- PBF Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

PBF Energy (PBF) S-1/AIPO registration (amended)

Filed: 22 Feb 12, 12:00am

Exhibit 10.9

SPECIFIC TERMS IN THIS EXHIBIT HAVE BEEN REDACTED BECAUSE CONFIDENTIAL TREATMENT FOR THOSE TERMS HAS BEEN REQUESTED. THE REDACTED MATERIAL HAS BEEN SEPARATELY FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, AND THE TERMS HAVE BEEN MARKED AT THE APPROPRIATE PLACE WITH THE WORD “[REDACTED]”.

CRUDE OIL/FEEDSTOCK SUPPLY/DELIVERY

AND SERVICES AGREEMENT

between

STATOIL MARKETING & TRADING (US) INC.

and

PBF HOLDING COMPANY LLC

TABLE OF CONTENTS

| Page | ||||||

1. | CONTRACT PARTIES | 1 | ||||

2. | DEFINITIONS AND CONSTRUCTION | 1 | ||||

3. | TERM OF OIL SUPPLY AND SERVICES | 15 | ||||

4. | QUALITY | 16 | ||||

5. | ACQUISITION OF OIL | 17 | ||||

6. | NOMINATIONS | 23 | ||||

7. | TITLE; CONTROL; RISK OF LOSS | 24 | ||||

8. | STORAGE FACILITIES | 26 | ||||

9. | PRICE AND PRICING | 26 | ||||

10. | PAYMENT AND THE EPQ PROCESS | 33 | ||||

11. | RECONCILIATION OF MONTH END VOLUMES AND ADJUSTMENT | 35 | ||||

12. | PETTY CASH BANKS | 36 | ||||

13. | VESSEL, BERTH AND SUPPLY PORT | 37 | ||||

14. | SHIPPING AND LIGHTERING | 41 | ||||

15. | DETERMINATION OF QUANTITY AND QUALITY | 42 | ||||

16. | LAYTIME AND DEMURRAGE | 44 | ||||

17. | UNSCHEDULED DISRUPTION TO NORMAL REFINERY OPERATIONS | 46 | ||||

18. | FORCE MAJEURE | 46 | ||||

19. | CREDIT CONDITIONS | 48 | ||||

20. | TAXES, DUTIES AND CHARGES | 50 | ||||

21. | INSURANCE | 51 | ||||

22. | REPRESENTATIONS, WARRANTIES AND COVENANTS | 52 | ||||

23. | AUDITING AND INSPECTION RIGHTS | 57 | ||||

24. | DEFAULT, SUSPENSION AND TERMINATION | 58 | ||||

25. | OBLIGATIONS AT TERMINATION | 61 | ||||

26. | INDEMNIFICATION AND CLAIMS | 63 | ||||

27. | DAMAGES | 66 | ||||

28. | ASSIGNMENT | 66 | ||||

29. | NOTICES AND ADDRESSES | 66 | ||||

30. | WARRANTIES; DISCLAIMER | 67 | ||||

-i-

TABLE OF CONTENTS

(Continued)

| Page | ||||||

31. | APPLICABLE LAW, LITIGATION AND ARBITRATION | 68 | ||||

32. | HSE, DRUG AND ALCOHOL POLICY | 70 | ||||

33. | MATERIAL SAFETY DATA SHEETS. | 71 | ||||

34. | VOICE RECORDING | 71 | ||||

35. | DISPOSAL | 71 | ||||

36. | CONFIDENTIALITY | 72 | ||||

37. | SOVEREIGN IMMUNITY | 73 | ||||

38. | ANTI-CORRUPTION AND FACILITATION PAYMENTS | 73 | ||||

39. | CONFLICT OF INTEREST | 74 | ||||

40. | MISCELLANEOUS | 74 | ||||

-ii-

APPENDICES

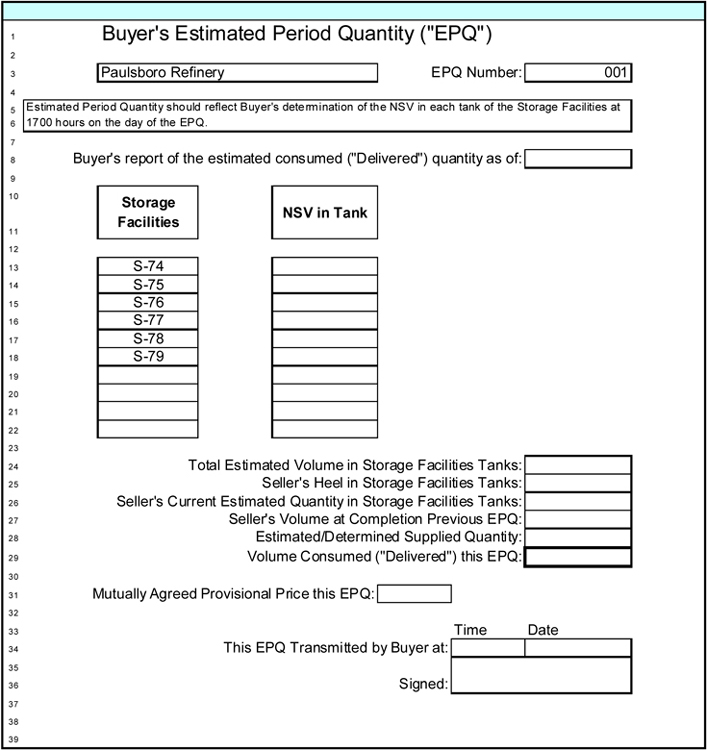

APPENDIX 1 | – | FORM OF ESTIMATED PERIOD QUANTITY (EPQ) STATEMENT | ||

APPENDIX 2 | – | INTERCREDITOR AGREEMENTS | ||

APPENDIX 3 | – | PAYMENT DIRECTION AGREEMENT | ||

APPENDIX 4 | – | REFINERY DESCRIPTION | ||

APPENDIX 5 | – | STORAGE FACILITIES USE PROVISIONS | ||

APPENDIX 6 | – | GENERAL PRINCIPLES OF SERVICE | ||

APPENDIX 7 | – | LIST OF MUTUALLY AGREED GRADES | ||

APPENDIX 8 | – | REQUIREMENTS SCHEDULE | ||

APPENDIX 9 | – | GRADE PECKING ORDER | ||

APPENDIX 10 | – | CARGO CONFIRMATION NOTICE | ||

APPENDIX 11 | – | COMMENCEMENT INVENTORY ACQUISITION | ||

APPENDIX 12 | – | TERMINATION OF DELIVERIES NOTICE | ||

APPENDIX 13 | – | SAUDI CONTRACT ARRANGEMENTS | ||

APPENDIX 14 | – | CARGO BANKS AND HEDGE MONTHS SPREADSHEET | ||

APPENDIX 15 | – | CARGO TABLE SPREADSHEET | ||

APPENDIX 16 | – | FORM OF DELAWARE CITY TANK LEASE | ||

APPENDIX 17 | – | FORM OF BUYER’S INVENTORY STATEMENT | ||

APPENDIX 18 | – | FORM OF PETTY CASH SPREADSHEET | ||

APPENDIX 19 | – | REFINERY MARINE TERMS | ||

APPENDIX 20 | – | STANDBY LETTER OF CREDIT | ||

APPENDIX 21 | – | HSE AND ETHICS POLICY | ||

-iii-

| 1. | CONTRACT PARTIES |

THIS CRUDE OIL/FEEDSTOCK SUPPLY, DELIVERY AND SERVICES AGREEMENT is made and entered into this 16th day of December 2010 (“Effective Date”) between:

Buyer:

PBF Holding Company LLC

1 Sylvan Way, 2nd Floor

Parsippany, NJ 07054-3887

Seller:

Statoil Marketing & Trading (US) Inc.

1055 Washington Boulevard – 7th Floor

Stamford, CT 06901

WHEREAS, Buyer is in the process of acquiring Valero Refining Company-New Jersey (“Refinery Project Company”), which owns the Refinery (as hereinafter defined); and

WHEREAS, Buyer and Seller each desire to enter into an agreement, pursuant to which Seller shall (a) purchase from third parties or Affiliates of Seller and then subsequently sell to Buyer crude oil and feedstock, (b) provide certain commodity-related services to Buyer, and (c) extend a line of credit, each for use by Buyer in connection with the procurement of Oil and Indigenous Feedstock for the Refinery; and

WHEREAS, on the Delivery Commencement Date, immediately after the closing of the acquisition of Refinery Project Company by Buyer, Buyer shall assign its rights and obligations in this Agreement to Refinery Project Company as set forth in Clause 28 below whereupon Refinery Project Company shall become “Buyer” for all purposes hereunder; and

WHEREAS, Buyer and Seller wish to cooperate with one another to seek out and make use of opportunities associated with optimizing the Refinery’s use of various grades and types of crude oil and feedstock.

NOW, THEREFORE, in consideration of the premises and the respective promises, conditions and agreements contained herein, and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the Parties hereby agree as follows:

| 2. | DEFINITIONS AND CONSTRUCTION |

(a)Definitions. For purposes of this Agreement, the following terms shall have the meanings indicated below and shall include the plural and singular forms of the terms:

“Acquisition Discussion” means the technical dialogue between Buyer and Seller covering all relevant issues pertinent to the decisions needed to allow Seller to acquire the optimal Cargo to cover its appropriate Requirement.

“Actual Refinery Slate” has the meaning given such term in Clause 9(a)(ii).

“Additional Acceptable Security” has the meaning given such term in Clause 19(b)(v).

“Adjusted IF Volume” has the meaning given such term in Clause 5(i)(ii)(1).

“Adjustment” has the meaning given such term in Clause 11(a).

“Affiliate” means, with respect to a given Person, any other Person (i) that directly or indirectly (through one or more intermediaries) controls, is controlled by, or is under common control with, such first mentioned Person, (ii) that beneficially owns or holds more than 50% of the interest of such first mentioned Person, or (iii) for which more than 50% of the interest therein is beneficially owned or held by such first mentioned Person. For the purposes of this definition, “control” when used with respect to any specified Person means the right or power to direct or cause the direction of the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

“Agreed Delivery Route” has the meaning given such term in Clause 5(c)(iv).

“Agreement” or “this Agreement” means this Crude Oil/Feedstock Supply/Delivery and Services Agreement, including the Appendices hereto, as it may be amended, modified, supplemented, extended, renewed or restated from time to time in accordance with the terms hereof.

“API” means American Petroleum Institute.

“ASTM” means American Society for Testing and Materials.

“Bankrupt” means, with respect to a Person if such Person (i) dissolves, other than pursuant to a consolidation, amalgamation or merger, (ii) becomes insolvent or is unable to pay its debts or fails or admits in writing its inability generally to pay its debts as they become due, (iii) makes a general assignment or arrangement for the benefit of its creditors, (iv) has instituted against it a proceeding seeking a judgment of insolvency or bankruptcy or any other relief under any similar Law affecting creditor’s rights, or a petition is presented against it for its winding-up or liquidation, (v) institutes a proceeding seeking a judgment of insolvency or bankruptcy of such Person or any other relief under any bankruptcy or insolvency Law or for reorganization relief under the winding-up or liquidation for such Person, (vi) has a resolution passed for its winding-up or liquidation, other than pursuant to a consolidation, amalgamation or merger, (vii) seeks or becomes subject to the appointment of an administrator, provisional liquidator, conservator, receiver, trustee, custodian or other similar official for all or substantially all of its assets, (viii) has a secured party take possession of all or substantially all of its assets, or has a distress, execution, attachment, sequestration or other legal process levied, enforced or sued on or against all or substantially all of its assets, (ix) files an answer or other pleading admitting or failing to contest the allegations of a petition filed against it in any proceeding of the foregoing nature, (x) has a proceeding against it seeking reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any Law, if 120 days after the commencement of such proceeding it has not been dismissed, or if within 90 days after the

-2-

appointment, without its consent or acquiescence, of a trustee, receiver, or liquidator of it or of all or any substantial part of its properties, the appointment is not vacated or stayed, or within 90 days after the expiration of any such stay, the appointment is not vacated, or (xi) takes any other action to authorize any of the actions set forth above.

“Bankruptcy Code” means Chapter 11 of Title 11, US Code, as amended.

“Barrel” or “Bbl” means a volume of 42 Gallons corrected for temperature to 60° F, and atmospheric pressure unless stated otherwise.

“Base Rate” means the lesser of (i) LIBOR plus [REDACTED]% and (ii) the maximum rate of interest permitted by Law.

“Berth” means the mooring, dock, anchorage, wharf, submarine line, single point or single buoy or single berth mooring facility, offshore location, offshore facility, alongside barges, lighters or any other mooring facility.

“Blended Price” has the meaning given such term in Clause 9(b).

“Business Day” means any Monday, Tuesday, Wednesday, Thursday or Friday on which commercial banks are open for business (including dealings in foreign exchange and foreign currency deposits) in New York, New York.

“Buyer” has the meaning given such term in Clause 1.

“Buyer’s Credit Agreement” means collectively: Term Loan and Credit Agreement and Revolving Credit Agreement, each by and between PBF Holding Company LLC, DCRC, Paulsboro Refining Company LLC and the other Guarantors Party thereto, and UBS Securities LLC, Deutsche Bank Trust Company Americas, Morgan Stanley Funding, Inc. and UBS AG, Stamford Branch; and Senior Secured Note Agreement by and between Paulsboro Refining Company LLC, Paulsboro Natural Gas Pipeline Company LLC, PBF Energy Company LLC and PBF Holding Company LLC, and Valero Energy Corporation, including any amendment, renewal, modification or replacement thereof.

“Buyer’s Guarantor” means PBF Energy Company LLC.

“Buyer’s Requirements Schedule” has the meaning given such term in Clause 6.

“Buyer’s Tentative Requirements Schedule” has the meaning given such term in Clause 5(a)(i).

“Calculated Payment Obligation” has the meaning set forth in Clause 11(b).

“Capital Leases” means, with respect to any Person, any lease of any property by such Person which would, in accordance with GAAP, be required to be classified and accounted for as a capital lease on the balance sheet of such Person.

-3-

“Cargo” means a specifically identified volume of Oil ascertained within the nomination process provided for herein, Supplied to, or to be Supplied to Buyer, whether located in the Storage Facilities, in any Statoil Storage Facility, on a Vessel, in a third party facility, in a pipeline or at any other location or facility.

“Cargo Bank” has the meaning given such term in Clause 9(a)(iii).

“Cargo Bank Differential” has the meaning given such term in Clause 9(b)(ii).

“Cargo Bank Hedge-Month” has the meaning given such term in Clause 9(a)(iii)(4).

“Cargo Bank Withdrawal” has the meaning given such term in Clause 9(a)(ii).

“Cargo Basis Differential” means the differential amount agreed to by the Parties relative to the Cargo Bank Hedge-Month.

“Cargo Confirmation Notice” has the meaning given such term in Clause 5(f)(iii).

“Cargo Final Price” means the estimated per Barrel Price for Oil delivered by Seller hereunder, calculated as the price per Barrel for the Cargo agreed on by Seller and Buyer [REDACTED].

“Change in Law” has the meaning given such term in Clause 31(g).

“Closing Inventory” has the meaning set forth in Clause 11(a)(i).

“Code” has the meaning given such term in Clause 20(b).

“Commercial Services” has the meaning given such term in Clause 3(a)(ii).

“Commodity Exchange Act” means 7 U.S.C. § 1, et seq.

“Completion of Supply” means, in respect of a Cargo, the final disconnection of the transfer hose(s)/arms(s) of the Vessel carrying such Cargo following Supply.

“Confidential Information” means all information (whether written, oral, visual, electronic or delivered by any other means) furnished either before or after the date hereof, either directly or indirectly, in connection with the performance of this Agreement by one Party (the “Disclosing Party”) or any of its directors, officers, employees, Affiliates, representatives (including without limitation a Disclosing Party’s real estate agents/brokers, financial advisors, attorneys and accountants), agents, or Affiliated, subsidiary or parent companies (the “Disclosing Party Representatives”) to the other Party (the “Receiving Party”) or any of its directors, officers, employees, Affiliates, representatives (including without limitation its real estate agents/brokers, financial advisors, attorneys, accountants and consultants), agents, or Affiliated, subsidiary or parent corporations (individually and collectively, the “Receiving Party Recipients”) and all analyses, compilations, forecasts, studies or other documents prepared by Receiving Party Recipients which contain any such information. Each of (i) the fact that such information has been delivered to the Receiving Party or Receiving Party Recipients, (ii) this

-4-

Agreement, and (iii) the other agreements entered into in connection with this Agreement, are “Confidential Information”. Notwithstanding the foregoing, “Confidential Information” shall not include any information which: (a) at the time of disclosure is in the public domain; (b) after disclosure to the Receiving Party Recipients enters the public domain, except as a result of any Receiving Party Recipient’s breach of this Agreement or any other agreement of confidentiality, it being understood and agreed, that information that is public or has, to the Receiving Party’s knowledge, become public through an unauthorized disclosure by a third party under a confidentiality obligation with respect to such information shall not be deemed to be public information or otherwise generally available to the public; or (c) is independently obtained by Receiving Party Recipients free from any obligation of confidentiality.

“Consolidated Average EBITDA” means the consolidated EBITDA of the PBF Entities.

“Credit Default” has the meaning given such term in Clause 24(c).

“Credit Usage” has the meaning given such term in Clause 19(b)(ii).

“Daily Default Pricing Volume” has the meaning given such term in Clause 9(c)(i)(1).

“Day 1” has the meaning given such term in Clause 10(c)(i).

“Day 2” has the meaning given such term in Clause 10(c)(ii).

“DCRC” means Delaware City Refining Company LLC, a Delaware limited liability company.

“Default” has the meaning given such term in Clause 24(a).

“Default Interest Rate” means the lesser of (i) LIBOR plus [REDACTED]% and (ii) the maximum rate of interest permitted by Law.

“Defaulting Party” has the meaning given such term in Clause 24(a).

“Delaware City Tank Lease” has the meaning given such term in Clause 8(c).

“Delivered” or “Delivery” or “Deliver” means when the Oil passes the title transfer point from Seller to Buyer.

“Delivered Volume” has the meaning set forth in Clause 11(a)(i).

“Delivery Commencement Date” has the meaning given such term in Clause 3(b).

“Delivery Month” means the month in which Oil was actually Delivered to Buyer at the Refinery.

“Direct Payment Excess” has the meaning given such term in Clause 10(e).

“Disclosing Party” has the meaning given such term in the definition of “Confidential Information”.

-5-

“Disclosing Party Representatives” has the meaning given such term in the definition of “Confidential Information”.

“Dispute” has the meaning given such term in Clause 31(b).

“Dollars” or “USD” or “US Dollars” or “$” means dollars of the US.

“EBITDA” means, with respect to any Person, and for any period of its determination, the consolidated net income of such Person for such period, plus the consolidated interest expense and income and franchise taxes of such Person for such period, plus the consolidated depreciation and amortization of such Person for such period, less extraordinary gains and interest income, as determined in accordance with GAAP.

“Effective Date” has the meaning given such term in Clause 1.

“Environmental Law” means any Law that governs or purports to govern the protection of Persons, natural resources or the environment (including the protection of ambient air, surface water, groundwater, land surface or subsurface strata, endangered species or wetlands), occupational health and safety and the manufacture, processing, distribution, use, generation, handling, treatment, storage, disposal, transportation, release or management of solid waste, industrial waste or hazardous substances or materials, as may be amended or modified from time to time.

“EPQ” means estimated period quantity.

“EPQ Form” means an EPQ form prepared per the format set forth in Appendix 1.

“EST” means the applicable, local Eastern Time in New York, New York.

“Estimated Credit Usage” has the meaning given such term in Clause 19(b)(iii).

“Event of Default” has the meaning given such term in Clause 24(a).

“Execution Method” has the meaning given such term in Clause 5(f)(i).

“Feedstock” means vacuum gas oil (VGO), straight run fuel oil and other similar hydrocarbons.

“FIFO” means the first-in first-out accounting principle for the valuation of inventories and the calculation of TVM Payments.

“Final Quality Differential” has the meaning given such term in Clause 9(b)(ii)(1).

“Force Majeure” has the meaning given such term in Clause 18(a).

“GAAP” means generally acceptable accounting principles in the US, applied on a consistent basis.

-6-

“Gallon” means a US standard gallon of 231 cubic inches at 60° F at atmospheric pressure.

“Governmental Authority” means any federal, state, regional, local, or municipal governmental body, agency, instrumentality, authority or entity established or controlled by a governmental or subdivision thereof, including any legislative, administrative or judicial body, or any Person purporting to act therefor.

“GPO”or “Grade Pecking Order” has the meaning given such term in Clause 5(a)(v).

“Grade” has the meaning given such term in Clause 4(b).

“Guarantors” means each Person required to guaranty the obligations of Buyer or any of its Affiliates under this Agreement, including Buyer’s Guarantor.

“Hazardous Substances” means any pollutant, contaminant, petroleum or petroleum product, dangerous or toxic substance, hazardous or extremely hazardous chemical, or otherwise hazardous material or waste regulated under Environmental Laws, including crude oil and feedstock.

“Hedge-Month” has the meaning given such term in Clause 9(b)(ii)(2).

“Hedge-Month Pool” has the meaning given such term in Clause 9(b)(iii).

“HSE” means health, safety and environmental.

“HSE Diligence” has the meaning given such term in Clause 23(b).

“ICC” has the meaning given such term in Clause 40(e).

“IF Conclusion Date” has the meaning given such term in Clause 5(i)(i)(2).

“IF Determination Date” has the meaning given such term in Clause 5(i)(ii)(1).

“IF Ending Price” has the meaning given such term in Clause 5(i)(i)(2).

“IF Exposure” has the meaning given such term in Clause 5(i)(iv)(2).

“IF Market Value” has the meaning given such term in Clause 5(i)(ii)(1).

“IF Starting Volume” has the meaning given such term in Clause 5(i)(i)(1).

“IF Storage Fee” has the meaning given such term in Clause 5(i)(iv)(1).

“Indemnified Party” has the meaning given such term in Clause 26(a)(iii).

“Indemnifying Party” has the meaning given such term in Clause 26(a)(iii).

-7-

“Independent Inspector” means a company that is approved by US Customs and Border Protection and that is mutually acceptable to the Parties for reporting the measurement of quality and quantity of Oil.

“Indigenous Feedstock” means Feedstock produced in the Refinery, transferred to Seller and subsequently transferred back to Buyer to be processed further within the Refinery, and which may from time to time be sold to third parties by Seller at Buyer’s direction in accordance with Clause 9(e) as if such transactions involved Oil; provided that, notwithstanding the foregoing, all Feedstock located in the Indigenous Feedstock Tanks on the Delivery Commencement Date which is included in the Initial Inventory shall be “Indigenous Feedstock” whether produced in the Refinery or elsewhere.

“Indigenous Feedstock Tank” means the storage tank(s) listed on Appendix 4 that will be used for storing Indigenous Feedstock as such list my be modified from time-to-time in accordance with the terms of Clause 5(d) of Appendix 5.

“Initial TLA” has the meaning set forth in Clause 14(e).

“Intercreditor Agreement(s)” means the Intercreditor Agreement(s) substantially in the form attached hereto as Appendix 2.

“Inventory” or “Inventories” means the Oil inventories that Seller owns and intends to sell to Buyer under this Agreement, wherever located, including at the Refinery, in any Statoil Storage Facility, carried upon Vessels and/or injected into or received from pipelines or other transport.

“Inventory Assessment” has the meaning set forth in Clause 11(a)(i).

“ISGOTT” means International Safety Guide for Oil Tankers and Terminals, as published by the International Chamber of Shipping, the Oil Companies International Marine Forum and the International Association of Ports and Harbors.

“ISPS Code” has the meaning given such term in Clause 13(a)(iii).

“Knowledge” means, with respect to a Party, the actual knowledge of the officers and directors of such Party, after making reasonable inquiry with respect to the particular matter in question, and “Know” has the correlative meaning.

“Law” means (i) any law, statute, regulation, code, ordinance, license, decision, order, writ, injunction, decision, directive, judgment, policy, decree of any Governmental Authority and any judicial or administrative interpretations thereof, (ii) any agreement, concession or arrangement with any Governmental Authority and (iii) any license, permit or compliance requirement, in each case as amended or modified from time to time.

“Liabilities” means any losses, claims, charges, damages, deficiencies, assessments, interests, penalties, costs and expenses of any kind (including reasonable attorneys’ fees and other fees, court costs and other disbursements), including any liabilities directly or indirectly arising out of or related to any suit, action, cause of action, proceeding, judgment, settlement or judicial or administrative order and any liabilities with respect to Environmental Law.

-8-

“LIBOR” means the rate of interest (expressed as a percentage per annum) for deposits in USD for a three-month period as provided by the British Bankers Association interest settlement rates (or the successor thereto) as of 11:00 a.m. (London time) on the date of determination, or, if such rate is not available, a reasonably comparable and available published rate as reasonably agreed by the Parties.

“Liens” means any lien (including judgment liens and liens arising by operation of law), mortgage, pledge, assignment, security interest, charge or encumbrance of any kind (including any agreement to give any of the foregoing) and any option, call, trust or other preferential arrangement having the practical effect of any of the foregoing.

“Lightering” means the operation wherein Oil is transferred from one Vessel to another at an approved and recognized offshore location so as to allow the first Vessel (the “Mother Vessel”) to reach a draft which allows it to safely proceed to and berth at the Supply Port.

“Loading Terminal“ means the port of loading of the Vessel for the applicable Oil being Supplied.

“Long-Term Debt” means, with respect to any Person or group of Persons on a consolidated basis, without duplication, in each case excluding the current liabilities of such Person, (i) indebtedness of such Person for borrowed money, (ii) obligations of such Person evidenced by bonds, debentures, notes, or other similar instruments, (iii) obligations of such Person to pay the deferred purchase price of property or services (other than trade debt and normal operating liabilities incurred in the ordinary course of business), (iv) obligations of such Person as lessee under Capital Leases, (v) obligations of such Person under or relating to letters of credit, guaranties, purchase agreements, or other creditor assurances assuring a creditor against loss in respect of indebtedness or obligations of others of the kinds referred to in clauses (i) through (iv) of this definition, and (vi) nonrecourse indebtedness or obligations of others of the kinds referred to in clauses (i) through (v) of this definition secured by any Lien on or in respect of any property of such Person. For the purposes of determining the amount of any Long-Term Debt, the amount of any Long-Term Debt described in clause (v) of the definition of Long-Term Debt shall be valued at the maximum amount of the contingent liability thereunder and the amount of any Long-Term Debt described in clause (vi) that is not covered by clause (v) shall be valued at the lesser of the amount of the Long-Term Debt secured or the book value of the property securing such Long-Term Debt.

“LP” means a linear program computer model which simulates refinery operations and is used to perform economic analysis that includes crude selection and optimization.

“LVEF” has the meaning given such term in Clause 15(d).

“Material Adverse Change” means, with respect to a Party, an event, change, development, effect, condition, or circumstance, which individually or in the aggregate with other events, changes, developments, effects, or circumstances, has resulted in or could be reasonably expected to result in a material adverse change in the business, operations, assets, properties, financial condition or prospects of such Party.

-9-

“Month” means a calendar month. Where a specified Month is defined as Month “M”, Month M-1 shall mean the Month prior to Month M and Month M+1 shall mean the Month subsequent to Month M.

“MonthEnd” has the meaning given such term in Clause 11(a).

“Monthly Quality and Basis Differential” has the meaning given such term in Clause 9(b)(i).

“Mother Vessel” has the meaning given such term in the definition of “Lightering”.

“MSCG” means Morgan Stanley Capital Group, Inc.

“MSCG Sales Agreement” means that certain Products Offtake Agreement to be effective as of the Delivery Commencement Date and entered into between Refinery Project Company and Morgan Stanley, together with all amendments, modifications and successor or replacement agreements entered into from time to time with respect thereto

“MSDS” has the meaning given such term in Clause 33(a).

“MTSA” has the meaning given such term in Clause 13(a)(iii).

“Non-Defaulting Party” has the meaning given such term in Clause 24(a).

“NOR” means Notice of Readiness.

“Normal Refinery Operations” means periods of time when the Refinery is operated in a routine manner with all operating units on-line. Normal Refinery Operations exclude maintenance turnarounds and shutdown periods.

“NSV” means net standard volume of Oil.

“NYMEX” means the New York Mercantile Exchange.

“Off-Taker” or “Off-Takers” means the company or companies that purchase the Refined Products produced at the Refinery.

“Oil” means crude oil and/or Feedstock, but shall not include Indigenous Feedstock.

“Opening Inventory” has the meaning set forth in Clause 11(a)(i).

“Optimization Account” has the meaning set forth in Clause 5(g)(ii).

“OSP” means the Official Selling Price as defined by the third party supplier of certain Oil for the relevant time period and destination, as applicable.

“Part Cargo” means a Cargo Delivered on a Vessel such that the volume of the Cargo does not substantially fill the Vessel.

-10-

“Party” means each of Buyer and Seller, and “Parties” means collectively, both Buyer and Seller.

“PBF Entities” has the meaning given such term in Clause 19(b)(ii)(1).

“PBF Holding Company” means PBF Holding Company LLC, a Delaware limited liability company.

“PBF Line of Credit” means a $50,000,000 line of credit from Seller to Buyer, subject to the conditions in Clause 24(c).

“PDA” means a Payment Direction Agreement substantially in the form attached hereto as Appendix 3.

“Person” means an individual, corporation, partnership, limited liability company, joint venture, trust or unincorporated organization, joint stock company or any other private entity or organization, including a Governmental Authority.

“Petty Cash Bank” has the meaning given such term in Clause 12(d).

“Pre-Adjustment Payments” has the meaning given such term in Clause 11(b).

“Predicted Refinery Slate” has the meaning given such term in Clause 9(a)(i).

“Pricing Day” means a day on which Buyer instructs to price Oil to be Delivered hereunder in accordance with Clause 9(c)(i)(1).

“Production Week” means, each period from Friday at 12:00 noon until the following Friday at 12:00 noon during the term of this Agreement;provided, however, the first Production Week shall commence on the Delivery Commencement Date and shall continue until 12:00 noon on the first Friday following the Delivery Commencement Date.

“Property Taxes” means any and all tangible personal property taxes, ad valorem property taxes or the like imposed on the value of the Oil held for sale by Seller to Buyer under this Agreement.

“Proposed Storage Site” has the meaning set forth in Clause 8(b).

“Provisional Invoice” has the meaning given such term in Clause 10(c)(iii).

“Provisional Price” has the meaning given such term in Clause 10(c)(iii) and shall be based on the estimated price of Oil and Indigenous Feedstock that make up the EPQ.

“PSI” means pounds per square inch.

“Qualified Institution” shall mean a major U.S. commercial bank or foreign bank with a U.S. branch office having an asset base of at least $[REDACTED] billion, with such bank having a Credit Rating of at least [REDACTED] by S&P or [REDACTED] by Moody’s Investor Services, Inc., or otherwise acceptable to the Party receiving such collateral, as such party shall determine in its sole discretion.

-11-

“Receiving Party” has the meaning given such term in the definition of “Confidential Information”.

“Receiving Party Recipients” has the meaning given such term in the definition of “Confidential Information”.

“Refined Products” means finished gasoline, heating oil, diesel, jet fuel and “Specialty Grades,” as defined in the MSCG Sales Agreement as of the date hereof.

“Refined Products Percentage” has the meaning set forth in Clause 19(d)(ii).

“Refinery” means the petroleum processing and refining facilities located in Paulsboro, New Jersey 08066, including all storage tanks (including the Storage Facilities), docks, platforms, pipelines, and any other associated equipment or facilities, as further described in Appendix 4.

“Refinery Project Company” has the meaning given such term in the recitals hereto.

“Refinery Subsidiaries” means subsidiaries of PBF Holding Company, including Refinery Project Company once acquired by PBF Holding Company, that own or operate a refinery that is being supplied Oil by Seller, including the Refinery.

“Replacement Grade Peeking Order” or“RGPO” has the meaning given such term in Clause 5(a)(x).

“Requirement” has the meaning given such term in Clause 4(a).

“ROB” has the meaning given such term in Clause 15(d).

“Saudi Arabian” shall mean the Saudi Arabian Oil Company, organized under the Laws of the Kingdom of Saudi Arabia.

“Saudi Contract” has the meaning set out on Appendix 13.

“Seller” has the meaning given such term in Clause 1.

“Shareholders Equity” means shareholders’ equity determined in accordance with GAAP.

“Shipping Services” has the meaning given such term in Clause 3(a)(iii).

“SMA” has the meaning given such term in Clause 31(e).

“Specified Buyer Price” has the meaning given such term in Clause 5(i)(ii)(2).

“Specified Seller Price” has the meaning given such term in Clause 5(i)(ii)(1).

-12-

“Standby Letter of Credit” means any commercial or standby letter of credit issued for the account of Seller pursuant to the terms of this Agreement.

“Statoil Storage Facility” means any facility in which Seller or its Affiliates owns, leases or otherwise has storage rights, including, if applicable, after execution of the Delaware City Tank Lease, the facilities leased thereunder.

“Storage Facilities” means the storage tanks described on Appendix 4, as such list may be modified from time-to-time in accordance with the terms of Clause 5(d) of Appendix 5, and which Storage Tanks Seller has exclusive rights all as provided for herein and in Storage Facilities Use Provisions attached hereto as Appendix 5. Appendix 4 shall reflect any storage tanks to be used to store Indigenous Feedstock.

“Supplied” or “Supply” or “Supplies” means or refers to when the Oil passes the flange connection between a Vessel’s permanent discharge manifold and the receiving pipeline or hose at the Supply Port.

“Supplied Volume” has the meaning set forth in Clause 11(a)(ii).

“Supply Point Method” has the meaning given such term in Clause 5(f)(ii).

“Supply Port” means the customary dockage, anchorage or place where a Vessel may safely lie in connection with Supply of a Cargo to the Refinery.

“Tank Heels” means the greater of: (i) the volume of Oil or Indigenous Feedstock below the lowest suction in a tank, unless the tank is equipped with a regular side entry pipe in which case “Tank Heels” means the volume below the middle of the lowest suction in such tank, or (ii) the volume of Oil or Indigenous Feedstock required to safely float a roof in a floating roof tank.

“Taxes” means any and all (i) US federal, state and local taxes, duties, fees and charges of every description, including all fuel, excise, environmental, spill, gross earnings, gross receipts and sales and use taxes, however designated (except for taxes on income), paid or incurred with respect to the purchase, storage, exchange, use, transportation, resale, importation or handling of the Oil or Indigenous Feedstock held for sale by Seller or Buyer under this Agreement and (ii) Property Taxes.

“Termination Date” has the meaning given such term in Clause 25(a)(i).

“Termination of Deliveries Notice” has the meaning given such term in Clause 7(f).

“TH Conclusion Date” has the meaning set forth in Clause 5(j)(i)(2).

“TH Ending Price” has the meaning set forth in Clause 5(j)(i)(2).

“TH Exposure” has the meaning set forth in Clause 5(j)(iii)(2).

“TH Market value” has the meaning set forth in Clause 5(j)(ii)(2).

-13-

“TH Starting Volume” has the meaning set forth in Clause 5(j)(i)(1).

“TH Storage Fee” has the meaning set forth in Clause 5(j)(iii)(1).

“Third Party Claim” has the meaning given such term in Clause 26(b).

“Time Chartered Vessel” means a Vessel chartered for a fixed period of time instead of for a certain number of voyages or trips.

“TLA” has the meaning set forth in Clause 14(e).

“Transparent Contractual Terms” means the contractual terms derived using either the Execution Method or the Supply Point Method.

“Trigger Event” has the meaning set forth in Clause 19(d)(ii).

“TVM” means the time value of money.

“TVM Payment” has the meaning given such term in Clause 19(g)(i).

“TVM Payment Date” means, with respect to a given Production Week, the first Thursday following the end of such Production Week, provided, that if such TVM Payment Date is not a Business Day, the TVM Payment Date shall mean the next following Business Day.

“TVM Statement Delivery Date” has the meaning given such term in Clause 19(g)(ii).

“Type” has the meaning given such term in Clause 4(b).

“UCC” means the Uniform Commercial Code in effect in the relevant state jurisdiction.

“Valero” means Valero Marketing and Supply Company, a Delaware corporation.

“Vessel” means a tankship, barge or other water-borne conveyance, as applicable, used for the Supply of a Cargo, whether owned or chartered or otherwise obtained by Seller to transport Oil for the benefit of Buyer.

“VGO Feedstock” has the meaning given such term in Clause 5(i)(ii)(3).

“Win3” has the meaning given such term in Clause 6(e).

“Win5” has the meaning given such term in Clause 6(d).

“Win8” has the meaning given such term in Clause 6(a).

“Worldscale” means the applicable standard freight rate stated in the most recent edition of the New Worldwide Tanker Nominal Freight Scale jointly published by Worldscale Association (London) Limited and Worldscale Association (NYC) Inc., or if Worldscale Association (London) Limited and Worldscale Association (NYC) Inc. shall no longer publish the New Worldwide Tanker Nominal Freight Scale, the equivalent replacement scale used in the shipping industry, expressed in USD per metric ton for the route specified.

-14-

“WTI” means West Texas Intermediate Oil, with specifications in accordance with the NYMEX futures contract.

“Year” means a period of 12 consecutive Months.

(b)Construction.

(i) All headings herein are intended solely for convenience of reference and shall not affect the meaning or interpretation of the provisions of this Agreement.

(ii) Unless expressly provided otherwise, the word “including” as used herein does not limit the preceding words or terms.

(iii) Unless expressly provided otherwise, all references to days, weeks, months, quarters and years mean calendar days, weeks, months, quarters and years, respectively. For purposes of this Agreement, a calendar day shall begin at 12:00 midnight and end at 11:59 p.m.

(iv) Unless expressly provided otherwise, references herein to “consent” mean the prior written consent of the Party at issue, which shall not be unreasonably withheld, delayed or conditioned.

(v) Unless expressly provided otherwise, all references to time in this Agreement are EST.

| 3. | TERM OF OIL SUPPLY AND SERVICES |

(a) Beginning on the Delivery Commencement Date, and continuing through the term of this Agreement and subject to the provisions of this Agreement:

(i) Except with respect to purchases, if any, to be completed by Buyer under the terms of the Saudi Contract, Seller will have the exclusive right to, and will, provide Oil for Delivery to the Refinery and Buyer will purchase such Oil in accordance with the terms set forth herein.

(ii) With respect to the Saudi Contract, Seller and Buyer shall comply with the terms of Appendix 13 with respect to such purchases of Oil and the subsequent delivery to and storage at the Refinery. Appendix 13 shall set out the terms regarding (1) the mechanism by which title to such crude oil will be acquired and by whom, (2) how pricing and TVM Payments will be calculated, (3) the timing and process as to how such Oil will be handled pursuant to the terms of this Agreement, and (4) such other details as Seller deems reasonably necessary to accomplish the foregoing.

(iii) Seller shall provide Buyer with certain operational services (the “Commercial Services”) and certain shipping-related services (the “Shipping

-15-

Services”) with respect to all purchases and sales of Oil reasonably necessary to enable Buyer to perform the manufacturing and operational processes at the Refinery as detailed in Appendix 6.

(b) This Agreement shall be binding on the Parties from the Effective Date hereof; however, the supply of Oil, Commercial Services, Shipping Services and related services shall commence on the later of December 17, 2010, or the date that Buyer or its Affiliate acquires Refinery Project Company and assigns its rights and obligations under this Agreement to Refinery Project Company pursuant to an assignment in form and substance acceptable to Seller (the “Delivery Commencement Date”) and shall continue for an initial term ending on September 30, 2011, and shall continue thereafter for successive one-Year extension periods commencing on each October 1 thereafter until this Agreement is terminated (i) by a termination in accordance with Clause 24, or (ii) by either Party giving 6 months prior notice that it has elected to terminate this Agreement;provided, that no Party shall have the right to give such a notice of election to terminate under this subpart (ii) prior to April 17, 2011.

| 4. | QUALITY |

(a)Oil Requirements. The Parties will agree upon the Oil supply requirements of the Refinery in accordance with the process described in Clause 5. Such Oil supply requirements are referred to herein as the Requirements. Each “Requirement” shall be an identified volume of a specified Type and a corresponding Supply time period (e.g. 500,000 Barrels of Type A Oil to be Supplied in the window of 1-10 January 2011).

(b)Oil Types. Oil Supplied and Delivered under this Agreement will be grouped in the following general categories, referred to herein as “Types”.

(i)Type A: sour crude oil with a sulfur content equal to or greater than zero point eight percent by weight (0.8% weight), as per ASTM. Type A Oil Requirements typically will be covered by the Kirkuk Grade of Oil as a base case, with other light and medium sour crudes as optimization alternatives, including, but not limited to, sourcing from the Urals and Vasconia.

(ii)Type B: sweet crude oil with a sulfur content less than zero point eight percent by weight (0.8% weight), as per ASTM. Type B Oil Requirements typically will be covered by crude oil Grades sourced from the East Coast Canadian Grand Banks as a base case, with light and medium sweet crudes as optimization alternatives, including, but not limited to, sourcing from the North Sea and Angola.

(iii)Type C: Crude oil specifically required to produce approved lube oils: initially to be covered by the Arab Light and/or Arab Medium Grades of crude oil.

(iv)Type D: Feedstocks, for example vacuum gasoil or straight run fuel oil.

Within each Type of Oil described herein there are multiple “Grades”. For example the Oil Grades Kirkuk, Urals and Vasconia could each be Type A Oil. Some Grades may meet the specifications of more than one Type. To avoid any misunderstanding the Parties shall clearly communicate which Requirement or Type a proposed Grade or Cargo is to cover. A summary of Grades approved by Seller for sale hereunder, and their associated Type, is attached as Appendix 7.

-16-

(c)Term Quality / Spot Quality.

(i)Term Supply. The Parties expect that over time approximately [REDACTED]% of Oil Supplied to Buyer at the Refinery will be sourced from term agreements entered into by Seller. Buyer will use its reasonable efforts in support of Seller’s efforts to enter into such term agreements with counterparties. To the extent Seller is unable to enter into term agreements with specified counterparties or for specified Types or Grades, the Parties will work together to determine an appropriate arrangement for supply of the affected Type and Grade. If the Parties are able to enter an agreement with Saudi Arabian as to the terms of the Saudi Contract that is acceptable to each Party in their sole discretion, then it is anticipated that the Saudi Contract will be for approximately [REDACTED] of Arab [REDACTED] Crude (Type C).

(ii)Spot Supply. The Parties agree that the balance of the Oil supplied to the Refinery will be sourced from the spot market for Oil.

(d)Quality Optimization Principle. The Parties agree that a fundamental part of this Agreement is, within the Cargo acquisition process, for (i) the flexibility of Buyer to receive different Grades within a certain Type, as generally listed in the appropriate GPO / RGPO, without disrupting Normal Refinery Operations allowing a commercial benefit of that flexibility to Buyer, and (ii) the flexibility for Seller to be able to have a range of options among such Grades to cover the Requirements of the Refinery allowing a commercial benefit to Seller. Specifically this shall mean that Seller shall be able to acquire different Grades at generally available market prices in order to cover a particular Requirement provided such price is reasonably acceptable to Buyer as listed in the appropriate GPO / RGPO. This principle is understood primarily to apply during the initial acquisition process for Type A and Type B Oils. Furthermore for other Types, Buyer will make commercially reasonable efforts to allow this acquisition process and flexibility. The Parties also agree that a fundamental objective of this Agreement is, that after a Requirement has been covered by a Cargo, in the event that either:

(i) Buyer’s refining economics for said Requirement change substantially, or

(ii) the market conditions for trading that Cargo with third parties change substantially and such change causes an economic benefit to be derivable from optimizing said Cargo into an alternative Cargo, then the Parties shall make commercially reasonable efforts to change that Cargo into an economically beneficial alternative. If successful, the Parties shall agree on commercial terms such that, under the RGPO process, the economic benefit of the optimization is shared in an appropriately equitable manner consistent with Clause 5.

| 5. | ACQUISITION OF OIL |

(a)Acquisition Process Steps. The process for selecting and then acquiring a Cargo of Oil to supply the Refinery shall comprise the following steps:

(i) Buyer and Seller shall mutually agree on the “Buyer’s Tentative Requirements Schedule” for any Month of Delivery of Oil to the Refinery, which shall consist of a list of Requirements with each Requirement being a volume of a Type to be delivered during a specified period in such Month, in a format following that in Appendix 8.

(ii) The Parties shall discuss the different Grade options for each Requirement.

(iii) The Parties shall agree on the volume, term, price and other key elements for term contract commitments, and Buyer shall give a written mandate to Seller to enter into such term contract(s), and Seller shall enter into such term contract(s). Thereafter, the Parties shall follow the term contract procedures set forth in Clause 5(c) below, which will result in Seller purchasing term Cargoes to cover certain Requirements in the Buyer’s Tentative Requirements Schedule.

(iv) The Parties shall identify target Grades and a number of target Cargoes that shall be acceptable for each Requirement that is not to be covered by term contract volumes.

(v) Buyer, in discussion with Seller, shall issue, and continue to update, a grade pecking order (a“Grade Pecking Order”or“GPO”), outlining the Grades that could cover each Requirement and the corresponding differences in price at which such Grades would have equal economics for the Buyer.

(vi) As to each target Cargo, Seller shall provide Buyer with the appropriate contractual terms in accordance with Clause 5(e)(ii).

-17-

(vii) Thereafter, Buyer shall give an oral or written mandate to Seller in accordance with Clause 5(e)(iii).

(viii) Seller shall purchase the Cargo covered by such mandate or, with respect to a Cargo acquired from Seller or Seller’s Affiliates, make appropriate internal allocations to reflect that such Cargo will cover a Requirement hereunder.

(ix) Seller shall send formal notification to Buyer of the purchase of the Cargo, or if the Cargo is acquired from Seller or Seller’s Affiliates portfolio, the internal allocation of such Cargo to cover a Requirement, covered by the mandate. Details of that notification shall be as described in Clause 5(f)(iii) below.

(x) In connection with seeking potential optimizations, following the purchase of each term or spot Cargo to cover a Requirement, the Buyer, in discussion with Seller, shall issue, and continue to update a replacement grade pecking order (“Replacement Grade Pecking Order” or “RGPO”) for such covered Requirement outlining the Grades that could replace the purchased Cargo and the corresponding differences in price at which such replacement Grades would have equal economics for the Buyer, which RGPO shall use the Cargo Bank Differential of the purchased Cargo as the basis for such price differences.

(b)Grade Pecking Order. The GPO and RGPO (each a list of Grades and differences in price) shall reflect the relative refining economics of different Grades for each Requirement in Buyer’s Tentative Requirement Schedule. The determination of the GPO or RGPO as applicable shall be based on:

(i) Seller’s advice to Buyer of the volumes available of different Grades in standard Cargo sizes and corresponding price estimates.

(ii) Buyer’s output from LP runs for the Refinery based on Seller’s Grade availability lists.

(iii) For each Requirement, Buyer shall prepare a GPO or RGPO that contains a base Grade and a minimum of four alternative Grades that Seller shall be reasonably able to acquire. Each alternative Grade shall have a value that reflects the difference in price delivered at the Refinery that has to be achieved by Buyer for that Grade to be of equal value to the base Grade for that Requirement. A Requirement shall remain relevant for the GPO or RGPO from its initial identification in the Buyer’s Tentative Requirements Schedule for a Month of Supply, up and until the end of its Acquisition Discussion and this time may include time after a Cargo has been purchased to cover the Requirement in order to allow for possible optimizations of that Requirement. The GPO and RGPO shall be generated by Buyer in the format specified in Appendix 9. The GPO and RGPO shall be issued once per week, in accordance with the following process steps:

(1) Seller shall communicate to Buyer no later than noon every Tuesday pertinent information containing the availability of different Grades and estimates of market prices for those Grades.

(2) Buyer shall issue the GPO/RGPO in the correct format no later than noon on the following day (Wednesday), whereupon any previous GPO/RGPO shall be superseded.

(c)Term Commitment Discussion Procedure. Subject to the provisions set forth in the term Oil supply contracts previously entered into under this Agreement, the Parties shall agree, at the appropriate times to:

(i) The volumes to be nominated to cover Buyer’s Tentative Requirements Schedule.

(ii) The Requirements that shall be covered by such term volumes (after the third party supplier of Oil under such term Oil supply contract confirms the final nomination of such Oil with the loading dates and final volume).

(iii) The Final Quality Differential for such volume. If such Cargo will be Supplied under the Execution Method then the FOB price will be set in principle to match the price reached by Seller with the supplier of the term volume, which if OSP-related will match the OSP of the respective Oil at the appropriate Loading Terminal, including any premium or discount. If the Cargo will be Supplied under the Supply Point Method then the price will be agreed between the Parties.

(iv) The costs for Supplying a term Cargo under the Execution Method will be agreed between the Parties based on the Agreed Delivery Route for each specific Oil term contract Cargo. The “Agreed Delivery Route” will define the salient factors attributable to that Cargo, including, but not limited to; (1) the Loading Terminal, (2) Vessel size, (3) transportation route and (4) any Lightering requirements. For example for an Arab [REDACTED] term Cargo, the Agreed Delivery Route might be: (1) Oil Loading Terminal to be [REDACTED], (2) Cargo to be loaded on an Aframax vessel, (3) Vessel to be routed by the most expeditious method (always allowing for carrier’s safety requirements) to Bigstone Lightering Point, (4) where one or two Lightering Vessel(s) will be taken off prior to the mother Vessel Berthing at the Refinery. Each term contract Cargo under this Agreement will have a similar corresponding Agreed Delivery Route. If the Execution Method is used, Seller shall use [REDACTED], etc. Except as otherwise set forth in this Agreement, if the Supply Point Method is used all supply costs up to the Supply Port are [REDACTED].

(d)Acquisition Discussion.

(i) Each Requirement will have an associated Acquisition Discussion that will commence upon Buyer advising Seller of Buyer’s Tentative Requirement Schedule and shall end when a Cargo or Cargoes covering the Requirement are Supplied to Buyer.

(ii) Until Buyer’s Tentative Requirements Schedule has become Buyer’s Requirements Schedule (as described in Clause 6), Buyer shall have the right to adjust the dates with the exception of any Requirements covered with Cargoes, which shall not be adjusted or modified without Seller’s consent.

-18-

(iii) As long as the relevant Acquisition Discussion has not concluded, the GPO / RGPO shall contain the alternatives as described in this Clause 5 for each Requirement.

(e)Acquisition Process and Target Cargo.

(i) Prior to the conclusion of the Acquisition Discussion, the Parties shall agree on a target Cargo for that Requirement within sufficient time to allow Seller to purchase such target Cargo in accordance with Clause 5(a)(viii). Buyer acknowledges that different Grades of Oil typically trade at different periods of time ahead of when such Cargo is to be delivered and that Seller may not be able to acquire a target Cargo if Buyer and Seller are unable to agree on a target Cargo in a timely manner. Seller shall keep Buyer apprised of such time periods.

(ii) Seller shall advise Buyer of all pertinent commercial details necessary with respect to each target Cargo, so that the Transparent Contractual Terms can be fully understood. If Seller is to provide the target Cargo from its or its Affiliates’ portfolio, then Seller shall notify Buyer of such fact.

(iii) Buyer shall give an oral (by way of a recorded means including recording of a telephone conversation with or without the consent of the other Party in accordance with Clause 34) or written mandate to Seller to fulfill the Requirement with such Cargo, such mandate shall include all of the information appropriate to fix the commercial terms for such Cargo, including the Grade of Oil, volume to be Supplied, Supply window and price. Such mandate, whether oral or written, shall be fully binding on Buyer, and Buyer thereafter shall be required to accept Delivery of such Cargo (unless Seller fails to acquire such Cargo) in accordance with this Agreement.

(iv) If Seller cannot acquire a target Cargo under the agreed contractual terms in accordance with Clauses 5(a), the Parties shall continue the Acquisition Discussion until either (1) it concludes with revised terms for the same target Cargo, (2) it concludes with terms for an alternative Cargo of the same Grade or (3) it concludes with terms for an alternative Cargo of an alternative Grade in the relevant GPO. This process shall continue until the Requirement is successfully covered.

(v) At any time during the Acquisition Discussion, Seller can propose that a Requirement be covered by an alternative Grade in the GPO / RGPO. Buyer shall accept such proposal as long as the alternate Grade Cargo will maintain equal or improved refining economics for that Requirement based on the GPO / RGPO. Furthermore, Seller may propose an alternate Grade not included in the GPO / RGPO; however, use of such alternate Grade requires Buyer’s consent.

(vi) The Parties shall make reasonable efforts to cover a Requirement with a suitable Cargo. Until the Requirement is covered by a Cargo the Seller shall continue to advise the Buyer of potential target Cargoes to fulfill such Requirement. If Seller is unable to procure a Cargo to meet a Requirement, Buyer shall have the option to amend the Requirement so that the Seller can continue to use its reasonable efforts to procure a Cargo to cover such Requirement. If Seller cannot procure a Cargo to cover a Requirement (either an original Requirement or an amended Requirement) Seller shall have no liability for such failure.

(f)Transparent Contractual Terms. For any potential Cargo to be acquired by Seller, a set of Transparent Contractual Terms shall be agreed to, thereby providing a clear mandate to Seller to purchase such Cargo. These Transparent Contractual Terms shall be established under one the following two methods, in Buyer’s option:

-19-

(i)The “Execution Method”. Under the Execution Method, the Transparent Contractual Terms shall include all of the terms necessary for Seller to negotiate and acquire a Cargo directly from a third party. However, the additional costs incurred to have such Cargo Supplied to the Refinery, including, but not limited to, freight, pricing elements, outturn loss, negotiated pricing basis and period shall be agreed at the appropriate times between the Parties and added as incurred in order to establish Buyer’s final price for such Cargo. If Buyer and Seller are unable to agree in a timely manner on such additional costs, then Seller can contract for such additional items and the related costs in a commercially reasonable manner and such costs shall be added to Buyer’s final price for such Cargo.

(ii)The “Supply Point Method”. Under the Supply Point Method, the Transparent Contractual Terms shall include all the terms necessary for the Parties to agree on a price for the Cargo supplied to an agree-upon supply point. The Supply Point Method terms shall include:

(1) the terms on which the Cargo will be purchased from a third party, and

(2) Seller’s offer for all other costs from the third party’s delivery point up to the agreed-upon supply point, including the cost of any difference between the agreed pricing basis and pricing period and that negotiated with the third party.

Under the Supply Point Method, any additional costs, including, but not limited to, Lightering barges in the Delaware River, outturn losses and storage costs, between the pre-defined supply point and such Cargo’s Supply to the Refinery shall be determined in the same manner as for Cargoes delivered under the Execution Method. The Supply Point Method shall be used whenever Buyer agrees to purchase a Cargo from Seller’s or its Affiliate’s portfolio.

(iii)Cargo Confirmation. Whether a Cargo is purchased under the Execution Method or the Supply Point Method above, Seller shall promptly complete and communicate to Buyer a notice in the format set forth in Appendix 10 (a “Cargo Confirmation Notice”) after a Cargo has been purchased. At any point where a transaction relevant to that Cargo is agreed to between the Parties thereafter, the Cargo Confirmation Notice shall be updated accordingly. For example, if a freight cost is negotiated and established at a time after the Cargo was purchased under the Execution Method, that freight cost shall be added to the Cargo Confirmation Notice. This process shall continue until the entire price of the Cargo is built up and fully agreed and finalized.

(iv)Establishment of the Final Quality Differential for a Cargo. The Final Quality Differential shall be identified in the Cargo Confirmation Notice. This Final Quality Differential is to be used in the pricing process as described in Clause 9. This Final Quality Differential shall be set by agreement between the Parties. Any further cost items or adjustments that are applied to the Cargo Confirmation Notice shall thereafter follow the “Petty Cash” process in Clause 12. The general principle in the Parties agreeing to the point at which the Final Quality Differential is established and fixed shall be that further anticipated costs and adjustments are small in nature and would have a low expected probability of having a significant impact on the value of the Final Quality Differential.

(g)RGPO Optimization and the Other Optimization Account.

(i)Replacement Pecking Order Cargo Optimizations. To the extent any Replacement Pecking Order Cargo replaces a Cargo originally purchased for Supply to the Refinery in Month M, which is subsequently disposed of by Seller due to an alternative Cargo or alternative Cargoes (which shall be of equivalent volume to the original purchased Cargo and may consist of different Grades of Oil) being acquired by agreement between the Parties, the Buyer will pay for the replacement Cargo or Cargoes the price specified by Buyer in the RGPO and the Seller will retain all profit and loss associated with: (1) disposing of the Cargo originally purchased for Supply to the Refinery and (2) the price differences between the RGPO terms and the terms executed between the Seller and the third party supplier of such replacement Cargo or Cargoes. To the extent Seller identifies a potential replacement Cargo or Cargoes that is not on the RGPO for the current Cargo, then such RGPO can be modified to add such replacement Cargo or Cargoes upon the Parties’ mutual agreement.

(ii)Other Optimizations. The“Optimization Account” has been established in order to capture any profit or loss from an optimization that is proposed by Seller and agreed to by Buyer, other than optimizations in connection with the replacement of Cargoes originally purchased for Supply to the Refinery by use of the RGPO as described in Clause 5(g)(i) above. This Optimization Account shall contain separate accounts for all Cargoes concerned and show in detail any commercial activity and its result, including, but not limited to, profit or loss from the purchase and resale of a Cargo, profit or loss from fixing and subsequent re-letting of any shipping, or other expenses arising from the optimization of a Cargo. Furthermore, any working capital considerations shall be included in the Optimization Account. Should the Parties agree that any other economic benefit to be shared between the Parties can most easily be reflected in the Optimization Account, then such economic activity shall also be recorded accordingly. For sake of clarity, all transactions that use the Optimization Account method for accounting for the economic result of an optimization implicitly require that all pricing and costs associated with the original transaction that was optimized be treated as though there were no optimization and be generally unaffected by any optimization process, so that all the benefits and costs of such optimization are aggregated in the Optimization Account for sharing between the Parties.

-20-

(h)Commencement Inventory at Paulsboro. On the Delivery Commencement Date, Seller shall acquire the Oil and Indigenous Feedstock held in inventory at the Refinery in accordance with the procedures set forth in Appendix 11.

(i)Indigenous Feedstock Obligations.

(i)Indigenous Feedstock Starting and Closing Volume Purchases.

(1) Seller will purchase all of the Indigenous Feedstock being purchased by Buyer from Valero (the “IF Starting Volume”) in connection with the acquisition of the Refinery. The purchase of the IF Starting Volume will be made in accordance with the provisions in Appendix 11 (Commencement Inventory Acquisition).

(2) Buyer shall purchase from Seller on October 17, 2011 (the “IF Conclusion Date”) a volume of Indigenous Feedstock equal to the IF Starting volume and will pay Seller a price equal to the IF Ending Price. The “IF Ending Price” shall be equal to [REDACTED] minus the amount by which the beginning Indigenous Feedstock purchase price is less than the [REDACTED] (For example, if the IF Starting Volume is purchased for a price equal to [REDACTED] then the IF Ending Price will be [REDACTED].

(3) Buyer and Seller may periodically agree upon an extension of theIF Conclusion Date and a modification to the IF Storage Fee described in Clause 5(i)(iv)(1) that is paid to Buyer with respect to such an extension period.

(ii)Interim Indigenous Feedstock Transactions. Unless Buyer has received a Termination of Deliveries Notice, Buyer shall either sell to Seller daily the net amount of Indigenous Feedstock produced by the Refinery or purchase from Seller daily the net amount of Indigenous Feedstock Buyer takes from the Storage Tanks for use in normal operations of the Refinery. Buyer will report to Seller daily the net amount of Indigenous Feedstock taken from or delivered to the Storage Tanks. All Indigenous Feedstock at any time placed in the Storage Tanks shall be owned by Seller unless and until it is sold to Buyer in accordance with this Clause 5 or Clause 24:

(1) If the amount of Indigenous Feedstock on any Wednesday during the term of the Agreement or the preceding Business Day if such Wednesday is not a Business Day (the “IF Determination Date”), is more than the Adjusted IF Volume (as defined below); then (1) Seller shall purchase such additional Indigenous Feedstock by paying Buyer the Specified Seller Price (as defined below) and (2) such new aggregate higher Indigenous Feedstock volume will become the Adjusted IF Volume until the next purchase or sale of Indigenous Feedstock takes place under Clause 5(i)(ii)(l) or (2) hereof.

The “Adjusted IF Volume” means, initially, the IF Starting Volume and thereafter such volume as adjusted on each IF Determination Date in accordance with Clause 5(i)(ii)(l) or (2) as appropriate.

The “Specified Seller Price” (A) for all Seller purchases of Indigenous Feedstock volumes that are in excess of the IF Starting Volume, will be [REDACTED], and (B) for all Seller purchases of Indigenous Feedstock volumes that are not in excess of the IF Starting Volume, which therefore were previously purchased by Buyer under Clause 5(i)(ii)(2), will be [REDACTED].

The “IF Market Value” means the current market price of such Indigenous Feedstock.

(2) If the amount of Indigenous Feedstock on any IF Determination Date is less than the Adjusted IF Volume; then (A) Buyer shall purchase such volume of consumed Indigenous Feedstock by paying Seller for such Indigenous Feedstock the Specified Buyer Price (as defined below) and (B) such new aggregate lower Indigenous Feedstock volume will become the Adjusted IF Volume until the next purchase or sale of Indigenous Feedstock takes place under Clause 5(i)(ii)(l) or (2).

The “Specified Buyer Price” (A) for all Buyer purchases of Indigenous Feedstock volumes that are not in excess of the IF Starting Volume, will be a fixed price equal to [REDACTED] and (B) for all Buyer purchases of Indigenous Feedstock volumes that are in excess of the IF Starting Volume, which therefore were previously purchased by Seller under Clause 5(i)(ii)(l), will be [REDACTED].

(3) Provided Buyer has not received a Termination of Deliveries Notice, Buyer may for efficient, prudent and safe operation of the Refinery and the Storage Tanks, (A) direct Seller to purchase VGO Feedstock from a third party (“VGO Feedstock”) and such VGO Feedstock shall thereafter be used and treated for all purposes under this Agreement as Indigenous Feedstock, and/or (B) direct Seller to sell a specified volume of Indigenous Feedstock to a third party with such sale being treated for all purposes under this Agreement as a purchase by Buyer of such Indigenous Feedstock from Seller. The terms and pricing for sales and purchases under this Clause 5(i)(ii)(3) will be [REDACTED] except that references to an IF Market Value shall be interpreted as [REDACTED] in the third party purchase or sale contract which shall be an arms length contract negotiated by Seller on a commercially reasonable manner.

-21-

(iii)Additional IF Conclusion Date Purchases and Payment Obligations.

(1) If the amount of Indigenous Feedstock on the IF Conclusion Date is less than the IF Starting Volume then Buyer shall direct Seller to obtain from a third party VGO Feedstock delivered to the Storage Tanks which shall thereafter be treated for all purposes as Indigenous Feedstock and Buyer shall pay Seller the amount [REDACTED], under Clause 5(i)(ii) above (provided that if the interim purchase price exceeds the price paid by Seller for such VGO Feedstock, then Buyer [REDACTED].

(2) If the amount of Indigenous Feedstock on the IF Conclusion Date is more than the IF Starting Volume then Buyer shall purchase such additional Indigenous Feedstock for prices [REDACTED].

(iv)Indigenous Feedstock Payments, Fees and Credit Provisions.

(1) All Indigenous Feedstock is subject to the normal service fees and TVM charges that are more fully described in Clause 19. Seller will pay Buyer on the IF Conclusion Date an “IF Storage Fee” which shall be an amount equal to the sum of the following amounts that are calculated monthly for each Month during the period from the purchase of the IF Starting Volume to the IF Conclusion Date: [REDACTED].

(2) Seller shall periodically determine the amount of exposure, if any, it has to Buyer based on the Buyers Indigenous Feedstock purchase obligations (the “IF Exposure”) and Seller shall have the right to [REDACTED]. The “IF Exposure” shall be equal to the [REDACTED].

(j)Tank Heel Obligations.

(i)Tank Heel Starting and Closing Volume Purchases.

(1) Seller will purchase all of the usable Oil and usable Indigenous Feedstock that as of the Delivery Commencement Date are Tank Heels which are being purchased by Buyer from Valero (the “TH Starting Volume”) in connection with the acquisition of the Refinery, The purchase of the TH Starting Volume will be made in accordance with the provisions in Appendix 11 (Commencement Inventory Acquisition). All other obligations to purchase Oil or Indigenous Feedstock referred to in this Agreement shall not include the Tank Heels which shall be governed by this Clause 5(j).

(2) Buyer shall purchase from Seller on October 17, 2011 (the “TH Conclusion Date”) a volume of Tank Heels equal to the TH Starting Volume and will pay Seller a price equal to the TH Ending Price. The “TH Ending Price” shall be equal to [REDACTED] minus the amount by which [REDACTED] (For example, if the TH Starting Volume is purchased for a price equal to “[REDACTED]” then the TH Ending Price will be [REDACTED]).

(3) Buyer and Seller may periodically agree upon an extension of the TH Conclusion Date and a modification to the TH Storage Fee described in Clause 5(j)(iii)(1) that is paid to Buyer with respect to such an extension period.

(ii)Interim Tank Heel Transactions. If Seller reasonably believes the volume of Tank Heels may have changed (for example a tank in the Storage Facilities is removed from service or because more water and sediment has displaced the usable Oil or Indigenous Feedstock that constitute the Tank Heel), then Seller can obtain a measurement or assessment of the affected Tank Heel(s):

(1) If such assessment shows there is more volume of Tank Heels than the TH Starting Volume then Seller shall purchase such additional Tank Heels volume from Buyer at [REDACTED], and on the TH Conclusion Date, Buyer shall repurchase such additional volume at [REDACTED].

(2) If such assessment shows there is less volume of Tank Heels than the TH Starting Volume then Buyer shall purchase such additional Tank Heels volume from Seller at [REDACTED], and on the TH Conclusion Date Seller shall repurchase such additional volume at [REDACTED].

All Tank Heels at any time in the Storage Tanks shall be owned by Seller unless and until they are sold to Buyer in accordance with this Clause 5 or Clause 24.

The “TH Market Value” means the current market price of such Tank Heel.

(iii)Tank Heel Payments, Fees and Credit Provisions.

(1) All Tank Heels are subject to the normal service fees and TVM charges that are more fully described in Clause 19. Seller will pay Buyer on the TH Conclusion Date a “TH Storage Fee” which shall be an amount equal to the sum of the following amounts that are calculated for each Month during the period from the purchase of the TH Starting Volume to the TH Conclusion Date:

[REDACTED]

-22-

(2) Seller shall periodically determine the amount of exposure, if any, it has to Buyer based on Buyer’s Tank Heels purchase obligations (the “TH Exposure”) and Seller shall have the right to [REDACTED]. The “TH Exposure” shall be equal to [REDACTED].

(3) For purposes of clarification, the Parties agree that all payments calculations with respect to Tank Heels payment obligations due at or in connection with the TH Conclusion Date or the Termination Date, shall be determined [REDACTED].

(iv)Line Fill. For the purposes of this Section 5(j) only, all Line Fill (as defined in Appendix 11) shall be treated as “Tank Heels,” and Buyer shall at the TH Conclusion Date purchase the same amount of Line Fill from Seller as Seller purchased from Buyer at the Delivery Commencement Date.

| 6. | NOMINATIONS |

The following schedule outlines the process for Buyer and Seller to agree on nominations for Supply of Oil into the Refinery for any Month M. For sake of clarity, Buyer’s Tentative Requirements Schedule/Buyer’s Requirements Schedule for Month M are the plans for Supply of Cargoes in Month M, whereas the Predicted Refinery Slate/Actual Refinery Slate for Month M (both as defined in Clause 9) are the plans for the number of Barrels of any Grade to be Delivered in that Month. These two plans will be separate and different from one another. The nominations for each Party shall progress in the following chronological order:

(a) Buyer shall nominate to Seller no later than the [REDACTED] Buyer’s Tentative Requirements Schedule. Each nomination shall be of [REDACTED] which is the [REDACTED] that Buyer envisages acceptable fulfillment of the Requirement to meet Buyer’s planned Refinery run schedule. Each nomination shall define the Type for that Requirement. No later than the [REDACTED], Seller shall nominate to Buyer the provisional [REDACTED] for all Requirements in M. Buyer’s Tentative Requirements Schedule for Month M will at this point become “Buyer’s Requirements Schedule”. Changes of either dates or Types within this Buyer’s Requirements Schedule shall only be by agreement between the Parties.

-23-

(b) At any time when a Requirement is either first covered by a specific Cargo or optimized from one Cargo to another Cargo, Buyer’s Requirements Schedule will be updated by replacing a Requirement (or optimized out Cargo) with the appropriate Cargo purchased.

(c) Buyer shall nominate to Seller no later than the [REDACTED] (i) the Deemed Volume for Month M, and (ii) the Predicted Refinery Slate for M.

(d) For any Requirement nominated for Supply in M, then promptly after Seller has covered such Requirement with a Cargo Seller shall contemporaneously nominate to Buyer a [REDACTED].

(e) For any Cargo nominated for Supply in M, Seller shall narrow the [REDACTED] prior to the beginning of such [REDACTED].

(f) Promptly following the end of Month M, Buyer shall communicate the Actual Refinery Slate for M based on the Delivered Oil in M. (See Clause 9).

| 7. | TITLE; CONTROL; RISK OF LOSS |

(a) Until title is transferred in accordance with subclause (c) below, Seller shall continuously have and retain title at all times to all Oil and Indigenous Feedstock Seller acquires for purposes of satisfying its Delivery obligations under this Agreement (including, without limitation, title to Oil or Indigenous Feedstock that is on the water, in transport, or in the Storage Facilities). Buyer shall not take any action that adversely affects or encumbers in any way Seller’s title to or rights in such Oil and Indigenous Feedstock.

(b) To further clarify Seller’s continuous title and ownership of Oil and Indigenous Feedstock, as described above, including the Oil and Indigenous Feedstock in the Storage Facilities, Buyer will facilitate the execution of Intercreditor Agreement(s) with any lenders, credit buyers, secured parties, debt buyers, or any other Person which seeks to obtain or maintain (i) a material security interest in the Refinery or in any related assets, operations or contracts or (iii) any security interest, lien or other rights in the Oil or Indigenous Feedstock. Buyer hereby authorizes Seller to make any and all filings under the UCC that are appropriate to clarify Seller’s ownership and other rights with respect to such Oil and Indigenous Feedstock. Buyer agrees to immediately notify Seller pursuant to the notice provision herein in the event that a Lien is placed upon the Refinery by any creditor of Buyer at any time during the term of this Agreement other than as described in the Intercreditor Agreement(s).

-24-

(c) Title to the Oil shall pass upon the following actions being completed: