the average expense ratio for all active stock funds is 1.14%, compared with 0.76% for stock index

1 Sources: Wall Street Journal; Morningstar, Inc.; and Investment Company Institute, 2016.

3

funds. And the expense advantage is even wider for bonds; the average expense ratio for an active bond fund is 0.93%, compared with 0.43% for bond index funds.

But even these big differences understate the real gap. These days, it’s not hard to find an index fund that charges maybe 0.05% or 0.10%. So even if you have identified active managers who are skilled at selecting stocks and bonds, to match the return of a comparable (much cheaper) index fund would require significant outperformance. Think about it. Any fund that charges 1.00% in expenses—not even the high end of the range—will find it extraordinarily difficult to overcome the index fund’s head start.

Active management also has taken a hit from a regulatory environment that has been favorable to low-cost strategies. The U.S. Department of Labor several years ago mandated greater disclosure of retirement plan fees. And its new fiduciary rule, which is set to take effect in April, requires financial advisors to demonstrate that their recommendations are aligned with their clients’ best interest. Both changes encourage the use of lower-cost investments, including index funds.

The future of active management

In light of all this, people have been asking me whether active management is “dead.” My response is both yes and no. High-cost active management is dead, and rightly so. It has never been a winning proposition

| | | |

| Market Barometer | | | |

| | Average Annual Total Returns |

| | Periods Ended October 31, 2016 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 4.26% | 8.48% | 13.51% |

| Russell 2000 Index (Small-caps) | 4.11 | 4.12 | 11.51 |

| Russell 3000 Index (Broad U.S. market) | 4.24 | 8.13 | 13.35 |

| FTSE All-World ex US Index (International) | 0.64 | -0.94 | 4.09 |

| |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 4.37% | 3.48% | 2.90% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | 4.06 | 4.89 | 4.34 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.22 | 0.07 | 0.07 |

| |

| CPI | | | |

| Consumer Price Index | 1.64% | 1.15% | 1.32% |

4

for investors. Low-cost active funds, though, can potentially play an important role for investors who seek to outperform the market.

Paying less for your funds is the only sure-fire way to improve your odds of achieving success in active management. But even if you have found an active manager with low costs, the odds of outperforming the market are still long. You have to be able to identify talented stock and bond portfolio managers with long time horizons and clear investment strategies. Look for managers with consistent track records and the discipline to stick closely to their investment strategy.

Know what you own and why

Despite the well-deserved reputation of indexing and the challenges for active managers, there’s still a place for traditional active strategies that are low-cost, diversified, and highly disciplined, and are run by talented managers who focus on the long term.

Vanguard has always applied these principles to our active strategies, and investors have benefited as a majority of our active funds outperformed their benchmarks and bested their peers’ average annual return over the ten years ended September 30, 2016.

|

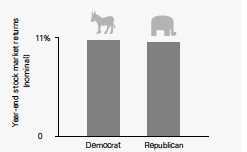

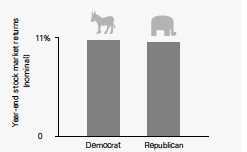

| Worried about the election’s impact on your portfolio? |

|

| The 2016 presidential election season was |

| one of the most intense and unpredictable |

| in U.S. history. In its aftermath, investors |

| may be left with lingering questions about |

| what the outcome will mean for their |

| portfolios. The answer, based on Vanguard |

| research into decades of historical data, is |

| that presidential elections typically have no |

| long-term effect on market performance. |

| |

| These findings hold true regardless of the |

| market’s initial reaction. Whether there’s |

| a swoon or bounce immediately after an |

| election, investors shouldn’t extrapolate |

| that performance to the long term. |

| |

| As you can see in the accompanying chart, |

| data going back to 1853 show that stock |

| market returns are virtually identical no matter |

| which party controls the White House. |

| Although headlines out of Washington at any |

| given time may still cause concern, investors |

| shouldn’t overreact to short-term events. |

| Instead, it’s best to maintain a balanced and |

| diversified portfolio and stay focused on your |

| long-term goals. |

| |

| Average annual stock market returns based |

| on party control of the White House |

| (1853–2015) |

| Sources: Global Financial Data, 1853–1926; Morningstar, Inc., |

| and Ibbotson Associates thereafter through 2015. |

5

But it’s crucial for investors to be patient. Even active managers with the best track records frequently underperform their benchmarks when their investment styles are out of favor. Such periods, though temporary, can persist. So it’s important when entrusting your assets to an active strategy to be in it for the long haul.

Make sure you know what you’re buying and what the risks are. Active strategies are becoming more complex, so it’s important to clearly understand what the investments in your portfolio are designed to accomplish and why you want to hold them. Otherwise, you run the risk of selecting strategies that don’t fit your needs or objectives.

Keeping these considerations in mind can potentially boost your chances of success in identifying active strategies that may be able to help you reach your goals.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

November 9, 2016

6

Tax-Exempt Bond Index Fund

Fund Profile

As of October 31, 2016

| | | |

| Share-Class Characteristics | | |

| |

| |

| | Investor | ETF | Admiral |

| | Shares | Shares | Shares |

| Ticker Symbol | VTEBX | VTEB | VTEAX |

| Expense Ratio1 | 0.20% | 0.12% | 0.12% |

| 30-Day SEC Yield | 1.61% | 1.70% | 1.70% |

| | |

| Financial Attributes | | |

| |

| | | S&P |

| | | National |

| | | AMT-Free |

| | Fund | Muni Bond Idx |

| Number of Bonds | 2,118 | 11,032 |

| Yield to Maturity | | |

| (before expenses) | 1.8% | 1.7% |

| Average Coupon | 4.7% | 4.6% |

| Average Duration | 5.6 years | 5.5 years |

| Average Stated | | |

| Maturity | 13.2 years | 13.0 years |

| Short-Term Reserves | 1.6% | — |

| |

| Largest Area Concentrations | |

| |

| New York | 20.8% |

| California | 14.9 |

| Texas | 10.1 |

| New Jersey | 5.7 |

| Pennsylvania | 4.9 |

| Massachusetts | 4.5 |

| Illinois | 4.3 |

| Florida | 3.6 |

| Maryland | 2.5 |

| Georgia | 2.3 |

| Top Ten | 73.6% |

| Percentage of net assets, excluding any futures contracts. |

| |

| Distribution by Stated Maturity | |

| (% of portfolio) | |

| Under 1 Year | 4.9% |

| 1 - 3 Years | 13.5 |

| 3 - 5 Years | 8.9 |

| 5 - 10 Years | 16.6 |

| 10 - 20 Years | 28.3 |

| 20 - 30 Years | 24.0 |

| Over 30 Years | 3.8 |

| |

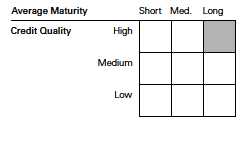

| Distribution by Credit Quality (% of portfolio) |

| AAA | 23.8% |

| AA | 57.1 |

| A | 15.3 |

| BBB | 2.9 |

| Not Rated | 0.9 |

Credit-quality ratings are from Moody's and S&P. The higher rating

for each issue is shown. "Not Rated" is used to classify securities

for which a rating is not available. For more information about

these ratings, see the Glossary entry for Credit Quality.

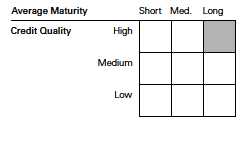

Investment Focus

1 The expense ratios shown are from the prospectus dated February 26, 2016, and represent estimated costs for the current fiscal year. For the fiscal

year ended October 31, 2016, the expense ratios were 0.19% for Investor Shares, 0.09% for ETF Shares, and 0.09% for Admiral Shares.

7

Tax-Exempt Bond Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

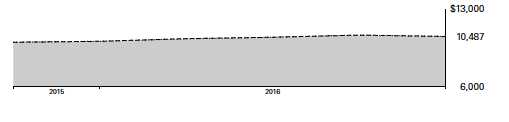

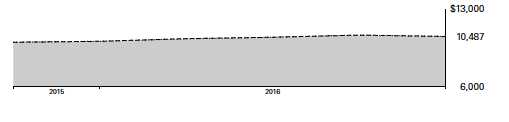

Cumulative Performance: August 21, 2015, Through October 31, 2016

Initial Investment of $10,000

| | | | |

| | | Average Annual Total Returns | |

| | | Periods Ended October 31, 2016 | |

| |

| | | | Since | Final Value |

| | | One | Inception | of a $10,000 |

| | | Year | (8/21/2015) | Investment |

| | Tax-Exempt Bond Index FundInvestor | | | |

| | Shares | 4.02% | 4.06% | $10,487 |

| | S&P National AMT-Free Municipal Bond | | | |

| • • • • • • • • | | | | |

| | Index | 4.32 | 4.32 | 10,519 |

| |

| – – – – | General Municipal Funds Average | 4.34 | 4.37 | 10,525 |

General Municipal Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

"Since Inception" performance is calculated from the Investor Shares’ inception date for both the fund and its comparative standards.

| | | |

| | | Since | Final Value |

| | One | Inception | of a $10,000 |

| | Year | (8/21/2015) | Investment |

| Tax-Exempt Bond Index Fund | | | |

| ETF Shares Net Asset Value | 4.29% | 4.32% | $10,518 |

| Tax-Exempt Bond Index Fund | | | |

| ETF Shares Market Price | 4.19 | 4.36 | 10,523 |

| S&P National AMT-Free Municipal Bond | | | |

| Index | 4.32 | 4.32 | 10,519 |

| "Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standards. |

Vanguard fund returns are adjusted to reflect the 0.25% fee on purchases of fund shares. The fee does not apply to the ETF Shares. The

Fiscal-Year Total Returns table is not adjusted for fees.

See Financial Highlights for dividend and capital gains information.

8

Tax-Exempt Bond Index Fund

| | | |

| | Average Annual Total Returns | |

| | Periods Ended October 31, 2016 | |

| |

| | | Since | Final Value |

| | One | Inception | of a $10,000 |

| | Year | (8/25/2015) | Investment |

| Tax-Exempt Bond Index Fund Admiral Shares | 4.10% | 4.26% | $10,507 |

| S&P National AMT-Free Municipal Bond | | | |

| Index | 4.32 | 4.45 | 10,528 |

| "Since Inception" performance is calculated from the Admiral Shares’ inception date for both the fund and its comparative standards. |

| | |

| Cumulative Returns of ETF Shares: August 21, 2015, Through October 31, 2016 | |

| | | Since |

| | One | Inception |

| | Year | (8/21/2015) |

| Tax-Exempt Bond Index Fund ETF Shares Market | | |

| Price | 4.19% | 5.23% |

| Tax-Exempt Bond Index Fund ETF Shares Net | | |

| Asset Value | 4.29 | 5.18 |

| S&P National AMT-Free Municipal Bond Index | 4.32 | 5.19 |

| "Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standards. |

| | | | |

| Fiscal-Year Total Returns (%): August 21, 2015, Through October 31, 2016 | |

| | | | | S&P |

| | | | | National |

| | | | | AMT-Free |

| | | | Investor Shares | Muni Bond Idx |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2015 | 0.32% | 0.50% | 0.82% | 0.83% |

| 2016 | 1.49 | 2.79 | 4.28 | 4.32 |

Average Annual Total Returns: Periods Ended September 30, 2016

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | |

| | | | Since Inception |

| | Inception Date | One Year | Income | Capital | Total |

| Investor Shares | 8/21/2015 | 5.72% | 1.55% | 3.95% | 5.50% |

| Fee-Adjusted Returns | | 5.45 | | | 5.27 |

| ETF Shares | 8/21/2015 | | | | |

| Market Price | | 5.58 | | | 5.47 |

| Net Asset Value | | 5.71 | | | 5.54 |

| Admiral Shares | 8/25/2015 | 5.74 | 1.69 | 4.04 | 5.73 |

| Fee-Adjusted Returns | | 5.48 | | | 5.49 |

Vanguard fund returns are adjusted to reflect the 0.25% fee on purchases of fund shares. The fee does not apply to the ETF Shares. The

Fiscal-Year Total Returns table is not adjusted for fees.

9

Tax-Exempt Bond Index Fund

Financial Statements

Statement of Net Assets

As of October 31, 2016

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (98.1%) | | | | |

| Alabama (0.9%) | | | | |

| Alabama Federal Aid Highway Finance | | | | |

| Authority GAN | 5.000% | 9/1/18 | 100 | 107 |

| Alabama Federal Aid Highway Finance | | | | |

| Authority GAN | 5.000% | 9/1/27 | 260 | 317 |

| Alabama Federal Aid Highway Finance | | | | |

| Authority Special | 5.000% | 9/1/19 | 200 | 221 |

| Alabama Federal Aid Highway Finance | | | | |

| Authority Special Obligation Revenue | 5.000% | 9/1/28 | 250 | 304 |

| Alabama Incentives Financing Authority Special | | | | |

| Obligation Revenue | 5.000% | 9/1/37 | 380 | 431 |

| Alabama Public School & College Authority | 5.000% | 1/1/24 | 225 | 275 |

| Alabama Public School & College Authority | 5.000% | 1/1/26 | 290 | 359 |

| Alabama Public School & College Authority | 5.000% | 1/1/27 | 325 | 398 |

| Alabama Public School & College Authority | | | | |

| Capital Improvement Revenue | 5.000% | 12/1/17 (Prere.) | 150 | 157 |

| Alabama Public School & College Authority | | | | |

| Capital Improvement Revenue | 5.000% | 5/1/18 | 55 | 58 |

| Alabama Public School & College Authority | | | | |

| Capital Improvement Revenue | 5.000% | 1/1/23 | 160 | 192 |

| Auburn University Alabama General Fee Revenue | 5.000% | 6/1/28 | 300 | 372 |

| Baldwin County AL Board of Education Revenue | 4.500% | 7/1/37 (2) | 505 | 516 |

| Birmingham AL Airport Authority Revenue | 5.250% | 7/1/30 (4) | 150 | 169 |

| Birmingham AL Airport Authority Revenue | 5.500% | 7/1/40 (4) | 140 | 158 |

| Birmingham AL Water Works & Sewer Board | | | | |

| Water Revenue | 4.500% | 1/1/43 (2) | 100 | 101 |

| Birmingham AL Water Works Board Water | | | | |

| Revenue | 5.000% | 1/1/21 (Prere.) | 575 | 665 |

| Birmingham AL Water Works Board Water | | | | |

| Revenue | 5.000% | 1/1/43 | 650 | 758 |

| | | | | 5,558 |

| Alaska (0.3%) | | | | |

| Alaska Municipal Bond Bank Authority Revenue | 5.000% | 2/1/27 | 515 | 607 |

| Alaska Municipal Bond Bank Authority Revenue | 5.000% | 3/1/27 | 245 | 296 |

| Anchorage AK Electric Utility Revenue | 5.000% | 12/1/41 | 270 | 312 |

| Anchorage AK GO | 5.000% | 9/1/19 | 700 | 776 |

| Anchorage AK Water Revenue | 5.000% | 5/1/37 (14) | 100 | 102 |

| | | | | 2,093 |

10

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Arizona (1.4%) | | | | |

| Arizona Board Regents Arizona State University | | | | |

| System Revenue | 5.000% | 7/1/37 | 380 | 441 |

| Arizona COP | 5.000% | 10/1/18 (4) | 50 | 54 |

| Arizona COP | 5.000% | 10/1/29 (4) | 110 | 121 |

| Arizona School Facilities Board COP | 5.250% | 9/1/18 (Prere.) | 200 | 216 |

| Arizona School Facilities Board COP | 5.750% | 9/1/18 (Prere.) | 420 | 457 |

| Arizona School Facilities Board COP | 5.000% | 9/1/23 | 500 | 606 |

| Arizona Transportation Board Excise Tax Revenue | 5.250% | 7/1/19 (Prere.) | 135 | 150 |

| Arizona Transportation Board Excise Tax Revenue | 5.000% | 7/1/23 | 60 | 73 |

| Arizona Transportation Board Excise Tax Revenue | | | | |

| (Maricopa County Regional Area) | 5.000% | 7/1/18 | 80 | 85 |

| Arizona Transportation Board Excise Tax Revenue | | | | |

| (Maricopa County Regional Area) | 5.000% | 7/1/19 (Prere.) | 300 | 331 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/24 | 145 | 182 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/25 | 520 | 622 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/26 | 50 | 60 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/31 | 55 | 66 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/32 | 60 | 72 |

| Arizona Water Infrastructure Finance Authority | | | | |

| Revenue | 5.000% | 10/1/20 (Prere.) | 150 | 172 |

| Arizona Water Infrastructure Finance Authority | | | | |

| Revenue | 5.000% | 10/1/23 | 125 | 154 |

| Phoenix AZ Civic Improvement Corp. Transit | | | | |

| Excise Tax Revenue (Light Rail Project) | 5.000% | 7/1/20 | 200 | 228 |

| Phoenix AZ Civic Improvement Corp. Water | | | | |

| System Revenue | 5.000% | 7/1/20 | 700 | 799 |

| Phoenix AZ Civic Improvement Corp. Water | | | | |

| System Revenue | 5.000% | 7/1/21 | 275 | 322 |

| Phoenix AZ GO | 4.000% | 7/1/24 | 65 | 76 |

| Phoenix AZ GO | 5.000% | 7/1/26 | 500 | 638 |

| Pima County AZ Industrial Development Authority | | | | |

| Lease Revenue (Clark County Detention | | | | |

| Facilities Project) | 5.000% | 9/1/39 | 270 | 282 |

| Pima County AZ Sewer Revenue | 5.000% | 7/1/24 | 200 | 249 |

| Pinal County AZ Electric District Revenue | 5.250% | 7/1/21 (Prere.) | 70 | 83 |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 12/1/19 | 100 | 112 |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 1/1/27 | 100 | 105 |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 12/1/27 | 300 | 352 |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 1/1/28 | 50 | 54 |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 12/1/28 | 125 | 147 |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 12/1/31 | 120 | 141 |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 1/1/32 | 55 | 60 |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 1/1/33 | 75 | 81 |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 1/1/38 | 195 | 204 |

11

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 1/1/39 | 525 | 566 |

| Salt River Project Arizona Agricultural | | | | |

| Improvement & Power District Revenue | 5.000% | 12/1/45 | 125 | 147 |

| | | | | 8,508 |

| Arkansas (0.1%) | | | | |

| Arkansas GO | 5.000% | 6/15/21 | 225 | 263 |

| Fort Smith AR Water & Sewer Revenue | 5.000% | 10/1/32 (4) | 100 | 107 |

| | | | | 370 |

| California (14.9%) | | | | |

| Alameda CA Corridor Transportation Authority | | | | |

| Revenue | 5.450% | 10/1/17 (Prere.) | 200 | 209 |

| Alameda CA Corridor Transportation Authority | | | | |

| Revenue | 0.000% | 10/1/19 (ETM) | 235 | 227 |

| Alameda CA Corridor Transportation Authority | | | | |

| Revenue | 0.000% | 10/1/19 (2) | 15 | 14 |

| Alameda CA Corridor Transportation Authority | | | | |

| Revenue | 0.000% | 10/1/20 (ETM) | 140 | 133 |

| Alameda CA Corridor Transportation Authority | | | | |

| Revenue | 0.000% | 10/1/20 (2) | 5 | 5 |

| Alameda CA Corridor Transportation Authority | | | | |

| Revenue | 5.000% | 10/1/34 | 250 | 293 |

| Alameda CA Corridor Transportation Authority | | | | |

| Revenue | 0.000% | 10/1/35 (14) | 315 | 160 |

| Alvord CA Unified School District GO | 0.000% | 8/1/41 (4) | 150 | 57 |

| Anaheim CA Housing & Public Improvements | | | | |

| Authority Revenue (Electric Utility Distribution | | | | |

| System) | 5.000% | 10/1/34 | 500 | 574 |

| Anaheim CA Public Financing Authority Lease | | | | |

| Revenue | 0.000% | 9/1/36 (4) | 140 | 69 |

| Anaheim CA Redevelopment Agency Tax | | | | |

| Allocation Revenue (Merged Redevelopment | | | | |

| Project Area) | 5.000% | 2/1/31 (4) | 100 | 104 |

| Baldwin Park CA Unified School District GO | 0.000% | 8/1/42 (15) | 100 | 23 |

| Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) | 5.000% | 4/1/18 (Prere.) | 150 | 159 |

| Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) | 5.250% | 4/1/19 (Prere.) | 125 | 138 |

| Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) | 5.000% | 4/1/28 | 355 | 425 |

| Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) | 5.000% | 4/1/43 | 145 | 169 |

| Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) | 5.000% | 10/1/54 | 760 | 879 |

| Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) PUT | 1.500% | 4/2/18 | 935 | 940 |

| Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) PUT | 2.000% | 4/1/21 | 250 | 256 |

| California Department of Water Resources | | | | |

| Power Supply Revenue | 5.000% | 5/1/17 (4) | 270 | 276 |

| California Department of Water Resources | | | | |

| Power Supply Revenue | 5.000% | 5/1/17 | 125 | 128 |

| California Department of Water Resources | | | | |

| Power Supply Revenue | 4.000% | 5/1/18 | 150 | 157 |

12

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| California Department of Water Resources | | | | |

| Power Supply Revenue | 5.000% | 5/1/18 (Prere.) | 250 | 266 |

| California Department of Water Resources | | | | |

| Power Supply Revenue | 5.000% | 5/1/18 (Prere.) | 250 | 266 |

| California Department of Water Resources | | | | |

| Power Supply Revenue | 5.000% | 5/1/19 | 305 | 336 |

| California Department of Water Resources | | | | |

| Power Supply Revenue | 5.000% | 5/1/20 | 225 | 256 |

| California Department of Water Resources | | | | |

| Power Supply Revenue | 5.000% | 5/1/21 | 500 | 585 |

| California Department of Water Resources Water | | | | |

| System Revenue (Central Valley Project) | 5.000% | 12/1/19 (Prere.) | 100 | 112 |

| California Department of Water Resources Water | | | | |

| System Revenue (Central Valley Project) | 5.000% | 12/1/26 | 100 | 125 |

| California Department of Water Resources Water | | | | |

| System Revenue (Central Valley Project) | 5.000% | 12/1/29 | 150 | 186 |

| California Economic Recovery GO | 5.000% | 7/1/19 (Prere.) | 100 | 111 |

| California Educational Facilities Authority Revenue | | | | |

| (Stanford University) | 5.000% | 3/15/39 | 400 | 541 |

| California Educational Facilities Authority Revenue | | | | |

| (Stanford University) | 5.000% | 6/1/43 | 150 | 207 |

| California Educational Facilities Authority Revenue | | | | |

| (Stanford University) | 5.000% | 5/1/45 | 300 | 418 |

| California Educational Facilities Authority Revenue | | | | |

| (University of Southern California) | 5.000% | 10/1/18 (Prere.) | 325 | 351 |

| California Educational Facilities Authority Revenue | | | | |

| (University of Southern California) | 5.250% | 10/1/18 (Prere.) | 580 | 629 |

| California GO | 5.000% | 2/1/17 | 370 | 374 |

| California GO | 5.000% | 2/1/17 | 125 | 126 |

| California GO | 5.000% | 6/1/17 (Prere.) | 335 | 343 |

| California GO | 5.000% | 6/1/17 (Prere.) | 340 | 348 |

| California GO | 5.000% | 9/1/17 | 1,200 | 1,243 |

| California GO | 3.500% | 10/1/17 | 140 | 144 |

| California GO | 5.000% | 11/1/17 | 400 | 417 |

| California GO | 5.000% | 11/1/17 (Prere.) | 595 | 620 |

| California GO | 5.000% | 12/1/17 (Prere.) | 230 | 241 |

| California GO | 5.000% | 12/1/17 (Prere.) | 200 | 209 |

| California GO | 6.000% | 2/1/18 (2) | 100 | 107 |

| California GO | 5.500% | 4/1/18 | 165 | 176 |

| California GO | 5.000% | 8/1/18 | 1,200 | 1,287 |

| California GO | 5.000% | 2/1/19 | 300 | 327 |

| California GO | 5.500% | 4/1/19 | 100 | 111 |

| California GO | 6.000% | 4/1/19 | 165 | 185 |

| California GO | 5.000% | 8/1/19 | 100 | 111 |

| California GO | 5.000% | 9/1/19 | 100 | 100 |

| California GO | 5.000% | 2/1/20 | 225 | 254 |

| California GO | 5.000% | 10/1/20 | 210 | 241 |

| California GO | 5.000% | 10/1/20 | 500 | 575 |

| California GO | 5.250% | 10/1/20 | 500 | 562 |

| California GO | 5.000% | 2/1/21 | 505 | 585 |

| California GO | 5.500% | 4/1/21 | 400 | 444 |

| California GO | 5.000% | 9/1/21 | 260 | 306 |

| California GO | 5.000% | 10/1/21 | 125 | 147 |

| California GO | 5.000% | 11/1/21 | 670 | 792 |

| California GO | 5.000% | 12/1/21 | 265 | 314 |

13

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| California GO | 5.000% | 2/1/22 | 100 | 119 |

| California GO | 5.000% | 2/1/22 | 175 | 208 |

| California GO | 5.000% | 9/1/22 | 350 | 421 |

| California GO | 5.000% | 10/1/22 | 110 | 133 |

| California GO | 5.250% | 10/1/22 | 150 | 183 |

| California GO | 5.000% | 2/1/23 | 250 | 298 |

| California GO | 5.000% | 8/1/23 | 170 | 172 |

| California GO | 5.000% | 9/1/23 | 100 | 121 |

| California GO | 5.250% | 9/1/23 | 100 | 120 |

| California GO | 5.000% | 11/1/23 | 1,025 | 1,260 |

| California GO | 5.000% | 12/1/23 | 250 | 308 |

| California GO | 5.000% | 12/1/23 | 75 | 92 |

| California GO | 5.000% | 3/1/24 | 500 | 616 |

| California GO | 5.000% | 8/1/24 | 600 | 745 |

| California GO | 5.500% | 2/1/25 | 500 | 643 |

| California GO | 5.625% | 4/1/25 | 310 | 344 |

| California GO | 5.000% | 10/1/25 | 500 | 615 |

| California GO | 5.000% | 10/1/25 | 70 | 86 |

| California GO | 5.000% | 3/1/26 | 200 | 248 |

| California GO | 5.000% | 3/1/26 | 565 | 699 |

| California GO | 5.000% | 4/1/26 | 100 | 106 |

| California GO | 5.000% | 8/1/26 | 500 | 623 |

| California GO | 5.000% | 9/1/26 | 145 | 156 |

| California GO | 5.000% | 10/1/26 | 100 | 123 |

| California GO | 5.000% | 11/1/26 | 100 | 104 |

| California GO | 5.000% | 3/1/27 | 390 | 478 |

| California GO | 4.500% | 8/1/27 | 155 | 156 |

| California GO | 5.000% | 9/1/27 | 315 | 382 |

| California GO | 5.000% | 10/1/27 | 100 | 120 |

| California GO | 5.000% | 10/1/27 | 170 | 209 |

| California GO | 5.000% | 11/1/27 | 500 | 609 |

| California GO | 5.750% | 4/1/28 | 295 | 328 |

| California GO | 4.500% | 8/1/28 (12) | 100 | 101 |

| California GO | 5.000% | 9/1/28 | 100 | 121 |

| California GO | 5.000% | 10/1/28 | 200 | 245 |

| California GO | 5.000% | 8/1/29 | 200 | 243 |

| California GO | 3.000% | 9/1/29 | 105 | 109 |

| California GO | 5.000% | 10/1/29 | 250 | 305 |

| California GO | 5.000% | 10/1/29 | 750 | 793 |

| California GO | 5.000% | 10/1/29 | 90 | 100 |

| California GO | 5.250% | 10/1/29 | 105 | 117 |

| California GO | 5.000% | 12/1/29 | 75 | 91 |

| California GO | 5.000% | 3/1/30 | 160 | 192 |

| California GO | 5.250% | 3/1/30 | 300 | 338 |

| California GO | 4.500% | 8/1/30 | 420 | 424 |

| California GO | 5.000% | 8/1/30 | 50 | 60 |

| California GO | 5.000% | 8/1/30 | 300 | 362 |

| California GO | 5.000% | 10/1/30 | 340 | 414 |

| California GO | 5.000% | 2/1/31 | 50 | 59 |

| California GO | 5.750% | 4/1/31 | 335 | 372 |

| California GO | 5.000% | 8/1/31 | 150 | 181 |

| California GO | 3.250% | 9/1/31 | 115 | 119 |

| California GO | 5.000% | 9/1/31 | 200 | 233 |

| California GO | 5.000% | 10/1/31 | 215 | 260 |

| California GO | 5.000% | 11/1/31 | 145 | 174 |

14

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| California GO | 5.000% | 5/1/32 | 50 | 60 |

| California GO | 5.000% | 8/1/32 | 250 | 296 |

| California GO | 5.250% | 8/1/32 (4) | 505 | 670 |

| California GO | 3.000% | 9/1/32 | 330 | 332 |

| California GO | 5.000% | 2/1/33 | 510 | 598 |

| California GO | 6.500% | 4/1/33 | 655 | 740 |

| California GO | 4.250% | 8/1/33 (14) | 740 | 746 |

| California GO | 5.000% | 8/1/33 | 300 | 360 |

| California GO | 5.000% | 8/1/33 | 275 | 325 |

| California GO | 3.000% | 9/1/33 | 310 | 309 |

| California GO | 3.375% | 9/1/33 | 210 | 216 |

| California GO | 4.000% | 9/1/33 | 250 | 275 |

| California GO | 4.000% | 8/1/34 | 275 | 297 |

| California GO | 4.000% | 9/1/34 | 250 | 274 |

| California GO | 5.000% | 9/1/34 | 750 | 901 |

| California GO | 5.500% | 11/1/34 | 145 | 163 |

| California GO | 4.500% | 12/1/34 | 130 | 130 |

| California GO | 6.000% | 4/1/35 | 270 | 301 |

| California GO | 5.000% | 8/1/35 | 330 | 393 |

| California GO | 4.000% | 9/1/35 | 250 | 272 |

| California GO | 3.750% | 12/1/35 | 500 | 524 |

| California GO | 5.250% | 3/1/36 | 100 | 105 |

| California GO | 5.125% | 8/1/36 | 100 | 107 |

| California GO | 4.000% | 9/1/36 | 250 | 272 |

| California GO | 4.500% | 12/1/36 (12) | 90 | 90 |

| California GO | 4.000% | 9/1/37 | 250 | 272 |

| California GO | 5.000% | 11/1/37 | 110 | 114 |

| California GO | 5.000% | 12/1/37 | 90 | 94 |

| California GO | 5.250% | 3/1/38 | 260 | 274 |

| California GO | 5.000% | 4/1/38 | 55 | 58 |

| California GO | 6.000% | 4/1/38 | 605 | 675 |

| California GO | 5.000% | 10/1/39 | 120 | 142 |

| California GO | 6.000% | 11/1/39 | 250 | 285 |

| California GO | 5.500% | 3/1/40 | 145 | 165 |

| California GO | 5.250% | 11/1/40 | 100 | 115 |

| California GO | 5.000% | 9/1/41 | 640 | 737 |

| California GO | 5.000% | 10/1/41 | 100 | 115 |

| California GO | 5.000% | 4/1/42 | 200 | 231 |

| California GO | 5.000% | 9/1/42 | 100 | 116 |

| California GO | 5.000% | 2/1/43 | 110 | 127 |

| California GO | 5.000% | 4/1/43 | 200 | 232 |

| California GO | 4.875% | 11/1/43 | 165 | 192 |

| California GO | 5.000% | 11/1/43 | 605 | 710 |

| California GO | 4.500% | 12/1/43 | 405 | 460 |

| California GO | 4.000% | 11/1/44 | 200 | 214 |

| California GO | 5.000% | 8/1/45 | 500 | 595 |

| California GO PUT | 3.000% | 12/1/19 | 125 | 131 |

| California Public Works Board Lease Revenue | | | | |

| (Department of Corrections) | 5.000% | 9/1/20 | 100 | 114 |

| California Public Works Board Lease Revenue | | | | |

| (Department of Corrections) | 4.000% | 6/1/28 | 60 | 67 |

| California Public Works Board Lease Revenue | | | | |

| (Department of Corrections) | 5.000% | 9/1/39 | 300 | 350 |

| California Public Works Board Lease Revenue | | | | |

| (Department of General Services) | 5.000% | 5/1/18 | 150 | 159 |

15

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| California Public Works Board Lease Revenue | | | | |

| (Judicial Council Projects) | 5.000% | 12/1/24 | 150 | 176 |

| California Public Works Board Lease Revenue | | | | |

| (Judicial Council Projects) | 5.250% | 12/1/25 | 250 | 296 |

| California Public Works Board Lease Revenue | | | | |

| (Regents of The University of California) | 5.000% | 12/1/21 (Prere.) | 205 | 244 |

| California Public Works Board Lease Revenue | | | | |

| (Various Capital Projects) | 5.000% | 4/1/21 | 125 | 145 |

| California Public Works Board Lease Revenue | | | | |

| (Various Capital Projects) | 5.250% | 11/1/28 | 300 | 367 |

| California Public Works Board Lease Revenue | | | | |

| (Various Capital Projects) | 5.000% | 11/1/29 | 100 | 120 |

| California Public Works Board Lease Revenue | | | | |

| (Various Capital Projects) | 5.750% | 10/1/30 | 200 | 225 |

| California Public Works Board Lease Revenue | | | | |

| (Various Capital Projects) | 5.000% | 4/1/37 | 205 | 235 |

| California St For Previous Issues See 13062T | | | | |

| Forfuture Issues See 13063B Rfdg | 5.500% | 8/1/30 | 100 | 108 |

| California State University Systemwide Revenue | 5.250% | 5/1/19 (Prere.) | 255 | 282 |

| California State University Systemwide Revenue | 5.250% | 5/1/19 (Prere.) | 90 | 100 |

| California State University Systemwide Revenue | 5.000% | 11/1/29 | 255 | 312 |

| California State University Systemwide Revenue | 5.000% | 11/1/31 | 150 | 182 |

| California State University Systemwide Revenue | 5.000% | 11/1/31 | 510 | 627 |

| California State University Systemwide Revenue | 5.000% | 11/1/32 | 50 | 61 |

| California State University Systemwide Revenue | 4.000% | 11/1/34 | 125 | 138 |

| California State University Systemwide Revenue | 4.000% | 11/1/35 | 235 | 259 |

| California State University Systemwide Revenue | 4.000% | 11/1/37 | 375 | 410 |

| California State University Systemwide Revenue | 5.000% | 11/1/37 | 250 | 291 |

| California State University Systemwide Revenue | 5.000% | 11/1/37 | 350 | 414 |

| California State University Systemwide Revenue | 4.000% | 11/1/38 | 125 | 137 |

| California State University Systemwide Revenue | 5.000% | 11/1/41 | 490 | 586 |

| California State University Systemwide Revenue | 4.000% | 11/1/43 | 200 | 217 |

| California State University Systemwide Revenue | 5.000% | 11/1/47 | 105 | 125 |

| Chino Basin Regional Financing Authority California | | | | |

| Revenue (Inland Empire Utilities Agency) | 5.000% | 11/1/33 (2) | 100 | 104 |

| Chino Basin Regional Financing Authority California | | | | |

| Revenue (Inland Empire Utilities Agency) | 5.000% | 11/1/38 (2) | 200 | 208 |

| Clovis CA Unified School District GO | 4.000% | 8/1/40 | 150 | 162 |

| Coast CA Community College District GO | 5.000% | 8/1/38 | 680 | 802 |

| Corona-Norco CA Unified School District GO | 0.000% | 8/1/39 (4) | 400 | 171 |

| Cypress CA Elementary School District GO | 0.000% | 8/1/40 | 250 | 109 |

| East Bay CA Municipal Utility District Water | | | | |

| System Revenue | 5.000% | 6/1/19 | 150 | 166 |

| East Bay CA Municipal Utility District Water | | | | |

| System Revenue | 5.000% | 6/1/32 | 145 | 176 |

| East Bay CA Municipal Utility District Water | | | | |

| System Revenue | 5.000% | 6/1/35 | 250 | 300 |

| Eastern California Municipal Water District Water | | | | |

| & Sewer COP | 5.000% | 7/1/18 (Prere.) | 200 | 214 |

| Gilroy CA School Facilities Finance Authority | | | | |

| Revenue | 4.000% | 8/1/42 | 320 | 348 |

| Imperial CA Irrigation District Electric Revenue | 5.000% | 11/1/18 (Prere.) | 105 | 114 |

| Los Angeles CA Community College District GO | 5.000% | 8/1/28 | 570 | 703 |

| Los Angeles CA Community College District GO | 5.000% | 8/1/29 | 250 | 307 |

| Los Angeles CA Community College District GO | 5.000% | 8/1/30 | 130 | 159 |

16

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Los Angeles CA Community College District GO | 5.000% | 8/1/31 | 305 | 371 |

| Los Angeles CA Community College District GO | 4.000% | 8/1/39 | 325 | 354 |

| Los Angeles CA Department of Airports | | | | |

| International Airport Revenue | 5.000% | 5/15/29 | 100 | 109 |

| Los Angeles CA Department of Airports | | | | |

| International Airport Revenue | 5.250% | 5/15/29 | 250 | 276 |

| Los Angeles CA Department of Airports | | | | |

| International Airport Revenue | 5.000% | 5/15/35 | 690 | 780 |

| Los Angeles CA Department of Airports | | | | |

| International Airport Revenue | 5.000% | 5/15/35 | 160 | 189 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/18 | 140 | 150 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/20 | 290 | 332 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/24 | 125 | 152 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/29 | 245 | 296 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/29 | 140 | 167 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/32 | 130 | 155 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/35 | 300 | 359 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/39 (2) | 200 | 205 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/43 | 180 | 210 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/43 | 240 | 281 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/44 (2) | 500 | 513 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/44 | 150 | 176 |

| Los Angeles CA Department of Water & Power | | | | |

| Revenue | 5.000% | 7/1/46 | 750 | 890 |

| Los Angeles CA GO | 4.500% | 9/1/28 | 200 | 213 |

| Los Angeles CA Municipal Improvement Corp. | | | | |

| Lease Revenue | 4.000% | 11/1/33 | 480 | 526 |

| Los Angeles CA Unified School District GO | 4.500% | 7/1/17 (Prere.) | 100 | 103 |

| Los Angeles CA Unified School District GO | 5.000% | 7/1/17 (Prere.) | 100 | 103 |

| Los Angeles CA Unified School District GO | 5.000% | 7/1/17 (Prere.) | 100 | 103 |

| Los Angeles CA Unified School District GO | 5.500% | 7/1/17 (3) | 100 | 103 |

| Los Angeles CA Unified School District GO | 5.000% | 7/1/19 | 70 | 78 |

| Los Angeles CA Unified School District GO | 4.500% | 7/1/22 (4) | 530 | 543 |

| Los Angeles CA Unified School District GO | 5.000% | 7/1/22 | 200 | 241 |

| Los Angeles CA Unified School District GO | 5.000% | 7/1/24 | 500 | 627 |

| Los Angeles CA Unified School District GO | 5.000% | 7/1/27 | 120 | 148 |

| Los Angeles CA Unified School District GO | 4.250% | 1/1/28 (3) | 100 | 102 |

| Los Angeles CA Unified School District GO | 4.500% | 1/1/28 (14) | 455 | 466 |

| Los Angeles CA Unified School District GO | 5.000% | 7/1/28 | 230 | 282 |

| Los Angeles CA Unified School District GO | 5.000% | 7/1/29 | 295 | 363 |

| Los Angeles CA Unified School District GO | 5.200% | 7/1/29 | 200 | 222 |

| Los Angeles CA Unified School District GO | 5.000% | 7/1/32 | 300 | 348 |

| Los Angeles CA Unified School District GO | 5.000% | 1/1/34 | 140 | 155 |

17

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Los Angeles CA Unified School District GO | 4.000% | 7/1/40 | 735 | 804 |

| Los Angeles CA Wastewater System Revenue | 5.000% | 6/1/35 | 500 | 590 |

| Los Angeles CA Wastewater System Revenue | 5.000% | 6/1/45 | 250 | 295 |

| Los Angeles County CA Public Works Financing | | | | |

| Authority Lease Revenue | 5.000% | 8/15/18 (Prere.) | 100 | 107 |

| Los Angeles County CA Public Works Financing | | | | |

| Authority Lease Revenue | 4.000% | 12/1/40 | 580 | 623 |

| Los Angeles County CA Sanitation Districts | | | | |

| Financing Authority Revenue | 5.000% | 10/1/20 | 55 | 63 |

| Metropolitan Water District of Southern California | | | | |

| Revenue | 5.000% | 7/1/35 | 100 | 111 |

| Metropolitan Water District of Southern California | | | | |

| Revenue | 5.000% | 7/1/37 | 100 | 103 |

| Mount San Antonio CA Community College | | | | |

| District GO | 0.000% | 8/1/43 | 150 | 124 |

| New Haven CA Unified School District GO | 0.000% | 8/1/34 (12) | 120 | 67 |

| Orange County CA Sanitation District Wastewater | | | | |

| Revenue | 3.000% | 2/1/31 | 150 | 154 |

| Orange County CA Water District Revenue | 5.000% | 8/15/39 | 125 | 138 |

| Pittsburg CA Unified School District Financing | | | | |

| Authority Revenue | 5.500% | 9/1/21 (Prere.) | 350 | 422 |

| Poway CA Unified School District GO | 0.000% | 8/1/33 | 300 | 171 |

| Riverside County CA Transportation Commission | | | | |

| Sales Tax Revenue | 5.250% | 6/1/39 | 515 | 614 |

| Sacramento CA Municipal Utility District Revenue | 5.000% | 8/15/18 (Prere.) | 40 | 43 |

| Sacramento CA Municipal Utility District Revenue | 5.000% | 8/15/20 | 195 | 224 |

| Sacramento CA Municipal Utility District Revenue | 5.000% | 8/15/27 (4) | 60 | 64 |

| Sacramento CA Municipal Utility District Revenue | 5.000% | 8/15/37 | 75 | 89 |

| Sacramento CA Water Revenue | 5.000% | 9/1/38 | 425 | 499 |

| Sacramento County CA Airport Revenue | 6.000% | 7/1/41 | 170 | 183 |

| San Diego CA Community College District GO | 5.000% | 8/1/30 | 95 | 114 |

| San Diego CA Public Facilities Financing Authority | | | | |

| Lease Revenue | 5.000% | 9/1/28 | 125 | 141 |

| San Diego CA Public Facilities Financing Authority | | | | |

| Sewer Revenue | 5.000% | 5/15/17 | 115 | 118 |

| San Diego CA Public Facilities Financing Authority | | | | |

| Sewer Revenue | 5.000% | 5/15/19 (Prere.) | 80 | 88 |

| San Diego CA Public Facilities Financing Authority | | | | |

| Sewer Revenue | 5.250% | 5/15/19 (Prere.) | 250 | 277 |

| San Diego CA Public Facilities Financing Authority | | | | |

| Sewer Revenue | 5.250% | 5/15/20 (Prere.) | 100 | 115 |

| San Diego CA Unified School District GO | 0.000% | 7/1/35 | 400 | 211 |

| San Diego CA Unified School District GO | 5.000% | 7/1/35 | 100 | 118 |

| San Diego CA Unified School District GO | 0.000% | 7/1/36 | 100 | 50 |

| San Diego CA Unified School District GO | 0.000% | 7/1/37 | 200 | 97 |

| San Diego CA Unified School District GO | 0.000% | 7/1/38 | 170 | 79 |

| San Diego CA Unified School District GO | 5.000% | 7/1/40 | 200 | 237 |

| San Diego CA Unified School District GO | 0.000% | 7/1/42 | 150 | 99 |

| San Diego CA Unified School District GO | 4.000% | 7/1/45 | 225 | 242 |

| San Diego CA Unified School District GO | 0.000% | 7/1/47 | 250 | 82 |

| San Diego CA Unified School District GO | 0.000% | 7/1/47 | 100 | 68 |

| San Diego County CA Regional Transportation | | | | |

| Commission Sales Tax Revenue | 5.000% | 4/1/42 | 350 | 407 |

| San Diego County CA Regional Transportation | | | | |

| Commission Sales Tax Revenue | 4.750% | 4/1/48 | 465 | 527 |

18

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| San Diego County CA Water Authority Revenue | 5.000% | 5/1/18 (Prere.) | 30 | 32 |

| San Diego County CA Water Authority Revenue | 5.000% | 5/1/18 (Prere.) | 140 | 149 |

| San Francisco CA City & County (War Memorial | | | | |

| Veterans Building Seismic Upgrade & | | | | |

| Improvements) COP | 4.000% | 4/1/45 | 150 | 160 |

| San Francisco CA City & County COP | 5.000% | 9/1/18 | 700 | 752 |

| San Francisco CA City & County GO | 5.000% | 6/15/26 | 100 | 122 |

| San Francisco CA City & County GO | 5.000% | 10/1/28 | 100 | 114 |

| San Francisco CA City & County International | | | | |

| Airport Revenue | 4.900% | 5/1/29 | 100 | 111 |

| San Francisco CA City & County International | | | | |

| Airport Revenue | 6.000% | 5/1/39 | 125 | 140 |

| San Francisco CA City & County International | | | | |

| Airport Revenue | 5.000% | 5/1/43 | 130 | 149 |

| San Francisco CA City & County Public Utilities | | | | |

| Commission Water Revenue | 5.000% | 11/1/32 | 540 | 649 |

| San Joaquin Hills CA Transportation Corridor | | | | |

| Agency Toll Road Revenue | 5.000% | 1/15/50 | 100 | 113 |

| San Jose CA Finance Authority Revenue | | | | |

| (Civic Center Project) | 5.000% | 6/1/39 | 100 | 115 |

| San Jose CA Unified School District Santa Clara | | | | |

| County GO | 5.000% | 8/1/18 (Prere.) | 100 | 107 |

| San Marcos CA Unified School District GO | 0.000% | 8/1/51 | 100 | 25 |

| San Mateo CA Union High School District GO | 5.000% | 9/1/21 (Prere.) | 10 | 12 |

| San Mateo CA Union High School District GO | 0.000% | 9/1/41 | 100 | 84 |

| San Mateo CA Union High School District GO | 5.000% | 9/1/42 | 90 | 104 |

| Santa Clara County CA GO | 5.000% | 8/1/34 | 250 | 278 |

| Santa Clara Valley CA Water District Revenue | 5.000% | 6/1/46 | 325 | 386 |

| Southern California Public Power Authority | | | | |

| Revenue (Windy Point/Windy Flats Project) | 5.000% | 7/1/25 | 120 | 137 |

| Southern California Water Replenishment District | | | | |

| Financing Authority Revenue | 5.000% | 8/1/41 | 680 | 810 |

| State of California | 5.000% | 9/1/22 | 185 | 223 |

| Turlock CA Irrigation District Revenue | 5.000% | 1/1/20 (Prere.) | 210 | 236 |

| University of California Regents Medical Center | | | | |

| Pooled Revenue | 4.000% | 5/15/37 | 300 | 327 |

| University of California Revenue | 5.000% | 5/15/22 | 100 | 120 |

| University of California Revenue | 5.000% | 5/15/23 | 500 | 615 |

| University of California Revenue | 5.000% | 5/15/27 | 75 | 94 |

| University of California Revenue | 5.000% | 5/15/29 | 195 | 241 |

| University of California Revenue | 5.000% | 5/15/31 | 55 | 67 |

| University of California Revenue | 5.000% | 5/15/32 | 1,050 | 1,272 |

| University of California Revenue | 5.000% | 5/15/33 | 700 | 828 |

| University of California Revenue | 4.000% | 5/15/36 | 350 | 383 |

| University of California Revenue | 5.000% | 5/15/37 | 100 | 117 |

| University of California Revenue | 5.000% | 5/15/42 | 640 | 745 |

| University of California Revenue | 5.000% | 5/15/46 | 500 | 595 |

| University of California Revenue PUT | 5.000% | 5/15/23 | 100 | 123 |

| Ventura County CA Public Financing Authority | | | | |

| Lease Revenue | 5.000% | 11/1/38 | 170 | 198 |

| Ventura County CA Public Financing Authority | | | | |

| Lease Revenue | 4.000% | 11/1/43 | 115 | 122 |

| Ventura County CA Public Financing Authority | | | | |

| Lease Revenue | 5.000% | 11/1/43 | 30 | 35 |

19

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| William S. Hart Union High School District | | | | |

| California GO | 4.000% | 8/1/38 | 100 | 107 |

| Yosemite CA Community College District GO | 5.000% | 8/1/18 (Prere.) | 100 | 107 |

| Yosemite CA Community College District GO | 5.000% | 8/1/32 | 100 | 121 |

| Yosemite CA Community College District GO | 0.000% | 8/1/42 | 75 | 54 |

| | | | | 92,839 |

| Colorado (0.5%) | | | | |

| Board of Governors of the Colorado State | | | | |

| University System Enterprise Revenue | 5.000% | 3/1/47 | 125 | 144 |

| Boulder Larimer & Weld Counties CO St. Vrain | | | | |

| Valley School District GO | 5.000% | 12/15/18 (Prere.) | 100 | 109 |

| Colorado Higher Education Capital Construction | | | | |

| Lease Purchase Financing Program COP | 5.250% | 11/1/18 (Prere.) | 155 | 168 |

| Colorado Higher Education Capital Construction | | | | |

| Lease Purchase Financing Program COP | 5.500% | 11/1/18 (Prere.) | 400 | 436 |

| Colorado Public Highway Authority Capital | | | | |

| Appreciation Revenue | 0.000% | 9/1/35 | 235 | 120 |

| Colorado Springs CO Utility System Revenue | 5.000% | 11/15/43 | 50 | 59 |

| Denver CO City & County Airport Revenue | 5.000% | 11/15/33 | 200 | 235 |

| Denver CO City & County Airport Revenue | 4.000% | 11/15/43 | 170 | 180 |

| Denver CO City & County Dedicated Tax Revenue | 4.000% | 8/1/46 | 150 | 160 |

| E-470 Public Highway Authority Colorado Revenue | 0.000% | 9/1/29 (14) | 200 | 134 |

| E-470 Public Highway Authority Colorado Revenue | 0.000% | 9/1/30 (14) | 230 | 148 |

| E-470 Public Highway Authority Colorado Revenue | 0.000% | 9/1/32 (14) | 155 | 92 |

| E-470 Public Highway Authority Colorado Revenue | 0.000% | 9/1/37 (14) | 350 | 138 |

| Regional Transportation District of Colorado COP | 5.000% | 6/1/39 | 245 | 278 |

| Regional Transportation District of Colorado Sales | | | | |

| Tax Revenue (FasTracks Project) | 5.000% | 11/1/16 (Prere.) | 50 | 50 |

| Regional Transportation District of Colorado Sales | | | | |

| Tax Revenue (FasTracks Project) | 5.000% | 11/1/29 | 350 | 418 |

| Regional Transportation District of Colorado Sales | | | | |

| Tax Revenue (FasTracks Project) | 4.500% | 11/1/34 (4) | 80 | 83 |

| University of Colorado Enterprise System Revenue | 5.000% | 6/1/37 | 125 | 146 |

| University of Colorado Enterprise System Revenue | 5.000% | 6/1/43 | 250 | 291 |

| | | | | 3,389 |

| Connecticut (1.4%) | | | | |

| Connecticut GO | 5.000% | 11/1/16 (Prere.) | 345 | 345 |

| Connecticut GO | 5.000% | 6/15/17 | 500 | 513 |

| Connecticut GO | 5.000% | 10/15/20 | 150 | 170 |

| Connecticut GO | 5.000% | 12/15/20 | 280 | 282 |

| Connecticut GO | 5.000% | 12/1/21 | 400 | 446 |

| Connecticut GO | 5.000% | 10/15/22 | 180 | 213 |

| Connecticut GO | 5.000% | 12/1/22 | 100 | 104 |

| Connecticut GO | 5.000% | 3/15/24 | 275 | 330 |

| Connecticut GO | 5.000% | 10/15/25 | 100 | 119 |

| Connecticut GO | 5.000% | 11/1/26 | 310 | 334 |

| Connecticut GO | 5.000% | 8/15/27 | 500 | 608 |

| Connecticut GO | 5.000% | 11/15/27 | 500 | 606 |

| Connecticut GO | 5.000% | 11/15/28 | 300 | 360 |

| Connecticut Health & Educational Facilities | | | | |

| Authority Revenue (Yale University) | 4.700% | 7/1/29 | 100 | 103 |

| Connecticut Health & Educational Facilities | | | | |

| Authority Revenue (Yale University) | 4.850% | 7/1/37 | 290 | 297 |

20

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Connecticut Health & Educational Facilities | | | | |

| Authority Revenue (Yale University) | 5.000% | 7/1/40 | 445 | 473 |

| Connecticut Health & Educational Facilities | | | | |

| Authority Revenue (Yale University) | 5.050% | 7/1/42 | 200 | 205 |

| Connecticut Health & Educational Facilities | | | | |

| Authority Revenue (Yale University) PUT | 1.375% | 7/11/18 | 100 | 101 |

| Connecticut Special Tax Revenue | | | | |

| (Transportation Infrastructure) | 5.000% | 2/1/19 | 175 | 190 |

| Connecticut Special Tax Revenue | | | | |

| (Transportation Infrastructure) | 5.000% | 8/1/23 | 315 | 381 |

| Connecticut Special Tax Revenue | | | | |

| (Transportation Infrastructure) | 5.000% | 9/1/26 | 150 | 184 |

| Connecticut Special Tax Revenue | | | | |

| (Transportation Infrastructure) | 5.000% | 9/1/26 | 950 | 1,196 |

| Connecticut Special Tax Revenue | | | | |

| (Transportation Infrastructure) | 5.000% | 8/1/27 | 100 | 122 |

| Connecticut Special Tax Revenue | | | | |

| (Transportation Infrastructure) | 5.000% | 8/1/30 | 300 | 360 |

| Connecticut Special Tax Revenue | | | | |

| (Transportation Infrastructure) | 5.000% | 10/1/30 | 225 | 270 |

| Connecticut Special Tax Revenue | | | | |

| (Transportation Infrastructure) | 5.000% | 10/1/33 | 100 | 119 |

| | | | | 8,431 |

| Delaware (0.2%) | | | | |

| Delaware GO | 5.000% | 7/1/23 | 400 | 493 |

| Delaware Transportation Authority Transportation | | | | |

| System Revenue | 5.000% | 6/1/55 | 450 | 510 |

| | | | | 1,003 |

| District of Columbia (1.0%) | | | | |

| District of Columbia GO | 5.000% | 6/1/24 | 75 | 91 |

| District of Columbia GO | 4.750% | 6/1/33 (14) | 520 | 531 |

| District of Columbia GO | 5.000% | 6/1/33 (4) | 430 | 449 |

| District of Columbia GO | 5.000% | 6/1/33 | 155 | 184 |

| District of Columbia GO | 5.000% | 6/1/33 (13) | 105 | 111 |

| District of Columbia GO | 5.000% | 6/1/34 | 500 | 593 |

| District of Columbia GO | 4.750% | 6/1/36 (14) | 240 | 245 |

| District of Columbia GO | 4.500% | 6/1/37 (14) | 100 | 102 |

| District of Columbia GO | 5.000% | 6/1/37 | 180 | 213 |

| District of Columbia GO | 4.000% | 6/1/41 | 170 | 185 |

| District of Columbia GO | 5.000% | 6/1/41 | 200 | 238 |

| District of Columbia Income Tax Revenue | 5.000% | 12/1/23 | 150 | 181 |

| District of Columbia Income Tax Revenue | 5.250% | 12/1/26 | 420 | 472 |

| District of Columbia Income Tax Revenue | 5.000% | 12/1/28 | 230 | 260 |

| District of Columbia Water & Sewer Authority | | | | |

| Public Utility Revenue | 5.250% | 10/1/40 | 100 | 121 |

| District of Columbia Water & Sewer Authority | | | | |

| Public Utility Revenue | 5.000% | 10/1/44 | 285 | 333 |

| District of Columbia Water & Sewer Authority | | | | |

| Public Utility Revenue | 5.000% | 10/1/45 | 930 | 1,088 |

| Metropolitan Washington DC/VA Airports | | | | |

| Authority Airport System Revenue | 5.000% | 10/1/35 | 125 | 141 |

| Metropolitan Washington DC/VA Airports | | | | |

| Authority Airport System Revenue | 5.000% | 10/1/39 | 145 | 163 |

| Metropolitan Washington DC/VA Airports | | | | |

| Authority Dulles Toll Road Revenue | 5.000% | 10/1/39 | 20 | 22 |

21

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Metropolitan Washington DC/VA Airports | | | | |

| Authority Dulles Toll Road Revenue (Dulles | | | | |

| Metrorail & Capital Improvement Projects) | 0.000% | 10/1/37 | 130 | 55 |

| Metropolitan Washington DC/VA Airports | | | | |

| Authority Dulles Toll Road Revenue (Dulles | | | | |

| Metrorail & Capital Improvement Projects) | 0.000% | 10/1/39 | 90 | 35 |

| Metropolitan Washington DC/VA Airports | | | | |

| Authority Dulles Toll Road Revenue (Dulles | | | | |

| Metrorail & Capital Improvement Projects) | 0.000% | 10/1/40 (12) | 1,000 | 388 |

| Metropolitan Washington DC/VA Airports | | | | |

| Authority Dulles Toll Road Revenue (Dulles | | | | |

| Metrorail & Capital Improvement Projects) | 5.250% | 10/1/44 | 20 | 22 |

| Metropolitan Washington DC/VA Airports | | | | |

| Authority Dulles Toll Road Revenue (Dulles | | | | |

| Metrorail & Capital Improvement Projects) | 5.000% | 10/1/53 | 270 | 300 |

| | | | | 6,523 |

| Florida (3.6%) | | | | |

| Broward County FL Airport System Revenue | 5.000% | 10/1/42 | 420 | 482 |

| Broward County FL School Board COP | 5.250% | 7/1/18 (Prere.) | 60 | 64 |

| Broward County FL School Board COP | 5.000% | 7/1/24 | 125 | 153 |

| Broward County FL Water & Sewer Utility | | | | |

| Revenue | 5.250% | 10/1/18 (Prere.) | 500 | 541 |

| Cape Coral FL Water & Sewer System Revenue | 5.000% | 10/1/41 (4) | 280 | 322 |

| Duval County FL School Board COP | 5.000% | 7/1/17 (Prere.) | 300 | 309 |

| Florida Board of Education Lottery Revenue | 5.000% | 7/1/24 | 220 | 273 |

| Florida Board of Education Public Education | | | | |

| Capital Outlay GO | 5.000% | 6/1/17 | 100 | 103 |

| Florida Board of Education Public Education | | | | |

| Capital Outlay GO | 5.000% | 6/1/18 | 205 | 218 |

| Florida Board of Education Public Education | | | | |

| Capital Outlay GO | 5.000% | 6/1/21 | 110 | 125 |

| Florida Board of Education Public Education | | | | |

| Capital Outlay GO | 5.000% | 6/1/25 | 250 | 291 |

| Florida Board of Education Public Education | | | | |

| Capital Outlay GO | 5.000% | 6/1/25 | 225 | 269 |

| Florida Board of Education Public Education | | | | |

| Capital Outlay GO | 5.000% | 6/1/33 | 715 | 804 |

| Florida Board of Education Public Education | | | | |

| Capital Outlay GO | 4.750% | 6/1/37 (14) | 145 | 149 |

| Florida Municipal Power Agency Revenue | 5.250% | 10/1/18 (Prere.) | 105 | 114 |

| Florida Municipal Power Agency Revenue | 5.250% | 10/1/18 (Prere.) | 125 | 135 |

| Florida Municipal Power Agency Revenue | 5.250% | 10/1/19 | 135 | 150 |

| Florida Municipal Power Agency Revenue | 5.000% | 10/1/22 | 290 | 345 |

| Florida Water Pollution Control Financing | | | | |

| Corp. Revenue | 5.000% | 1/15/20 | 200 | 217 |

| Fort Lauderdale FL Water & Sewer Revenue | 4.750% | 9/1/17 (Prere.) | 100 | 103 |

| Greater Orlando Aviation Authority Florida | | | | |

| Airport Facilities Revenue | 5.000% | 10/1/39 | 400 | 451 |

| Hillsborough County FL School Board | | | | |

| (Master Lease Program) COP | 5.000% | 7/1/26 | 55 | 68 |

| Hillsborough County FL School Board | | | | |

| (Master Lease Program) COP | 5.000% | 7/1/29 | 200 | 231 |

| Jacksonville FL Electric Authority Electric | | | | |

| System Revenue | 5.000% | 10/1/39 | 40 | 46 |

22

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Miami-Dade County FL Aviation Revenue | | | | |

| (Miami International Airport) | 4.500% | 10/1/17 (Prere.) | 105 | 108 |

| Miami-Dade County FL Aviation Revenue | | | | |

| (Miami International Airport) | 5.250% | 10/1/17 (Prere.) | 325 | 338 |

| Miami-Dade County FL Aviation Revenue | | | | |

| (Miami International Airport) | 5.000% | 10/1/18 (Prere.) | 375 | 404 |

| Miami-Dade County FL Aviation Revenue | | | | |

| (Miami International Airport) | 5.000% | 10/1/30 | 250 | 301 |

| Miami-Dade County FL Aviation Revenue | | | | |

| (Miami International Airport) | 5.375% | 10/1/35 | 100 | 113 |

| Miami-Dade County FL Aviation Revenue | | | | |

| (Miami International Airport) | 5.500% | 10/1/36 | 305 | 342 |

| Miami-Dade County FL Aviation Revenue | | | | |

| (Miami International Airport) | 5.000% | 10/1/41 | 250 | 292 |

| Miami-Dade County FL Aviation Revenue | | | | |

| (Miami International Airport) | 5.500% | 10/1/41 | 100 | 112 |

| Miami-Dade County FL Building Better | | | | |

| Communities GO | 5.625% | 7/1/18 (Prere.) | 165 | 178 |

| Miami-Dade County FL Building Better | | | | |

| Communities GO | 5.625% | 7/1/18 (Prere.) | 110 | 119 |

| Miami-Dade County FL Building Better | | | | |

| Communities GO | 5.000% | 7/1/38 | 500 | 592 |

| Miami-Dade County FL Educational Facilities | | | | |

| Authority Revenue (University of Miami) | 4.000% | 4/1/45 | 100 | 107 |

| Miami-Dade County FL Educational Facilities | | | | |

| Authority Revenue (University of Miami) | 5.000% | 4/1/45 | 180 | 207 |

| Miami-Dade County FL Expressway Authority | | | | |

| Toll System Revenue | 5.000% | 7/1/24 | 200 | 245 |

| Miami-Dade County FL Expressway Authority | | | | |

| Toll System Revenue | 5.000% | 7/1/40 | 370 | 414 |

| Miami-Dade County FL Industrial Development | | | | |

| Authority Revenue (Biscayne Properties LLC) | 5.000% | 6/1/48 | 255 | 268 |

| Miami-Dade County FL Professional Sports | | | | |

| Franchise Facilities Tax Revenue | 0.000% | 10/1/48 (12) | 200 | 55 |

| Miami-Dade County FL Professional Sports | | | | |

| Franchise Facilities Tax Revenue | 0.000% | 4/1/49 (12) | 475 | 127 |

| Miami-Dade County FL School Board COP | 5.000% | 5/1/17 (Prere.) | 100 | 102 |

| Miami-Dade County FL School Board COP | 5.250% | 5/1/18 (Prere.) | 150 | 160 |

| Miami-Dade County FL School Board COP | 5.250% | 5/1/18 (Prere.) | 100 | 107 |

| Miami-Dade County FL School Board COP | 5.250% | 5/1/18 (Prere.) | 120 | 128 |

| Miami-Dade County FL School Board COP | 5.250% | 5/1/18 (Prere.) | 100 | 107 |

| Miami-Dade County FL School Board COP | 5.250% | 5/1/18 (Prere.) | 250 | 266 |

| Miami-Dade County FL School Board COP | 5.375% | 2/1/19 (Prere.) | 195 | 214 |

| Miami-Dade County FL School Board COP | 5.625% | 5/1/31 | 65 | 75 |

| Miami-Dade County FL School Board COP | 3.250% | 2/1/33 | 695 | 697 |

| Miami-Dade County FL School District GO | 5.000% | 3/15/46 | 750 | 866 |

| Miami-Dade County FL Special Obligation | | | | |

| Revenue | 5.000% | 10/1/17 (Prere.) | 175 | 182 |

| Miami-Dade County FL Special Obligation | | | | |

| Revenue | 5.000% | 10/1/35 | 560 | 636 |

| Miami-Dade County FL Special Obligation | | | | |

| Revenue | 5.000% | 10/1/35 | 300 | 353 |

| Miami-Dade County FL Transit Sales Surtax | | | | |

| Revenue | 4.000% | 7/1/42 | 190 | 200 |

23

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Miami-Dade County FL Transit Sales Surtax | | | | |

| Revenue | 5.000% | 7/1/42 | 195 | 224 |

| Miami-Dade County FL Water & Sewer Revenue | 5.125% | 10/1/18 (Prere.) | 440 | 475 |

| Miami-Dade County FL Water & Sewer Revenue | 5.250% | 10/1/18 (4) | 300 | 325 |

| Miami-Dade County FL Water & Sewer Revenue | 6.000% | 10/1/18 (Prere.) | 110 | 121 |

| Miami-Dade County FL Water & Sewer Revenue | 5.000% | 10/1/23 | 100 | 122 |

| Miami-Dade County FL Water & Sewer Revenue | 5.000% | 10/1/24 | 250 | 311 |

| Miami-Dade County FL Water & Sewer Revenue | 5.000% | 10/1/34 | 65 | 73 |

| Miami-Dade County FL Water & Sewer Revenue | 5.000% | 10/1/39 (12) | 100 | 112 |

| Miami-Dade County FL Water & Sewer Revenue | 5.000% | 10/1/42 | 600 | 688 |

| Orange County FL School Board COP | 5.000% | 8/1/17 (Prere.) | 135 | 139 |

| Orange County FL School Board COP | 5.500% | 8/1/19 (Prere.) | 310 | 348 |

| Orlando & Orange County FL Expressway | | | | |

| Authority Revenue | 5.000% | 7/1/20 (Prere.) | 240 | 273 |

| Orlando FL Contract Tourist Development | | | | |

| Tax Payments Revenue | 5.250% | 11/1/31 | 200 | 240 |

| Orlando FL Contract Tourist Development | | | | |

| Tax Payments Revenue | 5.000% | 11/1/44 | 400 | 459 |

| Orlando FL Utility Commission Utility System | | | | |

| Revenue | 5.000% | 10/1/18 | 400 | 431 |

| Orlando FL Utility Commission Utility System | | | | |

| Revenue | 5.000% | 4/1/19 (Prere.) | 1,000 | 1,095 |

| Orlando FL Utility Commission Utility System | | | | |

| Revenue | 5.000% | 10/1/23 | 125 | 153 |

| Orlando FL Utility Commission Utility System | | | | |

| Revenue | 5.000% | 10/1/25 | 125 | 157 |

| Osceola County FL Expressway System Revenue | | | | |

| (Poinciana Parkway Project) | 0.000% | 10/1/22 | 50 | 39 |

| Osceola County FL Expressway System Revenue | | | | |

| (Poinciana Parkway Project) | 0.000% | 10/1/32 | 45 | 35 |

| Osceola County FL Expressway System Revenue | | | | |

| (Poinciana Parkway Project) | 0.000% | 10/1/39 | 590 | 447 |

| Osceola County FL Expressway System Revenue | | | | |

| (Poinciana Parkway Project) | 5.375% | 10/1/47 | 140 | 155 |

| Palm Beach County FL Public Improvement | | | | |

| Revenue | 5.000% | 5/1/18 (Prere.) | 210 | 223 |

| Palm Beach County FL Public Improvement | | | | |

| Revenue | 5.000% | 5/1/18 (Prere.) | 105 | 111 |

| Palm Beach County FL Solid Waste Authority | | | | |

| Revenue | 5.500% | 10/1/18 (Prere.) | 65 | 71 |

| Palm Beach County FL Solid Waste Authority | | | | |

| Revenue | 5.000% | 10/1/21 (Prere.) | 5 | 6 |

| Palm Beach County FL Solid Waste Authority | | | | |

| Revenue | 5.000% | 10/1/31 | 95 | 110 |

| Port St. Lucie FL Utility Revenue | 5.000% | 9/1/18 (Prere.) | 100 | 108 |

| Port St. Lucie FL Utility Revenue | 5.000% | 9/1/35 (12) | 10 | 11 |

| South Florida Water Management District COP | 5.000% | 10/1/33 | 275 | 328 |

| Tallahassee FL Utility System Revenue | 5.000% | 10/1/32 | 105 | 109 |

| Tallahassee FL Utility System Revenue | 5.000% | 10/1/37 | 150 | 155 |

| Tampa Bay FL Water Utility System Revenue | 5.000% | 10/1/18 (Prere.) | 85 | 92 |

| Tampa Bay FL Water Utility System Revenue | 5.000% | 10/1/18 (ETM) | 120 | 129 |

| Tampa Bay FL Water Utility System Revenue | 5.000% | 10/1/19 (ETM) | 130 | 145 |

| | | | | 22,398 |

24

| | | | |

| Tax-Exempt Bond Index Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Georgia (2.3%) | | | | |

| Atlanta GA Metropolitan Rapid Transit Authority | | | | |

| Revenue | 5.000% | 7/1/39 | 215 | 236 |

| Atlanta GA Water & Wastewater Revenue | 6.000% | 11/1/19 (Prere.) | 245 | 281 |

| Atlanta GA Water & Wastewater Revenue | 6.000% | 11/1/19 (Prere.) | 50 | 57 |

| Atlanta GA Water & Wastewater Revenue | 6.250% | 11/1/19 (Prere.) | 1,120 | 1,292 |

| Atlanta GA Water & Wastewater Revenue | 6.250% | 11/1/19 (Prere.) | 135 | 156 |

| Atlanta GA Water & Wastewater Revenue | 5.250% | 11/1/27 (4) | 150 | 197 |

| Atlanta GA Water & Wastewater Revenue | 5.000% | 11/1/33 | 550 | 652 |

| Atlanta GA Water & Wastewater Revenue | 5.000% | 11/1/40 | 100 | 117 |

| Atlanta GA Water & Wastewater Revenue | 5.000% | 11/1/43 | 475 | 554 |

| DeKalb County GA Water & Sewer Revenue | 5.250% | 10/1/41 | 215 | 251 |

| Georgia GO | 5.000% | 7/1/17 | 250 | 257 |

| Georgia GO | 5.000% | 7/1/17 | 1,000 | 1,029 |

| Georgia GO | 4.000% | 9/1/17 | 215 | 221 |

| Georgia GO | 5.000% | 7/1/18 (Prere.) | 150 | 160 |

| Georgia GO | 5.000% | 1/1/19 (Prere.) | 350 | 380 |

| Georgia GO | 5.000% | 7/1/19 | 665 | 736 |

| Georgia GO | 5.000% | 7/1/19 | 100 | 111 |

| Georgia GO | 5.000% | 10/1/21 | 250 | 296 |

| Georgia GO | 5.000% | 2/1/22 | 100 | 119 |

| Georgia GO | 4.500% | 11/1/22 | 135 | 156 |

| Georgia GO | 5.000% | 7/1/24 | 130 | 139 |

| Georgia GO | 5.000% | 7/1/27 | 100 | 120 |

| Georgia Road & Tollway Authority GAN | 5.000% | 6/1/17 | 200 | 205 |

| Georgia Road & Tollway Authority Revenue | 5.000% | 3/1/21 | 1,000 | 1,165 |

| Gwinnett County GA School District GO | 4.500% | 10/1/17 | 200 | 207 |

| Gwinnett County GA School District GO | 5.000% | 8/1/22 | 1,000 | 1,209 |

| Metropolitan Atlanta GA Rapid Transportation | | | | |

| Authority Georgia Sales Tax Revenue | 4.500% | 7/1/17 (Prere.) | 185 | 190 |

| Metropolitan Atlanta GA Rapid Transportation | | | | |

| Authority Georgia Sales Tax Revenue | 5.000% | 7/1/20 (14) | 570 | 649 |

| Metropolitan Atlanta GA Rapid Transportation | | | | |

| Authority Georgia Sales Tax Revenue | 5.250% | 7/1/36 | 180 | 198 |