Filed by Western Refining, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Northern Tier Energy LP

Commission File No.: 001-35612

On January 5, 2016, Western Refining, Inc. made available on its website the following presentation, which it will present later that day at the Wolfe Research 2016 Oil and Gas Refiners 1x1 Conference. This same presentation will be presented by Western Refining, Inc. at the Goldman Sachs Global Energy Conference 2016 on January 7, 2016.

Filed by Western Refining, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Northern Tier Energy LP

Commission File No.: 001-35612

On January 5, 2015, Western Refining, Inc. made the following presentation, which it presented

later that day at the Wolfe Research Conference, available on its website.

Wolfe Research

2016 Oil and Gas Refiners

1 x 1 Conference

January 5, 2016

Cautionary Statements

This presentation includes “forward-looking statements” by Western Refining, Inc. (“Western” or “WNR”) which are protected as forward-looking statements under the Private Securities Litigation Reform Act of 1995. The forward-looking statements reflect Western’s current expectations regarding future events, results or outcomes. Words such as “anticipate,” “assume,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “position,” “potential,” “predict,” “project,” “strategy,” “will,” “future” and similar terms and phrases are used to identify forward-looking statements. The forward-looking statements contained herein include statements related to, among other things, Western’s and Northern Tier Energy LP’s (“NTI”) plans and expectations with respect to the merger, including the anticipated closing date, financing of the merger, the likelihood of completion of the merger including the satisfaction of closing conditions, the expiration or termination of all waiting periods and approval of the merger at a special meeting of the NTI unitholders; the anticipated effect of the merger on Western’s financial and operational results including the merger resulting in a simplified organizational structure, diversified asset base with pipeline access to advantaged crude oil combined with strong refined product regions, financial and operational synergies, easier-to-understand financial reporting and valuation of equity, flexibility for NTI logistics assets drop-downs to Western Refining Logistics, LP (“WNRL”), lower cost of capital and more competitive acquisition currency, and accretion to Western’s earnings per share; the future financial and operating performance of the merged company; growth opportunities; gross margin improvement at the El Paso refinery including the crude oil substitution process and its expected additional gross margin, the ability of this process to result in better economics and improved gas/diesel yield, and the ability of Four Corners crude oil to provide further economics and mitigate exposure to the Midland/Cushing crude oil differential; the El Paso refinery crude oil slate; St. Paul Park organic projects such as the replacement of the crude unit desalters, modification to the crude unit/hydrotreater and solvent deasphalter and the anticipated capital expenditure and estimated EBITDA for such projects; expansion of the El Paso refinery including its anticipated timing, expected increase to throughput capacity and the drivers for such project; proposed pipeline from Wink, Texas to Crane, Texas including its anticipated mileage, capacity, cost for 2016 through 2017 and its ability to provide an outlet to move West Texas/New Mexico crude oil to the U.S. Gulf Coast; potential WNR and NTI logistics asset sales to WNRL including the estimated annual EBITDA from such sales which may include economics associated with crude oil throughput on the TexNew Mex pipeline above 13,000 bpd, Bobcat crude oil pipeline, proposed pipeline from Wink, Texas to Crane, Texas, Jal/Wingate/Clearbrook crude oil and liquefied petroleum gas (“LPG”) storage and rail logistics; WNR’s ability to continue to grow dividends and return cash to shareholders; and WNR’s capital allocation discipline. These statements are subject to the risk that the merger is not consummated at all, including due to the inability of Western or NTI to obtain all approvals necessary or the failure of other closing conditions, as well as to the general risks inherent in Western’s and NTI’s businesses and the merged company’s ability to compete in a highly competitive industry. Such expectations may or may not be realized and some expectations may be based upon assumptions or judgments that prove to be incorrect. In addition, Western’s business and operations involve numerous risks and uncertainties, many of which are beyond Western’s control, which could materially affect its financial condition, results of operations and cash flows and those of the merged company. Additional information relating to the uncertainties affecting Western’s businesses is contained in its filings with the Securities and Exchange Commission (the “SEC”). The forward-looking statements are only as of the date made, and Western does not undertake any obligation to (and each expressly disclaims any obligation to) update any forward-looking statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated events.

Important Notice to Investors

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval in any jurisdiction where such an offer or solicitation is unlawful. Any such offer will be made only by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, pursuant to a registration statement filed with the SEC. The proposed acquisition will be submitted to NTI’s unitholders for their consideration. Western will file a registration statement on Form S-4 with the SEC that will include a prospectus of Western and a proxy statement of NTI. Western and NTI will also file other documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS OF NTI ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the proxy statement/prospectus and other documents containing important information about Western and NTI once such documents are filed with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Western will be available free of charge on Western’s website at www.wnr.com under the “Investor Relations” section or by contacting Western’s Investor Relations Department at (602) 286-1530. Copies of the documents filed with the SEC by NTI will be available free of charge on NTI’s website at www.northerntier.com under the “Investors” section or by contacting NTI’s Investor Relations Department at (651) 769-6700.

Participants in Solicitation Relating to the Merger

Western, NTI and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the unitholders of NTI in connection with the proposed transaction. Information about the directors and executive officers of Western is set forth in the Proxy Statement on Schedule 14A for Western’s 2015 annual meeting of shareholders, which was filed with the SEC on April 22, 2015. Information about the directors and executive officers of the general partner of NTI is set forth in the 2014 Annual Report on Form 10-K for NTI, which was filed with the SEC on February 27, 2015. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

2

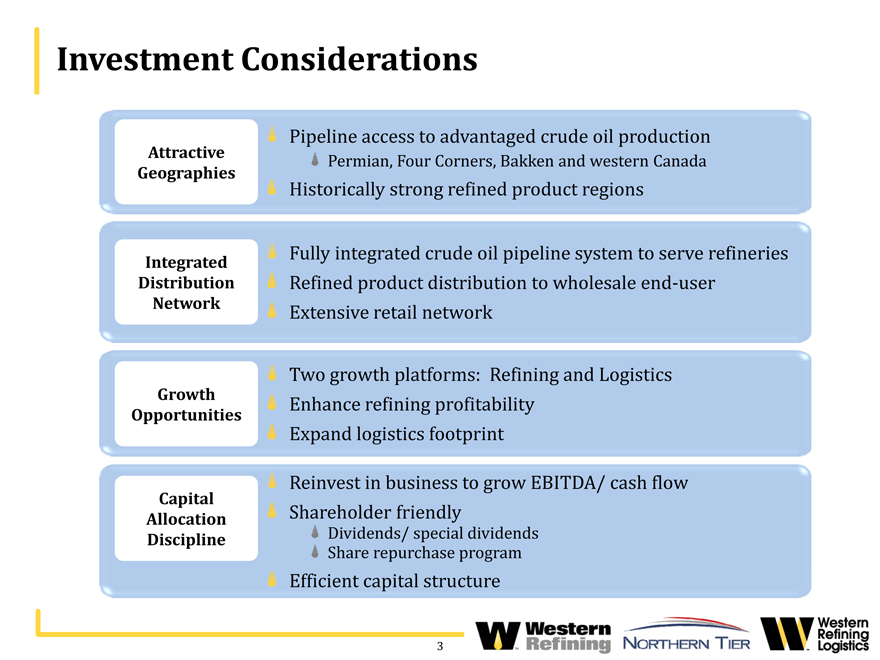

Investment Considerations

Pipeline access to advantaged crude oil production

Permian, Four Corners, Bakken and western Canada

Historically strong refined product regions

Attractive

Geographies

Fully integrated crude oil pipeline system to serve refineries

Refined product distribution to wholesale end-user

Integrated

Distribution

Extensive retail network

Network

Two platforms: Refining and Logistics

growth Enhance refining profitability

Expand logistics footprint

Growth

Opportunities

Reinvest in business to grow EBITDA/ cash flow

Shareholder friendly

Dividends/ special dividends

Share repurchase program

Capital

Allocation

Discipline

Efficient capital structure

3

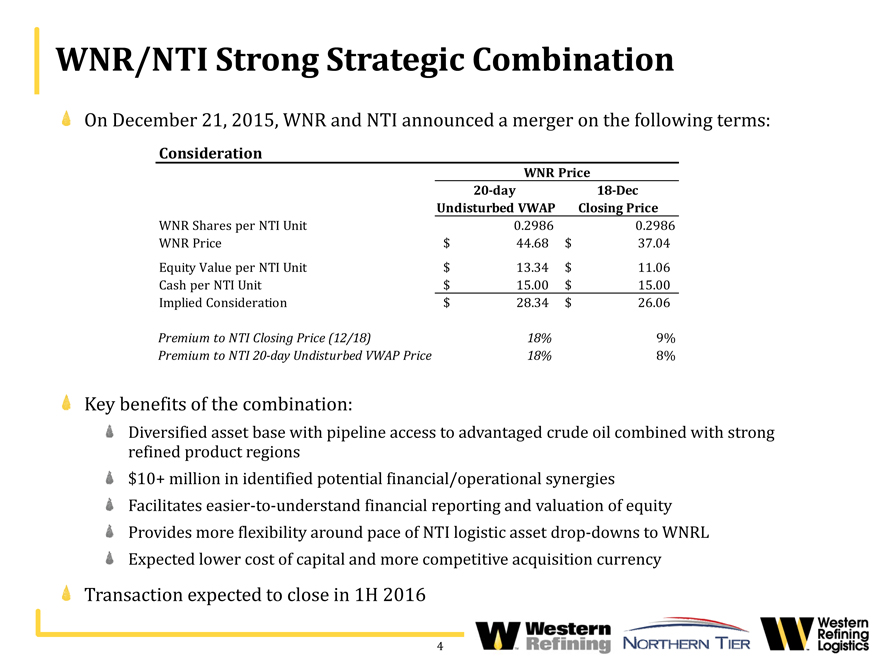

WNR/NTI Strong Strategic Combination

On December 21, 2015, WNR and NTI announced a merger on the following terms:

Consideration

20-day 18-Dec

WNR Price

Undisturbed VWAP Closing Price

WNR Shares per NTI Unit 0.2986 0.2986

WNR Price $ 44.68 $ 37.04

Equity Value per NTI Unit $ 13.34 $ 11.06

Cash per NTI Unit $ 15.00 $ 15.00

Implied Consideration $ 28.34 $ 26.06

Premium to NTI Closing Price (12/18) 18% 9%

Premium to NTI 20-day Undisturbed VWAP Price 18% 8%

Key benefits of the combination:

Diversified asset base with pipeline access to advantaged crude oil combined with strong

refined product regions

$10+ million in identified potential financial/operational synergies

Facilitates easier-to-understand financial reporting and valuation of equity

Provides more flexibility around pace of NTI logistic asset drop?downs to WNRL

Expected lower cost of capital and more competitive acquisition currency

Transaction expected to close in 1H 2016

4

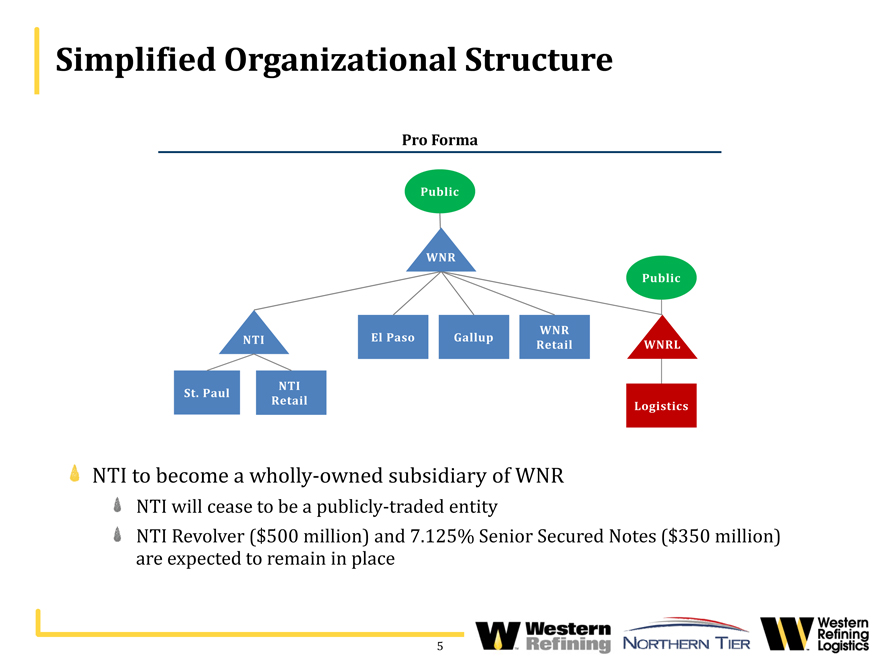

Simplified Organizational Structure

ProForma

Public

WNR

Public

WNR

NTI ElPaso Gallup WNR Retail WNRL

St.Paul NTI

Retail Logistics

NTI to become a wholly-owned subsidiary of WNR

NTI will cease to be a publicly-traded entity

NTI Revolver ($500 million) and 7.125% Senior Secured Notes ($350 million) are expected to remain in place

5

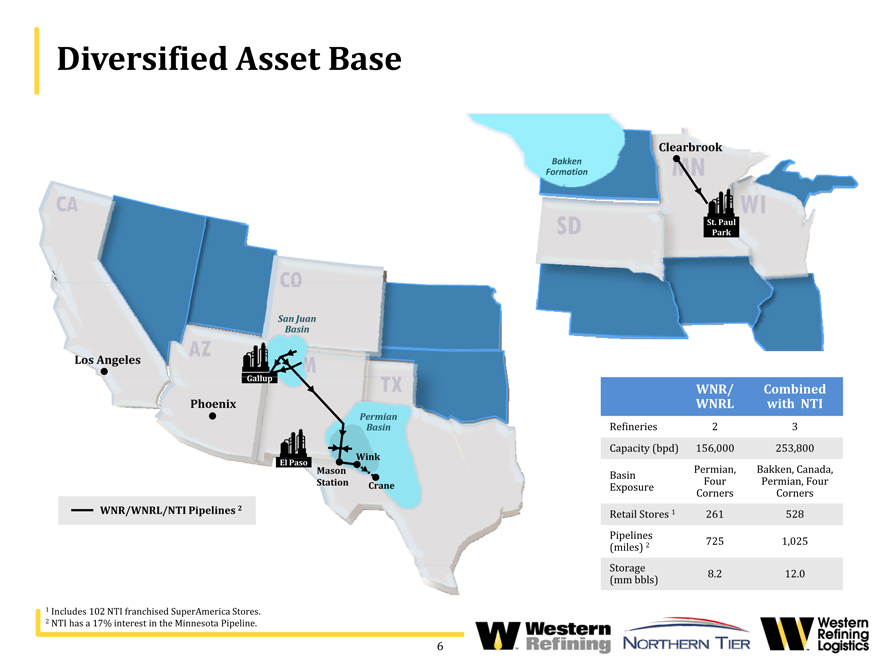

Diversified Asset Base

Clearbrook

Bakken

Formation

St.Paul

Park

San Juan

Basin

Los Angeles

Gallup

Phoenix

Permian

Basin

Wink

ElPaso

Mason

Station Crane

WNR/WNRL/NTI Pipelines2

WNR/ Combined

WNRL with NTI

Refineries 2 3

Capacity(bpd) 156,000 253,800

Basin Permian, Bakken,Canada,

Four Permian,Four

Exposure Corners Corners

Retail Stores1 261 528

Pipelines 725 1,025

(miles)2

Storage

(mmbbls) 8.2 12.0

1 Includes 102 NTI franchised SuperAmerica Stores.

2 NTI has a 17% interest in the Minnesota Pipeline.

6

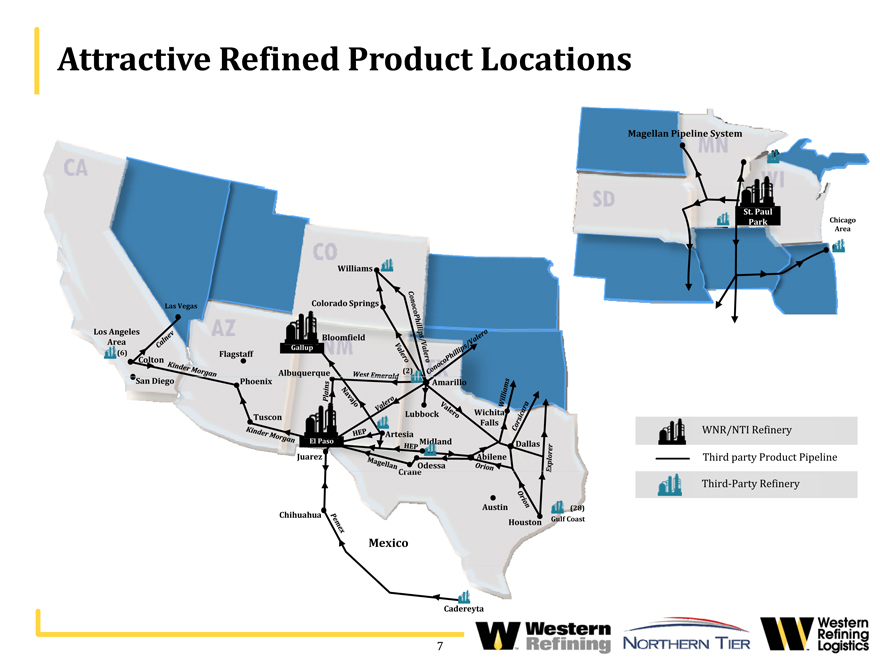

Attractive Refined Product Locations

Williams

LasVegas Colorado Springs

Los Angeles

Bloomfield

Area

Gallup

(6) Flagstaff

Colton

Albuquerque (2)

San Diego Phoenix Amarillo

Lubbock Wichita

Tuscon

Falls

El Paso Artesia

Midland Dallas

Juarez Abilene

Odessa

Chihuahua Austin (28)

Houston Gulf Coast

Mexico

Cadereyta

Magellan Pipeline System

St.Paul

Park Chicago Area

WNR/NTI Refinery Third party Product Pipeline Third-Party Refinery

7

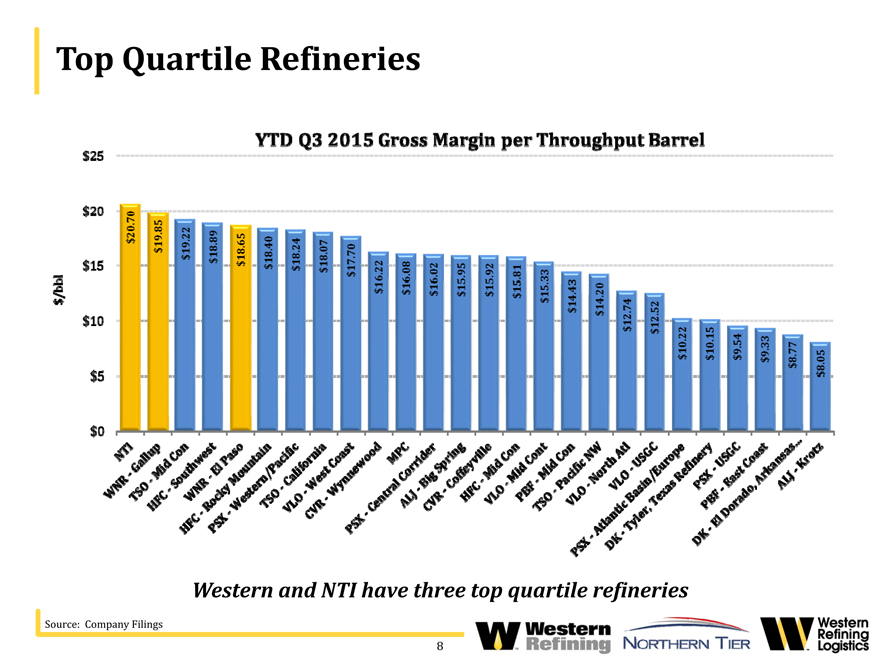

Top Quartile Refineries

Source: Company Filings

Western and NTI have three top quartile refineries

8 |

|

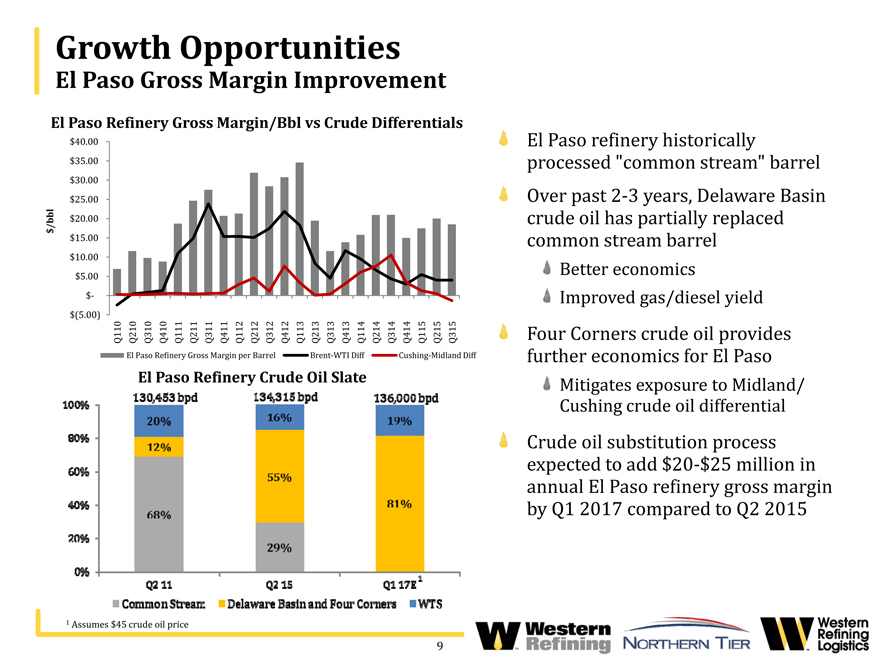

Growth Opportunities

El Paso Gross Margin Improvement

El Paso refinery historically processed “common stream” barrel

El Paso Refinery Gross Margin/Bbl vs Crude Differentials

$30.00

$35.00

$40.00

Over past 2-3 years, Delaware Basin

crude oil has partially replaced

common stream barrel

Better economics $5.00

$10.00

$15.00

$20.00

$25.00

$/bbl

Improved gas/diesel yield

Four Corners crude oil provides

further economics for El Paso

El Paso Refinery Crude Oil Slate

$(5.00)

$-

Q110

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

Q312

Q412

Q113

Q213

Q313

Q413

Q114

Q214

Q314

Q414

Q115

Q215

Q315

El Paso Refinery Gross Margin per Barrel Brent-WTI Diff Cushing-Midland Diff

Mitigates exposure to Midland/

Cushing crude oil differential

Crude oil substitution process

expected to add $20-$25 million in annual El Paso refinery gross margin by Q1 2017 compared to Q2 2015

1 Assumes $45 crude oil price

9

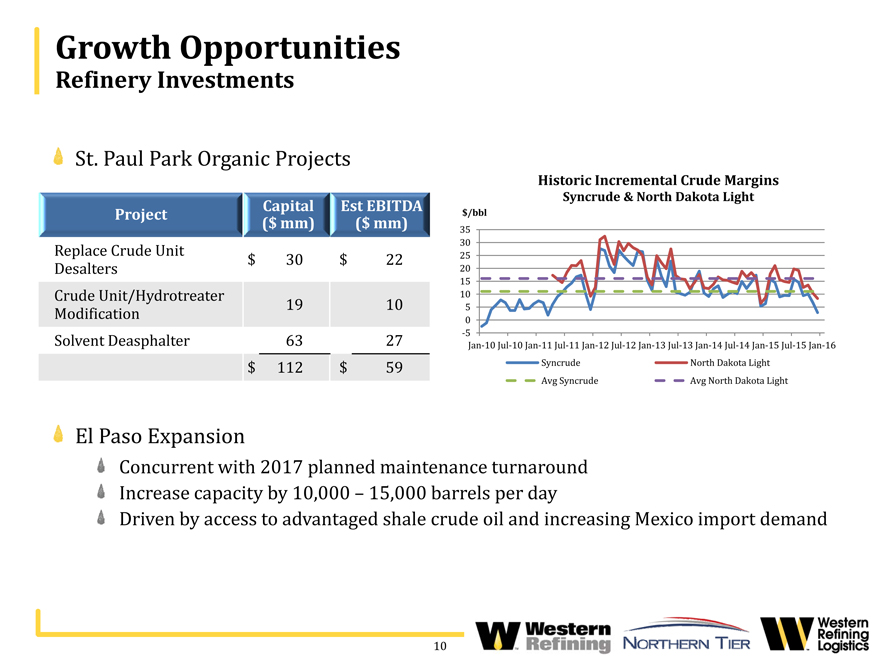

Growth Opportunities

Refinery Investments

St. Paul Park Organic Projects

Historic Incremental Crude Margins

Syncrude & North Dakota Light

Capital Est EBITDA

Project($ mm)($ mm)

Replace Crude Unit

Desalters $ 30 $ 22

CrudeUnit/Hydrotreater

Modification 19 10

Solvent Deasphalter 63 27

$ 112 $ 59

$/bbl

35

30

25

20

15

10

5

0

-5

Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16

Syncrude North Dakota Light

Avg Syncrude Avg North Dakota Light

10

El Paso Expansion

Concurrent with 2017 planned maintenance turnaround

Increase capacity by 10,000 – 15,000 barrels per day

Driven by access to advantaged shale crude oil and increasing Mexico import demand

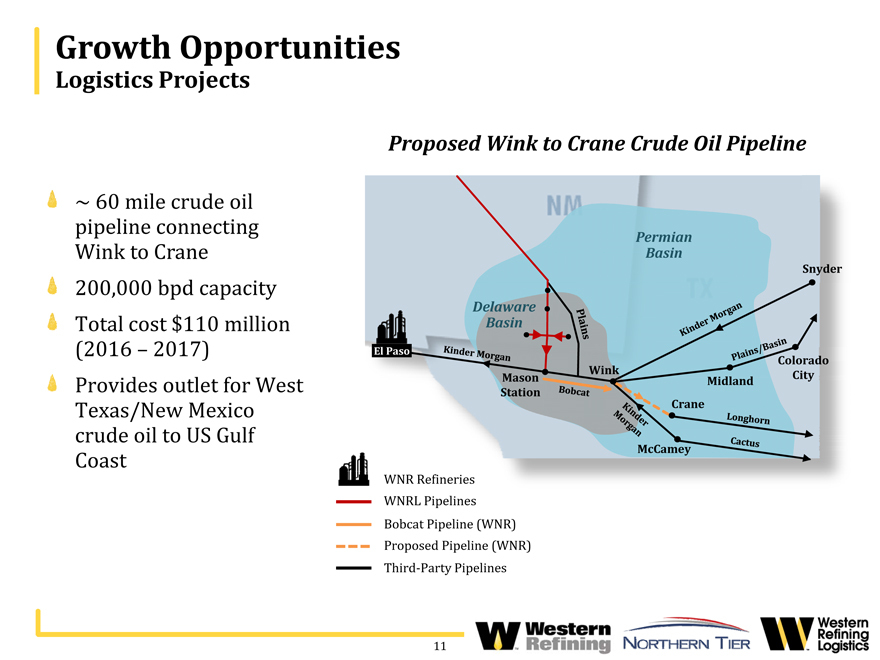

Growth Opportunities

Logistics Projects

Proposed Wink to Crane Crude Oil Pipeline

~ 60 mile crude oil pipeline connecting Wink to Crane

200,000 bpd capacity

Total cost $110 million (2016 – 2017)

Provides outlet for West Texas/New Mexico crude oil to US Gulf Coast

Permian

Basin

Snyder

Delaware

Basin

El Paso

Colorado City

Wink

Midland

Mason Station

Crane

McCamey

WNR Refineries

WNRL Pipelines

Bobcat Pipeline (WNR)

Proposed Pipeline (WNR)

Third-Party Pipelines

11

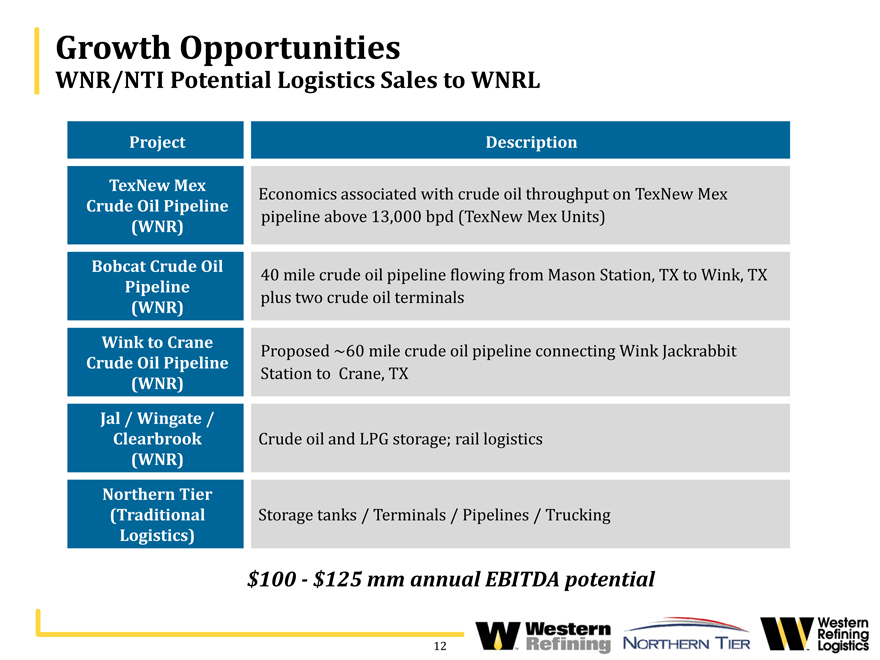

Growth Opportunities

WNR/NTI Potential Logistics Sales to WNRL

Project

Description

TexNew Mex

Crude Oil Pipeline

(WNR)

Economics associated with crude oil throughput on TexNew Mex pipeline above 13,000 bpd (TexNew Mex Units)

Bobcat Crude Oil

Pipeline

(WNR)

40 mile crude oil pipeline flowing from Mason Station, TX to Wink, TX

plus two crude oil terminals

Wink to Crane

Crude Oil Pipeline

(WNR)

Proposed ~60 mile crude oil pipeline connecting Wink Jackrabbit

Station to Crane, TX

Jal / Wingate / Clearbrook (WNR)

Crude oil and LPG storage; rail logistics

Northern Tier (Traditional Logistics)

Storage tanks / Terminals / Pipelines / Trucking

$100 - $125 mm annual EBITDA potential

12

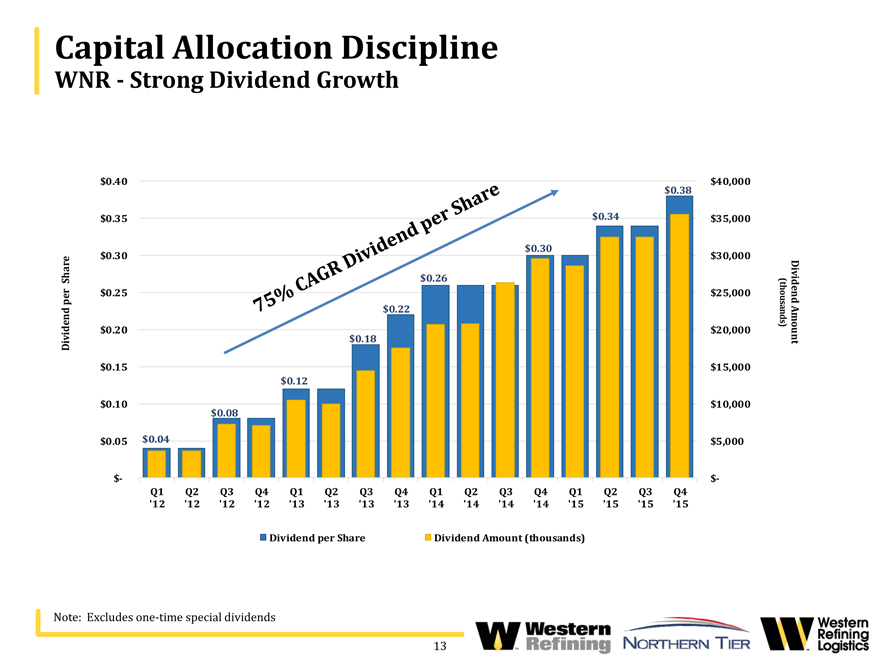

Capital Allocation Discipline

WNR ? Strong Dividend Growth

$0 38

$0.40 $40,000

$0.26

$0.30

$0.34

0.38

$30,000

$35,000

$0.30

$0.35

Divid

(t

Share

$

$0.18

$0.22

$15,000

$20,000

$25,000

$0.15

$0.20

$0.25

dend Amount

thousands)

Dividend per S

$0.04

$0.08

0.12

$5,000

$10,000

$0.05

$0.10

$? $?

Q1

‘12

Q2

‘12

Q3

‘12

Q4

‘12

Q1

‘13

Q2

‘13

Q3

‘13

Q4

‘13

Q1

‘14

Q2

‘14

Q3

‘14

Q4

‘14

Q1

‘15

Q2

‘15

Q3

‘15

Q4

‘15

Dividend per Share Dividend Amount (thousands)

13

Note: Excludes one?time special dividends

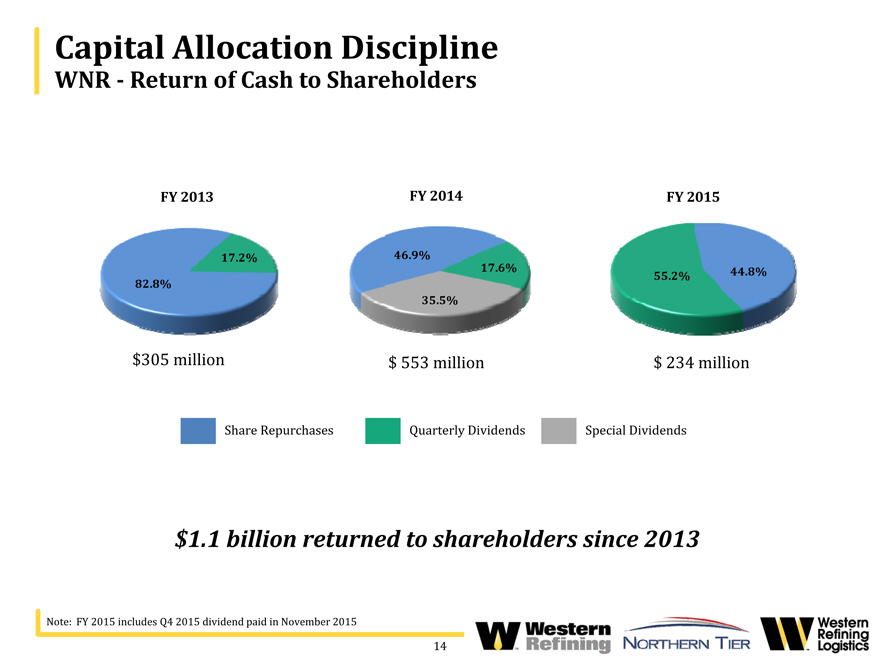

Capital Allocation Discipline

WNR ? Return of Cash to Shareholders

17.2%

82 8%

FY 2013

55.2% 44.8%

FY 2015

17.6%

46.9%

FY 2014

82.8%

35.5%

$305 million $ 553 million $ 234 million

Share Repurchases Quarterly Dividends Special Dividends

$1.1 billion returned to shareholders since 2013

14

Note: FY 2015 includes Q4 2015 dividend paid in November 2015

Investment Considerations

Attractive

Geographies

Integrated

Distribution

Network

Growth

Opportunities

Capital

Allocation

Discipline

Pipeline access to advantaged crude oil production

Permian, Four Corners, Bakken and western Canada

Historically strong refined product regions

Fully integrated crude oil pipeline system to serve refineries Refined product distribution to wholesale end-user Extensive retail network

Two growth platforms: Refining and Logistics Enhance refining profitability Expand logistics footprint Reinvest in business to grow EBITDA/ cash flow Shareholder friendly

Dividends/ special dividends Share repurchase program

Efficient capital structure

15

Appendix

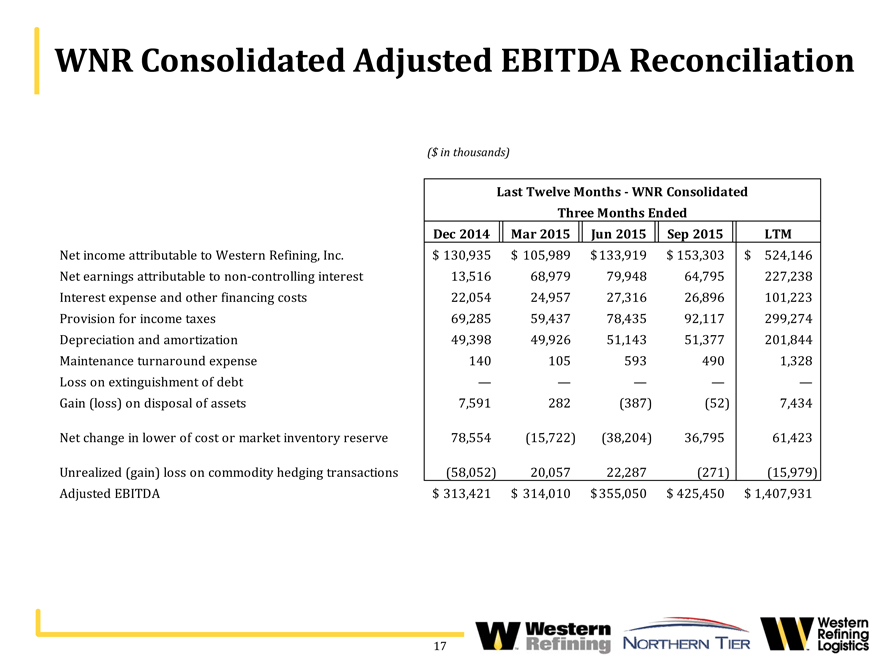

WNR Consolidated Adjusted EBITDA Reconciliation

($ in thousands)

Dec 2014 Mar 2015 Jun 2015 Sep 2015 LTM

Net income attributable to Western Refining, Inc. $130,935 $105,989 $133,919 $153,303 $524,146

Net earnings attributable to non-controlling interest 13,516 68,979 79,948 64,795 227,238

Last Twelve Months - WNR Consolidated

Three Months Ended

Interest expense and other financing costs 22,054 24,957 27,316 26,896 101,223

Provision for income taxes 69,285 59,437 78,435 92,117 299,274

Depreciation and amortization 49,398 49,926 51,143 51,377 201,844

Maintenance turnaround expense 140 105 593 490 1,328

Loss on extinguishment of debt — — — — —

Gain (loss) on disposal of assets 7,591 282 (387) (52) 7,434

Net change in lower of cost or market inventory reserve 78,554 (15,722) (38,204) 36,795 61,423

Unrealized (gain) loss on commodity hedging transactions (58,052) 20,057 22,287 (271) (15,979)

Adjusted EBITDA $313,421 $314,010 $355,050 $425,450 $1,407,931

17

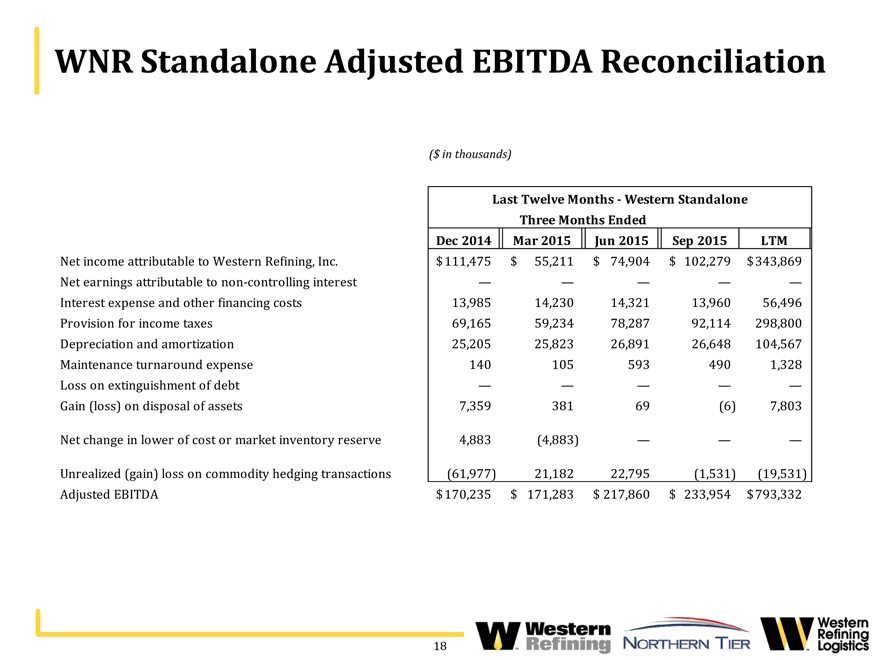

WNR Standalone Adjusted EBITDA Reconciliation

($ in thousands)

Dec 2014 Mar 2015 Jun 2015 Sep 2015 LTM

Net income attributable to Western Refining, Inc. $111,475 $55,211 $74,904 $102,279 $343,869

Net earnings attributable to non-controlling interest

Last Twelve Months - Western Standalone

Three Months Ended

Interest expense and other financing costs 13,985 14,230 14,321 13,960 56,496

Provision for income taxes 69,165 59,234 78,287 92,114 298,800

Depreciation and amortization 25,205 25,823 26,891 26,648 104,567

Maintenance turnaround expense 140 105 593 490 1,328

Loss on extinguishment of debt — — — — —

Gain (loss) on disposal of assets 7,359 381 69 (6) 7,803

Net change in lower of cost or market inventory reserve 4,883 (4,883) — — —

Unrealized (gain) loss on commodity hedging transactions (61,977) 21,182 22,795 (1,531) (19,531)

Adjusted EBITDA $170,235 $171,283 $217,860 $233,954 $793,332

18

WNRL Standalone EBITDA Reconciliation

($ in thousands)

Dec 2014 Mar 2015 Jun 2015 Sep 2015 LTM

Net income attributable to Western Refining, Inc. $ 12,458 $ 10,140 $ 10,525 $ 10,907 $ 44,030

Last Twelve Months - WNRL

Three Months Ended

Net earnings attributable to non-controlling interest 6,361 5,183 5,390 5,586 22,520

Interest expense and other financing costs 1,286 3,964 6,248 6,204 17,702

Provision for income taxes 120 203 148 3 474

Depreciation and amortization 4,478 4,738 4,737 4,983 18,936

Maintenance turnaround expense — — — — —

Loss on extinguishment of debt — — — — —

Gain (loss) on disposal of assets 223 (84) (160) (13) (34)

Net change in lower of cost or market inventory reserve — — — — —

Unrealized (gain) loss on commodity hedging transactions — — — — —

Adjusted EBITDA $ 24,926 $ 24,144 $ 26,888 $ 27,670 $ 103,628

19

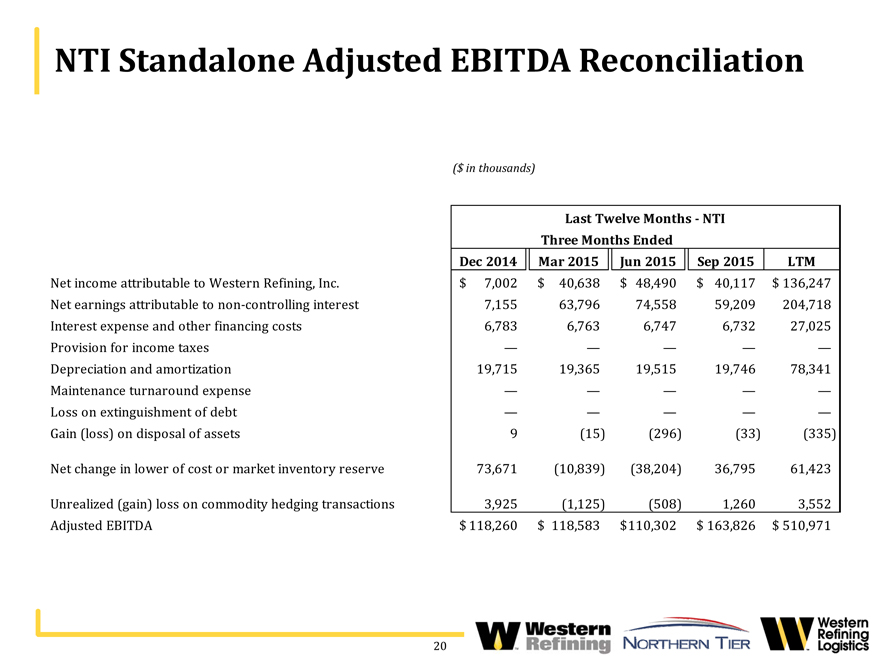

NTI Standalone Adjusted EBITDA Reconciliation

($ in thousands)

Last Twelve Months - NTI

Three Months Ended

Dec 2014 Mar 2015 Jun 2015 Sep 2015 LTM

Net income attributable to Western Refining, Inc. $ 7,002 $ 40,638 $ 48,490 $ 40,117 $ 136,247

Net earnings attributable to non-controlling interest 7,155 63,796 74,558 59,209 204,718

Interest expense and other financing costs 6,783 6,763 6,747 6,732 27,025

Provision for income taxes

Depreciation and amortization 19,715 19,365 19,515 19,746 78,341

Maintenance turnaround expense

Loss on extinguishment of debt

Gain (loss) on disposal of assets 9 (15) (296) (33) (335)

Net change in lower of cost or market inventory reserve 73,671 (10,839) (38,204) 36,795 61,423

Unrealized (gain) loss on commodity hedging transactions 3,925 (1,125) (508) 1,260 3,552

Adjusted EBITDA $ 118,260 $ 118,583 $ 110,302 $ 163,826 $ 510,971

20

WNR/NTI Adjusted EBITDA

The tables on the previous pages reconcile net income to Adjusted EBITDA for the periods presented.

Adjusted EBITDA represents earnings before interest expense and other financing costs, provision for income taxes, depreciation, amortization, maintenance turnaround expense, and certain other non-cash income and expense items. However, Adjusted EBITDA is not a recognized measurement under United States generally accepted accounting principles (“GAAP”). Our management believes that the presentation of Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. In addition, our management believes that Adjusted EBITDA is useful in evaluating our operating performance compared to that of other companies in our industry because the calculation of Adjusted EBITDA generally eliminates the effects of financings, income taxes, the accounting effects of significant turnaround activities (that many of our competitors capitalize and thereby exclude from their measures of EBITDA), and certain non-cash charges that are items that may vary for different companies for reasons unrelated to overall operating performance.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

Adjusted EBITDA does not reflect our cash expenditures or future requirements for significant turnaround activities, capital expenditures, or contractual commitments;

Adjusted EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt;

Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and

Adjusted EBITDA, as we calculate it, differs from the WNRL EBITDA calculation and may differ from the Adjusted EBITDA or EBITDA calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA should not be considered a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally.

21

WNRL EBITDA

We define WNRL EBITDA as earnings before interest expense and other financing costs, provision for income taxes and depreciation and amortization.

EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt;

EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and

EBITDA, as we calculate it, may differ from the EBITDA calculations of our affiliates or other companies in our industry, thereby limiting its usefulness as a comparative measure.

EBITDA is used as supplemental financial measures by management and by external users of our financial statements, such as investors and commercial banks, to assess:

our operating performance as compared to those of other companies in the midstream energy industry, without regard to financial methods, historical cost basis or capital structure;

the ability of our assets to generate sufficient cash to make distributions to our unitholders;

our ability to incur and service debt and fund capital expenditures; and

the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities.

We believe that the presentation of this non-GAAP measure provides useful information to investors in assessing our financial condition and results of operations. The GAAP measure most directly comparable to EBITDA is net income attributable to limited partners. This non-GAAP measure should not be considered as an alternative to net income or any other measure of financial performance presented in accordance with GAAP. EBITDA excludes some, but not all, items that affect net income attributable to limited partners. This non-GAAP measure may vary from those of other companies. As a result, EBITDA as presented herein may not be comparable to similarly titled measures of other companies.

22