UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| |

| Investment Company Act file number: | 811-22619 |

Name of Registrant: | Vanguard Charlotte Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: | (610) 669-1000 |

Date of fiscal year end: October 31 | |

Date of reporting period: November 1, 2017 – October 31, 2018 |

Item 1: Reports to Shareholders | |

|

| Annual Report | October 31, 2018 |

| |

| Vanguard Total International Bond |

| Index Fund |

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| CEO’s Perspective. | 3 |

| Fund Profile. | 5 |

| Performance Summary. | 7 |

| Financial Statements. | 10 |

| About Your Fund’s Expenses. | 145 |

| Glossary. | 147 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises

or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this

report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

Your Fund’s Performance at a Glance

• For the 12 months ended October 31, 2018, Vanguard Total International Bond Index Fund returned 1.68% for Investor Shares. Its benchmark returned 1.91% and the average return of its peer group was –2.22%.

• The period was marked by rising rates and an upswing in volatility. Among the largest constituents in the index, South Korea, Spain, and Australia outperformed while Canada and Italy underperformed.

• During the period, the fund entered into forward currency contracts to protect the value of the securities, and the related receivables and payables, against changes in future foreign exchange rates. The fund’s use of these contracts had a positive impact on performance and helped the fund achieve its objectives of minimizing currency-related fluctuations and closely tracking its benchmark.

• Please note that shortly after the close of the period, Vanguard lowered the investment minimum for your fund’s Admiral Shares from $10,000 to $3,000.

| | | | |

| Total Returns: Fiscal Year Ended October 31, 2018 | | | |

| | 30-Day SEC | Income | Capital | Total |

| | Yield | Returns | Returns | Returns |

| Vanguard Total International Bond Index Fund | | | | |

| Investor Shares | 1.09% | 2.23% | -0.55% | 1.68% |

| ETF Shares | 1.13 | | | |

| Market Price | | | | 1.61 |

| Net Asset Value | | | | 1.74 |

| Admiral™ Shares | 1.13 | 2.25 | -0.55 | 1.70 |

| Institutional Shares | 1.15 | 2.29 | -0.55 | 1.74 |

| Bloomberg Barclays Global Aggregate ex-USD Float | | | | |

| Adjusted RIC Capped Index (USD Hedged) | | | | 1.91 |

| International Income Funds Average | | | | -2.22 |

| International Income Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | | |

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements. Institutional Shares

are available to certain institutional investors who meet specific administrative, service, and account-size criteria. The Vanguard ETF®

Shares shown are traded on the Nasdaq exchange and are available only through brokers. The table provides ETF returns based on both

the Nasdaq market price and the net asset value for a share. U.S. Pat. Nos. 6,879,964; 7,337,138; 7,720,749; 7,925,573; 8,090,646; and

8,417,623.

For the ETF Shares, the market price is determined by the midpoint of the bid-offer spread as of the closing time of the New York Stock

Exchange (generally 4 p.m., Eastern time). The net asset value is also determined as of the NYSE closing time. For more information about

how the ETF Shares' market prices have compared with their net asset value, visit vanguard.com, select your ETF, and then select the

Price and Performance tab. The ETF premium/discount analysis there shows the percentages of days on which the ETF Shares' market

price was above or below the NAV.

1

| |

| Total Returns: Inception Through October 31, 2018 | |

| | Average |

| | Annual Return |

| Total International Bond Index Fund Investor Shares (Returns since inception: 5/31/2013) | 3.28% |

| Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged) | 3.58 |

| International Income Funds Average | 0.56 |

| International Income Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

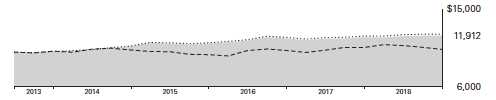

The figures shown represent past performance, which is not a guarantee of future results. (Current

performance may be lower or higher than the performance data cited. For performance data current to the

most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment

returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more

or less than their original cost.

| | | | | |

| Expense Ratios | | | | | |

| Your Fund Compared With Its Peer Group | | | | | |

| | Investor | ETF | Admiral | Institutional | Peer Group |

| | Shares | Shares | Shares | Shares | Average |

| Total International Bond Index Fund | 0.13% | 0.11% | 0.11% | 0.07% | 0.98% |

The fund expense ratios shown are from the prospectus dated February 23, 2018, and represent estimated costs for the current fiscal year.

For the fiscal year ended October 31, 2018, the fund’s expense ratios were 0.13% for Investor Shares, 0.09% for ETF Shares, 0.11% for

Admiral Shares, and 0.07% for Institutional Shares. The peer-group expense ratio is derived from data provided by Lipper, a Thomson

Reuters Company, and captures information through year-end 2017.

Peer group: International Income Funds.

2

CEO’s Perspective

Tim Buckley

President and Chief Executive Officer

Dear Shareholder,

Over the years, I’ve found that prudent investors exhibit a common trait: discipline. No matter how the markets move or what new investing fad hits the headlines, those who stay focused on their goals and tune out the noise are set up for long-term success.

The prime gateway to investing is saving, and you don’t usually become a saver without a healthy dose of discipline. Savers make the decision to sock away part of their income, which means spending less and delaying gratification, no matter how difficult that may be.

Of course, disciplined investing extends beyond diligent saving. The financial markets, in the short term especially, are unpredictable; I have yet to meet the investor who can time them perfectly. It takes discipline to resist the urge to go all-in when markets are frothy or to retreat when things look bleak.

Staying put with your investments is one strategy for handling volatility. Another, rebalancing, requires even more discipline because it means steering your money away from strong performers and toward poorer performers.

Patience—a form of discipline—is also the friend of long-term investors. Higher returns are the potential reward for weathering the market’s turbulence and uncertainty.

3

We have been enjoying one of the longest bull markets in history, but it won’t continue forever. Prepare yourself now for how you will react when volatility comes back. Don’t panic. Don’t chase returns or look for answers outside the asset classes you trust. And be sure to rebalance periodically, even when there’s turmoil.

Whether you’re a master of self-control, get a boost from technology, or work with a professional advisor, know that discipline is necessary to get the most out of your investment portfolio. And know that Vanguard is with you for the entire ride.

Thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

President and Chief Executive Officer

November 16, 2018

| | | |

| Market Barometer | | | |

| | Average Annual Total Returns |

| | Periods Ended October 31, 2018 |

| | One Year | Three Years | Five Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 6.98% | 11.31% | 11.05% |

| Russell 2000 Index (Small-caps) | 1.85 | 10.68 | 8.01 |

| Russell 3000 Index (Broad U.S. market) | 6.60 | 11.27 | 10.81 |

| FTSE All-World ex US Index (International) | -7.99 | 4.57 | 2.01 |

| |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | -2.05% | 1.04% | 1.83% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | -0.51 | 1.90 | 3.25 |

| FTSE Three-Month U. S. Treasury Bill Index | 1.67 | 0.86 | 0.52 |

| |

| CPI | | | |

| Consumer Price Index | 2.52% | 2.07% | 1.60% |

4

Total International Bond Index Fund

Fund Profile

As of October 31, 2018

| | | | |

| Share-Class Characteristics | | | | |

| | Investor | | Admiral | Institutional |

| | Shares | ETF Shares | Shares | Shares |

| Ticker Symbol | VTIBX | BNDX | VTABX | VTIFX |

| Expense Ratio1 | 0.13% | 0.11% | 0.11% | 0.07% |

| 30-Day SEC Yield | 1.09% | 1.13% | 1.13% | 1.15% |

| | |

| Financial Attributes | | |

| |

| | | Bloomberg |

| | | Barclays GA |

| | | ex-USD |

| | | Float Adj |

| | | RIC Capped |

| | | Idx |

| | | (USD |

| | Fund | Hedged) |

| |

| Number of Bonds | 5,261 | 9,939 |

| |

| Yield to Maturity | | |

| (before expenses) | 1.1% | 1.2% |

| |

| Average Coupon | 2.0% | 2.4% |

| |

| Average Duration | 7.7 years | 7.8 years |

| |

| Average Effective | | |

| Maturity | 9.2 years | 9.3 years |

| |

| Short-Term Reserves | 0.1% | — |

| |

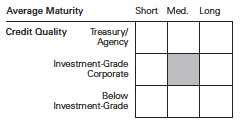

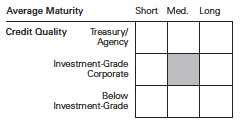

| Sector Diversification (% of portfolio) | |

| Asset-Backed | 0.1% |

| Finance | 5.7 |

| Foreign | 80.5 |

| Industrial | 6.6 |

| Utilities | 1.3 |

| Other | 5.8 |

| The agency and mortgage-backed securities sectors may include |

| issues from government-sponsored enterprises; such issues are |

| generally not backed by the full faith and credit of the U.S. | |

| government. | |

| |

| Volatility Measures | |

| | Bloomberg |

| | Barclays GA |

| | ex-USD |

| | Float Adj |

| | RIC Capped Idx |

| | (USD Hedged) |

| R-Squared | 0.99 |

| Beta | 0.99 |

| These measures show the degree and timing of the fund’s |

| fluctuations compared with the index over 36 months. |

| |

| Distribution by Credit Quality (% of portfolio) |

| Aaa | 22.4% |

| Aa | 27.7 |

| A | 33.7 |

| Baa | 16.2 |

Credit-quality ratings are obtained from Barclays and are from

Moody's, Fitch, and S&P. When ratings from all three agencies are

used, the median rating is shown. When ratings from two of the

agencies are used, the lower rating for each issue is shown. "Not

Rated" is used to classify securities for which a rating is not

available. For more information about these ratings, see the

Glossary entry for Credit Quality.

| |

| Distribution by Effective Maturity | |

| (% of portfolio) | |

| Under 1 Year | 1.4% |

| 1 - 3 Years | 21.5 |

| 3 - 5 Years | 19.3 |

| 5 - 10 Years | 30.1 |

| 10 - 20 Years | 16.0 |

| 20 - 30 Years | 9.2 |

| Over 30 Years | 2.5 |

1 The expense ratios shown are from the prospectus dated February 23, 2018, and represent estimated costs for the current fiscal year.

For the fiscal year ended October 31, 2018, the expense ratios were 0.13% for Investor Shares, 0.09% for ETF Shares, 0.11% for Admiral

Shares, and 0.07% for Institutional Shares.

5

Total International Bond Index Fund

Investment Focus

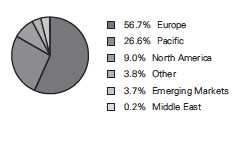

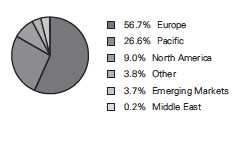

Allocation by Region (% of portfolio)

| |

| Market Diversification (% of portfolio) | |

| Europe | |

| France | 12.1% |

| Germany | 10.8 |

| Italy | 7.5 |

| United Kingdom | 7.5 |

| Spain | 5.5 |

| Netherlands | 2.9 |

| Belgium | 2.4 |

| Switzerland | 1.5 |

| Austria | 1.4 |

| Sweden | 1.4 |

| Other | 3.7 |

| Subtotal | 56.7% |

| Pacific | |

| Japan | 20.2% |

| Australia | 2.8 |

| South Korea | 2.8 |

| Other | 0.8 |

| Subtotal | 26.6% |

| Emerging Markets | 3.7% |

| North America | |

| Canada | 6.0% |

| United States | 3.0 |

| Subtotal | 9.0% |

| Middle East | 0.2% |

| Other | 3.8% |

6

Total International Bond Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

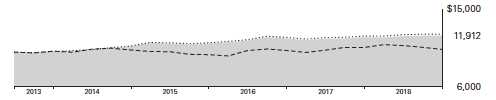

Cumulative Performance: May 31, 2013, Through October 31, 2018

Initial Investment of $10,000

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended October 31, 2018 | |

| |

| | | | Since | Final Value |

| | One | Five | Inception | of a $10,000 |

| | Year | Years | (5/31/2013) | Investment |

| Total International Bond Index Fund | | | | |

| Investor Shares | 1.68% | 3.46% | 3.28% | $11,912 |

| Bloomberg Barclays Global Aggregate | | | | |

| • • • • • • • • | | | | |

| ex-USD Float Adjusted RIC Capped | | | | |

| Index (USD Hedged) | 1.91 | 3.76 | 3.58 | 12,098 |

| |

| – – – – International Income Funds Average | -2.22 | 0.39 | 0.56 | 10,307 |

| International Income Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| "Since Inception" performance is calculated from the Investor Shares’ inception date for both the fund and its comparative standards. |

| | | | |

| | | | Since | Final Value |

| | One | Five | Inception | of a $10,000 |

| | Year | Years | (5/31/2013) | Investment |

| Total International Bond Index Fund | | | | |

| ETF Shares Net Asset Value | 1.74% | 3.49% | 3.31% | $11,932 |

| Total International Bond Index Fund | | | | |

| ETF Shares Market Price | 1.61 | 3.47 | 3.33 | 11,946 |

| Bloomberg Barclays Global Aggregate | | | | |

| ex-USD Float Adjusted RIC Capped Index | | | | |

| (USD Hedged) | 1.91 | 3.76 | 3.58 | 12,098 |

| "Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standard. |

See Financial Highlights for dividend and capital gains information.

7

Total International Bond Index Fund

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended October 31, 2018 | |

| |

| | | | Since | Final Value |

| | One | Five | Inception | of a $10,000 |

| | Year | Years | (5/31/2013) | Investment |

| Total International Bond Index Fund Admiral | | | | |

| Shares | 1.70% | 3.48% | 3.31% | $11,983 |

| Bloomberg Barclays Global Aggregate | | | | |

| ex-USD Float Adjusted RIC Capped Index | | | | |

| (USD Hedged) | 1.91 | 3.76 | 3.58 | 12,151 |

| "Since Inception" performance is calculated from the Admiral Shares’ inception date for both the fund and its comparative standard. |

| | | | |

| | | | Since | Final Value |

| | One | Five | Inception | of a $5,000,000 |

| | Year | Years | (5/31/2013) | Investment |

| Total International Bond Index Fund | | | | |

| Institutional Shares | 1.74% | 3.55% | 3.37% | $5,983,402 |

| Bloomberg Barclays Global Aggregate | | | | |

| ex-USD Float Adjusted RIC Capped Index | | | | |

| (USD Hedged) | 1.91 | 3.76 | 3.58 | 6,049,015 |

| "Since Inception" performance is calculated from the Institutional Shares’ inception date for both the fund and its comparative standard. |

| | | |

| Cumulative Returns of ETF Shares: May 31, 2013, Through October 31, 2018 | | |

| |

| | | | Since |

| | One | Five | Inception |

| | Year | Years | (5/31/2013) |

| Total International Bond Index Fund | | | |

| ETF Shares Market Price | 1.61% | 18.61% | 19.46% |

| Total International Bond Index Fund | | | |

| ETF Shares Net Asset Value | 1.74 | 18.71 | 19.32 |

| Bloomberg Barclays Global Aggregate ex-USD Float | | | |

| Adjusted RIC Capped Index (USD Hedged) | 1.91 | 20.24 | 20.98 |

| "Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standard. |

8

Total International Bond Index Fund

| | | | |

| Fiscal-Year Total Returns (%): May 31, 2013, Through October 31, 2018 | |

| | | | | Bloomberg |

| | | | | Barclays GA |

| | | | | ex-USD |

| | | | | Float Adj |

| | | | | RIC Capped Idx |

| | | | Investor Shares | (USD Hedged) |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2013 | 0.60% | -0.10% | 0.50% | 0.62% |

| 2014 | 1.52 | 4.60 | 6.12 | 6.46 |

| 2015 | 1.51 | 1.53 | 3.04 | 3.38 |

| 2016 | 1.52 | 3.86 | 5.38 | 5.70 |

| 2017 | 1.70 | -0.54 | 1.16 | 1.43 |

| 2018 | 2.23 | -0.55 | 1.68 | 1.91 |

Average Annual Total Returns: Periods Ended September 30, 2018

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | Since Inception |

| | Inception Date | One Year | Five Years | Income | Capital | Total |

| Investor Shares | 5/31/2013 | 2.14% | 3.62% | 1.69% | 1.59% | 3.28% |

| ETF Shares | 5/31/2013 | | | | | |

| Market Price | | 2.20 | 3.65 | | | 3.37 |

| Net Asset Value | | 2.24 | 3.65 | | | 3.32 |

| Admiral Shares | 5/31/2013 | 2.22 | 3.65 | 1.73 | 1.59 | 3.32 |

| Institutional Shares | 5/31/2013 | 2.30 | 3.71 | 1.77 | 1.61 | 3.38 |

9

Total International Bond Index Fund

Financial Statements

Statement of Net Assets

As of October 31, 2018

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov.

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| Australia (2.8%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.2%) | | | |

| Australia & New Zealand Banking Group Ltd. | 0.450% | 11/22/23 | EUR | 16,000 | 18,131 |

| Australia & New Zealand Banking Group Ltd. | 1.125% | 5/13/20 | EUR | 7,000 | 8,085 |

| Australia & New Zealand Banking Group Ltd. | 2.500% | 1/16/24 | EUR | 5,000 | 6,257 |

| Australia & New Zealand Banking Group Ltd. | 5.000% | 8/16/23 | AUD | 2,000 | 1,545 |

| Commonwealth Bank of Australia | 0.500% | 7/27/26 | EUR | 31,600 | 34,844 |

| Commonwealth Bank of Australia | 0.750% | 11/4/21 | EUR | 9,000 | 10,399 |

| Commonwealth Bank of Australia | 3.000% | 5/3/22 | EUR | 15,100 | 18,784 |

| Commonwealth Bank of Australia | 3.000% | 9/4/26 | GBP | 1,700 | 2,360 |

| National Australia Bank Ltd. | 0.875% | 11/16/22 | EUR | 5,000 | 5,804 |

| National Australia Bank Ltd. | 0.875% | 2/19/27 | EUR | 10,000 | 11,284 |

| National Australia Bank Ltd. | 1.375% | 5/28/21 | EUR | 700 | 821 |

| National Australia Bank Ltd. | 1.875% | 1/13/23 | EUR | 5,000 | 6,035 |

| National Australia Bank Ltd. | 2.250% | 6/6/25 | EUR | 1,800 | 2,244 |

| National Australia Bank Ltd. | 3.000% | 9/4/26 | GBP | 500 | 695 |

| National Australia Bank Ltd. | 5.000% | 3/11/24 | AUD | 4,000 | 3,100 |

| Westpac Banking Corp. | 0.625% | 1/14/22 | EUR | 10,000 | 11,504 |

| Westpac Banking Corp. | 1.375% | 4/17/20 | EUR | 2,000 | 2,317 |

| Westpac Banking Corp. | 1.500% | 3/24/21 | EUR | 7,200 | 8,452 |

| Westpac Banking Corp. | 2.750% | 8/31/22 | AUD | 10,000 | 7,061 |

| Westpac Banking Corp. | 5.250% | 11/21/23 | AUD | 2,000 | 1,568 |

| | | | | | 161,290 |

| Corporate Bonds (0.4%) | | | | | |

| AGL Energy Ltd. | 5.000% | 11/5/21 | AUD | 1,500 | 1,110 |

| APT Pipelines Ltd. | 1.375% | 3/22/22 | EUR | 300 | 348 |

| APT Pipelines Ltd. | 2.000% | 3/22/27 | EUR | 8,400 | 9,539 |

| APT Pipelines Ltd. | 3.500% | 3/22/30 | GBP | 12,200 | 16,080 |

| APT Pipelines Ltd. | 4.250% | 11/26/24 | GBP | 1,000 | 1,395 |

| Asciano Finance Ltd. | 5.000% | 9/19/23 | GBP | 500 | 708 |

| Asciano Finance Ltd. | 5.250% | 5/19/25 | AUD | 5,000 | 3,708 |

| Aurizon Network Pty Ltd. | 2.000% | 9/18/24 | EUR | 3,000 | 3,515 |

| Ausgrid Finance Pty Ltd. | 1.250% | 7/30/25 | EUR | 3,000 | 3,342 |

| AusNet Services Holdings Pty Ltd. | 1.500% | 2/26/27 | EUR | 2,700 | 3,101 |

| AusNet Services Holdings Pty Ltd. | 3.000% | 2/13/24 | EUR | 4,000 | 5,051 |

| Australia & New Zealand Banking Group Ltd. | 0.625% | 2/21/23 | EUR | 10,000 | 11,334 |

| Australia Pacific Airports Melbourne Pty Ltd. | 1.750% | 10/15/24 | EUR | 14,000 | 16,553 |

| Australia Pacific Airports Melbourne Pty Ltd. | 3.125% | 9/26/23 | EUR | 5,000 | 6,344 |

| Bank of Queensland Ltd. | 0.500% | 7/10/22 | EUR | 500 | 570 |

| |

| 10 |

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| BHP Billiton Finance Ltd. | 1.500% | 4/29/30 | EUR | 5,000 | 5,601 |

| BHP Billiton Finance Ltd. | 3.000% | 3/30/20 | AUD | 5,140 | 3,667 |

| BHP Billiton Finance Ltd. | 3.125% | 4/29/33 | EUR | 3,000 | 3,943 |

| BHP Billiton Finance Ltd. | 3.250% | 9/24/27 | EUR | 16,500 | 21,738 |

| BHP Billiton Finance Ltd. | 4.300% | 9/25/42 | GBP | 9,175 | 14,339 |

| 1 BHP Billiton Finance Ltd. | 5.625% | 10/22/79 | EUR | 100 | 132 |

| 1 BHP Billiton Finance Ltd. | 6.500% | 10/22/77 | GBP | 2,200 | 3,129 |

| Commonwealth Bank of Australia | 0.375% | 2/10/21 | EUR | 1,500 | 1,716 |

| Commonwealth Bank of Australia | 0.375% | 4/11/24 | EUR | 12,100 | 13,590 |

| Commonwealth Bank of Australia | 0.407% | 5/2/19 | JPY | 500,000 | 4,438 |

| Commonwealth Bank of Australia | 1.625% | 2/10/31 | EUR | 100 | 118 |

| 1 Commonwealth Bank of Australia | 1.936% | 10/3/29 | EUR | 6,000 | 6,659 |

| 1 Commonwealth Bank of Australia | 2.000% | 4/22/27 | EUR | 10,100 | 11,640 |

| Commonwealth Bank of Australia | 3.250% | 1/17/22 | AUD | 500 | 358 |

| Commonwealth Bank of Australia | 3.750% | 10/18/19 | AUD | 10,000 | 7,170 |

| Commonwealth Bank of Australia | 4.375% | 2/25/20 | EUR | 3,500 | 4,204 |

| Commonwealth Bank of Australia | 5.150% | 4/9/20 | CAD | 6,989 | 5,468 |

| Goodman Australia Finance Pty Ltd. | 1.375% | 9/27/25 | EUR | 4,000 | 4,356 |

| Macquarie Bank Ltd. | 1.125% | 1/20/22 | EUR | 600 | 695 |

| Macquarie Bank Ltd. | 3.250% | 3/3/20 | AUD | 1,000 | 714 |

| Macquarie Bank Ltd. | 3.500% | 12/18/20 | GBP | 1,000 | 1,329 |

| Macquarie Bank Ltd. | 6.000% | 9/21/20 | EUR | 1,500 | 1,872 |

| 1 Macquarie Group Ltd. | 1.250% | 3/5/25 | EUR | 20,000 | 21,874 |

| National Australia Bank Ltd. | 0.300% | 10/31/25 | CHF | 9,900 | 9,647 |

| National Australia Bank Ltd. | 0.350% | 9/7/22 | EUR | 10,100 | 11,387 |

| National Australia Bank Ltd. | 0.625% | 8/30/23 | EUR | 100 | 113 |

| National Australia Bank Ltd. | 0.875% | 1/20/22 | EUR | 18,000 | 20,721 |

| National Australia Bank Ltd. | 1.000% | 4/17/20 | CHF | 1,000 | 1,014 |

| National Australia Bank Ltd. | 1.125% | 11/10/21 | GBP | 1,600 | 2,030 |

| National Australia Bank Ltd. | 1.375% | 6/27/22 | GBP | 500 | 632 |

| National Australia Bank Ltd. | 1.875% | 2/20/20 | GBP | 11,100 | 14,278 |

| National Australia Bank Ltd. | 2.000% | 11/12/20 | EUR | 6,000 | 7,075 |

| 1 National Australia Bank Ltd. | 2.000% | 11/12/24 | EUR | 2,000 | 2,299 |

| National Australia Bank Ltd. | 4.000% | 7/13/20 | EUR | 5,850 | 7,088 |

| National Australia Bank Ltd. | 4.625% | 2/10/20 | EUR | 1,000 | 1,198 |

| National Australia Bank Ltd. | 5.125% | 12/9/21 | GBP | 5,500 | 7,760 |

| Origin Energy Finance Ltd. | 2.500% | 10/23/20 | EUR | 310 | 367 |

| Perth Airport Pty Ltd. | 5.500% | 3/25/21 | AUD | 6,500 | 4,866 |

| Qantas Airways Ltd. | 7.500% | 6/11/21 | AUD | 8,500 | 6,659 |

| Qantas Airways Ltd. | 7.750% | 5/19/22 | AUD | 1,230 | 995 |

| QPH Finance Co. Pty Ltd. | 5.750% | 7/29/20 | AUD | 780 | 580 |

| Rio Tinto Finance plc | 2.000% | 5/11/20 | EUR | 5,000 | 5,840 |

| Rio Tinto Finance plc | 2.875% | 12/11/24 | EUR | 300 | 380 |

| Rio Tinto Finance plc | 4.000% | 12/11/29 | GBP | 5,200 | 7,631 |

| Scentre Group Trust 1 | 1.500% | 7/16/20 | EUR | 5,000 | 5,787 |

| Scentre Group Trust 1 | 2.250% | 7/16/24 | EUR | 3,898 | 4,725 |

| Scentre Group Trust 1 | 4.500% | 9/8/21 | AUD | 1,600 | 1,174 |

| Scentre Group Trust 1 / Scentre Group | | | | | |

| Trust 2 | 1.750% | 4/11/28 | EUR | 6,000 | 6,870 |

| Scentre Group Trust 1 / Scentre Group | | | | | |

| Trust 2 | 2.375% | 4/8/22 | GBP | 4,100 | 5,352 |

| Scentre Group Trust 2 | 3.250% | 9/11/23 | EUR | 6,273 | 7,963 |

| Telstra Corp. Ltd. | 1.125% | 4/14/26 | EUR | 11,000 | 12,339 |

| Telstra Corp. Ltd. | 2.500% | 9/15/23 | EUR | 10,000 | 12,354 |

| Telstra Corp. Ltd. | 3.500% | 9/21/22 | EUR | 500 | 634 |

| |

| 11 |

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| Telstra Corp. Ltd. | 3.750% | 5/16/22 | EUR | 100 | 127 |

| Telstra Corp. Ltd. | 4.000% | 9/16/22 | AUD | 1,000 | 730 |

| Telstra Corp. Ltd. | 4.500% | 11/13/18 | AUD | 6,000 | 4,251 |

| Transurban Finance Co. Pty Ltd. | 1.875% | 9/16/24 | EUR | 3,000 | 3,535 |

| United Energy Distribution Pty Ltd. | 3.850% | 10/23/24 | AUD | 1,350 | 968 |

| Vicinity Centres | 3.375% | 4/7/26 | GBP | 1,259 | 1,677 |

| Wesfarmers Ltd. | 1.250% | 10/7/21 | EUR | 500 | 585 |

| Wesfarmers Ltd. | 2.750% | 8/2/22 | EUR | 3,000 | 3,695 |

| Wesfarmers Ltd. | 3.660% | 11/18/20 | AUD | 1,400 | 1,009 |

| Wesfarmers Ltd. | 4.750% | 3/12/20 | AUD | 10,000 | 7,288 |

| Westpac Banking Corp. | 0.250% | 1/17/22 | EUR | 1,000 | 1,129 |

| Westpac Banking Corp. | 0.625% | 11/22/24 | EUR | 5,000 | 5,576 |

| Westpac Banking Corp. | 0.875% | 2/16/21 | EUR | 15,000 | 17,314 |

| Westpac Banking Corp. | 0.875% | 4/17/27 | EUR | 200 | 222 |

| Westpac Banking Corp. | 1.125% | 9/5/27 | EUR | 1,100 | 1,235 |

| Westpac Banking Corp. | 1.450% | 7/17/28 | EUR | 800 | 912 |

| Westpac Banking Corp. | 2.625% | 12/14/22 | GBP | 2,300 | 3,038 |

| Westpac Banking Corp. | 3.250% | 1/22/20 | AUD | 10,000 | 7,148 |

| Westpac Banking Corp. | 4.125% | 6/4/26 | AUD | 1,000 | 732 |

| | | | | | 452,377 |

| Sovereign Bonds (2.2%) | | | | | |

| Australian Capital Territory | 4.000% | 5/22/24 | AUD | 5,000 | 3,791 |

| Commonwealth Bank of Australia | 1.125% | 12/22/21 | GBP | 1,800 | 2,283 |

| Commonwealth of Australia | 1.750% | 11/21/20 | AUD | 75,000 | 52,859 |

| Commonwealth of Australia | 2.000% | 12/21/21 | AUD | 145,000 | 102,520 |

| Commonwealth of Australia | 2.250% | 5/21/28 | AUD | 57,000 | 39,107 |

| Commonwealth of Australia | 2.500% | 5/21/30 | AUD | 40,000 | 27,797 |

| Commonwealth of Australia | 2.750% | 4/21/24 | AUD | 148,800 | 107,747 |

| Commonwealth of Australia | 2.750% | 11/21/27 | AUD | 116,000 | 83,118 |

| Commonwealth of Australia | 2.750% | 11/21/28 | AUD | 168,500 | 120,500 |

| Commonwealth of Australia | 2.750% | 11/21/29 | AUD | 97,000 | 69,268 |

| Commonwealth of Australia | 2.750% | 6/21/35 | AUD | 58,365 | 40,471 |

| Commonwealth of Australia | 3.000% | 3/21/47 | AUD | 35,000 | 24,209 |

| Commonwealth of Australia | 3.250% | 4/21/25 | AUD | 232,790 | 173,041 |

| Commonwealth of Australia | 3.250% | 4/21/29 | AUD | 110,000 | 82,265 |

| Commonwealth of Australia | 3.250% | 6/21/39 | AUD | 80,000 | 58,638 |

| Commonwealth of Australia | 3.750% | 4/21/37 | AUD | 41,000 | 32,266 |

| Commonwealth of Australia | 4.250% | 4/21/26 | AUD | 220,500 | 174,794 |

| Commonwealth of Australia | 4.500% | 4/15/20 | AUD | 119,350 | 87,562 |

| Commonwealth of Australia | 4.500% | 4/21/33 | AUD | 42,000 | 35,751 |

| Commonwealth of Australia | 4.750% | 4/21/27 | AUD | 159,351 | 131,613 |

| Commonwealth of Australia | 5.500% | 4/21/23 | AUD | 100,600 | 81,264 |

| Commonwealth of Australia | 5.750% | 5/15/21 | AUD | 62,540 | 48,372 |

| Commonwealth of Australia | 5.750% | 7/15/22 | AUD | 102,322 | 81,876 |

| New South Wales Treasury Corp. | 3.000% | 5/20/27 | AUD | 34,000 | 24,191 |

| New South Wales Treasury Corp. | 3.000% | 3/20/28 | AUD | 40,000 | 28,342 |

| New South Wales Treasury Corp. | 3.000% | 2/20/30 | AUD | 15,960 | 11,112 |

| New South Wales Treasury Corp. | 3.500% | 3/20/19 | AUD | 20,000 | 14,247 |

| New South Wales Treasury Corp. | 4.000% | 4/8/21 | AUD | 10,000 | 7,390 |

| New South Wales Treasury Corp. | 4.000% | 4/20/23 | AUD | 28,000 | 21,160 |

| New South Wales Treasury Corp. | 4.000% | 5/20/26 | AUD | 5,000 | 3,834 |

| New South Wales Treasury Corp. | 5.000% | 8/20/24 | AUD | 17,000 | 13,608 |

| New South Wales Treasury Corp. | 6.000% | 5/1/20 | AUD | 5,000 | 3,746 |

| New South Wales Treasury Corp. | 6.000% | 3/1/22 | AUD | 34,000 | 26,955 |

12

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| New South Wales Treasury Corp. | 6.000% | 5/1/30 | AUD | 3,000 | 2,705 |

| Northern Territory Treasury Corp. | 2.750% | 10/21/24 | AUD | 500 | 351 |

| Northern Territory Treasury Corp. | 4.250% | 9/20/21 | AUD | 2,200 | 1,640 |

| 2 Queensland Treasury Corp. | 2.750% | 8/20/27 | AUD | 18,000 | 12,482 |

| 2 Queensland Treasury Corp. | 3.250% | 7/21/26 | AUD | 18,500 | 13,421 |

| 2 Queensland Treasury Corp. | 3.250% | 7/21/28 | AUD | 42,200 | 30,274 |

| 2 Queensland Treasury Corp. | 3.500% | 8/21/30 | AUD | 10,000 | 7,228 |

| 2 Queensland Treasury Corp. | 4.250% | 7/21/23 | AUD | 43,000 | 32,800 |

| 2 Queensland Treasury Corp. | 4.750% | 7/21/25 | AUD | 42,000 | 33,365 |

| Queensland Treasury Corp. | 5.500% | 6/21/21 | AUD | 42,000 | 32,216 |

| Queensland Treasury Corp. | 5.750% | 7/22/24 | AUD | 36,000 | 29,698 |

| Queensland Treasury Corp. | 6.000% | 7/21/22 | AUD | 59,600 | 47,652 |

| Queensland Treasury Corp. | 6.250% | 2/21/20 | AUD | 45,000 | 33,554 |

| Queensland Treasury Corp. | 6.500% | 3/14/33 | AUD | 3,650 | 3,521 |

| SGSP Australia Assets Pty Ltd. | 2.000% | 6/30/22 | EUR | 3,700 | 4,420 |

| SGSP Australia Assets Pty Ltd. | 5.125% | 2/11/21 | GBP | 1,000 | 1,377 |

| SGSP Australia Assets Pty Ltd. | 5.500% | 3/12/21 | AUD | 4,000 | 3,001 |

| South Australian Government Financing | | | | | |

| Authority | 1.500% | 9/22/22 | AUD | 22,800 | 15,583 |

| South Australian Government Financing | | | | | |

| Authority | 2.250% | 8/15/24 | AUD | 15,000 | 10,356 |

| South Australian Government Financing | | | | | |

| Authority | 2.750% | 4/16/25 | AUD | 11,000 | 7,763 |

| South Australian Government Financing | | | | | |

| Authority | 3.000% | 7/20/26 | AUD | 6,500 | 4,618 |

| South Australian Government Financing | | | | | |

| Authority | 3.000% | 9/20/27 | AUD | 1,250 | 881 |

| South Australian Government Financing | | | | | |

| Authority | 4.250% | 11/20/23 | AUD | 5,000 | 3,819 |

| South Australian Government Financing | | | | | |

| Authority | 4.750% | 8/6/19 | AUD | 7,500 | 5,420 |

| South Australian Government Financing | | | | | |

| Authority | 5.000% | 5/20/21 | AUD | 10,000 | 7,570 |

| Tasmanian Public Finance Corp. | 3.250% | 2/19/26 | AUD | 9,000 | 6,491 |

| Treasury Corp. of Victoria | 2.250% | 10/29/21 | AUD | 10,000 | 7,080 |

| Treasury Corp. of Victoria | 3.000% | 10/20/28 | AUD | 25,620 | 18,142 |

| Treasury Corp. of Victoria | 4.250% | 12/20/32 | AUD | 20,500 | 16,215 |

| Treasury Corp. of Victoria | 5.500% | 11/15/18 | AUD | 25,000 | 17,722 |

| Treasury Corp. of Victoria | 5.500% | 12/17/24 | AUD | 10,000 | 8,246 |

| Treasury Corp. of Victoria | 5.500% | 11/17/26 | AUD | 35,800 | 30,308 |

| Treasury Corp. of Victoria | 6.000% | 6/15/20 | AUD | 10,000 | 7,520 |

| Treasury Corp. of Victoria | 6.000% | 10/17/22 | AUD | 22,000 | 17,733 |

| Western Australian Treasury Corp. | 2.500% | 7/22/20 | AUD | 59,000 | 42,033 |

| Western Australian Treasury Corp. | 2.500% | 7/23/24 | AUD | 37,000 | 25,906 |

| Western Australian Treasury Corp. | 2.750% | 10/20/22 | AUD | 45,000 | 32,230 |

| Western Australian Treasury Corp. | 3.000% | 10/21/26 | AUD | 10,000 | 7,088 |

| Western Australian Treasury Corp. | 3.000% | 10/21/27 | AUD | 10,000 | 7,040 |

| Western Australian Treasury Corp. | 3.250% | 7/20/28 | AUD | 8,000 | 5,722 |

| Western Australian Treasury Corp. | 5.000% | 7/23/25 | AUD | 12,000 | 9,639 |

| Western Australian Treasury Corp. | 7.000% | 10/15/19 | AUD | 15,000 | 11,112 |

| Westpac Banking Corp. | 0.750% | 7/22/21 | EUR | 10,000 | 11,540 |

| Westpac Banking Corp. | 1.000% | 6/30/22 | GBP | 1,500 | 1,889 |

| | | | | | 2,445,068 |

| Total Australia (Cost $3,272,890) | | | | | 3,058,735 |

| |

| 13 |

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| Austria (1.4%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.0%) | | | |

| Erste Group Bank AG | 0.750% | 2/5/25 | EUR | 2,500 | 2,876 |

| Erste Group Bank AG | 3.500% | 2/8/22 | EUR | 600 | 756 |

| Erste Group Bank AG | 4.000% | 1/20/21 | EUR | 2,000 | 2,473 |

| Hypo Tirol Bank AG | 0.500% | 2/11/21 | EUR | 1,000 | 1,145 |

| Hypoe NOE Landesbank fuer | | | | | |

| Niederoesterreich und Wien AG | 3.000% | 5/9/22 | EUR | 2,000 | 2,489 |

| Raiffeisen-Landesbank Steiermark AG | 0.625% | 1/20/23 | EUR | 3,700 | 4,258 |

| Raiffeisen-Landesbank Steiermark AG | 2.375% | 6/14/28 | EUR | 300 | 383 |

| Raiffeisenlandesbank | | | | | |

| Niederoesterreich-Wien AG | 0.625% | 3/3/25 | EUR | 300 | 342 |

| Raiffeisenlandesbank | | | | | |

| Niederoesterreich-Wien AG | 1.750% | 10/2/20 | EUR | 1,700 | 1,996 |

| UniCredit Bank Austria AG | 0.750% | 2/25/25 | EUR | 500 | 573 |

| UniCredit Bank Austria AG | 1.375% | 5/26/21 | EUR | 5,000 | 5,869 |

| UniCredit Bank Austria AG | 2.375% | 1/22/24 | EUR | 5,100 | 6,370 |

| UniCredit Bank Austria AG | 4.125% | 2/24/21 | EUR | 2,000 | 2,485 |

| | | | | | 32,015 |

| Corporate Bonds (0.1%) | | | | | |

| Erste Group Bank AG | 0.625% | 1/19/23 | EUR | 4,200 | 4,842 |

| Erste Group Bank AG | 0.625% | 4/17/26 | EUR | 15,000 | 16,906 |

| Erste Group Bank AG | 0.750% | 1/17/28 | EUR | 16,100 | 18,021 |

| JAB Holdings BV | 1.750% | 5/25/23 | EUR | 1,100 | 1,296 |

| JAB Holdings BV | 1.750% | 6/25/26 | EUR | 100 | 113 |

| JAB Holdings BV | 2.500% | 6/25/29 | EUR | 10,300 | 11,835 |

| OMV AG | 1.000% | 12/14/26 | EUR | 1,250 | 1,401 |

| OMV AG | 3.500% | 9/27/27 | EUR | 2,400 | 3,220 |

| OMV AG | 4.250% | 10/12/21 | EUR | 1,100 | 1,399 |

| 1 OMV AG | 5.250% | 12/29/49 | EUR | 1,550 | 1,937 |

| 1 OMV AG | 6.250% | 12/29/49 | EUR | 3,250 | 4,295 |

| Telekom Finanzmanagement GmbH | 3.125% | 12/3/21 | EUR | 5,000 | 6,158 |

| Telekom Finanzmanagement GmbH | 4.000% | 4/4/22 | EUR | 500 | 636 |

| 1 UNIQA Insurance Group AG | 6.000% | 7/27/46 | EUR | 3,100 | 3,973 |

| 1 Vienna Insurance Group AG Wiener | | | | | |

| Versicherung Gruppe | 5.500% | 10/9/43 | EUR | 1,200 | 1,553 |

| | | | | | 77,585 |

| Sovereign Bonds (1.3%) | | | | | |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs AG | 0.250% | 10/18/24 | EUR | 7,000 | 7,894 |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs AG | 1.750% | 10/21/20 | EUR | 200 | 236 |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs-AG | 1.375% | 4/9/21 | EUR | 17,000 | 20,037 |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs-AG | 2.750% | 6/11/32 | EUR | 500 | 671 |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs-AG | 2.750% | 6/20/33 | EUR | 1,200 | 1,615 |

| 3 Autobahnen- Und Schnellstrassen- | | | | | |

| Finanzierungs-AG | 3.375% | 9/22/25 | EUR | 2,000 | 2,713 |

| 3 Hypo Alpe-Adria-Bank International AG | 2.375% | 12/13/22 | EUR | 3,000 | 3,660 |

| Hypoe NOE Landesbank fuer | | | | | |

| Niederoesterreich und Wien AG | 0.500% | 9/11/20 | EUR | 31,500 | 36,091 |

14

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| 3 KA Finanz AG | 0.375% | 8/11/20 | EUR | 10,900 | 12,473 |

| KA Finanz AG | 1.625% | 2/19/21 | EUR | 2,000 | 2,350 |

| 3 Kaerntner Ausgleichszahlungs-Fonds | 0.000% | 1/14/32 | EUR | 40,000 | 38,235 |

| 3 OeBB Infrastruktur AG | 1.000% | 11/18/24 | EUR | 7,000 | 8,240 |

| 3 OeBB Infrastruktur AG | 2.250% | 7/4/23 | EUR | 10,000 | 12,455 |

| 3 OeBB Infrastruktur AG | 2.250% | 5/28/29 | EUR | 3,000 | 3,827 |

| 3 OeBB Infrastruktur AG | 3.375% | 5/18/32 | EUR | 7,000 | 10,002 |

| 3 OeBB Infrastruktur AG | 3.500% | 10/19/20 | EUR | 6,000 | 7,310 |

| 3 OeBB Infrastruktur AG | 3.500% | 10/19/26 | EUR | 1,800 | 2,490 |

| 3 OeBB Infrastruktur AG | 3.625% | 7/13/21 | EUR | 1,000 | 1,251 |

| 3 OeBB Infrastruktur AG | 3.000% | 10/24/33 | EUR | 150 | 208 |

| 3 OeBB Infrastruktur AG | 3.875% | 6/30/25 | EUR | 10,000 | 13,887 |

| 3 Oesterreichische Kontrollbank AG | 0.750% | 3/7/22 | GBP | 1,500 | 1,886 |

| 3 Oesterreichische Kontrollbank AG | 2.625% | 11/22/24 | CHF | 30,610 | 35,360 |

| 3 Oesterreichische Kontrollbank AG | 2.875% | 2/25/30 | CHF | 4,500 | 5,651 |

| 2 Republic of Austria | 0.000% | 9/20/22 | EUR | 101,250 | 115,705 |

| 2 Republic of Austria | 0.000% | 7/15/23 | EUR | 75,000 | 85,243 |

| 2 Republic of Austria | 0.500% | 4/20/27 | EUR | 41,000 | 46,431 |

| 2 Republic of Austria | 0.750% | 10/20/26 | EUR | 122,200 | 141,982 |

| 2 Republic of Austria | 0.750% | 2/20/28 | EUR | 75,000 | 86,125 |

| 2 Republic of Austria | 1.200% | 10/20/25 | EUR | 31,000 | 37,389 |

| 2 Republic of Austria | 1.500% | 2/20/47 | EUR | 21,800 | 25,220 |

| 2 Republic of Austria | 1.500% | 11/2/86 | EUR | 24,898 | 25,949 |

| 2 Republic of Austria | 1.650% | 10/21/24 | EUR | 41,900 | 51,865 |

| 2 Republic of Austria | 1.750% | 10/20/23 | EUR | 930 | 1,149 |

| 2 Republic of Austria | 2.100% | 9/20/17 | EUR | 24,067 | 30,671 |

| 2 Republic of Austria | 2.400% | 5/23/34 | EUR | 37,605 | 50,746 |

| 2 Republic of Austria | 3.150% | 6/20/44 | EUR | 40,245 | 63,901 |

| 2 Republic of Austria | 3.400% | 11/22/22 | EUR | 30,300 | 39,398 |

| 2 Republic of Austria | 3.500% | 9/15/21 | EUR | 40,435 | 51,001 |

| 2 Republic of Austria | 3.650% | 4/20/22 | EUR | 53,160 | 68,563 |

| 2 Republic of Austria | 3.800% | 1/26/62 | EUR | 1,100 | 2,145 |

| 2 Republic of Austria | 3.900% | 7/15/20 | EUR | 70,800 | 86,319 |

| 2 Republic of Austria | 4.150% | 3/15/37 | EUR | 55,565 | 94,439 |

| 2 Republic of Austria | 4.850% | 3/15/26 | EUR | 45,250 | 68,317 |

| Republic of Austria | 6.250% | 7/15/27 | EUR | 14,935 | 25,241 |

| | | | | | 1,426,341 |

| Total Austria (Cost $1,541,146) | | | | | 1,535,941 |

| Belgium (2.4%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.1%) | | | |

| Belfius Bank SA | 1.750% | 6/24/24 | EUR | 600 | 730 |

| Belfius Bank SA/NV | 0.625% | 10/14/21 | EUR | 29,700 | 34,247 |

| Belfius Bank SA/NV | 0.750% | 2/10/25 | EUR | 200 | 229 |

| Belfius Bank SA/NV | 1.375% | 6/5/20 | EUR | 11,500 | 13,352 |

| Belfius Bank SA/NV | 2.125% | 1/30/23 | EUR | 3,400 | 4,159 |

| KBC Bank NV | 0.450% | 1/22/22 | EUR | 5,000 | 5,740 |

| KBC Bank NV | 1.250% | 5/28/20 | EUR | 3,000 | 3,476 |

| | | | | | 61,933 |

| Corporate Bonds (0.3%) | | | | | |

| Anheuser-Busch InBev SA/NV | 0.625% | 3/17/20 | EUR | 15,000 | 17,152 |

| Anheuser-Busch InBev SA/NV | 0.875% | 3/17/22 | EUR | 12,900 | 14,841 |

| Anheuser-Busch InBev SA/NV | 1.150% | 1/22/27 | EUR | 12,400 | 13,612 |

| Anheuser-Busch InBev SA/NV | 1.500% | 3/17/25 | EUR | 6,320 | 7,333 |

| |

| 15 |

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| Anheuser-Busch InBev SA/NV | 1.875% | 1/20/20 | EUR | 3,000 | 3,479 |

| Anheuser-Busch InBev SA/NV | 2.000% | 12/16/19 | EUR | 750 | 869 |

| Anheuser-Busch InBev SA/NV | 2.000% | 3/17/28 | EUR | 16,500 | 19,143 |

| Anheuser-Busch InBev SA/NV | 2.000% | 1/23/35 | EUR | 10,000 | 10,546 |

| Anheuser-Busch InBev SA/NV | 2.700% | 3/31/26 | EUR | 200 | 249 |

| Anheuser-Busch InBev SA/NV | 2.750% | 3/17/36 | EUR | 16,150 | 18,486 |

| Anheuser-Busch InBev SA/NV | 2.850% | 5/25/37 | GBP | 6,900 | 8,104 |

| Anheuser-Busch InBev SA/NV | 2.875% | 9/25/24 | EUR | 4,500 | 5,677 |

| Anheuser-Busch InBev SA/NV | 3.250% | 1/24/33 | EUR | 5,000 | 6,295 |

| Anheuser-Busch InBev SA/NV | 4.000% | 6/2/21 | EUR | 5,100 | 6,350 |

| Anheuser-Busch InBev SA/NV | 4.000% | 9/24/25 | GBP | 11,200 | 15,709 |

| Anheuser-Busch InBev SA/NV | 9.750% | 7/30/24 | GBP | 1,900 | 3,380 |

| 1 Argenta Spaarbank NV | 3.875% | 5/24/26 | EUR | 24,300 | 29,193 |

| Belfius Bank SA/NV | 1.000% | 10/26/24 | EUR | 10,000 | 10,987 |

| Belfius Bank SA/NV | 0.750% | 9/12/22 | EUR | 4,900 | 5,515 |

| Belfius Bank SA/NV | 3.125% | 5/11/26 | EUR | 1,800 | 2,100 |

| BNP Paribas Fortis SA | 0.875% | 3/22/28 | EUR | 10,000 | 9,929 |

| Brussels Airport Co. SA/NV | 1.000% | 5/3/24 | EUR | 16,300 | 18,658 |

| Elia System Operator SA/NV | 1.375% | 5/27/24 | EUR | 100 | 116 |

| Elia System Operator SA/NV | 1.500% | 9/5/28 | EUR | 100 | 112 |

| Elia System Operator SA/NV | 3.000% | 4/7/29 | EUR | 400 | 512 |

| Elia System Operator SA/NV | 3.250% | 4/4/28 | EUR | 300 | 391 |

| Euroclear Bank SA/NV | 0.500% | 7/10/23 | EUR | 12,500 | 14,112 |

| FBG Finance Pty Ltd. | 3.750% | 9/6/24 | AUD | 6,500 | 4,641 |

| FBG Finance Pty Ltd. | 4.100% | 9/6/27 | AUD | 1,120 | 797 |

| KBC Bank NV | 0.375% | 9/1/22 | EUR | 32,000 | 36,579 |

| KBC Bank NV | 0.750% | 10/24/27 | EUR | 2,300 | 2,571 |

| KBC Group NV | 0.750% | 10/18/23 | EUR | 13,200 | 14,783 |

| KBC Group NV | 1.000% | 4/26/21 | EUR | 200 | 231 |

| Solvay SA | 1.625% | 12/2/22 | EUR | 8,300 | 9,823 |

| Solvay SA | 2.750% | 12/2/27 | EUR | 700 | 851 |

| | | | | | 313,126 |

| Sovereign Bonds (2.0%) | | | | | |

| 4 Dexia Credit Local SA | 0.200% | 3/16/21 | EUR | 5,000 | 5,708 |

| 4 Dexia Credit Local SA | 0.250% | 3/19/20 | EUR | 10,000 | 11,408 |

| Dexia Credit Local SA | 0.500% | 1/17/25 | EUR | 10,000 | 11,299 |

| 4 Dexia Credit Local SA | 0.625% | 1/21/22 | EUR | 16,500 | 19,052 |

| 4 Dexia Credit Local SA | 0.625% | 2/3/24 | EUR | 63,000 | 72,233 |

| 4 Dexia Credit Local SA | 0.750% | 1/25/23 | EUR | 28,000 | 32,445 |

| 4 Dexia Credit Local SA | 0.875% | 9/7/21 | GBP | 5,600 | 7,062 |

| 4 Dexia Credit Local SA | 1.000% | 10/18/27 | EUR | 200 | 228 |

| 4 Dexia Credit Local SA | 1.125% | 6/15/22 | GBP | 2,300 | 2,906 |

| 4 Dexia Credit Local SA | 1.250% | 11/26/24 | EUR | 17,200 | 20,317 |

| 4 Dexia Credit Local SA | 2.000% | 6/17/20 | GBP | 6,600 | 8,538 |

| 4 Dexia Credit Local SA | 2.125% | 2/12/25 | GBP | 3,000 | 3,907 |

| Eandis System Operator SCRL | 1.750% | 12/4/26 | EUR | 6,000 | 7,170 |

| Eandis System Operator SCRL | 2.875% | 10/9/23 | EUR | 3,000 | 3,758 |

| Eandis System Operator SCRL | 4.500% | 11/8/21 | EUR | 1,500 | 1,912 |

| Flemish Community | 0.375% | 10/13/26 | EUR | 5,000 | 5,509 |

| 2 Kingdom of Belgium | 0.200% | 10/22/23 | EUR | 31,500 | 35,969 |

| 2 Kingdom of Belgium | 0.500% | 10/22/24 | EUR | 2,000 | 2,304 |

| 2 Kingdom of Belgium | 0.800% | 6/22/25 | EUR | 62,510 | 73,005 |

| 2 Kingdom of Belgium | 0.800% | 6/22/27 | EUR | 178,800 | 205,114 |

| 2 Kingdom of Belgium | 0.800% | 6/22/28 | EUR | 30,000 | 34,046 |

| |

| |

| 16 |

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| 2 Kingdom of Belgium | 1.000% | 6/22/26 | EUR | 147,864 | 173,654 |

| 2 Kingdom of Belgium | 1.000% | 6/22/31 | EUR | 107,200 | 120,661 |

| Kingdom of Belgium | 1.250% | 4/22/33 | EUR | 30,000 | 34,272 |

| 2 Kingdom of Belgium | 1.450% | 6/22/37 | EUR | 5,220 | 5,925 |

| 2 Kingdom of Belgium | 1.600% | 6/22/47 | EUR | 51,225 | 56,441 |

| 2 Kingdom of Belgium | 1.900% | 6/22/38 | EUR | 93,642 | 114,076 |

| 2 Kingdom of Belgium | 2.150% | 6/22/66 | EUR | 48,500 | 57,172 |

| Kingdom of Belgium | 2.250% | 6/22/23 | EUR | 69,990 | 87,852 |

| 2 Kingdom of Belgium | 2.250% | 6/22/57 | EUR | 10,600 | 13,012 |

| 2 Kingdom of Belgium | 2.600% | 6/22/24 | EUR | 80,380 | 103,590 |

| 2 Kingdom of Belgium | 3.000% | 6/22/34 | EUR | 101,770 | 143,748 |

| 2 Kingdom of Belgium | 3.750% | 9/28/20 | EUR | 152,752 | 187,214 |

| Kingdom of Belgium | 3.750% | 6/22/45 | EUR | 21,445 | 35,278 |

| Kingdom of Belgium | 4.000% | 3/28/22 | EUR | 29,315 | 38,090 |

| Kingdom of Belgium | 4.000% | 3/28/32 | EUR | 40,320 | 62,367 |

| 2 Kingdom of Belgium | 4.250% | 9/28/21 | EUR | 137,475 | 176,809 |

| 2 Kingdom of Belgium | 4.250% | 9/28/22 | EUR | 82,650 | 109,980 |

| 2 Kingdom of Belgium | 4.250% | 3/28/41 | EUR | 76,430 | 131,210 |

| 2 Kingdom of Belgium | 4.500% | 3/28/26 | EUR | 7,400 | 10,872 |

| 2 Kingdom of Belgium | 5.000% | 3/28/35 | EUR | 4,430 | 7,784 |

| Kingdom of Belgium | 5.500% | 3/28/28 | EUR | 1,005 | 1,637 |

| Proximus SADP | 2.375% | 4/4/24 | EUR | 3,100 | 3,814 |

| | | | | | 2,239,348 |

| Total Belgium (Cost $2,631,148) | | | | | 2,614,407 |

| Bermuda (0.0%) | | | | | |

| Corporate Bond (0.0%) | | | | | |

| Bacardi Ltd. | 2.750% | 7/3/23 | EUR | 2,000 | 2,405 |

| Total Bermuda (Cost $2,671) | | | | | 2,405 |

| Brazil (0.0%) | | | | | |

| Corporate Bond (0.0%) | | | | | |

| Vale SA | 3.750% | 1/10/23 | EUR | 5,000 | 6,223 |

| Total Brazil (Cost $5,637) | | | | | 6,223 |

| Bulgaria (0.0%) | | | | | |

| Sovereign Bonds (0.0%) | | | | | |

| Republic of Bulgaria | 1.875% | 3/21/23 | EUR | 6,000 | 7,257 |

| Republic of Bulgaria | 2.000% | 3/26/22 | EUR | 3,000 | 3,609 |

| Republic of Bulgaria | 2.625% | 3/26/27 | EUR | 3,000 | 3,736 |

| Republic of Bulgaria | 2.950% | 9/3/24 | EUR | 800 | 1,025 |

| Republic of Bulgaria | 3.000% | 3/21/28 | EUR | 25,000 | 31,771 |

| Republic of Bulgaria | 3.125% | 3/26/35 | EUR | 3,000 | 3,599 |

| Total Bulgaria (Cost $45,483) | | | | | 50,997 |

| Canada (5.8%) | | | | | |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.2%) | | | |

| Bank of Montreal | 0.100% | 10/20/23 | EUR | 10,000 | 11,155 |

| Bank of Montreal | 0.125% | 4/19/21 | EUR | 200 | 227 |

| Bank of Montreal | 0.250% | 1/22/20 | EUR | 10,000 | 11,393 |

| Bank of Montreal | 0.375% | 8/5/20 | EUR | 15,000 | 17,146 |

| Bank of Nova Scotia | 0.125% | 1/13/22 | EUR | 1,100 | 1,246 |

| Bank of Nova Scotia | 0.500% | 7/23/20 | EUR | 23,000 | 26,338 |

| Bank of Nova Scotia | 0.750% | 9/14/21 | GBP | 1,500 | 1,886 |

17

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| Bank of Nova Scotia | 0.750% | 9/17/21 | EUR | 10,900 | 12,588 |

| Canadian Imperial Bank of Commerce | 0.000% | 7/25/22 | EUR | 15,000 | 16,867 |

| National Bank of Canada | 0.000% | 9/29/23 | EUR | 4,600 | 5,110 |

| National Bank of Canada | 0.500% | 1/26/22 | EUR | 14,000 | 16,052 |

| National Bank of Canada | 1.500% | 3/25/21 | EUR | 5,000 | 5,871 |

| Royal Bank of Canada | 0.125% | 3/11/21 | EUR | 4,000 | 4,548 |

| Royal Bank of Canada | 0.875% | 6/17/22 | EUR | 12,000 | 13,927 |

| Royal Bank of Canada | 1.625% | 8/4/20 | EUR | 21,500 | 25,118 |

| Toronto-Dominion Bank | 0.250% | 4/27/22 | EUR | 5,000 | 5,679 |

| Toronto-Dominion Bank | 0.375% | 1/12/21 | EUR | 10,000 | 11,435 |

| Toronto-Dominion Bank | 0.375% | 4/27/23 | EUR | 21,000 | 23,826 |

| Toronto-Dominion Bank | 0.750% | 10/29/21 | EUR | 6,000 | 6,934 |

| | | | | | 217,346 |

| Corporate Bonds (1.2%) | | | | | |

| 407 International Inc. | 3.600% | 5/21/47 | CAD | 6,900 | 4,925 |

| 407 International Inc. | 3.830% | 5/11/46 | CAD | 10,000 | 7,435 |

| 407 International Inc. | 4.190% | 4/25/42 | CAD | 5,500 | 4,321 |

| 407 International Inc. | 4.300% | 5/26/21 | CAD | 1,500 | 1,173 |

| 407 International Inc. | 4.450% | 11/15/41 | CAD | 5,000 | 4,079 |

| 407 International Inc. | 5.750% | 2/14/36 | CAD | 1,995 | 1,844 |

| Aeroports de Montreal | 5.170% | 9/17/35 | CAD | 325 | 292 |

| Aeroports de Montreal | 5.670% | 10/16/37 | CAD | 2,000 | 1,919 |

| Alberta Powerline LP | 4.065% | 12/1/53 | CAD | 5,000 | 3,827 |

| Alectra Inc. | 2.488% | 5/17/27 | CAD | 11,000 | 7,779 |

| 2 Algonquin Power Co. | 4.090% | 2/17/27 | CAD | 800 | 594 |

| Alimentation Couche-Tard Inc. | 3.056% | 7/26/24 | CAD | 10,000 | 7,274 |

| Alimentation Couche-Tard Inc. | 3.600% | 6/2/25 | CAD | 7,900 | 5,859 |

| Allied Properties REIT | 3.636% | 4/21/25 | CAD | 10,000 | 7,266 |

| AltaGas Ltd. | 4.500% | 8/15/44 | CAD | 1,757 | 1,181 |

| AltaLink LP | 3.399% | 6/6/24 | CAD | 10,000 | 7,651 |

| AltaLink LP | 3.668% | 11/6/23 | CAD | 12,000 | 9,318 |

| AltaLink LP | 3.717% | 12/3/46 | CAD | 4,000 | 2,938 |

| AltaLink LP | 3.990% | 6/30/42 | CAD | 2,925 | 2,249 |

| AltaLink LP | 4.922% | 9/17/43 | CAD | 3,000 | 2,642 |

| Bank of Montreal | 0.050% | 12/30/22 | CHF | 7,000 | 6,895 |

| Bank of Montreal | 0.200% | 1/26/23 | EUR | 6,600 | 7,449 |

| Bank of Montreal | 1.610% | 10/28/21 | CAD | 10,000 | 7,284 |

| Bank of Montreal | 1.625% | 6/21/22 | GBP | 1,000 | 1,277 |

| Bank of Montreal | 2.100% | 10/6/20 | CAD | 5,100 | 3,815 |

| Bank of Montreal | 2.120% | 3/16/22 | CAD | 15,300 | 11,252 |

| 1 Bank of Montreal | 2.570% | 6/1/27 | CAD | 5,000 | 3,659 |

| Bank of Montreal | 2.700% | 9/11/24 | CAD | 10,000 | 7,355 |

| Bank of Montreal | 2.700% | 12/9/26 | CAD | 10,000 | 7,226 |

| Bank of Montreal | 2.890% | 6/20/23 | CAD | 12,000 | 8,980 |

| Bank of Montreal | 3.190% | 3/1/28 | CAD | 10,000 | 7,445 |

| 1 Bank of Montreal | 3.320% | 6/1/26 | CAD | 10,500 | 7,953 |

| 1 Bank of Montreal | 3.340% | 12/8/25 | CAD | 10,750 | 8,168 |

| Bank of Montreal | 3.400% | 4/23/21 | CAD | 3,000 | 2,301 |

| Bank of Montreal | 4.609% | 9/10/25 | CAD | 5,000 | 4,088 |

| Bank of Nova Scotia | 1.250% | 6/8/22 | GBP | 500 | 629 |

| Bank of Nova Scotia | 1.900% | 12/2/21 | CAD | 10,000 | 7,329 |

| Bank of Nova Scotia | 2.090% | 9/9/20 | CAD | 8,400 | 6,284 |

| Bank of Nova Scotia | 2.130% | 6/15/20 | CAD | 20,000 | 15,021 |

| Bank of Nova Scotia | 2.360% | 11/8/22 | CAD | 5,000 | 3,677 |

18

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| 1 Bank of Nova Scotia | 2.580% | 3/30/27 | CAD | 4,550 | 3,339 |

| Bank of Nova Scotia | 2.620% | 12/2/26 | CAD | 15,000 | 10,773 |

| Bank of Nova Scotia | 2.980% | 4/17/23 | CAD | 10,000 | 7,511 |

| Bank of Nova Scotia | 3.100% | 2/2/28 | CAD | 25,000 | 18,473 |

| Bank of Nova Scotia | 3.270% | 1/11/21 | CAD | 5,000 | 3,825 |

| 1 Bank of Nova Scotia | 3.367% | 12/8/25 | CAD | 7,000 | 5,321 |

| Bell Canada Inc. | 3.000% | 10/3/22 | CAD | 5,200 | 3,879 |

| Bell Canada Inc. | 3.250% | 6/17/20 | CAD | 9,350 | 7,127 |

| Bell Canada Inc. | 3.350% | 3/22/23 | CAD | 5,000 | 3,763 |

| Bell Canada Inc. | 3.350% | 3/12/25 | CAD | 2,200 | 1,626 |

| Bell Canada Inc. | 3.550% | 3/2/26 | CAD | 3,000 | 2,224 |

| Bell Canada Inc. | 4.350% | 12/18/45 | CAD | 9,150 | 6,488 |

| Bell Canada Inc. | 4.450% | 2/27/47 | CAD | 8,098 | 5,828 |

| Bell Canada Inc. | 4.750% | 9/29/44 | CAD | 3,500 | 2,643 |

| Bell Canada Inc. | 7.850% | 4/2/31 | CAD | 5,000 | 5,007 |

| 1 BMO Capital Trust II | 10.221% | 12/31/07 | CAD | 700 | 538 |

| BP LP | 3.244% | 1/9/20 | CAD | 995 | 758 |

| British Columbia Ferry Services Inc. | 4.702% | 10/23/43 | CAD | 7,000 | 6,085 |

| Brookfield Asset Management Inc. | 3.800% | 3/16/27 | CAD | 4,235 | 3,089 |

| Brookfield Asset Management Inc. | 4.540% | 3/31/23 | CAD | 11,875 | 9,319 |

| Brookfield Asset Management Inc. | 4.820% | 1/28/26 | CAD | 21,000 | 16,491 |

| Brookfield Asset Management Inc. | 5.040% | 3/8/24 | CAD | 1,500 | 1,196 |

| Brookfield Infrastructure Finance ULC | 3.315% | 2/22/24 | CAD | 5,000 | 3,681 |

| Brookfield Infrastructure Finance ULC | 3.538% | 10/30/20 | CAD | 850 | 650 |

| Brookfield Renewable Partners ULC | 3.752% | 6/2/25 | CAD | 5,301 | 3,961 |

| Bruce Power LP | 3.969% | 6/23/26 | CAD | 5,000 | 3,787 |

| Bruce Power LP | 4.132% | 6/21/33 | CAD | 2,200 | 1,617 |

| Caisse Centrale Desjardins | 1.748% | 3/2/20 | CAD | 10,150 | 7,606 |

| Cameco Corp. | 4.190% | 6/24/24 | CAD | 3,500 | 2,630 |

| Canadian Imperial Bank of Commerce | 0.250% | 1/24/23 | EUR | 14,000 | 15,833 |

| Canadian Imperial Bank of Commerce | 1.640% | 7/12/21 | CAD | 250 | 183 |

| Canadian Imperial Bank of Commerce | 1.850% | 7/14/20 | CAD | 250 | 187 |

| Canadian Imperial Bank of Commerce | 1.900% | 4/26/21 | CAD | 14,000 | 10,356 |

| Canadian Imperial Bank of Commerce | 2.040% | 3/21/22 | CAD | 10,000 | 7,335 |

| Canadian Imperial Bank of Commerce | 2.300% | 7/11/22 | CAD | 15,000 | 11,049 |

| Canadian Imperial Bank of Commerce | 2.970% | 7/11/23 | CAD | 10,000 | 7,502 |

| Canadian Imperial Bank of Commerce | 3.300% | 5/26/25 | CAD | 15,000 | 11,355 |

| 1 Canadian Imperial Bank of Commerce | 3.420% | 1/26/26 | CAD | 20,000 | 15,189 |

| 1 Canadian Imperial Bank of Commerce | 3.450% | 4/4/28 | CAD | 8,000 | 5,961 |

| Canadian National Railway Co. | 2.800% | 9/22/25 | CAD | 5,000 | 3,680 |

| Canadian National Railway Co. | 3.600% | 8/1/47 | CAD | 10,000 | 7,140 |

| Canadian Natural Resources Ltd. | 2.890% | 8/14/20 | CAD | 10,400 | 7,867 |

| Canadian Natural Resources Ltd. | 3.310% | 2/11/22 | CAD | 20,000 | 15,102 |

| Canadian Natural Resources Ltd. | 3.550% | 6/3/24 | CAD | 10,000 | 7,504 |

| Canadian Pacific Railway Co. | 6.450% | 11/17/39 | CAD | 1,750 | 1,750 |

| Canadian Tire Corp. Ltd. | 2.646% | 7/6/20 | CAD | 16,000 | 12,078 |

| Canadian Tire Corp. Ltd. | 3.167% | 7/6/23 | CAD | 8,100 | 6,045 |

| 1 Capital Desjardins Inc. | 4.954% | 12/15/26 | CAD | 3,000 | 2,390 |

| Capital Desjardins Inc. | 5.187% | 5/5/20 | CAD | 5,355 | 4,195 |

| Capital Power Corp. | 5.276% | 11/16/20 | CAD | 4,650 | 3,656 |

| Chartwell Retirement Residences | 4.211% | 4/28/25 | CAD | 1,000 | 755 |

| Choice Properties REIT | 3.546% | 1/10/25 | CAD | 8,000 | 5,881 |

| Choice Properties REIT | 3.556% | 9/9/24 | CAD | 2,032 | 1,501 |

| CI Financial Corp. | 2.645% | 12/7/20 | CAD | 5,200 | 3,896 |

| |

| |

| 19 |

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| CI Financial Corp. | 2.775% | 11/25/21 | CAD | 10,000 | 7,438 |

| 1 CIBC Capital Trust | 10.250% | 6/30/08 | CAD | 225 | 202 |

| Cogeco Communications Inc. | 4.175% | 5/26/23 | CAD | 250 | 193 |

| Concordia University | 6.550% | 9/2/42 | CAD | 3,000 | 3,261 |

| CT REIT | 3.469% | 6/16/27 | CAD | 1,332 | 950 |

| CU Inc. | 3.805% | 9/10/42 | CAD | 450 | 332 |

| CU Inc. | 3.964% | 7/27/45 | CAD | 3,000 | 2,269 |

| CU Inc. | 4.085% | 9/2/44 | CAD | 5,400 | 4,164 |

| CU Inc. | 4.211% | 10/29/55 | CAD | 15,000 | 11,661 |

| CU Inc. | 4.543% | 10/24/41 | CAD | 1,000 | 823 |

| CU Inc. | 4.722% | 9/9/43 | CAD | 3,000 | 2,537 |

| Emera Inc. | 2.900% | 6/16/23 | CAD | 33,000 | 24,277 |

| Enbridge Gas Distribution Inc. | 2.500% | 8/5/26 | CAD | 2,000 | 1,415 |

| Enbridge Gas Distribution Inc. | 3.150% | 8/22/24 | CAD | 6,480 | 4,858 |

| Enbridge Gas Distribution Inc. | 3.310% | 9/11/25 | CAD | 240 | 181 |

| Enbridge Gas Distribution Inc. | 4.000% | 8/22/44 | CAD | 2,000 | 1,517 |

| Enbridge Gas Distribution Inc. | 4.040% | 11/23/20 | CAD | 350 | 272 |

| Enbridge Gas Distribution Inc. | 4.950% | 11/22/50 | CAD | 1,000 | 873 |

| Enbridge Inc. | 3.190% | 12/5/22 | CAD | 15,070 | 11,288 |

| Enbridge Inc. | 3.200% | 6/8/27 | CAD | 10,000 | 7,115 |

| Enbridge Inc. | 4.240% | 8/27/42 | CAD | 2,460 | 1,700 |

| Enbridge Inc. | 4.530% | 3/9/20 | CAD | 9,700 | 7,510 |

| Enbridge Inc. | 4.570% | 3/11/44 | CAD | 1,400 | 1,014 |

| Enbridge Income Fund | 3.950% | 11/19/24 | CAD | 3,000 | 2,285 |

| Enbridge Pipelines Inc. | 3.450% | 9/29/25 | CAD | 5,240 | 3,926 |

| Enbridge Pipelines Inc. | 4.130% | 8/9/46 | CAD | 5,000 | 3,538 |

| Enbridge Pipelines Inc. | 4.550% | 8/17/43 | CAD | 1,000 | 758 |

| Enbridge Pipelines Inc. | 4.550% | 9/29/45 | CAD | 5,600 | 4,237 |

| EPCOR Utilities Inc. | 3.554% | 11/27/47 | CAD | 7,000 | 4,943 |

| EPCOR Utilities Inc. | 4.550% | 2/28/42 | CAD | 2,995 | 2,475 |

| Fairfax Financial Holdings Ltd. | 4.250% | 12/6/27 | CAD | 2,465 | 1,812 |

| Fairfax Financial Holdings Ltd. | 4.500% | 3/22/23 | CAD | 2,500 | 1,952 |

| Fairfax Financial Holdings Ltd. | 4.700% | 12/16/26 | CAD | 5,000 | 3,834 |

| Fairfax Financial Holdings Ltd. | 4.950% | 3/3/25 | CAD | 575 | 453 |

| Fairfax Financial Holdings Ltd. | 5.840% | 10/14/22 | CAD | 2,800 | 2,290 |

| Federation des Caisses Desjardins du | | | | | |

| Quebec | 2.091% | 1/17/22 | CAD | 2,590 | 1,906 |

| Federation des Caisses Desjardins du | | | | | |

| Quebec | 3.056% | 9/11/23 | CAD | 5,000 | 3,759 |

| First Capital Realty Inc. | 4.323% | 7/31/25 | CAD | 10,000 | 7,618 |

| First Capital Realty Inc. | 4.790% | 8/30/24 | CAD | 5,000 | 3,925 |

| Fortis Inc. | 2.850% | 12/12/23 | CAD | 2,500 | 1,834 |

| FortisBC Energy Inc. | 6.050% | 2/15/38 | CAD | 10,000 | 9,762 |

| FortisBC Energy Inc. | 6.500% | 5/1/34 | CAD | 10,000 | 9,894 |

| Great-West Lifeco Inc. | 1.750% | 12/7/26 | EUR | 500 | 575 |

| Great-West Lifeco Inc. | 5.998% | 11/16/39 | CAD | 11,000 | 10,594 |

| Great-West Lifeco Inc. | 6.670% | 3/21/33 | CAD | 2,000 | 1,956 |

| Greater Toronto Airports Authority | 1.510% | 2/16/21 | CAD | 4,955 | 3,653 |

| 2 Greater Toronto Airports Authority | 4.530% | 12/2/41 | CAD | 5,000 | 4,312 |

| Greater Toronto Airports Authority | 5.300% | 2/25/41 | CAD | 3,100 | 2,945 |

| H&R REIT | 3.416% | 1/23/23 | CAD | 4,705 | 3,497 |

| Hospital for Sick Children | 3.416% | 12/7/57 | CAD | 2,792 | 1,961 |

| Hospital Infrastructure Partners NOH | | | | | |

| Partnership | 5.439% | 1/31/45 | CAD | 5,531 | 4,720 |

| |

| |

| 20 |

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| HSBC Bank Canada | 1.816% | 7/7/20 | CAD | 10,000 | 7,454 |

| HSBC Bank Canada | 2.170% | 6/29/22 | CAD | 10,500 | 7,666 |

| HSBC Bank Canada | 2.449% | 1/29/21 | CAD | 150 | 112 |

| HSBC Bank Canada | 2.542% | 1/31/23 | CAD | 10,000 | 7,345 |

| HSBC Bank Canada | 2.908% | 9/29/21 | CAD | 3,000 | 2,261 |

| HSBC Bank Canada | 2.938% | 1/14/20 | CAD | 1,950 | 1,488 |

| HSBC Bank Canada | 3.245% | 9/15/23 | CAD | 10,000 | 7,531 |

| Husky Energy Inc. | 3.600% | 3/10/27 | CAD | 3,000 | 2,188 |

| Hydro One Inc. | 1.840% | 2/24/21 | CAD | 400 | 296 |

| Hydro One Inc. | 2.570% | 6/25/21 | CAD | 2,045 | 1,534 |

| Hydro One Inc. | 2.770% | 2/24/26 | CAD | 9,800 | 7,087 |

| Hydro One Inc. | 2.970% | 6/26/25 | CAD | 245 | 181 |

| Hydro One Inc. | 3.200% | 1/13/22 | CAD | 350 | 266 |

| Hydro One Inc. | 3.630% | 6/25/49 | CAD | 10,420 | 7,294 |

| Hydro One Inc. | 3.720% | 11/18/47 | CAD | 1,441 | 1,028 |

| Hydro One Inc. | 3.790% | 7/31/62 | CAD | 2,000 | 1,399 |

| Hydro One Inc. | 4.390% | 9/26/41 | CAD | 5,115 | 4,065 |

| Hydro One Inc. | 4.400% | 6/1/20 | CAD | 3,000 | 2,332 |

| Hydro One Inc. | 4.590% | 10/9/43 | CAD | 5,500 | 4,509 |

| Hydro One Inc. | 4.890% | 3/13/37 | CAD | 5,000 | 4,218 |

| Hydro One Inc. | 5.360% | 5/20/36 | CAD | 1,000 | 888 |

| Hydro One Inc. | 5.490% | 7/16/40 | CAD | 3,525 | 3,219 |

| Hydro One Inc. | 6.930% | 6/1/32 | CAD | 1,000 | 995 |

| Hydro One Inc. | 7.350% | 6/3/30 | CAD | 2,000 | 1,999 |

| 1 Industrial Alliance Insurance & Financial | | | | | |

| Services Inc. | 3.300% | 9/15/28 | CAD | 5,000 | 3,758 |

| Intact Financial Corp. | 3.770% | 3/2/26 | CAD | 2,376 | 1,812 |

| Intact Financial Corp. | 5.160% | 6/16/42 | CAD | 2,530 | 2,158 |

| Inter Pipeline Ltd. | 2.608% | 9/13/23 | CAD | 10,000 | 7,224 |

| Inter Pipeline Ltd. | 2.734% | 4/18/24 | CAD | 5,000 | 3,593 |

| Inter Pipeline Ltd. | 3.173% | 3/24/25 | CAD | 4,950 | 3,596 |

| Inter Pipeline Ltd. | 3.776% | 5/30/22 | CAD | 2,300 | 1,759 |

| Inter Pipeline Ltd. | 4.637% | 5/30/44 | CAD | 3,000 | 2,182 |

| John Deere Canada Funding Inc. | 2.050% | 9/17/20 | CAD | 700 | 523 |

| John Deere Canada Funding Inc. | 2.700% | 1/17/23 | CAD | 1,611 | 1,195 |

| Keyera Corp. | 3.934% | 6/21/28 | CAD | 10,000 | 7,390 |

| Kraft Canada Inc. | 2.700% | 7/6/20 | CAD | 1,865 | 1,406 |

| Laurentian Bank of Canada | 2.500% | 1/23/20 | CAD | 300 | 227 |

| Laurentian Bank of Canada | 3.450% | 6/27/23 | CAD | 5,000 | 3,729 |

| Loblaw Cos. Ltd. | 4.860% | 9/12/23 | CAD | 7,000 | 5,576 |

| Loblaw Cos. Ltd. | 5.900% | 1/18/36 | CAD | 1,300 | 1,141 |

| 1 Manufacturers Life Insurance Co. | 2.100% | 6/1/25 | CAD | 9,000 | 6,737 |

| 1 Manufacturers Life Insurance Co. | 2.640% | 1/15/25 | CAD | 200 | 152 |

| 1 Manufacturers Life Insurance Co. | 3.181% | 11/22/27 | CAD | 5,000 | 3,767 |

| 1 Manulife Finance Delaware LP | 5.059% | 12/15/41 | CAD | 900 | 730 |

| 1 Manulife Financial Capital Trust II | 7.405% | 12/31/08 | CAD | 4,000 | 3,183 |

| Metro Inc. | 3.390% | 12/6/27 | CAD | 15,000 | 10,799 |

| Metro Inc. | 4.270% | 12/4/47 | CAD | 2,000 | 1,411 |

| Metro Inc. | 5.970% | 10/15/35 | CAD | 5,048 | 4,441 |

| National Bank of Canada | 1.742% | 3/3/20 | CAD | 500 | 375 |

| National Bank of Canada | 1.809% | 7/26/21 | CAD | 5,000 | 3,676 |

| 1 National Bank of Canada | 3.183% | 2/1/28 | CAD | 10,000 | 7,352 |

| Nissan Canada Financial Services Inc. | 2.606% | 3/5/21 | CAD | 10,000 | 7,476 |

| |

| |

| |

| 21 |

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| North West Redwater Partnership / NWR | | | | | |

| Financing Co. Ltd. | 2.800% | 6/1/27 | CAD | 10,000 | 7,101 |

| North West Redwater Partnership / NWR | | | | | |

| Financing Co. Ltd. | 3.700% | 2/23/43 | CAD | 4,000 | 2,833 |

| North West Redwater Partnership / NWR | | | | | |

| Financing Co. Ltd. | 4.050% | 7/22/44 | CAD | 3,350 | 2,503 |

| North West Redwater Partnership / NWR | | | | | |

| Financing Co. Ltd. | 4.250% | 6/1/29 | CAD | 250 | 196 |

| North West Redwater Partnership / NWR | | | | | |

| Financing Co. Ltd. | 4.750% | 6/1/37 | CAD | 5,000 | 4,110 |

| Nova Scotia Power Inc. | 5.610% | 6/15/40 | CAD | 4,300 | 3,963 |

| OMERS Realty Corp. | 2.858% | 2/23/24 | CAD | 5,000 | 3,709 |

| OMERS Realty Corp. | 3.328% | 11/12/24 | CAD | 1,374 | 1,039 |

| OMERS Realty Corp. | 3.331% | 6/5/25 | CAD | 3,000 | 2,261 |

| OMERS Realty Corp. | 3.628% | 6/5/30 | CAD | 4,380 | 3,305 |

| Ottawa MacDonald-Cartier International | | | | | |

| Airport Authority | 3.933% | 6/9/45 | CAD | 775 | 593 |

| Pembina Pipeline Corp. | 3.710% | 8/11/26 | CAD | 4,850 | 3,603 |

| Pembina Pipeline Corp. | 4.240% | 6/15/27 | CAD | 3,000 | 2,298 |

| Pembina Pipeline Corp. | 4.750% | 4/30/43 | CAD | 3,000 | 2,212 |

| Pembina Pipeline Corp. | 4.810% | 3/25/44 | CAD | 9,000 | 6,697 |

| Plenary Properties LTAP LP | 6.288% | 1/31/44 | CAD | 4,397 | 4,164 |

| RioCan REIT | 3.746% | 5/30/22 | CAD | 8,842 | 6,737 |

| Rogers Communications Inc. | 4.000% | 3/13/24 | CAD | 4,000 | 3,090 |

| Rogers Communications Inc. | 4.700% | 9/29/20 | CAD | 400 | 313 |

| Rogers Communications Inc. | 5.340% | 3/22/21 | CAD | 6,000 | 4,775 |

| Rogers Communications Inc. | 6.110% | 8/25/40 | CAD | 5,000 | 4,466 |

| Rogers Communications Inc. | 6.680% | 11/4/39 | CAD | 3,044 | 2,889 |

| Royal Bank of Canada | 0.250% | 6/28/23 | EUR | 2,100 | 2,366 |

| Royal Bank of Canada | 0.500% | 12/16/20 | EUR | 5,000 | 5,733 |

| Royal Bank of Canada | 1.125% | 12/22/21 | GBP | 3,300 | 4,191 |

| Royal Bank of Canada | 1.583% | 9/13/21 | CAD | 4,700 | 3,427 |

| Royal Bank of Canada | 1.650% | 7/15/21 | CAD | 37,000 | 27,111 |

| Royal Bank of Canada | 1.968% | 3/2/22 | CAD | 25,100 | 18,365 |

| Royal Bank of Canada | 2.000% | 3/21/22 | CAD | 4,500 | 3,295 |

| Royal Bank of Canada | 2.333% | 12/5/23 | CAD | 8,500 | 6,177 |

| Royal Bank of Canada | 2.350% | 12/9/19 | CAD | 6,750 | 5,118 |

| Royal Bank of Canada | 2.360% | 12/5/22 | CAD | 12,000 | 8,823 |

| Royal Bank of Canada | 2.949% | 5/1/23 | CAD | 10,000 | 7,509 |

| 1 Royal Bank of Canada | 2.990% | 12/6/24 | CAD | 14,225 | 10,837 |

| 1 Royal Bank of Canada | 3.040% | 7/17/24 | CAD | 400 | 304 |

| 1 Royal Bank of Canada | 3.310% | 1/20/26 | CAD | 10,900 | 8,280 |

| 1 Royal Bank of Canada | 3.450% | 9/29/26 | CAD | 10,000 | 7,594 |

| Royal Office Finance LP | 5.209% | 11/12/32 | CAD | 6,872 | 5,962 |

| Saputo Inc. | 2.654% | 11/26/19 | CAD | 250 | 190 |

| Saputo Inc. | 3.603% | 8/14/25 | CAD | 10,000 | 7,460 |

| 1 Scotiabank Capital Trust | 5.650% | 12/31/56 | CAD | 200 | 179 |

| Shaw Communications Inc. | 4.350% | 1/31/24 | CAD | 10,000 | 7,767 |

| Shaw Communications Inc. | 5.500% | 12/7/20 | CAD | 8,443 | 6,700 |

| Shaw Communications Inc. | 6.750% | 11/9/39 | CAD | 6,200 | 5,606 |

| SmartCentres REIT | 3.834% | 12/21/27 | CAD | 5,000 | 3,588 |

| 1 Sun Life Financial Inc. | 2.600% | 9/25/25 | CAD | 350 | 263 |

| 1 Sun Life Financial Inc. | 3.050% | 9/19/28 | CAD | 10,000 | 7,422 |

| Sun Life Financial Inc. | 4.570% | 8/23/21 | CAD | 3,000 | 2,363 |

22

| | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | Maturity | | Amount | Value • |

| | Coupon | Date | Currency | (000) | ($000) |

| 1 Sun Life Financial Inc. | 5.400% | 5/29/42 | CAD | 850 | 740 |

| Suncor Energy Inc. | 3.000% | 9/14/26 | CAD | 3,000 | 2,165 |

| Suncor Energy Inc. | 4.340% | 9/13/46 | CAD | 5,154 | 3,906 |

| TCHC Issuer Trust | 5.395% | 2/22/40 | CAD | 2,078 | 1,956 |

| TELUS Corp. | 2.350% | 3/28/22 | CAD | 9,800 | 7,195 |

| TELUS Corp. | 3.200% | 4/5/21 | CAD | 750 | 569 |

| TELUS Corp. | 3.350% | 4/1/24 | CAD | 10,700 | 7,987 |

| TELUS Corp. | 3.750% | 1/17/25 | CAD | 2,460 | 1,864 |

| TELUS Corp. | 3.750% | 3/10/26 | CAD | 900 | 676 |

| TELUS Corp. | 4.400% | 4/1/43 | CAD | 3,000 | 2,120 |

| TELUS Corp. | 4.400% | 1/29/46 | CAD | 250 | 176 |

| TELUS Corp. | 4.750% | 1/17/45 | CAD | 1,430 | 1,064 |

| TELUS Corp. | 4.850% | 4/5/44 | CAD | 9,250 | 6,985 |

| TELUS Corp. | 5.050% | 7/23/20 | CAD | 300 | 236 |

| Teranet Holdings LP | 4.807% | 12/16/20 | CAD | 8,875 | 6,908 |

| Teranet Holdings LP | 5.754% | 12/17/40 | CAD | 1,200 | 915 |

| Thomson Reuters Corp. | 3.309% | 11/12/21 | CAD | 2,500 | 1,905 |

| Toromont Industries Ltd. | 3.842% | 10/27/27 | CAD | 7,000 | 5,252 |

| Toronto-Dominion Bank | 0.500% | 4/3/24 | EUR | 8,000 | 9,070 |

| Toronto-Dominion Bank | 1.000% | 12/13/21 | GBP | 1,000 | 1,265 |

| Toronto-Dominion Bank | 1.680% | 6/8/21 | CAD | 10,000 | 7,375 |

| Toronto-Dominion Bank | 1.693% | 4/2/20 | CAD | 15,000 | 11,229 |

| Toronto-Dominion Bank | 1.994% | 3/23/22 | CAD | 10,000 | 7,330 |

| Toronto-Dominion Bank | 2.045% | 3/8/21 | CAD | 5,000 | 3,719 |

| Toronto-Dominion Bank | 2.621% | 12/22/21 | CAD | 22,450 | 16,833 |

| 1 Toronto-Dominion Bank | 2.982% | 9/30/25 | CAD | 7,400 | 5,593 |

| Toronto-Dominion Bank | 3.005% | 5/30/23 | CAD | 15,000 | 11,297 |

| 1 Toronto-Dominion Bank | 3.224% | 7/25/29 | CAD | 6,000 | 4,381 |

| Toronto-Dominion Bank | 3.226% | 7/24/24 | CAD | 5,450 | 4,129 |

| 1 Toronto-Dominion Bank | 3.589% | 9/14/28 | CAD | 8,000 | 5,989 |

| 1 Toronto-Dominion Bank | 4.859% | 3/4/31 | CAD | 5,150 | 4,105 |

| TransAlta Corp. | 5.000% | 11/25/20 | CAD | 2,650 | 2,070 |

| TransCanada PipeLines Ltd. | 3.390% | 3/15/28 | CAD | 20,000 | 14,600 |

| TransCanada PipeLines Ltd. | 3.650% | 11/15/21 | CAD | 5,000 | 3,854 |

| TransCanada PipeLines Ltd. | 3.690% | 7/19/23 | CAD | 5,240 | 4,023 |

| TransCanada PipeLines Ltd. | 4.180% | 7/3/48 | CAD | 15,000 | 10,661 |

| TransCanada PipeLines Ltd. | 4.330% | 9/16/47 | CAD | 5,000 | 3,652 |

| TransCanada PipeLines Ltd. | 4.350% | 6/6/46 | CAD | 4,000 | 2,934 |

| TransCanada PipeLines Ltd. | 4.550% | 11/15/41 | CAD | 2,000 | 1,515 |

| TransCanada PipeLines Ltd. | 6.280% | 5/26/28 | CAD | 4,514 | 3,979 |

| Union Gas Ltd. | 3.790% | 7/10/23 | CAD | 30,000 | 23,250 |

| Union Gas Ltd. | 4.200% | 6/2/44 | CAD | 2,400 | 1,877 |

| Union Gas Ltd. | 4.880% | 6/21/41 | CAD | 3,450 | 2,951 |

| University of Toronto | 5.841% | 12/15/43 | CAD | 130 | 132 |

| Veresen Inc. | 3.430% | 11/10/21 | CAD | 3,000 | 2,281 |

| Wells Fargo Canada Corp. | 3.040% | 1/29/21 | CAD | 10,000 | 7,596 |

| | | | | | 1,376,061 |

| Sovereign Bonds (4.4%) | | | | | |

| Canada | 0.500% | 3/1/22 | CAD | 50,330 | 35,939 |

| Canada | 0.750% | 9/1/20 | CAD | 235,955 | 174,197 |

| Canada | 0.750% | 3/1/21 | CAD | 139,695 | 102,292 |

| Canada | 1.000% | 9/1/22 | CAD | 207,652 | 149,622 |

| Canada | 1.250% | 11/1/19 | CAD | 133,950 | 100,865 |

| Canada | 1.250% | 2/1/20 | CAD | 65,892 | 49,477 |

| |

| |

| 23 |

| | | | | | |

| Total International Bond Index Fund | | | | | |

| |

| |

| |

| | | | | | Face | Market |

| | | | Maturity | | Amount | Value • |

| | | Coupon | Date | Currency | (000) | ($000) |

| | Canada | 1.500% | 3/1/20 | CAD | 59,625 | 44,860 |

| | Canada | 1.500% | 6/1/26 | CAD | 60,485 | 42,871 |

| | Canada | 1.750% | 5/1/20 | CAD | 118,155 | 89,071 |

| | Canada | 1.750% | 8/1/20 | CAD | 31,101 | 23,401 |

| | Canada | 1.750% | 3/1/23 | CAD | 120,376 | 88,923 |

| | Canada | 2.000% | 11/1/20 | CAD | 26,491 | 19,994 |

| | Canada | 2.000% | 9/1/23 | CAD | 33,535 | 24,980 |

| | Canada | 2.000% | 6/1/28 | CAD | 24,402 | 17,773 |

| | Canada | 2.000% | 12/1/51 | CAD | 13,600 | 9,117 |

| | Canada | 2.250% | 6/1/25 | CAD | 36,460 | 27,331 |

| | Canada | 2.250% | 6/1/29 | CAD | 32,000 | 23,746 |

| | Canada | 2.500% | 6/1/24 | CAD | 59,510 | 45,319 |

| | Canada | 2.750% | 6/1/22 | CAD | 1,755 | 1,349 |

| | Canada | 2.750% | 12/1/48 | CAD | 40,302 | 32,047 |

| | Canada | 2.750% | 12/1/64 | CAD | 93,529 | 76,007 |

| | Canada | 3.250% | 6/1/21 | CAD | 25,015 | 19,425 |

| | Canada | 3.500% | 1/13/20 | EUR | 2,000 | 2,374 |

| | Canada | 3.500% | 12/1/45 | CAD | 102,394 | 92,382 |

| | Canada | 4.000% | 6/1/41 | CAD | 108,350 | 102,801 |

| | Canada | 5.000% | 6/1/37 | CAD | 90,706 | 93,934 |

| | Canada | 5.750% | 6/1/29 | CAD | 31,844 | 31,436 |

| | Canada | 5.750% | 6/1/33 | CAD | 70,753 | 74,795 |

| | Canada | 8.000% | 6/1/23 | CAD | 1,100 | 1,036 |

| | Canada | 8.000% | 6/1/27 | CAD | 7,000 | 7,577 |

| | Canada | 9.000% | 6/1/25 | CAD | 20,000 | 21,183 |

| | Canada | 10.500% | 3/15/21 | CAD | 15,000 | 13,538 |

| 2 | Canada Housing Trust No 1 | 1.150% | 12/15/21 | CAD | 75,854 | 55,028 |

| 2 | Canada Housing Trust No 1 | 1.200% | 6/15/20 | CAD | 24,050 | 17,952 |

| 2 | Canada Housing Trust No 1 | 1.250% | 12/15/20 | CAD | 50,000 | 37,268 |

| 2,5 | Canada Housing Trust No 1 | 1.250% | 6/15/21 | CAD | 30,000 | 22,094 |

| 2 | Canada Housing Trust No 1 | 1.450% | 6/15/20 | CAD | 25,000 | 18,736 |

| 2 | Canada Housing Trust No 1 | 1.500% | 12/15/21 | CAD | 600 | 440 |

| 2 | Canada Housing Trust No 1 | 1.750% | 6/15/22 | CAD | 35,000 | 25,787 |

| 2 | Canada Housing Trust No 1 | 1.900% | 9/15/26 | CAD | 31,950 | 22,654 |

| 2 | Canada Housing Trust No 1 | 1.950% | 12/15/25 | CAD | 20,000 | 14,338 |

| 2 | Canada Housing Trust No 1 | 2.000% | 12/15/19 | CAD | 53,800 | 40,759 |

| 2 | Canada Housing Trust No 1 | 2.250% | 12/15/25 | CAD | 5,225 | 3,822 |

| 2 | Canada Housing Trust No 1 | 2.350% | 6/15/23 | CAD | 48,275 | 36,095 |

| 2 | Canada Housing Trust No 1 | 2.350% | 9/15/23 | CAD | 13,940 | 10,411 |

| 2 | Canada Housing Trust No 1 | 2.350% | 3/15/28 | CAD | 425 | 309 |

| 2 | Canada Housing Trust No 1 | 2.400% | 12/15/22 | CAD | 30,000 | 22,555 |