UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22619

| Name of Registrant: | Vanguard Charlotte Funds |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| Name and address of agent for service: | John E. Schadl, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2023—October 31, 2024

Item 1: Reports to Shareholders.

TABLE OF CONTENTS

Vanguard Global Credit Bond Fund

Investor Shares - VGCIX |

| | |

Vanguard Global Credit Bond Fund

Admiral™ Shares - VGCAX |

| | |

Vanguard Global Credit Bond Fund

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about Vanguard Global Credit Bond Fund (the "Fund") for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Shares | $37 | 0.35% |

How did the Fund perform during the reporting period?

For the 12 months ended October 31, 2024, the Fund outperformed its benchmark, the Bloomberg Global Aggregate Credit Index hedged in U.S. dollars.

Global economic growth appeared relatively stable at around 3% during the period, and U.S. recession fears faded. With inflation continuing to moderate across much of the world, major central banks including the European Central Bank, the Bank of England, and the U.S. Federal Reserve began lowering policy rates.

The Fund’s outperformance was driven by a number of factors, including an overweight to credit and tactical plays in emerging markets bonds. Issuer selection, primarily among corporate and emerging markets bonds, added value, as did selective investments in the supranational and agency sectors.

Since the Fund’s inception on November 15, 2018, its annualized return has outpaced that of its benchmark.

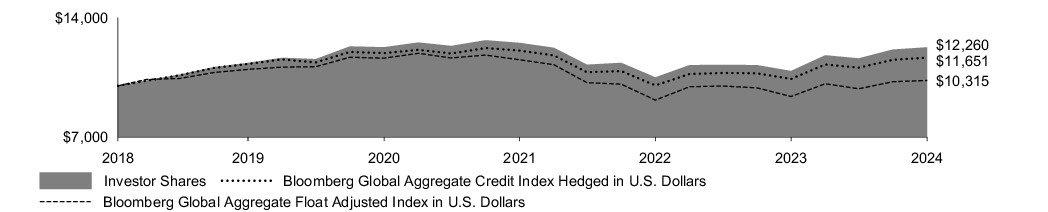

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: November 15, 2018, Through October 31, 2024

Initial Investment of $ 10,000

| Average Annual Total Returns | | | |

| 1 Year | 5 Years | Since Inception

(11/15/2018) |

| Investor Shares | 12.76% | 1.56% | 3.48% |

| Bloomberg Global Aggregate Credit Index Hedged in U.S. Dollars | 11.97% | 0.64% | 2.60% |

| Bloomberg Global Aggregate Float Adjusted Index in U.S Dollars | 10.02% | -1.22% | 0.52% |

This table reflects the Fund’s investments, including short-term investments, derivatives and other assets and liabilities.

Fund Statistics

(as of October 31, 2024) | |

Fund Net Assets

(in millions) | $603 |

| Number of Portfolio Holdings | 1,592 |

| Portfolio Turnover Rate | 157% |

Total Investment Advisory Fees

(in thousands) | $90 |

Portfolio Composition % of Net Assets

(as of October 31, 2024) |

| Africa | 0.6% |

| Asia | 3.4% |

| Europe | 37.9% |

| North America | 46.6% |

| Oceania | 4.7% |

| South America | 1.7% |

| Other Assets and Liabilities—Net | 5.1% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR2025

Vanguard Global Credit Bond Fund

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about Vanguard Global Credit Bond Fund (the "Fund") for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Admiral Shares | $27 | 0.25% |

How did the Fund perform during the reporting period?

For the 12 months ended October 31, 2024, the Fund outperformed its benchmark, the Bloomberg Global Aggregate Credit Index hedged in U.S. dollars.

Global economic growth appeared relatively stable at around 3% during the period, and U.S. recession fears faded. With inflation continuing to moderate across much of the world, major central banks including the European Central Bank, the Bank of England, and the U.S. Federal Reserve began lowering policy rates.

The Fund’s outperformance was driven by a number of factors, including an overweight to credit and tactical plays in emerging markets bonds. Issuer selection, primarily among corporate and emerging markets bonds, added value, as did selective investments in the supranational and agency sectors.

Since the Fund’s inception on November 15, 2018, its annualized return has outpaced that of its benchmark.

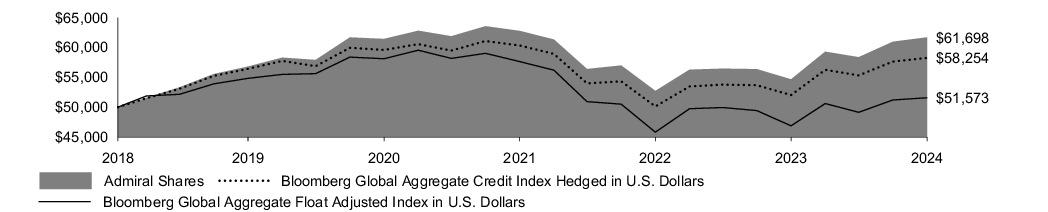

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: November 15, 2018, Through October 31, 2024

Initial Investment of $ 50,000

| Average Annual Total Returns | | | |

| 1 Year | 5 Years | Since Inception

(11/15/2018) |

| Admiral Shares | 12.88% | 1.67% | 3.59% |

| Bloomberg Global Aggregate Credit Index Hedged in U.S. Dollars | 11.97% | 0.64% | 2.60% |

| Bloomberg Global Aggregate Float Adjusted Index in U.S Dollars | 10.02% | -1.22% | 0.52% |

This table reflects the Fund’s investments, including short-term investments, derivatives and other assets and liabilities.

Fund Statistics

(as of October 31, 2024) | |

Fund Net Assets

(in millions) | $603 |

| Number of Portfolio Holdings | 1,592 |

| Portfolio Turnover Rate | 157% |

Total Investment Advisory Fees

(in thousands) | $90 |

Portfolio Composition % of Net Assets

(as of October 31, 2024) |

| Africa | 0.6% |

| Asia | 3.4% |

| Europe | 37.9% |

| North America | 46.6% |

| Oceania | 4.7% |

| South America | 1.7% |

| Other Assets and Liabilities—Net | 5.1% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR525

Item 2: Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Code of Ethics was amended during the reporting period covered by this report to make certain technical, non-material changes.

Item 3: Audit Committee Financial Expert.

All members of the Audit Committee have been determined by the Registrant’s Board of Trustees to be Audit Committee Financial Experts and to be independent: F. Joseph Loughrey, Mark Loughridge, Sarah Bloom Raskin, and Peter F. Volanakis.

Item 4: Principal Accountant Fees and Services.

Includes fees billed in connection with services to the Registrant only.

| | | Fiscal Year Ended

October 31, 2024 | | | Fiscal Year Ended

October 31, 2023 | |

| (a) Audit Fees. | | $ | 235,000 | | | $ | 231,000 | |

| (b) Audit-Related Fees. | | | 0 | | | | 0 | |

| (c) Tax Fees. | | | 0 | | | | 0 | |

| (d) All Other Fees. | | | 0 | | | | 0 | |

| Total. | | $ | 235,000 | | | $ | 231,000 | |

| (e) | (1) Pre-Approval Policies. The audit committee is responsible for pre-approving all audit and non-audit services provided by PwC to: (i) the Vanguard funds; and (ii) Vanguard, or any entity controlled by Vanguard that provides ongoing services to the Vanguard funds. All services provided to Vanguard entities by the independent auditor, whether or not they are subject to preapproval, must be disclosed to the audit committee. The audit committee chair may preapprove any permissible audit and non-audit services as long as any preapproval is brought to the attention of the full audit committee at the next scheduled meeting. |

(2) No percentage of the principal accountant’s fees or services were approved pursuant to the waiver provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

| (f) | For the most recent fiscal year, over 50% of the hours worked under the principal accountant’s engagement were not performed by persons other than full-time, permanent employees of the principal accountant. |

| (g) | Aggregate Non-Audit Fees. |

Includes fees billed for non-audit services provided to the Registrant, other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation.

| | | Fiscal Year Ended

October 31, 2024 | | | Fiscal Year Ended

October 31, 2023 | |

| Non-audit fees to the Registrant only, listed as (b) through (d) above. | | $ | 0 | | | $ | 0 | |

| | | | | | | | | |

| Non-audit Fees to other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation. | | | | | | | | |

| Audit-Related Fees. | | $ | 1,517,669 | | | $ | 3,295,934 | |

| Tax Fees. | | $ | 1,916,879 | | | $ | 1,678,928 | |

| All Other Fees. | | $ | 268,000 | | | $ | 25,000 | |

| Total. | | $ | 3,702,548 | | | $ | 4,999,862 | |

| (h) | For the most recent fiscal year, the Audit Committee has determined that the provision of all non-audit services was consistent with maintaining the principal accountant’s independence. |

Item 5: Audit Committee of Listed Registrants.

The Registrant is a listed issuer as defined in rule 10A-3 under the Securities Exchange Act of 1934 (“Exchange Act”). The Registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Registrant’s audit committee members are: F. Joseph Loughrey, Mark Loughridge, Sarah Bloom Raskin, and Peter F. Volanakis.

Item 6: Investments.

Not applicable. The complete schedule of investments is included in the financial statements filed under Item 7 of this Form.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial Statements

For the year ended October 31, 2024

Vanguard Global Credit Bond Fund

Contents

Financial Statements

| 1 |

Report of Independent Registered

Public Accounting Firm

| 43 |

Tax information

| 44 |

| | |

Schedule of Investments

As of October 31, 2024

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| U.S. Government and Agency Obligations (2.8%) |

| | United States Treasury Note/Bond | 0.750% | 1/31/28 | 1,000 | 898 |

| | United States Treasury Note/Bond | 2.500% | 2/15/45 | 1,000 | 720 |

| 1 | United States Treasury Note/Bond | 2.625% | 5/31/27 | 2,500 | 2,408 |

| | United States Treasury Note/Bond | 2.750% | 7/31/27 | 2,000 | 1,928 |

| 1 | United States Treasury Note/Bond | 3.000% | 5/15/45–11/15/45 | 2,000 | 1,567 |

| 1 | United States Treasury Note/Bond | 3.125% | 8/15/44 | 1,000 | 805 |

| 2 | United States Treasury Note/Bond | 3.375% | 9/15/27 | 1,000 | 980 |

| 1 | United States Treasury Note/Bond | 3.625% | 8/15/43–2/15/44 | 2,000 | 1,752 |

| | United States Treasury Note/Bond | 3.750% | 8/15/27 | 1,000 | 990 |

| 3 | United States Treasury Note/Bond | 4.125% | 8/15/44 | 1,000 | 939 |

| | United States Treasury Note/Bond | 4.250% | 6/30/31 | 1,000 | 1,001 |

| 2 | United States Treasury Note/Bond | 4.500% | 5/15/27 | 2,500 | 2,521 |

| Total U.S. Government and Agency Obligations (Cost $16,726) | 16,509 |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.0%) |

| United States (0.0%) |

| 4 | CD Mortgage Trust Series 2018-CD7 | 4.842% | 8/15/51 | 50 | 45 |

| 4,5 | Ford Credit Auto Owner Trust Series 2022-1 | 4.670% | 11/15/34 | 100 | 98 |

| Total Asset-Backed/Commercial Mortgage-Backed Securities (Cost $148) | 143 |

| Corporate Bonds (74.9%) |

| Australia (4.7%) |

| 4,6 | AGI Finance Pty Ltd. | 6.109% | 6/28/30 | 2,560 | 1,725 |

| 4,6 | Aurizon Finance Pty Ltd. | 3.000% | 3/9/28 | 2,000 | 1,216 |

| 4,6 | Aurizon Network Pty Ltd. | 2.900% | 9/2/30 | 2,000 | 1,125 |

| 4,6 | Aurizon Network Pty Ltd. | 6.100% | 9/12/31 | 890 | 592 |

| 4,6 | Ausgrid Finance Pty Ltd. | 1.814% | 2/5/27 | 2,150 | 1,317 |

| 4,6 | AusNet Services Holdings Pty Ltd. | 2.600% | 7/31/29 | 2,370 | 1,373 |

| 5 | Australia & New Zealand Banking Group Ltd. | 2.950% | 7/22/30 | 550 | 540 |

| 5 | Australia & New Zealand Banking Group Ltd. | 5.204% | 9/30/35 | 270 | 263 |

| 4,6,7 | Australia & New Zealand Banking Group Ltd., 3M Australian Bank Bill Rate + 1.950% | 6.343% | 1/16/34 | 1,625 | 1,088 |

| 4,6 | Australian Gas Networks Ltd. | 2.149% | 4/28/28 | 400 | 237 |

| 4,6 | Coles Group Treasury Pty Ltd. | 2.100% | 8/27/30 | 470 | 257 |

| 5 | Glencore Finance Canada Ltd. | 5.550% | 10/25/42 | 35 | 34 |

| 5 | Glencore Funding LLC | 6.125% | 10/6/28 | 120 | 125 |

| 5 | Glencore Funding LLC | 5.700% | 5/8/33 | 58 | 59 |

| 4,6 | Lonsdale Finance Pty Ltd. | 2.450% | 11/20/26 | 3,330 | 2,078 |

| 5 | Macquarie Bank Ltd. | 3.624% | 6/3/30 | 80 | 73 |

| 6 | Macquarie Bank Ltd. | 5.953% | 3/1/34 | 3,000 | 1,994 |

| 6,7 | Macquarie Bank Ltd., 3M Australian Bank Bill Rate + 1.950% | 6.347% | 3/1/34 | 2,870 | 1,910 |

| 5 | Macquarie Group Ltd. | 4.098% | 6/21/28 | 330 | 323 |

| 4,6 | Network Finance Co. Pty Ltd. | 2.579% | 10/3/28 | 760 | 451 |

| 4,6 | Pacific National Finance Pty Ltd. | 5.400% | 5/12/27 | 1,190 | 772 |

| 4,6 | Pacific National Finance Pty Ltd. | 3.700% | 9/24/29 | 1,500 | 881 |

| 4,6 | Perth Airport Pty Ltd. | 5.600% | 3/5/31 | 810 | 533 |

| 4,6 | Qantas Airways Ltd. | 2.950% | 11/27/29 | 1,130 | 652 |

| | Rio Tinto Finance USA Ltd. | 5.200% | 11/2/40 | 250 | 247 |

| 4,6 | Stockland Trust | 2.300% | 3/24/28 | 800 | 475 |

| 4,6 | Sydney Airport Finance Co. Pty Ltd. | 5.900% | 4/19/34 | 1,500 | 990 |

| 4,6 | Victoria Power Networks Finance Pty Ltd. | 5.057% | 3/14/29 | 1,500 | 978 |

| 4,6 | WestConnex Finance Co. Pty Ltd. | 6.150% | 10/9/30 | 3,380 | 2,286 |

| 4 | Westpac Banking Corp. | 2.894% | 2/4/30 | 500 | 496 |

| | Westpac Banking Corp. | 2.963% | 11/16/40 | 75 | 55 |

| 4,6,7 | Westpac Banking Corp., 3M Australian Bank Bill Rate + 1.000% | 5.404% | 1/15/29 | 3,200 | 2,123 |

| 4,6 | Woolworths Group Ltd. | 1.850% | 11/15/27 | 2,070 | 1,247 |

| | | | | | | 28,515 |

| Austria (0.2%) |

| 4,8 | Raiffeisen Bank International AG | 4.625% | 8/21/29 | 200 | 223 |

| 4,8 | Raiffeisen Bank International AG | 4.500% | 5/31/30 | 1,100 | 1,229 |

| | | | | | | 1,452 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| Belgium (1.4%) |

| 4 | Anheuser-Busch Cos. LLC | 4.700% | 2/1/36 | 230 | 222 |

| 4 | Anheuser-Busch Cos. LLC | 4.900% | 2/1/46 | 25 | 23 |

| | Anheuser-Busch InBev Finance Inc. | 4.625% | 2/1/44 | 468 | 425 |

| 4,8 | Anheuser-Busch InBev SA/NV | 2.750% | 3/17/36 | 1,700 | 1,724 |

| | Anheuser-Busch InBev Worldwide Inc. | 5.000% | 6/15/34 | 2,000 | 2,009 |

| | Anheuser-Busch InBev Worldwide Inc. | 5.875% | 6/15/35 | 240 | 256 |

| | Anheuser-Busch InBev Worldwide Inc. | 5.450% | 1/23/39 | 244 | 249 |

| | Anheuser-Busch InBev Worldwide Inc. | 4.750% | 4/15/58 | 219 | 198 |

| 4,8 | Argenta Spaarbank NV | 1.000% | 1/29/27 | 1,000 | 1,037 |

| 8 | Crelan SA | 5.250% | 1/23/32 | 2,100 | 2,439 |

| | | | | | | 8,582 |

| Brazil (0.2%) |

| 4 | Braskem Netherlands Finance BV | 4.500% | 1/31/30 | 200 | 174 |

| 5 | Braskem Netherlands Finance BV | 8.000% | 10/15/34 | 740 | 738 |

| 5 | Embraer Netherlands Finance BV | 7.000% | 7/28/30 | 200 | 212 |

| | | | | | | 1,124 |

| Canada (1.4%) |

| 5 | 1011778 BC ULC | 3.875% | 1/15/28 | 38 | 36 |

| 5 | 1011778 BC ULC | 6.125% | 6/15/29 | 5 | 5 |

| 5 | 1011778 BC ULC | 5.625% | 9/15/29 | 3 | 3 |

| 5 | Air Canada | 3.875% | 8/15/26 | 20 | 19 |

| | Bell Telephone Co. of Canada or Bell Canada | 5.100% | 5/11/33 | 4 | 4 |

| | Bell Telephone Co. of Canada or Bell Canada | 4.300% | 7/29/49 | 4 | 3 |

| | Bell Telephone Co. of Canada or Bell Canada | 3.650% | 8/15/52 | 4 | 3 |

| 5 | Bombardier Inc. | 7.250% | 7/1/31 | 5 | 5 |

| 5 | Bombardier Inc. | 7.000% | 6/1/32 | 5 | 5 |

| | Canadian National Railway Co. | 4.400% | 8/5/52 | 230 | 201 |

| | Canadian Natural Resources Ltd. | 2.950% | 7/15/30 | 125 | 112 |

| | Canadian Natural Resources Ltd. | 6.250% | 3/15/38 | 140 | 145 |

| | Canadian Pacific Railway Co. | 4.800% | 8/1/45 | 60 | 55 |

| | Cenovus Energy Inc. | 6.750% | 11/15/39 | 15 | 16 |

| | Cenovus Energy Inc. | 5.400% | 6/15/47 | 30 | 28 |

| | Enbridge Inc. | 6.000% | 11/15/28 | 300 | 313 |

| | Enbridge Inc. | 5.300% | 4/5/29 | 115 | 117 |

| | Enbridge Inc. | 3.125% | 11/15/29 | 42 | 39 |

| | Enbridge Inc. | 6.200% | 11/15/30 | 229 | 243 |

| | Enbridge Inc. | 6.700% | 11/15/53 | 140 | 157 |

| | Enbridge Inc. | 5.950% | 4/5/54 | 835 | 852 |

| 5 | Garda World Security Corp. | 8.250% | 8/1/32 | 14 | 14 |

| 5 | Hudbay Minerals Inc. | 4.500% | 4/1/26 | 35 | 35 |

| 5 | NOVA Chemicals Corp. | 9.000% | 2/15/30 | 41 | 44 |

| | Nutrien Ltd. | 4.200% | 4/1/29 | 125 | 122 |

| | Nutrien Ltd. | 5.400% | 6/21/34 | 498 | 500 |

| | Nutrien Ltd. | 4.125% | 3/15/35 | 70 | 63 |

| | Nutrien Ltd. | 5.800% | 3/27/53 | 90 | 92 |

| 5 | Ontario Gaming GTA LP | 8.000% | 8/1/30 | 5 | 5 |

| | Rogers Communications Inc. | 3.200% | 3/15/27 | 320 | 309 |

| | Rogers Communications Inc. | 5.000% | 2/15/29 | 540 | 540 |

| | Rogers Communications Inc. | 3.800% | 3/15/32 | 40 | 37 |

| | Rogers Communications Inc. | 5.300% | 2/15/34 | 280 | 278 |

| | Rogers Communications Inc. | 4.550% | 3/15/52 | 138 | 114 |

| 4 | Royal Bank of Canada | 4.969% | 8/2/30 | 770 | 772 |

| 4 | Royal Bank of Canada | 4.650% | 10/18/30 | 600 | 594 |

| 5 | South Bow Canadian Infrastructure Holdings Ltd. | 7.500% | 3/1/55 | 10 | 10 |

| 5 | South Bow Canadian Infrastructure Holdings Ltd. | 7.625% | 3/1/55 | 5 | 5 |

| | Suncor Energy Inc. | 3.750% | 3/4/51 | 40 | 29 |

| | TELUS Corp. | 3.700% | 9/15/27 | 360 | 349 |

| | TELUS Corp. | 4.300% | 6/15/49 | 89 | 71 |

| | TransCanada PipeLines Ltd. | 4.250% | 5/15/28 | 1,405 | 1,377 |

| | TransCanada PipeLines Ltd. | 4.100% | 4/15/30 | 520 | 497 |

| | TransCanada PipeLines Ltd. | 6.200% | 10/15/37 | 80 | 84 |

| | | | | | | 8,302 |

| China (0.1%) |

| | NXP BV | 5.000% | 1/15/33 | 310 | 305 |

| Czech Republic (0.2%) |

| 4,8 | EPH Financing International A/S | 6.651% | 11/13/28 | 1,000 | 1,168 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| Denmark (0.0%) |

| 5 | Danske Bank A/S | 5.427% | 3/1/28 | 200 | 202 |

| Finland (0.0%) |

| 5 | Amer Sports Co. | 6.750% | 2/16/31 | 5 | 5 |

| France (3.0%) |

| 4,8 | Ayvens SA | 4.875% | 10/6/28 | 500 | 571 |

| 8 | Ayvens SA | 4.000% | 1/24/31 | 2,300 | 2,543 |

| 5 | BNP Paribas SA | 5.497% | 5/20/30 | 300 | 304 |

| 5 | BNP Paribas SA | 5.738% | 2/20/35 | 150 | 152 |

| 9 | BPCE SA | 2.500% | 11/30/32 | 4,400 | 5,127 |

| 5 | BPCE SA | 5.936% | 5/30/35 | 50 | 51 |

| 8 | Credit Agricole Assurances SA | 1.500% | 10/6/31 | 200 | 185 |

| 8 | Credit Agricole Assurances SA | 2.625% | 1/29/48 | 800 | 837 |

| 5 | Credit Agricole SA | 4.631% | 9/11/28 | 250 | 248 |

| 4,8 | Engie SA | 3.875% | 1/6/31 | 200 | 223 |

| 4,8 | Engie SA | 4.000% | 1/11/35 | 1,500 | 1,676 |

| 4,8 | Engie SA | 4.250% | 1/11/43 | 300 | 332 |

| 8 | Groupe des Assurances du Credit Mutuel SADIR | 1.850% | 4/21/42 | 800 | 730 |

| 8 | Groupe des Assurances du Credit Mutuel SADIR | 5.000% | 10/30/44 | 500 | 557 |

| 4,8 | RCI Banque SA | 4.875% | 9/21/28 | 2,700 | 3,077 |

| 5 | SNF Group SACA | 3.125% | 3/15/27 | 10 | 10 |

| 5 | SNF Group SACA | 3.375% | 3/15/30 | 22 | 20 |

| 5 | Societe Generale SA | 2.797% | 1/19/28 | 540 | 511 |

| 5 | Societe Generale SA | 3.000% | 1/22/30 | 155 | 138 |

| 5 | Societe Generale SA | 4.027% | 1/21/43 | 80 | 56 |

| | TotalEnergies Capital SA | 5.275% | 9/10/54 | 225 | 216 |

| 4,8 | TotalEnergies SE | 2.000% | Perpetual | 300 | 313 |

| 4,8 | Unibail-Rodamco-Westfield SE | 2.000% | 4/28/36 | 200 | 180 |

| | | | | | | 18,057 |

| Germany (3.8%) |

| 4,8 | Allianz SE | 4.597% | 9/7/38 | 500 | 562 |

| 4,8 | Aroundtown SA | 0.000% | 7/16/26 | 300 | 308 |

| 4,8 | Aroundtown SA | 1.450% | 7/9/28 | 1,300 | 1,301 |

| 4,8 | Aroundtown SA | 4.800% | 7/16/29 | 1,000 | 1,113 |

| 4,9 | Aroundtown SA | 3.625% | 4/10/31 | 100 | 108 |

| 8 | Bayer AG | 0.625% | 7/12/31 | 600 | 532 |

| | Deutsche Bank AG | 7.146% | 7/13/27 | 100 | 103 |

| | Deutsche Bank AG | 5.706% | 2/8/28 | 220 | 222 |

| | Deutsche Bank AG | 6.720% | 1/18/29 | 200 | 208 |

| | Deutsche Bank AG | 6.819% | 11/20/29 | 210 | 221 |

| 4,8 | Deutsche Bank AG | 5.625% | 5/19/31 | 3,800 | 4,219 |

| 4,8 | Deutsche Bank AG | 4.000% | 6/24/32 | 2,100 | 2,278 |

| | Deutsche Bank AG | 7.079% | 2/10/34 | 200 | 210 |

| 4,8 | Deutsche Lufthansa AG | 2.875% | 5/16/27 | 1,300 | 1,394 |

| 5 | Deutsche Telekom International Finance BV | 4.875% | 3/6/42 | 75 | 69 |

| 4,8 | Fresenius Finance Ireland plc | 0.875% | 10/1/31 | 992 | 902 |

| 5 | Siemens Financieringsmaatschappij NV | 2.875% | 3/11/41 | 370 | 275 |

| 4,9 | Traton Finance Luxembourg SA | 5.625% | 1/16/29 | 1,900 | 2,439 |

| 4,8 | Volkswagen Bank GmbH | 4.250% | 1/7/26 | 1,500 | 1,650 |

| 4,9 | Volkswagen Financial Services NV | 5.875% | 5/23/29 | 100 | 130 |

| 5 | Volkswagen Group of America Finance LLC | 1.625% | 11/24/27 | 150 | 135 |

| 4,8 | Volkswagen International Finance NV | 3.875% | 3/29/26 | 500 | 548 |

| 8 | Volkswagen International Finance NV | 3.875% | Perpetual | 1,300 | 1,369 |

| 8 | Vonovia SE | 1.875% | 6/28/28 | 1,500 | 1,556 |

| 4,8 | Vonovia SE | 0.250% | 9/1/28 | 800 | 775 |

| 8 | Vonovia SE | 1.500% | 6/14/41 | 200 | 146 |

| | | | | | | 22,773 |

| Ireland (0.4%) |

| | AerCap Ireland Capital DAC | 6.100% | 1/15/27 | 880 | 902 |

| | AerCap Ireland Capital DAC | 4.625% | 10/15/27 | 150 | 149 |

| | AerCap Ireland Capital DAC | 3.000% | 10/29/28 | 380 | 353 |

| | AerCap Ireland Capital DAC | 3.400% | 10/29/33 | 100 | 86 |

| | AerCap Ireland Capital DAC | 3.850% | 10/29/41 | 150 | 120 |

| 5 | Avolon Holdings Funding Ltd. | 2.125% | 2/21/26 | 150 | 144 |

| 5 | Flutter Treasury DAC | 6.375% | 4/29/29 | 5 | 5 |

| 5 | GGAM Finance Ltd. | 8.000% | 2/15/27 | 7 | 7 |

| 5 | GGAM Finance Ltd. | 8.000% | 6/15/28 | 47 | 50 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 5 | Smurfit Kappa Treasury ULC | 5.200% | 1/15/30 | 220 | 222 |

| 5 | Smurfit Kappa Treasury ULC | 5.438% | 4/3/34 | 200 | 201 |

| 5 | Smurfit Kappa Treasury ULC | 5.777% | 4/3/54 | 335 | 339 |

| | | | | | | 2,578 |

| Israel (0.0%) |

| | Teva Pharmaceutical Finance Netherlands III BV | 3.150% | 10/1/26 | 20 | 19 |

| | Teva Pharmaceutical Finance Netherlands III BV | 4.100% | 10/1/46 | 4 | 3 |

| | | | | | | 22 |

| Italy (0.6%) |

| 4,8 | CA Auto Bank SpA | 4.375% | 6/8/26 | 500 | 553 |

| 5 | Enel Finance International NV | 1.625% | 7/12/26 | 200 | 189 |

| 5 | Enel Finance International NV | 4.750% | 5/25/47 | 200 | 175 |

| 4,9 | Intesa Sanpaolo SpA | 6.625% | 5/31/33 | 1,900 | 2,593 |

| | | | | | | 3,510 |

| Japan (1.0%) |

| | Mitsubishi UFJ Financial Group Inc. | 5.258% | 4/17/30 | 660 | 669 |

| | Mitsubishi UFJ Financial Group Inc. | 2.048% | 7/17/30 | 600 | 516 |

| | Mitsubishi UFJ Financial Group Inc. | 5.426% | 4/17/35 | 400 | 406 |

| | Mizuho Financial Group Inc. | 5.667% | 5/27/29 | 250 | 256 |

| | Nomura Holdings Inc. | 5.594% | 7/2/27 | 466 | 473 |

| | Nomura Holdings Inc. | 5.783% | 7/3/34 | 811 | 827 |

| | Sumitomo Mitsui Financial Group Inc. | 5.316% | 7/9/29 | 1,051 | 1,072 |

| | Sumitomo Mitsui Financial Group Inc. | 5.710% | 1/13/30 | 200 | 207 |

| | Sumitomo Mitsui Financial Group Inc. | 5.558% | 7/9/34 | 600 | 617 |

| | Sumitomo Mitsui Financial Group Inc. | 5.836% | 7/9/44 | 364 | 378 |

| | Takeda Pharmaceutical Co. Ltd. | 3.025% | 7/9/40 | 100 | 75 |

| | Takeda Pharmaceutical Co. Ltd. | 3.175% | 7/9/50 | 100 | 68 |

| | Takeda Pharmaceutical Co. Ltd. | 3.375% | 7/9/60 | 200 | 133 |

| | | | | | | 5,697 |

| Kazakhstan (0.1%) |

| 5 | Development Bank of Kazakhstan JSC | 5.500% | 4/15/27 | 485 | 489 |

| Luxembourg (1.8%) |

| 4,8 | Blackstone Property Partners Europe Holdings Sarl | 1.000% | 10/20/26 | 5,135 | 5,325 |

| 4,8 | Blackstone Property Partners Europe Holdings Sarl | 1.250% | 4/26/27 | 673 | 695 |

| 4,8 | Blackstone Property Partners Europe Holdings Sarl | 1.000% | 5/4/28 | 1,979 | 1,966 |

| 4,9 | Blackstone Property Partners Europe Holdings Sarl | 2.625% | 10/20/28 | 900 | 1,039 |

| 8 | Blackstone Property Partners Europe Holdings Sarl | 3.625% | 10/29/29 | 1,200 | 1,294 |

| 4,8 | Prologis International Funding II SA | 4.625% | 2/21/35 | 700 | 805 |

| | | | | | | 11,124 |

| Macao (0.0%) |

| 5 | MGM China Holdings Ltd. | 7.125% | 6/26/31 | 13 | 13 |

| 5 | Studio City Co. Ltd. | 7.000% | 2/15/27 | 10 | 10 |

| 5 | Studio City Finance Ltd. | 5.000% | 1/15/29 | 5 | 4 |

| 5 | Wynn Macau Ltd. | 5.625% | 8/26/28 | 37 | 36 |

| 5 | Wynn Macau Ltd. | 5.125% | 12/15/29 | 4 | 4 |

| | | | | | | 67 |

| Malaysia (0.1%) |

| 4 | Petronas Capital Ltd. | 3.500% | 4/21/30 | 445 | 416 |

| Mexico (0.1%) |

| 5 | FIEMEX Energia - Banco Actinver SA Institucion de Banca Multiple | 7.250% | 1/31/41 | 752 | 754 |

| Netherlands (1.5%) |

| 4,8 | ABN AMRO Bank NV | 5.125% | 2/22/33 | 1,100 | 1,241 |

| 4,8 | ABN AMRO Bank NV | 5.500% | 9/21/33 | 1,400 | 1,605 |

| | Cooperatieve Rabobank UA | 4.494% | 10/17/29 | 250 | 247 |

| 8 | ING Groep NV | 1.000% | 11/13/30 | 1,200 | 1,272 |

| 4,8 | NIBC Bank NV | 6.000% | 11/16/28 | 4,000 | 4,734 |

| 5 | Sunrise FinCo I BV | 4.875% | 7/15/31 | 15 | 14 |

| 5 | VZ Secured Financing BV | 5.000% | 1/15/32 | 15 | 13 |

| | | | | | | 9,126 |

| Peru (0.1%) |

| 5 | Banco de Credito del Peru S.A. | 5.800% | 3/10/35 | 177 | 174 |

| 5 | Niagara Energy SAC | 5.746% | 10/3/34 | 492 | 481 |

| | | | | | | 655 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| Poland (0.0%) |

| 5 | Canpack SA | 3.875% | 11/15/29 | 37 | 34 |

| Saudi Arabia (0.2%) |

| | Gaci First Investment Co. | 5.000% | 1/29/29 | 1,190 | 1,185 |

| Spain (0.3%) |

| 4 | Banco Santander SA | 5.365% | 7/15/28 | 400 | 403 |

| | Banco Santander SA | 6.607% | 11/7/28 | 340 | 361 |

| | Banco Santander SA | 6.921% | 8/8/33 | 75 | 81 |

| | Banco Santander SA | 6.938% | 11/7/33 | 75 | 83 |

| 4,8 | CaixaBank SA | 1.250% | 6/18/31 | 800 | 841 |

| | | | | | | 1,769 |

| Sweden (0.6%) |

| 4,8 | Castellum AB | 4.125% | 12/10/30 | 200 | 217 |

| 4,8 | Swedbank AB | 3.625% | 8/23/32 | 2,850 | 3,103 |

| | | | | | | 3,320 |

| Switzerland (1.1%) |

| | Credit Suisse USA LLC | 7.125% | 7/15/32 | 350 | 393 |

| | Novartis Capital Corp. | 4.700% | 9/18/54 | 155 | 143 |

| 4,8 | Raiffeisen Schweiz Genossenschaft | 5.230% | 11/1/27 | 1,900 | 2,184 |

| | UBS AG | 7.500% | 2/15/28 | 400 | 431 |

| 5 | UBS Group AG | 6.327% | 12/22/27 | 560 | 576 |

| 5 | UBS Group AG | 4.282% | 1/9/28 | 1,120 | 1,096 |

| 5 | UBS Group AG | 4.253% | 3/23/28 | 200 | 196 |

| 5 | UBS Group AG | 5.617% | 9/13/30 | 163 | 166 |

| 5 | UBS Group AG | 3.091% | 5/14/32 | 290 | 256 |

| 5 | UBS Group AG | 5.379% | 9/6/45 | 1,350 | 1,322 |

| | | | | | | 6,763 |

| United Arab Emirates (0.3%) |

| 4 | Abu Dhabi Developmental Holding Co. PJSC | 5.375% | 5/8/29 | 1,510 | 1,540 |

| 4 | MDGH GMTN RSC Ltd. | 3.000% | 3/28/27 | 300 | 288 |

| | | | | | | 1,828 |

| United Kingdom (10.9%) |

| | AstraZeneca plc | 4.000% | 9/18/42 | 160 | 137 |

| 4,9 | Aviva plc | 6.875% | 5/20/58 | 501 | 660 |

| 5 | BAE Systems plc | 5.000% | 3/26/27 | 3,000 | 3,018 |

| 5 | BAE Systems plc | 5.125% | 3/26/29 | 2,090 | 2,110 |

| 5 | BAE Systems plc | 5.250% | 3/26/31 | 1,410 | 1,432 |

| 5 | BAE Systems plc | 5.300% | 3/26/34 | 1,200 | 1,214 |

| 5 | BAE Systems plc | 5.500% | 3/26/54 | 650 | 655 |

| | Barclays plc | 5.304% | 8/9/26 | 200 | 200 |

| | Barclays plc | 5.829% | 5/9/27 | 1,000 | 1,012 |

| | Barclays plc | 5.674% | 3/12/28 | 560 | 569 |

| | Barclays plc | 4.836% | 5/9/28 | 300 | 296 |

| | Barclays plc | 4.837% | 9/10/28 | 390 | 388 |

| | Barclays plc | 7.385% | 11/2/28 | 600 | 639 |

| 9 | Barclays plc | 3.750% | 11/22/30 | 1,900 | 2,399 |

| 8 | Barclays plc | 4.506% | 1/31/33 | 1,000 | 1,136 |

| | Barclays plc | 7.119% | 6/27/34 | 200 | 217 |

| | Barclays plc | 3.330% | 11/24/42 | 200 | 148 |

| | BAT Capital Corp. | 3.215% | 9/6/26 | 900 | 875 |

| | BAT Capital Corp. | 3.557% | 8/15/27 | 235 | 228 |

| | BAT Capital Corp. | 2.259% | 3/25/28 | 1,930 | 1,771 |

| | BAT Capital Corp. | 2.726% | 3/25/31 | 75 | 65 |

| | BAT Capital Corp. | 4.742% | 3/16/32 | 585 | 567 |

| | BAT Capital Corp. | 4.390% | 8/15/37 | 560 | 488 |

| | BAT Capital Corp. | 7.079% | 8/2/43 | 165 | 180 |

| | BAT Capital Corp. | 4.540% | 8/15/47 | 124 | 99 |

| | BAT Capital Corp. | 5.650% | 3/16/52 | 110 | 102 |

| 4,8 | BAT Netherlands Finance BV | 5.375% | 2/16/31 | 300 | 354 |

| 5 | Belron UK Finance plc | 5.750% | 10/15/29 | 5 | 5 |

| 4,8 | British American Tobacco plc | 3.000% | Perpetual | 4,400 | 4,675 |

| 9 | CK Hutchison Group Telecom Finance SA | 2.625% | 10/17/34 | 1,869 | 1,749 |

| 4,9 | Close Brothers Finance plc | 1.625% | 12/3/30 | 1,700 | 1,651 |

| 4,8 | easyJet plc | 3.750% | 3/20/31 | 1,325 | 1,441 |

| 4,8 | Heathrow Funding Ltd. | 1.125% | 10/8/30 | 600 | 570 |

| 5 | Howden UK Refinance plc | 7.250% | 2/15/31 | 5 | 5 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 5 | Howden UK Refinance plc | 8.125% | 2/15/32 | 40 | 40 |

| | HSBC Holdings plc | 5.887% | 8/14/27 | 2,200 | 2,238 |

| 4 | HSBC Holdings plc | 3.973% | 5/22/30 | 460 | 438 |

| | HSBC Holdings plc | 5.733% | 5/17/32 | 500 | 512 |

| 8 | HSBC Holdings plc | 6.364% | 11/16/32 | 3,700 | 4,322 |

| 4 | HSBC Holdings plc | 6.500% | 9/15/37 | 125 | 132 |

| 4,9 | HSBC Holdings plc | 7.000% | 4/7/38 | 1,000 | 1,367 |

| | HSBC Holdings plc | 6.332% | 3/9/44 | 300 | 324 |

| | HSBC Holdings plc | 5.250% | 3/14/44 | 200 | 190 |

| 5 | Imperial Brands Finance plc | 6.125% | 7/27/27 | 200 | 205 |

| | Lloyds Banking Group plc | 4.582% | 12/10/25 | 520 | 516 |

| | Lloyds Banking Group plc | 4.716% | 8/11/26 | 200 | 199 |

| | Lloyds Banking Group plc | 7.953% | 11/15/33 | 140 | 159 |

| | Lloyds Banking Group plc | 4.344% | 1/9/48 | 40 | 32 |

| 5 | Lseg US Fin Corp. | 4.875% | 3/28/27 | 200 | 201 |

| 4,8 | Motability Operations Group plc | 3.500% | 7/17/31 | 992 | 1,082 |

| 4,8 | Motability Operations Group plc | 3.875% | 1/24/34 | 900 | 995 |

| 4,9 | Motability Operations Group plc | 4.875% | 1/17/43 | 300 | 350 |

| 4,8 | Nationwide Building Society | 3.828% | 7/24/32 | 4,000 | 4,399 |

| | NatWest Group plc | 4.964% | 8/15/30 | 600 | 595 |

| 5 | NatWest Markets plc | 5.416% | 5/17/27 | 2,200 | 2,233 |

| | RELX Capital Inc. | 3.000% | 5/22/30 | 100 | 91 |

| 9 | Rothesay Life plc | 8.000% | 10/30/25 | 600 | 792 |

| 9 | Rothesay Life plc | 3.375% | 7/12/26 | 2,087 | 2,607 |

| 4,9 | Rothesay Life plc | 7.734% | 5/16/33 | 100 | 138 |

| | Santander UK Group Holdings plc | 6.833% | 11/21/26 | 100 | 102 |

| 4,8 | Severn Trent Utilities Finance plc | 4.000% | 3/5/34 | 1,500 | 1,653 |

| 5 | Standard Chartered plc | 5.688% | 5/14/28 | 200 | 203 |

| 5 | Standard Chartered plc | 7.767% | 11/16/28 | 850 | 913 |

| 4,8 | United Utilities Water Finance plc | 3.750% | 5/23/34 | 3,100 | 3,338 |

| | Vodafone Group plc | 6.150% | 2/27/37 | 121 | 129 |

| | Vodafone Group plc | 5.625% | 2/10/53 | 260 | 252 |

| | Vodafone Group plc | 5.750% | 6/28/54 | 320 | 316 |

| 9 | Yorkshire Water Finance plc | 1.750% | 11/26/26 | 1,243 | 1,472 |

| 4,9 | Yorkshire Water Finance plc | 1.750% | 10/27/32 | 900 | 845 |

| 4,9 | Yorkshire Water Finance plc | 2.750% | 4/18/41 | 1,700 | 1,393 |

| | | | | | | 65,828 |

| United States (40.8%) |

| | AbbVie Inc. | 4.950% | 3/15/31 | 1,600 | 1,616 |

| | AbbVie Inc. | 4.050% | 11/21/39 | 418 | 367 |

| | AbbVie Inc. | 4.250% | 11/21/49 | 240 | 204 |

| | AbbVie Inc. | 5.400% | 3/15/54 | 955 | 963 |

| 5 | Advanced Drainage Systems Inc. | 6.375% | 6/15/30 | 5 | 5 |

| | Advanced Micro Devices Inc. | 4.393% | 6/1/52 | 160 | 140 |

| 4 | AdventHealth Obligated Group | 2.795% | 11/15/51 | 300 | 196 |

| | AEP Texas Inc. | 5.450% | 5/15/29 | 265 | 270 |

| | AEP Texas Inc. | 5.400% | 6/1/33 | 140 | 140 |

| | AEP Transmission Co. LLC | 4.250% | 9/15/48 | 100 | 83 |

| 4 | AEP Transmission Co. LLC | 3.650% | 4/1/50 | 70 | 53 |

| 4 | AEP Transmission Co. LLC | 2.750% | 8/15/51 | 100 | 62 |

| | AEP Transmission Co. LLC | 5.400% | 3/15/53 | 90 | 89 |

| | AES Corp. | 5.450% | 6/1/28 | 150 | 151 |

| | Aflac Inc. | 4.750% | 1/15/49 | 50 | 44 |

| | Agilent Technologies Inc. | 4.750% | 9/9/34 | 155 | 150 |

| | Agree LP | 2.000% | 6/15/28 | 50 | 45 |

| 4 | Air Lease Corp. | 2.875% | 1/15/26 | 105 | 103 |

| 4 | Air Lease Corp. | 3.750% | 6/1/26 | 100 | 98 |

| | Air Lease Corp. | 4.625% | 10/1/28 | 20 | 20 |

| | Air Products and Chemicals Inc. | 2.700% | 5/15/40 | 125 | 92 |

| | Alabama Power Co. | 4.150% | 8/15/44 | 50 | 42 |

| 5 | Alcon Finance Corp. | 3.800% | 9/23/49 | 200 | 154 |

| | Alexandria Real Estate Equities Inc. | 4.750% | 4/15/35 | 100 | 96 |

| | Alexandria Real Estate Equities Inc. | 3.000% | 5/18/51 | 130 | 83 |

| | Alexandria Real Estate Equities Inc. | 5.150% | 4/15/53 | 100 | 92 |

| | Alexandria Real Estate Equities Inc. | 5.625% | 5/15/54 | 230 | 227 |

| | Alleghany Corp. | 3.625% | 5/15/30 | 250 | 236 |

| 5 | Alliant Holdings Intermediate LLC | 6.500% | 10/1/31 | 10 | 10 |

| 5 | Alliant Holdings Intermediate LLC | 7.375% | 10/1/32 | 2 | 2 |

| 4 | Allina Health System | 3.887% | 4/15/49 | 130 | 102 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 5 | Allison Transmission Inc. | 4.750% | 10/1/27 | 24 | 23 |

| | Allstate Corp. | 5.250% | 3/30/33 | 550 | 554 |

| | Allstate Corp. | 5.350% | 6/1/33 | 121 | 122 |

| | Allstate Corp. | 4.500% | 6/15/43 | 230 | 201 |

| 5 | Alpha Generation LLC | 6.750% | 10/15/32 | 2 | 2 |

| | Altria Group Inc. | 2.450% | 2/4/32 | 165 | 137 |

| | Altria Group Inc. | 3.400% | 2/4/41 | 70 | 52 |

| | Altria Group Inc. | 5.375% | 1/31/44 | 100 | 97 |

| | Altria Group Inc. | 5.950% | 2/14/49 | 100 | 101 |

| | Altria Group Inc. | 4.450% | 5/6/50 | 40 | 32 |

| | Amazon.com Inc. | 3.875% | 8/22/37 | 50 | 45 |

| | Amazon.com Inc. | 2.500% | 6/3/50 | 115 | 71 |

| | Amazon.com Inc. | 3.950% | 4/13/52 | 85 | 70 |

| 5 | AMC Networks Inc. | 10.250% | 1/15/29 | 2 | 2 |

| | Ameren Illinois Co. | 4.150% | 3/15/46 | 75 | 63 |

| | Ameren Illinois Co. | 5.900% | 12/1/52 | 130 | 139 |

| 5 | American Airlines Inc. | 5.500% | 4/20/26 | 10 | 10 |

| 5 | American Airlines Inc. | 7.250% | 2/15/28 | 6 | 6 |

| 5 | American Airlines Inc. | 5.750% | 4/20/29 | 36 | 36 |

| 5 | American Airlines Inc. | 8.500% | 5/15/29 | 15 | 16 |

| | American Axle & Manufacturing Inc. | 5.000% | 10/1/29 | 15 | 14 |

| 5 | American Builders & Contractors Supply Co. Inc. | 4.000% | 1/15/28 | 5 | 5 |

| 5 | American Builders & Contractors Supply Co. Inc. | 3.875% | 11/15/29 | 3 | 3 |

| | American Express Co. | 5.043% | 7/26/28 | 403 | 405 |

| | American Express Co. | 5.915% | 4/25/35 | 275 | 284 |

| | American Express Co. | 5.284% | 7/26/35 | 1,427 | 1,429 |

| | American Tower Corp. | 3.600% | 1/15/28 | 100 | 96 |

| | Amgen Inc. | 5.150% | 3/2/28 | 935 | 948 |

| | Amgen Inc. | 6.375% | 6/1/37 | 460 | 503 |

| | Amgen Inc. | 5.150% | 11/15/41 | 61 | 59 |

| | Amgen Inc. | 5.600% | 3/2/43 | 250 | 250 |

| | Amgen Inc. | 3.375% | 2/21/50 | 340 | 246 |

| | Amgen Inc. | 5.650% | 3/2/53 | 85 | 85 |

| | Amgen Inc. | 2.770% | 9/1/53 | 147 | 90 |

| | Amgen Inc. | 5.750% | 3/2/63 | 76 | 76 |

| 5 | AmWINS Group Inc. | 6.375% | 2/15/29 | 7 | 7 |

| 5 | AmWINS Group Inc. | 4.875% | 6/30/29 | 2 | 2 |

| 5 | Antero Midstream Partners LP | 6.625% | 2/1/32 | 5 | 5 |

| | Aon Global Ltd. | 4.600% | 6/14/44 | 35 | 31 |

| | Aon Global Ltd. | 4.750% | 5/15/45 | 70 | 62 |

| | Aon North America Inc. | 5.150% | 3/1/29 | 510 | 515 |

| | Aon North America Inc. | 5.750% | 3/1/54 | 420 | 425 |

| | Apollo Global Management Inc. | 5.800% | 5/21/54 | 489 | 501 |

| | Apollo Global Management Inc. | 6.000% | 12/15/54 | 330 | 325 |

| 4 | Appalachian Power Co. | 4.500% | 3/1/49 | 30 | 25 |

| 5 | Arcosa Inc. | 6.875% | 8/15/32 | 3 | 3 |

| 5 | Ardagh Metal Packaging Finance USA LLC | 4.000% | 9/1/29 | 33 | 29 |

| | Ares Capital Corp. | 5.875% | 3/1/29 | 150 | 151 |

| | Ares Capital Corp. | 5.950% | 7/15/29 | 600 | 606 |

| | Asbury Automotive Group Inc. | 4.500% | 3/1/28 | 46 | 44 |

| 5 | Ascent Resources Utica Holdings LLC | 6.625% | 10/15/32 | 15 | 15 |

| 4 | AT&T Inc. | 4.300% | 2/15/30 | 56 | 55 |

| | AT&T Inc. | 5.400% | 2/15/34 | 276 | 280 |

| | AT&T Inc. | 4.500% | 5/15/35 | 130 | 122 |

| | AT&T Inc. | 4.900% | 8/15/37 | 245 | 234 |

| | AT&T Inc. | 3.500% | 6/1/41 | 95 | 75 |

| | AT&T Inc. | 4.750% | 5/15/46 | 70 | 62 |

| | AT&T Inc. | 3.500% | 9/15/53 | 455 | 317 |

| | AT&T Inc. | 3.550% | 9/15/55 | 213 | 148 |

| | AT&T Inc. | 3.800% | 12/1/57 | 111 | 80 |

| | AT&T Inc. | 3.650% | 9/15/59 | 340 | 233 |

| | Athene Holding Ltd. | 6.250% | 4/1/54 | 840 | 862 |

| | Athene Holding Ltd. | 6.625% | 10/15/54 | 801 | 789 |

| 5 | Atkore Inc. | 4.250% | 6/1/31 | 5 | 4 |

| | Atlassian Corp. | 5.250% | 5/15/29 | 630 | 638 |

| | Atlassian Corp. | 5.500% | 5/15/34 | 540 | 549 |

| | Atmos Energy Corp. | 6.200% | 11/15/53 | 110 | 122 |

| | Atmos Energy Corp. | 5.000% | 12/15/54 | 580 | 541 |

| 5 | Axalta Coating Systems Dutch Holding B BV | 7.250% | 2/15/31 | 5 | 5 |

| 5 | B&G Foods Inc. | 8.000% | 9/15/28 | 6 | 6 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Ball Corp. | 2.875% | 8/15/30 | 12 | 10 |

| | Ball Corp. | 3.125% | 9/15/31 | 15 | 13 |

| | Bank of America Corp. | 5.933% | 9/15/27 | 1,400 | 1,430 |

| | Bank of America Corp. | 6.204% | 11/10/28 | 440 | 457 |

| 4 | Bank of America Corp. | 3.970% | 3/5/29 | 200 | 194 |

| 4 | Bank of America Corp. | 2.087% | 6/14/29 | 100 | 91 |

| 4 | Bank of America Corp. | 3.974% | 2/7/30 | 300 | 288 |

| 4 | Bank of America Corp. | 3.194% | 7/23/30 | 165 | 153 |

| 4 | Bank of America Corp. | 2.496% | 2/13/31 | 150 | 133 |

| | Bank of America Corp. | 2.687% | 4/22/32 | 675 | 585 |

| | Bank of America Corp. | 4.571% | 4/27/33 | 200 | 192 |

| | Bank of America Corp. | 5.518% | 10/25/35 | 580 | 576 |

| 4 | Bank of America Corp. | 4.078% | 4/23/40 | 200 | 174 |

| 4 | Bank of America Corp. | 2.676% | 6/19/41 | 560 | 400 |

| | Bank of America Corp. | 3.311% | 4/22/42 | 60 | 46 |

| 4 | Bank of New York Mellon Corp. | 4.975% | 3/14/30 | 180 | 181 |

| | Bank of New York Mellon Corp. | 4.596% | 7/26/30 | 200 | 198 |

| | Bank of New York Mellon Corp. | 5.060% | 7/22/32 | 360 | 362 |

| 4 | Bank of New York Mellon Corp. | 6.474% | 10/25/34 | 170 | 186 |

| 4 | Bank of New York Mellon Corp. | 5.188% | 3/14/35 | 690 | 692 |

| 5 | Bausch + Lomb Corp. | 8.375% | 10/1/28 | 41 | 43 |

| 5 | Beacon Roofing Supply Inc. | 6.500% | 8/1/30 | 2 | 2 |

| | Becton Dickinson & Co. | 4.693% | 2/13/28 | 100 | 100 |

| | Becton Dickinson & Co. | 4.874% | 2/8/29 | 275 | 275 |

| 8 | Becton Dickinson & Co. | 3.519% | 2/8/31 | 2,045 | 2,240 |

| | Becton Dickinson & Co. | 4.685% | 12/15/44 | 36 | 32 |

| | Becton Dickinson & Co. | 4.669% | 6/6/47 | 40 | 35 |

| 8 | Becton Dickinson Euro Finance Sarl | 4.029% | 6/7/36 | 1,885 | 2,108 |

| 8 | Becton Dickinson Euro Finance Sarl | 1.336% | 8/13/41 | 500 | 373 |

| | Berkshire Hathaway Energy Co. | 2.850% | 5/15/51 | 100 | 64 |

| | Berkshire Hathaway Finance Corp. | 3.850% | 3/15/52 | 250 | 197 |

| 4 | Beth Israel Lahey Health Inc. | 3.080% | 7/1/51 | 180 | 115 |

| 5 | Big River Steel LLC | 6.625% | 1/31/29 | 22 | 22 |

| | Black Hills Corp. | 6.000% | 1/15/35 | 790 | 820 |

| | BlackRock Funding Inc. | 5.350% | 1/8/55 | 700 | 701 |

| | Blackrock Inc. | 4.750% | 5/25/33 | 300 | 299 |

| 5 | Blackstone Holdings Finance Co. LLC | 2.000% | 1/30/32 | 149 | 122 |

| 5 | Block Inc. | 6.500% | 5/15/32 | 18 | 18 |

| | Blue Owl Capital Corp. | 5.950% | 3/15/29 | 160 | 161 |

| 5 | Blue Racer Midstream LLC | 7.000% | 7/15/29 | 12 | 12 |

| 5 | Blue Racer Midstream LLC | 7.250% | 7/15/32 | 2 | 2 |

| 5 | Boeing Co. | 6.298% | 5/1/29 | 20 | 21 |

| | Boeing Co. | 5.150% | 5/1/30 | 277 | 274 |

| | Boeing Co. | 3.625% | 2/1/31 | 341 | 308 |

| 5 | Boeing Co. | 6.388% | 5/1/31 | 1,169 | 1,223 |

| 5 | Boeing Co. | 6.528% | 5/1/34 | 694 | 732 |

| | Boeing Co. | 5.805% | 5/1/50 | 445 | 420 |

| 5 | Boeing Co. | 6.858% | 5/1/54 | 190 | 204 |

| 5 | Boeing Co. | 7.008% | 5/1/64 | 220 | 237 |

| 5 | Boost Newco Borrower LLC | 7.500% | 1/15/31 | 5 | 5 |

| | BorgWarner Inc. | 4.950% | 8/15/29 | 120 | 120 |

| | BorgWarner Inc. | 5.400% | 8/15/34 | 235 | 233 |

| 8 | BP Capital Markets BV | 1.467% | 9/21/41 | 100 | 76 |

| | Bristol-Myers Squibb Co. | 5.750% | 2/1/31 | 290 | 305 |

| | Bristol-Myers Squibb Co. | 2.550% | 11/13/50 | 120 | 72 |

| | Bristol-Myers Squibb Co. | 5.650% | 2/22/64 | 465 | 468 |

| 5 | Broadcom Inc. | 1.950% | 2/15/28 | 1,160 | 1,062 |

| | Broadcom Inc. | 4.150% | 2/15/28 | 690 | 677 |

| | Broadcom Inc. | 4.350% | 2/15/30 | 700 | 682 |

| | Broadcom Inc. | 5.000% | 4/15/30 | 120 | 121 |

| | Broadcom Inc. | 4.150% | 11/15/30 | 530 | 508 |

| 5 | Broadcom Inc. | 4.150% | 4/15/32 | 185 | 175 |

| 5 | Broadcom Inc. | 3.187% | 11/15/36 | 145 | 118 |

| | Brown & Brown Inc. | 5.650% | 6/11/34 | 350 | 355 |

| 5 | Builders FirstSource Inc. | 6.375% | 3/1/34 | 10 | 10 |

| | Burlington Northern Santa Fe LLC | 5.750% | 5/1/40 | 325 | 341 |

| | Burlington Northern Santa Fe LLC | 5.500% | 3/15/55 | 135 | 138 |

| 5 | Cable One Inc. | 4.000% | 11/15/30 | 2 | 2 |

| | Cadence Design Systems Inc. | 4.700% | 9/10/34 | 235 | 229 |

| 5 | Caesars Entertainment Inc. | 6.500% | 2/15/32 | 5 | 5 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 5 | Calpine Corp. | 4.500% | 2/15/28 | 16 | 15 |

| 5 | Calpine Corp. | 5.125% | 3/15/28 | 10 | 10 |

| | Camden Property Trust | 3.350% | 11/1/49 | 110 | 78 |

| | Campbell Soup Co. | 5.400% | 3/21/34 | 730 | 738 |

| | Capital One Financial Corp. | 7.149% | 10/29/27 | 2,300 | 2,399 |

| | Capital One Financial Corp. | 5.468% | 2/1/29 | 90 | 91 |

| | Capital One Financial Corp. | 6.312% | 6/8/29 | 264 | 274 |

| | Capital One Financial Corp. | 5.700% | 2/1/30 | 400 | 408 |

| | Capital One Financial Corp. | 3.273% | 3/1/30 | 400 | 371 |

| 4 | Capital One Financial Corp. | 7.624% | 10/30/31 | 370 | 411 |

| | Capital One Financial Corp. | 2.618% | 11/2/32 | 175 | 146 |

| | Capital One Financial Corp. | 5.817% | 2/1/34 | 500 | 507 |

| | Capital One Financial Corp. | 5.884% | 7/26/35 | 530 | 538 |

| 5 | Cargill Inc. | 4.750% | 4/24/33 | 130 | 128 |

| 5 | Carnival Corp. | 5.750% | 3/1/27 | 24 | 24 |

| 5 | Carnival Corp. | 4.000% | 8/1/28 | 25 | 24 |

| 5 | Carnival Corp. | 6.000% | 5/1/29 | 1 | 1 |

| 5 | Carnival Holdings Bermuda Ltd. | 10.375% | 5/1/28 | 7 | 8 |

| 5 | Catalent Pharma Solutions Inc. | 3.125% | 2/15/29 | 18 | 17 |

| 5 | Catalent Pharma Solutions Inc. | 3.500% | 4/1/30 | 33 | 32 |

| | Cboe Global Markets Inc. | 1.625% | 12/15/30 | 61 | 51 |

| | Cboe Global Markets Inc. | 3.000% | 3/16/32 | 33 | 29 |

| 5 | CCO Holdings LLC | 5.375% | 6/1/29 | 40 | 38 |

| 5 | CCO Holdings LLC | 4.750% | 3/1/30 | 62 | 56 |

| | CDW LLC | 5.100% | 3/1/30 | 470 | 467 |

| | Cencora Inc. | 2.700% | 3/15/31 | 230 | 201 |

| | Cencora Inc. | 4.300% | 12/15/47 | 80 | 67 |

| | Centene Corp. | 2.450% | 7/15/28 | 145 | 130 |

| | Centene Corp. | 3.000% | 10/15/30 | 14 | 12 |

| | Centene Corp. | 2.625% | 8/1/31 | 60 | 50 |

| 4 | CenterPoint Energy Houston Electric LLC | 2.350% | 4/1/31 | 30 | 26 |

| | CenterPoint Energy Houston Electric LLC | 3.550% | 8/1/42 | 65 | 51 |

| | CenterPoint Energy Houston Electric LLC | 5.300% | 4/1/53 | 40 | 39 |

| | CenterPoint Energy Inc. | 5.400% | 6/1/29 | 1,910 | 1,944 |

| | CenterPoint Energy Inc. | 2.950% | 3/1/30 | 10 | 9 |

| | CenterPoint Energy Inc. | 2.650% | 6/1/31 | 190 | 165 |

| | CenterPoint Energy Resources Corp. | 1.750% | 10/1/30 | 200 | 168 |

| | CenterPoint Energy Resources Corp. | 5.400% | 3/1/33 | 47 | 48 |

| | CenterPoint Energy Resources Corp. | 4.100% | 9/1/47 | 50 | 40 |

| 5 | Central Parent Inc. | 7.250% | 6/15/29 | 4 | 4 |

| 5 | Central Parent LLC | 8.000% | 6/15/29 | 2 | 2 |

| | Charles Schwab Corp. | 5.643% | 5/19/29 | 35 | 36 |

| | Charles Schwab Corp. | 6.196% | 11/17/29 | 200 | 210 |

| | Charles Schwab Corp. | 6.136% | 8/24/34 | 784 | 831 |

| 5 | Chart Industries Inc. | 7.500% | 1/1/30 | 5 | 5 |

| 5 | Chart Industries Inc. | 9.500% | 1/1/31 | 2 | 2 |

| | Charter Communications Operating LLC | 3.750% | 2/15/28 | 140 | 133 |

| | Charter Communications Operating LLC | 2.250% | 1/15/29 | 40 | 35 |

| | Charter Communications Operating LLC | 5.050% | 3/30/29 | 480 | 471 |

| | Charter Communications Operating LLC | 2.300% | 2/1/32 | 270 | 213 |

| | Charter Communications Operating LLC | 6.650% | 2/1/34 | 382 | 392 |

| | Charter Communications Operating LLC | 3.500% | 3/1/42 | 200 | 135 |

| | Charter Communications Operating LLC | 6.484% | 10/23/45 | 85 | 80 |

| | Charter Communications Operating LLC | 5.375% | 5/1/47 | 395 | 322 |

| 5 | Chemours Co. | 4.625% | 11/15/29 | 32 | 28 |

| | Cheniere Corpus Christi Holdings LLC | 3.700% | 11/15/29 | 70 | 66 |

| | Cheniere Energy Inc. | 4.625% | 10/15/28 | 25 | 25 |

| | Cheniere Energy Partners LP | 4.000% | 3/1/31 | 25 | 23 |

| | Cheniere Energy Partners LP | 3.250% | 1/31/32 | 770 | 670 |

| | Cheniere Energy Partners LP | 5.950% | 6/30/33 | 35 | 36 |

| 4 | Children's Hospital of Philadelphia | 2.704% | 7/1/50 | 150 | 97 |

| | Chubb INA Holdings LLC | 4.350% | 11/3/45 | 82 | 71 |

| 5 | Churchill Downs Inc. | 5.500% | 4/1/27 | 23 | 23 |

| 5 | Churchill Downs Inc. | 4.750% | 1/15/28 | 41 | 40 |

| 5 | Churchill Downs Inc. | 5.750% | 4/1/30 | 5 | 5 |

| | Cigna Group | 2.375% | 3/15/31 | 75 | 64 |

| | Cigna Group | 4.800% | 8/15/38 | 155 | 144 |

| | Cigna Group | 3.400% | 3/15/50 | 150 | 103 |

| 4 | Citibank NA | 5.570% | 4/30/34 | 2,750 | 2,834 |

| | Citigroup Inc. | 4.542% | 9/19/30 | 1,340 | 1,313 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 4 | Citigroup Inc. | 2.976% | 11/5/30 | 140 | 127 |

| 4 | Citigroup Inc. | 2.572% | 6/3/31 | 500 | 439 |

| | Citigroup Inc. | 2.520% | 11/3/32 | 250 | 211 |

| | Citigroup Inc. | 5.411% | 9/19/39 | 290 | 281 |

| | Citigroup Inc. | 4.650% | 7/30/45 | 90 | 80 |

| | Citigroup Inc. | 4.650% | 7/23/48 | 55 | 49 |

| 4 | City of Hope | 4.378% | 8/15/48 | 80 | 66 |

| 5 | Civitas Resources Inc. | 8.375% | 7/1/28 | 4 | 4 |

| 5 | Civitas Resources Inc. | 8.625% | 11/1/30 | 35 | 37 |

| 5 | Civitas Resources Inc. | 8.750% | 7/1/31 | 6 | 6 |

| 5 | Clarios Global LP | 8.500% | 5/15/27 | 17 | 17 |

| 5 | Clearway Energy Operating LLC | 4.750% | 3/15/28 | 25 | 24 |

| 5 | Clearway Energy Operating LLC | 3.750% | 1/15/32 | 2 | 2 |

| 5 | Cleveland-Cliffs Inc. | 7.000% | 3/15/32 | 20 | 20 |

| 5 | Cleveland-Cliffs Inc. | 7.375% | 5/1/33 | 20 | 20 |

| 5 | Cloud Software Group Inc. | 6.500% | 3/31/29 | 5 | 5 |

| 5 | Cloud Software Group Inc. | 8.250% | 6/30/32 | 21 | 22 |

| | CMS Energy Corp. | 4.875% | 3/1/44 | 135 | 124 |

| 5 | CNX Resources Corp. | 7.375% | 1/15/31 | 5 | 5 |

| 5 | CNX Resources Corp. | 7.250% | 3/1/32 | 5 | 5 |

| 8 | Coca-Cola Co. | 3.750% | 8/15/53 | 500 | 545 |

| | Coca-Cola Co. | 5.200% | 1/14/55 | 390 | 388 |

| 5 | Columbia Pipelines Holding Co. LLC | 5.681% | 1/15/34 | 195 | 194 |

| | Comcast Corp. | 2.650% | 2/1/30 | 275 | 248 |

| | Comcast Corp. | 4.400% | 8/15/35 | 90 | 84 |

| | Comcast Corp. | 6.550% | 7/1/39 | 80 | 88 |

| | Comcast Corp. | 3.250% | 11/1/39 | 145 | 113 |

| | Comcast Corp. | 4.500% | 1/15/43 | 140 | 120 |

| | Comcast Corp. | 4.700% | 10/15/48 | 134 | 121 |

| | Comcast Corp. | 4.950% | 10/15/58 | 65 | 59 |

| | Comcast Corp. | 2.650% | 8/15/62 | 263 | 146 |

| | Comcast Corp. | 2.987% | 11/1/63 | 413 | 247 |

| 4 | CommonSpirit Health | 4.350% | 11/1/42 | 220 | 189 |

| | Commonwealth Edison Co. | 3.800% | 10/1/42 | 115 | 93 |

| 4 | Commonwealth Edison Co. | 3.125% | 3/15/51 | 50 | 34 |

| | Commonwealth Edison Co. | 5.300% | 2/1/53 | 180 | 176 |

| 5 | Community Health Systems Inc. | 5.625% | 3/15/27 | 35 | 34 |

| 5 | Community Health Systems Inc. | 10.875% | 1/15/32 | 14 | 15 |

| | Conagra Brands Inc. | 5.300% | 10/1/26 | 175 | 177 |

| | ConocoPhillips Co. | 4.300% | 11/15/44 | 65 | 56 |

| | ConocoPhillips Co. | 3.800% | 3/15/52 | 40 | 30 |

| | ConocoPhillips Co. | 5.300% | 5/15/53 | 75 | 72 |

| | ConocoPhillips Co. | 5.700% | 9/15/63 | 40 | 40 |

| 4 | Consolidated Edison Co. of New York Inc. | 5.500% | 12/1/39 | 65 | 66 |

| | Consolidated Edison Co. of New York Inc. | 5.700% | 6/15/40 | 160 | 164 |

| 4 | Consolidated Edison Co. of New York Inc. | 3.950% | 4/1/50 | 100 | 81 |

| | Consolidated Edison Co. of New York Inc. | 5.900% | 11/15/53 | 400 | 423 |

| 5 | Continental Resources Inc. | 2.268% | 11/15/26 | 100 | 94 |

| 5 | Continental Resources Inc. | 2.875% | 4/1/32 | 40 | 33 |

| | COPT Defense Properties LP | 2.250% | 3/15/26 | 175 | 168 |

| | COPT Defense Properties LP | 2.750% | 4/15/31 | 105 | 90 |

| | Corebridge Financial Inc. | 3.650% | 4/5/27 | 90 | 88 |

| | Corebridge Financial Inc. | 3.850% | 4/5/29 | 170 | 163 |

| | Corebridge Financial Inc. | 3.900% | 4/5/32 | 194 | 177 |

| | Corebridge Financial Inc. | 4.350% | 4/5/42 | 100 | 85 |

| | Corebridge Financial Inc. | 4.400% | 4/5/52 | 150 | 123 |

| | Coterra Energy Inc. | 4.375% | 3/15/29 | 130 | 126 |

| | Cotiviti Corp. | 7.625% | 5/1/31 | 2 | 2 |

| 5 | Cox Communications Inc. | 4.800% | 2/1/35 | 100 | 92 |

| 5 | Cox Communications Inc. | 5.800% | 12/15/53 | 180 | 169 |

| | Crown Castle Inc. | 4.750% | 5/15/47 | 125 | 108 |

| 5 | CSC Holdings LLC | 11.750% | 1/31/29 | 8 | 8 |

| 5 | CSC Holdings LLC | 3.375% | 2/15/31 | 10 | 7 |

| | CSX Corp. | 4.750% | 11/15/48 | 190 | 173 |

| | CubeSmart LP | 2.250% | 12/15/28 | 225 | 203 |

| | CVS Health Corp. | 1.300% | 8/21/27 | 900 | 815 |

| | CVS Health Corp. | 5.400% | 6/1/29 | 600 | 606 |

| | CVS Health Corp. | 5.125% | 2/21/30 | 365 | 362 |

| | CVS Health Corp. | 5.550% | 6/1/31 | 315 | 318 |

| | CVS Health Corp. | 5.700% | 6/1/34 | 240 | 241 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | CVS Health Corp. | 4.875% | 7/20/35 | 80 | 75 |

| | CVS Health Corp. | 4.780% | 3/25/38 | 419 | 373 |

| | CVS Health Corp. | 4.125% | 4/1/40 | 135 | 109 |

| | CVS Health Corp. | 5.125% | 7/20/45 | 85 | 74 |

| | CVS Health Corp. | 6.000% | 6/1/63 | 130 | 125 |

| | Dana Inc. | 4.250% | 9/1/30 | 10 | 9 |

| | Dana Inc. | 4.500% | 2/15/32 | 2 | 2 |

| 5 | DaVita Inc. | 3.750% | 2/15/31 | 10 | 9 |

| 5 | DaVita Inc. | 6.875% | 9/1/32 | 10 | 10 |

| | DCP Midstream Operating LP | 3.250% | 2/15/32 | 700 | 607 |

| 5 | DCP Midstream Operating LP | 6.750% | 9/15/37 | 300 | 317 |

| | Dell International LLC | 4.350% | 2/1/30 | 1,244 | 1,209 |

| | Dell International LLC | 6.200% | 7/15/30 | 219 | 232 |

| | Dell International LLC | 5.400% | 4/15/34 | 1,152 | 1,165 |

| | Dell International LLC | 8.350% | 7/15/46 | 44 | 57 |

| 5 | Delta Air Lines Inc. | 4.750% | 10/20/28 | 1,188 | 1,174 |

| | Delta Air Lines Inc. | 3.750% | 10/28/29 | 9 | 8 |

| | Devon Energy Corp. | 5.850% | 12/15/25 | 40 | 40 |

| | Devon Energy Corp. | 5.600% | 7/15/41 | 50 | 47 |

| 5 | Diamond Foreign Asset Co. | 8.500% | 10/1/30 | 10 | 10 |

| | Diamondback Energy Inc. | 5.200% | 4/18/27 | 740 | 748 |

| | Diamondback Energy Inc. | 3.125% | 3/24/31 | 15 | 13 |

| | Diamondback Energy Inc. | 5.400% | 4/18/34 | 365 | 364 |

| | Diamondback Energy Inc. | 5.750% | 4/18/54 | 470 | 456 |

| | Diamondback Energy Inc. | 5.900% | 4/18/64 | 255 | 248 |

| 8 | Digital Dutch Finco BV | 1.500% | 3/15/30 | 1,600 | 1,565 |

| 8 | Digital Dutch Finco BV | 1.250% | 2/1/31 | 600 | 566 |

| 8 | Digital Dutch Finco BV | 1.000% | 1/15/32 | 2,200 | 1,990 |

| 5 | Directv Financing LLC | 5.875% | 8/15/27 | 12 | 12 |

| | Discovery Communications LLC | 4.900% | 3/11/26 | 157 | 156 |

| | Discovery Communications LLC | 6.350% | 6/1/40 | 156 | 146 |

| 5 | DISH Network Corp. | 11.750% | 11/15/27 | 11 | 12 |

| 4 | Dominion Energy Inc. | 4.050% | 9/15/42 | 170 | 137 |

| | Dominion Energy South Carolina Inc. | 5.450% | 2/1/41 | 40 | 40 |

| | Dominion Energy South Carolina Inc. | 4.600% | 6/15/43 | 240 | 214 |

| | Dominion Energy South Carolina Inc. | 6.250% | 10/15/53 | 185 | 207 |

| | Dow Chemical Co. | 2.100% | 11/15/30 | 100 | 86 |

| | Dow Chemical Co. | 4.375% | 11/15/42 | 120 | 101 |

| | DR Horton Inc. | 5.000% | 10/15/34 | 465 | 454 |

| 5 | DT Midstream Inc. | 4.125% | 6/15/29 | 26 | 24 |

| 5 | DT Midstream Inc. | 4.375% | 6/15/31 | 15 | 14 |

| | DTE Electric Co. | 3.700% | 6/1/46 | 75 | 59 |

| | DTE Energy Co. | 5.100% | 3/1/29 | 1,890 | 1,905 |

| | Duke Energy Carolinas LLC | 2.450% | 2/1/30 | 85 | 76 |

| | Duke Energy Carolinas LLC | 5.300% | 2/15/40 | 20 | 20 |

| | Duke Energy Carolinas LLC | 4.250% | 12/15/41 | 125 | 109 |

| | Duke Energy Corp. | 3.400% | 6/15/29 | 1,910 | 1,795 |

| | Duke Energy Corp. | 3.500% | 6/15/51 | 100 | 70 |

| | Duke Energy Florida LLC | 5.875% | 11/15/33 | 160 | 170 |

| | Duke Energy Florida LLC | 3.400% | 10/1/46 | 35 | 25 |

| | Duke Energy Florida LLC | 6.200% | 11/15/53 | 110 | 120 |

| | Duke Energy Indiana LLC | 2.750% | 4/1/50 | 75 | 47 |

| | Duke Energy Ohio Inc. | 5.650% | 4/1/53 | 90 | 91 |

| | Duke Energy Ohio Inc. | 5.550% | 3/15/54 | 540 | 541 |

| | Duke Energy Progress LLC | 4.100% | 5/15/42 | 200 | 168 |

| | Duke Energy Progress LLC | 2.500% | 8/15/50 | 170 | 103 |

| 10 | Edison International | 5.250% | 3/15/32 | 820 | 818 |

| 5 | Element Solutions Inc. | 3.875% | 9/1/28 | 11 | 11 |

| | Elevance Health Inc. | 5.150% | 6/15/29 | 230 | 233 |

| | Elevance Health Inc. | 3.125% | 5/15/50 | 190 | 127 |

| | Elevance Health Inc. | 6.100% | 10/15/52 | 155 | 163 |

| | Elevance Health Inc. | 5.650% | 6/15/54 | 435 | 432 |

| | Elevance Health Inc. | 5.700% | 2/15/55 | 835 | 840 |

| | Eli Lilly & Co. | 5.050% | 8/14/54 | 645 | 627 |

| | Eli Lilly & Co. | 2.500% | 9/15/60 | 100 | 56 |

| | Enbridge Energy Partners LP | 7.375% | 10/15/45 | 230 | 266 |

| 5 | Endo Finance Holdings Inc. | 8.500% | 4/15/31 | 36 | 38 |

| 5 | Energizer Holdings Inc. | 4.750% | 6/15/28 | 33 | 32 |

| | Energy Transfer LP | 4.400% | 3/15/27 | 240 | 238 |

| | Energy Transfer LP | 5.250% | 7/1/29 | 230 | 232 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Energy Transfer LP | 3.750% | 5/15/30 | 30 | 28 |

| | Energy Transfer LP | 6.400% | 12/1/30 | 230 | 244 |

| | Energy Transfer LP | 5.750% | 2/15/33 | 130 | 133 |

| | Energy Transfer LP | 6.550% | 12/1/33 | 230 | 247 |

| | Energy Transfer LP | 6.050% | 6/1/41 | 535 | 535 |

| | Energy Transfer LP | 6.500% | 2/1/42 | 100 | 105 |

| | Energy Transfer LP | 5.300% | 4/1/44 | 75 | 69 |

| | Energy Transfer LP | 5.150% | 3/15/45 | 55 | 49 |

| | Energy Transfer LP | 6.250% | 4/15/49 | 70 | 71 |

| | Energy Transfer LP | 5.950% | 5/15/54 | 565 | 556 |

| 5 | Entegris Inc. | 4.750% | 4/15/29 | 190 | 184 |

| 5 | Entegris Inc. | 5.950% | 6/15/30 | 45 | 45 |

| | Entergy Arkansas LLC | 5.750% | 6/1/54 | 560 | 578 |

| | Entergy Louisiana LLC | 3.250% | 4/1/28 | 593 | 566 |

| | Entergy Texas Inc. | 5.550% | 9/15/54 | 545 | 542 |

| | Enterprise Products Operating LLC | 4.850% | 3/15/44 | 215 | 197 |

| | Enterprise Products Operating LLC | 4.900% | 5/15/46 | 59 | 54 |

| | Enterprise Products Operating LLC | 4.250% | 2/15/48 | 50 | 41 |

| | Enterprise Products Operating LLC | 3.700% | 1/31/51 | 70 | 52 |

| 5 | EQM Midstream Partners LP | 7.500% | 6/1/27 | 10 | 10 |

| 5 | EQM Midstream Partners LP | 6.500% | 7/1/27 | 16 | 16 |

| | EQM Midstream Partners LP | 5.500% | 7/15/28 | 15 | 15 |

| 5 | EQM Midstream Partners LP | 7.500% | 6/1/30 | 10 | 11 |

| | EQT Corp. | 3.900% | 10/1/27 | 96 | 93 |

| | Equitable Holdings Inc. | 5.594% | 1/11/33 | 148 | 151 |

| | Equitable Holdings Inc. | 5.000% | 4/20/48 | 79 | 72 |

| 5 | ERAC USA Finance LLC | 7.000% | 10/15/37 | 180 | 208 |

| | ERP Operating LP | 4.500% | 7/1/44 | 135 | 119 |

| | Essential Utilities Inc. | 4.800% | 8/15/27 | 2,685 | 2,686 |

| | Essex Portfolio LP | 4.500% | 3/15/48 | 60 | 51 |

| | Everest Reinsurance Holdings Inc. | 3.500% | 10/15/50 | 96 | 66 |

| | Evergy Kansas Central Inc. | 3.250% | 9/1/49 | 150 | 104 |

| 4 | Eversource Energy | 1.400% | 8/15/26 | 110 | 104 |

| | Exelon Corp. | 5.150% | 3/15/28 | 210 | 212 |

| | Exelon Corp. | 3.350% | 3/15/32 | 200 | 180 |

| | Exelon Corp. | 4.450% | 4/15/46 | 165 | 141 |

| | Exelon Corp. | 4.100% | 3/15/52 | 100 | 79 |

| | Exelon Corp. | 5.600% | 3/15/53 | 390 | 387 |

| | Extra Space Storage LP | 5.500% | 7/1/30 | 70 | 71 |

| | Extra Space Storage LP | 5.900% | 1/15/31 | 370 | 383 |

| | Extra Space Storage LP | 2.400% | 10/15/31 | 80 | 67 |

| | Exxon Mobil Corp. | 4.227% | 3/19/40 | 155 | 138 |

| | Exxon Mobil Corp. | 4.114% | 3/1/46 | 55 | 46 |

| | FedEx Corp. | 3.875% | 8/1/42 | 30 | 24 |

| | FedEx Corp. | 4.550% | 4/1/46 | 70 | 59 |

| | FedEx Corp. | 4.050% | 2/15/48 | 70 | 55 |

| | Fifth Third Bancorp | 1.707% | 11/1/27 | 100 | 94 |

| | Fifth Third Bancorp | 3.950% | 3/14/28 | 350 | 340 |

| | Fifth Third Bancorp | 6.339% | 7/27/29 | 310 | 324 |

| | Fifth Third Bancorp | 4.895% | 9/6/30 | 390 | 386 |

| | Fifth Third Bancorp | 5.631% | 1/29/32 | 370 | 376 |

| | FirstEnergy Corp. | 2.650% | 3/1/30 | 150 | 134 |

| 4 | FirstEnergy Corp. | 2.250% | 9/1/30 | 60 | 52 |

| 5 | FirstEnergy Pennsylvania Electric Co. | 5.150% | 3/30/26 | 60 | 60 |

| 5 | FirstEnergy Transmission LLC | 2.866% | 9/15/28 | 260 | 241 |

| 5 | FirstEnergy Transmission LLC | 4.550% | 1/15/30 | 460 | 451 |

| 5 | FirstEnergy Transmission LLC | 4.550% | 4/1/49 | 405 | 351 |

| 8 | Fiserv Inc. | 4.500% | 5/24/31 | 3,400 | 3,890 |

| | Fiserv Inc. | 5.600% | 3/2/33 | 120 | 123 |

| 5 | Five Corners Funding Trust IV | 5.997% | 2/15/53 | 220 | 230 |

| | FMC Corp. | 5.150% | 5/18/26 | 100 | 100 |

| 5 | Focus Financial Partners LLC | 6.750% | 9/15/31 | 5 | 5 |

| 4,9 | Ford Motor Credit Co. LLC | 6.860% | 6/5/26 | 500 | 654 |

| | Ford Motor Credit Co. LLC | 4.950% | 5/28/27 | 45 | 44 |

| | Ford Motor Credit Co. LLC | 4.125% | 8/17/27 | 5 | 5 |

| | Ford Motor Credit Co. LLC | 3.815% | 11/2/27 | 22 | 21 |

| | Ford Motor Credit Co. LLC | 6.800% | 5/12/28 | 20 | 21 |

| | Ford Motor Credit Co. LLC | 6.798% | 11/7/28 | 200 | 208 |

| | Ford Motor Credit Co. LLC | 2.900% | 2/10/29 | 53 | 47 |

| | Ford Motor Credit Co. LLC | 7.200% | 6/10/30 | 10 | 11 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 10 | Ford Motor Credit Co. LLC | 6.054% | 11/5/31 | 505 | 505 |

| | Ford Motor Credit Co. LLC | 7.122% | 11/7/33 | 200 | 212 |

| | Freeport-McMoRan Inc. | 4.250% | 3/1/30 | 10 | 10 |

| | Freeport-McMoRan Inc. | 5.450% | 3/15/43 | 10 | 10 |

| 5 | Frontier Communications Holdings LLC | 8.625% | 3/15/31 | 10 | 11 |

| 5 | Garrett Motion Holdings Inc. | 7.750% | 5/31/32 | 11 | 11 |

| 5 | Gates Corp. | 6.875% | 7/1/29 | 5 | 5 |

| | GE HealthCare Technologies Inc. | 4.800% | 8/14/29 | 155 | 155 |

| | GE HealthCare Technologies Inc. | 5.857% | 3/15/30 | 110 | 115 |

| | GE HealthCare Technologies Inc. | 6.377% | 11/22/52 | 100 | 111 |

| | General Dynamics Corp. | 4.250% | 4/1/40 | 95 | 85 |

| 4,8 | General Electric Co. | 4.125% | 9/19/35 | 900 | 1,016 |

| | General Motors Co. | 6.125% | 10/1/25 | 150 | 151 |

| | General Motors Co. | 5.200% | 4/1/45 | 88 | 79 |

| | General Motors Financial Co. Inc. | 6.050% | 10/10/25 | 555 | 561 |

| | General Motors Financial Co. Inc. | 1.250% | 1/8/26 | 1,255 | 1,203 |

| 8 | General Motors Financial Co. Inc. | 0.850% | 2/26/26 | 1,300 | 1,372 |

| | General Motors Financial Co. Inc. | 1.500% | 6/10/26 | 191 | 181 |

| | General Motors Financial Co. Inc. | 5.350% | 7/15/27 | 225 | 227 |

| | General Motors Financial Co. Inc. | 5.550% | 7/15/29 | 575 | 583 |

| | General Motors Financial Co. Inc. | 5.850% | 4/6/30 | 192 | 197 |

| | General Motors Financial Co. Inc. | 5.750% | 2/8/31 | 450 | 458 |

| | General Motors Financial Co. Inc. | 6.400% | 1/9/33 | 170 | 179 |

| 5 | Genesee & Wyoming Inc. | 6.250% | 4/15/32 | 10 | 10 |

| | Genesis Energy LP | 8.250% | 1/15/29 | 5 | 5 |

| | Genesis Energy LP | 7.875% | 5/15/32 | 5 | 5 |

| | Georgia Power Co. | 4.300% | 3/15/42 | 130 | 113 |

| | Georgia Power Co. | 5.125% | 5/15/52 | 70 | 67 |

| 5 | Georgia-Pacific LLC | 2.300% | 4/30/30 | 165 | 145 |

| | Gilead Sciences Inc. | 4.150% | 3/1/47 | 190 | 158 |

| 5 | Glatfelter Corp. | 7.250% | 11/15/31 | 5 | 5 |

| 5 | Global Atlantic Fin Co. | 7.950% | 6/15/33 | 700 | 780 |

| 5 | Global Atlantic Fin Co. | 6.750% | 3/15/54 | 240 | 245 |

| | Goldman Sachs Group Inc. | 5.727% | 4/25/30 | 2,500 | 2,570 |

| | Goldman Sachs Group Inc. | 4.692% | 10/23/30 | 380 | 375 |

| | Goldman Sachs Group Inc. | 6.750% | 10/1/37 | 300 | 329 |

| 4 | Goldman Sachs Group Inc. | 4.411% | 4/23/39 | 255 | 229 |

| | Goldman Sachs Group Inc. | 3.210% | 4/22/42 | 100 | 76 |

| 4 | Goldman Sachs Group Inc. | 4.800% | 7/8/44 | 90 | 83 |

| | Goodyear Tire & Rubber Co. | 5.000% | 7/15/29 | 55 | 50 |

| 5 | Graphic Packaging International LLC | 3.500% | 3/15/28 | 1 | 1 |

| 5 | Graphic Packaging International LLC | 3.750% | 2/1/30 | 2 | 2 |

| 5 | Hanesbrands Inc. | 9.000% | 2/15/31 | 7 | 8 |

| 5 | Harley-Davidson Financial Services Inc. | 3.050% | 2/14/27 | 130 | 123 |

| | HCA Inc. | 5.450% | 4/1/31 | 530 | 536 |

| | HCA Inc. | 5.250% | 6/15/49 | 115 | 104 |

| | HCA Inc. | 4.625% | 3/15/52 | 205 | 168 |

| | HCA Inc. | 6.000% | 4/1/54 | 285 | 286 |

| | Healthpeak OP LLC | 5.250% | 12/15/32 | 170 | 171 |

| | Helmerich & Payne Inc. | 2.900% | 9/29/31 | 220 | 185 |

| 5 | Herc Holdings Inc. | 6.625% | 6/15/29 | 5 | 5 |

| | Hess Corp. | 7.300% | 8/15/31 | 5 | 6 |

| 5 | Hess Midstream Operations LP | 6.500% | 6/1/29 | 6 | 6 |

| | Hewlett Packard Enterprise Co. | 4.550% | 10/15/29 | 1,601 | 1,571 |

| | Hewlett Packard Enterprise Co. | 5.000% | 10/15/34 | 294 | 285 |

| | Hewlett Packard Enterprise Co. | 5.600% | 10/15/54 | 405 | 390 |

| | Highwoods Realty LP | 7.650% | 2/1/34 | 429 | 481 |

| 5 | Hilcorp Energy I LP | 5.750% | 2/1/29 | 5 | 5 |

| 5 | Hilcorp Energy I LP | 6.000% | 2/1/31 | 6 | 6 |

| 5 | Hilton Domestic Operating Co. Inc. | 5.875% | 4/1/29 | 2 | 2 |

| 5 | Hilton Domestic Operating Co. Inc. | 5.875% | 3/15/33 | 15 | 15 |

| | Home Depot Inc. | 3.900% | 6/15/47 | 125 | 101 |

| | Home Depot Inc. | 4.500% | 12/6/48 | 75 | 66 |

| | Home Depot Inc. | 4.950% | 9/15/52 | 55 | 52 |

| | Home Depot Inc. | 5.300% | 6/25/54 | 930 | 923 |

| | Home Depot Inc. | 3.500% | 9/15/56 | 70 | 51 |

| | Honeywell International Inc. | 2.800% | 6/1/50 | 1,710 | 1,145 |

| | Host Hotels & Resorts LP | 5.700% | 7/1/34 | 215 | 215 |

| 5 | HUB International Ltd. | 7.250% | 6/15/30 | 5 | 5 |

| 5 | HUB International Ltd. | 7.375% | 1/31/32 | 5 | 5 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Huntington Bancshares Inc. | 6.208% | 8/21/29 | 350 | 363 |

| | Huntington Bancshares Inc. | 5.023% | 5/17/33 | 286 | 277 |

| | Huntington Bancshares Inc. | 5.709% | 2/2/35 | 1,460 | 1,478 |

| | Huntington Bancshares Inc. | 2.487% | 8/15/36 | 150 | 121 |

| | Hyatt Hotels Corp. | 5.250% | 6/30/29 | 45 | 45 |

| | Idaho Power Co. | 5.200% | 8/15/34 | 195 | 195 |

| 5 | Imola Merger Corp. | 4.750% | 5/15/29 | 13 | 13 |

| 4 | Indiana Michigan Power Co. | 3.750% | 7/1/47 | 250 | 188 |

| | Ingersoll Rand Inc. | 5.176% | 6/15/29 | 100 | 101 |

| | Ingersoll Rand Inc. | 5.314% | 6/15/31 | 140 | 143 |

| | Ingersoll Rand Inc. | 5.450% | 6/15/34 | 200 | 204 |

| | Intel Corp. | 2.450% | 11/15/29 | 1,148 | 1,009 |

| | Intel Corp. | 5.125% | 2/10/30 | 160 | 160 |

| | Intel Corp. | 2.000% | 8/12/31 | 158 | 128 |

| | Intel Corp. | 4.150% | 8/5/32 | 279 | 258 |

| | Intel Corp. | 5.200% | 2/10/33 | 206 | 202 |

| | Intel Corp. | 5.150% | 2/21/34 | 857 | 837 |

| | Intel Corp. | 5.625% | 2/10/43 | 80 | 76 |

| | Intel Corp. | 4.900% | 8/5/52 | 100 | 83 |

| | Intel Corp. | 5.700% | 2/10/53 | 420 | 392 |

| | Intel Corp. | 5.900% | 2/10/63 | 60 | 57 |

| | Intercontinental Exchange Inc. | 3.625% | 9/1/28 | 86 | 83 |

| | Intercontinental Exchange Inc. | 5.250% | 6/15/31 | 350 | 357 |

| | Intercontinental Exchange Inc. | 4.950% | 6/15/52 | 70 | 66 |

| | Intercontinental Exchange Inc. | 3.000% | 9/15/60 | 50 | 31 |

| | Intercontinental Exchange Inc. | 5.200% | 6/15/62 | 20 | 19 |

| 8 | International Business Machines Corp. | 4.000% | 2/6/43 | 200 | 222 |

| | Interpublic Group of Cos. Inc. | 3.375% | 3/1/41 | 100 | 75 |

| | Invesco Finance plc | 5.375% | 11/30/43 | 55 | 53 |

| 5 | ITC Holdings Corp. | 4.950% | 9/22/27 | 50 | 50 |

| | ITC Holdings Corp. | 3.350% | 11/15/27 | 320 | 307 |

| 5 | ITC Holdings Corp. | 2.950% | 5/14/30 | 150 | 135 |

| | Jacobs Engineering Group Inc. | 5.900% | 3/1/33 | 110 | 113 |

| 5 | JBS USA Holding Lux Sarl | 6.750% | 3/15/34 | 488 | 524 |

| 5 | JBS USA Holding Lux Sarl | 7.250% | 11/15/53 | 265 | 297 |

| 5 | JetBlue Airways Corp. | 9.875% | 9/20/31 | 14 | 15 |

| 4 | John Deere Capital Corp. | 3.900% | 6/7/32 | 95 | 90 |

| 4 | John Deere Capital Corp. | 5.150% | 9/8/33 | 95 | 97 |

| | JPMorgan Chase & Co. | 4.979% | 7/22/28 | 413 | 415 |

| | JPMorgan Chase & Co. | 4.851% | 7/25/28 | 140 | 140 |

| | JPMorgan Chase & Co. | 4.505% | 10/22/28 | 740 | 735 |

| | JPMorgan Chase & Co. | 5.012% | 1/23/30 | 730 | 733 |

| | JPMorgan Chase & Co. | 5.581% | 4/22/30 | 2,710 | 2,779 |

| | JPMorgan Chase & Co. | 4.995% | 7/22/30 | 1,000 | 1,003 |

| | JPMorgan Chase & Co. | 4.603% | 10/22/30 | 470 | 464 |

| | JPMorgan Chase & Co. | 4.586% | 4/26/33 | 100 | 97 |

| | JPMorgan Chase & Co. | 5.350% | 6/1/34 | 130 | 131 |

| | JPMorgan Chase & Co. | 5.294% | 7/22/35 | 415 | 417 |

| | JPMorgan Chase & Co. | 4.946% | 10/22/35 | 1,130 | 1,108 |

| | JPMorgan Chase & Co. | 6.400% | 5/15/38 | 150 | 168 |

| 4 | JPMorgan Chase & Co. | 3.882% | 7/24/38 | 62 | 54 |

| 4 | JPMorgan Chase & Co. | 3.109% | 4/22/41 | 379 | 291 |

| | JPMorgan Chase & Co. | 5.600% | 7/15/41 | 81 | 84 |

| | JPMorgan Chase & Co. | 2.525% | 11/19/41 | 190 | 133 |

| 5 | Kaiser Aluminum Corp. | 4.625% | 3/1/28 | 10 | 10 |

| 5 | KeHE Distributors LLC | 9.000% | 2/15/29 | 19 | 20 |

| | Kenvue Inc. | 5.100% | 3/22/43 | 95 | 93 |

| | Keurig Dr Pepper Inc. | 4.500% | 11/15/45 | 330 | 286 |

| | KeyBank NA | 5.000% | 1/26/33 | 100 | 96 |

| | KeyCorp | 6.401% | 3/6/35 | 110 | 116 |

| | Keysight Technologies Inc. | 4.950% | 10/15/34 | 266 | 258 |

| | Kimco Realty OP LLC | 4.250% | 4/1/45 | 75 | 62 |

| | Kimco Realty OP LLC | 3.700% | 10/1/49 | 70 | 52 |

| 5 | Kinetik Holdings LP | 6.625% | 12/15/28 | 5 | 5 |

| 5 | Kinetik Holdings LP | 5.875% | 6/15/30 | 2 | 2 |

| | Kraft Heinz Foods Co. | 3.750% | 4/1/30 | 340 | 323 |

| | Kraft Heinz Foods Co. | 4.875% | 10/1/49 | 27 | 24 |

| | Kroger Co. | 2.200% | 5/1/30 | 120 | 104 |

| | Kroger Co. | 5.000% | 9/15/34 | 340 | 334 |

| | Kroger Co. | 5.500% | 9/15/54 | 205 | 199 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Kyndryl Holdings Inc. | 6.350% | 2/20/34 | 100 | 104 |

| | L3Harris Technologies Inc. | 5.250% | 6/1/31 | 1,180 | 1,196 |

| | L3Harris Technologies Inc. | 5.054% | 4/27/45 | 30 | 28 |

| 5 | Ladder Capital Finance Holdings LLLP | 4.750% | 6/15/29 | 12 | 11 |

| 5 | Ladder Capital Finance Holdings LLLP | 7.000% | 7/15/31 | 18 | 19 |

| 5 | Lamb Weston Holdings Inc. | 4.875% | 5/15/28 | 6 | 6 |

| 5 | Level 3 Financing Inc. | 4.625% | 9/15/27 | 2 | 2 |

| 5 | Level 3 Financing Inc. | 3.875% | 11/15/29 | 5 | 3 |

| 5 | Level 3 Financing Inc. | 10.500% | 5/15/30 | 5 | 5 |

| 5 | Level 3 Financing Inc. | 10.000% | 10/15/32 | 5 | 5 |

| 5 | LifePoint Health Inc. | 11.000% | 10/15/30 | 3 | 3 |

| 5 | Lithia Motors Inc. | 4.625% | 12/15/27 | 10 | 10 |

| 5 | Lithia Motors Inc. | 3.875% | 6/1/29 | 52 | 48 |

| 5 | Lithia Motors Inc. | 4.375% | 1/15/31 | 12 | 11 |

| 5 | Live Nation Entertainment Inc. | 5.625% | 3/15/26 | 3 | 3 |

| 5 | Live Nation Entertainment Inc. | 6.500% | 5/15/27 | 31 | 31 |

| | Lockheed Martin Corp. | 4.500% | 5/15/36 | 665 | 635 |

| | Lockheed Martin Corp. | 4.300% | 6/15/62 | 295 | 244 |

| | Lockheed Martin Corp. | 5.200% | 2/15/64 | 520 | 504 |

| | Lowe's Cos. Inc. | 4.450% | 4/1/62 | 190 | 152 |

| | LPL Holdings Inc. | 6.750% | 11/17/28 | 430 | 453 |

| | LYB International Finance III LLC | 3.375% | 10/1/40 | 50 | 38 |

| | M&T Bank Corp. | 7.413% | 10/30/29 | 316 | 340 |

| | M&T Bank Corp. | 6.082% | 3/13/32 | 1,138 | 1,177 |

| | Manufacturers & Traders Trust Co. | 4.650% | 1/27/26 | 1,300 | 1,295 |

| | Manufacturers & Traders Trust Co. | 4.700% | 1/27/28 | 370 | 366 |

| | Marathon Oil Corp. | 5.300% | 4/1/29 | 380 | 386 |

| | Marriott International Inc. | 4.875% | 5/15/29 | 250 | 250 |

| | Marriott International Inc. | 4.800% | 3/15/30 | 410 | 407 |

| 5 | Mars Inc. | 3.875% | 4/1/39 | 178 | 153 |

| | Marsh & McLennan Cos. Inc. | 4.900% | 3/15/49 | 75 | 69 |

| | Marsh & McLennan Cos. Inc. | 2.900% | 12/15/51 | 150 | 96 |

| | Marsh & McLennan Cos. Inc. | 6.250% | 11/1/52 | 110 | 122 |

| 10 | Martin Marietta Materials Inc. | 5.500% | 12/1/54 | 558 | 546 |

| 5 | McAfee Corp. | 7.375% | 2/15/30 | 8 | 8 |

| 5 | Medline Borrower LP | 3.875% | 4/1/29 | 3 | 3 |

| 5 | Medline Borrower LP | 6.250% | 4/1/29 | 41 | 42 |

| 5 | Medline Borrower LP | 5.250% | 10/1/29 | 3 | 3 |

| 8 | Medtronic Global Holdings SCA | 2.250% | 3/7/39 | 200 | 183 |

| | Merck & Co. Inc. | 5.150% | 5/17/63 | 160 | 154 |

| | Meta Platforms Inc. | 4.650% | 8/15/62 | 42 | 37 |

| | MetLife Inc. | 4.125% | 8/13/42 | 60 | 51 |

| | MetLife Inc. | 4.875% | 11/13/43 | 60 | 56 |

| | MetLife Inc. | 5.250% | 1/15/54 | 60 | 59 |

| | MGM Resorts International | 6.500% | 4/15/32 | 5 | 5 |

| | MidAmerican Energy Co. | 5.300% | 2/1/55 | 530 | 521 |

| 5 | Midcontinent Communications | 8.000% | 8/15/32 | 15 | 15 |

| 5 | Mileage Plus Holdings LLC | 6.500% | 6/20/27 | 2,347 | 2,372 |

| 5 | Miter Brands Acquisition Holdco Inc. | 6.750% | 4/1/32 | 5 | 5 |

| | Mondelez International Inc. | 1.500% | 2/4/31 | 200 | 165 |

| | Morgan Stanley | 2.475% | 1/21/28 | 700 | 666 |

| 4 | Morgan Stanley | 5.652% | 4/13/28 | 530 | 540 |

| | Morgan Stanley | 5.173% | 1/16/30 | 740 | 746 |

| | Morgan Stanley | 4.654% | 10/18/30 | 740 | 730 |

| 4 | Morgan Stanley | 2.511% | 10/20/32 | 730 | 619 |

| | Morgan Stanley | 2.943% | 1/21/33 | 400 | 347 |

| | Morgan Stanley | 5.466% | 1/18/35 | 120 | 122 |