Merger of Western Refining and Northern Tier December 22, 2015 Exhibit 99.2

Cautionary Statements This presentation includes “forward-looking statements” by Western Refining, Inc. (“Western” or “WNR”) (which are protected as forward-looking statements under the Private Securities Litigation Reform Act of 1995) and by Northern Tier Energy LP (“Northern Tier” or “NTI”). The forward-looking statements reflect Western’s and/or NTI’s current expectations regarding future events, results or outcomes. Words such as “anticipate,” “assume,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “position,” “potential,” “predict,” “project,” “strategy,” “will,” “future” and similar terms and phrases are used to identify forward-looking statements. The forward-looking statements contained herein include statements related to, among other things, Western’s and NTI’s plans and expectations with respect to the merger, including the anticipated closing date, financing of the merger, composition of management and the boards of directors, the likelihood of completion of the merger including the satisfaction of closing conditions, the expiration or termination of all waiting periods and approval of the merger at a special meeting of the NTI unitholders; the anticipated effect of the acquisition on Western’s financial and operational results including for it to be immediately accretive to Western’s earnings per share; the ability of the merger to result in or to create: enhanced scale, an expanded and diversified asset base with access to advantaged crude oil, flexibility to sell NTI traditional logistics assets to Western Refining Logistics, LP (“WNRL”), improved access to capital, a simplified organizational structure that is easier for investors to understand or that will improve equity valuation, and increased operational and financial flexibility; the impact the merger will have on how Western is viewed by the capital markets and rating agencies including the potential for improved credit rating or additional trade credit from counterparties; anticipated synergies including the amounts of such synergies; the benefits of combining WNR and NTI under a single c-corp organizational structure including that this structure is a proven vehicle for operating and growing a refining platform, provides a broader pool of investor capital, offers the potential to lower the cost of capital and create a more competitive acquisition currency, and enables the efficient management of working capital and growth capital projects; the development of pipeline and storage logistics assets in the Permian, Four Corners, Bakken and Canadian regions; the ability to implement the Western wholesale distribution model at NTI; expansion of the retail footprint; the El Paso refinery expansion and anticipated throughput; continuation of the strategy to sell traditional logistics assets to WNRL and redeploy capital to fund future projects and return cash to shareholders; elimination of single asset risk; and the future financial and operating performance of the merged company. These statements are subject to the risk that the merger is not consummated at all, including due to the inability of Western or NTI to obtain all approvals necessary or the failure of other closing conditions, as well as to the general risks inherent in Western’s and NTI’s businesses and the merged company’s ability to compete in a highly competitive industry. Such expectations may or may not be realized and some expectations may be based upon assumptions or judgments that prove to be incorrect. In addition, Western’s and Northern Tier’s business and operations involve numerous risks and uncertainties, many of which are beyond Western’s and NTI’s control, which could materially affect their respective financial condition, results of operations and cash flows and those of the merged company. Additional information relating to the uncertainties affecting Western’s and NTI’s respective businesses is contained in their respective filings with the Securities and Exchange Commission (the “SEC”). The forward-looking statements are only as of the date made, and neither Western nor NTI undertake any obligation to (and each expressly disclaims any obligation to) update any forward-looking statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated events. Important Notice to Investors This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval in any jurisdiction where such an offer or solicitation is unlawful. Any such offer will be made only by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, pursuant to a registration statement filed with the SEC. The proposed acquisition will be submitted to NTI’s unitholders for their consideration. Western will file a registration statement on Form S-4 with the SEC that will include a prospectus of Western and a proxy statement of NTI. Western and NTI will also file other documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS OF NTI ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the proxy statement/prospectus and other documents containing important information about Western and NTI once such documents are filed with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Western will be available free of charge on Western’s website at www.wnr.com under the “Investor Relations” section or by contacting Western’s Investor Relations Department at (602) 286-1530. Copies of the documents filed with the SEC by NTI will be available free of charge on NTI’s website at www.northerntier.com under the “Investors” section or by contacting NTI’s Investor Relations Department at (651) 769-6700. Participants in Solicitation Relating to the Merger Western, NTI and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the unitholders of NTI in connection with the proposed transaction. Information about the directors and executive officers of Western is set forth in the Proxy Statement on Schedule 14A for Western’s 2015 annual meeting of shareholders, which was filed with the SEC on April 22, 2015. Information about the directors and executive officers of the general partner of NTI is set forth in the 2014 Annual Report on Form 10-K for NTI, which was filed with the SEC on February 27, 2015. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

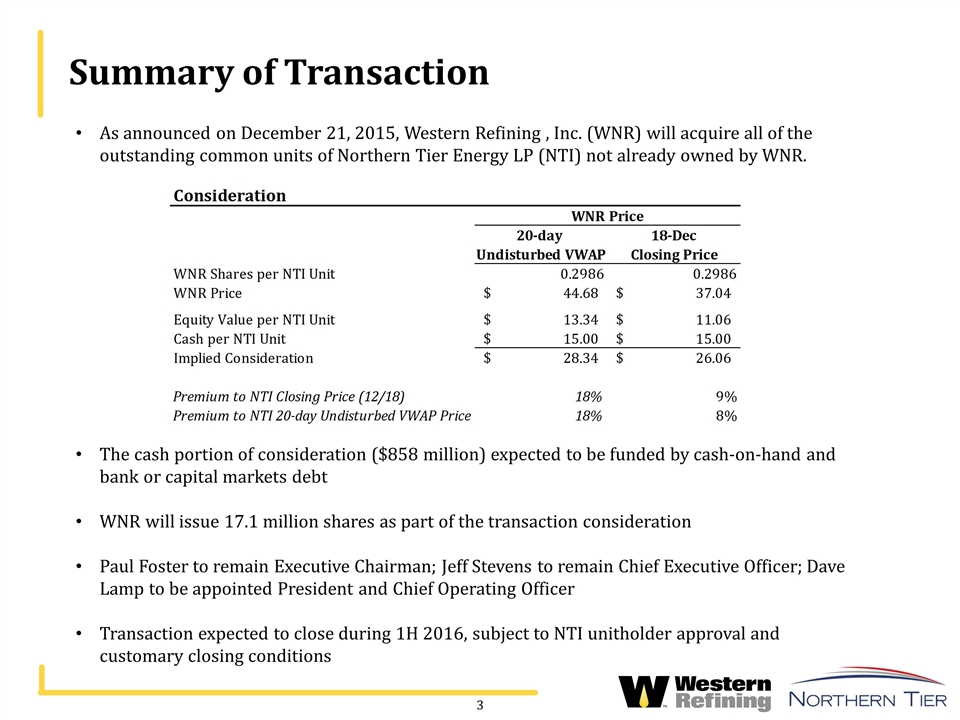

As announced on December 21, 2015, Western Refining , Inc. (WNR) will acquire all of the outstanding common units of Northern Tier Energy LP (NTI) not already owned by WNR. The cash portion of consideration ($858 million) expected to be funded by cash-on-hand and bank or capital markets debt WNR will issue 17.1 million shares as part of the transaction consideration Paul Foster to remain Executive Chairman; Jeff Stevens to remain Chief Executive Officer; Dave Lamp to be appointed President and Chief Operating Officer Transaction expected to close during 1H 2016, subject to NTI unitholder approval and customary closing conditions Summary of Transaction

Value Enhancing Combination Three top quartile refineries on a gross margin per barrel basis Direct pipeline access to advantaged Permian/Delaware, Four Corners, Bakken and Canadian crude oil Integrated wholesale and retail distribution network serving attractive geographic areas Expanded Asset Base Diversifies asset base and earnings profile Improves access to capital markets Potentially improves credit rating/ results in additional trade credit from counterparties Enhances Scale/ Diversification Proven C-corp vehicle Easier for investors to understand Improves equity valuation Simplifies Corporate Structure Expected to be immediately accretive to WNR’s earnings per share Facilitates pace of logistic asset sales from NTI to WNRL Optimizes working capital management Increases Operational/ Financial Flexibility

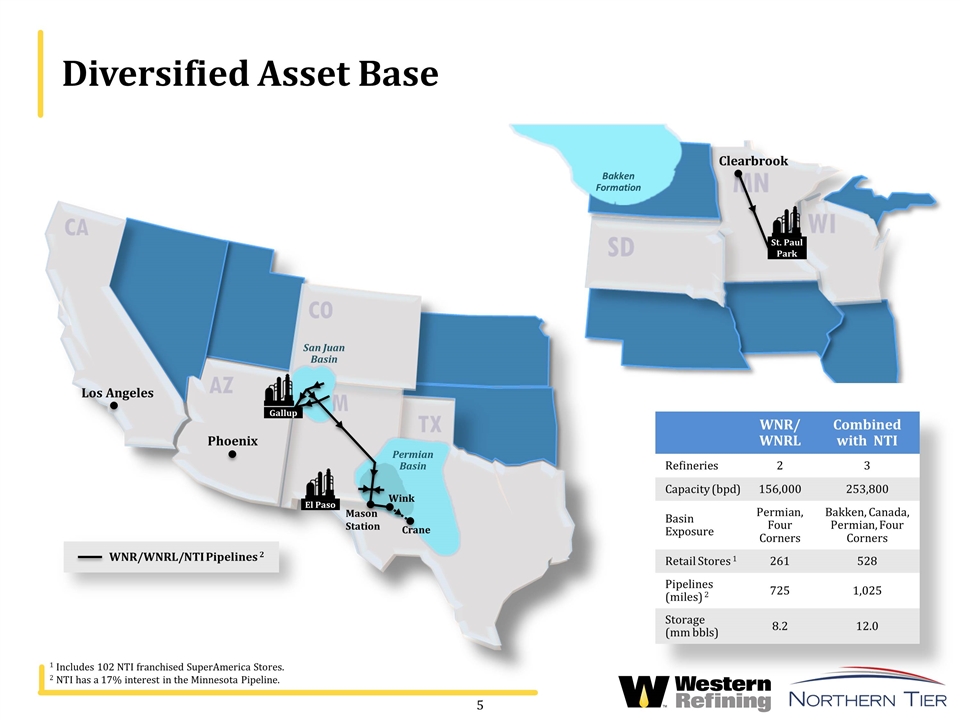

Diversified Asset Base WNR/ WNRL Combined with NTI Refineries 2 3 Capacity (bpd) 156,000 253,800 Basin Exposure Permian, Four Corners Bakken, Canada, Permian, Four Corners Retail Stores 1 261 528 Pipelines (miles) 2 725 1,025 Storage (mm bbls) 8.2 12.0 1 Includes 102 NTI franchised SuperAmerica Stores. 2 NTI has a 17% interest in the Minnesota Pipeline. Bakken Formation Permian Basin San Juan Basin El Paso Gallup St. Paul Park Clearbrook Phoenix Los Angeles WNR/WNRL/NTI Pipelines 2 Crane Mason Station Wink

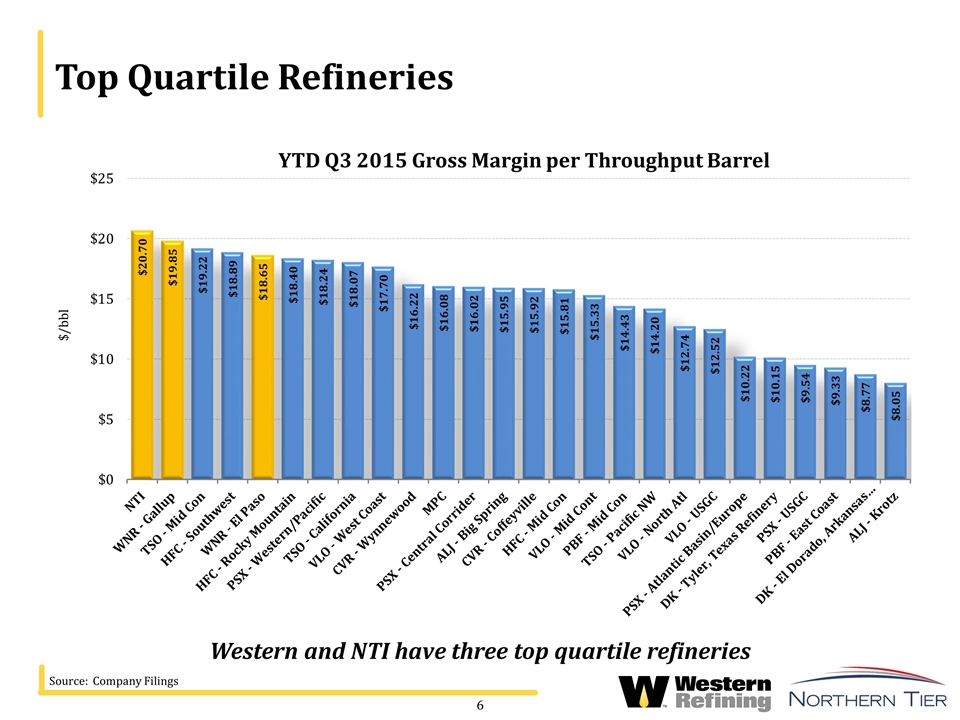

Top Quartile Refineries Source: Company Filings Western and NTI have three top quartile refineries

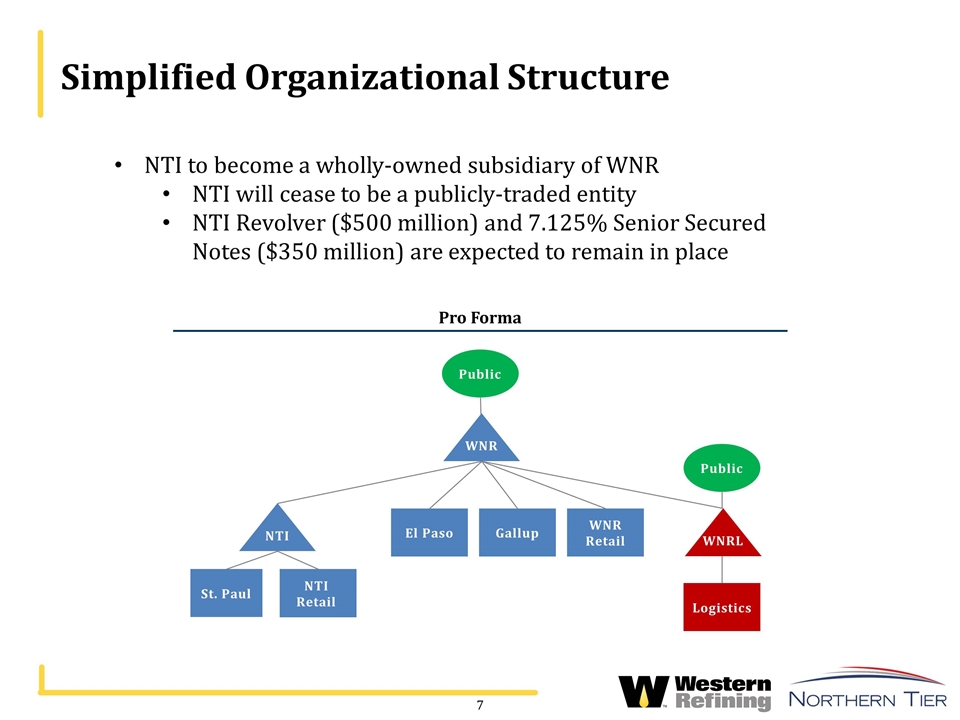

Simplified Organizational Structure NTI to become a wholly-owned subsidiary of WNR NTI will cease to be a publicly-traded entity NTI Revolver ($500 million) and 7.125% Senior Secured Notes ($350 million) are expected to remain in place Pro Forma Gallup WNR Retail WNRL St. Paul Logistics NTI Retail Public Public El Paso WNR NTI

Benefits of Combining Under a Single C-Corp Proven vehicle for operating and growing refining platform Broader pool of investor capital Expected to lower cost of capital and create a more competitive acquisition currency Improves ability to efficiently manage working capital and growth capital projects Facilitates easier-to-understand financial reporting and valuation of equity Provides more flexibility around pace of NTI logistic asset drop-downs to WNRL

Operational/ Financial Synergy Opportunities Since WNR’s original investment in NTI (November 2013), management has achieved approximately $20 million in synergies $5 million SG&A $15 million in commercial Additional opportunities exist in the following areas G&A Public company costs Insurance/ IT/ Accounting In excess of $10 million in identified synergy opportunities

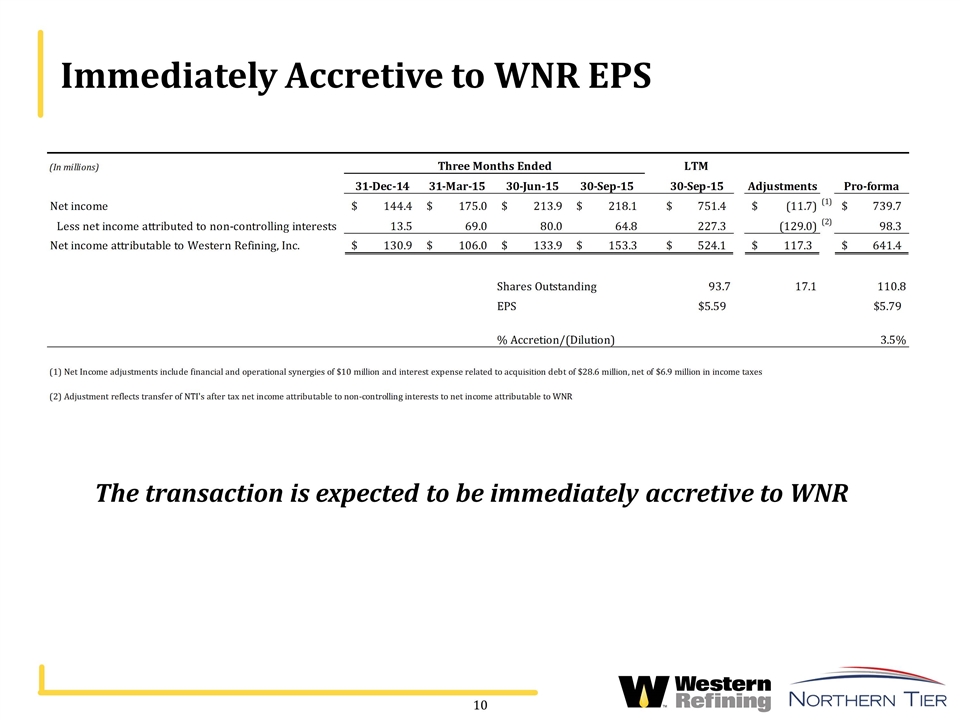

Immediately Accretive to WNR EPS The transaction is expected to be immediately accretive to WNR

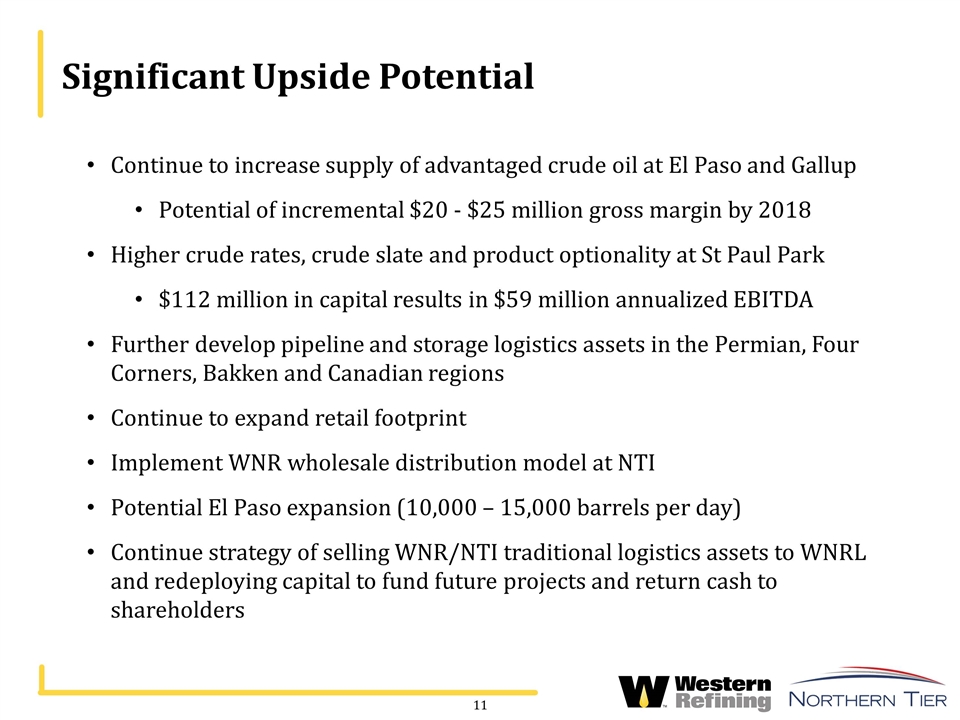

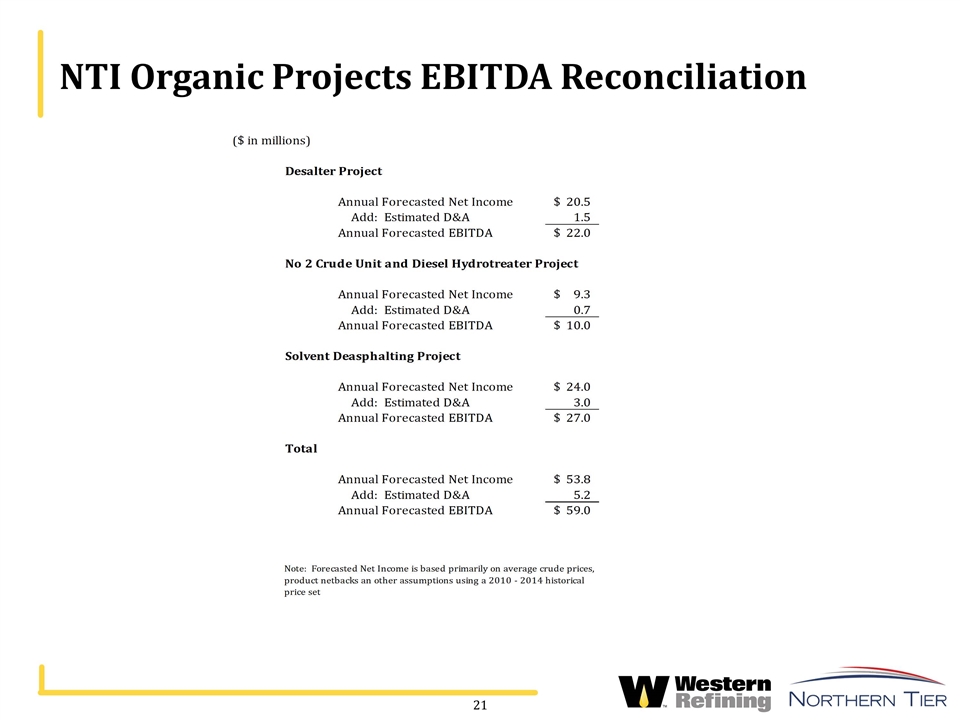

Significant Upside Potential Continue to increase supply of advantaged crude oil at El Paso and Gallup Potential of incremental $20 - $25 million gross margin by 2018 Higher crude rates, crude slate and product optionality at St Paul Park $112 million in capital results in $59 million annualized EBITDA Further develop pipeline and storage logistics assets in the Permian, Four Corners, Bakken and Canadian regions Continue to expand retail footprint Implement WNR wholesale distribution model at NTI Potential El Paso expansion (10,000 – 15,000 barrels per day) Continue strategy of selling WNR/NTI traditional logistics assets to WNRL and redeploying capital to fund future projects and return cash to shareholders

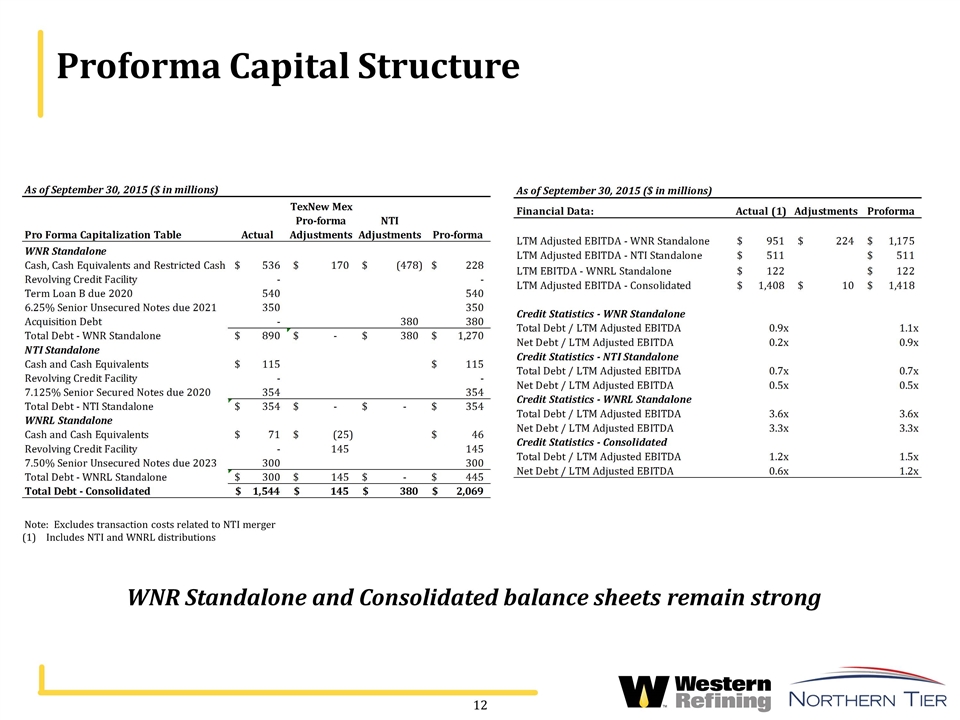

Proforma Capital Structure WNR Standalone and Consolidated balance sheets remain strong Note: Excludes transaction costs related to NTI merger Includes NTI and WNRL distributions

Governance Highlights Paul Foster to remain Executive Chairman Jeff Stevens to remain Chief Executive Officer Dave Lamp to be named President and Chief Operating Officer of Western WNR Board of Directors is not impacted; composition of NTI GP Board to change

Summary Combines three of the most profitable independent refineries (on a gross margin per barrel basis) 254,000 barrels per day crude oil capacity Diversified asset base with direct pipeline access to advantaged crude oil in the Permian/ Delaware, Four Corners, Bakken and Western Canada areas 528 retail outlets in growing regions; represents approximately 50,000 barrels per day of refined product Integrated wholesale distribution of refined product to 3,300 customers in the Southwest and 200 customers in the Upper Midwest Eliminates single asset risk In excess of $10 million in identified financial and operational synergies Significant upside growth potential Expected to be immediately accretive to WNR EPS; continued conservative balance sheet Proven and experienced leadership team

Appendix

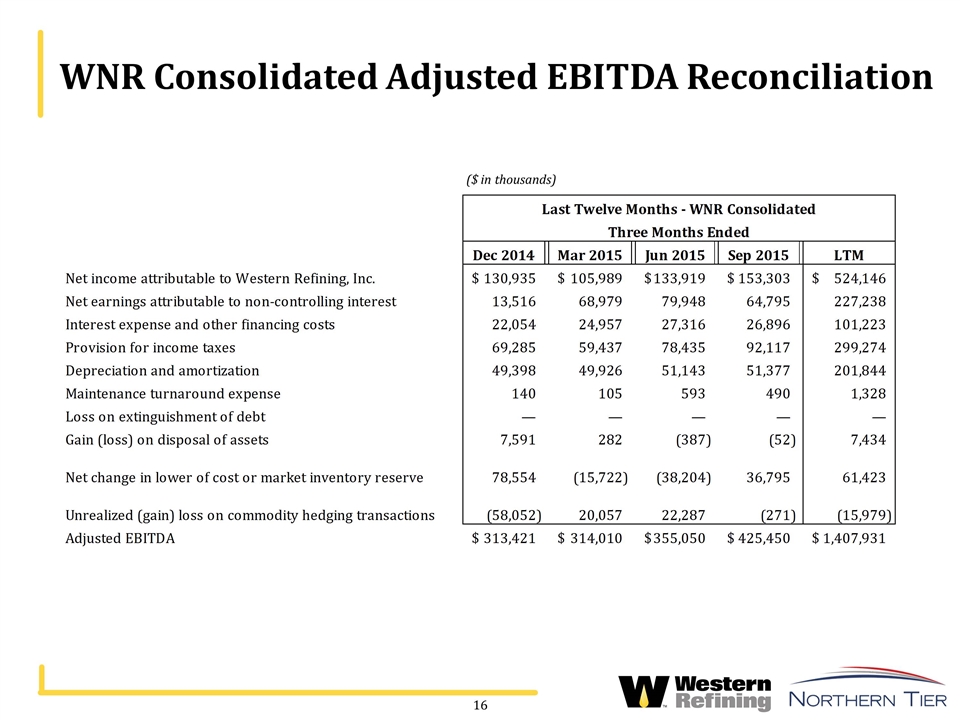

WNR Consolidated Adjusted EBITDA Reconciliation ($ in thousands)

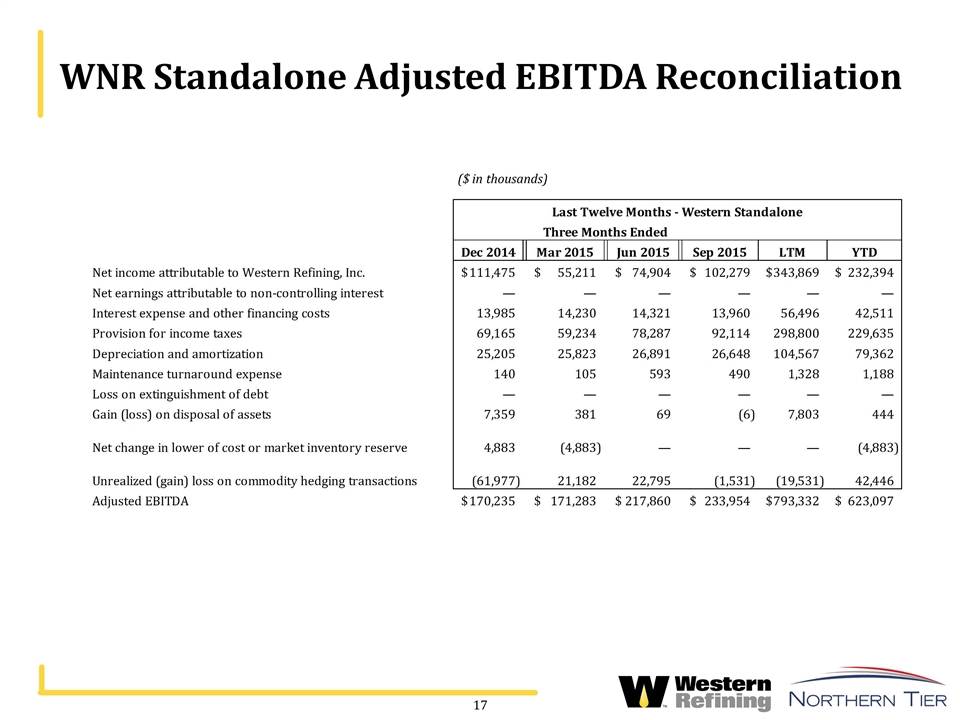

WNR Standalone Adjusted EBITDA Reconciliation ($ in thousands)

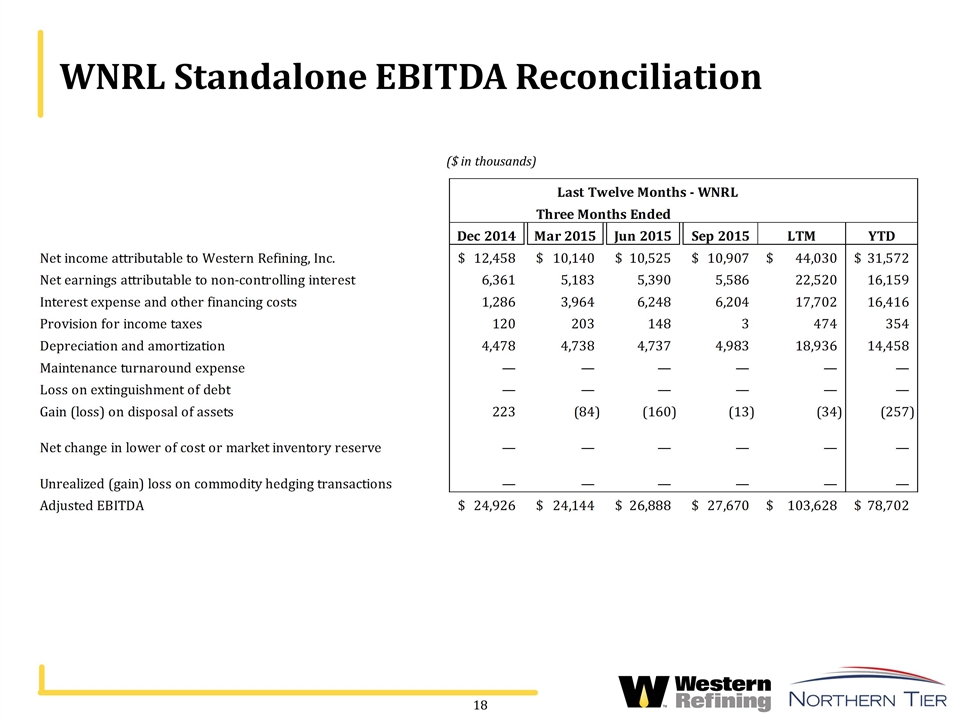

WNRL Standalone EBITDA Reconciliation ($ in thousands)

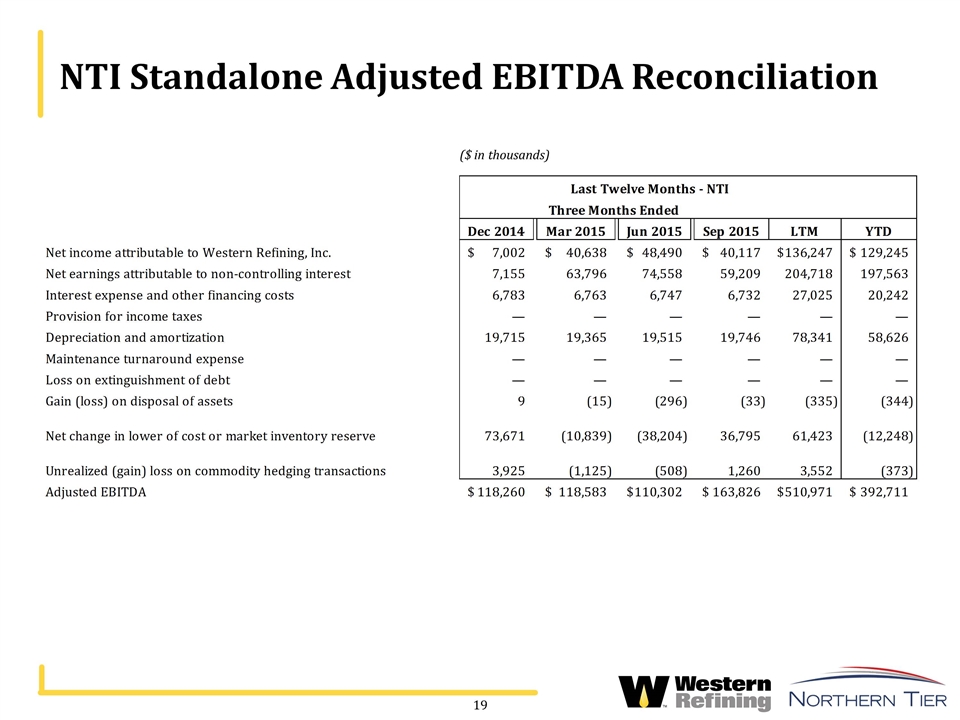

NTI Standalone Adjusted EBITDA Reconciliation ($ in thousands)

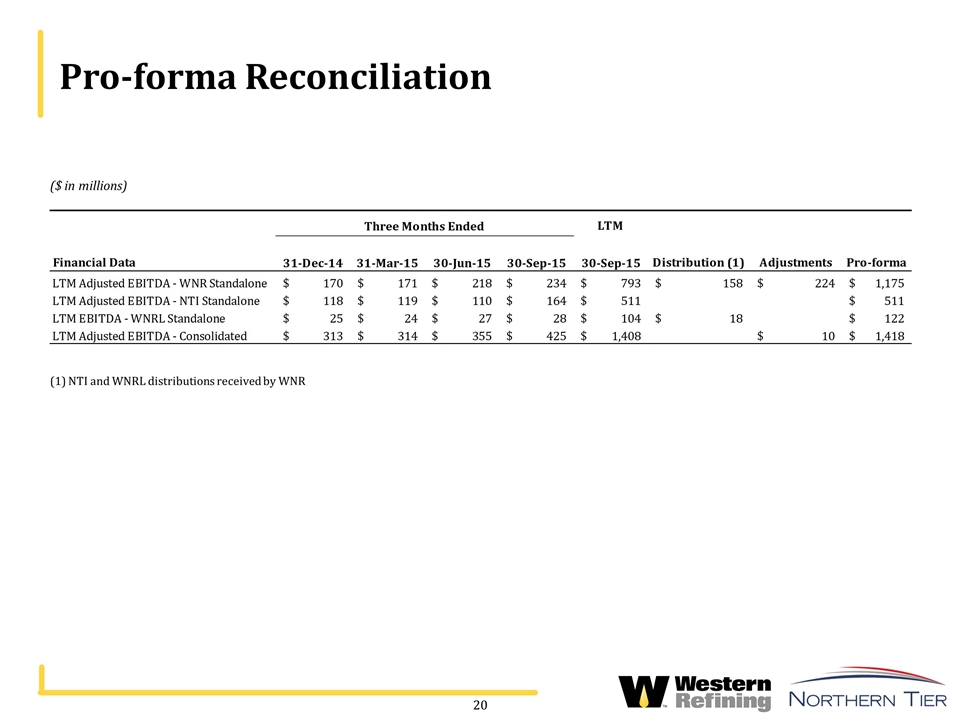

Pro-forma Reconciliation ($ in millions) (1) NTI and WNRL distributions received by WNR

NTI Organic Projects EBITDA Reconciliation

WNR/NTI Adjusted EBITDA The tables on the previous pages reconcile net income to Adjusted EBITDA for the periods presented. Adjusted EBITDA represents earnings before interest expense and other financing costs, provision for income taxes, depreciation, amortization, maintenance turnaround expense, and certain other non-cash income and expense items. However, Adjusted EBITDA is not a recognized measurement under United States generally accepted accounting principles ("GAAP"). Our management believes that the presentation of Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. In addition, our management believes that Adjusted EBITDA is useful in evaluating our operating performance compared to that of other companies in our industry because the calculation of Adjusted EBITDA generally eliminates the effects of financings, income taxes, the accounting effects of significant turnaround activities (that many of our competitors capitalize and thereby exclude from their measures of EBITDA), and certain non-cash charges that are items that may vary for different companies for reasons unrelated to overall operating performance. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • Adjusted EBITDA does not reflect our cash expenditures or future requirements for significant turnaround activities, capital expenditures, or contractual commitments; • Adjusted EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt; • Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and • Adjusted EBITDA, as we calculate it, differs from the WNRL EBITDA calculation and may differ from the Adjusted EBITDA or EBITDA calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. Because of these limitations, Adjusted EBITDA should not be considered a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally.

WNRL EBITDA We define WNRL EBITDA as earnings before interest expense and other financing costs, provision for income taxes and depreciation and amortization. EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt; EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and EBITDA, as we calculate it, may differ from the EBITDA calculations of our affiliates or other companies in our industry, thereby limiting its usefulness as a comparative measure. EBITDA is used as supplemental financial measures by management and by external users of our financial statements, such as investors and commercial banks, to assess: our operating performance as compared to those of other companies in the midstream energy industry, without regard to financial methods, historical cost basis or capital structure; the ability of our assets to generate sufficient cash to make distributions to our unitholders; our ability to incur and service debt and fund capital expenditures; and the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. We believe that the presentation of this non-GAAP measure provides useful information to investors in assessing our financial condition and results of operations. The GAAP measure most directly comparable to EBITDA is net income attributable to limited partners. This non-GAAP measure should not be considered as an alternative to net income or any other measure of financial performance presented in accordance with GAAP. EBITDA excludes some, but not all, items that affect net income attributable to limited partners. This non-GAAP measure may vary from those of other companies. As a result, EBITDA as presented herein may not be comparable to similarly titled measures of other companies.