| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-207340-10 | ||

March 8, 2018 FREE WRITING PROSPECTUS COLLATERAL TERM SHEET$839,904,551 (Approximate Total Mortgage Pool Balance) UBS 2018-C9 UBS Commercial Mortgage Securitization Corp.DepositorUBS AG Ladder Capital Finance LLC Cantor Commercial Real Estate Lending, L.P. Société GénéraleSponsors and Mortgage Loan SellersUBS Securities LLC Cantor Fitzgerald & Co. Société GénéraleCo-Lead Managers and Joint BookrunnersDrexel Hamilton Academy SecuritiesCo-ManagersThe depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (’’SEC’’) (SEC File No. 333-207340) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-877-713-1030 (8 a.m. – 5 p.m. EST). The Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale and ultimately by the final prospectus relating to the offered certificates. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) that have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of the offered certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the offered certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of UBS Securities LLC, Cantor Fitzgerald & Co., SG Americas Securities, LLC, Drexel Hamilton, LLC or Academy Securities, Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the offered certificates. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The offered certificates described herein are not suitable investments for all investors. In particular, you should not purchase any class of offered certificates unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with such class of certificates. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered certificates are subject to material variability from period to period and give rise to the potential for significant loss over the life of such certificates. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered certificates involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the certificates. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered certificates described in this free writing prospectus.

This free writing prospectus is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this free writing prospectus may not pertain to any securities that will actually be sold. The information contained in this free writing prospectus may be based on assumptions regarding market conditions and other matters as reflected in this free writing prospectus. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this free writing prospectus should not be relied upon for such purposes. The Underwriters and their respective affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this free writing prospectus may, from time to time, have long or short positions in, and buy or sell, the offered certificates mentioned in this free writing prospectus or derivatives thereof (including options). Information contained in this free writing prospectus is current as of the date appearing on this free writing prospectus only. None of UBS Securities LLC, Cantor Fitzgerald & Co., SG Americas Securities, LLC, Drexel Hamilton, LLC or Academy Securities, Inc. provides accounting, tax or legal advice.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Other Risks Relating to the Certificates—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

UBS 2018-C9

Capitalized terms used but not defined herein have the meanings assigned to them in the preliminary prospectus expected to be dated March 13, 2018 relating to the offered certificates (hereinafter referred to as the “Preliminary Prospectus”).

| KEY FEATURES OF SECURITIZATION |

| Offering Terms: | |

| Co-Lead Managers and Joint Bookrunners: | UBS Securities LLC Cantor Fitzgerald & Co. SG Americas Securities, LLC |

| Co-Managers: | Drexel Hamilton, LLC Academy Securities, Inc. |

| Mortgage Loan Sellers: | UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York (“UBS AG”) (41.2%), Ladder Capital Finance LLC (“LCF”) (23.3%), Société Générale (“SG”) (19.5%), and Cantor Commercial Real Estate Lending, L.P. (“CCRE”) (16.0%) |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Operating Advisor: | Pentalpha Surveillance LLC |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC |

| Special Servicer: | Rialto Capital Advisors LLC (with respect to all Mortgage Loans and related Serviced Companion Loans other than the DreamWorks Campus whole loan) and AEGON USA Realty Advisors, LLC (solely with respect to the DreamWorks Campus whole loan) |

| Trustee: | Wells Fargo Bank, National Association |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc. and Moody’s Investors Service, Inc. |

| U.S. Credit Risk Retention: | UBS AG is expected to act as the “retaining sponsor” for this securitization and intends to satisfy the U.S. credit risk retention requirement through the purchase by RREF III-D AIV RR H, LLC or an affiliate, as a third party purchaser (as defined in Regulation RR), from the initial purchasers, on the Closing Date, of an “eligible horizontal residual interest”. The aggregate estimated fair value of the “eligible horizontal residual interest” will equal at least 5% of the estimated fair value of all of the certificates issued by the issuing entity. The pooling and servicing agreement will include the required provisions applicable to an operating advisor necessary for the securitization to comply with the credit risk retention rules utilizing the “third party purchaser” option. For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU Credit Risk Retention: | The transaction isnot structured to satisfy the EU risk retention and due diligence requirements. |

| Closing Date: | On or about March 29, 2018 |

| Clean-up Call: | 1.0% |

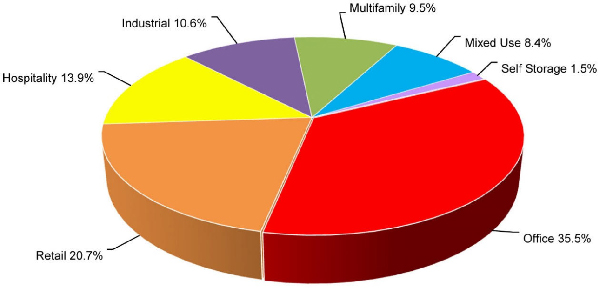

| Distribution of Collateral by Property Type |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

UBS 2018-C9

| TRANSACTION HIGHLIGHTS(1) |

| Mortgage Loan Sellers | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate Cut-Off Date Balance | % of Initial Outstanding Pool Balance(2) |

| UBS AG(3) | 19 | 47 | $345,894,363 | 41.2% |

| Ladder Capital Finance LLC | 10 | 13 | $195,633,188 | 23.3% |

| Société Générale(3) | 8 | 23 | $163,997,000 | 19.5% |

| Cantor Commercial Real Estate Lending, L.P. | 6 | 29 | $134,380,000 | 16.0% |

| Total/Weighted Average | 43 | 112 | $839,904,551 | 100.0% |

| Pooled Collateral Facts: | |

| Initial Outstanding Pool Balance: | $839,904,551 |

| Number of Mortgage Loans: | 43 |

| Number of Mortgaged Properties: | 112 |

| Average Mortgage Loan Cut-off Date Balance: | $19,532,664 |

| Average Mortgaged Property Cut-off Date Balance: | $7,499,148 |

| Weighted Average Mortgage Rate: | 4.903% |

| Weighted Average Mortgage Loan Original Term to Maturity Date or ARD (months)(4): | 117 |

| Weighted Average Mortgage Loan Remaining Term to Maturity Date or ARD (months)(4): | 117 |

| Weighted Average Mortgage Loan Seasoning (months): | 1 |

| % of Mortgaged Properties Leased to a Single Tenant: | 21.1% |

| % of Mortgage Loans Secured by a Property or a Portfolio of Mortgaged Properties Leased to a Single Tenant: | 15.0% |

| Credit Statistics | |

| Weighted Average Mortgage Loan U/W NCF DSCR(5): | 1.91x |

| Weighted Average Mortgage Loan Cut-off Date LTV(5)(6): | 58.9% |

| Weighted Average Mortgage Loan Maturity Date or ARD LTV(5)(6): | 54.5% |

| Weighted Average U/W NOI Debt Yield(5): | 10.9% |

| Amortization Overview | |

| % Mortgage Loans which pay Interest Only through Maturity Date or ARD(4): | 48.3% |

| % Mortgage Loans which pay Interest Only followed by Amortization through Maturity Date or ARD(4): | 27.6% |

| % Mortgage Loans with Amortization through Maturity Date or ARD(4): | 24.1% |

| Weighted Average Remaining Amortization Term (months)(7): | 357 |

| Loan Structural Features | |

| % Mortgage Loans with Upfront or Ongoing Tax Reserves: | 91.5% |

| % Mortgage Loans with Upfront or Ongoing Replacement Reserves(8): | 80.7% |

| % Mortgage Loans with Upfront or Ongoing Insurance Reserves: | 68.3% |

| % Mortgage Loans with Upfront or Ongoing TI/LC Reserves(9): | 83.7% |

| % Mortgage Loans with Upfront Engineering Reserves: | 53.4% |

| % Mortgage Loans with Upfront or Ongoing Other Reserves: | 82.3% |

| % Mortgage Loans with In Place Hard Lockboxes: | 71.7% |

| % Mortgage Loans with Cash Traps Triggered at DSCR Levels ≥ 1.05x: | 88.8% |

| % Mortgage Loans with Defeasance Only After a Lockout Period and Prior to an Open Period: | 82.1% |

| % Mortgage Loans with Prepayment with a Yield Maintenance Charge Only After a Lockout Period and Prior to an Open Period: | 15.4% |

| % Mortgage Loans with Lockout Followed by a Period of Prepayment with a Yield Maintenance Charge Followed by a Period of Prepayment with a Yield Maintenance Charge or Defeasance Followed by an Open Period: | 2.5% |

Please see footnotes on the following page.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

UBS 2018-C9

| TRANSACTION HIGHLIGHTS(1) |

| (1) | The Eastmont Town Center Whole Loan has not yet been originated. As such, any pool information related to Mortgage Rates, Maturity Dates, Seasoning, Prepayment Provisions, Reserves and UW NCF DSCR numbers presented herein are estimates that are subject to change upon origination of the Eastmont Town Center Whole Loan. |

| (2) | Unless otherwise indicated, all references to “% of Outstanding Pool Balance” in this Term Sheet reflect a percentage of the aggregate principal balance of the mortgage pool as of the Cut-off Date, after application of all payments of principal due during or prior to March 2018. |

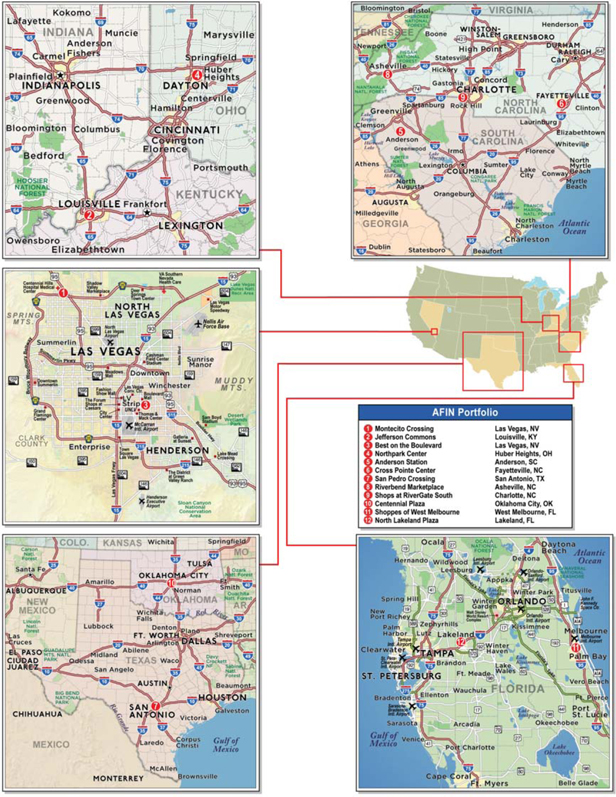

| (3) | With respect to the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as AFIN Portfolio, representing approximately 7.1% of the Initial Pool Balance, such mortgage loan is part of a whole loan that was co-originated by SG and UBS AG. The “Number of Mortgage Loans” and the “Number of Mortgaged Properties” shown in the table above for SG do not include the notes for which SG is acting as mortgage loan seller; however, the “Aggregate Cut-off Date Balance” and the “% of Outstanding Pool Balance” shown in the table above for SG do include these notes. |

| (4) | For any mortgage loan with an anticipated repayment date, calculated to or as of, as applicable, that anticipated repayment date. |

| (5) | With respect to any mortgage loan that is part of a whole loan, unless otherwise indicated, LTV, DSCR and Debt Yield calculations in this Term Sheet include any relatedpari passu companion loans and exclude any subordinate companion loans, as applicable. Additionally, LTV, DSCR and Debt Yield figures in this Term Sheet are calculated for mortgage loans without regard to any additional indebtedness that may be incurred at a future date. |

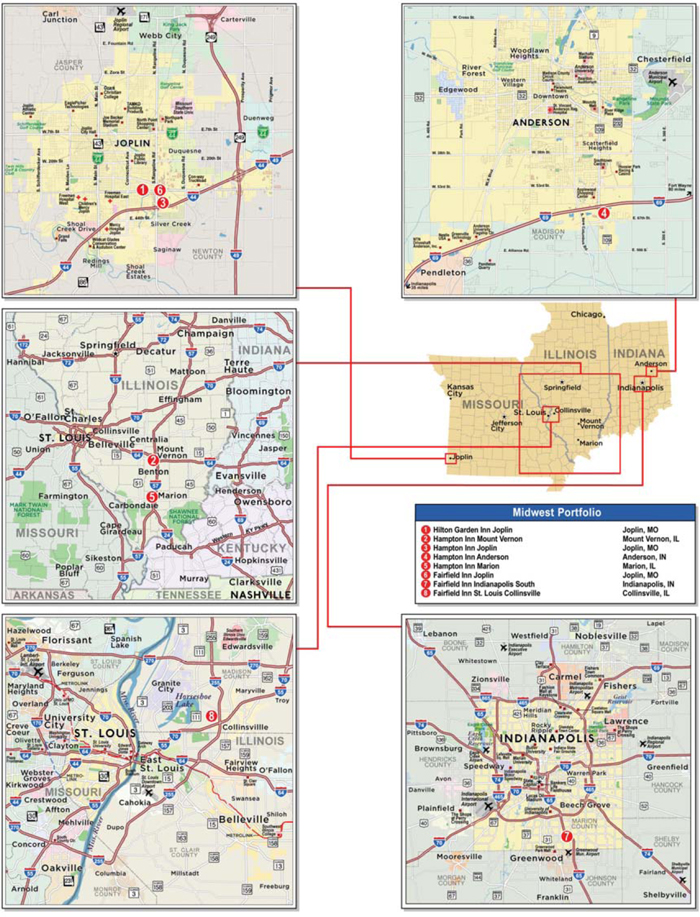

| (6) | With respect to the mortgage loan secured by the mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as Midwest Hotel Portfolio, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the sum of the “As-Is” appraised values for the Hampton Inn Mount Vernon Mortgaged Property, Hampton Inn Anderson Mortgaged Property, Fairfield Inn Joplin Mortgaged Property, and Fairfield Inn Indianapolis South Mortgaged Property and the “As Complete” appraised values for the Hilton Garden Inn Joplin Mortgaged Property, Hampton Inn Joplin Mortgaged Property, Hampton Inn Marion Mortgaged Property, and Fairfield Inn St. Louis Collinsville Mortgaged Property. The “As Complete” appraised values are based on the assumption that the specific amount for property improvement plans (“PIP”) and capital improvements are held in escrow by the lender at origination. At origination, the lender escrowed $4,598,885 into a PIP reserve and the work for the escrowed PIP and capital improvements are either underway or expected to commence in 2018 and 2019. The “As-Is” appraised value for the Hilton Garden Inn Joplin Mortgaged Property, Hampton Inn Joplin Mortgaged Property, Hampton Inn Marion Mortgaged Property, and Fairfield Inn St. Louis Collinsville Mortgaged Property is $13,400,000, $12,800,000, $8,100,000, and $3,500,000, respectively. The Cut-off Date LTV and Maturity Date or ARD LTV based on the appraised value representing the sum of the “As-Is” appraised values for each of the Midwest Hotel Portfolio Mortgaged Properties of $73.6 million, are 67.9% and 57.1%, respectively. With respect to the mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Chewy Fulfillment Center, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the alternate “Prospective Value Upon Stabilization” appraised value of $49,000,000, as of April 1, 2019, which assumes that outstanding landlord obligations for free rent, general contractor retainage payments, final billings, and remaining punch list work are fully funded and escrowed by the lender. At origination, landlord obligations of $2,822,812 were escrowed. The Cut-off Date LTV and Maturity Date or ARD LTV assuming the “As-Is” appraised value of $45,000,000 for the Chewy Fulfillment Center Mortgaged Property are 64.7% and 59.6%, respectively. With respect to the whole loan secured by the mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as Park Place at Florham Park, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the alternate market “As-Is” appraised value of $96,000,000 as of December 4, 2017, which assumes that outstanding landlord obligations for free rent, tenant improvements, and leasing commissions are fully funded and escrowed by the lender through a title company. At origination, landlord obligations of $5,044,401 were escrowed. The Cut-off Date LTV and Maturity Date or ARD LTV assuming the “As-Is” appraised value of $91,200,000 for the Park Place at Florham Park Mortgaged Properties are 68.5% and 68.5%, respectively. With respect to the mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Suntree Office Tower, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the alternate “As-Stabilized” appraised value of $14,900,000, as of January 1, 2019, which assumes that outstanding landlord obligations for forward starting rent, tenant improvements, and leasing commissions are fully funded and escrowed by the lender. At origination, landlord obligations of $358,116 were escrowed. The Cut-off Date LTV and Maturity Date or ARD LTV assuming the “As-Is” appraised value of $14,100,000 for the Suntree Office Tower Mortgaged Property are 73.8% and 65.8%, respectively. For additional information, see “Description of the Mortgage Pool—Mortgage Pool Characteristics – Appraised Value” in the Preliminary Prospectus and the footnotes to Annex A-1 in the Preliminary Prospectus. |

| (7) | Excludes mortgage loans that are interest-only for the full loan term. |

| (8) | Includes FF&E Reserves. |

| (9) | Represents the percent of the allocated aggregate principal balance of the mortgage pool as of the Cut-off Date of retail, office, industrial mixed use and the 53 South 11th Street properties only. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

UBS 2018-C9

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Distribution of Cut-off Date Balances | ||||||||||

| Weighted Averages | ||||||||||

| Range of Cut-off Date Balances | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) | ||

| $2,600,000 | - | $6,000,000 | 11 | $53,792,086 | 6.4% | 5.468% | 120 | 1.72x | 62.6% | 52.6% |

| $6,000,001 | - | $11,000,000 | 7 | $63,229,264 | 7.5% | 5.179% | 109 | 1.88x | 58.1% | 54.2% |

| $11,000,001 | - | $16,000,000 | 3 | $37,550,000 | 4.5% | 4.983% | 120 | 1.46x | 71.1% | 61.9% |

| $16,000,001 | - | $21,000,000 | 8 | $152,146,201 | 18.1% | 4.914% | 119 | 1.70x | 62.9% | 55.4% |

| $21,000,001 | - | $26,000,000 | 1 | $25,000,000 | 3.0% | 2.298% | 57 | 6.31x | 31.0% | 31.0% |

| $26,000,001 | - | $31,000,000 | 6 | $177,400,000 | 21.1% | 5.053% | 120 | 1.73x | 57.6% | 53.4% |

| $31,000,001 | - | $36,000,000 | 1 | $34,750,000 | 4.1% | 5.050% | 120 | 1.43x | 50.4% | 50.4% |

| $36,000,001 | - | $41,000,000 | 2 | $76,037,000 | 9.1% | 4.542% | 120 | 1.82x | 60.5% | 58.1% |

| $41,000,001 | - | $46,000,000 | 1 | $45,000,000 | 5.4% | 4.728% | 119 | 1.76x | 49.7% | 49.7% |

| $46,000,001 | - | $51,000,000 | 1 | $50,000,000 | 6.0% | 5.674% | 120 | 1.71x | 64.7% | 54.3% |

| $51,000,001 | - | $65,000,000 | 2 | $125,000,000 | 14.9% | 4.723% | 119 | 2.05x | 59.3% | 59.3% |

| Total/Weighted Average | 43 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% | ||

| Distribution of Mortgage Rates | ||||||||||

| Weighted Averages | ||||||||||

| Range of Mortgage Rates | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) | ||

| 2.2978% | - | 4.0000% | 2 | $33,000,000 | 3.9% | 2.700% | 73 | 5.78x | 29.4% | 29.4% |

| 4.0010% | - | 4.5000% | 4 | $138,207,000 | 16.5% | 4.254% | 119 | 2.15x | 58.9% | 58.1% |

| 4.5010% | - | 5.0000% | 10 | $254,026,201 | 30.2% | 4.775% | 119 | 1.74x | 57.3% | 53.4% |

| 5.0010% | - | 5.5000% | 19 | $300,148,000 | 35.7% | 5.215% | 118 | 1.61x | 61.6% | 57.0% |

| 5.5010% | - | 6.0000% | 6 | $78,236,363 | 9.3% | 5.667% | 120 | 1.70x | 65.1% | 54.4% |

| 6.0010% | - | 6.2130% | 2 | $36,286,986 | 4.3% | 6.046% | 120 | 1.55x | 62.0% | 50.9% |

| Total/Weighted Average | 43 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% | ||

| Property Type Distribution(1) | |||||||||||

| Weighted Averages | |||||||||||

| Property Type | Number of Mortgage Properties | Aggregate Cut-Off Date Balance | % of Initial Outstanding Pool Balance(1) | Number of Units/Rooms/Pads/ NRA/Beds | Cut-off Date Balance per Unit/Room/Pads NRA(1)(2) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | Occupancy | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) |

| Office | 27 | $298,043,208 | 35.5% | 4,837,276 | $179 | 4.782% | 114 | 93.1% | 2.14x | 57.4% | 54.8% |

| Suburban | 23 | $238,039,208 | 28.3% | 4,509,475 | $140 | 4.721% | 113 | 92.4% | 2.29x | 57.5% | 55.1% |

| CBD | 2 | $51,750,000 | 6.2% | 301,934 | $362 | 5.159% | 120 | 95.2% | 1.46x | 56.3% | 52.5% |

| Medical | 2 | $8,254,000 | 1.0% | 25,867 | $164 | 4.202% | 120 | 100.0% | 2.16x | 61.5% | 61.5% |

| Retail | 43 | $173,784,204 | 20.7% | 3,909,118 | $109 | 4.639% | 119 | 93.0% | 1.95x | 61.1% | 57.8% |

| Anchored | 20 | $118,158,609 | 14.1% | 3,252,698 | $95 | 4.639% | 119 | 91.1% | 1.94x | 60.7% | 56.6% |

| Single Tenant | 15 | $35,533,000 | 4.2% | 280,879 | $150 | 4.403% | 120 | 100.0% | 2.04x | 62.0% | 61.0% |

| Shadow Anchored | 2 | $10,814,063 | 1.3% | 90,609 | $130 | 5.196% | 120 | 92.0% | 2.16x | 63.4% | 63.1% |

| Unanchored | 6 | $9,278,532 | 1.1% | 284,932 | $104 | 4.890% | 119 | 91.0% | 1.48x | 59.4% | 54.7% |

| Hospitality | 13 | $116,636,986 | 13.9% | 1,383 | $88,434 | 5.723% | 120 | 70.2% | 1.70x | 64.0% | 52.9% |

| Limited Service | 11 | $64,636,986 | 7.7% | 896 | $72,813 | 5.719% | 120 | 69.0% | 1.80x | 63.8% | 52.0% |

| Full Service | 2 | $52,000,000 | 6.2% | 487 | $107,851 | 5.728% | 120 | 71.7% | 1.57x | 64.3% | 54.1% |

| Industrial | 14 | $89,268,812 | 10.6% | 2,276,584 | $69 | 4.896% | 120 | 99.8% | 1.48x | 60.5% | 53.6% |

| Warehouse/Distribution | 12 | $88,694,461 | 10.6% | 2,157,053 | $68 | 4.896% | 120 | 99.8% | 1.48x | 60.5% | 53.6% |

| Flex | 2 | $574,350 | 0.1% | 119,531 | $104 | 4.890% | 119 | 88.9% | 1.48x | 59.4% | 54.7% |

| Multifamily | 6 | $79,572,264 | 9.5% | 869 | $139,489 | 4.832% | 111 | 96.2% | 1.71x | 57.6% | 54.6% |

| Garden | 4 | $61,772,264 | 7.4% | 812 | $85,123 | 4.706% | 119 | 95.1% | 1.77x | 59.3% | 55.4% |

| Mid Rise | 2 | $17,800,000 | 2.1% | 57 | $328,158 | 5.269% | 82 | 100.0% | 1.49x | 51.7% | 51.7% |

| Mixed Use | 6 | $70,174,078 | 8.4% | 743,507 | $284 | 4.745% | 119 | 95.4% | 1.95x | 50.5% | 48.8% |

| Office/Garage/Retail | 1 | $45,000,000 | 5.4% | 246,136 | $366 | 4.728% | 119 | 94.2% | 1.76x | 49.7% | 49.7% |

| Retail/Other | 1 | $9,000,000 | 1.1% | 43,044 | $209 | 5.398% | 120 | 100.0% | 1.41x | 69.8% | 61.0% |

| Industrial/Office/Retail | 1 | $8,000,000 | 1.0% | 90,025 | $89 | 3.955% | 121 | 100.0% | 4.12x | 24.2% | 24.2% |

| Office/Retail | 2 | $5,510,863 | 0.7% | 235,008 | $104 | 4.890% | 119 | 94.5% | 1.48x | 59.4% | 54.7% |

| Retail/Education | 1 | $2,663,214 | 0.3% | 129,294 | $104 | 4.890% | 119 | 89.1% | 1.48x | 59.4% | 54.7% |

| Self Storage | 3 | $12,425,000 | 1.5% | 132,761 | $110 | 5.200% | 120 | 91.4% | 1.71x | 61.2% | 55.0% |

| Total/Weighted Average | 112 | $839,904,551 | 100.0% | 4.903% | 117 | 91.1% | 1.91x | 58.9% | 54.5% | ||

Please see footnotes on page 10.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

UBS 2018-C9

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Geographic Distribution(1) | ||||||||

| Weighted Averages | ||||||||

| State/Location | Number of Mortgage Properties | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) |

| California | 36 | $216,480,000 | 25.8% | 4.747% | 112 | 2.13x | 53.5% | 49.0% |

| California - Northern(4) | 7 | $132,758,351 | 15.8% | 5.175% | 120 | 1.58x | 55.7% | 50.4% |

| California - Southern(4) | 29 | $83,721,649 | 10.0% | 4.069% | 100 | 3.01x | 49.9% | 46.8% |

| Texas | 11 | $110,175,608 | 13.1% | 5.105% | 119 | 1.77x | 63.4% | 59.5% |

| Florida | 8 | $75,356,714 | 9.0% | 4.819% | 119 | 1.46x | 63.6% | 58.3% |

| Nevada | 5 | $67,937,143 | 8.1% | 4.651% | 120 | 2.10x | 56.9% | 55.8% |

| New York | 4 | $60,550,000 | 7.2% | 4.970% | 109 | 1.80x | 47.3% | 47.3% |

| Other | 48 | $309,405,086 | 36.8% | 5.003% | 119 | 1.88x | 62.7% | 56.8% |

| Total/Weighted Average | 112 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% |

| Distribution of Cut-off Date LTV Ratios(1)(2)(3) | ||||||||||

| Weighted Averages | ||||||||||

| Range of Cut-off Date LTV Ratios | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) | ||

| 24.2% | - | 40.0% | 2 | $33,000,000 | 3.9% | 2.700% | 73 | 5.78x | 29.4% | 29.4% |

| 40.1% | - | 50.0% | 3 | $58,600,000 | 7.0% | 4.834% | 108 | 1.78x | 48.3% | 48.3% |

| 50.1% | - | 55.0% | 3 | $85,750,000 | 10.2% | 4.724% | 120 | 1.91x | 50.9% | 50.9% |

| 55.1% | - | 60.0% | 10 | $261,180,000 | 31.1% | 4.790% | 119 | 1.80x | 58.1% | 53.9% |

| 60.1% | - | 65.0% | 12 | $246,793,188 | 29.4% | 5.247% | 120 | 1.79x | 62.9% | 57.5% |

| 65.1% | - | 70.0% | 10 | $120,542,100 | 14.4% | 5.151% | 120 | 1.49x | 67.9% | 60.3% |

| 70.1% | - | 73.5% | 3 | $34,039,264 | 4.1% | 5.106% | 119 | 1.46x | 71.8% | 61.1% |

| Total/Weighted Average | 43 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% | ||

| Distribution of Maturity Date or ARD LTV Ratios(1)(2)(3) | ||||||||||

| Weighted Averages | ||||||||||

| Range of LTV Ratios at Maturity or ARD | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) | ||

| 24.2% | - | 40.0% | 2 | $33,000,000 | 3.9% | 2.700% | 73 | 5.78x | 29.4% | 29.4% |

| 40.1% | - | 50.0% | 9 | $126,236,986 | 15.0% | 5.073% | 114 | 1.71x | 53.4% | 48.1% |

| 50.1% | - | 55.0% | 11 | $304,859,201 | 36.3% | 5.097% | 120 | 1.68x | 58.4% | 52.8% |

| 55.1% | - | 60.0% | 10 | $162,111,363 | 19.3% | 4.829% | 119 | 1.94x | 62.1% | 57.6% |

| 60.1% | - | 65.1% | 11 | $213,697,000 | 25.4% | 4.922% | 120 | 1.73x | 65.1% | 62.2% |

| Total/Weighted Average | 43 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% | ||

| Distribution of Underwritten NCF Debt Service Coverage Ratios(1)(2) | ||||||||||

| Weighted Averages | ||||||||||

| Range of Underwritten NCF Debt Service Coverage Ratios | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) | ||

| 1.25x | - | 1.35x | 7 | $83,681,363 | 10.0% | 5.040% | 119 | 1.33x | 65.2% | 59.1% |

| 1.36x | - | 1.45x | 8 | $102,613,000 | 12.2% | 5.082% | 120 | 1.41x | 60.5% | 54.8% |

| 1.46x | - | 1.55x | 5 | $120,980,000 | 14.4% | 5.349% | 120 | 1.50x | 60.7% | 53.5% |

| 1.56x | - | 1.65x | 4 | $71,300,000 | 8.5% | 5.048% | 110 | 1.62x | 61.2% | 53.8% |

| 1.66x | - | 1.75x | 3 | $73,986,986 | 8.8% | 5.593% | 120 | 1.70x | 63.2% | 52.4% |

| 1.76x | - | 1.85x | 4 | $147,696,201 | 17.6% | 4.986% | 119 | 1.79x | 58.9% | 57.3% |

| 1.86x | - | 2.05x | 1 | $5,000,000 | 0.6% | 5.063% | 120 | 2.01x | 59.5% | 49.0% |

| 2.06x | - | 2.30x | 6 | $133,547,000 | 15.9% | 4.552% | 120 | 2.21x | 57.4% | 57.0% |

| 2.31x | - | 6.31x | 5 | $101,100,000 | 12.0% | 3.803% | 103 | 3.49x | 47.3% | 46.6% |

| Total/Weighted Average | 43 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% | ||

Please see footnotes on page 10.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

UBS 2018-C9

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Original Terms to Maturity or ARD | ||||||||

| Weighted Averages | ||||||||

| Original Terms to Maturity or ARD | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) |

| 60 | 2 | $36,000,000 | 4.3% | 3.215% | 58 | 4.87x | 35.0% | 35.0% |

| 120 | 39 | $784,604,551 | 93.4% | 4.988% | 119 | 1.75x | 60.2% | 55.6% |

| 121 | 2 | $19,300,000 | 2.3% | 4.614% | 121 | 2.52x | 50.4% | 46.6% |

| Total/Weighted Average | 43 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% |

| Distribution of Remaining Terms to Maturity or ARD | ||||||||||

| Weighted Averages | ||||||||||

| Range of Remaining Terms to Maturity or ARD | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) | ||

| 57 | - | 59 | 2 | $36,000,000 | 4.3% | 3.215% | 58 | 4.87x | 35.0% | 35.0% |

| 118 | - | 121 | 41 | $803,904,551 | 95.7% | 4.979% | 119 | 1.77x | 60.0% | 55.4% |

| Total/Weighted Average | 43 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% | ||

| Distribution of Underwritten NOI Debt Yields(1)(2) | |||||||||||

| Weighted Averages | |||||||||||

| Range of Underwritten NOI Debt Yields | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) | |||

| 7.0% | - | 8.0% | 2 | $41,550,000 | 4.9% | 5.078% | 120 | 1.41x | 52.7% | 52.7% | |

| 8.1% | - | 8.5% | 1 | $18,750,000 | 2.2% | 4.365% | 118 | 1.35x | 68.2% | 62.3% | |

| 8.6% | - | 9.0% | 3 | $85,100,000 | 10.1% | 4.885% | 112 | 1.59x | 52.3% | 50.7% | |

| 9.1% | - | 9.5% | 5 | $68,299,100 | 8.1% | 4.617% | 119 | 1.80x | 64.8% | 61.0% | |

| 9.6% | - | 10.0% | 6 | $121,489,264 | 14.5% | 5.211% | 120 | 1.60x | 63.8% | 59.6% | |

| 10.1% | - | 10.5% | 4 | $78,143,000 | 9.3% | 4.838% | 119 | 1.75x | 56.4% | 53.2% | |

| 10.6% | - | 11.0% | 4 | $71,200,000 | 8.5% | 4.754% | 119 | 1.86x | 58.5% | 56.3% | |

| 11.1% | - | 11.5% | 2 | $90,000,000 | 10.7% | 4.547% | 119 | 2.05x | 56.3% | 54.3% | |

| 11.6% | - | 12.0% | 3 | $65,700,000 | 7.8% | 5.034% | 120 | 1.89x | 62.0% | 56.4% | |

| 12.1% | - | 12.5% | 3 | $63,196,201 | 7.5% | 5.437% | 119 | 1.65x | 65.0% | 54.2% | |

| 12.6% | - | 13.0% | 2 | $31,240,000 | 3.7% | 5.271% | 120 | 1.82x | 66.4% | 58.6% | |

| 13.1% | - | 20.7% | 8 | $105,236,986 | 12.5% | 4.716% | 105 | 3.09x | 52.3% | 44.5% | |

| Total/Weighted Average | 43 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% | |||

| Amortization Types | ||||||||||

| Weighted Averages | ||||||||||

| Amortization Type | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) | ||

| Full IO | 13 | $359,347,000 | 42.8% | 4.727% | 118 | 2.01x | 55.9% | 55.9% | ||

| Partial IO | 14 | $203,068,000 | 24.2% | 5.012% | 119 | 1.47x | 62.5% | 56.1% | ||

| Amortizing | 13 | $202,389,551 | 24.1% | 5.467% | 120 | 1.65x | 64.8% | 53.5% | ||

| Full IO, ARD | 2 | $46,000,000 | 5.5% | 3.273% | 85 | 4.48x | 40.8% | 40.8% | ||

| Partial IO, ARD | 1 | $29,100,000 | 3.5% | 4.970% | 120 | 1.33x | 59.4% | 54.8% | ||

| Total/Weighted Average | 43 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% | ||

| Loan Purposes | ||||||||||

| Weighted Averages | ||||||||||

| Loan Purpose | Number of Mortgage Loans | Aggregate Cut-off Date Balance | % of Initial Outstanding Pool Balance(1) | Mortgage Rate | Stated Remaining Term (Mos.)(6) | U/W NCF DSCR(1)(2) | Cut-off Date LTV Ratio(1)(2)(3) | Maturity Date or ARD LTV Ratio(1)(2)(3) | ||

| Refinance | 28 | $515,127,551 | 61.3% | 5.195% | 118 | 1.65x | 59.5% | 53.9% | ||

| Acquisition | 13 | $255,777,000 | 30.5% | 4.465% | 113 | 2.34x | 58.0% | 55.0% | ||

| Recapitalization | 2 | $69,000,000 | 8.2% | 4.348% | 118 | 2.22x | 58.2% | 57.1% | ||

| Total/Weighted Average | 43 | $839,904,551 | 100.0% | 4.903% | 117 | 1.91x | 58.9% | 54.5% | ||

Please see footnotes on page 10.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

UBS 2018-C9

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| (1) | All numerical information concerning the mortgage loans is approximate and, in the case of mortgage loans secured by multiple properties, is based on allocated loan amounts with respect to such properties. All weighted average information regarding the mortgage loans reflects the weighting of the mortgage loans based on their outstanding principal balances as of the Cut-off Date or, in the case of mortgage loans secured by multiple properties, allocated loan amounts. The sum of numbers and percentages in columns may not match the “Total” due to rounding. |

| (2) | With respect to any mortgage loan that is part of a whole loan, unless otherwise indicated, Balance per Unit/Room/Pad/NRA, LTV, DSCR and Debt Yield calculations in this Term Sheet include any relatedpari passu companion loans and exclude any subordinate companion loans, as applicable. Additionally, Balance per Unit/Room/Pad/NRA, LTV, DSCR and Debt Yield figures in this Term Sheet are calculated for mortgage loans without regard to any additional indebtedness that may be incurred at a future date. |

| (3) | With respect to the mortgage loan secured by the mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as Midwest Hotel Portfolio, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the sum of the “As-Is” appraised values for the Hampton Inn Mount Vernon Mortgaged Property, Hampton Inn Anderson Mortgaged Property, Fairfield Inn Joplin Mortgaged Property, and Fairfield Inn Indianapolis South Mortgaged Property and the “As Complete” appraised values for the Hilton Garden Inn Joplin Mortgaged Property, Hampton Inn Joplin Mortgaged Property, Hampton Inn Marion Mortgaged Property, and Fairfield Inn St. Louis Collinsville Mortgaged Property. The “As Complete” appraised values are based on the assumption that the specific amount for property improvement plans (“PIP”) and capital improvements are held in escrow by the lender at origination. At origination, the lender escrowed $4,598,885 into a PIP reserve and the work for the escrowed PIP and capital improvements are either underway or expected to commence in 2018 and 2019. The “As-Is” appraised value for the Hilton Garden Inn Joplin Mortgaged Property, Hampton Inn Joplin Mortgaged Property, Hampton Inn Marion Mortgaged Property, and Fairfield Inn St. Louis Collinsville Mortgaged Property is $13,400,000, $12,800,000, $8,100,000, and $3,500,000, respectively. The Cut-off Date LTV and Maturity Date or ARD LTV based on the appraised value representing the sum of the “As-Is” appraised values for each of the Midwest Hotel Portfolio Mortgaged Properties of $73.6 million, are 67.9% and 57.1%, respectively. With respect to the mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Chewy Fulfillment Center, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the alternate “Prospective Value Upon Stabilization” appraised value of $49,000,000, as of April 1, 2019, which assumes that outstanding landlord obligations for free rent, general contractor retainage payments, final billings, and remaining punch list work are fully funded and escrowed by the lender. At origination, landlord obligations of $2,822,812 were escrowed. The Cut-off Date LTV and Maturity Date or ARD LTV assuming the “As-Is” appraised value of $45,000,000 for the Chewy Fulfillment Center Mortgaged Property are 64.7% and 59.6%, respectively. With respect to the whole loan secured by the mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as Park Place at Florham Park, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the alternate market “As-Is” appraised value of $96,000,000 as of December 4, 2017, which assumes that outstanding landlord obligations for free rent, tenant improvements, and leasing commissions are fully funded and escrowed by the lender through a title company. At origination, landlord obligations of $5,044,401 were escrowed. The Cut-off Date LTV and Maturity Date or ARD LTV assuming the “As-Is” appraised value of $91,200,000 for the Park Place at Florham Park Mortgaged Properties are 68.5% and 68.5%, respectively. With respect to the mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Suntree Office Tower, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the alternate “As-Stabilized” appraised value of $14,900,000, as of January 1, 2019, which assumes that outstanding landlord obligations for forward starting rent, tenant improvements, and leasing commissions are fully funded and escrowed by the lender. At origination, landlord obligations of $358,116 were escrowed. The Cut-off Date LTV and Maturity Date or ARD LTV assuming the “As-Is” appraised value of $14,100,000 for the Suntree Office Tower Mortgaged Property are 73.8% and 65.8%, respectively. For additional information, see “Description of the Mortgage Pool—Mortgage Pool Characteristics – Appraised Value” in the Preliminary Prospectus and the footnotes to Annex A-1 in the Preliminary Prospectus. |

| (4) | “California—Northern” includes zip codes above 93600, and “California—Southern” includes zip codes at or below 93600. |

| (5) | With respect to the whole loan secured by the mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as AFIN Portfolio, loan proceeds were used to refinance existing debt of approximately $18.0 million encumbering the San Pedro Crossing Mortgaged Property and recapitalize the borrower sponsors recent acquisition of the remaining 11 AFIN Portfolio Mortgaged Properties. |

| (6) | With respect to an ARD loan, refers to the term through the related anticipated repayment date. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

UBS 2018-C9

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Ten Largest Mortgage Loans | |||||||||

| Mortgage Loan | Mortgage Loan Seller | City, State | Property Type | Cut-off Date Balance | % of Initial Outstanding Pool Balance | Cut-off Date Balance per Unit/Room/ Pad/NRA(1) | Cut-off Date LTV Ratio(1) | U/W NCF DSCR(1) | U/W NOI Debt Yield(1) |

| Aspen Lake Office Portfolio | UBS AG | Austin, TX | Office | $65,000,000 | 7.7% | $170 | 61.8% | 1.79x | 9.8% |

| AFIN Portfolio | SG; UBS AG | Various, Various | Retail | $60,000,000 | 7.1% | $87 | 56.5% | 2.34x | 11.1% |

| Midwest Hotel Portfolio(2) | UBS AG | Various, Various | Hospitality | $50,000,000 | 6.0% | $75,988 | 64.7% | 1.71x | 13.3% |

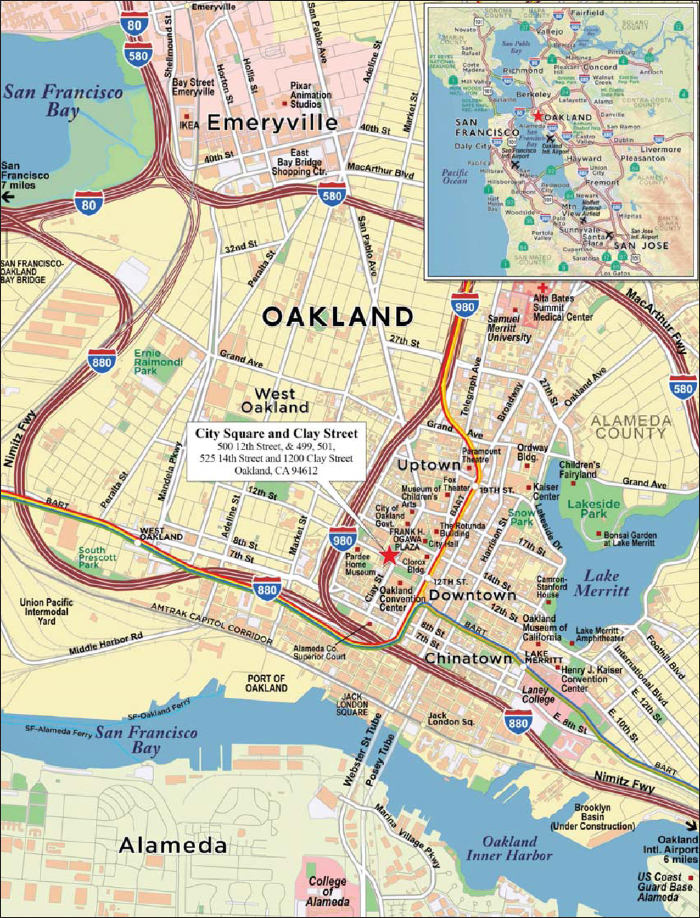

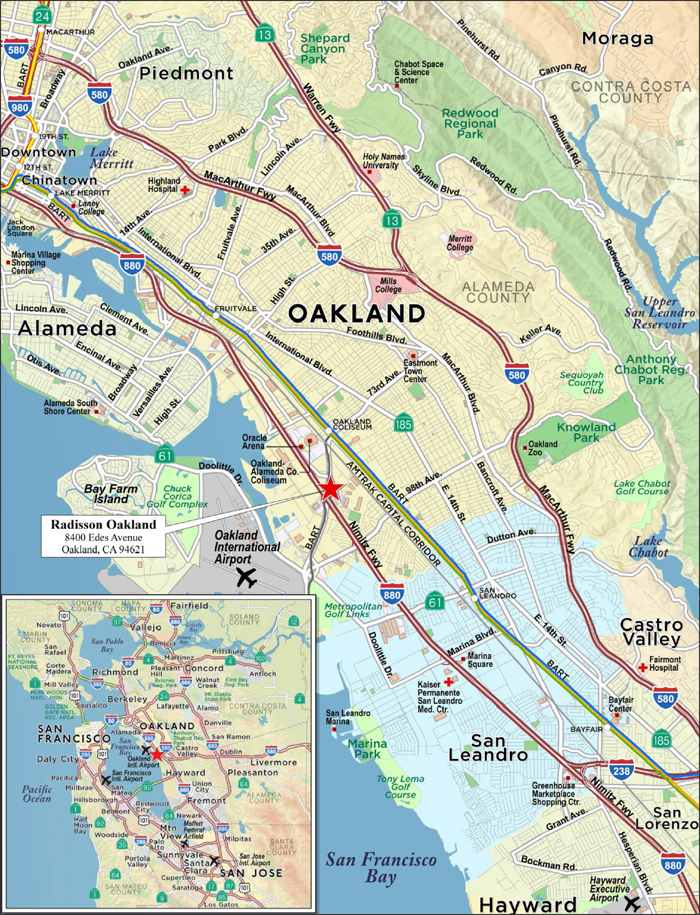

| City Square and Clay Street | LCF | Oakland, CA | Mixed Use | $45,000,000 | 5.4% | $366 | 49.7% | 1.76x | 8.9% |

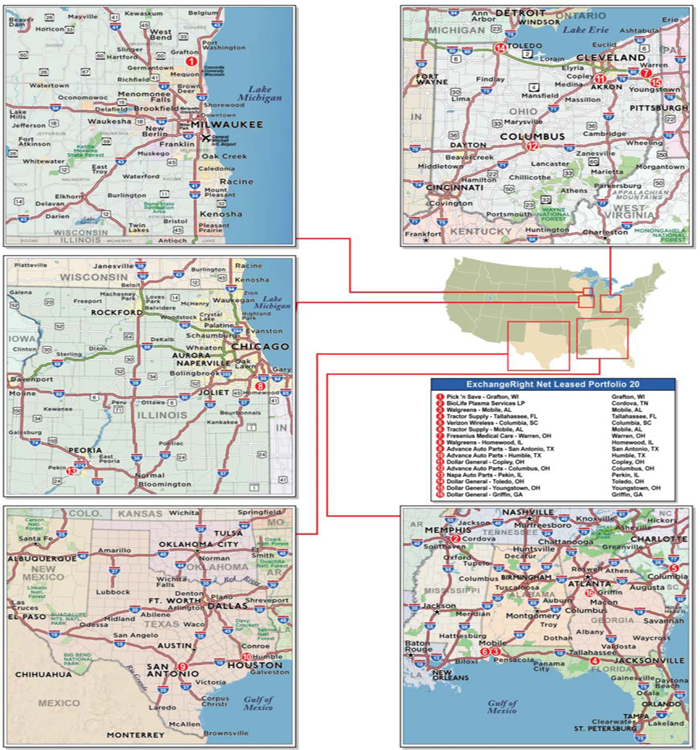

| ExchangeRight Net Leased Portfolio 20 | SG | Various, Various | Various | $38,457,000 | 4.6% | $164 | 61.5% | 2.16x | 9.4% |

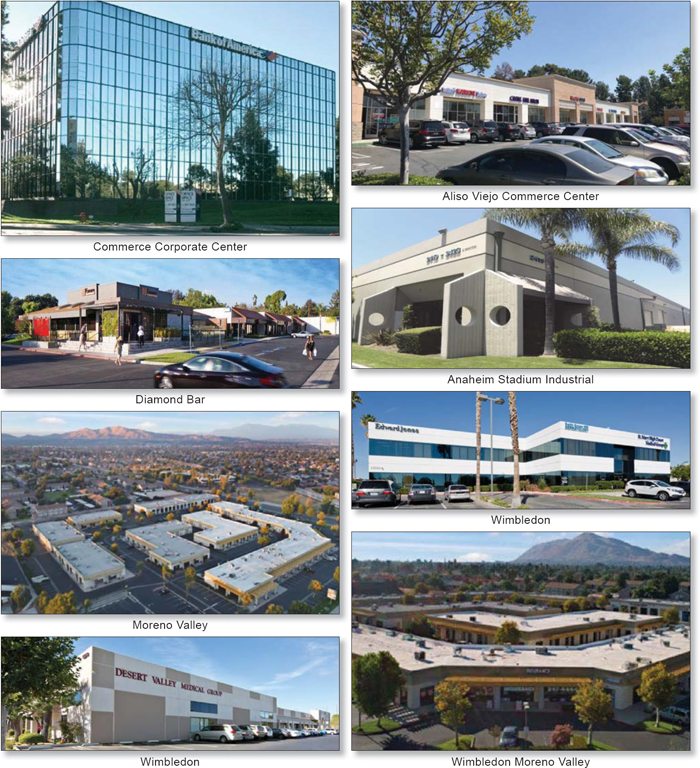

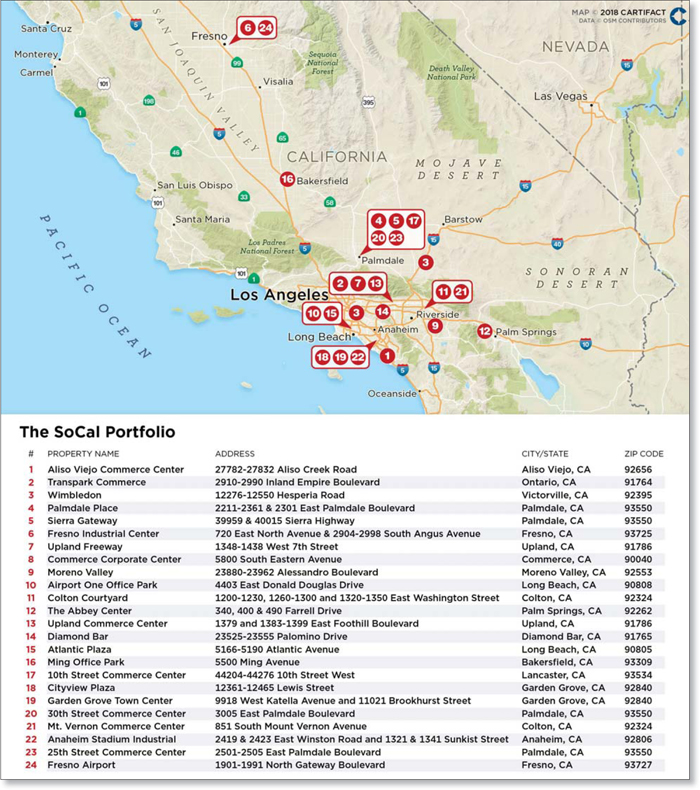

| The SoCal Portfolio | CCRE | Various, CA | Various | $37,580,000 | 4.5% | $104 | 59.4% | 1.48x | 10.2% |

| 22 West 38th Street | LCF | New York, NY | Office | $34,750,000 | 4.1% | $503 | 50.4% | 1.43x | 7.6% |

| Radisson Oakland | LCF | Oakland, CA | Hospitality | $31,000,000 | 3.7% | $116,541 | 62.0% | 1.53x | 12.4% |

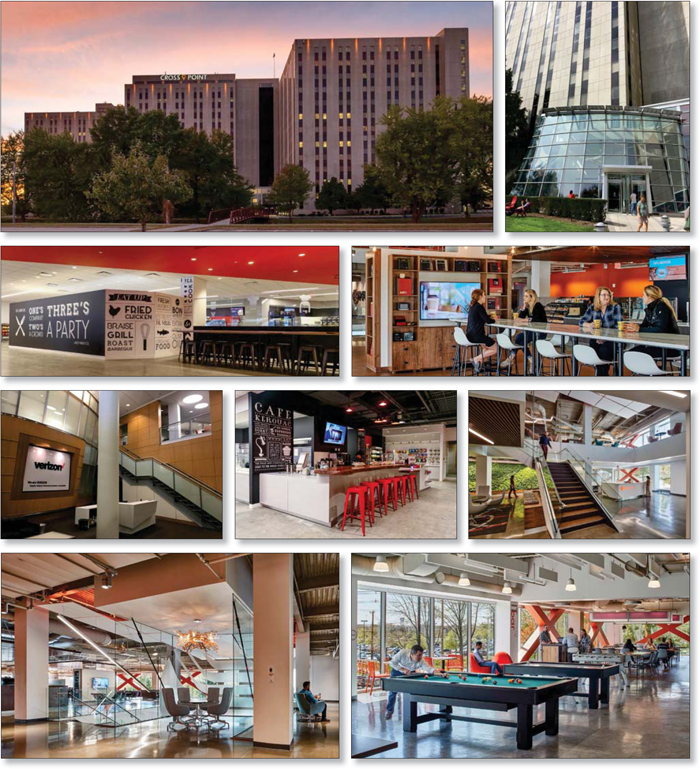

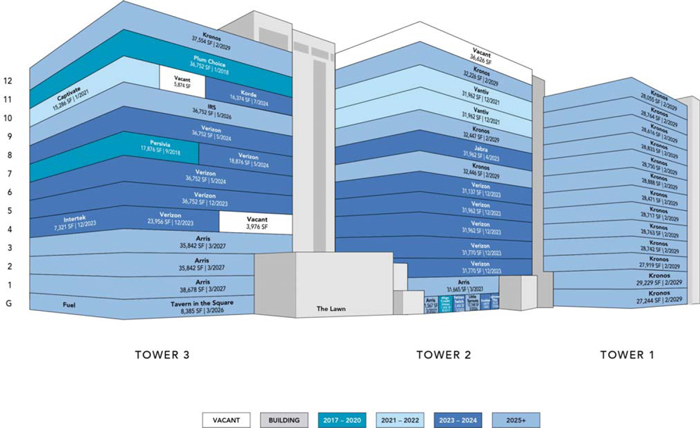

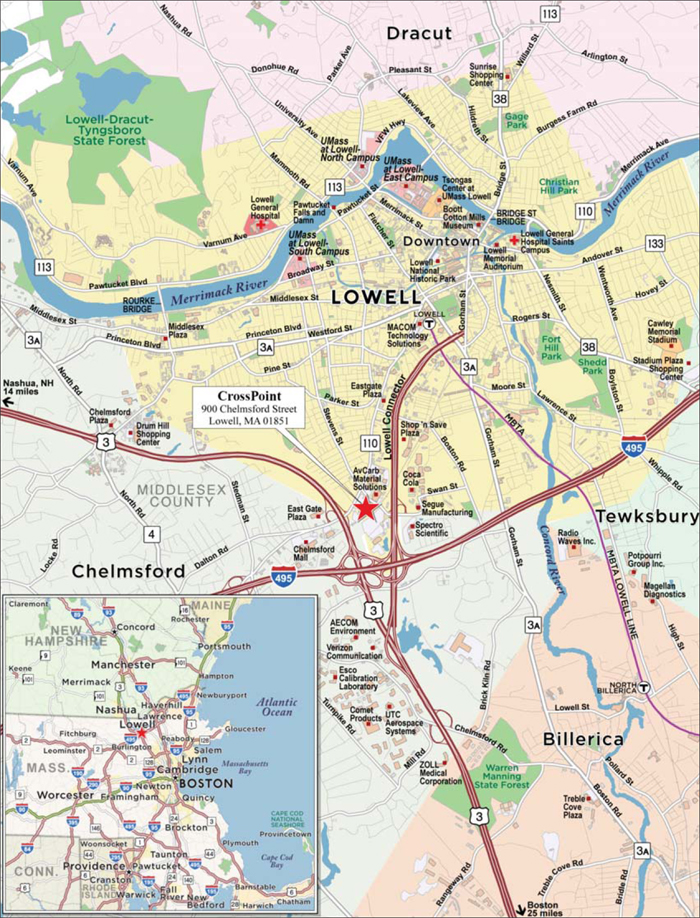

| CrossPoint | CCRE | Lowell, MA | Office | $30,000,000 | 3.6% | $114 | 60.0% | 2.24x | 11.8% |

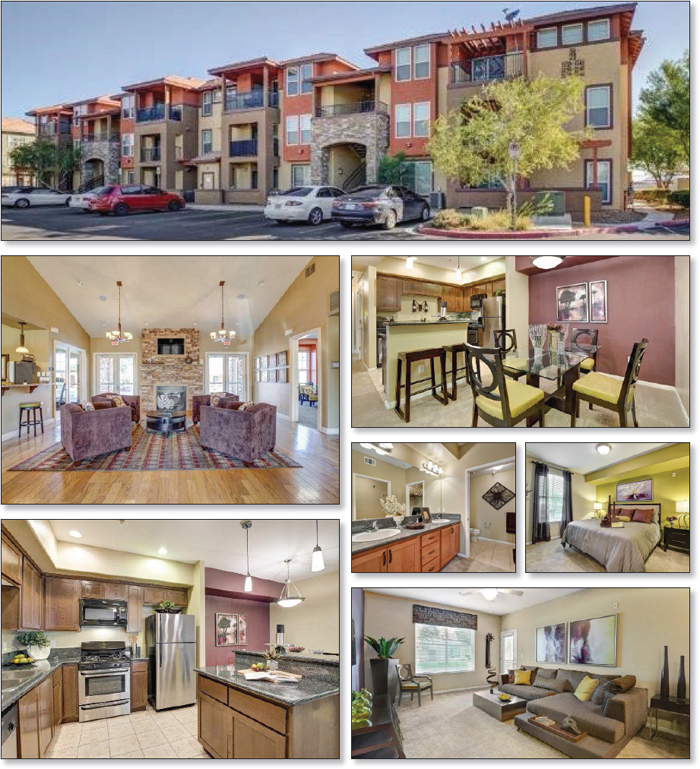

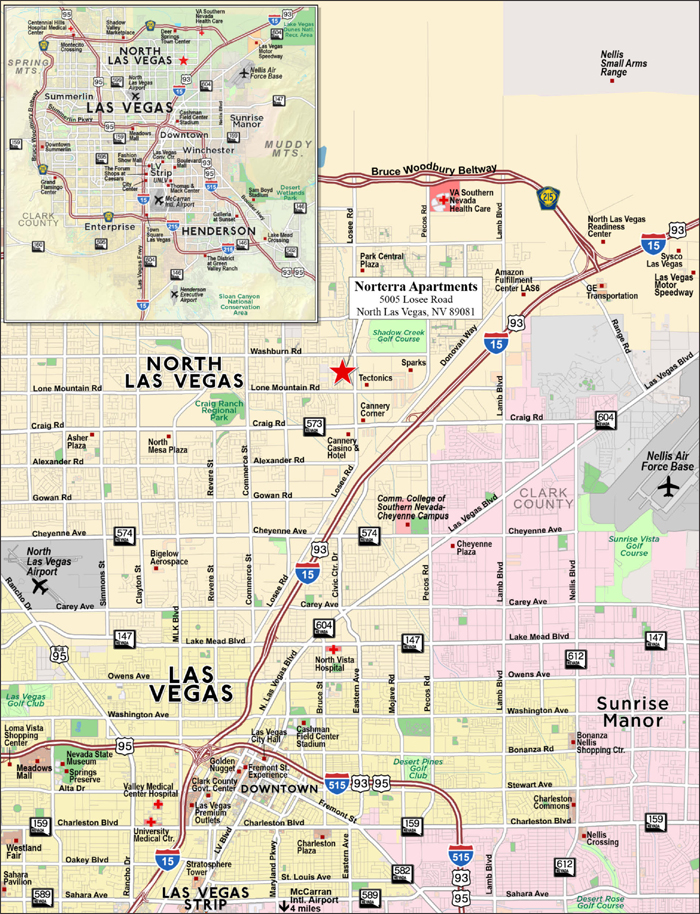

| Norterra Apartments | CCRE | North Las Vegas, NV | Multifamily | $30,000,000 | 3.6% | $70,423 | 50.3% | 2.20x | 10.5% |

| Total/Weighted Average | $421,787,000 | 50.2% | 58.0% | 1.87x | 10.5% | ||||

| (1) | With respect to any mortgage loan that is part of a whole loan, unless otherwise indicated, all LTV Ratio, U/W NCF DSCR, Debt Yield and Balance per Unit/Room/Pad/NRA calculations in this Term Sheet include any relatedpari passu companion loans and exclude any subordinate companion loans, as applicable. Additionally, LTV Ratio, U/W NCF DSCR, Debt Yield and Balance per Unit/Room/Pad/NRA figures in this Term Sheet are calculated for mortgage loans without regard to any additional indebtedness that may be incurred at a future date. |

| (2) | With respect to the mortgage loan secured by the mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as Midwest Hotel Portfolio, the Cut-off Date LTV, Maturity Date or ARD LTV, and appraised value are based on the sum of the “As-Is” appraised values for the Hampton Inn Mount Vernon Mortgaged Property, Hampton Inn Anderson Mortgaged Property, Fairfield Inn Joplin Mortgaged Property, and Fairfield Inn Indianapolis South Mortgaged Property and the “As Complete” appraised values for the Hilton Garden Inn Joplin Mortgaged Property, Hampton Inn Joplin Mortgaged Property, Hampton Inn Marion Mortgaged Property, and Fairfield Inn St. Louis Collinsville Mortgaged Property. The “As Complete” appraised values are based on the assumption that the specific amount for property improvement plans (“PIP”) and capital improvements are held in escrow by the lender at origination. At origination, the lender escrowed $4,598,885 into a PIP reserve and the work for the escrowed PIP and capital improvements are either underway or expected to commence in 2018 and 2019. The “As-Is” appraised value for the Hilton Garden Inn Joplin Mortgaged Property, Hampton Inn Joplin Mortgaged Property, Hampton Inn Marion Mortgaged Property, and Fairfield Inn St. Louis Collinsville Mortgaged Property is $13,400,000, $12,800,000, $8,100,000, and $3,500,000, respectively. The Cut-off Date LTV and Maturity Date or ARD LTV based on the appraised value representing the sum of the “As-Is” appraised values for each of the Midwest Hotel Portfolio Mortgaged Properties of $73.6 million, are 67.9% and 57.1%, respectively. |

| Existing Mezzanine Debt Summary | ||||||||

| Mortgage Loan | Mortgage Loan Cut-off Date Balance | Mezzanine Debt Cut-off Date Balance | Trust U/W NCF DSCR(1) | Total Debt U/W NCF DSCR(2) | Trust Cut-off Date LTV Ratio(1) | Total Debt Cut-off Date LTV Ratio(2) | Trust U/W NOI Debt Yield(1) | Total Debt U/W NOI Debt Yield(2) |

| Aspen Lake Office Portfolio | $65,000,000 | $20,000,000 | 1.79x | 1.20x | 61.8% | 80.8% | 9.8% | 7.5% |

| Park Place at Florham Park | $17,500,000 | $12,421,259 | 1.80x | 1.18x | 65.1% | 78.0% | 10.6% | 8.8% |

| (1) | With respect to any mortgage loan that is part of a whole loan, the Trust U/W NCF DSCR, Trust Cut-off Date LTV Ratio and Trust U/W NOI Debt Yield include the relatedpari passucompanion loan(s) and exclude any related subordinate companion loan(s) and the related mezzanine loan(s). |

| (2) | Total Debt U/W NCF DSCR, Total Debt Cut-off Date LTV Ratio and Total Debt U/W NOI Debt Yield calculations include any relatedpari passu companion loan(s), related subordinate companion loan(s) and/or related mezzanine loan(s). |

| Subordinate Debt Summary | |||||||||

| Mortgage Loan | Mortgage Loan Cut-off Date Balance | Pari Passu Companion Loan(s) Cut-off Date Balance | Subordinate Debt Cut-off Date Balance | Trust U/W NCF DSCR | Total Mortgage Debt U/W NCF DSCR(1) | Trust Cut-off Date LTV Ratio | Total Mortgage Debt Cut-off Date LTV Ratio(1) | Trust U/W NOI Debt Yield | Total Mortgage Debt U/W NOI Debt Yield(1) |

| DreamWorks Campus | $25,000,000 | $67,000,000 | $108,000,000 | 6.31x | 2.07x | 31.0% | 67.3% | 14.8% | 6.8% |

| (1) | Total Mortgage Debt U/W NCF DSCR, Total Mortgage Debt Cut-off Date LTV, Total Mortgage Debt U/W NOI Debt Yield calculations include any relatedpari passu companion loan(s), relate subordinate companion loan(s) and excludes related mezzanine loan(s), if any. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

UBS 2018-C9

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Pari Passu Companion Loan Summary | ||||||

| Mortgage Loan | Note(s) | Original Balance | Holder of Note(1) | Lead Servicer for Whole Loan (Y/N) | Master Servicer Under Lead Securitization | Special Servicer Under Lead Securitization |

| AFIN Portfolio(2) | A-2, A-7, A-11, A-12 | $60,000,000 | UBS 2018-C9 | No | Wells Fargo Bank, National Association | KeyBank Real Estate Capital |

| A-3, A-4, A-9, A-14 | $60,000,000 | UBS 2017-C7 | Yes | |||

| A-1, A-5, A-10, A-15 | $60,000,000 | UBS 2018-C8 | No | |||

| A-6, A-8 (controlling) | $15,000,000 | SG | No | |||

| A-13, A-16 | $15,000,000 | UBS AG | No | |||

| City Square and Clay Street | A-1 (controlling), A-3 | $45,000,000 | UBS 2018-C9 | Yes | Midland Loan Services, a Division of PNC Bank, National Association | Rialto Capital Advisors LLC |

| A-2, A-4 | $45,000,000 | UBS 2018-C8 | No | |||

| The SoCal Portfolio | A-1-4 | $37,850,000 | UBS 2018-C9 | No | Midland Loan Services, a Division of PNC Bank, National Association | LNR Partners, LLC |

| A-1-1 (controlling) | $50,000,000 | CGCMT 2018-B2(3) | Yes | |||

| A-1-2, A-1-3 | $50,000,000 | Citi Real Estate Funding Inc. | No | |||

| A-2-2 | $46,720,000 | Barclays Bank PLC | No | |||

| A-2-1 | $45,000,000 | WFCM 2018-C43(3) | No | |||

| CrossPoint(4) | A-4, A-8 | $30,000,000 | UBS 2018-C9 | No | Midland Loan Services, a Division of PNC Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| A-2, A-3, A-9 | $50,000,000 | UBS 2018-C8 | No | |||

| A-1 (controlling), A-8, A-10 | $45,000,000 | CCRE | Yes | |||

| A-5, A-6 | $25,000,000 | CGCMT 2018-B2(3) | No | |||

| Eastmont Town Center | A-1 (controlling), A-2 | $30,000,000 | UBS 2018-C9 | Yes | Midland Loan Services, a Division of PNC Bank, National Association | Rialto Capital Advisors LLC |

| A-3, A-4 | $16,900,000 | Rialto Mortgage Finance, LLC | No | |||

| A-5, A-6 | $9,100,000 | UBS AG | No | |||

| DreamWorks Campus | A-1 (controlling)(5) | $25,000,000 | UBS 2018-C9 | Yes | Midland Loan Services, a Division of PNC Bank, National Association | AEGON USA Realty Advisors, LLC |

| A-2, A-3, A-4, A-5 | $67,000,000 | CCRE | No | |||

| Park Place at Florham Park | A-3, A-4 | $17,500,000 | UBS 2018-C9 | No | Midland Loan Services, a Division of PNC Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| A-1 (controlling), A-2, A-5 | $45,000,000 | UBS 2018-C8 | Yes | |||

| (1) | Identifies the expected holder as of the Closing Date. |

| (2) | The AFIN Portfolio Whole Loan is expected to initially be serviced under the UBS 2018-C9 pooling and servicing agreement until the securitization of the related controllingpari passu Note A-8 (the “AFIN Portfolio Servicing Shift Securitization Date”), after which the AFIN Portfolio Whole Loan will be serviced under the pooling and servicing agreement related to the securitization of the related controllingpari passu Note A-8 (the “AFIN Portfolio Servicing Shift PSA”). The master servicer and special servicer under the AFIN Portfolio Servicing Shift PSA will be identified in a notice, report or statement to holders of the UBS 2018-C9 certificates after the securitization of the related controllingpari passu Note A-8. |

| (3) | The CGCMT 2018-B2 securitization and the WFCM 2018-C43 securitization are expected to close on or about March 20, 2018 and March 27, 2018, respectively. |

| (4) | The CrossPoint Whole Loan is expected to initially be serviced under the UBS 2018-C9 pooling and servicing agreement until the securitization of the related controllingpari passuNote A-1 (the “CrossPoint Servicing Shift Securitization Date”), after which the CrossPoint Whole Loan will be serviced under the pooling and servicing agreement related to the securitization of the related controllingpari passu Note A-1 (the “CrossPoint Servicing Shift PSA”). The master servicer and special servicer under the CrossPoint Servicing Shift PSA will be identified in a notice, report or statement to holders of the UBS 2018-C9 certificates after the securitization of the related controllingpari passu Note A-1. |

| (5) | The related whole loan will be serviced pursuant to the indicated pooling and servicing agreement or trust and servicing agreement, as applicable. However, so long as no “control appraisal period” (or similar term) has occurred and is continuing, the holder of the related subordinate companion loan will be the controlling noteholder and will have the right to approve certain modifications and consent to certain actions taken with respect to the related whole loan. If a control appraisal period has occurred and is continuing, the holder of the note indicated as the “controlling” note will be the controlling noteholder. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

UBS 2018-C9

| OVERVIEW OF MORTGAGE POOL CHARACTERISTICS |

| Previous Securitization History(1) | ||||||

| Mortgage Loan | Mortgage Loan Seller | City, State | Property Type | Cut-off Date Balance | % of Initial Outstanding Pool Balance | Previous Securitization(s) |

| Aspen Lake Office Portfolio | UBS AG | Austin, TX | Office | $65,000,000 | 7.70% | MSBAM 2014-C15 |

| Midwest Hotel Portfolio | UBS AG | Various, Various | Hospitality | $50,000,000 | 6.00% | CSMC 2008-C1 |

| City Square and Clay Street | LCF | Oakland, CA | Mixed Use | $45,000,000 | 5.40% | COMM 2014-CCRE14 |

| Eastmont Town Center | UBS AG | Oakland, CA | Office | $30,000,000 | 3.60% | CGCMT 2015 GC-29; JPMBB 2015 C-32 |

| Mira Loma Shopping Center | SG | Reno, NV | Retail | $11,300,000 | 1.30% | GSMS 2007-GG10 |

| Suntree Office Tower | SG | Melbourne, FL | Office | $10,400,000 | 1.20% | BANC 2016-CRE1 |

| Olde Lancaster Town Center | LCF | Pineville, NC | Mixed Use | $9,000,000 | 1.10% | CD 2007-CD5 |

| California Industrial Portfolio - Carson Industrial | UBS AG | Carson, CA | Industrial | $8,830,000 | 1.10% | JPMCC 2002-CIB5; JPMCC 2005-CB13(2) |

| Missoula Retail | UBS AG | Missoula, MT | Retail | $5,767,100 | 0.70% | JPMCC 2008-C2 |

| Lynn Haven Cove | UBS AG | Lynn Haven, FL | Multifamily | $5,233,000 | 0.60% | JPMCC 2005-LDP1; MSC 2006-HQ8 |

| Cobalt Storage - Edgewood | UBS AG | Edgewood, WA | Self Storage | $4,750,000 | 0.60% | BACM 2006-2 |

| AFIN Portfolio - San Pedro Crossing | SG; UBS AG | San Antonio, TX | Retail | $4,477,143 | 0.50% | COMM 2013-LC6(3) |

| (1) | Includes mortgage loans for which all or a portion of the previously existing debt was most recently securitized in one or more conduit securitizations, based on information provided by the related borrower or obtained through searches of a third-party database. The information has not otherwise been confirmed by the mortgage loan sellers. |

| (2) | Part of the collateral for the California Industrial Portfolio Mortgage Loan. |

| (3) | Part of the collateral for the AFIN Portfolio Mortgage Loan. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

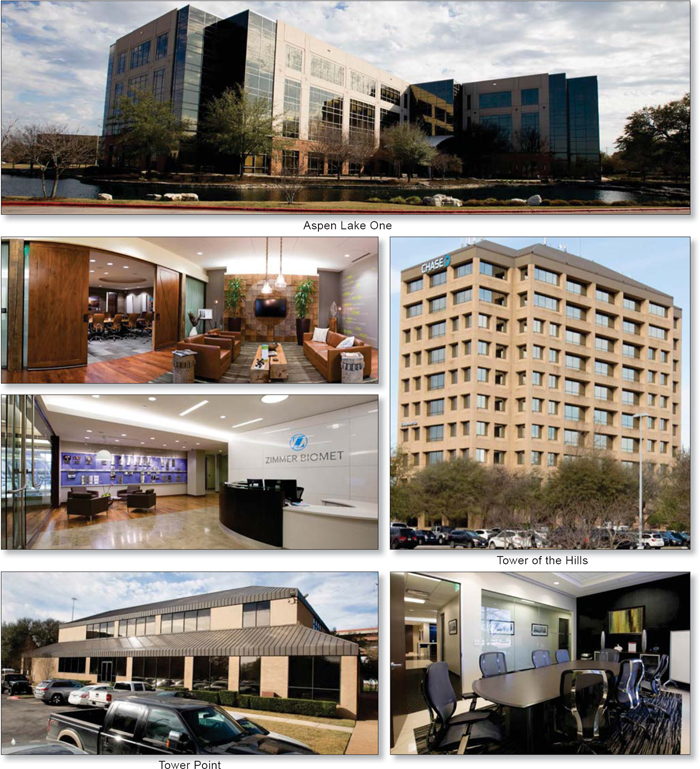

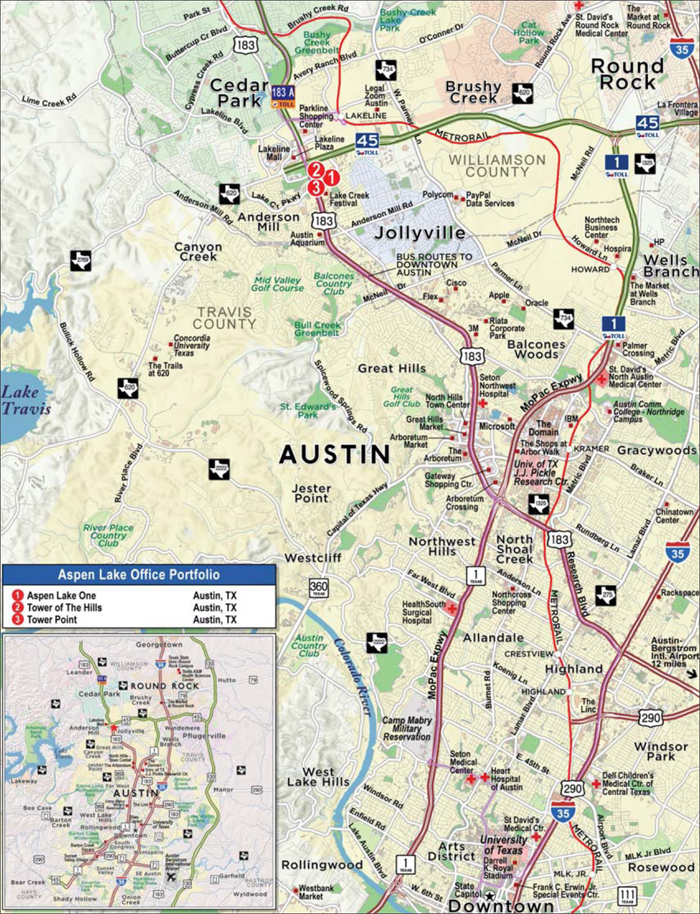

13785, 13805 and 13809 Research Boulevard Austin, TX 78750 | Collateral Asset Summary – Loan No. 1 Aspen Lake Office Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $65,000,000 61.8% 1.79x 9.8% |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

13785, 13805 and 13809 Research Boulevard Austin, TX 78750 | Collateral Asset Summary – Loan No. 1 Aspen Lake Office Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $65,000,000 61.8% 1.79x 9.8% |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

13785, 13805 and 13809 Research Boulevard Austin, TX 78750 | Collateral Asset Summary – Loan No. 1 Aspen Lake Office Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $65,000,000 61.8% 1.79x 9.8% |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

13785, 13805 and 13809 Research Boulevard Austin, TX 78750 | Collateral Asset Summary – Loan No. 1 Aspen Lake Office Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $65,000,000 61.8% 1.79x 9.8% |

| Mortgage Loan Information | Property Information | |||||

| Mortgage Loan Seller: | UBS AG | Single Asset/Portfolio: | Portfolio | |||

| Original Balance: | $65,000,000 | Location: | Austin, TX 78750 | |||

| Cut-off Date Balance: | $65,000,000 | General Property Type: | Office | |||

| % of Initial Pool Balance: | 7.7% | Detailed Property Type: | Suburban | |||

| Loan Purpose: | Refinance | Title Vesting: | Fee | |||

| Borrower Sponsor: | Fortis Property Group, LLC | Year Built/Renovated: | Various/Various | |||

| Mortgage Rate: | 5.2148% | Size: | 381,588 SF | |||

| Note Date: | 3/2/2018 | Cut-off Date Balance per SF: | $170 | |||

| First Payment Date: | 4/6/2018 | Maturity Date Balance per SF: | $170 | |||

| Maturity Date: | 3/6/2028 | Property Manager:

| FPG Texas Management, LP (borrower-related)

| |||

| Original Term to Maturity: | 120 months | |||||

| Original Amortization Term: | 0 months | |||||

| IO Period: | 120 months | |||||

| Seasoning: | 0 months | |||||

| Prepayment Provisions(1): | LO (24); DEF (92); O (4) | |||||

| Lockbox/Cash Mgmt Status: | Hard/In Place | Underwriting and Financial Information | ||||

| Additional Debt Type(2): | Mezzanine | UW NOI: | $6,386,820 | |||

| Additional Debt Balance(2): | $20,000,000 | UW NOI Debt Yield: | 9.8% | |||

| Future Debt Permitted (Type): | No (N/A) | UW NOI Debt Yield at Maturity: | 9.8% | |||

| Reserves(3) | UW NCF DSCR: | 1.79x | ||||

| Type | Initial | Monthly | Cap | Most Recent NOI: | $6,466,031 (9/30/2017 TTM) | |

| RE Tax: | $513,302 | $171,101 | N/A | 2nd Most Recent NOI: | $6,157,301 (12/31/2016) | |

| Insurance: | $0 | Springing | N/A | 3rd Most Recent NOI: | $6,208,594 (12/31/2015) | |

| Replacements: | $0 | $6,360 | N/A | Most Recent Occupancy(4): | 86.7% (1/1/2018) | |

| TI/LC: | $2,500,000 | Springing | $3,000,000 | 2nd Most Recent Occupancy: | 88.5% (9/30/2017) | |

| Deferred Maintenance: | $181,469 | $0 | N/A | 3rd Most Recent Occupancy: | 92.1% (12/31/2016) | |

| Landlord Obligations: | $1,881,964 | $0 | N/A | Appraised Value (as of): | $105,200,000 (1/4/2018) | |

| Free Rent: | $12,904 | $0 | N/A | Cut-off Date LTV Ratio: | 61.8% | |

| Tower Point Work: | $1,000,000 | $0 | N/A | Maturity Date LTV Ratio: | 61.8% | |

| Sources and Uses | ||||||

| Sources | Proceeds | % of Total | Uses | Proceeds | % of Total | |

| Loan Amount: | $65,000,000 | 76.5% | Loan Payoff: | $74,413,917 | 87.5% | |

| Mezzanine Loans: | $20,000,000 | 23.5% | Reserves: | $6,089,639 | 7.2% | |

| Closing Costs: | $1,452,889 | 1.7% | ||||

| Return of Equity: | $3,043,556 | 3.6% | ||||

| Total Sources: | $85,000,000 | 100.0% | Total Uses: | $85,000,000 | 100.0% | |

| (1) | See “Release of Individual Property” below for further discussion of release requirements. |

| (2) | See “The Mortgage Loan” and“Mezzanine Loan and Preferred Equity”below for further discussion of additional debt. |

| (3) | See “Escrows and Reserves” below for further discussion of reserve requirements. |

| (4) | 59,845 SF (15.7% of the net rentable area) is subleased to three tenants at the Aspen Lake One Property (as defined below). See“Major Tenants”below for further discussion of tenancy. |

The Mortgage Loan. The largest mortgage loan (the “Aspen Lake Office Portfolio Mortgage Loan”) is evidenced by twopari passupromissory notes with an aggregate original principal balance of $65,000,000. The Aspen Lake Office Portfolio Mortgage Loan is secured by a first priority mortgage encumbering the Aspen Lake Office Portfolio Borrower’s (as defined below) fee interest in (i) a four-story Class A office building (the “Aspen Lake One Property”), (ii) a 10-story Class B office building (the “Tower of the Hills Property”) and (iii) a two-story Class B office (the “Tower Point Property”) located in Austin, Texas (collectively, the “Aspen Lake Office Portfolio Property”). The proceeds of the Aspen Lake Office Portfolio Mortgage Loan and a $20,000,000 mezzanine loan (the “Aspen Lake Office Portfolio Mezzanine Loan”) were used to refinance the Aspen Lake Office Portfolio Property, fund reserves, pay closing costs and return equity to the borrower sponsor.

The Borrowers and the Borrower Sponsor. The borrowers are FPG Aspen Lake Owner, LP, which holds the Aspen Lake One Property (the “Aspen Lake One Borrower”), and FPG TOH Owner, LP, which holds the Tower of the Hills and Tower Point Properties (the “TOH Borrower”), (collectively, the “Aspen Lake Office Portfolio Borrower”). Each Aspen Lake Office Portfolio Borrower is structured with a bankruptcy remote single purpose general partner, FPG Aspen Lake GP, LLC, a Delaware limited liability company and FPG TOH GP, LLC, a Delaware limited liability company, each with two independent directors. The Aspen Lake Office Portfolio Borrower is indirectly owned by Fortis Property Group, LLC (97.8%) and Lisiere LLC (2.2%). The guarantor and borrower sponsor of the Aspen Lake Office Portfolio Mortgage Loan is Fortis Property Group, LLC (“Fortis”). Fortis is a private US real estate investment, operating and development company. Founded in 2005 and headquartered in Brooklyn, New York, Fortis has acquired and/or developed over 8 million SF of property in excess of $3.0 billion throughout the United States, with an emphasis on the Northeast and Dallas, Texas markets. Fortis has been

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

13785, 13805 and 13809 Research Boulevard Austin, TX 78750 | Collateral Asset Summary – Loan No. 1 Aspen Lake Office Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $65,000,000 61.8% 1.79x 9.8% |

involved in prior deeds in lieu of foreclosure, discounted payoffs and foreclosure proceedings. See “Description of the Mortgage Pool—Default History, Bankruptcy Issues and Other Proceedings” in the Preliminary Prospectus.

The Properties. The Aspen Lake Office Portfolio Property is comprised of the Aspen Lake One Property, the Tower of the Hills Property and the Tower Point Property. Situated on 16.6 acres, the improvements on the Aspen Lake One, the Tower of the Hills and the Tower Point Properties were built in 2008, 1986, and 1982, respectively, and renovations took place at the Tower of the Hills and Tower Point Properties in 2006. The Aspen Lake Office Portfolio Property offers 1,578 parking spaces (approximately 4.1 spaces per 1,000 SF) and is positioned along US Highway 183, a primary north/south route in Austin, approximately 15.9 miles from the Austin central business district. The Aspen Lake One Property totals 206,724 SF and is 100.0% leased by four tenants. The Tower of the Hills Property totals 155,677 SF and is 79.7% leased by 46 office and antenna tenants. The Tower Point Property totals 19,187 SF and is currently 100.0% vacant. In the event the TOH Borrower elects to construct certain amenities (such as, including, without limitation, conference rooms, breakout areas, coffee bar/café, prep kitchen/servery, game room/multi-purpose room, management/leasing office, restrooms and privacy booths) on the first floor of the Tower Point Property, the TOH Borrower and an affiliate of the TOH Borrower will enter into a master lease agreement for the first floor space of the Tower Point Property. Alternatively, the TOH Borrower can lease the Tower Point Property to tenants. The Aspen Lake Office Portfolio Borrower has budgeted a $1.5 million construction plan for such tenant amenity space and at loan origination, a Tower Point Work Reserve in the amount of $1.0 million was reserved for such construction. As of the January 1, 2018 rent roll, the Aspen Lake Office Portfolio Property was 86.7% leased by 50 tenants.

Major Tenants.

LDR Spine USA, Inc. (89,208 SF, 23.4% of NRA, 27.9% of underwritten base rent). LDR Spine USA, Inc. (“LDR Spine”) was founded in France in 2000 as a surgical technology developer for spine disorders. LDR Spine relocated its headquarters to the Aspen Lake One Property in 2011 and was strategically acquired by Zimmer Biomet Holdings, Inc. (“Zimmer Biomet”) (NYSE: ZBH) in July 2016. Zimmer Biomet is a global leader in musculoskeletal healthcare, designing, manufacturing, and marketing orthopedic reconstructive products; spine, bone healing, craniomaxillofacial and thoracic products; dental implants; and sports medicine, biologics, extremities and trauma products. It operates in more than 25 countries and sells products in more than 100 countries. LDR Spine leases 89,208 SF through December 31, 2024 at a current underwritten base rent of $21.86 PSF. Following Zimmer Biomet’s acquisition, LDR Spine needed to downsize some of its space as a result of redundancy between the two companies. LDR Spine subleases 18,930 SF to Ping Identity Corporation and 5,091 SF to Waid Corporation, d/b/a Waid Environmental, each at a sublease rent of $15.00 PSF through its lease expiration. LDR Spine had a termination option that required notice on June 30, 2017 for all of its leased space, which it did not exercise.

Q2 Software, Inc. (67,078 SF, 17.6% of NRA, 20.6% of underwritten base rent). Founded in 2004, Q2 Software, Inc. (“Q2 Software”) is a leading provider of secure, cloud-based digital banking solutions headquartered at the Aspen Lake One Property. Q2 Software’s mobile app products and cloud-based services help attract, serve, and retain account holders from the consumer level all the way up to the corporate level, enabling customers, such as financial institutions, to securely communicate and transact. Q2 Software occupies 67,078 SF through April 30, 2021 at a current underwritten base rent of $21.50 PSF with annual rent steps of $0.50 PSF. According to the borrower sponsor, Q2 Software is not actively utilizing approximately 10,000 SF of its space for the time being as the company expands. Q2 Software has a termination option effective November 30, 2019 upon 12 months’ prior notice and a termination fee of $2,181,400, and one five-year renewal option. Additionally, Q2 Software occupies 100.0% of a non-collateral 129,000 SF build-to-suit office building, adjacent to the Aspen Lake One Property.

Informatica Corporation (35,824 SF, 9.4% of NRA, 10.8% of underwritten base rent). Informatica Corporation (“Informatica”) was founded in 1993 and provides enterprise cloud data management services and products. Informatica leases 35,824 SF at a current underwritten base rent rate of $21.00 PSF with annual rent steps of $0.50 PSF through its lease expiration date of February 28, 2021. Informatica subleases all of its space to Trans Union LLC (“TransUnion”), through February 28, 2021 at a sublease rental rate of $17.32 PSF, which steps to $21.50 PSF in September 2019. Founded in 1968, TransUnion provides risk and information solutions to over 30 countries, operating in three segments: U.S. Information Services (USIS), International, and Consumer Interactive. Its products include consumer reports, risk scores, credit monitoring, fraud protection, and financial management solutions. Upon expiration of its sublease, TransUnion will remain in occupancy under a direct lease that expires on February 28, 2025 with a rental rate of $27.50 PSF and annual rent steps of approximately 3.0%.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

18

13785, 13805 and 13809 Research Boulevard Austin, TX 78750 | Collateral Asset Summary – Loan No. 1 Aspen Lake Office Portfolio | Cut-off Date Balance: Cut-off Date LTV Ratio: UW NCF DSCR: UW NOI Debt Yield: | $65,000,000 61.8% 1.79x 9.8% |

The following table presents certain information relating to the leases at the Aspen Lake Office Portfolio Property:

| Tenant Summary(1) | ||||||||

| Tenant Name | Individual Property | Credit Rating (Fitch/Moody’s/ S&P) | Tenant SF | Approximate % of SF | Annual UW Base Rent | % of Total Annual UW Base Rent | Annual UW Base Rent PSF(2) | Lease Expiration |

| LDR Spine USA, Inc.(3) | Aspen Lake One | NR/NR/NR | 89,208 | 23.4% | $1,949,672 | 27.9% | $21.86 | 12/31/2024 |

| Q2 Software, Inc.(4) | Aspen Lake One | NR/NR/NR | 67,078 | 17.6% | $1,442,177 | 20.6% | $21.50 | 4/30/2021 |

| Informatica Corporation(5) | Aspen Lake One | NR/NR/NR | 35,824 | 9.4% | $752,304 | 10.8% | $21.00 | 2/28/2025 |

| Regus | Aspen Lake One | NR/NR/NR | 14,614 | 3.8% | $275,655 | 3.9% | $18.86 | 10/31/2022 |

| James Avery Craftsman, Inc. | Tower of the Hills | NR/NR/NR | 12,198 | 3.2% | $243,960 | 3.5% | $20.00 | 2/28/2022 |

| Subtotal/Wtd. Avg. | 218,922 | 57.4% | $4,663,767 | 66.7% | $21.30 | |||

| Remaining Tenants(6) | 111,949 | 29.3% | $2,325,853 | 33.3% | $20.78 | |||

| Vacant Space | 50,717 | 13.3% | $0 | 0.0% | $0.00 | |||

| Total/Wtd. Avg. | 381,588 | 100.0% | $6,989,620 | 100.0% | $21.12 | |||

| (1) | Information is based on the underwritten rent roll. |

| (2) | Wtd. Avg. Annual UW Base Rent PSF excludes vacant space. |

| (3) | LDR Spine USA, Inc. subleases two spaces to Ping Identity Corporation (18,930 SF) and Waid Corporation, d/b/a Waid Environmental (5,091 SF), both at a sublease rental rate of $15.00 PSF through its lease expiration date of December 31, 2024. LDR Spine USA, Inc.’s prime lease rate of $21.86 PSF was underwritten. |

| (4) | Q2 Software, Inc. has a one-time right to terminate effective as of November 30, 2019, upon notice no later than November 2018 and a termination payment of $2,181,400. |

| (5) | Informatica Corporation subleases its entire space to TransUnion through February 2021 at a current sublease rental rate of $17.32 PSF, which steps to $21.50 PSF in September 2019. TransUnion has executed a direct lease with the Aspen Lake Office Portfolio Borrower that commences upon the expiration of the Informatica Corporation lease on March 1, 2021 and expires on February 28, 2025 at a rental rate of $27.50 PSF. Informatica Corporation’s prime lease rate of $21.00 PSF was underwritten. |

| (6) | Includes 5,971 SF of space (1.6% of net rentable area) dedicated to the management office (UW Base Rent of $32,706), fitness center, community break room, community conference center and engineer office. |

The following table presents certain information relating to the lease rollover schedule at the Aspen Lake Office Portfolio Property:

| Lease Rollover Schedule(1)(2) | ||||||||

| Year | # of Leases Rolling | SF Rolling | Approx. % of Total SF Rolling | Approx. Cumulative % of SF Rolling | UW Base Rent PSF Rolling(3) | Total UW Base Rent Rolling | Approx. % of Total Rent Rolling | Approx. Cumulative % of Total Rent Rolling |

| MTM(4) | 5 | 5,971 | 1.6% | 1.6% | $5.48 | $32,706 | 0.5% | 0.5% |

| 2018 | 13 | 30,894 | 8.1% | 9.7% | $19.19 | $592,867 | 8.5% | 9.0% |

| 2019 | 9 | 15,902 | 4.2% | 13.8% | $22.82 | $362,915 | 5.2% | 14.1% |

| 2020 | 12 | 29,519 | 7.7% | 21.6% | $21.10 | $622,935 | 8.9% | 23.1% |

| 2021 | 7 | 81,066 | 21.2% | 42.8% | $22.41 | $1,816,331 | 26.0% | 49.0% |

| 2022 | 5 | 36,888 | 9.7% | 52.5% | $19.89 | $733,585 | 10.5% | 59.5% |

| 2023 | 0 | 0 | 0.0% | 52.5% | $0.00 | $0 | 0.0% | 59.5% |

| 2024(5) | 2 | 91,260 | 23.9% | 76.4% | $21.87 | $1,996,170 | 28.6% | 88.1% |

| 2025(6) | 2 | 39,371 | 10.3% | 86.7% | $21.14 | $832,111 | 11.9% | 100.0% |

| 2026 | 0 | 0 | 0.0% | 86.7% | $0.00 | $0 | 0.0% | 100.0% |

| 2027 | 0 | 0 | 0.0% | 86.7% | $0.00 | $0 | 0.0% | 100.0% |

| 2028 | 0 | 0 | 0.0% | 86.7% | $0.00 | $0 | 0.0% | 100.0% |

| 2029 & Beyond | 0 | 0 | 0.0% | 86.7% | $0.00 | $0 | 0.0% | 100.0% |