| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-207340-10 | ||

March 14, 2018 FREE WRITING PROSPECTUS STRUCTURAL AND COLLATERAL TERM SHEET$839,904,551 (Approximate Total Mortgage Pool Balance) $726,517,000 (Approximate Offered Certificates) UBS 2018-C9 UBS Commercial Mortgage Securitization Corp.DepositorUBS AG Société Générale Cantor Commercial Real Estate Lending, L.P. Ladder Capital Finance LLCSponsors and Mortgage Loan SellersUBS Securities LLC Société Générale Cantor Fitzgerald & Co.Co-Lead Managers and Joint BookrunnersDrexel Hamilton Academy SecuritiesCo-ManagersThe depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (’’SEC’’) (SEC File No. 333-207340) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-877-713-1030 (8 a.m. – 5 p.m. EST). The offered certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale and ultimately by the final prospectus relating to the offered certificates. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) that have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of the offered certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the offered certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of UBS Securities LLC, SG Americas Securities, LLC, Cantor Fitzgerald & Co., Drexel Hamilton, LLC or Academy Securities, Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the offered certificates. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The offered certificates described herein are not suitable investments for all investors. In particular, you should not purchase any class of offered certificates unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with such class of certificates. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered certificates are subject to material variability from period to period and give rise to the potential for significant loss over the life of such certificates. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered certificates involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the certificates. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered certificates described in this free writing prospectus.

This free writing prospectus is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this free writing prospectus may not pertain to any securities that will actually be sold. The information contained in this free writing prospectus may be based on assumptions regarding market conditions and other matters as reflected in this free writing prospectus. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this free writing prospectus should not be relied upon for such purposes. The Underwriters and their respective affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this free writing prospectus may, from time to time, have long or short positions in, and buy or sell, the offered certificates mentioned in this free writing prospectus or derivatives thereof (including options). Information contained in this free writing prospectus is current as of the date appearing on this free writing prospectus only. None of UBS Securities LLC, SG Americas Securities, LLC, Cantor Fitzgerald & Co., Drexel Hamilton, LLC or Academy Securities, Inc. provides accounting, tax or legal advice.

| 2 |

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Other Risks Relating to the Certificates—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| 3 |

UBS 2018-C9

Capitalized terms used but not defined herein have the meanings assigned to them in the preliminary prospectus expected to be dated March 14, 2018 relating to the offered certificates (hereinafter referred to as the “Preliminary Prospectus”).

| KEY FEATURES OF SECURITIZATION |

| Offering Terms: | |

| Co-Lead Managers and Joint Bookrunners: | UBS Securities LLC SG Americas Securities, LLC Cantor Fitzgerald & Co. |

| Co-Managers: | Drexel Hamilton, LLC Academy Securities, Inc. |

| Mortgage Loan Sellers: | UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York (“UBS AG”) (41.2%), Ladder Capital Finance LLC (“LCF”) (23.3%), Société Générale (“SG”) (19.5%), and Cantor Commercial Real Estate Lending, L.P. (“CCRE”) (16.0%) |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Operating Advisor: | Pentalpha Surveillance LLC |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC |

| Special Servicer: | Rialto Capital Advisors LLC (with respect to all Mortgage Loans and related Serviced Companion Loans other than the DreamWorks Campus whole loan) and AEGON USA Realty Advisors, LLC (solely with respect to the DreamWorks Campus whole loan) |

| Trustee: | Wells Fargo Bank, National Association |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc. and Moody’s Investors Service, Inc. |

| U.S. Credit Risk Retention: | UBS AG is expected to act as the “retaining sponsor” for this securitization and intends to satisfy the U.S. credit risk retention requirement through the purchase by RREF III-D AIV RR H, LLC or an affiliate, as a “third party purchaser” (as defined in Regulation RR), from the initial purchasers, on the Closing Date, of an “eligible horizontal residual interest”. The aggregate estimated fair value of the “eligible horizontal residual interest” will equal at least 5% of the estimated fair value of all of the certificates (other than the Class R certificates) issued by the issuing entity. The pooling and servicing agreement will include the required provisions applicable to an operating advisor necessary for the securitization to comply with the credit risk retention rules utilizing the “third party purchaser” option. See “Operating Advisor” below. For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU Credit Risk Retention: | The transaction isnot structured to satisfy the EU risk retention and due diligence requirements. |

| Determination Date: | The 11th day of each month, or if such 11th day is not a business day, the succeeding business day, commencing in April 2018. |

| Distribution Date: | The 4th business day following the Determination Date in each month, commencing in April 2018. |

| Cut-off Date: | The mortgage loans will be considered part of the trust fund as of their respective cut-off dates. The cut-off date with respect to each mortgage loan is the respective due date for the monthly debt service payment that is due in March 2018 (or, in the case of any mortgage loan that has its first due date after March 2018, the date that would have been its due date in March 2018 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| Closing Date: | On or about March 28, 2018 |

| Settlement Terms: | DTC, Euroclear and Clearstream, same day funds, with accrued interest. |

| ERISA Eligible: | All of the offered certificates are expected to be ERISA eligible. |

| SMMEA Eligible: | None of the offered certificates will be SMMEA eligible. |

| Day Count: | 30/360 |

| Tax Treatment: | REMIC |

| Rated Final Distribution Date: | March 2051 |

| Minimum Denominations: | $10,000 (or $1,000,000 with respect to the Class X Certificates) and in each case in multiples of $1 thereafter. |

| Clean-up Call: | 1.0% |

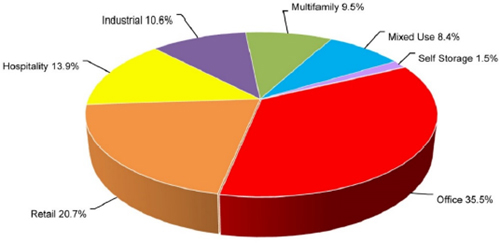

| Distribution of Collateral by Property Type |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 4 |

UBS 2018-C9

| TRANSACTION HIGHLIGHTS |

| Mortgage Loan Sellers | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate Cut-Off Date Balance | % of Initial Outstanding Pool Balance(1) |

| UBS AG(2) | 19 | 47 | $345,894,363 | 41.2% |

| Ladder Capital Finance LLC | 10 | 13 | $195,633,188 | 23.3% |

| Société Générale(2) | 8 | 23 | $163,997,000 | 19.5% |

| Cantor Commercial Real Estate Lending, L.P. | 6 | 29 | $134,380,000 | 16.0% |

| Total | 43 | 112 | $839,904,551 | 100.0% |

| Pooled Collateral Facts: | |

| Initial Outstanding Pool Balance: | $839,904,551 |

| Number of Mortgage Loans: | 43 |

| Number of Mortgaged Properties: | 112 |

| Average Mortgage Loan Cut-off Date Balance: | $19,532,664 |

| Average Mortgaged Property Cut-off Date Balance: | $7,499,148 |

| Weighted Average Mortgage Rate: | 4.904% |

| Weighted Average Mortgage Loan Original Term to Maturity Date or ARD (months)(3): | 117 |

| Weighted Average Mortgage Loan Remaining Term to Maturity Date or ARD (months)(3): | 117 |

| Weighted Average Mortgage Loan Seasoning (months): | 1 |

| % of Mortgage Loans Secured by a Property or a Portfolio of Mortgaged Properties Leased to a Single Tenant: | 15.0% |

| Credit Statistics | |

| Weighted Average Mortgage Loan U/W NCF DSCR(4): | 1.91x |

| Weighted Average Mortgage Loan Cut-off Date LTV(4)(5): | 58.9% |

| Weighted Average Mortgage Loan Maturity Date or ARD LTV(4)(5): | 54.5% |

| Weighted Average U/W NOI Debt Yield(4): | 10.9% |

| Amortization Overview | |

| % Mortgage Loans which pay Interest Only through Maturity Date or ARD(3): | 48.3% |

| % Mortgage Loans which pay Interest Only followed by Amortization through Maturity Date or ARD(3): | 27.6% |

| % Mortgage Loans with Amortization through Maturity Date or ARD(3): | 24.1% |

| Weighted Average Remaining Amortization Term (months)(6): | 357 |

| Loan Structural Features | |

| % Mortgage Loans with Upfront or Ongoing Tax Reserves: | 91.5% |

| % Mortgage Loans with Upfront or Ongoing Replacement Reserves(7): | 80.7% |

| % Mortgage Loans with Upfront or Ongoing Insurance Reserves: | 68.3% |

| % Mortgage Loans with Upfront or Ongoing TI/LC Reserves(8): | 83.7% |

| % Mortgage Loans with Upfront Engineering Reserves: | 53.4% |

| % Mortgage Loans with Upfront or Ongoing Other Reserves: | 82.3% |

| % Mortgage Loans with In Place Hard Lockboxes: | 71.7% |

| % Mortgage Loans with Cash Traps Triggered at DSCR Levels ≥ 1.05x: | 88.8% |

| % Mortgage Loans with Defeasance Only After a Lockout Period and Prior to an Open Period: | 82.1% |

| % Mortgage Loans with Prepayment with a Yield Maintenance Charge Only After a Lockout Period and Prior to an Open Period: | 15.4% |

| % Mortgage Loans with Lockout Followed by a Period of Prepayment with a Yield Maintenance Charge Followed by a Period of Prepayment with a Yield Maintenance Charge or Defeasance Followed by an Open Period: | 2.5% |

Please see footnotes on the following page.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 5 |

UBS 2018-C9

| TRANSACTION HIGHLIGHTS |

| (1) | Unless otherwise indicated, all references to “% of Outstanding Pool Balance” in this Term Sheet reflect a percentage of the aggregate principal balance of the mortgage pool as of the Cut-off Date, after application of all payments of principal due during or prior to March 2018. |

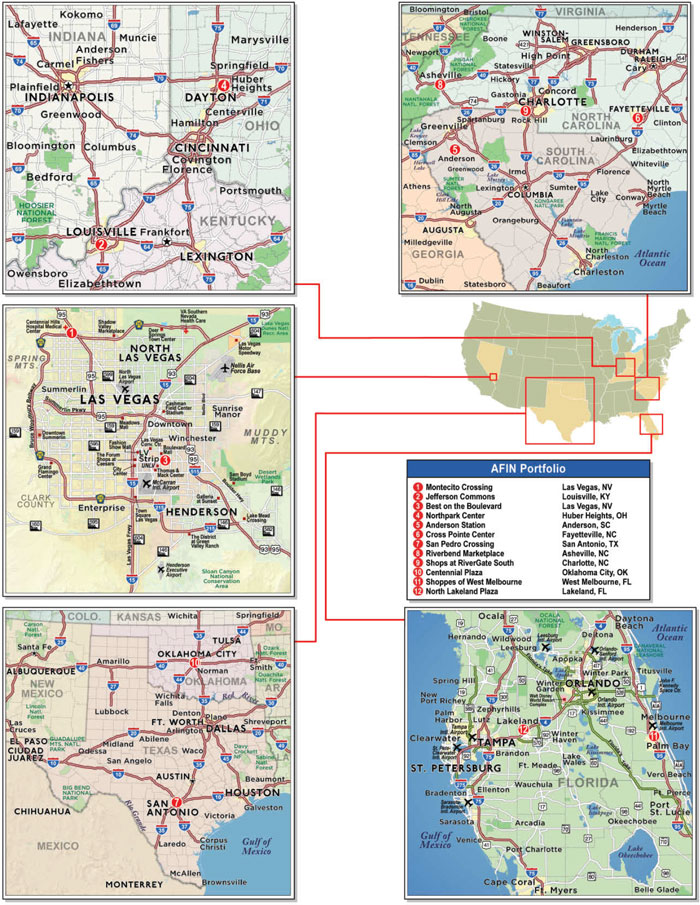

| (2) | With respect to the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as AFIN Portfolio, representing approximately 7.1% of the Initial Pool Balance, such mortgage loan is part of a whole loan that was co-originated by SG and UBS AG. The “Number of Mortgage Loans” and the “Number of Mortgaged Properties” shown in the table above for SG do not include the notes for which SG is acting as mortgage loan seller; however, the “Aggregate Cut-off Date Balance” and the “% of Outstanding Pool Balance” shown in the table above for SG do include these notes. |

| (3) | For any mortgage loan with an anticipated repayment date, calculated to or as of, as applicable, that anticipated repayment date. |

| (4) | With respect to any mortgage loan that is part of a whole loan, unless otherwise indicated, LTV, DSCR and Debt Yield calculations in this Term Sheet include any relatedpari passu companion loans and exclude any subordinate companion loans, as applicable. Additionally, LTV, DSCR and Debt Yield figures in this Term Sheet are calculated for mortgage loans without regard to any additional indebtedness that may be incurred at a future date. |

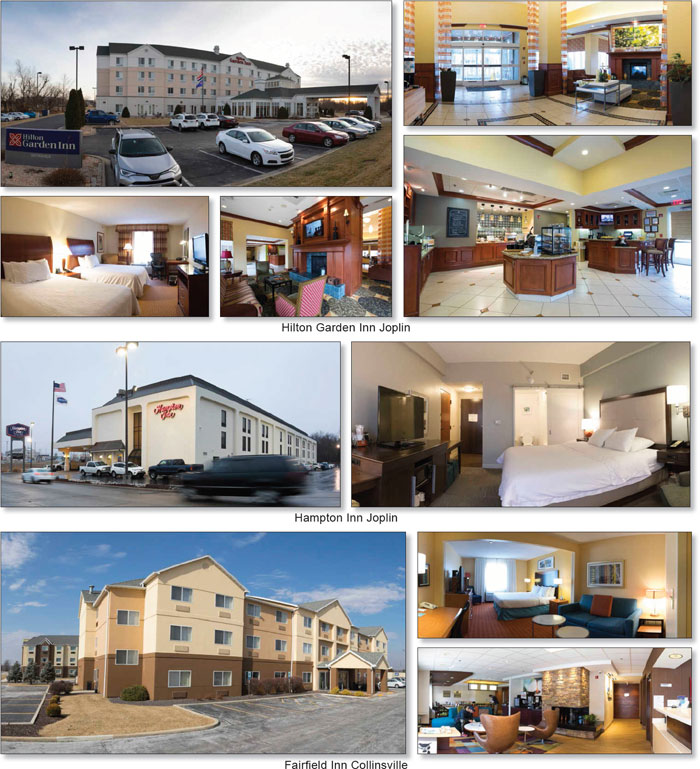

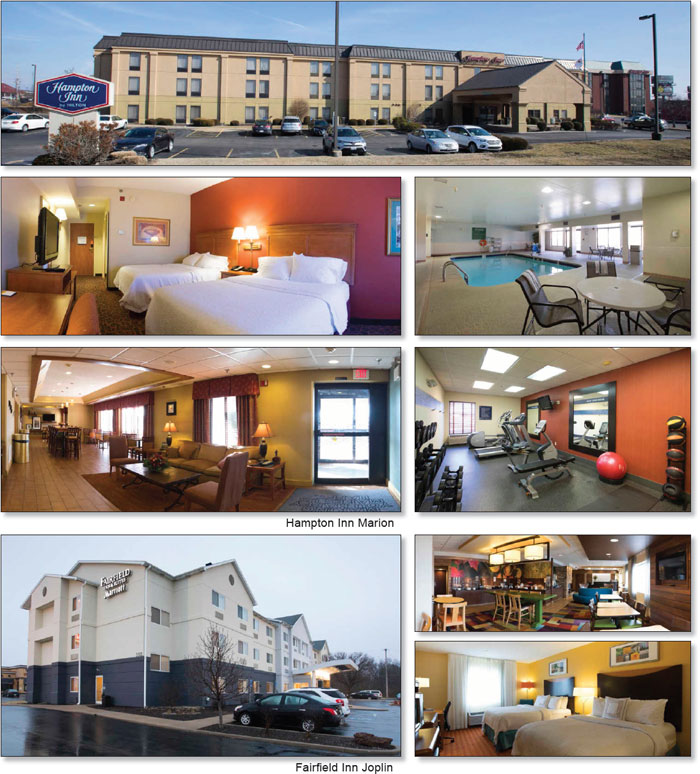

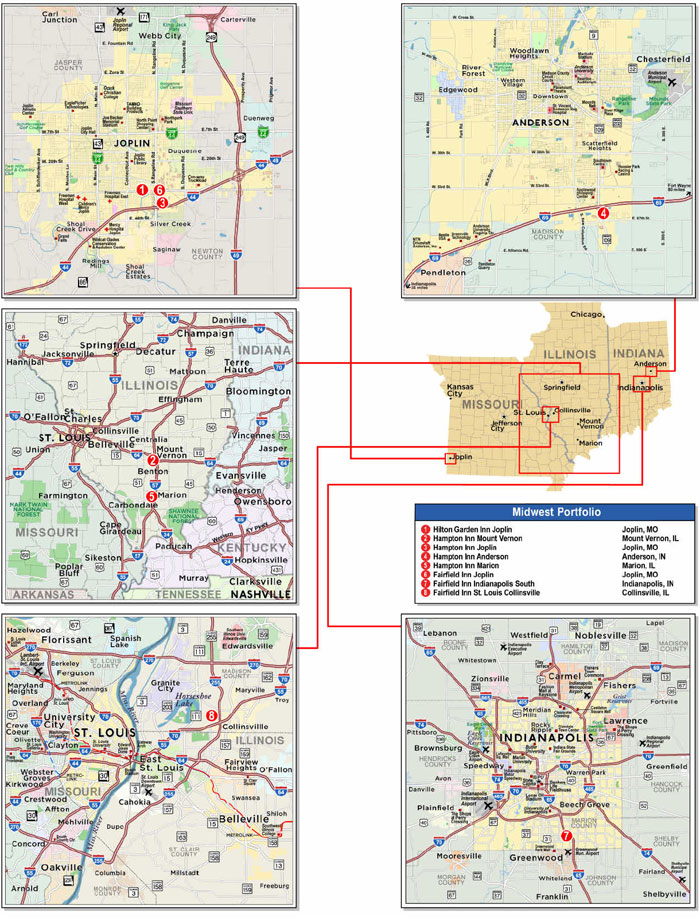

| (5) | With respect to the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as Midwest Hotel Portfolio, the Cut-off Date LTV, Maturity Date or ARD LTV and appraised value are based on the sum of the “As-Is” appraised values for the mortgaged properties identified on the Annex A-1 as the Hampton Inn Mount Vernon, Hampton Inn Anderson, Fairfield Inn Joplin, and Fairfield Inn Indianapolis and the “As Complete” appraised values for the mortgaged properties identified on the Annex A-1 as Hilton Garden Inn Joplin, Hampton Inn Joplin, Hampton Inn Marion, and Fairfield Inn St. Louis Collinsville. The “As Complete” appraised values are based on the assumption that the specific amount for property improvement plans (“PIP”) and capital improvements are held in escrow by the lender at origination. At origination, the lender escrowed $4,598,885 into a PIP reserve and the work for the escrowed PIP and capital improvements are either underway or expected to commence in 2018 and 2019. The “As-Is” appraised value for the mortgaged properties identified on the Annex A-1 as Hilton Garden Inn Joplin, Hampton Inn Joplin, Hampton Inn Marion, and Fairfield Inn St. Louis Collinsville is $13,400,000, $12,800,000, $8,100,000, and $3,500,000, respectively. The Cut-off Date LTV and Maturity Date or ARD LTV based on the appraised value representing the sum of the “As-Is” appraised values for each of the Midwest Hotel Portfolio Mortgaged Properties of $73.6 million, are 67.9% and 57.1%, respectively. With respect to the mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Chewy Fulfillment Center, the Cut-off Date LTV, Maturity Date or ARD LTV and appraised value are based on the alternate “Prospective Value Upon Stabilization” appraised value of $49,000,000, as of April 1, 2019, which assumes that outstanding landlord obligations for free rent, general contractor retainage payments, final billings, and remaining punch list work are fully funded and escrowed by the lender. At origination, landlord obligations of $2,822,812 were escrowed. The Cut-off Date LTV and Maturity Date or ARD LTV assuming the “As-Is” appraised value of $45,000,000 for the Chewy Fulfillment Center Mortgaged Property are 64.7% and 59.6%, respectively. With respect to the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as Park Place at Florham Park, the Cut-off Date LTV, Maturity Date or ARD LTV and appraised value are based on the alternate market “As-Is” appraised value of $96,000,000 as of December 4, 2017, which assumes that outstanding landlord obligations for free rent, tenant improvements, and leasing commissions are fully funded and escrowed by the lender through a title company. At origination, landlord obligations of $5,044,401 were escrowed. The Cut-off Date LTV and Maturity Date or ARD LTV assuming the “As-Is” appraised value of $91,200,000 for the Park Place at Florham Park Mortgaged Properties are 68.5% and 68.5%, respectively. With respect to the mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Suntree Office Tower, the Cut-off Date LTV, Maturity Date or ARD LTV and appraised value are based on the alternate “As-Stabilized” appraised value of $14,900,000, as of January 1, 2019, which assumes that outstanding landlord obligations for forward starting rent, tenant improvements, and leasing commissions are fully funded and escrowed by the lender. At origination, landlord obligations of $358,116 were escrowed. The Cut-off Date LTV and Maturity Date or ARD LTV assuming the “As-Is” appraised value of $14,100,000 for the Suntree Office Tower Mortgaged Property are 73.8% and 65.8%, respectively. For additional information, see “Description of the Mortgage Pool—Mortgage Pool Characteristics – Appraised Value” in the Preliminary Prospectus and the footnotes to Annex A-1 in the Preliminary Prospectus. |

| (6) | Excludes mortgage loans that are interest-only for the full loan term. |

| (7) | Includes FF&E Reserves. |

| (8) | Represents the percent of the allocated aggregate principal balance of the mortgage pool as of the Cut-off Date of only the office, retail, industrial, mixed use properties and the mortgaged property identified on Annex A-1 as 53 South 11th Street. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 6 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

OFFERED CERTIFICATES

| Class(1) | Ratings(2) (Fitch/KBRA/Moody’s) | Approx. Initial Certificate Balance or Notional Amount(3) | Initial Subordination Levels | Expected Weighted Average Life (years)(4) | Principal Window (months)(4) | Certificate Principal to Value Ratio(5) | Underwritten NOI Debt Yield(6) |

| Class A-1 | AAAsf / AAA(sf) / Aaa(sf) | $17,267,000 | 30.000%(7) | 2.63 | 1-57 | 41.2% | 15.6% |

| Class A-2 | AAAsf / AAA(sf) / Aaa(sf) | $37,271,000 | 30.000%(7) | 4.77 | 57-60 | 41.2% | 15.6% |

| Class A-SB | AAAsf / AAA(sf) / Aaa(sf) | $37,671,000 | 30.000%(7) | 7.44 | 60-118 | 41.2% | 15.6% |

| Class A-3 | AAAsf / AAA(sf) / Aaa(sf) | (8) | 30.000%(7) | (8) | (8) | 41.2% | 15.6% |

| Class A-4 | AAAsf / AAA(sf) / Aaa(sf) | (8) | 30.000%(7) | (8) | (8) | 41.2% | 15.6% |

| Class X-A(9) | AAAsf / AAA(sf) / Aaa(sf) | $587,933,000(10) | N/A | N/A | N/A | N/A | N/A |

| Class X-B(9) | A-sf / AAA(sf) / NR | $138,584,000(10) | N/A | N/A | N/A | N/A | N/A |

| Class A-S | AAAsf / AAA(sf) / Aa2(sf) | $56,693,000 | 23.250% | 9.96 | 120-120 | 45.2% | 14.2% |

| Class B | AA-sf / AA(sf) / NR | $41,995,000 | 18.250% | 9.96 | 120-120 | 48.2% | 13.3% |

| Class C | A-sf / A-(sf) / NR | $39,896,000 | 13.500% | 9.96 | 120-120 | 50.9% | 12.6% |

NON-OFFERED CERTIFICATES(10)

| Class(11) | Ratings(2) (Fitch/KBRA/Moody’s) | Approx. Initial Certificate Balance or Notional Amount(3) | Initial Subordination Levels | Expected Weighted Average Life (years)(4) | Principal Window (months)(4) | Certificate Value Ratio(5) | Underwritten NOI Debt Yield(6) |

| Class X-D(9) | BBB-sf / BBB(sf) / NR | $26,251,000(10)(12) | N/A | N/A | N/A | N/A | N/A |

| Class D | BBB-sf / BBB(sf) / NR | $26,251,000(12) | 10.375% | 9.96 | 120-120 | 52.8% | 12.2% |

| Class D-RR | BBB-sf / BBB-(sf) / NR | $18,894,000(12) | 8.125% | 9.96 | 120-120 | 54.1% | 11.9% |

| Class E-RR | BB-sf / BB-(sf) / NR | $20,997,000 | 5.625% | 9.96 | 120-120 | 55.6% | 11.5% |

| Class F-RR | B-sf / B-(sf) / NR | $10,499,000 | 4.375% | 10.03 | 120-121 | 56.3% | 11.4% |

| Class NR-RR | NR / NR / NR | $36,746,550 | 0.000% | 10.05 | 121-121 | 58.9% | 10.9% |

Please see footnotes on the following page.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 7 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

| (1) | Theper annum pass-through rates applicable to the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C, Class D, Class D-RR, Class E-RR, Class F-RR, and Class NR-RR Certificates (collectively, the “principal balance certificates”) will equal one of: (i) a fixed rate, (ii) a variable rateper annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date adjusted as necessary to a 30/360 basis (the “WAC Rate”), (iii) a variable rateper annum equal to the lesser of (a) a fixed rate and (b) the WAC Rate or (iv) a variable rateper annum equal to the WAC Rate minus a specified percentage. |

| (2) | Ratings shown are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, Inc. (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s”). Certain nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the certificates. There can be no assurance as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus. Fitch, KBRA and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (3) | Approximate; subject to a permitted variance of plus or minus 5% on the Closing Date, and further subject to the discussion in footnote (8) below. In addition, the notional amounts of the Class X Certificates may vary depending upon the final pricing of all classes of principal balance certificates and whose certificate balances comprise such notional amounts and, if as a result of such pricing the pass-through rate of the Class X Certificates, as applicable, would be equal to zero, such class of certificates may not be issued on the Closing Date of this securitization. |

| (4) | The principal window is expressed in months following the Closing Date and reflects the period during which distributions of principal would be received under the assumptions set forth in the following sentence. The expected weighted average life and principal window figures set forth above are based on the following assumptions, among others: (i) no defaults or subsequent losses on the mortgage loans; (ii) no extensions of maturity dates of the mortgage loans; (iii) payment in full on the stated maturity date; and (iv) no prepayments of the mortgage loans prior to maturity. See the structuring assumptions set forth under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (5) | “Certificate Principal to Value Ratio” for any class of principal balance certificates is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial certificate balance of such class of principal balance certificates and all other classes of principal balance certificates that are senior to such class, and the denominator of which is the total initial certificate balance of all the principal balance certificates. The Certificate Principal to Value Ratios of the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates are calculated in the aggregate for those classes as if they were a single class. |

| (6) | “Underwritten NOI Debt Yield” for any class of principal balance certificates is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial certificate balance of all the principal balance certificates, and the denominator of which is the total initial certificate balance of such class of principal balance certificates and all other classes of principal balance certificates, if any, that are senior to such class. The Underwritten NOI Debt Yields of the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates are calculated in the aggregate for those classes as if they were a single class. |

| (7) | The initial subordination levels for the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates represent the approximate credit support for those classes in the aggregate. |

| (8) | The exact initial certificate balances of the Class A-3 and Class A-4 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balances, final distribution dates, weighted average lives and principal windows of the Class A-3 and Class A-4 certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-3 and Class A-4 certificates is expected to be approximately $495,724,000, subject to a variance of plus or minus 5%. |

Class of | Expected Range of | Expected Range of Assumed | Expected Range of Weighted Average | Expected Range of Principal |

| Class A-3 | $75,000,000 - $175,000,000 | January 2028 / February 2028 | 9.80 / 9.83 | 118-118 / 118-119 |

| Class A-4 | $320,724,000 - $420,724,000 | March 2028 / March 2028 | 9.93 / 9.91 | 119-120 / 118-120 |

| (9) | The pass-through rate for the Class X-A certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the WAC Rate, over (b) the weighted average of the pass-through rates on the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates for the related distribution date, weighted on the basis of their respective certificate balances outstanding immediately prior to that distribution date. The pass-through rate for the Class X-B certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the WAC Rate, over (b) the weighted average of the pass-through rates on the Class A-S, Class B and Class C certificates for the related distribution date, weighted on the basis of their respective certificate balances outstanding immediately prior to that distribution date. The pass-through rate for the Class X-D certificates for any distribution date will be aper annumrate equal to the excess, if any, of (a) the WAC Rate, over (b) the pass-through rate on the Class D certificate for the related distribution date. |

| (10) | The Class X-A, Class X-B and Class X-D certificates (collectively the “Class X Certificates”) are notional amount certificates and will not be entitled to distributions of principal. The notional amount of the Class X-A certificates will be equal to the aggregate certificate balance of the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates. The notional amount of the Class X-B certificates will be equal to the aggregate certificate balance of the Class A-S, Class B and Class C certificates. The notional amount of the Class X-D certificate will be equal to the certificate balance of the Class D certificates. |

| (11) | Not offered pursuant to the Preliminary Prospectus or this Term Sheet. Information provided in this Term Sheet regarding the characteristics of these certificates is provided only to enhance your understanding of the offered certificates. The non-offered certificates also include the Class Z and Class R certificates, which do not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date, and which are not shown in the chart. The Class Z certificates represent the entitlement to distributions of excess interest accrued on the mortgage loans with an anticipated repayment date, as further described in the Preliminary Prospectus. The Class R certificates represent the beneficial ownership of the residual interest in each of the real estate mortgage investment conduits, as further described in the Preliminary Prospectus. |

| (12) | The approximate initial certificate balances of the Class D and Class D-RR Certificates are estimated based in part on the estimated ranges of certificate balances and estimated fair values described in“Credit Risk Retention” in the Preliminary Prospectus. The Class D certificate balances are expected to fall within a range of $23,839,000 and $28,604,000, with the ultimate certificate balance determined such that the aggregate fair value of the Yield-Priced Principal Balance Certificates will equal at least 5% of the estimated fair value of all the classes of certificates (other than the Class R Certificates) issued by the issuing entity. The Class D-RR certificate balances are expected to fall within a range of $16,541,000 and $21,306,000, with the ultimate certificate balance determined such that the aggregate fair value of the Yield-Priced Principal Balance Certificates will equal at least 5% of the estimated fair value of all the classes of certificates (other than the Class R Certificates) issued by the issuing entity. Any variation in the initial certificate balance of the Class D certificates would affect the initial notional amount of the Class X-D Certificates. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 8 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

| Class A-2 Principal Paydown(1) |

| Class | Mortgage Loan Seller | Mortgage Loan | Property Type | Cut-off Date Balance | Remaining Term to Maturity (Mos.) | Cut-off Date LTV Ratio(2) | U/W NCF DSCR(2) | U/W NOI Debt Yield(2) |

| A-2 | CCRE | DreamWorks Campus | Office | $25,000,000 | 57 | 31.0% | 6.31x | 14.8% |

| A-2 | UBS AG | 53 South 11th Street | Multifamily | $11,000,000 | 59 | 44.0% | 1.59x | 8.7% |

| (1) | This table reflects the mortgage loans whose balloon payments will be applied to pay down the Class A-2 certificates, assuming (i) that none of the mortgage loans experience prepayments (prior to maturity or anticipated repayment date, as applicable), defaults or losses, (ii) there are no extensions of maturity dates or anticipated repayment date, as applicable and (iii) each mortgage loan is paid in full on its stated maturity date. See “Yield and Maturity Considerations—Yield Considerations” in the Preliminary Prospectus. |

| (2) | With respect to any mortgage loan that is part of a whole loan, unless otherwise indicated, Cut-off Date LTV Ratio, U/W NCF DSCR and U/W NOI Debt Yield includes any relatedpari passu companion loans and excludes any subordinate companion loans. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 9 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

| Principal Distributions: | Payments in respect of principal of the certificates will be distributed, first, to the Class A-SB Certificates, until the certificate balance of such class is reduced to the planned principal balance for the related Distribution Date set forth on Annex E to the Preliminary Prospectus, then, to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class A-S, Class B, Class C, Class D, Class D-RR, Class E-RR, Class F-RR and Class NR-RR Certificates, in that order, until the certificate balance of each such class is reduced to zero. Notwithstanding the foregoing, if the aggregate certificate balances of the Class A-S, Class B, Class C, Class D, Class D-RR, Class E-RR, Class F-RR and Class NR-RR Certificates have been reduced to zero as a result of the allocation of mortgage loan losses to those certificates, or if the aggregate Cumulative Appraisal Reduction Amount equals or exceeds the aggregate certificate balances of the Class A-S through Class NR-RR Certificates, distributions in respect of principal of the certificates will be distributed,first, to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates, on apro ratabasis, based on the certificate balance of each such class,then, to the extent of any recoveries on realized losses, to the Class A-S, Class B, Class C, Class D, Class D-RR, Class E-RR, Class F-RR and Class NR-RR Certificates, in that order, in each case until the certificate balance of each such class is reduced to zero (or previously allocated realized losses have been fully reimbursed).

The Class X Certificates will not be entitled to receive distributions of principal; however, (i) the notional amount of the Class X-A Certificates will be reduced by the aggregate amount of principal distributions and realized losses, if any, allocated to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates, (ii) the notional amount of the Class X-B Certificates will be reduced by the aggregate amount of principal distributions and realized losses, if any, allocated to the Class A-S, Class B and Class C Certificates and (iii) the notional amount of the Class X-D Certificates will be reduced by the principal distributions and realized losses allocated to the Class D Certificates. |

| Interest Distributions: | On each Distribution Date, interest accrued for each class of the certificates at the applicable pass-through rate will be distributed in the following order of priority, to the extent of available funds: first, to the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class X-A, Class X-B and Class X-D Certificates, on apro rata basis, based on the accrued and unpaid interest on each such class and then, to the Class A-S, Class B, Class C, Class D, Class D-RR, Class E-RR, Class F-RR and Class NR-RR Certificates, in that order, in each case until the interest payable to each such class is paid in full.

Theper annum pass-through rates applicable to the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C, Class D, Class D-RR, Class E-RR, Class F-RR and Class NR-RR Certificates for each Distribution Date will equal one of: (i) a fixed rate, (ii) the WAC Rate, (iii) a variable rate equal to the lesser of (a) a fixed rate and (b) the WAC Rate or (iv) a variable rate equal to the WAC Rate less a specified percentage

As further described in the Preliminary Prospectus, theper annum pass-through rate on the Class X-A Certificates will generally be equal to the excess, if any, of (a) the WAC Rate, over (b) the weighted average of the pass-through rates of the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates, weighted on the basis of their respective certificate balances outstanding immediately prior to that Distribution Date as described in the Preliminary Prospectus. Theper annum pass-through rate on the Class X-B Certificates will generally be equal to the excess, if any, of (a) the WAC Rate, over (b) the weighted average of the pass-through rates of the Class A-S, Class B and Class C Certificates, weighted on the basis of their respective certificate balances outstanding immediately prior to that Distribution Date as described in the Preliminary Prospectus. Theper annumpass-through rate on the Class X-D Certificates will generally be equal to the excess, if any, of (a) the WAC Rate, over (b) the pass-through rate of the Class D Certificates as described in the Preliminary Prospectus. |

| Prepayment Interest Shortfalls: | Prepayment interest shortfalls will be allocatedpro ratabased on interest entitlements, in reduction of the interest otherwise payable with respect to each of the interest-bearing classes of certificates. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 10 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

| Realized Loss Allocation: | On each distribution date, immediately following the distributions to be made to the Certificateholders on that date, the certificate administrator is required to calculate the amount, if any, by which (i) the aggregate stated principal balance of the mortgage loans, including any REO loans, expected to be outstanding immediately following that distribution date is less than (ii) the then aggregate Certificate Balance of the Principal Balance Certificates after giving effect to distributions of principal on that distribution date. Such amount will be applied to the Class NR-RR, Class F-RR, Class E-RR, Class D-RR, Class D, Class C, Class B and Class A-S certificates, in that order, in each case until the related Certificate Balance has been reduced to zero, and then to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates,pro rata based upon their respective Certificate Balances, until their respective Certificate Balances have been reduced to zero. |

Prepayment Premiums/Yield Maintenance Charges: | If any yield maintenance charge or prepayment premium is collected during any collection period with respect to any mortgage loan, then on the distribution date corresponding to that collection period, the certificate administrator will pay that yield maintenance charge or prepayment premium in the following manner: (a) to the holders of each of the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C and Class D certificates, the product of (x) such yield maintenance charge or prepayment premium, (y) the related Base Interest Fraction for such class, and (z) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that distribution date, and the denominator of which is the total amount of principal distributed to such classes of Principal Balance Certificates for that distribution date, (b) to the holders of the Class X-A certificates, the excess, if any, of (x) the product of (1) such yield maintenance charge or prepayment premium and (2) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates for that distribution date, and the denominator of which is the total amount of principal distributed to the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C and Class D certificates for that distribution date, over (y) the amount of such yield maintenance charge or prepayment premium distributed to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates as described above, and (c) to the holders of the Class X-B certificates, any remaining portion of such yield maintenance charge or prepayment premium not distributed as described above.

No prepayment premiums or yield maintenance charges will be distributed to the holders of the Class X-D, Class D-RR, Class E-RR, Class F-RR, Class NR-RR, Class Z or Class R Certificates.

“Base Interest Fraction” means, with respect to any principal prepayment of any mortgage loan that provides for the payment of a yield maintenance charge or prepayment premium, and with respect to any class of Principal Balance Certificates, a fraction (A) the numerator of which is the greater of (x) zero and (y) the difference between (i) the pass-through rate on that class, and (ii) the applicable discount rate and (B) the denominator of which is the difference between (i) the mortgage interest rate on the related mortgage loan and (ii) the applicable discount rate;provided,however, that: under no circumstances will the Base Interest Fraction be greater than one; if the applicable discount rate is greater than or equal to both the mortgage interest rate on the related mortgage loan and the pass-through rate on that class, then the Base Interest Fraction will equal zero; and if the applicable discount rate is greater than or equal to the mortgage interest rate on the related mortgage loan and is less than the pass-through rate on that class, then the Base Interest Fraction will be equal to 1.0.

Consistent with the foregoing, the Base Interest Fraction is equal to:

(Pass-Through Rate - Discount Rate) |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 11 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

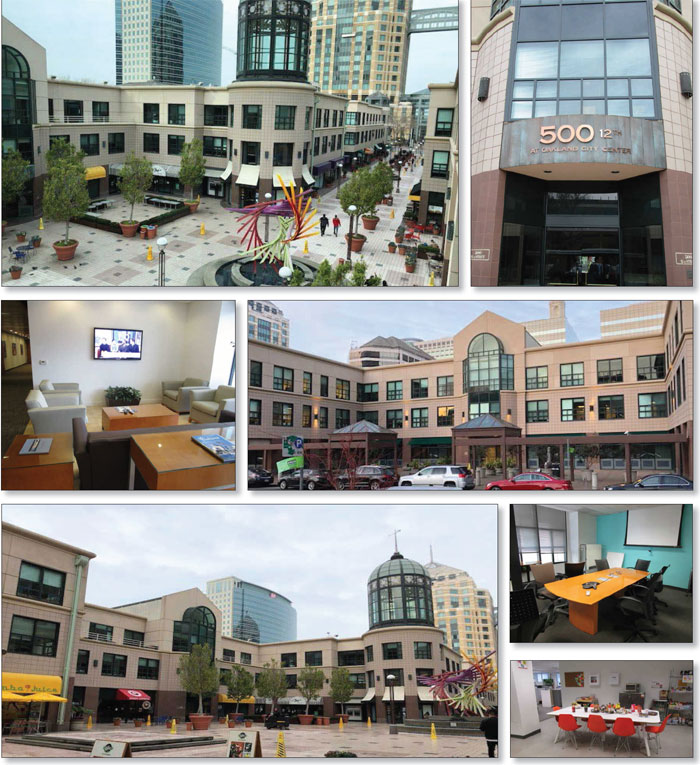

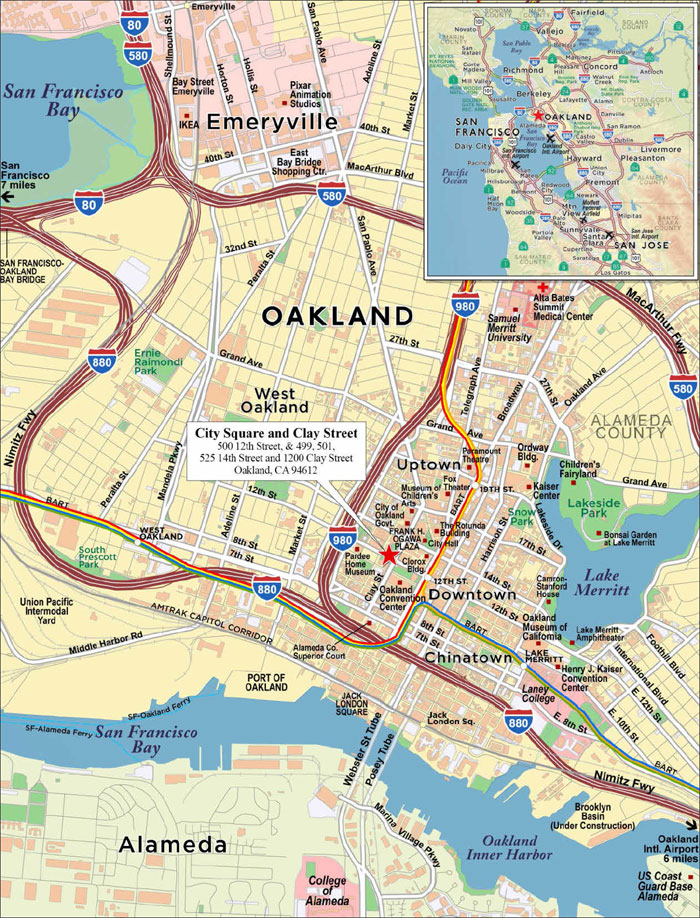

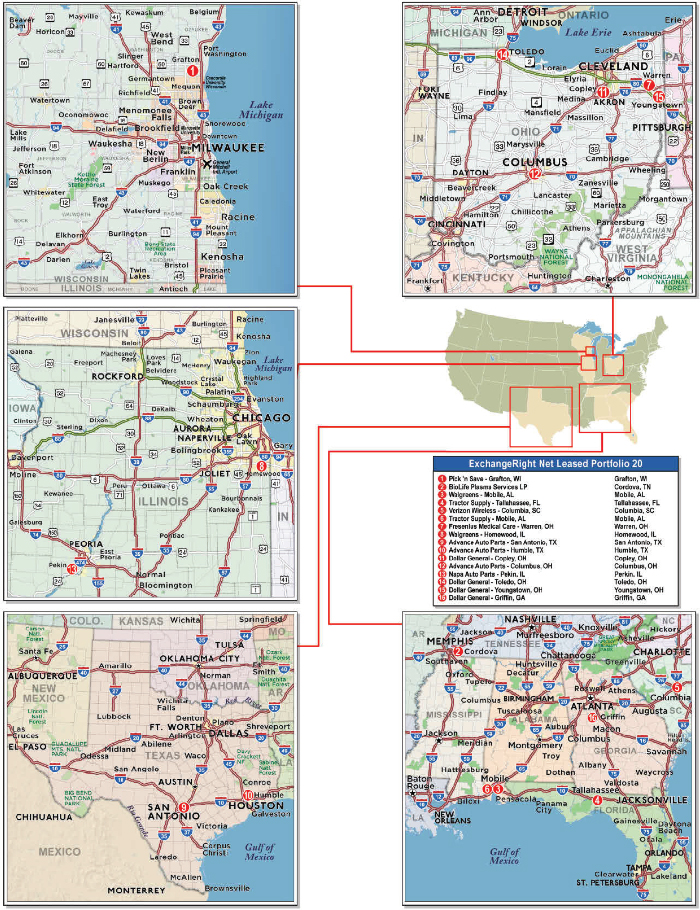

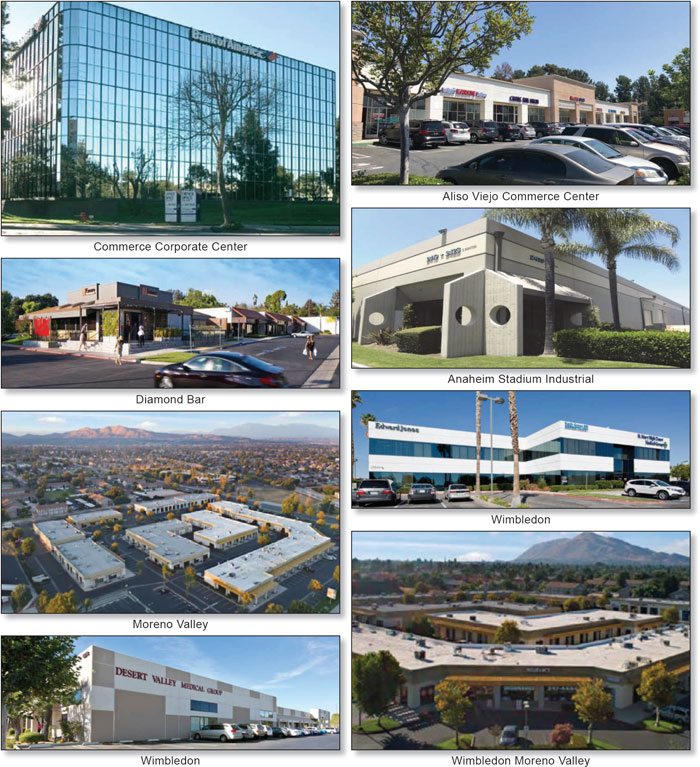

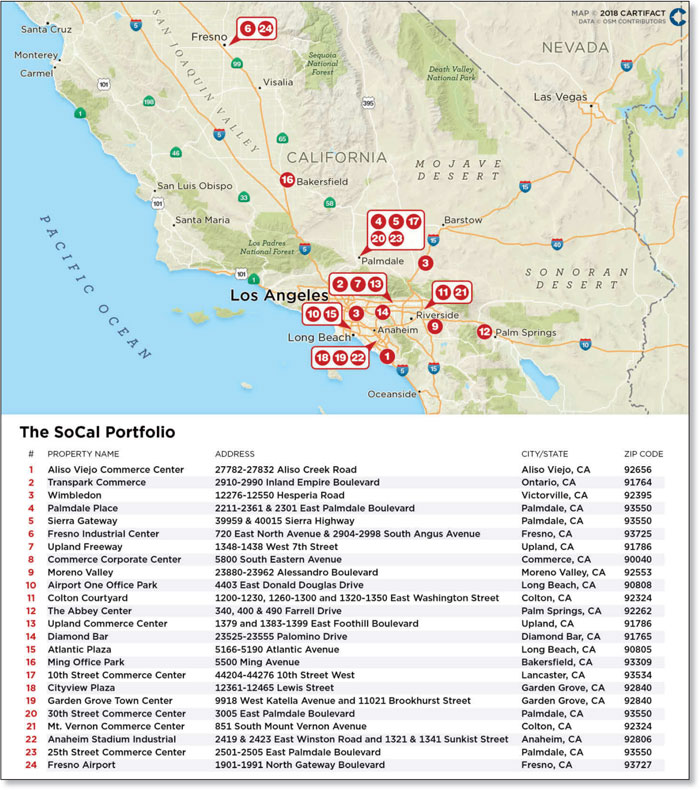

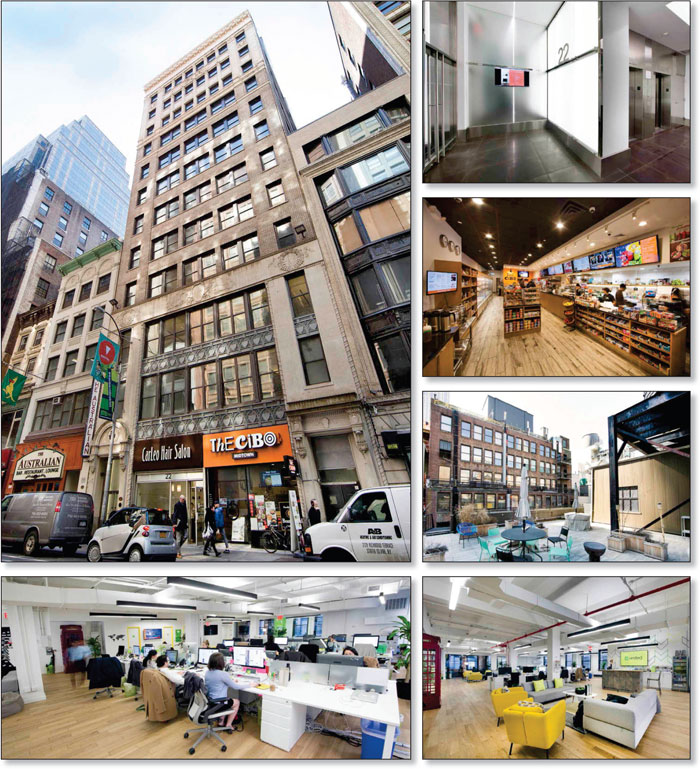

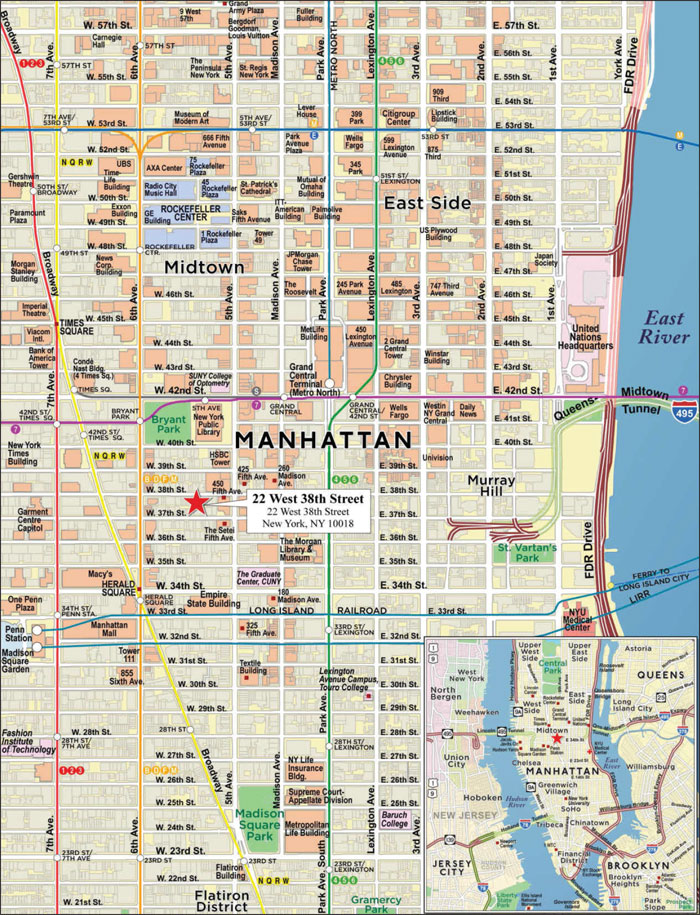

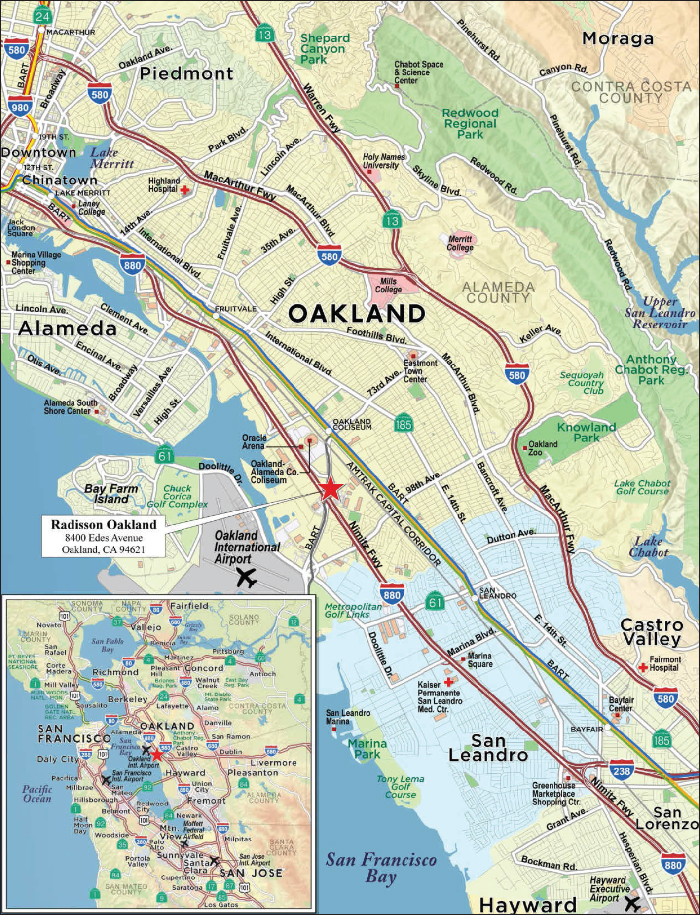

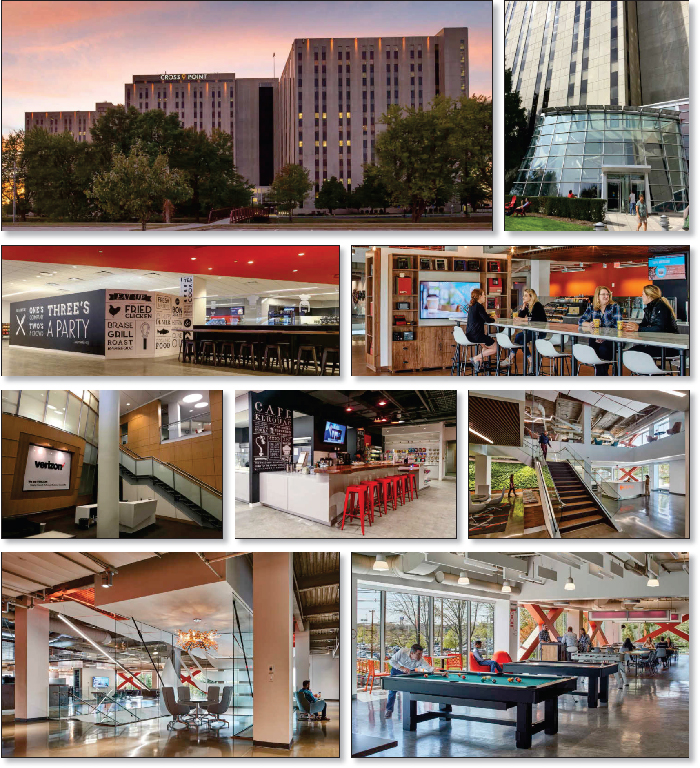

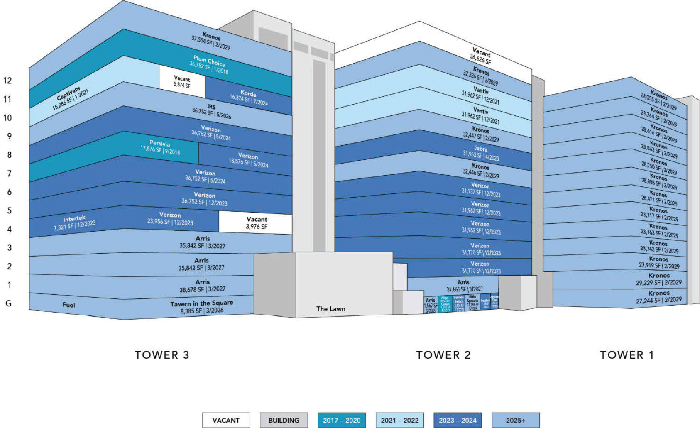

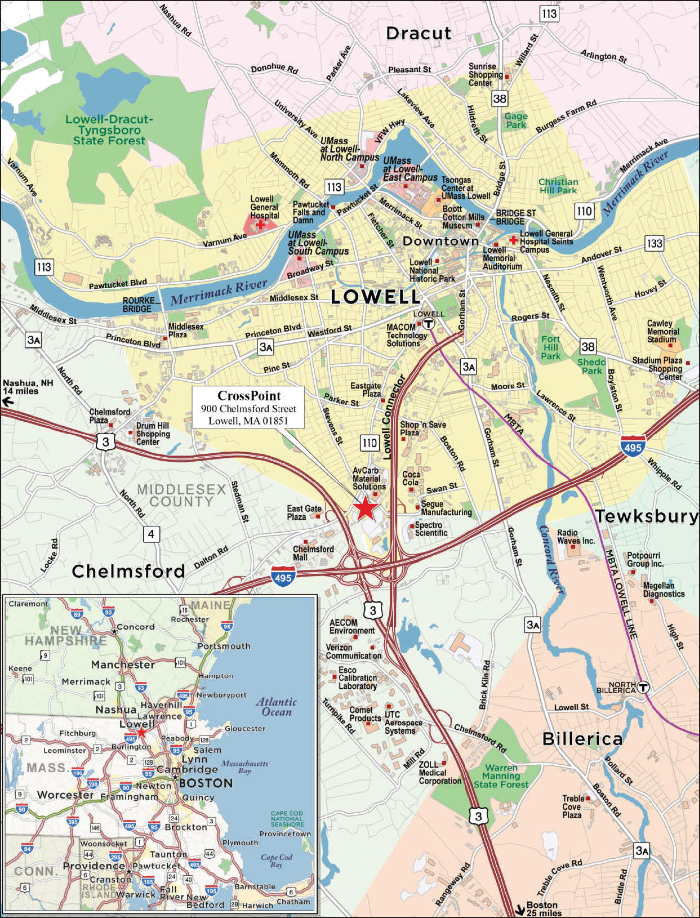

| Whole Loans: | The mortgaged properties identified on Annex A-1 to the Preliminary Prospectus as AFIN Portfolio, City Square and Clay Street, The SoCal Portfolio, CrossPoint, Eastmont Town Center, DreamWorks Campus and Park Place at Florham Park each secure both a mortgage loan to be included in the trust fund and one or more other mortgage loans that will not be included in the trust fund, each of which will bepari passu or subordinate in right of payment with the mortgage loan included in the trust fund. We refer to each such group of mortgage loans as a “whole loan”. The City Square and Clay Street whole loan, the Eastmont Town Center whole loan and the DreamWorks Campus whole loan will be principally serviced under the PSA for the UBS 2018-C9 securitization (each, a “Serviced Whole Loan”). The AFIN Portfolio whole loan will be serviced under the pooling and servicing agreement for the UBS 2017-C7 securitization until the date of securitization of the related controllingpari passunote, after which the related whole loan will be serviced under the pooling and servicing agreement related to the securitization of the related controllingpari passunote. The SoCal Portfolio whole loan is being serviced under the pooling and servicing agreement for the CGCMT 2018-B2 securitization. The CrossPoint whole loan will be serviced under the pooling and servicing agreement for the UBS 2018-C8 securitization until the date of securitization of the related controllingpari passunote, after which the related whole loan will be serviced under the pooling and servicing agreement related to the securitization of the related controllingpari passunote. The Park Place at Florham Park whole loan is being serviced under the pooling and servicing agreement for the UBS 2018-C8 securitization.

As of the Closing Date, thepari passucompanion loans in the whole loans are expected to be held by the party identified below under “Overview of Mortgage Pool Characteristics—Pari Passu Companion Loan Summary”. |

Control Rights and Directing Certificateholder: | The “Directing Certificateholder” with respect to each Serviced Mortgage Loan, will be the Controlling Class Certificateholder (or its representative) selected by more than 50% of the Controlling Class Certificateholders, by Certificate Balance, as determined by the certificate registrar from time to time;provided,however, that (for purposes of clause (ii) above in this definition) (1) absent that selection, (2) until a Directing Certificateholder is so selected, or (3) upon receipt of a notice from a majority of the Controlling Class Certificateholders, by Certificate Balance, that a Directing Certificateholder is no longer designated, the Controlling Class Certificateholder that owns the largest aggregate Certificate Balance of the Controlling Class (or its representative) will be the Directing Certificateholder;provided,however, that (i) in the case of clause (3) of the preceding proviso, if no one holder owns the largest aggregate Certificate Balance of the Controlling Class, then there will be no Directing Certificateholder until appointed in accordance with the terms of the PSA, and (ii) the certificate administrator and the other parties to the PSA will be entitled to assume that the identity of the Directing Certificateholder has not changed until such parties receive written notice of a replacement of the Directing Certificateholder from a party holding the requisite interest in the Controlling Class (as confirmed by the certificate registrar), or the resignation of the then-current Directing Certificateholder.

The Directing Certificateholder will be entitled to direct the Special Servicer to take, or refrain from taking certain actions with respect to each Serviced Mortgage Loan and any related Serviced Companion Loans. Furthermore, the Directing Certificateholder will also have the right to receive notice and consent to certain material actions that the Master Servicer and the Special Servicer proposes to take with respect to each Serviced Mortgage Loan and any related Serviced Companion Loans.

It is expected that RREF III-D AIV RR H, LLC, or its affiliate, will be the initial Directing Certificateholder with respect to each Serviced Mortgage Loan and any related Serviced Companion Loans.

With respect to the DreamWorks Campus mortgage loan, the rights of the Directing Certificateholder will be subject to the rights of the holder of the related subordinate companion loan. For a description of the rights of the holder of each Subordinate Companion Loan with respect to the Serviced AB Whole Loan, see “Description of the Mortgage Pool—The Whole Loans—The Serviced AB Whole Loan— DreamWorks Campus Whole Loan” in the Preliminary Prospectus.

Notwithstanding any contrary description set forth above, with respect to the City Square and Clay Street mortgage loan, the Eastmont Town Center mortgage loan and the DreamWorks Campus mortgage loan, the holders of the relatedpari passu companion loan(s) in the related whole loan (or its representative, including any directing certificateholder under any securitization |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 12 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

of suchpari passu companion loan(s)) will have consultation rights with respect to asset status reports and material special servicing actions involving the related whole loan, as provided for in the related intercreditor agreement and as described in the Preliminary Prospectus, and those rights will be in addition to the rights of the directing certificateholder in this transaction described above.

Notwithstanding any contrary description set forth above, with respect to the AFIN Portfolio mortgage loan, The SoCal Portfolio mortgage loan, the CrossPoint mortgage loan and the Park Place at Florham Park mortgage loan, in general the related whole loan will be serviced under the pooling and servicing agreement or trust and servicing agreement as indicated in the “Pari Passu Companion Loan Summary” table below, which grants the related directing certificateholder under the related securitization control rights that may include the right to approve or disapprove various material servicing actions involving the related whole loan. The directing certificateholder for this securitization (so long as no Consultation Termination Event has occurred and is occurring) will nonetheless have the right to be consulted on a non-binding basis with respect to such actions. For purposes of the servicing of the related whole loan, the occurrence and continuance of a Control Termination Event or Consultation Termination Event under this securitization will not limit the control or other rights of the directing certificateholder (or equivalent) under the related securitization.

For a description of the directing holder for each Non-Serviced Whole Loan, see “Description of the Mortgage Pool—The Whole Loans” and “Pooling and Servicing Agreement—The Directing Certificateholder—Rights of the Directing Certificateholder appointed by the Controlling Class with respect to Non-Serviced Mortgage Loans” in the Preliminary Prospectus. | |

| Control Eligible Certificates: | Class F-RR and Class NR-RR Certificates. |

| Controlling Class: | The “Controlling Class” will be, as of any time of determination, the most subordinate class of Control Eligible Certificates then-outstanding that has an aggregate Certificate Balance (as notionally reduced by any Cumulative Appraisal Reduction Amounts (as defined below) allocable to such class) at least equal to 25% of the initial Certificate Balance of that class;provided,however, that if at any time the Certificate Balances of the certificates other than the Control Eligible Certificates have been reduced to zero as a result of principal payments on the mortgage loans, then the Controlling Class will be the most subordinate class of Control Eligible Certificates that has a Certificate Balance greater than zero without regard to any Cumulative Appraisal Reduction Amounts. The Controlling Class as of the Closing Date will be the Class NR-RR certificates. |

| Appraised-Out Class: | An “Appraised-Out Class” is any class of Control Eligible Certificates that is determined at any time of determination to no longer be the Controlling Class as a result of the application of any Appraisal Reduction Amounts or Collateral Deficiency Amounts to notionally reduce the Certificate Balance of the constituent classes. Any Appraised-Out Class may not exercise any direction, control, consent and/or similar rights of the Controlling Class until such time, if any, as such class is reinstated as the Controlling Class, and the rights of the Controlling Class will be exercised by the next most senior class of Control Eligible Certificates that is not an Appraised-Out Class, if any, during such period.

With respect to the Serviced AB Whole Loan, the holder of the controlling Subordinate Companion Loan may in certain circumstances post collateral to avoid a change of control as described in “Description of the Mortgage Pool—The Whole Loans—The Serviced AB Whole Loan— DreamWorks Campus Whole Loan” in the Preliminary Prospectus. |

Remedies Available to Holders of an Appraised-Out Class: | The holders of the majority (by Certificate Balance) of an Appraised-Out Class will have the right, at their sole expense, to require the Special Servicer to order a second appraisal of any mortgage loan (or Serviced Whole Loan) for which an appraisal reduction event has occurred or as to which there exists a Collateral Deficiency Amount (such holders, the “Requesting Holders”). With respect to any Serviced Mortgage Loan, the Special Servicer will be required to use its reasonable best efforts to ensure that such appraisal is delivered within 30 days from receipt of the Requesting Holders’ written request and will ensure that such appraisal is prepared on an “as-is” basis by an MAI appraiser. Upon receipt of such supplemental appraisal, the Special Servicer will be required to determine, in accordance with the Servicing Standard, whether, based on its assessment of such supplemental appraisal, any recalculation of the applicable Appraisal Reduction Amount or Collateral Deficiency Amount, as applicable, is warranted and, if so warranted, will recalculate such |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 13 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

| Appraisal Reduction Amount or Collateral Deficiency Amount, as applicable, based upon such supplemental appraisal and receipt of information requested by the Special Servicer from the Master Servicer. If required by any such recalculation, the applicable Appraised-Out Class will be reinstated as the Controlling Class and each other Appraised-Out Class will, if applicable, have its related Certificate Balance notionally restored to the extent required by such recalculation of the Appraisal Reduction Amount or Collateral Deficiency Amount, if applicable. | |

| Control Rights: | Subject to the rights of the Subordinate Companion Loan solely with respect to the Serviced AB Whole Loan, described under “Description of the Mortgage Pool—The Whole Loans—The Serviced AB Whole Loan— DreamWorks Campus Whole Loan” in the Preliminary Prospectus, prior to a Control Termination Event, the Directing Certificateholder appointed by the Controlling Class Certificateholder will have certain consent and consultation rights under the PSA with respect to certain major decisions and other matters. A “Control Termination Event” will occur when (i) the Class F-RR certificates have a Certificate Balance (taking into account the application of any Cumulative Appraisal Reduction Amounts to notionally reduce the Certificate Balance of such class) of less than 25% of the initial Certificate Balance of such class; or (ii) a holder of the Class F-RR certificates is the majority Controlling Class Certificateholder and has irrevocably waived its right, in writing, to exercise any of the rights of the Controlling Class Certificateholder and such rights have not been reinstated to a successor Controlling Class Certificateholder;provided that a Control Termination Event will not be deemed continuing in the event that the Certificate Balances of the Certificates other than the Control Eligible Certificates have been reduced to zero as a result of principal payments on the mortgage loans.

After the occurrence of a Control Termination Event but prior to the occurrence of a Consultation Termination Event, the Directing Certificateholder appointed by the Controlling Class Certificateholder will not have any consent rights, but such Directing Certificateholder will have certain non-binding consultation rights under the PSA with respect to certain major decisions and other matters. A “Consultation Termination Event” will occur when (i) there is no class of Control Eligible Certificates that has a then-outstanding Certificate Balance at least equal to 25% of the initial Certificate Balance of that class, in each case, without regard to the application of any Cumulative Appraisal Reduction Amounts; or (ii) a holder of the Class F-RR certificates is the majority Controlling Class Certificateholder and has irrevocably waived its right, in writing, to exercise any of the rights of the Controlling Class Certificateholder and such rights have not been reinstated to a successor Controlling Class Certificateholder (providedthat no Consultation Termination Event resulting solely from the operation of clause (ii) will be deemed to have existed or be in continuance with respect to a successor holder of the Class F-RR certificates that has not irrevocably waived its right to exercise any of the rights of the Controlling Class Certificateholder);provided that a Control Termination Event will not be deemed continuing in the event that the Certificate Balances of the Principal Balance Certificates other than the Control Eligible Certificates have been reduced to zero as a result of principal payments on the mortgage loans.

After the occurrence of a Consultation Termination Event, the Directing Certificateholder appointed by the Controlling Class Certificateholder will not have any consent or consultation rights, except with respect to any rights expressly set forth in the PSA.

Notwithstanding the proviso to the definitions of “Control Termination Event” and “Consultation Termination Event,” a Control Termination Event and a Consultation Termination Event will be deemed to have occurred with respect to any Excluded Loan with respect to the Directing Certificateholder or the holder of the majority of the Controlling Class, and neither the Directing Certificateholder nor any Controlling Class Certificateholder will have any consent or consultation rights with respect to the servicing of such Excluded Loan.

An “Excluded Loan” means a mortgage loan or whole loan with respect to which the Directing Certificateholder or the holder of the majority of the Controlling Class is a Borrower Party. It is expected that there will be no Excluded Loans as of the Closing Date with respect to this securitization.

“Borrower Party” means a borrower, a mortgagor, a manager of a mortgaged property, a mezzanine lender under a mezzanine loan that has been accelerated or as to which foreclosure or enforcement proceedings have been commenced against the equity collateral pledged to secure the related mezzanine loan, or any Borrower Party Affiliate. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 14 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

“Borrower Party Affiliate” means, with respect to a borrower, a mortgagor, a manager of a mortgaged property or a mezzanine lender under a mezzanine loan that has been accelerated or as to which foreclosure or enforcement proceedings have been commenced against the equity collateral pledged to secure the related mezzanine loan, (a) any other person controlling or controlled by or under common control with such borrower, mortgagor, manager or mezzanine lender, as applicable, or (b) any other person owning, directly or indirectly, 25% or more of the beneficial interests in such borrower, mortgagor, manager or mezzanine lender, as applicable. For the purposes of this definition, “control” when used with respect to any specified person means the power to direct the management and policies of such person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

Notwithstanding any of the foregoing to the contrary, if any mortgage loan is part of a whole loan, the consent and/or consultation rights of a Controlling Class Certificateholder with respect thereto may be limited as described in the Preliminary Prospectus. In particular, with respect to each Non-Serviced Whole Loan, the Directing Certificateholder will only have certain consultation rights with respect to certain “major decisions” and other matters related to such whole loan, in each case only prior to a Control Termination Event or Consultation Termination Event, as applicable, and the controlling noteholder (or its representative) will be entitled to similar consent and/or consultation rights with respect to such whole loan. | |

Operating Advisor Consultation Event: | An “Operating Advisor Consultation Event” will occur when the Certificate Balances of the Class D-RR, Class E-RR, Class F-RR and Class NR-RR Certificates in the aggregate (taking into account the application of any Cumulative Appraisal Reduction Amounts to notionally reduce the Certificate Balances of such classes) is 25% or less of the initial Certificate Balances of such classes in the aggregate. |

Appointment and Replacement of Special Servicer: | The Directing Certificateholder will appoint the initial Special Servicer as of the Closing Date. Prior to the occurrence and continuance of a Control Termination Event, the Directing Certificateholder generally may replace the Special Servicer with or without cause at any time.

Upon the occurrence and during the continuance of a Control Termination Event, the Directing Certificateholder appointed by the Controlling Class Certificateholder will no longer have the right to replace the Special Servicer and such replacement will occur based on a vote of holders of all voting eligible classes of certificates as described in “Replacement of Special Servicer by Vote of Certificateholders” below.

Notwithstanding the foregoing, with respect to the Serviced AB Whole Loan, prior to the occurrence of a Control Appraisal Period with respect to the related Subordinate Companion Loan, the Directing Certificateholder appointed by the Controlling Class Certificateholder will not be entitled to exercise the above-described rights and the holder of such Subordinate Companion Loan will be entitled to replace the Special Servicer with or without cause in accordance with the PSA and the related intercreditor agreement. However, during a Control Appraisal Period with respect to the Serviced AB Whole Loan, the Directing Certificateholder appointed by the Controlling Class Certificateholder will have generally similar (although not necessarily identical) rights (including the rights described above) with respect to the Serviced AB Whole Loan as it does for the other mortgage loans in the issuing entity. See “Description of the Mortgage Pool—The Whole Loans—The Serviced AB Whole Loan—DreamWorks Campus Whole Loan” in the Preliminary Prospectus.

The Operating Advisor may also recommend the replacement of the Special Servicer at any time as described in “Operating Advisor” below. |

Replacement of Special Servicer by Vote of Certificateholders: | After the occurrence and during the continuance of a Control Termination Event and upon (a) the written direction of holders of Principal Balance Certificates evidencing not less than 25% of the Voting Rights of all classes of Principal Balance Certificates (taking into account the application of Cumulative Appraisal Reduction Amounts to notionally reduce the Certificate Balances of classes to which such Cumulative Appraisal Reduction Amounts are allocable) requesting a vote to replace the related Special Servicer with a replacement special servicer, (b) payment by such requesting holders to the Certificate Administrator of all reasonable fees and expenses (including any legal fees and any Rating Agency fees and expenses) to be incurred by the Certificate Administrator in connection with administering such vote (which fees and expenses will not be additional trust fund expenses) and (c) delivery by such holders to the Certificate Administrator and the Trustee of Rating Agency Confirmation from each |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 15 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

applicable Rating Agency (such Rating Agency Confirmation will be obtained at the expense of the holders of certificates requesting such vote) and confirmation from the applicable rating agencies that the contemplated appointment or replacement will not result in the downgrade, withdrawal or qualification of the then-current ratings of any class of any related Serviced Pari Passu Companion Loan Securities, the Certificate Administrator will be required to post such notice on its internet website and concurrently by mail and conduct the solicitation of votes of all certificates in such regard, which requisite affirmative votes must be received within 180 days of the posting of such notice. Upon the written direction of holders of at least 66-2/3% of a Certificateholder Quorum, the Trustee will be required to immediately terminate all of the rights and obligations of the Special Servicer under the PSA and replace the Special Servicer with a qualified replacement special servicer designated by such holders of certificates, subject to indemnification, right to outstanding fees, reimbursement of Advances and other rights set forth in the PSA, which survive such termination.

A “Certificateholder Quorum” means, in connection with any solicitation of votes in connection with the replacement of the special servicer or the asset representations reviewer, the holders of certificates evidencing at least 50% of the aggregate Voting Rights (taking into account the application of Realized Losses and, other than with respect to the termination of the Asset Representations Reviewer, the application of any Cumulative Appraisal Reduction Amounts to notionally reduce the Certificate Balance of the certificates) of all classes of certificates entitled to principal on an aggregate basis.

With respect to each Serviced Whole Loan, any holder of a relatedpari passu companion loan, following a Servicer Termination Event with respect to the related Special Servicer that remains unremedied and affects such holder, will be entitled to direct the Trustee (and the Trustee will be required) to terminate the Special Servicer solely with respect to such Serviced Whole Loan. A replacement special servicer will be selected by the Trustee or, prior to a Control Termination Event, by the Directing Certificateholder;provided that any successor special servicer appointed to replace the Special Servicer with respect to such whole loan can generally not be the entity (or its affiliate) that was terminated at the direction of the holder of the relatedpari passucompanion loan, without the prior written consent of such holder of the related Serviced Companion Loan.

With respect to any Non-Serviced Whole Loan, the UBS Commercial Mortgage Trust 2018-C9, as holder of the related mortgage loan, has the right to terminate the Special Servicer under the related pooling and servicing agreement if a servicer termination event occurs, with respect to such special servicer that affects the trust in its capacity as such holder. Such rights may be exercised by the Directing Certificateholder prior to a Control Termination Event (or the Special Servicer (consistent with the servicing standard), following the occurrence and during the continuance of a Control Termination Event). The successor special servicer will be selected pursuant to the applicable pooling and servicing agreement by the related directing holder prior to a control termination event under such pooling and servicing agreement. | |

Cap on Workout and Liquidation Fees: | The Special Servicer will also be entitled to (i) liquidation fees generally equal to 1.0% (or, if such rate would result in an aggregate liquidation fee less than $25,000, then the liquidation fee rate will be equal to such rate as would result in an aggregate liquidation fee equal to $25,000) of liquidation proceeds and certain other collections in respect of a Specially Serviced Loan (and any related Serviced Companion Loan) or related REO Property and of amounts received in respect of mortgage loan repurchases by the related mortgage loan sellers (less any Excess Modification Fees paid by or on behalf of the related borrower with respect to the related mortgage loan or REO Property and received by the Special Servicer within the prior 12 months); and (ii) workout fees generally equal to 1.0% (or, with respect to interest and principal payments made in respect of a rehabilitated mortgage loan (and any related Serviced Companion Loan), subject to a floor of $25,000 with respect to any mortgage loan, whole loan or related REO Property, subject to certain adjustments and exceptions as described in the Preliminary Prospectus under “Pooling and Servicing Agreement—Servicing and Other Compensation and Payment of Expenses—Special Servicing Compensation”. |

| Special Servicer Compensation: | The special servicing fee for each distribution date is calculated based on the outstanding principal balance of each Serviced Mortgage Loan that is a Specially Serviced Loan (and any related Serviced Companion Loan) or as to which the related mortgaged property has become an REO Property at the special servicing fee rate, which will be a rate equal to the greater of a |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 16 |

UBS 2018-C9

| STRUCTURE OVERVIEW |

per annumrate of 0.25000% and the rate that would result in a special servicing fee of $5,000. The special servicing fee will be payable monthly,first, from liquidation proceeds, insurance and condemnation proceeds, and other collections in respect of the related Specially Serviced Loan or REO Property and,then, from general collections on all the mortgage loans (other than a Non-Serviced Mortgage Loan) and any REO Properties.

With respect to any Non-Serviced Mortgage Loan, the related special servicer under the related other pooling and servicing agreement pursuant to which such mortgage loan is being serviced will be entitled to similar compensation as that described above with respect to such Non-Serviced Mortgage Loan under such other pooling and servicing agreement as further described in the Preliminary Prospectus, although any related fees may accrue at a different rate and there may be a higher (or no) cap on liquidation and workout fees. | |

| Operating Advisor: | The Operating Advisor will initially be Pentalpha Surveillance LLC. The Operating Advisor will have certain review and consultation rights relating to the performance of the Special Servicer and with respect to its actions taken in connection with the resolution and/or liquidation of Specially Serviced Loans. With respect to each mortgage loan or Serviced Whole Loan (in each case, other than a Non-Serviced Mortgage Loan), the Operating Advisor will be responsible for:

● reviewing the actions of the Special Servicer with respect to any Specially Serviced Loan to the extent described in the Preliminary Prospectus and required under the PSA;

● reviewing (i) all reports by the Special Servicer made available to Privileged Persons on the Certificate Administrator’s website and (ii) each Asset Status Report (after the occurrence and during the continuance of an Operating Advisor Consultation Event) and Final Asset Status Report;

● recalculating and verifying the accuracy of the mathematical calculations and the corresponding application of the non-discretionary portion of the applicable formulas required to be utilized in connection with Appraisal Reduction Amounts, Collateral Deficiency Amounts and net present value calculations used in the Special Servicer’s determination of what course of action to take in connection with the workout or liquidation of a Specially Serviced Loan; and